Dialog Semiconductor Investor Call

Call Operator:

This conference call contains “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve risks and uncertainties. In some cases, you can identify these forward-looking statements by the use of terms such as “expect,” “will,” “continue,” or similar expressions, and variations or negatives of these words, but the absence of these words does not mean that a statement is not forward-looking.

All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including, but not limited to: any statements regarding the expected timing of the completion of the transaction and the benefits of the transaction; the ability of Dialog Semiconductor plc and Adesto Technologies Corporation to complete the proposed transaction considering the various conditions to the transaction, some of which are outside the parties’ control, including those conditions related to regulatory approvals; any other statements of expectation or belief; and any statements of assumptions underlying any of the foregoing.

These forward-looking statements are inherently uncertain, and are based on information available to each of Dialog and Adesto as of the date hereof and current expectations, forecasts, estimates, and assumptions. A number of important factors and uncertainties could cause actual results or events to differ materially from those described in these forward-looking statements, including without limitation: the failure to satisfy or waive any of the conditions to the consummation of the proposed transaction, including the adoption of the Merger Agreement by Adesto’s stockholders and the receipt of certain governmental and regulatory approvals.

Matters arising in connection with the parties’ efforts to comply with and satisfy applicable regulatory approvals and closing conditions relating to the proposed transaction; the risk that the proposed transaction does not close when anticipated or at all; the effects of disruption from the transactions contemplated by the Merger Agreement on Adesto’s or Dialog’s business and the fact that the announcement and pendency of the transaction may make it more difficult to establish or maintain relationships with employees, suppliers and other business partners; the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement.

The outcome of any legal proceedings that may be instituted against Adesto or Dialog related to the Merger Agreement or the proposed transaction; unexpected costs, charges or expenses resulting from the proposed transaction; the occurrence of a Material Adverse Effect (as defined in the Merger Agreement); and other risks that are described in the reports of Adesto filed with the Securities and Exchange Commission (the “SEC”), including but not limited to the risks described in Adesto’s Annual Report on Form 10-K for its fiscal year ended December 31, 2018, which was filed with the SEC on March 18, 2019, and Adesto’s Quarterly Reports on Form 10-Q, and that are otherwise described or updated from time to time in other filings with the SEC.

All forward-looking statements attributable to Adesto or Dialog, or persons acting on behalf of either, are expressly qualified in their entirety by this cautionary statement. Further, Adesto and Dialog disclaim any obligation to update the information in this communication or to announce publicly the results of any revisions to any of the forward-looking statements to reflect future events or developments, except as otherwise required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

In connection with the proposed acquisition, Adesto will file relevant materials with the SEC, including a preliminary and definitive proxy statement. Promptly after filing the definitive proxy statement, Adesto will mail the definitive proxy statement and a proxy card to the stockholders of Adesto. ADESTO’S STOCKHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) CAREFULLY WHEN IT BECOMES AVAILABLE BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION.

Stockholders of Adesto will be able to obtain a free copy of these documents, when they become available, at the website maintained by the SEC at www.sec.gov or free of charge at www.adestotech.com.

Additionally, Adesto and Dialog will file other relevant materials in connection with the proposed acquisition of Adesto by Dialog pursuant to the terms of the Merger Agreement. Adesto, Dialog and their respective directors, executive officers and other members of management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of Adesto stockholders in connection with the proposed acquisition. Stockholders of Adesto may obtain more detailed information regarding the names, affiliations and interests of certain of Adesto’s executive officers and directors in the solicitation by reading Adesto’s most recent Annual Report on Form 10-K, and the proxy statement for Adesto’s 2019 annual meeting of stockholders, which was filed with the SEC on April 30, 2019.

These documents are available free of charge at the SEC’s web site at www.sec.gov or by going to Adesto’s Investor Relations Website at www.adestotech.com. Information about Dialog’s directors and executive officers is set forth in Dialog’s Annual Report and Accounts 2018. You can obtain free copies of this document by accessing Dialog’s website at https://www.dialog-semiconductor.com. Information concerning the interests of Adesto’s participants in the solicitation, which may, in some cases, be different than those of Adesto’s stockholders generally, will be set forth in the definitive proxy statement relating to the proposed transaction when it becomes available.

I will now hand it over to Jose Cano, Head of Investor Relations at Dialog Semiconductor, who will open the call. Mr. Cano, please proceed.

Jose Cano:

Thank you. Welcome to the conference today. And I'm joined – I'm in the room with

Dr. Jalal Bagherli, our CEO and Wissam Jabre, our CFO. And I think you guys had all forward looking statements that could be made. So, I'm just going to hand it over to Jalal to get on with the presentation.

Dr. Jalal Bagherli:

Thank you. Thank you. Good morning. And thank you for your patience for the start of this conference. Thanks for taking time to join us today. I'm very pleased to speak with you all about the acquisition of Adesto Technologies that we announced earlier today. Before we dove into the benefits of the transaction, I'd like to provide some background on Adesto. The company is headquartered in Santa Clara, California, and has a strong team of about 270 employees. Adesto is a leading provider of embedded systems, innovative custom ICs and specialty memory for Industrial IoT market – or what is commonly referred to as Industrial 4.0.

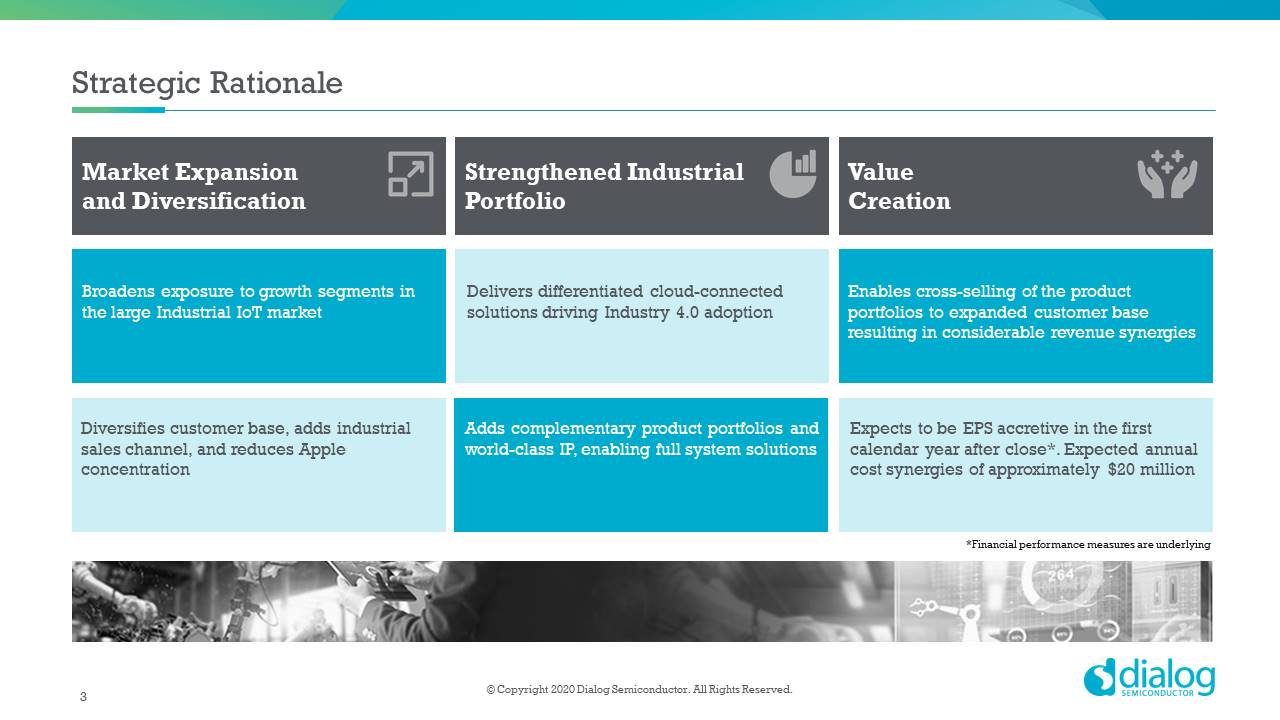

In our view, there are multiple benefits of this transaction, and on slide three, I'd like to focus on the main three benefits: Market Expansion and Diversification, Strengthened Portfolio and Value Creation. Let's break them down at this level. First, we are expanding our addressable market. To put it simply, this transaction gives us access to new growth segments in an industrial IoT market. Adesto Technology and IP enabled seamless connectivity of heterogeneous systems in an industrial environment through the cloud for building and industrial automation. These capabilities, together with Dialog's portfolio and factory automation from the acquisition of Creative Chips, will allow us to deliver fully integrated solutions to over 5,000 customers, the majority of which are new for Dialog.

Second, we are strengthening our product portfolio with this unique combination. For example, Adesto industrial wired connectivity portfolio perfectly complements one of the leading wireless portfolio, which we can now target for smart building and industrial applications. Cloud-connectivity adds further differentiation to Dialog's existing industrial solutions. Additionally, the combination enables full systems solutions for applications, including wearables here, hearables and IoT by combining Adesto's low-power specialty memory products with Dialog's BLE and Wi-Fi connectivity and True Wireless Stereo (TWS) Audio ICs.

Third, this transaction creates long-term value for shareholders. The acquisition is expected to be accretive to underlying EPS and to generate annual cost synergies of approximately $20 million within the first calendar year after close. The cost synergies are expected to come from identified efficiencies as well as improvements in the supply chain across the combined company. Additionally, for reasons I'll cover later, we also anticipate considerable revenue synergies from the deal.

Now let's move to Slide 4 to remind you briefly about our diversification strategy. In November 2018, we shared with you our plan to build a diverse low-power mixed -signal business. We have made very good progress throughout 2019, launching new products and expanding our presence in Automotive and IoT. In addition, we have continued to invest in the inorganic expansion of our business. The acquisition of Adesto is allowing us to expand into attractive growth segments of the industrial market. We identified these industrial market as an attractive market, complementing our low power, mixed-signal capabilities. Our strategy is to build upon this, to capitalise on these capabilities in the future. Creative Chips was our first initiative in the industrial market, bringing industrial IoT customer expertise and products, as well as an established tier-one industrial customer base in Europe.

And as part of our connectivity strategy, we added low-power Wi-Fi to our product portfolio with the acquisition of Silicon Motion's mobile division group, FCI, which addressed broad IoT applications. Turning to Slide 5, let me run though the benefits of combining Adesto and Dialog technologies.

If you think of a building automation application, the block diagram on the right is illustrative of the typical components used. As you can see, the combination of Adesto’s wireline transceivers and specialty memory together with Dialog’s wireless connectivity portfolio, power management ICs and CMICs (or configurable mixed-signal ICs), will give us a more complete product offering to cross-sell to our expanded customer base. In addition, Adesto products can also be sold to the tier-one industrial customer base we acquired with Creative Chips.

Adesto has a broad range of products that can address markets they have not yet entered. These products create interesting opportunities to unlock future growth and value:

For example, in the automotive market, our plan is to leverage our proven automotive qualification and test process to qualify Adesto’s specialty memory products, delivering the high-quality standards demanded by the Automotive market. Additionally, the features of the specialty memory portfolio are well suited to addressing the emerging, fast-growing Artificial Intelligence (AI) segment.

Finally, as you can see from the picture on the left, Adesto’s technology enables seamless connectivity to the cloud, powering smart buildings and industrial automation systems, adding further capabilities to the portfolio from the acquisition of Creative Chips. Let’s move on to Slide 6 to further discuss why Adesto is the right fit for Dialog.

Adesto’s product portfolio and end-market exposure perfectly complements our own focus end markets. In particular, this transaction expands our product offering in industrial and IoT, as well as enabling future revenue opportunities in Automotive.

In addition, within Adesto, we are welcoming a highly skilled team of engineers and designers with a proven track record of delivering complex custom mixed-signal ICs and a world class library of IP assets. Together with our own capabilities, I’m confident we have one of the largest and most experienced custom mixed-signal design teams in the industry. Our combined product portfolio will deliver increasing value to an expanded customer base and create multiple cross-selling opportunities.

Talking about customers, on Slide 7, I'd like to run through Adesto's customer base. More than 5,000 customers worldwide use Adesto's range of products across the industrial, consumer, medical and communications markets.

We will now have access to new Tier 1 industrial customers such as Honeywell, ABB, and Schneider Electric, where we will have multiple cross-selling opportunities.

As you well know, many customers prefer to buy entire solutions from a single vendor. By bringing Dialog and Adesto together, we can offer an extended product portfolio and full system solutions, delivering added value to customers and creating stronger and long-lasting customer relationships.

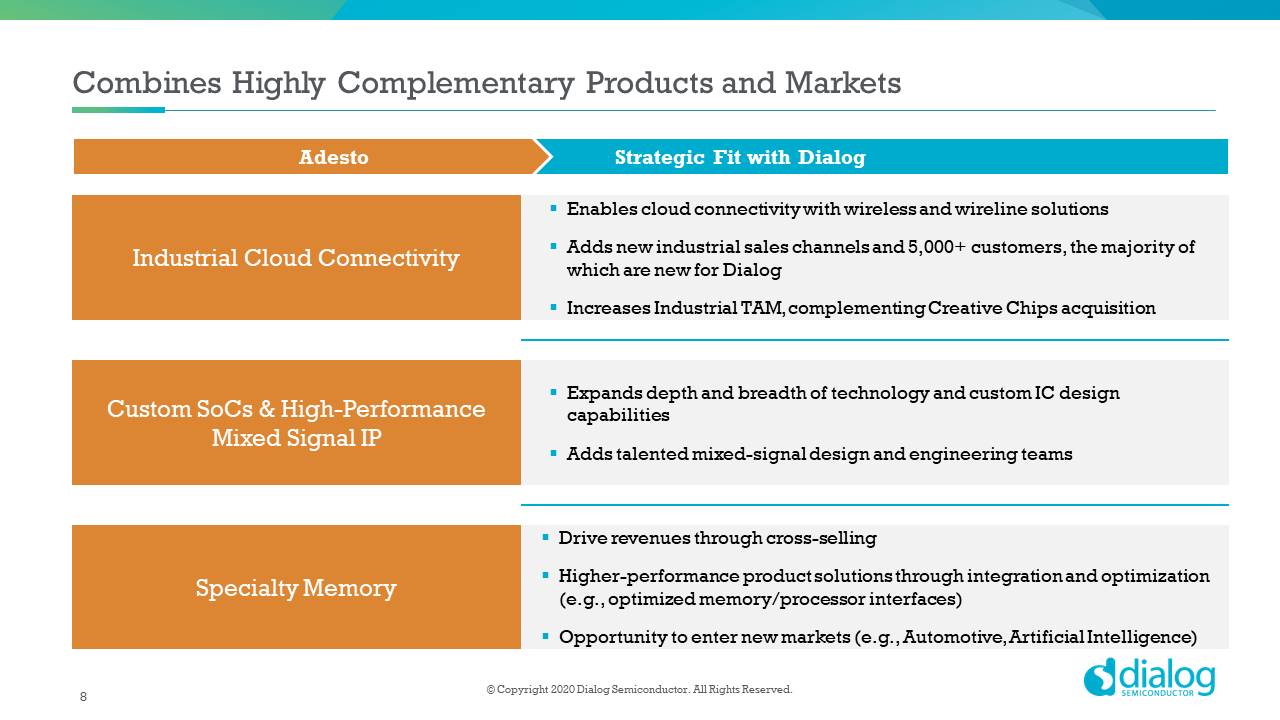

Let's move on to Slide 8 to run through the advantages that the combination of Adesto and Dialog will bring to customers in our target end markets. First, we are well positioned to provide end-to-end solutions that will enable industrial cloud connectivity to new customers. Everything from the connectivity IC for an HVAC system to multi-protocol communications module – all the way to the servers that can connect to cloud analytics.

The result of all this is delivering fast, accurate information to more efficiently automate and manage industrial equipment, buildings and cities. Second, we are expanding the depth and breadth of our technology and custom IC capabilities, with experienced IC design teams with a strong track record in complex mixed-signal design applications.

And third, in the IoT market, I estimate we have already supplied over 100 million units of our PMIC, Bluetooth low energy and Audio ICs alongside Adesto’s specialty low-power memory products into common applications such as hearables, wearables, tags and proximity sensors. We can offer these customers even higher performance solutions through either the integration of the specialty memory technology into our IoT connectivity, Audio SoCs or combining them in an innovative system in package. Additionally, as outlined earlier, we can also bring these products to the automotive and artificial intelligence markets.

Let me summarise on Slide 9 the main strength of the business combination. By acquiring Adesto, we are increasing our addressable market, targeting new growth segments of the Industrial IoT market. This will be possible with a comprehensive product offering which complements our existing portfolio. We are welcoming a team with strong mixed-signal and system expertise for the industrial market.

With over 5,000 customers, the majority of which are new for Dialog, the combined business will provide a solid platform from which we can leverage an established sales channel. And, last but not least, we are targeting cost synergies of approximately $20 million from identified efficiencies as well as improvements in supply chain across the combined company, in addition to considerable revenue synergies.

Before we open the line for questions, let me leave you with a few final remarks on the next slide. The agreement is to acquire the outstanding shares of Adesto for $12.55 per share in cash, or for approximately $500 million enterprise value. We are funding the deal from Dialog’s balance sheet, which at the end of December 2019 had over $1 billion in cash.

Again, the transaction is expected to be EPS accretive and we expect annual cost synergies of approximately $20 million within the first calendar year of close based on Adesto’s expected FY 2019 results. We also anticipate considerable additional revenue synergies given the complementary nature of the product portfolios and technology.

Adesto expects to report FY 2019 revenues of approximately $118 million and we anticipate continued revenue growth over the next few years. The transaction is subject to certain regulatory approvals and customary closing conditions, including the approval of Adesto’s stockholders, and is expected to close by the third quarter of 2020. In summary, please allow me to emphasise the key takeaways.

First, we are expanding into growth segments of the attractive Industrial IoT market. Second, we are strengthening our portfolio with highly complementary products. And third, we are accelerating our business expansion and diversification strategy – all of which make me incredibly excited about the future.

Operator, please open the line for questions.

Operator:

The first question we have from Sandeep Beshbande from JP Morgan. Sandy, your line is now open.

Sandeep Beshbande:

Hi. Thank you for letting me on. I have two questions, if I may. Firstly, on these memories, will you be embedding their memories in to SoC or is it intended that you would be selling an IOP solution consisting of multiple tips? And then secondly, in terms of product development for using Adesto's technologies. Is it intended that you will create again -- I mean the same question now a different way. Is it that, you know, you're going to be a cross-selling to their customer base, using your products which are complementary with Adesto's products? And then finally, on the on the synergies itself, could you help us understand what restructuring cost, if any, you expect?

Dr. Jalal Bagherli:

So thank you, Sandy, for those questions. Let me to try and answer them. So, I think there

Is timing issues. So, there's the short term and the short to medium term. My expectation is that we supply memories, productive specialty memories to customers who need to find better systems. And for cross-selling in addition to, for example, Bluetooth or Wi-Fi or other products that we have for embedded IoT markets. So, that is in the short to medium term. Over time, you know, they have expertise in memory design and some innovative memory architecture that will give a comeback and discuss. We alluded to, for example, some technology to have that is applicable to even AI market.

So over time, as the teams get together, we will look at also embedding where it makes sense, embedding differentiated memory architectures into our SoC products for Bluetooth, Wi-Fi or indeed a microcontroller type system because you know, you have on-base chips that we can use and better flash to improve the system performance. So, in the short term versus medium term and we're going to do both. The other thing we can do is, you know, again, in the short term, in addition to supplying discrete chips, if you like, we could also look at doing system in package. That would be SoCs combined with a memory in a SIP package.

So that's kind of an intermediate solution where the customer can gain space and cost benefits and they get a bigger selective software solution in one package. In terms of synergies, I don't think it's detailed the cost of it out. But my expectation is that $20 million is the cost that they we take across the company between the Adesto and Dialog. And you know, I'll Wissam comment on this.

Wissam Jabre:

Yes, Sandy. In terms of the restructuring costs, it's really not expected to be high. We're expecting it to be sub $5 million at this point. And you know, the cost synergies, as you'd expect in such a transaction is typically, you know, some eliminating duplicate functions as well as corporate, you know, overhead in terms of the public company costs and so on. And also, through the combination, we'll get supply chain efficiencies and other types of cost reductions.

Sandeep Beshbande:

Thank you.

Operator:

Our next question goes from Jurgen Wagner from MainFirst Bank. Your line is now open.

Jurgen Wagner:

Good morning. Can you say more -- was it a structured bidding process? And looking at the latest and out of Adesto, they targeted more 20 percent growth. That sounds like more than others in the space are targeting. Can you comment on that a little bit? Thank you.

Dr. Jalal Bagherli:

Hi again, good morning. I think, you know, the acquisition process, you know, go through banks and their process, so I don't want to comment on the rest the process. You know, we obviously went through a process and these are public companies. And I think on the, you know, in the U.S., we'll be filing the whole process with the SEC later. So, I don't want to say something that I'm not sure all the exact details. It's not appropriate for me to comment. The second is in terms of the growth. So, if you look at the publicly published information in the past years, they've had a track record of growth. It's a high growth rate in 2017 to 2018 -- from $56 million to $83 million from '18 to what we expect '19, $118 million. Again, another double-digit growth.

So, part of this growth has been because, you know, they've selected good areas of market to focus on. Part of it is through the acquisitions made in 2018, 2019. But you know, our expectation is that their growth will continue to happen. As a standalone business, but of course, the addition on Dialog means that we have also this cross-selling opportunities and combination of technologies that make a lot more sense for customers to buy the solution than buying, you know, fragmented chipset, if you like.

Jurgen Wagner:

Okay. Thank you.

Operator:

Our next question is from Adithya Methuka from Bank of America. Your line is now open.

Adithya Methuka:

Yeah. Good morning, guys. I have four questions. If I could firstly, just looking at the free cash generation for this company over the last 2 to 4 years, they don't seem to have generated any free cash flow. I just wondered if you could comment on the reasons behind this and how we should think about this going forward?

Secondly, 60 percent of the revenues came from memory. And I just wondered if you could give some colour on what type of memory this is and does it increase Dialog cyclicality as we look in the future? The third point is obviously Adesto reports on the U.S. GAAP and you report under IFRS and I know you guys do adjusted metrics, but how should we think about -- when we think about the accretion in our proforma model, how should we think about capitalisation of R&D? You know, any margin uplift that we should think about, anything related to share based comp that we should keep in mind. And yeah, and especially given when you look at Dialog that [unintelligible] goes away in share based comp. So, anything around those that we should think about when we update our models? Thank you.

Dr. Jalal Bagherli:

Okay. So, no free cashflow. Very, very good observation and correct. So, you know, again, company, the semiconductor space, which are small and growing, the domain money until they rescape [sic]. So, if you look at, for example, if you go back to 2016, they had $44 million revenue. '17 – that's $56 million. Right? So it's only in '19 that crossing to 118 as explained. So most of businesses we come across have the same type of approach when they're small or start up, obviously you don't expect to make money. They've been public I guess a couple of years. And, you know, if you look at the numbers you can see continuous improvement towards break even profitability year-on-year for the last few years.

So given that given that the now over a hundred and given that we've talked about taking twenty million dollars of OpEx out, we have no doubt that we would be generating good profits by the end of calendar year as we projected in our press release. So, question two. Sixty percent memory. Very correct. This started as a memory company. They're very much specialty memory.

So the type of memory that specialised in nor flash is a non-volatile memory card related to embedded systems. So, and they do both, if you like, specialty memory for IoT as well as some standard NOR Flash. But all of these are targeting again embedded type application and niche applications. With it as cyclicality, it would have if it was the main market for memory. You know, many mainstream memories, but these tend to go into like smog metering.

There is some consumer, some medical. So it's not pure industrial. But most of it is targeting industrial and embedded, which they tend to have long cycles of usage and not so volatile. So, I don't expect this to be – actually I expect this business to be less volatile than our mobile business. So hopefully that answers your question.

Number three. I think I'll hand over to our experts on finance, which is our CFO.

Wissam Jabre:

Thanks for the question. So, on the IFRS versus U.S. GAAP, as you rightly pointed out, obviously in IFRS, we would have the opportunity to -- we would need to capitalise part of the R&D investment.

But when we think of the accretion and the way we're communicating here is in the first full calendar year disclosing we do expect the business to be EPS accretive to our numbers. And when you think of the long-term model, it fits very nicely with our long term model once we get to the first full calendar year and that's the long term model that we communicated back in November. In terms of the share based comp, it is, as you rightly noted, excluded from our underlying figures. But I don't expect it to add sort of -- it will not add a lot to our share based comp simply for this acquisition. So again, on the accretion, it is expected to be accretive in the full calendar year. And as we delivered on the synergies, we expect it to fit very nicely within our long-term financial model.

Adithya Methuka:

Understood. Just one quick follow up on the memory NOR Flash, when a I look at market shares for NOR Flash, I don't see them at least in the top 10 players. But what level of market share do they have?

Dr. Jalal Bagherli:

I don't. I mean, you know. Okay. So, listen, this is as we said, the total business is $118 million in 2019, 64 percent of which is memory. Right? So, it is not a massive, you know, commodity memory place. The one that you see usually is people who supply, you know, everybody in the market and they're chasing every memory opportunity. This is for industrial embedded type solutions, which they grow gradually and fragmented and, you know, small volumes by customer.

And this will grow. So, for example, they announced some partnership bids in the past the past year with an NXT. So they will have specialty memory that fits with NXT's IMX series processors application process. They've announced things with the SD Micros processor. So as those processes going to different industrial application, factory automation, measurements, instrumentation, lighting and whatnot, these memories get used. They're not chasing mainstream volatiles or memory markets. That's why you don't see them in top ten because they're not that big to be in top ten.

Adithya Methuka:

Understood. Thank you.

Dr. Jalal Bagherli:

You're welcome.

Operator:

Our next question from Robert Sanders from Deutsche Bank. Robert, your line is now open.

Robert Sanders:

Yeah, maybe I missed this, I didn't see it. But run down the revenue between industrial consumer and auto?

Dr. Jalal Bagherli:

We don't split that. So we would be more, you know, post integration because then, you know, explain that a lot more. But I guess, suffice to say, a majority of the business is industrial. But they do have -- they don't have a lot of automotive. So that's clear to say, but they do have medical and they do have comms. They have consumer as well.

Robert Sanders:

And one of the circuits they've got is the airport [spelled phonetically]. How did you see the confidence on this circuit, given that it could be a potential growth driver in 2020? And then the last question would just be [unintelligible] What are you watching? Do you think you'll return on capital on this deal will actually be above whack? And what whack are you assuming on this rather than just talking about accretion, which is a pretty academic thing giving you're paying cash and interest rates are low.

Dr. Jalal Bagherli:

So let me take the question on the – so I don't want to comment specifically on a customer circuit, but what I would say is that we have confidence in the projections that Wiss talked about in terms of the 2019 continuing with that growth into 2020. But we can't talk about specific customers.

Wissam Jabre:

And with respect to two to your question, Robert. Obviously, the transaction was evaluated adaptive to the work of the company on standalone and out of whack, and we're very comfortable that we would be returning higher than the cost of capital on this deal.

Dr. Jalal Bagherli:

Well, I expected it to be did. Well, as we said, the at the end of the first full calendar year or the first for calendar year would be close to where our long term financial model. So I would say somewhere between year one and year two, it would be in a place where we started turning the cash on the cost of capital.

Robert Sanders:

Thank you.

Dr. Jalal Bagherli:

You're welcome.

Operator:

The next question is from Adithya Methuka Bank of America.

Caller:

Good morning. Thank you and congratulations for the transaction. I just wanted, if you could talk about the competition facing Adesto, look at the annual report of 10-K, it looks as though they name a number of Taiwanese and Chinese competitors, including Micronics and Wind Bonds, assumed competitors out of China. So, I appreciate that this is not a commodity memory business, but it looks like their competitors are in the commodity memory market. So, I just wondered if you could quantify the competition and related to that to give us a bit more confidence on the business you're acquiring. Can you talk about the length of the contracts, especially the pricing and the length of the pricing agreements that you have with the core customers of Adesto. That would be helpful -- thank you -- in terms of visibility.

Dr. Jalal Bagherli:

Good morning. So, I think, you know, our understanding is you correctly read the same documents. In our due diligence, we believe, you know, flash memory, as we said, the NOR Flash are those that you mentioned. Some of them only participate in the standard. NOR Flash -- some are in in other kinds. Adesto does both that do have standard NOR Flash. But again, you know, it depends on your customer target. And secondly, they have proprietary. So, they're all unique products. There is no direct competitors. A customer can choose to design a system in multiple ways. So, it depends how optimised you want to make the system and what quality. Right?

So, you know, there's a whole spectrum of grey here. Right? So, if you want to cut on quality and have a lower cost of components, you can do that. Depends what features you're building in. So I think in some areas that have not no competitors for memory, in some areas there are just those four bundled products with some of the Asian software that you mentioned. But you know, the source of supply in Asia in any case. So, there isn't a big, you know, problem in terms of cost base.

But, of course, you know, you could argue that the supply from Asia could be cheaper on their margin. And they are quite often. So I think many of the customers, particularly outside Asia, when they choose suppliers for products that they care about in terms of quality, they would like a Western supplier to be on hand to explain and to support and to stand behind the product rather than buying the cheapest possible from Taiwan. So that that would be my answer to that. In terms of length of customer contracts, I think you'll find that is not that different to respect the semiconductor industry in that you get visibility and you get forecasts.

Nobody gives you long term contracts on any products that I'm aware of and is just within typically a court that's two quarters you have beyond that is pretty much a forecast and we are confident from what you've seen that they have good circuits with good prospects. But they are not going to be any different to ourselves than any other semiconductor that we've seen in the sense that, you know, people give you, you know, contracts for the for the for the next quarter and beyond, that is really rolling forecast.

Adithya Methuka:

Got it. Thank you. Can I have a quick follow-up?

Dr. Jalal Bagherli:

Sure.

Adithya Methuka:

Just looking at the slide deck that's put together, there is a product that seems to be a glaring omission in your portfolio, particularly as you target the IoT market and as your competitors in the broader markets all have that as acquired anchoring [inaudible]. Presumably you've got the '18, say the company, you've got a Normcore license. Can you recall that a longer-term direction as you give your model away from, you know, smartphones into the industrial IoT markets. Thank you.

Dr. Jalal Bagherli:

Absolutely. So, actually on Slide 4 we have shown a microcontroller there on the diagram, but we haven't called it dialog just purely to reflect the commercial status today, which we're not into the generic microcontroller business. But, you know, I think people confuse -- let's not confuse the technology microcontroller vs. microcontroller franchise Okay. So we are not a microcontroller franchise company. We don't have the distribution, you know, the software platforms and the 20 years of relationship with small guys, because we came from a different background. So maybe approach is through the SoCs we make.

So a Bluetooth chip, for example, has two [unintelligible], one small for running the Bluetooth stack and the bigger, more capable one to run the applications. So, and so there's no real difference between that and a microcontroller. In fact, I know about customers that use one of our, if you like, the higher end Bluetooth chips and they call it wireless controller because they use it actually to access the domain on core and the fantastic peripherals and the power management they've built in. And they have the option to turn on or turn off the Bluetooth application if they want to use the Bluetooth radio. So, if you see what I mean, we're coming from SoC into this rather than sort of jelly bean microcontroller, but we have all the technologies we need for that. Yes, you're right.

Caller:

Okay, lovely. Thanks very much.

Dr. Jalal Bagherli:

You're welcome.

Operator:

We have another question again from Robert Sanders from Deutsche Bank. Robert. Your line is now open.

Robert Sanders:

Yeah, I just we're just grateful up actually to the previous question. I mean, when you look at Nordic versus you, you're in IoT, which is low energy. You know, they have a big ecosystem. They develop software, etc.. The developers have bought into the platform. It does seem in industrial that you're still quite far away from building relationships with the key developers on the other side. So, what are you actually doing there to build a kind of platform business? And how are you going to avoid having to spend big money on marketing, free developer boards, building software platforms, etc. in order to build kind of mindshare with these industrial customers?

Dr. Jalal Bagherli:

So, Robert. I mean, our approach has been really coming from segment identificti rather than broad, broad brush sort of distribution so far. Right. So, this is why we are so successful to be number one in, for example, fitness tracker market. And our competitors are nowhere to be seen. We are you know, we've expanded our revenue base based on targeting specific high volume application. There we've added from a cynical point of view, differentiation as well as software seen in case of, for example, fitness trackers as we've explained. We integrate sensor interfaces, power management's memory interfaces onto the Bluetooth chip. So, it's not just the regular Bluetooth chip, this is why it's difficult to compete. I'll give you a second example. We just launched a few months ago, a couple of months back, the product called TiNi, which is our smallest, lowest cost in the world, Bluetooth offering. Right? This is for pure IoT. And guess what? The first segment that's been targeted actually we designed it with that in mind was the connected health -- okay.

So we're not chasing everybody else's success. We have our own success, too. Connected health is an up and coming nascent market. And we have everything in place, including customer relationship engagements to grow there. So, these are the stuff we've done using our own products. And we've added Wi-Fi that other people don't have. There's no power Wi-Fi helping with expansion either. Now, this acquisition gives us access to those 5,000 customers that we didn't have, which gives us that, you know, one more step towards the broad market addition to where we are successful already with Bluetooth. And you can look at our Bluetooth revenue growth and other needs to talk about. You can look at the numbers and you can see that taking market share like crazy. You know, we are growing 30, 40 percent a year. We're not messing around one or two percent. Okay? So we are number two. But we have the highest cost Bluetooth 980 chip on the market. So, I have no worries about what everybody else has done for 10 years because we've done it in three or four.

Robert Sanders:

Thanks a lot.

Dr. Jalal Bagherli:

You're welcome.

Operator:

As a reminder, ladies and gentlemen, to ask further questions, please press star followed by 1 on your telephone keypad. There are no further questions on the line – we have one again from Bank of America. Follow up question. Your line is now open.

Adithya Methuka:

Yeah. Thank you. I just wanted also on Adesto -- it looks like they mixed guidance above 118 as far as I can see on Bloomberg. Any comment on that? And are you concerned at all by the miss? Can you just help us understand what was the difference between what is expected and what they reported?

Dr. Jalal Bagherli:

No, I can't comment on that because, you know, they need to release their official numbers. So, what we said is our expectation of 118 and you know, they've known this number from since the beginning of our due diligence. So, I think they need to comment when they publish. Remember [unintelligible] I can't comment on somebody else.

Adithya Methuka:

Understood. Thank you so much.

Operator:

There are no further questions on the line.

Jose Cano:

Thank you. I just want to thank everyone for joining us today and for your patience, especially the beginning of the call. As usual, if you have any other questions, please don't hesitate to contact us. Thank you.

Dr. Jalal Bagherli:

Thank you.

[end of transcript]

On February 20, 2020, Dialog CEO Jalal Bagherli sent the following email communication to employees of Adesto Technologies Corporation

To: All Adesto Employees

From: Jalal Bagherli

Subject: A Message from Dialog CEO Jalal Bagherli

Dear Adesto Team,

Earlier, we announced that Dialog has entered into an agreement to acquire Adesto. As CEO of Dialog, I wanted to reach out and tell you more about why we are pleased to be joining forces.

So, first and foremost, who is Dialog? Dialog is a fabless semiconductor company primarily focused on the development of highly integrated mixed-signal products and providing power management ICs and connectivity solutions for the IoT market. We are publicly traded, headquartered in the U.K. and, like Adesto, we have a strong presence in the U.S., Europe and Asia.

I have been particularly impressed with how Adesto has developed from the IPO in 2015 to the strong position you now enjoy under Narbeh’s leadership. During the due diligence process, I have visited your Santa Clara site and met many members of your team and have been impressed with the quality of talent.

Bringing Dialog and Adesto together is compelling for many reasons and, with this combination, we are together expanding our presence in the attractive Industrial IoT market and strengthening our portfolio with highly complementary products – all of which make me incredibly excited about the future.

This is the first step in the process and Adesto and Dialog will remain separate and independent companies until the transaction closes, which we expect to occur in the third quarter of 2020.

In conclusion, I can speak for the entire Dialog team when I say we are excited to welcome you in the near future and look forward to collaborating and building the leading IIoT semiconductor company in the industry!

Best regards,

Jalal Bagherli

Chief Executive Officer, Dialog Semiconductor

Forward-Looking Statements

This communication contains “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve risks and uncertainties. In some cases, you can identify these forward-looking statements by the use of terms such as “expect,” “will,” “continue,” or similar expressions, and variations or negatives of these words, but the absence of these words does not mean that a statement is not forward-looking. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including, but not limited to: any statements regarding the expected timing of the completion of the transaction and the benefits of the transaction; the ability of Dialog Semiconductor plc ("Dialog") and Adesto Technologies Corporation ("Adesto") to complete the proposed transaction considering the various conditions to the transaction, some of which are outside the parties’ control, including those conditions related to regulatory approvals; any other statements of expectation or belief; and any statements of assumptions underlying any of the foregoing. These forward-looking statements are inherently uncertain, and are based on information available to each of Dialog and Adesto as of the date hereof and current expectations, forecasts, estimates, and assumptions. A number of important factors and uncertainties could cause actual results or events to differ materially from those described in these forward-looking statements, including without limitation: the failure to satisfy or waive any of the conditions to the consummation of the proposed transaction, including the adoption of the Merger Agreement by Adesto’s stockholders and the receipt of certain governmental and regulatory approvals; matters arising in connection with the parties’ efforts to comply with and satisfy applicable regulatory approvals and closing conditions relating to the proposed transaction; the risk that the proposed transaction does not close when anticipated or at all; the effects of disruption from the transactions contemplated by the Merger Agreement on Adesto’s or Dialog’s business and the fact that the announcement and pendency of the transaction may make it more difficult to establish or maintain relationships with employees, suppliers and other business partners; the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement; the outcome of any legal proceedings that may be instituted against Adesto or Dialog related to the Merger Agreement or the proposed transaction; unexpected costs, charges or expenses resulting from the proposed transaction; the occurrence of a Material Adverse Effect (as defined in the Merger Agreement); and other risks that are described in the reports of Adesto filed with the Securities and Exchange Commission (the “SEC”), including but not limited to the risks described in Adesto’s Annual Report on Form 10-K for its fiscal year ended December 31, 2018, which was filed with the SEC on March 18, 2019, and Adesto’s Quarterly Reports on Form 10-Q, and that are otherwise described or updated from time to time in other filings with the SEC. All forward-looking statements attributable to Adesto or Dialog, or persons acting on behalf of either, are expressly qualified in their entirety by this cautionary statement. Further, Adesto and Dialog disclaim any obligation to update the information in this communication or to announce publicly the results of any revisions to any of the forward-looking statements to reflect future events or developments, except as otherwise required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

Additional Information and Where to Find It

In connection with the proposed acquisition, Adesto will file relevant materials with the SEC, including a preliminary and definitive proxy statement. Promptly after filing the definitive proxy statement, Adesto will mail the definitive proxy statement and a proxy card to the stockholders of Adesto. ADESTO’S STOCKHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) CAREFULLY WHEN IT BECOMES AVAILABLE BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. Stockholders of Adesto will be able to obtain a free copy of these documents, when they become available, at the website maintained by the SEC at www.sec.gov or free of charge at www.adestotech.com.

Additionally, Adesto and Dialog will file other relevant materials in connection with the proposed acquisition of Adesto by Dialog pursuant to the terms of the Merger Agreement. Adesto, Dialog and their respective directors, executive officers and other members of management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of Adesto stockholders in connection with the proposed acquisition. Stockholders of Adesto may obtain more detailed information regarding the names, affiliations and interests of certain of Adesto’s executive officers and directors in the solicitation by reading Adesto’s most recent Annual Report on Form 10-K, and the proxy statement for Adesto’s 2019 annual meeting of stockholders, which was filed with the SEC on April 30, 2019. These documents are available free of charge at the SEC’s web site at www.sec.gov or by going to Adesto’s Investor Relations Website at www.adestotech.com. Information about Dialog’s directors and executive officers is set forth in Dialog’s Annual Report and Accounts 2018. You can obtain free copies of this document by accessing Dialog’s website at https://www.dialog-semiconductor.com. Information concerning the interests of Adesto’s participants in the solicitation, which may, in some cases, be different than those of Adesto’s stockholders generally, will be set forth in the definitive proxy statement relating to the proposed transaction when it becomes available.