UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2021

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(DISTRIBUTION AND MARKETING COMPANY OF THE NORTH )

(Translation of Registrant's Name Into English)

Argentina

(Jurisdiction of incorporation or organization)

Av. del Libertador 6363,

12th Floor,

City of Buenos Aires (A1428ARG),

Tel: 54-11-4346-5000

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F X Form 40-F

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes No X

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .)

| Results for the fourth quarter 2020 |

Ticker: EDN Ratio: 20 Class B shares = 1 ADR Share Cap. Net of repurchases: 875 million shares | 43.8 million ADRs Market Cap. net of repurchases1: ARS 22.7 bn | USD 151 million | Investor Relations Contacts: Leandro Montero Chief Financial Officer Federico Mendez Planning and Investor Relations Manager |

ir.edenor.com | investor@edenor.com Tel: +54 (11) 4346 -5511 |

Buenos Aires, Argentina, March 10, 2021. Empresa Distribuidora y Comercializadora Norte S.A. (NYSE/BYMA: EDN) (“edenor” or “the Company”), Argentina’s largest electricity distributor both in terms of number of customers and energy sales, announces its results for the fourth quarter of 2020. All figures are stated in Argentine Pesos at constant currency, and the information has been prepared in accordance with International Financing Reporting Standards (“IFRS”), except for what is expressly indicated in the Statements of Comprehensive Income (Loss), which are expressed at historical values.

Conference Call Information

There will be a conference call to discuss 4Q20 results on Thursday, March 11, 2021, at 12:00 p.m. Buenos Aires time / 10:00 a.m. New York time.

The presentation will be given by Leandro Montero, edenor’s Chief Financial Officer. For those interested in participating, please dial:

+ 1 (844) 204-8586 in the United States;

+1 (412) 317-6346 if outside the United States;

+54 (11) 3984-5677 in Argentina.

Or via the internet by clicking HERE.

Participants should use conference ID “Edenor” and dial in five minutes before the call is set to begin. There will also be a live audio webcast of the conference at ir.edenor.com.

4Q 2020

EARNINGS CONFERENCE CALL | | To join the conference call, please click HERE

|

1 Listing as of 3/9/2021, ARS 25.90 per share and USD 3.45 per ADR

Edenor S.A. – 4Q20 Earnings Release | 2 |

SUMMARY OF RESULTS FOR THE FOURTH QUARTER 2020

| In millon of Pesos | 12 Months | 4Q |

| in constant purchising power | 2020 | 2019 | Δ% | 2020 | 2019 | Δ% |

| Revenue from sales | 91,316 | 122,437 | (25%) | 18,265 | 24,600 | (26%) |

| Adjusted EBITDA | 4,306 | 14,002 | (69%) | (1,414) | 680 | na |

| Net income | (17,698) | 16,518 | na | (15,660) | (2,386) | 556% |

| Capital expenditures | 11,073 | 13,501 | (18%) | 3,243 | 2,562 | 27% |

Revenue from sales decreased by 26%, reaching ARS 18,265 million in 4Q20, mainly due to the tariff freeze in both the Distribution Value Added and the seasonal price passed on to tariffs, which entailed a decrease in revenues in real terms. This decrease results from the non-application of the inflation adjustment on Own Distribution Costs (CPD) since March 2019, as well as the maintenance of the price of energy (the last 5% increase was in May 2019). On its part, the sales volume remained practically constant, with changes in the distribution on account of the increase in residential consumption and the decrease in consumption by commercial and industrial customers as a result of the changes generated by the pandemic.

Adjusted EBITDA decreased by ARS 2,094 million, recording losses for ARS 1,414 million in 4Q20, against profits for ARS 680 million in the same period of the previous year. This decrease is mainly accounted for by the decline in the gross margin due to lower sales in real terms as a result of the tariff freeze, which was partially offset by a slight improvement in energy losses, and operating costs that remained practically constant.

Net results accumulated losses for ARS 15.660 million in 4Q20, experiencing a ARS 13,274 million decrease compared to the same period of 2019. The variation is mainly due to the impairment of the Company's assets for ARS 17,396 million. Indications of loss of value have been identified in the assets of the Company as of December 31, 2020, various possible scenarios and weighing factors such as the current macroeconomic context and the projection of the Company's business in the medium and long term have been taken into account. Additionally, a lower operating result is observed, for ARS 2,168 million in 4Q20. These effects were partially offset by a lower income tax for ARS 5,757 million generated mainly by the impact of the assets impairment in deferred taxes for ARS 5,219 million.

Investments in 4Q20 reached ARS 3,243 million, representing a 27% increase compared to the same period of the previous year, which reflects the Company’s efforts although its gross margin has been reduced because of the tariff freeze and the restrictions generated by the pandemic throughout the year. These higher investments compared to the same period of 2019 are due to the recovery in Q4 of the deferments in investments of the previous months as a consequence of the delays caused by the preventive and mandatory social isolation (“ASPO”). The lack of predictability in the near future as a consequence of the tariff freeze and the accumulated drop in demand registered over the last years may affect the pace of investments in the ambitious plan set by edenor, always making sure this slowdown does not affect compliance with service quality indicators, which have exceeded regulatory requirements.

Edenor S.A. – 4Q20 Earnings Release | 3 |

RELEVANT EVENTS

Sale of Edenor’s Controlling Stake

On December 28, 2020, Pampa Energía S.A., holder of 100% of edenor’s Class A shares representing 51% of its capital stock, acting as seller, entered into a share purchase agreement with Empresa de Energía del Cono Sur S.A, with Integra Capital S.A., and Messrs. Daniel Eduardo Vila, Mauricio Filiberti and José Luis Manzano, acting as guarantors.

The agreed purchase price consists of (i) 21,876,856 Class B shares of edenor, representing 2.41% of Edenor’s capital stock and voting rights; (ii) USD 95 million; and (iii) a contingent payment for 50% of the generated gain in case of change of control in the Buyer or Edenor during the first year after the closing of the Transaction or as long as the Price Balance is pending settlement. The Price in Cash is paid in 3 installments: the first one, in the amount of USD 5 million, was paid after the signing of the agreement; the second one, in the amount of USD 50 million, will be paid on the Closing date, subject to the fulfillment of the precedent conditions; and the third one, in the amount of USD 40 million, must be paid on the first anniversary of the Closing date. The Price Balance will accrue a nominal annual fixed interest rate of 10% as from the Closing date, payable on a quarterly basis.

In this respect, on February 17, 2021, Pampa Energía’s shareholders meeting approved this transaction and, as of the issuance of this report, the approval procedure by the Regulatory Agency is in progress.

CBs Buyback Offer on account of the Change of Control

In relation to the previous section, as Edenor has outstanding market debt, its issuance prospectus contemplates this situation in section 10.3:

“Each CB holder will be entitled to require the Company to repurchase all or any part of that holder’s CBs through the presentation of a Change of Control Offer. This offer will be made for 100% of the FV, plus accrued and unpaid interest as of that date. Besides, the offer will be made within 30 days of the change of control (in the case of Edenor, from the sale’s approval by Pampa and the ENRE), indicating the specific repurchase date, which will take place between 30 and 60 days after the sending of the notice of the change of control offer.”

In this regard, the Company has contacted different banks specialized in debt restructuring to evaluate the possible courses of action, among which are considered (i) to require a waiver consent to the change of control clause, and (ii) to offer a restructuring of the debt that allows, at the same time, to extend the maturity terms, beyond any other alternatives that the buyer of the majority share package of the Company is evaluating in the event that the transaction is perfected.

Edenor S.A. – 4Q20 Earnings Release | 4 |

Impairment of Long-lived Assets

The Company analyzes the recoverability of its long-lived assets on a periodical basis or when events or changes in circumstances indicate that the recoverable amount of assets, which is measured as the higher of value in use and fair value less costs to sell at the end of the period, may be impaired.

In view of the lack of tariff updates and the economic and health situation affecting the country, the Company’s projections regarding the recoverability of its Property, Plant and Equipment have been updated.

The value in use is determined on the basis of projected and discounted cash flows, using discount rates that reflect the time value of money and the specific risks of the assets under consideration. Given the current uncertainty, several scenarios have been developed with their respective probabilities. More details on the process can be found on note 6.C. to the financial statements submitted as of December 2020.

After performing the recoverability analysis of long lived-assets, the Company has disclosed in its financial statements closing on December 2020 a depreciation of property, plant and equipment in the amount of ARS 17,396 million.

Executive Order No. 1020/20 | ITR Renegotiation Launch, Transition Regime and Tariff Freeze Extension

On December 16, 2020, pursuant to Executive Order No. 1020/20, the PEN declared the launch of the Integral Tariff Review renegotiation, which may not exceed two years of negotiations, suspending, until then, the Agreements corresponding to the respective current Integral Tariff Review, with the scopes to be determined in each case by the Regulatory Agencies. It is provided that Transitory Renegotiation Agreements may be executed to modify, to a limited extent, the specific conditions of the tariff review by establishing a Transitory Tariff Regime until reaching a Final Renegotiation Agreement.

Furthermore, ENRE’s administrative intervention provided for by Executive Order No. 277 was postponed until December 31st, 2021, or until the conclusion of the tariff review renegotiation.

In turn, the electricity tariff freeze was extended until March 31, 2021 or until the entry into effect of the new transitory tariff schemes resulting from the Transitory Tariff Regime, whichever occurs earlier.

Later, on January 19, 2021, the ENRE passed Resolution No. 16 launching the transitory tariff update procedure, which’s objective is to establish a Transitional Tariff Regime until the Definitive Renegotiation Agreement is complete. To this effect, the Regulatory Agency has requested, as a first measure, the submission of certain financial information, as well as information on the 2021-2022 investment plan based on the investment plan established in the 2017 ITR.

Call for Public Hearing on the Transitional Tariff Regime

On February 24, 2021, through Resolution No. 53/2021, the ENRE determined, in order to inform and hear opinions regarding the Transitional Tariff Regime for Edenor and Edesur, to call a Public Hearing for March 30th, 2021. The Hearing will be done virtually

Edenor S.A. – 4Q20 Earnings Release | 5 |

2021 Budget | Regularization of Liabilities with CAMMESA

On December 11, 2020, Executive Order No. 990/20 partially approved the 2021 Budget Law which, in its section 87, provides for a regime for the regularization of liabilities outstanding with CAMMESA and/or the MEM for the debts with Electricity Distributors accumulated as of September 30, 2020, whether on account of energy consumptions, power capacity, interest and/or penalties, under the conditions to be established by the enforcement authority, which may grant receivables for up to five times the monthly average bill or sixty six percent of the existing debt, whereas the balance should be regularized in up to sixty monthly installments, with a grace period of up to six months and at the MEM’s current rate reduced by fifty percent. The enforcement authority may enter into regularization agreements specifically with each of the Distributors.

In line with this, on January 21, 2020, the Secretariat of Energy passed Resolution No. 40, which established the “Special Liabilities Regularization Regime” for debts held with CAMMESA and/or the MEM validating the previously mentioned items. As of the date of this report, the Company is evaluating the scope and implications of this regime.

Agreement on Joint Regulatory Exercise

On January 19, 2021, the Company expressed its conformity with the Agreement on the Joint Exercise of Regulation and Control of the Electricity Distribution Public Utility entered into by the Federal Government, the Province and the City of Buenos Aires, which acknowledges that the title and capacity of the electricity distribution public utility’s Granting Authority in the Company’s concession area will remain vested in the Federal Government, agreeing to overrule a series of instruments associated with the transfer of said utility to the local jurisdictions and committing to create a Tripartite Body for the regulation and control of the activity.

Framework Agreement Collection

On December 22, 2020, the “Agreement for the Development of the Preventive and Corrective Work Plan for the Electrical Distribution Grid of the Metropolitan Area of Buenos Aires” was entered into to guarantee electricity supply to low-income neighborhoods in the metropolitan area of Buenos Aires.

As of December 31, 2020, the accumulated debt for shantytown consumption in the concession area of edenor was ARS 2,702 million, corresponding to the electricity supply during the October 2017 – December 2020 period to shantytowns and low-income neighborhoods, except for the portion by the Federal Government until May 2019 and the social tariff discounts contributed by the Province of Buenos Aires since January 1, 2019.

Under this Agreement, debts were recognized for ARS 2,126 million, for consumption until July 2020, amount to be applied be applied to the Works Plan for the performance of corrective and preventive maintenance works in the grids in charge of distributors and associated with low-income neighborhoods to improve the quality of services provided there and be able to meet contingencies and the potential consumption peaks that usually occur in the summer season.

In January 2021 the company received the first disbursement in the amount of AR$1,500 million has been received; the second disbursement, for AR$500 million, will be in the first quarter of 2021; the third disbursement, in the amount of AR$500 million, in the second quarter of 2021, and the fourth disbursement for the remainder must still be validated by the ENRE and corresponds to the total consumption of shantytowns between the months of August and December 2020.

Edenor S.A. – 4Q20 Earnings Release | 6 |

Seasonal Programming Modification

On February 24, 2021, through Resolution No. 131/2021, the Ministry of Energy determined to modify the stabilized price of energy of the Large Distribution Users (GUDI) to equate it with the Large Users of the Wholesale Electricity Market for the period between 1 of February and April 30, 2021. In turn, the category public health / education agencies large users was created and exempted from the increase.

Finally, through this resolution, the new value for the tax for the National Electricity Fund was increased from ARS 80 / MWh to ARS 160 / MWh. Then, through resolution Enre No. 270/2021, the price change of this tax was postponed for invoices issued as of March 1, 2021. For its part, edenor has requested the ENRE the transfer of the higher value of energy to GUDIs into the tariff. As of the date of this report, no response has been obtained.

Onerous Transfer of Receivable from Ribera Desarrollos SA (“RDSA”)

In November 2015 Edenor had completed the acquisition of a real estate asset from contracting company RDSA, which breached the contract, not even starting construction of the office building. Hence, Edenor terminated the contract for cause attributable to RDSA, and filed a claim with the Insurance Company. Later, in 2019, the collection of the surety bond in the amount of USD 15 MM was agreed, with Edenor’s receivable from RDSA still being pending. In RDSA’s reorganization proceeding, four alternatives were submitted for the recovery of the receivable. Edenor expressed its conformity with one of them, which requires making additional financial contributions. Given the Company’s complex economic and financial situation, and the necessity to focus resources in the investment plan to maintain service quality, added to the uncertainty regarding the recoverability of the credit subject to the evolution of RDSA's bankruptcy, the Board of Directors, in its meeting held on January 18, 2021, accepted the offer for the transfer of such credit, for a total amount of ARS 400 million plus a contingent price subject to the execution of the project under certain conditions. It is worth highlighting that the partial recovery of the provision has not been disclosed in these financial statements, and will be incorporated in the first quarter 2021.

Edenor S.A. – 4Q20 Earnings Release | 7 |

MAIN RESULTS FOR THE FOURTH QUARTER 2020

| In millon of Pesos | 12 Months | 4Q |

| in constant purchising power | 2020 | 2019 | Δ% | 2020 | 2019 | Δ% |

| Revenue from sales | 91,316 | 122,437 | (25%) | 18,265 | 24,600 | (26%) |

| Energy purchases | (57,930) | (77,649) | (25%) | (11,689) | (16,134) | (28%) |

| Gross margin | 33,386 | 44,788 | (25%) | 6,576 | 8,466 | (22%) |

| Operating expenses | (36,062) | (37,210) | (3%) | (9,479) | (9,442) | 0% |

| Other operating expenses | 155 | (1,113) | na | (191) | 50 | na |

| Asset Impairment | (17,396) | - | na | (17,396) | - | na |

| Net operating income | (19,917) | 6,465 | na | (20,490) | (926) | 2113% |

| Labilities regularization agreement | - | 23,270 | na | - | (0) | na |

| Financial Results, net | (11,111) | (13,923) | (20%) | (3,213) | (2,907) | 11% |

| RECPAM* | 9,767 | 15,236 | (36%) | 3,116 | 2,278 | 37% |

| Income Tax | 3,563 | (14,530) | na | 4,927 | (830) | na |

| Net income | (17,698) | 16,518 | na | (15,660) | (2,386) | 556% |

| *Result for exposure to changes in purching power | | | | | | |

Revenue from sales decreased by 26%, reaching ARS 18,265 million in 4Q20, against ARS 24,600 million in 4Q19. This ARS 6,336 million decrease is mainly due to the tariff freeze in both the Distribution Value Added and the seasonal price passed on to tariffs in an inflationary context, which entailed a decrease in revenues in real terms. The failure to apply the update mechanism on the CPD since March 2019, generates the same quarter-on-quarter nominal sales price, resulting in lower sales in real terms for approximately ARS 2,411 million. Lower revenues are also due to lower billings on account of the real-term decrease in the cost of energy purchases measured in pesos for ARS 3,908 million. Besides, the physical volume of electricity sales, excluding consumptions by shantytowns, experienced a slight decrease, generating lower revenues for ARS 16 million in 4Q20 compared to the same period of the previous year.

VAD adjustments corresponding to the increase in own distribution costs which have not been granted are summarized below:

If all owed adjustments had been implemented, the VAD for the quarter should have increased by ARS 4,851 million.

Edenor S.A. – 4Q20 Earnings Release | 8 |

| | 12 Months 2020 | 12 Months 2019 | Variation |

| | GWh | Part. % | Customers | GWh | Part. % | Customers | % GWh | % Customers |

| Residential * | 9,315 | 46.2% | 2,786,153 | 8,372 | 41.9% | 2,758,162 | 11.3% | 1.0% |

| Small commercial | 1,609 | 8.0% | 327,128 | 1,692 | 8.5% | 322,036 | (4.9%) | 1.6% |

| Medium commercial | 1,341 | 6.6% | 31,012 | 1,549 | 7.8% | 31,077 | (13.4%) | (0.2%) |

| Industrial | 3,210 | 15.9% | 6,860 | 3,503 | 17.5% | 6,830 | (8.4%) | 0.4% |

| Wheeling System | 3,364 | 16.7% | 687 | 3,569 | 17.9% | 684 | (5.8%) | 0.4% |

| Others | | | | | | | | |

| Public lighting | 676 | 3.4% | 21 | 713 | 3.6% | 21 | (5.2%) | 0.0% |

| Shantytowns and others | 664 | 3.3% | 482 | 575 | 2.9% | 469 | 15.6% | 2.8% |

| Total | 20,179 | 100% | 3,152,343 | 19,974 | 100% | 3,119,279 | 1.0% | 1.1% |

| | | | | | | | | |

| | 4Q 2020 | 4Q 2019 | Variation |

| | GWh | Part. % | Customers | GWh | Part. % | Customers | % GWh | % Customers |

| Residential * | 2,020 | 42.5% | 2,786,153 | 1,868 | 39.4% | 2,758,162 | 8.1% | 1.0% |

| Small commercial | 391 | 8.2% | 327,128 | 419 | 8.8% | 322,036 | (6.8%) | 1.6% |

| Medium commercial | 328 | 6.9% | 31,012 | 384 | 8.1% | 31,077 | (14.7%) | (0.2%) |

| Industrial | 821 | 17.3% | 6,860 | 883 | 18.6% | 6,830 | (7.1%) | 0.4% |

| Wheeling System | 911 | 19.2% | 687 | 913 | 19.2% | 684 | (0.1%) | 0.4% |

| Others | | | | | | | | |

| Public lighting | 148 | 3.1% | 21 | 155 | 3.3% | 21 | (4.3%) | 0.0% |

| Shantytowns and others | 134 | 2.8% | 482 | 124 | 2.6% | 469 | 8.2% | 2.8% |

| Total | 4,752 | 100% | 3,152,343 | 4,745 | 100% | 3,119,279 | 0.1% | 1.1% |

| | | | | | | | | |

| * 558,067 customersbenefit from Social Tariff |

The volume of energy sales increased by 0.1%, reaching 4,752 GWh in 4Q20, against 4,745 GWh for the same period of 2019. It is worth highlighting that this quarter has been affected by the outbreak of the COVID-19 crisis, which generated strong changes in energy consumptions. Electricity consumptions by residential customers increased by 8.1%, whereas commercial (small and medium) and industrial customers decreased their consumptions by 10.6% and 7.1%, respectively. The residential demand increased by 152 GWh, mainly because people spend more time at home due to the restrictions on movement and the implementation of the home office modality. The 85 GWh and 63 GWh decreases for commercial and industrial customers, respectively, were mainly due to the partial or total closure of stores and industries resulting from the measures implemented under the ASPO. However, despite the above-mentioned decreases, these sectors show a recovery in this quarter compared to the first months of the ASPO. Additionally, the recovery in sales volumes may be partly explained by the tariff lag.

Furthermore, edenor’s customer base rose by 1.1%, mainly on account of the increase in residential customers as a result of the market discipline actions implemented before the ASPO and the installation over the last year of more than 25,000 integrated energy meters that were mostly destined to regularize clandestine connections.

Edenor S.A. – 4Q20 Earnings Release | 9 |

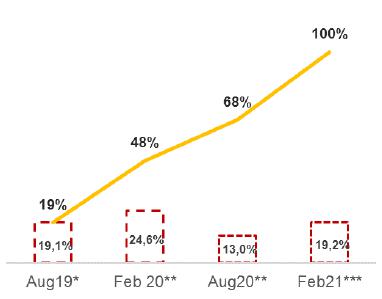

Energy purchases decreased by 28%, to ARS 11,689 million, in 4Q20, against ARS 16,134 million for the same period in 2019. This ARS 4,445 million decrease is mainly due to the 24.5% real-term decrease in the average purchase price, which generated lower expenses for ARS 3,939 million decrease. The last increase was 5% (with the exception of residential users) in August 2019, pursuant to Resolution No. 14/2019 of the Secretariat of Renewable Resources and Electricity Market. This decrease was not affected by the energy volumes net of losses, which only increased by 0.3% and was valued at approximately ARS 31 million. In turn, the reference seasonal price for customers is still subsidized by the Federal Government, especially in the case of residential customers, where between October and November 2020 the subsidy reached 54% of the system’s actual generation cost. Additionally, the energy loss rate decreased from 19.4% in 3Q19 to 18.4% in 4Q20. In turn, costs associated with these losses decreased by 35.1% in real terms due to the failure to update the reference seasonal price in an inflationary context, resulting in lower purchases for ARS 537 million.

It is worth highlighting that over the past few years edenor has suffered a systematic deterioration of its assets and financial position as a result of the tariff lag, the increase in operating costs, the drop in demand and the increase in energy theft. Besides, the outbreak of the global pandemic has brought several consequences in global economic activities which directly affected the Company’s activities, generating reduced collections, especially at the beginning of the mandatory lockdown. For these reasons, we have seen the need to partially defer payments to CAMMESA for the energy acquired in the Wholesale Electricity Market as from maturities taking place in March 2020, accumulating, as of December 30, 2020, a ARS 12,372 million debt before interest. In this sense, the debt accumulated as of September 30, 2020 is covered by the “Special Liabilities Regularization Regime” approved by Resolution No. 40 of the Secretariat of Energy. As of the date of this report, the company has submitted all the information that has been required under this resolution and is evaluating the scope and implications of this regime.

Edenor S.A. – 4Q20 Earnings Release | 10 |

Operating expenses have mostly remained stable, reaching ARS 9,479 million in 4Q20, against ARS 9,442 million in 4Q19. This is mainly explained by the ARS 332 million increase in fees and remuneration for services and the increase in the allowance for the impairment of receivables in the amount of ARS 278 million as a consequence of the increase in the uncollectibility rate associated with the COVID-19 context, which resulted in a substantial increase in the Delinquent Balance. Finally, salaries and social security taxes have increased by ARS 137 million and communications expenses, by ARS 54 million. These increases were partially offset by lower penalties in the amount of ARS 417 million as a result of the improvement in service quality levels, and lower supplies consumption in the amount of ARS 362 million caused by the reduction of certain activities as a consequence of the measures adopted by the regulator.

| In million of pesos | 12 Months | 4Q |

| in constant purchising power | 2020 | 2019 | Δ% | 2020 | 2019 | Δ% |

| Salaries, social security taxes | (11,315) | (11,909) | (5%) | (3,470) | (3,333) | 4% |

| Pensions Plans | (477) | (357) | 34% | (4) | (0) | na |

| Communications expenses | (662) | (640) | 3% | (200) | (147) | 37% |

| Allowance for the imp. of trade and other receivables | (4,183) | (1,844) | 127% | (837) | (559) | 50% |

| Supplies consumption | (2,026) | (2,356) | (14%) | (354) | (716) | (51%) |

| Leases and insurance | (317) | (308) | 3% | (93) | (70) | 32% |

| Security service | (373) | (507) | (26%) | (103) | (98) | 5% |

| Fees and remuneration for services | (7,603) | (7,540) | 1% | (2,263) | (1,931) | 17% |

| Amortization of assets by right of use | (321) | (223) | 44% | (107) | (81) | 32% |

| Public relations and marketing | (19) | (56) | (66%) | (2) | (3) | (26%) |

| Advertising and sponsorship | (10) | (29) | (66%) | (1) | (2) | (19%) |

| Depreciation of property, plant and equipment | (6,506) | (6,295) | 3% | (1,573) | (1,526) | 3% |

| Directors and Sup. Committee members’ fees | (28) | (30) | (7%) | (4) | (5) | (14%) |

| ENRE penalties | (695) | (3,769) | (82%) | (85) | (503) | (83%) |

| Taxes and charges | (1,517) | (1,325) | 14% | (381) | (460) | (17%) |

| Other | (9) | (21) | (57%) | (1) | (10) | (92%) |

| Total | (36,062) | (37,210) | (3%) | (9,479) | (9,442) | 0% |

Financial results experienced a 11% increase in losses, which amounted to ARS 3,213 million in 4Q20, against losses for ARS 2,907 million in 4Q19. This difference is mainly due to higher accrued interest on the debt incurred with CAMMESA for ARS 2,211 million and lower profits in the amount of ARS 625 million from the repurchase of CBs made in the 4Q19. These results were partially offset by lower financial interest charges for ARS 1,796 million, and a positive change in the value of financial assets for ARS 948 million.

Net income decreased by ARS 13,274 million, recording losses for ARS 15,660 million, in 4Q20, against losses for ARS 2,386 million for the same period in 2019. This difference is mainly due to the result of the impairment of assets recorded in 2020 for 17,396 million as a result of the analysis of the recoverability of the assets under a context of tariff uncertainty for Edenor and an economic and health emergency for the country. Without considering this effect, operating results would have decreased by ARS 2,168 million in 4Q20 against the same period of the previous year. These negative results were partially offset by better results from inflation adjustments and the effect of the assets impairment in income tax in 4Q2020.

Edenor S.A. – 4Q20 Earnings Release | 11 |

Adjusted EBITDA

Adjusted EBITDA showed ARS 1,414 million losses in 4Q20, ARS 2,094 million lower than in the same period of 2019. The EBITDA adjustment in the quarterly comparison periods corresponds to the impairment of assets and, in the 12-month period, the adjustment corresponding to the update of penalties for the transition period in 2019 is added.

| In millon of Pesos | 12 Months | 4Q |

| in constant purchising power | 2020 | 2019 | Δ% | 2020 | 2019 | Δ% |

| Net operating income | (19,917) | 6,465 | na | (20,490) | (926) | na |

| Depreciation of property, plant and equipment | 6,827 | 6,518 | 5% | 1,680 | 1,606 | 5% |

| EBITDA | (13,090) | 12,983 | na | (18,810) | 680 | na |

| Asset Impairment | 17,396 | - | na | 17,396 | - | na |

| Penalties - Actualization (*) | - | 1,019 | na | - | - | na |

| Adjusted EBITDA | 4,306 | 14,002 | (69%) | (1,414) | 680 | na |

(*) The liabilities regularization agreement executed on May 10, 2019 discontinued the updating of penalties for the transition period (2006-2016).

Edenor S.A. – 4Q20 Earnings Release | 12 |

Capital Expenditures

edenor’s capital expenditures in 4Q20 totaled ARS 3,243 million, compared to ARS 2,562 million in 4Q19. Our investments mainly consisted of the following:

| · | ARS 427 million in new connections; |

| · | ARS 1.074 million in grid enhancements; |

| · | ARS 744 million in maintenance; |

| · | ARS 33 million in legal requirements; |

| · | ARS 475 million in communications and telecontrol; |

| · | ARS 490 million in other investment projects. |

The 27% increase in investments compared to the same period of the previous year is mainly a result of the Company’s efforts although its gross margin has been reduced because of the tariff freeze and the restrictions generated by the pandemic throughout the year. These higher investments compared to the same period of 2019 are due to the recovery in Q4 of the deferments in investments of the previous months as a consequence of the delays caused by the preventive and mandatory social isolation (“ASPO”). The lack of predictability in the near future as a consequence of the tariff freeze and the accumulated drop in demand registered over the last years may affect the pace of investments in the ambitious plan set by edenor, always making sure this slowdown does not affect compliance with service quality indicators, which have exceeded regulatory requirements. All this with the due care of our employees, contractors and customers, and the application of strict health, safety and hygiene protocols in each of the activities conducted under this unprecedented circumstance.

The investment highlights for the quarter were the commissioning of the Colegiales, Libertad and Jose C Paz substations, and the new El Cruce step-down transformer center for 240 MVA. Additionally, two new capacitor banks, of 150 MVA each, were mounted in the Rodriguez substation. Lastly, 19 km of new high-voltage transmission lines were constructed, whereas other 4.5 km were renewed.

Edenor S.A. – 4Q20 Earnings Release | 13 |

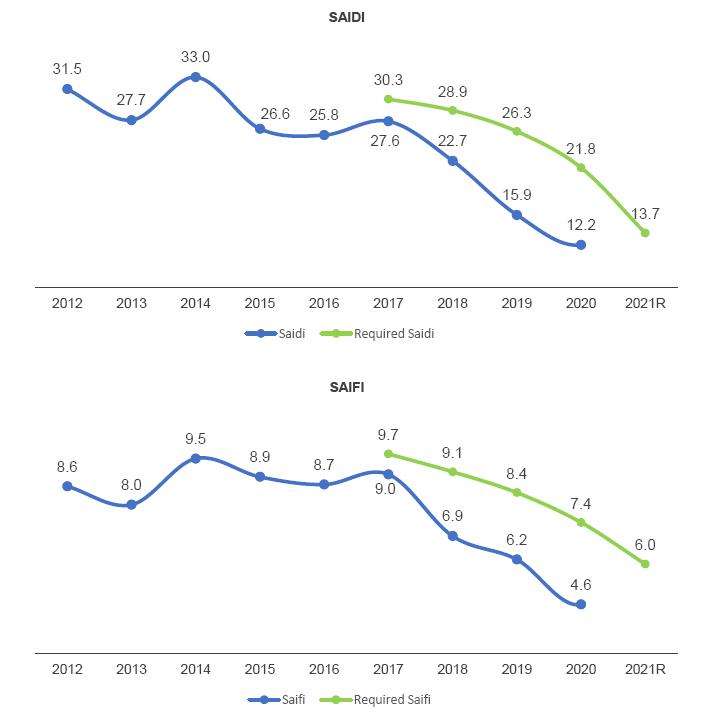

Service Quality Standards

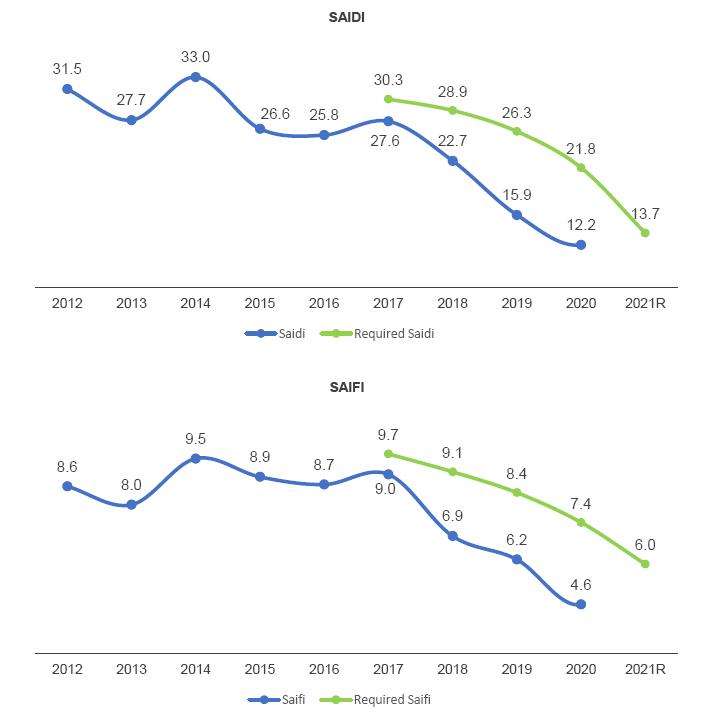

Quality standards are measured based on the duration and frequency of service outages using the SAIDI and SAIFI indicators. SAIDI refers to the duration of outages, and measures the number of outage hours per year. SAIFI refers to the frequency of outages, and measures the number of times a user experiences an outage during a year.

At the closing of the fourth quarter of 2020, SAIDI and SAIFI indicators were 12.2 hours and 4.6 outages per year over the last 12 months, evidencing a 23.3% and 25.8% improvement, respectively, compared to the same period of the previous year. In turn, these indicators are 43.9% and 37.3% lower than those required in the ITR. This recovery in service levels is mainly due to the ambitious plan devised by the company since 2014, the various improvements implemented in the operating processes, and the adoption of technology applied to the grid’s operation and management. The success of this plan is also evidenced by the fact that these indicators exceed the service quality improvement path defined by the regulatory agency, even complying with indexes required for 2021.

Edenor S.A. – 4Q20 Earnings Release | 14 |

Energy Losses

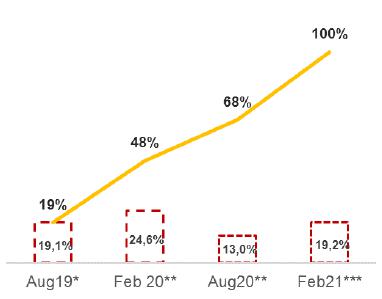

In 4Q20, energy losses experienced a 18.4% decrease, against 19.4% for the same period in 2019. Costs associated with these losses remained stable, decreasing by 35.1% in real terms. Resulting in a ARS 537 million improvement in real terms.

The works of multidisciplinary teams to develop new solutions to energy losses continued, as well as Market Discipline (DIME) actions aiming to reduce them. Analytical and artificial intelligence tools were used to enhance effectiveness in the routing of inspections, and DIME actions continued with the objective of detecting and normalizing irregular connections, fraud and energy theft.

Over the last year, approximately 462 thousand inspections of Tariff 1 meters were conducted with a 57% efficiency, and more than 25,000 Integrated Energy Meters (MIDE) were installed. Regarding the recovery of energy, besides the customers put back to normal with MIDE meters, clandestine customers with conventional meters were also put back to normal. Moreover, a new energy balance system was implemented and the development of micro-balances in private neighborhoods. In all cases, a striking rate of recidivism in fraud has been observed. Along these lines, 349 preliminary rulings were made, 125 criminal complaints were filed and 71 people were arrested in 42 operations carried out together with the security forces.

Indebtedness

As of December 31, 2020, the outstanding principal of our dollar-denominated financial debt amounts to USD 98.3 million, whereas the debt net of cash amounts to USD 21.9 million. The financial debt consists solely of Corporate Bonds maturing in 2022, as the last repayment of the loan taken out with ICBC, in the amount of USD 12.5 million, was made on October 5. Lastly, after the closing of the year, on January 28, treasury CBs in the amount of USD 114,000 were canceled, USD 98,167,000 remaining outstanding.

Edenor S.A. – 4Q20 Earnings Release | 15 |

About Edenor

Empresa Distribuidora y Comercializadora Norte S.A. (edenor) is the largest electricity distribution company in Argentina in terms of number of customers and electricity sold (in GWh). Through a concession, edenor distributes electricity exclusively to the northwestern zone of the greater Buenos Aires metropolitan area and the northern part of the City of Buenos Aires, which has a population of approximately 9 million people and an area of 4,637 sq. km. In 2020, edenor sold 20,179 GWh of energy and purchased 25,124 GWh (including wheeling system demands), with revenue from sales in the amount of ARS 91 billion adjusted by inflation as of December 2020. In turn, the company had negative net results in the amount of ARS 15.7 billion.

This press release may contain forward-looking statements. These statements are not historical facts, and are based on management’s current view and estimates of future economic circumstances, industry conditions, Company performance and financial results. The words “anticipates”, “believes”, “estimates”, “expects”, “plans” and similar expressions, as they relate to the Company, are intended to identify forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties, including those identified in the documents filed by the Company with the U.S. Securities and Exchange Commission. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

Edenor S.A.

Avenida del Libertador 6363, Piso 4º

(C1428ARG) Buenos Aires, Argentina

Tel: 5411.4346.5510

investor@edenor.com

www.edenor.com

Edenor S.A. – 4Q20 Earnings Release | 16 |

Condensed Interim Statements of Financial Position

As of December 31, 2020 and 2019

Values expressed in constant purchasing power

In million of Argentine Pesos

in constant purchising power | 12.31.2020 | | 12.31.2019 | | | 12.31.2020 | | 12.31.2019 |

| ARS | | ARS | | ARS | | ARS |

| | | | | | | | | |

| ASSETS | | | | | EQUITY | | | |

| | | | | | | | | |

| Non-current assets | | | | | Share capital | 875 | | 875 |

| Property, plant and equipment | 124,914 | | 137,894 | | Adjustment to share capital | 36,404 | | 36,404 |

| Interest in joint ventures | 11 | | 15 | | Additional paid-in capital | 504 | | 504 |

| Deferred tax asset | 280 | | 355 | | Treasury stock | 31 | | 31 |

| Other receivables | 42 | | 35 | | Adjustment to treasury stock | 782 | | 782 |

| Financial assets at amortized cost | 239 | | - | | Adquisition cost of own shares | (3,053) | | (3,053) |

| Total non-current assets | 125,486 | | 138,299 | | Legal reserve | 2,581 | | 1,755 |

| | - | | - | | Opcional reserve | 42,690 | | 26,998 |

| Current assets | - | | - | | Other comprehensive loss | (218) | | (294) |

| Inventories | 1,873 | | 2,623 | | Accumulated losses | (17,698) | | 16,518 |

| Other receivables | 624 | | 394 | | TOTAL EQUITY | 62,898 | | 80,520 |

| Trade receivables | 14,151 | | 16,961 | | | - | | - |

| Financial assets at amortized cost | 78 | | - | | LIABILITIES | - | | - |

| Cash and cash equivalents | 4,362 | | 558 | | Non-current liabilities | - | | - |

| Total current assets | 23,310 | | 24,334 | | | - | | - |

| | - | | - | | Trade payables | 521 | | 503 |

| | - | | - | | Other payables | 6,285 | | 5,472 |

| TOTAL ASSETS | 148,796 | | 162,633 | | Borrowings | 8,261 | | 11,159 |

| | | | | | Deferred revenue | 1,471 | | 368 |

| | | | | | Salaries and social security payable | 303 | | 327 |

| | | | | | Benefit plans | 749 | | 713 |

| | | | | | Deferred tax liability | 23,709 | | 27,300 |

| | | | | | Tax liabilities | - | | - |

| | | | | | Provisions | 2,431 | | 2,808 |

| | | | | | Total non-current liabilities | 43,730 | | 48,650 |

| | | | | | | - | | - |

| | | | | | Current liabilities | - | | - |

| | | | | | Trade payables | 33,019 | | 17,288 |

| | | | | | Other payables | 2,999 | | 4,895 |

| | | | | | Borrowings | 143 | | 2,259 |

| | | | | | Derivative financial instruments | 1 | | 279 |

| | | | | | Deferred revenue | 37 | | 7 |

| | | | | | Salaries and social security payable | 3,734 | | 3,278 |

| | | | | | Benefit plans | 84 | | 70 |

| | | | | | Tax payable | - | | 2,681 |

| | | | | | Tax liabilities | 1,793 | | 2,415 |

| | | | | | Provisions | 358 | | 291 |

| | | | | | Total current liabilities | 42,168 | | 33,463 |

| | | | | | TOTAL LIABILITIES | 85,898 | | 82,113 |

| | | | | | | - | | - |

| | | | | | TOTAL LIABILITIES AND EQUITY | 148,796 | | 162,633 |

Edenor S.A. – 4Q20 Earnings Release | 17 |

Condensed Interim Statements of Comprehensive Income (Loss)

for the twelve-month period ended on December 31, 2020 and 2019

Values expressed in constant purchasing power

In millon of Argentine Pesos

in constant purchising power | | 12.31.2020 | | 12.31.2019 |

| ARS | ARS |

| | | | | |

| Continuing operations | | | | |

| Revenue | | 91,316 | | 122,437 |

| Electric power purchases | | (57,930) | | (77,649) |

| Subtotal | | 33,386 | | 44,788 |

| Transmission and distribution expenses | | (19,866) | | (21,980) |

| Gross loss | | 13,520 | | 22,808 |

| Selling expenses | | (10,843) | | (10,007) |

| Administrative expenses | | (5,353) | | (5,223) |

| Other operating income | | 2,200 | | 2,364 |

| Other operating expense | | (2,045) | | (3,477) |

| Assets Impairment | | (17,396) | | - |

| Operating Profit (Loss) | | (19,917) | | 6,465 |

| Labilities regularization agreement | | - | | 23,270 |

| Financial income | | 55 | | 78 |

| Financial expenses | | (9,276) | | (9,205) |

| Other financial expense | | (1,890) | | (4,796) |

| Net financial expense | | (11,111) | | (13,923) |

| RECPAM | | 9,767 | | 15,236 |

| Profit (Loss) before taxes | | (21,261) | | 31,048 |

| | | | | |

| Income tax | | 3,563 | | (14,530) |

| Profit (Loss) for the period | | (17,698) | | 16,518 |

| | | | | |

| Basic and diluted earnings Profit (Loss) per share: | | | | |

| Basic and diluted earnings profit (loss) per share | | (20.23) | | 18.88 |

Edenor S.A. – 4Q20 Earnings Release | 18 |

Condensed Interim Statements of Comprehensive Income (Loss)

for the twelve-month period ended on December 31, 2020 and 2019

Expressed at historical values

In millon of Argentine Pesos

in historical values | | 12.31.2020 | | 12.31.2019 |

| | ARS | | ARS |

| | | | | |

| Continuing operations | | | | |

| Revenue | | 77,896 | | 73,669 |

| Electric power purchases | | (49,394) | | (46,814) |

| Subtotal | | 28,502 | | 26,855 |

| Transmission and distribution expenses | | (13,306) | | (10,348) |

| Gross loss | | 15,196 | | 16,507 |

| Selling expenses | | (8,760) | | (5,654) |

| Administrative expenses | | (4,251) | | (2,762) |

| Other operating expense, net | | 196 | | (622) |

| Operating Profit (Loss) | | 2,381 | | 7,470 |

| Labilities regularization agreement | | - | | 13,403 |

| Financial income | | 51 | | 46 |

| Financial expenses | | (8,346) | | (5,896) |

| Other financial expense | | (1,346) | | (2,552) |

| Net financial expense | | (9,641) | | (8,402) |

| | | | | |

| Profit (Loss) before taxes | | (7,259) | | 12,471 |

| | | | | |

| Income tax | | (123) | | (2,598) |

| Profit (Loss) for the period | | (7,382) | | 9,873 |

| | | | | |

| Basic and diluted earnings Profit (Loss) per share: | | | | |

| Basic and diluted earnings Profit (Loss) per share | | (8,436.70) | | 11,283.38 |

Edenor S.A. – 4Q20 Earnings Release | 19 |

Condensed Interim Statements of Cash Flows

for the twelve-month period ended on December 31, 2020 and 2019

Values expressed in constant purchasing power

In millon of Argentine Pesos

in constant purchising power | | 12.31.2020 | | 12.31.2019 |

| ARS | ARS |

| | | | | |

| Cash flows from operating activities | | | | |

| Loss (Profit) for the period | | (17,698) | | 16,518 |

| Adjustments to reconcile net (loss) profit to net cash flows provided by operating activities: | | 25,937 | | (972) |

| | | | | |

| Changes in operating assets and liabilities: | | | | |

| Increase in trade receivables | | (3,867) | | (5,164) |

| Increase in trade payables | | (296) | | 5,139 |

| Income tax payment | | (2,376) | | (3,572) |

| Cammesa Commercial Financing | | 13,866 | | - |

| Others | | 1,770 | | 1,881 |

| | | | | |

| Net cash flows provided by operating activities | | 17,336 | | 13,830 |

| | | | | |

| Net cash flows used in investing activities | | (7,219) | | (7,019) |

| | | | | |

| Net cash flows used in financing activities | | (6,152) | | (6,905) |

| | | | | |

| Net (decrease) increase in cash and cash equivalents | | 3,965 | | (94) |

| | | | | |

| Cash and cash equivalents at beginning of year | | 558 | | 58 |

| Exchange differences in cash and cash equivalents | | (364) | | 597 |

| Result for exposure to inflation in cash and cash equivalents | | 203 | | (3) |

| Net decrease in cash and cash equivalents | | 3,965 | | (94) |

| Cash and cash equivalents at the end of period | | 4,362 | | 558 |

| | | | | |

| Supplemental cash flows information | | | | |

| Non-cash operating, investing and financing activities | | | | |

| Labilities regularization agreement | | - | | (23,270) |

| Acquisitions of property, plant and equipment through increased trade payables | | (1,226) | | (746) |

| Acquisitions of assets for rights of use through an increase in other debts | | (246) | | (579) |

| Investor Relations Contacts: Leandro Montero Chief Financial Officer Federico Mendez Planning and Investor Relations Manager |

investor@edenor.com | Tel: +54 (11) 4346-5511 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Empresa Distribuidora y Comercializadora Norte S.A. |

| | |

| | |

| By: | /s/ Leandro Montero |

| Leandro Montero |

| Chief Financial Officer |

Date: March 10, 2021