Exhibit 99.3

New Gold Inc. dated March 3, 2009

This disclosure memorandum constitutes the New Gold Disclosure Memorandum referred to in the business combination agreement between New Gold Inc. (“New Gold”) and Western Goldfields Inc. (“Western Goldfields”) dated March 3, 2009 (the “Agreement”). Section references are to the corresponding sections of the Agreement.

The purpose of this New Gold Disclosure Memorandum is to set forth information called for under the representations, warranties and covenants in the Agreement.

Disclosure of any information in this New Gold Disclosure Memorandum that is not strictly required under the Agreement has been made for informational purposes only and does not imply disclosure of all matters of a similar nature. Inclusion of any item in this New Gold Disclosure Memorandum is deemed to be disclosure for all purposes for which disclosure is required under the Agreement.

All of the information contained in this New Gold Disclosure Memorandum is provided as of the date of this New Gold Disclosure Memorandum. The titles and headings in this New Gold Disclosure Memorandum are for convenient reference only and are not to affect the interpretation of the Agreement or this New Gold Disclosure Memorandum.

All matters expressly disclosed in the Agreement and all matters disclosed in the New Gold Public Disclosure Documents since January 1, 2007 are deemed to have been disclosed to Western Goldfields.

| 1. | Section 1.01(ddd) – Definition of New Gold Support Agreements |

Goldcorp Inc. has entered into a New Gold Support Agreement with Western Goldfields and New Gold.

| 2. | Section 3.01(a) – Organization – Encumbrances on Shares of New Gold Subsidiaries |

| · | Minera San Xavier US$25 million Credit Agreement with Bank of Nova Scotia dated May 9, 2008: This agreement required a pledge of the shares of Minera San Xavier, S.A. de C.V. and Servicios del Plata y Oro, S.A. de C.V. to secure payment. As of March 1, 2009, there is no amount owing under this Credit Agreement. |

| · | Macquarie security documents relating to a A$10 million performance bond (unexecuted). There are charges on Peak Gold Asia Pacific Ltd. and Peak Gold Mines Pty. Ltd. |

| · | Security documents, including pledge of shares of Sociedad Contractual Minera El Morro, in favour of Xstrata Copper Chile relating to Carried Funding Loan Agreement on New Gold’s El Morro project (being negotiated). |

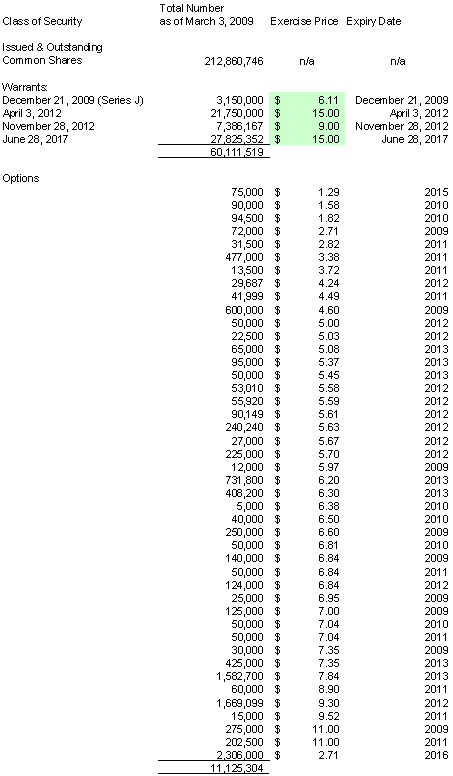

| 3. | Section 3.01(b) – Capitalization |

Issued and outstanding common shares of New Gold are 212,860,746 as at March 3, 2009. Warrants and options outstanding as at March 3, 2009 are set out in Schedule A.

- 2 - -

| 4. | Section 3.01(h) – Absence of Changes |

| | (v) | Scotia Bank Credit Agreement, Macquarie Performance Bond, Xstrata Carried Funding Loan Agreement Security. |

| | (vi) | New Gold had drawn down USD $9 million at Amapari but repaid the operating line in February 2009. New Gold had drawn down USD $10 million at Cerro San Pedro but repaid the operating line at December 31, 2008. |

| | (vii) | Certain resolutions relating to compensation arrangements were passed on February 17, 2009 and provided to Western Goldfields which set out a number of changes to compensation arrangements and options. |

| | (vii) | The union at New Gold’s Cerro San Pedro mine will begin negotiating a collective bargaining agreement at the beginning of March 2009. |

| 5. | Section 3.01(j) – Employment Agreements |

| (i) and (ii) Termination payments: |

As set out in employment agreements made available to Western Goldfields on its data site relating to the following persons:

[Text redacted.]

[The information above has been redacted as it constitutes personal information.]

(iii) Collective Bargaining Agreements

The union at New Gold’s Cerro San Pedro mine will begin negotiating a collective bargaining agreement at the beginning of March 2009.

| 6. | Section 3.01(m) – Litigation |

New Gold has received a notice that legal claims in the amount of approximately $46 million have been filed in Brazilian courts against its subsidiary, Mineração Pedra Branca do Amapari Ltda. The claims allege that Mineração Pedra Branca do Amapari Ltda has adversely impacted the quality of William Creek causing economic loss and health concerns. New Gold believes that these claims are unfounded and intends to vigorously defend against them. New Gold cannot reasonably predict the likelihood or outcome of these actions.

| 7. | Section 3.01(z) – No Option on Assets |

Participation Agreement

- 3 -

On March 20, 2008, New Gold entered into a participation agreement (the “Participation Agreement”) with Kamloops Division – Secwepemc Nation, comprising the Kamloops Indian Band and the Skeetchestn Indian Band (the “Kamloops Division”). Pursuant to the Participation Agreement, New Gold granted the Kamloops Division a right of first refusal to purchase the surface rights to the lands held in fee simple by New Gold as at March 20, 2008 and located in the Project Area north of the Trans Canada Highway and identified in Schedule H to the Participation Agreement (the “North Lands Surface Rights”), such right of first refusal to be exercised in the circumstances and subject to the terms and conditions set out in the Participation Agreement. The right of first refusal only applies where New Gold intends to dispose of the North Lands Surface Rights separately and distinctly from the New Afton Mine Site.

El Morro Agreement

An exploration agreement dated February 10, 2000 (the “El Morro Agreement”) between Falconbridge Limited (formerly Noranda Inc.) and Metallica (now New Gold). Falconbridge was acquired by Xstrata Plc. Xstrata Copper is the operator of the El Morro project and is one of the commodity business units within Xstrata Plc. Xstrata Plc, and Xstrata Copper are collectively referred to as Xstrata. Xstrata holds a 70% interest in the El Morro project and Metallica holds the remaining 30% interest. Xstrata Copper, Datawave Sciences Inc., Sociedad Contracual Minera El Morro and Inversiones El Morro Limitada entered into a shareholders’ agreement in November 2009. If New Gold intended to transfer its 30% interest in the El Morro project to an unaffiliated third party, under the Shareholders’ Agreement, Xstrata would have a right of first refusal.

| 8. | Section 3.01(aa) – Certain Contracts: Non-Competition and Non-Solicitation Agreement |

Non-competition and non-solicitation agreement between a subsidiary of New Gold and Goldcorp Inc. (“Goldcorp”) dated April 3, 2007 whereby a subsidiary of New Gold has agreed, for a period of three years ending April 3, 2010:

| | (a) | not to acquire, purchase, option, lease or acquire an interest in any mineral assets in Mexico or elsewhere in the Americas: |

| | (i) | that have or are reasonably expected to have an annual production in excess of 200,000 gold ounces, or hold an interest in an entity that so produces; or |

| | (ii) | that are within 20 kilometres of the external boundaries of any mineral assets in which Goldcorp held a direct or indirect interest as of April 3, 2007 (other than the Amapari Mine and the Peak Gold Mine), |

other than through ownership of less than 5% of the shares of any entity, without Goldcorp’s prior written consent; and

| | (b) | not to solicit for employment, offer employment to, employ or engage any person who, at any time within the 12 month period immediately preceding such solicitation, offer or employment or prospective employment or engagement, was an employee, officer or director of Goldcorp or any of its affiliates, other than those employees working solely at the Amapari Mine or the Peak Mine or as otherwise agreed to, without Goldcorp’s prior written consent. |

- 4 - -

| 9. | Section 3.01(kk) – No Broker’s Commission |

Fees set out in a letter agreement between New Gold and a financial advisor dated March 3, 2009 to provide financial advisory services in connection with acting as New Gold’s financial advisor in connection with a business combination with Western Goldfields, as provided to Western Goldfields.

| 10. | Section 1(d) of Schedule D to the Agreement – Ordinary Course |

New Gold has pledged $1 million to the Clinton Giustra Sustainable Growth Initiative (Canada). Of this amount, $200,000 is payable on each of June 30, 2009, June 30, 2010, June 30, 2011 and June 30, 2012.

New Gold is considering strategic alternatives for its Amapari mine, one of which is to sell its shares of Mineração Pedra Branca do Amapari Ltda which owns the Amapari mine.

| 11. | Section 1(k) of Schedule D to the Agreement – Certain Actions Prohibited |

Acceleration of options provided for in employment agreement if employee terminated following Change of Control for:

[Text redacted.]

[The information above has been redacted as it constitutes personal information.]

New Gold is considering strategic alternatives for its Amapari mine, one of which is to sell its shares of Mineração Pedra Branca do Amapari Ltda which owns the Amapari mine.

Minera San Xavier US$25 million Credit Agreement with Bank of Nova Scotia dated May 9, 2008 will be up for renewal.

Bank of Nova Scotia, Macquarie and Xstrata security documents set out in 2 above.

| 12. | Section 1(l) of Schedule D to the Agreement – Employment Arrangements |

As set out in Board resolution of February 17, 2009.

Stock option grants to operations employees to a maximum of 750,000.

The union at New Gold’s Cerro San Pedro mine will begin negotiating a collective bargaining agreement at the beginning of March 2009.

- 5 - -

Signature Page to Disclosure Memorandum of

New Gold Inc.

DATED this 3rd day of March, 2009.

NEW GOLD INC.

| By: | “Robert Gallagher” |

| Name: | Robert Gallagher |

| Title: | President and Chief Executive Officer |

SCHEDULE A

To

Disclosure Memorandum of

New Gold Inc.