Exhibit 99.1

LL Investor Presentation May 2017

2 The following information includes statements of our expectations, intentions, plans and beliefs that constitute “forward - looking statements” within the meanings of the Private Securities Litigation Reform Act of 1995 . These statements, which may be identified by words such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “thinks,” “estimates,” “seeks,” “predicts,” “could,” “projects,” “potential” and other similar terms and phrases, are based on the beliefs of our management, as well as assumptions made by, and information currently available to, our management as of the date of such statements . These statements are subject to risks and uncertainties, all of which are difficult to predict and many of which are beyond our control . Forward - looking statements may include, without limitation, statements regarding legal matters and settlement discussions, sales growth, comparable store net sales, number of stores providing installation services, impact of cannibalization, price changes, inventory availability and inventory per store, earnings performance, stock - based compensation expense, margins, return on invested capital, advertising costs, costs to administer our indoor air quality testing program, intention to conduct additional investigation and reviews in connection with certain consumers’ indoor air quality tests, strategic direction, the scale of the expansion of our laminate products sourced from Europe and North America, supply chain, the demand for our products, benefits from an improving housing market, construction of engineered hardwood as to not be subject to anti - dumping and countervailing duties, ultimate resolution of governmental investigation led by the Department of Justice, and store openings and remodels . Our actual results could differ materially from those projected in or contemplated by the forward - looking statements as a result of potential risks, uncertainties and other factors including, but not limited to, changes in general economic and financial conditions, such as the rate of unemployment, consumer access to credit, and interest rate ; the volatility in mortgage rates ; the legislative/regulatory climate ; political unrest in the countries of our suppliers ; the availability of sufficient suitable hardwood ; the impact on us if we are unable to maintain quality control over our products ; the cost and effect on our reputation of, and consumers’ purchasing decisions in connection with, unfavorable allegations surrounding the product quality of our laminates sourced from China ; our suppliers’ ability to meet quality assurance requirements ; disruption in our suppliers’ abilities to supply needed inventory ; the impact on our business of expansion of laminate products sourced from Europe and North America ; disruptions or delays in the production, shipment, delivery or processing through ports of entry ; the strength of our competitors and their ability to increase their market share ; slower growth in personal income ; the number of customers requesting and cost associated with addressing our indoor air quality testing program ; the ability to collect necessary additional information from applicable customers in connection with indoor air quality test results ; changes in business and consumer spending and the demand for our products ; changes in transportation costs ; the rate of growth of residential remodeling and new home construction ; the demand for and profitability of installation services ; changes in the scope or rates of any antidumping or countervailing duty rates applicable to our products ; the costs and outcome of pending or potential litigation or governmental investigations ; ability to reach an appropriate resolution in connection with the governmental investigation led by the DOJ ; and inventory levels . We specifically disclaims any obligation to update these statements, which speak only as of the dates on which such statements are made, except as may be required under the federal securities laws . Information regarding these additional risks and uncertainties is contained in our other reports filed with the Securities and Exchange Commission, including the Item 1 A, “Risk Factors,” section of (i) the Form 10 - K for the year ended December 31 , 2016 . Please also refer to the financial statements and notes and management discussion included in our annual reports on Form 10 - K and our quarterly reports on Form 10 - Q for definitions of key terms including comparable store net sales, average sale, comparable store traffic and SG&A expenses . Safe Harbor Statement

3 Non - GAAP Financial Measures • This presentation includes the non - GAAP measure adjusted SG&A . As an indicator of the Company's operating performance, adjusted SG&A should not be considered an alternative to, or more meaningful than, the GAAP measure, SG&A . • Adjusted SG&A excludes certain expenses, such as incremental legal and settlement costs and the costs for testing kits, as described herein . • The exclusion of certain expenses in the calculation of adjusted SG&A should not be construed as an inference that these costs are unusual or infrequent . The Company believes that adjusted SG&A provides useful information to management and investors regarding certain financial and business trends relating to the Company’s financial condition and results of operations . The Company’s management uses adjusted SG&A to compare the Company’s performance to that of prior periods . The Company believes that the use of adjusted SG&A provides an additional tool for investors to use in evaluating ongoing operating results and trends . • The Company does not consider adjusted SG&A in isolation or as an alternative to financial measures determined in accordance with GAAP . The principal limitation of this non - GAAP financial measure is that it excludes significant elements that are required by GAAP to be recorded in the Company’s financial statements . In addition, this non - GAAP financial measure is subject to inherent limitations as it reflects the exercise of judgment by management in determining the non - GAAP financial measures . In order to compensate for these limitations, management of the Company presents its non - GAAP financial measures in connection with its GAAP results . The Company urges investors to review the reconciliation of adjusted SG&A to the comparable GAAP financial measure, which the Company includes in this presentation, and not to rely on any single financial measure to evaluate the Company’s business . A reconciliation table of the most comparable GAAP financial measure to the non - GAAP measure is included in this presentation .

LL Overview

5 Leading North American multi - channel specialty retailer providing a complete purchasing solution and broad product selection to the hard surface flooring market • Founded in 1994; IPO in 2007 • NYSE: LL; recent market cap: $620M • 385 stores in 46 states and Canada • Extensive assortment: hardwoods, laminates, vinyl, bamboo, cork, wood - look tile • One - on - one customer engagement enabled by small store footprint and knowledgeable store personnel • Bicoastal Distribution Centers total over 1.5 million square feet • Headquartered in Toano, Virginia Introduction to Lumber Liquidators

6 Quality products, wide selection, attractive prices, strategic brick and mortar placement, and limited online competition Differentiated Business Model Improving gross margin profile, scalable cost structure, and sufficient liquidity, combined with disciplined capital allocation to drive shareholder value Improving Financials LL Investment Highlights Strategic team with balance of brick and mortar retail, home improvement, and multi - channel expertise Strong Management Team Favorable Industry Dynamics Growing demand for hard surface flooring driving significant opportunity across price points and materials

7 $58.8 $64.0 $63.9 $58.6 $51.8 $43.0 $44.8 $46.2 $48.6 $52.1 $55.1 Floor Covering Product Sales The overall flooring market has steadily improved since the recession Source: Floor Covering Weekly 2015 Report, July 25, 2016; Catalina Research $ in billions 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Carpet Laminate Vinyl Wood Stone/Marble Ceramic Tile Large and Growing U.S. Floor Covering Market $41.8 $43.2 $45.6 $49.0 $51.7 $54.1

8 24% 24% 25% 23% 22% 22% 25% 25% 26% 26% 26% 27% 4% 5% 5% 7% 7% 6% 6% 6% 6% 6% 6% 6% 12% 12% 12% 11% 11% 12% 13% 13% 13% 13% 15% 15% 7% 7% 7% 7% 7% 7% 6% 7% 6% 6% 5% 5% 10% 9% 9% 9% 11% 12% 13% 13% 14% 15% 15% 16% 43% 43% 42% 42% 43% 42% 37% 36% 35% 34% 33% 31% 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015* Carpet Vinyl Laminate Wood Stone/Marble Ceramic Tile Flooring Market by Material Hard surface products continue to take market share from traditional carpet and rug flooring Source: For 2004 - 2014, 2015 Catalina Research; *For 2015, data determined by YOY growth - Floor Covering Weekly 2015 Report, July 25, 2016 Steady Shift to Hard Surface Flooring Drives Opportunity

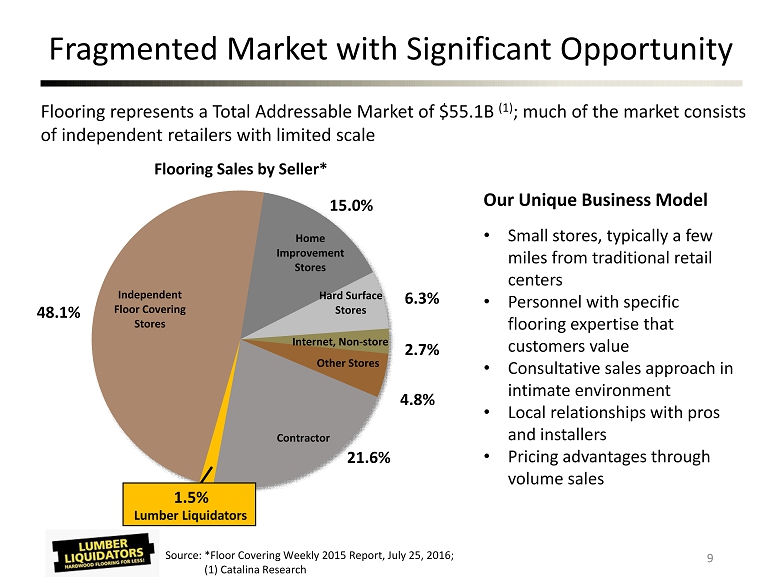

9 Independent Floor Covering Stores Home Improvement Stores Hard Surface Stores Internet, Non - store Other Stores Contractor Flooring Sales by Seller* Flooring represents a Total Addressable Market of $55.1B (1) ; much of the market consists of independent retailers with limited scale 48.1% 21.6% 15.0% 6.3% 2.7% 4.8% 1.5% Lumber Liquidators Source: *Floor Covering Weekly 2015 Report, July 25, 2016; (1) Catalina Research Fragmented Market with Significant Opportunity Our Unique Business Model • Small stores, typically a few miles from traditional retail centers • Personnel with specific flooring expertise that customers value • Consultative sales approach in intimate environment • Local relationships with pros and installers • Pricing advantages through volume sales

10 Store Network Characteristics • Small stores that can become profitable quickly • Expedited new store openings • Current store opening schedule of 10 to 15 new stores per year • Potential to reach 500+ stores within 5 years 385 100 200 300 400 2010 2011 2012 2013 2014 2015 2016 2017 Total Store Count Far Reaching National Store Network Large and Growing Store Network

11 Regulatory and Legal Issues Resolved Matters • DOJ Lacey Act investigation related to wood import regulations: $10 million charge taken in 1Q 2015; final settlement agreement reached in 4Q 2015. • Securities class action related to statements and filings during 2015: Charge initially taken in 1Q 2016 (with subsequent adjustments); finalized and funded in 4Q 2016. • Chinese laminate: • Discontinued selling product in 2Q 2015. • Settled allegations over CARB compliance in 1Q 2016. • Resolved product safety concerns with the CPSC in 3Q 2016. • Rebuilt laminate assortment with alternative sourcing in first half of 2016. Significant Outstanding Matters • Chinese laminate litigation: Class action lawsuits related to formaldehyde and abrasion claims. Company recorded an estimated liability of $18 million in its 1Q 2017 results. • DOJ/SEC investigation: Initiated in early 2015, relates to the Company's compliance with disclosure, financial reporting, and trading requirements under federal securities laws. To - date the Company has not been able to estimate a probable loss from this investigation and has not recognized a liability in its financial statements.

Financial Performance

13 $482 $545 $620 $682 $813 $1,000 $1,047 $979 $961 2008 2009 2010 2011 2012 2013 2014 2015 2016 ($ in millions) Net Sales Store Count 150 186 223 263 288 318 352 370 383 Store Growth 29.3% 24.0% 19.9% 17.9% 9.5% 10.4% 10.7% 5.1% 3.5% Total % 19.0% 12.9% 13.9% 9.9% 19.3% 23.0% 4.7% (6.5%) (1.8%) Comp % 1.6% FLAT 2.1% (2.0)% 11.4% 15.8% (4.3)% (11.1%) (4.6%) • Net sales impacted by product quality concerns beginning in 2015, as well as adjustments in sourcing and SKU optimization • Sales trend turned positive year over year beginning 3Q 2016

14 Quarterly Sales Trends • Sequential sales improvement since Q1 of 2016, and comp improvement for three straight quarters driven by improved store experience, expanded installation and pro businesses, and broader product assortment • Significant opportunity to increase sales per store and leverage investment in improved store personnel and training $259.9 $247.9 $236.1 $234.8 $233.5 $238.1 $244.1 $244.9 $248.4 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016 1Q 2017 Quarterly Net Sales $ millions $400,000 $500,000 $600,000 $700,000 $800,000 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016 1Q 2017 Quarterly Net Sales per Store

15 2014 2016 Increased Product Diversification 39% 20% 19% 19% 3% • In addition to its core hardwood business, Lumber Liquidators developed strong bamboo and vinyl plank businesses with attractive margins, while maintaining its laminate business, bringing innovative style and function to the assortment • Installation Services emerging as part of strategy to expand customer base among do - it - for - me shoppers 33% 26% 18% 16% 7% Solid & Engineered Hardwood Bamboo, Cork, Vinyl Plank & Other Moldings & Accessories Laminate Non-Merchandise Services

16 Quarterly Gross Margin and SG&A 35.2% 25.1% 30.1% 23.0% 32.6% 29.7% 31.4% 32.9% 34.9% 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016 1Q 2017 Quarterly GAAP Gross Margins 37.6% 36.5% 37.4% 36.4% 50.2% 37.8% 41.3% 36.6% 45.2% 31.8% 32.6% 32.4% 32.6% 37.3% 34.1% 36.7% 36.4% 37.0% 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016 1Q 2017 SG&A as Percentage of Sales* *Darker gray bars denote adjusted SG&A as a percentage of sales See Appendix for Non - GAAP measures and reconciliation to GAAP • Company is steadily improving gross margin and has begun scaling SG&A investments with identified opportunities to improve both measures and reach profitability in the medium term

17 Financial Statement Highlights $ in millions 2014 2017 FY 1Q 2Q 3Q 4Q FY 1Q 2Q 3Q 4Q FY 1Q Income Statement: Net Sales 1,047.4$ 260.0$ 247.9$ 236.1$ 234.8$ 978.8$ 233.5$ 238.1$ 244.1$ 244.9$ 960.6$ 248.4$ Gross Margin 418.2 91.6 62.3 71.0 54.0 278.9 76.1 70.6 76.7 80.5 303.9 86.8 Gross Margin as a % of Sales 39.9% 35.2% 25.1% 30.1% 23.0% 28.5% 32.6% 29.7% 31.4% 32.9% 31.6% 34.9% SG&A* 314.1 97.7 90.6 88.3 85.5 362.1 117.2 89.9 100.7 89.7 397.5 112.2 SG&A as a % of Sales 30.0% 37.6% 36.5% 37.4% 36.4% 37.0% 50.2% 37.8% 41.3% 36.6% 41.4% 45.2% Pre-Tax Profit (Loss) 104.1$ (6.1)$ (28.3)$ (17.3)$ (31.5)$ (83.2)$ (41.1)$ (19.3)$ (24.0)$ (9.2)$ (93.6)$ (25.4)$ Cash Flows: Cash Flow from Operations 57.1 13.2 6.1 14.8 (24.8) 9.2 (8.2) (15.5) 13.5 (17.4) (27.6) (29.8) Memo: Impact of change in net Inv. & A/P - 1.5 33.8 13.6 1.4 50.2 1.3 5.3 4.3 (3.0) 7.9 (32.7) Cash Flow from Investing Activities (71.1) (9.0) (5.3) (5.2) (3.0) (22.5) (2.4) (0.9) (4.4) (0.6) (8.3) (2.5) Cash Flow from Financing Activities (46.2) 19.7 (0.1) (0.6) 0.8 19.7 4.9 7.2 (0.9) 19.6 30.8 32.3 Effect of Exchange Rates (0.1) (0.2) 0.7 (0.4) (0.1) (0.0) 1.0 (0.1) (0.1) (0.1) 0.7 1.0 Total Cash Flow (60.3) 23.6$ 1.4$ 8.5$ (27.1) 6.4$ (4.7) (9.2) 8.1$ 1.5$ (4.4) 1.0$ Balance Sheet: Inventory 301.5$ 301.5$ 262.7$ 243.4$ 244.4$ 244.4$ 240.0$ 254.9$ 253.4$ 301.9$ 301.9$ 301.3$ AP 63.6 63.6 58.7 52.9 55.2 55.2 52.2 72.4 75.1 120.6 120.6 87.4 Net 237.9 237.9 204.1 190.5 189.2 189.2 187.8 182.5 178.3 181.2 181.2 214.0 Change in net Inv. & A/P (1.5) (33.8) (13.6) (1.4) (50.2) (1.3) (5.3) (4.3) 3.0 (7.9) 32.7 Total Debt 20.0$ 20.0$ 20.0$ 20.0$ 20.0$ 20.0$ 25.0$ 32.0$ 20.0$ 40.0$ 40.0$ 72.0$ Liquidity 0.3$ 111.1$ 112.4$ 121.0$ 93.9$ 93.9$ 83.6$ 65.3$ 118.0$ 101.0$ 101.0$ 71.7$ 2015 2016 * See appendix for items impacting SG&A by quarter.

Strategic Priorities

19 Committed to delivering a high - quality suite of products while providing superior customer service through the execution of four key principles with the ultimate goal of returning to profitability Strengthen Our Value Proposition • Align in - store inventory with demand to ensure the right products are available • Deliver exceptional service and expertise to guide customers through the purchasing process Enhance Responsible Compliant Sourcing • Implement smart sourcing practices to securely source from around the globe • Maintain rigorous testing and certification processes to ensure each facility and product meets regulatory and safety standards Opportunistically Expand the Business • Consistently reassess product and service portfolio to determine where we can enhance our offering • Invest resources in building capacity for in - demand products and services, including commercial and installation Focus on Store Performance • Evaluate individual store performance to optimize results across network • Train and develop store team to drive sales performance at each site Strategic Priorities Return to Profitability • Drive gross margin dollars through efficient pricing, assortment, and sourcing strategies while optimizing the cost structure • Effectively manage inventory levels through diligent capital allocation and cash flow management

20 Traffic & Sales Trained Teams Optimized Network We will remain competitive by ensuring our sites are located strategically and that each customer’s interaction with our associates is first class We are delivering tailored support – from the customer’s initial product exploration through the sale; this requires that each site is equipped with well - trained associates We are consistently reviewing the performance at each of our stores; this will enable us to identify and implement improvements We are optimizing performance across our store network through a diversified product offering and industry - leading expertise to drive customer engagement Focus on Store Performance

21 Renewed focus on selective sourcing, design, and manufacturing to drive quality Complete selection of 25 wood species, 400+ varieties, and extensive selection of moldings and accessories Vertical integration and direct - from - mill sourcing enables competitive pricing across categories Price Selection Quality Availability People Showroom and distribution network, focused supply chain, and inventory management ensures quick shipment of product Commitment to training ensures staff are equipped with market - leading expertise Renewed focus on our value proposition will elevate brand and stimulate share gains Strengthen Our Value Proposition

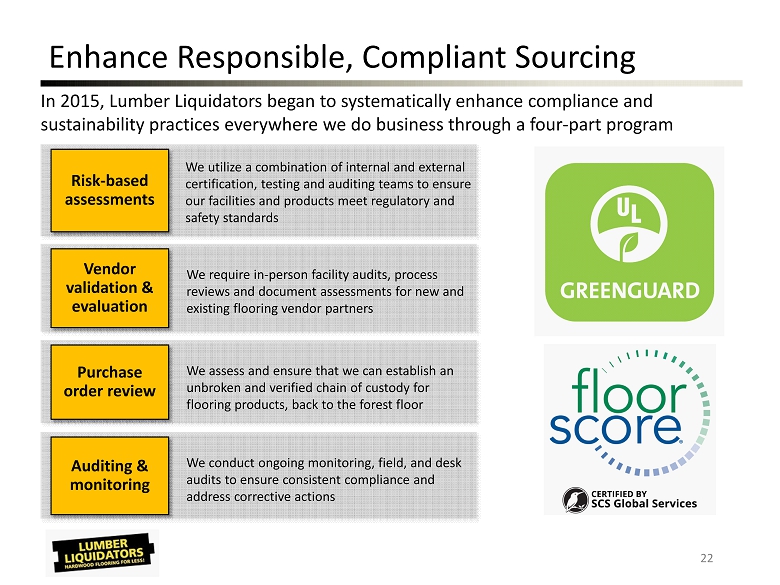

22 In 2015, Lumber Liquidators began to systematically enhance compliance and sustainability practices everywhere we do business through a four - part program Vendor validation & evaluation Purchase order review Auditing & monitoring Risk - based assessments We utilize a combination of internal and external certification, testing and auditing teams to ensure our facilities and products meet regulatory and safety standards We require in - person facility audits, process reviews and document assessments for new and existing flooring vendor partners We assess and ensure that we can establish an unbroken and verified chain of custody for flooring products, back to the forest floor We conduct ongoing monitoring, field, and desk audits to ensure consistent compliance and address corrective actions Enhance Responsible, Compliant Sourcing

23 We look for opportunities to align our offering and sales approach to meet the dynamic needs of the home improvement customer Do - it - for - me Commercial Do - it - yourself Our complete product solution equips customers who are eager to handle home improvement projects independently A larger and growing segment of customers seeking installation support are turning to our services for extra help in laying down the floorboards Our flooring is becoming increasingly popular among companies for offices and commercial activities We continue to conservatively evaluate new locations where there is high potential for an attractive ROI Opportunistically Expand the Business

24 Executive Position Selected Experience Dennis Knowles Chief Executive Officer Marty Agard Chief Financial Officer Jill Witter Secretary, Chief Legal Officer & Chief Compliance Officer Marco Pescara Chief Merchandising & Marketing Officer Carl Daniels Chief Supply Chain Officer Mark Gronemeyer Senior Vice President, Store Operations We have assembled a senior management team with strong leadership and compelling experience within the home improvement and retail sectors Strong Leadership Team

25 Quality products, wide selection, attractive prices, strategic brick and mortar placement, and limited online competition Differentiated Business Model Improving margin profile, scalable cost structure, and sufficient liquidity, combined with disciplined capital allocation to drive shareholder value Improving Financials LL Investment Highlights Strategic team with balance of brick and mortar retail, home improvement, and multi - channel expertise Strong Management Team Favorable Industry Dynamics Growing demand for hard surface flooring driving significant opportunity across price points and materials

Appendix

27 SG&A Non - GAAP Reconciliation Foot Notes (1) For the three months ended March 31, 2017, this amount represents the charge to earnings related to our formaldehyde - related M DL and abrasion - related MDL, which is described more fully in Note 7 to the condensed consolidated financial statements in the 1Q 2017 10 - Q filing. (2) Represents charges to earnings related to our defense of various significant legal actions during the period. This does not i n clude all legal costs incurred by the Company. (3) Amount represents the net charge to earnings related to the stock - based element of our settlement in the securities class acti on lawsuit in addition to $2.5 million related to our derivatives class action lawsuit. See Part II, Item 1 on Legal Proceedings for a comp let e discussion of these matters in the 2016 10 - K filing. (4) Represents settlement accruals related to the completed DOJ - Lacey Act investigation in 2015. (5) All Other primarily relates to various payroll factors, including our retention initiatives, impairment charges related to ou r decision to simplify our business and the net impact of the CARB and Prop 65 settlements in 2016. 000's 2017 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q SG&A Reported Total SG&A 97,680$ 90,551$ 88,333$ 85,487$ 117,236$ 89,900$ 100,661$ 89,707$ 112,214$ Less: Multi-District Litigation 1 - - - - - - - - (18,000) Legal & Professional Fees 2 (4,467) (6,328) (6,135) (4,129) (10,414) (8,294) (6,321) (3,385) (2,344) Securities and Derivatives Class Action 3 - - - - (18,520) 600 (4,250) 2,910 - Lacey/DOJ Settlement 4 (10,000) (3,155) - - - - - - - All Other 5 (440) (175) (5,687) (4,787) (1,275) (945) (580) - - Adjusted Total SG&A 82,773 80,893 76,511 76,571 87,027 81,261 89,510 89,232 91,870 2015 2016

Corporate Headquarters 3000 John Deere Road Toano, VA 23168 Investor Relations Steve Calk / Jackie Marcus 757.566.7512 ir@lumberliquidators.com