| As filed with the Securities and Exchange Commission on October 7, 2020 |

| Registration No. 333- |

| |

|

UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| FORM N-14 |

| |

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 |

| |

| | Pre-Effective Amendment No. | ☐ |

| | Post-Effective Amendment No. | ☐ |

| | | |

| WORLD FUNDS TRUST |

| (Exact Name of Registrant as Specified in Charter) |

| |

| 8730 Stony Point Parkway, Suite 205, Richmond, VA 23235 |

| (Address of Principal Executive Offices) |

| |

| (804) 267-7400 |

| (Registrant’s Telephone Number) |

| |

| The Corporation Trust Co. |

| Corporation Trust Center, 1209 Orange St., Wilmington, DE 19801 |

| (Name and Address of Agent for Service) |

| |

| With Copy to: |

| John H. Lively |

| Practus, LLP |

| 11300 Tomahawk Creek Parkway, Suite 310 |

| Leawood, KS 66211 |

| |

Title of Securities Being Registered: Advisor Class shares of the Union Street Partners Value Fund series of the Registrant.

No filing fee is required because the Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended, pursuant to which it has previously registered an indefinite number of shares.

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933, as amended.

It is proposed that this filing will become effective November 7, 2020 pursuant to Rule 488 under the Securities Act of 1933, as amended, unless effectiveness is accelerated as requested by the Registrant.

WORLD FUNDS TRUST

CONTENTS OF REGISTRATION STATEMENT

Cover Sheet

Contents of Registration Statement

Letter to Shareholders

Questions and Answers

Part A — Combined Information Statement/Prospectus

Part B — Statement of Additional Information

Part C — Other Information

Signature Page

Exhibits

The information in this combined proxy statement and prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This combined proxy statement and prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

COMBINED PROXY STATEMENT AND PROSPECTUS

For the Reorganization of

Mission-Auour Risk-Managed Global Equity Fund

Class A Shares (Ticker: OURAX)

Institutional Class Shares (Ticker: OURIX)

Class Z Shares (Ticker: OURZX)

8730 Stony Point Parkway

Suite 205

Richmond, VA 23235

(800) 673-0550

into the

Union Street Partners Value Fund

Advisor Class Shares (Ticker: USPFX)

8730 Stony Point Parkway

Suite 205

Richmond, VA 23235

(800) 673-0550

Each a series of World Funds Trust

November __, 2020

MISSION-AUOUR RISK-MANAGED GLOBAL EQUITY FUND

A SERIES OF WORLD FUNDS TRUST

8730 Stony Point Parkway

Suite 205

Richmond, VA 23235

November __, 2020

Dear Shareholder:

On behalf of the Board of Trustees (the “Board”) of World Funds Trust (the “Trust”), we are pleased to invite you to a special meeting of shareholders (the “Special Meeting”) of the Mission-Auour Risk-Managed Global Equity Fund (the “Target Fund”). The Special Meeting is scheduled for December 16, 2020, at 10:00 a.m.

We intend to hold the Special Meeting in person. However, we are sensitive to the public health and travel concerns our shareholders may have and recommendations that public health officials may issue in light of the evolving COVID-19 pandemic. As a result, we may impose additional procedures or limitations on Special Meeting attendees or may decide to hold the Special Meeting in a different location or solely by means of remote communication. We plan to announce any such updates on our proxy website _______________, and we encourage you to check this website prior to the Special Meeting if you plan to attend. We also encourage you to consider your options to vote by internet, telephone, or mail, as discussed below, in advance of the Special Meeting in the event that, as of December 16, 2020, in-person attendance at the Special Meeting is either prohibited under a federal, state, or local order or contrary to the advice of public health care officials.

At the Special Meeting, shareholders of the Target Fund will be asked to vote on the proposed reorganization (the “Reorganization”) of the Target Fund into the Union Street Partners Value Fund (the “Survivor Fund”). The Target Fund and the Survivor Fund are both series of the Trust. While the investment objectives, principal investment strategies and investment policies of the Target Fund and the Survivor Fund are similar, there are differences between the two, as further described in the enclosed combined proxy statement and prospectus (the “Proxy Statement/Prospectus”).

Mission Institutional Advisors, LLC, dba Mission Funds Advisors (“Mission”), the investment adviser to the Target Fund, recommended the reorganization of the Target Fund based largely on the Target Fund’s inability to attract assets and reach scale. At a special meeting of the Board held on September 22, 2020, the Board approved the Reorganization subject to the approval of shareholders of the Target Fund. A discussion of the factors considered by the Board in approving the Reorganization is set forth in the Proxy Statement/Prospectus.

If the Reorganization is approved by shareholders, you will become a shareholder of the Survivor Fund on or around the date the Reorganization occurs. The Agreement and Plan of Reorganization provides that the Target Fund will transfer all of its assets and liabilities to the Survivor Fund. In exchange for the transfer of these assets and liabilities, the Survivor Fund will simultaneously issue shares to the Target Fund in an amount equal in value to the net asset value of the Target Fund’s shares as of the close of business on the business day the foregoing transfers are made. These transfers are expected to occur on or about December 18, 2020 (the “Closing Date”). Immediately after the close of business on the Closing Date, the Target Fund will make a liquidating distribution to its shareholders of the Survivor Fund shares received, so that a holder of shares in the Target Fund on the Closing Date will receive a number of shares of the Survivor Fund with the same aggregate value as the value of the shares the shareholder had in the Target Fund immediately before the Reorganization. As a result of the Reorganization, you will receive Advisor Class shares (including fractional shares, if any) in the Survivor Fund with the same aggregate net asset value as the shares of the Target Fund you own immediately prior to the Reorganization.

Following the Reorganization, the Target Fund will be terminated and cease operations as a separate series of the Trust. Shareholders of the Target Fund will not be assessed any sales charges, redemption fees or any other shareholder fee in connection with the Reorganization.

Formal notice of the Special Meeting appears on the next page, followed by the Proxy Statement/Prospectus. The proposal is discussed in detail in the enclosed Proxy Statement/Prospectus, which you should read carefully. The Board recommends that you vote “FOR” the proposal.

Your vote is important regardless of the number of shares you own. To avoid the added cost of follow-up solicitations and possible adjournments, please read the Proxy Statement/Prospectus and cast your vote. It is important that your vote be received before December 16, 2020.

You can vote in one of four ways:

•By mail with the enclosed proxy card;

•By internet through the website listed in the proxy voting instructions;

•By telephone using the toll-free number listed in the proxy voting instructions; or

•In person at the special shareholder meeting on December 16, 2020.

We appreciate your participation and prompt response in this matter and thank you for your continued support.

Sincerely,

/s/ David A. Bogaert

David A. Bogaert

President

Mission-Auour Risk-Managed Global Equity Fund

a series of

World Funds Trust

8730 Stony Point Parkway

Suite 205

Richmond, VA 23235

Important Notice Regarding Availability of Proxy Materials for the

Shareholder Meeting to be held on December 16, 2020

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To the Shareholders of the Mission-Auour Risk-Managed Global Equity Fund:

NOTICE IS HEREBY GIVEN that a special meeting of the shareholders (the “Special Meeting”) of the Mission-Auour Risk-Managed Global Equity Fund (the “Target Fund”) is scheduled for December 16, 2020 at 10:00 a.m. Eastern Time at the offices of the Target Fund’s transfer agent, Commonwealth Fund Services, Inc., 8730 Stony Point Parkway, Suite 205, Richmond, Virginia 23235.

We intend to hold the Special Meeting in person. However, we are sensitive to the public health and travel concerns our shareholders may have and recommendations that public health officials may issue in light of the evolving COVID-19 pandemic. As a result, we may impose additional procedures or limitations on Special Meeting attendees or may decide to hold the Special Meeting in a different location or solely by means of remote communication. We plan to announce any such updates on our proxy website _______________, and we encourage you to check this website prior to the Special Meeting if you plan to attend. We also encourage you to consider your options to vote by internet, telephone, or mail, as discussed below, in advance of the Special Meeting in the event that, as of December 16, 2020, in-person attendance at the Special Meeting is either prohibited under a federal, state, or local order or contrary to the advice of public health care officials.

At the Special Meeting, the Target Fund’s shareholders will be asked to vote on one proposal:

| 1. | To approve an Agreement and Plan of Reorganization by and between the Target Fund and the Union Street Partners Value Fund (the “Survivor Fund”), providing for the reorganization of the Target Fund into the Survivor Fund (the “Reorganization”); and |

| 2. | To transact such other business, not currently contemplated, that may properly come before the Special Meeting, or any adjournments or postponements thereof, in the discretion of the proxies or their substitutes. |

Please read the enclosed combined proxy statement and prospectus (the “Proxy Statement/Prospectus”) carefully for information concerning the proposal to be placed before the Special Meeting.

The Board of Trustees recommends that you vote “FOR” the Proposal.

Shareholders of record as of the close of business on September 23, 2020, are entitled to notice of, and to vote at, the Special Meeting and are also entitled to vote at any adjournments or postponements thereof. Your attention is called to the accompanying Proxy Statement/Prospectus. Regardless of whether you plan to attend the Special Meeting, please complete, sign, and return the enclosed Proxy Ballot before December 16, 2020 so that a quorum will be present and a maximum number of shares may be voted. Proxies may be revoked at any time before they are exercised by submitting a revised Proxy Ballot, by giving written notice of revocation to the Target Fund or by voting in person at the Special Meeting.

This Notice of Special Meeting of Shareholders and the Proxy Statement/Prospectus are available by calling (toll-free) 1-800-434-3719 or on the internet at https://https://vote.proxyonline.com/wft/docs/MissionAuour.pdf. On this webpage, you also will be able to access the Target Fund’s Prospectus, the Survivor Fund’s Prospectus, and any amendments or supplements to the foregoing material that are required to be furnished to shareholders. We encourage you to access and review all of the important information contained in the proxy materials before voting.

By Order of the Board of Trustees

/s/ David A. Bogaert

David A. Bogaert

President

PROXY STATEMENT/PROSPECTUS

November __, 2020

Special Meeting of Shareholders

of the Mission-Auour Risk-Managed Global Equity Fund

Scheduled for December 16, 2020

| Acquisition of the Assets and Liabilities of: | By and in Exchange for Shares of Beneficial

Interest of: |

Mission-Auour Risk-Managed Global Equity Fund CLASS A SHARES Ticker: OURAX INSTITUTIONAL CLASS SHARES Ticker: OURIX CLASS Z SHARES Ticker: OURZX (A series of World Funds Trust) 8730 Stony Point Parkway, Suite 205 Richmond, Virginia 23235 (800) 673-0550 | Union Street Partners Value Fund ADVISOR CLASS SHARES Ticker: USPFX (A series of World Funds Trust) 8730 Stony Point Parkway, Suite 205 Richmond, Virginia 23235 (800) 673-0550 |

(each an open-end investment company)

Important Notice Regarding the Availability of Proxy Materials for

the Special Meeting to be held on December 16, 2020

The Proxy Statement/Prospectus explains what you should know before voting on the matter described herein or investing in the Union Street Partners Value Fund. Please read it carefully and keep it for future reference.

THE U.S. SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES, OR DETERMIEND THAT THIS PROXY STATEMENT/PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

TO OBTAIN MORE INFORMATION

To obtain more information about the Mission-Auour Risk-Managed Global Equity Fund (the “Target Fund”) and the Union Street Partners Value Fund (the “Survivor Fund”) (collectively, the “Funds”), please write or call for a free copy of the current prospectus, statement of additional information, annual/semi-annual shareholder reports, or other information. More information about the Target Fund is available at the Fund’s website at www.themissionfunds.com. More information about the Survivor Fund is available at the Fund’s website at www.unionstreetvaluefund.com.

Target Fund or Survivor Fund

| By Phone: | (800) 673-0550 |

| | |

| By Mail: | World Funds Trust c/o Commonwealth Fund Services, Inc. 8730 Stony Point Parkway Suite 205 Richmond, VA 23235 |

The following documents containing additional information about the Funds, each having been filed with the U.S. Securities and Exchange Commission (“SEC”), are incorporated by reference into this Proxy Statement/Prospectus:

| 1. | The Statement of Additional Information dated November __, 2020 relating to this Proxy Statement/Prospectus |

These documents are on file with the SEC and available through its website at http://www.sec.gov (File Nos. 333-148723; 811-22172). Copies of this information may be obtained, after paying a duplicating fee, by electronic request at publicinfo@sec.gov.

The Funds are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended, and the rules, regulations, and exemptive orders thereunder, and in accordance therewith, file reports and other information including proxy materials with the SEC.

This Proxy Statement/Prospectus will be mailed on or about November __, 2020 to shareholders of record of the Target Fund as of September 23, 2020 (the “Record Date”).

TABLE OF CONTENTS

QUESTIONS AND ANSWERS

We recommend that you read the complete Proxy Statement/Prospectus. The following Questions and Answers provide an overview of the key features of the reorganization (the “Reorganization”) of the Mission-Auour Risk-Managed Global Equity Fund (the “Target Fund” into the Union Street Partners Value Fund (the “Survivor Fund”) and of the information contained in this Proxy Statement/Prospectus. The Target Fund and the Survivor Fund are sometimes each referred to separately as a “Fund”, and together as the “Funds.” The series surviving the Reorganization, the Survivor Fund, will also be referred to herein as the “Combined Fund”.

| Q. | What is this document and why did we send it to you? |

| A. | This is a Proxy Statement/Prospectus that provides you with information about an agreement and plan of reorganization between the Target Fund and the Survivor Fund. Both the Target Fund and the Survivor Fund are series of the World Funds Trust (the “Trust”). When the Reorganization is completed, your shares of the Target Fund will be exchanged for shares of the Survivor Fund, and the Target Fund will be liquidated and terminated as a series of the Trust. Please refer to the Proxy Statement/Prospectus for a detailed explanation of the Reorganization, and a description of the Combined Fund. |

You are receiving this Proxy Statement/Prospectus because you own shares of the Target Fund as of September 23, 2020. The Reorganization requires shareholder approval and, if approved, is expected to be effective, close of business, on December 18, 2020, or such other date as the parties may agree (the “Closing Date”).

| Q. | Has the Board of Trustees approved the Reorganization? |

| A. | Yes, the Board of Trustees of the Trust (the “Board”) has approved the Reorganization. After careful consideration, the Board, including all of the Trustees who are not “interested persons,” as defined in the Investment Company Act of 1940 (the “1940 Act”), of the Trust (the “Independent Trustees”), determined that the Reorganization is in the best interests of the Target Fund’s and Survivor Fund’s shareholders and that neither Fund’s existing shareholders’ interests will be diluted as a result of the Reorganization. It is expected that the shareholders of the Target Fund will benefit from the possible operating efficiencies and economies of scale that may result from combining the assets of the Target Fund with the assets of the Survivor Fund. |

| Q. | Why is the Reorganization occurring? |

| A. | The investment adviser to the Target Fund has indicated that it is not willing to continue subsidizing the Target Fund at its current net asset level. The Board has determined that Target Fund shareholders may benefit from an investment in the Combined Fund because shareholders of the Target Fund will remain invested in an open-end fund with greater net assets that is expected to result in future operating efficiencies (e.g., certain fixed costs, such as audit fees, compliance fees, accounting fees and other expenses, will be spread across a larger asset base, thereby potentially lowering the total expense ratio borne by shareholders of the Combined Fund). |

| Q. | How will the Reorganization affect me as a shareholder? |

| A. | Upon the closing of the Reorganization, Target Fund shareholders will become shareholders of the Combined Fund. As a result of the Reorganization, all of the assets and the liabilities of the Target Fund will be combined with those of the Survivor Fund. You will receive Advisor Class Shares (including fractional shares, if any) in the Survivor Fund with the same aggregate net asset value as the shares of the Target Fund you own immediately prior to the Reorganization. An account will be created for each shareholder that will be credited with shares of the Combined Fund with an aggregate net asset value equal to the aggregate net asset value of the shareholder’s Target Fund shares at the time of the Reorganization. The number of shares a shareholder receives (and thus the number of shares allocated to a shareholder) will depend on the relative net asset values per share of the two Funds immediately prior to the Reorganization. Thus, although the aggregate net asset value in a shareholder’s account will be the same, a shareholder may receive a greater or lesser number of shares than it currently holds in the Target Fund. No physical share certificates will be issued to shareholders. As a result of the Reorganization, a Target Fund shareholder will hold a smaller percentage of ownership in the Combined Fund than such shareholder held in the Target Fund prior to the Reorganization. |

| Q. | How do the Funds compare in size? |

| A. | As of August 31, 2020, the Target Fund’s net assets were approximately $12 million and the Survivor Fund’s net assets were approximately $32 million. If the Reorganization were completed on September 30, 2020, the combined net assets of the Survivor Fund would be approximately $44 million. The asset size of each Fund fluctuates on a daily basis, and the asset size of the Survivor Fund after the Reorganization may be larger or smaller than the combined assets of the Funds as of September 30, 2020. |

| Q. | How do the fee and expense structures of the Funds compare? |

| A. | Though the annual management fee of the Survivor Fund (1.00%) is higher than the annual management fee of the Target Fund (0.60%), the annual operating expenses of the Combined Fund after management fee waivers and expense reimbursements by the Combined Fund’s investment adviser is expected to be lower than the current expenses of both the Target and Survivor Fund for all shareholders except Class Z shareholders. Class Z requires a $10,000,000 minimum investment and represents only approximately $26,000 of the Target Fund’s assets. The only shareholders of Class Z shares are the Target Fund’s investment adviser and/or its affiliates. |

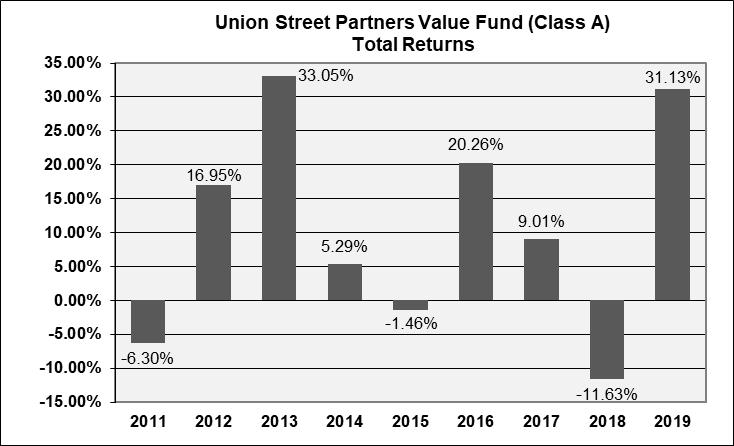

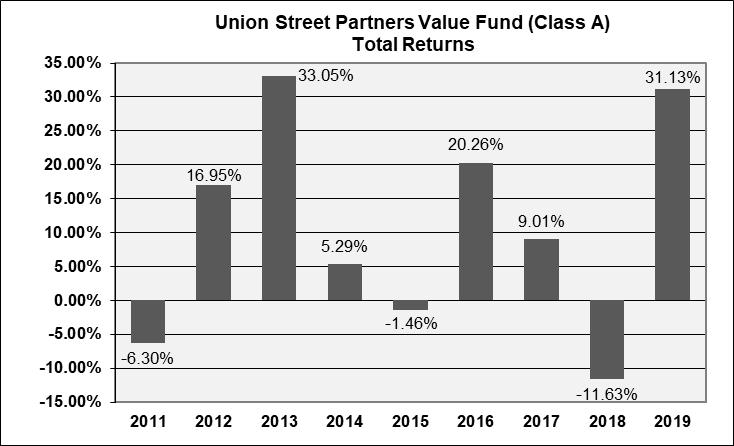

| Q. | How does the performance of the Funds compare? |

| A. | The Survivor Fund has a longer performance history and has outperformed the Target Fund since the Target Fund’s inception. |

| Q. | Who is eligible to vote? |

| A. | Shareholders holding an investment in shares of the Target Fund as of the close of business on September 23, 2020 (the “Record Date”), are eligible to vote at the Special Meeting or any adjournments or postponements thereof. Approval of the Reorganization requires the affirmative vote of the lesser of: (i) 67% or more of the voting securities present at the Special Meeting, provided that more than 50% of the voting securities are present in person or represented by proxy at the Special Meeting; or (ii) a majority of the voting securities entitled to vote. AST Fund Solutions, LLC has been retained by the Trust to collect and tabulate shareholder votes. |

| A. | You may submit your Proxy Ballot in one of four ways: |

By Internet. Vote through the website listed in the proxy voting instructions.

By Telephone. The toll-free number for telephone voting can be found on the enclosed Proxy Ballot. You will be required to provide your control number located on the Proxy Ballot.

By Mail. Mark the enclosed Proxy Ballot, sign and date it, and return it in the postage-paid envelope provided. If you are a joint owner, any one of you may sign the Proxy Ballot.

In Person at the Special Meeting. You can vote your shares in person at the Special Meeting. If you expect to attend the Special Meeting in person, please call toll-free at 1-800-673-0550.

To be certain your vote will be counted, a properly executed Proxy Ballot must be received prior to December 16, 2020. If you vote by any of these methods, the persons appointed as proxies will officially cast your votes on your behalf at the Special Meeting. You may also attend the Special Meeting and cast your vote in person at the Special Meeting.

You can revoke your proxy or change your voting instructions at any time until the vote is taken at the Special Meeting. For more details about shareholder voting, see the “General Information About the Proxy Statement/Prospectus” section of this Proxy Statement/Prospectus.

Should shareholders require additional information regarding the Special Meeting, they may contact 1-800-673-0550.

| Q. | What happens if the Proposal is not approved? |

| A. | If the Proposal is not approved by shareholders of the Target Fund or does not close for any reason, such shareholders will remain shareholders of the Target Fund, and the Target Fund will continue to operate. The Board then will consider such other actions as it deems necessary or appropriate, including re-soliciting shareholders to approve the proposal or possibly the liquidation of the Target Fund. |

| Q. | When and where will the Special Meeting be held? |

| A. | The Special Meeting is scheduled to be held at the offices of the Funds’ transfer agent, Commonwealth Fund Services, Inc., 8730 Stony Point Parkway, Suite 205, Richmond, Virginia 23235, at 10:00 a.m. Eastern Time on December 16, 2020. If the Special Meeting is adjourned or postponed, any adjournments or postponements of the Special Meeting will also be held at the above location. If you expect to attend the Special Meeting in person, please call 1-800-673-0550. |

| Q. | How does the Board recommend that I vote? |

| A. | The Board recommends that shareholders vote “FOR” the Proposal. |

| Q. | When will the Reorganization occur? |

| A. | The Reorganization is expected to take effect on or about December 18, 2020, or as soon as possible thereafter. |

| Q. | Who will pay for the Reorganization? |

| A. | The costs of the Reorganization will be borne by the Survivor Fund. The costs of the Reorganization are expected to be approximately $60,000 and consist of legal and accounting fees, and printing, shipping and proxy tabulation costs. The Survivor Fund will bear the costs because it has a larger asset base prior to the Reorganization and is expected to achieve a long-term benefit post-Reorganization through increased asset size and anticipated economies of scale resulting in lower gross operating expenses. |

| Q. | Will the Reorganization result in any federal tax liability to me? |

| A. | The Reorganization will not result in any federal tax liability to Target Fund shareholders. |

| Q. | Can I redeem my shares of the Target Fund before the Reorganization takes place? |

| A. | Yes. You may redeem your shares at any time before the Reorganization takes place as set forth in the Target Fund’s prospectus. If you choose to do so, your request will be treated as a normal exchange or redemption of shares. Shares that are held as of December 18, 2020 will be exchanged for shares of the Survivor Fund. |

| Q. | Will shareholders have to pay any sales load, commission or other similar fee in connection with the Reorganization? |

| A. | No. Shareholders will not pay any sales load, commission or other similar fee in connection with the Reorganization directly or indirectly. |

| Q. | Whom do I contact for further information? |

| A. | You can contact your financial adviser for further information. You may also contact the Funds at 1-800-673-0550 and/or also visit the Target Fund’s website at www.themissionfunds.com and the Survivor Fund’s website at www.unionstreetvaluefund.com. |

Important additional information about the Reorganization is set forth in the accompanying Proxy Statement/Prospectus. Please read it carefully.

SUMMARY OF THE PROPOSAL

The following is a summary of certain information contained elsewhere in this Proxy Statement/Prospectus and is qualified in its entirety by references to the more complete information contained herein. Shareholders should read the entire Proxy Statement/Prospectus carefully.

The Trust, organized under the laws of the state of Delaware, is an open-end management investment company registered with the SEC. The Target Fund and Survivor Fund are organized as separate series of the Trust. The investment objective of the Target Fund is long term capital appreciation through exposure to global equity markets. The investment objective of the Survivor Fund is to achieve capital appreciation.

Union Street Partners, LLC (the “Adviser”) is the investment adviser to the Survivor Fund and will serve as the investment adviser to the Combined Fund. McGinn Investment Management, Inc. (the “Sub-Adviser”) is the sub-adviser to the Survivor Fund and will serve as the sub-adviser to the Combined Fund. Bernard F. McGinn and R. McCoy Penninger are the portfolio managers of the Survivor Fund, and each of them will continue the day-to-day management of the Combined Fund following the Reorganization.

The Reorganization

You should read this entire Proxy Statement/Prospectus and the Form of Agreement and Plan of Reorganization (the “Plan of Reorganization”), which is included in Appendix A. For more information about the Survivor Fund, please consult Appendix B.

On September 22, 2020, the Board, including the Independent Trustees, approved the Plan of Reorganization. Subject to shareholder approval, the Plan of Reorganization provides for:

| ● | the transfer of all of the assets of the Target Fund to the Survivor Fund in exchange solely for shares of beneficial interest of the Survivor Fund; |

| ● | the assumption by the Survivor Fund of all the liabilities of the Target Fund; |

| ● | the distribution of shares of the Survivor Fund to the shareholders of the Target Fund; and |

| ● | the complete liquidation and dissolution of the Target Fund as a separate series of the Trust. |

If shareholders approve the Reorganization, each owner of shares of the Target Fund would become a shareholder of the Survivor Fund. The Reorganization is expected to be effective on the Closing Date. Each shareholder of the Target Fund will hold, immediately after the Closing Date, shares of the Survivor Fund having an aggregate value equal to the aggregate value of the shares of Target Fund held by that shareholder as of the close of business on the Closing Date.

In considering whether to approve the Reorganization, you should note that:

| ● | each Fund is serviced by the same distributor, administrator, and transfer agent; |

| ● | the Reorganization will not affect a shareholder’s right to purchase, redeem or exchange shares of the Funds; |

| ● | the interests of the current shareholders of the Funds will not be diluted as a result of the Reorganization; and |

| ● | the Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization pursuant to Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”); accordingly, pursuant to this treatment, neither the Target Fund nor its shareholders, and neither the Survivor Fund nor its shareholders, are expected to recognize any gain or loss for federal income tax purposes from the transactions contemplated by the Plan of Reorganization. |

PROPOSAL – APPROVAL OF THE REORGANIZATION

Introduction

Shareholders of the Target Fund are being asked to approve a Plan of Reorganization, providing for the reorganization of the Target Fund into the Survivor Fund. If the Reorganization is approved, shareholders in the Target Fund will become shareholders in the Survivor Fund as of the close of business on the Closing Date.

Background and Reasons for the Proposed Reorganization. The Reorganization has been proposed because Mission Institutional Advisors, LLC (“Mission”), the investment adviser to the Target Fund, believes that it is in the best interests of the Target Fund’s shareholders if the Target Fund is combined with the Survivor Fund because (1) the Survivor Fund has a similar investment objective; (2) the Survivor Fund has had better performance than the Target Fund; (3) the Reorganization will allow Target Fund shareholders to remain invested in an actively managed fund without incurring any federal tax liability as a result; (4) the annual operating expenses of the Combined Fund after management fee waivers and expense reimbursements by the Combined Fund’s investment adviser is expected to be lower than the current expenses of both the Target and Survivor Fund for all share classes except Class Z, a share class which is held only by the Target Fund’s investment adviser and/or its affiliates; and (5) Mission has indicated that it is not willing to continue to subsidize the expenses of the Target Fund. The assets of the Target Fund have not grown to the levels that Mission anticipated due to a number of factors, including market factors related to the COVID-19 global pandemic and its impact on the marketability of the Target Fund.

In approving the Plan of Reorganization, the Board, including the Independent Trustees, determined that the Reorganization is in the best interests of the Target Fund and the Survivor Fund and that the interests of the Target Fund and Survivor Fund shareholders will not be diluted as a result of the Reorganization. Before reaching this conclusion, the Board engaged in a thorough review process relating to the proposed Reorganization and considered other alternatives to the Reorganization, including the outright liquidation of the Target Fund or engaging another investment adviser to manage the Target Fund. In considering the alternative of liquidation, the Board noted that liquidation could result in tax consequences to Target Fund shareholders that would be avoided in the Reorganization. The Board also gave stronger weight to Mission’s recommendation to reorganize the Target Fund and noted that (1) shareholders not wishing to become part of the Survivor Fund could redeem or exchange their shares of the Target Fund at any time prior to the closing of the Reorganization without penalty and (2) that the Reorganization would allow shareholders of the Target Fund who wished to retain their investment after the Reorganization to do so in a registered mutual fund with a similar investment objective. The Board considered and approved the Plan of Reorganization at a Board meeting held on September 22, 2020.

The factors considered by the Board with regard to the Reorganization include, but are not limited to, the following:

| | ● | After the Reorganization, shareholders will be invested in a Combined Fund with a similar investment objective; |

| | | |

| | ● | While the investment strategies of the Funds are different in some ways, the Board reviewed the holdings of each Fund and noted that both Funds focus their investments in large capitalization equity securities and considered the representation of the Adviser that the exposure of the Survivor Fund’s portfolio to international investments is similar to that of the Target Fund; |

| | | |

| | ● | The Combined Fund, which will invest primarily in the equity securities of companies, will incur acquired fund fees and expenses to a much lesser than extent the Target Fund, which invests primarily in exchange-traded funds; |

| | | |

| | ● | The Combined Fund may achieve certain operating efficiencies in the future from its larger net asset size; |

| | | |

| | ● | The total expenses of the Combined Fund after management fee waivers and expense reimbursements by the Combined Fund’s investment adviser are expected to be lower than the current expenses of both the Target and Survivor Fund for all shareholders except Class Z shareholders. Class Z requires a $10,000,000 minimum investment and represents only approximately $26,000 of the Target Fund’s assets. The only shareholders of Class Z shares are the Target Fund’s investment adviser and/or its affiliates. |

| | | |

| | ● | The Combined Fund may achieve certain operating efficiencies in the future from its larger net asset size; |

| | | |

| | ● | The Combined Fund is expected to have a future lower gross ratio of expenses to average net assets than that of all Classes of the Target Fund prior to the Reorganization, and prior to the application of any expense limitation arrangements; |

| | | |

| | ● | The Adviser has contractually undertaken through January 31, 2021 to waive fees and/or reimburse expenses on behalf of the Survivor Fund to the extent that its total expenses exceed certain operating levels (“expense cap”), and that, in connection with the Reorganization, the expense cap on the Combined Fund will be reduced to 1.25% and extended through January 31, 2022; |

| | | |

| | ● | Further, while the annual management fee of the Survivor Fund (1.00% of the Fund’s average daily net assets) is higher than the annual management fee of the Target Fund (0.60% of the Fund’s average daily net assets), Mission has waived its entire management fee and reimbursed the Target Fund for other operating expenses since the inception of the Target Fund and has indicated that it is not willing to continue to subsidize the operating expenses of the Target Fund at the asset levels at which it is currently operating; |

| | | |

| | ● | The Reorganization is not expected to result in any federal tax liability to shareholders; |

| | | |

| | ● | The Adviser advised the Trust that the positions held by the Target Fund are not inconsistent with the types of investments that are permissible to be held by the Survivor Fund and that any repositioning of assets would not be material to the Survivor Fund, but that such costs would be borne by the Survivor Fund after the Reorganization; |

| | | |

| | ● | While the Survivor Fund will bear the costs of the Reorganization, the benefits to shareholders from the Combined Fund’s larger asset base and expected decrease in total operating expenses and the tax-free nature of the Reorganization will, in the longer term, benefit shareholders and outweigh the costs associated with the Reorganization; and |

| | | |

| | ● | The Target Fund shareholders will receive Survivor Fund shares with the same aggregate net asset value as their Target Fund shares. |

The Board, including all of the Independent Trustees, concluded, based upon the factors and determinations summarized above, that completion of the Reorganization is advisable and in the best interests of the shareholders of each Fund, and that the interests of the shareholders of each Fund will not be diluted as a result of the Reorganization. The determinations on behalf of each Fund were made on the basis of each Trustee’s business judgment after consideration of all of the factors taken as a whole, though individual Trustees may have placed different weight on various factors and assigned different degrees of materiality to various conclusions. The Board further recommended that shareholders vote “For” the Reorganization.

Comparison of the Funds’ Investment Objectives

Both Funds seek growth of capital as part of their respective investment objectives. However, the Funds have different primary benchmark indexes to which they compare their performance. The Target Fund’s benchmark is the MSCI-ACWI Index. The Survivor Fund’s benchmark is the Russell 1000 Value Index. Both Fund’s investment objectives may be changed without shareholder approval and both Funds have committed to providing shareholders with 60 days advance notice of any change in investment objective.

The chart below compares the investment objectives of the Funds.

| | Target Fund | Survivor Fund |

| Investment Objective | The Target Fund seeks long term capital appreciation through exposure to global equity markets. | The Survivor Fund seeks to achieve capital appreciation. |

Comparison of the Funds’ Fees and Expenses

As an investor, shareholders pay fees and expenses to buy and hold shares of the Funds. Shareholders may pay shareholder fees directly when they buy or sell shares. Shareholders pay annual fund operating expenses indirectly because they are deducted from Fund assets.

The following tables allow you to compare the shareholder fees and annual fund operating expenses as a percentage of the aggregate daily net assets of each Fund that you may pay for buying and holding each Class of shares of the Fund. As shown in the following tables, the annual expense ratio of the Combined Fund is expected to be lower than the annual expense ratio of the Target Fund. The tables show the fees and expenses of each Fund based on actual expenses incurred, fiscal year-to-date, as of August 31, 2020, as well as the pro forma fees and expenses for the Survivor Fund for its fiscal year ended September 30, 2020 assuming that the Reorganization occurs on October 1, 2020. The examples following the tables will help you compare the cost of investing in the Target Fund with the estimated cost of investing in the Combined Fund (based on the pro forma fees and expenses). Pro forma numbers are estimated in good faith and are hypothetical. Please keep in mind that, as a result of changing market conditions, total asset levels, and other factors, expenses at any time during the current fiscal year may be significantly different from those shown.

Target Fund Institutional, Class A and Class Z Shares

Shareholder Fees (fees paid directly from your investment) | | Target Fund

Institutional

Class Shares | | Target Fund

Class Z Shares | | Target Fund

Class A Shares | | Survivor Fund Advisor

Class Shares | | Pro Forma Combined

Fund Advisor

Class Shares |

| Maximum Sales Charge (load) | | | None | | | | None | | | | 5.75 | % | | | None | | | | None | |

| Maximum deferred sales charge (load) (as a percentage of the NAV at time of purchase) | | | None | | | | None | | | | None | | | | None | | | | None | |

| Redemption Fee | | | None | | | | None | | | | None | | | | None | | | | None | |

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

|

| Management Fee | | | 0.60 | % | | | 0.60 | % | | | 0.60 | % | | | 1.00 | % | | | 1.00 | % |

| Distribution (12b-1) and/or Service Fees | | | 0.00 | % | | | 0.00 | % | | | 0.25 | % | | | 0.00 | % | | | 0.00 | % |

| Other Expenses | | | | | | | | | | | | | | | | | | | | |

| Shareholder Services Plan | | | 0.08 | % | | | 0.00 | % | | | 0.15 | % | | | 0.06 | % | | | 0.08 | % |

| Other Expenses | | | 1.59 | % | | | 1.59 | % | | | 1.59 | % | | | 0.63 | % | | | 0.52 | % |

| Total Other Expenses | | | 1.67 | % | | | 1.59 | % | | | 1.74 | % | | | 0.69 | % | | | 0.60 | % |

| Acquired Fund Fees and Expenses | | | 0.09 | % | | | 0.09 | % | | | 0.09 | % | | | None | | | | None | |

| Total Annual Fund Operating Expenses | | | 2.36 | % | | | 2.28 | % | | | 2.68 | % | | | 1.69 | % | | | 1.60 | % |

| Less Fee Waivers and/or Expense Reimbursements | | | (1.07 | %)(1) | | | (1.07 | %)(1) | | | (0.33 | %)(4) | | | (0.34 | %)(2) | | | (0.35 | %)(3) |

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements | | | 1.29 | %(1) | | | 1.21 | %(1) | | | 1.54 | %(4) | | | 1.35 | %(2) | | | 1.25 | %(3) |

| | | | | | | | | | | | | | | | | | | | | |

| (1) | Mission has entered into a written expense limitation agreement under which it has agreed to limit the total expenses of the Target Fund (exclusive of interest, distribution fees pursuant to Rule 12b-1 Plans, taxes, acquired fund fees and expenses, brokerage commissions, extraordinary expenses and dividend expense on short sales) to an annual rate of 1.20% of the average daily net assets of the Institutional Class and Class A shares of Target Fund and 1.12% of the Class Z shares. Mission may not terminate this expense limitation agreement prior to April 30, 2021. Each waiver and/or reimbursement of an expense by Mission is subject to repayment by the Target Fund within three years following the date such waiver and/or reimbursement was made, provided that the Target Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and at the time the waiver or reimbursement is recouped. |

| (2) | The Adviser has entered into a written expense limitation agreement under which it has agreed to limit the total expenses of the Survivor Fund (exclusive of interest, distribution fees pursuant to Rule 12b-1 Plans, taxes, acquired fund fees and expenses, brokerage commissions, extraordinary expenses and dividend expense on short sales) to an annual rate of 1.35% of the average daily net assets of the Survivor Fund. The Adviser may not terminate this expense limitation agreement prior to January 31, 2021. Each waiver and/or reimbursement of an expense by the Adviser is subject to repayment by the Survivor Fund within three years following the date such waiver and/or reimbursement was made, provided that the Survivor Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and at the time the waiver or reimbursement is recouped. |

| (3) | The Adviser has entered into a written expense limitation agreement under which it has agreed to limit the total expenses of the Combined Fund (exclusive of interest, distribution fees pursuant to Rule 12b-1 Plans, taxes, acquired fund fees and expenses, brokerage commissions, extraordinary expenses and dividend expense on short sales) to an annual rate of 1.25% of the average daily net assets of the Combined Fund. The Adviser may not terminate this expense limitation agreement prior to January 31, 2022. Each waiver and/or reimbursement of an expense by the Adviser is subject to repayment by the Combined Fund within three years following the date such waiver and/or reimbursement was made, provided that the Combined Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and at the time the waiver or reimbursement is recouped. |

Example

This Example is intended to help you compare the cost of investing in the Funds with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in a Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The Example further assumes that the expense limitation described in the footnotes to the fee table is in effect only until the end of the 1-year period. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | 1 year | 3 years | 5 years | 10 years |

| Target Fund – Institutional Class Shares | $131 | $634 | $1,163 | $2,614 |

| Target Fund – Class Z Shares | $123 | $610 | $1,123 | $2,532 |

| Target Fund – Class A Shares | $723 | $1,258 | $1,817 | $3,335 |

| Survivor Fund – Advisor Class Shares | $137 | $499 | $886 | $1,969 |

Pro Forma — Combined Fund Advisor Class Shares | $127 | $471 | $838 | $1,871 |

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the Examples, affect each Fund’s performance. During the most recent fiscal year, the Target Fund’s portfolio turnover rate was 26.35% of the average value of its portfolio, and the Survivor Fund’s portfolio turnover rate was 13.56% of the average value of its portfolio.

Federal Tax Consequences

It is expected that the Reorganization will be a tax-free reorganization under Section 368(a) of the Internal Revenue Code. Accordingly, no gain or loss is expected to be recognized by the Funds as a direct result of the Reorganization.

COMPARISON OF THE TARGET FUND AND SURVIVOR FUND

The chart that follows compares the Funds, including their principal investment strategies. The Funds have similarities in their investment strategies, but they are not identical.

Similarities. First, both Funds focus their investments in large capitalization equity securities and have similar exposure to international investments. In addition, both Funds are actively traded. Last, the Funds’ fundamental investment policies with respect to borrowing money, acting as an underwriter, making loans, purchasing or selling real estate or commodities, purchasing the securities of any one issuer, concentrating in an industry, and issuing senior securities are substantially similar.

Differences. One of the main differences between the Funds is the Target Fund seeks to achieve it investment objective by investing primarily in exchange-traded funds (“ETFs”) and, while the Survivor Fund reserves the right to invest in securities of other investment companies, including ETFs, it does not commit to a certain level of exposure to such securities. Another difference in the Funds is that the Target Fund is a diversified fund while the Survivor Fund is non-diversified and therefore may invest in a smaller number of securities than the Target Fund. Also, the Target Fund has the ability to invest in fixed-income securities. The Target Fund also has the ability to utilize options on equity securities and levered and inverse ETFs for the purpose of managing risk associated with the Fund’s portfolio though it has never done so.

| | Mission-Auour Risk-Managed Global Equity Fund (Target Fund) | Union Street Partners Value Fund (Survivor Fund) |

| Form of Organization | A diversified series of World Funds Trust, an open-end investment management company organized as a Delaware Statutory trust. | Same |

| Net Assets as of June 30, 2020 | $13,738,008 | $30,268,832 |

| Investment Adviser and Portfolio Managers | Investment Adviser: Mission Institutional Advisors, LLC, dba Mission Funds Advisors Sub-Adviser: Auour Investments, LLC Portfolio Managers: Kenneth J. Doerr, Managing Principal of the

Sub-Adviser Joseph B Hosler, Managing Principal of the

Sub-Adviser Robert Z. Kuftinex, Managing Principal of the

Sub-Adviser | Investment Adviser: Union Street Partners, LLC Sub-Adviser: McGinn Investment Management, Inc. Portfolio Managers: Bernard F. McGinn, CFA, President of the Sub-Adviser R. McCoy Penninger, CFA, Vice President of the

Sub-Adviser |

| | Mission-Auour Risk-Managed Global Equity Fund (Target Fund) | Union Street Partners Value Fund (Survivor Fund) |

| Principal Investment Strategies | The Fund seeks to achieve its investment objective by investing in exchange traded funds (“ETFs”) that invest in domestic and foreign (including emerging markets ): (i) equity securities of any market capitalization, including common stock, preferred stock, real estate investment trusts (“REITs”) and master limited partnerships (“MLPs”), (ii) fixed income securities of any credit quality, duration or maturity, including corporate bonds, high-yield bonds (also known as “junk bonds”), convertible bonds, treasuries and emerging markets bonds, and (iii) other income producing securities. The Fund may also invest in these types of securities through other exchange traded products, such as exchange traded notes (“ETNs”). The Fund may also utilize options on equity securities and levered and inverse ETFs for the purpose of managing risk associated with the Fund’s portfolio. The Fund’s investments in options would be limited to those tied to ETFs following large, broad-based equity indices such as SPY (S&P 500® Index) and EFA (MSCI EAFE Index). The primary purpose of investing in such options would be for hedging purposes and may include both the purchase and writing of options (for covered positions only). Writing of naked options is not being contemplated. | Under normal market conditions, the Fund will invest primarily in the equity securities of large capitalization (“large-cap”) U.S. companies. The Fund defines a large-cap company as one whose market capitalization is $5 billion or greater at the time of purchase. The Fund will normally hold a core position of between 25 and 30 securities. The number of securities held by the Fund may occasionally exceed this range at times, such as when the portfolio managers are accumulating new positions, phasing out and replacing existing positions, or responding to exceptional market conditions. |

| Principal Investment Strategies | The Fund invests at least 80% of its net assets, plus the amount of borrowings for investment purposes, in equity securities. For purposes of the foregoing investment requirement, the Fund considers any investment in an ETF to be an equity security. When the Fund invests in ETFs, it will consider the underlying investments in the ETFs for purposes of its 80% policy. The Fund may also invest directly in equity securities. | Equity securities consist of common stock, depositary receipts (including American Depositary Receipts (“ADRs”), European Depositary Receipts (“EDRs”), Global Depositary Receipts (“GDRs”) and unsponsored depositary receipts), real estate investment trusts ("REITs"), master limited partnerships ("MLPs"), and securities convertible into common stock, such as warrants, rights, convertible bonds, debentures and convertible preferred stocks. ADRs are receipts typically issued by an American bank or trust company that evidence underlying securities issued by a foreign corporation. EDRs (issued in Europe) and GDRs (issued throughout the world) each evidence a similar ownership arrangement. MLPs are generally energy-related businesses and the Fund may invest in energy, real estate, and/or finance-related MLPs if the Adviser believes the business will deliver desirable returns. |

| | Mission-Auour Risk-Managed Global Equity Fund (Target Fund) | Union Street Partners Value Fund (Survivor Fund) |

| | | The Fund may invest up to 20% of its net assets in high quality money market instruments and repurchase agreements. The Fund may also invest in shares of other registered investment companies, such as closed-end investment companies and exchange-traded funds (“ETFs”). |

| Principal Investment Strategies | The Fund’s investment philosophy is focused on the three facets of investing that Auour (pronounced “our”) Investments, LLC (“Auour” or the “Sub-Adviser”) believes will drive performance: market participation, asset allocation, and total cost minimization. Auour acts as the sub-adviser of the Fund. Auour uses an investment process called Regime-Based Investing. At the heart of Regime-Based Investing is the Sub-Adviser’s belief that market conditions will vary throughout the investment cycle and that the asset allocation should adjust accordingly. The Sub-Adviser’s investment process is concentrated on determining the risk regime of the overall market and allocating the assets of the Fund to best match the regime. At the foundation of the process is an investment approach that blends fundamental investment principles with mathematics. In times of expected market duress, the intent is to reduce exposure to equity and fixed income markets through the use of cash positions, with the potential of a 100% cash position in extreme instances. | McGinn Investment Management, Inc. (the “Sub-Adviser”) utilizes a value approach to investing in that it selects investments for the Fund based on its belief that stock prices fluctuate around the true value of a company. The Sub-Adviser analyzes valuation ratios and typically selects stocks with low ratios of price/earnings, price/cash flow, price/book value and price/dividend. The Sub-Adviser desires to produce superior risk adjusted returns by building portfolios of businesses with outstanding risk/reward profiles without running a high degree of capital risk. The Sub-Adviser only invests in those businesses it understands and where it has confidence in the company's management and financial strength. Emphasis is placed on those companies which the Sub-Adviser believes are most likely to prosper under various economic conditions. The Sub-Adviser sells or reduces the Fund’s position in a security (1) when it approaches the Sub-Adviser’s estimate of its fair value, (2) when its economic fundamentals have deteriorated, or (3) when the facts or the analysis surrounding the reason to originally put the security in the Fund’s portfolio have changed. |

| | Mission-Auour Risk-Managed Global Equity Fund (Target Fund) | Union Street Partners Value Fund (Survivor Fund) |

| Principal Investment Strategies | The Auour Regime Model™ (“ARM”™), a proprietary risk detection algorithm, resides within the investment process. It evaluates the market risk appetite using nine factors that Auour believes have predictive ability to aid in detecting enduring downturns. The nine factors can be grouped into four general categories: Valuation, Asset Interaction, Credit Market Behavior, and Momentum. Based upon ARM™, market risk is categorized into one of five risk regimes with each regime having an asset allocation that optimizes to those factors that perform favorably in that particular regime. As an example, in the most aggressive risk regime, the Fund will have a higher percentage (relative to the Fund’s benchmark) of its assets in smaller company ETFs and emerging market funds. In certain extreme conditions, the Fund has the flexibility to move 100% into investment grade short term fixed income securities or money market instruments. Though the ARM model is updated daily, the Sub-Adviser aims to rebalance the Fund on a monthly basis, or as market conditions warrant. The Fund will normally hold between 10 and 20 securities, primarily ETFs, which the Sub-Adviser believes offer a broad exposure to the global equity markets. The allocation to any one security or ETF (other than to investment grade short term fixed income ETFs) is limited to 35% of the Fund’s assets calculated at the time of rebalancing. | |

| Diversified Status | The Fund is a diversified fund. | The Fund is a “non-diversified” fund, which means it can invest in fewer securities at any one time than a diversified fund. Also, from time to time the Fund may invest a significant portion of its assets in a limited number of industry sectors, but will not concentrate in any particular industry. |

| Temporary Defensive Positions | Temporary Investments. To respond to adverse market, economic, political or other conditions, the Fund may invest 100% of its total assets, without limitation, in high-quality short-term debt securities. These short-term debt securities include: treasury bills, commercial paper, certificates of deposit, bankers’ acceptances, U.S. Government securities, money market instruments, including money market funds, and repurchase agreements. While the Fund is in a defensive position, the opportunity to achieve its investment objective will be limited. The Fund may also invest a substantial portion of its assets in such instruments at any time to maintain liquidity or pending selection of investments in accordance with its policies. When the Fund takes such a position, it may not achieve its investment objective. | Temporary Defensive Position. The investments and strategies described in this prospectus are those that the Fund uses under normal conditions. The Fund may take temporary "defensive" positions in attempting to respond to adverse market conditions. The Fund may invest any amount of its assets in cash or money market instruments in a defensive posture when the Sub-Adviser believes it is advisable to do so. Although taking a defensive posture is designed to protect the Fund from an anticipated market downturn, it could have the effect of reducing the benefit from any upswing in the market. When the Fund takes a defensive position, it may not achieve its investment objective. |

| | Mission-Auour Risk-Managed Global Equity Fund (Target Fund) | Union Street Partners Value Fund (Survivor Fund) |

| Buying Shares | You may purchase shares of the Fund through financial intermediaries, such as fund supermarkets or through brokers or dealers or banks who are authorized by the Distributor to sell shares of the Fund (collectively, "Financial Intermediaries"). You may also purchase shares directly from the Distributor. | Same |

| Exchange Privilege | To the extent the Adviser or Sub-Adviser manages other funds in the Trust, you may exchange all or a portion of your shares in the Fund for shares of the same class of certain other funds of the Trust managed by the Adviser or Sub-Adviser having different investment objectives, provided that the shares of the fund you are exchanging into are registered for sale in your state of residence. An exchange is treated as a redemption and purchase and may result in realization of a gain or loss on the transaction. You won't pay a deferred sales charge on an exchange; however, when you sell the shares you acquire in an exchange, you will pay a deferred sales charge based on the date you bought the original shares you exchanged. As of the date of this prospectus, the Adviser and Sub-Adviser do not manage any other funds in the Trust. | Same. |

| Selling Shares | You may redeem your shares of the Fund at any time and in any amount by contacting your Financial Intermediary or by contacting the Fund by mail or telephone. For your protection, the Transfer Agent will not redeem your shares until it has received all information and documents necessary for your request to be considered in “proper form.” The Transfer Agent will promptly notify you if your redemption request is not in proper form. The Transfer Agent cannot accept redemption requests which specify a particular date for redemption or which specify any special conditions. | Same. |

Comparison of the Funds’ Principal Risks

The following tables set forth information on the principal risks of investing in the Funds. The first table lists each principal risk that is shared by both Funds. The Funds’ description of these principal risks, as set forth in their current prospectus, may vary slightly but are not materially different. The description of the principal risks set forth below is that of the Survivor Fund. The second table lists the principal risks that are unique to each Fund.

| | Description of the Principal Risk – Survivor Fund |

Principal Risks Shared by Both Funds | Risks of Investing in Common Stocks. Overall stock market risks may affect the value of the Fund. Factors such as domestic economic growth and market conditions, interest rate levels, and political events affect the securities markets. When the value of the Fund’s investments goes down, your investment in the Fund decreases in value and you could lose money. Stock Selection Risk. Like all managed funds, there is a risk that the Sub-Adviser’s strategy for managing the Fund may not achieve the desired results. The portfolio securities selected by the Sub-Adviser may decline in value or not increase in value when the stock market in general is rising and may fail to meet the Fund’s investment objective. In addition, the prices of common stocks move up and down in response to corporate earnings and developments, economic and market conditions and anticipated events. Individual issuers may report poor results or be negatively affected by industry and/or economic trends and developments. The Fund's investment success depends on the skill of the Sub-Adviser in evaluating, selecting and monitoring the portfolio assets. If the Sub-Adviser's conclusions about growth rates or securities values are incorrect, the Fund may not perform as anticipated. Risk of Investing in Investment Companies and ETFs. The Fund may invest in the securities of other investment companies to the extent permitted by the 1940 Act. By investing in other investment companies, the Fund indirectly pays a portion of the expenses and brokerage costs of these companies as well as its own expenses. Also, federal securities laws impose limits on such investments, which may affect the ability of the Fund to purchase or sell these shares. Because the value of ETF shares depends on the demand in the market, shares may trade at a discount or premium to net asset value and the Sub-Adviser may not be able to liquidate the Fund’s holdings at the most optimal time, which may result in a loss. When the Fund invests in other investment companies or ETFs, it will be subject to substantially the same risks as those associated with the direct ownership of securities comprising the underlying investment companies or ETFs or the index on which the other investment company or ETF is based and the value of the Fund’s investments will fluctuate in response to the performance and risks of the underlying investments or index. Because the Fund is not required to hold shares of ETFs and underlying funds for any minimum period, it may be subject to, and may have to pay, short-term redemption fees imposed by the underlying funds. ETFs are subject to additional risks such as the fact that the market price of its shares may trade above or below its net asset value or an active market may not develop. The Fund has no control over the investments and related risks taken by the underlying funds in which it invests. The 1940 Act and the rules and regulations adopted under that statute impose conditions on investment companies which invest in other investment companies, and as a result, the Fund is generally restricted on the amount of shares of another investment company to shares amounting to no more than 3% of the outstanding voting shares of such other investment company. |

| Risk of Investing in MLPs. The Fund may invest in MLPs. MLPs are limited partnerships in which the ownership units are publicly traded. MLP units are registered with the U.S. Securities and Exchange Commission (the “SEC”) and are freely traded on a securities exchange or in the over-the-counter market. MLPs often own several properties or businesses (or own interests) that are related to oil and gas industries or other natural resources, but they also may finance other projects. To the extent that an MLP’s interests are all in a particular industry, the MLP will be negatively impacted by economic events adversely impacting that industry. The risks of investing in an MLP are generally those involved in investing in a partnership as opposed to a corporation. For example, state law governing partnerships is often less restrictive than state law governing corporations. Accordingly, there may be fewer protections afforded to investors in an MLP than investors in a corporation. In addition, MLPs may be subject to state taxation in certain jurisdictions which will have the effect of reducing the amount of income paid by the MLP to its investors. Risk of Investing in REITs. The Fund may invest in REITs. REITs may be subject to certain risks associated with the direct ownership of real estate, including declines in the value of real estate, risks related to general and local economic conditions, overbuilding and increased competition, increases in property taxes and operating expenses, and variations in rental income. Generally, increases in interest rates will decrease the value of high yielding securities and increase the costs of obtaining financing, which could decrease the value of the REITs held in the Fund's portfolio. REITs are also subject to heavy cash flow dependency, defaults by borrowers, self-liquidation and the possibility of failing to qualify for the tax-free pass-through of income under the Code and to maintain their exemption from registration under the 1940 Act. Risks of Investing in Convertible Securities. Most convertible securities are subject to the risks and price fluctuations of the underlying stock. They may be subject to the risk that the issuer will not be able to pay interest or dividends when due and their market value may change based on changes in the issuer’s credit rating or the market’s perception of the issuer’s creditworthiness. |

| | Mission-Auour Risk-Managed Global Equity Fund (Target Fund) | Union Street Partners Value Fund (Survivor Fund) |

| Principal Risks Unique to Each Fund | Investment Model Risk. Like all quantitatively based investment processes, the Sub-Adviser’s investment model carries a risk that the mathematical model used might be based on one or more incorrect assumptions. Rapidly changing and unforeseen market dynamics could also lead to a decrease in effectiveness of the Sub-Adviser’s model. No assurance can be given that the fund will be successful under all or any market conditions. | Risks of Investing in Undervalued Securities. Undervalued securities are, by definition, out of favor with investors, and there is no way to predict when, if ever, the securities may return to favor. |

| | Mission-Auour Risk-Managed Global Equity Fund (Target Fund) | Union Street Partners Value Fund (Survivor Fund) |

| | Currency Risk. The value of investments in securities denominated in foreign currencies increases or decreases as the rates of exchange between those currencies and the U.S. dollar change. Currency conversion costs and currency fluctuations could erase investment gains or add to investment losses. Currency exchange rates can be volatile and are affected by factors such as general economic conditions, the actions of the U.S. and foreign governments or central banks, the imposition of currency controls and speculation. Index Management Risk. To the extent the Fund invests in an ETP that is intended to track a target index, it is subject to the risk that the ETP may track its target index less closely. For example, an adviser to the ETP may select securities that are not fully representative of the index, and the ETP’s transaction expenses, and the size and timing of its cash flows, may result in the ETP’s performance being different than that of its index. Additionally, the ETP will generally reflect the performance of its target index even when the index does not perform well. Health Crisis Risk. A widespread health crisis, such as a global pandemic, could cause substantial market volatility, exchange trading suspensions or restrictions and closures of securities exchanges and businesses, impact the ability to complete redemptions, and adversely impact Fund performance. An outbreak of an infectious respiratory illness, COVID-19, caused by a novel coronavirus, was first detected in China in December 2019 and spread globally. As of the date of this prospectus, this outbreak has resulted in travel restrictions, closed international borders, enhanced health screenings at ports of entry and elsewhere, disruption of and delays in healthcare service preparation and delivery, prolonged quarantines, cancellations, supply chain disruptions, disruptions in markets, lower consumer demand, layoffs, defaults and other significant economic impacts, as well as general concern and uncertainty. These types of market disruptions may adversely impact the Fund’s investments, including impairing hedging activity to the extent the Fund engages in such activity, as expected correlations between related markets or instruments may no longer apply. In addition, to the extent the Fund invests in short-term instruments that have negative yields, the Fund’s value may be impaired as a result. Any suspension of trading in markets in which the Fund invests will have an impact on the Fund and its investments and will impact the Fund’s ability to purchase or sell securities in those markets. The impact of this outbreak has adversely affected the economies of many nations and the entire global economy and may impact individual issuers and capital markets in ways that cannot be foreseen. The duration of the outbreak and its effects cannot be determined with any certainty. | Risk of Non-Diversification. The Fund is non-diversified under the 1940 Act. However, because it intends to qualify as a "regulated investment company" for purposes of Subchapter M of the Internal Revenue Code of 1986, as amended (the "Code"), the Fund must meet certain diversification requirements. These include the requirement that at the end of each tax year quarter, at least 50% of the market value of its total assets must be invested in cash, cash equivalents, U.S. government securities and securities of issuers (including foreign governments), in which it has invested not more than 5% of its assets. A regulated investment company is also limited in its purchases of voting securities of any issuer and may invest no more than 25% of the value of its total assets in securities (other than U.S. government securities) of any one issuer or of two or more issuers that the Fund controls and are engaged in the same, similar or related trades or businesses. An investment in a non-diversified fund may entail greater price risk than an investment in a diversified fund. The Fund will be subject to substantially more investment risk and potential for volatility than a diversified fund because the poor performance of an individual security in the Fund’s portfolio will have a greater negative impact on the Fund’s performance than if the Fund’s assets were diversified among a larger number of portfolio securities. Repurchase Agreement Risk. The Fund’s investment in repurchase agreements may be subject to market and credit risk with respect to the collateral securing the repurchase agreements. Investments in repurchase agreements also may be subject to the risk that the market value of the underlying obligations may decline prior to the expiration date of the repurchase agreement term. Risk of Investing in Depositary Receipts. ADRs are dollar-denominated depositary receipts that typically are issued by a United States bank or trust company and represent the deposit with that bank or trust company of a security of a foreign issuer. Generally, ADRs are designed for trading on U.S. securities exchanges or other markets. ADRs may be sponsored or unsponsored. EDRs are issued in Europe and GDRs are issued throughout the world. |

| | Mission-Auour Risk-Managed Global Equity Fund (Target Fund) | Union Street Partners Value Fund (Survivor Fund) |

| | In the past, governmental and quasigovernmental authorities and regulators throughout the world have responded to major economic disruptions with a variety of fiscal and monetary policy changes, including direct capital infusions into companies and other issuers, new monetary policy tools, and lower interest rates. An unexpected or sudden reversal of these policies, or the ineffectiveness of such policies, is likely to increase market volatility, which could adversely affect the Fund’s investments. The outbreak could also impair the information technology and other operational systems upon which the Fund’s service providers rely and could otherwise disrupt the ability of employees of the Fund’s service providers to perform critical tasks relating to the Fund. Other infectious illness outbreaks that may arise in the future could have similar or other unforeseen effects. Public health crises may exacerbate other pre-existing political, social, and economic risks in certain countries or globally. Dividend-Paying Securities Risk. To the extent the Fund invests directly in dividend-paying securities or in ETPs that invest in dividend-paying securities it will be subject to certain risks. The company issuing such securities may fail and have to decrease or eliminate its dividend. In such an event, an ETP, and in turn the Fund, may not only lose the dividend payout but the stock price of the company may fall. Small- and Mid-Cap Risk. To the extent the Fund invests directly in small- and mid-cap companies or in ETPs that invest in small- and mid-cap companies, the Fund will be subject to additional risks. These include: (1) the earnings and prospects of smaller companies are more volatile than larger companies; (2) smaller companies may experience higher failure rates than do larger companies; (3) the trading volume of securities of smaller companies is normally less than that of larger companies and, therefore, may disproportionately affect their market price, tending to make them fall more in response to selling pressure than is the case with larger companies; and (4) smaller companies may have limited markets, product lines or financial resources and may lack management experience. | Although depositary receipts provide a convenient means to invest in non-U.S. securities, such investments involve risks generally similar to investments directly in foreign securities including the risk that there is often less publicly available information about foreign issuers, and there is the possibility of negative governmental actions and of political and social unrest. The issuers of unsponsored depositary receipts may not receive information from the foreign issuer, and it is under no obligation to distribute shareholder communications or other information received from the foreign issuer of the deposited securities or to pass through voting rights to the holders of the depositary receipts. Additionally, although depositary receipts have risks similar to the securities that they represent, they may involve higher expenses, may trade at a discount (or premium) to the underlying security, may not pass through voting and other shareholder rights, and may be less liquid than the underlying securities listed on an exchange. To the extent that the Fund invests in issuers (or depositary receipts of issuers) located in emerging markets, the foreign securities risk may be heightened. |

| | Mission-Auour Risk-Managed Global Equity Fund (Target Fund) | Union Street Partners Value Fund (Survivor Fund) |