QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

October 31, 2007

Date of Report (Date of earliest event reported)

REABLE THERAPEUTICS FINANCE LLC

(Exact Name of Registrant as Specified in its Charter)

Delaware

(State or Other Jurisdiction

of Incorporation) | | 333-142188

(Commission

File Number) | | 20-5653965

(IRS Employer

Identification No.) |

| | | | | |

9800 Metric Blvd., Austin, Texas

(Address of Principal Executive Offices) | | 78758

(Zip Code) |

(512) 832-9500

Registrant's telephone number, including area code

N/A

(Former Name or Former Address, if Changed Since Last Report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01 Regulation FD Disclosure.

On July 15, 2007, ReAble Therapeutics Finance LLC, a Delaware limited liability company ("RTFL"), and Reaction Acquisition Merger Sub, a newly formed Delaware corporation and a wholly owned subsidiary of RTFL ("Reaction Merger Sub"), entered into an agreement and plan of merger (the "Merger Agreement") with DJO Incorporated, a Delaware corporation ("DJO"), pursuant to which Reaction Merger Sub will merge with and into DJO, with DJO continuing as the surviving corporation and a wholly owned subsidiary of RTFL (the "Merger").

On November 3, 2006, ReAble Therapeutics, Inc. ("ReAble") was acquired by Grand Slam Holdings, LLC ("BCP Holdings") (the "Blackstone Acquisition"). BCP Holdings is controlled by investment funds affiliated with Blackstone Capital Partners V L.P. ("Blackstone"). The Blackstone Acquisition, the equity contribution by affiliates of Blackstone, the initial borrowings under our existing senior secured credit facilities, the offering of our existing senior subordinated notes by RTFL and ReAble Therapeutics Finance Corporation ("Finco"), the repayment of ReAble's prior senior secured credit facilities, the repurchase of 9.75% senior subordinated notes due 2012 issued by a subsidiary of ReAble, Encore Medical IHC, Inc., the repayment of certain other indebtedness of ReAble and the payment of the related fees and expenses are collectively referred to as the "Prior Transactions."

Unless otherwise noted or the context otherwise requires, (1) references to "we," "our," "us," and "the company" prior to the Merger are to RTFL and its consolidated subsidiaries (which includes all of ReAble's operations), and following the Merger and the other transactions described herein are to RTFL and its consolidated subsidiaries (including DJO Incorporated and its subsidiaries); (2) references to "ReAble" are to ReAble Therapeutics, Inc. and its subsidiaries prior to the Merger and (3) references to "DJO" are to DJO Incorporated and its subsidiaries prior to the Merger.

In connection with the consummation of the Merger and the other transactions described herein: (1) ReAble, the ultimate parent company for our business, is expected to change its name to "DJO Incorporated"; (2) ReAble Therapeutics Holdings LLC ("Holdings") is expected to change its name to "DJO Holdings LLC"; (3) RTFL is expected to change its name to "DJO Finance LLC"; (4) ReAble Therapeutics Finance Corporation ("Finco") is expected to change its name to "DJO Finance Corporation"; and (5) DJO, the ultimate parent company for the DJO business prior to the Merger, is expected to change its name to "DJO Opco Holdings, Inc."

"Safe Harbor" Statement under Private Securities Litigation Reform Act of 1995

This Current Report on Form 8-K contains forward-looking statements. Generally, you can identify these statements because they contain words like "anticipates," "believes," "estimates," "expects," "forecasts," "future," "intends," "plans" and similar terms. These statements reflect only our current expectations. Forward-looking statements include statements concerning our plans, objectives, goals, strategies, future events, capital expenditures, future results, our competitive strengths, our business strategy, the trends in our industry, and the benefits of our recent acquisitions.

Although we do not make forward-looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy, and actual results may differ materially from those we anticipated due to a number of uncertainties, including, among others, the risks we face as described under the "Risk Factors" section below and elsewhere in this Current Report. You should not place undue reliance on these forward-looking statements. These forward-looking statements are within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to be covered by the safe harbors created thereby. To the extent that such statements are not recitations of historical fact, such statements constitute forward-looking statements that, by definition, involve risks and uncertainties. In any forward-looking statement where we express an expectation or belief as to future results or events, such expectation or belief is expressed in good faith and is believed to have a reasonable basis, but there can

2

be no assurance that such future results or events expressed by the statement of expectation or belief will be achieved or accomplished. Our actual results, performance or achievements could differ materially from those expressed in, or implied by, forward-looking statements. We can give you no assurance that any of the events anticipated by forward-looking statements will occur or, if any of them do, what impact they will have on our results of operations and financial condition.

Some of the important factors that we believe could affect our results include the risks more fully disclosed below under the section headed "Risk Factors" and elsewhere in this Current Report, as well as in our most recent Quarterly Reports on Form 10-Q, including, without limitation, in conjunction with the forward-looking statements included in this Current Report. We caution you that in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this Current Report may not in fact occur. We undertake no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

As provided in General Instruction B.2 of Form 8-K, the information contained in this Current Report on Form 8-K shall not be deemed to be "filed" for purposes of Section 18 of the Exchange Act, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act, except as shall be expressly set forth by specific reference in such a filing. By furnishing this information, we make no admission as to the materiality of any information in this report that is required to be disclosed solely by reason of Regulation FD.

The Company hereby furnishes the following information regarding its business that was prepared in connection with the financing activities related to the Merger:

3

Our Company

We are a leading global provider of high-quality non-surgical orthopedic devices, with a broad range of products used for rehabilitation, pain management and physical therapy. After giving effect to the Merger, we will be the largest non-surgical orthopedic rehabilitation device company in the United States, and among the largest globally, as measured by revenues. Many of our products have leading market positions. We derived over 60% of our pro forma net sales for the twelve months ended September 29, 2007 from products for which we estimate we have leading market positions. We believe that our strong brand names, comprehensive range of products, focus on quality, innovation and customer service, extensive distribution network, and our strong relationships with orthopedic and physical therapy professionals have contributed to our leading market positions. We believe that we are one of only a few orthopedic device companies that offer healthcare professionals and patients a diverse range of orthopedic rehabilitation products addressing the complete spectrum of preventative, pre-operative, post-operative, clinical and home rehabilitation care. In addition, we develop, manufacture and distribute a broad range of surgical reconstructive implant products.

The Merger will combine ReAble's rehabilitation and musculoskeletal pain management platforms with DJO's orthopedic bracing, cold therapy, bone growth stimulation and vascular systems platforms. The Merger increases our product, geographic and payor diversification and creates an extensive and diverse distribution network. We believe each company's products are currently under-penetrated in the other's core distribution channels, providing us with opportunities to generate incremental revenue through cross-selling and category expansion. We also expect to realize significant cost savings by consolidating facilities, eliminating duplicate operations, improving supply chain management and achieving other efficiencies. For the twelve months ended September 29, 2007, we generated pro forma net sales of $873.6 million and pro forma Adjusted EBITDA of $253.8 million. For the definition of Adjusted EBITDA and a reconciliation of pro forma net loss to pro forma Adjusted EBITDA, see footnote (1) under "—Summary Unaudited Pro Forma Condensed Consolidated Financial Data."

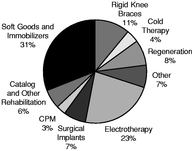

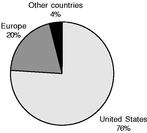

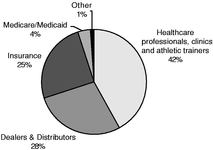

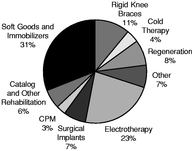

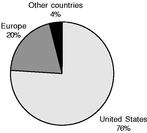

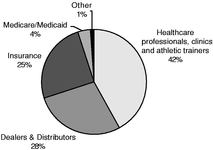

The following charts provide a breakdown of our pro forma net sales by product, geography and payor for the nine months ended September 29, 2007.

| Revenue by Product Category | | Revenue by Geography | | Revenue by Payor |

|

|

|

|

|

4

Our products are used by orthopedic specialists, spine surgeons, primary care physicians, pain management specialists, physical therapists, podiatrists, chiropractors, athletic trainers and other healthcare professionals to treat patients with musculoskeletal conditions resulting from degenerative diseases, deformities, traumatic events and sports-related injuries. In addition, many of our non-surgical medical devices and related accessories are used by athletes and patients for injury prevention and at-home physical therapy treatment.

Business Segments

After the completion of the Merger, we anticipate having three reportable segments: Domestic Rehabilitation, International Rehabilitation and Surgical Implant.

We market our domestic rehabilitation products through the three divisions described below. Our Domestic Rehabilitation Segment accounted for approximately 71% of our pro forma net sales for the twelve months ended September 29, 2007.

DonJoy, ProCare and Aircast. Our DonJoy, ProCare and Aircast division is the leader, based on revenues, in the U.S. orthopedic bracing and soft goods market, offering over 750 products in the following categories:

- •

- rigid knee bracing, which includes functional bracing for prevention and rehabilitation of ligament injuries, load shifting braces to relieve osteoarthritis pain and post-operative braces for protecting surgical repair;

- •

- orthopedic soft goods, which include over 500 products that offer immobilization and support from head to toe;

- •

- cold therapy products, which assist in the reduction of swelling and pain; and

- •

- vascular systems, which include products intended to prevent deep vein thrombosis following surgery.

This division also includes our OfficeCare business, through which we maintain an inventory of soft goods and other products at over 1,200 healthcare facilities, primarily orthopedic practices, for immediate distribution to patients. As of September 29, 2007, the DonJoy, ProCare and Aircast division employed 392 independent commissioned sales representatives. These representatives are primarily dedicated to selling our products to healthcare providers. In addition, as of September 29, 2007, this division had over 100 direct and independent representatives managing our relationships with buying groups and national contracts and over 380 distributors focused on primary and acute care facilities.

Empi. Our Empi division is the leader, based on revenues, in the U.S. electrotherapy market, offering over 20 products in the following categories:

- •

- home electrotherapy, which includes transcutaneous electrical nerve stimulation ("TENS") for pain management and neuromuscular electrical nerve stimulation ("NMES") devices for rehabilitation;

- •

- bone growth stimulation products, which promote the healing of bone tissue through combined magnetic field ("CMF") technology;

- •

- iontophoresis, which includes devices and accessories to deliver medication transdermally; and

- •

- home traction, which includes cervical and lumbar traction devices designed to provide decompression to the spine.

5

As of September 29, 2007, this division employed over 200 direct and independent sales representatives and managers, targeting physicians, physical therapists and other healthcare providers that prescribe home electrotherapy devices, and approximately 300 support representatives that call on payors and patients. This division also includes our regeneration, or bone growth stimulation, business which has 155 employed and independent sales representatives and several independent spine distributors targeting healthcare providers that prescribe bone growth stimulation products. To facilitate reimbursement, our Empi division utilizes a proprietary third-party billing system, which is designed to improve billing accuracy, shorten payment cycles, improve collection rates and strengthen relationships with payors.

This division also includes our Rehab Med + Equip ("RME") business. RME sells a wide range of proprietary and third-party rehabilitation products to physical therapists and chiropractors through a printed catalog and through an on-line e-commerce site.

Chattanooga. Our Chattanooga division offers over 1,000 products in the clinical rehabilitation market in the following categories:

- •

- clinical electrotherapy devices (such as TENS, NMES, laser, ultrasound and light therapy);

- •

- clinical traction devices; and

- •

- other clinical products and supplies such as treatment tables, continuous passive motion ("CPM") devices and dry heat therapy.

The Chattanooga division markets its products globally primarily through a network of independent distributors. As of September 29, 2007, the Chattanooga division had over 4,500 independent distributors, serviced by 16 dedicated business-to-business sales employees.

Our International Rehabilitation Segment, which generates most of its revenues in the European and Canadian markets, is divided into three main businesses:

- •

- the international sales of our DonJoy, ProCare and Aircast products, including rigid knee bracing products, orthopedic soft goods, cold therapy products and vascular systems;

- •

- our Ormed business, which provides bracing, CPM, electrotherapy and other products in Germany; and

- •

- our Cefar/Compex business, which provides electrotherapy products for medical and consumer markets and other physical therapy and rehabilitation products primarily in Europe.

We market and sell our International Rehabilitation Segment products to orthopedic surgeons, pharmacies, orthopedic shops, hospitals, physical therapy and rehabilitation clinics and consumer retail outlets. As of September 29, 2007, this division had over 250 employed and independent representatives and a large network of independent distributors. The International Rehabilitation Segment accounted for approximately 22% of our pro forma net sales for the twelve months ended September 29, 2007.

Our Surgical Implant Segment develops, manufactures and markets a wide variety of knee, hip and shoulder implant products that serve the orthopedic reconstructive joint implant market. We currently market and sell our Surgical Implant Segment products to hospitals and orthopedic surgeons through over 200 independent commissioned sales representatives in the United States and through independent distributors outside the United States. Our Surgical Implant Segment accounted for approximately 7% of our pro forma net sales for the twelve months ended September 29, 2007.

6

Market Opportunities

We participate globally in the rehabilitation, pain management, bone growth stimulation and reconstruction segments of the orthopedic device market. In the United States, we estimate these segments accounted for approximately $6.7 billion of total industry sales in 2006. We believe that several factors are driving growth in the orthopedic products industry, including the following:

- •

- Favorable demographics. An aging population is driving growth in the orthopedic products market. Many conditions that result in rehabilitation, physical therapy or orthopedic surgery are more likely to affect people in middle age or later in life. According to a 2005 United States Census Bureau projection, the aging baby boomer generation will result in the percentage of the U.S. population aged 65 and over growing from 12.4% in 2005 to 13.0% in 2010 and to 16.3% by 2020. In addition, according to the National Center for Health Statistics of the Centers for Disease Control, the average life expectancy in the United States increased from 75.4 years in 1990 to 77.5 years in 2003. According to a 2004 Frost & Sullivan report, these demographic trends in Europe are even more favorable as Europe has had the highest proportion of population age 65 and over among major world regions for many decades. As life expectancy increases, we believe people will remain active longer, causing the number of injuries requiring orthopedic rehabilitation, bone growth stimulation and reconstructive implants to increase.

- •

- Shift toward non-surgical rehabilitation devices and at-home physical therapy. We believe the growing awareness and clinical acceptance by healthcare professionals of the benefits of non-surgical, non-pharmaceutical treatment and rehabilitation products, combined with the increasing interest by patients in rehabilitation solutions that minimize risk and recuperation time and provide greater convenience, will continue to drive demand for these products. For example, TENS and NMES devices are increasingly being recognized as effective solutions for pain management and rehabilitation therapy, respectively. In addition, we believe that orthopedic surgeons are increasingly utilizing braces that assist in rehabilitation and bone growth stimulation devices that enable in-home treatment as viable alternatives to surgery. Many of our orthopedic rehabilitation products are designed for at-home use, which we believe should allow us to benefit from the market shift toward these treatment alternatives.

- •

- Lower cost alternatives appeal to third-party payors. With the cost of healthcare rising in the United States and internationally, third-party payors are seeking more cost-effective therapies without reducing quality of care. For example, third-party payors seek to reduce clinic visits and accommodate patients' preference for therapies that can be conveniently administered at home. We believe that many of our orthopedic rehabilitation products offer cost-effective alternatives to surgery, pharmaceutical and other traditional forms of physical therapy and pain management.

- •

- Increased need for rehabilitation due to increased orthopedic surgical volume. The combination of increased prevalence of degenerative joint disease (such as osteoarthritis), an increased number of sports-related injuries, an aging population and improvements in orthopedic surgical technique (such as arthroscopy) has contributed to an increase in the number of orthopedic surgeries. We believe that orthopedic surgical volume will continue to increase, which should result in an increase in the need for our products.

Competitive Strengths

We believe that we have a number of competitive strengths that will enable us to further enhance our position in the orthopedic rehabilitation device market:

- •

- Leading market positions. We derived over 60% of our pro forma net sales for the twelve months ended September 29, 2007 from products for which we estimate we have leading market positions, including soft goods, ankle braces, walking braces, rigid knee braces, clinical

7

electrotherapy, TENS, NMES, iontophoresis, cold therapy, home and clinical traction and CPM devices. We believe our orthopedic and physical therapy rehabilitation products marketed under the DonJoy, Aircast, ProCare, Chattanooga, Empi, Cefar/Compex and Ormed brands have a reputation for quality, durability and reliability among healthcare professionals. We believe the strength of our brands and our focus on customer service have allowed us to establish market leading positions in the highly fragmented and growing orthopedic rehabilitation market.

- •

- Comprehensive range of orthopedic rehabilitation products. We offer a diverse range of orthopedic devices, including orthopedic rehabilitation, pain management and physical therapy products, bone growth stimulation and surgical reconstructive implant products, to orthopedic specialists and patients for hospital, clinical and at-home therapies. Our broad product offering meets many of the needs of orthopedic rehabilitation professionals and patients and enables us to leverage our brand loyalty with our customer and distributor base. Our products are available across various stages of the orthopedic patient's continuum of care.

- •

- Extensive and diverse distribution network. We use multiple channels to distribute our products to our customers. As a result of the Merger, we will use the combined strength of over 5,500 distributors, our direct sales force of over 500 employed representatives and over 800 independent sales representatives to supply our products to physical therapy clinics, orthopedic surgeons and practices, orthotic and prosthetic clinics, hospitals, surgery centers, athletic trainers, chiropractors and retail outlets. We believe that our distribution network provides us with a significant competitive advantage in selling our existing products and in introducing new products.

- •

- Strong relationships with managed care organizations and rehabilitation healthcare providers. Our leading market positions in many of our orthopedic rehabilitation product lines and the breadth of our product offerings have enabled us to secure important preferred provider and managed care contracts. Our proprietary third-party billing system is designed to reduce our reimbursement cycles, improve relationships with managed care organizations and physicians and track patients to improve quality of care and create subsequent selling opportunities. Further, our OfficeCare business maintains inventory at over 1,200 healthcare facilities, primarily orthopedic practices, which further strengthens our relationships with these healthcare providers.

- •

- National contracts with group purchasing organizations. We enjoy strong relationships with a meaningful number of group purchasing organizations ("GPOs") due to our significant scale. We believe that our broad range of products is well suited to the goals of these buying groups. Under these national contracts, we provide favorable pricing to the buying group and are designated a preferred purchasing source for the members of the buying group for specified products. As we have made acquisitions and expanded our product range, we have been able to add incremental products to our national contracts. During the twelve months ended September 29, 2007, we signed or renewed five significant national contracts, and also added products from our recent acquisitions to a number of our national contracts.

- •

- Low cost, high quality manufacturing capabilities. Our principal manufacturing facility is located in Tijuana, Mexico and has been recognized for operational excellence. Our low cost manufacturing principles drive manufacturing efficiencies by employing lean manufacturing, Six Sigma concepts and continuous improvement processes. Following the Merger, we plan to move portions of ReAble's manufacturing to Mexico and expect to achieve savings from lower labor costs and implementation of more efficient processes. Further, we intend to extend lean manufacturing concepts to our manufacturing facilities in Clear Lake, South Dakota and Chattanooga, Tennessee.

- •

- Ability to generate significant cash flow. Historically, our strong competitive position, brand awareness and high quality products and service as well as our low cost manufacturing have

8

allowed us to generate attractive operating margins. These operating margins, together with limited capital expenditures and modest working capital requirements, significantly benefit our ability to generate free cash flow. Our combined capital expenditures of $21.3 million represented less than 8.4% of pro forma Adjusted EBITDA for the twelve months ended September 29, 2007.

- •

- Experienced and committed management team. The members of our combined management team have an average of over 24 years of relevant experience. This team has successfully integrated a number of acquisitions, including DJO's acquisition of Newmed SAS, a French orthopedics company ("Axmed") and Aircast Incorporated ("Aircast") in 2006 and ReAble's acquisition of Compex Technologies, Inc. ("Compex") and Cefar AB ("Cefar") in 2006. Certain members of our management are expected to make a contribution of new equity through the rollover of existing equity in connection with the Merger.

Strategy

Our strategy is to increase revenues and profitability and to enhance cash flow. Our key initiatives to implement this strategy include the following:

- •

- Increase our leading market positions. We believe we are the market leader in many of the markets in which we compete. We intend to continue to increase our market share by leveraging the cross-selling and other opportunities created by the Merger and by implementing the initiatives described below. The Merger will allow us to offer customers a more comprehensive range of products to better meet their evolving needs. We believe our size, scale, brand recognition, comprehensive and integrated product offerings and leading market positions will enable us to capitalize on the growth in the orthopedic product industry.

- •

- Increase sales force productivity. The distribution channels of DJO and ReAble are complementary and we believe that the Merger provides an opportunity to increase the productivity of our sales force. Following the Merger, our sales representatives will generally have a targeted customer base with a broader product offering for those customers. We plan to encourage cross-selling and increase the productivity of the entire sales force by focusing our sales organization and implementing a sales compensation plan to incentivize our sales representatives to sell a broader range of our products. For example, the Merger will combine DJO's strong relationship with orthopedic surgeons and ReAble's strong relationship with physical therapists. In addition, we intend to market DJO's bone growth stimulation products through Empi's extensive distribution network.

- •

- Maximize existing and secure additional national accounts. We plan to capitalize on the growing practice in healthcare in which hospitals and other large healthcare providers seek to consolidate their purchasing activities to national buying groups. Contracts with these national accounts represent a significant opportunity for revenue growth. We believe that our existing relationships with national buying groups and our broad range of products position us well not only to pursue additional national contracts, but also to expand the scope of our existing contracts.

- •

- Continue to develop and launch new products and product enhancements. Both DJO and ReAble have a history of developing and introducing innovative products into the marketplace, and we expect to continue future product launches by leveraging our internal research and development platforms. We believe our ability to develop new technology and to advance existing technology to create new products will position us to further diversify our revenues and to expand our target markets by providing viable alternatives to surgery or medication. We believe that product innovation though effective and focused research and development, as well as our relationships with a number of widely recognized orthopedic surgeons and professionals who assist us in product research, development and marketing, will provide a significant competitive advantage.

9

During the twelve months ended September 29, 2007, we launched 52 new products, which generated over $50 million in pro forma revenues.

- •

- Expand international sales. In recent years, we have successfully established direct distribution capabilities in several major international markets. We believe that sales to European and other markets outside the United States continue to represent a significant growth opportunity, and we intend to continue to expand our direct and independent distribution capabilities in attractive foreign markets. The Aircast, Axmed, Cefar and Compex acquisitions in 2006 have substantially increased our international revenues and operating infrastructure and have provided us with opportunities to expand our international product offerings. For the nine months ended September 29, 2007, international revenues increased to 23.0% of our pro forma revenues, compared to 18.9% for the year ended December 31, 2006, which included revenues of our International Rehabilitation Segment, as well as the international revenues of our Domestic Rehabilitation and Surgical Implant Segments.

- •

- Maximize cost savings opportunities. We expect the Merger to create significant opportunities to reduce manufacturing and other operating costs. We expect to achieve cost savings by leveraging DJO's low-cost manufacturing capabilities, rationalizing our combined manufacturing and distribution footprints, increasing procurement savings and eliminating duplicative overhead functions. We also intend to eliminate overlapping operating expenses and expect to reduce expenses through improved leveraging of our combined benefits of scale.

10

The Transactions

On July 15, 2007, RTFL and Reaction Merger Sub entered into the Merger Agreement with DJO pursuant to which Reaction Merger Sub will be merged with and into DJO, with DJO continuing as the surviving corporation and becoming a wholly owned subsidiary of RTFL. RTFL is controlled by affiliates of Blackstone Capital Partners V L.P. ("Blackstone"). As a result of the Merger:

- •

- each issued and outstanding share of common stock of DJO will generally be cancelled and converted into the right to receive $50.25 in cash, without interest and less any applicable withholding taxes; and

- •

- each outstanding option to purchase common stock under DJO's stock option plans, whether vested or unvested, except for options held by certain members of DJO management which will be rolled over in the Transactions, will be cancelled and entitle the holder to receive a cash payment equal to the excess, if any, of the per share merger consideration over the per share exercise price of the applicable stock option, multiplied by the number of shares subject to the stock option, less any applicable taxes required to be withheld.

The Merger is subject to a number of conditions and the completion of this offering is conditioned on the completion of the Merger.

In connection with the Merger, investment funds affiliated with Blackstone will provide equity financing in the aggregate amount of up to $421.9 million, which is expected to include the rollover of stock options by certain members of DJO management. In addition, in connection with the Merger, we intend to:

- •

- enter into new senior secured credit facilities, consisting of a $1,055.0 million six and a half-year term loan facility and a $100.0 million six-year revolving credit facility;

- •

- issue $575.0 million aggregate principal amount of new senior unsecured notes;

- •

- repay $428.3 million of ReAble's existing indebtedness, including accrued interest;

- •

- repay $288.6 million of DJO's existing indebtedness, including accrued interest; and

- •

- pay an estimated $84.0 million of fees and expenses.

11

Sources and Uses

The expected estimated sources and uses of the funds for the Transactions (assuming the Transactions had closed on September 29, 2007) are shown in the table below. Actual amounts may vary from estimated amounts depending on several factors, including differences from our estimate of the cost of repaying our and DJO's existing indebtedness, differences from our estimate of fees and expenses, fluctuations in cash on hand between September 29, 2007 and the actual closing date of the Transactions and any changes in the number of outstanding shares of DJO common stock or options to acquire DJO common stock since September 29, 2007, and any changes in these amounts may affect the amount of the final cash equity contribution.

(in millions)

Sources

| |

|

|---|

| New senior secured credit facilities: | | | |

| | Revolving credit facility(1) | | $ | — |

| | Term loan facility | | | 1,055.0 |

| New senior unsecured notes | | | 575.0 |

| Equity contribution(2) | | | 421.9 |

| Rollover equity(3) | | | 368.6 |

| Cash on hand | | | 43.8 |

| | |

|

| | Total sources | | $ | 2,464.3 |

| | |

|

Uses

| |

|

|---|

| DJO equity consideration(4) | | $ | 1,246.8 |

| Repayment of existing DJO indebtedness(5) | | | 288.6 |

| Repayment of existing ReAble indebtedness(6) | | | 428.3 |

| Cash on hand: | | | |

| | Prefunded integration costs | | | 33.0 |

| | Cash for operations | | | 15.0 |

| Rollover equity(3) | | | 368.6 |

| Transaction fees and expenses(7) | | | 84.0 |

| | |

|

| | Total uses | | $ | 2,464.3 |

| | |

|

- (1)

- We do not expect to have any outstanding borrowings under the revolving credit facility on the closing date of the Transactions.

- (2)

- Represents the approximate cash equity contribution to be made by investment funds affiliated with Blackstone and the expected contribution of new equity by certain members of DJO management through the rollover of existing stock options.

- (3)

- Represents (i) cash equity that investment funds affiliated with Blackstone contributed in connection with the Prior Transactions (as defined below) in November 2006, (ii) equity rollover in connection with a prior acquisition and (iii) the value of ReAble management stock options that were rolled over in the Prior Transactions, net of $1.4 million of rolled-over ReAble management stock options that will be cashed out in the Transactions. As of September 29, 2007, the total membership equity reflected on ReAble's balance sheet was $313.5 million.

- (4)

- Reflects the total consideration to be paid to holders of outstanding shares of DJO's common stock and holders of outstanding options to acquire shares of DJO common stock in the Merger, assuming that all stock options will be settled in cash. Assumes (i) 23.7 million shares outstanding, (ii) options to acquire DJO's common stock with a net option value of $57.7 million, which is calculated based on outstanding options to acquire 2.8 million shares of DJO common stock with an average exercise price of $29.69 per share, and (iii) the estimated number of shares issuable under the DJO employee stock purchase plan, with a net value of $0.3 million, in each case calculated as of September 29, 2007.

- (5)

- Consists of $285.5 million of outstanding borrowings and $3.1 million of accrued interest under DJO's existing senior secured credit facilities.

- (6)

- Consists of $423.4 million of outstanding borrowings and $4.9 million of accrued interest under ReAble's existing senior secured credit facilities.

- (7)

- Reflects our estimate of fees and expenses associated with the Transactions, including financing fees, advisory fees, other transaction costs and $4.4 million related to terminating DJO's and ReAble's existing interest rate swaps.

12

RISK FACTORS

Risks Related To Our Indebtedness

Our substantial leverage could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry and expose us to interest rate risk.

After completing the Transactions, we will be highly leveraged. As of September 29, 2007, on a pro forma basis, our total indebtedness would have been $1,835.8 million. We also would have had an additional $100.0 million available for borrowing under our revolving credit facility.

Our high degree of leverage could have important consequences for you, including:

- •

- making it more difficult for us to make payments on the notes and our other debt;

- •

- increasing our vulnerability to general economic and industry conditions;

- •

- requiring a substantial portion of cash flow from operations to be dedicated to the payment of principal and interest on our indebtedness, therefore reducing our ability to use our cash flow to fund our operations, capital expenditures and future business opportunities;

- •

- exposing us to the risk of increased interest rates as certain of our borrowings, including borrowings under our new senior secured credit facilities, will be at variable rates of interest;

- •

- limiting our ability to make strategic acquisitions or causing us to make non-strategic divestitures;

- •

- limiting our ability to obtain additional financing for working capital, capital expenditures, product development, debt service requirements, acquisitions and general corporate or other purposes; and

- •

- limiting our ability to adjust to changing market conditions and placing us at a competitive disadvantage compared to our competitors who are less highly leveraged.

We and our subsidiaries will be able to incur substantial additional indebtedness in the future. Although our new senior secured credit facilities, the indenture governing the new senior unsecured notes and the indenture governing our existing senior subordinated notes contain restrictions on the incurrence of additional indebtedness, these restrictions are subject to a number of significant qualifications and exceptions, and under certain circumstances, the amount of indebtedness that could be incurred in compliance with these restrictions could be substantial. If new indebtedness is added to our current debt levels, the related risks that we now face could intensify. In addition, the indenture governing the new senior unsecured notes will not prevent us from incurring obligations that do not constitute indebtedness under the indenture.

Our pro forma cash interest expense and fees for the unused portion of our new revolving credit facility for the twelve months ended September 29, 2007 would have been $171.5 million, compared to ReAble and DJO combined historical cash interest expense of $70.5 million for the twelve months ended September 29, 2007. At September 29, 2007, on a pro forma basis, we would have had $1,055.0 million of debt subject to floating interest rates under our new senior secured credit facilities. A 100 basis point increase in these floating interest rates would increase our cash annual interest expense by approximately $10.6 million. Any additional borrowings we make under our new senior secured credit facilities will also be subject to floating interest rates.

Our debt agreements will contain restrictions that limit our flexibility in operating our business.

Our new senior secured credit facilities and the indenture governing the new senior unsecured notes will contain and the indenture governing our existing senior subordinated notes already contains various covenants that will limit our ability to engage in specified types of transactions. These covenants will limit our and our restricted subsidiaries' ability to, among other things:

- •

- incur additional indebtedness or issue certain preferred shares;

- •

- pay dividends on, repurchase or make distributions in respect of our capital stock or make other restricted payments;

13

- •

- make certain investments;

- •

- sell certain assets;

- •

- create liens;

- •

- consolidate, merge, sell or otherwise dispose of all or substantially all of our assets; and

- •

- enter into certain transactions with our affiliates.

In addition, we will be required to satisfy and maintain a specified senior secured leverage ratio, which becomes more restrictive over time. This covenant could materially and adversely affect our ability to finance our future operations or capital needs. Furthermore, it may restrict our ability to conduct and expand our business and pursue our business strategies. Our ability to meet this senior secured leverage ratio can be affected by events beyond our control, including changes in general economic and business conditions, and we cannot assure you that we will meet the senior secured leverage ratio in the future or at all.

A breach of any of these covenants could result in a default under one or more of these agreements, including as a result of cross default provisions. Upon the occurrence of an event of default under the new senior secured credit facilities, the lenders could elect to declare all amounts outstanding under the new senior secured credit facilities to be immediately due and payable and terminate all commitments to extend further credit. Such actions by those lenders could cause cross defaults under our other indebtedness. If we were unable to repay those amounts, the lenders under the new senior secured credit facilities could proceed against the collateral granted to them to secure that indebtedness. We have pledged a significant portion of our assets as collateral under the new senior secured credit facilities.

We may not be able to generate sufficient cash to service all of our indebtedness, and may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful.

Our ability to make scheduled payments on or to refinance our debt obligations depends on our financial condition and operating performance, which is subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. We cannot assure you that we will maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our indebtedness.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay investments and capital expenditures, or to sell assets, seek additional capital or restructure or refinance our indebtedness. These alternative measures could affect the operation and growth of our business and may not be successful and may not permit us to meet our scheduled debt service obligations. If our operating results and available cash are insufficient to meet our debt service obligations, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations. In that case, we may not be able to consummate those dispositions or to obtain the proceeds that we could realize from them, and the proceeds from those dispositions may not be adequate to meet any debt service obligations then due. Additionally, our new senior secured credit facilities and the indenture governing our new senior unsecured notes will limit the use of the proceeds from dispositions of assets; as a result, we may not be permitted, under our new senior secured credit facilities and the indenture governing the notes, to use the proceeds from such dispositions to satisfy all current debt service obligations.

14

Risks Related To Our Business

We may not be able to successfully integrate ReAble and DJO, as well as other businesses ReAble and DJO have recently acquired, or businesses we acquire in the future, and we may not be able to realize the anticipated cost savings, revenue enhancements or other synergies from such acquisitions.

Our ability to successfully implement our business plan and achieve targeted financial results is highly dependent on our ability to successfully integrate ReAble and DJO, businesses ReAble and DJO have recently acquired and other businesses we acquire in the future. The process of integrating ReAble and DJO and such other acquired businesses involves risks. These risks include, but are not limited to:

- •

- demands on management related to the significant increase in the size of our business;

- •

- diversion of management's attention from the management of daily operations to the integration of newly acquired operations;

- •

- difficulties in the assimilation of different corporate cultures, practices and sales and distribution methodologies;

- •

- difficulties in conforming the acquired company's accounting policies to ours;

- •

- increased exposure to risks relating to business operations outside the United States;

- •

- retaining the loyalty and business of the customers of acquired businesses;

- •

- retaining employees that may be vital to the integration of the acquired business or to the future prospects of the combined businesses;

- •

- difficulties and unanticipated expenses related to the integration of departments, information technology systems, including accounting systems, technologies, books and records and procedures, and maintaining uniform standards, such as internal accounting controls, procedures and policies; and

- •

- costs and expenses associated with any undisclosed or potential liabilities.

Failure to successfully integrate ReAble and DJO, as well as Cefar, Compex, Saunders and IOMED or any other acquired businesses, may result in reduced levels of revenue, earnings or operating efficiency than we have achieved or might have achieved if we had not acquired such businesses, loss of customers of the acquired business.

In addition, an important part of our strategy is to generate revenue growth by cross selling the products of ReAble and DJO through the other's distribution network. Our ability to successfully cross sell our products to the extent we anticipate or at all is subject to considerable uncertainty. To the extent we are not successful in our cross selling efforts, our revenues and income will be adversely affected.

Furthermore, even if we are able to integrate successfully the operations of ReAble and DJO, as well as other businesses ReAble and DJO have recently acquired, or any other acquired business, we may not be able to realize the potential cost savings, synergies and revenue enhancements that were anticipated from the acquisition, either in the amount or within the time frame that we expect, and the costs of achieving these benefits may be higher than, and the timing may differ from, what we expect. Our ability to realize anticipated cost savings, synergies and revenue enhancements may be affected by a number of factors, including, but not limited to, the following:

- •

- the use of more cash or other financial resources on integration and implementation activities than we expect;

15

- •

- increases in other expenses unrelated to the acquisition, which may offset the cost savings and other synergies from the acquisition;

- •

- our ability to eliminate effectively duplicative back office overhead and overlapping and redundant selling, general and administrative functions, rationalize manufacturing capacity and shift production to more economical facilities; and

- •

- our ability to avoid labor disruptions in connection with any integration, particularly in connection with any headcount reduction.

Specifically, we expect the acquisition of DJO to create significant opportunities to reduce our manufacturing and other costs. We expect to achieve cost savings by leveraging DJO's low-cost manufacturing capabilities, rationalizing our combined manufacturing and distribution footprints, increasing procurement savings and eliminating duplicative overhead functions. We also expect to receive cost savings from initiatives we have undertaken in connection with a number of our previously completed acquisitions. However, while these anticipated cost savings reflect estimates and assumptions made by our management as to the benefits and associated expenses with respect to our cost savings initiatives, it is possible that these estimates and assumptions may not ultimately reflect actual results. In addition, these estimated cost savings are only estimates and may not actually be achieved in the timeframe anticipated or at all.

If we fail to realize anticipated cost savings, synergies or revenue enhancements, our financial results will be adversely affected, and we may not generate the cash flow from operations that we anticipated, or that is sufficient to repay our indebtedness.

As a result of the Merger, our concentration of manufacturing operations in Mexico increases our business and competitive risks.

Following the Merger, our most significant manufacturing facility will be DJO's facility in Tijuana, Mexico, and we will also have a relatively small manufacturing operation in Tunisia. In addition, we plan to move portions of ReAble's manufacturing to Mexico. Our current and future foreign operations are subject to risks of political and economic instability inherent in activities conducted in foreign countries. Because there are no readily accessible alternatives to these facilities, any event that disrupts manufacturing at or distribution or transportation from these facilities would materially adversely affect our operations. In addition, as a result of this concentration of manufacturing activities, our sales in foreign markets may be at a competitive disadvantage to products manufactured locally due to freight costs, custom and import duties and favorable tax rates for local businesses.

We may experience substantial fluctuations in our quarterly operating results and you should not rely on them as an indication of our future results.

Our quarterly operating results may vary significantly due to a combination of factors, many of which are beyond our control. These factors include:

- •

- demand for many of our products, which historically has been higher in the fourth quarter when scholastic sports and ski injuries are more frequent;

- •

- our ability to meet the demand for our products;

- •

- the direct distribution of our products in foreign countries that have seasonal variations;

- •

- the number, timing and significance of new products and product introductions and enhancements by us and our competitors, including delays in obtaining government review and clearance of medical devices;

16

- •

- our ability to develop, introduce and market new and enhanced versions of our products on a timely basis;

- •

- the impact of any acquisitions that occur in a quarter;

- •

- the impact of any changes in generally accepted accounting principles;

- •

- changes in pricing policies by us and our competitors and reimbursement rates by third-party payors, including government healthcare agencies and private insurers;

- •

- the loss of any of our significant distributors;

- •

- changes in the treatment practices of orthopedic and spine surgeons, primary care physicians, and pain-management specialists, and their allied healthcare professionals; and

- •

- the timing of significant orders and shipments.

Accordingly, our quarterly sales and operating results may vary significantly in the future and period-to-period comparisons of our results of operations may not be meaningful and should not be relied upon as indications of future performance. We cannot assure you that our sales will increase or be sustained in future periods or that we will be profitable in any future period.

We operate in a highly competitive business environment, and our inability to compete effectively could adversely affect our business prospects and results of operations.

We operate in highly competitive and fragmented markets. Our Domestic Rehabilitation Segment and International Rehabilitation Segment compete with both large and small companies, including several large, diversified companies with significant market share and numerous smaller niche companies, particularly in the physical therapy products market. Our Surgical Implant Segment competes with a small number of very large companies that dominate the market, as well as other companies similar to our size. We may not be able to offer products similar to, or more desirable than, those of our competitors or at a price comparable to that of our competitors. Compared to us, many of our competitors have:

- •

- greater financial, marketing and other resources;

- •

- more widely accepted products;

- •

- a larger number of endorsements from healthcare professionals;

- •

- a larger product portfolio;

- •

- superior ability to maintain new product flow;

- •

- greater research and development and technical capabilities;

- •

- patent portfolios that may present an obstacle to the conduct of our business;

- •

- stronger name recognition;

- •

- larger sales and distribution networks; and/or

- •

- international manufacturing facilities that enable them to avoid the transportation costs and foreign import duties associated with shipping our products manufactured in the United States to international customers.

Accordingly, we may be at a competitive disadvantage with respect to our competitors. These factors may materially impair our ability to develop and sell our products.

17

If we are unable to develop or license new products or product enhancements or find new applications for our existing products, we will not remain competitive.

The markets for our products are characterized by continued new product development and the obsolescence of existing products. Our future success and our ability to increase revenues and make payments on our indebtedness will depend, in part, on our ability to develop, license, acquire and distribute new and innovative products, enhance our existing products with new technology and find new applications for our existing products. However, we may not be successful in developing, licensing or introducing new products, enhancing existing products or finding new applications for our existing products. We also may not be successful in manufacturing, marketing and distributing products in a cost-effective manner, establishing relationships with marketing partners, obtaining coverage of and satisfactory reimbursement for our future products or product enhancements or obtaining required regulatory clearances and approvals in a timely fashion or at all. If we fail to keep pace with continued new product innovation or enhancement or fail to successfully commercialize our new or enhanced products, our competitive position, financial condition and results of operations could be materially and adversely affected.

In addition, if any of our new or enhanced products contain undetected errors or design defects, especially when first introduced, or if new applications that we develop for existing products do not work as planned, our ability to market these and other products could be substantially delayed, and we could ultimately become subject to product liability litigation, resulting in lost revenues, potential damage to our reputation and/or delays in regulatory clearance. In addition, approval of our products or obtaining acceptance of our products by physicians, physical therapists and other healthcare professionals that recommend and prescribe our products could be adversely affected.

The success of our surgical implant products depends on our relationships with leading surgeons who assist with the development and testing of our products.

A key aspect of the development and sale of our surgical implant products is the use of designing and consulting arrangements with orthopedic surgeons who are well recognized in the healthcare community. These surgeons assist in the development and clinical testing of new surgical implant products. They also participate in symposia and seminars introducing new surgical implant products and assist in the training of healthcare professionals in using our new products. We may not be successful in maintaining or renewing our current designing and consulting arrangements with these surgeons or in developing similar arrangements with new surgeons. In that event, our ability to develop, test and market new surgical implant products could be adversely affected.

Proposed laws that would limit the types of orthopedic professionals who can fit, sell or seek reimbursement for our products could, if adopted, adversely affect our business.

In response to pressure from certain groups (mostly orthotists), the United States Congress and state legislatures have periodically considered proposals that limit the types of orthopedic professionals who can fit or sell our orthotic device products or who can seek reimbursement for them. Several states have adopted legislation which imposes certification or licensing requirements on the measuring, fitting and adjusting of certain orthotic devices. Although some of these state laws exempt manufacturers' representatives, other states' laws subject the activities of such representatives to certification or licensing requirements. Additional states may be considering similar legislation. Such laws could reduce the number of potential customers by restricting the activities of our sales representatives in those jurisdictions where such legislation or regulations are enacted. Furthermore, because the sales of orthotic devices are driven in part by the number of professionals who fit and sell them, laws that limit these activities could reduce demand for these products. We may not be successful in opposing the adoption of such legislation or regulations and, therefore, such laws could have a material adverse effect on our business.

18

In addition, efforts have been made to establish similar requirements at the federal level for the Medicare program. For example, in 2000, Congress passed the Medicare, Medicaid and SCHIP Benefits Improvement and Protection Act of 2000 ("BIPA"). BIPA contained a provision requiring, as a condition for payment by the Medicare program, that certain certification or licensing requirements be met for individuals and suppliers furnishing certain, but not all, custom-fabricated orthotic devices. Although the Centers for Medicare and Medicaid Services have not implemented this requirement, we cannot predict the effect of implementation of BIPA or implementation of other such laws will have on our business.

If we fail to establish new sales and distribution relationships or maintain our existing relationships, or if our third-party distributors and independent sales representatives fail to commit sufficient time and effort or are otherwise ineffective in selling our products, our results of operations and future growth could be adversely impacted.

The sales and distribution of certain of our orthopedic rehabilitation products, regeneration products and our surgical implant products depend, in part, on our relationships with a network of third-party distributors and independent commissioned sales representatives. These third-party distributors and independent sales representatives maintain the relationships with the hospitals, orthopedic surgeons, physical therapists and other healthcare professionals that purchase, use and recommend the use of our products. Although our internal sales staff trains and manages these third-party distributors and independent sales representatives, we do not directly monitor the efforts that they make to sell our products. In addition, some of the independent sales representatives that we use to sell our surgical implant products also sell products that directly compete with our core product offerings. These sales representatives may not dedicate the necessary effort to market and sell our products. If we fail to attract and maintain relationships with third-party distributors and skilled independent sales representatives or fail to adequately train and monitor the efforts of the third-party distributors and sales representatives that market and sell our products, or if our existing third-party distributors and independent sales representatives choose not to carry our products, our results of operations and future growth could be adversely affected.

We rely on our own direct sales force for certain of our products, which may result in higher fixed costs than our competitors and may slow our ability to reduce costs in the face of a sudden decline in demand for our products.

We rely on our own direct sales force of over 340 representatives in the United States and over 190 representatives in Europe to market and sell certain of the orthopedic rehabilitation products which are intended for use in the home and in rehabilitation clinics. Some of our competitors rely predominantly on independent sales agents and third-party distributors. A direct sales force may subject us to higher fixed costs than those of companies that market competing products through independent third parties, due to the costs that we will bear associated with employee benefits, training and managing sales personnel. As a result, we could be at a competitive disadvantage. Additionally, these fixed costs may slow our ability to reduce costs in the face of a sudden decline in demand for our products, which could have a material adverse effect on our results of operations.

The success of all of our products depends heavily on our relationships with healthcare professionals who prescribe and recommend our products, and our failure to maintain or develop these relationships could adversely affect our business.

We have developed and maintain close relationships with a number of orthopedic surgeons, primary care physicians, other specialist physicians, physical therapists, athletic trainers, chiropractors and other healthcare professionals. We believe that sales of our products depend significantly on their recommendations of our products. Acceptance of our products depends on educating the healthcare

19

community as to the distinctive characteristics, perceived benefits, clinical efficacy and cost-effectiveness of our products compared to the products offered by our competitors and on training healthcare professionals in the proper use and application of our products. Failure to maintain these relationships and develop similar relationships with other leading healthcare professionals could result in a less frequent recommendation of our products, which may adversely affect our sales and profitability.

Our international operations expose us to risks related to conducting business in multiple jurisdictions outside the United States.

The international scope of our operations exposes us to economic, regulatory and other risks in the countries in which we operate. On a pro forma basis, we would have generated approximately 18% and 22% of our net revenues from customers outside the United States for the year ended December 31, 2006 and the nine months ended September 29, 2007, respectively. Doing business in foreign countries exposes us to a number of risks, including the following:

- •

- fluctuations in currency exchange rates;

- •

- imposition of investment, currency repatriation and other restrictions by foreign governments;

- •

- potential adverse tax consequences, including the imposition or increase of withholding and other taxes on remittances and other payments by foreign subsidiaries, which, among other things, may preclude payments or dividends from foreign subsidiaries from being used for our debt service, and exposure to adverse tax regimes;

- •

- difficulty in collecting accounts receivable and longer collection periods;

- •

- the imposition of additional foreign governmental controls or regulations on the sale of our products;

- •

- intellectual property protection difficulties;

- •

- changes in political and economic conditions;

- •

- difficulties in attracting high-quality management, sales and marketing personnel to staff our foreign operations;

- •

- labor disputes;

- •

- import and export restrictions and controls, tariffs and other trade barriers;

- •

- increased costs of transportation or shipping;

- •

- exposure to different approaches to treating injuries;

- •

- exposure to different legal, regulatory and political standards; and

- •

- difficulties of local governments in responding to severe weather emergencies, natural disasters or other such similar events.

In addition, as we grow our operations internationally, we will become increasingly dependent on foreign distributors and sales agents for our compliance and adherence to foreign laws and regulations that we may not be familiar with, and we cannot assure you that these distributors and sales agents will adhere to such laws and regulations or adhere to our own business practices and policies. Any violation of laws and regulations by foreign distributors or sales agents or a failure of foreign distributors or sales agents to comply with our business practices and policies could result in legal or regulatory sanctions against us or potentially damage our reputation in that international market. If we fail to manage these risks effectively, we may not be able to grow our international operations, and our business and results of operations may be materially adversely affected.

20

To date, we have not used international currency derivatives to hedge against our investment in our European subsidiaries or their operating results, which are converted into U.S. Dollars at period-end and average rates, respectively.

As a result of the Merger, our concentration of manufacturing operations in Mexico increases our business and competitive risks.

Following the Merger, our most significant manufacturing facility will be DJO's facility in Tijuana, Mexico, and we will also have a relatively small manufacturing operation in Tunisia. In addition, we plan to move portions of ReAble's manufacturing to Mexico. Our current and future foreign operations are subject to risks of political and economic instability inherent in activities conducted in foreign countries. Because there are no readily accessible alternatives to these facilities, any event that disrupts manufacturing at or distribution or transportation from these facilities would materially adversely affect our operations. In addition, as a result of this concentration of manufacturing activities, our sales in foreign markets may be at a competitive disadvantage to products manufactured locally due to freight costs, custom and import duties and favorable tax rates for local businesses.

Fluctuations in foreign exchange rates may adversely affect our financial condition and results of operations and may affect the comparability of our results between financial periods.

Our foreign operations expose us to currency fluctuations and exchange rate risks, and our acquisition of DJO will increase that exposure. We are exposed to the risk of currency fluctuations between the U.S. Dollar and the Euro, Pound Sterling, Canadian Dollar, Mexican Peso, Swiss Franc, Norwegian Krona, Danish Krona and Swedish Krona. On a pro forma basis after giving effect to the Transactions, sales denominated in foreign currencies accounted for approximately 18% of our consolidated net sales for the year ended December 31, 2006, of which 15% is related to the Euro, and approximately 22% of our consolidated net sales for the nine months ended September 29, 2007, of which 17% is related to the Euro. Our exposure to fluctuations in foreign currencies arises because certain of our subsidiaries' results are recorded in these currencies and then translated into U.S. Dollars for inclusion in our consolidated financial statements and certain of our subsidiaries enter into purchase or sale transactions using a currency other than our functional currency. Therefore, changes in currency exchange rates may adversely affect our financial condition and results of operations and may affect the comparability of our results between reporting periods.

We may not be able to effectively manage our currency translation risks, and volatility in currency exchange rates may adversely affect our financial condition and results of operations.

If adequate levels of reimbursement coverage from third-party payors for our products are not obtained, healthcare providers and patients may be reluctant to use our products, and our sales may decline.

Our sales depend largely on whether there is adequate reimbursement coverage by government healthcare programs, such as Medicare and Medicaid, and by private payors. We believe that surgeons, hospitals, physical therapists and other healthcare providers may not use, purchase or prescribe our products and patients may not purchase our products if these third-party payors do not provide satisfactory reimbursement for the costs of our products or the procedures involving the use of our products. Consequently, we may be unable to sell our products on a profitable basis if third-party payors deny coverage, reduce their current levels of reimbursement or fail to cause their levels of reimbursement to rise quickly enough to cover cost increases.

Changes in the coverage of, and reimbursement for, our products by these third-party payors could have a material adverse effect on our results of operations. Third-party payors continue to review their coverage policies carefully for existing and new therapies and can, without notice, decide not to reimburse for treatments that include the use of our products. They may attempt to control costs by

21

(i) authorizing fewer elective surgical procedures, including joint reconstructive surgeries, (ii) requiring the use of the least expensive product available or (iii) reducing the reimbursement for or limiting the number of authorized visits for rehabilitation procedures. For example, in the United States, Medicare frequently engages in efforts to contain costs, which may result in a reduction of coverage of, and reimbursement for, our products. Because many private payors model their coverage and reimbursement policies on Medicare policies, third-party payors' coverage of, and reimbursement for, our products could be negatively impacted by legislative, regulatory or other measures that reduce Medicare coverage and reimbursement generally.

Our international sales also depend in part upon the coverage and eligibility for reimbursement of our products through government-sponsored healthcare payment systems and third-party payors, the amount of reimbursement and the cost allocation of payments between the patient and government-sponsored healthcare payment systems and third-party payors. Coverage and reimbursement practices vary significantly by country, with certain countries requiring products to undergo a lengthy regulatory review in order to be eligible for third-party coverage and reimbursement. In addition, healthcare cost containment efforts similar to those we face in the United States are prevalent in many of the foreign countries in which our products are sold, and these efforts are expected to continue in the future, possibly resulting in the adoption of more stringent reimbursement standards. For example, in Germany, our largest foreign country market, new regulations generally require adult patients to pay a portion of the cost of each medical technical device purchased. This may adversely affect our sales and profitability by making it more difficult for patients in Germany to pay for our products.

Any developments in the United States or our foreign markets that eliminate, reduce or materially modify coverage of, and reimbursement rates for, our products could have an adverse effect on our ability to sell our products.

22

Recent changes in coverage and reimbursement policies for our products by Medicare or reductions in reimbursement rates for our products could adversely affect our business and results of operations.

The Medicare Prescription Drug, Improvement and Modernization Act of 2003 ("Medicare Modernization Act") mandates a number of changes in the Medicare payment methodology and conditions for coverage of orthotic devices and durable medical equipment, including many of our products. These changes include a temporary freeze in annual increases in payments for durable medical equipment from 2004 through 2008, competitive bidding requirements, new clinical conditions for payment and quality standards. Although these changes affect our products generally, specific products may be affected by some but not all of the Medicare Modernization Act's provisions.

Prefabricated orthotic devices and certain durable medical equipment, including many of our products, may be subject to a competitive bidding process established under the Medicare Modernization Act. In April 2007, the Centers for Medicare and Medicaid Services, the agency responsible for administering the Medicare program, issued final regulations in connection with the competitive bidding program. Under competitive bidding, Medicare will no longer reimburse for certain products and services based on the Medicare fee schedule amount in designated competitive bidding areas. Instead, the Centers for Medicare and Medicaid Services will provide reimbursement for these items and services based on a competitive bidding process. Only those suppliers selected as a result of the competitive bidding process within each designated region will be eligible to have their products reimbursed through Medicare. Competitive bidding will go into effect September 30, 2008 initially in ten metropolitan statistical areas and will apply to ten product categories. In 2009, the program will be expanded to 80 metropolitan statistical areas (and additional areas thereafter), and additional product categories may be selected. The competitive bidding process may reduce the number of suppliers providing certain items and services to Medicare beneficiaries and the amounts paid for such items and services within a given geographic area. None of our products were included in the initial round of items subject to bidding; however, there is no assurance they will not be included in the future. Inclusion of any of our products in Medicare competitive bidding or other Medicare reimbursement reductions could result in such products being sold in lesser quantities or for a lower price, or such products being discontinued altogether. Any of these developments could have a material adverse effect on our results of operations. In addition, if we are not selected to participate in the competitive bidding program in a particular region, it could have a material adverse effect on our sales and profitability.

Our success depends on receiving regulatory approval for our products, and failure to do so could adversely affect our growth and operating results.

Our products are subject to extensive regulation in the United States by the Food and Drug Administration (the "FDA") and by similar governmental authorities in the foreign countries where we do business. The FDA regulates virtually all aspects of a medical device's development, testing, manufacturing, labeling, promotion, distribution and marketing. In general, unless an exemption applies, a medical device must receive either pre-market approval or pre-market clearance from the FDA before it can be marketed in the United States. While in the past we have received such approvals, we may not be successful in the future in receiving such approvals in a timely manner or at all. If we begin to have significant difficulty obtaining such FDA approvals or clearances in a timely manner or at all, we could suffer a material adverse effect on our revenues and growth.

If we fail to obtain regulatory approval for the modification of or new uses for our products, our growth and operating results could suffer.

In order to market modifications to our existing products or market our existing products for new indications, we may be required to obtain pre-market approvals, pre-market approval supplements or pre-market clearances. The FDA requires device manufacturers themselves to make and document a determination of whether or not a modification requires a new approval, supplement or clearance; however, the FDA can review and disagree with a manufacturer's decision. We may not be successful in

23