Exhibit 99.1

Strategy and Vision Tom Hill Talent and Sustainability Darren Hicks & Janet Kavinoky Vulcan Way of Selling (VWS) Jerry Perkins Break Vulcan Way of Operating (VWO) Jason Teter Portfolio Management Ronnie Pruitt Raising the Bar Mary Andrews Carlisle Conclusion and Q&A All Agenda

This presentation contains forward-looking statements. Statements that are not historical fact, including statements about Vulcan's beliefs and expectations, are forward-looking statements. Generally, these statements relate to future financial performance, results of operations, business plans or strategies, projected or anticipated revenues, expenses, earnings (including EBITDA and other measures), dividend policy, shipment volumes, pricing, levels of capital expenditures, intended cost reductions and cost savings, anticipated profit improvements and/or planned divestitures and asset sales. These forward-looking statements are sometimes identified by the use of terms and phrases such as "believe," "should," "would," "expect," "project," "estimate," "anticipate," "intend," "plan," "will," "can," "may" or similar expressions elsewhere in this document. These statements are subject to numerous risks, uncertainties, and assumptions, including but not limited to general business conditions, competitive factors, pricing, energy costs, and other risks and uncertainties discussed in the reports Vulcan periodically files with the SEC. Forward-looking statements are not guarantees of future performance and actual results, developments, and business decisions may vary significantly from those expressed in or implied by the forward-looking statements. The following risks related to Vulcan's business, among others, could cause actual results to differ materially from those described in the forward-looking statements: general economic and business conditions; a pandemic, epidemic or other public health emergency, such as the COVID-19 outbreak; Vulcan’s dependence on the construction industry, which is subject to economic cycles; the timing and amount of federal, state and local funding for infrastructure; changes in the level of spending for private residential and private nonresidential construction; changes in Vulcan’s effective tax rate; the increasing reliance on information technology infrastructure, including the risks that the infrastructure does not work as intended, experiences technical difficulties or is subjected to cyber-attacks; the impact of the state of the global economy on Vulcan’s businesses and financial condition and access to capital markets; international business operations and relationships, including recent actions taken by the Mexican government with respect to Vulcan’s property and operations in that country; the highly competitive nature of the construction industry; the impact of future regulatory or legislative actions, including those relating to climate change, wetlands, greenhouse gas emissions, the definition of minerals, tax policy or international trade; the outcome of pending legal proceedings; pricing of Vulcan's products; weather and other natural phenomena, including the impact of climate change and availability of water; availability and cost of trucks, railcars, barges and ships as well as their licensed operators for transport of Vulcan’s materials; energy costs; costs of hydrocarbon-based raw materials; healthcare costs; labor shortages and constraints; the amount of long-term debt and interest expense incurred by Vulcan; changes in interest rates; volatility in pension plan asset values and liabilities, which may require cash contributions to the pension plans; the impact of environmental cleanup costs and other liabilities relating to existing and/or divested businesses; Vulcan's ability to secure and permit aggregates reserves in strategically located areas; Vulcan’s ability to manage and successfully integrate acquisitions; the effect of changes in tax laws, guidance and interpretations; significant downturn in the construction industry may result in the impairment of goodwill or long-lived assets; changes in technologies, which could disrupt the way Vulcan does business and how Vulcan’s products are distributed; and other assumptions, risks and uncertainties detailed from time to time in the reports filed by Vulcan with the SEC. All forward-looking statements in this communication are qualified in their entirety by this cautionary statement. Vulcan disclaims and does not undertake any obligation to update or revise any forward-looking statement in this document except as required by law. This presentation contains certain non-GAAP financial terms, which are defined in the Appendix. Reconciliations of non-GAAP terms to the closest GAAP terms are also provided in the Appendix. Because GAAP financial measures on a forward-looking basis are not accessible, and reconciling information is not available without unreasonable effort, we have not provided reconciliations for forward-looking non-GAAP measures. For the same reasons, we are unable to address the probable significance of the unavailable information, which could be material to future results. Safe Harbor and Non-GAAP Financial Measures

Well Positioned for Continued Growth and Value Creation Strong Cash Flow Generation and Investment-Grade Balance Sheet Durable Business Model to Extend the Cycle and Sustain Growth Industry Leader with Clear Competitive Advantages

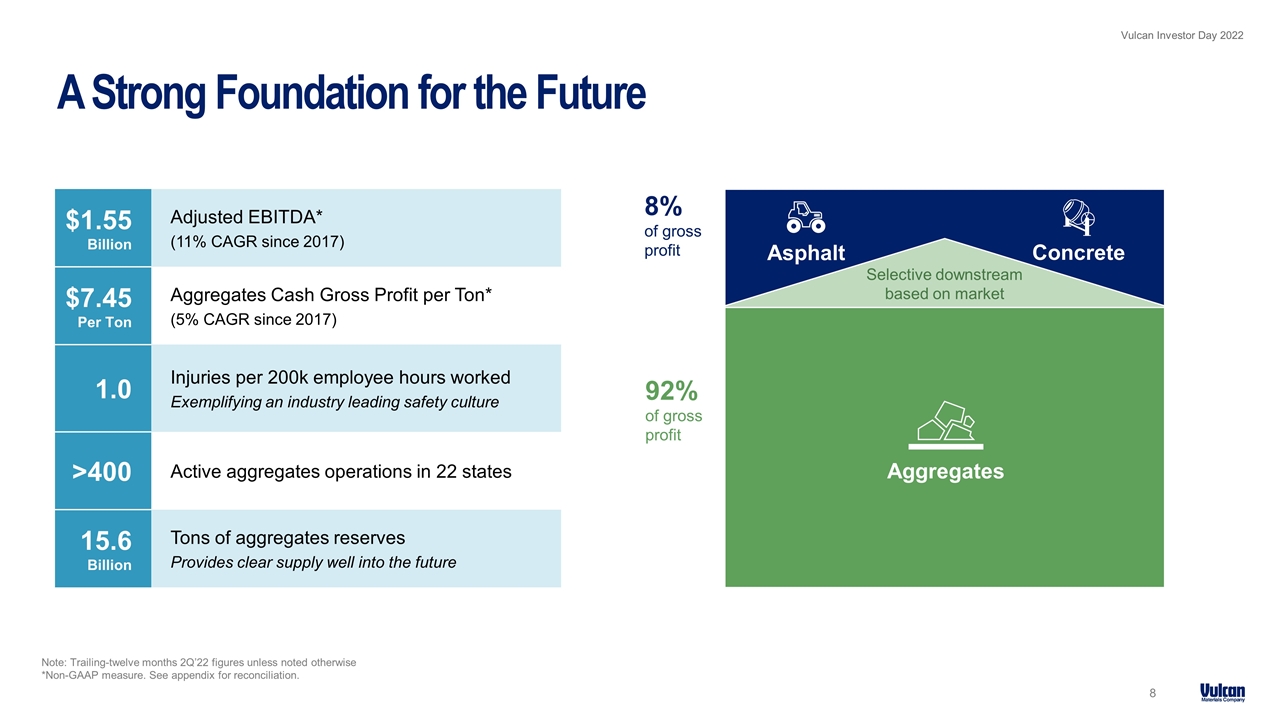

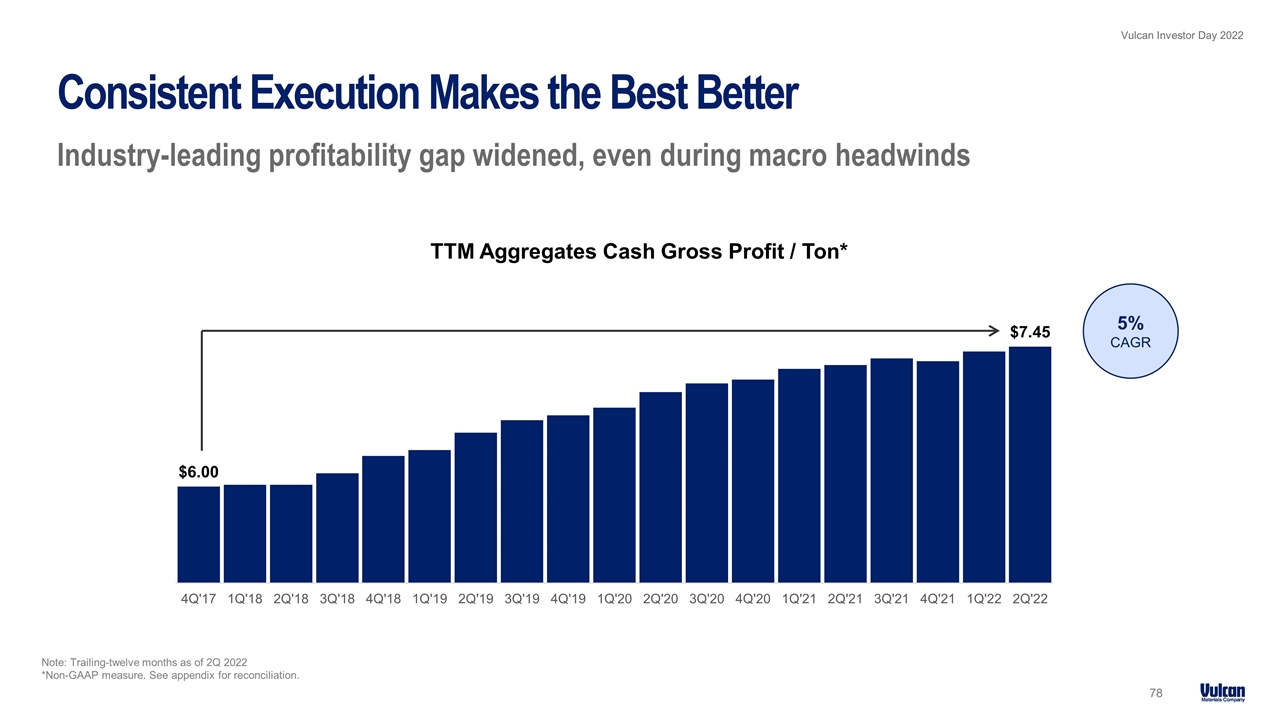

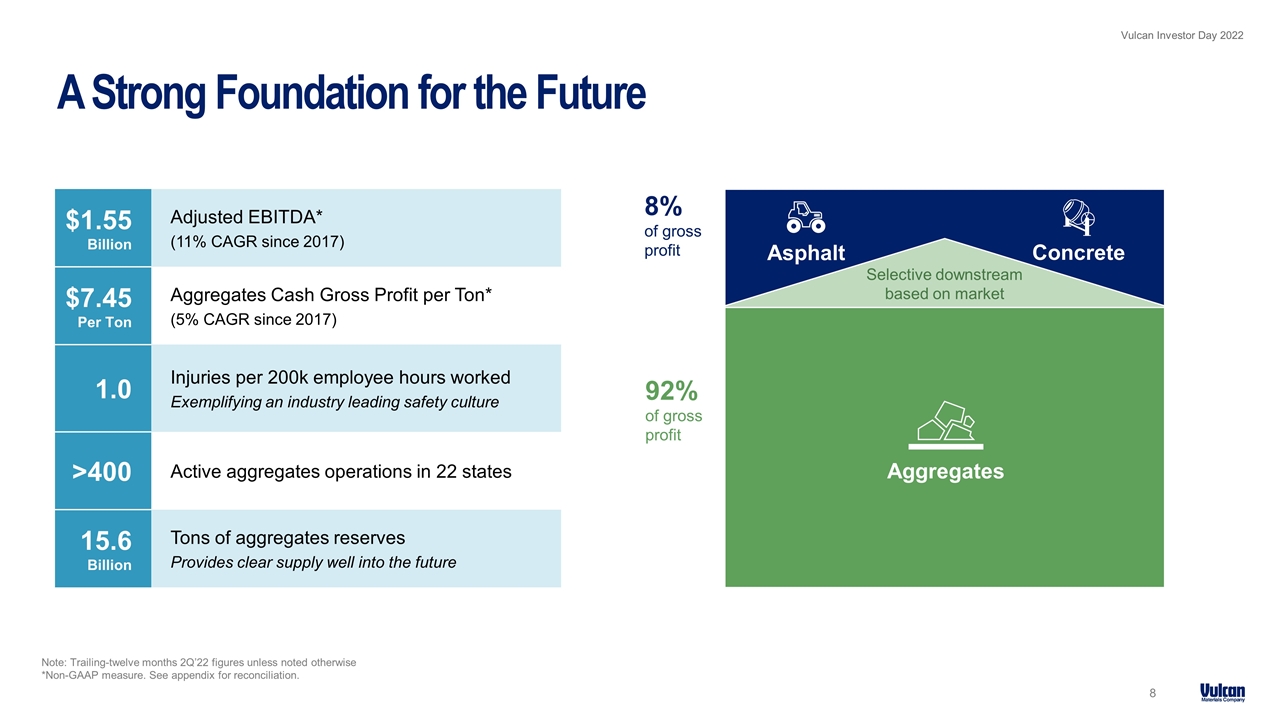

Note: Trailing-twelve months 2Q’22 figures unless noted otherwise *Non-GAAP measure. See appendix for reconciliation. A Strong Foundation for the Future $1.55 Billion Adjusted EBITDA* (11% CAGR since 2017) $7.45 Per Ton Aggregates Cash Gross Profit per Ton* (5% CAGR since 2017) 1.0 Injuries per 200k employee hours worked Exemplifying an industry leading safety culture >400 Active aggregates operations in 22 states 15.6 Billion Tons of aggregates reserves Provides clear supply well into the future 92% of gross profit 8% of gross profit Concrete Asphalt Aggregates Selective downstream based on market

Sources: USGS, Woods & Poole CEDDS 2021 and Company estimates Based on population growth from 2020 to 2030 Serving the Right U.S. Markets Well positioned to capture U.S. market opportunities 90% Revenues tied to markets where Vulcan has a #1 or #2 position 20 of top 25 Fastest growing markets served by Vulcan operations 60% Population living within 60 miles of a Vulcan operation $20B Aggregates opportunity in Vulcan-served states, $30B in total U.S.

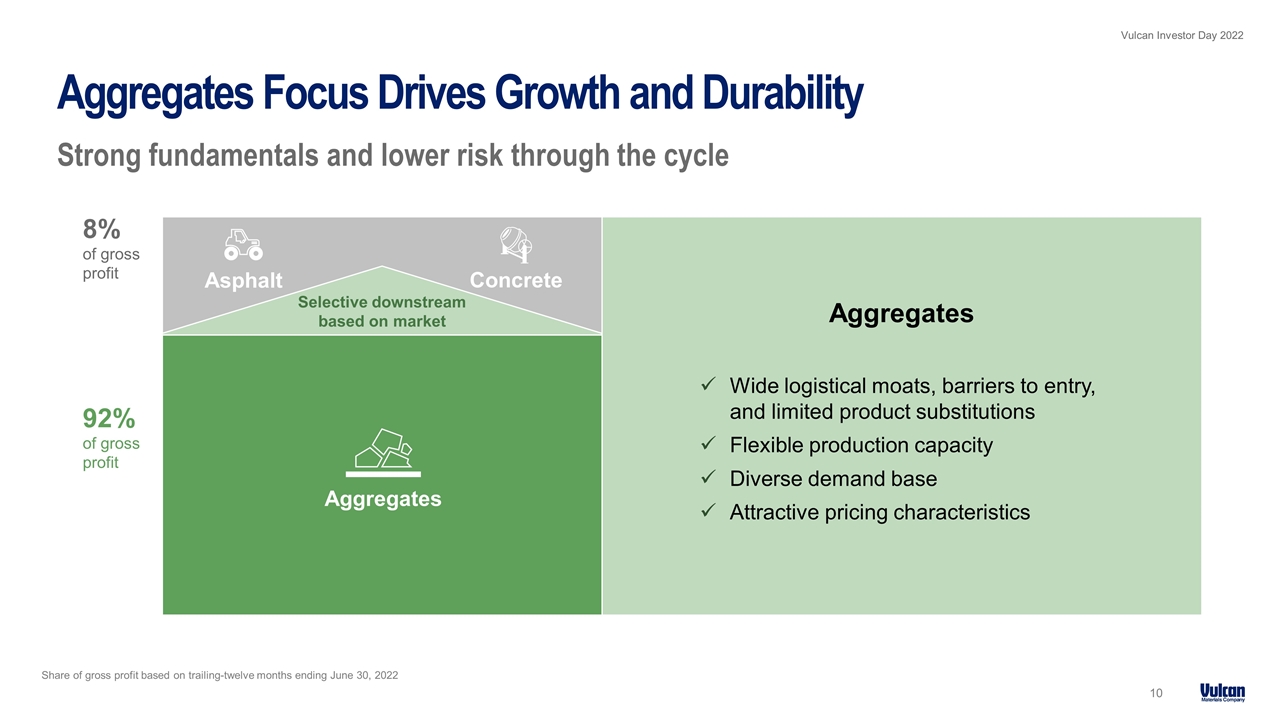

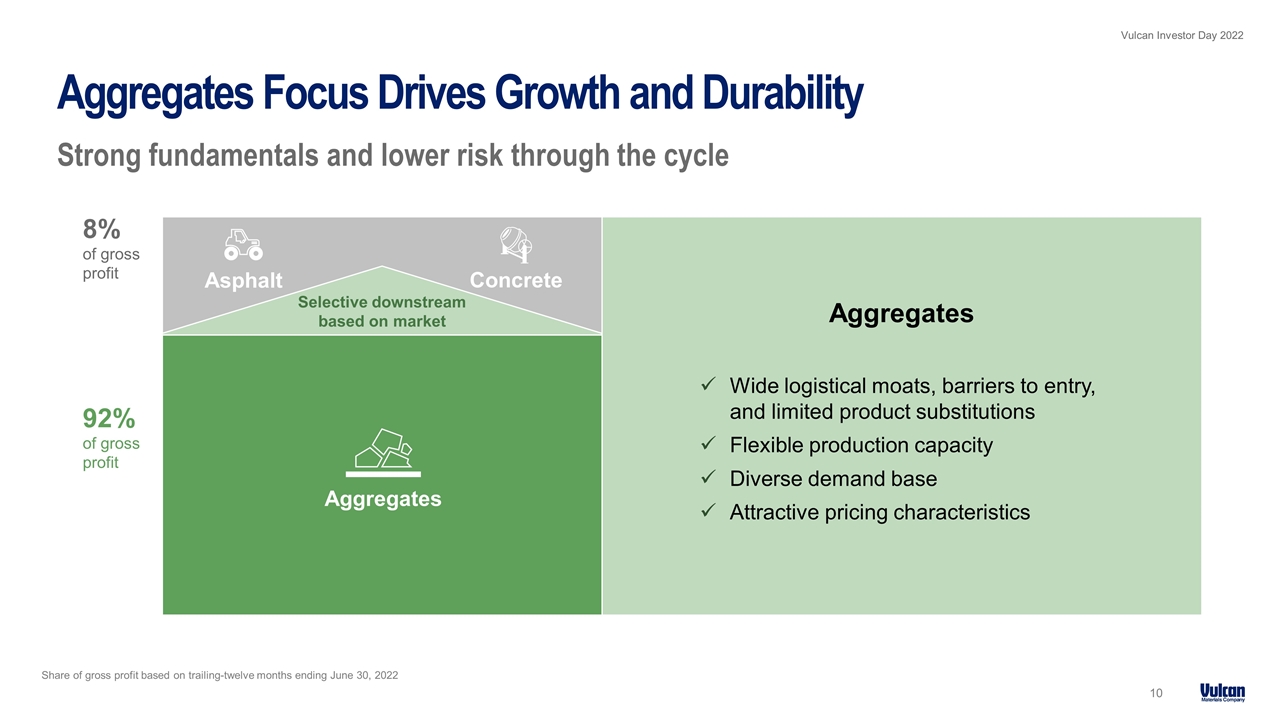

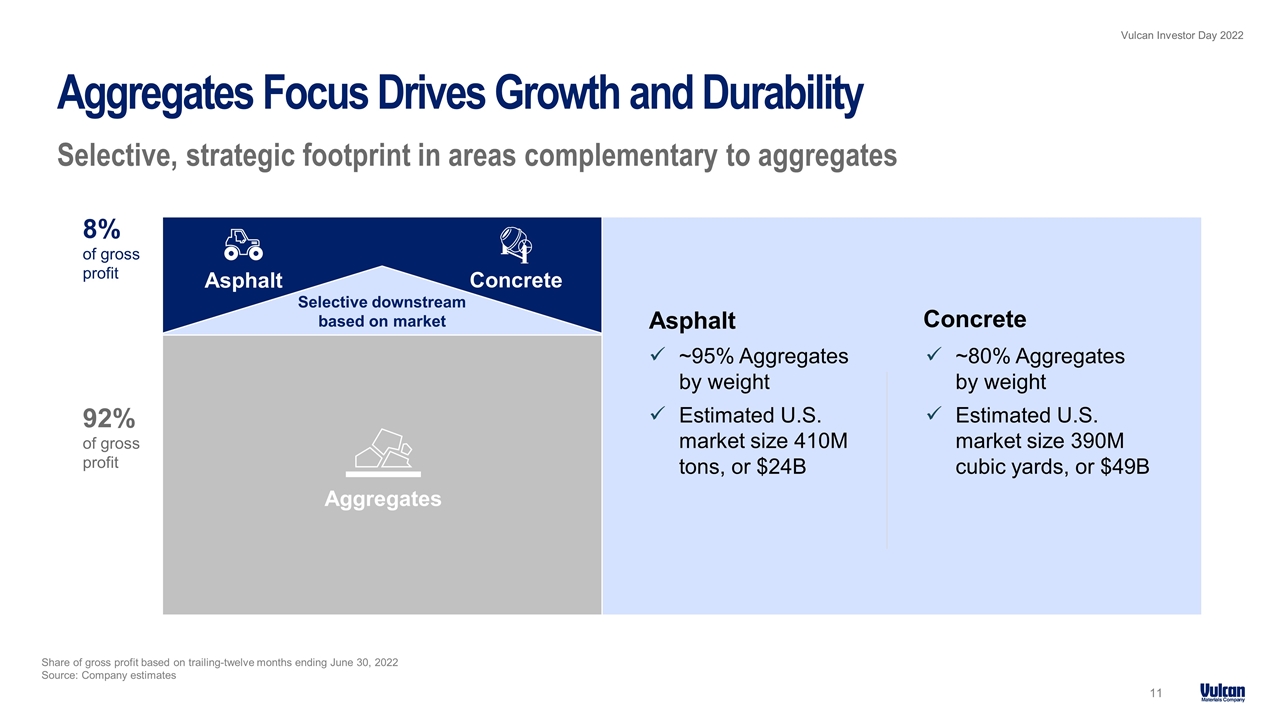

Share of gross profit based on trailing-twelve months ending June 30, 2022 Aggregates Focus Drives Growth and Durability Strong fundamentals and lower risk through the cycle Wide logistical moats, barriers to entry, and limited product substitutions Flexible production capacity Diverse demand base Attractive pricing characteristics Aggregates 92% of gross profit 8% of gross profit Concrete Asphalt Aggregates Selective downstream based on market

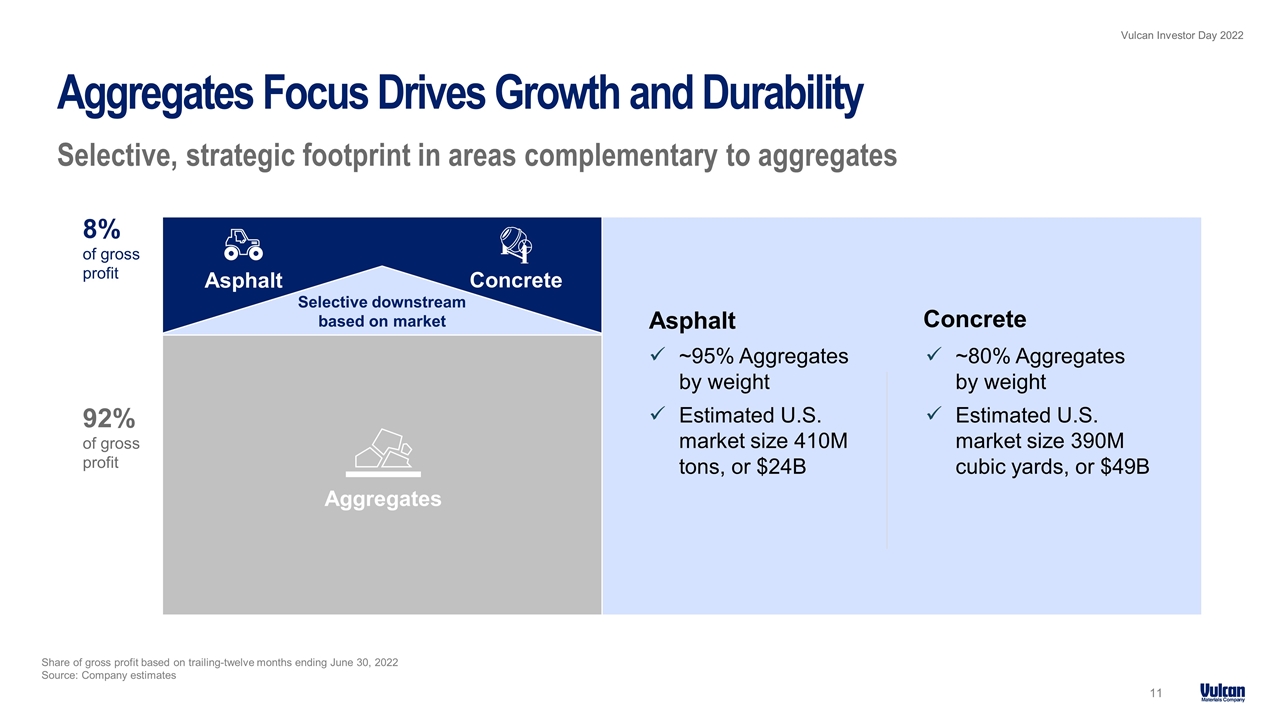

Share of gross profit based on trailing-twelve months ending June 30, 2022 Source: Company estimates Aggregates Focus Drives Growth and Durability Selective, strategic footprint in areas complementary to aggregates 92% of gross profit 8% of gross profit ~95% Aggregates by weight Estimated U.S. market size 410M tons, or $24B Asphalt Concrete Concrete Asphalt Aggregates Selective downstream based on market ~80% Aggregates by weight Estimated U.S. market size 390M cubic yards, or $49B

We Operate the Right Way 2021 ESG highlights People Health & Safety Environmental Stewardship Neighbors & Community Governance THE WAY FORWARD 2021 ENVIRONMENTAL, SOCIAL AND GOVERNANCE REPORT

Experienced, Proven Leadership Team 3 Chairman of the Board, President and Chief Executive Officer J. Thomas Hill Chief Operating Officer Thompson S. Baker II Senior Vice President, Chief Financial Officer Mary Andrews Carlisle Senior Vice President, General Counsel and Secretary Denson N. Franklin III Senior Vice President Jason P. Teter Senior Vice President Jerry F. Perkins Jr. Senior Vice President Ronnie A. Pruitt Senior Vice President David P. Clement Senior Vice President and Chief Human Resources Officer Darren L. Hicks Chief Strategy Officer Stanley G. Bass

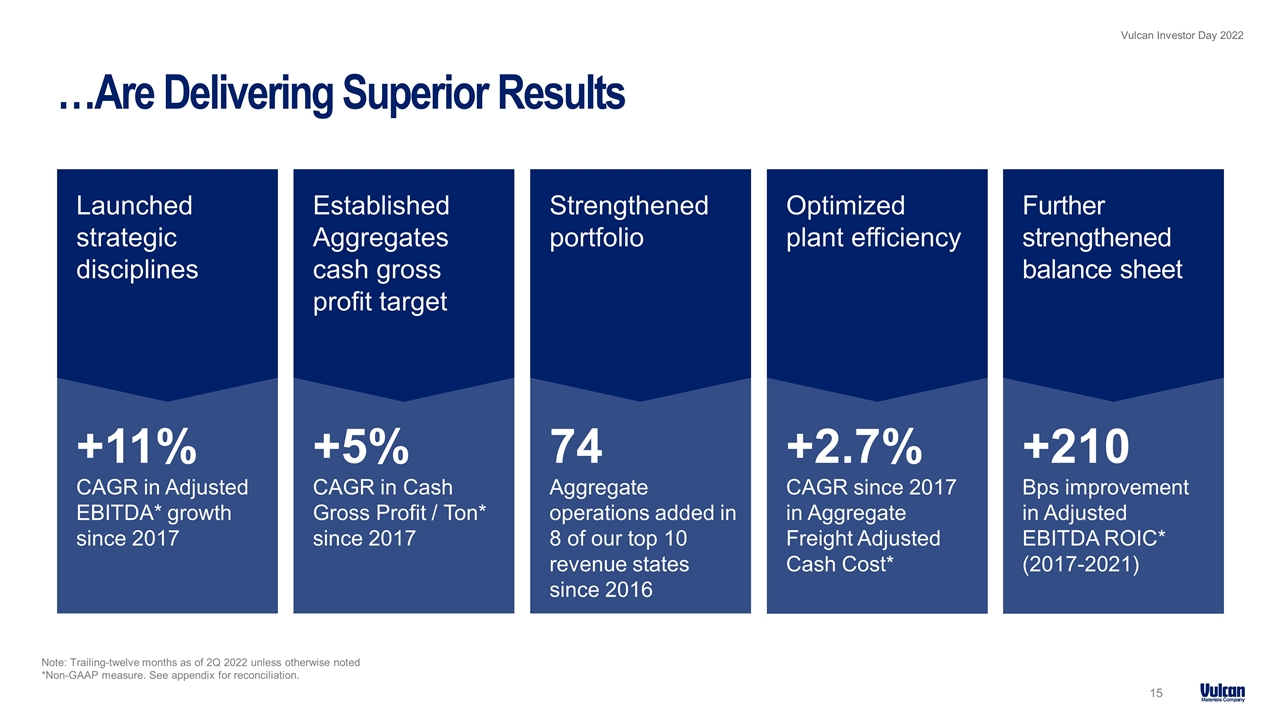

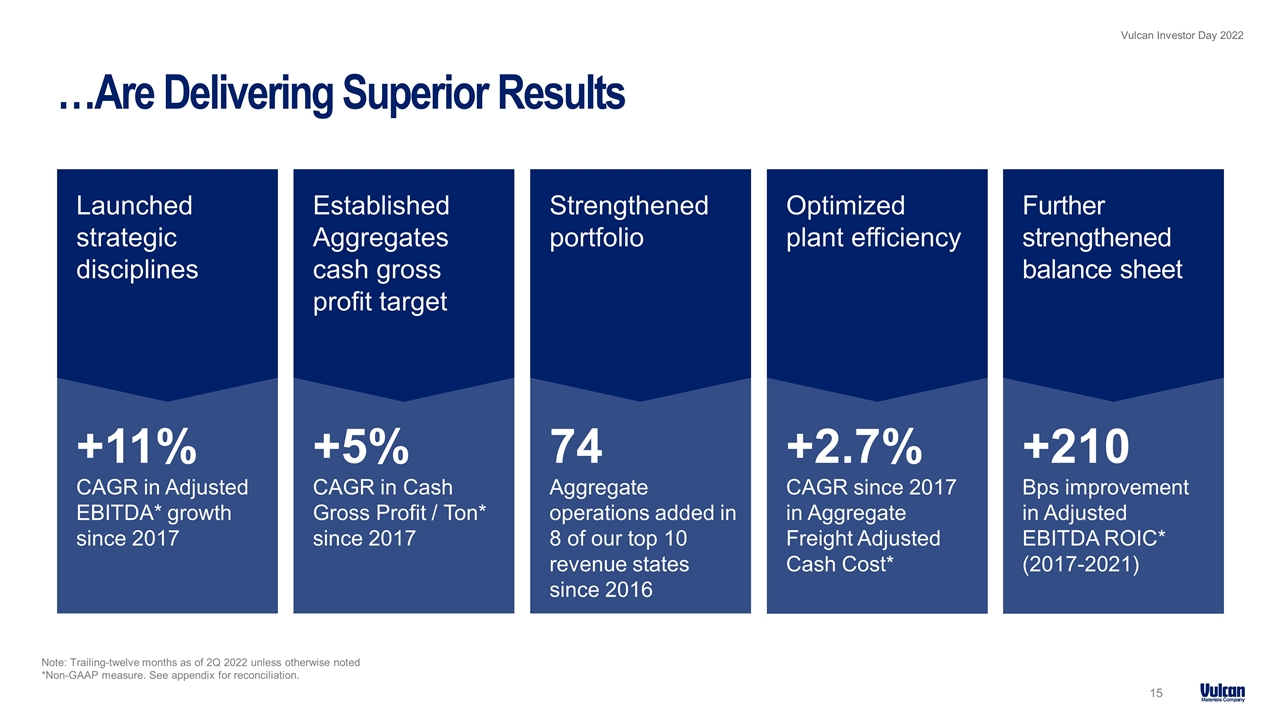

Business Initiatives… Launched strategic disciplines Further strengthened balance sheet Optimized plant efficiency Strengthened portfolio Established Aggregates cash gross profit target

+11% CAGR in Adjusted EBITDA* growth since 2017 Note: Trailing-twelve months as of 2Q 2022 unless otherwise noted *Non-GAAP measure. See appendix for reconciliation. …Are Delivering Superior Results 15 +210 Bps improvement in Adjusted EBITDA ROIC* (2017-2021) +5% CAGR in Cash Gross Profit / Ton* since 2017 74 Aggregate operations added in 8 of our top 10 revenue states since 2016 +2.7% CAGR since 2017 in Aggregate Freight Adjusted Cash Cost* Launched strategic disciplines Further strengthened balance sheet Optimized plant efficiency Strengthened portfolio Established Aggregates cash gross profit target

Two-Pronged Strategy to Drive Future Growth and Sustainable Value Supported by foundation of talent, sustainability and innovation Enhance Our Core Expand Our Reach Talent Sustainability Innovation

Enhance Our Core Driving the next horizon of growth and profitability Operational Excellence Strategic Sourcing VWO The Vulcan Way of Operating VWS The Vulcan Way of Selling Commercial Excellence Logistics Innovation

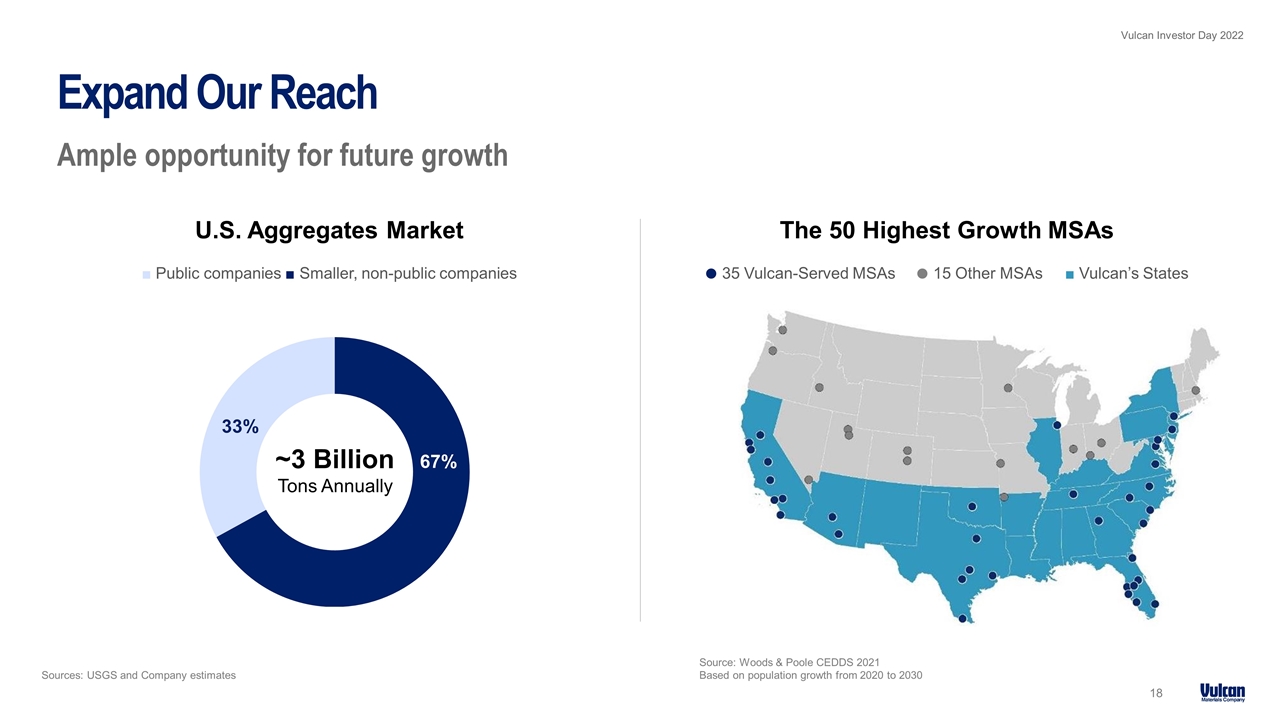

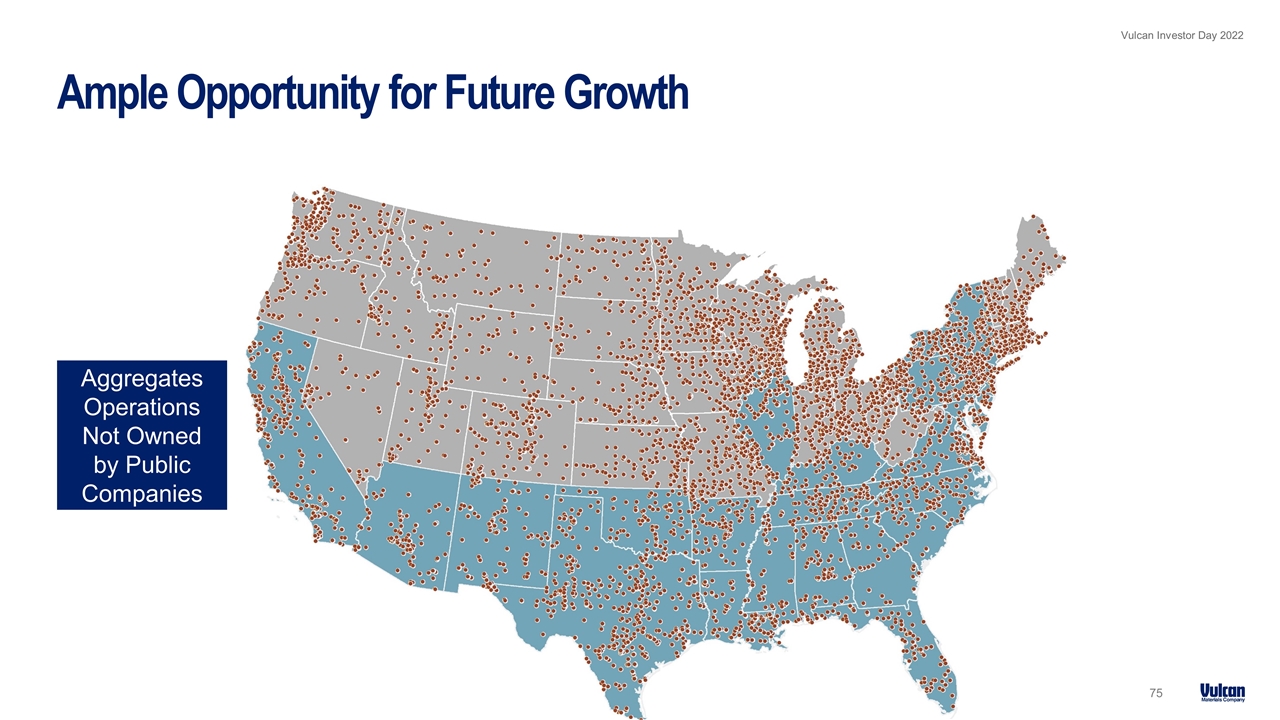

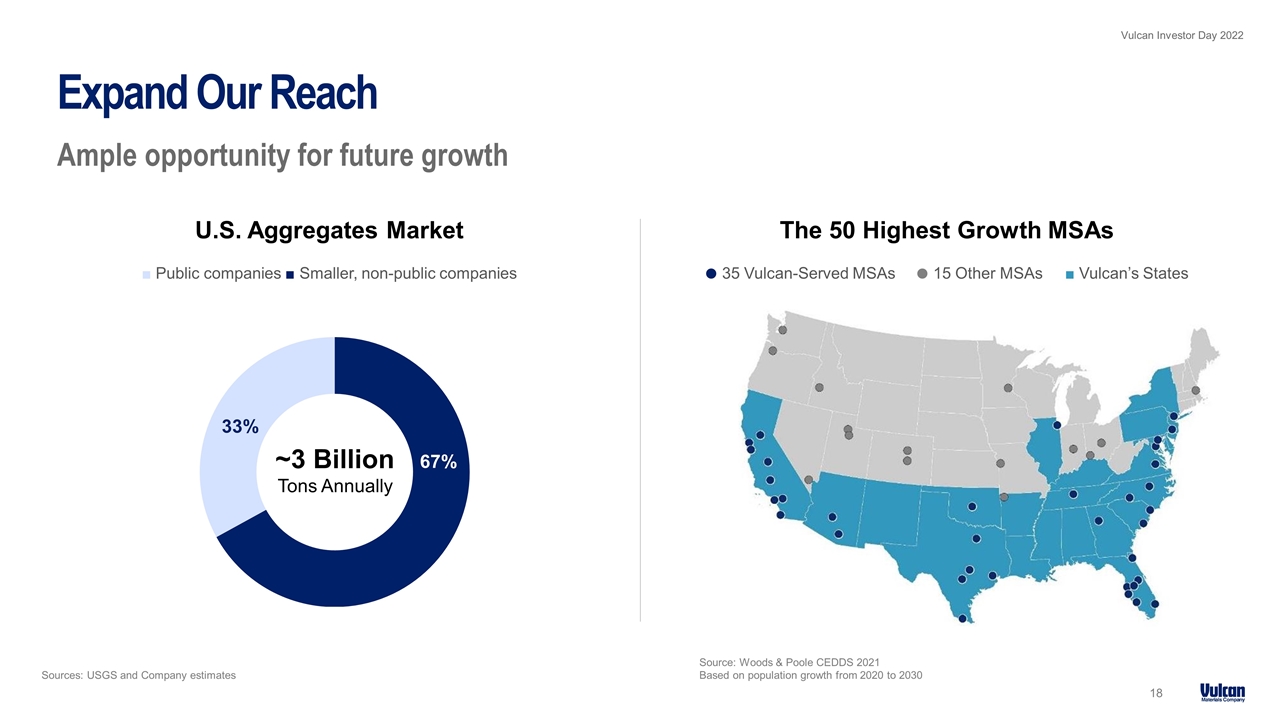

Source: Woods & Poole CEDDS 2021 Based on population growth from 2020 to 2030 Expand Our Reach Ample opportunity for future growth 37% U.S. Aggregates Market ■ Public companies ■ Smaller, non-public companies The 50 Highest Growth MSAs ˜ 35 Vulcan-Served MSAs ˜ 15 Other MSAs ■ Vulcan’s States ~3 Billion Tons Annually Sources: USGS and Company estimates

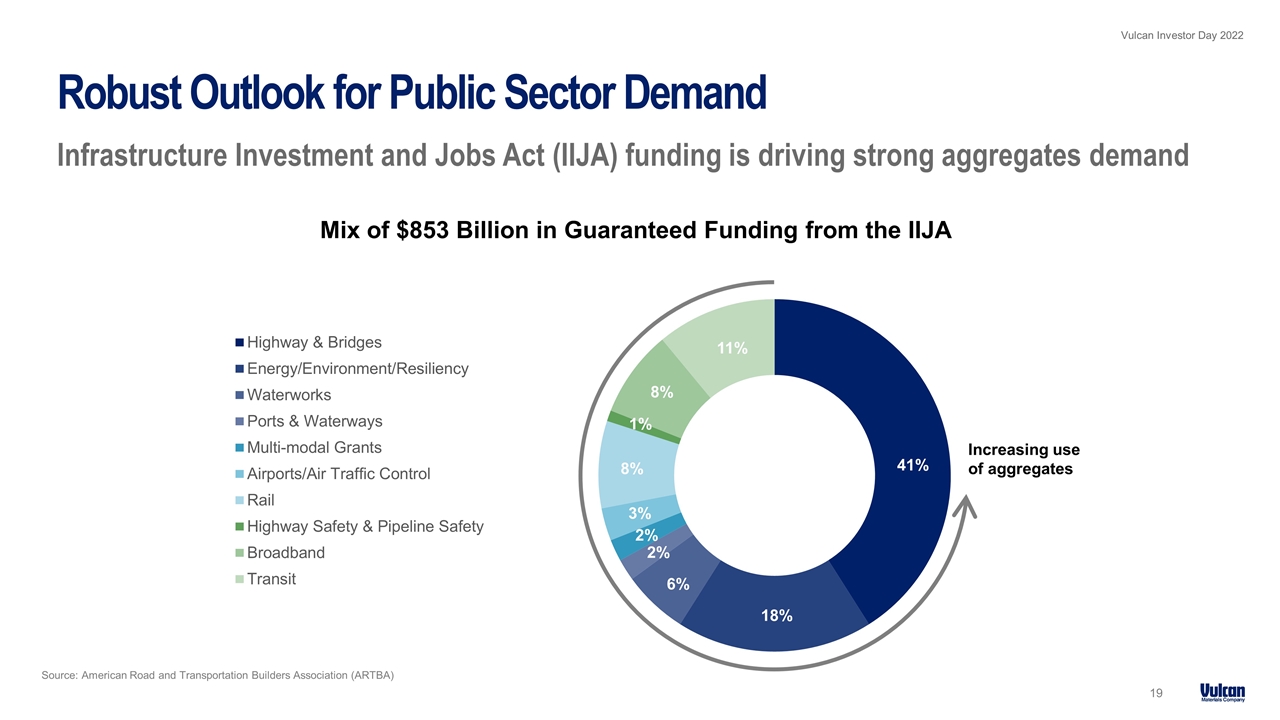

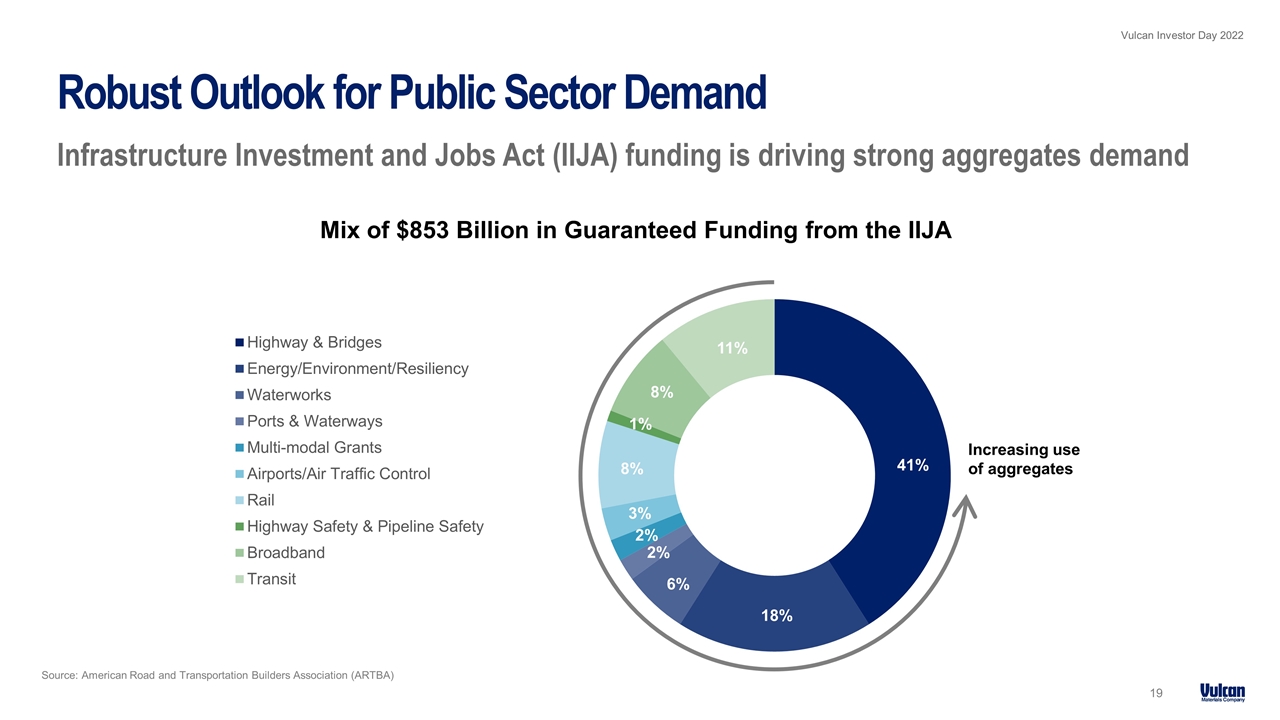

Robust Outlook for Public Sector Demand Infrastructure Investment and Jobs Act (IIJA) funding is driving strong aggregates demand Increasing use of aggregates 2% 6% 18% Mix of $853 Billion in Guaranteed Funding from the IIJA 2% 8% 8% 1% 3% 11% Source: American Road and Transportation Builders Association (ARTBA)

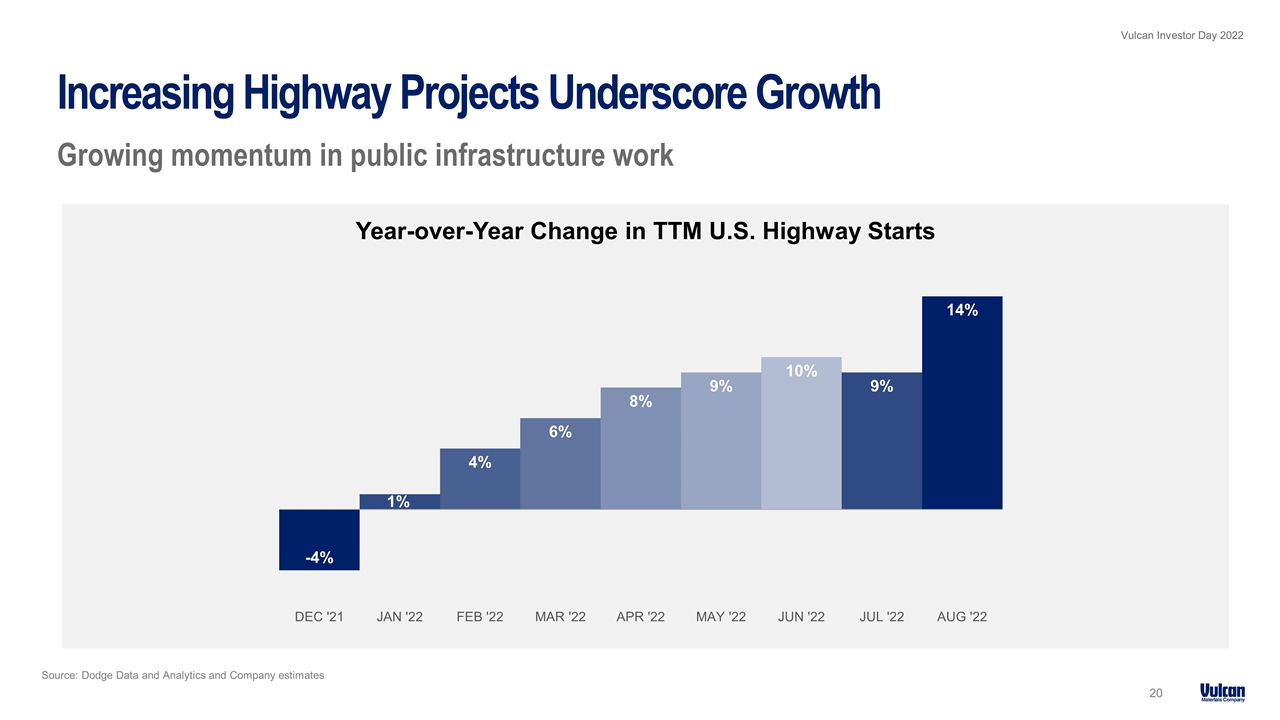

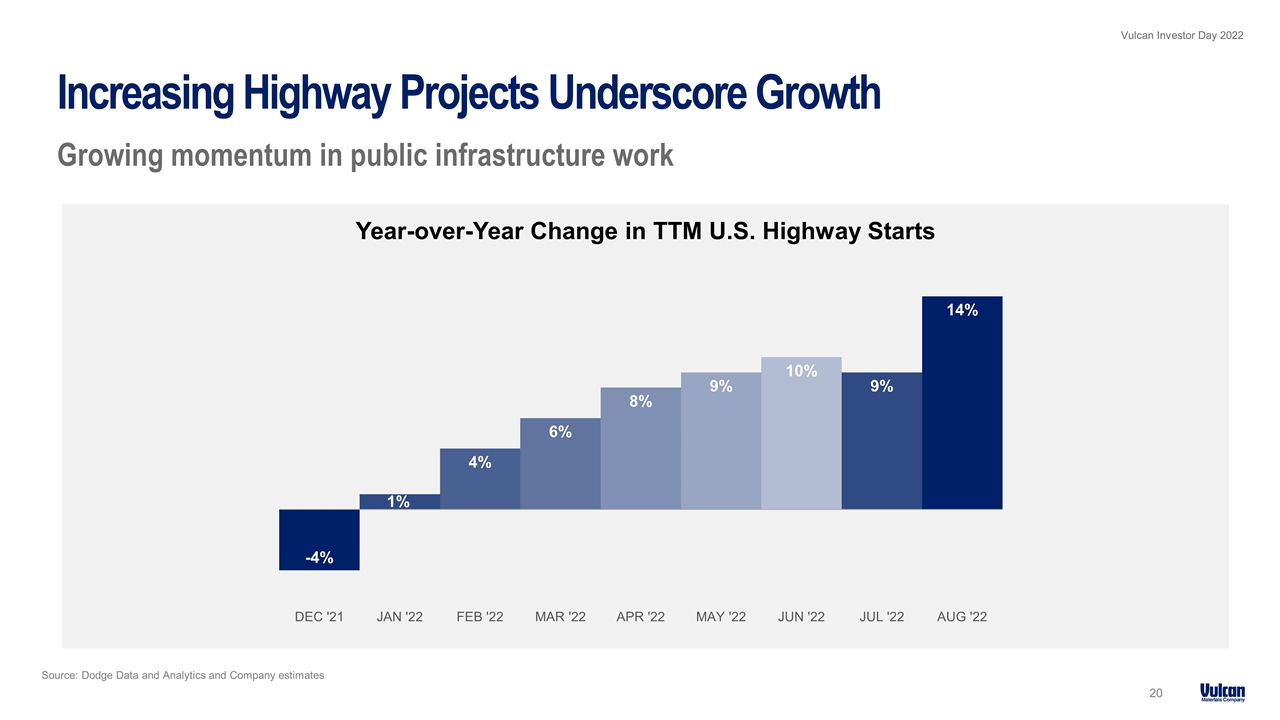

Source: Dodge Data and Analytics and Company estimates Increasing Highway Projects Underscore Growth Growing momentum in public infrastructure work Year-over-Year Change in TTM U.S. Highway Starts

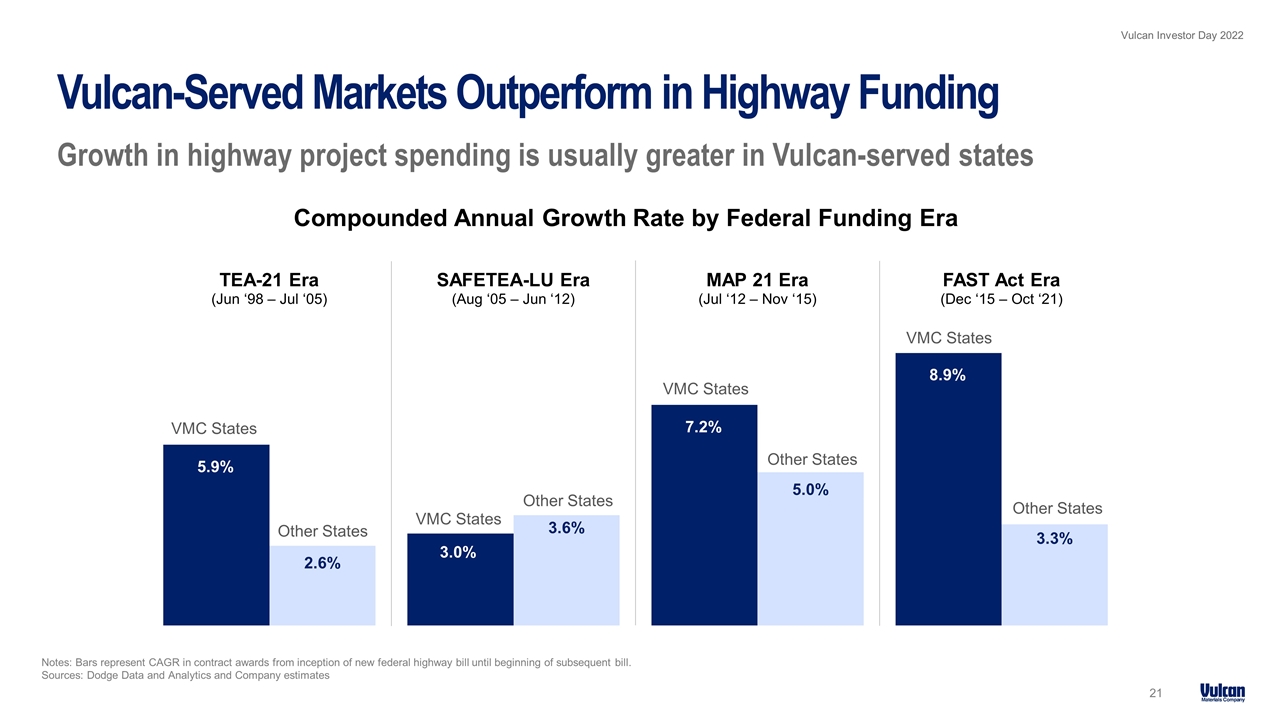

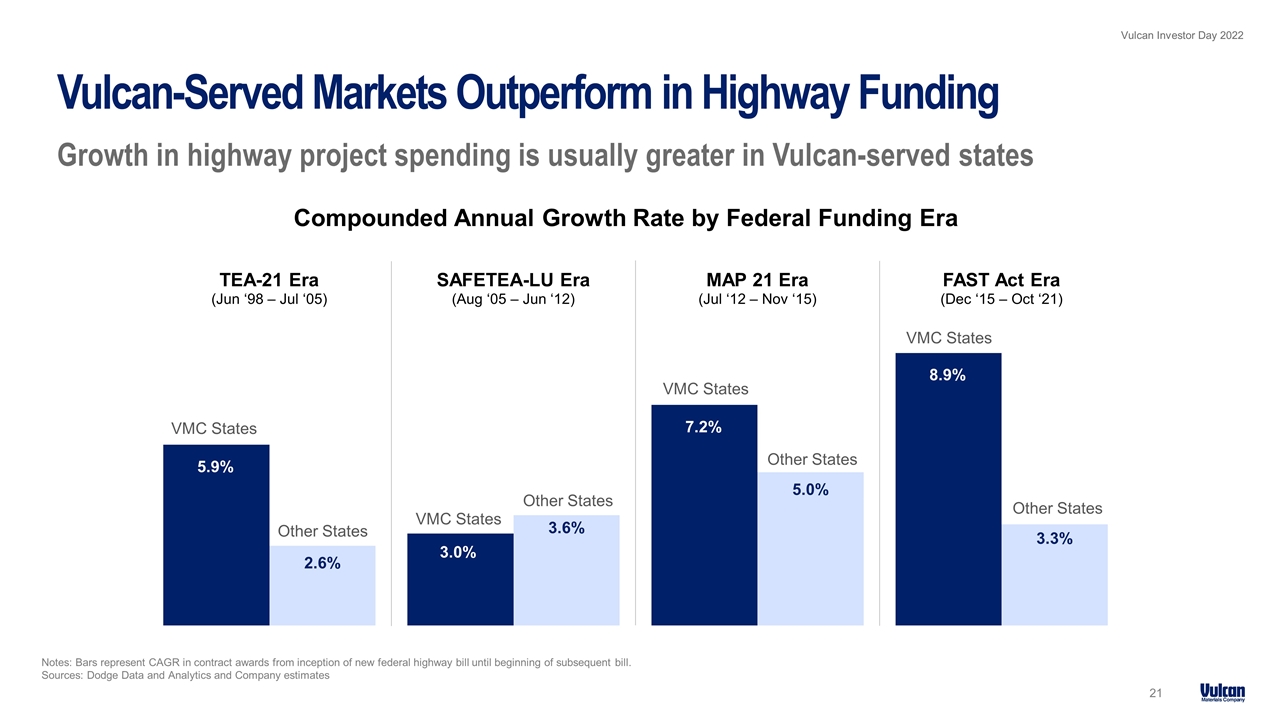

Notes: Bars represent CAGR in contract awards from inception of new federal highway bill until beginning of subsequent bill. Sources: Dodge Data and Analytics and Company estimates Vulcan-Served Markets Outperform in Highway Funding Growth in highway project spending is usually greater in Vulcan-served states Compounded Annual Growth Rate by Federal Funding Era VMC States Other States VMC States Other States VMC States Other States VMC States Other States

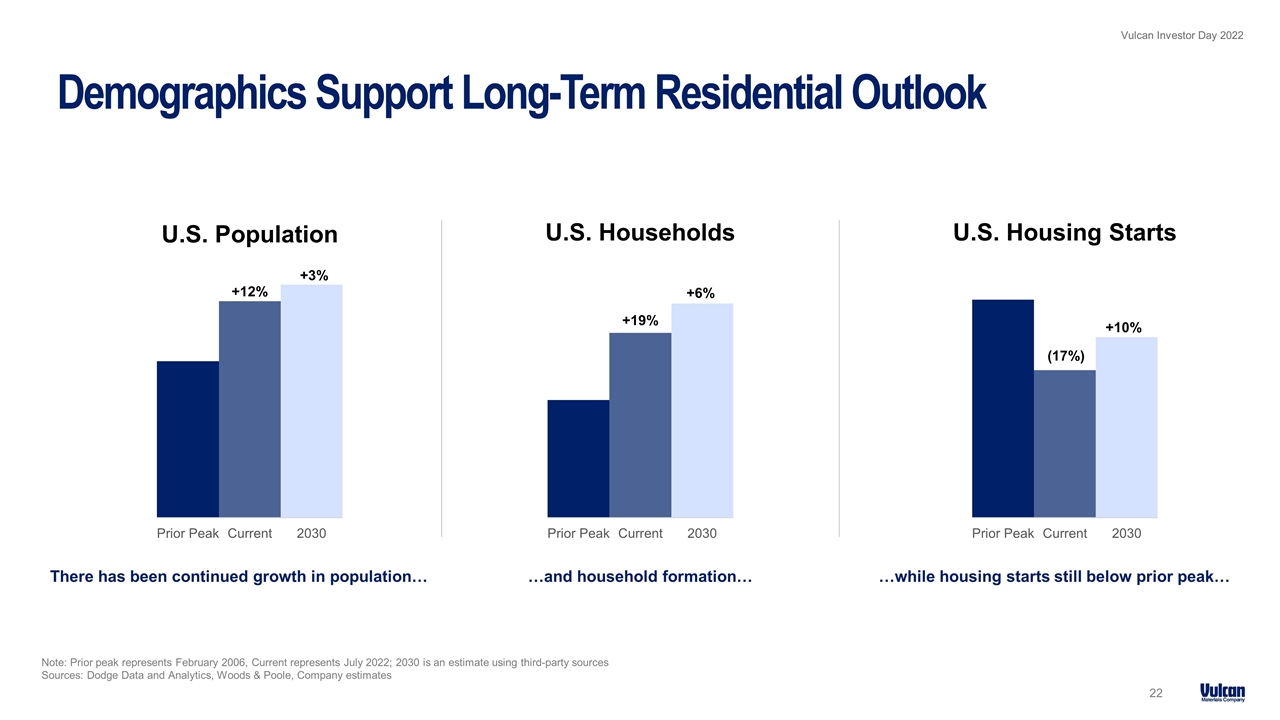

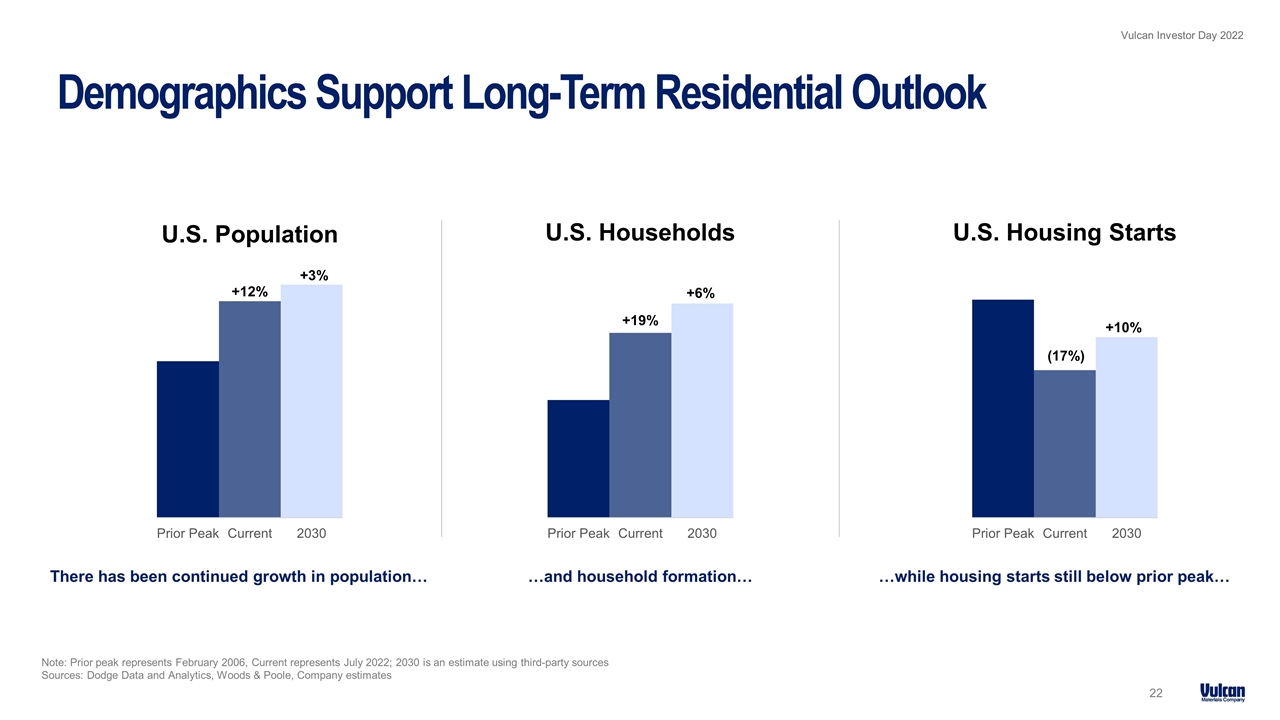

Note: Prior peak represents February 2006, Current represents July 2022; 2030 is an estimate using third-party sources Sources: Dodge Data and Analytics, Woods & Poole, Company estimates Demographics Support Long-Term Residential Outlook …while housing starts still below prior peak… (17%) U.S. Housing Starts There has been continued growth in population… U.S. Population +12% +3% …and household formation… U.S. Households +19% +6% +10%

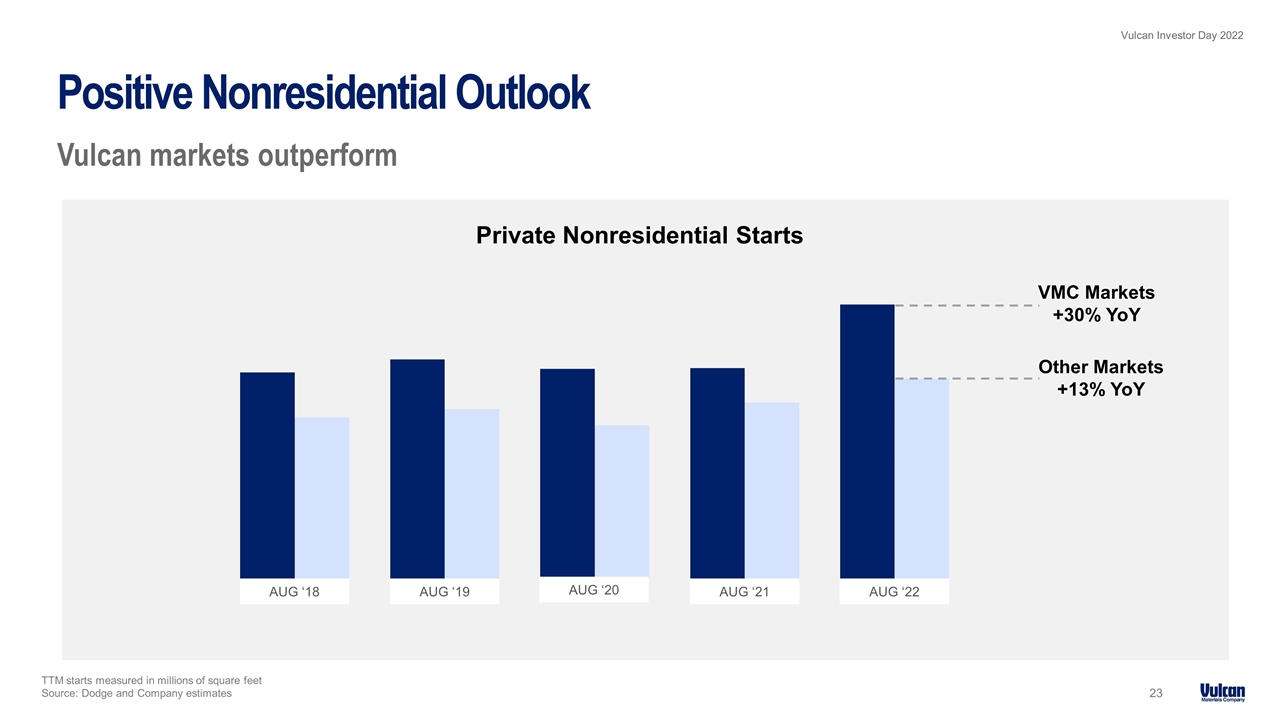

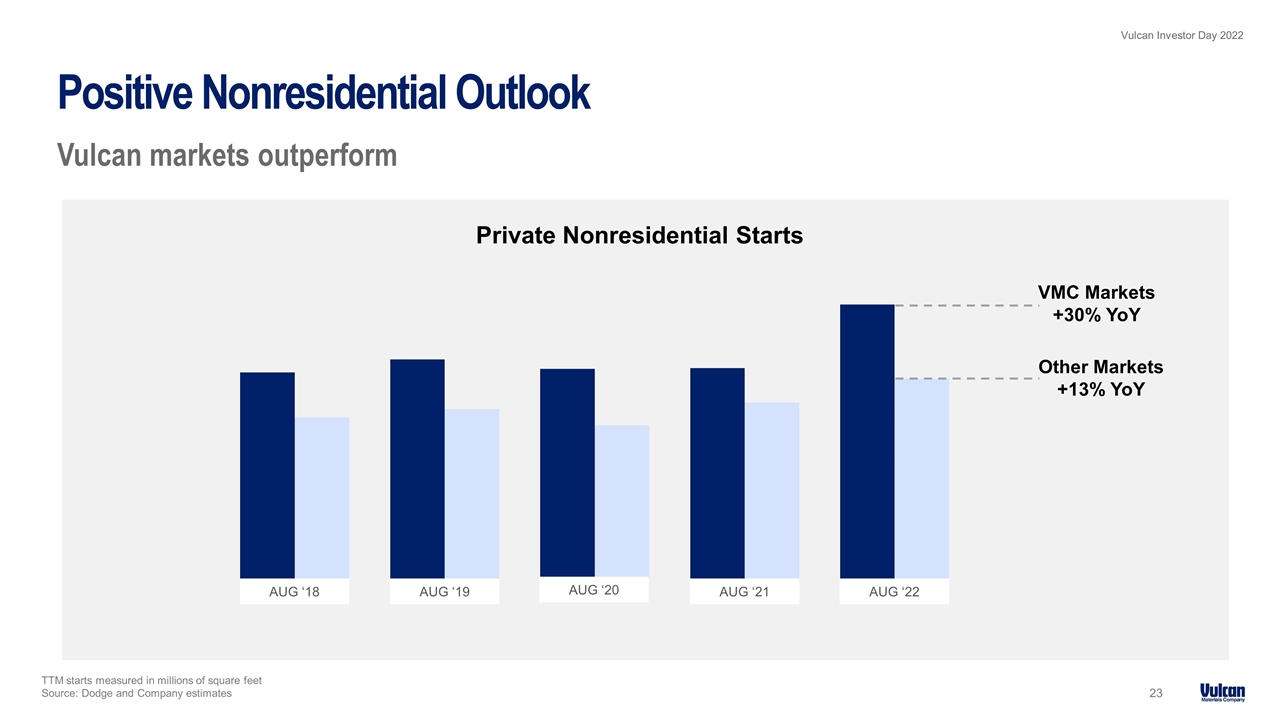

TTM starts measured in millions of square feet Source: Dodge and Company estimates Positive Nonresidential Outlook Vulcan markets outperform VMC Markets +30% YoY Other Markets +13% YoY AUG ‘18 AUG ‘19 AUG ‘20 AUG ‘22 AUG ‘21 Private Nonresidential Starts

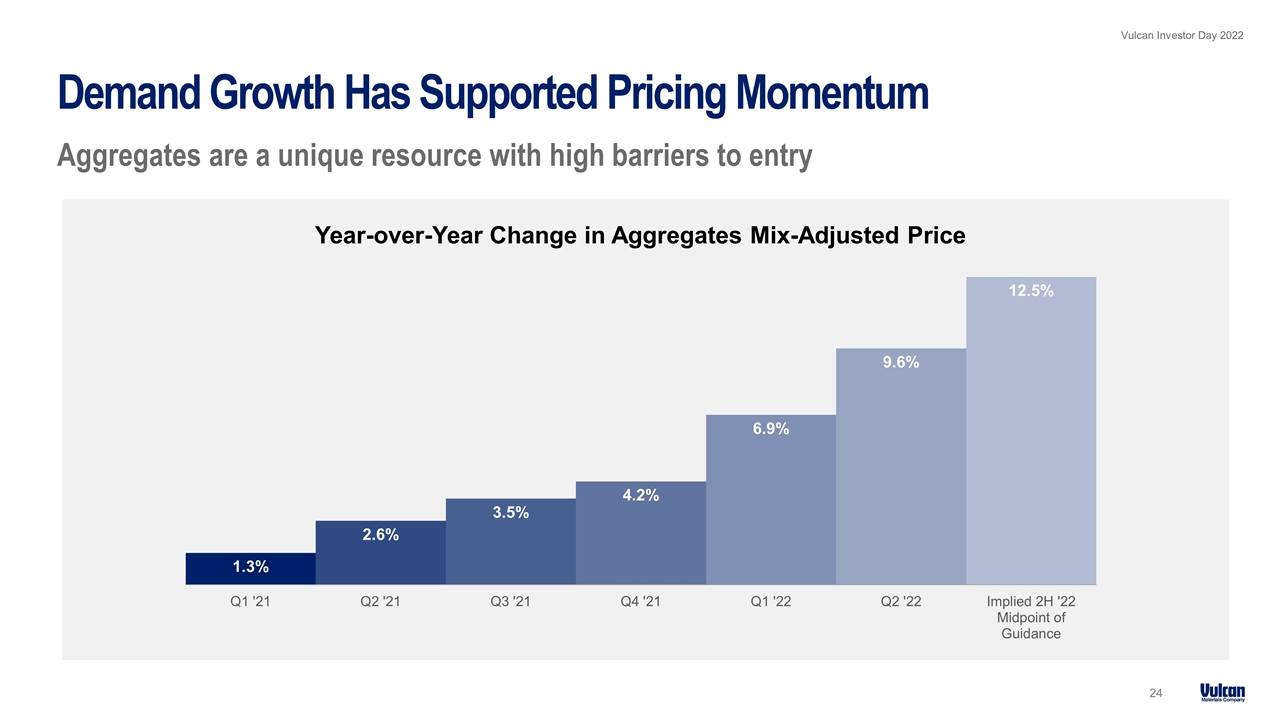

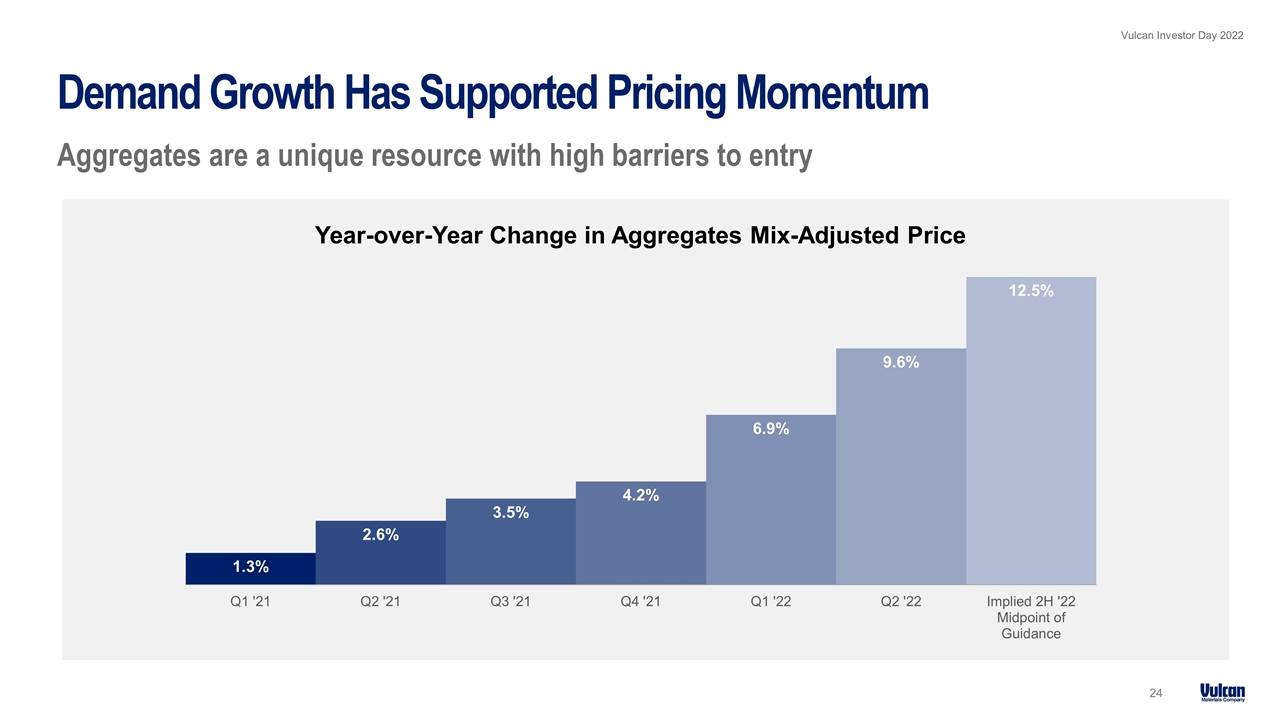

Demand Growth Has Supported Pricing Momentum Aggregates are a unique resource with high barriers to entry Year-over-Year Change in Aggregates Mix-Adjusted Price

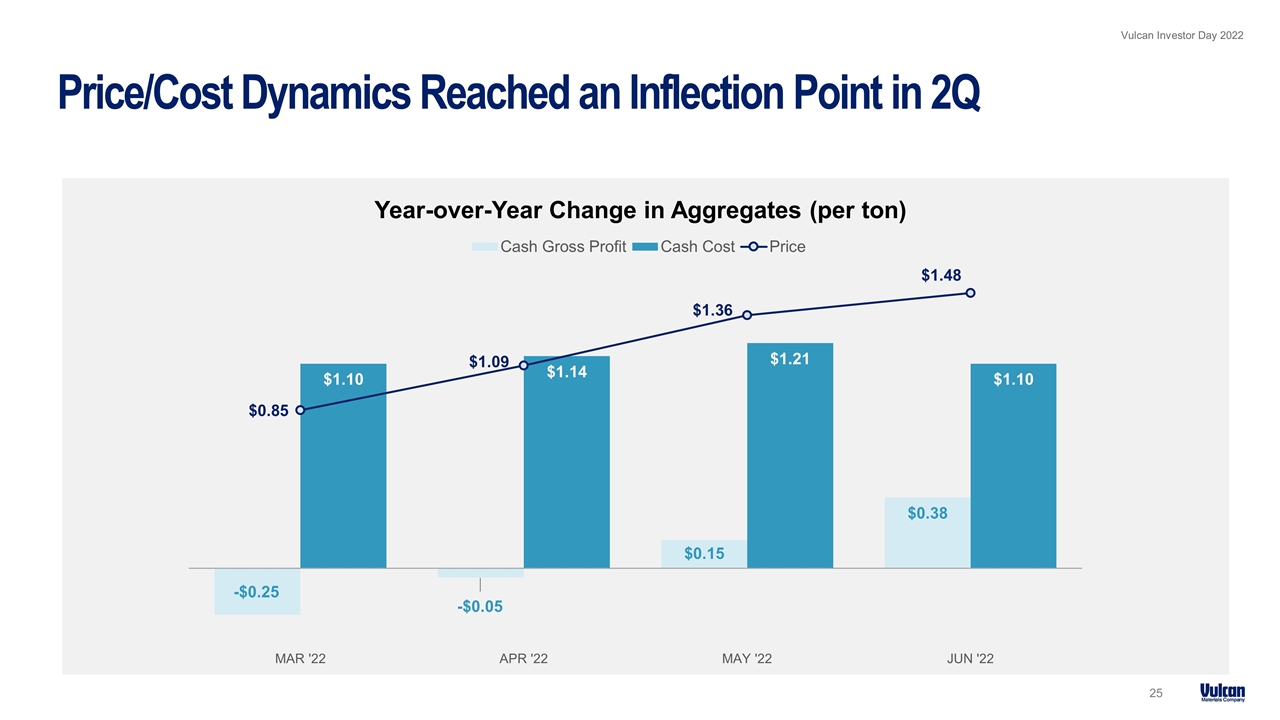

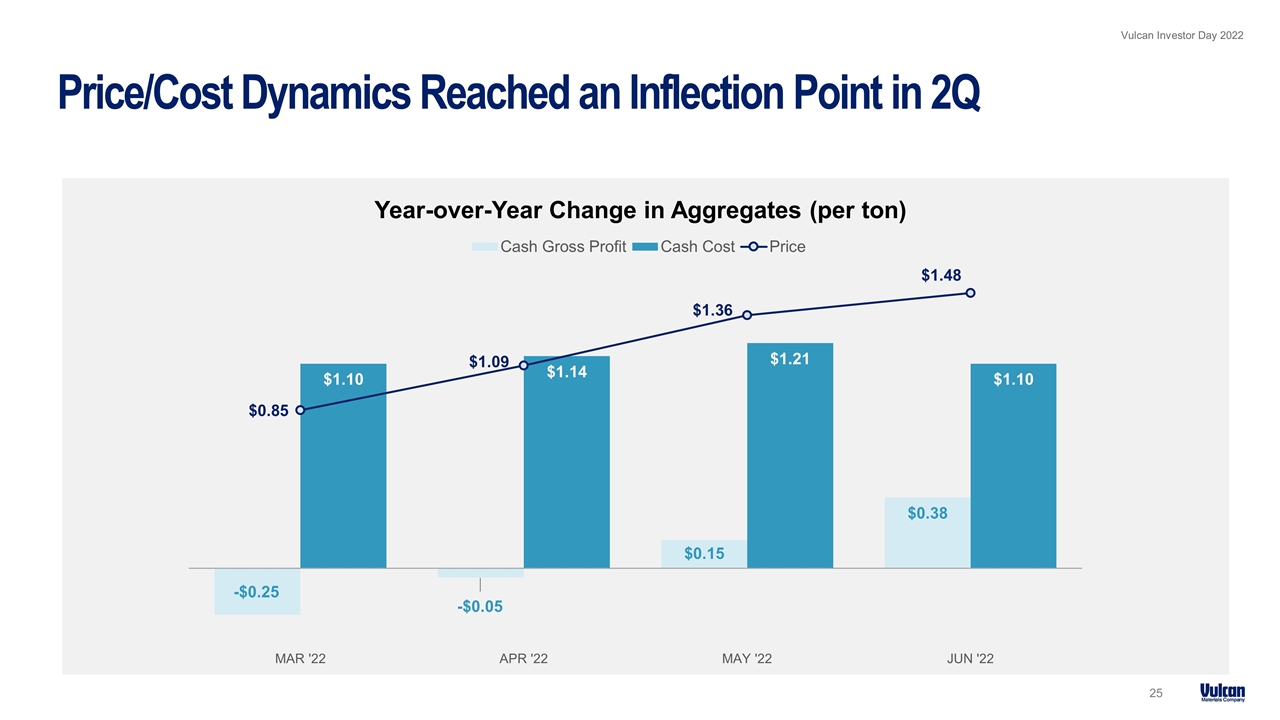

Year-over-Year Change in Aggregates (per ton) Price/Cost Dynamics Reached an Inflection Point in 2Q -$0.25 -$0.05

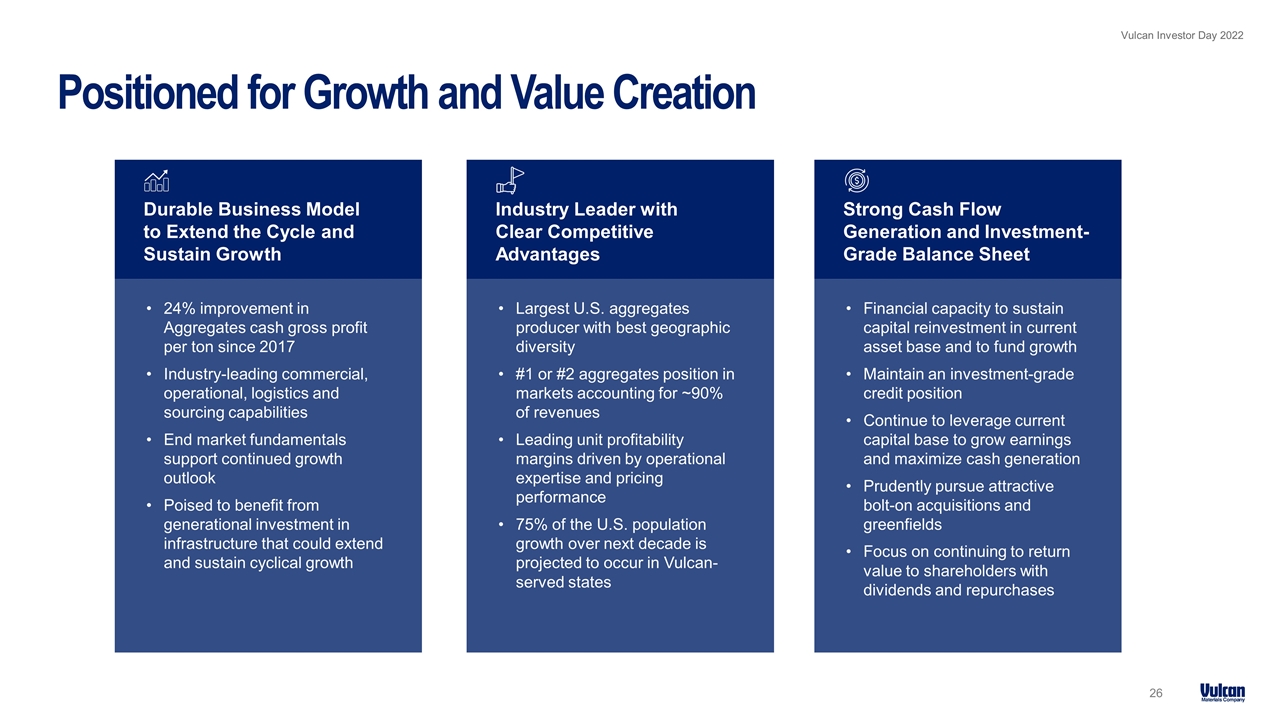

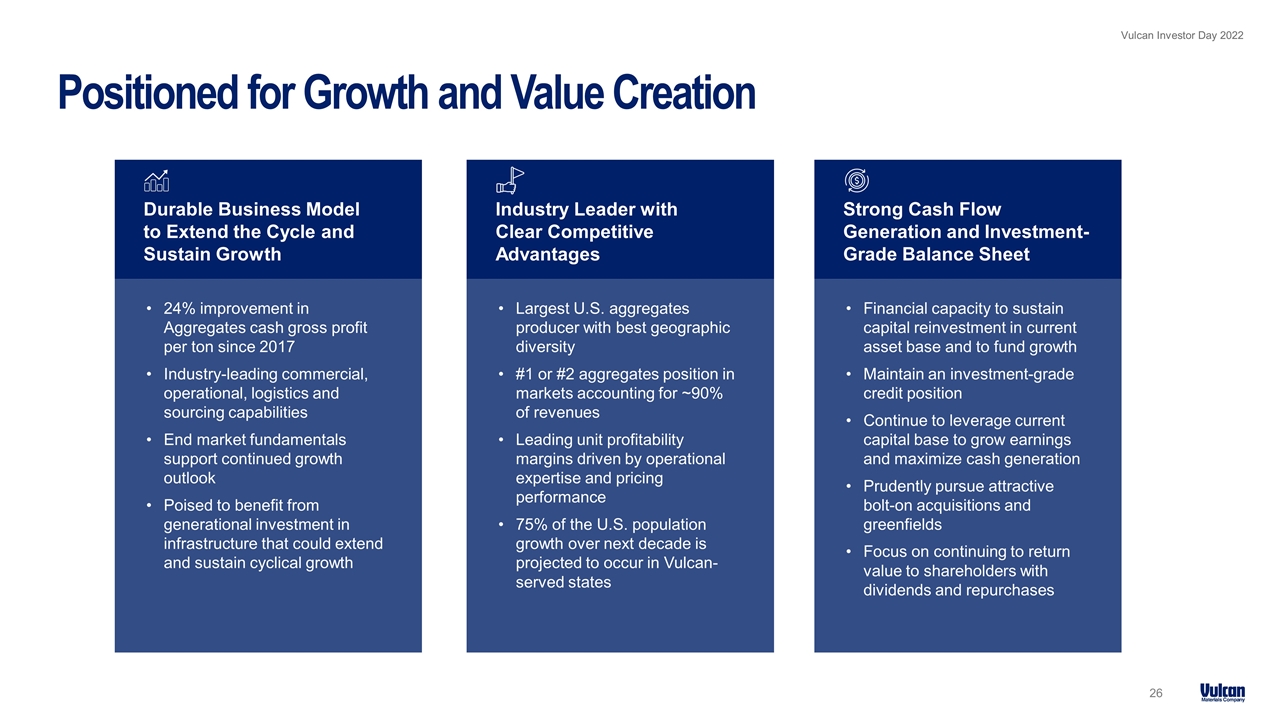

Positioned for Growth and Value Creation Strong Cash Flow Generation and Investment-Grade Balance Sheet Durable Business Model to Extend the Cycle and Sustain Growth Financial capacity to sustain capital reinvestment in current asset base and to fund growth Maintain an investment-grade credit position Continue to leverage current capital base to grow earnings and maximize cash generation Prudently pursue attractive bolt-on acquisitions and greenfields Focus on continuing to return value to shareholders with dividends and repurchases 24% improvement in Aggregates cash gross profit per ton since 2017 Industry-leading commercial, operational, logistics and sourcing capabilities End market fundamentals support continued growth outlook Poised to benefit from generational investment in infrastructure that could extend and sustain cyclical growth Largest U.S. aggregates producer with best geographic diversity #1 or #2 aggregates position in markets accounting for ~90% of revenues Leading unit profitability margins driven by operational expertise and pricing performance 75% of the U.S. population growth over next decade is projected to occur in Vulcan-served states Industry Leader with Clear Competitive Advantages

Talent and Sustainability Darren Hicks Senior Vice President and Chief Human Resources Officer Janet Kavinoky Vice President, External Affairs and Corporate Communications Serafin To Replace

Vulcan’s Five ESG Focus Areas ESG with a Value-Creation Mindset Focus is on ESG Priorities Material to Our Business Health & Safety Environmental Stewardship Neighbors & Community Governance People

Our Top Priority: Keeping Everyone Safe and Healthy Achieve and maintain zero fatalities at all sites Reduce MSHA reportable/OSHA recordable injuries by 25% by 2025 131,477 Hours of health and safety training delivered to Vulcan employees Health & Safety 94% Vulcan facilities with zero lost-time injuries 100 Safety audits conducted 1.01 2021 legacy Vulcan MSHA/OSHA injury rate 270 Triple zero facilities: zero accidents, MSHA citations and environmental citations ü Health & Safety Goals Further enhancing a world-class safety record

Honed Approach to Risk Prevention A more sophisticated method of driving safety Reduce Job Risks Avoiding Accidents To Forward Looking Metrics Backward Looking Statistics To

Figures for year-ending 2021 Attracting, Developing and Retaining Our People Recruiting and keeping the best talent in the industry 39% Employees with 10+ years tenure 20% Four-year Average Annual Turnover 251,320 Total Training Hours (2021) 52% - 48% Ratio of female to male salaried, non –exempt employees Employee Engagement & DE&I Goals Reduce employee turnover by 25% by 2030 and increase employee retention Increase employee diversity at director level and above by 20% by 2030

Initiatives Underscore Our Commitment to DE&I Employee Resource Groups (ERGs) Launched four ERGs in 2022 Expanding to include additional groups by 2025 Training Ongoing DE&I awareness training as part of new hire onboarding Unconscious Bias training DE&I Council Established in 2015 to guide on company-wide and divisional DE&I efforts Monthly meeting with Division DE&I leaders CEO ACT!ON on Diversity & Inclusion Signed pledge that commits Vulcan to creating and sharing strategic inclusion and diversity plans with the Vulcan Board of Directors Where everyone can build and advance their career

Strong Commitment to Environmental Stewardship A 60+ year record of doing the right thing, the right way, at the right time Environmental Compliance (98% Citation Free) Environmental Stewardship A durable and sustainable business Air Quality Recycling and waste reduction Energy Efficiency Product innovation and sustainability Climate Change & GHG Emissions Land Use and Biodiversity Water Management

The Way Forward Creating shareholder value, reducing impacts and mitigating risks 4 New initiatives and partnerships to reduce scope 2 emissions Florida Power & Light solar together program California solar development Texas wind energy Land Use and Business Planning ü Operational Efficiency ü Energy Efficiency & Sourcing ü Technology Innovation ü Supplier & Customer Partnerships ü Product Innovation ü

In Focus: Climate Change and GHG Emissions Doing our part to reduce overall GHG emissions and mitigate the effects of climate change Reduce Scope 1 and 2 GHG emissions intensity per ton of product produced by 10% by 2030 Reduce energy intensity per ton of product produced by 6.7% by 2030 Secure 5% of all energy from renewable sources by 2030 Engage with suppliers and customers to report Scope 3 emissions Secure SBTi validation for Science-Based Targets Near-Term GHG Emissions Reduction Goals – Longer-Term Commitments

Vulcan Way of Selling Jerry Perkins Senior Vice President

Competing and Winning Locally Supporting near-term performance and longer-term competiveness VWS The Vulcan Way of Selling Commercial Excellence Logistics Innovation Operational Excellence Strategic Sourcing VWO The Vulcan Way of Operating

Better Serving Our Customers and Enhancing Our Profitability Variety of customers and projects Highways Infrastructure Nonresidential Residential

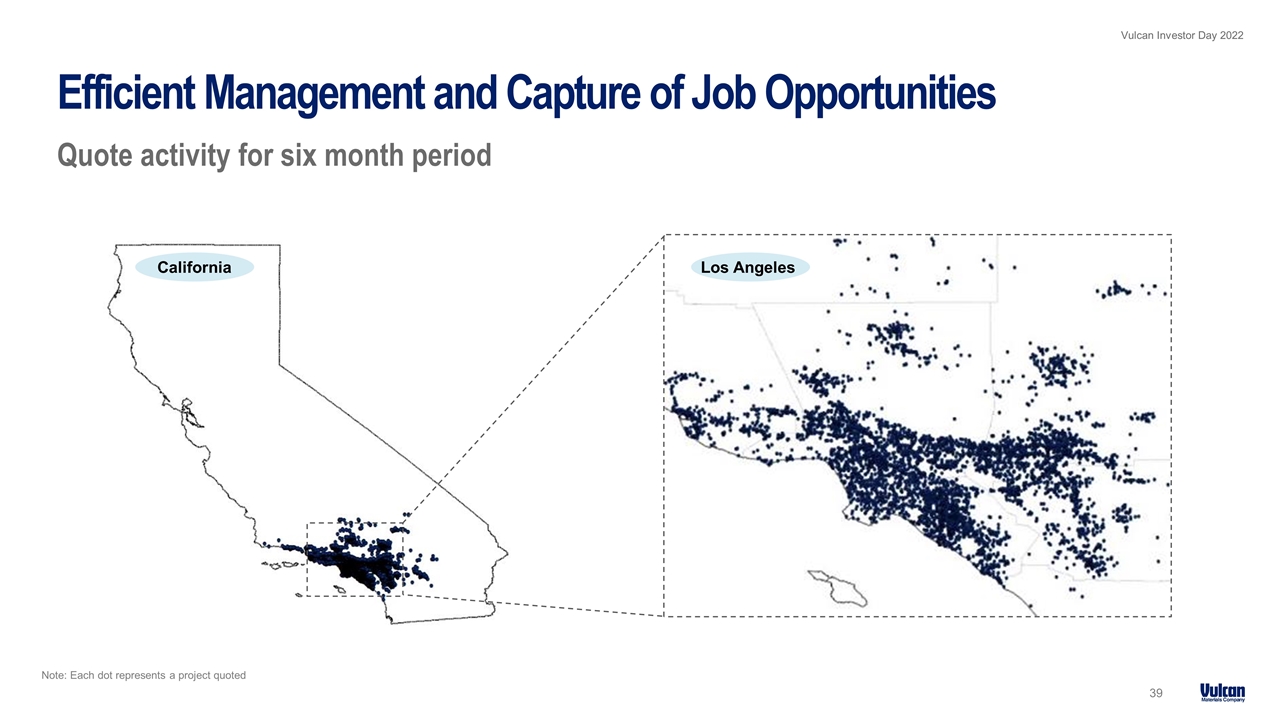

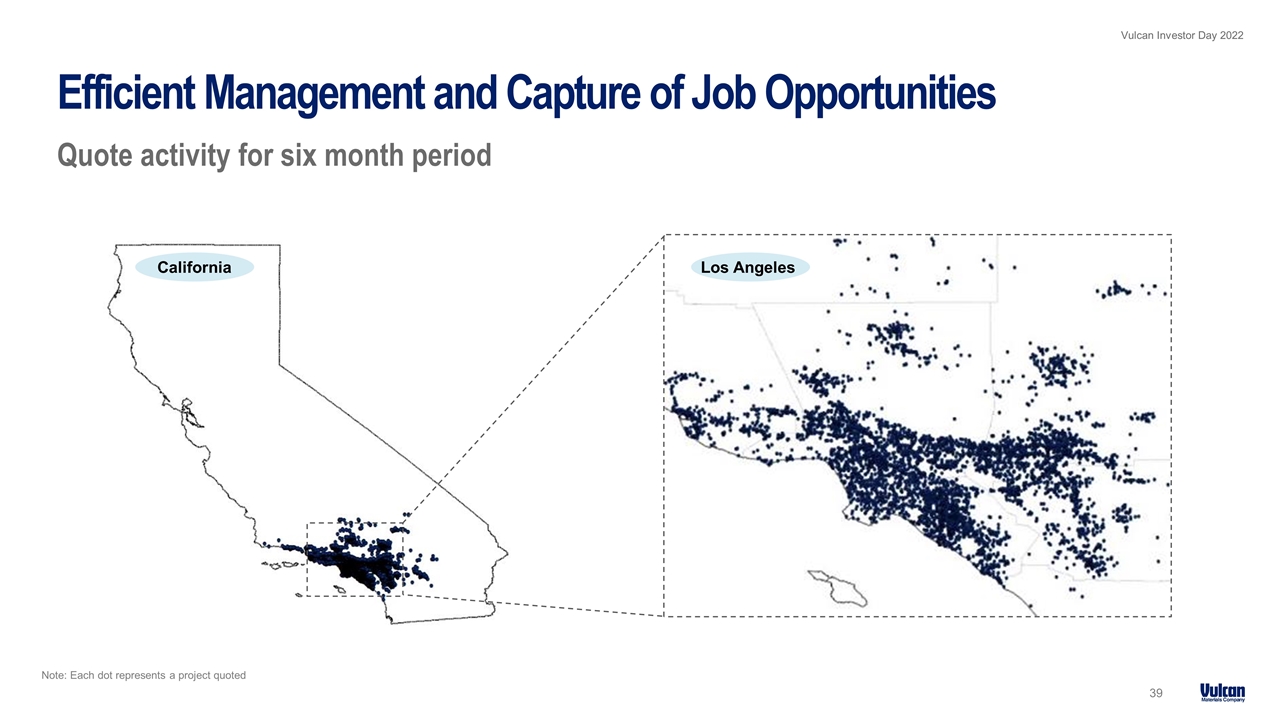

Note: Each dot represents a project quoted Efficient Management and Capture of Job Opportunities Quote activity for six month period California Los Angeles

Vulcan Way of Selling Fundamentals A more strategic approach to selling 0 Drives 1 More time with customers Development of our people 2 Accountability through improved technology, processes and metrics 3 Vulcan Way of Selling Defined Roles Technology Innovation Faster growth than the Industry 4 Traditional Market Sales Approach Relationship Selling Credit, Quoting, Billing Administrative Work To Pre-2017 Forward 2017

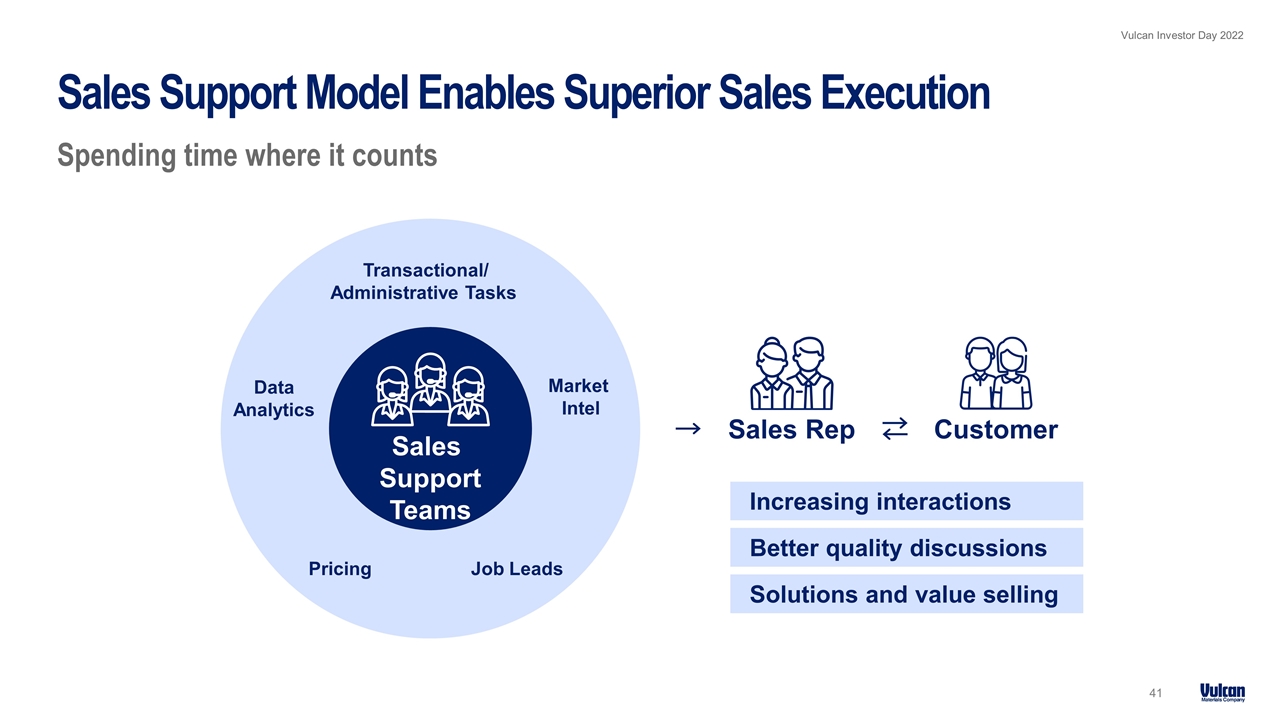

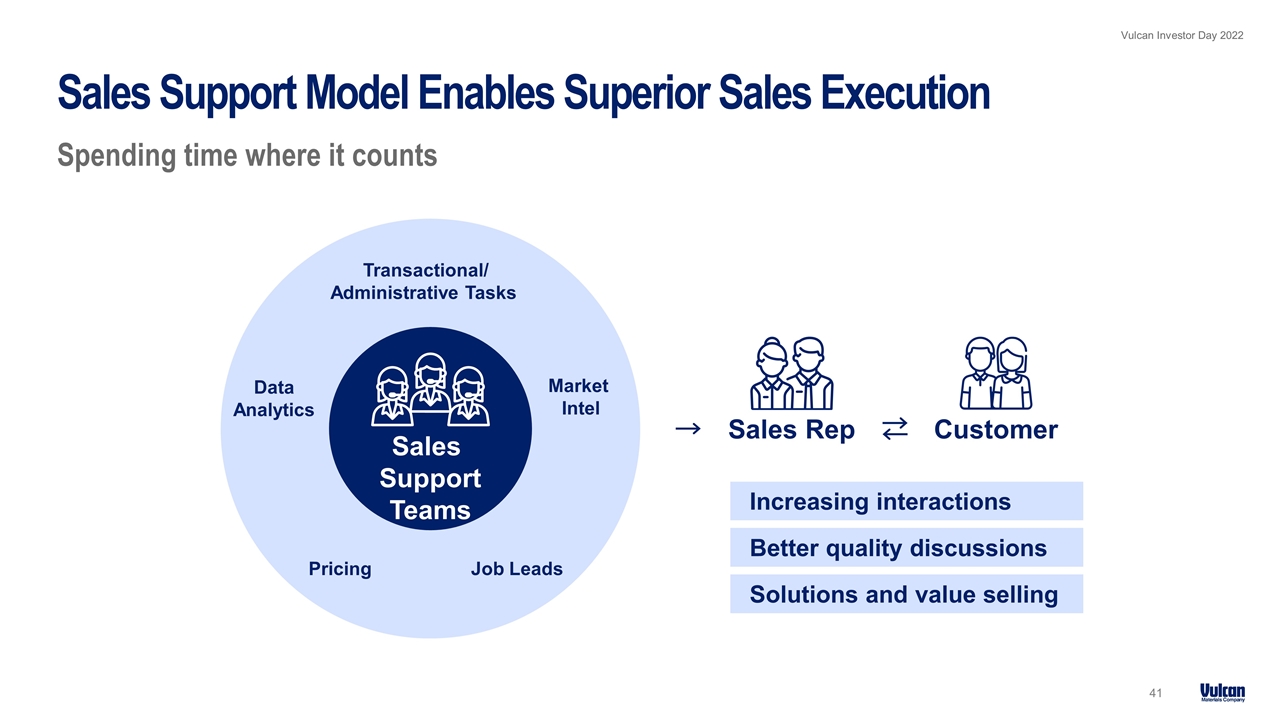

Sales Support Model Enables Superior Sales Execution Spending time where it counts Customer Data Analytics Market Intel Job Leads Pricing Sales Support Teams Sales Rep Increasing interactions Transactional/ Administrative Tasks Better quality discussions Solutions and value selling

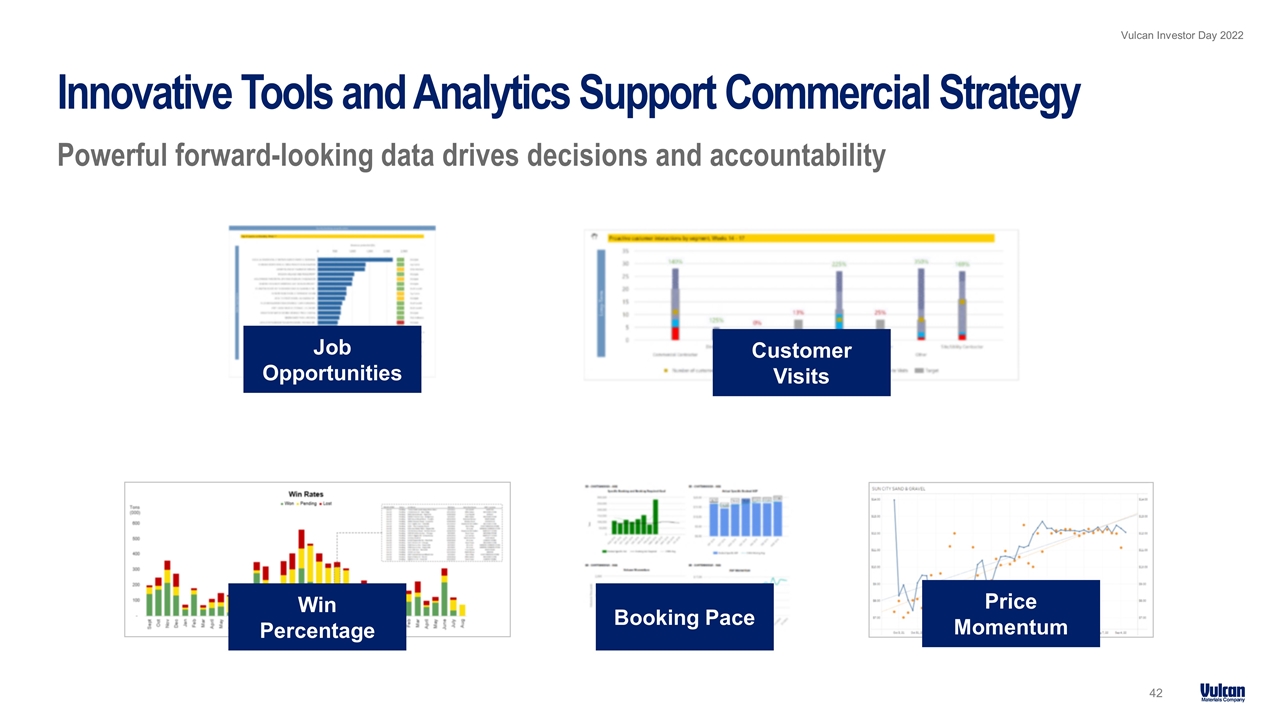

Innovative Tools and Analytics Support Commercial Strategy Powerful forward-looking data drives decisions and accountability Customer Visits Job Opportunities Booking Pace Win Percentage Price Momentum

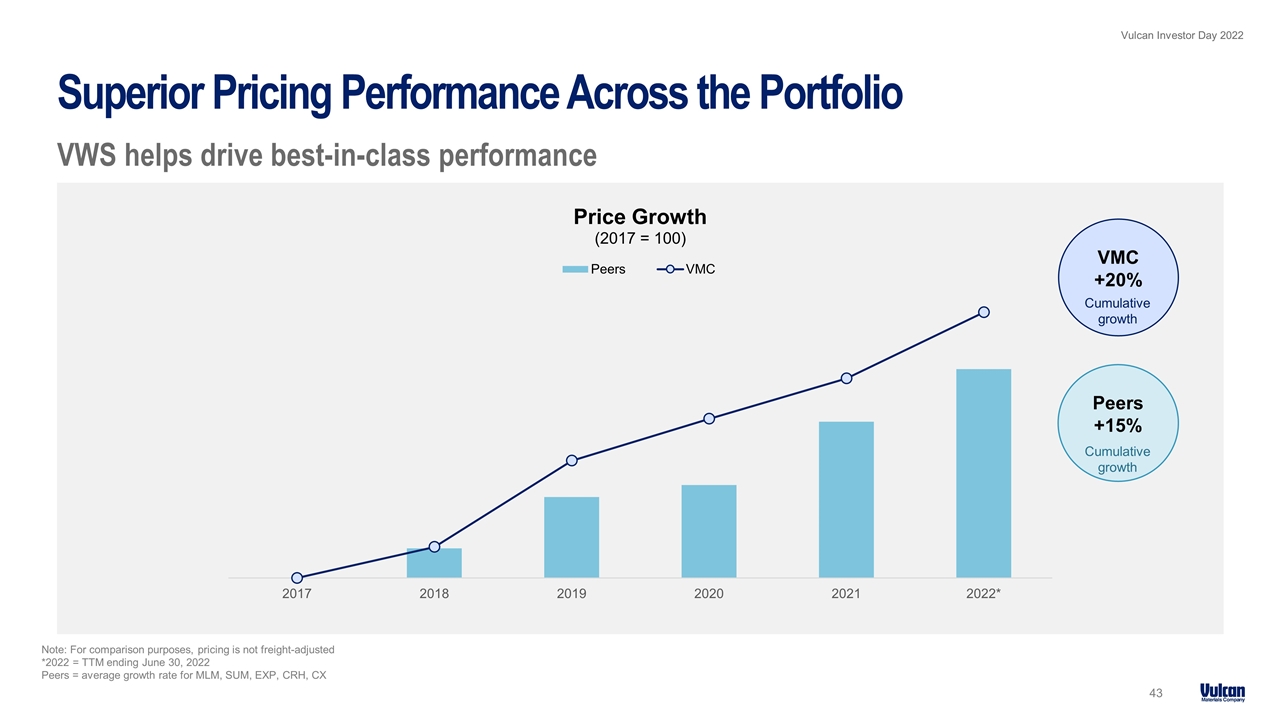

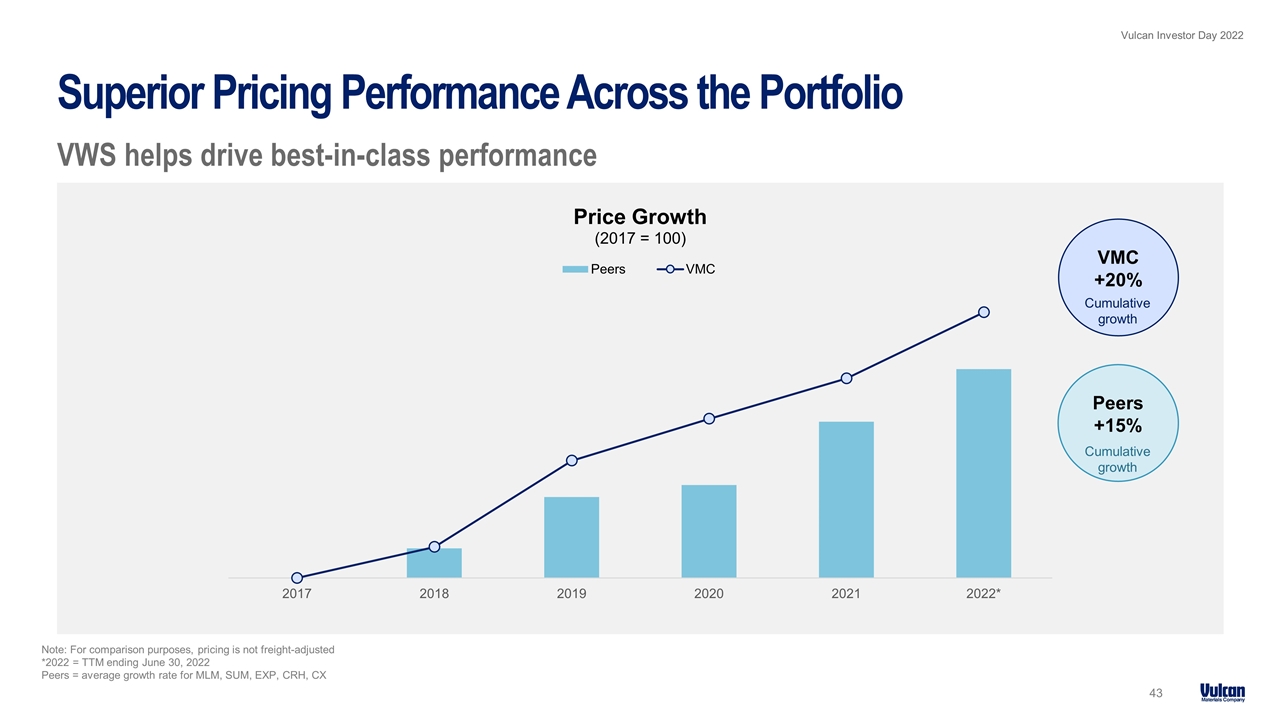

Note: For comparison purposes, pricing is not freight-adjusted *2022 = TTM ending June 30, 2022 Peers = average growth rate for MLM, SUM, EXP, CRH, CX Superior Pricing Performance Across the Portfolio VWS helps drive best-in-class performance VMC +20% Cumulative growth Peers +15% Cumulative growth

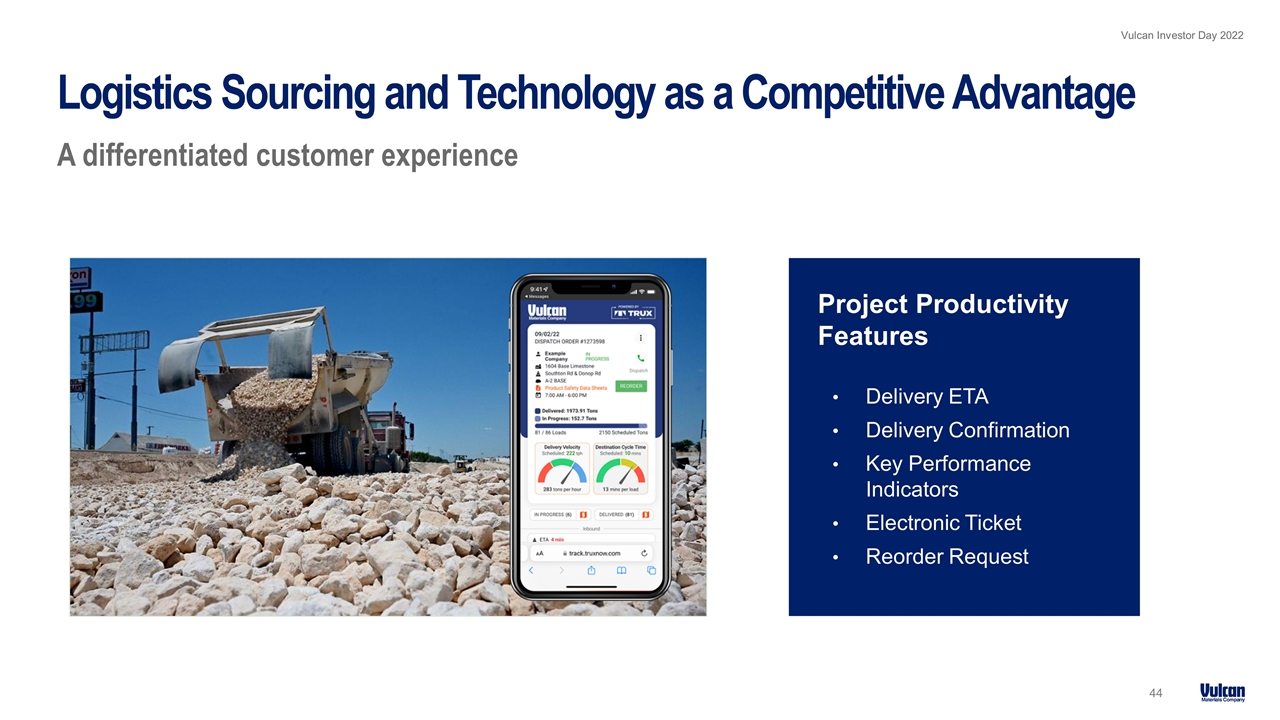

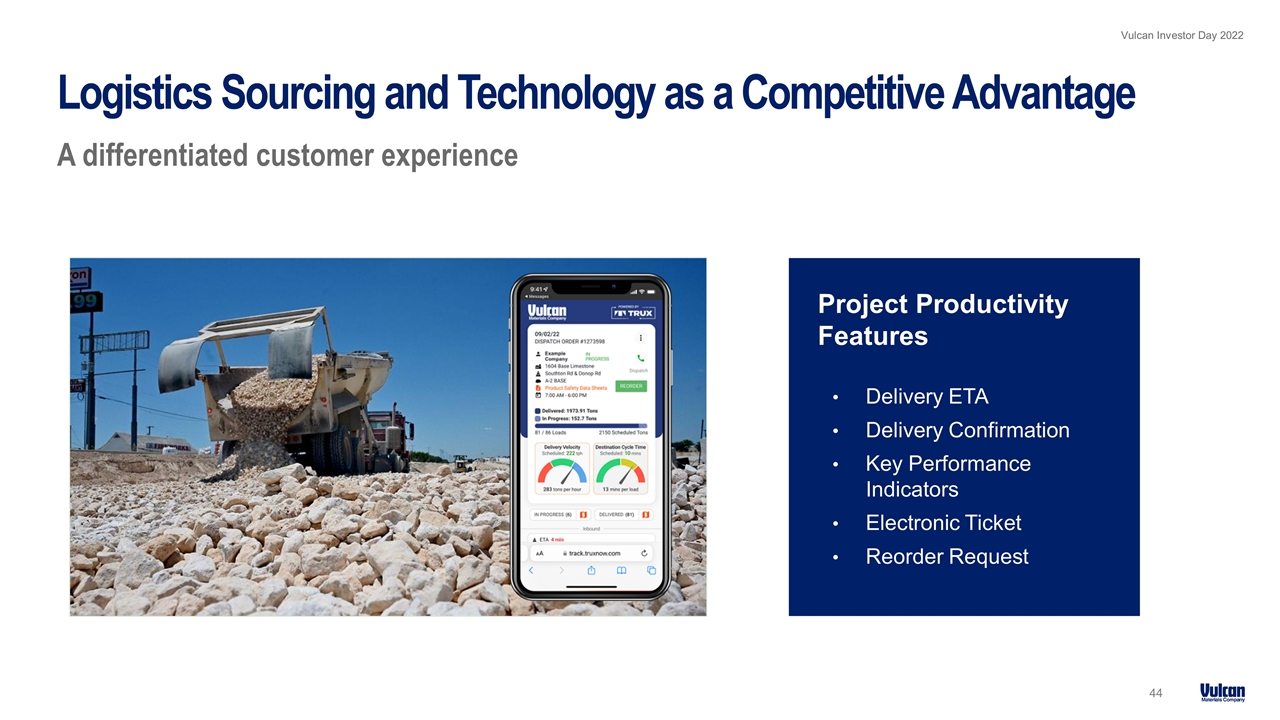

Logistics Sourcing and Technology as a Competitive Advantage A differentiated customer experience Project Productivity Features Delivery ETA Delivery Confirmation Key Performance Indicators Electronic Ticket Reorder Request

Building for the Future New Mobile Digital Sales Platform Better employee experience for our sales force New customer website with best-in-class functionality More robust, real-time market information

Delivering an Unmatched Customer Experience President and Chief Executive Officer Fred J. Smith, III

Break Investor Day 2022

Vulcan Way of Operating Jason Teter Senior Vice President Serafin To Replace

Operational Excellence Strategic Sourcing VWO The Vulcan Way of Operating Competing and Winning, Locally Strengthening existing capabilities to drive the next horizon of growth and profitability VWS The Vulcan Way of Selling Commercial Excellence Logistics Innovation

Building Our Capabilities for Continued Superior Performance Production efficiency Customer service Safety and health of our people

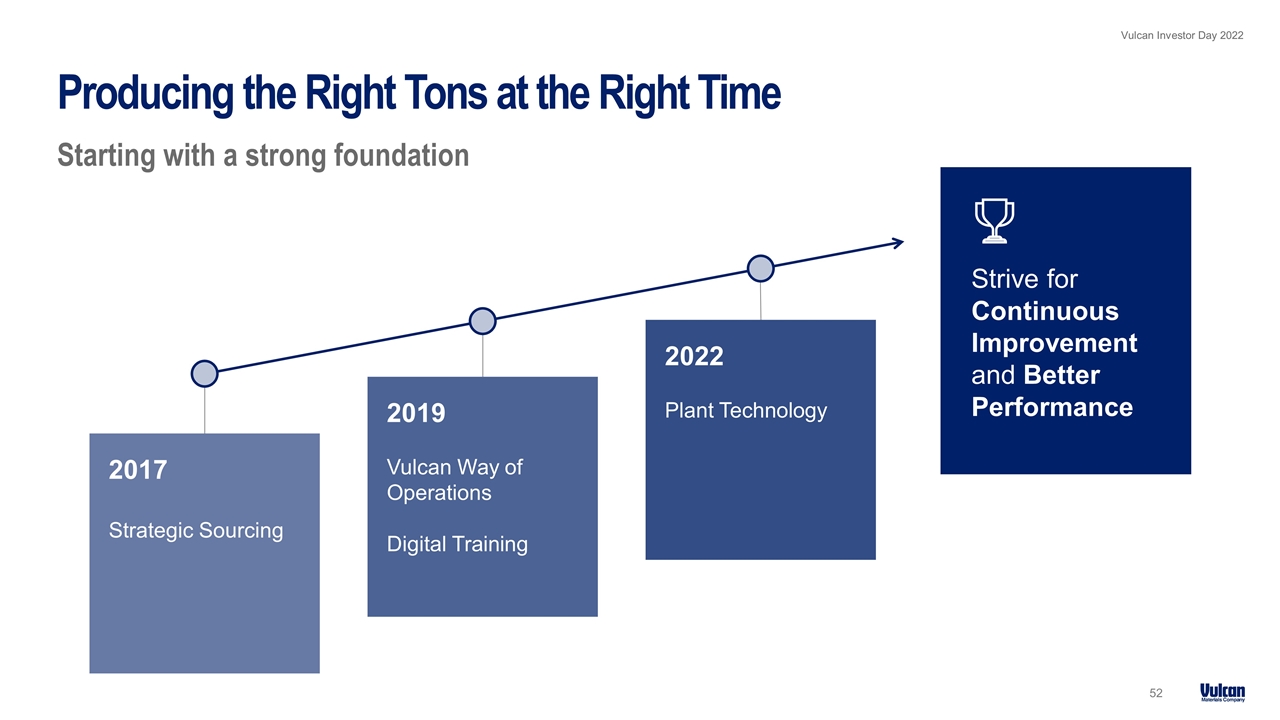

Producing the Right Tons at the Right Time Starting with a strong foundation 2019 Vulcan Way of Operations Digital Training 2022 Plant Technology 2017 Strategic Sourcing Strive for Continuous Improvement and Better Performance

Enhanced Training Program Improves Consistency Across Operations Leveraging technology to better equip and train our team Multifaceted proprietary digital library focusing on our major business lines Continuous training resources that support the entire employment life cycle 60+ modules (and counting) built in-house by Vulcan employees, translated into Spanish, and copyrighted

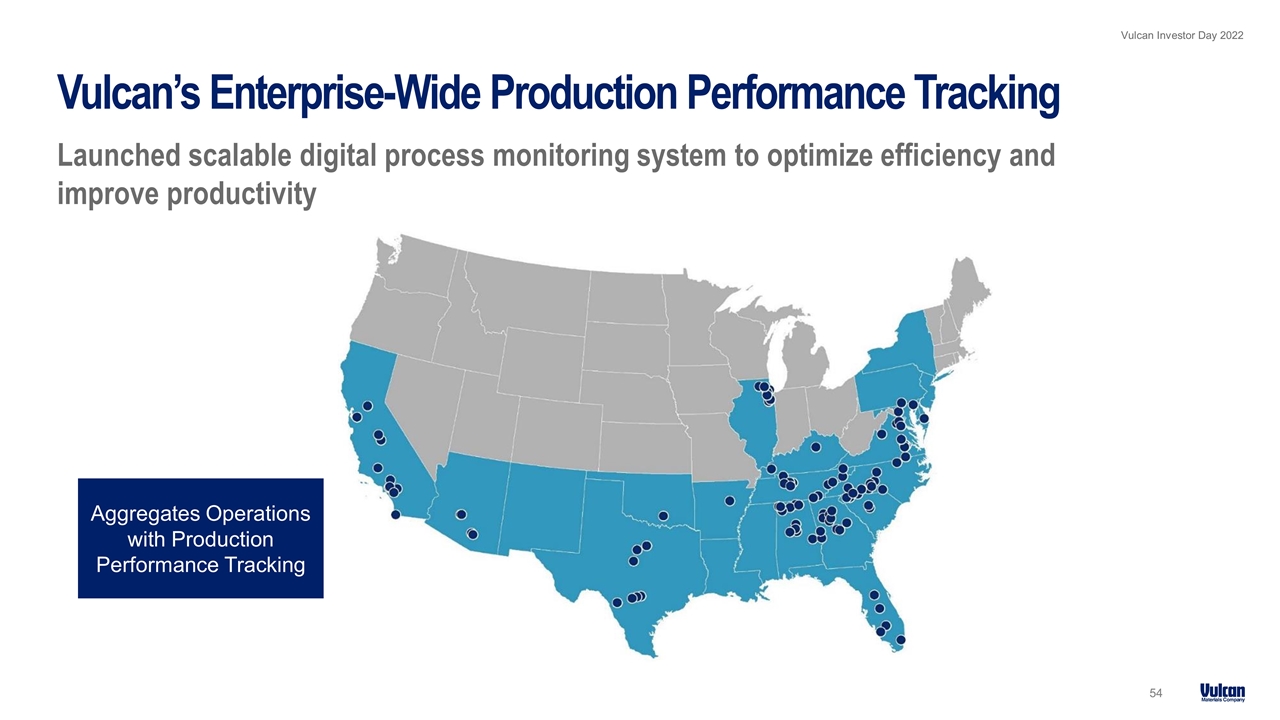

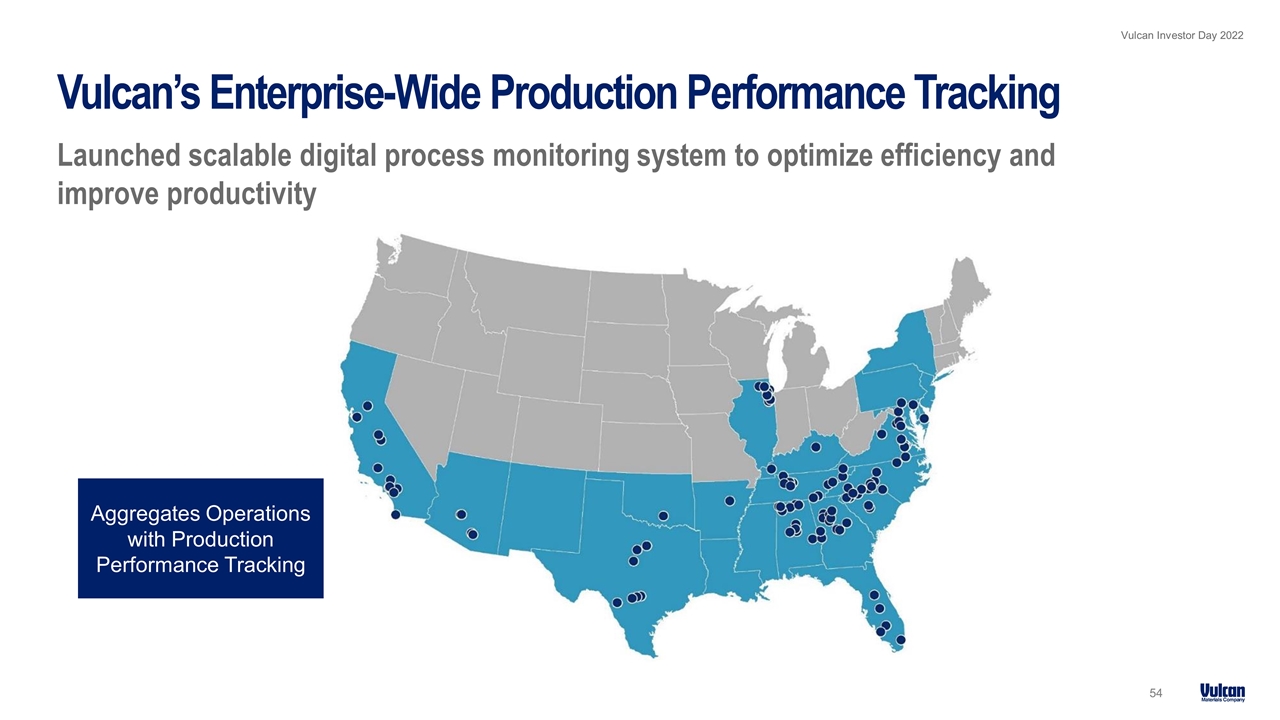

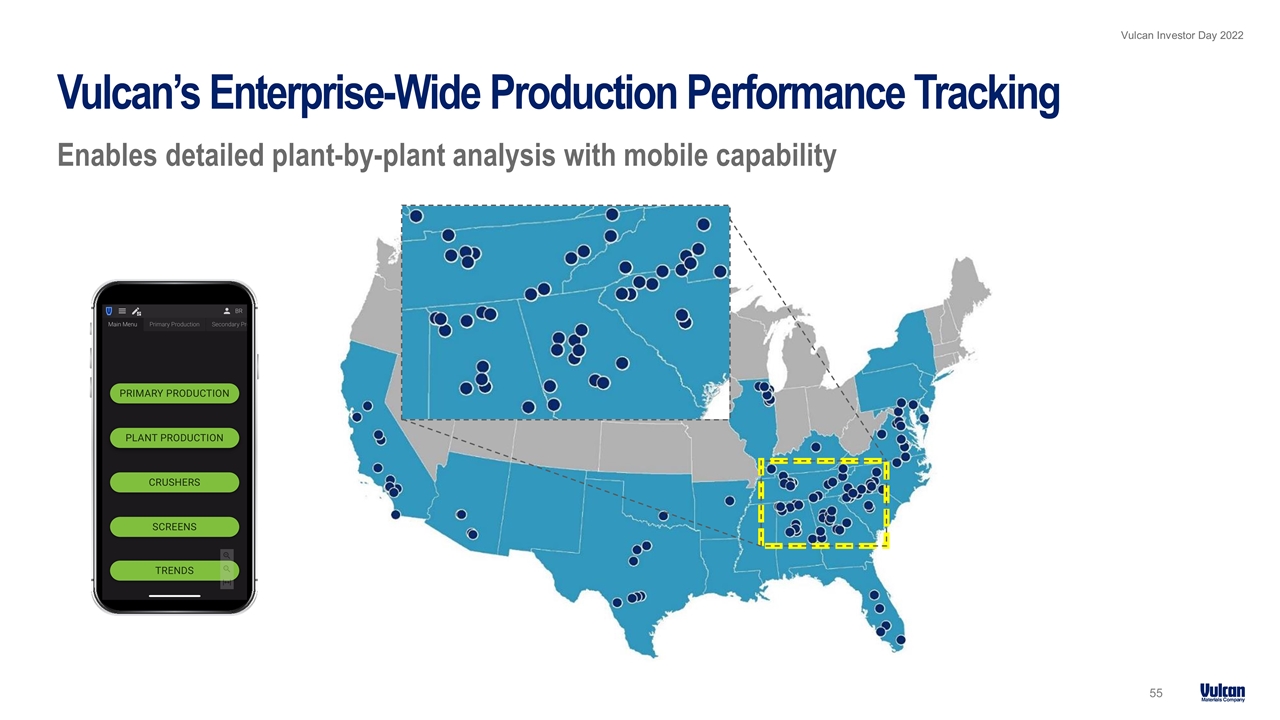

Vulcan’s Enterprise-Wide Production Performance Tracking Launched scalable digital process monitoring system to optimize efficiency and improve productivity Aggregates Operations with Production Performance Tracking

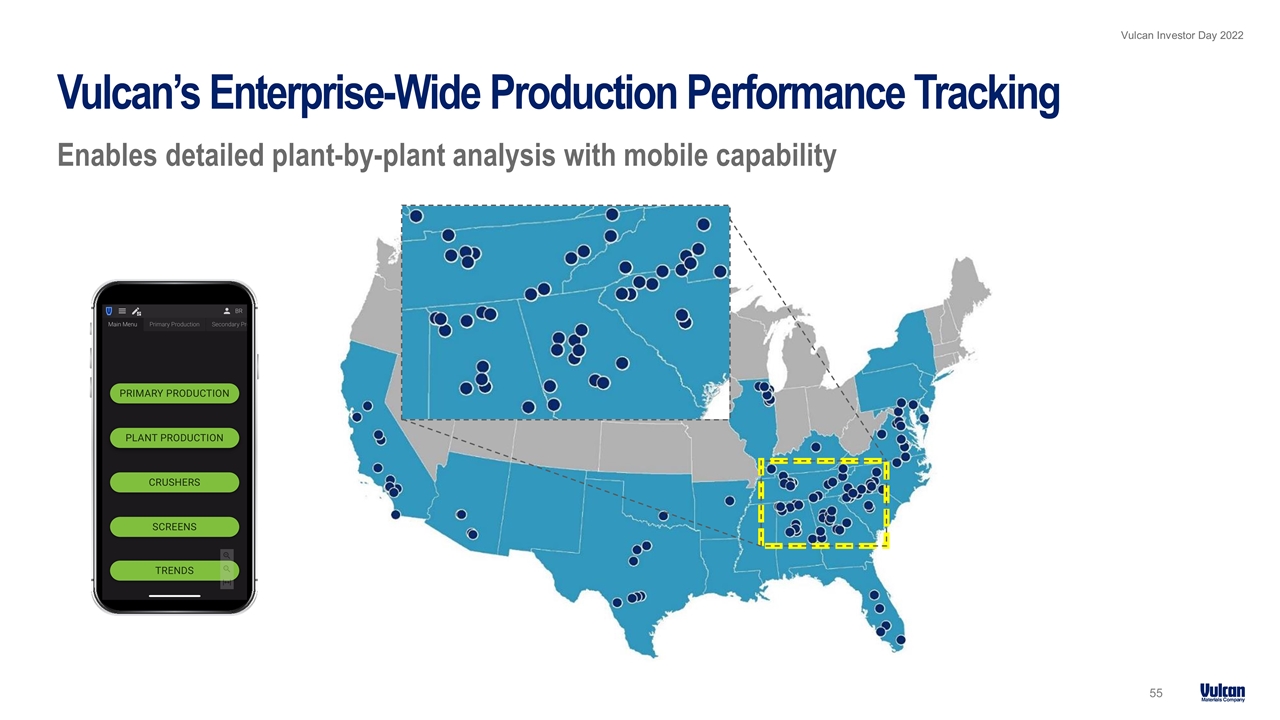

Vulcan’s Enterprise-Wide Production Performance Tracking Enables detailed plant-by-plant analysis with mobile capability

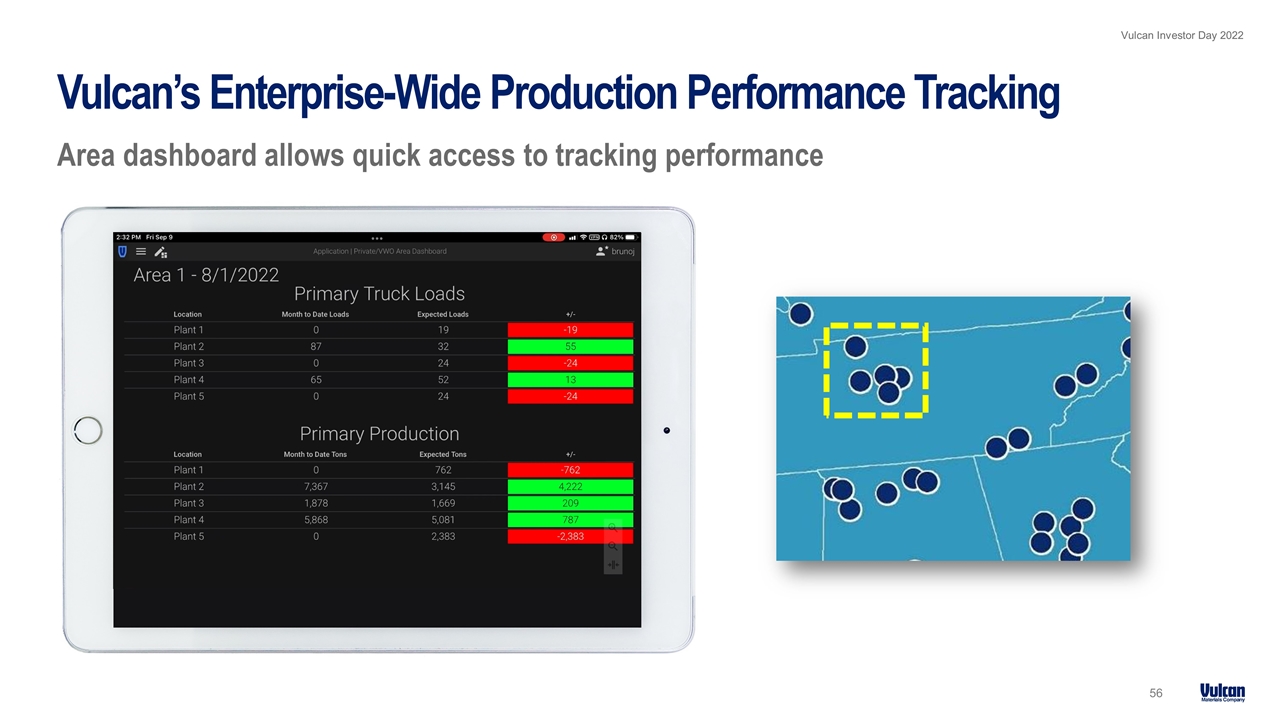

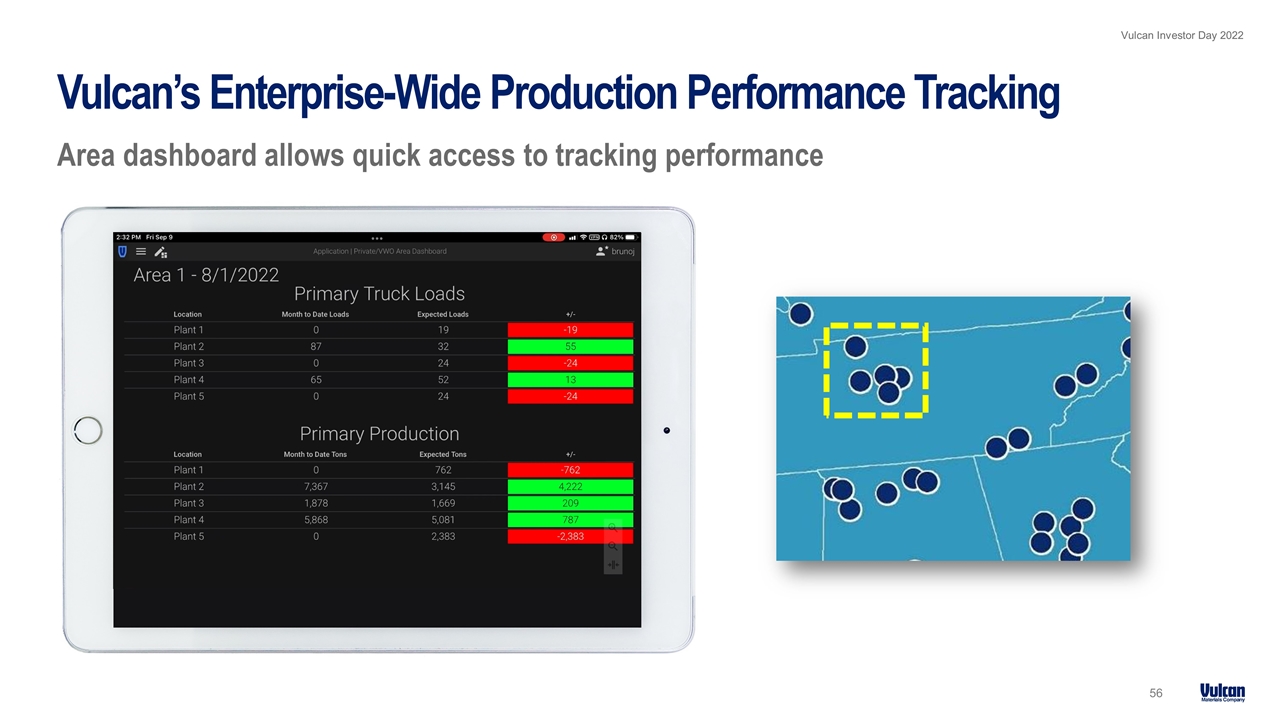

Vulcan’s Enterprise-Wide Production Performance Tracking Area dashboard allows quick access to tracking performance

Vulcan’s Enterprise-Wide Production Performance Tracking Plant dashboard helps monitor efficiencies and KPI’s throughout the day

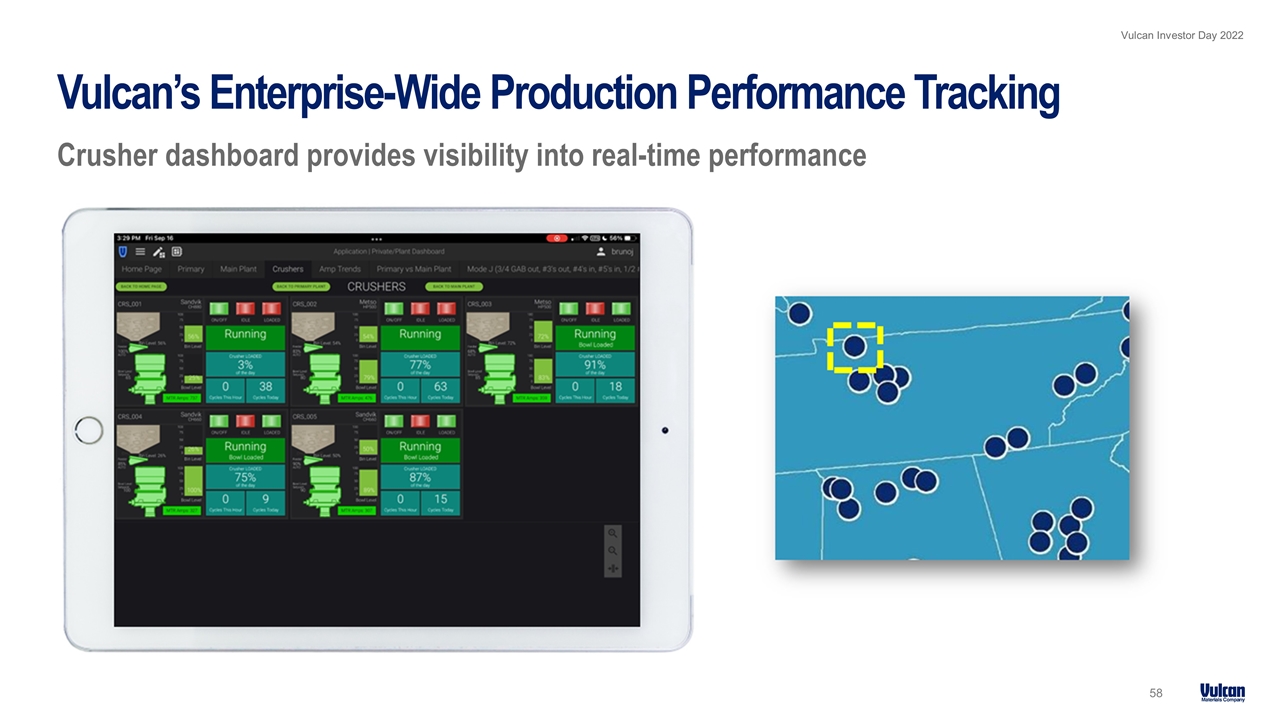

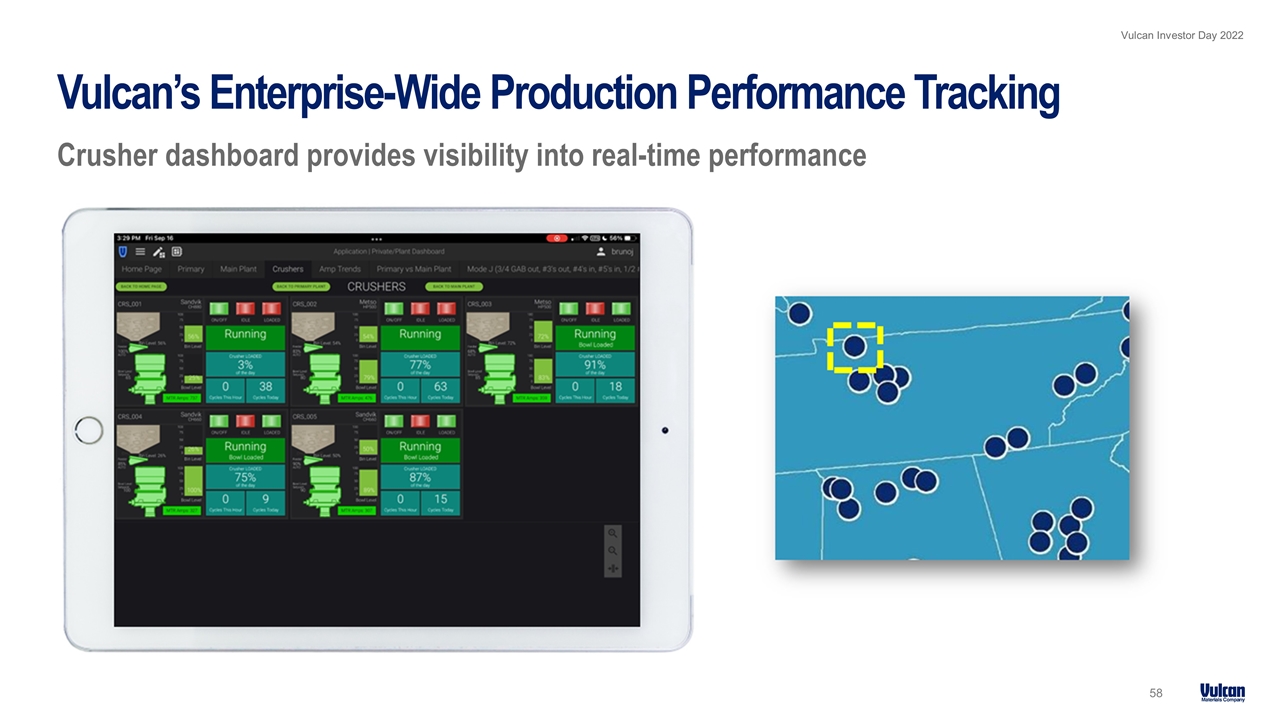

Vulcan’s Enterprise-Wide Production Performance Tracking Crusher dashboard provides visibility into real-time performance

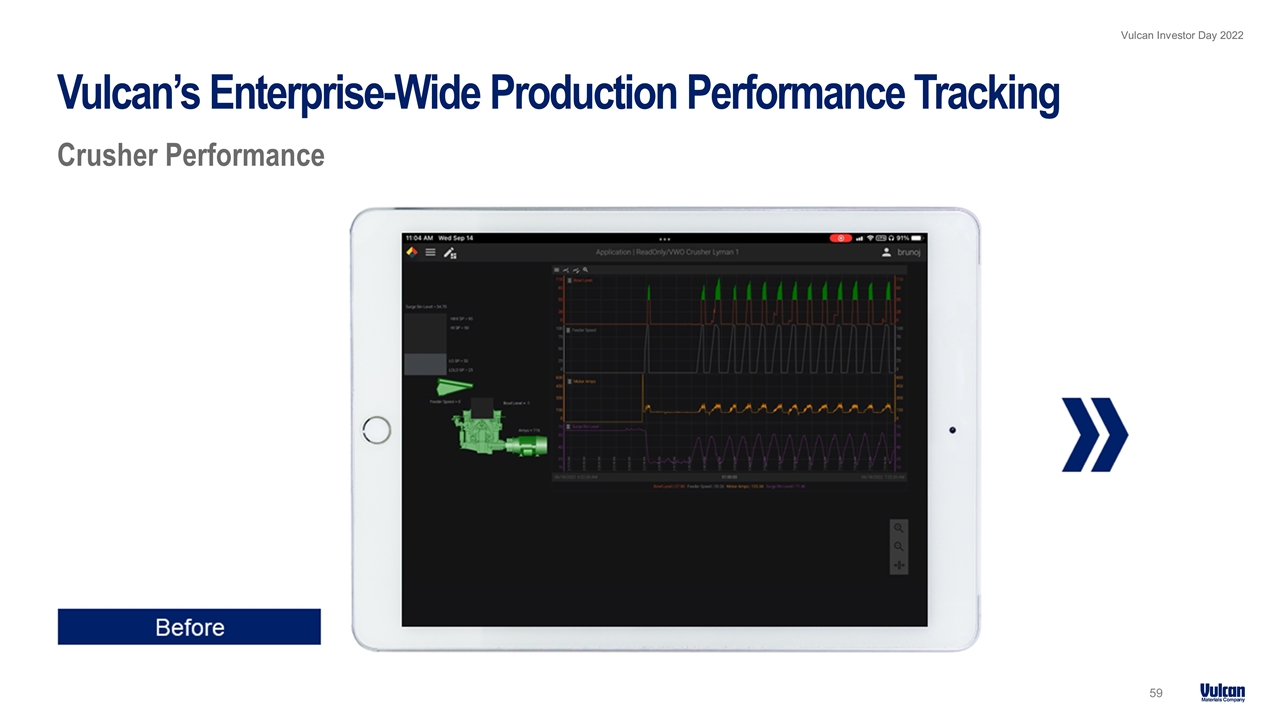

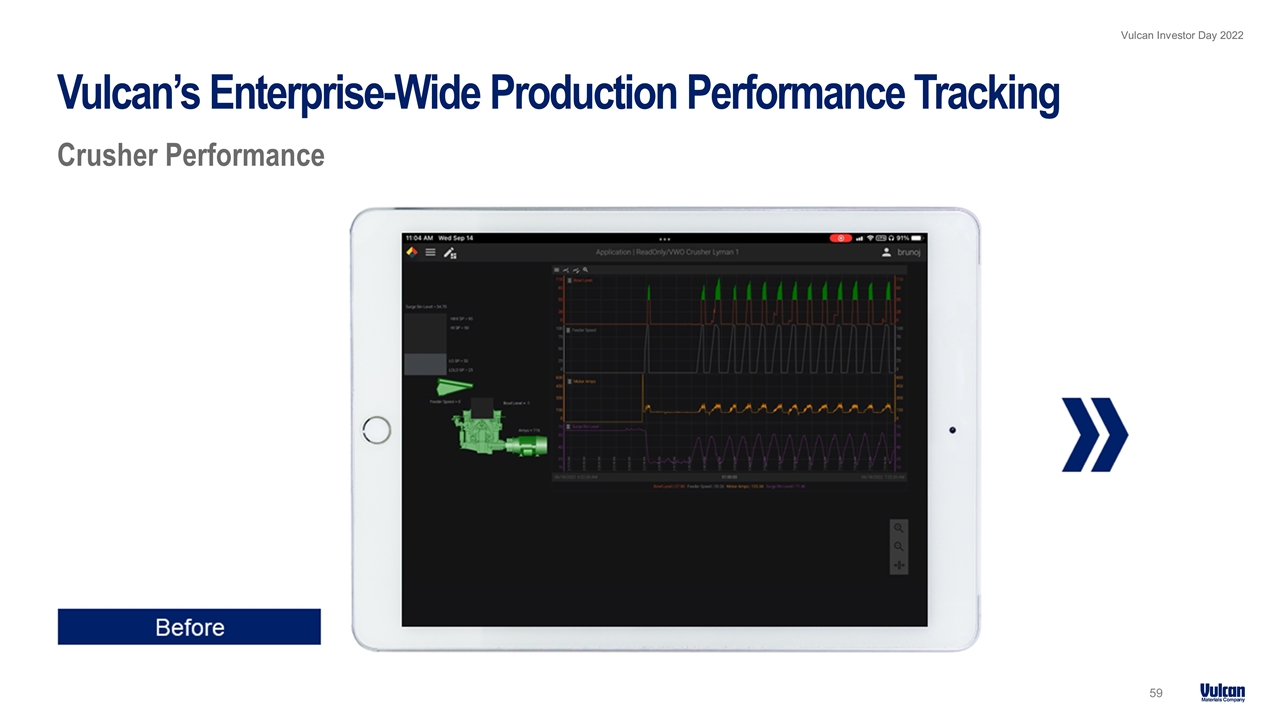

Vulcan’s Enterprise-Wide Production Performance Tracking Crusher Performance

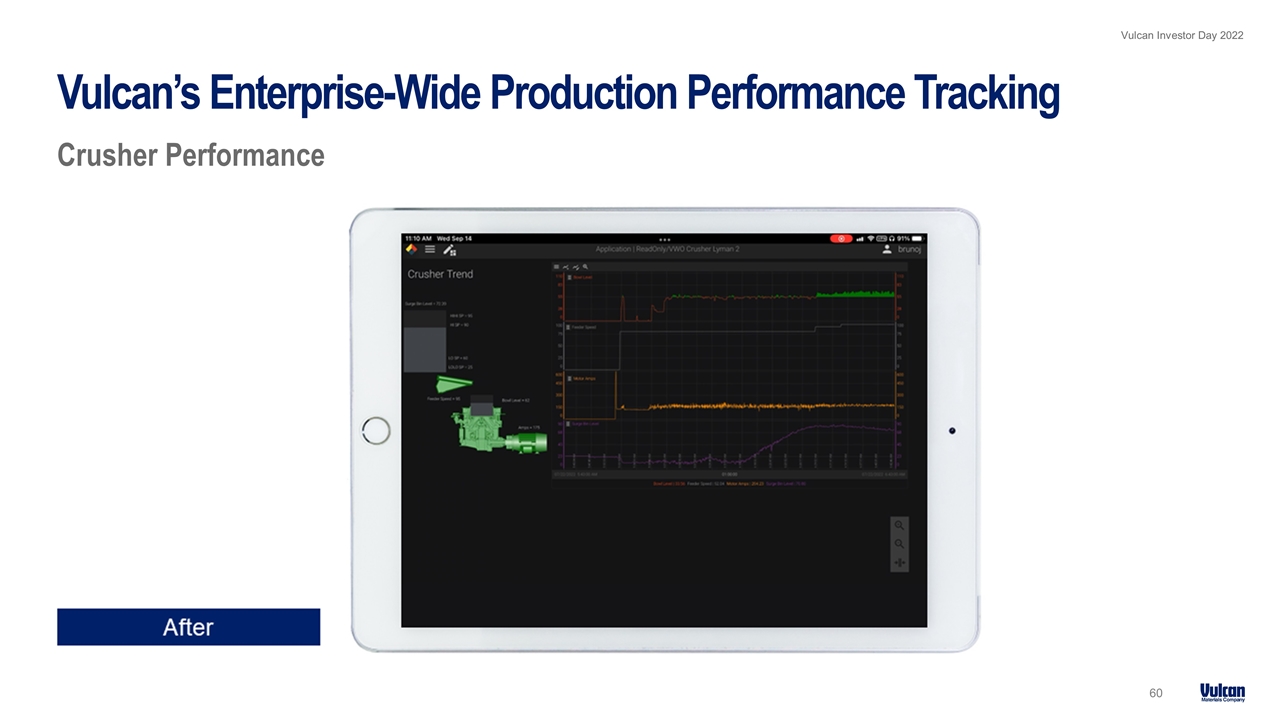

Vulcan’s Enterprise-Wide Production Performance Tracking Crusher Performance

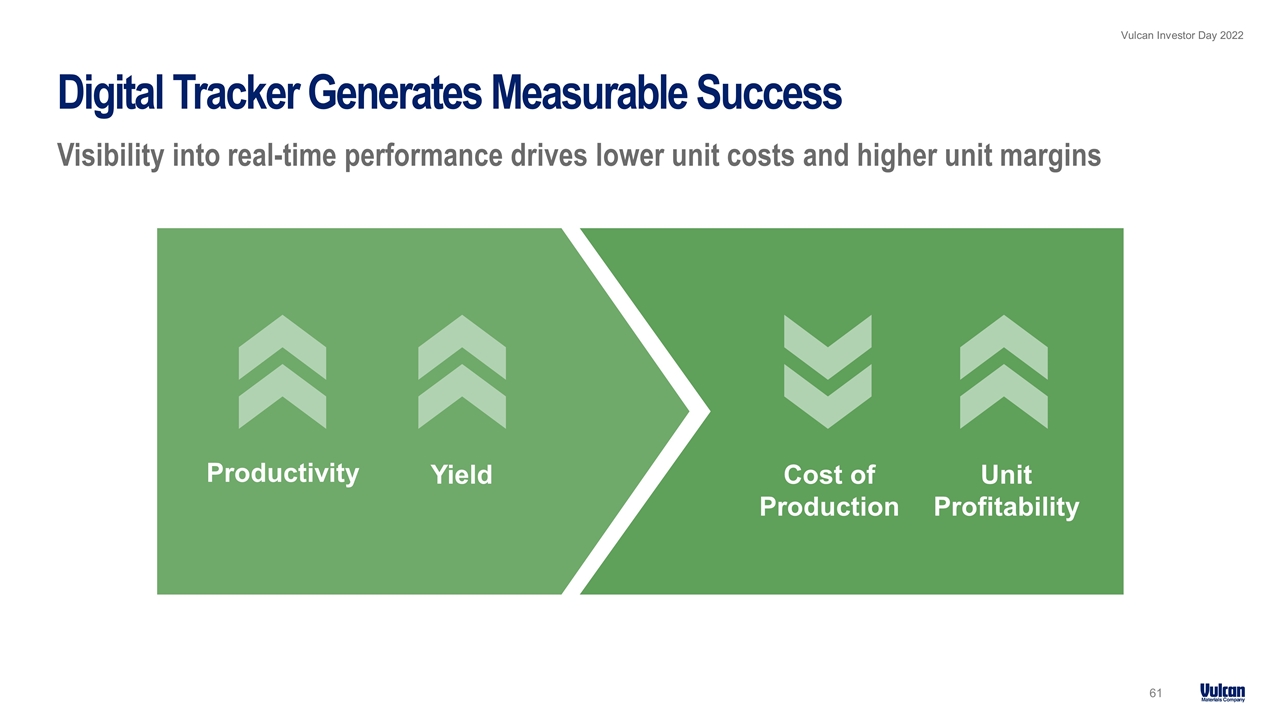

Digital Tracker Generates Measurable Success Visibility into real-time performance drives lower unit costs and higher unit margins Productivity Yield Unit Profitability Cost of Production

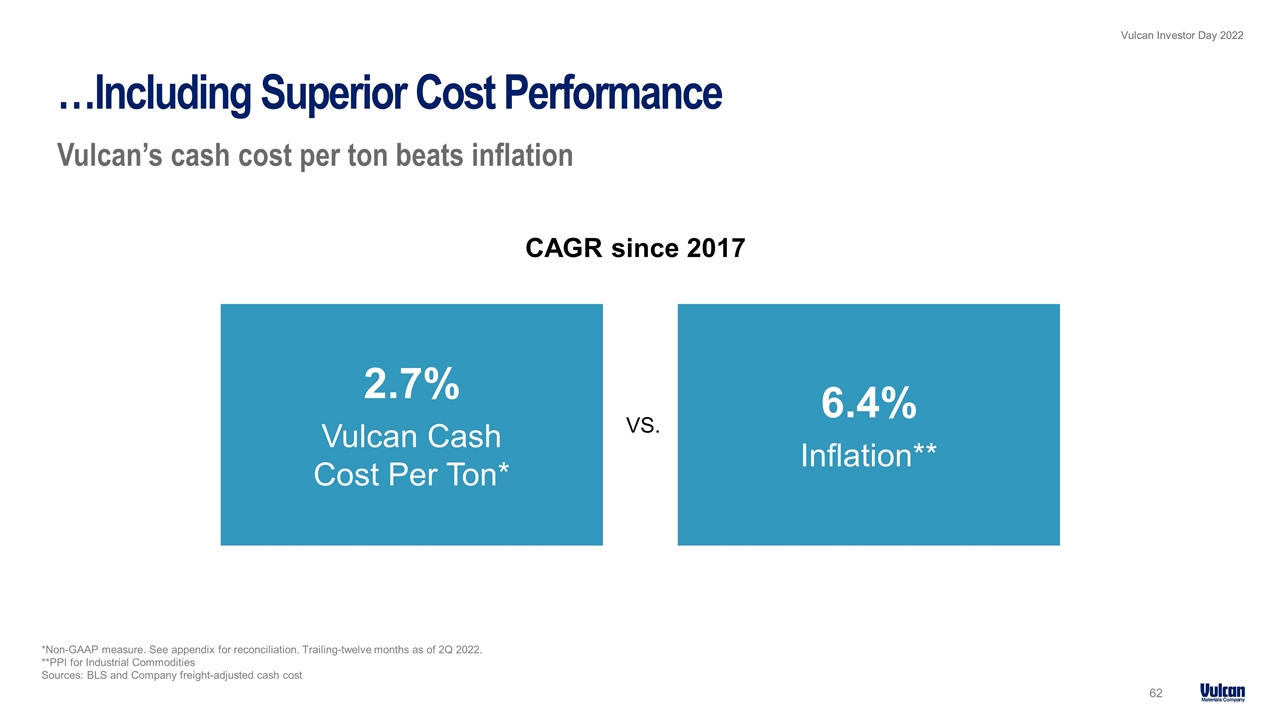

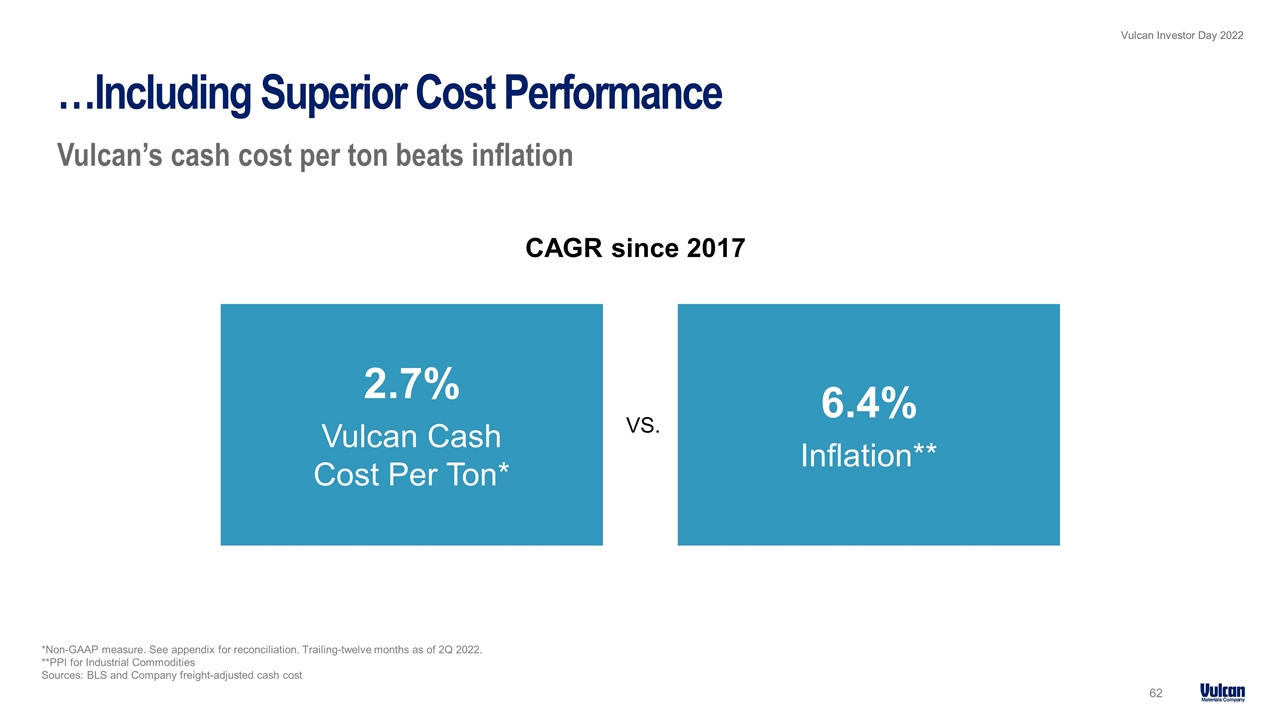

*Non-GAAP measure. See appendix for reconciliation. Trailing-twelve months as of 2Q 2022. **PPI for Industrial Commodities Sources: BLS and Company freight-adjusted cash cost …Including Superior Cost Performance Vulcan’s cash cost per ton beats inflation CAGR since 2017 VS. 2.7% Vulcan Cash Cost Per Ton* 6.4% Inflation**

Strong Momentum Will Continue to Drive Improved Performance Exciting developments – and we’re just getting started 1 Continued development of training Leveraging the technology across the enterprise 2

Portfolio Management Ronnie Pruitt Senior Vice President Serafin To Replace

Expanding and Enhancing Our Portfolio Guiding principles Foundation in Aggregates 1 Right Market Structure 2 Downstream in Select Markets 3 Disciplined Approach 4

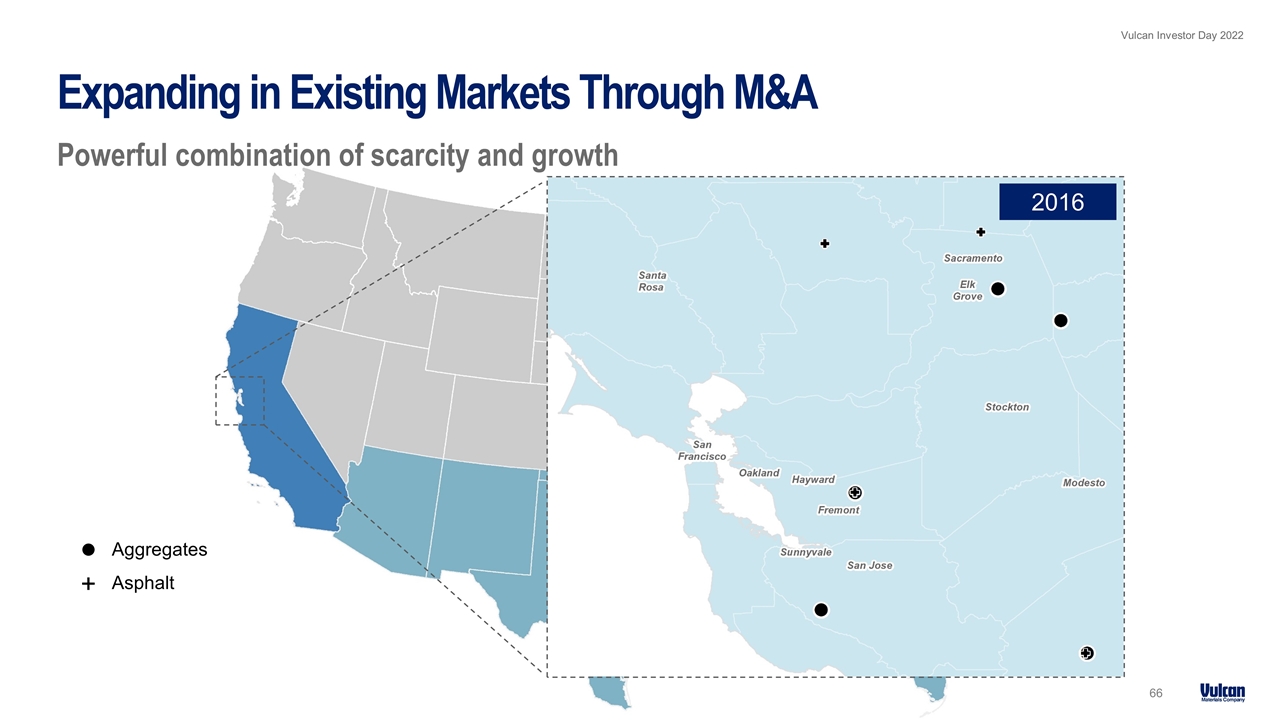

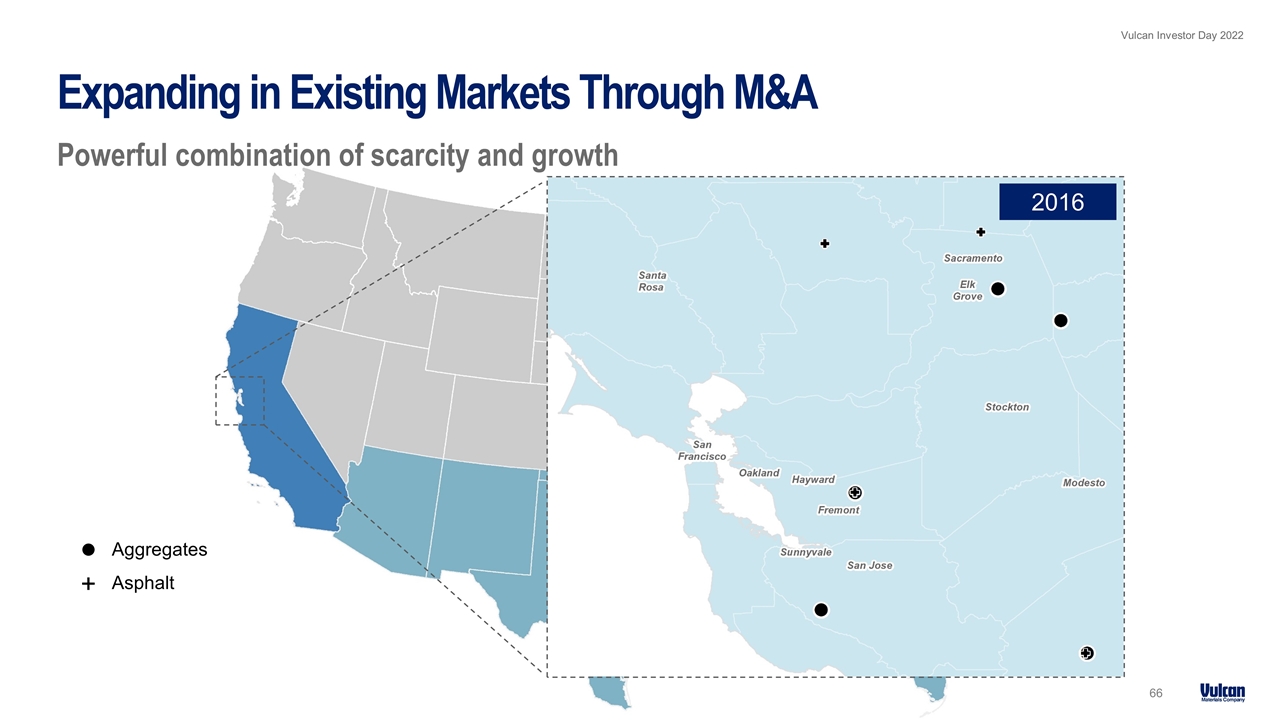

Expanding in Existing Markets Through M&A Powerful combination of scarcity and growth 66 Aggregates Asphalt + 2016

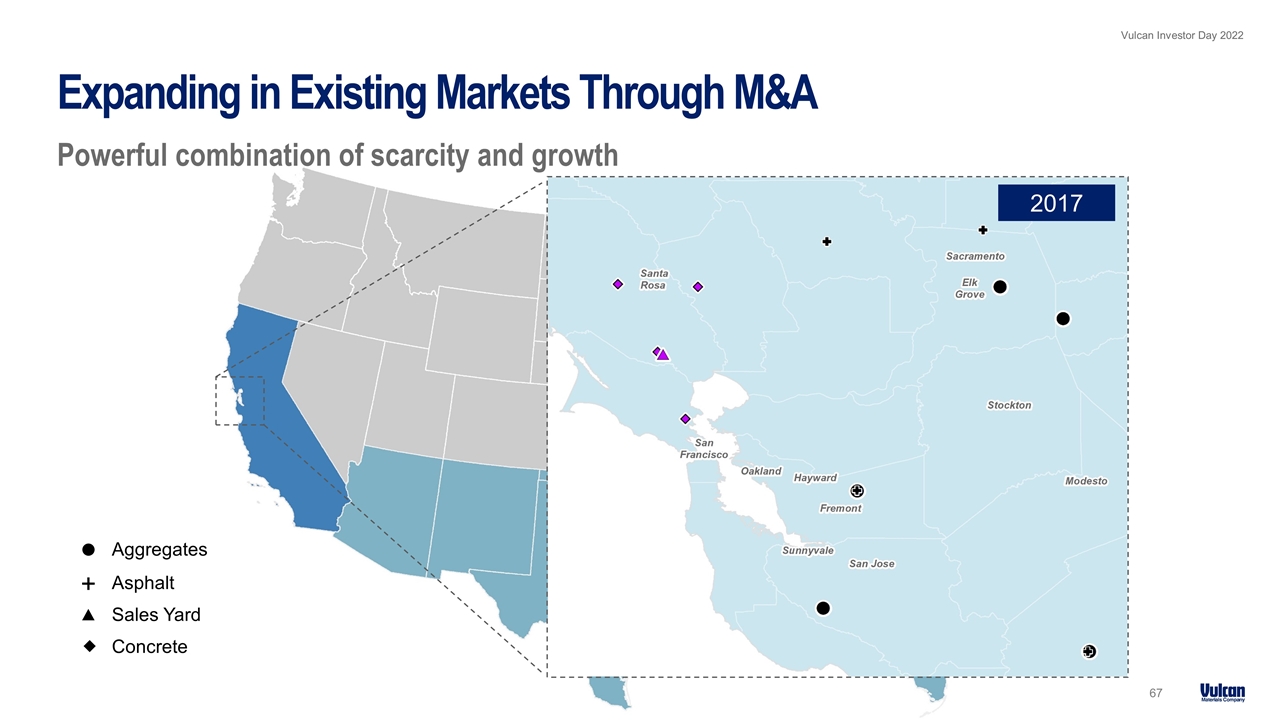

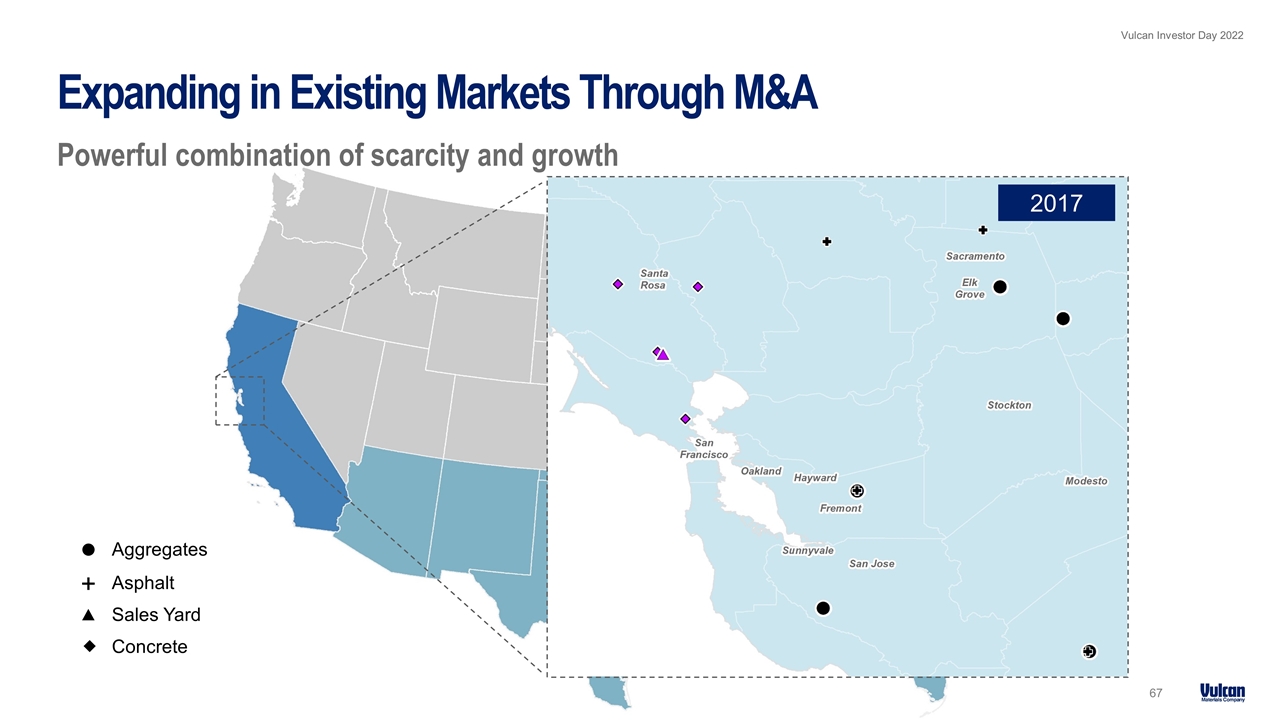

Expanding in Existing Markets Through M&A Powerful combination of scarcity and growth 7 Aggregates Asphalt + Sales Yard Concrete 2017

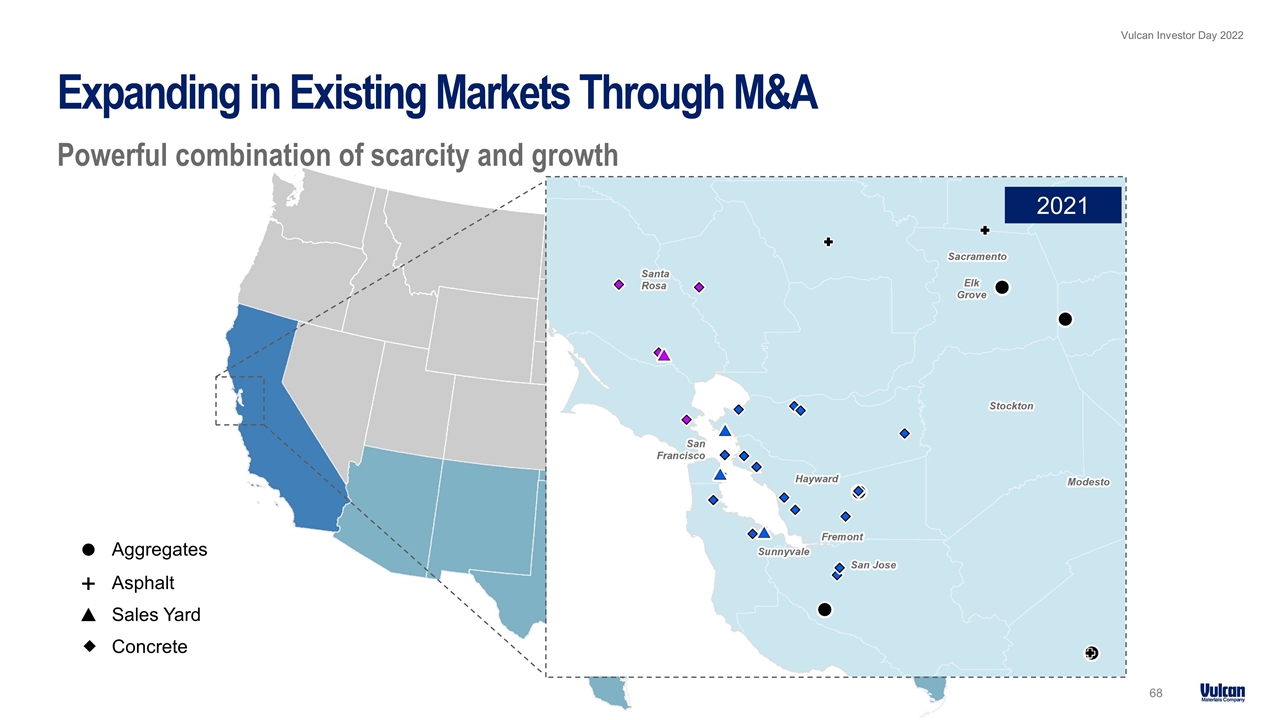

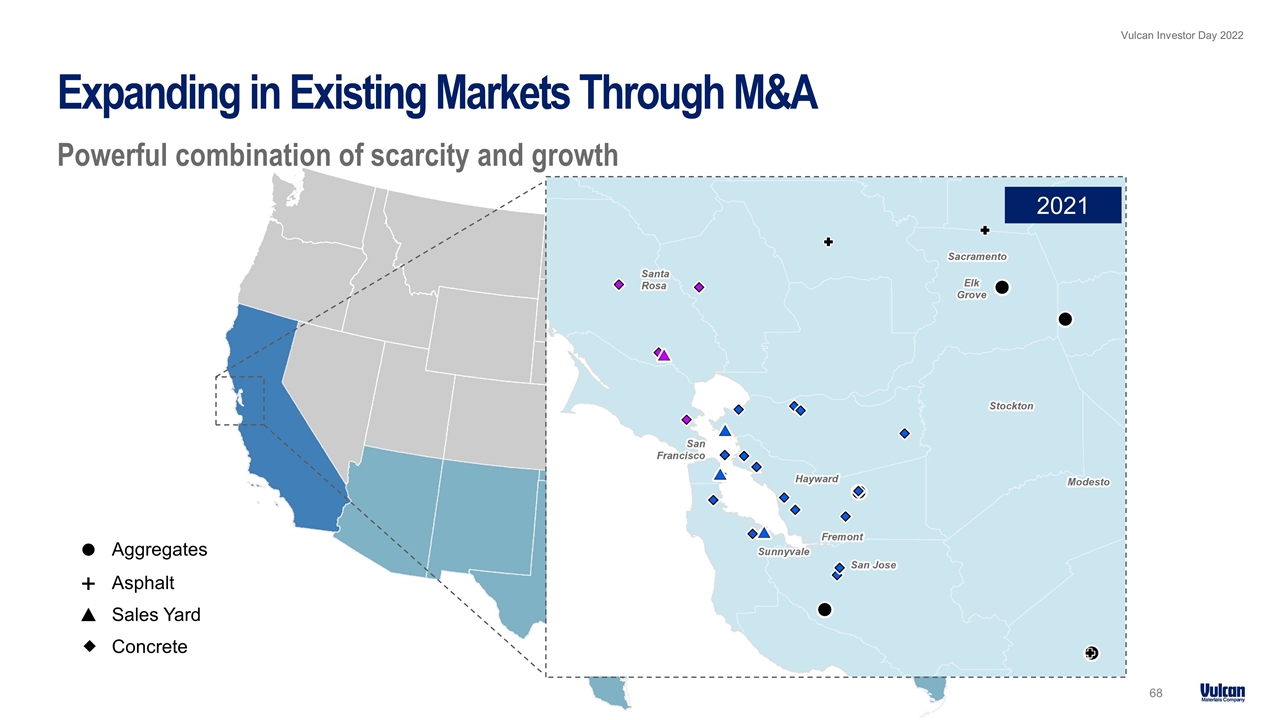

Expanding in Existing Markets Through M&A Powerful combination of scarcity and growth 68 Aggregates Asphalt + Sales Yard Concrete 2021

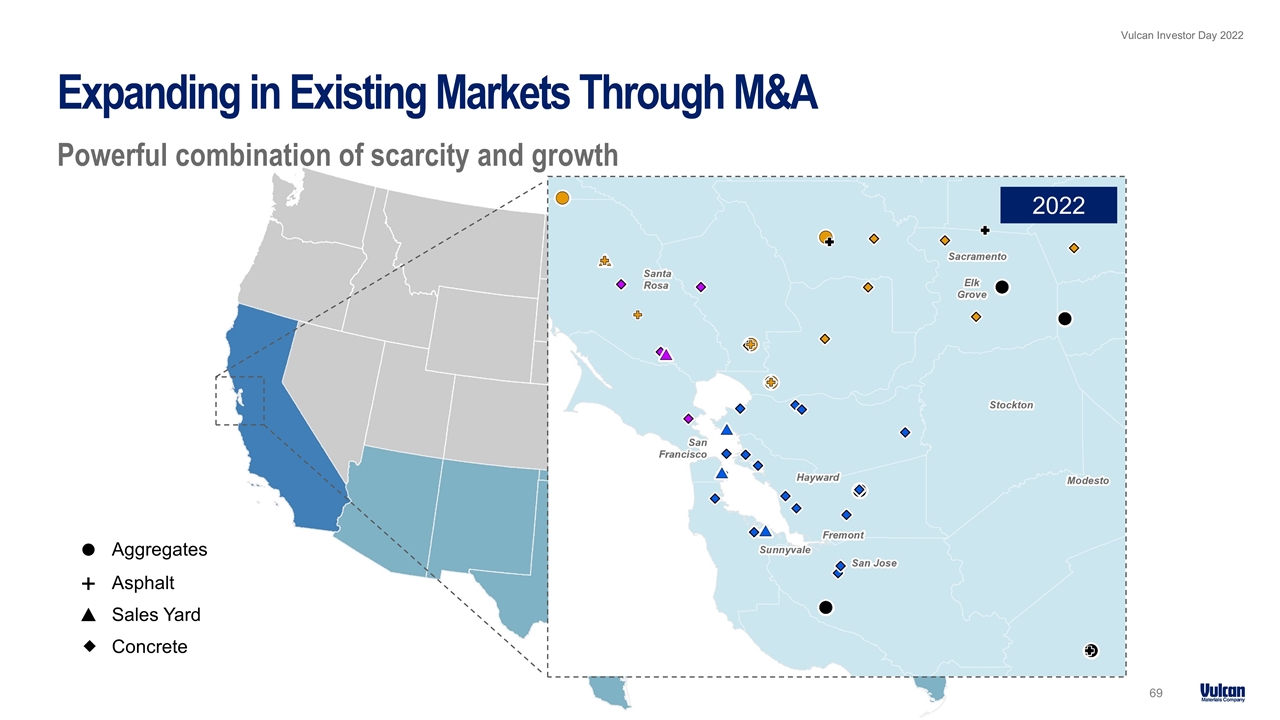

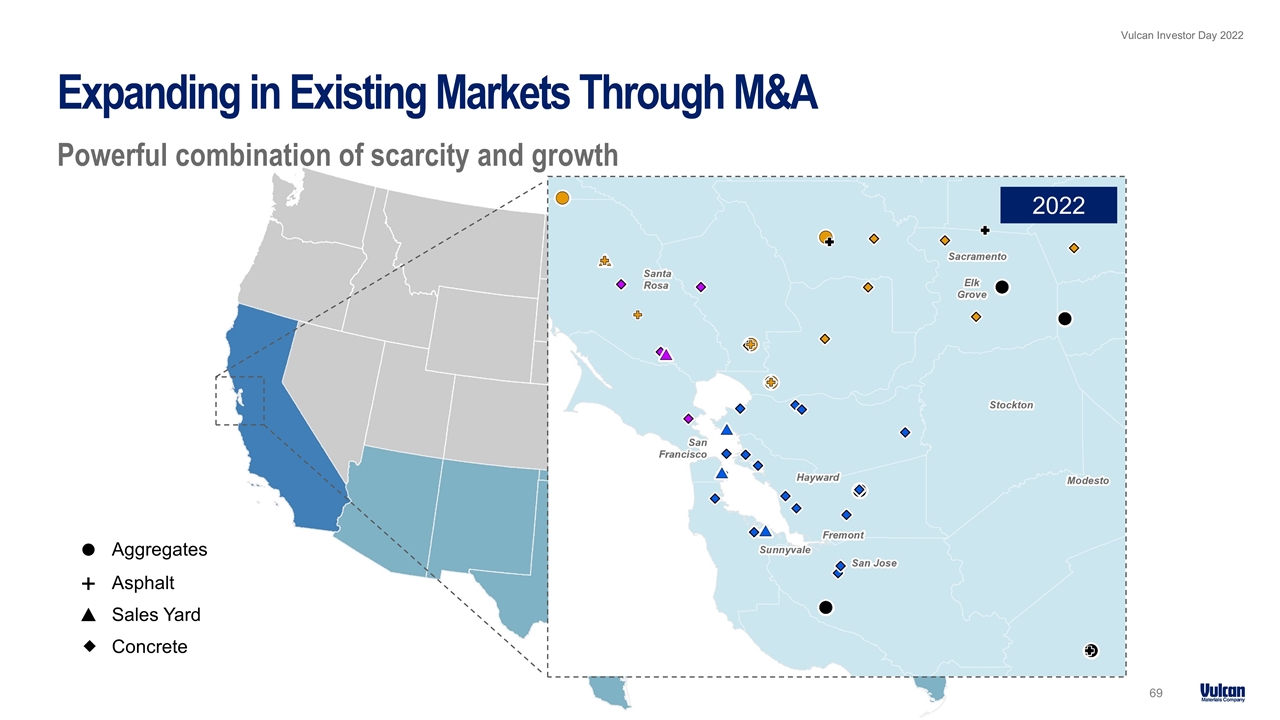

Expanding in Existing Markets Through M&A Powerful combination of scarcity and growth 69 Aggregates Asphalt + Sales Yard Concrete 2022

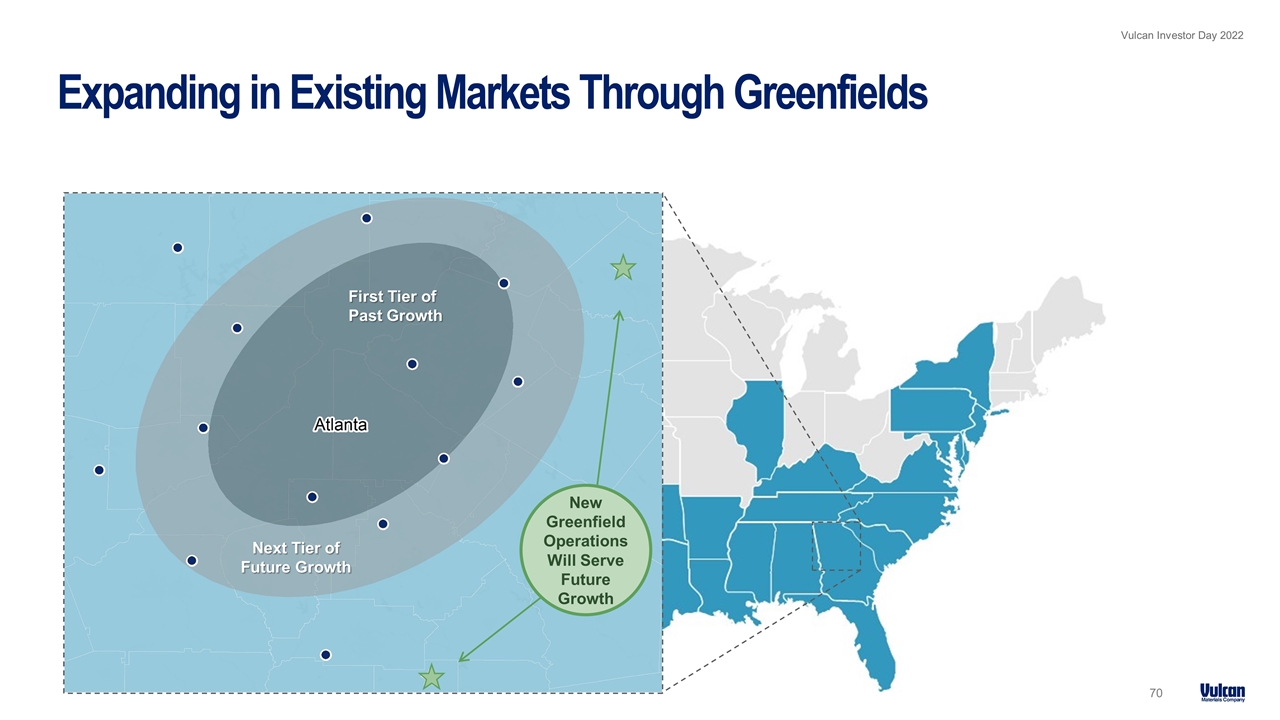

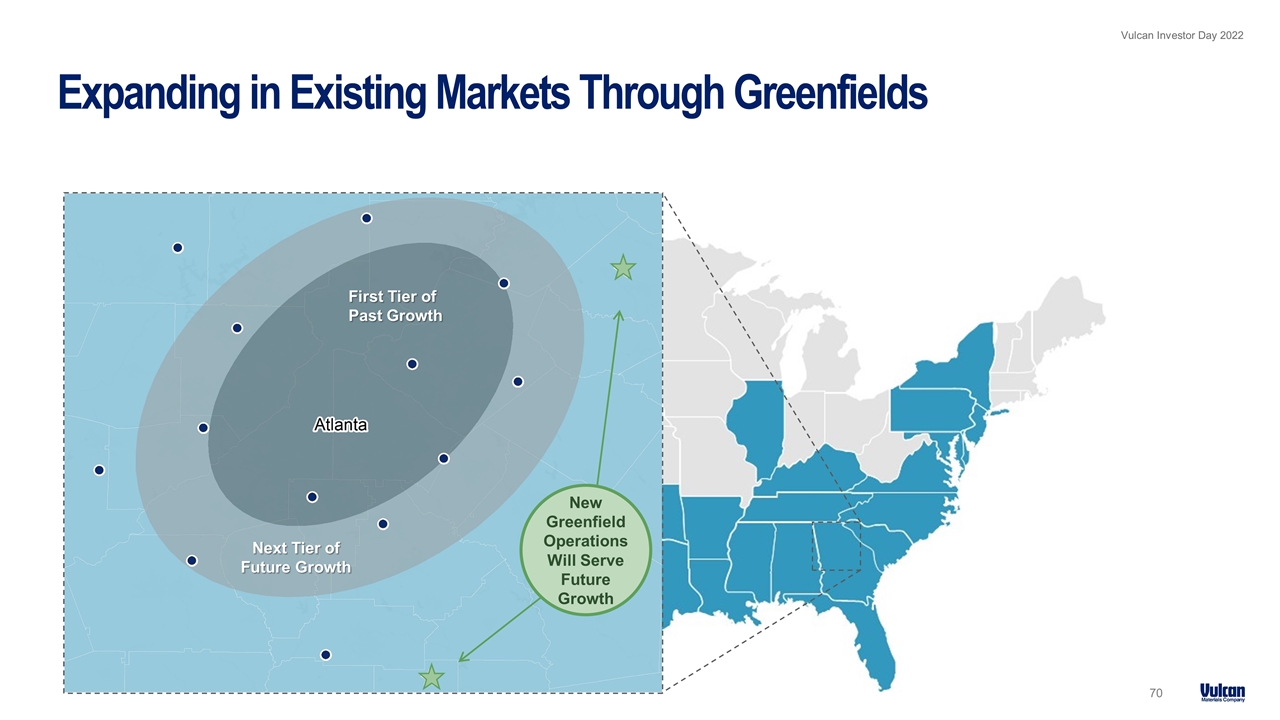

Expanding in Existing Markets Through Greenfields 70 First Tier of Past Growth Next Tier of Future Growth New Greenfield Operations Will Serve Future Growth

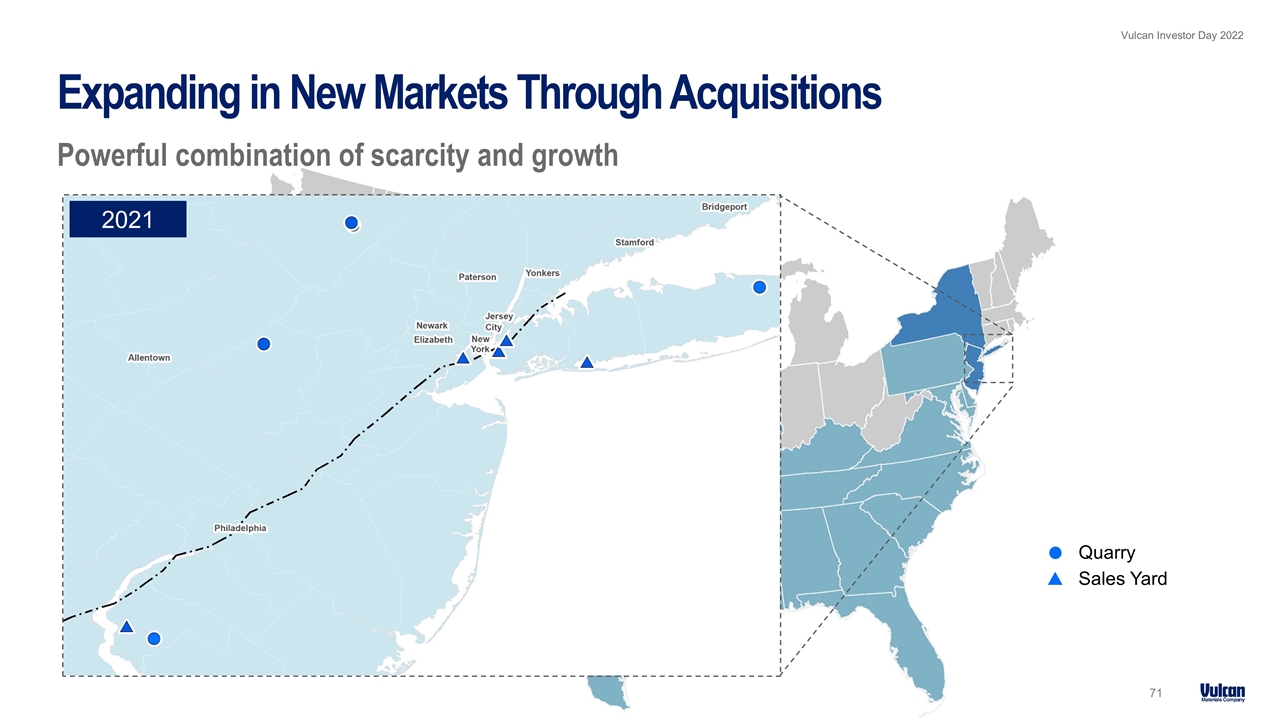

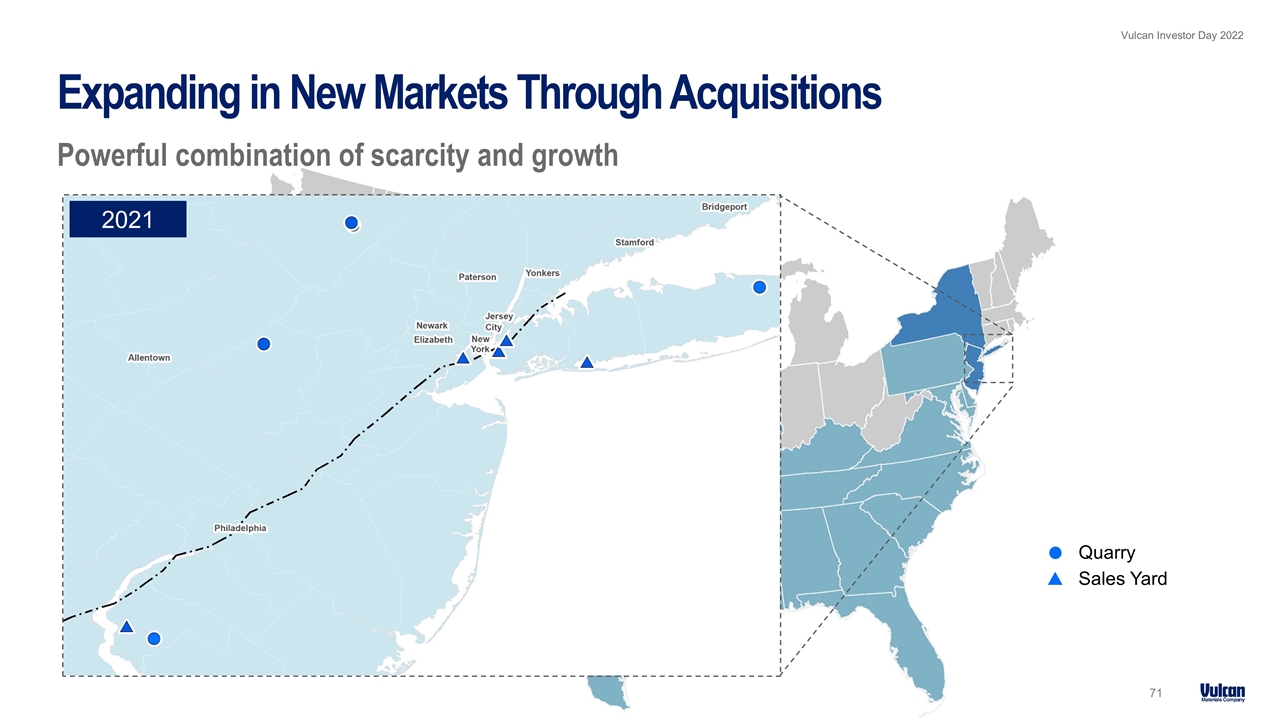

Expanding in New Markets Through Acquisitions Powerful combination of scarcity and growth 71 Quarry Sales Yard 2021

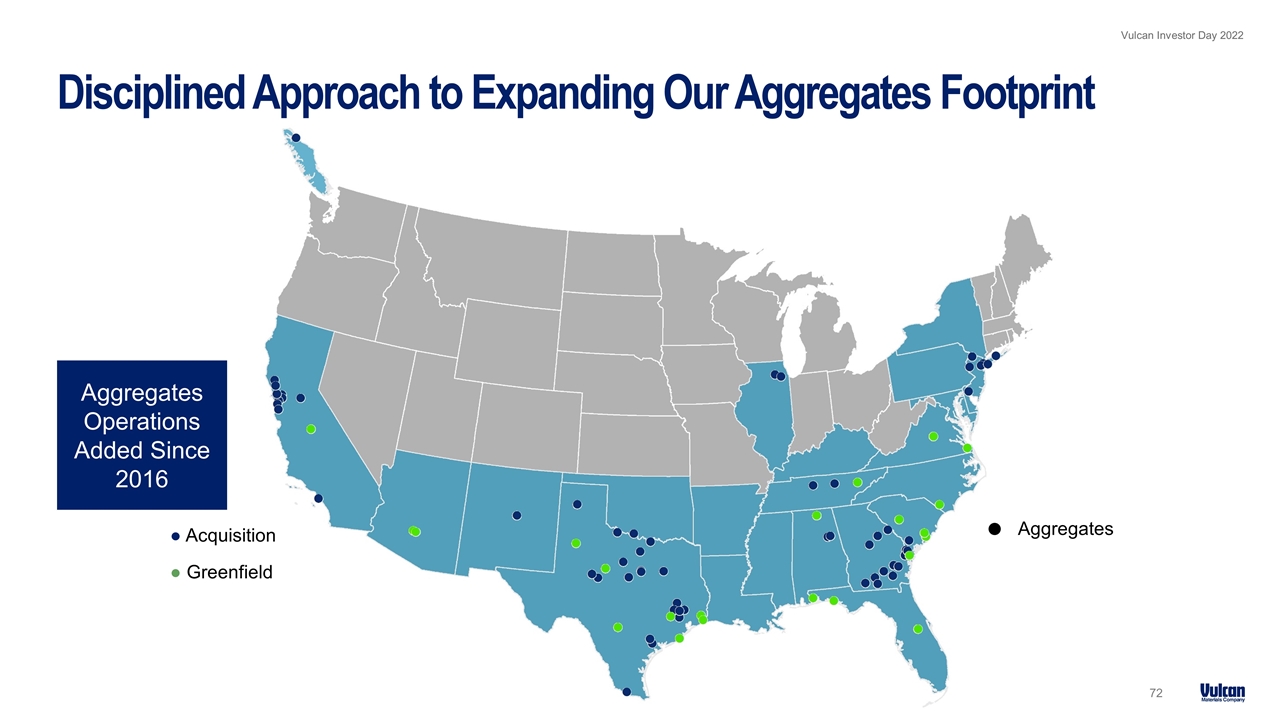

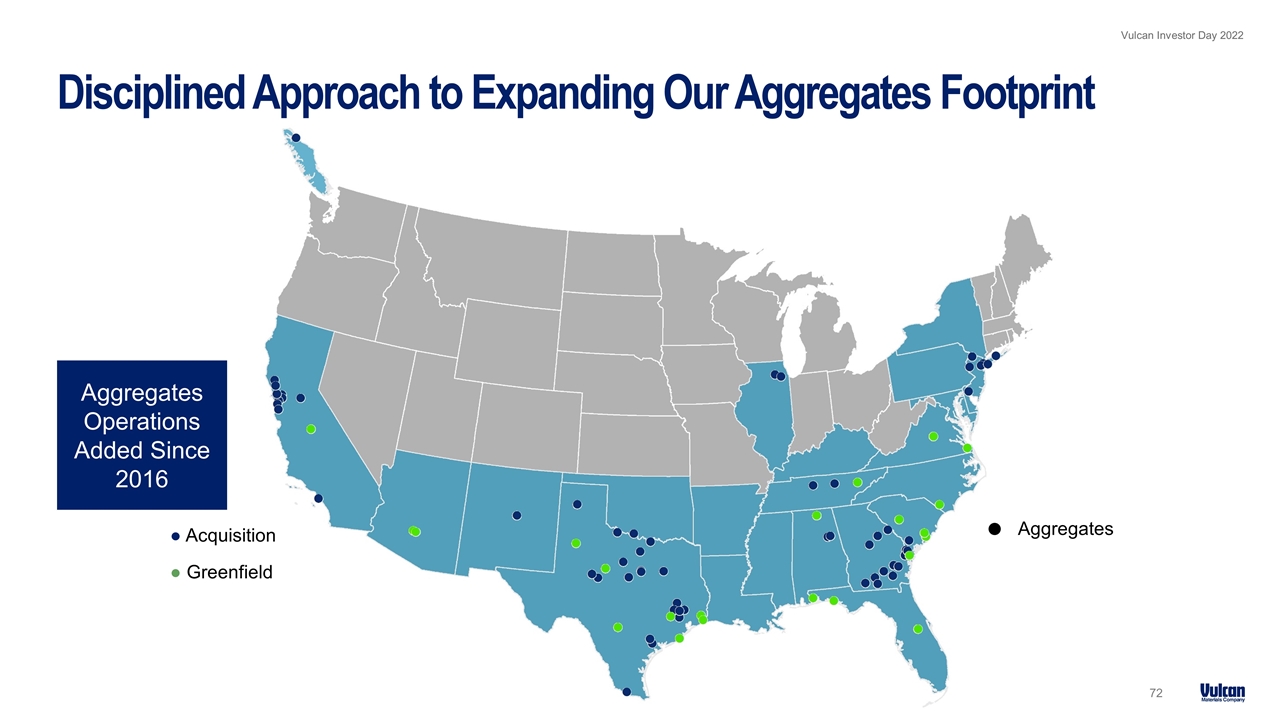

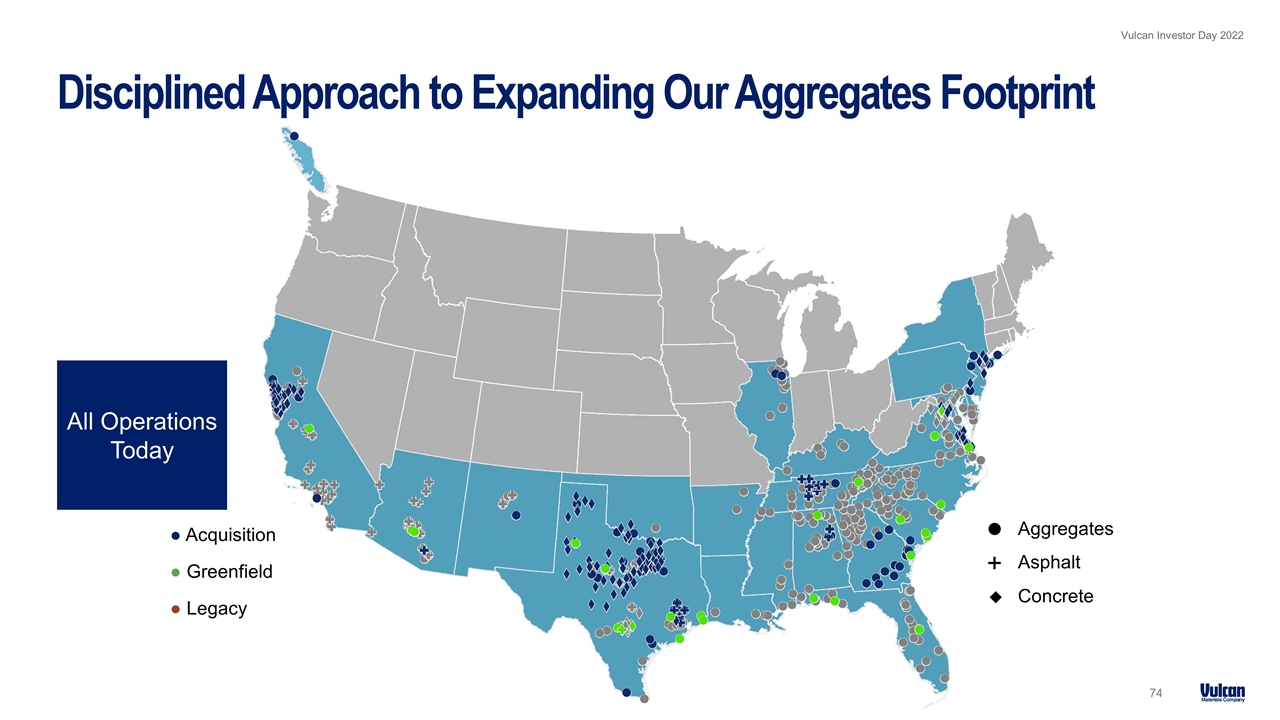

Disciplined Approach to Expanding Our Aggregates Footprint ● Acquisition ● Greenfield Aggregates Asphalt + Concrete Aggregates Operations Added Since 2016

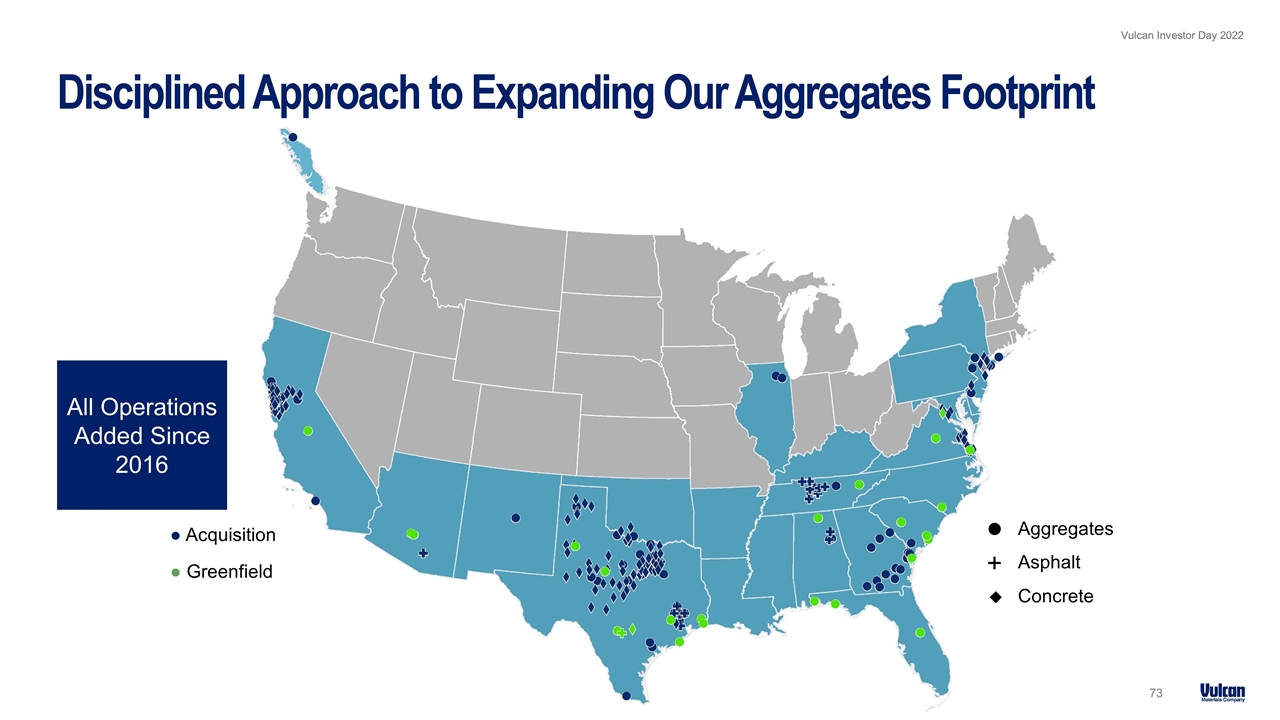

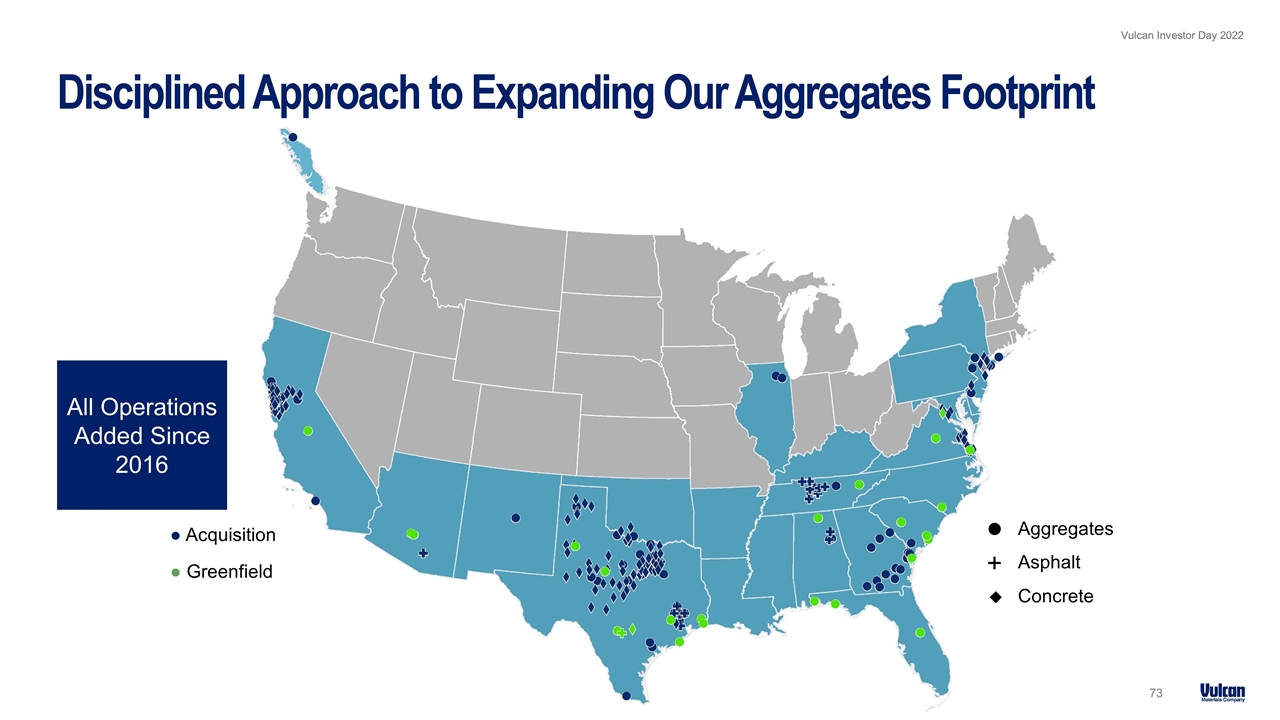

Disciplined Approach to Expanding Our Aggregates Footprint ● Acquisition ● Greenfield Aggregates Asphalt + Concrete All Operations Added Since 2016

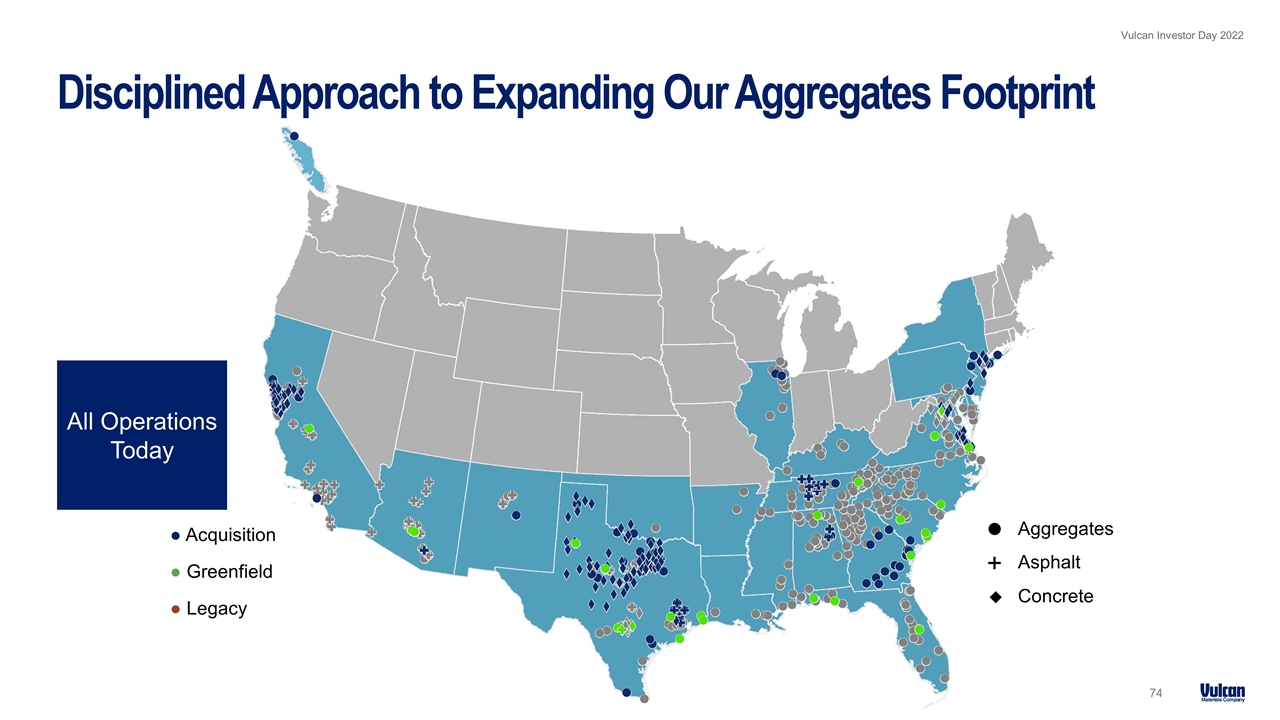

Disciplined Approach to Expanding Our Aggregates Footprint ● Acquisition ● Greenfield ● Legacy Aggregates Asphalt + Concrete All Operations Today

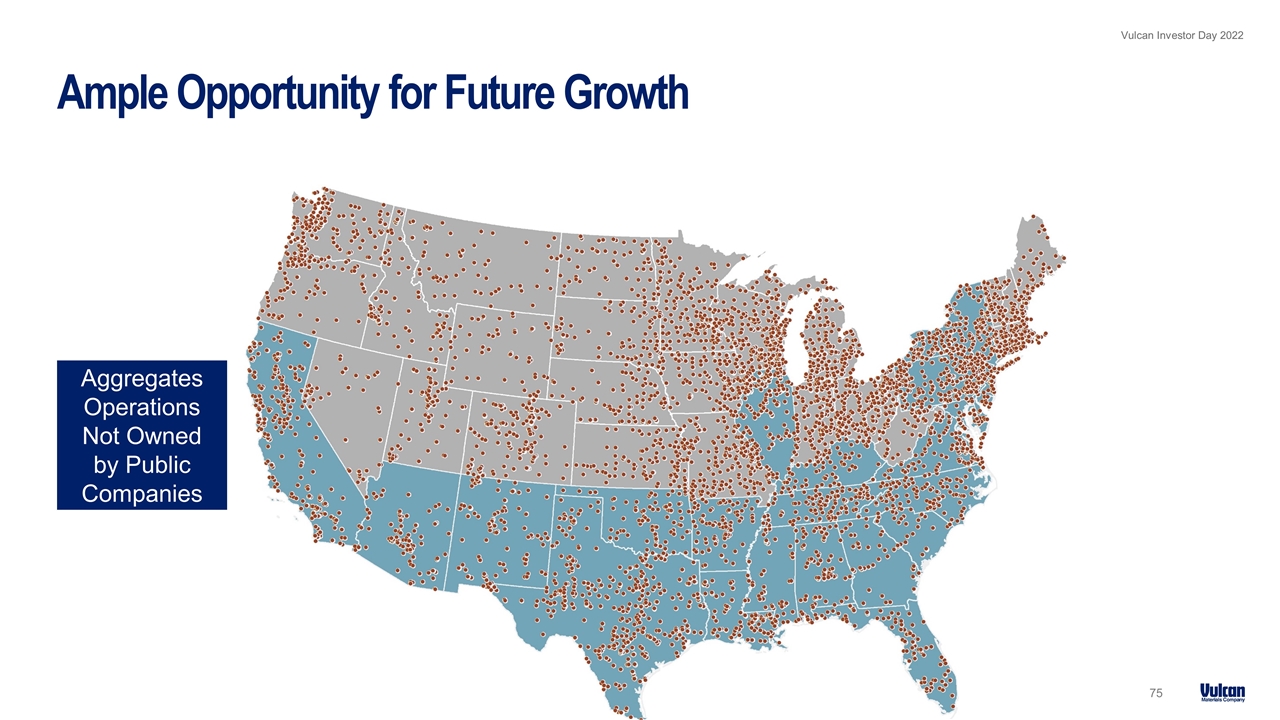

Ample Opportunity for Future Growth Aggregates Operations Not Owned by Public Companies

Raising the Bar Mary Andrews Carlisle Chief Financial Officer Serafin To Replace

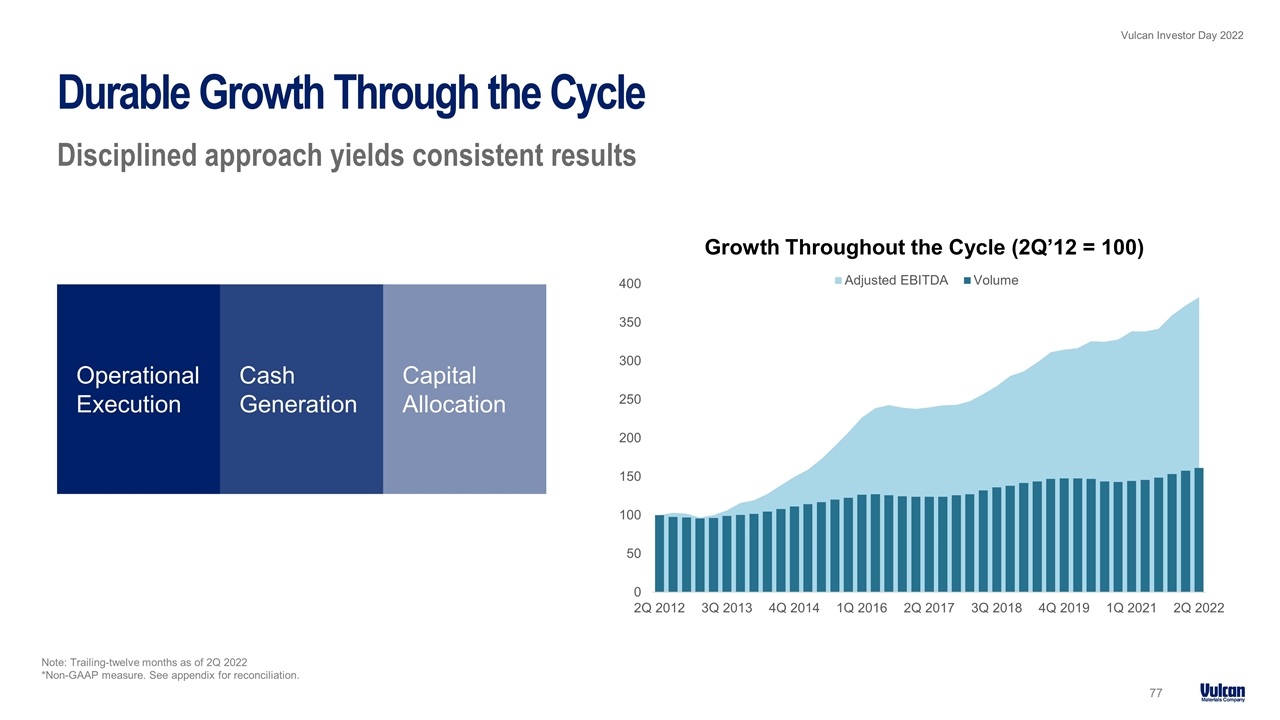

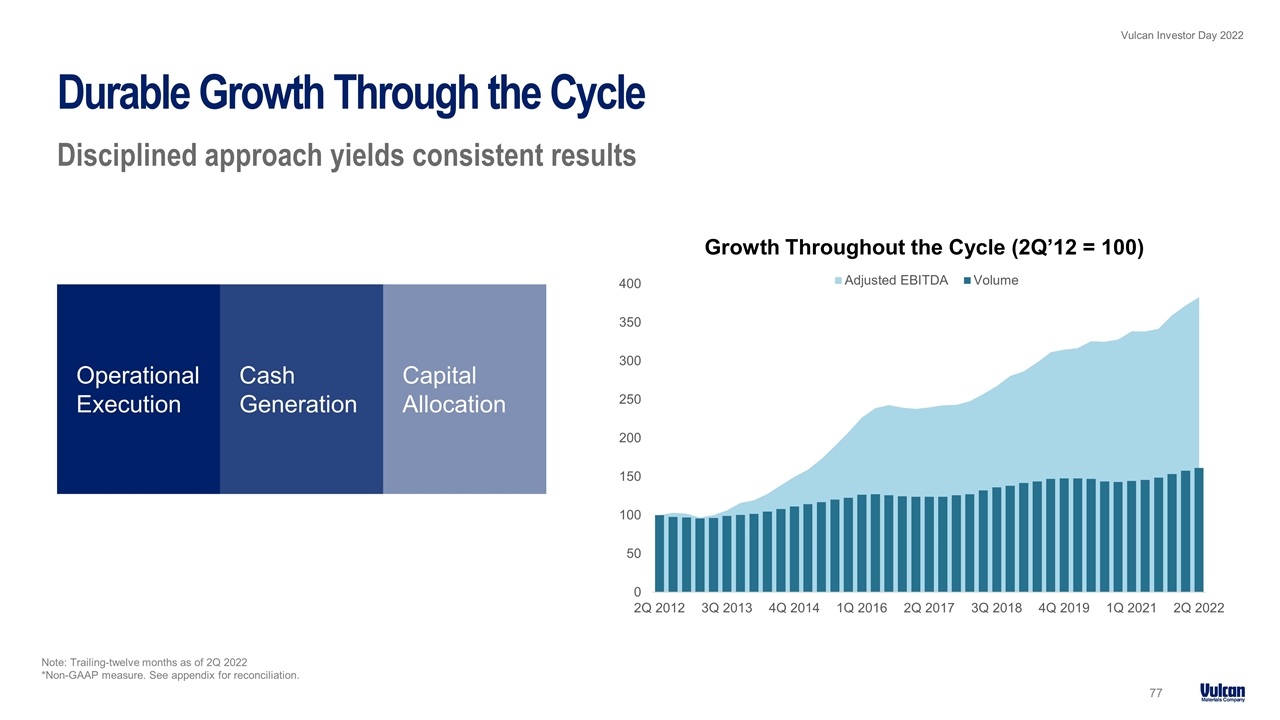

Durable Growth Through the Cycle Disciplined approach yields consistent results Operational Execution Cash Generation Capital Allocation Note: Trailing-twelve months as of 2Q 2022 *Non-GAAP measure. See appendix for reconciliation.

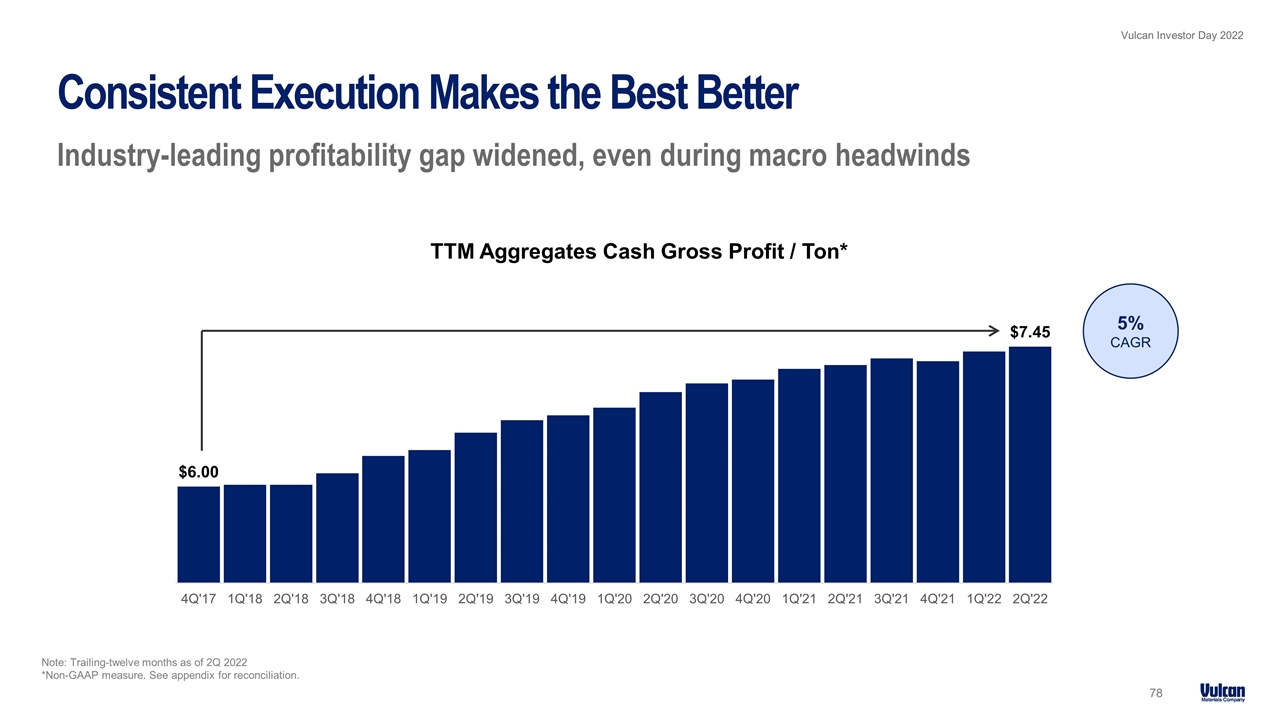

Note: Trailing-twelve months as of 2Q 2022 *Non-GAAP measure. See appendix for reconciliation. Consistent Execution Makes the Best Better Industry-leading profitability gap widened, even during macro headwinds 78 5% CAGR

Disciplined Capital Allocation Strategy Clear priorities in place to drive long-term shareholder value creation 79 1 Operating Capital maintain and grow the value of our franchise Growth Capital including greenfields and acquisitions 2 Dividend Growth with Earnings with a keen focus on sustainability 3 Return Excess Cash to Shareholders primarily via share repurchases 4

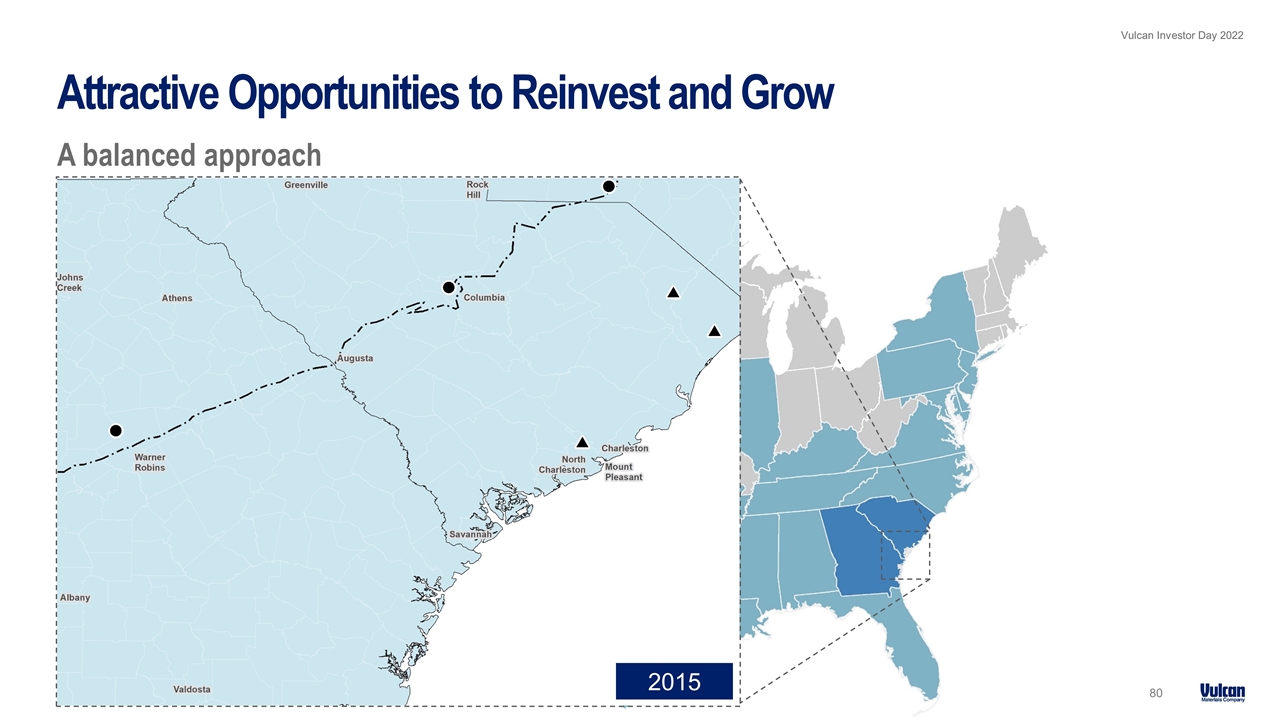

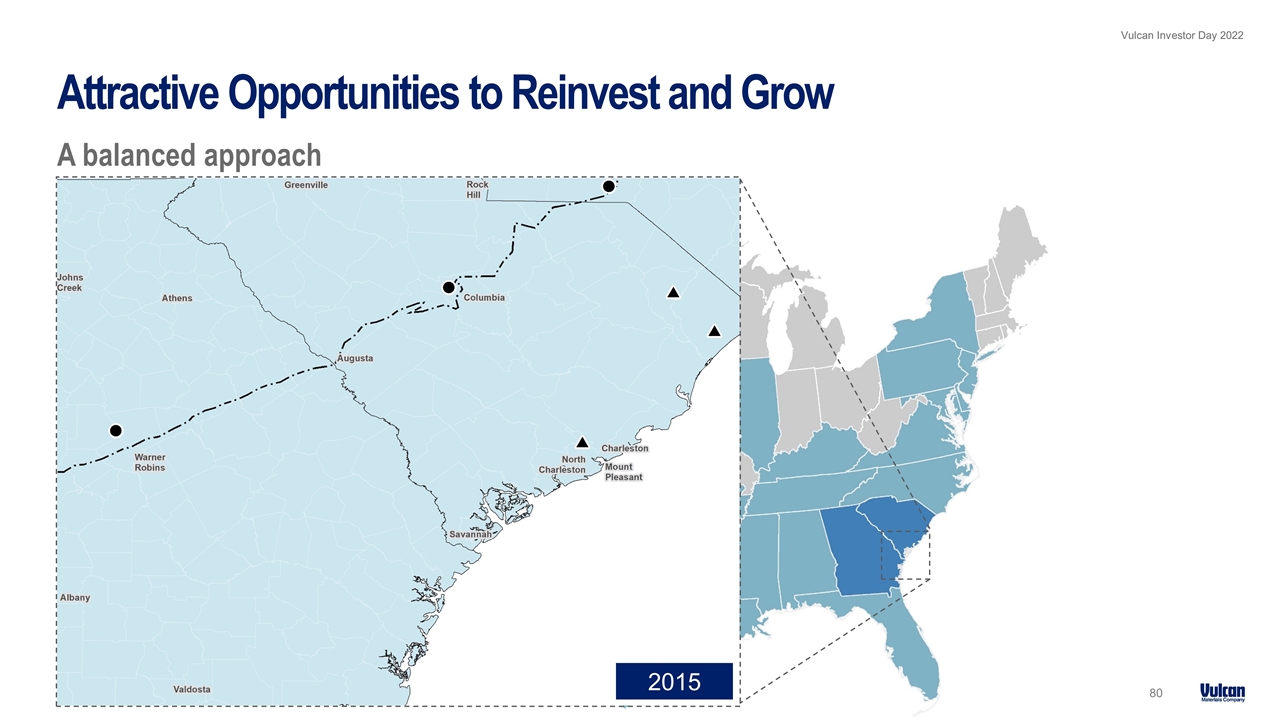

Attractive Opportunities to Reinvest and Grow A balanced approach 2015

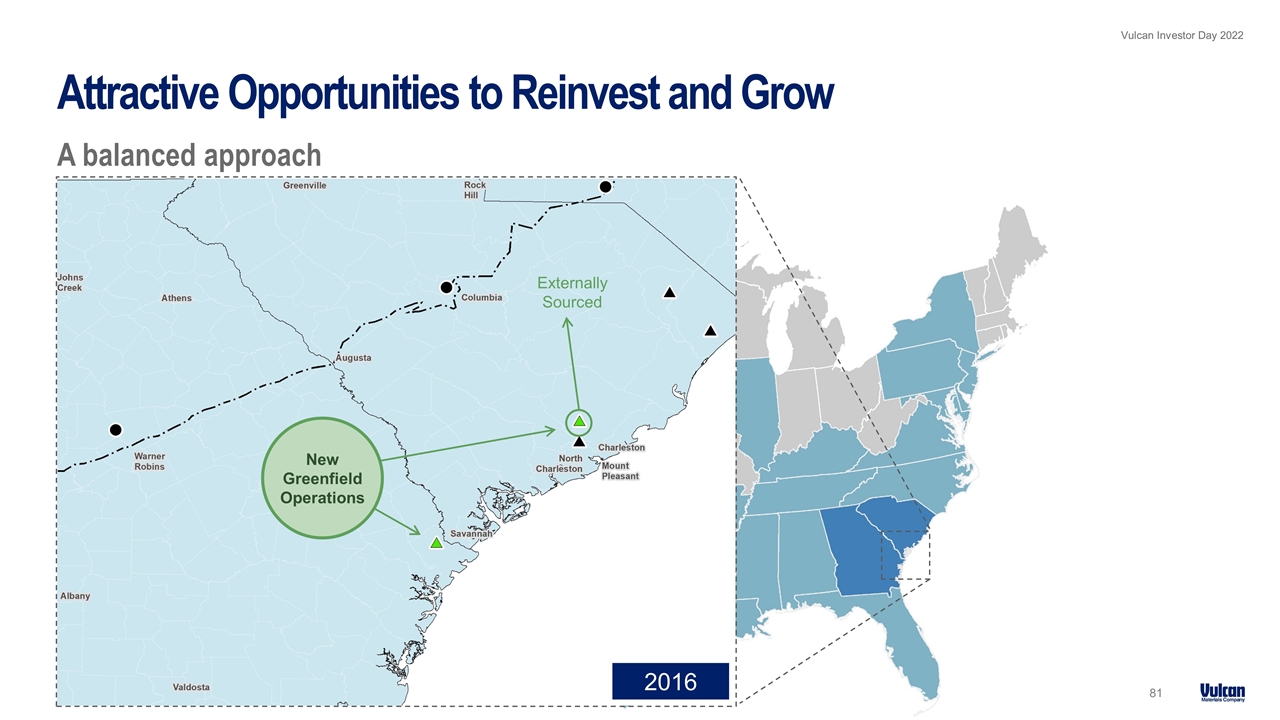

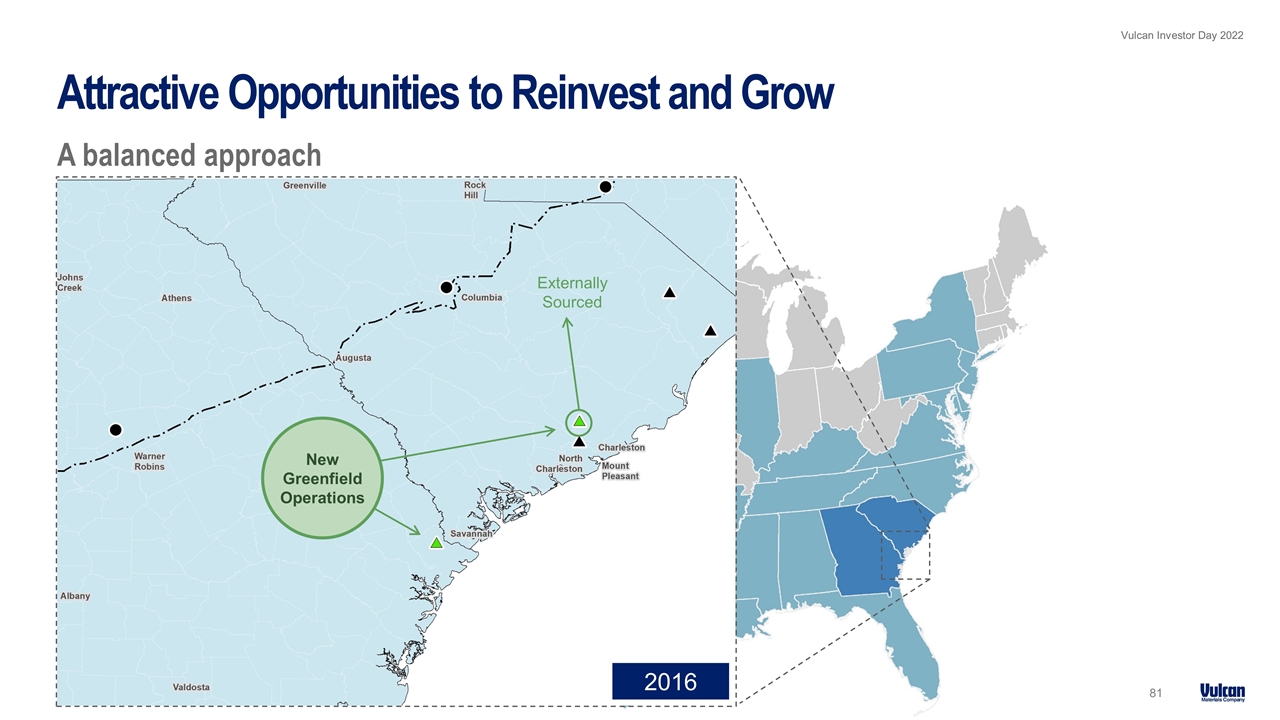

Attractive Opportunities to Reinvest and Grow A balanced approach Externally Sourced New Greenfield Operations 2016

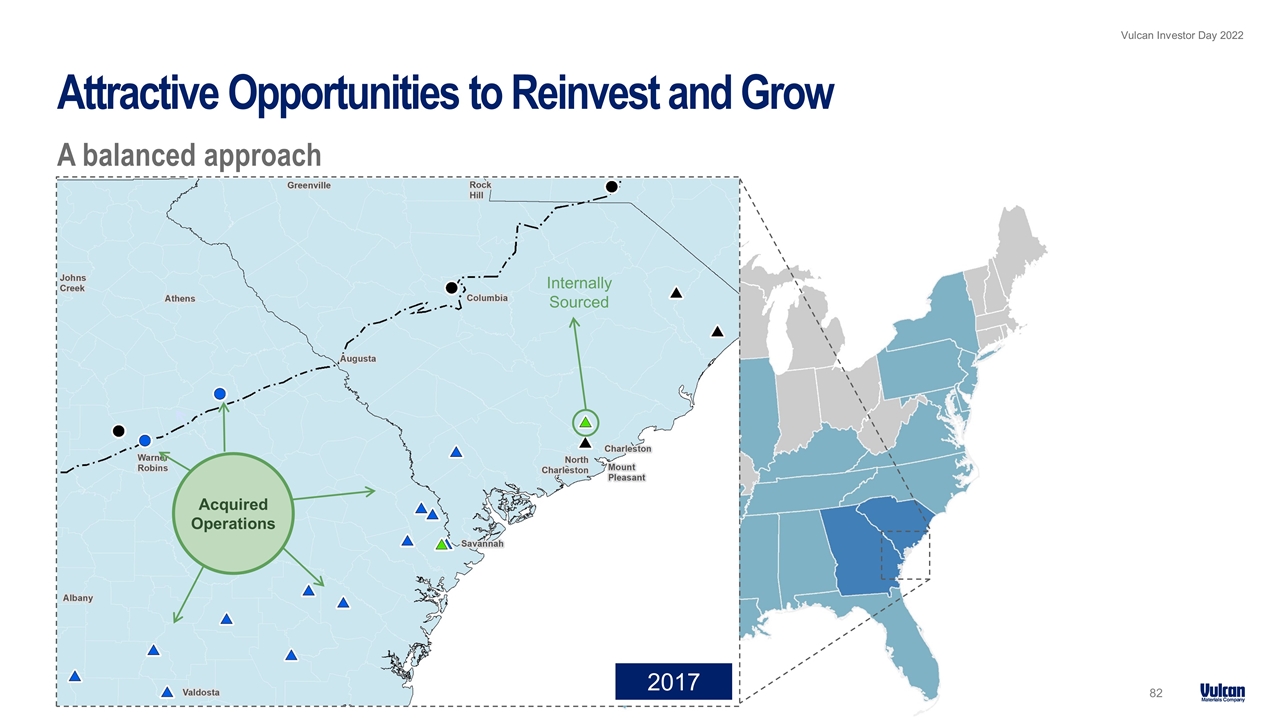

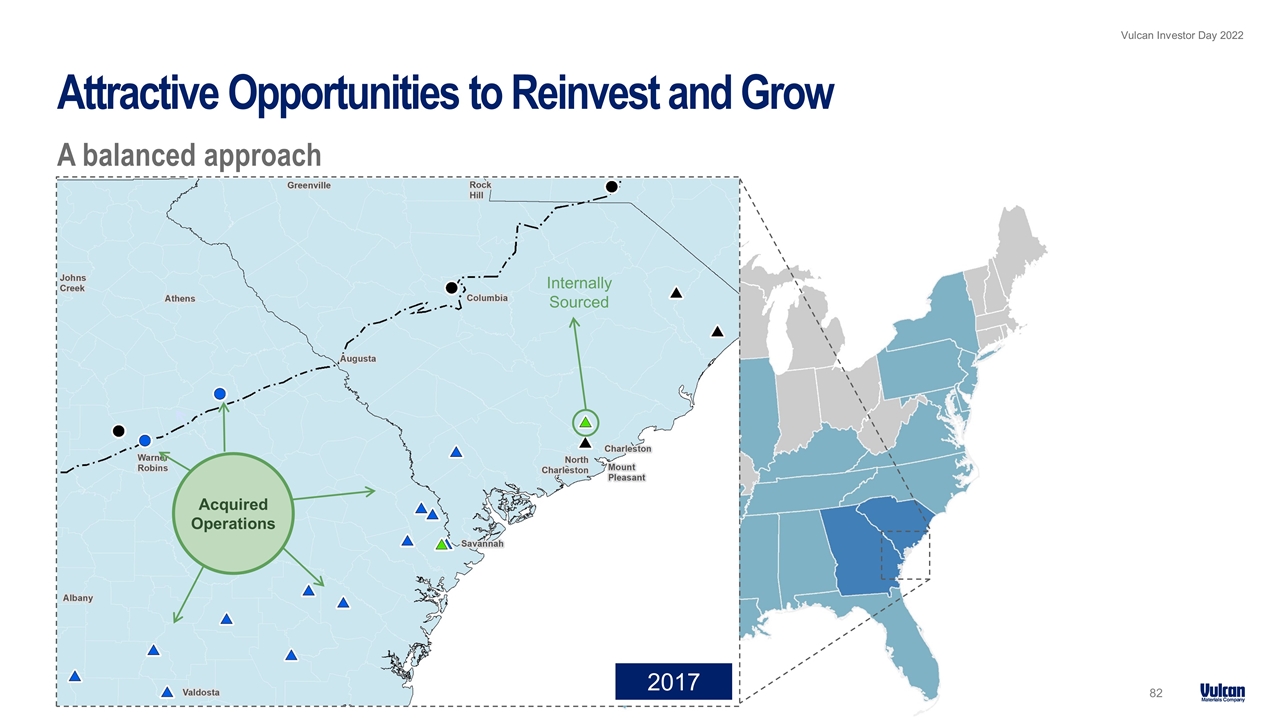

Attractive Opportunities to Reinvest and Grow A balanced approach 2017 Internally Sourced Acquired Operations

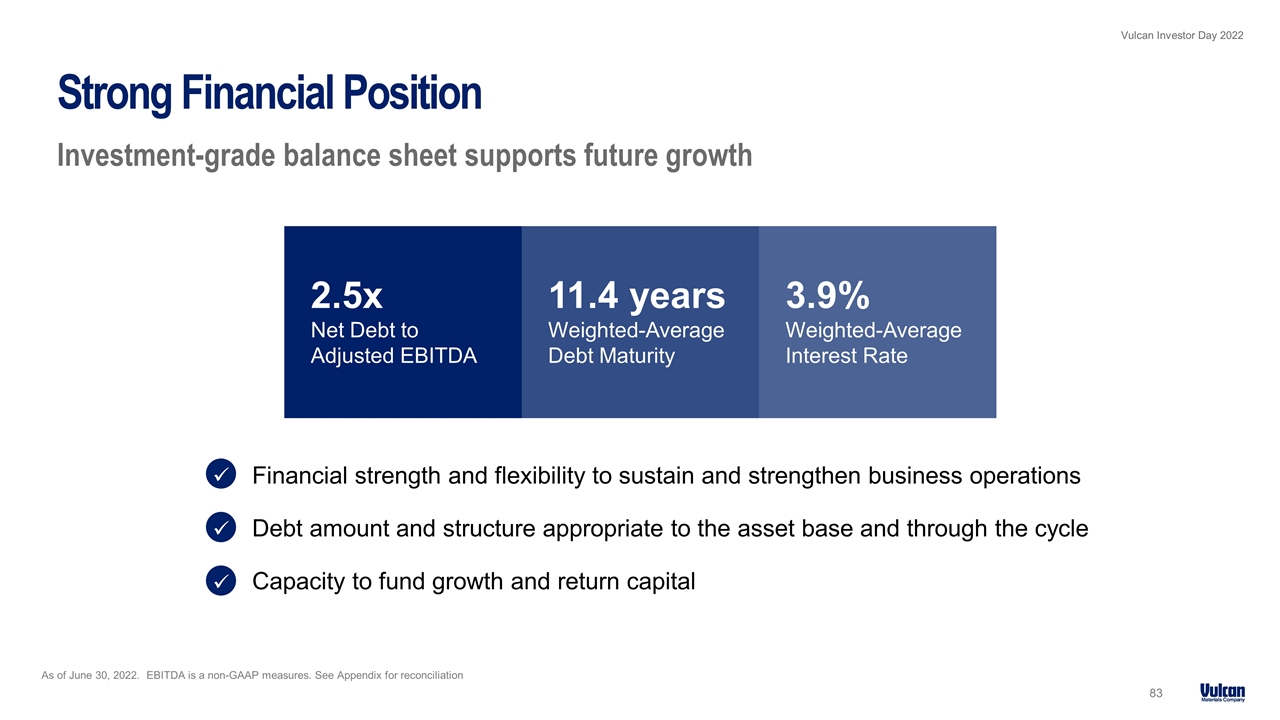

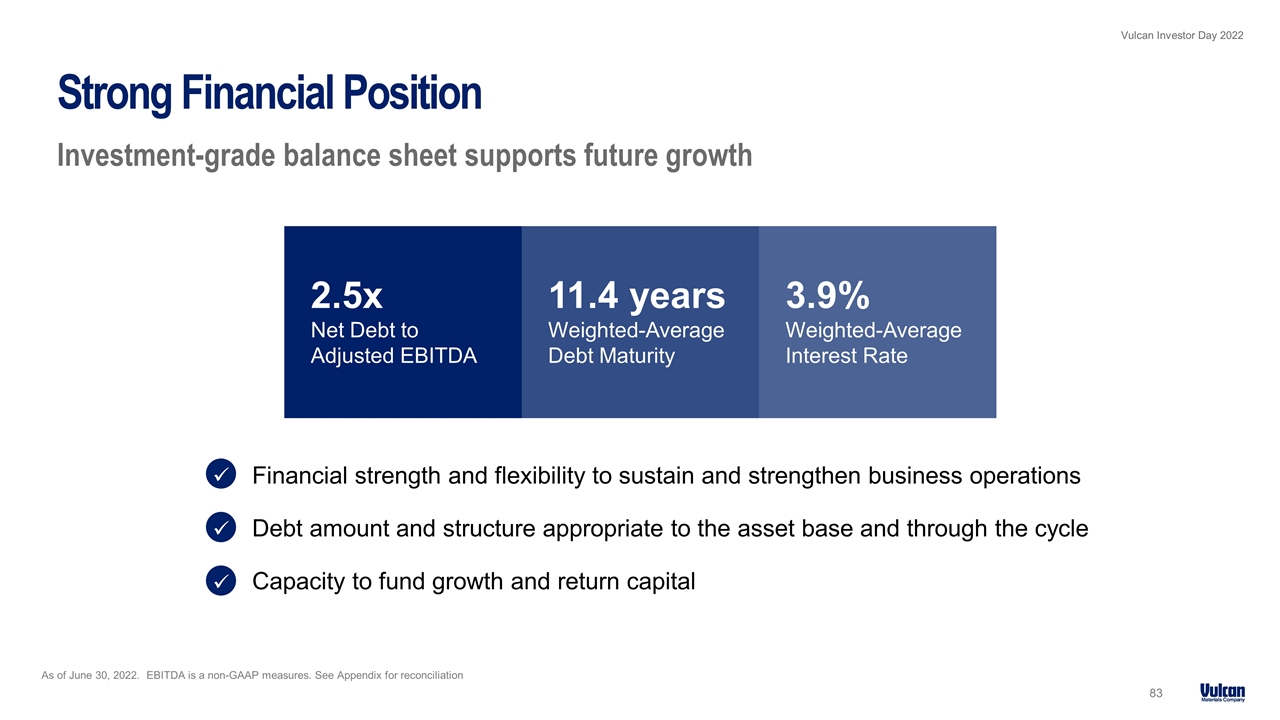

As of June 30, 2022. EBITDA is a non-GAAP measures. See Appendix for reconciliation Strong Financial Position Investment-grade balance sheet supports future growth Financial strength and flexibility to sustain and strengthen business operations Debt amount and structure appropriate to the asset base and through the cycle Capacity to fund growth and return capital 2.5x Net Debt to Adjusted EBITDA 11.4 years Weighted-Average Debt Maturity 3.9% Weighted-Average Interest Rate ü ü ü

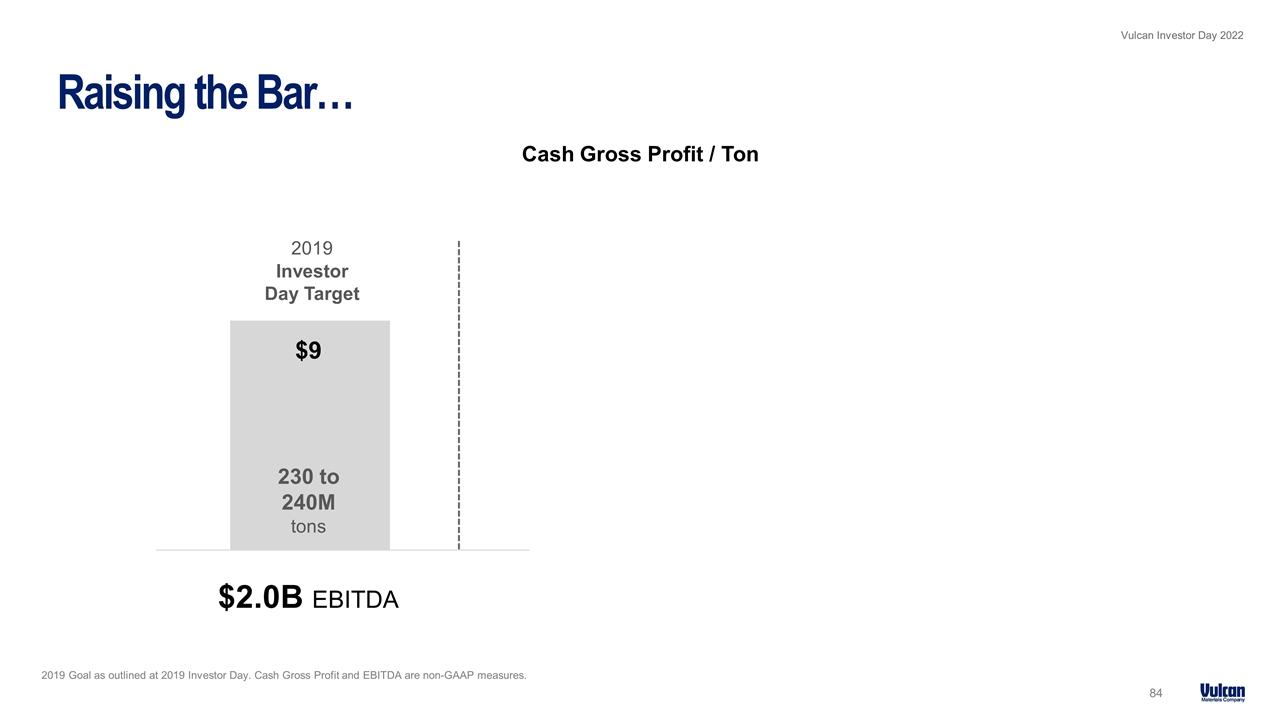

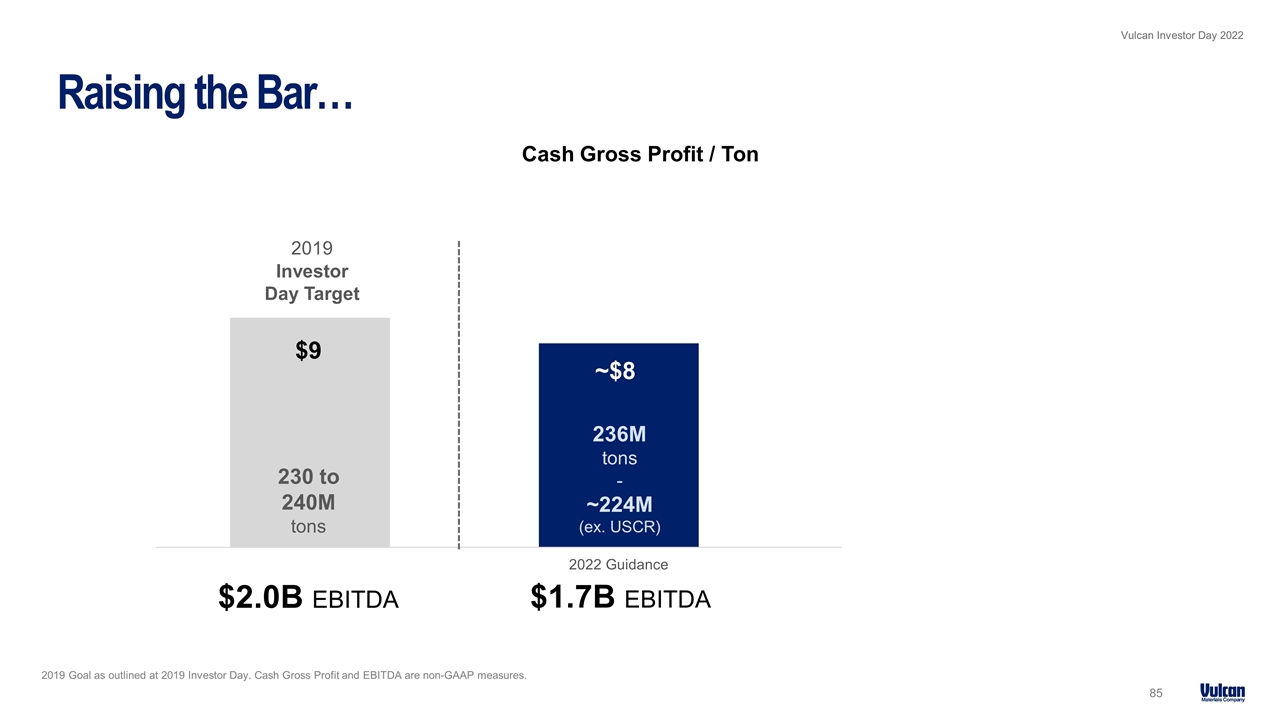

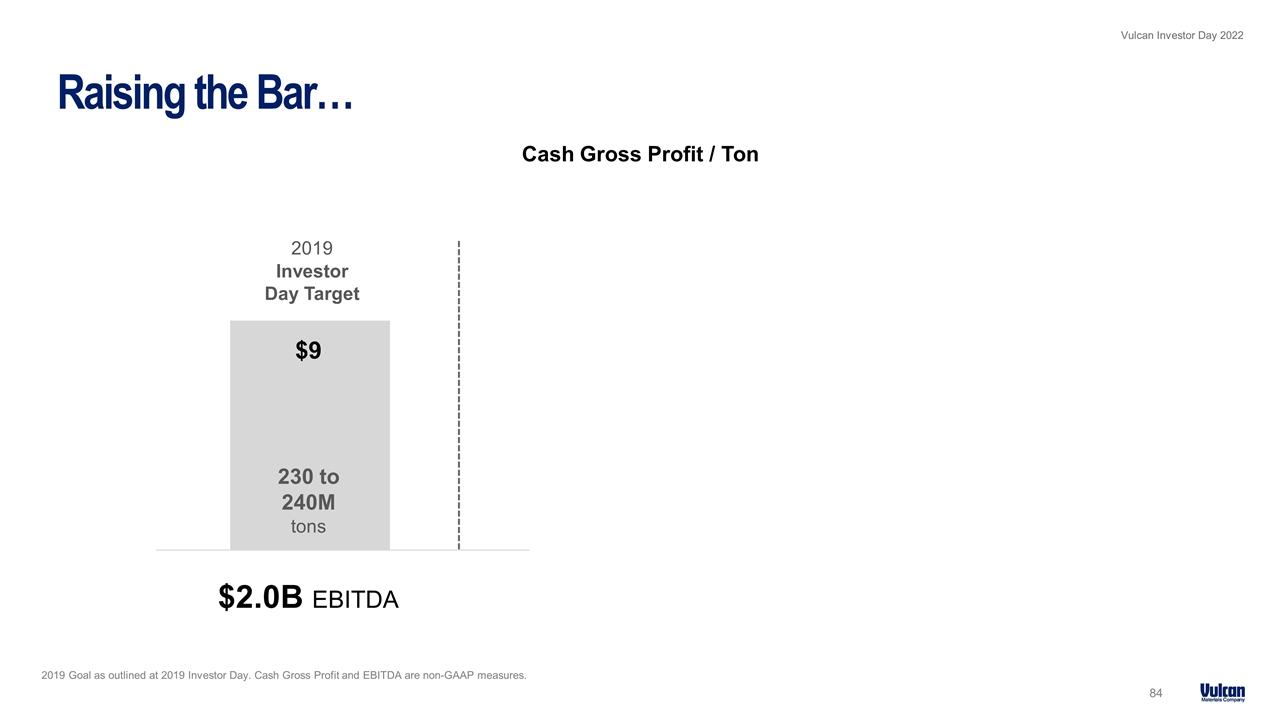

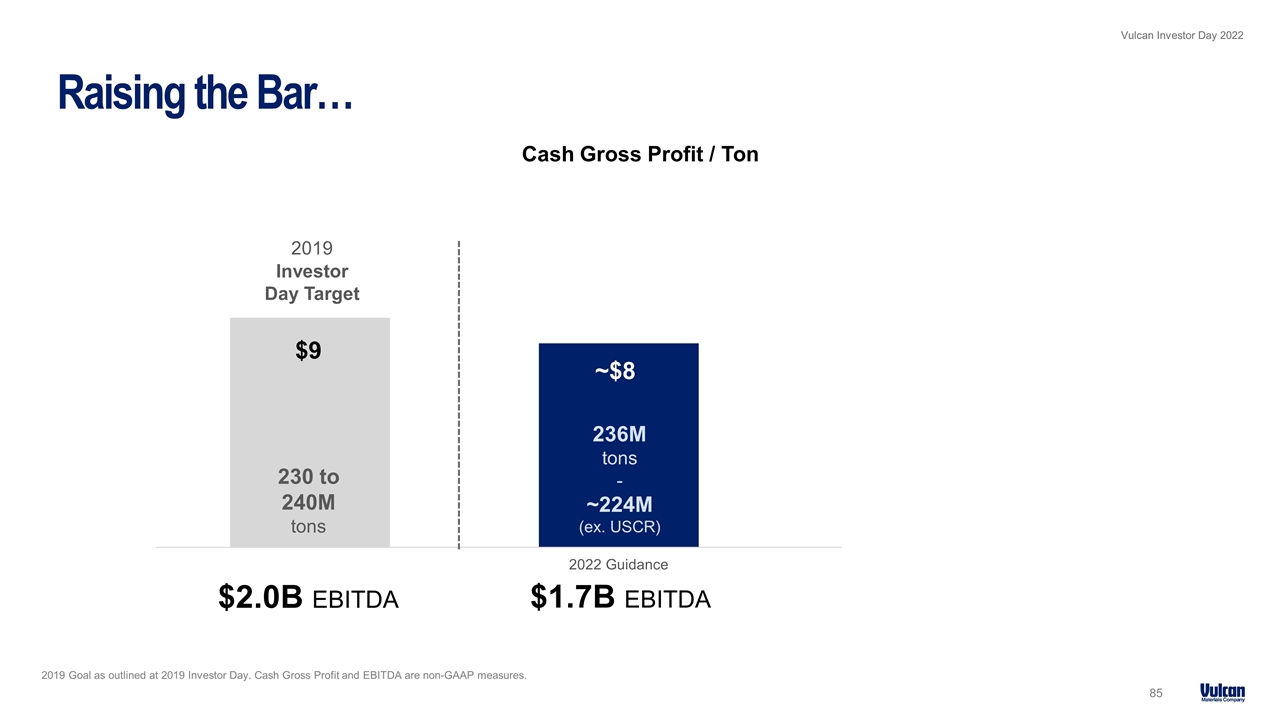

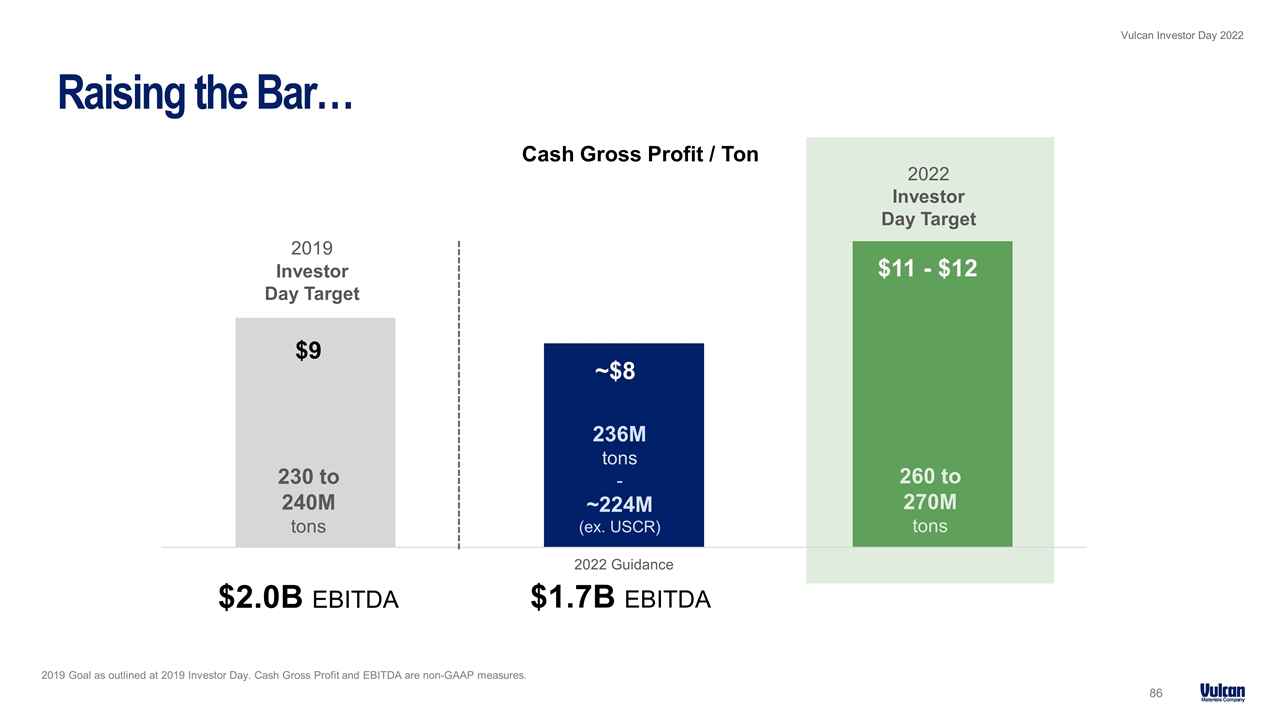

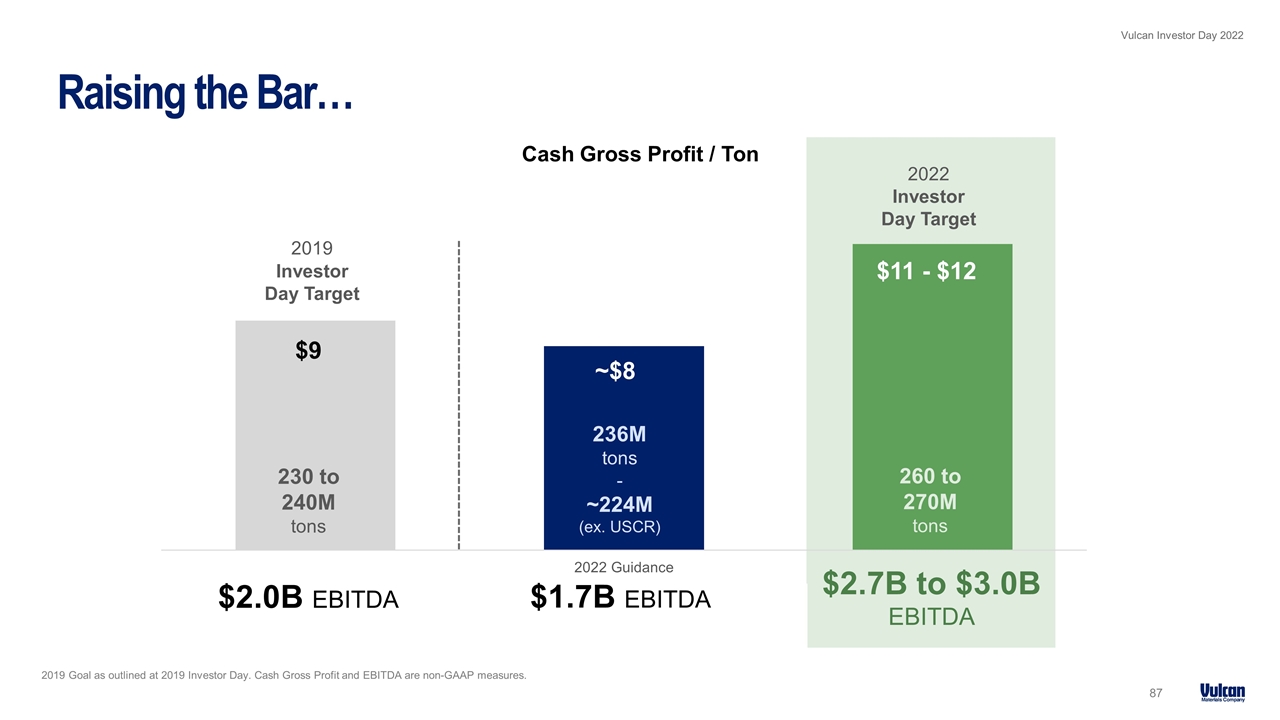

Raising the Bar… 84 2019 Goal as outlined at 2019 Investor Day. Cash Gross Profit and EBITDA are non-GAAP measures. $9 $6 ~$8 2019 Investor Day Target 2022 Investor Day Target 260 to 270M tons 230 to 240M tons 236M tons - ~224M (ex. USCR) Cash Gross Profit / Ton $2.0B EBITDA

Raising the Bar… 85 2019 Goal as outlined at 2019 Investor Day. Cash Gross Profit and EBITDA are non-GAAP measures. $9 $6 ~$8 2019 Investor Day Target 2022 Investor Day Target 260 to 270M tons 230 to 240M tons 236M tons - ~224M (ex. USCR) Cash Gross Profit / Ton $2.0B EBITDA $1.7B EBITDA

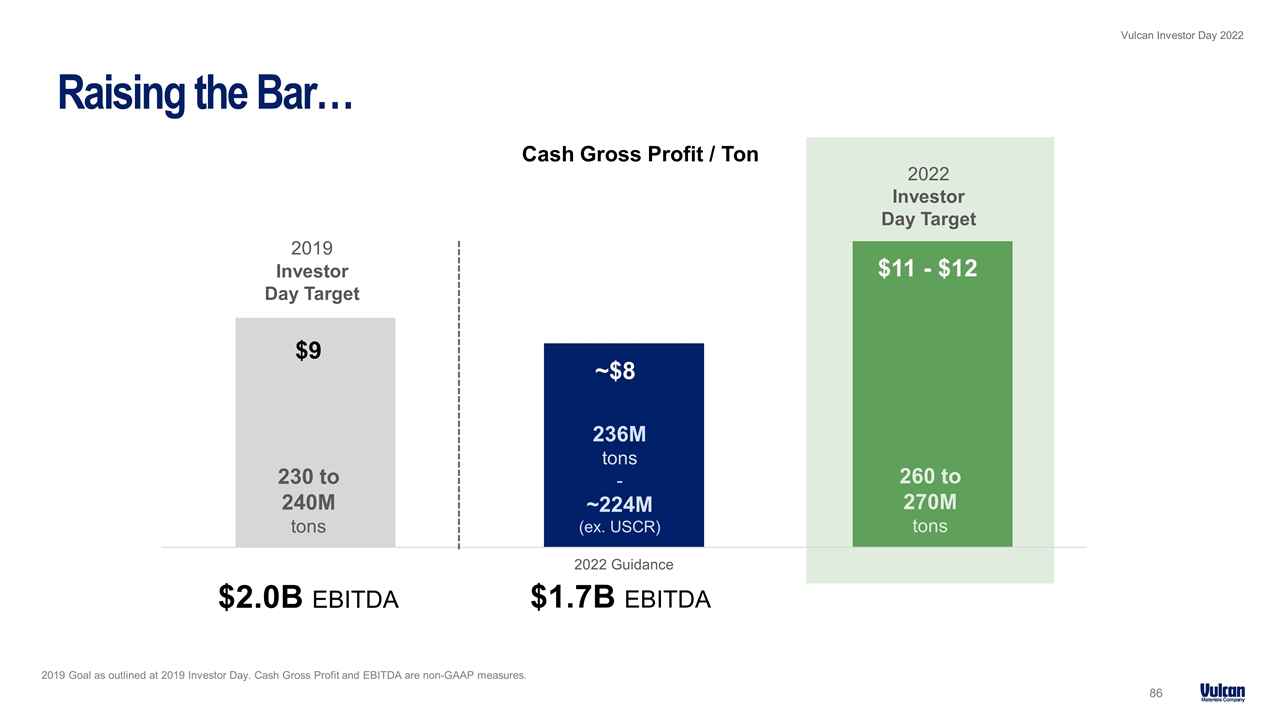

Raising the Bar… 86 2019 Goal as outlined at 2019 Investor Day. Cash Gross Profit and EBITDA are non-GAAP measures. $9 $6 ~$8 2019 Investor Day Target 2022 Investor Day Target 260 to 270M tons 230 to 240M tons 236M tons - ~224M (ex. USCR) Cash Gross Profit / Ton $2.0B EBITDA $1.7B EBITDA

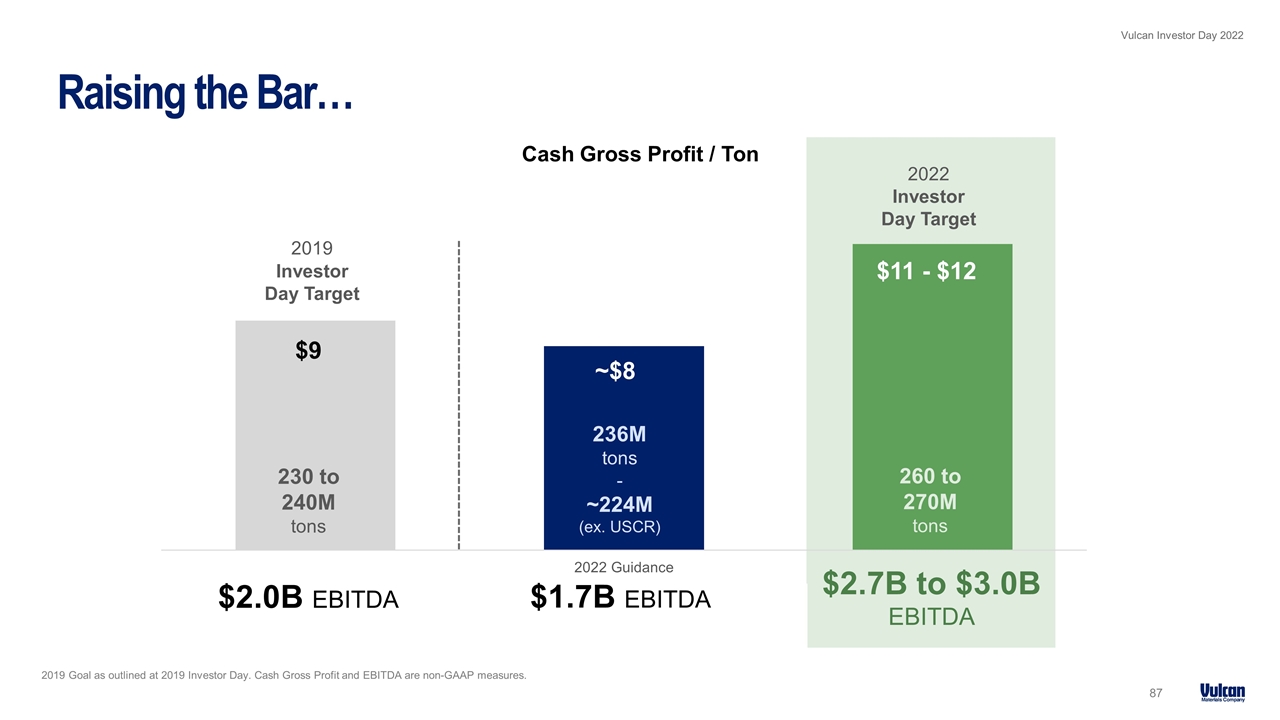

Raising the Bar… 87 2019 Goal as outlined at 2019 Investor Day. Cash Gross Profit and EBITDA are non-GAAP measures. $9 $6 ~$8 2019 Investor Day Target 2022 Investor Day Target 260 to 270M tons 230 to 240M tons 236M tons - ~224M (ex. USCR) Cash Gross Profit / Ton $2.7B to $3.0B EBITDA $1.7B EBITDA $2.0B EBITDA

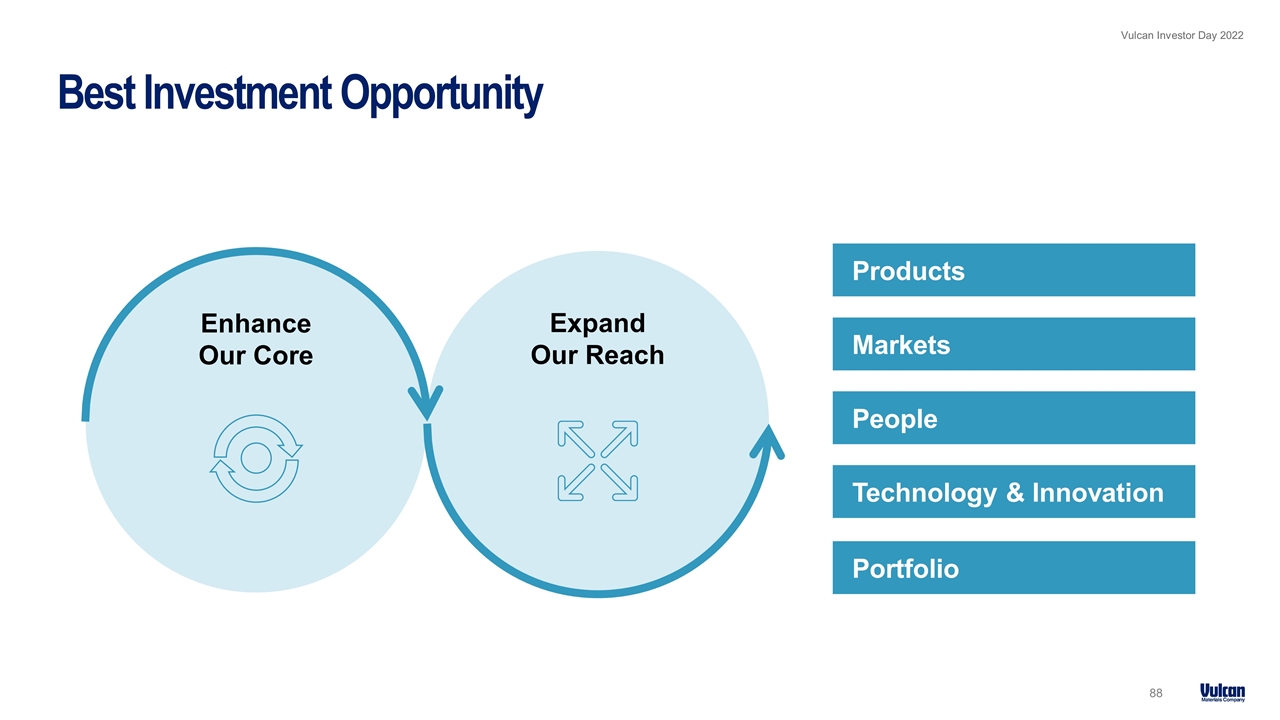

Best Investment Opportunity Enhance Our Core Expand Our Reach Products Markets People Technology & Innovation Portfolio

Q&A Serafin To Replace

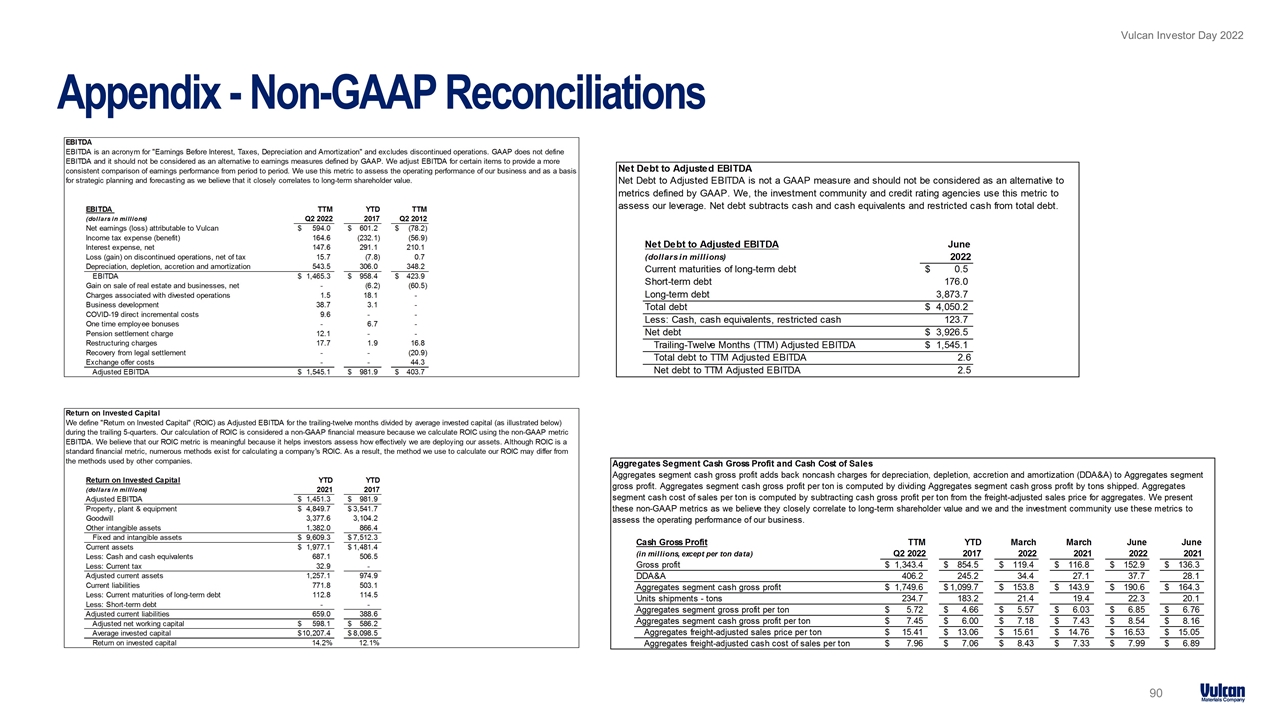

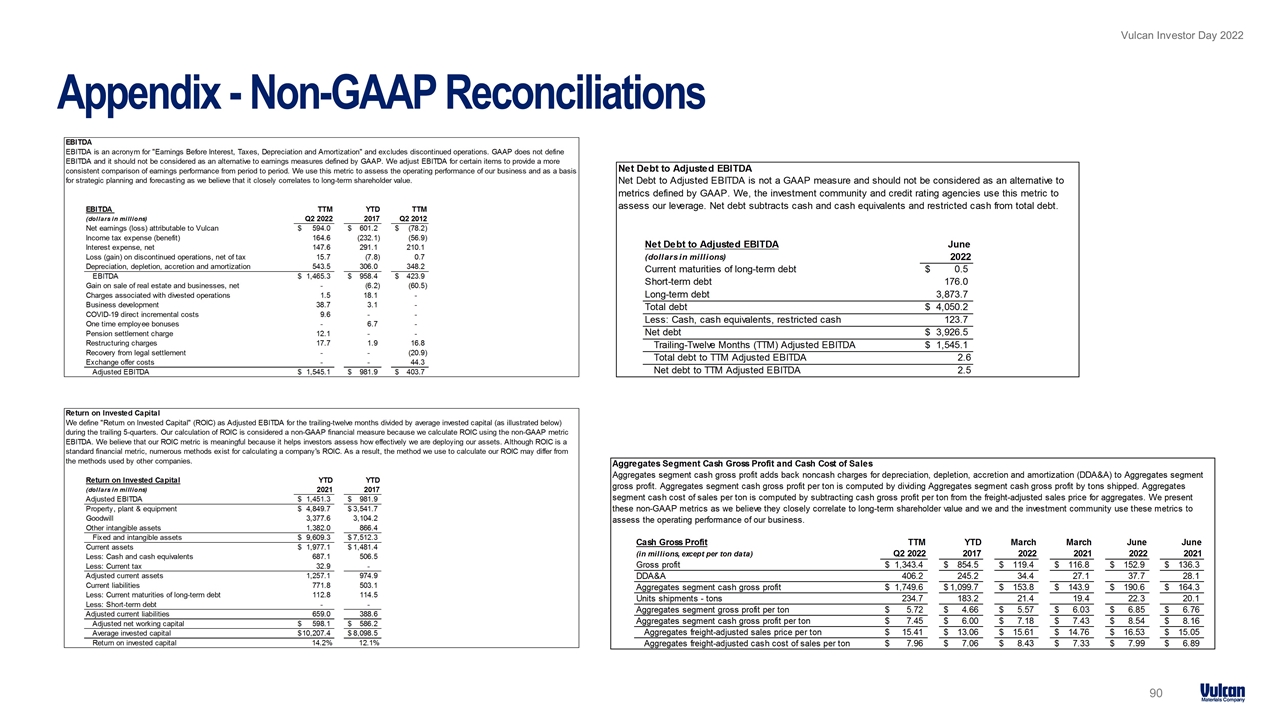

Appendix - Non-GAAP Reconciliations