Disclaimer: The financial information contained herein is limited in scope and covers a limited time period. These financial statements and accompanying notes do not purport to represent financial statements prepared in accordance with Generally Accepted Accounting Principles in the United States of America, nor are they intended to be fully reconciled to any financial statements otherwise prepared or distributed by the Debtors or any of the Debtors’ affiliates. This information is unaudited and is subject to further review and adjustments. The accompanying disclaimers and notes are an integral part of these financial statements.

Item 1. YTD Consolidated Financials

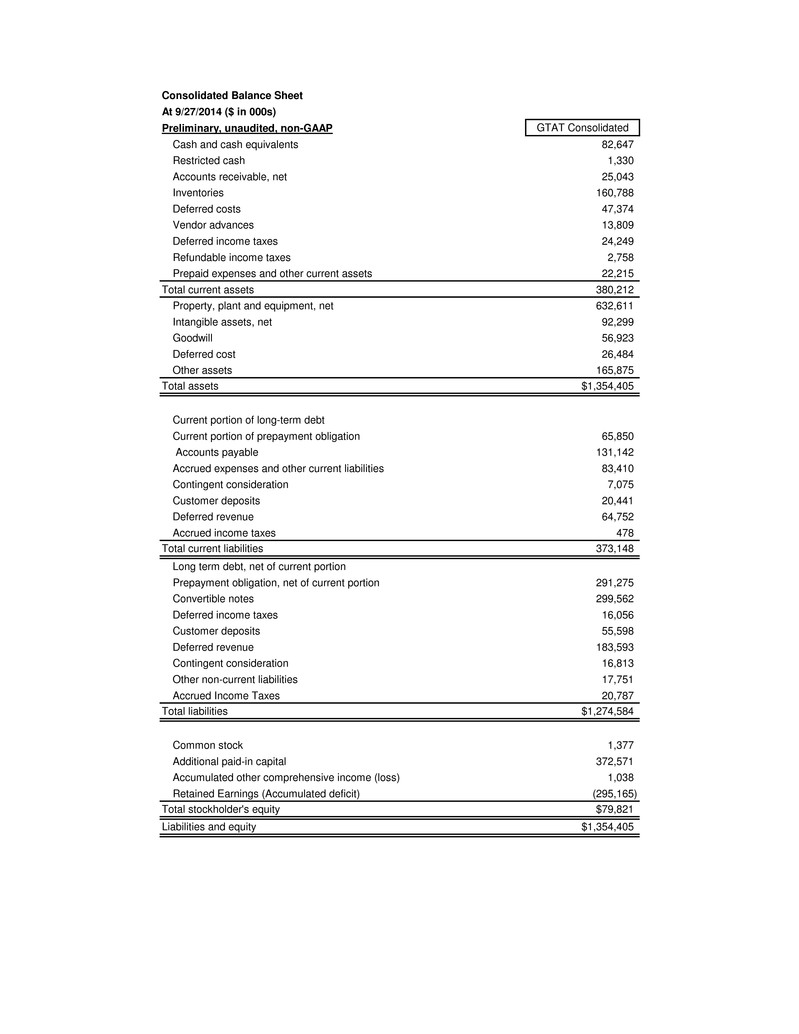

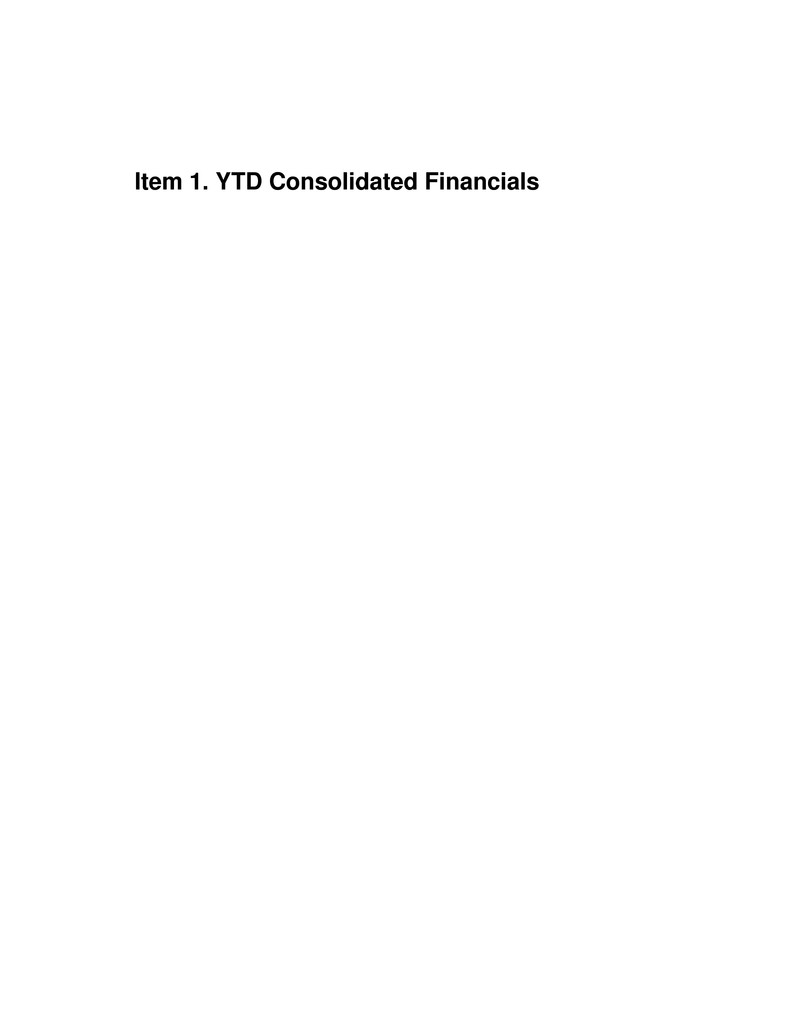

Consolidated Balance Sheet At 9/27/2014 ($ in 000s) Preliminary, unaudited, non-GAAP GTAT Consolidated Cash and cash equivalents 82,647 Restricted cash 1,330 Accounts receivable, net 25,043 Inventories 160,788 Deferred costs 47,374 Vendor advances 13,809 Deferred income taxes 24,249 Refundable income taxes 2,758 Prepaid expenses and other current assets 22,215 Total current assets 380,212 Property, plant and equipment, net 632,611 Intangible assets, net 92,299 Goodwill 56,923 Deferred cost 26,484 Other assets 165,875 Total assets $1,354,405 Current portion of long-term debt Current portion of prepayment obligation 65,850 Accounts payable 131,142 Accrued expenses and other current liabilities 83,410 Contingent consideration 7,075 Customer deposits 20,441 Deferred revenue 64,752 Accrued income taxes 478 Total current liabilities 373,148 Long term debt, net of current portion Prepayment obligation, net of current portion 291,275 Convertible notes 299,562 Deferred income taxes 16,056 Customer deposits 55,598 Deferred revenue 183,593 Contingent consideration 16,813 Other non-current liabilities 17,751 Accrued Income Taxes 20,787 Total liabilities $1,274,584 Common stock 1,377 Additional paid-in capital 372,571 Accumulated other comprehensive income (loss) 1,038 Retained Earnings (Accumulated deficit) (295,165) Total stockholder's equity $79,821 Liabilities and equity $1,354,405

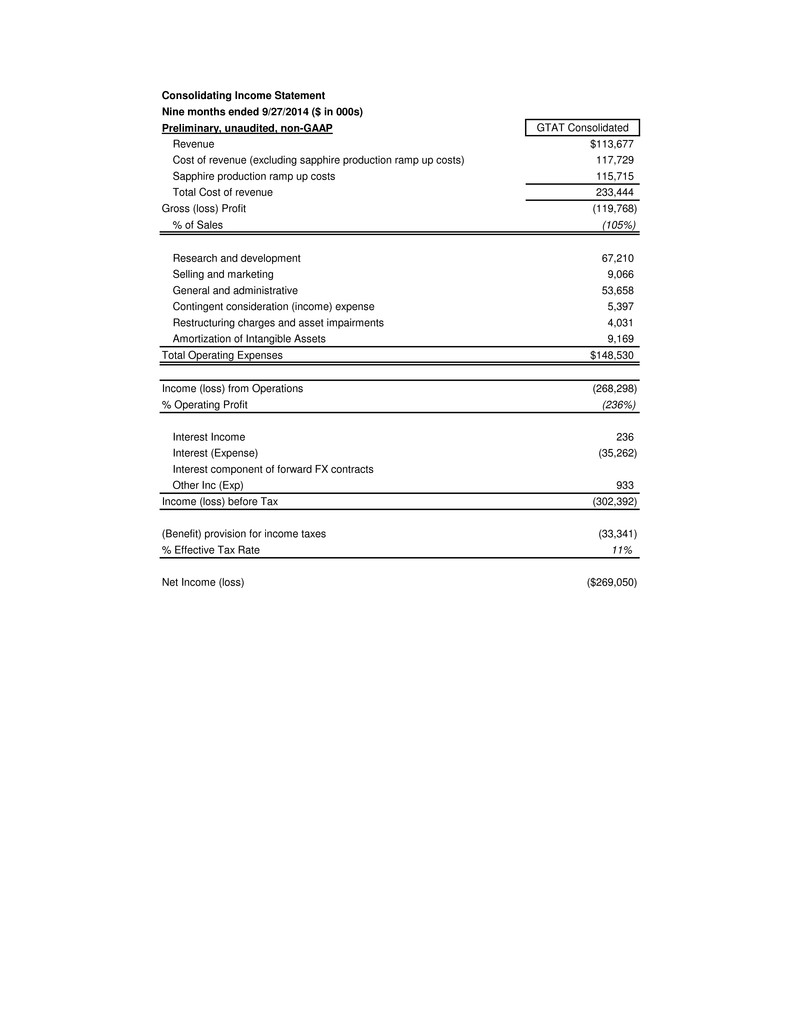

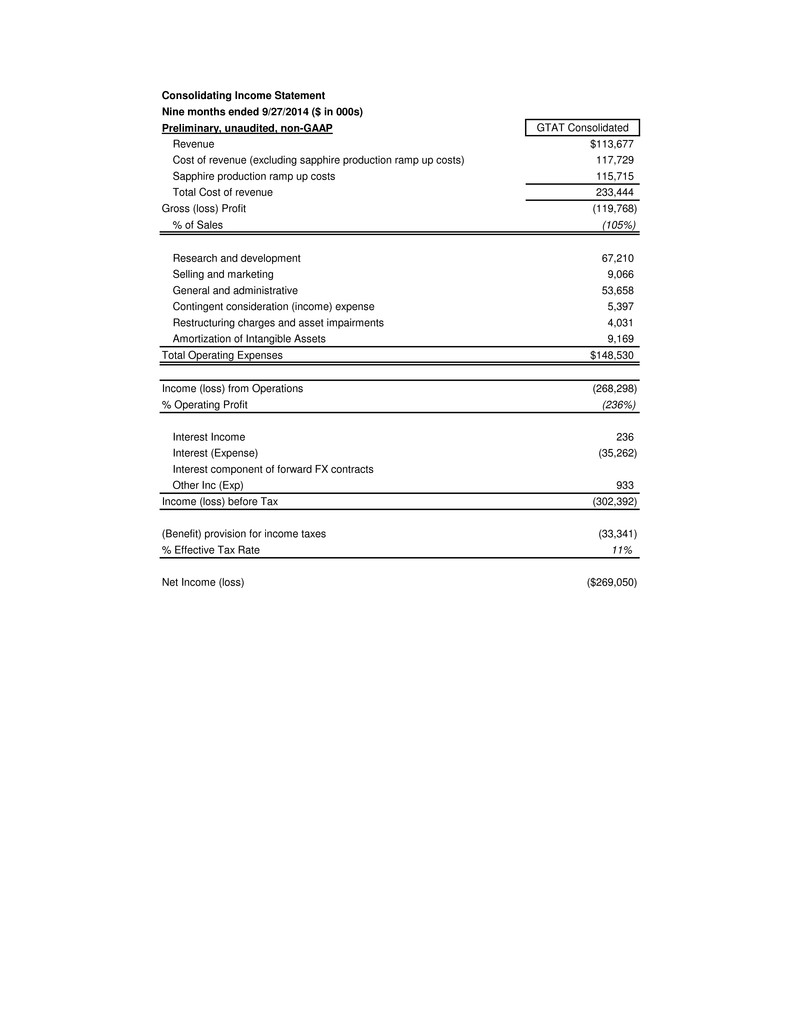

Consolidating Income Statement Nine months ended 9/27/2014 ($ in 000s) Preliminary, unaudited, non-GAAP GTAT Consolidated Revenue $113,677 Cost of revenue (excluding sapphire production ramp up costs) 117,729 Sapphire production ramp up costs 115,715 Total Cost of revenue 233,444 Gross (loss) Profit (119,768) % of Sales (105%) Research and development 67,210 Selling and marketing 9,066 General and administrative 53,658 Contingent consideration (income) expense 5,397 Restructuring charges and asset impairments 4,031 Amortization of Intangible Assets 9,169 Total Operating Expenses $148,530 Income (loss) from Operations (268,298) % Operating Profit (236%) Interest Income 236 Interest (Expense) (35,262) Interest component of forward FX contracts Other Inc (Exp) 933 Income (loss) before Tax (302,392) (Benefit) provision for income taxes (33,341) % Effective Tax Rate 11% Net Income (loss) ($269,050)

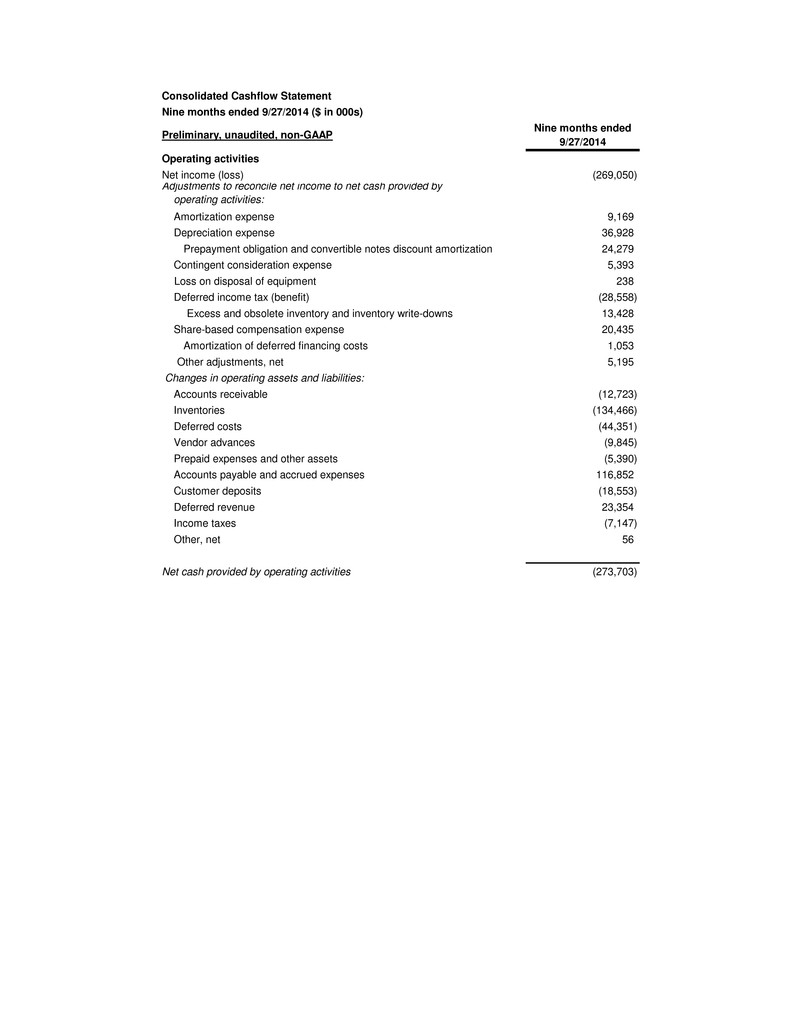

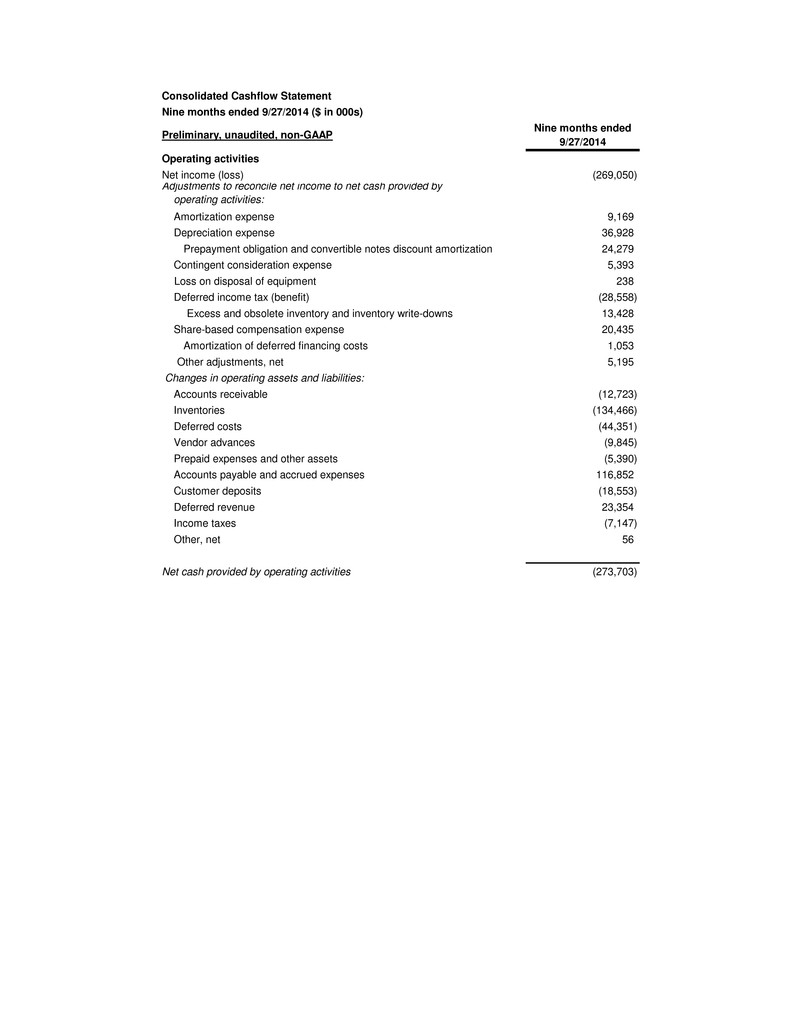

Consolidated Cashflow Statement Nine months ended 9/27/2014 ($ in 000s) Preliminary, unaudited, non-GAAP Nine months ended 9/27/2014 Operating activities Net income (loss) (269,050) Adjustments to reconcile net income to net cash provided by operating activities: Amortization expense 9,169 Depreciation expense 36,928 Prepayment obligation and convertible notes discount amortization 24,279 Contingent consideration expense 5,393 Loss on disposal of equipment 238 Deferred income tax (benefit) (28,558) Excess and obsolete inventory and inventory write-downs 13,428 Share-based compensation expense 20,435 Amortization of deferred financing costs 1,053 Other adjustments, net 5,195 Changes in operating assets and liabilities: Accounts receivable (12,723) Inventories (134,466) Deferred costs (44,351) Vendor advances (9,845) Prepaid expenses and other assets (5,390) Accounts payable and accrued expenses 116,852 Customer deposits (18,553) Deferred revenue 23,354 Income taxes (7,147) Other, net 56 Net cash provided by operating activities (273,703)

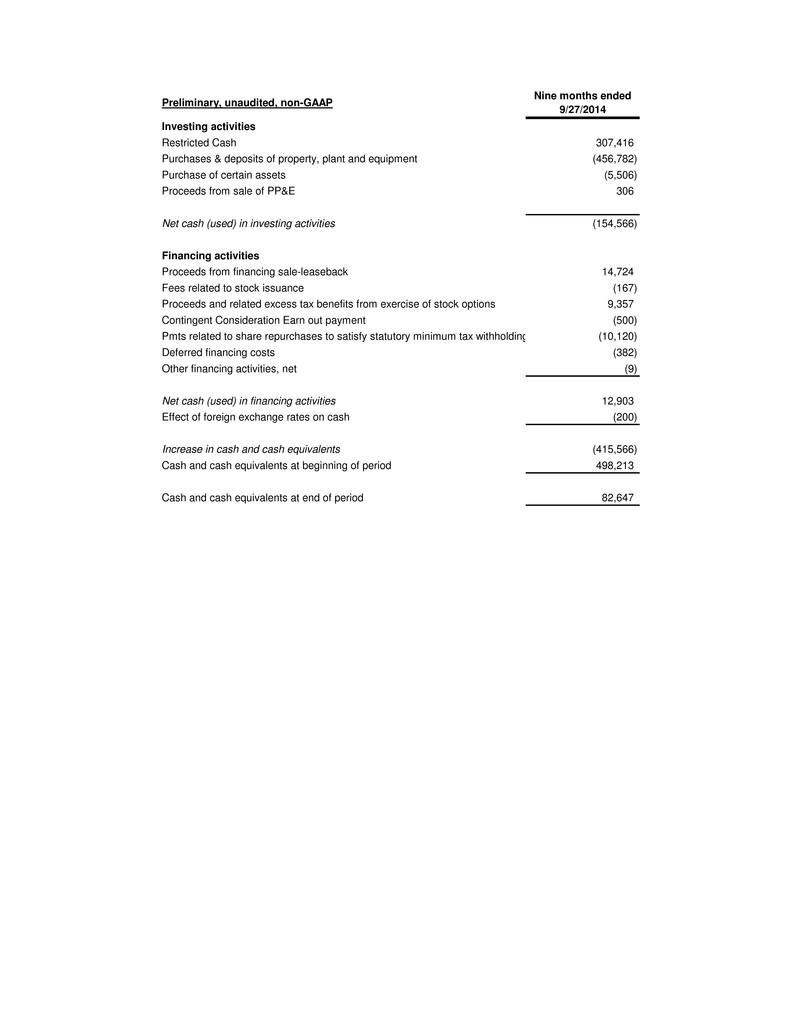

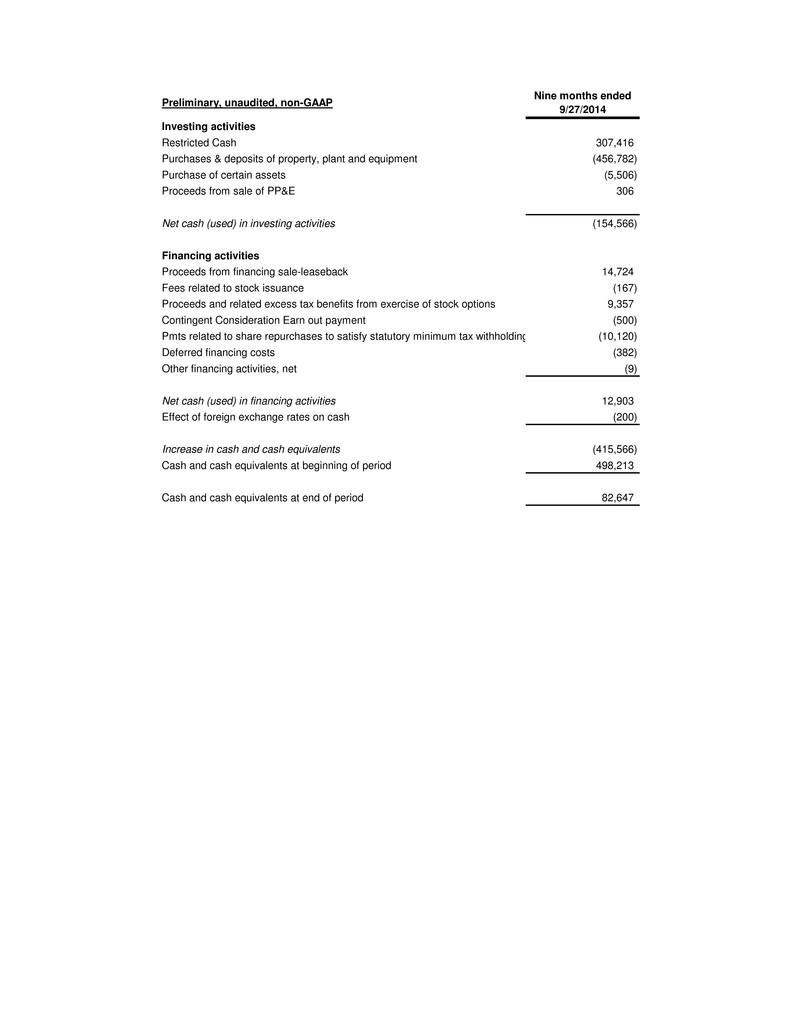

Preliminary, unaudited, non-GAAP Nine months ended 9/27/2014 Investing activities Restricted Cash 307,416 Purchases & deposits of property, plant and equipment (456,782) Purchase of certain assets (5,506) Proceeds from sale of PP&E 306 Net cash (used) in investing activities (154,566) Financing activities Proceeds from financing sale-leaseback 14,724 Fees related to stock issuance (167) Proceeds and related excess tax benefits from exercise of stock options 9,357 Contingent Consideration Earn out payment (500) Pmts related to share repurchases to satisfy statutory minimum tax withholdings (10,120) Deferred financing costs (382) Other financing activities, net (9) Net cash (used) in financing activities 12,903 Effect of foreign exchange rates on cash (200) Increase in cash and cash equivalents (415,566) Cash and cash equivalents at beginning of period 498,213 Cash and cash equivalents at end of period 82,647

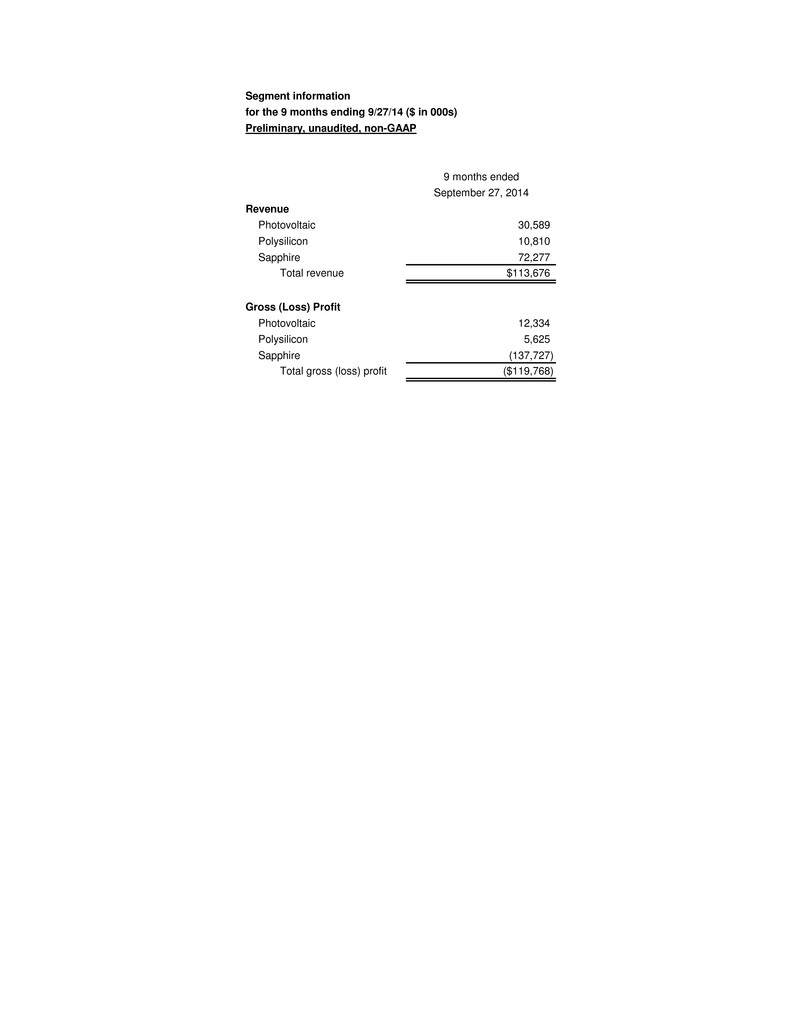

Item 2. YTD Segment Financials

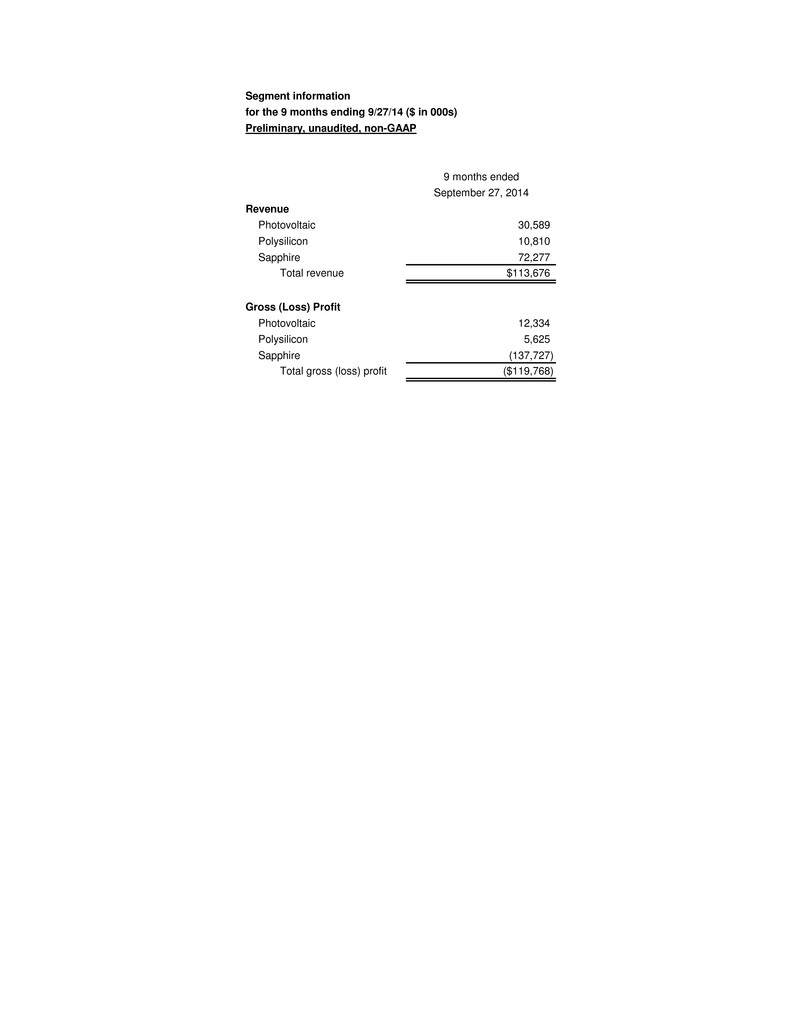

Segment information for the 9 months ending 9/27/14 ($ in 000s) Preliminary, unaudited, non-GAAP 9 months ended September 27, 2014 Revenue Photovoltaic 30,589 Polysilicon 10,810 Sapphire 72,277 Total revenue $113,676 Gross (Loss) Profit Photovoltaic 12,334 Polysilicon 5,625 Sapphire (137,727) Total gross (loss) profit ($119,768)

Item 3. 13 Week Projections

See Item 12 (Supplemental Information)

Item 4. (1) 2014PF & 2015E Projections

See Item 12 (Supplemental Information)

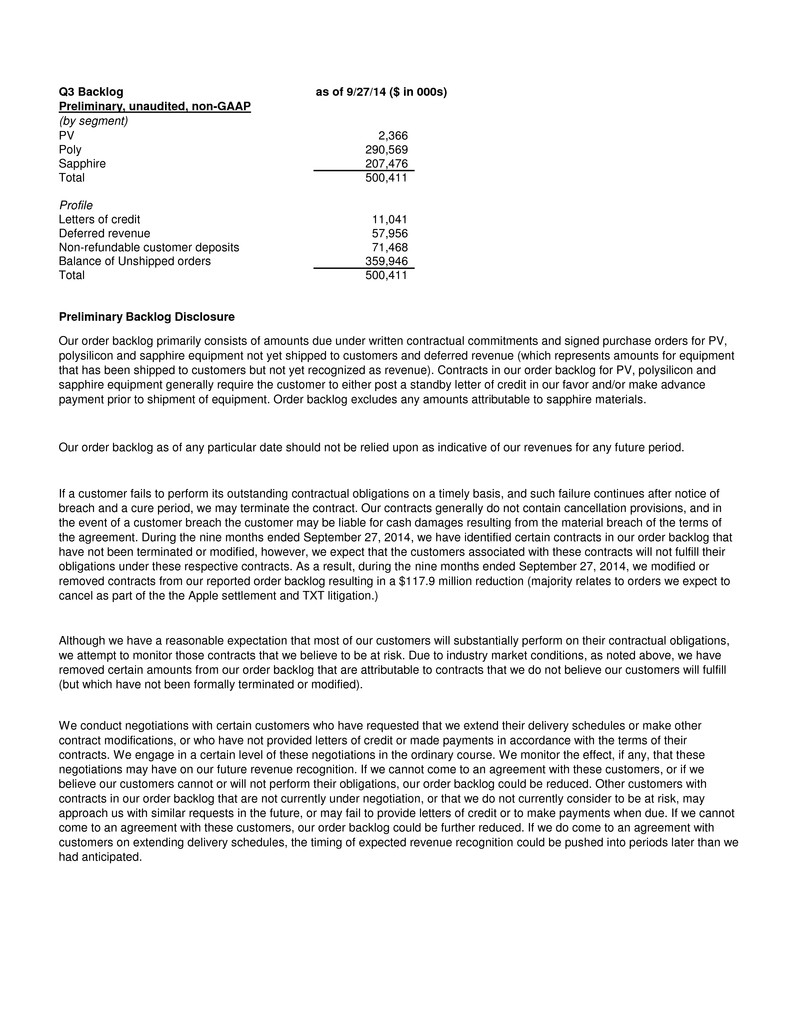

Item 5. Backlog

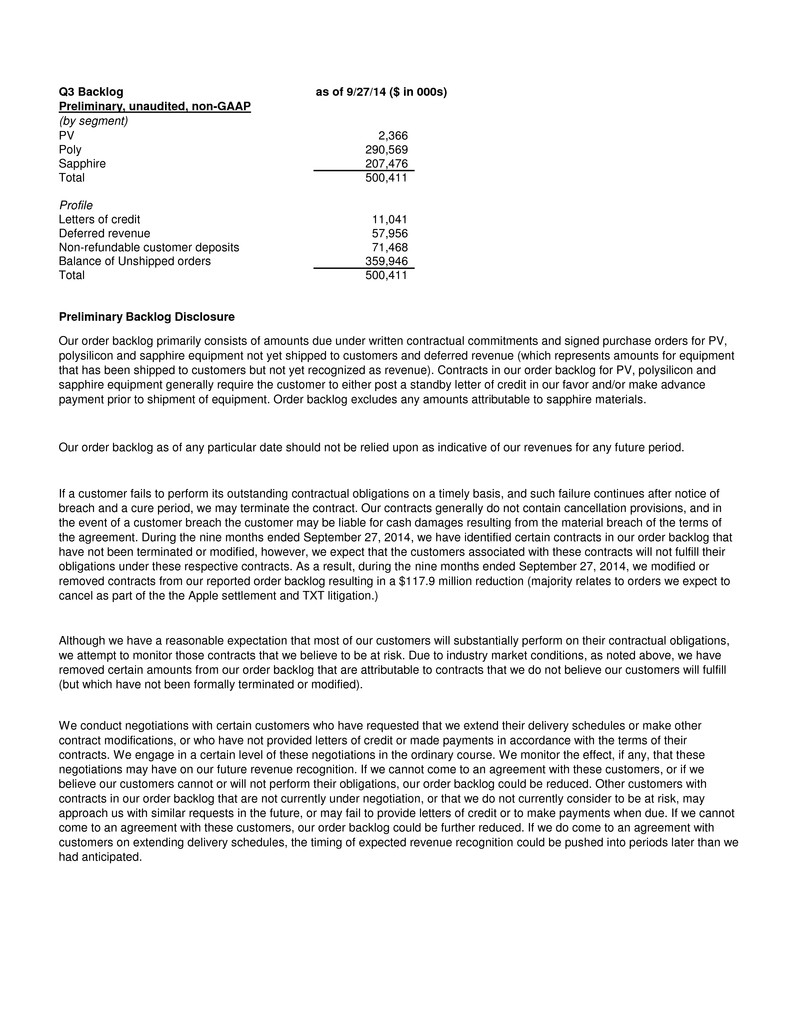

Q3 Backlog as of 9/27/14 ($ in 000s) Preliminary, unaudited, non-GAAP (by segment) PV 2,366 Poly 290,569 Sapphire 207,476 Total 500,411 Profile Letters of credit 11,041 Deferred revenue 57,956 Non-refundable customer deposits 71,468 Balance of Unshipped orders 359,946 Total 500,411 Preliminary Backlog Disclosure Our order backlog primarily consists of amounts due under written contractual commitments and signed purchase orders for PV, polysilicon and sapphire equipment not yet shipped to customers and deferred revenue (which represents amounts for equipment that has been shipped to customers but not yet recognized as revenue). Contracts in our order backlog for PV, polysilicon and sapphire equipment generally require the customer to either post a standby letter of credit in our favor and/or make advance payment prior to shipment of equipment. Order backlog excludes any amounts attributable to sapphire materials. Our order backlog as of any particular date should not be relied upon as indicative of our revenues for any future period. If a customer fails to perform its outstanding contractual obligations on a timely basis, and such failure continues after notice of breach and a cure period, we may terminate the contract. Our contracts generally do not contain cancellation provisions, and in the event of a customer breach the customer may be liable for cash damages resulting from the material breach of the terms of the agreement. During the nine months ended September 27, 2014, we have identified certain contracts in our order backlog that have not been terminated or modified, however, we expect that the customers associated with these contracts will not fulfill their obligations under these respective contracts. As a result, during the nine months ended September 27, 2014, we modified or removed contracts from our reported order backlog resulting in a $117.9 million reduction (majority relates to orders we expect to cancel as part of the the Apple settlement and TXT litigation.) Although we have a reasonable expectation that most of our customers will substantially perform on their contractual obligations, we attempt to monitor those contracts that we believe to be at risk. Due to industry market conditions, as noted above, we have removed certain amounts from our order backlog that are attributable to contracts that we do not believe our customers will fulfill (but which have not been formally terminated or modified). We conduct negotiations with certain customers who have requested that we extend their delivery schedules or make other contract modifications, or who have not provided letters of credit or made payments in accordance with the terms of their contracts. We engage in a certain level of these negotiations in the ordinary course. We monitor the effect, if any, that these negotiations may have on our future revenue recognition. If we cannot come to an agreement with these customers, or if we believe our customers cannot or will not perform their obligations, our order backlog could be reduced. Other customers with contracts in our order backlog that are not currently under negotiation, or that we do not currently consider to be at risk, may approach us with similar requests in the future, or may fail to provide letters of credit or to make payments when due. If we cannot come to an agreement with these customers, our order backlog could be further reduced. If we do come to an agreement with customers on extending delivery schedules, the timing of expected revenue recognition could be pushed into periods later than we had anticipated.

Backlog is not a term recognized under United States generally accepted accounting principles; however, it is a common measurement that the management team uses in assessing the business and operations. Our methodology for determining backlog may not be comparable to the methodologies used by other companies. Additionally, we adjusted our methodology for determining backlog to exclude contracts that were not formally modified or terminated but for which we do not expect the customer to fulfill their obligations. As of September 27, 2014, our order backlog did not include any amounts related to sapphire material customers, and we do not currently expect to include sapphire material in our backlog. Furthermore, backlog is difficult to determine with certainty and requires estimates and judgments to be made by management and it should not be relied upon as an indication of future performance. Our order backlog as of September 27, 2014, included deferred revenue of $58.0 million, of which $0.9 million related to our PV business, $54.9 million related to our polysilicon business and $2.2 million related to our sapphire business. Cash received in deposits related to our order backlog where deliveries have not yet occurred was $71.5 million as of September 27, 2014. As of September 27, 2014, our order backlog consisted of contracts with three PV customers, contracts with ten polysilicon customers, and contracts with ten sapphire equipment customers. Our order backlog as of September 27, 2014, included $261.3 million, and $142.3 million attributed to two different customers, each of which individually represents 52% and 28%, respectively, of our order backlog.

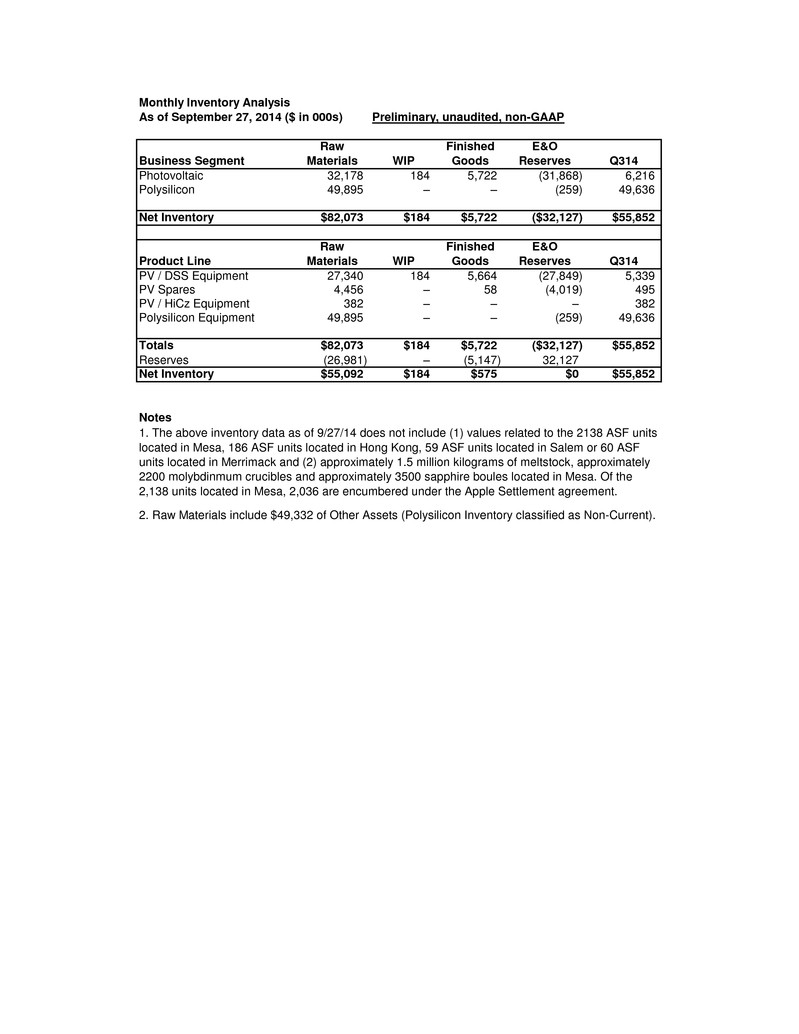

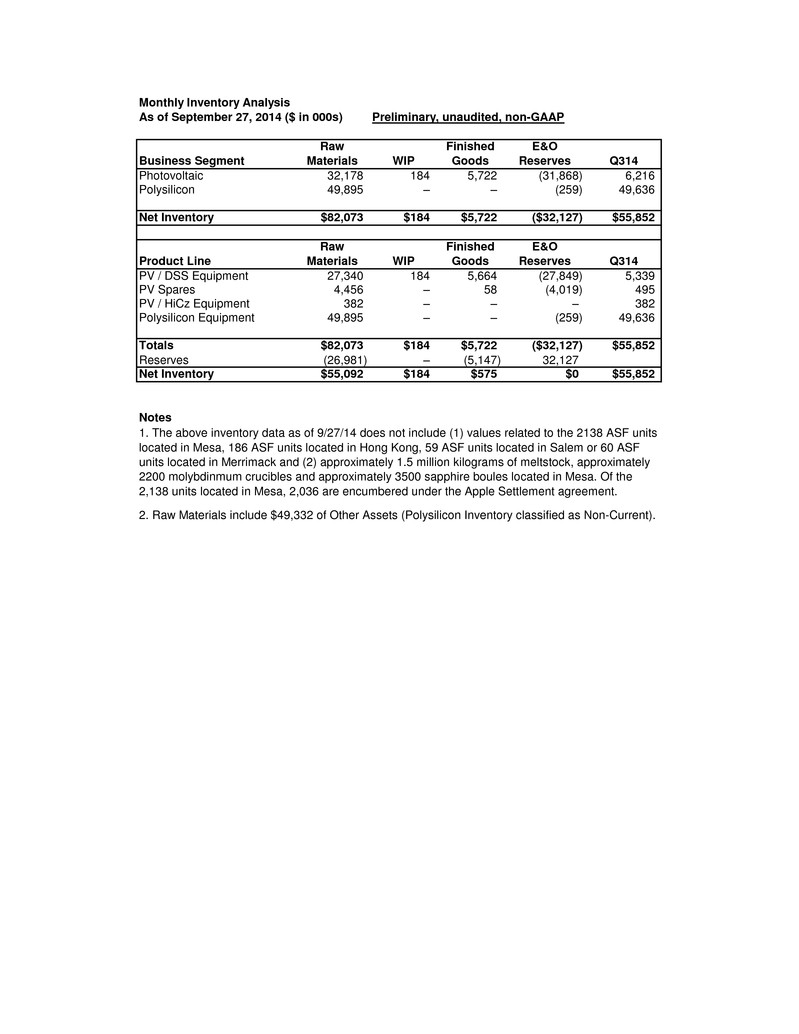

Item 6. Inventory Schedule

Monthly Inventory Analysis As of September 27, 2014 ($ in 000s) Preliminary, unaudited, non-GAAP Raw Finished E&O Business Segment Materials WIP Goods Reserves Q314 Photovoltaic 32,178 184 5,722 (31,868) 6,216 Polysilicon 49,895 – – (259) 49,636 Net Inventory $82,073 $184 $5,722 ($32,127) $55,852 Raw Finished E&O Product Line Materials WIP Goods Reserves Q314 PV / DSS Equipment 27,340 184 5,664 (27,849) 5,339 PV Spares 4,456 – 58 (4,019) 495 PV / HiCz Equipment 382 – – – 382 Polysilicon Equipment 49,895 – – (259) 49,636 Totals $82,073 $184 $5,722 ($32,127) $55,852 Reserves (26,981) – (5,147) 32,127 Net Inventory $55,092 $184 $575 $0 $55,852 Notes 1. The above inventory data as of 9/27/14 does not include (1) values related to the 2138 ASF units located in Mesa, 186 ASF units located in Hong Kong, 59 ASF units located in Salem or 60 ASF units located in Merrimack and (2) approximately 1.5 million kilograms of meltstock, approximately 2200 molybdinmum crucibles and approximately 3500 sapphire boules located in Mesa. Of the 2,138 units located in Mesa, 2,036 are encumbered under the Apple Settlement agreement. 2. Raw Materials include $49,332 of Other Assets (Polysilicon Inventory classified as Non-Current).

Item 7. (1) Summary Appraisal

Hilco performed an appraisal of GTAT’s non-ASF machinery & equipment, non-ASF inventory and New Hampshire real estate, which resulted in an appraised value of $60 - $80 million. The appraisals of non-ASF machinery & equipment and non-ASF inventory were conducted on the basis of a hypothetical net orderly disposal of assets and the appraisal of New Hampshire real estate was conducted on the basis of market value.

Item 7. (2) Historical ASP of ASFs

GTAT sold ASFs at a weighted average price of $545k since entering the ASF equipment business in 2011.

Item 8. (1) MD&A

Management Discussion and Key Business Plan Assumptions: GT Advanced Technologies Inc. is a diversified technology company producing advanced materials and equipment for the global consumer electronics, power electronics, solar and LED industries. Our products are designed to accelerate the adoption of advanced materials that improve performance and lower the cost of manufacturing. References herein to "we," "us," "our" and "Company" are to GT Advanced Technologies Inc., operating through its subsidiaries. GT Advanced Technologies Inc. was originally incorporated as GT Solar International, Inc. in Delaware in September 2006, and in July 2008, we completed our initial public offering. In August 2011, we changed the name of the Company to GT Advanced Technologies Inc., and such change was effected pursuant to Section 253 of the Delaware General Corporation Law of the State of Delaware by the merger of a wholly-owned subsidiary of the Company into the Company. On October 31, 2013, our wholly-owned subsidiary, GTAT Corporation (or GTAT), and Apple Inc. entered into a Master Development and Supply Agreement and related Statement of Work (or the MDSA), pursuant to which GTAT has agreed to supply sapphire material to Apple. On the same date, GTAT entered into a Prepayment Agreement with Apple pursuant to which we were eligible to receive $578 million, which we refer to as the Prepayment Amount as payment in advance for the purchase by Apple of sapphire material. The Prepayment Amount was to be used by GTAT to purchase ASF systems and related equipment for use in the manufacturing if sapphire and was required to be repaid ratably over a five-year period beginning in January 2015. We have received $439 million of the Prepayment Amount. On October 6, 2014, GT Advanced Technologies Inc., together with certain of its subsidiaries, commenced voluntary cases under chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court for the District of New Hampshire. GT expects the court will authorize the company to continue to conduct business as usual while it devotes renewed efforts to resolve its current issues and develops a reorganization plan. On October 16, 2014, Nasdaq suspended trading of the Company’s common stock. On December 22, 2014 the Bankruptcy Court approved a settlement agreement between GTAT and Apple, under which all exclusivity restrictions on GTAT were lifted, and GTAT retained control of its intellectual property and ownership of its production, ancillary and inventory assets located in Mesa. GTAT was provided a rent-free lease of the Mesa facility through the end of 2015 and a subsequent rent-free lease of a portion of the facility for storage through 2019, subject to early termination by Apple on 6-months prior notice, which can be issued no sooner than July 1, 2016. Apple has been provided with a mechanism for recovering its $439 million pre-payment made to GTAT whereby Apple will receive a portion of ASF sales for each furnace that GTAT sells. Each party was relieved of any other claims as part of the settlement agreement. Since filing for chapter 11, the Bankruptcy Court approved a plan to wind-down our sapphire manufacturing operation. The Company subsequently implemented a restructuring program, winding down its sapphire materials operations in Mesa and Salem and selectively discontinuing development efforts for certain of its product offerings in an effort to reduce its operating expenses. As part of the process, the Company reduced its global headcount to 369 and cash operating expenses to approximately $65M per annum. The restructured enterprise forms the basis of a business plan being pursued by the Company. For purposes of its business plan, the Company has segmented its product offerings into three segments; Crystal Systems, Solar and Industrial Systems. Our Crystal Systems business unit consists of our ASF furnace, Zephyr and SiClone™ product offerings. Our ASF furnaces are used by our customers to produce sapphire boules which are used, following certain cutting and polishing processes, to make sapphire wafers, a substrate for manufacturing light emitting diodes (LEDs), as well as sapphire material for a wide range of consumer applications including, mobile phone cover screens, watch crystals, medical devices, specialty optical and other industrial applications. Zephyr is a thin film aluminum oxide coating tool that we are developing. It can be used to hard-coat display substrates in high volumes, providing a performance

level superior to that of chemically strengthened glass and polycarbonates. Our SiClone™ silicon carbide sublimation furnaces are used to produce silicon carbide boules. These silicon carbide boules, after certain cutting and processing steps, are used to make silicon carbide wafers, which serve as a substrate for manufacturing power electronics semiconductors for applications such as electric and hybrid vehicles, and power conditioning equipment such as inverters for wind farms, solar arrays and other industrial applications. Our Solar business unit is comprised of our Polysilicon, Photovoltaic and Merlin product offerings. Polysilicon includes our Silicon Deposition Reactors (SDR™) and related equipment used to produce polysilicon, the key raw material used in silicon-based solar wafers and Hydrochlorination equipment which is utilized to convert silicon tetrachloride into trichlorosilane (TCS), which is used as seed material in the manufacture of high purity silicon. Photovoltaic includes our Directional solidification system (DSS™) furnaces and related equipment used to cast multicrystalline silicon ingots. These ingots are used to make photovoltaic (PV) solar wafers and cells and HiCz™ monocrystalline silicon ingot growth systems designed to produce high quality silicon monocrystalline wafers for higher efficiency N-type solar cells. HiCz growth systems produce larger, lower cost monocrystalline ingots with greater yields than traditional CZ systems. Our recently introduced Merlin technology offers the solar industry an alternative grid metallization and cell interconnect methodology which improves overall system cost, efficiency and performance for manufacturers of solar panels. In addition to selling grids and attach tools, we are marketing custom modules using the Merlin technology for low volume applications. Our Industrial Systems business unit is comprised of our Hyperion™, Specialty Furnace and Industrial Sapphire product lines. While our Hyperion™ ion implant system is still in development and undergoing testing, it can be used to exfoliate or "lift" off an ultra-thin, flexible substrate from certain target materials such as silicon, silicon carbide and sapphire. It is also being evaluated for use in a cancer treatment application known as Boron Neutron Capture Therapy (BNCT). We added the Specialty Furnace product line with the acquisition of Thermal Technologies which markets a series of specialty furnaces used for a variety of industrial purposes. Our Industrial Sapphire materials operation, which is located in a portion of our sapphire manufacturing facility in Salem, Massachusetts, is focused on producing sapphire materials for specific industrial applications including Low Absorption Optical Sapphire (LAOS) used in applications where minimal photon absorption is critical and Titanium- doped Sapphire (Ti:Sapphire) for applications such as tunable lasers and photonics products. Key assumptions regarding the Company’s business plan for each segment are as follows: Crystal Systems Business Unit: Our Crystal Systems business unit is expected to contribute significant free cash flow, driven by ASF sales. Under the settlement agreement between GTAT and Apple, exclusivity restrictions have been lifted. Accordingly, GTAT has re-launched ASF equipment marketing efforts. GTAT’s business plan assumes the consumer electronics market will increasingly adopt sapphire for use in display cover and other applications which will drive the need for a significant increase in sapphire manufacturing capacity in the industry. GTAT’s business plan assumes it will successfully sell substantially all of its ASF inventory (including those units located in Mesa, AZ), within a 4 year planning horizon and fully repay the $439 million due to Apple. We will maintain a development team and continue to invest in R&D programs to further improve our ASF technology over time. We believe ongoing improvements in process technology and hardware are critical to maintaining a competitive advantage in the long term. No revenues for Zephyr have been included in our business plan. Solar Business Unit: We expect to continue to sell DSS furnaces out of inventory through 2015, albeit at low gross margins. Further development efforts for DSS will be focused on the introduction of a next generation platform capable of delivering higher efficiency and throughput while lowering silicon wafer costs for our customers. Further investments in our HiCz product offering have been curbed until and unless we see a near-term opportunity with a major customer. We’ve assumed that our largest Polysilicon contract with a customer, reflected in our backlog as $261 million, would be delivered over three years, beginning in 2016.

We intend to invest aggressively in our Merlin technology and expect the business to contribute significantly to our growth over the next three years. Although the business is not expected to generate positive cash flow in 2015, we expect the business to generate marginally positive free cash flow in 2016 and significant cash flow in 2017 and beyond as the market adopts our Merlin technology. Industrial Systems Business Unit: In our Hyperion product line, we will focus our near term efforts on securing an order for BNCT (Boron Neutron Capture Therapy) application. If this order is not secured in the first half of 2015, we will explore strategic alternatives for the business. Accordingly, we have not included any revenues for Hyperion in our business plan. We’ve assumed we will divest Industrial Sapphire and Specialty Furnace product lines and have initiated a 363 sales process which we expect to conclude by the second quarter of 2015.

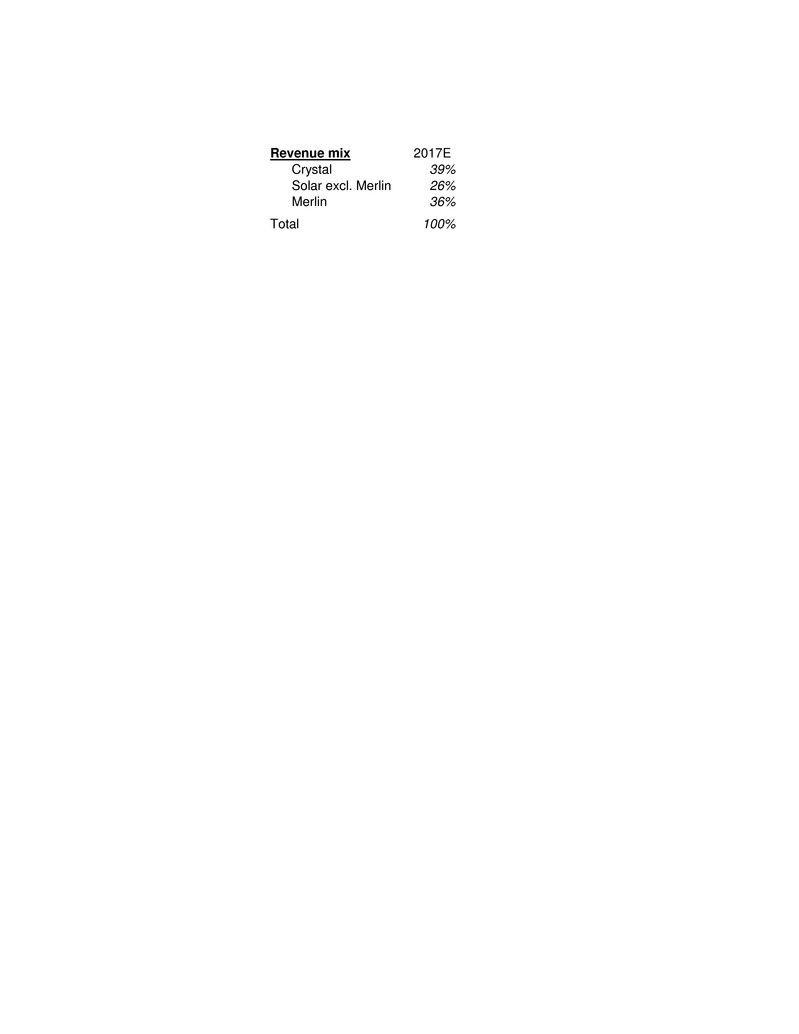

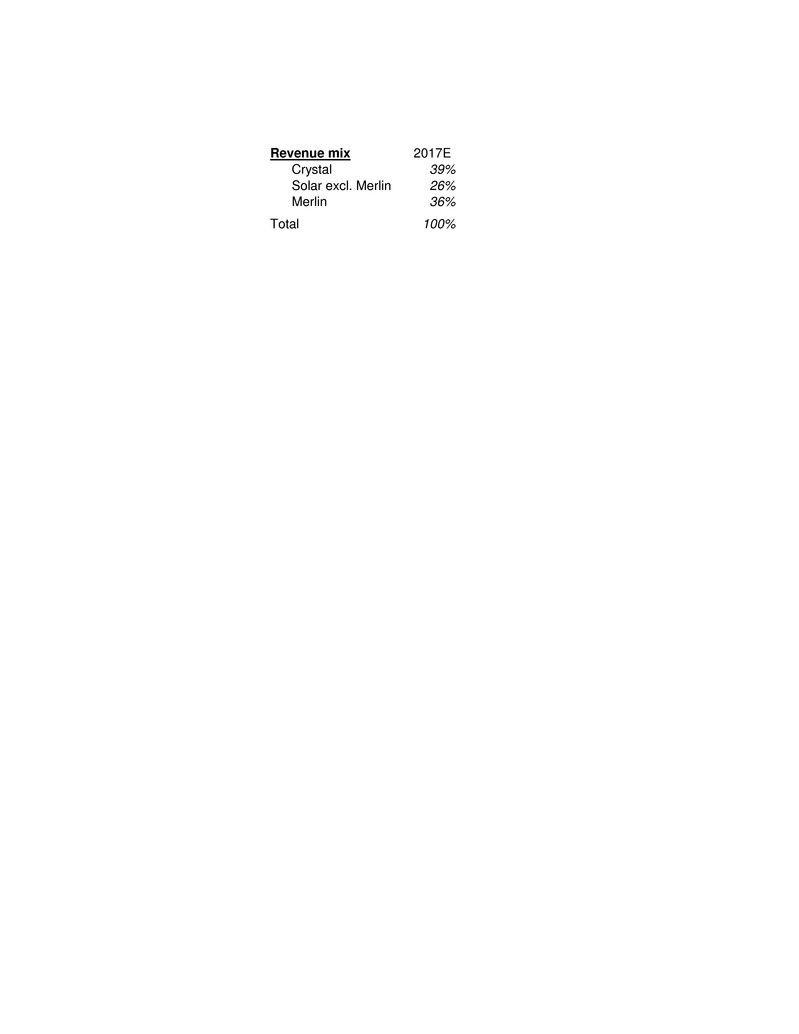

Item 8. (2) 2017 Revenue Mix

Revenue mix 2017E Crystal 39% Solar excl. Merlin 26% Merlin 36% Total 100%

9. Cost Structure

General Assumptions on GTAT Cost Structure: We have significantly reduced our cost structure by eliminating 369 positions throughout the company since filing for chapter 11. Our current cash operating expenditures, before accounting for any restructuring, professional fees, retention/performance incentives, are expected to be approximately $65 million for 2015. We’ve assumed minimal growth in operating expenditures as we grow the revenues of the Company in 2016 and beyond. As of December 31, 2014, we employed 365 full-time employee equivalents and contract personnel, consisting of 84 engineering and research and development employees; 27 customer service representatives; 8 executives; 28 sales and marketing employees; 84 finance, general and administrative employees; 123 manufacturing staff; and 11 information technology employees. As of December 31, 2014, 123 employees were located at our Merrimack, New Hampshire facility, 12 employees were located at our Salem, Massachusetts facility, 22 employees were located at our Danvers, Massachusetts facility, 45 employees were located at our Missoula, Montana facility, 23 employees were located at our San Jose, California facility, 9 employees were located in our Mesa, Arizona facility, 43 employees were located in our Santa Rosa, California facility, 23 employees were located at our Hong Kong facility, 8 employees were located at our Taiwan facility, and 57 employees were located at our Shanghai facility.

Item 10. Contingent Consideration

As of 9/27/2014, the Company held liabilities related to pre-petition acquisition contingent consideration arrangements with a fair value of approximately $23.8 million. Of this amount, approximately $20.5 million are liabilities related to GTAT Corporation (debtor entity) and $3.3 million are liabilities related to GT Sapphire Technology Company (non- debtor entity). Amounts may become payable based on and as related revenue is earned with payouts in the first quarter of fiscal 2015 through 2027. The Company is in the process of rejecting the debtor contracts that give rise to the contingent consideration liabilities and expects not to pay out any cash related to such liabilities. Amounts are payable as certain operating metrics are achieved through 2015. The Company is in the process of evaluating its obligations with respect to the contingent consideration liabilities of its non-debtor entities, but in any event, expects any payouts related to such entities not to exceed the book value of such obligations.

Item 11. Lease Costs

GTAT’s run-rate lease costs as at the December 31st, 2014 were approximately $263,000 including lease rejections (excluding lease rejections were approximately $171,000).

Item 12. Supplemental Information

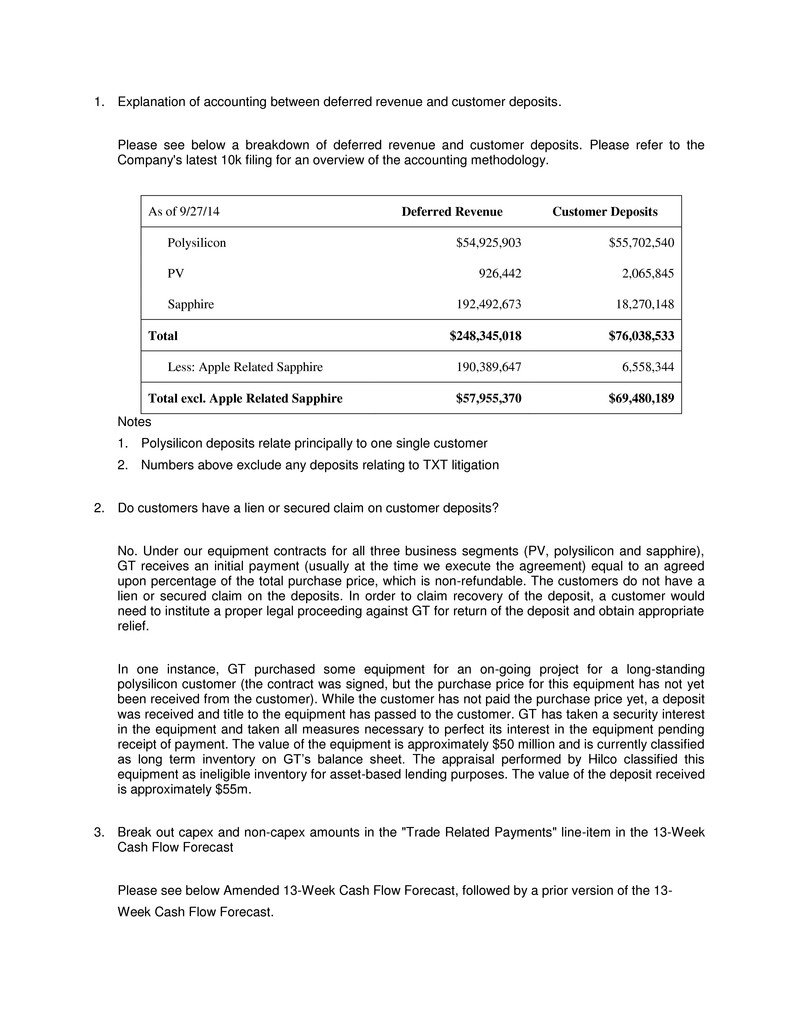

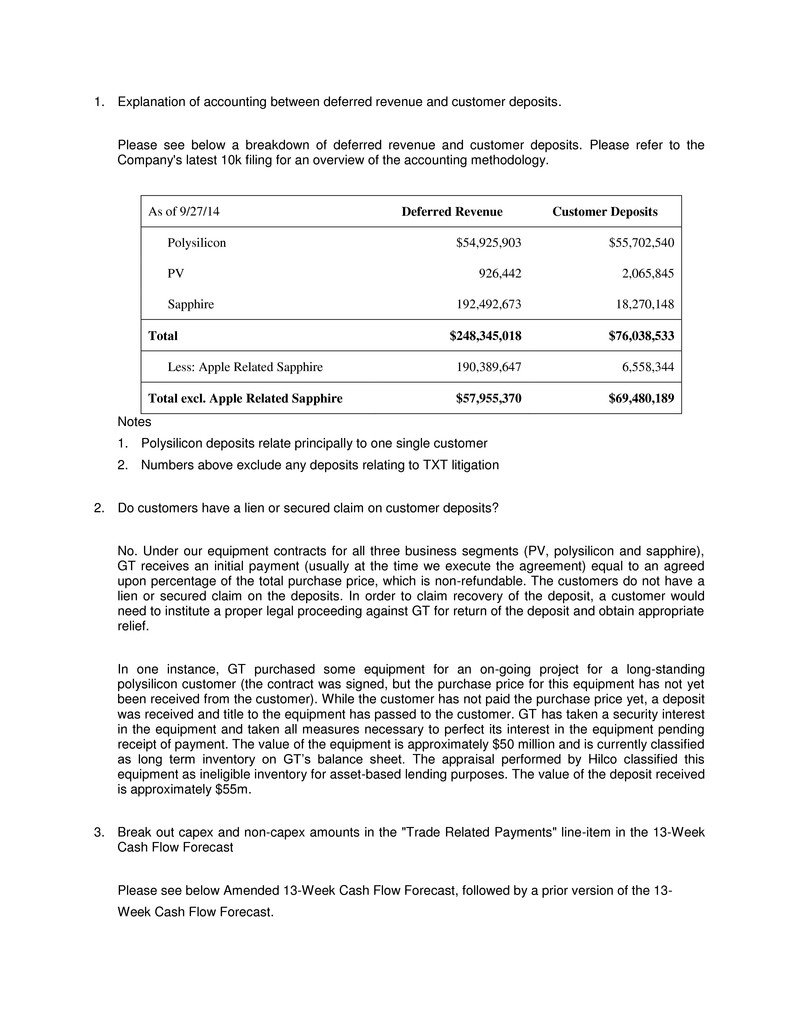

1. Explanation of accounting between deferred revenue and customer deposits. Please see below a breakdown of deferred revenue and customer deposits. Please refer to the Company's latest 10k filing for an overview of the accounting methodology. As of 9/27/14 Deferred Revenue Customer Deposits Polysilicon $54,925,903 $55,702,540 PV 926,442 2,065,845 Sapphire 192,492,673 18,270,148 Total $248,345,018 $76,038,533 Less: Apple Related Sapphire 190,389,647 6,558,344 Total excl. Apple Related Sapphire $57,955,370 $69,480,189 Notes 1. Polysilicon deposits relate principally to one single customer 2. Numbers above exclude any deposits relating to TXT litigation 2. Do customers have a lien or secured claim on customer deposits? No. Under our equipment contracts for all three business segments (PV, polysilicon and sapphire), GT receives an initial payment (usually at the time we execute the agreement) equal to an agreed upon percentage of the total purchase price, which is non-refundable. The customers do not have a lien or secured claim on the deposits. In order to claim recovery of the deposit, a customer would need to institute a proper legal proceeding against GT for return of the deposit and obtain appropriate relief. In one instance, GT purchased some equipment for an on-going project for a long-standing polysilicon customer (the contract was signed, but the purchase price for this equipment has not yet been received from the customer). While the customer has not paid the purchase price yet, a deposit was received and title to the equipment has passed to the customer. GT has taken a security interest in the equipment and taken all measures necessary to perfect its interest in the equipment pending receipt of payment. The value of the equipment is approximately $50 million and is currently classified as long term inventory on GT’s balance sheet. The appraisal performed by Hilco classified this equipment as ineligible inventory for asset-based lending purposes. The value of the deposit received is approximately $55m. 3. Break out capex and non-capex amounts in the "Trade Related Payments" line-item in the 13-Week Cash Flow Forecast Please see below Amended 13-Week Cash Flow Forecast, followed by a prior version of the 13- Week Cash Flow Forecast.

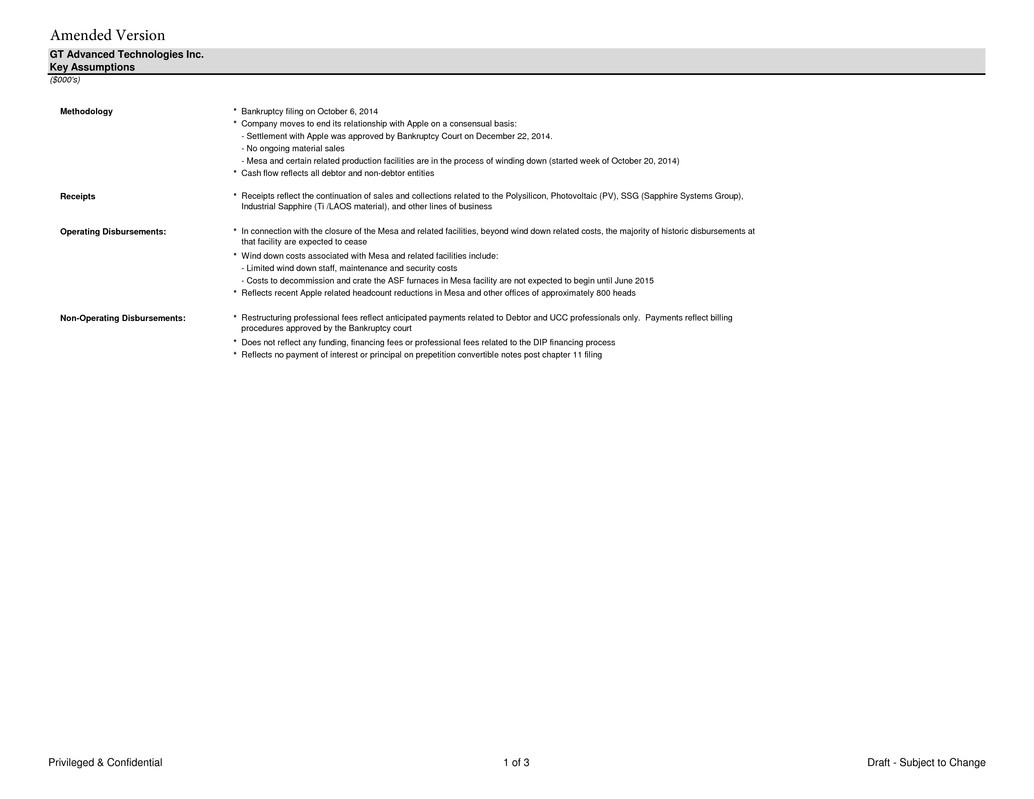

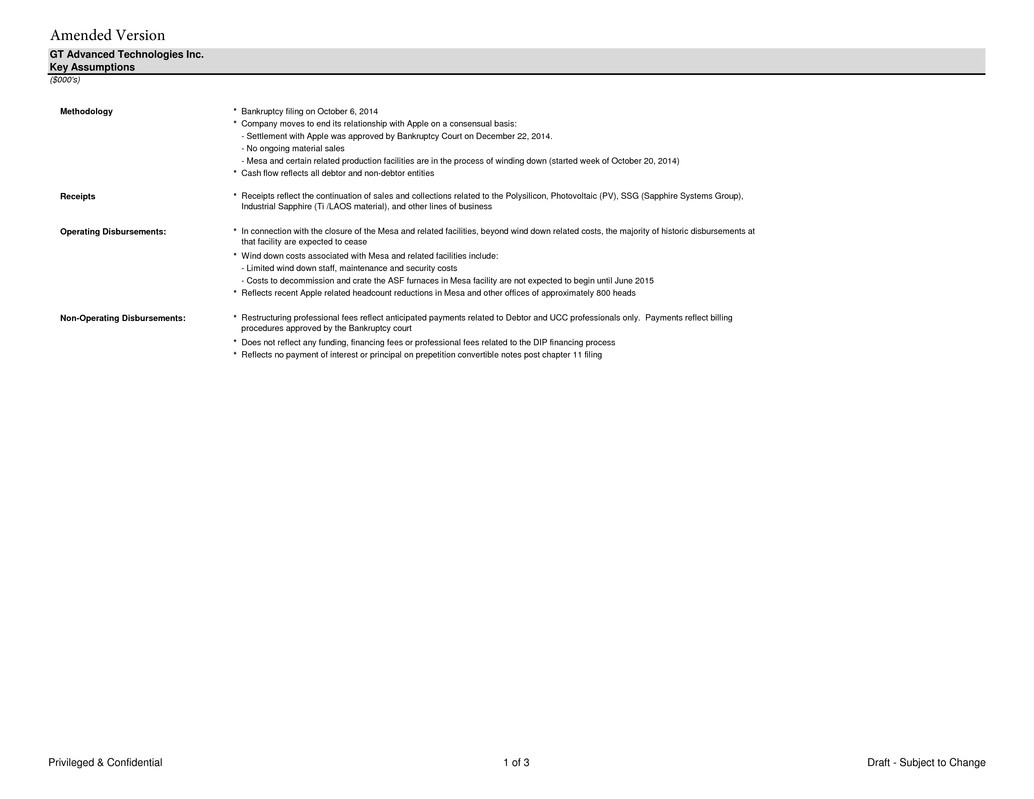

GT Advanced Technologies Inc. Key Assumptions ($000's) Methodology * * * Receipts * Operating Disbursements: * * * Non-Operating Disbursements: * * * Bankruptcy filing on October 6, 2014 Company moves to end its relationship with Apple on a consensual basis: - No ongoing material sales - Mesa and certain related production facilities are in the process of winding down (started week of October 20, 2014) Receipts reflect the continuation of sales and collections related to the Polysilicon, Photovoltaic (PV), SSG (Sapphire Systems Group), Industrial Sapphire (Ti /LAOS material), and other lines of business - Settlement with Apple was approved by Bankruptcy Court on December 22, 2014. Cash flow reflects all debtor and non-debtor entities - Costs to decommission and crate the ASF furnaces in Mesa facility are not expected to begin until June 2015 Restructuring professional fees reflect anticipated payments related to Debtor and UCC professionals only. Payments reflect billing procedures approved by the Bankruptcy court Reflects no payment of interest or principal on prepetition convertible notes post chapter 11 filing In connection with the closure of the Mesa and related facilities, beyond wind down related costs, the majority of historic disbursements at that facility are expected to cease Wind down costs associated with Mesa and related facilities include: - Limited wind down staff, maintenance and security costs Reflects recent Apple related headcount reductions in Mesa and other offices of approximately 800 heads Does not reflect any funding, financing fees or professional fees related to the DIP financing process Privileged & Confidential 1 of 3 Draft - Subject to Change

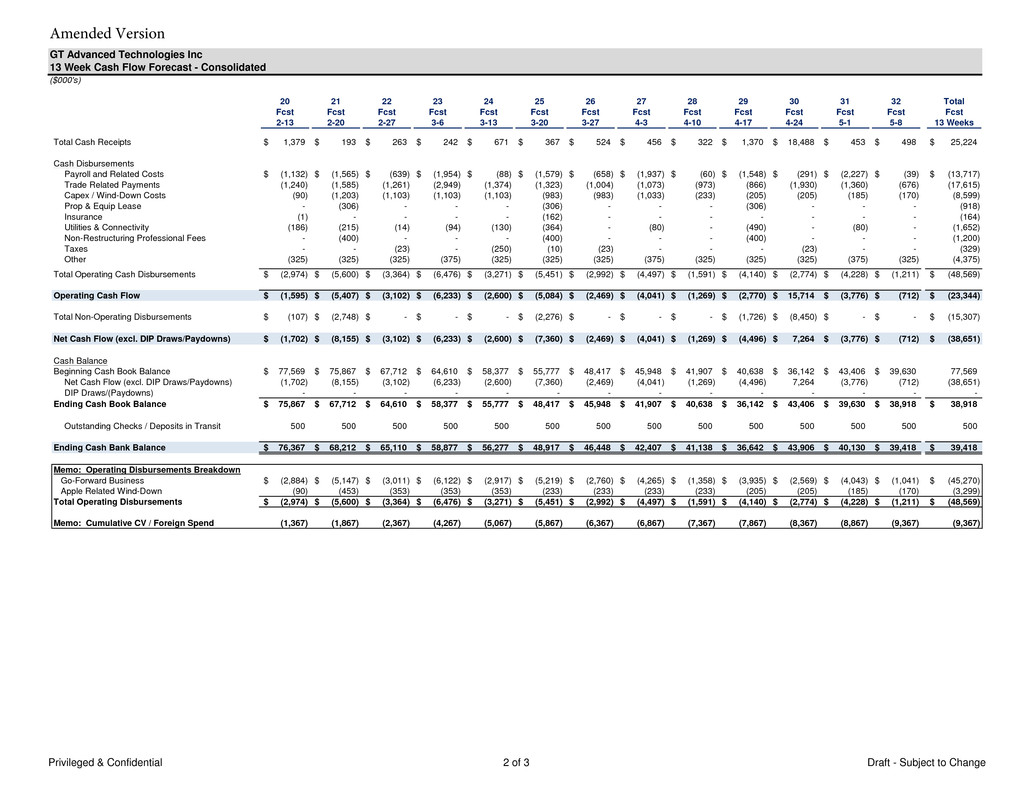

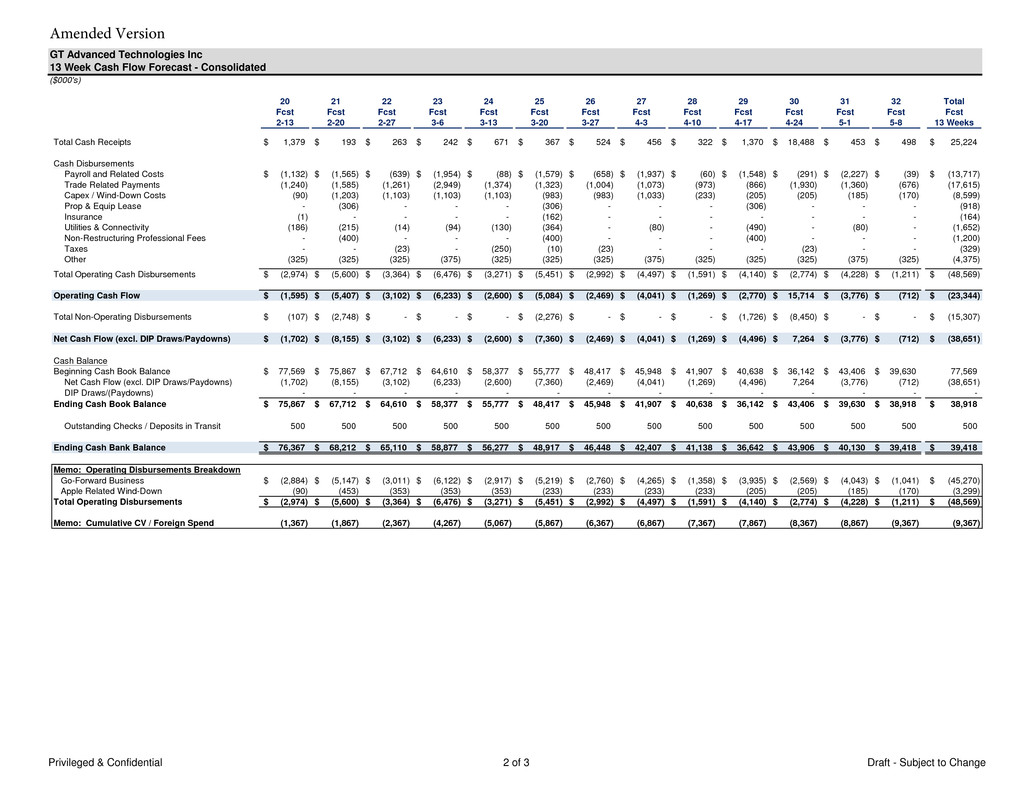

GT Advanced Technologies Inc 13 Week Cash Flow Forecast - Consolidated ($000's) 0 20 21 22 23 24 25 26 27 28 29 30 31 32 Total Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst 2-13 2-20 2-27 3-6 3-13 3-20 3-27 4-3 4-10 4-17 4-24 5-1 5-8 13 Weeks Total Cash Receipts 1,379$ 193$ 263$ 242$ 671$ 367$ 524$ 456$ 322$ 1,370$ 18,488$ 453$ 498$ 25,224$ Cash Disbursements Payroll and Related Costs (1,132)$ (1,565)$ (639)$ (1,954)$ (88)$ (1,579)$ (658)$ (1,937)$ (60)$ (1,548)$ (291)$ (2,227)$ (39)$ (13,717)$ Trade Related Payments (1,240) (1,585) (1,261) (2,949) (1,374) (1,323) (1,004) (1,073) (973) (866) (1,930) (1,360) (676) (17,615) Capex / Wind-Down Costs (90) (1,203) (1,103) (1,103) (1,103) (983) (983) (1,033) (233) (205) (205) (185) (170) (8,599) Prop & Equip Lease - (306) - - - (306) - - - (306) - - - (918) Insurance (1) - - - - (162) - - - - - - - (164) Utilities & Connectivity (186) (215) (14) (94) (130) (364) - (80) - (490) - (80) - (1,652) Non-Restructuring Professional Fees - (400) - - - (400) - - - (400) - - - (1,200) Taxes - - (23) - (250) (10) (23) - - - (23) - - (329) Other (325) (325) (325) (375) (325) (325) (325) (375) (325) (325) (325) (375) (325) (4,375) Total Operating Cash Disbursements (2,974)$ (5,600)$ (3,364)$ (6,476)$ (3,271)$ (5,451)$ (2,992)$ (4,497)$ (1,591)$ (4,140)$ (2,774)$ (4,228)$ (1,211)$ (48,569)$ Operating Cash Flow (1,595)$ (5,407)$ (3,102)$ (6,233)$ (2,600)$ (5,084)$ (2,469)$ (4,041)$ (1,269)$ (2,770)$ 15,714$ (3,776)$ (712)$ (23,344)$ Total Non-Operating Disbursements (107)$ (2,748)$ -$ -$ -$ (2,276)$ -$ -$ -$ (1,726)$ (8,450)$ -$ -$ (15,307)$ Net Cash Flow (excl. DIP Draws/Paydowns) (1,702)$ (8,155)$ (3,102)$ (6,233)$ (2,600)$ (7,360)$ (2,469)$ (4,041)$ (1,269)$ (4,496)$ 7,264$ (3,776)$ (712)$ (38,651)$ Cash Balance Beginning Cash Book Balance 77,569$ 75,867$ 67,712$ 64,610$ 58,377$ 55,777$ 48,417$ 45,948$ 41,907$ 40,638$ 36,142$ 43,406$ 39,630$ 77,569 Net Cash Flow (excl. DIP Draws/Paydowns) (1,702) (8,155) (3,102) (6,233) (2,600) (7,360) (2,469) (4,041) (1,269) (4,496) 7,264 (3,776) (712) (38,651) DIP Draws/(Paydowns) - - - - - - - - - - - - - - Ending Cash Book Balance 75,867$ 67,712$ 64,610$ 58,377$ 55,777$ 48,417$ 45,948$ 41,907$ 40,638$ 36,142$ 43,406$ 39,630$ 38,918$ 38,918$ Outstanding Checks / Deposits in Transit 500 500 500 500 500 500 500 500 500 500 500 500 500 500 Ending Cash Bank Balance 76,367$ 68,212$ 65,110$ 58,877$ 56,277$ 48,917$ 46,448$ 42,407$ 41,138$ 36,642$ 43,906$ 40,130$ 39,418$ 39,418$ Memo: Operating Disbursements Breakdown Go-Forward Business (2,884)$ (5,147)$ (3,011)$ (6,122)$ (2,917)$ (5,219)$ (2,760)$ (4,265)$ (1,358)$ (3,935)$ (2,569)$ (4,043)$ (1,041)$ (45,270)$ Apple Related Wind-Down (90) (453) (353) (353) (353) (233) (233) (233) (233) (205) (205) (185) (170) (3,299) Total Operating Disbursements (2,974)$ (5,600)$ (3,364)$ (6,476)$ (3,271)$ (5,451)$ (2,992)$ (4,497)$ (1,591)$ (4,140)$ (2,774)$ (4,228)$ (1,211)$ (48,569)$ Memo: Cumulative CV / Foreign Spend (1,367) (1,867) (2,367) (4,267) (5,067) (5,867) (6,367) (6,867) (7,367) (7,867) (8,367) (8,867) (9,367) (9,367) Privileged & Confidential 2 of 3 Draft - Subject to Change

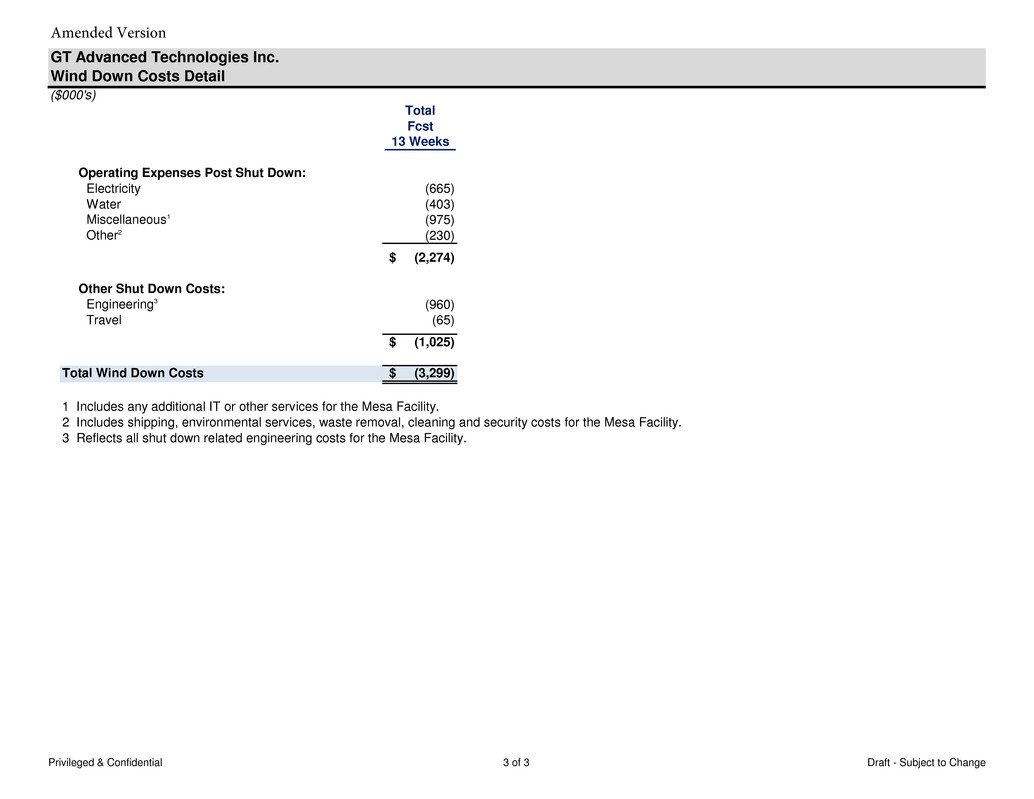

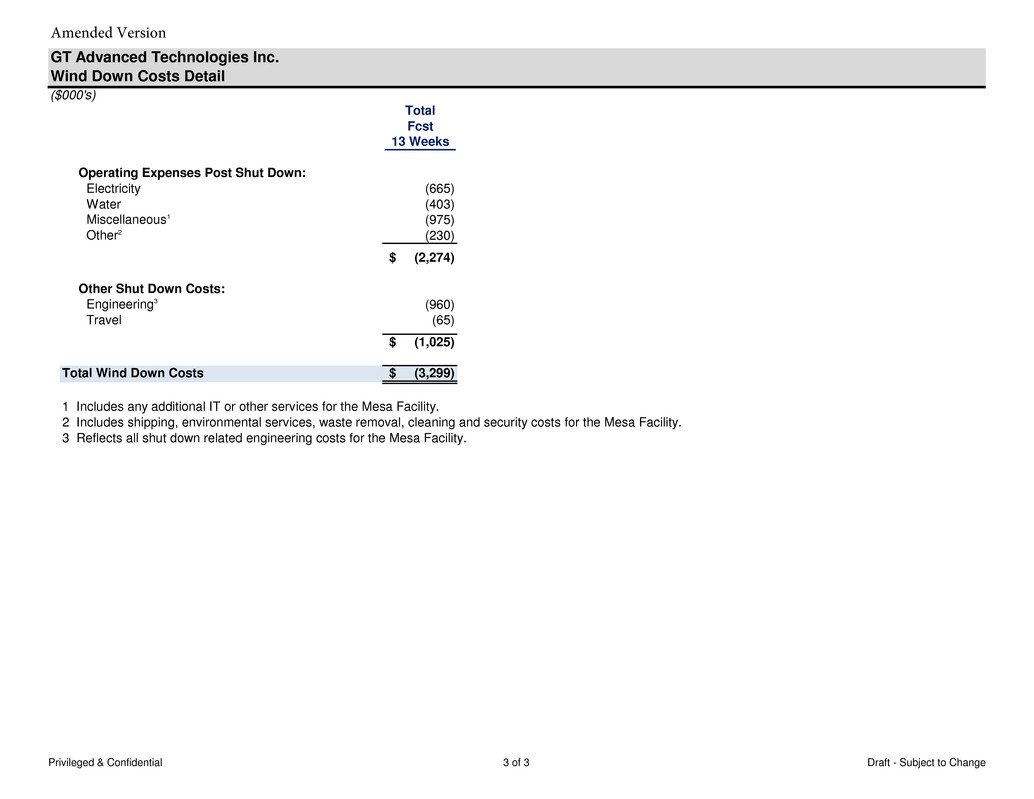

GT Advanced Technologies Inc. Wind Down Costs Detail ($000's) Total Fcst 13 Weeks Operating Expenses Post Shut Down: Electricity (665) Water (403) Miscellaneous1 (975) Other2 (230) (2,274)$ Other Shut Down Costs: Engineering3 (960) Travel (65) (1,025)$ Total Wind Down Costs (3,299)$ -$ 1 Includes any additional IT or other services for the Mesa Facility. 2 Includes shipping, environmental services, waste removal, cleaning and security costs for the Mesa Facility. 3 Reflects all shut down related engineering costs for the Mesa Facility. Privileged & Confidential 3 of 3 Draft - Subject to Change

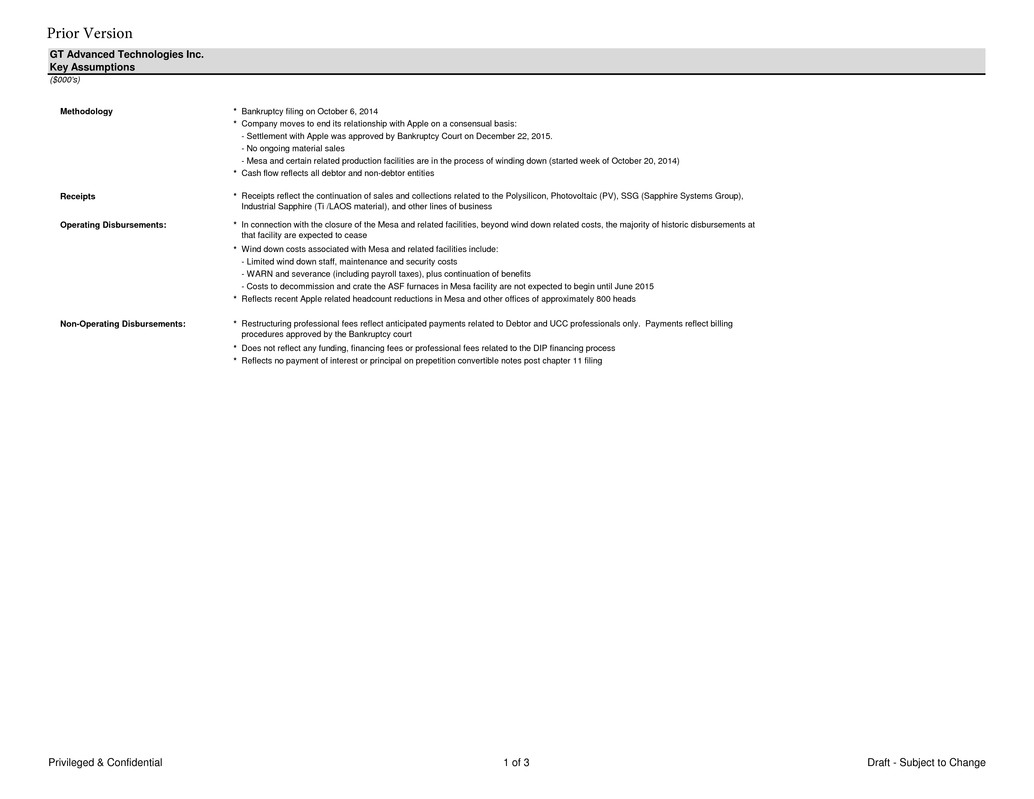

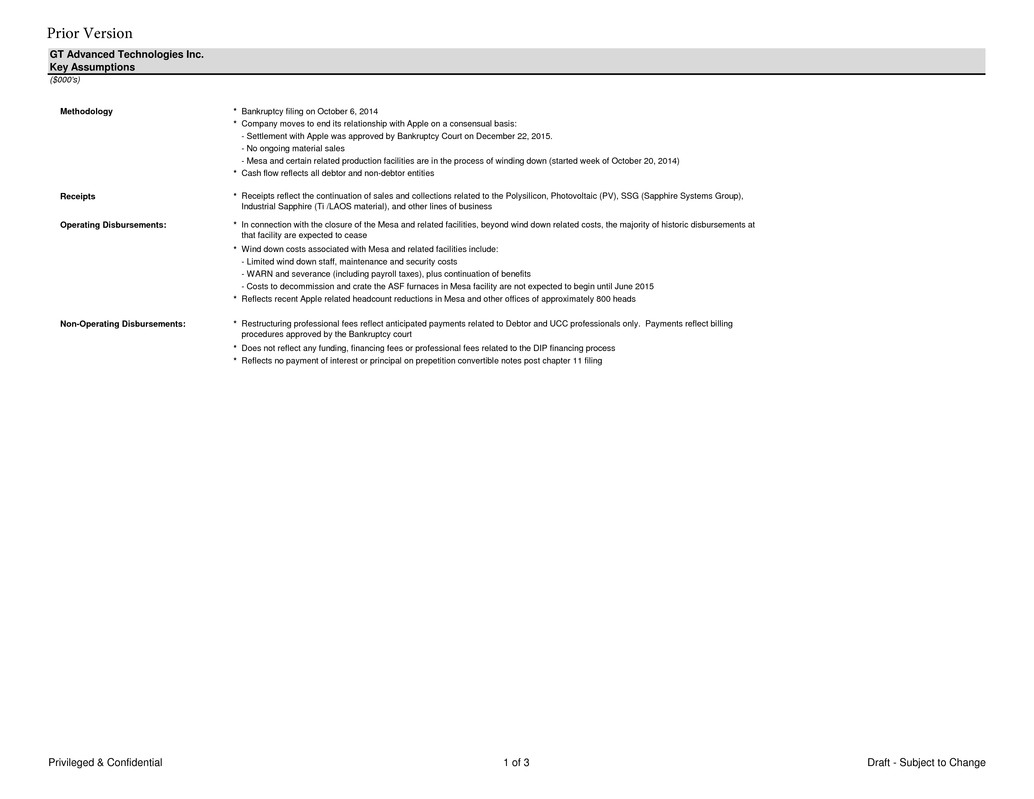

GT Advanced Technologies Inc. Key Assumptions ($000's) Methodology * * * Receipts * Operating Disbursements: * * * Non-Operating Disbursements: * * * Bankruptcy filing on October 6, 2014 Company moves to end its relationship with Apple on a consensual basis: - Settlement with Apple was approved by Bankruptcy Court on December 22, 2015. - No ongoing material sales - Mesa and certain related production facilities are in the process of winding down (started week of October 20, 2014) Cash flow reflects all debtor and non-debtor entities Receipts reflect the continuation of sales and collections related to the Polysilicon, Photovoltaic (PV), SSG (Sapphire Systems Group), Industrial Sapphire (Ti /LAOS material), and other lines of business In connection with the closure of the Mesa and related facilities, beyond wind down related costs, the majority of historic disbursements at that facility are expected to cease Wind down costs associated with Mesa and related facilities include: - Limited wind down staff, maintenance and security costs - WARN and severance (including payroll taxes), plus continuation of benefits - Costs to decommission and crate the ASF furnaces in Mesa facility are not expected to begin until June 2015 Reflects recent Apple related headcount reductions in Mesa and other offices of approximately 800 heads Restructuring professional fees reflect anticipated payments related to Debtor and UCC professionals only. Payments reflect billing procedures approved by the Bankruptcy court Does not reflect any funding, financing fees or professional fees related to the DIP financing process Reflects no payment of interest or principal on prepetition convertible notes post chapter 11 filing Privileged & Confidential 1 of 3 Draft - Subject to Change

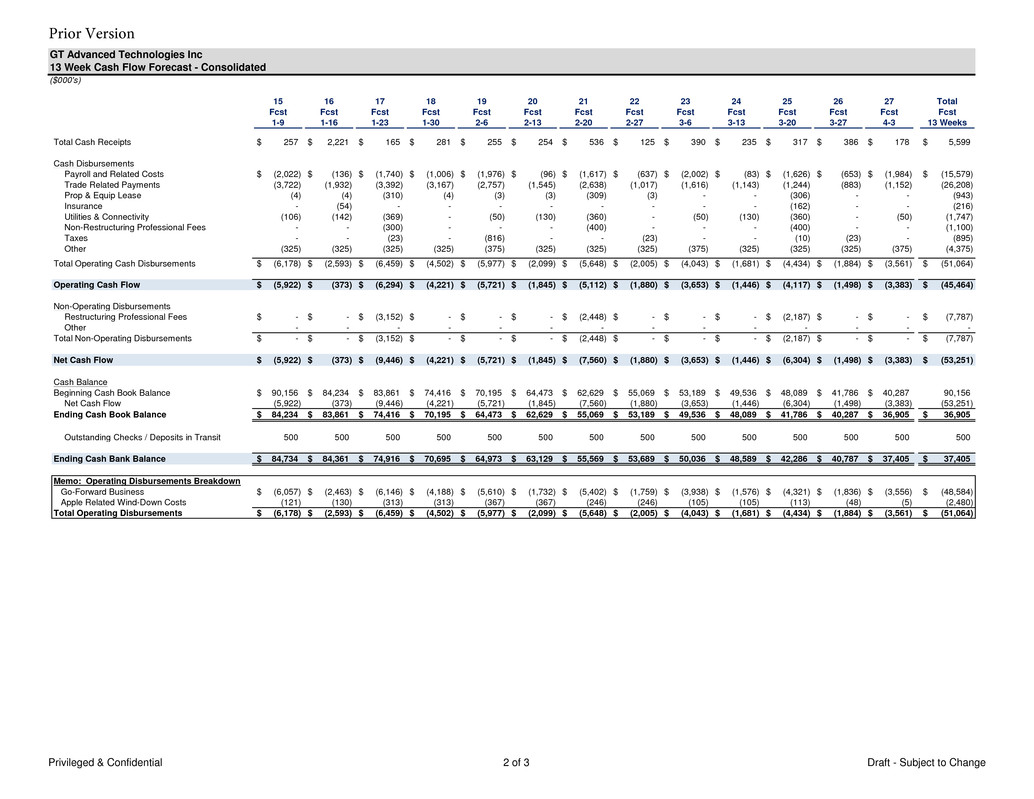

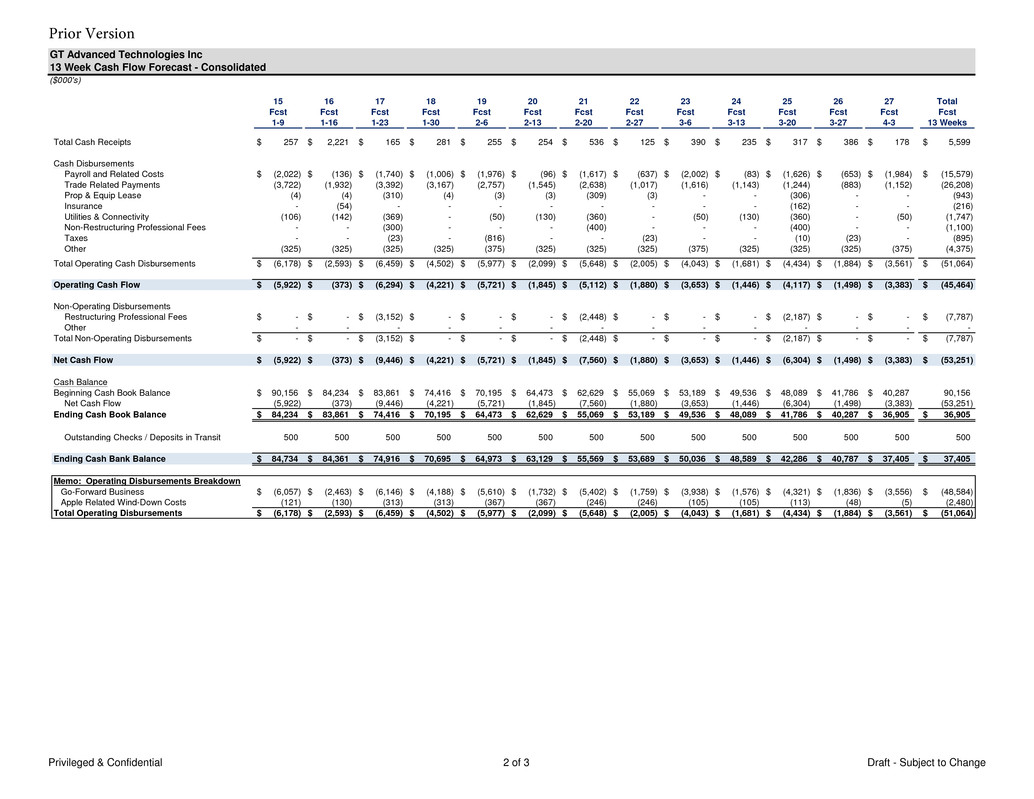

GT Advanced Technologies Inc 13 Week Cash Flow Forecast - Consolidated ($000's) 15 16 17 18 19 20 21 22 23 24 25 26 27 Total Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst 1-9 1-16 1-23 1-30 2-6 2-13 2-20 2-27 3-6 3-13 3-20 3-27 4-3 13 Weeks Total Cash Receipts 257$ 2,221$ 165$ 281$ 255$ 254$ 536$ 125$ 390$ 235$ 317$ 386$ 178$ 5,599$ Cash Disbursements Payroll and Related Costs (2,022)$ (136)$ (1,740)$ (1,006)$ (1,976)$ (96)$ (1,617)$ (637)$ (2,002)$ (83)$ (1,626)$ (653)$ (1,984)$ (15,579)$ Trade Related Payments (3,722) (1,932) (3,392) (3,167) (2,757) (1,545) (2,638) (1,017) (1,616) (1,143) (1,244) (883) (1,152) (26,208) Prop & Equip Lease (4) (4) (310) (4) (3) (3) (309) (3) - - (306) - - (943) Insurance - (54) - - - - - - - - (162) - - (216) Utilities & Connectivity (106) (142) (369) - (50) (130) (360) - (50) (130) (360) - (50) (1,747) Non-Restructuring Professional Fees - - (300) - - - (400) - - - (400) - - (1,100) Taxes - - (23) - (816) - - (23) - - (10) (23) - (895) Other (325) (325) (325) (325) (375) (325) (325) (325) (375) (325) (325) (325) (375) (4,375) Total Operating Cash Disbursements (6,178)$ (2,593)$ (6,459)$ (4,502)$ (5,977)$ (2,099)$ (5,648)$ (2,005)$ (4,043)$ (1,681)$ (4,434)$ (1,884)$ (3,561)$ (51,064)$ Operating Cash Flow (5,922)$ (373)$ (6,294)$ (4,221)$ (5,721)$ (1,845)$ (5,112)$ (1,880)$ (3,653)$ (1,446)$ (4,117)$ (1,498)$ (3,383)$ (45,464)$ Non-Operating Disbursements Restructuring Professional Fees -$ -$ (3,152)$ -$ -$ -$ (2,448)$ -$ -$ -$ (2,187)$ -$ -$ (7,787)$ Other - - - - - - - - - - - - - - Total Non-Operating Disbursements -$ -$ (3,152)$ -$ -$ -$ (2,448)$ -$ -$ -$ (2,187)$ -$ -$ (7,787)$ Net Cash Flow (5,922)$ (373)$ (9,446)$ (4,221)$ (5,721)$ (1,845)$ (7,560)$ (1,880)$ (3,653)$ (1,446)$ (6,304)$ (1,498)$ (3,383)$ (53,251)$ Cash Balance Beginning Cash Book Balance 90,156$ 84,234$ 83,861$ 74,416$ 70,195$ 64,473$ 62,629$ 55,069$ 53,189$ 49,536$ 48,089$ 41,786$ 40,287$ 90,156 Net Cash Flow (5,922) (373) (9,446) (4,221) (5,721) (1,845) (7,560) (1,880) (3,653) (1,446) (6,304) (1,498) (3,383) (53,251) Ending Cash Book Balance 84,234$ 83,861$ 74,416$ 70,195$ 64,473$ 62,629$ 55,069$ 53,189$ 49,536$ 48,089$ 41,786$ 40,287$ 36,905$ 36,905$ Outstanding Checks / Deposits in Transit 500 500 500 500 500 500 500 500 500 500 500 500 500 500 Ending Cash Bank Balance 84,734$ 84,361$ 74,916$ 70,695$ 64,973$ 63,129$ 55,569$ 53,689$ 50,036$ 48,589$ 42,286$ 40,787$ 37,405$ 37,405$ Memo: Operating Disbursements Breakdown Go-Forward Business (6,057)$ (2,463)$ (6,146)$ (4,188)$ (5,610)$ (1,732)$ (5,402)$ (1,759)$ (3,938)$ (1,576)$ (4,321)$ (1,836)$ (3,556)$ (48,584)$ Apple Related Wind-Down Costs (121) (130) (313) (313) (367) (367) (246) (246) (105) (105) (113) (48) (5) (2,480) Total Operating Disbursements (6,178)$ (2,593)$ (6,459)$ (4,502)$ (5,977)$ (2,099)$ (5,648)$ (2,005)$ (4,043)$ (1,681)$ (4,434)$ (1,884)$ (3,561)$ (51,064)$ Privileged & Confidential 2 of 3 Draft - Subject to Change

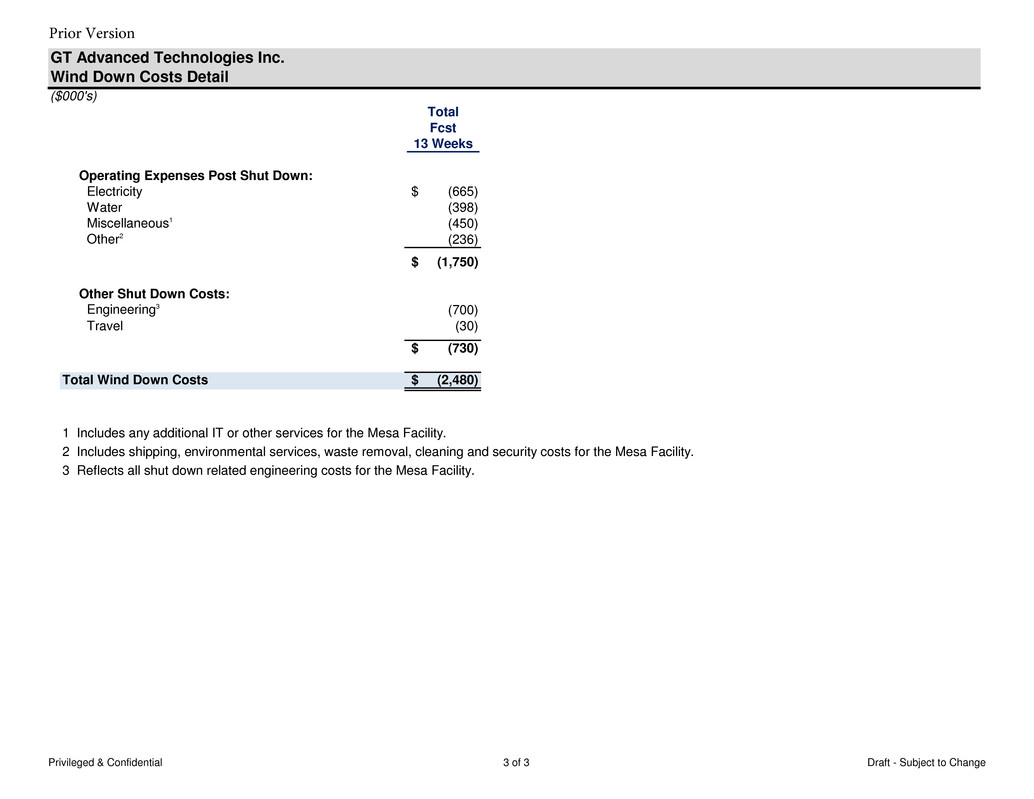

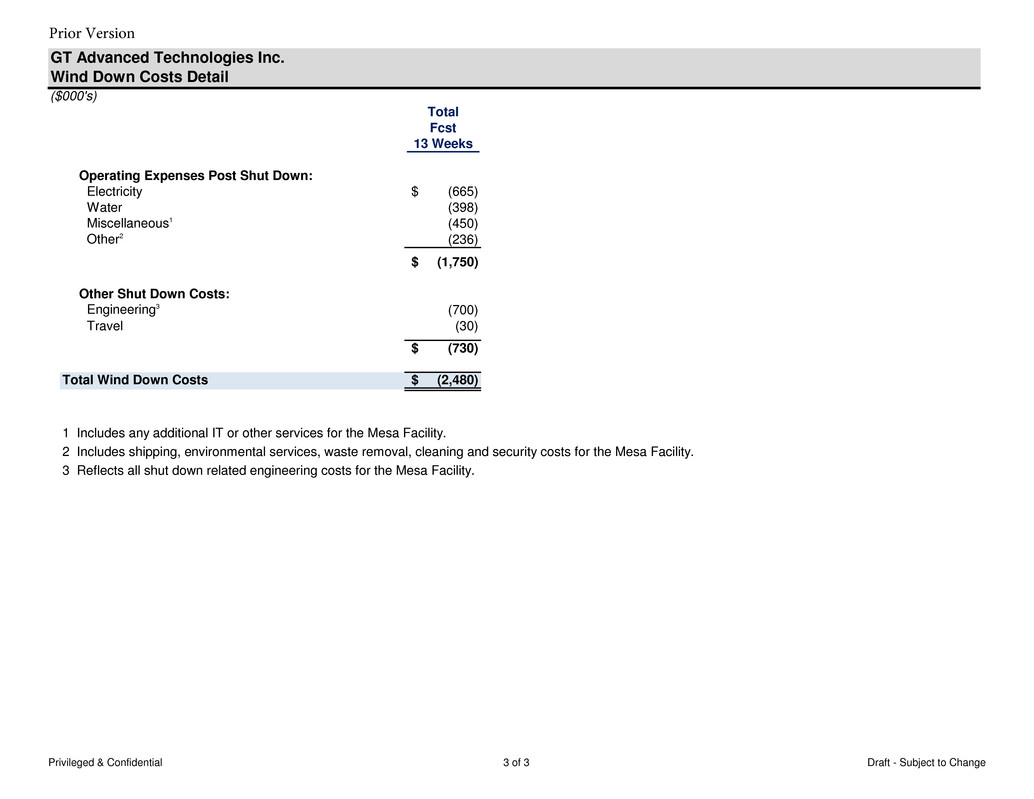

GT Advanced Technologies Inc. Wind Down Costs Detail ($000's) Total Fcst 13 Weeks Operating Expenses Post Shut Down: Electricity (665)$ Water (398) Miscellaneous1 (450) Other2 (236) (1,750)$ Other Shut Down Costs: Engineering3 (700) Travel (30) (730)$ Total Wind Down Costs (2,480)$ 1 Includes any additional IT or other services for the Mesa Facility. 2 Includes shipping, environmental services, waste removal, cleaning and security costs for the Mesa Facility. 3 Reflects all shut down related engineering costs for the Mesa Facility. Privileged & Confidential 3 of 3 Draft - Subject to Change

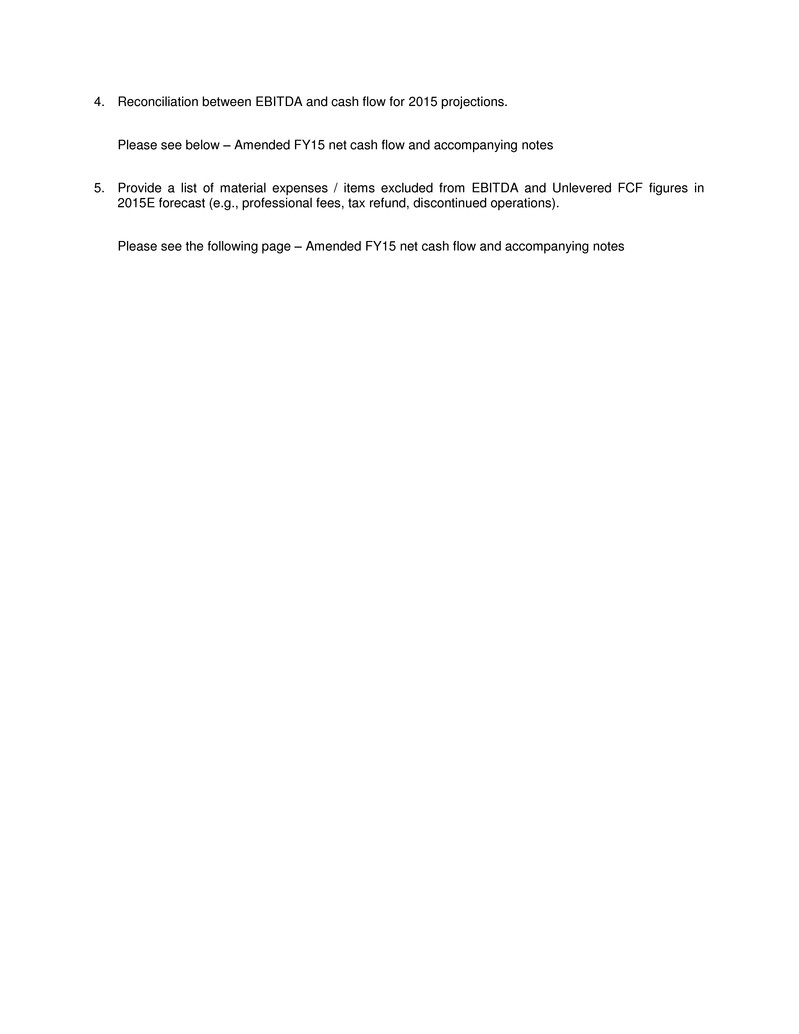

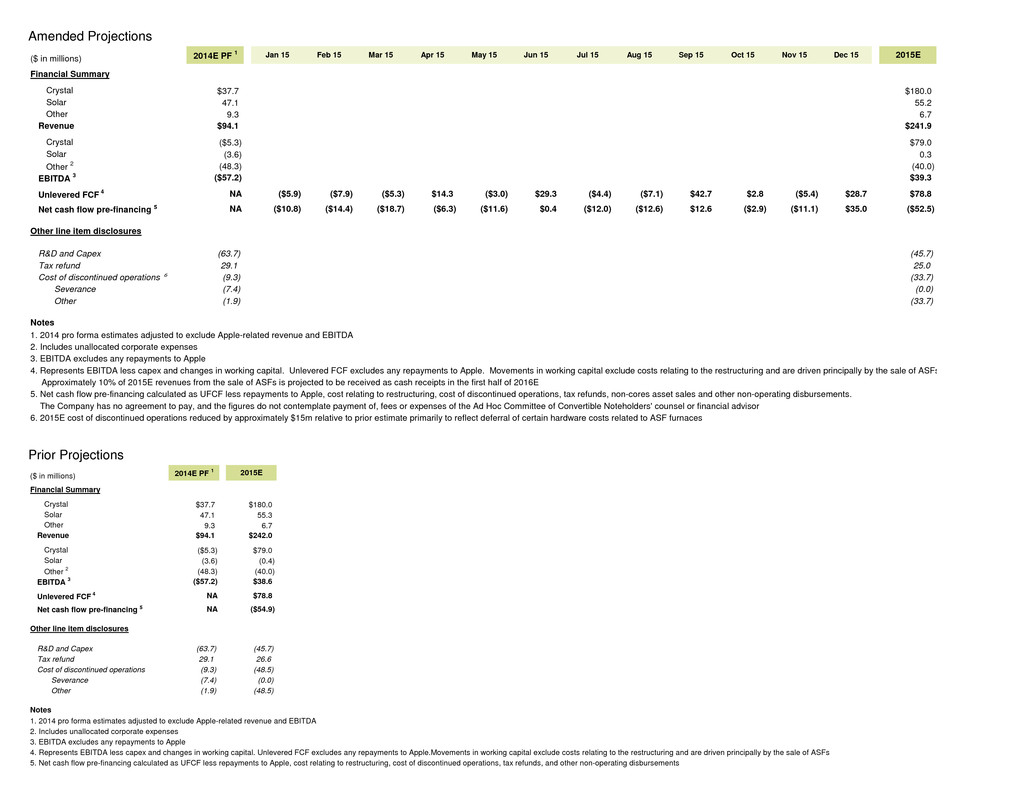

4. Reconciliation between EBITDA and cash flow for 2015 projections. Please see below – Amended FY15 net cash flow and accompanying notes 5. Provide a list of material expenses / items excluded from EBITDA and Unlevered FCF figures in 2015E forecast (e.g., professional fees, tax refund, discontinued operations). Please see the following page – Amended FY15 net cash flow and accompanying notes

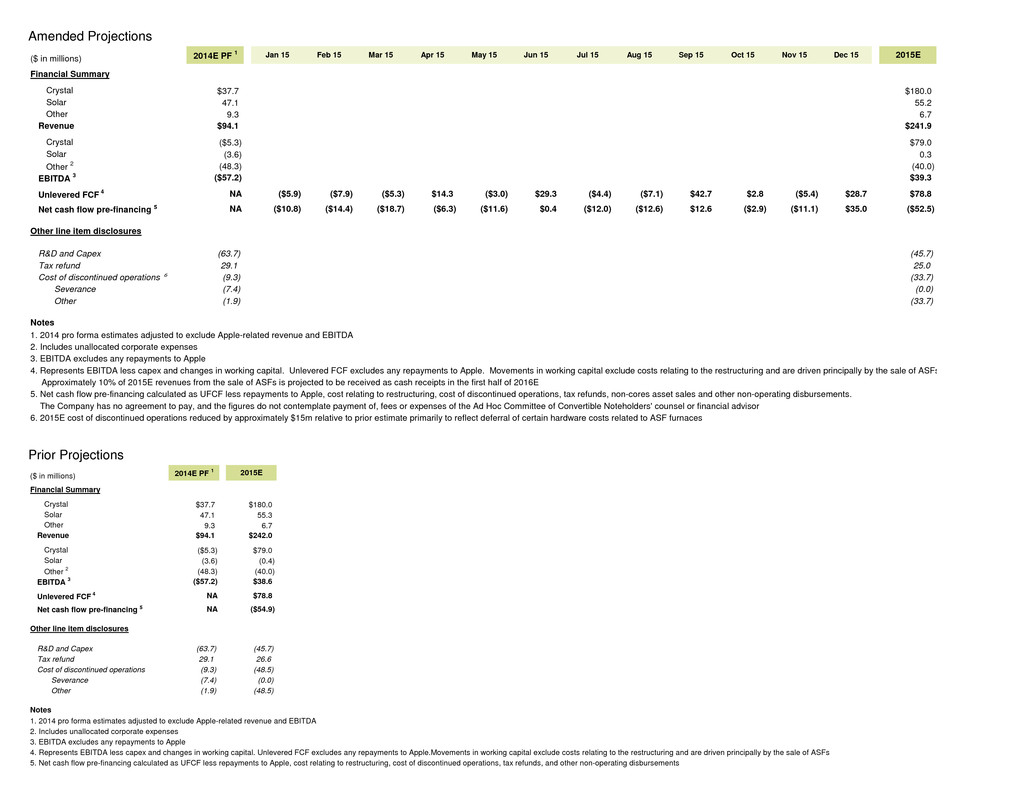

Amended Projections Prior Projections ($ in millions) 2014E PF 1 Jan 15 Feb 15 Mar 15 Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15 Oct 15 Nov 15 Dec 15 2015E Financial Summary Crystal $37.7 $180.0 Solar 47.1 55.2 Other 9.3 6.7 Revenue $94.1 $241.9 Crystal ($5.3) $79.0 Solar (3.6) 0.3 Other 2 (48.3) (40.0) EBITDA 3 ($57.2) $39.3 Unlevered FCF 4 NA ($5.9) ($7.9) ($5.3) $14.3 ($3.0) $29.3 ($4.4) ($7.1) $42.7 $2.8 ($5.4) $28.7 $78.8 Net cash flow pre-financing ⁵ NA ($10.8) ($14.4) ($18.7) ($6.3) ($11.6) $0.4 ($12.0) ($12.6) $12.6 ($2.9) ($11.1) $35.0 ($52.5) Other line item disclosures R&D and Capex (63.7) (45.7) Tax refund 29.1 25.0 Cost of discontinued operations ⁶ (9.3) (33.7) Severance (7.4) (0.0) Other (1.9) (33.7) Notes 1. 2014 pro forma estimates adjusted to exclude Apple-related revenue and EBITDA 2. Includes unallocated corporate expenses 3. EBITDA excludes any repayments to Apple 4. Represents EBITDA less capex and changes in working capital. Unlevered FCF excludes any repayments to Apple. Movements in working capital exclude costs relating to the restructuring and are driven principally by the sale of ASFs. Approximately 10% of 2015E revenues from the sale of ASFs is projected to be received as cash receipts in the first half of 2016E 5. Net cash flow pre-financing calculated as UFCF less repayments to Apple, cost relating to restructuring, cost of discontinued operations, tax refunds, non-cores asset sales and other non-operating disbursements. The Company has no agreement to pay, and the figures do not contemplate payment of, fees or expenses of the Ad Hoc Committee of Convertible Noteholders' counsel or financial advisor 6. 2015E cost of discontinued operations reduced by approximately $15m relative to prior estimate primarily to reflect deferral of certain hardware costs related to ASF furnaces ($ in millions) 2014E PF 1 2015E Financial Sum ary Crystal $37.7 $180.0 Solar 47.1 55.3 Other 9.3 6.7 Revenue $94.1 $242.0 Crystal ($5.3) $79.0 Solar (3.6) (0.4) Other 2 (48.3) (40.0) EBITDA 3 ($57.2) $38.6 Unlevered FCF 4 NA $78.8 Net cash flow pre-financing ⁵ NA ($54.9) Other line it m disclosures R&D and Capex (63.7) (45.7) Tax refund 29.1 26.6 Cost of discontinued operations (9.3) (48.5) Severance (7.4) (0.0) Other (1.9) (48.5) Notes 1. 2014 pro forma estimates adjusted to exclude Apple-related revenue and EBITDA 2. Includes unallocated corporate expenses 3. EBITDA excludes any repayments to Apple 4. Represents EBITDA less capex and changes in working capital. Unlevered FCF excludes any repayments to Apple.Movements in working capital exclude costs relating to the restructuring and are driven principally by the sale of ASFs 5. Net cash flow pre-financing calculated as UFCF less repayments to Apple, cost relating to restructuring, cost of discontinued operations, tax refunds, and other non-operating disbursements

6. Scrap value of ASFs Less than $25k per unit 7. Are the furnaces in Merrimack, Salem and Hong Kong the same as those installed at Mesa? Yes, except for the furnaces in Salem, which are an earlier version of the models installed in Mesa and Merrimack. 8. Does Hilco appraisal include non-debtor entities? The inventory appraisal did consider non-debtor entities; however, those inventories were classified as ineligible due to being located in foreign jurisdictions and thus excluded from the appraised value. 9. Confirm that meltstock, boules, etc. are included in the Hilco appraisal and long-term poly inventory is not. Yes 10. Does 13 Week Cash Flow Forecast include costs to disassemble furnaces? No 11. How is COGS calculated for the purpose of projecting Crystal Systems EBITDA in 2015? COGS based on historical standard cost for ASFs and $26k per furnace for installation and shipping 12. What is the budget for professional fees through the course of the case? Approximately $30m of restructuring professional fees are included through year-end 2015 in the figures provided in the answer to question 5. 13. Does cash operating cost estimate include capex? No 14. Do projections include costs associated with Hyperion in 2015? For what portion of the year? Yes, through June 2015. GT does not have estimates for costs associated with Hyperion beyond June 2015.

15. Do operating costs at Mesa ramp down over the course of 2015? Yes – they are highest during Q1 2015 and Q2 2015 then remain relatively flat during Q3-Q4 2015 (at a lower level than Q1-Q2 2015) excluding crating costs. 16. Are the items listed in section (2) of the footnote on p.1 of Item 6 (meltstock, boules, etc.) the primary assets associated with the KEIP critical area "Monetization of Mesa Assets"? Yes – along with the Mesa Fab equipment 17. Provide a list of business lines operating out of each company location. Danvers Hyperion, Zephyr Hong Kong PV, Poly, ASF sales Missoula PV, Poly Merrimack Corporate, ASF R&D Salem Industrial Sapphire San Jose Merlin Santa Rosa SSG 18. How many of the non-Mesa furnaces are installed and operational? 54 installed in Merrimack, of which 14 are non-operational 59 installed in Salem, of which 12 are non-operational 19. How many are necessary to perform R&D? 40 units (located in Merrimack) 20. Has Merlin technology been tested / vetted by third parties (or just in-house)? What was feedback? Yes, our Merlin solution has been thoroughly tested and certified compliant with IEC 61215 and UL 1703 standards. Testing and certification of product safety, strength and reliability was performed by a third party test house, RETC. 21. Does the cost of discontinued operations include crating and shipping costs? Yes, the cost of discontinued operations includes crating costs but not shipping costs. 22. Furnace information

a. Explanation of accounting for transfer of furnaces from PP&E to inventory in the December MOR. i. What is valuation methodology for furnaces? Furnaces are valued at historical cost, net of adjustments referenced in 1.a.ii. ii. Why were capitalized amounts related to the setup and installation of furnaces written-off? Although costs related to installation and set-up were appropriately capitalized when the furnaces were classified as fixed assets, such amounts are not appropriately capitalized now that the inventory is classified as inventory. Accordingly, these amounts were written-off. iii. What sort of charges, etc. impact the amount in inventory? As outlined in our Form 10-K, the Company values inventory at the lower of cost or market. The determination of the lower of cost or market requires that we quantify the difference between the cost of inventory and its estimated market value and to make significant assumptions including, but not limited to, future customer demand, future market trends and technological obsolescence. The company routinely incurs charges for excess and obsolescence of inventory which are determined based on factors such as inventory on hand, historical usage and forecasted demand based on backlog and other factors. iv. Provide commentary on the approximately $150 million write-off reflected in COGS? This charge reflects certain inventory adjustments including, but not limited to, the adjustment referenced in 1.a.ii., the write-down of sapphire material in Mesa to net realizable value, the write-down of inventory related to the Annealing program which was discontinued as part of the settlement agreement with Apple and other inventory deemed to be either excess or obsolete. b. Elaborate on commentary made in court about timing and process of selling furnaces. To what extent does success of selling furnaces depend on Apple (either directly or indirectly)? GTAT is in various stages of active discussions and negotiations with a number of existing and potential customers regarding the sale of ASFs. c. Provide estimates for security, insurance and other costs for storage of furnaces once moved outside of the Mesa facility. GTAT projects that the cost of storing ASFs (other than rent) after it exits the Mesa, AZ facility will average less than $600,000 per month 23. Intercompany transfer (from GTAT Corp. to GT Advanced Technologies Limited): Why were transfers of $30 million since the petition date necessary and what are ongoing needs?

This primarily relates to the transfer of cash from GTAT Corporation to GT Advanced Technologies Ltd that had previously been transferred from GT Advanced Technologies Ltd to GTAT Corporation. 24. Tax refund a. Does the Company expect to receive the proceeds from the tax refund in the next 6 months? The Company does not expect to receive the proceeds from the tax refund prior to Q4 2015. The ultimate timing and amount of the tax refund are uncertain. b. Does the Company have any tax sharing arrangements in place that would be applicable to the 2014 and 2015 tax refunds? No. 25. Merlin: Elaborate on testing done and results. Prior response to question was limited primarily to certifications. In addition to the certifications previously referenced, Merlin has been tested internally and has demonstrated significant advantages in terms of reliability, form factor and efficiency. 26. Does the new Polysilicon customer order announced on February 19, 2015 impact the Company’s forecast? If so, what is the impact? The new Polysilicon customer order announced on 2/19/15 is already contemplated and reflected in GTAT’s business plan.

Item 13. Latest Commitment Letter and Term Sheet from Ad Hoc Committee of the Pre-Petition Convertible Noteholders

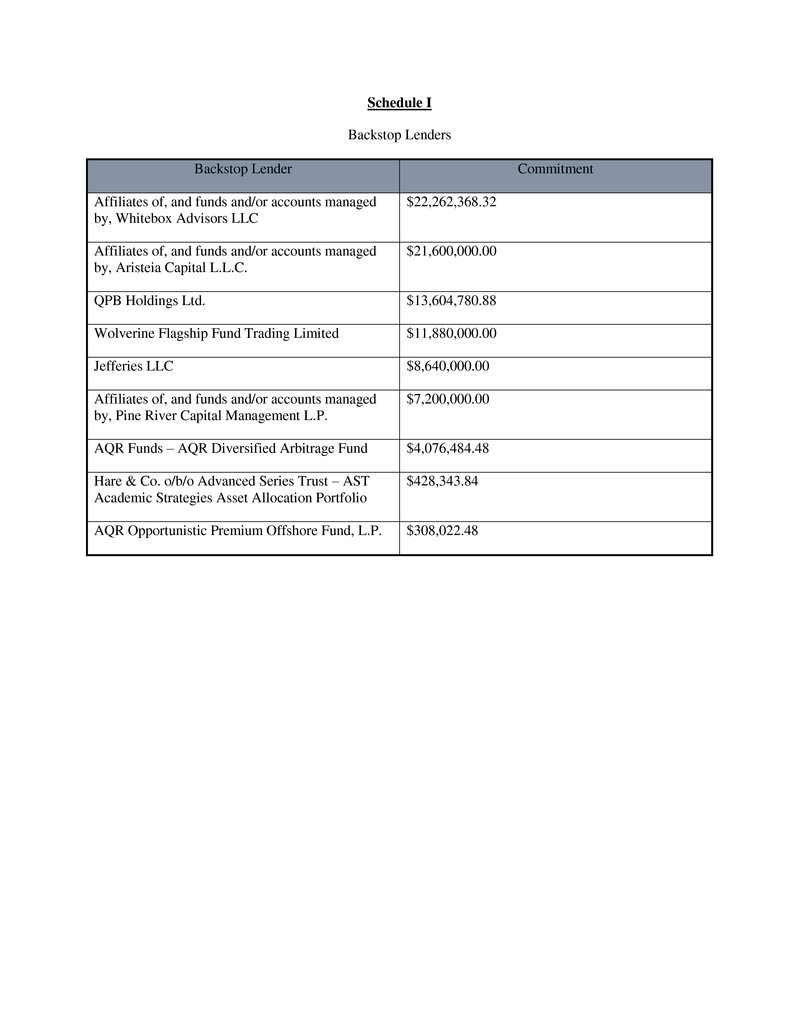

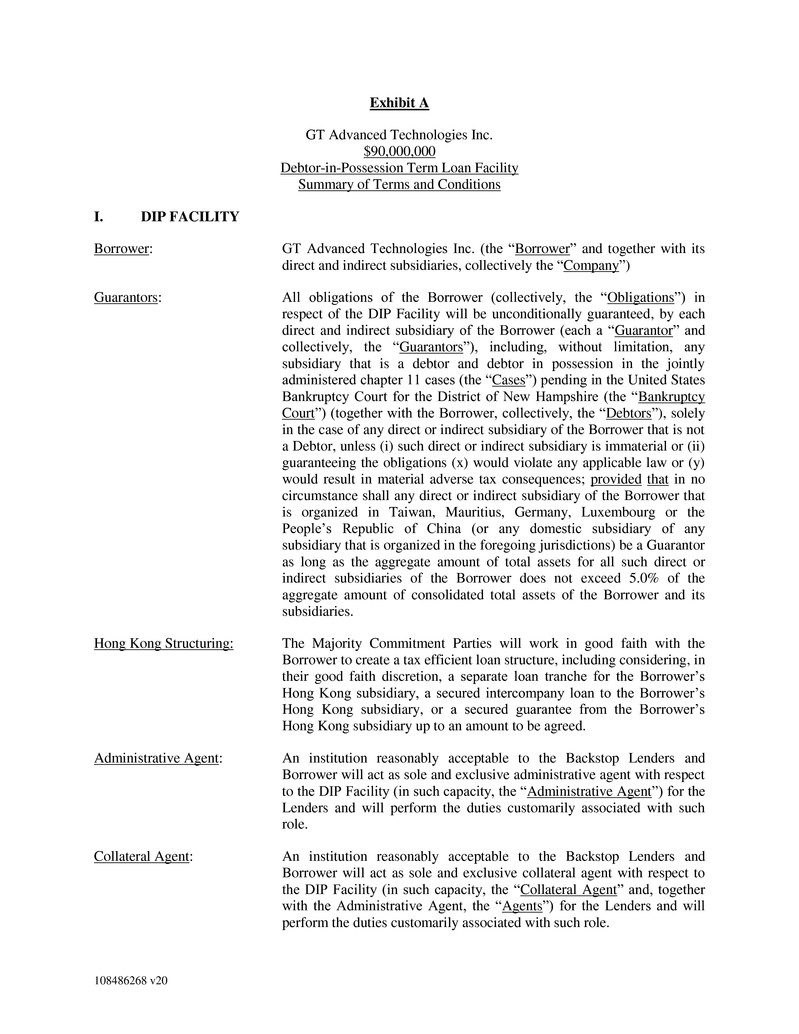

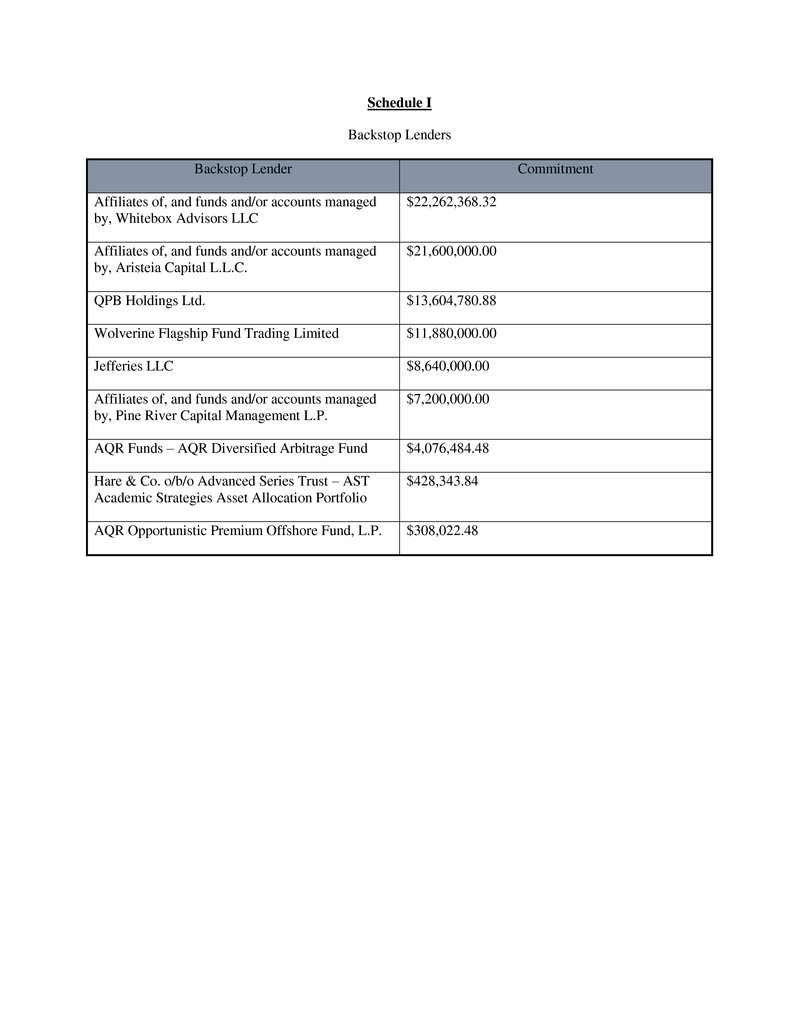

1 February 25, 2015 GT Advanced Technologies, Inc. 243 Daniel Webster Highway Merrimack, New Hampshire 03054 Attention: Kanwardev R. Bal, Chief Financial Officer $90,000,000 Debtor-in-Possession Term Loan Facility Commitment Letter Ladies and Gentlemen: On October 6, 2014 (the “Petition Date”), GT Advanced Technologies (“you” or the “Borrower”) and certain of its subsidiaries (collectively, the “Debtors” and each a “Debtor”) filed voluntary petitions for relief under Chapter 11 of Title 11 of the United States Code, 11 U.S.C. §§ 101 et seq. (as amended, the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of New Hampshire (the “Bankruptcy Court”). In connection with the foregoing, you have requested that the parties listed on Schedule I hereto (“us”, “we” or the “Commitment Parties”), agree to backstop a senior secured priming superpriority debtor-in- possession term loan facility (the “DIP Facility”) in an aggregate amount of $90,000,000 under Section 364 of the Bankruptcy Code. Capitalized terms used but not defined herein are used with the meanings assigned to them on the Exhibit A attached hereto (such Exhibit, together with this letter, collectively, this “Commitment Letter”). 1. Commitment In connection with the foregoing, the Commitment Parties are pleased to advise you of their commitment to backstop the DIP Facility, on a several and not joint basis, in the amounts set forth opposite each such Commitment Party’s name on Schedule I hereto (the “Commitments”) upon the terms and subject to the conditions set forth or referred to in this letter and Exhibit A hereto (the “Term Sheet”); provided that, if any Commitment Party fails to provide DIP Loans in an amount equal to its Commitment set forth in this Commitment Letter (other than pursuant to a reduction as set forth in the following sentence) (any such deficiencies, the “Unfunded Amount”), the Commitments of the remaining Commitment Parties shall be increased, on a pro rata basis in accordance with their Commitments set forth on Schedule I, by the Unfunded Amount; provided further that, in no event shall any Commitment Party be required to provide additional DIP Loans (including pursuant to its initial Commitment and additional funding of the Unfunded Amount as set forth in the immediately preceding proviso) to the extent that the aggregate amount of DIP Loans (including pursuant to its initial Commitment and additional funding of the Unfunded Amount as set forth in the immediate preceding proviso) required to be funded by such Commitment Party would exceed an amount equal to 1.39 multiplied by such Commitment Party’s Commitment set forth on Schedule I hereto. A portion of the Commitment Parties’ Commitments hereunder shall be reduced in an aggregate amount equal to any commitment allocated to holders (other than the Commitment Parties) (the “Other Pre-Petition Convertible Noteholders”) of the Borrower’s 3.00% Senior

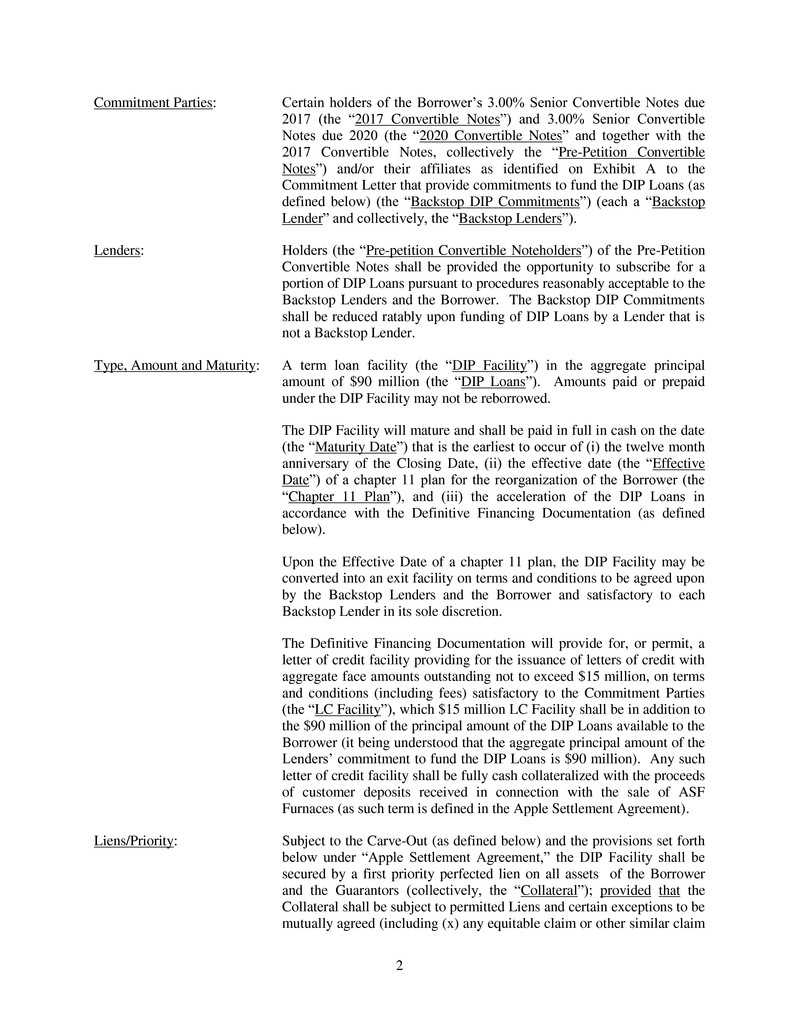

2 Convertible Notes due 2017 (the “2017 Convertible Notes”) and 3.00% Senior Convertible Notes due 2020 (the “2020 Convertible Notes” and together with the 2017 Convertible Notes, collectively the “Pre-Petition Convertible Notes”). Notwithstanding the foregoing, if any Other Pre-Petition Convertible Noteholder fails to fund any portion of its commitment on the date upon which all conditions precedent in the Definitive Financing Documentation are satisfied (the “Closing Date”), then the Commitment Parties shall fund such amount on the Closing Date as if there were no reductions in the respective commitment amounts set forth above as a result of the commitment allocated to such Other Pre-Petition Convertible Noteholder. 2. Information You hereby represent and covenant that (a) all information, other than the Projections (as defined below), other forward looking information and information of a general economic or industry specific nature (the “Information”), that has been or will be made available to us by you or on behalf of you or any of your representatives is or will be, when taken as a whole, correct in all material respects and does not or will not, when taken as a whole, contain any untrue statement of a material fact or omit to state a material fact necessary in order to make the statements contained therein not materially misleading in light of the circumstances under which such statements are made and (b) the financial projections and other forward-looking information (the “Projections”) that have been or will be made available to us by you or on behalf of you or any of your representatives have been or will be prepared in good faith based upon assumptions that are reasonable at the time made and at the time the related Projections are made available to us. You agree that if, at any time prior to the execution of the DIP Facility, you become aware that any of the representations in the preceding sentence would be incorrect if the Information and Projections were being furnished, and such representations were being made, at such time, then you will promptly supplement the Information and the Projections so that such representations will be correct under those circumstances. 3. Fees As a condition for the commitments and agreements of the Commitment Parties hereunder, you agree to pay or cause to be paid the nonrefundable fees and put option premium described in the Term Sheet on the terms and subject to the conditions set forth therein. 4. Conditions Each Commitment Party’s commitments and agreements hereunder are subject only to the conditions set forth in this Section 4. Each Commitment Party’s commitments and agreements hereunder are further subject to (a) the Majority Commitment Parties’ satisfaction in their sole good faith discretion with the approval by the Bankruptcy Court of (i) the DIP Facility, including without limitation, the superpriority administrative expense priority of, and the priming and other liens to be granted to secure, the DIP Facility and all definitive documentation in connection therewith consistent with the Term Sheet and (ii) all actions to be taken, undertakings to be made and obligations to be incurred by the Debtors in connection with the DIP Facility and all liens or other security to be

3 granted by the Debtors in connection with the DIP Facility (all such approvals to be evidenced by the entry of an order by the Bankruptcy Court which is in full force and effect and has not been stayed or modified and is satisfactory in form and substance to the Majority Commitment Parties in their sole good faith discretion (the “DIP Order”), which order shall, among other things, approve the payment by the Debtors of all of the fees that are provided for in, and the other terms of, this Commitment Letter); (b) satisfaction of the Majority Commitment Parties in their sole good faith discretion that since the date of this Commitment Letter, there has not been any event or occurrence which could reasonably be expected to have a material adverse effect, on (A) the business, properties, condition (financial or otherwise), results of operations or liabilities of the Borrower and its subsidiaries, taken as a whole, other than any change, event or occurrence, arising individually or in the aggregate, from (i) events leading up to the commencement of proceedings under Chapter 11 of the Bankruptcy Code and (ii) events that would reasonably be expected to result from the filing or commencement of the Cases or the announcement of the filing or commencement of the Cases, (B) the ability of the Borrower or the guarantors to perform their respective obligations under the loan agreement, guarantees and security documents relating to the DIP Facility (the “Loan Documents”) or (C) the ability of the Agent (as defined below) and/or the Lenders (as defined on the Term Sheet to enforce their rights and remedies under the Loan Documents (in each case, “Material Adverse Effect”); (c) your compliance in all material respects with your obligation to supplement Information and Projections as set forth in Section 2 hereof; (d) your compliance in all material respects with the terms of this Commitment Letter, (e) execution and delivery of definitive documentation evidencing the DIP Facility, which shall be substantially consistent with the Term Sheet and otherwise satisfactory to the Majority Commitment Parties in their sole good faith discretion, (f) the Apple Settlement Agreement shall be in full force and effect, and shall not be amended in any manner adverse to the interests of any Commitment Party in its sole good faith discretion, (g) each Commitment Party shall have received a budget projecting operations of the Debtors and their subsidiaries through the maturity of the DIP Facility, including, without limitation, a monthly budget through the maturity of the DIP Facility and a thirteen (13) week cash flow forecast, in each case, in form and substance satisfactory to the Majority Commitment Parties in their sole good faith discretion, (h) the Other Pre-Petition Convertible Noteholders shall have been provided the opportunity to subscribe for a portion of the Commitments under the DIP Facility pursuant to procedures to be approved by the Bankruptcy Court and reasonably acceptable to the Majority Commitment Parties and the Borrower (it being understood that the Commitments hereunder are not conditioned upon any Other Pre-Petition Noteholder’s actual subscription for any of the Commitments); (i) the transactions contemplated by this Commitment Letter and the Term Sheet shall have been consummated in accordance with applicable securities laws, rules and regulations in a manner reasonably acceptable to the Majority Commitment Parties and the Borrower; (j) all fees and reasonable and documented costs, fees, expenses (including, without limitation, legal and financial advisory fees and expenses) and other compensation contemplated hereby, payable to the Commitment Parties and the other Lenders or otherwise payable in respect of the transaction, shall have been paid to the extent due; (k) the Lenders shall have received (x) customary legal opinion(s) from counsel of the Debtors in form and substance reasonably satisfactory to the Majority Commitment Parties and (y) customary officer and secretary certificates; (l) absence of defaults or events of default; (m) accuracy of representations and warranties in all material respects; (n) each Commitment Party having received all documentation and other information required by regulatory

4 authorities under applicable “know your customer” and anti-money laundering rules and regulations; and (o) to the extent that the Borrower or its affiliates have provided the Commitment Parties with any additional material non-public information, the Borrower shall have publicly disclosed all material non-public information provided to the Commitment Parties pursuant to the terms of the confidentiality agreements entered into between the Commitment Parties and the Borrower (the “Confidentiality Agreements”). As used herein, “Majority Commitment Parties” means the Commitment Parties holding more than 50% of the outstanding Commitments of all Commitment Parties. 5. Indemnification and Expenses You agree to indemnify, hold harmless and defend the Commitment Parties, any administrative agent and collateral agent for the DIP facility (in any such capacity, the “Agent”), their respective affiliates and their respective directors, officers, employees, attorneys, advisors, agents and other representatives (each, an “Indemnified Person”) from and against any and all losses, claims, damages and liabilities to which any such Indemnified Person may become subject arising out of or in connection with this Commitment Letter, the DIP Facility, the use of the proceeds thereof or any claim, litigation, investigation or proceeding (a “Proceeding”) relating to any of the foregoing, regardless of whether any Indemnified Person is a party thereto, whether or not such Proceedings are brought by you, your equity holders, affiliates, creditors or any other person, and to reimburse each Indemnified Person upon demand for any reasonable legal or other out-of-pocket expenses incurred in connection with investigating or defending any of the foregoing, provided that the foregoing indemnity will not, as to any Indemnified Person, apply to losses, claims, damages, liabilities or related expenses (i) to the extent they are found by a final, nonappealable judgment of a court of competent jurisdiction to arise from the willful misconduct, bad faith or gross negligence of such Indemnified Person or its control affiliates, directors, officers or employees (collectively, the “Related Parties”) or (ii) arising out of any claim, litigation, investigation or proceeding that does not involve an act or omission of you or any of your affiliates and that is brought by an Indemnified Person against any other Indemnified Person. In addition, (a) all out-of-pocket expenses (including, without limitation, reasonable fees, disbursements and other charges of one lead counsel (and any special or local counsel reasonably necessary) and one financial advisor of the Commitment Parties and one lead counsel (and any special or local counsel reasonably necessary) for the Agents) in connection with the DIP Facility and the transactions contemplated thereby shall be paid by the Borrower, (b) all out-of-pocket expenses (including, without limitation, documented fees, disbursements and other charges of one lead counsel (and any special or local counsel reasonably necessary) and one financial advisor of the Commitment Parties and one lead counsel (and any special or local counsels reasonably necessary) for the Agents) for the enforcement costs and documentary taxes associated with the DIP Facility and the transactions contemplated thereby shall be paid by the Borrower, and (c) all out-of-pocket expenses (including, without limitation, documented fees, disbursements and other charges of one lead counsel (and any special or local counsel reasonably necessary) and one financial advisor) of an ad hoc group of the Pre-Petition Convertible Noteholders incurred following the commencement of the Cases through the date of the Commitment Letter Order (as defined below) shall be paid by the Borrower, in each case for clauses (a), (b) and (c) unless the Closing Date shall not occur

5 solely as a result of a material breach by the Commitment Parties of their obligations to fund their commitments hereunder after the satisfaction of all conditions precedent set forth in this Commitment Letter; provided that, absent a conflict of interest, the lead counsel and financial advisor of the Commitment Parties selected pursuant to clauses (a), (b) and (c) above shall initially be Akin Gump Strauss Hauer & Feld LLP (“Akin Gump”) and Blackstone Advisory Partners L.P. (“Blackstone”), respectively; provided further that, (x) fifty (50) percent of the aggregate amounts described in clauses (a) and (c) above payable to Akin Gump and Blackstone and incurred through the date of the Commitment Letter Order (as defined below) shall be paid on the date of the Commitment Letter Order and the Borrower shall have no obligation under this Commitment Letter to pay the remaining fifty (50) percent of the amounts described in clauses (a) and (c) incurred through the date of the Commitment Letter Order (it being understood for the avoidance of doubt that the Commitment Parties reserve the right to seek reimbursement of such remaining amounts through other means in connection with the Cases (as defined in the term sheet)), (y) amounts described in clause (a) above payable to Akin Gump and Blackstone (which in the case of Blackstone shall be equal to $50,000 per month, shall not include any restructuring or completion fee and shall be credited against any fees earned by Blackstone in connection with its representation of the ad hoc group of the Pre-Petition Convertible Noteholders) and incurred after the date of the Commitment Letter Order shall be paid on the earlier of the Closing Date and the termination of this Commitment Letter other than solely as a result of a material breach by the Commitment Parties of their obligations to fund their commitments under this Commitment Letter after the satisfaction of all conditions precedent in the Commitment Letter and (z) solely with respect to those amounts described in clause (a) payable to Akin Gump and Blackstone (which in the case of Blackstone shall be equal to $50,000 per month, shall not include any restructuring or completion fee and shall be credited against any fees earned by Blackstone in connection with its representation of the ad hoc group of the Pre-Petition Convertible Noteholders) incurred after the Closing Date and clause (b) whenever incurred, the Borrower shall pay such amounts on a current basis. It is further agreed that each Commitment Party shall only have liability to you (as opposed to any other person) and that each Commitment Party shall be liable solely in respect of its own commitment to the DIP Facility on a several, and not joint, basis with any other Commitment Party. No Indemnified Person shall be liable for any damages arising from the use by others of Information or other materials obtained through electronic, telecommunications or other information transmission systems, except to the extent any such damages are found by a final, nonappealable judgment of a court of competent jurisdiction to arise from the gross negligence or willful misconduct of, such Indemnified Person (or any of its Related Parties). None of the Indemnified Persons or you or any of your affiliates or the respective directors, officers, employees, advisors, and agents of the foregoing shall be liable for any indirect, special, punitive or consequential damages in connection with this Commitment Letter, the DIP Facility or the transactions contemplated hereby, provided that nothing contained in this sentence shall limit your indemnity obligations to the extent set forth in this Section 5. 6. Sharing of Information, Absence of Fiduciary Relationship, Affiliate Activities You acknowledge that each Commitment Party (or an affiliate) may from time to time effect transactions, for its own or its affiliates’ account or the account of customers, and hold positions in loans, securities or options on loans or securities of, or claims against, you, your

6 affiliates and of other companies that may be the subject of the transactions contemplated by this Commitment Letter. In addition, each Commitment Party and its affiliates will not use confidential information obtained from you or your affiliates or on your or their behalf by virtue of the transactions contemplated hereby in connection with the performance by such Commitment Party and its affiliates of services for other companies or persons and the Commitment Party and its affiliates will not furnish any such information to any of their other customers. You also acknowledge that the Commitment Parties and their respective affiliates have no obligation to use in connection with the transactions contemplated hereby, or to furnish to you, confidential information obtained from other companies or persons. You acknowledge for United States securities law purposes that any Commitment Party may establish an information blocking device or “Information Barrier” between, on the one hand, its directors, officers, employees, agents, affiliates (as such term is used in Rule 12b-2 under the Exchange Act) and, on the other hand, its affiliates and its and their attorneys, accountants, financial or other advisors, members, equityholders, partners, directors and employees who, pursuant to such Information Barrier policy, are permitted to receive confidential information or otherwise participate in discussions concerning the transactions contemplated hereby, and those of such Commitment Party’s, and its affiliates’, other employees. You acknowledge the potential existence of any Commitment Party’s Information Barrier but do not warrant or guarantee any Commitment Party’s compliance with United States securities law or that the Information Barrier will operate in accordance with its intended purpose. You further acknowledge and agree that (a) no fiduciary, advisory or agency relationship between you and the Commitment Parties is intended to be or has been created in respect of any of the transactions contemplated by this Commitment Letter, irrespective of whether the Commitment Parties have advised or are advising you on other matters, (b) the Commitment Parties, on the one hand, and you, on the other hand, have an arm’s length business relationship that does not directly or indirectly give rise to, nor do you rely on, any fiduciary duty to you or your affiliates on the part of the Commitment Parties, (c) you are capable of evaluating and understanding, and you understand and accept, the terms, risks and conditions of the transactions contemplated by this Commitment Letter, (d) you have been advised that the Commitment Parties are engaged in a broad range of transactions that may involve interests that differ from your interests and that the Commitment Parties have no obligation to disclose such interests and transactions to you, (e) you have consulted your own legal, accounting, regulatory and tax advisors to the extent you have deemed appropriate, (f) each Commitment Party has been, is, and will be acting solely as a principal and, except as otherwise expressly agreed in writing by it and the relevant parties, has not been, is not, and will not be acting as an advisor, agent or fiduciary for you, any of your affiliates or any other person or entity and (g) none of the Commitment Parties has any obligation or duty (including any implied duty) to you or your affiliates with respect to the transactions contemplated hereby except those obligations expressly set forth herein or in any other express writing executed and delivered by such Commitment Party and you or any such affiliate. Additionally, you acknowledge and agree that none of the Commitment Parties are advising you as to any legal, tax, investment, accounting or regulatory matters in any jurisdiction. You shall consult with your own advisors concerning such matters and shall be responsible for making your own independent investigation and appraisal of the transactions

7 contemplated by this Commitment Letter, and the Commitment Parties shall not have any responsibility or liability to you with respect thereto. Any review by the Commitment Parties of the transactions contemplated by this Commitment Letter or other matters relating thereto will be performed solely for the benefit of the Commitment Parties and shall not be on behalf of you or any of your affiliates. 7. Confidentiality This Commitment Letter is delivered to you on the understanding that neither this Commitment Letter nor any of its terms or substance shall be disclosed by you, directly or indirectly, to any other person except (a) you and your officers, directors, employees, members, partners, stockholders, attorneys, accountants, agents and advisors, in each case on a confidential and need-to-know basis, (b) to the extent required in any legal, judicial or administrative proceeding or as otherwise required by law or regulation (in which case you agree, to the extent permitted by law, to inform us promptly in advance thereof), (c) in a Bankruptcy Court filing in order to implement the transactions contemplated hereunder, (d) as may be required in accordance with the terms of the Confidentiality Agreements, (e) upon notice to the Commitment Parties, in connection with any public filing requirement you are legally obligated to satisfy, and (f) to the official committee of unsecured creditors formed in the Cases (as defined in the Term Sheet) (the “Committee”) and its legal counsel, independent auditors, professionals and other experts or agents who are informed of the confidential nature of such information and agree to be bound by confidentiality and use restrictions set forth in this Section 7. 8. Miscellaneous This Commitment Letter shall not be assignable by you without the prior written consent of each Commitment Party (and any purported assignment without such consent shall be null and void), is intended to be solely for the benefit of the parties hereto and the Indemnified Persons and is not intended to and does not confer any benefits upon, or create any rights in favor of, any person other than the parties hereto and the Indemnified Persons to the extent expressly set forth herein. Assignments by any Commitment Party shall be subject to Section 1 hereof. The Commitment Parties reserve the right to employ the services of their affiliates in providing services contemplated hereby, and to satisfy its obligations hereunder through, or assign its rights and obligations hereunder to, one or more of its affiliates, separate accounts within its control or investments funds under its or its affiliates’ management (collectively, “Commitment Party Affiliates”); and to allocate, in whole or in part, to their affiliates certain fees payable to the Commitment Parties in such manner as the Commitment Parties and their affiliates may agree in their sole discretion; provided that, no delegation or assignment to a Commitment Party Affiliate shall relieve such Commitment Party from its obligations hereunder to the extent that any Commitment Party Affiliate fails to satisfy the Commitments hereunder at the time required. This Commitment Letter may not be amended or waived except by an instrument in writing signed by you and each Commitment Party. This Commitment Letter may be executed in any number of counterparts, each of which shall be an original, and all of which, when taken

8 together, shall constitute one agreement. Delivery of an executed signature page of this Commitment Letter by facsimile or electronic transmission (e.g., “pdf” or “tif”) shall be effective as delivery of a manually executed counterpart hereof. This Commitment Letter (and the agreements referenced in this Commitment Letter) set forth the entire understanding of the parties with respect to the DIP Facility, and replace and supersede all prior agreements and understandings (written or oral) related to the subject matter hereof. This Commitment Letter shall be governed by, and construed and interpreted in accordance with, the laws of the State of New York and the Bankruptcy Code, to the extent applicable. You and we hereby irrevocably and unconditionally submit to the exclusive jurisdiction of the Bankruptcy Court and any other Federal court having jurisdiction over the Cases from time to time, over any suit, action or proceeding arising out of or relating to the transactions contemplated hereby, this Commitment Letter or the performance of services hereunder or thereunder. You and we agree that service of any process, summons, notice or document by registered mail addressed to you or us shall be effective service of process for any suit, action or proceeding brought in any such court. You and we hereby irrevocably and unconditionally waive any objection to the laying of venue of any such suit, action or proceeding brought in any such court and any claim that any such suit, action or proceeding has been brought in any inconvenient forum. You and we hereby irrevocably agree to waive trial by jury in any suit, action, proceeding, claim or counterclaim brought by or on behalf of any party related to or arising out of this Commitment Letter or the performance of services hereunder or thereunder. Each of the Commitment Parties hereby notifies you that, pursuant to the requirements of the USA PATRIOT Act, Title III of Pub. L. 107-56 (signed into law on October 26, 2001) (the “PATRIOT Act”), it is required to obtain, verify and record information that identifies the Debtors, which information includes names, addresses, tax identification numbers and other information that will allow such Lender to identify the Debtors in accordance with the PATRIOT Act. This notice is given in accordance with the requirements of the PATRIOT Act and is effective for the Commitment Parties and each Lender. The indemnification, expense reimbursement, jurisdiction, confidentiality, governing law, sharing of information, no agency or fiduciary duty, waiver of jury trial, service of process and venue provisions contained herein shall remain in full force and effect regardless of whether the Definitive Financing Documentation shall be executed and delivered and notwithstanding the termination of this Commitment Letter or the Commitments; provided that your obligations under this Commitment Letter (other than your obligations with respect to confidentiality) shall automatically terminate and be superseded by the provisions of the Definitive Financing Documentation upon the initial funding thereunder, and you shall automatically be released from all liability in connection therewith at such time, in each case to the extent the Definitive Financing Documentation has comparable provisions with comparable coverage. You and we hereto agree that this Commitment Letter is a binding and enforceable agreement with respect to the subject matter herein; it being acknowledged and agreed that the funding of the DIP Facility is subject to the conditions specified herein, including the execution and delivery of the Definitive Financing Documentation by the parties hereto in a manner consistent with this Commitment Letter. Each of the Commitment Parties and you will use their