| SCHEDULE 14A INFORMATION |

| | Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 |

| Filed by the Registrant  |

| Filed by a Party other than the Registrant o |

| Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to Sec. 240.14a-12 |

World Funds Trust

| (Name of Registrant as Specified in Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| | No fee required. |

| | | | | |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | 1) | | Title of each class of securities to which transactions applies: |

| | | | | |

| | | 2) | | Aggregate number of securities to which transaction applies: |

| | | | | |

| | | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | | |

| | | 4) | | Proposed maximum aggregate value of transaction: |

| | | | | |

| | | 5) | | Total fee paid: |

| o | | Fee paid previously with preliminary materials. |

| o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identity the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | | Amount Previously Paid: |

| 2) | | Form, Schedule or Registration Statement No.: |

| 3) | | Filing Party: |

| 4) | | Date Filed: |

| World Funds Trust |

| Global Strategic Income Fund |

| 8730 Stony Point Parkway, Suite 205 |

| Richmond, Virginia 23235 |

| | October 31, 2017 |

Dear Shareholder:

A Special Meeting of the Shareholders of the Global Strategic Income Fund (the “Fund”), a portfolio series of the World Funds Trust (the “Trust”), will be held on December 7, 2017 at 10:00 a.m., Eastern Time.

The Trust’s Board of Trustees is seeking your vote for the approval of: (i) a new investment advisory agreement for the Fund with a new investment adviser; (ii) a new investment sub-advisory agreement for the Fund with a new sub-adviser; and (iii) a change in the investment objective of the Fund and changing the investment objective to non-fundamental. These proposals, along with other changes to the Fund, are designed in part, to make the Fund more attractive in terms of cost, more competitive in the marketplace, and to provide for stable portfolio management for the Fund. The current adviser has not indicated a willingness to continue to serve as the investment adviser on a long-term basis and has asked the Board of Trustees to identify an alternative manager. The Board has determined after extensive assessments, that the newly proposed investment adviser, Mission Institutional Advisors, LLC dba Mission Funds Advisors (“Mission”), and sub-adviser, Auour Investments, LLC (“Auour”), will be the most beneficial option to shareholders. The Board believes Mission and Auour will be able to implement a superior investment program for shareholders. The Board notes that Mission has proposed an advisory fee that is more than 50% less than what is currently in place and it has proposed an expense limitation arrangement that also provides substantial benefits to shareholders. The Board also notes its belief that Auour has the capacity to deliver a superior investment program to the Fund. Accordingly, the Board has approved these measures and is putting forth these proposals for your review and approval.

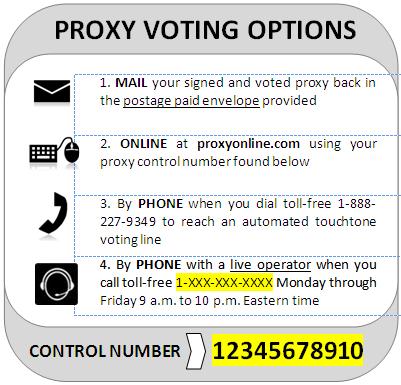

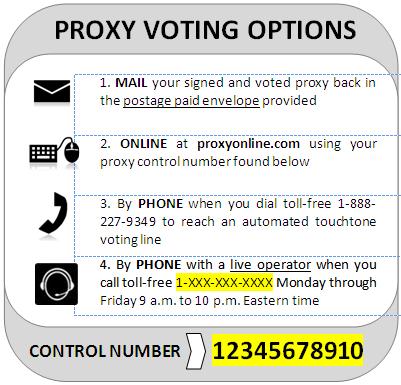

We urge you to complete, sign and return the enclosed proxy card promptly. A postage-paid envelope is enclosed for this purpose. Whether or not you plan to be present at the meeting, your vote is important and you are, therefore, strongly encouraged to return a proxy card for the Fund.

If your shares are held in street name, only your bank or broker can vote your shares and generally only upon receipt of your specific instructions. Please contact the person responsible for your account and instruct him or her to execute a proxy card today.

We look forward to receiving your proxy so that your shares may be voted at the meeting.

Sincerely,

/s/ David A. Bogaert

David A. Bogaert,

President

| World Funds Trust |

| Global Strategic Income Fund |

| 8730 Stony Point Parkway, Suite 205 |

| Richmond, Virginia 23235 |

| | Important Notice Regarding Availability of Proxy Materials for the |

| Shareholder Meeting to be held on December 7, 2017 |

| | This Proxy Statement is Available online at the Following Website: |

| http://www.theworldfundstrust.com/gsifproxy.2017 |

| | | NOTICE OF SPECIAL MEETING OF SHAREHOLDERS |

To Shareholders of the Global Strategic Income Fund (the “Fund”):

Notice is hereby given that a special meeting of the shareholders (the “Special Meeting”) of the Fund, a portfolio series of the World Funds Trust (the “Trust”) will be held on December 7, 2017 at the offices of the Trust (8730 Stony Point Parkway, Suite 205, Richmond, Virginia 23235), at 10:00 a.m., Eastern Time, for the following purposes, which are more fully described in the accompanying Proxy Statement:

| | 1. | | To approve a new investment advisory agreement between the Trust and Mission Institutional Advisors, LLC d/b/a Mission Fund Advisors on behalf of the Fund; |

| | | | |

| | 2. | | To approve a new investment sub-advisory agreement between Mission Institutional Advisors, LLC d/b/a Mission Fund Advisors and Auour Investments, LLC on behalf of the Fund; |

| | | | |

| | 3. | | To approve a revision to the investment objective of the Fund and to make the investment objective non-fundamental; and |

| | | | |

| | 4. | | To transact such other business as may properly come before the Special Meeting and any postponement or adjournment thereof. |

The Board of Trustees recommends that you vote FOR each Proposal identified in this Proxy Statement. The Board of Trustees of the Trust has set the close of business on October 11, 2017 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Special Meeting or any postponement or adjournment thereof. Copies of these proxy materials, including this notice of the Special Meeting, the Proxy Statement, and the proxy card, also are available to you at http://www.theworldfundstrust.com/gsifproxy2017. Information on how to obtain directions to attend the Special Meeting and vote in person can be obtained by calling 1-800-673-0550.

We urge you to mark, sign, date and mail the enclosed proxy in the postage-paid envelope provided as soon as possible so that you will be represented at the Special Meeting. If you desire to vote in person at the Special Meeting, you may revoke your proxy at any time before it is exercised. Your vote is important no matter how many shares you own. In order to avoid the additional expense of further solicitation, we ask your cooperation in completing your proxy card promptly.

By order of the Board of Trustees of the Trust,

Sincerely,

/s/ David A. Bogaert

David A. Bogaert,

President

| PROXY STATEMENT |

| | World Funds Trust |

| Global Strategic Income Fund |

| | 8730 Stony Point Parkway, Suite 205 |

| Richmond, Virginia 23235 |

| | INTRODUCTION |

The enclosed proxy is solicited by the Board of Trustees (the “Board”) of World Funds Trust (the “Trust”) for use at the Special Meeting of Shareholders (the “Special Meeting”) of the Global Strategic Income Fund (the “Fund”) to be held on December 7, 2017 at the offices of the Trust (8730 Stony Point Parkway, Suite 205, Richmond, Virginia 23235), at 10:00 a.m., Eastern Time, and any postponement or adjournment thereof, for action upon the matters set forth in the accompanying Notice of the Special Meeting of Shareholders (the “Notice”). Shareholders of record at the close of business on October 11, 2017 are entitled to be present and to vote at the Special Meeting or any postponed or adjourned session thereof. The Notice, this Proxy Statement and the enclosed proxy card are first being mailed to shareholders on approximately October 31, 2017.

The Trustees recommend that you vote:

| | 1. | | For the new investment advisory agreement. |

| | | | |

| | 2. | | For the new investment sub-advisory agreement. |

| | | | |

| | 3. | | For the change to the investment objective and to make the investment objective non-fundamental. |

| | | | |

| | 4. | | In the discretion of the persons named as proxies in connection with any other matters that may properly come before the Special Meeting or any postponement or adjournment thereof. |

Each whole share of each class of the Fund is entitled to one vote as to any matter on which it is entitled to vote and each fractional share of each class is entitled to a proportionate fractional vote. Shares represented by your duly executed proxy will be voted in accordance with your instructions. If no instructions are made on a submitted proxy, the proxy will be voted FOR each Proposal.

1

| |

| | INTRODUCTION AND BACKGROUND |

| | |

The Board of Trustees (the “Board”) of the World Funds Trust (the “Trust”) has approved, and its proposing for approval to shareholders, a new investment adviser (see Proposal 1 below) and a new sub-adviser (see Proposal 2 below) for the Global Strategic Income Fund (the “Fund”). The current investment adviser to the Fund, Commonwealth Capital Management, LLC (“CCM”), has indicated to the Board that it is not willing to continue to serve as investment adviser to the Fund on a long-term basis. CCM suggested to the Board that engagement of a new investment adviser, and upon the advice of such new investment adviser, the engagement of a new sub-adviser, may be an option that the Board would want to consider for the Fund. In this regard, the Board considered a number of options for the Fund, including focusing on alternative investment advisers to the Fund as a long-term proposition and whether the current sub-adviser (Shikiar Asset Management, Inc. “Shikiar”) would be suitable for assuming a full advisory capacity for the Fund. Shikiar did not indicate a willingness or interest to the Board in assuming full investment management responsibilities for the Fund. The Board also considered whether liquidating the Fund would be appropriate, but determined that this option would not be the best option for all shareholders in that it would force a potential tax event and investment decision on certain shareholders, and the Board felt that if a particular shareholder did not approve of any proposed new investment advisory and sub-advisory arrangements, they could easily and individually determine to redeem their interest in the Fund. After discussions with CCM and the Fund’s other service providers, the Board concluded that identifying and retaining a new investment adviser and/or sub-adviser selected by any such new investment adviser would be in the Fund’s and shareholders’ best interest. Upon identifying a potential adviser, the Board directed the officers of the Trust to terminate the advisory arrangements with CCM and Shikiar. Contemporaneously, the Board considered and approved an alternative investment adviser and sub-adviser at a special Board meeting held on September 20, 2017. The Board approved, subject to shareholder vote, Mission Institutional Advisors, LLC d/b/a Mission Fund Advisors (“Mission”) as the new investment adviser to the Fund and Auour Investments, LLC (“Auour”) as the new investment sub-adviser to the Fund. As discussed in greater detail below, the Board noted in particular the proposal by Mission to lower significantly the investment advisory fees and expense limitation arrangements for the Fund. Additionally, at its special meeting held on September 20, 2017, the Board approved an interim advisory agreement with Mission and an interim sub-advisory agreement with Auour so that they may commence providing advisory and sub-advisory services to the Fund effective on November 7, 2017. The Board noted that while the contractual advisory fee rate that would be in effect on November 7, 2017 would remain the same as the contractual rate that is in place with CCM (i.e., 1.25%), Mission agreed to voluntarily waive its fees to the contractual levels that are provided for in the new advisory agreement with Mission (i.e., 0.60%), subject to the other regulatory requirements applicable to interim advisory arrangements.

Along with the new advisory and sub-advisory arrangement proposals, the Board also approved certain other changes for the Fund at its special meeting held September 20, 2017. Each of these changes were designed with the view toward making the Fund more attractive in terms of costs, more competitive in the marketplace, and to provide for stable portfolio management for the Fund. These changes include:

2

| | • | | the creation of new share classes – Class Z Shares, Institutional Class Shares, and Investor Class Shares |

| | • | | the conversion of Class C Shares into Class A shares; |

| | • | | changes to certain service provider arrangements, including those relating to the provision of custodian and fund accounting services; |

| | • | | revisions to the Fund’s investment strategies; |

| | • | | approval of a new investment objective (see Proposal 3 below); and |

| | • | | a change to the Fund’s name – from Global Strategic Income Fund to the Mission – Auour Risk-Managed Global Equity Fund. |

NOTE: Shareholders are not required, and are not being asked, to vote on the foregoing changes, other than those specifically identified as Proposal 1, Proposal 2, or Proposal 3. The implementation of the foregoing changes is not contingent on any of the proposals in this proxy statement being passed. Notwithstanding, should Proposal 1 and Proposal 2 not be passed by shareholders, the Trustees would consider other options for the Fund, including liquidation and winding down the affairs of the Fund.

3

APPROVAL OF A NEW INVESTMENT ADVISORY AGREEMENT

The new investment advisory agreement with Mission is being submitted to shareholders for approval as required by the Investment Company Act of 1940, as amended (the “1940 Act”). The information provided in this section is designed to allow you to understand the new proposed advisory arrangement, as well as to compare the proposed arrangement to the arrangement that is in place with the current investment adviser.

Previous Investment Adviser

Until November 6, 2017, CCM will serve as the Fund’s investment adviser pursuant to an investment advisory agreement between CCM and the Trust dated August 15, 2014, and amended February 22, 2017 (the “CCM Advisory Agreement”). CCM is located at 8730 Stony Point Parkway, Suite 205, Richmond, Virginia 23235. As of March 31, 2017, CCM had approximately $13 million in assets under management. John Pasco, III, is President of CCM and is its sole owner.

The CCM Advisory Agreement was last approved by the Board of Trustees at its February 22-23, 2017 meeting. Prior to this approval, the CCM Advisory Agreement was approved by the Board of Trustees at its February 18-19, 2016 meeting and by the sole shareholder of the Fund on May 16, 2014 in connection with a reorganization of the Fund. The Fund was reorganized from a series of World Funds, Inc., a Maryland corporation, to a series of the Trust.

Pursuant to the terms of the CCM Advisory Agreement, the Adviser paid all expenses incurred by it in connection with its activities thereunder, except the cost of securities (including brokerage commissions, if any) purchased for the Fund. The services furnished by CCM under the CCM Advisory Agreement are not exclusive, and CCM was free to perform similar services for others.

CCM received from the Fund an annual fee of 1.25% of the first $500 million of average daily net assets and 1.00% on average daily net assets over $500 million of the Fund (and deducted proportionately from each class of shares). The fee payable pursuant to the CCM Advisory Agreement is calculated and accrued daily, and, subject to the provisions of an applicable expense limitation agreement, paid monthly. Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Fund within three fiscal years following the fiscal year in which the expense was incurred, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and at the time the waiver or reimbursement is recouped. CCM received the following payments for each of the years set forth below ending on December 31st:

| |

| | | | | | | | | | | | 2016 | | 2015 | | 2014 |

|

| |

| | | | | | | | | Gross Advisory Fees | | | $178,199 | | $213,905 | | $268,811 |

| |

| | | | | | | | |

| Waivers and reimbursements | | | $107,124 | | $192,856 | | $157,563 |

| |

| | | | | | | | |

| Net Advisory fees | | | $71,075 | | $21,049 | | $111,248 |

| |

4

CCM contractually agreed to waive or limit its fees and/or assume other expenses until April 30, 2018 so that the ratio of total annual operating expenses is limited to 2.35% of the Fund’s annual average net assets. The foregoing limitation excludes interest, distribution fees pursuant to Rule 12b-1 Plans, taxes, acquired funds fees and expenses, brokerage commissions, dividend expenses on short sales, and other expenditures which are capitalized in accordance with generally accepted accounting principles, and other extraordinary expenses not incurred in the ordinary course of the Fund’s business. This expense limitation agreement may be terminated by CCM or the Board of Trustees of the Trust at any time after April 30, 2018. Prior to May 1, 2017, CCM entered into a written expense limitation agreement with the same exclusions noted above, to limit total annual operating expenses to an annual rate of 2.50% of the average daily net assets of the Fund. Despite the foregoing, in conjunction with the termination of the CCM Advisory Agreement, the expense limitation obligations of CCM also were terminated. As a result, the Fund will not be subject to an expense limitation from November 7, 2017 (the date that the Interim Advisory Agreement becomes effective until on or about December 8, 2017 (i.e., the anticipated date of effectiveness of the New Advisory Agreement (defined below).

The total amount of reimbursement that would have been recoverable by CCM would have been the sum of all fees previously waived or reimbursed by CCM to the Fund during the previous three (3) years, less any reimbursement previously paid. The total amount of recoverable reimbursements as of December 31, 2016 was $457,543, which will expire as follows:

| 2017 | | | $157,563 |

| 2018 | | | 192,856 |

| 2019 | | | 107,124 |

| | | | |

| | | | $457,543 |

Such recoupment was approved by shareholders in connection with the reorganization of the Fund into the Trust. In conjunction with the termination of the CCM Advisory Agreement, the ability of CCM to recoup the foregoing amounts was also terminated.

Proposed New Adviser

The Board is recommending that shareholders approve Mission as the new investment adviser for the Fund. Mission was organized on August 22, 2017 as a Texas limited liability company and its address is 2651 North Harwood Street, Suite 525, Dallas, Texas 75201. The names, mailing addresses and principal occupation of the principal executive officers of Mission as of the date of this proxy statement are set forth below.

| Name and Address | Principal Occupation |

Jeff Groves

P.O. Box 25523

Dallas, Texas 75225 | Chief Executive Officer |

Michael Young

P.O. Box 25523

Dallas, Texas 75225 | President / Chief Operating Officer |

Sharon Goldberg

P.O. Box 25523

Dallas, Texas 75225 | Chief Compliance Officer |

5

At this time, Mission does not advise any other registered investment companies.

The principals of Mission are also affiliated with another investment adviser (Integrated Adviser Network LLC) and a compliance consulting firm (Compliance Works, Inc). As of the date of this proxy statement, it is contemplated, but not agreed to, that the affiliated compliance consulting firm may provide its services to Auour. Additionally, as described also in Proposal 2 below, Mission and Auour contemplate an on-going relationship between the parties pursuant to a separate agreement dated October 2, 2017 wherein, among other things: (i) Mission agrees to recommend to the Board that Auour continue to serve as sub-adviser for the Fund subject to Board approval and other conditions, insofar as recommendation is consistent with Mission’s and the Board’s respective fiduciary duties; (ii) Auour agrees to limit its provision of advisory or sub-advisory services to other open-end investment management companies with similar investment objectives to that of the Fund; and (iii) Auour makes certain concessions related to the expense limitation arrangements for the Fund.

The Interim Advisory Agreement

As noted above, the Board terminated the advisory relationship with CCM, and at its September 20, 2017 special meeting, the Board, including by separate vote of a majority of the Independent Trustees (as defined by the Investment Company Act of 1940, as amended (the “1940 Act”)), appointed Mission as the new adviser to the Fund on an interim basis pursuant to an interim advisory agreement effective November 7, 2017 (the “Interim Advisory Agreement”). Because the new Advisory Agreement with Mission (the “New Advisory Agreement”) has not been approved by shareholders of the Fund, the Interim Advisory Agreement will continue in effect for a term ending on the earlier of 150 days from November 7, 2017 or when the shareholders of the Fund approve the New Advisory Agreement.

The terms of the Interim Advisory Agreement are, in substance, substantially similar to those of the proposed New Advisory Agreement (as described below), except for certain provisions that are required by law. The provisions required by law include a requirement that fees payable under the Interim Advisory Agreement be paid into an escrow account. If the Fund’s shareholders approve the New Advisory Agreement by the end of the 150-day period, the compensation (plus interest) payable under the Interim Advisory Agreement will be paid to Mission, but if the New Advisory Agreement is not so approved, only the lesser of the costs incurred (plus interest) or the amount in the escrow account (including interest) will be paid to Mission.

Comparison of CCM Advisory Agreement and New Advisory Agreement

At its September 20, 2017 meeting, the Board, including by separate vote of a majority of the Independent Trustees, reviewed and approved the New Advisory Agreement between Mission and the Trust, subject to shareholder approval. The New Advisory Agreement will become effective the day after its approval by Fund shareholders. A general discussion of the differences

6

between the New Advisory Agreement and the CCM Advisory Agreement is described below. Additionally, set forth below is a summary of certain material terms of the New Advisory Agreement. The form of the New Advisory Agreement is included as Appendix A-1. The description of the differences between the agreements and the summary of certain material terms of the New Advisory Agreement below are included in Appendix A-1, as well as the current CCM Advisory Agreement that is included as Appendix A-2 are qualified in their entirety by reference to the form of New Advisory Agreement included as Appendix A-1 and the CCM Advisory Agreement included as Appendix A-2.

Differences Between the Agreements

Other than the dates of the Agreements, the parties to the Agreements, and the Fund name, the below lists certain differences among the Agreements. The Commonwealth Agreement is contained in Appendix A-2. Investors are encouraged to review and compare the CCM Advisory Agreement and the New Advisory Agreement. The discussion of the differences described below is qualified in its entirety by the actual terms of the agreements contained in Appendices A-1 and A-2.

The New Advisory Agreement includes certain modernized language such as language on recordkeeping requirements under the Investment Company Act of 1940, as amended. The New Advisory Agreement also places a specific requirement on Mission that it provide to the Board of Trustees information required by certain shareholder reports on Securities and Exchange Commission (“SEC”) Forms N-CSR, N-Q, N-PX, among others. It also places a specific requirement on Mission that it make its officers and employees available to meet with the Board from time to time, on a reasonable basis.

The New Advisory Agreement subjects Mission to a lower standard of care and liability than CCM. The New Advisory Agreement provides that Mission shall not be liability for any error of judgement or mistake of law or for any loss arising out of any investment or for any act or omission in the execution of securities transactions of the Fund; provided that nothing in the New Advisory Agreement shall be deemed to protect Mission against any liability to the Fund or its shareholders to which it would otherwise be subject by reason of willful misfeasance, bad faith or gross negligence in the performance of its duties or obligations hereunder or by reason of its reckless disregard of its duties or obligations hereunder. The Commonwealth Agreement provides that CCM shall not be subject to liability to the Trust or the Fund or to any shareholder of the Fund for any act or omission in the course of, or connected with, rendering services hereunder or for any losses that may be sustained in the purchase, holding, or sale of any security by the Fund in the absence of willful misfeasance, bad faith, negligence, or reckless disregard of the obligations or duties on the part of CCM (emphasis added). Advisory fees under both the New Advisory Agreement and the Commonwealth Agreement are paid monthly, but the specific provisions as to the timing of the payments differ. Additionally, as noted later in this Proposal 1, the fees under the New Advisory Agreement are lower than those under the Commonwealth Agreement.

Material Terms of the New Advisory Agreement

The New Advisory Agreement will become effective the day after its approval by Fund shareholders. The New Advisory Agreement is similar to the Commonwealth Agreement, except for the differences noted above and below, and the parties, the date and the name of the Fund. Set forth below is a summary of all material terms of the New Advisory Agreement. The form of the

7

New Advisory Agreement is included as Appendix A-1. The summary of all material terms of the New Advisory Agreement below is qualified in its entirety by reference to the form of New Advisory Agreement included as Appendix A-1.

The fee rate under the Commonwealth Agreement as compared to the New Advisory Agreement has been changed. CCM received from the Fund an annual fee of 1.25% of the first $500 million of average daily net assets and 1.00% on average daily net assets over $500 million of the Fund (and deducted proportionately from each class of shares). The fee was paid to CCM within the first 5 business days following month-end. Under the New Advisory Agreement the fee to be received by Mission from the Fund will be 0.60% of the Fund’s average daily net assets and the payment terms will remain as a monthly payment.

The New Advisory Agreement would require Mission to provide substantially the same services as provided by CCM. Mission shall, subject to supervision of the Board of Trustees, provide the Fund with investment research, advice and supervision and shall furnish continuously an investment program for the Fund, consistent with the respective investment objectives and policies of the Fund. Mission shall determine, from time to time, what securities shall be purchased for the Fund, what securities shall be held or sold by the Fund and what portion of the Fund’s assets shall be held uninvested in cash, subject to provisions of the Trust’s charter documents and the Fund’s registration statement, among other requirements under the 1940 Act and the Securities Act of 1933, as amended. As described in Proposal 2, it is proposed that Auour will become the sub-adviser to the Fund. Under these arrangements, Mission will be responsible for overseeing Auour. Under the terms of the New Sub-Advisory Agreement, Auour will be responsible for determining the appropriate securities to purchase and sell for the Fund; however, Mission will retain authority for trading and therefore will effect all purchase and sell transactions as directed by Auour.

In conjunction with the approval of the New Advisory Agreement, Mission has agreed to a written expense limitation agreement under which it will limit the total expenses of the Fund (exclusive of interest, distribution fees pursuant to Rule 12b-1 Plans, taxes, acquired fund fees and expenses, brokerage commissions, extraordinary expenses and dividend expense on short sales) to an annual rate of 1.20% of the average daily net assets of the Investor, Class A and Institutional Classes of shares of Fund and 1.12% of the Class Z shares. Mission may not terminate this expense limitation agreement prior to April 30, 2019. Each waiver or reimbursement of an expense by Mission is subject to repayment by the Fund within three fiscal years following the fiscal year in which the expense was incurred, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and at the time the waiver or reimbursement is recouped.

The New Advisory Agreement has the same duration and termination provisions as the Commonwealth Agreement. The New Advisory Agreement will have an initial term of two years from its effective date and will continue from year to year so long as the terms of the New Advisory Agreement are specifically approved by (i) a majority vote of the Trustees, including a majority vote of such Trustees who are not parties to the New Advisory Agreement or “interested persons” of the Trust or the investment adviser, at an in-person meeting called for the purpose of voting on such approval, or (ii) the vote of a majority of the outstanding voting securities of the Fund; provided, however, that if the continuance of this New Advisory Agreement is submitted to the shareholders of the Fund for their approval and such shareholders fail to approve such continuance of this agreement as provided herein, the investment adviser may continue to serve hereunder as to the Fund in a manner consistent with the 1940 Act and the rules

8

and regulations thereunder. The New Advisory Agreement may be terminated by the Trust or the investment adviser at any time on sixty (60) days’ prior written notice to the other, without payment of any penalty. Further, termination of the New Advisory Agreement may be authorized by action of the Board of Trustees or by an “affirmative vote of a majority of the outstanding voting securities of the Fund.” The New Advisory Agreement will terminate automatically in the event of its assignment.

The New Advisory Agreement subjects Mission to a different standard of care than CCM as noted in the above section titled “Differences Between the Agreements.”

If the Fund’s shareholders approve the New Advisory Agreement, it is expected that the New Advisory Agreement would become effective on or about December 8, 2017 subject to any adjournments of the Special Meeting.

Board Considerations of the New Advisory Agreement and New Sub-Advisory Agreement

At a meeting held on September 20, 2017, the Board reviewed and discussed the approval of the New Advisory Agreement between the Trust and Mission and the new investment sub-advisory agreement between Mission and Auour (the “New Sub-Advisory Agreement”). The Board also convened to reconsider the Sub-Advisory Agreement on October 5, 2017. At those meetings, legal counsel to the Trust (“Counsel”) noted that the 1940 Act requires the approval of these types of agreements between the Trust and its service providers by a majority of the Independent Trustees.

The Board reflected on its discussions regarding the proposed New Advisory Agreement, New Sub-Advisory Agreement, the proposed expense limitation arrangements and the anticipated manner in which the Fund would be managed with representatives of Mission and Auour. Counsel referred to the materials that had been provided in connection with the approval of the New Advisory Agreement and New Sub-Advisory Agreement for the Fund, and Counsel reviewed the types of information and factors that the Board should consider in order to make an informed decision regarding the approval of each of the New Advisory Agreement and New Sub-Advisory Agreement (collectively, the “Agreements” for purposes of this section of the proxy solely).

In assessing these factors and reaching its decisions, the Board took into consideration information specifically prepared and/or presented in connection with the approval process with respect to the Fund, including information presented to the Board by representatives from Mission and Auour. The Board requested and/or was provided with information and reports relevant to the approval of the Agreements, including: (i) reports regarding the services and support to be provided to the Fund and its shareholders; (ii) presentations by management of Mission and Auour addressing the investment philosophy, investment strategy, personnel and operations to be utilized in managing the Fund; (iii) disclosure information contained in the registration statement of the Trust and the Form ADV and/or policies and procedures of each of Mission and Auour; and (iv) the memorandum from Counsel that summarized the fiduciary duties and responsibilities of the Board in reviewing and approving the Agreements, including the material factors set forth above and the types of information included in each factor that should be considered by the Board in order to make an informed decision.

The Board also requested and received various informational materials including, without limitation: (i) documents containing information about Mission and Auour, including financial information, a description of personnel and the services to be provided to the Fund, information on

9

investment advice, performance, summaries of anticipated expenses for the Fund, compliance program, current legal matters, and other general information; (ii) comparative expense and performance information; (iii) the anticipated effect of size on the Fund’s performance and expenses; (iv) benefits to be realized by Mission and Auour from their respective relationships with the Trust and the Fund; and (v) information about the contemplated on-going relationship between Mission and Auour.

The Board did not identify any particular information that was most relevant to its consideration to approve the Agreements and each Trustee may have afforded different weight to the various factors. In deciding whether to approve the Agreements, the Trustees considered numerous factors, including:

| | 1. | | The nature, extent, and quality of the services to be provided by Mission and Auour. |

| | | | |

| | | | In this regard, the Board considered the responsibilities of Mission and Auour under their respective Agreements. The Board reviewed the services to be provided by each of Mission and Auour including, without limitation, the process for formulating investment recommendations and assuring compliance with the Fund’s investment objectives and limitations; the anticipated coordination of services for the Fund among the service providers, and the anticipated efforts of Mission and Auour to promote the Fund and grow assets. The Board considered: Mission and Auour’s staffing, personnel, and methods of operating; the education and experience of its personnel, and their compliance programs, policies and procedures. The Board considered that while Mission was a newly formed entity and that it had no experience managing a mutual fund or supervising a sub-adviser to a mutual fund, its personnel had significant experience in the asset management industry and were capable of overseeing Auour. The Board also considered the financial condition of Mission and Auour. The Board considered the measures that Mission and Auour had put in place to ensure compliance with applicable law and regulations, including specifically those governing conflicts in regard to Auour’s management of separate accounts. The Board considered the methods to be utilized by Mission in supervising Auour as a sub-adviser to the Fund. The Board also considered the on-going relationship contemplated between and Mission and Auour and the affiliated relationships of Mission, including the compliance consulting service and the resources that could be leveraged from those affiliations to supplement the services to be provided by Mission to the Fund. After reviewing the foregoing and further information from Mission and Auour, and notwithstanding the limited operating experience of Mission, the Board concluded that the quality, extent, and nature of the services to be provided by each of Mission and Auour under the Agreements were adequate for the Fund. |

| | | | |

| | 2. | | Investment Performance of the Fund. |

| | | | |

| | | | The Board noted that neither Mission nor Auour had commenced managing the Fund and therefore a consideration of the Fund’s performance was not relevant to this factor. It was also noted that Mission did not manage any separate accounts and it was not anticipated that Mission would ever have any separate account clients. It was noted that the Trust has approved revising the investment objective and principal investment strategies of the Fund. It was also noted that Auour has separate account |

10

| | | | clients that were managed with strategies that are substantially similar (i.e., the Instinct Global Equity composite (the “Composite”)) to the revised strategies approved by the Board for the Fund. In this regard, the Board reviewed the Composite performance returns noting recent underperformance from that Composite’s benchmark, but it also noted the rationale for such underperformance provided by Auour, including that the underperformance related to a less-than-benchmark weight in international, both developed and emerging markets, which performed well relative to the U.S. markets. The Board noted that the Composite had out-performed the benchmark on a 3-year annualized basis. Based on the foregoing, the Board concluded that Auour’s performance as reflected in the Composite performance was satisfactory. |

| | | | |

| | 3. | | The costs of services to be provided and profits to be realized by Mission and Auour from the relationship with the Fund. |

| | | | |

| | | | In this regard, the Board considered: the financial condition of Mission and Auour and the level of commitment to the Fund by Mission’s principals and the expenses of the Fund, including the nature and frequency of advisory and sub-advisory fee payments. The Board noted representations from each of Mission and Auour as to assets that needed to be under management in the Fund in order for each adviser to become profitable. The Board noted that the proposed advisory fee for the Fund was substantially less than that currently in effect for the Fund under its current investment mandate and with its current adviser and sub-adviser. The Board noted that the reduced fee would potentially make the Fund very competitive with its peers. The Board noted that the overall expense cap for the Fund was set at 1.20%, which would place the Fund in the top quartile of the Tactical Allocation category of Morningstar - the peer group the Fund is expected to be in following the change to its investment strategy. The Board noted that this expense cap was also substantially lower than had been in place previously. The Board determined that the advisory and sub-advisory fees were within an acceptable range, which is below its peer group median, in light of the services to be rendered by each of Mission and Auour. Following this comparison and upon further consideration and discussion of the foregoing, the Board concluded that the fees to be paid to Mission (who in turn would pay Auour) were fair and reasonable. |

| | | | |

| | 4. | | The extent to which economies of scale would be realized as the Fund grows and whether advisory fee levels reflect these economies of scale for the benefit of the Fund’s investors. |

| | | | |

| | | | In this regard, the Board considered the Fund’s fee arrangements with Mission. The Board noted that the advisory fee does not include a breakpoint but that the effect of the expense limitation agreement to be entered into for the Fund would have the effect of capping the expenses at a certain level. The Board noted, and indicated that it was influential that Mission indicated that it currently intended to keep the expense cap in place for the foreseeable future. Following further discussion of the Fund’s projected asset levels, expectations for growth, and levels of fees, the Board determined that the Fund’s fee arrangement with Mission was fair and reasonable in relation to the nature and quality of the services to be provided by Mission and Auour. |

11

| | 5. | | Possible conflicts of interest and other benefits. |

| | | | |

| | | | In evaluating the possibility for conflicts of interest, the Board considered such matters as: the experience and ability of the advisory personnel assigned to the Fund; the basis of decisions to buy or sell securities for the Fund; the method for bunching of portfolio securities transactions; the substance and administration of Codes of Ethics and other relevant policies described in each of Auour’s Form ADV and compliance policies and procedures and Mission’s policies and procedures, such as personal conduct policies, personal trading policies, risk management and internal controls. The Board also considered potential benefits for Mission and Auour in managing the Fund and, in particular, noted that Auour may benefit by being able to place accounts beneath its separate account minimum into the Fund, thus potentially adding to overall Fund assets. The Board noted that Mission represented that it does not anticipate utilizing soft dollars or commission recapture with regard to the Fund. The Board noted policies in place to avoid conflicts of interest inherent in Auour’s management of other separate accounts with similar objective and strategies. The Board took into consideration the affiliations of Mission and considered the potential for conflicts of interest. Following further consideration and discussion, the Board indicated that Mission and Auour’s standards and practices relating to the identification and mitigation of potential conflicts of interest, as well as the benefits to be derived by each of Mission and Auour from managing the Fund were satisfactory. |

After additional consideration of the factors delineated in the memorandum provided by Counsel and further discussion among the Board members, the Board determined that the compensation payable under the New Advisory Agreement and the New Sub-Advisory Agreement, as proposed, was fair, reasonable and within a range of what could have been negotiated at arms-length in light of all the surrounding circumstances, and they resolved to approve each of those Agreements for an initial two-year term pending shareholder approval.

Changes to Principal Investment Strategies and Other Changes

The Board of Trustees, at its September 20, 2017, also approved changes to the Fund’s investment strategies. The changes to the Fund’s investment strategy are intended to conform to investment strategies that Auour has offered its advisory clients as a separate account service since the latter half of 2013. The changes to the principal investment strategies will be implemented under the interim investment advisory agreement described above, as well as the interim arrangements with Auour described in Proposal 2. Also, Proposal 3 of this proxy statement proposes a revision to the investment objective of the Fund. In conjunction with these changes, the Board also approved a change in the Fund accounting agent and custodian, and the Board is of the view that each of these changes will result in costs savings for the Fund.

The team of portfolio managers that will execute the specific investment strategies and day-to-day investment operations for the Fund are discussed in Proposal 2 below.

As a result of all of the foregoing changes, it is anticipated that shareholders will experience significant savings on the ongoing operating expense. Below are the estimated new fees and expenses associated with an investment in each of the classes of shares of the Fund commencing on or about December 8, 2017.

12

Note that the first table below relates to fees and expenses that are estimated following the approval by shareholders of the New Advisory Agreement and the New Sub-Advisory Agreement. The second table shows the current fees and expenses of the Fund as they are currently in place. These two tables presented below will allow you to make a comparison of the estimated savings in the on-going expenses of the Fund.

Fees and Expenses – Post Fund Changes

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

| |

| Shareholder Transaction Fees (fees paid directly from your investment) |

| |

| | | Class A | | Investor | | Institutional | | Class Z |

| | | Shares | | Class Shares | | Class Shares | | Shares |

| Maximum Sales Charge (Load) Imposed on Purchases (as a | | | 5.75% | | | | None | | | | None | | | | None | |

| % of offering price) | | | | | | | | | | | | | | | | |

| Maximum Deferred Sales Charge (Load) | | | None | | | | None | | | | None | | | | None | |

| | | | | | | | | | | | | | | | | |

| |

| Annual Fund Operating Expenses |

| (expenses that you pay each year as a percentage of the value of your investment) |

| |

| | | Class A | | Investor | | Institutional | | Class Z |

| | | Shares | | Class Shares | | Class Shares | | Shares |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Management Fee(1) | | | 0.60% | | | | 0.60% | | | | 0.60% | | | | 0.60% | |

| Distribution (12b-1) and Service Fees | | | 0.25% | | | | 0.25% | | | | 0.00% | | | | 0.00% | |

| Other Expenses | | | | | | | | | | | | | | | | |

Shareholder Servicing Plan | | | 0.12% | | | | 0.12% | | | | 0.08% | | | | 0.00% | |

Other Expenses | | | 0.69% | | | | 0.69% | | | | 0.69% | | | | 0.69% | |

| | | | | | | | | | | | | | | | | |

| Total Other Expenses(1) | | | 0.81% | | | | 0.81% | | | | 0.77% | | | | 0.69% | |

| | | | | | | | | | | | | | | | | |

| Acquired Fund Fees and Expenses | | | 0.01% | | | | 0.01% | | | | 0.01% | | | | 0.01% | |

| | | | | | | | | | | | | | | | | |

| Total Annual Fund Operating Expenses(1)(2) | | | 1.67% | | | | 1.67% | | | | 1.38% | | | | 1.30% | |

| Less Fee Waiver and/or Expense Reimbursement(2) | | | (0.21% | ) | | | (0.21% | ) | | | (0.17% | ) | | | (0.17% | ) |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Total Annual Fund Operating Expenses | | | | | | | | | | | | | | | | |

| After Fee Waiver and/or Expense Reimbursement(2) | | | 1.46% | | | | 1.46% | | | | 1.21% | | | | 1.13% | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| |

| | (1) | | The Management Fee, Other Expenses and Total Annual Fund Operating Expenses have been restated to reflect modifications to the fees provided for under the contractual service arrangements in place with certain of the Fund’s service providers. |

| | (2) | | Mission Institutional Advisors, LLC, dba Mission Funds Advisors (the “Adviser”) has entered into a written expense limitation agreement under which it has agreed to limit the total expenses of the Fund (exclusive of interest, distribution fees pursuant to Rule 12b-1 Plans, taxes, acquired fund fees and expenses, brokerage commissions, extraordinary expenses and dividend expense on short sales) to an annual rate of 1.20% of the average daily net assets of the Investor, Class A and Institutional Classes of shares of Fund and 1.12% of the Class Z shares. The Adviser may not terminate this expense limitation agreement prior to April 30, 2019. Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Fund within three fiscal years following the fiscal year in which the expense was incurred, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and at the time the waiver or reimbursement is recouped. |

13

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The effect of the Adviser’s agreement to waive fees and/or reimburse expenses is only reflected in the first year of each example shown below. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Share Class | 1 Year | 3 Years | 5 Years | 10 Years |

| Class A Shares | $715 | $1,052 | $1,412 | $2,421 |

| Investor Class Shares | $149 | $506 | $888 | $1,959 |

| Institutional Class Shares | $123 | $420 | $739 | $1,643 |

| Class Z Shares | $115 | $395 | $697 | $1,553 |

Fees and Expenses – Pre Fund Changes

Note that the below represents fees and expenses currently in place and shown in the Fund’s current prospectus dated May 1, 2017.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Fund. More information about these and other discounts is available from your financial professional and in the section “Distribution Arrangements” of this prospectus and in the Fund’s Statement of Additional Information (the “SAI”).

| |

| | | | | | | | | |

| Shareholder Transaction Fees (fees paid directly from your investment) |

| |

| | | | | | | | | |

| | | Class A Shares | | Class C Shares |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | | | 5.75 | %(1) | | | None | |

| Maximum Deferred Sales Charge (Load)(2) | | | None | | | | 1.00% | |

| | | | | | | | | |

| |

| | | | | | | | | |

| Annual Fund Operating Expenses |

| (expenses that you pay each year as a percentage of the value of your investment) |

| |

| | | | | | | | | |

| | | Class A Shares | | Class C Shares |

| Management Fee | | | 1.25% | | | | 1.25% | |

| Distribution (12b-1) and Service Fees | | | 0.25% | | | | 1.00% | |

| Other Expenses(3) | | | 1.79% | | | | 1.79% | |

| Shareholder Servicing Plan | | | 0.06% | | | | 0.06% | |

| | | | | | | | | |

| | | | | | | | | |

| Total Annual Fund Operating Expenses(3) | | | 3.35% | | | | 4.10% | |

| Less Fee Waiver and/or Expense Reimbursement(4) | | | (0.75% | ) | | | (0.75% | ) |

| | | | | | | | | |

| | | | | | | | | |

| Total Annual Fund Operating Expenses | | | | | | | | |

| After Fee Waiver and/or Expense Reimbursement | | | 2.60% | | | | 3.35% | |

| | | | | | | | | |

14

| |

| | (1) | | Investments of $1 million or more are not subject to a front-end sales charge but generally will be subject to a deferred sales charge of 1.00% if redeemed within one year from the date of purchase. |

| | (2) | | This deferred sales charge applies to Class C Shares sold within one year of purchase. |

| | (3) | | Other Expenses and Total Annual Fund Operating Expenses have been restated to reflect modifications to the fees provided for under the contractual service arrangements in place with the Fund’s administrator. |

| | (4) | | Commonwealth Capital Management, LLC (the “Adviser” or “CCM”) has contractually agreed to waive or limit its fees and to assume other operating expenses until April 30, 2018 so that the ratio of total annual operating expenses is limited to 2.35% of the Fund’s annual average net assets. The foregoing limitation excludes interest, distribution fees pursuant to Rule 12b-1 Plans, taxes, acquired funds fees and expenses, brokerage commissions, dividend expenses on short sales, and other expenditures which are capitalized in accordance with generally accepted accounting principles, and other extraordinary expenses not incurred in the ordinary course of the Fund’s business. The total amount of reimbursement recoverable by the Adviser is the sum of all fees previously waived or reimbursed by the Adviser to the Fund during the previous three (3) years, less any reimbursement previously paid. Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Fund within the three fiscal years following the fiscal year in which the expense was incurred, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and at the time the waiver or reimbursement is recouped. This expense limitation agreement may be terminated by the Adviser or the Board of Trustees of the Trust at any time after April 30, 2018. |

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The effect of the Adviser’s agreement to waive fees and/or reimburse expenses is only reflected in the first year of each example shown below. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Share Class | 1 Year | 3 Years | 5 Years | 10 Years |

| Class A Shares | $823 | $1,480 | $2,160 | $3,958 |

| Class C Shares | $438(1) | $1,179 | $2,035 | $4,244 |

| | (1) If you did not redeem your shares, your cost would be $338 for the one year period. |

Required Vote. Approval of the proposal requires the vote of the “majority of the outstanding voting securities” of the Fund. Under the 1940 Act, a “majority of the outstanding voting securities” is defined as the lesser of: (1) 67% or more of the voting securities of the Fund entitled to vote present in person or by proxy at the Special Meeting, if the holders of more than 50% of the outstanding voting securities entitled to vote thereon are present in person or represented by proxy; or (2) more than 50% of the outstanding voting securities of the Fund entitled to vote thereon. Proposal 1 is not contingent on any other proposals described in the proxy statement being approved by shareholders.

THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE PROPOSED NEW ADVISORY AGREEMENT.

15

APPROVAL OF A NEW INVESTMENT SUB-ADVISORY AGREEMENT

The New Sub-Advisory Agreement is being submitted to shareholders for approval as required by the 1940 Act.

Previous Sub-Adviser

Shikiar Asset Management, Inc. (“Shikiar”) serves as the Fund’s sub-adviser pursuant to a sub-advisory agreement between CCM and Shikiar dated October 1, 2015 (the “Shikiar Agreement”). Shikiar is a Delaware corporation located at 1185 Avenue of the Americas, 18th Floor, New York, New York 10036. Shikiar is controlled by Stuart A. Shikiar. As of March 31, 2017, Shikiar had approximately $350 million in assets under management. Shikiar has provided investment advisory services to high net worth individuals, pension and profit sharing plans and charitable organizations since 1995.

The Shikiar Sub-Advisory Agreement was last approved by the Board of Trustees of the Trust at its February 22-23, 2017 board meeting and by shareholders of the Fund at a shareholder meeting held on September 21, 2015.

CCM oversees Shikiar to ensure it complies with the investment policies and guidelines of the Fund and monitors its adherence to the Fund’s investment style. Under the Shikiar Agreement, Shikiar is responsible for the day-to-day decision-making with respect to the Fund’s investment program. Shikiar, with CCM’s oversight, manages the investment and reinvestment of the assets of the Fund and continuously reviews, supervises and administers the investment program of the Fund, determines in its discretion the securities to be purchased or sold and provides the Trust and its agents with records relating to its activities. CCM pays Shikiar at an annualized rate of 0.55% for net assets in the Fund up to $50 million and 0.50% on net assets greater than $50 million.

Shikiar received the following payments from CCM for its services as sub-adviser to the Fund for each of the years set forth below ending on December 31:

| October 1, 2015 to December 31, 2015 | $22,318 |

| Year ended December 31, 2016 | $78,407 |

Proposed New Sub-Adviser

The Board is recommending that shareholders approve Auour as the new sub-adviser for the Fund. Auour was organized in March 2013 as a Massachusetts limited liability company and its address is 162 Main Street, Suite 2, Wenham, Massachusetts 01984. As of August 31, 2017, Auour had approximately $181,700,000 in assets under management. The names, addresses and principal occupation of the principal executive officers of Auour as of the date of this proxy statement are set forth below.

16

| Name and Address | Principal Occupation |

Joseph B. Hosler

162 Main Street, Suite 2

Wenham, Massachusetts 01984 | Managing Member, Chief Compliance Officer |

Robert Z. Kuftinec

162 Main Street, Suite 2

Wenham, Massachusetts 01984 | Managing Member |

Kenneth J. Doerr

162 Main Street, Suite 2

Wenham, Massachusetts 01984 | Managing Member |

At this time, Auour does not advise other registered investment companies.

The Interim Sub-Advisory Agreement

As noted above, the Board terminated the sub-advisory relationship with Shikiar, and at its September 20, 2017 special meeting, the Board, including by separate vote of a majority of the Independent Trustees, appointed Auour as the new sub-adviser to the Fund on an interim basis pursuant to an interim sub-advisory agreement effective November 7, 2017 (the “Interim Sub-Advisory Agreement”). Because the New Sub-Advisory Agreement has not been approved by shareholders of the Fund, the Interim Sub-Advisory Agreement will continue in effect for a term ending on the earlier of 150 days from November 7, 2017 or when the shareholders of the Fund approve the New Sub-Advisory Agreement.

The terms of the Interim Sub-Advisory Agreement are, in substance, substantially similar to those of the proposed New Sub-Advisory Agreement (as described below), except for certain provisions that are required by law. The provisions required by law include a requirement that fees payable under the Interim Sub-Advisory Agreement be paid into an escrow account. If the Fund’s shareholders approve the New Sub-Advisory Agreement by the end of the 150-day period, the compensation (plus interest) payable under the Interim Sub-Advisory Agreement will be paid to Mission (which, in turn, will pay the applicable amounts to Auour), but if the New Sub-Advisory Agreement is not so approved, only the lesser of the costs incurred (plus interest) or the amount in the escrow account (including interest) will be paid.

Comparison of Shikiar Sub-Advisory Agreement and New Sub-Advisory Agreement

At its September 20, 2017 meeting, the Board, including by separate vote of a majority of the Independent Trustees, reviewed and approved the New Sub-Advisory Agreement between Mission and Auour, subject to shareholder approval. The New Sub-Advisory Agreement will become effective the day after its approval by Fund shareholders. A general discussion of the differences between the New Sub-Advisory Agreement and the Shikiar Agreement are described below. Additionally, set forth below is a summary of certain material terms of the New Sub-Advisory Agreement. The form of the New Sub-Advisory Agreement is included as Appendix B-1. The description of the differences between the agreements and the summary of certain material terms of the New Sub-Advisory Agreement below are included in Appendix B-1, as well as the current Shikiar Sub-Advisory Agreement that is included as Appendix B-2 are qualified in their entirety by reference to the form of New Advisory Agreement included as Appendix B-1 and the Shikiar Sub-Advisory Agreement included as Appendix B-2.

17

Differences Between the Agreements

Other than the dates of the Agreements, the parties to the Agreements, and the Fund name, the below lists certain differences among the Agreements.

The New Sub-Advisory Agreement includes specific direction for Auour to vote proxies associated with the Fund as well as the requirement that Auour notify Mission in the event it becomes the subject of any administrative proceeding or enforcement action by the SEC or other regulatory body. The governing law of the two agreements differs. The Shikiar Agreement is governed by Maryland law while the New Sub-Advisory Agreement is governed by Virginia law. Sub-advisory fees under both the New Sub-Advisory Agreement and the Shikiar Agreement are paid monthly, but the specific provisions as to the timing of the payments differ.

Additionally, the ability of Auour under the New Sub-Advisory Agreement to terminate is different as compared to the Shikiar Sub-Advisory Agreement. Effectively, Auour may not terminate the New Sub-Advisory Agreement until after the two-year anniversary and then only upon six-month’s advance notice.

Material Terms of the New Sub-Advisory Agreement

The New Sub-Advisory Agreement will become effective the day after its approval by Fund shareholders. The New Sub-Advisory Agreement is similar to the Shikiar Agreement, except for the differences noted above and below, the parties, and the date and the name of the Fund. Set forth below is a summary of all material terms of the New Sub-Advisory Agreement. The form of the New Sub-Advisory Agreement is included as Appendix B-1. The summary of all material terms of the New Sub-Advisory Agreement below is qualified in its entirety by reference to the form of New Sub-Advisory Agreement included as Appendix B-1.

The fee rate under the Shikiar Agreement as compared to the New Sub-Advisory Agreement has been changed. The fee payable to Shikiar is 0.55% on the first $50 million dollars of average daily net asset of the Fund and 0.50% of average daily net assets of the Fund in excess of $50 million of average daily net assets. The fee payable to Auour under the New Sub-Advisory Agreement is 0.45%.

The New Sub-Advisory Agreement would require Auour to provide substantially the same services as provided by Shikiar. Auour will, subject to the supervision of the Trust’s Board of Trustees, provide a continuous investment program for the Fund, including investment research and management with respect to all securities, investments, cash and cash equivalents in the Fund. Auour will determine from time to time what securities and other investments will be purchased, retained or sold by the Fund.

The New Sub-Advisory Agreement will have an initial term of two years from its effective date and will continue from year to year so long as the terms of the New Sub-Advisory Agreement are specifically approved by (i) a majority vote of the Trustees, including a majority vote of such Trustees who are not parties to the New Sub-Advisory Agreement or “interested persons” of the Trust or the investment adviser, at an in-person meeting called for the purpose of voting on such approval, or (ii) the vote of a majority of the outstanding voting securities of the Fund; provided, however, that if the continuance of this New Sub-Advisory Agreement is submitted to the

18

shareholders of the Fund for their approval and such shareholders fail to approve such continuance of this Agreement as provided herein, the investment adviser may continue to serve hereunder as to the Fund in a manner consistent with the 1940 Act and the rules and regulations thereunder. The New Sub-Advisory Agreement may be terminated by Mission or the Trust at any time on sixty (60) days’ prior written notice to Auour, without payment of any penalty. The New Sub-Advisory Agreement may be terminated by Auour at any time on six-months written notice to Mission, without payment of any penalty. The New Sub-Advisory Agreement will terminate automatically in the event of its assignment. In the event that: (i) Mission engages in any conduct that could reasonably be expected to result in a material SEC enforcement action taken against Mission, Auour may terminate the New Sub-Advisory on sixty (60) days’ written notice to the Adviser; or (ii) any of the Fund’s Trustees, administrator, transfer agent and/or fund accounting agent or any of their respective officers, employees or affiliates who are directly involved with the Fund engage in any conduct that could reasonably be expected to result in a material SEC enforcement action taken against such person or entity and the Board or Mission does not take prompt action to terminate the relationship with such person or entity with respect to the Fund, then Auour may terminate this Agreement on sixty (60) days’ written notice to Mission.

The New Sub-Advisory Agreement subjects Auour to the same standard of care and liability to which Shikiar was subject under the Shikiar Agreement. Specifically, it states that Auour shall not be liable for any error of judgment or mistake of law or for any loss suffered by the Trust or Mission in connection with the performance of the New Sub-Advisory Agreement, except a loss resulting from a breach of fiduciary duty with respect to the receipt of compensation for services or a loss resulting from willful misfeasance, bad faith or negligence on the part of Auour in the performance of its duties or from reckless disregard by it of its obligations and duties under the agreement.

If the Fund’s shareholders approve the New Sub-Advisory Agreement, it is expected that the New Sub-Advisory Agreement would become effective on or about December 8, 2017.

Agreement between Mission and Auour

Pursuant to the New Sub-Advisory Agreement between Mission and Auour, Auour will assume the day-to-day investment management responsibilities for the Fund under the New Sub-Advisory Agreement. In addition, Mission and Auour contemplate an on-going relationship between the parties pursuant to a separate agreement dated October 2, 2017 wherein, among other things: (i) Mission agrees to recommend to the Board that Auour continue to serve as sub-adviser for the Fund subject to Board approval and other conditions, insofar as recommendation is consistent with Mission’s and the Board’s respective fiduciary duties; (ii) Auour agrees to limit its provision of advisory or sub-advisory services to other open-end investment management companies with similar investment objectives to that of the Fund; and (iii) Auour makes certain concessions related to the expense limitation arrangements for the Fund.

Board Considerations of the New Sub-Advisory Agreement

The Board reviewed and discussed the approval of the New Sub-Advisory Agreement between Mission and Auour. Counsel noted that the 1940 Act requires the approval of the investment advisory agreements between the Trust and its service providers by a majority of the Independent Trustees.

19

The Board’s considerations with respect to the New Sub-Advisory Agreement are provided in Proposal 1.

Portfolio Management

If this Proposal 2 is approved, subject to the supervision of Mission, Auour will be responsible for the execution of specific investment strategies and day-to-day investment operations for the Fund. Auour will manage the portfolio of the Fund using a team of portfolio managers. Kenneth J. Doerr, Joseph B. Hosler, and Robert Z. Kuftinec will serve as portfolio managers to the Fund. Messrs. Doerr, Hosler, and Kuftinec founded Auour and have a combined 70 years of institutional investment experience. They constitute the investment committee and are primarily responsible for the day-to-day management of the Fund. Below is background information on each of the portfolio managers.

| | • | | Kenneth J Doerr. Ken Doerr has been with the Auour Investments since May 2014. His 27 years of experience includes successfully managing funds with both growth and value mandates, long/short hedge funds, long-only portfolios, quantitative research, and risk modeling. He was a Senior Portfolio Manager Mid/SMid-Cap Growth and Head of Quantitative Research for Evergreen Investments Fundamental Equity Group. Prior to that, Ken was Founding Partner, Chief Investment Officer of Trilene Endeavour Partners, a newly-organized firm offering a Market Neutral U.S. Equity Hedge Fund. Ken was a Portfolio Manager at 2100 Capital Group, a subsidiary of Marsh & McLennan, managing the 2100 Capital Endeavour Fund, a market neutral equity hedge fund. Prior to 2100 Capital Group, he was a Senior Vice President and Portfolio Manager at Putnam Investments where he managed a $1 billion dollar sub-account of the Mid-Cap Putnam Vista Fund, a growth fund, and a $3.5 billion sub-account of the Specialty Growth Putnam New Opportunities Fund. Ken served as a member of the portfolio team at Equinox Capital Management that managed a $4.5 billion dollar sub-advisor account of Vanguard Windsor II, a large cap-value oriented fund. He was the portfolio manager for the Equinox Mid-Cap Value Fund. Before joining Equinox, Ken was a Senior Quantitative Analyst at Sanford C. Bernstein. He earned an M.S. in Electrical Engineering from Brown University and a B.E. in Electrical Engineering from the Cooper Union. |

| | | | |

| | • | | Joseph B. Hosler CFA. Joe Hosler has been with Auour Investments since March 2013. Joe brings 24 years of investment experience serving the needs of large institutional clients. His background includes portfolio management and investment analysis, predominantly focused on domestic and international public companies. Prior to the founding of Auour, Joe led investment activities within various sectors at Pioneer, Babson Capital, Putnam Investments, and Independence Investment Associates (IIA). While at IIA, Joe drove the effort to design, develop, and launch one of the first quantitatively driven tax efficient investment approaches focused on individuals and taxable organizations. Joe holds an MBA from The Darden School of the University of Virginia, as well as, a B.S. and M.S. in Mechanical Engineering from Boston University. He served on the Board of Trustees and as the Treasurer of Glen Urquhart School and volunteered as an advisor at North Shore InnoVentures. |

| | | | |

| | • | | Robert Z. Kuftinec. Robert Kuftinec has been with Auour Investments since June 2013. Robert has 25 years of investment experience. He has a background in investing and corporate finance having worked in both investment banking and private equity. Prior to the |

20

| | | | founding of Auour, Robert was a Managing Director at TransOcean Capital where he was responsible for significant foreign equity and real estate investments in the United States. Prior to TransOcean, he was a Managing Director at Overture Capital Partners, a private equity investment firm focused on the middle market, and a Managing Director at Shields & Company, a Boston-based investment bank. Robert has been active on several corporate Boards of Directors including those at the Deutsche Asset Management Small Cap Fund (NYSE), Stronghaven, Inc., and Halcore Inc. He also has been a board member and treasurer at several non-profit organizations. He has an undergraduate degree from Babson College and earned an MBA from the Darden School at the University of Virginia. |

Required Vote. Approval of the proposal requires the vote of the “majority of the outstanding voting securities” of the Fund. Under the 1940 Act, a “majority of the outstanding voting securities” is defined as the lesser of: (1) 67% or more of the voting securities of the Fund entitled to vote present in person or by proxy at the Special Meeting, if the holders of more than 50% of the outstanding voting securities entitled to vote thereon are present in person or represented by proxy; or (2) more than 50% of the outstanding voting securities of the Fund entitled to vote thereon. Approval of Proposal 2 is contingent on approval of Proposal 1. If Proposal 1 is not approved, then Proposal 2 will be withdrawn regardless of the number of votes received in favor of Proposal 2. Further, the proposed adviser and sub-adviser will begin to manage the Fund under the interim investment advisory agreement described above and will utilize the new investment strategy at that time.

THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE

PROPOSED NEW SUB-ADVISORY AGREEMENT

21

APPROVAL OF A CHANGE TO THE INVESTMENT OBJECTIVE AND

TO MAKE THE INVESTMENT OBJECTIVE NON-FUNDAMENTAL

The current investment objective of the Fund is that it seeks to provide a competitive level of total return consisting of income and growth. This investment objective is currently fundamental, which means that it may not be changed without shareholder approval.

The Trust (after feedback from the proposed investment adviser (Mission) and sub-adviser (Auour) to the Fund) is proposing that the Fund’s investment objective be amended from the objective as stated above to indicate that the Fund “seeks long term capital appreciation through exposure to global equity markets” and to change its investment objective to a non-fundamental policy that may be changed by the Board without shareholder approval upon 60 days’ prior written notice to shareholders.

Current Fundamental Investment Objective | Proposed Non-Fundamental Investment Objective |

The Fund seeks to provide a competitive level of total return consisting of income and growth. | The Fund seeks long term capital appreciation through exposure to global equity markets. |

A vote in favor of Proposal 3 also constitutes a vote in favor of making the Fund’s investment objective a non-fundamental policy of the Fund. As a non-fundamental policy of the Fund, any future changes to the investment objective may be made by the Board without shareholder approval upon prior notice to shareholders. The Fund’s current investment objective is a fundamental policy of the Fund, which means that any changes to Fund’s current investment objective are subject to shareholder approval. Changing the Fund’s investment objective to a non-fundamental policy of the Fund would give the Board more flexibility to make appropriate changes to the Fund’s investment objective in a timely manner without having to incur the cost of soliciting and obtaining shareholder approval.

The Board noted that the proposed new investment objective is, as indicted by Mission and Auour, is more consistent with the investment strategies that have been approved by the Board, which are described more fully after this section.

Required Vote. Approval of the proposal requires the vote of the “majority of the outstanding voting securities” of the Fund. Under the 1940 Act, a “majority of the outstanding voting securities” is defined as the lesser of: (1) 67% or more of the voting securities of the Fund entitled to vote present in person or by proxy at the Special Meeting, if the holders of more than 50% of the outstanding voting securities entitled to vote thereon are present in person or represented by proxy; or (2) more than 50% of the outstanding voting securities of the Fund entitled to vote thereon. Proposal 3 is not contingent on any other proposals described in the proxy statement being approved by shareholders. Approval of Proposal 3 is not contingent on the approval of any other proposals described in this Proxy Statement.

22

THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE PROPOSED REVISION TO THE INVESTMENT OBJECTIVE AND TO MAKE THE INVESTMENT OBJECTIVE NON-FUNDAMENTAL

23

FURTHER INFORMATION ABOUT VOTING AND THE SPECIAL MEETING

Quorum. One-third (1/3) of the outstanding shares entitled to vote, present in person or represented by proxy, shall constitute a quorum for the transaction of business at the Special Meeting. Approval of each Proposal requires the affirmative vote of a majority of the outstanding voting securities (as defined in the 1940 Act) of the Fund, which, for these purposes, is the vote of (1) 67% or more of the voting securities entitled to vote on the Proposal that are present at the Meeting, if the holders of more than 50% of the outstanding shares are present or represented by proxy, or (2) more than 50% of the outstanding voting securities entitled to vote on the Proposal, whichever is less. Abstentions and broker non-votes will have the effect of a “no” vote on the Proposals.