UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2021

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(DISTRIBUTION AND MARKETING COMPANY OF THE NORTH )

(Translation of Registrant's Name Into English)

Argentina

(Jurisdiction of incorporation or organization)

Av. del Libertador 6363,

12th Floor,

City of Buenos Aires (A1428ARG),

Tel: 54-11-4346-5000

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F X Form 40-F

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes No X

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .)

| Results for the third quarter 2021 |

Ticker: EDN Ratio: 20 Class B shares = 1 ADR Number of Shares: 824,15 million Shares | 82,3 million ADRs Market Capitalization: ARS 59.871 bn | USD 272.224 million | Investor Relation Contacts: Germán Ranftl Chief Financial Officer Silvana Coria Investor Relations Manager |

ir.edenor.com | investor@edenor.com Tel: +54 (11) 4346 -5511 |

Buenos Aires, Argentina, November 10, 2021. Empresa Distribuidora y Comercializadora Norte S.A. (NYSE/ BYMA: EDN) (“edenor” or “the Company”), Argentina’s largest electricity distributor both in terms of number of customers and energy sales, announces its results for the third quarter of 2021. All figures are stated in Argentine Pesos on a constant currency basis, and the information has been prepared in accordance with International Financing Reporting Standards (“IFRS”), except for what is expressly indicated in the Income Statement, which is expressed at historical values.

Webcast Information

There will be a webcast to discuss edenor’s 3Q21 results on Thursday, November 11, 2021, at 10:00 a.m. Buenos Aires time/ 8.00 a.m. New York time.

The presentation will be given by German Ranftl, edenor’s Chief Financial Officer. For those interested in participating, please click HERE.

Questions will be answered exclusively through the webcast system.

1 Listing as of 11/09/2021, ARS 68.40 per share y USD 6.22 per ADR

| Edenor S.A – EARNINGS RELEASE 3Q21 | 2 | |

SUMMARY OF RESULTS FOR THE THIRD QUARTER 2021

Edenor has managed to sustain the improvement in its service quality levels together with an improvement in the efficiency of the use of its resources.

| In million of Pesos | 9 Months | 3Q |

| in constant purchising power | 2021 | 2020 | Δ% | 2021 | 2020 | Δ% |

| Revenue from sales | 80,802 | 100,050 | (19%) | 29,236 | 34,961 | (16%) |

| EBITDA | 6,129 | 7,830 | (22%) | 3,496 | 3,378 | 3% |

| Adjusted EBITDA | 6,129 | 7,830 | (22%) | 3,496 | 3,378 | 3% |

| Net income | (13,341) | (2,791) | 378% | (618) | 153 | (504%) |

| Capital expenditures | 10,347 | 10,722 | (3%) | 3,599 | 4,253 | (15%) |

Revenue from sales decreased by 16%, reaching ARS 29,236 million in 3Q21, due to the fact that the company is renegotiating the tariff of the Distribution Value Added (VAD) and a decrease in revenues in real terms due to the effect of energy seasonal price purposes in an inflationary context. This effect was partially offset by an increase in demand driven by a recovery in commercial and industrial activity between the comparison periods, and the tariff adjustment applied as from May 1st.

It should be taken into account that, during the same period in 2020, the Executive Branch maintained the Preventive and Mandatory Social Isolation (“ASPO”, in Spanish), so the inter-annual comparison base is unusually low.

Adjusted EBITDA had a positive increase of 3% in 3Q21, however, in the first nine months of 2021 it decreased 22% compared to the same period in 2020. The difference can be explained by a decrease in revenue from sales, which was offset by a decrease in operating costs; an improvement in energy losses; recognized income under the Framework Agreement for investments, and a 9% increase on average in the tariff for users since May 1st, 2021.

Net results accumulated losses for ARS 618 million in 3Q21, increasing losses by ARS 771 million compared to the same period of last year.

During the last quarter, there was a higher gain in the operating income, higher financial losses mainly due to the deferral of the payment of obligations with the Wholesale Electricity Market and a higher result for exposure to changes in purchasing power (RECPAM).

During the first 9 months of 2021, investments reached ARS 10,347 million with no material changes in real terms compared to the same period of the previous year (-3%).

| Edenor S.A – EARNINGS RELEASE 3Q21 | 3 | |

REGULATORY FRAMEWORK

Reopening of Commercial Offices

By means of Notes NO-2021-84330919-APN-ENRE#MEC and NO-2021-84786820-APN-ENRE#MEC notified on September 9, 2021, the National Electricity Regulatory Entity (ENRE in Spanish) instructed the Company to reopen the commercial offices that had been closed under ENRE´s instruction due to the Preventive and Mandatory Social Isolation (“ASPO” in Spanish) and the Preventive and Compulsory Social Distancing (“DISPO” in Spanish) stipulated by the Argentine government.

Liquidation - Discontinuance of Service and/or Cancellation of Title

The ENRE established the procedure through which the Company must demand the debt at the time of discontinuance of service or cancellation of title. It was notified to the Company on September 13, 2021 by means of Note NO-2021-82569889 -APN-ENRE # MEC. The Company appealed and the case is pending before the ENRE.

Framework Agreement

As of September 30, 2021, the Company received, under the Agreement described in Note 2.f) to the Financial Statements as of December 31, 2020, a first disbursement for $ 1,500, which, as indicated in such agreement, must be used specifically to comply with the Preventive and Corrective Work Plan of the Electric Distribution Network. The Company may be able to dispose of the aforementioned funds once the ENRE certifies compliance with the progress of the execution of the works included in the aforementioned plan and their respective financial highlights.

As of the date of issue of these Condensed Interim Financial Statements, the Company has drawn down a total of $ 1,347.1 (same currency as of September 30, 2021, the total amounts to $ 1,455), corresponding to the presentations of works advance that have been carried out.

On October 15, 2021, the ENRE instructed the Company to return $ 76.4 million in excess of the corresponding amounts approved. On October 18, 2021, the Company made the payment under protest, reserving the right to recovery.

| Edenor S.A – EARNINGS RELEASE 3Q21 | 4 | |

MAIN RESULTS FOR THE THIRD QUARTER 2021

| In millon of Pesos | 9 Months | 3Q |

| in constant purchising power | 2021 | 2020 | Δ% | 2021 | 2020 | Δ% |

| Revenue from sales | 80,802 | 100,050 | (19%) | 29,236 | 34,961 | (16%) |

| Energy purchases | (49,365) | (63,331) | (22%) | (17,039) | (21,715) | (22%) |

| Gross margin | 31,437 | 36,719 | (14%) | 12,197 | 13,246 | (8%) |

| Operating expenses | (32,190) | (36,408) | (12%) | (10,738) | (12,088) | (11%) |

| Other operating expenses | 238 | 472 | (50%) | (180) | (134) | 34% |

| Asset Impairment | - | - | na | - | - | na |

| Net operating income | (515) | 783 | (166%) | 1,279 | 1,024 | 25% |

| Labilities regularization agreement | - | - | na | - | - | na |

| Financial Results, net | (15,307) | (10,816) | 42% | (4,914) | (3,697) | 33% |

| RECPAM* | 16,970 | 9,110 | 86% | 4,422 | 3,761 | 18% |

| Income Tax | (14,489) | (1,868) | 676% | (1,405) | (935) | na |

| Net income | (13,341) | (2,791) | (578%) | (618) | 153 | (504%) |

| *Result for exposure to changes in purching power |

Revenues from sales

Revenue from sales decreased by 16% reaching ARS 29,236 million in 3Q21, against ARD 34,961 million in 3Q20. This due to the fact that the company is renegotiating the tariff of the Distribution Value Added (VAD) and the effect of energy seasonal price purposes in an inflationary context. This effect was partially offset by an increase in demand driven by a recovery in commercial and industrial activity between the comparison periods, and the tariff adjustment applied as from May 1st.

Energy purchases

Energy purchases decreased by 22%, to ARS 17,039 million, in 3Q21, against ARS 21,715 million for the same period in 2020. In turn, the reference seasonal price for customers is still subsidized by the Federal Government, especially in the case of residential customers, where the subsidy reached 78% of the system’s actual generation cost in the third quarter of 2021, while the same was 17% for large users. Additionally, the energy loss rate decreased from 23% in 3Q20 to 19% in 3Q21.

Gross Margin

The gross margin corresponding to 3Q21 was ARS 12,197, which represents a fall of 8% compared to the same period of the previous year. In addition, a fall of 14% can be observed in the accumulated of the nine months closed as of September 30, 2021.

By means of Resolution No. 107/2021, the ENRE established new transitory tariffs schemes which are effective as of May and include a partial adjustment of tariffs of 9% on average for users. This increase entails a 20.9% increase in CPD for Edenor, which was not enough to offset the effects of inflation.

As regards the seasonal price, effective as of April, by means of Resolution No. 78/2021, the ENRE issued new tariffs schemes increasing the price of energy for large distribution users (GUDIS), making them equal to the large users of the wholesale electricity market (MEM). Such Resolution also included a 5% increase in the tariff (with the exception for residential users) pending as from August 2019, pursuant to Resolution No. 14/2019 by the Secretariat of Renewable Resources and Electricity Market, which had not been passed to tariff and was being burdened by Edenor. These increases in the seasonal price of energy are passed to final tariff without affecting Edenor's income.

| Edenor S.A – EARNINGS RELEASE 3Q21 | 5 | |

| | 9 Months 2021 | 9 Months 2020 | Variation |

| | GWh | Part. % | Customers | GWh | Part. % | Customers | % GWh | % Customers |

| Residential * | 7,601 | 46.2% | 2,834,790 | 7,295 | 47.3% | 2,773,726 | 4.2% | 2.2% |

| Small commercial | 1,373 | 8.3% | 334,583 | 1,218 | 7.9% | 325,183 | 12.7% | 2.9% |

| Medium commercial | 1,077 | 6.5% | 30,882 | 1,014 | 6.6% | 31,092 | 6.3% | (0.7%) |

| Industrial | 2,594 | 15.8% | 6,854 | 2,389 | 15.5% | 6,882 | 8.6% | (0.4%) |

| Wheeling System | 2,755 | 16.7% | 684 | 2,452 | 15.9% | 686 | 12.3% | (0.3%) |

| Others | | | | | | | | |

| Public lighting | 519 | 3.2% | 21 | 528 | 3.4% | 21 | (1.7%) | 0.0% |

| Shantytowns and others | 550 | 3.3% | 481 | 530 | 3.4% | 479 | 3.7% | 0.4% |

| Total | 16,469 | 100% | 3,208,295 | 15,427 | 100% | 3,138,069 | 6.8% | 2.2% |

| | | | | | | | | |

| | 3Q 2021 | 3Q 2020 | Variation |

| | GWh | Part. % | Customers | GWh | Part. % | Customers | % GWh | % Customers |

| Residential * | 2,757 | 47.6% | 2,834,790 | 2,708 | 49.8% | 2,773,726 | 1.8% | 2.2% |

| Small commercial | 469 | 8.1% | 334,583 | 404 | 7.4% | 325,183 | 16.3% | 2.9% |

| Medium commercial | 367 | 6.3% | 30,882 | 314 | 5.8% | 31,092 | 16.7% | (0.7%) |

| Industrial | 880 | 15.2% | 6,854 | 775 | 14.3% | 6,882 | 13.5% | (0.4%) |

| Wheeling System | 909 | 15.7% | 684 | 823 | 15.1% | 686 | 10.4% | (0.3%) |

| Others | | | | | | | | |

| Public lighting | 181 | 3.1% | 21 | 184 | 3.4% | 21 | (1.9%) | 0.0% |

| Shantytowns and others | 232 | 4.0% | 481 | 226 | 4.2% | 479 | 2.7% | 0.4% |

| Total | 5,795 | 100% | 3,208,295 | 5,434 | 100% | 3,138,069 | 6.6% | 2.2% |

| * 567,431 customers benefit from Social Tariff |

Volume of Energy Sales

The volume of energy sales increased by 7%, reaching 5,795 GWh in 3Q21, against 5,434 GWh for the same period of 2020. As regards the accumulated of 9 months, it also meant an increase of 7%, reaching 16,469 GWh.

Furthermore, edenor’s customer base rose by 2%, reaching 3.2 million of customers, mainly on account of the increase in residential customers and small commercials as a result of the market discipline actions and the installation over the last year of more than 34,958 integrated energy meters that were mainly intended for the regularization of clandestine connections.

The outbreak of the global pandemic has brought several consequences in economic activities worldwide that directly affected the Company’s activities, generating reduced collections, especially at the beginning of the lockdown. In addition, given the tariff delay, our income was highly committed. For these reasons, we have seen the need to partially defer payments to CAMMESA for the energy acquired in the Wholesale Electricity Market as from maturities taking place in March 2020. These obligations were partially regularized; even so, as of September 30, 2021 there is a debt of ARS 21,460 million before interest.

As regards the treatment of the debt accumulated, pursuant to Resolution No. 371/21 the Secretariat of Energy moved forward with the regulation of the “Special Liabilities Regularization Regime” and requested information to CAMMESA for their determination. As of the date of this report, the company has provided all the required information and is awaiting a definition by the Secretariat of Energy.

| Edenor S.A – EARNINGS RELEASE 3Q21 | 6 | |

Operating expenses

| In million of pesos | 9 Months | 3Q |

| in constant purchising power | 2021 | 2020 | Δ% | 2021 | 2020 | Δ% |

| Salaries, social security taxes | (10,644) | (10,744) | (1%) | (3,618) | (3,357) | 8% |

| Pensions Plans | (703) | (648) | 8% | (211) | (204) | 3% |

| Communications expenses | (588) | (632) | (7%) | (192) | (234) | (18%) |

| Allowance for the imp. of trade and other receivables | (1,270) | (4,583) | (72%) | (114) | (1,460) | (92%) |

| Supplies consumption | (1,640) | (2,289) | (28%) | (646) | (807) | (20%) |

| Leases and insurance | (349) | (307) | 14% | (123) | (101) | 21% |

| Security service | (436) | (371) | 18% | (167) | (136) | 23% |

| Fees and remuneration for services | (7,307) | (7,317) | (0%) | (2,512) | (2,565) | (2%) |

| Amortization of assets by right of use | (469) | (293) | 60% | (167) | (85) | 96% |

| Public relations and marketing | (9) | (23) | (61%) | (4) | (3) | 7% |

| Advertising and sponsorship | (5) | (12) | (58%) | (3) | (2) | 31% |

| Reimbursements to personnel | (1) | (1) | na | (1) | 0 | na |

| Depreciation of property, plant and equipment | (6,177) | (6,754) | (9%) | (2,050) | (2,268) | (10%) |

| Directors and Sup. Committee members’ fees | (25) | (32) | (22%) | (5) | (8) | (33%) |

| ENRE penalties | (1,316) | (835) | 58% | (438) | (302) | 45% |

| Taxes and charges | (1,232) | (1,556) | (21%) | (482) | (546) | (12%) |

| Other | (19) | (11) | 73% | (1) | (4) | (66%) |

| Total | (32,190) | (36,408) | (12%) | (10,732) | (12,082) | (11%) |

Operating expenses decreased by 11%, reaching ARS 10,732 million in 3Q21, against ARS 12,082 million in 3Q20. This is mainly explained by a lower impairment of trade receivables in the amount of ARS 1,346 million as a result of a normalization of receivables compared to the ASPO in force during the same period of the previous year. In turn, there was a lower consumption of supplies in the amount of ARS 161 million, and a lower depreciation of property, plant and equipment in the amount of ARS 217 million.

Financial results

Financial results experienced a 33% increase in losses, reaching ARS 4,914 million in 3Q21, against losses for ARS 3,697 million in 3Q20. This difference is mainly due to higher interest accrued on the debt incurred with CAMMESA, which to date accumulates interest for ARS 11,890 million. These results were partially offset by changes in the fair value of financial assets in the amount of ARS 784 million and lower losses from exchange differences in the amount of ARS 777 million due to a lower devaluation of the peso in the quarter and lower debt in foreign currency.

Net Income

Net income decreased by ARS 771 million, recording losses for ARS 618 million in 3Q21, against a gain of ARS 153 million for the same period in 2020. This can be explained by the impact of the decrease in income from the sale of services and the increase in financial expenses. In addition, the cumulative fall as of September 2021 is not only explained with the previous metrics, but also as a consequence of the income tax that generated a loss of ARS 1,405 million due to the higher income tax charge registered in the current period due to the adjustment generated by the deferred liability of the property, plant and equipment, which implies bringing the liabilities to an average rate of between 25% and 27% to a rate of 35%, which meant an additional loss of $ 7,473 million.

In addition, there was a higher gain in the operating income, higher financial charges due to the deferral of the payment of obligations with the Wholesale Electricity Market and a higher result for exposure to changes in purchasing power (RECPAM).

| Edenor S.A – EARNINGS RELEASE 3Q21 | 7 | |

EBITDA

| In millon of Pesos | 9 Months | 3Q |

| in constant purchising power | 2021 | 2020 | Δ% | 2021 | 2020 | Δ% |

| Net operating income | (515) | 783 | (166%) | 1,279 | 1,024 | 25% |

| Depreciation of property, plant and equipment | 6,644 | 7,047 | (6%) | 2,217 | 2,354 | -6% |

| EBITDA | 6,129 | 7,830 | (22%) | 3,496 | 3,378 | 3% |

EBITDA has a 3% increase in 3Q21, however, in the first nine months of the year, it decreased 22%, compared to the same period of the previous year. The difference can be explained by a decrease in revenue from sales, which was offset by a decrease in operating costs, an improvement in energy losses, and recognized income under the Framework Agreement for investments and an increase in the tariff since May 1st, 2021.

There have been no EBITDA adjustments between the comparison periods.

Capital Expenditures

During the first 9 months of 2021, edenor´s capital expenditures totaled ARS 10,347 million, a decrease of 3% in real terms compared to the same period of the previous year, against ARS 10,722 million in the same period of the last year. Investments for the period were as follows:

| · | ARS 1,235 million in new connections; |

| · | ARS 3,799 million in grid enhancements; |

| · | ARS 2,816 million in maintenance; |

| · | ARS 109 million in legal requirements; |

| · | ARS 797 million in communications and telecontrol; |

| · | ARS 1,038 million in other investment projects |

The difference in investments during the first nine months of 2021, compared to the same period of 2020, is mainly due to the impact of the extraordinary activation of $1,385 million of the 500/220 Kw 800 MVA transformer bank at General Rodriguez transformer station registered in the second quarter of last year which affects our 9-month comparison. Without this activation, investments would have shown more favorable numbers compared to 2020.

Then, the most outstanding investment in the third quarter of this year was the construction of 0.6 km of high voltage network that allowed high voltage in José C. Paz substation.

| Edenor S.A – EARNINGS RELEASE 3Q21 | 8 | |

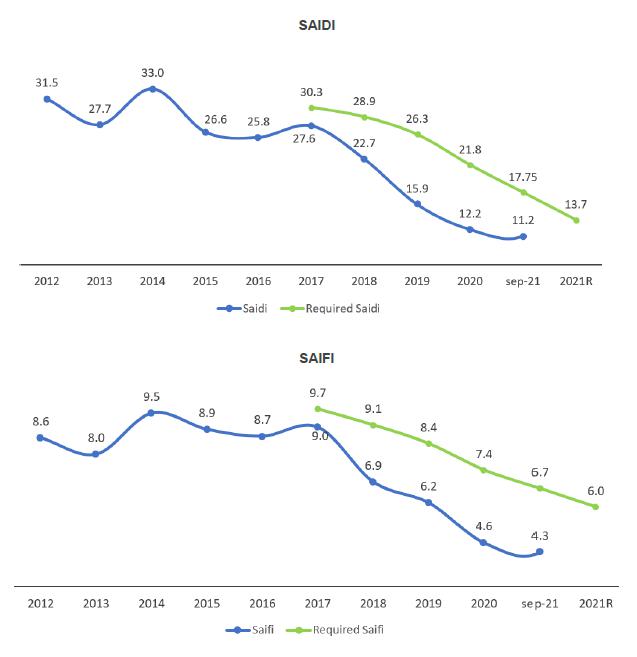

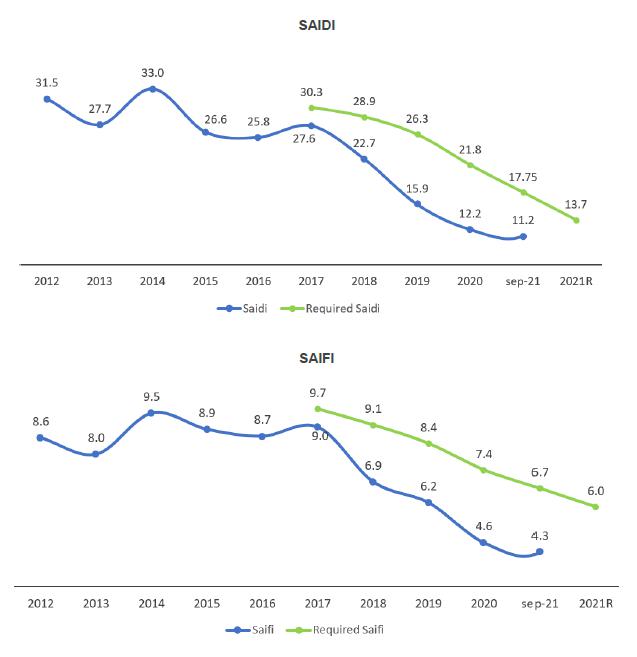

Service Quality Standards

The investment plan executed in recent years continues to show results that are reflected in a continuous improvement in the quality of service, by reducing the duration and frequency of outages since 2014, and thus exceeding the regulatory requirements set forth in the last comprehensive tariff review, and even exceeding this year the quality indicators required by the regulator for the end of the tariff period in February 2022.

Quality standards are measured based on the duration and frequency of service outages using SAIDI and SAIFI indicators. SAIDI refers to the duration of outages, and measures the number of outage hours a user experiences per year. SAIFI refers to the frequency of outages, and measures the number of times a user experiences an outage during a year.

At the closing of the third quarter of 2021, SAIDI and SAIFI indicators were 11.2 hours and 4.3 outages per year over the last 12 months, evidencing a 14% and 16% improvement, respectively, compared to the same period of the previous year. In turn, these indicators are 18% and 29% lower than target values required by the RTI for the end of 2021. This recovery in service levels is mainly due to the investment plan devised by the Company since 2014, the different improvements implemented in the operating processes, and the adoption of technology applied to the grid´s operation and management.

| Edenor S.A – EARNINGS RELEASE 3Q21 | 9 | |

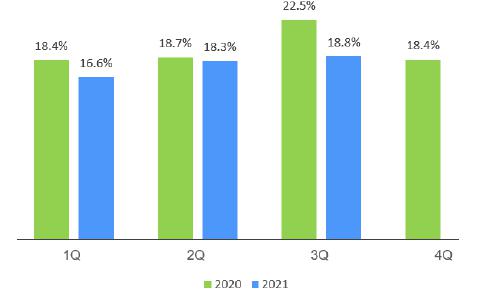

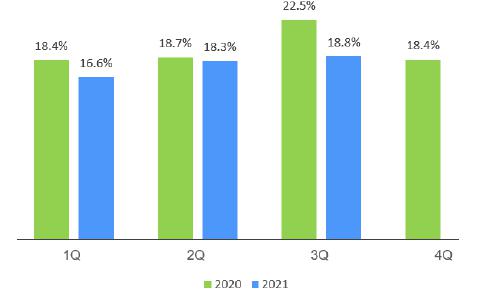

Energy Losses

In 3Q21, energy losses experienced a 19% decrease, against 23% for the same period of the previous year. Costs associated with these losses remained stable, experiencing a 53% decrease in real terms. This results in a ARS 1,390 million improvement in real terms.

The works of multidisciplinary teams to develop new solutions to energy losses continued, as well as Market Discipline (DIME) actions aiming to reduce them. Analytical and artificial intelligence tools were used to enhance effectiveness in the routing of inspections, and DIME actions continued with the objective of detecting and normalizing irregular connections, fraud and energy theft.

In addition, over the first nine months of 2021, 301,137 inspections of Tariff 1 (Residential users) were conducted with a 53% efficiency, while for the same period of the previous year 345,364 inspections were conducted with a 57 % efficiency. This means a 13% fall in inspections and a 4% fall in efficiency. Moreover, 34,958 Integrated Energy Meters (MIDE) were installed.

Regarding the recovery of energy, besides the normalization of customers with MIDE meters, clandestine customers with conventional meters were also put back to normal. Moreover, a new energy balance system was implemented, as well as the development of micro-balances in private neighborhoods. In all cases, a striking rate of recidivism in fraud has been observed.

Indebtedness

As of September 30, 2021, the outstanding principal of our dollar-denominated financial debt amounts to USD 98.1 million, whereas the cash position net of financial debt amounts to USD -80 million. Financial debt consists exclusively of Senior Notes maturing in 2022.

Sustainability

At Edenor we are committed to the sustainable development goals. Specifically, we made concrete and measurable contributions in 5 of these objectives: Good health and well being, quality education, affordable and clean energy, responsible consumption, production and partnerships to achieve the goals.

| Edenor S.A – EARNINGS RELEASE 3Q21 | 10 | |

Social Pillar: We made donations during the Covid 19 pandemic to improve the vaccination, testing and scientific processes. Furthermore, we installed more than 150,000 MIDE meters so that families without regular income can access to electricity, we work together with employees to collaborate with people in our counseling area and we are committed to help students at primary school and college to improve their experience about energy.

Environmental Pillar: Edenor is working with its consumers for them to install an electricity generation system for self-consumption and with eventual injection of surpluses to the grid. Also, Edenor acquired its first 100% electric vehicle for its operations and installed 1,900 smart meters that enable the company and customers to know in real time, 24 hours a day, the electricity consumption, credit balances, partial and total values of the electricity supply, among others.

Governance Pillar: All employees, members of the Board of Directors and members of the Supervisory Committee adhere to the code of ethics and Edenor has implemented a policy for facilitating the reporting of alleged irregularities.

| Edenor S.A – EARNINGS RELEASE 3Q21 | 11 | |

About Edenor

Empresa Distribuidora y Comercializadora Norte S.A. (edenor) is the largest electricity distribution company in Argentina in terms of number of customers and electricity sold (in GWh). Through a concession, edenor distributes electricity exclusively to the northwestern zone of the greater Buenos Aires metropolitan area and the northern part of the City of Buenos Aires, which has a population of approximately 9 million people and an area of 4,637 sq. km. In 2020, edenor sold 20,179 GWh of energy and purchased 25,124 GWh (including wheeling system demands), with revenue from sales in the amount of ARS 125 billion adjusted by inflation as of September 2021. In turn, the company had negative net results in the amount of ARS 24 billion.

Disclaimer

This press release may contain forward-looking statements. These statements are not historical facts, and are based on management’s current view and estimates of future economic circumstances, industry conditions, Company performance and financial results. The words “anticipates”, “believes”, “estimates”, “expects”, “plans” and similar expressions, as they relate to the Company, are intended to identify forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties, including those identified in the documents filed by the Company with the U.S. Securities and Exchange Commission. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

Edenor S.A.

Avenida del Libertador 6363, Piso 4º

(C1428ARG) Buenos Aires, Argentina

Tel: 5411.4346.5511

investor@edenor.com

www.edenor.com

| Edenor S.A – EARNINGS RELEASE 3Q21 | 12 | |

Condensed Interim Statements of Financial Position

as of September 30, 2021 and December 31, 2020

Values expressed on a constant currency basis

In million of Argentine Pesos

in constant purchising power | 09.30.2021 | | 12.31.2020 | | | 09.30.2021 | | 12.31.2020 |

| AR$ | AR$ | | AR$ | AR$ |

| | | | | | | | | |

| ASSETS | | | | | EQUITY | | | |

| | | | | | | | | |

| Non-current assets | | | | | Share capital | 875 | | 875 |

| Property, plant and equipment | 175,069 | | 171,082 | | Adjustment to share capital | 50,190 | | 50,182 |

| Interest in joint ventures | 8 | | 15 | | Additional paid-in capital | 695 | | 690 |

| Deferred tax asset | 393 | | 384 | | Treasury stock | 31 | | 31 |

| Other receivables | 13 | | 58 | | Adjustment to treasury stock | 1,074 | | 1,082 |

| Financial assets at amortized cost | - | | 328 | | Adquisition cost of own shares | (4,181) | | (4,181) |

| Total non-current assets | 175,483 | | 171,867 | | Legal reserve | 3,535 | | 3,535 |

| | | | | | Opcional reserve | 34,229 | | 58,467 |

| Current assets | | | | | Other comprehensive loss | (299) | | (299) |

| Inventories | 2,790 | | 2,563 | | Accumulated losses | (13,341) | | (24,238) |

| Other receivables | 399 | | 854 | | TOTAL EQUITY | 72,808 | | 86,144 |

| Trade receivables | 20,083 | | 19,381 | | | | | |

| Financial assets at fair value through profit or loss | 8,882 | | 3,043 | | LIABILITIES | | | |

| Financial assets at amortized cost | 322 | | 107 | | Non-current liabilities | | | |

| Cash and cash equivalents | 8,769 | | 5,975 | | | | | |

| Total current assets | 41,245 | | 31,923 | | Trade payables | 627 | | 714 |

| | | | | | Other payables | 8,696 | | 8,608 |

| | | | | | Borrowings | 9,676 | | 11,315 |

| TOTAL ASSETS | 216,728 | | 203,790 | | Deferred revenue | 1,698 | | 2,015 |

| | | | | | Salaries and social security payable | 454 | | 416 |

| | | | | | Benefit plans | 1,215 | | 1,026 |

| | | | | | Deferred tax liability | 44,814 | | 32,472 |

| | | | | | Tax liabilities | - | | - |

| | | | | | Provisions | 3,500 | | 3,329 |

| | | | | | Total non-current liabilities | 70,680 | | 59,895 |

| | | | | | | | | |

| | | | | | Current liabilities | | | |

| | | | | | Trade payables | 60,730 | | 45,222 |

| | | | | | Other payables | 3,653 | | 4,107 |

| | | | | | Borrowings | 404 | | 196 |

| | | | | | Derivative financial instruments | 1 | | 1 |

| | | | | | Deferred revenue | 44 | | 50 |

| | | | | | Salaries and social security payable | 4,192 | | 5,115 |

| | | | | | Benefit plans | 84 | | 115 |

| | | | | | Tax payable | 1,518 | | - |

| | | | | | Tax liabilities | 2,092 | | 2,455 |

| | | | | | Provisions | 522 | | 490 |

| | | | | | Total current liabilities | 73,240 | | 57,751 |

| | | | | | TOTAL LIABILITIES | 143,920 | | 117,646 |

| | | | | | | | | |

| | | | | | TOTAL LIABILITIES AND EQUITY | 216,728 | | 203,790 |

| Edenor S.A – EARNINGS RELEASE 3Q21 | 13 | |

Condensed Interim Statements of Comprehensive Income

for the nine-month period ended on September 30, 2021 and 2020

Values expressed on a constant currency basis

In millon of Argentine Pesos

in constant purchising power | 09.30.2021 | | 09.30.2020 |

| AR$ | AR$ |

| | | | |

| Continuing operations | | | |

| Revenue | 80,802 | | 100,050 |

| Electric power purchases | (49,365) | | (63,331) |

| Subtotal | 31,437 | | 36,719 |

| Transmission and distribution expenses | (19,221) | | (20,500) |

| Gross loss | 12,216 | | 16,219 |

| Selling expenses | (7,824) | | (11,200) |

| Administrative expenses | (5,145) | | (4,708) |

| Other operating income | 3,396 | | 2,367 |

| Other operating expense | (3,158) | | (1,895) |

| Assets Impairment | - | | - |

| Operating Profit (Loss) | (515) | | 783 |

| Labilities regularization agreement | - | | - |

| Financial income | 26 | | 25 |

| Financial expenses | (16,903) | | (8,215) |

| Other financial expense | 1,570 | | (2,626) |

| Net financial expense | (15,307) | | (10,816) |

| RECPAM | 16,970 | | 9,110 |

| Profit (Loss) before taxes | 1,148 | | (923) |

| | | | |

| Income tax | (14,489) | | (1,868) |

| Profit (Loss) for the period | (13,341) | | (2,791) |

| | | | |

| Basic and diluted earnings Profit (Loss) per share: | | | |

| Basic and diluted earnings profit (loss) per share | (15.25) | | (3.19) |

| Edenor S.A – EARNINGS RELEASE 3Q21 | 14 | |

Condensed Interim Statements of Comprehensive Income

for the nine-month period ended on September 30, 2021 and 2020

Values expressed at historical values

In millon of Argentine Pesos

at histórical values | | 09.30.2021 | | 09.30.2020 |

| AR$ | AR$ |

| | | | | |

| Continuing operations | | | | |

| Revenue | | 71,477 | | 60,254 |

| Electric power purchases | | (43,632) | | (38,108) |

| Subtotal | | 27,845 | | 22,147 |

| Transmission and distribution expenses | | (13,194) | | (9,479) |

| Gross loss | | 14,651 | | 12,668 |

| Selling expenses | | (6,190) | | (6,382) |

| Administrative expenses | | (4,134) | | (2,488) |

| Other operating expense, net | | (1,010) | | 339 |

| Operating Profit (Loss) | | 3,317 | | 4,137 |

| Labilities regularization agreement | | 1,347 | | - |

| Financial income | | 21 | | 15 |

| Financial expenses | | (15,178) | | (5,140) |

| Other financial expense | | 1,657 | | (1,417) |

| Net financial expense | | (13,501) | | (6,542) |

| | | | | |

| RECPAM | | - | | - |

| Profit (Loss) before taxes | | (8,836) | | (2,405) |

| | | | | |

| Income tax | | (1,344) | | (919) |

| Profit (Loss) for the period | | (10,180) | | (3,324) |

| | | | | |

| Basic and diluted earnings Profit (Loss) per share: | | | | |

| Basic and diluted earnings Profit (Loss) per share | | (11.63) | | (3.80) |

| Edenor S.A – EARNINGS RELEASE 3Q21 | 15 | |

Condensed Interim Statements of Cash Flows

for the nine-month period ended on September 30, 2021 and 2020

Values expressed on a constant currency basis

In millon of Argentine Pesos

in constant purchising power | | 03.31.2021 | | 03.31.2020 |

| AR$ | AR$ |

| | | | | |

| Cash flows from operating activities | | | | |

| Loss (Profit) for the period | | (13,341) | | (2,791) |

| Adjustments to reconcile net (loss) profit to net cash flows provided by operating activities: | | 21,825 | | 14,899 |

| | | | | |

| Changes in operating assets and liabilities: | | | | |

| Increase (Decrease) in trade receivables | | (5,529) | | (8,493) |

| Increase (Decrease) in trade payables | | (3,479) | | 7,257 |

| Income tax payment | | - | | (3,757) |

| Increase (Decrease) of Cammesa Commercial Financing | | 16,836 | | 19,371 |

| Others | | 958 | | (396) |

| | | | | |

| Net cash flows provided by operating activities | | 17,270 | | 26,090 |

| | | | | |

| Net cash flows used in investing activities | | (15,175) | | (11,371) |

| | | | | |

| Net cash flows used in financing activities | | (867) | | (7,830) |

| | | | | |

| Net (decrease) increase in cash and cash equivalents | | 1,228 | | 6,889 |

| | | | | |

| Cash and cash equivalents at beginning of year | | 5,975 | | 5,965 |

| Exchange differences in cash and cash equivalents | | 1,562 | | 712 |

| Result for exposure to inflation in cash and cash equivalents | | 4 | | 98 |

| Net Increase (Decrease) in cash and cash equivalents | | 1,228 | | 6,889 |

| Cash and cash equivalents at the end of period | | 8,769 | | 13,664 |

| | | | | |

| Supplemental cash flows information | | | | |

| Non-cash operating, investing and financing activities | | | | |

| Labilities regularization agreement | | | | - |

| Acquisitions of property, plant and equipment through increased trade payables | | (558) | | (931) |

| Acquisitions of assets for rights of use through an increase in other debts | | (477) | | (278) |

| Investor Relations Contacts: Germán Ranftl Chief Financial Officer Silvana Coria Investor Relations Manager |

investor@edenor.com | Tel: +54 (11) 4346-5511 |

| Edenor S.A – EARNINGS RELEASE 3Q21 | 16 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Empresa Distribuidora y Comercializadora Norte S.A. |

| | |

| | |

| By: | /s/ Germán Ranftl |

| Germán Ranftl |

| Chief Financial Officer |

Date: November 10, 2021