Q4 2022 & Annual Earnings Slides February 21, 2023

2 Forward-Looking Statements This presentation includes forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based on management’s current expectations, are not guarantees of future performance and are subject to certain risks, trends, and uncertainties that could cause actual results to differ materially from those projected, expressed or implied by such forward-looking statements. Many of these risk factors are outside of the company’s control, and as such, they involve risks which are not currently known to the company that could cause actual results to differ materially from forecasted results. Factors that could cause or contribute to such differences include those uncertainties regarding the impact of the COVID-19 pandemic on our business and the economy generally, and those other matters disclosed in the company’s Securities and Exchange Commission filings. The forward-looking statements in this document are made as of the date hereof and the company does not undertake to update its forward-looking statements.

3 2023 Guidance 2023 GUIDANCE (in millions, except per share amounts) Low High Income from continuing operations $33 $48 Add back: Income taxes 16 23 Interest expense, net of interest income 170 180 Depreciation and amortization 95 100 EBITDA $314 $351 Total deductions, net (64) (81) Adjusted EBITDA $250 $270 Income (loss) from continuing operations per share – diluted * ($0.08) $0.02 Income from continuing operations $33 $48 Total adjustments, net 21 21 Operating adjusted net income from continuing operations $54 $69 Operating adjusted net income from continuing operations per share - diluted $0.37 $0.47 Weighted average diluted shares – including assumed conversion of preferred shares 146 146 * The company uses the two-class method of calculating income from continuing operations per diluted share. Under the two-class method, income from continuing operations is adjusted for dividends and undistributed earnings (losses) to the holders of the Series A Preferred Stock, and the weighted average diluted shares do not assume conversion of the preferred shares to common shares.

4 F o u r t h Q u a r t e r & Y e a r - t o - D a t e R e s u l t s

5 KAR 2022 Highlights* ($ in millions, except per share amounts) KAR Q4 2022 Q4 2021 YTD 2022 YTD 2021 Total operating revenues from continuing operations $372.8 $357.7 $1,519.4 $1,450.6 Gross profit** $170.8 $163.5 $685.1 $658.1 % of revenue** 45.8% 45.7% 45.1% 45.4% SG&A $93.0 $102.2 $445.1 $420.7 Other (income) expense, net ($7.7) $8.0 ($1.3) ($12.5) EBITDA $118.7 $53.0 $255.3 $249.0 Adjusted EBITDA $56.5 $64.3 $231.2 $270.2 Income (loss) from continuing operations $41.9 $15.2 $28.6 ($0.8) Income (loss) from continuing operations per share – diluted $0.21 $0.04 ($0.10) ($0.27) Weighted average diluted shares 109.9 121.5 116.3 123.0 Operating adjusted net income (loss) from continuing operations per share – diluted $0.33 $0.17 $0.43 $0.31 Weighted average diluted shares – including assumed conversion of preferred shares 145.7 156.1 151.9 156.6 Effective tax rate 29.9% 320.3% 25.9% 105.6% Capital expenditures $15.1 $16.6 $60.9 $64.2 * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-K, both for the period ended December 31, 2022. ** Exclusive of depreciation and amortization

6 Marketplace 2022 Highlights* ($ in millions, except RPU) Marketplace Q4 2022 Q4 2021 YTD 2022 YTD 2021 Auction fees $80.8 $100.8 $370.3 $399.2 Service revenue $146.3 $125.8 $590.3 $541.3 Purchased vehicle sales $45.0 $51.9 $182.9 $220.9 Total Marketplace revenue from continuing operations $272.1 $278.5 $1,143.5 $1,161.4 Gross profit** $85.8 $98.7 $372.3 $424.3 % of revenue, excluding purchased vehicles** 37.8% 43.6% 38.8% 45.1% SG&A $82.8 $93.1 $398.6 $385.5 Other (income) expense, net ($8.3) $3.5 ($8.4) $4.5 EBITDA $44.6 $1.8 ($3.8) $33.4 Adjusted EBITDA $7.7 $11.7 $29.4 $84.3 % of revenue 2.8% 4.2% 2.6% 7.3% Commercial vehicles sold 151,000 162,000 661,000 948,000 Dealer consignment vehicles sold 138,000 180,000 636,000 651,000 Total vehicles sold 289,000 342,000 1,297,000 1,599,000 Auction fees per vehicle sold $280 $294 $286 $250 Gross profit per vehicle sold** $297 $288 $287 $265 * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-K, both for the period ended December 31, 2022. ** Exclusive of depreciation and amortization

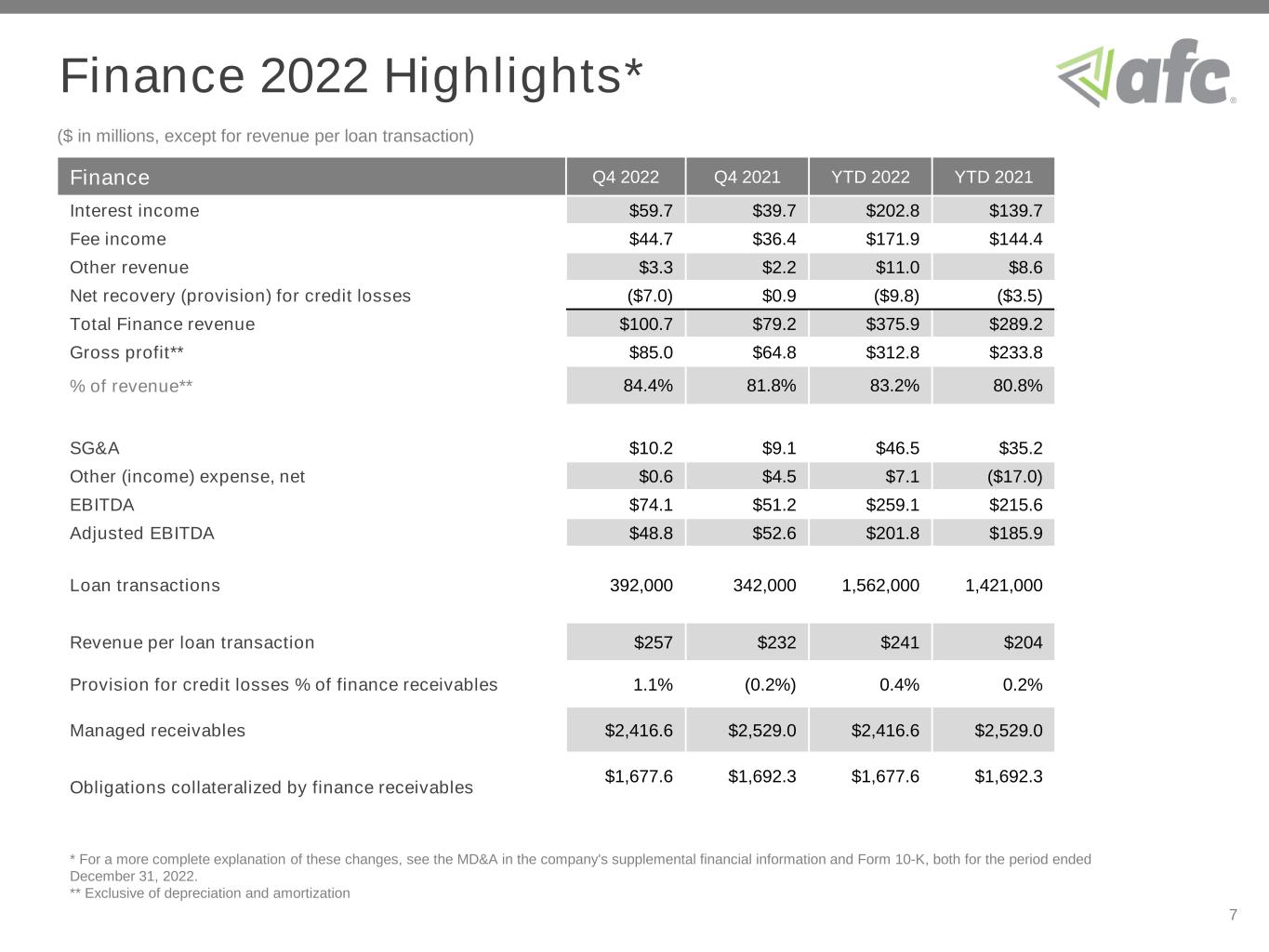

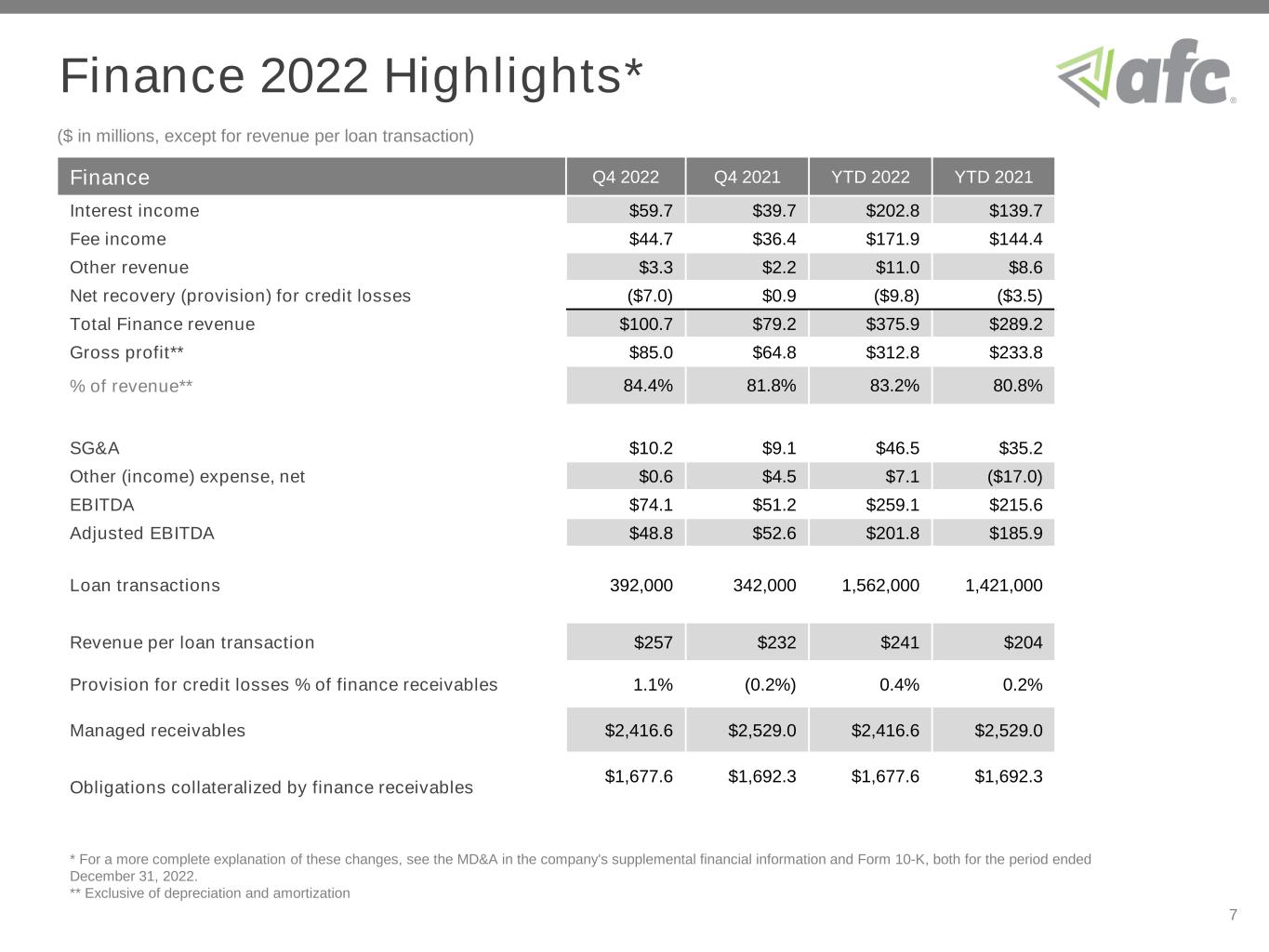

7 Finance 2022 Highlights* * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-K, both for the period ended December 31, 2022. ** Exclusive of depreciation and amortization ($ in millions, except for revenue per loan transaction) Finance Q4 2022 Q4 2021 YTD 2022 YTD 2021 Interest income $59.7 $39.7 $202.8 $139.7 Fee income $44.7 $36.4 $171.9 $144.4 Other revenue $3.3 $2.2 $11.0 $8.6 Net recovery (provision) for credit losses ($7.0) $0.9 ($9.8) ($3.5) Total Finance revenue $100.7 $79.2 $375.9 $289.2 Gross profit** $85.0 $64.8 $312.8 $233.8 % of revenue** 84.4% 81.8% 83.2% 80.8% SG&A $10.2 $9.1 $46.5 $35.2 Other (income) expense, net $0.6 $4.5 $7.1 ($17.0) EBITDA $74.1 $51.2 $259.1 $215.6 Adjusted EBITDA $48.8 $52.6 $201.8 $185.9 Loan transactions 392,000 342,000 1,562,000 1,421,000 Revenue per loan transaction $257 $232 $241 $204 Provision for credit losses % of finance receivables 1.1% (0.2%) 0.4% 0.2% Managed receivables $2,416.6 $2,529.0 $2,416.6 $2,529.0 Obligations collateralized by finance receivables $1,677.6 $1,692.3 $1,677.6 $1,692.3

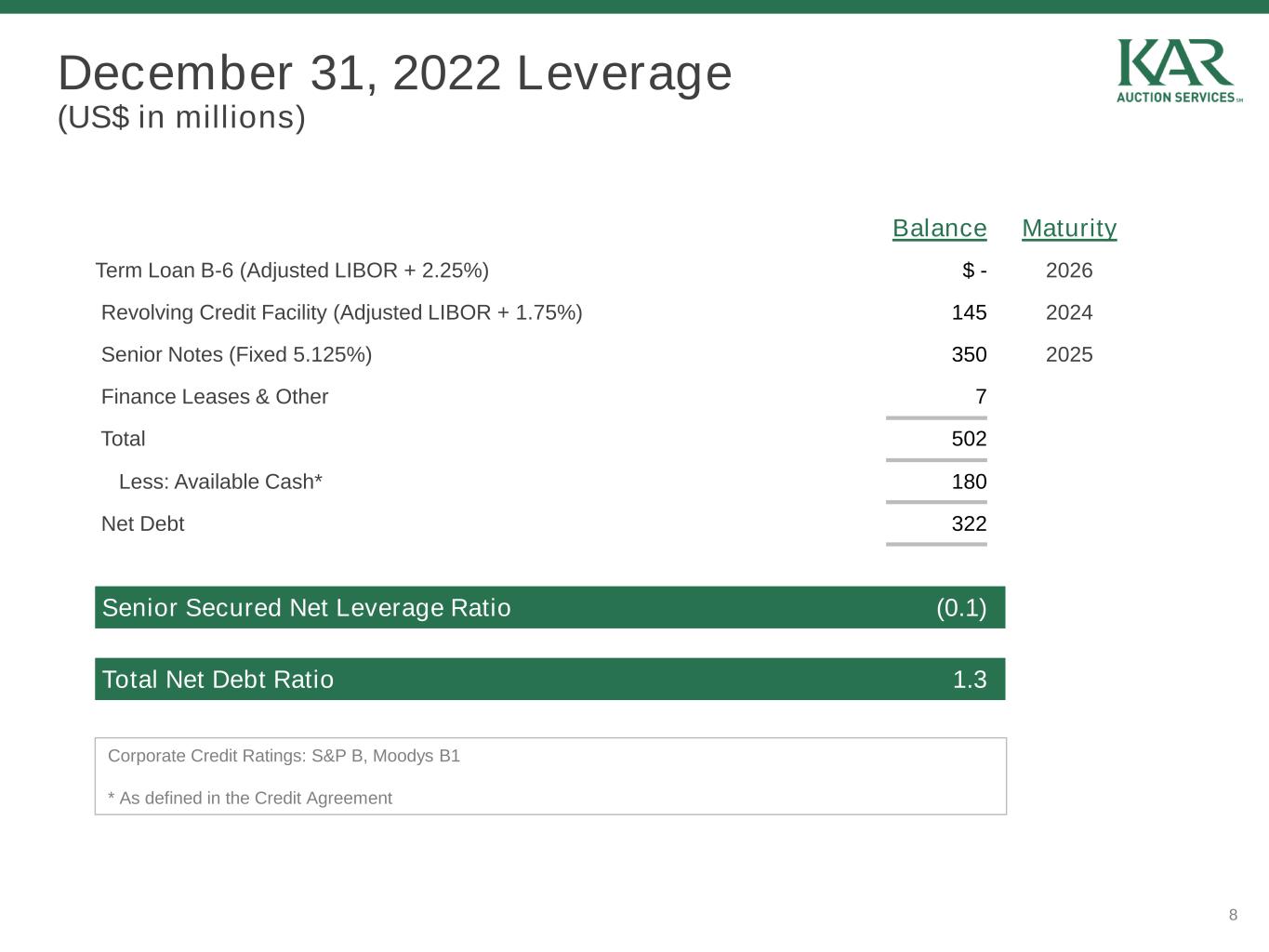

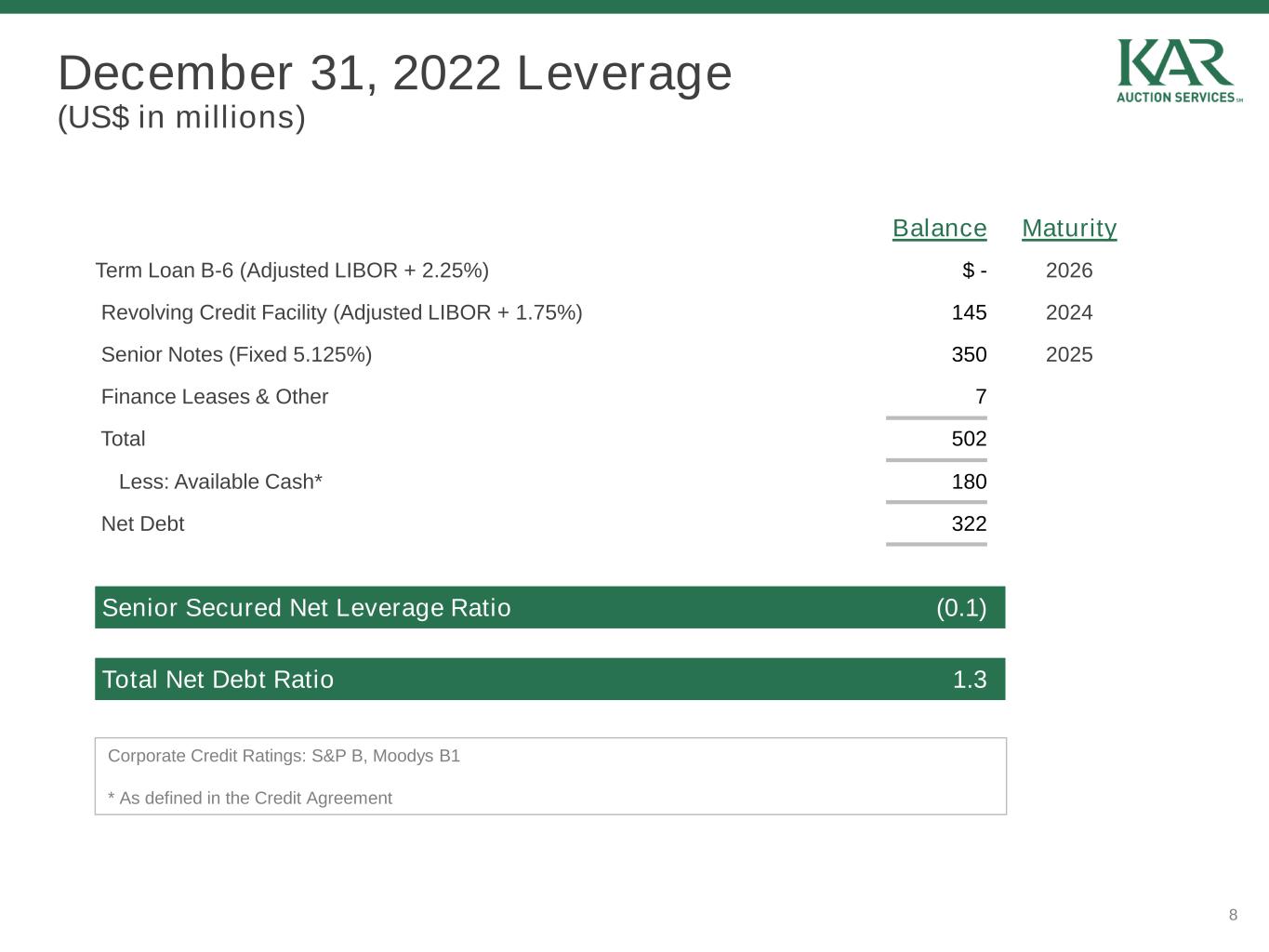

8 December 31, 2022 Leverage (US$ in millions) Corporate Credit Ratings: S&P B, Moodys B1 * As defined in the Credit Agreement Balance Maturity Term Loan B-6 (Adjusted LIBOR + 2.25%) $ - 2026 Revolving Credit Facility (Adjusted LIBOR + 1.75%) 145 2024 Senior Notes (Fixed 5.125%) 350 2025 Finance Leases & Other 7 Total 502 Less: Available Cash* 180 Net Debt 322 Senior Secured Net Leverage Ratio (0.1) Total Net Debt Ratio 1.3

9 H I S T O R I C A L D A TA

10 Consolidated Statement of Income – 2020 Marketplace Finance Consolidated Operating revenues $1,059.3 $267.6 $1,326.9 Operating expenses Cost of services (exclusive of depreciation & amortization) 665.2 79.1 744.3 Selling, general, and administrative 337.9 36.6 374.5 Depreciation and amortization 96.6 12.5 109.1 Goodwill and other intangibles impairment 29.8 - 29.8 Total operating expenses 1,129.5 128.2 1,257.7 Operating profit (loss) (70.2) 139.4 69.2 Interest expense 89.1 39.1 128.2 Other (income) expense, net 5.9 (0.1) 5.8 Intercompany 1.1 (1.1) - Income (loss) from continuing operations before income taxes (166.3) 101.5 (64.8) Income taxes (33.1) 21.9 (11.2) Income (loss) from continuing operations ($133.2) $79.6 ($53.6) Income (loss) from discontinued operations, net of income taxes 54.1 - 54.1 Net income (loss) ($79.1) $79.6 $0.5

11 Consolidated Statement of Income – Q1 2021 Marketplace Finance Consolidated Operating revenues $304.0 $65.8 $369.8 Operating expenses Cost of services (exclusive of depreciation & amortization) 190.3 13.5 203.8 Selling, general, and administrative 98.5 8.8 107.3 Depreciation and amortization 24.5 2.4 26.9 Total operating expenses 313.3 24.7 338.0 Operating profit (loss) (9.3) 41.1 31.8 Interest expense 21.5 9.3 30.8 Other (income) expense, net (5.4) (44.3) (49.7) Intercompany 0.1 (0.1) - Income (loss) from continuing operations before income taxes (25.5) 76.2 50.7 Income taxes 5.0 19.5 24.5 Income (loss) from continuing operations ($30.5) $56.7 $26.2 Income (loss) from discontinued operations, net of income taxes 24.7 - 24.7 Net income (loss) ($5.8) $56.7 $50.9

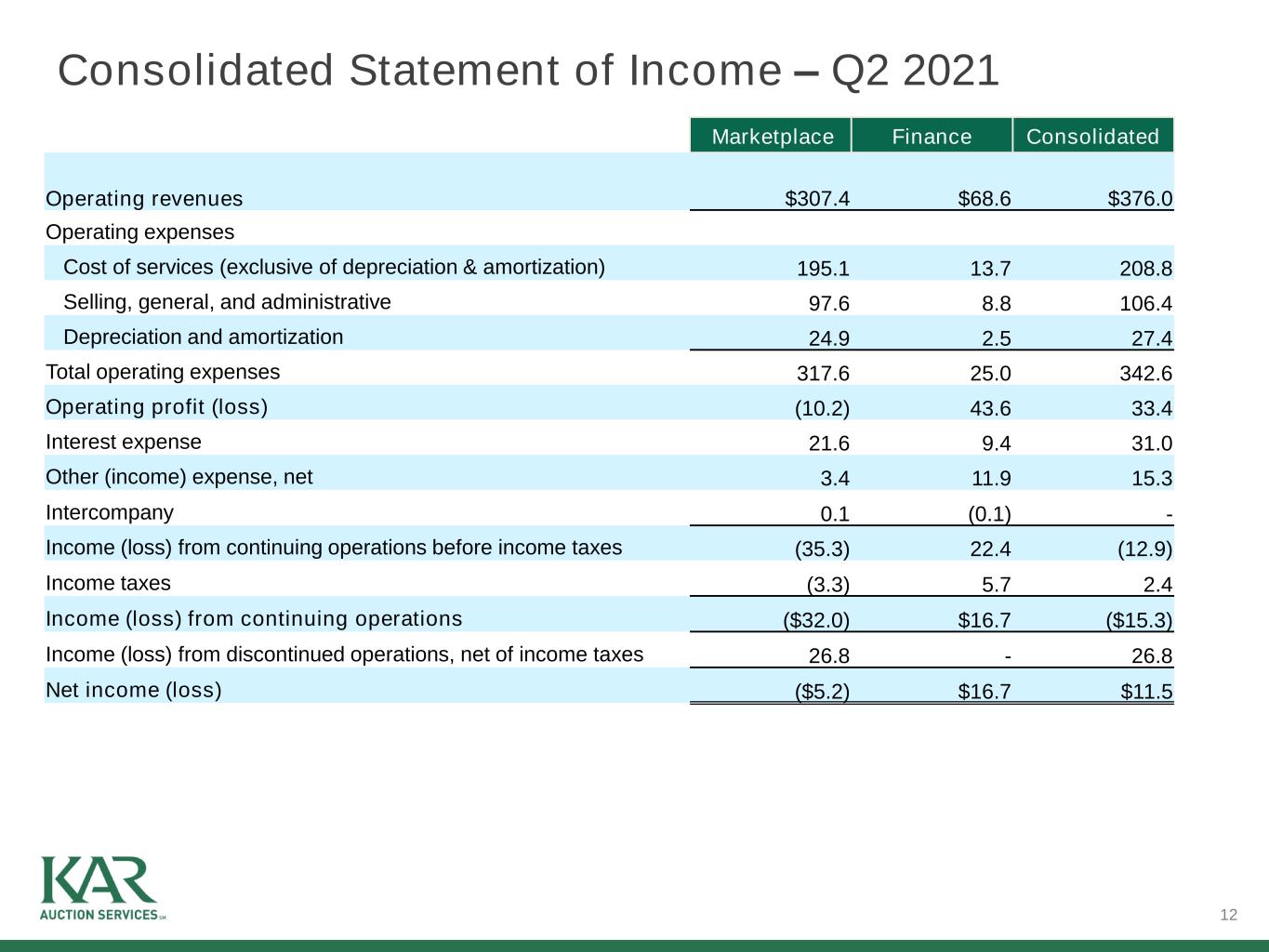

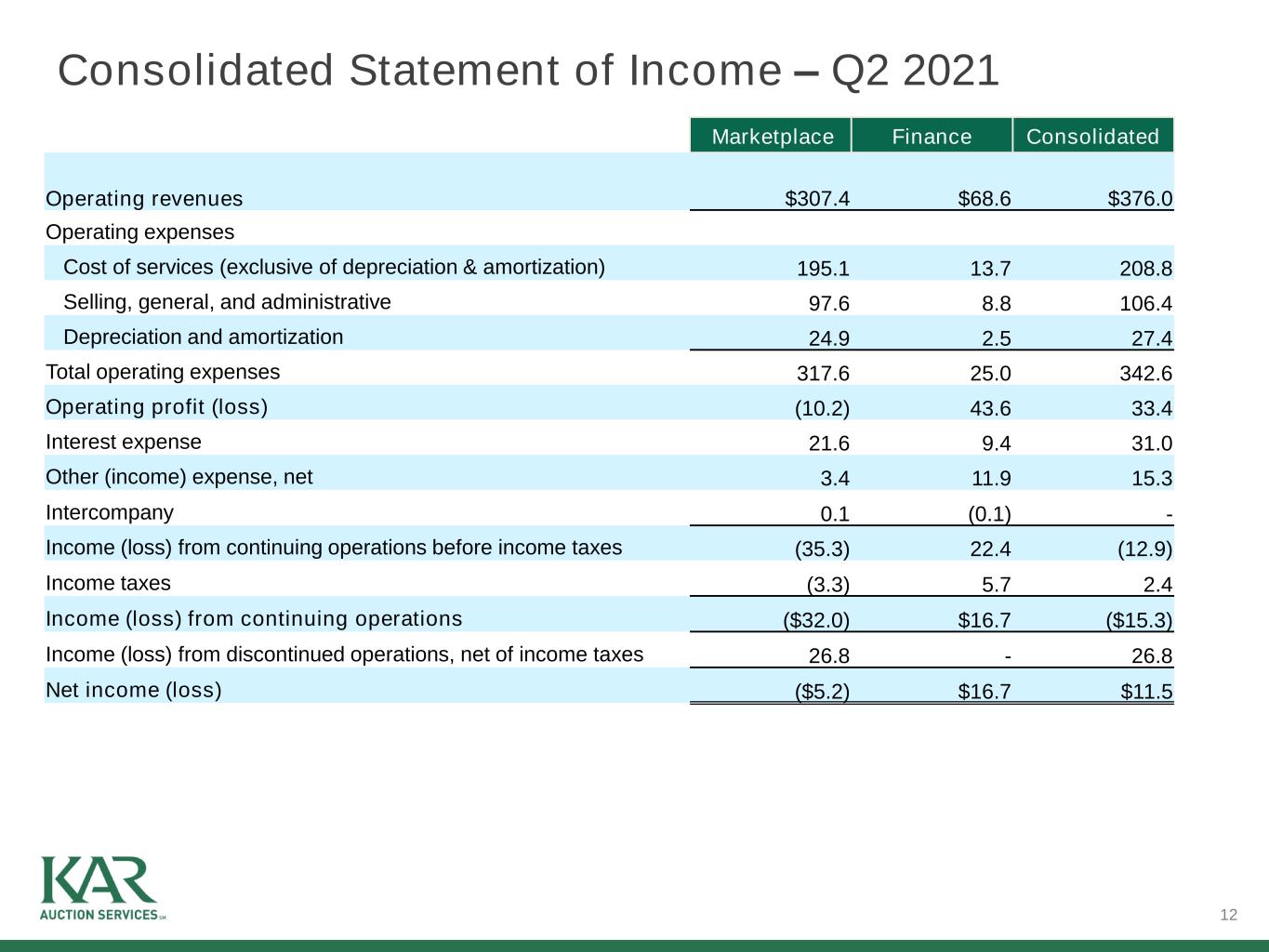

12 Consolidated Statement of Income – Q2 2021 Marketplace Finance Consolidated Operating revenues $307.4 $68.6 $376.0 Operating expenses Cost of services (exclusive of depreciation & amortization) 195.1 13.7 208.8 Selling, general, and administrative 97.6 8.8 106.4 Depreciation and amortization 24.9 2.5 27.4 Total operating expenses 317.6 25.0 342.6 Operating profit (loss) (10.2) 43.6 33.4 Interest expense 21.6 9.4 31.0 Other (income) expense, net 3.4 11.9 15.3 Intercompany 0.1 (0.1) - Income (loss) from continuing operations before income taxes (35.3) 22.4 (12.9) Income taxes (3.3) 5.7 2.4 Income (loss) from continuing operations ($32.0) $16.7 ($15.3) Income (loss) from discontinued operations, net of income taxes 26.8 - 26.8 Net income (loss) ($5.2) $16.7 $11.5

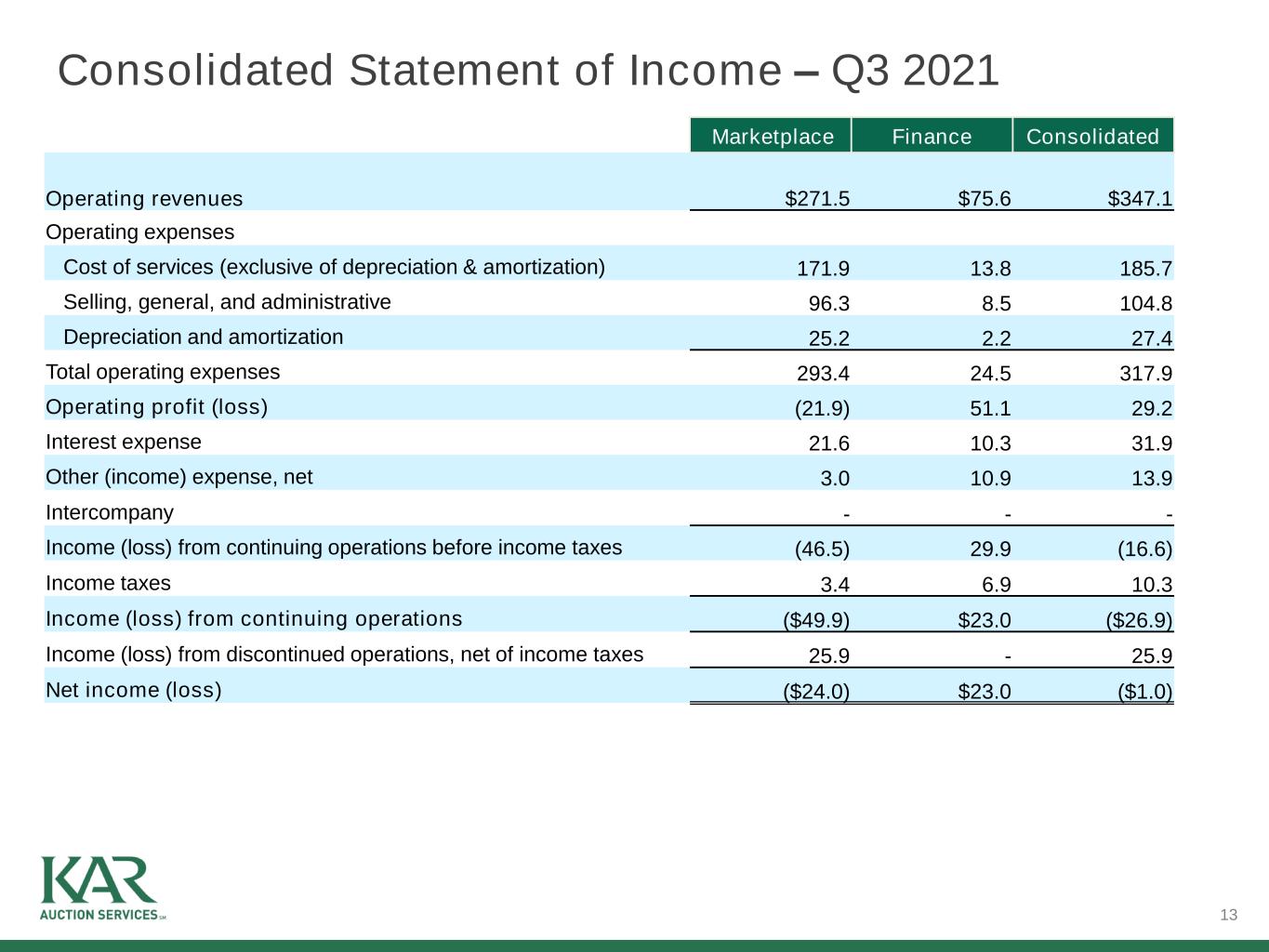

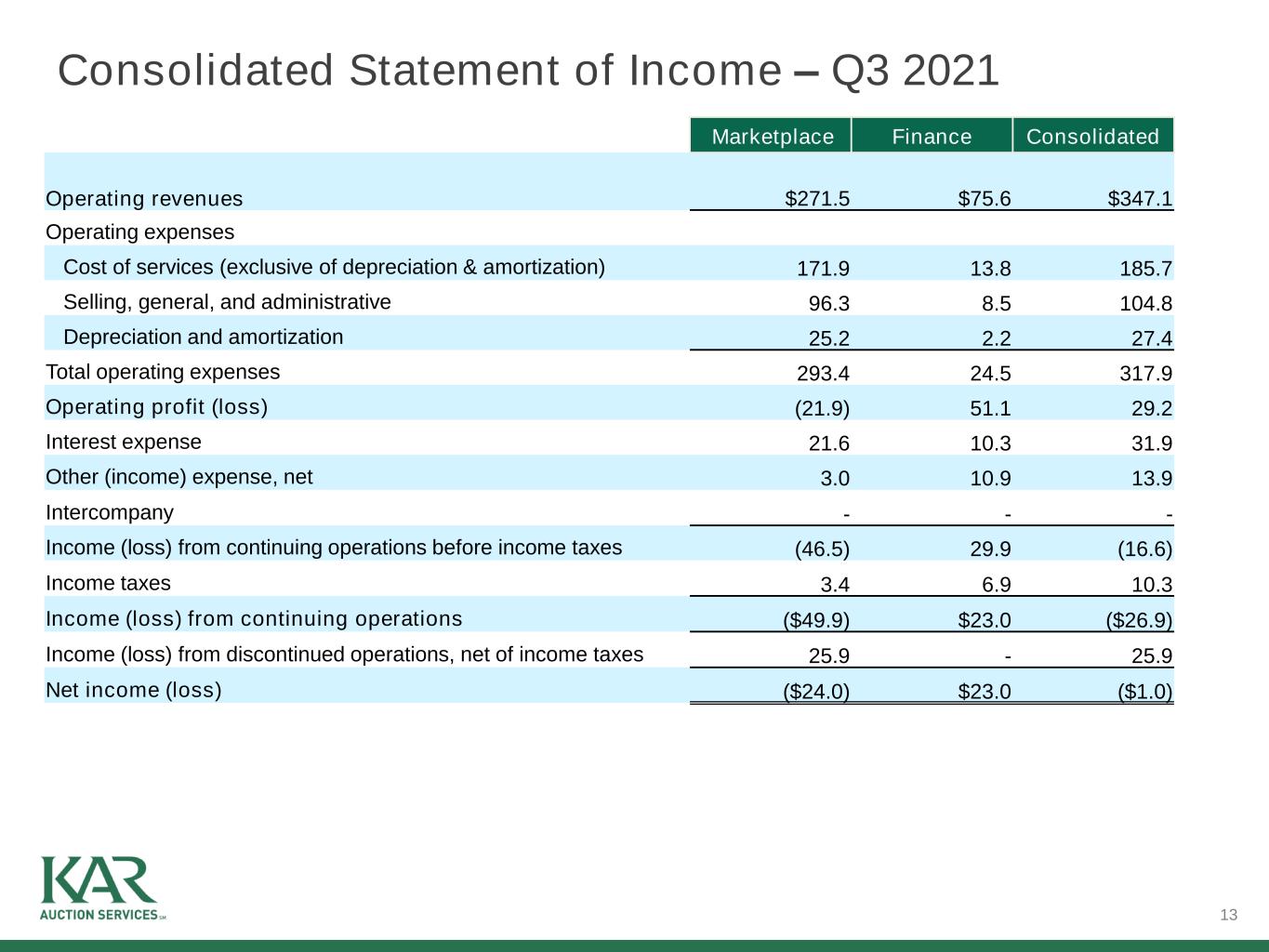

13 Consolidated Statement of Income – Q3 2021 Marketplace Finance Consolidated Operating revenues $271.5 $75.6 $347.1 Operating expenses Cost of services (exclusive of depreciation & amortization) 171.9 13.8 185.7 Selling, general, and administrative 96.3 8.5 104.8 Depreciation and amortization 25.2 2.2 27.4 Total operating expenses 293.4 24.5 317.9 Operating profit (loss) (21.9) 51.1 29.2 Interest expense 21.6 10.3 31.9 Other (income) expense, net 3.0 10.9 13.9 Intercompany - - - Income (loss) from continuing operations before income taxes (46.5) 29.9 (16.6) Income taxes 3.4 6.9 10.3 Income (loss) from continuing operations ($49.9) $23.0 ($26.9) Income (loss) from discontinued operations, net of income taxes 25.9 - 25.9 Net income (loss) ($24.0) $23.0 ($1.0)

14 Consolidated Statement of Income – Q4 2021 Marketplace Finance Consolidated Operating revenues $278.5 $79.2 $357.7 Operating expenses Cost of services (exclusive of depreciation & amortization) 179.8 14.4 194.2 Selling, general, and administrative 93.1 9.1 102.2 Depreciation and amortization 25.9 2.3 28.2 Total operating expenses 298.8 25.8 324.6 Operating profit (loss) (20.3) 53.4 33.1 Interest expense 21.5 10.5 32.0 Other (income) expense, net 3.5 4.5 8.0 Intercompany - - - Income (loss) from continuing operations before income taxes (45.3) 38.4 (6.9) Income taxes (31.5) 9.4 (22.1) Income (loss) from continuing operations ($13.8) $29.0 $15.2 Income (loss) from discontinued operations, net of income taxes (10.1) - (10.1) Net income (loss) ($23.9) $29.0 $5.1

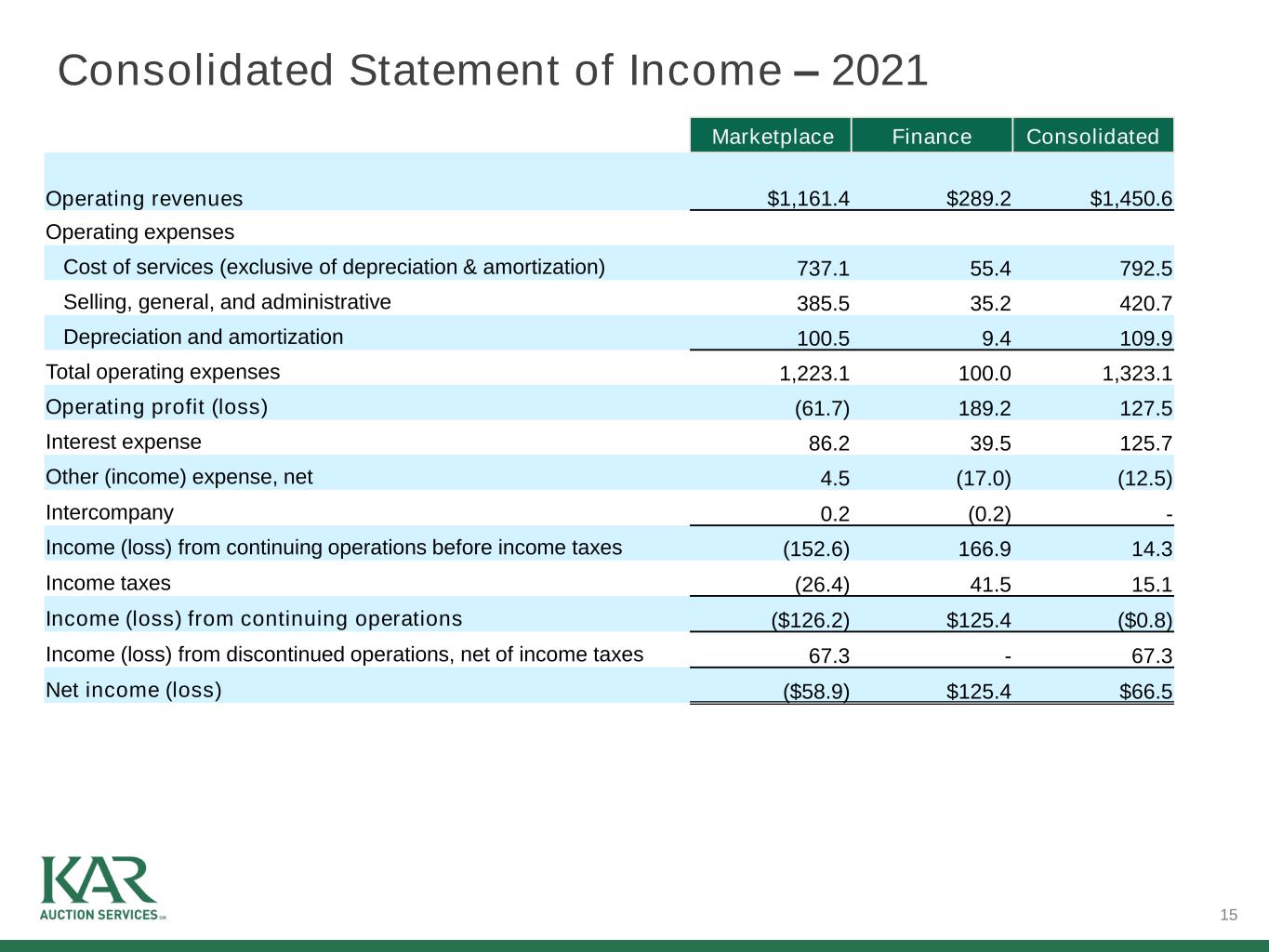

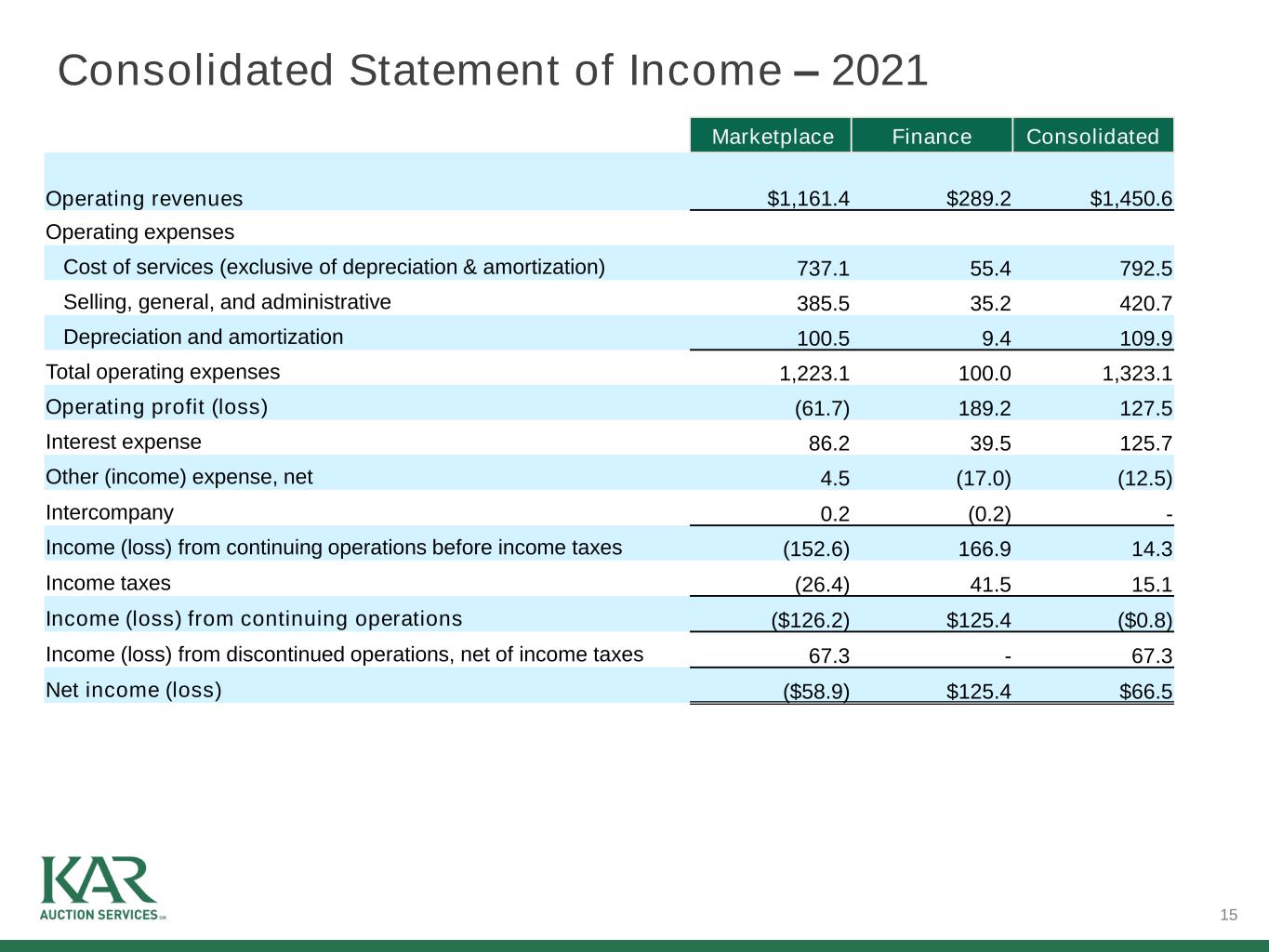

15 Consolidated Statement of Income – 2021 Marketplace Finance Consolidated Operating revenues $1,161.4 $289.2 $1,450.6 Operating expenses Cost of services (exclusive of depreciation & amortization) 737.1 55.4 792.5 Selling, general, and administrative 385.5 35.2 420.7 Depreciation and amortization 100.5 9.4 109.9 Total operating expenses 1,223.1 100.0 1,323.1 Operating profit (loss) (61.7) 189.2 127.5 Interest expense 86.2 39.5 125.7 Other (income) expense, net 4.5 (17.0) (12.5) Intercompany 0.2 (0.2) - Income (loss) from continuing operations before income taxes (152.6) 166.9 14.3 Income taxes (26.4) 41.5 15.1 Income (loss) from continuing operations ($126.2) $125.4 ($0.8) Income (loss) from discontinued operations, net of income taxes 67.3 - 67.3 Net income (loss) ($58.9) $125.4 $66.5

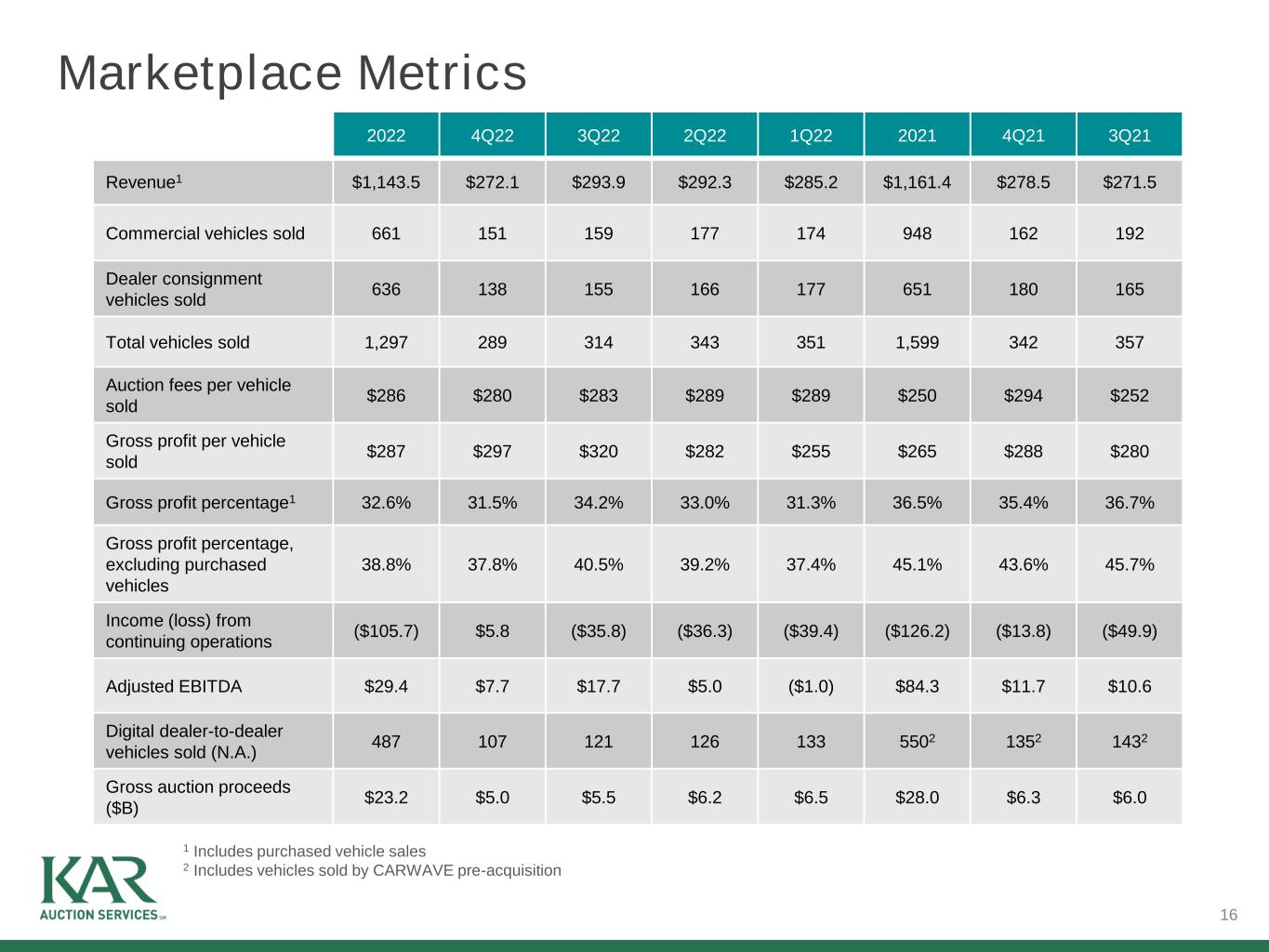

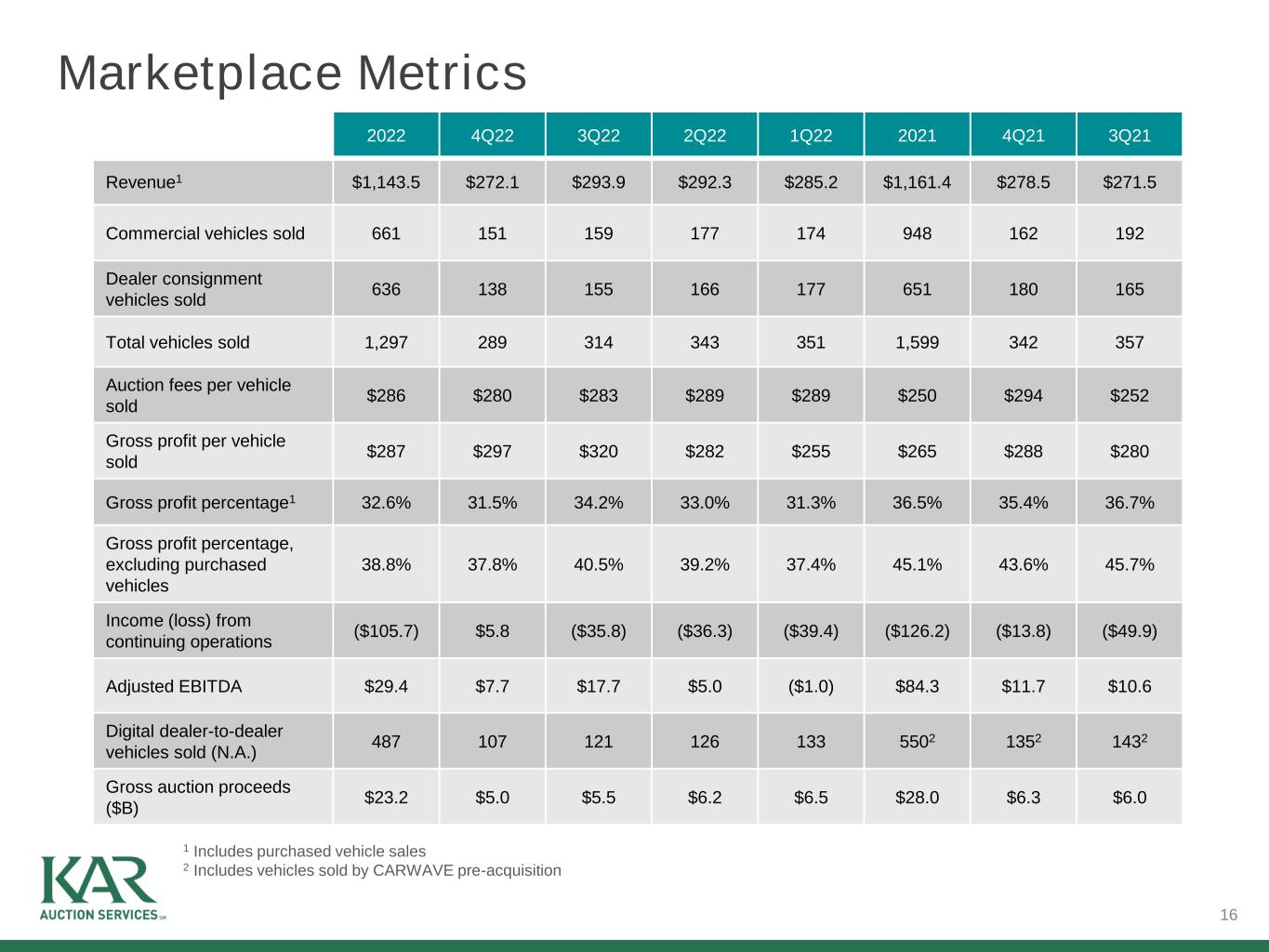

16 Marketplace Metrics 1 Includes purchased vehicle sales 2 Includes vehicles sold by CARWAVE pre-acquisition 2022 4Q22 3Q22 2Q22 1Q22 2021 4Q21 3Q21 Revenue1 $1,143.5 $272.1 $293.9 $292.3 $285.2 $1,161.4 $278.5 $271.5 Commercial vehicles sold 661 151 159 177 174 948 162 192 Dealer consignment vehicles sold 636 138 155 166 177 651 180 165 Total vehicles sold 1,297 289 314 343 351 1,599 342 357 Auction fees per vehicle sold $286 $280 $283 $289 $289 $250 $294 $252 Gross profit per vehicle sold $287 $297 $320 $282 $255 $265 $288 $280 Gross profit percentage1 32.6% 31.5% 34.2% 33.0% 31.3% 36.5% 35.4% 36.7% Gross profit percentage, excluding purchased vehicles 38.8% 37.8% 40.5% 39.2% 37.4% 45.1% 43.6% 45.7% Income (loss) from continuing operations ($105.7) $5.8 ($35.8) ($36.3) ($39.4) ($126.2) ($13.8) ($49.9) Adjusted EBITDA $29.4 $7.7 $17.7 $5.0 ($1.0) $84.3 $11.7 $10.6 Digital dealer-to-dealer vehicles sold (N.A.) 487 107 121 126 133 5502 1352 1432 Gross auction proceeds ($B) $23.2 $5.0 $5.5 $6.2 $6.5 $28.0 $6.3 $6.0

17 Finance Metrics 2022 4Q22 3Q22 2Q22 1Q22 2021 4Q21 3Q21 Interest income $202.8 $59.7 $53.4 $46.5 $43.2 $139.7 $39.7 $35.4 Fee income $171.9 $44.7 $44.3 $42.7 $40.2 $144.4 $36.4 $35.8 Other revenue $11.0 $3.3 $2.9 $2.6 $2.2 $8.6 $2.2 $2.2 Net recovery (provision) for credit losses ($9.8) ($7.0) ($1.5) $0.1 ($1.4) ($3.5) $0.9 $2.2 Total Finance revenue $375.9 $100.7 $99.1 $91.9 $84.2 $289.2 $79.2 $75.6 Loan Transaction Units (LTU) 1,562 392 397 401 372 1,421 342 351 Revenue per Loan Transaction $241 $257 $250 $229 $226 $204 $232 $215 Income (loss) from continuing operations $134.3 $36.1 $36.3 $30.9 $31.0 $125.4 $29.0 $23.0 Adjusted EBITDA $201.8 $48.8 $51.8 $51.1 $50.1 $185.9 $52.6 $56.0 Ending Managed Finance Receivables $2,416.6 $2,416.6 $2,555.1 $2,681.6 $2,757.8 $2,529.0 $2,529.0 $2,191.7 Ending Obligations Collateralized by Finance Receivables $1,677.6 $1,677.6 $1,707.8 $1,781.3 $1,866.6 $1,692.3 $1,692.3 $1,385.7

18 A P P E N D I X

19 Non-GAAP Financial Measures EBITDA is defined as net income (loss), plus interest expense net of interest income, income tax provision (benefit), depreciation and amortization. Adjusted EBITDA is EBITDA adjusted for the items of income and expense and expected incremental revenue and cost savings as described in the company's senior secured credit agreement covenant calculations. Management believes that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA is appropriate to provide additional information to investors about one of the principal measures of performance used by the company’s creditors. In addition, management uses EBITDA and Adjusted EBITDA to evaluate the company’s performance. Depreciation expense for property and equipment and amortization expense of capitalized internally developed software costs relate to ongoing capital expenditures; however, amortization expense associated with acquired intangible assets, such as customer relationships, software, tradenames and non-compete agreements are not representative of ongoing capital expenditures but have a continuing effect on our reported results. Non-GAAP financial measures of operating adjusted net income (loss) and operating adjusted net income (loss) per share, in the opinion of the company, provide comparability to other companies that may not have incurred these types of non-cash expenses or that report a similar measure. In addition, net income (loss) and net income (loss) per share have been adjusted for certain other charges, as seen in the following reconciliation. EBITDA, Adjusted EBITDA, operating adjusted net income (loss) and operating adjusted net income (loss) per share have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analysis of the results as reported under GAAP. These measures may not be comparable to similarly titled measures reported by other companies.

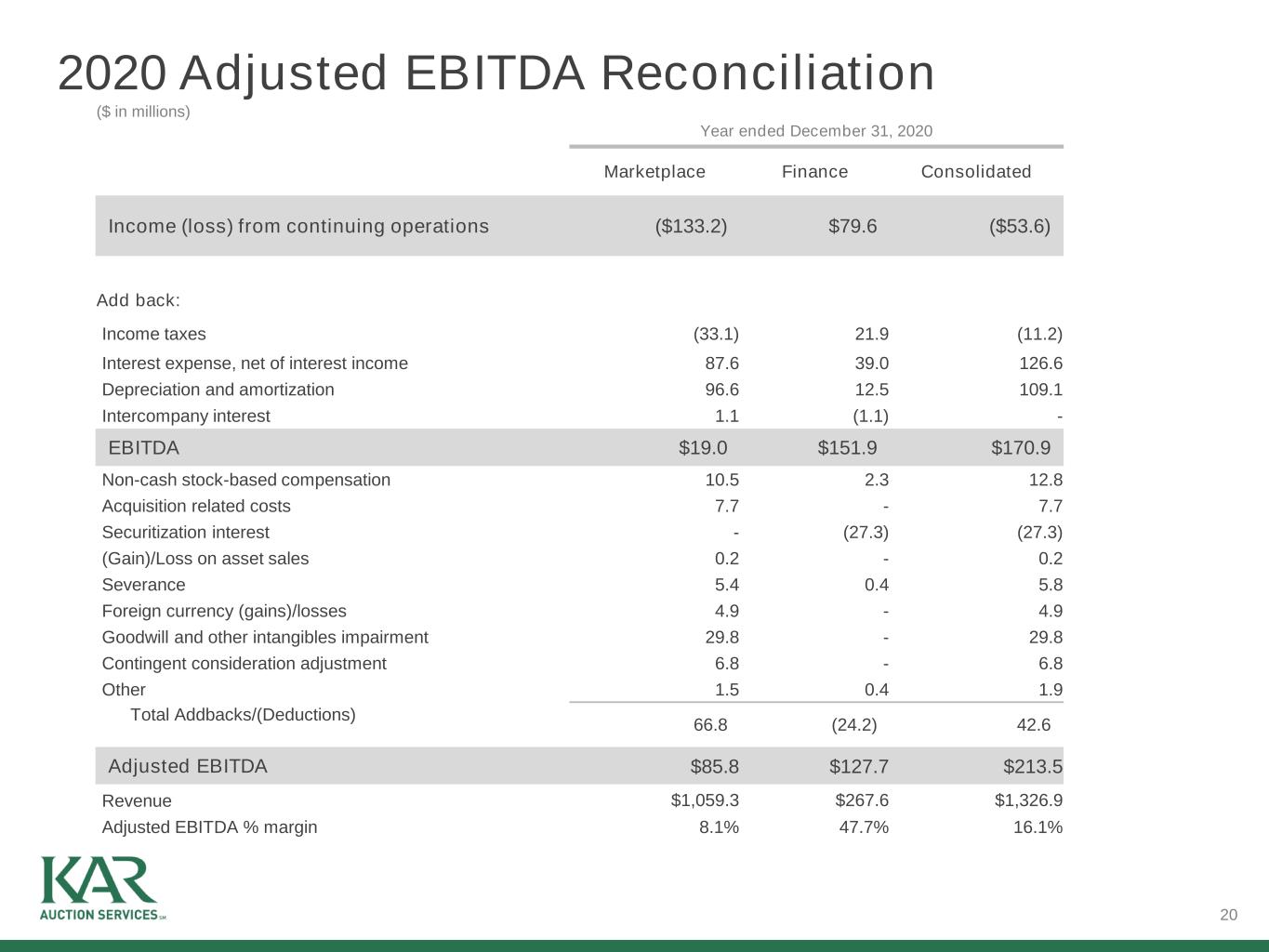

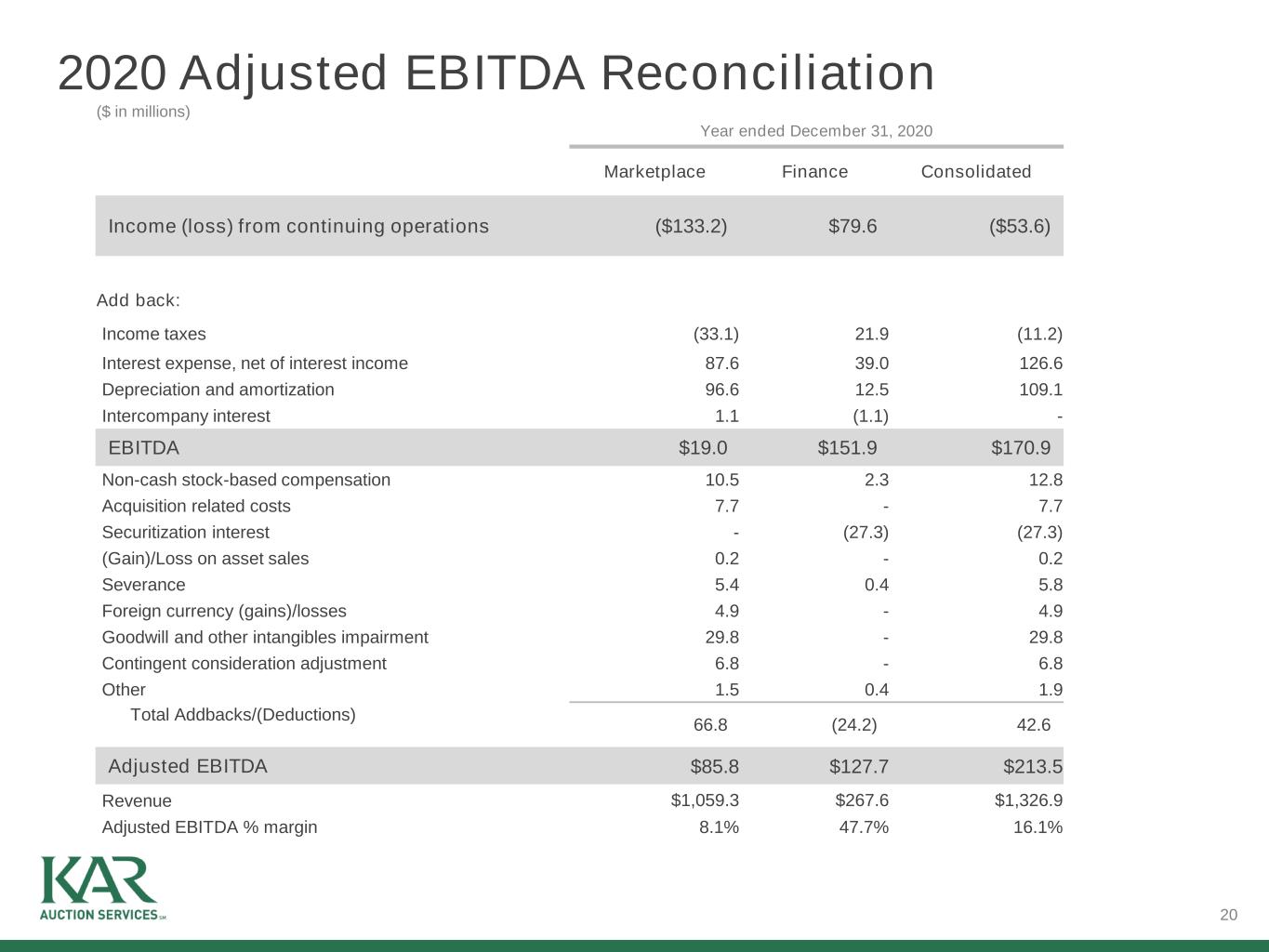

20 2020 Adjusted EBITDA Reconciliation ($ in millions) Year ended December 31, 2020 Marketplace Finance Consolidated Income (loss) from continuing operations ($133.2) $79.6 ($53.6) Add back: Income taxes (33.1) 21.9 (11.2) Interest expense, net of interest income 87.6 39.0 126.6 Depreciation and amortization 96.6 12.5 109.1 Intercompany interest 1.1 (1.1) - EBITDA $19.0 $151.9 $170.9 Non-cash stock-based compensation 10.5 2.3 12.8 Acquisition related costs 7.7 - 7.7 Securitization interest - (27.3) (27.3) (Gain)/Loss on asset sales 0.2 - 0.2 Severance 5.4 0.4 5.8 Foreign currency (gains)/losses 4.9 - 4.9 Goodwill and other intangibles impairment 29.8 - 29.8 Contingent consideration adjustment 6.8 - 6.8 Other 1.5 0.4 1.9 Total Addbacks/(Deductions) 66.8 (24.2) 42.6 Adjusted EBITDA $85.8 $127.7 $213.5 Revenue $1,059.3 $267.6 $1,326.9 Adjusted EBITDA % margin 8.1% 47.7% 16.1%

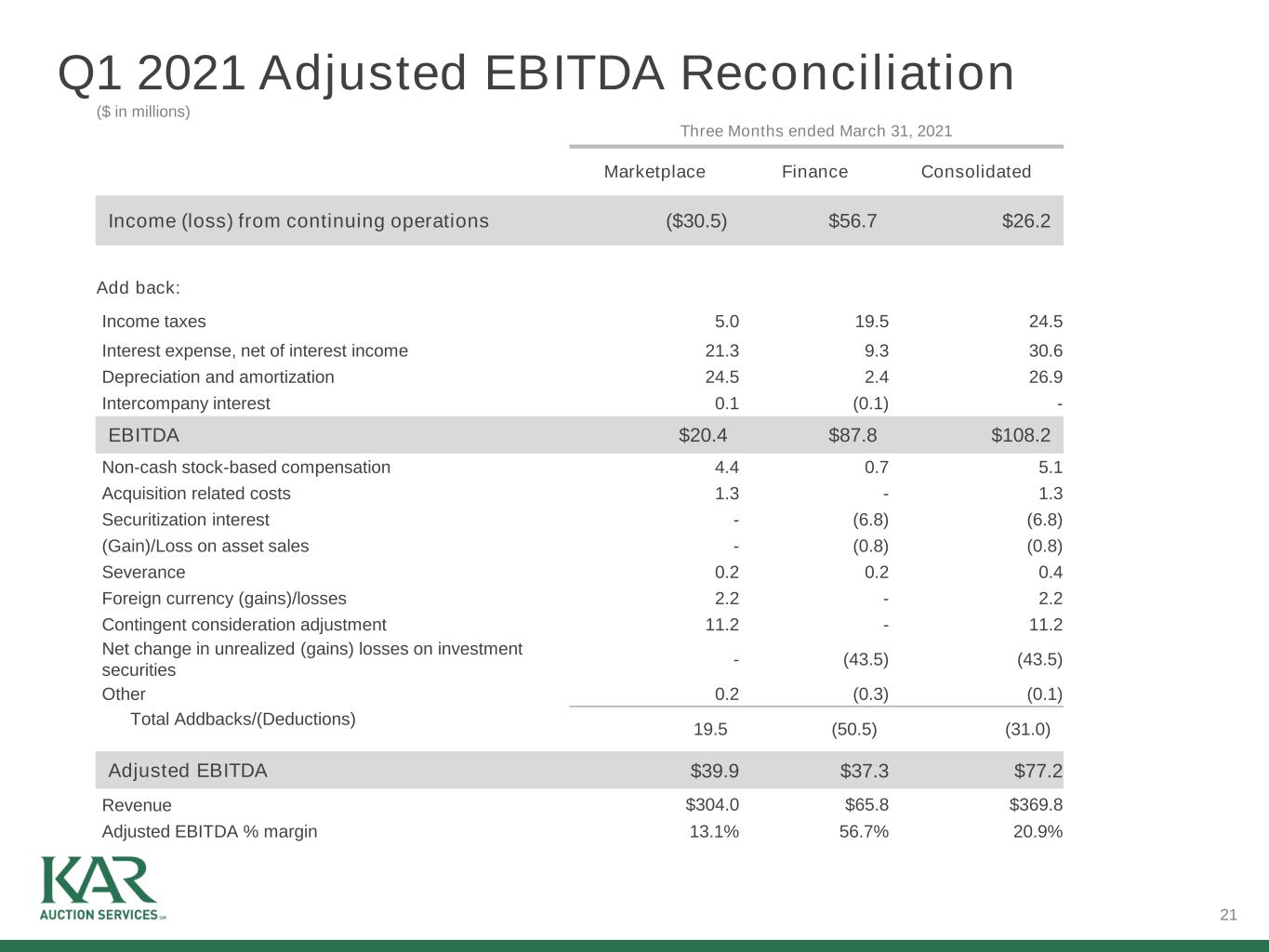

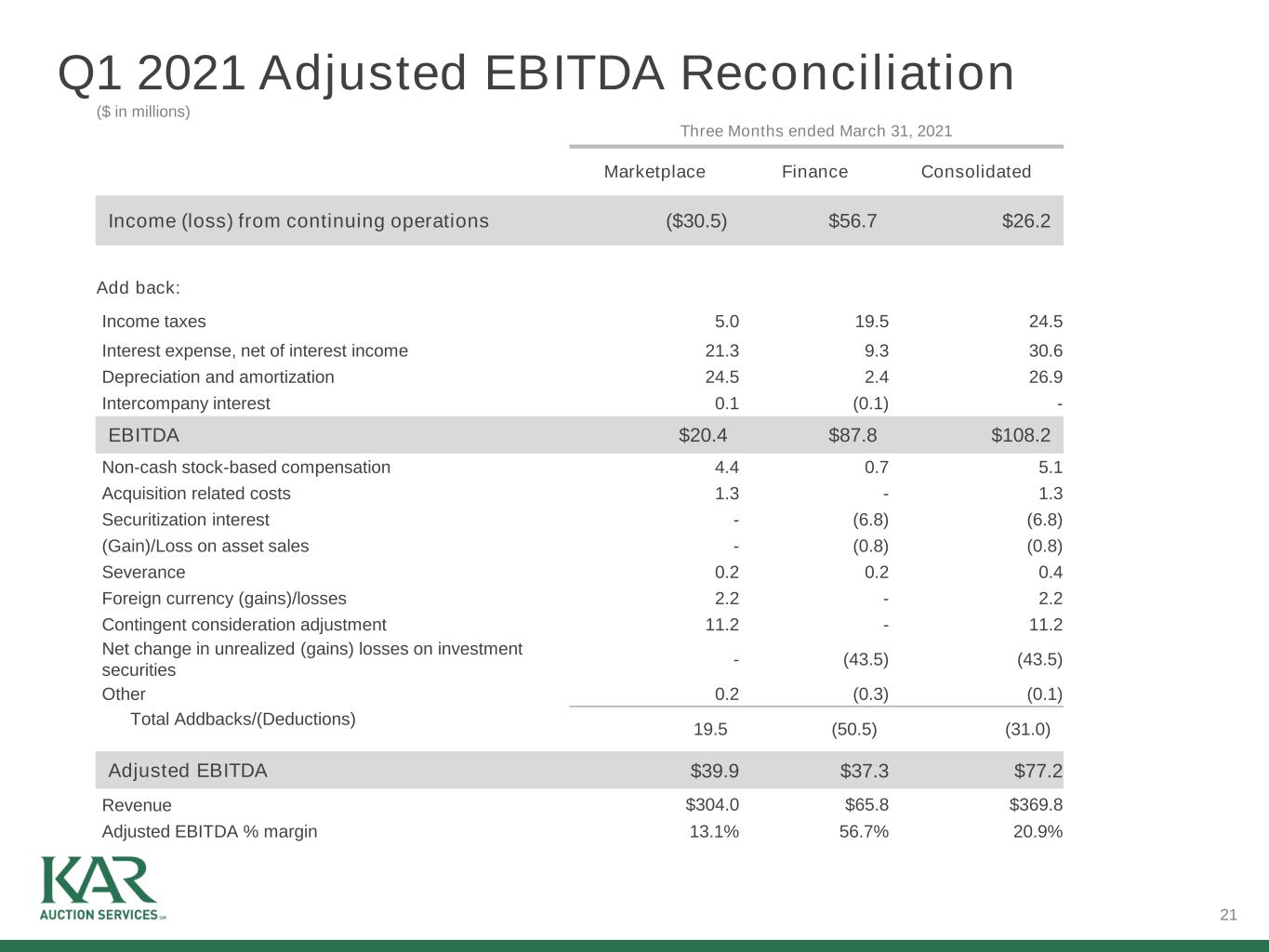

21 Q1 2021 Adjusted EBITDA Reconciliation ($ in millions) Three Months ended March 31, 2021 Marketplace Finance Consolidated Income (loss) from continuing operations ($30.5) $56.7 $26.2 Add back: Income taxes 5.0 19.5 24.5 Interest expense, net of interest income 21.3 9.3 30.6 Depreciation and amortization 24.5 2.4 26.9 Intercompany interest 0.1 (0.1) - EBITDA $20.4 $87.8 $108.2 Non-cash stock-based compensation 4.4 0.7 5.1 Acquisition related costs 1.3 - 1.3 Securitization interest - (6.8) (6.8) (Gain)/Loss on asset sales - (0.8) (0.8) Severance 0.2 0.2 0.4 Foreign currency (gains)/losses 2.2 - 2.2 Contingent consideration adjustment 11.2 - 11.2 Net change in unrealized (gains) losses on investment securities - (43.5) (43.5) Other 0.2 (0.3) (0.1) Total Addbacks/(Deductions) 19.5 (50.5) (31.0) Adjusted EBITDA $39.9 $37.3 $77.2 Revenue $304.0 $65.8 $369.8 Adjusted EBITDA % margin 13.1% 56.7% 20.9%

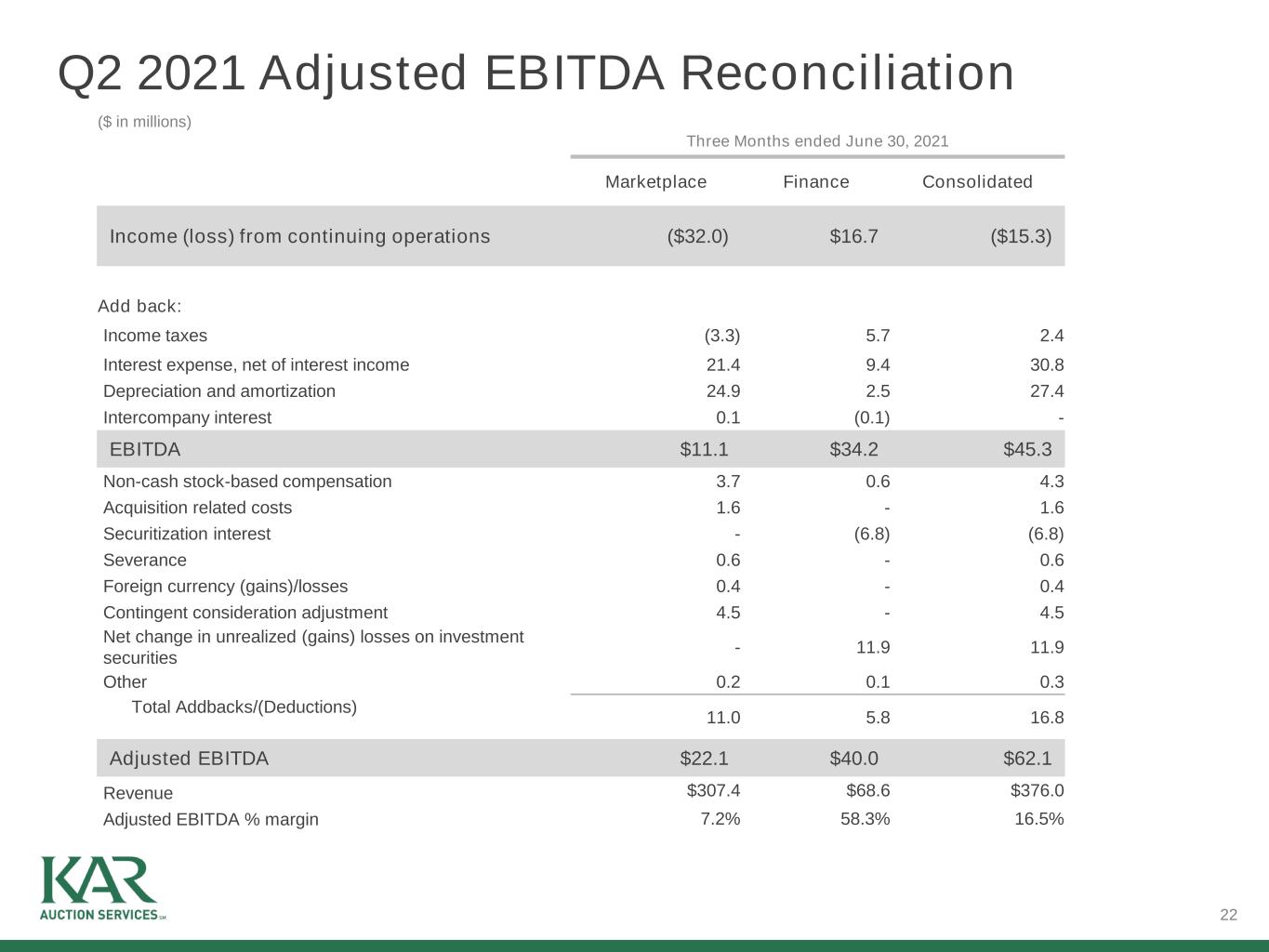

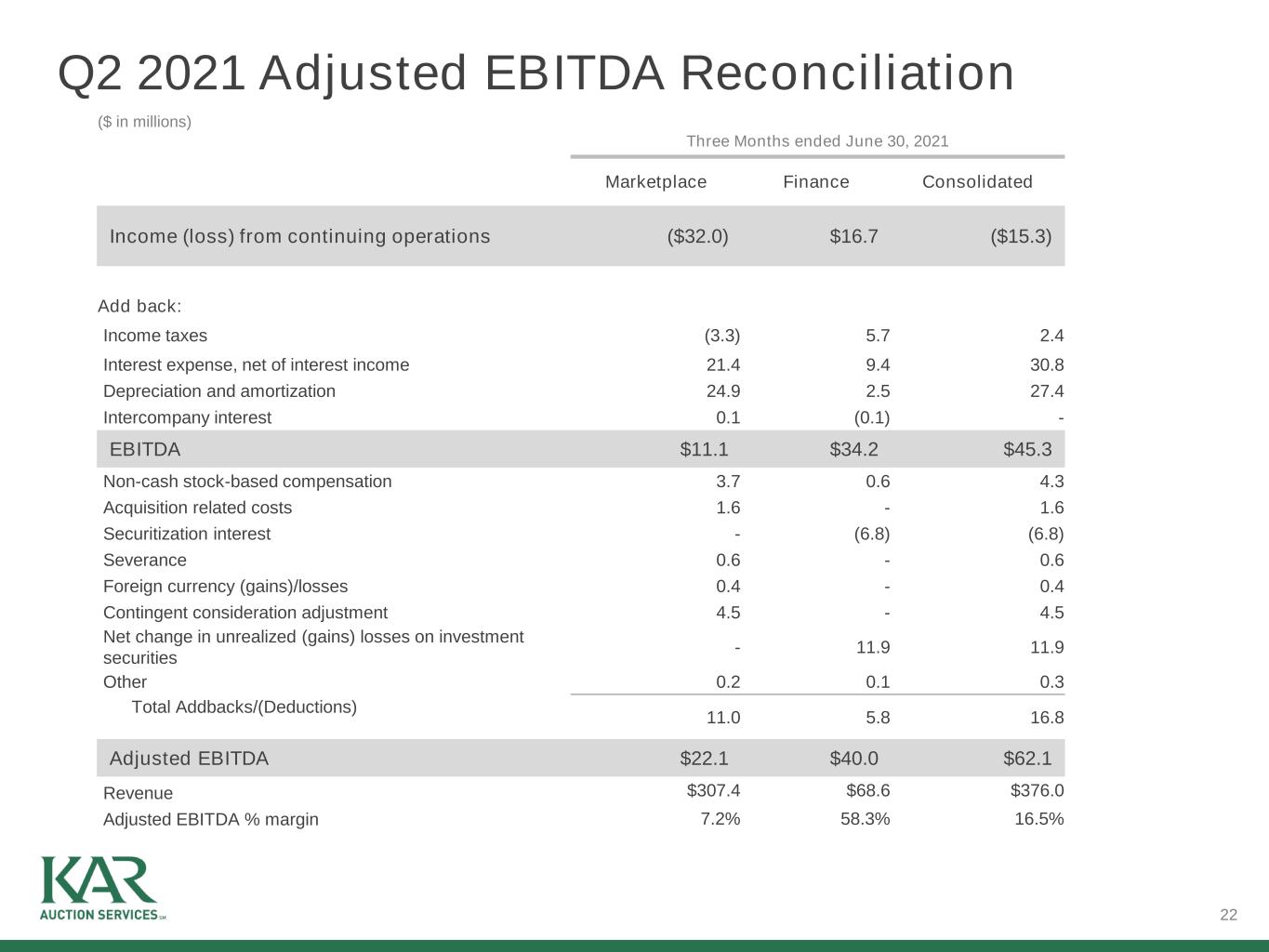

22 Q2 2021 Adjusted EBITDA Reconciliation ($ in millions) Three Months ended June 30, 2021 Marketplace Finance Consolidated Income (loss) from continuing operations ($32.0) $16.7 ($15.3) Add back: Income taxes (3.3) 5.7 2.4 Interest expense, net of interest income 21.4 9.4 30.8 Depreciation and amortization 24.9 2.5 27.4 Intercompany interest 0.1 (0.1) - EBITDA $11.1 $34.2 $45.3 Non-cash stock-based compensation 3.7 0.6 4.3 Acquisition related costs 1.6 - 1.6 Securitization interest - (6.8) (6.8) Severance 0.6 - 0.6 Foreign currency (gains)/losses 0.4 - 0.4 Contingent consideration adjustment 4.5 - 4.5 Net change in unrealized (gains) losses on investment securities - 11.9 11.9 Other 0.2 0.1 0.3 Total Addbacks/(Deductions) 11.0 5.8 16.8 Adjusted EBITDA $22.1 $40.0 $62.1 Revenue $307.4 $68.6 $376.0 Adjusted EBITDA % margin 7.2% 58.3% 16.5%

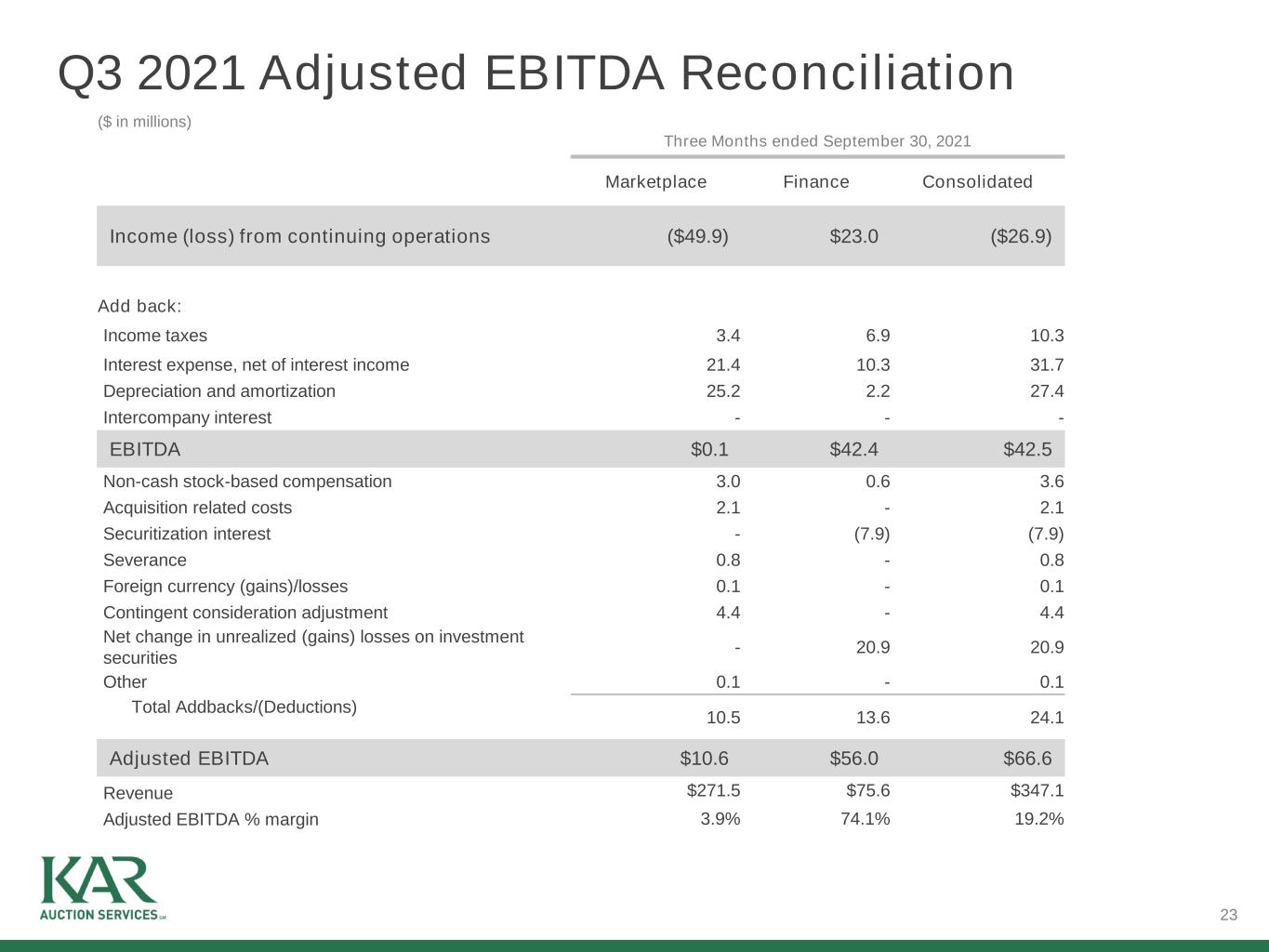

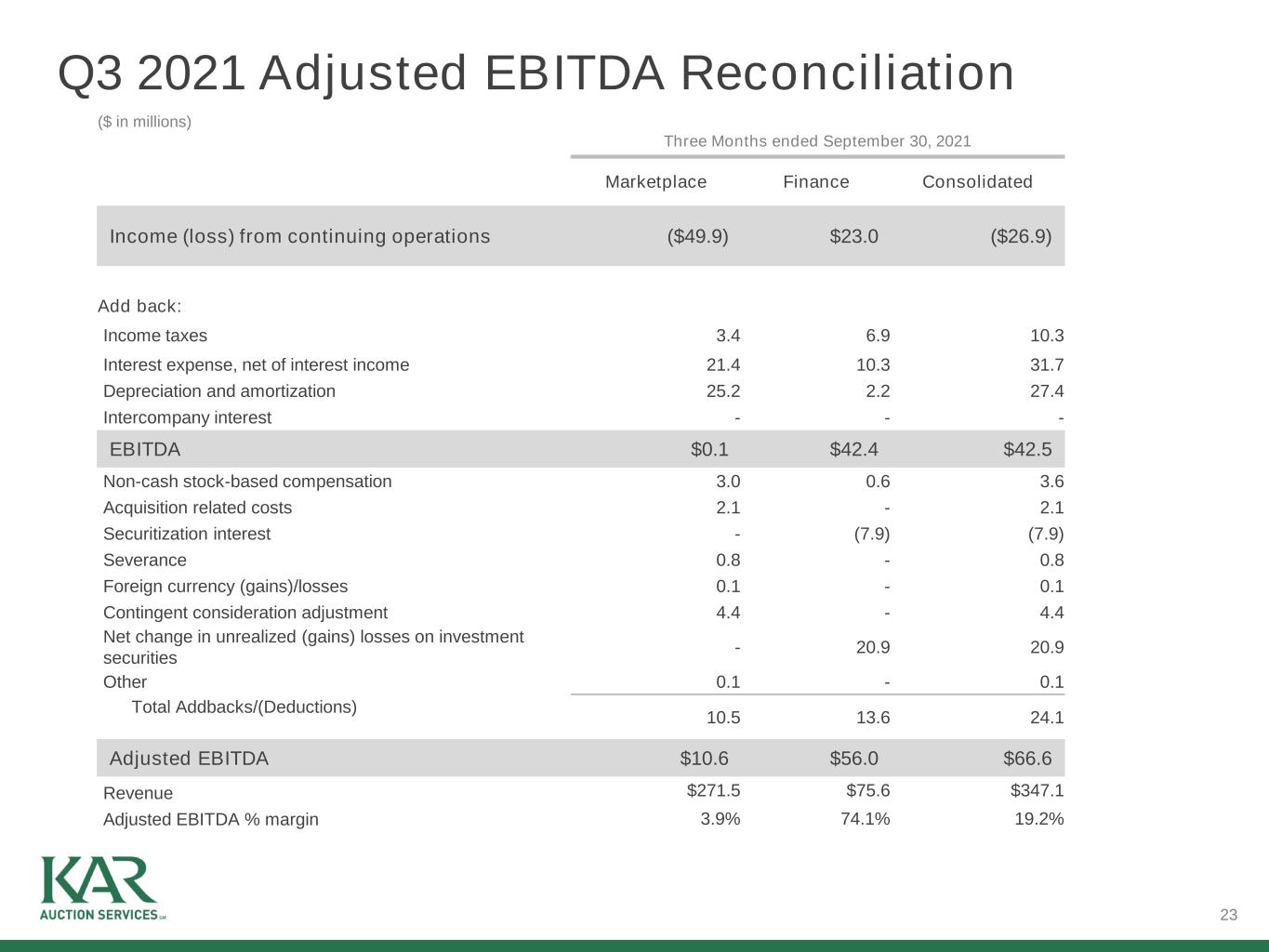

23 Q3 2021 Adjusted EBITDA Reconciliation ($ in millions) Three Months ended September 30, 2021 Marketplace Finance Consolidated Income (loss) from continuing operations ($49.9) $23.0 ($26.9) Add back: Income taxes 3.4 6.9 10.3 Interest expense, net of interest income 21.4 10.3 31.7 Depreciation and amortization 25.2 2.2 27.4 Intercompany interest - - - EBITDA $0.1 $42.4 $42.5 Non-cash stock-based compensation 3.0 0.6 3.6 Acquisition related costs 2.1 - 2.1 Securitization interest - (7.9) (7.9) Severance 0.8 - 0.8 Foreign currency (gains)/losses 0.1 - 0.1 Contingent consideration adjustment 4.4 - 4.4 Net change in unrealized (gains) losses on investment securities - 20.9 20.9 Other 0.1 - 0.1 Total Addbacks/(Deductions) 10.5 13.6 24.1 Adjusted EBITDA $10.6 $56.0 $66.6 Revenue $271.5 $75.6 $347.1 Adjusted EBITDA % margin 3.9% 74.1% 19.2%

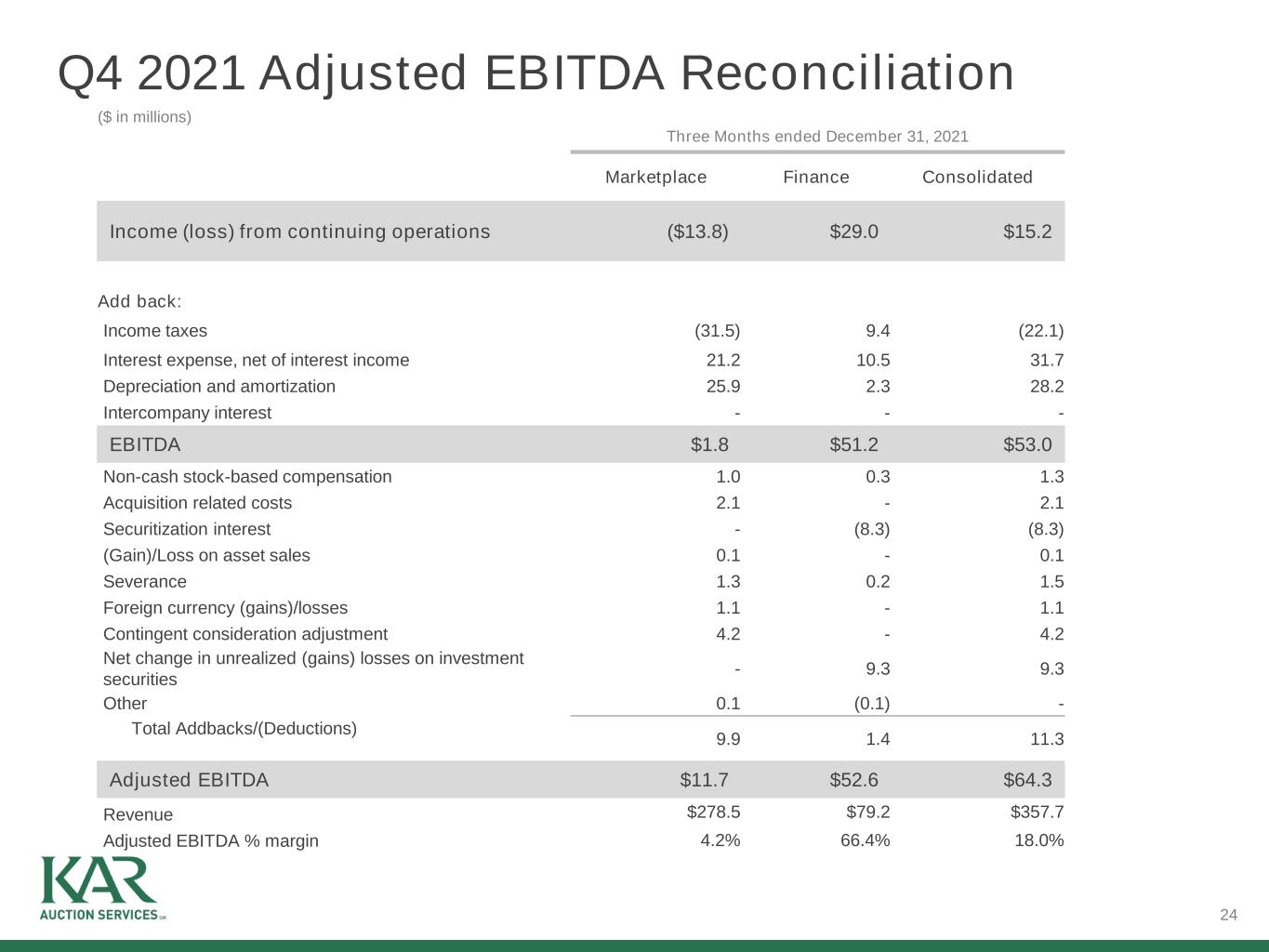

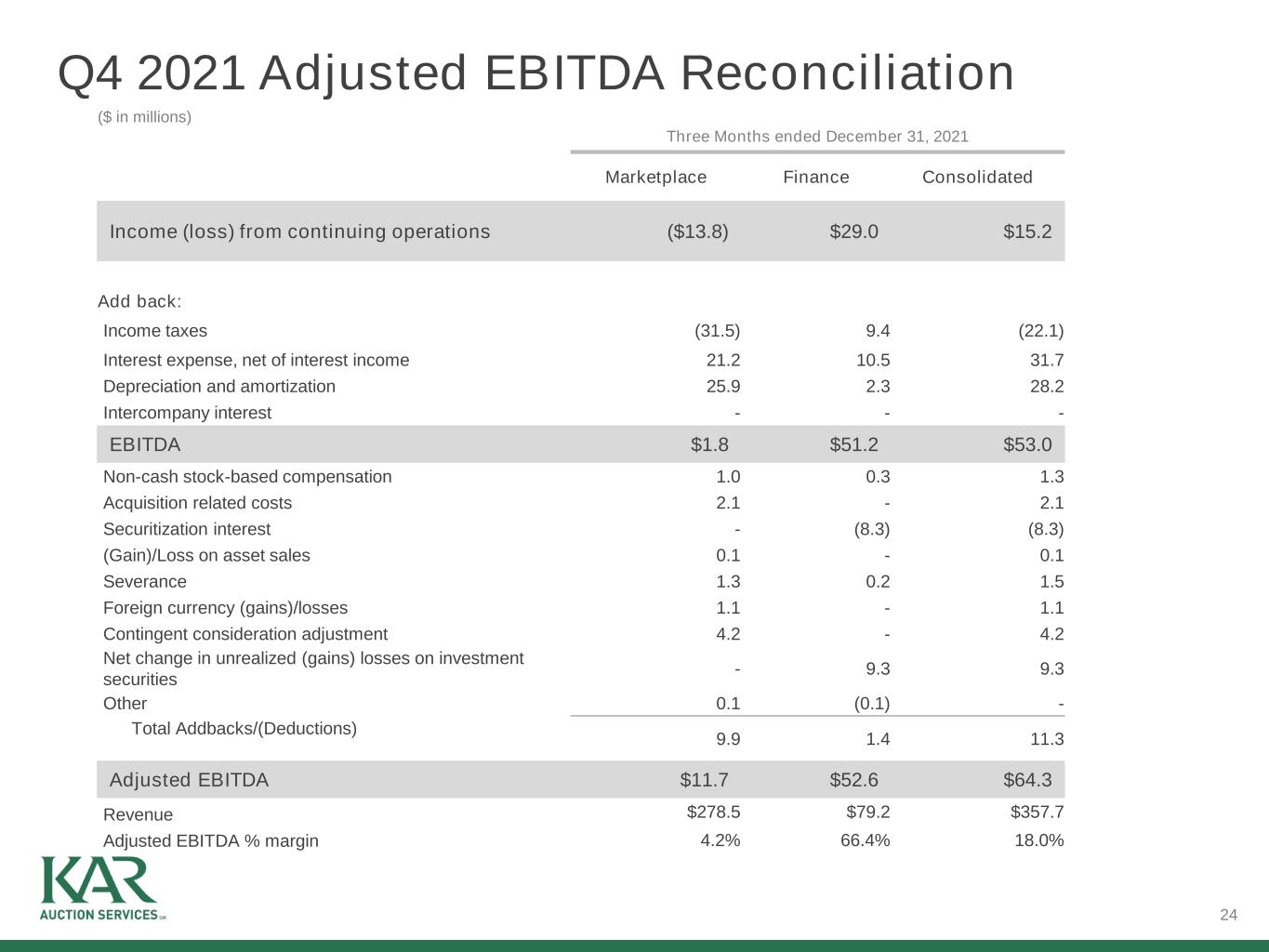

24 Q4 2021 Adjusted EBITDA Reconciliation ($ in millions) Three Months ended December 31, 2021 Marketplace Finance Consolidated Income (loss) from continuing operations ($13.8) $29.0 $15.2 Add back: Income taxes (31.5) 9.4 (22.1) Interest expense, net of interest income 21.2 10.5 31.7 Depreciation and amortization 25.9 2.3 28.2 Intercompany interest - - - EBITDA $1.8 $51.2 $53.0 Non-cash stock-based compensation 1.0 0.3 1.3 Acquisition related costs 2.1 - 2.1 Securitization interest - (8.3) (8.3) (Gain)/Loss on asset sales 0.1 - 0.1 Severance 1.3 0.2 1.5 Foreign currency (gains)/losses 1.1 - 1.1 Contingent consideration adjustment 4.2 - 4.2 Net change in unrealized (gains) losses on investment securities - 9.3 9.3 Other 0.1 (0.1) - Total Addbacks/(Deductions) 9.9 1.4 11.3 Adjusted EBITDA $11.7 $52.6 $64.3 Revenue $278.5 $79.2 $357.7 Adjusted EBITDA % margin 4.2% 66.4% 18.0%

25 2021 Adjusted EBITDA Reconciliation ($ in millions) Year ended December 31, 2021 Marketplace Finance Consolidated Income (loss) from continuing operations ($126.2) $125.4 ($0.8) Add back: Income taxes (26.4) 41.5 15.1 Interest expense, net of interest income 85.3 39.5 124.8 Depreciation and amortization 100.5 9.4 109.9 Intercompany interest 0.2 (0.2) - EBITDA $33.4 $215.6 $249.0 Non-cash stock-based compensation 12.1 2.2 14.3 Acquisition related costs 7.1 - 7.1 Securitization interest - (29.8) (29.8) (Gain)/Loss on asset sales 0.1 (0.8) (0.7) Severance 2.9 0.4 3.3 Foreign currency (gains)/losses 3.8 - 3.8 Contingent consideration adjustment 24.3 - 24.3 Net change in unrealized (gains) losses on investment securities - (1.4) (1.4) Other 0.6 (0.3) 0.3 Total Addbacks/(Deductions) 50.9 (29.7) 21.2 Adjusted EBITDA $84.3 $185.9 $270.2 Revenue $1,161.4 $289.2 $1,450.6 Adjusted EBITDA % margin 7.3% 64.3% 18.6%

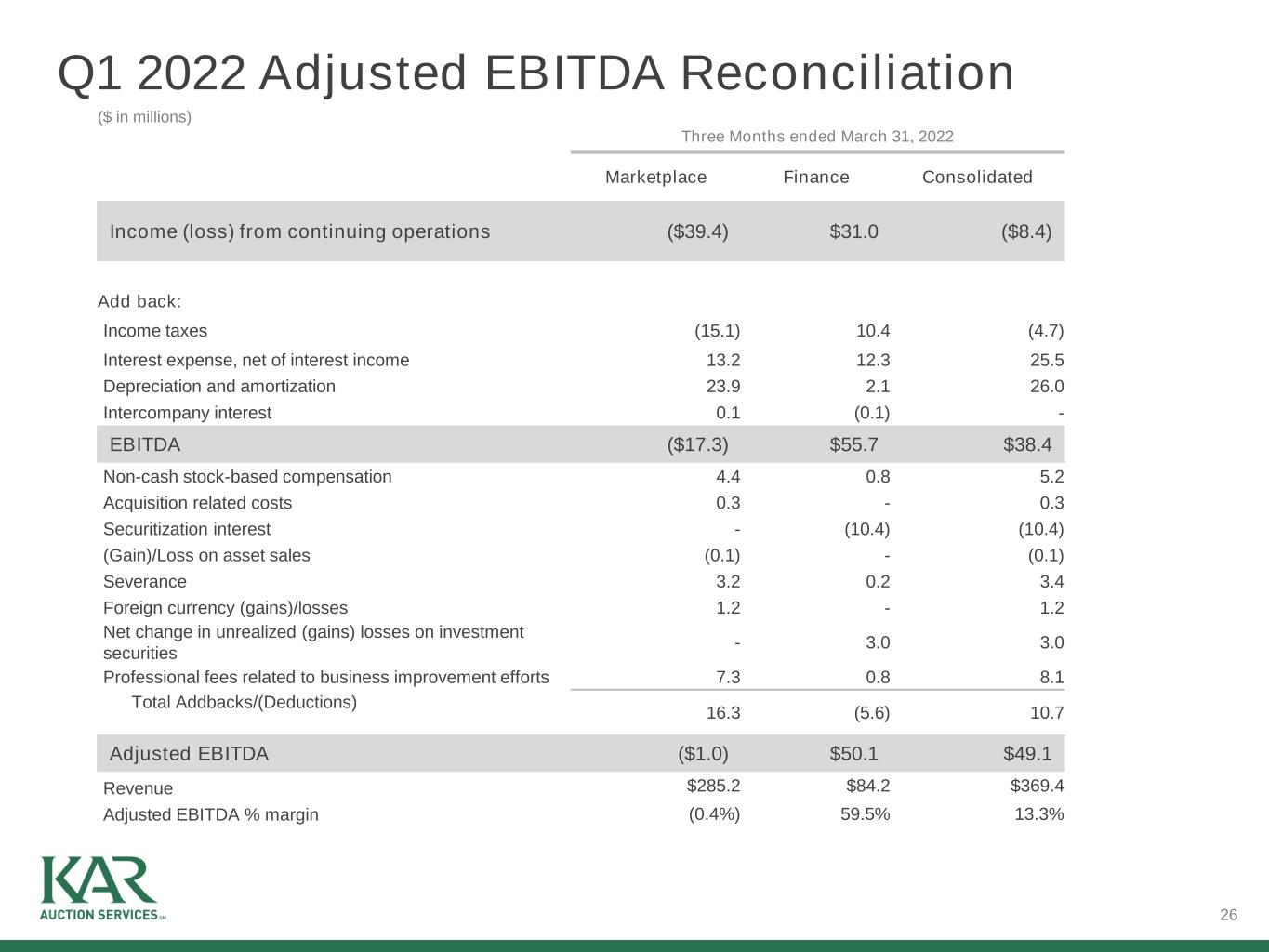

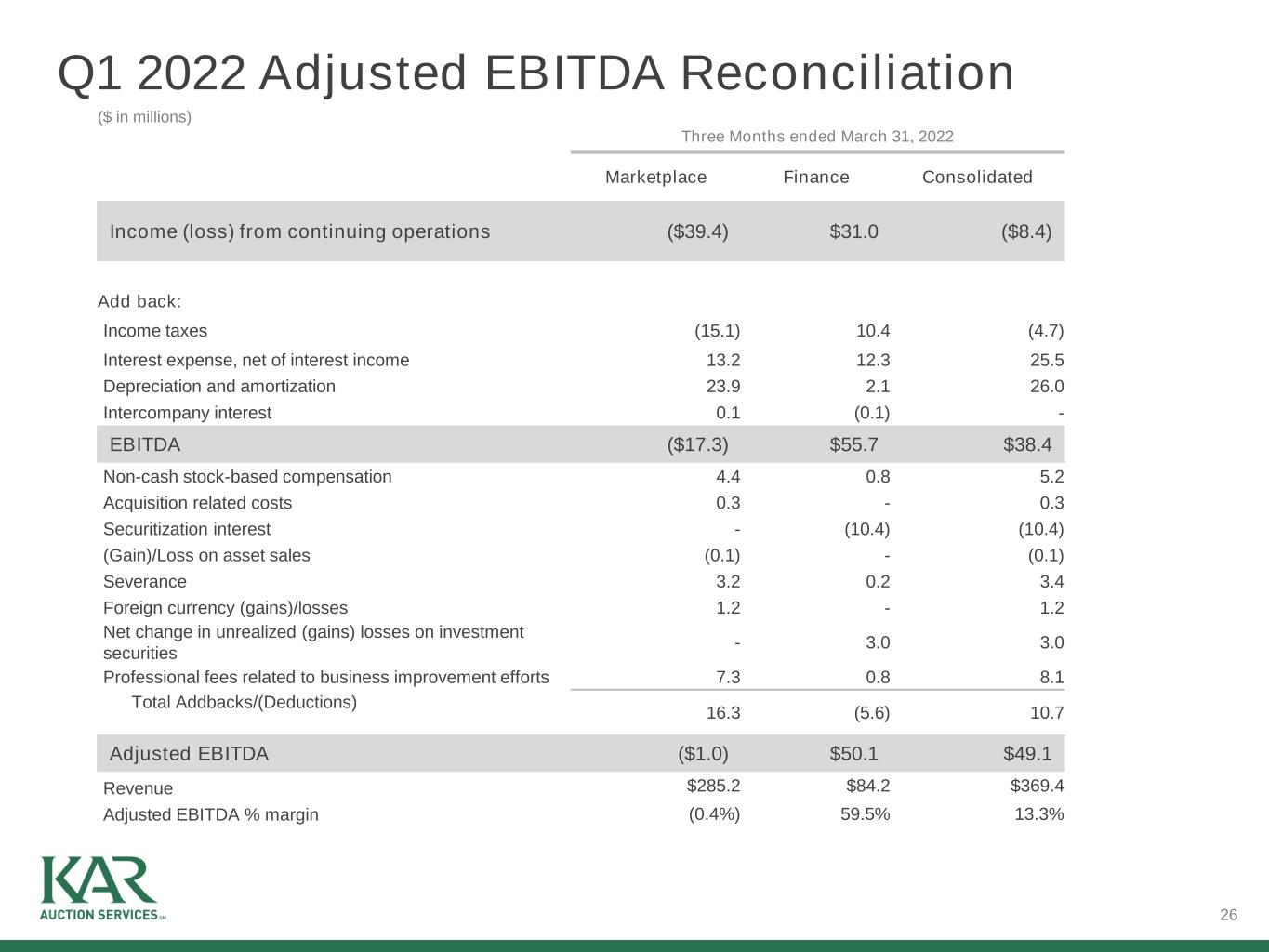

26 Q1 2022 Adjusted EBITDA Reconciliation ($ in millions) Three Months ended March 31, 2022 Marketplace Finance Consolidated Income (loss) from continuing operations ($39.4) $31.0 ($8.4) Add back: Income taxes (15.1) 10.4 (4.7) Interest expense, net of interest income 13.2 12.3 25.5 Depreciation and amortization 23.9 2.1 26.0 Intercompany interest 0.1 (0.1) - EBITDA ($17.3) $55.7 $38.4 Non-cash stock-based compensation 4.4 0.8 5.2 Acquisition related costs 0.3 - 0.3 Securitization interest - (10.4) (10.4) (Gain)/Loss on asset sales (0.1) - (0.1) Severance 3.2 0.2 3.4 Foreign currency (gains)/losses 1.2 - 1.2 Net change in unrealized (gains) losses on investment securities - 3.0 3.0 Professional fees related to business improvement efforts 7.3 0.8 8.1 Total Addbacks/(Deductions) 16.3 (5.6) 10.7 Adjusted EBITDA ($1.0) $50.1 $49.1 Revenue $285.2 $84.2 $369.4 Adjusted EBITDA % margin (0.4%) 59.5% 13.3%

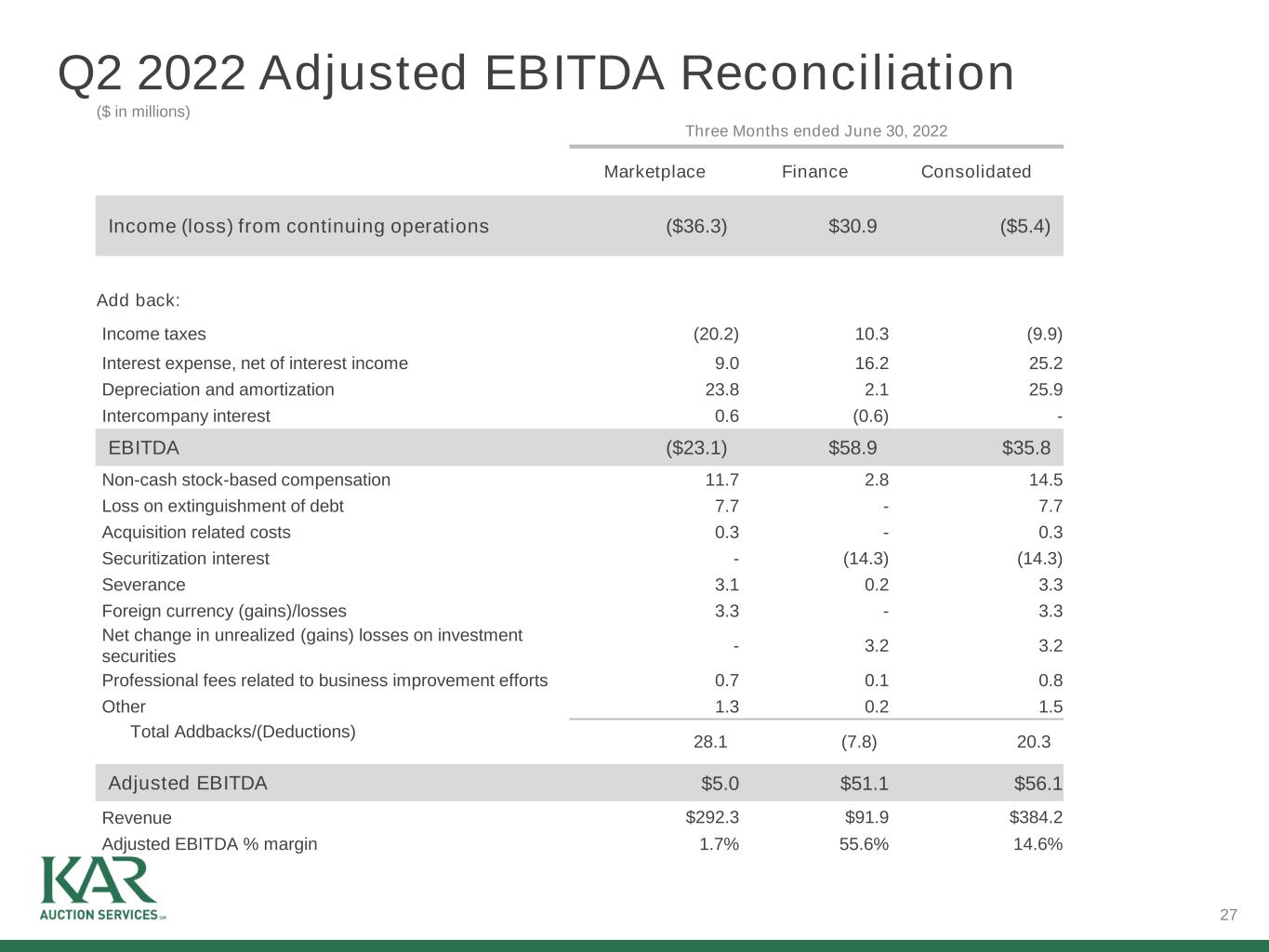

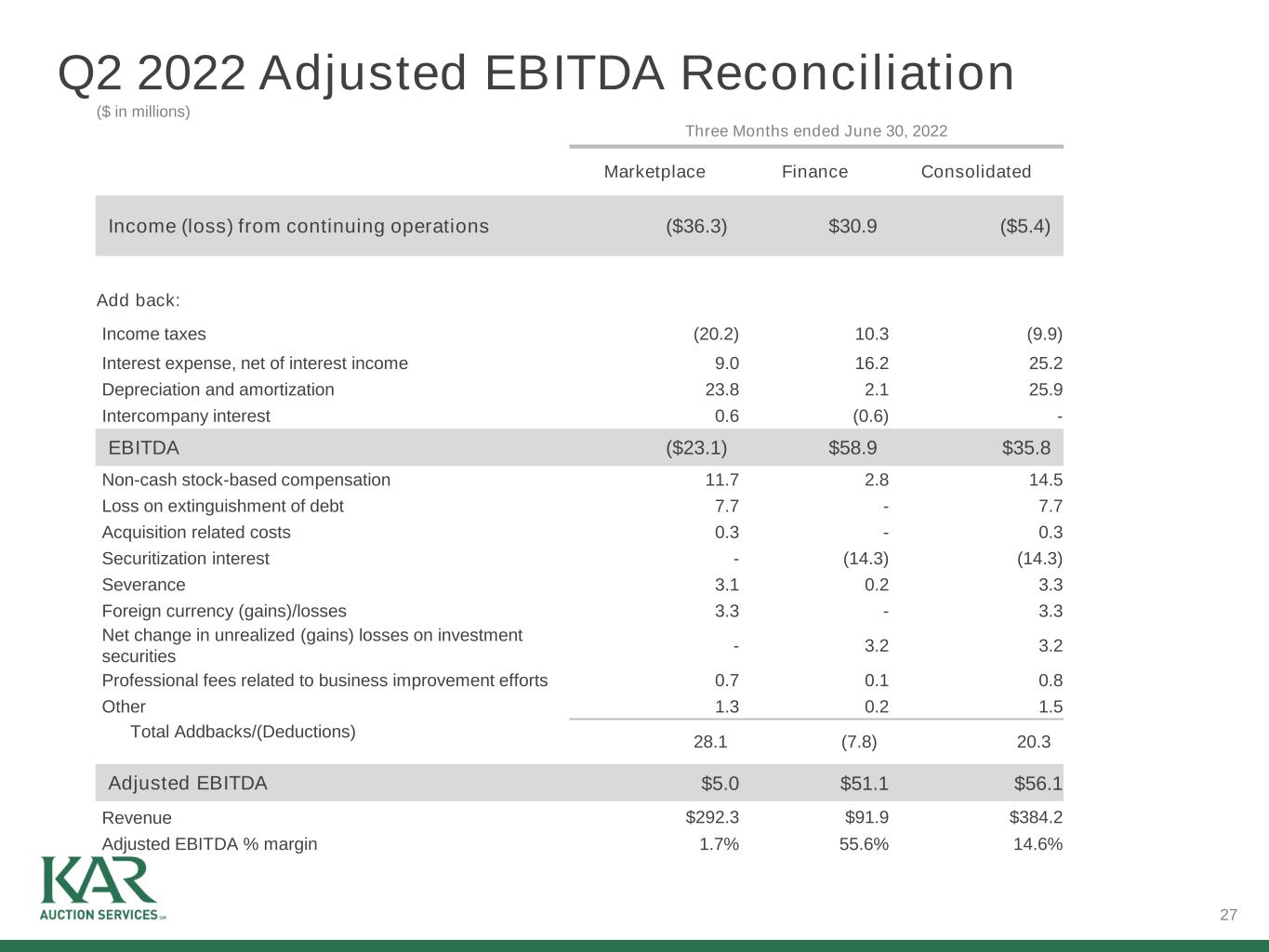

27 Q2 2022 Adjusted EBITDA Reconciliation ($ in millions) Three Months ended June 30, 2022 Marketplace Finance Consolidated Income (loss) from continuing operations ($36.3) $30.9 ($5.4) Add back: Income taxes (20.2) 10.3 (9.9) Interest expense, net of interest income 9.0 16.2 25.2 Depreciation and amortization 23.8 2.1 25.9 Intercompany interest 0.6 (0.6) - EBITDA ($23.1) $58.9 $35.8 Non-cash stock-based compensation 11.7 2.8 14.5 Loss on extinguishment of debt 7.7 - 7.7 Acquisition related costs 0.3 - 0.3 Securitization interest - (14.3) (14.3) Severance 3.1 0.2 3.3 Foreign currency (gains)/losses 3.3 - 3.3 Net change in unrealized (gains) losses on investment securities - 3.2 3.2 Professional fees related to business improvement efforts 0.7 0.1 0.8 Other 1.3 0.2 1.5 Total Addbacks/(Deductions) 28.1 (7.8) 20.3 Adjusted EBITDA $5.0 $51.1 $56.1 Revenue $292.3 $91.9 $384.2 Adjusted EBITDA % margin 1.7% 55.6% 14.6%

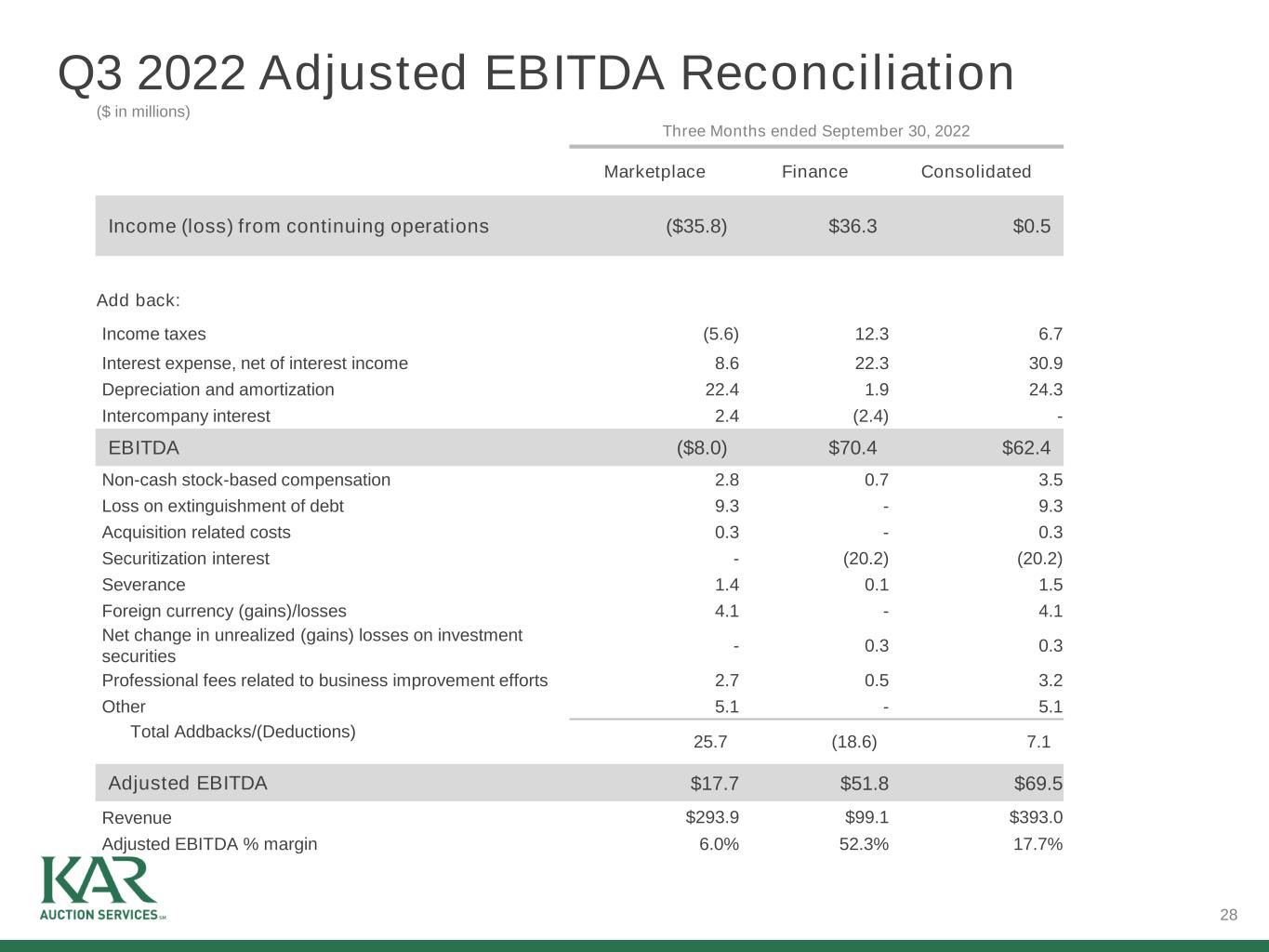

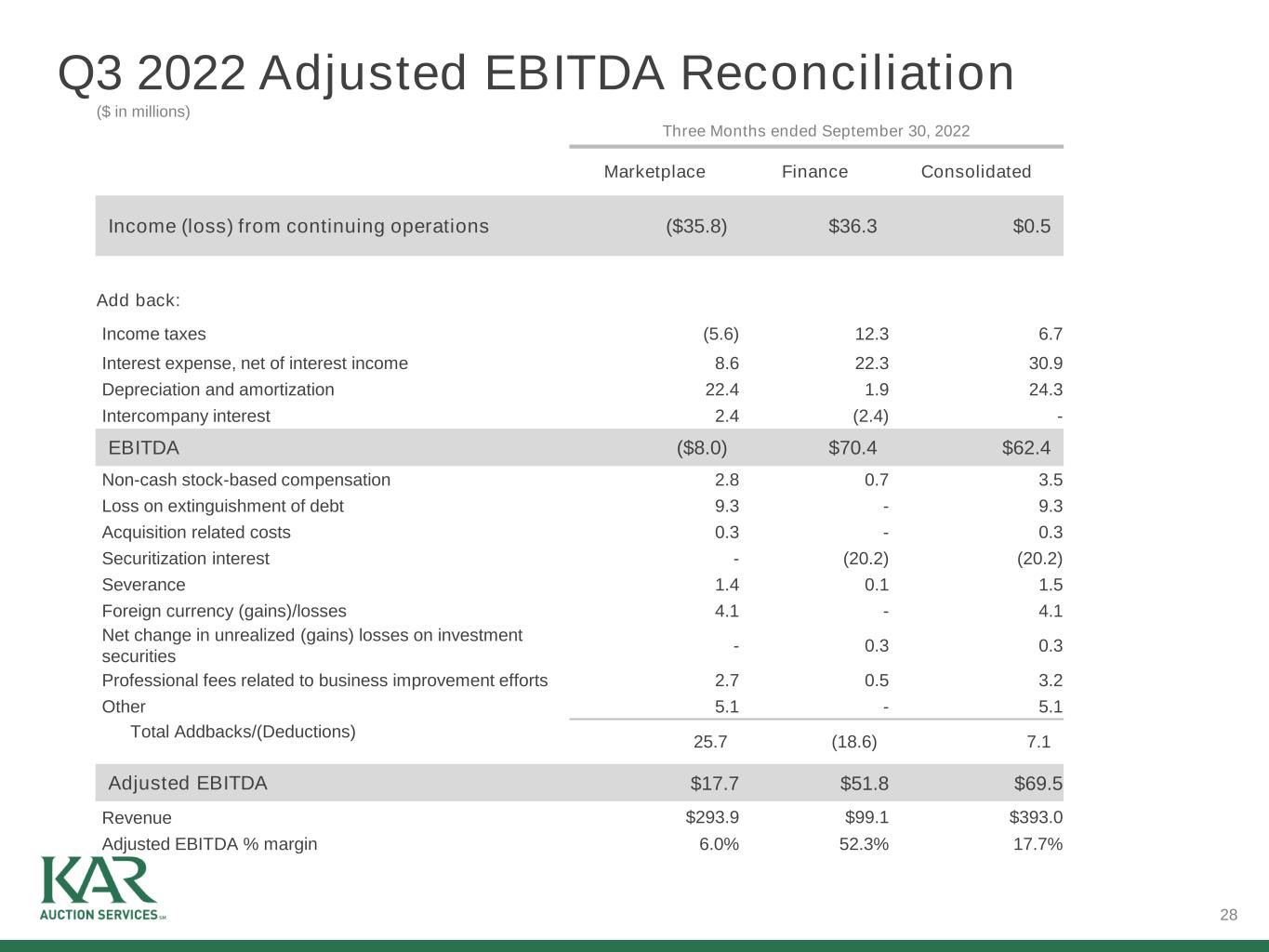

28 Q3 2022 Adjusted EBITDA Reconciliation ($ in millions) Three Months ended September 30, 2022 Marketplace Finance Consolidated Income (loss) from continuing operations ($35.8) $36.3 $0.5 Add back: Income taxes (5.6) 12.3 6.7 Interest expense, net of interest income 8.6 22.3 30.9 Depreciation and amortization 22.4 1.9 24.3 Intercompany interest 2.4 (2.4) - EBITDA ($8.0) $70.4 $62.4 Non-cash stock-based compensation 2.8 0.7 3.5 Loss on extinguishment of debt 9.3 - 9.3 Acquisition related costs 0.3 - 0.3 Securitization interest - (20.2) (20.2) Severance 1.4 0.1 1.5 Foreign currency (gains)/losses 4.1 - 4.1 Net change in unrealized (gains) losses on investment securities - 0.3 0.3 Professional fees related to business improvement efforts 2.7 0.5 3.2 Other 5.1 - 5.1 Total Addbacks/(Deductions) 25.7 (18.6) 7.1 Adjusted EBITDA $17.7 $51.8 $69.5 Revenue $293.9 $99.1 $393.0 Adjusted EBITDA % margin 6.0% 52.3% 17.7%

29 Q4 2022 Adjusted EBITDA Reconciliation ($ in millions) Three Months ended December 31, 2022 Marketplace Finance Consolidated Income (loss) from continuing operations $5.8 $36.1 $41.9 Add back: Income taxes 4.5 13.4 17.9 Interest expense, net of interest income 6.8 28.1 34.9 Depreciation and amortization 22.2 1.8 24.0 Intercompany interest 5.3 (5.3) - EBITDA $44.6 $74.1 $118.7 Non-cash stock-based compensation (4.7) (1.0) (5.7) Loss on extinguishment of debt 0.2 - 0.2 Acquisition related costs 0.3 - 0.3 Securitization interest - (25.8) (25.8) Gain on sale of property (33.9) - (33.9) Severance 4.0 0.2 4.2 Foreign currency (gains)/losses (6.1) - (6.1) Net change in unrealized (gains) losses on investment securities - 0.6 0.6 Professional fees related to business improvement efforts 2.6 0.5 3.1 Other 0.7 0.2 0.9 Total Addbacks/(Deductions) (36.9) (25.3) (62.2) Adjusted EBITDA $7.7 $48.8 $56.5 Revenue $272.1 $100.7 $372.8 Adjusted EBITDA % margin 2.8% 48.5% 15.2%

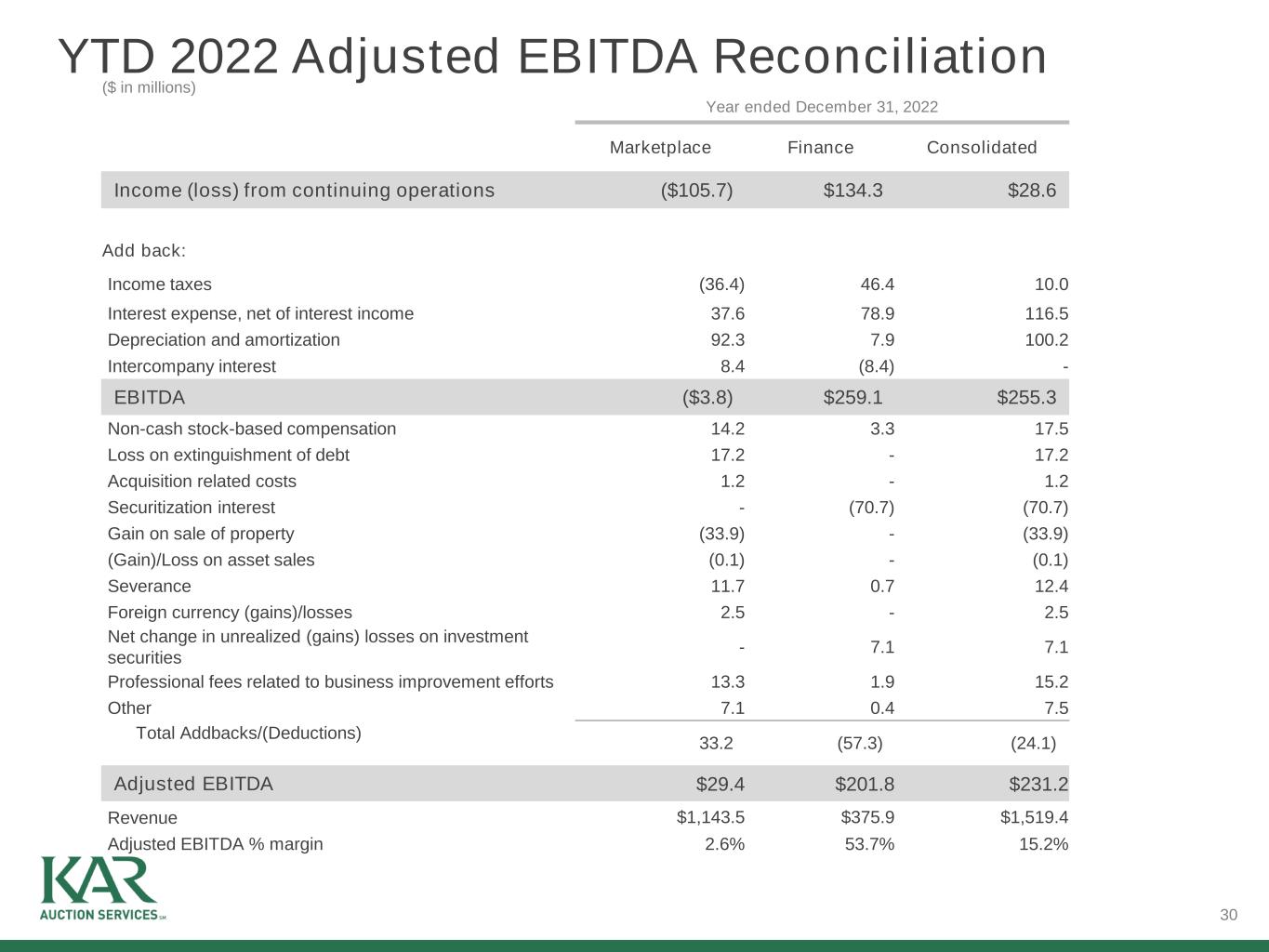

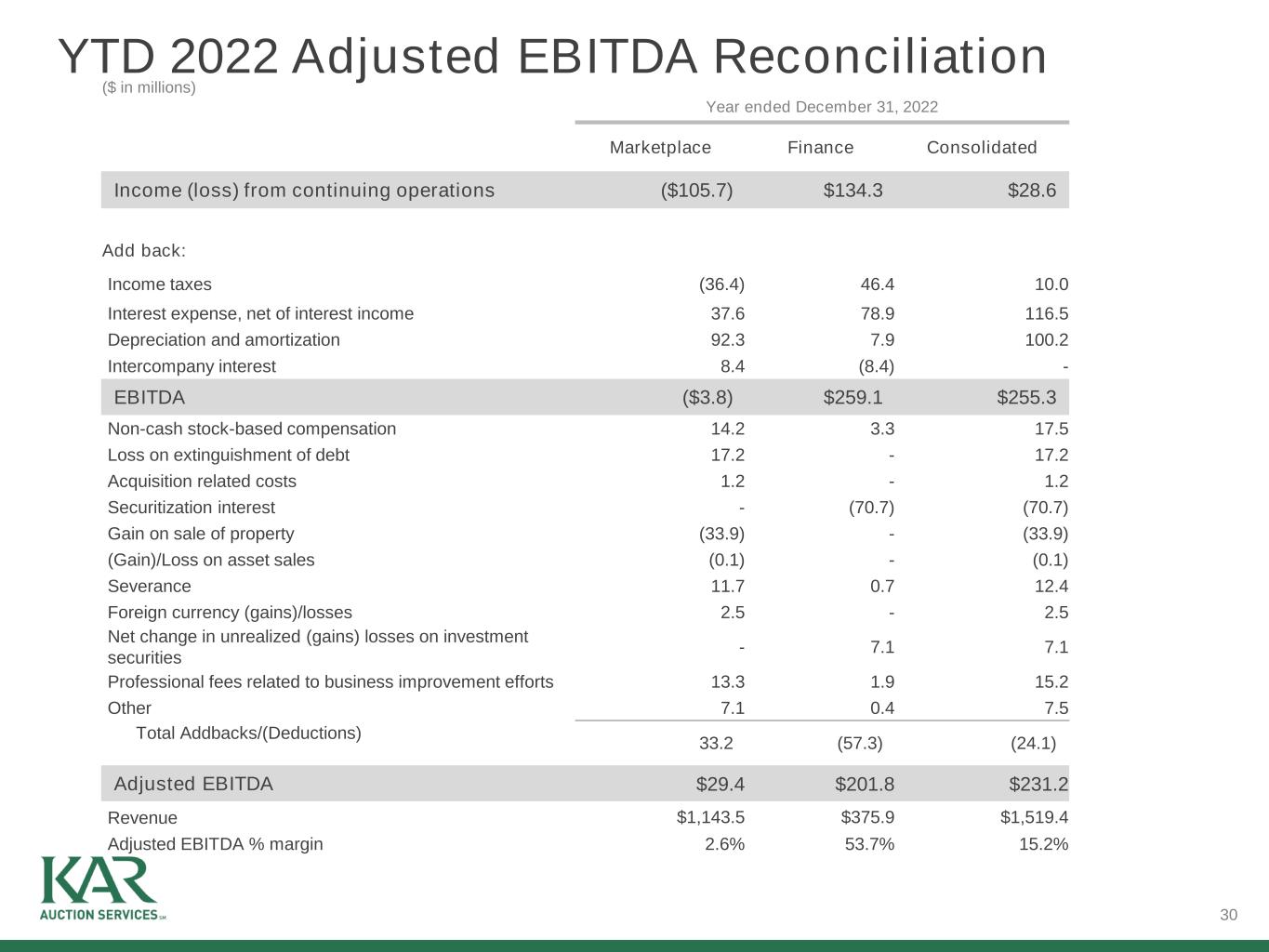

30 YTD 2022 Adjusted EBITDA Reconciliation ($ in millions) Year ended December 31, 2022 Marketplace Finance Consolidated Income (loss) from continuing operations ($105.7) $134.3 $28.6 Add back: Income taxes (36.4) 46.4 10.0 Interest expense, net of interest income 37.6 78.9 116.5 Depreciation and amortization 92.3 7.9 100.2 Intercompany interest 8.4 (8.4) - EBITDA ($3.8) $259.1 $255.3 Non-cash stock-based compensation 14.2 3.3 17.5 Loss on extinguishment of debt 17.2 - 17.2 Acquisition related costs 1.2 - 1.2 Securitization interest - (70.7) (70.7) Gain on sale of property (33.9) - (33.9) (Gain)/Loss on asset sales (0.1) - (0.1) Severance 11.7 0.7 12.4 Foreign currency (gains)/losses 2.5 - 2.5 Net change in unrealized (gains) losses on investment securities - 7.1 7.1 Professional fees related to business improvement efforts 13.3 1.9 15.2 Other 7.1 0.4 7.5 Total Addbacks/(Deductions) 33.2 (57.3) (24.1) Adjusted EBITDA $29.4 $201.8 $231.2 Revenue $1,143.5 $375.9 $1,519.4 Adjusted EBITDA % margin 2.6% 53.7% 15.2%

31 (1) The Series A Preferred Stock dividends and undistributed earnings allocated to participating securities have not been included in the calculation of operating adjusted net income (loss) and operating adjusted net income (loss) per diluted share. (2) For the three months and year ended December 31, 2022, the effective tax rate at the end of each period was used to determine the amount of income tax on the adjustments to net income. An effective tax rate of 24.5% was used to determine the amount of income tax benefit on the acquired amortization expense in 2021. There was no income tax benefit related to the contingent consideration adjustment because this item is not deductible for income tax purposes. Operating Adjusted Net Income (Loss) per Share Reconciliation ($ in millions, except per share amounts), (unaudited) Three Months ended December 31, Year ended December 31, 2022 2021 2022 2021 Net income (loss) from continuing operations (1) $41.9 $15.2 $28.6 ($0.8) Acquired amortization expense 8.0 8.6 33.0 33.4 Loss on extinguishment of debt 0.2 - 17.2 - Contingent consideration adjustment - 4.2 - 24.3 Income taxes (2) (2.5) (2.1) (13.0) (8.2) Operating adjusted net income (loss) from continuing operations $47.6 $25.9 $65.8 $48.7 Net income (loss) from discontinued operations ($4.8) ($10.1) $212.6 $67.3 Acquired amortization expense - 4.4 5.9 21.2 Income taxes (2) - (1.1) (1.5) (5.2) Operating adjusted net income (loss) from discontinued operations ($4.8) ($6.8) $217.0 $83.3 Operating adjusted net income $42.8 $19.1 $282.8 $132.0 Operating adjusted net income (loss) from continuing operations per share - diluted $0.33 $0.17 $0.43 $0.31 Operating adjusted net income (loss) from discontinued operations per share – diluted (0.04) (0.05) 1.43 0.53 Operating adjusted net income per share - diluted $0.29 $0.12 $1.86 $0.84 Weighted average diluted shares – including assumed conversion of preferred shares 145.7 156.1 151.9 156.6