LETTER OF TRANSMITTAL

Relating to

Takeda Pharmaceutical Company Limited

Offer to Exchange

Any and All of the Principal Amount Outstanding of:

$1,250,000,000 of Unregistered 4.000% Senior Notes due 2021

(CUSIP: J8129EAW8 / 874060AN6; ISIN: USJ8129EAW87 / US874060AN65)

$1,500,000,000 of Unregistered 4.400% Senior Notes due 2023

(CUSIP: J8129EAX6 / 874060AR7, ISIN: USJ8129EAX60 / US874060AR79)

$1,750,000,000 of Unregistered 5.000% Senior Notes due 2028

(CUSIP: J8129EAY4 / 874060AU0, ISIN: USJ8129EAY44 / US874060AU09)

for

a Like Principal Amount of

4.000% Senior Notes due 2021

4.400% Senior Notes due 2023

5.000% Senior Notes due 2028

which have been registered under the Securities Act of 1933

Pursuant to the Prospectus Dated [●], 2019

THE EXCHANGE OFFERS WILL EXPIRE AT 5:00 P.M., NEW YORK CITY TIME, ON [●], 2019, UNLESS EITHER EXCHANGE OFFER IS EXTENDED (SUCH DATE AND TIME, AS IT MAY BE EXTENDED, THE “EXPIRATION DATE”). TENDERS MAY BE WITHDRAWN AT OR PRIOR TO 5:00 P.M., NEW YORK CITY TIME, ON THE EXPIRATION DATE.

|

| |

| The Information and Exchange Agent For The Exchange Offers Is: |

| D.F. King |

| |

| By Hand, By Mail or Overnight Delivery: | Facsimile Transmissions: |

| | Eligible Institutions Only |

| D.F. King | +1 (212) 709-3328 |

| as Information and Exchange Agent | Confirmation: (212) 269-5552 attention Andrew Beck |

| | Banks and Brokers Call Collect: |

48 Wall Street

| +1 (212) 269-5550 |

| New York, NY 10005 | |

| | All Others, Please Call Toll-Free: |

| | +1 (866) 751-6315 |

| By E-mail: | |

| takeda@dfkingltd.com | |

Delivery of this Letter of Transmittal to an address, or transmission via facsimile, other than as set forth above will not constitute a valid delivery. The instructions contained herein should be read carefully before this Letter of Transmittal is completed.

HOLDERS WHO WISH TO BE ELIGIBLE TO RECEIVE EXCHANGE NOTES FOR THEIR OUTSTANDING NOTES PURSUANT TO THE EXCHANGE OFFERS MUST VALIDLY TENDER (AND NOT WITHDRAW) THEIR OUTSTANDING NOTES TO THE INFORMATION AND EXCHANGE AGENT AT OR PRIOR TO THE EXPIRATION DATE.

By execution hereof, the undersigned acknowledges receipt of the Prospectus (the “Prospectus”), dated [●], 2019, of Takeda Pharmaceutical Company Limited, a Japanese corporation (the “Company”), which, together with this Letter of Transmittal and the instructions hereto (the “Letter of Transmittal”), constitute the Company’s offer (the “Exchange Offer”) to exchange an aggregate principal amount of up to $1,250,000,000 of their 4.000% Senior Notes due 2021, $1,500,000,000 of their 4.400% Senior Notes due 2023 and $1,750,000,000 of their 5.000% Senior Notes due 2028 (collectively, the “Exchange Notes”) that have been registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), pursuant to a Registration Statement of which the Prospectus constitutes a part, for any and all of the principal amount of its outstanding unregistered $1,250,000,000 4.000% Senior Notes due 2021 (CUSIP: J8129EAW8 / 874060AN6; ISIN: USJ8129EAW87 / US874060AN65), $1,500,000,000 4.400$ Senior Notes due 2023 (CUSIP: J8129EAX6 / 874060AR7, ISIN: USJ8129EAX60 / US874060AR79) and $1,750,000,000 5.000% Notes due 2028 (CUSIP: J8129EAY4 / 874060AU0, ISIN: USJ8129EAY44 / US874060AU09) (collectively, the “Outstanding Notes”), upon the terms and subject to the conditions set forth in the Prospectus. Capitalized terms used but not defined herein shall have the same meaning given to them in the Prospectus.

The Company has agreed that, for a period of 180 days after the Expiration Date, they will make the Prospectus available to any broker-dealer for use in connection with resales.

Each holder of Outstanding Notes wishing to participate in the Exchange Offer, except holders of Outstanding Notes executing their tenders through the Automated Tender Offers Program (“ATOP”) procedures of The Depository Trust Company (“DTC”), should complete, sign and submit this Letter of Transmittal to the Information and Exchange Agent, D.F. King, at or prior to the Expiration Date.

This Letter of Transmittal may be used to participate in the Exchange Offer if Outstanding Notes are to be tendered by effecting a book-entry transfer into the Information and Exchange Agent’s account at DTC and instructions are not being transmitted through ATOP, for which the Exchange Offer is eligible. Unless you intend to tender your Outstanding Notes through ATOP, you should complete, execute and deliver this Letter of Transmittal to indicate the action you desire to take with respect to the Exchange Offer.

Holders of Outstanding Notes tendering by book-entry transfer to the Information and Exchange Agent’s account at DTC may execute tenders through ATOP, for which the Exchange Offer is eligible. Financial institutions that are DTC participants may execute tenders through ATOP by transmitting acceptance of the Exchange Offer to DTC at or prior to the Expiration Date. DTC will verify acceptance of the Exchange Offer, execute a book-entry transfer of the tendered Outstanding Notes into the account of the Information and Exchange Agent at DTC and send to the Information and Exchange Agent a “book-entry confirmation”, which shall include an agent’s message. An “agent’s message” is a message, transmitted by DTC to, and received by, the Information and Exchange Agent and forming part of a book-entry confirmation, which states that DTC has received an express acknowledgement from a DTC participant tendering Outstanding Notes that the participant has received and agrees to be bound by the terms of this Letter of Transmittal as an undersigned hereof and that the Company may enforce such agreement against the participant. Delivery of the agent’s message by DTC will satisfy the terms of the Exchange Offer as to execution and delivery of a Letter of Transmittal by the DTC participant identified in the agent’s message. Accordingly, holders who tender their Outstanding Notes through DTC’s ATOP procedures shall be bound by, but need not complete, this Letter of Transmittal.

If you are a beneficial owner that holds Outstanding Notes through Euroclear or Clearstream Luxembourg and wish to tender your Outstanding Notes, you must instruct Euroclear or Clearstream Luxembourg, as the case may be, to block the account in respect of the tendered Outstanding Notes in accordance with the procedures established by Euroclear or Clearstream Luxembourg. You are encouraged to contact Euroclear or Clearstream Luxembourg directly to ascertain their procedures for tendering Outstanding Notes.

Tendering holders of Outstanding Notes must tender Outstanding Notes in principal amounts equal to the minimum authorized denomination of $200,000 for the respective series of Outstanding Notes and any integral multiple of $1,000 in excess thereof. Exchange Notes will be issued in minimum denominations of $200,000.

Holders that anticipate tendering other than through DTC are urged to contact promptly a bank, broker or other intermediary (that has the capability to hold securities custodially through DTC) to arrange for receipt of Exchange Notes to be delivered pursuant to the Exchange Offer and to obtain the information necessary to provide the required DTC participant with account information in this Letter of Transmittal.

The Company reserve the right, in their sole discretion, to amend, at any time, the terms and conditions of the Exchange Offer, except for the condition that the registration statement of which the Prospectus forms a part is not subject to a stop order or any proceedings for that purpose. We will give you notice of any amendments, if required by applicable law. The term “Expiration Date” shall mean the latest time and date to which the Exchange Offer is extended.

NOTE: SIGNATURES MUST BE PROVIDED BELOW

PLEASE READ THE ACCOMPANYING INSTRUCTIONS CAREFULLY

The undersigned has completed, executed and delivered this Letter of Transmittal to indicate the action the undersigned desires to take with respect to the Exchange Offer.

As set forth in the instructions below, the undersigned hereby represents and warrants that the undersigned is (i) for Japanese tax purposes, neither an individual resident of Japan or a Japanese corporation, nor an individual non-resident of Japan or a non-Japanese corporation that in either case is a person having a special relationship with the Company as described in Article 6, Paragraph (4) of the Act on Special Taxation Measures, and (ii) not a resident in Japan for Japanese securities law purposes (including a natural person having his/her place of domicile or residence in Japan, a legal person having its main office in Japan or any branch, agency or other office in Japan of a non-resident (irrespective of whether it is legally authorized to represent its principal or not and even if its main office is located in a country other than Japan)).

The instructions included with this Letter of Transmittal must be followed. Questions and requests for assistance or for additional copies of the Prospectus or this Letter of Transmittal may be directed to the Information and Exchange Agent.

HOLDERS WHO WISH TO ACCEPT AN EXCHANGE OFFER AND TENDER THEIR OUTSTANDING NOTES MUST COMPLETE THIS LETTER OF TRANSMITTAL IN ITS ENTIRETY. YOU MUST SIGN THIS LETTER OF TRANSMITTAL IN THE APPROPRIATE SPACE PROVIDED, WITH SIGNATURE GUARANTEE IF REQUIRED, AND COMPLETE THE FORM W-9 (OR IRS FORM W-8, AS APPLICABLE), AS SET FORTH BELOW.

TENDER OF OUTSTANDING NOTES

To effect a valid tender of Outstanding Notes through the completion, execution and delivery of this Letter of Transmittal, the undersigned must complete the tables below entitled “Method of Delivery” and “Description of Outstanding Notes” and sign this Letter of Transmittal where indicated.

Exchange Notes will be delivered in book-entry form through DTC and only to the DTC account of the undersigned or the undersigned’s custodian, as specified in the table below entitled “Method of Delivery”.

We have not provided guaranteed delivery procedures in conjunction with the Exchange Offer or under any of the Prospectus or other materials provided therewith.

Failure to provide the information necessary to effect delivery of Exchange Notes will render such holder’s tender defective, and the Company will have the right, which they may waive, to reject such tender without notice.

METHOD OF DELIVERY

¨ CHECK HERE IF TENDERED OUTSTANDING NOTES ARE BEING DELIVERED BY BOOK-ENTRY TRANSFER MADE TO THE ACCOUNT MAINTAINED BY THE INFORMATION AND EXCHANGE AGENT WITH DTC.

PROVIDE BELOW THE NAME OF THE DTC PARTICIPANT AND PARTICIPANT’S ACCOUNT NUMBER IN WHICH THE TENDERED OUTSTANDING NOTES ARE HELD AND/OR THE CORRESPONDING EXCHANGE NOTES ARE TO BE DELIVERED.

Name of Tendering Institution: DTC Book-Entry Account No.: Transaction Code No.:

¨ CHECK HERE IF YOU ARE A BROKER-DEALER WHO ACQUIRED THE OUTSTANDING NOTES FOR ITS OWN ACCOUNT AS A RESULT OF MARKET MAKING OR OTHER TRADING ACTIVITIES (A “PARTICIPATING BROKER-DEALER”) AND WISH TO RECEIVE 10 ADDITIONAL COPIES OF THE PROSPECTUS AND 10 COPIES OF ANY AMENDMENTS OR SUPPLEMENTS THERETO.

Name:

Address:

List below the Outstanding Notes to which this Letter of Transmittal relates. If the space provided below is inadequate, the numbers and principal amount at maturity of Outstanding Notes should be listed on a separate signed schedule affixed hereto.

DESCRIPTION OF OUTSTANDING NOTES

|

| | | | |

DTC Participant Name(s), Number(s) and Address(es) of Holder(s) (Please fill in, if blank) |

Title of Security |

CUSIP Number |

Total Principal Amount Held | Aggregate Principal Amount Tendered (if less than all) * |

| TOTAL PRINCIPAL AMOUNT OF OUTSTANDING NOTES TENDERED | | | | |

* Unless otherwise indicated in this column, a holder will be deemed to have tendered ALL of their Outstanding Notes. The principal amount of Outstanding Notes tendered hereby must be equal to the minimum authorized denomination of $200,000 for the respective series of Outstanding Notes and integral multiples of $1,000 thereafter. See Instruction 3.

Note: Signatures must be provided below.

PLEASE READ THE ACCOMPANYING INSTRUCTIONS CAREFULLY

Ladies and Gentlemen:

Upon the terms and subject to the conditions of the Exchange Offer, the undersigned hereby tenders to the Company the aggregate principal amount of the Outstanding Notes indicated above. Subject to, and effective upon, the acceptance for exchange of the Outstanding Notes tendered hereby, the undersigned hereby sells, assigns and transfers to, or upon the order of, the Company, all right, title and interest in and to such Outstanding Notes as are being tendered hereby upon the terms and subject to the conditions set forth in the Prospectus dated [●], 2019 (as the same may be amended or supplemented from time to time, the “Prospectus”), receipt of which is acknowledged, and in this Letter of Transmittal. The undersigned hereby irrevocably constitutes and appoints the Information and Exchange Agent its agent and attorney-in-fact with respect to the tendered Outstanding Notes with full power of substitution to (1) transfer ownership of such Outstanding Notes on the account books maintained by DTC with all accompanying evidences of transfer and authenticity to, or upon the order of, the Company and (2) present such Outstanding Notes for transfer on the books of the Company and receive all benefits and otherwise exercise all rights of beneficial ownership of such Outstanding Notes, all in accordance with the terms of the Exchange Offer. The power of attorney granted in this paragraph shall be deemed irrevocable and coupled with an interest.

The undersigned hereby represents and warrants that the undersigned has full power and authority to tender, sell, assign and transfer the Outstanding Notes tendered hereby and that the Company will acquire good and unencumbered title thereto, free and clear of all liens, restrictions, charges and encumbrances and not subject to any adverse claim when the same are accepted by the Company. The undersigned hereby further represents that it is not an “affiliate”, as defined in Rule 405 under the U.S. Securities Act of 1933, as amended (the “Securities Act”), of the Company, that any Exchange Notes to be received by it will be acquired in the ordinary course of business and that at the time of commencement of the Exchange Offer it had no arrangement with any person to participate in a distribution of the Exchange Notes.

In addition, if the undersigned is a broker-dealer, the undersigned represents that it is not engaged in, and does not intend to engage in, a distribution of the Exchange Notes. If the undersigned is a broker-dealer that will receive Exchange Notes for its own account in exchange for Outstanding Notes, it represents that the Outstanding Notes to be exchanged for Exchange Notes were acquired by it as a result of market-making activities or other trading activities and acknowledges that it will deliver a prospectus in connection with any resale of such Exchange Notes; however, by so acknowledging and by delivering a prospectus, the undersigned will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act.

The Company has agreed that, subject to the provisions of the Registration Rights Agreement, dated as of November 19, 2018, the Prospectus, as it may be amended or supplemented from time to time, may be used by a participating broker-dealer (as defined below) in connection with resales of Exchange Notes received in exchange for Outstanding Notes, where such Outstanding Notes were acquired by such participating broker-dealer for its own account as a result of market-making activities or other trading activities, for a period ending 90-days after the Expiration Date or, if earlier, when all such Exchange Notes have been disposed of by such participating broker-dealer. In that regard, each broker-dealer who acquired Outstanding Notes for its own account as a result of market-making or other trading activities (a “participating broker-dealer”), by tendering such Outstanding Notes and executing this Letter of Transmittal, agrees that, upon receipt of notice from the Company of the occurrence of any event or the discovery of any fact which makes any statement contained or incorporated by reference in the Prospectus untrue in any material respect or which causes the Prospectus to omit to state a material fact necessary in order to make the statements contained or incorporated by reference therein, in light of the circumstances under which they were made, not misleading, or of the occurrence of certain other events specified in the Registration Rights Agreement, such participating broker-dealer will suspend the sale of Exchange Notes pursuant to the Prospectus until the Company has amended or supplemented the Prospectus to correct such misstatement or omission and has furnished copies of the amended or supplemented Prospectus to the participating broker-dealer or the Company has given notice that the sale of the Exchange Notes may be resumed, as the case may be. If the Company gives such notice to suspend the sale of the Exchange Notes, it shall extend the 90-day period referred to above during which participating broker-dealers are entitled to use the Prospectus in connection with the resale of Exchange Notes by the number of days during the period from and including the date of the giving of such notice to and including the date when participating broker-dealers shall have received copies of the supplemented or amended Prospectus necessary to permit resales of the Exchange Notes or to and including the date on which the Company has given notice that the sale of Exchange Notes may be resumed, as the case may be.

The undersigned additionally hereby represents and warrants that the undersigned is (i) for Japanese tax purposes, neither an individual resident of Japan or a Japanese corporation, nor an individual non-resident of Japan or a non-Japanese corporation that in either case is a person having a special relationship with the Company as described in Article 6, Paragraph (4) of the Act on Special Taxation Measures, and (ii) not a resident in Japan for Japanese securities law purposes (including a natural person having his/her place of domicile or residence in Japan, a legal person having its main office in Japan or any branch, agency or other office in Japan of a non-resident (irrespective of whether it is legally authorized to represent its principal or not and even if its main office is located in a country other than Japan)).

The undersigned also acknowledges that the Exchange Offer is being made by the Company based upon the Company’s understanding of an interpretation by the staff of the Securities and Exchange Commission (the “Commission”) as set forth in no-action letters issued to third parties, that the Exchange Notes issued in exchange for the Outstanding Notes pursuant to the Exchange Offer may be offered for resale, resold and otherwise transferred by holders thereof, without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that: (1) such holders are not affiliates of the Company within the meaning of Rule 405 under the Securities Act; (2) such Exchange Notes are acquired in the ordinary course of such holders’ business; (3) such holders are not engaged in, and do not intend to engage in, a distribution of such Exchange Notes and have no arrangement or understanding with any person to participate in the distribution of such Exchange Notes and (4) such holders are not broker-dealers tendering Outstanding Notes that have been acquired from the Company for their own account. However, the staff of the Commission has not considered the Exchange Offer in the context of a no-action letter, and there can be no assurance that the staff of the Commission would make a similar determination with respect to the Exchange Offer as in other circumstances. If a holder of Outstanding Notes is an affiliate of the Company, acquires the Exchange Notes other than in the ordinary course of such holder’s business or is engaged in or intends to engage in a distribution of the Exchange Notes or has any arrangement or understanding with respect to the distribution of the Exchange Notes to be acquired pursuant to the Exchange Offer, such holder could not rely on the applicable interpretations of the staff of the Commission and must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any secondary resale transaction.

The undersigned will, upon request, execute and deliver any additional documents deemed by the Company to be necessary or desirable to complete the sale, assignment and transfer of the Outstanding Notes tendered hereby. All authority conferred or agreed to be conferred in this Letter of Transmittal and every obligation of the undersigned hereunder shall be binding upon the successors, assigns, heirs, executors, administrators, trustees in bankruptcy and legal representatives of the undersigned and shall not be affected by, and shall survive, the death or incapacity of the undersigned. This tender may be withdrawn only in accordance with the procedures set forth in “The Exchange Offer — Withdrawal of Tenders” section of the Prospectus.

For purposes of the Exchange Offer, the Company shall be deemed to have accepted validly tendered Outstanding Notes when and if the Company has given oral or written notice thereof to the Information and Exchange Agent.

Unless otherwise indicated under “Special Issuance Instructions”, the undersigned hereby requests that the Information and Exchange Agent credit the DTC account specified in the table entitled “Description of Outstanding Notes”, for any book-entry transfers of Outstanding Notes not accepted for exchange. If the “Special Issuance Instructions” are completed, the undersigned hereby requests that the Information and Exchange Agent credit the DTC account indicated therein for any book-entry transfers of Outstanding Notes not accepted for exchange, in the name of the person or account indicated under “Special Issuance Instructions”. The undersigned recognizes that the Company has no obligation pursuant to the “Special Issuance Instructions” to transfer any Outstanding Notes from the name of the registered holder(s) thereof if the Company does not accept for exchange any of the Outstanding Notes so tendered.

THE UNDERSIGNED, BY COMPLETING THE BOX ENTITLED “DESCRIPTION OF OUTSTANDING NOTES” ABOVE AND SIGNING THIS LETTER OF TRANSMITTAL, WILL BE DEEMED TO HAVE TENDERED THE OUTSTANDING NOTES AS SET FORTH IN SUCH BOX ABOVE.

SPECIAL ISSUANCE INSTRUCTIONS (SEE INSTRUCTIONS 2, 4 AND 5)

To be completed ONLY if Outstanding Notes tendered by book-entry transfer that are not accepted for exchange are to be returned by credit to an account maintained at DTC other than the account indicated above.

□ Credit any unexchanged Outstanding Notes delivered by book-entry transfer to DTC account number set forth below:

DTC Account

Number: Name: (PLEASE PRINT OR TYPE)

Address:

(INCLUDE ZIP CODE)

Tax Identification or Social Security No:

IMPORTANT: This Letter of Transmittal or a facsimile hereof or an agent’s message in lieu thereof (together with a book-entry confirmation and all other required documents) must be received by the Information and Exchange Agent at or prior to 5:00 p.m. New York City time, on the Expiration Date.

PLEASE READ THIS ENTIRE LETTER OF TRANSMITTAL

CAREFULLY BEFORE COMPLETING ANY BOX ABOVE.

IN ORDER TO VALIDLY TENDER OUTSTANDING NOTES FOR EXCHANGE, HOLDERS OF OUTSTANDING NOTES MUST COMPLETE, EXECUTE, AND DELIVER THE LETTER OF TRANSMITTAL OR A PROPERLY TRANSMITTED AGENT’S MESSAGE.

PLEASE SIGN HERE

(To be Completed By All Tendering Holders of Outstanding Notes, Other Than Holders Effecting Delivery Through ATOP)

By completing, executing and delivering this Letter of Transmittal, the undersigned hereby tenders to the Company the principal amount of the Outstanding Notes listed in the table entitled “Description of Outstanding Notes”.

This Letter of Transmittal must be signed by the holder(s) of Outstanding Notes exactly as such participant’s name appears on a security position listing as the owner of Outstanding Notes, or by person(s) authorized to become registered Holder(s) by endorsements and documents transmitted with this Letter of Transmittal. If signature is by a trustee, executor, administrator, guardian, attorney-in-fact, officer or other person acting in a fiduciary or representative capacity, such person must set forth his or her full title below under “Capacity” and submit evidence satisfactory to the Company of such person’s authority to so act. See Instruction 4 herein.

IF THE SIGNATURE APPEARING BELOW IS NOT OF THE REGISTERED HOLDER(S) OF THE OUTSTANDING NOTES, THEN THE REGISTERED HOLDER(S) MUST SIGN A VALID PROXY, WHICH SIGNATURE MUST BE GUARANTEED BY AN ELIGIBLE INSTITUTION. THE PROXY MUST ACCOMPANY THIS LETTER OF TRANSMITTAL.

Signature(s) of Holder(s) or Authorized Signatory

|

| | | | | |

| Name(s): | | | Address | |

| | (Please Print) | | | | (Including Zip Code) |

| Capacity (full title) | | | Area Code and Telephone No. | |

SIGNATURE GUARANTEE

(Certain Signatures Must Be Guaranteed by an Eligible Institution - See Instruction 4 herein)

(Name of Eligible Institution Guaranteeing Signatures)

Address (including zip code)

Telephone Number (including area code) of Firm)

Authorized Signature

Printed Name

Title

Dated ......................................

INSTRUCTIONS

Forming Part of the Terms and Conditions of the Exchange Offer

| |

| 1. | Delivery of this Letter of Transmittal. |

This Letter of Transmittal is to be completed by holders if tenders of Outstanding Notes are to be made by book-entry transfer to the Information and Exchange Agent’s account at DTC and instructions are not being transmitted through ATOP.

Confirmation of a book-entry transfer into the Information and Exchange Agent’s account at DTC of all Outstanding Notes delivered electronically, as well as a properly completed and duly executed Letter of Transmittal (or a manually signed facsimile thereof) or properly transmitted agent’s message, and any other documents required by this Letter of Transmittal, must be received by the Information and Exchange Agent at its address set forth herein before the Expiration Date of the Exchange Offer.

Any financial institution that is a participant in DTC may electronically transmit its acceptance of the Exchange Offer by causing DTC to transfer Outstanding Notes to the Information and Exchange Agent in accordance with DTC’s ATOP procedures for such transfer at or prior to the Expiration Date of the Exchange Offer. The Information and Exchange Agent will make available its general participant account at DTC for the Outstanding Notes for purposes of the Exchange Offer.

Delivery of a Letter of Transmittal to DTC will not constitute valid delivery to the Information and Exchange Agent. No Letter of Transmittal should be sent to the Company or DTC.

The method of delivery of this Letter of Transmittal and all other required documents, including delivery through DTC and any acceptance or agent’s message delivered through ATOP, is at the option and risk of the tendering holder. Delivery is not complete until the required items are actually received by the Information and Exchange Agent. If you mail these items, we recommend that you (1) use registered mail properly insured with return receipt requested and (2) mail the required items in sufficient time to ensure timely delivery.

Any beneficial owner whose Outstanding Notes are held by or in the name of a custodial entity such as a broker, dealer, commercial bank, trust company or other nominee should be aware that such custodial entity may have deadlines earlier than the Expiration Date for such custodial entity to be advised of the action that the beneficial owner may wish for the custodial entity to take with respect to the beneficial owner’s Outstanding Notes. Accordingly, such beneficial owners are urged to contact any custodial entities through which such Outstanding Notes are held as soon as possible in order to learn of the applicable deadlines of such entities.

Neither the Company nor the Information and Exchange Agent are under any obligation to notify any tendering holder of the Company’s acceptance of tendered Outstanding Notes at or prior to the expiration of the Exchange Offer.

| |

| 2. | Delivery of Exchange Notes. |

Exchange Notes will be delivered only in book-entry form through DTC and only to the DTC account of the tendering holder or the tendering holder’s custodian. Accordingly, the appropriate DTC participant name and number (along with any other required account information) to permit such delivery must be provided in the table entitled “Description of Outstanding Notes”. Failure to do so will render a tender of Outstanding Notes defective and the Company will have the right, which it may waive, to reject such tender. Holders who anticipate tendering by a method other than through DTC are urged to promptly contact a bank, broker or other intermediary (that has the facility to hold securities custodially through DTC) to arrange for receipt of any Exchange Notes delivered pursuant to the Exchange Offer and to obtain the information necessary to complete the table.

Outstanding Notes may be tendered and accepted for payment only in principal amounts equal to the minimum authorized denomination of $200,000 for the respective series of Outstanding Notes and integral multiples of $1,000 thereafter. No alternative, conditional or contingent tenders will be accepted. Holders who tender less than all of their Outstanding Notes must continue to hold Outstanding Notes in the minimum authorized denomination of $1,000 principal amount.

| |

| 4. | Signatures on this Letter of Transmittal; Instruments of Transfer; Guarantee of Signatures. |

For purposes of this Letter of Transmittal, the term “registered holder” means an owner of record as well as any DTC participant that has Outstanding Notes credited to its DTC account. Except as otherwise provided below, all signatures on this Letter of Transmittal must be guaranteed by a recognized participant in the Securities Transfer Agents Medallion Program, the NYSE Medallion Signature Program or the Stock Exchange Medallion Program (each, a “Medallion Signature Guarantor”). Signatures on this Letter of Transmittal need not be guaranteed if:

| |

| • | this Letter of Transmittal is signed by a participant in DTC whose name appears on a security position listing of DTC as the owner of the Outstanding Notes and the holder(s) has/have not completed the box entitled “Special Issuance Instructions” on this Letter of Transmittal; or |

| |

| • | the Outstanding Notes are tendered for the account of an eligible institution. |

An eligible institution is one of the following firms or other entities identified in Rule 17Ad–15 under the Securities Exchange Act of 1934, as amended (as the terms are defined in such Rule):

| |

| • | a broker, dealer, municipal securities dealer, municipal securities broker, government securities dealer or government securities broker; |

| |

| • | a national securities exchange, registered securities association or clearing agency; or |

| |

| • | a savings institution that is a participant in a Securities Transfer Association recognized program. |

If Outstanding Notes are registered in the name of a person other than the signer of this Letter of Transmittal or if Outstanding Notes not accepted for exchange are to be returned to a person other than the registered holder, then the signatures on this Letter of Transmittal accompanying the tendered Outstanding Notes must be guaranteed by a Medallion Signature Guarantor as described above.

If any of the Outstanding Notes tendered are held by two or more registered holders, all of the registered holders must sign this Letter of Transmittal.

If a number of Outstanding Notes registered in different names are tendered, it will be necessary to complete, sign and submit as many separate copies of this Letter of Transmittal as there are different registrations of such Outstanding Notes.

If this Letter of Transmittal is signed by the registered holder or holders of the Outstanding Notes (which term, for the purposes described herein, shall include a participant in DTC whose name appears on a security listing as the owner of the Outstanding Notes) listed and tendered hereby, no endorsements of the tendered Outstanding Notes or separate written instruments of transfer or exchange are required. In any other case, if tendering Outstanding Notes, the registered holder (or acting holder) must either validly endorse the Outstanding Notes or transmit validly completed bond powers with this Letter of Transmittal (in either case executed exactly as the name(s) of the registered holder(s) appear(s) on the Outstanding Notes, and, with respect to a participant in DTC whose name appears on a security position listing as the owner of Outstanding Notes, exactly as the name of such participant appears on such security position listing), with the signature on the Outstanding Notes or bond power guaranteed by a Medallion Signature Guarantor (except where the Outstanding Notes are tendered for the account of an eligible institution).

If Outstanding Notes are to be tendered by any person other than the person in whose name the Outstanding Notes are registered, the Outstanding Notes must be endorsed or accompanied by an appropriate written instrument(s) of transfer executed exactly as the name(s) of the holder(s) appear on the Outstanding Notes, with the signature(s) on the Outstanding Notes or instrument(s) of transfer guaranteed by a Medallion Signature Guarantor, and this Letter of Transmittal must be executed and delivered either by the holder(s), or by the tendering person pursuant to a valid proxy signed by the holder(s), which signature must, in either case, be guaranteed by a Medallion Signature Guarantor.

The Company will not accept any alternative, conditional, irregular or contingent tenders. By executing this Letter of Transmittal (or a facsimile thereof) or directing DTC to transmit an agent’s message, you waive any right to receive any notice of the acceptance of your Outstanding Notes for exchange.

If this Letter of Transmittal or instruments of transfer are signed by trustees, executors, administrators, guardians or attorneys–in–fact, officers of corporations or others acting in a fiduciary or representative capacity, such persons should so indicate when signing and, unless waived by the Company, evidence satisfactory to the Company of their authority so to act must be submitted with this Letter of Transmittal.

Beneficial owners whose tendered Outstanding Notes are registered in the name of a broker, dealer, commercial bank, trust company or other nominee must contact such broker, dealer, commercial bank, trust company or other nominee if such beneficial owners desire to tender such Outstanding Notes.

| |

| 5. | Special Issuance Instructions. |

Holders tendering Outstanding Notes by book-entry transfer may request that Outstanding Notes not exchanged be credited to such account maintained at DTC as such note holder may designate hereon. Tendering Holders of Outstanding Notes should indicate in the box entitled “Special Issuance Instructions”, the DTC participant name and number, if different from the name or address or the DTC participant name and number, as the case may be, of the person signing this Letter of Transmittal. In the case of issuance in a different name, the employer identification or social security number of the person named also must be indicated. If no such instructions are given, such Outstanding Notes not exchanged will be returned to the name and address or the account maintained at DTC, as the case may be, of the person signing this Letter of Transmittal.

Holders who tender their Outstanding Notes for exchange will not be obligated to pay any transfer taxes in connection therewith. If, however, Exchange Notes are to be delivered to, or are to be issued in the name of, any person other than the registered holder of the Outstanding Notes tendered hereby, or if tendered Outstanding Notes are registered in the name of any person other than the person signing this Letter, or if a transfer tax is imposed for any reason other than the exchange of Outstanding Notes in connection with the Exchange Offer, the amount of any such transfer taxes (whether imposed on the registered holder or any other persons) will be payable by the tendering holder. If satisfactory evidence of payment of such taxes or exemption therefrom is not submitted herewith, the amount of such transfer taxes will be billed directly to such tendering holder.

Except as provided in this Instruction 6, it will not be necessary for transfer tax stamps to be affixed to the Outstanding Notes specified in this Letter of Transmittal.

| |

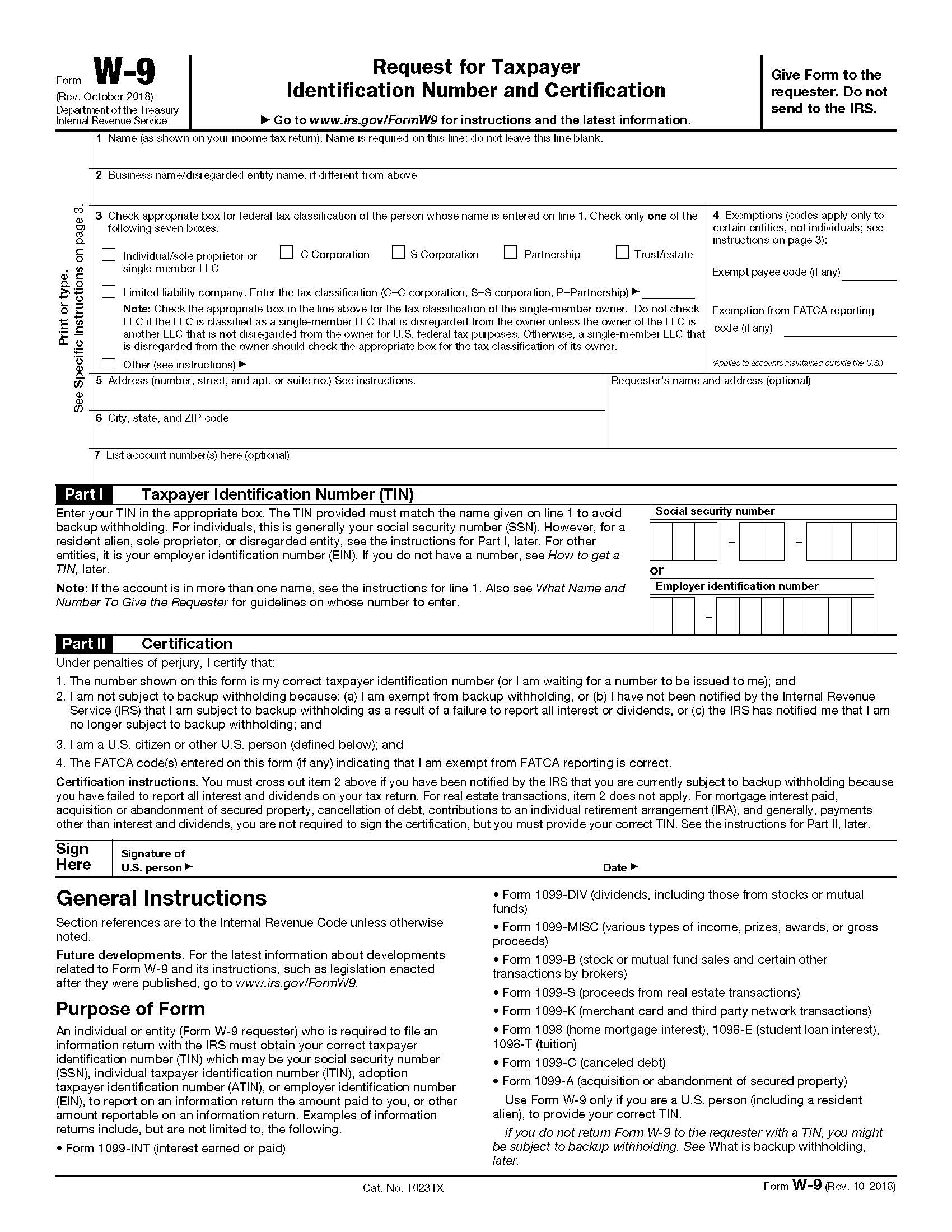

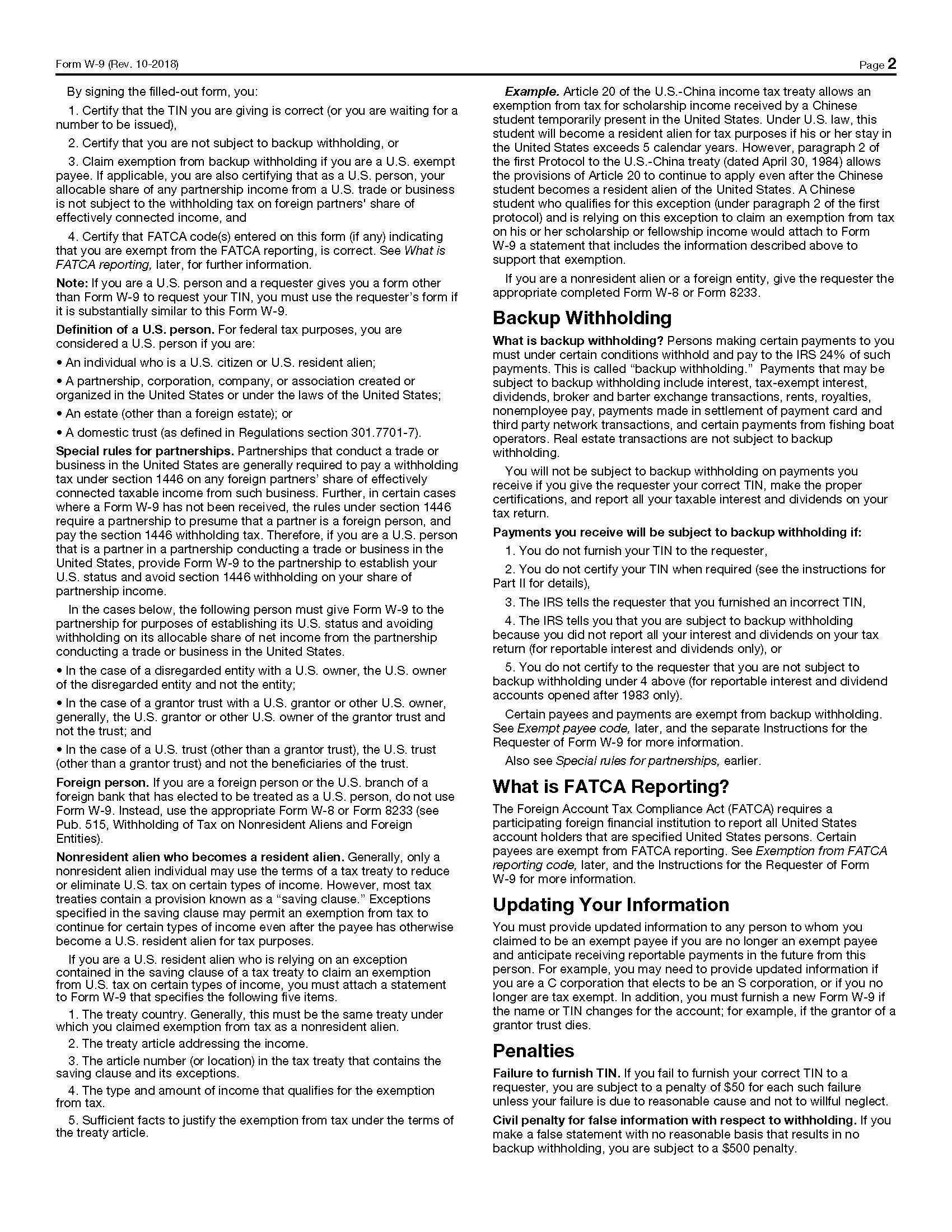

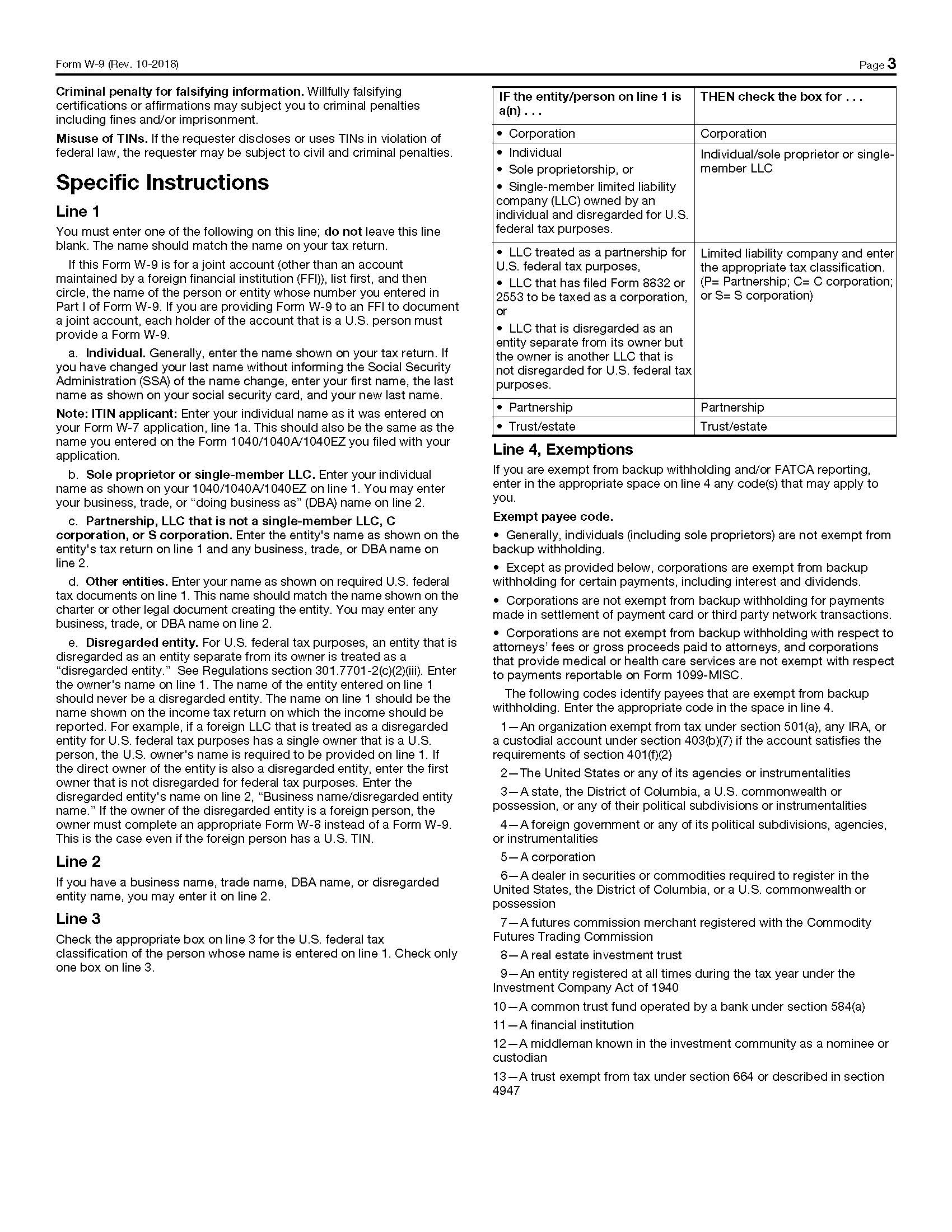

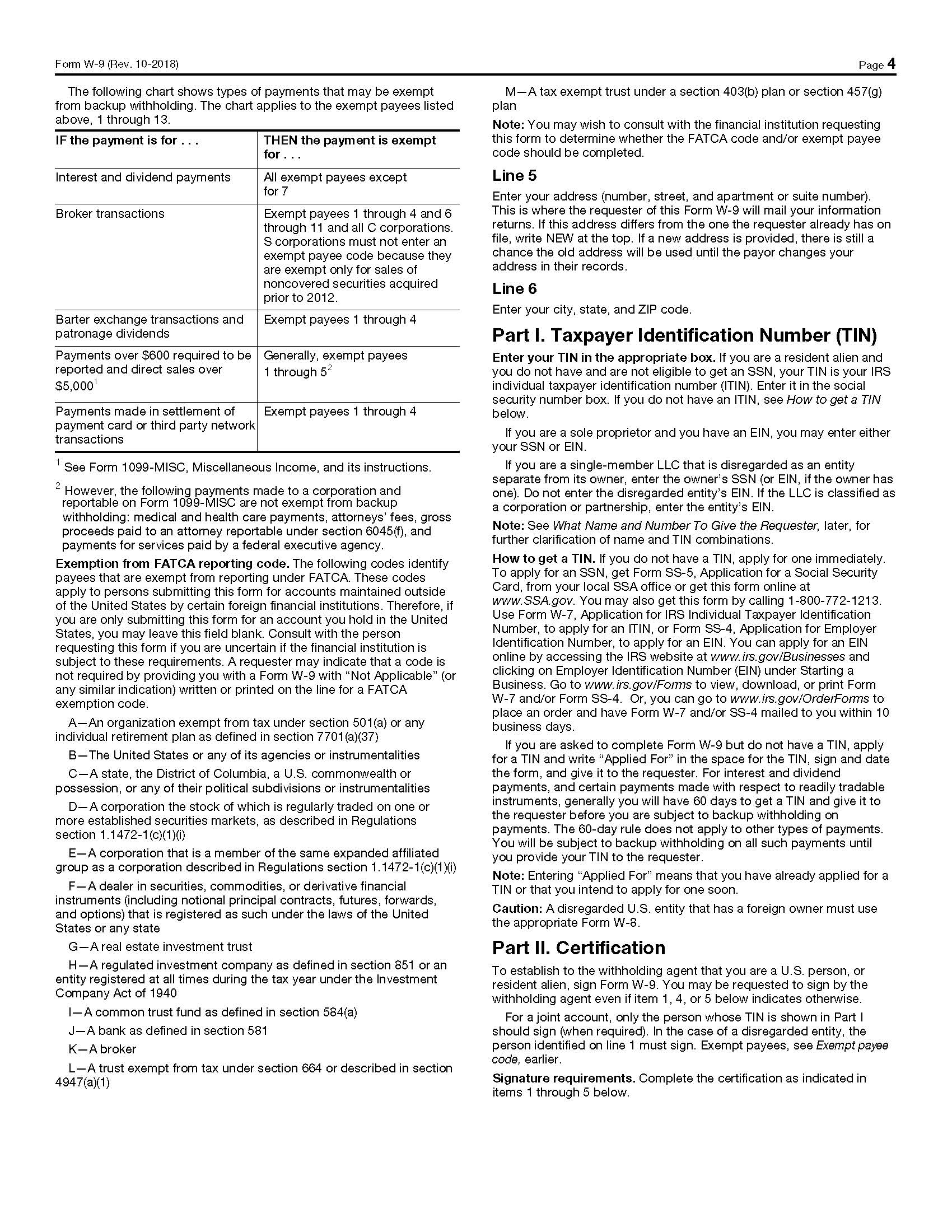

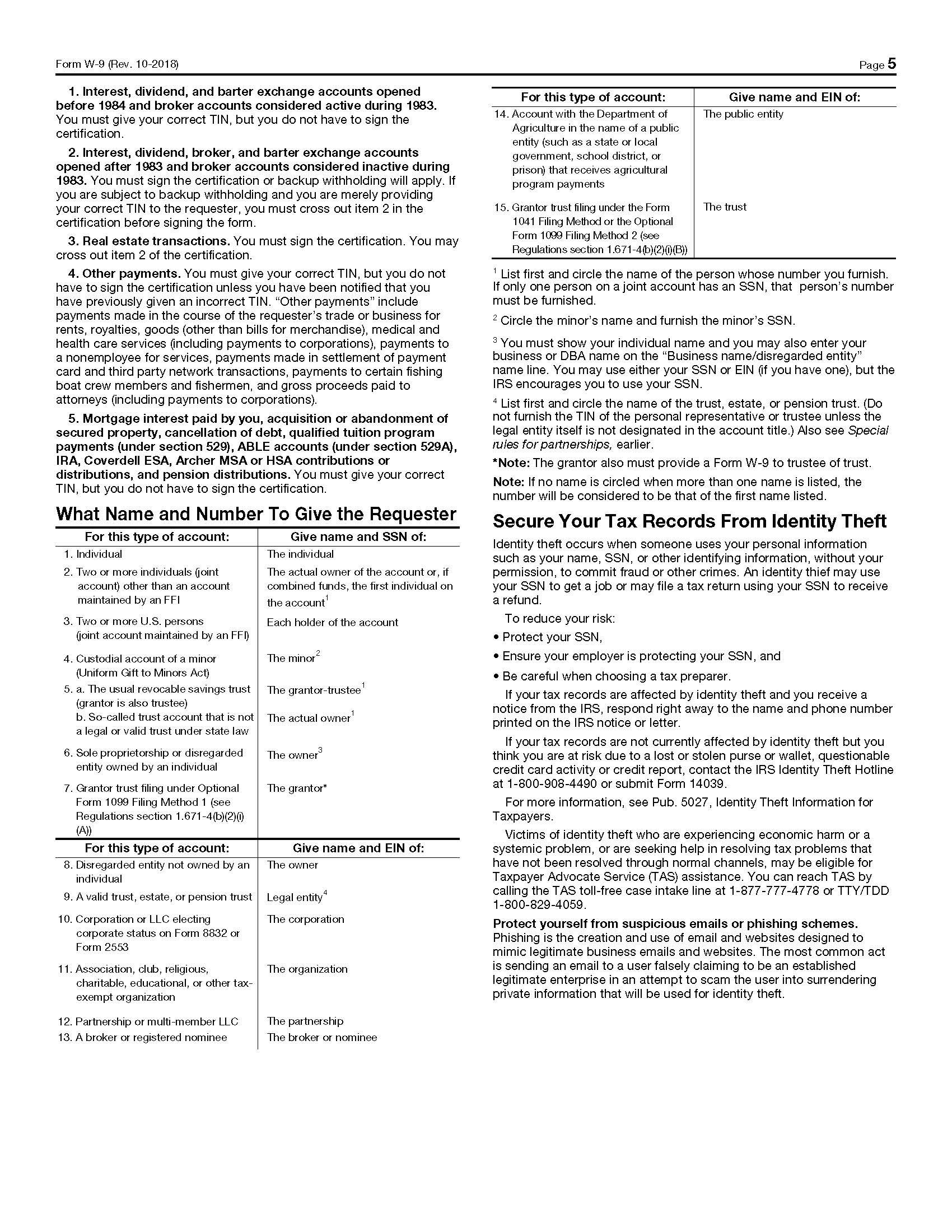

| 7. | Tax Identification Number and Backup Withholding. |

An exchange of Outstanding Notes for Exchange Notes generally will not be treated as a taxable exchange or other taxable event for U.S. federal income tax purposes. In particular, no backup withholding or information reporting is required in connection with such an exchange. However, U.S. federal income tax law generally requires that payments of principal and interest on a note to a holder be subject to backup withholding unless such holder provides the payor with such holder’s correct Taxpayer Identification Number (“TIN”) on the Form W-9 below or otherwise establishes a basis for exemption. If such holder is an individual, the TIN is his or her social security number. If the payor is not provided with the current TIN or an adequate basis for an exemption, such tendering holder may be subject to a $50 penalty imposed by the Internal Revenue Service. In addition, such holder may be subject to backup withholding on all reportable payments of principal and interest.

Certain holders (including, among others, all corporations and certain foreign individuals) are not subject to these backup withholding and reporting requirements. See the enclosed Form W-9 for additional instructions.

To prevent backup withholding on reportable payments of principal and interest, each tendering holder of Outstanding Notes must provide its correct TIN by completing the Form W-9 enclosed below, certifying (A) that the TIN provided is correct (or that such holder is awaiting a TIN), (B) that (i) the holder is exempt from backup withholding, (ii) the holder has not been notified by the Internal Revenue Service that such holder is subject to a backup withholding as a result of a failure to report all interest or dividends or (iii) the Internal Revenue Service has notified the holder that such holder is no longer subject to backup withholding and (C) that the holder is a U.S. person (including a U.S. resident alien). If the Outstanding Notes are in more than one name or are not in the name of the actual owner, such holder should consult the General Instructions on Form W-9 for information on which TIN to report. If such holder does not have a TIN, such holder should consult the General Instructions on Form W-9 for instructions on applying for a TIN, and write “applied for” in lieu of its TIN. Note: writing “applied for” on the form means that such holder has already applied for a TIN or that such holder intends to apply for one in the near future. If a holder writes “applied for” on Form W-9, backup withholding will nevertheless apply to all reportable payments made by such holder. If such a holder furnishes its TIN to the Company within 60 calendar days, however, any amounts so withheld shall be refunded to such holder.

If the tendering holder of Outstanding Notes is a nonresident alien or foreign entity not subject to backup withholding, such holder must give the Company a completed Form W-8BEN (Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding), W-8BEN-E or other appropriate Form W-8. These forms may be obtained from the Information and Exchange Agent or from the Internal Revenue Service’s website, www.irs.gov. If backup withholding applies, the payor will withhold the appropriate percentage from payments to the payee. Backup withholding is not an additional Federal income tax. Rather, the Federal income tax liability of persons subject to backup withholding will be reduced by the amount of tax withheld. If withholding results in overpayment of taxes, a refund may be obtained from the Internal Revenue Service.

The Company reserves the absolute right to amend or waive any of the conditions to the Exchange Offer enumerated in the Prospectus at any time and from time to time prior to the Expiration Date, except for the condition that the registration statement of which the Prospectus forms a part is not subject to a stop order or any proceedings for that purpose.

| |

| 9. | Validity of Tenders; No Conditional Tenders. |

All questions as to the validity, form, eligibility (including time of receipt) and acceptance for exchange of any tender of Outstanding Notes in connection with the Exchange Offer will be determined by the Company, in its sole discretion, and the Company’s determination will be final and binding. The Company reserves the absolute right to reject any or all tenders not in proper form or the acceptance for exchange of which may, in the opinion of its counsel, be unlawful. The Company also reserves the absolute right to waive any defect or irregularity in the tender of any Outstanding Notes in the Exchange Offer, and its interpretation of the terms and conditions of the Information and Exchange Offer (including the instructions in this Letter of Transmittal) will be final and binding on all parties. None of the Company, the Exchange Agent, the Trustee under the Company’s Indenture or any other person will be under any duty to give notification of any defects or irregularities in tenders or incur any liability for failure to give any such notification.

Tenders of Outstanding Notes involving any irregularities will not be deemed to have been made until such irregularities have been cured or waived. Outstanding Notes received by the Information and Exchange Agent in connection with the Exchange Offer that are not validly tendered and as to which the irregularities have not been cured or waived will be returned by the Information and Exchange Agent to the DTC participant who delivered such Outstanding Notes by crediting an account maintained at DTC designated by such DTC participant, in either case promptly after the Expiration Date of the Exchange Offer or the withdrawal or termination of the Exchange Offer.

No alternative, conditional, irregular or contingent tenders will be accepted. All tendering holders of Outstanding Notes, by execution of this Letter of Transmittal or, in lieu thereof, a Book-Entry Acknowledgement, shall waive any right to receive notice of the acceptance of their Outstanding Notes for exchange.

Tenders may be withdrawn only pursuant to the procedures and subject to the terms set forth in the Prospectus under the caption “The Exchange Offers

— Withdrawal of Tenders”.

| |

| 11. | Requests for Assistance or Additional Copies. |

Questions relating to the procedure for tendering, as well as requests for additional copies of the Prospectus and this Letter of Transmittal, may be directed to the Information and Exchange Agent, at the address and telephone number indicated herein.