- OSS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

One Stop Systems (OSS) DEF 14ADefinitive proxy

Filed: 19 Apr 22, 6:02am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

One Stop Systems, Inc.

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

2235 Enterprise Street #110

Escondido, CA 92029

ONE STOP SYSTEMS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

Dear Stockholder:

Notice is hereby given that the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of One Stop Systems, Inc. (the “Company”) will be held on Wednesday, May 18, 2022, at 11:00 a.m., Pacific Daylight time. We have adopted a virtual format for our Annual Meeting to provide a healthy, consistent, and convenient experience to all shareholders regardless of location. You may attend the Annual Meeting virtually via the Internet at www.proxydocs.com/OSS, where you will be able to vote electronically and submit questions. To attend, you must register at any time in advance of the Annual Meeting at www.proxydocs.com/OSS. Upon completing your registration, you will receive further instructions via email, including your unique links that will allow you access to the meeting and will also permit you to submit questions. Please be sure to follow instructions found on your proxy card and/or Voting Authorization Form and subsequent instructions that will be delivered to you via email. The purposes of the Annual Meeting are as follows:

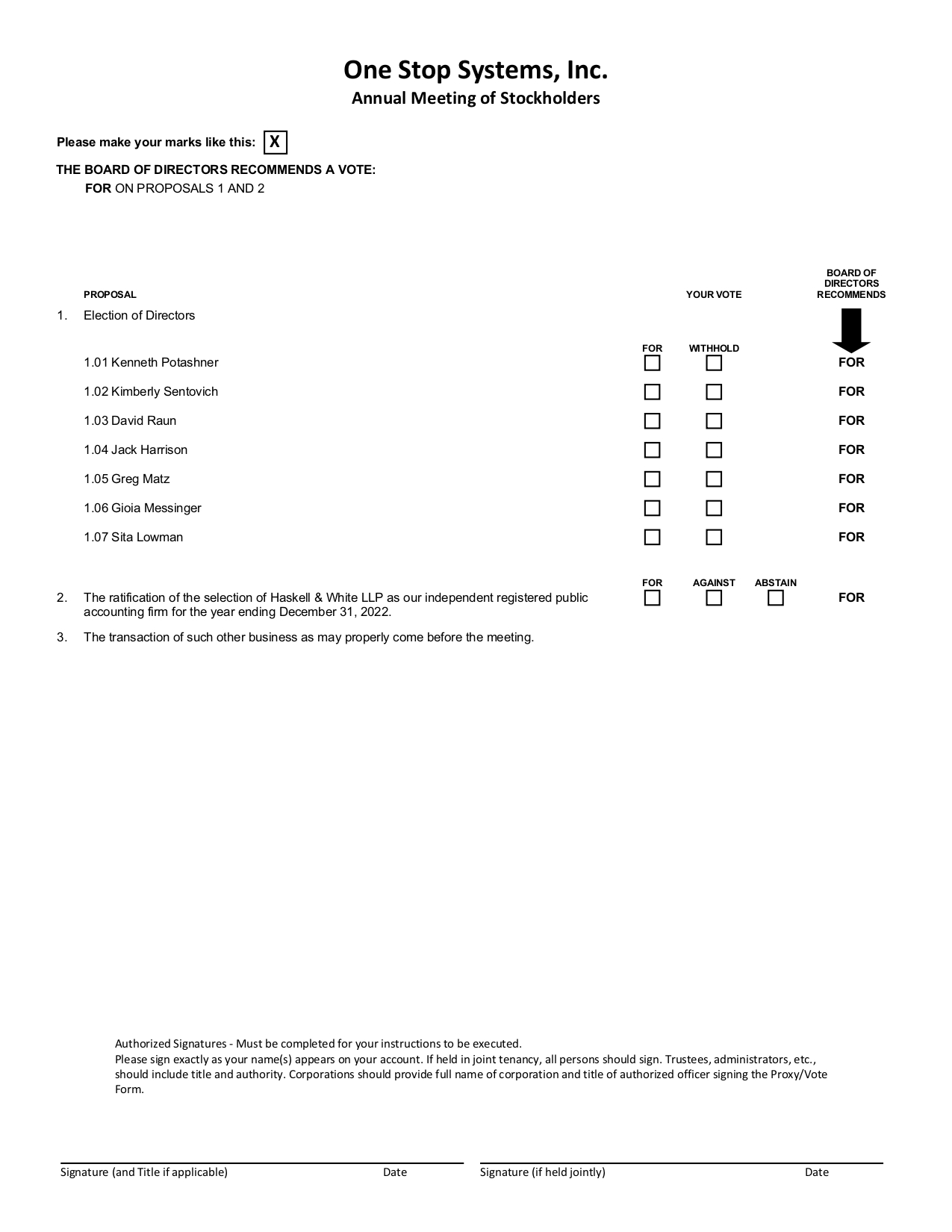

| 1. | To elect seven directors to hold office until the next annual meeting of stockholders or until their successors are duly elected and qualified, subject to prior death, resignation or removal; |

| 2. | The ratification of the selection of Haskell & White LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022; |

| 3. | To consider and act upon any other matters which may properly come before the Annual Meeting or any adjournment or postponement thereof. |

These proposals are more fully described in the proxy statement accompanying this Notice. Our board of directors has fixed the close of business on March 25, 2022, as the record date for the determination of the stockholders entitled to notice of, and to vote at, the Annual Meeting. Accordingly, only stockholders of record at the close of business on that date will be entitled to vote at the Annual Meeting. A list of the stockholders of record as of the close of business on March 25, 2022, will be available for inspection by any of our stockholders for any purpose germane to the Annual Meeting during normal business hours at our principal executive offices, 2235 Enterprise Street #110, Escondido, California 92029, beginning ten days before the Annual Meeting through the date of the Annual Meeting, and will also be made available and at the Annual Meeting.

Accompanying this Notice is a proxy card. Whether or not you expect to attend our Annual Meeting, please complete, sign and date the enclosed proxy card and return it promptly, or complete and submit your proxy via phone or the internet in accordance with the instructions provided on the enclosed proxy card.

Stockholders are cordially invited to attend the Annual Meeting virtually via the Internet at www.proxydocs.com/OSS.

By order of the Board of Directors, |

|

/s/ David Raun |

David Raun President and Chief Executive Officer |

April 19, 2022

YOUR VOTE IS IMPORTANT

TABLE OF CONTENTS

2235 Enterprise Street #110

Escondido, CA 92029

PROXY STATEMENT FOR THE 2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON WEDNESDAY, MAY 18, 2022

The board of directors of One Stop Systems, Inc. (the “Company”) is soliciting the enclosed proxy for use at the annual meeting of stockholders (the “Annual Meeting”) to be held on Wednesday, May 18, 2022, at 11:00 a.m., Pacific Daylight time. You may attend the Annual Meeting virtually via the Internet at www.proxydocs.com/OSS, where you will be able to vote electronically and submit questions, after you register prior to commencement of the Annual Meeting.

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why did you send me this proxy statement?

We sent you this proxy statement and the enclosed proxy card because our board of directors is soliciting your proxy to vote at the 2022 Annual Meeting. This proxy statement summarizes information related to the proposals being presented for your vote at the Annual Meeting. All stockholders who find it convenient to do so are cordially invited to attend the Annual Meeting virtually via the Internet at www.proxydocs.com/OSS. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or complete and submit your proxy via phone or the internet in accordance with the instructions provided on the enclosed proxy card.

We intend to begin mailing this proxy statement, the accompanying notice of Annual Meeting, the enclosed proxy card, and our Annual Report on Form 10-K for the year ended December 31, 2021, on or about April 19, 2022, to all stockholders of record entitled to vote at the Annual Meeting. Only stockholders who owned shares of our common stock at the close of business on March 25, 2022, the record date, are entitled to vote at the Annual Meeting. On this record date, there were 18,878,183 shares of our common stock outstanding. Common stock is our only class of stock outstanding and entitled to vote at the Annual Meeting.

What is the date, time and place of the Annual Meeting?

One Stop Systems, Inc.’s 2022 Annual Stockholders’ Meeting will be held on Wednesday, May 18, 2022, beginning at 11:00 a.m., Pacific Daylight time. You may attend the Annual Meeting virtually via the Internet at www.proxydocs.com/OSS. To attend, you must register at any time in advance of the Annual Meeting at www.proxydocs.com/OSS. Upon completing your registration, you will receive further instructions via email, including your unique links that will allow you access to the meeting and will also permit you to submit questions.

4

What is the purpose of the Annual Meeting?

At the Annual Meeting, stockholders will act upon the matters outlined in the notice of meeting on the cover page of this proxy statement, consisting of (i) election of seven directors to hold office until the next annual meeting of stockholders or until their successors are duly elected and qualified, subject to prior death, resignation or removal; (ii) ratification of the selection of Haskell & White LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022; and (iii) such other matters that may properly come before the Annual Meeting or any adjournment or postponement thereof.

Who is entitled to vote at the meeting?

Only our stockholders of record at the close of business on March 25, 2022, the record date for the Annual Meeting, are entitled to receive notice of and to participate in the Annual Meeting. If you were a stockholder of record on that date, you will be entitled to vote all of the shares you held on that date at the Annual Meeting, or any postponement(s) or adjournment(s) of the Annual Meeting. As of the record date, there were 18,878,183 shares of Company common stock outstanding, all of which are entitled to be voted at the Annual Meeting.

A list of stockholders will be available at our headquarters at 2235 Enterprise Street #110, Escondido, California 92029 for a period of ten days prior to the Annual Meeting through the date of the Annual Meeting, and will also be made available at the Annual Meeting itself for examination by any stockholder.

What are the voting rights of the holders of our common stock?

Holders of common stock are entitled to one vote per share on each matter that is submitted to stockholders for approval.

Who can attend the meeting?

All stockholders as of the record date, or their duly appointed proxies, may attend the Annual Meeting. Please also note that if you hold your shares in “street name” (that is, through a broker or other nominee), you too will need to register prior to commencement of the Annual Meeting.

What constitutes a quorum?

The presence at the meeting, virtually or by proxy, of the holders of common stock representing a majority of the combined voting power of the issued and outstanding shares of common stock on the record date will constitute a quorum, permitting the Annual Meeting to conduct its business. As of the record date, there were 18,878,183 shares of common stock outstanding, all of which are entitled to be voted at the Annual Meeting.

What vote is required to approve each item?

For purposes of electing directors at the Annual Meeting, the nominees receiving the support of stockholders representing the greatest numbers of shares of common stock present at the meeting, virtually or by proxy and entitled to vote, shall be elected as directors.

The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively at the Annual Meeting is required for the ratification of the selection of Haskell & White LLP; and approval of any other matter that may be submitted to a vote of our stockholders.

5

The inspector of election for the Annual Meeting shall determine the number of shares of common stock represented at the Annual Meeting, the existence of a quorum and the validity and effect of proxies, and shall count and tabulate ballots and votes and determine the results thereof. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting for purposes of determining a quorum. A “broker non-vote” will occur when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary power with respect to that proposal and has not received instructions from the beneficial owner. Broker non-votes will not be counted as votes cast “for” or votes “withheld” for the election of directors. Broker non-votes, if any, and abstentions will not be considered in tallying votes with respect to the ratification of the selection of Haskell & White LLP. If less than a majority of the combined voting power of the outstanding shares of common stock is represented at the Annual Meeting, then the chairperson of the Annual Meeting or a majority of the shares so represented may adjourn the Annual Meeting from time to time without further notice.

What are the Board’s recommendations?

As more fully discussed under “Matters to Come Before the Annual Meeting”, our board of directors recommends a vote FOR the election of each of the respective nominees for director named in this proxy statement, and FOR the ratification of the selection of Haskell & White LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022.

Unless contrary instructions are indicated on the enclosed proxy, all shares represented by valid proxies received pursuant to this solicitation (and which have not been revoked in accordance with the procedures set forth below) will be voted (i) FOR the election of each of the respective nominees for director named in this proxy statement; (ii) FOR the ratification of the selection of Haskell & White LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022; and (iii) in accordance with the recommendation of our board of directors, FOR or AGAINST, for all other matters as may properly come before the Annual Meeting or any adjournment or postponement thereof. In the event a stockholder specifies a different choice by means of the enclosed proxy, such shares will be voted in accordance with the specification made.

How do I vote?

If you are a holder of record (that is, if your shares are registered in your own name with our transfer agent), you may vote using the enclosed proxy card. Voting instructions are provided on the proxy card contained in the proxy materials.

If you are a street name holder (that is, if you hold your shares through a bank, broker, or other holder of record), you must vote in accordance with the voting instruction form provided by your bank, broker or other holder of record. The availability of telephone or internet voting will depend upon your bank’s, broker’s, or other holder of record’s voting process.

If you virtual attend the Annual Meeting, you can, of course, vote virtually. If you are a street name holder and wish to vote at the meeting, you must first obtain a legal proxy from your bank, broker or other holder of record authorizing you to vote.

Are dissenters’ rights available with respect to any proposal?

Dissenters’ rights are not available with respect to any proposal to be voted on at the Annual Meeting.

Can I change my vote after I return my proxy card?

Yes. The giving of a proxy does not eliminate the right to vote virtually should any stockholder giving the proxy so desire. Stockholders have an unconditional right to revoke their proxy at any time prior to the exercise of that proxy, by voting virtually at the Annual Meeting, or by filing a written revocation or duly executed proxy bearing a later date with our Secretary at our headquarters.

6

Who pays for costs relating to the proxy materials and Annual Meeting of stockholders?

The costs of preparing, assembling, and mailing this proxy statement, the Notice of Annual Meeting of Stockholders and the enclosed Annual Report and proxy card, along with the cost of posting the proxy materials on a website, are to be borne by us. In addition to the use of mail, our directors, officers, and employees may solicit proxies personally and by telephone, facsimile, and other electronic means. They will receive no compensation in addition to their regular salaries. We may request banks, brokers and other custodians, nominees, and fiduciaries to forward copies of the proxy material to their principals and to request authority for the execution of proxies. We may reimburse these persons for their expenses in so doing.

How can I find out the results of the voting?

We intend to announce preliminary voting results at the Annual Meeting and publish final results in a Current Report on Form 8-K within four business days following the Annual Meeting.

7

MATTERS TO COME BEFORE THE ANNUAL MEETING

Election of Directors

Nomination of Directors

The Nominations and Corporate Governance Committee of our board of directors (the “Nominating Committee”) is charged with making recommendations to our board of directors regarding qualified candidates to serve as members of the board of directors. The Nominating Committee’s goal is to assemble a board of directors with the skills and characteristics that, taken as a whole, will assure a strong board of directors with experience and expertise in all aspects of corporate governance. Accordingly, the Nominating Committee believes that candidates for director should have certain minimum qualifications, including personal integrity, strength of character, an inquiring and independent mind, practical wisdom, and mature judgment. In evaluating director nominees, the Nominating Committee considers the following factors:

(1) | The appropriate size of the board of directors; |

(2) | The Company’s needs with respect to the particular talents and experience of its directors; |

(3) | The knowledge, skills, and experience of nominees, including experience in technology, business, finance, administration, and/or public service; and |

(4) | Relevant Nasdaq, SEC, California, and Investor recommendations and requirements. |

Other than the foregoing, there are no stated minimum criteria for director nominees, although the Nominating Committee may also consider such other factors as it deems to be in the Company’s and its stockholders’ best interests, including diversity. Although the Company does not have a formal policy with regard to the consideration of diversity in identifying director nominees, the Nominating Committee is committed to complying with the diversity requirements recently adopted by Nasdaq and the State of California. The Nominating Committee does, however, believe it appropriate for at least one member of the board of directors to meet the criteria for an “audit committee financial expert,” as defined by SEC rules, and for a majority of the members of the board of directors to meet the definition of an “independent director” under Nasdaq listing standards. The Nominating Committee also believes it is appropriate for our Chief Executive Officer to serve on our board of directors.

The Nominating Committee identifies nominees by first evaluating the current members of the board of directors willing to continue in service. Current members of the board of directors with skills and experience that are relevant to our business and who are willing to continue in service are considered for re-nomination, but the Nominating Committee at all times seeks to balance the value of continuity of service by existing members of the board of directors with that of obtaining a new perspective. If any member of the board of directors does not wish to continue in service, the Nominating Committee’s policy is to not re-nominate that member for reelection. The Nominating Committee identifies the desired skills and experience of a new nominee, and then uses its network and external resources to solicit and compile a list of eligible candidates.

We do not have a formal policy concerning stockholder recommendations of nominees for director to the Nominating Committee as, to-date, we have not received any recommendations from stockholders requesting the Nominating Committee to consider a candidate for inclusion among the Nominating Committee’s slate of nominees in our proxy statement. The absence of such a policy does not mean, however, that such recommendations will not be considered. Stockholders wishing to recommend a candidate may do so by following the process outlined in Section 2.5 of our amended and restated bylaws and sending a written notice to the Nominating Committee, Attn: Chairman, One Stop Systems, Inc., 2235 Enterprise St. #110, Escondido, CA 92029, naming the proposed candidate and providing detailed biographical and contact information for such proposed candidate.

There are no arrangements or understanding between any of our directors, nominees for directors or officers, and any other person pursuant to which any director, nominee for director, or officer was or is to be selected as a director, nominee or officer, as applicable. There currently are no legal proceedings, and during the past ten years there have been no legal proceedings, that are material to the evaluation of the ability or integrity of any of our directors or director nominees. There are no material proceedings to which any director, officer, affiliate, or owner

8

of record or beneficial owner of more than 5% of any class of voting securities of the Company, or any associates of any such persons, is a party adverse to the Company or any of our subsidiaries, and none of such persons has a material interest adverse to the Company or any of its subsidiaries. Other than as disclosed below, during the last five years, none of our directors held any other directorships in any company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or subject to the requirements of Section 15(d) of the Exchange Act or any company registered as an investment company under the Investment Company Act of 1940.

The Nominating Committee has recommended, and our board of directors has nominated, Kenneth Potashner, David Raun, Kimberly Sentovich, Jack Harrison, Greg Matz, Sita Lowman and Gioia Messinger as nominees for election as members of our board of directors at the Annual Meeting for a period of one (1) year and until such director’s successor is elected and qualified or until such director’s earlier death, resignation or removal. At the Annual Meeting, seven directors will be elected to the board of directors.

Information Regarding Directors

Name |

| Age |

| Position |

Kenneth Potashner |

| 64 |

| Chairman of the Board |

David Raun |

| 60 |

| President and Chief Executive Officer, Director |

Kimberly Sentovich |

| 54 |

| Director |

Jack Harrison |

| 66 |

| Director |

Greg Matz |

| 62 |

| Director |

Sita Lowman |

| 57 |

| Director |

Gioia Messinger |

| 59 |

| Director |

Board of Directors

Kenneth Potashner has served as Chairman of our board of directors since May 2019. Mr. Potashner has extensive board experience in high growth, high technology global organizations. He served as Chairman of Newport Corporation, where he provided 18 years of service culminating in the sale of Newport in 2016 for $980 million. Mr. Potashner served as Chairman of the board of Maxwell Technologies and directed it through a period of rapid expansion. He has also served on the board of California Micro Devices, SonicBlue Inc, and Singapore Technologies, all publicly traded companies. Mr. Potashner is currently serving as the Executive Chairman of Generation Esports and on the board of directors of Launch Factory and Prologue Mobile. He has also served on the board of many private companies as well, including DynaOptics, MyOffice.com, Underground Elephant, Home Bay, Lumedyne, Events.com, and several others. Several of the private companies that Mr. Potashner has had affiliations with have achieved successful exits or significant financings. Mr. Potashner has a BSEE from Lafayette College and an MSEE from SMU, Executive certifications from Columbia and INSEAD in Lausanne, Switzerland. He also has an Advanced Professional Director certification from American Board of Directors.

David Raun served as our interim chief executive officer from February 15, 2020 until June 24, 2020, when he was appointed as the Company’s president and chief executive officer. Mr. Raun formerly served as the audit chair on the OSS board of directors and serves as a director. Mr. Raun was with PLX Technology, Inc. (“PLX”), a company that used to be publicly traded on Nasdaq, from 2004-2014, where he eventually became president, chief executive officer and a director. In this role, he led the company to an acquisition by Avago (now Broadcom) after driving the company to large PCI Express market share, record revenues and profits. This PCIe switch leadership position at PLX makes him very familiar with the OSS markets and the components he defined and marketed to many of OSS products. Mr. Raun also served as chief operations officer at Home Bay Technologies (“Home Bay”), an on-line technology based real estate company in 2019. Prior to joining Home Bay, he was the president, COO and interim chief financial officer at ASSIA, Inc. (“ASSIA”), a Silicon Valley-based SaaS providers from 2016-2018. While there, he led a turnaround effort, driving ASSIA to record revenues and sizable operating margins. Prior to these roles, he held multiple VP of marketing, business development, corporate development, and sales roles. He served as chairman of the board at Kilopass, a semiconductor IP supplier, until they were acquired by Synopsys in 2019. Mr. Raun holds a B.S. in computer and electrical engineering from University of California, Santa Barbara. Mr. Raun has more than 25 years of experience at senior management and board levels in public and private companies including over 10 M&A/fund raising events, which is a great benefit to OSS.

9

Kimberly Sentovich joined our board of directors in February 2019, and is a seasoned merchandising, operations, IT, and supply chain executive with three decades of experience with multi-billion-dollar profit and loss responsibility. Ms. Sentovich currently serves as the CEO of Rachio, a smart irrigation controller IoT device B-corp company focused on water efficiency. Before joining Rachio, she consulted for venture and private equity companies. Ms. Sentovich served in senior operations roles at Torrid and was Executive Vice President of Stores and Logistics at Gymboree, where she was responsible for 1,300 company-owned stores in North America from 2015-2018. Ms. Sentovich previously worked seven years (2008-2015) at Walmart, rising from Regional Vice President of Operations – California to Divisional Senior Vice President of Operations – Pacific Division and fifteen years at The Home Depot (1993-2008), rising to the level of Regional Vice President of Operations. Ms. Sentovich obtained her MBA from The Paul Merage School of Business, University of California, Irvine, and her B.A. in Philosophy and Political Science with a Minor in Economics from Bryn Mawr College. Ms. Sentovich’s extensive executive and operations experience, as well as her independence, judgment, and exceptional leadership experience, make her a valuable addition to our board.

Jack Harrison has served on our board of directors since December 2016. He founded, and served as president and chief executive officer of, Aspen Integrated Technologies, a world-class development engineering and manufacturing center of advanced microelectronics, which he grew through organic reinvestment and acquisition, and which had a successful exit in 2011. The companies that he has founded and/or worked for previously have been responsible for the assembly development and manufacture of microfluidic semiconductor DNA gene sequencing devices, next-gen military RF radar, missile guidance systems, miniaturization of neuro-modulation sensors and transmitters, medical implant devices, and more. Customers for such companies included major medical and technology companies, government prime contractors, NASA, DARPA, and others. Mr. Harrison is currently the president of Integrity Energy and serves as the chairman of the board of Reach Beyond, a non-profit charitable organization with which he has been affiliated for more than two decades. Mr. Harrison is an angel investor in several technology start-up companies and holds a BME degree from Wheaton College. He brings decades of experience in the microelectronics space and his business and technical expertise represent important assets to OSS.

Greg Matz, CPA, joined our board of directors in July 2020, and is an experienced financial executive, having served in controller, Vice President, and CFO roles for over two decades. Now retired, Mr. Matz is currently serving as a member of the board of directors and audit committee chair for Dare Bioscience, Inc. (NASDAQ: DARE), a public clinical-stage biopharmaceutical company. Mr. Matz also chairs the Dean’s Council for the University of San Francisco’s School of Management. From 2011 to 2016, he worked for The Cooper Companies, Inc. (NYSE: COO), holding roles as the Senior Vice President and Chief Financial Officer and Chief Risk Officer. From 2010 to 2011, Mr. Matz was the Chief Financial Officer for CooperVision, a business unit of The Cooper Companies, Inc. Prior to joining The Cooper Companies, Inc., he held key management roles in finance and marketing at Agilent Technologies and Hewlett Packard. He began his career at KPMG and is a CPA with an active certification. Mr. Matz graduated from the University of San Francisco with a B.S. in Business Administration and completed the University of Pennsylvania, The Wharton School’s Advanced Management Program. Mr. Matz is also a National Association of Corporate Directors (“NACD”) Board Leadership Fellow and has earned the NACD Directorship Certification credential. Our board of directors believes Mr. Matz’s experience as a chief financial officer and chief risk officer of a public company and his corporate experience in financial functions, risk management, capital markets and corporate strategy qualify him to serve as a member of our board of directors.

Sita Lowman joined our board of directors in July 2020, and is a Fortune 500 executive with business transformation and technology expertise. Her expertise identifying market trends, organizing multi-national diverse teams to quickly react to these trends, and leveraging partnerships to expand globally make her frequently called upon to lead new business ventures and to turn around struggling businesses. From 2017 to 2021, Ms. Lowman served as Vice President and General Manager for the Platform Services business of DXC Technologies, a multi-billion-dollar IT services Fortune 500 Company. At DXC, she actively engaged in strategic partnerships with the world’s largest public cloud providers and Enterprise application providers, with responsibilities including P&L financial management, GTM and operations activities. Prior to that, Ms. Lowman served as Senior Director, Enterprise Solutions on Demand Service Offering Management, Workload and Cloud for Hewlett Packard Enterprise. She has also held General Manager roles at Nortel Networks and Texas Instruments (TI) Defense Group (acquired by Raytheon). Sita is currently a mentor to several startups and is an advisor with the start-up community

10

through her involvement with San Diego based Launch Factory, UC San Diego Rady School of Management, and USD Knauss School of Business. Ms. Lowman holds a BSS of Electrical Engineering from Auburn University. Ms. Lowman’s extensive Fortune 500 P&L and GTM experience in the Technology sector servicing defense, automotive and other large commercial industries make her well suited to serve on our board.

Gioia Messinger, joined our board of directors in July 2020. She brings more than three decades of high technology executive experience, with over two decades focused on consumer electronics, IoT, robotics/ AI and digital health serving as Founder/CEO, board member, interim executive and venture capital advisor. Ms. Messinger founded, and since 2012 has served as Principal of LinkedObjects, Inc., a strategic advisory services business focused on digital transformation brought about by AI and IoT. In addition to founding and leading several start-ups, Ms. Messinger also founded and served as CEO of Avaak, Inc., now Arlo Technologies (NYSE: ARLO), that created Arlo, the award-winning smart video security system for the home that defined the category and is now the market leader. She currently is an advisor to several start-ups, serves on the board of directors of Indyme Solutions, a provider of IoT and AI solutions for the world’s largest retailers and CARI Health, a Connected Health company. She serves on the Dean’s Council of Advisors for the Jacobs School of Engineering at UC San Diego. Previously, Ms. Messinger served on the board of Vicon Industries (NYSE: VCON). Ms. Messinger obtained her MBA from the Paul Merage School of Business at the University of California, Irvine and her B.S. in Computer Engineering from University of California, San Diego. She’s an inventor on 11 patents. Ms. Messinger’s technical skills and understanding, thought leadership and industry relationships make her an invaluable addition to our board.

Vote Required

If a quorum is present and voting at the Annual Meeting, the seven nominees receiving the highest number of votes will be elected to our board of directors. Votes withheld from any nominee, abstentions and broker non-votes will be counted only for purposes of determining a quorum. Broker non-votes will have no effect on this proposal, as brokers or other nominees are not entitled to vote on such proposals in the absence of voting instructions from the beneficial owner.

RECOMMENDATION OF THE BOARD OF DIRECTORS

THE BOARD OF DIRECTORS UNANIMOUSLY

RECOMMENDS A VOTE FOR THE ELECTION OF EACH NOMINEE UNDER PROPOSAL ONE

11

Ratification of Selection of Independent Registered Public Accounting Firm

Our audit and risk committee has selected Haskell & White LLP (“H&W”) as the Company’s independent registered public accounting firm for the year ending December 31, 2022, and has further directed that management submit the selection of independent registered public accounting firm for ratification by the Company’s stockholders at the Annual Meeting. H&W has audited the Company’s financial statements since 2017. Representatives of H&W are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire, and will be available to respond to appropriate questions.

Stockholder ratification of the selection of H&W as the Company’s independent registered public accounting firm is not required by Delaware law, the Company’s amended and restated certificate of incorporation, or the Company’s amended and restated bylaws. However, our audit and risk committee is submitting the selection of H&W to our stockholders for ratification as a matter of good corporate practice. If our stockholders fail to ratify the selection, the audit and risk committee will reconsider whether to retain that firm. Even if the selection is ratified, our audit and risk committee, in its discretion, may direct the appointment of a different independent registered accounting firm at any time during the year if the audit and risk committee determines that such a change would be in the best interests of the Company and its stockholders.

Independent Registered Public Accounting Firm’s Fees

The following table represents aggregate fees billed to us for services rendered to us by H&W, our independent registered public accounting firm, related to the fiscal years ended December 31, 2021 and 2020 H&W:

|

| 2021 |

|

| 2020 |

| ||

Audit fees (1) |

| $ | 194,250 |

|

| $ | 207,500 |

|

Audit-Related fees (2) |

|

| 3,100 |

|

|

| - |

|

Tax fees |

|

| - |

|

|

| - |

|

Other fees |

|

| - |

|

|

| - |

|

Total fees |

| $ | 197,350 |

|

| $ | 207,500 |

|

1) | Includes fees for (i) audits of our consolidated financial statements for the fiscal years ended December 31, 2021 and 2020, and (ii) reviews of our interim period financial statements for fiscal year 2021 and 2020. |

2) | Preparation of a consent dated June 21, 2021. |

Pre-Approval Policies and Procedures

Our audit and risk committee pre-approves all auditing services and the terms of non-audit services provided by our independent registered public accounting firm, but only to the extent that the non-audit services are not prohibited under applicable law and the committee determines that the non-audit services do not impair the independence of the independent registered public accounting firm.

In situations where it is impractical to wait until the next regularly scheduled quarterly meeting, the chairman of the audit and risk committee has been delegated authority to approve audit and non-audit services to be provided by our independent registered public accounting firm. Fees payable to our independent registered public accounting firm for any specific, individual service approved by the chairman pursuant to the above-described delegation of authority may not exceed $25,000, and the chairman is required to report any such approvals to the full committee at its next scheduled meeting. In addition, our audit and risk committee has pre-approved a list of acceptable services and fees payable to H&W in an aggregate amount of up to $12,500 per quarter for such services, including without limitation audit and allowable non-audit and tax consulting. This pre-approval is for small projects needing quick reaction and judged by the audit and risk committee not to raise any independence issues with H&W. Such projects and fees are required to be presented in detail at the next audit and risk committee meeting. All fees that were incurred in 2021 and 2020, were pre-approved by the audit and risk committee.

12

Our audit and risk committee has considered and determined that the provision of the non-audit services described is compatible with maintaining the independence of our registered public accounting firm.

Vote Required

The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively at the Annual Meeting is required to ratify the selection of H&W. Abstentions and broker non-votes will be counted only for purposes of determining a quorum. Abstentions will not be considered in tallying votes with respect to this Proposal, and will have no effect on the outcome of the voting results for this Proposal 2. The approval of Proposal 2 is a routine proposal on which a broker or other nominee has discretionary authority to vote. Accordingly, no broker non-votes will likely result from this proposal. In the event that there are any broker non-votes, they will not be considered in tallying votes with respect to this Proposal 2, and will have no effect on the outcome of the voting results for this Proposal 2.

RECOMMENDATION OF THE BOARD OF DIRECTORS

THE BOARD OF DIRECTORS UNANIMOUSLY

RECOMMENDS A VOTE FOR THE RATIFICATION OF THE SELECTION OF HASKELL & WHITE LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2022

13

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding beneficial ownership of our common stock, as of March 31, 2022, by:

| • | each person, or group of affiliated persons, known by us to be the beneficial owner of more than 5% of our common stock; |

| • | each of our named executive officers; |

| • | each of our directors; and |

| • | all of our executive officers and directors as a group. |

We have determined beneficial ownership in accordance with SEC rules. The information does not necessarily indicate beneficial ownership for any other purpose. Under these rules, the number of shares of common stock deemed outstanding includes shares issuable upon exercise of stock options or warrants held by the respective person or group that may be exercised or converted within 60 days after March 31, 2022. For purposes of calculating each person’s or group’s percentage ownership, stock options and warrants exercisable within 60 days after March 31, 2022, are included for that person or group but not for any other person or group.

Applicable percentage ownership is based on 18,878,183 shares of common stock outstanding at March 31, 2022.

Unless otherwise indicated and subject to applicable community property laws, to our knowledge, each stockholder named in the following table possesses sole voting and investment power over the shares listed. Unless otherwise noted below, the address of each person listed on the table is c/o One Stop Systems, Inc., 2235 Enterprise Street, #110, Escondido, CA 92029.

Name and Address of Beneficial Owner |

| Number of Shares of Common Stock Beneficially Owned |

|

| Percent of Common Stock Beneficially Owned |

| ||

5% or greater stockholders: |

|

|

|

|

|

|

|

|

Steve Cooper (11) |

|

| 2,832,137 |

|

|

| 15.0 | % |

Bard & Associates LLC. (12) |

| �� | 989,075 |

|

|

| 5.2 | % |

Named Executive Officer and Directors: |

|

|

|

|

|

|

|

|

David Raun (1) |

|

| 626,629 |

|

|

| 3.2 | % |

Ken Potashner (2) |

|

| 370,723 |

|

|

| 2.0 | % |

Jack Harrison (3) |

|

| 68,884 |

|

| * |

| |

Kimberly Sentovich (4) |

|

| 26,166 |

|

| * |

| |

Sita Lowman (5) |

|

| 16,830 |

|

| * |

| |

Gioia Messinger (6) |

|

| 16,590 |

|

| * |

| |

Greg Matz (7) |

|

| 17,330 |

|

| * |

| |

Jim Ison (8) |

|

| 174,868 |

|

| * |

| |

John Morrison (9) |

|

| 91,166 |

|

| * |

| |

All executive officers and directors as a group (9 persons) (10) |

|

| 1,409,186 |

|

|

| 7.2 | % |

* | Less than 1%. |

(1) | Consists of (i) 190,551 shares of common stock held by Mr. Raun; (ii) 422,125 shares of common stock Mr. Raun has the right to acquire from us within 60 days of March 31, 2022, pursuant to the exercise of stock options and (iii) 13,953 shares of common stock that Mr. Raun has the right to exercise within 60 days of March 31, 2022, pursuant to common stock warrants. Mr. Raun is our president and chief executive officer. |

(2) | Consists of (i) 252,866 shares of common stock held by Mr. Potashner; (ii) 47,857 shares of common stock that Kenco, Inc. has the right to exercise within 60 days of March 31, 2022 (pursuant to common stock warrants, and (iii) 70,000 shares of common stock that Mr. Potashner has the right to acquire from us within |

14

60 days of March 31, 2022, pursuant to the exercise of stock options. Mr. Potashner has sole voting and investment control over Kenco, Inc. Mr. Potashner is the chairman of the board of directors. |

(3) | Consists of (i) 58,884 shares of common stock held by Mr. Harrison, and (ii) 10,000 shares of common stock that Mr. Harrison has the right to acquire from us within 60 days of March 31, 2022, pursuant to the exercise of stock options. Mr. Harrison is a member of the board of directors. |

(4) | Consists of 26,166 shares of common stock held by Ms. Sentovich. Ms. Sentovich is a member of the board of directors. |

(5) | Consists of 16,830 shares of common stock held by Ms. Lowman. Ms. Lowman is a member of the board of directors. |

(6) | Consists of 16,590 shares of common stock held by Ms. Messinger. Ms. Messinger is a member of the board of directors. |

(7) | Consists of 17,330 shares of common stock held by Mr. Matz. Mr. Matz is a member of the board of directors. |

(8) | Consists of (i) 70,776 shares of common stock held by the James J Ison Jr. and Sha-Marie A Ison Inter Vivos Revocable Trust dated June 4, 2020, which Mr. Ison is the trustee of, (ii) 99,092 shares of common stock, pursuant to the exercise of stock options that Mr. Ison has the right to acquire from us within 60 days of March 31, 2022, and (iii) 5,000 shares of common stock, pursuant to the exercise of restricted stock units that Mr. Ison has the right to receive from us within 60 days of March 31, 2022. Mr. Ison is the chief sales and marketing officer of the company. |

(9) | Consists of (i) 84,499 shares of common stock held by Mr. Morrison, and (ii) 6,667 shares of common stock, pursuant to the exercise of restricted stock units that Mr. Morrison has the right to receive from us within 60 days of March 31, 2022. Mr. Morrison is the chief financial officer of the Company. |

(10) | Includes (i) 734,492 shares beneficially owned by our current named executive officers and directors, and (ii) 674,694 shares subject to options, warrants or convertible securities, that are either exercisable or such person has a right to receive within 60 days of March 31, 2022, as set forth in the previous footnotes. |

(11) | Consists of 2,832,137 shares of common stock held by The Cooper Revocable Trust dated April 25, 2001. Mr. Cooper shares joint voting and investment control of The Cooper Revocable Trust dated April 25, 2001, with his wife Lori Cooper. Mr. Cooper served as our chief executive officer and president until February 15, 2020. |

(12) | Based on information provided by Bard & Associates, Inc. on Schedule 13G/A, filed with the SEC on February 14, 2022. |

15

BOARD MATTERS AND CORPORATE GOVERNANCE

Board Composition and Election of Directors

Director Independence

Our board of directors currently consists of seven members. Our board of directors has determined that Kenneth Potashner, Kim Sentovich, Jack Harrison, Greg Matz, Sita Lowman, and Gioia Messinger are all independent directors in accordance with the listing requirements of The Nasdaq Capital Market. The Nasdaq independence definition includes a series of objective tests, including that the director is not, and has not been for at least three years, one of our employees, and that neither the director nor any of his or her family members have engaged in various types of business dealings with us. In addition, as required by Nasdaq rules, our board of directors has made a subjective determination as to each independent director that no relationships exist, which, in the opinion of our board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, our board of directors reviewed and discussed information provided by the directors and us with regard to each director’s business and personal activities and relationships as they may relate to us and our management. There are no family relationships among any of our directors or executive officers.

Board Committees

Our board of directors has established three standing committees – audit and risk, compensation and nominating and corporate governance – each of which operates under a charter that has been approved by our board of directors. our former risk oversight committee has now been incorporated into the audit and risk committee.

The following table provides information for the current membership for each of the committees of the board of directors:

Name | Audit & Risk Committee |

| Compensation Committee |

| Nominations and Corporate Governance Committee |

|

Kenneth Potashner |

|

| X |

| X |

|

Kimberly Sentovich |

|

| X | * | X |

|

Jack Harrison | X |

|

|

| X | * |

Greg Matz | X | * |

|

| X |

|

Sita Lowman | X |

| X |

|

|

|

Gioia Messinger | X |

| X |

|

|

|

* Indicates chairperson

Audit and Risk Committee

The audit and risk committee’s main function is to oversee our accounting and financial reporting processes and the audits of our financial statements. This committee’s responsibilities include, among other things:

1. | Managing our independent registered public accounting firm, including: |

| • | selection and retention (subject to input by the Company’s stockholders), evaluation and termination when appropriate; |

| • | setting their compensation; |

| • | overseeing their work and pre-approving all audit services they provide; |

| • | approving all permitted non-audit services they perform; |

| • | establishing policies and procedures for their engagement to provide permitted audit and non-audit services; |

| • | at least annually, receiving and reviewing a report by the independent registered public accounting firm describing their internal quality- control procedures and any material issues raised by the most recent internal quality-control review, peer review or Public Company Accounting Oversight Board (“PCAOB”) review, of the independent auditing firm, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the firm, and any steps taken to deal with any such issues; and other required reports from the independent registered public accounting firm; and |

16

|

| • | At least annually, considering their independence, including whether their provision of permitted non-audit services is compatible with independence, and obtaining and reviewing a report describing all the relationships between them and the Company. |

2. | Reviewing the audit scope and plan of independent auditors, and effective use of audit resources. |

|

3. | Reviewing with management and our independent auditors the Company’s annual (Form 10-K) and quarterly (Form 10-Q) financial statements and related footnotes, the auditor’s judgments about the quality of the Company’s accounting principles as applied in its financial reporting, and significant changes in their audit plan and serious difficulties or disputes with management encountered during the audit, and matters required by PCAOB AS1301 (Communication with Audit committees). |

4. | Reviewing with management and the independent auditors their significant audit findings, and assessing the steps that management has taken or proposes to take to minimize significant financial risks or exposures facing the Company, and periodically reviewing compliance with such steps. |

5. | Reviewing management’s annual internal control report, which acknowledges management’s responsibility for establishing and maintaining an adequate internal control structure and procedures for financial reporting; and contains an assessment of the effectiveness of the internal control structure. |

6. | Discussing with management and the independent auditor, at least semi-annually, policies and programs with respect to enterprise risks, including the risk management process, risk assessments, and significant areas of risk or exposure for the Company. |

8. | Establishing procedures for the Company’s confidential and anonymous receipt, retention, and treatment of complaints regarding the Company’s accounting, internal controls, and auditing matters, as well as for the confidential, anonymous submissions by Company employees of concerns regarding questionable accounting or auditing matters. |

9. | Obtaining the advice and assistance, as appropriate, of independent counsel and other advisors as necessary to fulfill the responsibilities of the audit and risk committee, and receiving appropriate funding from the Company, as determined by the audit and risk committee, for the payment of compensation to any such advisors. |

10. | Conducting an annual performance evaluation of the audit and risk committee and annually evaluating the adequacy of its charter. |

The members of our audit and risk committee are Mr. Matz, Ms. Lowman, Ms. Messinger, and Mr. Harrison. Mr. Matz serves as the chairperson of the committee. All members of our audit and risk committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC and The Nasdaq Capital Market. Our board of directors has determined that Mr. Matz qualifies as an “audit committee financial expert” as defined by applicable SEC rules and has the requisite financial sophistication as defined under the applicable Nasdaq rules and regulations. Our board of directors has determined that Mr. Matz, Ms. Lowman, Ms. Messinger, and Mr. Harrison are independent under the applicable rules of the SEC and The Nasdaq Capital Market. We are currently in compliance with Nasdaq rules and Rule 10A-3 since all members of our audit and risk committee have been deemed independent by our board of directors. The audit and risk committee operates under a written charter that satisfies the applicable standards of the SEC and The Nasdaq Capital Market. In February 2021, this committee added enterprise risk assessment and management to their charter and changed the name of the committee from the audit committee to the audit and risk committee. During the year 2021 the audit and risk committee met six times.

17

Report of the Audit and Risk Committee of the Board of Directors

The audit and risk committee oversees the Company’s financial reporting process on behalf of our board of directors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the audit and risk committee reviewed the audited financial statements in the Company’s annual report with management, including a discussion of any significant changes in the selection or application of accounting principles, the reasonableness of significant judgments, the clarity of disclosures in the financial statements and the effect of any new accounting pronouncements.

The audit and risk committee reviewed with Haskell & White LLP, which is responsible for expressing an opinion on the conformity of the Company’s audited financial statements with generally accepted accounting principles, its judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the audit and risk committee under generally accepted auditing standards and the matters listed in Public Company Accounting Oversight Board Auditing Standard No. 1301, Communications with Audit Committees. In addition, the audit and risk committee has discussed with Haskell & White LLP, its independence from management and the Company, has received from Haskell & White LLP the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding Haskell & White LLP’s communications with the audit Public Company Accounting Oversight Board Auditing Standard No. 1301committee concerning independence, and has considered the compatibility of non-audit services with the auditors’ independence.

The audit and risk committee met with Haskell & White LLP to discuss the overall scope of its services, the results of its audit and reviews, and the overall quality of the Company’s financial reporting. Haskell & White LLP, as the company’s independent registered public accounting firm, also periodically updates the audit and risk committee about new accounting developments and their potential impact on the Company’s reporting. The audit and risk committee’s meetings with Haskell & White LLP were held with and without management present. The audit and risk committee is not employed by the Company, nor does it provide any expert assurance or professional certification regarding the Company’s financial statements. The audit committee relies, without independent verification, on the accuracy and integrity of the information provided, and representations made, by management and the Company’s independent registered public accounting firm.

In reliance on the reviews and discussions referred to above, the audit and risk committee has recommended to the Company’s board of directors that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2021 (the “Annual Report”). The audit and risk committee and the Company’s board of directors also have recommended, subject to stockholder approval, the ratification of the appointment of Haskell & White LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022.

This report of the audit and risk committee is not “soliciting material,” shall not be deemed “filed” with the SEC and shall not be incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such acts.

The foregoing report has been furnished by the audit and risk committee.

| Respectfully submitted, |

|

|

| The Audit and Risk Committee of the Board of Directors |

| Greg Matz (chairperson) |

| Jack Harrison Sita Lowman Gioia Messinger |

|

|

18

Compensation Committee

Our compensation committee approves, or recommends to our board of directors, policies relating to compensation and benefits of our officers and employees. The compensation committee approves, or recommends to our board of directors, annual and long-term corporate goals and objectives relevant to the compensation of our chief executive officer and other executive officers, evaluates the performance of these officers in light of those goals and objectives and approves, or recommends to our board of directors, the compensation of these officers based on such evaluations. The compensation committee also approves, or recommends to our board of directors, the issuance of stock options and other awards under our equity incentive plans. The compensation committee will review and evaluate, at least annually, the performance of the compensation committee and its members, including compliance by the compensation committee with its charter.

The members of our compensation committee are Ms. Sentovich, Mr. Potashner, Ms. Lowman, and Ms. Messinger. Ms. Sentovich serves as the chairperson of the committee. Our board of directors has determined that Ms. Sentovich, Mr. Potashner, Ms. Lowman, and Ms. Messinger are independent under the applicable rules and regulations of The Nasdaq Capital Market and all current members qualify as a “non-employee director” as defined in Rule 16b-3 promulgated under the Exchange Act. Our board of directors has determined that each of the members of our compensation committee is an “outside director” as that term is defined in Section 162(m) of the U.S. Internal Revenue Code of 1986, as amended, or Section 162(m). We are currently in compliance with Nasdaq rules since all members of our compensation committee have been deemed independent by our board of directors. The compensation committee operates under a written charter, which the compensation committee will review and evaluate at least annually. During the year 2021 the compensation committee met seven times.

Nominations and Corporate Governance Committee

The nominations and corporate governance committee is responsible for assisting our board of directors in discharging the board of directors’ responsibilities regarding the identification of qualified candidates to become board members, the selection of nominees for election as directors at our annual meetings of stockholders (or special meetings of stockholders at which directors are to be elected), and the selection of candidates to fill any vacancies on our board of directors and any committees thereof. In addition, the nominations and corporate governance committee is responsible for overseeing our corporate governance policies, reporting, and making recommendations to our board of directors concerning governance matters and oversight of the evaluation of our board of directors.

The members of our nominating and corporate governance committee are Mr. Harrison, Mr. Potashner, Ms. Sentovich, and Mr. Matz. Mr. Harrison serves as the chairman of the committee. Our board of directors has determined that Mr. Harrison, Mr. Potashner, Ms. Sentovich and Mr. Matz are independent under the applicable rules and regulations of The Nasdaq Capital Market relating to nominating and corporate governance committee independence. We are currently in compliance with Nasdaq rules due to the fact that all members of our nominating and corporate governance committee have been deemed independent by our board of directors. The nominating and corporate governance committee operates under a written charter, which the nominating and corporate governance committee will review and evaluate at least annually. During the year 2021, the nominations and corporate governance committee met five times.

Board Leadership Structure

Our board of directors consists of seven directors. We believe our leadership structure is appropriate for the size and scope of operations of a company of our size. Our board of directors will continue to periodically review our leadership structure and may make such changes in the future as it deems appropriate to ensure the interests of the Company and its stockholders are best served.

19

Role of Board in Risk Oversight Process

Our board of directors has responsibility for the oversight of the Company’s risk management processes and, either as a whole or through its committees, regularly discusses with management our major risk exposures, their potential impact on our business and the steps we take to manage them. The risk oversight process includes receiving regular reports from board committees and members of senior management to enable our board of directors to understand the Company’s risk identification, risk management and risk mitigation strategies with respect to areas of potential material risk, including operations, finance, legal, regulatory, strategic, and reputational risk.

The audit and risk committee reviews information regarding liquidity and operations, and oversees our management of financial risks. Periodically, the audit and risk committee reviews our policies with respect to risk assessment, risk management, loss prevention and regulatory compliance. Oversight by the audit and risk committee includes direct communication with our external auditors, and discussions with management regarding significant risk exposures and the actions management has taken to limit, monitor or control such exposures. In addition, the audit and risk committee, among other things, assists our board of directors in overseeing and monitoring the Company’s senior management with carrying out its responsibilities such as identifying and assessing the material risks the company faces, establishing a risk management, crisis management and emergency response plan, overseeing financial, strategic and market risks as well as other risks the Company may face and approving the Company’s enterprise wide risk management framework in conjunction with the board of directors.

The compensation committee is responsible for assessing whether any of our compensation policies or programs has the potential to encourage excessive risk-taking. The nomination and corporate governance committee reviews compliance with external and internal compliance with policies, procedures, and practices consistent with the Company’s amended and restated certificate of incorporation and amended and restated bylaws. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire board of directors is regularly informed through committee reports about such risks. Matters of significant strategic risk are considered by our board of directors as a whole.

Board of Directors Meetings

During the year 2021, our board of directors met five times, including telephonic meetings. In that year, each director attended at least 75% of the total number of meetings held during such director’s term of service by the board of directors and each committee of the board of directors on which such director served.

Board Diversity

Our nominations and corporate governance committee is responsible for reviewing with the board of directors, on an annual basis, the appropriate characteristics, skills, and experience required for the board of directors as a whole and its individual members. In evaluating the suitability of individual candidates (both new candidates and current members), the nominations and corporate governance committee, in recommending candidates for election, and the board of directors, in approving (and, in the case of vacancies, appointing) such candidates, will consider many factors, including the following:

• | Personal and professional integrity, ethics and values; |

• | Experience in corporate management, such as serving as an officer or former officer of a publicly-held company; |

• | Experience as a board member or executive officer of another publicly-held company; |

• | Strong finance experience; |

• | Diversity of expertise and experience in substantive matters pertaining to our business relative to other board members; |

• | Diversity of background and perspective, including, but not limited to, with respect to age, gender, race, sexual orientation, place of residence, and specialized experience; |

• | Experience relevant to our business industry and with relevant social policy concerns; and |

20

• | Relevant academic expertise or other proficiency in an area of our business operations. |

Currently, our board of directors evaluates each individual in the context of the board of directors as a whole, with the objective of assembling a group that can best maximize the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of experience in these various areas. The board values diversity and supports having directors of diverse gender, race, and ethnicity, along with varied skills and experiences. Information regarding the diversity of our board members is outlined in the below table:

OSS Board Diversity Matrix (January 1, 2022) | ||||

Total Number of Directors | 7 | |||

| Female | Male | Non-Binary | Gender Not Disclosed |

Part 1: Gender Identity |

|

|

|

|

Directors | 3 | 4 | 0 | 0 |

Part II: Demographic Background |

|

|

|

|

Hispanic or Latinx | 2 | 0 | 0 | 0 |

White | 1 | 4 | 0 | 0 |

Did Not Disclose Demographic Background | 0 | |||

Communications with our Board of Directors

Stockholders seeking to communicate with our board of directors should submit their written comments to our corporate secretary, One Stop Systems, Inc., 2235 Enterprise Street #110, Escondido, CA 92029. The corporate secretary will forward such communications to each member of our board of directors; provided that, if in the opinion of our corporate secretary it would be inappropriate to send a particular stockholder communication to a specific director, such communication will only be sent to the remaining directors (subject to the remaining directors concurring with such opinion) or specific committees of the board of directors, as applicable.

Corporate Governance

Our Code of Business Conduct and Ethics, Corporate Governance Guidelines, Audit and Risk Committee Charter, Compensation Committee Charter, and Nominations and Corporate Governance Committee Charter are available, free of charge, on our website at www.ir.onestopsystems.com. Please note, however, that the information contained on the website is not incorporated by reference in, or considered part of, this proxy statement. We will also provide a copy of these documents as well as our other corporate governance documents, free of charge, to any stockholder upon written request to One Stop Systems, Inc., 2235 Enterprise Street #110, Escondido, CA 92029.

Conflicts of Interest

Our directors and officers are not obligated to commit their full time and attention to our business and, accordingly, they may encounter a conflict of interest in allocating their time between our operations and those of other businesses. In the course of their other business activities, they may become aware of investment and business opportunities which may be appropriate for presentation to us as well as other entities to which they owe a fiduciary duty. As a result, they may have conflicts of interest in determining to which entity a particular business opportunity should be presented. They may also in the future become affiliated with entities that are engaged in business activities similar to those we intend to conduct.

In general, officers and directors of a corporation are required to present business opportunities to the corporation if:

| • | the corporation could financially undertake the opportunity; |

| • | the opportunity is within the corporation’s line of business; and |

| • | it would be unfair to the corporation and its stockholders not to bring the opportunity to the attention of the corporation. |

21

We have adopted a Code of Business Conduct and Ethics that obligates our directors, officers, and employees to disclose potential conflicts of interest and prohibits those persons from engaging in such transactions without our consent.

Director Compensation

The following table sets forth information for the year ended December 31, 2021, regarding the compensation awarded to, earned by or paid to our non-employee directors who served on our board of directors during 2021.

Name |

| Fees earned or paid in cash ($) |

|

| Stock awards ($) |

|

| RSU awards ($) |

|

| Non-equity incentive plan compensation ($) |

|

| Nonqualified deferred compensation earnings ($) |

|

| All other compensation ($) |

|

| Total ($) |

| |||||||

Ken Potashner |

| $ | 46,000 |

|

| $ | - |

|

| $ | 50,003 |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

| $ | 96,003 |

|

Kimberly Sentovich |

| $ | 40,250 |

|

| $ | - |

|

| $ | 50,003 |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

| $ | 90,253 |

|

Jack Harrison |

| $ | 40,250 |

|

| $ | - |

|

| $ | 50,003 |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

| $ | 90,253 |

|

Greg Matz |

| $ | 40,250 |

|

| $ | - |

|

| $ | 50,003 |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

| $ | 90,253 |

|

Sita Lowman |

| $ | 34,500 |

|

| $ | - |

|

| $ | 50,003 |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

| $ | 84,503 |

|

Gioia Messinger |

| $ | 34,500 |

|

| $ | - |

|

| $ | 50,003 |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

| $ | 84,503 |

|

On March 17, 2022, the annual cash fees payable to our non-employee directors for the 2022 fiscal year was increased by 4%; directors will continue to be entitled to $50,000 of RSUs per annum.

22

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Our Executive Officers

The following table sets forth the names, ages, and positions of our executive officers as of March 31, 2022. There are no arrangements, agreements or understandings between non-management security holders and management under which non-management security holders may directly or indirectly participate in or influence the management of our affairs. There are no arrangements or understandings between any director or executive officer and any other person pursuant to which any director or executive officer was or is to be selected as a director or executive officer, as applicable.

Name |

| Age |

| Position |

Executive Officers |

|

|

|

|

David Raun |

| 60 |

| President, Chief Executive Officer, Director |

John W. Morrison, Jr. |

| 64 |

| Chief Financial Officer, Treasurer and Secretary |

Jim Ison |

| 52 |

| Chief Sales and Marketing Officer |

The biography of David Raun can be found under “Proposal 1 – Election of Directors.”

John W. Morrison, Jr. has served as our chief financial officer since September 1, 2017. Mr. Morrison is a CPA with more than three decades of experience in public accounting and all aspects of financial reporting and financing. From June 2014 to September 2017, he served as the chief financial and operations officer for the Carol Cole Company (“Carole Cole”). Prior to joining Carol Cole, he served as a consultant to various private companies regarding their financial and operational affairs. From January 2013 to September 2013, he served as the chief financial officer of Gen-E, an information technology and services company. Mr. Morrison also served as the executive vice president and chief financial officer for the Kelley Blue Book Company for 11 years. He began his career working 15 years for the public accounting firm PricewaterhouseCoopers (now PwC) both in the U.S. and Asia. Mr. Morrison holds a B.S. in accounting and business management and MACC in Accounting from Brigham Young University.

Jim Ison, has been with OSS since 2004, and currently serves as the Chief Sales and Marketing Officer. Mr. Ison has nearly three decades of combined sales, product management and marketing management experience in leading-edge large-scale electronic systems using breakthrough technologies. His expertise covers government, communications and HPC markets with particular focus on AI applications in unique environments. Prior to joining OSS, Mr. Ison held senior sales and marketing positions for Ziatech and Rittal. During the 17 years he has served in a management role at OSS, he has led the technological evolution. Mr. Ison holds a bachelor’s degree in Aeronautical Engineering from CalPoly SLO and an MBA from University of Florida.

Overview

This section discusses the material components of the executive compensation program for our executive officers who are named in the “Summary Compensation Table” below. In 2021, our “named executive officers” and their positions were as follows:

| • | David Raun, President and Chief Executive Officer |

| • | John W. Morrison Jr., Chief Financial Officer, Treasurer and Secretary |

| • | Jim Ison, Chief Sales and Marketing Officer |

This discussion may contain forward-looking statements that are based on our current plans, considerations, expectations, and determinations regarding future compensation programs. Actual compensation programs that we adopt in the future may differ materially from the currently planned programs summarized in this discussion.

23

Summary Compensation Table

The following table provides information regarding the total compensation for services rendered in all capacities that was earned by each individual who served (i) as our principal executive officer at any time during 2021, and (ii) our two most highly compensated executive officers other than our principal executive officer who were serving as executive officers as of December 31, 2021. David Raun became a named executive officer effective February 15, 2020.

Name and Principal Position |

| Year |

| Salary ($) |

|

| Bonus ($) |

|

| Option Awards ($) (1) |

|

| Non-Equity Incentive Plan Compensation ($) |

|

| All Other Compensation ($) (2) |

|

| Total ($) |

| ||||||

David Raun (3) |

| 2021 |

| $ | 345,000 |

|

| $ | 77,625 |

|

| $ | - |

|

| $ | - |

|

| $ | 30,730 |

|

| $ | 453,355 |

|

President and Chief Executive Officer |

| 2020 |

| $ | 282,116 |

|

| $ | - |

|

| $ | 1,696,019 |

|

| $ | - |

|

| $ | 23,128 |

|

| $ | 2,001,263 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jim Ison |

| 2021 |

| $ | 269,618 |

|

| $ | 55,939 |

|

| $ | 317,350 |

|

| $ | - |

|

| $ | 33,980 |

|

| $ | 676,887 |

|

Chief Sales and Marketing Officer |

| 2020 |

| $ | 264,816 |

|

| $ | 74,973 |

|

| $ | 40,500 |

|

| $ | - |

|

| $ | 31,650 |

|

| $ | 411,938 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John W. Morrison Jr. |

| 2021 |

| $ | 285,962 |

|

| $ | 95,675 |

|

| $ | 346,200 |

|

| $ | - |

|

| $ | 33,415 |

|

| $ | 761,252 |

|

Chief Financial Officer |

| 2020 |

| $ | 285,574 |

|

| $ | 113,194 |

|

| $ | 40,500 |

|

| $ | - |

|

| $ | 31,957 |

|

| $ | 471,224 |

|

(1) | Amounts reflect the full grant-date fair value of stock awards granted during the relevant fiscal year computed in accordance with ASC Topic 718, rather than the amounts paid to or realized by the named individual. We provide information regarding the assumptions used to calculate the value of all stock awards and option awards made to our officers in Note 10 to the audited consolidated financial statements for the year ended December 31, 2021. |

(2) | Represents payment of health insurance premiums and 401(k) contributions. |

(3) | Mr. Raun was appointed interim chief executive officer on February 15, 2020, and was appointed president and chief executive officer on June 24, 2020. |

Narrative Disclosure to Compensation Tables

Employment Agreements

Executive Employment Agreement with David Raun