CMBS New Issue

Structural and Collateral Information

$3,834,224,000

(Approximate Offered Certificates)

$4,230,868,688

(Approximate Total Collateral Balance)

GE Commercial Mortgage Corporation

Commercial Mortgage Pass-Through Certificates

Series 2007-C1

GE Commercial Mortgage Corporation,

Series 2007-C1 Trust

as Issuing Entity

General Electric Capital Corporation

German American Capital Corporation

Bank of America, National Association

Barclays Capital Real Estate Inc.

as Sponsors and Mortgage Loan Sellers

| | | | | | | | | | | | | | | | | | |

| Class | | Initial

Certificate

Balance(1) | | | Initial

Pass-Through

Rate

(Approx.) | | | Ratings

(S&P/Moody’s)(2) | | Subordination

Levels | | | Weighted

Average

Life (yrs.)(3) | | Principal

Window(3) | | Assumed Final

Distribution

Date(4) |

A-1(6) | | $ | 68,000,000 | | | | %(5) | | AAA/Aaa | | 30.000 | %(7) | | 2.76 | | 1 - 57 | | January 10, 2012 |

A-2(6) | | $ | 491,000,000 | | | | %(5) | | AAA/Aaa | | 30.000 | %(7) | | 4.81 | | 57 - 60 | | April 10, 2012 |

A-3(6) | | $ | 187,000,000 | | | | %(5) | | AAA/Aaa | | 30.000 | %(7) | | 6.71 | | 81 - 83 | | March 10, 2014 |

A-AB(6) | | $ | 52,730,000 | | | | %(5) | | AAA/Aaa | | 30.000 | %(7) | | 6.90 | | 60 - 106 | | February 10, 2016 |

A-4FX(6) | | $ | 853,200,000 | | | | %(5) | | AAA/Aaa | | 30.000 | %(7) | | 9.67 | | 106 - 118 | | February 10, 2017 |

A-1A(6) | | $ | 1,309,678,000 | | | | %(5) | | AAA/Aaa | | 30.000 | %(7) | | 6.75 | | 1 - 118 | | February 10, 2017 |

X-P | | | TBD | (8) | | | %(8) | | AAA/Aaa | | N/A | | | N/A | | N/A | | N/A |

X-W | | | TBD | (8) | | | %(8) | | AAA/Aaa | | N/A | | | N/A | | N/A | | N/A |

A-MFX | | $ | 423,086,000 | | | | %(5) | | AAA/Aaa | | 20.000 | % | | 9.85 | | 118 - 120 | | April 10, 2017 |

A-JFX | | $ | 317,316,000 | | | | %(5) | | AAA/Aaa | | 12.500 | % | | 9.96 | | 120 - 120 | | April 10, 2017 |

B | | $ | 37,020,000 | | | | %(5) | | AA+/Aa1 | | 11.625 | % | | 9.96 | | 120 - 120 | | April 10, 2017 |

C | | $ | 52,886,000 | | | | %(5) | | AA/Aa2 | | 10.375 | % | | 9.96 | | 120 - 120 | | April 10, 2017 |

D | | $ | 42,308,000 | | | | %(5) | | AA–/Aa3 | | 9.375 | % | | 9.96 | | 120 - 120 | | April 10, 2017 |

(Footnotes to table begin on page 3)

| | |

Banc of America Securities LLC Co-Lead and Joint Bookrunning Manager | | Deutsche Bank Securities Co-Lead and Joint Bookrunning Manager |

| | | | |

| | | Barclays Capital Co-Lead Manager | | |

Bear, Stearns & Co. Inc. Co-Manager | | | | Citigroup Co-Manager |

April 11, 2007

The Depositor has filed a registration statement (including a prospectus) (SEC File no. 333-130174) with the SEC for the new offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in that registration statement and other documents the Depositor has filed with the SEC for more complete information about the Depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Depositor or any underwriter, or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling 1-800-294-1322 or by email to the following address: dg.prospectus_distribution@bofasecurites.com.

$3,834,224,000 (Approximate)

GE Commercial Mortgage Corporation

Commercial Mortgage Pass-Through Certificates

Series 2007-C1

Transaction Features

| | | | | | | | |

| Mortgage Loan Sellers | | No. of

Loans | | Cut-off Date

Balance | | % of Pool | |

German American Capital Corporation | | 37 | | $ | 1,821,312,239 | | 43.05 | % |

Bank of America, National Association | | 54 | | | 956,905,960 | | 22.62 | |

General Electric Capital Corporation | | 70 | | | 768,689,941 | | 18.17 | |

Barclays Capital Real Estate Inc. | | 41 | | | 683,960,548 | | 16.17 | |

Total: | | 202 | | $ | 4,230,868,688 | | 100.00 | % |

| | · | | Average Cut-off Date balance: $20,944,894. |

| | · | | Largest mortgage loan or cross-collateralized group by Cut-off Date balance: $249,000,000. |

| | · | | Five largest and ten largest loans or cross-collateralized groups: 25.58% and 45.89% of pool (Cut-off Date balance), respectively. |

| | · | | Weighted average Underwritten DSCR of 1.34x. |

| | · | | Weighted average Cut-off Date LTV ratio of 73.97%. |

| | · | | Weighted average Balloon LTV ratio of 71.55% (excluding fully amortizing mortgage loans). |

| | · | | Weighted average Mortgage Loan Interest Rate of 5.828%. |

| | · | | Weighted average Remaining Term to Maturity of 99 months. |

| | · | | Number of Groups of Cross-Collateralized and Cross-Defaulted Mortgage Loans is four. |

| Ø | | Call Protection (as applicable): |

| | · | | 61.93% of the pool (Cut-off Date balance) has a lockout period ranging from 24 to 41 payments from origination, then defeasance. |

| | · | | 30.07% of the pool (Cut-off Date balance) has a lockout period ranging from 11 to 60 payments from origination, then yield maintenance. |

| | · | | 4.37% of the pool (Cut-off Date balance) has a lockout period ranging from 11 to 23 payments from origination, then yield maintenance, then yield maintenance or defeasance. |

| | · | | 2.25% of the pool (Cut-off Date balance) has a lockout period of 24 payments from origination, then yield maintenance or defeasance. |

| | · | | 0.57% of the pool (Cut-off Date balance) has no lockout period and is immediately prepayable with yield maintenance from origination, then yield maintenance or defeasance. |

| | · | | 0.46% of the pool (Cut-off Date balance) has a lockout period ranging from 26 to 27 payments from origination, then defeasance, then yield maintenance or defeasance. |

| | · | | 0.20% of the pool (Cut-off Date balance) has a lockout period of 26 payments from origination, then defeasance, then a 1% prepayment penalty or defeasance. |

| | · | | 0.15% of the pool (Cut-off Date balance) has a lockout period of 27 payments from origination, then defeasance, then yield maintenance. |

| Ø | | Bond Information: Cash flows are expected to be modeled by TREPP and INTEX and are expected to be available on BLOOMBERG. |

The Depositor has filed a registration statement (including a prospectus) (SEC File no. 333-130174) with the SEC for the new offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in that registration statement and other documents the Depositor has filed with the SEC for more complete information about the Depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Depositor or any underwriter, or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling 1-800-294-1322 or by email to the following address: dg.prospectus_distribution@bofasecurites.com.

2

$3,834,224,000 (Approximate)

GE Commercial Mortgage Corporation

Commercial Mortgage Pass-Through Certificates

Series 2007-C1

Offered Certificates

| | | | | | | | | | | | | | | | | | |

| Class | | Initial Certificate

Balance or

Notional Amount(1) | | | Subordination

Levels | | | Ratings

(S&P/Moody’s)(2) | | Weighted

Average

Life (yrs.)(3) | | Principal

Window(3) | | Assumed Final

Distribution Date(4) | | Initial

Pass-Through

Rate (Approx.) | |

A-1(6) | | $ | 68,000,000 | | | 30.000 | %(7) | | AAA/Aaa | | 2.76 | | 1 - 57 | | January 10, 2012 | | % | (5) |

A-2(6) | | $ | 491,000,000 | | | 30.000 | %(7) | | AAA/Aaa | | 4.81 | | 57 - 60 | | April 10, 2012 | | % | (5) |

A-3(6) | | $ | 187,000,000 | | | 30.000 | %(7) | | AAA/Aaa | | 6.71 | | 81 - 83 | | March 10, 2014 | | % | (5) |

A-AB(6) | | $ | 52,730,000 | | | 30.000 | %(7) | | AAA/Aaa | | 6.90 | | 60 - 106 | | February 10, 2016 | | % | (5) |

A-4FX(6) | | $ | 853,200,000 | | | 30.000 | %(7) | | AAA/Aaa | | 9.67 | | 106 - 118 | | February 10, 2017 | | % | (5) |

A-1A(6) | | $ | 1,309,678,000 | | | 30.000 | %(7) | | AAA/Aaa | | 6.75 | | 1 - 118 | | February 10, 2017 | | % | (5) |

X-P | | | TBD | (8) | | N/A | | | AAA/Aaa | | N/A | | N/A | | N/A | | % | (8) |

X-W | | | TBD | (8) | | N/A | | | AAA/Aaa | | N/A | | N/A | | N/A | | % | (8) |

A-MFX | | $ | 423,086,000 | | | 20.000 | % | | AAA/Aaa | | 9.85 | | 118 - 120 | | April 10, 2017 | | % | (5) |

A-JFX | | $ | 317,316,000 | | | 12.500 | % | | AAA/Aaa | | 9.96 | | 120 - 120 | | April 10, 2017 | | % | (5) |

B | | $ | 37,020,000 | | | 11.625 | % | | AA+/Aa1 | | 9.96 | | 120 - 120 | | April 10, 2017 | | % | (5) |

C | | $ | 52,886,000 | | | 10.375 | % | | AA/Aa2 | | 9.96 | | 120 - 120 | | April 10, 2017 | | % | (5) |

D | | $ | 42,308,000 | | | 9.375 | % | | AA-/Aa3 | | 9.96 | | 120 - 120 | | April 10, 2017 | | % | (5) |

Private Certificates(9)

| | | | | | | | | | | | | | | | | | |

| Class | | Initial Certificate

Balance or

Notional Amount(1) | | | Subordination

Levels | | | Ratings

(S&P/Moody’s)(2) | | Weighted

Average

Life (yrs.)(3) | | Principal

Window(3) | | Assumed Final

Distribution Date(4) | | Initial

Pass-Through

Rate (Approx.) | |

A-4FL(6) | | | TBD | (11) | | TBD | (7) | | AAA/Aaa(10) | | N/A | | TBD | | TBD | | % | (12) |

X-C | | | TBD | (13) | | N/A | | | AAA/Aaa | | N/A | | N/A | | N/A | | % | (13) |

A-MFL | | | TBD | (11) | | TBD | | | AAA/Aaa(10) | | N/A | | TBD | | TBD | | % | (12) |

A-JFL | | | TBD | (11) | | TBD | | | AAA/Aaa(10) | | N/A | | TBD | | TBD | | % | (12) |

E | | $ | 31,732,000 | | | 8.625 | % | | A+/A1 | | 9.96 | | 120 - 120 | | April 10, 2017 | | % | (5) |

F | | $ | 31,731,000 | | | 7.875 | % | | A/A2 | | 9.96 | | 120 - 120 | | April 10, 2017 | | % | (5) |

G | | $ | 42,309,000 | | | 6.875 | % | | A-/A3 | | 9.96 | | 120 - 120 | | April 10, 2017 | | % | (5) |

H | | $ | 52,886,000 | | | 5.625 | % | | BBB+/Baa1 | | 9.96 | | 120 - 120 | | April 10, 2017 | | % | (5) |

J | | $ | 42,309,000 | | | 4.625 | % | | BBB/Baa2 | | 9.96 | | 120 - 120 | | April 10, 2017 | | % | (5) |

K | | $ | 58,174,000 | | | 3.250 | % | | BBB-/Baa3 | | 10.02 | | 120 - 121 | | May 10, 2017 | | % | (5) |

L | | $ | 15,866,000 | | | 2.875 | % | | BB+/Ba1 | | 10.04 | | 121 - 121 | | May 10, 2017 | | % | (5) |

M | | $ | 15,865,000 | | | 2.500 | % | | BB/Ba2 | | 11.08 | | 121 - 152 | | December 10, 2019 | | % | (5) |

N | | $ | 10,578,000 | | | 2.250 | % | | BB-/Ba3 | | 12.62 | | 152 - 152 | | December 10, 2019 | | % | (5) |

O | | $ | 10,577,000 | | | 2.000 | % | | B+/B1 | | 12.62 | | 152 - 152 | | December 10, 2019 | | % | (5) |

P | | $ | 10,577,000 | | | 1.750 | % | | B/B2 | | 12.62 | | 152 - 152 | | December 10, 2019 | | % | (5) |

Q | | $ | 15,866,000 | | | 1.375 | % | | B-/B3 | | 12.62 | | 152 - 152 | | December 10, 2019 | | % | (5) |

T | | $ | 58,174,687 | | | 0.000 | % | | Not Rated | | 12.62 | | 152 - 152 | | December 10, 2019 | | % | (5) |

(1) | | Approximate, subject to a permitted variance of plus or minus 5%. |

(2) | | Ratings shown are those of Standard and Poor’s Ratings Services, a division of The Mc-Graw Hill Companies and Moody’s Investors Service, Inc. |

(3) | | The weighted average life and period during which distributions of principal would be received set forth in the foregoing table with respect to each class of certificates is based on the assumptions set forth under “Yield and Maturity Considerations—Weighted Average Life” in the prospectus supplement and on the assumptions that there are no prepayments (other than on each anticipated prepayment date, if any) or losses on the mortgage loans and that there are no extensions of maturity dates of mortgage loans. The weighted average life has been rounded to the second decimal place. |

(4) | | The assumed final distribution dates set forth in the prospectus supplement have been determined on the basis of the assumptions described in “Description of the Certificates—Assumed Final Distribution Date; Rated Final Distribution Date” in the prospectus supplement and on the assumptions that there are no prepayments (other than on each anticipated prepayment date, if any) or losses on the mortgage loans and that there are no extensions of maturity dates of mortgage loans. The rated final distribution date for each class of certificates is the distribution date in December 2049. See “Description of the Certificates—Assumed Final Distribution Date; Rated Final Distribution Date” in the prospectus supplement. |

(5) | | The Class A-1, A-2, A-3, A-AB, A-4FX, A-1A, A-MFX, A-JFX, B, C, D, E, F, G, H, J, K, L, M, N, O, P, Q and T certificates will each accrue interest at either: (i) a fixed rate, (ii) a fixed rate subject to a cap at the weighted average of the net mortgage interest rates of the mortgage loans, (iii) a rate equal to the weighted average of the net mortgage interest rates of the mortgage loans less a specified percentage or (iv) a rate equal to the weighted average of the net mortgage interest rates of the mortgage loans. |

(6) | | For purposes of making distributions to the Class A-1, A-2, A-3, A-AB, A-4FX and A-1A certificates and the Class A-4FL regular interest, the pool of mortgage loans will be deemed to consist of two distinct Loan Groups, Loan Group 1 and Loan Group 2. Loan Group 1 will consist of 140 mortgage loans, representing approximately 69.04% of the aggregate principal balance of the pool of mortgage loans as of the Cut-off Date. Loan Group 2 will consist of 62 mortgage loans, representing approximately 30.96% of the aggregate principal balance of the pool of mortgage loans as of the Cut-off Date. Loan Group 2 will include 97.31% of the aggregate principal balance of all the mortgage loans secured by multifamily properties and approximately 97.00% of the mortgage loans secured by manufactured housing properties as of the Cut-off Date. |

The Depositor has filed a registration statement (including a prospectus) (SEC File no. 333-130174) with the SEC for the new offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in that registration statement and other documents the Depositor has filed with the SEC for more complete information about the Depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Depositor or any underwriter, or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling 1-800-294-1322 or by email to the following address: dg.prospectus_distribution@bofasecurites.com.

3

$3,834,224,000 (Approximate)

GE Commercial Mortgage Corporation

Commercial Mortgage Pass-Through Certificates

Series 2007-C1

So long as funds are sufficient on any distribution date to make distributions of all interest on such distribution date to the A-1, A-2, A-3, A-AB, A-4FX, A-1A, X-C, X-P and X-W certificates and the Class A-4FL regular interest , interest distributions on the Class A-1, A-2, A-3, A-AB and A-4FX certificates and the Class A-4FL regular interest will be based upon amounts available relating to mortgage loans in Loan Group 1 and interest distributions on the Class A-1A certificates will be based upon amounts available relating to mortgage loans in Loan Group 2. In addition, generally, the Class A-1, A-2, A-3, A-AB and Class A-4FX certificates and the Class A-4FL regular interest will be entitled to receive distributions of principal collected or advanced in respect of mortgage loans in Loan Group 1 and, after the certificate principal balance of the Class A-1A certificates has been reduced to zero, distributions of principal collected or advanced in respect of mortgage loans in Loan Group 2. The Class A-1A certificates will be entitled to receive distributions of principal collected or advanced in respect of mortgage loans in Loan Group 2 and, after the certificate principal balances of the Class A-4FX certificates and the Class A-4FL regular interest have been reduced to zero, distributions of principal collected or advanced in respect of mortgage loans in Loan Group 1. However, on and after any distribution date on which the certificate principal balances of the Class A-MFX and A-JFX certificates (and the Class A-MFL and A-JFL regular interests) through Class T certificates have been reduced to zero, distributions of principal collected or advanced in respect of the pool of mortgage loans will be distributed to the Class A-1, A-2, A-3, A-AB, A-4FX and A-1A certificates and the Class A-4FL regular interest,pro rata.

(7) | | Represents the approximate credit support for the Class A-1, A-2, A-3, A-AB, A-4FX and A-1A certificates and the Class A-4FL regular interest in the aggregate. |

(8) | | The aggregate amount of interest accrued on the Class X-P and X-W certificates will generally be equal to [ ]% of interest accrued on the stated principal balance of the mortgage loans at the excess, if any, of (1) the weighted average of the net mortgage interest rates of the mortgage loans determined without regard to any reductions in the interest rate resulting from modification of the mortgage loans (in each case converted to a rate expressed on the basis of a 360-day year consisting of twelve 30-day months), over (2) the weighted average of the pass-through rates of the other certificates (other than the residual certificates) as described in the prospectus supplement. The pass-through rate on the Class X-P and X-W certificates will be based on the weighted average of the interest strip rates of the components of the Class X-P or X-W certificates, as applicable, which will be based on the net mortgage rates applicable to the mortgage loans as of the preceding distribution date minus the pass-through rates of such components. See “Description of the Certificates—Distributions” in the prospectus supplement. |

(9) | | Certificates to be offered privately pursuant to Rule 144A and Regulation S. |

(10) | | Ratings shown for the Class A-4FL, A-MFL and A-JFL certificates only reflect the receipt of a fixed per annum rate of interest equal to [ ]%, [ ]% and [ ]%, respectively. See “Ratings” in the prospectus supplement. |

(11) | | The certificate balance of the Class A-4FL certificates will be equal to the balance of the Class A-4FL regular interest, the certificate balance of the Class A-MFL certificates will be equal to the balance of the Class A-MFL regular interest and the certificate balance of the Class A-JFL certificates will be equal to the balance of the Class A-JFL regular interest. |

(12) | | The Class A-4FL regular interest, Class A-MFL regular interest and the Class A-JFL regular interest will each accrue interest at either: (i) a fixed rate or (ii) a fixed rate subject to a cap at the weighted average net mortgage rate. The pass-through rate applicable to the Class A-4FL, A-MFL and A-JFL certificates on each distribution date will be a per annum rate equal to one-month LIBOR plus [ ]%, one-month LIBOR plus [ ]% and one-month LIBOR plus [ ]%, respectively. In addition, under certain circumstances described in the prospectus supplement, the pass-through rates applicable to each of the Class A-4FL, A-MFL and/or A-JFL certificates may convert so as to accrue interest at either: (i) a fixed rate or (ii) a fixed rate subject to a cap at the weighted average net mortgage rate. The initial LIBOR will be determined on April [ ], 2007, and subsequent LIBOR rates will determined two LIBOR business days before the start of the related interest accrual period. |

(13) | | The aggregate amount of interest accrued on the Class X-C certificates will generally be equal to [ ]% of interest accrued on the stated principal balance of the mortgage loans at the excess, if any, of (1) the weighted average of the net mortgage interest rates of the mortgage loans determined without regard to any reductions in the interest rate resulting from modification of the mortgage loans (in each case converted to a rate expressed on the basis of a 360-day year consisting of twelve 30-day months), over (2) the weighted average of the pass-through rates of the other certificates (other than the residual certificates) as described in the prospectus supplement. The pass-through rate on the Class X-C certificates will be based on the weighted average of the interest strip rates of the components of the Class X-C certificates, which will be based on the net mortgage rates applicable to the mortgage loans as of the preceding distribution date minus the pass-through rates of such components. See “Description of the Certificates—Distributions” in the prospectus supplement. |

The Depositor has filed a registration statement (including a prospectus) (SEC File no. 333-130174) with the SEC for the new offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in that registration statement and other documents the Depositor has filed with the SEC for more complete information about the Depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Depositor or any underwriter, or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling 1-800-294-1322 or by email to the following address: dg.prospectus_distribution@bofasecurites.com.

4

$3,834,224,000 (Approximate)

GE Commercial Mortgage Corporation

Commercial Mortgage Pass-Through Certificates

Series 2007-C1

| | |

| Issue Type: | | Public: Classes A-1, A-2, A-3, A-AB, A-4FX, A-1A, X-P, X-W, A-MFX, A-JFX, B, C and D (the “Offered Certificates”). |

| |

| | Private (Rule 144A, Regulation S): Classes A-4FL, X-C, A-JFL, A-MFL, E, F, G, H, J, K, L, M, N, O, P, Q and T. |

| |

| Securities Offered: | | $3,834,224,000 monthly pay, multi-class, sequential pay commercial mortgage REMIC Pass- Through Certificates, consisting of 13 principal and interest classes (Classes A-1, A-2, A-3, A-AB, A-4FX, A-1A, X-P, X-W, A-MFX, A-JFX, B, C and D). |

| |

| Mortgage Pool: | | The mortgage pool consists of 202 mortgage loans with an aggregate balance as of the Cut-off Date of $4,230,868,688. The mortgage loans are secured by 291 properties located throughout 41 states and Puerto Rico. The mortgage pool will be deemed to consist of 2 loan groups (“Loan Group 1” and “Loan Group 2”). Loan Group 1 will consist of (i) all of the mortgage loans that are not secured by mortgaged properties that are multifamily properties and/or manufactured housing properties and (ii) two mortgage loans that are secured by two mortgaged properties that are multifamily properties or manufactured housing properties. Loan Group 1 is expected to consist of 140 mortgage loans, with an aggregate balance as of the Cut-off Date of $2,921,189,971. Loan Group 2 will consist of 39 mortgage loans that are secured by 76 mortgaged properties that are multifamily properties and 23 mortgage loans that are secured by 31 mortgaged properties that are manufactured housing properties. Loan Group 2 is expected to consist of 62 mortgage loans, with an aggregate balance as of the Cut-off Date of $1,309,678,717. |

| |

| Depositor: | | GE Commercial Mortgage Corporation. |

| |

| Issuing Entity: | | GE Commercial Mortgage Corporation, Series 2007-C1 Trust. |

| |

| Sellers: | | General Electric Capital Corporation (“GECC”); German American Capital Corporation (“GACC”); Bank of America, National Association (“BofA”) and Barclays Capital Real Estate Inc. (“BCRE”). Each of the Sellers will also be a Sponsor. |

| |

| Co-Bookrunning Managers: | | Banc of America Securities LLC and Deutsche Bank Securities Inc. |

| |

| Co-Lead Managers: | | Banc of America Securities LLC, Deutsche Bank Securities Inc. and Barclays Capital Inc. |

| |

| Master Servicer: | | KeyCorp Real Estate Capital Markets, Inc. with respect to all mortgage loans other than the 666 Fifth Avenue Loan for which the Master Servicer will be Bank of America, National Association. |

| |

| Special Servicer: | | LNR Partners, Inc. |

| |

| Trustee: | | Wells Fargo Bank, N.A. |

| |

| Cut-off Date: | | With respect to each mortgage loan, the later of April 1, 2007 (or, with respect to Loan Numbers 1 and 16, April 5, 2007) or the origination date of such mortgage loan. |

| |

| Expected Closing Date: | | April 26, 2007 |

| |

| Distribution Dates: | | The 10th day of each month or, if such 10th day is not a business day, the business day immediately following such 10th day, beginning in May 2007. |

| |

| Minimum Denominations: | | The Offered Certificates will be issued in book-entry format in denominations of: (i) in the case of the Class A-1, A-2, A-3, A-AB, A-4FX, A-1A, A-MFX and Class A-JFX Certificates, $10,000 actual principal amount and in any whole dollar denomination in excess thereof; (ii) in the case of the Class B, Class C and Class D Certificates, $25,000 actual principal amount and in any whole dollar denomination in excess thereof; and (iii) in the case of the Class X-P and Class X-W Certificates, $1,000,000 notional amount and in any whole dollar denomination in excess thereof. Investments in excess of the minimum denominations may be made in multiples of $1. |

| |

| Settlement Terms: | | DTC, Euroclear and Clearstream, same day funds, with accrued interest. |

| |

| ERISA / SMMEA Status: | | The Offered Certificates are expected to be ERISA eligible. No Class of Certificates is SMMEA eligible. |

| |

| Rating Agencies: | | The Offered Certificates will be rated by Standard & Poor’s Ratings Services, a Division of the McGraw-Hill Companies, Inc. (“S&P”) and Moody’s Investors Service, Inc. (“Moody’s”). |

| |

| Risk Factors: | | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE PROSPECTUS SUPPLEMENT AND THE “RISK FACTORS” SECTION OF THE PROSPECTUS. |

The Depositor has filed a registration statement (including a prospectus) (SEC File no. 333-130174) with the SEC for the new offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in that registration statement and other documents the Depositor has filed with the SEC for more complete information about the Depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Depositor or any underwriter, or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling 1-800-294-1322 or by email to the following address: dg.prospectus_distribution@bofasecurites.com.

5

$3,834,224,000 (Approximate)

GE Commercial Mortgage Corporation

Commercial Mortgage Pass-Through Certificates

Series 2007-C1

| | | | | | | | | | | | | | |

| Property Type | | Number of

Mortgaged

Properties | | Aggregate

Cut-off Date

Balance | | % of

Initial Pool

Balance | | | Weighted

Average

Underwritten

DSCR | | Weighted

Average

Cut-off Date

LTV Ratio | | Weighted

Average

Mortgage

Rate |

Office | | 48 | | $ | 1,412,637,843 | | 33.39 | % | | 1.33x | | 72.27% | | 5.827% |

Multifamily | | 109 | | | 1,346,523,701 | | 31.83 | | | 1.35x | | 75.71% | | 5.886% |

Multifamily | | 77 | | | 1,151,427,798 | | 27.21 | | | 1.36x | | 75.81% | | 5.909% |

Manufactured Housing | | 32 | | | 195,095,903 | | 4.61 | | | 1.28x | | 75.08% | | 5.749% |

Retail | | 49 | | | 720,639,629 | | 17.03 | | | 1.28x | | 75.57% | | 5.728% |

Hotel | | 19 | | | 377,999,938 | | 8.93 | | | 1.43x | | 71.43% | | 5.908% |

Industrial | | 47 | | | 245,453,767 | | 5.80 | | | 1.44x | | 74.70% | | 5.789% |

Self Storage | | 10 | | | 53,504,000 | | 1.26 | | | 1.30x | | 77.09% | | 5.807% |

Mixed Use | | 7 | | | 49,913,000 | | 1.18 | | | 1.61x | | 60.02% | | 5.478% |

Special Purpose | | 1 | | | 22,704,179 | | 0.54 | | | 1.30x | | 84.45% | | 5.509% |

Other | | 1 | | | 1,492,631 | | 0.04 | | | 1.26x | | 59.12% | | 5.945% |

| | | | | | | | | | | | | | |

| Total/Weighted Average: | | 291 | | $ | 4,230,868,688 | | 100.00 | % | | 1.34x | | 73.97% | | 5.828% |

| | | | | | | | | | | | | | |

The Depositor has filed a registration statement (including a prospectus) (SEC File no. 333-130174) with the SEC for the new offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in that registration statement and other documents the Depositor has filed with the SEC for more complete information about the Depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Depositor or any underwriter, or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling 1-800-294-1322 or by email to the following address: dg.prospectus_distribution@bofasecurites.com.

6

$3,834,224,000 (Approximate)

GE Commercial Mortgage Corporation

Commercial Mortgage Pass-Through Certificates

Series 2007-C1

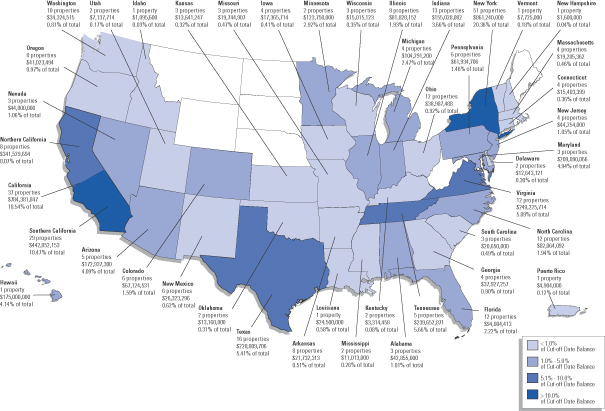

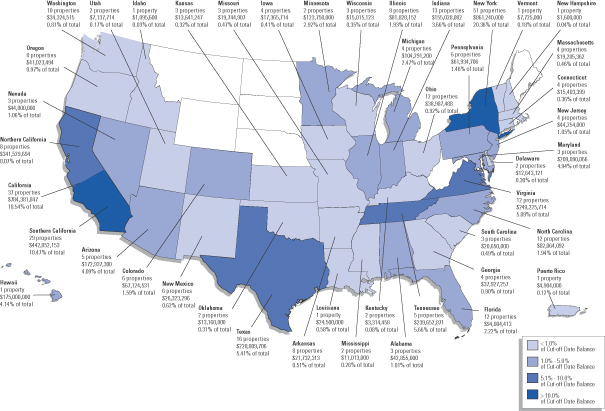

GEOGRAPHIC DISTRIBUTION

| | | | | | | | | | | | | | | | |

| Location | | Number of

Mortgaged

Properties | | Aggregate

Cut-off Date

Balance | | % of Initial

Pool Balance | | | Weighted

Average

Underwritten

DSCR | | Weighted

Average

Cut-off Date

LTV Ratio | | | Weighted

Average

Mortgage

Rate | |

New York | | 51 | | $ | 861,240,000 | | 20.36 | % | | 1.30x | | 73.15 | % | | 6.126 | % |

California | | 37 | | | 784,381,847 | | 18.54 | | | 1.28x | | 70.25 | % | | 5.669 | % |

Virginia | | 12 | | | 249,225,714 | | 5.89 | | | 1.26x | | 77.53 | % | | 5.723 | % |

Tennessee | | 5 | | | 239,652,871 | | 5.66 | | | 1.24x | | 79.01 | % | | 5.646 | % |

Texas | | 16 | | | 228,809,706 | | 5.41 | | | 1.22x | | 78.96 | % | | 5.740 | % |

Maryland | | 3 | | | 209,090,066 | | 4.94 | | | 2.02x | | 69.97 | % | | 6.118 | % |

Hawaii | | 1 | | | 175,000,000 | | 4.14 | | | 1.47x | | 70.83 | % | | 5.712 | % |

Arizona | | 5 | | | 172,937,300 | | 4.09 | | | 1.35x | | 81.28 | % | | 5.517 | % |

Indiana | | 13 | | | 155,028,082 | | 3.66 | | | 1.25x | | 72.43 | % | | 5.858 | % |

Minnesota | | 2 | | | 123,750,000 | | 2.92 | | | 1.40x | | 76.58 | % | | 5.830 | % |

Other | | 146 | | | 1,031,753,101 | | 24.39 | | | 1.35x | | 74.38 | % | | 5.794 | % |

| | | | | | | | | | | | | | | | |

Total/Weighted Average: | | 291 | | $ | 4,230,868,688 | | 100.00 | % | | 1.34x | | 73.97 | % | | 5.828 | % |

| | | | | | | | | | | | | | | | |

Note: The Mortgaged Properties are located throughout 41 states and Puerto Rico.

The Depositor has filed a registration statement (including a prospectus) (SEC File no. 333-130174) with the SEC for the new offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in that registration statement and other documents the Depositor has filed with the SEC for more complete information about the Depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Depositor or any underwriter, or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling 1-800-294-1322 or by email to the following address: dg.prospectus_distribution@bofasecurites.com.

7

$3,834,224,000 (Approximate)

GE Commercial Mortgage Corporation

Commercial Mortgage Pass-Through Certificates

Series 2007-C1

AMORTIZATION TYPES

| | | | | | | | | | | | | |

| | | Number

of Mortgage Loans | | Aggregate

Cut-off Date

Balance | | % of

Initial

Pool

Balance | | | % of

Loan Group 1

Balance | | | % of

Loan Group 2

Balance | |

Interest Only(1) | | 71 | | $2,839,495,000 | | 67.11 | % | | 61.17 | % | | 80.36 | % |

IO, Balloon(2) | | 83 | | 1,075,067,755 | | 25.41 | | | 29.18 | | | 17.00 | |

5 Months IO Loans | | 1 | | 6,403,399 | | 0.15 | | | 0.22 | | | 0.00 | |

12 Months IO Loans | | 5 | | 61,471,488 | | 1.45 | | | 2.10 | | | 0.00 | |

13 Months IO Loans | | 1 | | 7,725,000 | | 0.18 | | | 0.26 | | | 0.00 | |

24 Months IO Loans | | 12 | | 278,706,000 | | 6.59 | | | 8.80 | | | 1.64 | |

36 Months IO Loans(3) | | 19 | | 187,436,808 | | 4.43 | | | 4.78 | | | 3.65 | |

48 Months IO Loans | | 8 | | 36,984,621 | | 0.87 | | | 1.27 | | | 0.00 | |

60 Months IO Loans | | 32 | | 325,283,200 | | 7.69 | | | 6.56 | | | 10.20 | |

61 Months IO Loans | | 1 | | 7,200,000 | | 0.17 | | | 0.25 | | | 0.00 | |

72 Months IO Loans | | 3 | | 43,910,000 | | 1.04 | | | 0.83 | | | 1.51 | |

105 Months IO Loans(4) | | 1 | | 119,947,239 | | 2.84 | | | 4.11 | | | 0.00 | |

Balloon(5) | | 44 | | 302,278,277 | | 7.14 | | | 9.64 | | | 1.57 | |

Fully Amortizing | | 4 | | 14,027,655 | | 0.33 | | | 0.00 | | | 1.07 | |

| | | | | | | | | | | | | |

Total: | | 202 | | $4,230,868,688 | | 100.00 | % | | 100.00 | % | | 100.00 | % |

| | | | | | | | | | | | | |

(1) | Includes seven mortgage loans, representing 10.63% of the Initial Pool Balance (five mortgage loans representing 1.54% of the Group 1 Balance and two mortgage loans representing 30.92% of the Group 2 Balance), with respect to which there will be an initial interest deposit. |

(2) | Includes two mortgage loans, representing 0.35% of the Initial Pool Balance (0.51% of the Group 1 Balance), with respect to which there will be an initial interest deposit. |

(3) | Includes one mortgage loan, identified as Loan No. 165 on Annex A-1 to the prospectus supplement, that is amortizing for the first 72 months, interest-only for the next 36 months and amortizing for the last 12 months of the loan term. |

(4) | Includes one mortgage loan, identified as Loan No. 10 on Annex A-1 to the prospectus supplement, which amortizes based on a fixed amortization schedule (included in the accompanying prospectus supplement) for the first 48 months and is followed by a 105 month interest only period. |

(5) | Includes two mortgage loans, representing 0.28% of the Initial Pool Balance (0.41% of the Group 1 Balance), with respect to which there will be an initial interest deposit. |

The Depositor has filed a registration statement (including a prospectus) (SEC File no. 333-130174) with the SEC for the new offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in that registration statement and other documents the Depositor has filed with the SEC for more complete information about the Depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Depositor or any underwriter, or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling 1-800-294-1322 or by email to the following address: dg.prospectus_distribution@bofasecurites.com.

8

$3,834,224,000 (Approximate)

GE Commercial Mortgage Corporation

Commercial Mortgage Pass-Through Certificates

Series 2007-C1

| II. | Full Collateral Characteristics |

Cut-off Date Balance

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | % of Pool | |

$ 1,382,813 – $ 4,999,999 | | 65 | | $ | 232,693,940 | | 5.50 | % |

$ 5,000,000 – $ 9,999,999 | | 59 | | | 421,564,064 | | 9.96 | |

$10,000,000 – $ 14,999,999 | | 29 | | | 352,080,934 | | 8.32 | |

$15,000,000 – $ 19,999,999 | | 13 | | | 218,927,510 | | 5.17 | |

$20,000,000 – $ 24,999,999 | | 8 | | | 177,250,000 | | 4.19 | |

$25,000,000 – $ 29,999,999 | | 4 | | | 111,250,000 | | 2.63 | |

$30,000,000 – $ 34,999,999 | | 3 | | | 93,000,000 | | 2.20 | |

$35,000,000 – $ 39,999,999 | | 1 | | | 38,500,000 | | 0.91 | |

$40,000,000 – $ 44,999,999 | | 2 | | | 84,900,000 | | 2.01 | |

$45,000,000 – $ 54,999,999 | | 1 | | | 54,070,000 | | 1.28 | |

$55,000,000 – $249,000,000 | | 17 | | | 2,446,632,239 | | 57.83 | |

Total: | | 202 | | $ | 4,230,868,688 | | 100.00 | % |

Min: $1,382,813 Max: $249,000,000 Avg: $20,944,894 | |

Location

| | | | | | | | |

| | | No. of

Mortgaged

Properties | | Aggregate

Cut-off Date

Balance | | % of

Pool | |

New York | | 51 | | $ | 861,240,000 | | 20.36 | % |

California | | 37 | | | 784,381,847 | | 18.54 | |

Southern Cal | | 29 | | | 442,852,153 | | 10.47 | |

Northern Cal | | 8 | | | 341,529,694 | | 8.07 | |

Virginia | | 12 | | | 249,225,714 | | 5.89 | |

Tennessee | | 5 | | | 239,652,871 | | 5.66 | |

Texas | | 16 | | | 228,809,706 | | 5.41 | |

Maryland | | 3 | | | 209,090,066 | | 4.94 | |

Other(a) | | 167 | | | 1,658,468,484 | | 39.20 | |

Total: | | 291 | | $ | 4,230,868,688 | | 100.00 | % |

(a) | Includes 35 states and Puerto Rico. |

Property Type

| | | | | | | | |

| | | No. of

Mortgaged

Properties | | Aggregate

Cut-off Date

Balance | | % of

Pool | |

Office | | 48 | | $ | 1,412,637,843 | | 33.39 | % |

Multifamily | | 109 | | | 1,346,523,701 | | 31.83 | |

Multifamily | | 77 | | | 1,151,427,798 | | 27.21 | |

Manufactured Housing | | 32 | | | 195,095,903 | | 4.61 | |

Retail | | 49 | | | 720,639,629 | | 17.03 | |

Hotel | | 19 | | | 377,999,938 | | 8.93 | |

Industrial | | 47 | | | 245,453,767 | | 5.80 | |

Self Storage | | 10 | | | 53,504,000 | | 1.26 | |

Mixed Use | | 7 | | | 49,913,000 | | 1.18 | |

Special Purpose | | 1 | | | 22,704,179 | | 0.54 | |

Other | | 1 | | | 1,492,631 | | 0.04 | |

Total: | | 291 | | $ | 4,230,868,688 | | 100.00 | % |

Mortgage Rate

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance | | % of

Pool | |

5.185% – 5.399% | | 8 | | $ | 124,647,655 | | 2.95 | % |

5.400% – 5.799% | | 94 | | | 2,235,270,942 | | 52.83 | |

5.800% – 5.999% | | 66 | | | 631,551,895 | | 14.93 | |

6.000% – 6.968% | | 34 | | | 1,239,398,195 | | 29.29 | |

Total: | | 202 | | $ | 4,230,868,688 | | 100.00 | % |

| Min: 5.185% Max: 6.968% Wtd. Avg: 5.828% | |

Original Term to Stated Maturity (months)

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance | | % of

Pool | |

36 – 60 | | 35 | | $ | 902,678,967 | | 21.34 | % |

61 – 85 | | 4 | | | 590,985,988 | | 13.97 | |

86 – 120 | | 152 | | | 2,539,098,095 | | 60.01 | |

121 – 153 | | 11 | | | 198,105,638 | | 4.68 | |

Total: | | 202 | | $ | 4,230,868,688 | | 100.00 | % |

Min: 36 Max: 153 Wtd. Avg: 101 | |

Remaining Term to Stated Maturity (months)

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance | | % of

Pool | |

34 – 60 | | 35 | | $ | 902,678,967 | | 21.34 | % |

61 – 85 | | 4 | | | 590,985,988 | | 13.97 | |

86 – 120 | | 153 | | | 2,545,501,494 | | 60.16 | |

121 – 152 | | 10 | | | 191,702,239 | | 4.53 | |

Total: | | 202 | | $ | 4,230,868,688 | | 100.00 | % |

Min: 34 Max: 152 Wtd. Avg: 99 | |

Loans with Reserve Requirements(a)

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance | | % of

Pool | |

Taxes | | 156 | | $ | 2,934,789,700 | | 69.37 | % |

Insurance | | 125 | | $ | 2,425,381,548 | | 57.33 | % |

Replacement | | 134 | | $ | 2,084,401,362 | | 49.27 | % |

Other(b) | | 64 | | $ | 1,588,764,631 | | 37.55 | % |

TI/LC(c) | | 48 | | $ | 918,636,689 | | 40.89 | % |

Engineering | | 52 | | $ | 856,195,801 | | 20.24 | % |

LOC | | 9 | | $ | 112,470,986 | | 2.66 | % |

(a) | Includes upfront or on-going reserves. |

(b) | Generally consists of tenant reserves and holdbacks. |

(c) | Percentage based only on portion of pool secured by retail, office, industrial and mixed use properties. |

Cut-off Date Loan-to-Value Ratio

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance | | % of Pool | |

25.17% – 44.99% | | 8 | | $ | 30,606,981 | | 0.72 | % |

45.00% – 49.99% | | 1 | | | 15,000,000 | | 0.35 | |

50.00% – 54.99% | | 4 | | | 185,803,800 | | 4.39 | |

55.00% – 59.99% | | 6 | | | 64,719,524 | | 1.53 | |

60.00% – 64.99% | | 14 | | | 347,258,300 | | 8.21 | |

65.00% – 69.99% | | 19 | | | 170,529,387 | | 4.03 | |

70.00% – 74.99% | | 46 | | | 988,125,226 | | 23.36 | |

75.00% – 79.99% | | 67 | | | 1,415,637,471 | | 33.46 | |

80.00% – 84.45% | | 37 | | | 1,013,188,000 | | 23.95 | |

Total: | | 202 | | $ | 4,230,868,688 | | 100.00 | % |

| Min: 25.17% Max: 84.45% Wtd. Avg: 73.97% | |

Loan-to-Value Ratio at Maturity

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance | | % of Pool | |

Fully Amortizing | | 4 | | $ | 14,027,655 | | 0.33 | % |

21.39% – 44.99% | | 5 | | | 22,579,325 | | 0.53 | |

45.00% – 49.99% | | 6 | | | 96,110,618 | | 2.27 | |

50.00% – 54.99% | | 9 | | | 241,398,709 | | 5.71 | |

55.00% – 59.99% | | 12 | | | 132,999,649 | | 3.14 | |

60.00% – 64.99% | | 35 | | | 547,314,092 | | 12.94 | |

65.00% – 69.99% | | 28 | | | 230,478,659 | | 5.45 | |

70.00% – 74.99% | | 51 | | | 1,123,560,980 | | 26.56 | |

75.00% – 79.99% | | 35 | | | 1,089,865,000 | | 25.76 | |

80.00% – 84.45% | | 17 | | | 732,534,000 | | 17.31 | |

Total: | | 202 | | $ | 4,230,868,688 | | 100.00 | % |

| Min: 21.39%(a) Max: 84.45% Wtd. Avg: 71.55%(a) | |

(a) | Excludes fully amortizing mortgage loans. |

Debt Service Coverage Ratios

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance | | % of Pool | |

1.00x – 1.19x | | 41 | | $ | 1,013,493,131 | | 23.95 | % |

1.20x – 1.24x | | 47 | | | 762,172,173 | | 18.01 | |

1.25x – 1.29x | | 23 | | | 427,410,631 | | 10.10 | |

1.30x – 1.34x | | 24 | | | 288,925,217 | | 6.83 | |

1.35x – 1.39x | | 17 | | | 197,430,871 | | 4.67 | |

1.40x – 1.44x | | 9 | | | 425,307,664 | | 10.05 | |

1.45x – 1.49x | | 12 | | | 542,960,000 | | 12.83 | |

1.50x – 1.54x | | 3 | | | 21,350,000 | | 0.50 | |

1.55x – 1.59x | | 3 | | | 19,291,232 | | 0.46 | |

1.60x – 1.64x | | 6 | | | 198,730,711 | | 4.70 | |

1.65x – 1.69x | | 2 | | | 21,100,000 | | 0.50 | |

1.70x – 3.19x | | 15 | | | 312,697,058 | | 7.39 | |

Total: | | 202 | | $ | 4,230,868,688 | | 100.00 | % |

Min: 1.00x Max: 3.19x Wtd. Avg: 1.34x | |

All numerical information concerning the mortgage loans is approximate. All weighted average information regarding the mortgage loans reflects the weighting of the mortgage loans based on their outstanding principal balances as of the Cut-off Date. Location and Property Type tables reflect allocated loan amounts in the case of mortgage loans secured by multiple properties. Sum of columns may not match “Total” due to rounding. With respect to any split mortgage loan, unless otherwise specified, the calculations used for LTV ratios and DSCR include the relatedpari passu loan (if any) but exclude the related subordinated loan or component (if any). In addition, in the case of certain mortgage loans, the DSCR and/or LTV ratio was calculated taking into account a holdback amount, letter of credit and/or sponsor guarantee or was calculated based on assumptions regarding the future financial performance of the related mortgaged property on a stabilized basis. For information regarding additional adjustments to the calculations see “Description of the Mortgage Pool—Adjustments to DSCR and/or LTV Ratio.”

The Depositor has filed a registration statement (including a prospectus) (SEC File no. 333-130174) with the SEC for the new offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in that registration statement and other documents the Depositor has filed with the SEC for more complete information about the Depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Depositor or any underwriter, or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling 1-800-294-1322 or by email to the following address: dg.prospectus_distribution@bofasecurites.com.

9

$3,834,224,000 (Approximate)

GE Commercial Mortgage Corporation

Commercial Mortgage Pass-Through Certificates

Series 2007-C1

| III. | Loan Group 1 Characteristics |

Cut-off Date Balance

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance | | % of

Group 1 | |

$ 1,382,813 – $ 4,999,999 | | 49 | | $ | 176,124,474 | | 6.03 | % |

$ 5,000,000 – $ 9,999,999 | | 43 | | | 311,277,323 | | 10.66 | |

$10,000,000 – $ 14,999,999 | | 15 | | | 178,515,934 | | 6.11 | |

$15,000,000 – $ 19,999,999 | | 8 | | | 134,110,000 | | 4.59 | |

$20,000,000 – $ 24,999,999 | | 4 | | | 87,800,000 | | 3.01 | |

$25,000,000 – $ 29,999,999 | | 4 | | | 111,250,000 | | 3.81 | |

$30,000,000 – $ 34,999,999 | | 3 | | | 93,000,000 | | 3.18 | |

$40,000,000 – $ 44,999,999 | | 1 | | | 44,500,000 | | 1.52 | |

$55,000,000 – $ 249,000,000 | | 13 | | | 1,784,612,239 | | 61.09 | |

Total: | | 140 | | | $2,921,189,971 | | 100.00% | |

Min: $1,382,813 Max: $249,000,000 Avg: $20,865,643 | |

Location

| | | | | | | | |

| | | No. of

Mortgaged

Properties | | Aggregate

Cut-off Date

Balance | | % of

Group 1 | |

California | | 25 | | $ | 501,592,847 | | 17.17 | % |

Southern Cal | | 22 | | | 332,258,153 | | 11.37 | |

Northern Cal | | 3 | | | 169,334,694 | | 5.80 | |

New York | | 13 | | | 445,840,000 | | 15.26 | |

Virginia | | 12 | | | 249,225,714 | | 8.53 | |

Tennessee | | 4 | | | 234,112,871 | | 8.01 | |

Hawaii | | 1 | | | 175,000,000 | | 5.99 | |

Arizona | | 5 | | | 172,937,300 | | 5.92 | |

Texas | | 12 | | | 169,522,196 | | 5.80 | |

Other(a) | | 112 | | | 972,959,043 | | 33.31 | |

Total: | | 184 | | $ | 2,921,189,971 | | 100.00 | % |

(a) | Includes 32 states and Puerto Rico. |

Property Type

| | | | | | | | |

| | | No. of

Mortgaged

Properties | | Aggregate

Cut-off Date

Balance | | % of

Group 1 | |

Office | | 48 | | $ | 1,412,637,843 | | 48.36 | % |

Retail | | 49 | | | 720,639,629 | | 24.67 | |

Hotel | | 19 | | | 377,999,938 | | 12.94 | |

Industrial | | 47 | | | 245,453,767 | | 8.40 | |

Self Storage | | 10 | | | 53,504,000 | | 1.83 | |

Mixed Use | | 7 | | | 49,913,000 | | 1.71 | |

Multifamily | | 2 | | | 36,844,984 | | 1.26 | |

Multifamily | | 1 | | | 31,000,000 | | 1.06 | |

Manufactured Housing | | 1 | | | 5,844,984 | | 0.20 | |

Special Purpose | | 1 | | | 22,704,179 | | 0.78 | |

Other | | 1 | | | 1,492,631 | | 0.05 | |

Total: | | 184 | | $ | 2,921,189,971 | | 100.00 | % |

Mortgage Rate

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance | | % of

Group 1 | |

5.185% – 5.399% | | 3 | | $ | 53,600,000 | | 1.83 | % |

5.400% – 5.799% | | 62 | | | 1,803,153,488 | | 61.73 | |

5.800% – 5.999% | | 52 | | | 517,356,797 | | 17.71 | |

6.000% – 6.968% | | 23 | | | 547,079,685 | | 18.73 | |

Total: | | 140 | | | $2,921,189,971 | | 100.00% | |

Min: 5.185% Max: 6.968% Avg: 5.801% | |

Original Term to Stated Maturity (months)

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance | | % of

Group 1 | |

36 – 60 | | 19 | | $ | 514,092,360 | | 17.60 | % |

61 – 85 | | 2 | | | 185,985,988 | | 6.37 | |

86 – 120 | | 108 | | | 2,023,005,985 | | 69.25 | |

121 – 153 | | 11 | | | 198,105,638 | | 6.78 | |

Total: | | 140 | | | $2,921,189,971 | | 100.00% | |

Min: 36 Max: 153 Avg: 108 | |

Remaining Term to Stated Maturity (months)

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance | | % of

Group 1 | |

34 – 60 | | 19 | | $ | 514,092,360 | | 17.60 | % |

61 – 85 | | 2 | | | 185,985,988 | | 6.37 | |

86 – 120 | | 109 | | | 2,029,409,384 | | 69.47 | |

121 – 152 | | 10 | | | 191,702,239 | | 6.56 | |

Total: | | 140 | | | $2,921,189,971 | | 100.00% | |

Min: 34 Max: 152 Avg: 107 | |

Loans with Reserve Requirements(a)

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance | | % of

Group 1 | |

Taxes | | 96 | | $ | 1,639,510,983 | | 56.12 | % |

Replacement | | 88 | | $ | 1,419,886,644 | | 48.61 | % |

Insurance | | 76 | | $ | 1,253,186,831 | | 42.90 | % |

TI/LC(b) | | 48 | | $ | 918,636,689 | | 40.89 | % |

Other(c) | | 53 | | $ | 898,149,631 | | 30.75 | % |

Engineering | | 28 | | $ | 427,289,702 | | 14.63 | % |

LOC | | 8 | | $ | 95,670,986 | | 3.28 | % |

(a) | Includes upfront or on-going reserves. |

(b) | Percentage based only on portion of pool secured by retail, office, industrial and mixed use properties. |

(c) | Generally consists of tenant reserves and holdbacks. |

Cut-off Date Loan-to-Value Ratio

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance | | % of

Group 1 | |

25.17% – 44.99% | | 4 | | $ | 16,579,325 | | 0.57 | % |

45.00% – 49.99% | | 1 | | | 15,000,000 | | 0.51 | |

50.00% – 54.99% | | 4 | | | 185,803,800 | | 6.36 | |

55.00% – 59.99% | | 5 | | | 24,319,524 | | 0.83 | |

60.00% – 64.99% | | 12 | | | 336,849,121 | | 11.53 | |

65.00% – 69.99% | | 14 | | | 111,035,933 | | 3.80 | |

70.00% – 74.99% | | 37 | | | 662,436,797 | | 22.68 | |

75.00% – 79.99% | | 40 | | | 1,059,721,471 | | 36.28 | |

80.00% – 84.45% | | 23 | | | 509,444,000 | | 17.44 | |

Total: | | 140 | | | $2,921,189,971 | | 100.00% | |

Min: 25.17% Max: 84.45% Avg: 73.16% | |

Loan-to-Value Ratio at Maturity

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance | | % of

Group 1 | |

21.39% – 44.99% | | 5 | | $ | 22,579,325 | | 0.77 | % |

45.00% – 49.99% | | 6 | | | 96,110,618 | | 3.29 | |

50.00% – 54.99% | | 8 | | | 235,089,530 | | 8.05 | |

55.00% – 59.99% | | 11 | | | 92,599,649 | | 3.17 | |

60.00% – 64.99% | | 32 | | | 533,165,327 | | 18.25 | |

65.00% – 69.99% | | 22 | | | 156,615,542 | | 5.36 | |

70.00% – 74.99% | | 27 | | | 662,529,980 | | 22.68 | |

75.00% – 79.99% | | 18 | | | 832,550,000 | | 28.50 | |

80.00% – 84.45% | | 11 | | | 289,950,000 | | 9.93 | |

Total: | | 140 | | | $2,921,189,971 | | 100.00% | |

Min: 21.39% Max: 84.45% Avg: 69.93% | |

Debt Service Coverage Ratios

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance | | % of

Group 1 | |

1.00x – 1.19x | | 24 | | $ | 514,289,014 | | 17.61 | % |

1.20x – 1.24x | | 34 | | | 652,429,540 | | 22.33 | |

1.25x – 1.29x | | 15 | | | 351,470,631 | | 12.03 | |

1.30x – 1.34x | | 19 | | | 234,634,905 | | 8.03 | |

1.35x – 1.39x | | 11 | | | 134,097,335 | | 4.59 | |

1.40x – 1.44x | | 6 | | | 184,807,664 | | 6.33 | |

1.45x – 1.49x | | 8 | | | 500,060,000 | | 17.12 | |

1.50x – 1.54x | | 3 | | | 21,350,000 | | 0.73 | |

1.55x – 1.59x | | 2 | | | 16,985,988 | | 0.58 | |

1.60x – 1.64x | | 5 | | | 193,482,602 | | 6.62 | |

1.65x – 1.69x | | 2 | | | 21,100,000 | | 0.72 | |

1.70x – 3.19x | | 11 | | | 96,482,292 | | 3.30 | |

Total: | | 140 | | | $2,921,189,971 | | 100.00% | |

Min: 1.00x Max: 3.19x Avg: 1.34x | |

All numerical information concerning the mortgage loans is approximate. All weighted average information regarding the mortgage loans reflects the weighting of the mortgage loans based on their outstanding principal balances as of the Cut-off Date. Location and Property Type tables reflect allocated loan amounts in the case of mortgage loans secured by multiple properties. Sum of columns may not match “Total” due to rounding. With respect to any split mortgage loan, unless otherwise specified, the calculations used for LTV ratios and DSCR include the relatedpari passu loan (if any) but exclude the related subordinated loan or component (if any). In addition, in the case of certain mortgage loans, the DSCR and/or LTV ratio was calculated taking into account a holdback amount, letter of credit and/or sponsor guarantee or was calculated based on assumptions regarding the future financial performance of the related mortgaged property on a stabilized basis. For information regarding additional adjustments to the calculations see “Description of the Mortgage Pool—Adjustments to DSCR and/or LTV Ratio.”

The Depositor has filed a registration statement (including a prospectus) (SEC File no. 333-130174) with the SEC for the new offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in that registration statement and other documents the Depositor has filed with the SEC for more complete information about the Depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Depositor or any underwriter, or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling 1-800-294-1322 or by email to the following address: dg.prospectus_distribution@bofasecurites.com.

10

$3,834,224,000 (Approximate)

GE Commercial Mortgage Corporation

Commercial Mortgage Pass-Through Certificates

Series 2007-C1

| IV. | Loan Group 2 Characteristics |

Cut-off Date Balance

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance | | % of

Group 2 | |

$ 1,750,000–$ 4,999,999 | | 16 | | $ | 56,569,466 | | 4.32 | % |

$ 5,000,000–$ 9,999,999 | | 16 | | | 110,286,742 | | 8.42 | |

$10,000,000–$ 14,999,999 | | 14 | | | 173,565,000 | | 13.25 | |

$15,000,000–$ 19,999,999 | | 5 | | | 84,817,510 | | 6.48 | |

$20,000,000–$ 24,999,999 | | 4 | | | 89,450,000 | | 6.83 | |

$35,000,000–$ 39,999,999 | | 1 | | | 38,500,000 | | 2.94 | |

$40,000,000–$ 44,999,999 | | 1 | | | 40,400,000 | | 3.08 | |

$45,000,000–$ 54,999,999 | | 1 | | | 54,070,000 | | 4.13 | |

$55,000,000–$204,000,000 | | 4 | | | 662,020,000 | | 50.55 | |

| | |

Total: | | 62 | | $ | 1,309,678,717 | | 100.00 | % |

| | |

Min: $1,750,000 Max: $204,000,000 Avg: $21,123,850 | |

Location

| | | | | | | | |

| | | No. of

Mortgaged

Properties | | Aggregate

Cut-off Date

Balance | | % of

Group 2 | |

New York | | 38 | | $ | 415,400,000 | | 31.72 | % |

California | | 12 | | | 282,789,000 | | 21.59 | |

Northern Cal | | 5 | | | 172,195,000 | | 13.15 | |

Southern Cal | | 7 | | | 110,594,000 | | 8.44 | |

Maryland | | 1 | | | 200,000,000 | | 15.27 | |

Texas | | 4 | | | 59,287,510 | | 4.53 | |

Alabama | | 3 | | | 42,855,000 | | 3.27 | |

Florida | | 5 | | | 41,600,000 | | 3.18 | |

Ohio | | 11 | | | 34,816,000 | | 2.66 | |

Other(a) | | 33 | | | 232,931,207 | | 17.79 | |

| | |

Total: | | 107 | | $ | 1,309,678,717 | | 100.00 | % |

Property Type

| | | | | | | | |

| | | No. of

Mortgaged

Properties | | Aggregate

Cut-off Date

Balance | | % of

Group 2 | |

Multifamily | | 76 | | $ | 1,120,427,798 | | 85.55 | % |

Manufactured Housing | | 31 | | | 189,250,919 | | 14.45 | |

| | |

Total: | | 107 | | $ | 1,309,678,717 | | 100.00 | % |

Mortgage Rate

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance | | % of

Group 2 | |

5.350% – 5.399% | | 5 | | $ | 71,047,655 | | 5.42 | % |

5.400% – 5.799% | | 32 | | | 432,117,454 | | 32.99 | |

5.800% – 5.999% | | 14 | | | 114,195,098 | | 8.72 | |

6.000% – 6.730% | | 11 | | | 692,318,510 | | 52.86 | |

| | |

Total: | | 62 | | $ | 1,309,678,717 | | 100.00 | % |

| | |

| Min: 5.350% Max: 6.730% Wtd. Avg: 5.887% | |

Original Term to Stated Maturity (months)

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance | | % of

Group 2 | |

60 | | 16 | | $ | 388,586,608 | | 29.67 | % |

61 – 85 | | 2 | | | 405,000,000 | | 30.92 | |

86 – 120 | | 44 | | | 516,092,110 | | 39.41 | |

| | |

Total: | | 62 | | $ | 1,309,678,717 | | 100.00 | % |

| | |

Min: 60 Max: 120 Wtd. Avg: 84 | |

Remaining Term to Stated Maturity (months)

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance | | % of

Group 2 | |

56 – 60 | | 16 | | $ | 388,586,608 | | 29.67 | % |

61 – 85 | | 2 | | | 405,000,000 | | 30.92 | |

86 – 120 | | 44 | | | 516,092,110 | | 39.41 | |

| | |

Total: | | 62 | | $ | 1,309,678,717 | | 100.00 | % |

| | |

Min: 56 Max: 120 Wtd. Avg: 83 | |

Loans with Reserve Requirements(a)

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance | | % of

Group 2 | |

Taxes | | 60 | | $ | 1,295,278,717 | | 98.90 | % |

Insurance | | 49 | | $ | 1,172,194,717 | | 89.50 | % |

Other(b) | | 11 | | $ | 690,615,000 | | 52.73 | % |

Replacement | | 46 | | $ | 664,514,717 | | 50.74 | % |

Engineering | | 24 | | $ | 428,906,098 | | 32.75 | % |

LOC | | 1 | | $ | 16,800,000 | | 1.28 | % |

(a) | Includes upfront or on-going reserves. |

(b) | Generally consists of tenant reserves and holdbacks. |

Cut-off Date Loan-to-Value Ratio

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance | | % of

Group 2 | |

32.41% – 44.99% | | 4 | | $ | 14,027,655 | | 1.07 | % |

55.00% – 59.99% | | 1 | | | 40,400,000 | | 3.08 | |

60.00% – 64.99% | | 2 | | | 10,409,179 | | 0.79 | |

65.00% – 69.99% | | 5 | | | 59,493,454 | | 4.54 | |

70.00% – 74.99% | | 9 | | | 325,688,429 | | 24.87 | |

75.00% – 79.99% | | 27 | | | 355,916,000 | | 27.18 | |

80.00% – 82.29% | | 14 | | | 503,744,000 | | 38.46 | |

| | |

Total: | | 62 | | $ | 1,309,678,717 | | 100.00 | % |

| | |

| Min: 32.41% Max: 82.29% Wtd. Avg: 75.78% | |

Loan-to-Value Ratio at Maturity

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance | | % of

Group 2 | |

Fully Amortizing | | 4 | | $ | 14,027,655 | | 1.07 | % |

50.97% – 54.99% | | 1 | | | 6,309,179 | | 0.48 | |

55.00% – 59.99% | | 1 | | | 40,400,000 | | 3.08 | |

60.00% – 64.99% | | 3 | | | 14,148,765 | | 1.08 | |

65.00% – 69.99% | | 6 | | | 73,863,118 | | 5.64 | |

70.00% – 74.99% | | 24 | | | 461,031,000 | | 35.20 | |

75.00% – 79.99% | | 17 | | | 257,315,000 | | 19.65 | |

80.00% – 80.40% | | 6 | | | 442,584,000 | | 33.79 | |

| | |

Total: | | 62 | | $ | 1,309,678,717 | | 100.00 | % |

| | |

| Min: 50.97%(a) Max: 80.40% Wtd. Avg: 75.20%(a) | |

(a) | Excludes fully amortizing mortgage loans. |

Debt Service Coverage Ratios

| | | | | | | | |

| | | No. of

Mortgage

Loans | | Aggregate

Cut-off Date

Balance ($) | | % of

Group 2 | |

1.00x – 1.19x | | 17 | | $ | 499,204,118 | | 38.12 | % |

1.20x – 1.24x | | 13 | | | 109,742,633 | | 8.38 | |

1.25x – 1.29x | | 8 | | | 75,940,000 | | 5.80 | |

1.30x – 1.34x | | 5 | | | 54,290,312 | | 4.15 | |

1.35x – 1.39x | | 6 | | | 63,333,536 | | 4.84 | |

1.40x – 1.44x | | 3 | | | 240,500,000 | | 18.36 | |

1.45x – 1.49x | | 4 | | | 42,900,000 | | 3.28 | |

1.55x – 1.59x | | 1 | | | 2,305,244 | | 0.18 | |

1.60x – 1.64x | | 1 | | | 5,248,109 | | 0.40 | |

1.70x – 2.03x | | 4 | | | 216,214,767 | | 16.51 | |

| | |

Total: | | 62 | | $ | 1,309,678,717 | | 100.00 | % |

| | |

Min: 1.00x Max: 2.03x Wtd. Avg: 1.35x | |

All numerical information concerning the mortgage loans is approximate. All weighted average information regarding the mortgage loans reflects the weighting of the mortgage loans based on their outstanding principal balances as of the Cut-off Date. Location and Property Type tables reflect allocated loan amounts in the case of mortgage loans secured by multiple properties. Sum of columns may not match “Total” due to rounding. With respect to any split mortgage loan, unless otherwise specified, the calculations used for LTV ratios and DSCR include the relatedpari passu loan (if any) but exclude the related subordinated loan or component (if any). In addition, in the case of certain mortgage loans, the DSCR and/or LTV ratio was calculated taking into account a holdback amount, letter of credit and/or sponsor guarantee or was calculated based on assumptions regarding the future financial performance of the related mortgaged property on a stabilized basis. For information regarding additional adjustments to the calculations see “Description of the Mortgage Pool—Adjustments to DSCR and/or LTV Ratio.”

The Depositor has filed a registration statement (including a prospectus) (SEC File no. 333-130174) with the SEC for the new offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in that registration statement and other documents the Depositor has filed with the SEC for more complete information about the Depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Depositor or any underwriter, or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling 1-800-294-1322 or by email to the following address: dg.prospectus_distribution@bofasecurites.com.

11

$3,834,224,000 (Approximate)

GE Commercial Mortgage Corporation

Commercial Mortgage Pass-Through Certificates

Series 2007-C1

| V. | GROUP 1 FIVE YEAR LOANS |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loan

Number | | Property Name | | Mortgage

Loan

Seller | | Property

Type | | Aggregate

Cut-off Date

Balance | | % of

Initial

Pool

Balance | | | Amortization

Type | | No. of

Units/

SF/

Keys/

Pads | | Loan

Balance

per Unit

of Measure | | UW DSCR | | Cut-off

Date

LTV

Ratio | | | LTV

Ratio at

Maturity | | | Remaining

Interest

Only

Period | | Remaining

Term to

Maturity |

| 9 | | Pacific Shores | | BofA | | Office | | $ | 165,875,000 | | 3.92 | % | | Interest Only | | 1,224,326 | | $ | 271 | | 1.65x | | 54.98 | % | | 54.98 | % | | 57 | | 57 |

| 12 | | Galleria Officentre | | GECC | | Office | | | 89,600,000 | | 2.12 | | | IO, Balloon | | 1,003,716 | | $ | 89 | | 1.27x | | 80.00 | % | | 76.96 | % | | 24 | | 60 |

| 23 | | 1865 Burnett Street | | GACC | | Multifamily | | | 31,000,000 | | 0.73 | | | Interest Only | | 144 | | $ | 215,278 | | 1.20x | | 72.60 | % | | 72.60 | % | | 59 | | 59 |

| 26 | | Sealy NW Business Center | | GECC | | Industrial | | | 28,750,000 | | 0.68 | | | Interest Only | | 471,952 | | $ | 61 | | 1.46x | | 77.08 | % | | 77.08 | % | | 57 | | 57 |

| 27 | | 1604 Broadway | | GACC | | Retail | | | 27,000,000 | | 0.64 | | | IO, Balloon | | 29,875 | | $ | 904 | | 1.10x | | 75.00 | % | | 72.24 | % | | 36 | | 60 |

| 28 | | Wyndham Jacksonville Riverwalk Hotel | | BCRE | | Hotel | | | 26,000,000 | | 0.61 | | | IO, Balloon | | 322 | | $ | 80,745 | | 1.16x | | 72.63 | % | | 70.01 | % | | 21 | | 57 |

| 32 | | 7700 Leesburg Pike | | BofA | | Office | | | 22,600,000 | | 0.53 | | | Interest Only | | 147,231 | | $ | 154 | | 1.12x | | 79.86 | % | | 79.86 | % | | 59 | | 59 |

| 42 | | Media Center | | GACC | | Office | | | 17,100,000 | | 0.40 | | | Interest Only | | 73,162 | | $ | 234 | | 1.34x | | 79.53 | % | | 79.53 | % | | 60 | | 60 |

| 68 | | Albuquerque Portfolio | | GACC | | Office | | | 12,250,000 | | 0.29 | | | IO, Balloon | | 116,278 | | $ | 105 | | 1.10x | | 80.00 | % | | 77.99 | % | | 35 | | 59 |

| 69 | | Inverness Business Center North | | GACC | | Industrial | | | 12,000,000 | | 0.28 | | | Interest Only | | 155,227 | | $ | 77 | | 1.23x | | 77.42 | % | | 77.42 | % | | 59 | | 59 |

| 33 | | Springhill Suites—Burr Ridge | | BCRE | | Hotel | | | 11,840,000 | | 0.28 | | | IO, Balloon | | 128 | | $ | 87,891 | | 1.35x | | 79.51 | % | | 75.65 | % | | 9 | | 57 |

| 34 | | Springhill Suites—Elmhurst | | BCRE | | Hotel | | | 10,660,000 | | 0.25 | | | IO, Balloon | | 128 | | $ | 87,891 | | 1.35x | | 79.51 | % | | 75.65 | % | | 9 | | 57 |

| 79 | | Courtyard Chicago Glenview | | GECC | | Hotel | | | 10,500,000 | | 0.25 | | | IO, Balloon | | 149 | | $ | 70,470 | | 1.63x | | 65.63 | % | | 63.22 | % | | 21 | | 57 |

| 98 | | Hilton Village Shopping Center and Hilton Village Office Park | |

BofA | | Mixed Use | | | 8,600,000 | | 0.20 | | | Interest Only | | 96,546 | | $ | 89 | | 1.86x | | 36.60 | % | | 36.60 | % | | 58 | | 58 |

| 102 | | Hampton Inn West | | BofA | | Hotel | | | 7,882,557 | | 0.19 | | | Balloon | | 121 | | $ | 65,145 | | 1.39x | | 75.79 | % | | 70.94 | % | | 0 | | 58 |

| 127 | | Portland Fairview RV Resort | | GECC | | Manufactured

Housing | | | 5,844,984 | | 0.14 | | | Balloon | | 407 | | $ | 14,361 | | 1.28x | | 75.91 | % | | 70.96 | % | | 0 | | 59 |

| 132 | | Holiday Inn Select Wilmington-Brandywine | | BofA | | Hotel | | | 5,343,121 | | 0.13 | | | Balloon | | 189 | | $ | 28,270 | | 1.44x | | 61.42 | % | | 55.58 | % | | 0 | | 59 |

| 169 | | 2301 & 2321 East Del Amo Boulevard | | BofA | | Industrial | | | 3,946,698 | | 0.09 | | | Balloon | | 45,494 | | $ | 87 | | 1.21x | | 71.76 | % | | 67.17 | % | | 0 | | 59 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total/Weighted Average: | | | | | | $ | 496,792,360 | | 11.74 | % | | | | | | | | | 1.40x | | 68.81 | % | | 67.47 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| VI. | GROUP 1 SEVEN YEAR LOANS |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loan

Number | | Property Name | | Mortgage

Loan

Seller | | Property

Type | | Aggregate

Cut-off Date

Balance | | % of

Initial

Pool

Balance | | | Amortization

Type | | No. of

Keys | | Loan

Balance

per Unit

of Measure | | UW DSCR | | Cut-off

Date

LTV

Ratio | | | LTV

Ratio at

Maturity | | | Remaining

Interest

Only

Period | | Remaining

Term to

Maturity |

| 8 | | Four Seasons Resort Maui(1) | | GACC | | Hotel | | $ | 175,000,000 | | 4.14 | % | | Interest Only | | 380 | | $ | 1,118,421 | | 1.47x | | 70.83 | % | | 70.83 | % | | 81 | | 81 |

| 75 | | Holiday Inn Vail Apex | | BCRE | | Hotel | | | 10,985,988 | | 0.26 | | | Balloon | | 103 | | $ | 106,660 | | 1.59x | | 54.93 | % | | 47.15 | % | | 0 | | 83 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total/Weighted Average: | | | | | | $ | 185,985,988 | | 4.40 | % | | | | | | | | | 1.48x | | 69.89 | % | | 69.43 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) | The Four Seasons Resort Maui UW DSCR is based on projected occupancy and ADR figures. |

The Depositor has filed a registration statement (including a prospectus) (SEC File no. 333-130174) with the SEC for the new offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in that registration statement and other documents the Depositor has filed with the SEC for more complete information about the Depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Depositor or any underwriter, or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling 1-800-294-1322 or by email to the following address: dg.prospectus_distribution@bofasecurites.com.

12

$3,834,224,000 (Approximate)

GE Commercial Mortgage Corporation

Commercial Mortgage Pass-Through Certificates

Series 2007-C1

| VII. | Large Loan or Cross-Collateralized Group Description |

Ten Largest Loans or Cross-Collateralized Groups

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loan

Number | | Property Name | | Loan Seller | | City | | State | | Property

Type | | Cut-off Date

Balance | | % of

Pool | | | Loan

Group | | % of

Applicable

Initial Loan

Group | | | Number

of Units/

SF/Keys/

Spaces | | Units of

Measure | | Loan Balance

per Unit

of Measure | | UW

DSCR | | Cut-off

Date

LTV | | Balloon

LTV |

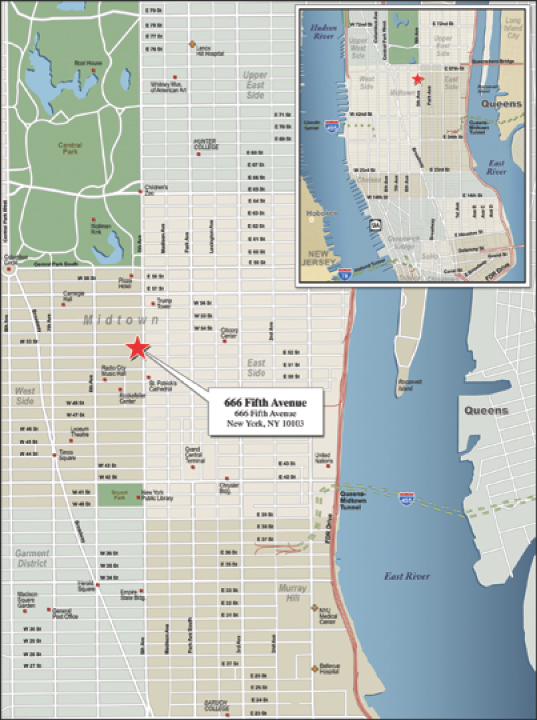

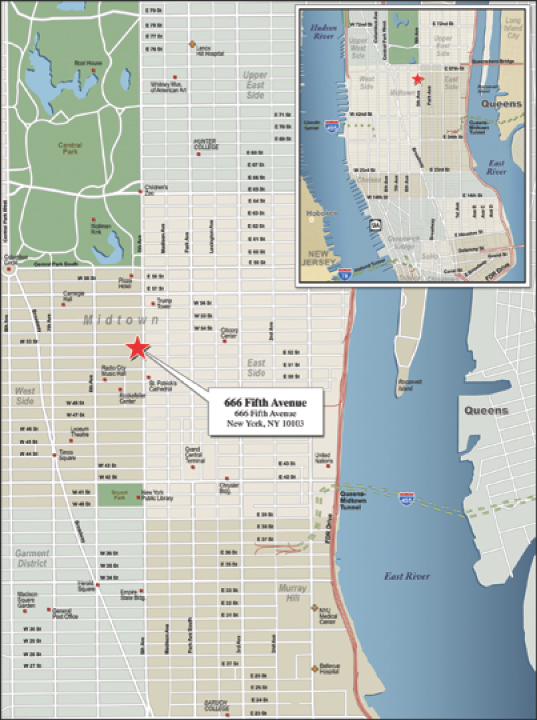

| 1 | | 666 Fifth Avenue(1)(2) | | BCRE | | New York | | New York | | Office | | $ | 249,000,000 | | 5.89 | % | | 1 | | 8.52 | % | | 1,454,110 | | Sq. Ft. | | $ | 836 | | 1.46x | | 61.36% | | 61.36% |

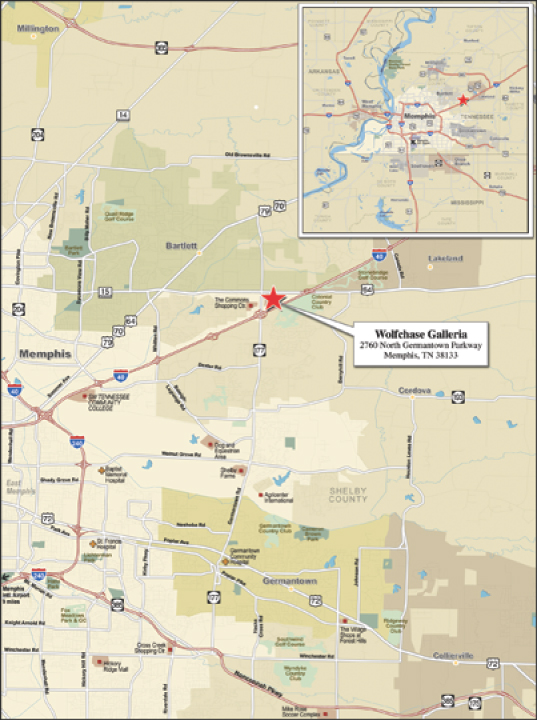

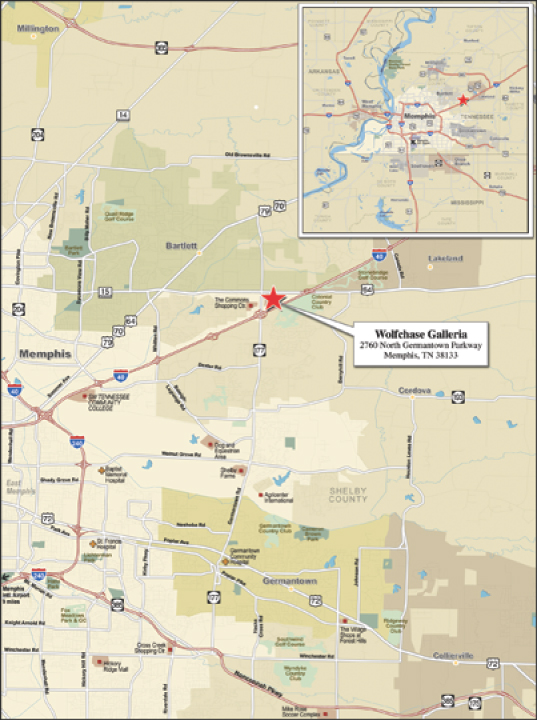

| 2 | | Wolfchase Galleria | | GECC | | Memphis | | Tennessee | | Retail | | | 225,000,000 | | 5.32 | | | 1 | | 7.70 | % | | 392,400 | | Sq. Ft. | | $ | 573 | | 1.23x | | 79.11% | | 79.11% |

| 3 | | Manhattan Apartment Portfolio(3) | | GACC | | New York | | New York | | Multifamily | | | 204,000,000 | | 4.82 | | | 2 | | 15.58 | % | | 1,083 | | Units | | $ | 188,366 | | 1.42x | | 80.00% | | 80.00% |

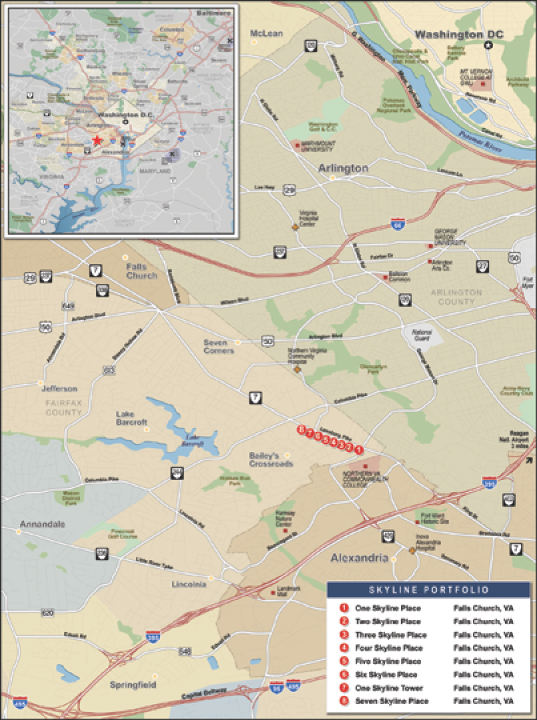

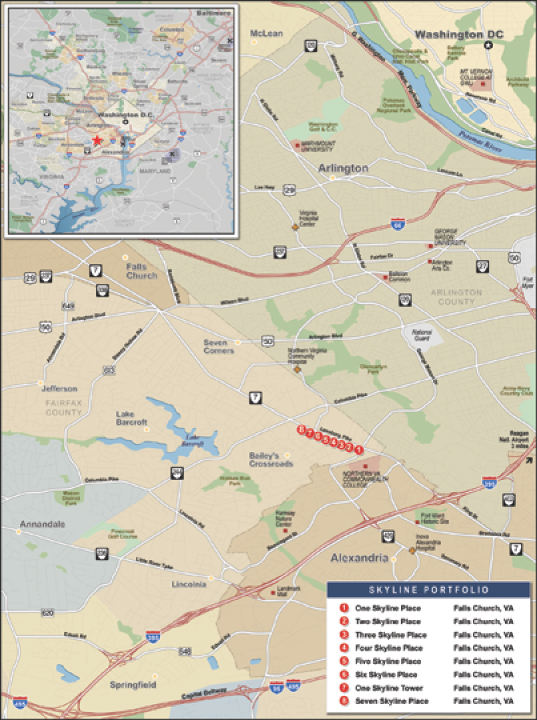

| 4 | | Skyline Portfolio(1) | | BofA | | Falls Church | | Virginia | | Office | | | 203,400,000 | | 4.81 | | | 1 | | 6.96 | % | | 2,566,783 | | Sq. Ft. | | $ | 264 | | 1.24x | | 77.75% | | 77.75% |

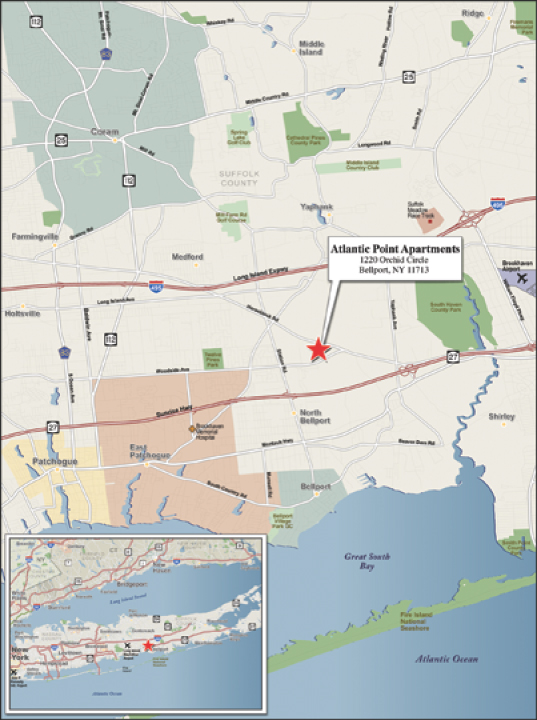

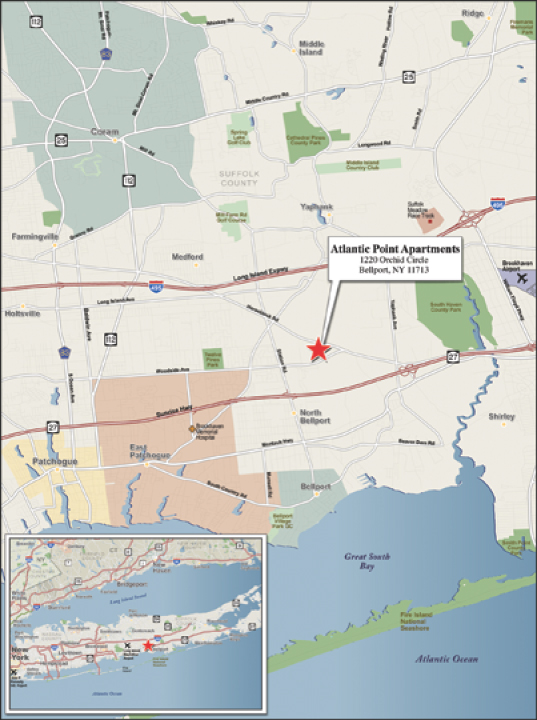

| 5 | | Atlantic Point Apartments(4) | | GACC | | Bellport | | New York | | Multifamily | | | 201,000,000 | | 4.75 | | | 2 | | 15.35 | % | | 795 | | Units | | $ | 252,830 | | 1.00x | | 80.40% | | 80.40% |

| 6 | | The Enclave(5) | | GACC | | Silver Spring | | Maryland | | Multifamily | | | 200,000,000 | | 4.73 | | | 2 | | 15.27 | % | | 1,119 | | Units | | $ | 178,731 | | 2.03x | | 70.42% | | 70.42% |

| 7 | | JP Morgan Portfolio(6) | | GACC | | Various | | Various | | Various | | | 198,500,000 | | 4.69 | | | 1 | | 6.80 | % | | (5) | | Various | | $ | 153(6) | | 1.30x | | 84.45% | | 84.45% |

| 8 | | Four Seasons Resort Maui(1)(7) | | GACC | | Wailea | | Hawaii | | Hotel | | | 175,000,000 | | 4.14 | | | 1 | | 5.99 | % | | 380 | | Keys | | $ | 1,118,421 | | 1.47x | | 70.83% | | 70.83% |

| 9 | | Pacific Shores(1) | | BofA | | Redwood City | | California | | Office | | | 165,875,000 | | 3.92 | | | 1 | | 5.68 | % | | 1,224,326 | | Sq. Ft. | | $ | 271 | | 1.65x | | 54.98% | | 54.98% |

| 10 | | Wellpoint Office Tower(8) | | GACC | | Woodland Hills | | California | | Office | | | 119,947,239 | | 2.84 | | | 1 | | 4.11 | % | | 448,072 | | Sq. Ft. | | $ | 268 | | 1.01x | | 79.96% | | 74.76% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total/Weighted Average: | | | | | | | | $ | 1,941,722,239 | | 45.89 | % | | | | | | | | | | | | | | 1.39x | | 73.82% | | 73.49% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) | The Cut-off Date Balance excludes any related pari passu or subordinate loans in the split loan structure. |

(2) | UW DSCR is based on projected underwritten net cash flow and net operating income. See “666 Fifth Avenue” below. |

(3) | DSCR is based on projected underwritten net cash flow and net operating income. See “Manhattan Apartment Portfolio” below. |

(4) | DSCR is based on projected underwritten net cash flow and underwritten net operating income. See “Atlantic Point Apartments” below. |

(5) | The Cut-off Date Balance represents a senior note in a split loan structure. The DSCR is based on projected underwritten cash flow and projected underwritten net operating income. See “The Enclave” below. |

(6) | The mortgaged property contains 1,152,551 square feet plus 1,905 parking spaces. The Loan/SF is $153. The 1,905 parking spaces have a Loan/Space value of $11,918. DSCR includes income from monthly payments under a rent enhancement lease. See “JP Morgan Portfolio” below. |

(7) | The DSCR is based on occupancy and ADR figures projected to be achieved. See “Four Seasons Resort Maui” below. |

(8) | The DSCR is based on a fixed payment schedule included in the accompanying prospectus supplement. |

All numerical information concerning the mortgage loans is approximate. All weighted average information regarding the mortgage loans reflects the weighting of the mortgage loans based on their outstanding principal balances as of the Cut-off Date. Location and Property Type tables reflect allocated loan amounts in the case of mortgage loans secured by multiple properties. Sum of columns may not match “Total” due to rounding. With respect to any split mortgage loan, unless otherwise specified, the calculations used for LTV ratios, DSCR and Loan per Unit/SF/Key include the related pari passu loan (if any) but exclude the related subordinated loan or component (if any). In addition, in the case of certain mortgage loans, the DSCR and/or LTV ratio was calculated taking into account a holdback amount, letter of credit and/or sponsor guarantee or was calculated based on assumptions regarding the future financial performance of the related mortgaged property on a stabilized basis.

The Depositor has filed a registration statement (including a prospectus) (SEC File no. 333-130174) with the SEC for the new offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in that registration statement and other documents the Depositor has filed with the SEC for more complete information about the Depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Depositor or any underwriter, or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling 1-800-294-1322 or by email to the following address: dg.prospectus_distribution@bofasecurites.com.

13

$3,834,224,000 (Approximate)

GE Commercial Mortgage Corporation

Commercial Mortgage Pass-Through Certificates

Series 2007-C1

| | | | | | |

| | | 666 Fifth Avenue | | TMA Balance: | | $249,000,000 |

| | | | TMA DSCR: | | 1.46x |

| | | | TMA LTV: | | 61.36% |

The Depositor has filed a registration statement (including a prospectus) (SEC File no. 333-130174) with the SEC for the new offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in that registration statement and other documents the Depositor has filed with the SEC for more complete information about the Depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Depositor or any underwriter, or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling 1-800-294-1322 or by email to the following address: dg.prospectus_distribution@bofasecurites.com.

14

$3,834,224,000 (Approximate)

GE Commercial Mortgage Corporation

Commercial Mortgage Pass-Through Certificates

Series 2007-C1

| | | | | | |

| | | 666 Fifth Avenue | | TMA Balance: | | $249,000,000 |

| | | | TMA DSCR: | | 1.46x |

| | | | TMA LTV: | | 61.36% |

| | | | |

| Mortgage Loan Information |

| | |

| Loan Seller: | | BCRE |

| | |

| Loan Purpose: | | Acquisition |

| | |

| Original Principal Balance(1): | | $249,000,000 |

| | |

| Cut-off Date Principal Balance(1): | | $249,000,000 |

| | |

| % of Initial UPB: | | 5.89% |

| | |

| Interest Rate: | | 6.3530% |

| | |

| Payment Date: | | 5th of each month |

| | |

| First Payment Date: | | March 5, 2007 |

| | |

| Maturity Date: | | February 5, 2017 |

| | |

| Amortization: | | Interest Only |

| | |

| Call Protection: | | Lockout until the date that is the earlier to occur of: (i) two years after the securitization of the last note or (ii) four years after the loan origination date, then defeasance is permitted. On or after August 5, 2016, prepayment permitted without penalty. |

| | |

| Sponsor: | | George Gellert and Jared Kushner |

| | |