UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. |

For the fiscal year ended December 31, 2008

| o | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. |

Commission file number 0-52549

RINO International Corporation

(Exact name of registrant as specified in its charter)

| Nevada | 41-1508112 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

11 Youquan Road, Zhanqian Street, Jinzhou District

Dalian, China 116100

(Address of principal executive offices)

00186 411 8766 1222

(Registrant’s telephone number)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common stock, par value $.0001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer, large accelerated filer and smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

Large Accelerated Filer o Accelerated Filer o Non-

Accelerated Filer o Smaller Reporting Company x

Accelerated Filer o Smaller Reporting Company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant (assuming for these purposes, but without conceding, that all executive officers and directors and 10% stockholders are “affiliates” of the Registrant) as of June 30, 2008 (based on the closing sale price on such date of the Registrant’s common stock, on the Over-the-Counter Bulletin Board as reported on Yahoo Finance) was $46,538,695.

DOCUMENTS INCORPORATED BY REFERENCE

None

2

RINO International Corporation

Annual Report on Form 10-K

For the Year Ended December 31, 2008

Table of Contents

| PART I | ||

| Item 1. | Business | 4 |

| Item 1A. | Risk Factors | 23 |

| Item 1B. | Unresolved Staff Comments | 41 |

| Item 2. | Properties | 41 |

| Item 3. | Legal Proceedings | 42 |

| Item 4. | Submission of Matters to a Vote of Security Holders | 42 |

| PART II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 42 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 45 |

| Item 8. | Financial Statements | 58 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 58 |

| Item 9A. | Controls and Procedures | 59 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 62 |

| Item 11. | Executive Compensation | 66 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 69 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 70 |

| Item 14. | Principal Accountant Fees and Services | 72 |

| PART IV | ||

| Item 15. | Exhibits and Financial Statement Schedules | 72 |

| Signatures | 75 | |

3

PART I.

Disclosure Regarding Forward Looking Statements

Certain statements made in this report, and other written or oral statements made by or on behalf of RINO International Corporation, may constitute “forward-looking statements” under the Private Securities Litigation Reform Act of 1995, which represent the expectations or beliefs of, including, but not limited to, statements concerning the operations, performance, financial condition and growth of RINO International Corporation, together with its direct and indirect subsidiaries and controlled-affiliates. For this purpose, any statements contained in this report that are not statements of historical fact may be deemed forward-looking statements. Without limiting the generality of the foregoing, when used in this report, the word “believes,” “expects,” “estimates,” “intends,” “will,” “may,” “anticipate,” “could,” “should,” “can,” or “continue” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. Examples of such statements in this report include descriptions of our plans and strategies with respect to developing certain market opportunities, our overall business plan, our plans to develop additional strategic partnerships, our intention to develop our products and platform technologies, our continuing growth and our ability to contain our operating expenses. All forward-looking statements are subject to certain risks and uncertainties that could cause actual events to differ materially from those projected, including those described under the caption “Risk Factors” in Item 1A of this report. We believe that these forward-looking statements are reasonable; however, you should not place undue reliance on such statements. These statements are based on current expectations and speak only as of the date of such statements. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of future events, new information or otherwise.

Except as otherwise specifically stated or unless the context otherwise requires, the "Company", "we," "us,"and "our" refer to (i) RINO International Corporation (formerly Jade Mountain Corporation), (ii) Innomind Group Limited (“Innomind Group”), a wholly-owned subsidiary of RINO International Corporation organized under the laws of the British Virgin Islands, (iii) Dalian Innomind Environment Engineering Co., Ltd. (“Dalian Innomind”), a wholly-owned subsidiary of Innomind Group organized under the laws of the People’s Republic of China (the “PRC” or “China”), (iv) Dalian RINO Environment Engineering Science and Technology Co., Ltd., a contractually controlled affiliate of Dalian Innomind organized under the laws of the PRC (“Dalian Rino”); and (v) and Dalian Rino’s wholly owned subsidiaries, Dalian Rino Environmental Engineering Project Design Co., Ltd. (“Dalian Rino Design”) and Dalian Rino Environmental Construction & Installation Project Co., Ltd. (“Dalian Rino Installation”).

ITEM 1. BUSINESS

Through our contractually controlled affiliates in the People’s Republic of China, since October 5, 2007, we have been engaged in the business of environmental protection and remediation. Our business consists of designing, manufacturing, installing and servicing wastewater treatment and flue gas desulphurization equipment principally for use in China’s iron and steel industry, and anti-oxidation products and equipment designed for use in the manufacture of hot rolled steel plate products. At the present, RINO International’s sole business activities are acting as a holding company of our direct and indirect subsidiaries, Innomind Group Limited, a company organized under the laws of the British Virgin Islands, and Dalian Innomind Environment Engineering Co., Ltd. (“Dalian Innomind”), a limited liability company organized under the laws of the People’s Republic of China (“PRC”), which contractually controls and operates our affiliate Dalian Rino Engineering Science and Technology Co., Ltd. (“Dalian Rino”), a limited liability company organized under the laws of the PRC, and its subsidiaries Dalian Rino Environmental Engineering Design Co., Ltd. and Dalian Rino Environmental Construction and Installation Engineering Project Co., Ltd.

Our History

We were originally incorporated in Minnesota in 1984 as Applied Biometrics, Inc., for the purpose of developing and marketing a cardiac output monitoring system. In August, 2000, the Company’s Board of Directors (“Board of Directors” or “Board”) determined that the Company would be unable to complete the development of its primary product, and thereupon ceased its business operations. During the latter part of 2000 we wound down our operations, eliminated most expenses and negotiated the termination or satisfaction of all of the Company’s obligations.

4

On May 14, 2002, we filed a Form 15 with the Securities and Exchange Commission (the “SEC”) and ceased being a reporting company under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

At a special meeting held on August 4, 2005, our shareholders voted to adopt a plan of complete liquidation and dissolution of the Company (the “Plan”). After that shareholder vote, but before the Company’s remaining funds were distributed, on October 20, 2005, Glenn A. Little (“Little”) contacted the Company and proposed a reorganization that consisted of: (i) revoking the Plan; (ii) Little lending $100,000 to the Company (the “Loan”) pursuant to a convertible promissory note (the “Convertible Note”); (iii) a one-time distribution of all of the Company’s assets (including $75,000 of the Loan) to all of our shareholders other than Little; and (iv) amending the Company’s Articles of Incorporation to increase the authorized capital in order to permit the conversion of the Convertible Note. At a special shareholders’ meeting held on February 8, 2006, Little’s proposal was approved, and the Convertible Note was subsequently converted to 10,000,000 shares of the Company’s common stock (which became 5,000 shares subsequent to the reverse stock splits described below). As a result, Little became the Company’s majority shareholder with (at the time) 64.1% of the issued and outstanding shares.

At a special meeting held on October 18, 2006, the shareholders voted to approve a proposal to change the Company’s state of incorporation from Minnesota to Nevada, and to authorize the Board of Directors to change the Company’s name from “Applied Biometrics, Inc.” to such other name as the Board deemed appropriate. In January 2007 the Company (still named Applied Biometrics) merged with and into its wholly owned subsidiary, RINO International Corporation (a Nevada corporation), in order to effect a change of domicile from Minnesota to Nevada. The Company’s name became RINO International Corporation.

By written consent of the holder of a majority of the outstanding shares of our common stock, on June 5, 2007, the shareholders authorized a two hundred thousand (200,000) for one (1) reverse stock split (with fractional shares rounded up to the nearest whole number), which was effectuated on July 16, 2007.

On August 31, 2007, our Board of Directors authorized an amendment to its Articles of Incorporation to: (i) increase the number of its authorized shares of common stock from 100,000,000 shares, par value $.0001 per share, to 10,000,000,000 shares, par value $.0001 per share (the “Authorized Share Increase”); and (ii) forward split its issued and outstanding common stock on a one share for one hundred (100) shares basis (the “Forward Split”). Under Nevada law, neither the Authorized Share Increase nor the Forward Split required the approval of the Company’s shareholders.

Recent Development

Share Exchange Transaction

On October 5, 2007, the Company acquired Innomind Group Limited, a British Virgin Islands corporation (“Innomind Group”), in a share exchange transaction whereby the Company issued 17,899,643 shares of our common stock (“Control Shares”) to the sole holder of 100% of the capital stock of Innomind Group, Mr. Zhang Ze, a PRC resident, in exchange for all the capital stock of Innomind Group held by Zhang Ze. As a result of the share exchange transaction, Innomind Group became our wholly owned subsidiary and Innomind Group’s wholly-owned subsidiary, Dalian Innomind Environment Engineering Co., Ltd. (“Dalian Rino”), a limited liability company organized under the laws of the PRC, became the Company’s indirect subsidiary (the “Share Exchange Transaction”).

5

Simultaneously with the consummation of the Share Exchange, Zhang Ze transferred and conveyed all of the Control Shares (and all of his right, title and interest in and to the Control Shares) to The Innomind Trust, a trust established under the laws of and domiciled in the British Virgin Islands, of which Zou Dejun and Qiu Jianping, the founders and sole equity owners of Dalian Rino, are the sole beneficiaries. As of December 31, 2008, the Control Shares represent 71.5% of our total outstanding common stock.

The acquisition of Innomind Group and Dalian Innomind on October 5, 2007 by RINO International Corporation effected a change in control and was accounted for as a “reverse acquisition” whereby Innomind Group is the accounting acquirer for financial statement purposes. Accordingly, for all periods and filings subsequent to the October 5, 2007 “reverse acquisition” transaction, the historical financial statements of the Company reflect the consolidated financial statements of Innomind Group since its inception and the operations of RINO International subsequent to October 5, 2007. See the Current Report on Form 8-K that we filed with the Securities and Exchange Commission on October 12, 2007 for additional information.

Please refer to the Current Report on Form 8-K filed with the SEC on October 12, 2008 and the Annual Report on Form 10K for the fiscal year 2007 filed with the SEC, as for more details about the Share Exchange Transaction.

Private Placement

In connection with the Share Exchange Transaction, on October 5, 2007, we completed a private placement transaction with 24 accredited investors in which we raised $24,480,319 in gross proceeds (or $21,251,000 in net proceeds) from the sale of 5,464,357 shares of our common stock to these investors pursuant to a Securities Purchase Agreement with such investors dated the same date (the “Securities Purchase Agreement”). As part of the private placement transaction, we entered into a Registration Rights Agreement with the investors in the private placement to register for resale of the shares issued to the investors under the Securities Purchase Agreement under the Securities Act of 1933, as amended. We also granted piggy-back registration right to Glenn Little, our majority shareholder and executive officer prior to the Share Exchange Transaction, as to 116,071 of the shares of common stock beneficially owned by him. Also as part of the private placement and Share Exchange Transaction, we entered into lock-up agreements with Mr. Zou Dejun, our CEO and director, and his wife Ms. Qiu Jianping, our Chairman of the Board, who together beneficially own 71.5% of our common stock as of the date of this report, which generally prohibit them from selling our stock until October 3, 2009 (the transactions contemplated under the foregoing Securities Purchase Agreement, the Registration Rights Agreement and related agreements, collectively, the “Private Placement Transaction” or “Private Placement”).

The Securities Purchase Agreement and Registration Rights Agreement contain certain covenants on our part, including the following:

Board Appointment Right.

Pursuant to the Securities Purchase Agreement, Hare & Co., an investor in the Private Placement, has the right to designate one member of our (or at their election, Dalian Innomind’s or Dalian Rino’s) Board of Directors. As of the date of this Prospectus, Hare & Co. has not designated a member of the board.

Continued Listing.

Pursuant to the Securities Purchase Agreement, if we apply to have our common stock traded on another trading market, we are required to include in that application all of the shares of common stock purchased in the private placement. We are also required to take all reasonably necessary action to continue the listing and trading of our common stock on the OTC:BB and any other trading market on which the common stock is listed, and to comply with all applicable rules of the trading market.

6

Delivery of up to 5,580,000 Additional Shares of Common Stock from Escrow Based on After-Tax Net Income.

Pursuant to the Securities Purchase Agreement, a total of 5,580,000 shares of our common stock beneficially owned by our founders Mr. Zou Dejun and his wife, Ms. Qiu Jianping, through the Innomind Trust, are subject to escrow in order to secure our obligation under the Securities Purchase Agreement to deliver additional common stock to the private placement investors in the event we fail to achieve certain financial performance targets for fiscal years 2007 and 2008 (“Make Good Escrow Shares”). In the event we do not achieve these financial performance targets, we are required to release and distribute the Make Good Escrow Shares to the investors. Those targets are $16,000,000 in after-tax net income for the fiscal year ended December 31, 2007, $28,000,000 in after-tax net income for the fiscal year ending December 31, 2008 and $1.120 for earnings per share on a fully-diluted basis for 2008. In the event we do not achieve the 2007 net income target, we are obligated to transfer 1,674,000 shares of our common stock to the private placement investors on a pro-rata basis, and if we fail to achieve the 2008 net income or earnings per share targets, we must transfer to the investors a further 3,906,000 shares. In the event the Company is required to recognize any expense or deduction from revenue or income for releasing the Made Good Escrow Shares to the investors or the founders, as the case maybe, then such expense or deduction will be excluded for purposes of determining whether the company’s after-tax net incomes and earnings per share (for fiscal year 2008) have met the respective targets. In connection with the release of the Make Good Escrow Shares to the Innomind Trust, which releases are deemed as stock compensation to Mr. Zou and Ms. Qiu, we accrued $17.5 and $7.5 million of compensation expense for fiscal years 2008 and 2007, respectively.

Liquidated Damages for late appointment of independent board members and registration related matters.

Under the Registration Rights Agreement, we are obligated to cause the registration statement filed with the SEC covering and registering under the Securities Act of 1933, as amended, for the re-sale of all the common stock offered and sold in the private placement to be declared effective by the SEC by March 3, 2008. If we fail to comply with the foregoing, we are obligated to pay liquidated damages to the investors equal in amount to 1% of the total investment amount invested by the investors on the first day of such failure and for each month (or part of a month)(an aggregate of $244,353) after March 3, 2008, until the registration statement is declared effective (“Effectiveness Damages”), which are capped at 10% ($2,494,600) of the total investment amount raised in the Private Placement Transaction. The registration statement was declared effective by the SEC on October 2, 2008. Consequently, we incurred liquidated damages in the amount of $1,971,116.

Under the Securities Purchase Agreement, we are obligated to appoint a board of directors with a minimum of 5 members, a majority of whom must be “independent directors” as defined in NASDAQ Marketplace Rule 4200(a)(15) by February 2, 2008. Until this covenant is complied with, we are required to hold $1,000,000 in escrow (“Board Escrow Holdback”) for distribution to the investors as liquidated damages equal in amount to 1% of the total investment amount invested by the investors on the first day of such failure and for each month (or part of a month)(an aggregate of $244,353) after February 2, 2008. On March 20, 2008, we appointed three independent directors to our Board of Directors and fulfilled this obligation. As a result, we incurred liquidated damages in the amount of $627,173.

Such liquidated damages payable by the Company are accounted for in accordance with FSP EITF 00-19-2. Estimated damages at the time of closing are recorded as a liability and deducted from additional paid-in capital as costs of issuance. Estimated damages determined later pursuant to the criteria for SFAS 5 are recorded as a liability and deducted from operating income.

Liquidated Damages for PRC Governmental Rescission of Restructuring Transaction.

If any governmental agency in the PRC challenges or otherwise takes any action that adversely affects the transactions contemplated by the Restructuring Agreements or the Share Exchange Agreement, and the Company cannot undo or otherwise address its materially adverse effect to the investors’ reasonable satisfaction within sixty (60) days of the occurrence of the PRC governmental action, then, upon written demand from an investor, we are required to, within thirty (30) days from the date of the written demand, pay to the investor, as liquidated damages, an amount equal to the entire amount that he or it invested in the private placement, without interest.

7

The cash held in escrow pursuant to the Board Escrow Holdback as described above is accounted for as other current assets and are not shown as cash or cash equivalents on the our balance sheet until such funds have been released from escrow pursuant to the terms of the Securities Purchase Agreement. The shares held in escrow as Make Good Escrow Shares will not be accounted for on our books until such shares are released from escrow pursuant to the terms of the Securities Purchase Agreement. If any Make Good Escrow Shares are released to the Company’s management or employees, the value of such shares at the time of release will be recorded as compensation expense with a corresponding offset to additional paid-in capital in accordance with SFAS 123(R) paragraph 11. If any Make Good Escrow Shares are released to the Investors, no entry will be made. During the time such Make Good Escrow Shares are held in escrow, they are accounted for as contingently issuable shares in determining the EPS denominator in accordance with SFAS 128.

Liquidated damages potentially payable by the Company under the Securities Purchase Agreement and the Registration Rights Agreement will be accounted for in accordance with FSP EITF 00-19-2. Estimated damages at the time of closing will be recorded as a liability and deducted from additional paid-in capital as costs of issuance. Estimated damages determined later pursuant to the criteria for SFAS 5 will be recorded as a liability and deducted from operating income. The Company may be required to pay to the investors, as liquidated damages, an amount equal to the entire amount that the investors invested in the private placement, without interest, if any governmental agency in the PRC challenges or otherwise takes any action that adversely affects the transactions contemplated by the Restructuring Agreements or the Share Exchange Agreement, and the Company cannot undo or otherwise address its materially adverse effect to the investors’ reasonable satisfaction. Such liquidated damages have the initial appearance of a redemption provision, in that there is no apparent end date to the provision and it appears to be outside the control of the Company. However, according to the legal opinion issued by the Company’s PRC counsel, the Restructuring Agreements and the organizational structure resulted thereunder are legal and enforceable under current PRC law and that changes to current law would need to be enacted in order for the PRC government or any of its entities to challenge the structure of the Company. Therefore, the Company believes that the chances of the restructuring structure being successfully challenged are remote, and therefore such liquidated damages are not recordable as a liability under SFAS 5.

The warrants to purchase 382,500 shares of our common stock issued to Douglas Capital, our placement agent, qualify as permanent equity under EITF 00-19, the value of which warrants has created offsetting debit and credit entries to additional paid-in capital.

Please refer to the Current Report on Form 8-K filed with the SEC on October 12, 2008 and the Annual Report on Form 10K for the fiscal year 2007, as amended filed with the SEC for more details about the Share Exchange Transaction.

Restructuring Agreements to Acquire Dalian Rino’s Operating Business

In connection with the consummation of the Share Exchange Transaction and the Private Placement, Dalian Innomind, entered into and consummated a series of transactions (collectively, the “Restructuring Transactions” and the agreements related thereto, collectively, the “Restructuring Agreements”), with Dalian Rino. Pursuant to the Restructuring Agreements, Dalian Innomind purchased and leased substantially all of the assets of Dalian Rino and assumed control of the operations and management of Dalian Rino’s business. As part of the Restructuring Agreements, the shareholders of Dalian Rino, Dalian Rino and Dalian Innomind entered into an Entrusted Management Agreement, pursuant to which the shareholders of Dalian Rino and Dalian Rino entrusted Dalian Innomind with the operations and management of Dalian Rino’s business. Under the agreement, Dalian Innomind will manage Dalian Rino’s operations and assets, control all of Dalian Rino's cash flow through an entrusted bank account, will be entitled to the payment of Dalain Rino's net profits as a management fee, and will be obligated to pay all Dalian Rino’s payables and loan payments. The Entrusted Management Agreement will remain in effect until Dalian Innomind acquires all of the assets or equity of Dalian Rino (as more fully described below under “Exclusive Option Agreement”). Prior to that acquisition, Dalian Rino will only own those certain assets that have not been sold or leased to Dalian Innomind pursuant to the Restructuring Agreements. As part of the Restructuring Agreements, Dalian Rino transferred its employees and provided its supply and sales channels to Dalian Innomind, and Dalian Rino and Dalian Rino’s founders transferred certain patents and trademarks to Dalian Innmond.

8

The following ancillary agreements were also entered into as part of the Restructuring Agreements:

Shareholders’ Voting Proxy Agreement. Under the shareholders' voting proxy agreement among the Dalian Rino shareholders and Dalian Innomind, the Dalian Rino shareholders irrevocably and exclusively appointed the members of Dalian Innomind’s board of directors as their proxies to vote on all matters that require Dalian Rino shareholder approval.

Exclusive Option Agreement. Under the exclusive option agreement among Dalian Innomind, Dalian Rino and the Dalian Rino shareholders, the Dalian Rino shareholders have granted Dalian Innomind an irrevocable and exclusive purchase option (the “Option”) to acquire Dalian Rino’s equity and/or remaining assets, but only to the extent that the acquisition does not violate limitations imposed by PRC law on such transactions. Current PRC law does not specifically provide for a non-PRC entity's equity to be used as consideration for the purchase of a PRC entity's assets or equity. Accordingly, the Option is exercisable when PRC law would allow foreign equity to be used as consideration to acquire a PRC entity's equity interests and/or assets, or when the Company has sufficient funds to purchase Dalian Rino's equity or remaining assets. The consideration for the exercise of the Option is to be determined by the parties and memorialized in future, definitive agreements setting forth the kind and value of such consideration. To the extent the Dalian Rino shareholders receive any of such consideration, the Option requires them to transfer (and not retain) the same to Dalian Rino or Dalian Innomind.

Share Pledge Agreement. Under the share pledge agreement among Dalian Innomind and the Dalian Rino shareholders (the "Share Pledge Agreement"), the Dalian Rino shareholders have pledged all of their equity interests in Dalian Rino, including the proceeds thereof, to guarantee all of Dalian Innomind's rights and benefits under the Restructuring Agreements. Prior to termination of the Share Pledge Agreement, the pledged equity interests cannot be transferred without Dalian Innomind's prior written consent.

Please refer to the Current Report on Form 8-K filed with the SEC on October 12, 2008 and the Annual Report on Form 10K for the fiscal year 2007, as amended filed with the SEC for more details about the Share Exchange Transaction.

As a result of the Restructuring Agreements, Dalian Rino became an indirectly contractually controlled affiliate of the Company. As of the date of this report, Dalian Rino has two wholly owned subsidiaries: Dalian Rino Environmental Engineering Project Design Co., Ltd. (“Dalian Rino Design”) and Dalian Rino Environmental Construction & Installation Project Co., Ltd. (“Dalian Rino Installation”).

The Company’s current structure is set forth in the diagram below:

9

Organizational History of Innomind Group Limited (“Innomind Group”) and Dalian Innomind Environment Engineering Co., Ltd. (Dalian Innomind”)

Innomind Group.

Innomind Group Limited was incorporated under the laws of the British Virgin Islands on November 17, 2006. Until the consummation of the Share Exchange Transaction, Innomind Group’s sole shareholder was Zhang Ze, a citizen and resident of the PRC.

Dalian Innomind Environment Engineering Co., Ltd. (“Dalian Innomind”).

On July 9, 2007, Innomind Group incorporated Dalian Innomind under the laws of the PRC. All of Dalian Innomind’s outstanding capital stock is held by Innomind, and by virtue of such ownership Dalian Innomind is a “wholly foreign owned enterprise (“WFOE”) under PRC law.

10

Organizational History of Dalian Rino Engineering Science and Technology Co., Ltd (“Dalian Rino”)

Dalian Rino Engineering Science and Technology Co., Ltd. (unless the context indicate otherwise, together with its subsidiaries, collectively, “Dalian Rino”) was formed on March 5, 2003, under PRC law. Its initial registered capital was RMB 7,000,000 (approximately US $922,327), which was increased to RMB 30,500,000 (approximately US $4,018,711) on April 18, 2006. Dalian Rino is owned by its two founders, Zou Dejun (90%) and his wife, Qiu Jianping (10%). Since its founding, Dalian Rino has been engaged in developing, marketing and selling its three principal products: the Lamella Inclined Tube Settler Wastewater Treatment System (also called the “Lamella Wastewater System”), the Circulating Fluidized Bed Flue Gas Desulphurization System (also called the “Desulphurization System”), and the High Temperature Hot Rolled Steel Anti-Oxidation System (also called the “Anti-Oxidation System”).

On September 24, 2008, Dalian Rino formed Dalian Rino Environmental Engineering Project Design Co., Ltd. (“Dalian Rino Design”), as a wholly owned subsidiary under the laws of the PRC, to focus on research, development and the technical design aspects of our business. Pursuant to the business permits, Dalian Rino Design’s right of operation expires on September 23, 2018 and its business permit is renewable upon expiration.

On October 14, 2008, Dalian Rino formed Dalian Rino Environmental Construction & Installation Project Co., Ltd. (“Dalian Rino Installation”), as a wholly-owned subsidiary under the laws of the PRC. Pursuant to its business license, Dalian Rino Installation is permitted and will focus primarily on installation of environmental protection and energy saving equipment. Dalian Rino Installation’s right of operation expires on October 13, 2018 and its business permit is renewable upon expiration.

Description of the Business

We are an industrial technology-based, PRC environmental protection and remediation company. Specifically, through our subsidiaries and controlled affiliates in China, we are engaged in the business of designing, manufacturing, installing and servicing wastewater treatment and exhaust emission desulphurization equipment principally for use in China’s iron and steel industry, and anti-oxidation products and equipment designed for use in the manufacture of hot rolled steel plate products. All of our products are custom-built for specific project installations, and we execute supply contracts during the design phase of our projects. Our products are all designed to reduce either or both industrial pollution and energy utilization, and comply with ISO 9001 Quality Management System and ISO 14001 Environment Management System requirements, for which RINO received certificates in 2004.

Since 1978, the PRC has undergone a substantial economic transformation and rapid economic growth, becoming the world’s fourth largest national economy, with the world’s largest and most rapidly growing iron and steel market. Through its continuous focus on nation-wide economic development, China’s overall industrial pollution output has become a central issue for the national government, and a priority in the PRC’s eleventh five-year plan. For example, in 2006 China’s industrial enterprises emitted 25.9 million tons of sulphur dioxide, the principal cause of “acid-rain,” and the PRC has become the world’s largest emitter of sulphur dioxide pollution. As a consequence of this and other industrially-based environmental challenges, Dalian Rino’s customer base - the Chinese iron and steel industry - faces governmental mandates to decrease or eliminate water pollution and sulphur emissions, which are key applications for our technologies.

Accordingly, environmental protection and remediation is a relatively new industry in the PRC. Nonetheless, like the Chinese economy, it is rapidly growing – we estimate that in the next 5 years, there is a wastewater remediation market of $260 million per year and the desulphurization market will grow at approximately 5% annually.. Further, the market for the Company’s products is highly regulated by the central PRC government, which sets specific pollution output targets for industrial enterprises. For this reason, we believe that the demand for our products is predictable, and will follow the growth of the PRC’s iron and steel industry and government-mandated pollution control standards that are being made more stringent annually. We also believe that our revenue and profitability growth to date arises from these same factors. Our revenues increased 119.8% to $139.3 million for fiscal year 2008 from $63.4 million for fiscal year 2007. Our gross profit increased 78.3% to $54.3 million for fiscal year 2008 from $30.5 million for fiscal year 2007. Our income from operations increased 36.9% to $21.6 million for fiscal year 2008 from $15.8 million. Our after-tax net income increased 108.3% to $21.3 million for fiscal year 2008 from $10.2 million for fiscal year 2007. Without taking into account certain non-cash stock compensation expenses that we incurred in connection with our release of the Make Good Escrow Shares to the Innomind Trust with our founders as beneficiaries, our income from operations increased 67.9% to $39.1 million for fiscal year 2008 from $23.3 million from fiscal year 2007, and our after-tax net income increased 118.9% to $38.8 million for fiscal year 2008 from $17.7 million for fiscal year 2007.

11

Principal Products

Traditionally, we have three principal products and product lines: the “Lamella Inclined Tube Settler Waste Water Treatment System,” the “Circulating, Fluidized Bed, Flue Gas Desulphurization System,” and the “High Temperature Anti-Oxidation System for Hot Rolled Steel.”

In addition to the environmental remediation and protection systems above, since late 2005 we have also been using our over capacity during “down time” to perform contract machining services for third-party industrial enterprises.

Lamella Inclined Tube Settler Wastewater Treatment System.

Our core product, the “Lamella Wastewater System,” is a highly efficient wastewater treatment system that incorporates our proprietary and patented ‘Lamella Inclined Tube Settler’ technology. We believe that the System is among the most technologically advanced wastewater treatment systems presently in use in China’s iron and steel industry. It includes industrial water treatment equipment, complete sets of effluent-condensing equipment, highly efficient solid and liquid abstraction dewatering equipment and coal gas dust removal and cleaning equipment. The technology has received numerous regional and national design awards, and has been successfully installed and used at some of the largest steel mills in China, including Jinan Iron & Steel Group Co., Ltd., Benxi Iron & Steel (Group) Co., Ltd., Handan Iron & Steel Group Co., Ltd., Tianjin Tiangang Group Co., Ltd., Shijiazhuang Iron & Steel Group Co., Ltd., Panzhihua Iron & Steel Group Co., Ltd., Anyang Iron & Steel Group Co., Ltd., Nanchang Changli Steel Co., Ltd., Shaogang Steel Co., Ltd., Linggang Steel Co., Ltd. and Puyang Steel.

Our combination of proprietary system design and patented technology allows wastewater to flow through the system in layers while at the same time settling particulate matter without disturbing the water flow. Operating results of the above, Lamella Wastewater System installations, show that our technology improves the stability of the settling deposition, increases the available settling area, shortens the settling distance for waste particles, reduces the settling time, and results in particle removal efficiency rates of up to 99%. After treatment with our technology and system, coal gas wastewater and wastewater containing iron mineral powder can be reused and returned to the production process without further treatment, allowing users to create a closed-loop. This lowers the overall use of industrial water for the enterprises utilizing our technology, reduces the output of solid industrial waste, and improves the efficient use of resources.

Compared with alternative inclined plate technology, the Lamella Wastewater System has several important advantages as shown in the following table:

| Normal Inclined Plate Settling Pool | Lamella Inclined Tube Settler | |

| Water power staying time 30 min, surface load 3m3/m2·h, small volume, small space use coefficient, short waterpower process (with short current in winter). | Water power staying time 45 min with surface load 8m3/㎡·h, large use coefficient, long water power process. | |

| First settling, is not fit for a wide range wave of floats, affected by the stability and effect of the water outlet | Tertiary settling (with sludge abstraction collection system in every layer) anti-pump load, no interference between water inlet and sludge outlet, water outlet stable. |

12

| Water inlet float content: SS3000 ~ 5000mg/L, water outlet float content: SS100 ~ 200 mg/L, low treatment efficiency. | Water inlet float content: SS3000 ~ 16000mg/L water outlet float content: SS50 ~ 80 mg/L, high treatment efficiency. | |

| Inclined plate, inclining angle 60 degree, small settling deposition area. | Inclined plate, inclined tube inclining angle 450, results show that the smaller the inclining angle of the inclined tube or plate, the smaller the settling particles removed, the higher settling efficiency for removal of particulate matter. | |

| Adopt glass steel and compound Nylon Ether ketone, easy to age degrade and become clogged with sludge, needs to be changed often, has high operation and maintenance costs. | Compound new material plate, PP inner Surface Coating, resistant corrosion, smooth and clean surface, minimal sludge collection. | |

| Small sludge abstraction area, bad sludge water abstraction efficiency, short life cycle of the sludge outlet, high and unstable water content of sludge, adds difficulty to the next sludge treatment process. | With sludge water abstraction area and dust collection transmission device, long sludge outlet circle, special sludge disposal equipment sludge outlet, lower water content of sludge, convenient for new process to recycle. |

| The low carbon steel structures - such as pool surface frame - exposed to humidity and high temperature, easily corrode, which greatly reduces the life of equipment. | Lamella Inclined Tube Settler system is enclosed, the high humidity of the tank will not cause corrosion of the equipment. | |

| Occupies large area - large footprint, strict requirement for placement. | Occupying small area - small footprint - equipment can save over 30% area to treat same amount of water and is flexible for installation. | |

| Complicated system technique, complicated equipment configuration, high maintenance, inconvenient for use with automated control, often creates secondary pollution. | Short technical process, simple equipment, low failure rate - high MTBF, easy maintenance, highly automated, low operational cost, closed-end circulating treatment, without secondary pollution. |

Circulating, Fluidized Bed, Flue Gas Desulphurization System.

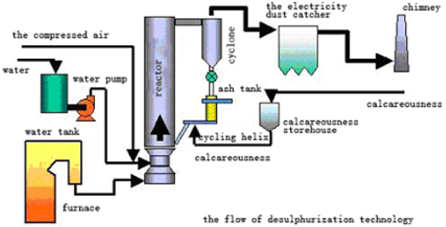

The Circulating, Fluidized Bed, Flue Gas Desulphurization System (the “Desulphurization System”) is a highly effective system that removes particulate sulphur from flue gas emissions generated by the sintering process in the production of iron and steel (a process in which sulphur and other impurities are removed from iron ore by heating, without melting, pulverized iron ore) with the resulting discharge meeting all relevant PRC air pollution standards. Without treatment, flue gasses that result from sintering contain high content of sulphur dioxide which reacts with atmospheric water and oxygen to produce sulphuric acid that precipitates as “acid rain.” As illustrated below, the Desulphurization System is comprised of a desulphurization agent inlet system, circulating fluidized bed desulphurization reactor, dust removal system, desulphurization dust removal treatment system, desulphurization wind pump system, monitoring system, electrical control system, and smoke flue system.

13

The Desulphurization System utilizes proprietary technology jointly developed by RINO and the Chinese Academy of Sciences. On May 18, 2007, Dalian Rino acquired the intellectual property rights to this technology (including the right to patent the same) from the Chinese Academy of Sciences for RMB 1,000,000.

As compared with equipment using other desulphurization technologies, our proprietary technology has the following advantages: our equipment has a smaller footprint, a shorter circulation process and a low calcium sulphur ratio, the cost of operating the system is lower; the system is more efficient with higher desulphurization rates (for coal with a high (i.e., 6%) sulphur content, desulphurization rates can reach 92%). Our desulphurization process does not generate wastewater, dust or other secondary pollutants. In addition, the costs for the manufacturing and installation of the equipment are relatively affordable to the targeted iron and steel mills.

Although historically we have concentrated our marketing and efforts for this system in the PRC iron and steel industry, the technology also can be widely used in fields such as metallurgy, electrical power generation, rubbish treatment. We plan to expand our sales and marketing to such additional applications both in the PRC and internationally.

High Temperature Anti-Oxidation System for Hot Rolled Steel

The Anti-Oxidation System is a set of products and a mechanized system, to substantially reduce oxidation-related output losses in the production of continuous cast, hot rolled steel. In the process of continuous cast, hot rolled steel, oxidation-related output loss ranges from 2% -5% on average. This translates into a loss of production output or throughput of 2%-5%. Our Anti-Oxidation System reduces oxidation-related output loss by over 60%, from the current level of approximately 3% to around 1.2%. In addition, oxidation in high-temperature steel production results in the waste of water and energy and generates pollution. In the United States, Japan, and Europe, technology has been developed to ameliorate this problem, but the cost of the coating used in the process and the inability of the equipment to be utilized in high temperature environments limits its application to specialty steel products such as stainless steel, and silicon and carbide steel products.

Our Anti-Oxidation System is specifically designed to work effectively with hot rolled steel product in high temperature environment. As illustrated below, our system operates at significantly higher product temperatures than its competitors, thereby increasing its general utility and its range of steel product applications. We believe that in design and technology the Anti-Oxidation System is the only anti-oxidation process available for the iron and steel industry (both in the PRC and internationally) that can be applied in high temperature environments, and is a unique solution to the loss of production output due to high-temperature oxidation, which is a long-standing problem in the world-wide iron and steel industry.

14

The technology used in our Anti-Oxidation System is jointly developed by Dalian RINO and the Chinese Academy of Sciences. In March, 2006, Dalian Rino acquired the technology from the Chinese Academy of Sciences under an agreement that provides for the co-ownership of the intellectual property rights to the formula for the anti-oxidizing paint used in the system and to the spray system for applying the paint, co-ownership of any patents granted, and the transfer to Dalian Rino of all commercialization rights.

As hot rolled steel consists of approximately 90% of the PRC steel production and 90% of world-wide production, we believe that our technology has a far broader market both in China and internationally than is the case for competing systems and technologies.

Each unit of our Anti-Oxidation System services one steel line and costs approximately $1.4 million installed. The coating material developed by Dalian Rino for use with the anti-oxidation equipment can be produced at relatively low cost at approximately $1,264 per ton which covers approximately 1180 tons of steel. The coating material is usable in high temperature environments and is easily applied in a uniform manner. That coating can be directly sprayed onto hot steel slabs at temperatures of 600°-1000° C, thereby saving the increased costs and energy utilization that all other anti-oxidation equipment entails.

In July 2007, our Anti-Oxidation System has first been installed, tested and accepted by Jinan Iron & Steel Group Co., a major PRC steel manufacturer. The installation results show that the coating system fully conforms to the hot rolling mill environment, effectively reduces oxidation loss by 60%, saves energy, and increases production throughput.

Additional Line of Business

In addition to the environmental remediation and protection systems above, since late 2005 we have also being using our over capacity during “down time” to perform contract machining services for third-party industrial enterprises.

The specialized heavy machinery and equipment that we use to produce our Lamella Wastewater System, Desulphurization System and Anti-Oxidation System also provides us with a substantial capacity to undertake the machining of large, high-precision and advanced structures from areas outside of northeast China. To this end, Dalian Rino established and the Company maintains strategic cooperation relationships with Dalian Heavy Industry (Zhonggong) and China First Heavy Industries with which we contract to provide production time on our heavier machine tools, during “down time” on our own production. For fiscal years 2006, 2007 and 2008, such contract manufacturing business has provided the Company with $3,608,075, $13,021,070 and $13,884,528 in revenues, respectively, and $2,473,614, $6,625,134 and $6,702,975 in gross profit, respectively.

The Company expects that as sales of its own products increase, we will reduce or eliminate contracting the use of our machines and equipment to third parties.

15

New Products and Product Development

Integrated Dust Catching System

In the first quarter of 2008, the Company commercialized and received initial purchase orders for a new integrated dust catching system which removes up to 99% of the dust from sintering iron during the production process and complements its current desulphurization equipment.

The integrated dust catching system uses electric preceptors to remove part of the dust load from flue gases, followed by a bag filtration system, which together achieve dust removal rates of up to 99%. The integrated dust catching system completes the treatment of sintering flue gases begun by the Company’s desulphurization equipment. Adoption of the integrated dust catching system is being driven in part by China’s regulatory pressure to reduce particulate emissions to as low as 30mg/cubic meter of flue gas, down from levels usually above 80mg/cubic meter. New Chinese regulations for dust content of flue gases in major cities will be comparable to those in place in the European Union. To date, the Company’s integrated dust catchers have been installed in several steelmaker in China. The Company anticipates the average selling price will be around US$2.0 million and the time from contract signing to final installation will equate to approximately two to three months.

Sludge Treatment System

In November 2008, we successfully developed a new sludge treatment system through cooperation with the Dalian University of Technology. The new sludge treatment system can be used to treat sludge generated by the municipal wastewater treatment process, industrial sludge generated by the chemical industry and oil sludge generated by oil industry. We estimate that there is a market of approximately $28.8 billion for the treatment of sludge generated by various municipal wastewater and industrial processing systems in the PRC market. To treat the sludge, the first and most critical step is to remove water from the sludge through a dehydration process, which will reduce the quantity of the sludge and make it easier to be incinerated. Depending on the heavy metal content of the desiccated sludge, the final product can be used as agricultural fertilizer if the heavy metal content is low, or, after further processing, as a component in various construction materials if the heavy metal content is high.

The current best sludge treatment technology available in the PRC market (provided by a Korean company) allows for a 30% reduction of water in the sludge while our technology, using superheated steam to dehydrate sludge, provides an improvement of 10% in water reduction. In addition, our new sludge treatment system costs approximately 50% less than imported products and the costs of daily operation are approximately 45% less. The Chinese government recently promulgated a new regulation requiring at least 60% of municipal wastewater be treated by 2010, the implementation of which is expected to significantly increase the amount of sludge generated by the wastewater treatment process in China in the next several years. We estimate the profit to process one ton of sludge generated by municipal wastewater treatment process varies between $12 and $19 depending on the steam source. Currently, approximately 27.8 million metric tons of sludge is being generated by the wastewater treatment process annually with a water content of approximately 80%.

Northeastern China, where Dalian RINO is located, is the oil industry center and this region generates approximately 2 million tons of oil sludge annually. The profit to process one ton of oil sludge ranges between $39 and $44.

Dalian University of Technology has made a patent application for this technology in China (Application number: 200710011115.0). Based our agreement with Dalian University of Technology, Dalian Rino will pay an ongoing royalty of approximately 5% of sales to the university.

16

Environmental Challenges in the PRC

China currently had been in the midst of extraordinarily rapid economic growth and reform that is closely tied to its pace of industrial development. In 2004, the PRC’s total industrial output reached RMB 7,238.7 billion (US $934 billion). Since 1978, China’s real GDP has grown at an average rate of approximately 11.3% per year, while its share of world trade has risen from less than 1% to almost 8% in the same timeframe. Foreign trade growth has averaged nearly 15% over the same period, or more than 2,700% in the aggregate. Over the last decade the PRC has become a preferred destination for direct foreign investment, and in 2005 attracted $72.4 billion in foreign direct investment, according to the Chinese Ministry of Commerce. China also is competitive in many advanced technologies and continues to be a preferred destination for the relocation of global manufacturing facilities in virtually every manufacturing sector. China is now the fourth largest economy and the third largest trader in the world.

With the PRC’s rapid industrial expansion has come its inevitable by-product: industrially generated pollution of water, the air and the environment, generally. It is estimated that approximately 80% of China’s environmental pollution results from industry-produced solid waste, waste water and waste gas emissions. During the 1990’s the extent of and dangers posed by China’s increasing levels of environmental pollution became widely perceived and developed into a priority for the PRC’s central government. During the 2000-2005 period, China expended over $90 billion on environmental protection efforts. Prior to the global financial crisis, for the eleventh five-year plan (2006-2010), the PRC is expected to spend approximately $193 billion on such efforts The reduction or elimination of waste water and airborne pollutants has become a key element in the country’s next five year economic plan.

In addition, in response to the recent global financial crisis, the PRC government introduced a 4 trillion RMB stimulus program on November 27, 2008. The stimulus package - to be spread over a period of two years - aimed to boost the slowing Chinese economy by spurring domestic spending and demand, as its GDP growth slid to 9% in 2008 after years of double-digit growth. On February 26, 2009, China’s State Council reinforced China’s 2008 stimulation package by further measures to stimulate specific industries in 2009. Specifically, 5.3% of the total stimulus package will be spent on sustainable development that promotes energy saving and environmental control.

Based on the breakdown of the stimulus spending unveiled by China’s top economic planner, the National Development and Reform Commission (NDRC), the percentage allocation of the total stimulus package is as follows: approximately 38% to public infrastructure (such as railway, road, irrigation, and airport construction), 25% to post-quake reconstruction (construction of low-cost housing, rehabilitation of slums, and other social safety net projects), 9% to technology advancement (projects to upgrade the Chinese industrial sector, gearing towards high-end production to move away from the current export-oriented and labor-intensive mode of growth), 5% to sustainable development (projects to promote energy saving and cuts in harmful gas emissions, and environmental engineering projects), 4% to educational & cultural projects and 9% to rural development (building public facilities, resettling nomadic people, supporting agriculture works, and providing safe drinking water).

Serving the environmental control needs for the iron and steel industries, we believe we stand to benefit from the stimulus spending on both environment control related projects and from the growth of the iron and steel industries which will be beneficiaries of the infrastructural spending under the stimulus package.

PRC Markets for Dalian Rino’s Products and Technologies

Wastewater Treatment Market.

China is a country that has limited water resources, with approximately 2,200 cubic meters per person, or one-fourth the world average. Conservation through the improvement of usage efficiency is the fundamental way to resolve this tension between water supply and demand. China’s very high rate of industrial water consumption (as compared to that of developed countries) offers great potential for water conservation and re-usage programs. Our principal target market, the iron & steel industry, consumes large quantities of water by the nature of the processes employed, and, therefore, has an inherent need to increase efficiency and thereby reduce its usage costs, as well as reclamation costs and governmental penalties.

17

Today, there are approximately 730 iron-making blast furnaces over 300 cubic meters in size operating in China. Of these, 495 have already adopted wastewater treatment facilities, some of which are utilizing the traditional inclined plate settling pool technology, while 235 have no wastewater treatment whatsoever. The average cost of equipment for wastewater treatment of a blast furnace of this size is $2,000,000. Additionally, there are 670 steel-making converters in China with a capacity of over 75 tons. 360 of these converters have existing wastewater treatment equipment, while 310 converters have no wastewater treatment facilities whatsoever. The average cost of equipment for a converter of this size is $1,700,000. The PRC government has mandated that all blast furnaces and converters have wastewater treatment facilities in place by 2012. Accordingly, these mandates have created a $216 million annual market for the next several years.

In addition to the blast furnaces and converters with no wastewater treatment facilities, we believe that there is a large replacement market potential for those operations with wastewater treatment systems that utilize the traditional inclined plate settling pool technology. This is older technology introduced by the former Soviet Union in the late 1970s and applied in iron & steel industry in the 1980s. Compared with our proprietary Lamella Wastewater System technology, wastewater treatment systems using the traditional inclined plate settling pool technology has lower throughput capability, a much larger footprint and involves high maintenance requirements and expenses. Based on our market research with our end-use customers as well as market investigation with other iron & steel foundries and mills, we believe there will be a substantial need to replace this aging technology in 10 years, thereby creating an additional market of $87,900,000 for blast furnace and converter retrofits based on an average cost of $2 million to retrofit a blast furnace and $1.7 million to retrofit a converter.

Using proprietary and patented technology which removes up to 98% of particulates, producing 100-150 m3 of effluent water per hour with an average of 50mg/L of particulates, we believe our Lamella Wastewater System has been a market leader for wastewater treatment in the iron & steel industry. For fiscal years 2007 and 2008, revenues generated from our wastewater treatment business was $7.0 million and $14.4 million, respectively, representing 11.0% and 10.4% of our total revenues for fiscal years 2007 and 2008, respectively.

Desulphurization Market

In China, the main cause of airborne pollution is sulfur dioxide emissions from coal. According to joint research by the Chinese Institute of Environmental Science and Tsinghua University, sulphur dioxide-induced acid rain costs China over $13.3 billion annually in various losses, and atmospheric pollution results in an annual loss equivalent to two or three percent of China's GDP.

In 2005, the latest year for which statistics are available, the Chinese iron & steel industry discharged 1.24 million metric tons of sulphur dioxide into the atmosphere. Decades of lightly monitored growth in this industry sector, with little or no consequences attached to sulphur dioxide emissions, combined with mandatory, industry-wide sulphur dioxide reductions over the next few years, presents the industry with a pressing need to remediate these emissions from iron & steel sinters.

Based on government mandates, over the next few years, coal-fired sinters and other like furnace operations must install desulphurization equipment or face stiff, monthly penalties or, possibly, have their operations shut down. We believe that, because our Desulphurization System is the only sinter processing equipment available in the PRC market that is specifically designed for flue gas desulphurization applications that are larger than 90 square meters - the standard size for sinter operations in the PRC iron & steel industry - the Company has a substantial competitive advantage over its international competitors.

18

Today, there are around 200 coal-fired sinters in China without flue gas desulphurization equipment (this number is expected to rise along with the expansion of China’s iron and steel industry). Prior to June 2008, government policy only capped total gas emissions in a geographic area and there was no restriction on the gas emissions of any individual coal-fired sinter. Accordingly, some coal-fired sinters only had desulphurization equipment that partially treated their gas emissions and some had no desulphurization equipment installed so long as the emission cap in the area was not exceeded. After June 2008, the government tightened gas emission control and is now requiring all coal-fired sinters to have desulphurization equipment installed. This translates into a cumulative market for our desulphurization technology of more than $1 billion in the next few years based on our estimate. We plan to penetrate this market aggressively by marketing the Desulphurization System as a turn-key solution for the Chinese iron & steel industry’s sulphur dioxide emission problems.

Our desulphurization system has been installed in steel mills such as Jinan Iron & Steel Co., Panzhihua Iron & Steel, Shengfeng Iron & Steel, Handan Iron & Steel, Chongqing Iron & Steel. and Kunming Iron & Steel, Hulingnianyuan Iron and Steel, Nanchangchangli Iron & Steel, Qianjing Iron & Steel and Yuhua Iron & Steel. For fiscal years 2007 and 2008, revenues generated from our desulphurization business was $33.1 million and $105.3 million, respectively, representing 52.3% and 75.6% of our total revenues for fiscal years 2007 and 2008, respectively.

Anti-Oxidation Market

The oxidation of hot rolled steel results, on average, in the loss of 3% of the output in steel production. Although a number of U.S. and European anti-oxidation systems are available internationally, the high costs of the paints and coatings they use, as well as their ineffectiveness at high temperatures, have limited their application and utility to low temperature, specialty steel products. The suppliers of these anti-oxidation systems include America Advanced Technical Products, ATP Metallurgical, Duffy, Condursal, and Berktekt. Because of the high cost of usage, these paint/coating systems are all applied on only specialty steel and additionally, have limitations of low temperature application - they cannot be used on-line.

Importantly, the temperature range limitations of these systems prevent them from being used “on-line” in the high temperature ranges of hot rolled steel products, which historically account for over 90% of the PRC’s crude steel production. China is estimated to have produced approximately 500 million tons of steel in 2008, of which the expected output of hot rolled steel is estimated at 450 million tons. On this basis, it can be expected that, if not treated, China would lose approximately 13.5 million tons from its 2008 hot rolled steel production - a volume that is equal to a large steel producer’s annual output. Unlike its international competition, our Anti-Oxidation System is specifically designed to use less costly coating material and to operate effectively at temperatures ranging from 600° - 1,000° C - the environment of hot rolled steel plate. Based on the confirmed results of the installation of our anti-oxidation equipment and technology at Jinan Iron & Steel in 2007, we believe that the Anti-Oxidation System reduces hot rolled steel oxidation loss by a minimum of 60%. This would have resulted in an increase of 8.1 million tons of China’s 2008 output, and estimated commensurate savings in coal (6.4 million tons) and water (80 million tons) consumption for processing and throughput.

Using the PRC hot rolled steel estimate for 2008 as a benchmark, we estimate that the full application of the Anti-Oxidation System to that projected production output would result in approximately $567,000,000 in water and cost savings per year.

With these factors in mind, we believe that our Anti-Oxidation System can achieve a significant degree of penetration in the PRC market, as it addresses a domestic production need which is beyond the applicability of presently available U.S. and European technologies and systems.

For fiscal years 2008 and 2007, revenues generated from our anti-oxidation business was $5.7 million and $2.0 million, respectively, representing 4.1% and 3.1% of our total revenues for fiscal years 2008 and 2007, respectively.

19

Raw Materials Supply

The principal raw materials used in our business are steel and steel products, ancillary components used in our final products (such as motors), electrical cable, lubricants, cutting and welding material, and special plastic tubes used in our wastewater treatment system. Our principal supplier, Dalian Shuntongda Trading Co., Ltd., provided approximately 82% of the Company’s purchases of raw materials for the year ended December 31, 2008 and 95% of the Company’s purchase of raw materials for the year ended December 31, 2007. Dalian Shuntongda is well connected in the iron and steel industries and can obtain steel and steel products from numerous suppliers in the PRC market at favorable (often below market) prices. In addition, we are able to purchase steel and steel products from other suppliers and we intend to work with other qualified suppliers if the supply terms are more competitive than the existing terms available to us.

Intellectual Property

Set forth below is a list of the patents that we own or with regard to which we have submitted applications for patent approval:

| Jurisdiction | Project description | Patent No. | Patent type | Patent Status | Expiration Date | |||||

China | Desilting Inclined Plate and Tube Settler in Full Automation | 200920010319.7 | Practical new | Application under review | ||||||

China | Inclined Plate and Tube Settler of Deposition with Three Continuous Processes | 200920010318.1 | Practical new | Application under review | ||||||

China | Slurry Cleaning Equipment | 032119135 | Practical new | Granted | March 13, 2013 | |||||

| China | Wastewater comprehensive treatment system and method | ZL03111178.5 | Invention patent | Granted | March 13, 2023 | |||||

| China | Desulphurization Process of Sintering Flue Gas | 200810128193.3 | Invention patent | Application under review | ||||||

PCT International | Antioxidation Coating for Steel and Antioxidation Method Using the Same | 7494692 | Invention patent | Granted | April 3, 2028 | |||||

PCT International | Inorganic Composite Binders with High-temperature Resistance | PCT/CN2007/000568 | Invention patent | Application under review | ||||||

| PCT International | Anti-oxidation Spray Methods and Spray Equipment for Steel Billets | PCT/CN2007/001475 | Invention patent | Application under review |

International patent applications are administered under the Patent Cooperation Treaty (the “PCT”). A PCT application covers all the PCT member countries, which include most major industrialized countries. The PRC became a member of the PCT in 1994.

20

There are two phases in a PCT application. The first phase is the International Phase. Under this phase, an applicant like the Company can file an application using Chinese language in the PRC. Then it will have one year to claim the priority of its PRC filing date in other member countries. The main benefit of filing under the PCT instead of directly in the member countries is to allow an applicant to delay the “National Phase” filing in the member countries up to 30 months from the initial filing, which is 18 months more than the applicant would normally have when filing directly in foreign countries. During this International Phase, the applicant can gather more market information and have more time to make decisions about where to file patent applications. At the end of the International Phase period, it will enter the National Phase by filing national applications in each country in which the applicant desires a patent. The Trade-Related Aspects of Intellectual Property Rights (the “TRIPS”) determine the term of a patent applied under the PCT in the member countries.

Trademark and Logo.

The Chinese version of the “RINO” trademark,绿诺,and associated logo are both registered by Dalian Rino in the PRC. Their perpetual, royalty-free use by Dalian Innomind is authorized as part of the Restructuring Agreements.

Other Intellectual Property Rights Protections in the PRC.

In addition to patent protection law in the PRC, we also rely on contractual confidentiality provisions to protect our intellectual property rights and our brand. The Company’s research and development personnel and executive officers are subject to confidentiality agreements to keep our proprietary information confidential. In addition, they are subject to a three-year covenant not to compete following the termination of employment with our Company. Further, they agree that any work product belongs to our Company.

Customers

Historically, we generate revenues from large scale projects based on long-term fixed price contracts with customers for the manufacturing and installation of customized industrial equipment. Five major customers accounted for 88% of the sales for the year ended December 31, 2007. Due to the size of our projects, we generally work on a limited number of projects with a limited number of customers at any given period of time. Generally, each of our projects involves the manufacturing, installation and testing of the equipment we sell. Due to the size of our projects and the length of time to complete our projects (averaging six to eight months), it appears that our revenues are generated from a limited number of customers at any given period of time. However, we do not rely on a limited number of customers for revenue generation over time, as they constantly change. Nevertheless, given the cost of our Lamella Wastewater System, Desulphurization System and Anti-Oxidation System products, we believe that for the foreseeable future the Company will continue to rely on large customers for a substantial portion of its gross revenues. There are approximately 34 iron and steel companies in the PRC of a size and with annual production levels that make our products feasible for sale and installation. In order to expand our sales, we plan to capture increasing numbers of these potential customers for primary product sales, and aggressively cross-sell our products to each customer. In fiscal year 2008, we enlarged our customer base and revenue generation was much less concentrated. As a result, 2008 revenues generated from our prior year top customers did not account for a large percentage of total revenues in fiscal year 2008. In fiscal year 2008, revenues generated from our top six customers accounted for 34.7% of our total gross revenues.

During the year ended December 31, 2008, the Company has enlarged its customer base and no customer accounted for more than 10% of the Company’s total sales, and during the year ended December 31, 2007, the Company made sales to a small number of customers with five customers accounting for 88% of the Company’s total sales. Accounts receivable from those five customers totaled $18,479,541 as of December 31, 2007.

21

Competition

Lamella Wastewater System.

Prior to Dalian Rino’s introduction of its Lamella Wastewater System, the typical industrial wastewater treatment technology used in China relied on an inclined “plate settling pool” process. Such systems continue to be generally available in the PRC, and a substantial portion of them are self-installed by iron and steel companies. The Lamella Wastewater System’s advanced technology results in the following competitive advantages: lower installation and usage costs, increased throughput, smaller equipment footprint, and lower ongoing maintenance costs. We know of no comparable technology presently available in China, and we will emphasize the foregoing cost and efficiency advantages as we compete for customers.

Desulphurization System.

In the PRC, the sulphur dioxide emitted in flue gases from the sintering of iron during steel-making, is a major component of the environmental pollution that has followed China’s industrial expansion. Sintering is a step in steel-making, in which sulphur and other impurities are removed from raw iron by heating (without melting) pulverized iron ore. Removing the sulphur dioxide from a steel mill’s hot flue gas emissions is, therefore, a principal way of controlling acid rain.

Presently in China, major companies engaged in the desulphurization equipment market include: Beijing Guodian Longyuan Environmental Company, Zhejiang Feida Company, Fujian Longjing Environmental Company, Wuhan Kaidi Electric Power Company, Jiulong Electric Power Company, and Qinghua Tongfang Company. To the best of our knowledge, these companies have little or no production and installation experience in the iron and steel industry, and do not currently design or manufacture equipment that is applicable to sintering processes. We believe we are the first company to design, manufacture and complete an iron and steel sinter machine desulphurization installation in the PRC. Accordingly, we do not expect to have any direct competitors in this sector for approximately 2-3 years - - the minimum time necessary for potential competitors to complete product development.

Anti-Oxidation System.

We believe that the Company’s Anti-Oxidation System is unique and virtually without competition in the China market. We know of no entity other than the Company that is engaged in developing or supplying anti-oxidation technology that can operate on-line at the high temperatures (600° - 1,000° C) involved in hot rolled steel production - which represents 90% of China’s steel output. A number of anti-oxidation technologies are available internationally from suppliers that include: Advanced Technical Products Company, ATP Metallurgical Coatings, Duffy Company, Condursal and Berktekt. However, the high costs of the anti-oxidizing coatings these technologies rely on, and most especially their ineffectiveness at high temperatures, have limited their market to specialty steels, and have made them ill-suited to China’s iron and steel industry.

Research and Development; Growth Strategy

In 2008, Dalian Rino expended approximately $0.7 million for product research and development, approximately $0.6 million of which was directed at flue gas desulphurization and $0.1 million was directed at the new sludge treatment system. In 2007, Dalian Rino expended approximately $0.8 million for product research and development, approximately $0.5 million of which was directed at anti-oxidation research and approximately $0.3 million of which was directed at flue gas desulphurization. The Company’s continuing research and development program is linked to our growth strategy directed towards 2009 and several years thereafter, during which time we will develop export markets for our products in the United States and Western Europe and seek to develop new applications for our products suited to and targeted at these new, international markets. In conducting our research and development, the Company expects to continue its collaborative relationship with the Chinese Academy of Sciences, and also collaborate with Dalian Technology University.

22

ITEM 1A. RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information contained in this report before deciding to invest in our common stock.

If any of the following risks, or any other risks not described below because they are currently unknown to us or we currently deem such risks as immaterial but they later become material, actually occurs, it is likely that our business, financial condition, and operating results could be seriously harmed. As a result, the trading price of our common stock could decline and you could lose part or all of your investment.

Risks Related to our Business

The recent global financial crisis could negatively affect our business, results of operations, and financial condition.