SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. _________)

Filed by the registrant ☒

Filed by a party other than the registrant ☐

Check the appropriate box:

| ☐ | Preliminary proxy statement |

| ☐ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive proxy statement |

| ☐ | Definitive additional materials |

| ☐ | Soliciting material under Rule 14a-12 |

World Funds Trust

(Name of Registrant as Specified in Its Charter)

(Names of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| | ☐ | Fee paid previously with materials. |

| | ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| | |

| 2) | Form, Schedule or Registration Statement No.: |

| | |

| 3) | Filing Party: |

| | |

| 4) | Date Filed: |

WORLD FUNDS TRUST

c/o Commonwealth Fund Services, Inc.

8730 Stony Point Parkway, Suite 205

Richmond, Virginia 23235

The E-Valuator Funds

The E-Valuator Very Conservative (0%-15%) RMS Fund

The E-Valuator Conservative (15%-30%) RMS Fund

The E-Valuator Conservative/Moderate (30%-50%) RMS Fund

The E-Valuator Moderate (50%-70%) RMS Fund

The E-Valuator Growth (70%-85%) RMS Fund

The E-Valuator Aggressive Growth (85%-99%) RMS Fund

Important Voting Information Inside

Table of Contents

March 17, 2021

Dear Shareholder:

I am writing to inform you of the upcoming special meeting of the shareholders of The E-Valuator Very Conservative (0-15%) RMS Fund, The E-Valuator Conservative (15%-30%) RMS Fund, The E-Valuator Conservative/Moderate (30%-50%) RMS Fund, The E-Valuator Moderate (50%-70%) RMS Fund, The E-Valuator Growth (70%-85%) RMS Fund, and The E-Valuator Aggressive Growth (85%-99%) RMS Fund (each a “Fund”, and, collectively the “Funds”), each a series of the World Funds Trust (the “Trust”).

The meeting is scheduled to be held at 10:00 a.m. Eastern Time on April 9, 2021, at the offices of Commonwealth Fund Services, Inc. at 8730 Stony Point Parkway, Suite 205, Richmond, Virginia 23235. Please take the time to carefully read the Proxy Statement and cast your vote.

The purpose of the meeting is to seek your approval for a proposed change of the trust of which each of the Funds are a series. Each Fund is currently organized as a series of the Trust, an investment company with its principal offices in Richmond, Virginia. After completion of the proposed tax-free reorganization, each Fund would be a series of the E-Valuator Funds Trust, a newly formed investment company with its principal offices in Bloomington, Minnesota. This reorganization of the Funds will not result in a change in adviser, or any change to the objectives, strategies or investment policies of the Funds.

We think that this proposal is in the best interest of the shareholders of each Fund. The Board of Trustees has unanimously recommended that shareholders of each Fund vote “FOR” the reorganization of their Fund.

Should you have any questions, please feel free to call us at 888-507-2798. We will be happy to answer any questions you may have. For voting instructions, including a toll-free number and website for voting, please refer to the enclosed ballot.

YOUR VOTE IS IMPORTANT REGARDLESS OF THE NUMBER OF SHARES YOU OWN. TO ASSURE YOUR REPRESENTATION AT THE MEETING, PLEASE COMPLETE THE ENCLOSED PROXY AND RETURN IT PROMPTLY WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE MEETING. IF YOU ATTEND THE MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE YOUR SHARES IN PERSON.

Sincerely,

/s/ David Bogaert

David Bogaert

President

World Funds Trust

WORLD FUNDS TRUST

c/o Commonwealth Fund Services, Inc.

8730 Stony Point Parkway, Suite 205

Richmond, Virginia 23235

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON

April 9, 2021

To the Shareholders:

A special meeting (the “Special Meeting”) of the shareholders of The E-Valuator Very Conservative (0-15%) RMS Fund, The E-Valuator Conservative (15%-30%) RMS Fund, The E-Valuator Conservative/Moderate (30%-50%) RMS Fund, The E-Valuator Moderate (50%-70%) RMS Fund, The E-Valuator Growth (70%-85%) RMS Fund, and The E-Valuator Aggressive Growth (85%-99%) RMS Fund (each a “Fund”, and collectively, the “Funds”), each a series portfolio of the World Funds Trust, will be held at the offices of Commonwealth Fund Services, Inc. at 8730 Stony Point Parkway, Suite 205, Richmond, Virginia 23235, on April 9, 2021 at 10:00 a.m., Eastern time, for the following purposes:

(1) To approve a proposed change of organization of the Funds. Each Fund is currently organized as a series of World Funds Trust, an investment company organized as a Delaware statutory trust. After completion of the proposed tax-free reorganization, each Fund would be a series of the E-Valuator Funds Trust, an investment company newly organized as a Delaware statutory trust.

(2) To consider and act upon any other business as may properly come before the Special Meeting and any adjournments thereof.

You are entitled to vote at the Special Meeting and any adjournment(s) if you owned shares of any of the Funds at the close of business on March 8, 2021.

YOUR VOTE IS IMPORTANT REGARDLESS OF THE NUMBER OF SHARES YOU OWN. TO ASSURE YOUR REPRESENTATION AT THE SPECIAL MEETING, PLEASE COMPLETE THE ENCLOSED PROXY AND RETURN IT PROMPTLY WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE MEETING. IF YOU ATTEND THE SPECIAL MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE YOUR SHARES IN PERSON.

If you have any questions, please call 888-507-2798. For voting instructions, including a toll-free number and website for voting, please refer to the enclosed ballot.

Sincerely,

/s/ David Bogaert

David Bogaert

President

World Funds Trust

March 17, 2021

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING TO BE HELD ON April 9, 2021: This Notice, Proxy Statement and the Funds’ most recent Annual Report to shareholders are available on the internet at https:// vote.proxyonline.com/ wft/ docs/ evaluator2021.pdf.

We intend to hold the Special Meeting in person. However, we are sensitive to the public health and travel concerns our shareholders may have and recommendations that public health officials may issue in light of the evolving COVID-19 pandemic. As a result, we may impose additional procedures or limitations on Special Meeting attendees or may decide to hold the Special Meeting in a different location. We plan to announce any such updates on our proxy website, https://vote.proxyonline.com/wft/docs/evaluator2021, and we encourage you to check this website prior to the Special Meeting if you plan to attend. We also encourage you to consider your options to vote by internet, telephone, or mail, as discussed below, in advance of the Special Meeting in the event that, as of April 9, 2021, in-person attendance at the Special Meeting is either prohibited under a federal, state, or local order or contrary to the advice of public health care officials.

The E-Valuator Funds

The E-Valuator Very Conservative (0%-15%) RMS Fund

The E-Valuator Conservative (15%-30%) RMS Fund

The E-Valuator Conservative/Moderate (30%-50%) RMS Fund

The E-Valuator Moderate (50%-70%) RMS Fund

The E-Valuator Growth (70%-85%) RMS Fund

The E-Valuator Aggressive Growth (85%-99%) RMS Fund

Each A Series Of

World Funds Trust

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS

This proxy statement is being furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board”) of World Funds Trust (the “Trust”), with its principal office located at 8730 Stony Point Parkway, Suite 205, Richmond, Virginia 23235. The proxies are to be used at a meeting (the “Special Meeting”) of the shareholders of The E-Valuator Very Conservative (0-15%) RMS Fund, The E-Valuator Conservative (15%-30%) RMS Fund, The E-Valuator Conservative/Moderate (30%-50%) RMS Fund, The E-Valuator Moderate (50%-70%) RMS Fund, The E-Valuator Growth (70%-85%) RMS Fund, and The E-Valuator Aggressive Growth (85%-99%) RMS Fund (each an “Existing Fund” and, collectively, the “Existing Funds”) at the offices of Commonwealth Fund Services, Inc. at 8730 Stony Point Parkway, Suite 205, Richmond, Virginia 23235 on April 9, 2021 at 10:00 a.m., Eastern time, and any adjournment of the meeting, for the purposes set forth in the accompanying Notice of Special Meeting of Shareholders.

We intend to hold the Special Meeting in person. However, we are sensitive to the public health and travel concerns our shareholders may have and recommendations that public health officials may issue in light of the evolving COVID-19 pandemic. As a result, we may impose additional procedures or limitations on Special Meeting attendees or may decide to hold the Special Meeting in a different location. We plan to announce any such updates on our proxy website, https://vote.proxyonline.com/wft/docs/evaluator2021, and we encourage you to check this website prior to the Special Meeting if you plan to attend. We also encourage you to consider your options to vote by internet, telephone, or mail, as discussed below, in advance of the Special Meeting in the event that, as of April 9, 2021, in-person attendance at the Special Meeting is either prohibited under a federal, state, or local order or contrary to the advice of public health care officials.

The primary purpose of the Special Meeting is for shareholders of the Existing Funds to consider and approve the following proposals:

(1) To approve a proposed change of organization of the Existing Funds (the “Reorganization”) to be effected in accordance with the Agreement and Plan of Reorganization (the “Reorganization Plan”) attached as Exhibit A to this Proxy Statement, pursuant to which each Existing Fund would reorganize into a newly created fund with the same name in a newly created trust, the E-Valuator Funds Trust, an investment company organized as a Delaware statutory trust.

(2) To consider and act upon any other business that may properly come before the Special Meeting and any adjournments thereof.

The date of the first mailing of this Proxy Statement will be on or about March 17, 2021.

PROPOSAL

At a meeting of the Trustees of the Trust held on February 10, 2021, the Trustees, including the Trustees who are not “interested persons” of the Trust as that term is defined in the Investment Company Act of 1940 (“Independent Trustees”), considered the Reorganization Plan substantially in the form attached to this Proxy Statement, and unanimously determined that the Reorganization is in the best interests of the shareholders of each Existing Fund and that the interests of those shareholders will not be diluted as a result of the Reorganization.

SUMMARY OF PROPOSAL

Below is brief summary of the proposal and how it will affect each Existing Fund. We urge you to read the Proxy Statement.

You are being asked to consider a reorganization of the Existing Funds. Each Existing Fund is currently a separate series of the Trust. Each Existing Fund offers two classes of shares, R4 Class and Service Class shares. If approved by shareholders, each Existing Fund will be reorganized into newly formed series (each a “New Fund” and, collectively, the “New Funds”) of a newly created trust, the E-Valuator Funds Trust (the “New Trust”), an investment company organized as a Delaware statutory trust, that will offer identical share classes as the Existing Funds. Shareholders of each Existing Fund will receive shares of the applicable class of the corresponding New Fund as follows:

| World Funds Trust (Existing Funds) | E-Valuator Funds Trust (New Funds) |

| The E-Valuator Very Conservative (0%-15%) RMS Fund | The E-Valuator Very Conservative (0%-15%) RMS Fund |

| The E-Valuator Conservative (15%-30%) RMS Fund | The E-Valuator Conservative (15%-30%) RMS Fund |

| The E-Valuator Conservative/Moderate (30%-50%) RMS Fund | The E-Valuator Conservative/Moderate (30%-50%) RMS Fund |

| The E-Valuator Moderate (50%-70%) RMS Fund | The E-Valuator Moderate (50%-70%) RMS Fund |

| The E-Valuator Growth (70%-85%) RMS Fund | The E-Valuator Growth (70%-85%) RMS Fund |

| The E-Valuator Aggressive Growth (85%-99%) RMS Fund | The E-Valuator Aggressive Growth (85%-99%) RMS Fund |

In addition, the Reorganization will not result in the any changes in the name, investment objective or principal investment strategy of the Existing Funds, or their fiscal year. The Existing Funds’ investment adviser, portfolio manager, independent registered public accountants and custodian will remain the same as well. The Existing Funds’ distributor, administrator, fund accounting agent and transfer agent will be changing as part of the Reorganization but these changes are not expected to materially impact the services the Existing Funds have been receiving or the fees being charged to the Existing Funds for such services. You will own the same number and class of shares of the New Fund immediately after the Reorganization equal in value to the value of your shares in the Existing Fund immediately prior to the Reorganization. Each New Fund will offer similar shareholder services as its corresponding Fund. However, the New Funds will have a newly elected slate of trustees and officers who will be responsible for overseeing the New Funds operations. Information about the new trustees and officers is included in the section titled “Certain Information Regarding the Trustees and Officers of the New Funds.”

Systelligence, LLC (the “Adviser”), the Existing Funds’ investment adviser, requested that the Board consider the Reorganization. The Adviser represented to the Trustees that the Reorganization offers several potential benefits to the Existing Funds, including that the Adviser believes that the New Funds may be marketed more effectively as part of their own trust, the New Funds will be served by a new Board of Trustees that is only responsible for overseeing the New Funds, and that utilizing a single service platform for the New Funds may result in administrative efficiencies over time.

Pursuant to the Reorganization Plan, the Reorganization will be accomplished as follows: (a) each Existing Fund transfers all of its assets to an identically-named series of the New Trust in exchange for shares of such New Fund and the assumption by the New Fund of all of the liabilities of its transferring Existing Fund, and (b) each Existing Fund distributes the New Fund’s shares to its shareholders. A form of the Reorganization Plan is attached as Exhibit A.

The Adviser has also recommended, and the Board of the New Trust has approved, the appointment of UMB Bank and its affiliates to provide operational services to the New Trust including serving as custodian, distributor, administrator, fund accounting agent and transfer agent.

The Board recommends a vote for this proposal. For information about the anticipated benefits of the Reorganization, see “Reasons for the Proposed Reorganization” below.

VOTING INFORMATION

Shareholders of record of the Existing Funds at the close of business on March 8, 2021 will be entitled to vote at the Special Meeting or at any adjournments thereof. As of the record date, there were issued and outstanding the following number of shares for each Existing Fund:

| Existing Fund | R4 Class | Service Class |

| The E-Valuator Very Conservative (0%-15%) RMS Fund | 1,029,449 | 895,300 |

| The E-Valuator Conservative (15%-30%) RMS Fund | 1,404,957 | 4,658,730 |

| The E-Valuator Conservative/Moderate (30%-50%) RMS Fund | 462,407 | 1,769,637 |

| The E-Valuator Moderate (50%-70%) RMS Fund | 3,067,673 | 11,946,792 |

| The E-Valuator Growth (70%-85%) RMS Fund | 2,870,291 | 18,907,221 |

| The E-Valuator Aggressive Growth (85%-99%) RMS Fund | 919,922 | 9,591,914 |

Shareholders are entitled to one vote for each share held and a proportionate vote for each fractional share held. Shareholders of each Existing Fund will vote separately on each proposal, without regard to the class of shares held. The presence at the Special Meeting of holders of a majority of the outstanding shares of each Existing Fund entitled to vote, in person or by proxy, shall constitute a quorum for the Special Meeting for that Existing Fund. A quorum being present, the Existing Funds will adopt the proposal if a majority of the shares of such Fund vote to approve the proposal. For purposes of the proposal, majority means the lesser of: (a) 67% or more of the voting securities of that Fund present at the meeting, if 50% or more of the outstanding voting securities of such Fund are represented in person or by proxy; or (b) 50% or more of the outstanding voting securities of such Fund. The New Trust may terminate the Reorganization if the Reorganization is not approved by the Shareholders of each Existing Fund.

For purposes of determining (i) the presence of a quorum, and (ii) whether sufficient votes have been received for approval of a particular proposal, abstentions and broker “non-votes” (that is, proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owner or other persons entitled to vote shares on a particular matter with respect to which the brokers or nominees do not have discretionary power) will be treated as shares that are present at the meeting, but which have not been voted. For this reason, abstentions and broker non-votes will assist the Existing Fund in obtaining a quorum, but both have the practical effect of a “no” vote for purposes of obtaining the requisite vote for approval of the proposal.

If, with respect to any Existing Fund, either (a) a quorum is not present at the meeting, or (b) a quorum is present but sufficient votes in favor of the proposal have not been obtained, then the persons named as proxies may propose one or more adjournments of the Special Meeting with respect to such Fund, without further notice to the shareholders of the Fund, to permit further solicitation of proxies, provided such persons determine, after consideration of all relevant factors, including the nature of the proposal, the percentage of votes then cast, the percentage of negative votes then cast, the nature of the proposed solicitation activities and the nature of the reasons for such further solicitation, that an adjournment and additional solicitation is reasonable and in the interests of shareholders. The persons named as proxies will vote those proxies that such persons are required to vote FOR the proposal, as well as proxies for which no vote has been directed, in favor of such an adjournment and will vote those proxies required to be voted AGAINST such proposal against such adjournment.

The Special Meeting may be adjourned from time to time by the vote of a majority of the shares represented at the meeting, whether or not a quorum is present. If the Special Meeting is adjourned to another time or place, notice need not be given of the adjourned Special Meeting at which the adjournment is taken, unless a new record date of the adjourned Special Meeting is fixed. At any adjourned meeting, the Trust may transact any business which might have been transacted at the original meeting.

The individuals named as proxies on the enclosed proxy card will vote in accordance with the shareholder’s direction, as indicated thereon, if the proxy card is received and is properly executed. If the shareholder properly executes a proxy and gives no voting instructions with respect to a proposal, the shares will be voted in favor of such proposal. The proxies, in their discretion, may vote upon such other matters as may properly come before the Special Meeting. The Board of Trustees of the Trust is not aware of any other matters to come before the Special Meeting.

Revocation of Proxies

If you return a properly executed proxy card, but later wish to revoke it, you may do so at any time before it is voted by doing any of the following:

| - | delivering written notice of the proxy’s revocation to the Secretary of the Trust at the above address on the cover page prior to the Special Meeting; |

| - | submitting a properly executed proxy bearing a later date, but prior to the Special Meeting; |

| - | submitting a subsequent telephone or online vote; or |

| - | attending and voting in person at the Special Meeting and giving oral notice of revocation to the Chairman of the Special Meeting. |

Solicitation of Proxies

We are soliciting these proxies by U.S. mail, and may also solicit them in person, by telephone, by facsimile, or by any other electronic means. The Existing Funds are paying for the costs of this proposed reorganization, including the expense of preparing, printing, and mailing of this Proxy Statement, the enclosed proxy card, and other expenses relating to the shareholder meeting. The costs of the Reorganization and other related proxy costs are expected to be approximately $425,000 and will be allocated among the Existing Funds based on average net assets. The Trust has engaged AST Fund Solutions to assist in proxy solicitation. Employees of the Adviser and of Commonwealth Fund Services, Inc., a service provider for the Existing Funds, may make additional solicitations to obtain the necessary shareholder representation at the meeting, but will receive no additional compensation for doing so. We will count proxies that are properly authorized by telephone or electronically transmitted instruments, to the extent that we are able to verify your identity when you authorize your proxy in that manner.

ANNUAL AND SEMI-ANNUAL REPORTS

The most recent annual report of the Existing Funds, including financial statements, for the fiscal year ended September 30, 2020, as well as the semi-annual report for each of the Existing Funds for the semi-annual period ended March 31, 2020, have been mailed previously to the shareholders. If you have not received these reports or would like to receive additional copies free of charge, please contact the Existing Funds at the address set forth on the first page of this proxy statement or by calling 888-507-2798, and they will be sent to you within three (3) business days by first class mail.

REASONS FOR THE PROPOSED REORGANIZATION

The Adviser requested that the Board consider the Reorganization. The Adviser represented to the Trustees that the Reorganization offers several potential benefits to the Existing Funds described below. Finally, the Adviser assured the Board that the Reorganization would not result in any changes to the Existing Funds’ investment objectives or strategies, or in the portfolio manager. The Board of Trustees of the Trust, including the Independent Trustees, unanimously approved the Reorganization Plan based on information requested by the Board and provided by the Adviser. In approving the Reorganization, the Trustees of the Trust determined that the proposed Reorganization would be in the best interests of each Existing Fund, and that the interests of each Existing Fund’s shareholders would not be diluted as a result of effecting the Reorganization. Before reaching this conclusion, the Board engaged in a thorough review process relating to the proposed Reorganization and carefully considered information provided by the Adviser regarding the Reorganization in response to requests for information from the Board and information gained from the Board’s on-going oversight of the Existing Funds and the Adviser, including presentations at meetings of the Board of Trustees by the Adviser. The Board also considered maintaining the Existing Funds as series of the Trust. The Board gave stronger weight to the Adviser’s recommendation to reorganize the Existing Funds and noted that (1) shareholders not wishing to become part of a New Fund could redeem or exchange their shares of the Existing Fund at any time prior to the closing of the Reorganization without penalty, and (2) that the Reorganization would allow shareholders of the Existing Fund who wished to retain their investment after the Reorganization to do so in a registered mutual fund with the same investment objective, investment limitations and strategies, investment adviser and portfolio manager. The Board determined in its reasonable business judgment that the Existing Funds will bear the costs of the Reorganization because they are expected to achieve long-term benefits post-Reorganization as detailed below, and because the Reorganization costs ultimately borne by each Existing Fund will be limited by the Existing Fund’s contractual expense limitation (discussed below). In discussing the mechanics of the Reorganization with legal counsel to the Trust, the Trustees considered the following factors:

| ● | The Adviser believes that the New Funds may be marketed more effectively as part of their own trust because they can be branded exclusively under the E-Valuator brand. |

| ● | The New Funds will be served by a new Board of Trustees that is only responsible for overseeing the New Funds. The Board has reviewed information provided to it by the Adviser and its representatives regarding the background and experience of the members of the contemplated new Board of Trustees for the New Funds and has determined that the members of the new Board of Trustees are adequately qualified to fulfill their responsibilities. |

| ● | Based on information provided by the service providers, the Adviser believes that the fees and expenses of the new service provider platform are expected to be no higher than those currently in effect, and that the new platform may result in administrative efficiencies over time as a result of having all services integrated with a single service provider. |

| ● | The investment objective, policies and restrictions of each New Fund are identical to those of the corresponding Existing Fund, and each New Fund will be managed by the same portfolio manager and in accordance with the same investment strategies and techniques utilized in managing the corresponding Existing Fund immediately prior to the Reorganization. |

| ● | The Trust will receive an opinion of legal counsel that the Reorganization is not a taxable event for shareholders. |

The Board did not identify any particular information that was most relevant to its consideration of whether to approve the Reorganization and each Trustee may have afforded different weight to the various factors. The Board now submits to shareholders of each Existing Fund a proposal to approve the Reorganization Plan. If shareholders approve the proposal, the Reorganization is expected to take effect (the “Closing”) on or about the close of business on April 16, 2021 (the “Closing Date”), although that date may be adjusted in accordance with the Reorganization Plan.

SUMMARY OF PLAN OF REORGANIZATION

Below is a summary of the important terms of the Reorganization Plan. This summary is qualified in its entirety by reference to the Reorganization Plan itself, which is set forth in Exhibit A to this Proxy Statement, and which we encourage you to read in its entirety. All information regarding the New Trust, its operations and the various agreements between the New Trust and its service providers have been supplied by the Adviser, and the Trust and its Trustees and officers relied exclusively on such information.

General Plan of Reorganization

The Reorganization Plan consists of several steps that will occur on the Closing Date after shareholder approval. First, each Existing Fund will transfer all of its assets to a corresponding New Fund of the New Trust in exchange solely for shares of the corresponding New Fund and an assumption by such New Fund of all of the liabilities of the corresponding Existing Fund. Immediately thereafter, each Existing Fund will liquidate and distribute the shares received from the corresponding New Fund to its shareholders in exchange for their shares of that Existing Fund. This will be accomplished by opening an account on the books of the corresponding New Fund in the name of each shareholder of record of the Existing Fund and by crediting to each such account the shares due to the shareholder in the Reorganization. Every shareholder will own the same type and number of shares of the corresponding New Fund as the type and number of Existing Fund shares held by the shareholder immediately before the Reorganization. For example, if you held 100 Service Class shares of The E-Valuator Moderate (50%-70%) RMS Fund immediately prior to the close of the New York Stock Exchange on the Closing Date, those Service Class shares would be canceled and you would receive 100 Service Class shares of the corresponding newly created E-Valuator Moderate (50%-70%) RMS Fund. The value of your investment immediately after the Reorganization will be the same as it was immediately prior to the Reorganization. All of these transactions would occur as of the Closing Date. A vote in favor of the proposed Reorganization will constitute an approval by shareholders of the written advisory agreement entered into by the New Trust on behalf of the New Funds.

Other Provisions

The Reorganization Plan, a form of which is attached as Exhibit A, contains certain representations and warranties, obligations, and covenants of the parties including certain indemnification obligations of the New Trust and the Adviser. The Reorganization Plan also includes a number of conditions to the Closing of each Reorganization. Certain of these conditions may be waived by the Board of Trustees of each of the Trust and the New Trust. The significant conditions include: (a) the receipt by the Trust and the New Trust of an opinion of counsel as to certain federal income tax aspects of the Reorganization, (b) the receipt by each of the Trust and New Trust of an opinion of counsel regarding corporate and securities matters, and (c) with respect to each Reorganization, the approval of the Reorganization Plan by shareholders of such Existing Fund (which may not be waived). The Reorganization Plan may be terminated by mutual agreement of the Trust and the New Trust. The Reorganization Plan may be terminated at any time prior to the Closing Date, before or after approval by the shareholders of the Existing Funds, by the Board of Trustees of the Trust or the Board of Trustees of the New Trust due to (i) a breach by the other party of any representation, warranty, or agreement contained in the Reorganization Plan to be performed on or before the Closing Date, (ii) failure of the other party to satisfy conditions precedent to the Closing, or (iii) a determination by either the Board of Trustees of the Trust or the New Trust that the consummation of the transactions is not in the best interest of such party. The Reorganization may be terminated with respect to an Existing Fund if the shareholders of the Fund do not approve the Reorganization Plan. If the Reorganization Plan is not approved by shareholders of an Existing Fund, the Trust’s Board of Trustees would have to consider its next steps, which may include a new solicitation of shareholders of such Fund or the possible termination of such Fund. In addition, the Reorganization Plan may be amended by the Board of Trustees of the Trust and the New Trust. However, shareholder approval would be required in order to amend the Reorganization Plan, subsequent to the shareholders meeting, in a manner that would change the method for determining the number of shares to be issued to shareholders of the Existing Funds.

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT

TRUSTEES, UNANIMOUSLY RECOMMENDS

THAT SHAREHOLDERS APPROVE THE REORGANIZATION PLAN

ELECTIONS, APPROVALS AND RATIFICATIONS

The Investment Company Act of 1940, as amended (“1940 Act”) generally requires that shareholders of a mutual fund elect the fund’s trustees, approve the fund’s investment advisory agreement and any distribution plans adopted pursuant to Rule 12b-1 under the 1940 Act, as well as ratify the trustees’ selection of an independent accountant for the fund. Those requirements apply to all new mutual funds, including the New Funds. If shareholders of the Existing Funds approve the proposed Reorganization, they will effectively be:

| - | electing the trustees of the New Trust; |

| - | approving the investment advisory agreement with Systelligence, LLC with respect to each New Fund; |

| - | approving the 12b-1 plan for each New Fund’s R4 Class |

| - | approving the shareholder services plan for each New Fund’s R4 Class*; and |

| - | ratifying the selection of Cohen & Company, Ltd. as the independent registered public accountants for the New Funds. |

* Each Existing Fund has adopted a shareholder services plan with respect to the R4 Class, which provides up to 0.25% of a Fund’s average net assets to pay for a variety of shareholder related services.

Technically, these elections, approvals and ratifications will be accomplished by a vote of Systelligence, LLC, as the sole initial shareholder of each New Fund prior to the Closing. The New Trust has approved (i) an investment advisory agreement with the same fees and substantially the same terms as the current investment advisory agreement for the Existing Funds and (ii) a 12b-1 Plan and a Shareholder Services Plan with the same fees and terms as the Existing Funds with respect to the R4 Class. The New Trust has appointed the same auditor that has served as auditor of the Existing Funds since their inception. The New Trust has a new set of Trustees and officers. Individuals who serve as Trustees and officers of the New Trust and New Funds are listed below under “Certain Information Regarding the Trustees and Officers of the New Funds.”

COMPARISON OF EXISTING FUNDS AND NEW FUNDS

Investment Objectives

The investment objective for each New Fund will be identical to that of its identically named Existing Fund.

| Existing Fund | Investment Objective |

| E-Valuator Very Conservative (0%-15%) RMS (Risk-Managed Strategy) Fund | The E-Valuator Very Conservative (0%-15%) RMS (Risk-Managed Strategy) Fund seeks as a primary objective to provide income and as a secondary objective stability of principal. |

| E-Valuator Conservative (15%-30%) RMS (Risk-Managed Strategy) Fund | The E-Valuator Conservative (15%-30%) RMS (Risk-Managed Strategy) Fund seeks to provide income but will at times seek growth and income within the stated asset allocation range. |

| E-Valuator Conservative/ Moderate (30%-50%) RMS (Risk-Managed Strategy) Fund | The E-Valuator Conservative/Moderate (30%-50%) RMS (Risk-Managed Strategy) Fund seeks to provide both growth of principal and income but will at times focus primarily on providing income within the stated asset allocation range. |

| E-Valuator Moderate (50%-70%) RMS (Risk-Managed Strategy) Fund | The E-Valuator Moderate (50%-70%) RMS (Risk-Managed Strategy) Fund seeks to provide both growth of principal and income but will at times focus primarily on providing growth of principal within the stated asset allocation range. |

| E-Valuator Growth (70%-85%) RMS (Risk-Managed Strategy) Fund | The E-Valuator Growth (70%-85%) RMS (Risk-Managed Strategy) Fund seeks to provide growth of principal but will at times seek to provide both growth of principal and income within the stated asset allocation range. |

| E-Valuator Aggressive Growth (85%-99%) RMS (Risk-Managed Strategy) Fund | The E-Valuator Aggressive Growth (85%-99%) RMS (Risk-Managed Strategy) Fund seeks to provide growth of principal within the stated asset allocation range. |

Principal Investment Strategies and Risks; Investment Limitations and Restrictions

The Adviser has represented that the investment objective and principal investment strategies for each New Fund, as well as the New Funds’ investment limitations and restrictions, will not change as a result of the Reorganization. For detailed information about each New Fund’s principal investment strategies and risks, and the New Funds’ investment limitations and restrictions, see Exhibit B of this Proxy Statement.

Fees and Expenses and Performance History

The tables of Fees and Expenses and the Examples shown below are based on fees and expenses as shown in the Existing Funds’ prospectus and on estimates for the New Funds. The following tables are designed to help you understand the fees and expenses that you may pay, both directly and indirectly, by investing in a New Fund’s shares as compared to the shares of the corresponding Existing Fund. Information is presented as of September 30, 2020 for each Fund and their respective share classes. The fee tables do not take into consideration the costs of the Reorganization, which are one-time, non-recurring costs that will be allocated among the Existing Funds based on average net assets. To the extent the Reorganization costs allocated to an Existing Fund would cause the Existing Fund’s total operating expenses to exceed the Fund’s contractual expense limitation (discussed below), such Reorganization costs will ultimately be borne by the Adviser. Notwithstanding the contractual expense limitation, the costs of the Reorganization could be considered material to an Existing Fund.

Information regarding the Portfolio Turnover and Performance History of each Existing Fund is also set forth below.

Service Class Shares

The E-Valuator Very Conservative (0%-15%) RMS Fund

This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund.

Shareholder Fees (fees paid directly from your investment) | Service Class | New Service Class |

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | None | None |

Maximum deferred sales charges (load) (as a percentage of the NAV at time of purchase) | None | None |

| Redemption Fee | None | None |

| Exchange Fee | None | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Service Class | New Service Class(3) |

| Management Fee (1) | 0.45% | 0.45% |

| Distribution (12b-1) and Service Fees | None | None |

| Other Expenses | 0.44%(2) | 0.44% |

| Acquired Fund Fees and Expenses | 0.20% | 0.20% |

| Total Annual Fund Operating Expenses | 1.09%(2) | 1.09% |

| Fee Waivers and/or Expense Reimbursements(1) | (0.09%) | (0.09%) |

Total Annual Fund Operating Expenses (after fee waivers and expense Reimbursements)(1) | 1.00% | 1.00% |

| (1) | Systelligence, LLC (the “Adviser”), has contractually agreed to waive its management fee to an annual rate of 0.38% of the average daily net assets of the Fund. Additionally, after giving effect to the foregoing fee waiver, the Adviser has contractually agreed to limit the total expenses of the Fund (exclusive of interest, distribution fees pursuant to Rule 12b-1 Plans, taxes, acquired fund fees and expenses, brokerage commissions, dividend expense on short sales, other expenditures which are capitalized in accordance with generally accepted accounting principles and other extraordinary expenses not incurred in the ordinary course of business) to an annual rate of 0.80% of the average daily net assets of the Fund. Each waiver and/or reimbursement of an expense by the Adviser is subject to repayment by the Fund within three years following the date that such waiver was made or such expense was incurred, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and at the time the waiver or reimbursement is recouped. The Adviser may not terminate these contractual arrangements prior to January 31, 2022. Any Existing Fund expenses waived or reimbursed by the Adviser prior to the Closing of the Reorganization will remain subject to recoupment by the Adviser from the New Fund after the Closing, subject further to the three-year limitation on recoupment. |

| (2) | Other Expenses and Total Annual Fund Operating Expenses differ from the expenses set forth in the Existing Fund’s annual report for the period ended September 30, 2020. Please refer to the Annual Report for historical expenses incurred. Such fees and expenses have been restated to reflect the elimination of the Shareholder Services Plan for Service Class Shares and to exclude certain non-recurring expenses, including the expenses of the Reorganization that are described elsewhere in this Proxy Statement. |

| (3) | The New Fund is newly formed and will commence operations following the Reorganization. Fees and expenses are estimated for the New Fund’s first year of operations. Such amounts are based on actual expenses of the Existing Fund for the fiscal period ended September 30, 2020 (excluding non-recurring expenses), adjusted for the fee and expense schedules of the service providers of the New Fund. |

Example

This example is intended to help you compare the cost of investing in the New Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the New Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the New Fund’s operating expenses remain the same. The effect of the Adviser’s agreement to waive fees and/or reimburse expenses is only reflected in the first year of each example shown below. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Share Class | 1 Year | 3 Years | 5 Years | 10 Years |

| Service Class | $102 | $338 | $592 | $1,321 |

| New Service Class | $102 | $338 | $592 | $1,321 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the example, affect the Fund’s performance. During the most recent fiscal year ended September 30, 2020, the Fund’s portfolio turnover rate was 302.98% of the average value of its portfolio.

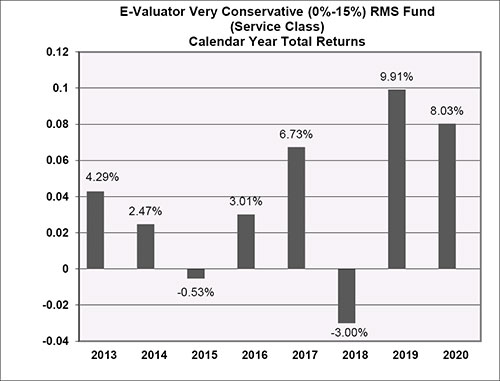

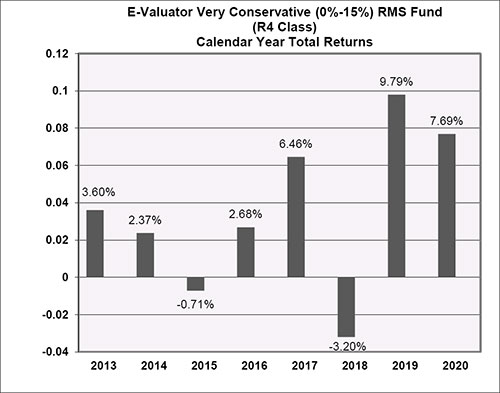

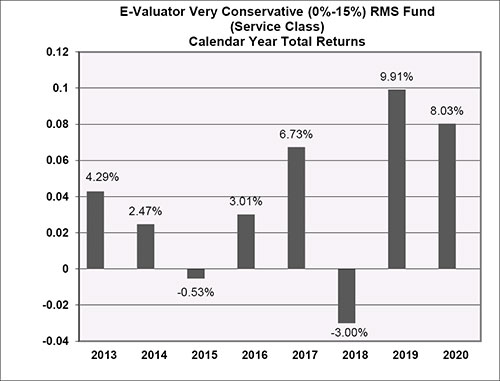

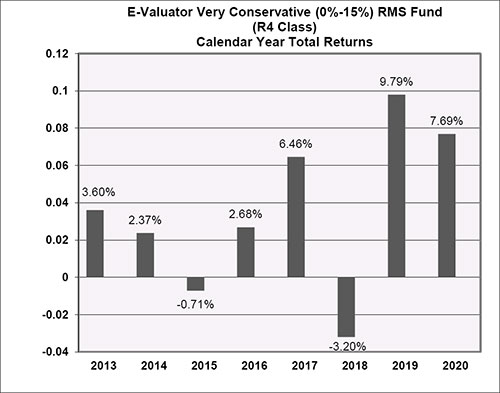

Performance History

The performance information shows summary performance information for the Fund in a bar chart and an Average Annual Total Returns table. The information provides some indication of the risks of investing in the Fund by showing changes in its performance from year to year and by showing how the Fund’s average annual returns compare with the returns of a broad-based securities market index.

The Fund is a successor to a bank-sponsored collective investment fund established pursuant to 12 C.F.R. 9.18, The E-Valuator Very Conservative Risk Managed Strategy (i.e., the predecessor fund), which was terminated by its Trustee on May 26, 2016. Prior to its termination, Mr. Kevin Miller served as portfolio manager of the predecessor fund. The Fund commenced operations on May 26, 2016 on which date the predecessor fund’s assets were transferred to the Fund. The investment objective, strategy, policies, guidelines and restrictions of the Fund are, in all material respects, the same as those previously applicable to the predecessor fund. However, the predecessor fund was not registered or required to be registered as an investment company under the 1940 Act, and the predecessor fund was not subject to certain investment limitations, diversification requirements, liquidity requirements, and other restrictions imposed by the 1940 Act and the Internal Revenue Code of 1986 which, if applicable, may have adversely affected its performance.

The performance presented for periods prior to the commencement of operations on May 26, 2016 is the historic performance of the predecessor fund (net of actual fees and expenses charged to predecessor fund). The performance of the predecessor fund has not been restated to reflect the fees, expenses and fee waivers and/or expense limitations applicable to each class of shares of the Fund. If the performance of the predecessor fund were restated to reflect the applicable fees and expenses of each class of shares of the Fund, the performance may have been lower than the performance shown in the bar chart and Average Annual Total Returns table on the following page. For periods following the Fund’s commencement of operations on May 26, 2016, the performance of each class of shares differs as a result of the different levels of fees and expenses applicable to each class of shares. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

Updated information on the Fund’s results can be obtained by visiting www.evaluatorfunds.com or by calling toll-free at 888-507-2798.

During the periods shown in the bar chart, the Fund’s highest return for a calendar quarter was 8.76% (quarter ending 6/30/2020) and the Fund’s lowest return for a calendar quarter was -8.24% (quarter ending 3/31/2020).

The following table shows how average annual total returns of the Fund compared to those of the Fund’s benchmarks.

Average Annual Total Return as of December 31, 2020

| The E-Valuator Very Conservative RMS (0%-15%) Fund – Service Class | 1 Year | 5 Years | Since Inception (February 29, 2012) |

| Return Before Taxes | 8.03% | 4.83% | 3.77% |

| Return After Taxes on Distributions(1) | 7.47% | 3.74% | 3.16% |

| Return After Taxes on Distributions and Sale of Fund Shares(1) | 4.74% | 3.26% | 2.68% |

| Barclays Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) | 7.50% | 4.44% | 3.37% |

| | (1) | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. |

The E-Valuator Conservative (15%-30%) RMS Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

Shareholder Fees (fees paid directly from your investment) | Service Class | New Service Class |

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | None | None |

Maximum deferred sales charges (load) (as a percentage of the NAV at time of purchase) | None | None |

| Redemption Fee | None | None |

| Exchange Fee | None | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Service Class | New Service Class(3) |

| Management Fee (1) | 0.45% | 0.45% |

| Distribution (12b-1) and Service Fees | None | None |

| Other Expenses | 0.28%(2) | 0.28% |

| Acquired Fund Fees and Expenses | 0.20% | 0.20% |

| Total Annual Fund Operating Expenses | 0.93%(2) | 0.93% |

| Fee Waivers and/or Expense Reimbursements(1) | (0.07%) | (0.07%) |

Total Annual Fund Operating Expenses (after fee waivers and expense Reimbursements)(1) | 0.86% | 0.86% |

| (1) | Systelligence, LLC (the “Adviser”), has contractually agreed to waive its management fee to an annual rate of 0.38% of the average daily net assets of the Fund. Additionally, after giving effect to the foregoing fee waiver, the Adviser has contractually agreed to limit the total expenses of the Fund (exclusive of interest, distribution fees pursuant to Rule 12b-1 Plans, taxes, acquired fund fees and expenses, brokerage commissions, dividend expense on short sales, other expenditures which are capitalized in accordance with generally accepted accounting principles and other extraordinary expenses not incurred in the ordinary course of business) to an annual rate of 0.80% of the average daily net assets of the Fund. Each waiver and/or reimbursement of an expense by the Adviser is subject to repayment by the Fund within three years following the date that such waiver was made or such expense was incurred, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and at the time the waiver or reimbursement is recouped. The Adviser may not terminate these contractual arrangements prior to January 31, 2022. Any Existing Fund expenses waived or reimbursed by the Adviser prior to the Closing of the Reorganization will remain subject to recoupment by the Adviser from the New Fund after the Closing, subject further to the three-year limitation on recoupment. |

| (2) | Other Expenses and Total Annual Fund Operating Expenses differ from the expenses set forth in the Existing Fund’s annual report for the period ended September 30, 2020. Please refer to the Annual Report for historical expenses incurred. Such fees and expenses have been restated to reflect the elimination of the Shareholder Services Plan for Service Class Shares and to exclude certain non-recurring expenses, including the expenses of the Reorganization that are described elsewhere in this Proxy Statement. |

| (3) | The New Fund is newly formed and will commence operations following the Reorganization. Fees and expenses are estimated for the New Fund’s first year of operations. Such amounts are based on actual expenses of the Existing Fund for the fiscal period ended September 30, 2020 (excluding non-recurring expenses), adjusted for the fee and expense schedules of the service providers of the New Fund. |

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The effect of the Adviser’s agreement to waive fees and/or reimburse expenses is only reflected in the first year of each example shown below. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Share Class | 1 Year | 3 Years | 5 Years | 10 Years |

| Service Class | $88 | $289 | $508 | $1,137 |

| New Service Class | $88 | $289 | $508 | $1,137 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the example, affect the Fund’s performance. During the most recent fiscal year ended September 30, 2020, the Fund’s portfolio turnover rate was 328.64% of the average value of its portfolio.

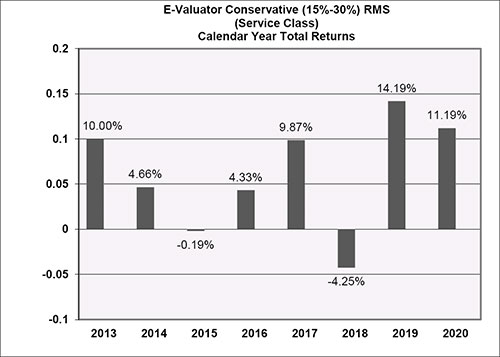

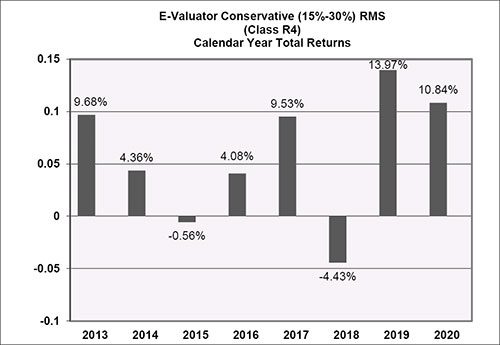

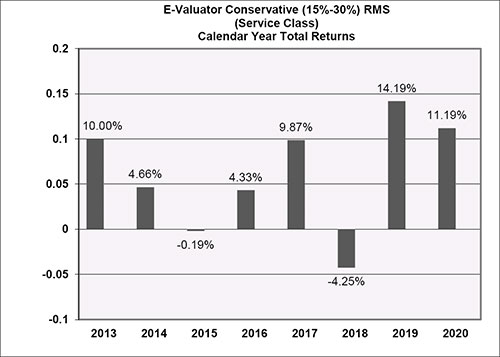

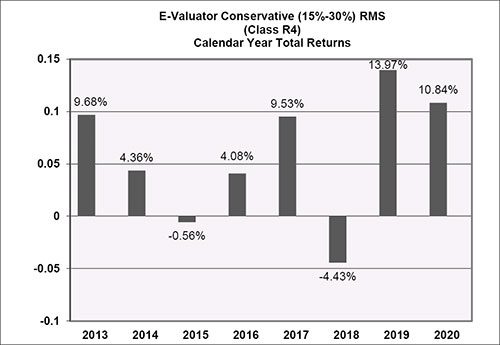

Performance History

The performance information shows summary performance information for the Fund in a bar chart and an Average Annual Total Returns table. The information provides some indication of the risks of investing in the Fund by showing changes in its performance from year to year and by showing how the Fund’s average annual returns compare with the returns of a broad-based securities market index.

The Fund is a successor to a bank-sponsored collective investment fund established pursuant to 12 C.F.R. 9.18, The E-Valuator Conservative Risk Managed Strategy (i.e., the predecessor fund), which was terminated by its Trustee on May 26, 2016. Prior to its termination, Mr. Kevin Miller served as portfolio manager of the predecessor fund. The Fund commenced operations on May 26, 2016 on which date the predecessor fund’s assets were transferred to the Fund. The investment objective, strategy, policies, guidelines and restrictions of the Fund are, in all material respects, the same as those previously applicable to the predecessor fund. However, the predecessor fund was not registered or required to be registered as an investment company under the 1940 Act, and the predecessor fund was not subject to certain investment limitations, diversification requirements, liquidity requirements, and other restrictions imposed by the 1940 Act and the Internal Revenue Code of 1986 which, if applicable, may have adversely affected its performance.

The performance presented for periods prior to the commencement of operations on May 26, 2016 is the historic performance of the predecessor fund (net of actual fees and expenses charged to predecessor fund). The performance of the predecessor fund has not been restated to reflect the fees, expenses and fee waivers and/or expense limitations applicable to each class of shares of the Fund. If the performance of the predecessor fund were restated to reflect the applicable fees and expenses of each class of shares of the Fund, the performance may have been lower than the performance shown in the bar chart and Average Annual Total Returns table on the following page. For periods following the Fund’s commencement of operations on May 26, 2016, the performance of each class of shares differs as a result of the different levels of fees and expenses applicable to each class of shares. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

Updated information on the Fund’s results can be obtained by visiting www.evaluatorfunds.com or by calling toll-free at 888-507-2798.

During the periods shown in the bar chart, the Fund’s highest return for a calendar quarter was 10.81% (quarter ending 6/30/2020) and the Fund’s lowest return for a calendar quarter was -10.54% (quarter ending 3/31/2020).

The following table shows how average annual total returns of the Fund compared to those of the Fund’s benchmarks.

Average Annual Total Return as of December 31, 2020

| The E-Valuator Conservative (15%-30%) RMS Fund – Service Class | 1 Year | 5 Years | Since Inception (February 29, 2012) |

| Return Before Taxes | 11.19% | 6.86% | 6.10% |

| Return After Taxes on Distributions(1) | 10.51% | 5.48% | 5.32% |

| Return After Taxes on Distributions and Sale of Fund Shares(1) | 6.71% | 4.77% | 4.52% |

| Barclays Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) | 7.50% | 4.44% | 3.37% |

| | (1) | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. |

The E-Valuator Conservative/Moderate (30%-50%) RMS Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund.

Shareholder Fees (fees paid directly from your investment) | Service Class | New Service Class |

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | None | None |

Maximum deferred sales charges (load) (as a percentage of the NAV at time of purchase) | None | None |

| Redemption Fee | None | None |

| Exchange Fee | None | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Service Class | New Service Class(3) |

| Management Fee (1) | 0.45% | 0.45% |

| Distribution (12b-1) and Service Fees | None | None |

| Other Expenses | 0.44%(2) | 0.44% |

| Acquired Fund Fees and Expenses | 0.21% | 0.21% |

| Total Annual Fund Operating Expenses | 1.10%(2) | 1.10% |

| Fee Waivers and/or Expense Reimbursements(1) | (0.09%) | (0.09%) |

Total Annual Fund Operating Expenses (after fee waivers and expense Reimbursements)(1) | 1.01% | 1.01% |

| (1) | Systelligence, LLC (the “Adviser”), has contractually agreed to waive its management fee to an annual rate of 0.38% of the average daily net assets of the Fund. Additionally, after giving effect to the foregoing fee waiver, the Adviser has contractually agreed to limit the total expenses of the Fund (exclusive of interest, distribution fees pursuant to Rule 12b-1 Plans, taxes, acquired fund fees and expenses, brokerage commissions, dividend expense on short sales, other expenditures which are capitalized in accordance with generally accepted accounting principles and other extraordinary expenses not incurred in the ordinary course of business) to an annual rate of 0.80% of the average daily net assets of the Fund. Each waiver and/or reimbursement of an expense by the Adviser is subject to repayment by the Fund within three years following the date that such waiver was made or such expense was incurred, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and at the time the waiver or reimbursement is recouped. The Adviser may not terminate these contractual arrangements prior to January 31, 2022. Any Existing Fund expenses waived or reimbursed by the Adviser prior to the Closing of the Reorganization will remain subject to recoupment by the Adviser from the New Fund after the Closing, subject further to the three-year limitation on recoupment. |

| (2) | Other Expenses and Total Annual Fund Operating Expenses differ from the expenses set forth in the Existing Fund’s annual report for the period ended September 30, 2020. Please refer to the Annual Report for historical expenses incurred. Such fees and expenses have been restated to reflect the elimination of the Shareholder Services Plan for Service Class Shares and to exclude certain non-recurring expenses, including the expenses of the Reorganization that are described elsewhere in this Proxy Statement. |

| (3) | The New Fund is newly formed and will commence operations following the Reorganization. Fees and expenses are estimated for the New Fund’s first year of operations. Such amounts are based on actual expenses of the Existing Fund for the fiscal period ended September 30, 2020 (excluding non-recurring expenses), adjusted for the fee and expense schedules of the service providers of the New Fund. |

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The effect of the Adviser’s agreement to waive fees and/or reimburse expenses is only reflected in the first year of each example shown below. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Share Class | 1 Year | 3 Years | 5 Years | 10 Years |

| Service Class | $103 | $341 | $597 | $1,332 |

| New Service Class | $103 | $341 | $597 | $1,332 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the example, affect the Fund’s performance. During the most recent fiscal year ended September 30, 2020, the Fund’s portfolio turnover rate was 280.35% of the average value of its portfolio.

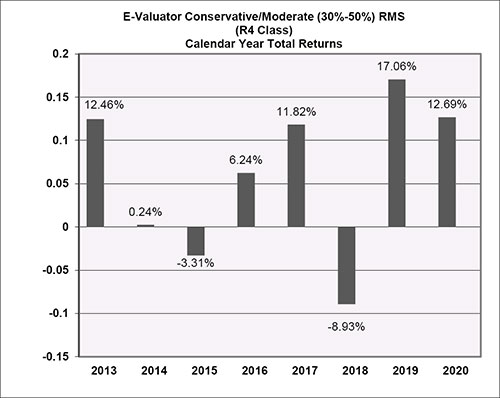

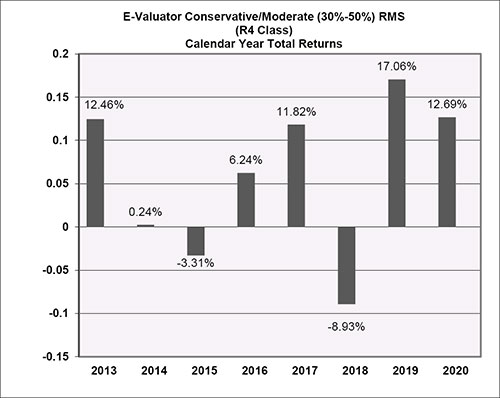

Performance History

The performance information shows summary performance information for the Fund in a bar chart and an Average Annual Total Returns table. The information provides some indication of the risks of investing in the Fund by showing changes in its performance from year to year and by showing how the Fund’s average annual returns compare with the returns of a broad-based securities market index.

The Fund is a successor to a bank-sponsored collective investment fund established pursuant to 12 C.F.R. 9.18, The E-Valuator Tactically Managed Strategy (i.e., the predecessor fund), which was terminated by its Trustee on May 26, 2016. Prior to its termination, Mr. Kevin Miller served as portfolio manager of the predecessor fund. The Fund commenced operations on May 26, 2016 on which date the predecessor fund’s assets were transferred to the Fund. Until the Fund’s investment objective and strategies were changed effective January 31, 2019, the investment objective, strategy, policies, guidelines and restrictions of the Fund were, in all material respects, the same as those previously applicable to the predecessor fund. However, the predecessor fund was not registered or required to be registered as an investment company under the 1940 Act, and the predecessor fund was not subject to certain investment limitations, diversification requirements, liquidity requirements, and other restrictions imposed by the 1940 Act and the Internal Revenue Code of 1986 which, if applicable, may have adversely affected its performance.

The performance presented for periods prior to the commencement of operations on May 26, 2016 is the historic performance of the predecessor fund (net of actual fees and expenses charged to predecessor fund). The performance of the predecessor fund has not been restated to reflect the fees, expenses and fee waivers and/or expense limitations applicable to each class of shares of the Fund. If the performance of the predecessor fund were restated to reflect the applicable fees and expenses of each class of shares of the Fund, the performance may have been lower than the performance shown in the bar chart and Average Annual Total Returns table on the following page. For periods following the Fund’s commencement of operations on May 26, 2016, the performance of each class of shares differs as a result of the different levels of fees and expenses applicable to each class of shares. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

Updated information on the Fund’s results can be obtained by visiting www.evaluatorfunds.com or by calling toll-free at 888-507-2798.

During the periods shown in the bar chart, the Fund’s highest return for a calendar quarter was 14.25% (quarter ending 6/30/2020) and the Fund’s lowest return for a calendar quarter was -14.75% (quarter ending 3/31/2020).

The following table shows how average annual total returns of the Fund compared to those of the Fund’s benchmarks.

Average Annual Total Return as of December 31, 2020

| The E-Valuator Conservative/Moderate (30%-50%) RMS Fund – Service Class | 1 Year | 5 Years | Since Inception (February 29, 2012) |

| Return Before Taxes | 12.78% | 7.52% | 5.90% |

| Return After Taxes on Distributions(1) | 12.17% | 6.04% | 5.07% |

| Return After Taxes on Distributions and Sale of Fund Shares(1) | 7.55% | 5.22% | 4.31% |

| S&P 500®Index (reflects no deduction for fees, expenses or taxes) | 16.26% | 12.94% | 12.13% |

| | (1) | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. |

The E-Valuator Moderate (50%-70%) RMS Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund.

Shareholder Fees (fees paid directly from your investment) | Service Class | New Service Class |

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | None | None |

Maximum deferred sales charges (load) (as a percentage of the NAV at time of purchase) | None | None |

| Redemption Fee | None | None |

| Exchange Fee | None | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Service Class | New Service Class(3) |

| Management Fee (1) | 0.45% | 0.45% |

| Distribution (12b-1) and Service Fees | None | None |

| Other Expenses | 0.24%(2) | 0.24% |

| Acquired Fund Fees and Expenses | 0.22% | 0.22% |

| Total Annual Fund Operating Expenses | 0.91%(2) | 0.91% |

| Fee Waivers and/or Expense Reimbursements(1) | (0.07%) | (0.07%) |

Total Annual Fund Operating Expenses (after fee waivers and expense Reimbursements)(1) | 0.84% | 0.84% |

| (1) | Systelligence, LLC (the “Adviser”), has contractually agreed to waive its management fee to an annual rate of 0.38% of the average daily net assets of the Fund. Additionally, after giving effect to the foregoing fee waiver, the Adviser has contractually agreed to limit the total expenses of the Fund (exclusive of interest, distribution fees pursuant to Rule 12b-1 Plans, taxes, acquired fund fees and expenses, brokerage commissions, dividend expense on short sales, other expenditures which are capitalized in accordance with generally accepted accounting principles and other extraordinary expenses not incurred in the ordinary course of business) to an annual rate of 0.80% of the average daily net assets of the Fund. Each waiver and/or reimbursement of an expense by the Adviser is subject to repayment by the Fund within three years following the date that such waiver was made or such expense was incurred, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and at the time the waiver or reimbursement is recouped. The Adviser may not terminate these contractual arrangements prior to January 31, 2022. Any Existing Fund expenses waived or reimbursed by the Adviser prior to the Closing of the Reorganization will remain subject to recoupment by the Adviser from the New Fund after the Closing, subject further to the three-year limitation on recoupment. |

| (2) | Other Expenses and Total Annual Fund Operating Expenses differ from the expenses set forth in the Existing Fund’s annual report for the period ended September 30, 2020. Please refer to the Annual Report for historical expenses incurred. Such fees and expenses have been restated to reflect the elimination of the Shareholder Services Plan for Service Class Shares and to exclude certain non-recurring expenses, including the expenses of the Reorganization that are described elsewhere in this Proxy Statement. |

| (3) | The New Fund is newly formed and will commence operations following the Reorganization. Fees and expenses are estimated for the New Fund’s first year of operations. Such amounts are based on actual expenses of the Existing Fund for the fiscal period ended September 30, 2020 (excluding non-recurring expenses), adjusted for the fee and expense schedules of the service providers of the New Fund. |

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The effect of the Adviser’s agreement to waive fees and/or reimburse expenses is only reflected in the first year of each example shown below. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Share Class | 1 Year | 3 Years | 5 Years | 10 Years |

| Service Class | $86 | $283 | $497 | $1,113 |

| New Service Class | $86 | $283 | $497 | $1,113 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the example, affect the Fund’s performance. During the most recent fiscal year ended September 30, 2020, the Fund’s portfolio turnover rate was 333.55% of the average value of its portfolio.

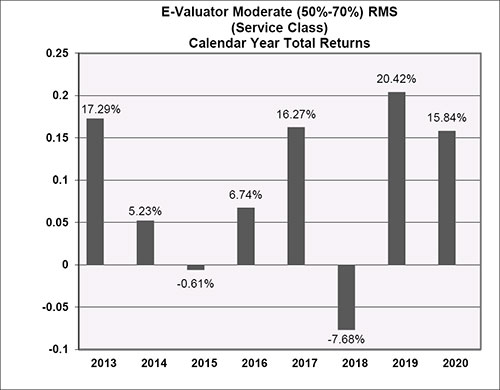

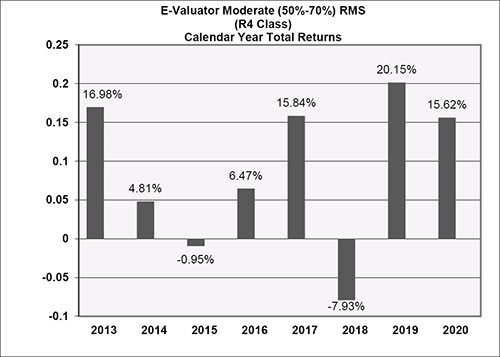

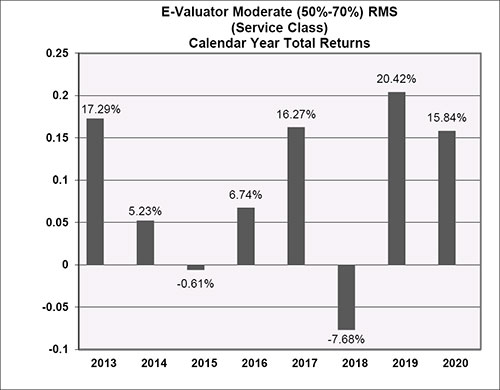

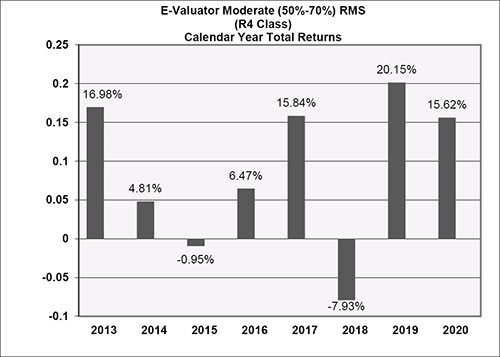

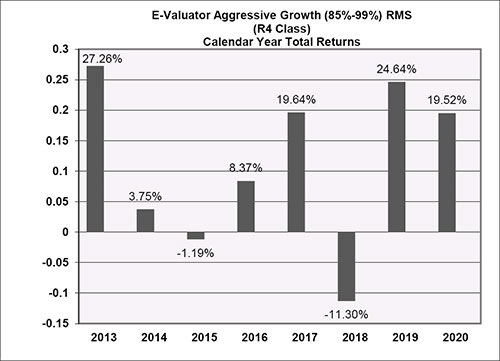

Performance History

The performance information shows summary performance information for the Fund in a bar chart and an Average Annual Total Returns table. The information provides some indication of the risks of investing in the Fund by showing changes in its performance from year to year and by showing how the Fund’s average annual returns compare with the returns of a broad-based securities market index.

The Fund is a successor to a bank-sponsored collective investment fund established pursuant to 12 C.F.R. 9.18, The E-Valuator Moderate Risk Managed Strategy (i.e., the predecessor fund), which was terminated by its Trustee on May 26, 2016. Prior to its termination, Mr. Kevin Miller served as portfolio manager of the predecessor fund. The Fund commenced operations on May 26, 2016 on which date the predecessor fund’s assets were transferred to the Fund. The investment objective, strategy, policies, guidelines and restrictions of the Fund are, in all material respects, the same as those previously applicable to the predecessor fund. However, the predecessor fund was not registered or required to be registered as an investment company under the 1940 Act, and the predecessor fund was not subject to certain investment limitations, diversification requirements, liquidity requirements, and other restrictions imposed by the 1940 Act and the Internal Revenue Code of 1986 which, if applicable, may have adversely affected its performance.

The performance presented for periods prior to the commencement of operations on May 26, 2016 is the historic performance of the predecessor fund (net of actual fees and expenses charged to predecessor fund). The performance of the predecessor fund has not been restated to reflect the fees, expenses and fee waivers and/or expense limitations applicable to each class of shares of the Fund. If the performance of the predecessor fund were restated to reflect the applicable fees and expenses of each class of shares of the Fund, the performance may have been lower than the performance shown in the bar chart and Average Annual Total Returns table on the following page. For periods following the Fund’s commencement of operations on May 26, 2016, the performance of each class of shares differs as a result of the different levels of fees and expenses applicable to each class of shares. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

Updated information on the Fund’s results can be obtained by visiting www.evaluatorfunds.com or by calling toll-free at 888-507-2798.

During the periods shown in the bar chart, the Fund’s highest return for a calendar quarter was 17.46% (quarter ending 6/30/2020) and the Fund’s lowest return for a calendar quarter was -17.50% (quarter ending 3/31/2020).

The following table shows how average annual total returns of the Fund compared to those of the Fund’s benchmarks.

Average Annual Total Return as of December 31, 2020

| The E-Valuator Moderate (50%-70%) RMS Fund – Service Class | 1 Year | 5 Years | Since Inception (February 29, 2012) |

| Return Before Taxes | 15.84% | 9.83% | 8.73% |

| Return After Taxes on Distributions(1) | 14.55% | 8.03% | 7.72% |

| Return After Taxes on Distributions and Sale of Fund Shares(1) | 9.66% | 7.00% | 6.64% |

| S&P 500® Index (reflects no deduction for fees, expenses or taxes) | 16.26% | 12.94% | 12.13% |

| | (1) | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. |

The E-Valuator Growth (70%-85%) RMS Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund.

Shareholder Fees (fees paid directly from your investment) | Service Class | New Service Class |

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | None | None |

Maximum deferred sales charges (load) (as a percentage of the NAV at time of purchase) | None | None |

| Redemption Fee | None | None |

| Exchange Fee | None | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Service Class | New Service Class(3) |

| Management Fee (1) | 0.45% | 0.45% |

| Distribution (12b-1) and Service Fees | None | None |

| Other Expenses | 0.23%(2) | 0.23% |

| Acquired Fund Fees and Expenses | 0.23% | 0.23% |

| Total Annual Fund Operating Expenses | 0.91%(2) | 0.91% |

| Fee Waivers and/or Expense Reimbursements(1) | (0.07%) | (0.07%) |

Total Annual Fund Operating Expenses (after fee waivers and expense Reimbursements)(1) | 0.84% | 0.84% |

| (1) | Systelligence, LLC (the “Adviser”), has contractually agreed to waive its management fee to an annual rate of 0.38% of the average daily net assets of the Fund. Additionally, after giving effect to the foregoing fee waiver, the Adviser has contractually agreed to limit the total expenses of the Fund (exclusive of interest, distribution fees pursuant to Rule 12b-1 Plans, taxes, acquired fund fees and expenses, brokerage commissions, dividend expense on short sales, other expenditures which are capitalized in accordance with generally accepted accounting principles and other extraordinary expenses not incurred in the ordinary course of business) to an annual rate of 0.80% of the average daily net assets of the Fund. Each waiver and/or reimbursement of an expense by the Adviser is subject to repayment by the Fund within three years following the date that such waiver was made or such expense was incurred, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and at the time the waiver or reimbursement is recouped. The Adviser may not terminate these contractual arrangements prior to January 31, 2022. Any Existing Fund expenses waived or reimbursed by the Adviser prior to the Closing of the Reorganization will remain subject to recoupment by the Adviser from the New Fund after the Closing, subject further to the three-year limitation on recoupment. |

| (2) | Other Expenses and Total Annual Fund Operating Expenses differ from the expenses set forth in the Existing Fund’s annual report for the period ended September 30, 2020. Please refer to the Annual Report for historical expenses incurred. Such fees and expenses have been restated to reflect the elimination of the Shareholder Services Plan for Service Class Shares and to exclude certain non-recurring expenses, including the expenses of the Reorganization that are described elsewhere in this Proxy Statement. |

| (3) | The New Fund is newly formed and will commence operations following the Reorganization. Fees and expenses are estimated for the New Fund’s first year of operations. Such amounts are based on actual expenses of the Existing Fund for the fiscal period ended September 30, 2020 (excluding non-recurring expenses), adjusted for the fee and expense schedules of the service providers of the New Fund. |

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The effect of the Adviser’s agreement to waive fees and/or reimburse expenses is only reflected in the first year of each example shown below. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Share Class | 1 Year | 3 Years | 5 Years | 10 Years |

| Service Class | $86 | $283 | $497 | $1,113 |

| New Service Class | $86 | $283 | $497 | $1,113 |

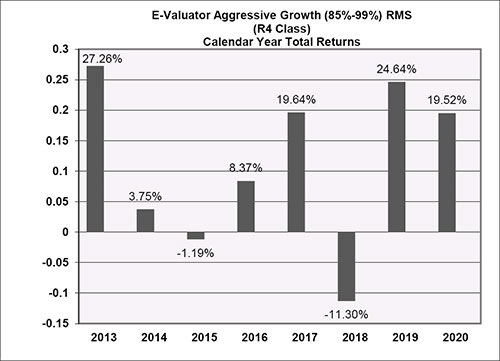

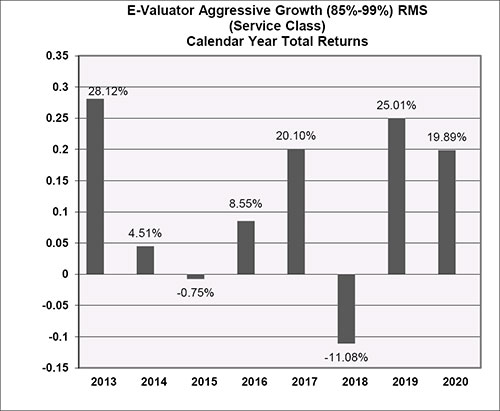

Portfolio Turnover