Exhibit 99.1

| North America’s Next Growth Story in Gold Mining |

| |

Randall Oliphant, Chairman |

Fellow shareholders:

Setting and meeting objectives for our shareholders is a commitment at Western Goldfields Inc. During the past year, we moved smoothly and rapidly from a developer to a producer, we added to our financial strength, and we made solid progress in communicating these milestones to investors. As a result, the market has begun to re-rate our share price upward to reflect our status as a producer. For 2008 and beyond, we intend to build on this progress with a singular vision in mind: to become North America’s next growth story in gold mining.

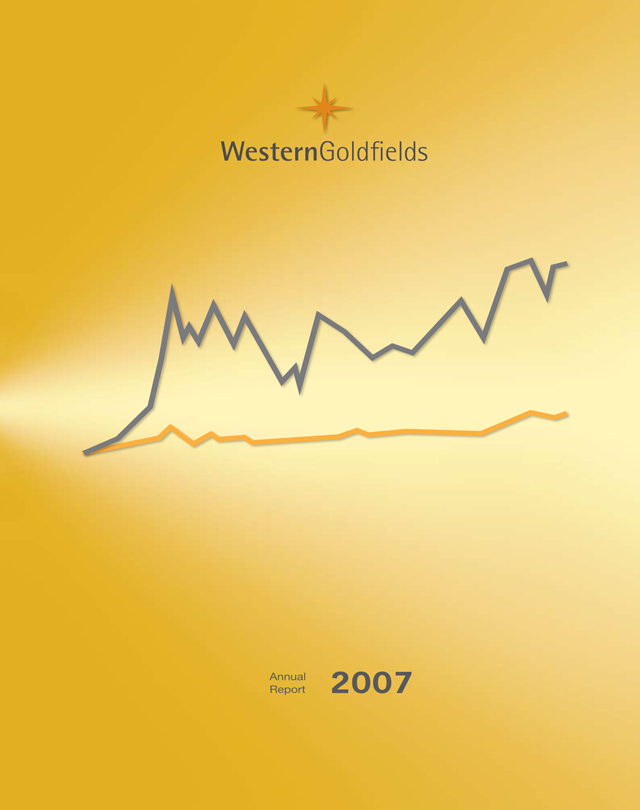

As a major shareholder myself, I can attest that the ultimate measure of our success is our stock’s performance. So far, so good. In 2006, our share price rose approximately 1,100 percent on the NASD bulletin board, following the arrival of your new management team at the Company. In 2007, our price rose 37 percent on the Toronto Stock Exchange, significantly outpacing the average performance of our peer group.

In the past two years, the Company’s capitalization has risen from less than $10 million to $440 million. While past performance is satisfying, it is the potential for share appreciation ahead, as we continue delivering on our commitments, which is of greatest interest to shareholders.

A year of achievements…

With an eye on results and little regard for fanfare, Chief Executive Officer Ray Threlkeld and the rest of our management team met their objectives. They brought our premier asset, the Mesquite Mine in California, into full production in January this year, three months ahead of schedule and on budget. Their achievement, carried out in just 17 months from feasibility study to production, called on the exceptional breadth of experience they bring to the table, ranging from mine financing and project economics, to technical and operational expertise. On behalf of shareholders, I would like to congratulate Ray, as well as the rest of our senior management team, Brian Penny, Chief Financial Officer; Paul Semple, Vice President of Projects; and Wesley Hanson, Vice President of Mine Development.

Dilution minimized by financial flexibility: Financially, we took several initiatives to fully fund our plans for 2007 and 2008. We raised a net $92.6 million in two equity offerings during the year, and finalized a $105 million credit facility in June. In doing so, we have made full use of our financial flexibility, keeping the interests of our shareholders foremost in mind. By employing the debt facility, we minimized the significant dilution that further equity sales would have entailed. In approximate terms, using equity instead of debt to raise $105 million would have required us to issue another 48 million shares, using the stock price in mid-June last year. Based on our year-end 2007 share price of $3.80, those 48 million shares would be worth about $182 million. Our choice was to avoid that dilution. I am pleased to note to that every shareholder who has participated in our equity offerings is in the money.

…and increased market reach.

During the year, we took steps to extend our market reach and increase liquidity. In November, we were listed on the American Stock Exchange, adding to our existing listing on the Toronto Stock Exchange. Notably, in December, Standard & Poor’s Index Operations included Western Goldfields in the S&P/TSX Global Gold Index and Global Mining Index, which are leading benchmarks of the global gold and mining industry sectors.

Western Goldfields Inc. Annual Report 2007 1

Western Goldfields Inc. Annual Report 2007 1

Expanding analyst coverage: We have made significant strides in increasing our market profile, in terms of an expanded shareholder base, larger trading volumes, and steadily increasing analyst coverage. The growing roster of analysts following the Company rank among the most respected in the industry. The re-rating of our shares to reflect our producer status is underway, but there is still a valuation gap to close. In terms of one useful measure, Enterprise Value per reserve ounce, our valuation went from $77 per ounce in June 2007 to $190 per ounce in December 2007. The latter figure compares to an average of $310 per ounce among our gold-producing peers, so there is room for nearterm appreciation in our share price, as well as longer term gains as we implement our growth plans.

A base to build on…

With a platform for growth in place, operationally and financially, we have now turned our attention to building on it in 2008 and beyond. As we do so, we have several factors working in our favor that I would like to highlight.

A strong gold price environment: In recent months, gold has been trading at new nominal highs, accompanied by a broader rise in commodity prices. We are witnessing the impact on the gold price of falling global mine supply and growing demand, the spread of prosperity to the goldbuying public in key developing countries, geopolitical tensions, and the weakening of the US dollar. WGI is fortunate to be one of the few gold companies that does business in US dollars, reporting revenues and incurring input costs in that currency. The only companies that wholly benefit from the gold price rise, as the US currency declines in value, are those whose revenues and input costs are priced in US dollars.

Cash flow leveraged to the gold price: We have tremendous leverage to a rising gold price. At $800 gold, our average annual cash flow over the coming eight years is projected to be $50.8 million, at $900 gold - $58.1 million and at $1,000 gold - $65.5 million. These projections take into account that, under the terms of our debt facility, we have arranged flat forward sales contracts for 66,000 ounces a year at $801 an ounce over 6.5 years. That income virtually covers our operating costs each year at the Mesquite Mine, while leaving 77 percent of current recoverable reserves, or about 100,000 ounces of production a year, leveraged to the gold price.

An exceptional Board of Directors: Your Company has a Board of Directors with qualities to inspire confidence in any shareholder. As shareholders themselves, they bring a keen sense of engagement to the Company’s affairs, as well as a shared entrepreneurial spirit and diverse range of experience. Their backgrounds span senior positions in investment banking, stock regulation and resource investment. We are fortunate to have the guidance of Vahan Kololian, Martyn Konig, and Gerald Ruth.

… and positioned for growth

Looking for more gems: With Mesquite up and running, your senior management team is assessing further opportunities, drawing on our broad network of contacts in the industry. In a sense, Mesquite was a proverbial “diamond in the rough” back in 2006, largely overlooked and undervalued. We saw its potential and moved to realize it, with the result that Mesquite is now a gem of an asset for Western Goldfields. We are looking for more opportunities like Mesquite. Our focus is on assets that have attractive economics and are low-risk, in that they are located in politically stable North America and are mineable with proven technologies. We also take a financially disciplined approach. We will only target additional assets that would be accretive to shareholders. This means prospective assets must have a lower enterprise-value-per-ounce basis than WGI, and trade at a lower net-asset-value multiple.

Shareholders should expect to see us build on our track record in coming months. We have a checklist of milestones that are not yet complete. Our milestones are:

To delineate Mesquite’s full resource and production potential;

To fully realize the upward re-rating of our share price to reflect our transition from developer to producer; and most importantly,

To add to shareholder returns through our growth strategy.

We expect that shareholder patience, as we target this checklist, will be rewarded.

Western Goldfields is moving forward on all fronts – gold production is underway, our stock is beginning to reflect our success, and we have a well-honed strategy to realize our vision. If what we are trying to achieve galvanizes us; why we are trying to achieve it inspires us – and that is to generate attractive returns for our shareholders.

Randall Oliphant,

Chairman

March 2008

Western Goldfields Inc. Annual Report 2007 2

Western Goldfields Inc. Annual Report 2007 2

| Achieving our vision with unique strengths and a well-honed approach |

| |

Ray Threlkeld, President and Chief Executive Officer |

Fellow shareholders:

During 2007, we made considerable progress in building Western Goldfields Inc. into the exceptional Company we envision. I am pleased to report that we met or exceeded every operational objective we set, which is the fundamental measure by which the capital markets assess, and reward our performance. The main significance of last year’s progress, however, lies not in what we have achieved, but in how it positions us to move ahead with our plans for growth.

A sense of momentum…

There is a sense of momentum at your Company, driven by our successful transition from developer to producer at the Mesquite Mine early this year, and the potential we see to add comparable assets where we can enhance value and repeat our success. Our senior management team is now redeployed on the search for other opportunities, while our team on the ground at Mesquite is focused on fine-tuning operations and adding to its production potential.

…with our vision in mind…

We are working toward an exceptional vision for Western Goldfields, as North America’s next growth story in gold mining, but my confidence in our ability to achieve it rests on solid ground – the unique strengths that distinguish your Company from its peers. Our premier asset, Mesquite, is the only multi-million-ounce gold deposit in the United States not controlled by a major producer. Our acquisition strategy is singularly focused on low-risk assets located in North America. Our management team is second to none, based on their breadth of experience in developing and operating mines around the world. They possess a critical blend of experience and initiative, discipline and dynamism that investors can take confidence in.

…and a three-phased approach.

With these strengths providing us with a competitive advantage, we are taking a systematic, three-phased approach to growth, with one ultimate goal in mind – generating attractive returns for shareholders.

Phase One, moving from a developer to a producer:

We marked this milestone in January with the first gold pour of 2008 at our Mesquite refinery. The mine is now up and running, with a fully permitted mine and processing site. Production for the first quarter is expected to be 10,000-13,000 ounces, and for the second quarter, 40,000-50,000 ounces, as we ramp up to production of 155,000-165,000 ounces of gold for the year.

Mesquite is a large, world-class gold deposit, where, back in 2006, we saw significant upside potential to increase reserves and return the operation to full production. It has certainly lived up to our expectations. Our plans for enhancing the mine progressed without a hitch.

Firstly, we hit our budget targets. During 2007, capital spending on Mesquite was $98.4 million, with the remainder of $109.2 million in development capital spent in the first quarter of 2008, bringing the total within one percent of the development plan budget.

Secondly, we successfully refurbished the operation with new facilities and a modern mining fleet. Upon full completion in early April, we will have invested $73.6 million to acquire a new mining fleet, $19.4 million to construct a new heap leach pad, and $16.2 million to refurbish plant and infrastructure, including a new truck shop and processing facilities. On the environmental front, it is notable that we opted to purchase a mining fleet with improved emission standards that are compliant with future California air quality standards.

Western Goldfields Inc. Annual Report 2007 3

Western Goldfields Inc. Annual Report 2007 3

Thirdly, we have expanded resources, inclusive of reserves, at Mesquite to 4.3 million ounces, up from a previously announced 3.9 million ounces. The rise reflected both our drilling success and an increase in our gold price assumption from $600 to $650 an ounce. During 2007, drilling results confirmed the excellent potential for additional resources at Brownie Hill, where we targeted a new oxide resource discovered last year. The results added approximately 200,000 ounces of gold to reserves, which now stand at about 2.8 million ounces.

I would like to congratulate the team on the ground who carried out these achievements, particularly, Cory Atiyeh, Vice President and General Manager; Mine Manager Chuck Geary; Arnold DeHerrera in Processing; and Mary Munoz in Human Resources.

Phase Two, maximizing the potential of Mesquite:

This second phase is already well underway, and involves two thrusts.

The first thrust entails identifying further resources at Mesquite and bringing them into production. During 2008, we will spend approximately $1 million on additional definition and exploration drilling at Brownie Hill, a program that began in February. Our drilling at Brownie Hill is targeting new oxide mineralization, which is amenable to heap leaching. However, there is another dimension to Mesquite’s resource potential. In drilling at the Vista zone, we confirmed the presence of a large nonoxide system external to the current reserve pits. We are investigating the potential for bringing this extensive nonoxide mineralization into production with the right processing technology at attractive recovery rates.

The second thrust involves fine-tuning the operation, through the continuous improvement of our methods and processes. This is all the more important in the face of the numerous cost pressures that arise in this business. The key is to deal with them decisively, which is what we are doing. For 2008, our cost of sales is expected to average $410-$430 an ounce. Part of that increase is non-operational – an accounting adjustment in the value of our stockpiled ore added $25-$30 an ounce to cost of sales. As well, labour and fuel costs rose as we added a fourth crew of truck operators to make up for poorly performing truck tires that required reduced speeds. In the future, as steady state production is achieved, the inventory adjustment cost will diminish. We also plan to purchase better performing radial truck tires that will permit increased speeds, allowing Mesquite to lower the cost of production. For 2009, we expect cost of sales to be on plan at $360-$370 per ounce.

Phase Three, growth through acquisitions:

This phase holds the most exciting potential for shareholders. It will play out over coming months as we bring our energies to bear on identifying opportunities for growth within North America. The rest of the management team and I look forward to fresh opportunities to enhance the value of such assets and bring them into our production stream.

In closing, I am confident that Western Goldfields can implement its three-phased plan for growth smoothly; a confidence based on this Company’s unique strengths and steadfast commitment to our goals. We have shown at Mesquite what we mean by translating opportunity into actuality, and we’ve just begun. Our track record at Mesquite so far is a blueprint for the future. We intend to repeat that success as we identify and act on other opportunities that arise.

Ray Threlkeld,

President and Chief Executive Officer,

March 2008

Western Goldfields Inc. Annual Report 2007 4

Western Goldfields Inc. Annual Report 2007 4UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.20549

FORM 10 - KSB

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2007

OR

oTRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from – to –

Commission File Number: 000 - 51076

WESTERN GOLDFIELDS INC.

(Name of Small Business Issuer in its Charter)

| Ontario, Canada | | 98 - 0544546 |

| (State or Other Jurisdiction of | | (I.R.S. Employer Identification No.) |

| Incorporation or Organization) | | |

| | | |

| 2 Bloor Street West, Suite 2102, PO Box 110 | | |

| Toronto, Canada | | M4W 3E2 |

| (Address of Principal Executive Office) | | (Zip Code) |

Registrant’s telephone number, including area code: (416) 324 - 6000

Securities registered under Section 12(b) of the Exchange Act: None

Securities Registered pursuant to Section 12 (g) of the Act: Common Stock

(Title of Class)

Check whether the issuer is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. o

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act during the past 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past ninety (90) days. Yes xNo o

Check if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-B contained in this form, and no disclosure will be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-KSB or any amendment to this Form 10-KSB o.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

State issuer’s revenues for its most recent fiscal year: $4,665,890

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the issuer as of February 29, 2008 was $479,400,000. For purposes of this computation, all executive officers, directors and 10% shareholders were deemed affiliates. Such a determination should not be construed as an admission that such 10% shareholders are affiliates.

As of February 29, 2008 there were 136,174,686 shares of common stock of the issuer issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None

Transitional Small Business Disclosure Form at (check one): Yes oNo x

Western Goldfields Inc. Annual Report 2007 5

Western Goldfields Inc. Annual Report 2007 5Table of Contents

| | | | Page |

PART I | | | |

| | | | |

| Item 1. | Description of Business | | 8 |

| | | | |

| Item 2. | Description of Properties | | 32 |

| | | | |

| Item 3. | Legal Proceedings | | 32 |

| | | | |

| Item 4. | Submission of Matters to a Vote of Security Holders | | 33 |

| | | | |

PART II | | | |

| | | | |

| Item 5. | Market for Common Equity, Related Stockholder Matters and Small Business Issuer Purchases of Equity Securities | | 34 |

| | | | |

| Item 6. | Management’s Discussion and Analysis and Results of Operations | | 36 |

| | | | |

| Item 7. | Financial Statements | | 54 |

| | | | |

| Item 8. | Changes in and Disagreements with Accountants on Accounting and Financial Statements | | 78 |

| | | | |

| Item 8A. | Controls and Procedures | | 78 |

| | | | |

| Item 8B. | Other Information | | 79 |

| | | | |

PART III | | | |

| | | | |

| Item 9. | Directors, Executive Officers, Promoters, Control Persons and Corporate Governance; Compliance with Section 16(a) of the Exchange Act | | 80 |

| | | | |

| Item 10. | Executive Compensation | | 83 |

| | | | |

| Item 11. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 87 |

| | | | |

| Item 12. | Certain Relationships and Related Transactions, and Director Independence | | 88 |

| | | | |

| Item 13. | Exhibits | | 89 |

| | | | |

| Item 14. | Principal Accountant Fees and Services | | 89 |

Western Goldfields Inc. Annual Report 2007 6

Western Goldfields Inc. Annual Report 2007 6

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

We have included and from time to time may make in our public filings, press releases or other public statements, certain statements, including, without limitation, those under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 6. In some cases these statements are identifiable through the use of words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “project,” “target,” “can,” “could,” “may,” “should,” “will,” “would” and similar expressions. You are cautioned not to place undue reliance on these forward-looking statements. In addition, our management may make forward-looking statements to analysts, investors, representatives of the media and others. These forward-looking statements are not historical facts and represent only our beliefs regarding future events and, by their nature, are inherently uncertain and beyond our control.

The nature of our business makes predicting the future trends of our revenues, expenses and net income difficult. The risks and uncertainties involved in our businesses could affect the matters referred to in such statements and it is possible that our actual results may differ materially from the anticipated results indicated in these forward-looking statements. Important factors that could cause actual results to differ from those in the forward-looking statements include, without limitation:

| · | the effect of political, economic and market conditions and geopolitical events; |

| · | the actions and initiatives of current and potential competitors; |

| · | other risks and uncertainties detailed elsewhere throughout this report. |

Accordingly, you are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made. We undertake no obligation to update publicly or revise any forward-looking statements to reflect the impact of circumstances or events that arise after the dates they are made, whether as a result of new information, future events or otherwise except as required by applicable law. You should, however, consult further disclosures we may make in future filings of our Annual Reports on Form 10-K/SB, Quarterly Reports on Form 10-Q/SB and Current Reports on Form 8-K, any amendments thereto, available on the Securities and Exchange Commission website at www.sec.gov, and in the corresponding documents filed in Canada.

CAUTIONARY NOTE TO U.S INVESTORS CONCERNING ESTIMATES OF MEASURED, INDICATED AND INFERRED RESOURCES

This 10-KSB uses the terms “measured”, “indicated” and/or “inferred” mineral resources. United States investors are advised that while such terms are recognized by Canadian regulations, the United States Securities and Exchange Commission does not recognize them. United States investors are cautioned not to assume that all or any part of mineral resources will ever be converted into mineral reserves. Inferred mineral resources have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies. United States investors are cautioned not to assume that all or any part of an inferred mineral resource exists, or is economically or legally mineable.

Western Goldfields Inc. Annual Report 2007 7

Western Goldfields Inc. Annual Report 2007 7Item 1. Description of Business

(a) Business Development

We were formed pursuant to a reorganization completed in June 2007 whereby our predecessor, Western Goldfields, Inc., an Idaho corporation (“WGI Idaho”), became our wholly-owned subsidiary as a result of a merger with a newly created subsidiary company, Western Goldfields (USA) Inc., a Nevada Corporation. WGI Idaho was incorporated as Bismarck Mining in the State of Idaho in 1924 and changed its name to Western Goldfields, Inc. in July 2002. We are an independent gold producer focused on completing the expansion of the Mesquite Mine (“Mesquite” or the Mine”) in Imperial County, California.

In early 2003, we acquired Mesquite from Hospah Coal Company (“Hospah”), a wholly-owned subsidiary of Newmont Mining Corporation (“Newmont”), pursuant to an asset purchase agreement. These assets are now held by our wholly-owned subsidiary, Western Mesquite Mining Inc. The transaction included:

| · | Assumption of reclamation and closure liabilities at the property, estimated at $6,000,000; |

| · | Provision of approximately $7,800,000 in reclamation bonds to various governmental authorities replacing equivalent bonds previously provided by Newmont. In January 2007 and May 2007, we were notified that the required amount of bonding had been increased to $8,600,000 and $11,300,000, respectively; |

| · | Issuance of additional common shares and warrants to purchase our common shares valued at approximately $3,100,000. As a result of the transaction, Hospah acquired 3,454,468 of our common shares and warrants to purchase an additional 8,091,180 of our common shares. On April 18, 2005, Hospah surrendered warrants to purchase 2,035,000 of our common shares; |

| · | The grant to Hospah of a perpetual net smelter return royalty ranging, according to location, from 0.5% to 2.0% on any newly mined ore; and |

| · | The grant to Hospah of a net operating cash flow royalty equal to 50% of the proceeds received from the sale of gold and silver produced from materials in place on the heap leach pads on the date of the acquisition, less certain operating costs, capital expenses and other allowances and adjustments. |

Mesquite is our most important asset, and provided us with current gold production from material that was placed on the heap leach pads by Newmont and previous owners of the property until late 2007. The gold produced provided us with operating cash flow. In January 2008 we commenced operations for the production of gold from ore placed on the leach pads in the second half of 2007.

In 2007 we completed the financing required for the development of the Mesquite Mine to bring it back into full production based on the feasibility report completed in August 2006. See “Our Feasibility Study” below and “Cautionary Notice Regarding Forward-Looking Statements.”

In early 2006, we conducted a review of certain of our other exploration properties which were located in California, Idaho and Nevada. Based on the outcome of this review, we disposed of these exploration properties on June 19, 2006.

New Management and Private Placement Financing

On February 13, 2006, we announced the restructuring of our Board of Directors and the appointment of a new senior management team, including Mr. Randall Oliphant as Chairman of the Board, Mr. Raymond Threlkeld as President and Chief Executive Officer, Mr. Brian Penny as Chief Financial Officer and Mr. Paul Semple as Vice President of Projects. On February 20, 2006, we announced the completion of a $6,000,000 private placement of our common stock. The proceeds from this private placement were used:

| · | to repay in full our outstanding debt facility of $1,500,000 plus accrued interest; |

| · | to pay $1,953,257 to Romarco Minerals Inc. in full satisfaction of amounts owing upon termination of a merger agreement with that company; |

Western Goldfields Inc. Annual Report 2007 8

Western Goldfields Inc. Annual Report 2007 8

| · | to pay costs of approximately $821,000 for the completion of the Mesquite feasibility study; and |

| · | the balance for general corporate purposes. |

Feasibility Study and Subsequent Developments

On August 9, 2006, we announced the completion of a positive feasibility study to expand the operation of our Mesquite mine property. We also announced proven and probable reserves of 2.36 million ounces of gold. See “Our Feasibility Study”. Accordingly, we have begun to capitalize costs considered to be development of the Mesquite mineral property.

Since completion of the feasibility study, our primary focus has been on obtaining financing for and completing the expansion of the Mine. We expect to complete the expansion project in the second fiscal quarter of 2008. On August 28, 2006, our common shares commenced trading on the Toronto Stock Exchange under the symbol WGI, and on November 8, 2007, our common shares commenced trading on the American Stock Exchange under the symbol WGW.

On November 21, 2006, we announced that the Board of Directors had approved capital expenditures for the mining fleet totaling $67.0 million and that we had issued purchase orders totaling $60.9 million.

On November 30, 2006, we announced the signing of a mandate letter with Investec Bank (UK) Limited to arrange and underwrite up to $105 million of project debt and that we had received an indicative term sheet.

On December 13, 2006, we announced positive initial results from the exploration drilling program underway at the Mesquite Mine.

On January 25, 2007, we sold 31,115,000 shares of common stock pursuant to a prospectus supplement to our shelf prospectus, which we filed in October 2006 for gross proceeds of approximately $59.4 million and net proceeds of approximately $55.2 million. On February 1, 2007, we sold a further 2,215,000 shares of common stock pursuant to a prospectus supplement to our shelf prospectus, for gross proceeds of approximately $4.2 million and net proceeds of approximately $4.0 million. These shares of common stock were issued upon the exercise of the underwriter’s over allotment option. We have been using the proceeds from this offering to finance our ongoing activities at Mesquite, including the acquisition of the majority of the mining equipment fleet, as well as for general corporate purposes.

On March 30, 2007, the Company, through its wholly-owned subsidiary, Western Mesquite Mines, Inc., entered into a new term loan facility with Investec Bank (UK) Limited under which the Company will be able to borrow up to $105.0 million in connection with the development of the Mesquite Mine. Interest on advances will be at U.S. LIBOR plus 2.2% until completion (as defined in the credit agreement) and 1.75% after completion. Completion is expected to occur during the second half of 2008. The agreement, in conjunction with the earlier equity financing, completed the financing requirements for Mesquite. The Company anticipates drawing $87.3 million to complete the Mesquite development plan. As of December 31, 2007, $76.5 million had been drawn and a further $2.7 million was drawn on February 7, 2008.

On October 12, 2007 we completed an offering of an aggregate of 11,316,000 common shares of the Company, no par value, at Cdn$3.05 per share pursuant to a short form prospectus filed in Canada. The offering was not registered in the United States. The gross proceeds received from this offering were $35.0 million and the net proceeds were approximately $33.4 million. We plan to use the proceeds from this offering to finance regional exploration activities, carrying out testing on the non-oxide resources, corporate development activities and for general working capital purposes.

Hedging Activities

Our preferred approach is to avoid hedging and provide our shareholders with leverage to changes in the price of gold by selling in the spot market. Under the terms of the term loan facility which we negotiated in early 2007, we were required to enter into a gold hedging program acceptable to the banking syndicate. In June, 2007 we entered into a series of flat forward sales contracts for 429,000 ounces of gold at a price of $801 per ounce. These hedging contracts represent a commitment of 5,500 ounces per month for 78 months commencing July 2008 with the last commitment deliverable in December 2014.

Western Goldfields Inc. Annual Report 2007 9

Western Goldfields Inc. Annual Report 2007 9The Company has not designated these contracts as cash flow hedges. Accordingly the hedge accounting rules of SFAS No. 133 are not being applied and the period-end mark-to-market of these contracts is immediately reflected on the income statement of the Company and the cumulative effect is reflected as an asset or liability on the balance sheet. At December 31, 2007, the spot price for gold was $836 per ounce as compared with our forward sale price of $801, which resulted in our recording an unrealized loss and a long term liability of $58.9 million.

Reorganization

On June 19, 2007 the shareholders of our predecessor company, Western Goldfields, Inc., an Idaho corporation (“WGI Idaho”), approved an agreement and plan of merger which became effective June 29, 2007 whereby our place of incorporation was changed from Idaho, USA to Ontario, Canada, and our name was changed from Western Goldfields, Inc. to Western Goldfields Inc. (or “WGI Ontario”). We believe that the reorganization allows us to take advantage of financial and other business opportunities that would not be available under our previous corporate structure, including: being able to complete transactions requiring shareholder approval more quickly; having a higher profile in the Canadian markets, as we will now be considered a “mid-cap” Canadian company and, being a more attractive investment to a wider range of Canadian investors, while still being able to access U.S. capital markets.

On completion of the reorganization, the shares of common stock in Western Goldfields, Inc. (the predecessor Idaho corporation) automatically became an equal number of common shares of no par value in Western Goldfields Inc. (the successor Ontario corporation) and the economic ownership of shareholders in the new company remained unchanged.

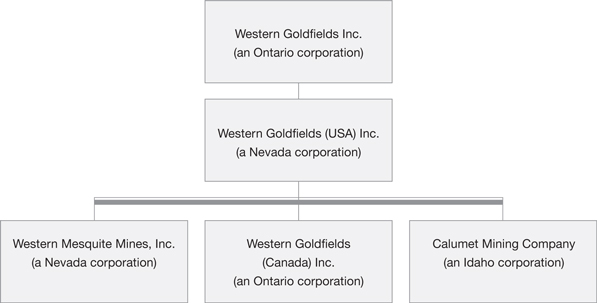

The Company’s four wholly owned subsidiaries are now: Western Goldfields (USA) Inc. (a holding company), Western Goldfields (Canada) Inc. (a management company), Western Mesquite Mines, Inc. (an operating company), and Calumet Mining Company (an exploration company).

Our current corporate structure is as follows:

(b) Business of the Issuer

We are an independent gold production and exploration company with a focus on precious metal mining opportunities in North America. Currently the Mesquite Mine is our sole mineral property. Mesquite is a lowgrade, open-pit operation employing heap leach pad technology which we acquired in November 2003 from Newmont. The mine is fully permitted.

From late 2003 until late 2007, the Mine provided us with residual gold production from material that had been placed on the heap leach pads by Newmont and previous owners of the property. This production provided us with some operating cash flow to help sustain our operations pending the reactivation of the Mine. In January 2008 we commenced operations for the production of gold from ore placed on the leach pads in the second half of 2007.

Western Goldfields Inc. Annual Report 2007 10

Western Goldfields Inc. Annual Report 2007 10

After a change in the management team and the provision of interim new financing in February 2006, in August 2006 we completed a feasibility study for expansion and operation of Mesquite based on proven and probable reserves of 2.36 million ounces of gold. The feasibility study provided grounds to resume mining operations and to expand existing, inactive open pit mines on the property. See “Our Reserves”.

In 2006 we also conducted a review of certain of our other exploration properties. Based on the outcome of this review, we disposed of these exploration properties on June 19, 2006.

Since completion of the feasibility study, our priority has been to finance the development of the Mesquite Mine and bring it back into full production. We achieved both these objectives by December 31, 2007. The Mine is now fully funded and we anticipate average annual production between 150,000 - 170,000 ounces of gold during the first eight years of the twelve year mine life. Full production at the Mine resumed in January 2008 and our focus is now on achieving the anticipated rate of production and completing planned improvements to the property.

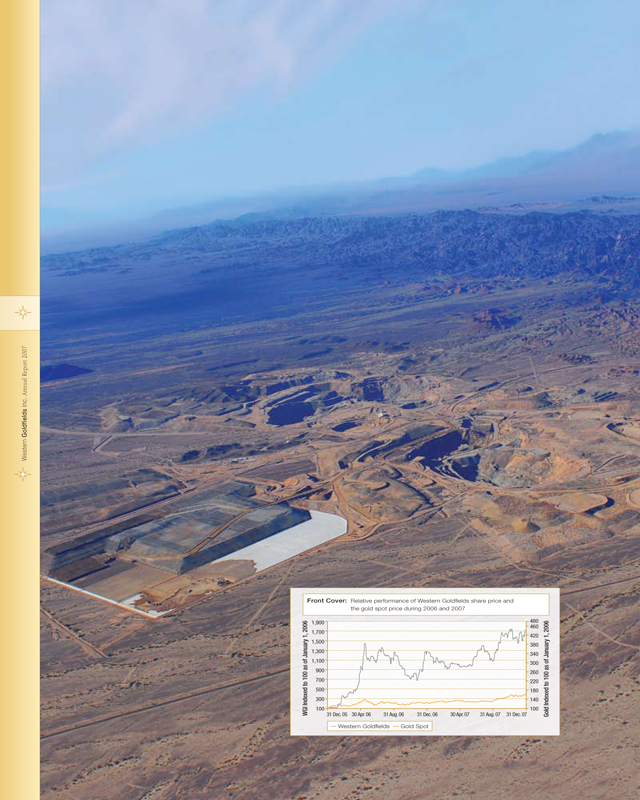

In late 2006 we embarked on an expansion capital expenditure program of $108.6 million to acquire the mobile mining fleet and carry out several major infrastructure projects necessary to bring Mesquite back into full production. The fleet includes 14 haul trucks, 2 shovels, 1 front end loader and several ancillary items. Commencing in the Spring of 2007 we started to take delivery of the mining units and by year-end all the units had been placed into service. The major items in the construction program are the leach pad expansion, retrofit of the process plant, and construction of a truck repair shop, warehouse and mine operations administrative office. Much of this work had been completed by December 31, 2007 and we expect the remaining tasks to be completed early in the second quarter of 2008. The expansion program has gone according to plan and is on budget; on the basis of progress in the construction program, we were able to accelerate the start of gold production at Mesquite to January 2008, three months ahead of the original schedule.

On March 26, 2007 we announced that we had increased proven and probable reserves at Mesquite from 2.36 million ounces of gold to 2.77 million ounces. Approximately 50% of the increase is attributable to assay results from a drilling program of 27 holes at the Brownie Hill area of the mine which converted inferred oxide resources to proven and probable reserves, and the remaining 50% is attributable to an increase in the reserve gold price assumption from $450 to $500 per ounce. At December 31, 2007, proven and probable reserves were estimated to be 2.76 million ounces, reflecting production depletion from the March 2007 estimates.

Our current operations involve circulating cyanide solution through the heap leach pads. The gold and silver in solution is then extracted by processing the “pregnant” solution through activated carbon which is then periodically treated to recover the gold and silver into dore. The dore is then transported to Johnson Matthey Inc. for further refining to 99.99% pure bullion.

We sell our gold production to bullion dealers and refiners. In 2007, our sales of $4.7 million were exclusively to one customer. In 2006, sales to two customers were $6.9 million and $0.9 million, respectively.

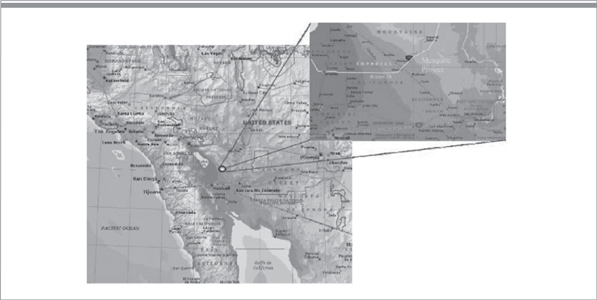

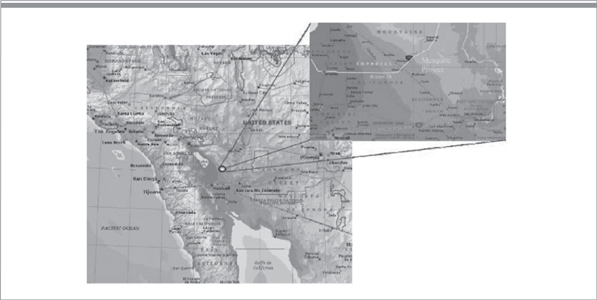

Description of the Mesquite Mine

The Mine property is located primarily in Sections 3-10 and 15-19, Township 13 South, Range 19 East, SBB&M, south of the Chocolate Mountains in Imperial County, California, approximately 35 miles east of Brawley, California, and 45 miles northwest of Yuma, Arizona, just north of the Mexican border at an elevation of between 600 and 1,000 feet above sea level. The property consists of 309 unpatented mining and millsite claims located on federal land administered by the Bureau of Land Management (“BLM”), approximately 170 patented tracts that are privately owned, and one piece of school trust lands leased from the California State Lands Commission (“State”). Part of the property is operated by Western Mesquite Mines, Inc. (“WMMI”) for mining purposes and part is operated by County Sanitation District No. 2 of Los Angeles (“LACSD”) for a regional landfill facility. The rights and obligations of WMMI and the LACSD are contained in a Mineral Lease and Landfill Facilities Lease Agreement dated June 25, 1993 (“the Landfill Agreement”). The term of the Landfill Agreement is 31 years commencing June 25, 1993, and so long thereafter as WMMI continues to mine or process ore on the property, but not to exceed 85 years in total.

Western Goldfields Inc. Annual Report 2007 11

Western Goldfields Inc. Annual Report 2007 11

With regard to that part of the property used for mining purposes, portions are privately owned by WMMI, portions consist of unpatented mining and millsite claims on BLM land that are owned (264 claims) or leased (45 claims) by WMMI, and portions are owned by the State and leased by WMMI. The subject leases are as follows:

| | | WMMI leases a group of 40 unpatented mining and millsite claims from the Sanitation District under the terms of the Landfill Agreement. As noted above, the term of that lease is 31 years commencing June 25, 1993, and so long thereafter as WMMI continues to mine or process ore on the property, but not to exceed 85 years in total. |

| | | WMMI leases a group of five unpatented mining claims from Bonnie Kovac, James Harbison and Stephen Galambos Jr. pursuant to a Mineral Lease and Purchase Option dated October 20, 1982. The term of that lease is initially for 21 years and for a period so long thereafter as WMMI continues to exercise certain rights and continues to make minimum advance royalty payments under the lease. |

| | | WMMI leases 657.87 acres of land from the State pursuant to a Mineral Extraction Lease (No. PRC 8039.2) issued October 1, 2002. The term of that lease is ten years with a preferential right to renew for two successive periods not to exceed ten years each upon such reasonable terms and conditions as may be prescribed by the State. |

The overall area covered by the Conditional Use Permit, issued by Imperial County, and the Record of Decision, issued by the BLM, is approximately 5,200 acres. Mining operations are supported by existing infrastructure, a reliable water supply, grid electric power and State Highway 78, which passes close to the Mine. The nearest rail siding is 15 miles away, but the rail line will be extended to the Mine as part of the LACSD landfill project. The property is in a desert region with average annual rainfall of approximately three inches and sparse desert vegetation.

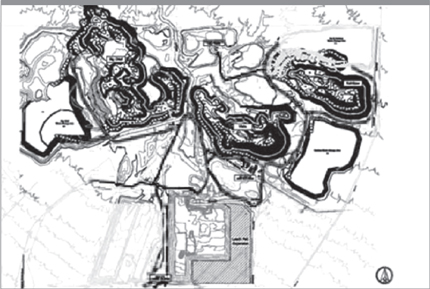

Since mining operations commenced in 1986, three major pits have been developed: Big Chief to the northwest of the property, Rainbow to the northeast of the property, and Vista in between them. The Mine infrastructure is located in the center of the property, feeding two distinct areas of leach pads located to the south on the pediment. Gold recovery and leach pad infrastructure is located to the northeast of the two pad areas and to the south of the mine infrastructure.

Western Goldfields Inc. Annual Report 2007 12

Western Goldfields Inc. Annual Report 2007 12Expansion plan

Newmont developed a Mesquite Mine expansion plan to mine additional mineralized material remaining in-situ and adjacent to the open pits. A Record of Decision (“ROD”) was issued by the U.S. Bureau of Land Management (“BLM”) in 2002, allowing for the expansion of the existing operations. The ROD defines and authorizes future new disturbance that allows for expansion of the Big Chief, Rainbow and Vista open pits. Our feasibility study of August 2006 is the basis for the redevelopment of the mining operations.

Under the terms of our permits, new operations will process run-of-mine ore by expanding the easternmost, Phase 6 leach pads. The feasibility study report set out the mining fleet requirements for pre-production and commercial production. Our fleet acquisition program in 2007 was based on these requirements. Additional investment in the processing facilities, in the amount of $26.5 million, which includes $19.5 million for the heap leach pad expansion and $7 million for new processing facilities and modernization of existing facilities was also included in the expansion. In May 2007, an additional $2.6 million surety bond was posted in respect of future reclamation costs, bringing the total amount subject to such bonds in respect of reclamation costs to $11.3 million. Permit conditions defined by the ROD also include, among other things, the implementation and maintenance of tortoise education programs for employees, the construction of approved tortoise fencing and the provision of 1,394 acres of tortoise habitat within the Chuckawalla Bench Area, an area to the north of Mesquite Mine, to mitigate future disturbance of tortoise habitat. During the fourth quarter of 2006 we provided funds to the appropriate regulatory agencies for the purchase and management of the compensation lands.

Hanson Natural Resources Company (“HNRC”), a previous owner of the Mine, permitted a permanent landfill facility on a portion of the lands occupying the south-west sector of the property. In June 1993, Newmont entered into a mineral lease and landfill facilities lease agreement with HNRC to conduct mining operations concurrently with the proposed landfill operation. HNRC subsequently sold the landfill site to LACSD which proposes to commence landfill operations in 2009. We believe that there are opportunities for synergies between our mining operations and this future landfill operation. This agreement is more fully described in Future Landfill Development, below.

Geology and mineralization

The Mesquite Mining District lies beneath alluvial pediment deposits at the base of the Chocolate Mountains. Small bedrock outcrops were left uncovered by this pediment to form the pre-mine surface exposure of the deposit. Several regional blocks, comprised of distinct rock units, form boundaries to the district.

Lithologies exposed in the southern Chocolate Mountains include Proterozoic granitic and metamorphic rocks, Mesozoic metamorphic and plutonic units, early to mid-Tertiary volcanic and plutonic rocks, and Tertiary to Recent sedimentary units. Proterozoic to Mesozoic units are represented by the Chuckwalla Complex, while the Mesozoic terrain is a structurally complicated package of gneisses, schist, phylitte, and plutons (Manske, 1991). These include the Orocopia Schist, and probable Jurassic Winterhaven Formation, overlain by the Tertiary Quechan Volcanic rocks and Quaternary alluvial deposits. There are three main structural components which appear to have provided conduits for mineralization and offsets to mineralization found at the Mesquite Mine.

The Mesquite mine area is hosted in a Jurassic aged gneiss and pluton terrain. The stratigraphic sequence is, from bottom to top: mafic, hornblende biotite, and biotite gneiss overlain by Bay Horse Quartzite and Muscovite Schist. These units have been crosscut by a number of quartz, feldspar, biotite and muscovite rich granite sills, plutons and dikes. The gneiss units are present in a shallowly dipping stratigraphic sequence, offset by numerous high and low angle faults. This package is overlain by up to 400 feet of Tertiary lithified silts, sands, and gravels and unconsolidated Quaternary gravels.

Northwest trending structures appear to have the greatest control on gold distribution, while the younger northeast trending faults have offset mineralization in a stair step fashion. East west striking near vertical and northwest striking low angle structures are also seen on the property. The system is bounded by structures sub-parallel to the San Andreas Fault system. Deposition of gold was within an epithermal environment along fractures, and the deposit was subsequently oxidized down to around 500 feet below current surface topography. Visible gold has been identified throughout the Mesquite area. Small flakes of free “flour” gold have been found within the fault zones. Gold occurs at Mesquite as both submicron disseminated and coarse gold. All documented gold occurrences are native gold, and classification has been based on silver content and grain size.

Western Goldfields Inc. Annual Report 2007 13

Western Goldfields Inc. Annual Report 2007 13

The ores of Mesquite have proven to be readily amenable to heap leach processing over the past twenty years of operations.

Prior ownership and mining operations

In 1980, Goldfields Mining Corporation (“Goldfields”), began acquiring leases and started an exploratory drill program. In 1982, Goldfields announced it had discovered a bulk mineable gold deposit and the Mine was developed in 1985 with the construction of an open pit mine with heap leach gold recovery that commenced commercial operations in March 1986. In 1989, HNRC acquired Goldfields and subsequently exchanged its wholly owned gold operations for assets held by Santa Fe Pacific Minerals Corporation (“Santa Fe”) in 1993. In 1997, Newmont acquired Santa Fe and continued mining operations until May 2001. Newmont continued depositing ore on the heap leach pads until August 2001. Residual gold was drawn from the leach pads from 2001 until late 2007.

Total gold production from mine inception in 1986 through December 31, 2007 has been approximately 3,000,000 ounces of gold. Production during the final five years of mining operations is set out in the following table:

| | | Ore mined | | Gold production | |

Year | | (000 tons) | | (000 ounces) | |

| 1997 | | | 16,463 | | | 228 | |

| 1998 | | | 11,537 | | | 154 | |

| 1999 | | | 14,087 | | | 165 | |

| 2000 | | | 12,841 | | | 121 | |

| 2001 | | | 4,226 | | | 93 | |

| Total | | | 59,154 | | | 761 | |

Since cessation of mining operations in 2001, production from the residual leach operations has been as

follows:

Year | | Gold Production (000 ounces) | |

| 2002 | | | 57 | |

| 2003 | | | 53 | |

| 2004 | | | 27 | |

| 2005 | | | 22 | |

| 2006 | | | 13 | |

| 2007 | | | 8 | |

| Total | | | 180 | |

Past results are not necessarily indicative of future production; although we anticipate annual production could be vary between 150,000 – 170,000 ounces of gold during the first eight years of a twelve year mine life, there can be no assurance that this production will occur on an economically feasible basis, if at all.

Holding costs and royalty agreements

We pay annual holding costs for our Mesquite properties of approximately $180,000. These include payments to the BLM, maintenance fees to Imperial County, California, state lease fees, a lease payment to LACSD and other lease fees and property taxes.

Previously mined material and any newly mined material at Mesquite will be subject to production royalties

ranging from 2% to 6.8% depending on the location.

Western Goldfields Inc. Annual Report 2007 14

Western Goldfields Inc. Annual Report 2007 14

Newmont retained a 50% interest in the net operating cash flow on ore currently on the pad undergoing residual leaching. No royalty was paid under the contractual agreement in 2006 and 2007. This cash flow royalty was terminated in 2007.

In addition, Newmont retained a production royalty ranging from 0.5% to 2% net smelter return (“NSR”) on any newly mined ore. We started to pay this royalty in respect of our new production in late 2007. This interest was assigned by Newmont to Franco-Nevada U.S. Corporation under an agreement dated December 20, 2007.

Property | | Original Owner | | Newmont | |

| California State Lands Lease | | | 4.0 - 6.0 | % | | 0.5 | % |

| Wade/Kelly Patents | | | 6.3 | % | | 0.5 | % |

| McCrae/Hoover Patents | | | 6.3 | % | | 0.5 | % |

| Glamis & Associates Claims | | | 2.0 | % | | 1.0 | % |

| Hospah Claims (Newmont) | | | — | | | 2.0 | % |

The majority of the property is not subject to production royalties since the original owners’ claims were mined out during earlier mining at Mesquite. The majority of the tons planned for the initial reactivation and expansion of Mesquite will be subject only to the Newmont 2% production royalty.

Mining permits

In May 2001, Newmont ceased mining at Mesquite. Permits for a proposed expansion were obtained by Newmont in early 2002 and include a Conditional Use Permit from Imperial County, California, dated March 27, 2002 and a Record of Decision from the Bureau of Land Management dated July 16, 2002. These permits were covered by our Asset Purchase Agreement of November 7, 2003 with Newmont and were fully transferred to us in April 2004. In addition, in February 2002, Newmont prepared a reclamation and closure plan for Mesquite that was approved by the relevant governmental agencies.

Discontinued residual leaching operations

With no new ore having been placed on the leach pads since 2001, the productive capacity of the leach pads has progressively deteriorated through 2007. Although we implemented various strategies to maintain output levels and monitor solution grades being produced by the leach pads, during the third quarter of 2006 we concluded that it was no longer economic to continue leaching the Vista pad and we commenced closure operations. Rinsing of the pad was completed in late January 2007 and a 16 hole drilling program was conducted to provide information as to residual cyanide levels. Formal approval of this closure was received from the California Regional Water Quality Board in May 2007. Costs of $350,000 relating to the Vista Pad reclamation and closure program were fully recoverable from the reimbursement account maintained with AIG.

We carry out regular reviews of our plans and provisions for closure operations. The feasibility study completed in August 2006 increased the mineral reserves for the Mesquite Mine. As a result, we completed a review of the reclamation plan and the reclamation and remediation liability as at September 1, 2006. The net present value of these obligations was revised to $4.9 million. In May 2007, we announced a further increase in the mineral reserves and the net effect is reflected in an increase of $0.1 million in our provision for reclamation and remediation as at December 31, 2007.

Until late 2007, virtually all our gold production at Mesquite came from residual leaching operations. During this period we were operating under an Interim Management Plan (IMP) prepared and approved by the U.S. Bureau of Land Management. The plan outlined the measures to be undertaken by us, as operator of the Mesquite site, to maintain the site during the period of non-mining activity. Under the IMP, priority was given to protecting public health and safety, while maintaining the site in a condition suitable for reopening when economic conditions were favourable.

In 2007 and 2006, all processing and gold dore bar production up to final refining was carried out on-site with our mine personnel. Poured gold production for the year was 8,000 ounces and 12,668 ounces in 2007 and 2006 respectively.

Western Goldfields Inc. Annual Report 2007 15

Western Goldfields Inc. Annual Report 2007 15

In the Spring of 2007 we started to place our new mining fleet in service and we began stripping operations in May. In July, we started to move new ore to the heap leach pads. Ore production and haulage rates improved rapidly and by year-end we had placed approximately 1.0 million tons of material, containing an estimated approximately 19,000 ounces of gold, on the leach pads. Leaching of the new ore started in December and was being reflected in gold production and sales in January 2008. Our focus is now on achieving levels of production commensurate with our objective of sales of approximately 155,000 - 165,000 ounces in 2008.

Our feasibility study

In March 2006 we initiated a feasibility study with a view to establishing mineable reserves at Mesquite. Specifically, the study is designed to determine whether mineralized material, that is accessible under the approved expansion permits, can be economically exploited. The study used drilling results conducted by previous holders of the property and mineral rights. The total cost of the feasibility study was approximately $821,000.

In August 2006, Micon International Limited (“Micon”), an independent consultant of Toronto, Canada, completed the feasibility study and reported positive results.

The mineral reserve estimate for the Mesquite Mine Feasibility Study was prepared by M. Hester FAusIMM, Vice President, Independent Mining Consultants, Inc. (IMC), Tucson AZ. IMC updated the resource block model for the Mesquite Mine in May 2006.

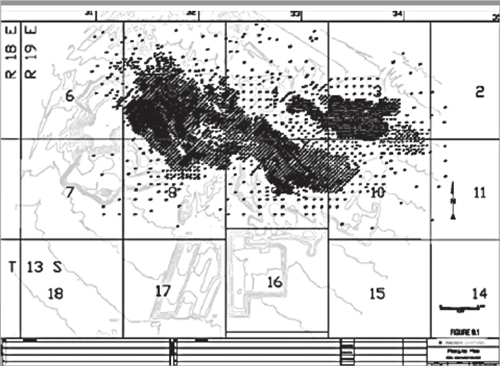

The May resource model was estimated and classified based primarily on the historical drill data, consisting of 6,221 predominantly reverse circulation drill holes totaling 2.7 million feet. Gold assays were collected on five foot intervals providing approximately 487,850 sample intervals that were used in completing the estimate.

The following figure shows the drill hole density over the Mesquite Mine area.

The resource block model is a computer generated model encompassing the entire proposed mining area with a series of regular blocks with dimensions of 25 feet x 25 feet x 30 feet in height. Relevant geological contacts, including the gravel-rock contact and the oxide-non oxide contacts were coded into the model blocks as was the current topographic surface. The contacts were primarily soft boundaries which had limited influence on grade interpolation.

Individual sample grades were capped at appropriate levels based on statistical analysis of the available sample data. The capped five foot sample data was composited over a 15 foot interval and used to interpolate gold grades into the individual model cells using an ordinary kriging algorithm based on variograms developed through geostatistical analysis of the composite data.

Western Goldfields Inc. Annual Report 2007 16

Western Goldfields Inc. Annual Report 2007 16Block tonnage factors of 13.58 cubic feet per ton and 15.94 cubic feet per ton were assigned for hard rock and gravel respectively based on historical data.

The resulting block model was then classified as Measured, Indicated or Inferred based on modern geostatistical classification methods. IMC verified the resource model grade estimation by comparing the tonnages and grades estimated by the drill data to the tonnages and grades indicated by the historical blasthole data collected when the mine was in operation.

The resource model was subjected to floating cone analyses, based on the Lerchs-Grossman algorithm, at a gold price of US $450 per ounce and operating cost estimates as outlined in the following Table.

Economics for Floating Cone Evaluation (US$)

| | | Oxide | | Non-oxide | |

| Mining Cost Per Ton | | | | | | | |

| Ore | | $ | 1.00 | | $ | 1.00 | |

| Waste | | $ | 0.60 | | $ | 0.60 | |

| Processing Cost Per Ore Ton | | $ | 1.00 | | $ | 1.00 | |

| G&A Cost Per Ore Ton | | $ | 0.25 | | $ | 0.25 | |

| Process Recovery | | | 75 | % | | 35 | % |

| Gold Price Per Troy Ounce | | $ | 450 | | $ | 450 | |

Pit slope angles were based on “Report to Newmont Gold Company - Mesquite Mine - Re: Pit Slope Design and Development” by C.O. Brawner Engineering Ltd., dated June 1999.

Final pit designs were based on floating cones at a gold price of US$ 450 per ounce, except for the west side of Vista and east side of Big Chief where the $350 cone defined the location of a planned surface diversion drainage channel. The designs include haul roads and adequate working room for the equipment. The roads are 90 feet wide and at a maximum grade of 10%.

Based on the final pit designs, IMC developed a life of mine plan scheduled to deliver ore containing approximately 165,000 ounces recoverable gold per year to a run-of-mine (ROM) leach pad by conventional open pit mining methods. Depending on ore grade and recovery, this requires mining from 10.1 million to 16.2 million tons of ore per year (average of 13.6 million tons of ore per year). The peak total material movement is 54 million tons per year. The mine plan was sequenced to allow a significant amount of waste to be backfilled into previously completed mining areas.

IMC completed a life of mine production schedule to tabulate ore tons, gold grade, total material tons, and waste material tons on an annual basis. The distribution of ore and waste contained in each of the mining phases was used to develop the schedule, assuring that criteria such as continuous ore exposure, mining accessibility, and consistent material movements were met.

It is the opinion of IMC that the mine production schedule defines a mineral reserve for a mining project. Measured and indicated mineral resources in the design pits are converted to proven and probable mineral reserves respectively. Oxide reserves are reported above a cut-off grade of 0.006 oz per ton, non-oxide reserves are reported above a 0.012 oz per ton cut-off grade.

Western Goldfields Inc. Annual Report 2007 17

Western Goldfields Inc. Annual Report 2007 17

IMC estimated a mineral reserve for the Mesquite Mine as described in the following Table.

Mesquite Mineral Reserves (1)

| | | Tonnage | | Grade | | | | Metallurgical | |

| Reserve Class | | (000s) (2) | | oz/ton | | Gold Ounces | | Recovery (3) | |

| Proven Mineral Reserves | | | | | | | | | |

| Oxide | | | 55,923 | | | 0.017 | | | 923,000 | | | 75-80 | % |

| Non-oxide | | | 12,749 | | | 0.024 | | | 306,000 | | | 35-40 | % |

| Subtotal | | | 68,672 | | | 0.018 | | | 1,229,000 | | | | |

| Probable Mineral Reserves | | | | | | | | | | | | | |

| Oxide | | | 52,589 | | | 0.017 | | | 910,000 | | | 75-80 | % |

| Non-oxide | | | 9,647 | | | 0.023 | | | 222,000 | | | 35-40 | % |

| Subtotal | | | 62,236 | | | 0.018 | | | 1,132,000 | | | | |

| Proven and Probable Total | | | 130,908 | | | 0.018 | | | 2,361,000 | | | | |

| (1) | The term “reserve” means that part of a mineral deposit that can be economically and legally extracted or produced at the time of the reserve determination. |

The term “economically,” as used in the definition of reserve, means that profitable extraction or production has been established or analytically demonstrated in a full feasibility study to be viable and justifiable under reasonable investment and market assumptions.

The term “legally,” as used in the definition of reserve, does not imply that all permits needed for mining and processing have been obtained or that other legal issues have been completely resolved. However, for a reserve to exist, we must have a justifiable expectation, based on applicable laws and regulations, that issuance of permits or resolution of legal issues necessary for mining and processing at the Mesquite Mine will be accomplished in the ordinary course and in a timeframe consistent with our current mine plans.

The term “proven reserves” means reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; (b) grade and/or quality are computed from the results of detailed sampling; and (c) the sites for inspection, sampling and measurements are spaced so closely and the geologic character is sufficiently defined that size, shape, depth and mineral content of reserves are well established.

The term “probable reserves” means reserves for which quantity and grade are computed from information similar to that used for proven reserves, but the sites for sampling are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.

Proven and probable reserves were calculated using different cut-off grades. The term “cut-off grade” means the lowest grade of mineralized material that can economically be included in the reserves in a given deposit. Cut-off grades vary between deposits depending upon prevailing economic conditions, mineability of the deposit, amenability of the ore to gold extraction, and type of milling or leaching facilities available. The cut-off grades used in the reserve estimates at the Mesquite Mine were 0.006 for oxide material and 0.012 for non-oxide material.

August 2006 reserves were calculated at a gold price of $450.

| (2) | Tonnages include allowances for losses resulting from mining methods. Tonnages are rounded to the nearest 100,000. |

Western Goldfields Inc. Annual Report 2007 18

Western Goldfields Inc. Annual Report 2007 18| (3) | Ounces are estimates of metal contained in ore tonnages and do not include allowances for processing losses. Metallurgical recovery rates represent the estimated amount of metal to be recovered through metallurgical extraction processes. Ounces are rounded to the nearest 1,000. |

Based on these estimated mineable reserves, we have developed a mine plan and processing design to mine and treat around 16 million tons per year of ore. Based on the total of 131 million tonnes contained in the mineable reserves, a project life of about 13 years is proposed, including 19 months of engineering, procurement, construction and development followed by about 9½ years of mine production and 2 additional years of releaching.

The feasibility study results were based on the following main assumptions:

| | • | sunk costs were not included |

| | • | payment of applicable royalties, estimated at approximately $20 million, was included |

| | • | payment of California gold tax, estimated at approximately $8 million, was included |

| | • | a working capital allowance was not included |

| | • | state and federal taxes, including property taxes, were included; and |

| | • | all operating and capital costs were based on second quarter 2006 US dollar costs. |

Capital Cost Estimates

The following chart shows the December 2006 estimates of the main initial capital costs involved in the reactivation of the Mine. These estimates are based on the feasibility study, updated to include the actual cost of the mining fleet and other expenditures committed to at December 31, 2006.

| | | | | Millions | |

| Mining fleet | | | | | $ | 67.0 | |

| Infrastructure | | | | | | | |

| Plant and infrastructure | | $ | 15.0 | | | | |

| Heap leach pad expansion | | | 10.3 | | | 25.3 | |

| Contingency | | | | | | 3.3 | |

| Owner’s cost | | | | | | 2.3 | |

| Total | | | | | $ | 97.9 | |

In addition, approximately $18.7 million was required to be spent on pre-stripping activities in 2007 prior to the commencement of expanded operations in 2008.

Western Goldfields Inc. Annual Report 2007 19

Western Goldfields Inc. Annual Report 2007 19

Operating Cost Estimates

The following chart shows the feasibility study estimates regarding the main operating costs involved in the operation of the Mine. Operating cost estimates included all on site mining and processing activities as well as general and administration costs to manage the operations. The operating costs were based upon August 2006 salary levels and consumable costs for the existing operations at the Mine.

Unit Operating Costs Estimates | | | |

| Mining cost per ton | | $ | 0.76 | |

| Processing cost per ton of ore | | $ | 1.02 | |

| General and administrative cost per ton | | $ | 0.32 | |

| California gold tax per ounce | | $ | 5.00 | |

| Royalties (NSR) | | | 2.41 | % |

Cost of Sales Per Ounce

The following chart shows the feasibility study estimates regarding the cost of sales from the Mine during the life of the mine.

Cost of Sales Per Ounce(1) ($ per ounce) | | | |

| Cost of sales per ounce before California gold tax and royalties | | $ | 318 | |

| California gold tax | | | 5 | |

| Royalties | | | 12 | |

| Cost of sales per ounce before pre-production stripping expense | | | 335 | |

| Pre-production stripping expense (principally 2007) | | | 11 | |

| Total cost of sales per ounce | | | 346 | |

| Total capital (LOM) - $112.6 million | | | | |

| Total ounces of gold recovered - 1,666,255 | | | | |

| Capital cost per ounce recovered | | | 68 | |

| Total costs per ounce | | $ | 414 | |

Capital and Operating Costs – Updated Projections to Early 2008.

While we believe that the Feasibility Study provided an excellent basis for the long term planning for resumption and continuation of mining operations at Mesquite, we recognize that the cost structure and assumptions that underpin it are dynamic. We continue to experience a period of worldwide high demand for mineral resources which has had a significant impact on commodity prices and on the price and availability of many of our major cost inputs. We are continually updating our projections and assumptions based on changing circumstances.

A $108.6 million expansion capital spending plan for Mesquite, including $76.5 million for acquisition of the mining fleet, was approved by our Board of Directors in late 2006. The major reason for the increase over the Feasibility Study estimate of $97.9 million was our decision to source truck haul units that would meet more stringent environmental standards in California. We currently estimate that actual spending on the program will be approximately $109.2 million.

In early March 2008, we announced that forecasted cost of sales per ounce for the full year 2008 will be in the range of $410 - $430(1). The increase over previous guidance is due to certain factors and assumptions that were not built into the Feasibility Study, such as additional labour and fuel costs associated with adding a fourth crew of truck operators. The additional crew will ensure adequate waste removal to offset the effect of lower than modeled truck speeds for waste and ore hauls. The reduced speeds are a result of the type of tires currently available in the marketplace. The Company expects to procure better performing radial tires for 2009 which will result in increased truck speeds for its haul trucks, allowing Mesquite to return to originally anticipated production rates and cost of sales. Production for 2009 is forecast between 150,000 - 160,000 ounces of gold at a cost of sales of $360 - $370(1)per ounce, in line with original forecasts.

Western Goldfields Inc. Annual Report 2007 20

Western Goldfields Inc. Annual Report 2007 20

| (1) | Cost of sales per ounce is a non-GAAP measure and is defined as cost of sales per the company’s Financial statements (Mine operating costs plus royalties) divided by the numbered ounces sold. |

Current Mineral Resources and Reserves

In March 2007, we announced that we had increased proven and probable reserves at Mesquite to 2.77 million ounces. Approximately 50% of the increase was attributable to assay results from a drilling program of 27 holes at the Brownie Hill area of the mine which converted inferred oxide resources to proven and probable reserves, and the remaining 50% was attributable to an increase in the reserve gold price assumption from $450 to $500 per ounce.

As at December 31, 2007, proven and probable reserves were estimated to be 2.76 million ounces, reflecting production depletion from the March 2007 estimate.

Estimated measured and indicated resources for the project as at December 31, 2007 were based on an assumed gold price of US$650 per ounce, a US$50 increase over the March 2007 estimate. The mineral resource model was also updated to include results of all drilling completed subsequent to the March 2007 estimate.

The majority of the data used to estimate the December 31, 2007 resources and reserves was previously reviewed and verified by IMC as part of the 2006 feasibility study and a description of the procedures used is included in the Mesquite Gold Project Technical Report dated May 26, 2006. Data collected since filing of said Technical Report has been reviewed and verified by W. Hanson, P.Geo., Vice President of Mine Development.

Mesquite Mineral Reserves and Resources (1) (4) (6)

December 31, 2007

Mineral Reserves

| | | | | Tons | | Grade | | | | Metallurgical | |

Class | | Type | | (x 1,000) (2) | | (Au ozs / ton) | | Ounces | | Recovery (3) | |

Proven | | | Oxide | | | 97,513 | | | 0.016 | | | 1,533,000 | | | 75-80 | % |

| | | | Non oxide | | | 16,429 | | | 0.023 | | | 386,000 | | | 35-40 | % |

| | | | Subtotal | | | 113,942 | | | 0.017 | | | 1,919,000 | | | | |

| | | | | | | | | | | | | | | | | |

Probable | | | Oxide | | | 38,000 | | | 0.017 | | | 660,000 | | | 75-80 | % |

| | | | Non oxide | | | 7,914 | | | 0.022 | | | 176,000 | | | 35-40 | % |

| | | | Subtotal | | | 45,914 | | | 0.018 | | | 836,000 | | | | |

Proven & Probable | | | Total | | | 159,856 | | | 0.017 | | | 2,755,000 | | | | |

Mineral Resources (4) (5) (6)

(Exclusive of Reserves)

| | | | | Tons | | Grade | |

Class | | Type | | (x 1,000)(2) | | (Au ozs / ton) | |

Measured | | | Oxide | | | — | | | — | |

| | | | Non oxide | | | 4,706 | | | 0.025 | |

| | | | Subtotal | | | 4,706 | | | 0.025 | |

Indicated | | | Oxide | | | 63,626 | | | 0.011 | |

| | | | Non oxide | | | 32,344 | | | 0.021 | |

| | | | Subtotal | | | 95,970 | | | 0.015 | |

Measured & Indicated | | | Total | | | 100,676 | | | 0.015 | |

Inferred | | | Oxide | | | 4,958 | | | 0.013 | |

| | | | Non oxide | | | 4,798 | | | 0.022 | |

Inferred | | | Total | | | 9,756 | | | 0.018 | |

| (1) | The term “reserve” means that part of a mineral deposit that can be economically and legally extracted or produced at the time of the reserve determination. |

Western Goldfields Inc. Annual Report 2007 21

Western Goldfields Inc. Annual Report 2007 21

The term “economically,” as used in the definition of reserve, means that profitable extraction or production has been established or analytically demonstrated in a full feasibility study to be viable and justifiable under reasonable investment and market assumptions.

The term “legally,” as used in the definition of reserve, does not imply that all permits needed for mining and processing have been obtained or that other legal issues have been completely resolved. However, for a reserve to exist, we must have a justifiable expectation, based on applicable laws and regulations, that issuance of permits or resolution of legal issues necessary for mining and processing at the Mesquite Mine will be accomplished in the ordinary course and in a timeframe consistent with our current mine plans.

The term “proven reserves” means reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; (b) grade and/or quality are computed from the results of detailed sampling; and (c) the sites for inspection, sampling and measurements are spaced so closely and the geologic character is sufficiently defined that size, shape, depth and mineral content of reserves are well established.

The term “probable reserves” means reserves for which quantity and grade are computed from information similar to that used for proven reserves, but the sites for sampling are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.

Proven and probable reserves were calculated using different cut-off grades. The term “cut-off grade” means the lowest grade of mineralized material that can economically be included in the reserves in a given deposit. Cut-off grades vary between deposits depending upon prevailing economic conditions, mineability of the deposit, amenability of the ore to gold extraction, and type of milling or leaching facilities available. The cut-off grades used in the reserve estimates at the Mesquite Mine were 0.006 for oxide material and 0.012 for non-oxide material.

December 2007 reserves were calculated at a gold price of $500.

| (2) | Tonnages include allowances for losses resulting from mining methods. Tonnages are rounded to the nearest 1,000. |

| (3) | Ounces are estimates of metal contained in ore tonnages and do not include allowances for processing losses. Metallurgical recovery rates represent the estimated amount of metal to be recovered through metallurgical extraction processes. Ounces are rounded to the nearest 1,000. |

| (4) | Mineral resources and mineral reserves are classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum’s (CIM) “Standards on Mineral Resources and Reserves, Definitions and Guidelines”. |

| (5) | CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING MEASURED, INDICATED AND INFERRED MINERAL RESOURCES: These terms are required by the CIM’s “Standards on Mineral Resources and Reserves, Definitions and Guidelines”. U.S. INVESTORS ARE CAUTIONED NOT TO ASSUME THAT ALL OR ANY PART OF THE STATED MINERAL RESOURCES WILL BE CONVERTED INTO RESERVES. |

| (6) | The mineral resource and reserve estimates set out above were prepared under the supervision of Mr. W. Hanson, P.Geo., Vice-President of Mine Development, Western Goldfields Inc. |

Exploration and environmental matters

Our exploration, production and processing operations are extensively regulated under various U.S. federal, state and local laws and regulations relating to the protection of air and water quality, hazardous waste management and mine reclamation. These laws and regulations are subject to change and could substantially increase our liability or the costs of compliance. This could have a material adverse effect on our operations or financial position. In addition, whenever a previously unrecognized remediation claim becomes known or a previously estimated cost is increased, the additional costs could have a material adverse effect on our operations or financial position.

Western Goldfields Inc. Annual Report 2007 22

Western Goldfields Inc. Annual Report 2007 22

We believe that we operate Mesquite in compliance with all local, state and federal regulations. Stipulations in permits and approvals issued in respect of the Mine further define the site requirements. Based on our mode of operations, compliance with local, state and federal regulations relating to the protection of the environment is expected to require expenditures of approximately $0.6 million in 2008.