Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | | |

| | Filed by the Registrant ý |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

|

o |

|

Preliminary Proxy Statement |

|

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

|

Definitive Proxy Statement |

|

o |

|

Definitive Additional Materials |

|

o |

|

Soliciting Material Pursuant to §240.14a-12 |

|

GT ADVANCED TECHNOLOGIES INC. |

| |

(Name of Registrant as Specified In Its Charter) |

|

|

| |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

| | | | |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Table of Contents

April 26, 2013

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of GT Advanced Technologies Inc., which will be held on Wednesday, June 5, 2013, at 8:00 a.m., local time, at the offices of Ropes & Gray, LLP, Prudential Tower, 800 Boylston Street, Boston, Massachusetts.

The notice of annual meeting, proxy statement and proxy card (or voter instruction form if your shares are held through a broker, bank or other nominee) are enclosed along with a copy of our Transition Report on Form 10-K for the nine-month period ended December 31, 2012. The notice and proxy statement are first being sent to stockholders on or about April 26, 2013.

You will find information regarding the matters to be voted on at the meeting in the attached notice and proxy statement.

Whether or not you plan to attend the 2013 Annual Meeting of Stockholders, it is important that your shares be represented. You may vote your shares by proxy by mailing a completed proxy card or by phone or the Internet by following the instructions provided on the enclosed proxy card or voter instruction form, as applicable.

We look forward to seeing you at the meeting.

| | |

| | | Sincerely, |

|

|

Thomas Gutierrez

President and Chief Executive Officer |

Table of Contents

20 Trafalgar Square

Nashua, New Hampshire 03063

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The 2013 Annual Meeting of Stockholders of GT Advanced Technologies Inc. will be held on Wednesday, June 5, 2013, at 8:00 a.m., local time, at the offices of Ropes & Gray, LLP, Prudential Tower, 800 Boylston Street, Boston, Massachusetts. At the 2013 Annual Meeting, we expect stockholders will consider and vote upon the following matters:

- 1.

- To elect as directors to the Board of Directors the nine (9) nominees named in the attached proxy statement;

- 2.

- To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013; and

- 3.

- To conduct an advisory vote on executive officer compensation.

The stockholders will also act on such other business as may properly come before the 2013 Annual Meeting or any adjournment or postponement thereof.

Our Board of Directors recommends you vote"FOR": (i) each of the nominees for director named in this proxy statement, (ii) the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013, and (iii) our 2012 executive officer compensation.

You may vote at the 2013 Annual Meeting if you were a stockholder of record at the close of business on April 8, 2013. To ensure that your vote is properly recorded, please vote as soon as possible using the Internet, by phone or by mail, even if you plan to attend the 2013 Annual Meeting. You may still vote in person if you attend the 2013 Annual Meeting. For further details about voting, please refer to the section entitled "About the 2013 Annual Meeting" beginning on page 1 of the attached proxy statement.

Our Transition Report on Form 10-K for the nine-month period ended December 31, 2012 is being sent with this notice and proxy statement.

IF YOU PLAN TO ATTEND:

Please note that space limitations make it necessary to limit attendance to stockholders. Registration will begin at 7:30 a.m. Each stockholder may be asked to present valid picture identification, such as a driver's license or passport. Stockholders holding stock in brokerage accounts will need to bring a copy of the voting instruction card or a brokerage statement reflecting stock ownership as of April 8, 2013 in order to be admitted to the meeting. Cameras, recording devices and other electronic devices will not be permitted at the meeting. Directions to the 2013 Annual Meeting of Stockholders where you may vote in person, can be found in the Investor Relations section of our website at www.gtat.com.

By Order of the Board of Directors,

Hoil Kim

Vice President, Chief Administrative Officer,

General Counsel and Secretary

April 26, 2013

Table of Contents

2013 ANNUAL MEETING OF STOCKHOLDERS

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

TABLE OF CONTENTS

| | |

ABOUT THE ANNUAL MEETING | | 1 |

PROPOSAL 1—ELECTION OF DIRECTORS | |

5 |

Certain Information Regarding Directors | | 5 |

Vote Required | | 13 |

Recommendation | | 13 |

CORPORATE GOVERNANCE | |

14 |

Corporate Governance Guidelines | | 14 |

Board Leadership Structure | | 14 |

Risk Oversight | | 14 |

Board Diversity | | 15 |

Board Composition | | 15 |

Committees of the Board of Directors | | 16 |

Code of Ethics for Senior Financial Officers | | 18 |

Compensation Committee Interlocks and Insider Participation | | 19 |

Code of Conduct | | 19 |

Communications with the Board | | 19 |

Nominating and Corporate Governance Committee Processes for Identifying Director Nominees | | 19 |

Family Relationships | | 20 |

EXECUTIVE COMPENSATION | |

21 |

Compensation Discussion and Analysis | | 21 |

Compensation Committee Report | | 46 |

Summary Compensation Table | | 46 |

Grants of Plan-Based Awards Table | | 48 |

Outstanding Equity Awards at Fiscal Year-End | | 50 |

Option Exercises and Stock Vested Table | | 51 |

Pension Benefits | | 52 |

Non-qualified Deferred Compensation | | 52 |

Employment Agreements | | 52 |

Potential Payments Upon Termination or Change-in-Control | | 54 |

DIRECTOR COMPENSATION | |

58 |

Cash Compensation | | 58 |

Equity Awards | | 58 |

Reimbursement of Certain Expenses | | 58 |

Director Compensation Table | | 59 |

EXECUTIVE OFFICERS | |

61 |

BENEFICIAL STOCK OWNERSHIP OF DIRECTORS, EXECUTIVE OFFICERS AND PERSONS OWNING MORE THAN FIVE PERCENT OF COMMON STOCK | |

64 |

TRANSACTIONS WITH RELATED PERSONS | |

67 |

AUDIT COMMITTEE MATTERS | |

67 |

Audit Committee Report | | 67 |

Principal Accountant Services and Fees | | 68 |

Audit Committee Pre-Approval Policy | | 68 |

i

Table of Contents

| | |

PROPOSAL 2—RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | 69 |

PROPOSAL 3—ADVISORY VOTE ON EXECUTIVE COMPENSATION | |

70 |

OTHER INFORMATION | |

72 |

Section 16(a) Beneficial Ownership Reporting Compliance | | 72 |

Stockholder Proposals and Director Nominations | | 72 |

Transition Report on Form 10-K | | 72 |

Solicitation of Proxies | | 72 |

Miscellaneous | | 73 |

HOUSEHOLDING OF ANNUAL MEETING MATERIALS | |

74 |

ii

Table of Contents

GT ADVANCED TECHNOLOGIES INC.

20 TRAFALGAR SQUARE

NASHUA, NEW HAMPSHIRE 03063

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

June 5, 2013

This proxy statement contains important information about the 2013 Annual Meeting of Stockholders of GT Advanced Technologies Inc. This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of GT Advanced Technologies Inc. for use at the 2013 Annual Meeting and at any adjournment of the 2013 Annual Meeting. All proxies will be voted in accordance with the instructions they contain. You may revoke your proxy at any time before it is exercised at the 2013 Annual Meeting by giving our Secretary written notice to that effect, by submitting a later dated proxy or by attending the meeting and voting in person. If you need directions to the 2013 Annual Meeting of Stockholders, please call GTAT's Investor Relations Group at (603) 883-5200 or visit the Investor Relations section of our website atwww.gtat.com.

ABOUT THE 2013 ANNUAL MEETING

References to the "Company," "GTAT," "we," "us" and "our" in this proxy statement mean GT Advanced Technologies Inc. operating through its subsidiaries.

On April 16, 2012, we amended our amended and restated by-laws to provide that our fiscal year will end on December 31 of each year. Prior to this amendment, our by-laws had provided that our fiscal year ended on the Saturday closest to March 31st of each year. As a result of this change to our fiscal year end, we reported a nine-month transition period consisting of the period from April 1, 2012 to December 31, 2012.

Who is soliciting my vote?

The Board of Directors of GT Advanced Technologies Inc. (the "Board of Directors" or the "Board") is soliciting your vote at the 2013 Annual Meeting of Stockholders ("2013 Annual Meeting").

What am I voting on?

You are voting on:

- •

- Proposal 1: Election of the nominees named in this proxy statement to the Board of Directors.

- •

- Proposal 2: Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013.

- •

- Proposal 3: Approval of executive officer compensation (on an advisory basis).

The stockholders will also act on any other business that may properly come before the 2013 Annual Meeting.

How does the Board recommend that I vote my shares?

The Board recommends a vote "FOR": (i) each of the nominees for director named in this proxy statement, (ii) the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013, and (iii) our 2012 executive officer compensation. Unless you give other instructions on your proxy card or voting instruction form that you return, the persons named as proxy holders will vote in accordance with the recommendation of the Board.

1

Table of Contents

Who is entitled to vote?

Only stockholders of record at the close of business on April 8, 2013 will be entitled to vote at the 2013 Annual Meeting. As of that date, we had outstanding 119,402,180 shares of our common stock. Each share of common stock is entitled to one vote on each proposal submitted to the shareholders at the 2013 Annual Meeting. There is no cumulative voting.

How many votes must be present to hold the meeting?

Your shares are counted as present at the 2013 Annual Meeting if you attend the meeting and vote in person or if you return a properly completed proxy by Internet, telephone or mail (or a voting instruction form if you are not the registered owner of your shares). In order for us to convene the 2013 Annual Meeting, holders of a majority of our outstanding shares of common stock as of April 8, 2013 must be present in person or by proxy at the 2013 Annual Meeting. This is referred to as a quorum. Proxy cards or voting instruction forms that reflect abstentions and "broker non-votes" (as described below) will be counted as shares present to determine whether a quorum exists to hold the 2013 Annual Meeting, but will not be counted as voting on a particular matter.

What is a "broker non-vote"?

Under the rules that govern brokers who have record ownership of shares that they hold in a brokerage account for their clients who are the beneficial owners of the shares (which shares are commonly referred to as being held in "street name"), brokers have the discretion to vote such shares on discretionary, or routine, matters but not on non-discretionary, or non-routine, matters. "Broker non-votes" generally occur when shares held by a broker nominee for a beneficial owner are not voted with respect to a proposal because the broker nominee has not received voting instructions from the beneficial owner and lacks discretionary authority to vote the shares. "Broker non-votes," if any, will not be counted in determining whether a majority (or plurality) of the vote of the shares present and entitled to vote have been cast, or whether a matter requiring a majority (or plurality) of the shares present and entitled to vote has been approved.

As noted above, stockbrokers, banks and other nominees will have discretionary authority with respect to routine matters such as the ratification of the appointment of our independent registered public accounting firm; however, they will not have discretionary authority with respect to the election of directors or the executive compensation (also referred to as "say on pay") advisory vote. As a result, with respect to all matters other than ratification of the appointment of our independent registered public account firm, if the beneficial owners have not returned a voting instruction form and provided instructions to the stockbroker, bank and other nominee, as applicable, with respect to that matter, those beneficial owners' shares will be included in determining whether a quorum is present but will not be voted and will have no effect on the vote for such matters.

We encourage you to promptly and accurately complete the voting instruction form provided by your broker so your votes are counted in accordance with your wishes at the 2013 Annual Meeting.

How many votes are needed for the proposal to pass?

A plurality of the voting power present in person or represented by proxy and entitled to vote at the 2013 Annual Meeting is required for the election of each director. Accordingly, the nine nominees for director identified in this proxy statement who receive the highest number of votes at the 2013 Annual Meeting will be elected. Votes for directors that are withheld and broker non-votes will have no effect on the election of directors.

Approval of proposal 2 (ratification of Deloitte & Touche LLP as our independent registered public accounting firm) requires the affirmative vote of a majority of the shares present in person or

2

Table of Contents

represented by proxy and entitled to vote at the 2013 Annual Meeting. Proposal 3 (advisory vote on executive compensation) is advisory and therefore there is no vote that is required for approval. For proposal 3, although the vote is non-binding, the Board of Directors and the Compensation Committee value the views of the stockholders and will consider the results when making future compensation decisions for our named executive officers.

What if I vote "WITHHOLD" or "ABSTAIN"?

In the election of directors, you may vote "FOR" all or some of the nominees or you may vote to "WITHHOLD" with respect to one or more of the nominees. A vote to "WITHHOLD" on the election of directors will have no effect on the outcome.

For (i) the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013 and (ii) our 2012 executive officer compensation, you may vote "FOR", "AGAINST" OR "ABSTAIN". If you "ABSTAIN", your shares will be counted as present for purposes of determining whether enough votes are present to hold the 2013 Annual Meeting, but a vote to "ABSTAIN" on the ratification of the appointment of the independent registered public accounting firm will have the effect of a vote of "AGAINST".

How do I vote?

If your shares are registered directly in your name with GTAT's transfer agent, Computershare Shareowner Services LLC, or "Computershare," you are considered, with respect to those shares, the holder of record. You can vote eitherin person at the meeting orby proxy without attending the 2013 Annual Meeting. Holders of record have three options for submitting their votes by proxy: (1) using the Internet, (2) by phone or (3) by mail. Please follow the voting instructions on your proxy card. Proxies submitted by the Internet or telephone must be received by 11:59 p.m. Eastern Time on June 4, 2013.

If you hold your GTAT stock in "street name", your ability to vote by telephone, by mail or over the Internet depends on your broker's voting process. Please follow the directions on your voter instruction form carefully.

Even if you plan to attend the 2013 Annual Meeting, we encourage you to vote your shares by proxy. If you plan to vote in person at the 2013 Annual Meeting and you hold your shares of GTAT common stock in "street name," you must bring a copy of the voting instruction card or a brokerage statement reflecting stock ownership on the close of business on the record date to be admitted to the meeting and you must obtain a proxy from your broker and bring that proxy to the 2013 Annual Meeting.

Can I change or revoke my vote?

Yes. You can change or revoke your vote at any time before the polls close at the 2013 Annual Meeting by (1) submitting another timely and later-dated proxy by Internet, telephone or mail, (2) delivering written instructions to our Secretary prior to the meeting, or (3) attending the meeting and voting in person. Your attendance at the meeting alone will not revoke your proxy.

If you hold shares in "street name," you must follow the instructions on your voting instruction form to revoke any prior voting instructions.

Who counts the votes?

We have hired Computershare to count the votes represented by proxies cast by ballot, telephone and the Internet. A representative of Computershare will act as Inspector of Election and will be present at the 2013 Annual Meeting.

3

Table of Contents

What if I return my proxy card or voting instruction form but don't vote for some of the matters listed?

If you are the record holder of your shares and return a signed proxy card without indicating your vote, your shares will be voted "FOR" (i) each of the nominees for director named in this Proxy Statement, (ii) the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013, and (iii) our 2012 executive officer compensation. If you are the beneficial owner of your shares and return a signed voting instruction form without indicating your vote, please see the discussion on "What is a "broker non-vote"?" above.

Can other matters be decided at the 2013 Annual Meeting?

We are not aware of any other matters that will be considered at the 2013 Annual Meeting. If any other matters are properly presented at the 2013 Annual Meeting, Thomas Gutierrez, Richard Gaynor and Hoil Kim, the named proxies, will vote or act in accordance with their best judgment on such matters.

Who can attend the meeting?

The 2013 Annual Meeting is open to all GTAT stockholders. If you need directions for the 2013 Annual Meeting, please call GTAT's Investor Relations Department at (603) 883-5200 or visit the Investor Relations section of our website atwww.gtat.com. The location for the 2013 Annual Meeting is the offices of Ropes & Gray, LLP, Prudential Tower, 800 Boylston Street, Boston, Massachusetts. Signs will direct you to the meeting room at Ropes & Gray's facilities and staff will be on hand to direct stockholders to the meeting room. You need not attend the 2013 Annual Meeting to vote.

What happens if the 2013 Annual Meeting is postponed or adjourned?

Your proxy will still be valid and may be voted at the postponed or adjourned meeting. You will still be able to change or revoke your proxy until it is voted.

Can I access the Proxy Statement and Annual Report on the Internet?

Yes. Our proxy statement and Transition Report to Stockholders are available on our website athttp://investor.gtat.com.

Where can I find the voting results?

We will report the voting results in a Form 8-K within four business days after the end of our 2013 Annual Meeting.

4

Table of Contents

PROPOSAL 1—ELECTION OF DIRECTORS

Certain Information Regarding Directors

There are nine nominees for election to our Board of Directors this year. Each director is elected annually to serve until the next annual meeting or until such director's successor is elected and qualified or until such director's earlier death, resignation or removal.

If you are the record holder of your shares and sign your proxy but do not give instructions with respect to voting for directors, your shares will be voted for the nine persons recommended by the Board. If you are the beneficial owner of your shares and sign your voting instruction card but do not give instructions with respect to voting for directors, your shares will be voted for the nine persons recommended by the Board. If you wish to give specific instructions with respect to voting for directors, you may do so by indicating your instructions on your proxy card or following the instruction on the voting instruction card provided to you.

The Nominating and Corporate Governance Committee has recommended to the Board the nomination of the nine nominees set forth below, and the Board has nominated the nine nominees set forth below for election at the 2013 Annual Meeting. All of the nominees have indicated to GTAT that they will be available to serve as directors. Each nominee currently serves as a director of GTAT. In the event that any nominee should become unavailable, the named proxies, Thomas Gutierrez, Richard Gaynor and Hoil Kim, will vote for a nominee or nominees designated by the Board, unless the Board chooses to reduce the number of directors serving on the Board.

Under the rules of the U.S. Securities and Exchange Commission, we are required to disclose that proxies cannot be voted for a greater number of persons than the number of nominees named, in this case nine nominees.

Set forth below is the principal occupation and other information about the nominees based on information furnished to us by each director. Following each nominee's biographical information, we have provided information concerning the particular experience, qualifications, attributes and/or skills that led the Nominating and Corporate Governance Committee and the Board to conclude that each nominee should serve as a director. Information about the number of shares of GTAT common stock beneficially owned by each director appears below under the heading "Beneficial Stock Ownership of Directors, Executive Officers and Persons Owning More than Five Percent of Common Stock." There are no family relationships among any of the directors and executive officers of GTAT.

5

Table of Contents

| | |

| |

|

|

|

J. Michal Conaway

Director

Age: 64

Committee Memberships: Audit (Chair), Nominating and Corporate Governance

Director since: 2008 | | J. Michal Conaway has served as a director since May 2008. He is the founder and has served as the Chief Executive Officer of Peregrine Group, LLC, an executive consulting firm, since 2002, and has been providing consulting services since 2000. Prior to 2000, Mr. Conaway held various management and executive positions, including serving as Chief Financial Officer of Fluor Corporation, an engineering, procurement, construction and maintenance services provider. He serves as a director of Quanta Services, Inc., a provider of specialized contracting services, as well as a director of privately-held Enterra Holdings Ltd., which provides consulting services through one of its subsidiaries. Within the last five years, Mr. Conaway also served as a director of InfraSource Services, Inc., specialty contractors servicing electric, natural gas and telecommunications infrastructure, and Cherokee International Corporation, a designer and manufacturer of power supplies for original equipment manufacturing. Mr. Conaway holds an M.B.A. degree from Pepperdine University and is a Certified Public Accountant. |

|

|

Key Attributes, Experience and Skills:

Mr. Conaway was selected to serve as a director because he has extensive accounting and financial experience, including having served as Chief Financial Officer of multiple public companies, and due to his related operating, financial and strategic experience, and his service on the board of directors of several public and private companies (including service on their Audit Committees). |

|

6

Table of Contents

| | |

| |

|

|

|

Kathleen A. Cote

Director

Age: 64

Committee Membership: Audit

Director since: 2012 | | Kathleen A. Cote has served as a director since March 2012. Ms. Cote was the Chief Executive Officer of Worldport Communications, Inc., a European provider of Internet managed services, from May 2001 to June 2003. From September 1998 until May 2001, she served as President of Seagrass Partners, a provider of expertise in business planning and strategic development for early stage companies. From November 1996 until January 1998, she served as President and Chief Executive Officer of Computervision Corporation, an international supplier of product development and data management software. Ms. Cote is currently a director of Western Digital Corporation, a provider of computer hard disk drives, and VeriSign, Inc., a provider of Internet infrastructure services. Within the last five years, Ms. Cote also served as a director of Asure Software, Inc. (formerly Forgent Networks, Inc.), a provider of web-based workforce management solutions, and 3Com Corporation, a global enterprise networking solutions provider. Ms. Cote holds an Honorary Doctorate from the University of Massachusetts, an M.B.A. degree from Babson College, and a B.A. degree from the University of Massachusetts, Amherst. |

|

|

Key Attributes, Experience and Skills:

Ms. Cote was selected to serve as a director because she has numerous years of experience overseeing global companies focused on technology and operations and brings a proven expertise in assisting growing enterprises. In addition, Ms. Cote's financial skills, developed over years with various companies, bring to the Board of Directors a solid understanding of financial statements and financial markets. She has also served on numerous public company boards of directors, including on the audit and governance committees of those boards. We believe these experiences, qualifications, attributes and skills qualify her to serve as a member of our Board of Directors. |

|

7

Table of Contents

| | |

| |

|

|

|

Ernest L. Godshalk

Director

Age: 68

Committee Membership: Compensation (Chair)

Director since: 2006 | | Ernest L. Godshalk has served as a director since July 2006. From 1993 until 2012, Mr. Godshalk served as the Managing Director of Elgin Management Group, a private investment company. From February 2001 until he retired in December 2004, Mr. Godshalk served as President, Chief Operating Officer and a director of Varian Semiconductor Equipment Associates, Inc., a supplier of semiconductor manufacturing equipment. He is also a director of Hittite Microwave Corporation, which provides integrated circuits, modules and systems for technically demanding radio frequency, microwave and millimeterwave applications. Within the last five years, Mr. Godshalk also served as a director of Verigy Ltd., a provider of test systems and solutions to the semiconductor industry. Mr. Godshalk is a graduate of Yale University and Harvard Business School, and is a Board Leadership Fellow of the National Association of Corporate Directors. |

|

|

Key Attributes, Experience and Skills:

Mr. Godshalk was selected to serve as a director for his experience in management, accounting and finance, his extensive knowledge of our industry that was gained from his employment as a senior operating executive and chief financial officer of public companies engaged in businesses similar to ours, his experience as a director of other public companies, as well as his educational background. |

|

8

Table of Contents

| | |

| |

|

|

|

Thomas Gutierrez

Director

Age: 64

Director since: 2009 | | Thomas Gutierrez was appointed our President and Chief Executive Officer and a director in October 2009. He served as Chief Executive Officer and a member of the board of directors of Xerium Technologies Inc., a company that develops, manufactures and markets technically advanced synthetic textiles, from 2001 to 2008. From 1995 to 2001, Mr. Gutierrez also served as Chief Executive Officer of Invensys Power Systems, a provider of power control and energy storage products, systems and services for industrial applications. Mr. Gutierrez has extensive international experience in product development, manufacturing, marketing and sales. Mr. Gutierrez has also held various positions with Pulse Engineering from 1992 to 1994, Pitney Bowes, Inc. from 1985 to 1992 and Motorola, Inc. from 1981 to 1984. Mr. Gutierrez currently serves on the board of directors of Verso Paper Corp., a provider of coated papers, and PhytoChem Pharmaceuticals, a pharmaceutical company he founded. Within the last five years, Mr. Gutierrez also served as a director of Veeco Instruments Inc., a global provider of process equipment solutions for data storage, LED, solar and other advanced manufacturers, a director of Comverge, Inc., a provider of clean energy alternatives, and a director of Xerium Technologies, Inc. He received his BSc. degree in Electrical Engineering from Florida Institute of Technology. |

|

|

Key Attributes, Experience and Skills:

Mr. Gutierrez was selected to serve as a director for his extensive international experience in product development, manufacturing, marketing and sales in the energy storage industry and other related industries and his service as a director of a public company. Mr. Gutierrez's training and established leadership skills, including having served as Chief Executive Officer of a public company, enable him to provide operational, strategic and financial guidance. |

|

9

Table of Contents

| | |

| |

|

|

|

Matthew E. Massengill

Chairman of the Board

Age: 52

Committee Memberships: Nominating and Corporate Governance (Chair)

Director since: 2008 | | Mr. Massengill has served as a director since September 2008 and as Chairman of the Board since November 2010. Mr. Massengill served as Chairman of the Board of Western Digital Corporation, a provider of computer hard disk drives, from November 2001 to March 2007. Mr. Massengill served as President and Chief Executive Officer of Western Digital Corporation from January 2000 to October 2005. Mr. Massengill currently serves as a director of Western Digital Corporation and MicroSemi Corporation, an integrated circuits and semiconductor manufacturing company. Within the last five years, Mr. Massengill also served as a director of Conexant Systems, Inc., which designs, develops and sells semiconductor system solutions, and ViewSonic Corporation, a global provider of LCD and CRT display products. Mr. Massengill holds a B.S. in engineering from Purdue University. |

|

|

Key Attributes, Experience and Skills:

Mr. Massengill was selected to serve as a director because he has technical training and over 20 years business and leadership experience in the technology industry, including service as the Chief Executive Officer of a public company in the technology industry and service on the boards of directors of several public companies. |

|

10

Table of Contents

| | |

| |

|

|

|

Mary Petrovich

Director

Age: 50

Committee Memberships: Compensation

Director since: 2011 | | Ms. Petrovich has served as a director since May 2011. Since June 2011, Ms. Petrovich has been serving as a senior advisor to the Carlyle Group and American Security Partners, both private equity firms. From December 2008 through June 2011, Ms. Petrovich served as General Manager of AxleTech International, a supplier of off-highway and specialty vehicle drive train systems and components. Ms. Petrovich served as Chairman and Chief Executive Officer of AxleTech International from 2001 through December 2008, at which time the company was sold to General Dynamics. Prior to joining AxleTech, in 2000, Ms. Petrovich was President of the Driver Controls Division of Dura Automotive, a designer and manufacturer of driver control systems. Ms. Petrovich is also a director of Woodward, Inc., an independent designer, manufacturer, and service provider of energy control and optimization solutions used in global infrastructure equipment, Modine Manufacturing Company, a diversified global leader in thermal management technology and solutions and WABCO Holdings Inc., a supplier of electronic, mechanical and mechatronic products for commercial truck, trailer, bus and passenger car manufacturers. Ms. Petrovich holds a B.S. in Industrial and Operations Engineering from the University of Michigan, and an MBA from Harvard Business School. |

|

|

Key Attributes, Experience and Skills:

Ms. Petrovich was selected as a director due to her extensive experience with operating and leading large industrial organizations, including service as the Chief Executive Officer in the industrial design and manufacturing industry and service on the boards of directors of several public companies. In addition, Ms. Petrovich brings a wealth of experience in mergers, acquisitions and the integration of acquired businesses. This experience, together with her operational experience with Six Sigma lean manufacturing techniques and supply chain management, and her experience in evaluating new business opportunities, provides the Board with valuable perspective. |

|

11

Table of Contents

| | |

| |

|

|

|

Robert E. Switz

Director

Age: 66

Committee Memberships: Audit, Nominating and Corporate Governance

Director since: 2011 | | Mr. Switz has served as a director since May 2011. Mr. Switz served as a director, President and Chief Executive Officer of ADC Telecommunications, Inc., a supplier of network infrastructure products and services, from 2003 to 2010, and as its Chairman from 2008 to 2010. Mr. Switz served as ADC's Chief Financial Officer as well as Executive Vice President from 1994 to 2003. Mr. Switz also served as President and Chief Financial Officer of ADC's former Broadband Access and Transport Group from November 2000 to April 2001. Prior to joining ADC, Mr. Switz was employed by Burr-Brown Corporation, a manufacturer of precision micro-electronics, including as Vice President, Chief Financial Officer and Director, Ventures & Systems Business. Mr. Switz is also a director of Broadcom Corporation, a manufacturer of semiconductor solutions for wired and wireless communications, Micron Technology, Inc., a manufacturer of advanced memory and semiconductor technology and Leap Wireless International, Inc., a provider of wireless communications services. During the past five years, Mr. Switz also served on the board of directors of ADC Telecommunications, Inc. Mr. Switz holds a B.S. in Marketing/Economics from Quinnipiac University and an MBA in Finance from the University of Bridgeport. |

|

|

Key Attributes, Experience and Skills:

Mr. Switz was selected as a director due to his extensive operations, finance and international experience in the technology industry, including service as a Chief Executive Officer of a large and growing organization. Mr. Switz also offers in-depth expertise in finance and accounting, both due to his tenure as a Chief Financial Officer and service as an Audit Committee financial expert with another public company. Mr. Switz also brings considerable directorial and governance experience through his past service on the board of directors of public companies. |

|

Noel G. Watson

Director

Age: 76

Committee Memberships: Compensation

Director since: 2008 |

|

Noel G. Watson has served as a director since November 2008. Mr. Watson is the Chairman of the Board of Jacobs Engineering Group Inc., a provider of technical, professional and construction services, a position he has held since 2006. Mr. Watson served as Chief Executive Officer of Jacobs Engineering Group Inc. from November 1992 to April 2006 and as President of Jacobs Engineering Group Inc. from 1987 to July 2002. Mr. Watson holds a B.S. in chemical engineering from the University of North Dakota. |

|

|

Key Attributes, Experience and Skills:

Mr. Watson was selected to serve as a director for his technical training, leadership experience and service on the other boards of directors for other companies, including service as the Chief Executive Officer of a public company. |

|

12

Table of Contents

| | |

| |

|

|

|

Thomas Wroe, Jr.

Director

Age: 62

Committee Memberships: Compensation

Director since: 2013 | | Thomas Wroe, Jr. has served as a director since February 2013. Mr. Wroe has served as Chairman of the Board of Sensata Technologies Holdings N.V., a mission-critical sensor and control manufacturer, since March 2010, and served as its Chief Executive Officer from March 2010 to December 2012. From June 2006 to March 2010, Mr. Wroe served as Chief Executive Officer and director of its principal operating subsidiary, Sensata Technologies, Inc. and as Chairman of the Board since 2006. From June 1995 to June 2006, Mr. Wroe served as the President of the Sensors & Controls business of Texas Instruments Incorporated, a global semiconductor design and manufacturing company, and as a Senior Vice President of Texas Instruments Incorporated from March 1998 to June 2006. Mr. Wroe also serves on the board of directors of Chase Corporation, a manufacturer of industrial coatings and tapes for high reliability applications with a global customer base operating in diverse market sectors. |

|

|

Key Attributes, Experience and Skills:

Mr. Wroe's strong executive experience, including as chief executive of a large public company, provides a well-rounded global perspective. He has experience in the oversight of complex operations and engineering, acquisitions and integration, manufacturing and customer relations, and offers additional business development expertise to the Board. |

|

Mr. Wroe was appointed to our Board of Directors in February 2013. The procedures used to identify and appoint Mr. Wroe were consistent with the process described below under "Corporate Governance—Nominating and Corporate Governance Committee Processes for Identifying Director Nominees." Mr. Wroe was identified through a third-party search firm, Korn/Ferry International. Mr. Wroe is nominated for re-election to the Board of Directors.

Vote Required

The nine persons named in this Proxy Statement receiving the highest number of "FOR" votes represented by shares of GTAT common stock present in person or represented by proxy at the 2013 Annual Meeting will be elected.

Recommendation

The Board of Directors recommends that you vote "FOR" the election of each of the nine nominees identified above.

13

Table of Contents

CORPORATE GOVERNANCE

Corporate Governance Guidelines

In August 2009, our Nominating and Corporate Governance Committee adopted corporate governance guidelines, which include guidelines for determining director independence and qualifications for directors, and are published on the Company's website (www.gtat.com) under the Corporate Governance section of the Investor Relations page. In March 2013, the Corporate Governance Guidelines were amended to provide for processes for reviewing Board committee assignments and Board committee chair positions with a view towards balancing director experience and interest, committee continuity and needs, and evolving legal and regulatory considerations. Our Corporate Governance Guidelines, as amended, provide that directors should not be nominated for election to the Board after their 73rd birthday, although the Board may nominate candidates over age 73 if the Board deems appropriate in the stockholders' best interests and GTAT's best interests. Mr. Watson, a current director who is being nominated for reelection to the Board at the 2013 Annual Meeting, has reached the age of 76. Mr. Watson has served as a director since 2008, and is a key board member with strong management and industry experience. As a result, the Board has determined that it is appropriate and in our stockholders' and our best interests to nominate Mr. Watson for an additional one-year term.

Board Leadership Structure

Matthew E. Massengill has served as Chairman of our Board of Directors since November 2010. Including Mr. Massengill, our Board has eight independent directors. Thomas Gutierrez, who has served as our President and Chief Executive Officer (CEO), is also a member of our Board of Directors. Mr. Gutierrez has served in these positions since October 2009.

We believe that our current leadership structure has been effective for GTAT. We believe that having different individuals serve as CEO and Chairman of the Board and having independent chairs for each of our board committees provides an effective form of leadership for GTAT. Our President and CEO is responsible for managing the Company and, based on feedback we have received, we believe he is seen by our customers, business partners, investors and other stakeholders as providing strong leadership for GTAT. The Chairman of the Board, in comparison, provides leadership on corporate governance and matters relating to Board deliberations. Each of the committee chairs performs a similar leadership role with regard to each committee.

Our Board has three standing independent committees with separate chairs—the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. Our corporate governance guidelines provide that our non-management directors will meet in executive session regularly, and after each executive session a designated director will update the CEO on the key items discussed. These guidelines further provide that directors participating in the executive sessions may make recommendations for consideration by the full Board.

Risk Oversight

We believe that our President and CEO, together with the Chairman of the Board, the independent committees and the full board of directors, provides effective oversight of the risk management function. Our full Board regularly engages in discussions of risk management and receives reports on business, regulatory, operational and other risks from our officers, employees and our advisors. The full Board (or the appropriate committee in the case of risks that are under the purview of a particular committee) receives periodic reports from the appropriate "risk owner" within the organization to enable it to understand our risk identification, risk management and risk mitigation strategies. Our Board also provides direction on mitigating the risks identified by management,

14

Table of Contents

employees and external advisors. Each of our Board committees also considers the risks to our operations and business within its area of responsibilities. For example:

- •

- financial reporting risks are typically addressed in the Audit Committee through review of internal audits, reviewing the services provided by the independent auditor, the independence of such auditors, committee agenda items, ethics and whistleblower updates and other discussions (in addition, the Audit Committee and Board regularly review information regarding our liquidity and operations, as well as the risks associated with each);

- •

- in consultation with our independent executive compensation consultants, our Compensation Committee reviews executive compensation and retention risks as part of its on-going executive compensation review and individual compensation discussions; and

- •

- Nominating and Corporate Governance Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks associated with Board organization, membership and structure, succession planning for our directors and executive officers, and corporate governance (In addition, the full Board of Directors annually reviews executive succession planning and development).

Board Diversity

Our Board does not have a specific diversity policy, but it, and the Nominating and Corporate Governance Committee, considers diversity of race, ethnicity, gender, age, cultural background and professional experiences in evaluating candidates for Board membership. Our Company believes that diversity is important because a variety of experiences and points of view contributes to a more effective decision-making process. In March 2012, the Board appointed Kathleen A. Cote as its second female board member.

Board Composition

Our amended and restated certificate of incorporation provides that our Board of Directors shall consist of such number of directors as determined from time to time by resolution adopted by a majority of the total number of directors then in office. Our Board of Directors currently consists of nine members. Any additional directorships resulting from an increase in the number of directors or any vacancies may only be filled by a vote of the majority of the directors then in office. The term of office for each director will be until such director's successor is elected and qualified or until such director's earlier death, resignation or removal. Elections for all directors will be held annually.

Director Independence

The Board has determined that each of the directors, other than Mr. Gutierrez, qualifies as "independent" as the term independence is defined by Rule 5605(a)(2) of the NASDAQ Stock Market LLC, or NASDAQ, Marketplace Rules. The Board has not adopted categorical standards in making its determination of independence and instead relies on standards set forth in the NASDAQ Marketplace Rules.

Our Board of Directors held ten meetings in the nine-month transition period ended December 31, 2012. Each director attended at least 75% of the Board meetings and the total meetings held by all of the committees on which he or she served during the periods that he or she served.

Recognizing that director attendance at the Annual Meeting can provide our stockholders with an opportunity to communicate with Board members about issues affecting GTAT, we encourage our directors to attend the annual meeting of stockholders. All of the directors serving at the time of the 2012 Annual Meeting attended and were present at the 2012 Annual Meeting.

15

Table of Contents

Committees of the Board of Directors

We currently have an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. The Audit Committee and the Nominating and Corporate Governance Committee each currently consist of three persons. The Compensation Committee currently consists of four persons. All of the members of our Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee are "independent" as defined by the NASDAQ Marketplace Rules. All of the members of our Audit Committee are "independent" as defined by the rules of the Securities and Exchange Commission, or SEC, with respect to Audit Committee membership. The composition of the Audit Committee is also consistent with the requirements of Rule 5605(c)(2) of the NASDAQ Marketplace Rules

The following table shows the current membership of the three standing board committees.

| | | | | | | | | | |

Name | | Audit

Committee | | Compensation

Committee | | Nominating and

Corporate

Governance

Committee | |

|---|

J. Michal Conaway | | | X | * | | | | | X | |

Kathleen A. Cote | | | X | | | | | | | |

Ernest L. Godshalk | | | | | | X | * | | | |

Thomas Gutierrez | | | | | | | | | | |

Matthew E. Massengill | | | | | | | | | X | * |

Noel G. Watson | | | | | | X | | | | |

Mary Petrovich | | | | | | X | | | | |

Robert E. Switz | | | X | | | | | | X | |

Thomas Wroe, Jr. | | | | | | X | | | | |

Audit Committee

The Audit Committee consists of Messrs. Conaway (Chair), and Switz and Ms. Cote. Mr. Massengill served on the Audit Committee from November 2011 to May 2012. Ms. Cote joined the Audit Committee in March 2012. The Audit Committee assists the Board of Directors in its oversight of (i) the integrity of GTAT's financial statements and its financial reporting process, (ii) the systems of internal accounting and financial controls, (iii) the performance of our independent auditor, (iv) the independent auditor's qualifications and independence, and (v) our compliance with legal and regulatory requirements.

The Audit Committee is responsible for, among other things:

- •

- selecting, retaining and terminating the independent auditors, establishing the compensation for the independent auditors and resolving disputes between management and the independent auditors regarding financial reporting;

- •

- discussing with the auditor the overall scope of the audit and the plan for its audit;

- •

- annually reviewing the independent auditors' report describing the auditing firms' internal quality-control procedures and any material issues raised by the most recent internal quality-control review, or peer review, of the auditing firm;

- •

- discussing the annual audited financial statements and quarterly financial statements with management and the independent auditor;

- •

- discussing earnings press releases, as well as financial information and earnings guidance;

16

Table of Contents

- •

- discussing with management and the independent auditors policies with respect to the adequacy and effectiveness of our accounting and financial controls, including our policies and procedures to assess, monitor and manage risk of financial misstatements or deficiencies in internal controls, and legal and ethical compliance programs;

- •

- periodically meeting separately with management, internal auditors and the independent auditor;

- •

- reviewing with the independent auditor any audit problems or difficulties and management's response;

- •

- handling such other matters that are specifically delegated to the Audit Committee by the Board of Directors from time to time; and

- •

- reporting regularly to the full Board of Directors.

Each member of the Audit Committee has the ability to read and understand fundamental financial statements. Our Board of Directors has determined that Messrs. Conaway and Switz and Ms. Cote, who are the current members of the Audit Committee, meet the requirements for an "audit committee financial expert" as defined by the rules of the SEC.

The specific responsibilities and functions of the Audit Committee are identified in the Audit Committee's Charter, a copy of which is posted on our website (www.gtat.com) under the heading "Investors—Corporate Governance." A printed copy of this charter may be obtained, without charge, by writing to the Secretary, GT Advanced Technologies Inc., 20 Trafalgar Square, Nashua, New Hampshire 03063. The Audit Committee met seven times during the nine-month transition period ended December 31, 2012.

Compensation Committee

The Compensation Committee consists of Messrs. Godshalk (Chair), Watson and Wroe, and Ms. Petrovich. Mr. Wroe joined the Compensation Committee in February 2013. The Compensation Committee is responsible for:

- •

- reviewing executive compensation policies, plans and programs;

- •

- reviewing and approving the compensation of our executive officers;

- •

- reviewing and approving employment contracts and other similar arrangements between us and our executive officers;

- •

- reviewing and consulting with the Chief Executive Officer on the selection of officers and evaluation of executive performance and other related matters;

- •

- administration of equity incentive plans;

- •

- reviewing other incentive compensation plans, if any;

- •

- establishing compensation for our directors; and

- •

- such other matters that are specifically delegated to the Compensation Committee by the Board of Directors from time to time.

The specific responsibilities and functions of the Compensation Committee are identified in the Compensation Committee's Charter, a copy of which is posted on our website (www.gtat.com) under the heading "Investors—Corporate Governance." A printed copy of this charter may be obtained, without charge, by writing to the Secretary, GT Advanced Technologies Inc., 20 Trafalgar Square, Nashua, New Hampshire 03063. The Compensation Committee met eleven times during the nine-month transition period ended December 31, 2012.

17

Table of Contents

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee consists of Messrs. Massengill (Chair), Conaway and Switz. The Nominating and Corporate Governance Committee assists the Board of Directors in (i) identifying individuals qualified to become members of our Board of Directors consistent with criteria set by our Board and (ii) developing our corporate governance principles. The Nominating and Corporate Governance Committee is responsible for:

- •

- evaluating the composition, size and governance of our Board of Directors and its committees and making recommendations regarding future planning and the appointment of directors to our board committees;

- •

- establishing a policy for considering stockholder nominees for election to our Board of Directors;

- •

- evaluating and recommending candidates for election to our Board of Directors;

- •

- overseeing the performance and self-evaluation process of our Board of Directors and developing continuing education programs for our directors;

- •

- developing our corporate governance principles and providing recommendations to the Board regarding possible changes; and

- •

- periodically reviewing and recommending to the Board of Directors for approval the Code of Conduct Policy, Code of Ethics for Senior Financial Officers Policy, Insider Trading Policy, and Related Party Transaction Policies and Procedures.

The specific responsibilities and functions of the Nominating and Corporate Governance Committee are identified in its Charter, a copy of which is posted on our website (www.gtat.com) under the heading "Investors—Corporate Governance." A printed copy of this charter may be obtained, without charge, by writing to the Secretary, GT Advanced Technologies Inc., 20 Trafalgar Square, Nashua, New Hampshire 03063. The Nominating and Corporate Governance Committee met three times during the nine-month transition period ended December 31, 2012.

Code of Ethics for Senior Financial Officers

We have adopted a code of ethics that applies to our principal executive, financial and accounting officers and all persons performing similar functions. The code of ethics for senior financial officers is published on the Company's website (www.gtat.com) the heading "Investors—Corporate Governance." A printed copy of this Code may be obtained, without charge, by writing to the Secretary, GT Advanced Technologies Inc., 20 Trafalgar Square, Nashua, New Hampshire 03063. If we waive any material provisions of our code of ethics for senior financial officers or substantively change this code, we will disclose that fact on our website (www.gtat.com).

Limitation on Additional Board and Board Committee Service

Pursuant to our Corporate Governance Guidelines, there are restrictions on the number of other boards of directors on which our directors may serve. Directors who serve as chief executives of public companies may not serve on more than two other boards of a public company, and other directors may not serve on more than five other boards of public companies in addition to the Company's Board. The Corporate Governance Guidelines also provide that the members of the Audit Committee should not serve on more than two additional audit committees of public companies. Current positions in excess of these limits may be maintained unless the Board determines that doing so would impair the director's service on the Company's Board. The Audit Committee Charter also provides that a member of the Audit Committee may serve on the audit committees of other public companies, unless the Board

18

Table of Contents

determines that such concurrent service would impair the ability of such member to serve effectively on our Audit Committee.

Compensation Committee Interlocks and Insider Participation

Members of our Compensation Committee during the Transition Period were Messrs. Godshalk and Watson and Ms. Petrovich.

No member of our compensation committee is an officer or employee, nor has any member been an officer or employee at any prior time. There are no interlocking relationships between any of our executive officers and our Compensation Committee, on the one hand, and the executive officers and Compensation Committee of any other companies, on the other hand.

Code of Conduct

We have adopted a Code of Conduct, a code of ethics that applies to all of our employees and directors, including the Chief Executive Officer, the Chief Financial Officer and other senior financial officers. The Code of Conduct is published on the Company's website (www.gtat.com) under the heading "Investors—Corporate Governance." A printed copy may be obtained, without charge, by writing to the Secretary, GT Advanced Technologies Inc., 20 Trafalgar Square, Nashua, New Hampshire 03063. If we waive any material provisions of our Code of Conduct with respect to our principal executive officer, principal financial officer, principal accounting officer or controller, or substantively change the Code of Conduct, we will disclose that fact on our website.

Communications with the Board

Stockholders or other interested parties wishing to communicate with the Board, non-management directors or any individual director may contact the Board or individual directors by writing to the Board or individual directors, c/o Secretary, GT Advanced Technologies Inc., 20 Trafalgar Square, Nashua, New Hampshire 03063. Our Secretary distributes communications to the Board, or to any individual directors as appropriate, depending on the facts and circumstances outlined in the communication. In general, communications relating to corporate governance and corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which GTAT tends to receive repetitive or duplicative communications.

Nominating and Corporate Governance Committee Processes for Identifying Director Nominees

The Nominating and Corporate Governance Committee will consider as potential nominees to become members of our Board of Directors individuals properly recommended by stockholders. Recommendations concerning individuals proposed for consideration by the Nominating and Corporate Governance Committee should be addressed to Secretary, GT Advanced Technologies Inc., 20 Trafalgar Square, Nashua, New Hampshire 03063. Each recommendation should include a personal biography of the suggested nominee, an indication of the background or experience that qualifies the person for consideration, and a statement that the person has agreed to serve if nominated and elected. Stockholders who themselves wish to effectively nominate a person for election to the Board of Directors for consideration by the stockholders, as contrasted with recommending a potential nominee to the Nominating and Corporate Governance Committee for its consideration, are required to comply with the advance notice and other requirements set forth in our By-Laws and described under "Other Information—Stockholder Proposals and Director Nominations."

The Nominating and Corporate Governance Committee identifies candidates for election to the Board of Directors, reviews their skills, characteristics and experience and recommends nominees for director to the Board for approval. As noted above, the Nominating and Corporate Governance Committee considers properly submitted stockholder recommendations for candidates for the Board.

19

Table of Contents

We believe that potential directors should possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of our stockholders. In addition to reviewing a candidate's background and accomplishments, candidates are reviewed in the context of the current composition of the Board and the evolving needs of our businesses. The Nominating and Corporate Governance Committee has identified collectively desirable attributes and experiences of all of the Board members taken together. Desirable experience for Board members includes experience in the areas of: (i) management; (ii) strategic planning; (iii) accounting and finance; (iv) domestic and international markets; (v) corporate governance; (vi) industrial equipment manufacturing; and (vii) the solar and LED industries sufficient to provide sound and prudent guidance about GTAT's operations and interests.

Desirable personal attributes for prospective Board members include (i) the judgment, strength of character, reputation in the business community, ethics and integrity of the individual; (ii) record of accomplishment in leadership roles; (iii) the business or other relevant experience, skills and knowledge that the individual may have that will enable him or her to provide effective oversight of our business; (iv) the fit of the individual's skills and personality with those of the other Board members; (v) the individual's ability to devote sufficient time to carry out his or her responsibilities as a director in light of his or her occupation and other commitments, including, but not limited to, the number of boards of directors of other public companies on which he or she serves; and (vi) the independence of the individual.

The Nominating and Corporate Governance Committee does not evaluate potential nominees for director differently based on whether they are recommended to the Nominating and Corporate Governance Committee by officers or directors of GTAT or by a stockholder. The Nominating and Corporate Governance Committee will select qualified candidates and review its recommendations with the Board. During the nine-month transition period ended December 31, 2012, the Company paid $63,097 to Korn/Ferry International in connection with filling vacancies on our Board of Directors.

Family Relationships

There are no family relationships among any of our executive officers or directors.

20

Table of Contents

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

On April 16, 2012, we amended our amended and restated by-laws to provide that our fiscal year will end on December 31 of each year. Prior to this amendment, our by-laws had provided that our fiscal year ended on the Saturday closest to March 31st of each year. As a result of this change to our fiscal year end, we reported a nine-month transition period consisting of the period from April 1, 2012 to December 31, 2012. We refer to the nine-month transition period ended December 31, 2012 as the Transition Period. This report describes the compensation program for GT Advanced Technologies' named executive officers ("NEOs") for the Transition Period, who are:

- •

- Thomas Gutierrez—President and Chief Executive Officer

- •

- Richard Gaynor—Vice President and Chief Financial Officer

- •

- Daniel W. Squiller—Chief Operating Officer

- •

- David W. Keck—Executive Vice President, Worldwide Sales and Services

- •

- Jeffrey J. Ford—Vice President of Business Development, DSS Business

The Company continued to place significant emphasis on pay-for-performance in the Transition Period. The following are the key executive compensation and business highlights in connection with our 2012 executive compensation:

21

Table of Contents

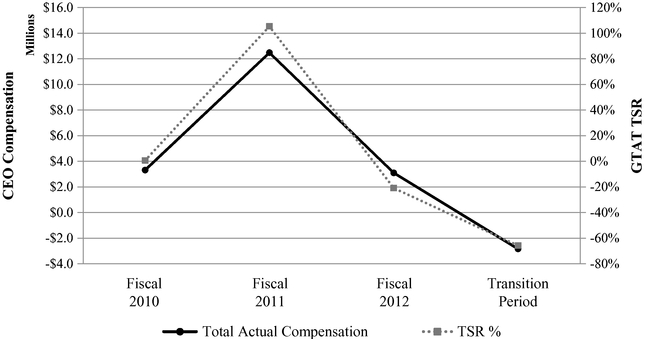

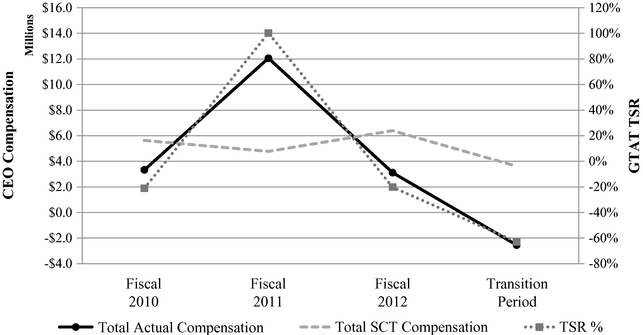

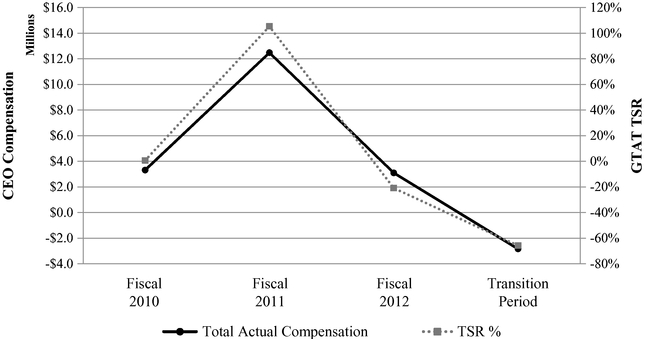

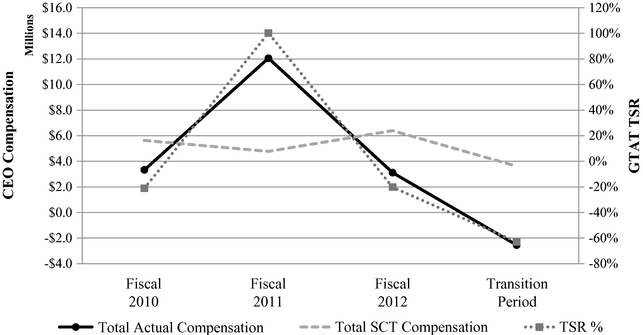

CEO Compensation vs. TSR Performance

- •

- Total Actual CEO compensation for the Transition Period (based on annualized base salary for the Transition Period) was approximately $6.2 million less than the total amount reported in the Summary Compensation Table for the Transition Period and was $5.7 million less than Total Actual CEO compensation reported for fiscal 2012.

- •

- No cash bonus was paid to any of the NEOs (other than Messrs. Keck and Squiller) due to the fact that the Company did not achieve the financial performance metrics for the Transition Period. Messrs. Keck and Squiller were paid pursuant to contractual agreements (as described below).

- •

- Performance share units ("PSUs") granted in fiscal 2011 that were eligible for vesting in March 2013 are not expected to be earned because the target performance goals will likely not be satisfied.

- •

- PSUs were awarded during the Transition Period based on financial performance for the two-year period ending December 31, 2013.

- •

- Base salaries for NEOs were frozen for the Transition Period. In addition, the President and Chief Executive Officer's base salary was frozen for 2013. This is the second consecutive year that the base salary for the President and Chief Executive Officer has remained unchanged.

- •

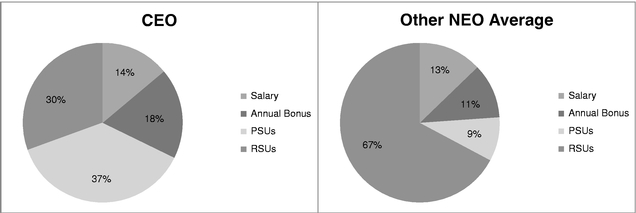

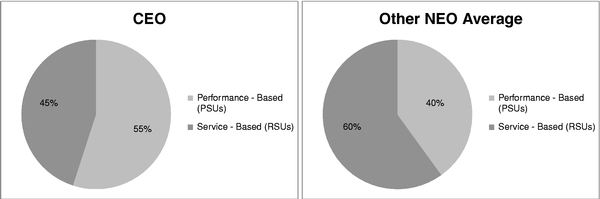

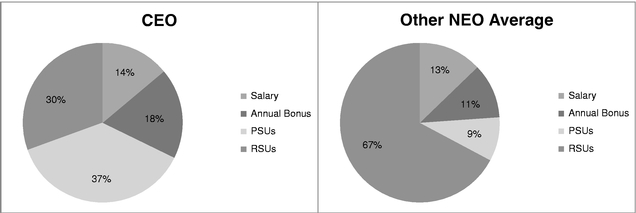

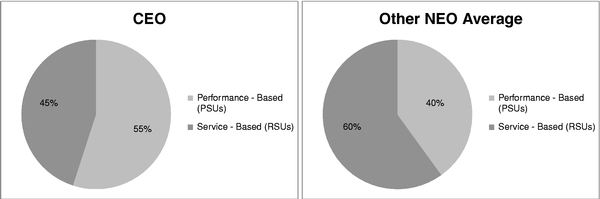

- A greater share of overall NEO direct compensation was in the form of equity than in fiscal 2012, and the Company maintained its program under which a significant portion of equity compensation is subject to achievement of performance-based metrics in order to be earned.

Financial Highlights

- •

- Demand for our polysilicon and PV products and services are driven by end-user demand for solar power and demand for our sapphire products are driven by end-user demand for sapphire material, LED-quality material in particular. In each of our three business segments, the end-user demand for the output of our equipment has either declined substantially or supply has surpassed demand, particularly during the Transition Period.

22

Table of Contents

- •

- Transition Period financial results were negatively impacted by significant one-time charges totaling $164.8 million.

- •

- For the Transition Period, the Company had revenue of $380 million, net loss from operations of $147 million and diluted earnings per share of ($1.20), all of which reflect the challenges that are being experienced in the polysilicon, solar and LED industries.

- •

- Gross margin decreased to approximately 14% during the Transition Period. Gross margins during the Transition Period were materially and adversely impacted by significant one-time charges taken in the Transition Period.

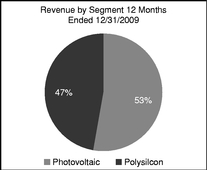

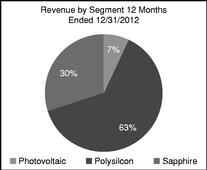

- •

- Management continued its efforts to diversify the Company's business. In calendar year ended December 31, 2009, 100% of revenues were attributable to the sale of solar-related equipment and services. In the calendar year ended December 31, 2012, 70% of revenues were attributable to the sale of solar-related equipment and services and 30% were attributable to the sale of sapphire equipment and materials.

- •

- The Company continued to make significant investment in advancing its future product lines and further diversifying its offerings and applications.

We also continue to implement and maintain best practices in the design and governance of our executive compensation program. These practices include the following:

- •

- Company prohibits the repricing of stock options without prior stockholder approval.

- •

- Company prohibits the payment of dividends on a performance equity award until the award is actually earned.

- •

- Company has a clawback policy covering executive officers.

- •

- Company does not include excise tax gross-ups in change in control termination benefits, and equity awards have double-trigger vesting.

- •

- Company has stock ownership guidelines that apply to the executive officers and directors requiring them to hold shares of the Company's common stock.

- •

- Company also has prohibitions on hedging or pledging Company shares.

Performance Overview

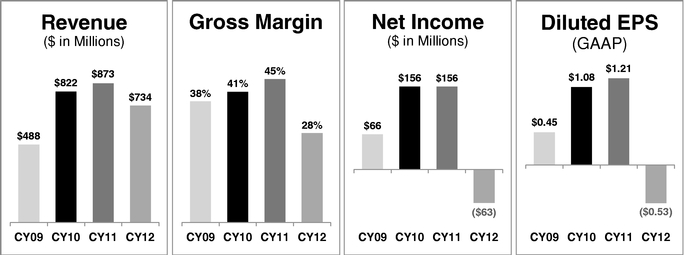

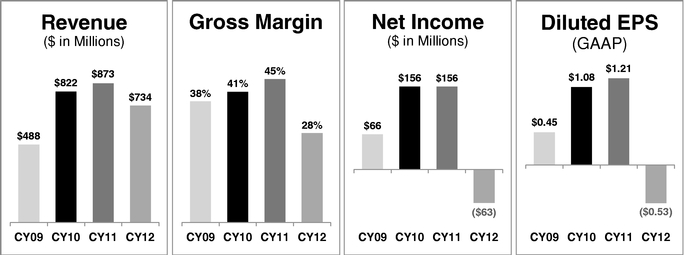

As management had expected, soft demand and overcapacity in the polysilicon, photovoltaic and sapphire markets, persisted throughout calendar year 2012, resulting in decreased revenues, gross margins, net income and fully diluted earnings per share for the calendar year ended December 31, 2012 as compared to the calendar year ended December 31, 2011. As shown in the following charts,

23

Table of Contents

while calendar year 2011 was a record calendar year for GTAT, industry-wide challenges negatively impacted results for calendar year 2012.

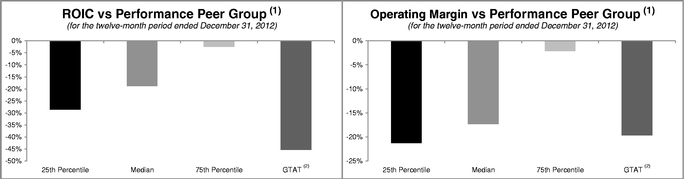

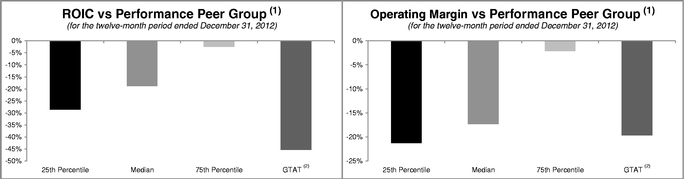

When compared with a group of companies consisting of all leading publicly-traded equipment suppliers in the solar and LED industries and global solar companies identified below (the "Performance Peer Group"), the following reflects the Company's performance with respect to profitability and return on invested capital (ROIC) for the periods identified below.

- (1)

- The information in these tables were derived from a database created and operated by an independent third party. Results for Centrotherm Photovoltaics AG and Suntech Power Holdings Co., Ltd. reflect return on invested capital and operating margin for the twelve months ended March 30, 2012 (not December 31, 2012), which are the most recent publicly available results for both companies.

- (2)

- Return on invested capital and operating margin results as reported in the foregoing tables for GTAT include one-time charges totaling $164.8 million incurred by GTAT in the calendar year ended December 31, 2012.

24

Table of Contents

The Performance Peer Group consists of the following companies:

| | |

• Advanced Metallurgical Group N.V. | | • MEMC Electronic Materials, Inc. |

• Aixtron SE | | • Meyer Burger Ltd. |

• Amtech Systems, Inc. | | • OC Oerlikon Corporation AG |

• Canadian Solar Inc. | | • RenaSola Ltd. |

• Centrotherm Photovoltaics AG | | • Rubicon Technology, Inc. |

• China Sunergy Co., Ltd. | | • SunPower Corporation |

• First Solar, Inc. | | • Suntech Power Holdings Co., Ltd. |

• Hanwha SolarOne Co., Ltd. | | • Trina Solar Limited |

• JA Solar Holdings Co., Ltd. | | • Veeco Instruments Inc. |

• LDK Solar Co., Ltd. | | • Yingli Green Energy Holding Company Limited |

• Manz AG | | |

While most of the companies in the Performance Peer Group are not included in the compensation peer group discussed on pages 36 and 37 (primarily because they are non-US companies for which compensation data is not available and compensation practices are not comparable), this group includes all leading publicly-traded equipment suppliers to the solar and LED industries and global solar companies. Due to the commonality of markets served and geographical distribution of the revenue base, we believe this is the appropriate and most relevant peer group for comparing the Company's financial performance. The Performance Peer Group is consistent with that presented in connection with the 2012 Annual Meeting.

In the calendar year ended December 31, 2012, we took actions to better align the business with current and expected market conditions which impacted our performance, including with respect to our Performance Peer Group. These actions resulted in one-time charges totaling approximately $165 million including the following non-cash charges: $71.8 million for the write down of inventory and related charges, primarily related to DSS inventory as a result of prevailing poor PV market conditions; $57.0 million of charges related to the impairment of goodwill related to the PV business, $30.3 million of asset impairment charges related to the workforce reduction and idling of the St. Louis facility; and $2.5 million of charges primarily related to certain sapphire materials assets acquired with the acquisition of the business which are now obsolete and a cash-charge of $3.1 million for restructuring related to the workforce reduction announced in October 2012 and the idling of the St. Louis pilot manufacturing facility. These one-time charges had a significant impact on our results and, excluding these one-time charges, the Company's performance with respect to profitability and investment-return metrics would have been significantly better for the calendar year ended December 31, 2012.

Although the Compensation Committee relies on financial performance measures that in its view drive long-term shareholder value, it should be noted that the Company's total shareholder return ("TSR") performance with respect to the Performance Peer Group was in the bottom quartile for the most recent one-year period and in the top quartile for the most recent three-year period, which reflects the significant and prolonged headwinds experienced by equipment manufacturers in the solar and LED industries in the last year.

Management was able to execute on its earlier strategic initiatives to enable us to obtain the results we did despite the significant market challenges affecting the end-markets for our equipment and materials. For example, approximately 30 percent of revenue in calendar year 2012 came from our sapphire business, which we launched in 2011 with the successful acquisition of Crystal Systems. This compares to calendar 2009 during which solar accounted for 100 percent of our business. The Company's sapphire business, as of December 31, 2012, generated approximately $1 billion in net

25

Table of Contents

bookings and delivered over $279 million of revenue since the acquisition in 2010, a noteworthy result given the approximately $75 million cost of its acquisition.

Management took additional significant strategic steps during and following the Transition Period that we believe will position our business for improved financial performance when the industries we serve begin to experience growth. Among these initiatives are:

- •

- Our HiCz™ equipment offering, which we made significant investments in during the Transition Period, targets increased efficiencies in solar cells. We expect to bring our HiCz™ to market in 2014.

- •

- Our Silicon Carbide (SiC) systems directed at the power electronics market, a market where, we believe, there are currently no capable suppliers of merchant SiC furnaces. We expect to bring our SiC solution to market in 2013.

- •

- Our HVPE gallium nitride (GaN) technology, which will be directed at the growing LED market and also has potential application in power electronics.

- •

- Our Hyperion™ R&D initiative, which could have application in several markets including solar, SiC and sapphire.

In addition, we grew our research and development investment in calendar year 2012 by approximately 65 percent over calendar year 2011 levels, during a time when many peers retrenched from investing in their future. This reflects our continued funding of several important growth and diversification programs such as the development of our HiCz equipment offering, which is based on technology obtained in connection with our acquisition of Confluence Solar in 2011.

Finally, as noted above, management recognized the on-going challenges the business is confronted with and, in response, took several steps to restructure the Company and manage the balance sheet. Management reduced the overall workforce by approximately 25 percent; idled the St. Louis HiCz pilot manufacturing facility; and completed a convertible debt offering with net proceeds of $196 million.