| | |

OMB APPROVAL |

OMB Number: | | 3235-0570 |

Expires: | | August 31, 2011 |

Estimated average burden |

hours per response: | | 18.9 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number: | | 811-22051 |

ING International High Dividend Equity Income Fund

|

| (Exact name of registrant as specified in charter) |

| | |

| 7337 E. Doubletree Ranch Rd., Scottsdale, AZ | | 85258 |

| (Address of principal executive offices) | | (Zip code) |

The Corporation Trust Company, 1209 Orange

Street, Wilmington, DE 19801

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: 1-800-992-0180

Date of fiscal year end: February 28

Date of reporting period: February 28, 2010

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

| Item 1. | Reports to Stockholders. |

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Annual Report

February 28, 2010

ING International High Dividend Equity Income Fund

| | |

| | E-Delivery Sign-up – details inside |

This report is submitted for general information to shareholders of the ING Funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the fund’s investment objectives, risks, charges, expenses and other information. This information should be read carefully.

FUNDS

| |

TABLE OF CONTENTS

| | | | |

| | | |

| | Go Paperless with E-Delivery! | |  |

Sign up now for on-line prospectuses, fund reports, and proxy statements. In less than five minutes, you can help reduce paper mail and lower fund costs. Just go to www.ingfunds.com, click on the E-Delivery icon from the home page, follow the directions and complete the quick 5 Steps to Enroll. You will be notified by e-mail when these communications become available on the internet. Documents that are not available on the internet will continue to be sent by mail. |

PROXY VOTING INFORMATION

A description of the policies and procedures that the Fund uses to determine how to vote proxies related to portfolio securities is available (1) without charge, upon request, by calling Shareholder Services toll-free at (800) 992-0180; (2) on the Fund’s website at www.ingfunds.com and (3) on the SEC’s website at www.sec.gov. Information regarding how the Fund voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the Fund’s website at www.ingfunds.com and on the SEC’s website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at www.sec.gov. The Fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330; and is available upon request from the Fund by calling Shareholder Services toll-free at (800) 992-0180.

PRESIDENT’S LETTER

Dear Shareholder,

ING International High Dividend Equity Income Fund (the “Fund”) is a non-diversified, closed-end management investment company whose shares are traded on the New York Stock Exchange under the symbol “IID.” The primary objective of the Fund is to seek current income and realized gains, with a secondary objective of long-term capital appreciation.

The Fund seeks to achieve its investment objective by investing at least 80% of its managed assets in dividend-producing equity securities of foreign companies and/or derivatives linked to such securities or indices that include such securities. The Fund also seeks to enhance total returns over a market cycle by selling call options on selected international, regional or country indices, and or equity securities.

For the fiscal year ended February 28, 2010, the Fund made monthly total distributions of $1.81 per share, including a return of capital of $1.61 per share and net investment income of $0.20 per share. During the fiscal year, the Fund reduced its monthly distribution from $0.163 to $0.115 per month, commencing with the distribution paid on December 15, 2009.

Based on net asset value (“NAV”), the Fund provided a total return of 51.96% for the fiscal year ended February 28, 2010.(1) This NAV return reflects an increase in its NAV from $8.12 on

February 28, 2009 to $10.52 on February 28, 2010. Based on its share price as of February 28, 2010, the Fund provided a total return of 86.17% for the fiscal year ended February 28, 2010.(2) This share price return reflects an increase in its share price from $7.68 on February 28, 2009 to $12.19 on February 28, 2010.

The global equity markets have witnessed a challenging and turbulent period. Please read the Market Perspective and Portfolio Managers’ Report for more information on the market and the Fund’s performance.

At ING Funds our mission is to set the standard in helping our clients manage their financial future. We seek to assist you and your financial advisor by offering a range of global investment solutions. We invite you to visit our website at www.ingfunds.com. Here you will find information on our products and services, including current market data and fund statistics on our open- and closed-end funds. You will see that we offer a broad variety of equity, fixed income and multi-asset funds that aim to fulfill a variety of investor needs.

We thank you for trusting ING Funds with your investment assets, and we look forward to serving you in the months and years ahead.

Sincerely,

Shaun P. Mathews

President & Chief Executive Officer

ING Funds

April 9, 2010

The views expressed in the President’s Letter reflect those of the President as of the date of the letter. Any such views are subject to change at any time based upon market or other conditions and ING Funds disclaim any responsibility to update such views. These views may not be relied on as investment advice and because investment decisions for an ING Fund are based on numerous factors, may not be relied on as an indication of investment intent on behalf of any ING Fund. Reference to specific company securities should not be construed as recommendations or investment advice. International investing does pose special risks including currency fluctuation, economic and political risks not found in investments that are solely domestic.

For more complete information, or to obtain a prospectus for any ING Fund, please call your Investment Professional or the Fund’s Shareholder Service Department at (800) 992-0180 or log on to www.ingfunds.com. The prospectus should be read carefully before investing. Consider the fund’s investment objectives, risks, charges and expenses carefully before investing. The prospectus contains this information and other information about the fund. Check with your Investment Professional to determine which funds are available for sale within their firm. Not all funds are available for sale at all firms.

| (1) | | Total investment return at net asset value has been calculated assuming a purchase at net asset value at the beginning of each period and a sale at net asset value at the end of each period and assumes reinvestment of dividends, capital gain distributions and return of capital distributions/allocations, if any, in accordance with the provisions of the Fund’s dividend reinvestment plan. |

| (2) | | Total investment return at market value measures the change in the market value of your investment assuming reinvestment of dividends, capital gain distributions, and return of capital distributions/allocations, if any, in accordance with the provisions of the Fund’s dividend reinvestment plan. |

1

MARKET PERSPECTIVE: YEAR ENDED FEBRUARY 28, 2010

In our semi-annual report, we described how global equities in the form of the MSCI World Index SM(1) measured in local currencies, including net reinvested dividends (“MSCI” for regions discussed below), staged a dramatic recovery beginning on March 9, from a 22% deficit for the calendar year to date. Smaller gains were made in the second half of the fiscal year, and for the whole fiscal year the index rose 46.06%. (The MSCI World IndexSM(1) returned 54.30% for the entire fiscal year, measured in U.S. dollars.) In currencies, the U.S. dollar, on a trade weighted basis, touched a 15-month low in late November but rebounded somewhat against European currencies. For the fiscal year, the U.S. dollar lost 6.9% to the euro, 9.0% against the yen, and 6.4% against the pound.

Gradually, the seeds of recovery from global recession started to bear fruit as opposed to just the “green shoots” on which the prices of risky assets had improbably surged since March. The financial crisis that caused the recession led governments to intervene massively to recapitalize companies considered systemically important, or at least make practically unlimited amounts of liquidity available to them at low cost. These were mainly banks and other financial institutions, but in the U.S. also included major auto makers. Some financial giants once thought impregnable now sit meekly under government control. Interest rates have been reduced to record low levels to encourage these institutions to lend and generally to support demand. Bank lending has continued to stagnate however (except in China, where banks tend to follow government directions).

“Cash-for-Clunkers” programs were successfully introduced in a number of countries, under which governments subsidized the trade-in of old vehicles for newer models. In the U.S. the government offered an $8,000 tax credit to first-time home buyers and extended jobless benefits. In Europe, to reduce the number of workers being laid off, corporations were subsidized to keep them on part time. The U.K. reduced value added tax (“VAT”).

Government budget deficits have soared to modern-day records: in the U.S. alone $1.42 trillion for the fiscal year ending September 2009. To keep interest rates down the Federal Reserve Board and the Bank of England have been buying U.S. Treasury bonds in a strategy known as quantitative easing.

What will happen when large-scale government intervention ends, is probably the greatest concern for investors. But China’s rate of gross domestic product

(“GDP”) growth is now back above 10% and some key areas of the economy are clearly looking better.

House prices have started to rise again. The Standard & Poor’s (“S&P”)/Case-Shiller National U.S. Home Price Index(2) of house prices in 20 cities was reported in February to have risen for seven consecutive months and was only down 3.1% from a year earlier. Sales of existing homes reached the highest levels since February 2007 but then fell in December and January, perhaps distorted by tax credit effects.

On the employment front, improvement has so far been too slow to sustain a vigorous recovery. Jobs were still being lost as our fiscal year ended, although the trend is falling. The unemployment rate was reported at 9.7% in February, having peaked at 10.2%. Wage growth remains weak and the participation rate (percentage of the population in the labor force) fell to 64.6%, the lowest level since August 1985, before edging up in January.

At least the economy has started to expand again after four quarterly declines. In the third quarter of 2009, GDP in the U.S. rose by 2.2% at an annual rate and in the fourth quarter 5.90%, largely due to inventory rebuilding. U.S. equities, represented by the S&P 500® Composite Stock Price (“S&P 500®”) Index(3) including dividends returned 53.62% in the fiscal year, five sixths of it in the first half. The rally was led by the financials sector which almost doubled in value. The index suffered its first monthly fall since February 2009 in October, when a rather flat personal incomes report issued on the last day of the month drove the market down by over 2%. A more serious setback took place in January, when, after a bright start, concerns over the employment situation, enforced credit tightening in China and the possibility of sovereign debt default in Greece depressed risk appetites and sent markets tumbling. Profits for S&P 500® companies suffered their ninth straight quarter of annual decline in the third quarter before showing strong improvement in the fourth.

In international markets, the MSCI Japan® Index(4) rose 21.76% over the fiscal year, but actually fell nearly 6.00% in the second half. GDP resumed growth in the fourth quarter, bolstered by government stimulus and because imports are falling faster than exports. But domestic demand is generally weak, with wages down for 18 consecutive months and deflation again the norm. The MSCI Europe ex UK® Index(5) surged 44.27% for the entire fiscal year. As in the U.S. the region’s economy returned to growth in the third quarter of

2

MARKET PERSPECTIVE: YEAR ENDED FEBRUARY 28, 2010

2009, by 0.4% over the previous quarter, but only rose by 0.1% in the fourth quarter. Adding to the sense of a stalled recovery, composite sentiment and purchasing managers’ indices slipped after months of increase. Unemployment rose to a decade-high 9.9% and stayed there. Greece’s credit rating was downgraded on concerns about its burgeoning budget deficit. The MSCI UK® Index(6) gained 46.17% for the entire fiscal year. The U.K. had to wait until the fourth quarter for a rise in GDP, of 0.3%. Consumers continued to pay down debt at record rates and the household savings rate rose to 8.6%, the highest since 1998. Yet unemployment stabilized at 7.8% and purchasing managers’ indices held firmly in expansion mode. House prices resumed rising on an annual basis but ominously fell in February for the first month in ten.

(1) The MSCI World IndexSM is an unmanaged index that measures the performance of over 1,400 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East.

(2) The S&P/Case-Shiller National U.S. Home Price Index tracks the value of single-family housing within the United States. The index is a composite of single-family home price indices for the nine U.S. Census divisions and is calculated quarterly.

(3) The S&P 500® Index is an unmanaged index that measures the performance of securities of approximately 500 large-capitalization companies whose securities are traded on major U.S. stock markets.

(4) The MSCI Japan® Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in Japan.

(5) The MSCI Europe ex UK® Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in Europe, excluding the UK.

(6) The MSCI UK® Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in the UK.

All indices are unmanaged and investors cannot invest directly in an index.

Past performance does not guarantee future results. The performance quoted represents past performance. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. The Fund’s performance is subject to change since the period’s end and may be lower or higher than the performance data shown. Please call (800) 992-0180 or log on to www.ingfunds.com to obtain performance data current to the most recent month end.

Market Perspective reflects the views of ING’s Chief Investment Risk Officer only through the end of the period, and is subject to change based on market and other conditions.

3

| | |

| ING INTERNATIONAL HIGH DIVIDEND EQUITY INCOME FUND | | PORTFOLIO MANAGERS’ REPORT |

ING International High Dividend Equity Income Fund’s (the “Fund”) primary investment objective is to provide current income and realized gains, with a secondary objective of long-term capital appreciation. The Fund seeks to achieve its investment objectives by:

| • | | investing primarily in a portfolio of international dividend producing securities or derivatives linked to such securities or indices that include such securities, which the sub-adviser believes will pay above-average, sustainable, dividends; and |

| • | | selling call options on selected international, regional or country indices, and/or on equity securities. |

The Fund is managed by Martin Jansen and David Powers, Portfolio Managers of ING Investment Management Co.*; Nicolas Simar, Manu Vandenbulck, Bas Peeters and Frank van Etten, Portfolio Managers of ING Investment Management Advisors B.V. (Europe); and Teik Cheah, Portfolio Managers of ING Investment Management Asia/Pacific (Hong Kong) Limited.

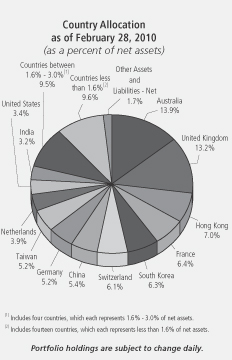

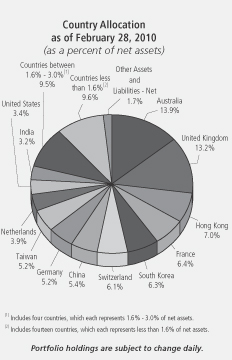

Equity Portfolio Construction: Under normal market conditions, the Fund seeks to achieve its investment objectives by investing in dividend-producing equity securities of foreign companies (“foreign securities”) and/or derivatives linked to such securities or indices that include such securities. The Fund normally invests across a broad range of countries, industries and market sectors, including in issuers located in countries that are considered emerging markets.

The sub-adviser seeks to construct a portfolio with a dividend yield that exceeds the weighted average dividend yield of the MSCI AC (All Countries) ex USA IndexSM and allocates the Fund’s assets among the Europe region, the Asia Pacific region and the Rest-of-the-World region in proportions (“sleeves”) that depend on the sub-adviser’s assessment of market conditions across the investing spectrum. The target allocation is expected to be approximately 50% invested in the European sleeve in approximately 50-100 European

equity securities, 40% invested in the Asia Pacific sleeve in approximately 65-100 Asia Pacific equity securities and 10% invested in the Rest-of-the-World sleeve in approximately 50 equity securities. The Fund invests in approximately 130 to 220 equity securities and will select securities through a bottom-up process that is based upon quantitative screening and fundamental industry, sector and company analysis.

The Fund’s Option Strategy: To generate premiums, the Fund writes (sells) call options on selected international, regional or country indices, and/or on equity securities, with the underlying value of such calls having 20% to 50% of the value of its holdings of equity securities. The Fund seeks to generate gains from the call writing strategy over a market cycle to supplement the dividend yield of its underlying portfolio of high dividend yield equity securities. Call options will be written (sold) usually at-the money or near-the-money and will be written both in exchange-listed option markets and over-the-counter markets with major international banks, broker-dealers and financial institutions. The Fund seeks to maintain written call options positions on selected international, regional or country indices, and/or on equity securities whose price movements, taken in the aggregate, are correlated with the price movements of the Fund’s portfolio.

Performance: Based on net asset value (“NAV”) as of February 28, 2010, the Fund provided a total return of 51.96% for the year. This NAV return reflects an increase in its NAV from $8.12 on February 28, 2009 to $10.52 on February 28, 2010. Based on its share price as of

February 28, 2010, the Fund provided a total return of 86.17% for the year. This share price return reflects an increase in its share price from $7.68 on February 28, 2009 to $12.19 on February 28, 2010. To reflect the strategic emphasis of the Fund, the equity portfolio uses a blend of 55% MSCI Europe Index(1) and 45% MSCI Asia Pacific ex-Japan Index(2) as a reference index. The blend of 55% in the MSCI Europe Index and 45% in the MSCI Asia Pacific ex-Japan Index returned 72.58% for the reporting period. During the period, the Fund made monthly total distributions of $1.81 per share, including a return of capital of $1.61 per share and net investment income of $0.20 per share. During the fiscal year, the Fund reduced its monthly distribution from $0.163 to $0.115 per month, commencing with the distribution paid on December 15, 2009. As of February 28, 2010, the Fund had 8,199,250 shares outstanding.

Market Review: To reflect the strategic emphasis of the Fund, the equity portfolio uses a blend of 55% in the MSCI Europe® Index and 45% in MSCI Asia Pacific ex-Japan® Index as a reference index. For the year ended February 28, 2010, this reference index returned 72.58%, reflecting the strong market recovery from early March 2009 as the market became increasingly confident that the unprecedented levels of global monetary and fiscal support would stabilize the global economy. The Asia-Pacific ex-Japan region was especially strong, and returned a stellar 88.91% for the fiscal year.

Top Ten Holdings

as of February 28, 2010

(as a percent of net assets)

| | |

BHP Billiton Ltd. | | 2.0% |

Samsung Kodex200 Exchange Traded Fund | | 1.7% |

Commonwealth Bank of Australia | | 1.3% |

HSBC Holdings PLC | | 1.3% |

Novartis AG | | 1.2% |

Royal Dutch Shell PLC — Class B | | 1.2% |

Total S.A. | | 1.2% |

GlaxoSmithKline PLC | | 1.2% |

BP PLC | | 1.2% |

Sanofi-Aventis | | 1.2% |

Portfolio holdings are subject to change daily.

4

| | |

| PORTFOLIO MANAGERS’ REPORT | | ING INTERNATIONAL HIGH DIVIDEND EQUITY INCOME FUND |

Europe recorded a solid gain of 57.81% for the period. Market volatility, which had spiked to record levels in the fourth quarter of 2008, fell steadily as markets recovered; by the fiscal year-end, volatility was near its long-term average but still well above the low levels prevailing before the recent financial crisis.

Equity Portfolio: For the period, the Fund’s underlying equity portfolio underperformed its reference index. In a strong market recovery led by lower quality stocks, our focus on sustainable and growing dividends supported by strong balance sheets constituted a headwind. This phenomenon was especially acute in the financials sector. By the last quarter of 2009, the market had become more discriminating. Well-capitalized and dividend-paying companies have fared relatively well since then. In the Asia Pacific ex-Japan equity sleeve, the lower than market beta embedded in the selection process manifested itself in a selection shortfall in all sectors, especially financials and telecommunication services. The European sleeve similarly lagged its regional benchmark, primarily because of adverse stock selection in the financials and materials sectors, despite a meaningful contribution from industrials. The Fund can invest up to 20% of its assets in regions outside Asia Pacific and Europe (North America, Eastern Europe, Latin America and Africa). The average allocation of about 8% added materially to the result versus the reference index due primarily to strong performances from its energy, utilities, material and healthcare holdings in North and South America. The financials exposure partly offset this positive result.

Option Portfolio: During the reporting period, we wrote call options against Asian/Pacific indices (ASX, KOSPI, TWSE and Hang Seng) and European indices (FTSE 100 and DJ EuroStoxx 50). The option portfolio consists of a basket of short-dated index options generally sold at-the-money and implemented in the over-the-counter market. The options generally had a maturity in the range of four to five weeks. The coverage ratio for both the European and Asia-Pacific sleeves was maintained in the 35-40% range.

Sharply declining market volatility resulted in much lower call premiums received, although the impact was muted by the strongly recovering net asset value of the Fund and the slightly higher average coverage ratio compared to the prior fiscal year. Consequently, the amounts that needed to be paid on the expiry of the options materially exceeded the option premiums received. The coverage ratio for the Fund averaged around 35% for the year. Shareholders benefited from this relatively low coverage ratio, as most of the portfolio participated in the market recovery.

Current Strategy and Outlook: High-dividend and income strategies are designed to dampen volatility versus the broader market across an investment cycle. While we remain constructive on the market outlook, we believe a continuation of the strong gains since the March 2009 market trough is unlikely. For the developed economies, we expect the economic recovery to be anemic by historical standards, as deleveraging and modest consumption growth at best constrains growth. Given this scenario, we believe market gains are likely to be modest and erratic. Our dividend approach, which should capture a substantial portion of the market’s return under these circumstances, is, we believe, well positioned for this outcome. On the other hand, the Fund’s strategic focus on Asia provides exposure to a region that is expected to grow at a much higher rate than the developed economies. While the extreme market volatility of 2008 and early 2009 is unlikely to be repeated, current volatility levels remain higher than when the Fund was launched in September 2007, thereby indicating continued opportunities for attractive call writing to enhance dividend income. The relatively low coverage ratio should also allow the portfolio to participate meaningfully as markets advance.

| * | | Effective April 19, 2010, Uri Landesman is no longer a portfolio manager to the Fund. |

| (1) | | The MSCI Europe® Index is a free float-adjusted market capitalization weighted index designed to measure the equity market performance of the developed markets in Europe. |

| (2) | | The MSCI Asia Pacific ex-Japan® Index is a free float-adjusted market capitalization weighted index designed to measure the equity market performance of Asia, excluding Japan. |

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics.

Performance data represents past performance and is no guarantee of future results.

Past performance is not indicative of future results. The indices do not reflect fees, brokerage commissions, taxes or other expenses of investing. Investors cannot invest directly in an index.

5

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Shareholders and Board of Trustees

ING International High Dividend Equity Income Fund

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of ING International High Dividend Equity Income Fund as of February 28, 2010, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the two-year period then ended, and the period from September 25, 2007 (commencement of operations) to February 29, 2008. These financial statements and financial highlights are the responsibility of management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of February 28, 2010, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of ING International High Dividend Equity Income Fund as of February 28, 2010, and the results of its operations, the changes in its net assets, and the financial highlights for the periods specified in the first paragraph above, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

April 26, 2010

6

STATEMENT OF ASSETS AND LIABILITIES ASOF FEBRUARY 28, 2010

| | | | |

ASSETS: | | | | |

Investments in securities at value* | | $ | 84,719,964 | |

Cash | | | 1,082,348 | |

Foreign currencies at value** | | | 666,452 | |

Receivables: | | | | |

Investment securities sold | | | 481,103 | |

Dividends and interest | | | 356,402 | |

Prepaid expenses | | | 789 | |

| | | | |

Total assets | | | 87,307,058 | |

| | | | |

LIABILITIES: | | | | |

Payable for investment securities purchased | | | 1,078 | |

Payable to affiliates | | | 58,508 | |

Payable for trustees fees | | | 2,180 | |

Other accrued expenses and liabilities | | | 122,866 | |

Written options*** | | | 905,773 | |

| | | | |

Total liabilities | | | 1,090,405 | |

| | | | |

NET ASSETS (equivalent to $10.52 per share on 8,199,250 shares outstanding) | | $ | 86,216,653 | |

| | | | |

NET ASSETS WERE COMPRISED OF: | | | | |

Paid-in capital — shares of beneficial interest at $0.01 par value (unlimited shares authorized) | | $ | 129,116,857 | |

Distributions in excess of net investment income | | | (833,153 | ) |

Accumulated net realized loss on investments, foreign currency related transactions, and written options | | | (46,003,330 | ) |

Net unrealized appreciation on investments, foreign currency related transactions, and written options | | | 3,936,279 | |

| | | | |

NET ASSETS | | $ | 86,216,653 | |

| | | | |

| | | | |

* Cost of investments in securities | | $ | 80,620,884 | |

** Cost of foreign currencies | | $ | 667,350 | |

*** Premiums received on written options | | $ | 748,030 | |

See Accompanying Notes to Financial Statements

7

STATEMENT OF OPERATIONS FORTHE YEAR ENDED FEBRUARY 28, 2010

| | | | |

INVESTMENT INCOME: | | | | |

Dividends, net of foreign taxes withheld* | | $ | 3,083,016 | |

Interest | | | 28,495 | |

| | | | |

Total investment income | | | 3,111,511 | |

| | | | |

EXPENSES: | | | | |

Investment management fees | | | 836,423 | |

Transfer agent fees | | | 33,220 | |

Administrative service fees | | | 83,641 | |

Shareholder reporting expense | | | 55,860 | |

Registration fees | | | 1,700 | |

Professional fees | | | 54,394 | |

Custody and accounting expense | | | 64,984 | |

Trustees fees | | | 1,587 | |

Miscellaneous expense | | | 47,621 | |

| | | | |

Total expenses | | | 1,179,430 | |

Net waived and reimbursed fees | | | (132,566 | ) |

| | | | |

Net expenses | | | 1,046,864 | |

| | | | |

Net investment income | | | 2,064,647 | |

| | | | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, FOREIGN CURRENCY RELATED TRANSACTIONS, AND WRITTEN OPTIONS: | | | | |

Net realized loss on: | | | | |

Investments | | | (5,462,952 | ) |

Foreign currency related transactions | | | (223,742 | ) |

Written options | | | (4,991,353 | ) |

| | | | |

Net realized loss on investments, foreign currency related transactions, and written options | | | (10,678,047 | ) |

| | | | |

Net change in unrealized appreciation or depreciation on: | | | | |

Investments | | | 43,444,062 | |

Foreign currency related transactions | | | 9,209 | |

Written options | | | (1,023,899 | ) |

| | | | |

Net change in unrealized appreciation or depreciation on investments, foreign currency related transactions, and written options | | | 42,429,372 | |

| | | | |

Net realized and unrealized gain on investments, foreign currency related transactions, and written options | | | 31,751,325 | |

| | | | |

Increase in net assets resulting from operations | | $ | 33,815,972 | |

| | | | |

| | | | |

* Foreign taxes withheld | | $ | 264,290 | |

See Accompanying Notes to Financial Statements

8

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Year Ended February 28, 2010 | | | Year Ended February 28, 2009 | |

FROM OPERATIONS: | | | | | | | | |

Net investment income | | $ | 2,064,647 | | | $ | 4,625,880 | |

Net realized loss on investments, foreign currency related transactions, and written options | | | (10,678,047 | ) | | | (35,110,855 | ) |

Net change in unrealized appreciation or depreciation on investments, foreign currency related transactions, and written options | | | 42,429,372 | | | | (23,562,356 | ) |

| | | | | | | | |

Increase (decrease) in net assets resulting from operations | | | 33,815,972 | | | | (54,047,331 | ) |

| | | | | | | | |

FROM DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

Net investment income | | | (1,670,254 | ) | | | (3,838,907 | ) |

Return of capital | | | (13,057,458 | ) | | | (12,066,739 | ) |

| | | | | | | | |

Total distributions | | | (14,727,712 | ) | | | (15,905,646 | ) |

| | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

Reinvestment of distributions | | | 1,724,169 | | | | 191,873 | |

Cost of shares redeemed | | | (389,261 | ) | | | (347,523 | ) |

| | | | | | | | |

Net increase (decrease) in net assets resulting from capital share transactions | | | 1,334,908 | | | | (155,650 | ) |

| | | | | | | | |

Net increase (decrease) in net assets | | | 20,423,168 | | | | (70,108,627 | ) |

| | | | | | | | |

NET ASSETS: | | | | | | | | |

Beginning of year | | | 65,793,485 | | | | 135,902,112 | |

| | | | | | | | |

End of year | | $ | 86,216,653 | | | $ | 65,793,485 | |

| | | | | | | | |

Distributions in excess of net investment income at end of year | | $ | (833,153 | ) | | $ | (1,125,927 | ) |

| | | | | | | | |

See Accompanying Notes to Financial Statements

9

FINANCIAL HIGHLIGHTS

Selected data for a share of beneficial interest outstanding throughout the year or period.

| | | | | | | | | | |

| | | | | Year Ended February 28, 2010 | | Year Ended February 28, 2009 | | | September 25, 2007(1) to February 29, 2008 | |

Per Share Operating Performance: | | | | | | | | | | |

| Net asset value, beginning of period | | $ | | 8.12 | | 16.72

|

| | 19.06 | (2) |

| Income (loss) from investment operations: | | | | | | | | | | |

| Net investment income | | $ | | 0.25 | | 0.57 | * | | 0.10 | |

| Net realized and unrealized gain (loss) on investments | | $ | | 3.96 | | (7.22 | ) | | (1.79 | ) |

| Total from investment operations | | $ | | 4.21 | | (6.65 | ) | | (1.69 | ) |

| Less distributions from: | | | | | | | | | | |

| Net investment income | | $ | | 0.20 | | 0.47 | | | 0.25 | |

| Net realized gains on investments | | $ | | — | | — | | | 0.17 | |

| Return of capital | | $ | | 1.61 | | 1.48 | | | 0.23 | |

| Total distributions | | $ | | 1.81 | | 1.95 | | | 0.65 | |

| Net asset value, end of period | | $ | | 10.52 | | 8.12 | | | 16.72 | |

| Market value, end of period | | $ | | 12.19 | | 7.68 | | | 16.32 | |

Total investment return at net asset value(3) | | % | | 51.96 | | (41.94 | ) | | (8.68 | ) |

Total investment return at market value(4) | | % | | 86.17 | | (43.74 | ) | | (15.06 | ) |

Ratios and Supplemental Data: | | | | | | | | | | |

| Net assets, end of period (000’s) | | $ | | 86,217 | | 65,793 | | | 135,902 | |

| Ratios to average net assets: | | | | | | | | | | |

| Gross expenses prior to expense waiver(5) | | % | | 1.41 | | 1.39 | | | 1.26 | |

| Net expenses after expense waiver(5)(6) | | % | | 1.25 | | 1.25 | | | 1.24 | |

| Net investment income after expense waiver(5)(6) | | % | | 2.47 | | 4.31 | | | 1.32 | |

| Portfolio turnover rate | | % | | 55 | | 81 | | | 42 | |

| (1) | | Commencement of operations. |

| (2) | | Net asset value at beginning of period reflects the deduction of the sales load of $0.90 per share and offering costs of $0.04 per share paid by the shareholder from the $20.00 offering price. |

| (3) | | Total investment return at net asset value has been calculated assuming a purchase at net asset value at the beginning of each period and a sale at net asset value at the end of each period and assumes reinvestment of dividends, capital gain distributions and return of capital distributions/allocations, if any, in accordance with the provisions of the dividend reinvestment plan. Total investment return at net asset value is not annualized for periods less than one year. |

| (4) | | Total investment return at market value measures the change in the market value of your investment assuming reinvestment of |

| | dividends, capital gain distributions and return of capital distributions/allocations, if any, in accordance with the provisions of the Fund’s dividend reinvestment plan. Total investment return at market value is not annualized for periods less than one year. |

| (5) | | Annualized for periods less than one year. |

| (6) | | The Investment Adviser has entered into a written expense limitation agreement with the Fund under which it will limit the expenses of the Fund (excluding interest, taxes, leverage expenses and extraordinary expenses) subject to possible recoupment by the Investment Adviser within three years of being incurred. |

| * | | Calculated using average number of shares outstanding throughout the period. |

See Accompanying Notes to Financial Statements

10

NOTES TO FINANCIAL STATEMENTSASOF FEBRUARY 28, 2010

NOTE 1 — ORGANIZATION

ING International High Dividend Equity Income Fund (the “Fund”) is a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund is organized as a Delaware statutory trust.

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies are consistently followed by the Fund in the preparation of its financial statements, and such policies are in conformity with U.S. generally accepted accounting principles for investment companies.

| A. | Security Valuation. Investments in equity securities traded on a national securities exchange are valued at the last reported sale price. Securities reported by NASDAQ are valued at the NASDAQ official closing prices. Securities traded on an exchange or NASDAQ for which there has been no sale and equity securities traded in the over-the-counter-market are valued at the mean between the last reported bid and ask prices. All investments quoted in foreign currencies will be valued daily in U.S. dollars on the basis of the foreign currency exchange rates prevailing at that time. Debt securities acquired with more than 60 days to maturity are fair valued using matrix pricing methods determined by an independent pricing service which takes into consideration such factors as yields, maturities, liquidity, ratings and traded prices in similar or identical securities. Securities for which valuations are not readily available from an independent pricing service may be valued by brokers which use prices provided by market makers or estimates of fair market value obtained from yield data relating to investments or securities with similar characteristics. Investments in open-end mutual funds are valued at the net asset value. Investments in securities maturing in 60 days or less from date of acquisition are valued at amortized cost which approximates market value. |

| | Securities and assets for which market quotations are not readily available (which may include certain restricted securities that are subject to limitations as to their sale) are valued at their fair values, as defined by the 1940 Act, and as determined in good faith by or under the supervision of the Fund’s Board of Trustees (“Board”), in accordance with methods that are specifically authorized by the Board. Securities |

| | traded on exchanges, including foreign exchanges, which close earlier than the time that the Fund calculates its net asset value (“NAV”) may also be valued at their fair values, as defined by the 1940 Act, and as determined in good faith by or under the supervision of the Board, in accordance with methods that are specifically authorized by the Board. The value of a foreign security traded on an exchange outside the United States is generally based on its price on the principal foreign exchange where it trades as of the time the Fund determines its NAV or if the foreign exchange closes prior to the time the Fund determines its NAV, the most recent closing price of the foreign security on its principal exchange. Trading in certain non-U.S. securities may not take place on all days on which the NYSE Euronext (“NYSE”) is open. Further, trading takes place in various foreign markets on days on which the NYSE is not open. Consequently, the calculation of the Fund’s NAV may not take place contemporaneously with the determination of the prices of securities held by the Fund in foreign securities markets. Further, the value of the Fund’s assets may be significantly affected by foreign trading on days when a shareholder cannot purchase or redeem shares of the Fund. In calculating the Fund’s NAV, foreign securities denominated in foreign currency are converted to U.S. dollar equivalents. If an event occurs after the time at which the market for foreign securities held by the Fund closes but before the time that the Fund’s NAV is calculated, such event may cause the closing price on the foreign exchange to not represent a readily available reliable market value quotation for such securities at the time the Fund determines its NAV. In such a case, the Fund will use the fair value of such securities as determined under the Fund’s valuation procedures. Events after the close of trading on a foreign market that could require the Fund to fair value some or all of its foreign securities include, among others, securities trading in the U.S. and other markets, corporate announcements, natural and other disasters, and political and other events. Among other elements of analysis in the determination of a security’s fair value, the Board has authorized the use of one or more independent research services to assist with such determinations. An independent research service may use statistical analyses and quantitative models to help determine fair value as of the time the Fund calculates its NAV. There can be no |

11

NOTES TO FINANCIAL STATEMENTSASOF FEBRUARY 28, 2010 (CONTINUED)

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

| | assurance that such models accurately reflect the behavior of the applicable markets or the effect of the behavior of such markets on the fair value of securities, or that such markets will continue to behave in a fashion that is consistent with such models. Unlike the closing price of a security on an exchange, fair value determinations employ elements of judgment. Consequently, the fair value assigned to a security may not represent the actual value that the Fund could obtain if it were to sell the security at the time of the close of the NYSE. Pursuant to procedures adopted by the Board, the Fund is not obligated to use the fair valuations suggested by any research service, and valuation recommendations provided by such research services may be overridden if other events have occurred or if other fair valuations are determined in good faith to be more accurate. Unless an event is such that it causes the Fund to determine that the closing prices for one or more securities do not represent readily available reliable market value quotations at the time the Fund determines its NAV, events that occur between the time of the close of the foreign market on which they are traded and the close of regular trading on the NYSE will not be reflected in the Fund’s NAV. |

Options that are traded over-the-counter will be valued using one of three methods: (1) dealer quotes; (2) industry models with objective inputs; or (3) by using a benchmark arrived at by comparing prior-day dealer quotes with the corresponding change in the underlying security or index. Exchange traded options will be valued using the last reported sale. If no last sale is reported, exchange traded options will be valued using an industry accepted model such as “Black Scholes.” Options on currencies purchased by the Fund are valued using industry models with objective inputs at their last bid price in the case of listed options or at the average of the last bid prices obtained from dealers in the case of over-the-counter options.

Fair value is defined as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. Each investment asset or liability of the Fund is assigned a level at measurement date based on the significance and source of the inputs to its

valuation. Quoted prices in active markets for identical securities are classified as “Level 1”, inputs other than quoted prices for an asset or liability that are observable are classified as “Level 2” and unobservable inputs, including the sub-adviser’s judgment about the assumptions that a market participant would use in pricing an asset or liability are classified as “Level 3”. The inputs used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. Short-term securities of sufficient credit quality which are valued at amortized cost, which approximates fair value, are generally considered to be Level 2 securities under applicable accounting rules. A table summarizing the Fund’s investments under these levels of classification is included following the Portfolio of Investments.

For the year ended February 28, 2010, there have been no significant changes to the fair valuation methodologies.

| B. | Security Transactions and Revenue Recognition. Security transactions are recorded on the trade date. Realized gains or losses on sales of investments are calculated on the identified cost basis. Interest income is recorded on the accrual basis. Premium amortization and discount accretion are determined using the effective yield method. Dividend income is recorded on the ex-dividend date, or in the case of some foreign dividends, when the information becomes available to the Fund. |

| C. | Foreign Currency Translation. The books and records of the Fund are maintained in U.S. dollars. Any foreign currency amounts are translated into U.S. dollars on the following basis: |

| | (1) | Market value of investment securities, other assets and liabilities — at the exchange rates prevailing at the end of the day. |

| | (2) | Purchases and sales of investment securities, income and expenses — at the rates of exchange prevailing on the respective dates of such transactions. |

Although the net assets and the market values are presented at the foreign exchange rates at the end of the day, the Fund does not isolate the portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gains or losses

12

NOTES TO FINANCIAL STATEMENTSASOF FEBRUARY 28, 2010 (CONTINUED)

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

from investments. For securities, which are subject to foreign withholding tax upon disposition, liabilities are recorded on the Statement of Assets and Liabilities for the estimated tax withholding based on the securities current market value. Upon disposition, realized gains or losses on such securities are recorded net of foreign withholding tax. Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments in securities at period end, resulting from changes in the exchange rate. Foreign security and currency transactions may involve certain considerations and risks not typically associated with investing in U.S. companies and U.S. government securities. These risks include, but are not limited to, revaluation of currencies and future adverse political and economic developments which could cause securities and their markets to be less liquid and prices more volatile than those of comparable U.S. companies and U.S. government securities.

| D. | Distributions to Shareholders. The Fund intends to make monthly distributions from its cash available for distribution, which consists of the Fund’s dividends and interest income after payment of Fund expenses, net option premiums and net realized and unrealized gains on investments. At least annually, the Fund intends to distribute all or substantially all of its net realized capital gains. Distributions are recorded on the ex-dividend date. Distributions are determined annually in accordance with federal tax principles, which may differ from U.S. generally accepted accounting principles for investment companies. |

The tax treatment and characterization of the Fund’s distributions may vary significantly from time to time depending on whether the Fund has gains or losses on the call options written on its portfolio versus gains or losses on the equity securities in the portfolio. Each month, the Fund will provide disclosures with distribution payments made that estimate the percentages of that distribution that

represent net investment income, other income or capital gains, and return of capital, if any. The final composition of the tax characteristics of the distributions cannot be determined with certainty until after the end of the Fund’s tax year, and will be reported to shareholders at that time. A significant portion of the Fund’s distributions may constitute a return of capital. The amount of monthly distributions will vary, depending on a number of factors. As portfolio and market conditions change, the rate of dividends on the common shares will change. There can be no assurance that the Fund will, be able to declare a dividend in each period.

| E. | Federal Income Taxes. It is the policy of the Fund to comply with the requirements of subchapter M of the Internal Revenue Code that are applicable to regulated investment companies and to distribute substantially all of its net investment income and any net realized capital gains to its shareholders. Therefore, a federal income tax or excise tax provision is not required. Management has considered the sustainability of the Fund’s tax positions taken on federal income tax returns for all open tax years in making this determination. No capital gain distributions shall be made until the capital loss carryforwards have been fully utilized or expire. |

| F. | Use of Estimates. The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. |

| G. | Risk Exposures and the use of Derivative Instruments. The Fund’s investment objectives permit the Fund to enter into various types of derivatives contracts, including, but not limited to, forward foreign currency exchange contracts and purchased and written options. In doing so, the Fund will employ strategies in differing combinations to permit it to increase or decrease the level of risk, or change the level or types of exposure to market risk factors. This may allow the Fund to pursue its objectives more quickly, and efficiently than if it were to make direct purchases or sales of securities capable of affecting a similar response to market factors. |

13

NOTES TO FINANCIAL STATEMENTSASOF FEBRUARY 28, 2010 (CONTINUED)

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

Market Risk Factors. In pursuit of its investment objectives, the Fund may seek to use derivatives to increase or decrease their exposure to the following market risk factors:

Credit Risk. Credit risk relates to the ability of the issuer to meet interest and principal payments, or both, as they come due. In general, lower-grade, higher-yield bonds are subject to credit risk to a greater extent than lower-yield, higher-quality bonds.

Equity Risk. Equity risk relates to the change in value of equity securities as they relate to increases or decreases in the general market.

Foreign Exchange Rate Risk. Foreign exchange rate risk relates to the change in U.S. dollar value of a security held that is denominated in a foreign currency. The U.S. dollar value of a foreign currency denominated security will decrease as the dollar appreciates against the currency, while the U.S. dollar value will increase as the dollar depreciates against the currency.

Interest Rate Risk. Interest rate risk refers to the fluctuations in value of fixed-income securities resulting from the inverse relationship between price and yield. For example, an increase in general interest rates will tend to reduce the market value of already issued fixed-income investments, and a decline in general interest rates will tend to increase their value. In addition, debt securities with longer maturities, which tend to have higher yields, are subject to potentially greater fluctuations in value from changes in interest rates than obligations with shorter maturities.

Risks of Investing in Derivatives. The Fund’s use of derivatives can result in losses due to unanticipated changes in the market risk factors and the overall market. In instances where the Fund is using derivatives to decrease, or hedge, exposures to market risk factors for securities held by the Fund, there are also risks that those derivatives may not perform as expected resulting in losses for the combined or hedged positions.

The use of these strategies involves certain special risks, including a possible imperfect correlation, or even no correlation, between price movements of derivative instruments and price movements of related investments. While some strategies

involving derivative instruments can reduce the risk of loss, they can also reduce the opportunity for gain or even result in losses by offsetting favorable price movements in related investments or otherwise, due to the possible inability of the Fund to purchase or sell a portfolio security at a time that otherwise would be favorable or the possible need to sell a portfolio security at a disadvantageous time because the Fund is required to maintain asset coverage or offsetting positions in connection with transactions in derivative instruments. Additional associated risks from investing in derivatives also exist and potentially could have significant effects on the valuation of the derivative and the Fund. Associated risks are not the risks that the Fund is attempting to increase or decrease exposure to, per its investment objectives, but are the additional risks from investing in derivatives. Examples of these associated risks are liquidity risk, which is the risk that the Fund will not be able to sell the derivative in the open market in a timely manner, and counterparty credit risk, which is the risk that the counterparty will not fulfill its obligation to the Fund. Associated risks can be different for each type of derivative and are discussed by each derivative type in the following notes.

Counterparty Credit Risk and Credit Related Contingent Features. Certain derivative positions are subject to counterparty credit risk, which is the risk that the counterparty will not fulfill its obligation to the Fund. The Fund’s derivative counterparties are financial institutions who are subject to market conditions that may weaken their financial position. The Fund intends to enter into financial transactions with counterparties that it believes to be creditworthy at the time of the transaction. To reduce this risk, the Fund generally enters into master netting arrangements, established within the Fund’s International Swap and Derivatives Association, Inc. (“ISDA”) Master Agreements (“Master Agreements”). These agreements are with select counterparties and they govern transactions, including certain over-the-counter (“OTC”) derivative and forward foreign currency contracts, entered into by the Fund and the counterparty. The Master Agreements maintain provisions for general obligations, representations, agreements, collateral, and events of default or termination. The occurrence of a specified event of termination may give a counterparty the right to terminate all of its

14

NOTES TO FINANCIAL STATEMENTSASOF FEBRUARY 28, 2010 (CONTINUED)

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

contracts and affect settlement of all outstanding transactions under the applicable Master Agreement.

The Fund may also enter into collateral agreements with certain counterparties to further mitigate OTC derivative and forward foreign currency contracts. Subject to established minimum levels, collateral is generally determined based on the net aggregate unrealized gain or loss on contracts with a certain counterparty. Collateral pledged to the Fund is held in a segregated account by a third-party agent and can be in the form of cash or debt securities issued by the U.S. government or related agencies.

The Fund’s maximum risk of loss from counterparty credit risk on OTC derivatives is generally the aggregate unrealized gain in excess of any collateral pledged by the counterparty to the Fund. For purchased OTC options, the Fund bears the risk of loss in the amount of the premiums paid and the change in market value of the options should the counterparty not perform under the contracts. The Fund did not enter into any purchased OTC options during the year ended February 28, 2010.

The Fund has credit related contingent features that if triggered would allow its derivatives counterparties to close out and demand payment or additional collateral to cover their exposure from the Fund. Credit related contingent features are established between the Fund and its derivatives counterparties to reduce the risk that the Fund will not fulfill its payment obligations to its counterparties. These triggering features include, but are not limited to, a percentage decrease in the Fund’s net assets and or a percentage decrease in the Fund’s NAV, which could cause the Fund to accelerate payment of any net liability owed to the counterparty. The contingent features are established within the Fund’s Master Agreements.

Written options by the Fund do not give rise to counterparty credit risk, as written options obligate the Fund to perform and not the counterparty. As of February 28, 2010, the total value of written OTC call options subject to Master Agreements in a net liability position was $905,773. If a contingent feature had been triggered, the Fund could have been required to pay this amount in cash to its

counterparties. The Fund did not hold or post collateral for its open written OTC call options at year end.

| H. | Forward Foreign Currency Contracts. The Fund may enter into forward foreign currency contracts primarily to hedge against foreign currency exchange rate risks on its non-U.S. dollar denominated investment securities. When entering into a currency forward contract, the Fund agrees to receive or deliver a fixed quantity of foreign currency for an agreed-upon price on an agreed future date. These contracts are valued daily and the Fund’s net equity therein, representing unrealized gain or loss on the contracts as measured by the difference between the forward foreign exchange rates at the dates of entry into the contracts and the forward rates at the reporting date, is included in the statement of assets and liabilities. Realized and unrealized gains and losses on forward foreign currency contracts are included on the Statement of Operations. These instruments involve market and/or credit risk in excess of the amount recognized in the statement of assets and liabilities. Risks arise from the possible inability of counterparties to meet the terms of their contracts and from movement in currency and securities values and interest rates. |

| I. | Options Contracts. The Fund may purchase put and call options and may write (sell) put options and covered call options. The premium received by the Fund upon the writing of a put or call option is included in the Statement of Assets and Liabilities as a liability which is subsequently marked-to-market until it is exercised or closed, or it expires. The Fund will realize a gain or loss upon the expiration or closing of the option contract. When an option is exercised, the proceeds on sales of the underlying security for a written call option or purchased put option or the purchase cost of the security for a written put option or a purchased call option is adjusted by the amount of premium received or paid. The risk in writing a call option is that the Fund gives up the opportunity for profit if the market price of the security increases and the option is exercised. The risk in buying an option is that the Fund pays a premium whether or not the option is exercised. Risks may also arise from an illiquid secondary market or from the inability of counterparties to meet the terms of the contract. |

The Fund is subject to equity price risk in the normal course of pursuing its investment objectives. During the year ended February 28,

15

NOTES TO FINANCIAL STATEMENTSASOF FEBRUARY 28, 2010 (CONTINUED)

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

2010, the Fund has written call options on equity indices in an attempt to manage this risk. Please refer to Note 7 for the volume of written option activity during the year ended February 28, 2010.

| J. | Indemnifications. In the normal course of business, the Fund may enter into contracts that provide certain indemnifications. The Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, management believes, based on experience, the risk of loss from such claims is considered remote. |

NOTE 3 — INVESTMENT MANAGEMENT AND ADMINISTRATIVE FEES

ING Investments, LLC (“ING Investments” or the “Investment Advisor”), an Arizona limited liability company, is the Investment Adviser of the Fund. The Fund pays the Investment Adviser for its services under the investment management agreement (“Management Agreement”), a fee, payable monthly, based on an annual rate of 1.00% of the Fund’s average daily managed assets. For the purposes of the Management Agreement, managed assets are defined as the Fund’s average daily gross asset value, minus the sum of the Fund’s accrued and unpaid dividends on any outstanding preferred shares and accrued liabilities (other than liabilities for the principal amount of any borrowings incurred, commercial paper or notes issued by the Fund and the liquidation preference of any outstanding preferred shares). As of February 28, 2010, there were no preferred shares outstanding.

The Investment Adviser entered into a sub-advisory agreement (a “Sub-Advisory Agreement”) with ING Investment Management Co. (“ING IM”). ING IM has in turn entered into sub-sub-advisory agreements (each are “Sub-Sub-Advisory Agreement” and collectively, the “Sub-Sub-Advisory Agreements”) with each of ING Investment Management Asia/Pacific (Hong Kong) Limited (“ING IM Asia/Pacific”) and ING Investment Management Advisors B.V. (“IIMA”). Subject to policies as the Board or the Investment Adviser might determine, ING IM, ING IM Asia/Pacific and IIMA manage the Fund’s assets in accordance with the Fund’s investment objectives, policies and limitations.

ING Funds are permitted to invest end-of-day cash balances into ING Institutional Prime Money Market Fund. Investment management fees paid by the Fund will be reduced by an amount equal to the management fees paid indirectly to the ING Institutional Prime Money Market Fund with respect to assets invested by the Fund. For year ended February 28, 2010, the Fund did not invest in ING Institutional Prime Money Market Fund and thus waived no such management fees. These fees are not subject to recoupment.

ING Funds Services, LLC (the “Administrator”) serves as Administrator to the Fund. The Fund pays the Administrator for its services a fee based on an annual rate of 0.10% of the Fund’s average daily managed assets. The Investment Adviser, ING IM, ING IM Asia/Pacific, IIMA, and the Administrator are indirect, wholly-owned subsidiaries of ING Groep N.V. (“ING Groep”). ING Groep is a global financial institution of Dutch origin offering banking, investments, life insurance and retirement services.

On October 19, 2008, ING Groep announced that it reached an agreement with the Dutch government to strengthen its capital position. ING Groep issued non-voting core Tier-1 securities for a total consideration of EUR 10 billion to the Dutch State. The transaction boosted ING Bank’s core Tier-1 ratio, strengthened the insurance balance sheet and reduced ING Groep’s Debt/Equity ratio.

On October 26, 2009, ING Groep announced that it will move towards a complete separation of its banking and insurance operations. A formal restructuring plan (“Restructuring Plan”) was submitted to the European Commission (“EC”), which approved it on November 18, 2009. It is expected that the Restructuring Plan will be achieved over the next four years by a divestment of all insurance operations (including ING Investment Management) as well as a divestment of ING Direct US by the end of 2013. ING Groep will explore all options, including initial public offerings, sales or combinations thereof.

On December 21, 2009, ING Groep announced that it has completed its planned repurchase of EUR 5 billion of Core Tier 1 securities issued in November 2008 to the Dutch State and its EUR 7.5 billion rights issue.

16

NOTES TO FINANCIAL STATEMENTSASOF FEBRUARY 28, 2010 (CONTINUED)

NOTE 4 — OTHER TRANSACTIONS WITH AFFILIATED AND RELATED PARTIES

As of February 28, 2010, the Fund had the following amounts recorded in payable to affiliates on the accompanying Statement of Assets and Liabilities:

| | | | | | | |

Accrued Investment Management Fees | | Accrued Administrative Fees | | Total |

| $ | 51,922 | | $ | 6,586 | | $ | 58,508 |

The Fund has adopted a Deferred Compensation Plan (the “Plan”), which allows eligible non-affiliated trustees as described in the Plan to defer the receipt of all or a portion of the trustees fees payable. Amounts deferred are treated as though invested in various “notional” funds advised by ING Investments until distribution in accordance with the Plan.

The Fund placed a portion of its portfolio transactions with a brokerage firm that is an affiliate of the Investment Adviser. The commission paid to the affiliated firm is:

| | | |

Affiliated Broker | | Commission Paid |

| ING Baring LLC | | $ | 2,459 |

NOTE 5 — PURCHASES AND SALES OF INVESTMENT SECURITIES

The cost of purchases and proceeds from sales of investments for the year ended February 28, 2010, excluding short-term securities, were $64,030,003 and $45,966,057, respectively.

NOTE 6 — EXPENSE LIMITATIONS

The Investment Adviser has entered into a written expense limitation agreement (“Expense Limitation Agreement”) with the Fund under which it will limit the expenses of the Fund, excluding interest, taxes, leverage expenses, and extraordinary expenses to 1.25% of average daily managed assets. The Investment Adviser may at a later date recoup from the Fund fees waived and other expenses assumed by the Investment Adviser during the previous 36 months, but only if, after such reimbursement, the Fund’s expense ratio does not exceed the percentage described above. The Expense Limitation Agreement is contractual and shall renew automatically for one-year terms unless ING Investments or the Fund provides written notice of the termination within 90 days of the end of the then current term or upon written termination of the Management Agreement.

As of February 28, 2010, the amount of waived and reimbursed fees that are subject to recoupment by the Investment Adviser, and the related expiration dates are as follows:

| | | | | | | | | | |

| February 28, | | |

2010 | | 2011 | | 2012 | | Total |

| $ | — | | $ | 143,913 | | $ | 132,566 | | $ | 276,479 |

NOTE 7 — TRANSACTIONS IN WRITTEN OPTIONS

Written option activity for the Fund for the year ended February 28, 2010 was as follows:

| | | | | | | |

| | | Number of Contracts | | | Premium | |

Balance at 02/28/09 | | 18,930,570 | | | $ | 995,053 | |

Options Written | | 195,852,280 | | | | 10,129,222 | |

Options Expired | | (200,367,110 | ) | | | (10,376,245 | ) |

Options Exercised | | — | | | | — | |

Options Terminated in Closing Purchase Transactions | | — | | | | — | |

| | | | | | | |

Balance at 02/28/10 | | 14,415,740 | | | $ | 748,030 | |

| | | | | | | |

NOTE 8 — CONCENTRATION OF INVESTMENT RISKS

All mutual funds involve risk — some more than others — and there is always the chance that you could lose money or not earn as much as you hope. The Fund’s risk profile is largely a factor of the principal securities in which it invests and investment techniques that it uses. For more information regarding the types of securities and investment techniques that may be used by the Fund and its corresponding risks, see the Fund’s most recent Prospectus and/or the Statement of Additional Information.

Foreign Securities and Emerging Markets. The Fund makes significant investments in foreign securities and securities issued by companies located in countries with emerging markets. Investments in foreign securities may entail risks not present in domestic investments. Since investments in securities are denominated in foreign currencies, changes in the relationship of these foreign currencies to the U.S. dollar can significantly affect the value of the investments and earnings of the Fund. Foreign investments may also subject the Fund to foreign government exchange restrictions, expropriation, taxation or other political, social or economic developments, as well as from movements in currency, security value and interest rate, all of which could affect the market and/or credit risk of the investments. The risks of investing in foreign securities can be intensified in the case of investments in issuers located in countries with emerging markets.

17

NOTES TO FINANCIAL STATEMENTSASOF FEBRUARY 28, 2010 (CONTINUED)

NOTE 8 — CONCENTRATION OF INVESTMENT RISKS (continued)

Leverage. Although the Fund has no current intention to do so, the Fund is authorized to utilize leverage through the issuance of preferred shares and/or borrowings, including the issuance of debt securities. In the event that the Fund determines in the future to utilize investment leverage, there can be no assurance that such a leveraging strategy will be successful during any period in which it is employed.

Non-Diversified. The Fund is classified as a “non-diversified” investment company under the 1940 Act, which means that the Fund may invest a greater proportion of its assets in the securities of a smaller number of issuers. If the Fund invests a relatively high percentage of its assets in obligations of a limited number of issuers, the Fund will be more at risk to any single corporate, economic, political or regulatory event that impacts one or more of those issuers. Conversely, even though classified as non-diversified, the Fund may actually maintain a portfolio that is highly diversified with a large number of issuers. In such an event, the Fund would benefit less from appreciation in a single corporate issuer than if it had greater exposure to that issuer.

NOTE 9 — CAPITAL SHARES

Transactions in capital shares and dollars were as follows:

| | | | | | | | |

| | | Year Ended February 28, 2010 | | | Year Ended February 28, 2009 | |

Number of Shares | | | | | | | | |

Reinvestment of distributions | | | 151,698 | | | | 20,653 | |

Shares repurchased | | | (57,659 | ) | | | (45,442 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | 94,039 | | | | (24,789 | ) |

| | | | | | | | |

$ | | | | | | | | |

Reinvestment of distributions | | $ | 1,724,169 | | | $ | 191,873 | |

Shares repurchased, net of commissions | | | (389,261 | ) | | | (347,523 | ) |

| | | | | | | | |

Net increase (decrease) | | $ | 1,334,908 | | | $ | (155,650 | ) |

| | | | | | | | |

Share Repurchase Program

Effective December 2008, the Board authorized an open-market share repurchase program pursuant to which the Fund may purchase, over the period ending December 31, 2009, up to 10% of its stock, in open- market transactions. There is no assurance that the Fund will purchase shares at any particular discount level or in any particular amounts. The share repurchase

program seeks to enhance shareholder value by purchasing shares trading at a discount from their NAV per share, in an attempt to reduce or eliminate the discount or to increase the NAV per share of the applicable remaining shares of the Fund.

For the year ended February 28, 2010, the Fund repurchased 57,659 shares, representing approximately 0.7% of the Fund’s outstanding shares for a net purchase price of $389,261 (including commissions of $1,730). Shares were repurchased at a weighted-average discount from NAV per share of 13.27% and a weighted-average price per share of $6.72.

For the year ended February 28, 2009, the Fund repurchased 45,442 shares, representing approximately 0.6% of the Fund’s outstanding shares for a net purchase price of $347,523 (including commissions of ($1,363). Shares were repurchased at a weighted-average discount from NAV per share of 8.35% and a weighted-average price per share of $7.62.

NOTE 10 — FEDERAL INCOME TAXES

The amount of distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from U.S. generally accepted accounting principles for investment companies. These book/tax differences may be either temporary or permanent. Permanent differences are reclassified within the capital accounts based on their federal tax-basis treatment; temporary differences are not reclassified. Key differences include the treatment of short-term capital gains, foreign currency transactions, income from passive foreign investment corporations and wash sale deferrals. Distributions in excess of net investment income and/or net realized capital gains for tax purposes are reported as return of capital.

The following permanent tax differences have been reclassified as of the Fund’s tax year ended December 31, 2009:

| | | | | | | | | |

Paid-in

Capital | | | Undistributed

Net

Investment

Income | | | Accumulated

Net Realized

Gains /

(Losses) |

| $ | (7,338 | ) | | $ | (101,619 | ) | | $ | 108,957 |

Dividends paid by the Fund from net investment income and distributions of net realized short-term capital gains are, for federal income tax purposes, taxable as ordinary income to shareholders.

The tax composition of dividends and distributions in the current period will not be determined until after

18

NOTES TO FINANCIAL STATEMENTSASOF FEBRUARY 28, 2010 (CONTINUED)

NOTE 10 — FEDERAL INCOME TAXES (continued)

the Fund’s tax year-end of December 31, 2010. The tax composition of dividends and distributions as of the Fund’s most recent tax year-ends were as follows:

| | | | | | | | | | |

Tax Year Ended

December 31, 2009 | | Tax Year Ended

December 31, 2008 |

Ordinary

Income | | Return of

Capital | | Ordinary

Income | | Return of

Capital |

| $ | 2,056,938 | | $ | 13,057,458 | | $ | 3,835,541 | | $ | 12,066,739 |

The tax-basis components of distributable earnings and the expiration dates of the capital loss carryforwards which may be used to offset future realized capital gains for federal income tax purposes as of the tax year ended December 31, 2009 were:

| | | | | | | | | | | | | | | |

Unrealized

Appreciation | | Post-October

Capital Loss

Deferred | | | Post-October

Currency Loss

Deferred | | | Capital Loss

Carryforwards | | | Expiration

Date |

| $ | 7,962,960 | | $ | (277,767 | ) | | $ | (41,077 | ) | | $ | (15,251,764 | ) | | 2016 |

| | | | | | | | | | | | (29,731,444 | ) | | 2017 |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | $ | (44,983,208 | ) | | |

| | | | | | | | | | | | | | | |