Q4 2024 & Annual Earnings Slides // February 19, 2025

2 Q4 | 2024 Forward-Looking Statements Certain statements contained in this presentation include, and OPENLANE may make related oral, "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. In particular, statements made that are not historical facts (including but not limited to expectations, estimates, assumptions, projections and/or financial guidance) may be forward-looking statements. Words such as "should," "may," "will," "would," "anticipate," "expect," "project," "intend,“ “contemplate,” "plan," "believe," "seek," "estimate," "assume," “can,” "could," "continue,” "outlook," “target” and similar expressions identify forward-looking statements. Such statements are based on management's current assumptions, expectations and/or beliefs, are not guarantees of future performance and are subject to substantial risks, uncertainties and changes that could cause actual results to differ materially from the results projected, expressed or implied by these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in the section entitled "Risk Factors" in OPENLANE’s annual and quarterly periodic reports, and in OPENLANE’s other filings and reports filed with the Securities and Exchange Commission. Many of these risk factors are outside of our control, and as such, they involve risks which are not currently known that could cause actual results to differ materially from those discussed or implied herein. The forward-looking statements are made as of the date of this presentation. OPENLANE undertakes no obligation to update any forward-looking statements.

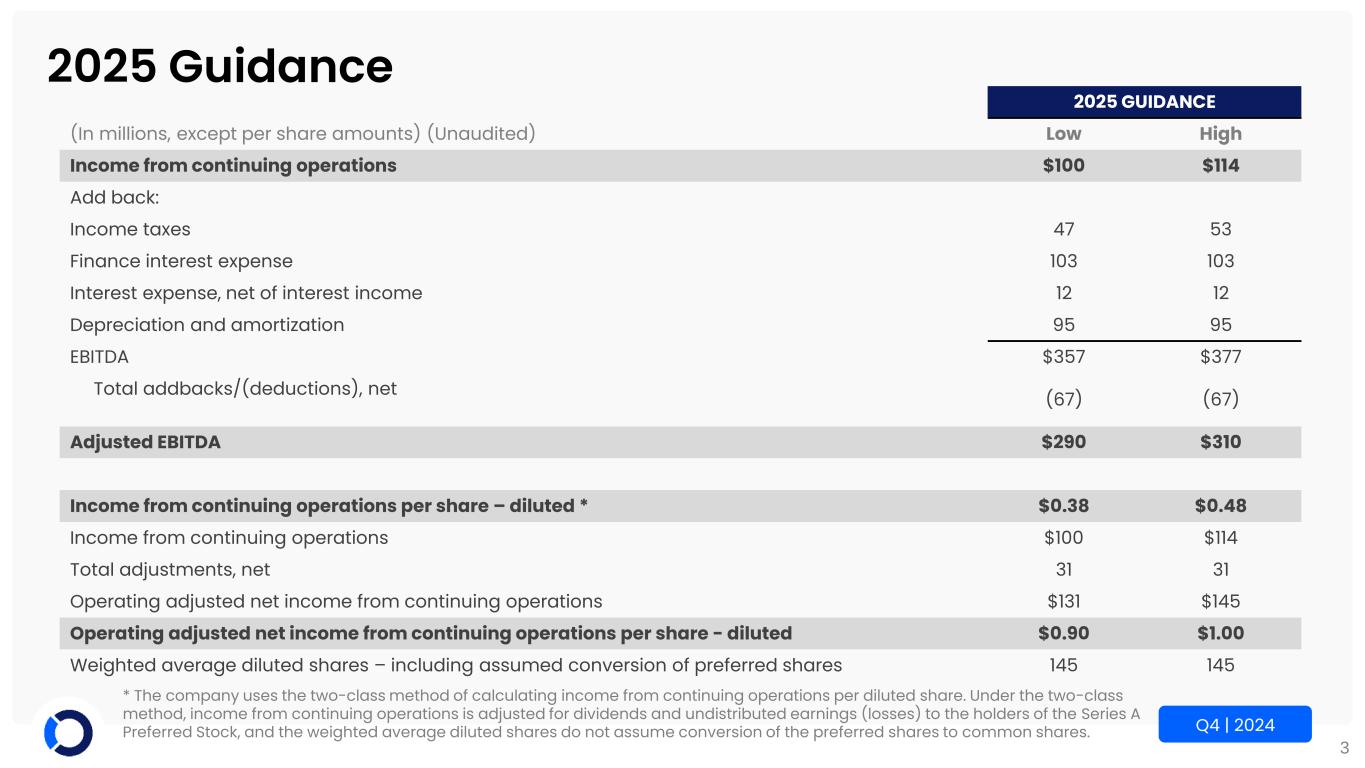

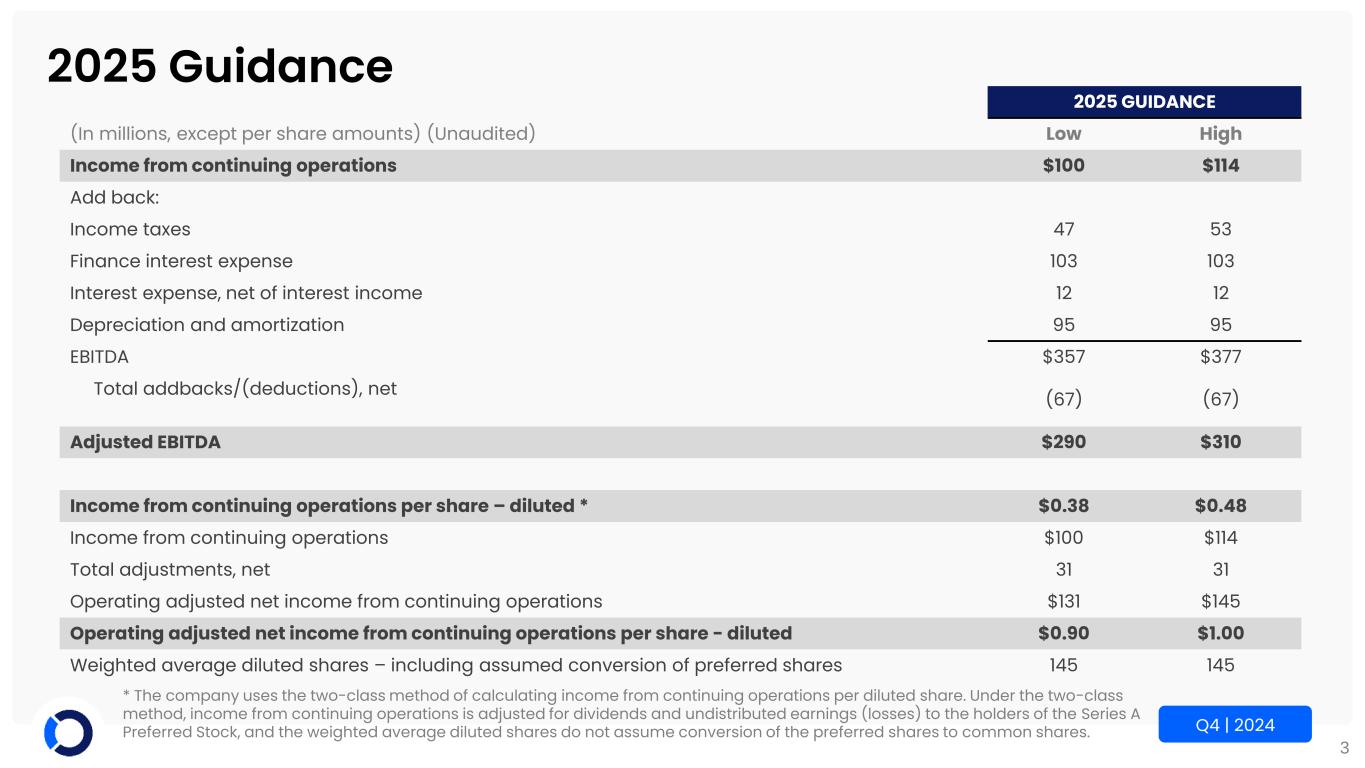

3 Q4 | 2024 2025 Guidance 2025 GUIDANCE (In millions, except per share amounts) (Unaudited) Low High Income from continuing operations $100 $114 Add back: Income taxes 47 53 Finance interest expense 103 103 Interest expense, net of interest income 12 12 Depreciation and amortization 95 95 EBITDA $357 $377 Total addbacks/(deductions), net (67) (67) Adjusted EBITDA $290 $310 Income from continuing operations per share – diluted * $0.38 $0.48 Income from continuing operations $100 $114 Total adjustments, net 31 31 Operating adjusted net income from continuing operations $131 $145 Operating adjusted net income from continuing operations per share - diluted $0.90 $1.00 Weighted average diluted shares – including assumed conversion of preferred shares 145 145 * The company uses the two-class method of calculating income from continuing operations per diluted share. Under the two-class method, income from continuing operations is adjusted for dividends and undistributed earnings (losses) to the holders of the Series A Preferred Stock, and the weighted average diluted shares do not assume conversion of the preferred shares to common shares.

4 Q4 | 2024 Fourth Quarter & Year-to-Date Results

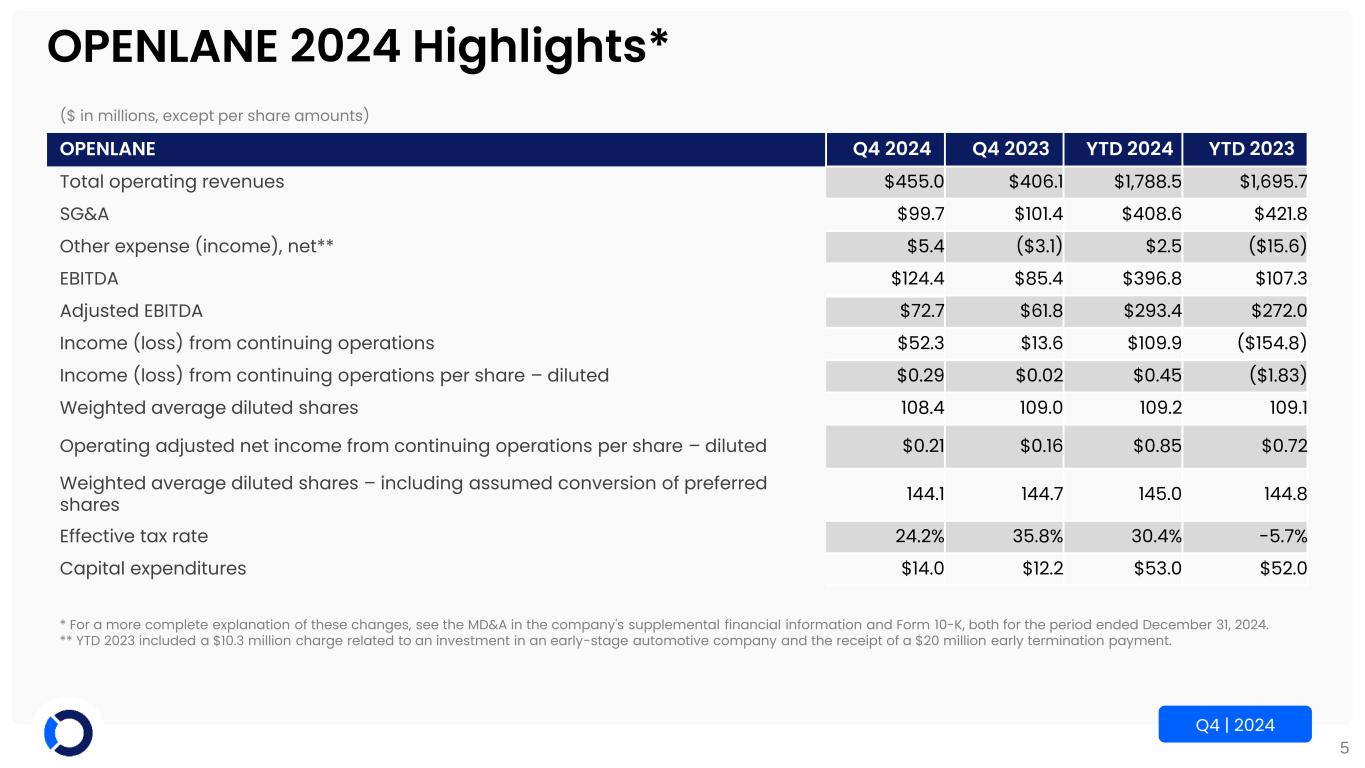

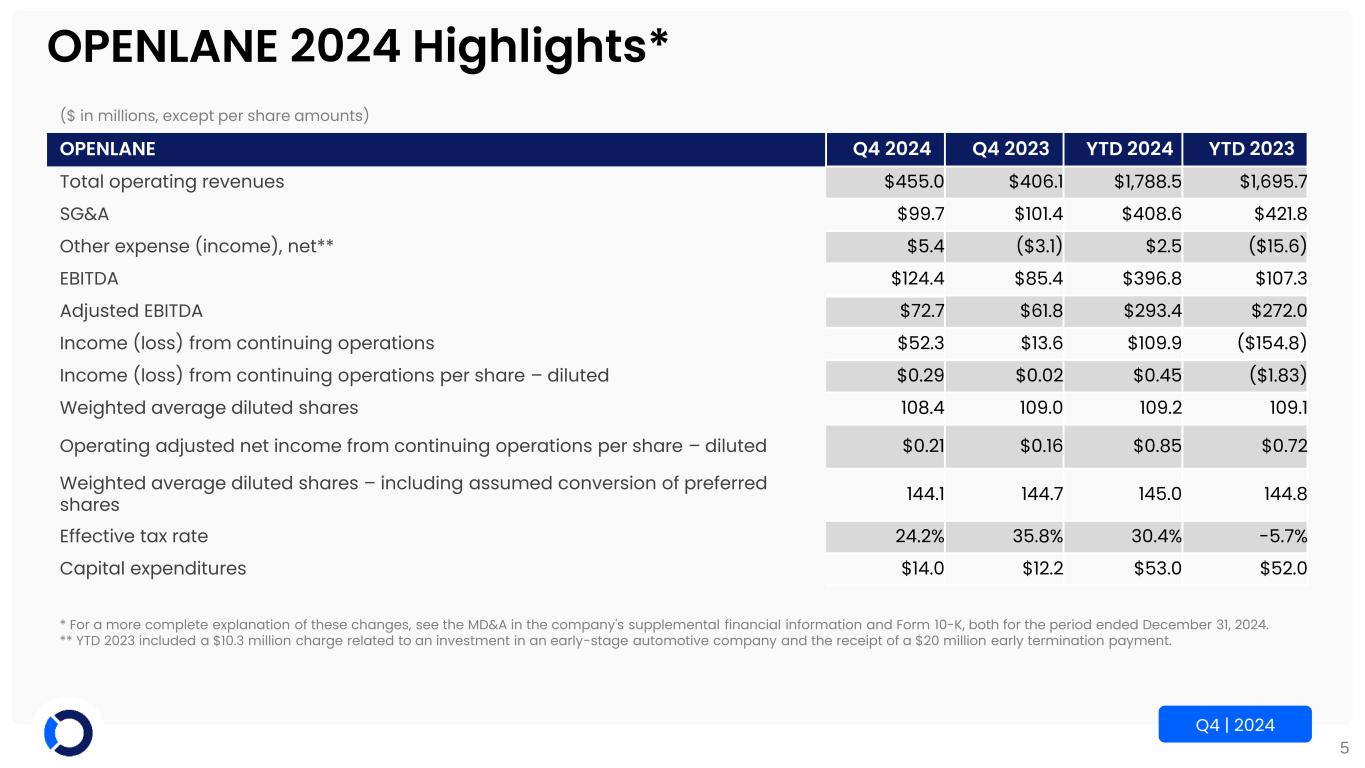

5 Q4 | 2024 OPENLANE 2024 Highlights* ($ in millions, except per share amounts) OPENLANE Q4 2024 Q4 2023 YTD 2024 YTD 2023 Total operating revenues $455.0 $406.1 $1,788.5 $1,695.7 SG&A $99.7 $101.4 $408.6 $421.8 Other expense (income), net** $5.4 ($3.1) $2.5 ($15.6) EBITDA $124.4 $85.4 $396.8 $107.3 Adjusted EBITDA $72.7 $61.8 $293.4 $272.0 Income (loss) from continuing operations $52.3 $13.6 $109.9 ($154.8) Income (loss) from continuing operations per share – diluted $0.29 $0.02 $0.45 ($1.83) Weighted average diluted shares 108.4 109.0 109.2 109.1 Operating adjusted net income from continuing operations per share – diluted $0.21 $0.16 $0.85 $0.72 Weighted average diluted shares – including assumed conversion of preferred shares 144.1 144.7 145.0 144.8 Effective tax rate 24.2% 35.8% 30.4% -5.7% Capital expenditures $14.0 $12.2 $53.0 $52.0 * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-K, both for the period ended December 31, 2024. ** YTD 2023 included a $10.3 million charge related to an investment in an early-stage automotive company and the receipt of a $20 million early termination payment.

6 Q4 | 2024 Marketplace 2024 Highlights* ($ in millions) Marketplace Q4 2024 Q4 2023 YTD 2024 YTD 2023 Auction fees $112.0 $90.0 $443.8 $395.3 Service revenue $141.2 $144.5 $586.6 $619.7 Purchased vehicle sales $95.6 $60.2 $327.0 $236.7 Total Marketplace revenue $348.8 $294.7 $1,357.4 $1,251.7 Gross profit $103.2 $85.9 $393.4 $368.1 Gross profit % of revenue 29.6% 29.1% 29.0% 29.4% Adjusted gross profit** $121.3 $106.2 $468.5 $450.0 Adjusted gross profit % of revenue** 47.9% 45.3% 45.5% 44.3% SG&A $88.3 $89.3 $359.6 $372.0 Other expense (income), net*** $5.3 ($3.1) $2.4 ($15.9) EBITDA $57.3 $17.2 $129.8 ($170.1) Adjusted EBITDA $30.9 $23.7 $134.5 $108.3 % of revenue 8.9% 8.0% 9.9% 8.7% Commercial vehicles sold 192,000 183,000 826,000 710,000 Dealer consignment vehicles sold 155,000 135,000 620,000 621,000 Total vehicles sold 347,000 318,000 1,446,000 1,331,000 * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-K, both for the period ended December 31, 2024. ** Exclusive of depreciation and amortization. The calculation as a percentage of revenue also excludes purchased vehicles. *** YTD 2023 included a $10.3 million charge related to an investment in an early-stage automotive company and the receipt of a $20 million early termination payment.

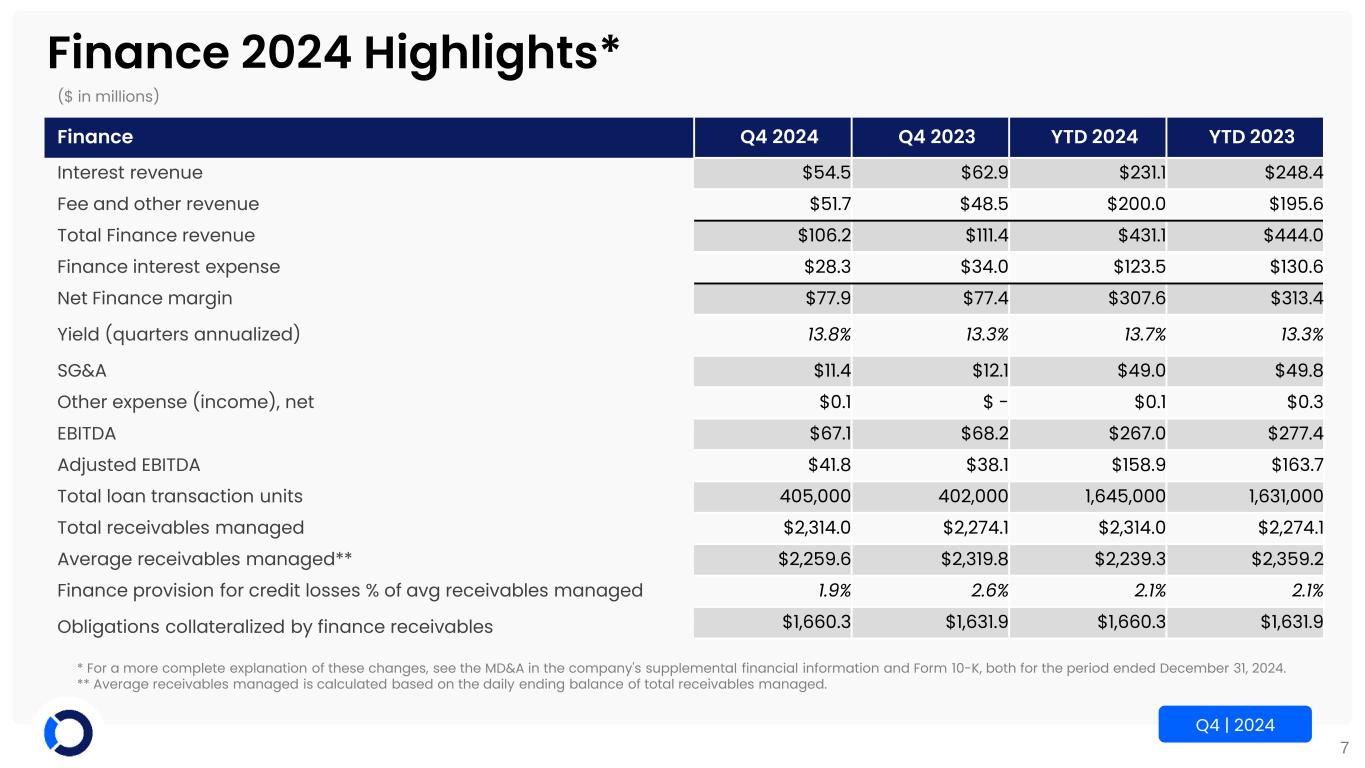

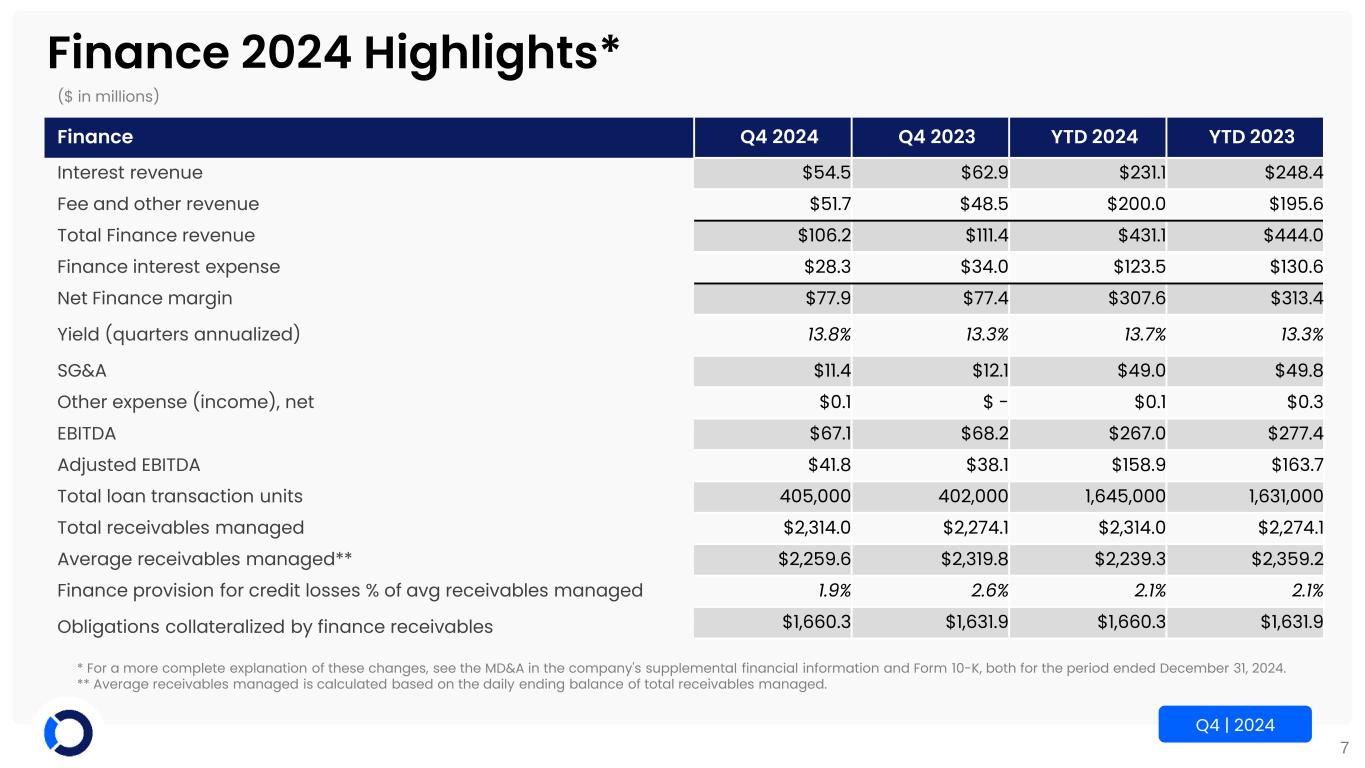

7 Q4 | 2024 Finance 2024 Highlights* ($ in millions) Finance Q4 2024 Q4 2023 YTD 2024 YTD 2023 Interest revenue $54.5 $62.9 $231.1 $248.4 Fee and other revenue $51.7 $48.5 $200.0 $195.6 Total Finance revenue $106.2 $111.4 $431.1 $444.0 Finance interest expense $28.3 $34.0 $123.5 $130.6 Net Finance margin $77.9 $77.4 $307.6 $313.4 Yield (quarters annualized) 13.8% 13.3% 13.7% 13.3% SG&A $11.4 $12.1 $49.0 $49.8 Other expense (income), net $0.1 $ - $0.1 $0.3 EBITDA $67.1 $68.2 $267.0 $277.4 Adjusted EBITDA $41.8 $38.1 $158.9 $163.7 Total loan transaction units 405,000 402,000 1,645,000 1,631,000 Total receivables managed $2,314.0 $2,274.1 $2,314.0 $2,274.1 Average receivables managed** $2,259.6 $2,319.8 $2,239.3 $2,359.2 Finance provision for credit losses % of avg receivables managed 1.9% 2.6% 2.1% 2.1% Obligations collateralized by finance receivables $1,660.3 $1,631.9 $1,660.3 $1,631.9 * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-K, both for the period ended December 31, 2024. ** Average receivables managed is calculated based on the daily ending balance of total receivables managed.

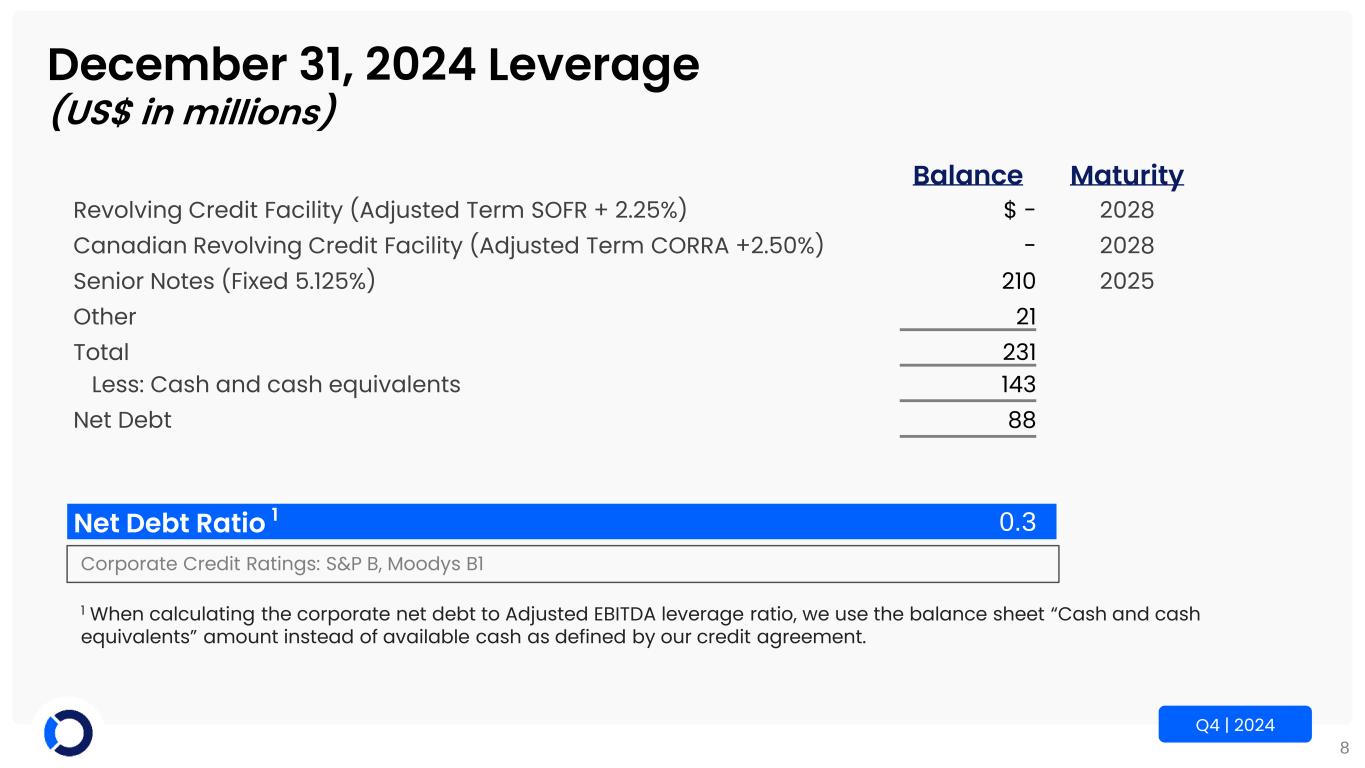

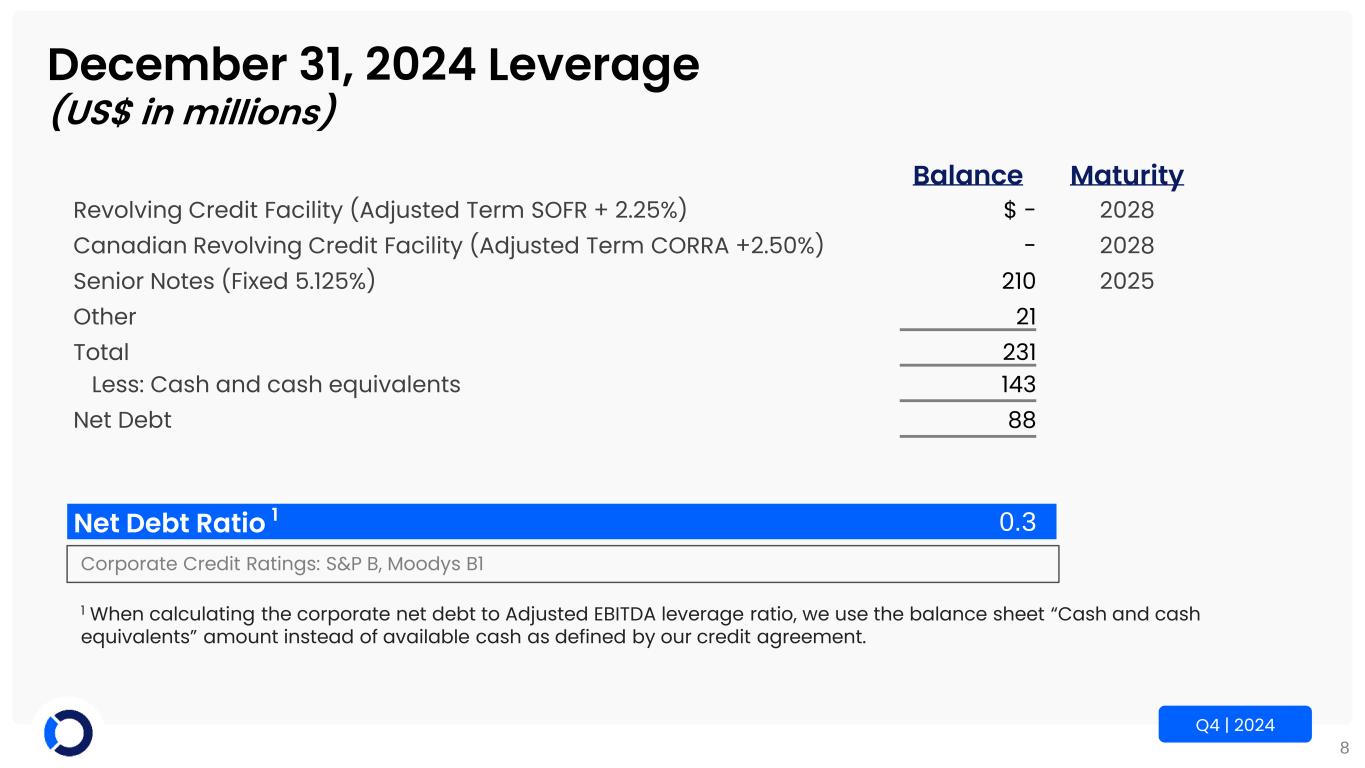

8 Q4 | 2024 December 31, 2024 Leverage (US$ in millions) Corporate Credit Ratings: S&P B, Moodys B1 1 When calculating the corporate net debt to Adjusted EBITDA leverage ratio, we use the balance sheet “Cash and cash equivalents” amount instead of available cash as defined by our credit agreement. Balance Maturity Revolving Credit Facility (Adjusted Term SOFR + 2.25%) $ - 2028 Canadian Revolving Credit Facility (Adjusted Term CORRA +2.50%) - 2028 Senior Notes (Fixed 5.125%) 210 2025 Other 21 Total 231 Less: Cash and cash equivalents 143 Net Debt 88 Net Debt Ratio 1 0.3

9 Q4 | 2024 Historical Data

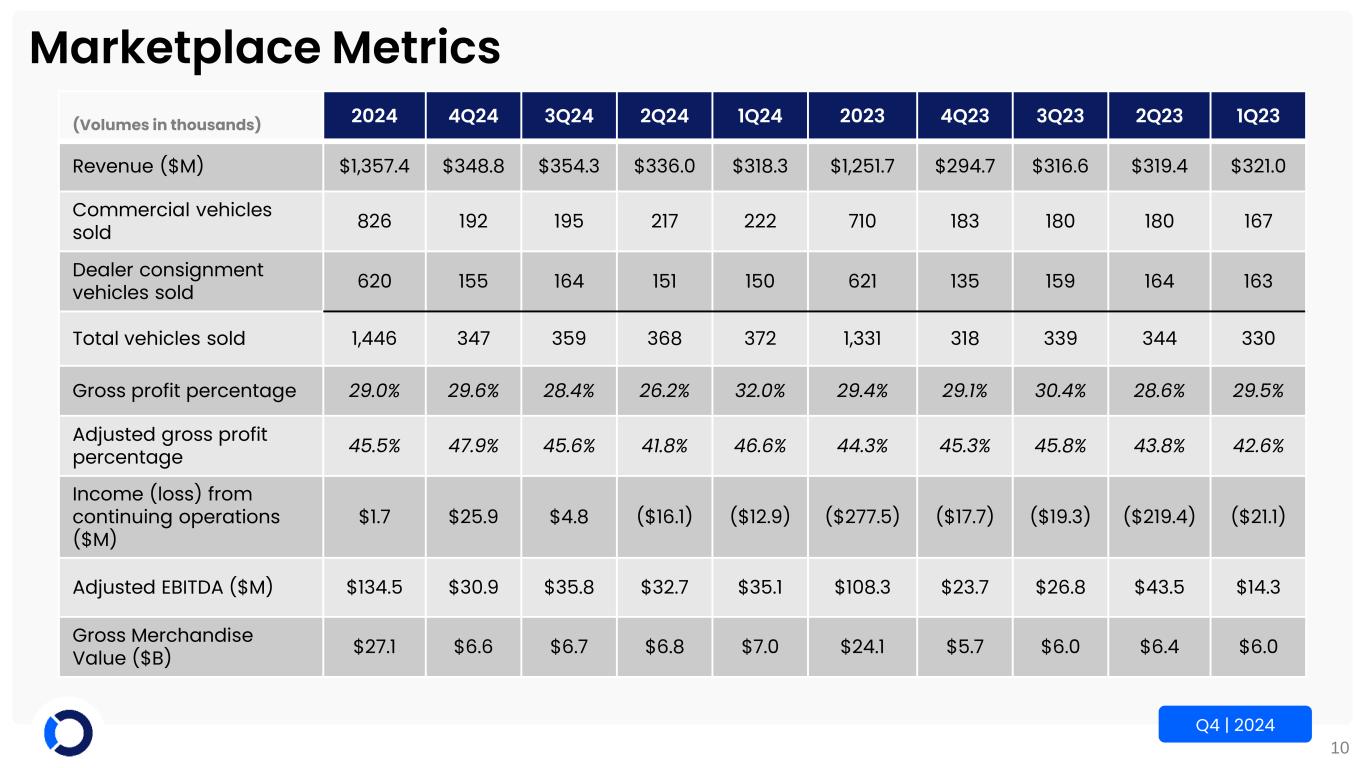

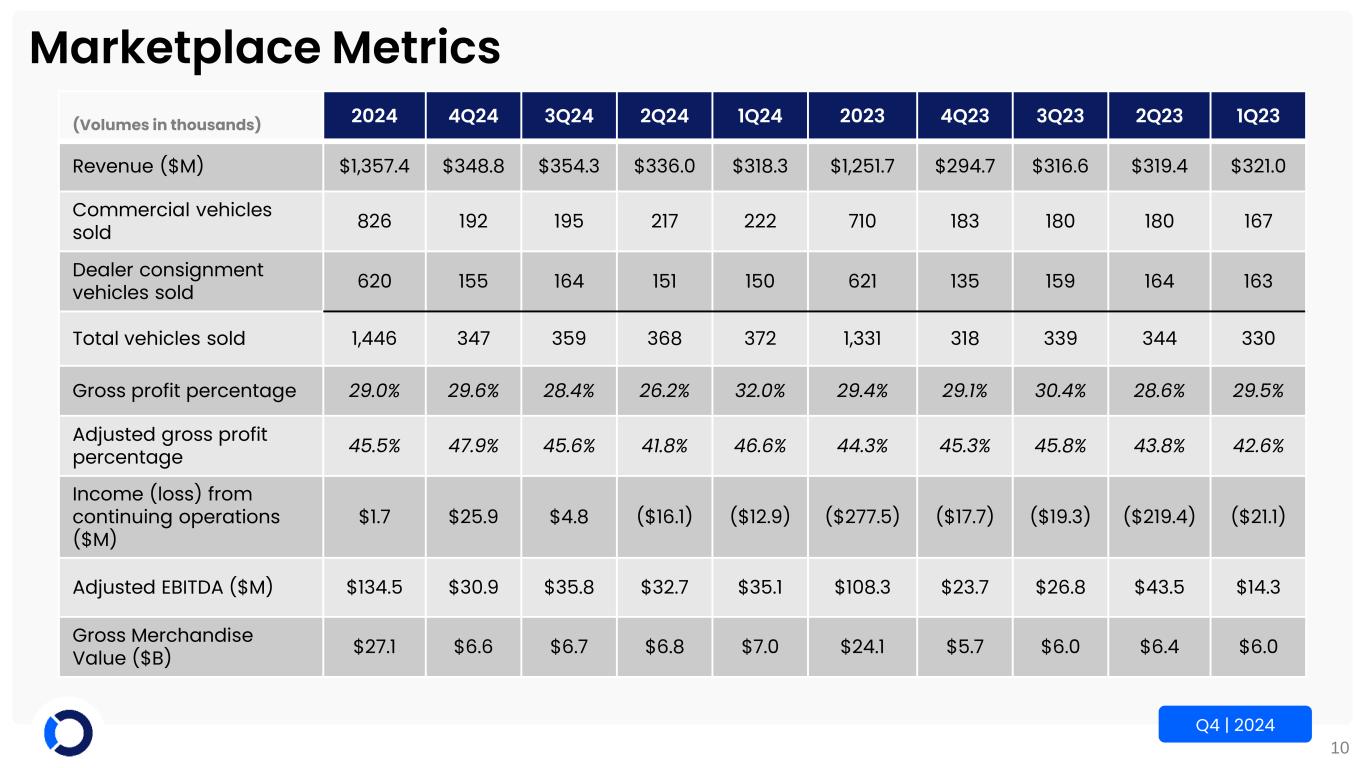

10 Q4 | 2024 Marketplace Metrics (Volumes in thousands) 2024 4Q24 3Q24 2Q24 1Q24 2023 4Q23 3Q23 2Q23 1Q23 Revenue ($M) $1,357.4 $348.8 $354.3 $336.0 $318.3 $1,251.7 $294.7 $316.6 $319.4 $321.0 Commercial vehicles sold 826 192 195 217 222 710 183 180 180 167 Dealer consignment vehicles sold 620 155 164 151 150 621 135 159 164 163 Total vehicles sold 1,446 347 359 368 372 1,331 318 339 344 330 Gross profit percentage 29.0% 29.6% 28.4% 26.2% 32.0% 29.4% 29.1% 30.4% 28.6% 29.5% Adjusted gross profit percentage 45.5% 47.9% 45.6% 41.8% 46.6% 44.3% 45.3% 45.8% 43.8% 42.6% Income (loss) from continuing operations ($M) $1.7 $25.9 $4.8 ($16.1) ($12.9) ($277.5) ($17.7) ($19.3) ($219.4) ($21.1) Adjusted EBITDA ($M) $134.5 $30.9 $35.8 $32.7 $35.1 $108.3 $23.7 $26.8 $43.5 $14.3 Gross Merchandise Value ($B) $27.1 $6.6 $6.7 $6.8 $7.0 $24.1 $5.7 $6.0 $6.4 $6.0

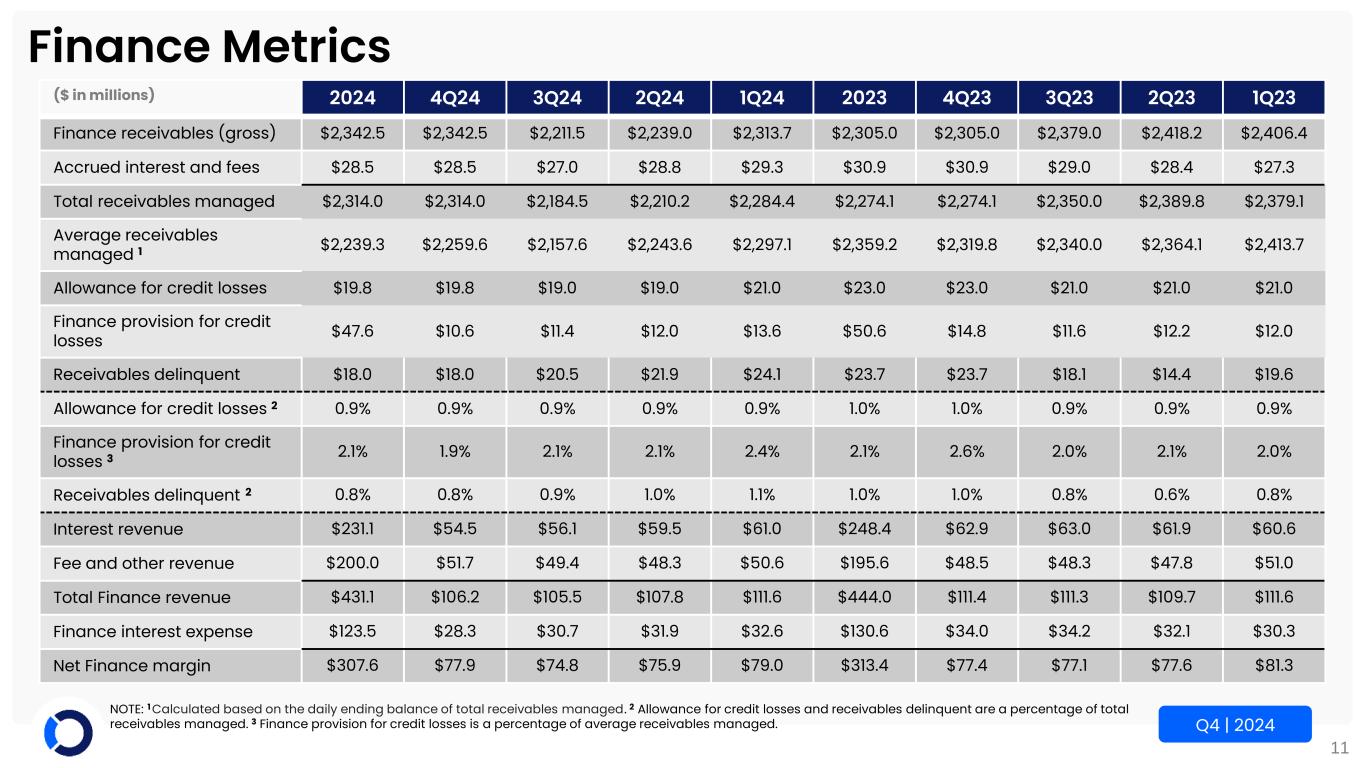

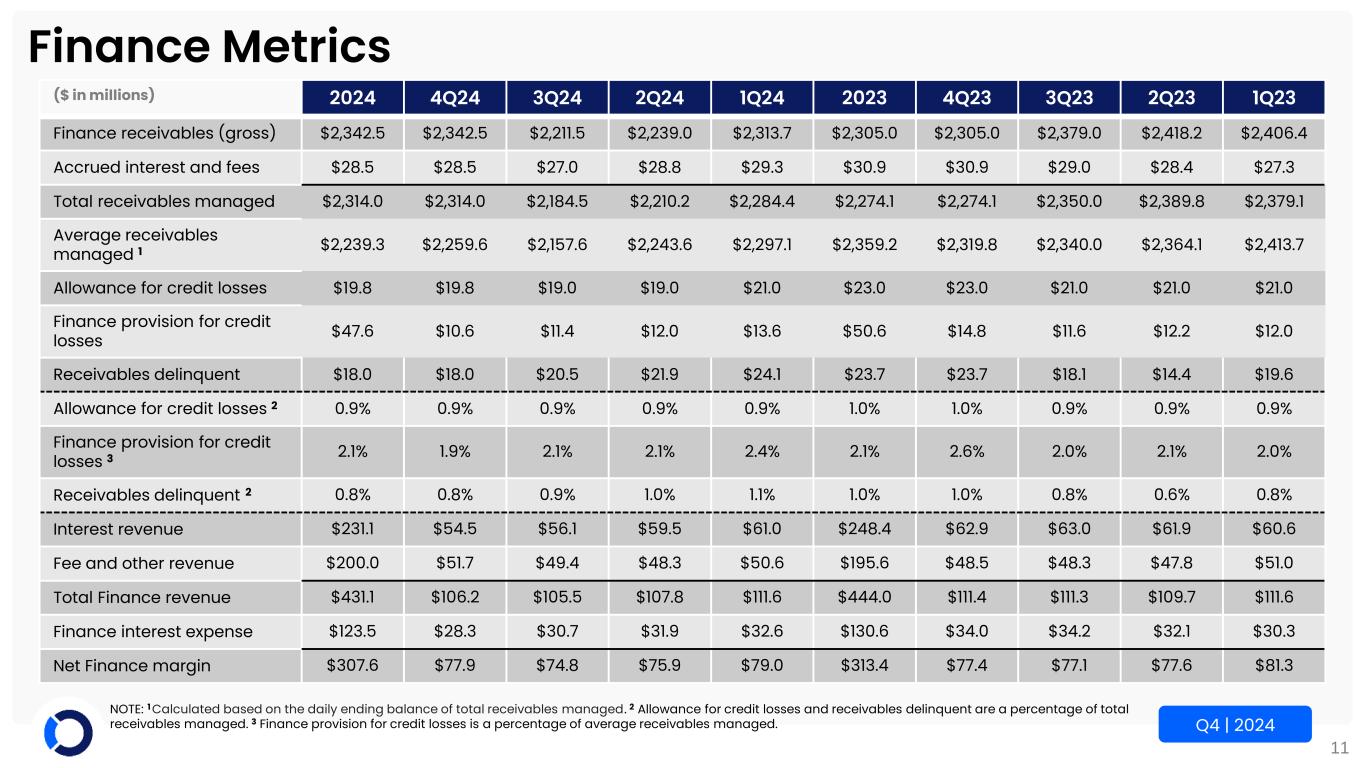

11 Q4 | 2024 Finance Metrics ($ in millions) 2024 4Q24 3Q24 2Q24 1Q24 2023 4Q23 3Q23 2Q23 1Q23 Finance receivables (gross) $2,342.5 $2,342.5 $2,211.5 $2,239.0 $2,313.7 $2,305.0 $2,305.0 $2,379.0 $2,418.2 $2,406.4 Accrued interest and fees $28.5 $28.5 $27.0 $28.8 $29.3 $30.9 $30.9 $29.0 $28.4 $27.3 Total receivables managed $2,314.0 $2,314.0 $2,184.5 $2,210.2 $2,284.4 $2,274.1 $2,274.1 $2,350.0 $2,389.8 $2,379.1 Average receivables managed 1 $2,239.3 $2,259.6 $2,157.6 $2,243.6 $2,297.1 $2,359.2 $2,319.8 $2,340.0 $2,364.1 $2,413.7 Allowance for credit losses $19.8 $19.8 $19.0 $19.0 $21.0 $23.0 $23.0 $21.0 $21.0 $21.0 Finance provision for credit losses $47.6 $10.6 $11.4 $12.0 $13.6 $50.6 $14.8 $11.6 $12.2 $12.0 Receivables delinquent $18.0 $18.0 $20.5 $21.9 $24.1 $23.7 $23.7 $18.1 $14.4 $19.6 Allowance for credit losses 2 0.9% 0.9% 0.9% 0.9% 0.9% 1.0% 1.0% 0.9% 0.9% 0.9% Finance provision for credit losses 3 2.1% 1.9% 2.1% 2.1% 2.4% 2.1% 2.6% 2.0% 2.1% 2.0% Receivables delinquent 2 0.8% 0.8% 0.9% 1.0% 1.1% 1.0% 1.0% 0.8% 0.6% 0.8% Interest revenue $231.1 $54.5 $56.1 $59.5 $61.0 $248.4 $62.9 $63.0 $61.9 $60.6 Fee and other revenue $200.0 $51.7 $49.4 $48.3 $50.6 $195.6 $48.5 $48.3 $47.8 $51.0 Total Finance revenue $431.1 $106.2 $105.5 $107.8 $111.6 $444.0 $111.4 $111.3 $109.7 $111.6 Finance interest expense $123.5 $28.3 $30.7 $31.9 $32.6 $130.6 $34.0 $34.2 $32.1 $30.3 Net Finance margin $307.6 $77.9 $74.8 $75.9 $79.0 $313.4 $77.4 $77.1 $77.6 $81.3 NOTE: 1 Calculated based on the daily ending balance of total receivables managed. 2 Allowance for credit losses and receivables delinquent are a percentage of total receivables managed. 3 Finance provision for credit losses is a percentage of average receivables managed.

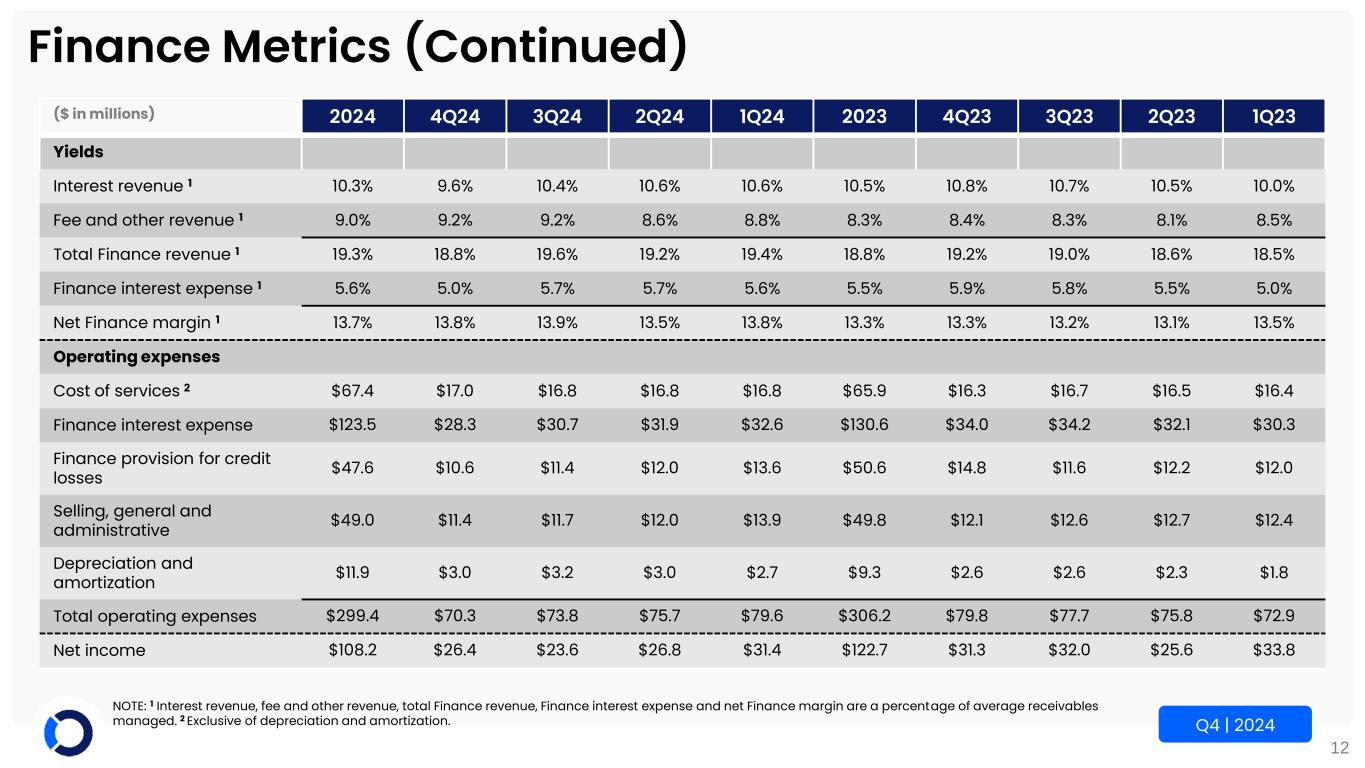

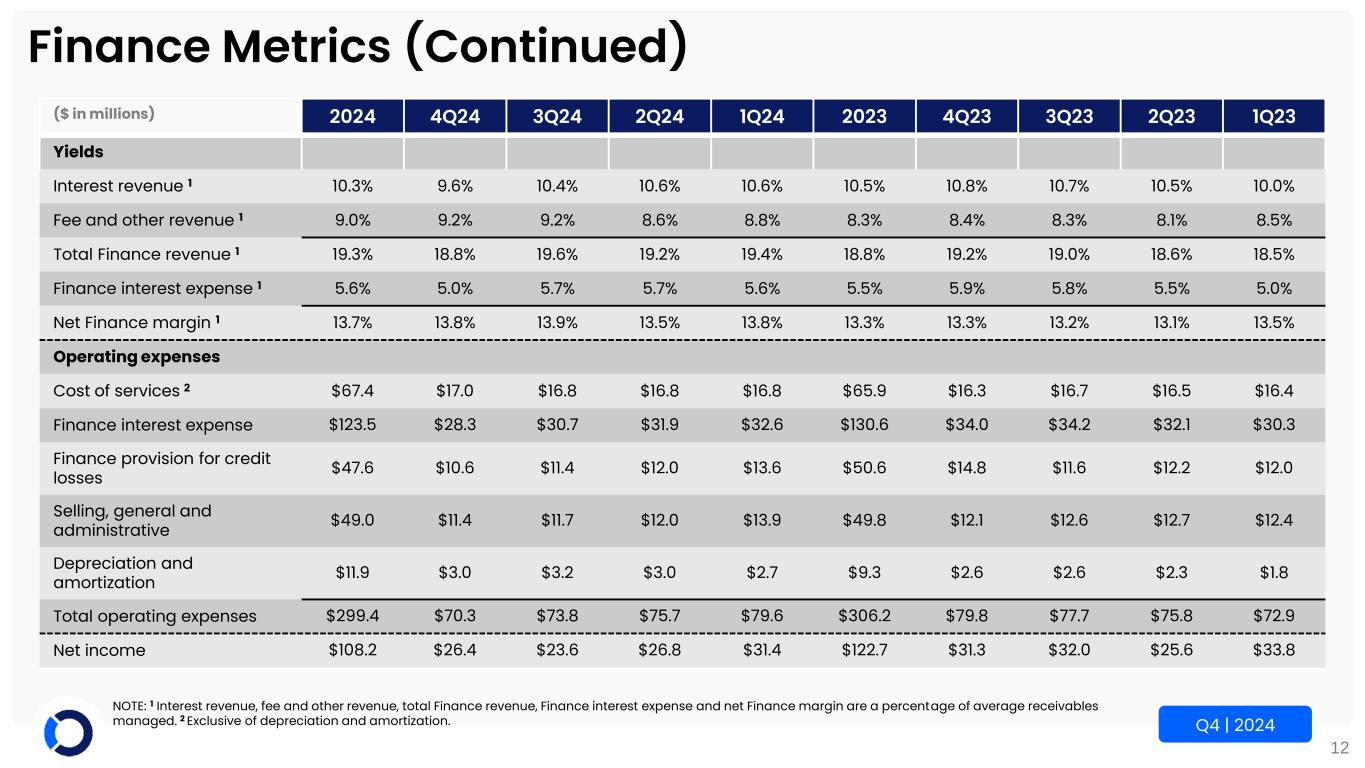

12 Q4 | 2024 Finance Metrics (Continued) ($ in millions) 2024 4Q24 3Q24 2Q24 1Q24 2023 4Q23 3Q23 2Q23 1Q23 Yields Interest revenue 1 10.3% 9.6% 10.4% 10.6% 10.6% 10.5% 10.8% 10.7% 10.5% 10.0% Fee and other revenue 1 9.0% 9.2% 9.2% 8.6% 8.8% 8.3% 8.4% 8.3% 8.1% 8.5% Total Finance revenue 1 19.3% 18.8% 19.6% 19.2% 19.4% 18.8% 19.2% 19.0% 18.6% 18.5% Finance interest expense 1 5.6% 5.0% 5.7% 5.7% 5.6% 5.5% 5.9% 5.8% 5.5% 5.0% Net Finance margin 1 13.7% 13.8% 13.9% 13.5% 13.8% 13.3% 13.3% 13.2% 13.1% 13.5% Operating expenses Cost of services 2 $67.4 $17.0 $16.8 $16.8 $16.8 $65.9 $16.3 $16.7 $16.5 $16.4 Finance interest expense $123.5 $28.3 $30.7 $31.9 $32.6 $130.6 $34.0 $34.2 $32.1 $30.3 Finance provision for credit losses $47.6 $10.6 $11.4 $12.0 $13.6 $50.6 $14.8 $11.6 $12.2 $12.0 Selling, general and administrative $49.0 $11.4 $11.7 $12.0 $13.9 $49.8 $12.1 $12.6 $12.7 $12.4 Depreciation and amortization $11.9 $3.0 $3.2 $3.0 $2.7 $9.3 $2.6 $2.6 $2.3 $1.8 Total operating expenses $299.4 $70.3 $73.8 $75.7 $79.6 $306.2 $79.8 $77.7 $75.8 $72.9 Net income $108.2 $26.4 $23.6 $26.8 $31.4 $122.7 $31.3 $32.0 $25.6 $33.8 NOTE: 1 Interest revenue, fee and other revenue, total Finance revenue, Finance interest expense and net Finance margin are a percentage of average receivables managed. 2 Exclusive of depreciation and amortization.

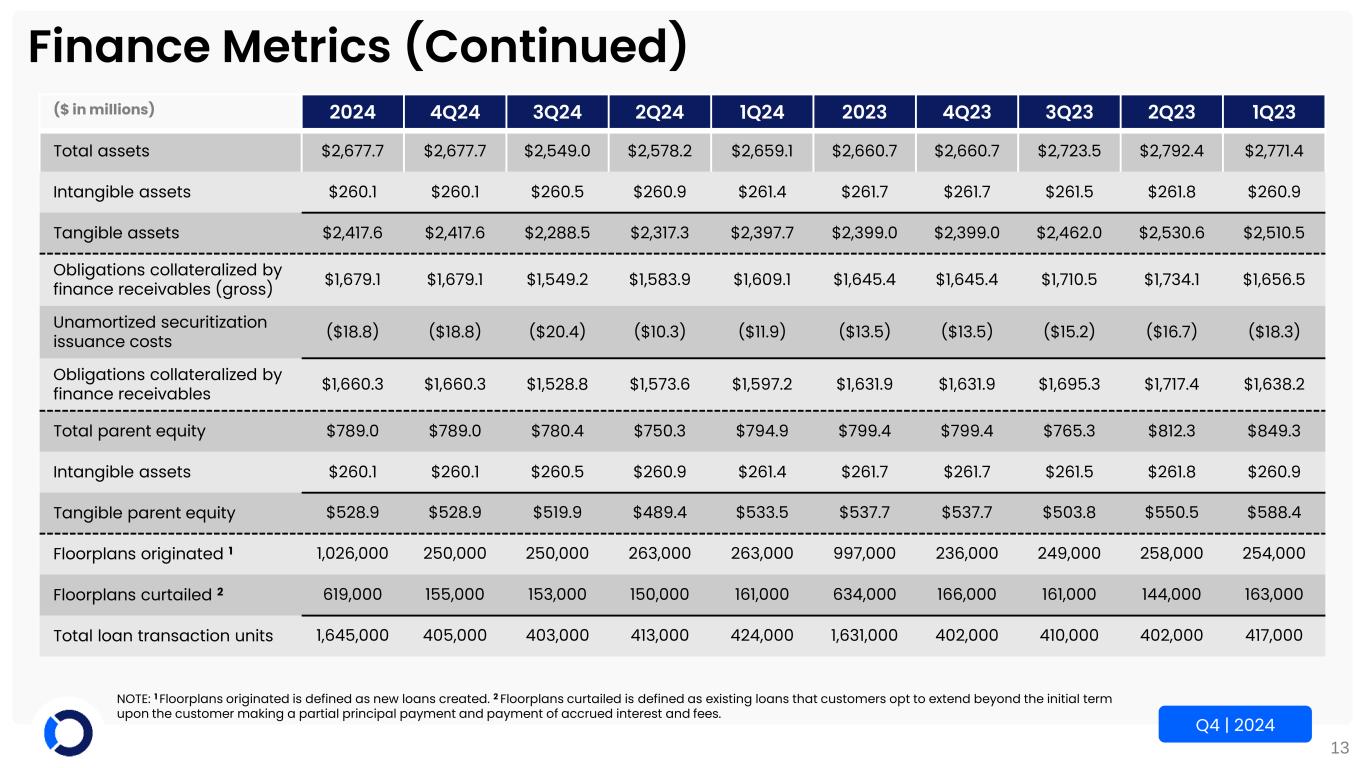

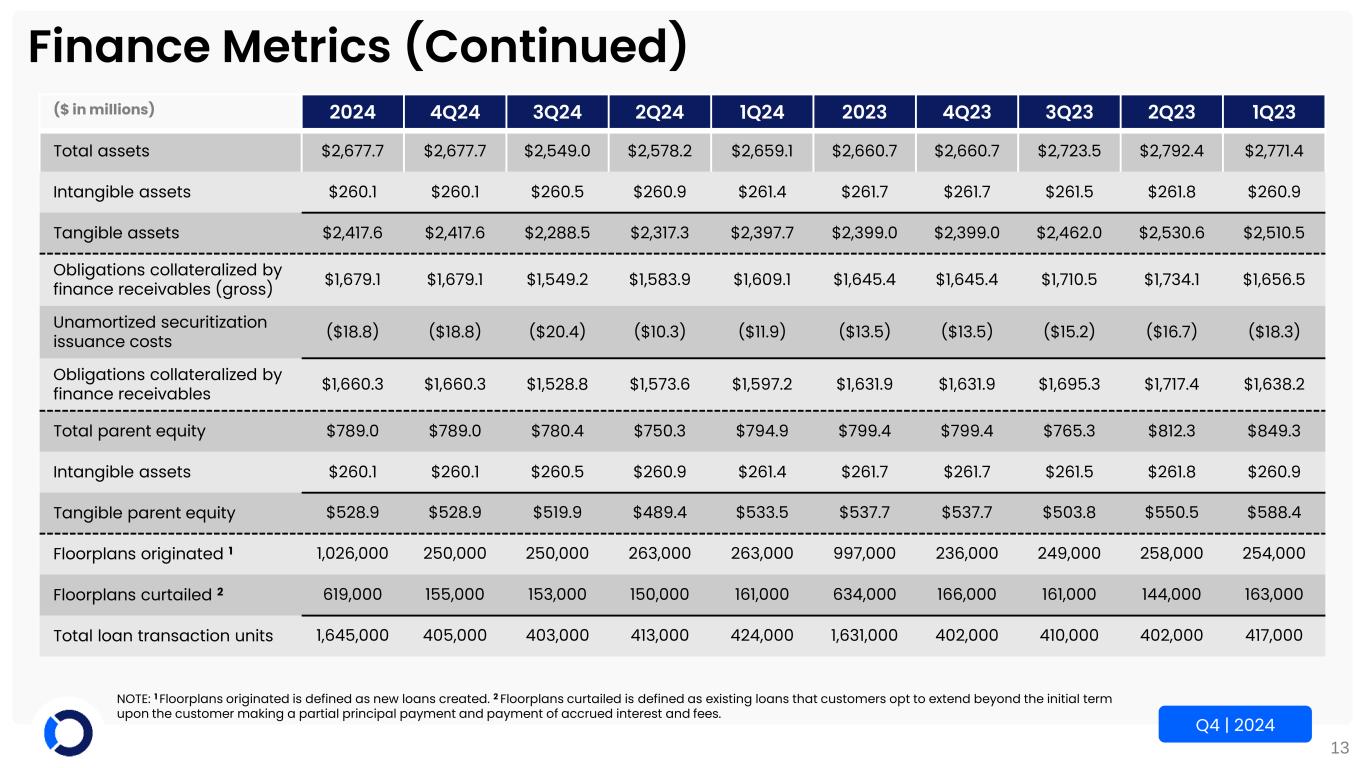

13 Q4 | 2024 Finance Metrics (Continued) ($ in millions) 2024 4Q24 3Q24 2Q24 1Q24 2023 4Q23 3Q23 2Q23 1Q23 Total assets $2,677.7 $2,677.7 $2,549.0 $2,578.2 $2,659.1 $2,660.7 $2,660.7 $2,723.5 $2,792.4 $2,771.4 Intangible assets $260.1 $260.1 $260.5 $260.9 $261.4 $261.7 $261.7 $261.5 $261.8 $260.9 Tangible assets $2,417.6 $2,417.6 $2,288.5 $2,317.3 $2,397.7 $2,399.0 $2,399.0 $2,462.0 $2,530.6 $2,510.5 Obligations collateralized by finance receivables (gross) $1,679.1 $1,679.1 $1,549.2 $1,583.9 $1,609.1 $1,645.4 $1,645.4 $1,710.5 $1,734.1 $1,656.5 Unamortized securitization issuance costs ($18.8) ($18.8) ($20.4) ($10.3) ($11.9) ($13.5) ($13.5) ($15.2) ($16.7) ($18.3) Obligations collateralized by finance receivables $1,660.3 $1,660.3 $1,528.8 $1,573.6 $1,597.2 $1,631.9 $1,631.9 $1,695.3 $1,717.4 $1,638.2 Total parent equity $789.0 $789.0 $780.4 $750.3 $794.9 $799.4 $799.4 $765.3 $812.3 $849.3 Intangible assets $260.1 $260.1 $260.5 $260.9 $261.4 $261.7 $261.7 $261.5 $261.8 $260.9 Tangible parent equity $528.9 $528.9 $519.9 $489.4 $533.5 $537.7 $537.7 $503.8 $550.5 $588.4 Floorplans originated 1 1,026,000 250,000 250,000 263,000 263,000 997,000 236,000 249,000 258,000 254,000 Floorplans curtailed 2 619,000 155,000 153,000 150,000 161,000 634,000 166,000 161,000 144,000 163,000 Total loan transaction units 1,645,000 405,000 403,000 413,000 424,000 1,631,000 402,000 410,000 402,000 417,000 NOTE: 1 Floorplans originated is defined as new loans created. 2 Floorplans curtailed is defined as existing loans that customers opt to extend beyond the initial term upon the customer making a partial principal payment and payment of accrued interest and fees.

14 Q4 | 2024 APPENDIX

15 Q4 | 2024 Non-GAAP Financial Measures EBITDA is defined as net income (loss), plus interest expense net of interest income, income tax provision (benefit), depreciation and amortization. Adjusted EBITDA is EBITDA adjusted for the items of income and expense and expected incremental revenue and cost savings as described in the company's senior secured credit agreement covenant calculations. Management believes that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA is appropriate to provide additional information to investors about one of the principal measures of performance used by the company’s creditors. In addition, management uses EBITDA and Adjusted EBITDA to evaluate the company’s performance. Depreciation expense for property and equipment and amortization expense of capitalized internally developed software costs relate to ongoing capital expenditures; however, amortization expense associated with acquired intangible assets, such as customer relationships, software, tradenames and non-compete agreements are not representative of ongoing capital expenditures but have a continuing effect on our reported results. Non-GAAP financial measures of operating adjusted net income (loss) and operating adjusted net income (loss) per share, in the opinion of the company, provide comparability to other companies that may not have incurred these types of non-cash expenses or that report a similar measure. In addition, net income (loss) and net income (loss) per share have been adjusted for certain other charges, as seen in the following reconciliation. Adjusted gross profit is defined as gross profit excluding depreciation and amortization associated with cost of services. Adjusted gross profit eliminates potential differences between periods caused by historic cost, age of assets and amortization of intangible assets from prior acquisitions. Adjusted gross profit percentage is defined as adjusted gross profit divided by revenue excluding purchased vehicle sales. Adjusted gross profit percentage eliminates the impact of depreciation and amortization on gross profit and purchased vehicle sales on revenue, allowing for more meaningful comparisons of operational efficiency between periods. Management believes these measures provide useful information about the operating results and financial performance of the Marketplace segment. EBITDA, Adjusted EBITDA, operating adjusted net income (loss), operating adjusted net income (loss) per share, adjusted gross profit and adjusted gross profit percentage have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analysis of the results as reported under GAAP. These measures may not be comparable to similarly titled measures reported by other companies.

16 Q4 | 2024 2024 Marketplace Adjusted Gross Profit Reconciliation ($ in millions) Marketplace YTD 2024 Q4 2024 Q3 2024 Q2 2024 Q1 2024 Operating revenue A $1,357.4 $348.8 $354.3 $336.0 $318.3 Purchased vehicle sales B 327.0 95.6 93.0 80.2 58.2 Operating revenue excluding purchased vehicle sales A–B=C $1,030.4 $253.2 $261.3 $255.8 $260.1 Components of depreciation and amortization: Cost of services E $75.1 $18.1 $18.6 $19.0 $19.4 Selling, general and administrative 8.2 1.9 2.0 2.1 2.2 Total depreciation and amortization $83.3 $20.0 $20.6 $21.1 $21.6 Cost of services including depreciation and amortization D $964.0 $245.6 $253.8 $248.1 $216.5 Depreciation and amortization E 75.1 18.1 18.6 19.0 19.4 Cost of services excluding depreciation and amortization D-E=F $888.9 $227.5 $235.2 $229.1 $197.1 Gross profit including depreciation and amortization A-D=G $393.4 $103.2 $100.5 $87.9 $101.8 Depreciation and amortization E 75.1 18.1 18.6 19.0 19.4 Adjusted gross profit G+E=H $468.5 $121.3 $119.1 $106.9 $121.2 Gross profit % G/A 29.0% 29.6% 28.4% 26.2% 32.0% Adjusted gross profit % H/C 45.5% 47.9% 45.6% 41.8% 46.6%

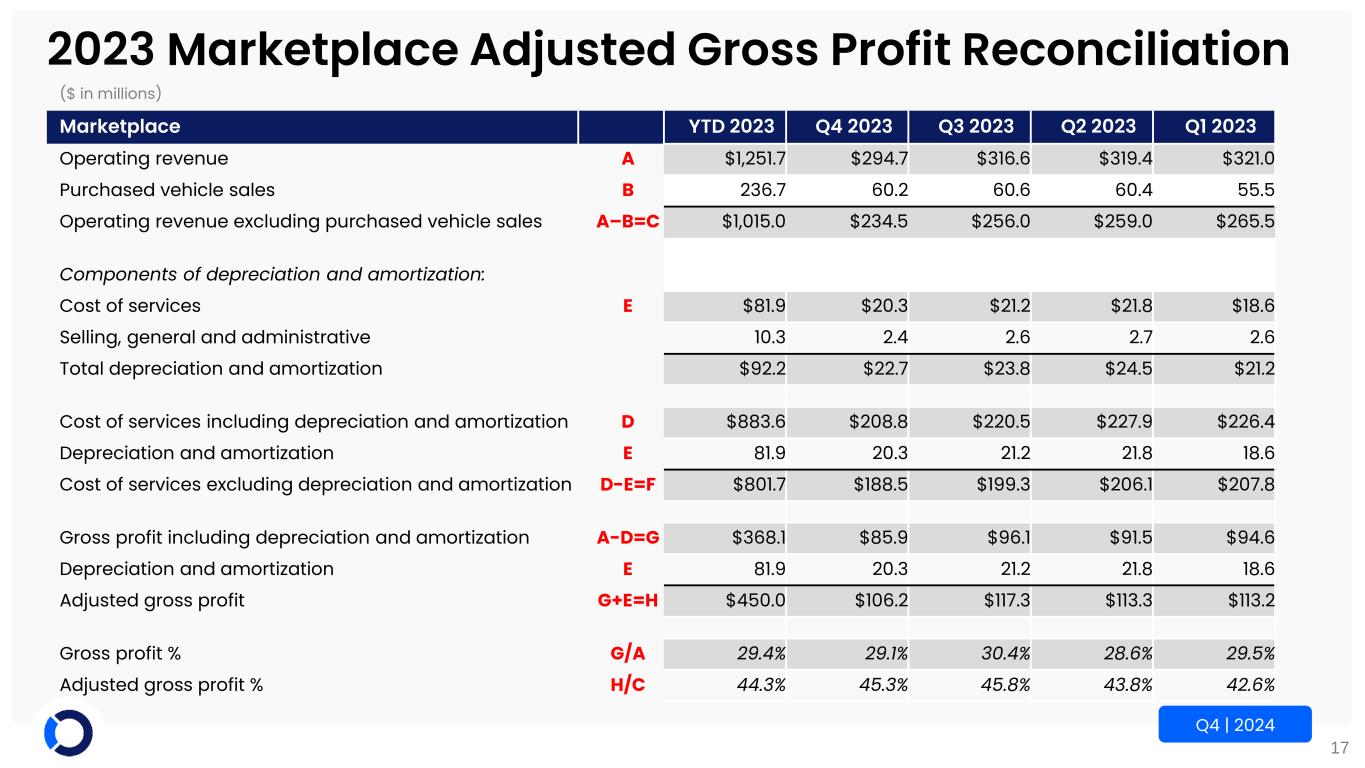

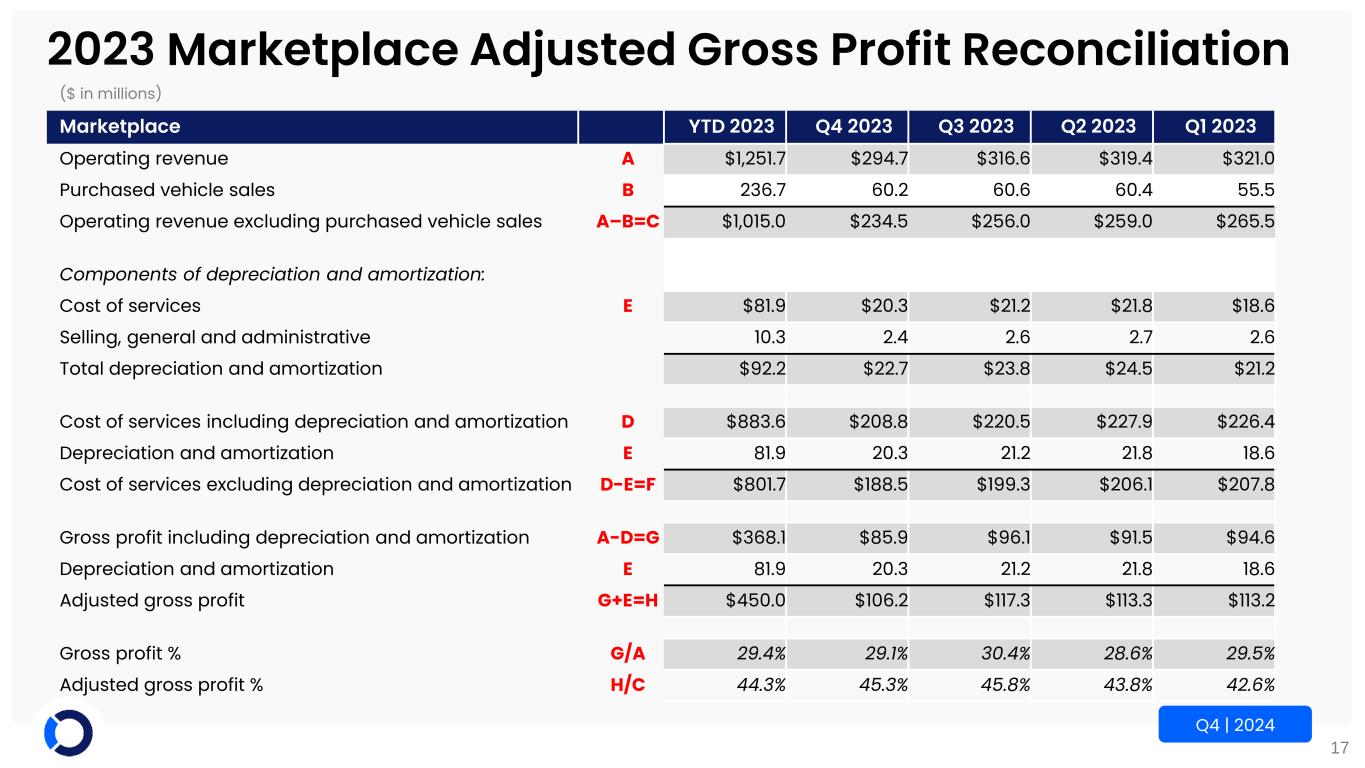

17 Q4 | 2024 2023 Marketplace Adjusted Gross Profit Reconciliation ($ in millions) Marketplace YTD 2023 Q4 2023 Q3 2023 Q2 2023 Q1 2023 Operating revenue A $1,251.7 $294.7 $316.6 $319.4 $321.0 Purchased vehicle sales B 236.7 60.2 60.6 60.4 55.5 Operating revenue excluding purchased vehicle sales A–B=C $1,015.0 $234.5 $256.0 $259.0 $265.5 Components of depreciation and amortization: Cost of services E $81.9 $20.3 $21.2 $21.8 $18.6 Selling, general and administrative 10.3 2.4 2.6 2.7 2.6 Total depreciation and amortization $92.2 $22.7 $23.8 $24.5 $21.2 Cost of services including depreciation and amortization D $883.6 $208.8 $220.5 $227.9 $226.4 Depreciation and amortization E 81.9 20.3 21.2 21.8 18.6 Cost of services excluding depreciation and amortization D-E=F $801.7 $188.5 $199.3 $206.1 $207.8 Gross profit including depreciation and amortization A-D=G $368.1 $85.9 $96.1 $91.5 $94.6 Depreciation and amortization E 81.9 20.3 21.2 21.8 18.6 Adjusted gross profit G+E=H $450.0 $106.2 $117.3 $113.3 $113.2 Gross profit % G/A 29.4% 29.1% 30.4% 28.6% 29.5% Adjusted gross profit % H/C 44.3% 45.3% 45.8% 43.8% 42.6%

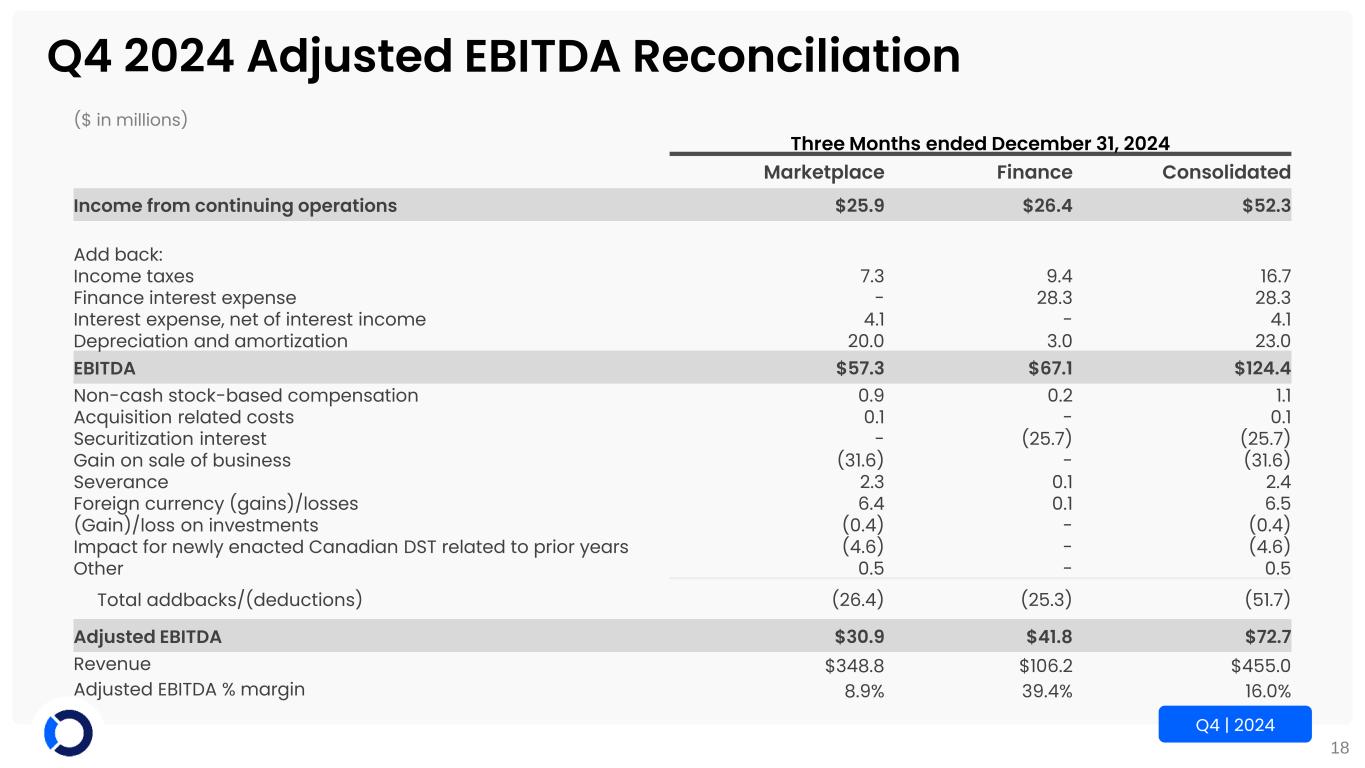

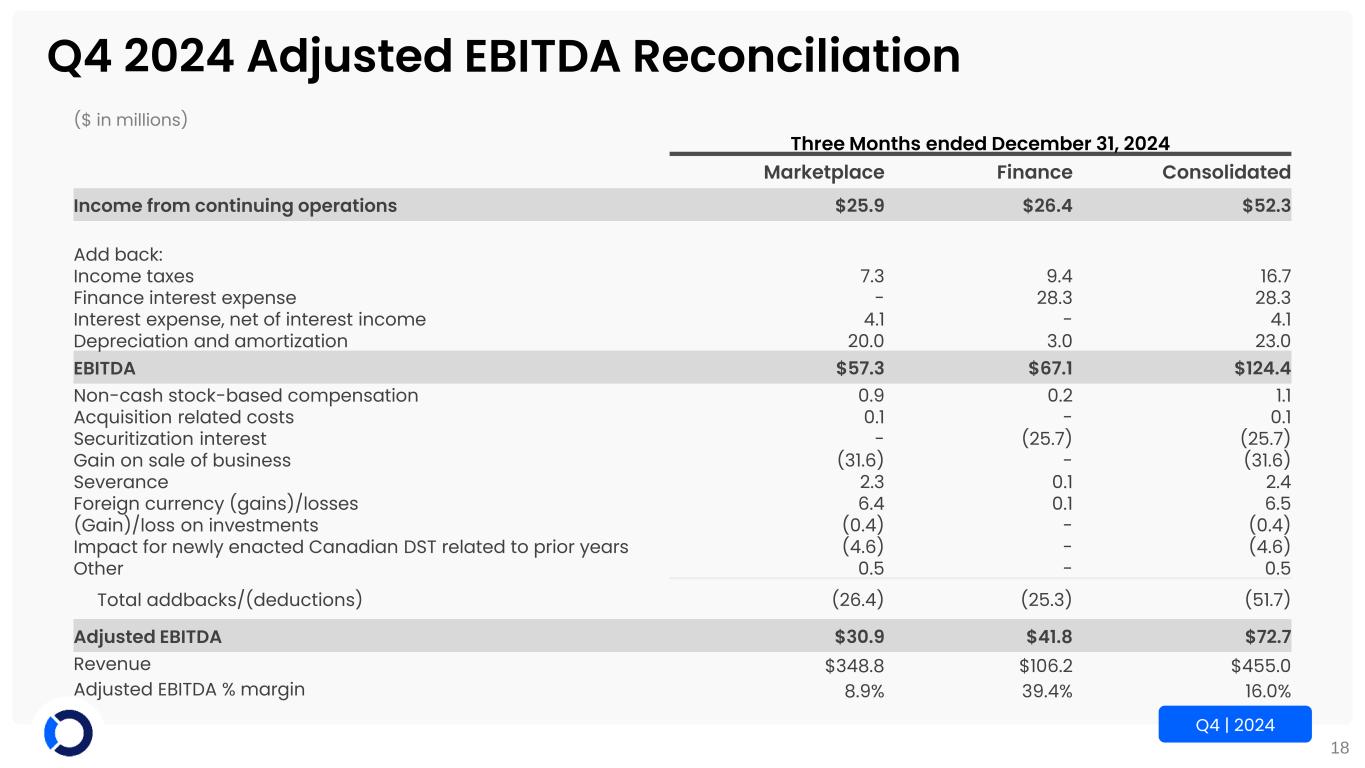

18 Q4 | 2024 Q4 2024 Adjusted EBITDA Reconciliation ($ in millions) Three Months ended December 31, 2024 Marketplace Finance Consolidated Income from continuing operations $25.9 $26.4 $52.3 Add back: Income taxes 7.3 9.4 16.7 Finance interest expense - 28.3 28.3 Interest expense, net of interest income 4.1 - 4.1 Depreciation and amortization 20.0 3.0 23.0 EBITDA $57.3 $67.1 $124.4 Non-cash stock-based compensation 0.9 0.2 1.1 Acquisition related costs 0.1 - 0.1 Securitization interest - (25.7) (25.7) Gain on sale of business (31.6) - (31.6) Severance 2.3 0.1 2.4 Foreign currency (gains)/losses 6.4 0.1 6.5 (Gain)/loss on investments (0.4) - (0.4) Impact for newly enacted Canadian DST related to prior years (4.6) - (4.6) Other 0.5 - 0.5 Total addbacks/(deductions) (26.4) (25.3) (51.7) Adjusted EBITDA $30.9 $41.8 $72.7 Revenue $348.8 $106.2 $455.0 Adjusted EBITDA % margin 8.9% 39.4% 16.0%

19 Q4 | 2024 Q4 2023 Adjusted EBITDA Reconciliation ($ in millions) Three Months ended December 31, 2023 Marketplace Finance Consolidated Income (loss) from continuing operations ($17.7) $31.3 $13.6 Add back: Income taxes (2.5) 10.1 7.6 Finance interest expense - 34.0 34.0 Interest expense, net of interest income 4.9 - 4.9 Depreciation and amortization 22.7 2.6 25.3 Intercompany interest 9.8 (9.8) - EBITDA $17.2 $68.2 $85.4 Non-cash stock-based compensation 2.7 0.9 3.6 Acquisition related costs 2.0 - 2.0 Securitization interest - (31.4) (31.4) Severance 2.0 0.1 2.1 Foreign currency (gains)/losses (2.1) - (2.1) (Gain)/loss on investments - (0.4) (0.4) Professional fees related to business improvement efforts 1.7 0.4 2.1 Other 0.2 0.3 0.5 Total addbacks/(deductions) 6.5 (30.1) (23.6) Adjusted EBITDA $23.7 $38.1 $61.8 Revenue $294.7 $111.4 $406.1 Adjusted EBITDA % margin 8.0% 34.2% 15.2%

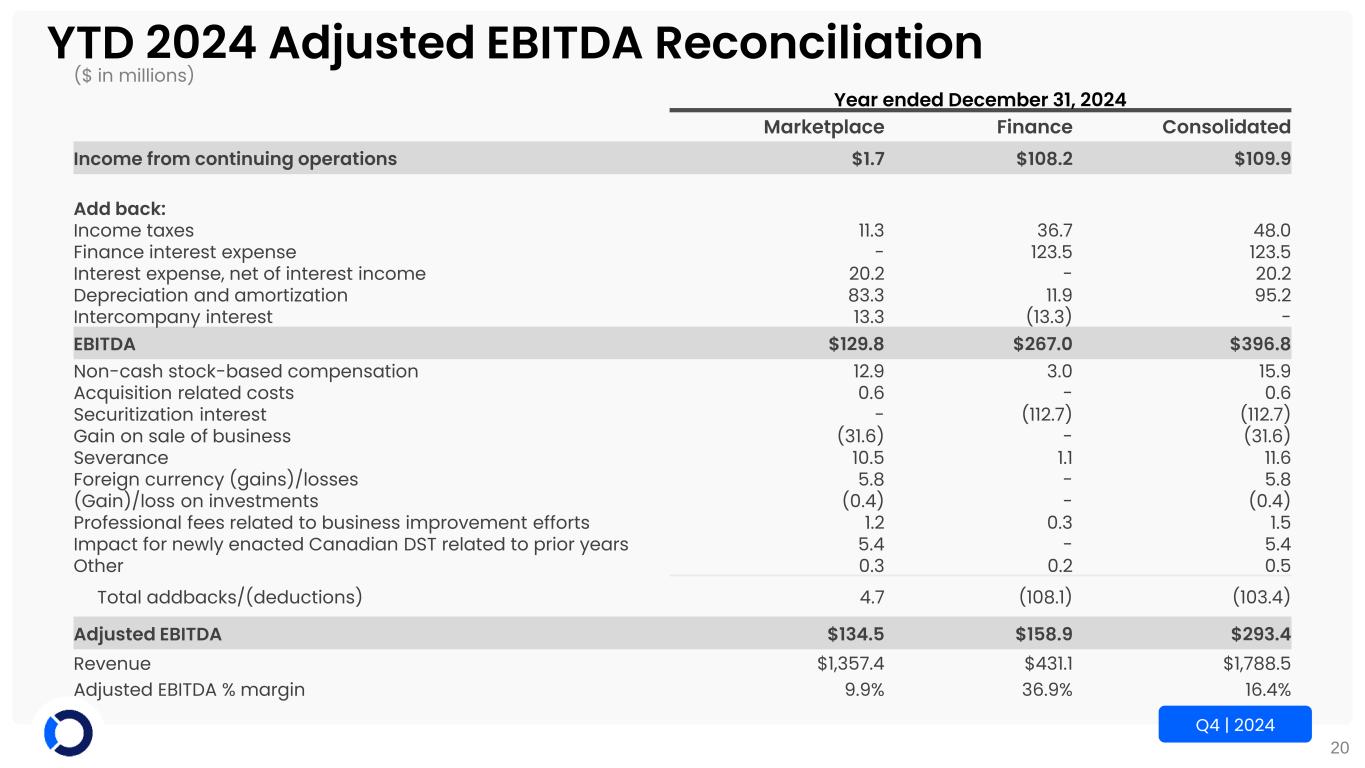

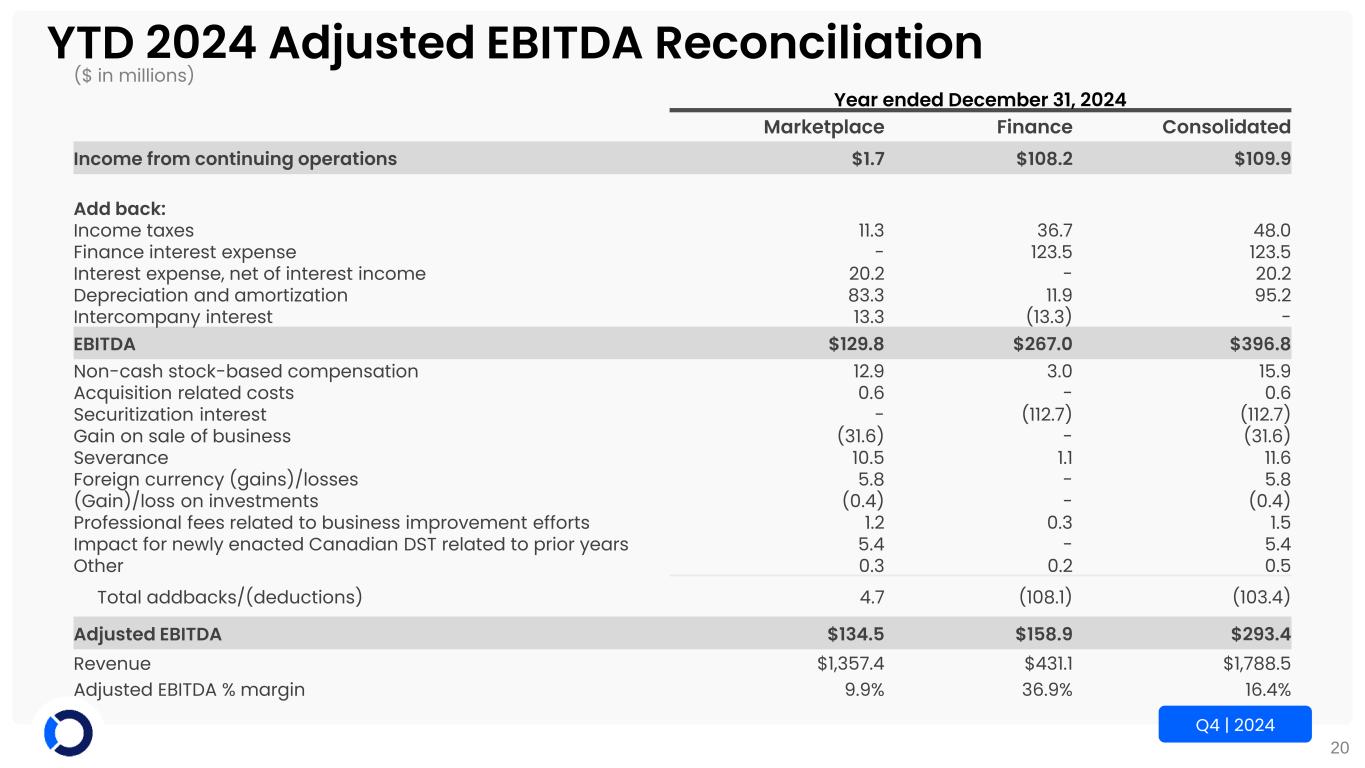

20 Q4 | 2024 YTD 2024 Adjusted EBITDA Reconciliation ($ in millions) Year ended December 31, 2024 Marketplace Finance Consolidated Income from continuing operations $1.7 $108.2 $109.9 Add back: Income taxes 11.3 36.7 48.0 Finance interest expense - 123.5 123.5 Interest expense, net of interest income 20.2 - 20.2 Depreciation and amortization 83.3 11.9 95.2 Intercompany interest 13.3 (13.3) - EBITDA $129.8 $267.0 $396.8 Non-cash stock-based compensation 12.9 3.0 15.9 Acquisition related costs 0.6 - 0.6 Securitization interest - (112.7) (112.7) Gain on sale of business (31.6) - (31.6) Severance 10.5 1.1 11.6 Foreign currency (gains)/losses 5.8 - 5.8 (Gain)/loss on investments (0.4) - (0.4) Professional fees related to business improvement efforts 1.2 0.3 1.5 Impact for newly enacted Canadian DST related to prior years 5.4 - 5.4 Other 0.3 0.2 0.5 Total addbacks/(deductions) 4.7 (108.1) (103.4) Adjusted EBITDA $134.5 $158.9 $293.4 Revenue $1,357.4 $431.1 $1,788.5 Adjusted EBITDA % margin 9.9% 36.9% 16.4%

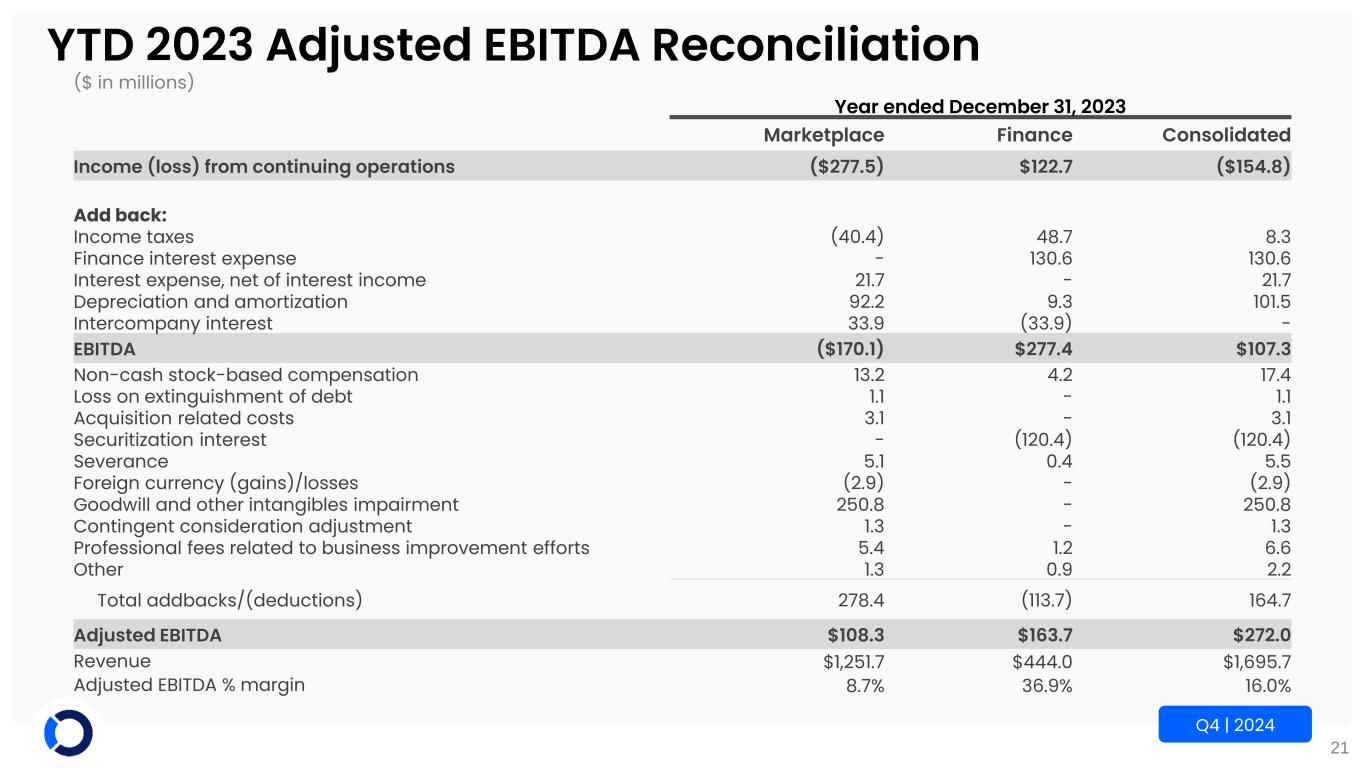

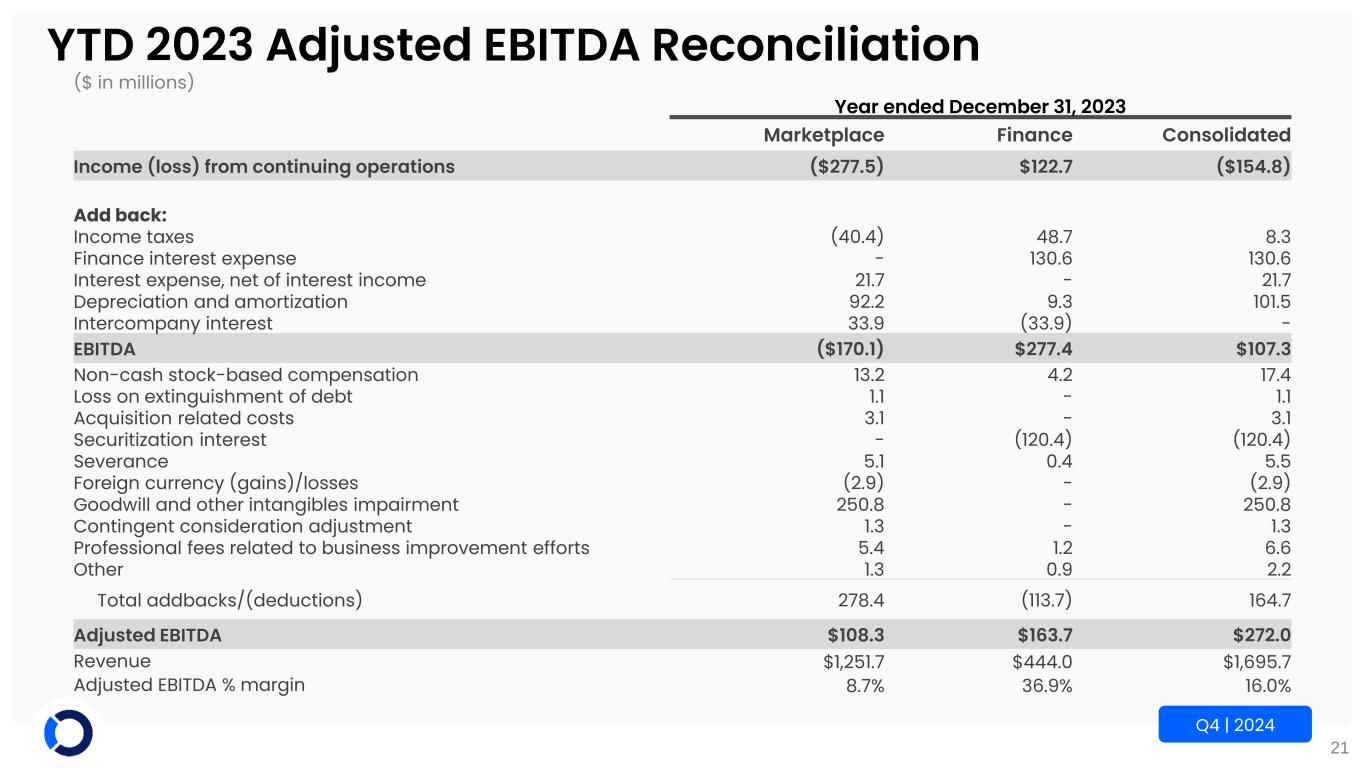

21 Q4 | 2024 YTD 2023 Adjusted EBITDA Reconciliation ($ in millions) Year ended December 31, 2023 Marketplace Finance Consolidated Income (loss) from continuing operations ($277.5) $122.7 ($154.8) Add back: Income taxes (40.4) 48.7 8.3 Finance interest expense - 130.6 130.6 Interest expense, net of interest income 21.7 - 21.7 Depreciation and amortization 92.2 9.3 101.5 Intercompany interest 33.9 (33.9) - EBITDA ($170.1) $277.4 $107.3 Non-cash stock-based compensation 13.2 4.2 17.4 Loss on extinguishment of debt 1.1 - 1.1 Acquisition related costs 3.1 - 3.1 Securitization interest - (120.4) (120.4) Severance 5.1 0.4 5.5 Foreign currency (gains)/losses (2.9) - (2.9) Goodwill and other intangibles impairment 250.8 - 250.8 Contingent consideration adjustment 1.3 - 1.3 Professional fees related to business improvement efforts 5.4 1.2 6.6 Other 1.3 0.9 2.2 Total addbacks/(deductions) 278.4 (113.7) 164.7 Adjusted EBITDA $108.3 $163.7 $272.0 Revenue $1,251.7 $444.0 $1,695.7 Adjusted EBITDA % margin 8.7% 36.9% 16.0%

22 Q4 | 2024 Operating Adjusted Net Income per Share Reconciliation ($ in millions, except per share amounts), (Unaudited) Three Months ended Year ended December 31, December 31, 2024 2023 2024 2023 Net income (loss) from continuing operations $52.3 $13.6 $109.9 ($154.8) Acquired amortization expense 8.3 9.5 35.7 37.8 Impact for newly enacted Canadian DST related to prior years (4.6) - 5.4 - Gain on sale of business (31.6) - (31.6) - Loss on extinguishment of debt - - - 1.1 Contingent consideration adjustment - - - 1.3 Goodwill and other intangibles impairment - - - 250.8 Income taxes (1) 6.1 (0.1) 3.3 (32.5) Operating adjusted net income from continuing operations $30.5 $23.0 $122.7 $103.7 Operating adjusted net income from discontinued operations $ - $0.7 $ - $0.7 Operating adjusted net income $30.5 $23.7 $122.7 $104.4 Operating adjusted net income from continuing operations per share – diluted (2) $0.21 $0.16 $0.85 $0.72 Operating adjusted net income from discontinued operations per share – diluted - - - - Operating adjusted net income per share – diluted $0.21 $0.16 $0.85 $0.72 Weighted average diluted shares - including assumed conversion of preferred shares 144.1 144.7 145.0 144.8 (1) For the three months and years ended December 31, 2024 and 2023, each tax deductible item was booked to the applicable statutory rate. The deferred tax benefits of $52.5 million and $6.5 million associated with the goodwill and tradename impairments in 2023, respectively, resulted in the U.S. being in a net deferred tax asset position. Due to the three-year cumulative loss related to U.S. operations, we currently have a $35.8 million valuation allowance against the U.S. net deferred tax asset. (2) The Series A Preferred Stock dividends and undistributed earnings allocated to participating securities have not been included in the determination of operating adjusted net income (loss) for purposes of calculating operating adjusted net income (loss) per diluted share.