Takeda R&D Day 2024 Focus on Late-stage Pipeline & Market Opportunity Friday, December 13th, 2024 Tokyo This material is prepared and distributed solely for the purpose of providing information about Takeda's management or business to shareholders, investors, and analysts, and is not intended to induce purchase or prescription of any specific drugs and other products. This material is not intended for healthcare professionals, patients, or other persons other than those mentioned above. This material is prohibited from being used by persons other than those mentioned above and for the purpose other than one mentioned above.

For the purposes of this notice, “presentation” means this document, any oral presentation, any question and answer session and any written or oral material discussed or distributed by Takeda Pharmaceutical Company Limited (“Takeda”) regarding this presentation. This presentation (including any oral briefing and any question-and-answer in connection with it) is not intended to, and does not constitute, represent or form part of any offer, invitation or solicitation of any offer to purchase, otherwise acquire, subscribe for, exchange, sell or otherwise dispose of, any securities or the solicitation of any vote or approval in any jurisdiction. No shares or other securities are being offered to the public by means of this presentation. No offering of securities shall be made in the United States except pursuant to registration under the U.S. Securities Act of 1933, as amended, or an exemption therefrom. This presentation is being given (together with any further information which may be provided to the recipient) on the condition that it is for use by the recipient for information purposes only (and not for the evaluation of any investment, acquisition, disposal or any other transaction). Any failure to comply with these restrictions may constitute a violation of applicable securities laws. The companies in which Takeda directly and indirectly owns investments are separate entities. In this presentation, “Takeda” is sometimes used for convenience where references are made to Takeda and its subsidiaries in general. Likewise, the words “we”, “us” and “our” are also used to refer to subsidiaries in general or to those who work for them. These expressions are also used where no useful purpose is served by identifying the particular company or companies. The product names appearing in this document are trademarks or registered trademarks owned by Takeda, or their respective owners. Forward-Looking Statements This presentation and any materials distributed in connection with this presentation may contain forward-looking statements, beliefs or opinions regarding Takeda’s future business, future position and results of operations, including estimates, forecasts, targets and plans for Takeda. Without limitation, forward-looking statements often include words such as “targets”, “plans”, “believes”, “hopes”, “continues”, “expects”, “aims”, “intends”, “ensures”, “will”, “may”, “should”, “would”, “could”, “anticipates”, “estimates”, “projects”, “forecasts”, “outlook” or similar expressions or the negative thereof. These forward-looking statements are based on assumptions about many important factors, including the following, which could cause actual results to differ materially from those expressed or implied by the forward-looking statements: the economic circumstances surrounding Takeda’s global business, including general economic conditions in Japan and the United States; competitive pressures and developments; changes to applicable laws and regulations; challenges inherent in new product development, including uncertainty of clinical success and decisions of regulatory authorities and the timing thereof; uncertainty of commercial success for new and existing products; manufacturing difficulties or delays; fluctuations in interest and currency exchange rates; claims or concerns regarding the safety or efficacy of marketed products or product candidates; the impact of health crises, like the novel coronavirus pandemic; the success of our environmental sustainability efforts, in enabling us to reduce our greenhouse gas emissions or meet our other environmental goals; the extent to which our efforts to increase efficiency, productivity or cost-savings, such as the integration of digital technologies, including artificial intelligence, in our business or other initiatives to restructure our operations will lead to the expected benefits; and other factors identified in Takeda’s most recent Annual Report on Form 20-F and Takeda’s other reports filed with the U.S. Securities and Exchange Commission, available on Takeda’s website at: https://www.takeda.com/investors/sec-filings-and-security-reports/ or at www.sec.gov. Takeda does not undertake to update any of the forward-looking statements contained in this presentation or any other forward-looking statements it may make, except as required by law or stock exchange rule. Past performance is not an indicator of future results and the results or statements of Takeda in this presentation may not be indicative of, and are not an estimate, forecast, guarantee or projection of Takeda’s future results. Financial Information and Certain Non-IFRS Financial Measures Takeda’s financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”). This presentation and materials distributed in connection with this presentation include certain financial measures not presented in accordance with IFRS, such as Core Revenue, Core Operating Profit, Core Net Profit, Core EPS, Constant Exchange Rate (“CER”) change, Net Debt, EBITDA, Adjusted EBITDA, Free Cash Flow and Adjusted Free Cash Flow. Takeda’s management evaluates results and makes operating and investment decisions using both IFRS and non-IFRS measures included in this presentation. These non-IFRS measures exclude certain income, cost and cash flow items which are included in, or are calculated differently from, the most closely comparable measures presented in accordance with IFRS. Takeda’s non-IFRS measures are not prepared in accordance with IFRS and such non-IFRS measures should be considered a supplement to, and not a substitute for, measures prepared in accordance with IFRS (which we sometimes refer to as “reported” measures). Investors are encouraged to review the definitions and reconciliations of non-IFRS financial measures to their most directly comparable IFRS measures, which are in the financial appendix of Takeda’s FY2024 Q2 quarterly earnings presentation. Peak Revenue Potential and PTRS Estimates References in this presentation to peak revenue ranges are estimates that have not been adjusted for probability of technical and regulatory success (PTRS) and should not be considered a forecast or target. These peak revenue ranges represent Takeda’s assessments of various possible future commercial scenarios that may or may not occur. References in this presentation to PTRS are to internal estimates of Takeda regarding the likelihood of obtaining regulatory approval for a particular product in a particular indication. These estimates reflect the subjective judgment of responsible Takeda personnel and have been approved by Takeda’s Portfolio Review Committee for use in internal planning. Exchange Rates In this presentation, certain amounts presented in Japanese yen have been translated to US dollars solely for the convenience of the reader at the exchange rates disclosed herein. The rate and methodologies used for these convenience translations differ from the currency exchange rates and translation methodologies under IFRS used for the preparation of Takeda’s consolidated financial statements. These translations should not be construed as a representation that the relevant Japanese yen amounts could be converted into U.S. dollars at this or any other rate. Medical information This presentation contains information about products that may not be available in all countries, or may be available under different trademarks, for different indications, in different dosages, or in different strengths. Nothing contained herein should be considered a solicitation, promotion or advertisement for any prescription drugs including the ones under development. Elritercept license agreement Elritercept is included for reference only. Takeda entered into an exclusive license agreement with Keros for global rights, in all territories outside of mainland China, Hong Kong and Macau, to Elritercept. The closing of the transaction is subject to receipt of regulatory approval(s), expected in the first calendar quarter of 2025. Takeda does not currently have rights to Elritercept. Important Notice 2

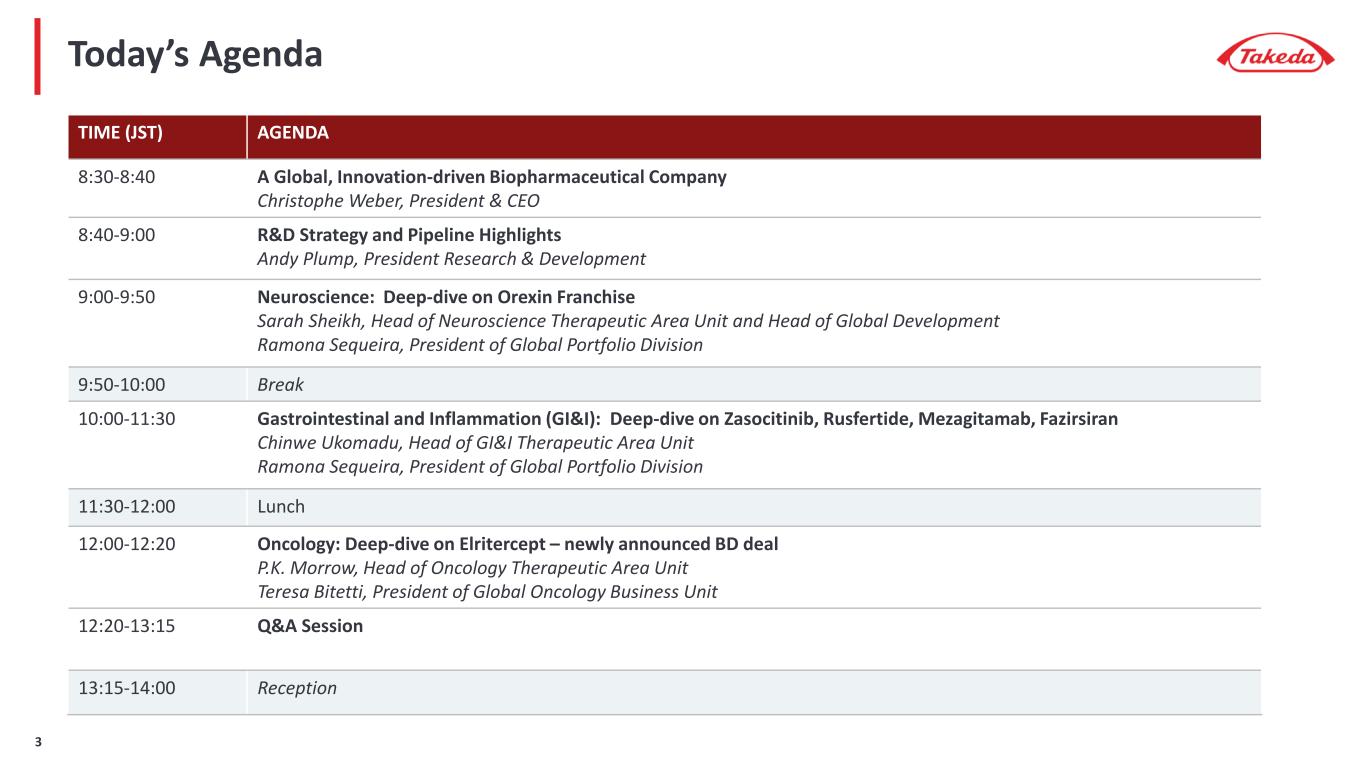

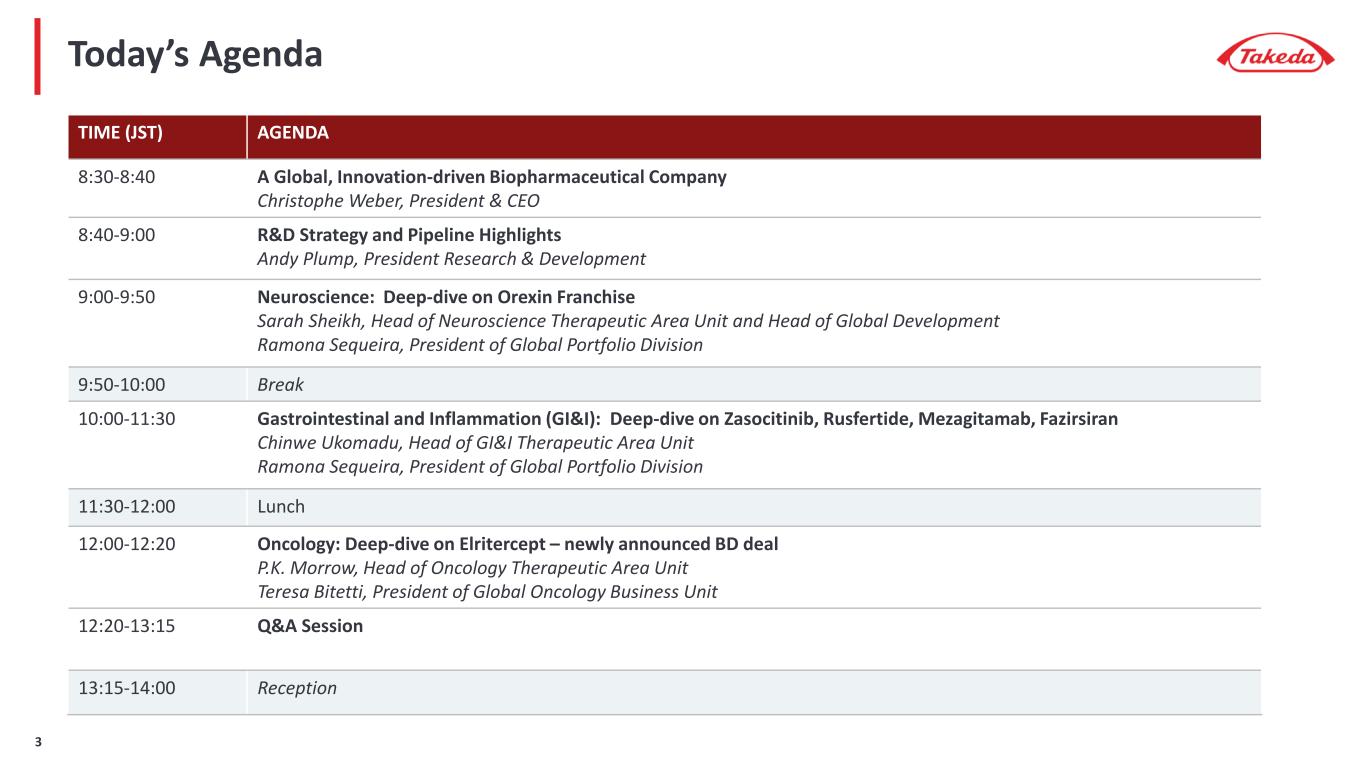

Today’s Agenda TIME (JST) AGENDA 8:30-8:40 A Global, Innovation-driven Biopharmaceutical Company Christophe Weber, President & CEO 8:40-9:00 R&D Strategy and Pipeline Highlights Andy Plump, President Research & Development 9:00-9:50 Neuroscience: Deep-dive on Orexin Franchise Sarah Sheikh, Head of Neuroscience Therapeutic Area Unit and Head of Global Development Ramona Sequeira, President of Global Portfolio Division 9:50-10:00 Break 10:00-11:30 Gastrointestinal and Inflammation (GI&I): Deep-dive on Zasocitinib, Rusfertide, Mezagitamab, Fazirsiran Chinwe Ukomadu, Head of GI&I Therapeutic Area Unit Ramona Sequeira, President of Global Portfolio Division 11:30-12:00 Lunch 12:00-12:20 Oncology: Deep-dive on Elritercept – newly announced BD deal P.K. Morrow, Head of Oncology Therapeutic Area Unit Teresa Bitetti, President of Global Oncology Business Unit 12:20-13:15 Q&A Session 13:15-14:00 Reception 3

Better health for people, brighter future for the world PATIENT PEOPLE PLANET Our vision is to discover and deliver life-transforming treatments, guided by our commitment to: We are guided by our values of Takeda-ism which incorporate Integrity, Fairness, Honesty, and Perseverance, with Integrity at the core. They are brought to life through actions based on Patient-Trust-Reputation-Business, in that order. … A N D B Y U N L E A S H I N G T H E P O W E R O F D A T A A N D D I G I T A L 4

15% GROWTH & EMERGING MARKETS 23% EUROPE & CANADA 11% JAPAN 51% U.S. FY2023 REVENUE ¥4.3T ~$28.2B1 A global, innovation-driven biopharmaceutical company 80PRESENCE IN APPROX COUNTRIES & REGIONS Global Footprint Aligned With Key Market Opportunities GLOBAL HEADQUARTERS TOKYO, JAPAN GLOBAL HUB CAMBRIDGE, MA, USA 1. Convenience translation calculated with 1 USD = 151.22 JPY, the Noon Buying Rate certified by the Federal Reserve Bank of New York on March 29, 2024 2. Convenience translation calculated with FY2024 full year assumption rate of 1 USD = 150 JPY 6 KEY BUSINESS AREAS REPRESENT ~94% OF REVENUE GI, RARE DISEASES, PLASMA- DERIVED THERAPIES, ONCOLOGY, VACCINES, NEUROSCIENCE 4 FOCUS MODALITIES SMALL MOLECULES, BIOLOGICS, ANTIBODY DRUG CONJUGATES (ADCs), ALLOGENEIC CELL THERAPIES CORE R&D THERAPEUTIC AREAS GASTROINTESTINAL & INFLAMMATION, NEUROSCIENCE, ONCOLOGY R&D Engine Focused on Discovering & Developing Highly Innovative Medicines 3 2 RESEARCH SITES SHONAN, JAPAN CAMBRIDGE, MA, USA ANNUAL R&D INVESTMENT (FY2024 FORECAST) ¥770B ~$5.1B2 5

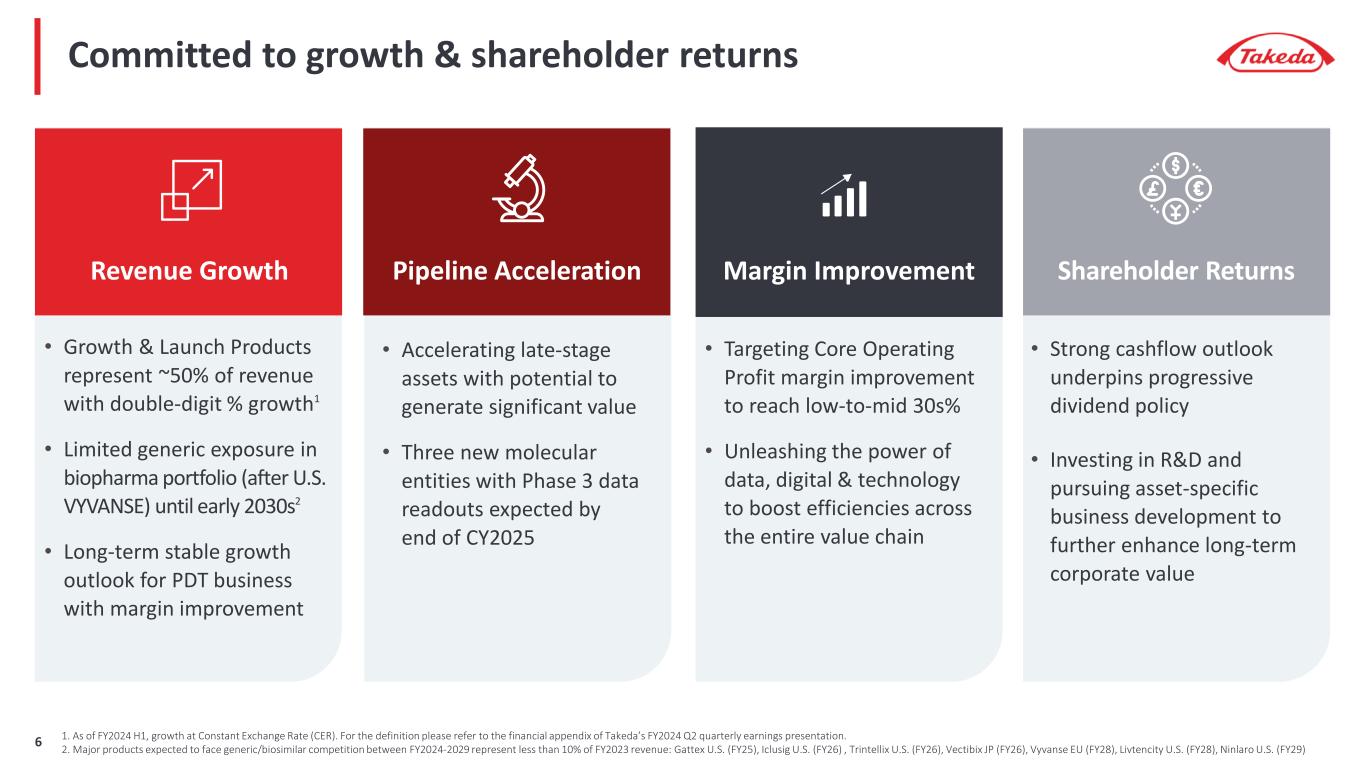

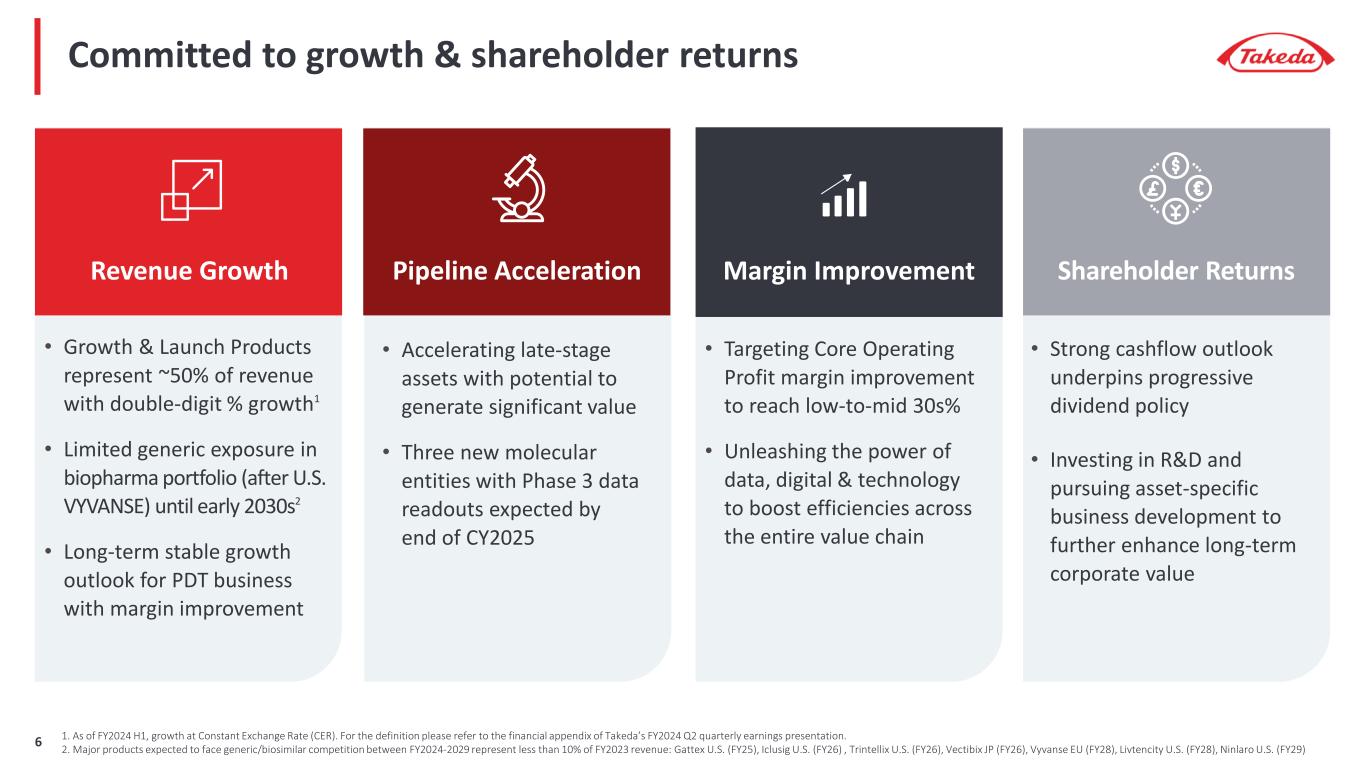

Committed to growth & shareholder returns Revenue Growth Pipeline Acceleration • Accelerating late-stage assets with potential to generate significant value • Three new molecular entities with Phase 3 data readouts expected by end of CY2025 Margin Improvement Shareholder Returns • Strong cashflow outlook underpins progressive dividend policy • Investing in R&D and pursuing asset-specific business development to further enhance long-term corporate value • Targeting Core Operating Profit margin improvement to reach low-to-mid 30s% • Unleashing the power of data, digital & technology to boost efficiencies across the entire value chain • Growth & Launch Products represent ~50% of revenue with double-digit % growth1 • Limited generic exposure in biopharma portfolio (after U.S. VYVANSE) until early 2030s2 • Long-term stable growth outlook for PDT business with margin improvement 1. As of FY2024 H1, growth at Constant Exchange Rate (CER). For the definition please refer to the financial appendix of Takeda’s FY2024 Q2 quarterly earnings presentation. 2. Major products expected to face generic/biosimilar competition between FY2024-2029 represent less than 10% of FY2023 revenue: Gattex U.S. (FY25), Iclusig U.S. (FY26) , Trintellix U.S. (FY26), Vectibix JP (FY26), Vyvanse EU (FY28), Livtencity U.S. (FY28), Ninlaro U.S. (FY29)6

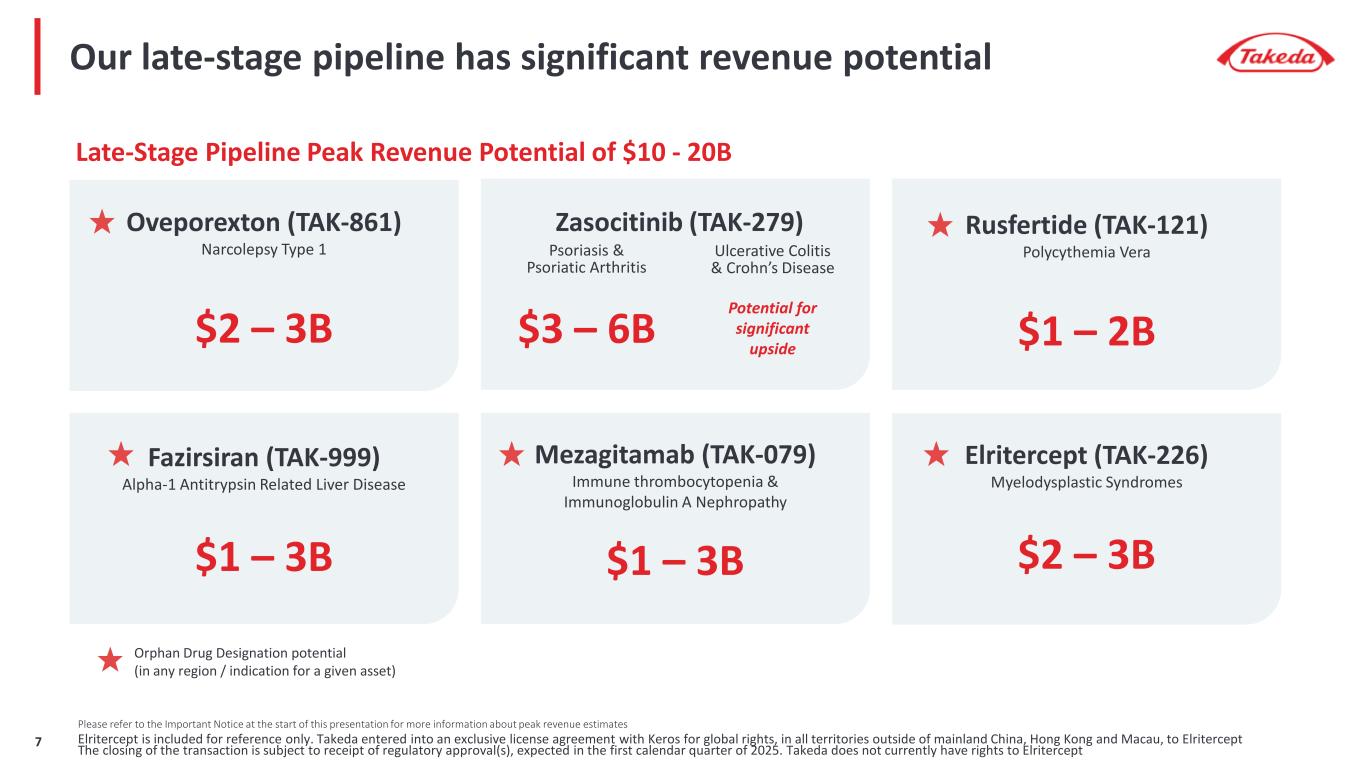

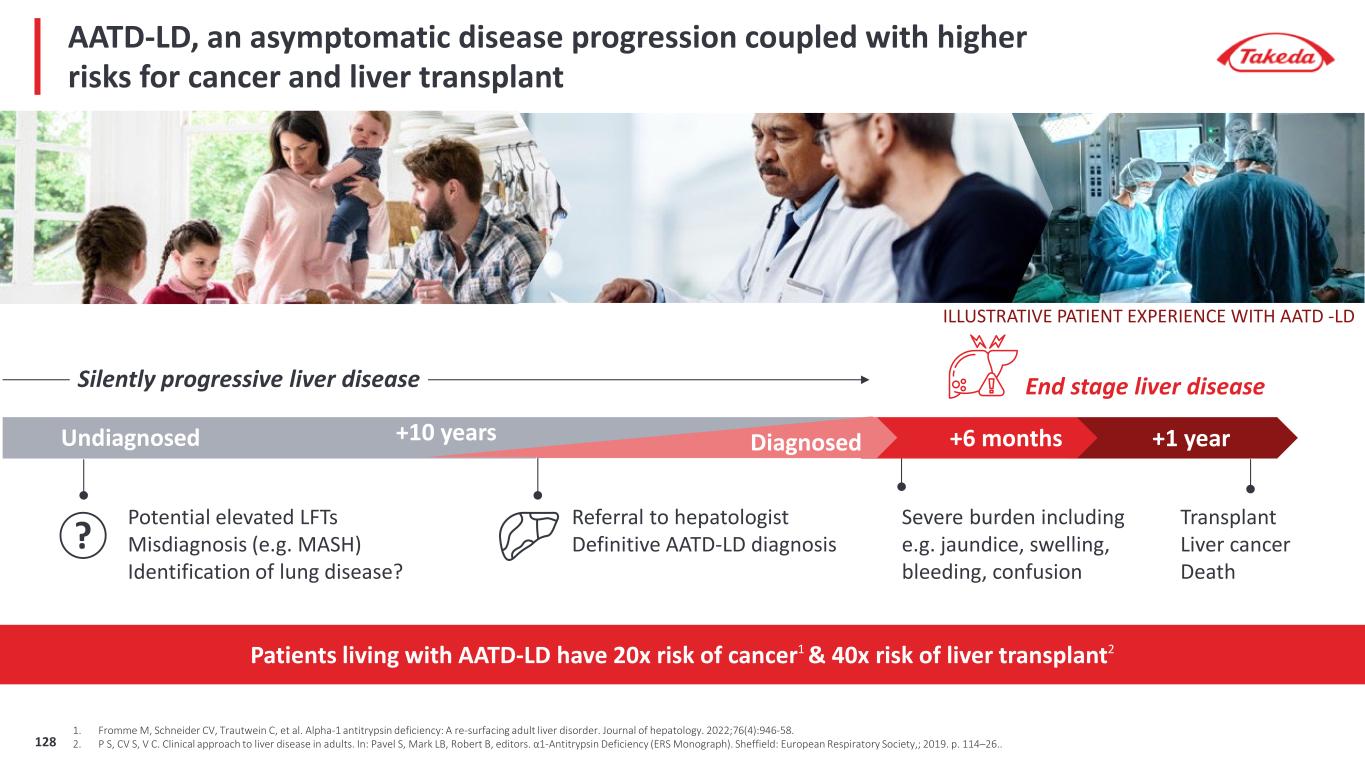

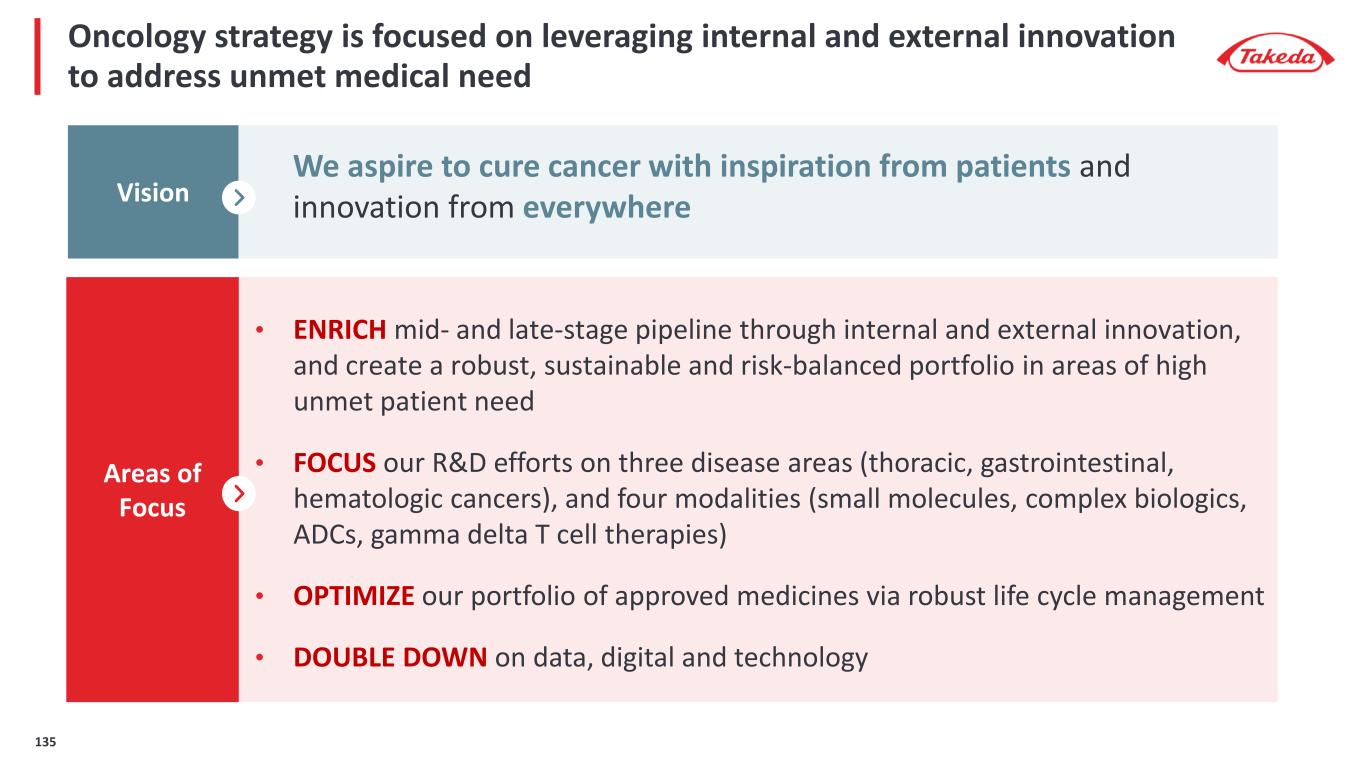

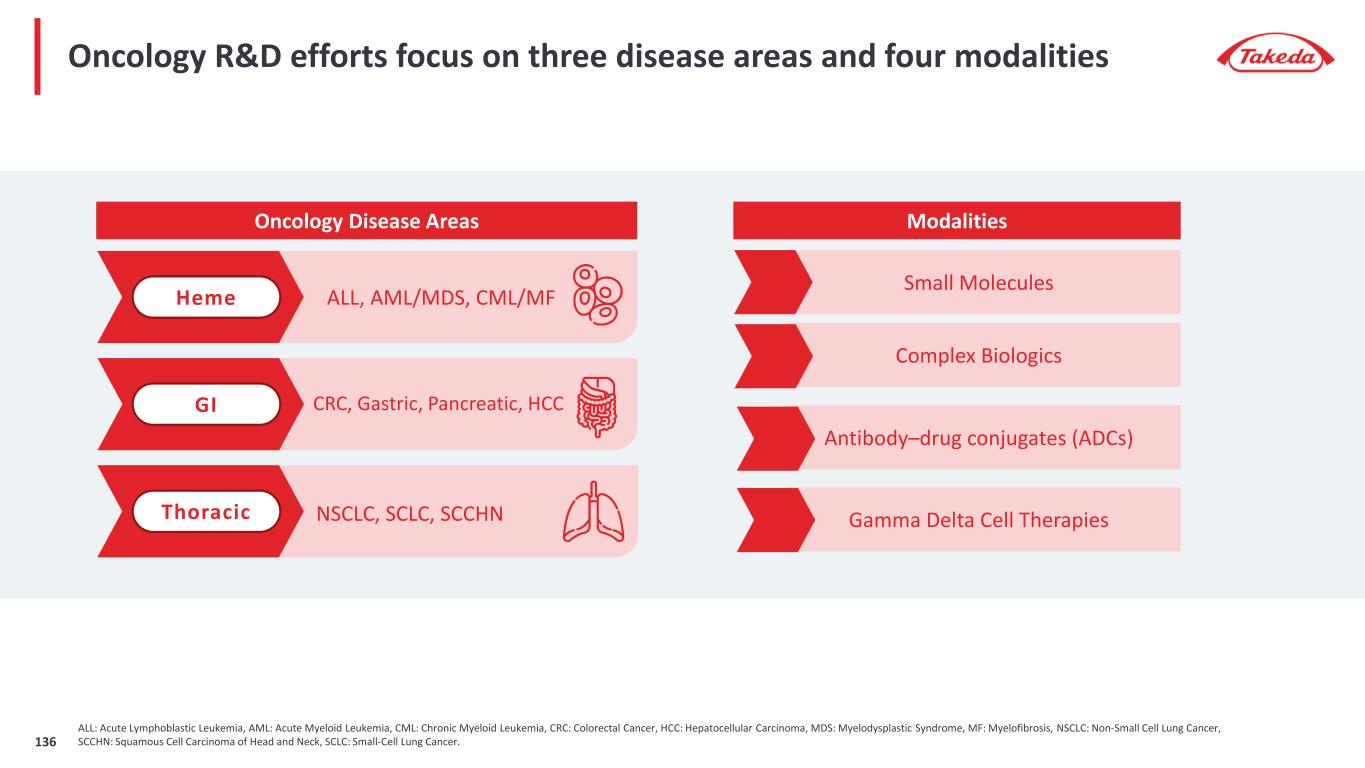

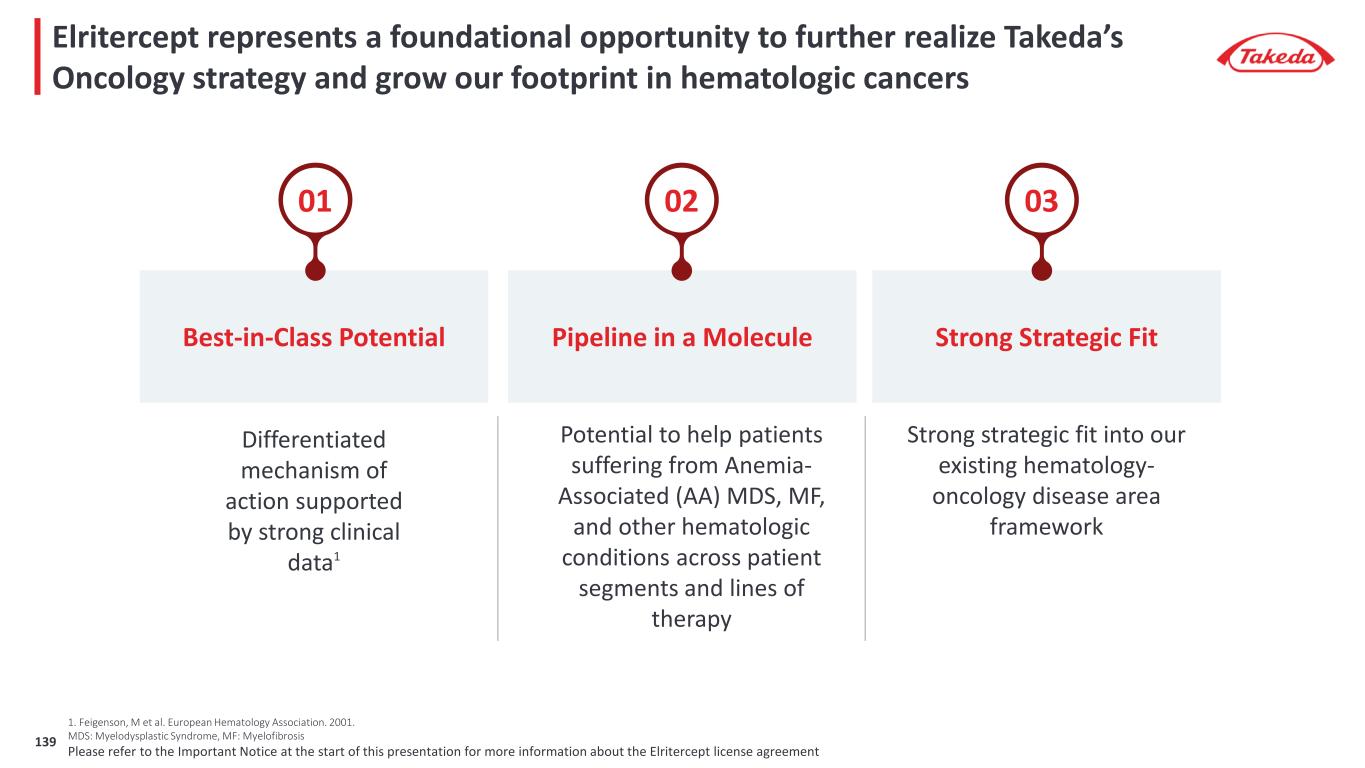

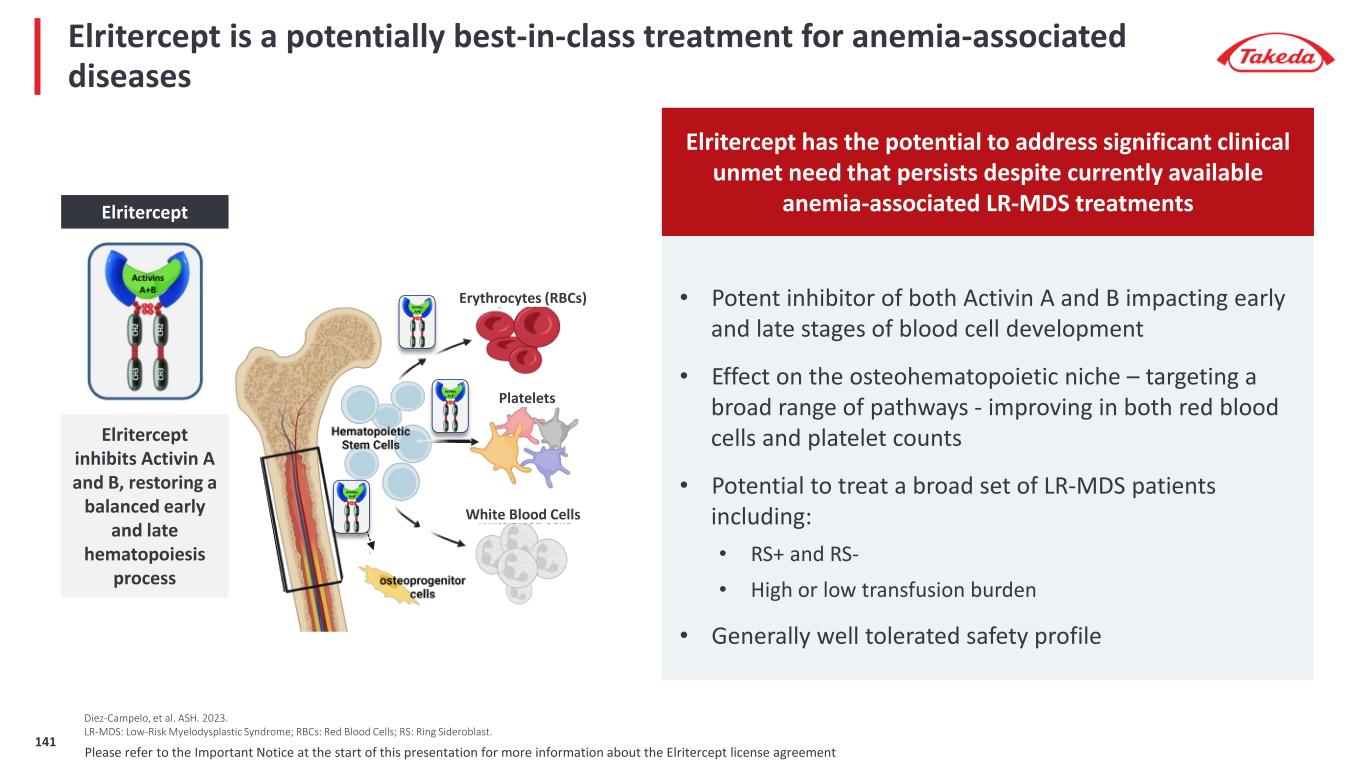

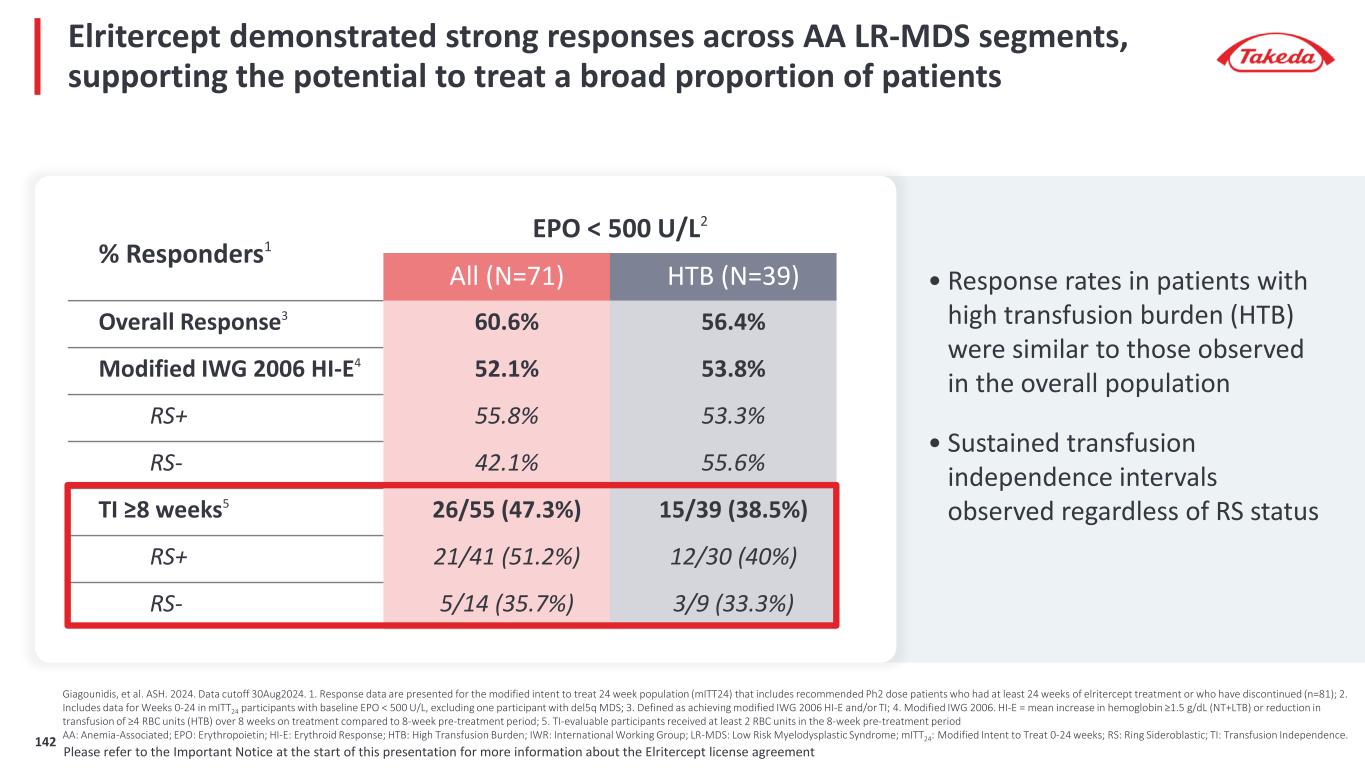

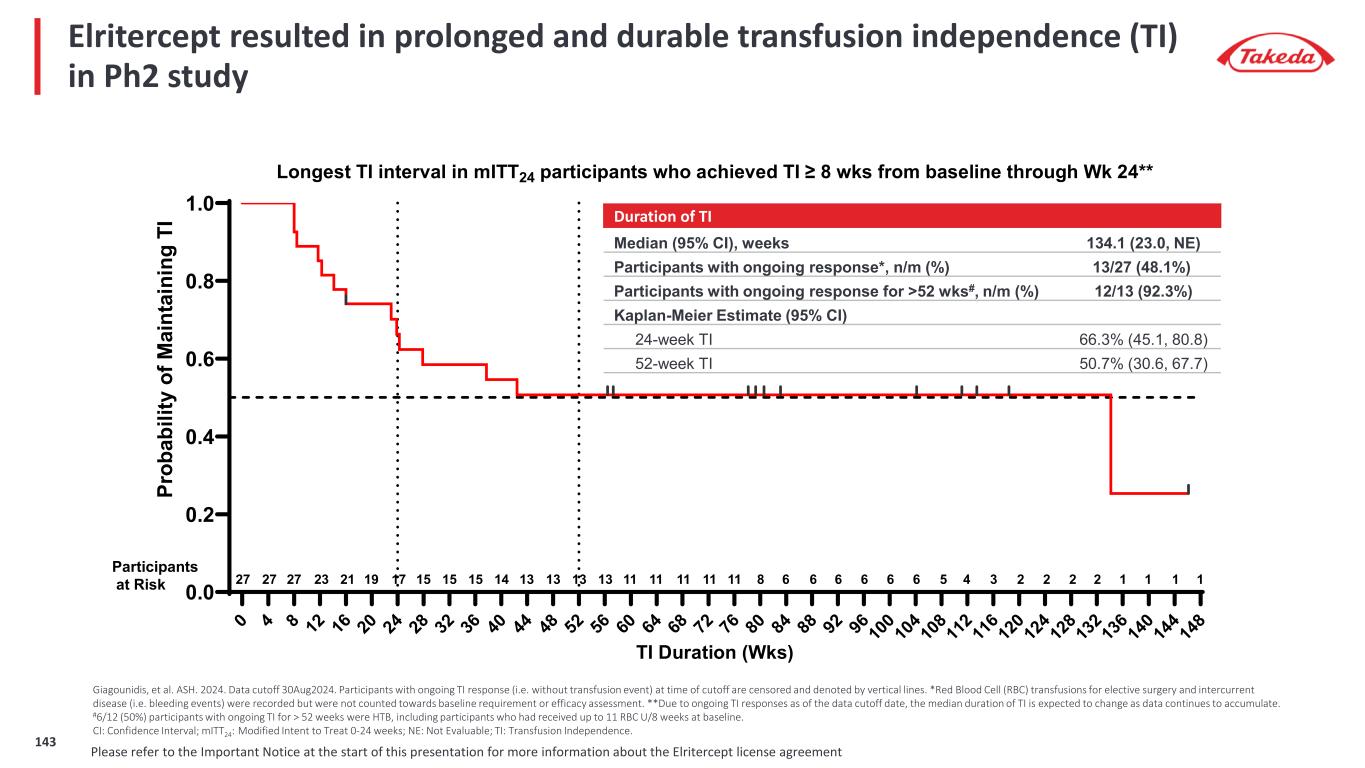

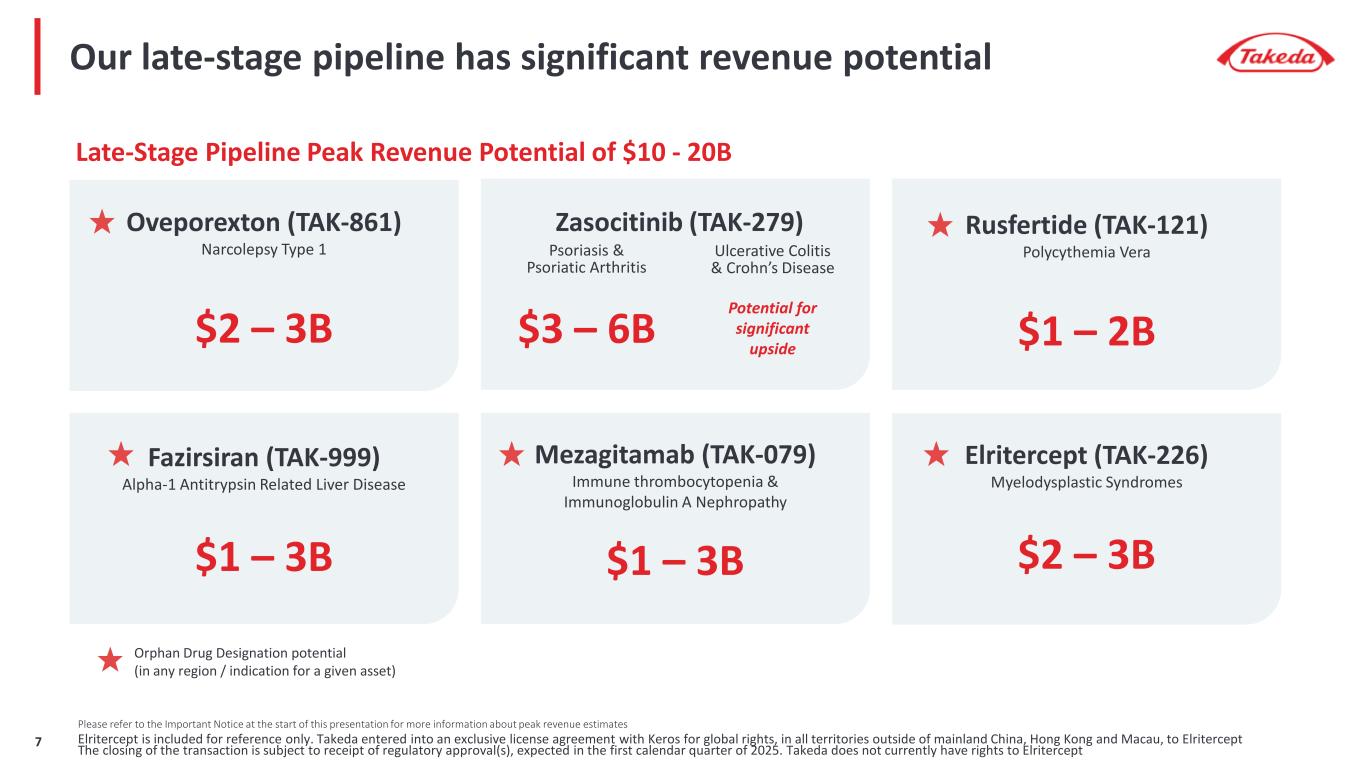

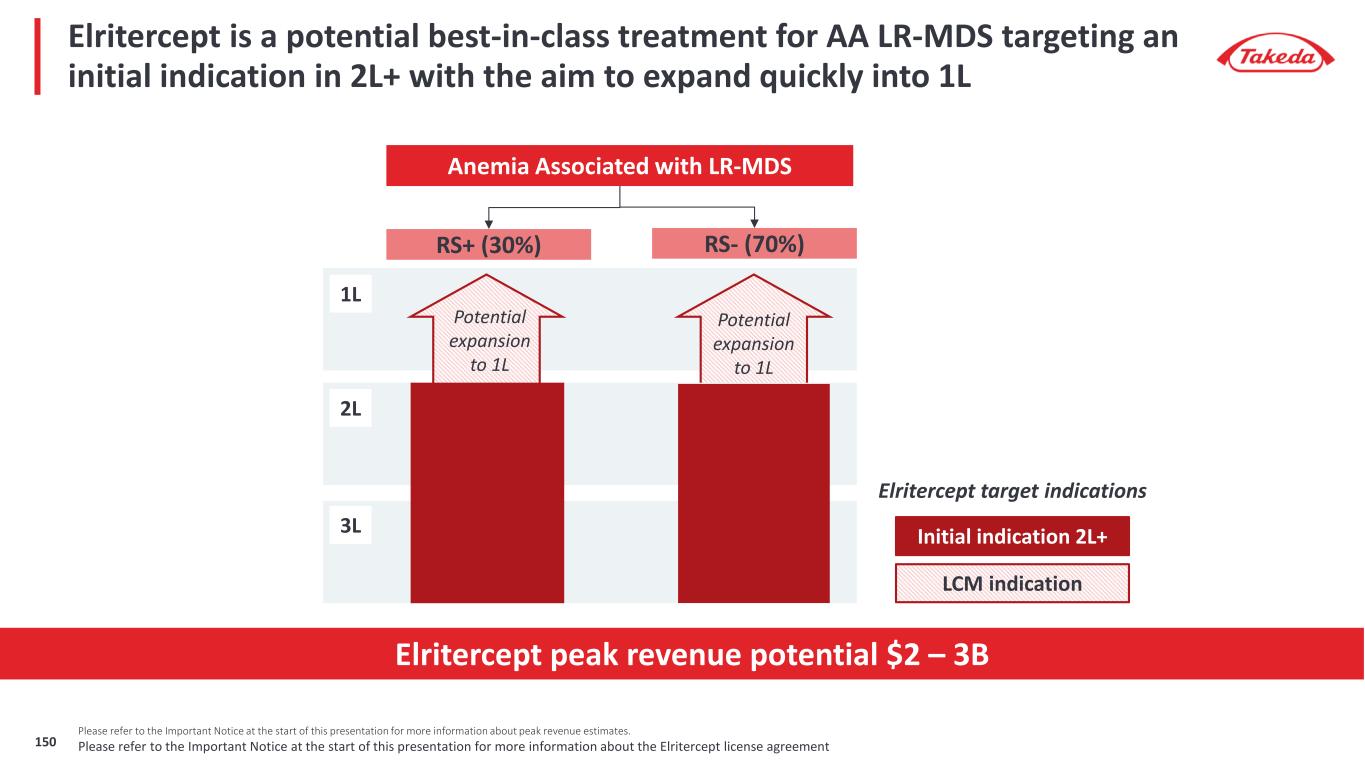

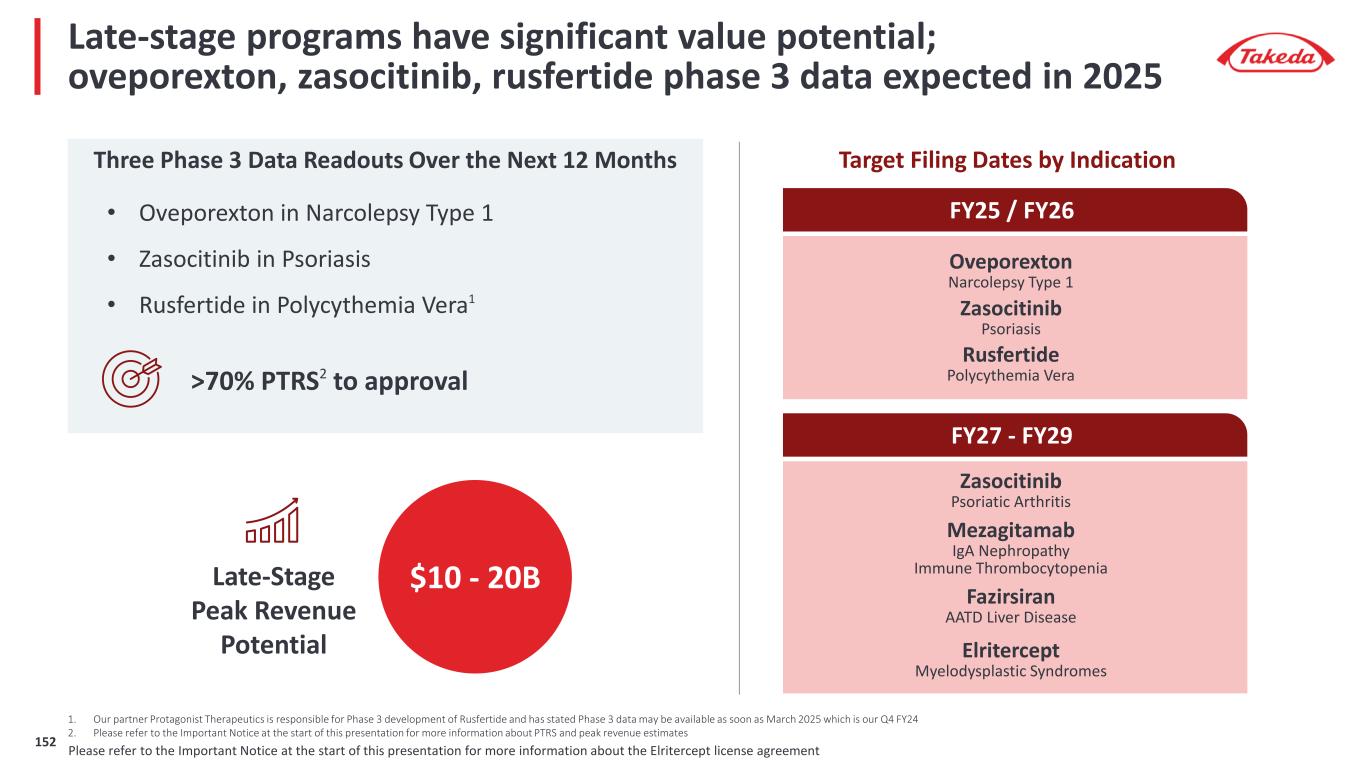

7 Please refer to the Important Notice at the start of this presentation for more information about peak revenue estimates Elritercept is included for reference only. Takeda entered into an exclusive license agreement with Keros for global rights, in all territories outside of mainland China, Hong Kong and Macau, to Elritercept The closing of the transaction is subject to receipt of regulatory approval(s), expected in the first calendar quarter of 2025. Takeda does not currently have rights to Elritercept Our late-stage pipeline has significant revenue potential Orphan Drug Designation potential (in any region / indication for a given asset) Late-Stage Pipeline Peak Revenue Potential of $10 - 20B Rusfertide (TAK-121) Polycythemia Vera $1 – 2B Oveporexton (TAK-861) Narcolepsy Type 1 $2 – 3B Zasocitinib (TAK-279) Psoriasis & Psoriatic Arthritis Ulcerative Colitis & Crohn’s Disease Fazirsiran (TAK-999) Alpha-1 Antitrypsin Related Liver Disease $1 – 3B Mezagitamab (TAK-079) Immune thrombocytopenia & Immunoglobulin A Nephropathy $1 – 3B Elritercept (TAK-226) Myelodysplastic Syndromes $2 – 3B $3 – 6B Potential for significant upside

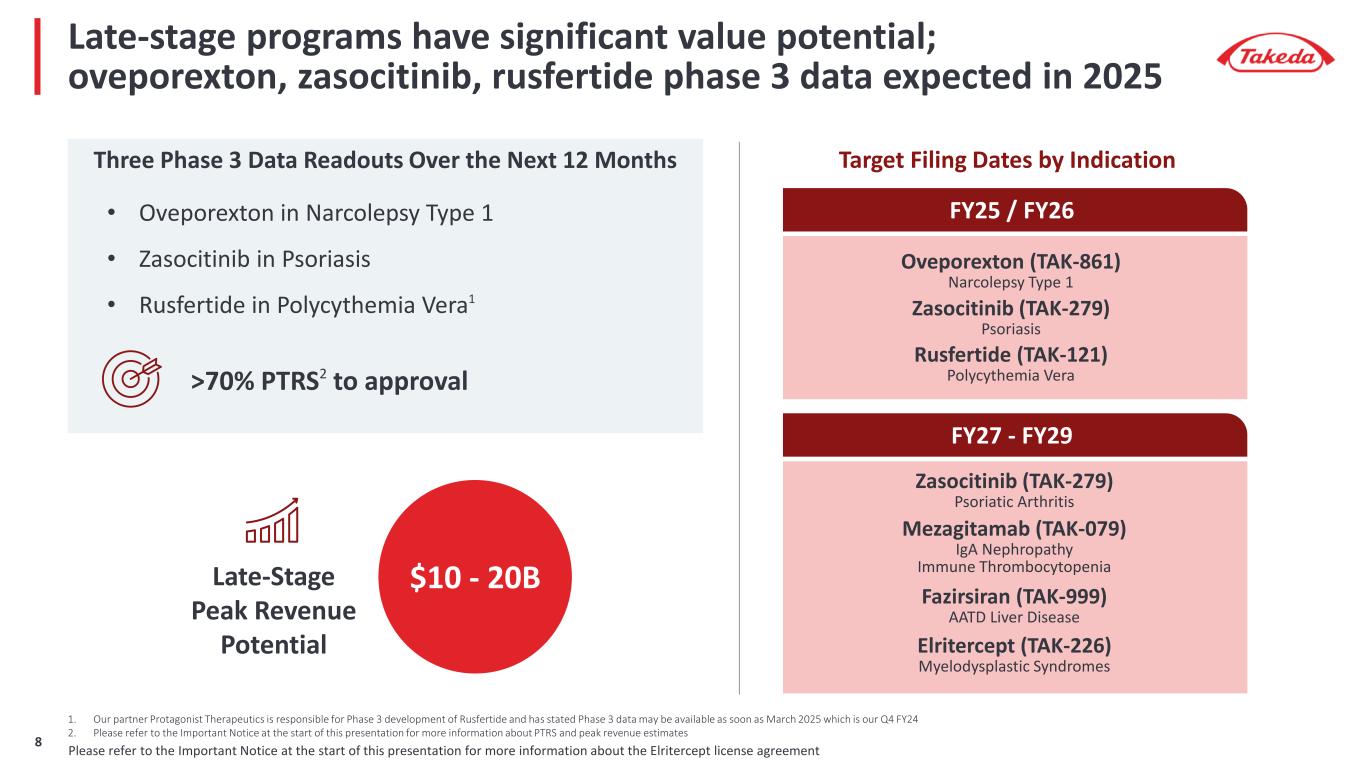

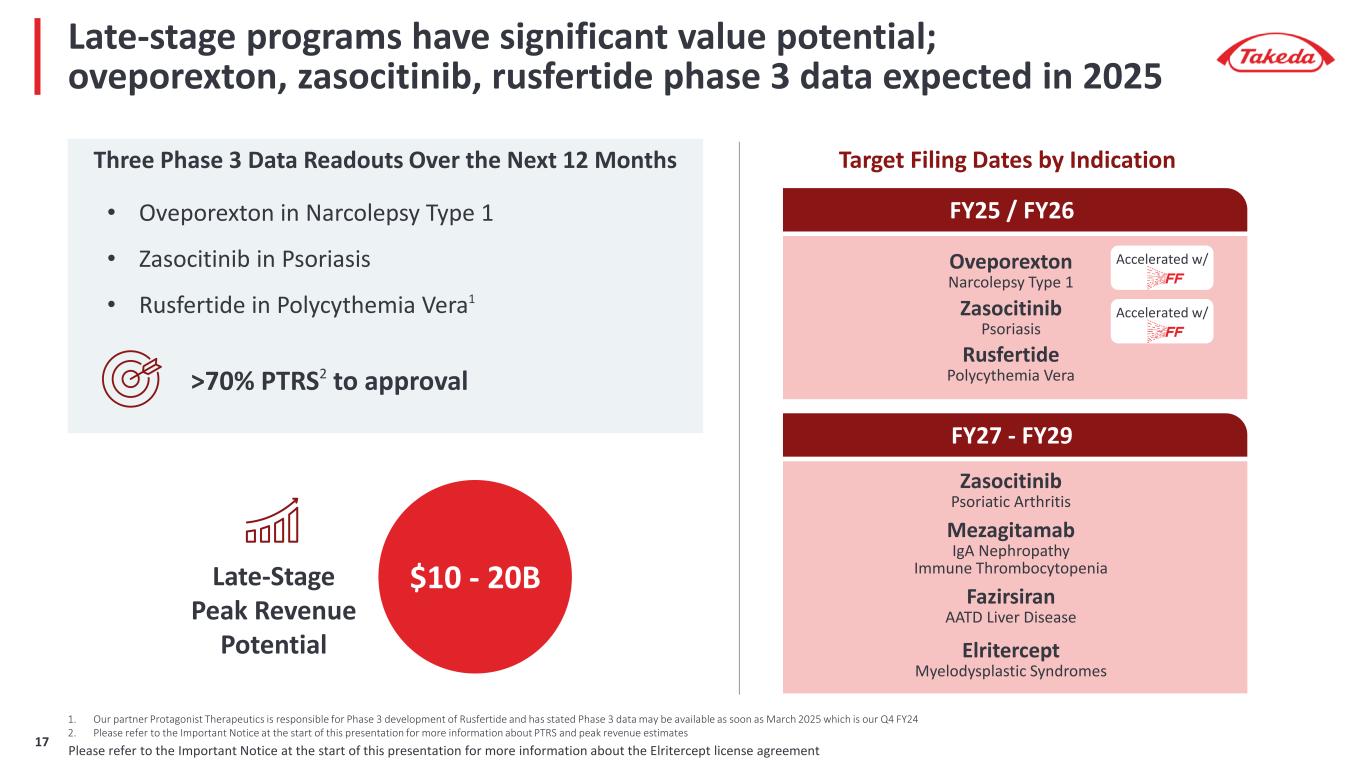

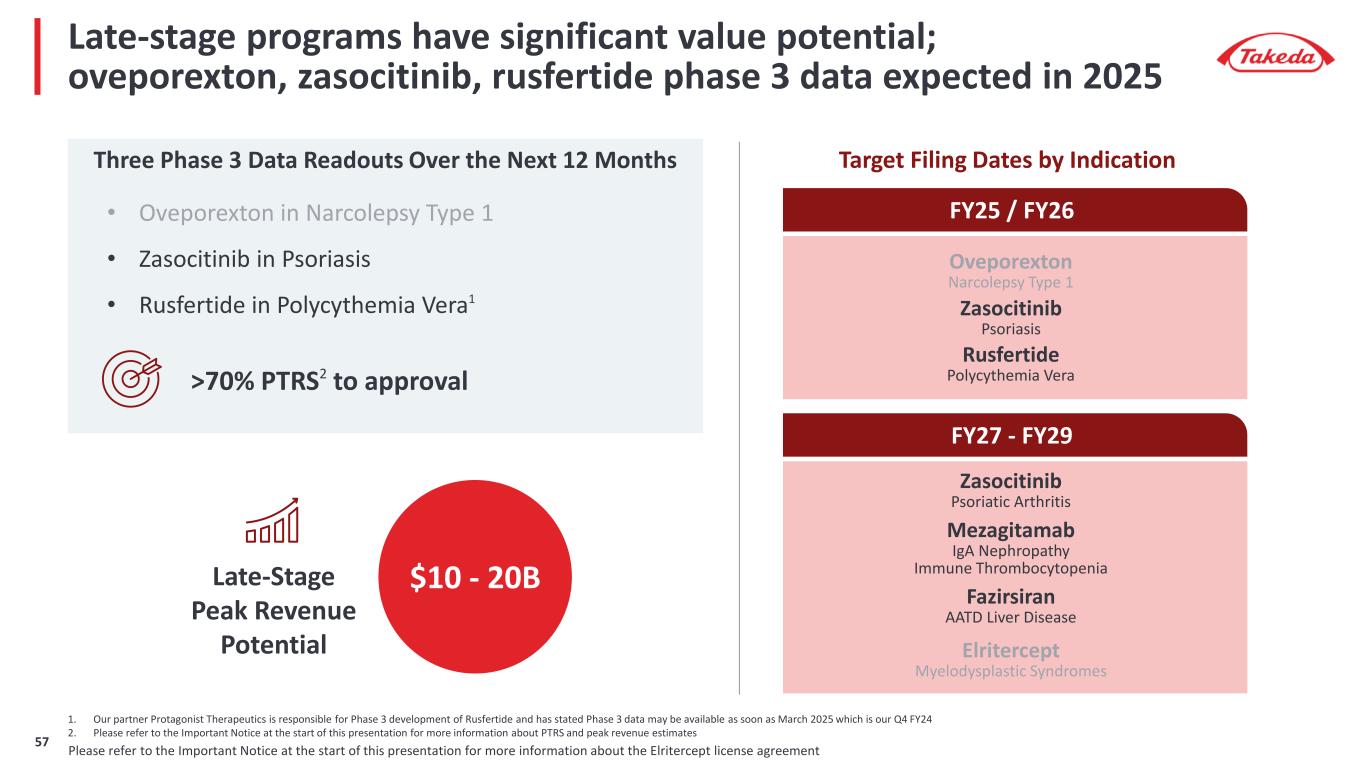

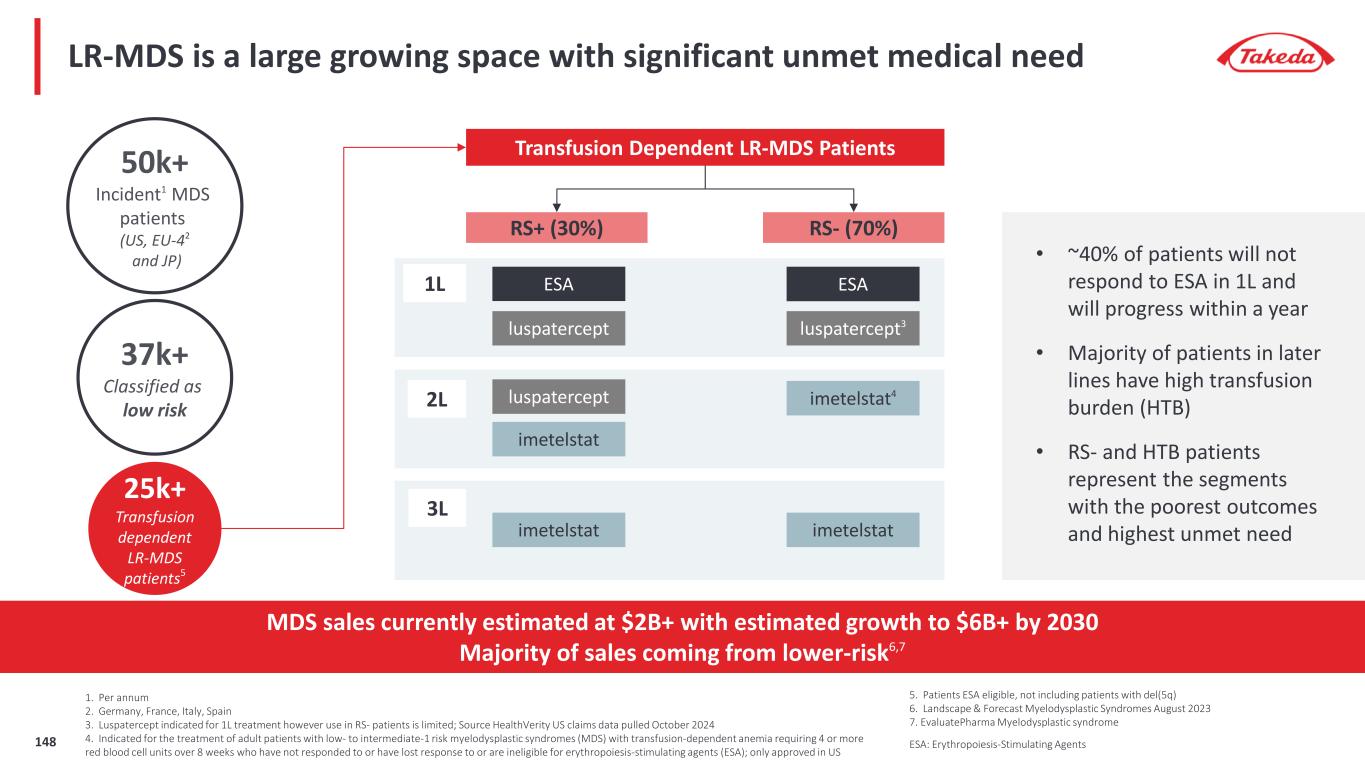

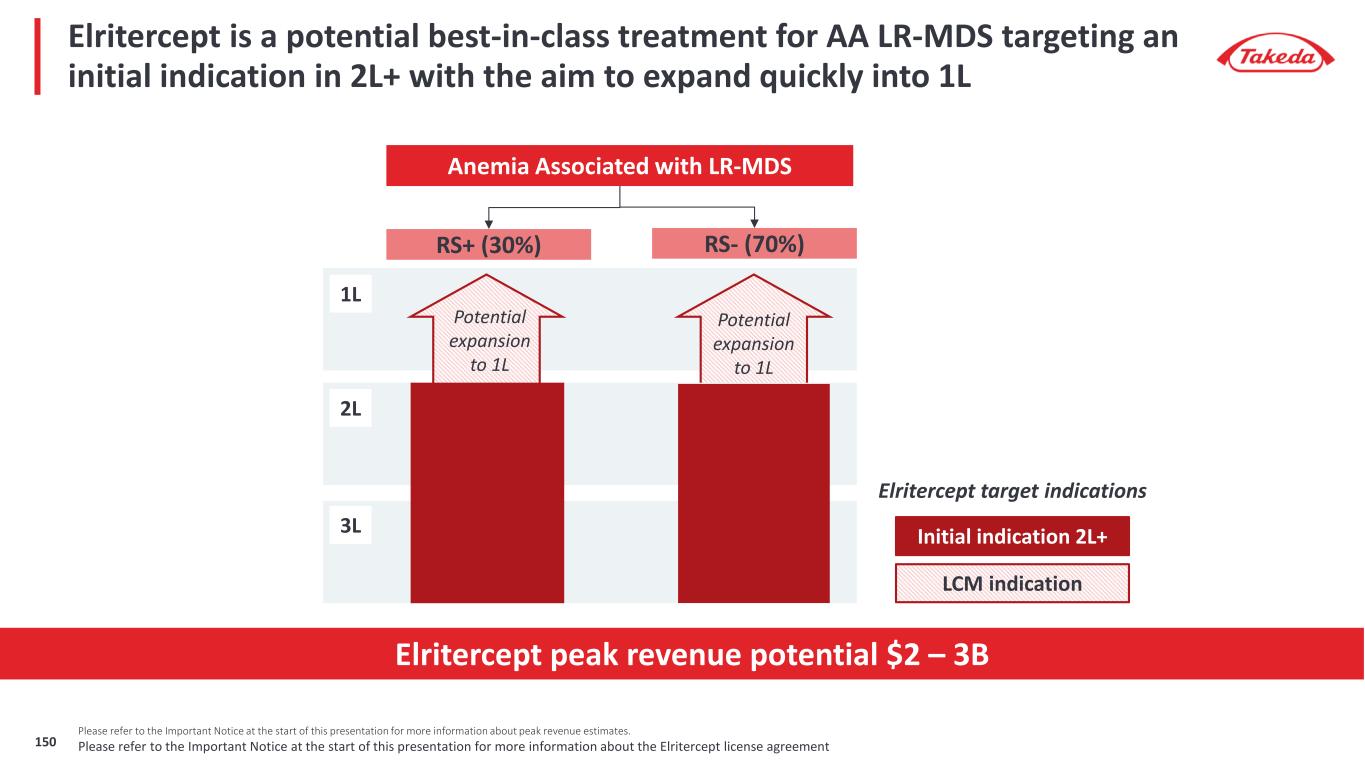

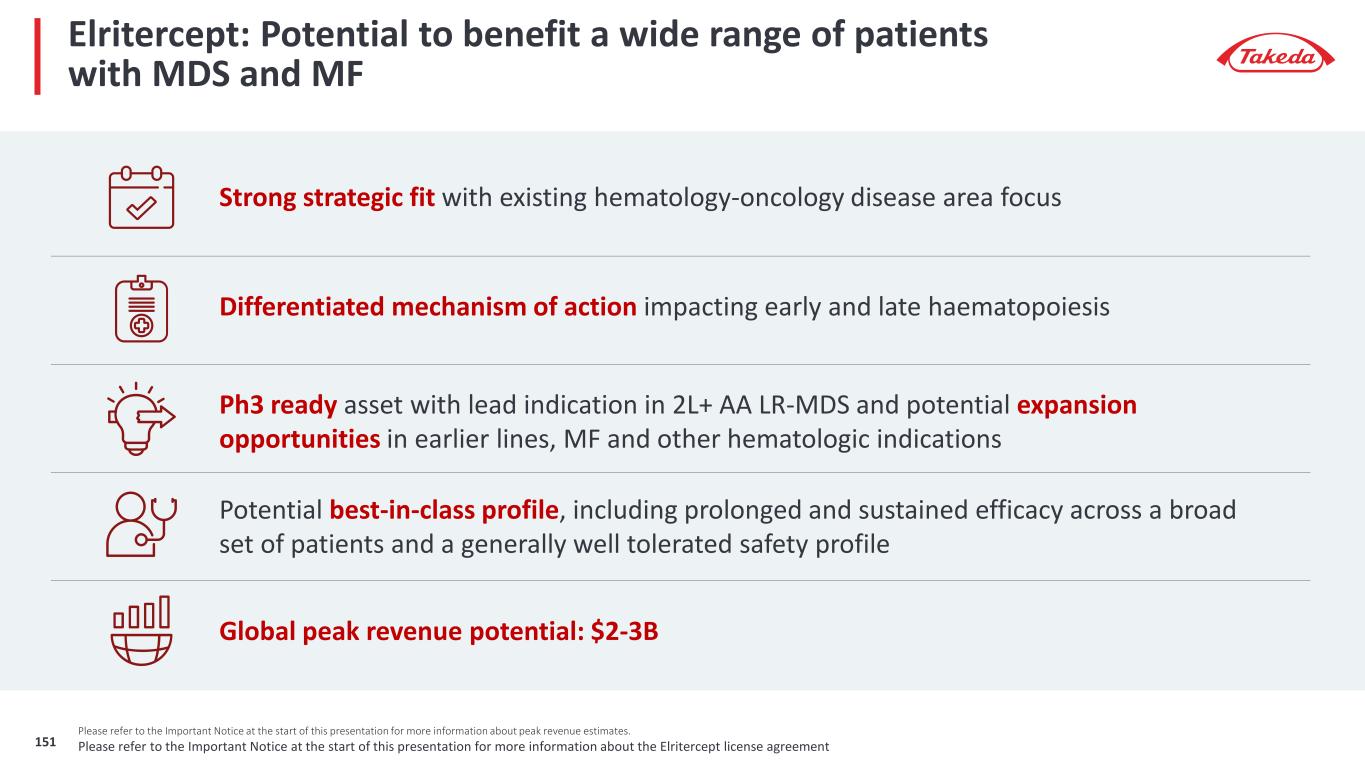

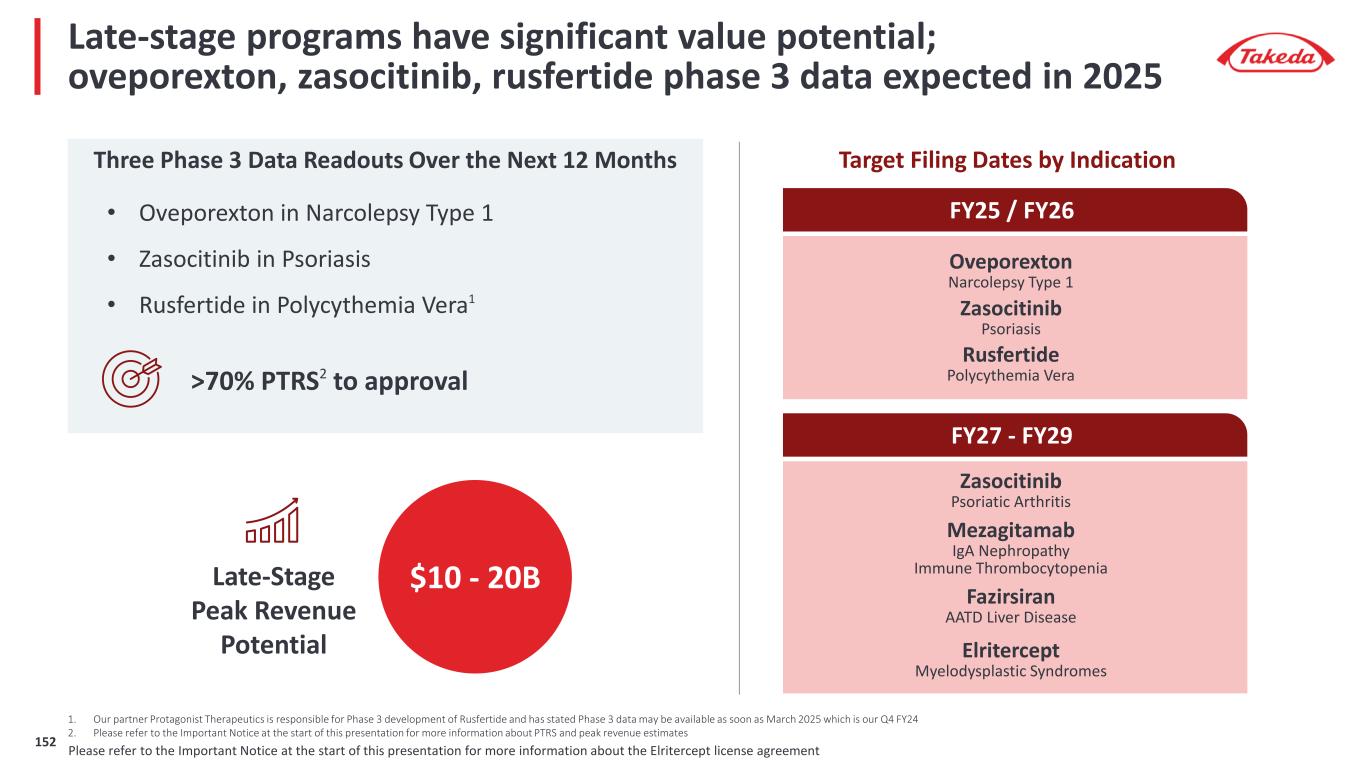

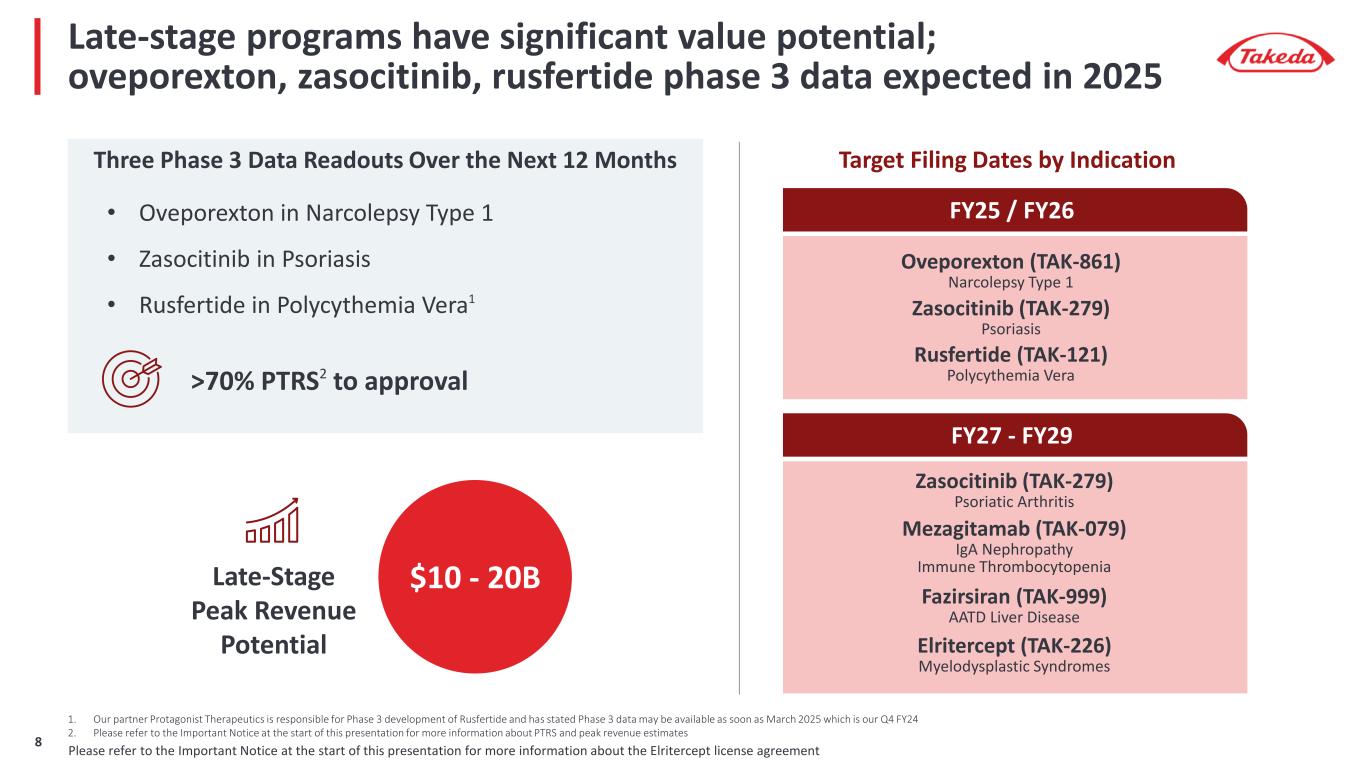

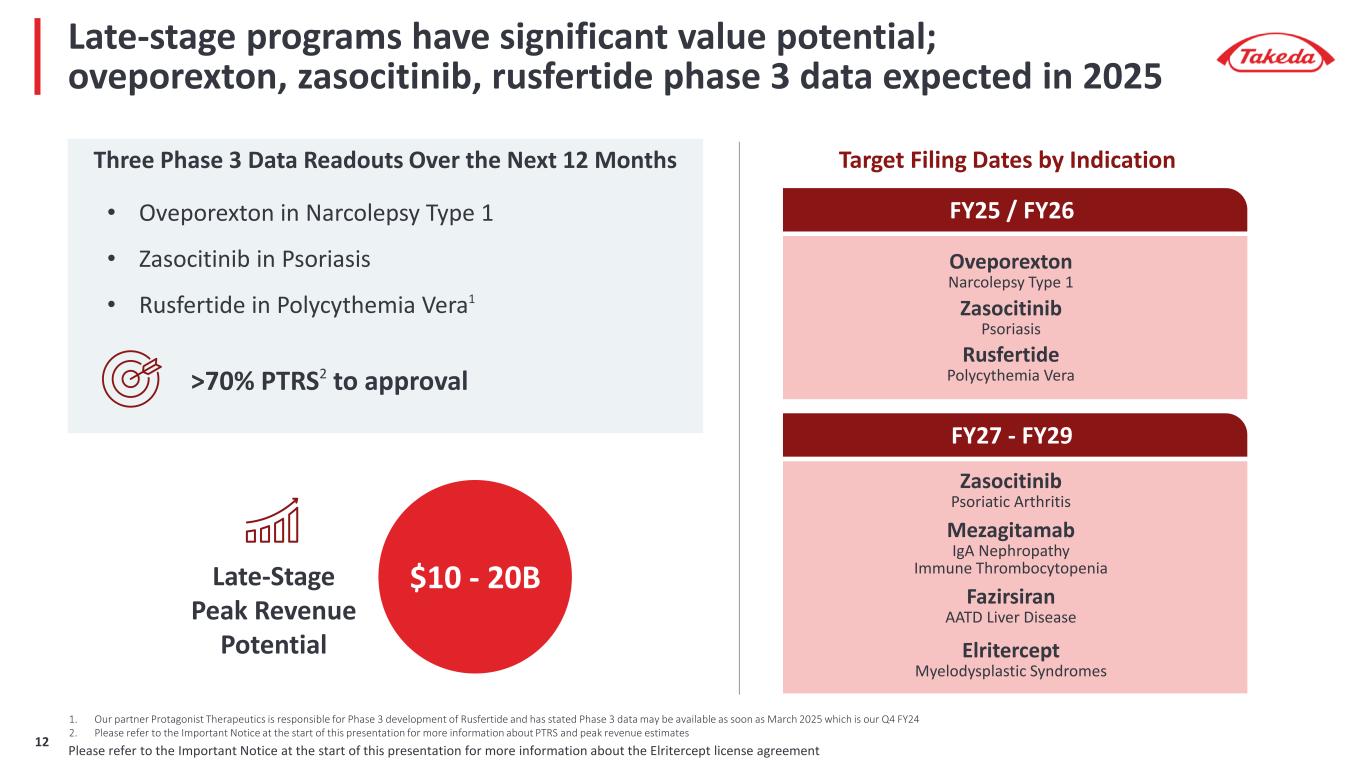

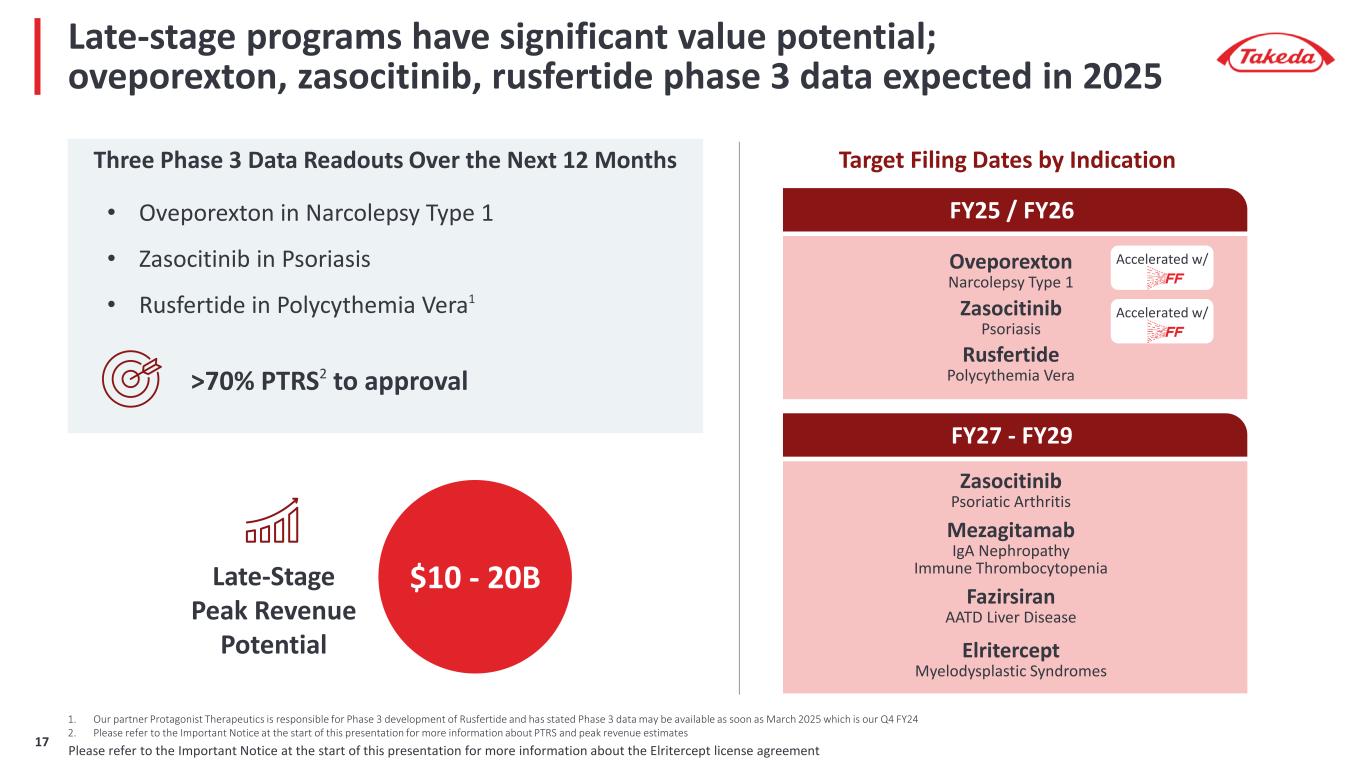

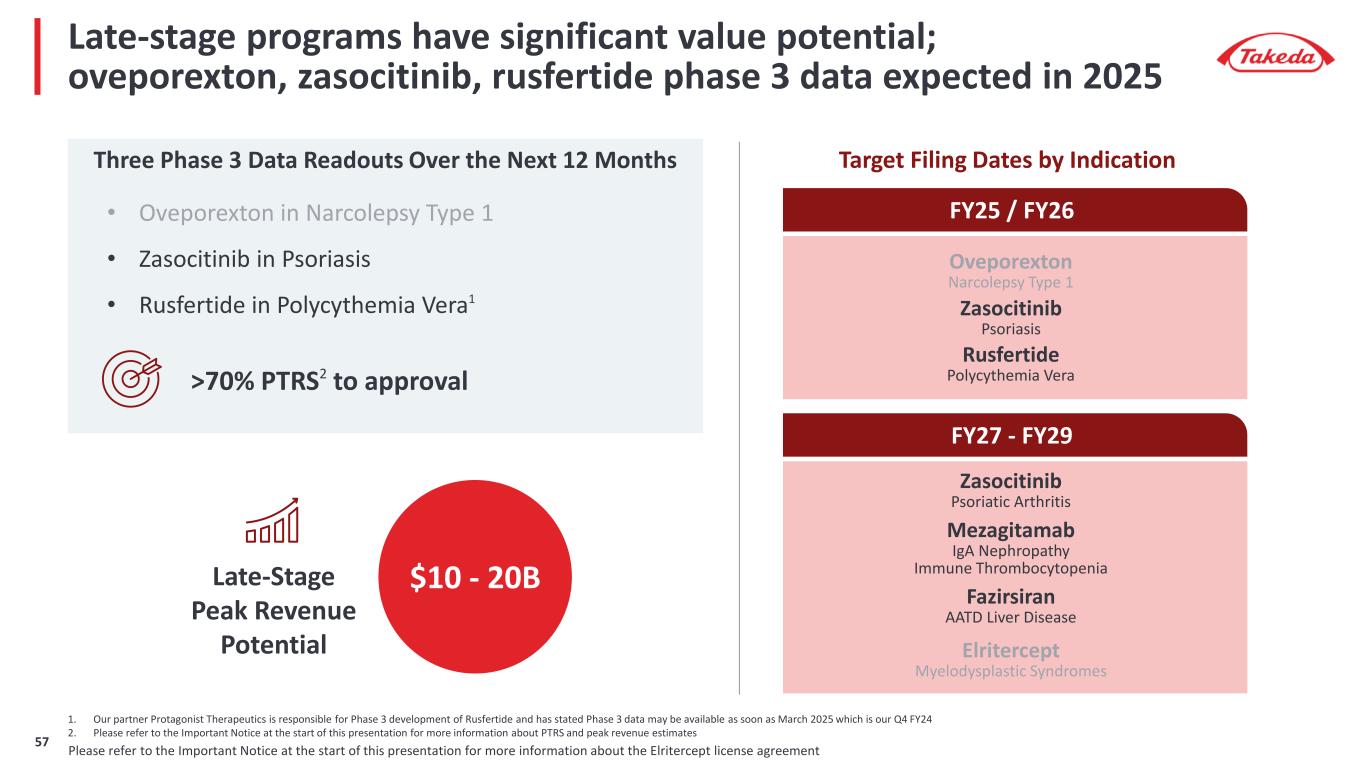

Late-stage programs have significant value potential; oveporexton, zasocitinib, rusfertide phase 3 data expected in 2025 Three Phase 3 Data Readouts Over the Next 12 Months 1. Our partner Protagonist Therapeutics is responsible for Phase 3 development of Rusfertide and has stated Phase 3 data may be available as soon as March 2025 which is our Q4 FY24 2. Please refer to the Important Notice at the start of this presentation for more information about PTRS and peak revenue estimates Late-Stage Peak Revenue Potential >70% PTRS2 to approval $10 - 20B Fazirsiran (TAK-999) AATD Liver Disease Elritercept (TAK-226) Myelodysplastic Syndromes Zasocitinib (TAK-279) Psoriatic Arthritis Mezagitamab (TAK-079) IgA Nephropathy Immune Thrombocytopenia FY25 / FY26 Oveporexton (TAK-861) Narcolepsy Type 1 Rusfertide (TAK-121) Polycythemia Vera Zasocitinib (TAK-279) Psoriasis Target Filing Dates by Indication FY27 - FY29 • Oveporexton in Narcolepsy Type 1 • Zasocitinib in Psoriasis • Rusfertide in Polycythemia Vera1 Please refer to the Important Notice at the start of this presentation for more information about the Elritercept license agreement8

R&D Strategy and Pipeline Highlights Andy Plump President, Research & Development Accelerating Our Late-Stage Pipeline to Transform Patients’ Lives and Deliver Significant Value to Takeda

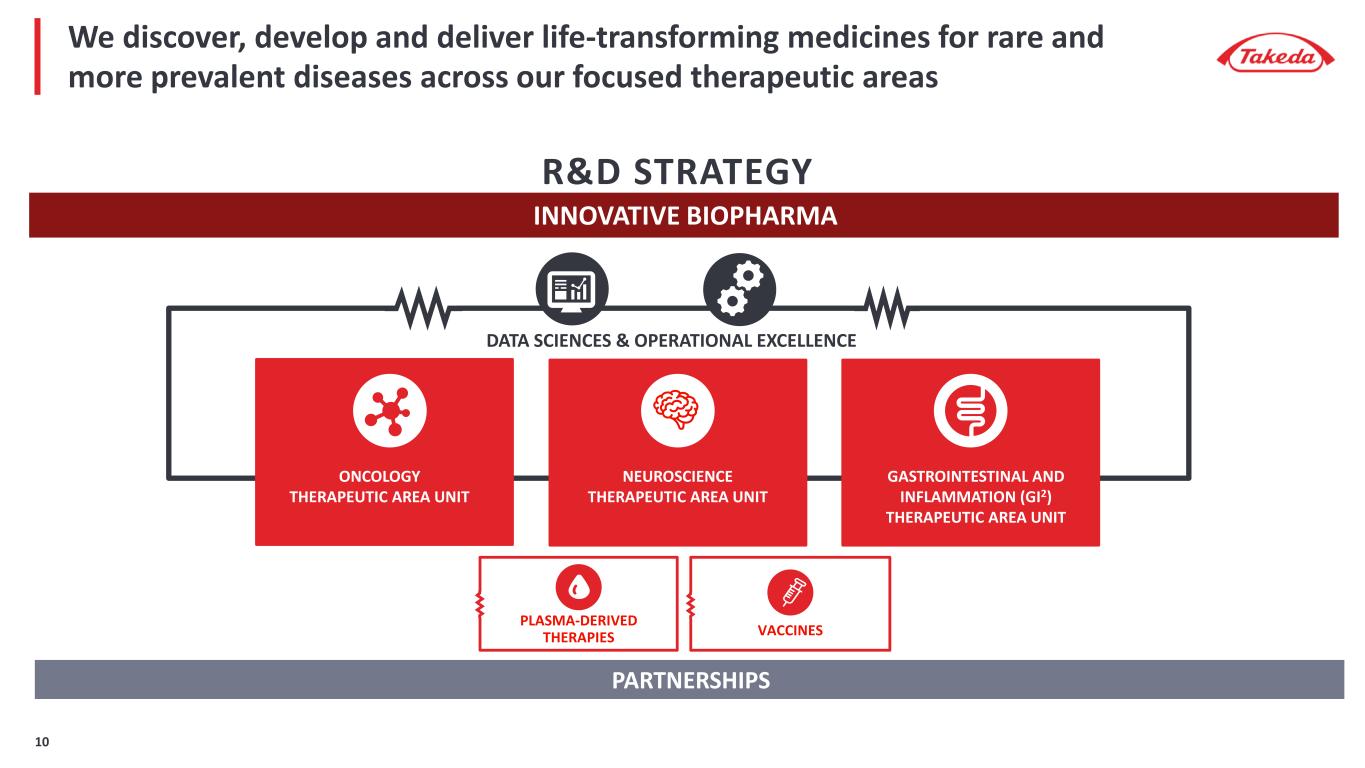

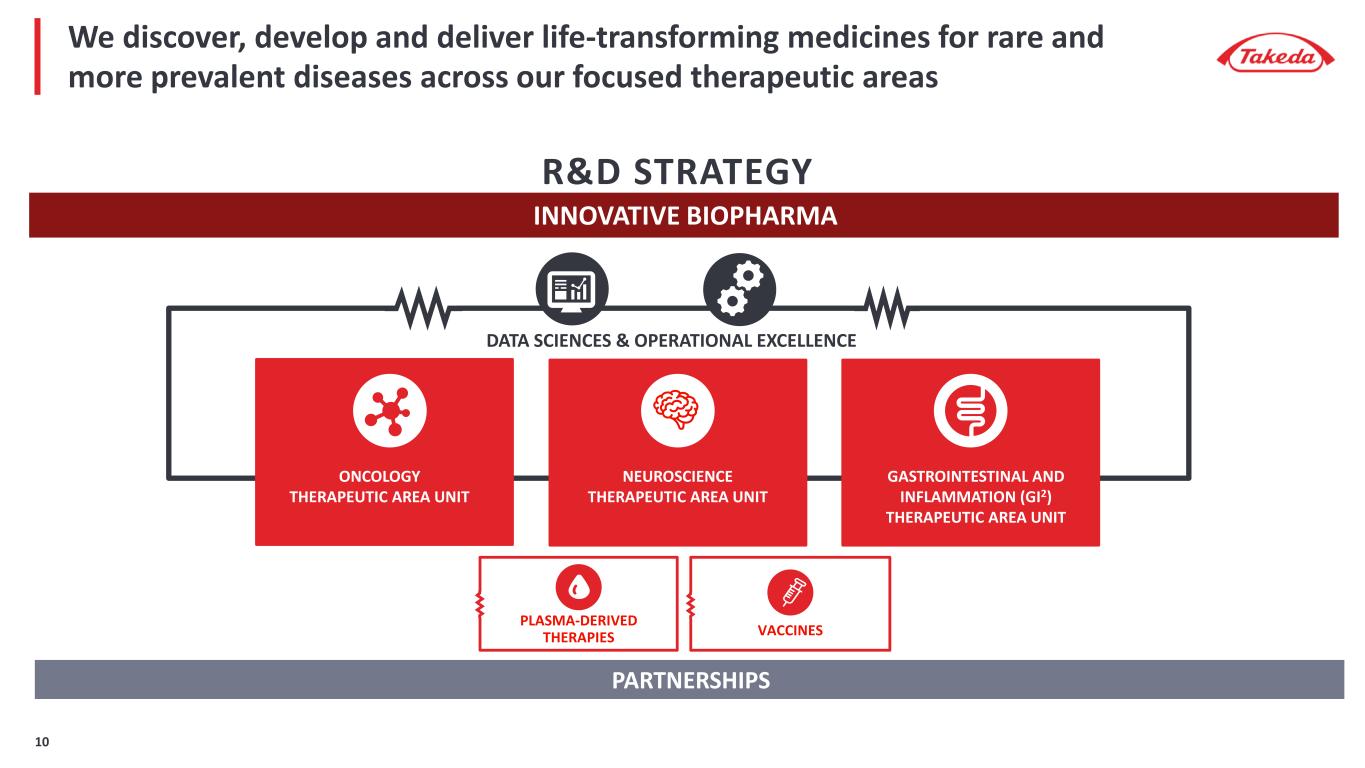

We discover, develop and deliver life-transforming medicines for rare and more prevalent diseases across our focused therapeutic areas R&D STRATEGY INNOVATIVE BIOPHARMA ONCOLOGY THERAPEUTIC AREA UNIT NEUROSCIENCE THERAPEUTIC AREA UNIT GASTROINTESTINAL AND INFLAMMATION (GI2) THERAPEUTIC AREA UNIT DATA SCIENCES & OPERATIONAL EXCELLENCE PARTNERSHIPS VACCINESPLASMA-DERIVED THERAPIES 10

Global Development, Global Launch Capability 3 Therapeutic Areas, 4 Key Modalities R&D Investment 770 bn JPY1 Robust, High Value Late-Stage Pipeline Our scale, focus, and capabilities have advanced significantly since FY2015 Shire Integration R&D Transformation Enhance R&D Productivity Invest Data Sciences + AI Regional Development and Launch Capability 10 Therapeutic Areas, Small Molecule Focus R&D Investment 346 bn JPY Small Late-Stage Pipeline FY2015 FY2024 1. Projected R&D Investment as of Q2 FY24 earnings, October 31, 2024. 11

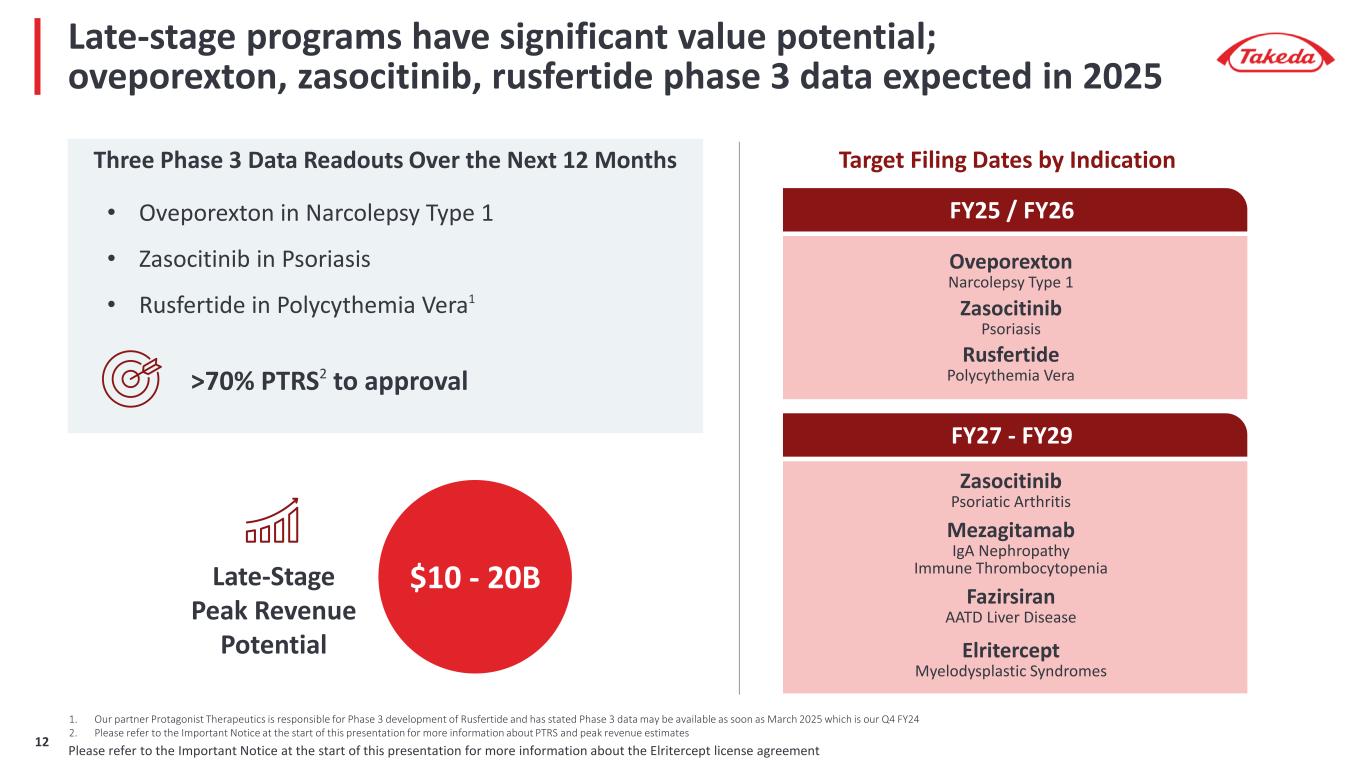

Late-stage programs have significant value potential; oveporexton, zasocitinib, rusfertide phase 3 data expected in 2025 Three Phase 3 Data Readouts Over the Next 12 Months Late-Stage Peak Revenue Potential >70% PTRS2 to approval $10 - 20B Fazirsiran AATD Liver Disease Elritercept Myelodysplastic Syndromes Zasocitinib Psoriatic Arthritis Mezagitamab IgA Nephropathy Immune Thrombocytopenia FY25 / FY26 Target Filing Dates by Indication FY27 - FY29 • Oveporexton in Narcolepsy Type 1 • Zasocitinib in Psoriasis • Rusfertide in Polycythemia Vera1 Oveporexton Narcolepsy Type 1 Rusfertide Polycythemia Vera Zasocitinib Psoriasis 1. Our partner Protagonist Therapeutics is responsible for Phase 3 development of Rusfertide and has stated Phase 3 data may be available as soon as March 2025 which is our Q4 FY24 2. Please refer to the Important Notice at the start of this presentation for more information about PTRS and peak revenue estimates Please refer to the Important Notice at the start of this presentation for more information about the Elritercept license agreement12

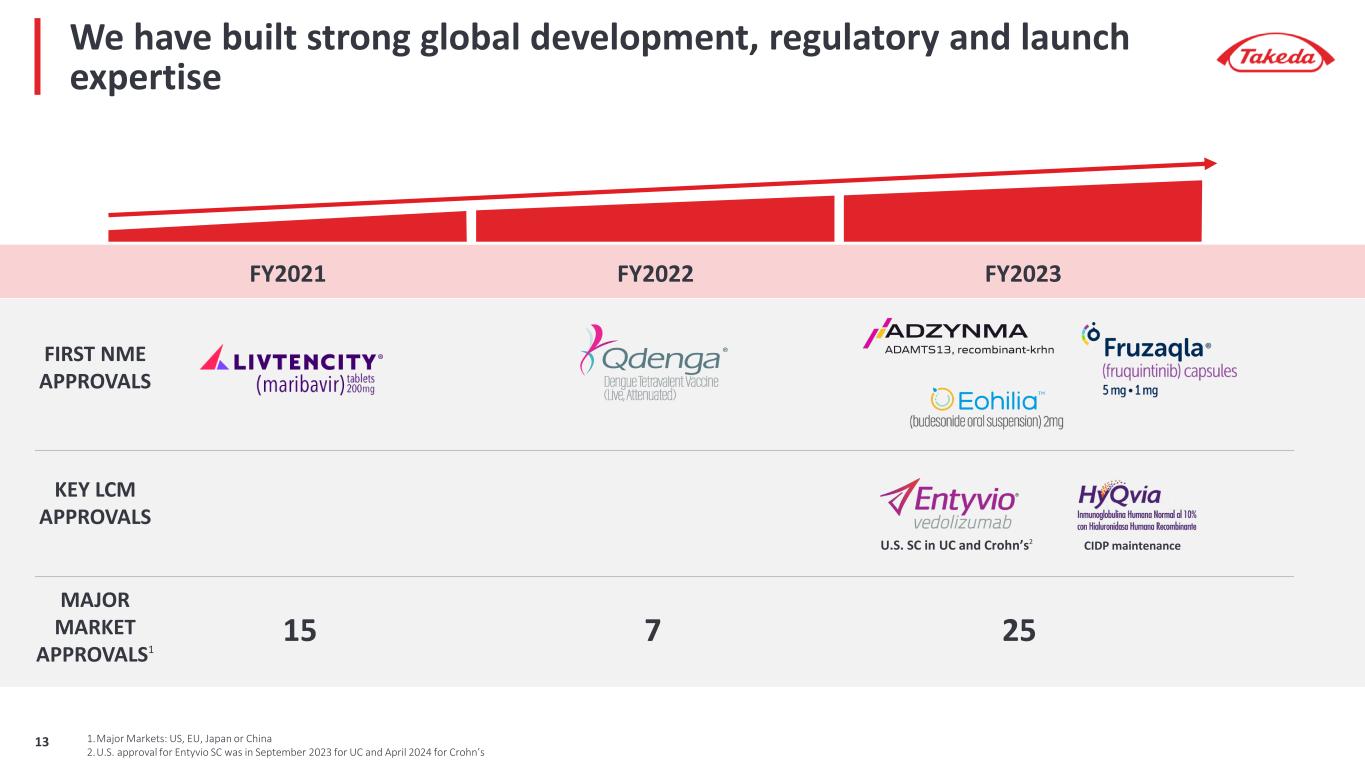

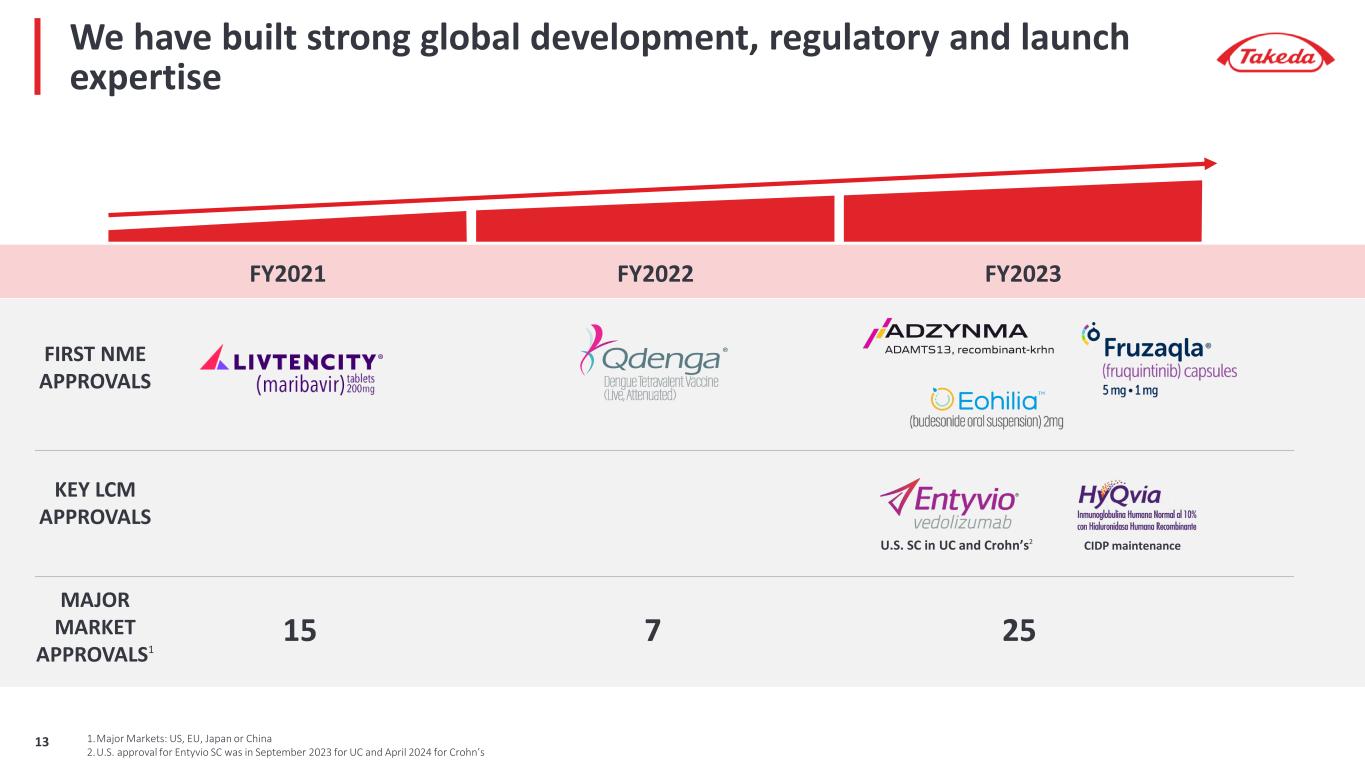

We have built strong global development, regulatory and launch expertise FY2021 FY2022 FY2023 FIRST NME APPROVALS MAJOR MARKET APPROVALS1 CIDP maintenance U.S. SC in UC and Crohn’s2 KEY LCM APPROVALS 25715 1.Major Markets: US, EU, Japan or China 2.U.S. approval for Entyvio SC was in September 2023 for UC and April 2024 for Crohn’s 13

Rigorous prioritization to deliver our high value late-stage pipeline GLOBAL NMEs1 % OF EXTERNAL SPEND3 1.Lead indication only, no regional assets/expansions 2.Phase 3 trials ongoing or planned that support the development of the NMEs 3.External spend refers to direct pipeline spend in R&D Business Unit. Early-stage refers to pre-proof of concept; late stage refers to post-proof of concept. 4.Total R&D Spend refers to all R&D related expenses as per Takeda's consolidated statement of profit and loss. Calculated with actual FY2021 average exchange rate of 1 USD = 112 JPY and FY2024 full year assumption rate of 1 USD = 150 JPY respectively. 17 12 3 1 Phase 1 Phase 2 Phase 3 Filed Q4 FY21 4 Ph3 Trials2 48% 31% 31% 51% 21% 18% 0% 100% Actual FY21 Projected FY24e LCM Late-Stage Early-Stage $4.7 $5.1 Total R&D Spend4 (Bn USD) Program Selection Criteria 1. Unmet medical need 2. Scientific validity 3. Accelerated development path 4. Commercial opportunity Investing in Robust Late-Stage Pipeline FY25+ Q2 FY24 6 8 6 14 Ph3 Trials2 14

Execute Clinical Trials with top tier industry performance Future Fit development model: delivering improved speed, quality and efficiencies across the pipeline Preclinical Ph 1 Ph 2 Ph 3 Filing Launch Research Development Study level: 3 core elements that can be optimized Closeout & Reporting Recruitment & Conduct Study & Planning Document generation powered by AI and automation for regulatory submission Study planning, site selection, and site activation improved performance Recruitment enhanced by leveraging advanced analytics COMPASS Clinical trial management and analytics People & Process 15

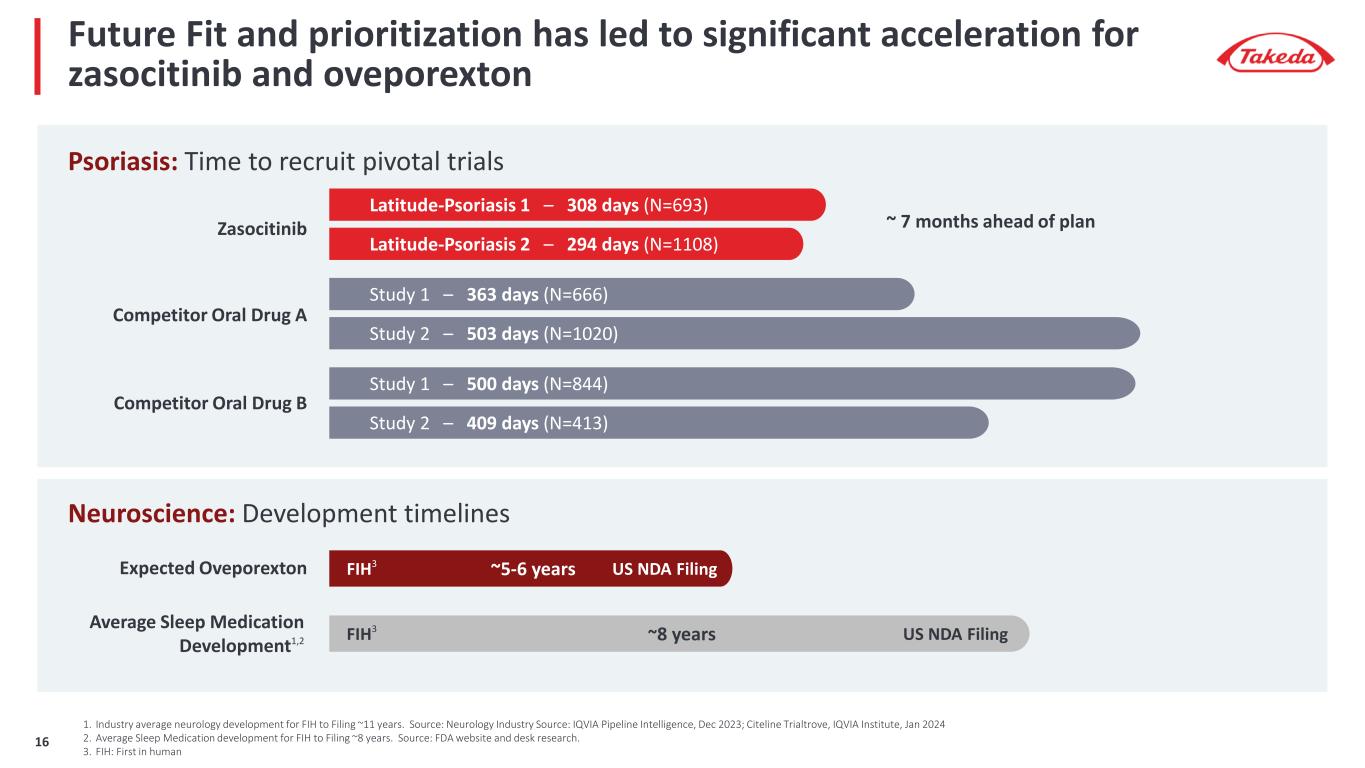

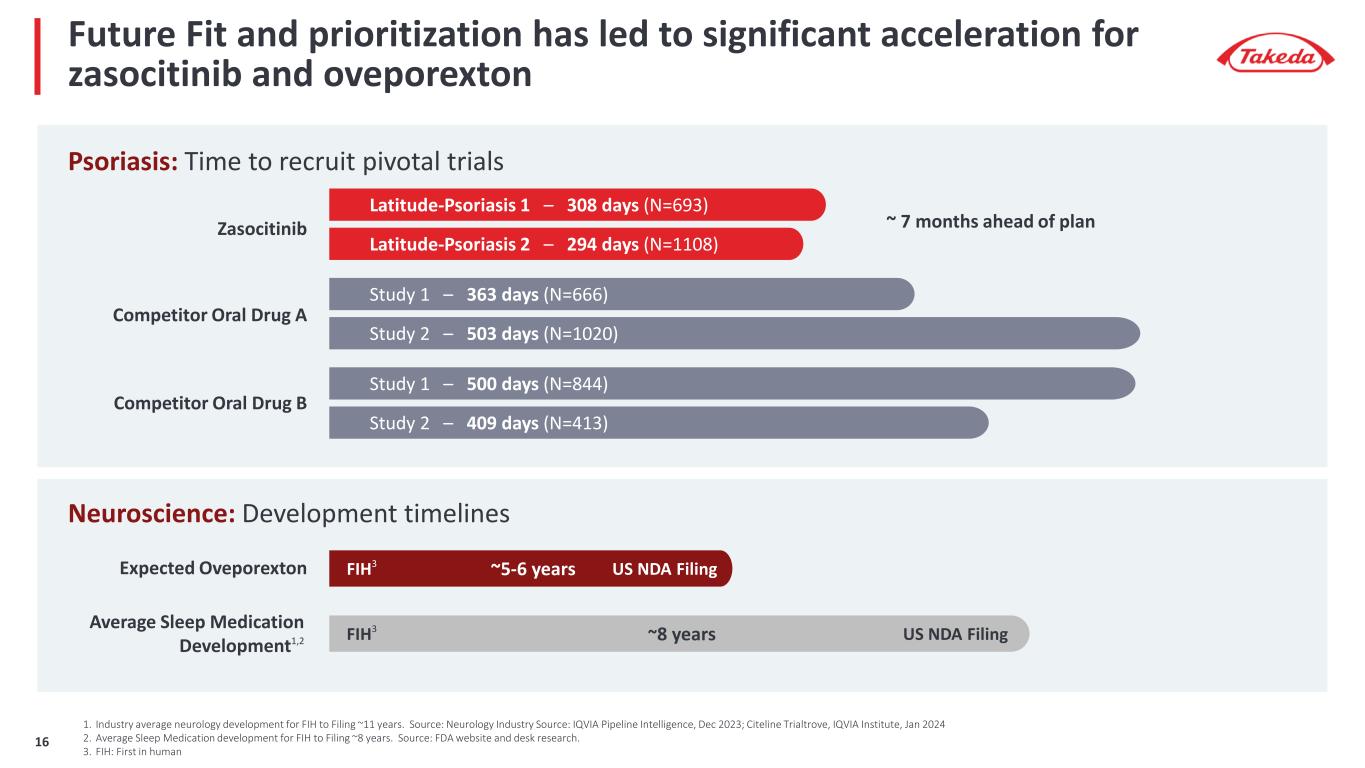

Future Fit and prioritization has led to significant acceleration for zasocitinib and oveporexton ~8 yearsAverage Sleep Medication Development1,2 Study 2 – 503 days (N=1020) Study 2 – 409 days (N=413) Latitude-Psoriasis 1 – 308 days (N=693) Zasocitinib Psoriasis: Time to recruit pivotal trials Latitude-Psoriasis 2 – 294 days (N=1108) Study 1 – 363 days (N=666) Study 1 – 500 days (N=844) Competitor Oral Drug B Competitor Oral Drug A ~ 7 months ahead of plan FIH3 US NDA Filing Neuroscience: Development timelines 1. Industry average neurology development for FIH to Filing ~11 years. Source: Neurology Industry Source: IQVIA Pipeline Intelligence, Dec 2023; Citeline Trialtrove, IQVIA Institute, Jan 2024 2. Average Sleep Medication development for FIH to Filing ~8 years. Source: FDA website and desk research. 3. FIH: First in human Expected Oveporexton ~5-6 yearsFIH3 US NDA Filing 16

Late-stage programs have significant value potential; oveporexton, zasocitinib, rusfertide phase 3 data expected in 2025 Three Phase 3 Data Readouts Over the Next 12 Months Late-Stage Peak Revenue Potential >70% PTRS2 to approval $10 - 20B Fazirsiran AATD Liver Disease Elritercept Myelodysplastic Syndromes Zasocitinib Psoriatic Arthritis Mezagitamab IgA Nephropathy Immune Thrombocytopenia FY25 / FY26 Target Filing Dates by Indication FY27 - FY29 • Oveporexton in Narcolepsy Type 1 • Zasocitinib in Psoriasis • Rusfertide in Polycythemia Vera1 Oveporexton Narcolepsy Type 1 Rusfertide Polycythemia Vera Zasocitinib Psoriasis Accelerated w/ Accelerated w/ 1. Our partner Protagonist Therapeutics is responsible for Phase 3 development of Rusfertide and has stated Phase 3 data may be available as soon as March 2025 which is our Q4 FY24 2. Please refer to the Important Notice at the start of this presentation for more information about PTRS and peak revenue estimates Please refer to the Important Notice at the start of this presentation for more information about the Elritercept license agreement17

Sustainable acceleration of First-in-Human, and BLA/NDA First Filing Preclinical stage: 3 core elements for optimization Apply Digital Accelerators Driving Efficiency with Real-Time Decision Support Accelerate Delivery to Clinic (Fast to First-in-Human) Building unified digital infrastructure and the Lab of the Future at 585 Kendall with augmented ways of working Fast pivot to develop TAK-360 leveraging AI and cryogenic electron microscopy Quality targets, right modalities, and resourcing from project inception PharmSciResearch DD&T Right modalities and resourcing from project inception; Research engine to fuel our sustainable pipeline 585 Kendall, CambridgeShonan iPark, Japan 18

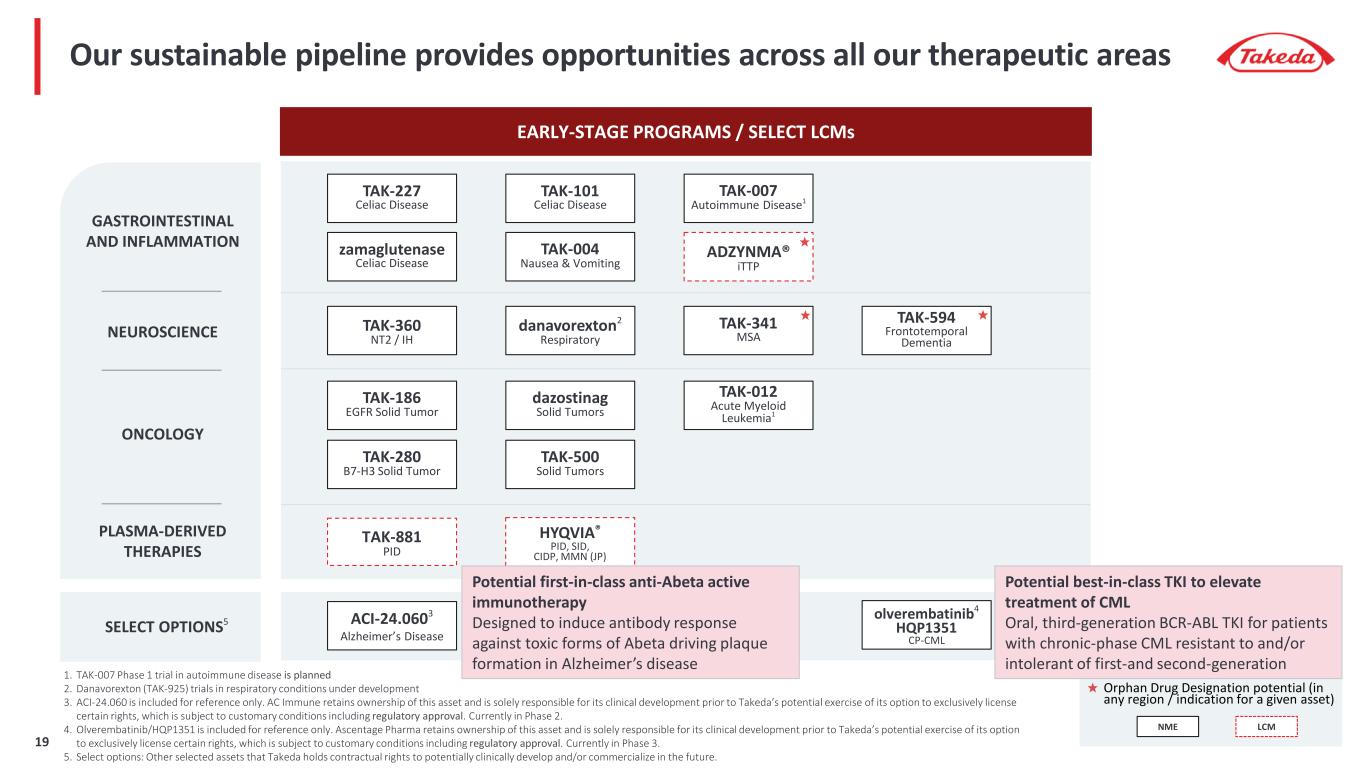

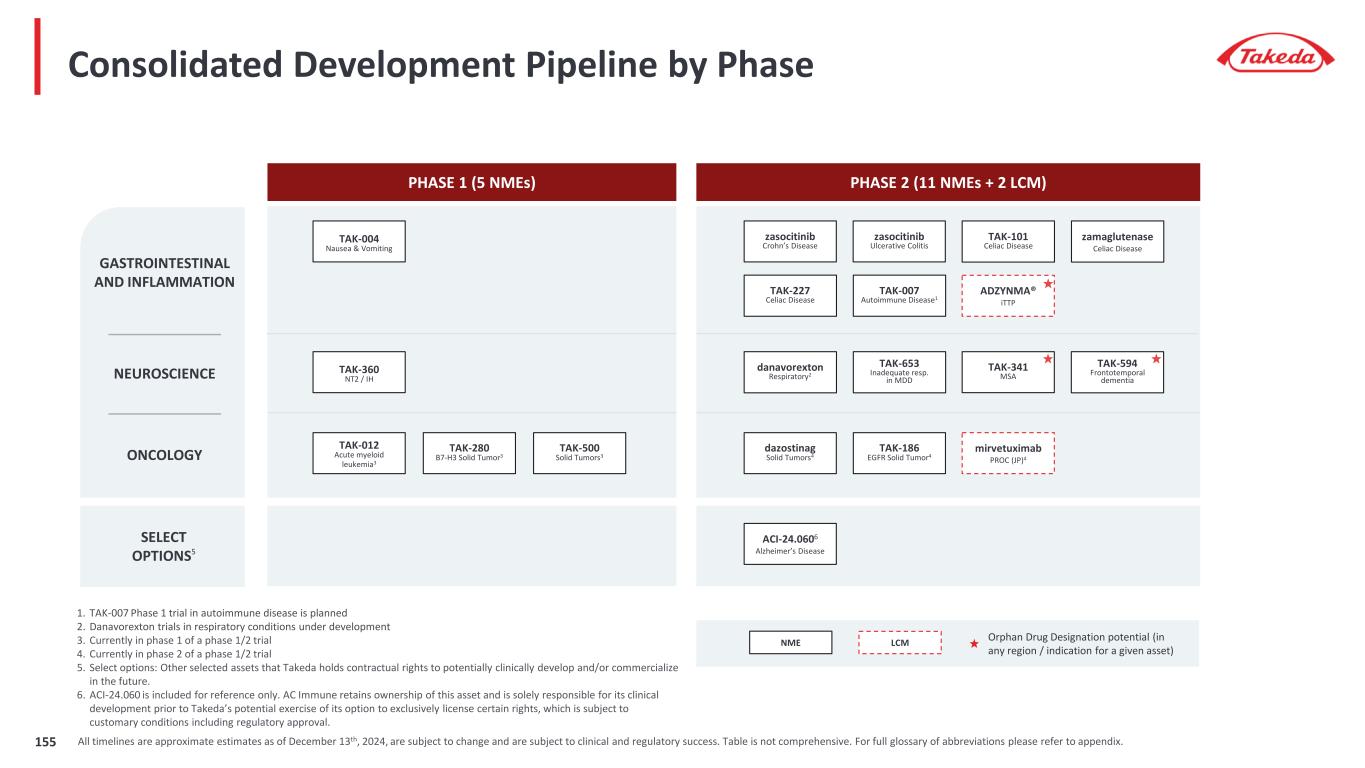

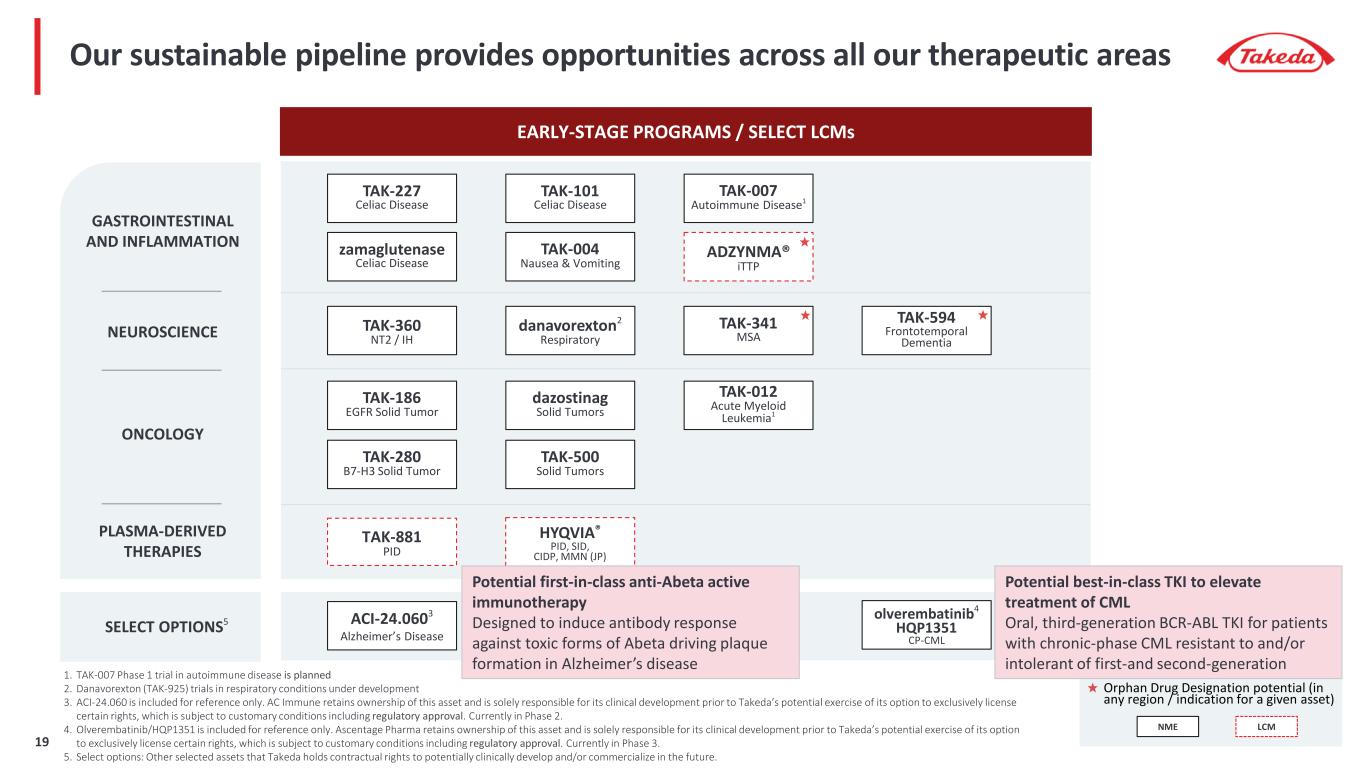

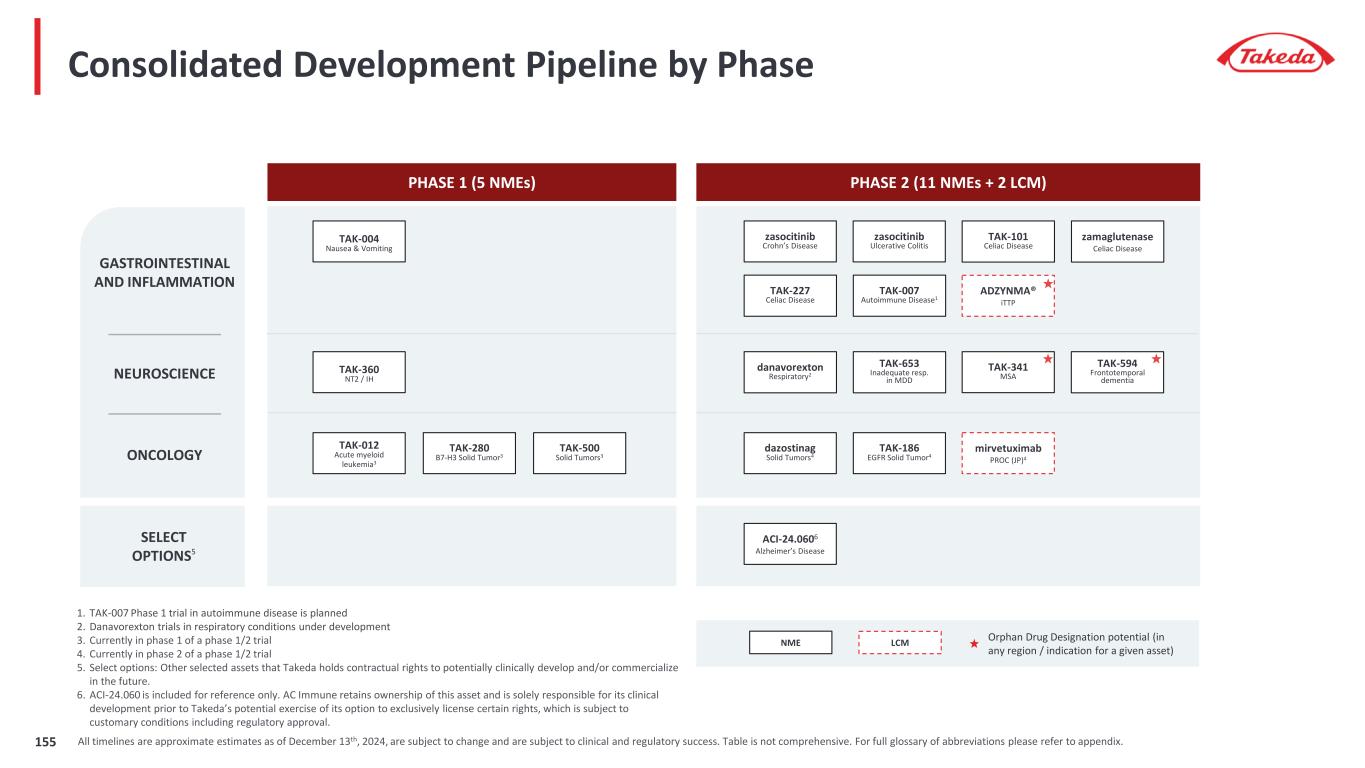

EARLY-STAGE PROGRAMS / SELECT LCMs SELECT OPTIONS5 NEUROSCIENCE zamaglutenase Celiac Disease Orphan Drug Designation potential (in any region / indication for a given asset) TAK-594 Frontotemporal Dementia TAK-341 MSA GASTROINTESTINAL AND INFLAMMATION TAK-101 Celiac Disease TAK-227 Celiac Disease danavorexton2 Respiratory PLASMA-DERIVED THERAPIES ACI-24.0603 Alzheimer’s Disease ADZYNMA® iTTP Our sustainable pipeline provides opportunities across all our therapeutic areas olverembatinib4 HQP1351 CP-CML TAK-004 Nausea & Vomiting 1. TAK-007 Phase 1 trial in autoimmune disease is planned 2. Danavorexton (TAK-925) trials in respiratory conditions under development 3. ACI-24.060 is included for reference only. AC Immune retains ownership of this asset and is solely responsible for its clinical development prior to Takeda’s potential exercise of its option to exclusively license certain rights, which is subject to customary conditions including regulatory approval. Currently in Phase 2. 4. Olverembatinib/HQP1351 is included for reference only. Ascentage Pharma retains ownership of this asset and is solely responsible for its clinical development prior to Takeda’s potential exercise of its option to exclusively license certain rights, which is subject to customary conditions including regulatory approval. Currently in Phase 3. 5. Select options: Other selected assets that Takeda holds contractual rights to potentially clinically develop and/or commercialize in the future. TAK-007 Autoimmune Disease1 TAK-360 NT2 / IH dazostinag Solid Tumors TAK-012 Acute Myeloid Leukemia1 TAK-186 EGFR Solid Tumor TAK-500 Solid Tumors TAK-280 B7-H3 Solid Tumor ONCOLOGY HYQVIA® PID, SID, CIDP, MMN (JP) Potential first-in-class anti-Abeta active immunotherapy Designed to induce antibody response against toxic forms of Abeta driving plaque formation in Alzheimer’s disease NME LCM Potential best-in-class TKI to elevate treatment of CML Oral, third-generation BCR-ABL TKI for patients with chronic-phase CML resistant to and/or intolerant of first-and second-generation TAK-881 PID 19

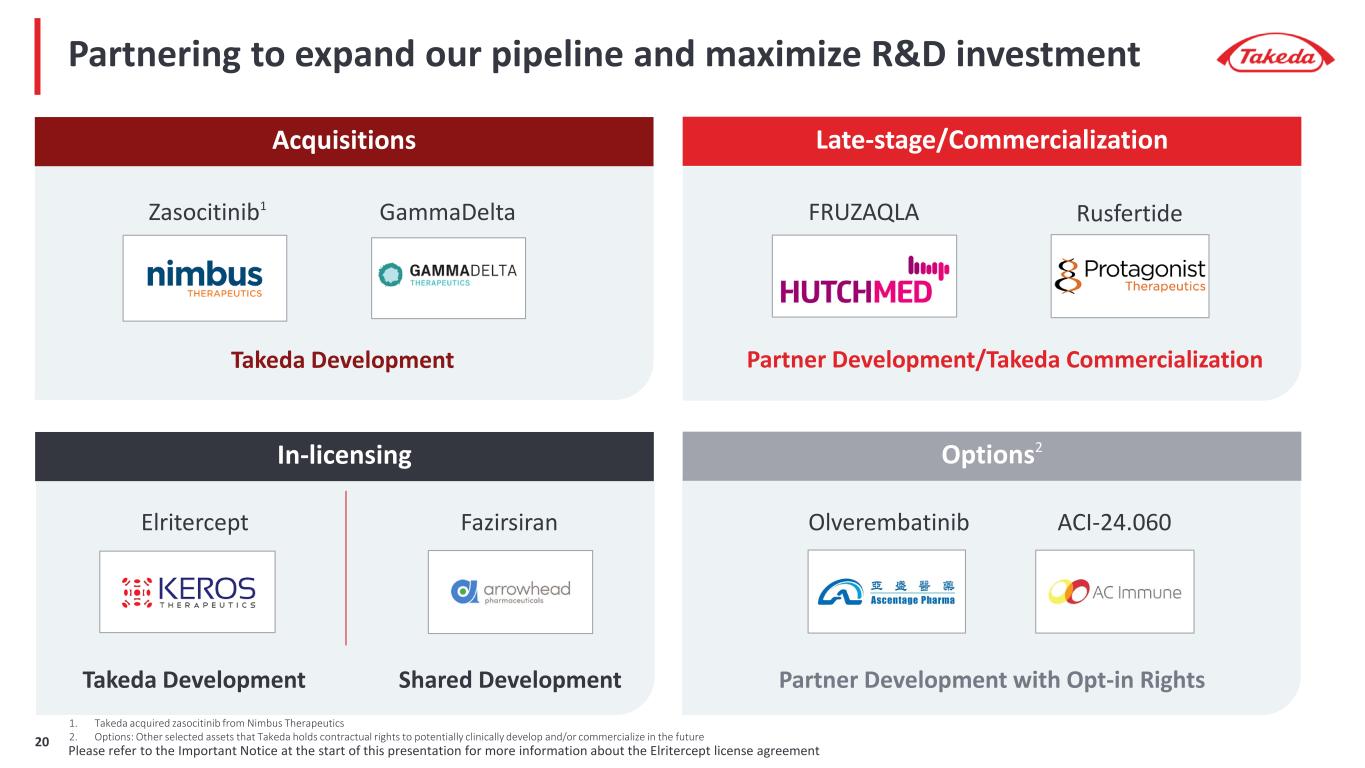

Partnering to expand our pipeline and maximize R&D investment Acquisitions Late-stage/Commercialization In-licensing Zasocitinib1 Takeda Development FRUZAQLA Partner Development/Takeda Commercialization Fazirsiran Olverembatinib Shared Development Partner Development with Opt-in Rights RusfertideGammaDelta ACI-24.060Elritercept Takeda Development 1. Takeda acquired zasocitinib from Nimbus Therapeutics 2. Options: Other selected assets that Takeda holds contractual rights to potentially clinically develop and/or commercialize in the future Please refer to the Important Notice at the start of this presentation for more information about the Elritercept license agreement20 Options2

Late-stage programs have significant value potential; oveporexton, zasocitinib, rusfertide phase 3 data expected in 2025 Three Phase 3 Data Readouts Over the Next 12 Months Late-Stage Peak Revenue Potential >70% PTRS2 to approval $10 - 20B Fazirsiran AATD Liver Disease Elritercept Myelodysplastic Syndromes Zasocitinib Psoriatic Arthritis Mezagitamab IgA Nephropathy Immune Thrombocytopenia FY25 / FY26 Target Filing Dates by Indication FY27 - FY29 • Oveporexton in Narcolepsy Type 1 • Zasocitinib in Psoriasis • Rusfertide in Polycythemia Vera1 Oveporexton Narcolepsy Type 1 Rusfertide Polycythemia Vera Zasocitinib Psoriasis 1. Our partner Protagonist Therapeutics is responsible for Phase 3 development of Rusfertide and has stated Phase 3 data may be available as soon as March 2025 which is our Q4 FY24 2. Please refer to the Important Notice at the start of this presentation for more information about PTRS and peak revenue estimates Please refer to the Important Notice at the start of this presentation for more information about the Elritercept license agreement21

Neuroscience: Deep-dive on Orexin Franchise Sarah Sheikh Head of Neuroscience Therapeutic Area Unit & Global Development Ramona Sequeira President, Global Portfolio Division

High Unmet Need Recent scientific advancements & regulatory momentum heralds a new era in Neuroscience Growing Scientific Understanding Innovative Regulatory Approaches BBB Shuttle Technology • Enhanced understanding of underlying pathophysiology • Identification & validation of previously undruggable targets • Discovery of novel biomarkers to de-risk • Enhanced Drug Delivery tools • 1 in 3 people will develop a neurological disorder in their lifetime • Neurological disorders impose $1.1 trillion in direct global healthcare costs annually • 32 new neurological indications approved from 2018-2023 • Advancement in supportive reimbursement framework Estimated to be 9 million deaths per year due to neurological conditions1 Evidenced by Numerous Recent FDA Approvals 1. Lancet Neuro, 2019 May;18(5):459–480 WHO https://www.who.int/news/item/14-03-2024-over-1-in-3-people-affected-by-neurological-conditions--the-leading-cause-of-illness-and-disability-worldwide 2) Global, regional, and national burden of neurological disorders, 1990–2016: a systematic analysis for the Global Burden of Disease Study 2016 3) Estimating the Economic Impact of Direct Health Expenditure on Brain Disorders, Globally and in the United States 4) https://www.ncbi.nlm.nih.gov/books/NBK53103/ 5) Thomas et al, 2024, A Comprehensive Review of Novel FDA-approved Neurological Indications from 2018–2023 6) https://pmc.ncbi.nlm.nih.gov/articles/PMC9945815/ 23

Our vision is to be a leader and partner in neuroscience by discovering and delivering life-changing medicines for people and society NEURODEGENERATION RARE NEUROLOGY Strategically focused on three core areas OREXIN Transform care for rare sleep disorders and orexin-related conditions Leverage Takeda’s pioneering science to fully harness orexin biology Address the leading driver of health burdens in an aging society Utilize validated targets & next-gen modalities to alleviate societal burden Address the devastating diseases with significant unmet need Develop potential disease modifying medicines 24

Leading Orexin Franchise

• TAK-360: Accelerated development in NT2 & IH • New chemistry and profile • Fast track designation received in U.S. • Target Ph2 start FY2024 in NT2/IH • Exploration of indications pertinent to orexin biology: sleep-wake, respiration and metabolism • Tailored assets/profiles (e.g., TAK-9252 and others) to deliver optimal exposure for additional indications Takeda pioneering the field of orexin therapeutics – franchise leading with oveporexton, a potential first-in-class treatment for NT1 1. Dauvilliers, Y., N Engl J Med, 2023; 389, 309-321; 2. Suzuki M et al., British Journal of Anaesthesia, 2024; IARS Conference, Denver, 2023; HV: Healthy Volunteer 3. Referring to the accelerated development timeline Oveporexton (TAK-861): First & Fast3 in NT1 TAK-360 and beyond: Additional assets/indications • The most advanced orexin agonist – Addressing orexin deficiency as the underlying pathophysiology in NT11 • Target Ph3 readout in CY2025 • Ph2 and Long-term Extension (LTE) data support potential transformative profile • Significantly accelerated Phase 3 program • Breakthrough therapy designation received in U.S., China 26

Nighttime Symptoms Excessive Daytime Sleepiness (EDS) Cataplexy Hallucinations, Sleep Paralysis Disrupted Nighttime Sleep, Disturbing Dreams1 NT1 patients face daytime and nighttime debilitating symptoms impacting daily function Cognitive Symptoms Daytime Symptoms 1 Sateia MJ. Chest 2014;146:1387–94 Reduced Work productivity Reduced School Performance Challenged Social Interactions Reduced Personal Responsibilities Limited Recreational Activities These symptoms may have significant impact on daily functions 27

OX2R Orexin Downstream Neurotransmitter OX2R Agonist Mahoney CE, et al. Nat Rev Neurosci. 2019;20(2):83-93; Chastain EM, et al. Biochim Biophys Acta. 2011;1812:265–274; Nishino S. Sleep Med. 2007;8(4):373-399; Saper CB, et al. Trends Neurosci. 2001;24(12):726-731; Yoshida Y, et al. Eur J Neurosci. 2001;14(7):1075-1081; Dauvilliers, Y., N Engl J Med, 2023; 389, 309-321 Healthy orexin neurons with normal postsynaptic downstream neurotransmitter activity Healthy Individual 01 Reduced availability of orexin as orexin neurons are lost, reducing downstream neurotransmitter activity Individual with Narcolepsy type 1 02 Orexin 2 receptor (OX2R) agonist may restore downstream neurotransmitter activity lost when endogenous orexin levels decline Highly Specific OX2R Agonist 03 NT1 pathophysiology is caused by loss of orexin neurons 28

Sleep Diary, PSG ESS: Epworth Sleepiness Scale; MWT: Maintenance of Wakefulness Test; NSS-CT: Narcolepsy severity scale; PVT: Psychomotor Vigilance Task; WCR: Weekly cataplexy rate; FINI: Functional Impacts of Narcolepsy Instrument; CGI-C: Clinical Global Impression of Change; PGI-C: Patient Clinical Global Impression of Change; PSG: polysomnography Comprehensive approach to evaluate full spectrum of NT1 symptoms with established and novel endpoints defining a new treatment class WCR PVTMWT, ESS NSS-CT, FINI, CGI-C, PGI-C Nighttime Symptoms Excessive Daytime Sleepiness (EDS) Cataplexy Hallucinations, Sleep Paralysis Cognitive Symptoms Daytime Symptoms Disrupted Nighttime Sleep, Disturbing Dreams1 29

*Randomized to active arms The extensive oveporexton (TAK-861) phase 2 program laid solid foundation for phase 3 program 95% of participants that completed the placebo-controlled study enrolled in the LTE TAK-861 0.5 mg twice daily ~3 hours apart TAK-861 2 mg twice daily ~3 hours apart TAK-861 2 mg followed by 5 mg ~3 hours apart TAK-861 7 mg QD Ph2b TAK-861 2001 (NT1) N=112 Long Term Extension (LTE) Key Efficacy Measures • MWT • ESS • WCR • NSS-CT Safety • TEAEsPlacebo twice daily ~3 hours apart R* 30

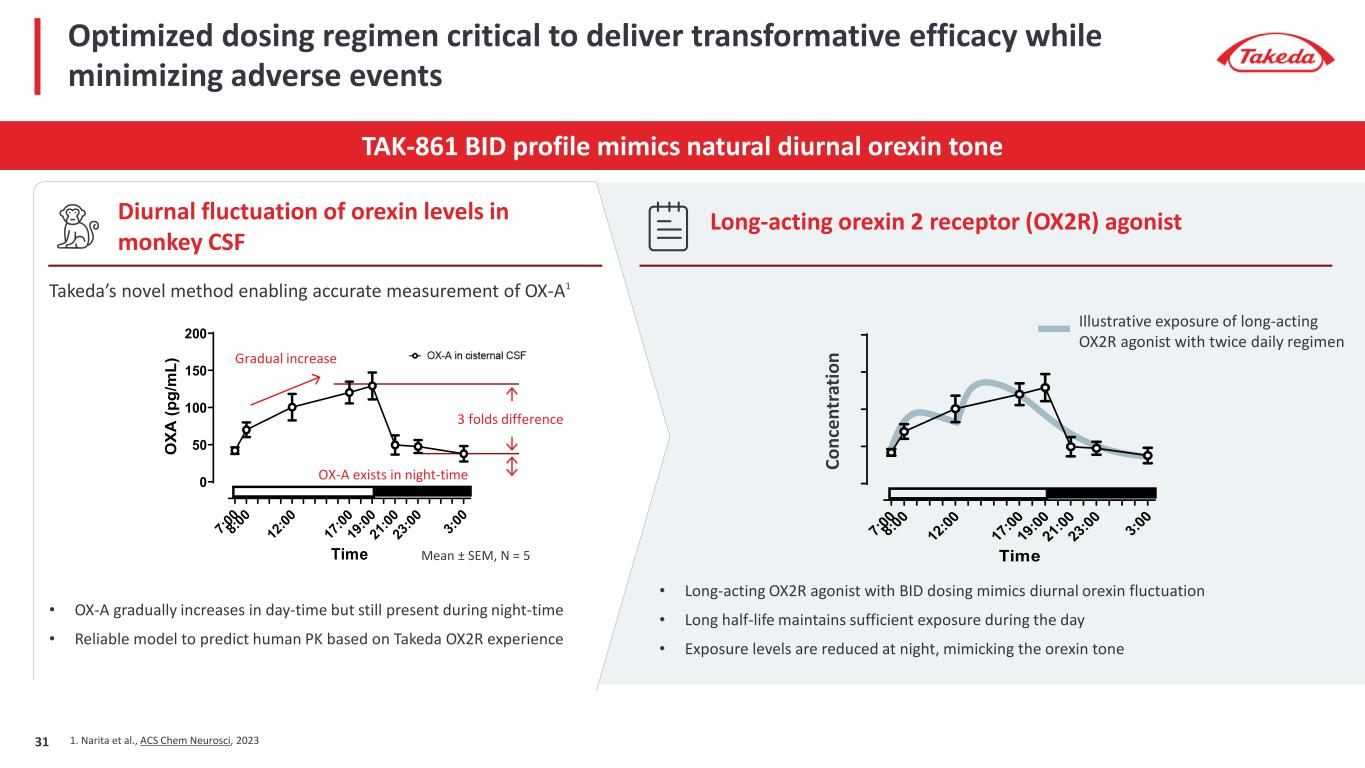

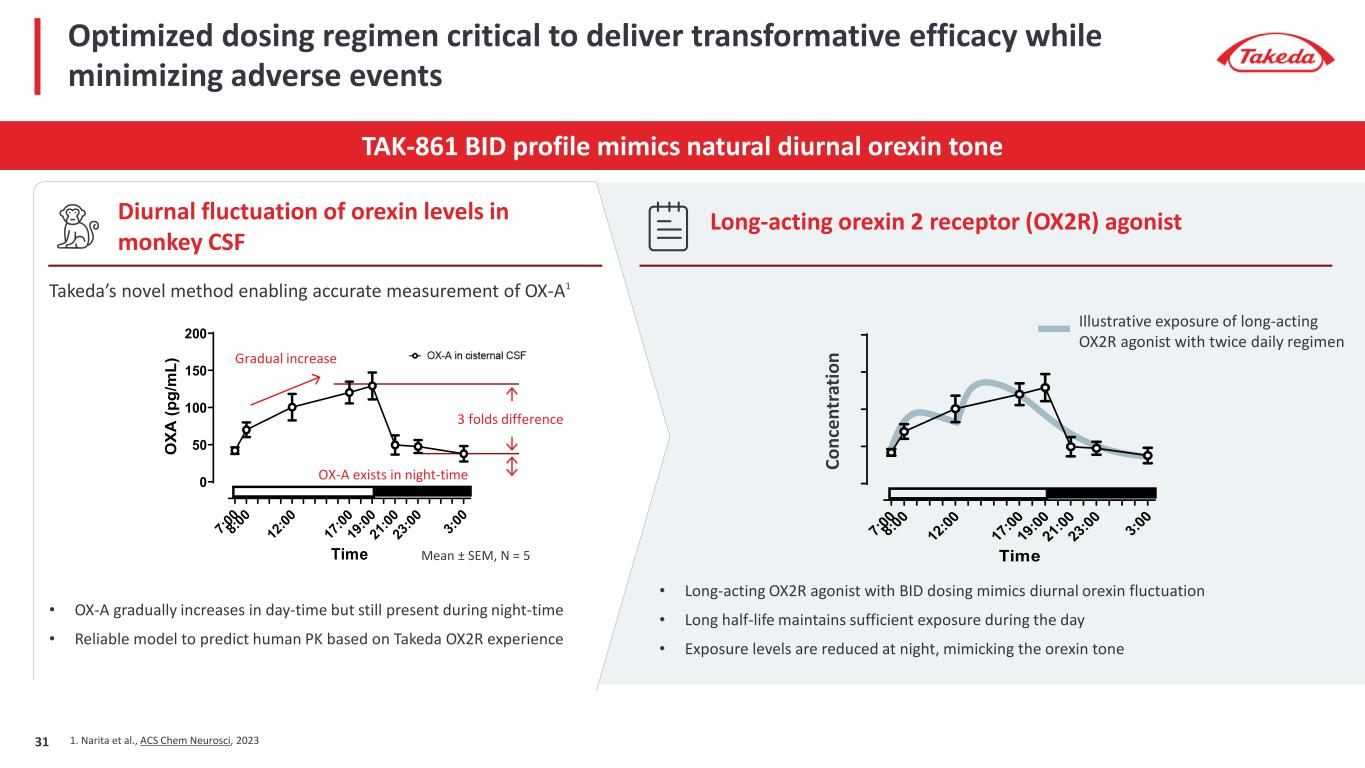

Optimized dosing regimen critical to deliver transformative efficacy while minimizing adverse events TAK-861 BID profile mimics natural diurnal orexin tone Diurnal fluctuation of orexin levels in monkey CSF Long-acting orexin 2 receptor (OX2R) agonist 7:0 0 8:0 0 12 :00 17 :00 19 :00 21 :00 23 :00 3:0 0 0 50 100 150 200 Time O XA (p g/ m L) Takeda’s novel method enabling accurate measurement of OX-A1 • OX-A gradually increases in day-time but still present during night-time • Reliable model to predict human PK based on Takeda OX2R experience 1. Narita et al., ACS Chem Neurosci, 2023 Gradual increase 3 folds difference OX-A exists in night-time Mean ± SEM, N = 5 7:0 0 8:0 0 12 :00 17 :00 19 :00 21 :00 23 :00 3:0 0 0 50 100 150 200 Time OX A (p g/ m L) • Long-acting OX2R agonist with BID dosing mimics diurnal orexin fluctuation • Long half-life maintains sufficient exposure during the day • Exposure levels are reduced at night, mimicking the orexin tone Illustrative exposure of long-acting OX2R agonist with twice daily regimen Co nc en tr at io n 31

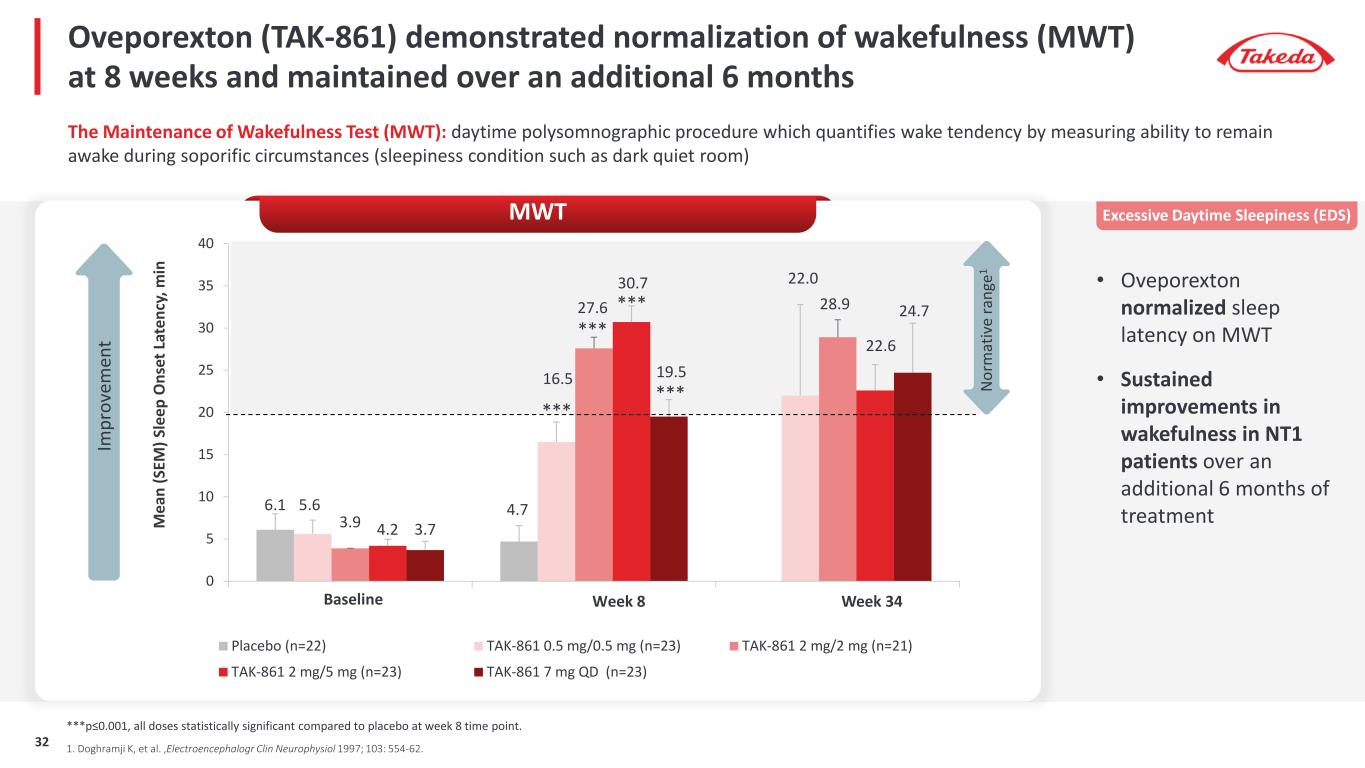

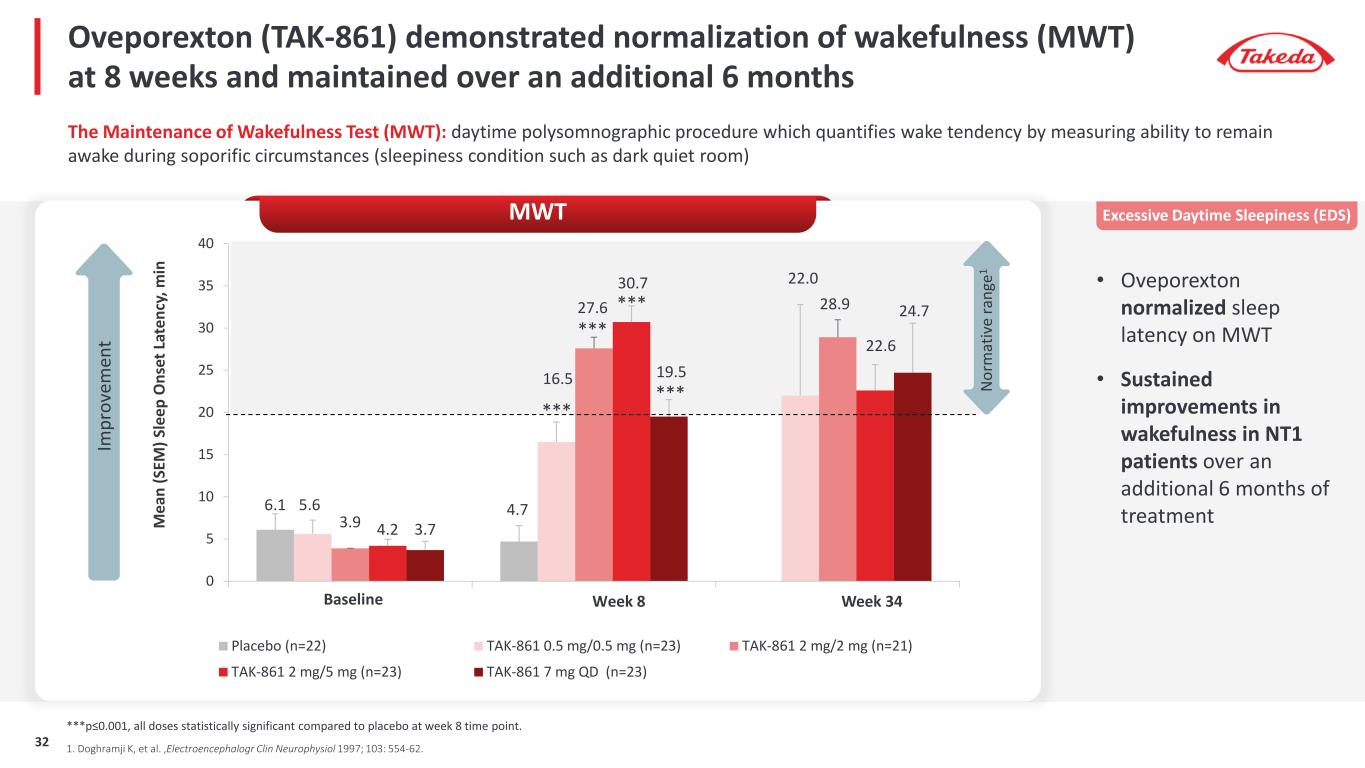

Oveporexton (TAK-861) demonstrated normalization of wakefulness (MWT) at 8 weeks and maintained over an additional 6 months • Oveporexton normalized sleep latency on MWT • Sustained improvements in wakefulness in NT1 patients over an additional 6 months of treatment The Maintenance of Wakefulness Test (MWT): daytime polysomnographic procedure which quantifies wake tendency by measuring ability to remain awake during soporific circumstances (sleepiness condition such as dark quiet room) 6.1 4.75.6 16.5 22.0 3.9 27.6 28.9 4.2 30.7 22.6 3.7 19.5 24.7 0 5 10 15 20 25 30 35 40 M ea n (S EM ) S le ep O ns et L at en cy , m in Placebo (n=22) TAK-861 0.5 mg/0.5 mg (n=23) TAK-861 2 mg/2 mg (n=21) TAK-861 2 mg/5 mg (n=23) TAK-861 7 mg QD (n=23) Baseline Week 34Week 8 MWT N or m at iv e ra ng e1 1. Doghramji K, et al. ,Electroencephalogr Clin Neurophysiol 1997; 103: 554-62. ***p≤0.001, all doses statistically significant compared to placebo at week 8 time point. *** *** *** *** Excessive Daytime Sleepiness (EDS) Im pr ov em en t 32

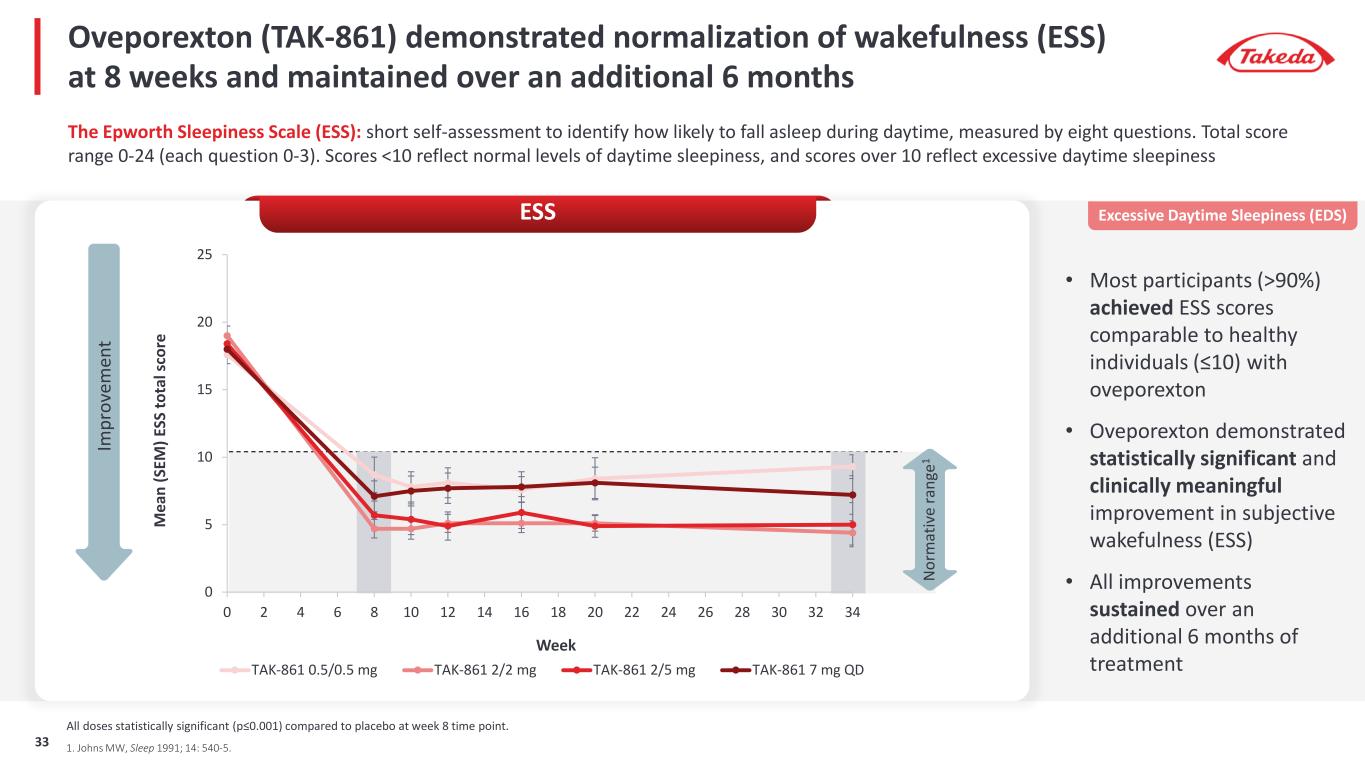

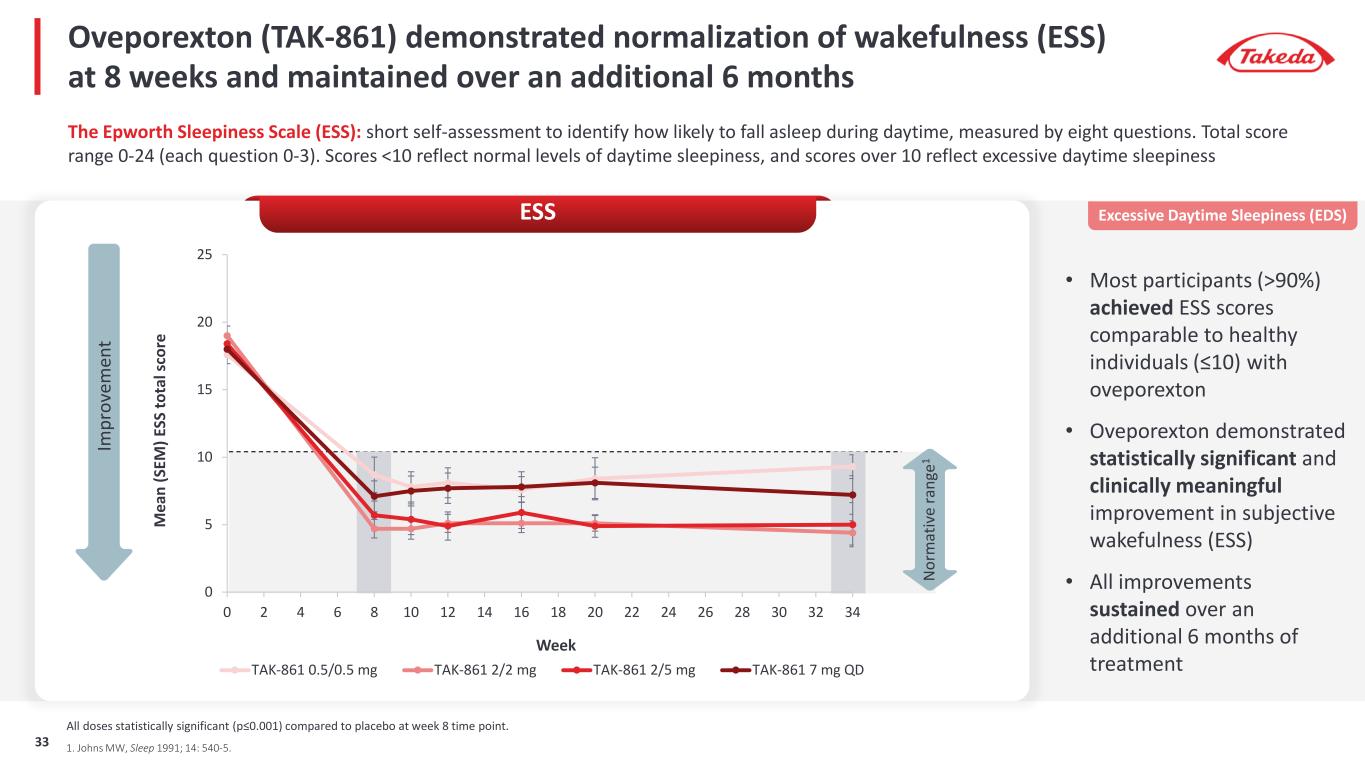

0 5 10 15 20 25 0 2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 M ea n (S EM ) E SS to ta l s co re Week TAK-861 0.5/0.5 mg TAK-861 2/2 mg TAK-861 2/5 mg TAK-861 7 mg QD Oveporexton (TAK-861) demonstrated normalization of wakefulness (ESS) at 8 weeks and maintained over an additional 6 months N or m at iv e ra ng e1 1. Johns MW, Sleep 1991; 14: 540-5. The Epworth Sleepiness Scale (ESS): short self-assessment to identify how likely to fall asleep during daytime, measured by eight questions. Total score range 0-24 (each question 0-3). Scores <10 reflect normal levels of daytime sleepiness, and scores over 10 reflect excessive daytime sleepiness • Most participants (>90%) achieved ESS scores comparable to healthy individuals (≤10) with oveporexton • Oveporexton demonstrated statistically significant and clinically meaningful improvement in subjective wakefulness (ESS) • All improvements sustained over an additional 6 months of treatment Excessive Daytime Sleepiness (EDS)ESS Im pr ov em en t All doses statistically significant (p≤0.001) compared to placebo at week 8 time point. 33

Oveporexton (TAK-861) demonstrated sustained reduction in cataplexy events over an additional 6 months IQR: Interquartile Range 0 5 10 15 20 25 0 2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 M ed ia n (IQ R) W CR Week TAK-861 0.5/0.5 mg TAK-861 2/2 mg TAK-861 2/5 mg TAK-861 7 mg QD Weekly Cataplexy Rate (WCR): average number of cataplexy events per week • Oveporexton showed statistically significant and clinically meaningful reduction in cataplexy events compared to placebo • Reduction in WCR is sustained over an additional 6 months of treatment CataplexyWCR Im pr ov em en t p ≤ 0.01 and p≤0.001, for 2/2 mg and 2/5 mg respectively compared to placebo at week 8 time point. 34

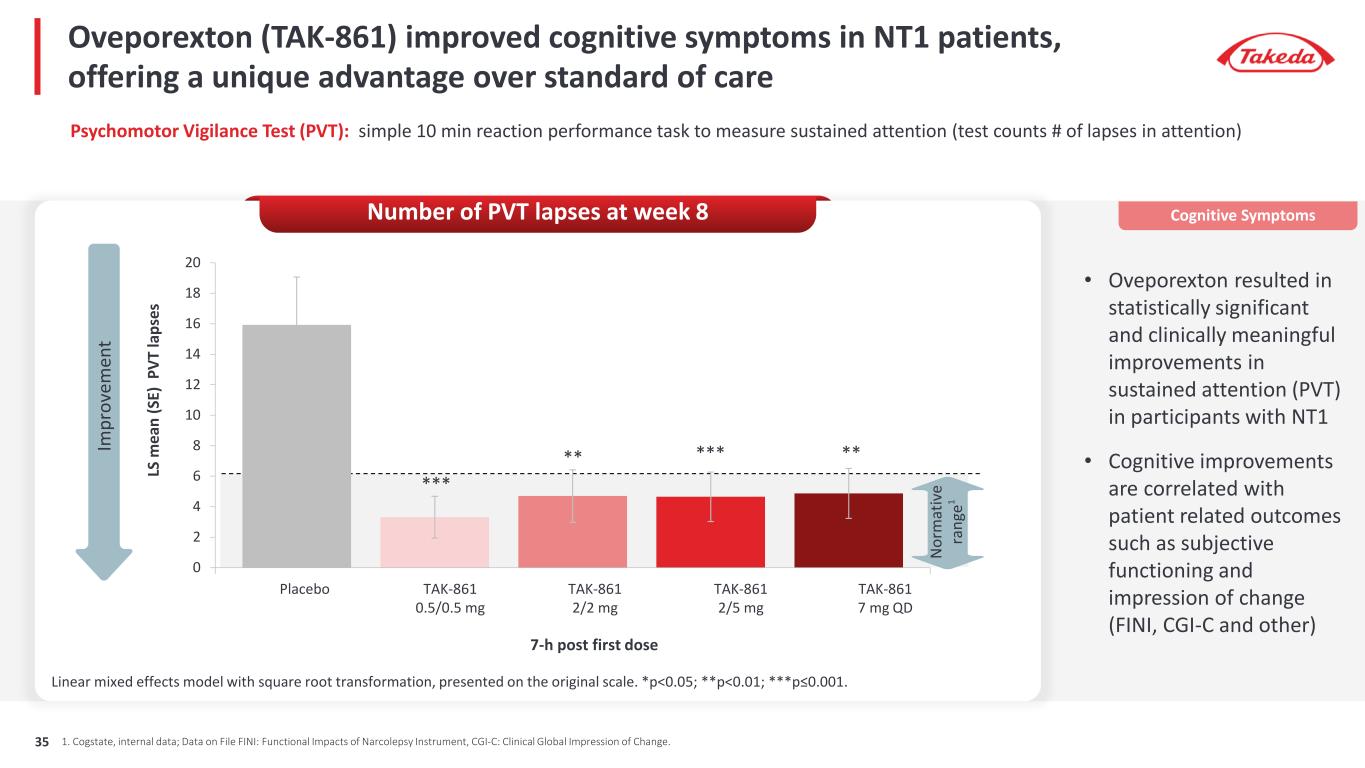

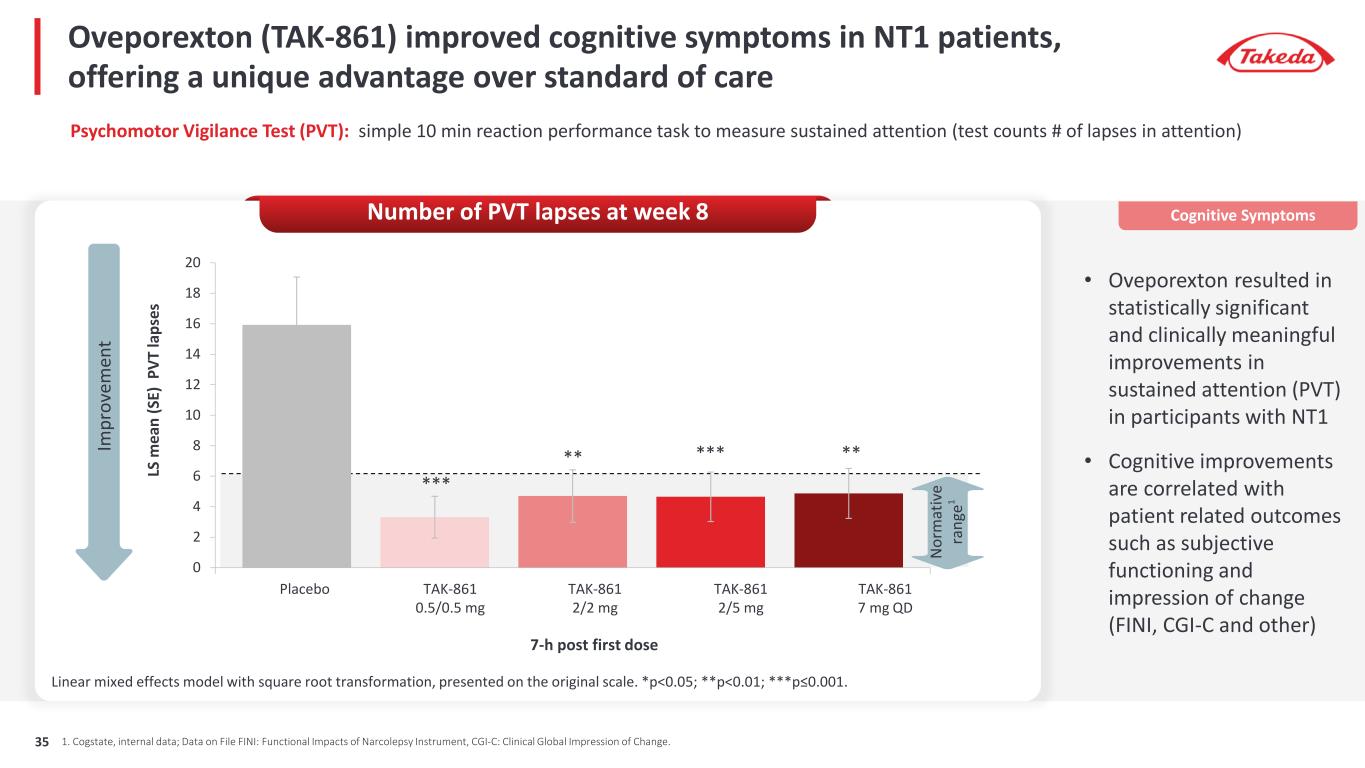

Oveporexton (TAK-861) improved cognitive symptoms in NT1 patients, offering a unique advantage over standard of care Linear mixed effects model with square root transformation, presented on the original scale. *p<0.05; **p<0.01; ***p≤0.001. 0 2 4 6 8 10 12 14 16 18 20 LS m ea n (S E) P VT la ps es *** ** *** ** TAK-861 0.5/0.5 mg TAK-861 2/2 mg TAK-861 2/5 mg TAK-861 7 mg QD Placebo 7-h post first dose N or m at iv e ra ng e1 1. Cogstate, internal data; Data on File FINI: Functional Impacts of Narcolepsy Instrument, CGI-C: Clinical Global Impression of Change. Psychomotor Vigilance Test (PVT): simple 10 min reaction performance task to measure sustained attention (test counts # of lapses in attention) • Oveporexton resulted in statistically significant and clinically meaningful improvements in sustained attention (PVT) in participants with NT1 • Cognitive improvements are correlated with patient related outcomes such as subjective functioning and impression of change (FINI, CGI-C and other) Cognitive SymptomsNumber of PVT lapses at week 8 Im pr ov em en t 35

NT1 patients reported substantial improvements in nighttime symptoms with oveporexton (TAK-861) 0 0.5 1 1.5 2 2.5 3 3.5 4 Baseline Week 8 N ig ht s p er w ee k Placebo 2mg/2mg 0 0.5 1 1.5 2 2.5 3 3.5 4 4.5 5 Baseline Week 8 N ig ht s p er w ee k Placebo 2mg/2mg *** * Sleep diary: daily recording of last night's sleep quality and disturbances (difficulty falling or staying asleep, nightmares as well as sleep paralysis and hallucinations) • Patients treated with oveporexton showed substantial reductions in the frequency of disturbing dreams, nighttime hallucinations and sleep paralysis • Subjective measures are supported by objective assessments such as nocturnal polysomnography Nighttime SymptomsNights Per Week With HallucinationsNights Per Week With Disturbing Dreams Figure shows the subset of patients who experienced the symptom at baseline. *p<0.05; ***p<0.00136

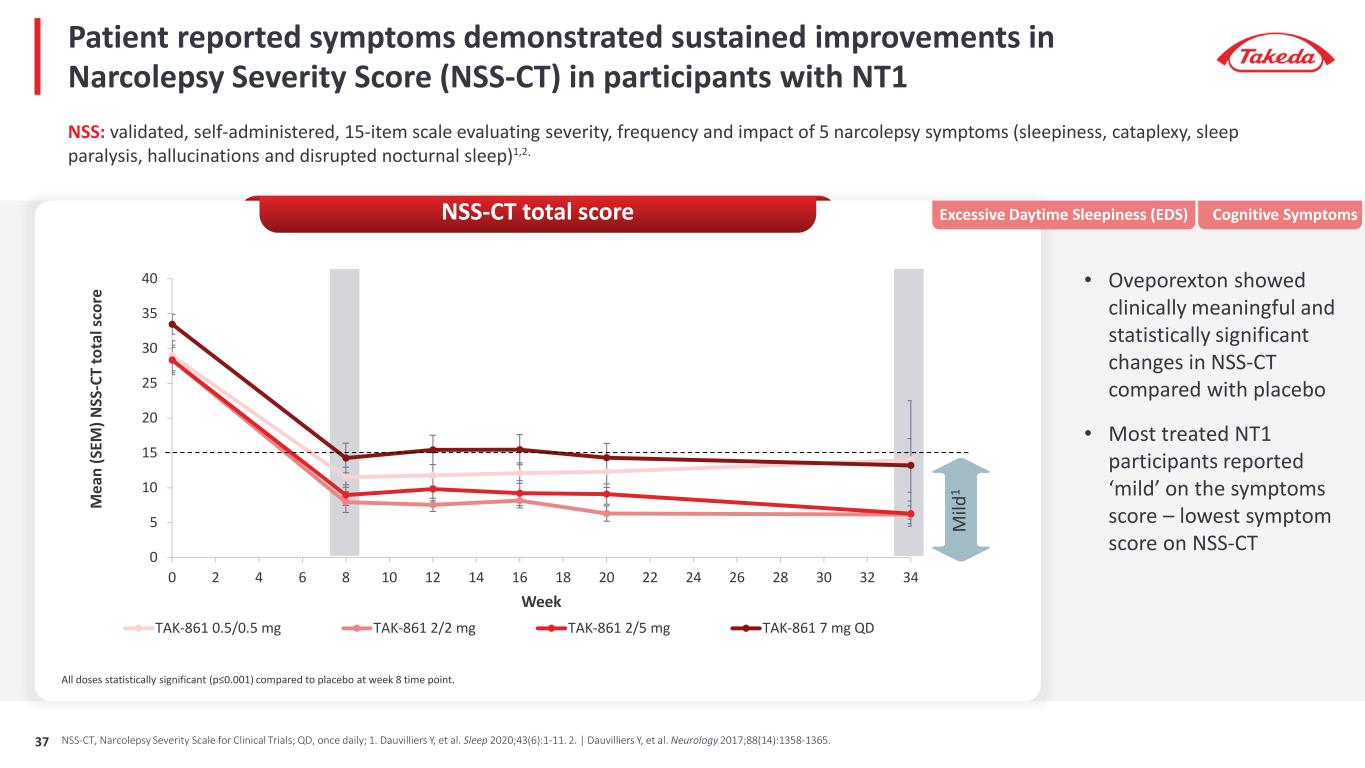

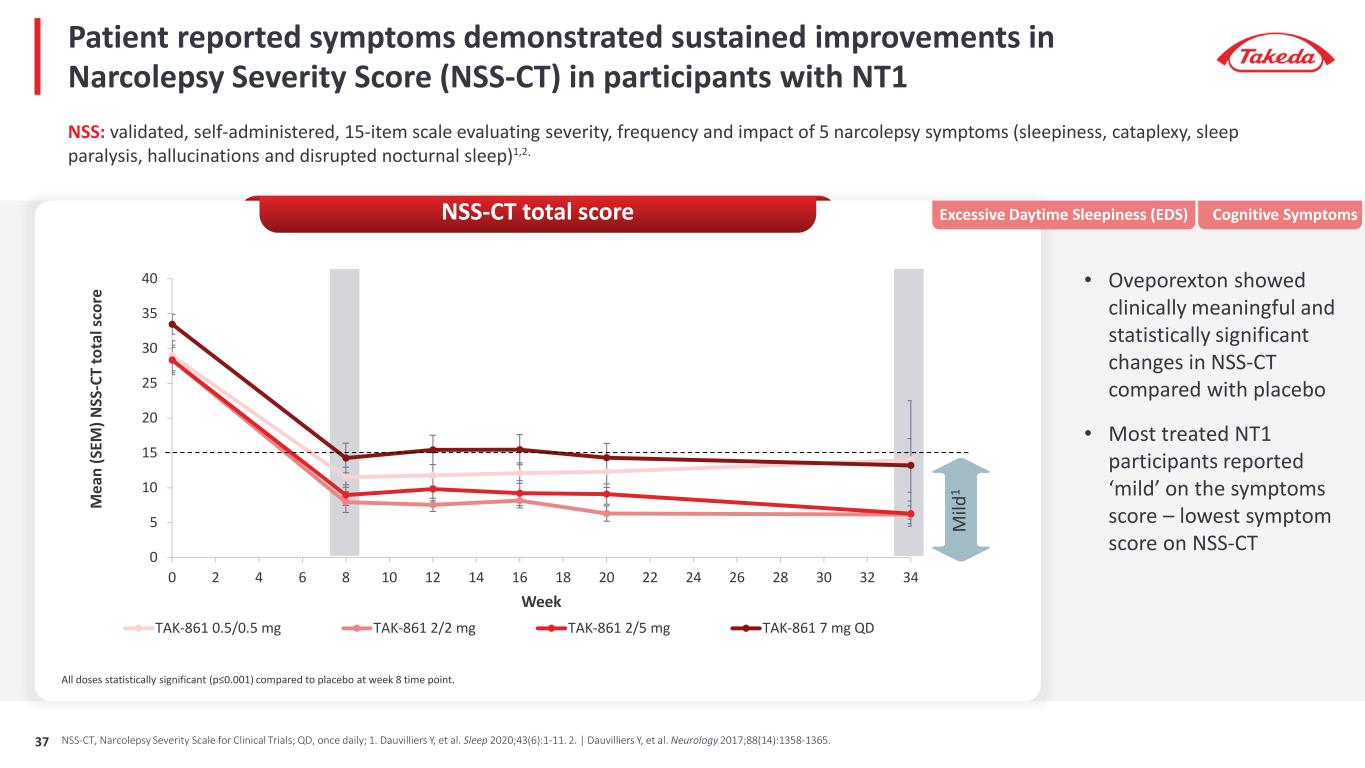

Patient reported symptoms demonstrated sustained improvements in Narcolepsy Severity Score (NSS-CT) in participants with NT1 0 5 10 15 20 25 30 35 40 0 2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 M ea n (S EM ) N SS -C T to ta l s co re Week TAK-861 0.5/0.5 mg TAK-861 2/2 mg TAK-861 2/5 mg TAK-861 7 mg QD M ild 1 All doses statistically significant (p≤0.001) compared to placebo at week 8 time point. NSS: validated, self-administered, 15-item scale evaluating severity, frequency and impact of 5 narcolepsy symptoms (sleepiness, cataplexy, sleep paralysis, hallucinations and disrupted nocturnal sleep)1,2. • Oveporexton showed clinically meaningful and statistically significant changes in NSS-CT compared with placebo • Most treated NT1 participants reported ‘mild’ on the symptoms score – lowest symptom score on NSS-CT Excessive Daytime Sleepiness (EDS) Cognitive SymptomsNSS-CT total score NSS-CT, Narcolepsy Severity Scale for Clinical Trials; QD, once daily; 1. Dauvilliers Y, et al. Sleep 2020;43(6):1-11. 2. | Dauvilliers Y, et al. Neurology 2017;88(14):1358-1365.37

Oveporexton was well tolerated by NT1 participants with no serious treatment-related TEAEs or discontinuations due to TEAEs in the Ph2b trial and LTE. ~90% of patients continuing in LTE - will provide long term data for benefit-risk. The most common TEAEs observed were insomnia, urinary urgency and salivary hypersecretion. Most AEs mild to moderate, occurring within 1-2 weeks of treatment and transient. No cases of hepatotoxicity or visual disturbances reported in Ph2b or in the ongoing LTE. Oveporexton (TAK-861) was well tolerated by participants with NT1 over an additional 6 months of treatment 38

N = 152 Oveporexton (TAK-861) Dose 1 Placebo Oveporexton (TAK-861) Dose 2 N = 93 Oveporexton (TAK-861) Dose 2 Placebo Oveporexton (TAK-861) Ph3 NT1 studies on track to readout in CY2025 LTE Ph2 completed Q4 FY2023 Ph3 start Q2 FY2024 Ph3 readout CY2025 Potentially transformative profile at launch Primary Endpoint: • MWT @ wk 12 Secondary Endpoints including: • ESS @ wk 12 • WCR @ wk 12 • PVT @ wk 12 • Safety/Tolerability Exploratory Endpoints 1. Clinicaltrial.gov-TAK-861-3001 2. Clinicaltrial.gov-TAK-861-3002 1 2 39

• Positioned to be first orexin agonist with potentially transformative profile: • Statistically significant and clinically meaningful improvements in daytime and nighttime NT1 symptoms after 8 weeks of administration returning patients to normative range • Sustained improvements over an additional 6 months of treatment period • Optimized BID profile providing flexibility and optimal balance in efficacy and safety • Functional improvements and quality of life support the potential for a new standard of care for patients living with NT1 • Oveporexton was well tolerated by NT1 participants with no serious treatment-related TEAEs or discontinuations due to TEAEs in the Ph2b trial and LTE • No cases of hepatotoxicity or visual disturbances reported in Ph2b or in the ongoing LTE Oveporexton (TAK-861) with potential best-in-class, transformative profile addressing NT1 symptoms holistically 40

TAK-360 and beyond Additional assets/indications

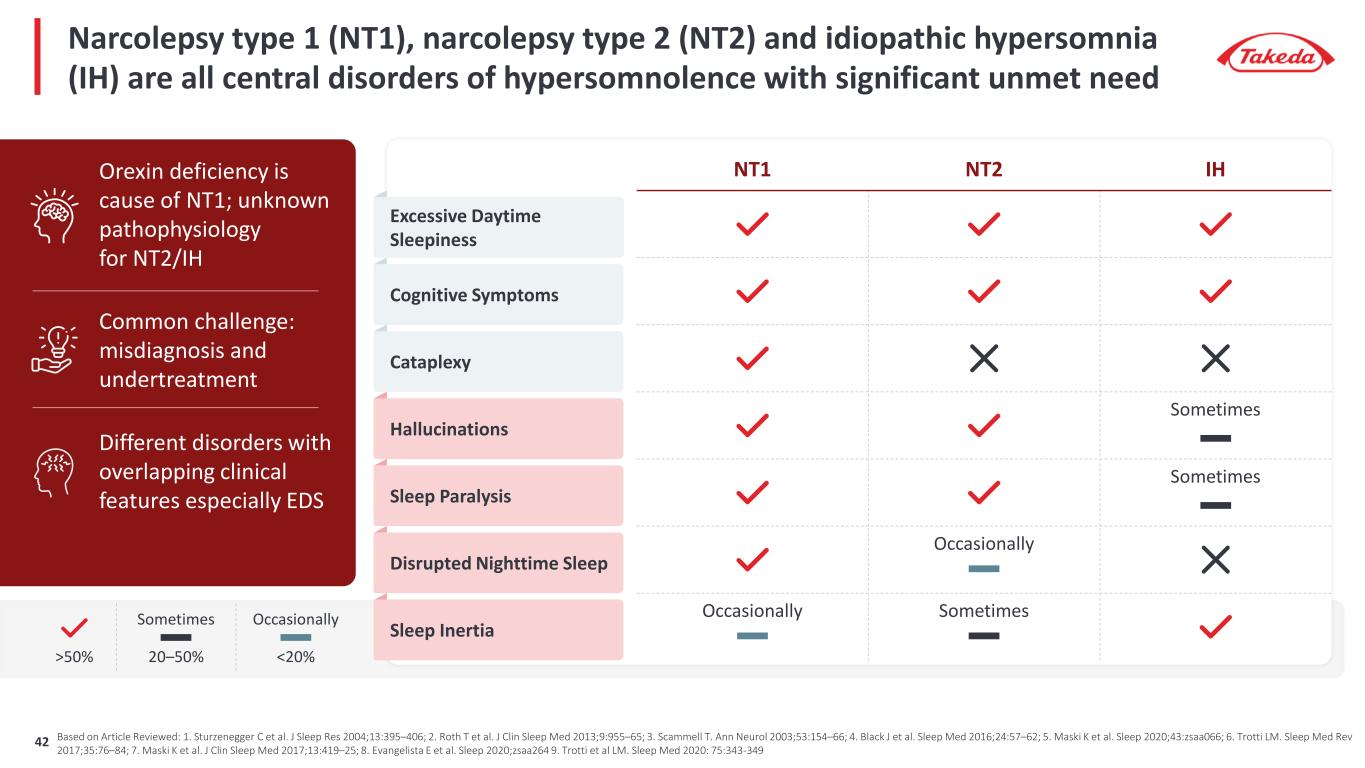

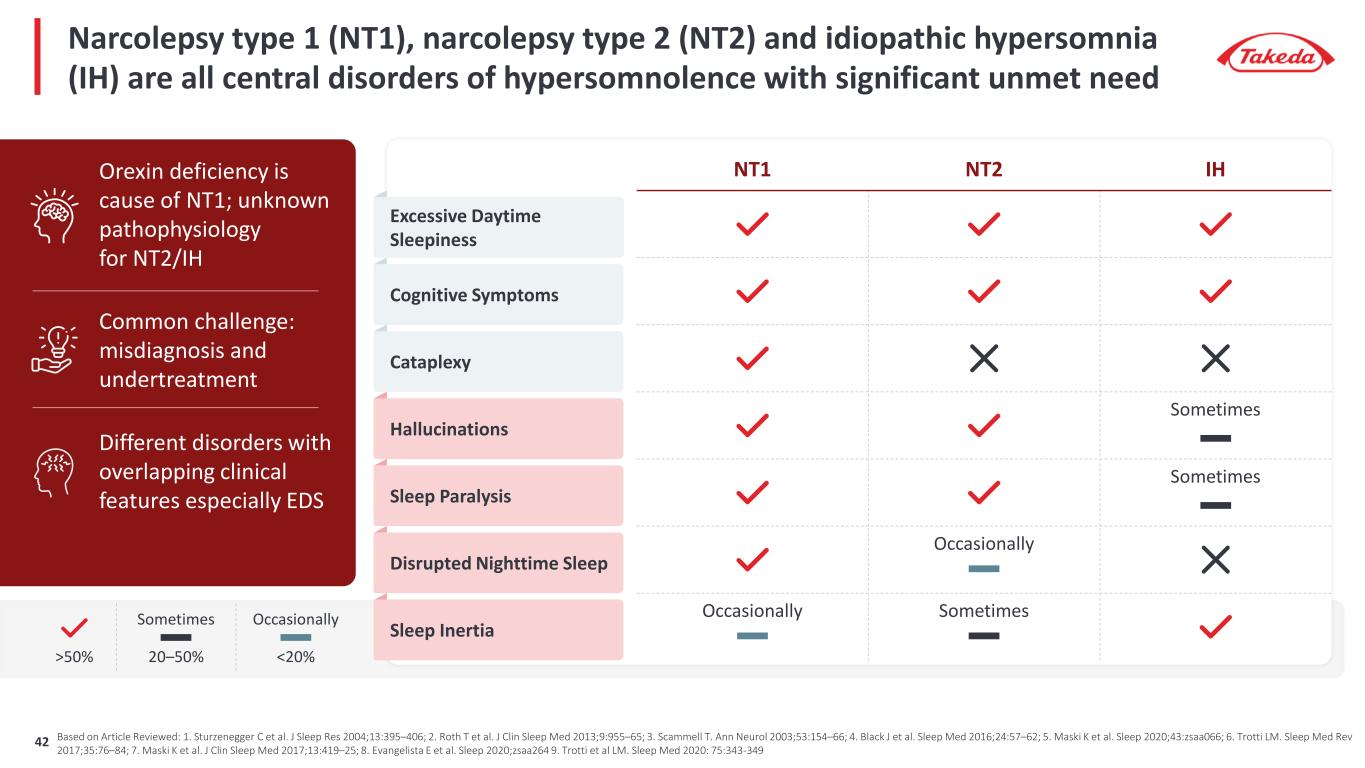

Based on Article Reviewed: 1. Sturzenegger C et al. J Sleep Res 2004;13:395–406; 2. Roth T et al. J Clin Sleep Med 2013;9:955–65; 3. Scammell T. Ann Neurol 2003;53:154–66; 4. Black J et al. Sleep Med 2016;24:57–62; 5. Maski K et al. Sleep 2020;43:zsaa066; 6. Trotti LM. Sleep Med Rev 2017;35:76–84; 7. Maski K et al. J Clin Sleep Med 2017;13:419–25; 8. Evangelista E et al. Sleep 2020;zsaa264 9. Trotti et al LM. Sleep Med 2020: 75:343-349 NT1 NT2 IH Sometimes Sometimes Occasionally Occasionally Sometimes Excessive Daytime Sleepiness Cognitive Symptoms Cataplexy Hallucinations Sleep Paralysis Disrupted Nighttime Sleep Sleep Inertia Orexin deficiency is cause of NT1; unknown pathophysiology for NT2/IH Common challenge: misdiagnosis and undertreatment Different disorders with overlapping clinical features especially EDS >50% Sometimes 20–50% Occasionally <20% Narcolepsy type 1 (NT1), narcolepsy type 2 (NT2) and idiopathic hypersomnia (IH) are all central disorders of hypersomnolence with significant unmet need 42

Higher doses (>3X) of an OX2R agonist necessary for orexin normal populations Best in class development guided by models using extensive OX2R agonism data across multiple assets TAK-360 Distinct structure -- target profile supported by pre-clinical data01 02 Potent - greater flexibility in dosing orexin normal population 03 Target engagement supported by exploratory digital biomarkers PK profile suitable for NT2/IH, demonstrating good oral bioavailability 04 Ph1 started FY2024 Ph2 NT2/IH target start FY2024 Proof of concept FY2025 TAK-360: next-generation orexin agonist for NT2 and IH and potentially other indications in patients with normal orexin levels 43

• TAK-360: Accelerated development in NT2 & IH • New chemistry and profile • Fast track designation received in U.S. • Target Ph2 start FY2024 in NT2/IH • Exploration of indications pertinent to orexin biology: sleep-wake, respiration and metabolism • Tailored assets/profiles (e.g., TAK-9252 and others) to deliver optimal exposure for additional indications Takeda pioneering the field of orexin therapeutics – franchise leading with oveporexton, a potential first-in-class treatment for NT1 1. Dauvilliers, Y., N Engl J Med, 2023; 389, 309-321; 2. Suzuki M et al., British Journal of Anaesthesia, 2024; IARS Conference, Denver, 2023; HV: Healthy Volunteer 3. Referring to the accelerated development timeline Oveporexton (TAK-861): First & Fast3 in NT1 TAK-360 and beyond: Additional assets/indications • The most advanced orexin agonist – Addressing orexin deficiency as the underlying pathophysiology in NT11 • Target Ph3 readout in CY2025 • Ph2 and Long-term Extension (LTE) data support potential transformative profile • Significantly accelerated Phase 3 program • Breakthrough therapy designation received in U.S., China 44

Orexin Franchise Market Opportunity Unlocking the full value of orexin and potentially transforming patient care in sleep and beyond

EDS or cataplexy are just the tip of the iceberg Functional impairments Work & school impacts Daily activities Quality of life Relationships Family life Stigma Mood True burden of narcolepsy is often unrecognized and underappreciated - leaving patients vulnerable to isolation and stigma Impact of narcolepsy extends to many aspects of patient life, making daily activities: working, caring for a family or exercising often impossible Narcolepsy is a life-altering condition with a significant burden – expanding far beyond symptoms 46

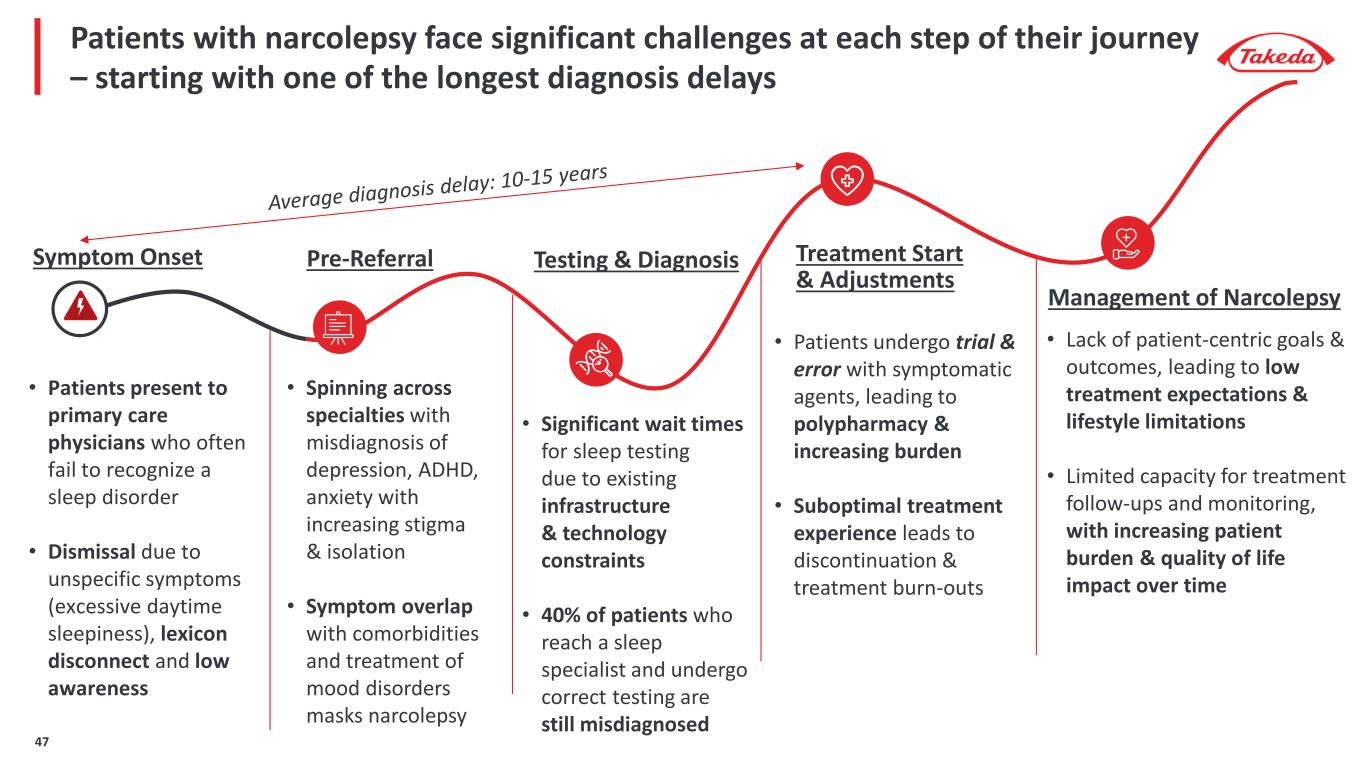

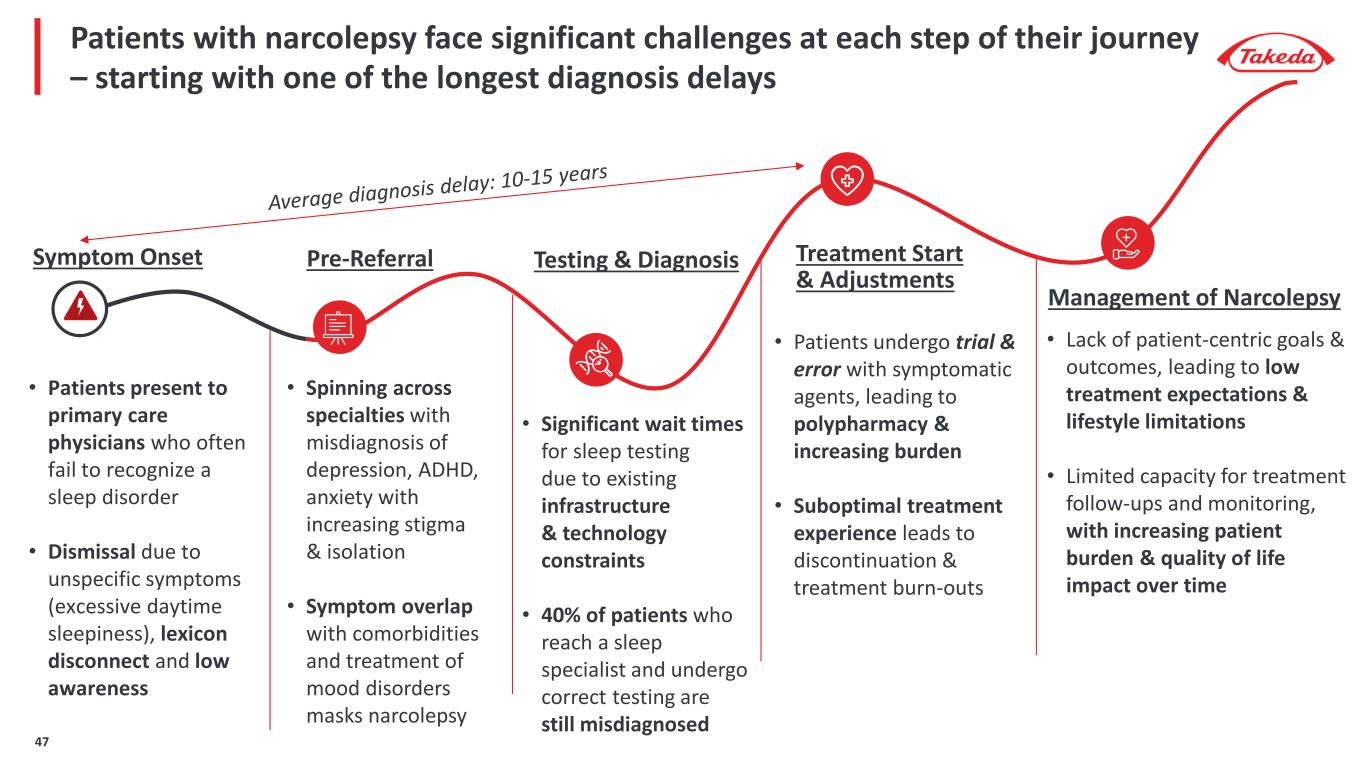

Testing & DiagnosisPre-Referral Treatment Start & Adjustments Patients with narcolepsy face significant challenges at each step of their journey – starting with one of the longest diagnosis delays Symptom Onset • Spinning across specialties with misdiagnosis of depression, ADHD, anxiety with increasing stigma & isolation • Symptom overlap with comorbidities and treatment of mood disorders masks narcolepsy • Patients present to primary care physicians who often fail to recognize a sleep disorder • Dismissal due to unspecific symptoms (excessive daytime sleepiness), lexicon disconnect and low awareness • Significant wait times for sleep testing due to existing infrastructure & technology constraints • 40% of patients who reach a sleep specialist and undergo correct testing are still misdiagnosed • Patients undergo trial & error with symptomatic agents, leading to polypharmacy & increasing burden • Suboptimal treatment experience leads to discontinuation & treatment burn-outs Management of Narcolepsy • Lack of patient-centric goals & outcomes, leading to low treatment expectations & lifestyle limitations • Limited capacity for treatment follow-ups and monitoring, with increasing patient burden & quality of life impact over time 47

Symptom dismissal Diagnosis delays >10-15 years Discontinuation rate ~25% Add-on polypharmacy >60% Low disease awareness Undervalued disease burden Residual symptoms >80%1 Diagnosis rate <50% Low treatment expectations Treatment rate3 ~75% Significant unmet needs remain today - with no treatment options addressing the underlying cause and holistic burden of NT1 Published population-based prevalence estimates that NT1 affects ~95,000 - 120,000 people in U.S.2 1. Burden of Illness Study Among Patients with Central Disorders of Hypersomnolence in Six European Countries, Y. Dauvilliers et al, EAN, 2024 2. Silber MH, et al. Sleep. 2002;25(2):197-202 3. Treatment rate of diagnosed patients 48

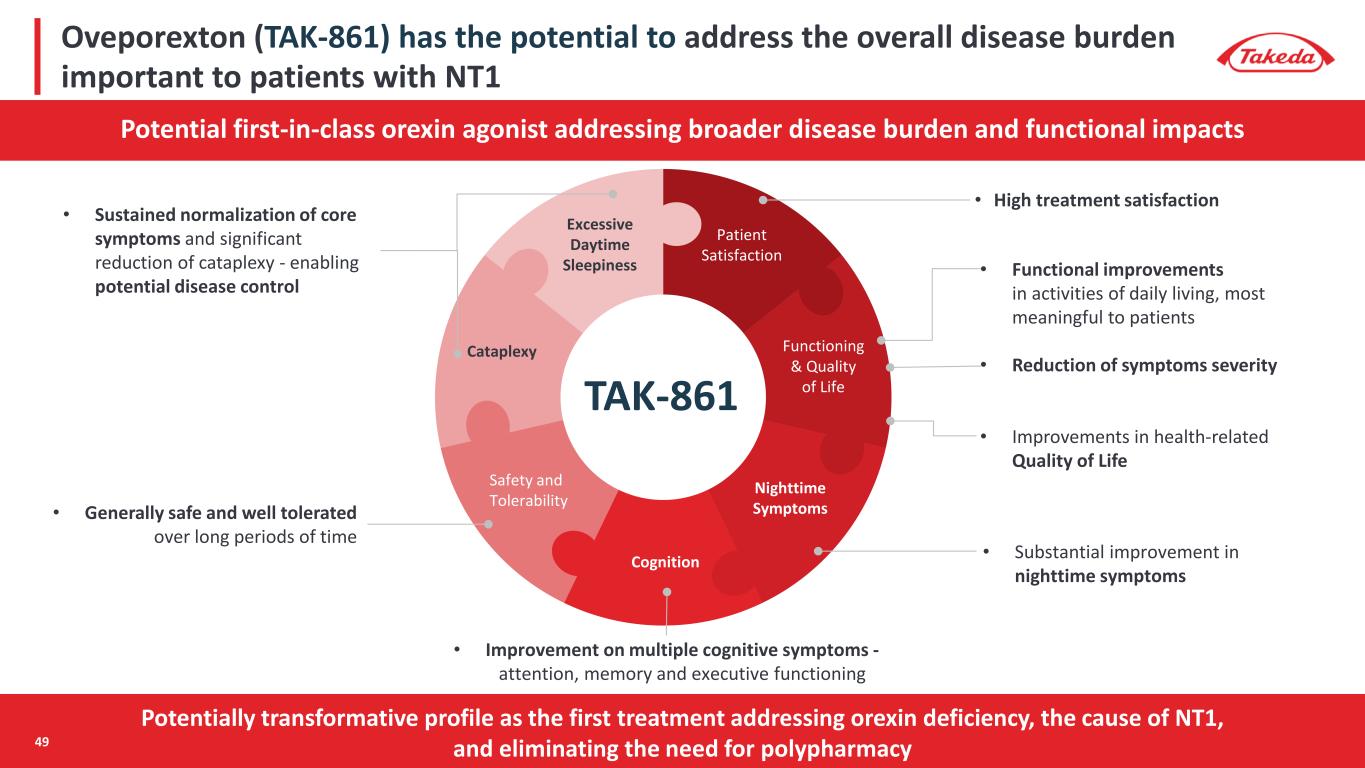

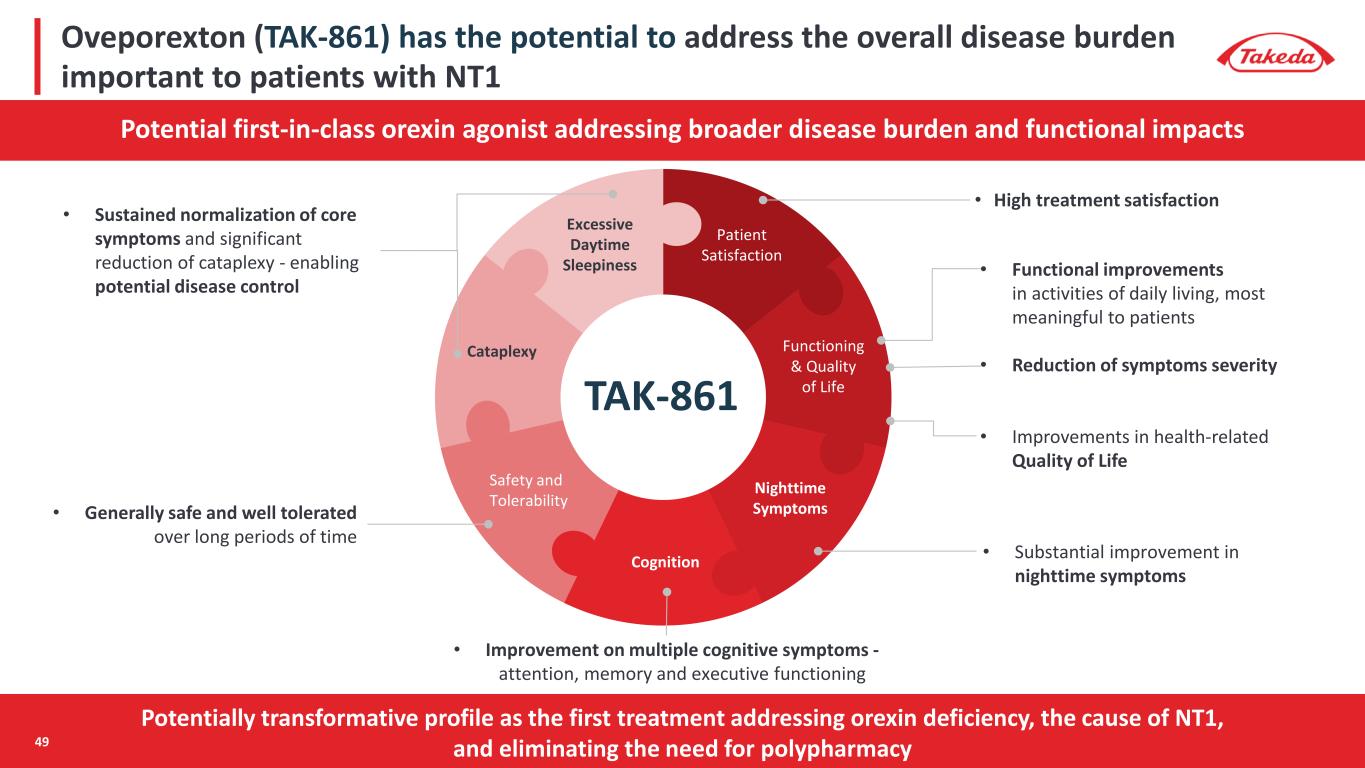

Potentially transformative profile as the first treatment addressing orexin deficiency, the cause of NT1, and eliminating the need for polypharmacy TAK-861 Patient Satisfaction Cataplexy Safety and Tolerability Functioning & Quality of Life Nighttime Symptoms Cognition Excessive Daytime Sleepiness • Sustained normalization of core symptoms and significant reduction of cataplexy - enabling potential disease control • Generally safe and well tolerated over long periods of time • High treatment satisfaction • Functional improvements in activities of daily living, most meaningful to patients • Reduction of symptoms severity • Improvements in health-related Quality of Life • Improvement on multiple cognitive symptoms - attention, memory and executive functioning • Substantial improvement in nighttime symptoms Potential first-in-class orexin agonist addressing broader disease burden and functional impacts Oveporexton (TAK-861) has the potential to address the overall disease burden important to patients with NT1 49

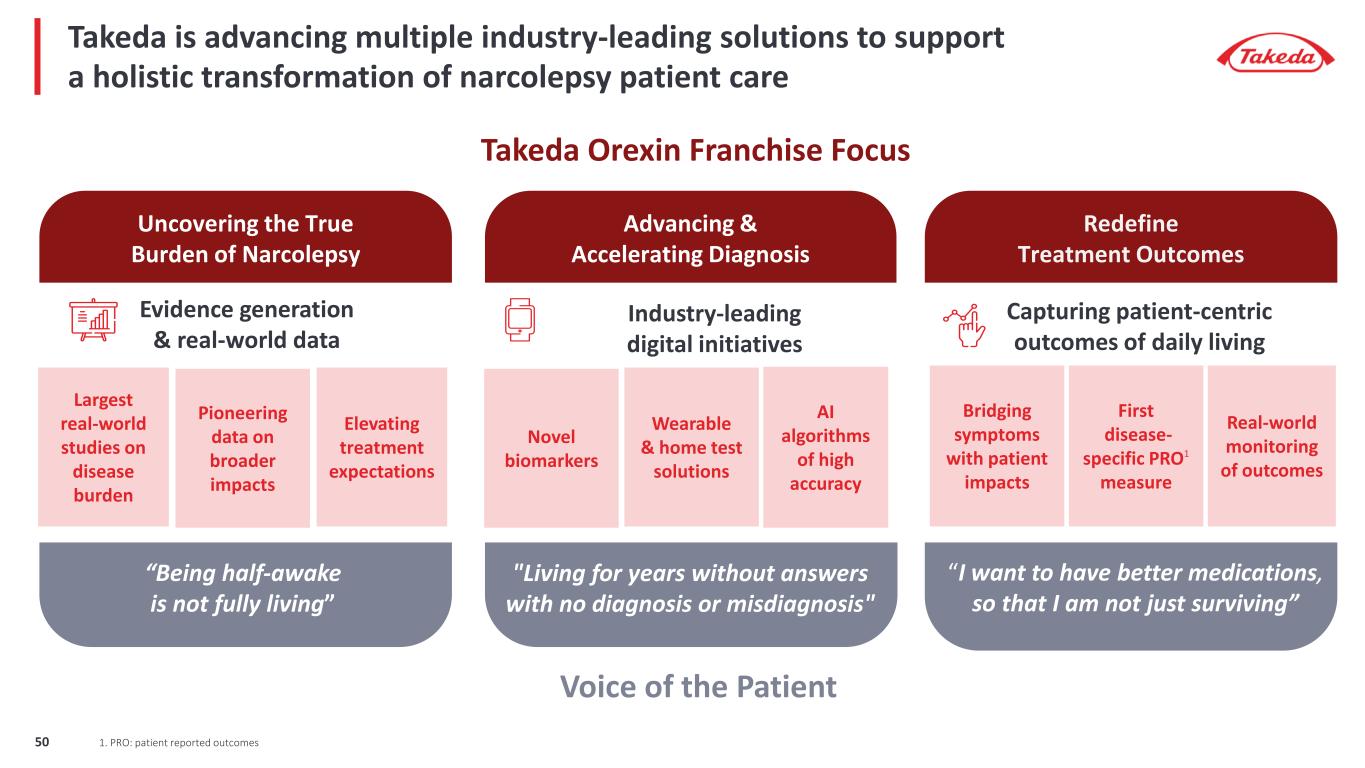

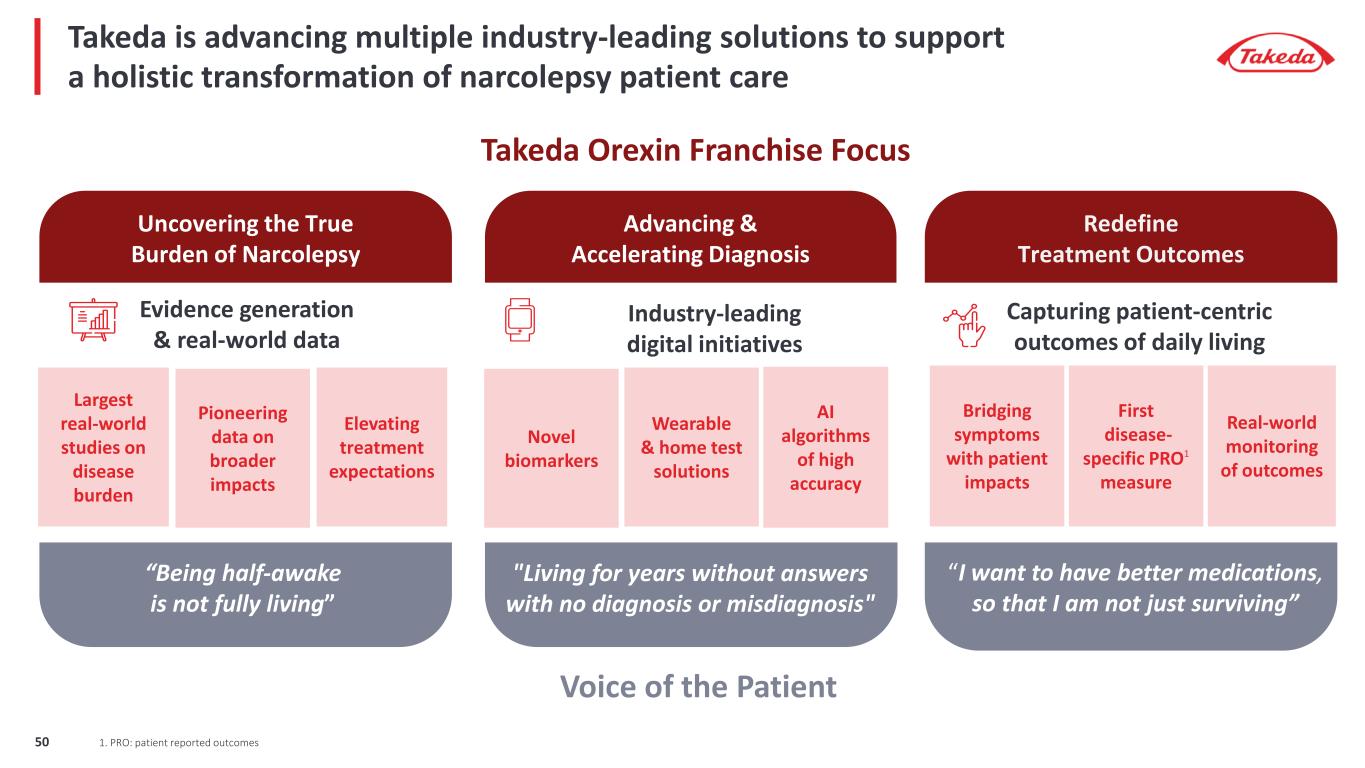

Takeda Orexin Franchise Focus Voice of the Patient Capturing patient-centric outcomes of daily living Industry-leading digital initiatives Evidence generation & real-world data Uncovering the True Burden of Narcolepsy Advancing & Accelerating Diagnosis Redefine Treatment Outcomes “Being half-awake is not fully living” "Living for years without answers with no diagnosis or misdiagnosis" “I want to have better medications, so that I am not just surviving” Largest real-world studies on disease burden Pioneering data on broader impacts Elevating treatment expectations Novel biomarkers Wearable & home test solutions AI algorithms of high accuracy Bridging symptoms with patient impacts First disease- specific PRO1 measure Real-world monitoring of outcomes Takeda is advancing multiple industry-leading solutions to support a holistic transformation of narcolepsy patient care 1. PRO: patient reported outcomes50

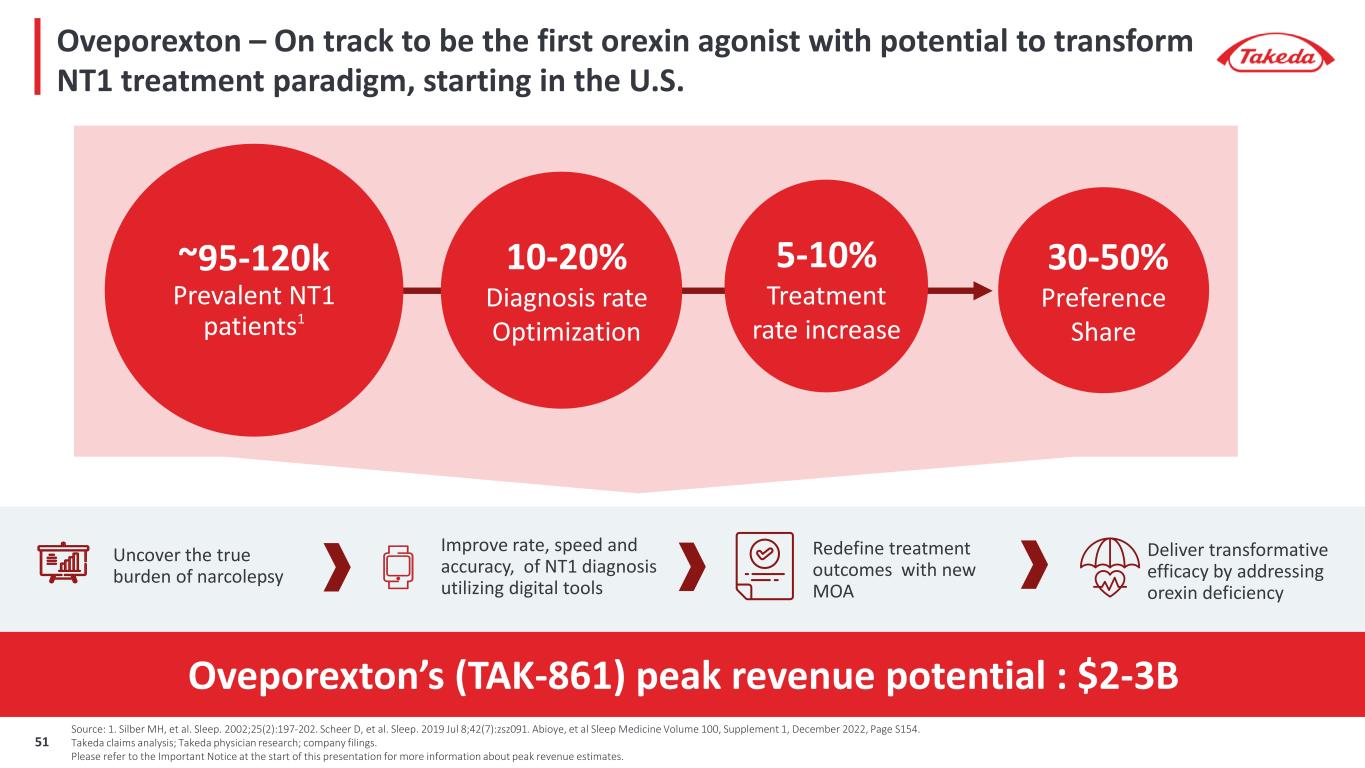

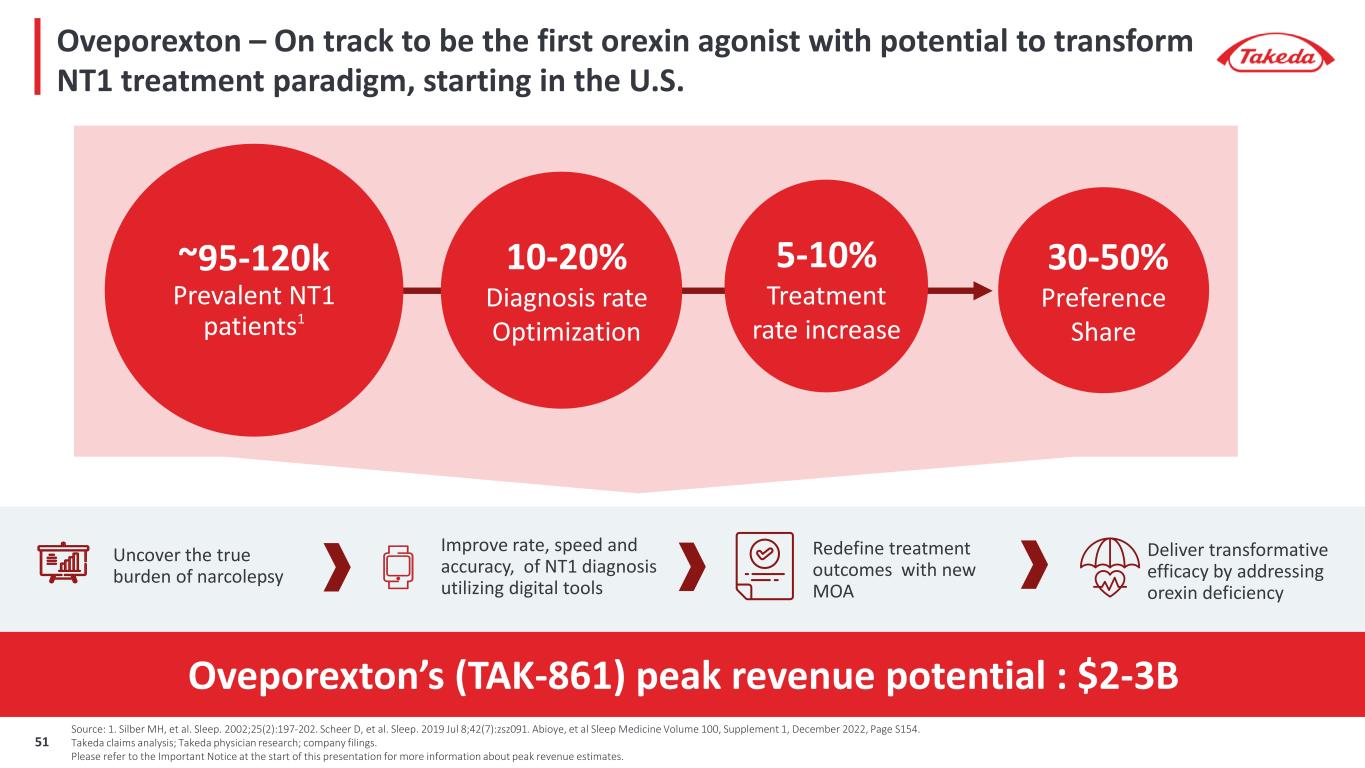

Oveporexton – On track to be the first orexin agonist with potential to transform NT1 treatment paradigm, starting in the U.S. Redefine treatment outcomes with new MOA Improve rate, speed and accuracy, of NT1 diagnosis utilizing digital tools Uncover the true burden of narcolepsy Deliver transformative efficacy by addressing orexin deficiency Source: 1. Silber MH, et al. Sleep. 2002;25(2):197-202. Scheer D, et al. Sleep. 2019 Jul 8;42(7):zsz091. Abioye, et al Sleep Medicine Volume 100, Supplement 1, December 2022, Page S154. Takeda claims analysis; Takeda physician research; company filings. Please refer to the Important Notice at the start of this presentation for more information about peak revenue estimates. Oveporexton’s (TAK-861) peak revenue potential : $2-3B ~95-120k Prevalent NT1 patients1 30-50% Preference Share 10-20% Diagnosis rate Optimization 5-10% Treatment rate increase 51

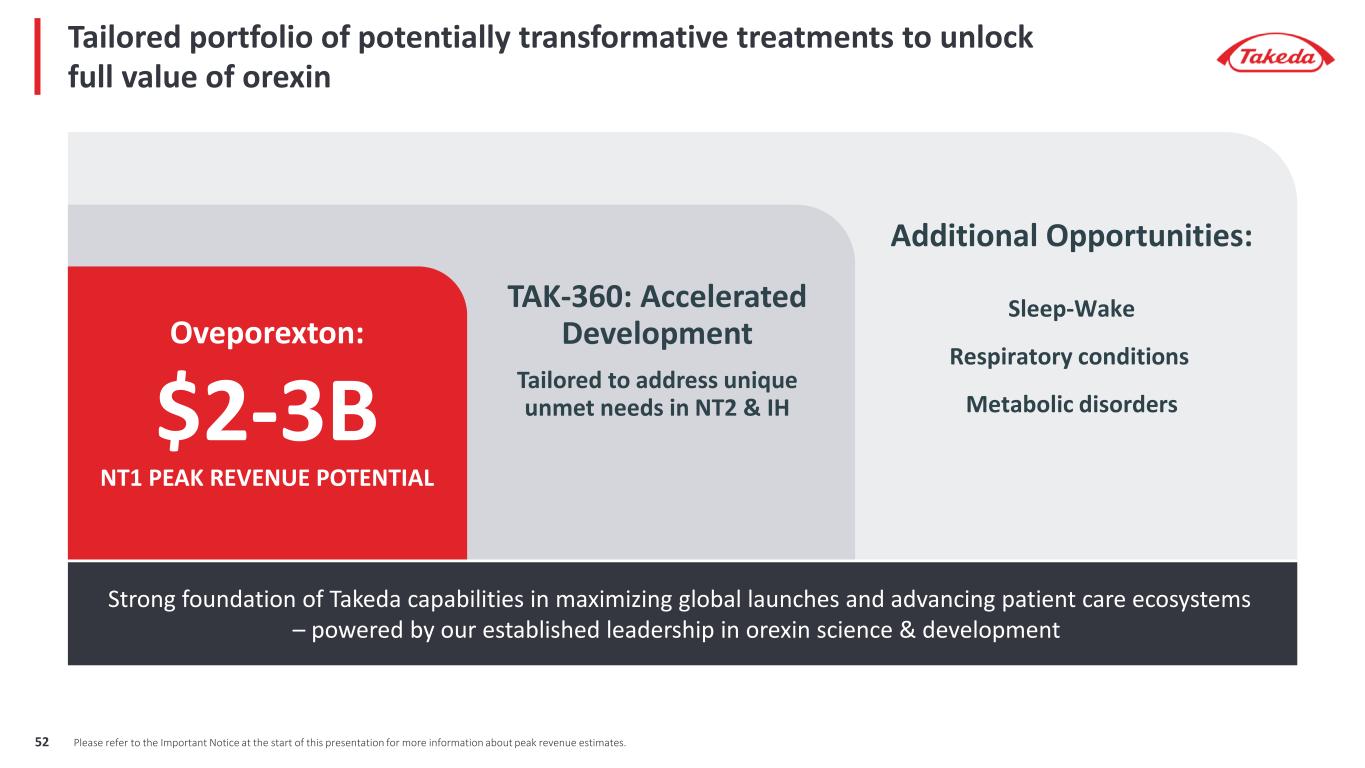

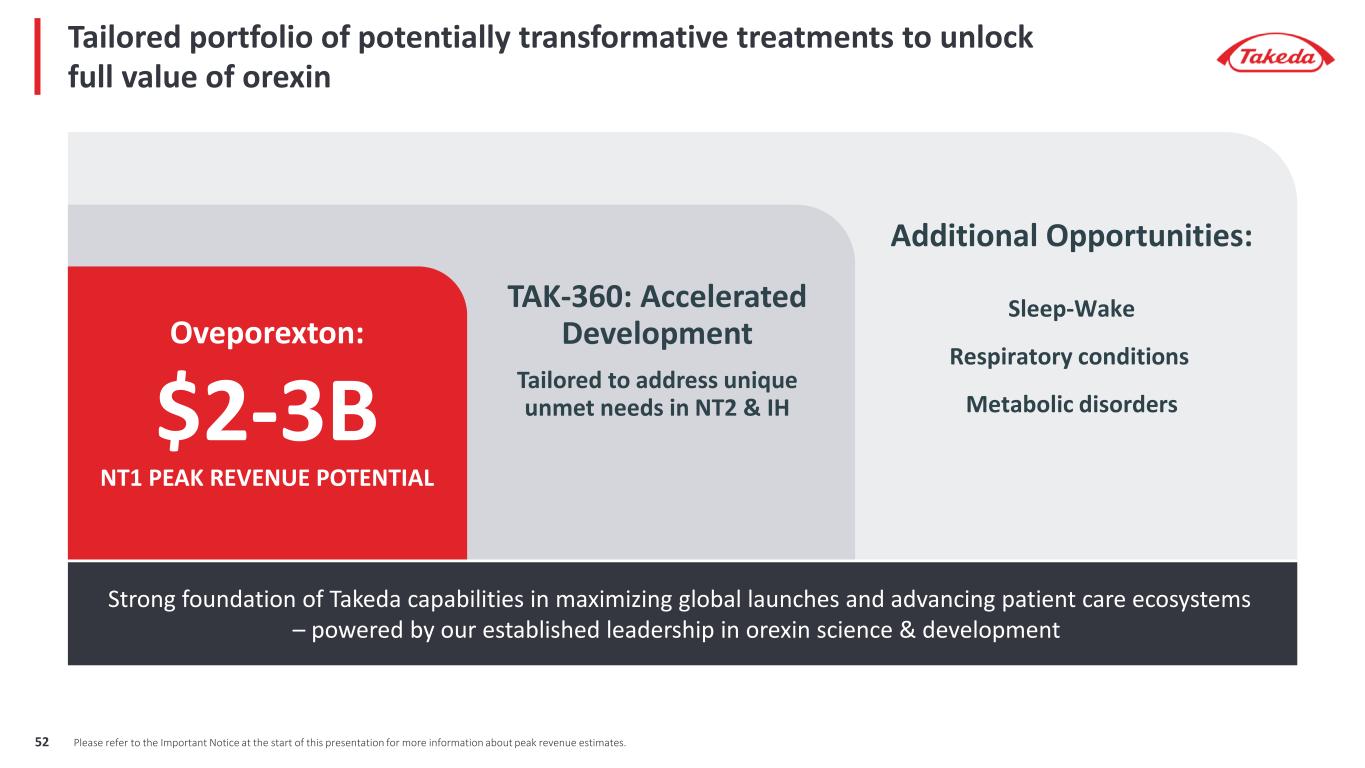

Tailored portfolio of potentially transformative treatments to unlock full value of orexin Oveporexton: $2-3B NT1 PEAK REVENUE POTENTIAL TAK-360: Accelerated Development Tailored to address unique unmet needs in NT2 & IH Strong foundation of Takeda capabilities in maximizing global launches and advancing patient care ecosystems – powered by our established leadership in orexin science & development Additional Opportunities: Sleep-Wake Respiratory conditions Metabolic disorders Please refer to the Important Notice at the start of this presentation for more information about peak revenue estimates.52

Takeda is unlocking the full value of orexin with a multi-asset, multi-indication franchise – Leading with oveporexton (TAK-861), peak revenue potential $2-3B Global peak revenue potential: $2-3B Oveporexton is on track to become the 1st and potentially best-in-class, transformative treatment indicated for NT1 Unprecedented Ph2 and LTE data demonstrated oveporexton normalized symptoms across all aspects of the disease Continue expanding the franchise by exploring indications relevant to orexin biology leading with TAK-360 in NT2/IH Takeda is uniquely positioned to holistically transform the treatment landscape of NT1 and advance diagnosis through digital innovation and data generation Please refer to the Important Notice at the start of this presentation for more information about peak revenue estimates.53

Today’s Agenda TIME (JST) AGENDA 8:30-8:40 A Global, Innovation-driven Biopharmaceutical Company Christophe Weber, President & CEO 8:40-9:00 R&D Strategy and Pipeline Highlights Andy Plump, President Research & Development 9:00-9:50 Neuroscience: Deep-dive on Orexin Franchise Sarah Sheikh, Head of Neuroscience Therapeutic Area Unit and Head of Global Development Ramona Sequeira, President of Global Portfolio Division 9:50-10:00 Break 10:00-11:30 Gastrointestinal and Inflammation (GI&I): Deep-dive on Zasocitinib, Rusfertide, Mezagitamab, Fazirsiran Chinwe Ukomadu, Head of GI&I Therapeutic Area Unit Ramona Sequeira, President of Global Portfolio Division 11:30-12:00 Lunch 12:00-12:20 Oncology: Deep-dive on Elritercept – newly announced BD deal P.K. Morrow, Head of Oncology Therapeutic Area Unit Teresa Bitetti, President of Global Oncology Business Unit 12:20-13:15 Q&A Session 13:15-14:00 Reception 54

Gastrointestinal & Inflammation (GI&I): Deep-dive on Zasocitinib, Rusfertide, Mezagitamab, and Fazirsiran Chinwe Ukomadu Head of GI&I Therapeutic, Area Unit Ramona Sequeira President, Global Portfolio Division

The GI & Inflammation portfolio is designed to deliver high-value therapies in the next 5 years and over the long-term to ensure strong & sustainable growth 11 unique drugs being developed to treat 13 diseases, with more programs poised to enter the clinic over the next year Large portfolio of differentiated assets Following up blockbuster products like Entyvio with potentially transformational therapies for Celiac, IBD, AATD-LD and other diseases Deep focus in GI to build on our leadership Multiple phase 3 programs in new disease areas allow us to quickly expand into new disease areas with significant unmet need Growing quickly in Dermatology, Rheumatology & Hematology The GI & Inflammation Portfolio Our strategy rapidly expands Takeda into new inflammatory disease areas with high unmet need in the near-term while strengthening our leadership in GI over the long-term 56

Late-stage programs have significant value potential; oveporexton, zasocitinib, rusfertide phase 3 data expected in 2025 Three Phase 3 Data Readouts Over the Next 12 Months Late-Stage Peak Revenue Potential >70% PTRS2 to approval $10 - 20B Fazirsiran AATD Liver Disease Elritercept Myelodysplastic Syndromes Zasocitinib Psoriatic Arthritis Mezagitamab IgA Nephropathy Immune Thrombocytopenia FY25 / FY26 Target Filing Dates by Indication FY27 - FY29 • Oveporexton in Narcolepsy Type 1 • Zasocitinib in Psoriasis • Rusfertide in Polycythemia Vera1 Oveporexton Narcolepsy Type 1 Rusfertide Polycythemia Vera Zasocitinib Psoriasis 1. Our partner Protagonist Therapeutics is responsible for Phase 3 development of Rusfertide and has stated Phase 3 data may be available as soon as March 2025 which is our Q4 FY24 2. Please refer to the Important Notice at the start of this presentation for more information about PTRS and peak revenue estimates Please refer to the Important Notice at the start of this presentation for more information about the Elritercept license agreement57

Zasocitinib (TAK-279) Next-generation TYK2 Inhibitor, potential to be the 1st choice advanced therapy

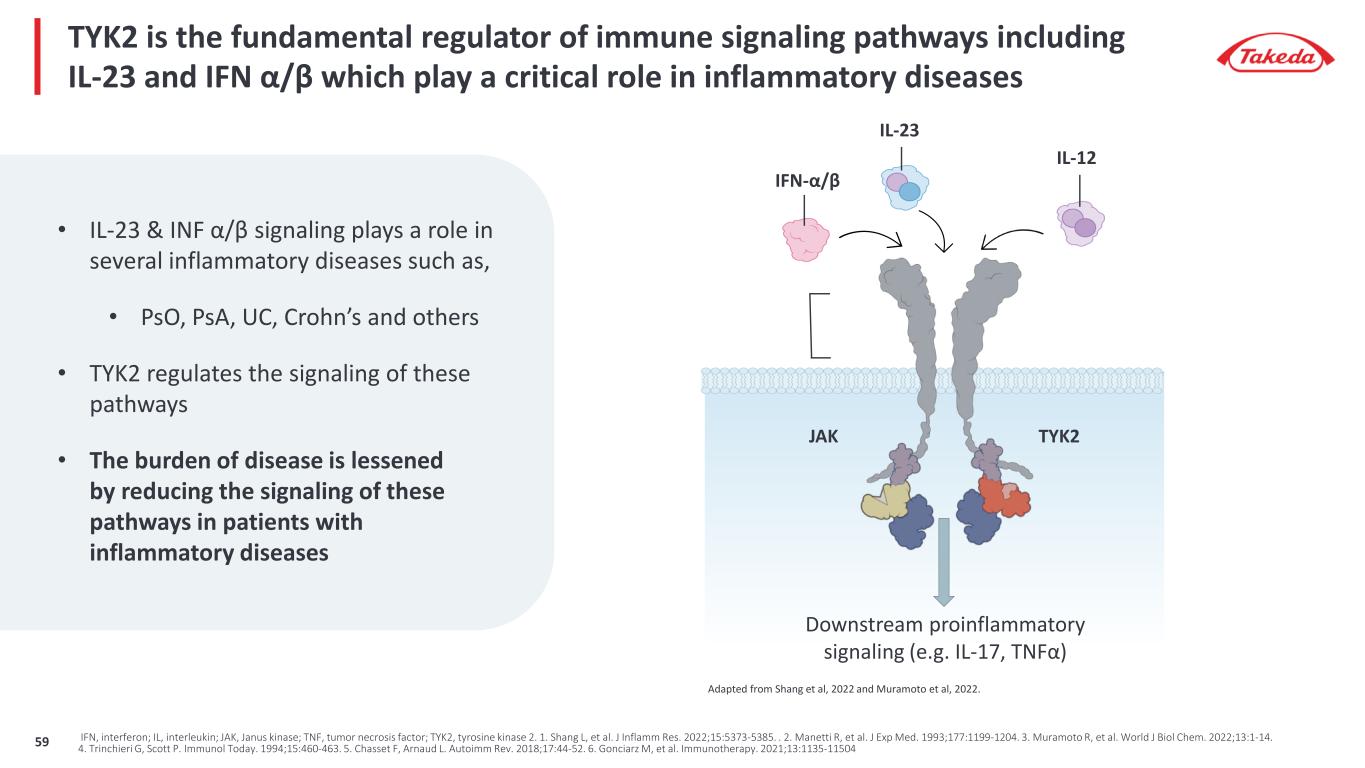

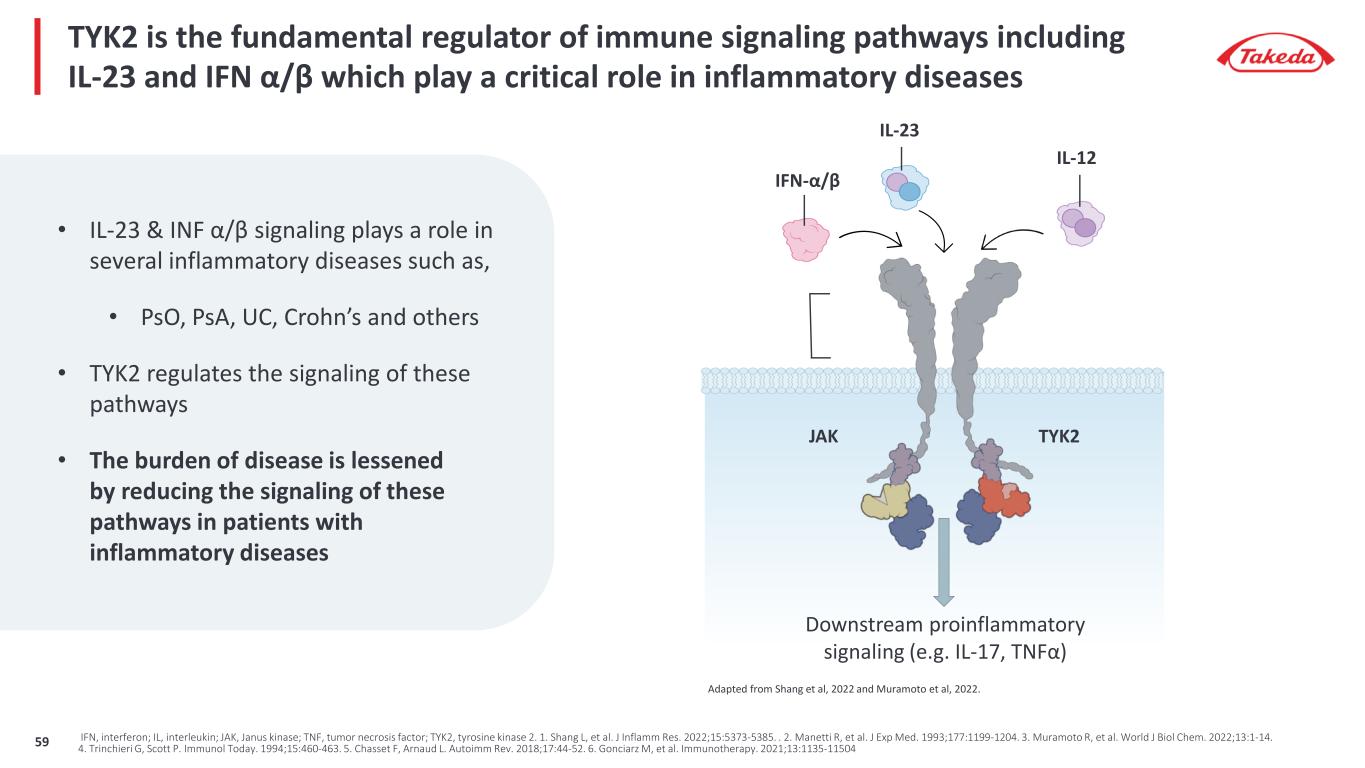

TYK2 is the fundamental regulator of immune signaling pathways including IL-23 and IFN α/β which play a critical role in inflammatory diseases JAK TYK2 IL-23 Downstream proinflammatory signaling (e.g. IL-17, TNFα) IFN-α/β IL-12 Adapted from Shang et al, 2022 and Muramoto et al, 2022. IFN, interferon; IL, interleukin; JAK, Janus kinase; TNF, tumor necrosis factor; TYK2, tyrosine kinase 2. 1. Shang L, et al. J Inflamm Res. 2022;15:5373-5385. . 2. Manetti R, et al. J Exp Med. 1993;177:1199-1204. 3. Muramoto R, et al. World J Biol Chem. 2022;13:1-14. 4. Trinchieri G, Scott P. Immunol Today. 1994;15:460-463. 5. Chasset F, Arnaud L. Autoimm Rev. 2018;17:44-52. 6. Gonciarz M, et al. Immunotherapy. 2021;13:1135-11504 • IL-23 & INF α/β signaling plays a role in several inflammatory diseases such as, • PsO, PsA, UC, Crohn’s and others • TYK2 regulates the signaling of these pathways • The burden of disease is lessened by reducing the signaling of these pathways in patients with inflammatory diseases 59

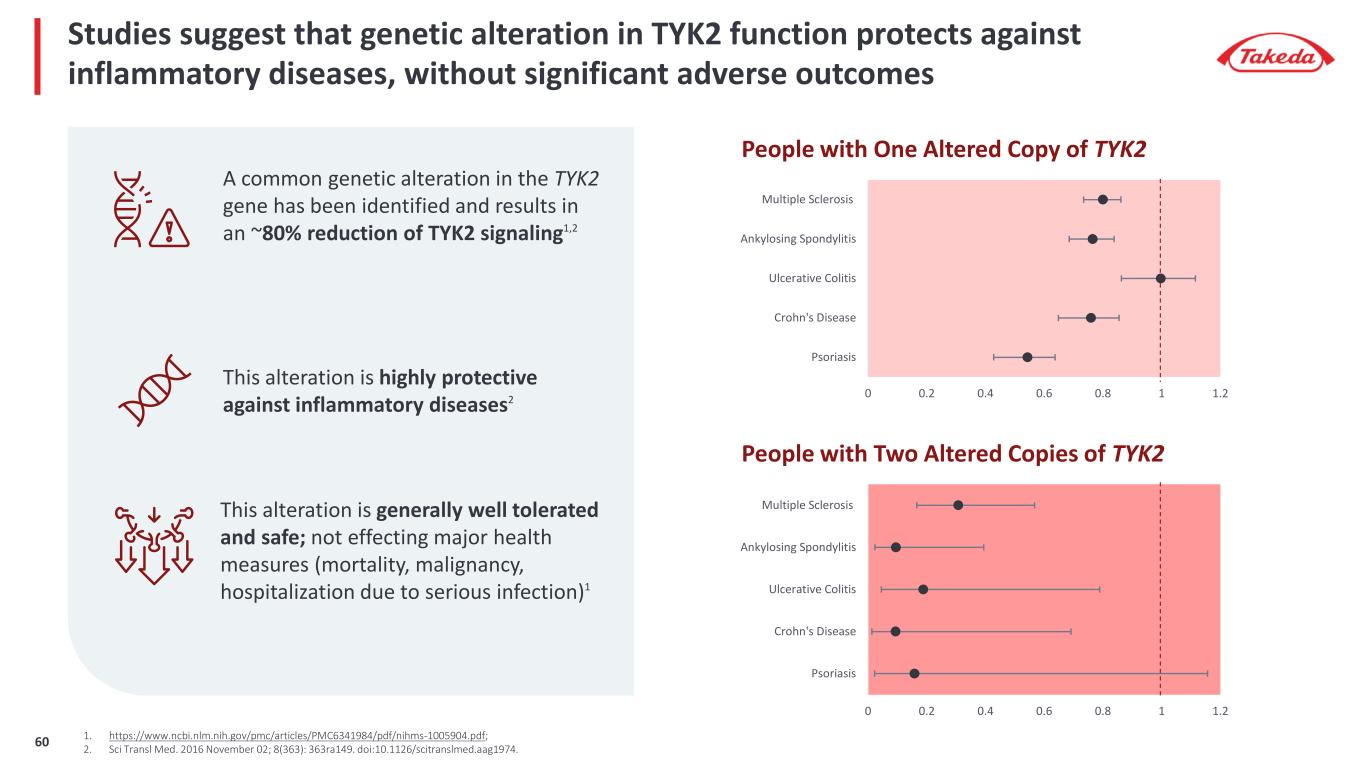

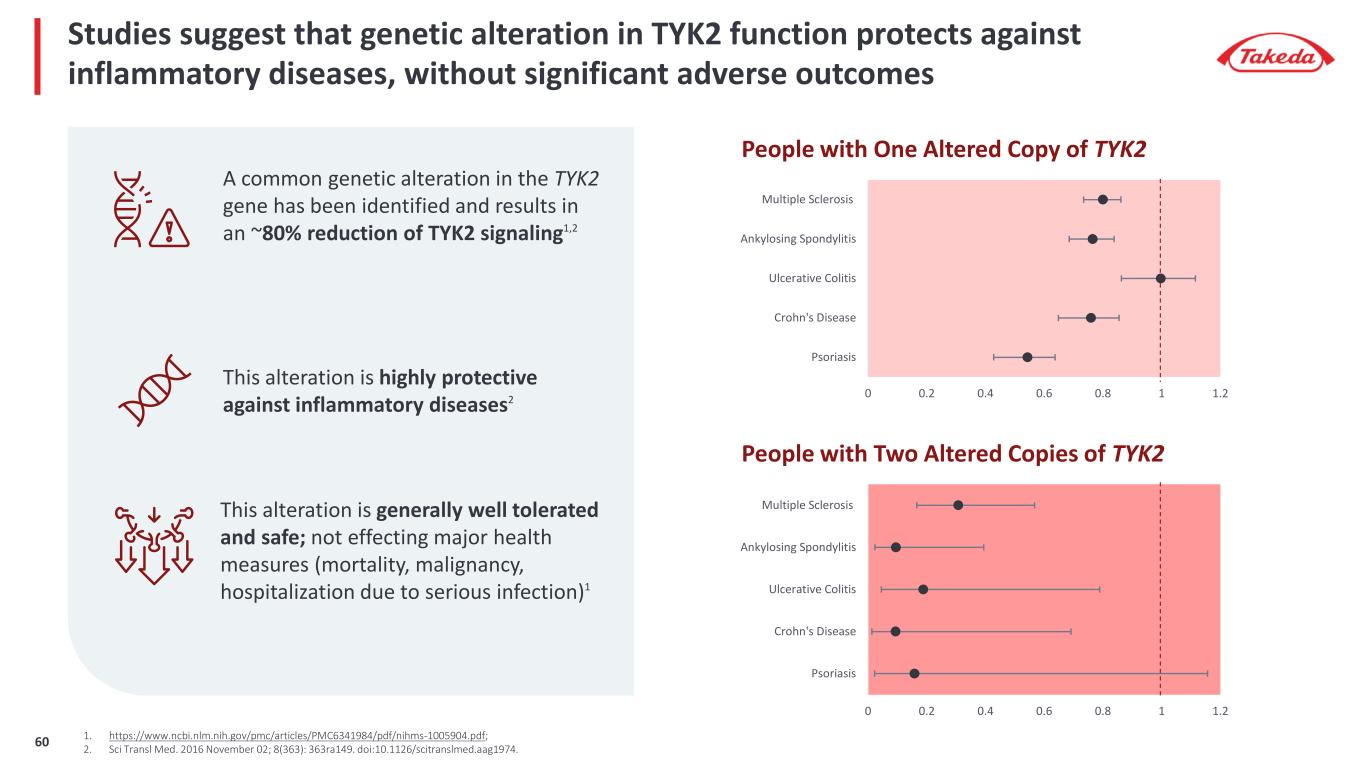

0 0.2 0.4 0.6 0.8 1 1.2 Psoriasis Crohn's Disease Ulcerative Colitis Ankylosing Spondylitis Multiple Sclerosis 0 0.2 0.4 0.6 0.8 1 1.2 Psoriasis Crohn's Disease Ulcerative Colitis Ankylosing Spondylitis Multiple Sclerosis People with One Altered Copy of TYK2 People with Two Altered Copies of TYK2 Studies suggest that genetic alteration in TYK2 function protects against inflammatory diseases, without significant adverse outcomes This alteration is highly protective against inflammatory diseases2 A common genetic alteration in the TYK2 gene has been identified and results in an ~80% reduction of TYK2 signaling1,2 This alteration is generally well tolerated and safe; not effecting major health measures (mortality, malignancy, hospitalization due to serious infection)1 1. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6341984/pdf/nihms-1005904.pdf; 2. Sci Transl Med. 2016 November 02; 8(363): 363ra149. doi:10.1126/scitranslmed.aag1974.60

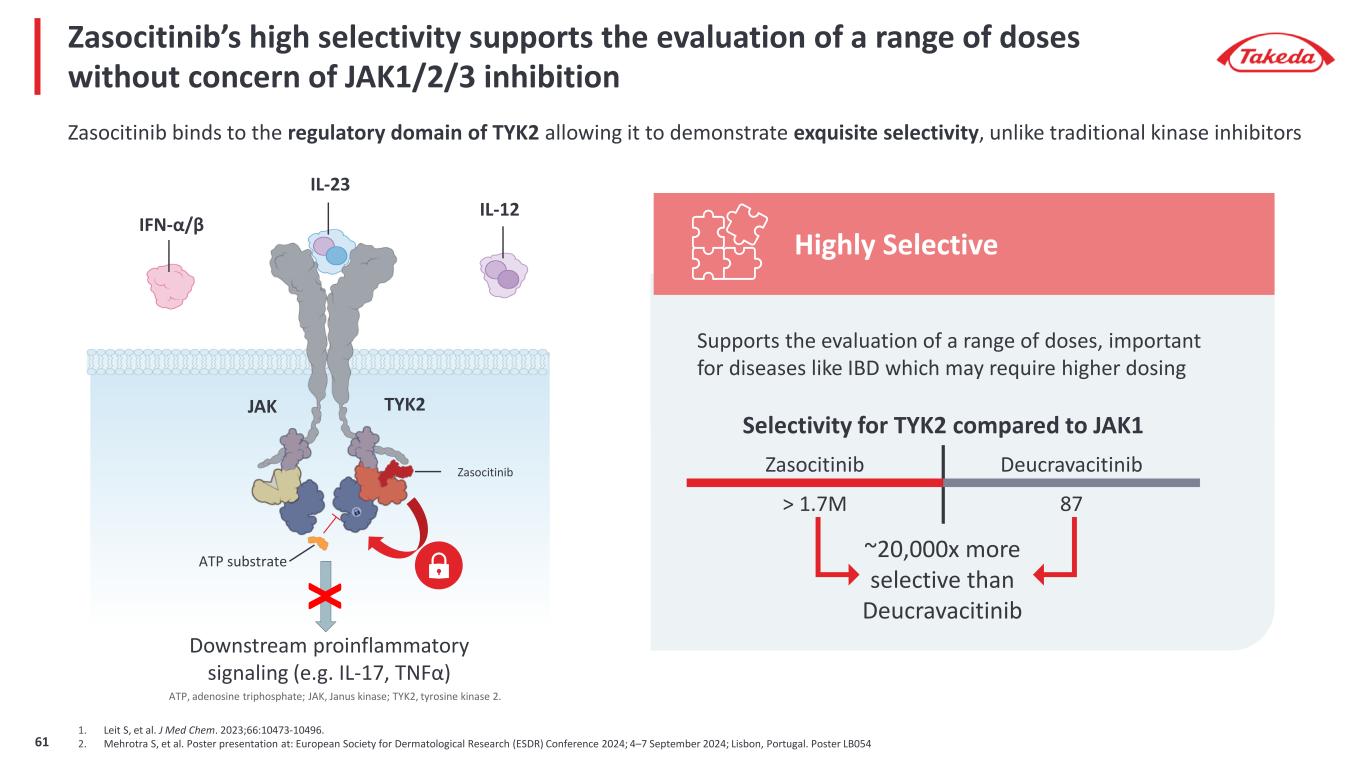

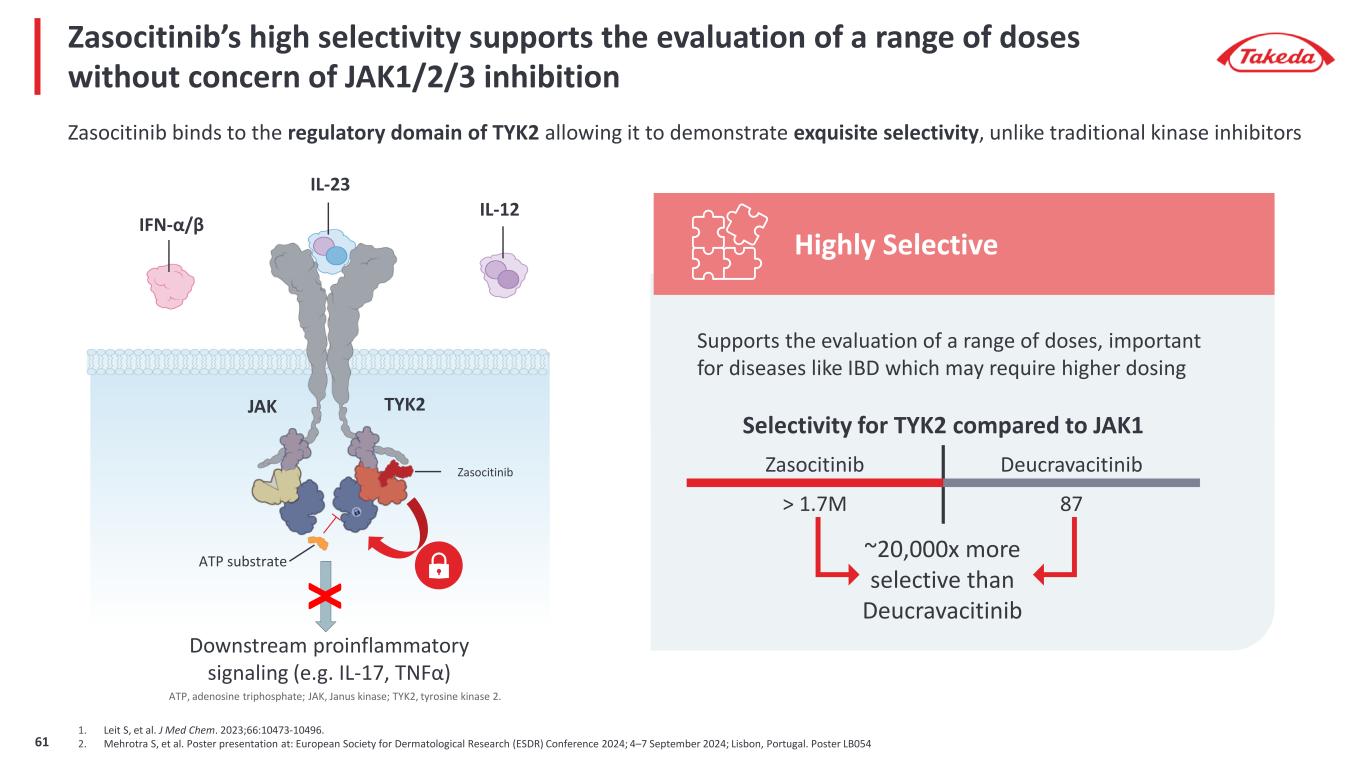

Zasocitinib’s high selectivity supports the evaluation of a range of doses without concern of JAK1/2/3 inhibition 1. Leit S, et al. J Med Chem. 2023;66:10473-10496. 2. Mehrotra S, et al. Poster presentation at: European Society for Dermatological Research (ESDR) Conference 2024; 4–7 September 2024; Lisbon, Portugal. Poster LB054 Zasocitinib binds to the regulatory domain of TYK2 allowing it to demonstrate exquisite selectivity, unlike traditional kinase inhibitors JAK TYK2 IL-23 Downstream proinflammatory signaling (e.g. IL-17, TNFα) IFN-α/β IL-12 ATP substrate Zasocitinib X Selectivity for TYK2 compared to JAK1 Zasocitinib Deucravacitinib > 1.7M 87 ~20,000x more selective than Deucravacitinib Supports the evaluation of a range of doses, important for diseases like IBD which may require higher dosing Highly Selective ATP, adenosine triphosphate; JAK, Janus kinase; TYK2, tyrosine kinase 2. 61

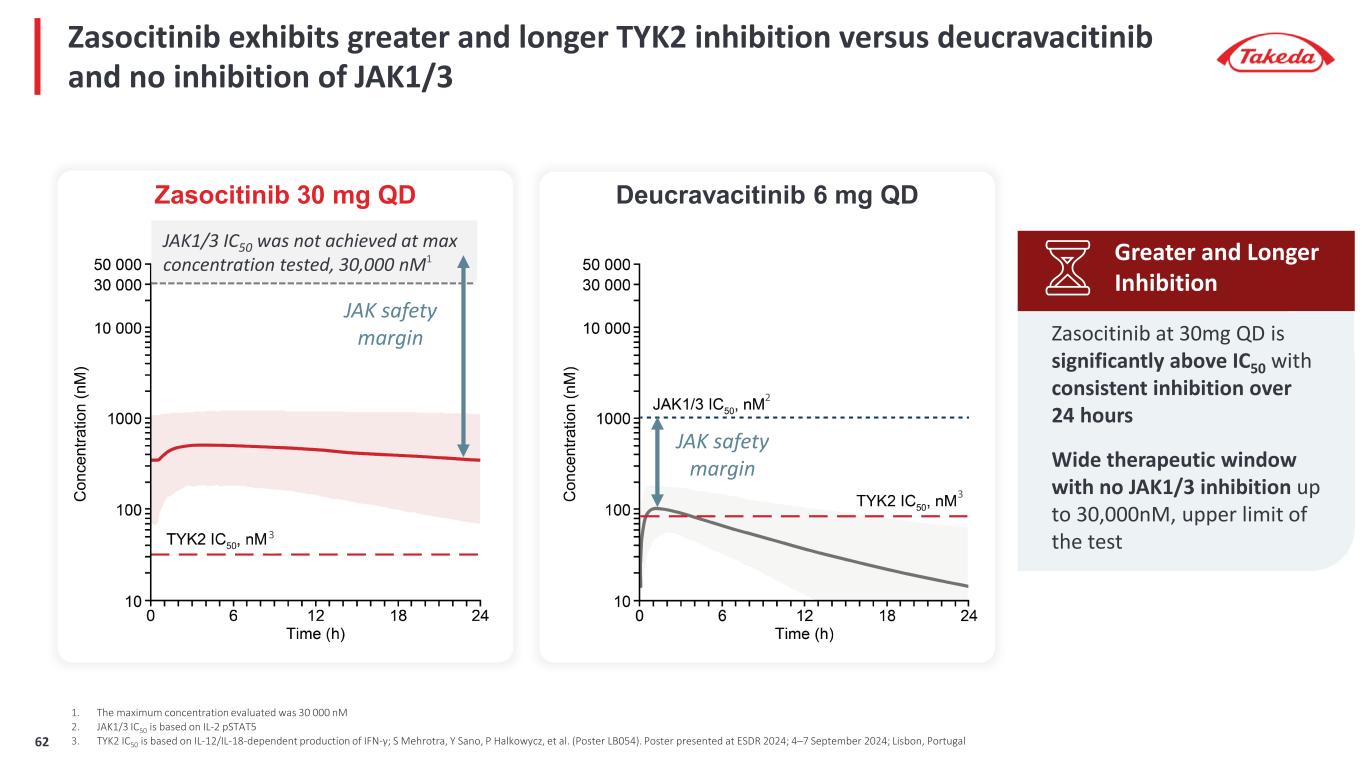

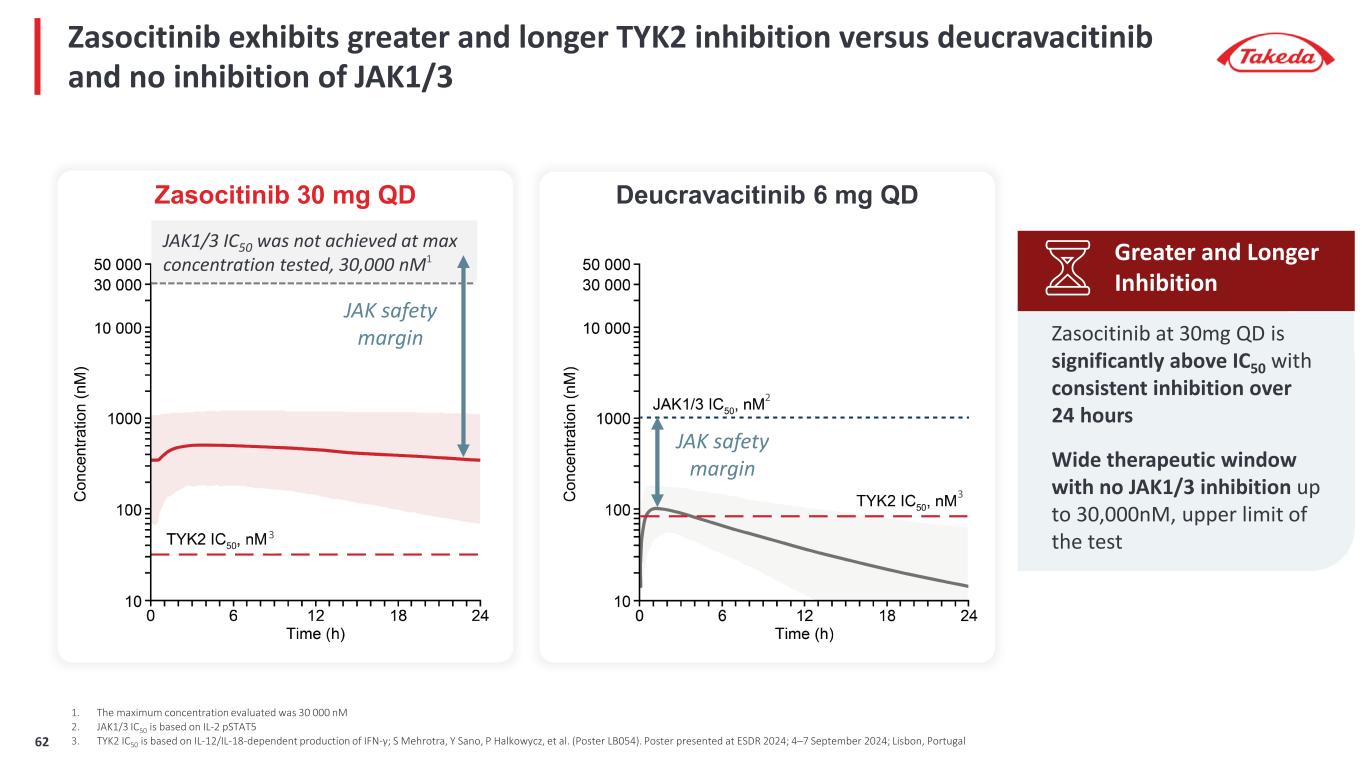

Zasocitinib exhibits greater and longer TYK2 inhibition versus deucravacitinib and no inhibition of JAK1/3 1. The maximum concentration evaluated was 30 000 nM 2. JAK1/3 IC50 is based on IL-2 pSTAT5 3. TYK2 IC50 is based on IL-12/IL-18-dependent production of IFN-γ; S Mehrotra, Y Sano, P Halkowycz, et al. (Poster LB054). Poster presented at ESDR 2024; 4–7 September 2024; Lisbon, Portugal Zasocitinib at 30mg QD is significantly above IC50 with consistent inhibition over 24 hours Wide therapeutic window with no JAK1/3 inhibition up to 30,000nM, upper limit of the test Greater and Longer Inhibition Zasocitinib 30 mg QD Deucravacitinib 6 mg QD JAK safety margin JAK safety margin JAK1/3 IC50 was not achieved at max concentration tested, 30,000 nM1 2 3 3 62

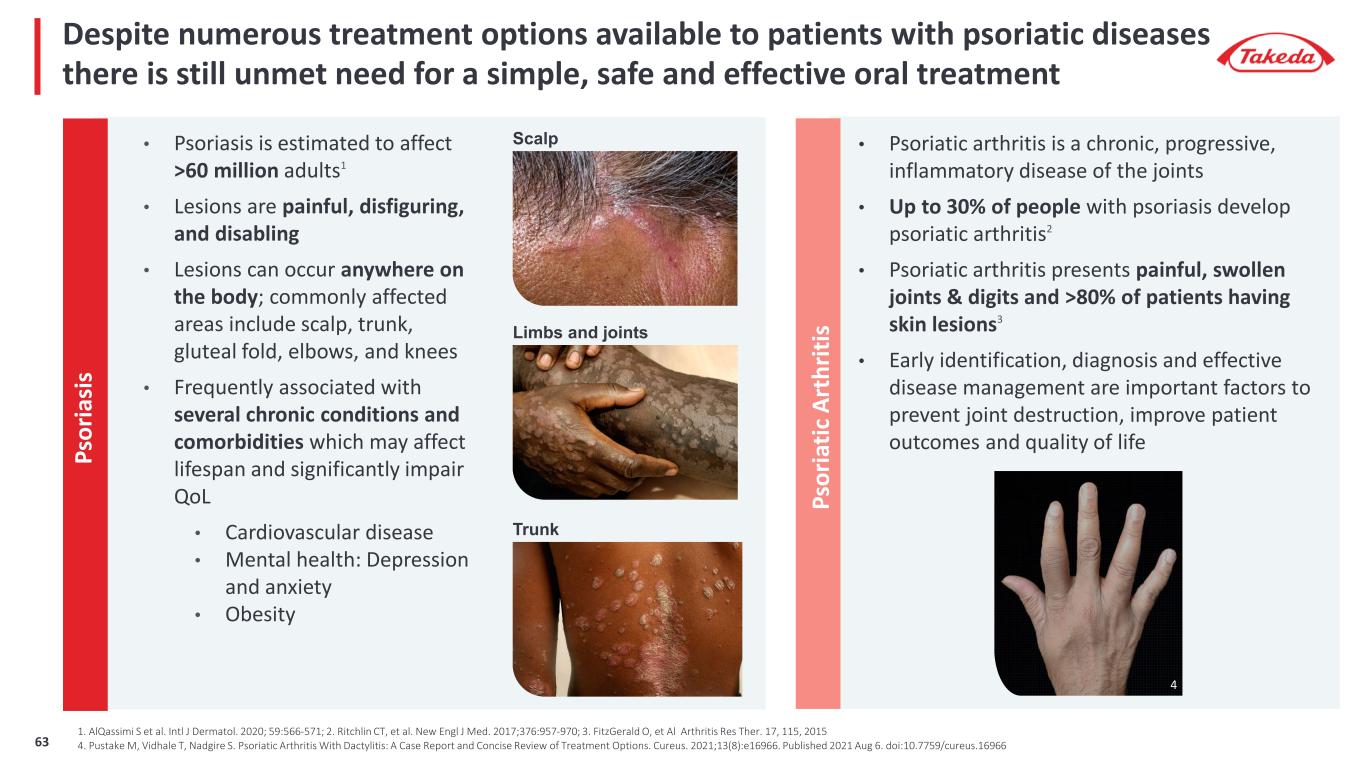

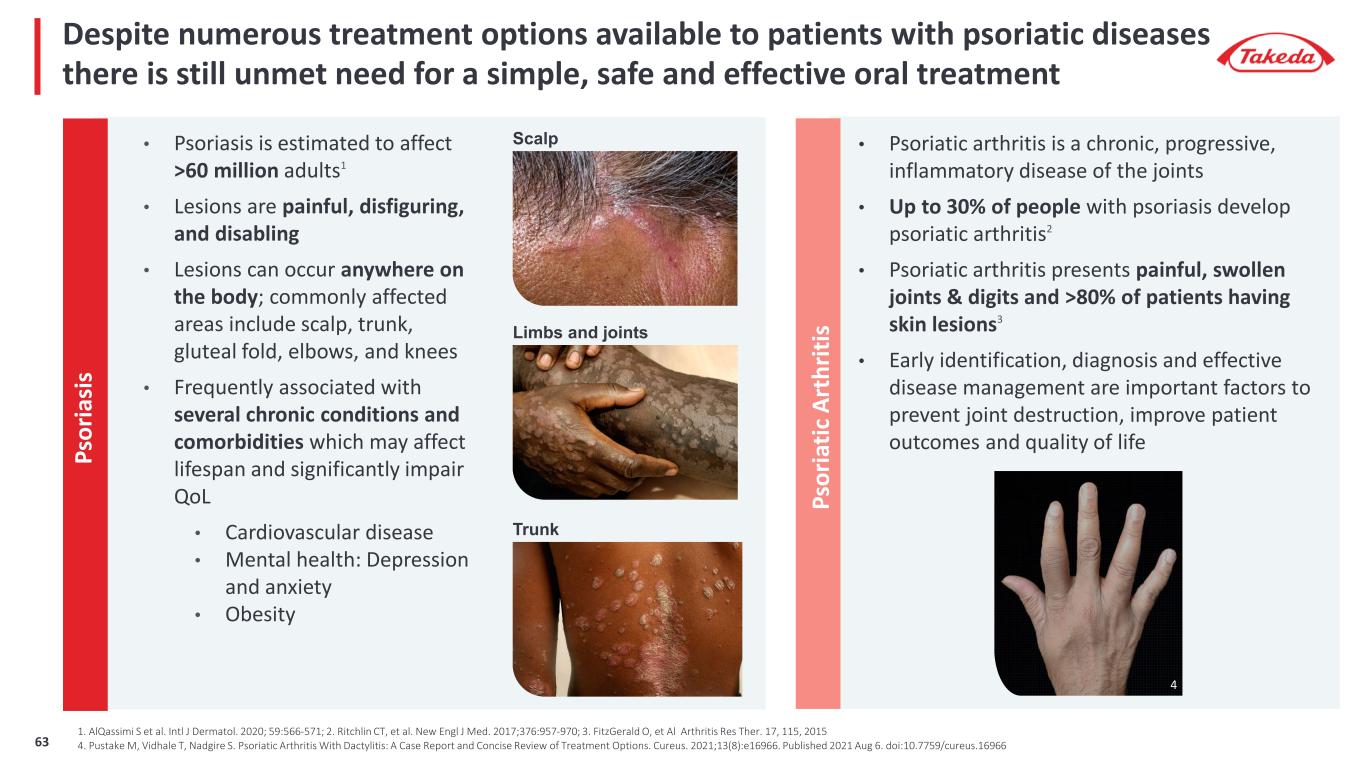

Despite numerous treatment options available to patients with psoriatic diseases there is still unmet need for a simple, safe and effective oral treatment • Psoriasis is estimated to affect >60 million adults1 • Lesions are painful, disfiguring, and disabling • Lesions can occur anywhere on the body; commonly affected areas include scalp, trunk, gluteal fold, elbows, and knees • Frequently associated with several chronic conditions and comorbidities which may affect lifespan and significantly impair QoL • Cardiovascular disease • Mental health: Depression and anxiety • Obesity Ps or ia si s • Psoriatic arthritis is a chronic, progressive, inflammatory disease of the joints • Up to 30% of people with psoriasis develop psoriatic arthritis2 • Psoriatic arthritis presents painful, swollen joints & digits and >80% of patients having skin lesions3 • Early identification, diagnosis and effective disease management are important factors to prevent joint destruction, improve patient outcomes and quality of life Ps or ia tic A rt hr iti s Scalp Trunk Limbs and joints 1. AlQassimi S et al. Intl J Dermatol. 2020; 59:566-571; 2. Ritchlin CT, et al. New Engl J Med. 2017;376:957-970; 3. FitzGerald O, et Al Arthritis Res Ther. 17, 115, 2015 4. Pustake M, Vidhale T, Nadgire S. Psoriatic Arthritis With Dactylitis: A Case Report and Concise Review of Treatment Options. Cureus. 2021;13(8):e16966. Published 2021 Aug 6. doi:10.7759/cureus.16966 4 63

One-third of patients achieved complete skin clearance at 12 weeks with 30 mg once daily of zasocitinib PASI 100 PASI 90 PASI 75 6% 18% *** 44% *** 68% *** 67% 0% * 8% *** 21% *** 45% *** 46% 0% 2% * 10% ** 15% *** 33% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Placebo (n=52) Zasocitinib 2 mg once daily (n=50) Zasocitinib 5 mg once daily (n=52) Zasocitinib 15 mg once daily (n=53) Zasocitinib 30 mg once daily (n=52) Pr op or tio n of p at ie nt s ac hi ev in g PA SI s co re s PASI Score @ 12 weeks Ph2b PsO study results P values from a Cochran-Mantel-Haenszel test, with prior biologic treatment included as a stratification factor, comparing the proportion of patients in the treatment group versus placebo. For secondary endpoints (PASI 90 and PASI 100), P values are nominal: *P<0.05; **P<0.005; ***P<0.001. Modified intent-to-treat (mITT) analysis set: all patients who were randomized and received at least one dose of study treatment.; PASI, psoriasis area and severity index.; Armstrong AW, Gooderham M, Lynde C, et al. Tyrosine Kinase 2 Inhibition With Zasocitinib (TAK-279) in Psoriasis: A Randomized Clinical Trial. JAMA Dermatol. Published online August 21, 2024. doi:10.1001/jamadermatol.2024.2701;64

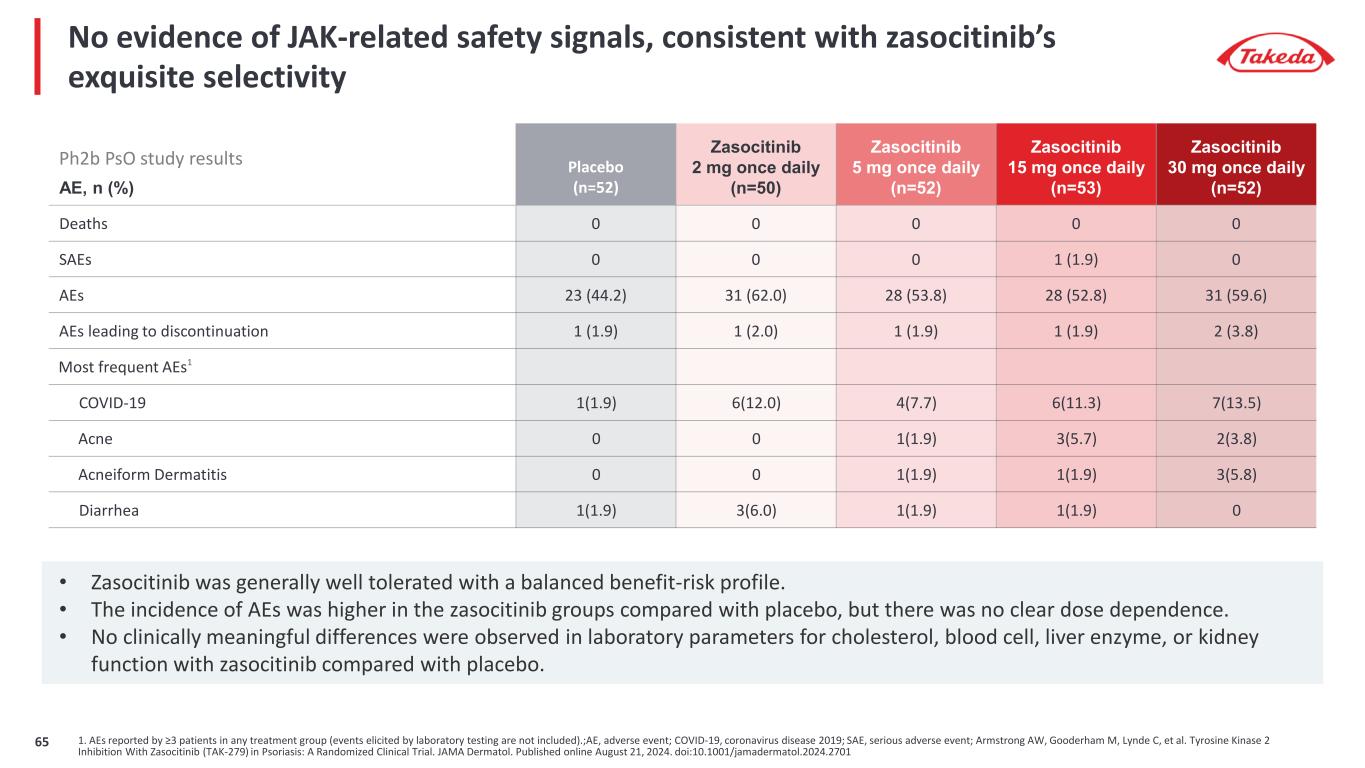

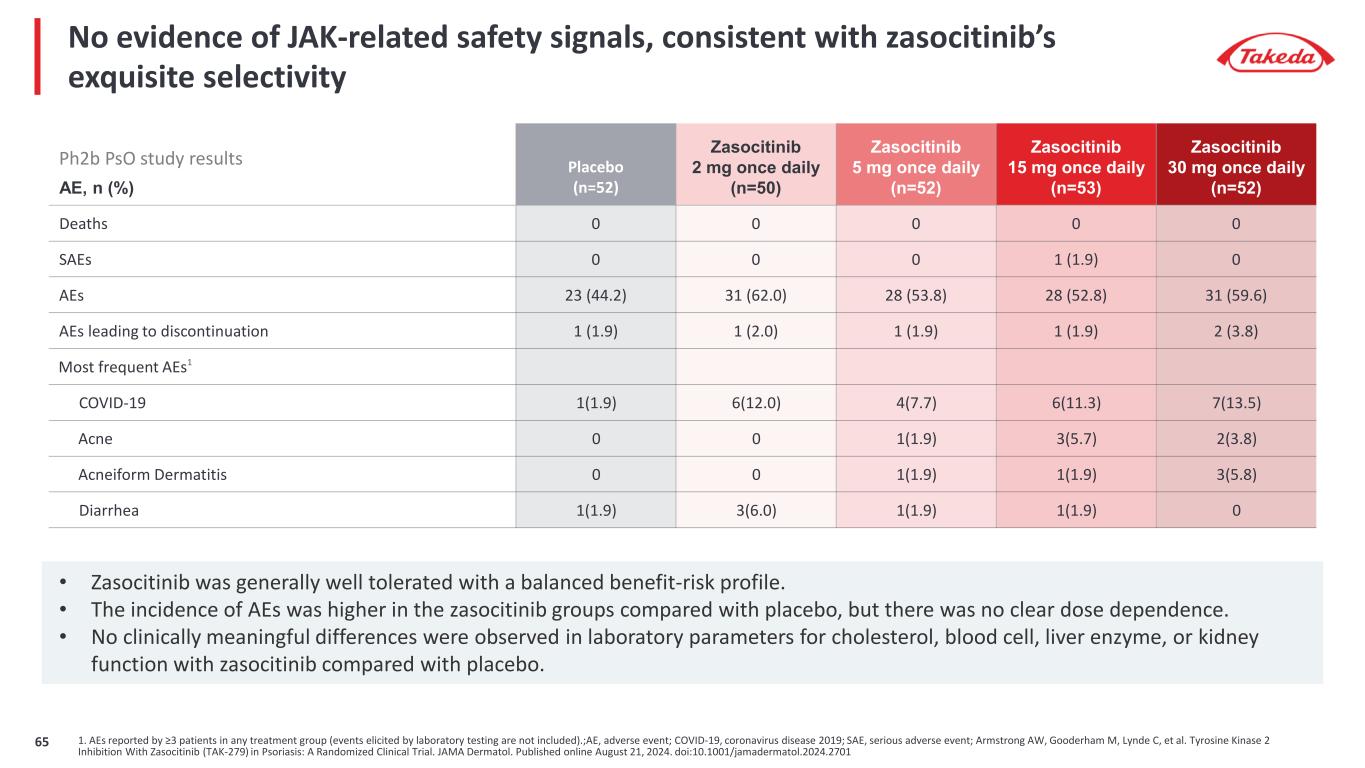

No evidence of JAK-related safety signals, consistent with zasocitinib’s exquisite selectivity AE, n (%) Placebo (n=52) Zasocitinib 2 mg once daily (n=50) Zasocitinib 5 mg once daily (n=52) Zasocitinib 15 mg once daily (n=53) Zasocitinib 30 mg once daily (n=52) Deaths 0 0 0 0 0 SAEs 0 0 0 1 (1.9) 0 AEs 23 (44.2) 31 (62.0) 28 (53.8) 28 (52.8) 31 (59.6) AEs leading to discontinuation 1 (1.9) 1 (2.0) 1 (1.9) 1 (1.9) 2 (3.8) Most frequent AEs1 COVID-19 1(1.9) 6(12.0) 4(7.7) 6(11.3) 7(13.5) Acne 0 0 1(1.9) 3(5.7) 2(3.8) Acneiform Dermatitis 0 0 1(1.9) 1(1.9) 3(5.8) Diarrhea 1(1.9) 3(6.0) 1(1.9) 1(1.9) 0 • Zasocitinib was generally well tolerated with a balanced benefit-risk profile. • The incidence of AEs was higher in the zasocitinib groups compared with placebo, but there was no clear dose dependence. • No clinically meaningful differences were observed in laboratory parameters for cholesterol, blood cell, liver enzyme, or kidney function with zasocitinib compared with placebo. 1. AEs reported by ≥3 patients in any treatment group (events elicited by laboratory testing are not included).;AE, adverse event; COVID-19, coronavirus disease 2019; SAE, serious adverse event; Armstrong AW, Gooderham M, Lynde C, et al. Tyrosine Kinase 2 Inhibition With Zasocitinib (TAK-279) in Psoriasis: A Randomized Clinical Trial. JAMA Dermatol. Published online August 21, 2024. doi:10.1001/jamadermatol.2024.2701 Ph2b PsO study results 65

Strong efficacy across joint and skin endpoints demonstrated in Ph2b PsA study ACR 20, ACR 50, ACR 70 Response at Week 121 Ph2b Study Results PASI 75 Response at Week 121 Ph2b Study Results 15.4% 25.6% 28.3% * 45.7% 0 20 40 60 80 100 Re sp on se ra te , % (9 5% C I) Placebo (n=39) TAK-279 5mg QD (N=39) TAK-279 15mg QD (N=46) TAK-279 30mg QD (N=46) 12.5% 18.3% * 28% * 29.2% 0 20 40 60 80 100 Re sp on se ra te , % (9 5% C I) Placebo (n=72) TAK-279 5mg QD (N=71) TAK-279 15mg QD (N=75) TAK-279 30mg QD (N=72) MDA for Psoriatic Arthritis at Week 121 Ph2b Study Results 29% 35% * 53% * 54% 10% 16% * 27% * 26% 6% 9% 15% 14% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Placebo (n=72) Zasocitinib 5 mg once daily (n=71) Zasocitinib 15 mg once daily (n=75) Zasocitinib 30 mg once daily (n=72) R es po ns e R at e (% ) ACR 70ACR 50ACR 20 * p<0.005, vs placebo; p values for secondary endpoints (ACR 50, ACR 70, MDA, PASI 75) are nominal. ; ACR, American College of Rheumatology; CI, confidence interval; MDA, minimal disease activity; QD, once daily. 1. Kivitz A, et al. Poster L12. Presented at: the 2023 American College of Rheumatology Annual Meeting; November 10-15, 2023; San Diego, CA,, USA. 66

Safety data from psoriatic arthritis Ph2b study supports that zasocitinib is generally well tolerated with a balanced benefit-risk profile Placebo (n=72) Zasocitinib 5 mg QD (n=71) Zasocitinib 15 mg QD (n=75) Zasocitinib 30 mg QD (n=72) n (%) n (%) n (%) n (%) Any TEAEs 39 (54.2) 42 (59.2) 45 (60.0) 56 (77.8) TEAEs leading to study discontinuation* 1 (1.4) 0 3 (4.0) 5 (6.9) Serious TEAEs 4 (5.6) 4 (5.6) 3 (4.0) 2 (2.8) Grade 3 or higher TEAEs 7 (9.7) 6 (8.5) 7 (9.3) 3 (4.2) TEAEs leading to death 0 0 0 0 Most frequent TEAEs† Nasopharyngitis 3 (4.2) 6 (8.5) 7 (9.3) 7 (9.7) URTIs 2 (2.8) 8 (11.3) 3 (4.0) 7 (9.7) Headache 3 (4.2) 2 (2.8) 6 (8.0) 4 (5.6) Rash 0 3 (4.2) 6 (8.0) 4 (5.6) • The incidence of AEs was higher in the zasocitinib groups compared with placebo, but there was no clear dose dependence. • No clinically meaningful differences were observed in laboratory parameters for cholesterol, blood cell, liver enzyme, or kidney function with zasocitinib compared with placebo. *Placebo: psoriatic arthropathy; zasocitinib 15 mg: erythema nodosum, gastrointestinal inflammation, atrial fibrillation/atrial flutter/mitral valve incompetence; zasocitinib 30 mg: dermatitis acneiform, dermatitis allergic, abdominal pain, pharyngitis, Bell’s palsy. †TEAEs occurring at ≥5% by preferred term in any treatment arm.; QD, once daily; TEAE, treatment-emergent adverse event; URTI, upper respiratory tract infection.; Kivitz A, et al. Poster L12. Presented at: the 2023 American College of Rheumatology Annual Meeting; November 10-15, 2023; San Diego, CA, USA. Ph2b PsA study results 67

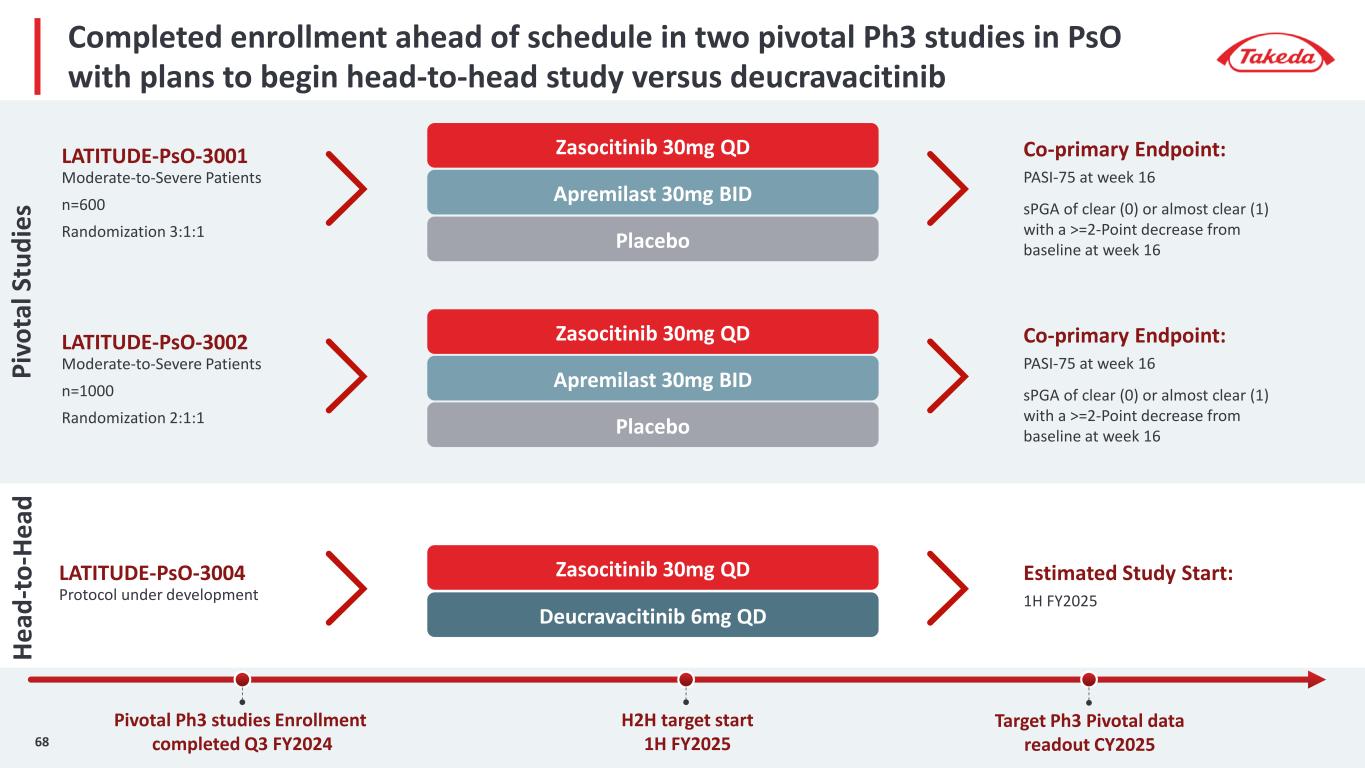

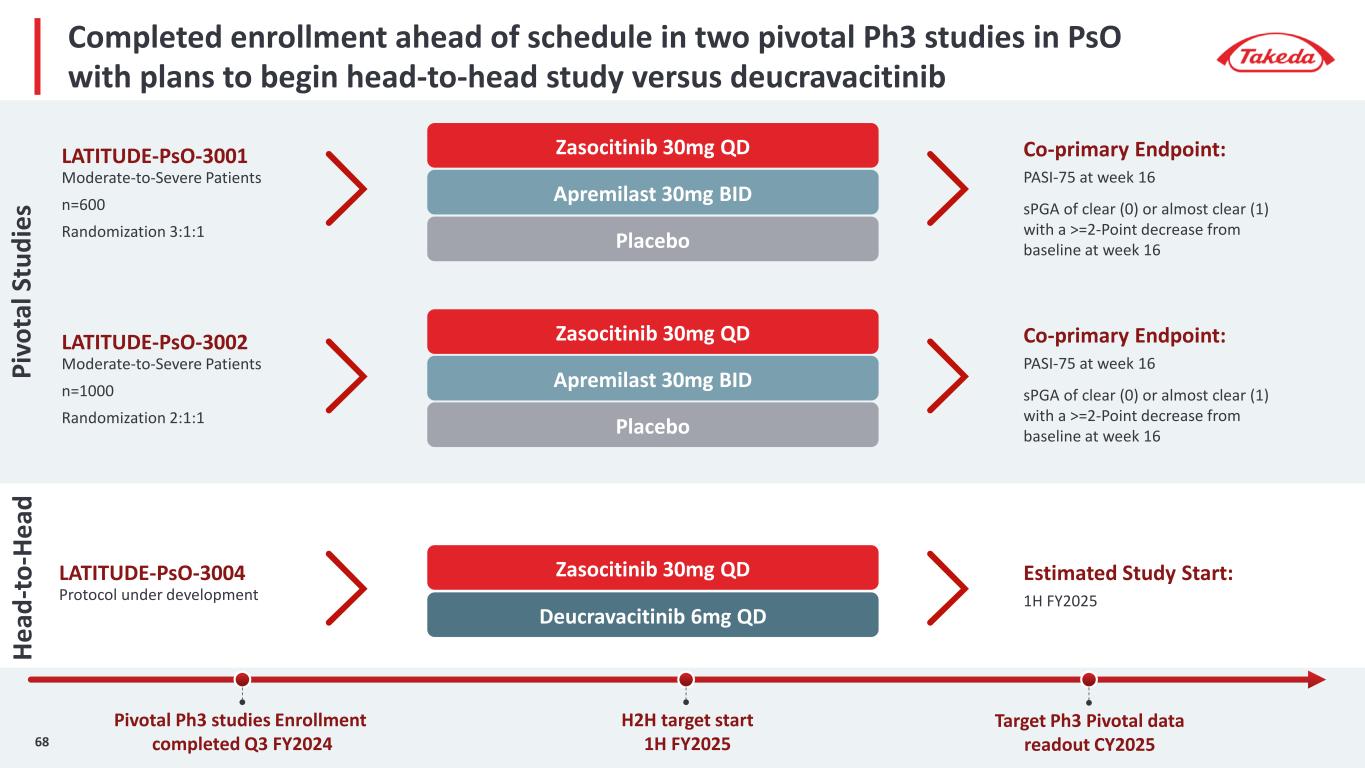

Completed enrollment ahead of schedule in two pivotal Ph3 studies in PsO with plans to begin head-to-head study versus deucravacitinib Zasocitinib 30mg QDLATITUDE-PsO-3001 Moderate-to-Severe Patients n=600 Randomization 3:1:1 Co-primary Endpoint: PASI-75 at week 16 sPGA of clear (0) or almost clear (1) with a >=2-Point decrease from baseline at week 16 Apremilast 30mg BID Placebo Zasocitinib 30mg QDLATITUDE-PsO-3002 Moderate-to-Severe Patients n=1000 Randomization 2:1:1 Co-primary Endpoint: PASI-75 at week 16 sPGA of clear (0) or almost clear (1) with a >=2-Point decrease from baseline at week 16Placebo Apremilast 30mg BID Zasocitinib 30mg QDLATITUDE-PsO-3004 Protocol under development Estimated Study Start: 1H FY2025 Deucravacitinib 6mg QD Pivotal Ph3 studies Enrollment completed Q3 FY2024 H2H target start 1H FY2025 Target Ph3 Pivotal data readout CY2025 Pi vo ta l S tu di es 68 He ad -t o- He ad

Takeda has advanced zasocitinib into phase 3 for psoriatic arthritis LATITUDE-PsA-3001 n=1088 Randomization 1:1:1:1 Primary Endpoint: ACR20 at week 16 Key Secondary Endpoint: PASI-75 at week 16 MDA at week 16 Zasocitinib 15mg QD Placebo Zasocitinib 30mg QD Apremilast 30mg BID LATITUDE-PsA-3002 n=600 Randomization 1:1:1 Primary Endpoint: ACR20 at week 16 Key Secondary Endpoint: PASI-75 at week 16 MDA at week 16 Zasocitinib 15mg QD Placebo Zasocitinib 30mg QD Ph2 completed FY2023 Target Ph3 Start FY2024 Target Filing FY28/2969

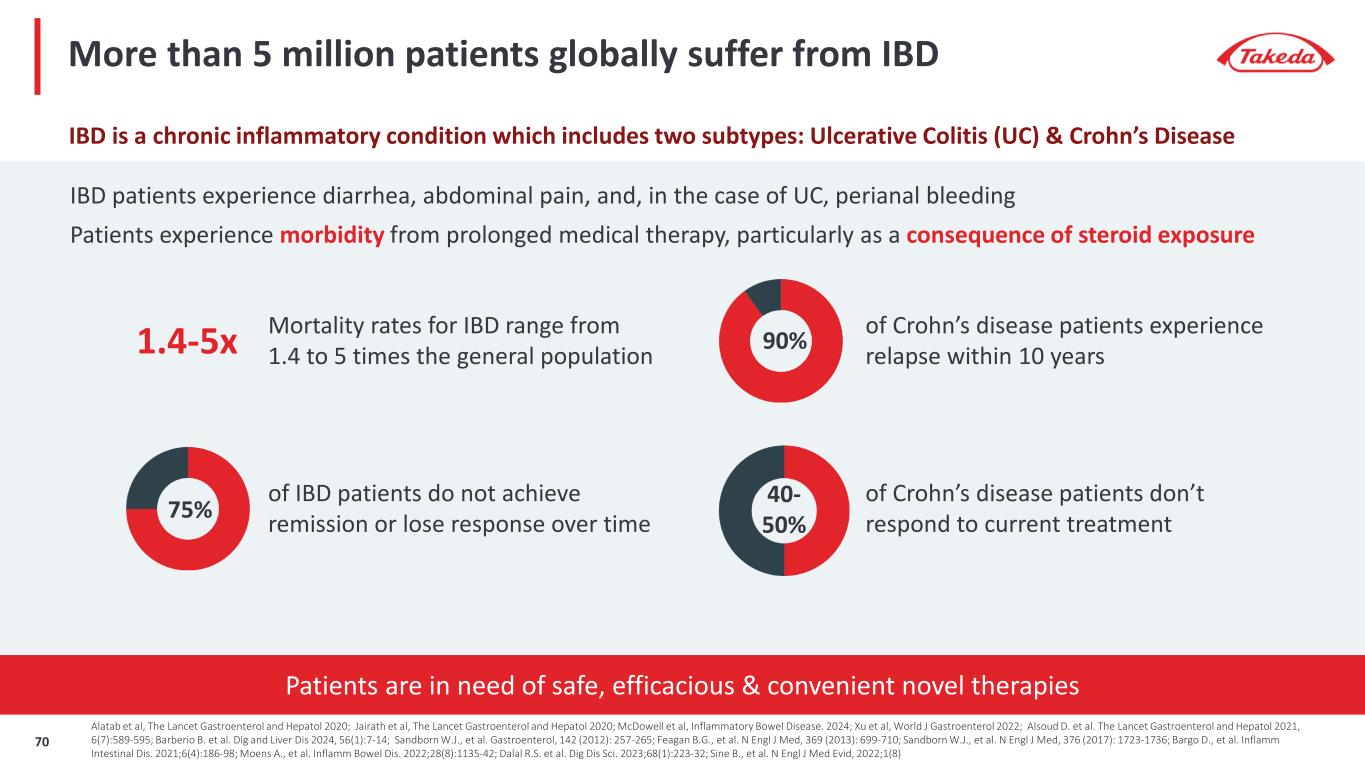

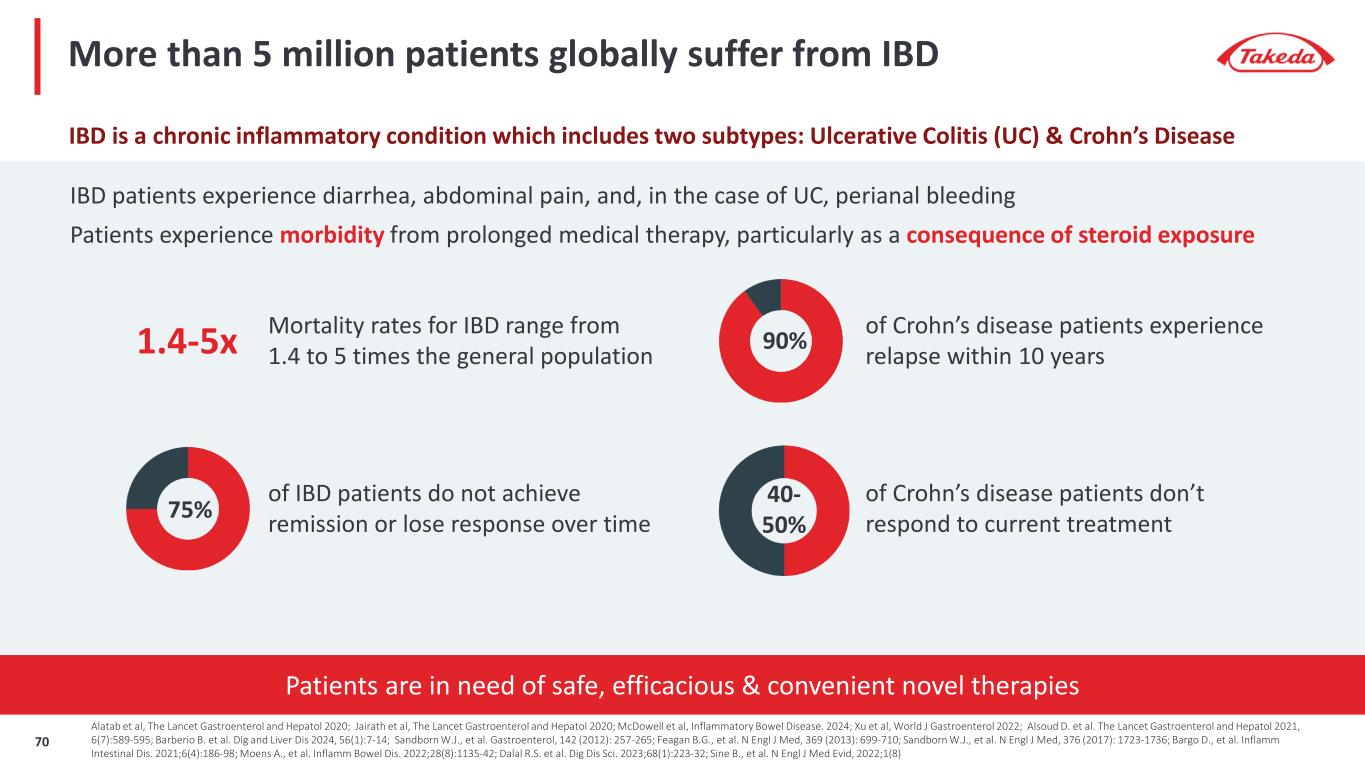

Patients are in need of safe, efficacious & convenient novel therapies More than 5 million patients globally suffer from IBD Mortality rates for IBD range from 1.4 to 5 times the general population 1.4-5x 90% of Crohn’s disease patients experience relapse within 10 years 75% of IBD patients do not achieve remission or lose response over time 40- 50% of Crohn’s disease patients don’t respond to current treatment IBD patients experience diarrhea, abdominal pain, and, in the case of UC, perianal bleeding Patients experience morbidity from prolonged medical therapy, particularly as a consequence of steroid exposure IBD is a chronic inflammatory condition which includes two subtypes: Ulcerative Colitis (UC) & Crohn’s Disease Alatab et al, The Lancet Gastroenterol and Hepatol 2020; Jairath et al, The Lancet Gastroenterol and Hepatol 2020; McDowell et al, Inflammatory Bowel Disease. 2024; Xu et al, World J Gastroenterol 2022; Alsoud D. et al. The Lancet Gastroenterol and Hepatol 2021, 6(7):589-595; Barberio B. et al. Dig and Liver Dis 2024, 56(1):7-14; Sandborn W.J., et al. Gastroenterol, 142 (2012): 257-265; Feagan B.G., et al. N Engl J Med, 369 (2013): 699-710; Sandborn W.J., et al. N Engl J Med, 376 (2017): 1723-1736; Bargo D., et al. Inflamm Intestinal Dis. 2021;6(4):186-98; Moens A., et al. Inflamm Bowel Dis. 2022;28(8):1135-42; Dalal R.S. et al. Dig Dis Sci. 2023;68(1):223-32; Sine B., et al. N Engl J Med Evid, 2022;1(8) 70

3.2 2.5 1.2 0.9 0 1 2 3 4 Placebo Zasocitinib Low Dose Zasocitinib High Dose Biologic Positive Control Zasocitinib has strong scientific rationale to support exploration in IBD Genetic analysis has identified an alteration in the TYK2 gene that is highly protective against inflammatory diseases, including Crohn’s & UC1 Zasocitinib can achieve and maintain near- complete TYK2 inhibition2 Zasocitinib is highly selective, supporting higher dosing to ensure target tissue coverage in IBD Animal models of colitis demonstrate a significant reduction in disease activity at high dose zasocitinib3 1 2 3 4 Di se as e Ac tiv ity Disease Activity in a Pre-clinical Colitis Model * * Im pr ov em en t 1. Dendrou CA, et al. Sci Transl Med. 2016;8(363):363ra149. 2. Mehrotra S, et al. Poster presentation at: European Society for Dermatological Research (ESDR) Conference 2024; 4–7 September 2024; Lisbon, Portugal. Poster LB054. 3. Kong KF, et al. Poster presentation at: Congress of the European Crohn's and Colitis Organisation (ECCO) 2024; 21-24 February 2024; Stockholm, Sweden. Poster 143. 71

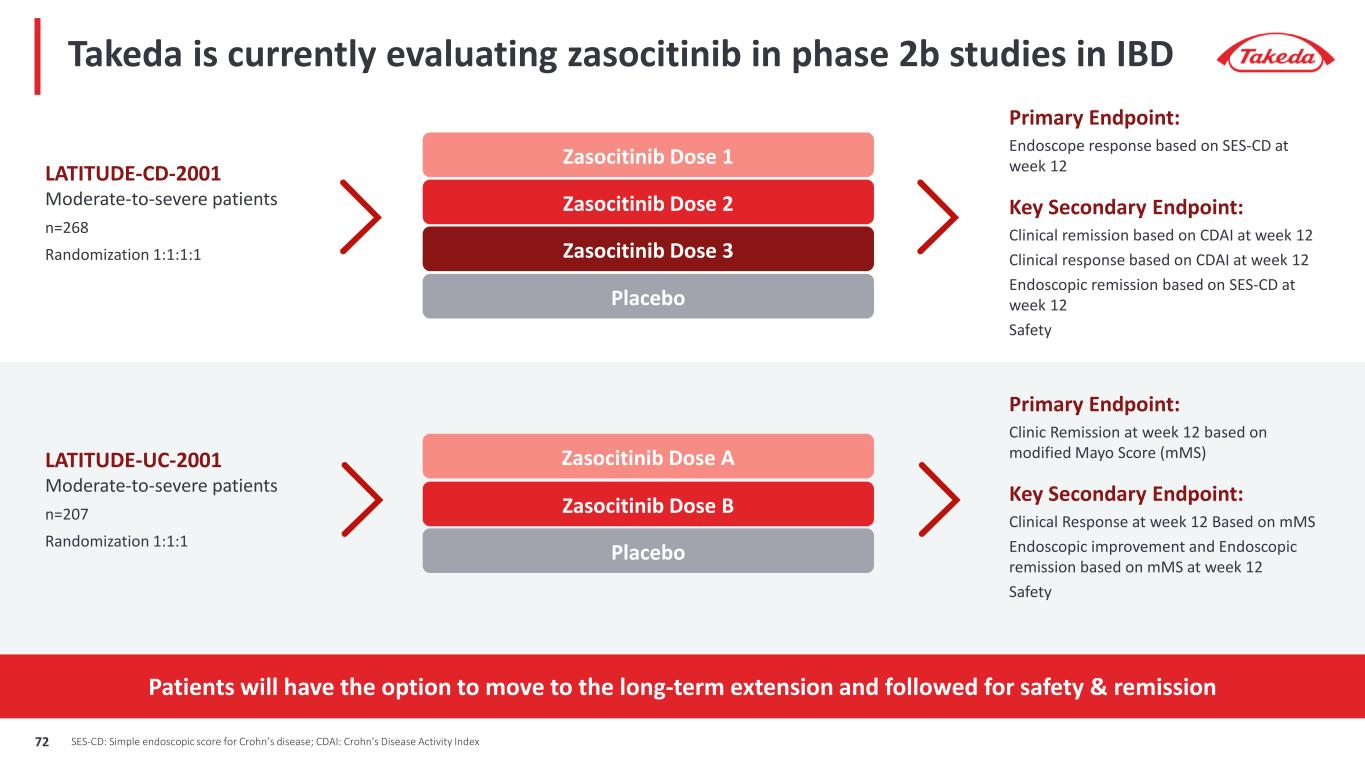

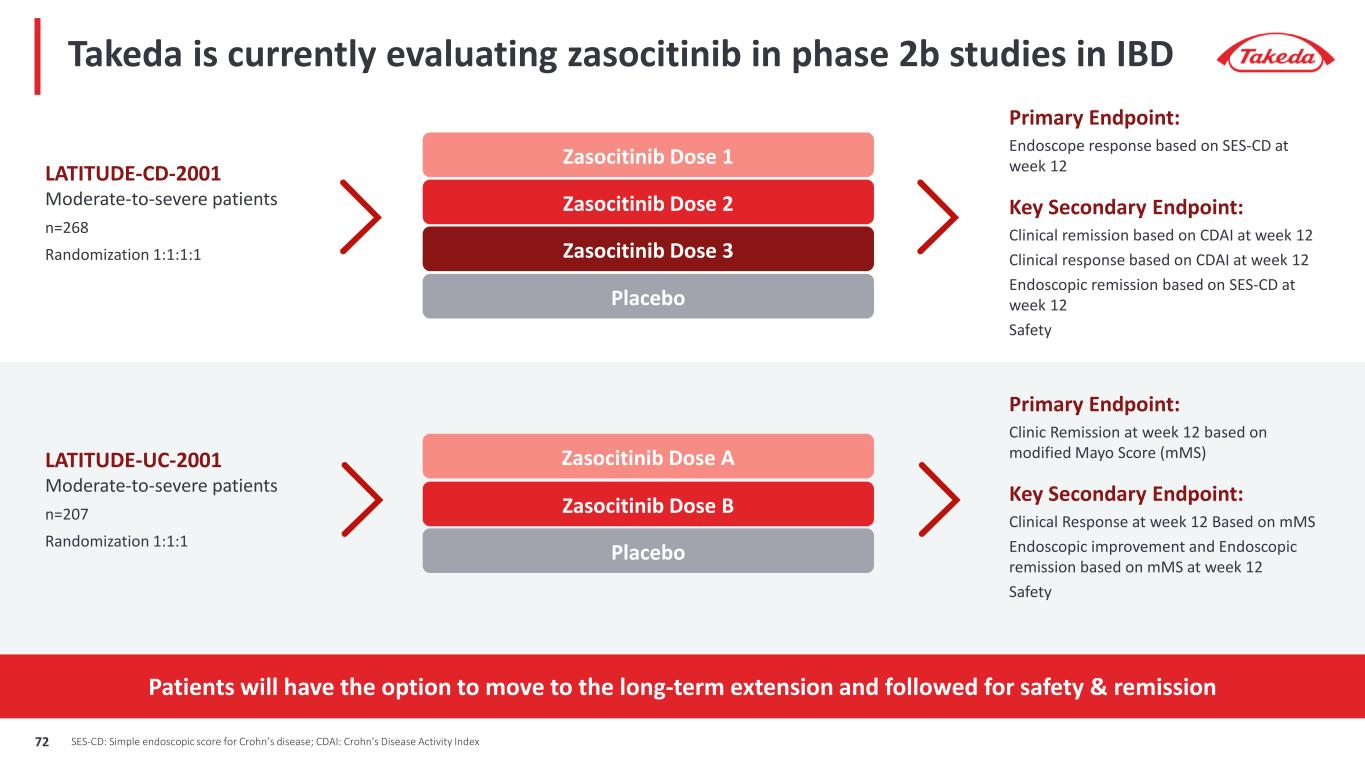

Takeda is currently evaluating zasocitinib in phase 2b studies in IBD LATITUDE-CD-2001 Moderate-to-severe patients n=268 Randomization 1:1:1:1 Primary Endpoint: Endoscope response based on SES-CD at week 12 Key Secondary Endpoint: Clinical remission based on CDAI at week 12 Clinical response based on CDAI at week 12 Endoscopic remission based on SES-CD at week 12 Safety Zasocitinib Dose 1 Placebo Zasocitinib Dose 2 Zasocitinib Dose 3 LATITUDE-UC-2001 Moderate-to-severe patients n=207 Randomization 1:1:1 Primary Endpoint: Clinic Remission at week 12 based on modified Mayo Score (mMS) Key Secondary Endpoint: Clinical Response at week 12 Based on mMS Endoscopic improvement and Endoscopic remission based on mMS at week 12 Safety Zasocitinib Dose A Placebo Zasocitinib Dose B Patients will have the option to move to the long-term extension and followed for safety & remission SES-CD: Simple endoscopic score for Crohn’s disease; CDAI: Crohn's Disease Activity Index72

PHASE 2b START PHASE 2b READOUT PHASE 3 FILING Psoriasis Ph2b March 2023 Ph3 Start FY2023 Zaso vs Deucra Start FY2025 Target FY2026 Psoriatic Arthritis Ph2b September 2023 Target Ph3 Start FY2024 Target FY28/29 Crohn’s Disease Ph2b March 2024 Target FY2026 Ulcerative Colitis Ph2b June 2024 Target FY2026 Others Planned With a deep history in inflammation, Takeda is uniquely placed to advance zasocitinib Complete 73

Zasocitinib Market Opportunity Well-positioned to be the first-choice advanced therapy for psoriatic disease patients, leading the next-generation orals

PsO is much more than just a rash; patients are really suffering 1. The total body inflammatory burden increases the risk of medical comorbidities, including CVD, diabetes and obesity. Symptoms can restrict patients to stay home increasing feeling of disconnect and also cause frustration and embarrassment. Associated comorbidities CV disease and chronic obstructive pulmonary disorder Metabolic syndrome, obesity, diabetes, and IBD Depression, anxiety, suicidal ideation Psoriatic arthritis “Psoriasis first spread over my entire body and then onto my face. For me personally facial psoriasis was the hardest to come to terms with. Not because it was the most painful, itchy or sore, but because it could be seen by everyone around me.” “The pain and itching were severe, and sometimes I couldn't sleep because of it. My life had simply turned into a living nightmare and negative thoughts were overpowering everything inside me, making me feel frustrated and hopeless.” The visible plaques, social stigma and higher risk of comorbidities negatively impact patients’ QoL1 75

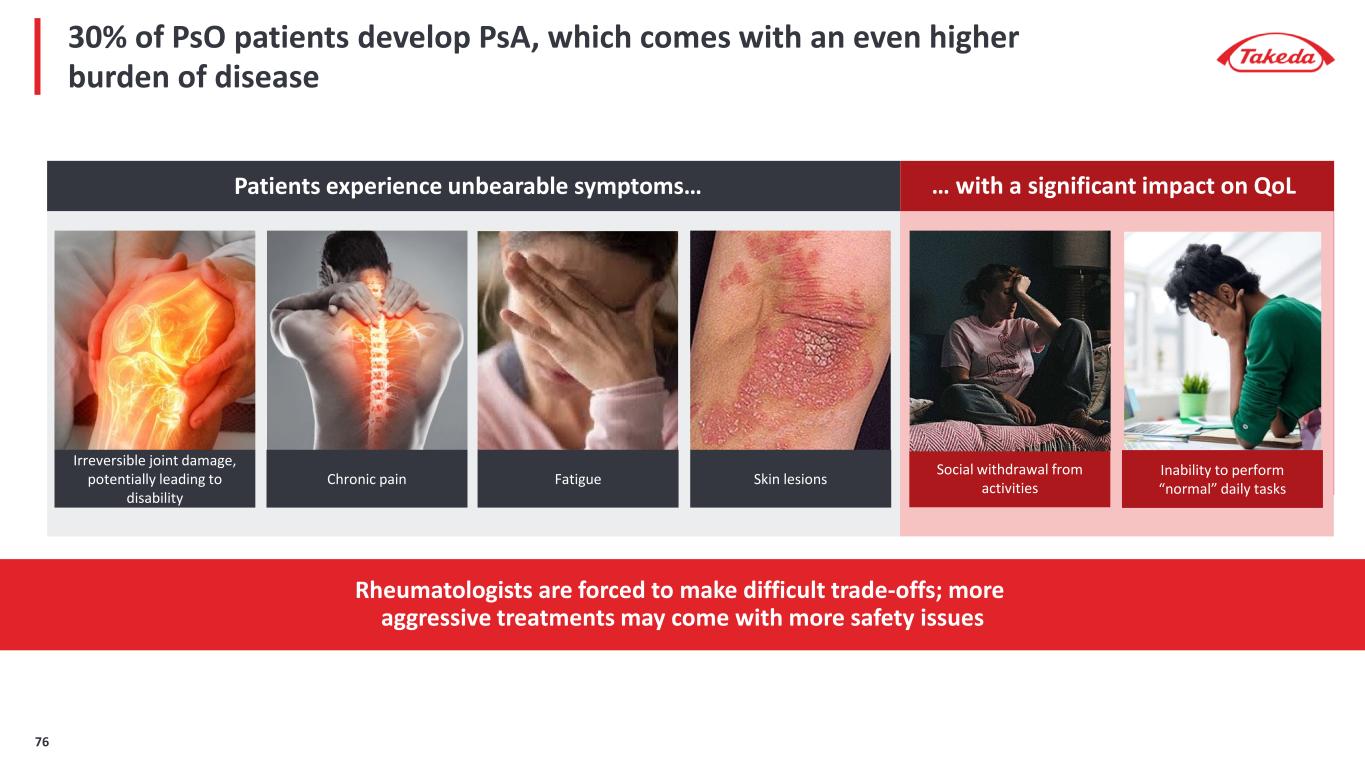

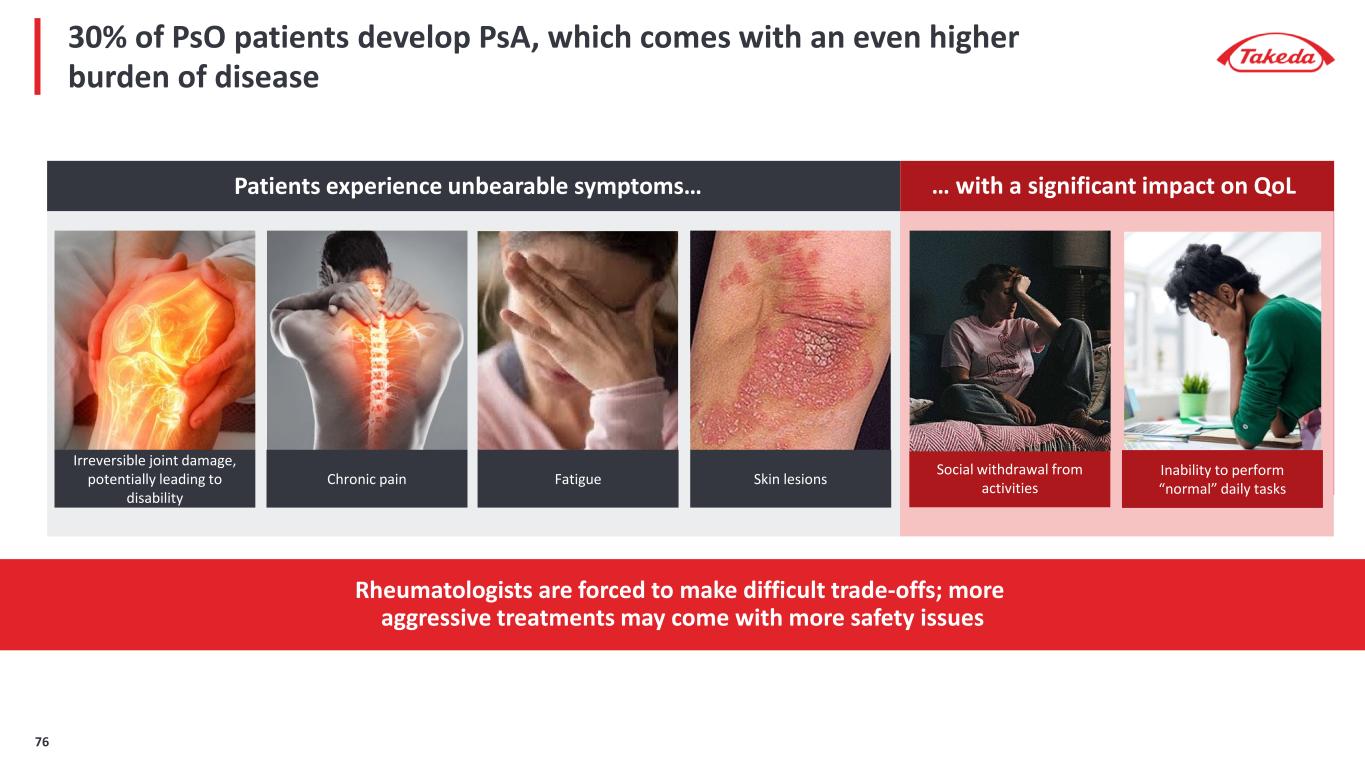

30% of PsO patients develop PsA, which comes with an even higher burden of disease Patients experience unbearable symptoms… … with a significant impact on QoL Social withdrawal from activities Inability to perform “normal” daily tasks Rheumatologists are forced to make difficult trade-offs; more aggressive treatments may come with more safety issues Irreversible joint damage, potentially leading to disability Chronic pain Fatigue Skin lesions 76

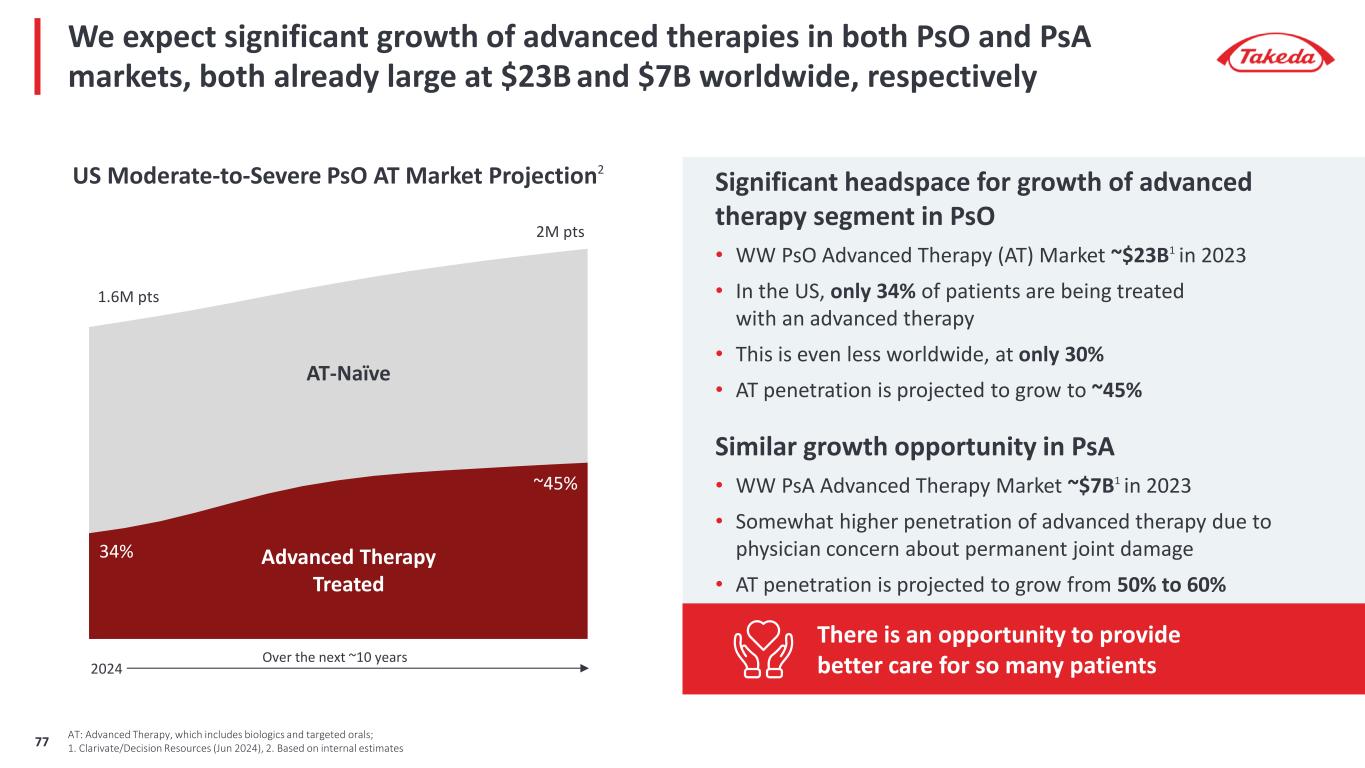

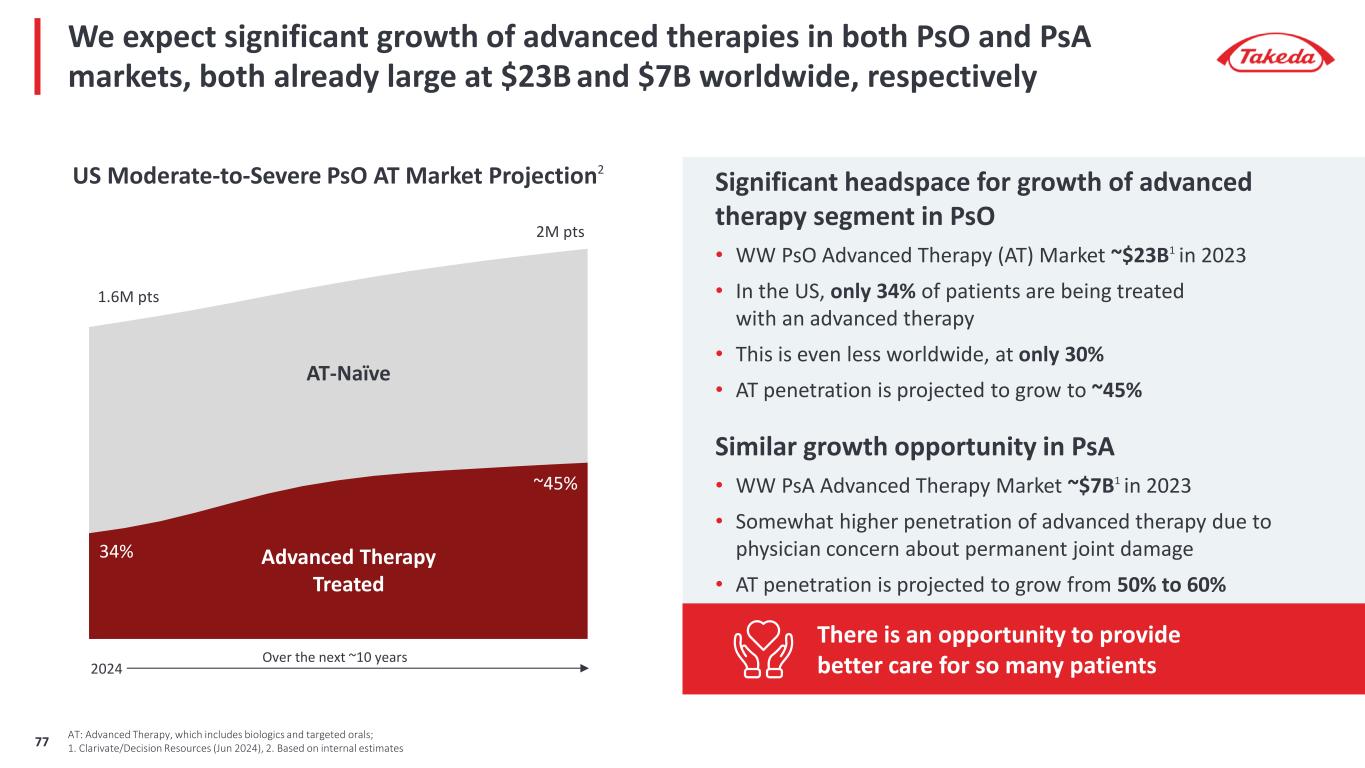

Significant headspace for growth of advanced therapy segment in PsO • WW PsO Advanced Therapy (AT) Market ~$23B1 in 2023 • In the US, only 34% of patients are being treated with an advanced therapy • This is even less worldwide, at only 30% • AT penetration is projected to grow to ~45% Similar growth opportunity in PsA • WW PsA Advanced Therapy Market ~$7B1 in 2023 • Somewhat higher penetration of advanced therapy due to physician concern about permanent joint damage • AT penetration is projected to grow from 50% to 60% We expect significant growth of advanced therapies in both PsO and PsA markets, both already large at $23B and $7B worldwide, respectively AT: Advanced Therapy, which includes biologics and targeted orals; 1. Clarivate/Decision Resources (Jun 2024), 2. Based on internal estimates US Moderate-to-Severe PsO AT Market Projection2 1.6M pts 2M pts 34% ~45% Advanced Therapy Treated AT-Naïve There is an opportunity to provide better care for so many patientsOver the next ~10 years 2024 77

This growth of advanced therapies is driven by improved oral options 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 900K AT treated pts 33% of AT 16% of AT 1.4M AT treated pts US Moderate to Severe PsO and Active PsA Oral Market Projection1 Biologic AT segment Oral AT segment “ Orals are where the market is going. It's where all the companies are investing. When a patient comes off of topicals, orals will be next. - US Dermatologist Over the next 10yrs Oral share is expected to double in both PsO and PsA 1. Based on internal estimates78

REDEFINE WHAT IS POSSIBLE WITH AN ORAL THERAPY IN PSORIATIC DISEASE Zasocitinib aims to…

Patients are seeking safe and effective oral treatment options when topical and conventional treatments aren't enough Clear skin Safety data Well-tolerated Once daily oral / easy to take WHAT PATIENTS TELL US THEY WANT Zasocitinib has the potential to be the first oral treatment option that can address all patient needs Zasocitinib Apremilast Deucravacitinib Target profile based on Ph2b results Scoring is based on apremilast and deucravacitinib labels, and target profile of zasocitinib based on Ph2b results. No H2H studies have been performed to date.80

Zasocitinib was designed to provide both efficacy & safety, along with a simple and easy treatment experience A next-generation, highly selective and potent TYK2 inhibitor A simple & easy treatment experience Favorable safety profile Biologic-like efficacy • Once daily oral treatment • Well-tolerated • Can be taken any time of the day without regard to food • Highly selective TYK2 inhibitor, with potential for no JAK effects • Strongly favorable benefit-risk profile PsO • Potential for rapid, durable and complete skin clearance • ~1/3 of patients with completely clear skin in 12 wks PsA • Reduced pain, swelling and inflammation in joints • Minimal Disease Activity (MDA) reached in ~1/3 of patients Greater and Longer inhibition Highly selective without off target effects Target profile based on Ph2b results81

PsO & PsA combine for up to $6B of peak revenue, with the potential for additional indications including Crohn’s & UC Global Peak Revenue Potential PsO and PsA $3 - 6B Plus Crohn’s & UC Plus potential additional indications Diagnosed PsO & PsA Patients Advanced Therapy Treated Oral treated Zasocitinib 1st Choice AT 2.2M → ~2.8M 39% → ~50% 16% → ~33% US PsO + PsA Market Evolution over next ~10 yrs Please refer to the Important Notice at the start of this presentation for more information about peak revenue estimates. Simple and streamlined onboarding Winning access strategy Targeting the right patients and physicians Head-to-head superiority trials vs currently marketed orals 82

Large, growing market in PsO/PsA with only ~30-50% of moderate-to-severe patients currently on advanced therapy Opportunity for improved oral options to expand the use of advanced therapy and more than double the share of AT patients on orals As a next-generation, highly selective TYK2 inhibitor, Zasocitinib has the potential to deliver biologic-like efficacy with favorable tolerability & safety, in a simple once-daily oral formulation Zasocitinib is poised to be the first-choice advanced therapy, with global peak revenue potential of $3-6B Unique opportunity for zasocitinib Please refer to the Important Notice at the start of this presentation for more information about peak revenue estimates.83

Rusfertide: Advancing Polycythemia Vera (PV) Treatment for Superior Hematocrit Control

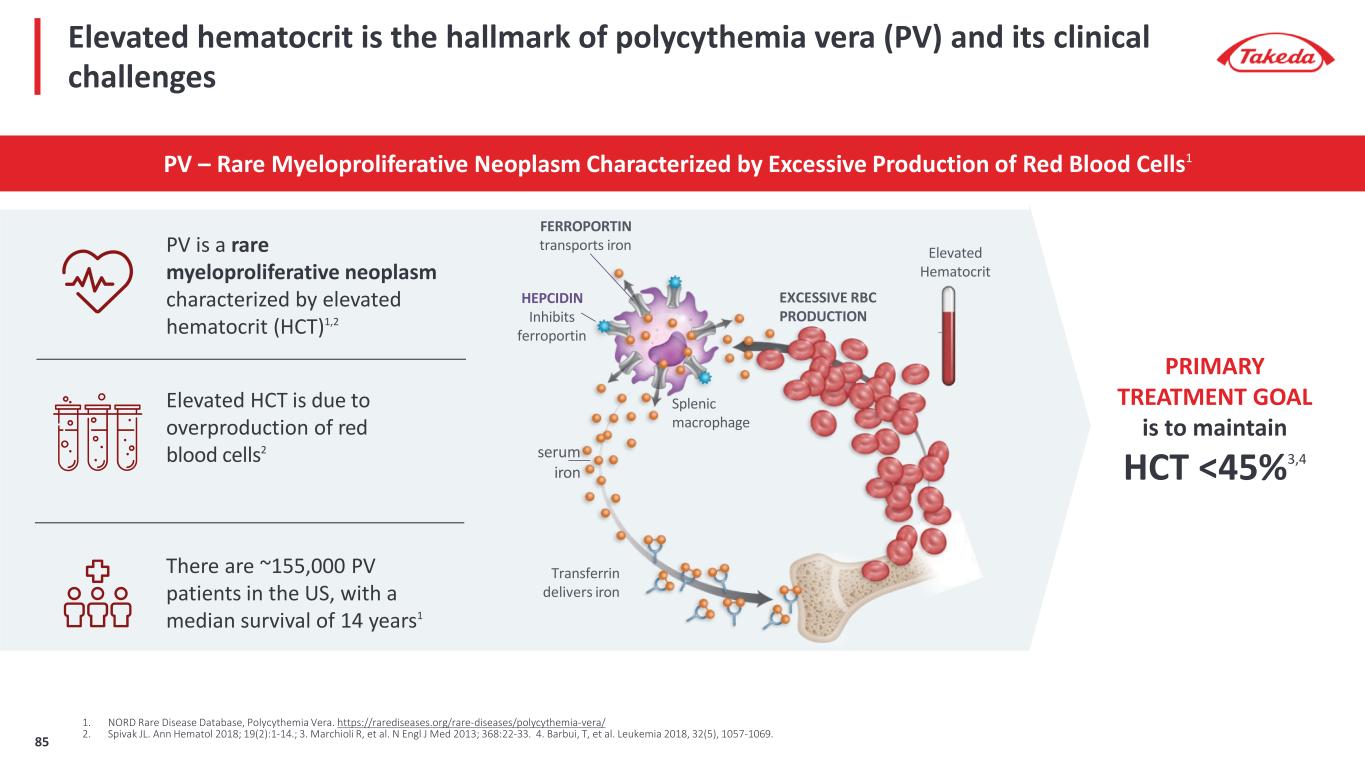

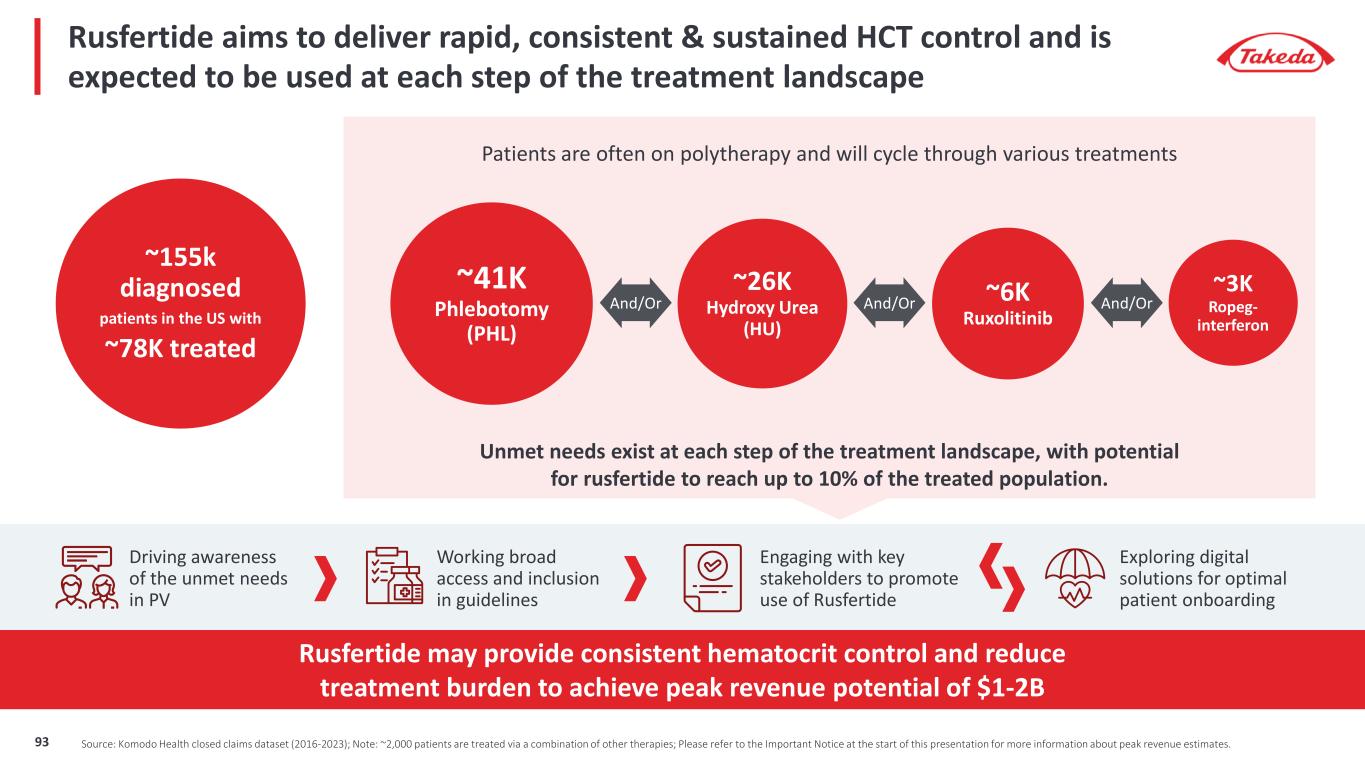

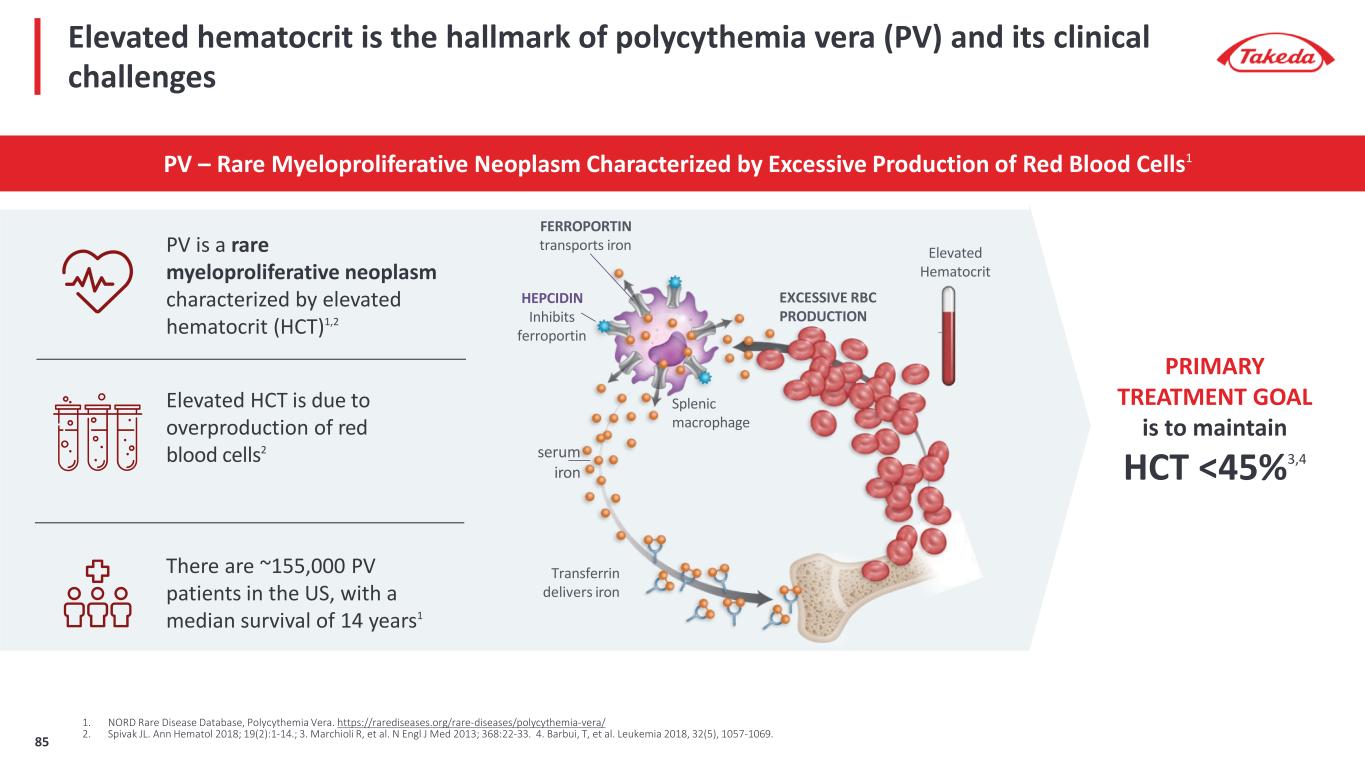

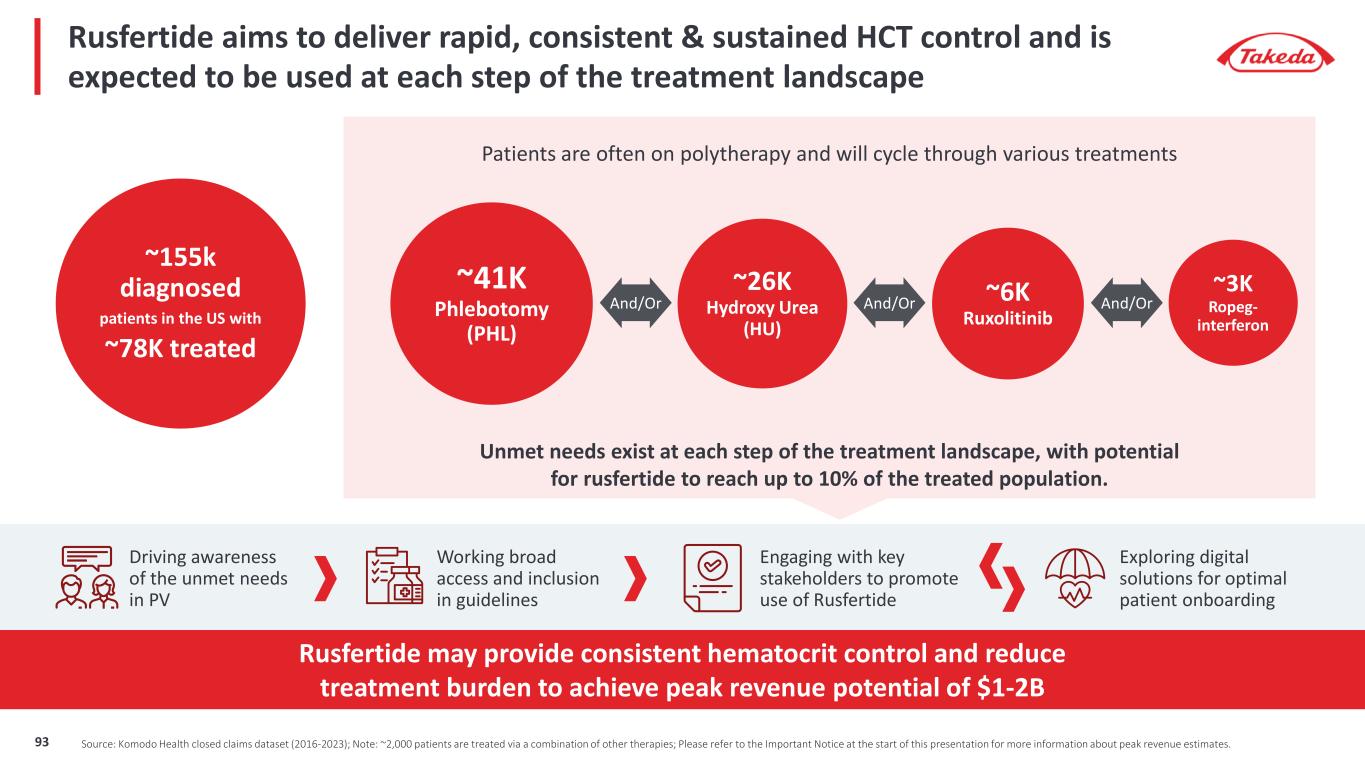

Elevated hematocrit is the hallmark of polycythemia vera (PV) and its clinical challenges PV – Rare Myeloproliferative Neoplasm Characterized by Excessive Production of Red Blood Cells1 FERROPORTIN transports iron HEPCIDIN Inhibits ferroportin serum iron Transferrin delivers iron EXCESSIVE RBC PRODUCTION Elevated Hematocrit Splenic macrophage 1. NORD Rare Disease Database, Polycythemia Vera. https://rarediseases.org/rare-diseases/polycythemia-vera/ 2. Spivak JL. Ann Hematol 2018; 19(2):1-14.; 3. Marchioli R, et al. N Engl J Med 2013; 368:22-33. 4. Barbui, T, et al. Leukemia 2018, 32(5), 1057-1069. PV is a rare myeloproliferative neoplasm characterized by elevated hematocrit (HCT)1,2 Elevated HCT is due to overproduction of red blood cells2 There are ~155,000 PV patients in the US, with a median survival of 14 years1 PRIMARY TREATMENT GOAL is to maintain HCT <45%3,4 85

There remains significant unmet need in polycythemia vera treatment Increased Risk of Thrombotic Events Significant BurdenInconsistent HCT Control • Consistent HCT <45% is critical, as uncontrolled HCT is associated with ~4 times higher risk of death from cardiovascular causes or thrombotic events1 • Real-world data shows that 78% of patients have uncontrolled HCT2 • 34-41% of patients experience thrombotic events3-5 • Common events include acute coronary syndrome, stroke, deep vein thrombosis, and pulmonary embolism3,5 • PV impacts daily activities and productivity6 • 84% of patients report fatigue, and 23% report spending full days in bed because of symptoms6 • Patients with PV often present with iron deficiency that can be further exacerbated due to iron loss from phlebotomy7 1. Marchioli R, et al. N Engl J Med 2013; 368:22-33; 2. Verstovsek S, et al. Ann Hematol 2023 Mar;102(3):571-581; 3. Kaifie A, et al. J Hematol Oncol 2016;9:18.; 4. Griesshammer M, et al. Ann Hematol 2019;98(5):1071-1082.; 5. Polycythemia vera: the natural history of 1213 patients followed for 20 years. Gruppo Italiano Studio Policitemia. Ann Intern Med 1995;123(9):656-664.; 6. Mesa R, et al. BMC Cancer 2016;16,167. 7. Ginzburg et al. Leukemia 2018;32:2105-2116. 86

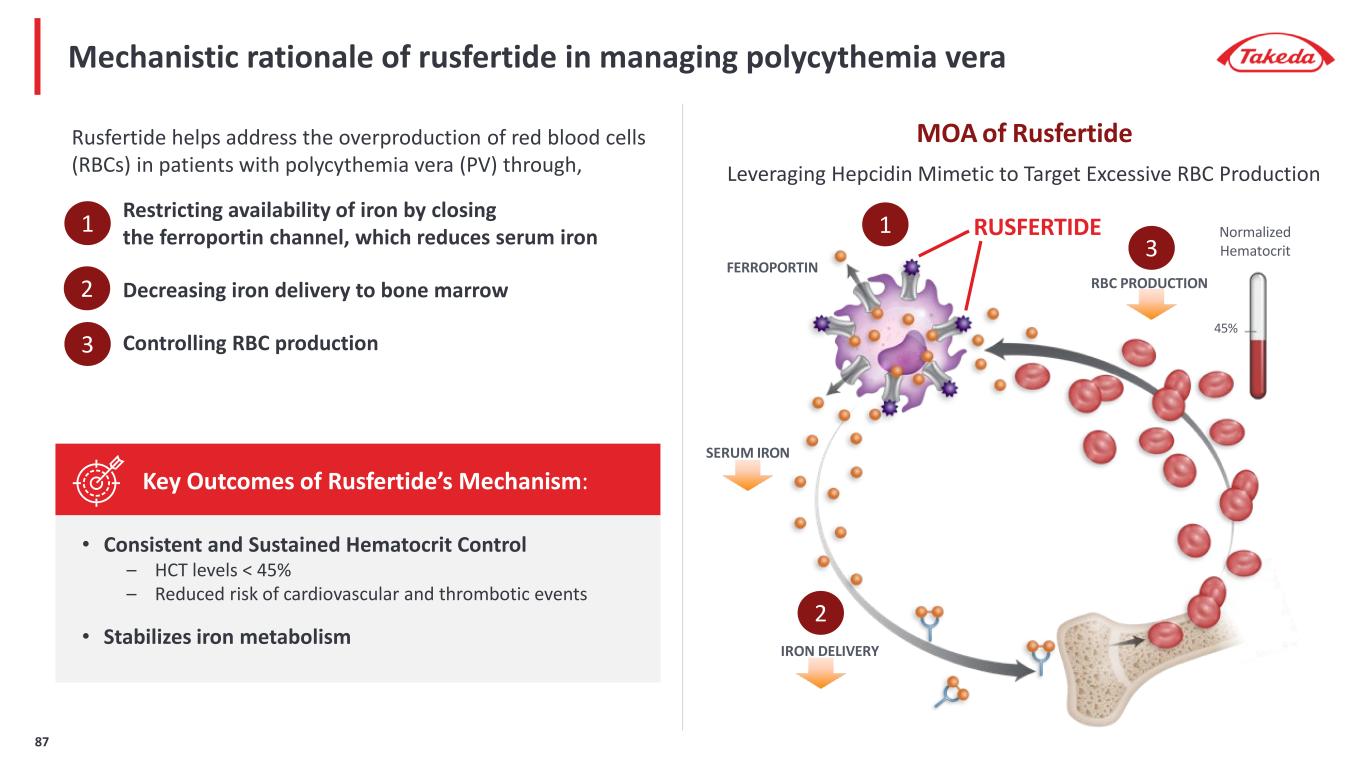

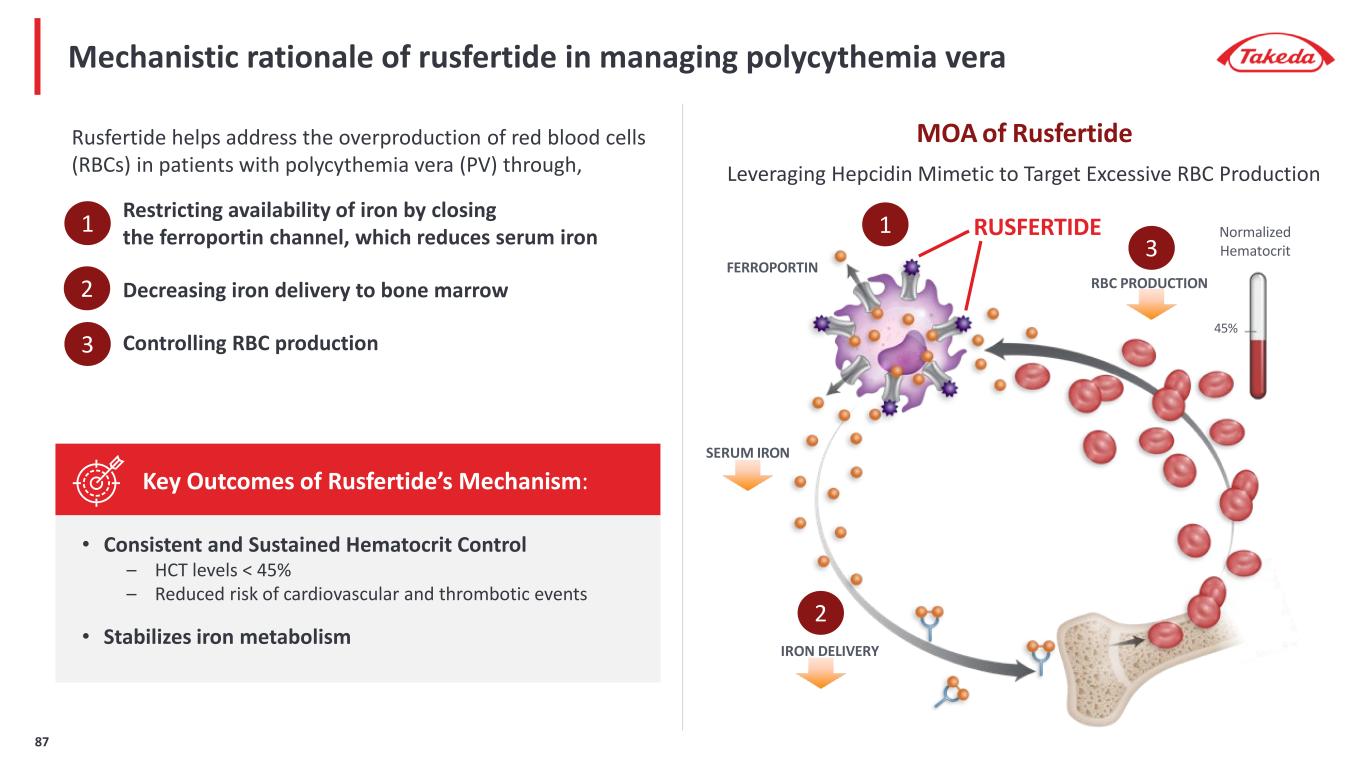

MOA of Rusfertide Mechanistic rationale of rusfertide in managing polycythemia vera Rusfertide helps address the overproduction of red blood cells (RBCs) in patients with polycythemia vera (PV) through, Restricting availability of iron by closing the ferroportin channel, which reduces serum iron Decreasing iron delivery to bone marrow Controlling RBC production Leveraging Hepcidin Mimetic to Target Excessive RBC Production • Consistent and Sustained Hematocrit Control – HCT levels < 45% – Reduced risk of cardiovascular and thrombotic events • Stabilizes iron metabolism Key Outcomes of Rusfertide’s Mechanism: FERROPORTIN Normalized Hematocrit 45% SERUM IRON IRON DELIVERY RBC PRODUCTION RUSFERTIDE1 2 3 1 2 3 87

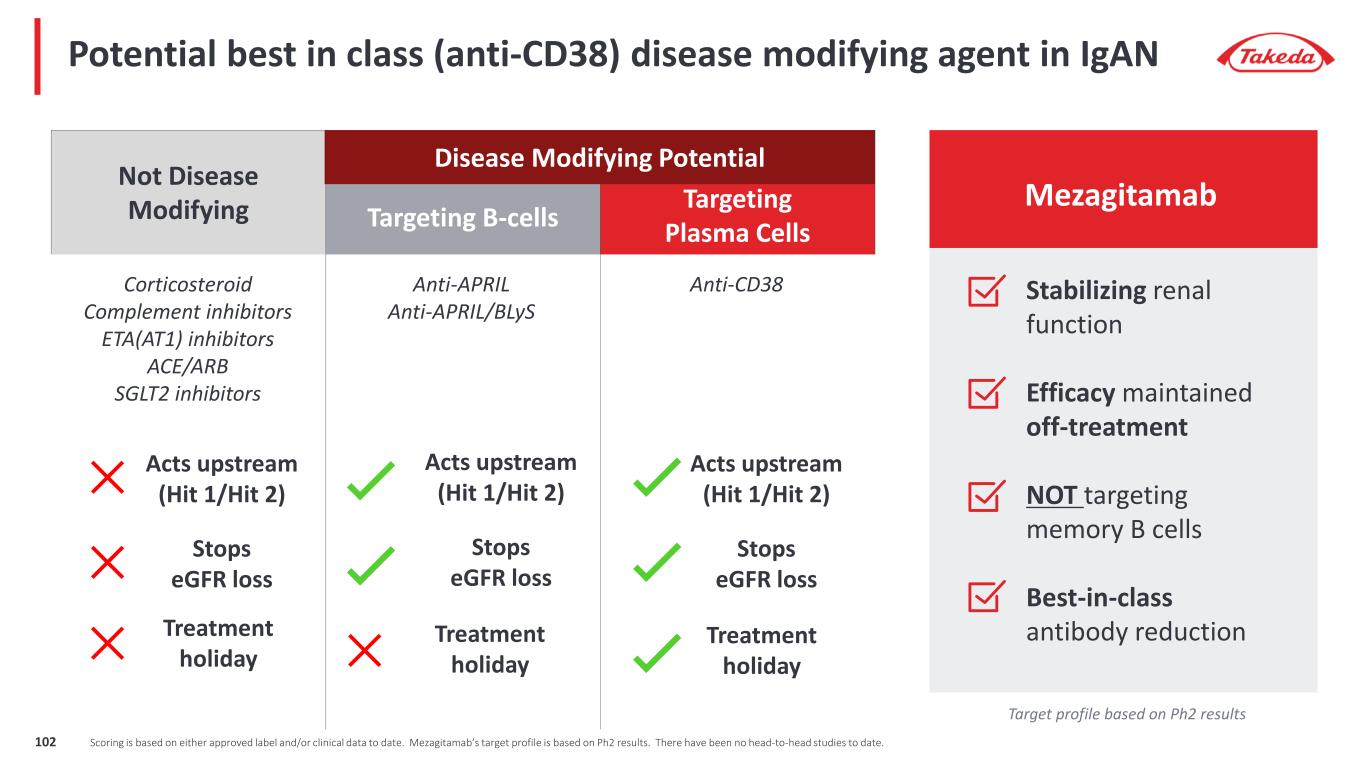

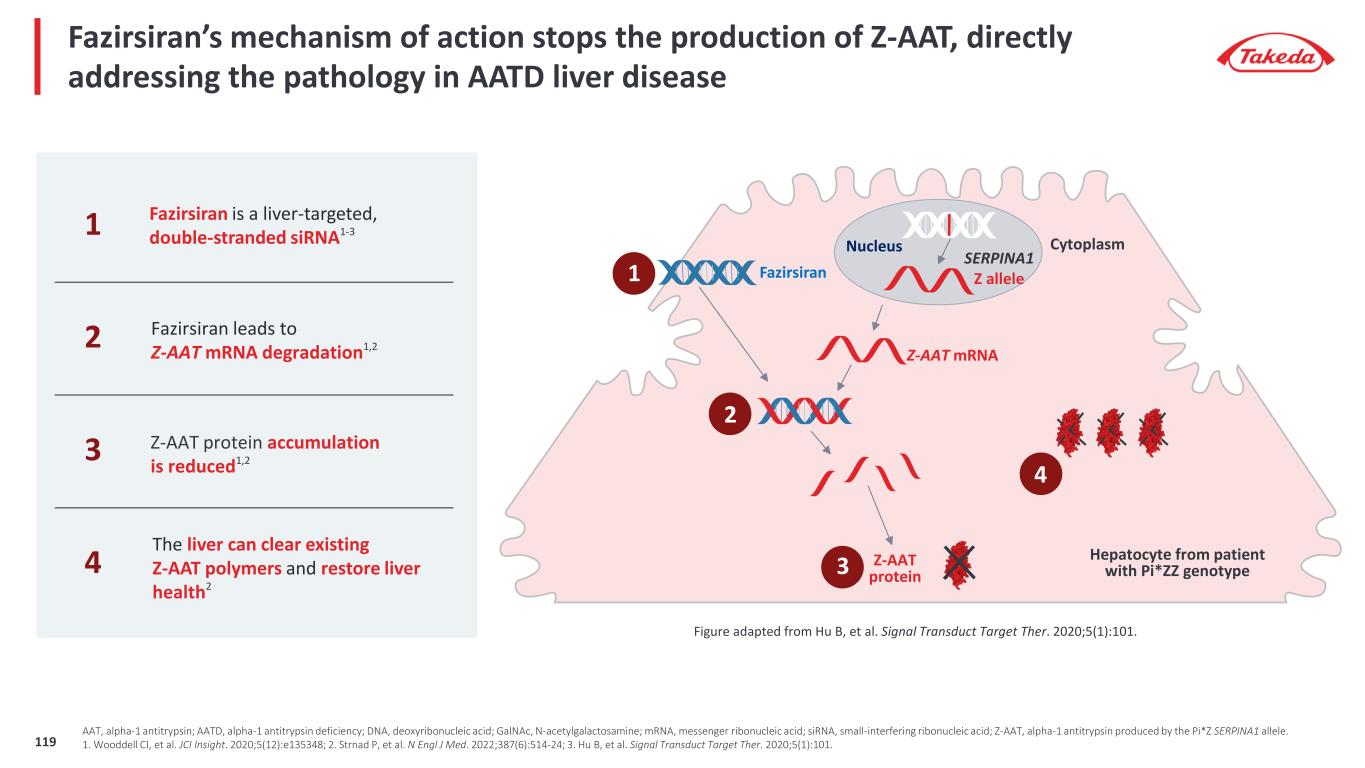

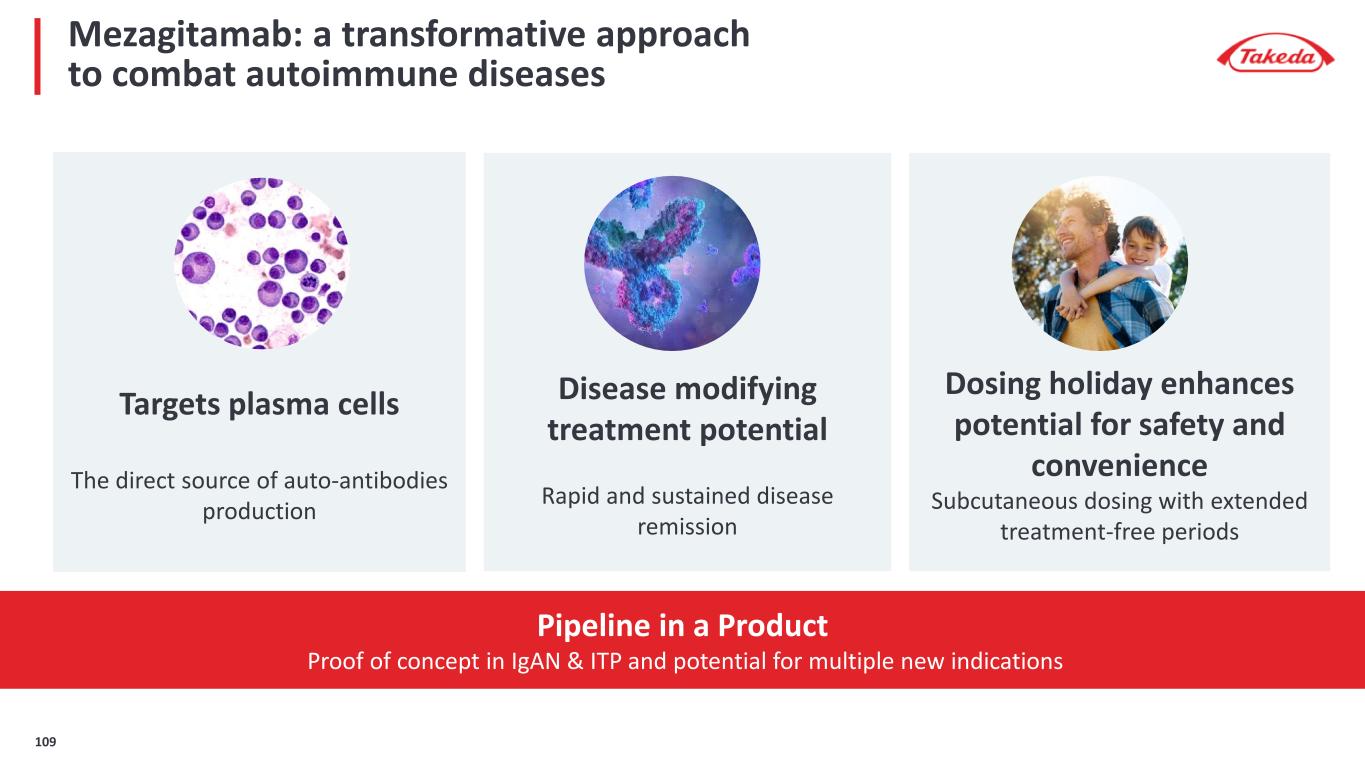

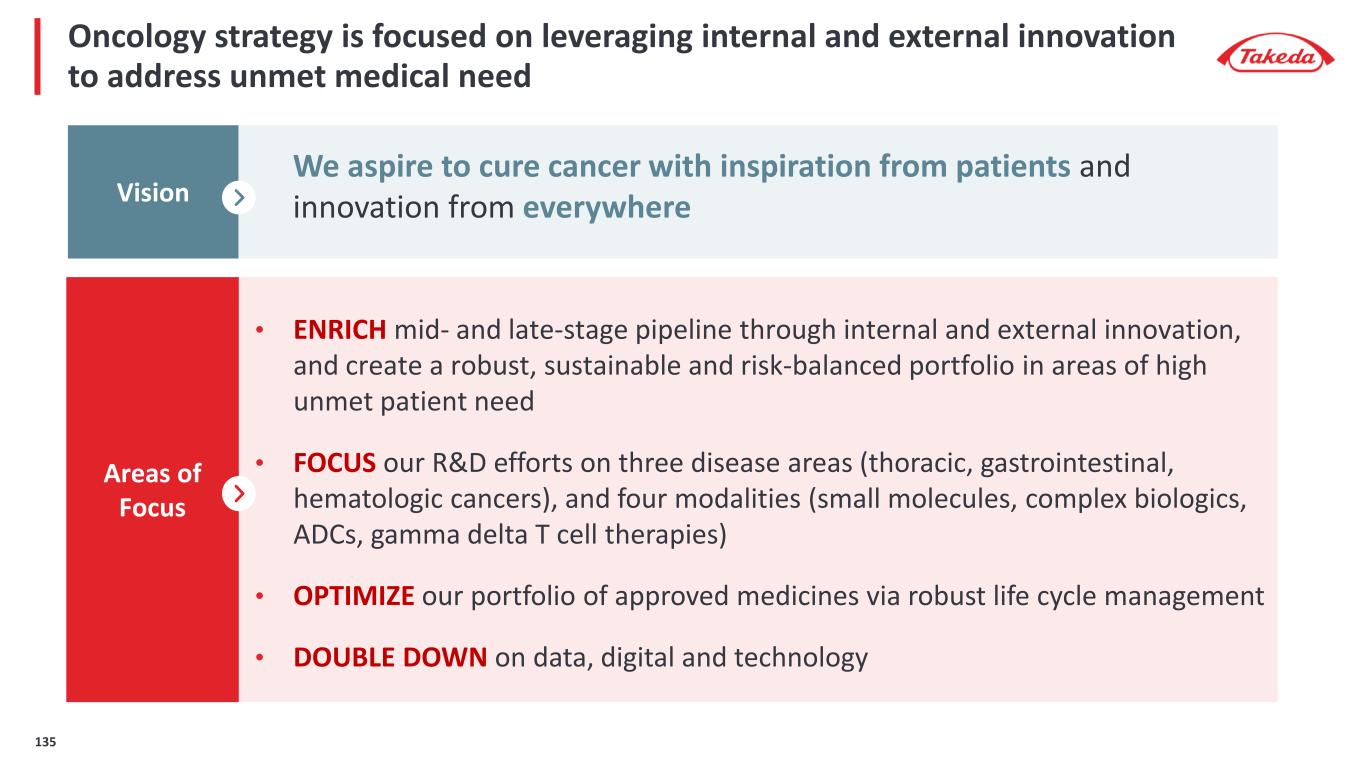

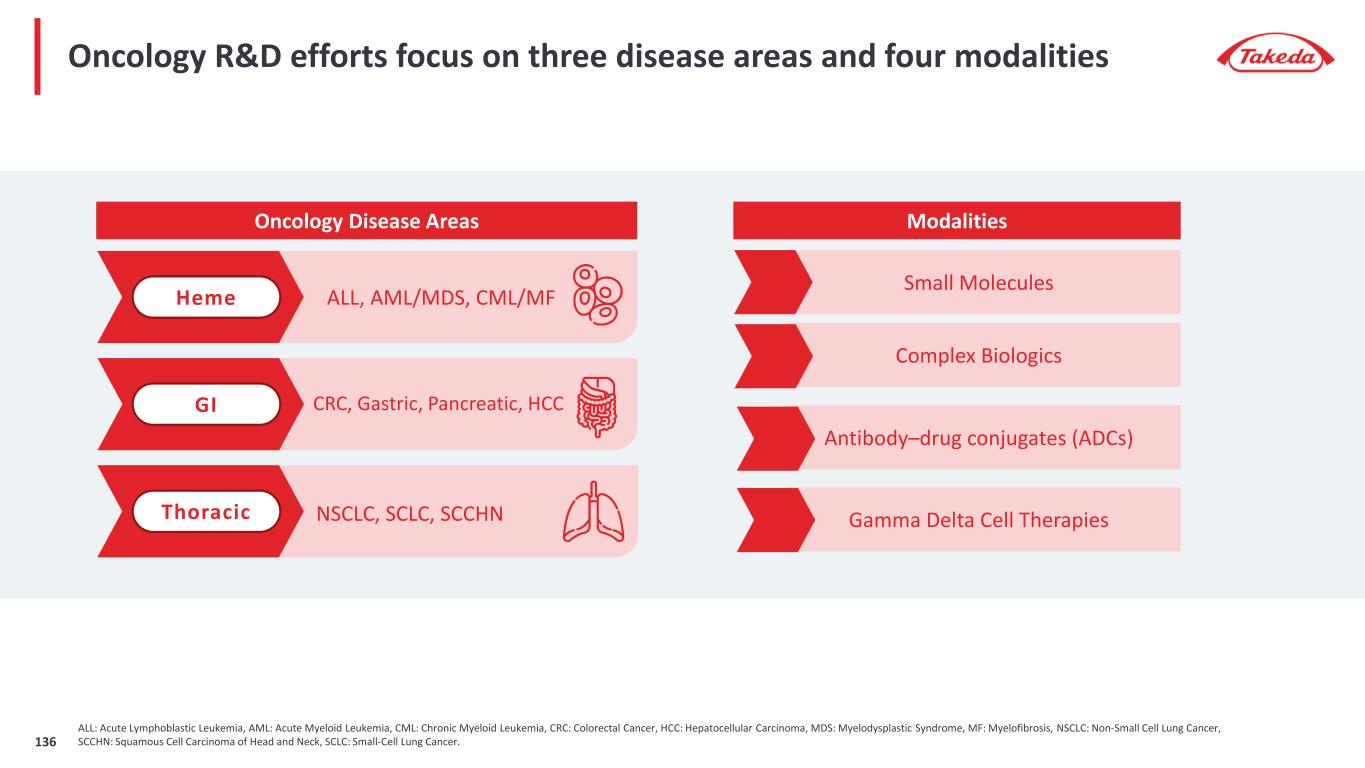

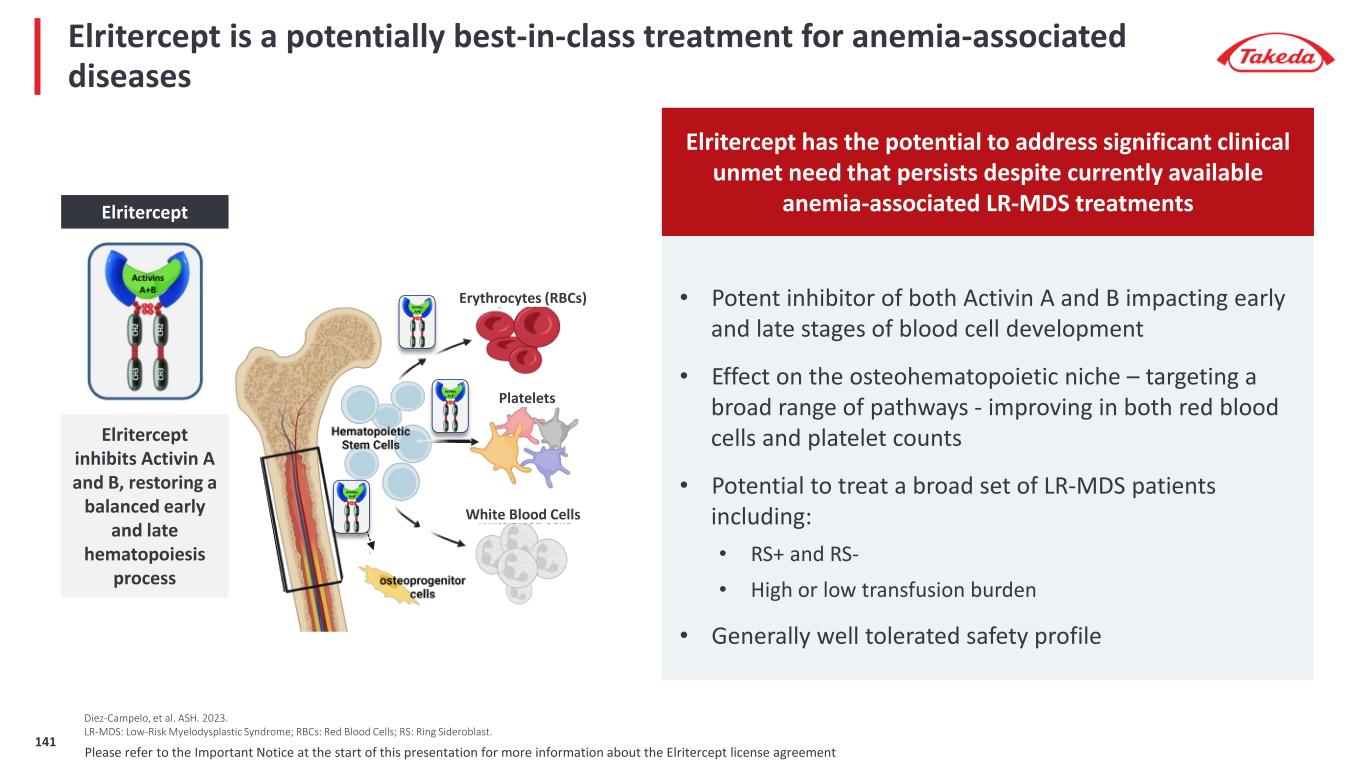

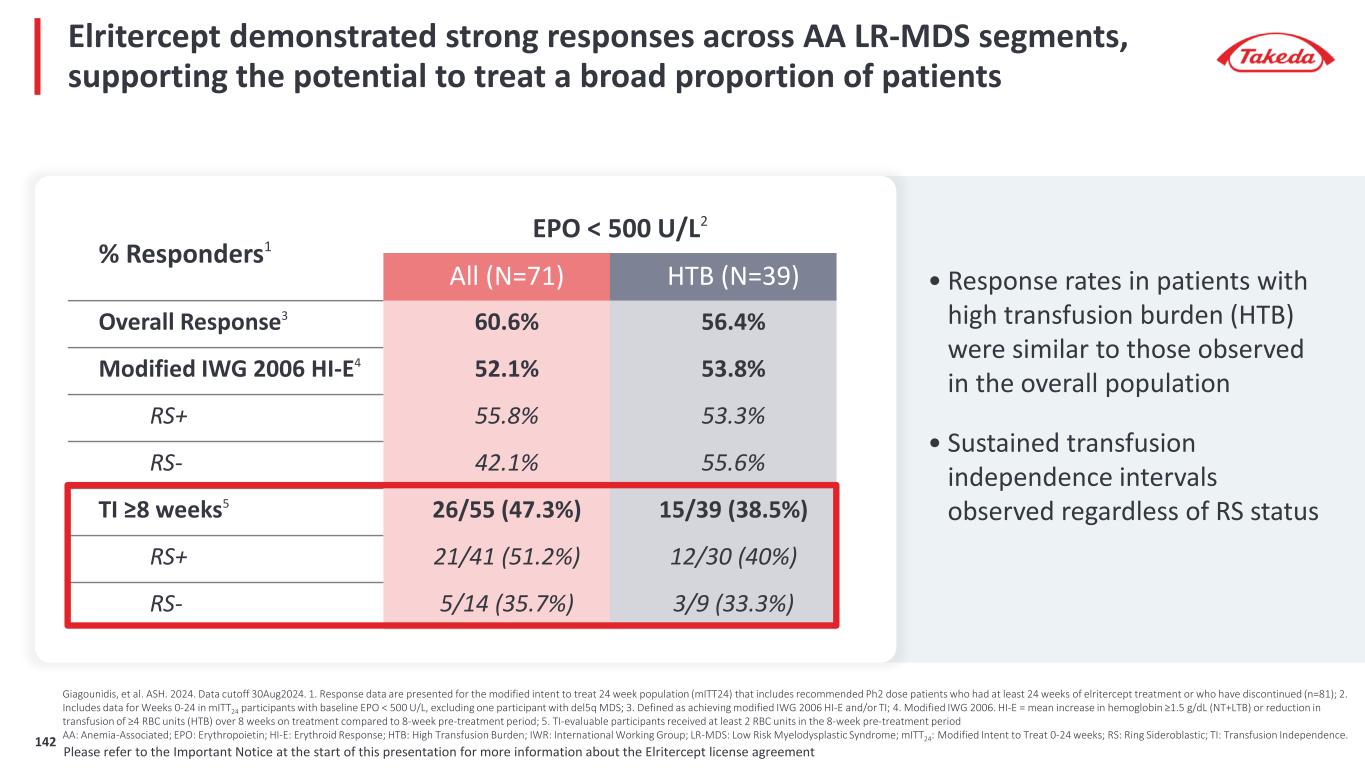

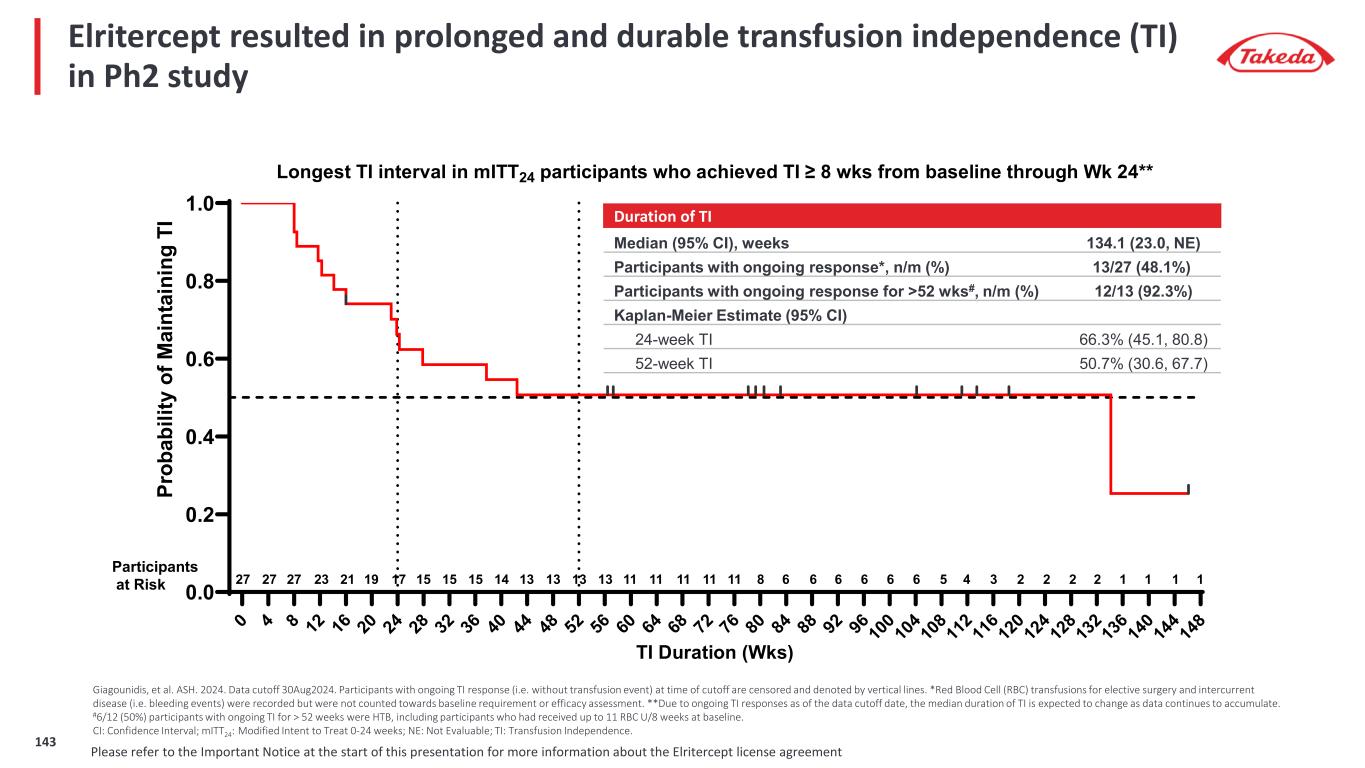

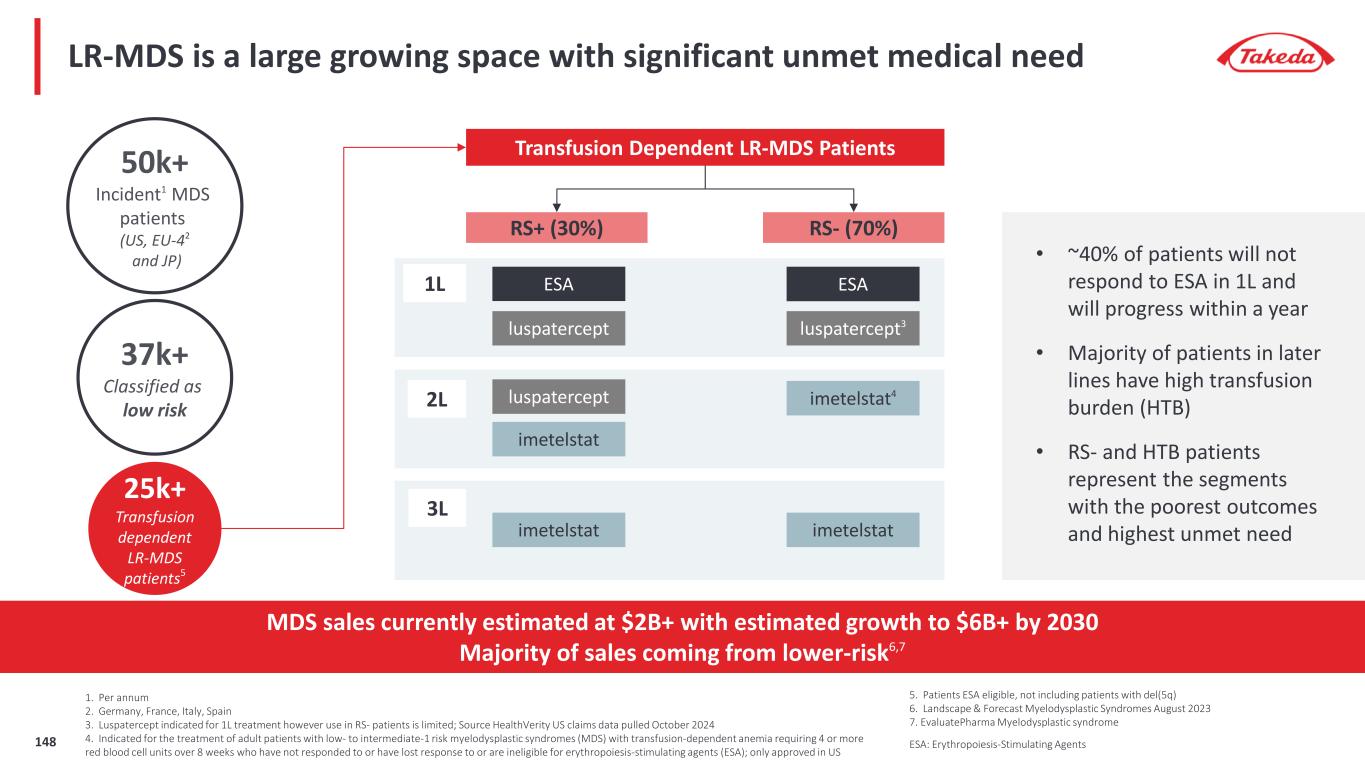

38 39 40 41 42 43 44 45 46 47 1 5 9 1 3 1 7 2 1 2 5 2 9 3 3 3 7 40 44 48 52 56 60 64 68 72 76 80 84 88 92 96 10 0 10 4 10 8 11 2 11 6 12 0 12 4 12 8 13 2 13 6 14 0 14 4 14 8 15 2 15 6 16 0 16 4 16 8 17 2 17 6 18 0 18 4 18 8 Placebo Rusfertide M ea n (± SE M ) H em at oc rit (% ) Week 0.5 yrs 1 yr 1.5 yrs 2 yrs 2.5 yrs 3 yrs 3.5 yrs Clinical efficacy of rusfertide: rapid, sustained and durable hematocrit control • Rapid, Sustained and Durable hematocrit control • Robust efficacy for all patient categories • Positive improvements in symptom scores3 Hematocrit Results1 (Mean ± 1 SEM) N = 582, 1:1 randomization 1. Local laboratory results; Data on file 2. Includes all REVIVE patients who continued to Part 3 3. improvement in symptom scores were in patients with moderate or severe symptoms at baseline assessed by the MPN-SAF REVIVE Study: PV patients requiring frequent phlebotomy + cytoreductives; 90% phlebotomy free • HCT levels rise during placebo period (wk 29-37) • HCT levels revert to being controlled when rusfertide is restarted (wk 37-41) Placebo Period 58 58 57 57 54 40 58 30 24 19 57 57 54 52 55 51 53 48 52 47 52 45 51 51 50 47 43 35 24 19 10 7 26 14 7 n (Rusfertide) n (Placebo) 88