| 777 South Figueroa Street

Los Angeles, California 90017 | |

Eva H. Davis

To Call Writer Directly:

(213) 680-8508

eva.davis@kirkland.com |

(213) 680-8400

www.kirkland.com

|

Facsimile:

(213) 680-8500

|

September 17, 2009

Via EDGAR Submission and Overnight Delivery

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

Attn: | Daniel Morris |

| Tom Jones |

| Re: | GT Solar International, Inc. |

| | Amendment No. 1. to Registration Statement on Form S-3 |

| | (SEC File No. 333-161300) |

Ladies and Gentlemen:

This letter is being furnished on behalf of GT Solar International, Inc. (the “Company”) in response to comments contained in the letter dated September 2, 2009 from Daniel Morris of the Staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) to Hoil Kim, Vice President, General Counsel and Secretary of the Company, with respect to the Company’s Registration Statement on Form S-3 (File No. 333-161300) (the “Registration Statement”) that was filed with the Commission on August 12, 2009.

The text of the Staff’s comments has been included in this letter in italics for your convenience, and we have numbered the paragraphs below to correspond to the numbers in the Staff’s letter. The Company’s responses are as follows:

Chicago | Hong Kong | London | Munich | New York | Palo Alto | San Francisco | Washington, D.C. |

Prospectus Cover Page

1. Given the size of the offering relative to the number of shares outstanding held by non-affiliates and the nature of the offering, advise us of your basis for determining that the transaction is appropriately characterized as a transaction that is eligible to be made on a shelf basis under Rule 415(a)(1)(i).

Response:

For the reasons set forth below, the Company respectfully believes that the shares being registered in the Registration Statement constitute a valid secondary offering and may be registered as contemplated by the Registration Statement.

Background

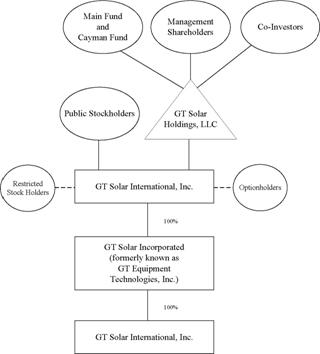

Effective January 1, 2006, GT Solar Incorporated (formerly known as GT Equipment Technologies, Inc.) was acquired by GT Solar Holdings, LLC (the “Selling Stockholder”) (the “Acquisition”). The Acquisition was effected through the merger of Glow Merger Corporation, a newly formed wholly owned subsidiary of the Selling Stockholder, with and into GT Solar Incorporated, with GT Solar Incorporated being the surviving corporation. In connection with the merger, each of the existing stockholders of GT Solar Incorporated (other than the rollover stockholders) received $106.94 per share of common stock held by such stockholder. Certain of the existing stockholders of GT Solar Incorporated (the rollover stockholders) reinvested a portion of the proceeds they would have otherwise received in the merger by receiving Class A shares of the Selling Stockholder.

OCM/GFI Power Opportunities Fund II, L.P. (the “Main Fund”) and OCM/GFI Power Opportunities Fund II (Cayman), L.P. (the “Cayman Fund”) are together the managing member of the Selling Stockholder and own a significant portion of the outstanding shares of the Selling Stockholder. The Main Fund and the Cayman Fund are private investment funds and act as fiduciaries to their respective investors. These funds are in the business of investing in, holding and then selling positions in energy related portfolio companies.

2

The following chart illustrates our corporate structure as of January 1, 2006 after giving effect to the Acquisition:

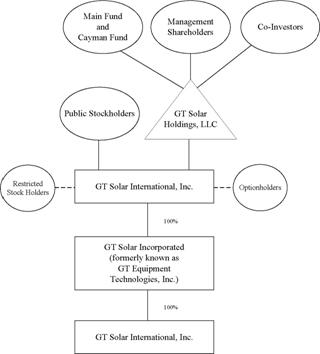

The Company was originally incorporated on September 27, 2006 as a wholly owned, direct subsidiary of the Selling Stockholder. On September 28, 2006, the Company entered into the Agreement and Plan of Merger with GT Solar Incorporated and GT Solar Merger Corp., a newly formed wholly owned subsidiary of the Company, pursuant to which GT Solar Merger Corp. was merged with and into GT Solar Incorporated with GT Solar Incorporated continuing as the surviving corporation in the merger (the “Reorganization Merger”). In the Reorganization Merger, each outstanding share of common stock of GT Solar Incorporated was converted into one share of common stock of the Company, and each outstanding option to acquire a share of common stock of GT Solar Incorporated was converted into an option to acquire one share of common stock of the Company. As a result of the Reorganization Merger, the Company issued 8,370,000 shares of common stock. Immediately following, and as a result of, the Reorganization Merger, GT Solar Incorporated became a wholly owned, direct subsidiary of the Company. The Company is a direct subsidiary of the Selling Stockholder.

On July 29, 2008, the Selling Stockholder sold 30,300,000 shares of the Company’s common stock in an initial public offering pursuant to a registration statement.

3

The following chart illustrates our current corporate structure which gives effect to the Reorganization Merger and our July 2008 initial public offering:

The securities issued in the Acquisition were issued pursuant to the exemption from registration provided by Section 4(2) of the Securities Act of 1933 (the “Act”) and Regulation D promulgated thereunder. In the Acquisition, the Selling Stockholder made extensive representations and warranties regarding its investment intent, including representations that it was purchasing the securities for investment purposes and not for the purpose of effecting any distribution of the securities in violation of the Act.

The Company believes that the Selling Stockholder is viewed in the capital markets as a long-term investor that does not engage in trading activities to which the Commission deems manipulative or otherwise.

4

Rule 415 Analysis

In 1983 the Commission adopted Rule 415 under the Securities Act to permit the registration of offerings to be made on a delayed or continuous basis. Rule 415 specifies certain conditions that must be met by an issuer in order to avail itself of the Rule. In relevant part, Rule 415 provides:

“(a) Securities may be registered for an offering to be made on a continuous or delayed basis in the future, Provided, That:

(1) The registration statement pertains only to:

(i) Securities which are to be offered or sold solely by or on behalf of a person or persons other than the registrant, a subsidiary of the registrant or a person of which the registrant is a subsidiary;...[or]

(x) Securities registered (or qualified to be registered) on Form S-3 or Form F-3 (§239.13 or §239.33 of this chapter) which are to be offered and sold on an immediate, continuous or delayed basis by or on behalf of the registrant, a majority-owned subsidiary of the registrant or a person of which the registrant is a majority-owned subsidiary....”

Under Rule 415(a)(1)(i), an issuer may register shares to be sold on a delayed or continuous basis by selling stockholders in a bona fide secondary offering without restriction.

In the event that an offering registered in reliance on Rule 415(a)(1)(i) is deemed to be an offering that is “by or on behalf of the registrant” as specified in Rule 415(a)(1)(x), Rule 415 contains additional limitations. Rule 415(a)(4) provides that:

“In the case of a registration statement pertaining to an at the market offering of equity securities by or on behalf of the registrant, the offering must come within paragraph (a)(1)(x) of this section. As used in this paragraph, the term ‘at the market offering’ means an offering of equity securities into an existing trading market for outstanding shares of the same class at other than a fixed price.”

As a result, if an offering which purports to be a secondary offering is characterized as an offering “by or on behalf of the registrant,” Rule 415 is only available to register an “at the market offering” if the registrant is eligible to use Form S-3 or Form F-3 to register a primary offering.

5

In the event that the offering registered by the Registration Statement is recharacterized as a primary offering on behalf of the Company, (i) the offering would have to be made on a fixed price basis (in other words, the Selling Stockholder would not be able to sell its securities at prevailing market prices), (ii) the Selling Stockholder would be deemed to be an “underwriter” with respect to the offering (with the attendant liabilities under Section 11 of the Securities Act) and (iii) in accordance with the Staff’s long-standing interpretive position, Rule 144 would never be available to the Selling Stockholder to effect resales of its securities.

Because of the requirements of Rule 415, the Staff’s interpretation of Rule 415 has a dramatic and potentially disastrous impact on the ability of smaller public companies—like the Company—to raise capital and on the ability of a selling stockholder to effect the resale of its securities. Therefore, the Staff should only recharacterize a secondary offering as being on behalf of a registrant after careful and complete review of the relevant facts and circumstances.

The Staff has previously recognized the delicacy with which the analysis of a particular transaction must be undertaken. In its Compliance and Disclosure Interpretations (formerly known as the Telephone Interpretations Manual) (the “Disclosure Interpretations”), the Staff has set forth a detailed analysis of the relevant factors that should be examined. Interpretation D.29, which was recently confirmed by the Staff on January 26, 2009 in Interpretive Response 612.09 (the “Interpretation”), provides that:

“It is important to identify whether a purported secondary offering is really a primary offering, i.e., the selling shareholders are actually underwriters selling on behalf of an issuer. Underwriter status may involve additional disclosure, including an acknowledgment of the seller’s prospectus delivery requirements. In an offering involving Rule 415 or Form S-3, if the offering is deemed to be on behalf of the issuer, the Rule and Form in some cases will be unavailable (e.g., because of the Form S-3 ‘public float’ test for a primary offering, or because Rule 415 (a)(l)(i) is available for secondary offerings, but primary offerings must meet the requirements of one of the other subsections of Rule 415). The question of whether an offering styled a secondary one is really on behalf of the issuer is a difficult factual one, not merely a question of who receives the proceeds. Consideration should be given to how long the selling shareholders have held the shares, the circumstances under which they received them, their relationship to the issuer, the amount of shares involved, whether the sellers are in the business of underwriting securities, and finally, whether under all the circumstances it appears that the seller is acting as a conduit for the issuer.” (emphasis added)

As the Interpretation indicates, the question is a “difficult” and “factual” one that involves an analysis of many factors and “all the circumstances.”

6

Each of the relevant factors listed in the Interpretation is discussed below in the context of the offering under the Registration Statement. In our view, based on a proper consideration of all of those factors, the Staff should conclude that the Registration Statement relates to a valid secondary offering and that all of the shares of common stock issuable in the Acquisition can be registered for sale on behalf of the Selling Stockholder pursuant to Rule 415.

How long the Selling Stockholder Has Held the Shares

Presumably, the longer shares are held, the less likely it is that the selling stockholder is acting as a mere conduit for the Company. Here, the Selling Stockholder has held its shares since January 1, 2006. In connection with the Acquisition, GT Solar Incorporated, the Selling Stockholder, the Main Fund, the Cayman Fund and the other shareholders of the Selling Stockholder entered into a registration rights agreement, dated December 30, 2005, which was later amended to give effect to the Reorganization Merger. The Company’s obligation to file the registration statement for its July 2008 initial public offering and to file this Registration Statement was pursuant to such amended and restated registration rights agreement. The Selling Stockholder has made an investment in the Company and it holds the risk of ownership. Even after the registration is declared effective, the Selling Stockholder will continue to bear the risk of ownership.

The Circumstances Under Which The Shares Were Received

The Selling Stockholder acquired the securities from GT Solar Incorporated (which shares of common stock of GT Solar Incorporated were converted into shares of common stock of the Company pursuant to the Reorganization Merger described above) in a private placement on January 1, 2006. Such transaction was exempt from registration pursuant to Section 4(2) of the Act and Regulation D promulgated thereunder. The private placement constitutes the primary offering by GT Solar Incorporated. The Acquisition was an arms’ length transaction and was for valid and sufficient consideration. Furthermore, the Selling Stockholder purchased the securities for investment and specifically represented that they were not acquiring the securities with the purpose or intent of effecting a distribution in violation of the Act. There is no evidence to suggest that those representations are false.

The Relationship to the Company

The relationship between the Selling Stockholder and the Company at the time of the Acquisition, as it is now, is as an investor. Only two out of the eight members of the board of directors of the Company are affiliates of the Selling Stockholder. The Selling Stockholder does not control the board of directors of the Company nor the Company’s day-to-day decision making activities.

7

Because of the potential access the two affiliated directors have to material non-public information, the Company does not expect that the Selling Stockholder will be active in the market for the Company’s stock unless the Selling Stockholder is confident that all material information regarding the Company has been made public.

The Amount of Shares Involved

At the outset, it is important to note that the amount of shares involved is only one factor cited in the Interpretation to be considered by the Staff in applying Rule 415. That concept has been reiterated by members of the Office of Chief Counsel. However, in practical application, it appears that the amount of shares being registered has become the only factor which is relevant to the Staff. This single focus on the number of shares is inconsistent with the Interpretation and the facts and circumstances recited above.

The availability of Rule 415 depends on whether the offering is made by a selling stockholder or deemed to be made by or on behalf of the issuer. In order for the Staff to determine that the offering is really being made on behalf of the issuer, by definition the Staff must conclude that the selling stockholder is seeking to effect a distribution of the shares. However, if the Staff’s concern is that a distribution is taking place, the number of shares being registered should be one of the less important factors in the Staff’s analysis. An illegal distribution of shares can take place when the amount of shares involved is significantly less.

In addition, Interpretation H.20, regarding the use of Form S-3 to effect a secondary offering, provides:

“A number of persons have asked whether Form S-3 is available for secondary offerings to be made by affiliates of the issuer. The concern was that because the seller was an affiliate, the Division staff might consider the secondary offering a sale on behalf of the issuer and, in reality, a primary offering requiring the affiliate-registrant to meet the more stringent Form S-3 standards applicable to primary offerings by issuers. The Division staff had indicated, however, that secondary sales by affiliates may be made under General Instruction I.B.3. to Form S-3 relating to secondary offerings, even in cases where the affiliate owns more than 50% of the issuer’s securities, unless the facts clearly indicate that the affiliate is acting as an underwriter on behalf of the issuer. However, if the percentage is too high, it must be examined on a case-by-case basis.” (emphasis added)

This interpretive position makes clear that the holder of well in excess of half of the public float can effect a valid secondary offering of its shares unless other facts—beyond the mere level of ownership—indicate that the affiliate is acting as a conduit for the issuer.

8

Whether the Selling Stockholder is in the Business of Underwriting Securities

The Selling Stockholder is not in the business of underwriting securities. As stated above, the Selling Stockholder is managed by two private investment funds — the Main Fund and the Cayman Fund. These funds are in the business of investing in, holding and then selling positions in energy related portfolio companies. The Main Fund and the Cayman Fund own a significant portion of the outstanding shares of the Selling Stockholder and act as fiduciaries to their respective investors. The Main Fund and the Cayman Fund directed the Selling Stockholder to buy the Company’s securities on January 1, 2006 for investment purposes and not with an intention to distribute in violation of the Act. There is no allegation that those representations and warranties are untrue and no factual basis for any such allegation.

Furthermore, as stated above, the Selling Stockholder made an investment in the Company and it holds the ownership of risk. The Selling Stockholder has held the risk of ownership for more than three years, and even after the Registration Statement is declared effective, it will continue to bear the risk of ownership thereafter. The Selling Stockholder determined, after holding its investment in the Company for more than two years, to sell part of its investment in the July 2008 initial public offering. The Selling Stockholder has now determined, after holding its remaining investment in the Company for more than three years, to effect a Registration Statement to provide further liquidity with respect to its initial investment. That liquidity will likely be effected “from time to time” through a combination of several separate transactions, as described in the “Plan of Distribution” section of the Registration Statement.

Whether Under All the Circumstances it Appears that the Selling Stockholder is Acting as a Conduit for the Company

Based on the above discussion and facts, the Company respectfully submits that a reasonable person cannot conclude that the Selling Stockholder is acting as a conduit for the Company. The Selling Stockholder made a fundamental decision to invest in the Company and has held the securities for over three years. The Selling Stockholder is an investor in the Company and does not control the board of directors of the Company nor the Company’s day-to-day decision making activities. The Selling Stockholder is not in the business of underwriting securities. In these circumstances we believe that the offering the Company seeks to register is a valid secondary offering and may proceed consistent with Rule 415.

Conclusion

For all the foregoing reasons, we believe that the facts and circumstances compel the conclusion that the offering by the Selling Stockholder pursuant to the Registration Statement is a “true” secondary offering eligible to be made on a shelf basis under Rule 415(a)(1)(i) and that

9

the Company should be permitted to proceed with the registration of all the shares issuable in the Acquisition. We do not believe that the proposed offering is one the Staff had in mind when it invoked Rule 415 to express its objection to “PIPE” transactions by micro-cap companies when those transactions are found to be abusive. No potential violation of Rule 415 exists and, in these circumstances, there is not risk to the investing public if the Registration Statement is declared effective.

Selling Stockholder, page 23

2. Please tell us whether GT Solar Holdings is a broker-dealer or an affiliate of a broker-dealer.

Response:

GT Solar Holdings, LLC is not a broker-dealer. GT Solar Holdings, LLC may be an affiliate of a broker-dealer. The Main Fund and the Cayman Fund are together the managing member of GT Solar Holdings, LLC. OCM Investments, LLC, the ultimate parent of which exercises control over OCM Power Opportunities Fund II GP, LLC (one of the two general partners of each of the Main Fund and the Cayman Fund), is a FINRA member.

* * * * *

Finally, the Company will furnish a letter at the time it requests acceleration of the effective date of the registration statement acknowledging the statements set forth in the Staff’s comment letter.

We hope that the foregoing has been responsive to the Staff’s comments. Should you have any questions relating to any of the foregoing, please feel free to contact the undersigned at (213) 680-8508.

| Sincerely, |

| |

| /s/ EVA H. DAVIS |

| |

| Eva H. Davis |

cc: Mr. Hoil Kim, General Counsel, GT Solar International, Inc.

10