SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant

Filed by a Party other than the Registrant o

| Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to Sec. 240.14a-12 |

| | | World Funds Trust | | |

| | | (Name of Registrant as Specified in Its Charter) | | |

| (Name of Person(s) Filing Proxy Statement, if other than Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| | No fee required. |

| | | | | |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | 1) | | Title of each class of securities to which transactions applies: |

| | | | | |

| | | 2) | | Aggregate number of securities to which transaction applies: |

| | | | | |

| | | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | | |

| | | 4) | | Proposed maximum aggregate value of transaction: |

| | | | | |

| | | 5) | | Total fee paid: |

| o | | Fee paid previously with preliminary materials. |

| o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identity the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| 1) | | Amount Previously Paid: |

| | | |

| 2) | | Form, Schedule or Registration Statement No.: |

| | | |

| 3) | | Filing Party: |

| | | |

| 4) | | Date Filed: |

World Funds Trust

European Equity Fund

8730 Stony Point Parkway, Suite 205

Richmond, Virginia 23235

July 24, 2015

Dear Shareholder:

A Special Meeting of the Shareholders of the European Equity Fund (the “Fund”), a portfolio series of the World Funds Trust (the “Trust”), will be held on August 24, 2015 at 9:00 a.m., Eastern Time.

The Trust’s Board of Trustees is seeking your vote for the approval of (i) a new investment sub-advisory agreement for the Fund; (ii) a change to the Fund’s investment objective; and (iii) revisions to the Fund’s fundamental investment restrictions. These proposals are designed, in part, to modernize the Fund’s operations and make the Fund a more attractive investment alternative in a competitive marketplace.

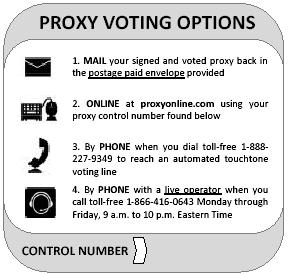

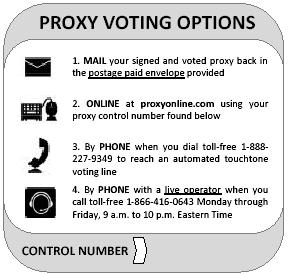

We urge you to complete, sign and return the enclosed proxy card promptly. A postage-paid envelope is enclosed for this purpose. Whether or not you plan to be present at the meeting, your vote is important and you are, therefore, strongly encouraged to return a proxy card for the Fund.

If your shares are held in street name, only your bank or broker can vote your shares and generally only upon receipt of your specific instructions. Please contact the person responsible for your account and instruct him or her to execute a proxy card today.

We look forward to receiving your proxy so that your shares may be voted at the meeting.

Sincerely,

John H. Lively

Secretary

World Funds Trust

European Equity Fund

8730 Stony Point Parkway, Suite 205

Richmond, Virginia 23235

Important Notice Regarding Availability of Proxy Materials for the

Shareholder Meeting to be held on August 24, 2015:

This Proxy Statement is Available online at the Following Website:

http://www.theworldfundstrust.com

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Shareholders of the European Equity Fund (the “Fund”):

Notice is hereby given that a special meeting of the shareholders (the “Special Meeting”) of the Fund, a portfolio series of the World Funds Trust (the “Trust”) will be held on August 24, 2015 at the offices of the Trust (8730 Stony Point Parkway, Suite 205, Richmond, Virginia 23235), at 9:00 a.m., Eastern Time, for the following purposes, which are more fully described in the accompanying Proxy Statement:

| | 1. | | To approve a new investment sub-advisory agreement between Commonwealth Capital Management, LLC and Shikiar Asset Management, Inc. on behalf of the Fund. |

| | | | |

| | 2. | | To approve a change to the Fund’s investment objective; |

| | | | |

| | 3. | | To approve revisions to the Fund’s fundamental investment restrictions; and |

| | | | |

| | 4. | | To transact such other business as may properly come before the Special Meeting and any postponement or adjournment thereof. |

The Board of Trustees recommends that you vote FOR each Proposal identified in this Proxy Statement. The Board of Trustees of the Trust has fixed the close of business on June 24, 2015 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Special Meeting or any postponement or adjournment thereof. Copies of these proxy materials, including this notice of the Special Meeting, the Proxy Statement, and the proxy card, also are available to you at http://www.theworldfundstrust.com. Information on how to obtain directions to attend the Special Meeting and vote in person can be obtained by calling 1-800-673-0550.

We urge you to mark, sign, date and mail the enclosed proxy in the postage-paid envelope provided as soon as possible so that you will be represented at the Special Meeting. If you desire to vote in person at the Special Meeting, you may revoke your proxy at any time before it is exercised. Your vote is important no matter how many shares you own. In order to avoid the additional expense of further solicitation, we ask your cooperation in completing your proxy card promptly.

By order of the Board of Trustees of the Trust,

John H. Lively

Secretary

July 24, 2015

PROXY STATEMENT

World Funds Trust

European Equity Fund

8730 Stony Point Parkway, Suite 205

Richmond, Virginia 23235

INTRODUCTION

The enclosed proxy is solicited by the Board of Trustees (the “Board”) of World Funds Trust (the “Trust”) for use at the Special Meeting of Shareholders (the “Special Meeting”) of the European Equity Fund (the “Fund”) to be held on August 24, 2015 at 9:00 a.m., Eastern Time, and any postponement or adjournment thereof, for action upon the matters set forth in the accompanying Notice of the Special Meeting of Shareholders (the “Notice”). Shareholders of record at the close of business on June 24, 2015 are entitled to be present and to vote at the Special Meeting or any postponed or adjourned session thereof. The Notice, this Proxy Statement and the enclosed proxy card are first being mailed to shareholders on approximately July 27, 2015.

| The Trustees recommend that you vote: |

| | | |

| 1. | | For the new investment sub-advisory agreement. |

| | | |

| 2. | | For the change to the Fund’s investment objective. |

| | | |

| 3. | | For the revisions to the Fund’s fundamental investment restrictions. |

| | | |

| 4. | | In the discretion of the persons named as proxies in connection with any other matters that may properly come before the Special Meeting or any postponement or adjournment thereof. |

Each whole share of the Fund is entitled to one vote as to any matter on which it is entitled to vote and each fractional share is entitled to a proportionate fractional vote. Shares represented by your duly executed proxy will be voted in accordance with your instructions. If no instructions are made on a submitted proxy, the proxy will be voted FOR each Proposal.

1

APPROVAL OF A NEW INVESTMENT SUB-ADVISORY AGREEMENT

Commonwealth Capital Management, LLC (“Commonwealth”), the investment adviser of the Fund, has proposed, and the Board of Trustees of the Trust has approved, changing the Fund’s sub-adviser to Shikiar Asset Management, Inc. (“Shikiar”) to implement a different investment strategy for the Fund with the view to making the Fund a more attractive investment alternative in a competitive marketplace. The Fund would also change its name to the Global Strategic Income Fund. The new investment sub-advisory agreement with Shikiar is being submitted to shareholders for approval as required by the Investment Company Act of 1940, as amended (the “1940 Act”).

Previous Sub-Adviser

Vontobel Asset Management, Inc. (“Vontobel”) serves as the Fund’s sub-adviser pursuant to a sub-advisory agreement between Commonwealth and Vontobel dated August 15, 2014 (the “Vontobel Sub-Advisory Agreement”). Vontobel is located at 450 Park Avenue, New York, New York 10022. Vontobel is a wholly owned and controlled subsidiary of Vontobel Holding AG, a Swiss bank holding company, having its registered offices in Zurich, Switzerland. In 2014, Vontobel informed Commonwealth that it proposed to redesign its business model. To that end, it indicated its intent to discontinue its relationship as the sub-adviser to the Fund.

The Vontobel Sub-Advisory Agreement was last approved by the Board of Trustees of the Trust at its May 16, 2014 board meeting and by the sole shareholder of the Fund on August 15, 2014 in connection with a reorganization of the Fund. The Fund was reorganized on August 15, 2014 from a series of World Funds, Inc., a Maryland corporation (the “Predecessor Fund”), to a series of the Trust. As of June 24, 2015, the Fund has 987 accounts (included in “accounts” are omnibus type accounts which may have several sub-accounts).

Vontobel receives a fee from Commonwealth for sub-advisory services of 0.55% on the first $50 million dollars of average daily net assets and 0.50% of average daily net assets in excess of $50 million of the investment advisory fee received by Commonwealth on the assets less a proportionate reduction in such fee resulting from any contractual and/or voluntary reduction in the fee (provided Vontobel agreed to such reduction in advance in the case of a voluntary reduction). Vontobel received the following payments from Commonwealth for its services as sub-adviser to the Fund/Predecessor Fund for each of the years set forth below ending on December 31:

| |

| | | | | | | | |

| | | 2014 | | 2013 | | 2012 | |

| |

| | | | | | | | |

| Sub-Advisory Fees | | $53,800 | | $122,306 | | $143,409 | |

| |

Proposed New Sub-Adviser

Commonwealth and the Board are recommending that shareholders approve Shikiar as the new sub-adviser for the Fund. Shikiar was organized in 1995 as a Delaware corporation and its address is 1185 Avenue of the Americas, New York, New York 10036. As of May 31, 2015, Shikiar had approximately $350 million in assets under management. The names, addresses and principal occupation of the principal executive officers of Shikiar as of the date of this proxy statement are set forth below.

2

| Name and Address | Principal Occupation |

Stuart A. Shikiar

1185 Avenue of the Americas

New York, New York 10036 | President, Chairman, Secretary and Treasurer |

Diane M. McDermott

1185 Avenue of the Americas

New York, New York 10036 | Chief Compliance Officer |

Albert I. Sipzener

1185 Avenue of the Americas

New York, New York 10036 | Partner |

Gary A. Friedle

1185 Avenue of the Americas

New York, New York 10036 | Vice President and Chief Operating Officer |

Shikiar does not advise other registered investment companies with similar investment objectives to the Fund.

Comparison of Previous Sub-Advisory Agreement and New Sub-Advisory Agreement

At its May 27-28, 2015 meeting, the Board, including by separate vote of a majority of the Independent Trustees, reviewed and approved the New Sub-Advisory Agreement between Shikiar and Commonwealth, subject to shareholder approval. The New Sub-Advisory Agreement will become effective upon its approval by Fund shareholders. The New Sub-Advisory Agreement is similar to the previous sub-advisory agreement with Vontobel, except for the differences noted below and the parties, the date and the name of the Fund. Set forth below is a summary of all material terms of the New Sub-Advisory Agreement. The form of the New Sub-Advisory Agreement is included as Appendix A. The summary of all material terms of the New Sub-Advisory Agreement below is qualified in its entirety by reference to the form of New Sub-Advisory Agreement included as Appendix A.

The fee rate under the previous sub-advisory agreement as compared to the New Sub-Advisory Agreement has been changed. Commonwealth paid Vontobel from its net advisory fee (i.e., after any fee reductions), 0.55% on the first $50 million dollars of average daily net assets and 0.50% of average daily net assets in excess of $50 million. Under the New Sub-Advisory Agreement, Commonwealth will pay Shikiar at the foregoing rate regardless of whether there are any contractual or voluntary fee waivers and expense reimbursements. Shareholders should note that this change in the fee payable to Shikiar will not impact the expenses paid by the Fund as this fee is paid by Commonwealth. Further, shareholders should note that Commonwealth has contractually agreed to waive or limit its advisory fees and/or assume other expenses for the Fund until April 30, 2017 so that the total annual operating expenses of the Fund’s Class A Shares and Class C Shares are limited to 2.75% and 3.50%, respectively. Additionally, the New Sub-Advisory Agreement provides that the compensation payable to Shikiar be paid within five (5) business days following each month-end. It also provides, unlike the previous sub-advisory agreement, that if the agreement is terminated prior to a month’s end, the fee to Shikiar will be prorated.

The New Sub-Advisory Agreement would require Shikiar to provide the same services as provided by Vontobel. Shikiar shall, subject to the supervision of Commonwealth, assist Commonwealth in managing the investment and reinvestment of the assets of the Fund, and will continuously review, supervise, and administer the investment program of the Fund, to determine in its discretion the securities to be purchased or sold.

3

The New Sub-Advisory Agreement has the same duration and termination provisions as the previous sub-advisory agreement. The New Sub-Advisory Agreement will have an initial term of two years from its effective date and will continue from year to year so long as its renewal is specifically approved by (a) a majority of the Trustees who are not parties to the New Sub-Advisory Agreement and who are not “interested persons” (as defined in the 1940 Act) of any party to the New Sub-Advisory Agreement, cast in person at a meeting called for the purpose of voting on such approval and a majority vote of the Trustees or (b) by vote of a majority of the voting securities of the Fund. It may be terminated by the Trust, without the payment of any penalty, by a vote of the Board or with respect to the Fund, upon the affirmative vote of a majority of the outstanding voting securities of the Fund. It may also be terminated at any time upon 60 days’ notice without the payment of any penalty by the Board, by a vote of a majority of the outstanding voting securities of the Fund, by Commonwealth, or by Shikiar. The New Sub-Advisory Agreement will terminate automatically in the event of its assignment.

The New Sub-Advisory Agreement subjects Shikiar to the same standard of care and liability to which Vontobel was subject under the previous sub-advisory agreement. Specifically, it states that Shikiar not be liable for any error of judgment or mistake of law or for any loss suffered by the Trust or Commonwealth in connection with the performance of the agreement, except a loss resulting from a breach of fiduciary duty with respect to the receipt of compensation for services or a loss resulting from willful misfeasance, bad faith or negligence on the part of Shikiar in the performance of its duties or from reckless disregard by it of its obligations and duties under this agreement. Unlike the prior sub-advisory agreement however, the New Sub-Advisory also provides for the indemnification of Shikiar by Commonwealth against any loss, liability, claim, damage or expense arising out of Shikiar’s performance or non-performance of its duties under the agreement unless there is any issue of willful misfeasance, bad faith or negligence on the part of Shikiar.

If the Fund’s shareholders approve the New Sub-Advisory Agreement, it is expected that the New Sub-Advisory Agreement would become effective on or about August 25, 2015.

Board Considerations of the New Sub-Advisory Agreement

The Board reviewed and discussed the approval of the New Sub-Advisory between the Commonwealth and Shikiar. Counsel noted that the 1940 Act requires the approval of the investment advisory agreements between the Trust and its service providers by a majority of the Independent Trustees.

The Board discussed the arrangements between Shikiar and Commonwealth with respect to the Fund. The Board reflected on its discussions at its January 2015 meeting regarding the New Sub-Advisory Agreement with a representative of Shikiar and the manner in which the Fund was to be managed. Counsel referred the Board to the Board Materials, which included, among other things, a memorandum from Counsel addressing the duties of Trustees regarding the approval of the proposed New Sub-Advisory Agreement, a letter from Counsel to the Shikiar and Shikiar’s responses to that letter, information on Shikiar’s financial information , a fee comparison analysis for the Fund and comparable mutual funds, and the New Sub-Advisory Agreement. Counsel reviewed with the Board the memorandum from Counsel and the proposed New Sub-Advisory Agreement. He outlined the various factors the Board should consider in deciding whether to approve the Agreement. The Board reflected on information provided by Shikiar at its May 27-28, 2015 Board meeting.

4

In deciding whether to approve the New Sub-Advisory Agreement, the Trustees considered numerous factors, including:

(1) The nature, extent, and quality of the services to be provided by Shikiar.

In this regard, the Board considered the responsibilities Shikiar would have under the New Sub-Advisory Agreement. The Board reviewed the services to be provided by Shikiar to the Fund including, without limitation, Shikiar’s procedures for formulating investment recommendations and assuring compliance with the Fund’s investment objectives and limitations. The Board noted that while Shikiar did not manage other accounts in a manner that is substantially similar to that of the Fund, the employees of Shikiar who will be responsible for serving as portfolio managers of the Fund had experience implementing, in domestic markets, the strategy intended to be employed by the Fund, including, in particular in another mutual fund (the other mutual fund was advised by an affiliate of Shikiar in which the prospective portfolio managers of the Fund were dual employees), and it had experience trading in non-US securities. The Board expressed its belief that the foregoing experiences were relevant and Shikiar could leverage those experiences to implement the Fund’s strategy adequately. The Board considered Shikiar’s staffing, personnel, the education and experience of Shikiar’s personnel, and its methods of operation and concluded that the foregoing were satisfactory in light of the services to be rendered to the Fund by Shikiar. The Board also considered the adequacy of Shikiar’s compliance program, including representations from the Trust’s CCO that the policies and procedures under the program were adequate and the Board determined that the compliance program was satisfactory in light of the services to be rendered to the Fund by Shikiar. After reviewing the foregoing and further information from Shikiar, the Board concluded that the quality, extent, and nature of the services to be provided by Shikiar were satisfactory and adequate for the Fund.

(2) Investment Performance of the Fund and Shikiar.

The Board considered that Shikiar had not managed a mutual fund and did not have composite information of its management of separate accounts with the same investment mandate as the Fund. The Trustees discussed their belief that the Fund would be placed in another category for future performance comparison following the upcoming strategy and objective changes, and as such, they discussed that such performance was not relevant at this time and would not be relevant until the Fund had established a record under the new strategies. The Board did not consider retaining any other investment advisers – rather, the Board relied on the representations Commonwealth made at the Meeting that Shikiar would be able to effectively implement the strategy.

(3) The costs of the services to be provided and profits to be realized by Shikiar from the relationship with the Fund.

In considering the costs of the services to be provided and profits to be realized by Shikiar from the relationship with the Fund, the Trustees considered Shikiar’s staffing, personnel, and methods of operating; the financial condition of Shikiar and the level of commitment to the Fund by the principals of Shikiar; the expected asset levels of the Fund; and the projected overall expenses of the Fund. The Trustees considered financial information of the firm. The Trustees considered the expected fees and expenses of the Fund (including the management fee and sub-advisory fee), as well as the proposed change in the fee structure with respect to payments to Shikiar. The Trustees noted that the overall management fee, including the sub-advisory fee, would not change from that of the prior sub-adviser to the Fund. The Trustees noted that the management fee (including the sub-advisory fee) was on the high end of the Morningstar category average. The Trustees noted that the proposed fee rate payable to Shikiar is the same as the rate payable to the prior-sub-adviser, including breakpoints, although the Board observed that Shikiar would not have its fees reduced by any expense limitation arrangements put in place by Commonwealth although the Board noted that this new structure would not have any impact on fees paid by the Fund. Following this analysis and upon further consideration and discussion of the foregoing, the Board concluded that the fees to be paid to Shikiar were fair and reasonable.

5

| | (4) | The extent to which economies of scale would be realized as the Fund grows and whether advisory fee levels reflect these economies of scale for the benefit of the Fund’s investors. |

In this regard, the Board considered the Fund’s fee arrangements with Shikiar. The Trustees noted that while the sub-advisory fee had a breakpoint and would decrease as assets increased, this breakpoint would not benefit the Fund. The Trustees considered that although the proposed sub-advisory fee structure for Shikiar differed from the current sub-advisory fee structure, neither of them was structured to allow the Fund to realize economies of scale. The Board expressed the view that in circumstances where the payment of a sub-advisory fee was not an obligation of a mutual fund, but rather was an obligation of the investment adviser (as in the circumstances involving the sub-advisory arrangements (current and proposed) for the Fund), the fact that the mutual fund would not realize economies of scale from a fee structure was not uncommon, nor was it detrimental to the fund. Following further discussion, the Board determined that the Fund’s fee arrangements, in light of all the facts and circumstances, were fair and reasonable.

(5) Possible conflicts of interest and benefits derived by Shikiar.

In considering Shikiar’s practices regarding conflicts of interest, the Trustees evaluated the potential for conflicts of interest and considered such matters as the experience and ability of the advisory and compliance personnel assigned to the Fund and noted that they each had considerable experience to bring to the management of the Fund. The Board considered the basis of decisions to buy or sell securities for the Fund and Shikiar’s other accounts and concluded that those processes were appropriate to manage any potential conflicts of interests. The Board also considered Shikiar’s policies with respect to the utilization of soft dollar payments with broker/dealers and concluded that those policies were appropriate and fair to the Fund. The Board also considered the substance and administration of Shikiar’s code of ethics, including representations from Shikiar that the code of ethics was compliant with Section 17j-1 of the Investment Company Act of 1940, and it concluded that Shikiar’s code was appropriate. Based on the foregoing, the Board determined that Shikiar’s standards and practices relating to the identification and mitigation of possible conflicts of interest were satisfactory. It was noted that Shikiar specified that it would receive no benefits, other than receipt of advisory fees, in managing the assets of the Fund.

Differences Between Vontobel’s and Shikiar’s Investment Strategies

The Board of Trustees, at its May 27-28, 2015 meeting, also approved changes to the Fund’s investment strategies to take advantage of certain areas of expertise offered by Shikiar. In connection with the implementation of the sub-adviser change and related changes to the Fund’s investment strategy and objective, the Fund will be renamed the Global Strategic Income Fund.

Note that in Proposal 2 you are being asked to approve a change to the Fund’s fundamental investment objective and in Proposal 3 you are being asked to approve changes to the Fund’s fundamental investment restrictions – all parts of the efforts to modernize the Fund with the goal of making it a more attractive investment alternative.

Note that if Proposal 1 is not approved, the Trustees may consider other alternatives for the Fund, including identifying another sub-adviser, liquidation or having the Fund managed by the Adviser.

If this Proposal 1 is approved, subject to the supervision of Commonwealth, Shikiar will be responsible for the execution of specific investment strategies and day-to-day investment operations for the Fund. Shikiar will manage the portfolio of the Fund using a team of analysts and portfolio managers. Stuart A. Shikiar, Albert I. Sipzener and Gary A. Friedle will serve as portfolio managers to the Fund.

| | Stuart A. Shikiar. Since 1995, Mr. Shikiar has served as Chairman and Chief Investment Officer of Shikiar Asset Management Inc., which he founded in 1995. Mr. Shikiar has over 35 years of investment management experience. Prior to 1995, he was a Partner and Portfolio Manager at Omega Advisors, a hedge fund with $10B+ in assets under management. Prior to joining Omega Advisors, Mr. Shikiar was Chief Investment Officer and Managing Director of Prudential Securities Investment | |

6

| | Management for ten years, overseeing $2B+ in assets under management. He also held the Chief Investment Officer position at Furman Selz Capital Management prior to Prudential, and before that was part of an investment team as a portfolio manager at Wertheim & Company, catering to high net worth individuals and institutions. Mr. Shikiar has served on the Board of Directors of three publicly traded companies, one listed on the NYSE, one listed on the AMEX, and one NASDAQ listed. He has a BBA from City College of New York. Mr. Shikiar is a trustee of the Baruch College Fund. He is also former Chairman of Baruch’s Endowment Investment Committee and is still an active member of that committee. | |

| | | |

| | Albert I. Sipzener. Mr. Sipzener joined Shikiar Asset Management Inc. in 2001 and is now a partner and portfolio manager. Prior to 2001, he covered diversified industrials, machinery, electrical equipment, and capital goods companies for two years as a sell-side research analyst at Bear Stearns & Co. Mr. Sipzener began his research career in 1993 as an investment banking analyst in Lehman Brothers’ Debt Capital Markets group. He has a B.A. in Biology and Mathematics from Brown University and an MBA from Columbia Business School. | |

| | | |

| | Gary A. Friedle. Mr. Friedle joined Shikiar Asset Management Inc. in 2002 as a portfolio manager and is now also the Chief Operating Officer of Shikiar Asset Management Inc. Prior to 2002, Mr. Friedle worked at UBS/PaineWebber for over 10 years. Mr. Friedle started his career at PaineWebber in 1991 as a financial advisor, and then moved to manage the firm’s Unit Investment Trust Sales and Trading Desk. He became a senior investment manager research analyst and Divisional Vice President at PaineWebber in 1999, covering multiple styles of investment managers in the firm’s $50 billion sub-advisory programs. He has a B.A. in economics from Franklin & Marshall College and an MBA in Finance from New York University. Mr. Friedle is a member of the New York Society of Security Analysts and the CFA Institute. | |

Certain changes will be made to the Fund’s strategy subject to the approval of Shikiar as the new sub-adviser to the Fund. These changes are indicated below in the comparison of the Fund’s current strategy with its new strategy to be implemented by Shikiar.

| Current Strategy | New Strategy |

The Fund will seek to achieve its investment objective by investing in equity securities, (primarily common stocks but also preferred stocks and convertible securities). Under normal circumstances, the Fund will invest at least 80% of its total assets in equity securities of companies located in Europe or which conduct a significant portion of their business in countries which are generally considered to comprise Europe. Vontobel Asset Management, Inc. (the “Sub-Adviser”), the Fund’s investment sub-adviser, selects securities of companies that are located in, or listed on the exchanges of, European countries, as well as companies that derive at least two-thirds of their sales from such countries. The Fund normally will invest in business activities of not less than three different European countries.

Certain of the countries in which the Fund invests may be considered emerging markets. The Sub-Adviser generally will decide when and how much to invest in these developing markets based upon its assessment of their continuing development. As these stock markets develop | Under normal market conditions, the Fund will invest primarily in securities that pay dividends or other distributions, including common stocks, preferred stocks, and high-yield (non-investment grade) corporate fixed income securities of U.S. and foreign companies without regard to market capitalization or credit rating as determined by any of the credit agencies. Under normal circumstances, the Fund will be invested in at least three countries (one of which may be the United States) and will invest at least 40% of its net assets in securities of foreign companies (including depositary receipts). The Fund may invest in emerging markets securities. For these purposes, “foreign companies” are firms that are organized or generate a majority (greater than 50%) of their revenue outside the United States, or otherwise expose the assets of the Fund to the economic fortunes and risks of countries other than the United States.

The Fund will normally hold a core position of between approximately 30 and 60 securities. Shikiar Asset Management, Inc. (the “Sub-Adviser”) invests the Fund’s |

7

and more investment opportunities emerge, the Fund will broaden its portfolio to include securities of companies located in or which conduct a significant portion of their business in countries in these developing markets.

The foreign securities the Fund purchases may be bought directly in their principal markets or may be acquired through the use of sponsored and unsponsored American Depositary Receipts (“ADRs”), Global Depositary Receipts (“GDRs”), European Depositary Receipts (“EDRs”) and other types of Depositary Receipts (collectively “Depositary Receipts”), to the extent such Depositary Receipts become available. ADRs are typically issued by a U.S. bank or trust company and represent ownership of underlying foreign securities. GDRs, EDRs and other types of Depositary Receipts are typically issued by foreign banks or trust companies, although they also may be issued by U.S. banks or trust companies, and represent ownership of underlying securities issued by either a foreign or a United States corporation. Depositary Receipts may not necessarily be denominated in the same currency as the underlying securities into which they may be converted. For purposes of the Fund's investment policies, investments in Depositary Receipts will be deemed to be investments in the underlying securities.

In determining which portfolio securities to sell, the Sub-Adviser considers the following: (1) if a stock appreciates such that, as a total percentage of the portfolio, it becomes too large; (2) if the sector or stock appears to be under-performing; (3) if the company management appears to be engaging in conduct not in the best interest of public shareholders; (4) to sell loss positions in order to reduce taxable gains to shareholders reflected in earlier sales of positions with gains; and, (5) to raise funds to cover redemptions. | assets opportunistically and tactically with the aim of providing capital appreciation, limiting volatility and providing income generation.

With regard to the Fund’s equity investments, the Sub-Adviser utilizes a “bottom-up” security selection process (meaning it focuses on the individual security rather than economic or market cycles or the industry in which the company operates) with a focus on in-depth, quantitative and qualitative primary research. The Sub-Adviser considers companies with:

• A proven track record of enhancing shareholder value

• Growth in revenue and earnings

�� • Leading market share and sustainable secular drivers

• Strong balance sheet and free cash flow generation

• Expanding gross, operating and net profit margins

• Significant insider ownership

• High standards of corporate governance and ethics

• Prices trading at a discount to the Sub-Adviser’s calculation of net asset value

With regard to the Fund’s fixed income investments, the Sub-Adviser may utilize several disciplines, including value-based security selection involving “top-down” and “bottom-up” selection. The “top-down” approach may consider macro-economic factors such as interest rates, inflation, fiscal policy, demographic trends, and other considerations. Additionally, the Sub-Adviser may seek to identify sectors, industries and companies that may benefit from macro-economic trends the Sub-Adviser has observed. The Sub-Adviser may also actively overweight sectors it determines have the best relative value compared to the market. The Sub-Adviser may determine to emphasize traditional sectors such as energy, industrials and materials. With regard to “bottom-up” selection, the Sub-Adviser may consider attractive yield, pricing and underlying credit metrics (i.e., a company’s leverage, its coverage ratio, and other fundamentals). The Sub-Adviser attempts to optimize individual maturity allocations to capture relative value.

The Fund may also invest in master limited partnerships (“MLPs”), real estate investment trusts (“REITs”) and publicly traded business development companies (“BDCs”). Many MLPs operate pipelines transporting crude oil, natural gas and other petroleum products along with associated facilities. The Fund may also utilize options on equity securities for the purpose of managing risk associated with the Fund’s portfolio. The Fund may also invest in the securities of other investment companies, including exchange-traded funds. The Fund may also invest in U.S. and foreign government securities. The Fund’s investments in MLPs is limited to no more than 25% of its total assets. The Fund may invest in REITs without limitation. |

8

Principal Risks Associated with the Fund’s New Investment Strategy

After implementing the change to the investment strategies, and pending shareholder approval of Proposals 1 and 2, the Fund will continue to be subject to various risks associated with investing primarily in a portfolio of common stocks with an international focus. The implementation of the new strategy described above would also subject the Fund to the following additional risks: Preferred Stock Risk, Dividend-Paying Securities Risk, Fixed Income Securities Risk, Currency Risk, Business Development Companies (“BDCs”) Risk, Undervalued Securities Risk, Master Limited Partnership (“MLP”) Risk, Real Estate Investment Trust (“REIT”) Risk, Mid-Cap and Small-Cap Company Risk, Market Sector Risk, Options Risk, Investments in Other Investment Companies and Underlying Funds Risk, and Investment Selection Risk.

| | Preferred Stock Risk. Investing in preferred stocks subjects the Fund to risks such as dividend suspension or company failure, rising interest rates and low trading volumes. Preferred stocks typically decline in value when interest rates rise, and vice versa. |

| | |

| | Dividend-Paying Securities Risk. Investing in dividend-paying securities subjects the Fund to certain risks. The company issuing such securities may fail and have to decrease or eliminate its dividend. In such an event, the Fund may not only lose the dividend payout but the stock price of the company may fall. |

| | |

| | Fixed Income Securities Risk. Investing in fixed income securities subjects the Fund to interest rate risk and credit risk. Interest rate risk is the risk that increases in interest rates could cause the prices of the Fund’s investments in fixed income securities to decline. Credit risk is the risk that the issuer of bonds may not be able to meet interest or principal payments when bonds become due. |

| | |

| | High Yield Securities Risk. To the extent the Fund invests in high-yield securities rated below investment grade by a credit rating agency (“junk bonds”) it may experience a lower rate of return as those securities are subject to higher credit risks and are less liquid than other fixed income securities. |

| | |

| | Currency Risk. The value of investments in securities denominated in foreign currencies increases or decreases as the rates of exchange between those currencies and the U.S. dollar change. Currency conversion costs and currency fluctuations could erase investment gains or add to investment losses. Currency exchange rates can be volatile, and are affected by factors such as general economic conditions, the actions of the U.S. and foreign governments or central banks, the imposition of currency controls and speculation. |

| | |

| | Business Development Companies (“BDCs”) Risk. The Fund may invest in publicly traded BDCs. BDCs are closed-end funds that help provide capital to small- and mid-size businesses that do not have access to traditional sources of funding. BDCs invest in private companies and thinly traded securities of public companies, including debt instruments of such companies. Generally, little public information exists for private and thinly traded companies. Less mature and smaller private companies involve greater risk than well-established larger publicly-traded companies. Shares of BDCs in which the Fund may invest typically are publicly traded on an exchange just like the stock of public companies. A BDC’s gains and losses may be magnified through the use of leverage. This may increase the risk associated with these securities. BDCs generally depend on the ability to |

9

| | access capital markets, raise cash, acquire suitable investments and monitor and administer those investments in order to maintain their status as a BDC. A failure to do so may adversely affect the value of the BDCs’ shares. BDCs are subject to management fees (which are generally higher than those of other investment companies) and other expenses, and so when the Fund invests in the BDC it will bear its proportionate share of the costs of the BDC’s operations. | |

| | | |

| | Undervalued Securities Risk. Undervalued securities are, by definition, out of favor with investors, and there is no way to predict when, if ever, the securities may return to favor. | |

| | | |

| | Master Limited Partnerships (“MLPs”) Risk. Master limited partnerships are generally considered interest-rate sensitive investments. During periods of interest rate volatility, these investments may not provide attractive returns. Depending on the state of interest rates in general, the use of MLPs could enhance or harm the overall performance of the Fund. To the extent that an MLP’s interests are all in a particular industry (such as the energy sector), the MLP will be negatively impacted by economic events adversely impacting that industry. | |

| | | |

| | Real Estate Investment Trust (“REIT”) Risk. REITs may be subject to certain risks associated with the direct ownership of real estate, including declines in the value of real estate, risks related to general and local economic conditions, overbuilding and increased competition, increases in property taxes and operating expenses, and variations in rental income. REITs are subject to management fees and other expenses, and so when the Fund invests in REITs it will bear its proportionate share of the costs of the REIT’s operations. REITS are also subject to heavy cash flow dependency, defaults by borrowers, self-liquidation and the possibility of failing to qualify for the tax-free pass-through of income under the Internal Revenue Code and to maintain their exemption from registration under the 1940 Act. Additionally, distributions received by the Fund from REITs may consist of dividends, capital gains and/or return of capital. Generally, dividends received by the Fund from REIT shares and distributed to the Fund’s shareholders will not constitute “qualified income dividends” eligible for reduced tax rates applicable to qualified dividend income; therefore, the tax rate applicable to that portion of the dividend income attributable to REIT shares held by the Fund that shareholders of the Fund will receive will be taxed at a higher rate than dividends eligible for reduced tax rate application to qualified dividend income. Dividends from REITs are generally not eligible for the reduced rate of income tax on certain dividends because the income that REITs receive is primarily rent and interest income. | |

| | | |

| | Mid-Cap and Small Cap Company Risk. To the extent the Fund invests in mid-cap and small-cap companies, it will be subject to additional risks. The earnings and prospects of smaller companies are more volatile than larger companies, and smaller companies may experience higher failure rates than do larger companies. The trading volume of securities of smaller companies is normally less than that of larger companies and, therefore, may disproportionately affect their market price, tending to make prices fall more in response to selling pressure than is the case with larger companies. Smaller companies may also have limited markets, product lines, or financial resources, and may lack management experience. | |

| | | |

| | Market Sector Risk. The Fund may significantly overweight or underweight certain industries or market sectors, which may cause the Fund’s performance to be more or less sensitive to developments affecting those industries or sectors. | |

| | | |

| | Options Risk. Options are a type of derivative instrument. The value of derivatives may rise or fall more rapidly than other investments. For some derivatives, it is possible to lose more than the amount invested in the derivative. If the Fund uses derivatives to “hedge” the risk of its portfolio, it is possible that the hedge may not succeed. Over the counter derivatives are also subject to counterparty risk, which is the risk that the other party to the contract will not fulfill its contractual obligation to complete the transaction with the Fund. Other risks of investments in derivatives | |

10

| | include imperfect correlation between the value of these instruments and the underlying assets; risks of default by the other party to the derivative transactions; risks that the transactions may result in losses that offset gains in portfolio positions; and risks that the derivative transactions may not be liquid. Specific risks that the Fund will seek to manage include the following: interest rate, liquidity, credit and market risks. By investing in options, the Fund may be subject to the risk of counterparty default, as well as the potential for unlimited loss. | |

| | | |

| | Tax Risk. Prior to August 25, 2015, the Fund pursued another investment strategy and utilized the services of another sub-adviser. In transitioning to a new sub-adviser and implementing new strategies, the risk exists that the Fund will realize certain gains and losses sooner than it may have otherwise realized under the old strategies and as a result of any repositioning of the Fund’s portfolio. As a result, these transitions could result in negative tax consequences to investors. | |

| | | |

| | Investments in Other Investment Companies and Underlying Funds. The Fund will incur higher and duplicative expenses when it invests in mutual funds, exchange-traded funds (“ETFs”), closed-end funds, and REITs (see the separate discussion above on risks related to REITs). ETFs are investment companies that are traded on stock exchanges similar to stocks. Typically, ETFs hold assets such as stocks, commodities or bonds, and track an index such as a stock or bond index. There is also the risk that the Fund may suffer losses due to the investment practices of the underlying funds. When the Fund invests in an underlying mutual fund or ETF, or REIT, the Fund will be subject to substantially the same risks as those associated with the direct ownership of securities comprising the underlying fund or index on which the ETF or other vehicle is based and the value of the Fund’s investments will fluctuate in response to the performance and risks of the underlying investments or index. In addition to the brokerage costs associated with the fund’s purchase and sale of the underlying securities, ETFs, closed-end funds, and REITs incur fees that are separate from those of the Fund. As a result, the Fund’s shareholders will indirectly bear a proportionate share of the operating expenses of these investment vehicles in addition to Fund expenses. Because the Fund is not required to hold shares of underlying funds for any minimum period, it may be subject to, and may have to pay, short-term redemption fees imposed by the underlying funds. The Fund has no control over the investments and related risks taken by the underlying funds in which it invests. The Investment Company Act of 1940 and the rules and regulations adopted under that statute impose conditions on investment companies which invest in other investment companies, and as a result, the Fund is generally restricted on the amount of shares of another investment company to shares amounting to no more than 3% of the outstanding voting shares of such other investment company.

In addition to risks generally associated with investments in investment company securities, ETFs are subject to the following risks that do not apply to traditional mutual funds: (i) an ETF’s shares may trade at a market price that is above or below their net asset value; (ii) an active trading market for an ETF’s shares may not develop or be maintained; (iii) the ETF may employ an investment strategy that utilizes high leverage ratios; or (iv) trading of an ETF’s shares may be halted if the listing exchange’s officials deem such action appropriate, the shares are de-listed from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally (which is a risk of any security that trades on a listed exchange).

Inverse and leveraged ETFs are subject to additional risks not generally associated with traditional ETFs. To the extent that the Fund invests in inverse ETFs, the value of the Fund’s investment will decrease when the index underlying the ETF’s benchmark rises, a result that is the opposite from traditional equity or bond funds. The net asset value and market price of leveraged or inverse ETFs are usually more volatile than the value of the tracked index or of other ETFs that do not use leverage. This is because inverse and leveraged ETFs use investment techniques and financial instruments that may be considered aggressive, including the use of derivative transactions and short selling techniques. The use of these techniques may cause the inverse or leveraged ETFs to lose more money in market environments that are adverse to their investment strategies than other funds that do not use such techniques. | |

11

| | Closed-end funds may utilize more leverage than other types of investment companies. They can utilize leverage by issuing preferred stocks or debt securities to raise additional capital which can, in turn, be used to buy more securities and leverage its portfolio. Closed-end fund shares may also trade at a discount or premium to their net asset value. | |

| | | |

| | Investment Selection Risk. The Fund’s ability to achieve its investment objective is dependent on the Sub-Adviser’s ability to identify profitable investment opportunities for the Fund. | |

| | | |

| | New Adviser Risk. The investment sub-adviser (Shikiar) has not previously managed a mutual fund and does not have significant experience in managing foreign securities in the investment strategy to be utilized by the Fund. | |

Required Vote. Approval of the proposal requires the vote of the “majority of the outstanding voting securities” of the Fund. Under the 1940 Act, a “majority of the outstanding voting securities” is defined as the lesser of: (1) 67% or more of the voting securities of the Fund entitled to vote present in person or by proxy at the Special Meeting, if the holders of more than 50% of the outstanding voting securities entitled to vote thereon are present in person or represented by proxy; or (2) more than 50% of the outstanding voting securities of the Fund entitled to vote thereon.

THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE

PROPOSED NEW SUB-ADVISORY AGREEMENT

12

APPROVAL OF A CHANGE TO THE FUND’S FUNDAMENTAL INVESTMENT OBJECTIVE

At a meeting held on May 27-28, 2015, the Board of Trustees of the Trust approved a proposal by Commonwealth, the Fund’s investment adviser, to change the Fund’s investment objective. As part of a broader proposed restructuring of the Fund, the goal of which is to create a Fund that is more available and attractive in a competitive marketplace, Commonwealth recommended a change to the Fund’s objective. Currently, the Fund’s investment objective is to “seek to achieve capital appreciation.” If approved by shareholders, the investment objective will be changed to “provide a competitive level of total return consisting of income and growth.” The Board considered information on the potential benefits of the proposal, including that the broader objective would likely result in a greater overall potential returns for shareholders and the change in objective may promote the goal of implementing a better differentiated product thus leading to stronger demand for the product over time. The Board determined that this broader objective was in the best interests of the Fund and its shareholders.

The 1940 Act permits a fund to designate any of its policies as fundamental policies but does not require that an investment objective be classified as fundamental, and it is common practice for investment objectives of investment companies to be classified as non-fundamental. A fundamental investment policy may be changed only with the approval of a majority of a fund’s outstanding voting securities, as defined in the 1940 Act, while a non-fundamental investment policy may be changed by the Board without shareholder approval. Designating the Fund’s investment objective as non-fundamental would provide the Board greater flexibility to respond to changing conditions, in the manner it determines to be in the best interests of the Fund and its shareholders without the cost of a proxy solicitation. The Fund’s proposed non-fundamental investment objective, if approved by shareholders, may be changed by the Board upon 60 days prior notice to shareholders.

To conform to the new investment objective, the Fund’s principal investment strategies would be revised as described in Proposal 1.

Note that Proposal 2 is contingent on the approval by shareholders of Proposal 1 and a new sub-adviser for the Fund.

Required Vote. Approval of the proposal requires the vote of the “majority of the outstanding voting securities” of the Fund. Under the 1940 Act, a “majority of the outstanding voting securities” is defined as the lesser of: (1) 67% or more of the voting securities of the Fund entitled to vote present in person or by proxy at the Special Meeting, if the holders of more than 50% of the outstanding voting securities entitled to vote thereon are present in person or represented by proxy; or (2) more than 50% of the outstanding voting securities of the Fund entitled to vote thereon.

THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE

PROPOSED CHANGE TO THE FUND’S FUNDAMENTAL INVESTMENT OBJECTIVE

13

____________________________________________________________

PROPOSAL 3

____________________________________________________________

APPROVAL OF REVISIONS TO THE FUND’S FUNDAMENTAL INVESTMENT RESTRICTIONS

The 1940 Act requires all mutual funds, including the Fund, to adopt certain investment restrictions as “fundamental” restrictions. Fundamental restrictions may be modified or eliminated only with the approval of the requisite vote of the Fund’s outstanding voting securities. Upon the recommendation of Commonwealth, the investment adviser to the Fund, the Trustees have reviewed the Fund’s current fundamental investment restrictions and have recommended that the fundamental restrictions be amended or eliminated in order to increase the investment flexibility of the Fund and to simplify and modernize the restrictions to conform to changes in the law.

For example, in 1996, Congress enacted the National Securities Markets Improvement Act of 1996 ("NSMIA"), which preempted state "blue sky" securities regulation of all mutual funds. Since many of the investment restrictions initially adopted by the Fund (and its Predecessor Fund) were imposed by the states, these investment restrictions no longer apply. Additionally, some of the Fund’s other investment restrictions are more restrictive than the 1940 Act requires. As a result, certain changes are proposed in order to preserve the ability of the Fund to respond to favorable future legal, regulatory, market or technical changes.

While the increased flexibility may mean that the Fund will be subject to greater risk, the Trustees do not anticipate that the proposed changes, individually or in the aggregate, will change the overall level of risk associated with investing in the Fund. Furthermore, the Trustees want to assure you that these amendments do not indicate a departure from the principal investment objectives and strategies long held by the Fund’s management. Should the Proposals be approved by shareholders, it is anticipated that they would become effective on or about August 25, 2015.

Each of the investment restrictions proposed to be amended or eliminated, as well as the reason for each Proposal, is outline below.

| Proposal 3.1 | | Diversification. |

To amend the investment restriction that currently provides that the Fund will not:

| | | As to 75% of its assets, purchase the securities of any issuer (other than obligations issued or guaranteed as to principal and interest by the Government of the United States or any agency or instrumentality thereof) if, as a result of such purchase, more than 5% of its total assets would be invested in the securities of such issuer.

|

If the proposed amendment is approved by shareholders, the restriction would read that the Fund:

| | | Shall be a “diversified company” as that term is defined in the 1940 Act, as interpreted or modified by regulatory authorities from time to time.

|

The revisions to this fundamental restriction are merely to provide the Fund with maximum flexibility that is available under applicable law. The Fund has always operated as a “diversified” fund under the 1940 Act and this change does not change the Fund’s status. Currently, the 1940 Act requirements of a diversified company are:

| | at least 75 per centum of the value of its total assets is represented by cash and cash items (including receivables), Government securities, securities of | |

14

| | | other investment companies, and other securities for the purposes of this calculation limited in respect of any one issuer to an amount not greater in value than 5 per centum of the value of the total assets of such management company and to not more than 10 per centum of the outstanding voting securities of such issuer. | |

Moreover, if the current applicable law were to change, the Fund would be able to conform to any such new law.

| Proposal 3.2 | | 10% Ownership. |

To eliminate the investment restriction that currently provides that the Fund will not:

| | | Purchase stock or securities of an issuer (other than the obligations of the United States or any agency or instrumentality thereof) if such purchase would cause the Fund to own more than 10% of any class of the outstanding voting securities of such issuer. |

Applicable federal law currently does not require the Fund to have a fundamental investment restriction regarding 10% ownership of securities. The Fund is still required to comply with the “diversification” requirements as provided under Proposal 3.1 above. The restriction, as written and as applicable to the entire portfolio of the Fund, is more restrictive than current law requires. The elimination of this fundamental investment restriction is merely to provide the Fund with maximum flexibility. The Fund would remain subject to applicable provisions of the 1940 Act addressing diversification as noted above.

| Proposal 3.3 | | Acting as Underwriter. |

To amend the restriction that currently provides that the Fund will not:

| | | Act as an underwriter of securities of other issuers, except that the Fund may invest up to 10% of the value of its total assets (at time of investment) in portfolio securities which the Fund might not be free to sell to the public without registration of such securities under the Securities Act of 1933, as amended, or any foreign law restricting distribution of securities in a country of a foreign issuer. |

If the proposed amendment is approved by shareholders, the restriction would read that the Fund:

| | | May not underwrite securities issued by others except to the extent the Fund may be deemed to be an underwriter under the federal securities laws, in connection with the disposition of portfolio securities. |

The revisions to this fundamental restriction are merely to provide the Fund with maximum flexibility that is available under applicable law. Moreover, if the current applicable law were to change, the Fund would be able to conform to any such new law.

| Proposal 3.4 | | Buying or Selling Commodities. |

To amend the restriction that currently provides that the Fund will not:

| | | Buy or sell commodities or commodity contracts, provided that the Fund may utilize not more than 1.00% of its assets for deposits or commissions required to enter into and forward foreign currency contracts for hedging purposes. |

15

If the proposed amendment is approved by the shareholders, the investment restriction would read that the Fund:

| | | May invest in commodities only as permitted by the 1940 Act or other governing statute, by the Rules thereunder, or by the SEC or other regulatory agency with authority over the Fund. |

The current restriction prohibits the Fund from investing in commodities or commodity futures contracts pursuant to the specified percentage. The proposed restriction, while continuing to prohibit the purchase of physical commodities, would expand the ability of the Fund to purchase and sell futures contracts and options on futures. Such strategies are generally accepted under modern portfolio management and are regularly used by many mutual funds and other institutional investors.

To the extent the Fund invests in these derivative instruments, the Fund will be subject to certain risks. These risks include possible default by the other party to the transaction, illiquidity, and to the extent the Fund’s view as to certain market movements is incorrect, the risk that the use of such transactions could result in losses greater than if they had not been used. The use of such options may result in losses to the Fund, force the sale or purchase of securities at inopportune times or for prices other than current market values, limit the amount of appreciation the Fund can realize on its investments or cause the Fund to hold a security it might otherwise sell. The ability of the Fund to engage in futures contracts and options on futures will be subject to applicable rules of the Commodity Futures Trading Commission (“CFTC”). Additionally, income and gains from certain commodity-related derivatives are not qualifying income under Subchapter M of the Internal Revenue Code. As a result, the Fund’s ability to invest directly in commodity-linked derivatives as part of its investment strategy is limited by the requirement that it receive no more than 10% of its gross income from such investments.

In the event that this Proposal 3.4 is approved, the Fund would have authority to make investments in each of these areas, all of which may have certain risks associated with them. Although management of the Fund does not expect the Fund to invest in such derivative instruments, the Fund would not be prohibited from engaging in such activity in the future without shareholder approval.

To amend the restriction that currently provides that the Fund will not:

| | | Borrow money except for temporary or emergency purposes and then only in an amount not in excess of 5% of the lower of value or cost of its total assets, in which case the Fund may pledge, mortgage or hypothecate any of its assets as security for such borrowing but not to an extent greater than 5% of its total assets.

|

If the proposed amendment is approved by the shareholders, the investment restriction would read that the Fund:

| | | The Fund may not borrow money except as permitted under the 1940 Act, and as interpreted or modified by regulatory authority having jurisdiction, from time to time. |

The revisions to this fundamental restriction are merely to provide the Fund with maximum flexibility that is available under applicable law. The 1940 Act currently permits a fund to borrow up to an amount that has 300% asset coverage, which effectively permits a fund to borrow up to one-third of its assets measured after the borrowing, plus an additional 5% for temporary purposes. Since the Fund’s investment restriction is more restrictive than the current law, the proposed change would give the Fund’s investment sub-adviser maximum flexibility in managing the Fund’s assets. In the event this Proposal 3.5 is approved, the Fund would have greater borrowing authority than it currently has. Should the Fund choose in the future

16

to borrow, the volatility of the Fund’s net asset value may increase. Additionally, money borrowed would be subject to interest and other costs. These costs may exceed the gain on securities purchased with borrowed funds. Although management of the Fund does not expect the Fund to borrow money at this time, the Fund would not be prohibited from engaging in such activity in the future without shareholder approval. Generally, the risks associated with borrowing are that borrowing creates leverage which exaggerates the effect of any increase or decrease in the market price of securities in a fund’s portfolio and may make a fund more volatile than if it had not engaged in borrowing.

To amend the restriction that currently provides that the Fund will not:

| | | Make loans, except that the Fund may (1) lend portfolio securities; and (2) enter into repurchase agreements secured by U.S. Government securities. |

If the proposed amendment is approved by shareholders, the investment restriction would read that the Fund:

| | | May not make loans to others, except as permitted under the 1940 Act, and as interpreted or modified by regulatory authority having jurisdiction, from time to time. |

The revisions to this fundamental restriction are merely to provide the Fund with maximum flexibility that is available under applicable law.

| Proposal 3.7 | | Concentration. |

To amend the restriction that currently provides that the Fund may not:

| | | Invest more than 25% of the Fund’s total assets in securities of one or more issuers having their principal business activities in the same industry. For the purpose of this restriction, telephone companies are considered to be in a separate industry from gas and electric public utilities, and wholly owned finance companies are considered to be in the industry of their parents if their activities are primarily related to financing the activities of their parents. |

If the proposed amendment is approved by shareholders, the investment restriction would read that the Fund:

| | | May not invest more than 25% of the value of its net assets in any one industry or group of industries (except that securities of the U.S. government, its agencies and instrumentalities are not subject to these limitations.) |

The revisions to this fundamental restriction are merely to provide the Fund with maximum flexibility that is available under applicable law. Additionally, the 1940 Act requirement relates to 25% of the value of a fund’s “net” assets as opposed to “total” assets and, while the Fund has been operated in a manner that is consistent with the 1940 Act, the prior restriction specified “total” assets.

| Proposal 3.8 | | Investments in Other Investment Companies. |

To eliminate the investment restriction that currently provides that the Fund will not:

| | | Invest in securities of other investment companies except by purchase in the open market involving only customary broker’s commissions, or as part of a merger, consolidation, or acquisition of assets. |

17

Applicable federal law currently does not require the Fund to have a fundamental investment restriction regarding investments in other investment companies. The Fund is required to comply with the 1940 Act restrictions on investments in other investment companies. Under Section 12(d)(1) of the 1940 Act, a fund may invest up to 5% of its total assets in the securities of any one investment company, but may not own more than 3% of the outstanding voting stock of any one investment company or invest more than 10% of its total assets in the securities of other investment companies.

| Proposal 3.9 | | Investments in Oil and Gas. |

To eliminate the investment restriction that currently provides that the Fund will not:

| | | Invest in interests in oil, gas, or other mineral explorations or development programs. |

Applicable law currently does not require the Fund to have a fundamental investment restriction on investments in oil and gas. Restrictions on purchasing or selling interests in oil, gas, etc. are based on the requirements formerly imposed by state “blue sky” regulators as a condition to registration. As a result of the NSMIA, this restriction is no longer applicable and may be eliminated. While management of the Fund does not have a current intent of making any such investments that view may change at any time.

| Proposal 3.10 | | Senior Securities. |

To amend the restriction that currently provides that the Fund may not:

Issue senior securities.

If the proposed amendment is approved by shareholders, the investment restriction would read that the Fund:

| | | May not issue any senior security to others, except as permitted under the 1940 Act, and as interpreted or modified by regulatory authority having jurisdiction, from time to time. |

A “senior security” is an obligation of a fund with respect to its earnings or assets that takes precedence over the claims of the fund’s shareholders with respect to the same earnings. A Fund may not issue a senior security. However, the SEC staff has indicated that it will not raise the issue as to whether a fund has created a senior security where the fund had segregated assets appropriately or entered into offsetting transactions. For example, short sales, certain options and futures transactions, reverse repurchase agreements and any securities transactions that obligate a fund to pay money at a future date (such as when-issued, forward commitment, or delayed delivery transactions) are permitted investments that may raise these issues. In the event that this Proposal 3.10 is approved, the Fund would have a more standardized senior securities restriction.

| Proposal 3.11 | | Joint Trading Account. |

To eliminate the restriction that currently provides that the Fund may not:

| | | Participate on a joint or joint and several basis in any securities trading account. |

Applicable federal law currently does not require the Fund to have a fundamental investment restriction regarding participation in securities trading accounts. The elimination of this fundamental investment restriction is merely to provide the Fund with maximum flexibility. The Fund would remain subject to the applicable provisions of the 1940 Act relating to participating in securities trading accounts.

18

| Proposal 3.12 | | Real Estate. |

To amend the restriction that currently provides that the Fund will not:

| | | Purchase or sell real estate (except that the Fund may invest in: (i) securities of companies which deal in real estate or mortgages; and (ii) securities secured by real estate or interests therein, and that the Fund reserves freedom of action to hold and to sell real estate acquired as a result of the Fund’s ownership of securities). |

If the proposed amendment is approved by shareholders, the investment restriction would read that the Fund:

| | | May not purchase or sell real estate except as permitted under the 1940 Act, and as interpreted or modified by regulatory authority having jurisdiction, from time to time. |

The revisions to this fundamental restriction are merely to provide the Fund with maximum flexibility that is available under applicable law. In the event Proposal 3.12 is approved, it may minimize the necessity for the Fund to obtain shareholder approval in order to take advantage of changes in applicable law and regulatory policy or to employ new types of investment opportunities and investment practices that are consistent with the Fund’s investment objectives and policies and with applicable law and regulatory policy.

| Proposal 3.13 | | Investments for Control. |

To eliminate the restriction that currently provides that the Fund will not:

| | | Invest in companies for the purpose of exercising control. |

The restriction on investing in a security for the purpose of obtaining or exercising control over the issuer was based on the requirements formerly imposed by state “blue sky” regulators, as a condition to registration. As a result of NSMIA, this restriction is no longer required and it is proposed it be eliminated from the Fund’s fundamental investment restrictions.

The Fund would remain subject to the applicable provisions of the 1940 Act that restrict the ability of an investment company to invest for control. Certain of those provisions are described above under Proposal 3.1 in the discussion of “diversified” funds and other provisions in the 1940 Act address limitations on investment by one investment company in another investment company. Management of the Fund does not anticipate making investments that are for the purposes of exercising voting control over any issuer.

| Proposal 3.14 | | Purchasing Securities on Margin. |

To eliminate the restriction that currently provides that the Fund will not:

| | | Purchase securities on margin, except that it may utilize such short-term credits as may be necessary for clearance of purchases or sales of securities. |

The fundamental investment restrictions on margin activities were based on the requirements formerly imposed by state “blue sky” regulators as a condition to registration. As a result of NSMIA, this restriction is no longer required. The Fund would remain subject to the applicable provisions of the 1940 Act and/or SEC staff guidance relating to purchases of securities on margin.

| Proposal 3.15 | | Short Sales. |

To eliminate the restriction that currently provides that the Fund will not:

19

The restriction on selling securities short was based on the requirements formerly imposed by state “blue sky” regulators as a condition to registration. As a result of NSMIA, this restriction is no longer required and the Trustees propose that it be eliminated from the Fund’s fundamental investment restrictions. Short sale transactions occur when a fund sells a borrowed security and agrees to return the same security to the lender. Should the Fund choose in the future to engage in short sales, the volatility of the Fund’s net assets value may increase. Engaging in short selling of securities involves leverage of the Fund’s assets and presents various other risks. The Fund may be obligated to cover its short position at a higher price than the short price, resulting in a loss. Losses on short sales are potentially unlimited as a loss occurs when the value of a security sold short increases. Nonetheless, the Fund would remain subject to applicable provisions of the 1940 Act relating to short sale transactions. Should the Fund engage in short sales, it may determine to cover its positions in a short sale by owning the shorted security or a call option on the shorted security with a strike price no higher than the price at which the security was sold short.

Note that Proposal 3 is NOT contingent on the approval by shareholders of Proposals 1 or 2.

Required Vote

Approval of the proposal requires the vote of the “majority of the outstanding voting securities” of the Fund. Under the 1940 Act, a “majority of the outstanding voting securities” is defined as the lesser of: (1) 67% or more of the voting securities of the Fund entitled to vote present in person or by proxy at the Special Meeting, if the holders of more than 50% of the outstanding voting securities entitled to vote thereon are present in person or represented by proxy; or (2) more than 50% of the outstanding voting securities of the Fund entitled to vote thereon.

THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE

PROPOSED REVISIONS TO THE FUND’S FUNDAMENTAL INVESTMENT RESTRICTIONS

20

FURTHER INFORMATION ABOUT VOTING AND THE SPECIAL MEETING

Quorum. One-third (1/3) of the outstanding shares entitled to vote, present in person or represented by proxy, shall constitute a quorum for the transaction of business at the Special Meeting. Approval of each Proposal requires the affirmative vote of a majority of the outstanding voting securities (as defined in the 1940 Act) of the Fund, which, for these purposes, is the vote of (1) 67% or more of the voting securities entitled to vote on the Proposal that are present at the Meeting, if the holders of more than 50% of the outstanding shares are present or represented by proxy, or (2) more than 50% of the outstanding voting securities entitled to vote on the Proposal, whichever is less. Abstentions and broker non-votes will have the effect of a “no” vote on the Proposals.

“Broker non-votes” (i.e., shares held by brokers or nominees as to which (i) instructions have not been received from the beneficial owners or the persons entitled to vote and (ii) the broker or nominee does not have discretionary voting power on a particular matter) and abstentions will be counted for purposes of determining the presence of a quorum. However, since such shares are not voted in favor of a Proposal, they have the effect as counting AGAINST the proposal.

Note that Proposal 2 is contingent on the approval by shareholders of Proposal 1 and a new sub-adviser for the Fund.

Other Business. The Trustees know of no other business to be brought before the Special Meeting. However, if any other matters properly come before the Special Meeting, they intend that proxies that do not contain specific restrictions to the contrary be voted on such matters in accordance with the judgment of the persons named in the proxy card. The Trust does not have annual meetings and, as such, does not have a policy relating to the attendance by the Trustees at shareholder meetings.

Revocation of Proxies. If you appoint a proxy by signing and returning your proxy card, you can revoke that appointment at any time before it is exercised. You can revoke your proxy by sending in another proxy with a later date, by notifying the Trust’s Secretary in writing, that you have revoked your proxy prior to the Special Meeting, at the following address: 8730 Stony Point Parkway, Suite 205, Richmond, VA 23235, or by attending the Special Meeting and voting in person.

Shareholder Proposals. Any shareholder proposals to be included in the proxy statement for the Trust’s next meeting of shareholders must be received by the Trust within a reasonable period of time before the Trust begins to print and send its proxy materials.