UNITED STATES BANKRUPTCY COURT DISTRICT OF NEW HAMPSHIRE --------------------------------------------------------------- In re: GT ADVANCED TECHNOLOGIES INC., et al., Debtors.1 --------------------------------------------------------------- x : : : : : : : x Chapter 11 Case No. 14-11916-HJB Jointly Administered DISCLOSURE STATEMENT FOR DEBTORS’ JOINT PLAN OF REORGANIZATION UNDER CHAPTER 11 OF THE BANKRUPTCY CODE, DATED DECEMBER 21, 2015 THIS IS NOT A SOLICITATION OF ACCEPTANCES OR REJECTIONS OF ANY CHAPTER 11 PLAN DESCRIBED HEREIN. ACCEPTANCES OR REJECTIONS OF A CHAPTER 11 PLAN MAY NOT BE SOLICITED UNTIL A DISCLOSURE STATEMENT HAS BEEN APPROVED BY THE BANKRUPTCY COURT. THIS DISCLOSURE STATEMENT HAS BEEN SUBMITTED FOR BANKRUPTCY COURT APPROVAL BUT HAS NOT BEEN APPROVED BY THE BANKRUPTCY COURT. THE DEBTORS RESERVE THE RIGHT TO AMEND OR SUPPLEMENT THIS PROPOSED DISCLOSURE STATEMENT AT OR BEFORE THE HEARING TO CONSIDER APPROVAL OF THIS DISCLOSURE STATEMENT.2 PAUL HASTINGS LLP Luc A. Despins, Esq. James T. Grogan, Esq. G. Alexander Bongartz, Esq. 75 East 55th Street, First Floor New York, New York 10022 Dated: December 21, 2015 Counsel to the Debtors and Debtors-in-Possession 1 The Debtors, along with the last four digits of each debtor’s tax identification number, as applicable, are: GT Advanced Technologies Inc. (6749), GTAT Corporation (1760), GT Advanced Equipment Holding LLC (8329), GT Equipment Holdings, Inc. (0040), Lindbergh Acquisition Corp. (5073), GT Sapphire Systems Holding LLC (4417), GT Advanced Cz LLC (9815), GT Sapphire Systems Group LLC (5126), and GT Advanced Technologies Limited (1721). The Debtors’ corporate headquarters are located at 243 Daniel Webster Highway, Merrimack, NH 03054. 2 This text box will be removed upon Bankruptcy Court approval of the Disclosure Statement. EXHIBIT 99.1

DISCLAIMER THE DEBTORS ARE PROVIDING THE INFORMATION IN THIS DISCLOSURE STATEMENT TO HOLDERS OF CLAIMS ENTITLED TO VOTE ON THE PLAN FOR THE PURPOSE OF SOLICITING VOTES TO ACCEPT THE PLAN. NOTHING IN THIS DISCLOSURE STATEMENT MAY BE RELIED UPON OR USED BY ANY ENTITY FOR ANY OTHER PURPOSE. NO PERSON MAY GIVE ANY INFORMATION OR MAKE ANY REPRESENTATIONS, OTHER THAN THE INFORMATION AND REPRESENTATIONS CONTAINED IN THIS DISCLOSURE STATEMENT, REGARDING THE PLAN OR THE SOLICITATION OF ACCEPTANCES OF THE PLAN. ALL CREDITORS ARE ADVISED AND ENCOURAGED TO READ THIS DISCLOSURE STATEMENT (INCLUDING ALL EXHIBITS) AND THE PLAN IN THEIR ENTIRETY BEFORE VOTING ON THE PLAN. PLAN SUMMARIES AND STATEMENTS MADE IN THIS DISCLOSURE STATEMENT, INCLUDING THE EXECUTIVE SUMMARY, ARE MADE ONLY AS OF THE DATE HEREOF, AND THERE CAN BE NO ASSURANCE THAT THE STATEMENTS CONTAINED HEREIN SHALL BE CORRECT AT ANY TIME AFTER THE DATE HEREOF. ALL CREDITORS SHOULD READ CAREFULLY AND CONSIDER FULLY THE “RISK FACTORS” SECTION HEREIN BEFORE VOTING TO ACCEPT OR REJECT THE PLAN. SEE SECTION IX (“CERTAIN RISK FACTORS TO BE CONSIDERED”). THIS DISCLOSURE STATEMENT HAS BEEN PREPARED IN ACCORDANCE WITH SECTION 1125 OF THE BANKRUPTCY CODE AND RULE 3016(b) OF THE FEDERAL RULES OF BANKRUPTCY PROCEDURE AND NOT IN ACCORDANCE WITH FEDERAL OR STATE SECURITIES LAWS OR OTHER NON-BANKRUPTCY LAWS. PERSONS OR ENTITIES TRADING IN, OR OTHERWISE PURCHASING, SELLING, OR TRANSFERRING SECURITIES OF GT ADVANCED TECHNOLOGIES INC. (“GT INC.”) AND ITS SUBSIDIARIES SHOULD NOT RELY UPON THIS DISCLOSURE STATEMENT FOR SUCH PURPOSES AND SHOULD EVALUATE THIS DISCLOSURE STATEMENT AND THE PLAN IN LIGHT OF THE PURPOSE FOR WHICH THEY WERE PREPARED. THIS DISCLOSURE STATEMENT HAS NEITHER BEEN APPROVED NOR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE OR FOREIGN AUTHORITY, NOR HAS THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE OR FOREIGN AUTHORITY PASSED UPON THE ACCURACY OR ADEQUACY OF THE STATEMENTS CONTAINED HEREIN. AS TO CONTESTED MATTERS, ADVERSARY PROCEEDINGS, AND OTHER ACTIONS OR THREATENED ACTIONS, THIS DISCLOSURE STATEMENT SHALL NOT CONSTITUTE OR BE CONSTRUED AS AN ADMISSION OF ANY FACT, LIABILITY, STIPULATION, OR WAIVER, BUT RATHER AS A STATEMENT MADE IN SETTLEMENT NEGOTIATIONS.

ii THIS DISCLOSURE STATEMENT SUMMARIZES CERTAIN PROVISIONS OF THE PLAN, STATUTORY PROVISIONS, DOCUMENTS RELATED TO THE PLAN, FINANCIAL INFORMATION, AND EVENTS IN THE CHAPTER 11 CASES OF GT ADVANCED TECHNOLOGIES INC. AND ITS DIRECT AND INDIRECT SUBSIDIARIES THAT ARE DEBTORS IN THE CHAPTER 11 CASES (THE “DEBTORS”). ALTHOUGH THE DEBTORS BELIEVE THAT THE PLAN AND RELATED DOCUMENT SUMMARIES ARE FAIR AND ACCURATE, SUCH SUMMARIES ARE QUALIFIED TO THE EXTENT THAT THEY DO NOT SET FORTH THE ENTIRE TEXT OF SUCH DOCUMENTS OR STATUTORY PROVISIONS. TO THE EXTENT THERE ARE ANY INCONSISTENCIES BETWEEN THIS DISCLOSURE STATEMENT, ON THE ONE HAND, AND THE PLAN (INCLUDING ANY ATTACHMENTS TO THE PLAN) OR THE PLAN SUPPLEMENT, ON THE OTHER HAND, THE LATTER SHALL CONTROL. FACTUAL INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT HAS BEEN PROVIDED BY MANAGEMENT AND VARIOUS ADVISORS OF THE DEBTORS, EXCEPT WHERE OTHERWISE SPECIFICALLY NOTED. THE DEBTORS ARE UNABLE TO WARRANT OR REPRESENT THAT THE INFORMATION CONTAINED HEREIN, INCLUDING THE FINANCIAL INFORMATION, IS WITHOUT INACCURACY OR OMISSION. THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT IS INCLUDED HEREIN FOR PURPOSES OF SOLICITING ACCEPTANCES OF THE PLAN AND MAY NOT BE RELIED UPON FOR ANY PURPOSE OTHER THAN TO DETERMINE HOW TO VOTE ON THE PLAN. THE DESCRIPTIONS OF THE ACTIONS, CONCLUSIONS, OR RECOMMENDATIONS OF THE DEBTORS OR ANY OTHER PARTY IN INTEREST HAVE BEEN SUBMITTED TO OR APPROVED BY SUCH PARTY, BUT NO SUCH PARTY MAKES ANY REPRESENTATION REGARDING SUCH DESCRIPTIONS. THIS DISCLOSURE STATEMENT MAY NOT BE DEEMED AS PROVIDING ANY LEGAL, FINANCIAL, SECURITIES, TAX, OR BUSINESS ADVICE. THE DEBTORS URGE ALL HOLDERS OF A CLAIM OR EQUITY INTEREST TO CONSULT WITH THEIR OWN LEGAL ADVISORS WITH RESPECT TO ANY SUCH ADVICE IN REVIEWING THIS DISCLOSURE STATEMENT AND THE PLAN. THE BANKRUPTCY COURT’S APPROVAL OF THE ADEQUACY OF THE DISCLOSURES CONTAINED HEREIN DOES NOT CONSTITUTE THE BANKRUPTCY COURT’S APPROVAL OF THE MERITS OF THE PLAN. THE DEBTORS URGE EACH HOLDER OF A CLAIM ENTITLED TO VOTE ON THE PLAN TO (I) READ THE ENTIRE DISCLOSURE STATEMENT AND THE PLAN, (II) CONSIDER ALL OF THE INFORMATION IN THE DISCLOSURE STATEMENT, INCLUDING THE RISK FACTORS DESCRIBED IN ARTICLE XII OF THE DISCLOSURE STATEMENT, AND (III) CONSULT WITH ITS OWN ADVISORS BEFORE DECIDING WHETHER TO VOTE TO ACCEPT OR REJECT THE PLAN. THE FINANCIAL INFORMATION CONTAINED HEREIN HAS NOT BEEN AUDITED BY A CERTIFIED PUBLIC ACCOUNTANT AND HAS NOT BEEN PREPARED IN ACCORDANCE WITH GENERALLY ACCEPTED ACCOUNTING PRINCIPLES.

iii CERTAIN INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT IS BY ITS NATURE FORWARD-LOOKING AND CONTAINS ESTIMATES, ASSUMPTIONS AND PROJECTIONS THAT MAY BE MATERIALLY DIFFERENT FROM ACTUAL FUTURE RESULTS. THIS DISCLOSURE STATEMENT SHALL NOT BE ADMISSIBLE IN ANY NON- BANKRUPTCY PROCEEDING INVOLVING THE DEBTORS OR ANY OTHER PARTY, NOR SHALL IT BE CONSTRUED TO BE ADVICE ON THE TAX, SECURITIES, OR OTHER LEGAL EFFECTS OF THE REORGANIZATION AS TO HOLDERS OF CLAIMS AGAINST THE DEBTORS. YOU SHOULD CONSULT YOUR OWN COUNSEL OR TAX ADVISOR ON ANY QUESTIONS OR CONCERNS RESPECTING TAX, SECURITIES, OR OTHER LEGAL EFFECTS OF THE REORGANIZATION ON HOLDERS OF CLAIMS. NOTE: THE DEBTORS, THE CREDITORS’ COMMITTEE3 AND THE CONSENTING PARTIES BELIEVE THAT ACCEPTANCE OF THE PLAN DESCRIBED IN THIS DOCUMENT IS IN THE BEST INTERESTS OF THE DEBTORS’ ESTATES, THEIR CREDITORS, AND ALL OTHER PARTIES IN INTEREST. ACCORDINGLY, THE DEBTORS, THE CREDITORS’ COMMITTEE AND THE CONSENTING PARTIES RECOMMEND THAT YOU VOTE IN FAVOR OF THE PLAN. 3 [All statements in this Disclosure Statement regarding the Creditors’ Committee’s or the Majority Consenting Parties’ support for the Plan are subject to final approval by the Creditors’ Committee and the Majority Consenting Parties, respectively, of the terms of the Plan, which shall occur on or before the Disclosure Statement hearing date.]

iv EXECUTIVE SUMMARY4 GT Advanced Technologies Inc. and its affiliated debtors and debtors in possession (collectively, “GTAT” or the “Debtors”) submit this Disclosure Statement pursuant to section 1125 of the Bankruptcy Code to holders of Claims against and Equity Interests in the Debtors in connection with the solicitation of acceptances of the Debtors’ Joint Plan of Reorganization under Chapter 11 of the Bankruptcy Code, Dated December 21, 2015 (the “Plan”). A copy of the Plan is attached to the Disclosure Statement as Exhibit A. The purpose of this Disclosure Statement is to provide information of a kind, and in sufficient detail, to enable creditors of the Debtors who are entitled to vote on the Plan to make informed decisions on whether to vote to accept or reject the Plan. To that end, this Disclosure Statement contains various summaries of the Plan and events that occurred during the Chapter 11 Cases. The Debtors are proposing the Plan following extensive negotiations with certain of their key stakeholders, including the Financing Support Parties, the Consenting Parties, and the Creditors’ Committee. As a result of these discussions, these key stakeholders have agreed to support the restructuring set forth in the Plan. In connection with the Plan, the Financing Support Parties5 have committed $80 million of Exit Financing that will fund, in part, the Debtors’ obligations under the Plan. Without new financing, the Debtors could not emerge from chapter 11 as a going concern. The Financing Support Parties consist of certain of the DIP Lenders in the Chapter 11 Cases, as well as holders of large prepetition claims against GT Hong Kong, the Corp Debtors, and GT Inc. In addition, the Creditors’ Committee and the Consenting Parties6 support the Plan. The Consenting Parties consist of Financing Support Parties as well as certain of the DIP Lenders and holders of Claims arising under the GT Inc. Notes. Under the Exit Financing Commitment Letter, each Consenting Party and each Financing Support Party agreed that it will vote all its Claims against the Debtors, including the Claims identified on Schedule 1 to the Exit Financing Commitment Letter and any Claims acquired after November 28, 2015, to accept the Plan (so long it is consistent with the Plan Term Sheet). As a result, the Plan has the support of a large, diverse group of creditors holding substantial claims at multiple levels of the Debtors’ capital structure. 4 This executive summary is qualified in its entirety by the more detailed information contained in the Plan and elsewhere in this Disclosure Statement. Capitalized terms that are used but not defined in this Disclosure Statement have the meanings ascribed to them in the Plan. A term used but not defined in either this Disclosure Statement or the Plan has the meaning given it in the Bankruptcy Code or the Bankruptcy Rules. 5 The Financing Support Parties include one or more affiliates of or funds managed by WBox 2014-3 Ltd., Jefferies LLC, QPB Holdings Ltd., Wolverine Flagship Fund Trading Limited, Privet Fund Management LLC, Citigroup Financial Products Inc., Caspian Capital LP, Corre Partners Management LLC, and Empyrean Capital Partners, LP. 6 The Consenting Parties include AQR Capital Management, LLC, Aristeia Capital, L.L.C., CNH Partners, LLC, Latigo Partners, LP, New Generation Advisors, LLC, Pine River Capital Management, L.P., and their respective permitted assignees.

v The Plan and the distributions contemplated thereby are premised on a global settlement (the “Global Settlement”) of numerous inter-Debtor, Debtor-creditor, and inter-creditor issues, including substantive consolidation, the allocation of Reorganized Common Stock and other value to be distributed to creditors under the Plan, treatment of the Debtors’ tax attributes, and other issues affecting the Debtors and their creditors. In the weeks leading to the filing of the Plan, the parties to the Global Settlement exchanged numerous proposals and counterproposals on the terms of a chapter 11 plan, and the parties conferred on numerous occasions in an attempt to achieve a global consensus in these Chapter 11 Cases. In addition, in the months leading up to the Global Settlement, the Debtors, through their investment banker Rothschild, and in consultation with the Creditors’ Committee, solicited proposals for exit financing and a comprehensive restructuring from more than 100 separate parties, including certain of the Debtors’ DIP Lenders. Notwithstanding the breadth of these marketing efforts, only two competing restructuring proposals were submitted for consideration by the Debtors, the Creditors’ Committee, and other key constituencies in these Chapter 11 Cases. The Global Settlement that forms the basis for the Plan emerged as the superior proposal following extensive good faith negotiations amongst the Debtors, the Creditors’ Committee, and the Financing Support Parties, when compared to the alternative restructuring proposal received by the Debtors. As a result of the market-testing that preceded the Global Settlement, the parties supporting the Plan, including the Creditors’ Committee appointed in these Chapter 11 Cases, believe the Plan represents the best available option for all creditors and parties in interest. The Plan not only keeps the Debtors operating as a going concern but also provides for the distribution to holders of Allowed General Unsecured Claims of a portion of the Reorganized Debtors’ equity or Cash (in lieu of such equity) that is not being distributed to the Financing Support Parties. In addition, the Plan also establishes a Litigation Trust that may generate Cash for distribution for holders of Allowed General Unsecured Claims in accordance with the procedures and methodologies set forth in the Litigation Trust Agreement. In light of the lack of a superior proposals for the Debtors’ emergence from chapter 11, and the fact that the Liquidation Analysis attached hereto as Exhibit D shows that liquidation of the Debtors under chapter 7 of the Bankruptcy Code would not produce any recoveries for general unsecured creditors, the Creditors’ Committee believes that the Plan embodies the best alternative for unsecured creditors and recommends that all unsecured creditors vote to accept the Plan. Under the Plan, holders of Allowed Administrative Expense Claims, Allowed Priority Tax Claims, Allowed Priority Non-Tax Claims, and Allowed Secured Tax Claims, will be paid in full in Cash unless such holders agree to less favorable treatment, and holders of Allowed Other Secured Claims, at the option of the applicable Debtor, will either be reinstated, paid in full in Cash, or the holders of such Allowed Other Secured Claims will receive the collateral securing such Allowed Other Secured Claim. Holders of DIP Facility Claims will receive (i) Cash in an amount of such Allowed DIP Facility Claim; (ii) the DIP Warrants; (iii) the DIP Amendment Fee, and (iv) the DIP Prepayment Fee. Any holder of a DIP Facility Claim or and Administrative Expense Claim that is also a Financing Support Party may, at its option, elect to exchange, on a dollar-for-dollar basis, some or all of such Claims to participate in the Exit Financing based upon and solely up to its

vi respective Exit Financing Commitment Amount, which exchanged amount shall be in lieu of the cash distribution to which it would otherwise be entitled. In accordance with the Plan, (a) holders of Allowed GT Inc. Notes Claims in Class 4A will receive (i) Reorganized Common Stock (subject to the Cashing-Out Programs), (iii) a portion of the Excess Proceeds, if any; (iii) a beneficial interest in the Litigation Trust, and (iv) the Noteholder Warrants, and (b) holders of Allowed General Unsecured Claims in Classes 4C and 4D will receive (i) Reorganized Common Stock (subject to the Cashing-Out Programs), (ii) a portion of the Excess Proceeds, if any, and (iii) a beneficial interest in the Litigation Trust, in each case, in a percentage as set forth in Section 5.4, 5.6 and 5.7 of the Plan. Upon the Effective Date of the Plan, the Reorganized Debtors’ capital structure will consist of (a) the Senior Secured Notes in the amount of $60 million, (b) shares of Preferred Stock, which will represent 86% of the ownership of the common stock in Reorganized GT Inc. on an as-converted basis (subject to dilution), and (c) shares of Reorganized Common Stock. Reorganized GT Inc. will issue the Preferred Stock to the Financing Support Parties in exchange for $20 million. Reorganized GT Inc. will also issue shares of Reorganized Common Stock to holders of Allowed General Unsecured Claims in Class 4A, Class 4C, and Class 4D, subject to dilution and the Cashing-Out Programs described below and in the Plan, which will represent 14% of the equity in Reorganized GT Inc. In accordance with the Plan, (a) holders of Allowed GT Inc. Notes Claims in Class 4A will receive their pro rata share of (i) 21.6% of the Reorganized Common Stock Pool, (ii) 12.5% of the Excess Proceeds, if any, (iii) a 12.5% beneficial interest in the Litigation Trust, and (iv) the Noteholder Warrants; (b) holders of Allowed Corp. Debtors General Unsecured Claims will receive their pro rata share of (i) 62.0% of the Reorganized Common Stock Pool, (ii) 71.1% of the Excess Proceeds, if any, and (iii) a 71.1% beneficial interest in the Litigation Trust; and (c) holders of Allowed GT Hong Kong General Unsecured Claims will receive their pro rata share of (i) 16.4% of the Reorganized Common Stock Pool, (ii) 16.4% of Excess Proceeds, if any, and (iii) a 16.4% beneficial interest in the Litigation Trust. The Cashing-Out Programs set forth in the Plan are described in further detail in Section 6.1(d) of the Plan. The Cashing-Out Programs apply to holders of General Unsecured Claims in Classes 4A, 4C and 4D of the Plan. In accordance with the Cashing-Out Programs, a Cashing- Out Reserve of $1.5 million (the “Cashing-Out Cap”) will be established under the Plan to pay, under certain circumstances, Cash in lieu of distributions of Reorganized Common Stock to the holders of Claims in Classes 4A, 4C and 4D. Subject to the Cashing-Out Cap, a holder of a Claim in one of those Classes may, in lieu of any Reorganized Common Stock it is entitled to receive under the Plan, elect to receive Cash in an amount equal to the imputed value as of the Effective Date of the shares of Reorganized Common Stock that would otherwise be distributed to such holders under the Plan. In the event of a Cashing-Out Oversubscription, Cash shall be distributed from the Cashing-Out Reserve (1) first, to make the Cash payments pursuant to Section 6.1(d)(ii) of the Plan and (2) second, to make Cash payments to satisfy Allowed General Unsecured Claims of Cashing-Out Election Holders and Cash payments pursuant to Section 6.1(d)(iii) in order of smallest Claim to largest Claim until all funds in the Cashing-Out Reserve are depleted, at which

vii point the Reorganized Debtors shall distribute shares of Reorganized Common Stock to Cashing- Out Election Holders in accordance with Section 5.4, 5.6, or 5.7 of the Plan, as applicable. Additionally, holders of Allowed GT Inc. General Unsecured Claims in Class 4B will receive a Cash distribution pursuant to Section 5.5 of the Plan substantially equal, as a percentage of its Allowed GT Inc. General Unsecured Claim, to the recovery, calculated as of the Effective Date and as a percentage of such Claim, that a holder of an Allowed GT Inc. Notes Claim is to obtain under the Plan. The Plan also contains certain releases, including (a) the releases set forth in Section 14.2 of the Plan by the Debtors and Reorganized Debtors in favor of the D&O Releasees, (b) the releases set forth in Section 14.3 of the Plan by the Debtor Releasees, the D&O Releasees, the Litigation Trust, the Litigation Trustee, and holders of Claims against or Equity Interests in any of the Debtors in favor of the Plan Support Party Releasees and the DIP Facility Lender Releasees, and (c) the releases set forth in Section 14.4 of the Plan by (1) the Financing Support Parties, (2) the Consenting Parties, and (3) each holder of Claims against any of the Debtors who either (i) does not opt out of this release, (ii) is paid in full under the Plan, or (iii) is deemed to have accepted the Plan, in favor of the Debtor Releasees and the D&O Releasees. The Ballots to be distributed to holders of Claims entitled to vote on the Plan will allow such holders to opt out of the release of the Debtor Releasees and the D&O Releasees under Section 14.4 of the Plan. THIS EXECUTIVE SUMMARY IS INTENDED SOLELY AS A SUMMARY OF CERTAIN PROVISIONS OF THIS DISCLOSURE STATEMENT AND THE PLAN. YOU SHOULD READ THIS DISCLOSURE STATEMENT AND THE PLAN AND EACH OF THEIR RESPECTIVE EXHIBITS AND SCHEDULES IN THEIR ENTIRETY PRIOR TO MAKING ANY DETERMINATION TO ACCEPT OR REJECT THE PLAN. TO THE EXTENT THERE ARE ANY INCONSISTENCIES BETWEEN THIS EXECUTIVE SUMMARY AND THE PLAN (INCLUDING ANY ATTACHMENTS TO THE PLAN) AND THE PLAN SUPPLEMENT, THE LATTER SHALL CONTROL. THE DEBTORS BELIEVE THAT THE PLAN WILL ENABLE THEM TO ACCOMPLISH THE OBJECTIVES OF CHAPTER 11 AND THAT ACCEPTANCE OF THE PLAN IS IN THE BEST INTERESTS OF THE DEBTORS AND THEIR CREDITORS. THE CREDITORS’ COMMITTEE SUPPORTS CONFIRMATION OF THE PLAN. THE DEBTORS AND THE CREDITORS’ COMMITTEE URGE CREDITORS TO VOTE TO ACCEPT THE PLAN. THE CREDITORS’ COMMITTEE HAS ALSO PREPARED A LETTER IN SUPPORT OF CONFIRMATION OF THE PLAN, WHICH LETTER IS INCLUDED IN THE SOLICITATION PACKAGES. CREDITORS SHOULD REVIEW THE CREDITORS’ COMMITTEE’S LETTER IN CONNECTION WITH EVALUATING THE PLAN AND DISTRIBUTIONS TO BE MADE UNDER THE PLAN. ARTICLE XII OF THE PLAN CONTAIN RELEASE, EXCULPATION, AND INJUNCTIVE PROVISIONS. YOU ARE ADVISED TO CAREFULLY REVIEW AND CONSIDER THESE PROVISIONS OF THE DISCLOSURE STATEMENT AND THE PLAN BECAUSE YOUR RIGHTS MIGHT BE AFFECTED THEREUNDER.

viii A. SOLICITATION AND ACCEPTANCE OF PLAN 1. General On [_______], 2016, the Bankruptcy Court entered the Disclosure Statement Order approving the Disclosure Statement Order approving this Disclosure Statement as containing “adequate information” (information of a kind and in sufficient detail to enable a hypothetical reasonable investor typical of the holders of Claims and Equity Interests to make an informed judgment regarding the Plan. This Disclosure Statement is submitted pursuant to Section 1125 of the Bankruptcy Code and is being furnished to holders of Claims in the Voting Classes (as defined herein) (i) for the purpose of soliciting their votes on the Plan; and (ii) in connection with the hearing scheduled for _______, 2016, at __:__ _.m. (Eastern Time) to consider an order confirming the Plan. THE BANKRUPTCY COURT’S APPROVAL OF THIS DISCLOSURE STATEMENT CONSTITUTES NEITHER A GUARANTY OF THE ACCURACY OR COMPLETENESS OF THE INFORMATION CONTAINED HEREIN NOR AN ENDORSEMENT OF THE MERITS OF THE PLAN BY THE BANKRUPTCY COURT. This Disclosure Statement is also being furnished to certain other creditors and other entities for notice or informational purposes. The primary purpose of this Disclosure Statement is to provide adequate information to holders of Claims in the Voting Classes to make a reasonably informed decision with respect to the Plan prior to exercising the right to vote to accept or reject the Plan. A copy of the Disclosure Statement Order entered by the Bankruptcy Court and a notice of, among other things, voting procedures and the dates set for objections to and the hearing on confirmation of the Plan (the “Notice of Confirmation Hearing”) are also being transmitted with this Disclosure Statement. The Disclosure Statement Order and the Notice of Confirmation Hearing set forth in detail the deadlines, procedures, and instructions for casting votes to accept or reject the Plan, for filing objections to confirmation of the Plan, the treatment for balloting purposes of certain types of Claims, and the assumptions for tabulating Ballots. In addition, detailed voting instructions accompany each Ballot. The last day for a Ballot to be actually received with respect to voting to accept or reject the Plan is _______, 2016, at __:_.m. (Eastern Time). Each holder of a Claim within a Class entitled to vote should read the Disclosure Statement, the Plan, the Disclosure Statement Order, the Notice of Confirmation Hearing, and the instructions accompanying the Ballots in their entirety before voting on the Plan. These documents contain important information concerning how Claims and Equity Interests are classified for voting purposes and how votes will be tabulated. 2. Overview of Chapter 11 In accordance with the provisions of the Bankruptcy Code, a debtor may propose to either reorganize or liquidate its assets. The commencement of a chapter 11 bankruptcy case creates an estate this is comprised of all of the legal, contractual, and equitable interests of the debtor as of the commencement of the case. The Bankruptcy Code provides authority for a

ix debtor to continue to manage and operate its business and remain in possessions of its property. The consummation of a plan is the primary objective of the chapter 11 process. A chapter 11 plan (i) divides claims and equity interests into classes, (ii) sets forth the consideration each class will receive under the plan, (iii) provides a mechanism for implementation of the plan, and (iv) in the case of a reorganization, sets forth the future conduct of the reorganized debtor. Confirmation of a plan by a bankruptcy court binds the debtor, creditors, and equity security holders to the terms of the plan. Generally, certain holders of claims against and equity interest in the debtor are permitted to vote to accept or reject a plan. A plan will designate whether a class of claims is “impaired” or “unimpaired” and whether holders of claims in such class are entitled to vote on the plan. Prior to soliciting votes on the plan, section 1125 of the Bankruptcy Code requires a debtor to prepare a disclosure statement containing adequate information of a kind, and in sufficient detail, to enable a hypothetical reasonable investor to make an informed judgment to accept or reject the plan. The Debtors are distributing this Disclosure Statement to holders of Claims against the Debtors that are expected to receive a distribution under the Plan in satisfaction of the requirements of section 1125 of the Bankruptcy Code. Because existing shareholders of GT Inc. are not receiving a distribution under the Plan, they are deemed to have rejected the Plan, and their vote is therefore not being solicited. 3. Who Is Entitled to Vote Under the Bankruptcy Code, only holders of Claims that are “impaired” are entitled to vote to accept or reject the Plan. The Bankruptcy Code defines acceptance of a plan by a class of claims as acceptance by holders of at least two-thirds (⅔) in dollar amount and more than one- half (½) in number of the claims of that class that cast ballots for acceptance or rejection of the plan. Thus, acceptance by a class of claims occurs only if at least two-thirds (⅔) in dollar amount and a majority in number of the holders of Claims voting cast their ballots to accept the plan. See Section IX (“Voting Requirements”) and Section X (“Confirmation of the Plan”). Your vote on the Plan is important. The Bankruptcy Code requires as a condition to confirmation of a plan of reorganization that each class that is impaired and entitled to vote under a plan votes to accept such plan, unless the plan is being confirmed under the “cramdown” provisions of section 1129(b) of the Bankruptcy Code. Section 1129(b) permits confirmation of a plan of reorganization, notwithstanding the nonacceptance of the plan by one or more impaired classes of claims or equity interests, so long as at least one impaired class of claims or interests votes to accept a proposed plan. Under that section, a plan may be confirmed by a bankruptcy court if it does not “discriminate unfairly” and is “fair and equitable” with respect to each non- accepting class. Each of Classes 5 (Subordinated Securities Claims) and 6 (GT Inc. Equity Interests) will receive no distribution or benefits under the Plan, and, therefore, are conclusively deemed to have rejected the Plan, and are not entitled to vote. The Debtors are seeking acceptances of the Plan from holders of Claims in each of Classes 4A (GT Inc. Notes Claims), 4B (GT Inc. General Unsecured Claims), 4C (Corp Debtors General Unsecured Claims), and 4D (GT Hong Kong General Unsecured Claims) (collectively, the “Voting Classes”). The Claims in all other Classes

x are Unimpaired, and the holders of Claims in Unimpaired Classes are conclusively presumed to have accepted the Plan pursuant to section 1126(f) of the Bankruptcy Code and are not entitled to vote. For a description of the Classes, Claims, and Equity Interests, and their treatment under the Plan, see Articles III, IV, and V of the Plan. 4. Ballots If you are entitled to vote to accept or reject the Plan, see Section IX.B (“Voting Requirements—Holders of Claims Entitled to Vote”), a Ballot or Ballots, specific to the Claim held, is enclosed for voting on the Plan. As further detailed below, on the Ballot you will also have the option to opt out of the releases set forth in Section 14.4 of the Plan in favor of the Debtor Releasees and the D&O Releasees. If you hold Claims in more than one Class and are entitled to vote such Claims in more than one Class, you must use separate Ballots for each Class of Claims. If you hold more than one Claim classified in a single class of Claims, you must vote all your Claims within that Class to either accept or reject the Plan, and may not split your votes within a particular Class; thus, a Ballot (or group of Ballots) within a particular Class that partially accepts and partially rejects the Plan shall not be counted. Importantly, when you vote, you must use only the Ballot or Ballots sent to you (or copies if necessary) with this Disclosure Statement. IN ORDER FOR YOUR BALLOT TO BE COUNTED, YOUR BALLOT MUST BE PROPERLY COMPLETED AND RECEIVED SO THAT IT IS RECEIVED NO LATER THAN [__________], 2016 AT 4:00 P.M. (PREVAILING EASTERN TIME) BY THE VOTING AGENT AS SET FORTH ON THE BALLOT. See Section IX.A (“Voting Requirements— Voting Deadline”) and Section IX.D.1 (“Voting Requirements— Voting Procedures— Ballots”). Prior to the Voting Deadline, if you cast more than one Ballot voting the same Claim, the last received, validly executed Ballot received before the Voting Deadline shall be deemed to reflect your intent and thus to supersede any prior Ballots. After the Voting Deadline, if you wish to change your vote, you can do so, if you meet the requirements of Bankruptcy Rule 3018(a), by filing a motion with the Bankruptcy Court with sufficient advanced notice so that it can be heard prior to the Confirmation Hearing scheduled for [______], 2016. Any such application must be filed and served in accordance with the procedures set forth in detail in the Disclosure Statement Order. 4. Inquiries If you have any questions about the procedure for voting your Claim or the packet of materials you received, please contact the GTAT Ballot Processing Center, c/o KCC, by regular mail at 2335 Alaska Avenue, El Segundo, CA 90245, by telephone at (888) 647-1732 (or outside of the U.S. at (310) 751-2622), or by email at gtatinfo@kccllc.com. If you wish to obtain an additional copy of the Plan, this Disclosure Statement, or any exhibits to such documents, at your own expense, unless otherwise specifically required by Bankruptcy Rule 3017(d), please contact the GTAT Ballot Processing Center, c/o KCC, by regular mail at 2335 Alaska Avenue, El Segundo, CA 90245, by telephone at (888) 647-1732 (or

xi outside of the U.S. at (310) 751-2622), or by email at gtatinfo@kccllc.com. Copies of the Plan, this Disclosure Statement, or any exhibits to such documents may also be obtained free of charge on KCC’s website for these chapter 11 cases (http://www.kccllc.net/gtat). B. PLAN OF REORGANIZATION 1. Overview of the Plan The following is a brief summary of certain material provisions of the Plan. These descriptions are qualified in their entirety by the provisions of the Plan, which is attached hereto as Exhibit A. As previously noted, the Plan is premised upon the Global Settlement, which represents a compromise and settlement of numerous inter-Debtor, Debtor-creditor, and inter-creditor issues designed to achieve an economic settlement of Claims against the Debtors and an efficient resolution of the Chapter 11 Cases. The Global Settlement constitutes a settlement of a number of potential litigation issues, including issues regarding substantive consolidation, the validity and enforceability of Intercompany Claims, and the allocation of Assets among the Estates. The Global Settlement is the result of extensive and vigorous negotiations among the Debtors, certain of their largest creditor constituencies, and the Creditors’ Committee. Absent the Global Settlement, many of the issues resolved by the Global Settlement, such as substantive consolidation, intercompany claims, allocation of tax attributes, and other issues, would likely result lengthy and expensive litigation to the detriment of Debtors’ estates and all stakeholders. Through the integrated Global Settlement of all disputed issues among the Debtors, the Consenting Parties, and the Creditors’ Committee, the Debtors believe they will be able to avoid the incurrence of significant litigation costs and delays in connection with the disputed intercompany and inter-creditor issues and exit bankruptcy protection expeditiously and with sufficient liquidity to execute their business plan. One of the main inter-Debtor issues faced by the Debtors in these Chapter 11 Cases is the possibility of substantive consolidation of some or all of the Debtors. A court order granting substantive consolidation of two or more legal entities results in (a) pooling of the assets of the consolidated entities into a common fund against which the creditors of all entities may assert their claims, (b) eliminating of intercompany claims among the consolidated entities, (c) permitting any creditor with an allowed claim against one of the consolidated entities to have an allowed claim against the consolidated pool, and (d) combining all of the creditors of a particular priority for purposes of voting on a reorganization plan. In these Chapter 11 Cases, the holders of the GT Inc. Notes are likely to be proponents of substantive consolidation of GT Inc. with GTAT Corp, with creditors of GTAT Corp likely to oppose such consolidation. It is possible that holders of GT Inc. Notes may establish a prima facie case that there is a substantial identity between GT Inc. and GTAT Corp. The noteholders would likely assert that the benefits to be gained from substantive consolidation include increased recoveries for unsecured creditors of GT Inc. and avoidance of the expense of unscrambling the assets and liabilities of GT Inc. from GTAT Corp. On the other hand, creditors of GTAT Corp likely would object strenuously. Among other arguments, they likely would

xii assert that (i) they relied upon the separate credit of GTAT Corp., (ii) holders of GT Inc. Notes have no basis to believe that GT Inc. and GTAT Corp are the same entity because of express disclosures and risk factors set forth in the GT Inc. Notes’ offering memoranda, and (iii) untangling the assets and liabilities of GT Inc. from those of GTAT Corp presents little difficulty as GT Inc. has few assets other than its equity interest in GTAT Corp. Because of competing interests and complexity on the facts and the law, a dispute over the substantive consolidation of GT Inc. and GTAT Corp is likely to lead to extensive and costly litigation. With respect to consolidation of GTAT Corp with GT Hong Kong, the Debtors’ analysis shows that the majority of substantial identity factors do not favor consolidation. With respect to consolidation of the remaining Debtor entities with GTAT Corp, the Debtors’ analysis shows a much stronger case for substantive consolidation among entities. Moreover, in the Debtors’ view, the benefits of substantive consolidation of those entities (including administrative convenience) significantly outweigh the costs and delay that would result from any litigation regarding the propriety of substantive consolidation in that context. Accordingly, the Plan proposes to substantive consolidate the Corp Debtors. The Global Settlement resolves all these substantive consolidation issues (and avoids the cost of related litigation) by allocating the Reorganized Common Stock Pool, the Excess Proceeds, and interests in the Litigation Trust to the general unsecured creditors of GT Inc., the Corp Debtors, and GT Hong Kong. The Debtors believe that the settlement of the substantive consolidation issues, as part of the Global Settlement, is fair and reasonable, especially in light of the fact that the Plan is the product of extensive, good faith negotiations among all key stakeholders, including the DIP Lenders, the Consenting Parties, and the Creditors’ Committee. The entry of the Confirmation Order shall constitute the Bankruptcy Court’s approval of the Global Settlement and all other compromises and settlements provided for in the Plan, and the Bankruptcy Court’s findings shall constitute its determination that such compromises and settlements are in the best interests of the Debtors, their Estates, their creditors, and other parties- in-interest, and are fair, equitable, and within the range of reasonableness. Each provision of the Global Settlement will be deemed non-severable from each other and from the remaining terms of the Plan. 2. Summary of Classification and Treatment under Plan The Plan sets forth how Claims against and Equity Interests in the Debtors will be treated if the Plan is confirmed by the Bankruptcy Court and subsequently consummated. With respect to general unsecured creditors, the Plan creates three different debtor groups: (i) GT Inc.; (ii) GT Hong Kong; and (iii) all other Debtors, which are defined as the Corp Debtors. All holders of Corp Debtors General Unsecured Claims will receive the same treatment, regardless of the specific Debtor against with such holder’s general unsecured claim is against. Only holders of “allowed” claims or equity interest may receive a distribution under a chapter 11 plan. A claim is “allowed” if the debtor agrees with the claim or, if there is a dispute regarding the claim, the bankruptcy court determines that the claim, including the amount, is a valid obligation of the debtors. Section 502(a) of the Bankruptcy Code provides that a timely filed claim is allowed unless the debtor or another party in interest objects to the claims. Section

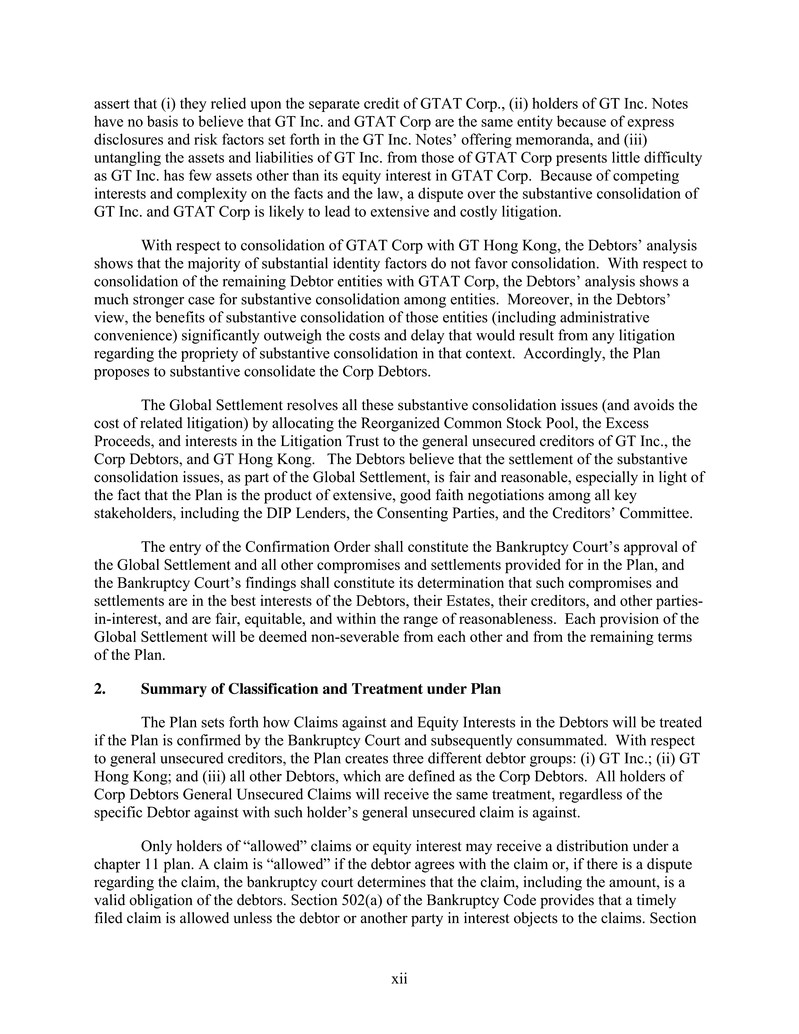

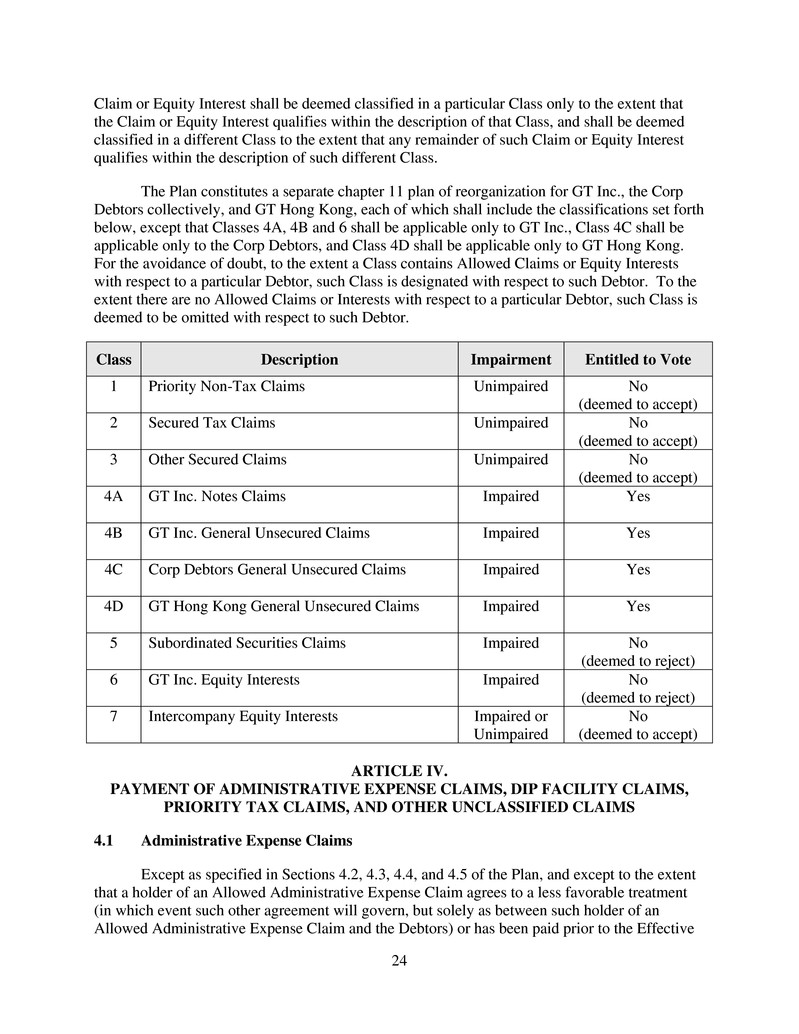

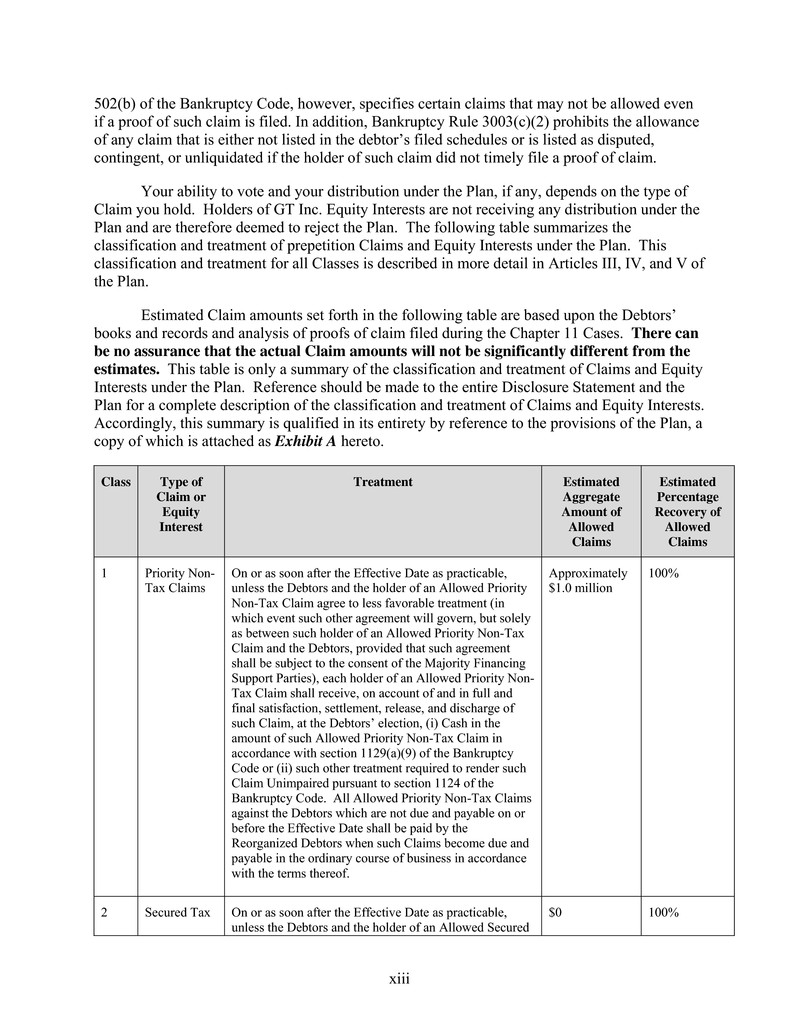

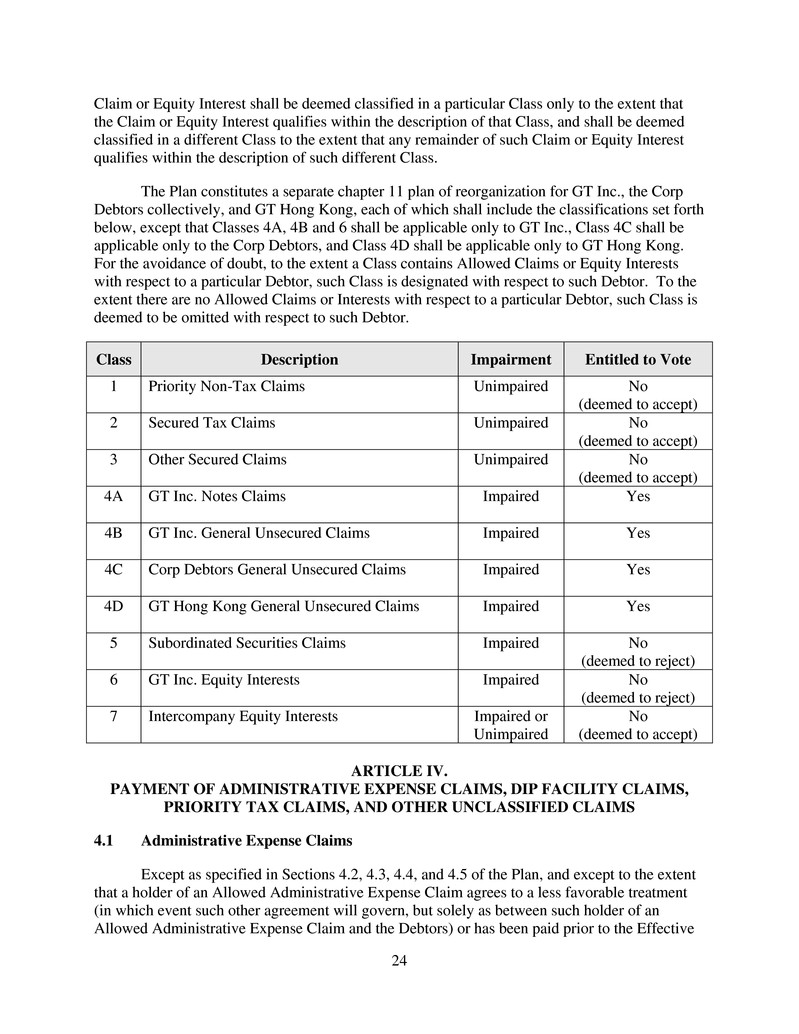

xiii 502(b) of the Bankruptcy Code, however, specifies certain claims that may not be allowed even if a proof of such claim is filed. In addition, Bankruptcy Rule 3003(c)(2) prohibits the allowance of any claim that is either not listed in the debtor’s filed schedules or is listed as disputed, contingent, or unliquidated if the holder of such claim did not timely file a proof of claim. Your ability to vote and your distribution under the Plan, if any, depends on the type of Claim you hold. Holders of GT Inc. Equity Interests are not receiving any distribution under the Plan and are therefore deemed to reject the Plan. The following table summarizes the classification and treatment of prepetition Claims and Equity Interests under the Plan. This classification and treatment for all Classes is described in more detail in Articles III, IV, and V of the Plan. Estimated Claim amounts set forth in the following table are based upon the Debtors’ books and records and analysis of proofs of claim filed during the Chapter 11 Cases. There can be no assurance that the actual Claim amounts will not be significantly different from the estimates. This table is only a summary of the classification and treatment of Claims and Equity Interests under the Plan. Reference should be made to the entire Disclosure Statement and the Plan for a complete description of the classification and treatment of Claims and Equity Interests. Accordingly, this summary is qualified in its entirety by reference to the provisions of the Plan, a copy of which is attached as Exhibit A hereto. Class Type of Claim or Equity Interest Treatment Estimated Aggregate Amount of Allowed Claims Estimated Percentage Recovery of Allowed Claims 1 Priority Non- Tax Claims On or as soon after the Effective Date as practicable, unless the Debtors and the holder of an Allowed Priority Non-Tax Claim agree to less favorable treatment (in which event such other agreement will govern, but solely as between such holder of an Allowed Priority Non-Tax Claim and the Debtors, provided that such agreement shall be subject to the consent of the Majority Financing Support Parties), each holder of an Allowed Priority Non- Tax Claim shall receive, on account of and in full and final satisfaction, settlement, release, and discharge of such Claim, at the Debtors’ election, (i) Cash in the amount of such Allowed Priority Non-Tax Claim in accordance with section 1129(a)(9) of the Bankruptcy Code or (ii) such other treatment required to render such Claim Unimpaired pursuant to section 1124 of the Bankruptcy Code. All Allowed Priority Non-Tax Claims against the Debtors which are not due and payable on or before the Effective Date shall be paid by the Reorganized Debtors when such Claims become due and payable in the ordinary course of business in accordance with the terms thereof. Approximately $1.0 million 100% 2 Secured Tax On or as soon after the Effective Date as practicable, unless the Debtors and the holder of an Allowed Secured $0 100%

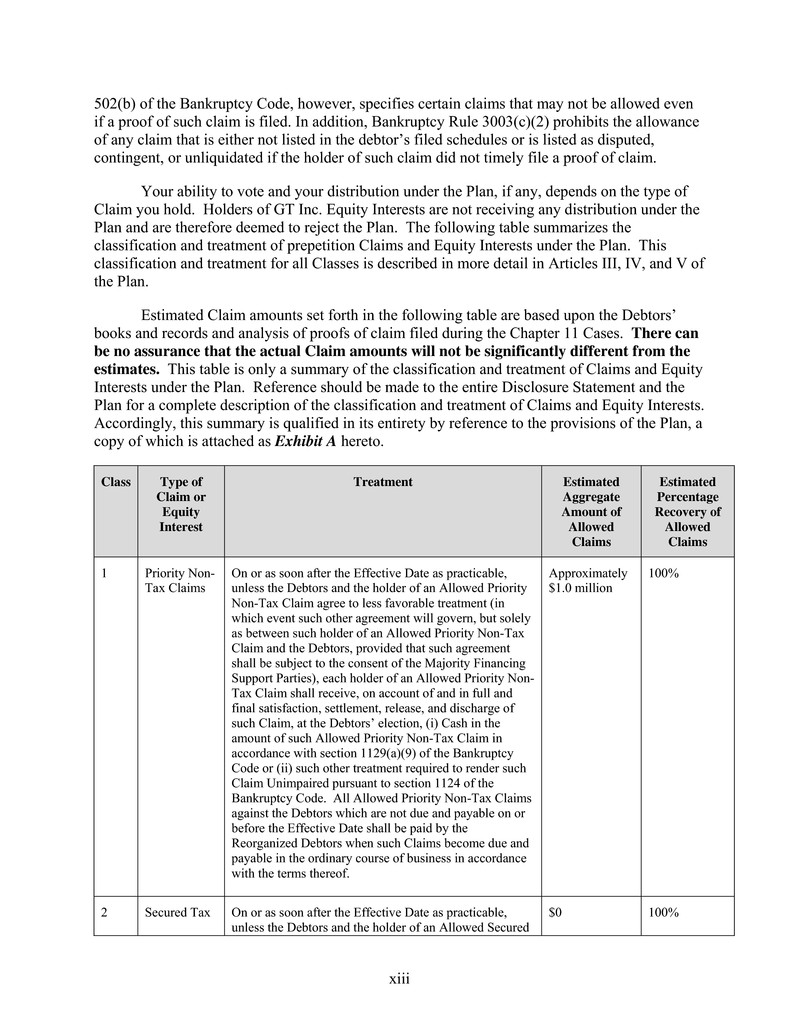

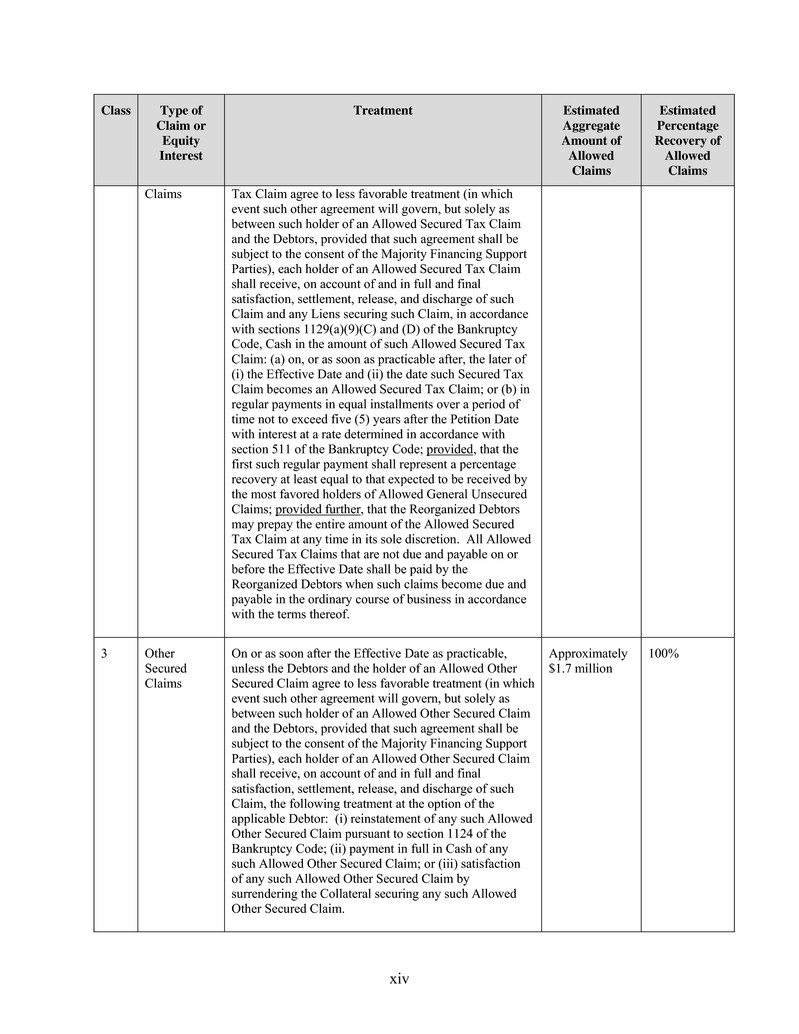

xiv Class Type of Claim or Equity Interest Treatment Estimated Aggregate Amount of Allowed Claims Estimated Percentage Recovery of Allowed Claims Claims Tax Claim agree to less favorable treatment (in which event such other agreement will govern, but solely as between such holder of an Allowed Secured Tax Claim and the Debtors, provided that such agreement shall be subject to the consent of the Majority Financing Support Parties), each holder of an Allowed Secured Tax Claim shall receive, on account of and in full and final satisfaction, settlement, release, and discharge of such Claim and any Liens securing such Claim, in accordance with sections 1129(a)(9)(C) and (D) of the Bankruptcy Code, Cash in the amount of such Allowed Secured Tax Claim: (a) on, or as soon as practicable after, the later of (i) the Effective Date and (ii) the date such Secured Tax Claim becomes an Allowed Secured Tax Claim; or (b) in regular payments in equal installments over a period of time not to exceed five (5) years after the Petition Date with interest at a rate determined in accordance with section 511 of the Bankruptcy Code; provided, that the first such regular payment shall represent a percentage recovery at least equal to that expected to be received by the most favored holders of Allowed General Unsecured Claims; provided further, that the Reorganized Debtors may prepay the entire amount of the Allowed Secured Tax Claim at any time in its sole discretion. All Allowed Secured Tax Claims that are not due and payable on or before the Effective Date shall be paid by the Reorganized Debtors when such claims become due and payable in the ordinary course of business in accordance with the terms thereof. 3 Other Secured Claims On or as soon after the Effective Date as practicable, unless the Debtors and the holder of an Allowed Other Secured Claim agree to less favorable treatment (in which event such other agreement will govern, but solely as between such holder of an Allowed Other Secured Claim and the Debtors, provided that such agreement shall be subject to the consent of the Majority Financing Support Parties), each holder of an Allowed Other Secured Claim shall receive, on account of and in full and final satisfaction, settlement, release, and discharge of such Claim, the following treatment at the option of the applicable Debtor: (i) reinstatement of any such Allowed Other Secured Claim pursuant to section 1124 of the Bankruptcy Code; (ii) payment in full in Cash of any such Allowed Other Secured Claim; or (iii) satisfaction of any such Allowed Other Secured Claim by surrendering the Collateral securing any such Allowed Other Secured Claim. Approximately $1.7 million 100%

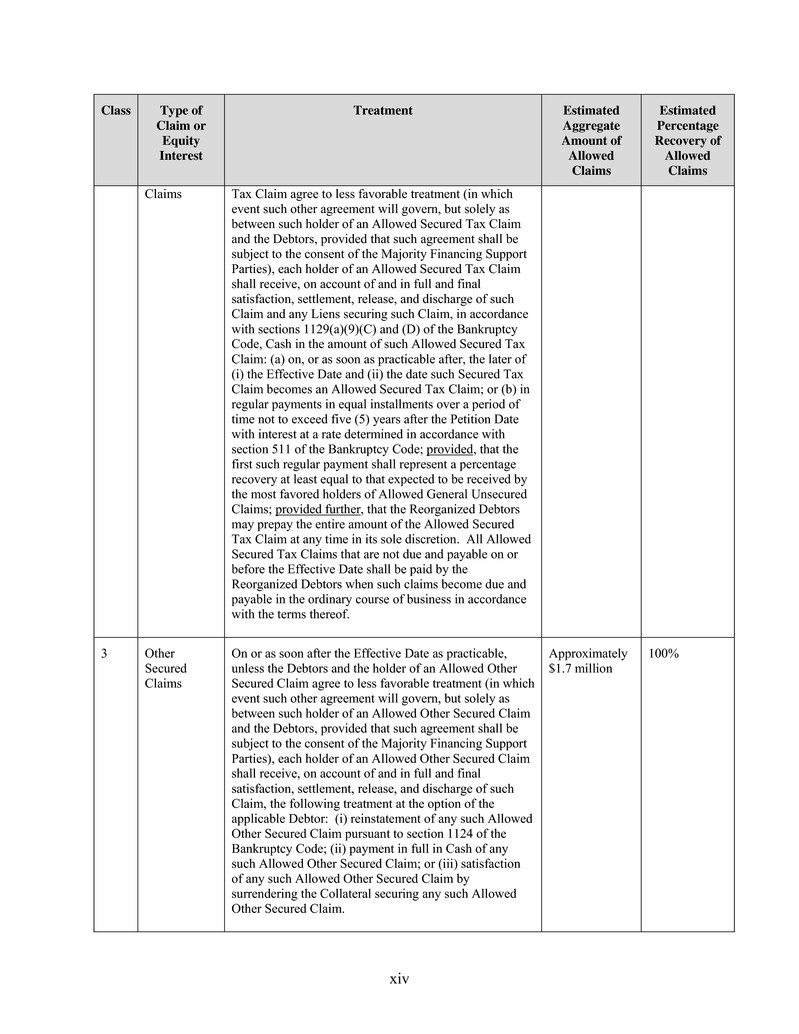

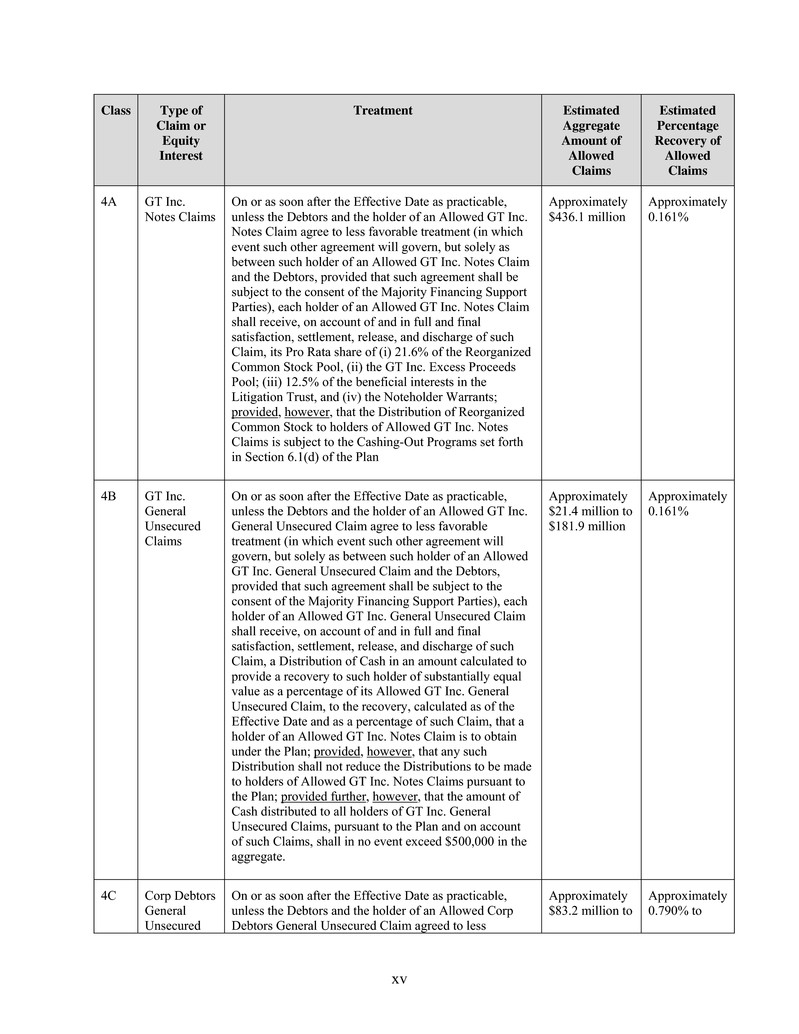

xv Class Type of Claim or Equity Interest Treatment Estimated Aggregate Amount of Allowed Claims Estimated Percentage Recovery of Allowed Claims 4A GT Inc. Notes Claims On or as soon after the Effective Date as practicable, unless the Debtors and the holder of an Allowed GT Inc. Notes Claim agree to less favorable treatment (in which event such other agreement will govern, but solely as between such holder of an Allowed GT Inc. Notes Claim and the Debtors, provided that such agreement shall be subject to the consent of the Majority Financing Support Parties), each holder of an Allowed GT Inc. Notes Claim shall receive, on account of and in full and final satisfaction, settlement, release, and discharge of such Claim, its Pro Rata share of (i) 21.6% of the Reorganized Common Stock Pool, (ii) the GT Inc. Excess Proceeds Pool; (iii) 12.5% of the beneficial interests in the Litigation Trust, and (iv) the Noteholder Warrants; provided, however, that the Distribution of Reorganized Common Stock to holders of Allowed GT Inc. Notes Claims is subject to the Cashing-Out Programs set forth in Section 6.1(d) of the Plan Approximately $436.1 million Approximately 0.161% 4B GT Inc. General Unsecured Claims On or as soon after the Effective Date as practicable, unless the Debtors and the holder of an Allowed GT Inc. General Unsecured Claim agree to less favorable treatment (in which event such other agreement will govern, but solely as between such holder of an Allowed GT Inc. General Unsecured Claim and the Debtors, provided that such agreement shall be subject to the consent of the Majority Financing Support Parties), each holder of an Allowed GT Inc. General Unsecured Claim shall receive, on account of and in full and final satisfaction, settlement, release, and discharge of such Claim, a Distribution of Cash in an amount calculated to provide a recovery to such holder of substantially equal value as a percentage of its Allowed GT Inc. General Unsecured Claim, to the recovery, calculated as of the Effective Date and as a percentage of such Claim, that a holder of an Allowed GT Inc. Notes Claim is to obtain under the Plan; provided, however, that any such Distribution shall not reduce the Distributions to be made to holders of Allowed GT Inc. Notes Claims pursuant to the Plan; provided further, however, that the amount of Cash distributed to all holders of GT Inc. General Unsecured Claims, pursuant to the Plan and on account of such Claims, shall in no event exceed $500,000 in the aggregate. Approximately $21.4 million to $181.9 million Approximately 0.161% 4C Corp Debtors General Unsecured On or as soon after the Effective Date as practicable, unless the Debtors and the holder of an Allowed Corp Debtors General Unsecured Claim agreed to less Approximately $83.2 million to Approximately 0.790% to

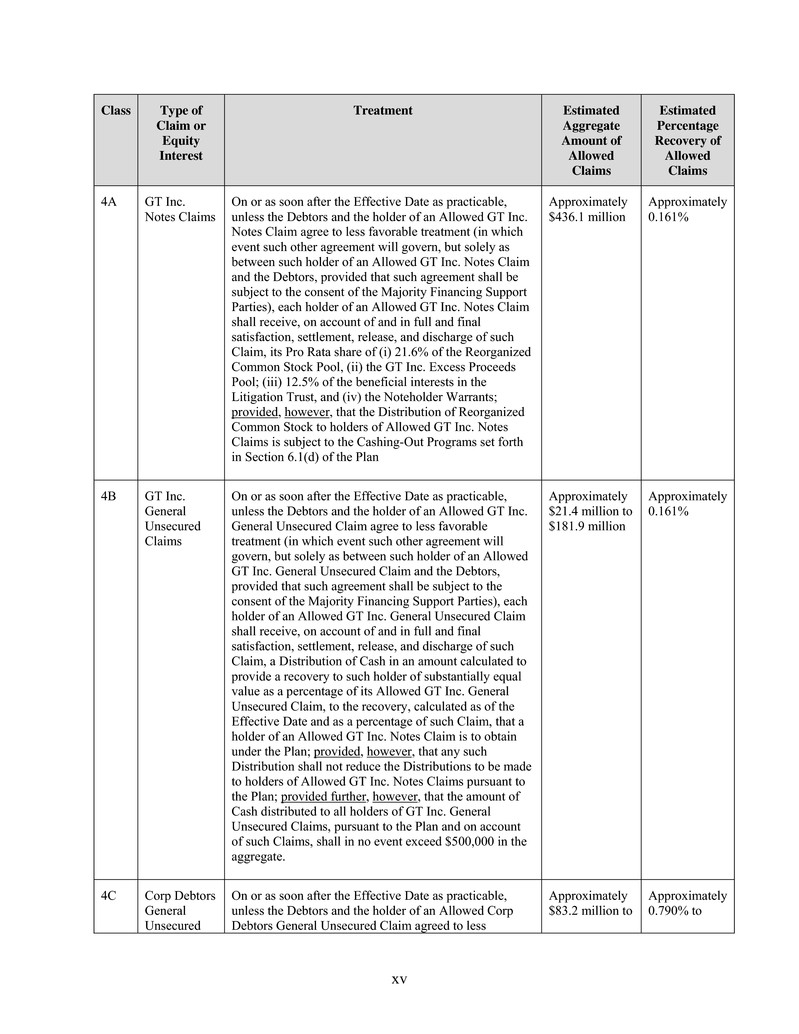

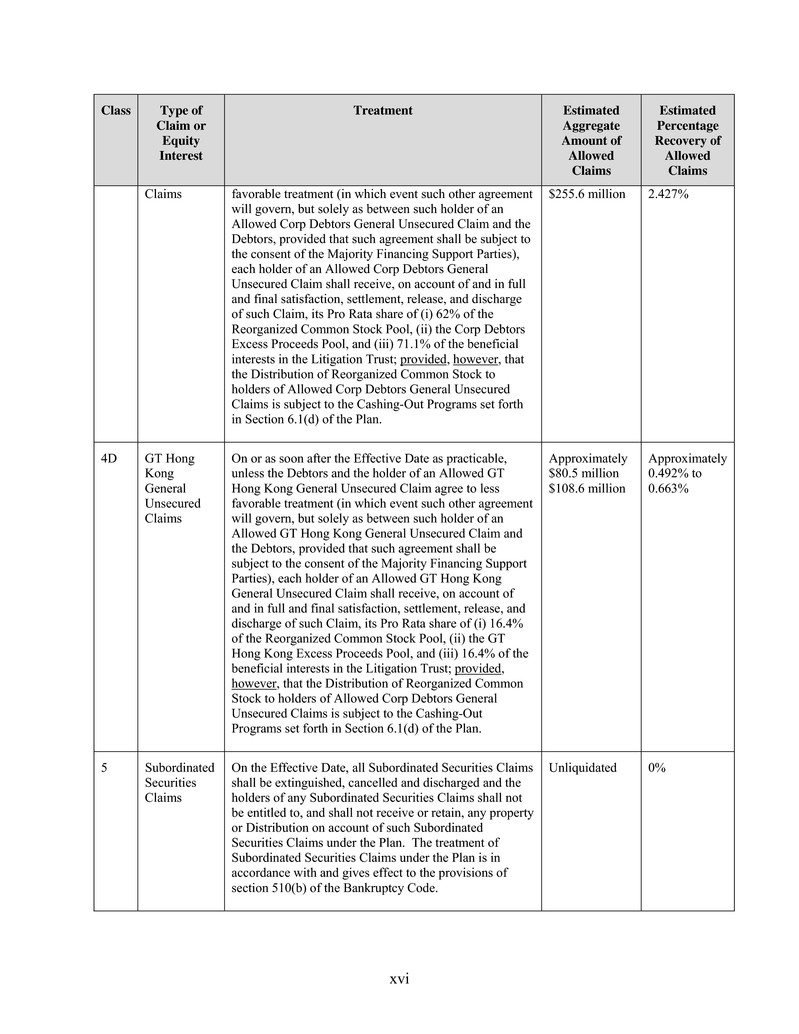

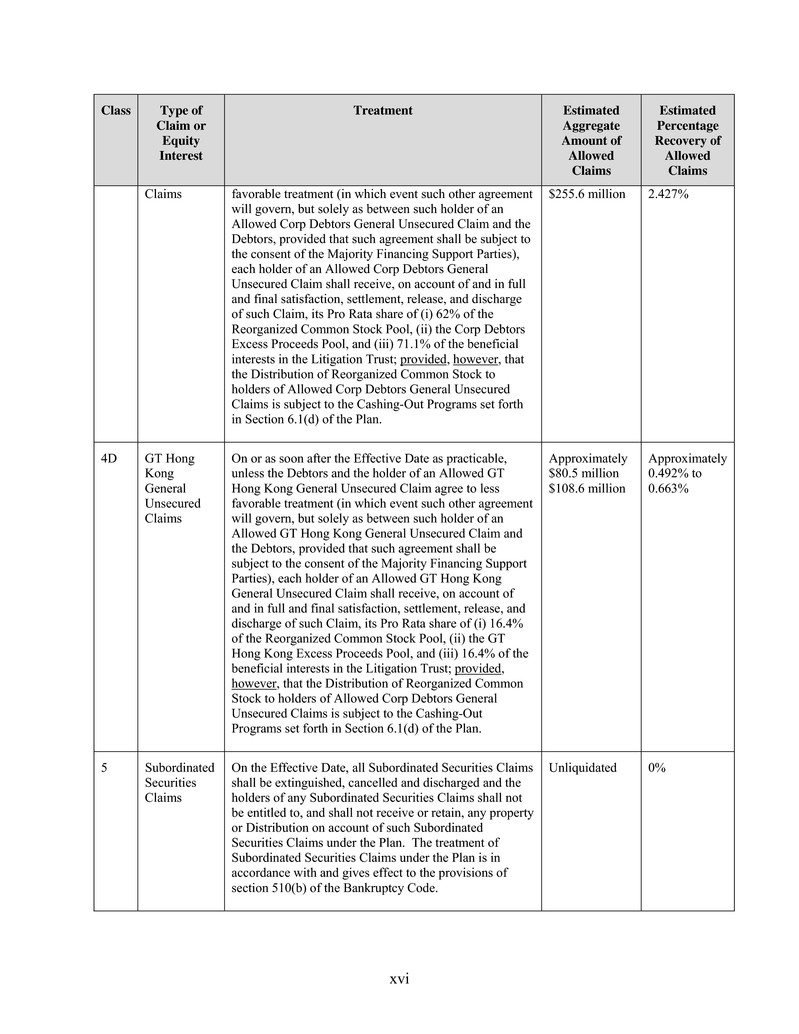

xvi Class Type of Claim or Equity Interest Treatment Estimated Aggregate Amount of Allowed Claims Estimated Percentage Recovery of Allowed Claims Claims favorable treatment (in which event such other agreement will govern, but solely as between such holder of an Allowed Corp Debtors General Unsecured Claim and the Debtors, provided that such agreement shall be subject to the consent of the Majority Financing Support Parties), each holder of an Allowed Corp Debtors General Unsecured Claim shall receive, on account of and in full and final satisfaction, settlement, release, and discharge of such Claim, its Pro Rata share of (i) 62% of the Reorganized Common Stock Pool, (ii) the Corp Debtors Excess Proceeds Pool, and (iii) 71.1% of the beneficial interests in the Litigation Trust; provided, however, that the Distribution of Reorganized Common Stock to holders of Allowed Corp Debtors General Unsecured Claims is subject to the Cashing-Out Programs set forth in Section 6.1(d) of the Plan. $255.6 million 2.427% 4D GT Hong Kong General Unsecured Claims On or as soon after the Effective Date as practicable, unless the Debtors and the holder of an Allowed GT Hong Kong General Unsecured Claim agree to less favorable treatment (in which event such other agreement will govern, but solely as between such holder of an Allowed GT Hong Kong General Unsecured Claim and the Debtors, provided that such agreement shall be subject to the consent of the Majority Financing Support Parties), each holder of an Allowed GT Hong Kong General Unsecured Claim shall receive, on account of and in full and final satisfaction, settlement, release, and discharge of such Claim, its Pro Rata share of (i) 16.4% of the Reorganized Common Stock Pool, (ii) the GT Hong Kong Excess Proceeds Pool, and (iii) 16.4% of the beneficial interests in the Litigation Trust; provided, however, that the Distribution of Reorganized Common Stock to holders of Allowed Corp Debtors General Unsecured Claims is subject to the Cashing-Out Programs set forth in Section 6.1(d) of the Plan. Approximately $80.5 million $108.6 million Approximately 0.492% to 0.663% 5 Subordinated Securities Claims On the Effective Date, all Subordinated Securities Claims shall be extinguished, cancelled and discharged and the holders of any Subordinated Securities Claims shall not be entitled to, and shall not receive or retain, any property or Distribution on account of such Subordinated Securities Claims under the Plan. The treatment of Subordinated Securities Claims under the Plan is in accordance with and gives effect to the provisions of section 510(b) of the Bankruptcy Code. Unliquidated 0%

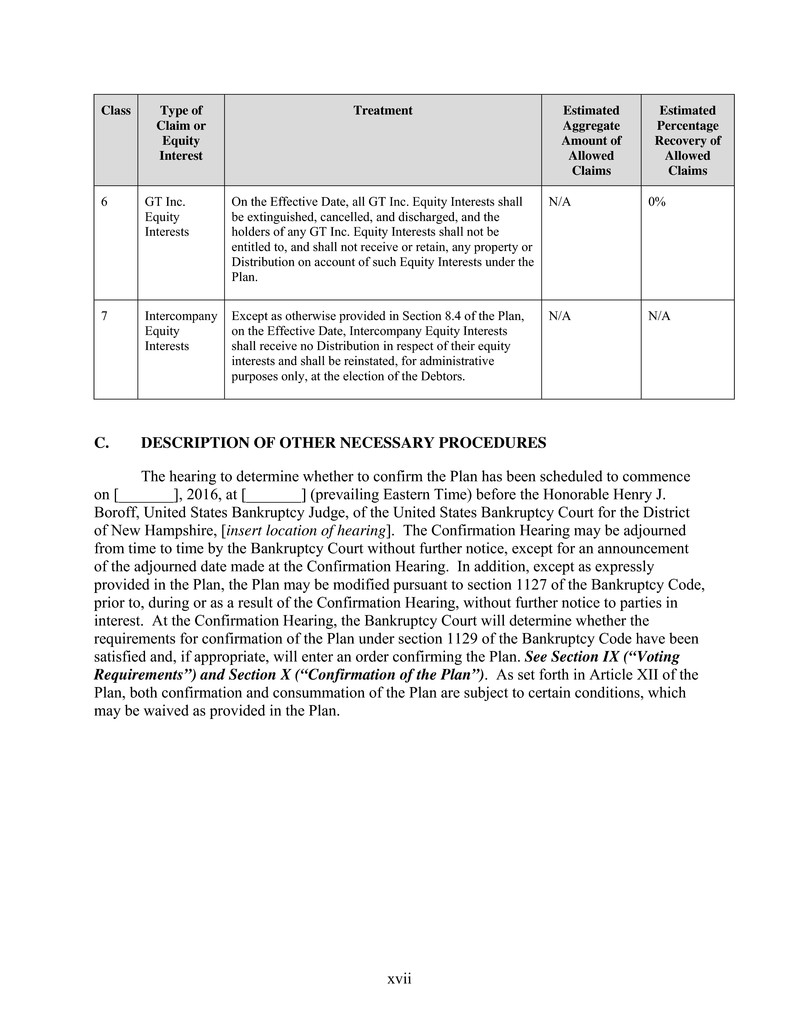

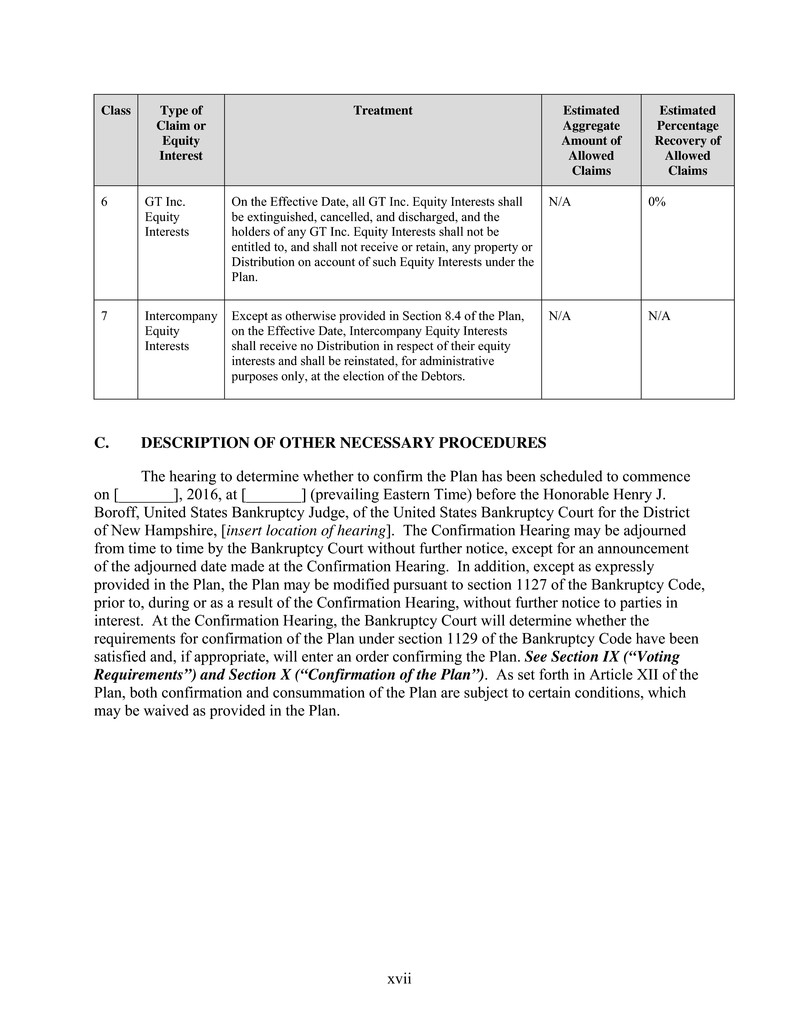

xvii Class Type of Claim or Equity Interest Treatment Estimated Aggregate Amount of Allowed Claims Estimated Percentage Recovery of Allowed Claims 6 GT Inc. Equity Interests On the Effective Date, all GT Inc. Equity Interests shall be extinguished, cancelled, and discharged, and the holders of any GT Inc. Equity Interests shall not be entitled to, and shall not receive or retain, any property or Distribution on account of such Equity Interests under the Plan. N/A 0% 7 Intercompany Equity Interests Except as otherwise provided in Section 8.4 of the Plan, on the Effective Date, Intercompany Equity Interests shall receive no Distribution in respect of their equity interests and shall be reinstated, for administrative purposes only, at the election of the Debtors. N/A N/A C. DESCRIPTION OF OTHER NECESSARY PROCEDURES The hearing to determine whether to confirm the Plan has been scheduled to commence on [_______], 2016, at [_______] (prevailing Eastern Time) before the Honorable Henry J. Boroff, United States Bankruptcy Judge, of the United States Bankruptcy Court for the District of New Hampshire, [insert location of hearing]. The Confirmation Hearing may be adjourned from time to time by the Bankruptcy Court without further notice, except for an announcement of the adjourned date made at the Confirmation Hearing. In addition, except as expressly provided in the Plan, the Plan may be modified pursuant to section 1127 of the Bankruptcy Code, prior to, during or as a result of the Confirmation Hearing, without further notice to parties in interest. At the Confirmation Hearing, the Bankruptcy Court will determine whether the requirements for confirmation of the Plan under section 1129 of the Bankruptcy Code have been satisfied and, if appropriate, will enter an order confirming the Plan. See Section IX (“Voting Requirements”) and Section X (“Confirmation of the Plan”). As set forth in Article XII of the Plan, both confirmation and consummation of the Plan are subject to certain conditions, which may be waived as provided in the Plan.

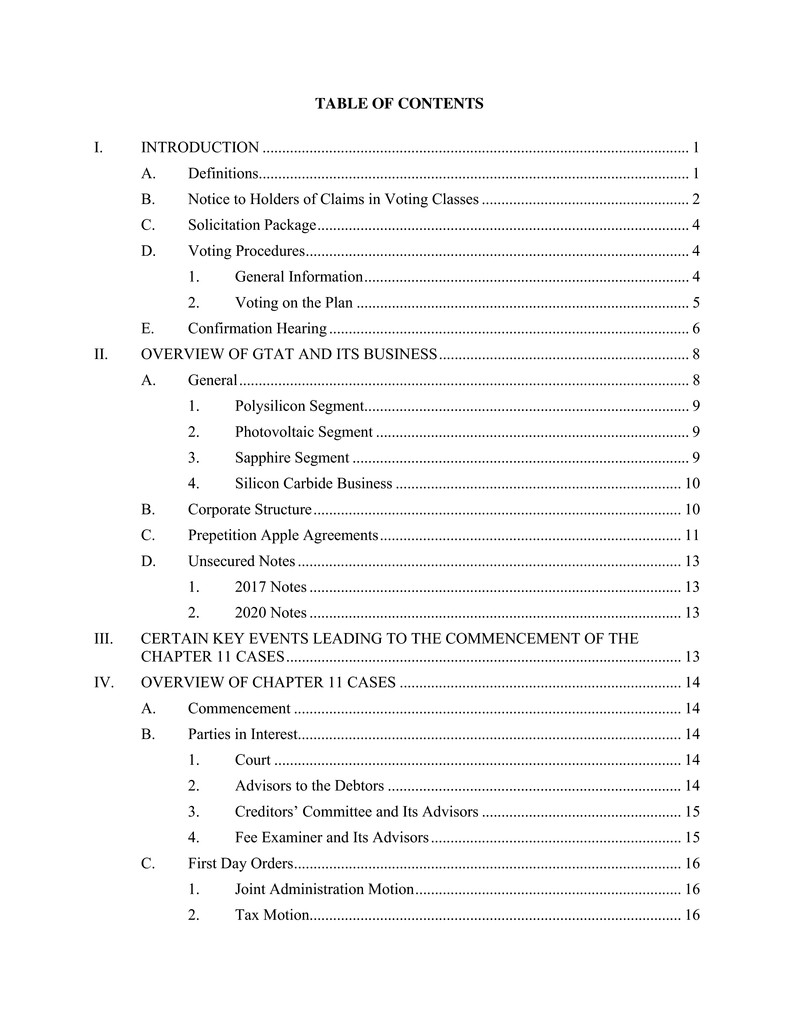

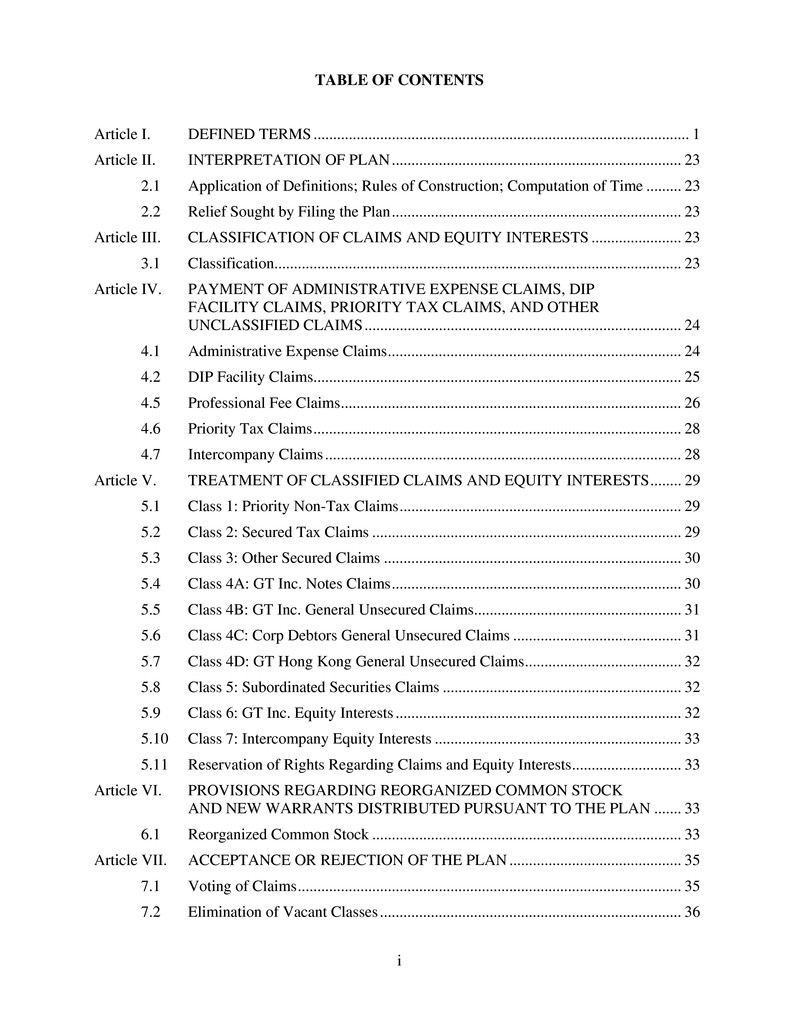

TABLE OF CONTENTS I. INTRODUCTION ............................................................................................................. 1 A. Definitions.............................................................................................................. 1 B. Notice to Holders of Claims in Voting Classes ..................................................... 2 C. Solicitation Package ............................................................................................... 4 D. Voting Procedures .................................................................................................. 4 1. General Information ................................................................................... 4 2. Voting on the Plan ..................................................................................... 5 E. Confirmation Hearing ............................................................................................ 6 II. OVERVIEW OF GTAT AND ITS BUSINESS ................................................................ 8 A. General ................................................................................................................... 8 1. Polysilicon Segment................................................................................... 9 2. Photovoltaic Segment ................................................................................ 9 3. Sapphire Segment ...................................................................................... 9 4. Silicon Carbide Business ......................................................................... 10 B. Corporate Structure .............................................................................................. 10 C. Prepetition Apple Agreements ............................................................................. 11 D. Unsecured Notes .................................................................................................. 13 1. 2017 Notes ............................................................................................... 13 2. 2020 Notes ............................................................................................... 13 III. CERTAIN KEY EVENTS LEADING TO THE COMMENCEMENT OF THE CHAPTER 11 CASES ..................................................................................................... 13 IV. OVERVIEW OF CHAPTER 11 CASES ........................................................................ 14 A. Commencement ................................................................................................... 14 B. Parties in Interest.................................................................................................. 14 1. Court ........................................................................................................ 14 2. Advisors to the Debtors ........................................................................... 14 3. Creditors’ Committee and Its Advisors ................................................... 15 4. Fee Examiner and Its Advisors ................................................................ 15 C. First Day Orders ................................................................................................... 16 1. Joint Administration Motion .................................................................... 16 2. Tax Motion............................................................................................... 16

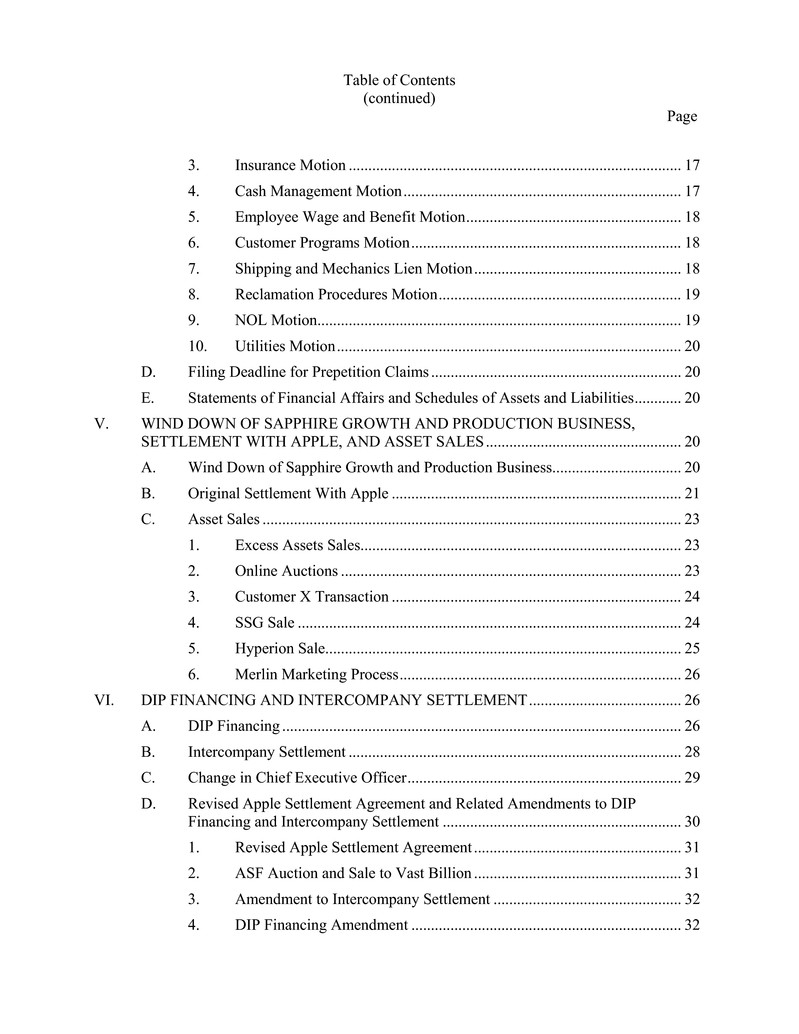

Table of Contents (continued) Page 3. Insurance Motion ..................................................................................... 17 4. Cash Management Motion ....................................................................... 17 5. Employee Wage and Benefit Motion ....................................................... 18 6. Customer Programs Motion ..................................................................... 18 7. Shipping and Mechanics Lien Motion ..................................................... 18 8. Reclamation Procedures Motion .............................................................. 19 9. NOL Motion............................................................................................. 19 10. Utilities Motion ........................................................................................ 20 D. Filing Deadline for Prepetition Claims ................................................................ 20 E. Statements of Financial Affairs and Schedules of Assets and Liabilities ............ 20 V. WIND DOWN OF SAPPHIRE GROWTH AND PRODUCTION BUSINESS, SETTLEMENT WITH APPLE, AND ASSET SALES .................................................. 20 A. Wind Down of Sapphire Growth and Production Business................................. 20 B. Original Settlement With Apple .......................................................................... 21 C. Asset Sales ........................................................................................................... 23 1. Excess Assets Sales.................................................................................. 23 2. Online Auctions ....................................................................................... 23 3. Customer X Transaction .......................................................................... 24 4. SSG Sale .................................................................................................. 24 5. Hyperion Sale ........................................................................................... 25 6. Merlin Marketing Process ........................................................................ 26 VI. DIP FINANCING AND INTERCOMPANY SETTLEMENT ....................................... 26 A. DIP Financing ...................................................................................................... 26 B. Intercompany Settlement ..................................................................................... 28 C. Change in Chief Executive Officer ...................................................................... 29 D. Revised Apple Settlement Agreement and Related Amendments to DIP Financing and Intercompany Settlement ............................................................. 30 1. Revised Apple Settlement Agreement ..................................................... 31 2. ASF Auction and Sale to Vast Billion ..................................................... 31 3. Amendment to Intercompany Settlement ................................................ 32 4. DIP Financing Amendment ..................................................................... 32

Table of Contents (continued) Page E. Exit Financing Commitment ................................................................................ 33 1. Senior Secured Notes ............................................................................... 34 2. Preferred Stock......................................................................................... 35 VII. OTHER DEVELOPMENTS IN THE CHAPTER 11 CASES ........................................ 35 A. SEC Matters ......................................................................................................... 35 1. Regulatory Inquiries ................................................................................. 35 2. Stipulation With SEC Regarding Challenge to Dischargeability ............ 36 B. Litigation with Tera Xtal Technology Corp. ....................................................... 36 1. Undelivered ASF Furnaces ...................................................................... 36 2. TXT’s Motion for Allowance and Payment of Purported Administrative Expense Claims ............................................................... 37 3. Preferential Transfer Litigation Against TXT ......................................... 38 C. Litigation With Manz AG and Manz China Suzhou Ltd. .................................... 38 D. APS Settlement .................................................................................................... 39 E. Meyer Burger Settlement ..................................................................................... 39 F. Stipulations with Expeditors and Kerry Logistics ............................................... 40 1. Stipulation with Expeditors...................................................................... 40 2. Stipulation with Kerry.............................................................................. 40 G. Mesa Fire ............................................................................................................. 41 H. Waaree Transaction ............................................................................................. 42 I. 503(b)(9) Claims Report ...................................................................................... 42 J. Key Employee Incentive Plan and Key Employee Retention Plan ..................... 43 K. Request for Official Committee of Equity Holders ............................................. 44 L. Extensions of Exclusivity .................................................................................... 44 M. Claims Objections ................................................................................................ 44 1. Omnibus Claims Objection Procedures ................................................... 44 2. Expedited Adjudication of Claims ........................................................... 45 3. Administrative Expense Bar Date ............................................................ 45 N. Preferential Transfers ........................................................................................... 46 VIII. SUMMARY OF CHAPTER 11 PLAN ........................................................................... 47

Table of Contents (continued) Page A. Global Settlement................................................................................................. 47 1. Considerations Related to Substantive Consolidation ............................. 47 2. Recharacterization of Intercompany Obligations .................................... 50 B. Overall Structure of the Plan................................................................................ 50 IX. VOTING REQUIREMENTS .......................................................................................... 51 A. Voting Deadline ................................................................................................... 52 B. Holders of Claims Entitled to Vote ...................................................................... 52 C. Vote Required for Acceptance of Class ............................................................... 54 D. Voting Procedures ................................................................................................ 54 1. Ballots ...................................................................................................... 54 2. Withdrawal or Change of Votes on Plan ................................................. 55 3. Voting Multiple Claims ........................................................................... 56 X. CONFIRMATION OF THE PLAN................................................................................. 56 A. Confirmation Hearing .......................................................................................... 56 B. Deadline to Object to Confirmation ..................................................................... 56 C. Requirements for Confirmation of the Plan ......................................................... 57 1. Requirements of Section 1129(a) of Bankruptcy Code ........................... 57 2. Acceptance by Impaired Classes ............................................................. 60 3. Feasibility ................................................................................................. 60 4. Requirements of Section 1129(b) of Bankruptcy Code ........................... 61 XI. ALTERNATIVES TO CONFIRMATION AND CONSUMMATION OF THE PLAN ............................................................................................................................... 62 A. Liquidation Under Chapter 7 ............................................................................... 62 B. Alternative Plan ................................................................................................... 62 C. Dismissal .............................................................................................................. 62 XII. CERTAIN RISK FACTORS TO BE CONSIDERED .................................................... 63 A. General Considerations ........................................................................................ 63 B. Certain Bankruptcy Considerations ..................................................................... 63 1. Failure to Satisfy Vote Requirement........................................................ 63 2. Risk of Non-Confirmation of Plan; Feasibility ........................................ 63

Table of Contents (continued) Page 3. Non-Consensual Confirmation ................................................................ 64 4. The Debtors May Object to the Amount or Classification of a Claim ........................................................................................................ 64 5. Contingencies Not to Affect Votes of Impaired Classes to Accept or Reject the Plan ..................................................................................... 64 6. Risk of Non-Consummation of Plan ........................................................ 64 7. Risk of Chapter 7 Liquidation.................................................................. 65 8. Estimation for Allowed Claims ............................................................... 66 9. Potential Claims Against Non-Debtor GT Guiyang ................................ 66 C. Factors That May Affect the Value of Distributions Under the Plan .................. 66 1. Risks Associated with the Debtors’ Business Operations ....................... 66 2. Certain Risks Relating to the Reorganized Common Stock .................... 76 3. Certain Risks Relating to the Litigation Trust ......................................... 81 D. Inherent Uncertainty of the Financial Projections ............................................... 81 E. Additional Factors That May Affect Distributions to Holder of General Unsecured Claims ................................................................................................ 82 1. Allowance of General Unsecured Claims ................................................ 82 2. Proceeds of Preference Litigation ............................................................ 82 3. Excess Proceeds ....................................................................................... 82 4. Litigation Risks ........................................................................................ 83 F. Disclosure Statement Disclaimer ......................................................................... 83 1. Information Contained Herein is for Soliciting Votes ............................. 83 2. Disclosure Statement Was Not Approved by the Securities and Exchange Commission or any State Regulatory Authority ..................... 83 3. Disclosure Statement May Contain Forward Looking Statements .......... 83 4. No Legal or Tax Advice is Provided to You by this Disclosure Statement.................................................................................................. 84 5. No Admissions Made ............................................................................... 84 6. Failure to Identify Litigation Claims or Projected Objections ................. 84 7. No Waiver of Right to Object or Right to Recover Transfers and Assets ....................................................................................................... 84

Table of Contents (continued) Page 8. Information Was Provided by the Debtors and Was Relied upon by the Debtors’ Advisors and the Creditors’ Committee’s Advisors ........... 84 9. No Representations Outside the Disclosure Statement are Authorized................................................................................................ 85 G. Certain Tax Considerations.................................................................................. 85 XIII. CERTAIN UNITED STATES FEDERAL INCOME TAX CONSEQUENCES OF CONSUMMATION OF THE PLAN .............................................................................. 85 A. General ................................................................................................................. 85 B. U.S. Federal Income Tax Consequences to the U.S. Debtors .............................. 86 1. Cancellation of Debt Income.................................................................... 86 2. Limitation on NOL Carryforwards .......................................................... 87 3. Alternative Minimum Tax ........................................................................ 88 C. U.S. Federal Income Tax Consequences to U.S. Holders of Allowed Claims .................................................................................................................. 88 1. Definition of Securities ............................................................................ 89 2. Tax Treatment of Exchange of Securities for Stock or Securities............ 90 3. Tax Treatment of Other Exchanges ......................................................... 90 4. Reorganized Common Stock ................................................................... 91 5. Noteholder Warrants ................................................................................ 92 D. Certain Other Tax Considerations for U.S. Holders of Allowed Claims ............. 92 1. Medicare Surtax ....................................................................................... 92 2. Accrued but Unpaid Interest .................................................................... 92 3. Post-Effective Date Distributions ............................................................ 93 4. Possible Deductions in Respect of Claims ............................................... 93 5. Market Discount ....................................................................................... 93 6. Information Reporting and Backup Withholding ..................................... 93 E. Certain U.S. Federal Income Tax Consequences of the Plan to Non-U.S. Holders of Allowed Claims Against U.S. Debtors ............................................... 94 1. Tax Treatment of Exchange or Disposition ............................................. 94 2. Interest ..................................................................................................... 95 3. Distributions With Respect to Reorganized Common Stock Paid to Non-U.S. Holders..................................................................................... 96

Table of Contents (continued) Page 4. FATCA .................................................................................................... 97 F. Importance of Obtaining Professional Tax Assistance ........................................ 97 XIV. CONCLUSION ................................................................................................................ 98

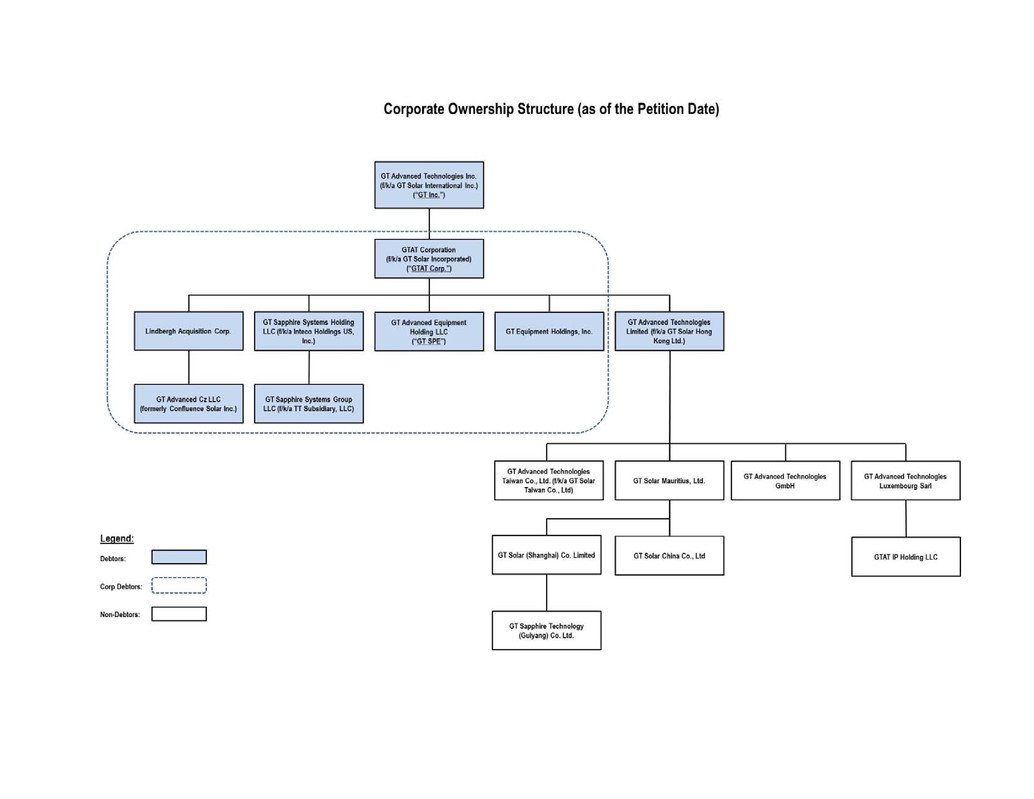

TABLE OF EXHIBITS Exhibit A PLAN OF REORGANIZATION Exhibit B DISCLOSURE STATEMENT ORDER (WITHOUT EXHIBITS) Exhibit C CORPORATE OWNERSHIP STRUCTURE Exhibit D LIQUIDATION ANALYSIS Exhibit E VALUATION ANALYSIS Exhibit F PROJECTIONS Exhibit G MANAGEMENT AGREEMENTS

DISCLOSURE STATEMENT FOR DEBTORS’ JOINT PLAN OF REORGANIZATION UNDER CHAPTER 11 OF THE BANKRUPTCY CODE I. INTRODUCTION The Debtors submit this Disclosure Statement in accordance with section 1125 of the Bankruptcy Code, to holders of Claims against and Equity Interests in the Debtors for use in the solicitation of votes on the Joint Plan of Reorganization of GT Advanced Technologies Inc. and Its Subsidiaries under Chapter 11 of the Bankruptcy Code (the “Plan”), which is attached as Exhibit A to this Disclosure Statement. The Debtors have not filed any other chapter 11 plan in connection with the Chapter 11 Cases. This Disclosure Statement sets forth specific information regarding the Debtors’ pre- bankruptcy history, significant events that have occurred during the Chapter 11 Cases, and the anticipated organizational and capital structure and operations of the Reorganized Debtors after confirmation of the Plan and the Debtors’ emergence from chapter 11. This Disclosure Statement also describes the Plan, alternatives to the Plan, effects of confirmation of the Plan, and certain risk factors regarding the Plan, including risk factors associated with the new equity that will be issued under the Plan. In addition, this Disclosure Statement discusses the confirmation process and the voting procedures that holders of Impaired Claims must follow for their votes to be counted. FOR A SUMMARY OF THE PLAN AND VARIOUS RISKS AND OTHER FACTORS PERTAINING TO THE PLAN AS IT RELATES TO HOLDERS OF CLAIMS, PLEASE SEE SECTION VIII (“SUMMARY OF CHAPTER 11 PLAN”) AND SECTION IX.C (“CERTAIN RISK FACTORS TO BE CONSIDERED”). SECTIONS II THROUGH VI FOLLOWING THIS INTRODUCTION DISCUSS THE BACKGROUND OF THE DEBTORS’ BUSINESSES AND THE CHAPTER 11 CASES. A. Definitions Capitalized terms not otherwise defined in this Disclosure Statement have the meanings ascribed to them in the Plan. A term used but not defined in this Disclosure Statement or the Plan has the meaning given it in the Bankruptcy Code or the Bankruptcy Rules. For purposes herein: (a) in the appropriate context, each term, whether stated in the singular or the plural, will include both the singular and the plural, and pronouns stated in the masculine, feminine or neutral gender will include the masculine, feminine, and the neutral gender; (b) any reference herein to a contract, lease, instrument, release, indenture, or other agreement or document, including the Plan Documents and any document contained in the Plan Supplement, being in a particular form or on particular terms and conditions means that the referenced document will be substantially in that form or substantially on those terms and conditions; (c) any reference herein to an existing document or exhibit having been filed or to be filed will mean that document or exhibit, as it may thereafter be amended, modified, or supplemented; (d) unless otherwise stated, the words “herein,” “hereof,” and “hereto” refer to the Disclosure Statement in its entirety rather than to a particular portion of the Disclosure Statement; (e) captions and headings to sections are inserted for convenience of reference only

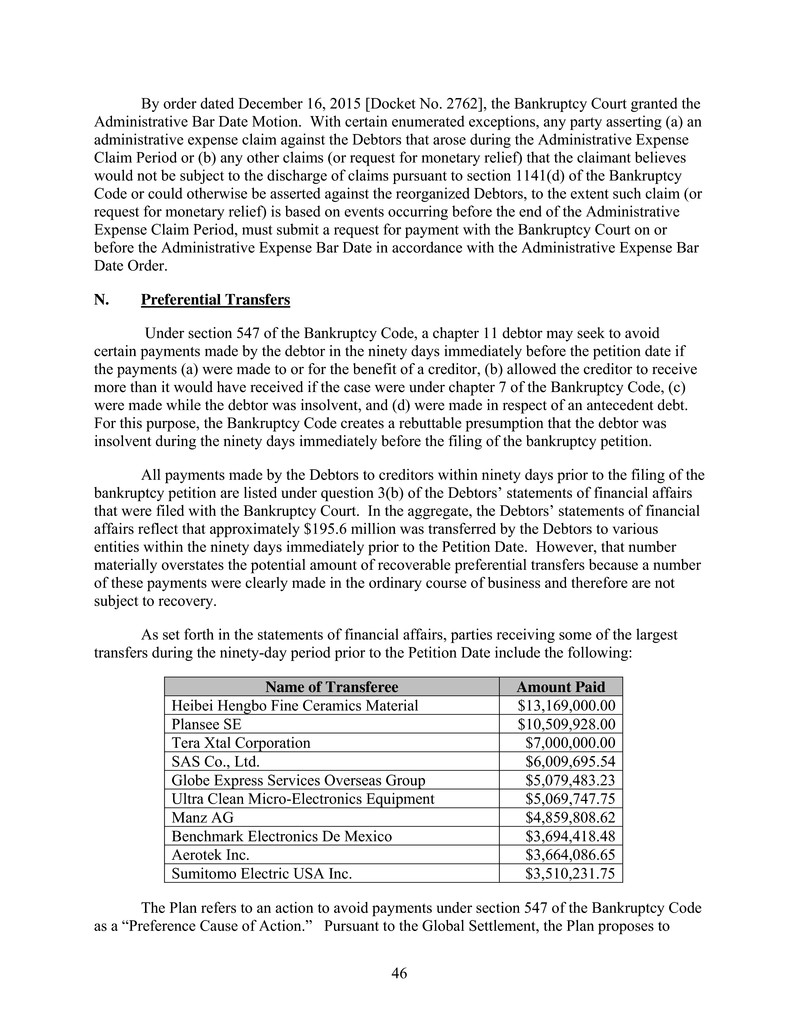

2 and are not intended to be a part of or to affect the interpretation hereof; (f) the rules of construction set forth in section 102 of the Bankruptcy Code will apply; and (g) any term used in capitalized form herein that is not otherwise defined but that is used in the Bankruptcy Code or the Bankruptcy Rules will have the meaning assigned to that term in the Bankruptcy Code or the Bankruptcy Rules, as the case may be. B. Notice to Holders of Claims in Voting Classes This Disclosure Statement is being furnished to holders of Claims in the Voting Classes for the purpose of soliciting their votes on the Plan. This Disclosure Statement is also being furnished to certain other creditors and other entities for notice or informational purposes. The primary purpose of this Disclosure Statement is to provide adequate information to holders of Claims in the Voting Classes to enable such holders to make a reasonably informed decision with respect to the Plan prior to exercising the right to vote to accept or reject the Plan. On [______], 2016, the Bankruptcy Court entered the Disclosure Statement Order approving the Disclosure Statement as containing information of a kind and in sufficient detail to enable holders of Claims in Voting Classes to make an informed judgment about the Plan. THE BANKRUPTCY COURT’S APPROVAL OF THIS DISCLOSURE STATEMENT CONSTITUTES NEITHER A GUARANTEE OF THE ACCURACY OR COMPLETENESS OF THE INFORMATION CONTAINED HEREIN NOR AN ENDORSEMENT OF THE PLAN BY THE BANKRUPTCY COURT. IF THE BANKRUPTCY COURT CONFIRMS THE PLAN, THE PLAN WILL BIND ALL HOLDERS OF CLAIMS AGAINST AND EQUITY INTERESTS IN THE DEBTORS, WHETHER OR NOT THEY ARE ENTITLED TO VOTE OR DID VOTE ON THE PLAN AND WHETHER OR NOT THEY RECEIVE OR RETAIN ANY DISTRIBUTIONS OR PROPERTY UNDER THE PLAN WHEREVER LOCATED. THUS, IN PARTICULAR, ALL HOLDERS OF IMPAIRED CLAIMS AGAINST THE DEBTORS ARE ENCOURAGED TO READ THIS DISCLOSURE STATEMENT AND ITS EXHIBITS CAREFULLY AND IN THEIR ENTIRETY BEFORE VOTING TO ACCEPT OR REJECT THE PLAN. This Disclosure Statement contains important information about the Plan, the Debtors’ businesses and operations, considerations pertinent to acceptance or rejection of the Plan, and developments concerning the Chapter 11 Cases. THIS DISCLOSURE STATEMENT IS THE ONLY DOCUMENT AUTHORIZED BY THE BANKRUPTCY COURT TO BE USED IN CONNECTION WITH THE SOLICITATION OF VOTES ON THE PLAN. No solicitation of votes may be made except pursuant to this Disclosure Statement, and no person has been authorized to use any information concerning the Debtors other than the information contained herein. Other than as explicitly set forth in this Disclosure Statement, you should not rely on any information relating to the Debtors, their Estates, the value of their properties, the nature of their Liabilities, their creditors’ Claims, or the value of any securities or instruments issued under the Plan.