QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on June 12, 2008

Registration No. 333-150354

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

DJO Finance LLC

DJO Finance Corporation

(Exact name of registrant as specified in its charter)

SEE TABLE OF ADDITIONAL REGISTRANTS

Delaware

Delaware | | 3842

3842 | | 20-5653965

20-5653825 |

(State or other jurisdiction

of incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

1430 Decision Street

Vista, California 92081

(800) 336-5690

(Address, including zip code, and telephone number, including area code, of registrants' principal executive offices)

Donald M. Roberts, Esq.

Executive Vice President and General Counsel

1430 Decision Street

Vista, California 92081

(800) 336-5690

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Richard A. Fenyes, Esq.

Simpson Thacher & Bartlett LLP

425 Lexington Avenue

New York, New York 10017-3954

(212) 455-2000

Approximate date of commencement of proposed exchange offer:As soon as practicable after this Registration Statement is declared effective.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, please check the following box.o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list Securities Act registration statement number of the earlier effective registration statement for the same offering.o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definition of "large accelerated filer," "accelerated filer" and "small reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | | | | Accelerated filer o |

| Non-accelerated filer ý | | (Do not check if a small reporting company) | | Small reporting company o |

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

| | Amount to be

Registered

| | Proposed Maximum

Offering

Price Per Note

| | Proposed Maximum

Aggregate

Offering Price(1)

| | Amount of

Registration Fee

|

|---|

|

| 107/8% Senior Notes due 2014 | | $575,000,000 | | 100% | | $575,000,000 | | $22,597.50(2) |

|

| Guarantees of 107/8% Senior Notes due 2014(3) | | N/A(4) | | (4) | | (4) | | (4) |

|

- (1)

- Estimated solely for the purpose of calculating the registration fee under Rule 457(f) of the Securities Act of 1933, as amended (the "Securities Act").

- (2)

- Previously paid.

- (3)

- See inside facing page for additional registrant guarantors.

- (4)

- Pursuant to Rule 457(n) under the Securities Act, no separate filing fee is required for the guarantees.

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Additional Registrant Guarantors

Exact Name of Registrant

Guarantor as Specified in its Charter

| | State or

Other Jurisdiction

of Incorporation

or Organization

| | I.R.S. Employer

Identification Number

| | Address, Including Zip Code

and Telephone Number,

Including Area Code,

of Registrant Guarantor's

Principal Executive Offices

|

|---|

| DJO Opco Holdings, Inc | | Delaware | | 33-0978270 | | 1430 Decision Street

Vista, California 92081

800-336-5690 |

DJO, LLC. |

|

Delaware |

|

52-2165554 |

|

1430 Decision Street

Vista, California 92081

800-336-5690 |

ReAble Therapeutics LLC |

|

Delaware |

|

20-5653240 |

|

1430 Decision Street

Vista, California 92081

800-336-5690 |

Encore Medical, LP |

|

Delaware |

|

74-2863979 |

|

9800 Metric Boulevard

Austin, Texas 78758

800-336-5690 |

Encore Medical Partners, Inc |

|

Nevada |

|

20-0295933 |

|

9800 Metric Boulevard

Austin, Texas 78758

800-336-5690 |

Encore Medical GP, Inc. |

|

Nevada |

|

74-3020852 |

|

9800 Metric Boulevard

Austin, Texas 78758

800-336-5690 |

Encore Medical Asset Corporation |

|

Nevada |

|

74-3020851 |

|

701 North Green Valley Parkway

Suite 209

Henderson, Nevada 89074

800-336-5690 |

Empi, Inc. |

|

Minnesota |

|

41-1310335 |

|

599 Cardigan Road

St. Paul, Minnesota 55126

800-336-5690 |

Empi Corp. |

|

Minnesota |

|

41-1933682 |

|

599 Cardigan Road

St. Paul, Minnesota 55126

800-336-5690 |

EmpiCare, Inc. |

|

Kentucky |

|

31-1538883 |

|

11802 Brinley Avenue

Suite 102

Louisville, Kentucky 40243

800-336-5690 |

IOMED, LLC. |

|

Utah |

|

87-0441272 |

|

599 Cardigan Road

St. Paul, Minnesota 55126

800-336-5690 |

SUBJECT TO COMPLETION, DATED JUNE 12, 2008

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS

DJO Finance LLC

DJO Finance Corporation

Offer to Exchange

$575,000,000 aggregate principal amount of its 107/8% Senior Notes due 2014, which have been registered under the Securities Act of 1933, for any and all of its outstanding 107/8% Senior Notes due 2014.

We are conducting the exchange offer in order to provide you with an opportunity to exchange your unregistered notes for freely tradable notes that have been registered under the Securities Act.

The Exchange Offer

- •

- We will exchange all outstanding notes that are validly tendered and not validly withdrawn for an equal principal amount of exchange notes that are freely tradable.

- •

- You may withdraw tenders of outstanding notes at any time prior to the expiration date of the exchange offer.

- •

- The exchange offer expires at 12:00 a.m. midnight, New York City time, on , 2008, unless extended. We do not currently intend to extend the expiration date.

- •

- The exchange of outstanding notes for exchange notes in the exchange offer will not be a taxable event for United States federal income tax purposes.

- •

- The terms of the exchange notes to be issued in the exchange offer are substantially identical to the outstanding notes, except that the exchange notes will be freely tradable.

Results of the Exchange Offer

- •

- The exchange notes may be sold in the over-the-counter market, in negotiated transactions or through a combination of such methods. We do not plan to list the exchange notes on a national market.

All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the outstanding notes and in the indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offer, we do not currently anticipate that we will register the outstanding notes under the Securities Act.

See "Risk Factors" beginning on page 21 for a discussion of certain risks that you should consider before participating in the exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the exchange notes to be distributed in the exchange offer or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2008.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. The prospectus may be used only for the purposes for which it has been published and no person has been authorized to give any information not contained herein. If you receive any other information, you should not rely on it. We are not making an offer of these securities in any state where the offer is not permitted.

TABLE OF CONTENTS

| | Page

|

|---|

Prospectus Summary |

|

1 |

Risk Factors |

|

21 |

The Transactions |

|

48 |

Use Of Proceeds |

|

51 |

Capitalization |

|

52 |

Unaudited Pro Forma Condensed Consolidated Financial Information |

|

53 |

Selected Historical Consolidated and Combined Financial Data |

|

58 |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

|

60 |

Business |

|

88 |

Management |

|

114 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

133 |

Certain Relationships and Related Transactions, and Director Independence |

|

135 |

Description of Other Indebtedness |

|

137 |

The Exchange Offer |

|

141 |

Description of Notes |

|

152 |

United States Federal Income Tax Consequences of the Exchange Offer |

|

210 |

Plan of Distribution |

|

210 |

Legal Matters |

|

211 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

211 |

Experts |

|

212 |

Where You Can Find More Information |

|

212 |

Index to Consolidated Financial Statements |

|

F-1 |

i

MARKET, RANKING AND OTHER INDUSTRY DATA

The data included in this prospectus regarding the markets and the industry in which we operate, including the size of certain markets and our position and the position of our competitors within these markets, are based on reports of government agencies, independent industry sources and our own estimates relying on our management's knowledge and experience in the markets in which we operate. Our management's knowledge and experience is based on information obtained from our customers, distributors, suppliers, trade and business organizations and other contacts in the markets in which we operate.

TRADEMARKS

This prospectus contains some of our trademarks, trade names and service marks, including the following: Encore®, OTI Osteoimplant Technology, Inc®, Cefar®, Empi®, Ormed® Chattanooga Group™, Compex®, EmpiCare®, Aircast®, DonJoy®, OfficeCare®, ProCare®, SpinaLogic®, RME™, CMF™, OL1000™, and OL1000 SC™. Each one of these trademarks, trade names or service marks is (i) our registered trademark, (ii) a trademark for which we have a pending application, (iii) a trade name or service mark for which we claim common law rights or (iv) a registered trademark or application for registration which we have been licensed by a third party to use. All other trademarks, trade names or service marks of any other company appearing in this prospectus belong to their respective owners.

FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. Generally, you can identify these statements because they use words like "anticipates," "believes," "estimates," "expects," "forecasts," "future," "intends," "plans," and similar terms. These statements reflect only our current expectations. Forward-looking statements include statements concerning our plans, objectives, goals, strategies, future events, capital expenditures, future results, our competitive strengths, our business strategy, the trends in our industry and the benefits of our recent acquisitions.

Although we do not make forward-looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy, and actual results may differ materially from those we anticipated due to a number of uncertainties, many of which are unforeseen, including, among others, the risks we face as described under the "Risk Factors" section and elsewhere in this prospectus. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this prospectus. These forward-looking statements are within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act") and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and are intended to be covered by the safe harbors created thereby. To the extent that such statements are not recitations of historical fact, such statements constitute forward-looking statements that, by definition, involve risks and uncertainties. In any forward-looking statement where we express an expectation or belief as to future results or events, such expectation or belief is expressed in good faith and is believed to have a reasonable basis, but there can be no assurance that such future results or events expressed by the statement of expectation or belief will be achieved or accomplished.

We believe it is important to communicate our expectations to our investors. There may be events in the future, however, that we are unable to predict accurately or over which we have no control. The risk factors described under the "Risk Factors" section in this prospectus, as well as any cautionary language in this prospectus, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements.

ii

PROSPECTUS SUMMARY

This summary highlights selected information in this prospectus and may not contain all of the information that is important to you. You should carefully read this entire prospectus, including the information set forth under the heading "Risk Factors" and the financial statements included elsewhere in this prospectus, before making an investment decision. Unless the context otherwise requires, references in this prospectus to "we," "our," "us," and "our Company" for the purposes of this section refer to DJO Finance LLC (formerly ReAble Therapeutics Finance LLC, "DJOFL") and its consolidated subsidiaries, (which include all operations of DJO Incorporated, formerly ReAble Therapeutics Inc.).

Our Company

We are a leading global provider of high-quality, orthopedic devices, with a broad range of products used for rehabilitation, pain management and physical therapy. We also develop, manufacture and distribute a broad range of surgical reconstructive implant products. We are the largest non-surgical orthopedic rehabilitation device company in the United States and among the largest globally, as measured by revenues. Many of our products have leading market positions. We believe that our strong brand names, comprehensive range of products, focus on quality, innovation and customer service, extensive distribution network, and our strong relationships with orthopedic and physical therapy professionals have contributed to our leading market positions. We believe that we are one of only a few orthopedic device companies that offer healthcare professionals and patients a diverse range of orthopedic rehabilitation products addressing the complete spectrum of preventative, pre-operative, post-operative, clinical and home rehabilitation care. Our products are used by orthopedic specialists, spine surgeons, primary care physicians, pain management specialists, physical therapists, podiatrists, chiropractors, athletic trainers and other healthcare professionals to treat patients with musculoskeletal conditions resulting from degenerative diseases, deformities, traumatic events and sports-related injuries. In addition, many of our non-surgical medical devices and related accessories are used by athletes and patients for injury prevention and at-home physical therapy treatment.

Our current business activities are the result of a combination of two companies with broad orthopedic product offerings in the United States and foreign countries. One of those companies, ReAble Therapeutics, Inc. ("ReAble"), was a leading manufacturer and distributor of electrotherapy products for pain therapy and rehabilitation, a broad range of clinical devices for the treatment of patients in physical therapy clinics, and a broad range of knee, hip and shoulder implant products. In 2006, ReAble was acquired by an affiliate of Blackstone Capital Partners V L.P. ("Blackstone"). The other company, DJO Opco Holdings, Inc. ("DJO Opco"), formerly named DJO Incorporated, was a leading manufacturer and distributor of orthopedic rehabilitation products, including rigid knee bracing, orthopedic soft goods, cold therapy systems, vascular systems and bone growth stimulation devices. On November 20, 2007, ReAble acquired DJO Opco through a merger transaction (the "DJO Merger"). ReAble then changed its name to DJO Incorporated ("DJO") and continues to be owned primarily by affiliates of Blackstone.

Historical financial results include results of ReAble and its subsidiaries before and after its acquisition by Blackstone and include the results of DJO Opco since the date of the DJO Merger. Pro forma financial information (unaudited) includes the combined results of operations of DJO Opco and ReAble as though the companies had been combined as of the beginning of the period presented. Pro forma information is presented for informational purposes only and is not indicative of the results of operations that would have been achieved if the acquisition had taken place at the beginning of the period presented.

1

Operating Segments

Following the DJO Merger, we provide a broad array of orthopedic rehabilitation and regeneration products, as well as implants to customers in the United States and abroad. Our reportable segments are managed separately because each segment requires different sales and marketing strategies and in some cases offers different products. We currently develop, manufacture and distribute our products through the following three operating segments:

We market our domestic rehabilitation products through the three divisions described below.

DonJoy, ProCare and Aircast. Our DonJoy, ProCare and Aircast division was acquired with the DJO Merger and offers products in the following categories:

- •

- rigid knee bracing, which includes functional bracing for prevention and rehabilitation of ligament injuries, load shifting braces to relieve osteoarthritis pain and post-operative braces for protecting surgical repair;

- •

- orthopedic soft goods, which include products that offer immobilization and support from head to toe;

- •

- cold therapy products, which assist in the reduction of swelling and pain; and

- •

- vascular systems, which include products intended to prevent deep vein thrombosis following surgery.

This division also includes our OfficeCare business, through which we maintain an inventory of soft goods and other products at healthcare facilities, primarily orthopedic practices, for immediate distribution to patients.

Empi. Our Empi division offers products in the following categories:

- •

- home electrotherapy, which includes transcutaneous electrical nerve stimulation ("TENS") for pain management and neuromuscular electrical nerve stimulation ("NMES") devices for rehabilitation;

- •

- bone growth stimulation products acquired with the DJO Merger, which promote the healing of bone tissue through combined magnetic field ("CMF") technology;

- •

- iontophoresis, which includes devices and accessories to deliver medication transdermally; and

- •

- home traction, which includes cervical and lumbar traction devices designed to provide decompression to the spine.

This division also includes our Rehab Med + Equip ("RME") and EmpiCare business. RME sells a wide range of proprietary and third party rehabilitation products to physical therapists and chiropractors through a printed catalog and through an on-line e-commerce site. Through our EmpiCare business, we maintain an inventory of soft goods and other products at healthcare facilities, primarily orthopedic practices, for immediate distribution to patients.

Chattanooga. Our Chattanooga Group offers products in the clinical rehabilitation market in the following categories:

- •

- clinical electrotherapy devices (such as TENS, NMES, laser, ultrasound and light therapy);

- •

- clinical traction devices; and

- •

- other clinical products and supplies such as treatment tables, continuous passive motion ("CPM") devices and dry heat therapy.

2

Our International Rehabilitation Segment, which generates most of its revenues in Europe, is divided into three main businesses:

- •

- the international sales of our DonJoy, ProCare and Aircast products, including rigid knee bracing products, orthopedic soft goods, cold therapy products and vascular systems;

- •

- our Ormed business, which provides bracing, CPM, electrotherapy and other products primarily in Germany; and

- •

- our Cefar-Compex business, which provides electrotherapy products for medical and consumer markets and other physical therapy and rehabilitation products primarily in Europe.

Surgical Implant

Our Surgical Implant Segment develops, manufactures and markets a wide variety of knee, hip and shoulder implant products that serve the orthopedic reconstructive joint implant market.

Market Opportunities

We participate globally in the rehabilitation, pain management, bone growth stimulation and reconstruction segments of the orthopedic device market. In the United States, we estimate these segments accounted for approximately $6.7 billion of total industry sales in 2006. We believe that several factors are driving growth in the orthopedic products industry, including the following:

- •

- Favorable demographics. An aging population is driving growth in the orthopedic products market. Many conditions that result in rehabilitation, physical therapy or orthopedic surgery are more likely to affect people in middle age or later in life. According to a 2007 United States Census Bureau—International Data Base projection, the aging baby boomer generation will result in the percentage of the North American population aged 65 and over to grow from 12.0% in 2008 to 16.0% in 2020 and to 20.0% by 2030. In Western Europe, the population aged 65 and over is expected to grow from 17.0% in 2008 to 20.0% in 2020 and to 24.0% by 2030. In addition, according to a 2007 United States Census Bureau—International Data Base projection, the average life expectancy in North America increased from 77.9 years in 2005 to 78.3 years in 2008 and is expected to grow to 81.3 years by 2030. In Western Europe, the average life expectancy increased from 79.2 years in 2005 to 79.7 years in 2008 and is expected to grow to 82.0 years by 2030. As life expectancy increases, we believe people will remain active longer, causing the number of injuries requiring orthopedic rehabilitation, bone growth stimulation and reconstructive implants to increase.

- •

- Shift toward non-surgical rehabilitation devices and at-home physical therapy.We believe the growing awareness and clinical acceptance by healthcare professionals of the benefits of non-surgical, non-pharmaceutical treatment and rehabilitation products, combined with the increasing interest by patients in rehabilitation solutions that minimize risk and recuperation time and provide greater convenience, will continue to drive demand for these products. For example, TENS and NMES devices are increasingly being recognized as effective solutions for pain management and rehabilitation therapy, respectively. In addition, we believe that orthopedic surgeons are increasingly utilizing braces that assist in rehabilitation and bone growth stimulation devices that enable in-home treatment as viable alternatives to surgery. Many of our orthopedic rehabilitation products are designed for at-home use, which we believe should allow us to benefit from the market shift toward these treatment alternatives.

- •

- Lower cost alternatives appeal to third party payors. With the cost of healthcare rising in the United States and internationally, third party payors are seeking more cost-effective therapies without reducing quality of care. For example, third party payors seek to reduce clinic visits and

3

Competitive Strengths

We believe that we have a number of competitive strengths that will enable us to further enhance our position in the orthopedic rehabilitation device market:

- •

- Leading market positions. We derived nearly one-half of our net sales in 2007 from products for which we estimate we have leading market positions, including soft goods, ankle braces, walking braces, rigid knee braces, clinical electrotherapy, TENS, NMES, iontophoresis, cold therapy, home and clinical traction and CPM devices. We believe our orthopedic and physical therapy rehabilitation products marketed under the DonJoy, Aircast, ProCare, Chattanooga Group, Empi, Cefar, Compex and Ormed brands have a reputation for quality, durability and reliability among healthcare professionals. We believe the strength of our brands and our focus on customer service have allowed us to establish market leading positions in the highly fragmented and growing orthopedic rehabilitation market.

- •

- Comprehensive range of orthopedic products. We offer a diverse range of orthopedic devices, including orthopedic rehabilitation, pain management and physical therapy products, bone growth stimulation and surgical reconstructive implant products, to orthopedic specialists and patients for hospital, clinical and at-home therapies. Our broad product offering meets many of the needs of orthopedic professionals and patients and enables us to leverage our brand loyalty with our customer and distributor base. Our products are available across various stages of the orthopedic patient's continuum of care.

- •

- Extensive and diverse distribution network. We use multiple channels to distribute our products to our customers. We use over 13,000 dealers and distributors and a direct sales force of over 500 employed sales representatives and approximately 900 independent sales representatives to supply our products to physical therapy clinics, orthopedic surgeons and practices, orthotic and prosthetic centers, hospitals, surgery centers, athletic trainers, chiropractors, other healthcare professionals and retail outlets. We believe that our distribution network provides us with a significant competitive advantage in selling our existing products and in introducing new products.

- •

- Strong relationships with managed care organizations and rehabilitation healthcare providers. Our leading market positions in many of our orthopedic rehabilitation product lines and the breadth of our product offerings have enabled us to secure important preferred provider and managed care contracts. We have developed a third party billing system. Our database includes approximately 9,000 different insurance companies and other payors, including over 1,000 active payor contracts. Our proprietary third party billing system is designed to reduce our reimbursement cycles, improve relationships with managed care organizations and physicians and track patients to improve quality of care and create subsequent selling opportunities. Further, our OfficeCare and EmpiCare businesses maintain inventory at over 1,300 healthcare facilities, primarily orthopedic practices, which further strengthens our relationships with these healthcare providers.

4

- •

- National contracts with group purchasing organizations. Following the DJO Merger, we enjoy strong relationships with a meaningful number of group purchasing organizations ("GPOs") due to our significant scale. We believe that our broad range of products is well suited to the goals of these buying groups. Under these national contracts, we provide favorable pricing to the buying group and are designated a preferred purchasing source for the members of the buying group for specified products. As DJO Opco made acquisitions and expanded its product range, it has been able to add incremental products to its national contracts. During 2007, DJO Opco signed or renewed six significant national contracts, and also added products from its recent acquisitions to a number of these national contracts. Following the DJO Merger, we believe we will be able to add additional products to these contracts.

- •

- Low cost, high quality manufacturing capabilities. Our principal manufacturing facility is located in Tijuana, Mexico and has been recognized for operational excellence. Our low cost manufacturing principles drive manufacturing efficiencies by employing lean manufacturing, Six Sigma concepts and continuous improvement processes. Following the DJO Merger, we plan to move additional portions of our manufacturing to Mexico and expect to achieve savings from lower labor costs and implementation of more efficient processes. Further, we intend to extend lean manufacturing concepts to our manufacturing facilities in Clear Lake, South Dakota and Chattanooga, Tennessee.

- •

- Ability to generate significant cash flow. Historically, our strong competitive position, brand awareness and high quality products and service as well as our low cost manufacturing have allowed us to generate attractive operating margins. These operating margins, together with limited capital expenditures and modest working capital requirements, significantly benefit our ability to generate free cash flow.

- •

- Experienced management team. The members of our management team have an average of over 24 years of relevant experience. This team has successfully integrated a number of acquisitions in the last several years.

Strategy

Our strategy is to increase our leading position in key products and markets, increase revenues and profitability and enhance cash flow. Our key initiatives to implement this strategy include the following:

- •

- Increase our leading market positions. We believe we are the market leader in many of the markets in which we compete. We intend to continue to increase our market share by leveraging the cross-selling and other opportunities created by the DJO Merger and by implementing the initiatives described below. The DJO Merger will allow us to offer customers a more comprehensive range of products to better meet their evolving needs. We believe our size, scale, brand recognition, comprehensive and integrated product offerings and leading market positions will enable us to capitalize on the growth in the orthopedic product industry.

- •

- Increase sales force productivity. We believe that our complementary distribution channels following the DJO Merger will provide an opportunity to increase the productivity of our sales force. Our sales representatives will generally have a targeted customer base with a broader product offering for those customers. We plan to encourage cross-selling and increase the productivity of the entire sales force by focusing our sales organization and implementing a sales compensation plan to incentivize our sales representatives to sell a broader range of our products. For example, as a result of the DJO Merger, we will combine our strong relationships with orthopedic surgeons and our strong relationships with physical therapists. In addition, we intend to market DJO Opco's bone growth stimulation products through Empi's extensive distribution network.

5

- •

- Maximize existing and secure additional national accounts. We plan to capitalize on the growing practice in healthcare in which hospitals and other large healthcare providers seek to consolidate their purchasing activities to national buying groups. Contracts with these national accounts represent a significant opportunity for revenue growth. We believe that our existing relationships with national buying groups and our broad range of products position us well not only to pursue additional national contracts, but also to expand the scope of our existing contracts.

- •

- Continue to develop and launch new products and product enhancements. We have a history of developing and introducing innovative products into the marketplace, and we expect to continue future product launches by leveraging our internal research and development platforms. We believe our ability to develop new technology and to advance existing technology to create new products will position us to further diversify our revenues and to expand our target markets by providing viable alternatives to surgery or medication. We believe that product innovation through effective and focused research and development, as well as our relationships with a number of widely recognized orthopedic surgeons and professionals who assist us in product research, development and marketing, will provide a significant competitive advantage. During 2007, we launched 38 new products, which generated over $34.1 million in revenues and on a pro forma basis 51 new products, which generated $38.2 million in revenues.

- •

- Expand international sales. In recent years, DJO Opco successfully established direct distribution capabilities in several major international markets. We believe that sales to European and other markets outside the United States continue to represent a significant growth opportunity, and we intend to continue to expand our direct and independent distribution capabilities in attractive foreign markets. The recent DJO Merger and several of the acquisitions we made in 2006 have substantially increased our international revenues and operating infrastructure and have provided us with opportunities to expand our international product offerings. For the year ended December 31, 2007, we generated approximately 27.0% of our net sales from customers outside the United States as compared to 23.9% for the year ended December 31, 2006. On a pro forma basis, we generated international sales of approximately 25.0% for the year ended December 31, 2007.

- •

- Maximize cost savings opportunities. We expect the DJO Merger to create significant opportunities to reduce manufacturing and other operating costs. We expect to achieve cost savings by leveraging our low-cost manufacturing capabilities, rationalizing our combined manufacturing and distribution footprints, increasing procurement savings and eliminating duplicative overhead functions. We also intend to eliminate overlapping operating expenses and expect to reduce expenses through improved leveraging of our benefits of scale created by the DJO Merger.

The Transactions

On July 15, 2007, we entered into an Agreement and Plan of Merger (the "DJO Merger Agreement") with DJO Opco, formerly known as DJO Incorporated, in a merger transaction (the "DJO Merger") pursuant to which DJO Opco became a wholly owned subsidiary of DJOFL. The total purchase price for the DJO Merger, which consummated on November 20, 2007, was approximately $1.3 billion and consisted of $1.2 billion paid to former equity holders (or $50.25 (the "per share merger consideration") in cash for each share of common stock of DJO Opco they then held), $15.2 million related to the fair value of rollover options as explained below, and $22.8 million in direct acquisition costs. The DJO Merger was financed through a combination of equity contributed by Blackstone, borrowings under our new senior secured credit facility (the "New Senior Secured Credit Facility"), and proceeds from our newly issued 10.875% senior notes due 2014.

Except for certain options held by certain members of DJO Opco management who chose to rollover their options, each outstanding option to purchase common stock of DJO Opco was cancelled

6

in exchange for the right to receive, for each share of common stock of DJO Opco issuable upon exercise of such option, cash in the amount equal to the excess of $50.25 over the exercise price per share of any such options, multiplied by the number of shares of common stock for which such option was exercisable immediately prior to the effective time of the DJO Merger. Former holders of options to acquire DJO Opco's common stock received an aggregate of $47.8 million in cash in exchange for their options in the DJO Merger, and was included as part of the total purchase consideration of the DJO Merger. Certain members of DJO Opco management elected to rollover certain options held by them that had not been exercised at or prior to the effective time of the DJO Merger. Such rollover options were converted to options to purchase 1,912,577 shares of DJO's common stock (the "DJO Merger Management Rollover Options"). The fair value of these fully vested options approximated $15.2 million and was recorded as a component of the cost of the acquisition.

The following capitalization and financing transactions occurred in connection with the DJO Merger:

- •

- Blackstone made a cash equity contribution of $434.6 million;

- •

- DJOFL entered into the New Senior Secured Credit Facility, which provided for a senior secured term loan facility of $1,065.0 million, all of which was borrowed at closing of the DJO Merger, and a new revolving loan facility of $100.0 million, of which no amount was drawn at the closing of the DJO Merger. The Company issued the new term loan at a 1.2% discount resulting in net proceeds of approximately $1,052.4 million; and

- •

- DJOFL and Finco, as co-issuers, issued $575.0 million aggregate principal amount of notes.

The proceeds from the capitalization and financing transactions described above were used to:

- •

- pay cash of approximately $1.2 billion to holders of the outstanding shares of common stock and outstanding stock options of DJO Opco immediately prior to the effective time of the DJO Merger (other than the DJO Merger Management Rollover Options);

- •

- repay approximately $430.9 million of indebtedness under our then existing credit facility and accrued interest thereon of $1.3 million;

- •

- repay approximately $271.5 million of outstanding indebtedness under DJO Opco's senior secured credit facilities existing at the time of the DJO Merger, including accrued interest thereon of $0.4 million;

- •

- pay fees and expenses of the DJO Merger and related debt financing costs of approximately $25.7 million and $54.7 million, respectively;

- •

- pay approximately $9.2 million of fees and expenses incurred by DJO Opco prior to the effective time of the DJO Merger; and

- •

- pay $4.8 million in cash related to the termination of interest rate swaps in connection with the repayment of our existing credit facility.

In connection with the DJO Merger, we also agreed to pay approximately $5.6 million of retention bonuses to certain of our executive officers and senior management team members, of which $2.8 million was paid in January 2008 and the remainder is to be paid in January 2009, subject to certain conditions.

The DJO Merger, the equity contribution by affiliates of Blackstone, the initial borrowings under our New Senior Secured Credit Facility, the offering of the outstanding notes, the repayment of certain indebtedness of ReAble and DJO Opco and the payment of the related fees and expenses are collectively referred to in this prospectus as the "Transactions." For a more complete description of the Transactions, see "—Corporate Structure" and "The Transactions."

7

Sources and Uses

The sources and uses of the funds for the Transactions are shown in the table below.

Sources

| | Uses

|

|---|

(in millions)

|

|---|

| New senior secured credit facilities(1): | | | | | DJO Opco equity consideration(4) | | $ | 1,236.7 |

| | Revolving credit facility | | $ | — | | Repayment of existing DJO Opco | | | |

| | Term loan facility | | | 1,052.4 | | indebtedness(5) | | | 271.9 |

| Outstanding notes | | | 575.0 | | Repayment of existing | | | |

| Equity contribution(2) | | | 449.8 | | ReAble indebtedness(6) | | | 432.1 |

| Rollover equity(3) | | | 372.3 | | Cash on hand: | | | |

| | | | | | Prefunded integration costs | | | 33.0 |

| | | | | | Cash for operations | | | 44.7 |

| | | | | | Rollover equity(3) | | | 372.3 |

| Cash on hand | | | 35.6 | | Transaction fees and expenses(7) | | | 94.4 |

| | |

| | | |

|

| | | Total sources | | $ | 2,485.1 | | Total uses | | $ | 2,485.1 |

| | |

| | | |

|

- (1)

- We incurred $1,065.0 million of term loan borrowings at the closing of the Transactions. The term loan was issued at a 1.2% discount resulting in net proceeds of $1,052.4 million. We did not have any outstanding borrowings under the revolving credit facility on the closing date of the Transactions. As of March 29, 2008, we had $99.1 million of available borrowings under our revolving credit facility, net of $0.9 million used for letters of credit.

- (2)

- Represents the cash equity contribution made by investment funds affiliated with Blackstone and the contribution of new equity by certain members of DJO Opco management through the rollover of existing stock options.

- (3)

- Represents (i) cash equity that investment funds affiliated with Blackstone contributed in connection with the Prior Transaction (as defined below in "Management's Discussion and Analysis of Financial Condition and Results of Operations—Recent Acquisitions, Dispositions and Other Transactions") in November 2006, (ii) equity rollover in connection with a prior acquisition and (iii) the value of ReAble management stock options that were rolled over in the Prior Transaction, net of $1.4 million of rolled-over ReAble management stock options cashed out in the Transactions.

- (4)

- Reflects the total consideration paid to holders of outstanding shares of DJO Opco's common stock and holders of outstanding options to acquire shares of DJO Opco common stock in the DJO Merger.

- (5)

- Consists of $271.5 million of outstanding borrowings and $0.4 million of accrued interest under DJO Opco's senior secured credit facilities existing at the time of the DJO Merger.

- (6)

- Consists of $430.9 million of outstanding borrowings and $1.3 million of accrued interest under ReAble's senior secured credit facilities existing at the time of the DJO Merger.

- (7)

- Reflects fees and expenses associated with the Transactions, including financing fees, advisory fees, other transaction costs and $4.8 million related to terminating ReAble's interest rate swaps.

8

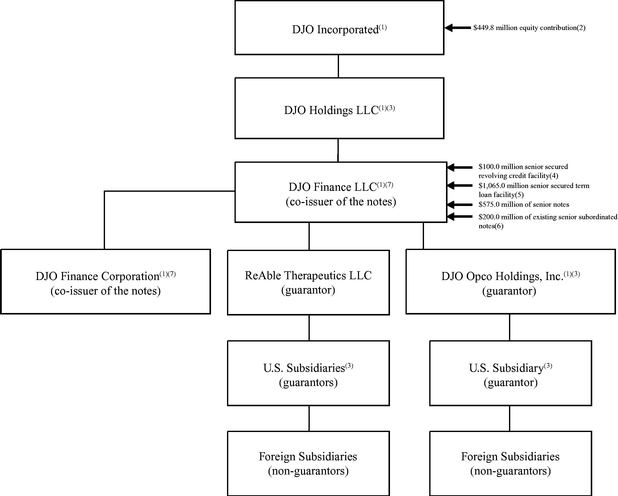

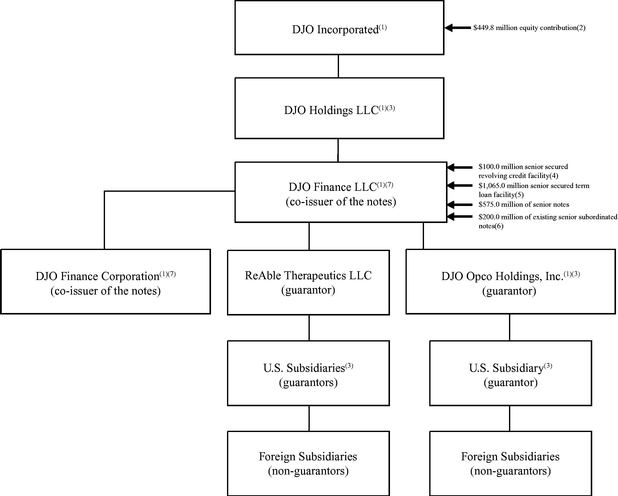

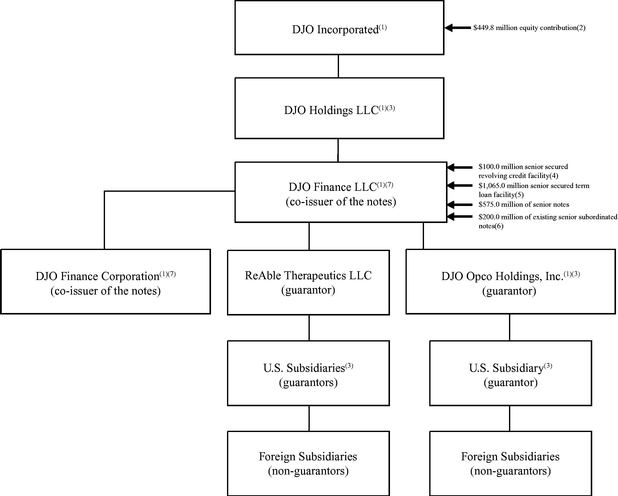

Corporate Structure

The following diagram illustrates our corporate structure. See "The Transactions."

- (1)

- In connection with the consummation of the Transactions: (i) ReAble Therapeutics, Inc. ("ReAble"), the ultimate parent company for our business, changed its name to "DJO Incorporated" ("DJO"); (ii) ReAble Therapeutics Holdings LLC changed its name to "DJO Holdings LLC" ("Holdings"); (iii) ReAble Therapeutics Finance LLC, a co-issuer of the notes, changed its name to "DJO Finance LLC" ("DJOFL"); (iv) ReAble Therapeutics Finance Corporation, a co-issuer of the notes, changed its name to "DJO Finance Corporation" ("Finco"); and (v) DJO Incorporated, the ultimate parent company for the DJO business prior to the DJO Merger, changed its name to "DJO Opco Holdings, Inc." ("DJO Opco").

- (2)

- Represents cash equity contributed by investment funds affiliated with Blackstone and the contribution of new equity by certain members of DJO Opco management through the rollover of existing stock options.

- (3)

- The obligations under our New Senior Secured Credit Facility are guaranteed by Holdings and all of DJOFL's existing and future direct and indirect wholly owned domestic restricted subsidiaries, subject to certain exceptions. The outstanding notes are guaranteed by all of DJOFL's subsidiaries, other than Finco, that guarantee the obligations under our New Senior Secured Credit Facility. The outstanding notes are not guaranteed by Holdings. The guarantors of the notes are also

9

guarantors of our existing senior subordinated notes. See "Description of Other Indebtedness—New Senior Secured Credit Facility" and "—Existing Senior Subordinated Notes due 2014."

- (4)

- We did not have any outstanding borrowings under the revolving credit facility on the closing date of the Transactions. As of March 29, 2008, we had $99.1 million of available borrowings under our revolving credit facility, net of $0.9 million used for letters of credit.

- (5)

- The loans under the New Senior Secured Credit Facility were issued at a 1.2% discount and generated net proceeds of $1,052.4 million.

- (6)

- DJOFL and Finco issued $200.0 million of 113/4% senior subordinated notes due 2014 (our "existing senior subordinated notes") in connection with the acquisition of ReAble by affiliates of Blackstone in 2006.

- (7)

- DJOFL and Finco are co-issuers of the notes. Finco has only nominal assets and does not conduct any operations. See "Description of Notes."

Corporate Information

DJOFL was formed and Finco was incorporated under the laws of the State of Delaware in September 2006. ReAble was incorporated under the laws of the State of Delaware in March 1995 (as Healthcare Acquisition Corporation). Our principal executive offices are located at 1430 Decision Street, Vista, California 92081, and our telephone number is (800) 336-5690.

The Blackstone Group

The Blackstone Group, a global private investment and advisory firm, was founded in 1985. Through its different investment businesses, as of March 31, 2008, Blackstone has total assets under management of approximately $113.5 billion. This is comprised of $57 billion in corporate private equity and real estate funds, $28 billion in discretionary marketable alternative asset programs, $23 billion in credit-oriented alternative asset programs (including proprietary hedge funds), $3 billion in other proprietary hedge funds, and $2 billion in closed-end mutual funds. Blackstone's other businesses include real estate, marketable alternative asset management, which comprises Blackstone's management of funds of hedge funds, mezzanine funds, senior debt vehicles, proprietary hedge funds and publicly-traded closed-end mutual funds, and financial advisory, which comprises Blackstone's corporate and mergers and acquisitions advisory services, restructuring and reorganization advisory services and Park Hill Group, which provides fund placement services for alternative investment funds. In June 2007, Blackstone conducted an initial public offering of common units representing limited partner interests in The Blackstone Group L.P., which are listed on the New York Stock Exchange under the symbol "BX."

10

The Exchange Offer

In this prospectus, the term "outstanding notes" refers to the $575.0 million aggregate principal amount of 107/8% Senior Notes due 2014 that were issued in a private offering as part of the Transactions on November 20, 2007. The term "exchange notes" refers to the 107/8% Senior Notes due 2014, as registered under the Securities Act of 1933, as amended (the "Securities Act"). The term "notes" refers collectively to the outstanding notes and the exchange notes.

General |

|

In connection with the private offering, DJOFL and Finco and the guarantors of the outstanding notes entered into a registration rights agreement with the initial purchasers in which they agreed, among other things, to deliver this prospectus to you and to complete the exchange offer within 360 days after the date of original issuance of the outstanding notes. You are entitled to exchange in the exchange offer your outstanding notes for the exchange notes which are identical in all material respects to the outstanding notes except: |

|

|

• |

|

the exchange notes have been registered under the Securities Act; |

|

|

• |

|

the exchange notes are not entitled to any registration rights which are applicable to the outstanding notes under the registration rights agreement; and |

|

|

• |

|

the liquidated damages provisions of the registration rights agreement are no longer applicable. |

The Exchange Offer |

|

DJOFL and Finco are offering to exchange $575.0 million aggregate principal amount of 107/8% Senior Notes due 2014 which have been registered under the Securities Act for any and all of their outstanding 107/8% Senior Notes due 2014. |

|

|

You may only exchange outstanding notes in denominations of $2,000 and integral multiples of $1,000, in excess thereof. |

Resale |

|

Based on an interpretation by the staff of the Securities and Exchange Commission (the "SEC") set forth in no-action letters issued to third parties, we believe that the exchange notes issued pursuant to the exchange offer in exchange for outstanding notes may be offered for resale, resold and otherwise transferred by you (unless you are our "affiliate" within the meaning of Rule 405 under the Securities Act) without compliance with the registration and prospectus delivery provisions of the Securities Act; provided that: |

|

|

• |

|

you are acquiring the exchange notes in the ordinary course of your business; and |

|

|

• |

|

you have not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in, a distribution of the exchange notes. |

11

|

|

If you are a broker-dealer and receive exchange notes for your own account in exchange for outstanding notes that you acquired as a result of market-making activities or other trading activities, you must acknowledge that you will deliver this prospectus in connection with any resale of the exchange notes. See "Plan of Distribution." |

|

|

Any holder of outstanding notes who: |

|

|

• |

|

is our affiliate; |

|

|

• |

|

does not acquire exchange notes in the ordinary course of its business; or |

|

|

• |

|

tenders its outstanding notes in the exchange offer with the intention to participate, or for the purpose of participating, in a distribution of exchange notes |

|

|

cannot rely on the position of the staff of the SEC enunciated inMorgan Stanley & Co. Incorporated (available June 5, 1991) andExxon Capital Holdings Corporation (available May 13, 1988), as interpreted in the SEC's letter toShearman & Sterling, dated available July 2, 1993, or similar no-action letters and, in the absence of an exemption therefrom, must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale of the exchange notes. |

Expiration Date |

|

The exchange offer will expire at 12:00 a.m. midnight, New York City time, on , 2008, unless extended by DJOFL and Finco. DJOFL and Finco do not currently intend to extend the expiration date. |

Withdrawal |

|

You may withdraw the tender of your outstanding notes at any time prior to the expiration of the exchange offer. DJOFL and Finco will return to you any of your outstanding notes that are not accepted for any reason for exchange, without expense to you, promptly after the expiration or termination of the exchange offer. |

Conditions to the Exchange Offer |

|

The exchange offer is subject to customary conditions, which DJOFL and Finco may waive. See "The Exchange Offer—Conditions to the Exchange Offer." |

Procedures for Tendering Outstanding Notes |

|

If you wish to participate in the exchange offer, you must complete, sign and date the applicable accompanying letter of transmittal, or a facsimile of such letter of transmittal, according to the instructions contained in this prospectus and the letter of transmittal. You must then mail or otherwise deliver the applicable letter of transmittal, or a facsimile of such letter of transmittal, together with the outstanding notes and any other required documents, to the exchange agent at the address set forth on the cover page of the letter of transmittal. |

12

|

|

If you hold outstanding notes through The Depository Trust Company ("DTC") and wish to participate in the exchange offer, you must comply with the Automated Tender Offer Program procedures of DTC by which you will agree to be bound by the letter of transmittal. By signing, or agreeing to be bound by, the letter of transmittal, you will represent to us that, among other things: |

|

|

• |

|

you are not our "affiliate" within the meaning of Rule 405 under the Securities Act; |

|

|

• |

|

you do not have an arrangement or understanding with any person or entity to participate in the distribution of the exchange notes; |

|

|

• |

|

you are acquiring the exchange notes in the ordinary course of your business; and |

|

|

• |

|

if you are a broker-dealer that will receive exchange notes for your own account in exchange for outstanding notes that were acquired as a result of market-making activities, that you will deliver a prospectus, as required by law, in connection with any resale of such exchange notes. |

Special Procedures for Beneficial Owners |

|

If you are a beneficial owner of outstanding notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, and you wish to tender those outstanding notes in the exchange offer, you should contact the registered holder promptly and instruct the registered holder to tender those outstanding notes on your behalf. If you wish to tender on your own behalf, you must, prior to completing and executing the applicable letter of transmittal and delivering your outstanding notes, either make appropriate arrangements to register ownership of the outstanding notes in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time and may not be able to be completed prior to the expiration date. |

Guaranteed Delivery Procedures |

|

If you wish to tender your outstanding notes and your outstanding notes are not immediately available or you cannot deliver your outstanding notes, the applicable letter of transmittal or any other required documents, or you cannot comply with the procedures under DTC's Automated Tender Offer Program for transfer of book-entry interests, prior to the expiration date, you must tender your outstanding notes according to the guaranteed delivery procedures set forth in this prospectus under "The Exchange Offer—Guaranteed Delivery Procedures." |

13

Effect on Holders of Outstanding Notes |

|

As a result of the making of, and upon acceptance for exchange of all validly tendered outstanding notes pursuant to the terms of the exchange offer, DJOFL and Finco and the guarantors of the notes will have fulfilled a covenant under the registration rights agreement. Accordingly, there will be no increase in the interest rate on the outstanding notes under the circumstances described in the registration rights agreement. If you do not tender your outstanding notes in the exchange offer, you will continue to be entitled to all the rights and limitations applicable to the outstanding notes as set forth in the indenture; however, DJOFL and Finco and the guarantors of the notes will not have any further obligation to you to provide for the exchange and registration of the outstanding notes under the registration rights agreement. To the extent that the outstanding notes are tendered and accepted in the exchange offer, the trading market for the outstanding notes could be adversely affected. |

Consequences of Failure to Exchange |

|

All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the outstanding notes and in the indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offer, DJOFL and Finco and the guarantors of the notes do not currently anticipate that they will register the outstanding notes under the Securities Act. |

United States Federal Income Tax Consequences |

|

The exchange of outstanding notes in the exchange offer will not be a taxable event for United States federal income tax purposes. See "United States Federal Income Tax Consequences of the Exchange Offer." |

Use of Proceeds |

|

We will not receive any cash proceeds from the issuance of the exchange notes in the exchange offer. See "Use of Proceeds." |

Exchange Agent |

|

The Bank of New York is the exchange agent for the exchange offer. The addresses and telephone numbers of the exchange agent are set forth under the "The Exchange Offer—Exchange Agent" section. |

14

The Exchange Notes

The summary below describes the principal terms of the exchange notes. Certain of the terms and conditions described below are subject to important limitations and exceptions. The "Description of Notes" section of this prospectus contains a more detailed description of the terms and conditions of the outstanding notes and the exchange notes. The exchange notes will have terms identical in all material respects to the outstanding notes, except that the exchange notes will not contain terms with respect to transfer restrictions, registration rights and additional interest for failure to observe certain obligations in the registration rights agreement.

Issuers |

|

DJOFL, an indirect wholly owned subsidiary of DJO, and Finco, a wholly owned subsidiary of DJOFL, jointly and severally issued the outstanding notes. |

Securities Offered |

|

$575.0 million aggregate principal amount of 107/8% Senior Notes due 2014. |

Maturity |

|

The exchange notes will mature on November 15, 2014, unless earlier redeemed or repurchased. |

Interest Rate |

|

The exchange notes will bear interest at a rate of 107/8% per annum. |

Interest Payment Dates |

|

May 15 and November 15 of each year, beginning on May 15, 2008. |

Ranking |

|

The exchange notes and the exchange guarantees will be the issuers' and the guarantors' unsecured senior obligations. Accordingly, they will: |

|

|

• |

|

be effectively subordinated in right of payment to all of the existing and future secured debt of the issuers and the guarantors (including our New Senior Secured Credit Facility), to the extent of the value of the assets securing such debt; |

|

|

• |

|

rank equally with all of the issuers' and guarantors' unsecured senior indebtedness; and |

|

|

• |

|

rank senior in right of payment to all of the issuers' and guarantors' subordinated indebtedness, including our $200.0 million existing senior subordinated notes. |

|

|

In addition, the exchange notes will be structurally subordinated to all of the existing and future liabilities of our subsidiaries that do not guarantee the exchange notes. |

|

|

As of March 29, 2008, (1) the outstanding notes and the related guarantees ranked effectively junior to approximately $1,065.0 million of senior secured indebtedness under our New Senior Secured Credit Facility and (2) we had an additional $99.1 million of available borrowings under our revolving credit facility, net of $0.9 million used for letters of credit. In addition, we have the option to increase the amount available under our New Senior Secured Credit Facility by the greater of $150.0 million (subject to pro forma compliance with our |

15

|

|

senior secured leverage ratio financial maintenance covenant) and the amount of indebtedness we could incur to the extent our senior secured leverage ratio remains below a certain threshold. In addition, as of March 29, 2008, our non-guarantor subsidiaries had approximately $41.4 million of indebtedness and liabilities (excluding intercompany indebtedness and deferred tax liabilities) to which the outstanding notes were structurally subordinated. |

Guarantees |

|

The exchange notes will be guaranteed jointly and severally and on an unsecured senior basis by each of our existing and future direct and indirect wholly owned domestic subsidiaries that guarantees any of our indebtedness or any indebtedness of our domestic subsidiaries or is an obligor under our New Senior Secured Credit Facility. |

Optional Redemption |

|

We are entitled to redeem some or all of the exchange notes at any time on or after November 15, 2011 at the redemption prices set forth in this prospectus. Prior to November 15, 2011, we are entitled to redeem some or all of the exchange notes at a price equal to 100% of the principal amount thereof, plus accrued and unpaid interest, if any, plus the "make-whole" premium set forth in this prospectus. In addition, we are entitled to redeem up to 35% of the aggregate principal amount of the exchange notes until November 15, 2010 with the net proceeds from certain equity offerings at the redemption price set forth in this prospectus. |

Change of Control Offer |

|

Upon the occurrence of a change of control, we must give holders of the exchange notes an opportunity to sell to us some or all of their exchange notes at a price equal to 101% of their principal amount, plus accrued and unpaid interest to the repurchase date. See "Description of Notes—Repurchase at the Option of Holders—Change of Control." |

Certain Covenants |

|

The indenture governing the exchange notes contains covenants limiting our ability and the ability of our restricted subsidiaries to: |

|

|

• |

|

incur additional debt or issue certain preferred and convertible shares; |

|

|

• |

|

pay dividends on, redeem, repurchase or make distributions in respect of our capital stock or make other restricted payments; |

|

|

• |

|

make certain investments; |

|

|

• |

|

sell certain assets; |

|

|

• |

|

create liens on certain assets to secure debt; |

|

|

• |

|

consolidate, merge, sell or otherwise dispose of all or substantially all of our assets; |

|

|

• |

|

enter into certain transactions with our affiliates; and |

16

|

|

• |

|

designate our subsidiaries as unrestricted subsidiaries. |

|

|

These covenants are subject to a number of important limitations and exceptions. In addition, during any period of time that the exchange notes have investment grade ratings from both Moody's Investors Service, Inc. and Standard & Poor's, many of these covenants will cease to apply. See "Description of Notes." |

No Public Market |

|

The exchange notes will be freely transferable but will be new securities for which there will not initially be a market. Accordingly, we cannot assure you whether a market for the exchange notes will develop or as to the liquidity of any market. The initial purchasers in the private offering of the outstanding notes have advised us that they intend to make a market in the exchange notes. The initial purchasers are not obligated, however, to make a market in the exchange notes, and any such market-making may be discontinued by the initial purchasers in their discretion at any time without notice. |

Risk Factors

You should carefully consider all the information in the prospectus prior to exchanging your outstanding notes. In particular, we urge you to carefully consider the factors set forth under the "Risk Factors" section.

17

SUMMARY HISTORICAL AND UNAUDITED PRO FORMA

CONDENSED CONSOLIDATED FINANCIAL DATA

Set forth below is summary historical consolidated and combined financial data and summary unaudited pro forma financial data of our business, at the dates and for the periods presented below. When the context so requires, we use the term "Predecessor" to refer to the historical financial results and operations of ReAble, our indirect parent, prior to the Prior Transaction and the term "Successor" to refer to the historical financial results and operations of DJOFL after the Prior Transaction.

We have derived the summary historical financial data for the fiscal year ended December 31, 2005 and the period from January 1, 2006 through November 3, 2006 from the Predecessor's historical audited consolidated financial statements included elsewhere in this prospectus. We have derived the Predecessor's historical balance sheet data as of December 31, 2005 presented in the table below from the Predecessor's historical audited consolidated financial statements that are not included in this prospectus. We have derived the summary historical financial data from the period from November 4, 2006 through December 31, 2006 and as of December 31, 2006 from the Successor's historical audited consolidated financial statements included elsewhere in this prospectus. We have derived the summary historical financial data as of December 31, 2007 and for the fiscal year ended December 31, 2007 from the Successor's historical audited consolidated financial statements included elsewhere in this prospectus.

We have derived the summary consolidated financial data as of March 29, 2008 and for each of the three months ended March 31, 2007 and March 29, 2008 from our unaudited consolidated financial statements included elsewhere in this prospectus, which have been prepared on a basis consistent with our annual audited consolidated financial statements. In the opinion of management, such unaudited financial statements reflect all adjustments, consisting only of normal and recurring adjustments, necessary for a fair presentation of the results for those periods. The results of operations for any interim periods are not necessarily indicative of the results to be expected for the full year or any future period.

The summary unaudited pro forma statements of operations data and other financial data for the fiscal year ended December 31, 2007 have been prepared to give effect to the Transactions as if they had occurred on January 1, 2007. The summary unaudited pro forma condensed statement of operations for the year ended December 31, 2007 is based on ReAble's audited financial statements for the year ended December 31, 2007 and DJO Opco's financial results for the period from January 1, 2007 to November 19, 2007, the period prior to the date of the DJO Merger. The pro forma adjustments are based upon available information and certain assumptions that we believe are reasonable. The summary unaudited pro forma condensed consolidated financial data are for informational purposes only and do not purport to represent what our results of operations or financial position actually would have been if the Transactions had occurred at any date, and such data do not purport to project the results of operations for any future period.

The DJO Merger was accounted for using the purchase method of accounting. The total purchase price was allocated to net tangible and identifiable intangible assets based on their estimated fair values as of November 20, 2007. The excess of the purchase price over the net tangible and identifiable intangible assets was recorded as goodwill. The preliminary allocation of the purchase price was based upon preliminary valuation and other data and the estimates and assumptions are subject to change, based on the finalization of the asset and liability valuation analyses.

During the periods presented below, ReAble (now renamed DJO Incorporated) has made various acquisitions, including the acquisition of DJO Opco on November 20, 2007, the acquisition of Compex completed on February 24, 2006 and the acquisition of Cefar completed on November 7, 2006, and the results for the acquired businesses are included in our historical financial statements from the date of their respective acquisitions. See "Management's Discussion and Analysis of Financial Condition and

18

Results of Operations—Recent Acquisitions, Dispositions and Other Transactions" for a description of our most recent acquisitions.

The summary historical and unaudited pro forma condensed consolidated and combined financial data should be read in conjunction with "The Transactions," "Unaudited Pro Forma Condensed Consolidated Financial Information," "Selected Historical Consolidated and Combined Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our historical consolidated financial statements and related notes appearing elsewhere in this prospectus.

| |

| |

| |

| |

| |

| | Successor

| | Successor

| | Pro Forma

| |

|---|

| | Predecessor

| | Successor

| | Combined

| |

| |

|---|

| | Successor

| | Three months ended

| |

| |

|---|

| |

| | January 1

through

November 3,

2006

| | November 4

through

December 31,

2006

| | Year ended

December 31,

2006(1)(3)

(unaudited)

| | Year Ended

December 31,

2007

(unaudited)

| |

|---|

| | Year ended

December 31,

2005(2)

| | Year Ended

December 31,

2007(4)

| | March 31, 2007

(unaudited)

| | March 29, 2008

(unaudited)

| |

|---|

| | (in thousands)

| |

|---|

| Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net sales | | $ | 293,726 | | $ | 304,383 | | $ | 57,902 | | $ | 362,285 | | $ | 492,134 | | $ | 106,707 | | $ | 239,728 | | $ | 914,619 | |

| Cost of sales | | | 115,373 | | | 127,280 | | | 26,787 | | | 154,067 | | | 205,864 | | | 45,282 | | | 95,084 | | | 372,762 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| | Gross profit | | | 178,353 | | | 177,103 | | | 31,115 | | | 208,218 | | | 286,270 | | | 61,425 | | | 144,644 | | | 541,857 | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Selling, general and administrative | | | 120,036 | | | 179,164 | | | 41,099 | | | 220,263 | | | 271,163 | | | 50,973 | | | 110,612 | | | 448,483 | |

| | Research and development | | | 9,577 | | | 14,772 | | | 28,128 | | | 42,900 | | | 21,047 | | | 3,635 | | | 6,676 | | | 25,312 | |

| | Amortization of acquired

intangibles | | | 5,053 | | | 5,965 | | | 4,035 | | | 10,000 | | | 33,496 | | | 6,507 | | | 19,116 | | | 82,302 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Operating income (loss) | | | 43,687 | | | (22,798 | ) | | (42,147 | ) | | (64,945 | ) | | (39,436 | ) | | 310 | | | 8,240 | | | (14,240 | ) |

| Other income (expense): | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Interest income | | | 393 | | | 527 | | | 312 | | | 839 | | | 1,132 | | | 217 | | | 587 | | | 2,204 | |

| | Interest expense | | | (28,509 | ) | | (26,008 | ) | | (8,611 | ) | | (34,619 | ) | | (72,409 | ) | | (14,021 | ) | | (45,187 | ) | | (164,567 | ) |

| | Other income (expense), net | | | (23 | ) | | (23 | ) | | 133 | | | 110 | | | 742 | | | 143 | | | 1,343 | | | 2,149 | |

| | Loss on early extinguishment of debt | | | — | | | (9,154 | ) | | — | | | (9,154 | ) | | (14,539 | ) | | — | | | — | | | — | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Income (loss) from continuing operations before income taxes and minority interests | | | 15,548 | | | (57,456 | ) | | (50,313 | ) | | (107,769 | ) | | (124,510 | ) | | (13,351 | ) | | (35,017 | ) | | (174,454 | ) |

| Provision (benefit) for income taxes | | | 6,061 | | | (11,452 | ) | | (8,756 | ) | | (20,208 | ) | | (42,503 | ) | | (2,341 | ) | | (11,055 | ) | | (56,275 | ) |

| Minority interests | | | 140 | | | 158 | | | 39 | | | 197 | | | 415 | | | 77 | | | 200 | | | 415 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Income (loss) from continuing operations | | | 9,347 | | | (46,162 | ) | | (41,596 | ) | | (87,758 | ) | | (82,422 | ) | | (11,087 | ) | | (24,162 | ) | | (118,594 | ) |

| Discontinued operations: | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Gain on disposal of discontinued operations (net of income tax expense)(5) | | | 2,445 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | Income (loss) from discontinued operations (net of income tax expense (benefit)(5) | | | 538 | | | (614 | ) | | (38 | ) | | (652 | ) | | — | | | — | | | — | | | — | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Net income (loss)(6) | | $ | 12,330 | | $ | (46,776 | ) | $ | (41,634 | ) | $ | (88,410 | ) | $ | (82,422 | ) | $ | (11,087 | ) | $ | (24,162 | ) | $ | (118,594 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Statement of Cash Flows Data: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net cash provided by (used in): | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating activities | | $ | 19,560 | | $ | 16,675 | | $ | (15,829 | ) | $ | 846 | | $ | (28,759 | ) | $ | (2,041 | ) | $ | 7,433 | | | | |

| Investing activities | | | (20,364 | ) | | (14,272 | ) | | (536,411 | ) | | (550,683 | ) | | (1,323,064 | ) | | (5,059 | ) | | (4,491 | ) | | | |

| Financing activities | | | (1,238 | ) | | 12,261 | | | 550,439 | | | 562,700 | | | 1,383,558 | | | (1,197 | ) | | (108 | ) | | | |

| Other Financial Data: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Depreciation and amortization | | | 13,749 | | | 14,804 | | | 6,404 | | | 21,208 | | | 48,240 | | | 9,587 | | | 24,777 | | | | |

| Capital expenditures | | | 8,010 | | | 12,304 | | | 1,331 | | | 13,635 | | | 13,962 | | | 4,432 | | | 4,272 | | | | |

| Ratio of earnings to fixed charges (unaudited)(7) | | | 1.52x | | | — | | | — | | | — | | | — | | | — | | | — | | | | |

| Balance Sheet Data (at period end): | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 17,200 | | | | | | | | $ | 30,903 | | $ | 63,471 | | $ | 23,481 | | $ | 67,694 | | | | |

| Total assets | | | 552,037 | | | | | | | | | 1,060,636 | | | 3,086,272 | | | 1,065,535 | | | 3,087,421 | | | | |

| Long-term debt and capital leases, net of current portion | | | 307,794 | | | | | | | | | 548,037 | | | 1,818,598 | | | 547,091 | | | 1,818,989 | | | | |

| Stockholders' equity/membership equity | | | 167,107 | | | | | | | | | 335,208 | | | 704,988 | | | 323,401 | | | 679,646 | | | | |

- (1)

- The unaudited combined results for the fiscal year ended December 31, 2006 represent the combination of the Predecessor period from January 1, 2006 through November 3, 2006 and the Successor period from November 4, 2006 through December 31, 2006. This mathematical combination does not

19

comply with generally accepted accounting principles or with the rules for unaudited pro forma presentation, but is presented because we believe it is useful to compare our financial results on an annualized basis. The Successor period reflects the acquisition of ReAble by Blackstone using the purchase method of accounting pursuant to the provisions of Statement of Financial Accounting Standards No. 141, "Business Combinations". Accordingly, the comparability of the results of the Successor for the full year 2007 to the combined results of the Successor and the Predecessor for the full year 2006 is affected by differences in the basis of presentation, which reflects purchase accounting in the Successor periods and historical cost in the Predecessor period. In addition the comparability of the combined results is impacted by changes in our capital structure which occurred on the date the Prior Transaction was completed.

- (2)

- The 2005 data include $5.3 million in sales as a result of the acquisition of assets of OTI on February 22, 2005.

- (3)