TRACON PHARMACEUTICALS January 2018 NASDAQ: TCON Exhibit 99.1

This presentation contains statements that are, or may be deemed to be, "forward-looking statements." In some cases these forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” "expects,” “plans,” "intends,” “may,” “could,” “might,” “will,” “should,” “approximately,” “potential,” or, in each case, their negatives or other variations thereon or comparable terminology, although not all forward-looking statements contain these words. These statements relate to future events or our future financial performance or condition, business strategy, current and prospective product candidates, planned clinical trials and preclinical activities, product approvals, research and development costs, current and prospective collaborations, timing and likelihood of success of development activities and business strategies, plans and objectives of management for future operations, and future results of anticipated product development efforts, including potential benefits derived therefrom. These statements involve substantial known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. These risks, uncertainties and other factors include, but are not limited to, risks associated with conducting clinical trials, whether any of our product candidates will be shown to be safe and effective, our ability to finance continued operations, our reliance on third parties for various aspects of our business, competition in our target markets, our ability to protect our intellectual property, and other risks and uncertainties described in our filings with the Securities and Exchange Commission, including under the heading “Risk Factors”. In light of the significant uncertainties in our forward-looking statements, you should not place undue reliance on these statements or regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. The forward-looking statements contained in this presentation represent our estimates and assumptions only as of the date of this presentation and, except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this presentation. This presentation also contains estimates, projections and other information concerning our industry, our business, and the markets for our drug candidates, as well as data regarding market research, estimates and forecasts prepared by our management. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected in this information. Forward-Looking Statements

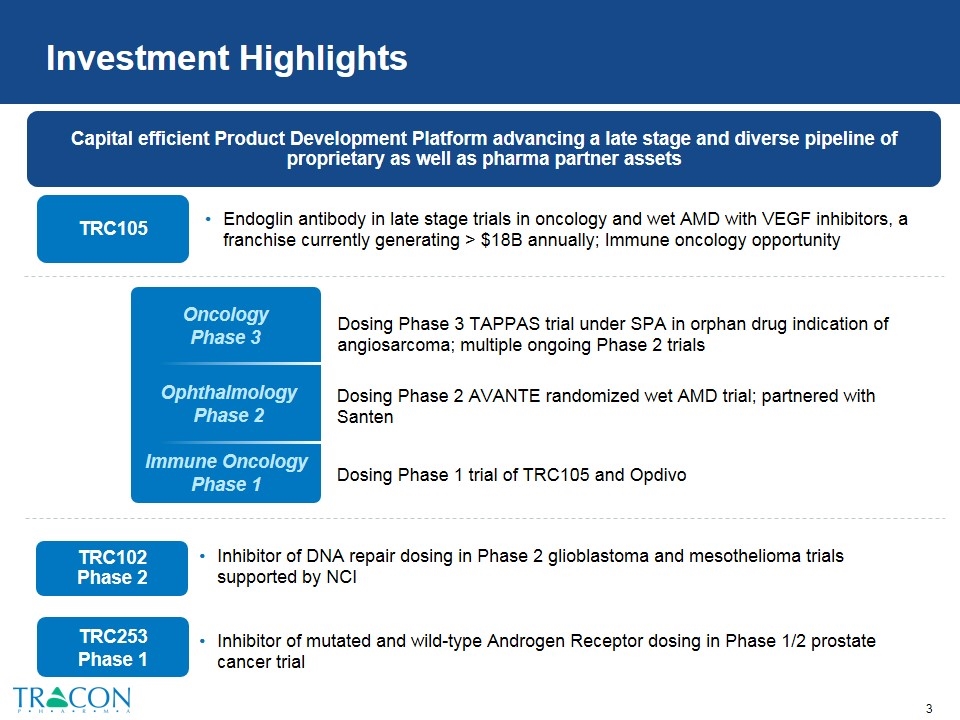

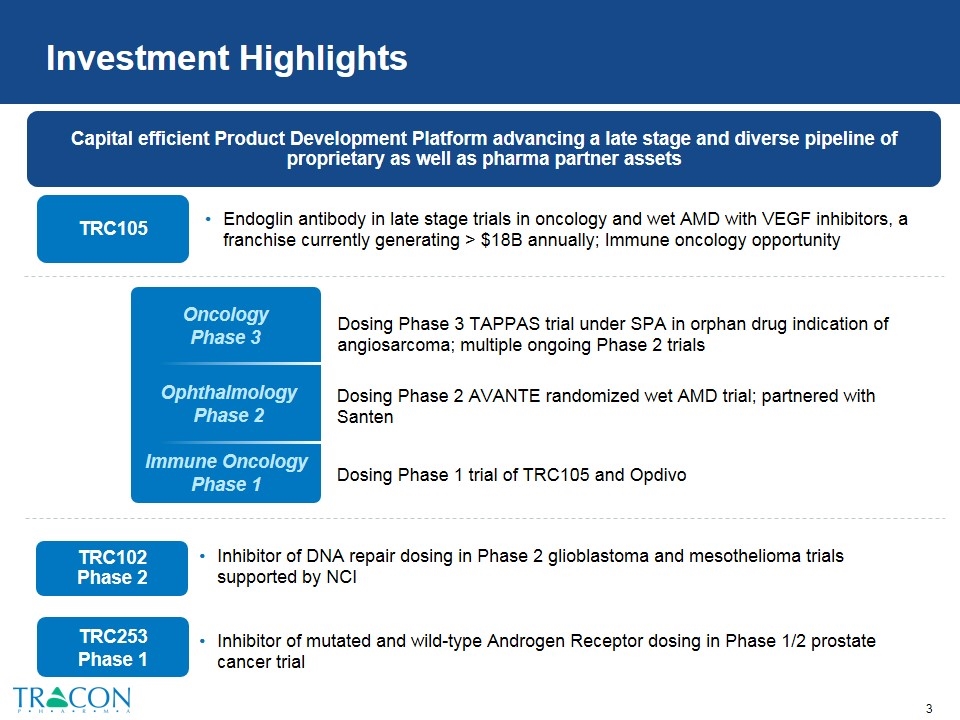

TRC105 Investment Highlights Endoglin antibody in late stage trials in oncology and wet AMD with VEGF inhibitors, a franchise currently generating > $18B annually; Immune oncology opportunity Experienced Team Inhibitor of DNA repair dosing in Phase 2 glioblastoma and mesothelioma trials supported by NCI TRC102 Phase 2 TRC253 Phase 1 Dosing Phase 3 TAPPAS trial under SPA in orphan drug indication of angiosarcoma; multiple ongoing Phase 2 trials Oncology Phase 3 Ophthalmology Phase 2 Immune Oncology Phase 1 Dosing Phase 2 AVANTE randomized wet AMD trial; partnered with Santen Dosing Phase 1 trial of TRC105 and Opdivo Capital efficient Product Development Platform advancing a late stage and diverse pipeline of proprietary as well as pharma partner assets Inhibitor of mutated and wild-type Androgen Receptor dosing in Phase 1/2 prostate cancer trial

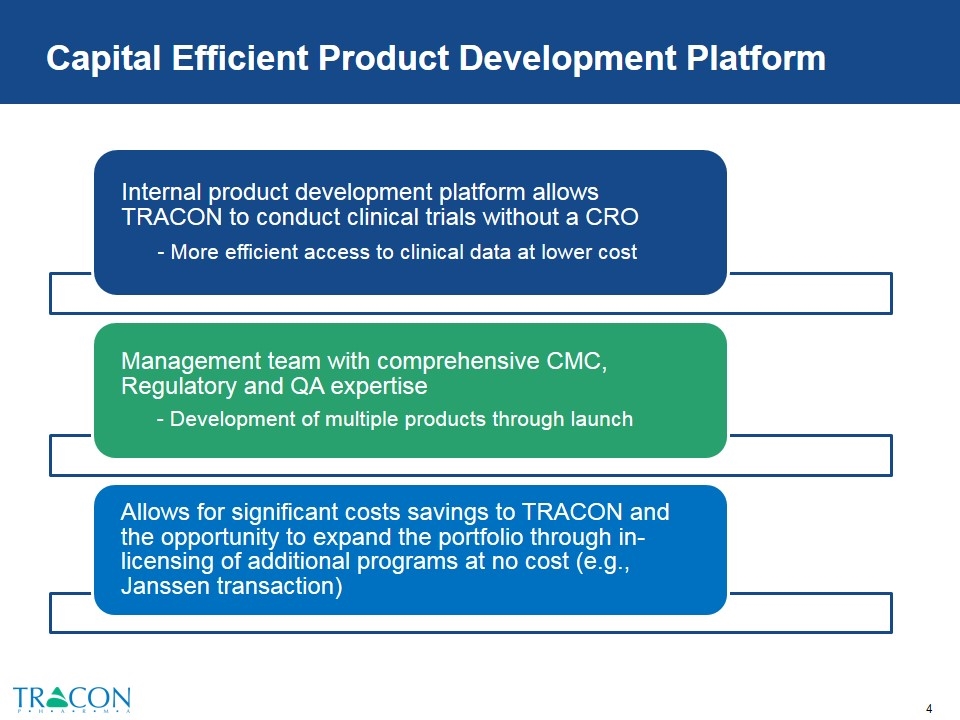

Capital Efficient Product Development Platform Internal product development platform allows TRACON to conduct clinical trials without a CRO - More efficient access to clinical data at lower cost Management team with comprehensive CMC, Regulatory and QA expertise - Development of multiple products through launch Allows for significant costs savings to TRACON and the opportunity to expand the portfolio through in-licensing of additional programs at no cost (e.g., Janssen transaction)

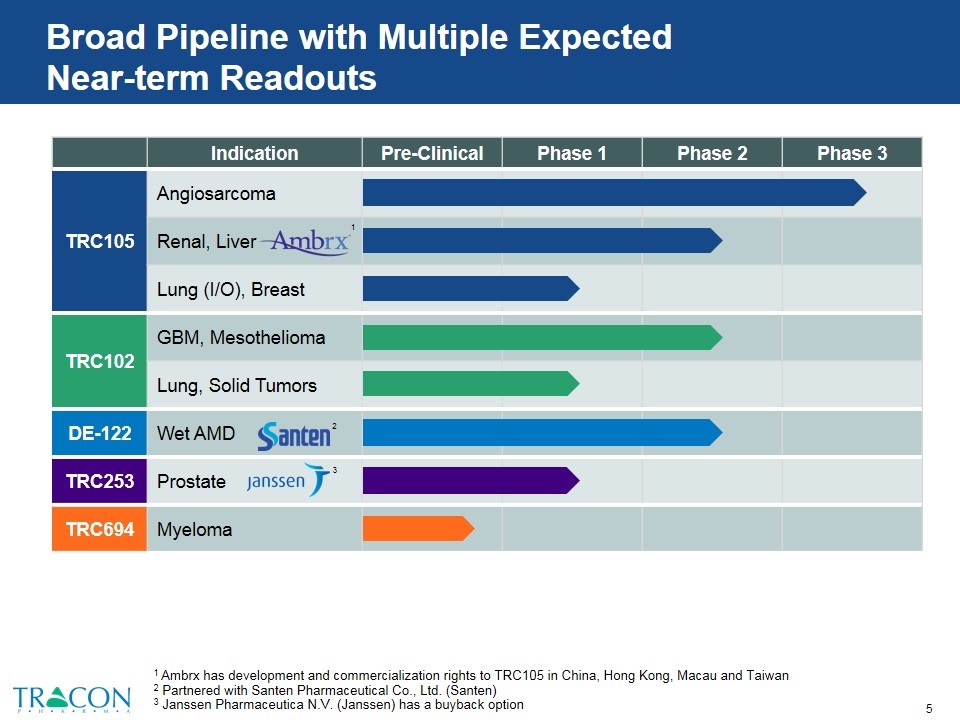

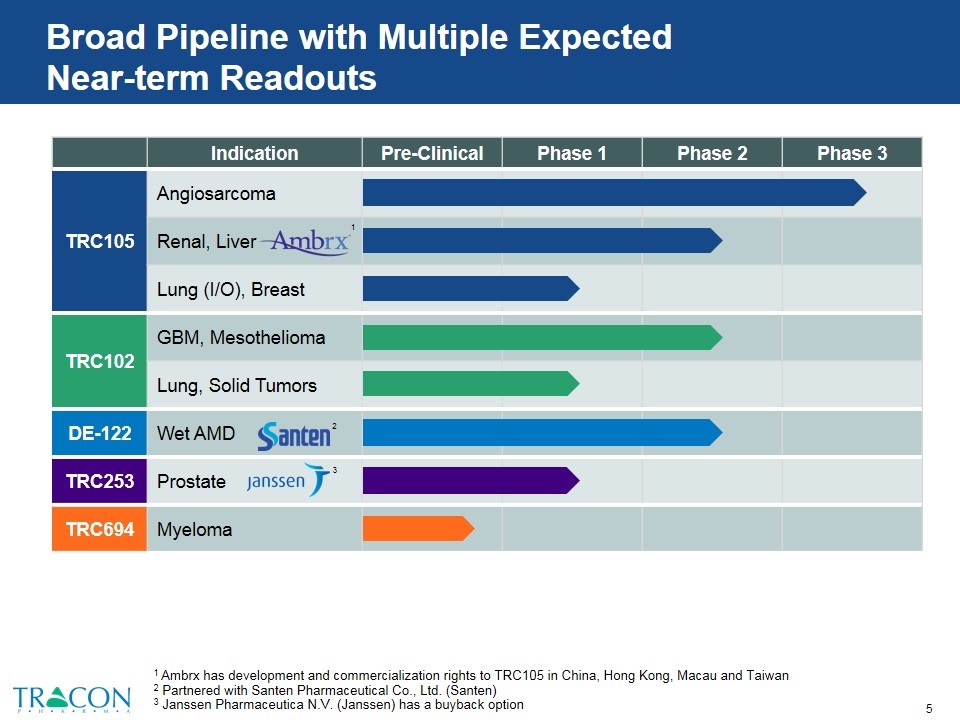

Broad Pipeline with Multiple Expected Near-term Readouts 1 Ambrx has development and commercialization rights to TRC105 in China, Hong Kong, Macau and Taiwan 2 Partnered with Santen Pharmaceutical Co., Ltd. (Santen) 3 Janssen Pharmaceutica N.V. (Janssen) has a buyback option Indication Pre-Clinical Phase 1 Phase 2 Phase 3 TRC105 Angiosarcoma Renal, Liver Lung (I/O), Breast TRC102 GBM, Mesothelioma Lung, Solid Tumors DE-122 Wet AMD TRC253 Prostate TRC694 Myeloma 2 3 1

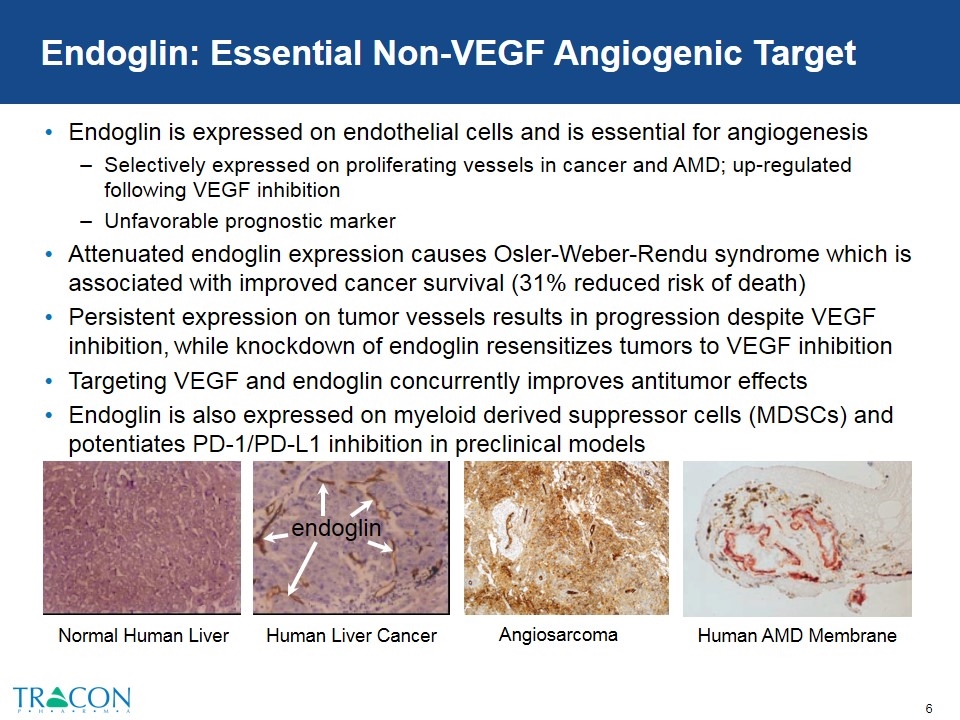

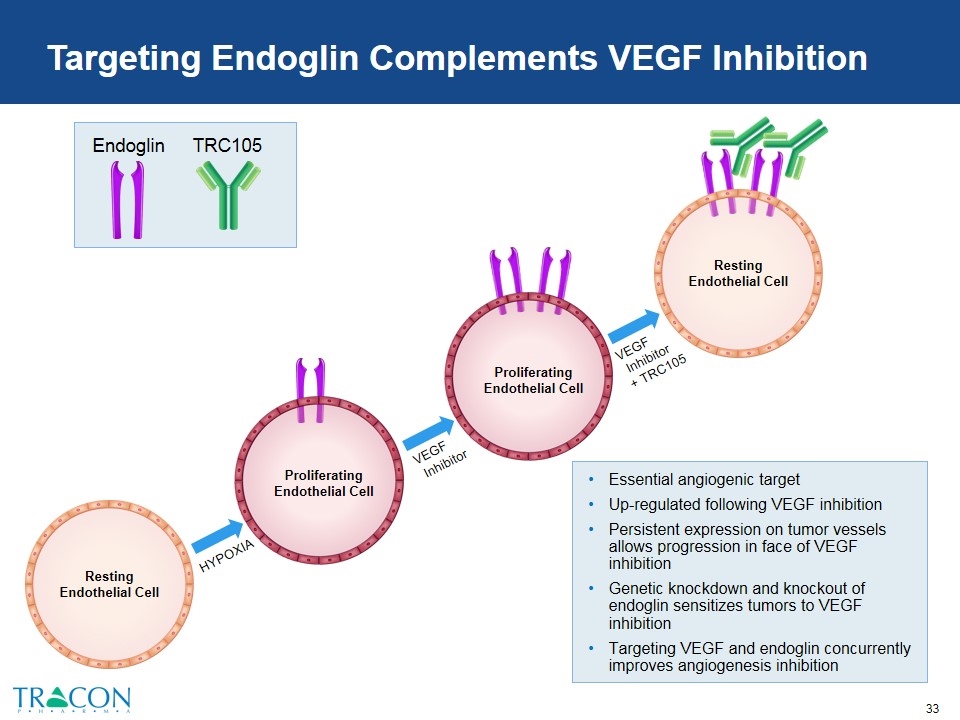

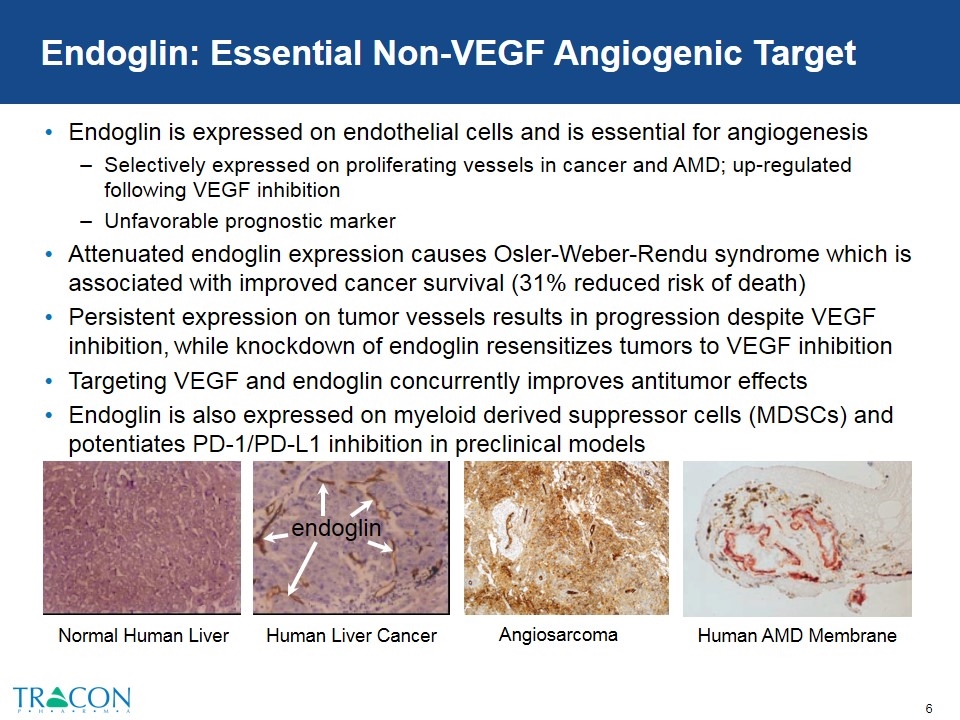

Endoglin: Essential Non-VEGF Angiogenic Target Endoglin is expressed on endothelial cells and is essential for angiogenesis Selectively expressed on proliferating vessels in cancer and AMD; up-regulated following VEGF inhibition Unfavorable prognostic marker Attenuated endoglin expression causes Osler-Weber-Rendu syndrome which is associated with improved cancer survival (31% reduced risk of death) Persistent expression on tumor vessels results in progression despite VEGF inhibition, while knockdown of endoglin resensitizes tumors to VEGF inhibition Targeting VEGF and endoglin concurrently improves antitumor effects Endoglin is also expressed on myeloid derived suppressor cells (MDSCs) and potentiates PD-1/PD-L1 inhibition in preclinical models endoglin Normal Human Liver Human Liver Cancer Human AMD Membrane Angiosarcoma

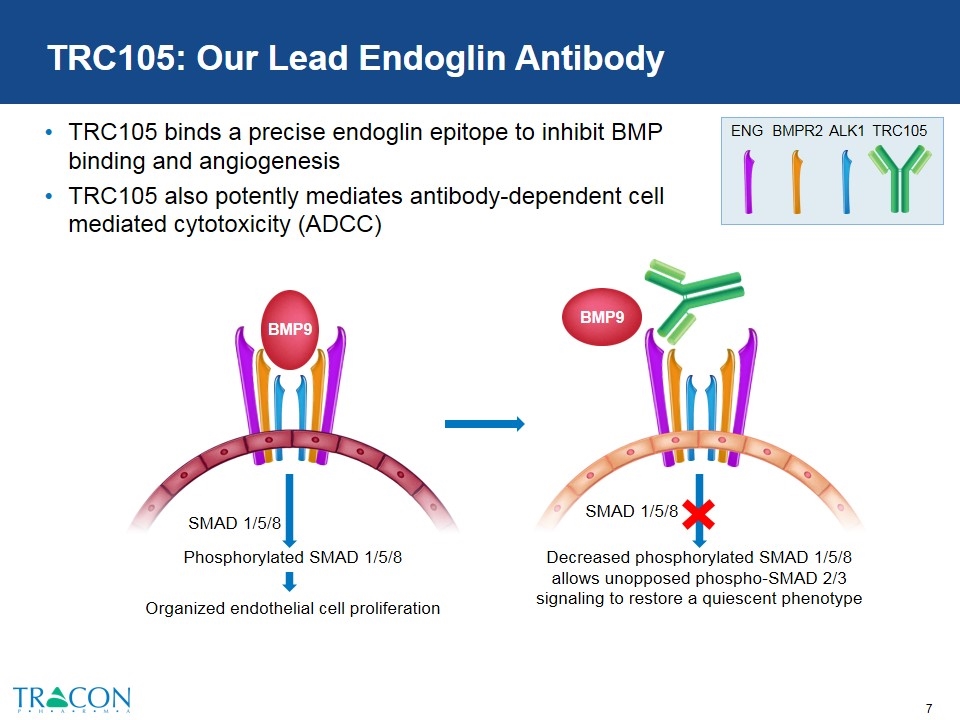

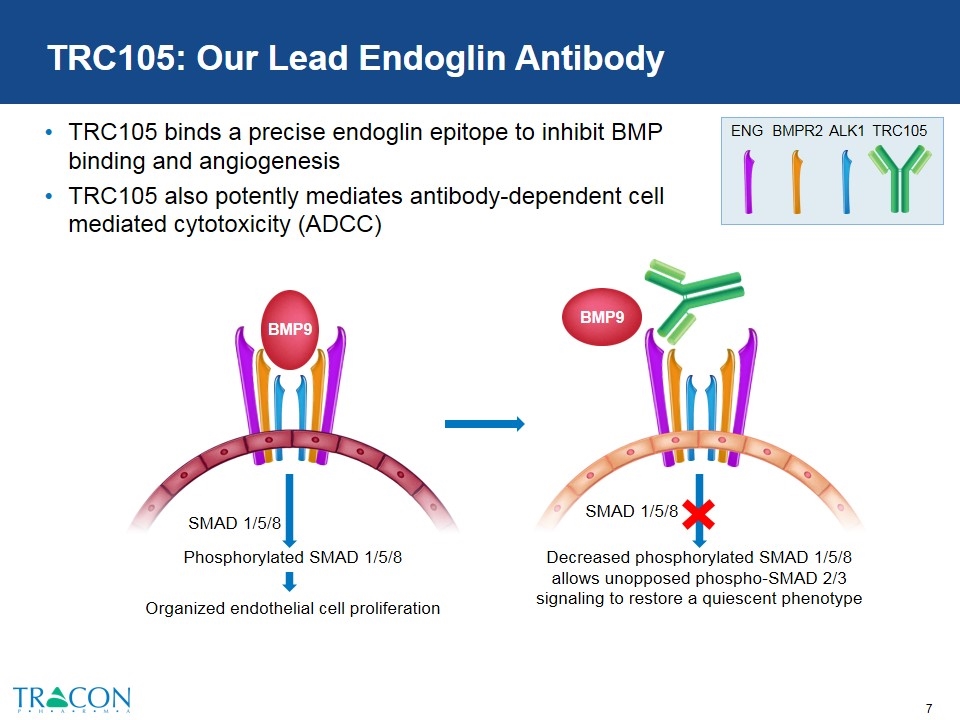

TRC105: Our Lead Endoglin Antibody TRC105 binds a precise endoglin epitope to inhibit BMP binding and angiogenesis TRC105 also potently mediates antibody-dependent cell mediated cytotoxicity (ADCC) Decreased phosphorylated SMAD 1/5/8 allows unopposed phospho-SMAD 2/3 signaling to restore a quiescent phenotype SMAD 1/5/8 BMP9 Phosphorylated SMAD 1/5/8 Organized endothelial cell proliferation SMAD 1/5/8 BMP9 TRC105 BMPR2 ALK1 ENG

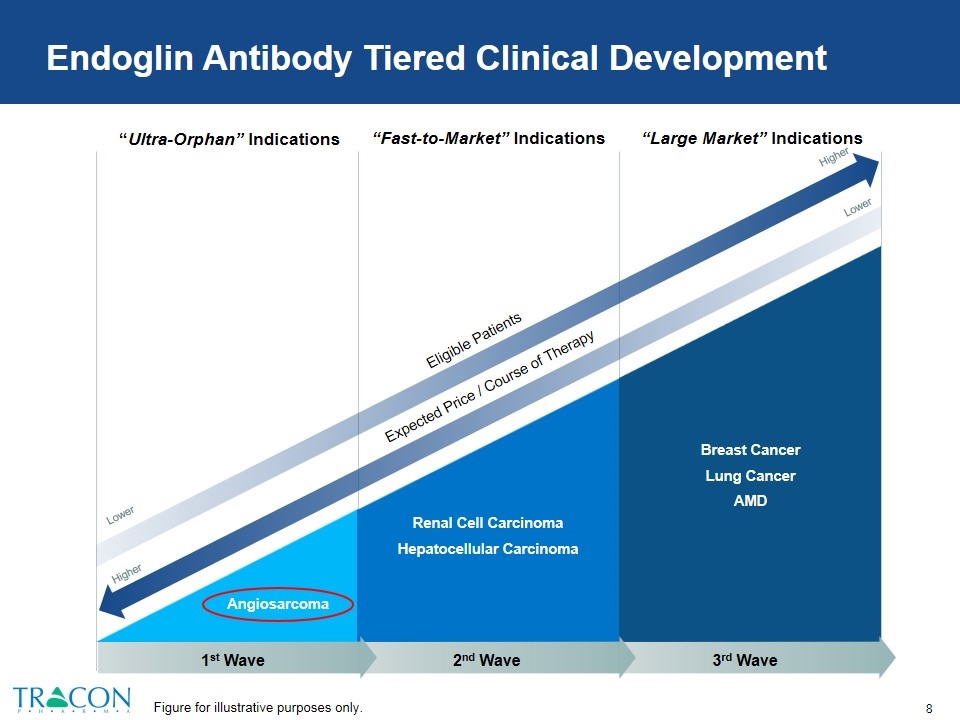

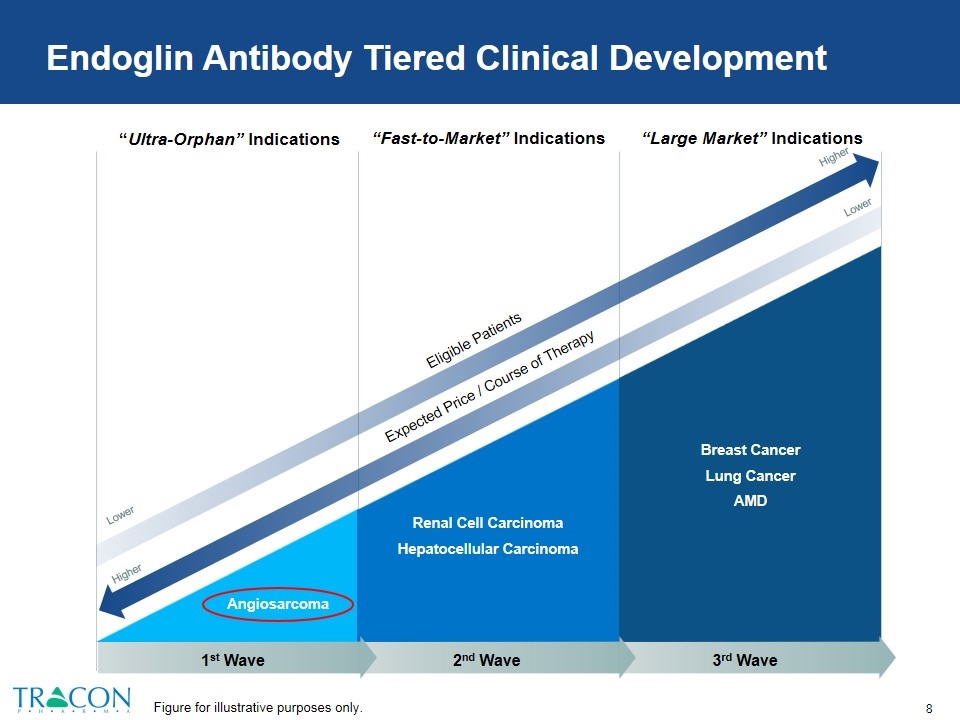

Endoglin Antibody Tiered Clinical Development “Ultra-Orphan” Indications “Fast-to-Market” Indications “Large Market” Indications Expected Price / Course of Therapy Higher Lower Lower Higher Eligible Patients Angiosarcoma Renal Cell Carcinoma Hepatocellular Carcinoma Breast Cancer Lung Cancer AMD 3rd Wave 1st Wave 2nd Wave Figure for illustrative purposes only.

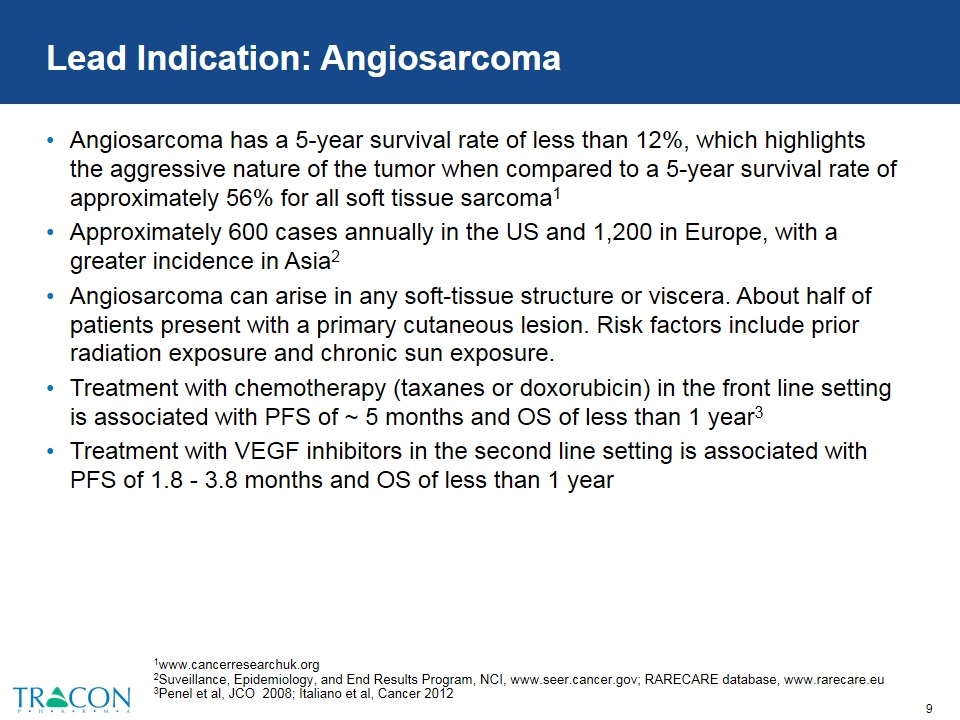

Lead Indication: Angiosarcoma Angiosarcoma has a 5-year survival rate of less than 12%, which highlights the aggressive nature of the tumor when compared to a 5-year survival rate of approximately 56% for all soft tissue sarcoma1 Approximately 600 cases annually in the US and 1,200 in Europe, with a greater incidence in Asia2 Angiosarcoma can arise in any soft-tissue structure or viscera. About half of patients present with a primary cutaneous lesion. Risk factors include prior radiation exposure and chronic sun exposure. Treatment with chemotherapy (taxanes or doxorubicin) in the front line setting is associated with PFS of ~ 5 months and OS of less than 1 year3 Treatment with VEGF inhibitors in the second line setting is associated with PFS of 1.8 - 3.8 months and OS of less than 1 year 1www.cancerresearchuk.org 2Suveillance, Epidemiology, and End Results Program, NCI, www.seer.cancer.gov; RARECARE database, www.rarecare.eu 3Penel et al, JCO 2008; Italiano et al, Cancer 2012

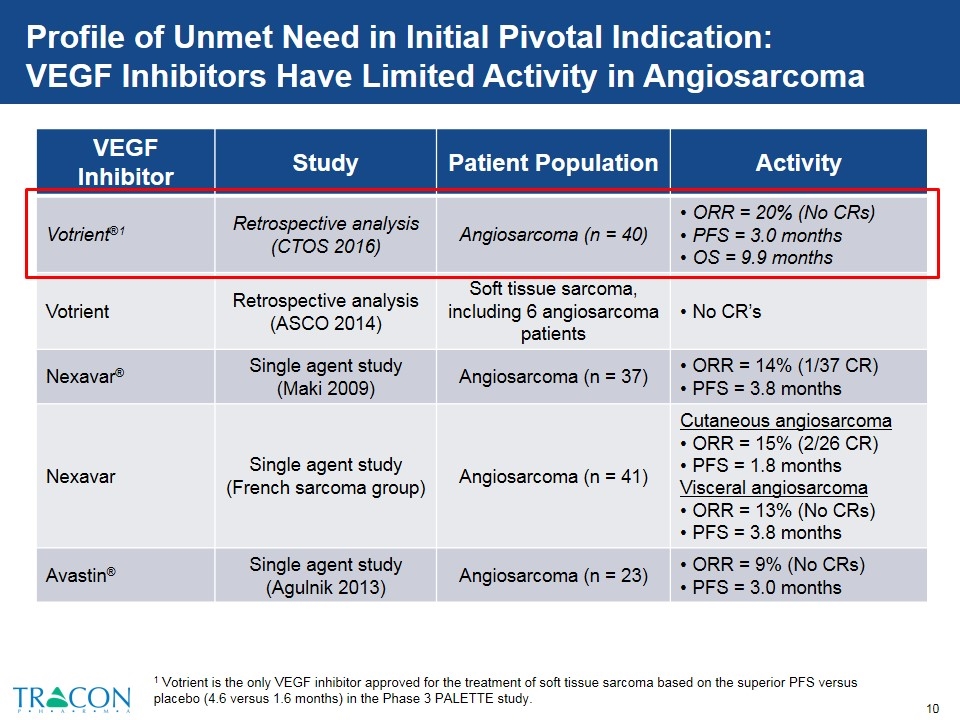

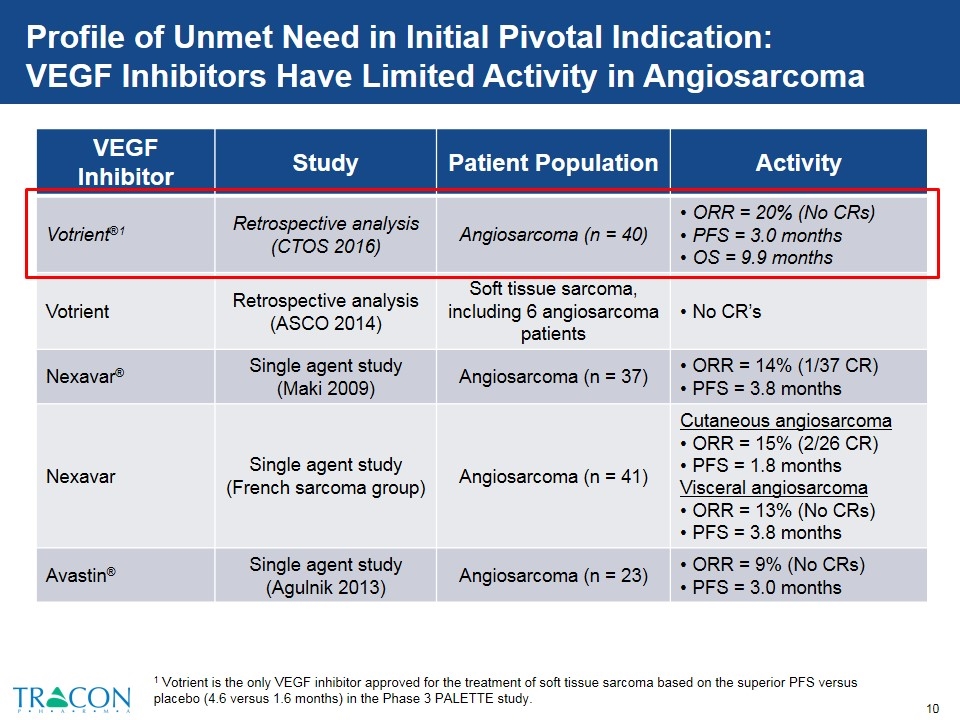

Profile of Unmet Need in Initial Pivotal Indication: VEGF Inhibitors Have Limited Activity in Angiosarcoma VEGF Inhibitor Study Patient Population Activity Votrient®1 Retrospective analysis (CTOS 2016) Angiosarcoma (n = 40) ORR = 20% (No CRs) PFS = 3.0 months OS = 9.9 months Votrient Retrospective analysis (ASCO 2014) Soft tissue sarcoma, including 6 angiosarcoma patients No CR’s Nexavar® Single agent study (Maki 2009) Angiosarcoma (n = 37) ORR = 14% (1/37 CR) PFS = 3.8 months Nexavar Single agent study (French sarcoma group) Angiosarcoma (n = 41) Cutaneous angiosarcoma ORR = 15% (2/26 CR) PFS = 1.8 months Visceral angiosarcoma ORR = 13% (No CRs) PFS = 3.8 months Avastin® Single agent study (Agulnik 2013) Angiosarcoma (n = 23) ORR = 9% (No CRs) PFS = 3.0 months 1 Votrient is the only VEGF inhibitor approved for the treatment of soft tissue sarcoma based on the superior PFS versus placebo (4.6 versus 1.6 months) in the Phase 3 PALETTE study.

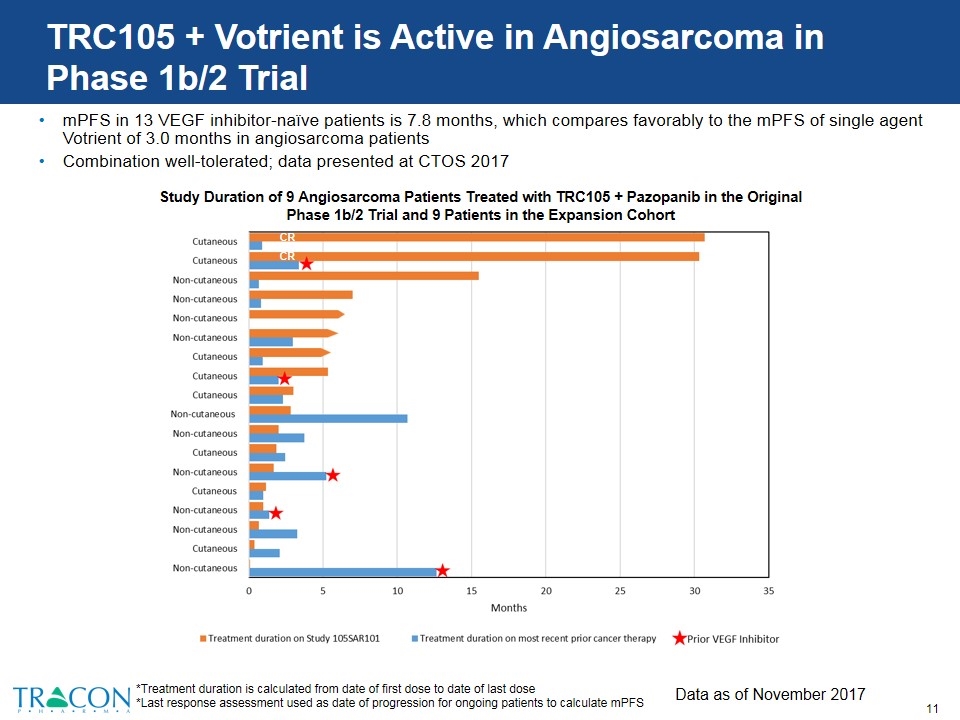

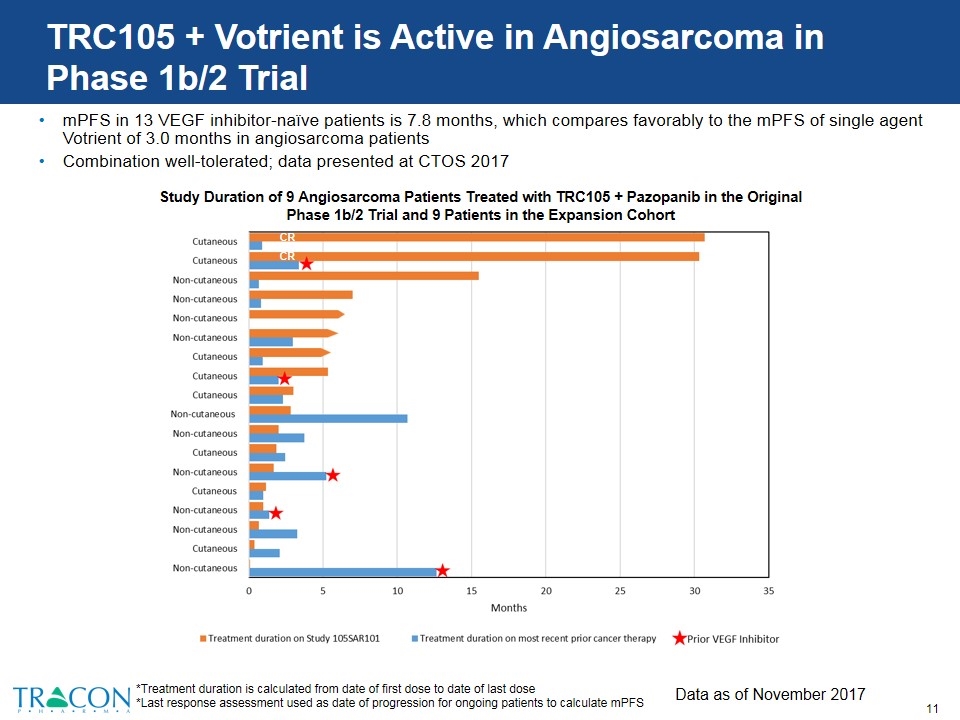

TRC105 + Votrient is Active in Angiosarcoma in Phase 1b/2 Trial mPFS in 13 VEGF inhibitor-naïve patients is 7.8 months, which compares favorably to the mPFS of single agent Votrient of 3.0 months in angiosarcoma patients Combination well-tolerated; data presented at CTOS 2017 Data as of November 2017 CR *Treatment duration is calculated from date of first dose to date of last dose *Last response assessment used as date of progression for ongoing patients to calculate mPFS CR CR Study Duration of 9 Angiosarcoma Patients Treated with TRC105 + Pazopanib in the Original Phase 1b/2 Trial and 9 Patients in the Expansion Cohort

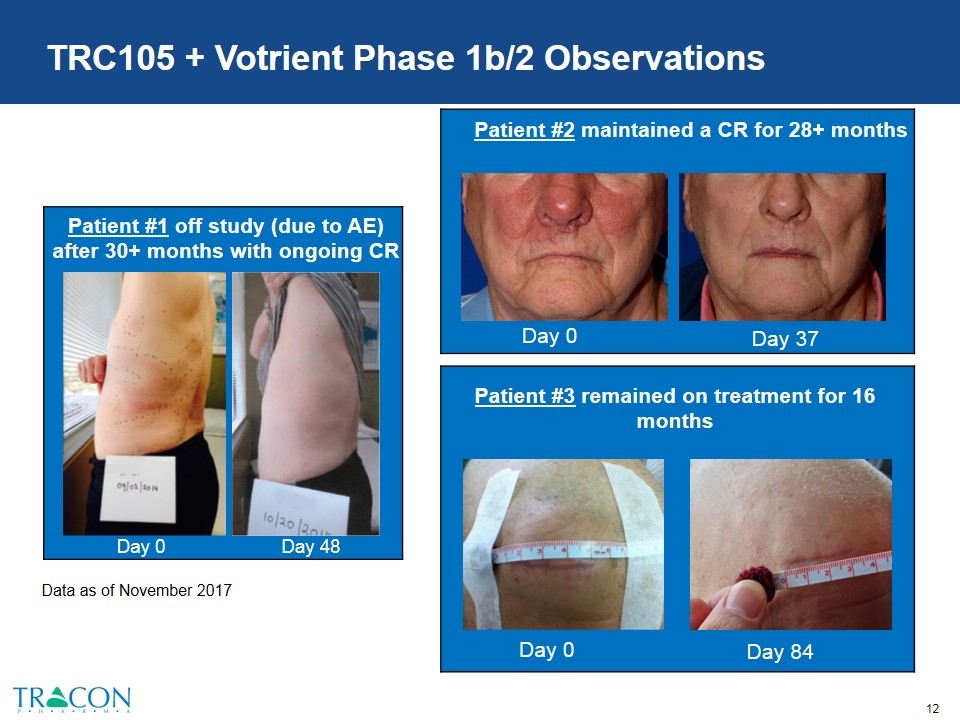

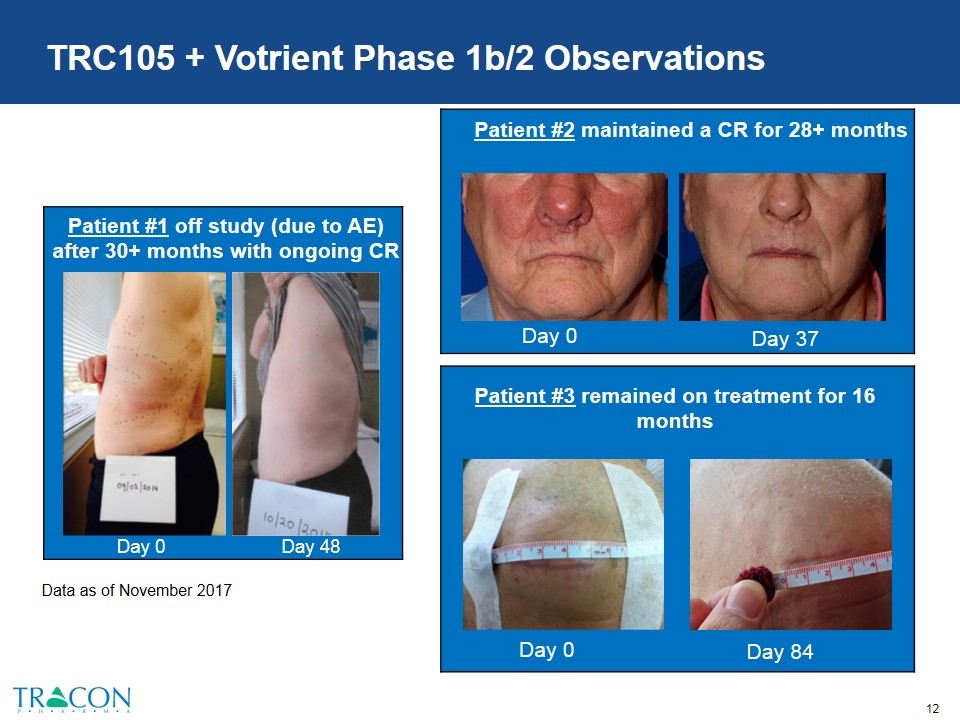

TRC105 + Votrient Phase 1b/2 Observations Complete Response Day 48 Day 0 Day 48 Patient #2 maintained a CR for 28+ months Day 0 Day 37 Patient #1 off study (due to AE) after 30+ months with ongoing CR Patient #3 remained on treatment for 16 months Day 0 Day 84 Data as of November 2017

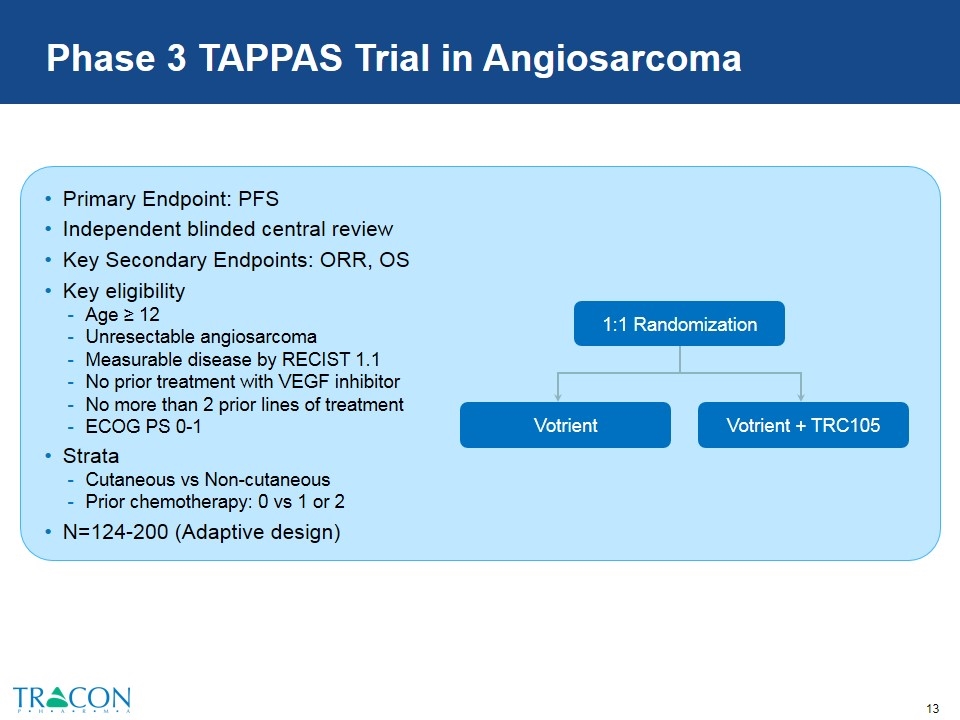

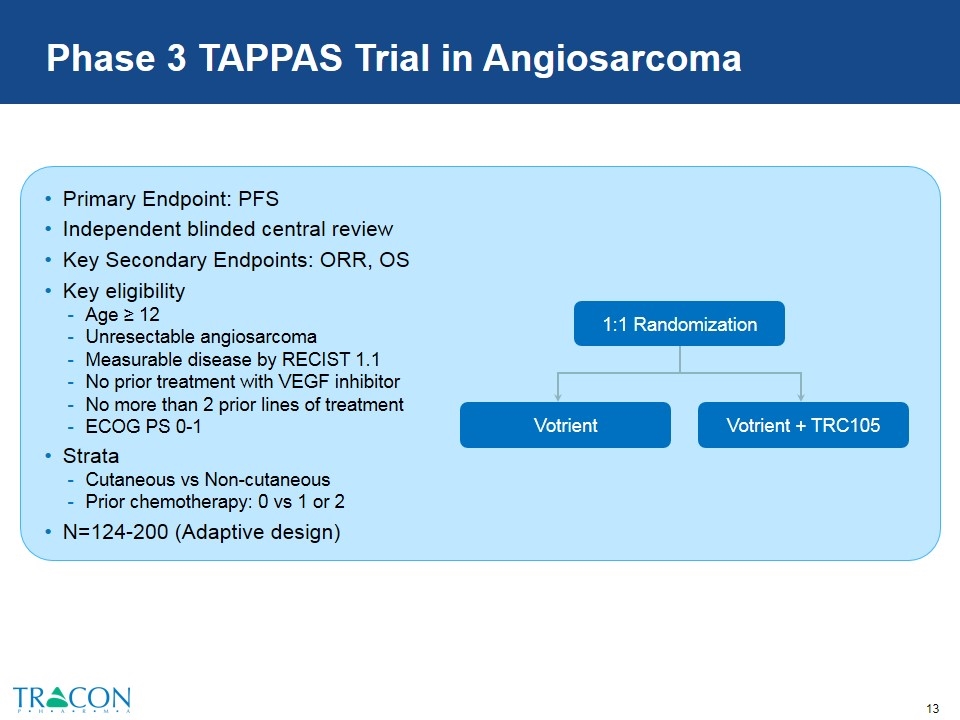

Phase 3 TAPPAS Trial in Angiosarcoma Primary Endpoint: PFS Independent blinded central review Key Secondary Endpoints: ORR, OS Key eligibility Age ≥ 12 Unresectable angiosarcoma Measurable disease by RECIST 1.1 No prior treatment with VEGF inhibitor No more than 2 prior lines of treatment ECOG PS 0-1 Strata Cutaneous vs Non-cutaneous Prior chemotherapy: 0 vs 1 or 2 N=124-200 (Adaptive design) Votrient + TRC105 Votrient 1:1 Randomization

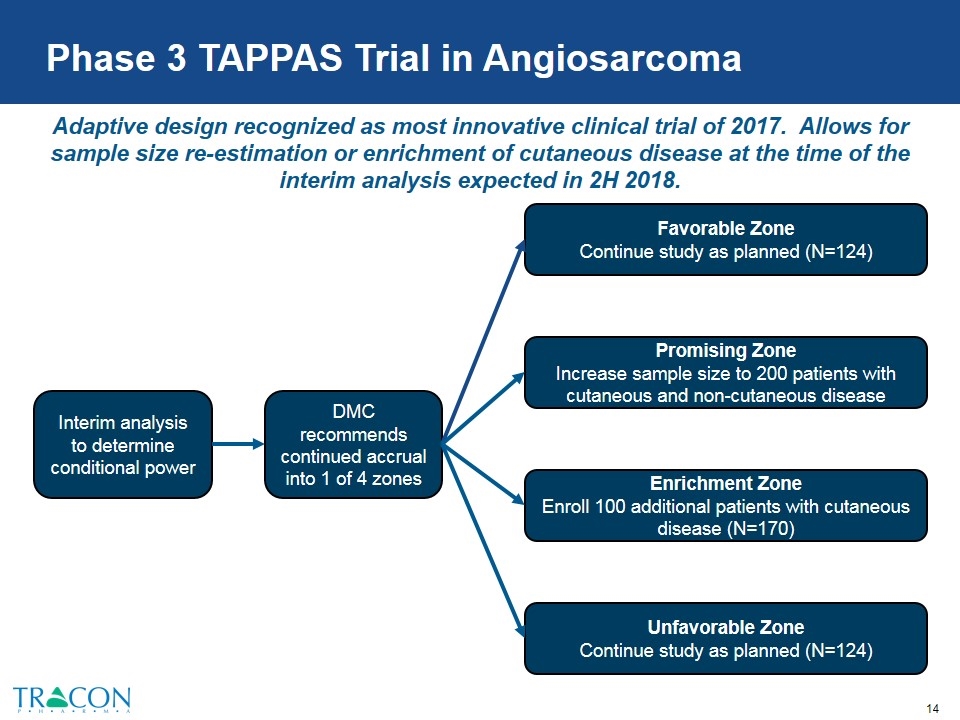

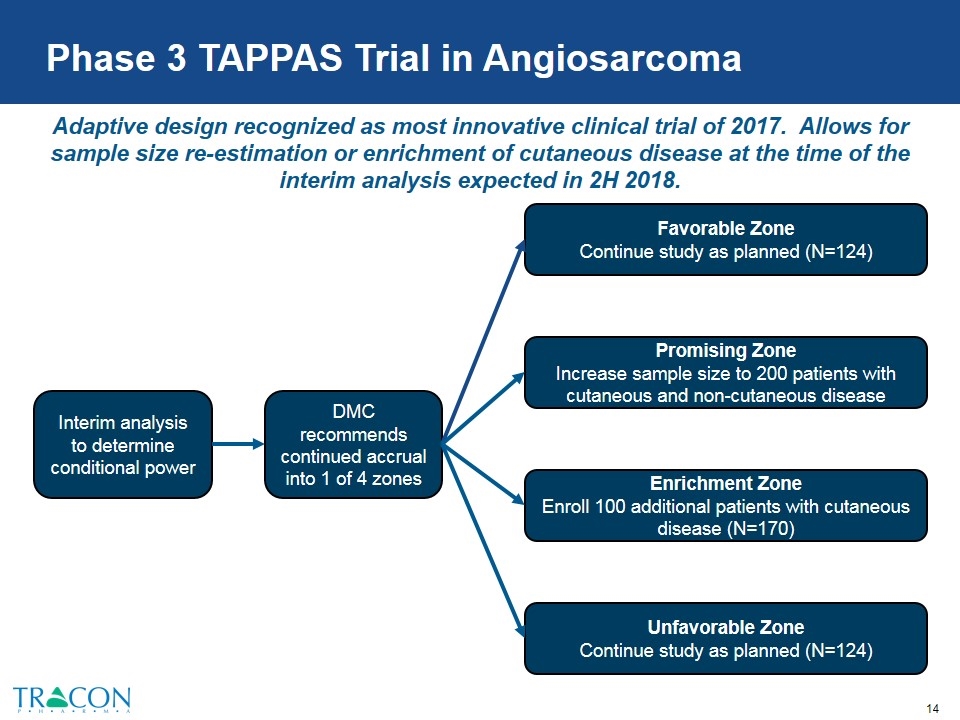

Adaptive design recognized as most innovative clinical trial of 2017. Allows for sample size re-estimation or enrichment of cutaneous disease at the time of the interim analysis expected in 2H 2018. Interim analysis to determine conditional power DMC recommends continued accrual into 1 of 4 zones Favorable Zone Continue study as planned (N=124) Promising Zone Increase sample size to 200 patients with cutaneous and non-cutaneous disease Enrichment Zone Enroll 100 additional patients with cutaneous disease (N=170) Unfavorable Zone Continue study as planned (N=124) Phase 3 TAPPAS Trial in Angiosarcoma

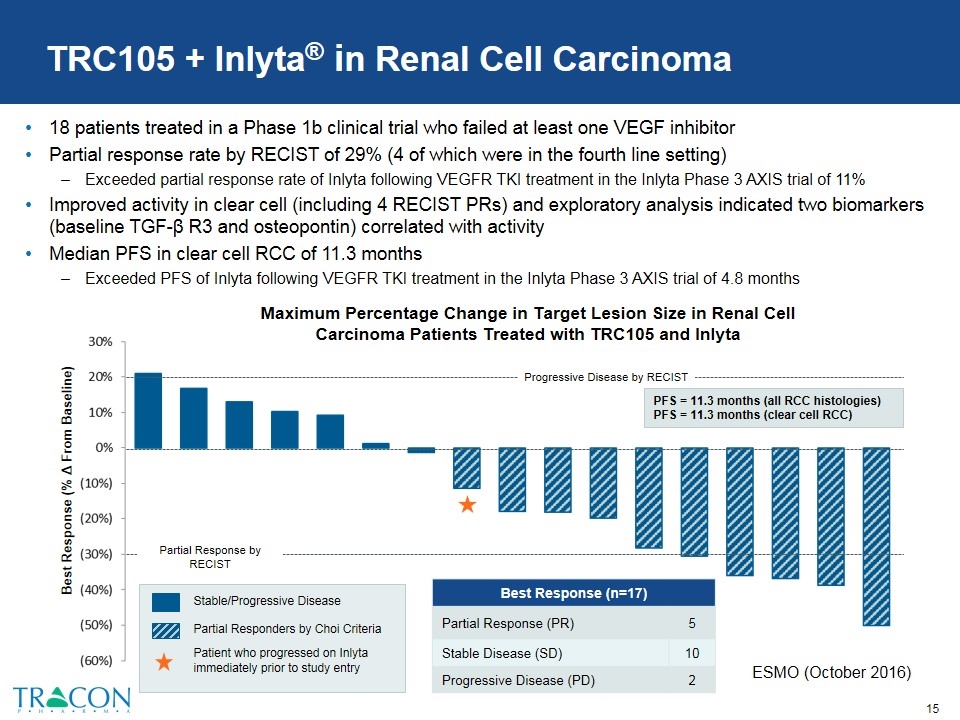

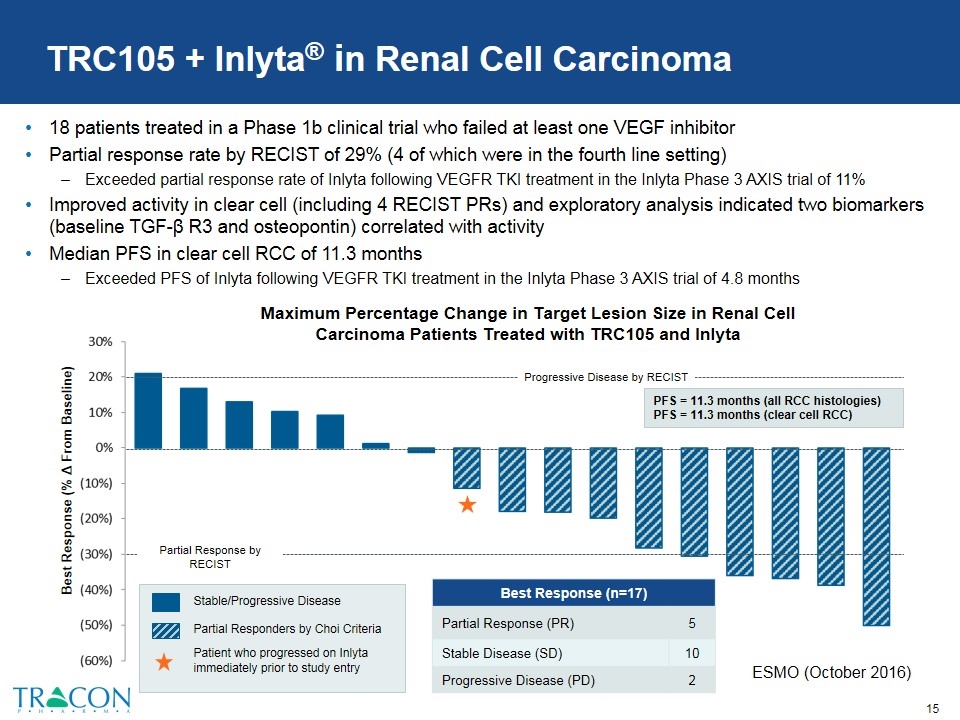

TRC105 + Inlyta® in Renal Cell Carcinoma 18 patients treated in a Phase 1b clinical trial who failed at least one VEGF inhibitor Partial response rate by RECIST of 29% (4 of which were in the fourth line setting) Exceeded partial response rate of Inlyta following VEGFR TKI treatment in the Inlyta Phase 3 AXIS trial of 11% Improved activity in clear cell (including 4 RECIST PRs) and exploratory analysis indicated two biomarkers (baseline TGF-β R3 and osteopontin) correlated with activity Median PFS in clear cell RCC of 11.3 months Exceeded PFS of Inlyta following VEGFR TKI treatment in the Inlyta Phase 3 AXIS trial of 4.8 months Maximum Percentage Change in Target Lesion Size in Renal Cell Carcinoma Patients Treated with TRC105 and Inlyta Best Response (% Δ From Baseline) Stable/Progressive Disease Partial Responders by Choi Criteria Patient who progressed on Inlyta immediately prior to study entry Progressive Disease by RECIST Partial Response by RECIST PFS = 11.3 months (all RCC histologies) PFS = 11.3 months (clear cell RCC) Best Response (n=17) Partial Response (PR) 5 Stable Disease (SD) 10 Progressive Disease (PD) 2 ESMO (October 2016)

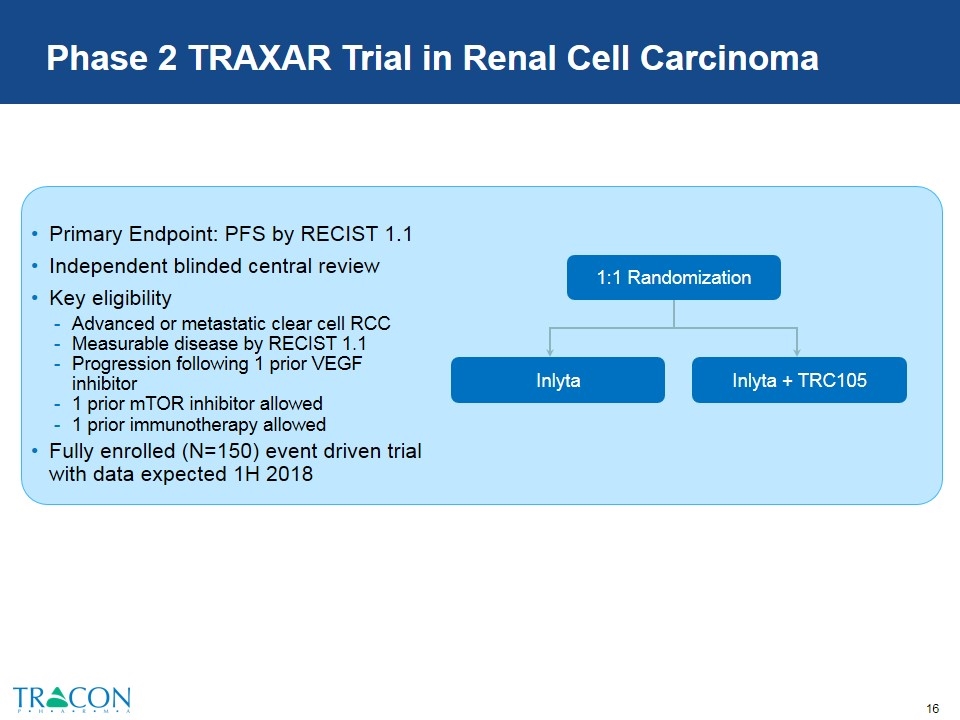

Phase 2 TRAXAR Trial in Renal Cell Carcinoma Primary Endpoint: PFS by RECIST 1.1 Independent blinded central review Key eligibility Advanced or metastatic clear cell RCC Measurable disease by RECIST 1.1 Progression following 1 prior VEGF inhibitor 1 prior mTOR inhibitor allowed 1 prior immunotherapy allowed Fully enrolled (N=150) event driven trial with data expected 1H 2018 Inlyta + TRC105 Inlyta 1:1 Randomization

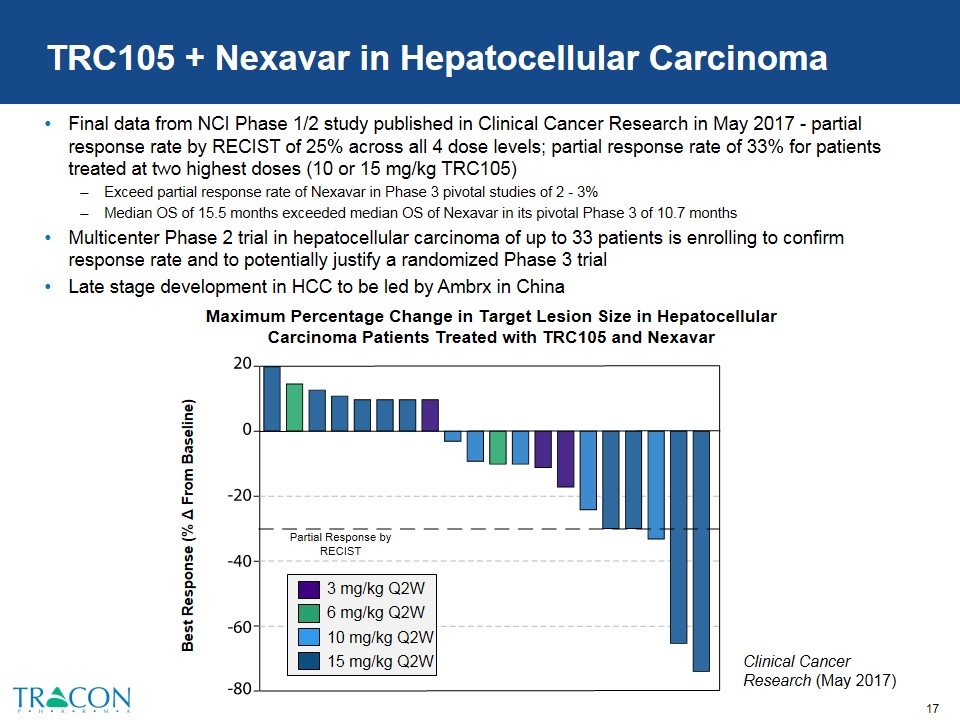

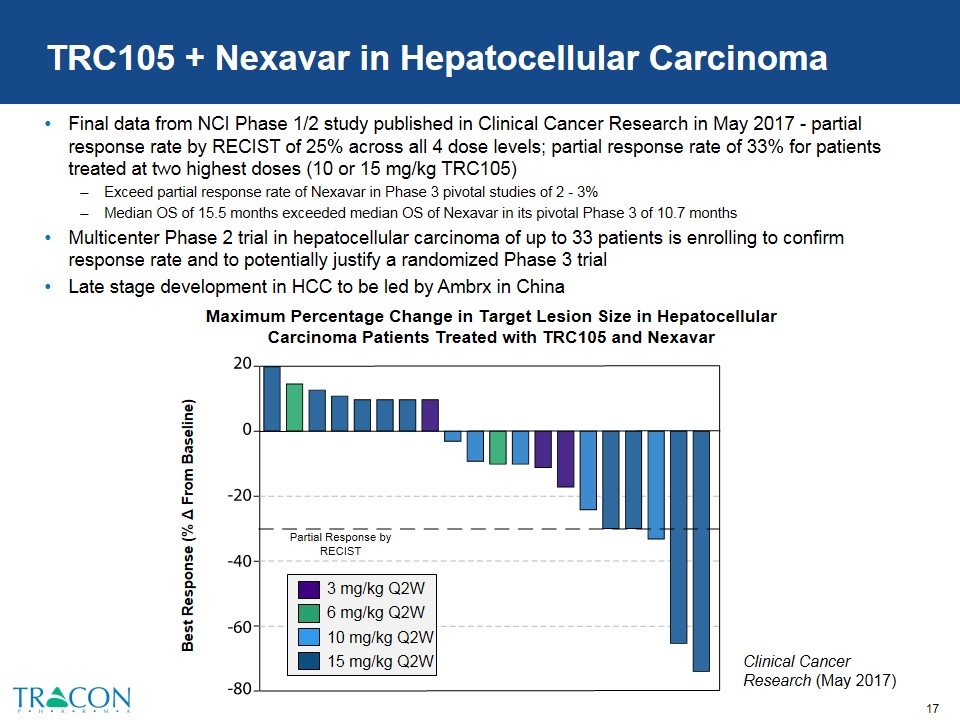

TRC105 + Nexavar in Hepatocellular Carcinoma Final data from NCI Phase 1/2 study published in Clinical Cancer Research in May 2017 - partial response rate by RECIST of 25% across all 4 dose levels; partial response rate of 33% for patients treated at two highest doses (10 or 15 mg/kg TRC105) Exceed partial response rate of Nexavar in Phase 3 pivotal studies of 2 - 3% Median OS of 15.5 months exceeded median OS of Nexavar in its pivotal Phase 3 of 10.7 months Multicenter Phase 2 trial in hepatocellular carcinoma of up to 33 patients is enrolling to confirm response rate and to potentially justify a randomized Phase 3 trial Late stage development in HCC to be led by Ambrx in China Maximum Percentage Change in Target Lesion Size in Hepatocellular Carcinoma Patients Treated with TRC105 and Nexavar Partial Response by RECIST Best Response (% Δ From Baseline) Clinical Cancer Research (May 2017) 3 mg/kg Q2W 6 mg/kg Q2W 10 mg/kg Q2W 15 mg/kg Q2W

TRC105 + Opdivo® in Lung Cancer Endoglin is expressed on myeloid derived suppressor cells (MDSCs), a cell type not addressed by checkpoint inhibition TRC105 mediates ADCC of endoglin expressing cells TRC105 potentiates the activity of PD-1 inhibition in syngeneic mouse tumor models Publication in preparation from Leiden University TRC105 is being studied with Opdivo in second line non-small cell lung cancer in a Phase 1 trial Opdivo single agent response rate1 in this setting is 20% Correlation between response and MDSC content of tumors will be assessed 1Opdivo® package insert

Development in AMD Partnered with Santen Failed Phase 2 and 3 studies from Ophthotech and Regeneron leaves substantial opportunity for a superior MOA to build on VEGF inhibition in wet AMD; regulatory path confirmed; substantial commercial opportunity Santen, a global ophthalmology company with $1.8 billion in annual revenue, leads global development and commercialization efforts for DE-122 (ophthalmic formulation of TRC105) in wet AMD and other eye diseases Deal terms $20 million received thus far Santen pays all development costs Up to $145 million in additional milestone payments Royalties in the high single digits to low teens Phase 1/2 PAVE trial results to be presented February 10, 2018 at the Angiogenesis, Exudation and Degeneration meeting at Bascom Palmer Eye Institute Dosing randomized Phase 2 AVANTE trial

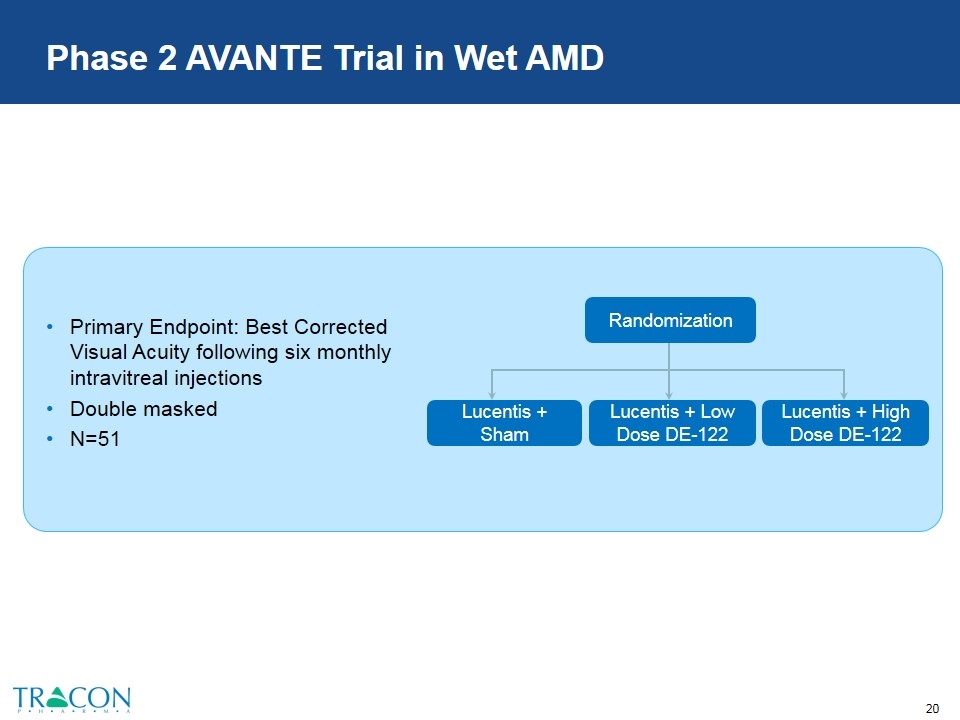

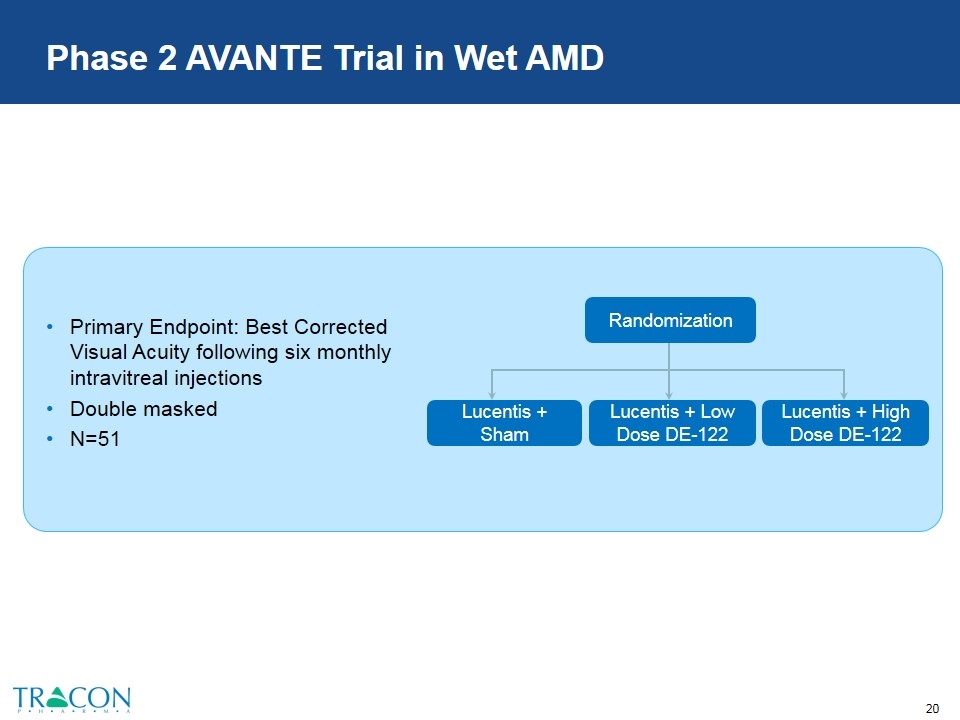

Phase 2 AVANTE Trial in Wet AMD Primary Endpoint: Best Corrected Visual Acuity following six monthly intravitreal injections Double masked N=51 Lucentis + Low Dose DE-122 Lucentis + Sham Randomization Lucentis + High Dose DE-122

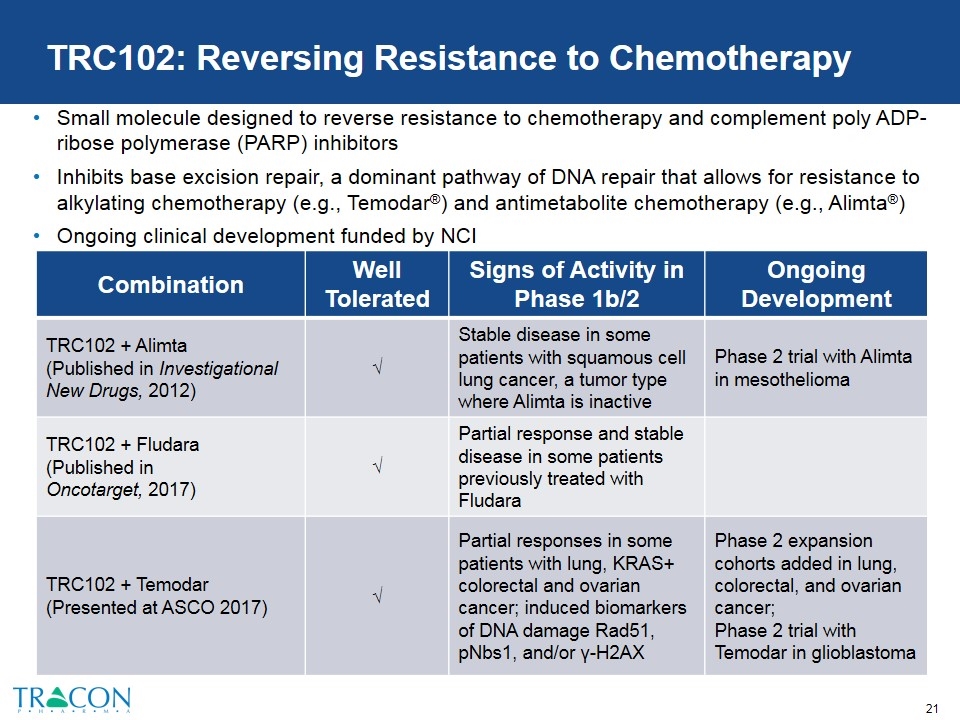

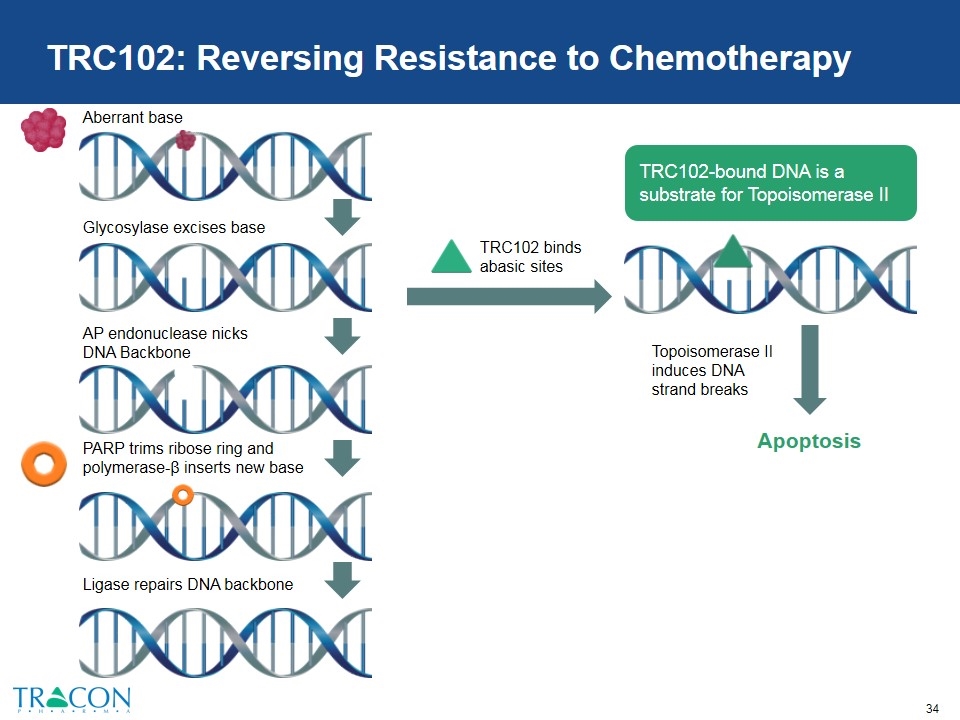

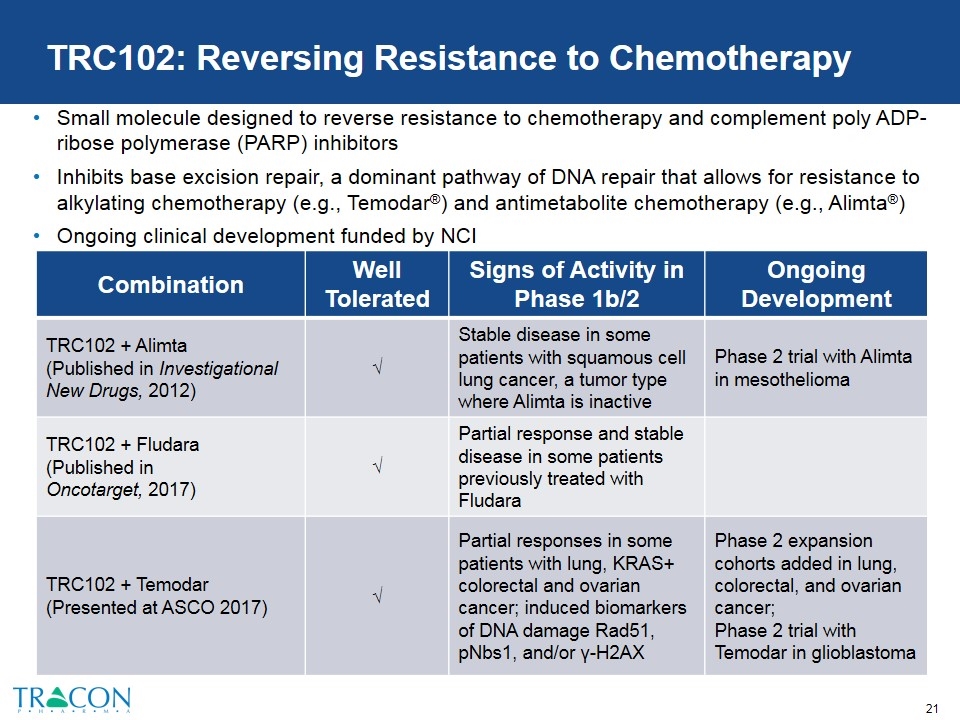

TRC102: Reversing Resistance to Chemotherapy Small molecule designed to reverse resistance to chemotherapy and complement poly ADP-ribose polymerase (PARP) inhibitors Inhibits base excision repair, a dominant pathway of DNA repair that allows for resistance to alkylating chemotherapy (e.g., Temodar®) and antimetabolite chemotherapy (e.g., Alimta®) Ongoing clinical development funded by NCI Combination Well Tolerated Signs of Activity in Phase 1b/2 Ongoing Development TRC102 + Alimta (Published in Investigational New Drugs, 2012) √ Stable disease in some patients with squamous cell lung cancer, a tumor type where Alimta is inactive Phase 2 trial with Alimta in mesothelioma TRC102 + Fludara (Published in Oncotarget, 2017) √ Partial response and stable disease in some patients previously treated with Fludara TRC102 + Temodar (Presented at ASCO 2017) √ Partial responses in some patients with lung, KRAS+ colorectal and ovarian cancer; induced biomarkers of DNA damage Rad51, pNbs1, and/or γ-H2AX Phase 2 expansion cohorts added in lung, colorectal, and ovarian cancer; Phase 2 trial with Temodar in glioblastoma

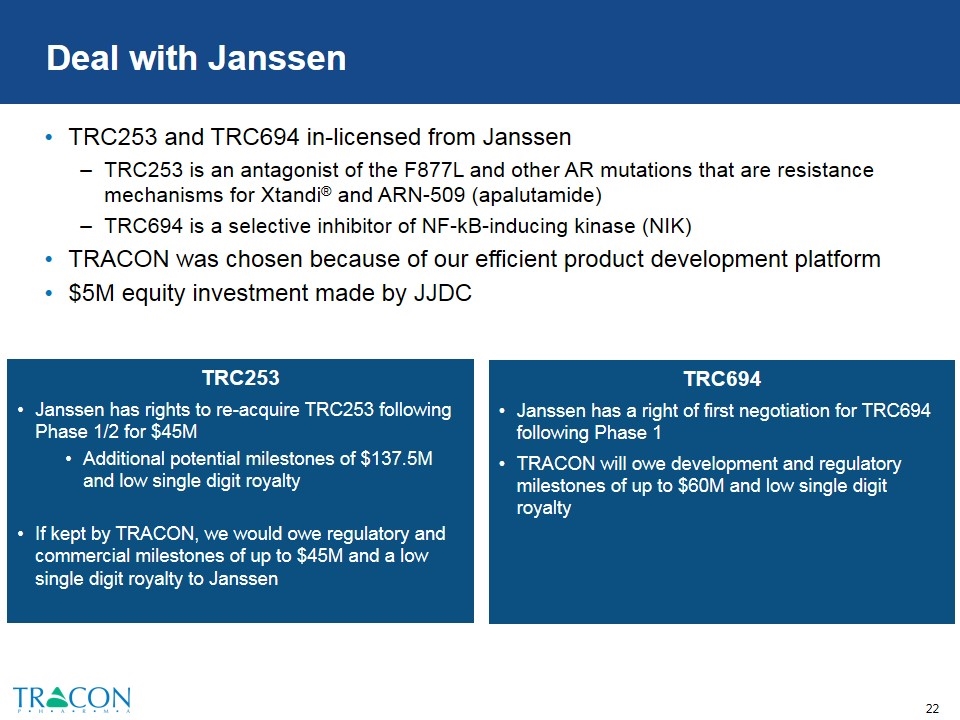

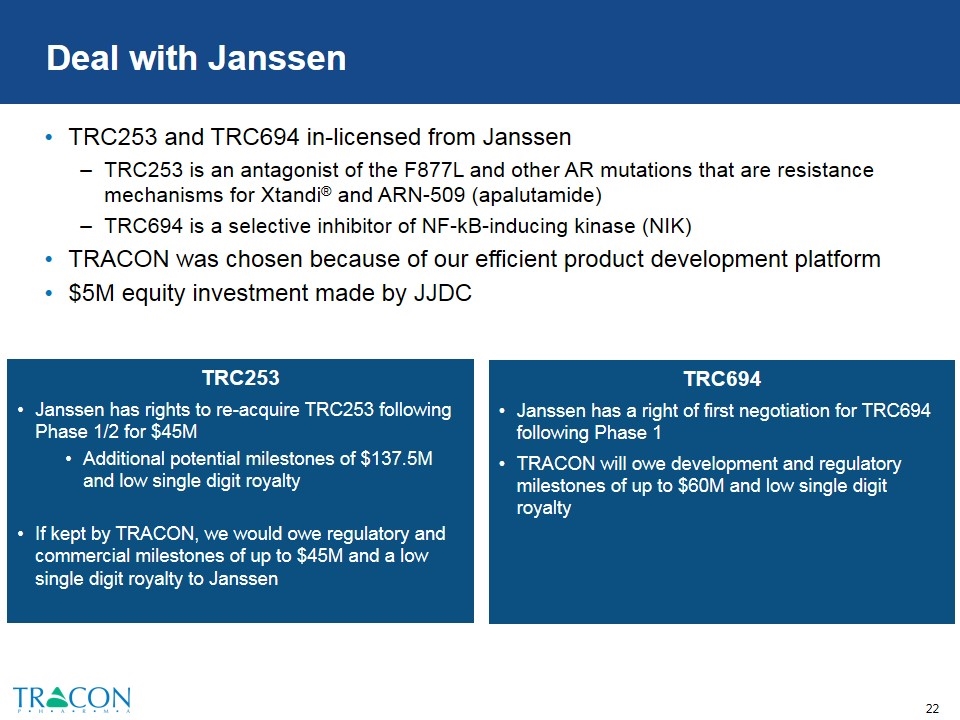

Deal with Janssen TRC253 and TRC694 in-licensed from Janssen TRC253 is an antagonist of the F877L and other AR mutations that are resistance mechanisms for Xtandi® and ARN-509 (apalutamide) TRC694 is a selective inhibitor of NF-kB-inducing kinase (NIK) TRACON was chosen because of our efficient product development platform $5M equity investment made by JJDC TRC253 Janssen has rights to re-acquire TRC253 following Phase 1/2 for $45M Additional potential milestones of $137.5M and low single digit royalty If kept by TRACON, we would owe regulatory and commercial milestones of up to $45M and a low single digit royalty to Janssen TRC694 Janssen has a right of first negotiation for TRC694 following Phase 1 TRACON will owe development and regulatory milestones of up to $60M and low single digit royalty

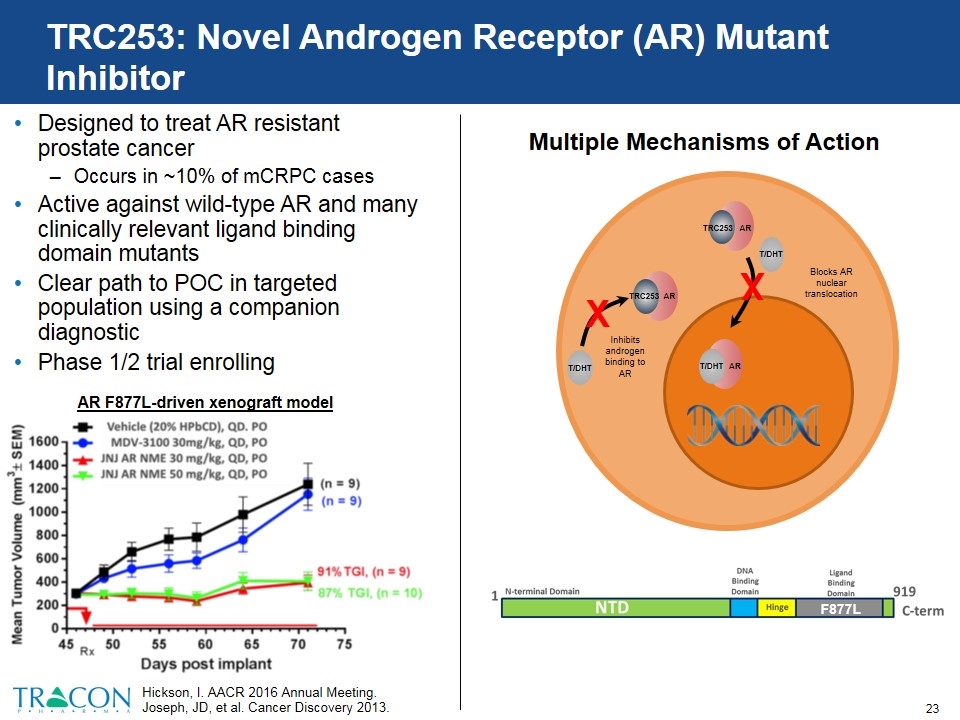

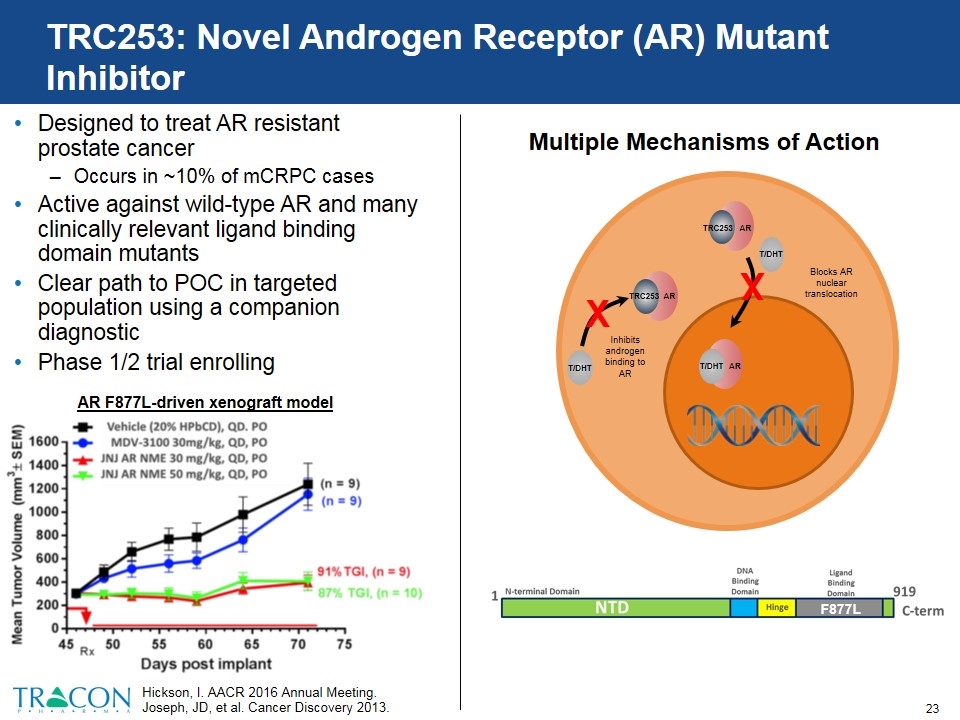

TRC253: Novel Androgen Receptor (AR) Mutant Inhibitor Designed to treat AR resistant prostate cancer Occurs in ~10% of mCRPC cases Active against wild-type AR and many clinically relevant ligand binding domain mutants Clear path to POC in targeted population using a companion diagnostic Phase 1/2 trial enrolling Hickson, I. AACR 2016 Annual Meeting. Joseph, JD, et al. Cancer Discovery 2013. AR F877L-driven xenograft model Multiple Mechanisms of Action F877L T/DHT X Inhibits androgen binding to AR AR TRC253 AR TRC253 X Blocks AR nuclear translocation AR T/DHT T/DHT

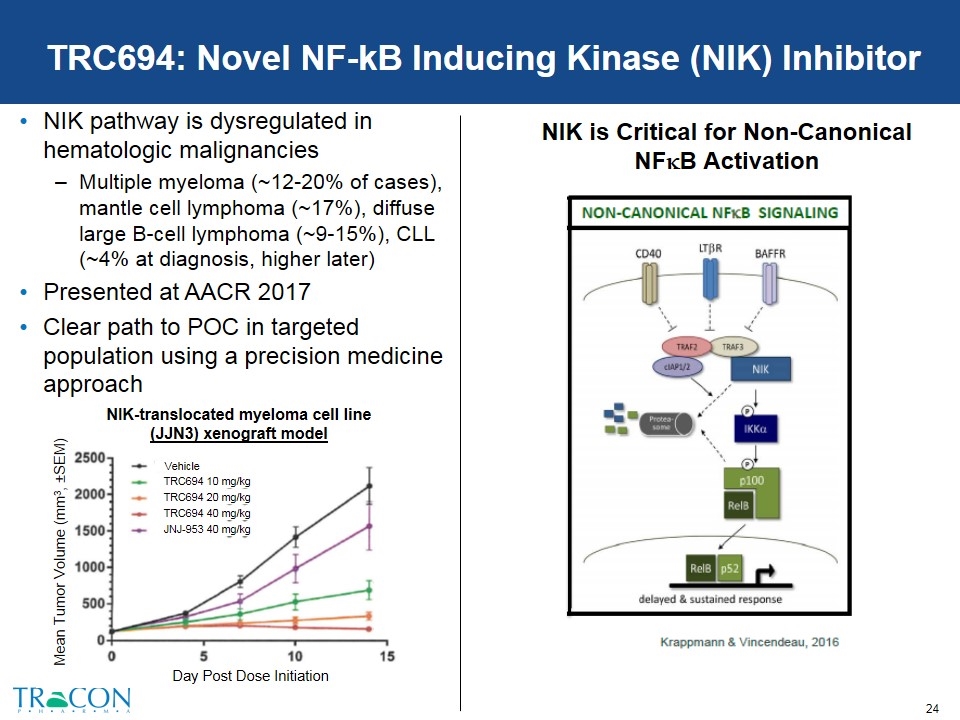

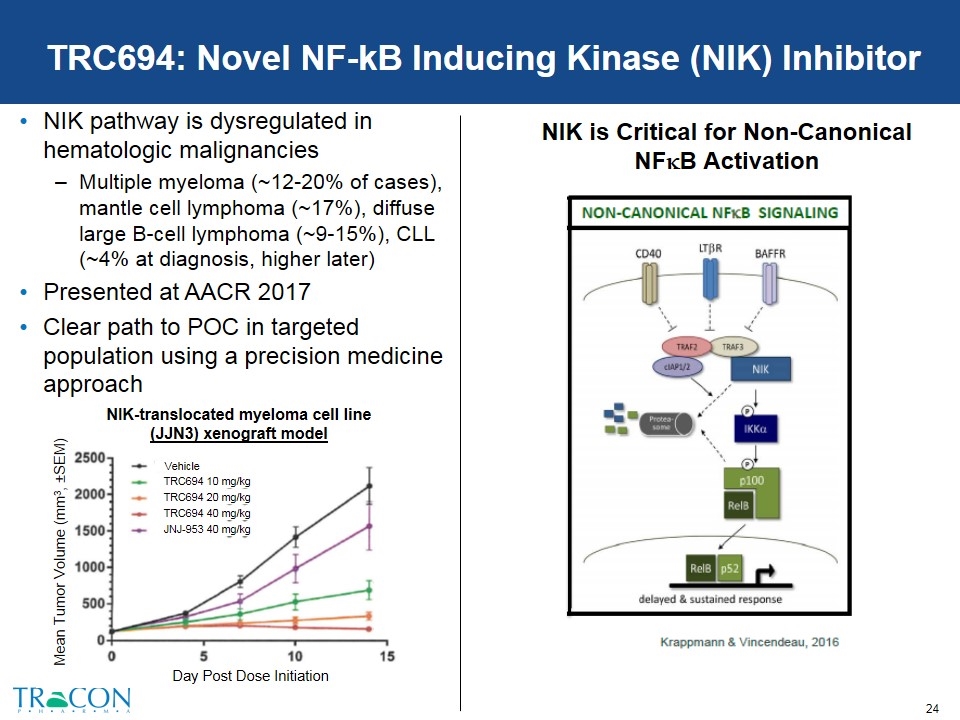

TRC694: Novel NF-kB Inducing Kinase (NIK) Inhibitor NIK pathway is dysregulated in hematologic malignancies Multiple myeloma (~12-20% of cases), mantle cell lymphoma (~17%), diffuse large B-cell lymphoma (~9-15%), CLL (~4% at diagnosis, higher later) Presented at AACR 2017 Clear path to POC in targeted population using a precision medicine approach NIK is Critical for Non-Canonical NFkB Activation Vehicle TRC694 10 mg/kg TRC694 20 mg/kg TRC694 40 mg/kg JNJ-953 40 mg/kg Day Post Dose Initiation Mean Tumor Volume (mm3, ±SEM) NIK-translocated myeloma cell line (JJN3) xenograft model

Business Development Strategy Leverage the TRACON Product Development Platform to develop promising oncology assets while diversifying the TRACON portfolio Transactions similar to the Janssen transaction where TRACON develops asset(s) to certain value inflection points in return for substantial economics and/or downstream commercial rights For companies with little or no development infrastructure in the US, conduct proof-of-concept clinical trials in the US in exchange for substantial economics and/or product rights in the US

Multiple Expected Near-Term Value Inflection Points TRC105 (carotuximab) Companion Therapy Indication 2018 2019 Votrient Angiosarcoma Inlyta Renal Nexavar Liver Opdivo Lung DE-122 Lucentis Wet AMD TRC102 Alimta Mesothelioma Temodar GBM TRC 253 Prostate Phase 1B/2 Phase 3 Phase 2 Phase 2 Phase 1/2 Phase 2B Phase 2B Phase 1B

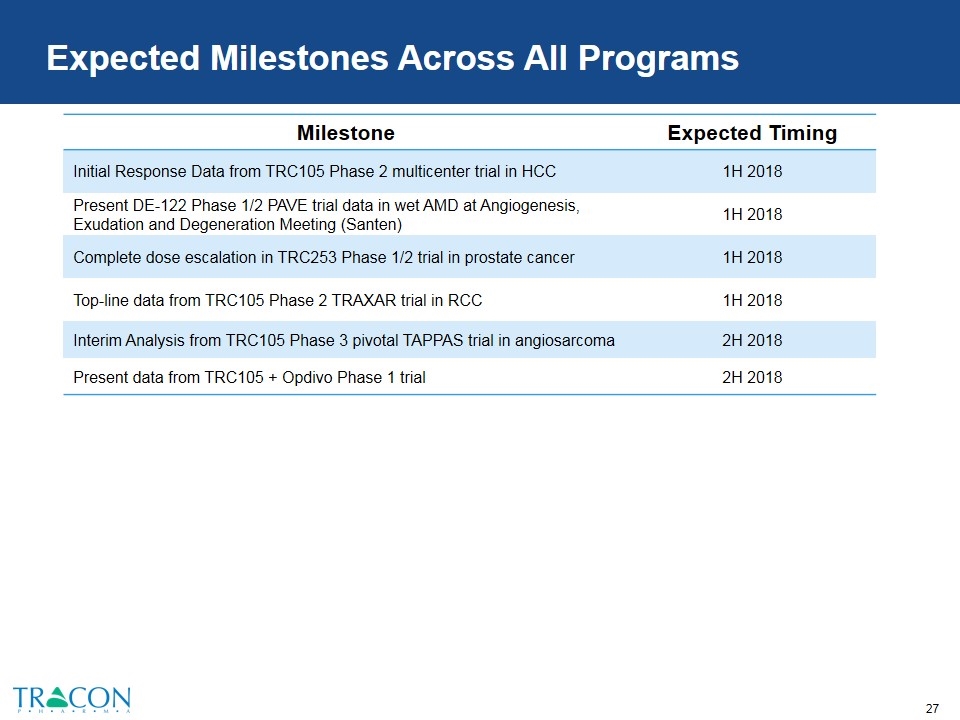

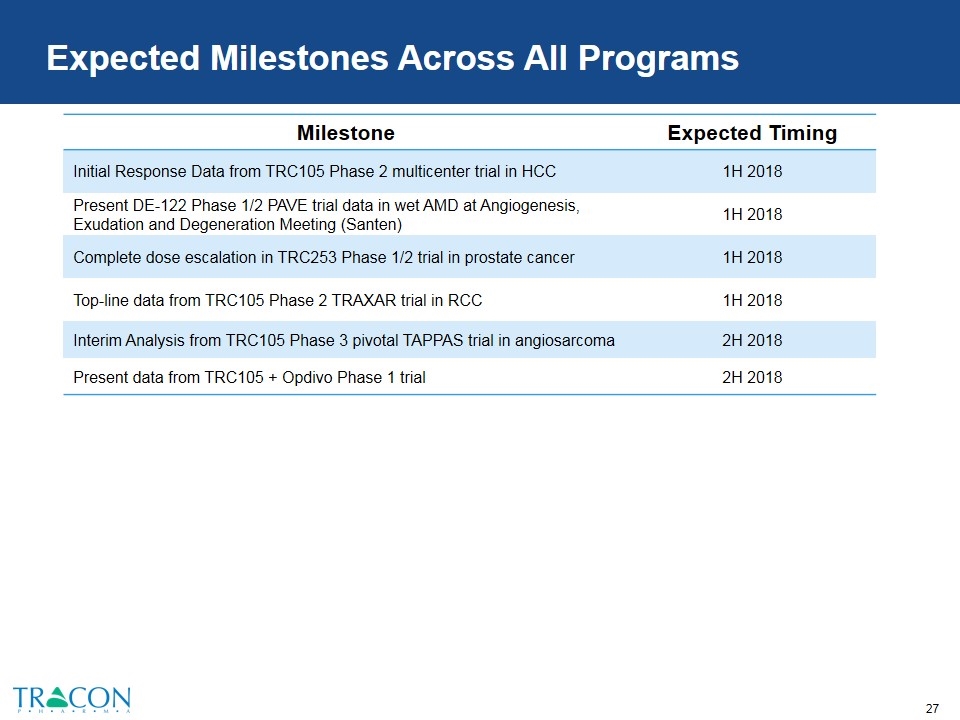

Expected Milestones Across All Programs Milestone Expected Timing Initial Response Data from TRC105 Phase 2 multicenter trial in HCC 1H 2018 Present DE-122 Phase 1/2 PAVE trial data in wet AMD at Angiogenesis, Exudation and Degeneration Meeting (Santen) 1H 2018 Complete dose escalation in TRC253 Phase 1/2 trial in prostate cancer 1H 2018 Top-line data from TRC105 Phase 2 TRAXAR trial in RCC 1H 2018 Interim Analysis from TRC105 Phase 3 pivotal TAPPAS trial in angiosarcoma 2H 2018 Present data from TRC105 + Opdivo Phase 1 trial 2H 2018

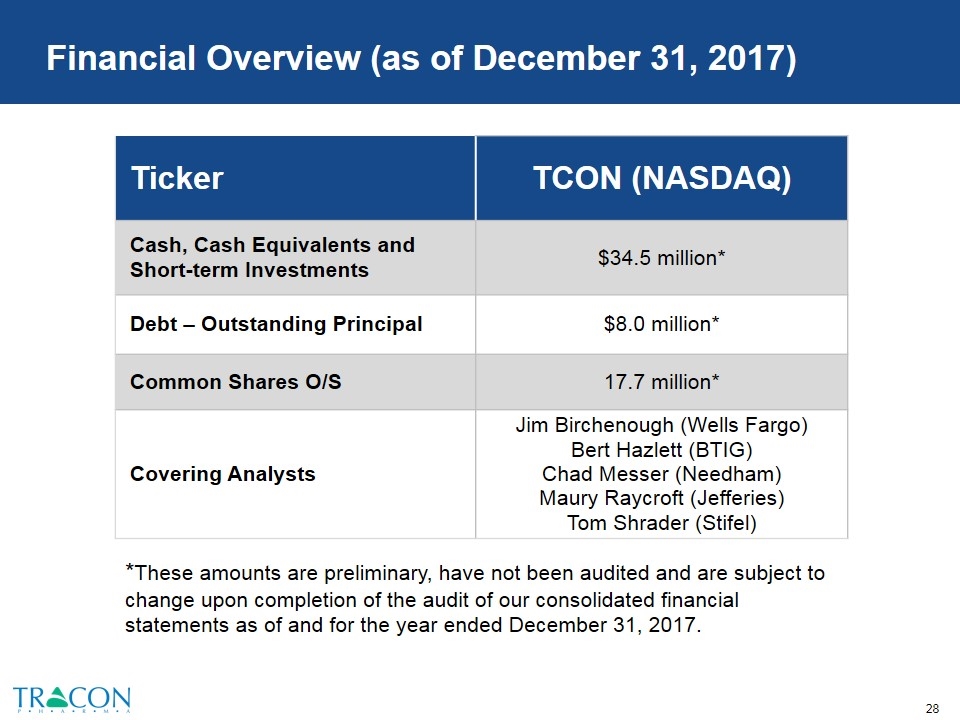

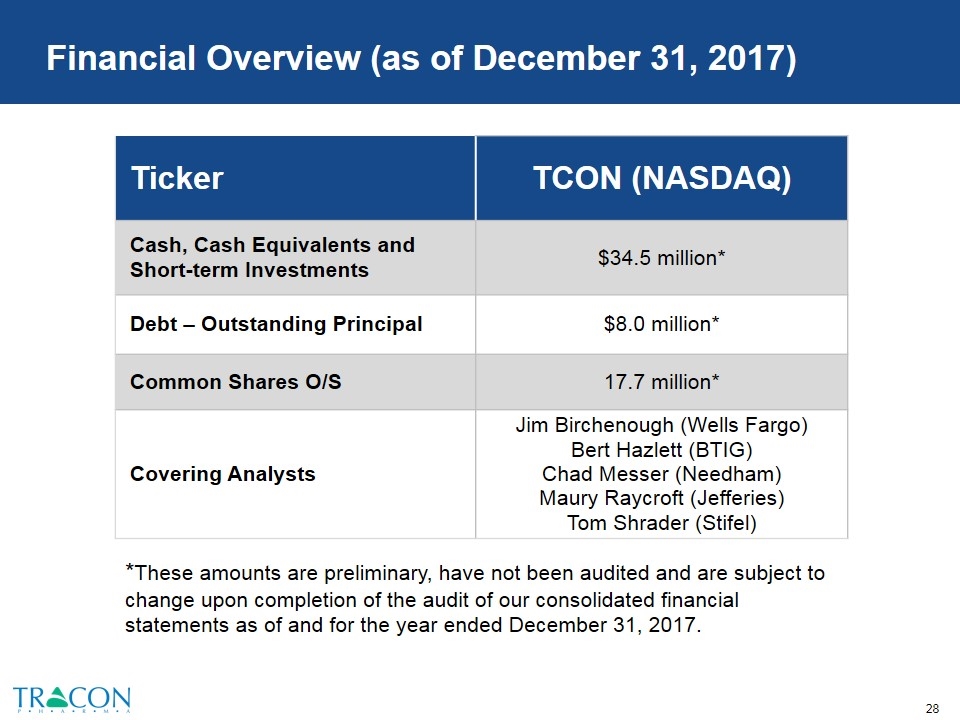

Financial Overview (as of December 31, 2017) Ticker TCON (NASDAQ) Cash, Cash Equivalents and Short-term Investments $34.5 million* Debt – Outstanding Principal $8.0 million* Common Shares O/S 17.7 million* Covering Analysts Jim Birchenough (Wells Fargo) Bert Hazlett (BTIG) Chad Messer (Needham) Maury Raycroft (Jefferies) Tom Shrader (Stifel) *These amounts are preliminary, have not been audited and are subject to change upon completion of the audit of our consolidated financial statements as of and for the year ended December 31, 2017.

TRC105 Investment Highlights Endoglin antibody in late stage trials in oncology and wet AMD with VEGF inhibitors, a franchise currently generating > $18B annually; Immune oncology opportunity Experienced Team Inhibitor of DNA repair dosing in Phase 2 glioblastoma and mesothelioma trials supported by NCI TRC102 Phase 2 TRC253 Phase 1 Dosing Phase 3 TAPPAS trial under SPA in orphan drug indication of angiosarcoma; multiple ongoing Phase 2 trials Oncology Phase 3 Ophthalmology Phase 2 Immune Oncology Phase 1 Dosing Phase 2 AVANTE randomized wet AMD trial; partnered with Santen Dosing Phase 1 trial of TRC105 and Opdivo Capital efficient Product Development Platform advancing a late stage and diverse pipeline of proprietary as well as pharma partner assets Inhibitor of mutated and wild-type Androgen Receptor dosing in Phase 1/2 prostate cancer trial

TRACON PHARMACEUTICALS January 2018 NASDAQ: TCON

Backup

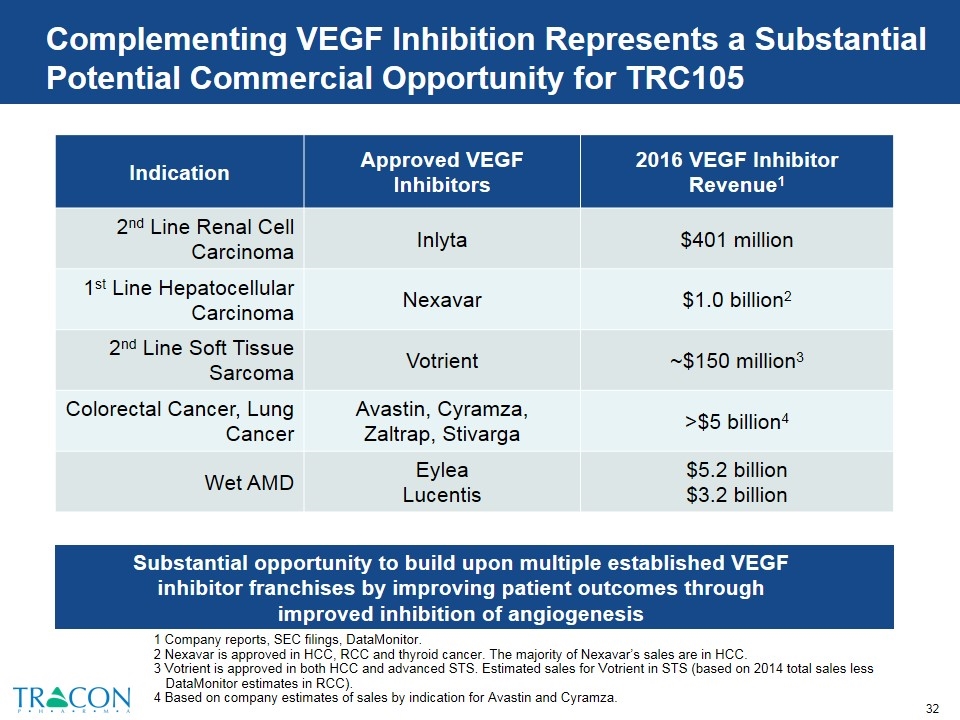

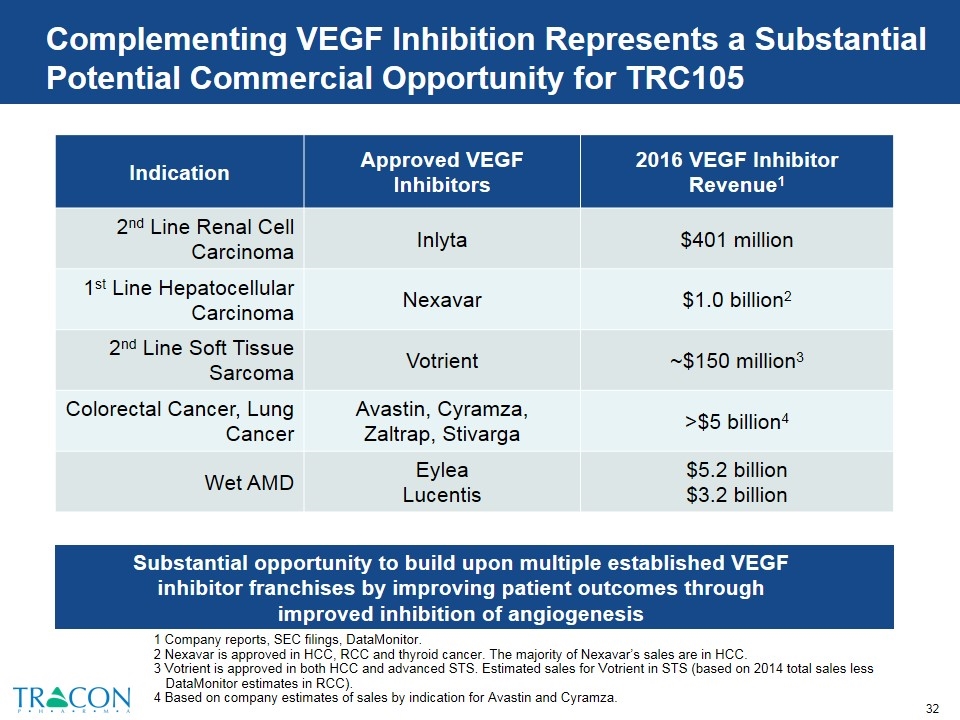

Complementing VEGF Inhibition Represents a Substantial Potential Commercial Opportunity for TRC105 1 Company reports, SEC filings, DataMonitor. 2 Nexavar is approved in HCC, RCC and thyroid cancer. The majority of Nexavar’s sales are in HCC. 3 Votrient is approved in both HCC and advanced STS. Estimated sales for Votrient in STS (based on 2014 total sales less DataMonitor estimates in RCC). 4 Based on company estimates of sales by indication for Avastin and Cyramza. Indication Approved VEGF Inhibitors 2016 VEGF Inhibitor Revenue1 2nd Line Renal Cell Carcinoma Inlyta $401 million 1st Line Hepatocellular Carcinoma Nexavar $1.0 billion2 2nd Line Soft Tissue Sarcoma Votrient ~$150 million3 Colorectal Cancer, Lung Cancer Avastin, Cyramza, Zaltrap, Stivarga >$5 billion4 Wet AMD Eylea Lucentis $5.2 billion $3.2 billion Substantial opportunity to build upon multiple established VEGF inhibitor franchises by improving patient outcomes through improved inhibition of angiogenesis

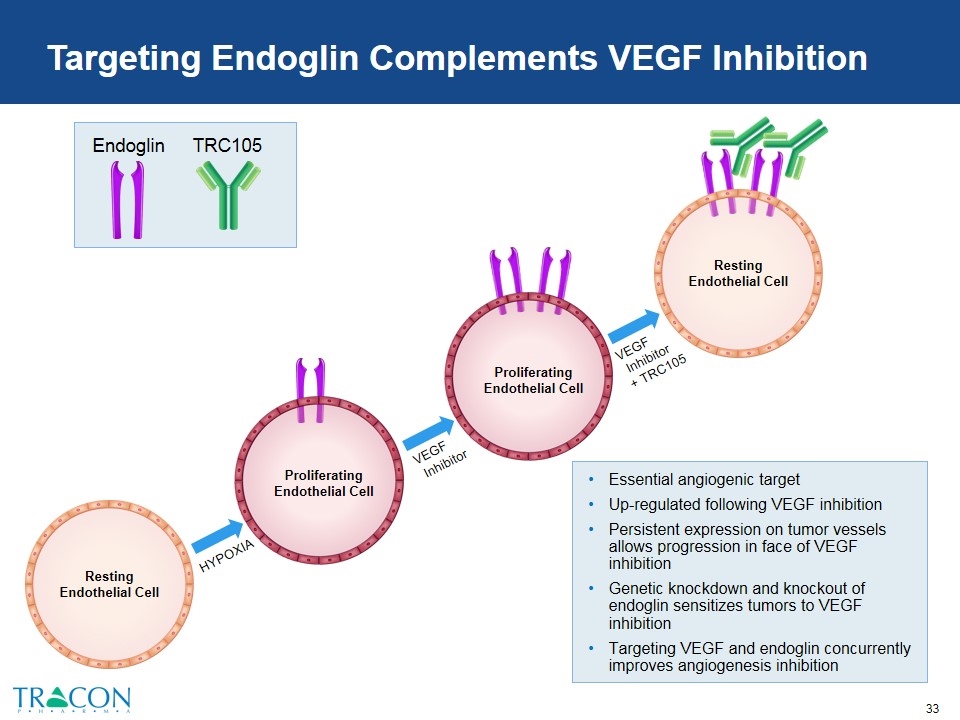

Targeting Endoglin Complements VEGF Inhibition Resting Endothelial Cell Essential angiogenic target Up-regulated following VEGF inhibition Persistent expression on tumor vessels allows progression in face of VEGF inhibition Genetic knockdown and knockout of endoglin sensitizes tumors to VEGF inhibition Targeting VEGF and endoglin concurrently improves angiogenesis inhibition Resting Endothelial Cell TRC105 Endoglin Proliferating Endothelial Cell HYPOXIA VEGF Inhibitor VEGF Inhibitor + TRC105 Proliferating Endothelial Cell

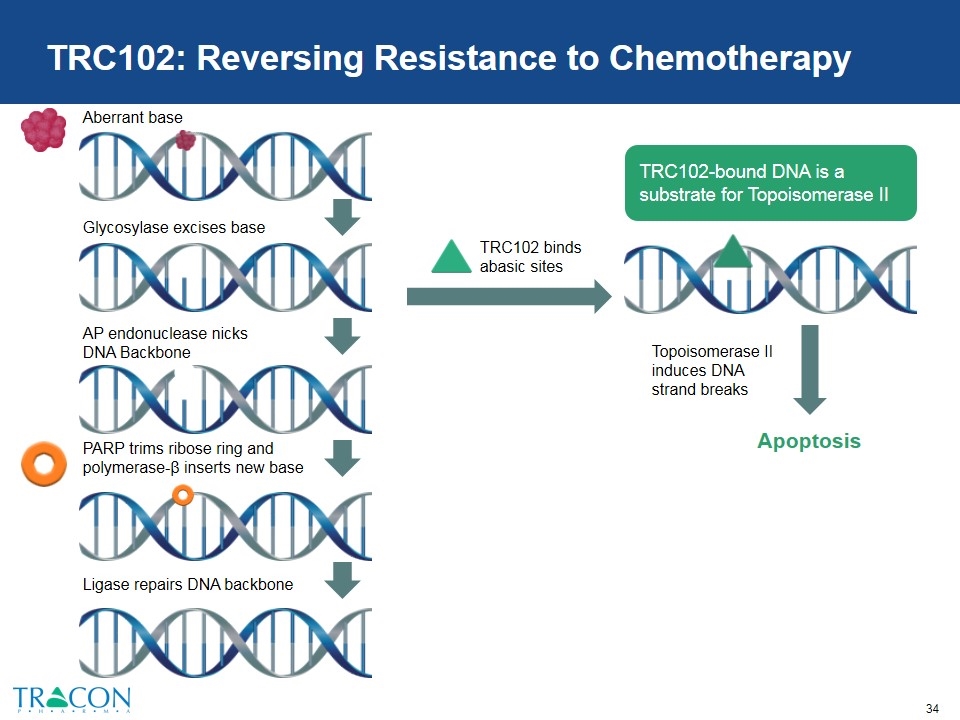

TRC102: Reversing Resistance to Chemotherapy TRC102 binds abasic sites Apoptosis Topoisomerase II induces DNA strand breaks TRC102-bound DNA is a substrate for Topoisomerase II Aberrant base Glycosylase excises base AP endonuclease nicks DNA Backbone PARP trims ribose ring and polymerase-β inserts new base Ligase repairs DNA backbone