Exhibit 99.2

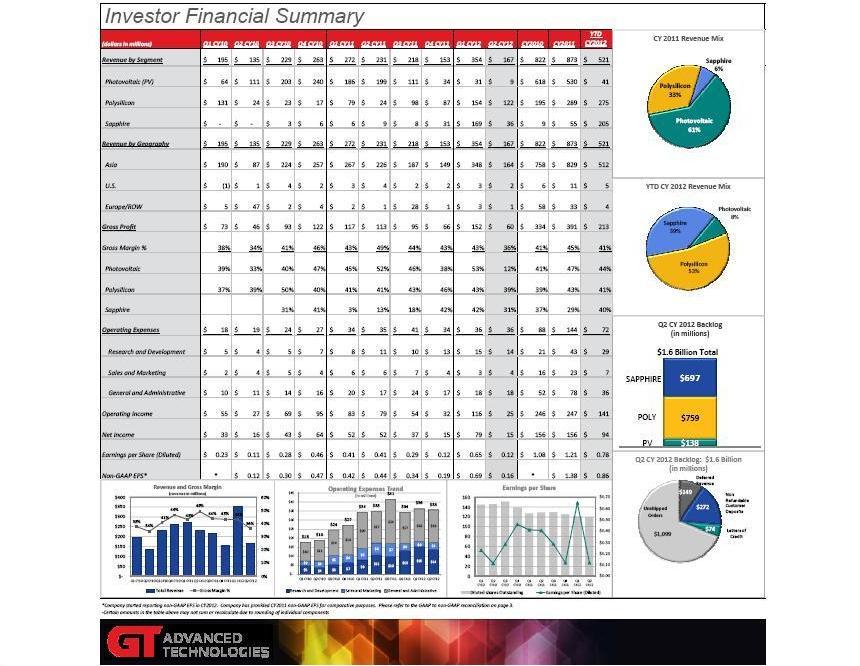

Investor Financial Summary (dollars in millions) Q1 CY10 Q2 CY10 Q3 CY10 Q4 CY10 Q1 CY11 Q2 CY11 Q3 CY11 Q4 CY11 Q1 CY12 Q2 CY12 CY2010 CY2011 YTD CY2012 Revenue by Segment 195 $ 135 $ 229 $ 263 $ 272 $ 231 $ 218 $ 153 $ 354 $ 167 $ 822 $ 873 $ 521 $ Photovoltaic (PV) 64 $ 111 $ 203 $ 240 $ 186 $ 199 $ 111 $ 34 $ 31 $ 9 $ 618 $ 530 $ 41 $ Polysilicon 131 $ 24 $ 23 $ 17 $ 79 $ 24 $ 98 $ 87 $ 154 $ 122 $ 195 $ 289 $ 275 $ Sapphire ‐ $ ‐ $ 3 $ 6 $ 6 $ 9 $ 8 $ 31 $ 169 $ 36 $ 9 $ 55 $ 205 $ Revenue by Geography 195 $ 135 $ 229 $ 263 $ 272 $ 231 $ 218 $ 153 $ 354 $ 167 $ 822 $ 873 $ 521 $ Asia 190 $ 87 $ 224 $ 257 $ 267 $ 226 $ 187 $ 149 $ 348 $ 164 $ 758 $ 829 $ 512 $ U.S. (1) $ 1 $ 4 $ 2 $ 3 $ 4 $ 2 $ 2 $ 3 $ 2 $ 6 $ 11 $ 5 $ Europe/ROW 5 $ 47 $ 2 $ 4 $ 2 $ 1 $ 28 $ 1 $ 3 $ 1 $ 58 $ 33 $ 4 $ Gross Profit 73 $ 46 $ 93 $ 122 $ 117 $ 113 $ 95 $ 66 $ 152 $ 60 $ 334 $ 391 $ 213 $ Gross Margin % 38% 34% 41% 46% 43% 49% 44% 43% 43% 36% 41% 45% 41% Photovoltaic 39% 33% 40% 47% 45% 52% 46% 38% 53% 12% 41% 47% 44% Polysilicon 37% 39% 50% 40% 41% 41% 43% 46% 43% 39% 39% 43% 41% Sapphire 31% 41% 3% 13% 18% 42% 42% 31% 37% 29% 40% YTD CY 2012 Revenue Mix Sapphire 39% Polysilicon 53% Photovoltaic 8% CY 2011 Revenue Mix Polysilicon 33% Photovoltaic 61% Sapphire 6% pp Operating Expenses 18 $ 19 $ 24 $ 27 $ 34 $ 35 $ 41 $ 34 $ 36 $ 36 $ 88 $ 144 $ 72 $ Research and Development 5 $ 4 $ 5 $ 7 $ 8 $ 11 $ 10 $ 13 $ 15 $ 14 $ 21 $ 43 $ 29 $ Sales and Marketing 2 $ 4 $ 5 $ 4 $ 6 $ 6 $ 7 $ 4 $ 3 $ 4 $ 16 $ 23 $ 7 $ General and Administrative 10 $ 11 $ 14 $ 16 $ 20 $ 17 $ 24 $ 17 $ 18 $ 18 $ 52 $ 78 $ 36 $ Operating Income 55 $ 27 $ 69 $ 95 $ 83 $ 79 $ 54 $ 32 $ 116 $ 25 $ 246 $ 247 $ 141 $ Net Income 33 $ 16 $ 43 $ 64 $ 52 $ 52 $ 37 $ 15 $ 79 $ 15 $ 156 $ 156 $ 94 $ Earnings per Share (Diluted) 0.23 $ 0.11 $ 0.28 $ 0.46 $ 0.41 $ 0.41 $ 0.29 $ 0.12 $ 0.65 $ 0.12 $ 1.08 $ 1.21 $ 0.78 $ Non‐GAAP EPS* * 0.12 $ 0.30 $ 0.47 $ 0.42 $ 0.44 $ 0.34 $ 0.19 $ 0.69 $ 0.16 $ * 1.38 $ 0.86 $ 15.937 *Company started reporting non‐GAAP EPS in CY2012. Company has provided CY2011 non‐GAAP EPS for comparative purposes. Please refer to the GAAP to non‐GAAP reconciliation on page 3. ‐Certain amounts in the table above may not sum or recalculate due to rounding of individual components 38% 34% 41% 46% 43% 49% 44% 43% 43% 36% 0% 10% 20% 30% 40% 50% 60% $‐ $50 $100 $150 $200 $250 $300 $350 $400 Q1 CY10 Q2 CY10Q3 CY10Q4 CY10 Q1 CY11Q2 CY11Q3 CY11 Q4 CY11Q1 CY12Q2 CY12 Revenue and Gross Margin (revenue in millions) Total Revenue Gross Margin % $0.00 $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 0 20 40 60 80 100 120 140 160 Q1 CY10 Q2 CY10 Q3 CY10 Q4 CY10 Q1 CY11 Q2 CY11 Q3 CY11 Q4 CY11 Q1 CY12 Q2 CY12 Earnings per Share Diluted shares Outstanding Earnings per Share (Diluted) $5 $4 $5 $7 $8 $11 $10 $13 $15 $14 $2 $4 $5 $4 $6 $6 $7 $4 $3 $4 $10 $11 $14 $16 $20 $17 $24 $17 $18 $18 $18 $19 $24 $27 $34 $35 $41 $34 $36 $36 $‐ $5 $10 $15 $20 $25 $30 $35 $40 $45 Q1 CY10 Q2 CY10 Q3 CY10 Q4 CY10 Q1 CY11 Q2 CY11 Q3 CY11 Q4 CY11 Q1 CY12 Q2 CY12 Operating Expenses Trend (in millions) Research and Development Sales and Marketing General and Administrative $138 $759 $697 Q2 CY 2012 Backlog (in millions) PV POLY SAPPHIRE $1.6 Billion Total $149 $272 $74 $1,099 Q2 CY 2012 Backlog: $1.6 Billion (in millions) Deferred Revenue Letters of Credit Non Refundable Customer Deposits Unshipped Orders

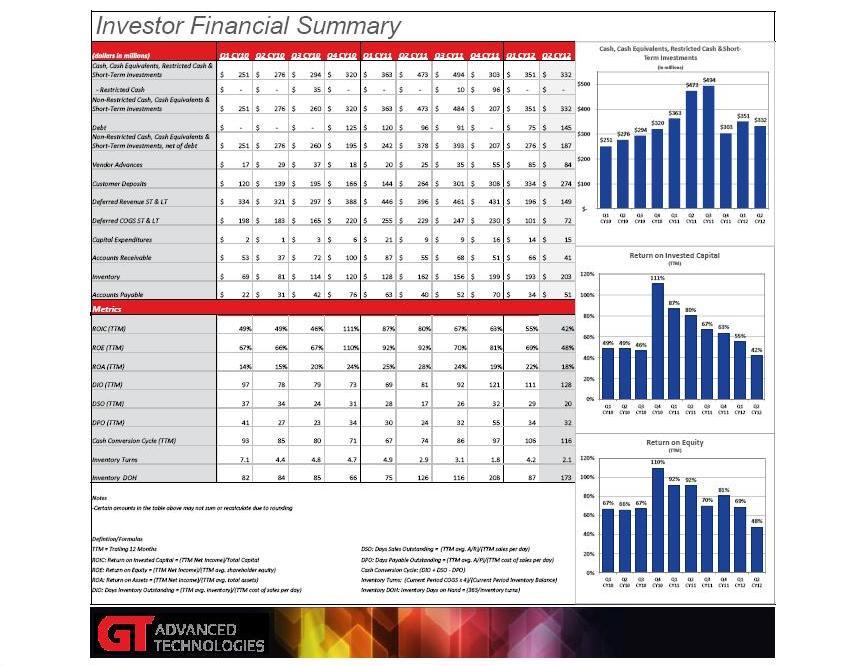

Investor Financial Summary (dollars in millions) Q1 CY10 Q2 CY10 Q3 CY10 Q4 CY10 Q1 CY11 Q2 CY11 Q3 CY11 Q4 CY11 Q1 CY12 Q2 CY12 Cash, Cash Equivalents, Restricted Cash & Short‐Term Investments 251 $ 276 $ 294 $ 320 $ 363 $ 473 $ 494 $ 303 $ 351 $ 332 $ 1,254 ‐ Restricted Cash ‐ $ ‐ $ 35 $ ‐ $ ‐ $ ‐ $ 10 $ 96 $ ‐ $ ‐ $ 35 Non‐Restricted Cash, Cash Equivalents & Short‐Term Investments 251 $ 276 $ 260 $ 320 $ 363 $ 473 $ 484 $ 207 $ 351 $ 332 $ 1,219 Debt ‐ $ ‐ $ ‐ $ 125 $ 120 $ 96 $ 91 $ ‐ $ 75 $ 145 $ 245 Non‐Restricted Cash, Cash Equivalents & Short‐Term Investments, net of debt 251 $ 276 $ 260 $ 195 $ 242 $ 378 $ 393 $ 207 $ 276 $ 187 $ Vendor Advances 17 $ 29 $ 37 $ 18 $ 20 $ 25 $ 35 $ 55 $ 85 $ 84 $ 104 Customer Deposits 120 $ 139 $ 195 $ 166 $ 144 $ 264 $ 301 $ 308 $ 334 $ 274 $ 645 Deferred Revenue ST & LT 334 $ 321 $ 297 $ 388 $ 446 $ 396 $ 461 $ 431 $ 196 $ 149 $ 1,452 Deferred COGS ST & LT 198 $ 183 $ 165 $ 220 $ 255 $ 229 $ 247 $ 230 $ 101 $ 72 $ 823 Capital Expenditures 2 $ 1 $ 3 $ 6 $ 21 $ 9 $ 9 $ 16 $ 14 $ 15 $ 31 Accounts Receivable 53 $ 37 $ 72 $ 100 $ 87 $ 55 $ 68 $ 51 $ 66 $ 41 $ 296 Inventory 69 $ 81 $ 114 $ 120 $ 128 $ 162 $ 156 $ 199 $ 193 $ 203 $ 442 Accounts Payable 22 $ 31 $ 42 $ 76 $ 63 $ 40 $ 52 $ 70 $ 34 $ 51 $ 213 Metrics $251 $276 $294 $320 $363 $473 $494 $303 $351 $332 $‐ $100 $200 $300 $400 $500 Q1 CY10 Q2 CY10 Q3 CY10 Q4 CY10 Q1 CY11 Q2 CY11 Q3 CY11 Q4 CY11 Q1 CY12 Q2 CY12 Cash, Cash Equivalents, Restricted Cash &Short‐ Term Investments (in millions) 111% 87% 80% 100% 120% Return on Invested Capital (TTM) ROIC (TTM) 49% 49% 46% 111% 87% 80% 67% 63% 55% 42% 2 ROE (TTM) 67% 66% 67% 110% 92% 92% 70% 81% 69% 48% 3 ROA (TTM) 14% 15% 20% 24% 25% 28% 24% 19% 22% 18% DIO (TTM) 97 78 79 73 69 81 92 121 111 128 DSO (TTM) 37 34 24 31 28 17 26 32 29 20 DPO (TTM) 41 27 23 34 30 24 32 55 34 32 Cash Conversion Cycle (TTM) 93 85 80 71 67 74 86 97 106 116 Inventory Turns 7.1 4.4 4.8 4.7 4.9 2.9 3.1 1.8 4.2 2.1 Inventory DOH 82 84 85 66 75 126 116 208 87 173 Notes ‐Certain amounts in the table above may not sum or recalculate due to rounding Defintion/Formulas TTM = Trailing 12 Months DSO: Days Sales Outstanding = (TTM avg. A/R)/(TTM sales per day) ROIC: Return on Invested Capital = (TTM Net Income)/Total Capital DPO: Days Payable Outstanding = (TTM avg. A/P)/(TTM cost of sales per day) ROE: Return on Equity = (TTM Net Income)/(TTM avg. shareholder equity) Cash Conversion Cycle: (DIO + DSO ‐ DPO) ROA: Return on Assets = (TTM Net Income)/(TTM avg. total assets) Inventory Turns: (Current Period COGS x 4)/(Current Period Inventory Balance) DIO: Days Inventory Outstanding = (TTM avg. inventory)/(TTM cost of sales per day) Inventory DOH: Inventory Days on Hand = (365/inventory turns) 49% 49% 46% 67% 63% 55% 42% 0% 20% 40% 60% 80% Q1 CY10 Q2 CY10 Q3 CY10 Q4 CY10 Q1 CY11 Q2 CY11 Q3 CY11 Q4 CY11 Q1 CY12 Q2 CY12 67% 66% 67% 110% 92% 92% 70% 81% 69% 48% 0% 20% 40% 60% 80% 100% 120% Q1 CY10 Q2 CY10 Q3 CY10 Q4 CY10 Q1 CY11 Q2 CY11 Q3 CY11 Q4 CY11 Q1 CY12 Q2 CY12 Return on Equity (TTM)

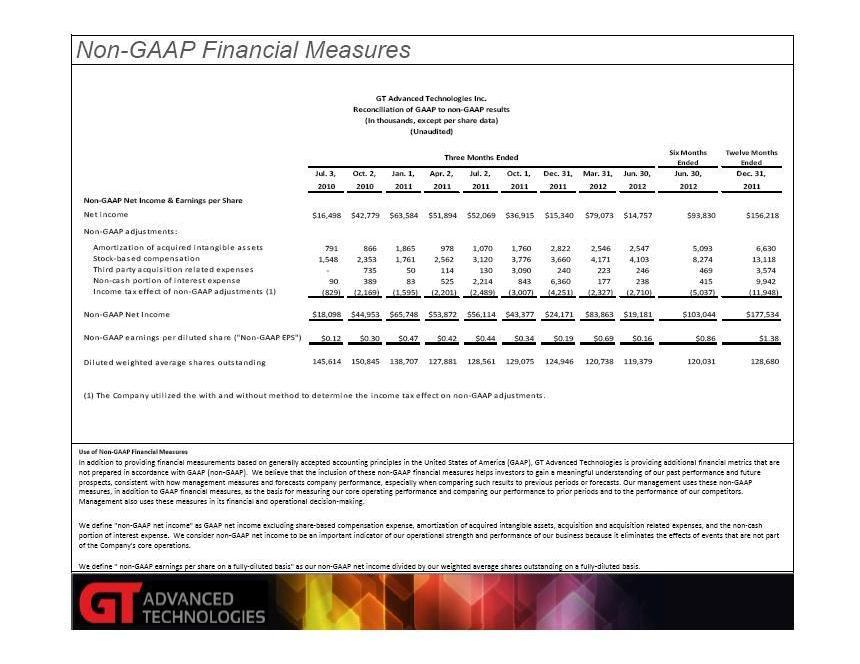

Non-GAAP Financial Measures Six Months Ended Twelve Months Ended Jul. 3, Oct. 2, Jan. 1, Apr. 2, Jul. 2, Oct. 1, Dec. 31, Mar. 31, Jun. 30, Jun. 30, Dec. 31, 2010 2010 2011 2011 2011 2011 2011 2012 2012 2012 2011 Non‐GAAP Net Income & Earnings per Share Net income $16,498 $42,779 $63,584 $51,894 $52,069 $36,915 $15,340 $79,073 $14,757 $93,830 $156,218 Non‐GAAP adjustments: Amortization of acqui red intangible assets 791 866 1,865 978 1,070 1,760 2,822 2,546 2,547 5,093 6,630 Stock‐based compensation 1,548 2,353 1,761 2,562 3,120 3,776 3,660 4,171 4,103 8,274 13,118 Thi rd party acquis i tion related expenses ‐ 735 50 114 130 3,090 240 223 246 469 3,574 Non‐cash portion of interest expense 90 389 83 525 2,214 843 6,360 177 238 415 9,942 Income tax effect of non‐GAAP adjustments (1) (829) (2,169) (1,595) (2,201) (2,489) (3,007) (4,251) (2,327) (2,710) (5,037) (11,948) Three Months Ended GT Advanced Technologies Inc. Reconciliation of GAAP to non‐GAAP results (In thousands, except per share data) (Unaudited) Use of Non‐GAAP Financial Measures In addition to providing financial measurements based on generally accepted accounting principles in the United States of America (GAAP), GT Advanced Technologies is providing additional financial metrics that are not prepared in accordance with GAAP (non‐GAAP). We believe that the inclusion of these non‐GAAP financial measures helps investors to gain a meaningful understanding of our past performance and future prospects, consistent with how management measures and forecasts company performance, especially when comparing such results to previous periods or forecasts. Our management uses these non‐GAAP measures, in addition to GAAP financial measures, as the basis for measuring our core operating performance and comparing our performance to prior periods and to the performance of our competitors. Management also uses these measures in its financial and operational decision‐making. We define "non‐GAAP net income" as GAAP net income excluding share‐based compensation expense, amortization of acquired intangible assets, acquisition and acquisition related expenses, and the non‐cash portion of interest expense. We consider non‐GAAP net income to be an important indicator of our operational strength and performance of our business because it eliminates the effects of events that are not part of the Company's core operations. We define " non‐GAAP earnings per share on a fully‐diluted basis" as our non‐GAAP net income divided by our weighted average shares outstanding on a fully‐diluted basis. Non‐GAAP Net Income $18,098 $44,953 $65,748 $53,872 $56,114 $43,377 $24,171 $83,863 $19,181 $103,044 $177,534 Non‐GAAP earnings per diluted share ("Non‐GAAP EPS") $0.12 $0.30 $0.47 $0.42 $0.44 $0.34 $0.19 $0.69 $0.16 $0.86 $1.38 Diluted weighted average shares outs tanding 145,614 150,845 138,707 127,881 128,561 129,075 124,946 120,738 119,379 120,031 128,680 (1) The Company uti l i zed the with and without method to determine the income tax effect on non‐GAAP adjustments .