Third Quarter 2023 Earnings Slides // November 1, 2023

2 Q3 | 2023 Forward-Looking Statements This presentation includes forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based on management’s current expectations, are not guarantees of future performance and are subject to certain risks, trends, and uncertainties that could cause actual results to differ materially from those projected, expressed or implied by such forward-looking statements. Many of these risk factors are outside of the company’s control, and as such, they involve risks which are not currently known to the company that could cause actual results to differ materially from forecasted results. Factors that could cause or contribute to such differences include but are not limited to risks and uncertainties regarding the impact of adverse market, economic and geopolitical conditions and those other matters disclosed in the company’s Securities and Exchange Commission filings, including those discussed under the heading “Risk Factors” in the company’s annual and quarterly periodic reports. The forward-looking statements in this document are made as of the date hereof and the company does not undertake to update its forward-looking statements.

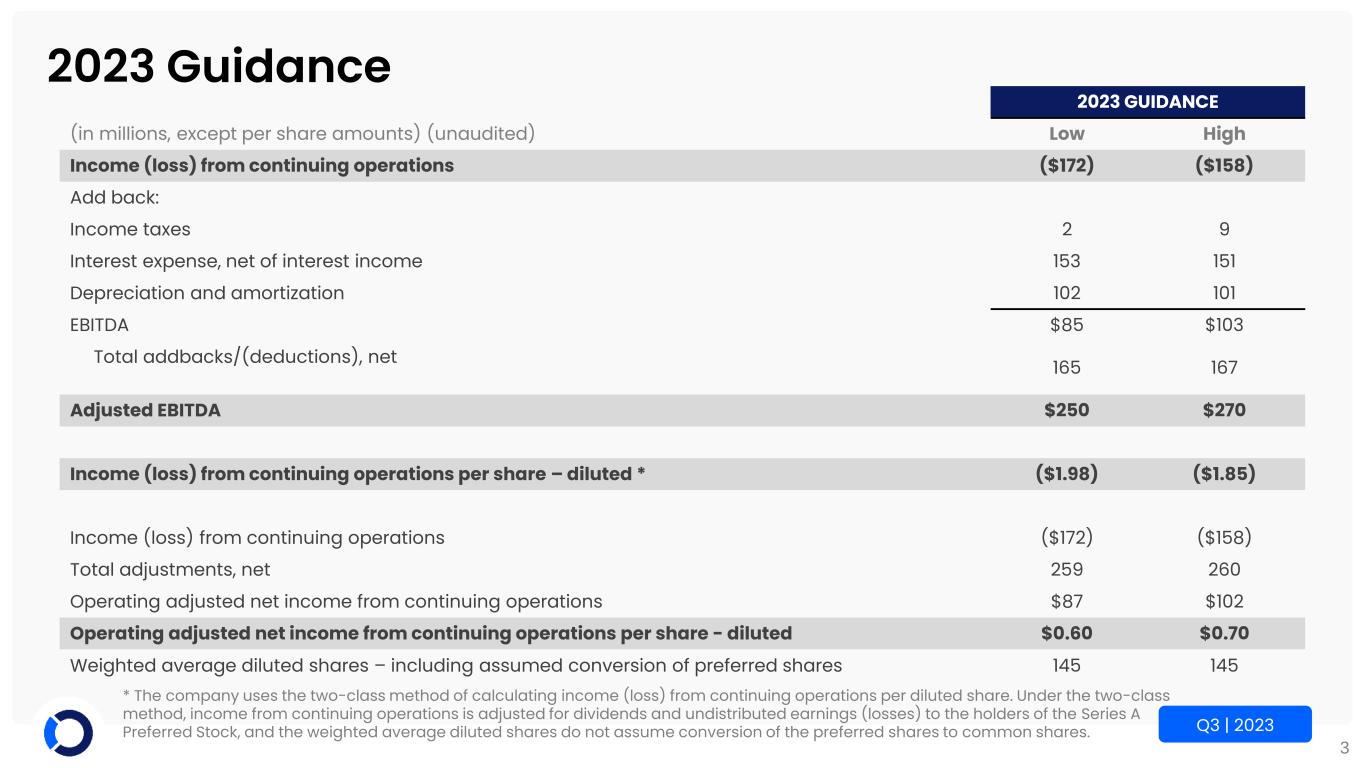

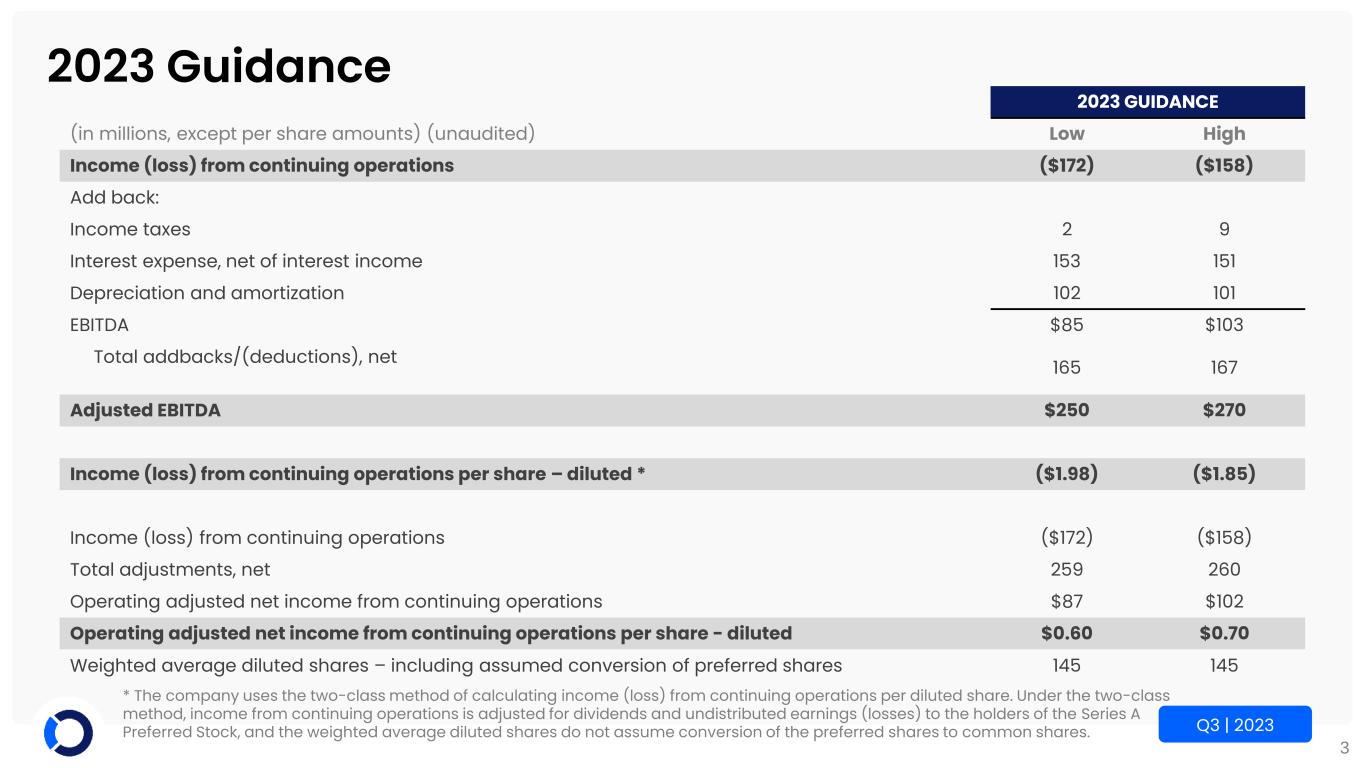

3 Q3 | 2023 2023 Guidance 2023 GUIDANCE (in millions, except per share amounts) (unaudited) Low High Income (loss) from continuing operations ($172) ($158) Add back: Income taxes 2 9 Interest expense, net of interest income 153 151 Depreciation and amortization 102 101 EBITDA $85 $103 Total addbacks/(deductions), net 165 167 Adjusted EBITDA $250 $270 Income (loss) from continuing operations per share – diluted * ($1.98) ($1.85) Income (loss) from continuing operations ($172) ($158) Total adjustments, net 259 260 Operating adjusted net income from continuing operations $87 $102 Operating adjusted net income from continuing operations per share - diluted $0.60 $0.70 Weighted average diluted shares – including assumed conversion of preferred shares 145 145 * The company uses the two-class method of calculating income (loss) from continuing operations per diluted share. Under the two-class method, income from continuing operations is adjusted for dividends and undistributed earnings (losses) to the holders of the Series A Preferred Stock, and the weighted average diluted shares do not assume conversion of the preferred shares to common shares.

4 Q3 | 2023 Third Quarter & Year-to-Date Results

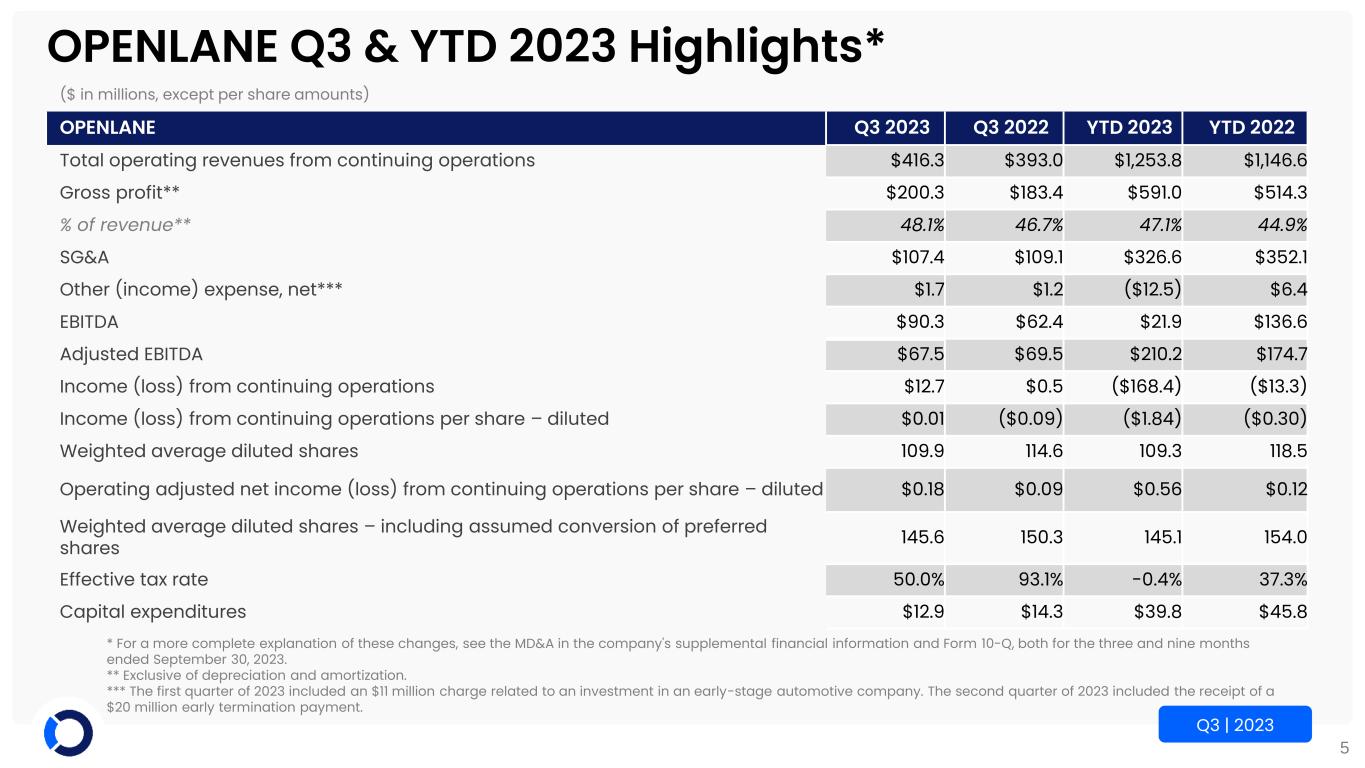

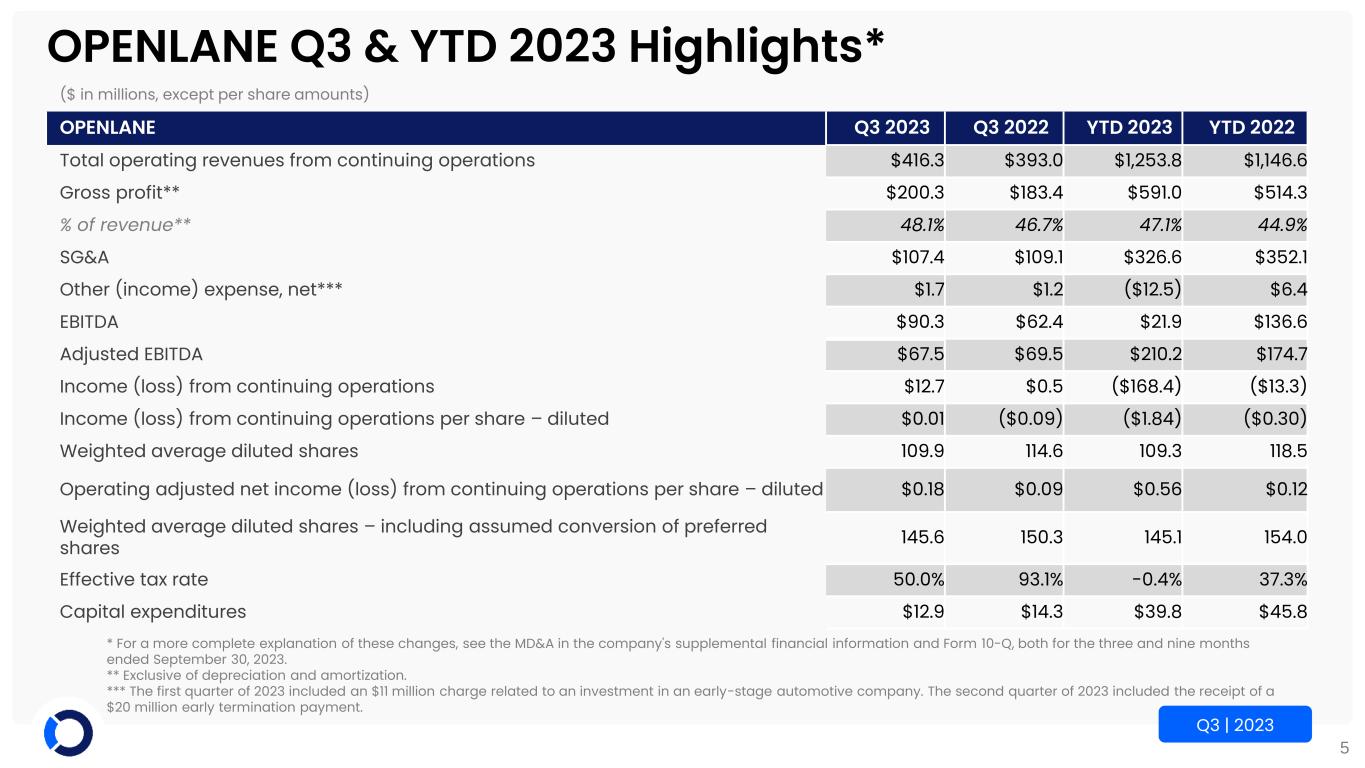

5 Q3 | 2023 OPENLANE Q3 & YTD 2023 Highlights* ($ in millions, except per share amounts) OPENLANE Q3 2023 Q3 2022 YTD 2023 YTD 2022 Total operating revenues from continuing operations $416.3 $393.0 $1,253.8 $1,146.6 Gross profit** $200.3 $183.4 $591.0 $514.3 % of revenue** 48.1% 46.7% 47.1% 44.9% SG&A $107.4 $109.1 $326.6 $352.1 Other (income) expense, net*** $1.7 $1.2 ($12.5) $6.4 EBITDA $90.3 $62.4 $21.9 $136.6 Adjusted EBITDA $67.5 $69.5 $210.2 $174.7 Income (loss) from continuing operations $12.7 $0.5 ($168.4) ($13.3) Income (loss) from continuing operations per share – diluted $0.01 ($0.09) ($1.84) ($0.30) Weighted average diluted shares 109.9 114.6 109.3 118.5 Operating adjusted net income (loss) from continuing operations per share – diluted $0.18 $0.09 $0.56 $0.12 Weighted average diluted shares – including assumed conversion of preferred shares 145.6 150.3 145.1 154.0 Effective tax rate 50.0% 93.1% -0.4% 37.3% Capital expenditures $12.9 $14.3 $39.8 $45.8 * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-Q, both for the three and nine months ended September 30, 2023. ** Exclusive of depreciation and amortization. *** The first quarter of 2023 included an $11 million charge related to an investment in an early-stage automotive company. The second quarter of 2023 included the receipt of a $20 million early termination payment.

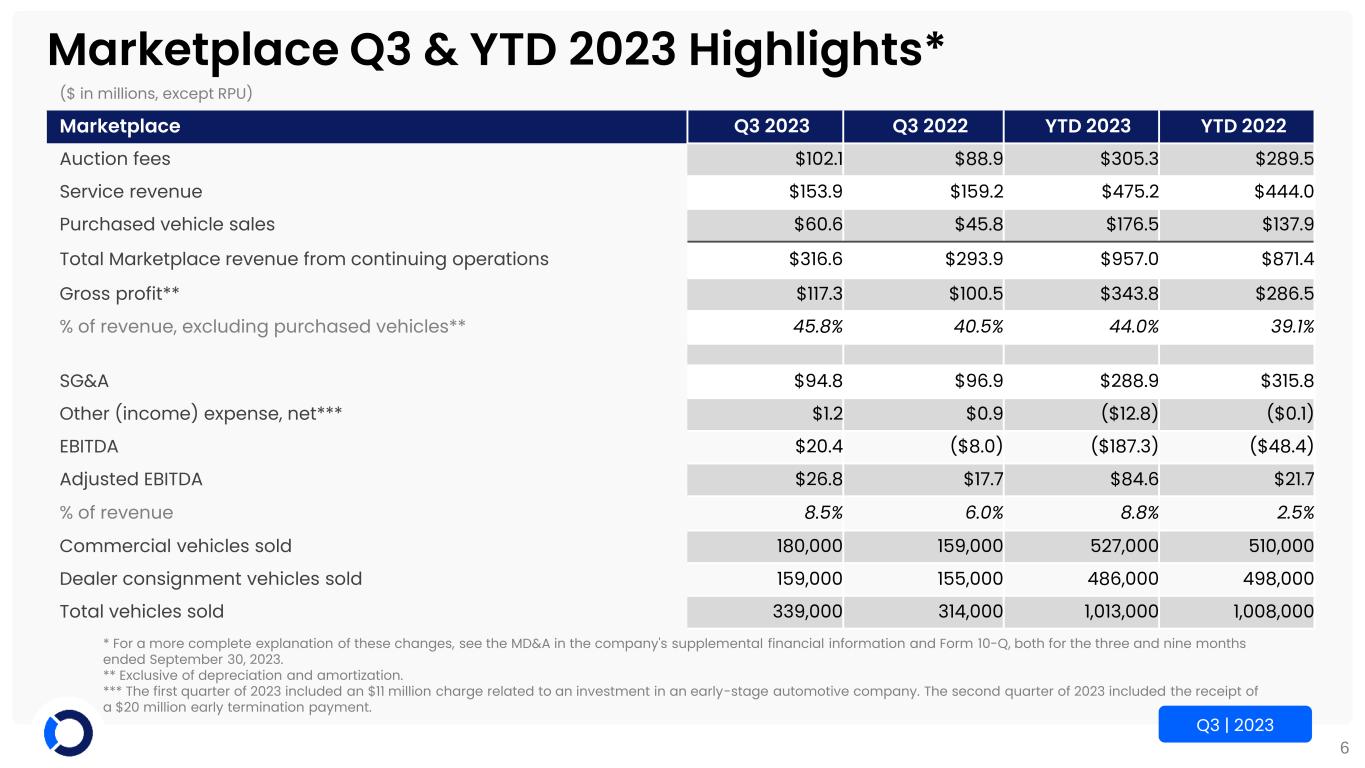

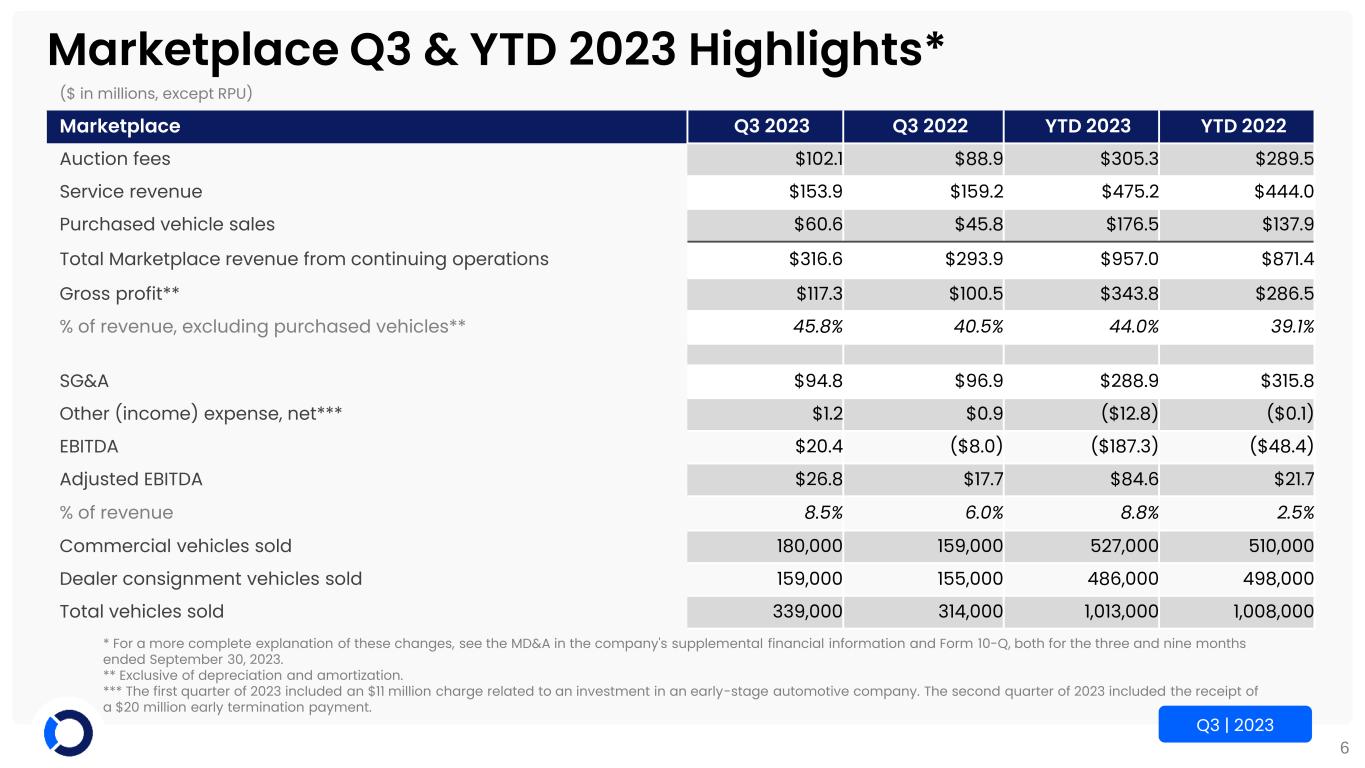

6 Q3 | 2023 Marketplace Q3 & YTD 2023 Highlights* ($ in millions, except RPU) Marketplace Q3 2023 Q3 2022 YTD 2023 YTD 2022 Auction fees $102.1 $88.9 $305.3 $289.5 Service revenue $153.9 $159.2 $475.2 $444.0 Purchased vehicle sales $60.6 $45.8 $176.5 $137.9 Total Marketplace revenue from continuing operations $316.6 $293.9 $957.0 $871.4 Gross profit** $117.3 $100.5 $343.8 $286.5 % of revenue, excluding purchased vehicles** 45.8% 40.5% 44.0% 39.1% SG&A $94.8 $96.9 $288.9 $315.8 Other (income) expense, net*** $1.2 $0.9 ($12.8) ($0.1) EBITDA $20.4 ($8.0) ($187.3) ($48.4) Adjusted EBITDA $26.8 $17.7 $84.6 $21.7 % of revenue 8.5% 6.0% 8.8% 2.5% Commercial vehicles sold 180,000 159,000 527,000 510,000 Dealer consignment vehicles sold 159,000 155,000 486,000 498,000 Total vehicles sold 339,000 314,000 1,013,000 1,008,000 * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-Q, both for the three and nine months ended September 30, 2023. ** Exclusive of depreciation and amortization. *** The first quarter of 2023 included an $11 million charge related to an investment in an early-stage automotive company. The second quarter of 2023 included the receipt of a $20 million early termination payment.

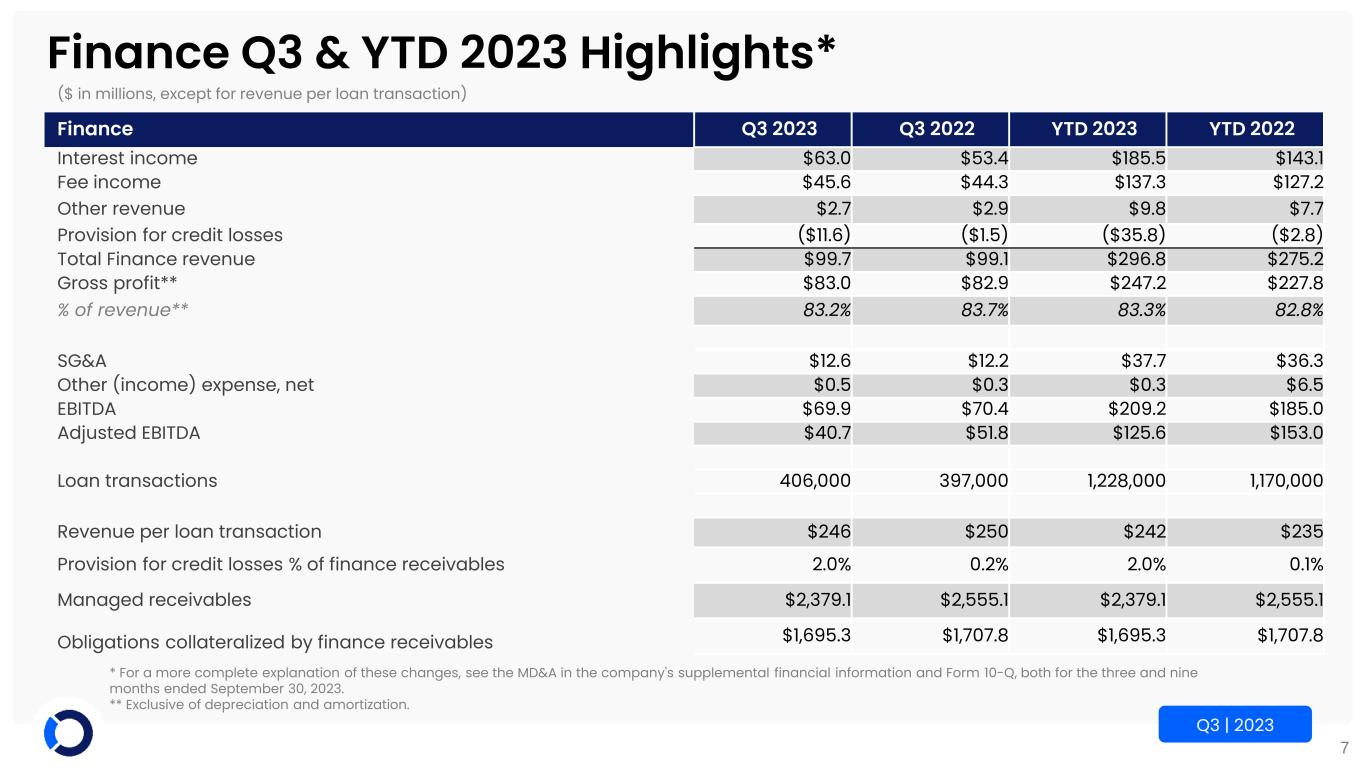

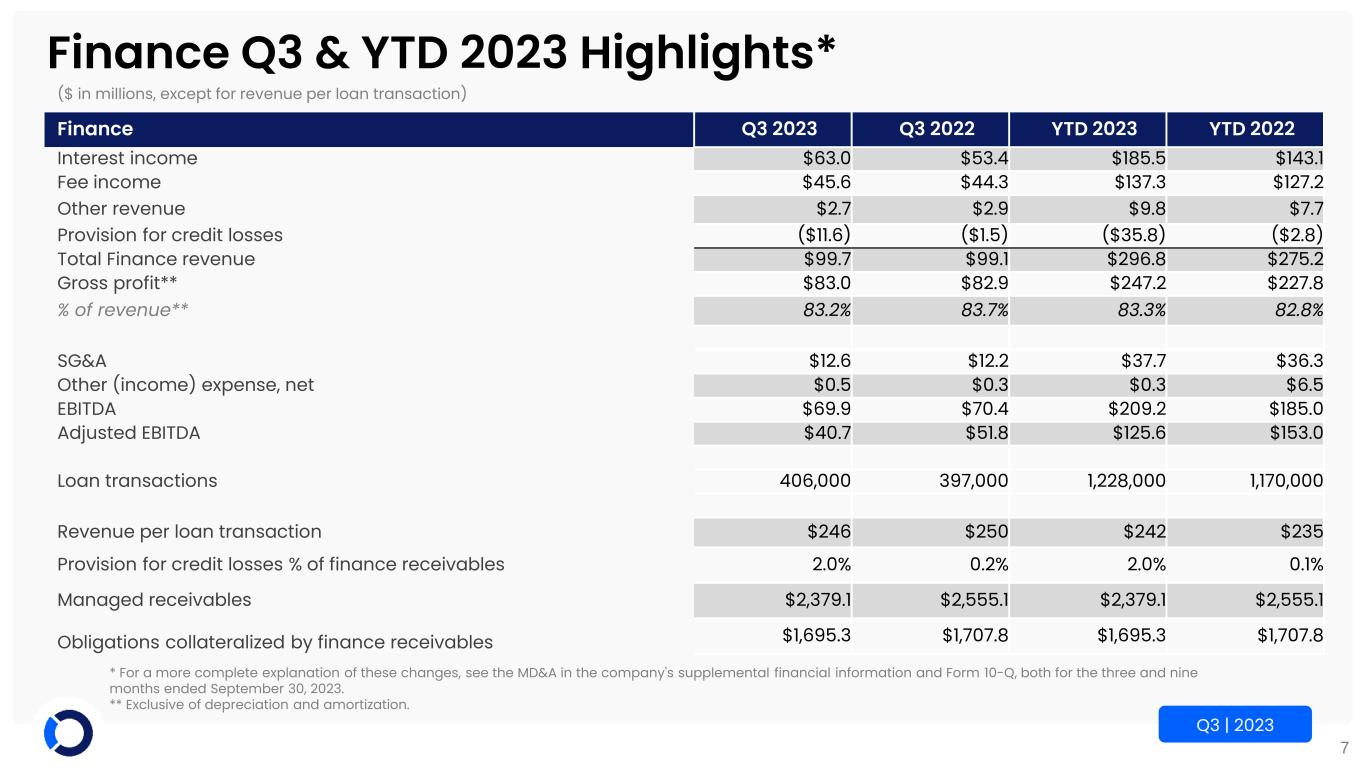

7 Q3 | 2023 Finance Q3 & YTD 2023 Highlights* ($ in millions, except for revenue per loan transaction) Finance Q3 2023 Q3 2022 YTD 2023 YTD 2022 Interest income $63.0 $53.4 $185.5 $143.1 Fee income $45.6 $44.3 $137.3 $127.2 Other revenue $2.7 $2.9 $9.8 $7.7 Provision for credit losses ($11.6) ($1.5) ($35.8) ($2.8) Total Finance revenue $99.7 $99.1 $296.8 $275.2 Gross profit** $83.0 $82.9 $247.2 $227.8 % of revenue** 83.2% 83.7% 83.3% 82.8% SG&A $12.6 $12.2 $37.7 $36.3 Other (income) expense, net $0.5 $0.3 $0.3 $6.5 EBITDA $69.9 $70.4 $209.2 $185.0 Adjusted EBITDA $40.7 $51.8 $125.6 $153.0 Loan transactions 406,000 397,000 1,228,000 1,170,000 Revenue per loan transaction $246 $250 $242 $235 Provision for credit losses % of finance receivables 2.0% 0.2% 2.0% 0.1% Managed receivables $2,379.1 $2,555.1 $2,379.1 $2,555.1 Obligations collateralized by finance receivables $1,695.3 $1,707.8 $1,695.3 $1,707.8 * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-Q, both for the three and nine months ended September 30, 2023. ** Exclusive of depreciation and amortization.

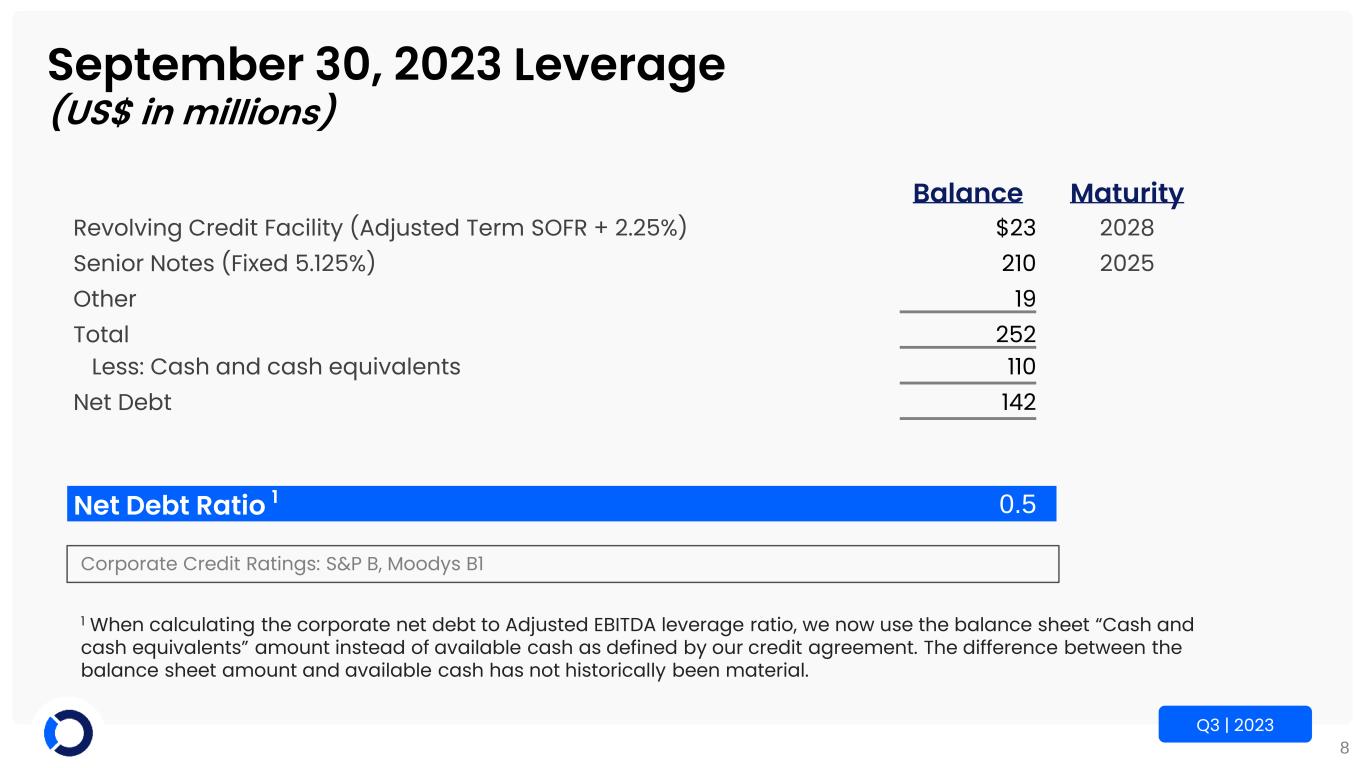

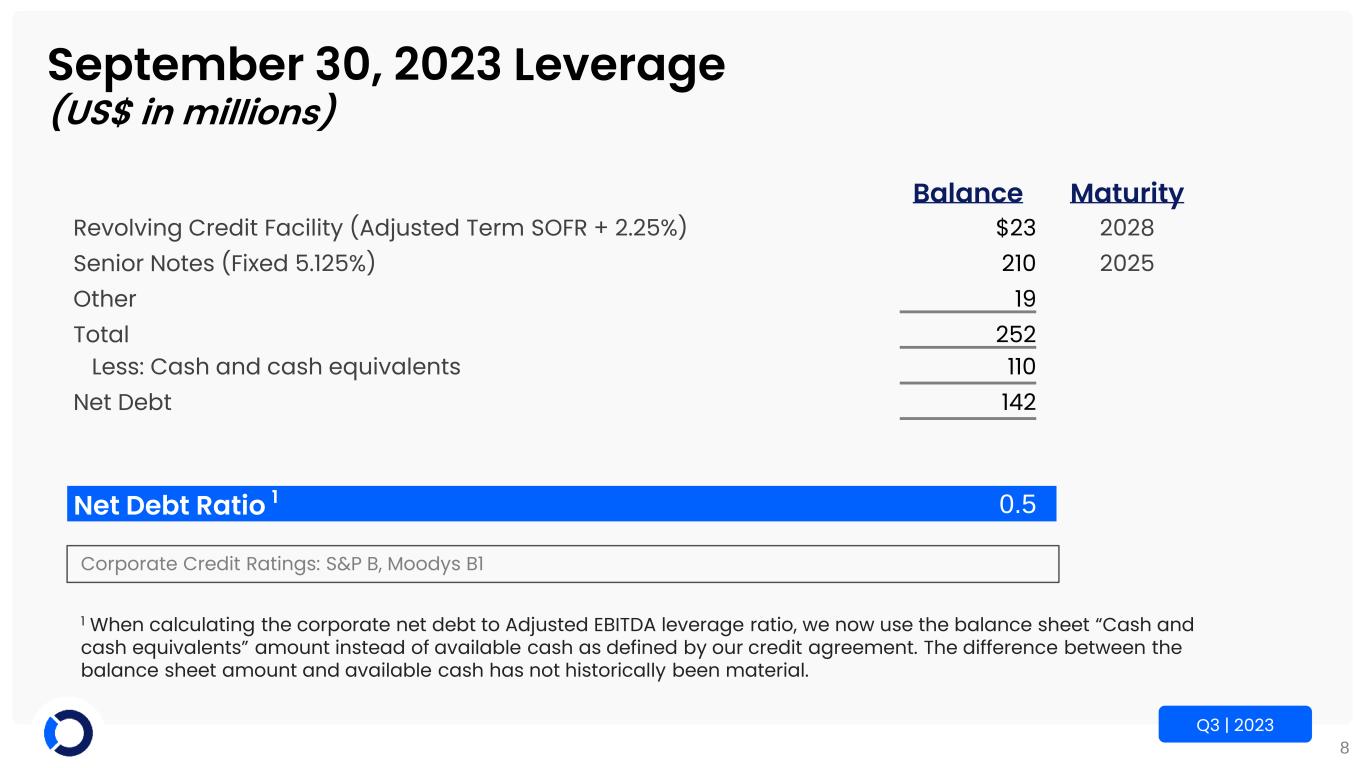

8 Q3 | 2023 September 30, 2023 Leverage (US$ in millions) Balance Maturity Revolving Credit Facility (Adjusted Term SOFR + 2.25%) $23 2028 Senior Notes (Fixed 5.125%) 210 2025 Other 19 Total 252 Less: Cash and cash equivalents 110 Net Debt 142 Net Debt Ratio 1 0.5 Corporate Credit Ratings: S&P B, Moodys B1 1 When calculating the corporate net debt to Adjusted EBITDA leverage ratio, we now use the balance sheet “Cash and cash equivalents” amount instead of available cash as defined by our credit agreement. The difference between the balance sheet amount and available cash has not historically been material.

9 Q3 | 2023 Historical Data

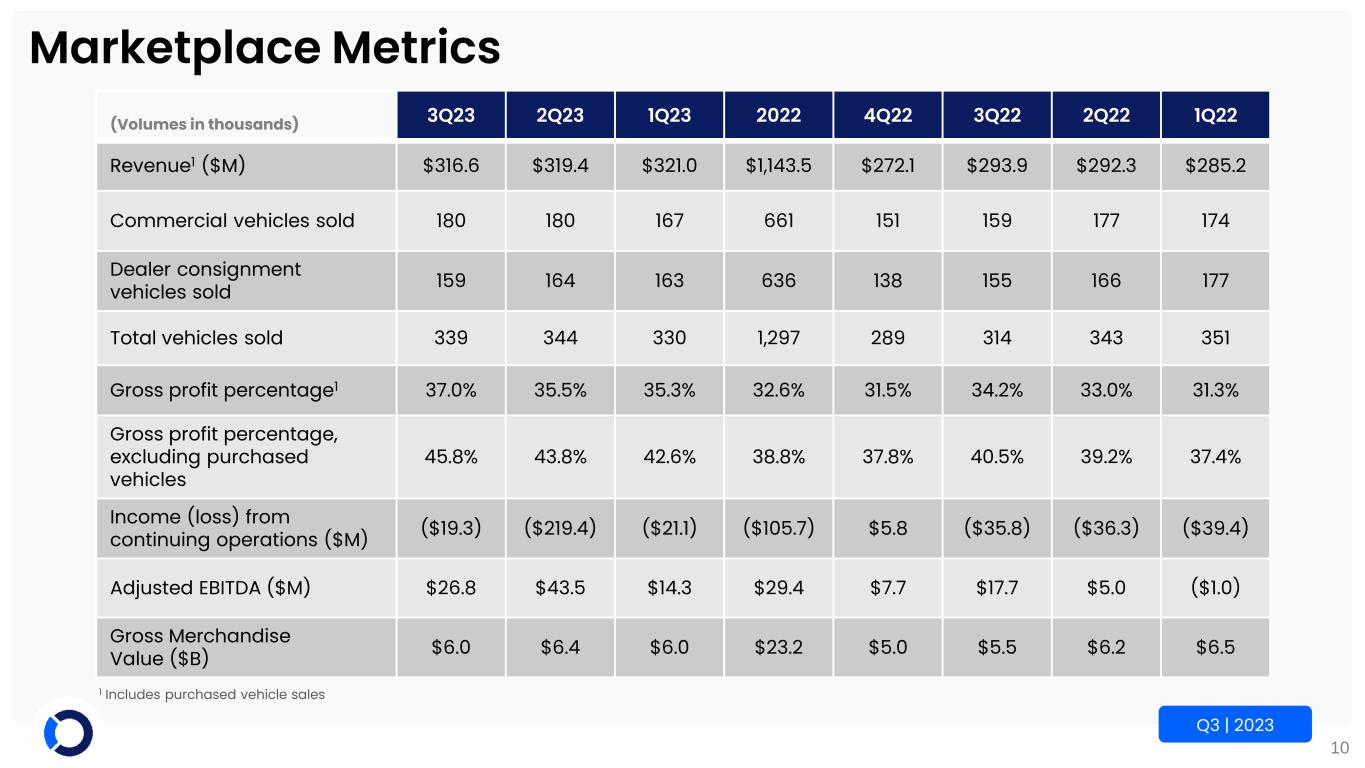

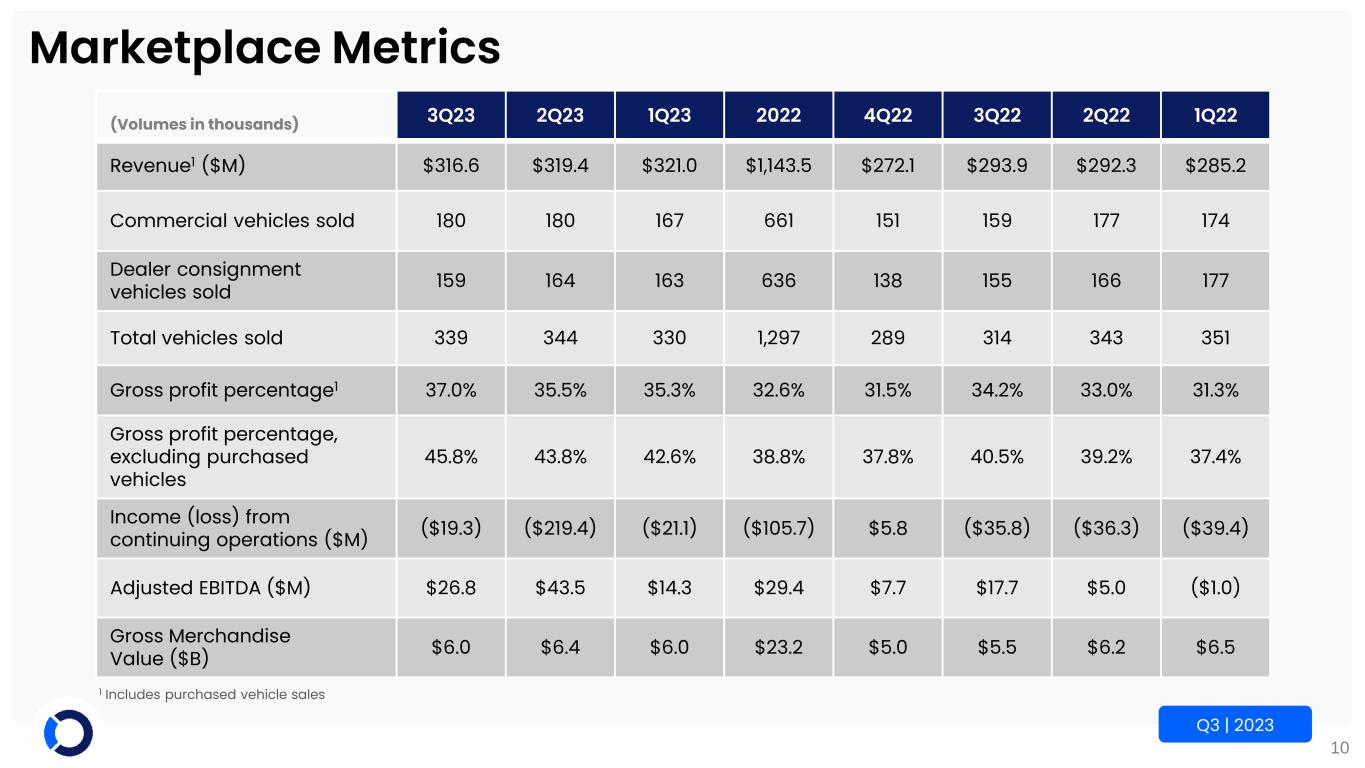

10 Q3 | 2023 Marketplace Metrics (Volumes in thousands) 3Q23 2Q23 1Q23 2022 4Q22 3Q22 2Q22 1Q22 Revenue1 ($M) $316.6 $319.4 $321.0 $1,143.5 $272.1 $293.9 $292.3 $285.2 Commercial vehicles sold 180 180 167 661 151 159 177 174 Dealer consignment vehicles sold 159 164 163 636 138 155 166 177 Total vehicles sold 339 344 330 1,297 289 314 343 351 Gross profit percentage1 37.0% 35.5% 35.3% 32.6% 31.5% 34.2% 33.0% 31.3% Gross profit percentage, excluding purchased vehicles 45.8% 43.8% 42.6% 38.8% 37.8% 40.5% 39.2% 37.4% Income (loss) from continuing operations ($M) ($19.3) ($219.4) ($21.1) ($105.7) $5.8 ($35.8) ($36.3) ($39.4) Adjusted EBITDA ($M) $26.8 $43.5 $14.3 $29.4 $7.7 $17.7 $5.0 ($1.0) Gross Merchandise Value ($B) $6.0 $6.4 $6.0 $23.2 $5.0 $5.5 $6.2 $6.5 1 Includes purchased vehicle sales

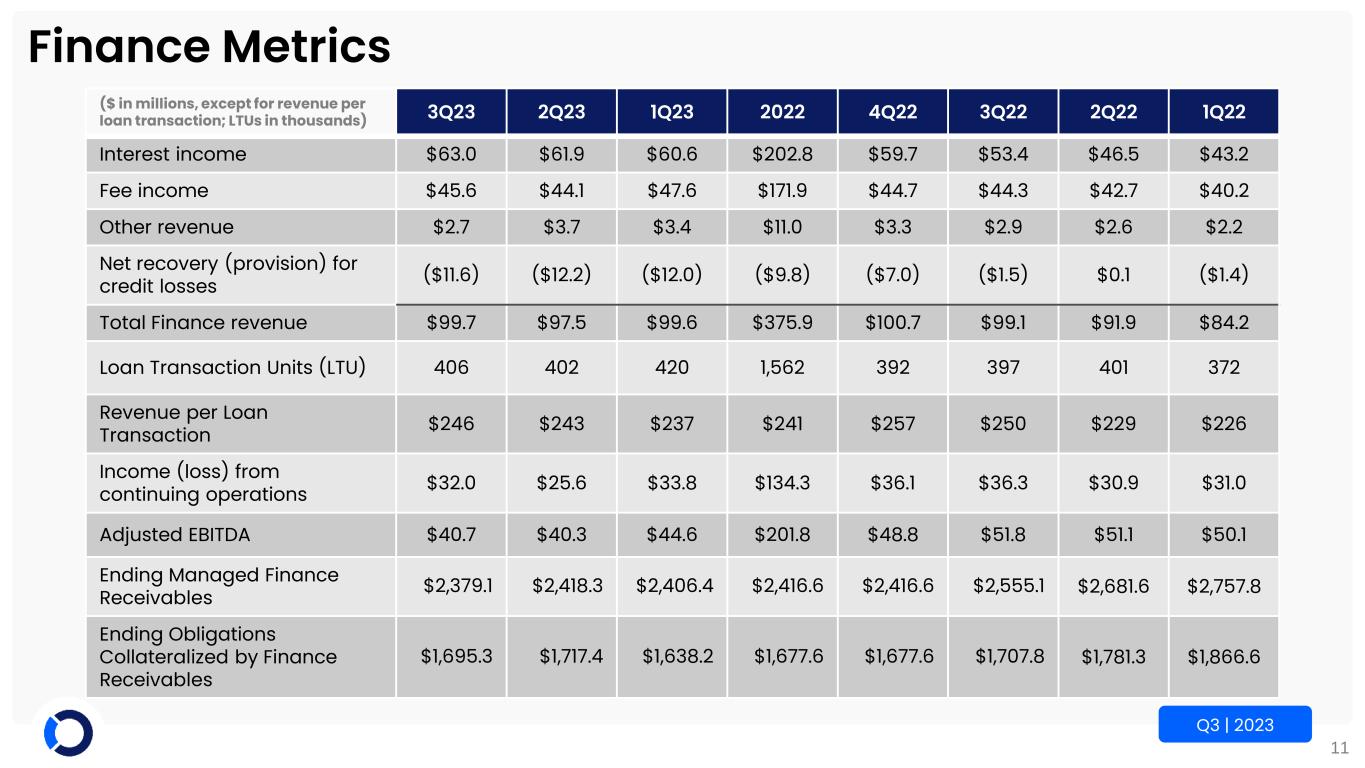

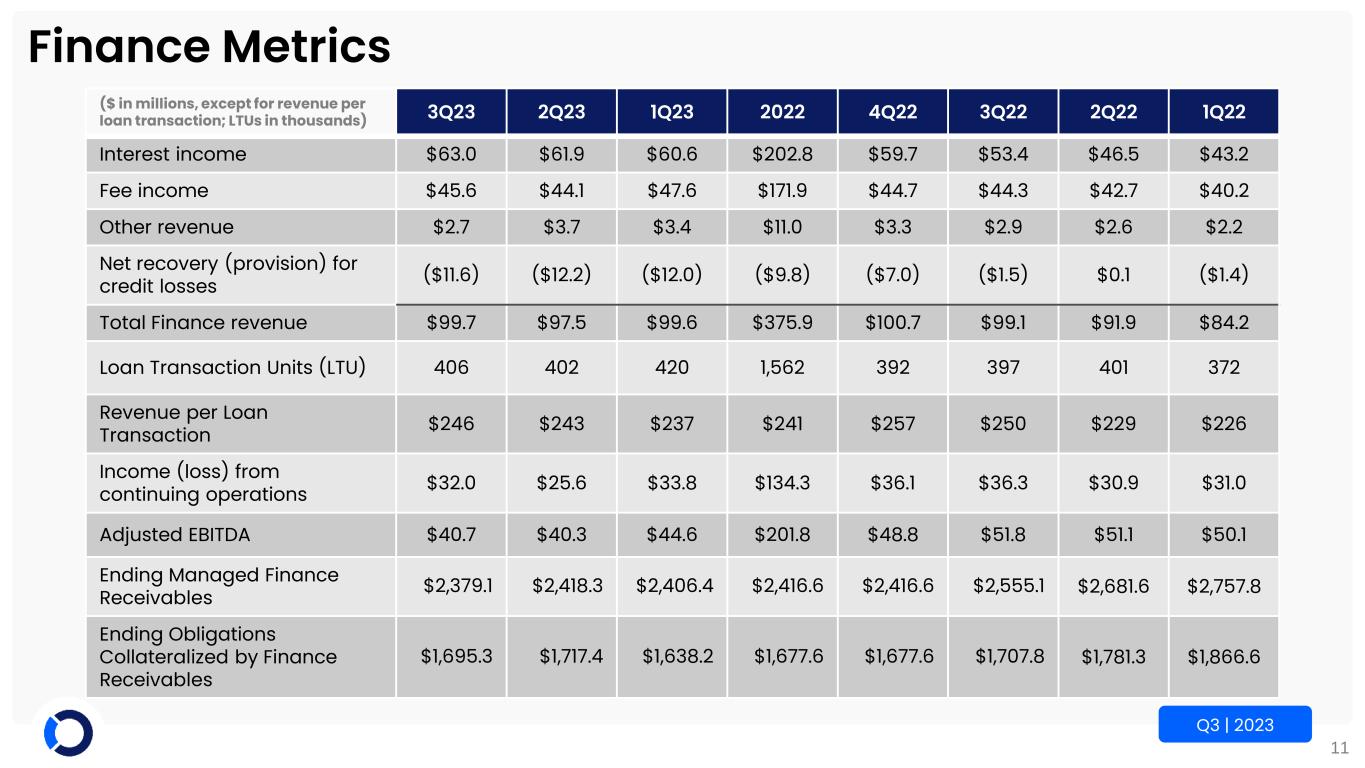

11 Q3 | 2023 Finance Metrics ($ in millions, except for revenue per loan transaction; LTUs in thousands) 3Q23 2Q23 1Q23 2022 4Q22 3Q22 2Q22 1Q22 Interest income $63.0 $61.9 $60.6 $202.8 $59.7 $53.4 $46.5 $43.2 Fee income $45.6 $44.1 $47.6 $171.9 $44.7 $44.3 $42.7 $40.2 Other revenue $2.7 $3.7 $3.4 $11.0 $3.3 $2.9 $2.6 $2.2 Net recovery (provision) for credit losses ($11.6) ($12.2) ($12.0) ($9.8) ($7.0) ($1.5) $0.1 ($1.4) Total Finance revenue $99.7 $97.5 $99.6 $375.9 $100.7 $99.1 $91.9 $84.2 Loan Transaction Units (LTU) 406 402 420 1,562 392 397 401 372 Revenue per Loan Transaction $246 $243 $237 $241 $257 $250 $229 $226 Income (loss) from continuing operations $32.0 $25.6 $33.8 $134.3 $36.1 $36.3 $30.9 $31.0 Adjusted EBITDA $40.7 $40.3 $44.6 $201.8 $48.8 $51.8 $51.1 $50.1 Ending Managed Finance Receivables $2,379.1 $2,418.3 $2,406.4 $2,416.6 $2,416.6 $2,555.1 $2,681.6 $2,757.8 Ending Obligations Collateralized by Finance Receivables $1,695.3 $1,717.4 $1,638.2 $1,677.6 $1,677.6 $1,707.8 $1,781.3 $1,866.6

12 Q3 | 2023 APPENDIX

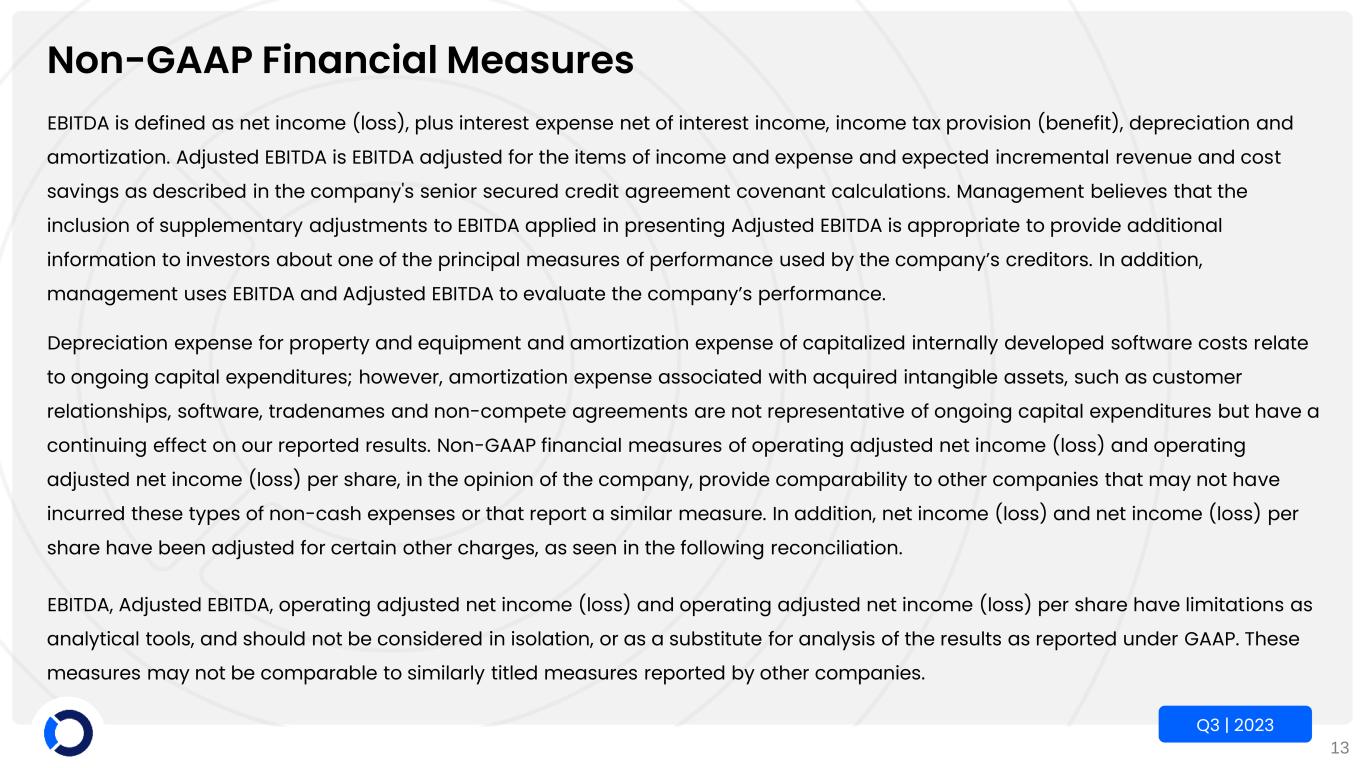

13 Q3 | 2023 Non-GAAP Financial Measures EBITDA is defined as net income (loss), plus interest expense net of interest income, income tax provision (benefit), depreciation and amortization. Adjusted EBITDA is EBITDA adjusted for the items of income and expense and expected incremental revenue and cost savings as described in the company's senior secured credit agreement covenant calculations. Management believes that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA is appropriate to provide additional information to investors about one of the principal measures of performance used by the company’s creditors. In addition, management uses EBITDA and Adjusted EBITDA to evaluate the company’s performance. Depreciation expense for property and equipment and amortization expense of capitalized internally developed software costs relate to ongoing capital expenditures; however, amortization expense associated with acquired intangible assets, such as customer relationships, software, tradenames and non-compete agreements are not representative of ongoing capital expenditures but have a continuing effect on our reported results. Non-GAAP financial measures of operating adjusted net income (loss) and operating adjusted net income (loss) per share, in the opinion of the company, provide comparability to other companies that may not have incurred these types of non-cash expenses or that report a similar measure. In addition, net income (loss) and net income (loss) per share have been adjusted for certain other charges, as seen in the following reconciliation. EBITDA, Adjusted EBITDA, operating adjusted net income (loss) and operating adjusted net income (loss) per share have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analysis of the results as reported under GAAP. These measures may not be comparable to similarly titled measures reported by other companies.

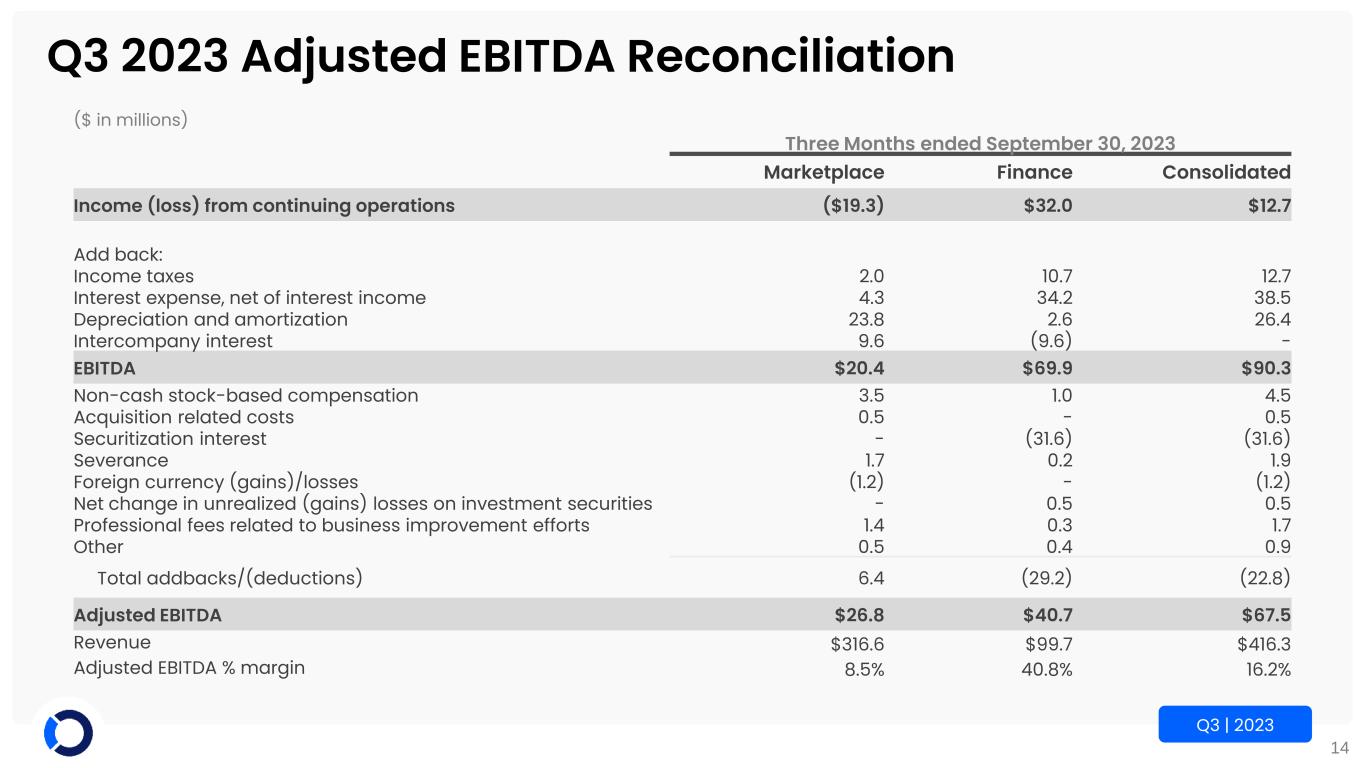

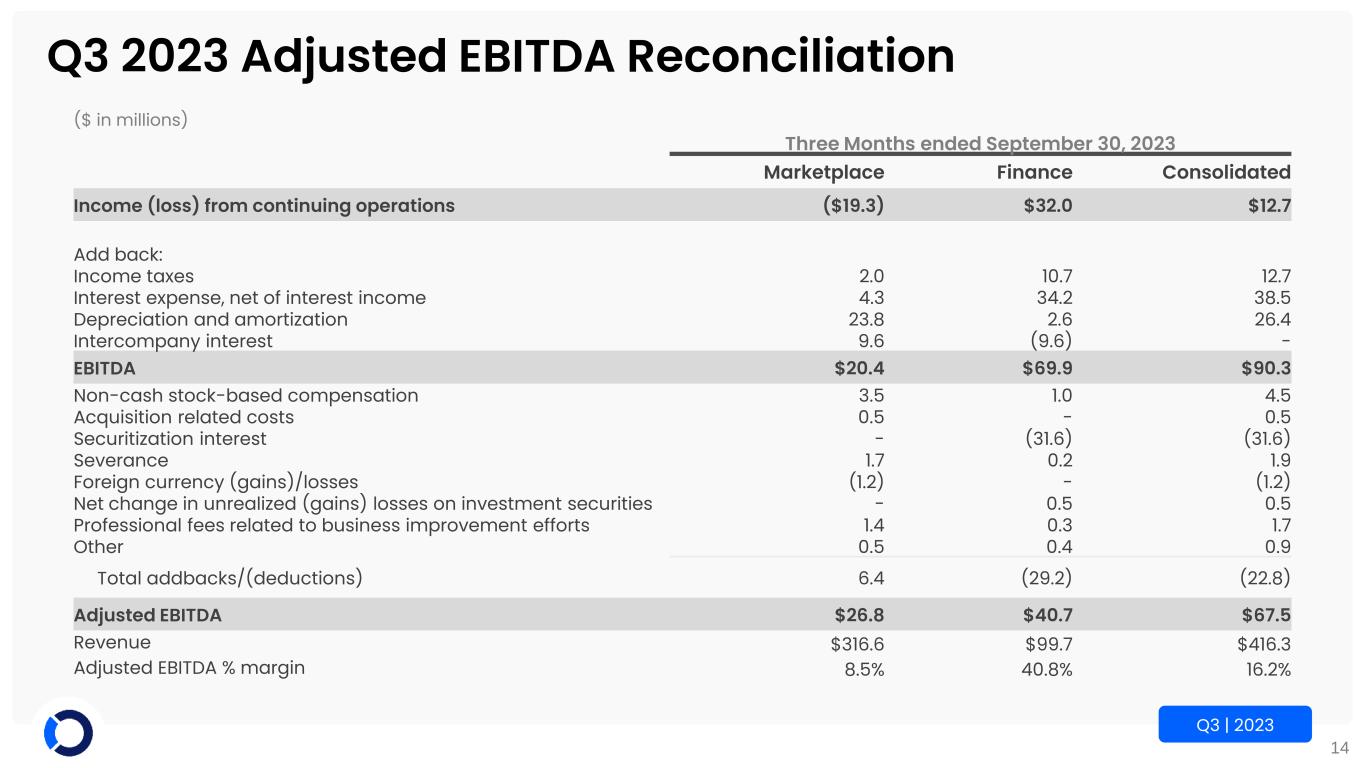

14 Q3 | 2023 Q3 2023 Adjusted EBITDA Reconciliation ($ in millions) Three Months ended September 30, 2023 Marketplace Finance Consolidated Income (loss) from continuing operations ($19.3) $32.0 $12.7 Add back: Income taxes 2.0 10.7 12.7 Interest expense, net of interest income 4.3 34.2 38.5 Depreciation and amortization 23.8 2.6 26.4 Intercompany interest 9.6 (9.6) - EBITDA $20.4 $69.9 $90.3 Non-cash stock-based compensation 3.5 1.0 4.5 Acquisition related costs 0.5 - 0.5 Securitization interest - (31.6) (31.6) Severance 1.7 0.2 1.9 Foreign currency (gains)/losses (1.2) - (1.2) Net change in unrealized (gains) losses on investment securities - 0.5 0.5 Professional fees related to business improvement efforts 1.4 0.3 1.7 Other 0.5 0.4 0.9 Total addbacks/(deductions) 6.4 (29.2) (22.8) Adjusted EBITDA $26.8 $40.7 $67.5 Revenue $316.6 $99.7 $416.3 Adjusted EBITDA % margin 8.5% 40.8% 16.2%

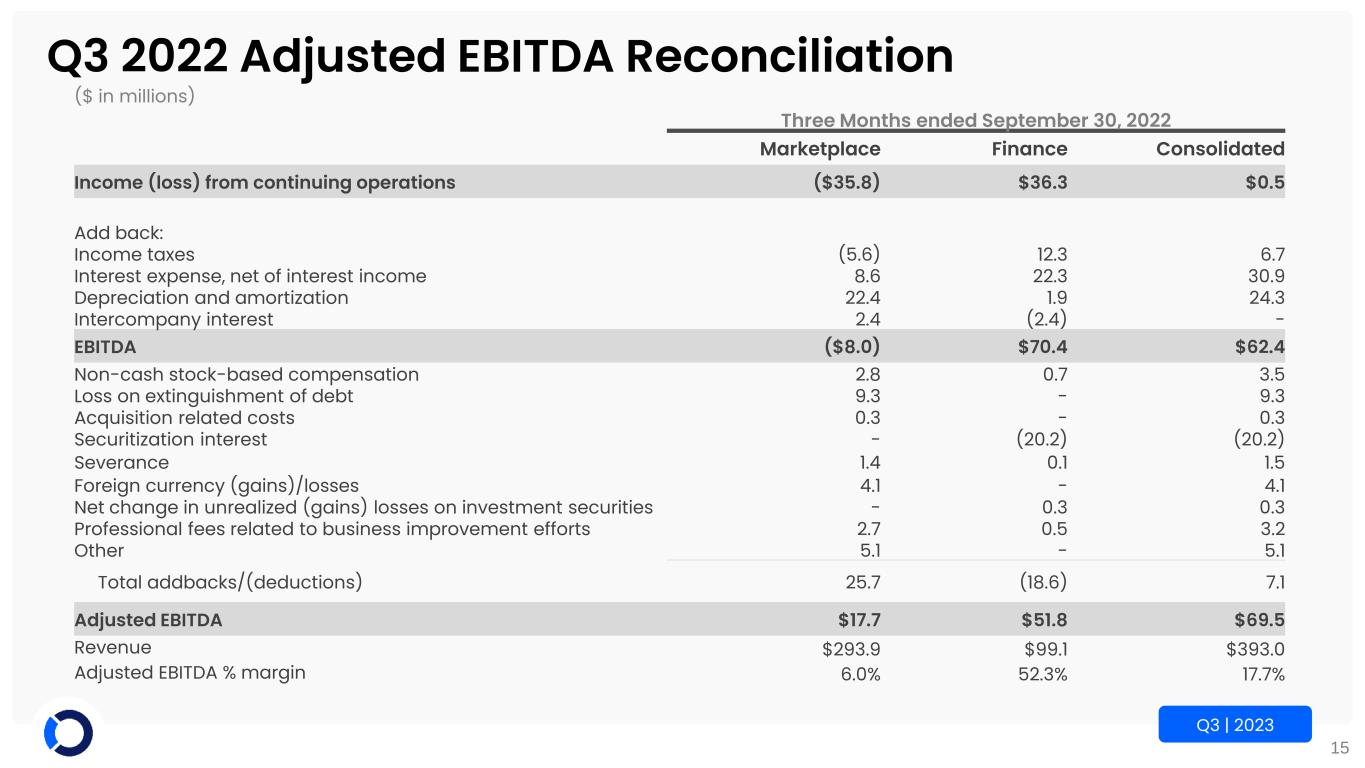

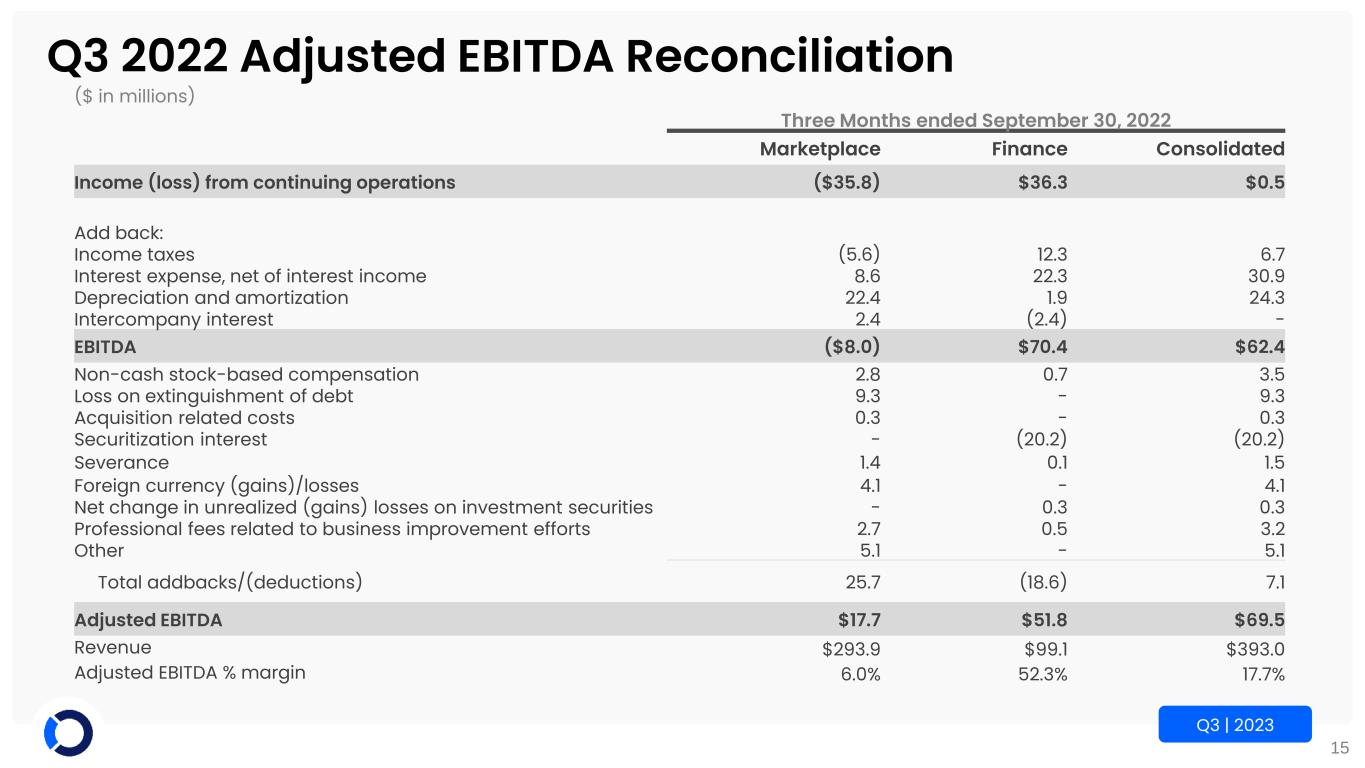

15 Q3 | 2023 Q3 2022 Adjusted EBITDA Reconciliation ($ in millions) Three Months ended September 30, 2022 Marketplace Finance Consolidated Income (loss) from continuing operations ($35.8) $36.3 $0.5 Add back: Income taxes (5.6) 12.3 6.7 Interest expense, net of interest income 8.6 22.3 30.9 Depreciation and amortization 22.4 1.9 24.3 Intercompany interest 2.4 (2.4) - EBITDA ($8.0) $70.4 $62.4 Non-cash stock-based compensation 2.8 0.7 3.5 Loss on extinguishment of debt 9.3 - 9.3 Acquisition related costs 0.3 - 0.3 Securitization interest - (20.2) (20.2) Severance 1.4 0.1 1.5 Foreign currency (gains)/losses 4.1 - 4.1 Net change in unrealized (gains) losses on investment securities - 0.3 0.3 Professional fees related to business improvement efforts 2.7 0.5 3.2 Other 5.1 - 5.1 Total addbacks/(deductions) 25.7 (18.6) 7.1 Adjusted EBITDA $17.7 $51.8 $69.5 Revenue $293.9 $99.1 $393.0 Adjusted EBITDA % margin 6.0% 52.3% 17.7%

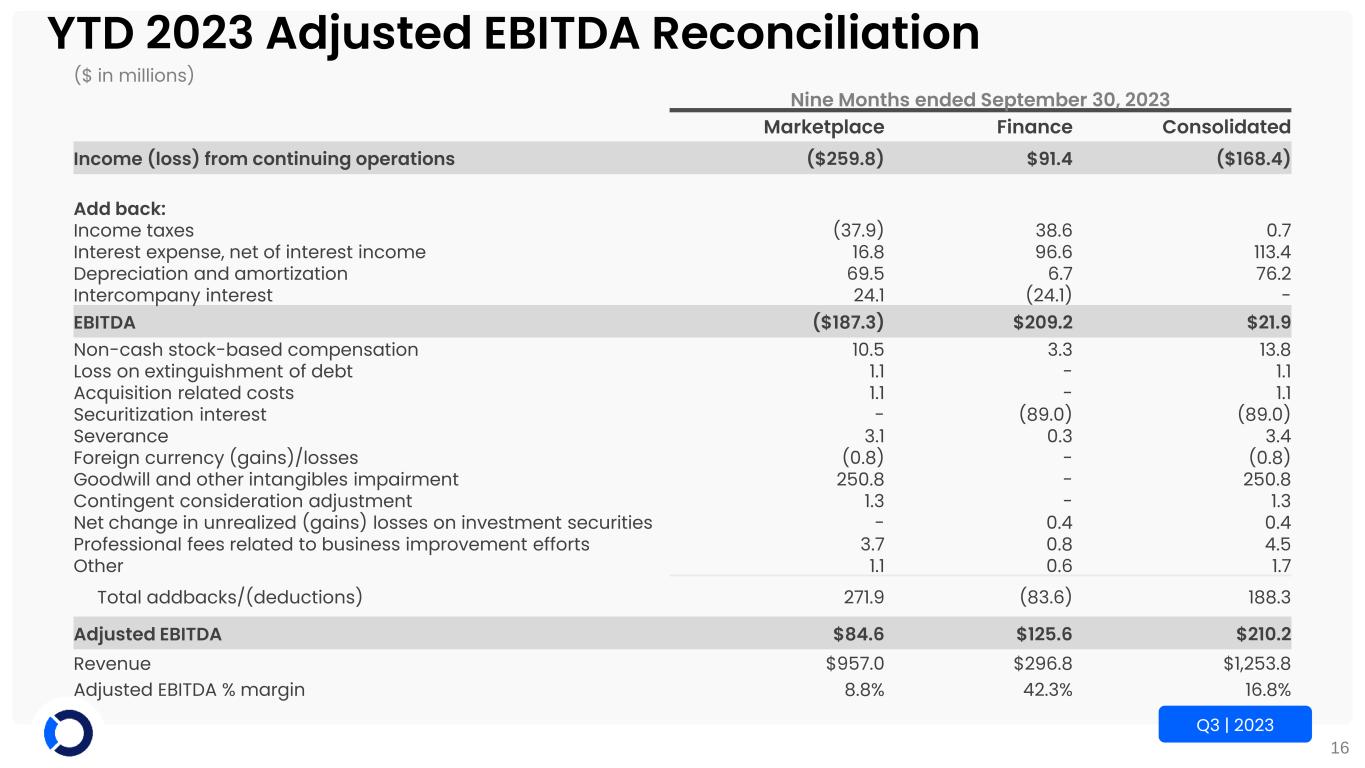

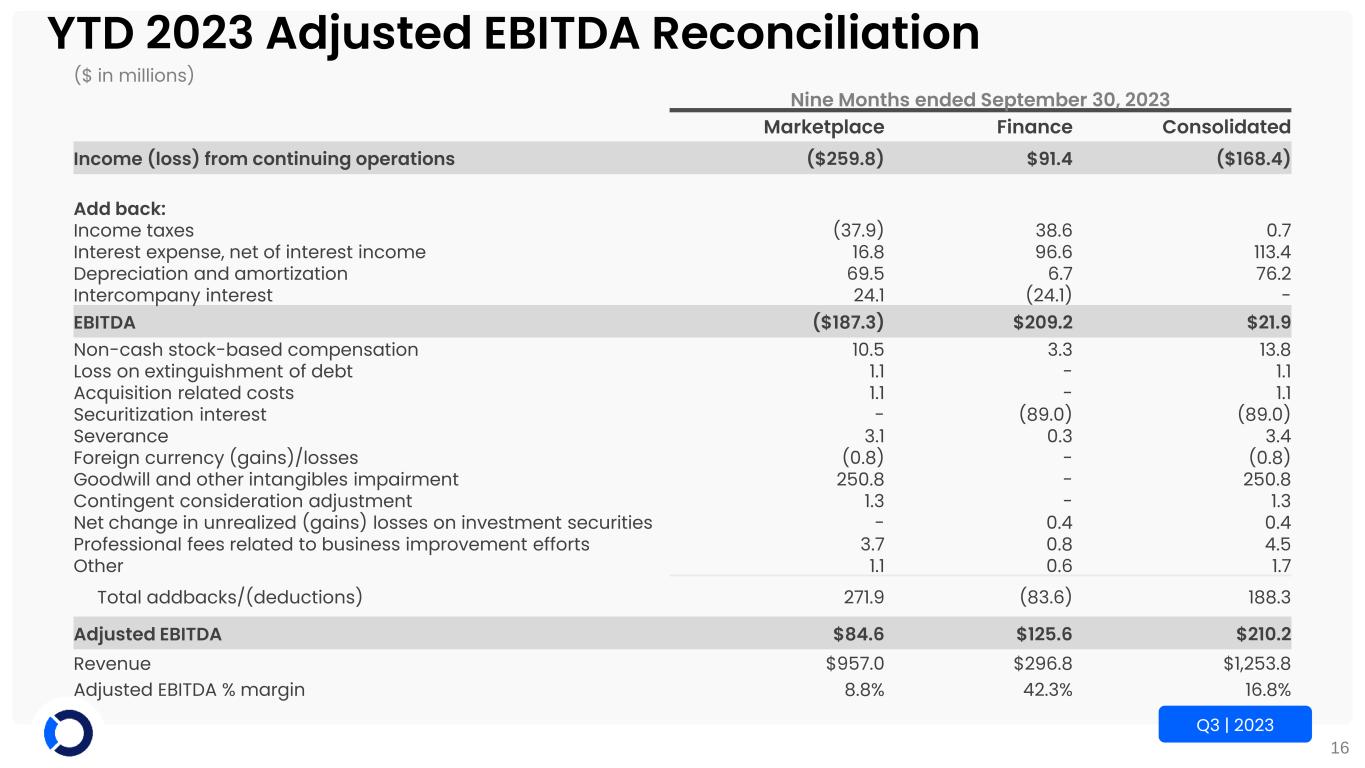

16 Q3 | 2023 YTD 2023 Adjusted EBITDA Reconciliation ($ in millions) Nine Months ended September 30, 2023 Marketplace Finance Consolidated Income (loss) from continuing operations ($259.8) $91.4 ($168.4) Add back: Income taxes (37.9) 38.6 0.7 Interest expense, net of interest income 16.8 96.6 113.4 Depreciation and amortization 69.5 6.7 76.2 Intercompany interest 24.1 (24.1) - EBITDA ($187.3) $209.2 $21.9 Non-cash stock-based compensation 10.5 3.3 13.8 Loss on extinguishment of debt 1.1 - 1.1 Acquisition related costs 1.1 - 1.1 Securitization interest - (89.0) (89.0) Severance 3.1 0.3 3.4 Foreign currency (gains)/losses (0.8) - (0.8) Goodwill and other intangibles impairment 250.8 - 250.8 Contingent consideration adjustment 1.3 - 1.3 Net change in unrealized (gains) losses on investment securities - 0.4 0.4 Professional fees related to business improvement efforts 3.7 0.8 4.5 Other 1.1 0.6 1.7 Total addbacks/(deductions) 271.9 (83.6) 188.3 Adjusted EBITDA $84.6 $125.6 $210.2 Revenue $957.0 $296.8 $1,253.8 Adjusted EBITDA % margin 8.8% 42.3% 16.8%

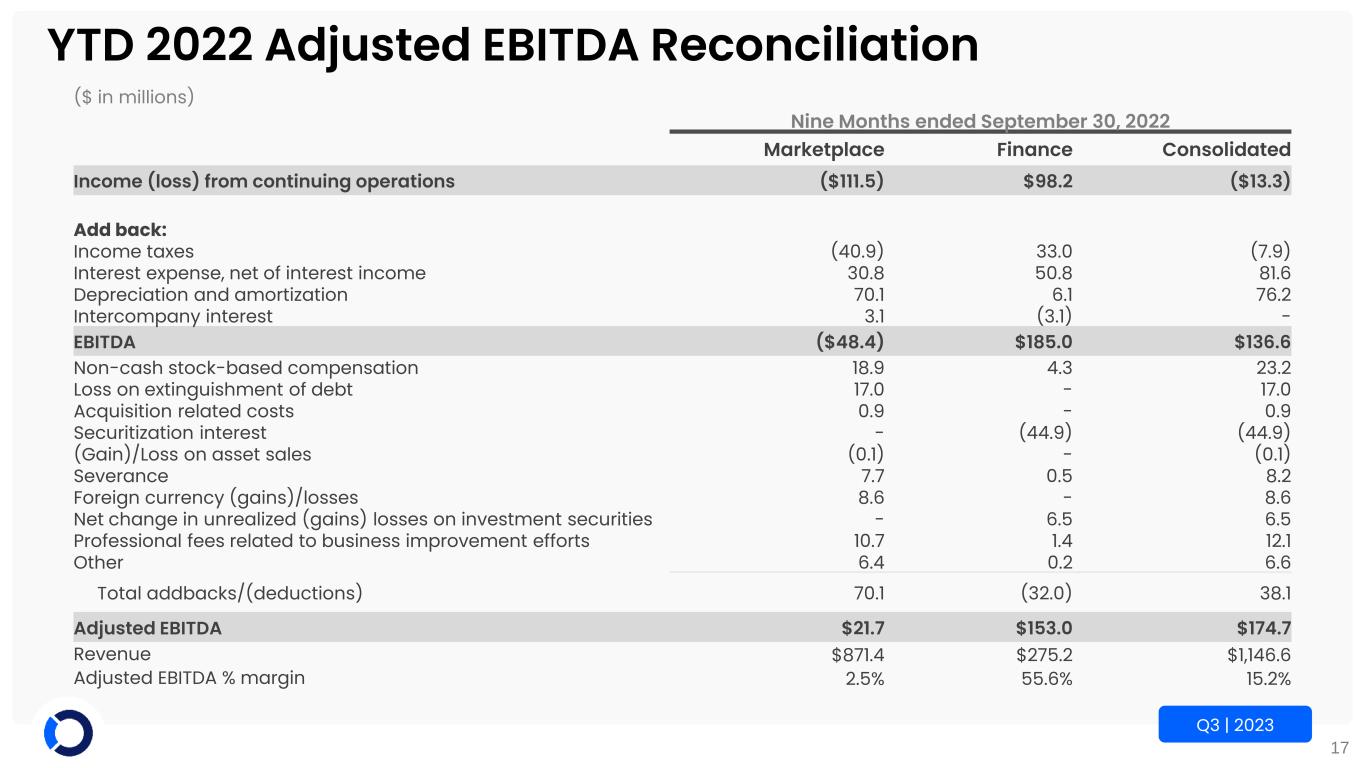

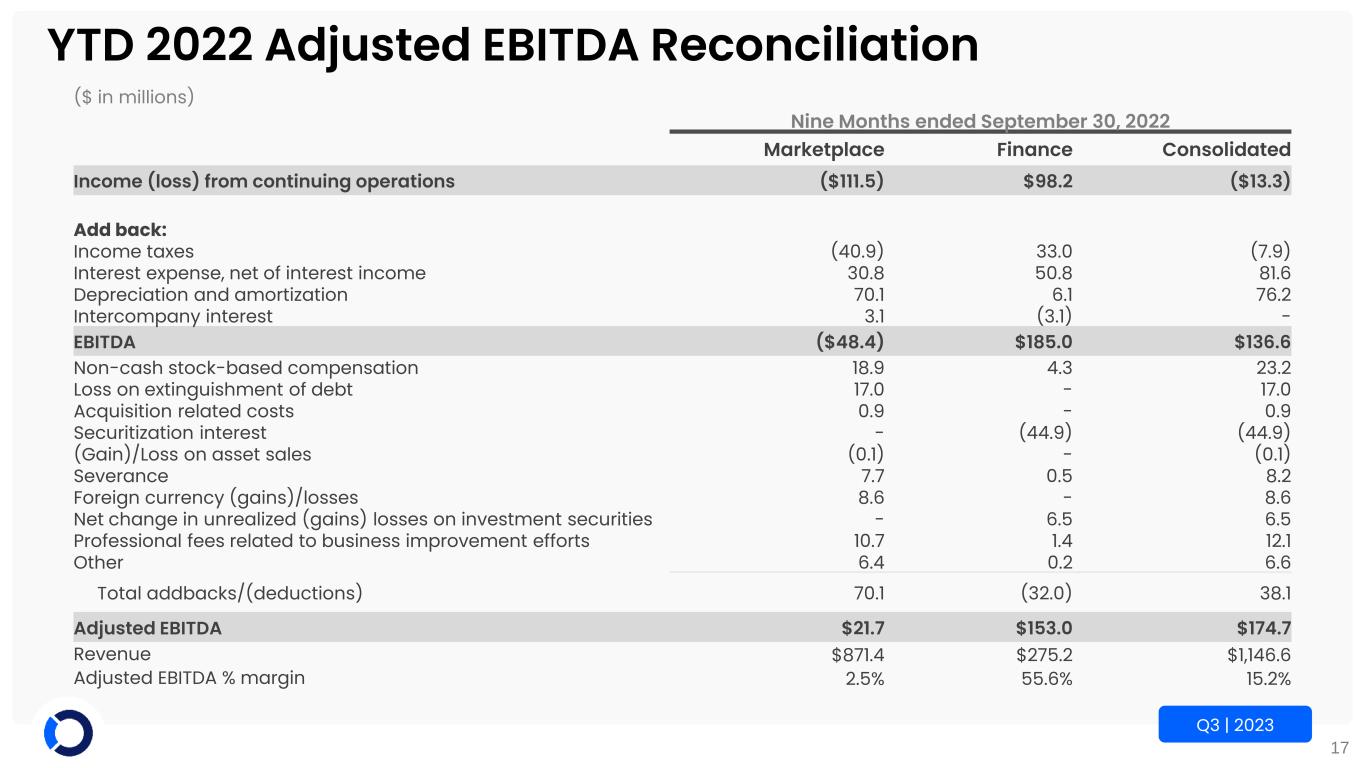

17 Q3 | 2023 YTD 2022 Adjusted EBITDA Reconciliation ($ in millions) Nine Months ended September 30, 2022 Marketplace Finance Consolidated Income (loss) from continuing operations ($111.5) $98.2 ($13.3) Add back: Income taxes (40.9) 33.0 (7.9) Interest expense, net of interest income 30.8 50.8 81.6 Depreciation and amortization 70.1 6.1 76.2 Intercompany interest 3.1 (3.1) - EBITDA ($48.4) $185.0 $136.6 Non-cash stock-based compensation 18.9 4.3 23.2 Loss on extinguishment of debt 17.0 - 17.0 Acquisition related costs 0.9 - 0.9 Securitization interest - (44.9) (44.9) (Gain)/Loss on asset sales (0.1) - (0.1) Severance 7.7 0.5 8.2 Foreign currency (gains)/losses 8.6 - 8.6 Net change in unrealized (gains) losses on investment securities - 6.5 6.5 Professional fees related to business improvement efforts 10.7 1.4 12.1 Other 6.4 0.2 6.6 Total addbacks/(deductions) 70.1 (32.0) 38.1 Adjusted EBITDA $21.7 $153.0 $174.7 Revenue $871.4 $275.2 $1,146.6 Adjusted EBITDA % margin 2.5% 55.6% 15.2%

18 Q3 | 2023 Operating Adjusted Net Income (Loss) per Share Reconciliation ($ in millions, except per share amounts), (unaudited) Three Months ended Nine Months ended September 30, September 30, 2023 2022 2023 2022 Net income (loss) from continuing operations (1) $12.7 $0.5 ($168.4) ($13.3) Acquired amortization expense 11.1 8.2 28.3 25.0 Loss on extinguishment of debt - 9.3 1.1 17.0 Contingent consideration adjustment - - 1.3 - Goodwill and other intangibles impairment - - 250.8 - Income taxes (2) 1.9 (4.3) (32.3) (10.3) Operating adjusted net income (loss) from continuing operations $25.7 $13.7 $80.8 $18.4 Net income (loss) from discontinued operations $- ($6.3) $- $217.4 Acquired amortization expense - - - 5.9 Income taxes (2) - - - (1.4) Operating adjusted net income (loss) from discontinued operations $- ($6.3) $- $221.9 Operating adjusted net income $25.7 $7.4 $80.8 $240.3 Operating adjusted net income (loss) from continuing operations per share – diluted $0.18 $0.09 $0.56 $0.12 Operating adjusted net income (loss) from discontinued operations per share – diluted - (0.04) - 1.44 Operating adjusted net income per share – diluted $0.18 $0.05 $0.56 $1.56 Weighted average diluted shares - including assumed conversion of preferred shares 145.6 150.3 145.1 154.0 (1) The Series A Preferred Stock dividends and undistributed earnings allocated to participating securities have not been included in the calculation of operating adjusted net income (loss) and operating adjusted net income (loss) per diluted share. (2) For the three and nine months ended September 30, 2023 and 2022, each tax deductible item was booked to the applicable statutory rate. The deferred tax benefits of $52.5 million and $6.5 million associated with the goodwill and tradename impairments, respectively, resulted in the U.S. being in a net deferred tax asset position. Due to the three year cumulative loss related to U.S. operations, we currently have a $34.2 million valuation allowance against the U.S. net deferred tax asset.