UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2020

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(DISTRIBUTION AND MARKETING COMPANY OF THE NORTH )

(Translation of Registrant's Name Into English)

Argentina

(Jurisdiction of incorporation or organization)

Av. del Libertador 6363,

12th Floor,

City of Buenos Aires (A1428ARG),

Tel: 54-11-4346-5000

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F X Form 40-F

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes No X

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .)

| Results for the first quarter 2020 |

Ticker:EDN Ratio: 20 Class B shares = 1 ADR Share Cap. Net of repurchases: 875 million shares | 43.8 million ADRs Market Cap. net of repurchases1: ARS 16.3 bn | USD 137 million | Investor Relations Contacts: Leandro Montero Chief Financial Officer Federico Mendez Planning and Investor Relations Manager |

ir.edenor.com |investor@edenor.com Tel: +54 (11) 4346 -5511 |

Buenos Aires, Argentina, May 11, 2020. Empresa Distribuidora y Comercializadora Norte S.A. (NYSE/ BYMA: EDN) (“edenor” or “the Company”), Argentina’s largest electricity distributor both in terms of number of customers and electricity sales, announces its results for 1Q20. All figures are stated in Argentine Pesos at constant currency, and the information has been prepared in accordance with International Financing Reporting Standards (“IFRS”), except for what is expressly indicated in the Statements of Comprehensive Income (Loss), which are expressed at historical values.

Conference Call Information

There will be a conference call to discuss edenor’s 1Q20 results on Tuesday, May 12, 2020, at 11:00 a.m. Buenos Aires time / 10:00 a.m. New York time.

The presentation will be given by Leandro Montero,edenor’s Chief Financial Officer. For those interested in participating, please dial:

+ 1 (844) 204-8586 in the United States;

+1 (412) 317-6346 if outside the United States;

+54 (11) 3984-5677 in Argentina.

Participants should use conference ID “Edenor” and dial in five minutes before the call is set to begin. There will also be a live audio webcast of the conference atir.edenor.com.

1 Listing as of5/8/2020, ARS 18.60 per share and USD 3.14 per ADR

Edenor S.A. – 1Q20 Earnings Release

2

SUMMARY OF RESULTS FOR THE FIRST QUARTER 2020

In millon of Pesos | 1Q |

in constant purchising power | 2020 | 2019 | ΔARS | Δ% |

Revenue from sales | 20,531 | 23,617 | (3,086) | (13.1%) |

Adjusted EBITDA | 2,928 | 1,794 | 1,134 | 63.2% |

Net income | 720 | 194 | 526 | 270.7% |

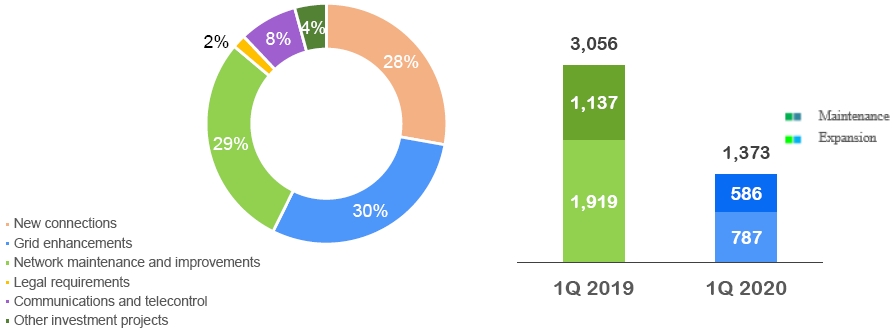

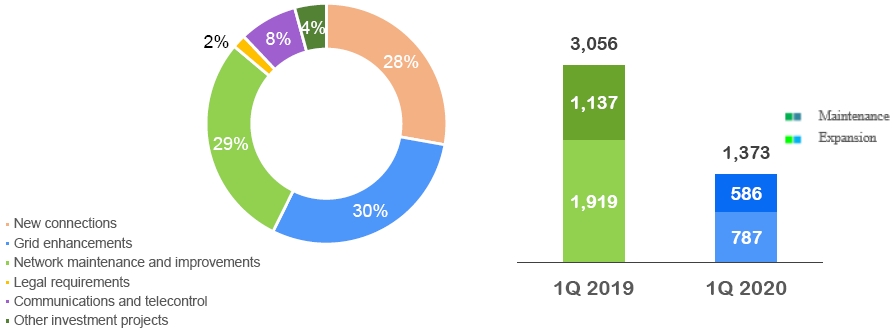

Capital expenditures | 1,373 | 3,056 | (1,683) | (55.1%) |

Revenue from sales decreased by 13.1%, reaching ARS 20.531 million in 1Q20, mainly since the rate freezing of both the Value Added by Distribution (“VAD”) and the seasonal price passed through to tariff, which implied a drop in income in real terms. This decrease in revenues is a result of the failure to apply the inflation adjustment over the CPD in August 2019 and February 2020, and of a lower adjustment in the price of energy (the last one, of 5%, was applied in May 2019). These effects were partially offset by an increase in the volume of energy sales and the continued collection of the tariff deferral updates for the August 2018 - February 2019 period.

Adjusted EBITDA increased by ARS 1,134 million, recording profits of ARS 2,928 million in 1Q20, against ARS 1,794 million in the same period last year. The decrease in the gross margin resulting from lower sales in real terms and an increase in losses has been offset by lower operating expenses mainly as a result of a sharp decrease in penalties received, both in commercial and technical service quality, reflecting the maturity of the investments made in recent years. Regarding the adjustments to the EBITDA the 1Q19 includes penalty update adjustments corresponding to the transition period.

Net income accumulated profits for ARS 720 million in 1Q20, experiencing a ARS 526 million increase compared to the same period of 2019. The net result was driven by improvements in operating results, lower financial losses due to the liabilities regularization reached in May 2019 and lower US dollar variation against the peso and lower tax accruals. These effects were partially offset by a lower RECPAM result.

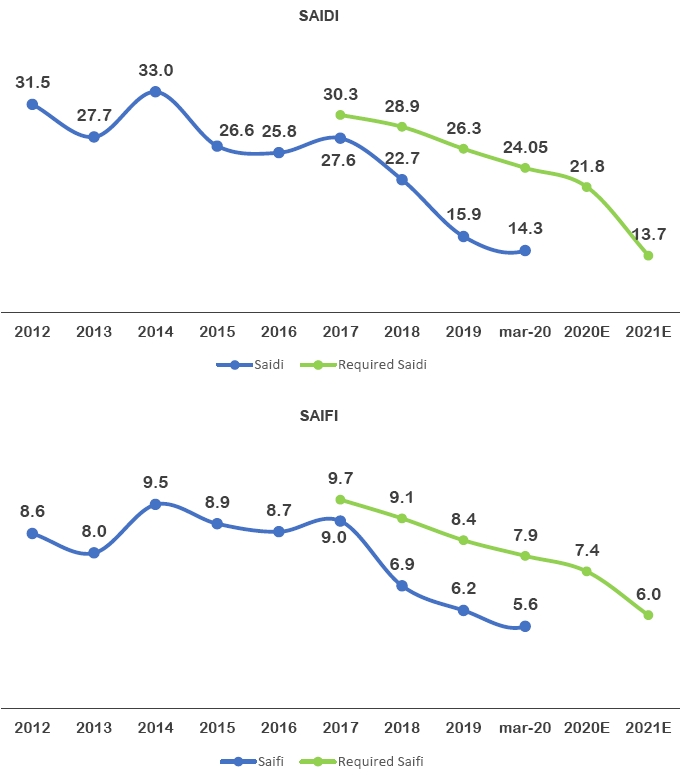

Investmentsin 1Q20 reached ARS 1,373 million and reflect the readjustment of the investment plan originally set byedenor for the 2017-2021 period. This change has been forced mainly due to the tariff freeze, but also has accompanied the fall in demand recorded over the last 3 years, and does not affect compliance with service quality indicators. Even further, the service quality levels achieved in the last few years allows us to present indicators exceeding regulatory requirements.

Edenor S.A. – 1Q20 Earnings Release

3

RELEVANT EVENTS

Health Emergency:

Social, Preventive and Mandatory Isolation

Under the health emergency declared in response to COVID-19, the National Executive Branch (“PEN”) implemented a series of measures to decrease the movement of population, providing for a social, preventive and mandatory isolation (“mandatory social isolation”), consisting of different stages as of March 20, only allowing movements by persons associated with the provision of essential products and services, includingedenor and other companies making up the energy production cycle.

Edenor’s Measures regarding COVID-19

Within the framework of the previously described public emergency,edenor has focused all its efforts on the actions necessary to protect and care for the health of its employees, suppliers and customers, and with it the continuity of the public service of energy distribution, so relevant and key to coping with the mandatory social isolation.

In this context, the company set up a COVID-19 Crisis Committee which include specialist counselors on the matter for the creation of a Contingency and Business Continuity Plan attending the recommendations issued by specialists and official regulations.

The implemented measures include the definition of hygiene, safety and health protocols for each type of activity considered essential, the adoption of the teleworking modality for more than 1,650 collaborators and the reinforcement of digital and telephone channels for the attention of our clients. Simultaneous operation of the Network Control Center and the company's back-up control center began in order to minimize contact by operators in a key area that is sensitive to our operation.

Likewise, we maintain a fluid and permanent communication with the staff on recommendations and the prevention measures we continue adopting. We also permanently evaluate the situation of contractors and suppliers to guarantee materials supply and contractors’ operational sustainability. Many of these changes have been enabled by the digitalization works and technology investments implemented over the last few years and enhanced lately.

As regards the commercial area, commercial offices were closed and their staff's tasks were reassigned; reading activities were temporarily and partially suspended and estimate parameters were defined in accordance with the current regulations. Efforts were focused on remote customer service, functionality and the promotion of digital channels, the edenordigital app and website, which allow for a comprehensive customer management. In turn, new services were implemented in record time, such as the SOS recharge for MIDE, debit card payments at edenordigital and online appointments.

As for collection management, we constantly monitor collection and the impact that the closing of the collection points has had on delinquency levels. Collection has slightly improved due to the recent opening of external collection entities. However, high levels of delinquency are still maintained in the collection of our invoices, and we cannot estimate the impact of the economic crisis will have on our client´s ability to afford the future electricity payments.

Suspension of Customer Service Activities at Commercial Offices

On March 21, 2020 and pursuant to Resolution No. 3/2020, the ENRE resolved to fully suspend on-site customer service activities and provided for the closing ofedenor’s commercial offices during the mandatory isolation, with the implementation of a customer service and claims electronic system. In this situation, new forms of collectionhave been enabled for T2 and T3 clients through non-contact channels, and a collection contact and management plan has been developed with our clients to bring them different payment alternatives.

Edenor S.A. – 1Q20 Earnings Release

4

Service Suspensions

On March 25, 2020, the PEN issued Executive order No. 311/2020, which forbids utility companies to suspend their services to vulnerable users on account of the lack of payment of three consecutive or alternate bills, effective as from March 1, 2020 for a term of 180 days. Customers with a prepaid system will receive the service during such term even if the applicable recharges are not made. In compliance with this decision of the regulator, we have made SOS charges available to our MIDE clients through our edenordigital platform and call center, which represent approximately 4.1% of the total charges made by MIDE clients, maintaining the remaining 95.9% the payment of charges by the usual means.

Utility Payment Scheme

On April 18, 2020, pursuant to Resolution No. 173/2020, the Ministry of Productive Development provided that the utility service may be payable in up to 30 monthly installments, the first one maturing on September 30, 2020. This resolution is limited to the specific group of customers detailed in it. Furthermore, the financing may apply to the purchase of energy to the MEM associated with these consumptions.However, to date the users reached by this measure have not been informed by the regulator.

Consumption Estimate

Between April 13 and May 5, 2020, the ENRE, pursuant to Resolutions No. 3, 318 and 328/2020, regulated the estimation of consumptions while the first meter reading is not available. These resolutions authorized edenor to apply the methodology for the validation of consumption readings and estimates (“MVLEC”) set by ENRE Resolution No. 209/2018 with the following exceptions in order to reflect a substantial reduction in consumption at minimum operating values under the mandatory isolation:(i) for residential T1 category customers (T1R), the lowest consumption recorded over the last three years prior to the issuance of the bill for the same estimated period should apply, and (ii) for T1G tariff customers, reading estimates according to the MVLEC will be affected by a 20% activity allocation factor.

Furthermore, as of May 6, 2020, middle and large customers readings (T2 and T3) have been considered an essential activity by the ENRE and therefore it recently started being normalized with due precautions. Additionally, users with meters allowing for remote meter reading will not be covered. Finally, customers may challenge the reading estimate, provided they declare the differences with their actual consumption, and request a new billing for the challenged period.

Modification of the Seasonal Programming

On April 30, 2020, the Energy Secretariat of the Ministry of Productive Development issued Resolution No. 70/2020, which maintained the power capacity reference prices and the stabilized prices for energy previously set by Resolution No. 14/2019 for quarterly periods between May and October 2020.

Change in Moody’s Ratings

On April 8, 2020,in line with the change in Argentina’s credit risk perspectives, Moody’s Investors Service resolved to modify the Company’s Corporate Bonds maturing in 2022’s local ratings from Baa3 to Caa1, and global ratings from Caa1 to Caa3, as well as to modify the ratings of the Company shares from Category 2 to 3; with a future negative outlook.

Edenor S.A. – 1Q20 Earnings Release

5

MAIN RESULTS FOR THE FIRST QUARTER 2020

In millon of Pesos | 1Q |

in constant purchising power | 2020 | 2019 | ΔARS | Δ% |

Revenue from sales | 20,531 | 23,617 | (3,086) | (13.1%) |

Energy purchases | (12,809) | (15,504) | 2,695 | (17.4%) |

Gross margin | 7,722 | 8,113 | (391) | -5% |

Operating expenses | (6,154) | (7,723) | 1,569 | (20.3%) |

Other operating expenses | (57) | (407) | 350 | (85.9%) |

Net operating income | 1,511 | (16) | 1,528 | na |

Financial Results, net | (1,622) | (3,091) | 1,469 | (47.5%) |

RECPAM | 1,678 | 4,887 | (3,209) | (65.7%) |

Income Tax | (847) | (1,586) | 739 | (46.6%) |

Net income | 720 | 194 | 526 | 270.7% |

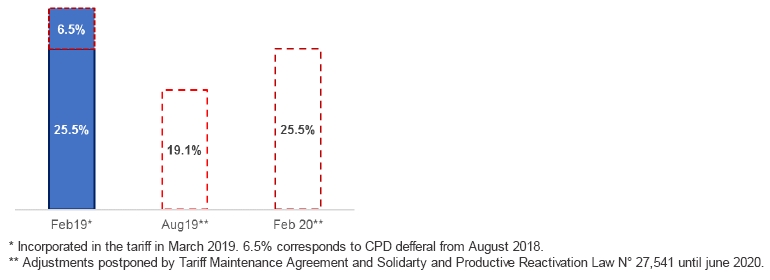

Revenue from sales decreased by 13.1%, reaching ARS 20,531 million in 1Q20, against ARS 23,617 million in 1Q19. This ARS 3,086 million decrease is mainly due to the rate freezing of both the VAD and the seasonal price passed through to tariff, which implied a drop in income in real terms. The failure to apply the inflation adjustment mechanism over the CPD in August 2019 and February 2020, resulted in a negative impact in revenues for ARS 1,738 million. Lower revenues are also due to lower billings on account of the real-term decrease in the cost passed on to tariffs of energy purchases measured in pesos for ARS 2,205 million. These decreases were partially offset by a higher physical volume of electricity sales and higher revenues from the continued collection of the tariff deferral installments for the August 2018 - February 2019 period for ARS 743 million and ARS 431 million, respectively. Finally, between the comparison periods a single CPD adjustment was applied in March 2019 for a total 32%, corresponding to the second semester of 2018 and the deferral of half of the adjustment for the first semester of 2018, plus the recognition on account of the deferral of such adjustment.

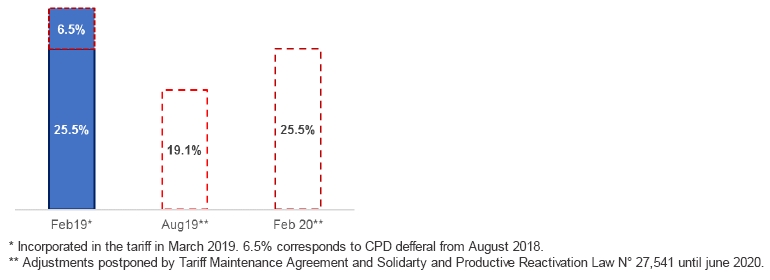

It is worth highlighting that Resolution No. 14/2019 provided for a 5% increase in the seasonal price for non-residential demands and a 7% increase for large users for August 2019. As no new tariff schemes were issued, this increase was not passed on to tariffs, but it was included in the payments made by edenor to CAMMESA for a total ARS 317 million in 1Q20. In turn, the failure to grant the tariff updates in an inflationary context as that observed in 2019 and 2020 has a very negative impact on the Distribution Value Added, combined with the fact that the composition of the CPD formula (which replicatesedenor’s cost structure) has a greater weight on the salary index, and was below the evolution of the IPC and the IPIM. VAD adjustments on the recognition of increases in own distribution costs are summarized below:

Edenor S.A. – 1Q20 Earnings Release

6

Edenor S.A. – 1Q20 Earnings Release

7

| 1Q 2020 | 1Q 2019 | Variation |

| GWh | Part. % | Customers | GWh | Part. % | Customers | % GWh | % Customers |

Residential * | 2,194 | 42.2% | 2,762,301 | 2,081 | 41.5% | 2,704,169 | 5.4% | 2.1% |

Small commercial | 466 | 9.0% | 322,303 | 437 | 8.7% | 323,470 | 6.6% | (0.4%) |

Medium commercial | 409 | 7.9% | 31,008 | 410 | 8.2% | 31,909 | (0.4%) | (2.8%) |

Industrial | 922 | 17.7% | 6,847 | 894 | 17.8% | 6,881 | 3.2% | (0.5%) |

Wheeling System | 920 | 17.7% | 692 | 920 | 18.3% | 692 | (0.0%) | 0.0% |

Others | | | | | | | | |

Public lighting | 155 | 3.0% | 21 | 161 | 3.2% | 21 | (3.4%) | 0.0% |

Shantytowns and others | 137 | 2.6% | 473 | 114 | 2.3% | 466 | 19.7% | 1.5% |

Total | 5,203 | 100% | 3,123,645 | 5,017 | 100% | 3,067,608 | 3.7% | 1.8% |

| | | | | | | | | |

* 566,690 customers benefit from Social Tariff | | | | | | | | |

The volume of energy sales increased by 3.7%, reaching 5,203 GWh, in 1Q20, against 5,017 GWh for the same period of 2019. This increase was mainly explained by a 5.4% increase in consumptions for residential customers, 3.2% increases for medium and small commercial customers, and 3.2% increases for industrial customers. The residential demand increased by 113 GWh, mainly as a result of a higher average temperature in March, which was 3 °C higher compared to the previous year. The improvement in small and medium commercial customers amounted to 27 GWh, mainly on account of its comparison against a quarter with a low commercial activity in the previous year, whereas the increase in large users amounted to 28 GWh as a result of the improvement in the industrial activity in the last months of 2019, which is reflected in the recovery in the industrial production index for this period, then interrupted by the COVID-19 crisis. Additionally, the improvement in sales volumes may be partly explained by the tariff lag. It is important to point out that, due to the declaration of the COVID-19 pandemic and pursuant to Executive Order No. 297/20, the Federal Government established, effective as from March 20, a “social, preventive and mandatory isolation” regime which resulted in a reduction in the total demand during the last days of the quarter. This reduction is verified in commercial and industrial customers, and is partly offset by an increase in residential demand.

Furthermore, edenor’s customer base rose by 1.8%, mainly on account of the increase in residential customers as a result of the implemented market discipline actions and the installation during the last year of almost 57,000 integrated energy meters that were mostly destined to regularize clandestine connections.

Edenor S.A. – 1Q20 Earnings Release

8

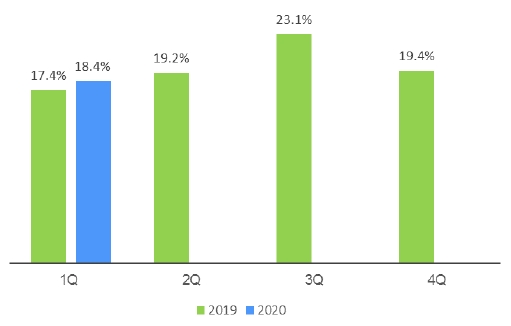

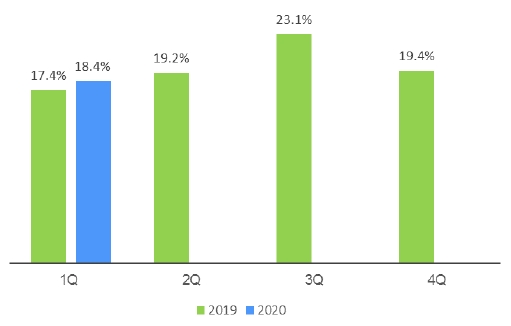

Energy purchases decreased by 17.4%, to ARS 12,809 million, in 1Q20, against ARS 15,504 million for the same period in 2019. This ARS 2,695 million decline is mainly due to the 22% decrease in the average purchase price in real terms, which generated a ARS 3,035 million decrease in purchases as a result of the entry into effect of the new reference seasonal prices for electricity applicable as from May and August 2019 pursuant to Resolution No. 14/2019 of the Secretariat of Renewable Resources and Electricity Market, but that did not reflect the increase in prices of the economy. This decrease was partially offset by an 4.6% increase in energy volumes net of losses due to the increase in demand, which was valued at approximately ARS 514 million. In turn, the electricity reference seasonal price for residential customers is still subsidized by the Federal Government, especially in the case of residential customers, where in 1Q20 the subsidy reached 51% of the system’s actual generation cost. Additionally, the energy loss rate increased from 17.4% in 1Q19 to 18.4% in 1Q20, and was mainly generated by an increase in the incentive to fraud as a result of the economic recession. In turn, costs associated with these losses decreased by 14.1% in real terms, resulting in lower purchases for ARS 174 million despite the increase in GWh.

It is worth highlighting that over the past few yearsedenor has suffered a systematic deterioration of its assets and financial position as a result of the tariff lag, the increase in operating costs, the drop in demand and the increase in energy theft. Furthermore, the outbreak of the world pandemic has brought several consequences in global economic activities which directly affected edenor’s activities, generating reduced collections and a drop in demand; for this reason, we have seen the need to partially defer payments to CAMMESA for the energy acquired in the Wholesale Electricity Market as from maturities taking place in March 2020.

Operating expenses decreased by 20.3%, reaching ARS 6,154 million in 1Q20, against ARS 7,723 million in 1Q19. This is mainly accounted for by a ARS 1,604 million decrease in penalties as a result of the improvement in service quality levels and, secondly, the update of penalties recorded in 1Q19 in the amount of ARS 485 million, which were later included in the liabilities regularization agreement.

In million of pesos | 1Q |

in constant purchising power | 2020 | 2019 | ΔARS | Δ% |

Salaries, social security taxes | (2,148) | (2,277) | 129 | (5.6%) |

Pensions Plans | (131) | (16) | (115) | 723.7% |

Communications expenses | (96) | (119) | 23 | (19.2%) |

Allowance for the imp. of trade and other receivables | (417) | (260) | (158) | 60.7% |

Supplies consumption | (413) | (526) | 113 | (21.5%) |

Leases and insurance | (58) | (66) | 8 | (11.9%) |

Security service | (63) | (134) | 71 | (52.8%) |

Fees and remuneration for services | (1,327) | (1,425) | 98 | (6.9%) |

Amortization of assets by right of use | (67) | 0 | (67) | na |

Public relations and marketing | (0) | (12) | 12 | (96.3%) |

Advertising and sponsorship | (0) | (6) | 6 | (96.3%) |

Depreciation of property, plant and equipment | (1,281) | (1,231) | (50) | 4.1% |

Directors and Sup. Committee members’ fees | (8) | (8) | (1) | 10.2% |

ENRE penalties | 159 | (1,445) | 1,604 | (111.0%) |

Taxes and charges | (299) | (198) | (101) | 50.7% |

Other | (3) | (1) | (2) | 121.9% |

Total | (6,154) | (7,723) | 1,569 | (20.3%) |

Edenor S.A. – 1Q20 Earnings Release

9

Financial results experienced a 47.5% decrease in losses, which reached ARS 1,622 million in 1Q20, against ARS 3,091 million for 1Q19. These differences are mainly explained by a ARS 1,156 million reduction in the accrual of commercial interest on the debt with CAMMESA as a result of the regularization of liabilities registered in the second quarter, and lower foreign exchange losses for ARS 526 million as a result of a lower devaluation of the peso against the U.S. dollar in 1Q20 compared to the same period in 2019. These results were partially offset by a negative variation in the reasonable value of financial assets in the amount of ARS 285 million.

Net income increased by ARS 526 million, reaching ARS 720 million in 1Q20, against ARS 194 million in the same period of 2019. This difference is due to better operating and financial results in the amount of ARS 1,528 million and ARS 1,469 million, respectively, added to lower income tax accruals for ARS 739 million. These effects were partially offset by a lower result for exposure to changes in purchasing power in 1Q20 for 3,209 million.

Adjusted EBITDA

Adjusted EBITDA showed ARS 2,928 million profits in 1Q20, ARS 1,134 million higher than in the same period of 2019. Adjustments correspond to the update of penalties for the transition period and commercial interest.

In millon of Pesos | 1Q |

in constant purchising power | 2020 | 2019 | ΔARS | Δ% |

Net operating income | 1,511 | (16) | 1,528 | na |

Depreciation of property, plant and equipment | 1,348 | 1,231 | 117 | 9.5% |

EBITDA | 2,860 | 1,215 | 1,645 | 135.4% |

Penalties - Actualization (*) | - | 485 | (485) | na |

Commercial Interests | 68 | 94 | (26) | -27.6% |

Adjusted EBITDA | 2,928 | 1,794 | 1,134 | 63.2% |

(*)The liabilities regularization agreement signed on May 10, 2019, discontinued the updating of penalties corresponding to the transition period (2006-2016).

Edenor S.A. – 1Q20 Earnings Release

10

Capital Expenditures

edenor’ s capital expenditures in 1Q20 totaled ARS 1,373 million, compared to ARS 3,056 million in 1Q19. Our investments mainly consisted of the following:

· ARS 382 million in new connections;

· ARS 405 million in grid enhancements;

· ARS 395 million in maintenance;

· ARS 25 million in legal requirements;

· ARS 107 million in communications and telecontrol;

· ARS 58 million in other investment projects.

Investments were reduced by 55.1% compared to the same period of the previous year, mainly on account of the slowdown in the plan set byedenor as a result of lower revenues due to the fall in sales volumes and the deferral of tariff updates. The plan maintains focus on investments improving the service quality, which can be seen in the fulfillment of the quality curves required by the regulatory entity in the RTI.

Edenor S.A. – 1Q20 Earnings Release

11

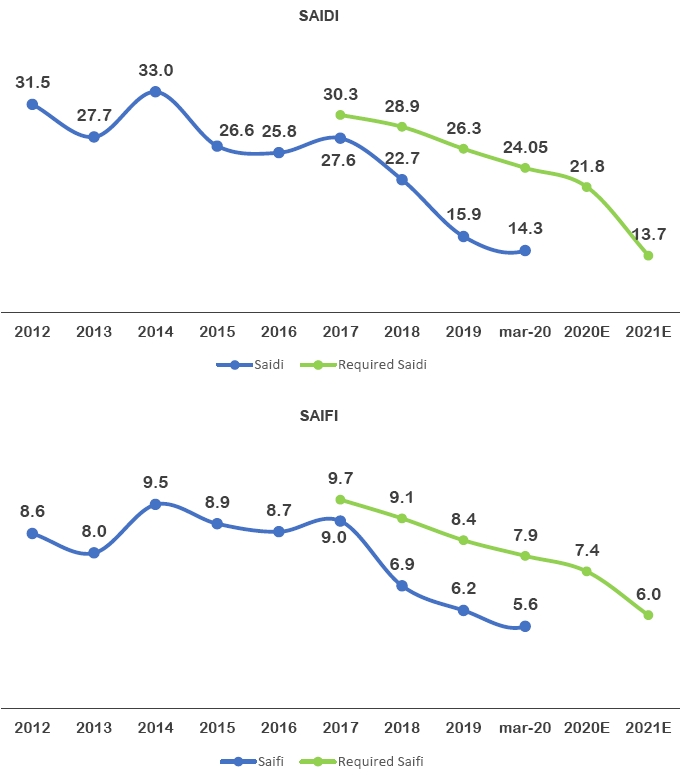

Service Quality Standards

Quality standards are measured based on the duration and frequency of service outages using the SAIDI and SAIFI indicators. SAIDI refers to the duration of outages, and measures the number of outage hours per year. SAIFI refers to the frequency of outages, and measures the number of times a user experiences an outage during a year.

At the closing of the first quarter of 2020, SAIDI and SAIFI indicators were 14.3 hours and 5.6 outages per year over the last 12 months, evidencing a 34.4% and 17.2% improvement, respectively, compared to the same period of the previous year. In turn, these indicators are 40.5% and 28.6% lower than those required in the RTI. This recovery in service levels is mainly due to the ambitious plan devised by the company since the RTI. The plans success is also evidenced by the fact that these indicators exceed the service quality improvement path defined by the regulatory entity.

Edenor S.A. – 1Q20 Earnings Release

12

Energy LossesIn 1Q20, energy losses experienced a 18.4% increase, against 17.4% for the same period in 2019, encouraged by a greater incentive to fraud as a result of the economic recession. Furthermore, costs associated with these losses decreased by 14.1% in real terms, resulting in a ARS 174 million improvement despite their increase in GWh. It is important to note that as of March 20 this year, after the application of the mandatory there are no real measurements of consumption due to the initial suspension of meter reading activity, and therefore the values are partially estimated. Over the last year, multidisciplinary teams were created to work on new solutions to energy losses; furthermore, activities aimed at reducing losses continued, and analytical and artificial intelligence tools were used to enhance effectiveness in the routing of inspections. Market Discipline actions (DIME) continued with the objective of detecting and normalizing irregular connections, fraud and energy theft, and the installation of Inclusion Meters (Integrated Energy Meter - MIDE) for more users was intensified.

Over the last year, approximately 536,000 inspections of Tariff 1 meters were conducted with a 53% efficiency, and more than 57,000 MIDE meters were installed. Regarding the recovery of energy, besides the customers put back to normal with MIDE meters, clandestine customers with conventional meters were also put back to normal. In all cases, a striking fraud recidivism rate was observed. Despite these measures, losses continued to grow as a result of a greater number of clandestine connections due to the impact of the economic recession.

Indebtedness

As of March 31, 2020, the outstanding principal of our dollar-denominated financial debt amounts to USD 162.1 million, whereas the net debt amounts to USD 98.9 million. The financial debt consists of USD 137.1 million corresponding to Corporate Bonds maturing in 2022, net of repurchases, and USD 25.0 million to the bank loan taken out with the Industrial and Commercial Bank of China (ICBC) Dubai Branch. Currently both liabilities bear interest at a fixed rate. After the financial statements’ closing date, on April 15 the third principal installment of the loan with the ICBC in the amount of USD 12.5 million was repaid upon maturity, together with the applicable interest for the period. In turn, on May 6, repurchases of Corporate Bonds maturing in 2022 were made for total face value of USD 690 thousand at an average price of USD 59.3.

Edenor S.A. – 1Q20 Earnings Release

13

About Edenor

Empresa Distribuidora y Comercializadora Norte S.A. (edenor) is the largest electricity distribution company in Argentina in terms of number of customers and electricity sold (in GWh). Through a concession,edenor distributes electricity exclusively to the northwestern zone of the greater Buenos Aires metropolitan area and the northern part of the City of Buenos Aires, which has a population of approximately 9 million people and an area of 4,637 sq. km. In 2019,edenor sold 19,974 GWh of energy and purchased 24,960 GWh (including wheeling system demands), with revenue from sales in the amount of ARS 97 billion adjusted by inflation as of March 2020. In turn, the company had positive net results in the amount of ARS 13 billion adjusted by inflation as of March 2020.

This press release may contain forward-looking statements. These statements are not historical facts, and are based on management’s current view and estimates of future economic circumstances, industry conditions, Company performance and financial results. The words “anticipates”, “believes”, “estimates”, “expects”, “plans” and similar expressions, as they relate to the Company, are intended to identify forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties, including those identified in the documents filed by the Company with the U.S. Securities and Exchange Commission. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

Edenor S.A.

Avenida del Libertador 6363, Piso 4º

(C1428ARG) Buenos Aires, Argentina

Tel: 5411.4346.5510

investor@edenor.com

www.edenor.com

Edenor S.A. – 1Q20 Earnings Release

14

Condensed Interim Statements of Financial Position

as of March 31, 2020 and December 31, 2019

Values expressed in constant purchasing power

In million of Argentine Pesos

in constant purchising power | 3.31.2020 | | 12.31.2019 | | | 3.31.2020 | | 12.31.2019 |

ARS | ARS | | ARS | ARS |

| | | | | | | | |

ASSETS | | | | | EQUITY | | | |

| | | | | | | | |

Non-current assets | | | | | Share capital | 875 | | 875 |

Property, plant and equipment | 108,931 | | 108,883 | | Adjustment to share capital | 28,560 | | 28,560 |

Interest in joint ventures | 11 | | 12 | | Additional paid-in capital | 398 | | 398 |

Deferred tax asset | 268 | | 280 | | Treasury stock | 31 | | 31 |

Other receivables | 24 | | 28 | | Adjustment to treasury stock | 611 | | 611 |

Total non-current assets | 109,233 | | 109,204 | | Adquisition cost of own shares | (2,411) | | (2,411) |

| | | | | Legal reserve | 1,386 | | 1,386 |

Current assets | | | | | Opcional reserve | 21,318 | | 21,318 |

Inventories | 1,793 | | 2,071 | | Other comprehensive loss | (232) | | (232) |

Other receivables | 291 | | 311 | | Accumulated losses | 13,763 | | 13,043 |

Trade receivables | 14,962 | | 13,393 | | TOTAL EQUITY | 64,300 | | 63,580 |

Financial assets at fair value through profit or loss | 1,931 | | 2,999 | | | | | |

Cash and cash equivalents | 2,540 | | 440 | | LIABILITIES | | | |

Total current assets | 21,516 | | 19,215 | | Non-current liabilities | | | |

| | | | | | | | |

| | | | | Trade payables | 411 | | 397 |

TOTAL ASSETS | 130,749 | | 128,418 | | Other payables | 5,232 | | 4,321 |

| | | | | Borrowings | 8,826 | | 8,811 |

| | | | | Deferred revenue | 269 | | 290 |

| | | | | Salaries and social security payable | 274 | | 259 |

| | | | | Benefit plans | 627 | | 563 |

| | | | | Deferred tax liability | 21,740 | | 21,557 |

| | | | | Tax liabilities | 664 | | - |

| | | | | Provisions | 1,914 | | 2,217 |

| | | | | Total non-current liabilities | 39,957 | | 38,415 |

| | | | | | | | |

| | | | | Current liabilities | | | |

| | | | | Trade payables | 15,906 | | 13,652 |

| | | | | Other payables | 2,809 | | 3,866 |

| | | | | Borrowings | 2,023 | | 1,783 |

| | | | | Derivative financial instruments | 254 | | 221 |

| | | | | Deferred revenue | 5 | | 6 |

| | | | | Salaries and social security payable | 2,036 | | 2,587 |

| | | | | Benefit plans | 51 | | 55 |

| | | | | Tax payable | 1,665 | | 2,117 |

| | | | | Tax liabilities | 1,521 | | 1,907 |

| | | | | Provisions | 222 | | 230 |

| | | | | Total current liabilities | 26,493 | | 26,424 |

| | | | | TOTAL LIABILITIES | 66,449 | | 64,838 |

| | | | | | | | |

| | | | | TOTAL LIABILITIES AND EQUITY | 130,749 | | 128,418 |

Edenor S.A. – 1Q20 Earnings Release

15

Condensed Interim Statements of Comprehensive Income (Loss)

for the three-month period ended on March 31, 2020 and 2019

Values expressed in constant purchasing power

In millon of Argentine Pesos

in constant purchising power | | 3.31.2020 | | 3.31.2019 |

ARS | ARS |

| | | | | |

Continuing operations | | | | |

Revenue | | 20,531 | | 23,617 |

Electric power purchases | | (12,809) | | (15,504) |

Subtotal | | 7,722 | | 8,113 |

Transmission and distribution expenses | | (3,626) | | (4,514) |

Gross loss | | 4,096 | | 3,599 |

Selling expenses | | (1,701) | | (2,231) |

Administrative expenses | | (827) | | (978) |

Other operating expense, net | | (57) | | (407) |

Operating Profit (Loss) | | 1,511 | | (16) |

Financial income | | 343 | | 266 |

Financial expenses | | (1,215) | | (2,417) |

Other financial expense | | (749) | | (939) |

Net financial expense | | (1,622) | | (3,091) |

RECPAM | | 1,678 | | 4,887 |

Profit (Loss) before taxes | | 1,567 | | 1,780 |

| | | | |

Income tax | | (847) | | (1,586) |

Profit (Loss) for the period | | 720 | | 194 |

| | | | |

Basic and diluted earnings Profit (Loss) per share: | | | | |

Basic and diluted earnings profit (loss) per share | | 0.82 | | 0.22 |

Edenor S.A. – 1Q20 Earnings Release

16

Condensed Interim Statements of Comprehensive Income (Loss)

for the three-month period ended on March 31, 2020 and 2019

Expressed at historical values

In millon of Argentine Pesos

in constant purchising power | | 3.31.2020 | | 3.31.2019 |

ARS | ARS |

| | | | | |

Continuing operations | | | | |

Revenue | | 20,184 | | 15,377 |

Electric power purchases | | (12,586) | | (10,085) |

Subtotal | | 7,598 | | 5,292 |

Transmission and distribution expenses | | (2,580) | | (2,274) |

Gross loss | | 5,018 | | 3,018 |

Selling expenses | | (1,549) | | (1,389) |

Administrative expenses | | (697) | | (556) |

Other operating expense, net | | (11) | | (265) |

Operating Profit (Loss) | | 2,761 | | 808 |

Financial income | | 337 | | 172 |

Financial expenses | | (1,242) | | (1,592) |

Other financial expense | | (698) | | (619) |

Net financial expense | | (1,604) | | (2,039) |

| | | | |

Profit (Loss) before taxes | | 1,157 | | (1,231) |

| | | | |

Income tax | | (791) | | 316 |

Profit (Loss) for the period | | 366 | | (914) |

| | | | |

Basic and diluted earnings Profit (Loss) per share: | | | | |

Basic and diluted earnings Profit (Loss) per share | | 0.42 | | (1.03) |

Edenor S.A. – 1Q20 Earnings Release

17

Condensed Interim Statements of Cash Flows

for the three-month period ended on March 31, 2019 and 2018

Values expressed in constant purchasing power

In millon of Argentine Pesos

in constant purchising power | | 3.31.2020 | | 3.31.2019 |

ARS | ARS |

| | | | |

Cash flows from operating activities | | | | |

Loss (Profit) for the period | | 720 | | 194 |

Adjustments to reconcile net (loss) profit to net cash flows provided by operating activities: | | 2,614 | | 1,615 |

| | | | |

Changes in operating assets and liabilities: | | | | |

Increase in trade receivables | | (2,585) | | (4,640) |

Increase in trade payables | | 2,516 | | 5,107 |

Income tax payment | | (322) | | (91) |

Others | | (834) | | (1,299) |

| | | | |

Net cash flows provided by operating activities | | 2,108 | | 888 |

| | | | |

Net cash flows used in investing activities | | 86 | | (163) |

| | | | |

Net cash flows used in financing activities | | (66) | | (776) |

| | | | |

Net (decrease) increase in cash and cash equivalents | | 2,128 | | (52) |

| | | | |

Cash and cash equivalents at beginning of year | | 440 | | 46 |

Exchange differences in cash and cash equivalents | | (20) | | 107 |

Result for exposure to inflation in cash and cash equivalents | | (9) | | 3 |

Net decrease in cash and cash equivalents | | 2,128 | | (52) |

Cash and cash equivalents at the end of period | | 2,540 | | 104 |

| | | | |

Supplemental cash flows information | | | | |

Non-cash operating, investing and financing activities | | | | |

Acquisitions of property, plant and equipment through increased trade payables | | (316) | | (1,091) |

| Investor Relations Contacts: Leandro Montero Chief Financial Officer Federico Mendez Planning and Investor Relations Manager |

investor@edenor.com |Tel: +54 (11) 4346-5511 |

Edenor S.A. – 1Q20 Earnings Release

18

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Empresa Distribuidora y Comercializadora Norte S.A. |

| | |

| | |

| By: | /s/ Leandro Montero |

| Leandro Montero |

| Chief Financial Officer |

Date:May11, 2020