Exhibit 99.2

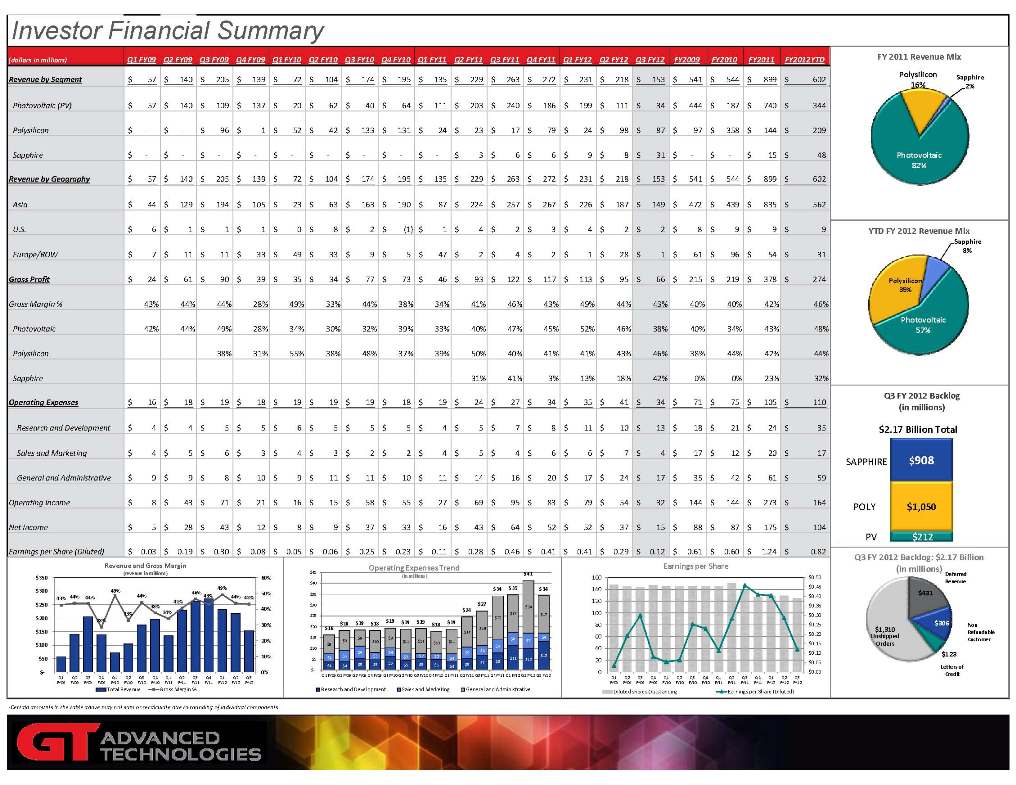

Investor Financial Summary (dollars in millions) Q1 FY09 Q2 FY09 Q3 FY09 Q4 FY09 Q1 FY10 Q2 FY10 Q3 FY10 Q4 FY10 Q1 FY11 Q2 FY11 Q3 FY11 Q4 FY11 Q1 FY12 Q2 FY12 Q3 FY12 FY2009 FY2010 FY2011 FY2012YTD Revenue by Segment 57 $ 140 $ 205 $ 139 $ 72 $ 104 $ 174 $ 195 $ 135 $ 229 $ 263 $ 272 $ 231 $ 218 $ 153 $ 541 $ 544 $ 899 $ 602 $ Photovoltaic (PV) 57 $ 140 $ 109 $ 137 $ 20 $ 62 $ 40 $ 64 $ 111 $ 203 $ 240 $ 186 $ 199 $ 111 $ 34 $ 444 $ 187 $ 740 $ 344 $ Polysilicon ‐ $ ‐ $ 96 $ 1 $ 52 $ 42 $ 133 $ 131 $ 24 $ 23 $ 17 $ 79 $ 24 $ 98 $ 87 $ 97 $ 358 $ 144 $ 209 $ Sapphire ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ 3 $ 6 $ 6 $ 9 $ 8 $ 31 $ ‐ $ ‐ $ 15 $ 48 $ Revenue by Geography 57 $ 140 $ 205 $ 139 $ 72 $ 104 $ 174 $ 195 $ 135 $ 229 $ 263 $ 272 $ 231 $ 218 $ 153 $ 541 $ 544 $ 899 $ 602 $ Asia 44 $ 129 $ 194 $ 105 $ 23 $ 63 $ 163 $ 190 $ 87 $ 224 $ 257 $ 267 $ 226 $ 187 $ 149 $ 472 $ 439 $ 835 $ 562 $ U.S. 6 $ 1 $ 1 $ 1 $ 0 $ 8 $ 2 $ (1) $ 1 $ 4 $ 2 $ 3 $ 4 $ 2 $ 2 $ 8 $ 9 $ 9 $ 9 $ Europe/ROW 7 $ 11 $ 11 $ 33 $ 49 $ 33 $ 9 $ 5 $ 47 $ 2 $ 4 $ 2 $ 1 $ 28 $ 1 $ 61 $ 96 $ 54 $ 31 $ Gross Profit 24 $ 61 $ 90 $ 39 $ 35 $ 34 $ 77 $ 73 $ 46 $ 93 $ 122 $ 117 $ 113 $ 95 $ 66 $ 215 $ 219 $ 378 $ 274 $ Gross Margin % 43% 44% 44% 28% 49% 33% 44% 38% 34% 41% 46% 43% 49% 44% 43% 40% 40% 42% 46% Photovoltaic 42% 44% 49% 28% 34% 30% 32% 39% 33% 40% 47% 45% 52% 46% 38% 40% 34% 43% 48% Polysilicon 38% 31% 55% 38% 48% 37% 39% 50% 40% 41% 41% 43% 46% 38% 44% 42% 44% Sapphire 8% YTD FY 2012 Revenue Mix Polysilicon 35% Photovoltaic 57% Sapphire 2% FY 2011 Revenue Mix Polysilicon 16% Photovoltaic 82% Sapphire 31% 41% 3% 13% 18% 42% 0% 0% 23% 32% Operating Expenses 16 $ 18 $ 19 $ 18 $ 19 $ 19 $ 19 $ 18 $ 19 $ 24 $ 27 $ 34 $ 35 $ 41 $ 34 $ 71 $ 75 $ 105 $ 110 $ Research and Development 4 $ 4 $ 5 $ 5 $ 6 $ 5 $ 5 $ 5 $ 4 $ 5 $ 7 $ 8 $ 11 $ 10 $ 13 $ 18 $ 21 $ 24 $ 35 $ Sales and Marketing 4 $ 5 $ 6 $ 3 $ 4 $ 3 $ 2 $ 2 $ 4 $ 5 $ 4 $ 6 $ 6 $ 7 $ 4 $ 17 $ 12 $ 20 $ 17 $ General and Administrative 9 $ 9 $ 8 $ 10 $ 9 $ 11 $ 11 $ 10 $ 11 $ 14 $ 16 $ 20 $ 17 $ 24 $ 17 $ 35 $ 42 $ 61 $ 59 $ Operating Income 8 $ 43 $ 71 $ 21 $ 16 $ 15 $ 58 $ 55 $ 27 $ 69 $ 95 $ 83 $ 79 $ 54 $ 32 $ 144 $ 144 $ 273 $ 164 $ Net Income 5 $ 28 $ 43 $ 12 $ 8 $ 9 $ 37 $ 33 $ 16 $ 43 $ 64 $ 52 $ 52 $ 37 $ 15 $ 88 $ 87 $ 175 $ 104 $ Earnings per Share (Diluted) 0.03 $ 0.19 $ 0.30 $ 0.08 $ 0.05 $ 0.06 $ 0.25 $ 0.23 $ 0.11 $ 0.28 $ 0.46 $ 0.41 $ 0.41 $ 0.29 $ 0.12 $ 0.61 $ 0.60 $ 1.24 $ 0.82 $ 15.937 ‐Certain amounts in the table above may not sum or recalculate due to rounding of individual components 43% 44% 44% 28% 49% 33% 44% 38% 34% 41% 46% 43% 49% 44% 43% 0% 10% 20% 30% 40% 50% 60% $‐ $50 $100 $150 $200 $250 $300 $350 Q1 FY09 Q2 FY09 Q3 FY09 Q4 FY09 Q1 FY10 Q2 FY10 Q3 FY10 Q4 FY10 Q1 FY11 Q2 FY11 Q3 FY11 Q4 FY11 Q1 FY12 Q2 FY12 Q3 FY12 Revenue and Gross Margin (revenue in millions) Total Revenue Gross Margin % $0.00 $0.05 $0.10 $0.15 $0.20 $0.25 $0.30 $0.35 $0.40 $0.45 $0.50 0 20 40 60 80 100 120 140 160 Q1 FY09 Q2 FY09 Q3 FY09 Q4 FY09 Q1 FY10 Q2 FY10 Q3 FY10 Q4 FY10 Q1 FY11 Q2 FY11 Q3 FY11 Q4 FY11 Q1 FY12 Q2 FY12 Q3 FY12 Earnings per Share Diluted shares Outstanding Earnings per Share (Diluted) $4 $4 $5 $5 $6 $5 $5 $5 $4 $5 $7 $8 $11 $10 $13 $4 $5 $6 $3 $4 $3 $2 $2 $4 $5 $4 $6 $6 $7 $4 $9 $9 $8 $10 $9 $11 $11 $10 $11 $14 $16 $20 $17 $24 $17 $16 $18 $19 $18 $19 $19 $19 $18 $19 $24 $27 $34 $35 $41 $34 $‐ $5 $10 $15 $20 $25 $30 $35 $40 $45 Q1 FY09 Q2 FY09 Q3 FY09 Q4 FY09 Q1 FY10 Q2 FY10 Q3 FY10 Q4 FY10 Q1 FY11 Q2 FY11 Q3 FY11 Q4 FY11 Q1 FY12 Q2 FY12 Q3 FY12 Operating Expenses Trend (in millions) Research and Development Sales and Marketing General and Administrative $212 $1,050 $908 Q3 FY 2012 Backlog (in millions) PV POLY SAPPHIRE $2.17 Billion Total $431 $306 $123 $1,310 Q3 FY 2012 Backlog: $2.17 Billion (in millions) Deferred Revenue Letters of Credit Non Refundable Customer Unshipped Orders

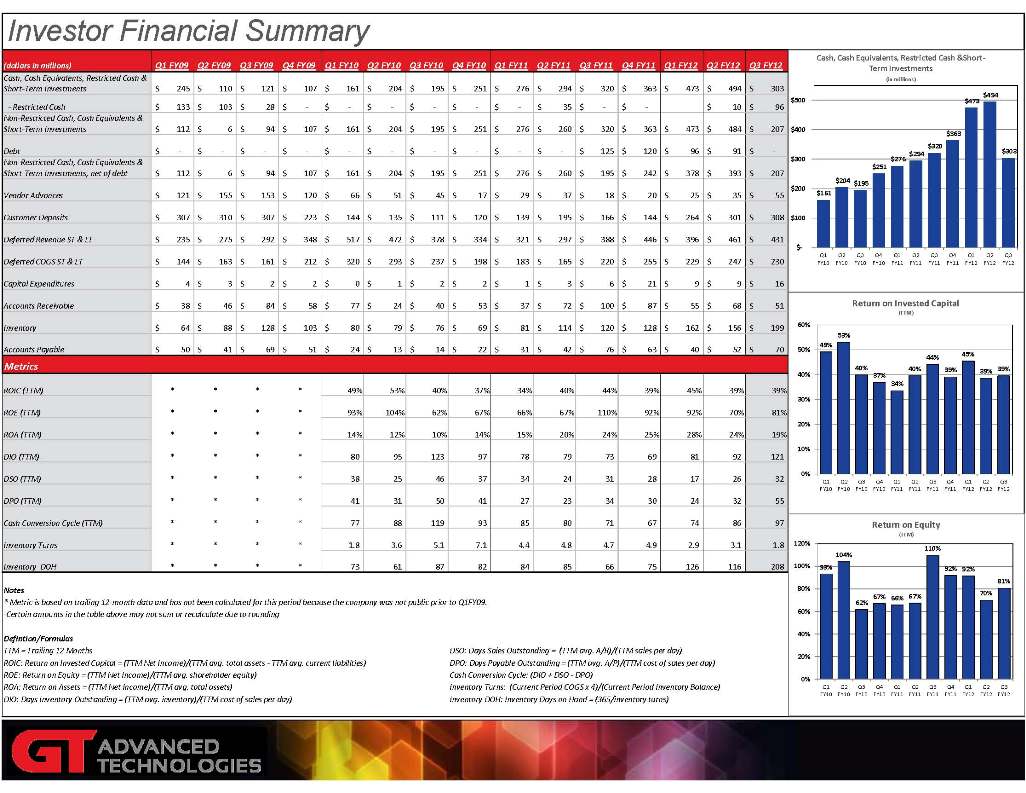

Investor Financial Summary (dollars in millions) Q1 FY09 Q2 FY09 Q3 FY09 Q4 FY09 Q1 FY10 Q2 FY10 Q3 FY10 Q4 FY10 Q1 FY11 Q2 FY11 Q3 FY11 Q4 FY11 Q1 FY12 Q2 FY12 Q3 FY12 Cash, Cash Equivalents, Restricted Cash & Short‐Term Investments 245 $ 110 $ 121 $ 107 $ 161 $ 204 $ 195 $ 251 $ 276 $ 294 $ 320 $ 363 $ 473 $ 494 $ 303 $ 1,254 ‐ Restricted Cash 133 $ 103 $ 28 $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ 35 $ ‐ $ ‐ $ 10 $ 96 $ 35 Non‐Restricted Cash, Cash Equivalents & Short‐Term Investments 112 $ 6 $ 94 $ 107 $ 161 $ 204 $ 195 $ 251 $ 276 $ 260 $ 320 $ 363 $ 473 $ 484 $ 207 $ 1,219 Debt ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ 125 $ 120 $ 96 $ 91 $ ‐ $ 245 Non‐Restricted Cash, Cash Equivalents & Short‐Term Investments, net of debt 112 $ 6 $ 94 $ 107 $ 161 $ 204 $ 195 $ 251 $ 276 $ 260 $ 195 $ 242 $ 378 $ 393 $ 207 $ Vendor Advances 121 $ 155 $ 153 $ 120 $ 66 $ 51 $ 45 $ 17 $ 29 $ 37 $ 18 $ 20 $ 25 $ 35 $ 55 $ 104 Customer Deposits 307 $ 310 $ 307 $ 223 $ 144 $ 135 $ 111 $ 120 $ 139 $ 195 $ 166 $ 144 $ 264 $ 301 $ 308 $ 645 Deferred Revenue ST & LT 235 $ 275 $ 292 $ 348 $ 517 $ 472 $ 378 $ 334 $ 321 $ 297 $ 388 $ 446 $ 396 $ 461 $ 431 $ 1,452 Deferred COGS ST & LT 144 $ 163 $ 161 $ 212 $ 320 $ 293 $ 237 $ 198 $ 183 $ 165 $ 220 $ 255 $ 229 $ 247 $ 230 $ 823 Capital Expenditures 4 $ 3 $ 2 $ 2 $ 0 $ 1 $ 2 $ 2 $ 1 $ 3 $ 6 $ 21 $ 9 $ 9 $ 16 $ 31 Accounts Receivable 38 $ 46 $ 84 $ 58 $ 77 $ 24 $ 40 $ 53 $ 37 $ 72 $ 100 $ 87 $ 55 $ 68 $ 51 $ 296 Inventory 64 $ 88 $ 128 $ 103 $ 80 $ 79 $ 76 $ 69 $ 81 $ 114 $ 120 $ 128 $ 162 $ 156 $ 199 $ 442 Accounts Payable 50 $ 41 $ 69 $ 51 $ 24 $ 13 $ 14 $ 22 $ 31 $ 42 $ 76 $ 63 $ 40 $ 52 $ 70 $ 213 Metrics $161 $204 $195 $251 $276 $294 $320 $363 $473 $494 $303 $‐ $100 $200 $300 $400 $500 Q1 FY10 Q2 FY10 Q3 FY10 Q4 FY10 Q1 FY11 Q2 FY11 Q3 FY11 Q4 FY11 Q1 FY12 Q2 FY12 Q3 FY12 Cash, Cash Equivalents, Restricted Cash &Short‐ Term Investments (in millions) 49% 53% 40% 40% 44% 39% 45% 39% 39% 50% 60% Return on Invested Capital (TTM) ROIC (TTM) * * * * 49% 53% 40% 37% 34% 40% 44% 39% 45% 39% 39% 2 ROE (TTM) * * * * 93% 104% 62% 67% 66% 67% 110% 92% 92% 70% 81% 3 ROA (TTM) * * * * 14% 12% 10% 14% 15% 20% 24% 25% 28% 24% 19% DIO (TTM) * * * * 80 95 123 97 78 79 73 69 81 92 121 DSO (TTM) * * * * 38 25 46 37 34 24 31 28 17 26 32 DPO (TTM) * * * * 41 31 50 41 27 23 34 30 24 32 55 Cash Conversion Cycle (TTM) * * * * 77 88 119 93 85 80 71 67 74 86 97 Inventory Turns * * * * 1.8 3.6 5.1 7.1 4.4 4.8 4.7 4.9 2.9 3.1 1.8 Inventory DOH * * * * 73 61 87 82 84 85 66 75 126 116 208 Notes * Metric is based on trailing 12‐month data and has not been calculated for this period because the company was not public prior to Q1FY09. ‐Certain amounts in the table above may not sum or recalculate due to rounding Defintion/Formulas TTM = Trailing 12 Months DSO: Days Sales Outstanding = (TTM avg. A/R)/(TTM sales per day) ROIC: Return on Invested Capital = (TTM Net Income)/(TTM avg. total assets ‐ TTM avg. current liabilities) DPO: Days Payable Outstanding = (TTM avg. A/P)/(TTM cost of sales per day) ROE: Return on Equity = (TTM Net Income)/(TTM avg. shareholder equity) Cash Conversion Cycle: (DIO + DSO ‐ DPO) ROA: Return on Assets = (TTM Net Income)/(TTM avg. total assets) Inventory Turns: (Current Period COGS x 4)/(Current Period Inventory Balance) DIO: Days Inventory Outstanding = (TTM avg. inventory)/(TTM cost of sales per day) Inventory DOH: Inventory Days on Hand = (365/inventory turns) 37% 34% 0% 10% 20% 30% 40% Q1 FY10 Q2 FY10 Q3 FY10 Q4 FY10 Q1 FY11 Q2 FY11 Q3 FY11 Q4 FY11 Q1 FY12 Q2 FY12 Q3 FY12 93% 104% 62% 67% 66% 67% 110% 92% 92% 70% 81% 0% 20% 40% 60% 80% 100% 120% Q1 FY10 Q2 FY10 Q3 FY10 Q4 FY10 Q1 FY11 Q2 FY11 Q3 FY11 Q4 FY11 Q1 FY12 Q2 FY12 Q3 FY12