|

Exhibit 99.1

|

Lenders Presentation - Public

June 6th, 2016

Disclaimer

This document contains highly confidential information and is solely for informational purposes. You should not rely upon or use it to form the definitive basis for any decision or action whatsoever, with respect to any proposed transaction or otherwise. You and your affiliates and agents must hold this document and any oral information provided in connection with this document, as well as any information derived by you from the information contained herein, in strict confidence and may not communicate, reproduce or disclose it to any other person, or refer to it publicly, in whole or in part at any time except with our prior written consent. If you are not the intended recipient of this document, please delete and destroy all copies immediately.

This document is “as is” and is based, in part, on information obtained from other sources. Our use of such information does not imply that we have independently verified or necessarily agree with any of such information, and we have assumed and relied upon the accuracy and completeness of such information for purposes of this document. Neither we nor any of our affiliates or agents, make any representation or warranty, express or implied, in relation to the accuracy or completeness of the information contained in this document or any oral information provided in connection herewith, or any data it generates and expressly disclaim any and all liability (whether direct or indirect, in contract, tort or otherwise) in relation to any of such information or any errors or omissions therein. Any views or terms contained herein are preliminary, and are based on financial, economic, market and other conditions prevailing as of the date of this document and are subject to change. We undertake no obligations or responsibility to update any of the information contained in this document. Past performance does not guarantee or predict future performance.

This document does not constitute an offer to sell or the solicitation of an offer to buy any security, nor does it constitute an offer or commitment to lend, syndicate or arrange a financing, underwrite or purchase or act as an agent or advisor or in any other capacity with respect to any transaction, or commit capital, or to participate in any trading strategies, and does not constitute legal, regulatory, accounting or tax advice to the recipient. This document does not constitute and should not be considered as any form of financial opinion or recommendation by us or any of our affiliates. This document is not a research report nor should it be construed as such.

This document includes projections. Any projections reflect various estimates and assumptions concerning anticipated results. No representations or warranties are made by us or any of our affiliates as to the accuracy of any such projections. Whether or not any such projections are in fact achieved will depend upon future events some of which are not within our control. Accordingly, actual results may vary from the projected results and such variations may be material. We undertake no obligation, and do not currently intend, to update our projections.

Forward-Looking Statements

In this presentation, all statements that are not purely historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements may be identified by the words “believe,” “expect,” “anticipate,” “project,” “plan,”

“estimate,” “intend” and other similar expressions. Forward-looking statements are based on currently available business, economic, financial and other information and reflect the current beliefs, expectations and views of the management team of Verso Corporation (the “Company”) with respect to future developments and their potential effects on the

Company. Actual results could vary materially depending on risks and uncertainties that may affect the Company and its business including for example, our ability to consummate a financing. For a discussion of the risks and uncertainties affecting the Company and its business, please refer to the risks and uncertainties identified elsewhere in this presentation as well as those discussed in the Company’s filings with the Securities and Exchange Commission. Neither the Company nor PJT assume any obligation to update forward-looking statements made in this presentation to reflect subsequent events or circumstances or actual outcomes.

Non-GAAP Measures

In this presentation, “EBITDA,” “Adjusted EBITDA” and “Adjusted EBITDA margin” are financial measures not prepared in accordance with U.S. GAAP. These non-GAAP measures should be considered a supplement to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

CONFIDENTIAL 2

Presenters

Dave Paterson Chief Executive Officer Verso Corp Allen Campbell Chief Financial Officer Verso Corp Rob Anderson Managing Director Barclays

Lee Minor Director Wells Fargo

CONFIDENTIAL 3

Table of Contents

1. Introduction

2. Company Overview and Credit Highlights

3. Industry Update and Outlook

4. Recent Financial Performance

5. Financial Projections Overview

6. Transaction Overview

Appendices

CONFIDENTIAL

Introduction

CONFIDENTIAL

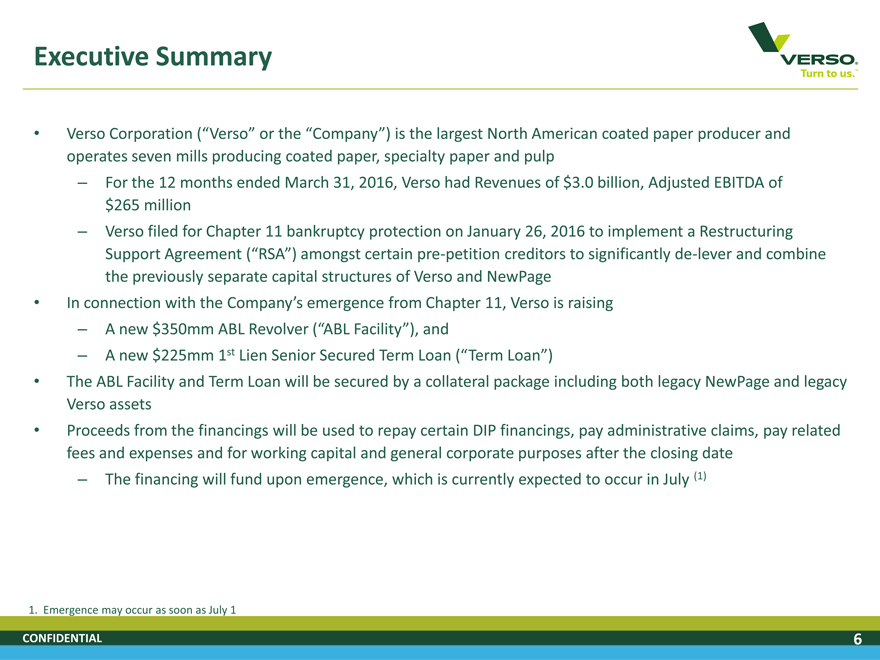

Executive Summary

Verso Corporation (“Verso” or the “Company”) is the largest North American coated paper producer and operates seven mills producing coated paper, specialty paper and pulp

– For the 12 months ended March 31, 2016, Verso had Revenues of $3.0 billion, Adjusted EBITDA of $265 million

– Verso filed for Chapter 11 bankruptcy protection on January 26, 2016 to implement a Restructuring

Support Agreement (“RSA”) amongst certain pre-petition creditors to significantly de-lever and combine the previously separate capital structures of Verso and NewPage

In connection with the Company’s emergence from Chapter 11, Verso is raising

– A new $350mm ABL Revolver (“ABL Facility”), and

– A new $225mm 1st Lien Senior Secured Term Loan (“Term Loan”)

The ABL Facility and Term Loan will be secured by a collateral package including both legacy NewPage and legacy Verso assets

Proceeds from the financings will be used to repay certain DIP financings, pay administrative claims, pay related fees and expenses and for working capital and general corporate purposes after the closing date

– The financing will fund upon emergence, which is currently expected to occur in July (1)

1. Emergence may occur as soon as July 1

CONFIDENTIAL 6

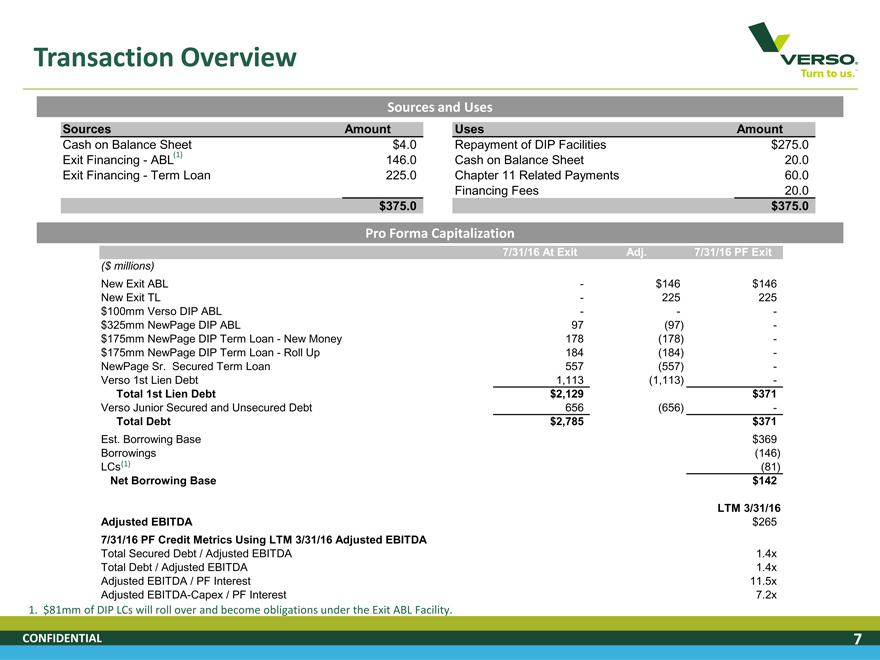

Transaction Overview

Sources and Uses

Sources Amount Uses Amount

Cash on Balance Sheet $4.0 Repayment of DIP Facilities $275.0

Exit Financing—ABL(1) 146.0 Cash on Balance Sheet 20.0

Exit Financing—Term Loan 225.0 Chapter 11 Related Payments 60.0

Financing Fees 20.0

$375.0 $375.0

Pro Forma Capitalization

7/31/16 At Exit Adj. 7/31/16 PF Exit

($ millions)

New Exit ABL—$146 $146

New Exit TL—225 225

$100mm Verso DIP ABL — -

$325mm NewPage DIP ABL 97(97) -

$175mm NewPage DIP Term Loan—New Money 178(178) -

$175mm NewPage DIP Term Loan—Roll Up 184(184) -

NewPage Sr. Secured Term Loan 557(557) -

Verso 1st Lien Debt 1,113(1,113) -

Total 1st Lien Debt $ 2,129 $371

Verso Junior Secured and Unsecured Debt 656(656) -

Total Debt $ 2,785 $371

Est. Borrowing Base $369

Borrowings(146)

LCs(1)(81)

Net Borrowing Base $142

LTM 3/31/16

Adjusted EBITDA $265

7/31/16 PF Credit Metrics Using LTM 3/31/16 Adjusted EBITDA

Total Secured Debt / Adjusted EBITDA 1.4x

Total Debt / Adjusted EBITDA 1.4x

Adjusted EBITDA / PF Interest 11.5x

Adjusted EBITDA-Capex / PF Interest 7.2x

1. $81mm of DIP LCs will roll over and become obligations under the Exit ABL Facility.

CONFIDENTIAL 7

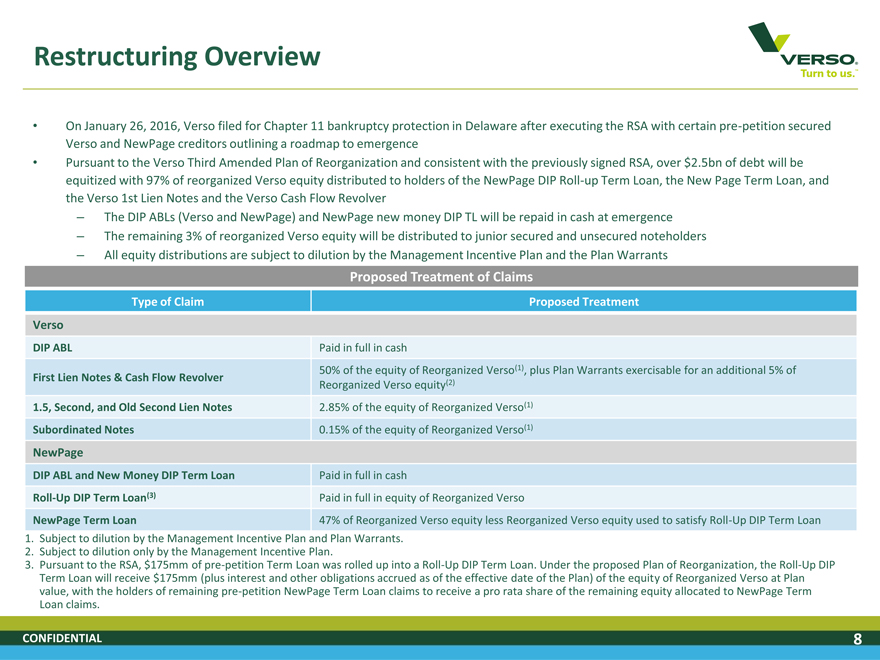

Restructuring Overview

On January 26, 2016, Verso filed for Chapter 11 bankruptcy protection in Delaware after executing the RSA with certain pre-petition secured Verso and NewPage creditors outlining a roadmap to emergence

Pursuant to the Verso Third Amended Plan of Reorganization and consistent with the previously signed RSA, over $2.5bn of debt will be equitized with 97% of reorganized Verso equity distributed to holders of the NewPage DIP Roll-up Term Loan, the New Page Term Loan, and the Verso 1st Lien Notes and the Verso Cash Flow Revolver

– The DIP ABLs (Verso and NewPage) and NewPage new money DIP TL will be repaid in cash at emergence

– The remaining 3% of reorganized Verso equity will be distributed to junior secured and unsecured noteholders

– All equity distributions are subject to dilution by the Management Incentive Plan and the Plan Warrants

Proposed Treatment of Claims

Type of Claim Proposed Treatment

Verso

DIP ABL Paid in full in cash

50% of the equity of Reorganized Verso(1), plus Plan Warrants exercisable for an additional 5% of

First Lien Notes & Cash Flow Revolver

Reorganized Verso equity(2)

1.5, Second, and Old Second Lien Notes 2.85% of the equity of Reorganized Verso(1)

Subordinated Notes 0.15% of the equity of Reorganized Verso(1)

NewPage

DIP ABL and New Money DIP Term Loan Paid in full in cash

Roll-Up DIP Term Loan(3) Paid in full in equity of Reorganized Verso

NewPage Term Loan 47% of Reorganized Verso equity less Reorganized Verso equity used to satisfy Roll-Up DIP Term Loan

1. Subject to dilution by the Management Incentive Plan and Plan Warrants.

2. Subject to dilution only by the Management Incentive Plan.

3. Pursuant to the RSA, $175mm of pre-petition Term Loan was rolled up into a Roll-Up DIP Term Loan. Under the proposed Plan of Reorganization, the Roll-Up DIP Term Loan will receive $175mm (plus interest and other obligations accrued as of the effective date of the Plan) of the equity of Reorganized Verso at Plan value, with the holders of remaining pre-petition NewPage Term Loan claims to receive a pro rata share of the remaining equity allocated to NewPage Term Loan claims.

CONFIDENTIAL 8

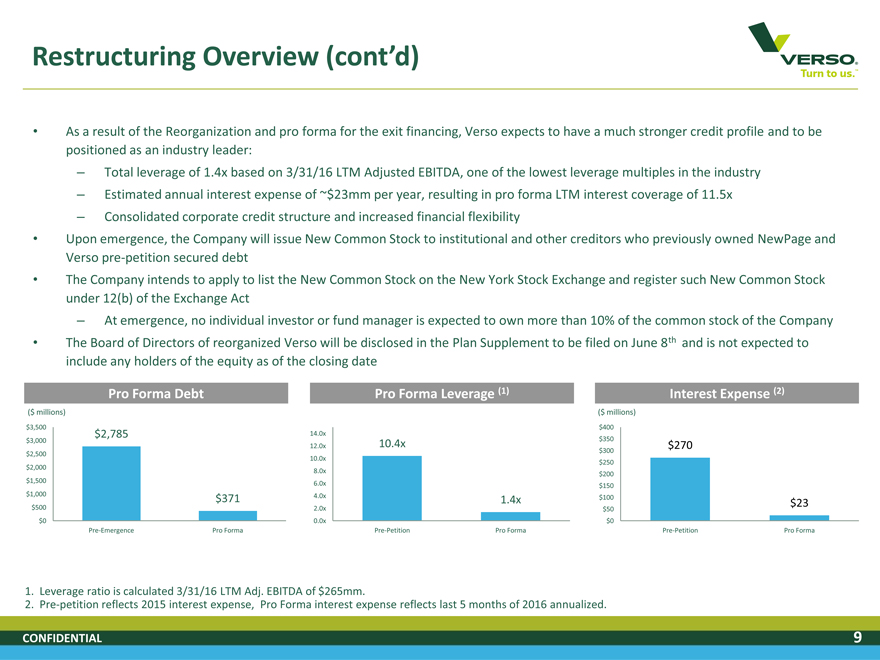

Restructuring Overview (cont’d)

As a result of the Reorganization and pro forma for the exit financing, Verso expects to have a much stronger credit profile and to be positioned as an industry leader:

– Total leverage of 1.4x based on 3/31/16 LTM Adjusted EBITDA, one of the lowest leverage multiples in the industry

– Estimated annual interest expense of ~$23mm per year, resulting in pro forma LTM interest coverage of 11.5x

– Consolidated corporate credit structure and increased financial flexibility

Upon emergence, the Company will issue New Common Stock to institutional and other creditors who previously owned NewPage and Verso pre-petition secured debt

The Company intends to apply to list the New Common Stock on the New York Stock Exchange and register such New Common Stock under 12(b) of the Exchange Act

– At emergence, no individual investor or fund manager is expected to own more than 10% of the common stock of the Company

The Board of Directors of reorganized Verso will be disclosed in the Plan Supplement to be filed on June 8th and is not expected to include any holders of the equity as of the closing date

Pro Forma Debt Pro Forma Leverage (1) Interest Expense (2)

($ millions)($ millions)

$3,500 $400

$2,785 14.0x

$3,000 12.0x 10.4x $350 $270

$2,500 $300

10.0x $250

$2,000

8.0x $200

$1,500

6.0x $150

$1,000

$371 4.0x 1.4x $100 $23

$500 2.0x $50

$0 0.0x $0

Pre-Emergence Pro Forma Pre-Petition Pro Forma Pre-Petition Pro Forma

1. Leverage ratio is calculated 3/31/16 LTM Adj. EBITDA of $265mm.

2. Pre-petition reflects 2015 interest expense, Pro Forma interest expense reflects last 5 months of 2016 annualized.

CONFIDENTIAL 9

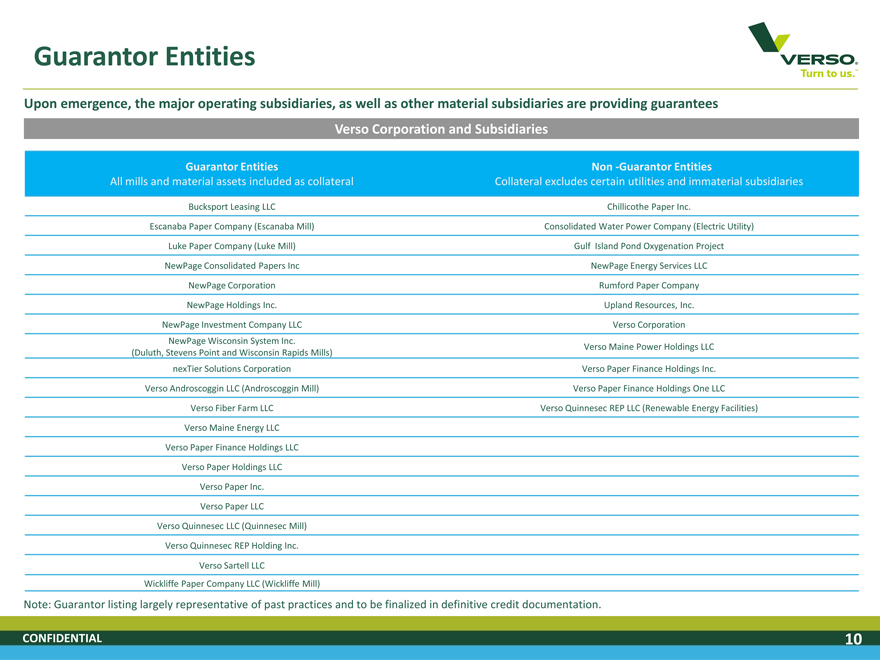

Guarantor Entities

Upon emergence, the major operating subsidiaries, as well as other material subsidiaries are providing guarantees

Verso Corporation and Subsidiaries

Guarantor Entities Non -Guarantor Entities

All mills and material assets included as collateral Collateral excludes certain utilities and immaterial subsidiaries

Bucksport Leasing LLC Chillicothe Paper Inc.

Escanaba Paper Company (Escanaba Mill) Consolidated Water Power Company (Electric Utility)

Luke Paper Company (Luke Mill) Gulf Island Pond Oxygenation Project

NewPage Consolidated Papers Inc NewPage Energy Services LLC

NewPage Corporation Rumford Paper Company

NewPage Holdings Inc. Upland Resources, Inc.

NewPage Investment Company LLC Verso Corporation

NewPage Wisconsin System Inc.

Verso Maine Power Holdings LLC

(Duluth, Stevens Point and Wisconsin Rapids Mills)

nexTier Solutions Corporation Verso Paper Finance Holdings Inc.

Verso Androscoggin LLC (Androscoggin Mill) Verso Paper Finance Holdings One LLC

Verso Fiber Farm LLC Verso Quinnesec REP LLC (Renewable Energy Facilities)

Verso Maine Energy LLC

Verso Paper Finance Holdings LLC

Verso Paper Holdings LLC

Verso Paper Inc.

Verso Paper LLC

Verso Quinnesec LLC (Quinnesec Mill)

Verso Quinnesec REP Holding Inc.

Verso Sartell LLC

Wickliffe Paper Company LLC (Wickliffe Mill)

Note: Guarantor listing largely representative of past practices and to be finalized in definitive credit documentation.

CONFIDENTIAL 10

Strategic Focus

Post-emergence, the Company intends to continue its focus on reducing costs and enhancing liquidity

Key Goals

Seek to improve margin by driving product mix to more profitable grades (specialty papers, CFS, etc.)

Continue to realize operational improvements that reduce costs

Generate cash flow to repay debt and provide currency for strategic investments

Capture savings from rationalized capital/corporate structure

Explore machine conversions to higher-growth, higher-profit product areas

CONFIDENTIAL 11

Company Overview and Credit Highlights

CONFIDENTIAL

Key Credit Highlights

Leading Producer with Significant Share of Manufacturing Capacity

Broad Product Offering

Profitable Low Cost Mill Portfolio

Exposure to Growing Specialty Paper Grades

Substantial Cost Savings Achieved

Significant Collateral Coverage

CONFIDENTIAL 13

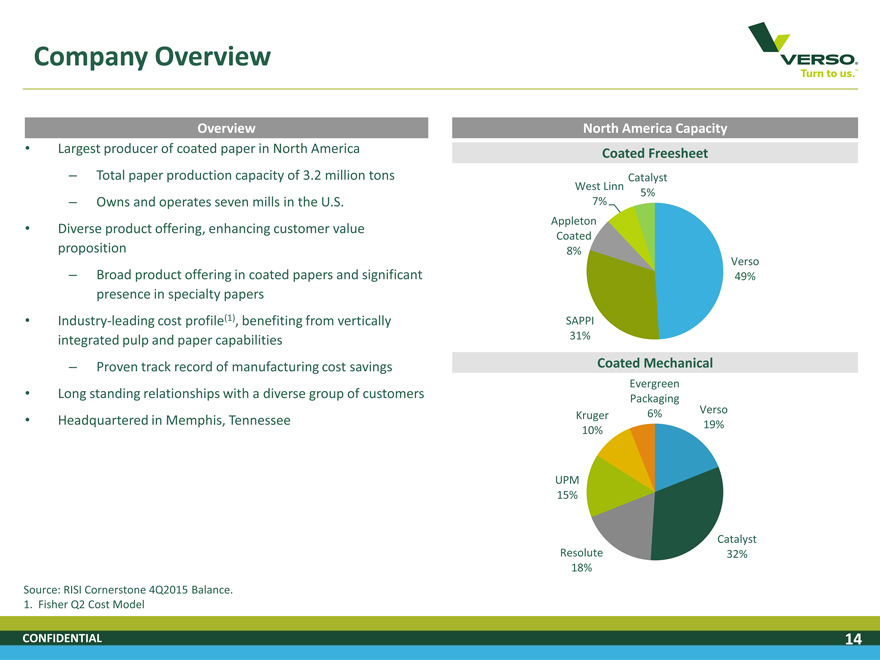

Company Overview

Overview North America Capacity

Largest producer of coated paper in North America Coated Freesheet

– Total paper production capacity of 3.2 million tons Catalyst

West Linn 5%

– Owns and operates seven mills in the U.S. 7%

Diverse product offering, enhancing customer value Appleton

Coated

proposition 8%

Verso

– Broad product offering in coated papers and significant 49%

presence in specialty papers

Industry-leading cost profile(1), benefiting from vertically SAPPI

integrated pulp and paper capabilities 31%

– Proven track record of manufacturing cost savings Coated Mechanical

Evergreen

Long standing relationships with a diverse group of customers Packaging

Verso

Headquartered in Memphis, Tennessee Kruger 6% 19%

10%

UPM

15%

Catalyst

Resolute 32%

18%

Source: RISI Cornerstone 4Q2015 Balance.

1. Fisher Q2 Cost Model

CONFIDENTIAL 14

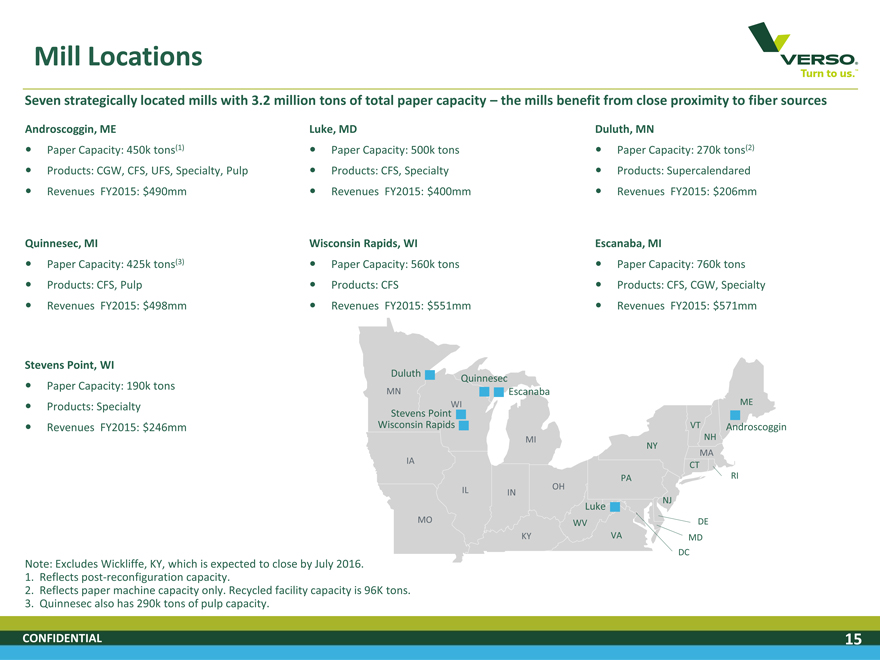

Mill Locations

Seven strategically located mills with 3.2 million tons of total paper capacity – the mills benefit from close proximity to fiber sources

Androscoggin, ME Luke, MD Duluth, MN

Paper Capacity: 450k tons(1) ?Paper Capacity: 500k tons Paper Capacity: 270k tons(2)

Products: CGW, CFS, UFS, Specialty, Pulp ?Products: CFS, Specialty Products: Supercalendared

Revenues FY2015: $490mm ?Revenues FY2015: $400mm Revenues FY2015: $206mm

Quinnesec, MI Wisconsin Rapids, WI Escanaba, MI

Paper Capacity: 425k tons(3) ?Paper Capacity: 560k tons Paper Capacity: 760k tons

Products: CFS, Pulp ?Products: CFS Products: CFS, CGW, Specialty

Revenues FY2015: $498mm ?Revenues FY2015: $551mm Revenues FY2015: $571mm

Stevens Point, WI

Duluth Quinnesec

Paper Capacity: 190k tons MN Escanaba

Products: Specialty WI ME

Stevens Point

Revenues FY2015: $246mm Wisconsin Rapids VT Androscoggin

MI NH

NY

MA

IA CT

PA RI

IL IN OH

NJ

Luke

MO WV DE

KY VA MD

DC

Note: Excludes Wickliffe, KY, which is expected to close by July 2016.

1. Reflects post-reconfiguration capacity.

2. Reflects paper machine capacity only. Recycled facility capacity is 96K tons.

3. Quinnesec also has 290k tons of pulp capacity.

CONFIDENTIAL 15

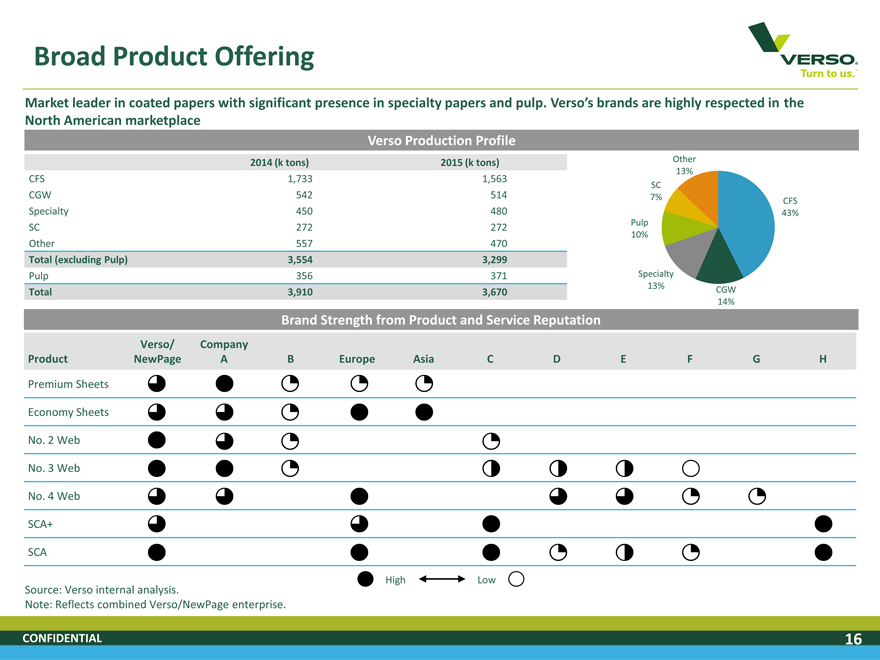

Broad Product Offering

Market leader in coated papers with significant presence in specialty papers and pulp. Verso’s brands are highly respected in the

North American marketplace

Verso Production Profile

2014 (k tons) 2015 (k tons) Other

13%

CFS 1,733 1,563

SC

CGW 542 514 7% CFS

Specialty 450 480 43%

SC 272 272 Pulp

10%

Other 557 470

Total (excluding Pulp) 3,554 3,299

Pulp 356 371 Specialty

13%

Total 3,910 3,670 CGW

14%

Brand Strength from Product and Service Reputation

Verso/ Company

Product NewPage A B Europe Asia C D E F G H

Premium Sheets

Economy Sheets

No. 2 Web

No. 3 Web

No. 4 Web

SCA+

SCA

High Low

Source: Verso internal analysis.

Note: Reflects combined Verso/NewPage enterprise.

CONFIDENTIAL 16

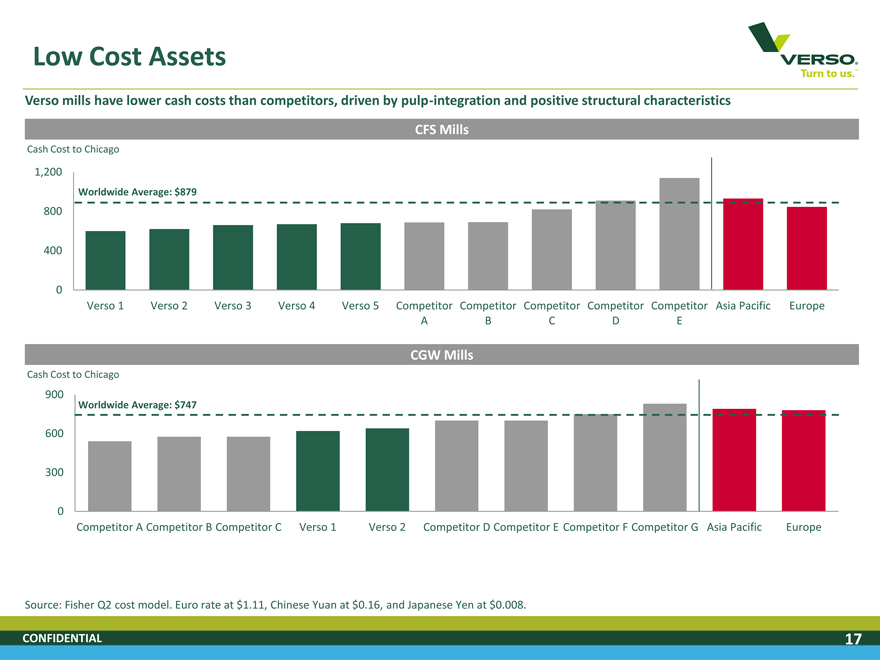

Low Cost Assets

Verso mills have lower cash costs than competitors, driven by pulp-integration and positive structural characteristics

CFS Mills

Cash Cost to Chicago

1,200

Worldwide Average: $879

800

400

0

Verso 1 Verso 2 Verso 3 Verso 4 Verso 5 Competitor Competitor Competitor Competitor Competitor Asia Pacific Europe A B C D E

CGW Mills

Cash Cost to Chicago

900

Worldwide Average: $747

600

300

0

Competitor A Competitor B Competitor C Verso 1 Verso 2 Competitor D Competitor E Competitor F Competitor G Asia Pacific Europe

Source: Fisher Q2 cost model. Euro rate at $1.11, Chinese Yuan at $0.16, and Japanese Yen at $0.008.

CONFIDENTIAL 17

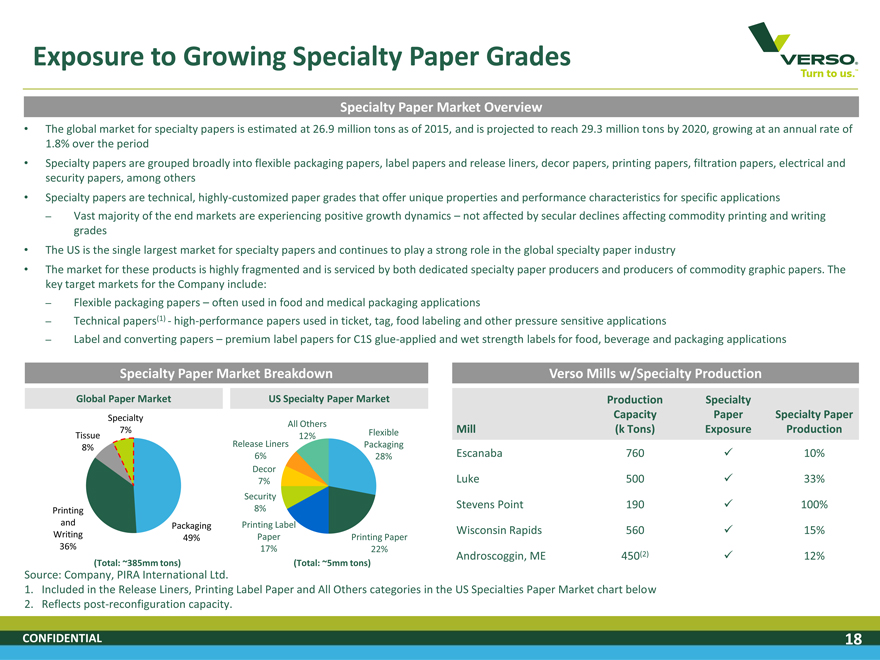

Exposure to Growing Specialty Paper Grades

Specialty Paper Market Overview

The global market for specialty papers is estimated at 26.9 million tons as of 2015, and is projected to reach 29.3 million tons by 2020, growing at an annual rate of

1.8% over the period

Specialty papers are grouped broadly into flexible packaging papers, label papers and release liners, decor papers, printing papers, filtration papers, electrical and

security papers, among others

Specialty papers are technical, highly-customized paper grades that offer unique properties and performance characteristics for specific applications

– Vast majority of the end markets are experiencing positive growth dynamics – not affected by secular declines affecting commodity printing and writing

grades

The US is the single largest market for specialty papers and continues to play a strong role in the global specialty paper industry

The market for these products is highly fragmented and is serviced by both dedicated specialty paper producers and producers of commodity graphic papers. The

key target markets for the Company include:

– Flexible packaging papers – often used in food and medical packaging applications

– Technical papers(1)—high-performance papers used in ticket, tag, food labeling and other pressure sensitive applications

– Label and converting papers – premium label papers for C1S glue-applied and wet strength labels for food, beverage and packaging applications

Specialty Paper Market Breakdown Verso Mills w/Specialty Production

Global Paper Market US Specialty Paper Market Production Specialty

Specialty Capacity Paper Specialty Paper

All Others

Tissue 7% 12% Flexible Mill(k Tons) Exposure Production

8% Release Liners Packaging

6% 28% Escanaba 760 ? 10%

Decor

7% Luke 500 ? 33%

Security

Printing 8% Stevens Point 190 ? 100%

and Packaging Printing Label Wisconsin Rapids 560 ? 15%

Writing 49% Paper Printing Paper

36% 17% 22% Androscoggin, ME 450(2) ? 12%

(Total: ~385mm tons)(Total: ~5mm tons)

Source: Company, PIRA International Ltd.

1. Included in the Release Liners, Printing Label Paper and All Others categories in the US Specialties Paper Market chart below

2. Reflects post-reconfiguration capacity.

CONFIDENTIAL 18

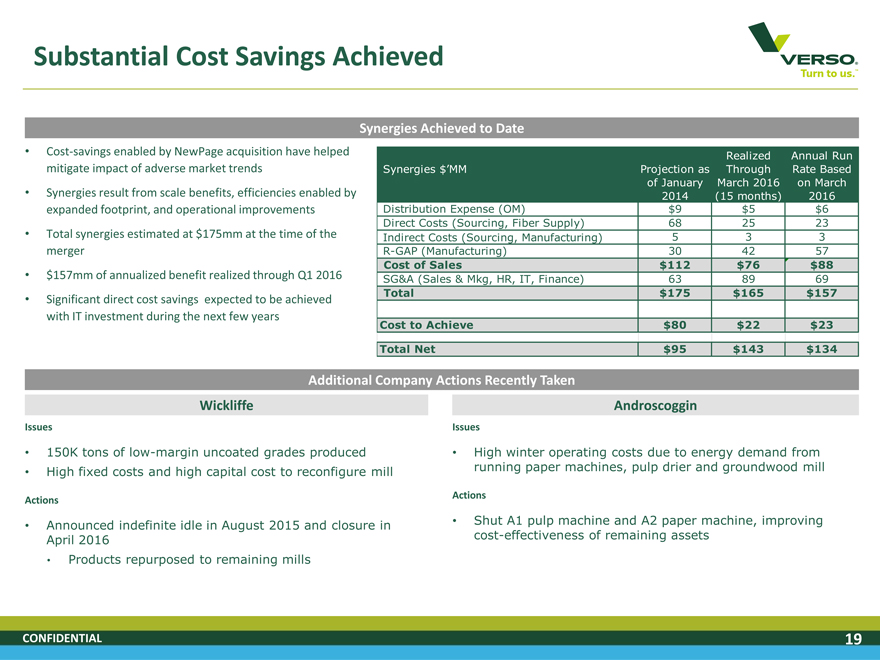

Substantial Cost Savings Achieved

Synergies Achieved to Date

Cost-savings enabled by NewPage acquisition have helped Realized Annual Run

mitigate impact of adverse market trends Synergies $’MM Projection as Through Rate Based

of January March 2016 on March

Synergies result from scale benefits, efficiencies enabled by 2014(15 months) 2016

expanded footprint, and operational improvements Distribution Expense (OM) $9 $5 $6

Direct Costs (Sourcing, Fiber Supply) 68 25 23

Total synergies estimated at $175mm at the time of the Indirect Costs (Sourcing, Manufacturing) 5 3 3

merger R-GAP (Manufacturing) 30 42 57

Cost of Sales $112 $76 $88

$157mm of annualized benefit realized through Q1 2016 SG&A (Sales & Mkg, HR, IT, Finance) 63 89 69

Significant direct cost savings expected to be achieved Total $175 $165 $157

with IT investment during the next few years

Cost to Achieve $80 $22 $23

Total Net $95 $143 $134

Additional Company Actions Recently Taken

Wickliffe Androscoggin

Issues Issues

150K tons of low-margin uncoated grades produced • High winter operating costs due to energy demand from

High fixed costs and high capital cost to reconfigure mill running paper machines, pulp drier and groundwood mill

Actions Actions

Announced indefinite idle in August 2015 and closure in • Shut A1 pulp machine and A2 paper machine, improving

April 2016 cost-effectiveness of remaining assets

Products repurposed to remaining mills

CONFIDENTIAL 19

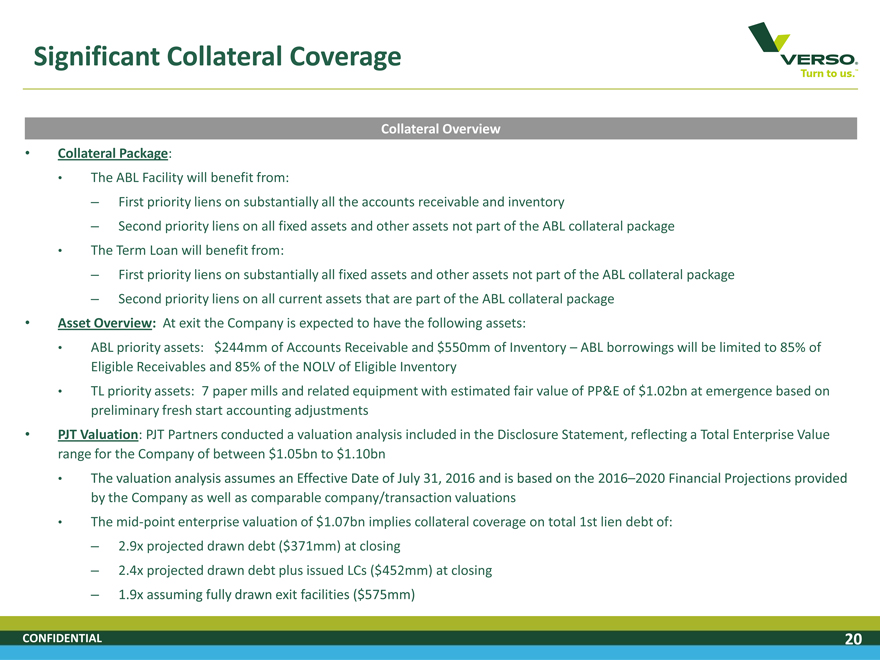

Significant Collateral Coverage

Collateral Overview

Collateral Package:

The ABL Facility will benefit from:

– First priority liens on substantially all the accounts receivable and inventory

– Second priority liens on all fixed assets and other assets not part of the ABL collateral package

The Term Loan will benefit from:

– First priority liens on substantially all fixed assets and other assets not part of the ABL collateral package

– Second priority liens on all current assets that are part of the ABL collateral package

Asset Overview: At exit the Company is expected to have the following assets:

ABL priority assets: $244mm of Accounts Receivable and $550mm of Inventory – ABL borrowings will be limited to 85% of

Eligible Receivables and 85% of the NOLV of Eligible Inventory

TL priority assets: 7 paper mills and related equipment with estimated fair value of PP&E of $1.02bn at emergence based on

preliminary fresh start accounting adjustments

PJT Valuation: PJT Partners conducted a valuation analysis included in the Disclosure Statement, reflecting a Total Enterprise Value

range for the Company of between $1.05bn to $1.10bn

The valuation analysis assumes an Effective Date of July 31, 2016 and is based on the 2016–2020 Financial Projections provided

by the Company as well as comparable company/transaction valuations

The mid-point enterprise valuation of $1.07bn implies collateral coverage on total 1st lien debt of:

– 2.9x projected drawn debt ($371mm) at closing

– 2.4x projected drawn debt plus issued LCs ($452mm) at closing

– 1.9x assuming fully drawn exit facilities ($575mm)

CONFIDENTIAL 20

Industry Update and Outlook

CONFIDENTIAL

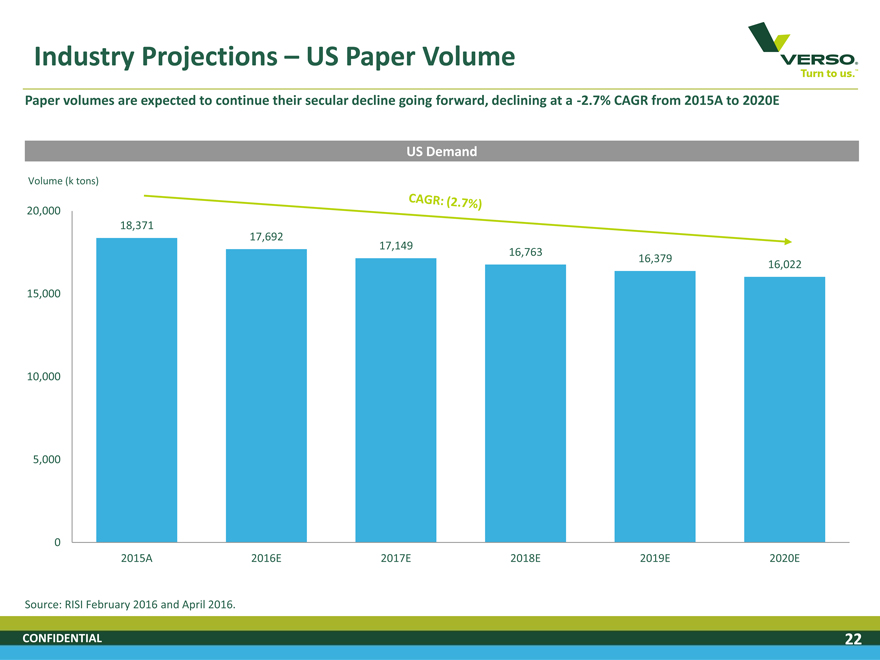

Industry Projections – US Paper Volume

Paper volumes are expected to continue their secular decline going forward, declining at a -2.7% CAGR from 2015A to 2020E

US Demand

Volume (k tons)

20,000

18,371

17,692 17,149

16,763

16,379

16,022

15,000

10,000

5,000

0

2015A 2016E 2017E 2018E 2019E 2020E

Source: RISI February 2016 and April 2016.

CONFIDENTIAL 22

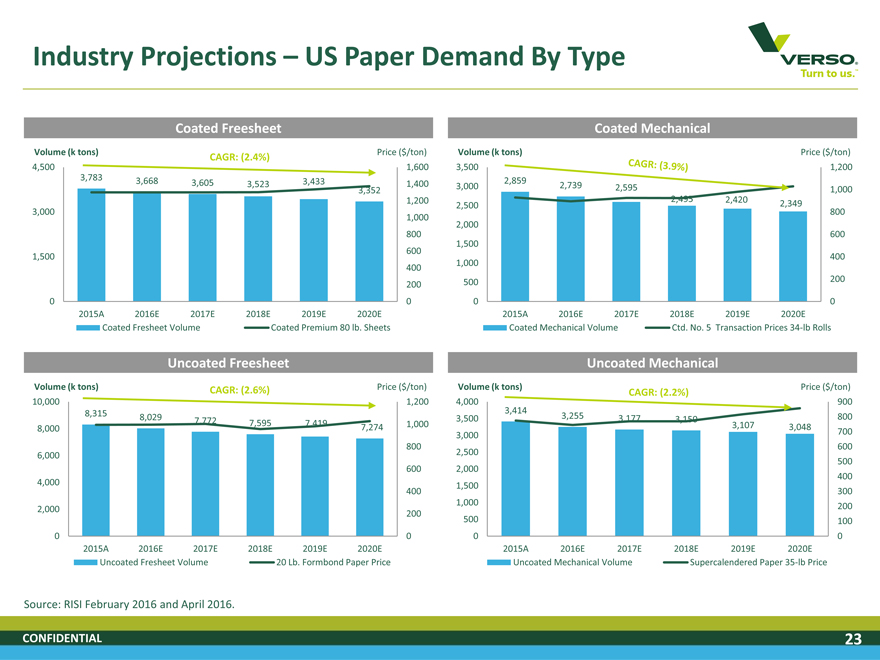

Industry Projections – US Paper Demand By Type

Coated Freesheet Coated Mechanical

Volume (k tons) Price ($/ton) Volume (k tons) Price ($/ton)

CAGR: (2.4%)

4,500 1,600 3,500 1,200 3,783 3,668 2,859 3,605 3,523 3,433 1,400 3,000 2,739 2,595 3,352 1,000 1,200 2,495 2,420 2,500 2,349 3,000 800 1,000 2,000 800 600 600 1,500 1,500 400 1,000 400 500 200 200

0 0 0 0 2015A 2016E 2017E 2018E 2019E 2020E 2015A 2016E 2017E 2018E 2019E 2020E

Coated Fresheet Volume Coated Premium 80 lb. Sheets Coated Mechanical Volume Ctd. No. 5 Transaction Prices 34-lb Rolls

Uncoated Freesheet Uncoated Mechanical

Volume (k tons) CAGR: (2.6%) Price ($/ton) Volume (k tons) Price ($/ton)

CAGR: (2.2%)

10,000 1,200 4,000 900 8,315 3,414 8,029 3,500 3,255 3,177 3,150 800 7,772 7,595 7,419 1,000 8,000 7,274 3,107 3,048 700 3,000 800 600 6,000 2,500 600 2,000 500 400 4,000 1,500 400 300 1,000 2,000 200 200 500 100

0 0 0 0 2015A 2016E 2017E 2018E 2019E 2020E 2015A 2016E 2017E 2018E 2019E 2020E

Uncoated Fresheet Volume 20 Lb. Formbond Paper Price Uncoated Mechanical Volume Supercalendered Paper 35-lb Price

Source: RISI February 2016 and April 2016.

CONFIDENTIAL 23

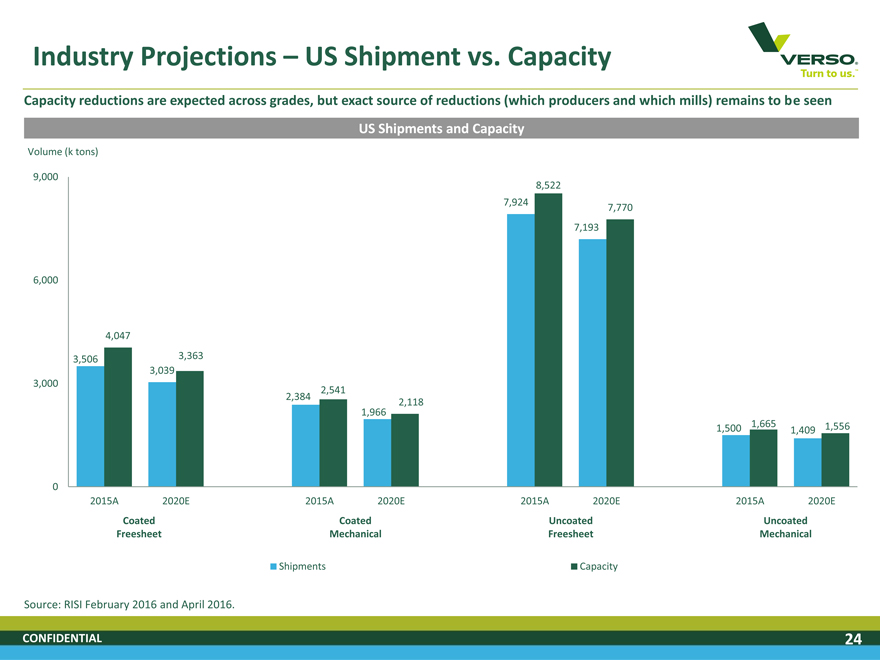

Industry Projections – US Shipment vs. Capacity

Capacity reductions are expected across grades, but exact source of reductions (which producers and which mills) remains to be seen

US Shipments and Capacity

Volume (k tons)

9,000 8,522 7,924

7,770

7,193

6,000

4,047

3,506 3,363 3,039 3,000

2,541 2,384

2,118 1,966

1,665 1,556 1,500 1,409

0

2015A 2020E 2015A 2020E 2015A 2020E 2015A 2020E

Coated Coated Uncoated Uncoated Freesheet Mechanical Freesheet Mechanical

Shipments Capacity

Source: RISI February 2016 and April 2016.

CONFIDENTIAL 24

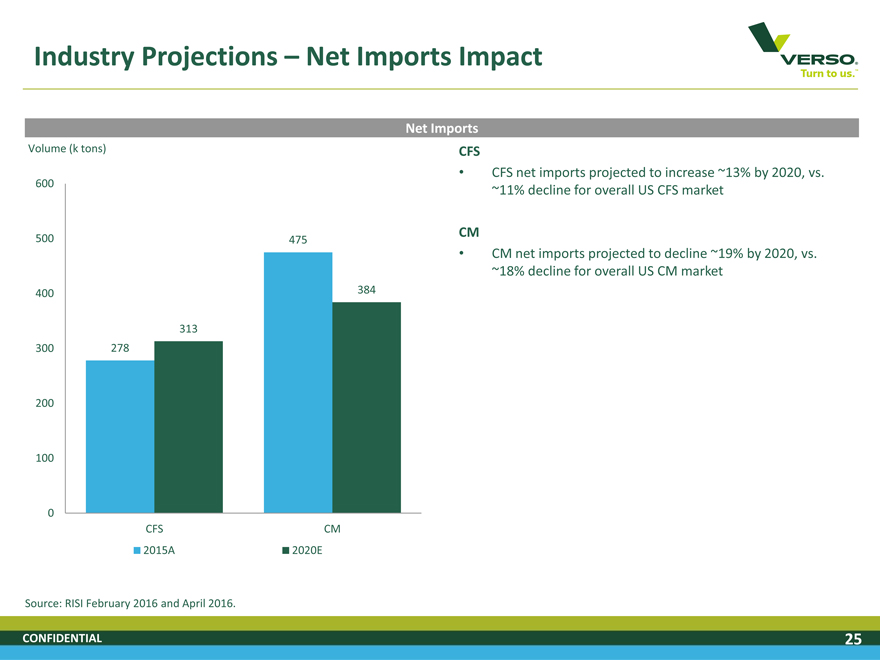

Industry Projections – Net Imports Impact

Net Imports

Volume (k tons) CFS

CFS net imports projected to increase ~13% by 2020, vs.

600

~11% decline for overall US CFS market

CM

500 475

CM net imports projected to decline ~19% by 2020, vs. ~18% decline for overall US CM market

400 384

313 300 278

200

100

0

CFS CM

2015A 2020E

Source: RISI February 2016 and April 2016.

CONFIDENTIAL 25

Recent Financial Performance

CONFIDENTIAL

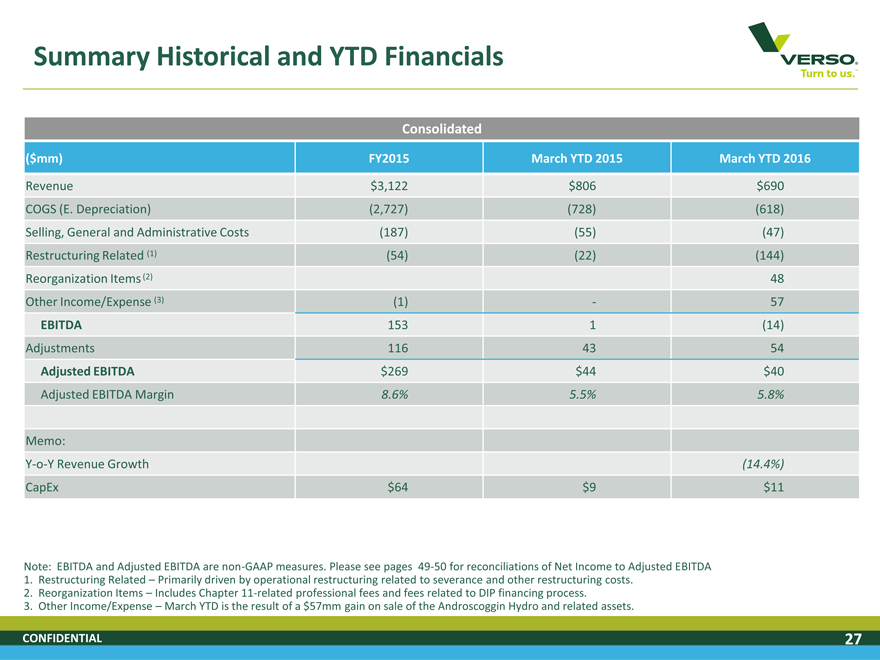

Summary Historical and YTD Financials

Consolidated

($mm) FY2015 March YTD 2015 March YTD 2016

Revenue $3,122 $806 $690 COGS (E. Depreciation) (2,727) (728) (618) Selling, General and Administrative Costs (187) (55) (47) Restructuring Related (1) (54) (22) (144) Reorganization Items (2) 48 Other Income/Expense (3) (1)—57 EBITDA 153 1 (14) Adjustments 116 43 54

Adjusted EBITDA $269 $44 $40

Adjusted EBITDA Margin 8.6% 5.5% 5.8%

Memo:

Y-o-Y Revenue Growth (14.4%)

CapEx $64 $9 $11

Note: EBITDA and Adjusted EBITDA are non-GAAP measures. Please see pages 49-50 for reconciliations of Net Income to Adjusted EBITDA

1. Restructuring Related – Primarily driven by operational restructuring related to severance and other restructuring costs.

2. Reorganization Items – Includes Chapter 11-related professional fees and fees related to DIP financing process.

3. Other Income/Expense – March YTD is the result of a $57mm gain on sale of the Androscoggin Hydro and related assets.

CONFIDENTIAL 27

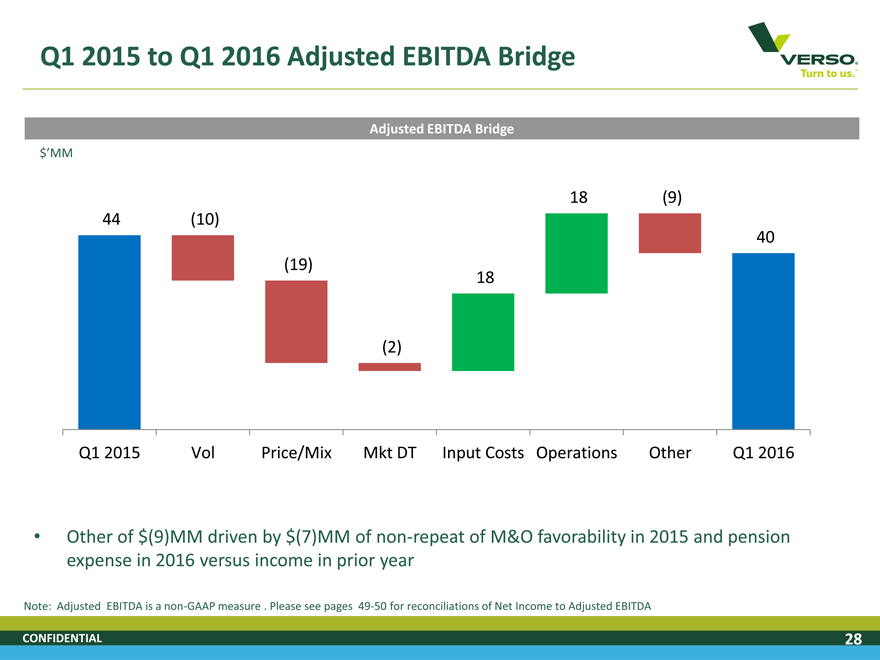

Q1 2015 to Q1 2016 Adjusted EBITDA Bridge

Adjusted EBITDA Bridge $’MM

18 (9)

44 (10)

40 (19) 18

(2)

Q1 2015 Vol Price/Mix Mkt DT Input Costs Operations Other Q1 2016

Other of $(9)MM driven by $(7)MM of non-repeat of M&O favorability in 2015 and pension expense in 2016 versus income in prior year

Note: Adjusted EBITDA is a non-GAAP measure . Please see pages 49-50 for reconciliations of Net Income to Adjusted EBITDA

CONFIDENTIAL 28

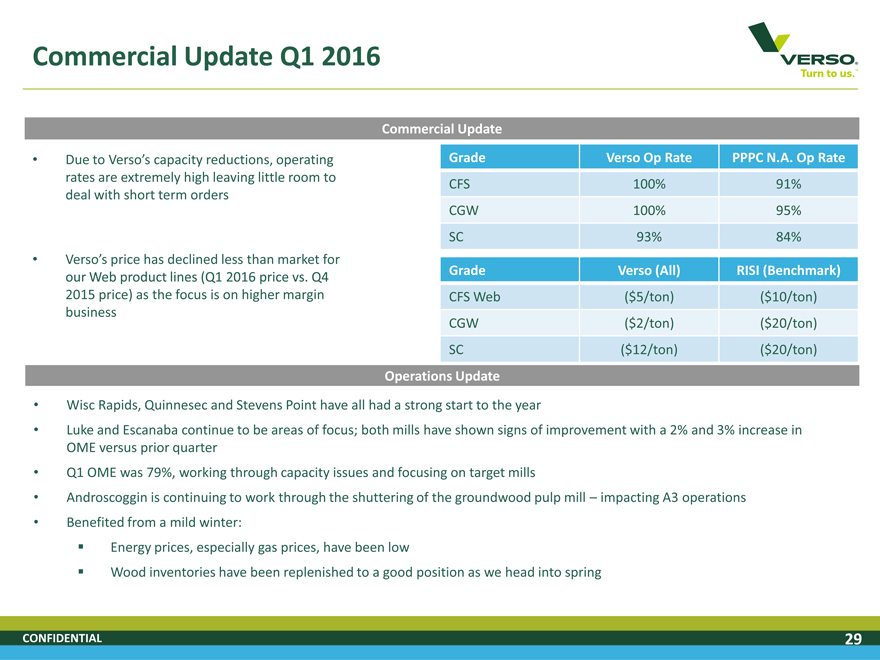

Commercial Update Q1 2016

Commercial Update

Due to Verso’s capacity reductions, operating Grade Verso Op Rate PPPC N.A. Op Rate rates are extremely high leaving little room to deal with short term orders CFS 100% 91% CGW 100% 95%

SC 93% 84%

Verso’s price has declined less than market for Grade Verso (All) RISI (Benchmark) our Web product lines (Q1 2016 price vs. Q4

2015 price) as the focus is on higher margin CFS Web ($5/ton) ($10/ton) business CGW ($2/ton) ($20/ton) SC ($12/ton) ($20/ton)

Operations Update

Wisc Rapids, Quinnesec and Stevens Point have all had a strong start to the year

Luke and Escanaba continue to be areas of focus; both mills have shown signs of improvement with a 2% and 3% increase in OME versus prior quarter

Q1 OME was 79%, working through capacity issues and focusing on target mills

Androscoggin is continuing to work through the shuttering of the groundwood pulp mill – impacting A3 operations

Benefited from a mild winter:

Energy prices, especially gas prices, have been low

Wood inventories have been replenished to a good position as we head into spring

CONFIDENTIAL 29

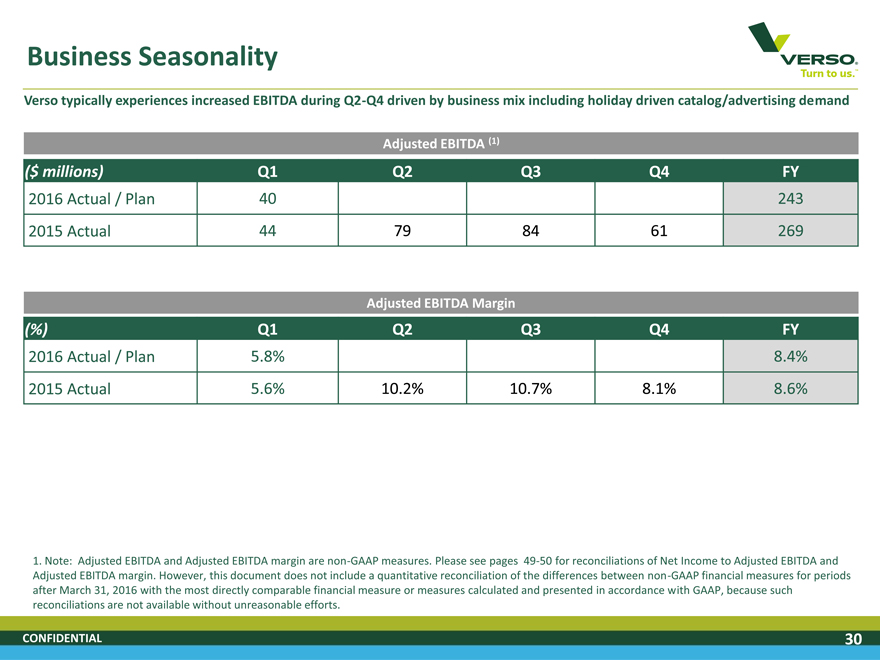

Business Seasonality

Verso typically experiences increased EBITDA during Q2-Q4 driven by business mix including holiday driven catalog/advertising demand

Adjusted EBITDA (1)

($ millions) Q1 Q2 Q3 Q4 FY

2016 Actual / Plan 40 243

2015 Actual 44 79 84 61 269

Adjusted EBITDA Margin

(%) Q1 Q2 Q3 Q4 FY

2016 Actual / Plan 5.8% 8.4%

2015 Actual 5.6% 10.2% 10.7% 8.1% 8.6%

1. Note: Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP measures. Please see pages 49-50 for reconciliations of Net Income to Adjusted EBITDA and Adjusted EBITDA margin. However, this document does not include a quantitative reconciliation of the differences between non-GAAP financial measures for periods after March 31, 2016 with the most directly comparable financial measure or measures calculated and presented in accordance with GAAP, because such reconciliations are not available without unreasonable efforts.

CONFIDENTIAL 30

Financial Projections Overview

CONFIDENTIAL

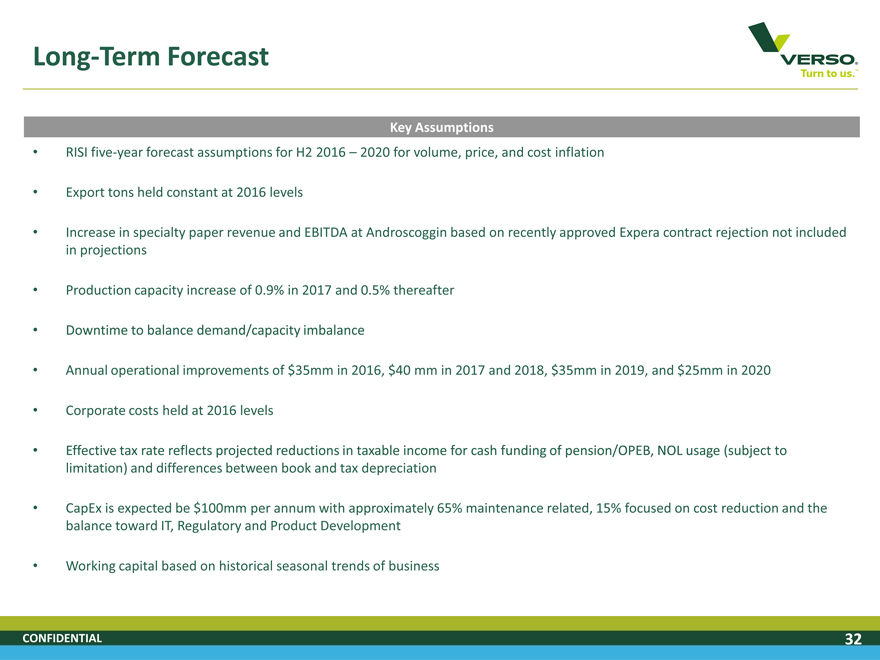

Long-Term Forecast

Key Assumptions

RISI five-year forecast assumptions for H2 2016 – 2020 for volume, price, and cost inflation

Export tons held constant at 2016 levels

Increase in specialty paper revenue and EBITDA at Androscoggin based on recently approved Expera contract rejection not included in projections

Production capacity increase of 0.9% in 2017 and 0.5% thereafter

Downtime to balance demand/capacity imbalance

Annual operational improvements of $35mm in 2016, $40 mm in 2017 and 2018, $35mm in 2019, and $25mm in 2020

Corporate costs held at 2016 levels

Effective tax rate reflects projected reductions in taxable income for cash funding of pension/OPEB, NOL usage (subject to limitation) and differences between book and tax depreciation

CapEx is expected be $100mm per annum with approximately 65% maintenance related, 15% focused on cost reduction and the balance toward IT, Regulatory and Product Development

Working capital based on historical seasonal trends of business

CONFIDENTIAL 32

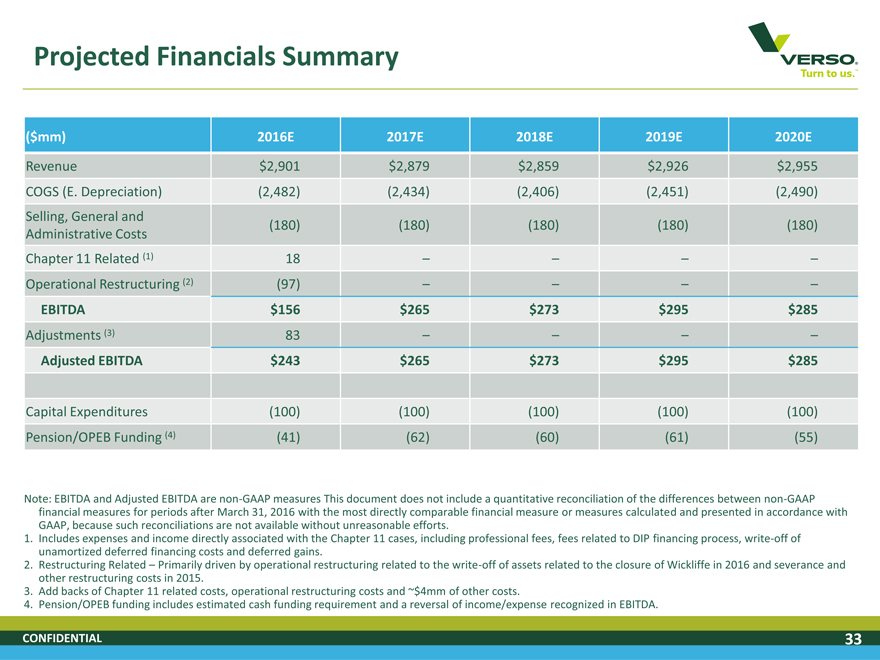

Projected Financials Summary

($mm) 2016E 2017E 2018E 2019E 2020E

Revenue $2,901 $2,879 $2,859 $2,926 $2,955

COGS (E. Depreciation) (2,482) (2,434) (2,406) (2,451) (2,490) Selling, General and (180) (180) (180) (180) (180) Administrative Costs Chapter 11 Related (1) 18 Operational Restructuring (2) (97) EBITDA $156 $265 $273 $295 $285

Adjustments (3) 83

Adjusted EBITDA $243 $265 $273 $295 $285

Capital Expenditures (100) (100) (100) (100) (100)

Pension/OPEB Funding (4) (41) (62) (60) (61) (55)

Note: EBITDA and Adjusted EBITDA are non-GAAP measures This document does not include a quantitative reconciliation of the differences between non-GAAP financial measures for periods after March 31, 2016 with the most directly comparable financial measure or measures calculated and presented in accordance with GAAP, because such reconciliations are not available without unreasonable efforts.

1. Includes expenses and income directly associated with the Chapter 11 cases, including professional fees, fees related to DIP financing process, write-off of unamortized deferred financing costs and deferred gains.

2. Restructuring Related – Primarily driven by operational restructuring related to the write-off of assets related to the closure of Wickliffe in 2016 and severance and other restructuring costs in 2015.

3. Add backs of Chapter 11 related costs, operational restructuring costs and ~$4mm of other costs.

4. Pension/OPEB funding includes estimated cash funding requirement and a reversal of income/expense recognized in EBITDA.

CONFIDENTIAL 33

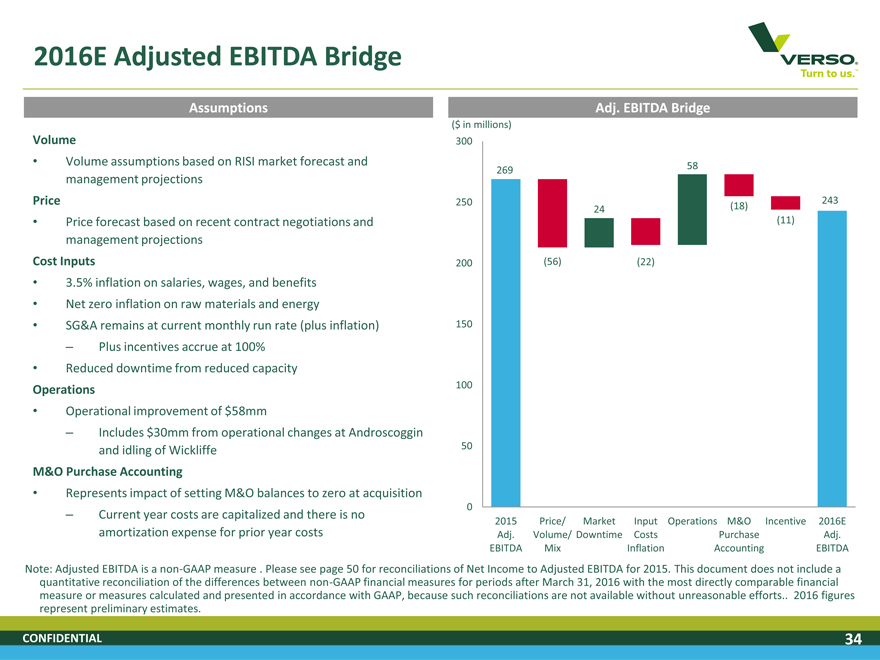

2016E Adjusted EBITDA Bridge

Assumptions Adj. EBITDA Bridge

($ in millions)

Volume 300

Volume assumptions based on RISI market forecast and 269 58 management projections

Price 250 243

24 (18)

Price forecast based on recent contract negotiations and (11) management projections

Cost Inputs 200 (56) (22)

3.5% inflation on salaries, wages, and benefits

Net zero inflation on raw materials and energy

SG&A remains at current monthly run rate (plus inflation) 150

– Plus incentives accrue at 100%

Reduced downtime from reduced capacity

Operations 100

Operational improvement of $58mm

– Includes $30mm from operational changes at Androscoggin and idling of Wickliffe 50

M&O Purchase Accounting

Represents impact of setting M&O balances to zero at acquisition

0

– Current year costs are capitalized and there is no

2015 Price/ Market Input Operations M&O Incentive 2016E

amortization expense for prior year costs Adj. Volume/ Downtime Costs Purchase Adj.

EBITDA Mix Inflation Accounting EBITDA

Note: Adjusted EBITDA is a non-GAAP measure . Please see page 50 for reconciliations of Net Income to Adjusted EBITDA for 2015. This document does not include a quantitative reconciliation of the differences between non-GAAP financial measures for periods after March 31, 2016 with the most directly comparable financial measure or measures calculated and presented in accordance with GAAP, because such reconciliations are not available without unreasonable efforts 2016 figures represent preliminary estimates.

CONFIDENTIAL 34

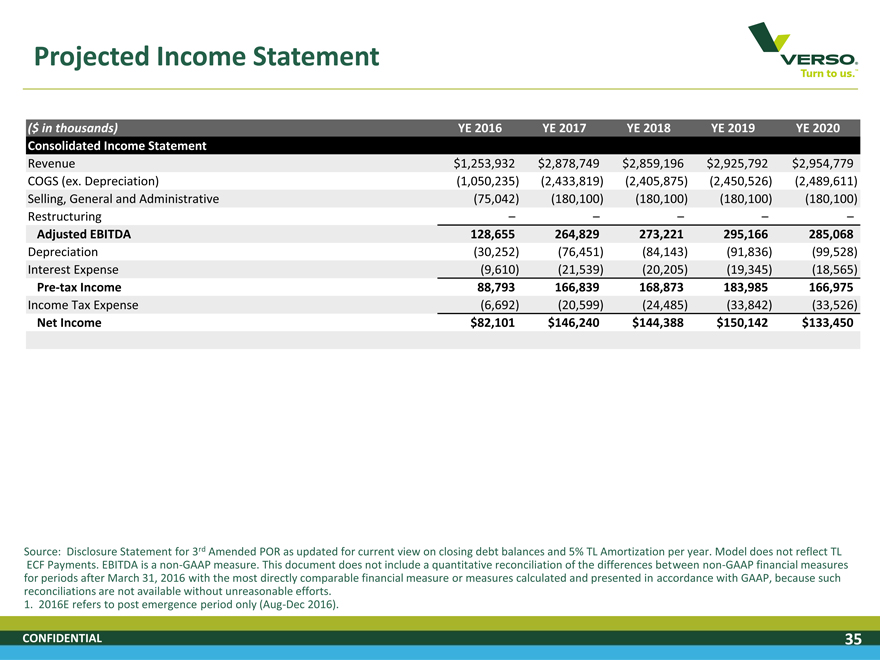

Projected Income Statement

($ in thousands) YE 2016 YE 2017 YE 2018 YE 2019 YE 2020 Consolidated Income Statement

Revenue $1,253,932 $2,878,749 $2,859,196 $2,925,792 $2,954,779 COGS (ex. Depreciation) (1,050,235) (2,433,819) (2,405,875) (2,450,526) (2,489,611) Selling, General and Administrative (75,042) (180,100) (180,100) (180,100) (180,100) Restructuring Adjusted EBITDA 128,655 264,829 273,221 295,166 285,068

Depreciation (30,252) (76,451) (84,143) (91,836) (99,528) Interest Expense (9,610) (21,539) (20,205) (19,345) (18,565)

Pre-tax Income 88,793 166,839 168,873 183,985 166,975

Income Tax Expense (6,692) (20,599) (24,485) (33,842) (33,526)

Net Income $82,101 $146,240 $144,388 $150,142 $133,450

Source: Disclosure Statement for 3rd Amended POR as updated for current view on closing debt balances and 5% TL Amortization per year. Model does not reflect TL ECF Payments. EBITDA is a non-GAAP measure. This document does not include a quantitative reconciliation of the differences between non-GAAP financial measures for periods after March 31, 2016 with the most directly comparable financial measure or measures calculated and presented in accordance with GAAP, because such reconciliations are not available without unreasonable efforts.

1. 2016E refers to post emergence period only (Aug-Dec 2016).

CONFIDENTIAL 35

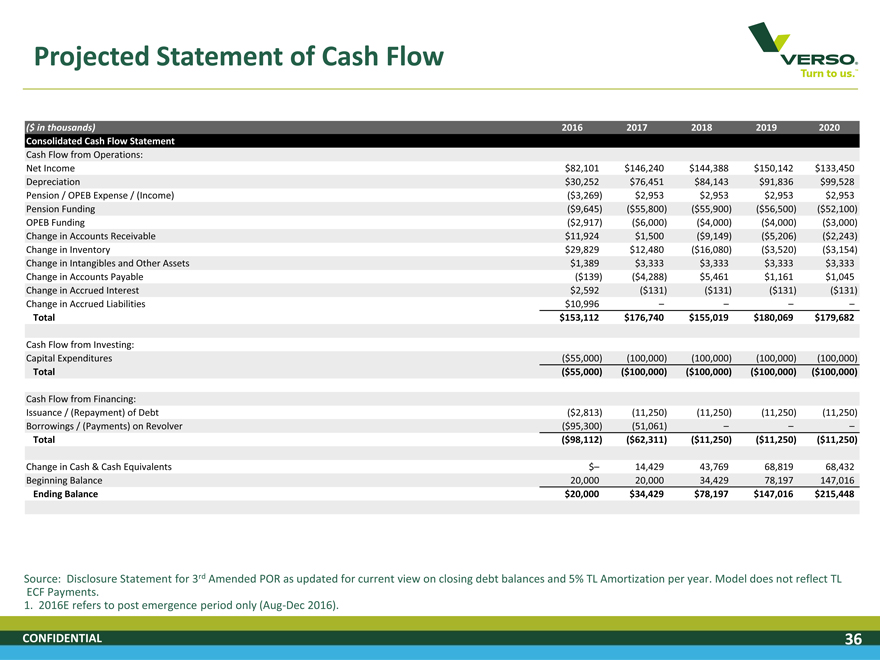

Projected Statement of Cash Flow

($ in thousands) 2016 (1) 2017 2018 2019 2020 Consolidated Cash Flow Statement

Cash Flow from Operations:

Net Income $82,101 $146,240 $144,388 $150,142 $133,450 Depreciation $30,252 $76,451 $84,143 $91,836 $99,528 Pension / OPEB Expense / (Income) ($3,269) $2,953 $2,953 $2,953 $2,953 Pension Funding ($9,645) ($55,800) ($55,900) ($56,500) ($52,100) OPEB Funding ($2,917) ($6,000) ($4,000) ($4,000) ($3,000) Change in Accounts Receivable $11,924 $1,500 ($9,149) ($5,206) ($2,243) Change in Inventory $29,829 $12,480 ($16,080) ($3,520) ($3,154) Change in Intangibles and Other Assets $1,389 $3,333 $3,333 $3,333 $3,333 Change in Accounts Payable ($139) ($4,288) $5,461 $1,161 $1,045 Change in Accrued Interest $2,592 ($131) ($131) ($131) ($131) Change in Accrued Liabilities $10,996 Total $153,112 $176,740 $155,019 $180,069 $179,682

Cash Flow from Investing:

Capital Expenditures ($55,000) (100,000) (100,000) (100,000) (100,000)

Total ($55,000) ($100,000) ($100,000) ($100,000) ($100,000)

Cash Flow from Financing:

Issuance / (Repayment) of Debt ($2,813) (11,250) (11,250) (11,250) (11,250) Borrowings / (Payments) on Revolver ($95,300) (51,061) Total ($98,112) ($62,311) ($11,250) ($11,250) ($11,250)

Change in Cash & Cash Equivalents $– 14,429 43,769 68,819 68,432 Beginning Balance 20,000 20,000 34,429 78,197 147,016

Ending Balance $20,000 $34,429 $78,197 $147,016 $215,448

Source: Disclosure Statement for 3rd Amended POR as updated for current view on closing debt balances and 5% TL Amortization per year. Model does not reflect TL ECF Payments.

1. 2016E refers to post emergence period only (Aug-Dec 2016).

CONFIDENTIAL 36

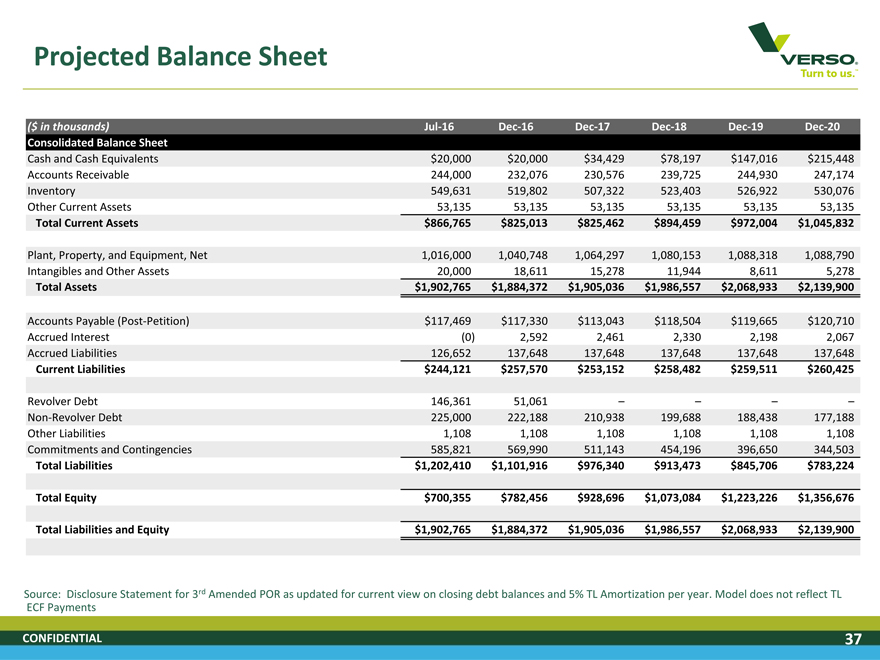

Projected Balance Sheet

($ in thousands) Jul-16 Dec-16 Dec-17 Dec-18 Dec-19 Dec-20 Consolidated Balance Sheet

Cash and Cash Equivalents $20,000 $20,000 $34,429 $78,197 $147,016 $215,448 Accounts Receivable 244,000 232,076 230,576 239,725 244,930 247,174 Inventory 549,631 519,802 507,322 523,403 526,922 530,076 Other Current Assets 53,135 53,135 53,135 53,135 53,135 53,135

Total Current Assets $866,765 $825,013 $825,462 $894,459 $972,004 $1,045,832

Plant, Property, and Equipment, Net 1,016,000 1,040,748 1,064,297 1,080,153 1,088,318 1,088,790 Intangibles and Other Assets 20,000 18,611 15,278 11,944 8,611 5,278

Total Assets $1,902,765 $1,884,372 $1,905,036 $1,986,557 $2,068,933 $2,139,900

Accounts Payable (Post-Petition) $117,469 $117,330 $113,043 $118,504 $119,665 $120,710 Accrued Interest (0) 2,592 2,461 2,330 2,198 2,067 Accrued Liabilities 126,652 137,648 137,648 137,648 137,648 137,648

Current Liabilities $244,121 $257,570 $253,152 $258,482 $259,511 $260,425

Revolver Debt 146,361 51,061–Non-Revolver Debt 225,000 222,188 210,938 199,688 188,438 177,188 Other Liabilities 1,108 1,108 1,108 1,108 1,108 1,108 Commitments and Contingencies 585,821 569,990 511,143 454,196 396,650 344,503

Total Liabilities $1,202,410 $1,101,916 $976,340 $913,473 $845,706 $783,224 Total Equity $700,355 $782,456 $928,696 $1,073,084 $1,223,226 $1,356,676 Total Liabilities and Equity $1,902,765 $1,884,372 $1,905,036 $1,986,557 $2,068,933 $2,139,900

Source: Disclosure Statement for 3rd Amended POR as updated for current view on closing debt balances and 5% TL Amortization per year. Model does not reflect TL ECF Payments

CONFIDENTIAL 37

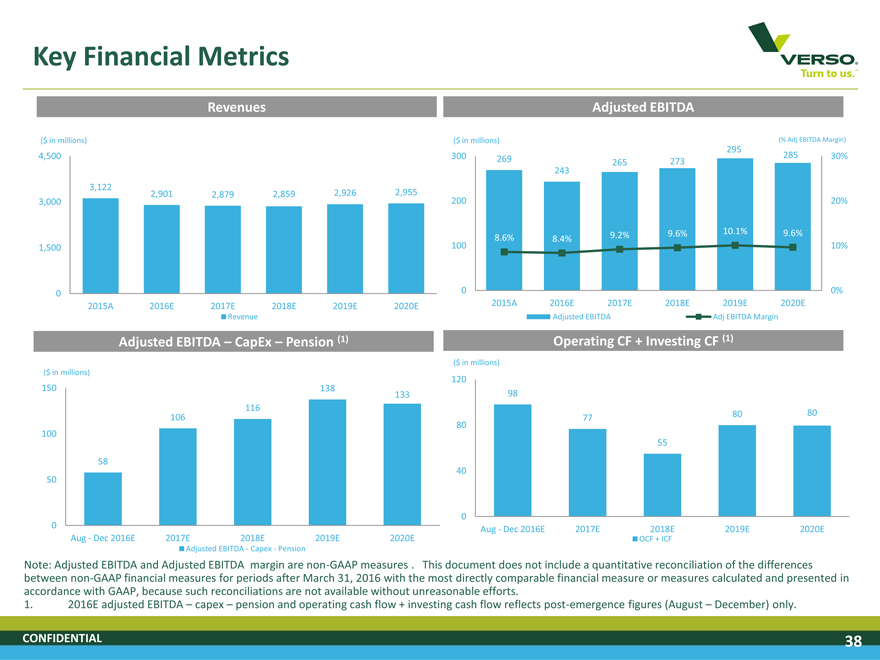

Key Financial Metrics

Revenues Adjusted EBITDA

($ in millions) ($ in millions) (% Adj EBITDA Margin)

295

4,500 300 285 30% 269 265 273 243 3,122 2,901 2,879 2,859 2,926 2,955 3,000 200 20%

9.6% 10.1% 9.6%

8.6% 9.2%

8.4%

1,500 100 10%

0 0 0% 2015A 2016E 2017E 2018E 2019E 2020E 2015A 2016E 2017E 2018E 2019E 2020E

Revenue Adjusted EBITDA Adj EBITDA Margin

Adjusted EBITDA – CapEx – Pension (1) Operating CF + Investing CF (1)

($ in millions) ($ in millions) 120

150 138

133 98 116

80 80 106 80 77 100 55

58

40 50

0 0

Aug—Dec 2016E 2017E 2018E 2019E 2020E Aug—Dec 2016E 2017E 2018E 2019E 2020E OCF + ICF

Adjusted EBITDA—Capex—Pension

Note: Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP measures . This document does not include a quantitative reconciliation of the differences between non-GAAP financial measures for periods after March 31, 2016 with the most directly comparable financial measure or measures calculated and presented in accordance with GAAP, because such reconciliations are not available without unreasonable efforts.

1. 2016E adjusted EBITDA – capex – pension and operating cash flow + investing cash flow reflects post-emergence figures (August – December) only.

CONFIDENTIAL 38

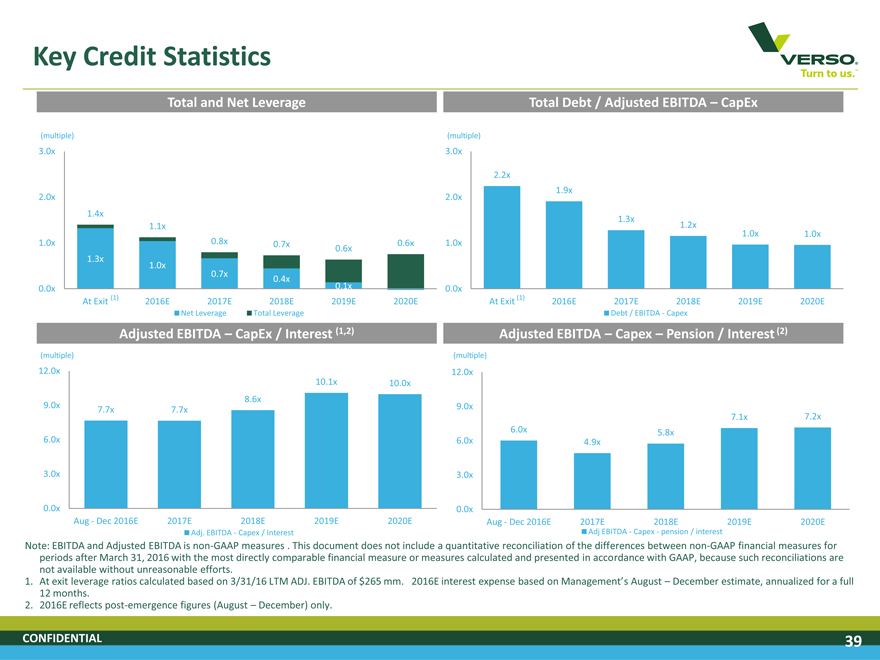

Key Credit Statistics

Total and Net Leverage Total Debt / Adjusted EBITDA – CapEx

(multiple) (multiple)

3.0x 3.0x

10.7x 14. 2.2x 0x

2.0x 2.0x 1.9x

1.4x 1.3x

1.1x 1.2x

0.8x 1.0x 1.0x

1.0x 0.7x 0.6x 1.0x

0.6x

1.3x 1.0x

0.7x 0.4x 0.1x

0.0x 0.0x

At Exit (1) 2016E 2017E 2018E 2019E 2020E At Exit (1) 2016E 2017E 2018E 2019E 2020E

Net Leverage Total Leverage Debt / EBITDA—Capex

Adjusted EBITDA – CapEx / Interest (1,2) Adjusted EBITDA – Capex – Pension / Interest (2)

(multiple) (multiple) 12.0x 12.0x 10.1x 10.0x 8.6x

9.0x 9.0x

7.7x 7.7x 7.1x 7.2x 6.0x 5.8x

6.0x 6.0x 4.9x 3.0x 3.0x

0.0x 0.0x

Aug—Dec 2016E 2017E 2018E 2019E 2020E Aug—Dec 2016E 2017E 2018E 2019E 2020E

Adj. EBITDA—Capex / Interest Adj EBITDA—Capex—pension / interest

Note: EBITDA and Adjusted EBITDA is non-GAAP measures . This document does not include a quantitative reconciliation of the differences between non-GAAP financial measures for periods after March 31, 2016 with the most directly comparable financial measure or measures calculated and presented in accordance with GAAP, because such reconciliations are not available without unreasonable efforts.

1. At exit leverage ratios calculated based on 3/31/16 LTM ADJ. EBITDA of $265 mm. 2016E interest expense based on Management’s August – December estimate, annualized for a full

12 months.

2. 2016E reflects post-emergence figures (August – December) only.

CONFIDENTIAL 39

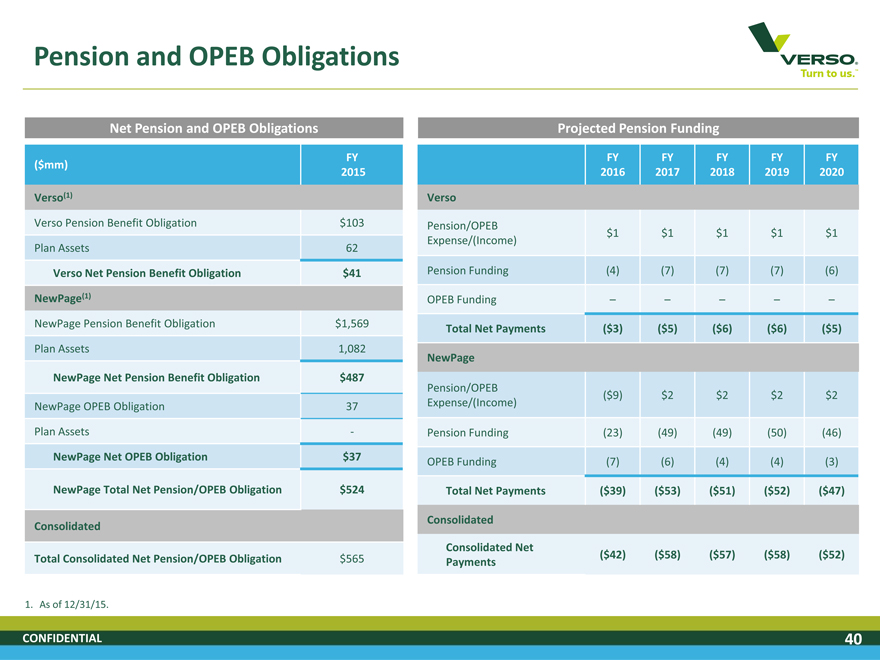

Pension and OPEB Obligations

Net Pension and OPEB Obligations Projected Pension Funding

FY FY FY FY FY FY ($mm) 2015 2016 2017 2018 2019 2020

Verso(1) Verso

Verso Pension Benefit Obligation $103 Pension/OPEB

$1 $1 $1 $1 $1 Expense/(Income) Plan Assets 62

Verso Net Pension Benefit Obligation $41 Pension Funding (4) (7) (7) (7) (6)

NewPage(1) OPEB Funding – – – – –

NewPage Pension Benefit Obligation $1,569

Total Net Payments ($3) ($5) ($6) ($6) ($5)

Plan Assets 1,082

NewPage NewPage Net Pension Benefit Obligation $487

Pension/OPEB

($9) $2 $2 $2 $2 NewPage OPEB Obligation 37 Expense/(Income) Plan Assets—Pension Funding (23) (49) (49) (50) (46)

NewPage Net OPEB Obligation $37

OPEB Funding (7) (6) (4) (4) (3)

NewPage Total Net Pension/OPEB Obligation $524 Total Net Payments ($39) ($53) ($51) ($52) ($47)

Consolidated Consolidated

Consolidated Net

Total Consolidated Net Pension/OPEB Obligation $565 ($42) ($58) ($57) ($58) ($52) Payments

1. As of 12/31/15.

CONFIDENTIAL 40

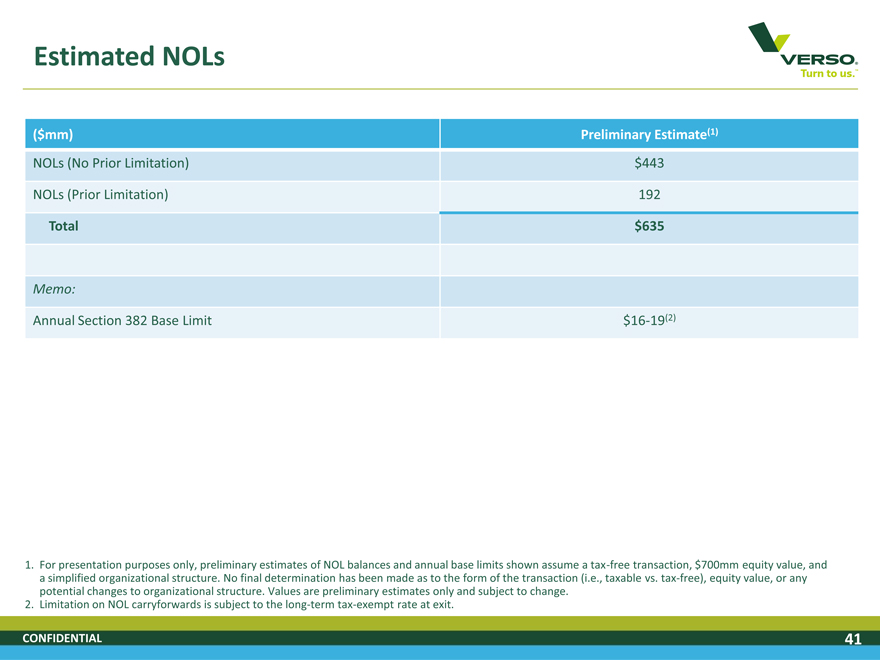

Estimated NOLs

VERSO Turn to us.

($mm) Preliminary Estimate(1)

NOLs (No Prior Limitation) $443

NOLs (Prior Limitation) 192

Total $635

Memo:

Annual Section 382 Base Limit $16-19(2)

1. For presentation purposes only, preliminary estimates of NOL balances and annual base limits shown assume a tax-free transaction, $700mm equity value, and a simplified organizational structure. No final determination has been made as to the form of the transaction (i.e., taxable vs. tax-free), equity value, or any potential changes to organizational structure. Values are preliminary estimates only and subject to change.

2. Limitation on NOL carryforwards is subject to the long-term tax-exempt rate at exit.

CONFIDENTIAL 41

VERSO Turn to us.

Transaction Overview

CONFIDENTIAL

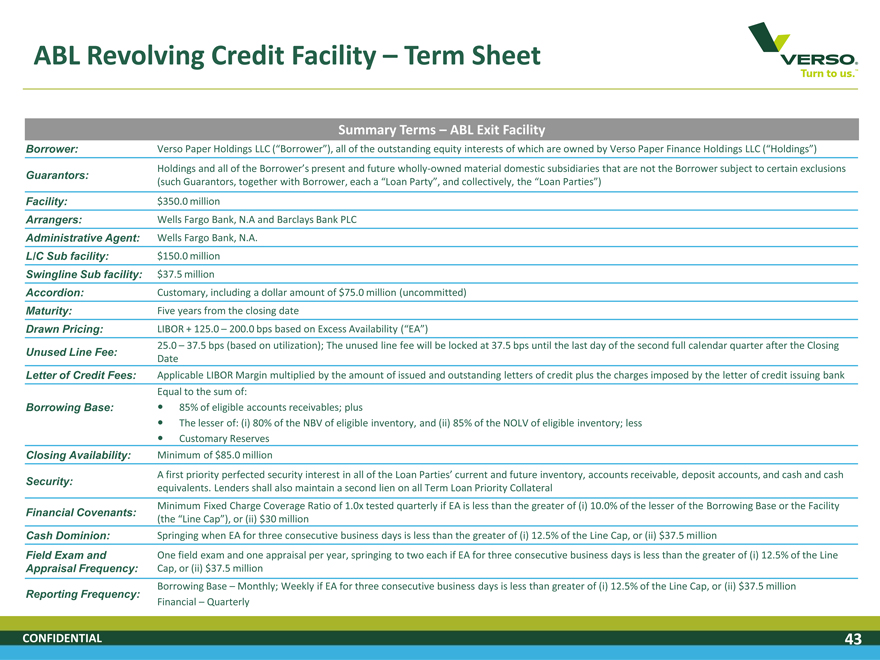

ABL Revolving Credit Facility – Term Sheet

VERSO Turn to us.

Summary Terms – ABL Exit Facility

Borrower: Verso Paper Holdings LLC (“Borrower”), all of the outstanding equity interests of which are owned by Verso Paper Finance Holdings LLC (“Holdings”)

Guarantors: Holdings and all of the Borrower’s present and future wholly-owned material domestic subsidiaries that are not the Borrower subject to certain exclusions

(such Guarantors, together with Borrower, each a “Loan Party”, and collectively, the “Loan Parties”) Facility: $350.0 million

Arrangers: Wells Fargo Bank, N.A and Barclays Bank PLC

Administrative Agent: Wells Fargo Bank, N.A.

L/C Sub facility: $150.0 million

Swingline Sub facility: $37.5 million

Accordion: Customary, including a dollar amount of $75.0 million (uncommitted)

Maturity: Five years from the closing date

Drawn Pricing: LIBOR + 125.0 – 200.0 bps based on Excess Availability (“EA”)

Unused Line Fee: 25.0 – 37.5 bps (based on utilization); The unused line fee will be locked at 37.5 bps until the last day of the second full calendar quarter after the Closing Date

Letter of Credit Fees: Applicable LIBOR Margin multiplied by the amount of issued and outstanding letters of credit plus the charges imposed by the letter of credit issuing bank

Equal to the sum of: Borrowing Base: 85% of eligible accounts receivables; plus

The lesser of: (i) 80% of the NBV of eligible inventory, and (ii) 85% of the NOLV of eligible inventory; less

Customary Reserves

Closing Availability: Minimum of $85.0 million

Security: A first priority perfected security interest in all of the Loan Parties’ current and future inventory, accounts receivable, deposit accounts, and cash and cash equivalents. Lenders shall also maintain a second lien on all Term Loan Priority Collateral

Financial Covenants: Minimum Fixed Charge Coverage Ratio of 1.0x tested quarterly if EA is less than the greater of (i) 10.0% of the lesser of the Borrowing Base or the Facility (the “Line Cap”), or (ii) $30 million

Cash Dominion: Springing when EA for three consecutive business days is less than the greater of (i) 12.5% of the Line Cap, or (ii) $37.5 million

Field Exam and One field exam and one appraisal per year, springing to two each if EA for three consecutive business days is less than the greater of (i) 12.5% of the Line

Appraisal Frequency: Cap, or (ii) $37.5 million

Borrowing Base – Monthly; Weekly if EA for three consecutive business days is less than greater of (i) 12.5% of the Line Cap, or (ii) $37.5 million

Reporting Frequency:

Financial – Quarterly

CONFIDENTIAL 43

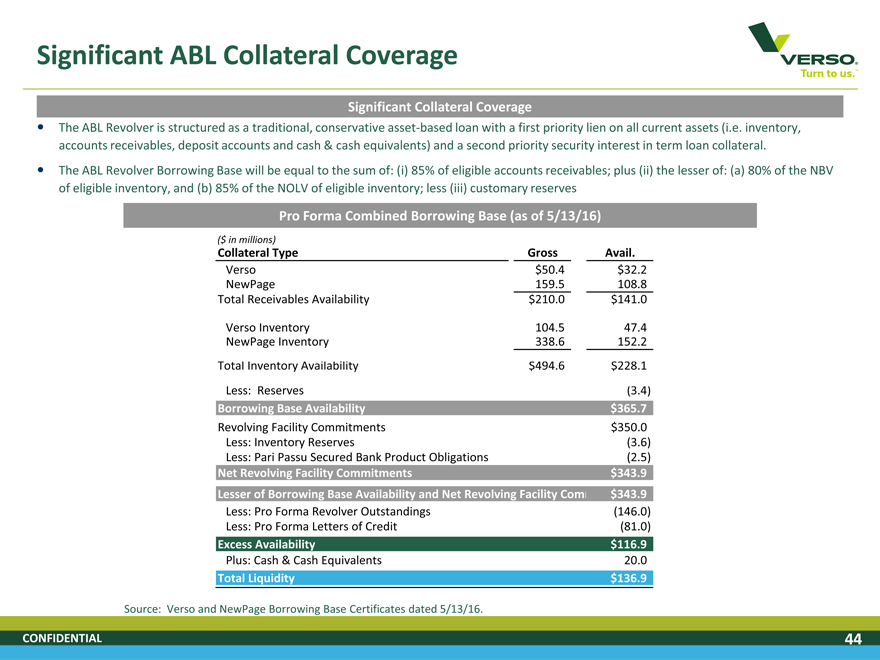

Significant ABL Collateral Coverage

VERSO Turn to us.

Significant Collateral Coverage

The ABL Revolver is structured as a traditional, conservative asset-based loan with a first priority lien on all current assets (i.e. inventory, accounts receivables, deposit accounts and cash & cash equivalents) and a second priority security interest in term loan collateral.

The ABL Revolver Borrowing Base will be equal to the sum of: (i) 85% of eligible accounts receivables; plus (ii) the lesser of: (a) 80% of the NBV of eligible inventory, and (b) 85% of the NOLV of eligible inventory; less (iii) customary reserves

Pro Forma Combined Borrowing Base (as of 5/13/16)

($ in millions)

Collateral Type Gross Avail.

Verso $50.4 $32.2

NewPage 159.5 108.8

Total Receivables Availability $210.0 $141.0

Verso Inventory 104.5 47.4

NewPage Inventory 338.6 152.2

Total Inventory Availability $494.6 $228.1

Less: Reserves (3.4)

Borrowing Base Availability $365.7

Revolving Facility Commitments $350.0

Less: Inventory Reserves (3.6)

Less: Pari Passu Secured Bank Product Obligations (2.5)

Net Revolving Facility Commitments $343.9

Lesser of Borrowing Base Availability and Net Revolving Facility Com $343.9

Less: Pro Forma Revolver Outstandings (146.0)

Less: Pro Forma Letters of Credit (81.0)

Excess Availability $116.9

Plus: Cash & Cash Equivalents 20.0

Total Liquidity $136.9

Source: Verso and NewPage Borrowing Base Certificates dated 5/13/16.

CONFIDENTIAL 44

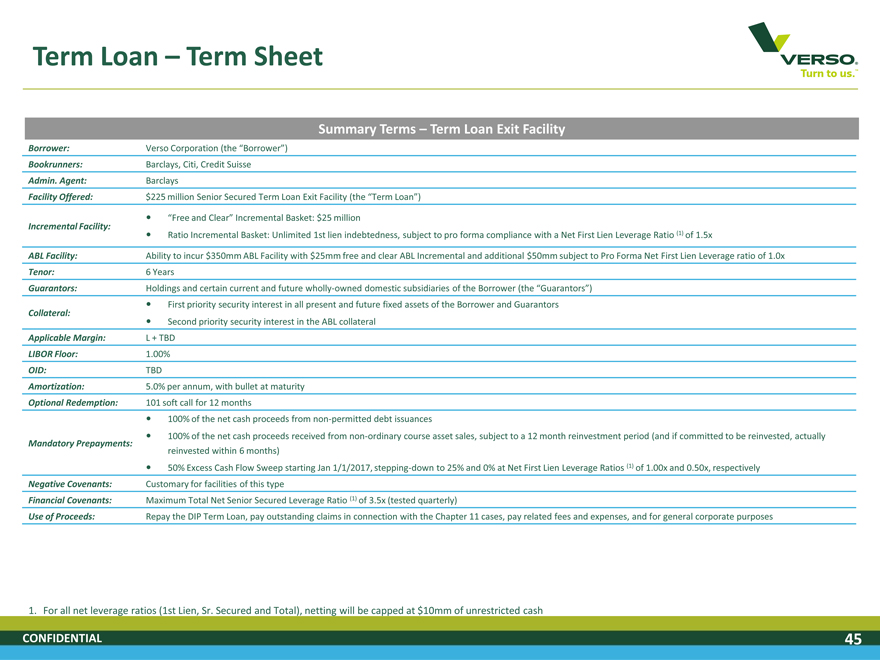

Term Loan – Term Sheet

VERSO Turn to us.

Summary Terms – Term Loan Exit Facility

Borrower: Verso Corporation (the “Borrower”)

Bookrunners: Barclays, Citi, Credit Suisse

Admin. Agent: Barclays

Facility Offered: $225 million Senior Secured Term Loan Exit Facility (the “Term Loan”)

“Free and Clear” Incremental Basket: $25 million

Incremental Facility:

Ratio Incremental Basket: Unlimited 1st lien indebtedness, subject to pro forma compliance with a Net First Lien Leverage Ratio (1) of 1.5x

ABL Facility: Ability to incur $350mm ABL Facility with $25mm free and clear ABL Incremental and additional $50mm subject to Pro Forma Net First Lien Leverage ratio of 1.0x

Tenor: 6 Years

Guarantors: Holdings and certain current and future wholly-owned domestic subsidiaries of the Borrower (the “Guarantors”)

First priority security interest in all present and future fixed assets of the Borrower and Guarantors

Collateral:

Second priority security interest in the ABL collateral

Applicable Margin: L + TBD

LIBOR Floor: 1.00%

OID: TBD

Amortization: 5.0% per annum, with bullet at maturity

Optional Redemption: 101 soft call for 12 months

100% of the net cash proceeds from non-permitted debt issuances

100% of the net cash proceeds received from non-ordinary course asset sales, subject to a 12 month reinvestment period (and if committed to be reinvested, actually reinvested within 6 months)

Mandatory Prepayments:

50% Excess Cash Flow Sweep starting Jan 1/1/2017, stepping-down to 25% and 0% at Net First Lien Leverage Ratios (1) of 1.00x and 0.50x, respectively

Negative Covenants: Customary for facilities of this type

Financial Covenants: Maximum Total Net Senior Secured Leverage Ratio (1) of 3.5x (tested quarterly)

Use of Proceeds: Repay the DIP Term Loan, pay outstanding claims in connection with the Chapter 11 cases, pay related fees and expenses, and for general corporate purposes

1. For all net leverage ratios (1st Lien, Sr. Secured and Total), netting will be capped at $10mm of unrestricted cash

CONFIDENTIAL 45

Financing Timeline

VERSO Turn to us.

June 2016 July 2016

S M T W T F S S M T W T F S

1 2 3 4 1 2

5 6 7 8 9 10 11 3 4 5 6 7 8 9

12 13 14 15 16 17 18 10 11 12 13 14 15 16

19 20 21 22 23 24 25 17 18 19 20 21 22 23 24

26 27 28 29 30 25 26 27 28 29 30 Bank holiday 31

Week Company/BK Process ABL Process TL Process

6/6/16 File POR Sup. with draft exit financing TS Launch ABL retail syndication (6/6) Launch TL syndication (6/6) and board of directors (6/8)

6/20/16 Confirmation Hearing (6/23) Commitments are due on 6/20 at 5 PM ET Commitments are due on 6/20 at 5 PM ET

Finalize ABL documentation Finalize Credit Agreement

Finalize allocations and close syndication Allocate TL and close TL syndication

July (expected) Emergence Funding of ABL Funding of Term Loan

CONFIDENTIAL 46

Public-Side Q&A

VERSO Turn to us.

Leading Producer with Significant Share of Manufacturing Capacity

Profitable Low Cost Mill Portfolio

Broad Product Offering

Exposure to Growing Specialty Paper Grades

Substantial Cost Savings Achieved

Significant Collateral Coverage

CONFIDENTIAL 47

Appendices

VERSO Turn to us.

CONFIDENTIAL

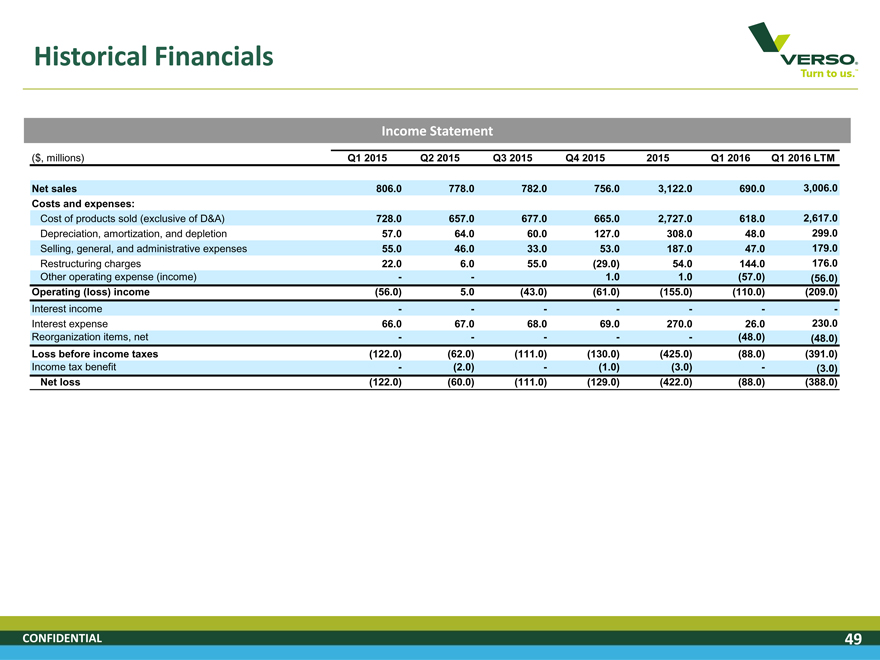

Historical Financials

VERSO Turn to us.

Income Statement

($, millions) Q1 2015 Q2 2015 Q3 2015 Q4 2015 2015 Q1 2016 Q1 2016 LTM

Net sales 806.0 778.0 782.0 756.0 3,122.0 690.0 3,006.0

Costs and expenses:

Cost of products sold (exclusive of D&A) 728.0 657.0 677.0 665.0 2,727.0 618.0 2,617.0

Depreciation, amortization, and depletion 57.0 64.0 60.0 127.0 308.0 48.0 299.0

Selling, general, and administrative expenses 55.0 46.0 33.0 53.0 187.0 47.0 179.0

Restructuring charges 22.0 6.0 55.0 (29.0) 54.0 144.0 176.0

Other operating expense (income) — 1.0 1.0 (57.0) (56.0)

Operating (loss) income (56.0) 5.0 (43.0) (61.0) (155.0) (110.0) (209.0)

Interest income — — — -

Interest expense 66.0 67.0 68.0 69.0 270.0 26.0 230.0

Reorganization items, net — ——(48.0) (48.0)

Loss before income taxes (122.0) (62.0) (111.0) (130.0) (425.0) (88.0) (391.0)

Income tax benefit—(2.0)—(1.0) (3.0)—(3.0)

Net loss (122.0) (60.0) (111.0) (129.0) (422.0) (88.0) (388.0)

CONFIDENTIAL 49

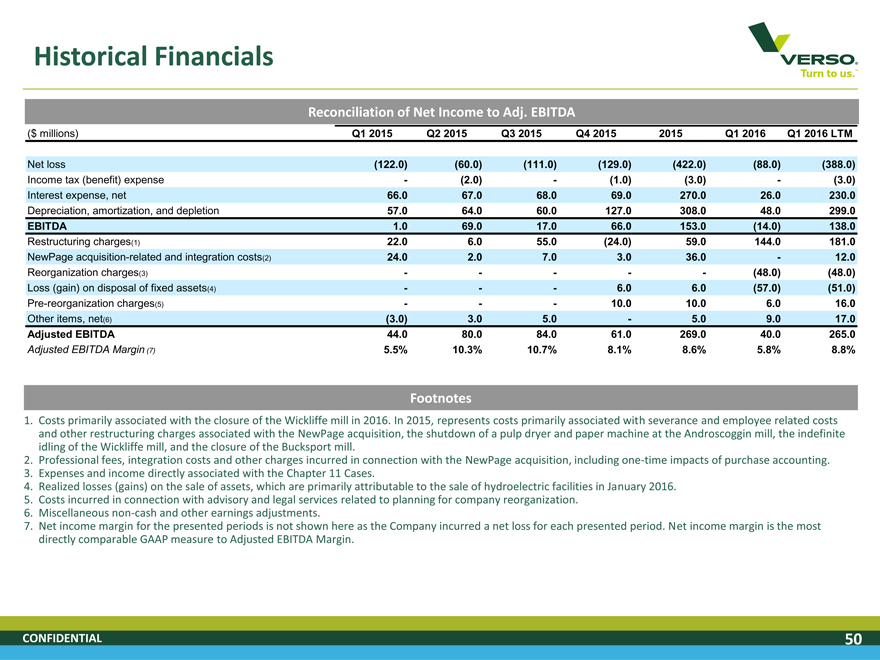

Historical Financials

VERSO Turn to us.

Reconciliation of Net Income to Adj. EBITDA

($ millions) Q1 2015 Q2 2015 Q3 2015 Q4 2015 2015 Q1 2016 Q1 2016 LTM

Net loss (122.0) (60.0) (111.0) (129.0) (422.0) (88.0) (388.0)

Income tax (benefit) expense—(2.0)—(1.0) (3.0)—(3.0)

Interest expense, net 66.0 67.0 68.0 69.0 270.0 26.0 230.0

Depreciation, amortization, and depletion 57.0 64.0 60.0 127.0 308.0 48.0 299.0

EBITDA 1.0 69.0 17.0 66.0 153.0 (14.0) 138.0

Restructuring charges(1) 22.0 6.0 55.0 (24.0) 59.0 144.0 181.0

NewPage acquisition-related and integration costs(2) 24.0 2.0 7.0 3.0 36.0—12.0

Reorganization charges(3) — ——(48.0) (48.0)

Loss (gain) on disposal of fixed assets(4) ——6.0 6.0 (57.0) (51.0)

Pre-reorganization charges(5) ——10.0 10.0 6.0 16.0

Other items, net(6) (3.0) 3.0 5.0—5.0 9.0 17.0

Adjusted EBITDA 44.0 80.0 84.0 61.0 269.0 40.0 265.0

Adjusted EBITDA Margin (7) 5.5% 10.3% 10.7% 8.1% 8.6% 5.8% 8.8%

Footnotes

1. Costs primarily associated with the closure of the Wickliffe mill in 2016. In 2015, represents costs primarily associated with severance and employee related costs and other restructuring charges associated with the NewPage acquisition, the shutdown of a pulp dryer and paper machine at the Androscoggin mill, the indefinite idling of the Wickliffe mill, and the closure of the Bucksport mill.

2. Professional fees, integration costs and other charges incurred in connection with the NewPage acquisition, including one-time impacts of purchase accounting.

3. Expenses and income directly associated with the Chapter 11 Cases.

4. Realized losses (gains) on the sale of assets, which are primarily attributable to the sale of hydroelectric facilities in January 2016.

5. Costs incurred in connection with advisory and legal services related to planning for company reorganization.

6. Miscellaneous non-cash and other earnings adjustments.

7. Net income margin for the presented periods is not shown here as the Company incurred a net loss for each presented period. Net income margin is the most directly comparable GAAP measure to Adjusted EBITDA Margin.

CONFIDENTIAL 50

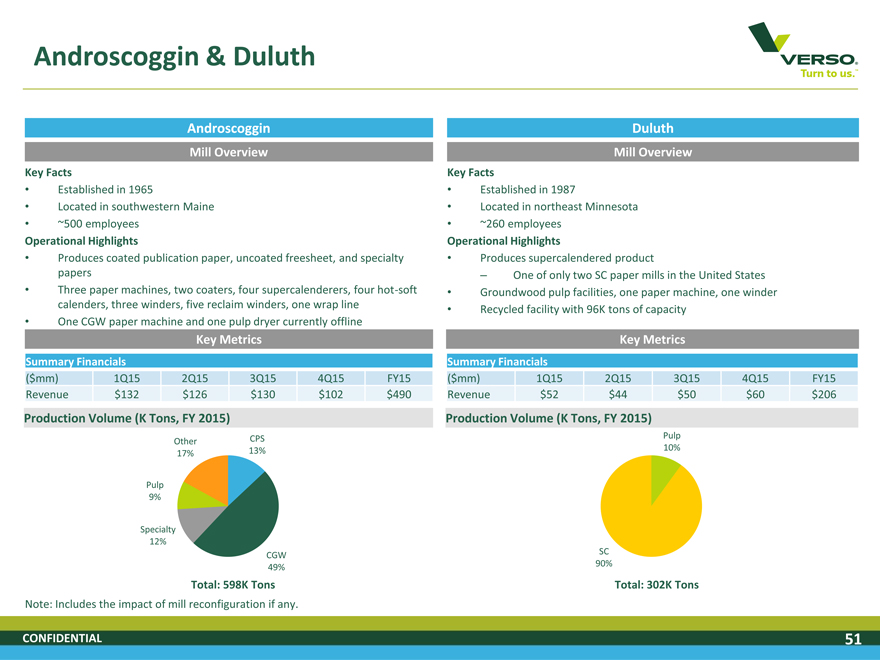

Androscoggin & Duluth

VERSO Turn to us.

Androscoggin

Mill Overview

Key Facts

Established in 1965

Located in southwestern Maine

~500 employees

Operational Highlights

Produces coated publication paper, uncoated freesheet, and specialty papers

Three paper machines, two coaters, four supercalenderers, four hot-soft calenders, three winders, five reclaim winders, one wrap line

One CGW paper machine and one pulp dryer currently offline

Key Metrics

Summary Financials

($mm) 1Q15 2Q15 3Q15 4Q15 FY15 Revenue $132 $126 $130 $102 $490

Production Volume (K Tons, FY 2015)

Other CPS 17% 13%

Pulp 9%

Specialty 12%

CGW 49%

Total: 598K Tons

Note: Includes the impact of mill reconfiguration if any.

Duluth

Mill Overview

Key Facts

Established in 1987

Located in northeast Minnesota

~260 employees

Operational Highlights

Produces supercalendered product

– One of only two SC paper mills in the United States

Groundwood pulp facilities, one paper machine, one winder

Recycled facility with 96K tons of capacity

Key Metrics

Summary Financials

($mm) 1Q15 2Q15 3Q15 4Q15 FY15 Revenue $52 $44 $50 $60 $206

Production Volume (K Tons, FY 2015)

Pulp 10%

SC 90%

Total: 302K Tons

CONFIDENTIAL 51

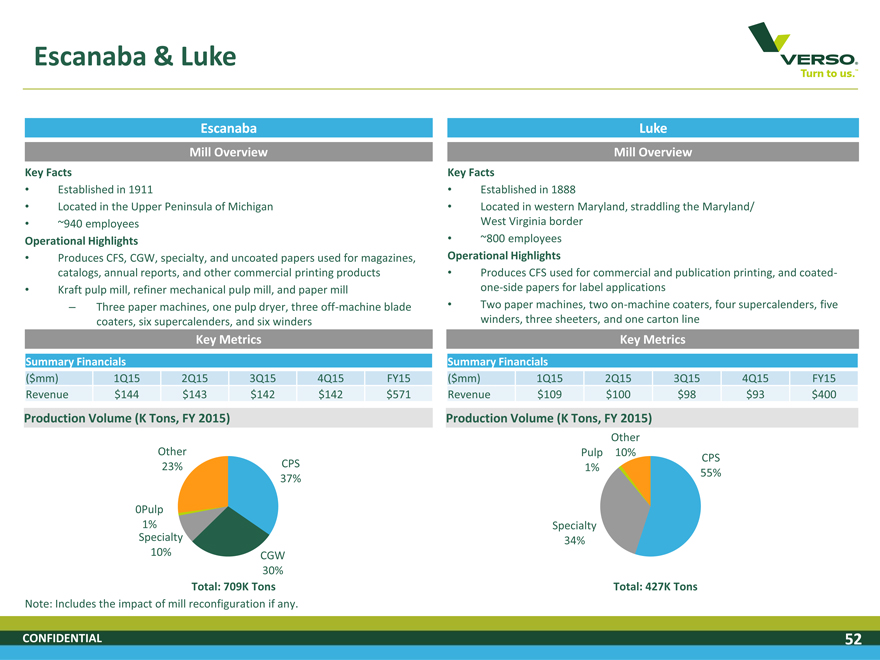

Escanaba & Luke

VERSO Turn to us.

Escanaba

Mill Overview

Key Facts

Established in 1911

Located in the Upper Peninsula of Michigan

~940 employees

Operational Highlights

Produces CFS, CGW, specialty, and uncoated papers used for magazines, catalogs, annual reports, and other commercial printing products

Kraft pulp mill, refiner mechanical pulp mill, and paper mill

– Three paper machines, one pulp dryer, three off-machine blade coaters, six supercalenders, and six winders

Key Metrics

Summary Financials

($mm) 1Q15 2Q15 3Q15 4Q15 FY15 Revenue $144 $143 $142 $142 $571

Production Volume (K Tons, FY 2015)

Other

23% CPS 37%

0Pulp 1% Specialty

10% CGW 30%

Total: 709K Tons

Note: Includes the impact of mill reconfiguration if any. Luke

Mill Overview

Key Facts

Established in 1888

Located in western Maryland, straddling the Maryland/ West Virginia border

~800 employees

Operational Highlights

Produces CFS used for commercial and publication printing, and coated-one-side papers for label applications

Two paper machines, two on-machine coaters, four supercalenders, five winders, three sheeters, and one carton line

Key Metrics

Summary Financials

($mm) 1Q15 2Q15 3Q15 4Q15 FY15 Revenue $109 $100 $98 $93 $400

Production Volume (K Tons, FY 2015)

Other Pulp 10%

1% CPS 55%

Specialty 34%

Total: 427K Tons

CONFIDENTIAL 52

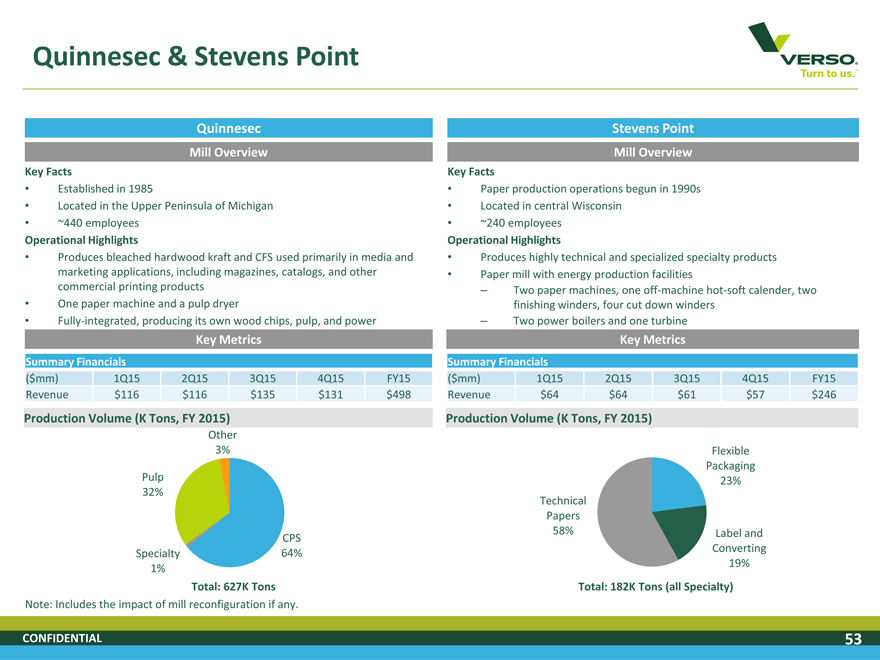

Quinnesec & Stevens Point

VERSO Turn to us.

Quinnesec

Mill Overview

Key Facts

Established in 1985

Located in the Upper Peninsula of Michigan

~440 employees

Operational Highlights

Produces bleached hardwood kraft and CFS used primarily in media and marketing applications, including magazines, catalogs, and other commercial printing products

One paper machine and a pulp dryer

Fully-integrated, producing its own wood chips, pulp, and power

Key Metrics

Summary Financials

($mm) 1Q15 2Q15 3Q15 4Q15 FY15 Revenue $116 $116 $135 $131 $498

Production Volume (K Tons, FY 2015)

Other 3%

Pulp 32%

CPS Specialty 64% 1%

Total: 627K Tons

Note: Includes the impact of mill reconfiguration if any.

Stevens Point

Mill Overview

Key Facts

Paper production operations begun in 1990s

Located in central Wisconsin

~240 employees

Operational Highlights

Produces highly technical and specialized specialty products

Paper mill with energy production facilities

– Two paper machines, one off-machine hot-soft calender, two finishing winders, four cut down winders

– Two power boilers and one turbine

Key Metrics

Summary Financials

($mm) 1Q15 2Q15 3Q15 4Q15 FY15 Revenue $64 $64 $61 $57 $246

Production Volume (K Tons, FY 2015)

Flexible Packaging 23% Technical Papers 58% Label and Converting 19%

Total: 182K Tons (all Specialty)

CONFIDENTIAL 53

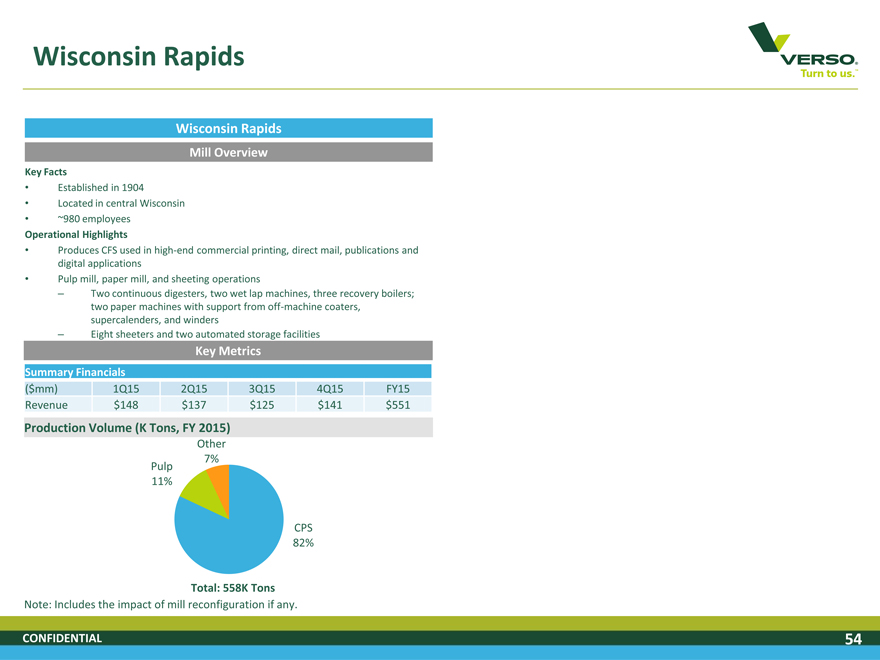

Wisconsin Rapids

VERSO Turn to us.

Wisconsin Rapids

Mill Overview

Key Facts

Established in 1904

Located in central Wisconsin

~980 employees

Operational Highlights

Produces CFS used in high-end commercial printing, direct mail, publications and digital applications

Pulp mill, paper mill, and sheeting operations

– Two continuous digesters, two wet lap machines, three recovery boilers; two paper machines with support from off-machine coaters, supercalenders, and winders

– Eight sheeters and two automated storage facilities

Key Metrics

Summary Financials

($mm) 1Q15 2Q15 3Q15 4Q15 FY15 Revenue $148 $137 $125 $141 $551

Production Volume (K Tons, FY 2015)

Other 7% Pulp 11%

CPS 82%

Total: 558K Tons

Note: Includes the impact of mill reconfiguration if any.

CONFIDENTIAL 54