As filed with the Securities and Exchange Commission on April 18, 2007.

Registration Statement No. 333-141958

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

OceanFreight Inc.

(Exact name of registrant as specified in its charter)

| Republic of the Marshall Islands (State or other jurisdiction of incorporation or organization) | 4412 (Primary Standard Industrial Classification Code Number) | N/A (I.R.S. Employer Identification Number) | ||||

| OceanFreight Inc. Attention: Robert Cowen 80 Kifissias Avenue Athens 15125, Greece (011)(30) 210 614 0283 (Address and telephone number of registrant’s principal executive offices) | Seward & Kissel LLP Attention: Gary J. Wolfe, Esq. One Battery Park Plaza New York, New York 10004 (212) 574-1200 (Name, address and telephone number of agent for service) | |||||

| Copies to: | ||||||

| Gary J. Wolfe, Esq. Seward & Kissel LLP One Battery Park Plaza New York, New York 10004 (212) 574-1200 (telephone number) (212) 480-8421 (facsimile number) | Stephen P. Farrell, Esq. Morgan, Lewis & Bockius LLP 101 Park Avenue New York, New York 10178 (212) 309-6000 (telephone number) (212) 309-6001 (facsimile number) | |||||

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are being offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ![]()

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ![]()

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ![]()

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ![]()

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ![]()

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED APRIL 18, 2007.

Prospectus

10,750,000 Common Shares

OceanFreight Inc. is offering 10,750,000 of its common shares. This is our initial public offering, and no public market currently exists for our shares. We anticipate that the initial public offering price will be between $19.00 and $21.00 per share. After the offering, the market price for our shares may be outside this range.

We have applied to have our common shares listed on the NASDAQ Global Market under the symbol ‘‘OCNF.’’

Investing in our common shares involves a high degree of risk. See ‘‘Risk Factors’’ beginning on page 14 of this prospectus.

| Per Share | Total | |||||||||||

| Offering price | $ | $ | ||||||||||

| Discounts and commissions to underwriters | $ | $ | ||||||||||

| Offering proceeds to OceanFreight Inc., before expenses | $ | $ | ||||||||||

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We have granted the underwriters the right to purchase up to 1,612,500 additional common shares to cover any over-allotments. The underwriters can exercise this right at any time within 30 days after the closing of this offering.

The underwriters expect to deliver the shares to purchasers on or about , 2007.

| Banc of America Securities LLC | Cantor Fitzgerald & Co. | ||

| Oppenheimer & Co. | Ferris, Baker Watts Incorporated | Fortis Securities LLC | ||||

The date of this prospectus is April , 2007.

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized any person to provide you with different information. This prospectus is not an offer to sell, nor is it an offer to buy, these securities in any jurisdiction where the offer or sale is not permitted. The information in this prospectus is complete and accurate as of the date on the front cover, but the information may have changed since that date.

TABLE OF CONTENTS

i

PROSPECTUS SUMMARY

This section summarizes some of the key information and financial data that appear later in this prospectus. This summary may not contain all of the information that may be important to you. As an investor or prospective investor, you should review carefully the entire prospectus, including the risk factors and the more detailed information and financial statements included in this prospectus. We use the term deadweight tons, or dwt, in describing the capacity of our drybulk carriers. Dwt, expressed in metric tons each of which is equivalent to 1,000 kilograms, refers to the maximum weight of cargo and supplies that a vessel can carry. We use the term lightweight tons, or lwt, in describing the amount of recoverable steel, measured in tons, when a vessel is scrapped. We refer you to ‘‘Glossary of Certain Shipping Terms’’ beginning on page 156 for definitions of certain shipping industry terms that w e use in this prospectus.

Unless otherwise indicated, all references and data in this prospectus to ‘‘our Initial Fleet’’ or ‘‘our vessels’’ refer to the seven vessels we have agreed to acquire. Unless otherwise indicated, references in this prospectus to ‘‘OceanFreight,’’ ‘‘we,’’ ‘‘us,’’ ‘‘our’’ and the ‘‘Company’’ refer to OceanFreight Inc. and our subsidiaries. Unless otherwise indicated, information presented in this prospectus assumes that the underwriters will not exercise their option to purchase additional shares. The information in this prospectus gives effect to a stock split in the form of a share dividend in the ratio of 1,999:1 on our subordinated shares which was effected on April 5, 2007. All references in this prospectus to ‘‘$’’ and ‘&ls quo;dollars’’ refer to United States Dollars.

Our Company

We are a newly formed development stage company that was incorporated on September 11, 2006 under the laws of the Republic of the Marshall Islands. Accordingly, we have no history of operations or revenues and we will only produce revenues after the closing of this offering. For the period from inception through December 31, 2006, our net loss was $105,145. We were formed to initially acquire a fleet of seven secondhand drybulk carriers engaged in the seaborne transportation of commodities. We refer to these vessels comprised of six Panamax drybulk carriers and one Capesize drybulk carrier as our Initial Fleet. We have entered into agreements to acquire, subject to the completion of this offering, our Initial Fleet of seven secondhand vessels for an aggregate purchase price of $311.9 million. We expect that the net proceeds of this offering will be $198.4 million. We intend to use a portion of the net proceeds from this offering, es timated at $193.9 million, and approximately $118.0 million in borrowings under our senior secured term loan to purchase our Initial Fleet. The remaining proceeds from this offering will be used for general corporate purposes. Six of the seven vessels in our Initial Fleet will be employed under fixed rate period charters, with expiration dates ranging from March 2008 to May 2011, representing an average remaining charter term of approximately 31.3 months. Period charters refer to both time and bareboat charters. We intend to enter into a fixed rate period charter for the seventh vessel in our Initial Fleet with a minimum term of two years following this offering and prior to its delivery to us. We expect that all of the vessels in our Initial Fleet will be delivered to us prior to August 15, 2007.

We currently intend to pay holders of our common shares cash dividends of $0.5125 per share per quarter, or $2.05 per share annually, before we pay any dividends to holders of our subordinated shares commencing with a partial dividend of $0.39 per share in August 2007. Please read ‘‘Our Dividend Policy’’ below.

We believe that developments in the seaborne transportation industry, including the drybulk sector, have created opportunities to acquire vessels and employ them at attractive fixed rate period charters that will generate steady cash flows and provide long-term shareholder value. We further believe that investing in different sectors of the seaborne transportation industry by acquiring vessels that operate in diverse geographical areas carrying a wide range of commodities enables us to lower our dependence on any one shipping sector to seek to generate revenues and find attractive acquisition opportunities. In the future we will review and consider acquisition opportunities and chartering strategies in a number of sectors in the

1

seaborne transportation industry described under the heading ‘‘—Industry Review & Trends’’ in order to identify and consummate transactions that we believe will enhance shareholder value. Please read ‘‘—Our Business Strategy.’’

We will initially contract the day-to-day management of our fleet, under separate vessel management agreements, to two third party management companies, Allseas Marine S.A. and Quintana Management LLC. We refer to these companies collectively as our Fleet Managers. See ‘‘Business—Vessel Management Agreements’’ for a description of our vessel management agreements. Our senior executive officers will actively monitor the performance of our Fleet Managers. We will also enter into an interim management agreement with Cardiff Marine Inc., or Cardiff, a management company with offices in Greece. Pursuant to the interim management agreement, Cardiff will provide management services to us, including overseeing the delivery of the vessels in our Initial Fleet. Cardiff is controlled by the Entrepreneurial Spirit Foundation, or the Foundation, which is controlled by Mr. George Economou, the brother-in-law of our director, Mr. Konstan dinos Kandylidis, and the uncle of Mr. Antonios Kandylidis, who controls our sole shareholder Basset Holdings Inc., or Basset. The interim management agreement is designed to assist us in initiating our operations and will have a duration of up to 12 months. Upon expiry or termination of this agreement, Cardiff will have no ongoing relationship with us, although we may elect to use Cardiff’s services from time to time in the future.

Under our Amended and Restated Articles of Incorporation, our authorized capital stock includes two classes of common stock: common shares and subordinated shares. Our subordinated shares are subordinated with respect to dividend payments, as described below under ‘‘Our Dividend Policy,’’ but not as to liquidation or voting rights. We are offering our common shares through this prospectus. Please read ‘‘Description of Capital Stock.’’

Our Initial Fleet

The following table summarizes information about our Initial Fleet:

| Vessel Name(1) | Size | Year Built | Charterer | Estimated Expiration of Charter(2) | Net Daily Charter Rate(3) | Estimated Daily Vessel Operating Expense(4) | ||||||||||||||||||||||||

| dwt | lwt | |||||||||||||||||||||||||||||

| Topeka | 74,710 | 12,627 | 2000 | D’Amato Societa di Navigazione S.p.A. | July 2010 to May 2011 | $ | 21,656 | $ | 4,900 | |||||||||||||||||||||

| Lansing | 73,040 | 10,788 | 1996 | Transbulk 1904 AB | March to August 2009 | $ | 23,100 | $ | 4,900 | |||||||||||||||||||||

| Pierre | 70,316 | 9,106 | 1996 | Magellanno Marine C.V. | April to October 2010 | $ | 22,425 | $ | 4,900 | |||||||||||||||||||||

| Austin | 75,229 | 11,608 | 1995 | Deiulemar Shipping S.p.A. | February to August 2010 | $ | 24,700 | $ | 4,900 | |||||||||||||||||||||

| Trenton | 75,229 | 11,608 | 1995 | Deiulemar Shipping S.p.A. | February to August 2010 | $ | 24,700 | $ | 4,900 | |||||||||||||||||||||

| Helena | 73,744 | 9,352 | 1999 | Express Sea Transport Corp. | March to July 2008 | $ | 28,125 | $ | 4,900 | |||||||||||||||||||||

| Juneau(5) | 149,495 | 18,467 | 1990 | $ | 7,900 | |||||||||||||||||||||||||

| (1) | The vessel name provided represents the new name we will designate to each vessel following delivery to us from the seller. |

| (2) | The date provided represents the earliest and latest month during which the charterer may re-deliver the vessel to us upon termination of the charter. The actual re-delivery dates may differ based on the delivery of the vessels to us and the charterer having the option in certain cases to deliver the vessel 15 to 30 days prior to or after the scheduled re-delivery dates. |

| (3) | This table shows net charter rates, excluding commissions payable by OceanFreight to third party charter brokers, which are up to 6.25% of the daily time-charter rate. |

| (4) | The daily vessel operating expense amounts shown in this column are the anticipated vessel operating expenses, including management fees payable by OceanFreight to our Fleet Managers which are approximately $650 per vessel per day. |

| (5) | Following the closing of this offering we intend to enter into a fixed rate period charter for this vessel with a minimum term of two years. |

2

Industry Review & Trends

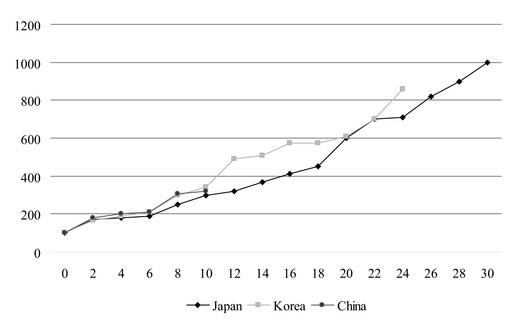

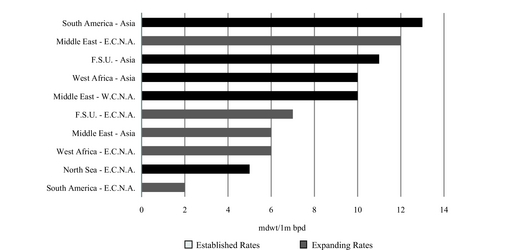

Strong Market Dynamics in Drybulk Sector. Seaborne transportation of dybulk cargoes is fundamental to international trade as it is often the most practical and cost effective means of transporting large quantities of many essential commodities, including major bulk commodities consisting of iron ore, coal and grains, and minor bulks, consisting of a wide variety of cargoes, such as forest products, iron and steel products, fertilizers, agricultural products, non-ferrous ores, minerals and petcoke, cement, other construction materials and salt. According to Drewry Shipping Consultants Limited, or Drewry, since the fourth quarter of 2002, the drybulk seaborne transportation sector has experienced historically high charter rates and vessel values due to the favorable imbalance between the supply of drybulk carriers and demand for drybulk transportati on resulting principally from the limited supply of newbuilding vessels due to fully booked shipyards and strong demand driven by the expansion of world trade, particularly in China and India. Our Initial Fleet will operate in the drybulk sector which, according to Drewry, grew at a compounded annual rate of 5.2% between 2001 and 2006 in terms of the volume of cargoes transported at sea.

Above Average Growth. We define the seaborne transportation industry as encompassing vessels that carry a wide range of energy resources, commodities, semi-finished and finished consumer and industrial products carried on tankers, drybulk carriers and containerships, respectively. According to Drewry, the seaborne transportation industry, as a whole, which represents approximately two-thirds of global trade in terms of volume, has grown at a compounded annual rate of approximately 4.4% during the 20-year period through 2005, with approximately 8.0 billion tons of cargo representing 1.3 tons per global capita of approximately 6.5 billion people transported by sea on board vessels in 2005. By contrast, in 1985, approximately 3.4 billion tons of cargo were transported by sea on board vessels representing 0.7 tons per global capita of a pproximately 4.8 billion people. During this 20-year period, seaborne trade has grown steadily at an average annual compounded rate of approximately 4.4%, compared with approximately 3.3% annual compounded world economic growth.

Accelerating Economic Globalization. In recent years there has been a trend towards the integration of world economies requiring increased imports and exports, outsourcing production to overseas locations away from consuming centers and the need to source scarce commodities from remote locations. In our view, seaborne transportation is the best and, in many cases, the only, means available to transport these large quantities of commodities and manufactured products efficiently, at a low cost and in a timely manner compared with land or air based transportation modes.

Varying Sector Cycles. Each year, newbuildings increase the supply of vessels providing seaborne transportation services. Historically the relationship between incremental supply and demand has varied among different sectors, meaning that at any one time different sectors of the seaborne transportation industry may be at differing stages of their respective supply and demand cycle. In addition, new regulatory requirements may impose additional constraints on vessel supply and changes in cyclical patterns. We intend to grow our fleet and operate in different sectors and we believe that our diversified fleet profile will enable us to benefit from favorable trends in supply and demand prevailing at different times in these sectors.

Regulation, Consolidation, Transparency. During the past decade, there has been a trend towards consolidation among shipping companies as well as charterers in the drybulk and other seaborne transportation sectors. In addition, shipping companies have become subject to increased vessel safety regulations imposed by the International Maritime Organization as well as requirements by shipping lenders to provide audited financial statements and enhanced disclosure rules for public companies under the Sarbanes-Oxley Act of 2002. We believe the trend towards consolidation and increased regulation have resulted and will continue to result in higher levels of corporate transparency, increased barriers of entry and enhanced credit quality of participants in our industry.

Chartered-in Fleet Reliance. Industrial participants such as commodity producers and importers, oil companies and container line operators, which are companies responsible for the global traffic of containers at sea, have reduced their direct ownership of seaborne transportation assets but continue to

3

maintain a portfolio of vessels under their commercial control through medium to long-term period charter contracts. These vessels are commonly referred to as being ‘‘chartered-in.’’ These charterers rely on companies to own and operate vessels under the charterer’s commercial control. As a result there are opportunities available to acquire vessels and charter them under fixed rate contracts to these charterers.

Our Business Strategy

Our strategy is to be a reliable and responsible provider of seaborne transportation services and to manage and expand our company in a manner that we believe will enable us to pay attractive dividends to our shareholders and enhance shareholder value by increasing long-term cash flow. We intend to realize these objectives by adhering to the following:

Strategic Fleet Expansion. We intend to grow our fleet using our management’s knowledge of the seaborne transportation industry to make accretive, timely and selective acquisitions of vessels in different sectors based on a number of financial and operational criteria. We will consider and analyze our expectation of fundamental developments in the particular industry sector, the level of liquidity in the resale and charter market, the cash flow earned by the vessel in relation to its value, its condition and technical specifications, expected remaining useful life, the credit quality of the charterer and duration and terms of charter contracts for vessels acquired with charters attached, as well as the overall diversification of our fleet and customers. We believe that secondhand vessels approximately in the middle of their useful economic l ife when operated in a cost efficient manner often provides better value to our shareholders and return on capital as compared with more expensive newer vessels.

Tailored Fleet Composition. Our Initial Fleet consists of seven drybulk carriers. We have initially focused on the drybulk sector because these vessel acquisitions and employment contracts satisfy our financial and operating criteria. As we grow our fleet over time, we intend to explore acquisitions in other seaborne transportation sectors, as opportunities arise that meet our financial and operating criteria. We believe that monitoring developments in multiple sectors will position us to opportunistically select vessels in different sectors for acquisition and vessel employment opportunities as conditions in those sectors dictate. We also believe that this outlook enables us to lower our dependence on any one shipping sector to seek to generate revenues and find attractive acquisition opportunities.

Fixed Rate Charters. We have entered into fixed rate period charters for all six of the Panamax drybulk carriers in our Initial Fleet with an average remaining term of approximately 31.3 months. Following the closing of this offering we will seek to enter into a fixed rate period charter for our Capesize drybulk carrier, Juneau, with a minimum term of two years. We believe these charters will provide us with stable cash flow and high vessel utilization rates and also limit our exposure to charter rate volatility. In the future we will continue to seek fixed rate period charter contracts for our vessels, which include time and bareboat charters, pursuant to which the charterer pays a fixed daily charter rate over a specified period of time. Period charter contracts may include profit sharing arrangements whereby we receive additional charterhire when spot charter rates exceed the fixed daily rate under the period charter. We may also enter into period charters that afford some exposure to the spot market through floating rate period charters where the daily charter rate fluctuates in line with spot rates but cannot fluctuate below a minimum rate, or floor, or above a maximum rate, or ceiling. We may enter into short-term spot charters or place our vessels in pools which enable participating vessels to combine revenues. Please read ‘‘Glossary of Certain Shipping Terms’’ for additional information.

Staggered Charter Renewals. We intend to further diversify our portfolio of vessels and charters by acquiring vessels with staggered charter maturities or by entering into charters with staggered maturities in order to complement the vessels in our Initial Fleet that are employed on fixed rate period charters with remaining terms ranging from March 2008 to May 2011. We will seek employment for our vessels based on our analysis and assessment of fundamental developments in each particular sector of the industry and the difference in rates for short, medium and long-term charters. Renewing our period charters at different times enables us to reduce our exposure to market conditions prevailing at any one time.

4

Diversified Charter Counterparties. The six vessels in our Initial Fleet for which we have arranged charters are chartered to five different charterers operating in the drybulk carrier sector. We believe that chartering our vessels to a number of well established and reputable charterers, such as D’Amato Societa di Navigazione S.p.A., Transbulk 1904 AB, Magellanno Marine C.V., Deiulemar Shipping S.p.A. and Express Sea Transport Corporation, reduces counterparty risk. As we grow our fleet over time, we may invest in other seaborne transportation sectors and seek to further diversify the end-users of our vessels thereby enhancing the overall credit quality of our charter portfolio.

Quality Fleet Managers. Our Fleet Managers have established a reputation in the international shipping industry for high standards of performance, reliability and safety. We believe that contracting fleet managers that have achieved this reputation will create greater opportunities for us to seek employment contracts with well established charterers, many of whom consider the reputation of the fleet manager when entering into charters. We believe we will derive important benefits from our Fleet Managers’ experience, which enables them to achieve significant economies of scale and scalability in areas such as crewing, supply procurement, and insurance which in addition to other benefits, are passed to us as the vessel owner. We intend to maintain the quality of our fleet through our Fleet Managers’ rigorous maintenance programs. We beli eve that owning a fleet of well-maintained vessels will enable us to operate our vessels with lower operating costs, maintain their resale value and secure employment for our vessels with high quality charterers.

Risk Factors

Investing in our common shares involves substantial risk. These risks include, among others:

We may not pay dividends to our shareholders. Our ability to pay dividends to our shareholders will depend on, among other things, our ability to comply with relevant legal requirements, our earnings, capital requirements, financial condition, our ability to obtain financing on terms acceptable to us and our ability to satisfy financial covenants contained in our financing arrangements. Due to these limitations, we may be unable to pay dividends.

If we cannot complete the purchase of our Initial Fleet, we may use the proceeds of this offering for general corporate purposes with which you may not agree. If the sellers of some or all of the vessels in our Initial Fleet fail to deliver the vessels to us as agreed, or if we cancel a purchase agreement because a seller has not met its obligations to us, our management will have the discretion to apply the proceeds of this offering that we would have used to purchase those vessels to acquire other vessels or for general corporate purposes with which you may not agree. We will not escrow the proceeds from this offering and we will not return the proceeds to you if we do not take delivery of one or more vessels. It may take a substantial period of time before we can locate and purchase other suitable vessels. We cannot assure you that we will be abl e to charter these vessels at rates that yield returns comparable to those the vessels in our Initial Fleet might have earned.

We are a newly formed company with no history of operations. We are a newly formed company and have no performance record, operating history or historical financial statements upon which you can evaluate our operations or our ability to implement and achieve our business strategy.

We will be entirely dependent on our Fleet Managers to manage our fleet, which may create conflicts of interest between us and other clients of our Fleet Managers. Our executive management team consists of only four individuals and we will be dependent on our Fleet Managers to whom we will subcontract the day-to-day technical management of our fleet. Our Fleet Managers provide similar vessel management services for other vessels owned by other shipping companies, including vessels which their affiliates own and operate. The responsibilities and relationships of our Fleet Managers could present conflicts of interest in connection with the crewing, supply, provisioning and operations of the vessels in our fleet versus vessels owned by their other clients. In particular, our Fleet Managers may give preferential treatment to vessels that are beneficiall y owned by other parties. These conflicts of interest may have an adverse effect on our results of operations.

5

The seaborne transportation industry is cyclical and volatile, and this may lead to reductions in our charter rates, vessel values and results of operations. The international seaborne transportation industry, including the drybulk sector in which our Initial Fleet will be deployed, is both cyclical and volatile in terms of charter rates and profitability. The degree of charter rate volatility for vessels has varied widely. Fluctuations in charter rates result from changes in the supply and demand for vessel capacity and changes in the supply and demand for energy resources, commodities, semi-finished and finished consumer and industrial products internationally carried at sea. Currently, charter rates in some industry segments and vessel values remain high relative to historic levels.

An economic slowdown in the Asia Pacific region could have a material adverse effect on our business, financial condition and results of operations. A significant number of the port calls that our vessels will make involve the loading or discharging of commodities in ports in the Asia Pacific region. As a result, a negative change in economic conditions in any Asia Pacific country, particularly China, may have an adverse effect on our business, financial condition and results of operations, as well as our future prospects.

Purchasing and operating previously owned, or secondhand, vessels may result in increased drydocking costs and vessels off-hire, which could adversely affect our earnings. Even following an inspection of a secondhand vessel prior to purchase, we would not have the same knowledge about its condition and cost of any required (or anticipated) repairs that we would have had if these vessels had been built for and operated exclusively by us. Accordingly, we may not discover defects or other problems with such vessels prior to purchase. If this were to occur, such hidden defects or problems, when detected, may be expensive to repair, and if not detected, may result in accidents or other incidents for which we may become liable to third parties. Increased drydocking costs or vessels off-hire may adversely affect our earnings.

This is our initial public offering and there is no public market for our common shares. We cannot assure you that a trading market for our common shares will develop or that you will be able to sell your common shares in the future.

This is not a comprehensive list of risks to which we are subject, and you should carefully consider all the information in this prospectus prior to investing in our common shares. In particular, we urge you to consider carefully the factors set forth in the section of this prospectus entitled ‘‘Risk Factors’’ beginning on page 14.

Our Corporate Structure

OceanFreight Inc. is a holding company incorporated under the laws of the Republic of the Marshall Islands on September 11, 2006. We currently maintain our principal executive offices at 80 Kifissias Avenue, Athens 15125, Greece. Our telephone number at that address is (011) 30 210 614 0283. Our United States telephone number is (212) 488-5050. Following completion of this offering, we intend to move from our current office and establish a new office in Athens, Greece. We will also maintain an office in New York, New York.

On September 26, 2006, we issued 1,000 common shares, par value $0.01 per share, to Basset Holdings Inc., or Basset, a company controlled by Mr. Antonios Kandylidis, the son of one of our directors, in exchange for a capital contribution of $500,000. Under our Amended and Restated Articles of Incorporation, these shares were converted into 1,000 subordinated shares. Also, on April 5, 2007, we effectuated a stock split, in the form of a share dividend, in the ratio of 1,999:1 on our subordinated shares. Please read ‘‘Related Party Transactions—Basset Holdings Inc.’’ The right of the holders of our subordinated shares to receive dividend payments is subordinate to the right of the holders of our common shares during the subordination period described below. Our subordinated shares have the same voting rights as our common shares. Upon completion of this offering, we will issue to our Chief Executive Officer and President, Mr . Robert Cowen, and our Chief Financial Officer and Executive Vice President, Mr. James Christodoulou, the equivalent of $1.8 million in the aggregate in the form of common stock, or approximately 60,000 subordinated shares and 30,000 restricted common shares,

6

based on the mid-point of the range on the cover of this prospectus. Basset will own 2,000,000 subordinated shares which will represent approximately 15.6% of our outstanding stock following the completion of this offering, assuming the underwriters do not exercise their over-allotment option.

We are responsible for the strategic management of our company, including the formulation and implementation of our overall business strategy. Please read ‘‘Business—Management.’’ We will oversee our Fleet Managers, and continuously research, analyze and review the sectors in which we operate and other sectors to identify acquisition and employment opportunities. We will also be responsible for obtaining financing for our vessels and acquisitions, negotiating charters, purchasing and selling vessels, accounting and corporate administration functions as well as managing relationships with our charterers. We expect to own our vessels through separate wholly-owned subsidiaries that will be incorporated in the Republic of the Marshall Islands. We will contract the day-to-day management of our fleet, which includes performing the day-to-day operations and the maintenance of our vessels, to our Fleet Managers who will be engaged, under se parate vessel management agreements, directly by those respective wholly-owned subsidiaries.

We have entered into an interim management agreement with Cardiff to provide us with certain services for a period of six months following the closing of this offering which we may, at our option, extend for up to an additional six months. We have the right to terminate this agreement upon 30 days’ written notice. See ‘‘Business—Interim Management Agreement.’’ The purpose of this agreement is to utilize Cardiff, which has approximately 150 shore-based employees, to take delivery of our Initial Fleet and ensure the smooth commencement of our operations while our senior executive officers establish our internal systems and procedures. Upon expiry or termination of this agreement, Cardiff will have no ongoing relationship with us, although we may elect to use Cardiff’s services from time to time in the future.

Our Dividend Policy

Although we have no history of paying dividends, our board of directors has adopted a dividend policy to pay a regular quarterly dividend to shareholders while reinvesting a portion of our operating surplus (as defined on page 129) in our business. We expect to pay dividends in the amount of $0.5125 per share to shareholders on a quarterly basis. We expect to pay a partial dividend in August 2007 in respect of the second quarter of 2007 in an amount equal to $0.39 per share. However, as described below, if we do not have sufficient available cash to pay a quarterly dividend to our common shareholders in the amount of $0.5125 per share, which we call our base dividend, out of operating surplus, the right of the holders of our subordinated shares to receive dividends in respect of those shares will be subordinate to the right of the holders of our common shares during the subordination period. The subordination period will expire on the first day after M arch 31, 2012 on which all of the tests described below in ‘‘—The Offering’’ are met; however, the subordination period for a specified percentage of the outstanding subordinated shares will end earlier and such subordinated shares will convert into common shares if certain tests are met. Declaration and payment of dividends is at the discretion of our board of directors and there can be no assurance that we will not reduce or eliminate our dividend. There are a number of factors that can affect our ability to pay dividends and there is no guarantee that we will pay dividends in any quarter. Please read ‘‘Risk Factors’’ for a discussion of these factors. In addition, we will not be allowed to pay dividends in the event we are in default under any of the covenants in our term loan. Please read ‘‘Business—Senior Secured Term Loan’’ for a description of these covenants.

We may use a portion of our operating surplus for reinvestment in our business such as to maintain the minimum cash balance required under our term loan, maintain sufficient working capital, capital expenditures and debt repayments as determined by our board of directors. Our dividend policy reflects our judgment that by retaining a portion of our operating surplus in our business, we believe we will be able to provide better value to our shareholders by enhancing our ability to pay dividends over the long-term. It is our goal to grow our dividend through accretive acquisitions of additional vessels beyond our Initial Fleet. There can be no assurance that we will be successful in meeting our goal.

7

As of the date of this prospectus, Basset, a company controlled by Mr. Antonios Kandylidis, the son of one of our directors, will own 2,000,000 subordinated shares. Upon completion of this offering, we will issue to our Chief Executive Officer, Mr. Robert Cowen, and our Chief Financial Officer, Mr. James Christodoulou, the equivalent of $1.8 million in the form of common stock, or approximately 60,000 subordinated shares and 30,000 restricted common shares, based on the mid-point of the range on the cover of this prospectus, subject to applicable vesting periods. The right of the holders of our subordinated shares to receive dividend payments is subordinate to the right of the holders of our common shares during the subordination period. Upon completion of this offering, we intend to grant to our officers a total of 100 dividend participation rights, as an incentive for our officers to increase the amount of dividends per share to o ur shareholders. The dividend participation rights will have the right to receive payments only after quarterly dividends paid to holders of common and subordinated shares exceed $0.57 per share.

Our authorized capital stock includes two classes of common stock. The right of the holders of our subordinated shares to receive dividend payments is subordinate to the right of the holders of our common shares during the subordination period. We believe that the provisions of our Amended and Restated Articles of Incorporation provide added assurance that we will be able to pay quarterly dividends on our common shares by limiting or eliminating dividends to the holders of our subordinated shares in the circumstances described below. In general, during the subordination period, holders of our common shares must receive regular quarterly dividends of $0.5125 per share, plus any arrearages from prior quarters, before the holders of our subordinated shares will receive any dividends. No interest will accrue on dividend arrearages and holders of our subordinated shares will not be entitled to arrearages. During the subordination period, we will pay quarterly dividen ds on our common and subordinated shares from operating surplus as described below:

| • | first, 100% of dividends to all common shares, pro rata, until they have received the base dividend of $0.5125 per share; |

| • | second, 100% of dividends to all common shares, pro rata, until they have received the unpaid arrearages in the base dividend for all prior quarters during the subordination period; |

| • | third, 100% to all the subordinated shares, pro rata, until they have received the base dividend; and |

| • | fourth, 100% of incremental dividends to all common shares and subordinated shares, pro rata, until each share has received $0.57 per share. |

If our quarterly cash dividend from operating surplus exceeds specified target dividend levels beginning with $0.57 per common and subordinated share, our dividend participation rights will have the right to receive payment in respect of incremental dividends based on specified sharing ratios described below:

| • | fifth, 90% of dividends declared from $0.57 to $0.63 per share to all common shares and subordinated shares, pro rata, and the equivalent of 10% of dividends declared from $0.57 to $0.63 per share to all common shares and subordinated shares to be paid on the dividend participation rights; |

| • | sixth, 80% of dividends declared from $0.63 to $0.77 per share to all common shares and subordinated shares, pro rata, and the equivalent of 20% of dividends declared from $0.63 to $0.77 per share to all common shares and subordinated shares to be paid on the dividend participation rights; and |

| • | after that, 75% of dividends declared above $0.77 to all common shares and subordinated shares, pro rata and the equivalent of 25% of dividends declared above $0.77 to be paid on the dividend participation rights. |

The dividend participation rights represent contractual rights to receive an amount equal to a portion of our incremental dividends, rather than actual shares in our company. Accordingly, when our board of directors declares a dividend of above $0.57 per common and subordinated share, it will actually pay a dividend to our shareholders that is net of the percentage to which the dividend

8

participation rights are entitled. For instance, if our board of directors declares a dividend of $0.60 per common and subordinated share, we would actually pay a dividend of $0.597 per share to our shareholders that is calculated as follows:

| $0.60 - .10 (0.60-0.57) = | |||||||||

| $0.60 - .10 (.03) = | |||||||||

| $0.60 - $.003 = | |||||||||

| $0.597 | |||||||||

The balance of $0.003, multiplied by the number of common and subordinated shares outstanding, would be paid to the holders of the dividend participation rights.

Please read ‘‘Management—Dividend Participation Rights’’ for more detailed information concerning our dividend participation rights.

Our declaration and payment of any dividend is subject to the discretion of our board of directors. The timing and amount of dividend payments will be dependent upon our earnings, financial condition, cash requirements and availability, fleet renewal and expansion, restrictions in our credit agreements, the provisions of Marshall Islands law affecting the payment of dividends to shareholders and other factors. Under Marshall Islands law, a company may not declare or pay dividends if the company is insolvent or would be rendered insolvent upon the payment of such dividend and dividends may be declared and paid out of surplus only; but in case there is no surplus, dividends may be declared or paid out of net profits for the fiscal year in which the dividend is declared and for the preceding fiscal year. The payment of dividends is not guaranteed or assured, and may be discontinued at any time. Because we are a holding company with no material assets other than the stock of our subsidiaries, our ability to pay dividends will depend on the earnings and cash flow of our subsidiaries and their ability to pay dividends to us. If there is a substantial decline in the charter market, this would negatively affect our earnings and limit our ability to pay dividends. Please read ‘‘Risk Factors—Company Specific Risk Factors—We cannot assure you that we will pay dividends.’’

In particular, our ability to pay dividends is subject to our ability to satisfy financial covenants contained in our senior secured term loan. Under our senior secured term loan we will be prohibited from paying dividends if:

| (i) | an event of default has occurred or will occur as a result of the payment of the dividend; |

| (ii) | the ratio of debt to the sum of debt plus shareholders’ equity as adjusted for the market value of our vessels exceeds 70%; |

| (iii) | our cash and cash equivalents are less than (x) between $2.5 million and $3.5 million by the end of six months following our last drawdown; (y) between $5.0 million and $7.0 million by the end of the first year following our last drawdown; and (z) increasing to between $7.0 million and $14.0 million by the end of three years following our last drawn down, in each case depending on the aggregate drawdown under our term loan; |

| (iv) | our market capitalization, including common and subordinated shares held by our affiliates, during the previous quarter is less than $150.0 million; |

| (v) | our EBITDA (earnings before interest, taxes, depreciation and amortization) as adjusted for non-cash gains or losses on asset sales adding back vessel survey expenses to net interest expense is less than 3.0x on a trailing four quarter basis; and |

| (vi) | the aggregate market value of our vessels is less than 150% to 160% of our aggregate outstanding balance under the senior secured term loan, depending on the aggregate drawdown under our term loan. |

Please read ‘‘Business—Senior Secured Term Loan.’’ For more information on cash that we may have available to pay you dividends, please read ‘‘Forecasted Earnings and Cash Available for Dividends.’’

9

The Offering

| Common shares offered | 10,750,000 shares | |

| Shares outstanding upon completion of this offering (1) (2) (3) | 10,780,000 common shares, 2,060,000 subordinated shares | |

| Underwriters’ over-allotment option | 1,612,500 common shares | |

| Use of proceeds | We estimate that we will receive net proceeds of approximately $198.4 million from the offering, after deducting underwriting discounts and commissions and estimated expenses payable by us. We intend to use the net proceeds of this offering to fund a portion of the aggregate purchase price of our Initial Fleet that we have agreed to acquire, subject to the completion of this offering, and for general corporate purposes. Please read ‘‘Use of Proceeds.’’ In particular, certain events may arise which could result in our not taking delivery of a vessel, such as a total loss of a vessel, a constructive total loss of a vessel or substantial damage to a vessel prior to its delivery. Please read ‘‘Risk Factors’’ and ‘‘Business—Our Fle et.’’ | |

| Dividends | Declaration and payment of dividends is subject to the discretion of our board of directors. We expect to pay dividends in the amount of $0.5125 per share to holders of our common and subordinated shares on a quarterly basis, or $2.05 per share per year. We expect to pay a partial dividend in August 2007 in respect of the second quarter of 2007 in an amount equal to $0.39 per share. However, there is no guarantee that we will pay dividends on our shares in any quarter. In general, during the subordination period, we will pay quarterly dividends on our common and subordinated shares from operating surplus (as defined on page 129) in the following manner: | |

| • | first, 100% to all common shares, pro rata, until they receive $0.5125 per share; | |||

| • | second, 100% to all common shares, pro rata, until they have received any unpaid arrearages in the $0.5125 per share base dividend for prior quarters; | |||

| • | third, 100% to all subordinated shares, pro rata, until they have received $0.5125 per share; and | |||

| • | fourth, 100% to all common and subordinated shares, pro rata, until they have received $0.57 per share. | |||

| (1) | Assumes that the underwriters do not exercise their over-allotment option to purchase an additional 1,612,500 common shares. |

| (2) | Includes approximately 60,000 subordinated shares and 30,000 restricted common shares that we will issue to our Chief Executive Officer and our Chief Financial Officer immediately following this offering, based on the mid-point of the price range on the cover of this prospectus. |

| (3) | Does not include shares that may be issued under our equity incentive plan. Please read ‘‘Management—Equity Incentive Plan.’’ |

10

| If our quarterly cash dividend from operating surplus exceeds specified target dividend levels beginning with $0.57 per common share and subordinated share, our dividend participation rights will have the right to receive payment in respect of incremental dividends based on specified sharing ratios. Please read ‘‘Management—Dividend Participation Rights’’ for information concerning our dividend participation rights. | ||

| During the subordination period, our common shares will accrue dividend arrearages to the extent they do not receive a quarterly dividend of $0.5125 per share. No interest will accrue on dividend arrearages. Our subordinated shares will not accrue any arrearages. Please read ‘‘Description of Capital Stock’’ for a more detailed description of our common and subordinated shares. | ||

| Subordination Period | The subordination period will commence upon the date of this offering. Our subordinated shares will convert into common shares on a one-for-one basis if each of the following tests are met on the schedule specified below: | |

| (1) | we have paid quarterly dividends in an amount at least equal to $0.5125 per share on both our common and subordinated shares for the immediately preceding four-quarter period; | |||

| (2) | operating surplus available to pay the dividends during the four-quarter period referred to above equaled on a quarterly basis at least $0.5125 per share on all of our outstanding common and subordinated shares on a fully diluted basis during that period; and | |||

| (3) | there are no unpaid arrearages in payment of the quarterly dividend on our common shares. | |||

| We refer to the tests set forth in sub-paragraphs (1) through (3) above as the ‘‘Basic Conversion Tests.’’ Our subordinated shares will convert into common shares on a one-for-one basis on the following schedule: | ||

| (i) | The first day after March 31, 2010 on which the Basic Conversion Tests are met, 25% of the subordinated shares outstanding immediately after this offering shall convert into common shares on a one-for-one basis (the ‘‘First Early Conversion’’). | |||

| (ii) | The first day after March 31, 2011 on which the Basic Conversion Tests are met, 25% of the subordinated shares outstanding immediately after this offering shall convert into common shares on a one-for-one basis (the ‘‘Second Early Conversion’’); however, the Second Early Conversion will not occur prior to the first anniversary of the First Early Conversion. | |||

11

| (iii) | The first day after March 31, 2012 on which the Basic Conversion Tests are met, all outstanding subordinated shares shall convert in common shares on a one-for-one basis. | |||

| Contingent Conversion of Subordinated Shares to Common Shares | ||

| Provided that the Basic Conversion Tests are met: | ||

| • | In addition to any subordinated shares converted into common shares in the First Early Conversion or the Second Early Conversion, 25% of the subordinated shares outstanding immediately after this offering shall convert into common shares on a one-for-one basis if we have paid quarterly dividends in an amount at least equal to $0.57 per share on the common shares and subordinated shares for any consecutive three-quarter period (the ‘‘First Contingent Conversion’’). | |||

| • | In addition to any subordinated shares converted into common shares in the First Early Conversion, the Second Early Conversion or the First Contingent Conversion, an additional 25% (or 50% if the First Contingent Conversion has not occurred) of the subordinated shares outstanding immediately after this offering shall convert into common shares on a one-for-one basis if we have paid quarterly dividends in an amount at least equal to $0.63 per share on the common shares and subordinated shares for any consecutive preceding three-quarter period (the ‘‘Second Contingent Conversion&rsqu o;’). | |||

| • | The subordination period will terminate automatically and all outstanding subordinated shares will convert into common shares on a one-for-one basis if we have paid quarterly dividends in an amount at least equal to $0.77 per share (approximately 150% of the base dividend) on both the common shares and subordinated shares for any consecutive preceding three-quarter period (the ‘‘Full Contingent Conversion’’). | |||

| However, none of the First Contingent Conversion, the Second Contingent Conversion or the Full Contingent Conversion will occur prior to the first anniversary of this offering. | ||

| Notwithstanding the above, the subordination period will end immediately and all arrearages will become immediately payable upon a change of control of us as defined in our Amended and Restated Articles of Incorporation. See ‘‘Description of Capital Stock—Subordination Period.’’ | ||

| Nasdaq Listing | We have applied to have our common shares listed on the Nasdaq Global Market, or Nasdaq, under the symbol ‘‘OCNF.’’ | |

12

Senior Secured Term Loan

We expect to enter into a commitment letter with Fortis Bank prior to this offering that will, subject to the completion of the offering, provide us with a senior secured term loan of up to $147.0 million or 50% of the fair market value of our Initial Fleet, whichever is lower, with an eight year term. Upon signing the term loan we will be committed to pay an arrangement fee of 0.7% of the loan amount and a commitment fee of 0.4% per annum payable semi-annually in arrears over the committed but un-drawn portion of the loan. We expect to drawdown $118.0 million, which we expect will be less than 40% of the fair market value of our Initial Fleet, under our term loan to partially fund the acquisition of our Initial Fleet. Under the terms of our senior secured term loan, the $118.0 million we expect to drawdown will be repayable in sixteen consecutive semi-annual installments commencing six months after the last drawdown (the first six installments wi ll amount to $4.0 million each and the remaining ten installments will amount to $8.4 million each) and a final balloon payment of $10.0 million payable together with the last installment. In the event we drawdown in excess of $118.0 million, we will be obligated to repay the excess amount ratably over the first five installments. Our term loan is expected to be effective as of the closing of this offering, and bear interest at LIBOR plus a margin at a minimum of 1.15% to a maximum of 1.25% depending on whether our aggregate drawdown equals up to 40%, up to 45%, or up to 50% of the aggregate market value of our Initial Fleet. Our term loan will contain financial covenants, including requirements to maintain (i) a ratio of debt to the sum of debt plus shareholders’ equity as adjusted for the market value of our vessels not to exceed 70%; (ii) cash and cash equivalents of (x) between $2.5 million and $3.5 million by the end of six months following our last drawdown; (y) betw een $5.0 million and $7.0 million by the end of the first year following our last drawdown; and (z) increasing semiannually thereafter to between $7.0 million and $14.0 million by the end of the third year following our last drawdown, in each case depending on the ratio of the aggregate drawdown under our term loan to the market value of our fleet securing the loan as described above; (iii) market capitalization, including common and subordinated shares held by our affiliates, during the previous quarter of no less than $150.0 million; (iv) EBITDA (earnings before interest, taxes, depreciation and amortization) as adjusted for non-cash gains or losses on asset sales adding back vessel survey expenses to net interest expense of at least 3.0x on a trailing four quarter basis; and (v) aggregate fair market value of our vessels at a minimum of 150% to 160% of our aggregate outstanding balance under the senior secured term loan, depending on the ratio of the aggregate drawdown u nder our term loan to the market value of our fleet securing the loan as described above. Following this offering we expect to be able to comply with all of these covenants. In addition, we will be required to enter a time charter at a minimum net daily rate of $40,000 for a period of at least two years for the Juneau prior to the drawdown relating to the purchase of that vessel. We intend to enter into an interest rate swap with a term of up to three years to hedge our exposure to interest rate fluctuations on amounts drawn under our senior secured term loan. Amounts drawn under our term loan will be secured by the vessels in our Initial Fleet. We will be permitted to pay dividends under the term loan so long as an event of default has not occurred and will not occur upon the payment of such dividends. We refer you to ‘‘Business — Senior Secure d Term Loan’’ for additional information about our senior secured term loan.

13

RISK FACTORS

You should consider carefully the following factors, as well as the other information set forth in this prospectus, before making an investment in our common shares. Some of the following risks relate principally to the seaborne transportation industry in which we operate and our business in general. Other risks relate principally to the securities market and ownership of our stock. Any of the risk factors could significantly and negatively affect our business, financial condition or operating results and the trading price of our stock. You may lose all or part of your investment.

Industry Specific Risk Factors

The seaborne transportation industry is cyclical and volatile, and this may lead to reductions in our charter rates, vessel values and results of operations.

The international seaborne transportation industry is both cyclical and volatile in terms of charter rates and profitability. The degree of charter rate volatility for vessels has varied widely. Fluctuations in charter rates result from changes in the supply and demand for vessel capacity and changes in the supply and demand for energy resources, commodities, semi-finished and finished consumer and industrial products internationally carried at sea. The factors affecting the supply and demand for vessels are outside of our control, and the nature, timing and degree of changes in industry conditions are unpredictable.

Factors that influence demand for vessel capacity include:

| • | supply and demand for energy resources, commodities, semi-finished and finished consumer and industrial products; |

| • | changes in the production of energy resources, commodities, semi-finished and finished consumer and industrial products; |

| • | the location of regional and global production and manufacturing facilities; |

| • | the location of consuming regions for energy resources, commodities, semi-finished and finished consumer and industrial products; |

| • | the globalization of production and manufacturing; |

| • | global and regional economic and political conditions; |

| • | developments in international trade; |

| • | changes in seaborne and other transportation patterns, including the distance cargo is transported by sea; |

| • | environmental and other regulatory developments; |

| • | currency exchange rates; and |

| • | weather. |

Factors that influence the supply of vessel capacity include:

| • | the number of newbuilding deliveries; |

| • | the scrapping rate of older vessels; |

| • | the price of steel; |

| • | changes in environmental and other regulations that may limit the useful lives of vessels; |

| • | the number of vessels that are out of service; and |

| • | port or canal congestion. |

We anticipate that the future demand for our vessels and charter rates will be dependent upon continued economic growth in China, India and the rest of the world, seasonal and regional changes in

14

demand and changes to the capacity of the world fleet. We believe the capacity of the world fleet is likely to increase and there can be no assurance that economic growth will continue at a rate sufficient to utilize this new capacity. Adverse economic, political, social or other developments could negatively impact charter rates and therefore have a material adverse effect on our business, results of operations and ability to pay dividends.

Charter rates in the seaborne transportation industry are at levels that remain high relative to historic levels and may decrease in the future, which may adversely affect our earnings and ability to pay dividends.

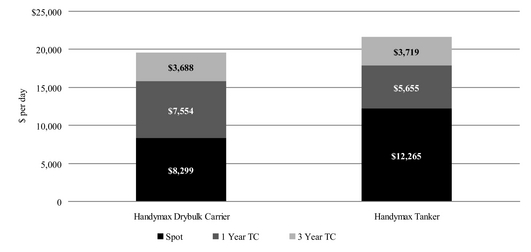

The industry’s current rates are at levels that remain high relative to historic levels in certain sectors. According to Drewry, charter rates for drybulk carriers, tankers and containers reached historically high levels at different times during the period between late 2004 and mid 2005 but declined in certain sectors significantly from these levels. Charter rates for drybulk carriers have increased since July 2006 and are currently at historically high levels while charter rates for container vessels and tankers are below their historically high levels reached during the period between late 2004 and mid 2005. The decline, although significant in certain sectors, was to levels that remain high relative to historic levels. If the seaborne transportation industry, which has been highly cyclical, is depressed in the future when our charters expire or at a time when we may want to sell a vessel, our earnings and available cash flow may be adversely affec ted. We cannot assure you that we will be able to successfully charter our vessels in the future or renew our existing charters at rates sufficient to allow us to operate our business profitably, meet our obligations including payment of debt service to our lenders or to pay dividends to our shareholders. Our ability to renew the charters on our vessels on the expiration or termination of our current charters, or on vessels that we may acquire in the future, the charter rates payable under any replacement charters and vessel values will depend upon, among other things, economic conditions in the sectors in which our vessels operate at that time, changes in the supply and demand for vessel capacity and changes in the supply and demand for the seaborne transportation of energy resources, commodities, semi-finished and finished consumer and industrial products.

An over-supply of drybulk carrier capacity may lead to reductions in charter hire rates and profitability.

The market supply of drybulk carriers has been increasing, and the number of drybulk carriers on order are near historic highs. An over-supply of drybulk carrier capacity may result in a reduction of charter hire rates. If a reduction occurs, upon the expiration or termination of our vessels’ current charters, we may only be able to recharter our vessels at reduced or unprofitable rates or we may not be able to charter these vessels at all.

The market value of our vessels remain high relative to historic levels, may fluctuate significantly, and we may incur losses if we sell vessels following a decline in their market value.

According to Drewry, values for all sizes of drybulk carriers, tankers and container vessels are currently at or near historically high levels. If the seaborne transportation industry, which historically has been highly cyclical, does not maintain these high levels in the future the fair market value of our vessels will decline.

The fair market value of our vessels may increase and decrease depending on a number of factors including:

| • | prevailing level of charter rates; |

| • | general economic and market conditions affecting the shipping industry; |

| • | competition from other shipping companies; |

| • | types and sizes of vessels; |

| • | supply and demand for vessels; |

| • | other modes of transportation; |

15

| • | cost of newbuildings; |

| • | governmental or other regulations; and |

| • | technological advances. |

| • | In addition, as vessels grow older, they generally decline in value. |

If the fair market value of our vessels declines, we may incur losses when we sell one or more of our vessels, which would adversely affect our business and financial condition, we may not be in compliance with certain provisions of our term loan and we may not be able to refinance our debt or obtain additional financing. If we sell any vessel at a time when vessel prices have fallen and before we have recorded an impairment adjustment to our financial statements, the sale may be at less than the vessel’s carrying amount on our financial statements, resulting in a loss and a reduction in earnings.

The seaborne transportation industry is highly competitive, and we may not be able to compete successfully for charters with new entrants or established companies with greater resources.

We will employ our vessels in a highly competitive industry that is capital intensive and highly fragmented. Competition arises primarily from other vessel owners, some of whom have substantially greater resources than we do. Competition among vessel owners for the seaborne transportation of energy resources, commodities, semi-finished and finished consumer and industrial products can be intense and depends on the charter rate, location, size, age, condition and the acceptability of the vessel and its operators to the charterers. Due in part to the highly fragmented market, competitors with greater resources than we have could operate larger fleets than our fleet and, thus, may be able to offer lower charter rates or higher quality vessels than we are able to offer. If this were to occur, we may be unable to retain or attract new charterers.

An economic slowdown in the Asia Pacific region could have a material adverse effect on our business, financial condition and results of operations.

A significant number of the port calls made by the vessels in our Initial Fleet and vessels we may acquire in the future will involve the loading or discharging of energy resources, commodities, semi-finished and finished consumer and industrial products in ports in the Asia Pacific region. As a result, a negative change in economic conditions in any Asia Pacific country, particularly China, may have an adverse effect on our business, financial condition and results of operations, as well as our future prospects. In recent years, China has been one of the world’s fastest growing economies in terms of gross domestic product, which has had a significant impact on shipping demand. We cannot assure you that such growth will be sustained or that the Chinese economy will not experience negative growth in the future. Moreover, any slowdown in the economies of the United States, the European Union or certain Asian countries may adversely effect economic growth in China and elsewhere. Our business, financial condition, results of operations, ability to pay dividends as well as our future prospects, will likely be materially and adversely affected by an economic downturn in any of these countries.

Changes in the economic and political environment in China and policies adopted by the government to regulate its economy may have a material adverse effect on our business, financial condition and results of operations.

The Chinese economy differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development, or OECD, in such respects as structure, government involvement, level of development, growth rate, capital reinvestment, allocation of resources, rate of inflation and balance of payments position. Prior to 1978, the Chinese economy was a planned economy. Since 1978, increasing emphasis has been placed on the utilization of market forces in the development of the Chinese economy. Annual and five year State Plans are adopted by the Chinese government in connection with the development of the economy. Although state-owned enterprises still account for a substantial portion of the Chinese industrial output, in general, the Chinese government is reducing the level of direct control that it exercises over the economy through State Plans and other measures. There is an increasing level of freedom and autonomy in areas such as allocat ion of resources, production, pricing

16

and management and a gradual shift in emphasis to a ‘‘market economy’’ and enterprise reform. Limited price reforms were undertaken, with the result that prices for certain commodities are principally determined by market forces. Many of the reforms are unprecedented or experimental and may be subject to revision, change or abolition based upon the outcome of such experiments. We cannot assure you that the Chinese government will continue to pursue a policy of economic reform. The level of imports to and exports from China could be adversely affected by changes to these economic reforms by the Chinese government, as well as by changes in political, economic and social conditions or other relevant policies of the Chinese government, such as changes in laws, regulations or export and import restrictions, all of which could, adversely affect our business, operating results and financial condition.

Charter rates are subject to seasonal fluctuations, which may adversely affect our financial condition and ability to pay dividends.

Our Initial Fleet consists of drybulk carriers that operate in markets that have historically exhibited seasonal variations in demand and, as a result, in charter rates. This seasonality may result in quarter-to-quarter volatility in our operating results. The drybulk sector is typically stronger in the fall and winter months in anticipation of increased consumption of coal and other raw materials in the northern hemisphere during the winter months. As a result, we expect our revenues from our drybulk carriers to be weaker during the fiscal quarters ended June 30 and September 30, and, conversely, we expect our revenues from our drybulk carriers to be stronger in fiscal quarters ended December 31 and March 31. We may acquire tankers in the future and be subject to seasonal trends in the tanker sector as follows: The tanker sector is also typically stronger in the fall and winter months in anticipation of increased consumption of oil and petro leum products in the northern hemisphere during the winter months. As a result, our revenues from tankers may be weaker during the fiscal quarters ended June 30 and September 30, and, conversely, revenues may be stronger in fiscal quarters ended December 31 and March 31. If we acquire container vessels in the future we will be subject to seasonal trends in the container vessel sector as follows: Seasonal trends in the container sector are driven by the import patterns of manufactured goods and refrigerated cargoes by major importers, such as the United States, Europe, Japan and others. The volume of containerized trade is usually higher in the fall in preparation for the holiday season. During this period, container shipping rates are higher, and as a result, the charter rates for containerships are higher. Seasonality in the sectors in which we operate could materially affect our operating results and cash available for dividends in the future.

We are subject to complex laws and regulations, including environmental regulations that can adversely affect the cost, manner or feasibility of doing business.

Our operations are subject to numerous laws and regulations in the form of international conventions and treaties, national, state and local laws and national and international regulations in force in the jurisdictions in which our vessels operate or are registered, which can significantly affect the ownership and operation of our vessels. These requirements include, but are not limited to, the U.S. Oil Pollution Act of 1990, or OPA, the International Convention on Civil Liability for Oil Pollution Damage of 1969, the International Convention for the Prevention of Pollution from Ships, the IMO International Convention for the Prevention of Marine Pollution of 1973, the IMO International Convention for the Safety of Life at Sea of 1974, the International Convention on Load Lines of 1966 and the U.S. Marine Transportation Security Act of 2002. Compliance with such laws, regulations and standards, where applicable, may require installation of costly equipment or op erational changes and may affect the resale value or useful lives of our vessels. We may also incur additional costs in order to comply with other existing and future regulatory obligations, including, but not limited to, costs relating to air emissions, the management of ballast waters, maintenance and inspection, elimination of tin-based paint, development and implementation of emergency procedures and insurance coverage or other financial assurance of our ability to address pollution incidents. These costs could have a material adverse effect on our business, results of operations, cash flows and financial condition and our ability to pay dividends.

A failure to comply with applicable laws and regulations may result in administrative and civil penalties, criminal sanctions or the suspension or termination of our operations. Environmental laws often impose strict liability for remediation of spills and releases of oil and hazardous substances, which

17

could subject us to liability without regard to whether we were negligent or at fault. Under OPA, for example, owners, operators and bareboat charterers are jointly and severally strictly liable for the discharge of oil within the 200-mile exclusive economic zone around the United States. An oil spill could result in significant liability, including fines, penalties, criminal liability and remediation costs for natural resource damages under other federal, state and local laws, as well as third-party damages. We are required to satisfy insurance and financial responsibility requirements for potential oil (including marine fuel) spills and other pollution incidents. Although we have arranged insurance to cover certain environmental risks, there can be no assurance that such insurance will be sufficient to cover all such risks or that any claims will not have a material adverse effect on our business, results of operations, cash flows and financial condition and our ability to pay dividends.

Our vessels may suffer damage due to the inherent operational risks of the seaborne transportation industry and we may experience unexpected dry-docking costs, which may adversely affect our business and financial condition.

Our vessels and their cargoes will be at risk of being damaged or lost because of events such as marine disasters, bad weather, business interruptions caused by mechanical failures, grounding, fire, explosions and collisions, human error, war, terrorism, piracy and other circumstances or events. These hazards may result in death or injury to persons, loss of revenues or property, environmental damage, higher insurance rates, damage to our customer relationships, delay or rerouting.

If our vessels suffer damage, they may need to be repaired at a dry-docking facility. The costs of dry-dock repairs are unpredictable and may be substantial. We may have to pay dry-docking costs that our insurance does not cover in full. The loss of earnings while these vessels are being repaired and repositioned, as well as the actual cost of these repairs, would decrease our earnings. In addition, space at dry-docking facilities is sometimes limited and not all dry-docking facilities are conveniently located. We may be unable to find space at a suitable dry-docking facility or our vessels may be forced to travel to a dry-docking facility that is not conveniently located to our vessels’ positions. The loss of earnings while these vessels are forced to wait for space or to steam to more distant dry-docking facilities would decrease our earnings.

Our insurance may not be adequate to cover our losses that may result from our operations due to the inherent operational risks of the seaborne transportation industry.

We carry insurance to protect us against most of the accident-related risks involved in the conduct of our business, including marine hull and machinery insurance, protection and indemnity insurance, which includes pollution risks, crew insurance and war risk insurance. However, we may not be adequately insured to cover losses from our operational risks, which could have a material adverse effect on us. Additionally, our insurers may refuse to pay particular claims and our insurance may be voidable by the insurers if we take, or fail to take, certain action, such as failing to maintain certification of our vessels with applicable maritime regulatory organizations. Any significant uninsured or under-insured loss or liability could have a material adverse effect on our business, results of operations, cash flows and financial condition and our ability to pay dividends. In addition, we may not be able to obtain adequate insurance coverage at reasonable rates in the future during adverse insurance market conditions.

As a result of the September 11, 2001 attacks, the U.S. response to the attacks and related concern regarding terrorism, insurers have increased premiums and reduced or restricted coverage for losses caused by terrorist acts generally. Accordingly, premiums payable for terrorist coverage have increased substantially and the level of terrorist coverage has been significantly reduced.

In addition, we may not carry loss-of-hire insurance, which covers the loss of revenue during extended vessel off-hire periods, such as those that occur during an unscheduled dry-docking due to damage to the vessel from accidents. Accordingly, any loss of a vessel or extended vessel off-hire, due to an accident or otherwise, could have a material adverse effect on our business, results of operations and financial condition and our ability to pay dividends to our shareholders.

18

We may be subject to calls because we obtain some of our insurance through protection and indemnity associations.