Table of Contents

Filed with the Securities and Exchange Commission on May 4, 2007

Registration No. 333-142367

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM F-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

China Sunergy Co., Ltd.

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| Cayman Islands | 3674 | Not Applicable | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

No. 123 Focheng West Road

Jiangning Economic & Technical Development Zone

Nanjing, Jiangsu 211100, People’s Republic of China

(86 25) 5276 6688

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

CT Corporation System

111 Eighth Avenue

New York, New York 10011

(212) 664-1666

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

David T. Zhang Latham & Watkins LLP 41st Floor, One Exchange Square 8 Connaught Place, Central Hong Kong (852) 2522-7886 | Howard Zhang O’Melveny & Myers LLP 31st Floor, China World Tower I 1 Jian Guo Men Wai Avenue Beijing 100004, China (86 10) 6535-4200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earliest effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered (1)(2) | Proposed maximum aggregate offering price (3) | Amount of registration fee | ||||

Ordinary shares, par value $0.0001 per ordinary share | $ | 100,000,000 | $ | 3,070 | ||

| (1) | Includes (i) ordinary shares initially offered and sold outside the United States that may be resold from time to time in the United States either as part of their distribution or within 40 days after the later of the effective date of this registration statement and the date the shares are first bona fide offered to the public and (ii) ordinary shares that may be purchased by the underwriters pursuant to an over-allotment option. These ordinary shares are not being registered for the purposes of sales outside of the United States. |

| (2) | American depositary shares issuable upon deposit of the ordinary shares registered hereby have been registered under a separate registration statement on Form F-6 (Registration No.333-142574). Each American depositary share represents six ordinary shares. |

| (3) | Estimated solely for the purpose of determining the amount of registration fee in accordance with Rule 457(o) under the Securities Act of 1933. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting any offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated May 4, 2007

PROSPECTUS

8,500,000 American Depositary Shares

China Sunergy Co., Ltd.

Representing 51,000,000 Ordinary Shares

This is China Sunergy’s initial public offering. China Sunergy is offering 8,500,000 American depositary shares, or ADSs. Each ADS represents six ordinary shares.

We expect the public offering price to be between $8.00 and $10.00 per ADS. Prior to this offering, there has been no public market for the ADSs or our ordinary shares. We have applied to list the ADSs on the Nasdaq Global Market under the symbol “CSUN.”

Investing in the ADSs and ordinary shares involves risks that are described in the “Risk Factors” section beginning on page 9 of this prospectus.

| Per ADS | Total | |||

Public offering price | $ | $ | ||

Underwriting discount | $ | $ | ||

Proceeds, before expenses, to us | $ | $ |

The underwriters may also purchase up to an additional 1,275,000 ADSs from us at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover over-allotments.

Neither the Securities and Exchange Commission nor any state securities regulator has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The ADSs will be ready for delivery on or about , 2007.

Merrill Lynch & Co.

| Cowen and Company | Jefferies & Company |

The date of this prospectus is , 2007.

Table of Contents

Table of Contents

| Page | ||

| 1 | ||

| 9 | ||

| 30 | ||

| 31 | ||

| 32 | ||

| 33 | ||

| 34 | ||

| 36 | ||

| 37 | ||

| 38 | ||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 40 | |

| 63 | ||

| 80 | ||

| 83 | ||

| 90 | ||

| 92 | ||

| 98 | ||

| 103 | ||

| 113 | ||

| 115 | ||

| 120 | ||

| 130 | ||

| 131 | ||

| 132 | ||

| 133 | ||

| F-1 | ||

You should rely only on the information contained in this prospectus. Neither we nor the underwriters have authorized anyone to provide you with information that is different from that contained in this prospectus. This prospectus may only be used where it is legal to offer and sell these securities. The information in this prospectus is only accurate as of the date of this prospectus.

We have not undertaken any efforts to qualify this offering for offers to individual investors in any jurisdiction outside the United States. Therefore, individual investors located outside the United States should not expect to be eligible to participate in this offering.

i

Table of Contents

Conventions That Apply to This Prospectus

Unless the context otherwise requires, in this prospectus:

| • | “we,” “us,” “our company,” “our,” “Sunergy” and “China Sunergy” refer to China Sunergy Co., Ltd. incorporated in the Cayman Islands, its predecessor entities and its subsidiaries; |

| • | “shares” or “ordinary shares” refers to our ordinary shares, “ADSs” refers to our American depositary shares, each of which represents six ordinary shares, and “ADRs” refers to the American depositary receipts that evidence our ADSs; |

| • | “China” or “PRC” refers to the People’s Republic of China, excluding the Hong Kong Special Administrative Region, the Macau Special Administrative Region and Taiwan; |

| • | “RMB” or “Renminbi” refers to the legal currency of China; “$” or “U.S. dollars” refers to the legal currency of the United States; and “Euro” or “€” refers to the legal currency of the European Union; |

| • | “passivated emitter and rear cell” refers a solar cell which uses oxide on its front and rear surfaces, and of which the rear surface is contacted by metal only at certain regions; and |

| • | “selective emitter cell” refers to a solar cell, where the regions under the front metal contact and the rest of the front surface areas are separately diffused and optimized. |

This prospectus contains translations of certain RMB amounts into U.S. dollar amounts at specified rates. All translations from RMB to U.S. dollars were made at the noon buying rate in The City of New York for cable transfers of RMB as certified for customs purposes by the Federal Reserve Bank of New York. Unless otherwise stated, the translations of RMB into U.S. dollars have been made at the noon buying rate in effect on March 30, 2007, which was RMB7.7232 to $1.00. We make no representation that the RMB or U.S. dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or RMB, as the case may be, at any particular rate or at all. On May 2, 2007, the noon buying rate was RMB7.7039 to $1.00.

Unless otherwise indicated, all historical share information and per-share information contained in our audited financial statements, consolidated statement of operations data, the “Capitalization” and the “Dilution” sections in this prospectus has been retroactively adjusted to reflect a 100-for-one share split that became effective on April 24, 2007.

ii

Table of Contents

You should read the following summary together with the entire prospectus, including the more detailed information regarding us, the ADSs being sold in this offering, and our financial statements and related notes appearing elsewhere in this prospectus.

Overview

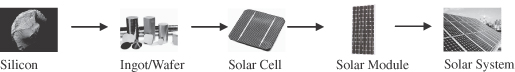

We are a leading manufacturer of solar cell products in China as measured by production capacity. We manufacture our solar cells from silicon wafers utilizing crystalline silicon solar cell technology to convert sunlight directly into electricity through a process known as the photovoltaic effect. We sell our solar cell products to Chinese and overseas module manufacturers and system integrators, who assemble our solar cells into solar modules and solar power systems for use in various markets.

Since we commenced business operations in August 2004, our management’s operational expertise and execution capability, coupled with our strong research and development capabilities, have allowed us to rapidly install five solar cell manufacturing lines and expand our annual manufacturing capacity by 160 megawatts, or MW, in 2006. As of December 2006, we had six solar cell manufacturing lines with an aggregate production capacity of 192 MW per year, assuming the use of 156-millimeter monocrystalline silicon wafers. We plan to increase our annual production capacity to approximately 390 MW by the second quarter of 2008, with twelve manufacturing lines in total.

Our research and development team is led by three solar power researchers, each with over 10 years of experience and established credentials in the solar power industry. Our research and development efforts focus on continually enhancing our solar cell conversion efficiencies, which measure the ability of solar power products to convert sunlight into electricity, and improving our manufacturing operations. We are currently developing selective emitter cells, an improved version of the P-type solar cells that most solar cell manufacturers produce. Using our experimental manufacturing line, we have manufactured selective emitter cells with an average conversion efficiency rate of 17.6% on a trial basis, and we expect to commence commercial production in 2007. In addition, we are focusing on the development of advanced process technologies for manufacturing new products, such as N-type solar cells, which generally have higher conversion efficiencies than those of P-type solar cells. We also plan to develop passivated emitter and rear cells in the future.

We have experienced significant sales and revenue growth since we commenced operations. We sold 4.4 MW and 46.4 MW of solar cells in 2005 and 2006, respectively. Our net revenues increased from $13.7 million in 2005 to $149.5 million in 2006. We turned a net loss of $0.3 million in 2005 into a net income of $11.8 million in 2006.

Industry Background

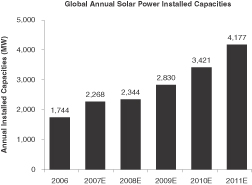

The solar power market has grown rapidly in the past several years. According to Solarbuzz LLC, or Solarbuzz, an independent solar energy research firm, the global solar power market, as measured by annual solar power system installed capacities, increased from 427 MW in 2002 to 1,744 MW in 2006, representing a compound annual growth rate, or CAGR, of 42%. Under the lowest of three different projections, Solarbuzz expects annual solar power system installed capacities to further increase to 4,177 MW in 2011. Solar power industry revenue is expected to increase from $10.6 billion in 2006 to $18.6 billion in 2011, representing a CAGR of 12%. Currently, the majority of installed solar systems employ crystalline silicon technology. Most solar cell manufacturers apply crystalline silicon technology to manufacture P-type solar cells, while only a few manufacturers produce, on a commercial scale, N-type solar cells, which generally have higher conversion efficiencies than P-type solar cells. The solar cell production industry is currently dominated by a small number of manufacturers. According to Solarbuzz, the top 10 solar cell manufacturers together accounted for 75% of the solar cell production worldwide in 2006.

1

Table of Contents

We believe the solar power market will continue to experience growth as a result of the following factors:

| • | Government policies to drive adoption of solar power. Various governmental bodies globally have implemented financial incentives to further accelerate the development and adoption of solar power. These incentives include feed-in tariffs, capital cost rebates, net metering, tax credits and low-interest loans; |

| • | Growing demand for electricity and supply constraints of traditional energy sources. Electric power demand is expected to increase from 16.1 trillion kilowatt hours in 2002 to 31.7 trillion kilowatt hours by 2030 globally. Meanwhile the generation of electric power is capacity constrained and dependent upon fossil fuel feedstock. Further, for national security reasons many governments seek to further develop domestic sources of energy, particularly solar power and other renewable energy sources; and |

| • | Growing awareness of the advantages of solar power. Solar power offers a variety of advantages over other sources of power, including an absence of the need for fuel, environmental cleanliness, location-based energy production, greater efficiency during peak demand periods, high reliability and modularity. |

Our Competitive Strengths

We believe that the following strengths enable us to compete effectively and to capitalize on the projected growth in the global solar power market:

| • | proven track record of capacity expansion and scalable operations; |

| • | strong research and development capabilities; |

| • | production in a low-cost manufacturing region; |

| • | well-balanced and experienced management team; and |

| • | existing relationships with established solar power industry participants. |

Our Strategies

Our objective is to be a global leader in the innovation, development and manufacture of solar cells. We intend to pursue the following strategies to enhance our competitiveness and to increase our market share:

| • | continue our focus on solar cell manufacturing; |

| • | enhance our technological competitiveness through continued research and development; |

| • | further expand our production capacity; |

| • | further optimize raw material supply sources and enhance business relationships with key raw material suppliers; |

| • | achieve a diversified customer base; and |

| • | continue to pursue a proactive marketing strategy and establish a global sales network. |

Our Challenges

We believe that the following are some of the major risks and uncertainties that may materially affect us:

| • | our limited operating history may not serve as an adequate measure of our future prospects and results of operations; |

2

Table of Contents

| • | the current industry-wide shortage of silicon raw materials may constrain our revenue growth and decrease our gross margins and profitability; |

| • | our dependence on a limited number of suppliers for key raw materials and customized manufacturing equipment could result in order cancellation and decreased revenues; |

| • | our quarterly operating results may fluctuate from period to period in the future; |

| • | the reduction or elimination of government subsidies and economic incentives for on-grid solar energy applications could cause a reduction in demand for our products and a reduction in our revenues; |

| • | if solar power technology is not suitable for widespread adoption, or if sufficient demand for solar power products does not develop or takes longer to develop than we anticipate, our sales may not continue to increase or may even decline, and we may be unable to achieve or sustain profitability; |

| • | we face competition from both renewable and conventional energy sources and products; |

| • | we may not be successful in the commercial production of N-type solar cells, selective emitter cells or other new products; and |

| • | we may be unable to manage our growth and expansion effectively. |

Corporate Structure

Our operating subsidiary, CEEG (Nanjing) PV-Tech Co. Ltd., or Nanjing PV, was incorporated in August 2004 in Nanjing, China. China Sunergy Co., Ltd., or Sunergy BVI, our holding company incorporated in the British Virgin Islands, acquired all of the equity interests in Nanjing PV in April 2006 through a series of transactions that have been accounted for as a legal reorganization. As part of a restructuring in anticipation of our initial public offering, we incorporated China Sunergy Co., Ltd., or Sunergy, in the Cayman Islands on August 4, 2006. Sunergy became our ultimate holding company upon its issuance of shares to the existing shareholders of Sunergy BVI on August 30, 2006 in exchange for all shares of equivalent classes that these shareholders previously held in Sunergy BVI. We conduct substantially all of our operations through Nanjing PV.

Corporate Information

Our principal executive offices are located at No. 123 Focheng West Road, Jiangning Economic & Technical Development Zone, Nanjing, Jiangsu 211100, People’s Republic of China. Our telephone number at this address is (86-25) 5276-6688 and our fax number is (86-25) 5276-6882.

You should direct all inquiries to us at the address and telephone number of our principal executive offices set forth above. Our website is www.n-pv.com. The information contained on our website does not form part of this prospectus. Our agent for service of process in the United States is CT Corporation System located at 111 Eighth Avenue, New York, New York 10011.

3

Table of Contents

The Offering

American depositary shares offered:

By Sunergy | 8,500,000 ADSs |

Offering price | We currently estimate that the initial public offering price will be between $8.00 and $10.00 per ADS. |

The ADSs | Each ADS represents six ordinary shares, par value $0.0001 per share. The ADS will be evidenced by ADRs. To understand the terms of the ADSs, you should carefully read the section in this prospectus entitled “Description of American Depositary Shares.” We also encourage you to read the deposit agreement, which has been filed as an exhibit to the registration statement that includes this prospectus. |

ADSs outstanding immediately after the offering | 8,500,000 ADSs |

Ordinary shares outstanding immediately after the offering | 229,676,773 ordinary shares (or 237,326,773 ordinary shares if the underwriters exercise the over-allotment option in full.) |

Over-allotment option | We have granted to the underwriters an option, exercisable for 30 days from the date of this prospectus, to purchase up to an aggregate of 1,275,000 additional ADSs at the initial public offering price listed on the cover page of this prospectus, less underwriting discounts and commissions, solely for the purpose of covering over-allotments. |

Reserved ADSs | At our request, the underwriters have reserved for sale, at the initial public offering price, up to an aggregate of 425,000 ADSs to certain directors, officers, employees and associates of our company through a directed share program. These reserved ADSs account for an aggregate of approximately 5% of the ADSs offered in the offering. |

Use of proceeds | We intend to use the proceeds of this offering for the following purposes: |

| • | to purchase or prepay for raw materials; and |

| • | to expand our solar cell manufacturing facilities. |

Depositary | JPMorgan Chase Bank, N.A. |

Risk factors | See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in the ADSs. |

4

Table of Contents

Proposed Nasdaq Global Market Symbol | CSUN |

Lock-up | We, our directors, executive officers and all of our shareholders have agreed with the underwriters not to sell, transfer or dispose of any ADSs, ordinary shares or similar securities for a period of 180 days after the date of this prospectus. See “Underwriting.” |

The number of ordinary shares outstanding immediately after this offering includes, on an as-converted basis, all of our outstanding Series A, Series B and Series C preferred shares, which will be converted into 74,132,773 ordinary shares upon the completion of this offering and excludes ordinary shares issuable upon the exercise of outstanding share options and ordinary shares reserved for future issuance under our share incentive plan. This number assumes the underwriters’ over-allotment option is not exercised. If the over-allotment option is exercised in full, we will issue and sell an additional 7,650,000 ordinary shares. Pursuant to our current memorandum and articles of association, the conversion ratios used in this prospectus to calculate the number of ordinary shares into which all of our outstanding Series A, Series B and Series C preferred shares will automatically convert upon the completion of this offering are derived in part from the calculation of a 3% annual dividend to which all holders of preferred shares are entitled and are, therefore, based upon the estimated closing date of this offering, which we estimate to be May 21, 2007. In the event that the closing date of this offering deviates from that assumed in this prospectus, we will include the adjusted ordinary share number in our final prospectus relating to this offering. For details relating to the 3% annual dividend, see “Related Party Transactions—Issuance and Sale of Preferred Shares.”

5

Table of Contents

SUMMARY FINANCIAL AND OPERATING DATA

Our operating subsidiary, Nanjing PV, was incorporated in August 2004. Our holding company incorporated in the British Virgin Islands, Sunergy BVI, acquired all of the equity interests in Nanjing PV in April 2006 through a series of transactions that have been accounted for as a legal reorganization. In anticipation of our initial public offering, we incorporated China Sunergy Co., Ltd., or Sunergy, in the Cayman Islands as a listing vehicle on August 4, 2006. Sunergy became our ultimate holding company upon its issuance of shares to the existing shareholders of Sunergy BVI on August 30, 2006 in exchange for all shares of equivalent classes that these shareholders previously held in Sunergy BVI, and Sunergy BVI became our wholly owned subsidiary. We conduct substantially all of our operations through Nanjing PV.

The following summary consolidated statement of operations data for the period August 2, 2004 (date of inception) to December 31, 2004, the years ended December 31, 2005 and 2006, and the summary consolidated balance sheet data as of December 31, 2005 and 2006 have been derived from our audited financial statements included elsewhere in this prospectus. You should read the summary consolidated financial data in conjunction with those financial statements and the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our consolidated financial statements are prepared and presented in accordance with United States generally accepted accounting principles, or U.S. GAAP. Our historical results do not necessarily indicate our results expected for any future periods.

6

Table of Contents

| For the Period August 2 (Date of Inception) to December 31, 2004 | For the Year Ended December 31, | |||||||||||

| 2005 | 2006 | |||||||||||

(in thousands, except share, per share, operating data and percentages) | ||||||||||||

Consolidated Statement of Operations Data | ||||||||||||

Net revenues | — | $ | 13,750 | $ | 149,521 | |||||||

Cost of revenues | — | (11,796 | ) | (122,889 | ) | |||||||

Gross profit | — | 1,954 | 26,632 | |||||||||

Operating expenses: | ||||||||||||

Selling expenses | — | (38 | ) | (1,014 | ) | |||||||

General and administrative expenses | $ | (953 | )(1) | (1,584 | ) | (9,901 | )(2) | |||||

Research and development expenses | — | (49 | ) | (546 | ) | |||||||

Total operating expenses | $ | (953 | )(1) | (1,671 | ) | (11,461 | )(2) | |||||

(Loss) income from operations | (953 | ) | 283 | 15,171 | ||||||||

Net (loss) income | $ | (959 | ) | $ | (307 | ) | $ | 11,814 | ||||

Dividend on Series A redeemable convertible preferred shares | — | — | (13,377 | )(3) | ||||||||

Dividend on Series B redeemable convertible preferred shares | — | — | (28,552 | )(4) | ||||||||

Dividend on Series C redeemable convertible preferred shares | — | — | (7,097 | )(5) | ||||||||

Net loss attributable to holders of ordinary shares | (959 | ) | (307 | ) | (37,212,121 | ) | ||||||

Net loss per share | ||||||||||||

-Basic | $ | (0.01 | ) | $ | (0.00 | ) | $ | (0.36 | ) | |||

-Diluted | $ | (0.01 | ) | $ | (0.00 | ) | $ | (0.36 | ) | |||

Shares used in computation | ||||||||||||

-Basic | 108,000,000 | 108,000,000 | 103,583,178 | |||||||||

-Diluted | 108,000,000 | 108,000,000 | 103,583,178 | |||||||||

Pro forma net income per share(6): | ||||||||||||

-Basic | — | — | $ | 0.09 | ||||||||

-Diluted | — | — | $ | 0.09 | ||||||||

Shares used in pro forma computation | ||||||||||||

Basic | — | — | 129,749,993 | |||||||||

Diluted | — | — | 129,749,993 | |||||||||

Other Consolidated Financial Data | ||||||||||||

Gross margin | — | 14.2% | 17.8% | |||||||||

Consolidated Operating Data | ||||||||||||

Solar cells sold (in MW) | — | 4.4 | 46.4 | |||||||||

Average selling price (in $ per watt) | — | $ | 3.10 | $ | 3.22 | |||||||

| (1) | Included a non-cash charge of $0.8 million relating to forgiveness of shareholder receivables from certain of our directors and executive officers. |

| (2) | Included a non-cash charge of $3.7 million relating to the excess distribution to our president and a non-cash charge of $0.5 million relating to forgiveness of shareholder receivables from certain of our directors and executive officers. |

| (3) | Included a one-time beneficial conversion feature of $13,110,400. |

| (4) | Included a one-time beneficial conversion feature of $27,999,948. |

| (5) | Included a one-time beneficial conversion feature of $6,941,170. |

| (6) | The number of shares used in computation is the weighted-average number of ordinary shares outstanding for the period plus the weighted average number of ordinary shares resulting from the automatic conversion of all of our outstanding redeemable convertible preferred shares upon completion of this offering. |

7

Table of Contents

The following table presents a summary of the balance sheet data of as of December 31, 2005 and 2006:

| • | on an actual basis; and |

| • | on an as adjusted basis to give effect to (1) the automatic conversion of all of our outstanding preferred shares into 111,695,797 ordinary shares upon completion of this offering and (2) the issuance and sale of 51,000,000 ordinary shares in the form of ADSs by us in this offering, assuming an initial public offering price of $9.00 per ADS, the midpoint of the estimated range of the initial public offering price, after deducting estimated underwriting discounts and commissions and estimated aggregate offering expenses payable by us and assuming no exercise of the underwriters’ over-allotment option and no other change to the number of ADSs sold by us as set forth on the cover page of this prospectus. Pursuant to our current memorandum and articles of association, the conversion ratios used in this prospectus to calculate the number of ordinary shares into which all of our outstanding Series A, Series B and Series C preferred shares will automatically convert upon the completion of this offering are derived in part from the calculation of a 3% annual dividend to which all holders of preferred shares are entitled and are, therefore, based upon the estimated closing date of this offering, which we estimate to be May 21, 2007. In the event that the closing date of this offering deviate from that assumed in this prospectus, we will include the adjusted ordinary share number in our final prospectus relating to this offering. For details relating to the 3% annual dividend, see “Related Party Transactions—Issuance and Sale of Preferred Shares.” |

| 2005 | As of December 31, 2006 | |||||||||

| Actual | Actual | As Adjusted | ||||||||

| (in thousands) | ||||||||||

Consolidated Balance Sheet Data | ||||||||||

Cash and cash equivalents | $ | 2,765 | $ | 14,750 | $ | 81,296 | ||||

Restricted cash | 21,959 | 4,952 | 4,952 | |||||||

Inventories | 6,647 | 44,331 | 44,331 | |||||||

Accounts receivable, net | 1,705 | 43,048 | 43,048 | |||||||

Advances to suppliers | 17,408 | 26,281 | 26,281 | |||||||

Amounts due from related parties | 14,104 | 1,976 | 1,976 | |||||||

Total current assets | 64,870 | 136,421 | 202,967 | |||||||

Property, plant and equipment, net | 13,414 | 38,730 | 38,730 | |||||||

Total assets | $ | 79,307 | $ | 176,327 | $ | 242,873 | ||||

Short-term borrowings | $ | 21,685 | $ | 69,263 | $ | 69,263 | ||||

Current portion of long-term borrowings | — | 8,674 | 8,674 | |||||||

Accounts payable | 3,216 | 11,845 | 11,845 | |||||||

Advances from customers | 11,132 | 950 | 950 | |||||||

Amounts due to related parties | 28,437 | 4 | 4 | |||||||

Total current liabilities | 65,393 | 92,104 | 92,104 | |||||||

Long-term borrowings | 8,674 | — | — | |||||||

Series A redeemable convertible preferred shares | — | 13,228 | — | |||||||

Series B redeemable convertible preferred shares | — | 28,502 | — | |||||||

Series C redeemable convertible preferred shares | — | 20,056 | — | |||||||

Additional paid-in capital | 9,450 | 20,145 | 148,461 | |||||||

Subscription receivable | (3,052 | ) | — | — | ||||||

Total shareholders’ equity | 5,240 | 22,280 | 150,612 | |||||||

Total liabilities, mezzanine equity and shareholders’ equity | $ | 79,307 | $ | 176,327 | $ | 242,873 | ||||

8

Table of Contents

An investment in our ADSs involves significant risks. You should carefully consider all the information in this prospectus, including the risks and uncertainties described below before you decide to buy our ADSs. If any of the following risks actually occurs, our business, prospects, financial condition and results of operations could be materially harmed, the trading price of our ADSs could decline and you could lose all or part of your investment.

Risks Related to Our Company and Our Industry

Our limited operating history may not serve as an adequate measure of our future prospects and results of operations.

Our limited operating history may not provide a meaningful basis for evaluating our business, financial performance and prospects. We completed our first solar cell manufacturing line in June 2005 and began commercial shipment of solar cells in August 2005. Relative to the solar power industry as a whole, we have shipped only a limited number of solar cells and have recognized limited revenues from sales of our solar cells. In line with the rapid growth of the solar power industry, we have experienced a high growth rate since we began commercial shipment of solar cells. Our net revenues increased from $13.7 million in 2005 to $149.5 million in 2006. We may not be able to achieve similar growth, or any growth, in future periods. In addition, our future success will require us to continue to expand our manufacturing capacity and total output significantly beyond current levels. We may not be able to achieve or maintain satisfactory manufacturing yields or conversion efficiencies, which measure the ability of solar power products to convert sunlight into electricity, following the expansion of our operations. Accordingly, you should not rely on our results of operations for any prior periods as an indication of our future performance. You should consider our business and prospects in light of the risks, expenses and challenges that we face as an early-stage company seeking to develop and manufacture new products in a rapidly evolving market.

We have incurred losses in certain prior periods and may incur losses in the future.

We incurred net losses of $0.3 million in 2005, and we may incur losses in the future. We expect our costs and expenses to increase as we expand our operations. Our ability to achieve and maintain profitability depends on the growth rate of the solar power market, the continued global market acceptance of solar power products in general and our existing and future products in particular, the pricing trend of solar power products, the competitiveness of our products as well as our ability to provide new products to meet the demands of our customers and our ability to control our costs and expenses. We may not be able to achieve or sustain profitability on a quarterly or annual basis.

The current industry-wide shortage of silicon raw materials may constrain our revenue growth and decrease our gross margins and profitability.

Polysilicon is an essential raw material in our production of solar cells, and is also used in the semiconductor industry. Polysilicon is created by refining quartz sand. In order to manufacture solar cells, polysilicon is melted and processed into crystalline silicon ingots, which are then sliced into wafers. We primarily purchase wafers from third-party suppliers to manufacture our solar cells. We also procure polysilicon, silicon ingots and other silicon-based raw materials from various suppliers, and outsource the production of silicon wafers from these raw materials under toll manufacturing arrangements with third parties. Toll manufacturing is a type of contract manufacturing frequently used in the solar power industry, in which part of the manufacturing process is outsourced to qualified third parties, or toll manufacturers. The raw materials used by toll manufacturers are usually supplied by the originating company. The procurement costs of silicon wafers and other silicon-based raw materials have accounted for a substantial majority of our cost of revenues since we began our commercial production of solar cells in August 2005. In contrast to some of our vertically integrated

9

Table of Contents

competitors that can obtain polysilicon supplies internally below market price, we do not have, and will not in the foreseeable future establish, any polysilicon manufacturing facility.

The global supply of polysilicon is controlled by a limited number of producers and there is currently an industry-wide shortage of polysilicon due to the growing demand for solar power products and the continuing expansion of the semiconductor industry. According to Solarbuzz, the average long-term supply contract price of polysilicon increased from approximately $35-$40 per kilogram in 2005 to $50-$55 per kilogram in 2006, and is expected to increase to $60-$65 per kilogram in 2007. In addition, according to Solarbuzz, spot prices for polysilicon were, in some cases, as high as $300 per kilogram in 2006. Increase in the price of polysilicon has resulted in increase in the price of wafer. For example, our monthly average purchase price of 125-millimeter monocrystalline wafer rose by approximately 14.2% from January 2006 to September 2006. These increases in the price of silicon raw materials have in the past increased our production costs and may continue to impact our cost of revenues and net income. According to Solarbuzz, the polysilicon shortage is expected to last until 2008. We do not expect that the supply shortage of polysilicon and silicon-based raw materials, including crystalline silicon ingots and silicon wafers, will be remedied in the near term.

Partly as a result of the industry-wide shortage, we have, from time to time, faced a shortage of silicon raw materials and experienced late delivery from suppliers and have purchased silicon raw materials of lower quality that have resulted in lower conversion efficiencies and reduced revenues per cell. We may continue to face such shortage, late delivery or lower quality of supply in the future for the following reasons, among others. First, we do not have a history of long-term relationships with silicon raw material suppliers. Second, many of our competitors, who also purchase silicon raw materials from our suppliers, have had stronger relationships as well as greater bargaining power over the suppliers. Currently we procure a substantial portion of our silicon wafer or other silicon-based raw material supplies under short-term supply contracts. To address shortage of silicon wafer supplies, we also secure silicon wafers from some of our customers, and sell solar cells to them in return. We also focus on forging long-term supply relationships with global and domestic suppliers throughout the supply chain in an effort to secure a cost-effective supply of silicon wafers and silicon-based raw materials. However, we cannot assure you that our procurement efforts will be successful in ensuring an adequate supply of silicon raw materials at commercially viable prices or at satisfactory quality to meet our solar cell production requirements. If we are unable to meet customer demand for our products, or if our products are only available at a higher cost because of a shortage of silicon raw materials, we could lose customers, market share and revenue. This would materially and adversely affect our business, financial condition and results of operations.

Our dependence on a limited number of third-party suppliers for key raw materials and customized manufacturing equipment could prevent us from timely delivering our products to our customers in the required quantities, which could result in order cancellations and decreased revenue.

We purchase silicon raw materials from a limited number of third-party suppliers. Our top five suppliers supplied approximately 48.4% of our total silicon raw material needs in 2006, mostly under contracts with a term of less than one year. If we fail to develop or maintain our relationships with our major suppliers, we may be unable to manufacture our products or our products may only be available at a higher cost or after a long delay, and we could be prevented from delivering our products to our customers in the required quantities and at prices that are profitable. Problems of this kind could cause order cancellations and loss of market share. Historically, we encountered problems with respect to the quality of silicon raw material supplied by some of our suppliers, which resulted in lower conversion efficiencies of our solar cells. The failure of a supplier to supply materials and components that meet our quality, quantity and cost requirements in a timely manner could impair our ability to manufacture our products or increase our costs, particularly if we are unable to obtain these materials and components from alternative sources on a timely basis or on commercially reasonable terms. As of the date of this prospectus, we have entered into contracts and framework agreements for sufficient raw material supplies to support our planned production of approximately 110 MW of solar cells in 2007. The pricing terms under our framework agreements are to be determined based on future negotiations. In the event that we cannot reach agreement on the pricing terms with the suppliers in the future, those framework agreements will not be

10

Table of Contents

enforceable and, we will then need to seek alternative supplies. We may not be able to secure sufficient alternative supplies.

In addition, certain of our manufacturing equipment has been designed and made specifically for us. As a result, such equipment is not readily available from multiple vendors and would be difficult to repair or replace. Any significant damage to, or breakdown of, our customized manufacturing equipment could cause material interruptions to our operations and consequentially could have a material adverse effect on our business and results of operations.

We have significant outstanding bank borrowings, and we may not be able to arrange adequate financing when they mature or may encounter other difficulties in maintaining liquidity.

As of December 31, 2006, we had $14.7 million in cash and cash equivalents, and $77.9 million in outstanding borrowings, all of which would become due within one year. In the first quarter of 2007, we borrowed additional loans, and as of March 31, 2007, we had $113.3 million in outstanding borrowings, all of which will become due within one year of the date of this prospectus. We cannot assure you that we will be able to obtain extensions of these facilities as they mature. In the event we are unable to obtain extensions of these facilities, or if we are unable to obtain sufficient alternative funding on reasonable terms to make repayments, we will have to repay these borrowings with cash generated by our operating activities. We cannot assure you that our business will generate sufficient cash flows from operations to repay these borrowings. In addition, repaying these borrowings with cash generated by our operating activities will divert our financial resources from the requirements of our ongoing operations and future growth.

Given the current state of the industry, we generally need to make prepayments to our suppliers of silicon raw materials in advance of shipment. As a result, our purchases of silicon raw materials have required, and we anticipate will continue to require, us to make significant working capital commitments. We will also incur additional capital expenditures for the future expansion of our manufacturing lines. Furthermore, we have granted credit terms for our sales to our large customers, particularly our top three customers. Receivables from these three customers represented approximately 90.2% of our total accounts receivable as of December 31, 2006, and our failure to timely collect these receivables may adversely affect our cash flows. If we fail to effectively manage our cash flows from operations, borrowings and equity contributions to support our cash flow requirements, we may encounter difficulty in liquidity, which would have a material adverse effect on our business, financial condition and future prospects.

Our advance payments to most of our silicon raw material suppliers expose us to the credit risk of such suppliers, which may materially and adversely affect our financial condition, results of operations and liquidity.

In order to secure more supply of silicon raw materials, we make advance payments to most of our silicon raw material suppliers, which is consistent with the industry practice. As of December 31, 2006, our advances to suppliers were approximately $26.3 million. We depend on a limited number of suppliers and we make such advance payments without receiving collateral. As a result, our claims for such advance payments would rank only as unsecured claims, exposing us to the credit risks of the suppliers in the event of their insolvency or bankruptcy. We may not be able to recover such advance payments and would suffer losses should the suppliers fail to fulfill their delivery obligations under the contracts. Accordingly, defaults by our suppliers may materially and adversely affect our financial condition, results of operations and liquidity.

Our quarterly operating results may fluctuate from period to period in the future.

Purchases of solar power products tend to decrease during the winter months because of adverse weather conditions in certain regions, which complicate the installation of solar power systems. Although the industry demand for solar power products decreased in the fourth quarter of 2006, our revenues increased

11

Table of Contents

significantly because during that period, our fourth to sixth manufacturing lines achieved full-scale manufacturing capacity and we sold a substantial portion of our solar cells under sales contracts concluded before September 2006 with pre-agreed prices. However, we experienced a significant decrease in revenues in the first quarter of 2007 primarily due to the seasonality of demand for solar power products and the decreases of the demand for solar cells and market prices of solar cells after the solar cell market prices reached, in the third quarter of 2006, a peak over recent years. In the future, our quarterly operating results may fluctuate from period to period based on the seasonality of industry demand for solar power products. As a result, you may not be able to rely on period to period comparisons of our operating results as an indication of our future performance.

The reduction or elimination of government subsidies and economic incentives for on-grid solar energy applications could cause demand for our products and our revenues to decline.

Almost all of our solar cells sold are eventually utilized in the on-grid market, where the solar power systems are connected to the utility grid and generate electricity to feed into the grid. We believe that the near-term growth of the market for on-grid applications depends in large part on the availability and size of government subsidies and economic incentives. The reduction or elimination of subsidies and economic incentives may adversely affect the growth of this market or result in increased price competition, either of which could cause our revenues to decline.

Today, when upfront system costs are factored into cost per kilowatt, the cost of solar power substantially exceeds the cost of power furnished by the electric utility grid in many locations. As a result, national and local governmental bodies in many countries, most notably in Germany, Spain, Italy, the United States and China, have provided subsidies and economic incentives in the form of feed-in tariffs, rebates, tax credits and other incentives to distributors, system integrators and manufacturers of solar power products to promote the use of solar energy in on-grid applications and to reduce dependence on other forms of energy. These government economic incentives could potentially be reduced or eliminated altogether. For example, Germany has been a strong supporter of solar power products and systems, and is a significant market for our customers that engage in solar module and system integration businesses. Utilities in Germany are generally obligated to purchase electricity generated from grid-connected solar power systems at defined feed-in tariff rates, which will decline over time according to a predetermined schedule. Specifically, German subsidies decline at a rate of 5.0% to 6.5% per year for systems installed after 2006 based on the type and size of the solar power systems, and discussions are currently underway about amending the incentives for solar power systems under the German Renewable Energy Law. Any political or market changes in Germany could result in significant reductions or eliminations of subsidies or economic incentives, such as a more accelerated reduction of feed-in tariffs than as planned according to the current schedule. The solar power industry is currently moving towards the economies of scale necessary for solar power to become cost-effective in a non-subsidized market. Reductions in, or eliminations of, subsidies and economic incentives for on-grid solar energy applications could result in decreased demand for our products and cause our revenues to decline.

If solar power technology is not suitable for widespread adoption, or if sufficient demand for solar power products does not develop or takes longer to develop than we anticipate, our revenues may not continue to increase or may even decline, and we may be unable to achieve or sustain our profitability.

The solar power market is at a relatively early stage of development, and the extent of acceptance of solar power products is uncertain. Historical and current market data on the solar power industry are not as readily available as those for other more established industries where trends can be assessed more reliably from data gathered over a longer period of time. In addition, demand for solar power products may not develop or may develop to a lesser extent than we anticipate. Many factors may affect the viability of widespread adoption of solar power technology and demand for solar power products, including:

| • | cost-effectiveness, performance and reliability of solar power products compared to conventional and other renewable energy sources and products; |

12

Table of Contents

| • | success of other alternative energy generation technologies, such as wind power, hydroelectric power and biomass; |

| • | fluctuations in economic and market conditions that affect the viability of conventional and other renewable energy sources, such as increases or decreases in the prices of oil and other fossil fuels or decreases in capital expenditures by end users of solar power products; and |

| • | deregulation of the electric power industry and the broader energy industry. |

If solar power technology is not viable for widespread adoption or sufficient demand for solar power products does not develop or develops to a lesser extent than we anticipate, our revenues may suffer and we may be unable to sustain our profitability.

Because the markets in which we compete are highly competitive and many of our competitors have greater resources than we do, we may not be able to compete successfully and we may lose or be unable to gain market share.

The market for solar power products is highly competitive and continually evolving. We expect to face increased competition, which may result in price reductions, reduced margins or loss of market share. Our competitors include solar power divisions of large conglomerates such as BP Solar, Kyocera, Sanyo and Sharp Corporation, as well as specialized cell manufacturers such as Motech Industries Inc., Q-Cells AG, Suntech Power Holdings Co., Ltd., Solarfun Power Holdings Co., Ltd. and JA Solar Holdings Co., Ltd.. Some of our competitors have also become vertically integrated, from upstream polysilicon manufacturing to solar system integration, such as Renewable Energy Corporation ASA. During the current period of silicon supply shortage, their internally produced raw materials may enable them to realize a higher margin in comparison with other solar cell manufacturers. Many of our competitors have a stronger market position than ours and have larger resources and better name recognition than we have. Further, many of our competitors are developing and are currently producing products based on alternative solar power technologies, such as thin-film technologies, which may ultimately have costs similar to, or lower than, our projected costs. There are also other companies planning to enter into the solar cell business. For example, we may face competition from semiconductor manufacturers, a few of which have already announced their intention to start producing solar cells. In addition, the entire solar power industry faces competition from conventional and non-solar renewable energy technologies. Due to the relatively high manufacturing costs compared to most other energy sources, solar energy is generally not competitive without government subsidies and economic incentives.

Many of our existing and potential competitors have substantially greater financial, technical, manufacturing and other resources than we do. Our competitors’ greater size in some cases provides them with a competitive advantage with respect to manufacturing costs due to their economies of scale and their ability to purchase raw materials at lower prices. For example, those of our competitors that also manufacture semiconductors may source both semiconductor grade silicon wafers and solar grade silicon wafers from the same supplier. As a result, such competitors may have stronger bargaining power with the supplier and have an advantage over us in pricing as well as obtaining silicon wafer supplies at times of materials shortage. Many of our competitors also have more established distribution networks and larger customer bases. In addition, many of our competitors have well-established relationships with our customers and have extensive knowledge of our target markets. As a result, they may be able to devote greater resources to the research, development, promotion and sale of their products or respond more quickly to evolving industry standards and changes in market conditions than we can. It is possible that new competitors or alliances among existing competitors could emerge and rapidly acquire significant market share, which would harm our business. If we fail to compete successfully, our business would suffer and we may lose or be unable to gain market share.

13

Table of Contents

Advances in solar power technology could render our products uncompetitive or obsolete, which could reduce our market share and cause our sales and profit to decline.

The solar power market is characterized by evolving technology standards that require improved features, such as higher conversion efficiencies and higher power output. This requires us to develop new solar power products and enhancements for existing solar power products to keep pace with evolving industry standards and changing customer requirements. For example, currently we are focused on crystalline silicon technology and the expansion of efficient production capacity based on crystalline silicon, which currently is the primary technology used by most solar cell manufacturers. In addition to our existing P-type solar cells, we are developing the manufacturing process for N-type solar cells. Some overseas producers have focused on developing alternative forms of solar power technologies, such as thin-film technologies. Our failure to further refine our technology and to develop and introduce new solar power products could cause our products to become uncompetitive or obsolete, which could reduce our market share and cause our revenues to decline. We will need to invest significant financial resources in research and development to maintain our market position, keep pace with technological advances in the solar power industry and effectively compete in the future.

If our future innovations fail to enable us to maintain or improve our competitive position, we may lose market share. If we are unable to successfully design, develop and bring to market competitive new solar power products or enhance our existing solar power products, we may not be able to compete successfully. Competing solar power technologies may result in lower manufacturing costs or higher product performance than those expected from our solar power products. In addition, if we, or our customers, are unable to manage product transitions, our business and results of operations would be negatively affected.

We may not be successful in the commercial production of N-type solar cells, selective emitter cells or other new products, which could limit our growth prospects.

We are currently developing process technologies for manufacturing N-type solar cells. The conversion efficiency rate of N-type solar cells may generally be higher than that of P-type solar cells. But there is substantial technical difficulty in manufacturing N-type solar cells on a large scale, such as the problems associated with applying electrical contacts to the silicon materials. Therefore, we believe that to date, only a limited number of manufacturers in the world produce N-type solar cells on a commercial scale.

We may face significant challenges in manufacturing N-type solar cells. Minor deviations in the manufacturing process can cause substantial decreases in yield and cell conversion efficiencies and, in some cases, cause production to be suspended or yield no output. In addition, the silicon wafer required for the manufacture of N-type solar cell is different from that is used for the manufacture of P-type solar cell. We may face difficulty in securing wafer supply for the manufacture of N-type solar cells. If we are unable to commence manufacturing our N-type solar cells on a timely basis, or if we face technological difficulties in cost-efficiently producing our N-type solar cells with the expected performance on a stable level, or if we are unable to secure sufficient raw material supplies or generate sufficient customer demand for our N-type solar cells, our business and prospects may be adversely impacted.

In addition, we are currently developing selective emitter cells. Using our experimental manufacturing line, we have manufactured selective emitter cells with an average conversation efficiency rate of 17.6% on a trial basis, and we expect to commence commercial production in 2007. However, we may face difficulty in the development and commercial production of selective emitter cells or other new products, which may adversely affect our business, results of operations and financial condition.

Our future success substantially depends on our ability to significantly increase both our manufacturing capacity and total output, which exposes us to a number of risks and uncertainties.

We currently have six solar cell manufacturing lines, and we expect to add another six lines by the second quarter of 2008. Our future success depends on our ability to significantly increase both our

14

Table of Contents

manufacturing capacity and total output. If we are unable to do so, we may be unable to expand our business, decrease our costs per watt, maintain our competitive position and improve our profitability. Our ability to establish additional manufacturing capacity and increase output is subject to significant risks and uncertainties, including:

| • | the need to raise significant additional funds, which we may be unable to obtain on commercially viable terms or at all, to purchase raw materials or to build additional manufacturing facilities; |

| • | delays and cost overruns as a result of a number of factors, many of which are beyond our control, such as increases in the price of silicon raw materials and problems with equipment vendors; |

| • | delays or denial of required approvals by relevant government authorities; |

| • | diversion of significant management attention; and |

| • | the ability to secure sufficient silicon raw materials to support our expanded manufacturing capacity. |

If we are unable to establish or successfully operate additional manufacturing capacity, or if we encounter any of the risks described above, we may be unable to expand our business as planned. Moreover, we cannot assure you that if we do expand our manufacturing capacity as planned, we will be able to generate sufficient customer demand for our solar power products to support our increased production levels.

We may experience difficulty in achieving acceptable yields and product performance as a result of manufacturing problems, which could negatively impact our future revenue.

The technology for the manufacture of solar cells is highly complex, and is continually being modified in an effort to improve yields and product performance. Microscopic impurities such as dust and other contaminants, difficulties in the manufacturing process, or malfunctions of the equipment or facilities used can lower yields, cause quality control problems, interrupt production or result in losses of products in process.

Because our existing manufacturing capabilities are, and our future manufacturing capabilities will likely remain, concentrated in our manufacturing facilities in Nanjing, China, any problem in our facilities may limit our ability to manufacture products. We may encounter problems in our manufacturing facilities as a result of, among other things, production failures, construction delays, human errors, equipment malfunction or process contamination, which could seriously harm our operations. We may also experience floods, droughts, power losses and similar events beyond our control that would affect our facilities. A disruption to any step of the manufacturing process would affect our yields and the performance of our products.

Our business depends substantially on the continuing efforts of our executive officers and key employees, and our business may be severely disrupted if we lose their services.

Our future success depends substantially on the continued services of our executive officers and key employees, especially Mr. Tingxiu Lu, our chairman and chief executive officer, Dr. Jianhua Zhao, our vice chairman, president and chief scientist, Dr. Aihua Wang, our vice president and Dr. Fengming Zhang, our vice president. If one or more of our executive officers or key employees were unable or unwilling to continue in their present positions, we might not be able to replace them easily, timely, or at all. Our business may be severely disrupted, our financial conditions and results of operations may be materially and adversely affected and we may incur additional expenses to recruit, train and retain personnel. If any of our executive officers or key employees joins a competitor or forms a competing company, we may lose customers, suppliers, know-how and key professionals and staff members. Each of our executive officers and key employees has entered into an employment agreement with us, which contains non-competition provisions. However, if any dispute arises

15

Table of Contents

between our executive officers and us, these agreements may not be enforceable in China, where these executive officers reside, in light of the uncertainties with China’s legal system. See “—Risks Related to Doing Business in China—Uncertainties with respect to the Chinese legal system could have a material adverse effect on us.”

Our costs and expenses may be greater than those of competitors as a result of entering into fixed-price, prepaid arrangements with our suppliers.

We plan to secure a portion of our supply of silicon raw materials through fixed-price, prepaid supply arrangements with both overseas and domestic suppliers. If the prices of silicon raw materials were to decrease in the future and we were locked into fixed-price, prepaid arrangements, our cost of revenues may be greater than that of our competitors. Additionally, if demand for our solar cells decreases, we may incur costs associated with carrying excess inventory, which may have a material adverse effect on our cash flows. To the extent we would not be able to pass these increased costs and expenses on to our customers, our business, results of operations and financial condition may be materially and adversely affected.

Our dependence on a limited number of customers may cause significant fluctuations or declines in our revenues.

We currently sell a substantial portion of our solar cells to a limited number of customers. In 2006, each of our top three customers contributed over 10% of our net revenues. Sales to these three customers together accounted for approximately 53.1% of our total net revenues in 2006. Sales to our top five customers accounted for 65.6% of our net revenues during the same period. In the fourth quarter of 2006, sales to our top five customers accounted for 86.8% of our net revenues, and sales to our top ten customers accounted for 98.1% of our net revenues.

Sales to our customers are typically made through non-exclusive arrangements. We anticipate that our dependence on a limited number of customers will continue in the foreseeable future. Consequently, any one of the following events may cause material fluctuations or declines in our revenues:

| • | reduction, delay or cancellation of orders from one or more of our significant customers; |

| • | loss of one or more of our significant customers and our failure to identify additional or replacement customers; and |

| • | failure of any of our significant customers to make timely payment for our products. |

If we fail to manage our growth and expansion effectively, our business may be adversely affected.

We have experienced a period of rapid growth and expansion that has placed, and continues to place, significant strain on our management personnel, systems and resources. To accommodate our growth, we anticipate that we will need to implement a variety of new and upgraded operational and financial systems, procedures and controls, including the improvement of our accounting and other internal management systems, all of which require substantial management efforts. We also will need to continue to expand, train, manage and motivate our workforce, manage our customer relationships and manage our relationships with raw material suppliers. All of these endeavors will require substantial management effort and skill and the incurrence of additional expenditures. If we fail to manage our growth effectively, that failure may have a material adverse effect on our business.

Future acquisitions may have an adverse effect on our ability to manage our business.

If we are presented with appropriate opportunities, we may acquire technologies, businesses or assets that are complementary to our business. Future acquisitions would expose us to potential risks, including risks associated with the assimilation of new personnel, unforeseen or hidden liabilities, the diversion of management

16

Table of Contents

attention and resources from our existing business and the inability to generate sufficient revenues to offset the costs and expenses of acquisitions. Any difficulties encountered in the acquisition and integration process may have an adverse effect on our ability to manage our business.

We face risks associated with the marketing, distribution and sale of our solar power products internationally, and if we are unable to effectively manage these risks, they could impair our ability to expand our business abroad.

In 2006, we sold approximately 20.3% of our products to customers outside of China. We intend to expand our sales internationally, particularly to customers located in Germany, Korea, Spain, the United Kingdom and the United States. The marketing, distribution and sale of our solar power products in the international markets expose us to a number of risks, including:

| • | fluctuations in the currency exchange rates; |

| • | increased costs associated with maintaining marketing efforts in various countries; |

| • | difficulty and costs relating to compliance with the different commercial and legal requirements of the overseas markets in which we offer our products; |

| • | difficulty in engaging and retaining sales personnel who are knowledgeable about, and can function effectively in, overseas markets; and |

| • | trade barriers such as export requirements, tariffs, taxes and other restrictions and expenses, which could increase the prices of our products and make us less competitive in some countries. |

If we are unable to attract, train and retain qualified personnel, our business may be materially and adversely affected.

Our future success depends, to a significant extent, on our ability to attract, train and retain qualified personnel, particularly technical personnel with expertise in the solar power industry. Since our industry is characterized by high demand and intense competition for talent, there can be no assurance that we will be able to attract or retain qualified technical staff or other highly-skilled employees that we will need to achieve our strategic objectives. As we are still a relatively young company and our business has grown rapidly, our ability to train and integrate new employees into our operations may not meet the growing demands of our business. If we are unable to attract and retain qualified personnel, our business may be materially and adversely affected.

We may be exposed to infringement or misappropriation claims by third parties, which, if determined adversely to us, could cause us to pay significant damage awards.

Our success depends largely on our ability to use and develop our technology and know-how without infringing the intellectual property rights of third parties. The validity and scope of claims relating to solar power technology patents involve complex scientific, legal and factual questions and analysis and, therefore, may be highly uncertain. We may be subject to litigation involving claims of patent infringement or violation of other intellectual property rights of third parties. The defense and prosecution of intellectual property suits, patent opposition proceedings and related legal and administrative proceedings can be both costly and time-consuming and may significantly divert the efforts and resources of our technical and management personnel. An adverse determination in any such litigation or proceedings to which we may become a party could subject us to significant liability to third parties, require us to seek licenses from third parties, to pay ongoing royalties, or to redesign our products or subject us to injunctions prohibiting the manufacture and sale of our products or the use of our technologies. Protracted litigation could also result in our customers or potential customers deferring or limiting their purchase or use of our products until resolution of such litigation.

17

Table of Contents

Our failure to protect our intellectual property rights may undermine our competitive position, and litigation to protect our intellectual property rights may be costly.

We rely primarily on trade secrets, patent laws and other contractual restrictions to protect our intellectual property. Nevertheless, these afford only limited protection and the actions we take to protect our intellectual property rights may not be adequate to provide us with meaningful protection or commercial advantage. For example, we have three pending patent applications in China and no issued patent yet. We cannot assure you that our patent applications will be eventually issued with claims sufficiently broad for our business. As a result, third parties may be able to use the technologies that we have developed and compete with us, which could have a material adverse effect on our business, financial condition or operating results.

Furthermore, we have granted NewSouth Innovations Pty Limited, or NewSouth Innovations, a non-exclusive, royalty-free license to use the technology for manufacturing N-type solar cells covered in one of our patent applications in China for internal research purposes, and a right to commercially utilize or sublicense such technology after March 1, 2009, provided that the sublicense to our certain Chinese competitors is only permissible after March 1, 2010. As a result, even if this patent application issues with sufficiently broad claims, we may not be able to block our competitors from using the technology covered by such issued patent after March 1, 2010, which could have a material adverse effect on our business, financial condition or operating results.

In addition, litigation may be necessary to enforce our intellectual property rights. We cannot assure you that the outcome of such potential litigation will be in our favor. Such litigation may be costly and may divert management attention as well as expend our other resources away from our business. In addition, we have no insurance coverage against litigation costs and would have to bear all costs arising from such litigation to the extent we are unable to recover them from other parties. The occurrence of any of the foregoing could have a material adverse effect on our business, results of operations and financial condition.

Changes to existing regulations and policies may present technical, regulatory and economic barriers to the purchase and use of solar power products, which may significantly reduce demand for our products.

The market for electricity generation products is heavily influenced by government regulations and policies concerning the electric utility industry, as well as policies adopted by electric utilities. These regulations and policies often relate to electricity pricing and technical requirements regarding the interconnection between customer-owned electricity generation and the grid. In a number of countries, these regulations and policies are being modified and may continue to be modified. Customer purchases of, or further investment in the research and development of, alternative energy sources, including solar power technology, could be deterred by these regulations and policies, which could result in a significant reduction in the potential demand for our products. For example, without a regulatory mandated exception for solar power systems, utility customers are often charged interconnection or standby fees for putting distributed power generation on the electric utility grid. These fees could increase the cost to customers of using our solar power products and make them less desirable, thereby harming our business, prospects, results of operations and financial condition.

We anticipate that our products and their installation will be subject to oversight and regulation in accordance with national and local regulations relating to building codes, safety, environmental protection, utility interconnection and metering and related matters. It is difficult to track the requirements of individual jurisdictions and to design products that comply with the varying standards. Any new government regulations or utility policies pertaining to our solar power products may result in significant additional expenses to us and, as a result, could cause a significant reduction in demand for our solar power products.

Fluctuations in exchange rates could adversely affect our business.

A major portion of our sales is denominated in Renminbi, with the remainder in U.S. dollars and Euros, while a substantial portion of our costs and expenses is denominated in Renminbi and U.S. dollars, with the

18

Table of Contents

remainder in Euros. Fluctuations in exchange rates, particularly among the U.S. dollar, Renminbi and Euro, could affect our net profit margins and could result in foreign exchange losses and operating losses.

We generated net foreign exchange losses of $0.2 million and $1.3 million in 2005 and 2006, respectively. We cannot predict the impact of future exchange rate fluctuations on our results of operations and may incur net foreign exchange losses in the future.

Compliance with environmental regulations can be expensive, and noncompliance with these regulations may result in adverse publicity and potentially significant monetary damages and fines.

As our manufacturing processes generate noise, waste water, gaseous and other industrial wastes, we are required to comply with all national and local regulations regarding protection of the environment. We are in compliance with present environmental protection requirements and have all necessary environmental permits to conduct our business. However, if more stringent regulations are adopted in the future, the costs of compliance with these new regulations could be substantial. We believe that we have all of the permits necessary to conduct our business as it is presently conducted. If we fail to comply with present or future environmental regulations, however, we may be required to pay substantial fines, suspend production or cease operations. We use, generate and discharge toxic, volatile and otherwise hazardous chemicals and wastes in our research and development and manufacturing activities. Any failure by us to control the use of, or to restrict adequately the discharge of, hazardous substances could subject us to potentially significant monetary damages and fines or suspensions in our business operations.

We have limited insurance coverage and may incur losses resulting from product liability claims or business interruptions.