UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F/A

Amendment No. 1

(Mark One)

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THESECURITIES EXCHANGE ACT OF 1934

OR

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THESECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended November 30, 2007

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THESECURITIES EXCHANGE ACT OF 1934

OR

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THESECURITIES EXCHANGE ACT OF 1934

COMMISSION FILE NUMBER: ______________

JOURNEY RESOURCES CORP.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

407 – 808 Nelson Street,

Vancouver, British Columbia V6Z 2H2

Canada

(Address of principal executive offices)

Securities registered or to be registered pursuant to section 12(b) of the Act:

| Title of each Class | Name of each exchange on which registered |

| None | N/A |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Common Shares

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

N/A

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period

covered by the annual report. 38,094,187 common shares outstanding as of June 16, 2008.

i

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

If this report is an annual or a transition report, indicate by check mark if the registrant is not required to file reports pursuant to

Section 13 or 15(d) of theSecurities Exchange Act of 1934.

Yes [ ] No [ ] N/A

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of theSecurities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [ ] No [ ] N/A

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See

definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [X]

Indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 [X] Item 18 [ ]

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by checkmark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d)

of theSecurities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes [ ] No [ ] N/A

- ii -

T A B L E O F C O N T E N T S

- iii -

GENERAL

We use the Canadian dollar as our reporting currency. All references in this document to “dollars” or “$” or “CDN$” are expressed in Canadian dollars, unless otherwise indicated. References to "US$" refer to United States dollars.

Except as noted, the information set forth in this Registration Statement is as of June 16, 2008 and all information included in this document should only be considered correct as of such date.

NOTE REGARDING FORWARD LOOKING STATEMENTS

Except for statements of historical fact, certain information contained herein constitutes “forward-looking statements” including, without limitation, statements containing the words "may," "will," "should," "could," "would," "expect," "plan," "anticipate," "believe," "intend," "estimate," "project," "predict," "potential" and similar expressions, as well as all projections of future results. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from our future results, performance or achievements expressed or implied by such forward-looking statements. Such risks are discussed in Item 3D “Risk Factors.” The statements contained in Item 4B “Business Overview”, Item 5 “Operating and Financial Review and Prospects” and Item 11 “Quantitative and Qualitative Disclosures About Market Risk” are inherently subject to a variety of risks and uncertainties that could cause actual results, performance or achievements to differ significantly. Factors that might cause future results to differ include, but are not limited to, the following:

resources devoted to research and development may not yield new products that achieve commercial success;

the production and launch of commercially viable products may take longer and cost more than expected;

competition may lead to worse than expected financial condition and results of operations;

changes in reimbursement procedures and/or amounts by third-party payors;

changes caused by regulatory or market forces in the prices we receive for our products;

the global economic environment in which we operate, as well as the economic conditions in our markets;

currency exchange rate fluctuations may negatively affect our financial condition and results of operations;

the impact of any future events with material unforeseen impacts, including, but not limited to, war, natura terrorism;

supply and manufacturing disruptions could negatively impact our financial condition or results of operations;

inability to attract qualified personnel, which could negatively impact our ability to grow our business;

difficulty in protecting our intellectual property rights;

4

pending or future litigation may negatively impact our financial condition and results of operations;

government regulation or legislation may negatively impact our financial condition or results of operations;

product recalls or withdrawals may negatively impact our financial condition or results of operations;

the occurrence of environmental liabilities arising from our operations; and

the occurrence of any losses from property and casualty, general liability, business interruption and environmental liability risks could negatively affect our financial condition because we self-insure against those risks through our captive insurance subsidiaries.

You should read this document completely and with the understanding that the Company’s actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements. Except to the extent required under the federal securities laws and the rules and regulations promulgated by the United States Securities and Exchange Commission ("SEC"), we undertake no obligation to publicly update or revise any of these forward-looking statements, whether to reflect new information or future events or circumstances or otherwise.

GLOSSARY OF TERMS USED IN THIS FORM 20-F

Certain terms used herein are defined as follows:

| Mineral Deposit | A deposit of mineralization, which may or may not be ore, the determination o comprehensive feasibility study. |

| | |

| Mineral Reserve | The Securities and Exchange Commission Industry Guide 7 – “Description ofProperty by Issuers Engaged or to be Engaged in Significant MiningOperations”defines a “reserve” as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves consist of: |

| | |

| (1)Proven (Measured) Reserves.Reserves for which: (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling; and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. |

| | |

| (2)Probable (Indicated) Reserves.Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation. |

| | |

| Mineral Resource | National Instrument 43-101 of the Canadian Securities Administrators, “Standards of Disclosure for Mineral Projects”,defines a “Mineral Resource” as a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth’s crust in such form and quantity and of |

- 5 -

such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge.

Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories. An Inferred Mineral Resource has a lower level of confidence than that applied to an Indicated Mineral Resource. An Indicated Mineral Resource has a higher level of confidence than an Inferred Mineral Resource but has a lower level of confidence than a Measured Mineral Resource.

(1)Inferred Mineral Resource.An “Inferred Mineral Resource” is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.Cautionary Note to U.S. Investors concerning estimates of Inferred Mineral Resources.

This document uses the term “Inferred Mineral Resources.” We advise U.S. investors that while such term is recognized and permitted under Canadian regulations, the U.S. Securities and Exchange Commission does not recognize it. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies.U.S. investors are cautioned not to assume that any part or all of an Inferred Mineral Resource exists, or is economically or legally mineable.

(2)Indicated Mineral Resource.An “Indicated Mineral Resource” is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.Cautionary Note to U.S. Investors concerning estimates of Indicated Mineral Resources.

This document uses the term “Indicated Mineral Resource.” We advise U.S. investors that while such terms are recognized and required under Canadian regulations, the U.S. Securities and Exchange Commission does not recognize it.U.S. investors are cautioned not to assume that any part or all of the mineral deposits in this category will ever be converted into reserves

(3)Measured Mineral Resource.A “Measured Mineral Resource” is that part of a Mineral Resource for which quantity, grade or quality, densities, shape

- 6 -

and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

The Securities and Exchange Commission Industry Guide 7 – “Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations”does not define or recognize resources. As used in this Registration Statement, “resources” are as defined in National Instrument 43-101.

- 7 -

PART I

ITEM 1 IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

A. Directors and Senior Management

The names, business addresses and functions of our directors and senior management are:

| Name and Business Address | Function |

Jatinder (Jack) Bal

407 – 808 Nelson Street

Vancouver, British Columbia V6Z 2H2 |

President, Chief Executive Officer and Director

|

Lorne Torhjelm

975 – 163rdStreet

Surrey, British Columbia V4A 9T8 |

Chief Financial Officer and Secretary

|

Robert C. Bryce

465 Blvd. Sabourin

Val D’Or, Quebec J9P 4W6 |

Director

|

Clinton Sharples

240 Neave Road

Kelowna, British Columbia V1V 2L9 |

Director

|

Peter Pollard

53 Endcliffe Vale Road

Sheffield, England

SI0 3EP

United Kingdom |

Director

|

Chris Wilson

Wythways, Starvebeeach

GL17 9BJ

England |

Vice President, Exploration

|

B. Advisors

Not applicable.

C. Auditor

The names and addresses of our auditors for each of the three preceding years and their governing professional body memberships are:

- 8 -

Name and Address |

Governing Professional Body |

Audit Period |

Watson Dauphinee & Masuch, Chartered

Accountants

Suite 420, 1501 West Broadway

Vancouver, British Columbia

V6J 4Z6

|

Institute of Chartered Accountants of

British Columbia

Registered with the Canadian Public

Accountability Board (Canada) and

the Public Company Accounting

Oversight Board (US) |

Financial years ending

November 30, 2007,

2006 and 2005

|

ITEM 2 OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3 KEY INFORMATION

A. Selected Financial Data

The following table presents selected consolidated financial data derived from our audited consolidated financial statements for the fiscal years ended November 30, 2007, 2006, 2005 and 2004. You should read this information in conjunction with the consolidated financial statements for each of the three years ended November 30, 2007, 2006, 2005 and 2004 included elsewhere in this Registration Statement. Please note that the earliest two years of financial information have been omitted from the following table as the Company was engaged in the business of lifestyle and leisure product development and distribution during 2001 and 2002. These operations were abandoned and a change of business took place in December 2003.

Our current independent auditor, Watson Dauphinee & Masuch, Chartered Accountants, audited our 2007, 2006, 2005 and 2004 annual financial statements. Our auditors prepared the financial statements in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”). Note 16 to the annual 2007, 2006 and 2005 financial statements provides descriptions of material measurement differences between Canadian GAAP and accounting principles generally accepted in the United States of America (“US GAAP”) as they relate to us and a reconciliation of our financial statements to US GAAP.

All information provided in the Summary of Financial Information below and in this Registration Statement is presented in Canadian dollars (“dollars”, “$” or “CDN$”) and is in accordance with Canadian GAAP, unless indicated otherwise.

- 9 -

SUMMARY OF FINANCIAL INFORMATION

IN JOURNEY’S FINANCIAL STATEMENTS

Consolidated Statements of

Operations and Deficit Data |

Years ended November 30 |

|

2007 |

2006 |

2005 |

2004 |

Revenues(1)

Canadian GAAP

US GAAP |

nil

nil |

nil

nil |

nil

nil |

nil

nil |

Net earnings (loss) from

operations and continuing

operations

Canadian GAAP

US GAAP |

($2,362,986)

($2,217,067) |

($1,460,225)

($2,841,320) |

($849,692)

($895,085) |

($45,610)

($45,610) |

Basic and diluted loss per

common share

Canadian GAAP

US GAAP |

($0.09)

($0.08) |

($0.08)

($0.15) |

($0.06)

($0.07) |

($0.01)

($0.01) |

(1) Revenues represent gross revenues from operations and does not include interest income or foreign exchange gain.

Balance Sheet | As at November 30 |

|

2007 |

2006 |

2005 |

2004 |

Total assets

Canadian GAAP

US GAAP |

$4,621,933

$3,162,862 |

$3,307,454

$1,880,966 |

$1,205,674

$1,160,281 |

$859,218

$859,218 |

Mineral property interests

Canadian GAAP

US GAAP |

$3,249,024

$1,789,953 |

$2,781,047

$1,299,468 |

$879,782

$834,389 |

nil

nil |

Liabilities

Canadian GAAP

US GAAP |

$173,262

$173,262 |

$498,440

$498,440 |

$95,305

$95,305 |

$77,604

$77,604 |

Share capital

Canadian GAAP

US GAAP |

$10,029,591

$10,029,591 |

$6,626,840

$6,626,840 |

$4,004,723

$4,004,723 |

$3,214,130

$3,214,130 |

Contributed surplus

Canadian GAAP

US GAAP |

$1,222,406

$1,222,406 |

$924,607

$924,607 |

$387,854

$387,854 |

nil

nil |

Deficit

Canadian GAAP

US GAAP |

(7,105,419)

(8,385,988) |

($4,742,433)

($6,168,921) |

($3,282,208)

($3,327,601) |

($2,432,516)

($2,432,516) |

Shareholders equity

(deficiency)

Canadian GAAP

US GAAP |

$4,070,169

$2,789,600 |

$2,809,014

$1,382,526 |

$1,110,369

$1,064,976 |

$781,614

$781,614 |

Number of outstanding

common shares at end of

period

Number |

37,244,187 |

24,701,130 |

14,190,898 |

10,093,898 |

We have never declared any cash or other dividends.

- 10 -

Exchange Rate

The exchange rate between the Canadian dollar and the U.S. dollar was CDN$1.02 per US$1.00 (or US$0.98 per CDN$1.00) as of June 16, 2008.

The average exchange rates for the financial years and interim periods listed above (based on the average exchange rate for each period using the average of the exchange rates on the last day of each month during the period) are as follows:

| |

Years ended November 30 |

|

2007 |

2006 |

2005 |

Average exchange rate

CDN$ per US$1.00 |

$1.07 |

$1.14 |

$1.22 |

Average exchange rate US$

per CDN$1.00 |

$0.93 |

$0.88 |

$0.82 |

The high and low exchange rates between the Canadian dollar and the U.S. dollar for the past six months are as follows:

| | Exchange rate |

| Month | CDN$ per US$1.00 |

| | High | Low |

| June 2008 | $1.001 | $1.028 |

| May 2008 | $1.003 | $0.996 |

| April 2008 | $1.018 | $1.010 |

| March 2008 | $1.006 | $0.996 |

| February 2008 | $1.003 | $0.995 |

| January 2008 | $1.015 | $1.006 |

| December 2007 | $1.008 | $0.998 |

B. Capitalization and Indebtedness

Not applicable.

- 11 -

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Our securities are highly speculative and subject to a number of risks. You should not consider an investment in our securities unless you are capable of sustaining an economic loss of the entire investment.

The risks associated with our business include:

Our settlement on the Empire Mine Project is dependant upon satisfactory due diligence by Zico LLC .

Our interest in the Empire Mine Project arises from an option agreement we entered into with Trio Gold Corp. (“Trio”), whereby we had a right to earn a 50% leasehold interest from Trio. The interest that we may obtain from Trio is based on Trio’s right to acquire a 100% operating interest in the Empire Mine Property from Sultana Resources LLC (“Sultana”) pursuant to an agreement between Trio and Sultana dated March 17, 2004 (as amended June 30, 2004) (the “2004 Trio/Sultana Agreement”). In June 2006, Sultana served Trio with a notice claiming a breach of the 2004 Trio/Sultana Agreement and that Trio should therefore assign the Empire Mine Property back to Sultana. Trio believed that Sultana’s claim has no merit and filed an answer and counterclaim. Subsequently, we entered into a settlement agreement dated February 26, 2008 (the “Settlement Agreement”) with Trio Gold Corp. (“Trio”), the underlying owners, Sultana Resources LLC and Zico LLC (“Zico”) with regard to our leasehold interest in the Empire Mine Project.

Pursuant to the Settlement Agreement, Zico has agreed to pay Journey a total cash amount of CDN$1,000,000 on or before July 3, 2008 in consideration for 100% of Journey and Trio’s interest in the Property and all work product to date. Journey has agreed to pay Trio a total of CDN$100,000 of such consideration for its interest in the Property. The payment obligation by Zico is subject to a 120 day satisfactory due diligence period, during which Zico shall conduct due diligence on the work product on the Property. In the event that satisfactory due diligence is completed and Zico delivers payment to Journey in the amount of CDN$1,000,000, Journey and Trio will release any claim of interest in and to the Property. The pending litigation on the Property has been dismissed and deemed fully and finally settled.

- 12 -

Because we may be unable to meet property payment obligations we may lose interests in our exploration properties.

We hold limited or contingent interests in certain of our mineral properties. The agreements pursuant to which we acquired our interests in some of our properties provide that we must make a series of cash payments over certain time periods, expend certain minimum amounts on the exploration of the properties or contribute our share of ongoing expenditures (for details of outstanding obligations, see Item 4A). In particular, we must fund CDN$1,300,000 on the Silveria Project on or before the seventh (7th) business day following the date we receive TSX Venture Exchange approval of the joint venture transaction (the “Approval Date”), an additional CDN$1,500,000 for funding of exploration expenditures on the Silveria Project three (3) months from the Approval Date, and a further CDN$3,000,000 in order to earn a 50% interest in the Silveria Project. If we fail to make such payments or expenditures in a timely fashion, we may lose our interest in this property.

We may lose the ability to continue exploration and, if warranted, development of the Vianey Mine Silver Project, the Musgrove Creek Gold Project, the Silver Mountain Project and the Silveria Project in the event that we do not own valid title to our mining claims and leases.

As indicated above, we are the owner of concessions to the mineral properties that comprise the Vianey Mine Silver Project, the Musgrove Creek Gold Project and the Silver Mountain Project, and we have a contingent interest in the Silveria Project. Our interests in these Projects should not be construed as a guarantee that title to such interests will not be challenged or impugned. The rights associated with these Projects may be subject to prior unregistered agreements or transfers or native land claims, and title may also be affected by undetected defects. If we do not have valid title to our concessions in the Vianey Mine Project, the Musgrove Creek Gold Project or the Silver Mountain Project, or if we do not obtain and maintain title in our interests in and the Silveria Project, then we may lose the rights to explore and, if warranted, develop, these Projects.

Because our mineral properties do not contain any known body of economic mineralization, we may not discover commercially exploitable quantities of ore on our mineral properties that would enable us to enter into commercial production, achieve revenues and recover the money we spend on exploration.

The Vianey Mine Silver Project, Musgrove Creek Gold Project, Silver Mountain Project and Silveria Project are in the exploration stage as opposed to the development stage and have no known body of economic mineralization. The mineralization at these projects has not yet been determined to be economic ore, and may never be determined to be economic. In May 2007, we commenced a Phase II exploration program on the Musgrove Creek Gold Project. In January, 2007 we completed a diamond drill program on the Vianey Mine Project. In addition, we commenced an exploration program of sampling and mapping on the Silveria Project in February 2008. We have not yet begun planned exploration programs with respect to the Silver Mountain Project. There is a substantial risk that these exploration activities will not result in discoveries of commercially recoverable quantities of ore. Any determination that our mineral properties contain commercially recoverable quantities of ore may not be reached until such time that final comprehensive feasibility studies have been concluded that establish that a potential mine is likely to be economic. There is a substantial risk that any preliminary or final feasibility studies we carry out will not result in a positive determination that the Vianey Mine Silver Project, the Musgrove Creek Gold Project, the Silver Mountain Project or the Silveria Project can be commercially developed.

Our exploration activities on our mineral properties may not be commercially successful, which could lead us to abandon our plans to develop the property and our investments in exploration.

Our long-term success depends on our ability to establish commercially recoverable quantities of ore at the Vianey Mine Silver Project, the Musgrove Creek Gold Project, the Silver Mountain Project or the Silveria Project that can then be developed into commercially viable mining operations. Mineral exploration is

- 13 -

highly speculative in nature, involves many risks and is frequently non-productive. These risks include unusual or unexpected geologic formations and the inability to obtain suitable or adequate machinery, equipment or labour.

Substantial expenditures are required to establish proven and probable reserves through drilling and analysis, to develop metallurgical processes to extract metal, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Whether a mineral deposit will be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. We may invest significant capital and resources in exploration activities and abandon such investments if we are unable to identify commercially exploitable mineral reserves. The decision to abandon a project may reduce the trading price of our common shares and impair our ability to raise future financing. We cannot provide any assurance to investors that we will discover or acquire any mineralized material in sufficient quantities on any of our properties to justify commercial operations. Further, we will not be able to recover the funds that we spend on exploration if we are not able to establish commercially recoverable quantities of ore on the Vianey Mine Silver Project, the Musgrove Creek Gold Project, the Silver Mountain Project or the Silveria Project.

The Mineral Resource estimates we presented for Musgrove Creek Gold Project are estimates only and there is no assurance that these resources represent economically recoverable mineralization.

We have included Mineral Resource estimates with respect to the Musgrove Creek Gold Project, made in accordance with Canadian National Instrument 43-101. These resources estimates are classified as “inferred resources.” We advise investors that while this term is recognized and required by Canadian securities regulations, the U.S. Securities and Exchange Commission does not recognize this term.Investors are cautioned not to assume that any part or all of mineral deposits classified as “inferred resources” will ever be converted into reserves.Further, “inferred resources” have a great amount of uncertainty as to their existence and their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases.Investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally mineable.

All amounts of mineral resources are estimates only, and we cannot be certain that any specified level of recovery of metals from the mineralized material will in fact be realized or that any other identified mineral deposit will ever qualify as a commercially mineable (or viable) ore body that can be economically exploited. Mineralized material, which is not mineral reserves, does not have demonstrated economic viability. Any material change in the quantity of mineralization, grade or stripping ratio, or metal prices may affect the economic viability of our properties.

We must continue to maintain the concessions that comprise the Vianey Mine Project in good standing in order to maintain our rights to continue exploration and, if warranted, the development of the Vianey Mine Project.

The Vianey Mine Project is comprised of concessions that have been granted under Mexican mining law. We must pay annual fees based on the area covered by the concessions. Our failure to maintain the concessions that comprise the Vianey Mine Project in good standing could cause us to lose our interest in these mineral properties, with the result that we would lose our rights to continue exploration and, as a result, the development of the Vianey Mine Project.

- 14 -

We require further permits in order to conduct our current and anticipated future operations, and delays or a failure to obtain such permits, or a failure to comply with the terms of any such permits that we have obtained, would adversely affect our business.

Our current and anticipated future operations, including further exploration, development activities and commencement of production on our mineral properties, require permits from various governmental authorities.

We cannot assure you that all permits that we require for our operations, including any construction of mining facilities or conduct of mining, will be obtainable or renewable on reasonable terms, or at all. Delays or a failure to obtain such required permits, or the expiry, revocation or failure by us to comply with the terms of any such permits that we have obtained, would adversely affect our business.

In particular, we may require future permits to allow for surface disturbance on the Vianey Mine Silver Project in the event that we decide to conduct any surface drilling on the property in late 2008 or early 2009. We would also require mining permits should the Vianey Mine Silver Project advance into production in the future.

We will require significant additional financing in order to continue our exploration activities and our assessment of the commercial viability of the Vianey Mine Silver Project, the Musgrove Creek Gold Project, the Silver Mountain Project and the Silveria Project.

We will need to raise additional financing to complete further feasibility studies for the Vianey Mine Silver Project, the Musgrove Creek Gold Project, the Silver Mountain Project and the SIlveria Project. Furthermore, if the costs of our planned exploration programs are greater than anticipated, we may have to seek additional funds through public and private share offerings, arrangements with corporate partners or debt financing. There can be no assurance that we will be successful in our efforts to raise these require funds, or on terms satisfactory to us. The continued exploration of the Vianey Mine Silver Project, the Musgrove Creek Gold Project, the Silver Mountain Project and the Silveria Project and the development of our business will depend upon our ability to establish the commercial viability of these Projects and to ultimately develop our cash flow from operations and reach profitable operations.

We are currently in the exploration stage, have no revenue from operations and are experiencing significant negative cash flow. Accordingly, the only sources of funds presently available to us are through the sale of equity and debt capital. Alternatively, we may finance our business by offering an interest in our mineral properties to be earned by another party or parties carrying out further exploration and development thereof (such as the option agreement and subsequent joint venture agreement we entered into with Wits Basin Precious Minerals, Inc. with respect to the Vianey Mine Silver Project) or to obtain project or operating financing from financial institutions, neither of which is presently intended. If we are unable to obtain this additional financing, we will not be able to continue our exploration activities and our assessment of the commercial viability of the Projects. Further, if we are able to establish that development of any of the Projects is commercially viable, our inability to raise additional financing at this stage would result in our inability to place that Project into production and recover our investment.

Prices for gold, silver, zinc, copper and lead are volatile. In the event they decline, we may not be able to raise the additional financing required to fund our exploration activities for the Vianey Mine Silver Project, the Musgrove Creek Gold Project, the Silver Mountain Project and the Silveria Project.

Our ability to raise financing to fund our exploration activities and, if warranted, development of the Vianey Silver Mine Project, the Musgrove Creek Gold Project, the Silver Mountain Project and the Silveria Project will be significantly affected by changes in the market price of the metals for which we mine or explore. The

- 15 -

prices of gold, silver, zinc, copper and lead are volatile, and are affected by numerous factors beyond our control. Factors influencing such volatility include the following:

global or regional consumption patterns;

the supply of, and demand for, these metals;

speculative activities;

the availability and costs of metal substitutes;

expectations for inflation; and

political and economic conditions, including interest rates and currency values.

In addition, the level of interest rates, the rate of inflation, the world supply of gold, silver, zinc, copper and lead and the stability of exchange rates can all cause fluctuations in these prices. Such external economic factors are influenced by changes in international investment patterns and monetary systems and political developments. The prices of gold, silver, zinc, copper and lead have fluctuated in recent years, and future significant price declines could cause investors to be unprepared to finance exploration of gold, silver, zinc, copper and lead, with the result that we may not have sufficient financing with which to fund our exploration activities. In this event, we may not be able to carry out planned exploration activities and, if warranted, development of the Vianey Silver Mine Project, the Musgrove Creek Gold Project, the Silver Mountain Project and the Silveria Project with the result that we may not be able to continue our plan of operations.

Political instability and uncertainty in Mexico could increase our cost of carrying out our plan of operations, delay our exploration and, if warranted, development activities and make it more difficult for us to obtain additional financing with respect to the Vianey Mine Silver Project.

The Vianey Mine Silver Project is located in Guerrero State, Mexico. Operating in a foreign country, particularly Mexico, usually involves great uncertainties relating to political and economic matters. Significantly, a presidential election was held in Mexico in July 2006. The outcome of this election results of the election were quite close, and the losing candidate has contested the results. A number of protests have occurred in Mexico as a result of these contested results. Continued protests or challenges to the election results may result in political and economic uncertainty which may cause us to delay our plan of operations or which may decrease the willingness of investors to provide financing to us.

Changes in government legislation in Mexico could affect our exploration of the Vianey Mine Silver Project and could preclude us from continuing to explore and, if warranted, to develop this Project.

In connection with the Vianey Mine Silver Project, we are required to carry out our exploration activities and, if warranted, any development activities in accordance with Mexican federal and state legislation and regulations. We intend to conduct our exploration activities on the Vianey Silver Mine Project in compliance with current applicable mining permit and exploration requirements. Changes in government legislation, including changes in environmental regulations or land claims, or the adoption of new legislation governing mining operations, ownership of mineral properties or environmental protection could increase our costs of conducting our exploration activities and, if warranted, development of this Project or could preclude us from proceeding with our exploration activities and, if warranted, development activities.

- 16 -

Political instability and uncertainty in Peru could increase our cost of carrying out our plan of operations, delay our exploration and, if warranted, development activities and make it more difficult for us to obtain additional financing with respect to the Silver Mountain Project and the Silveria Project.

The Silver Mountain Project is located in Lima, Peru and the Silveria Project is located in the Huarochiri Province of Peru. Operating in a foreign country usually involves great uncertainties relating to political and economic matters. Significantly, in the early 1990’s there were terrorist activities occurring in Peru by groups such as the Shining Path. There are no certainties that there will be no future terrorist activities in Peru which may result in political and economic uncertainty which may cause us to delay our plan of operations, or which may decrease the willingness of investors to provide financing to us.

The adoption of stricter environmental legislation governing the Vianey Silver Mine Project, the Musgrove Creek Gold Project, the Silver Mountain Project or the Silveria Project could increase our costs of exploring and, if warranted, developing these Projects and could delay these activities.

We must comply with applicable environmental legislation in carrying out our exploration and, if warranted, development of the Vianey Silver Mine Project, the Musgrove Creek Gold Project, the Silver Mountain Project and the Silveria Project. Environmental legislation in Mexico, Peru and the United States is evolving in a manner that may require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. Changes in environmental legislation could increase our costs of carrying out our exploration and, if warranted, development of these Projects. Further, compliance with stricter environmental legislation may result in delays to our exploration and, if warranted, development activities.

The presence of unknown environmental hazards on our mineral properties may result in significant unanticipated compliance and reclamation costs that may increase our costs of exploring and, if warranted, developing the Vianey Silver Mine Project, the Musgrove Creek Gold Project, the Silver Mountain Project or the Empire Mine Project.

Environmental hazards may exist on the properties in which we hold interests which are unknown to us at present and which have been caused by previous or existing owners or operators of the properties. The presence of such environmental hazards may result in us being required to comply with environmental reclamation, closure and other requirements that may involve significant costs and other liabilities. In particular, our operations and exploration activities are subject to Mexican laws and regulations (with respect to the Vianey Silver Mine Project), Peruvian laws and regulations (with respect to the Silver Mountain Project and the Silveria Project), and U.S. laws and regulations (with respect to the Musgrove Creek Gold Project) governing protection of the environment. These laws are continually changing and, in general, are becoming more restrictive.

We may not be able to successfully establish mining operations.

We have not yet established mining operations on any of the properties in which we hold an interest. The development of our properties and the future development of any other properties found to be economically feasible and approved by the board will require the construction and operation of mines, processing plants and related infrastructure. As a result, we are and will be subject to all of the risks associated with establishing new mining operations including:

the timing and cost, which can be considerable, of the construction of mining and processing facilities;

the availability and cost of skilled labour and mining equipment;

the availability and cost of appropriate smelting and refining arrangements;

- 17 -

the need to obtain necessary environmental and other governmental approvals and permits and the timing of the receipt of those approvals and permits;

the availability of funds to finance construction and development activities;

potential opposition from non-governmental organizations, environmental groups or local groups which may delay or prevent development activities; and

potential increases in construction and operating costs due to changes in the cost of fuel, power materials and supplies.

The costs, timing and complexities of mine construction and development may be greater than we anticipate, particularly to the extent that such property interests are not located in developed areas and as a result may not be served by appropriate road access, water and power supply, and other support infrastructure. Also, cost estimates may increase as more detailed engineering work is completed on a project. It is common in new mining operations to experience unexpected costs, problems and delays during construction, development and mine start-up. In addition, delays in the commencement of mineral production often occur. Accordingly, we cannot assure you that our activities will result in profitable mining operations.

We compete with larger, better capitalized competitors in the mining industry.

The mining industry is competitive in all of its phases, including financing, technical resources, personnel and property acquisition. It requires significant capital, technical resources, personnel and operational experience to effectively compete in the mining industry. Because of the high costs associated with exploration, the expertise required to analyze a project’s potential and the capital required to develop a mine, larger companies with significant resources may have a competitive advantage over us. We face strong competition from other mining companies, some with greater financial resources, operational experience and technical capabilities than we have. As a result of this competition, we may be unable to maintain or acquire financing, personnel, technical resources or attractive mining properties on terms we consider acceptable or at all.

If we were to lose the services of Jatinder Bal or other members of our management team, we may be delayed in our plan of operations for the Vianey Silver Mine Project, the Musgrove Creek Gold Project, the Silver Mountain Project and the Silveria Project and our operating expenses may be increased.

Our success is dependent upon the performance of key personnel working in management, supervisory and administrative capacities, or as consultants. These personnel include Jatinder Bal, who is our President and Chief Executive Officer. We do not maintain life insurance or key man insurance for such personnel. The loss of the services of senior management or key personnel may result in Journey being required to identify and engage qualified management personnel who are capable of managing our business activities. We may be delayed in the implementation of our plan of operations and our operating expenses may be increased if we were to lose the services of senior management or key personnel.

If we lose the services of the independent contractors that we engage to undertake our exploration, then our plan of operations may be delayed or be more expensive to undertake than anticipated.

Our success depends to a significant extent on the performance and continued service of certain independent contractors. We have contracted the services of professional geologists, drillers and other contractors for exploration, environmental, construction and engineering services. Poor performance by such contractors or the loss of such services could result in our planned exploration activities being delayed or being more expensive to undertake than anticipated.

- 18 -

Some of our officers and directors do not have technical training or experience in exploring for mineral resources and may not be aware of certain of the technical requirements related to working within the industry, which could adversely affect our plan of operations.

Some of our directors and officers do not have experience exploring for mineral resources. In particular our CEO, Jatinder Bal, has limited prior mining experience. As a result, our directors and officers may not be fully aware of many of the specific requirements related to working within the industry. Their decisions and choices would typically take into account standard engineering or managerial approaches mineral exploration companies commonly use in carrying out their plan of operations. However, our exploration activities, earnings and ultimate financial success could suffer irreparable harm due to certain of management’s decisions. As a result, we may have to suspend or cease exploration activities which would likely result in the loss of your investment.

Management May Be Subject To Conflicts of Interest Due to Affiliation With Other Resource Companies.

Other than our CEO, Jatinder Bal, who devotes approximately 90% of his time to the Company, each of our executive officers and directors serves only on a part time basis. As most of our directors and officers serve as officers and or directors of other resource exploration companies, which are themselves engaged in the search for additional opportunities, situations may arise where these directors and officers are presented with or identify resource exploration opportunities and may be, or perceived to be in competition with us for exploration opportunities. Such potential conflicts, if any arise, will be dealt with in accordance with the relevant provisions of applicable corporate and common law.Our directors and officers expect that participation in exploration prospects offered to the directors will be allocated between the various companies that they serve on the basis of prudent business judgement and the relative financial abilities and needs of the companies to participate. In addition, many of our officers and directors have a financial interest in other resource issuers to which they serve as management, and hence may never be financially disinterested in the outcomes of these potential conflict of interest situations. This situation may require that shareholders favourably consider ratification of directors’ decisions where financial conflicts arise resulting in uncertainty with respect to completion of such matters.

Our consolidated financial statements have been prepared assuming we will continue on a going concern basis, but there can be no assurance that we will continue as a going concern.

Our consolidated financial statements have been prepared on the basis that we will continue as a going concern. At February 29, 2008, we had working capital deficit of CDN$182,190, which isnot sufficient to meet our planned business objectives. We will need to generate additional financial resources in order to meet our planned business objectives. There can be no assurances that we will continue to obtain additional financial resources and/or achieve profitability or positive cash flows. If we are unable to obtain adequate additional financing, we will be required to curtail operations and exploration activities. Furthermore, failure to continue as a going concern would require that our assets and liabilities be restated on a liquidation basis which would differ significantly from the going concern basis.

We follow Canadian disclosure practices concerning our mineral reserves and resources which allow for more disclosure than is permitted for U.S. reporting companies.

Our resource estimates are not directly comparable to those made in filings subject to SEC reporting and disclosure requirements, as we generally report resources in accordance with Canadian practices. These practices are different from the practices used to report resource estimates in reports and other materials filed with the SEC in that the Canadian practice is to report measured, indicated and inferred resources. In the United States, mineralization may not be classified as a ‘‘reserve’’ unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. U.S. investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. Further, ‘‘inferred resources’’ have a great amount

- 19 -

of uncertainty as to their existence and as to whether they can be mined legally or economically. Disclosure of ‘‘contained ounces’’ is permitted disclosure under Canadian regulations; however, the SEC only permits issuers to report ‘‘resources’’ as in place tonnage and grade without reference to unit measures. Accordingly, information concerning descriptions of mineralization and resources contained in this prospectus, or in the documents incorporated herein by reference, may not be comparable to information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

We are subject to many risks that are not insurable and, as a result, we will not be able to recover losses through insurance should such risks occur.

Hazards such as unusual or unexpected geological formations and other conditions are involved in mineral exploration and development. We may become subject to liability for pollution, cave-ins or hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities would result in an increase in our operating expenses which would, in turn, have a material adverse effect on our financial position and results of operations. Although we maintain liability insurance in an amount which we consider adequate, the nature of these risks is such that the liabilities might exceed policy limits, the liabilities and hazards might not be insurable against, or we might not elect to insure ourselves against such liabilities due to high premium costs or other reasons, in which event we could incur significant liabilities and costs that could materially increase our operating expenses.

Fluctuations in foreign currency exchange rates may increase our operating expenditures.

We raise our equity in Canadian dollars and maintain our financial reporting in Canadian dollars. We hold, from time to time, significant funds on deposit denominated in Canadian dollars and in Mexican pesos. Our exploration expenditures are generally denominated in United States dollars, Mexican pesos or Peruvina Nuevo Soles. As a result, our expenditures are subject to foreign currency fluctuations. Foreign currency fluctuations may materially and adversely increase our operating expenditures and reduce the amount of exploration activities that we are able to complete with our current capital. We do not engage in any hedging or other transactions to protect ourselves against such currency fluctuations.

Because we have no history of earnings with respect to our mineral exploration business and no foreseeable earnings, we may never achieve profitability or pay dividends.

We have a history of losses and there can be no assurance that we will ever be profitable. We have paid no dividends on our shares since incorporation. We presently have no ability to generate earnings because our mineral properties are in the exploration stage. If we are successful in developing the Vianey Mine Silver Project, the Musgrove Creek Gold Project, the Silver Mountain Project or the Silveria Project, we anticipate that we will retain future earnings and other cash resources for the future operation and development of our business. We do not intend to declare or pay any cash dividends in the foreseeable future. Payment of any future dividends is solely at the discretion of our board of directors, which will take into account many factors including our operating results, financial condition and anticipated cash needs. For these reasons, we may never achieve profitability or pay dividends.

We do not have a history of paying dividends and do not have any intention of paying dividends in the foreseeable future.

Investors cannot expect to receive a dividend on their investment in the foreseeable future, if at all. Accordingly, it is likely investors will not receive any return on their investment in our securities other than possible capital gains.

- 20 -

Because there is no established market for our securities in the United States, U.S. investors may not be able to sell our common shares within the United States.

There is no established market in the United States for our securities. Accordingly, investors may have to rely on Canadian equity markets to trade in our securities. Such markets might not have the liquidity found in markets in the United States, resulting in investors being unable to dispose of our securities.

U.S. investors who obtain judgments against us or our officers or directors for breaches of U.S. securities laws may have difficulty in enforcing such judgments against us and our officers and directors.

We are incorporated under the laws of a province of Canada and a majority of our directors and officers are residents of Canada. Consequently, it may be difficult for United States investors to effect service of process within the United States upon us or upon those directors or officers who are not residents of the United States, or to enforce, inside or outside of the United States, any judgments of United States courts predicated upon civil liabilities under the United StatesSecurities Exchange Act of 1934, as amended. A judgment of a U.S. court predicated solely upon such civil liabilities may not be enforceable in Canada by a Canadian court if the U.S. court in which the judgment was obtained is determined by the Canadian court not to have had jurisdiction in the matter. Furthermore, an original action might not be able to be brought successfully in Canada against any of such persons or us predicated solely upon such civil liabilities.

If our directors cause us to enter into transactions in which our officers and/or directors have an interest, we may enter into transactions that are on less favourable terms than would be negotiated with an arms length party.

Our directors and officers may, from time to time, serve as directors of other similar companies involved in natural resource development. Accordingly, it may occur that properties will be offered to both us and such other companies. Furthermore, those other companies may participate in the same properties as those in which we have an interest. As a result there may be situations that involve a conflict of interest. In that event, the directors would not be entitled to vote at meetings of directors which evoke any such conflict. The directors will attempt to avoid dealing with such other companies in situations where conflicts might arise and will at all times use their best efforts to act in the best interests of Journey. If our directors cause us to enter into transactions in which our officers and/or directors have an interest, we may enter into transactions that are on less favourable terms than would be negotiated with an arms length party. Other than prohibiting our directors and officers from voting on a matter which may involve a conflict of interest, we do not have a specific formal policy in place to address conflicts or the allocations of corporate opportunities.

Our failure to maintain effective internal controls could result in us not being able to produce reliable financial statements.

We are in the process of documenting and testing our internal control procedures in order to satisfy the requirements of Section 404 of theSarbanes-Oxley Act, which requires annual management assessments of the effectiveness of our internal controls over financial reporting and a report by our Independent Auditors addressing these assessments. During the course of our testing we may identify deficiencies which we may not be able to remediate in time to meet the deadline imposed by theSarbanes-Oxley Act for compliance with the requirements of Section 404. In addition, if we fail to achieve and maintain the adequacy of our internal controls, as such standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404 of theSarbanes-Oxley Act. Moreover, effective internal controls are necessary for us to produce reliable financial reports and are important to helping prevent financial fraud. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our stock could drop significantly.

- 21 -

Because we may be considered a passive foreign investment company under U.S. tax laws, U.S. investors in our common shares may be required to include as ordinary income each year the excess of the fair market value of the common shares over the investor’s tax basis in such shares.

Potential investors who are U.S. taxpayers should be aware that we may be considered a passive foreign investment company (“PFIC”) under United States tax laws. If we are a PFIC for any year during a U.S. taxpayer’s holding period, then such U.S. taxpayer generally will be required to treat any so-called “excess distribution” received on its common shares, or any gain realized upon a disposition of common shares, as ordinary income and to pay an interest charge on a portion of such distribution or gain, unless the taxpayer makes a qualified electing fund (“QEF”) election or a mark-to-market election with respect to our shares. In certain circumstances, the sum of the tax and the interest charge may exceed the amount of the excess distribution received, or the amount of proceeds of disposition realized, by the taxpayer. A U.S. taxpayer who makes a QEF election generally must report on a current basis his or her share of our net capital gain and ordinary earnings for any year in which we are a PFIC, whether or not we distribute any amounts to our shareholders. A U.S. taxpayer who makes the mark-to-market election generally must include as ordinary income each year the excess of the fair market value of the common shares over the taxpayer’s tax basis therein. U.S. taxpayers are advised to seek the counsel of their professional tax advisors.

The exercise of outstanding options and warrants redeemable for our common shares will result in our issuance of additional common shares and the unrestricted resale of these additional common shares may have a depressing effect on the current trading price of our common shares.

At June 16, 2008, there were approximately 6,085,204 warrants and 2,983,373 options outstanding, redeemable for an aggregate of 9,068,577 of our common shares. The exercise of these outstanding warrants and options will result in our issuance of additional common shares and the unrestricted resale of these additional common shares may have a depressing effect on the current trading price of our common shares.

Broker-dealers may be discouraged from effecting transactions in our common shares because they are considered a penny stock and are subject to the SEC’s penny stock rules.

The SEC has adopted rules (the “Penny Stock Rules”) that regulate broker-dealer practices in connection with transactions in “penny” stocks. Penny stocks are equity securities with a price of less than US$5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current prices and volume information with respect to transactions in such securities is provided by the exchange or system).

The Penny Stock Rules require a broker-dealer, prior to effecting a transaction in a penny stock not otherwise exempt from such rules, to deliver a standardized risk disclosure document prepared by the SEC that provides information about penny stocks and the nature and level of risks in the penny stock market. In particular the statement must contain:

| | (a) | a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; |

| | | |

| | (b) | a description of the broker-dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of securities laws; |

| | | |

| | (c) | a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; |

| | | |

| | (d) | a toll-free telephone number for inquiries on disciplinary actions; |

- 22 -

| | (e) | the definitions of significant terms in the disclosure document or in the conduct of trading in penny stocks; and |

| | | |

| | (f) | such other information and be in such form, including language, type, size and format, as the Commission shall require by rule or regulation. |

The broker-dealer must obtain from the customer a written acknowledgement of receipt of the standardized disclosure document.

The broker-dealer also must provide the customer with:

| | (a) | the inside bid and offer quotations for the penny stock, or other bid and offer price information for the penny stock if inside bid and offer quotations are not available; |

| | | |

| | (b) | the compensation of the broker-dealer and its salespersons in the transaction; |

| | | |

| | (c) | the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and |

| | | |

| | (d) | a monthly account statements showing the market value of each penny stock held in the customer’s account. |

In addition, the Penny Stock Rules require that prior to a transaction in a penny stock not otherwise exempt from such rules the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. At the present market prices our common shares will (and in the foreseeable future are expected to continue to) fall within the definition of a penny stock. Accordingly, United States broker-dealers trading in our shares will be subject to the Penny Stock Rules. Rather than complying with those rules, some broker-dealers may refuse to attempt to sell penny stock. As a result, shareholders and their broker-dealers in the United States may find it more difficult to sell their shares of Journey, if a market for the shares should develop in the United States.

ITEM 4 INFORMATION ON THE COMPANY

A. History and Development of the Company

Our legal and commercial name is Journey Resources Corp. We are a mineral resource exploration company trading on the TSX Venture Exchange (Symbol: JNY), the Third Market Segment of the Frankfurt Stock Exchange (Symbol: JL4) and the OTC Bulletin Board (Symbol: JNYRF). Our principal office is located at Suite 407, 808 Nelson Street, Vancouver, British Columbia, V6Z 2H2, Canada. Our telephone number is (604) 633-2442.

We were incorporated on March 29, 2000 pursuant to the Company Act of the Province of British Columbia, Canada, under the name Access West Capital Corp. We were listed on the TSX Venture Exchange on September 26, 2000. On June 12, 2002, we changed our name from Access West Capital Corp. to Journey Unlimited Omni Brand Corporation, and on June 14, 2002 we acquired Journey Unlimited Equipment Inc. via a reverse takeover. Journey Unlimited Equipment Inc. had been incorporated pursuant to the Company Act of the Province of British Columbia, Canada, on April 21, 1999. As a result of the reverse takeover of Journey Unlimited Equipment Inc., we became a development-stage company engaged in the business of developing and distributing lifestyle and leisure products. Until November 30, 2003, we developed and sold innovative backpacks and carry bags in North America and selected international markets. This venture was

- 23 -

not successful, and we began examining other opportunities in the retail products industry as well as opportunities in the mining and oil and gas industries.

Since April 2005, we have been in the business of acquisition and exploration of mineral properties. On November 4, 2005, we changed our name from Journey Unlimited Omni Brand Corporation to our current name, Journey Resources Corp. We were listed on the Frankfurt Stock Exchange on November 28, 2006. We are also listed for quotation on the OTC Bulletin Board. We are currently exploring four exploration-stage projects: the Vianey Mine Silver Project, the Musgrove Creek Gold Project, the Silver Mountain Project and the Silveria Project, as described below. The information contained in this Registration Statement is current as at June 16, 2008, other than where a different date is specified.

Acquisitions of Vianey Mine Silver Project, Musgrove Creek Gold Project, Silver Mountain Project and Silveria Project

Vianey Mine Silver Project

The Vianey Silver Mine Project consists of concessions covering 5,022 hectares in Guerrero State, Mexico. We acquired a 99% interest in concessions covering 44 hectares in a reverse takeover pursuant to a share purchase agreement dated April 11, 2005 with Murcielago Capital, S.A. and Minerales Jazz S.A. de C.V. (“Minerales Jazz”). Under the share purchase agreement, we acquired 99% of the shares of Minerales Jazz, a private Mexican company whose only material asset was these concessions, in exchange for a payment to Murcielago of CDN$150,000 in cash and the issuance to Murcielago of 900,000 of our common shares. In addition, under the share purchase agreement, we are required to issue 500,000 of our common shares to Murcielago (issued on June 6, 2007) following our completion of certain exploratory work as well as an additional 800,000 of our common shares following the earlier of completion of an economically viable pre-feasibility study and the commencement of commercial production. We entered into an option agreement to acquire the remaining 1% of Minerales Jazz’s shares for nominal consideration on April 11, 2005 with two individuals who owned these remaining shares. We exercised our right to acquire these shares on September 11, 2006. In August 2005, we acquired additional exploration concessions to the east of the 44-hectare site by staking such concessions. As a result, our concessions cover 5,022 hectares. For a description of the Vianey Mine Silver Project, see Section D. – “Property, Plants and Equipment – The Vianey Mine Silver Project.”

Pursuant to an option agreement that we entered into with Wits Basin Precious Minerals, Inc. (“Wits Basin”) on June 28, 2006, we granted Wits Basin the option to acquire up to a 50% interest in our Vianey Mine Silver Project concessions in consideration of Wits Basin issuing 500,000 shares to us, incurring exploration expenses on the property of US$500,000 by December 31, 2006, issuing an additional 500,000 shares to us by January 15, 2007 (which were issued and received on January 09, 2007), and incurring additional exploration expenses of US$500,000 by September 30, 2007. To date Wits Basin has earned a 25% interest in and to the Vianey Property, and we were deemed to have formed a joint venture with Wits in December 2006.

We entered into a formal joint venture agreement with Wits Basin on December 18, 2006. Pursuant to the joint venture agreement we will act as operator of the joint venture and Wits Basin maintained its option to earn an additional 25% interest in and to the Vianey Mine Project by fulfilling certain expenditure requirements, including expending an additional aggregate amount of $500,000towards the joint venture on or before September 30, 2007.

Subsequently, we entered into an amendment to the joint venture agreement with Wits Basin on October 31, 2007, whereby we agreed to Wits Basin issuing a further 1,600,000 common shares of its capital to Journey, rather than fulfilling the original expenditure requirement of US$500,000 on or before September 30, 2007. Upon the issuance of the 1,600,000 shares by Wits Basin, as per the amended joint venture agreement, Wits

- 24 -

Basin was deemed to have exercised its option and earned an additional 25% interest, for a total interest of 50% in the Vianey Mine Project under the joint venture.

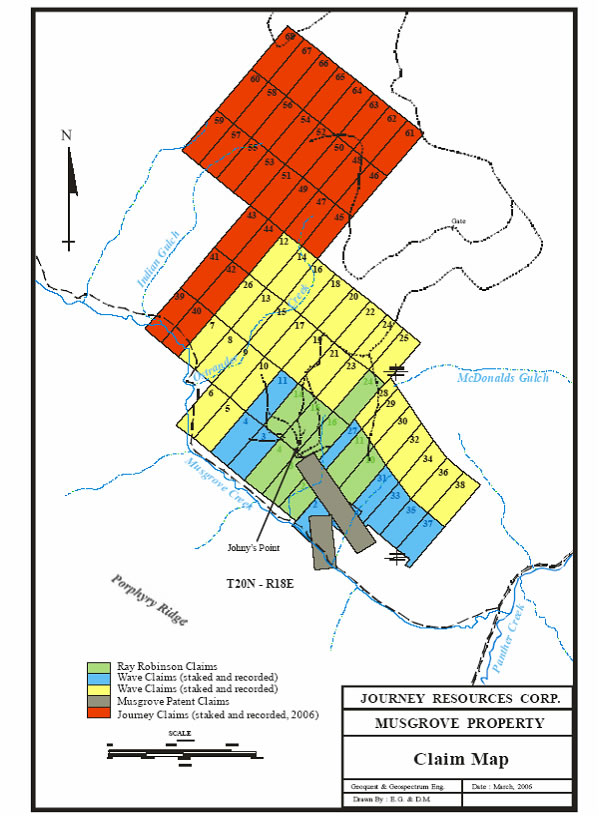

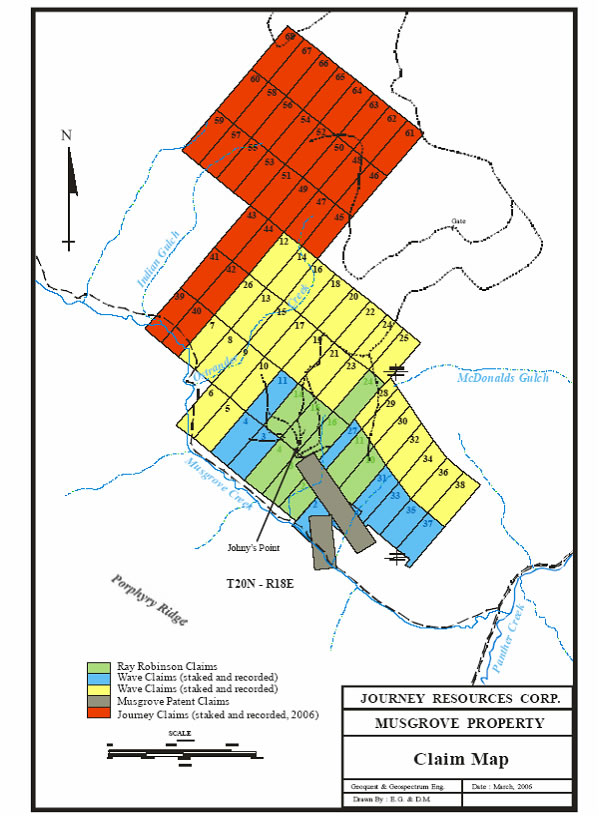

Musgrove Creek Gold Project

The Musgrove Creek Property consists of 77 contiguous, unpatented mining claims located in the Cobalt Mining District of Lemhi County, close to Salmon, Idaho. Pursuant to a mineral claim option agreement dated November 30, 2005 that we entered into with Wave Exploration Corp. (“Wave”) and its wholly-owned subsidiary, Wave Mining Inc., we will have a 100% interest in 47 claims that they hold an interest in upon satisfaction of the following conditions: (i) we issue 300,000 shares and make a cash payment of CDN$75,000 to Wave (which we did on January 5, 2006) and (ii) we make further cash payments of CDN$100,000 (which we did on November 30, 2006) and CDN$150,000 to Wave on or before November 30, 2007, respectively.

Under the terms of the mineral claim option agreement, we also assumed the obligations of Wave under an underlying lease agreement dated June 12, 2003. The underlying lease has a 10 year term and can be renewed for two successive terms of 10 years provided that the conditions of the lease are met. The Company is required to pay annual lease payments to the underlying lessor which progressively increase from US$25,000 due on the third anniversary (June 12, 2006) of the lease to a maximum of US$50,000 per year for the duration of the lease. These claims are subject to an underlying 2% production royalty and a lump sum payment of $1,000,000 upon completion of a feasibility study. In addition, the Company is required to incur minimum annual exploration expenditures of $100,000 on the property during the term of the lease. As at November 30, 2007, the Company had paid a total of US$55,000 for the third and fourth annual lease payments to the underlying lessor, and has incurred a total of $797,397 (US$717,806) of exploration expenditures on the property.

We subsequently entered into an amended mineral claim option agreement on May 23, 2007 with Roxgold Inc. (formerly Wave Exploration Corp.) and Wave Mining Inc., whereby we could expedite our obligations to earn a 100% right, title and interest in the Musgrove Creek Project. We received regulatory approval on the amended option agreement on June 12, 2007 and has subsequently made final payment in the amount of CDN$25,000 cash and 75,000 common shares of its capital to Roxgold Inc., rather than the original payment of CDN$150,000 in cash on or before November 30, 2007. Accordingly, we currently own a 100% right, title and interest in the Musgrove Creek Project.

We estimate that the cost of the 2008 exploration program will be $380,000. For a breakdown of estimated exploration costs for 2008 on the Musgrove Creek Gold Project, please see table in Section B. – “Business Overview - - Our Business Strategy and Principal Activities – The Musgrove Creek Gold Project.”

In April 2006, we staked and recorded an additional 30 claims to the northwest of these 47 claims. As a result, the Musgrove Creek Gold Project consists of a total of 77 claims. For a description of the Musgrove Creek Gold Project, see Section D. – “Property, Plants and Equipment – The Musgrove Creek Gold Project.”

Empire Mine Project

The Empire Mine Project consists of 26 patented mining claims, six millsite claims and 21 unpatented mining claims located in the Alder Creek Mining District in Custer County, Idaho. Pursuant to a May 31, 2006 option agreement that we entered into with Trio Gold Corp., we had an option to acquire a 50% interest in these mining claims from Trio. Under the terms of this option agreement, we will be deemed to have earned a 50% interest in and to the claims, and a joint venture between us and Trio will have been formed, upon the satisfaction of the following conditions: (i) our cash payment of a US$50,000 non-refundable deposit as well as CDN$200,000 and issuance of 700,000 shares to Trio at a deemed price of CDN$0.30 per share (which we completed in June 2006) and (ii) our expenditure of US$1,500,000 for exploration on the property by August 31, 2007.

- 25 -

The Empire Mine property is subject to an underlying agreement between Trio and Sultana Resources LLC dated March 17, 2004 (as amended June 30, 2004) (the “2004 Trio/Sultana Agreement”), as well as underlying agreements between Sultana and two underlying owners, Honolulu Copper Corp. and Mackay LLC. Pursuant to the 2004 Trio/Sultana Agreement, Trio has the right to acquire a 100% operating interest in the Empire Mine Project from Sultana, provided that, among other things, Trio completed an acceptable bankable feasibility study by December 31, 2005. In June 2006, Sultana served Trio with a notice claiming breach of the 2004 Trio/Sultana Agreement. Sultana claims that Trio failed to complete a bankable feasibility study by December 31, 2005 and therefore, should assign the Empire Mine Property back to Sultana. In July 2006, Trio filed an answer and counterclaim to Sultana’s claim.

Subsequently, we entered into a settlement agreement with Trio, the underlying owners, Sultana and Zico LLC (“Zico”) with regard to our leasehold interest in the Empire Mine property. Pursuant to the settlement agreement, Zico has agreed to pay us a total cash amount of CDN$1,000,000 on or before July 3, 2008 in consideration for a the 100% leasehold interest in the Property held by Journey and Trio. We have agreed to pay Trio a total of CDN$100,000 of the CDN$1,000,000 for its interest in the Property. The payment obligations by Zico are subject to a 120 day satisfactory due diligence period, during which Zico shall conduct due diligence on the work product on the property to date. In the event that satisfactory due diligence is completed and Zico delivers payment to us in the amount of CDN$1,000,000, the pending litigation on the property will be dismissed and be deemed fully and finally settled, and Journey and Trio will release any claim of interest in and to the Empire Mine property.

There can be no assurance, however, that Zico will be satisfied with the results of their due diligence and make payment of CDN$1,000,000 in consideration for our interest in the property. .”

Silver Mountain Project