Exhibit 99.1

Dear shareholder:

It is my pleasure to update you on the progress of First Trinity Financial Corporation (“FTFC” or the Company) and its subsidiaries Trinity Life Insurance Company (“TLIC”), Family Benefit Life Insurance Company (“FBLIC”), Trinity American Inc (“TAI”), and Trinity Mortgage Corporation (“TMC”). As you may have seen in an April 25, 2023 press release, FTFC entered into an agreement to be acquired by Brickell L&A Holdings LLC, subject to certain conditions. Brickell L&A Holdings LLC is a portfolio company of the Brickell Insurance Group of companies, and an affiliate of 777 Partners LLC, a private equity firm based in Miami Florida. The parties are working on the various matters to prepare to finish the proposed transaction. The purchase price will be calculated at closing and will be 1.17 times the Company’s GAAP shareholders’ equity as of closing, excluding accumulated other comprehensive income (loss), and subject to transaction expense adjustments. We expect the transaction to close on or before mid-2024, subject to receipt of insurance regulatory approvals, shareholder approval and customary closing conditions. Proceeds from the transaction will be paid in cash to the Company’s shareholders.

Due to the ongoing potential sale transaction, our Board of Directors has determined that FTFC will not hold an annual shareholders meeting during 2023. All directors currently serving will continue to serve until the next annual meeting planned to be held in 2024.

From the beginning, our goals at FTFC were to build a successful life insurance holding company built on moral and ethical principles, increase shareholder value, be a good corporate citizen, provide competitive life and annuity products to our policy owners and ultimately create a liquidity event for our shareholders. If this acquisition takes place, FTFC will have achieved every goal we set out to accomplish since we formed the Company in 2004. As Chairman, President and CEO, I am proud of our track record, our success, and our history of regulatory compliance. We have met many challenges along the way, beginning with the financial meltdown in 2007, our first year in the life insurance business, the mortgage crisis in 2008 and 2009, eight years of the slowest economic growth in American history since the Great Depression, and the COVID 19 pandemic. Through it all FTFC has continued to prosper and has remained profitable each year since 2010.

The year 2022 was a period of recovery for our life operations after the COVID pandemic. The Company achieved pre-COVID profits equal to that of 2019. Our international marketing though TAI continued to produce positive results. Our mortgage operations through TMC continued to provide quality assets with above market returns for our life companies. In addition, due to our success, TMC now brokers mortgage loans to several other life insurance companies, creating additional revenue streams. Also during 2022, FBLIC was re-domesticated from Missouri to Oklahoma and is now an Oklahoma domestic insurer.

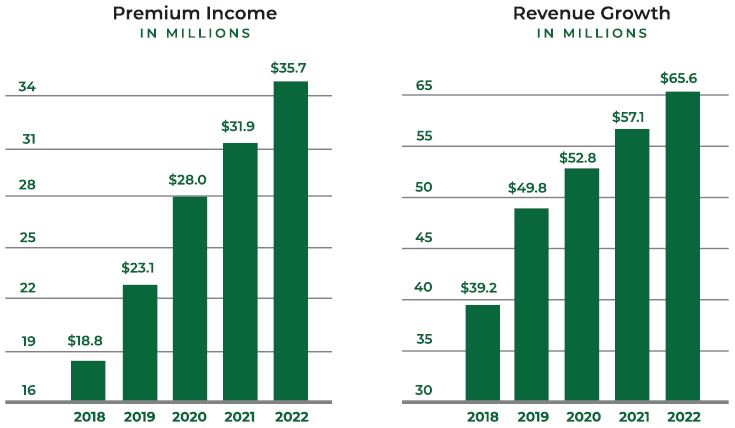

In 2022 assets increased by $6,105,103 from $659,758,934 in 2021 to $665,864,037. Total revenues increased by $8,442,858 from $57,116,241 in 2021 to $65,559,099 in 2022, an increase of 14.8%. Premium income from our life operations increased by $3,783,272 from $31,922,288 in 2021 to $35,705,560 in 2022, an increase of 11.9%. Income before federal tax expense increased $4,297,364 from $3,673,288 to $7,970,652, an increase of 117% and net income after tax increased $3,327,333 from $2,857,370 to $6,184,703, an increase of 116%.

As of June 30, 2023, income before tax increased $243,546 as compared to June 30, 2022, from $2,903,577 to $3,147,123 an increase of 8.39%, while net income after tax increased $146,255 from $2,370,750 to $2,517,005 in increase 6.17%.

As you can see, the Company continued to grow and prosper through 2022 and through the first half of 2023. We remain confident in our ability to meet new challenges ahead and we will continue to thrive in the future. We appreciate the dedication of our staff, management team, the Board of Directors, and the continued support of our shareholders.

Thank you,

Gregg Zahn

Chairman of the Board, President, and CEO.

Important Information For Investors and Shareholders

In connection with the proposed transaction, the Company will file with the SEC a proxy statement that will include important information about both the Company and Brickell L&A Holdings LLC. Investors and security holders are urged to carefully read the proxy statement and other relevant documents the Company files with the SEC when they become available because they will contain important information about the Company and the proposed transaction. Investors and security holders may obtain these documents when available free of charge at the SEC‘s website at www.sec.gov. In addition, documents filed with the SEC by the Company can be obtained free of charge at the Company’s website at https://firsttrinityfinancial.com/ or by contacting the Company by mail at 7633 East 63rd Place, Suite 230, Tulsa, Oklahoma, 74133, or by telephone at 918.249.2438.

Participants in the Solicitation

The Company and its executive officers and directors may be deemed to be participants in the solicitation of proxies from the shareholders of the Company with respect to the approval of the proposed transaction. Information regarding the persons who may, under rules of the SEC, be considered participants in the solicitation of the shareholders of the Company in connection with the proposed transaction, including the interests of such persons in the proposed transaction, will be set forth in the definitive proxy statement of the Company when it is filed by the Company. You can find information regarding the directors and the executive officers of the Company its definitive proxy statement for its 2022 annual meeting of shareholders filed with the SEC on March 29, 2022.

Assets increased by $6,105,103 from $659,758,934 in 2021 to $665,864,037, an increase of 0.9%.

| | Premium income increased by $3,783,272 from $31,922,288 in 2021 to $35,705,560 in 2022, an increase of 11.9%. | | Total revenues increased by $8,442,858 from $57,116,241 in 2021 to $65,559,099 in 2022, an increase of 14.8%. | |