UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

☒ Registration statement pursuant to Section 12(b) OR (g) of the Securities Exchange Act of 1934

or

☐ Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended________________

or

☐ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ___________to_____________

Commission file number________________

BLENDER BITES LIMITED

(Exact name of Registrant as specified in its charter)

_______________________________________

(Translation of Registrant's name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

Suite 800 - 1199 West Hastings Street, Vancouver, British Columbia, Canada V6E 3T5

(Address of principal executive offices)

Contact Person: Geoff Balderson, Tel: 236 521-0626, Email: gb@amalficorp.ca

Suite 800 - 1199 West Hastings Street, Vancouver, British Columbia, Canada V6E 3T5

(Name, telephone, e-mail and/or facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

None | Not applicable |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Common Shares Without Par Value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer's capital or common stock as of the close period covered by the annual report: N/A

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☐

Note - Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ |

| | Emerging Growth Company ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term "new or revised financial accounting standard" refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ | International Financial Reporting Standards as issued by

the International Accounting Standards Board ☒ | Other ☐ |

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ ITEM 17 ☐ ITEM 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ YES ☐ NO

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This registration statement contains forward-looking statements, meaning statements that reflect our current expectations and views of future events and future financial performance. These forward-looking statements are made under the applicable safe-harbor provisions of United States and Canadian securities laws. In some cases, you can identify forward-looking statements by terminology such as "estimate", "project", "believe", "anticipate", "intend", "expect", "plan", "predict", "may", "should", "potential", or "continue", the negative thereof or other variations thereon or comparable terminology.

These forward-looking statements include, but are not limited to, statements about:

- our future business development, financial conditions and results of operations;

- the expect growth of the industry that we operate in;

- our expectations regarding demand for and market acceptance of our products and services;

- competition in our industry;

- the belief that the Company is well-positioned to capitalize on the increasing demand for functional foods;

- the expectations regarding trends in the functional foods industry and the belief that as the functional foods sector evolves, demand for more wholesome options such as the Company's products will grow;

- our expectations regarding our ability to develop, manufacture and deliver our products in fulfilment of our contractual commitments;

- expectations regarding the production capacity of the existing and future facilities and the ability to increase and/or maximize production and ultimately sales as a result thereof;

- our expectations regarding our relationships with distributors, customers, ingredient and other suppliers, strategic partners and other stakeholders; and

- assumptions underlying or related to any of the foregoing.

Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. There can be no assurance that the forward-looking statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements.

Known and unknown risks, uncertainties and other factors include, but are not limited to:

• the ability of the Company to continue as a going concern;

• the availability of capital on acceptable terms;

• volatile market price of shares;

• protection of intellectual property rights;

• the effect of competition on the business;

• government regulation of the food industry creating risks and challenges;

• the effect of product labelling requirements;

• the price of raw materials;

• consumer trends;

• supply chain management;

• availability of suppliers of raw materials;

• limited or disrupted supply of key ingredients;

• the effect of climate change on the availability of key ingredients for the Company's products;

• product liability;

• product recalls;

• customer consolidation in the food retail business;

• food safety and consumer health;

• brand value;

• reputation risk;

• effect of public health crises including the current COVID-19 pandemic;

• failure to expand production capacity;

• effect of product innovation;

• failure to retain current customers and/or recruit new customers;

• litigation risk;

• third party reliance for manufacturing, shipping and payment processing;

• failure to meet social responsibility metrics;

• speculative nature of investment risk;

• the Company's history of losses;

• liquidity and future financing risk;

• additional funding requirements and risks;

• general global economic risk;

• technical, logistical or processing problems;

• restrictions on sales activities;

• key personnel risks;

• security breaches;

• competition;

• dependence on suppliers;

• conflicts of interest;

• cyber security risks; and

• other factors specifically identified as risk factors in this registration statement and the documents incorporated herein by reference herein.

Accordingly, shareholders and prospective investors should not place undue reliance on forward-looking statements. The forward-looking statements in this registration statement speak only as to the date hereof. Except as required by applicable law, including the securities laws of the United States and Canada, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

REPORTING CURRENCY AND IFRS

In this registration statement, unless otherwise stated, all dollar amounts are expressed in Canadian dollars ("$"). "US$" refers to United States dollars. The financial statements and summaries of financial information contained in this registration statement are also reported in Canadian dollars ("$") unless otherwise stated. All such financial statements have been prepared in accordance with International Financial Reporting Standards ("IFRS"), unless expressly stated otherwise.

FOREIGN PRIVATE ISSUER STATUS

As used in this registration statement, the terms "we", "us", "our", our "Company" and the "Company" refer to Blender Bites Limited, a British Columbia corporation.

More than 50% of the outstanding voting common shares of the Company are held by non-United States residents as of June 8, 2023. As 50% or more of our common shares are not held by United States residents, we do not need to review the tests regarding directors and officer residence, location of the principal administration of our business, and the location of the majority of our assets. Based on the foregoing, we believe that we qualify as a "foreign private issuer" and, as a result, are able to continue to report regarding our common shares using this Form 20-F registration statement.

EMERGING GROWTH COMPANY STATUS

Pursuant to The Jumpstart Our Business Startups Act of 2012 (the "JOBS Act"), we are classified as an "Emerging Growth Company." Under the JOBS Act, Emerging Growth Companies are exempt from certain reporting requirements, including the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act. Under this exemption, our auditor will not be required to attest to and report on management's assessment of our internal controls over financial reporting during a five-year transition period. We are also exempt from certain other requirements, including the requirement to adopt certain new or revised accounting standards until such time as those standards would apply to private companies. The Company will remain an Emerging Growth Company for up to the last day of the fiscal year following the fifth anniversary of the date of the first sale of common equity securities pursuant to an effective registration statement under the Securities Act of 1933, although it will lose that status earlier if revenues exceed $1 billion, or if the Company issues more than $1 billion in non-convertible debt in a three year period, or the Company will lose that status on the date that it is deemed to be a large accelerated filer.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors and Senior Management

Names | Business Addresses | Functions |

Chelsie Hodge | Suite 800, 1199 W Hastings St Vancouver, BC V6E 3T5 | As Chief Executive Officer and director, Ms. Hodge is responsible for the management of our operations. |

Geoff Balderson | Suite 800, 1199 W Hastings St Vancouver, BC V6E 3T5 | As Chief Financial Officer, Mr. Balderson is responsible for the management and supervision of all of the financial aspects of our business. |

Steve Pear | Suite 800, 1199 W Hastings St Vancouver, BC V6E 3T5 | As Chief Operating Officer, Mr. Pear is responsible for overseeing the complete operation of the Company in accordance with the direction established in the strategic plans; and evaluating the success of the Company in reaching its goals. |

Patrick Morris | Suite 800, 1199 W Hastings St Vancouver, BC V6E 3T5 | As a director, Mr. Morris participates in management oversight and helps to ensure compliance with our corporate governance policies and standards. |

Christopher Mackay | Suite 800, 1199 W Hastings St Vancouver, BC V6E 3T5 | As a director, Mr. Mackay participates in management oversight and helps to ensure compliance with our corporate governance policies and standards. |

Grant Smith | Suite 800, 1199 W Hastings St Vancouver, BC V6E 3T5 | As a director, Mr. Smith participates in management oversight and helps to ensure compliance with our corporate governance policies and standards. |

Nima Bahrami | Suite 800, 1199 W Hastings St Vancouver, BC V6E 3T5 | As a director, Mr. Bahrami participates in management oversight and helps to ensure compliance with our corporate governance policies and standards. |

Nicole Lacson | Suite 800, 1199 W Hastings St Vancouver, BC V6E 3T5 | As Corporate Secretary, Ms. Lacson is responsible for the management and supervision of all of the compliance aspects of our business. |

B. Advisers

Our legal advisers for matters related to Canadian law are Cassels Brock & Blackwell LLP, with a business address at Suite 2200, 885 West Georgia Street, Vancouver, British Columbia, Canada V6C 3E8. Our legal advisers for matters related to U.S. law are Galanopoulos & Company, with a business address at Suite 1480, 885 West Georgia Street, Box 1078, Vancouver, British Columbia, Canada V6C 3E8.

C. Auditors

Our auditors are Crowe MacKay LLP, Chartered Professional Accountants, with a business office located at 1100, 1177 West Hastings Street, Vancouver, British Columbia, V6E 4T5.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable to Form 20-F filed as a registration statement under the Exchange Act.

ITEM 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

The Company's authorized capital consists of an unlimited number of common shares without par value. As of April 30, 2023, the Company had 5,702,558 common shares issued and outstanding as well as 87,500 stock options, 909,237 share purchase warrants and 20,000 restricted share units ("RSUs").

As of April 30, 2023, the Company had current liabilities of $1,139,640, comprised of $1,103,683 in accounts payable and accrued liabilities and $35,957 in promissory notes, which is unguaranteed and unsecured.

C. Reason for the Offer and Use of Proceeds

Not applicable to Form 20-F filed as a registration statement filed under the Exchange Act.

D. Risk Factors

In addition to the other information presented in this registration statement, the following should be considered carefully in evaluating our Company and its business. This registration statement contains forward-looking statements and information within the meaning of U.S. and Canadian securities laws that involve risks and uncertainties. Our actual results may differ materially from the results discussed in the forward-looking statements and information. Factors that might cause such differences include those discussed below and elsewhere in this registration statement.

Limited operating history

We have a very limited history of operations, which makes evaluating our business and future prospects difficult. As such, we are subject to many risks common to enterprises in similar circumstances, including under-capitalization, limitations with respect to personnel, financial, and other resources and lack of revenues. There is no assurance that we will be successful in achieving a return to investors and the likelihood of success must be considered in light of our lack of experience in the functional foods and plant-based industry in North America.

Because we have a limited operating history in an emerging area of business, potential investors should consider and evaluate our operating prospects in light of the risks and uncertainties frequently encountered by early-stage companies in rapidly evolving markets. These risks may include:

- risks that we may not have sufficient capital to achieve its growth strategy;

- risks that we may not develop our product and service offerings in a manner that enables us to be profitable and meet our customers' requirements;

- risks that our growth strategy may not be successful;

- risks that fluctuations in our operating results will be significant relative to our revenues; and

- risks relating to an evolving regulatory regime.

Our growth will depend substantially on our ability to address these and the other risks described in this section. If we do not successfully address these risks, our business may be significantly harmed, and our common shares may lose value or become worthless.

Uncertainty about our ability to continue as a going concern

Our ability to continue as a going concern will be dependent upon our ability in the future to grow our revenue and achieve profitable operations and, in the meantime, to obtain the necessary financing to meet its obligations and repay its liabilities when they become due. External financing, predominantly by the issuance of equity and debt, will be sought to finance our operations; however, there can be no certainty that such funds will be available at terms acceptable to the Company, or at all. These conditions indicate the existence of material uncertainties that may cast significant doubt about our ability to continue as a going concern.

Our actual financial position and results of operations may differ materially from the expectations of our management.

Our actual financial position and results of operations may differ materially from management's expectations. As a result, our revenue, net income and cash flow may differ materially from our projected revenue, net income and cash flow. The process for estimating our revenue, net income and cash flow requires the use of judgment in determining the appropriate assumptions and estimates. These estimates and assumptions may be revised as additional information becomes available and as additional analyses are performed. In addition, the assumptions used in planning may not prove to be accurate, and other factors may affect our financial condition or results of operations.

Probable lack of business diversification

Because we will be initially focused solely on developing its functional foods and plant-based business, the prospects for our success will be dependent upon the future performance and market acceptance of our intended facilities, products, processes and services. Unlike certain entities that have the resources to develop and explore numerous product lines, operating in multiple industries or multiple areas of a single industry, we do not anticipate having the ability to immediately diversify or benefit from the possible spreading of risks or offsetting of losses. Again, the prospects for our success may become dependent upon the development or market acceptance of a very limited number of facilities, products, processes or services.

Public health crises

Public health crises could adversely affect our business. Our financial and/or operating performance could be materially adversely affected by the outbreak of public health crises, epidemics, pandemics or outbreaks of new infectious diseases or viruses. Such public health crises can result in volatility and disruption to global supply chains, consumer, trade and market sentiment, mobility of people, and global financial markets, which could affect share prices, interest rates, credit ratings, credit risk, inflation, business, financial conditions and results of operations, and other factors relevant to the Company. The risks to the Company of such public health crises also include risks to employee health and safety, a slowdown or temporary suspension of operations in geographic locations impacted by an outbreak or could result in the cancellation of orders, as well as supply chain disruptions and could negatively impact our business, financial condition, results of operations, cash flows and the trading price of our common shares.

Regulatory compliance risks

Achievement of our business objectives is contingent, in part, upon compliance with regulatory requirements enacted by governmental authorities and obtaining all regulatory approvals, where necessary, for the sale of its products. The Company may not be able to obtain or maintain the necessary licenses, permits, quotas, authorizations or accreditations to operate its business or may only be able to do so at great cost. The Company cannot predict the time required to secure all appropriate regulatory approvals for its products, or the extent of testing and documentation that may be required by local governmental authorities.

The officers and directors of the Company must rely, to a great extent, on our legal counsel and local consultants retained by the Company in order to keep abreast of material legal, regulatory and governmental developments as they pertain to and affect our business operations, and to assist the Company with its governmental relations. The Company will rely on the advice of local experts and professionals in connection with current and new regulations that develop in respect of banking, financing and tax matters.

The Company will incur ongoing costs and obligations related to regulatory compliance. Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. The Company may be required to compensate those suffering loss or damage by reason of its operations and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations. In addition, changes in regulations, more vigorous enforcement thereof or other unanticipated events could require extensive changes to our operations, increase compliance costs or give rise to material liabilities, which could all have a material adverse effect on the business, results of operations and financial condition of the Company.

Food safety and consumer health

The Company will be subject to risks that affect the food industry in general, including risks posed by food spoilage, accidental contamination, product tampering, consumer product liability, and the potential costs and disruptions of a product recall. The Company attempts to manage these risks by maintaining strict and rigorous controls and processes in its production facility and distribution system. However, the Company cannot assure investors that such systems will eliminate the risks related to food safety. The Company could be required to recall certain or a large portion of its products in the event of contamination or adverse test results or as a precautionary measure. There is also a risk that not all of the products subject to the recall will be properly identified, or that the recall will not be successful or not be enacted in a timely manner. A product recall could result in significant losses due to its costs, destruction of product inventory and lost sales due to the unavailability of the product or potential loss of current or new customers as a result of an adverse impact on our reputation. In addition, once purchased by consumers, the Company has no further control over its products and consumers may prepare its products in a manner that is inconsistent with its directions which may adversely affect the quality and safety of our products. Any product contamination could subject the Company to product liability claims, adverse publicity and government scrutiny, investigation or intervention, resulting in increased costs and decreased sales. Any of these events could have a material adverse impact on our business, financial condition and results of operations.

The Company faces competition from other companies that may have higher capitalization, more experienced management or may be more mature as a business.

Many other businesses in North America engage in similar activities to the Company. An increase in the companies competing in this industry could limit the ability of the Company to expand its operations. Current and new competitors may have better capitalization, a longer operating history, more expertise and be able to develop higher quality equipment or products at the same or a lower cost. The Company cannot provide assurances that it will be able to compete successfully against current and future competitors. Competitive pressures faced by the Company could have a material adverse effect on its business, operating results and financial condition.

The Company expects to incur significant ongoing costs and obligations related to its investment in infrastructure, growth, regulatory compliance and operations.

The Company expects to incur significant ongoing costs and obligations related to its investment in infrastructure and growth and for regulatory compliance, which could have a material adverse impact on our results of operations, financial condition and cash flows. In addition, future changes in regulations, more vigorous enforcement thereof or other unanticipated events could require extensive changes to our operations, increased compliance costs or give rise to material liabilities, which could have a material adverse effect on the business, results of operations and financial condition of the Company. Our efforts to grow its business may be costlier than the Company expects, and the Company may not be able to increase its revenue enough to offset its higher operating expenses. The Company may incur significant losses in the future for a number of reasons, and unforeseen expenses, difficulties, complications and delays, and other unknown events. If the Company is unable to achieve and sustain profitability, the market price of our common shares may significantly decrease.

Development of the business of the Company

The development of the business of the Company and its ability to execute on its expansion opportunities described herein will depend, in part, upon the amount of additional financing available. Failure to obtain sufficient financing may result in delaying, scaling back, eliminating or indefinitely postponing expansion opportunities and the business of our current or future operations. There can be no assurance that additional capital or other types of financing will be available if needed or that, if available, the terms of such financing will be acceptable to the Company. In addition, there can be no assurance that future financing can be obtained without substantial dilution to existing shareholders.

There is no assurance that the Company will become profitable or pay dividends.

There is no assurance as to whether the Company will become profitable or pay dividends. The Company has incurred and anticipates that it will continue to incur substantial expenses relating to the development and initial operations of its business. The payment and amount of any future dividends will depend upon, among other things, our results of operations, cash flow, financial condition and operating and capital requirements. There is no assurance that future dividends will be paid, and, if dividends are paid, there is no assurance with respect to the amount of any such dividends. In the event that any of our investments, or any proceeds thereof, any dividends or distributions therefrom, or any profits or revenues accruing from such investments in the United States were found to be in violation of money laundering legislation or otherwise, such transactions may be viewed as proceeds of crime under one or more of the statutes noted above or any other applicable legislation. This could restrict or otherwise jeopardize the ability of the Company to declare or pay dividends, affect other distributions or subsequently repatriate such funds back to Canada.

The Company may not be able to effectively manage its growth and operations, which could materially and adversely affect its business.

If the Company implements its business plan as intended, it may in the future experience rapid growth and development in a relatively short period of time. The management of this growth will require, among other things, continued development of our financial and management controls and management information systems, stringent control of costs, the ability to attract and retain qualified management personnel and the training of new personnel. The Company intends to utilize outsourced resources and hire additional personnel to manage its expected growth and expansion. Failure to successfully manage its possible growth and development could have a material adverse effect on our business and the value of our common shares.

Our growth depends, in part, on expanding into additional food service and geographic markets, and we may not be successful in doing so.

We believe that our future growth depends not only on continuing to reach our current customer base and demographic, but also continuing to expand our business into other foodservice markets and geographies. The growth of our business will depend, in part, on our ability to continue to expand into additional foodservice markets including club stores, grocery stores, and other foodservice venues. Additionally, we are expanding our sales and marketing efforts to further penetrate additional geographies, particularly in the Southwestern United States. In these markets, we may encounter difficulties in attracting customers due to a lack of consumer familiarity with or acceptance of our brand. We continue to evaluate marketing efforts and other strategies to expand the customer base for our products. In addition, although we are investing in sales and marketing activities to further penetrate newer regions, including expansion of our dedicated sales force, we cannot assure you that we will be successful. If we are not successful, our business and results of operations may be harmed.

Liability, enforcement and complaints

Our participation in the functional foods and plant-based industry may lead to litigation, formal or informal complaints, enforcement actions and inquiries by third parties, other companies or various governmental authorities against the Company. Litigation, complaints and enforcement actions involving the Company could consume considerable amounts of financial and other corporate resources, which could have an adverse effect on our future cash flows, earnings, results of operations and financial condition.

Breaches of security at its facilities, or in respect of electronic documents and data storage and may face risks related to breaches of applicable privacy laws

Given the nature of our product, despite meeting or exceeding all legislative security requirements, there remains a risk of shrinkage, as well as theft. A security breach could expose the Company to additional liability and to potentially costly litigation, increase expenses relating to the resolution and future prevention of these breaches and may deter potential consumers from choosing our products. A privacy breach may occur through procedural or process failure, information technology malfunction, or deliberate unauthorized intrusions. Theft of data for competitive purposes, particularly consumer lists and preferences, is an ongoing risk whether perpetrated via employee collusion or negligence or through a deliberate cyber-attack. Any such theft or privacy breach would have a material adverse effect on our business, financial condition and results of operations.

Sources and availability of raw materials

Our ability to ensure a continuing supply of non-genetically modified organisms ("non-GMO") and organic ingredients at competitive prices depends on many factors beyond our control, such as the number and size of farms that grow organic crops, climate conditions, changes in national and world economic conditions, currency fluctuations and forecasting adequate need of seasonal ingredients.

The organic ingredients that we use in the production of our products are vulnerable to adverse weather conditions and natural disasters, such as floods, droughts, water scarcity, temperature extremes, frosts, earthquakes and pestilences. Natural disasters and adverse weather conditions (including the potential effects of climate change) can lower crop yields and reduce crop size and crop quality, which in turn could reduce our supplies of non-GMO and organic ingredients or increase the prices of non-GMO and organic ingredients. If our supplies of non-GMO and organic ingredients are reduced, we may not be able to find enough supplemental supply sources on favorable terms, if at all, which could impact our ability to supply product to our customers and adversely affect our business, financial condition and results of operations. We also compete with other manufacturers in the procurement of non-GMO and organic product ingredients, which may be less plentiful in the open market than conventional product ingredients. This competition may increase in the future if consumer demand for non-GMO and organic products increases. This could cause our expenses to increase or could limit the amount of product that we can manufacture and sell.

Dependence on suppliers, manufacturers and distributors

We rely on a combination of purchase orders and supply contracts with our suppliers and distributors. With all of our suppliers and distributors, we face the risk that they may fail to produce and deliver supplies or our products on a timely basis, or at all. Furthermore, the products they manufacture for us may not comply with our quality standards. In addition, our suppliers and manufacturers may raise prices in the future, which would increase our costs and harm our margins. Even those suppliers and manufacturers with whom we have supply contracts may breach these agreements, and we may not be able to enforce our rights under these agreements or may incur significant costs attempting to do so. As a result, we cannot predict with certainty our ability to obtain supplies and finished products in adequate quantities, of required quality and at acceptable prices from our suppliers and manufacturers in the future. Any one of these risks could harm our ability to deliver our products on time, or at all, damage our reputation and our relationships with our customers, and increase our product costs thereby reducing our margins.

Our suppliers, manufacturers, and distributors could produce similar products for our competitors

Some of our arrangements with our manufacturers and suppliers are not exclusive. As a result, our suppliers or manufacturers could produce similar products for our competitors, some of which could potentially purchase products in significantly greater volume. Furthermore, while certain of our long-term contracts stipulate contractual exclusivity, those suppliers or manufacturers could choose to breach our agreements and work with our competitors. Our competitors could enter into restrictive or exclusive arrangements with our manufacturers or suppliers that could impair or eliminate our access to manufacturing capacity or supplies. Our manufacturers or suppliers could also be acquired by our competitors, and may become our direct competitors, thus limiting or eliminating our access to supplies or manufacturing capacity.

Changes in freight carrier costs related to the shipment of our products could have a material adverse impact on our results of operations

We rely upon third-party freight carriers for product shipments to our customers. Any failure to obtain sufficient freight capacity on a timely basis or at favorable shipping rates will result in our inability to receive products from suppliers or deliver products to our customers in a timely and cost-effective manner, which will result in a material adverse impact on our business, financial condition, results of operations or cash flows.

Insurance coverage

Our business is subject to a number of risks and hazards generally, including adverse environmental conditions, accidents, labor disputes, product liability and changes in the regulatory environment. Such occurrences could result in damage to assets, personal injury or death, environmental damage, delays in operations, monetary losses and possible legal liability. Although the Company will maintain insurance to protect against certain risks in such amounts as it considers to be reasonable, its insurance may not cover all the potential risks associated with its operations. The Company may also be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. Moreover, insurance against risks such as environmental pollution or other hazards encountered in the operations of the Company is not generally available on acceptable terms. The Company might also become subject to liability for pollution or other hazards which may not be insured against or which the Company may elect not to insure against because of premium costs or other reasons. Losses from these events may cause the Company to incur significant costs that could have a material adverse effect upon its financial performance and results of operations.

Product recalls

Manufacturers and distributors of products can be subject to the recall or return of their products for a variety of reasons, including product defects, such as contamination, unintended harmful side effects or interactions with other substances, packaging safety and inadequate or inaccurate labelling disclosure. If any of our products are recalled due to an alleged product defect or for any other reason, the Company could be required to incur the unexpected expense of the recall and any legal proceedings that might arise in connection with the recall. The Company may lose a significant number of sales and may not be able to replace those sales at an acceptable margin or at all. In addition, a product recall may require significant management attention. A recall for any of the foregoing reasons could lead to decreased demand for our products and could have a material adverse effect on our results of operations and financial condition. Additionally, product recalls may lead to increased scrutiny of our operations by regulatory agencies, requiring further management attention and potential legal fees and other expenses.

Failure to successfully integrate acquired businesses, its products and other assets into the Company, or if integrated, failure to further our business strategy, may result in our inability to realize any benefit from such acquisition

The Company may grow by acquiring other businesses. The consummation and integration of any acquired business, product or other assets into the Company may be complex and time consuming and, if such businesses and assets are not successfully integrated, the Company may not achieve the anticipated benefits, cost-savings or growth opportunities. Furthermore, these acquisitions and other arrangements, even if successfully integrated, may fail to further our business strategy as anticipated, expose the Company to increased competition or other challenges with respect to our products or geographic markets, and expose the Company to additional liabilities associated with an acquired business, technology or other asset or arrangement.

The size of our target market is difficult to quantify and investors will be reliant on their own estimates on the accuracy of market data

As the plant-based industry is in an early stage with uncertain boundaries, there is a lack of information about comparable companies available for potential investors to review in deciding about whether to invest in the Company and, few, if any, established companies whose business model the Company can follow or upon whose success the Company can build. Accordingly, investors will have to rely on their own estimates in deciding about whether to invest in the Company. There can be no assurance that our estimates are accurate or that the market size is sufficiently large for our business to grow as projected, which may negatively impact our financial results. The Company regularly purchases and follows market research.

Our industry is experiencing rapid growth and consolidation that may cause the Company to lose key relationships and intensify competition

The plant-based industry and businesses ancillary to and directly involved with plant-based businesses are undergoing rapid growth and substantial change, which has resulted in an increase in competitors, consolidation and formation of strategic relationships. Acquisitions or other consolidating transactions could harm the Company in a number of ways, including by losing strategic partners if they are acquired by or enter into relationships with a competitor, losing customers, revenue and market share, or forcing the Company to expend greater resources to meet new or additional competitive threats, all of which could harm our operating results. As competitors enter the market and become increasingly sophisticated, competition in our industry may intensify and place downward pressure on retail prices for our products and services, which could negatively impact our profitability.

There is no guarantee that the Company will be able to achieve its business objectives. The continued development of the Company and its business will require additional financing. The failure to raise such capital could result in the delay or indefinite postponement of current business objectives or the Company going out of business. There can be no assurance that additional capital or other types of financing will be available if needed or that, if available, the terms of such financing will be favorable to the Company

The Company may continue to sell shares for cash to fund operations, capital expansion and mergers and acquisitions that will dilute the current shareholders' equity. If additional funds are raised through issuances of equity or convertible debt securities, existing shareholders could suffer significant dilution, and any new equity securities issued could have rights, preferences and privileges superior to those of holders of the Company's common shares. Our constating documents permit the issuance of an unlimited number of common shares, and shareholders will have no pre-emptive rights in connection with such further issuance. The directors of the Company have discretion to determine the price and the terms of issue of further issuances. Moreover, additional common shares will be issued by the Company on the exercise of outstanding options and warrants of the Company. In addition, from time to time, the Company may enter into transactions to acquire assets or shares of other companies. These transactions may be financed wholly or partially with debt, which may temporarily increase our debt levels above industry standards. Any debt financing secured in the future could involve restrictive covenants relating to capital raising activities and other financial and operational matters, which may make it more difficult for the Company to obtain additional capital and to pursue business opportunities, including potential acquisitions. The Company may require additional financing to fund its operations to the point where it is generating positive cash flows. Negative cash flow may restrict our ability to pursue its business objectives.

If an investor purchases common shares in an offering, it will experience substantial and immediate dilution because the price that such investor will pay will be substantially greater than the net tangible book value per share of the Company's shares that it acquires. This dilution is due in large part to the fact that our earlier investors will have paid substantially less than a public offering price when they purchased their shares of our capital stock.

The Company will be reliant on information technology systems and may be subject to damaging cyberattacks

The Company has entered into agreements with third parties for hardware, software, telecommunications and other information technology ("IT") services in connection with its operations. Our operations depend, in part, on how well we and our suppliers protect networks, equipment, IT systems and software against damage from a number of threats, including, but not limited to, cable cuts, damage to physical plants, natural disasters, intentional damage and destruction, fire, power loss, hacking, computer viruses, vandalism and theft. Our operations also depend on the timely maintenance, upgrade and replacement of networks, equipment, IT systems and software, as well as pre-emptive expenses to mitigate the risks of failures. Any of these and other events could result in information system failures, delays or increases in capital expenses. The failure of information systems or a component of information systems could, depending on the nature of any such failure, adversely impact our reputation and results of operations.

The Company has not experienced any material losses to date relating to cyber-attacks or other information security breaches, but there can be no assurance that the Company will not incur such losses in the future. Our risk and exposure to these matters cannot be fully mitigated because of, among other things, the evolving nature of these threats. As a result, cyber security and the continued development and enhancement of controls, processes and practices designed to protect systems, computers, software, data and networks from attack, damage or unauthorized access is a priority. As cyber threats continue to evolve, the Company may be required to expend additional resources to continue to modify or enhance protective measures or to investigate and remediate any security vulnerabilities.

Our major shareholders, officers and directors may be engaged in a range of business activities resulting in conflicts of interest

Although certain major shareholders, officers and board members of the Company are expected to be bound by anti-circumvention agreements limiting their ability to enter into competing or conflicting ventures or businesses, the Company may be subject to various potential conflicts of interest because some of our officers and directors may be engaged in a range of business activities. In addition, our executive officers and directors may devote time to their outside business interests as long as such activities do not materially or adversely interfere with their duties to the Company. In some cases, our executive officers and directors may have fiduciary obligations associated with these business interests that interfere with their ability to devote time to our business and affairs and that could adversely affect our operations. These business interests could require significant time and attention of our executive officers and directors.

In addition, the Company may also become involved in other transactions which conflict with the interests of our directors and the officers who may, from time to time, deal with persons, firms, institutions or companies with which the Company may be dealing, or which may be seeking investments similar to those desired by it. The interests of these persons could conflict with those of the Company. In addition, from time to time, these persons may be competing with the Company for available investment opportunities. Conflicts of interest, if any, will be subject to the procedures and remedies provided under applicable laws. In particular, if such a conflict of interest arises at a meeting of our directors, a director who has such a conflict will abstain from voting for or against the approval of such participation or such terms. In accordance with applicable laws, the directors of the Company are required to act honestly, in good faith and in the best interests of the Company.

Risks relating to the Company's shares

The Company cannot assure investors that a market will continue to develop or exist for the Company's shares or what the market price of the Company's shares will be. If a market does not continue to develop or is not sustained, it may be difficult for investors to sell the Company's shares at an attractive price or at all. The Company cannot predict the prices at which the Company's shares will trade.

The Company may be subject to additional regulatory burden resulting from being publicly listed on the CSE and registered with the SEC

We are subject to the continuous and timely disclosure requirements of Canadian securities laws or other rules, regulations and policies of the Canadian Securities Exchange (the "CSE"). Pending effectiveness of this registration statement, we will be subject to the continuous and timely disclosure requirements of U.S. securities laws or other rules, regulations and policies of the SEC and similar administrative bodies. The Company works with its legal, accounting and financial advisors to identify those areas in which changes should be made to our financial management control systems to manage its obligations as a public company listed on the CSE and registered with the SEC. These areas include corporate governance, corporate controls, disclosure controls and procedures and financial reporting and accounting systems. The Company has made, and will continue to make, changes in these and other areas, including our internal controls over financial reporting. However, the Company cannot assure holders of its common shares that these and other measures that the Company might take will be sufficient to allow it to satisfy our obligations as a public company listed on the CSE or with the SEC on a timely basis. In addition, compliance with reporting and other requirements applicable to public companies listed on the CSE or registered with the SEC creates additional costs for the Company and will require the time and attention of management. The Company cannot predict the amount of the additional costs that the Company might incur, the timing of such costs or the impact that management's attention to these matters will have on our business.

The market price for our shares may be volatile and subject to wide fluctuations in response to numerous factors, many of which are beyond our control

The trading price for our shares on the CSE has been and is likely to continue to be highly volatile. The trading price may be subject to wide fluctuations in response to numerous factors, many of which are beyond our control, including the following:

- actual or anticipated fluctuations in our quarterly results of operations;

- recommendations by securities research analysts;

- changes in the economic performance or market valuations of companies in the industry in which the Company operates;

- the addition or departure of our executive officers and other key personnel;

- release or expiration of lock-up or other transfer restrictions on outstanding shares of the Company;

- sales or perceived sales of additional shares of the Company;

- significant acquisitions or business combinations, strategic partnerships, joint ventures or capital commitments by or involving us or our competitors;

- fluctuations to the costs of vital production materials and services;

- changes in global financial markets and global economies and general market conditions, such as interest rates and pharmaceutical product price volatility;

- operating and share price performance of other companies that investors deem comparable to the Company or from a lack of market comparable companies;

- news reports relating to trends, concerns, technological or competitive developments, regulatory changes and other related issues in our industry or target markets; and

- regulatory changes in the industry.

Future sales of the Company's shares by existing shareholders could reduce the market price of the Company's shares

Sales of a substantial number of the Company's shares in the public market could occur at any time. These sales, or the market perception that the holders of a large number of the Company's shares intend to sell their shares, could reduce the market price of the Company's shares. Additional shares of the Company may be available for sale into the public market, subject to applicable securities laws, which could reduce the market price for the Company's shares.

Tax issues

There may be income tax consequences in relation to the Company's shares, which will vary according to circumstances of each investor. Prospective investors should seek independent advice from their own tax and legal advisers.

No guarantee on the use of available funds by the Company

The Company cannot specify with certainty the particular uses of its available funds. Management has broad discretion in the application of its available funds. Accordingly, shareholders of the Company will have to rely upon the judgment of management with respect to the use of available funds, with only limited information concerning management's specific intentions. Our management may spend a portion or all of the available funds in ways that our shareholders might not desire, that might not yield a favorable return and that might not increase the value of a shareholder's investment. The failure by management to apply these funds effectively could harm our business. Pending use of such funds, the Company might invest available funds in a manner that does not produce income or that loses value.

Environmental, health and safety laws

The Company is subject to environmental, health and safety laws and regulations in each jurisdiction in which the Company operates. Such regulations govern, among other things, emissions of pollutants into the air, wastewater discharges, waste disposal, the investigation and remediation of soil and groundwater contamination, and the health and safety of our employees. The Company may be required to obtain environmental permits from governmental authorities for certain of its current or proposed operations. The Company may not have been, nor may it be able to be at all times, in full compliance with such laws, regulations and permits. If the Company violates or fails to comply with these laws, regulations or permits, the Company could be fined or otherwise sanctioned by regulators. As with other companies engaged in similar activities or that own or operate real property, the Company faces inherent risks of environmental liability at its current and historical production sites. Certain environmental laws impose strict and, in certain circumstances, joint and several liability on current or previous owners or operators of real property for the cost of the investigation, removal or remediation of hazardous substances as well as liability for related damages to natural resources. In addition, the Company may discover new facts or conditions that may change its expectations or be faced with changes in environmental laws or their enforcement that would increase its liabilities. Furthermore, its costs of complying with current and future environmental and health and safety laws, or our liabilities arising from past or future releases of, or exposure to, regulated materials, may have a material adverse effect on its business.

Governmental regulations and risks

Government approvals and permits may in the future be required in connection with our operations. To the extent such approvals are required and not obtained, the Company may be curtailed or prohibited from conducting its business. Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, or remedial actions. The Company may be required to compensate those suffering loss or damage by reason of its operations and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations. Changes to current laws and regulations may be unfavorable and have an adverse effect on the Company's operations.

Products that we sell carry claims as to their origin, ingredients or health benefits, including, by way of example, the use of the term "natural", "functional", or "healthy", or similar synonyms or implied statements relating to such benefits. Plaintiffs have commenced legal actions against several food companies that market "natural" products, asserting false, misleading and deceptive advertising and labeling claims, including claims related to genetically modified ingredients. In limited circumstances, governments have taken regulatory action against products labeled "natural" but that nonetheless contain synthetic ingredients or components. Should we become subject to similar claims, consumers may avoid purchasing products from us or seek alternatives, even if the basis for the claim is unfounded. Adverse publicity about these matters may discourage consumers from buying our products. The cost of defending against any such claims could be significant. Any loss of confidence on the part of consumers in the truthfulness of our labeling or ingredient claims would be difficult and costly to overcome and may significantly reduce our brand value. Any of these events could adversely affect our reputation and brand and decrease our sales, which would have a material adverse effect on our business, financial condition and results of operations.

Similarly, certain governmental regulations set forth minimum standards producers must meet in order to have their products labeled as "certified organic," and we currently manufacture several organic products. While we believe our products and our supply chain are in compliance with these regulations, changes to food regulations may increase our costs to remain in compliance. We could lose our "organic" certification if a facility becomes contaminated with non-organic ingredients, if we do not use raw materials that are certified organic, or if key ingredients used in our products are no longer allowed to be used in food certified as "organic." The loss of our "organic" certifications could materially and adversely affect our business, financial condition or results of operations.

Reliance on Management

The Company has plans to expand its distribution across North America. As of the date of this registration statement, the Company has four people on its management team. The success of the Company is dependent to a certain degree upon the ability, expertise, judgment, discretion and good faith of certain key members of management. It is expected that these individuals will be a significant factor in the growth and success of the Company. Any loss of the services of such individuals could have a material adverse effect on our ability to implement its business plan and achieve its objectives.

Competition

The Company will likely face intense competition from other companies, some of which have longer operating histories and more financial resources and marketing experience than the Company. Increased competition by larger and better-financed competitors could materially and adversely affect the proposed business, financial condition and results of operations of the Company. The competition among the vendors is expected to intensify due to the increase in demand for healthy superfood products and product innovations with convenience and exotic flavors. Current competitors of the Company include Evive Smoothie, Sambazon, Blendtopia, Dole and Pitaya Foods.

Because of the early stage of the industry in which the Company operates, the Company expects to face additional competition from new entrants. To remain competitive, the Company will require a continued investment in facilities and product development to be able to compete on costs. The Company may not have sufficient resources to maintain marketing, sales and patient support efforts on a competitive basis which could materially and adversely affect the business, financial condition and results of operations.

Fluctuations in various food and supply costs, particularly fruit and vegetables, could adversely affect our operating results.

Supplies and prices of the various ingredients can be affected by a variety of factors, such as weather, seasonal fluctuations, demand, politics and economics in the producing countries.

These factors subject us to shortages or interruptions in product supplies, which could adversely affect our revenue and profits. In addition, the prices of fruit and vegetables, which are the main ingredients in our products, can be highly volatile. The fruit of the quality we seek tends to trade on a negotiated basis, depending on supply and demand at the time of the purchase. An increase in pricing of any fruit that we are going to use in our products could have a significant adverse effect on our profitability. We cannot assure you that we will be able to secure our fruit supply.

Demand for our products could be affected by changes in laws and regulations applicable to food and beverages and changes in consumer preferences.

We package our products with single-use disposable plastic. Because our products are used to package consumer goods, we are subject to a variety of risks that could influence consumer behavior and negatively impact demand for our products, including changes in consumer preferences driven by various health and environmental-related concerns and perceptions.

Furthermore, we are subject to social and cultural changes, which could impact demand for certain products. For example, the banning of plastic straws was triggered by a social media backlash, which caused corresponding legislative changes within a short time period, resulting in the ban of plastic straws in certain jurisdictions, and a movement toward eco-friendly packaging. If we are unable to quickly adapt to changes in consumer preferences and subsequent legislation, our financial condition and results of operations could be adversely affected.

Liability for actions of employees, contractors and consultants

The Company could be liable for fraudulent or illegal activity by its employees, contractors and consultants resulting in significant financial losses to claims against the Company.

The Company is exposed to the risk that its employees, independent contractors and consultants may engage in fraudulent or other illegal activity. Misconduct by these parties could include intentional, reckless and/or negligent conduct or disclosure of unauthorized activities to the Company that violates: (i) government regulations; (ii) manufacturing standards; (iii) fraud and abuse laws and regulations; or (iv) laws that require the true, complete and accurate reporting of financial information or data. It is not always possible for the Company to identify and deter misconduct by its employees and other third parties, and the precautions taken by the Company to detect and prevent this activity may not be effective in controlling unknown or unmanaged risks or losses or in protecting the Company from governmental investigations or other actions or lawsuits stemming from a failure to be in compliance with such laws or regulations. If any such actions are instituted against the Company, and it is not successful in defending itself or asserting its rights, those actions could have a significant impact on its business, including the imposition of civil, criminal and administrative penalties, damages, monetary fines, contractual damages, reputational harm, diminished profits and future earnings, the curtailment of our operations or asset seizures, any of which could have a material adverse effect on our business, financial condition and results of operations.

Breach of confidentiality

While discussing potential business relationships or other transactions with third parties, the Company may disclose confidential information relating to the business, operations or affairs of the Company. Although confidentiality agreements are to be signed by third parties prior to the disclosure of any confidential information, a breach of such confidentiality agreement could put the Company at competitive risk and may cause significant damage to its business. The harm to our business from a breach of confidentiality cannot presently be quantified but may be material and may not be compensable in damages. There can be no assurance that, in the event of a breach of confidentiality, the Company will be able to obtain equitable remedies, such as injunctive relief from a court of competent jurisdiction in a timely manner, if at all, in order to prevent or mitigate any damage to its business that such a breach of confidentiality may cause.

Inability to protect intellectual property

Our success is heavily dependent upon its intangible property and technology. The Company relies upon copyrights, patents, trade secrets, unpatented proprietary know-how and continuing innovation to protect the intangible property, technology and information that are considered important to the development of the business. The Company relies on various methods to protect its proprietary rights, including confidentiality agreements with consultants, service providers and management that contain terms and conditions prohibiting unauthorized use and disclosure of confidential information. However, despite efforts to protect intangible property rights, unauthorized parties may attempt to copy or replicate intangible property, technology or processes. There can be no assurances that the steps taken by the Company to protect its intangible property, technology and information will be adequate to prevent misappropriation or independent third-party development of our intangible property, technology or processes. It is likely that other companies can duplicate a production process similar to ours. Other companies may also be able to materially duplicate our proprietary plant strains. To the extent that any of the above would occur, revenue could be negatively affected, and in the future, the Company may have to litigate to enforce its intangible property rights, which could result in substantial costs and divert management's attention and other resources.

Our ability to successfully implement its business plan depends in part on its ability to obtain, maintain and build brand recognition using its trademarks, service marks, trade dress, domain names and other intellectual property rights, including our names and logos. If our efforts to protect its intellectual property are unsuccessful or inadequate, or if any third party misappropriates or infringes on its intellectual property, the value of its brands may be harmed, which could have a material adverse effect on our business and might prevent its brands from achieving or maintaining market acceptance.

The Company may be unable to obtain registrations for its intellectual property rights for various reasons, including refusal by regulatory authorities to register trademarks or other intellectual property protections, prior registrations of which it is not aware, or it may encounter claims from prior users of similar intellectual property in areas where it operates or intends to conduct operations. This could harm its image, brand or competitive position and cause the Company to incur significant penalties and costs.

If the Company is unable to continually innovate and increase efficiencies, its ability to attract new customers may be adversely affected. In the area of innovation, the Company must be able to develop new technologies and products that appeal to its customers. This depends, in part, on the technological and creative skills of its personnel and on its ability to protect its intellectual property rights. The Company may not be successful in the development, introduction, marketing, and sourcing of new technologies or innovations, that satisfy customer needs, achieve market acceptance, or generate satisfactory financial returns.

Limited market for securities

There can be no assurance that an active and liquid market for our shares will develop or be maintained.

There is no active market for our shares, and no significant U.S. market may develop. If such a market develops, prices on that market are also likely to be highly volatile. As a result, an investor may find it difficult to sell, or to obtain accurate quotations of the price of our shares.

Emerging industry

As a participant in the emerging plant-based industry, the Company will have limited access to industry benchmarks in relation to its business. Industry-specific data points such as operating ratios, research and development projects, debt structures, compliance and other financial and operational related data is limited and accordingly, management will be required to make decisions in the absence of such data points.

Key personnel risks

Our efforts are dependent to a large degree on the skills and experience of certain of its key personnel, including the Board. The Company does not maintain "key man" insurance policies on these individuals. Should the availability of these persons' skills and experience be in any way reduced or curtailed, this could have a material adverse outcome on the Company and its securities. Our future success depends on its continuing ability to attract, develop, motivate and retain highly qualified and skilled employees. Qualified individuals are in high demand, and the Company may incur significant costs to attract and retain them.

Litigation

The Company may become party to litigation from time to time in the ordinary course of business which could adversely affect its business including as a result of contractual or other disputes or as a consequence of our being listed on the CSE and registered with the SEC. Should any litigation in which the Company becomes involved be determined against the Company, such decision could adversely affect our ability to continue operating and the market price for the Company's shares and could use significant resources. Even if the Company is involved in litigation and wins, litigation can redirect significant company resources. Litigation may also create a negative perception of our brand.

The Company may be forced to litigate to defend its intellectual property rights, or to defend against claims by third parties against the Company relating to intellectual property rights, or to protect its trade secrets or to determine the validity and scope of other parties' proprietary rights. Any such litigation could be very costly and could distract its management from focusing on operating our business. The existence or outcome of any such litigation could harm our business.

The Company may also become subject to litigation for possible product liability claims, which may have a material adverse effect on our reputation, business, results from operations and financial condition.

The Company may be named as a defendant in a lawsuit or regulatory action. The Company may also incur uninsured losses for liabilities which arise in the ordinary course of business, or which are unforeseen, including, but not limited to, employment liability and business loss claims. Any such losses could have a material adverse effect on our business, results of operations, sales, cash flow or financial condition.

The marketing and labeling of any food product in recent years has brought increased risk that consumers will bring class action lawsuits and that the U.S. Federal Trade Commission (the "FTC") and state attorneys general will bring legal action concerning the truth and accuracy of the marketing and labeling of the product. Examples of causes of action that may be asserted in a consumer class action lawsuit include fraud, unfair trade practices and breach of state consumer protection statutes. The FTC and/or state attorneys general may bring legal action that seeks removal of a product from the marketplace and impose fines and penalties. Even when unmerited, class claims, action by the FTC or state attorneys general enforcement actions can be expensive to defend and adversely affect our reputation with existing and potential customers and consumers and our corporate and brand image, which could have a material and adverse effect on our business, financial condition or results of operations.

Negative cash flow

The Company has not and does not expect to generate significant revenue or cash flow for a period of time. As a result of our negative cash flow, the Company will continue to rely on the issuance of securities or other sources of financing to generate the funds required to fund corporate expenditures. The Company may continue to have negative operating cash flow for the foreseeable future.

If our Company's business is unsuccessful, our shareholders may lose their entire investment

Although shareholders will not be bound by or be personally liable for our Company's expenses, liabilities or obligations beyond their total original capital contributions, should we suffer a deficiency in funds with which to meet our obligations, the shareholders as a whole may lose their entire investment in the Company.

As a "foreign private issuer", the Company is exempt from certain sections of the Securities Exchange Act of 1934 which results in shareholders having less complete and timely data than if the Company were a domestic U.S. issuer

Because we are a foreign private issuer under the Exchange Act, we are exempt from certain provisions of the securities rules and regulations in the United States that are applicable to U.S. domestic issuers, including:

• the rules under the Exchange Act requiring the filing of quarterly reports on Form 10-Q or current reports on Form 8-K with the SEC;

• the sections of the Exchange Act, including Section 14, regulating the solicitation of proxies, consents, or authorizations in respect of a security registered under the Exchange Act;

• the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and

• the selective disclosure rules by issuers of material nonpublic information under Regulation FD.

We are required to file an annual report on Form 20-F within four months of the end of each fiscal year. In addition, we publish our material events through press releases, distributed pursuant to the rules and regulations of the CSE. Press releases relating to material events will also be furnished to the SEC on Form 6-K. However, the information we are required to file with or furnish to the SEC will be less extensive and less timely compared to that required to be filed with the SEC by U.S. domestic issuers. As a result, you may not be afforded the same protections or information which would be made available to you were you investing in a U.S. domestic issuer.

In addition, due to our status as a foreign private issuer, the officers, directors and principal shareholders of our Company are exempt from the short-swing insider disclosure and profit recovery provisions of Section 16 of the Exchange Act. Therefore, these officers, directors and principal shareholders are exempt from short-swing profits which apply to insiders of U.S. issuers. The foregoing exemption results in shareholders having less data in this regard than is available with respect to U.S. issuers.

Loss of foreign private issuer status

If we lose our foreign private issuer status, we will be considered a U.S. domestic issuer starting with the first day of our next fiscal year after the loss of status. There are significant consequences to losing foreign private issuer status, some of which include:

• SEC reporting Canadian issuers must begin reporting as a U.S. domestic issuer using U.S. domestic forms such as Form 10-K for annual reports, Form 10-Q for quarterly reports and Form 8-K for current reports;

• non-SEC reporting Canadian issuers may be required to register and begin reporting with the SEC if they meet the registration thresholds required by the Exchange Act;

• directors, executive officers and shareholders of 10% or greater of the issuer's securities would become subject to the reporting requirements of the beneficial ownership reporting and short swing profit rules of Section 16 under the Exchange Act on acquisitions and dispositions of the issuer's securities;

• the requirement to comply with U.S. proxy rules for communication with shareholders;

• the loss of the availability of the Canada-US multijurisdictional disclosure system;

• financial statements must be presented under U.S. GAAP and can no longer be presented under IFRS or home country GAAP with a reconciliation to U.S. GAAP;

• the loss of certain corporate governance and other ongoing listing exemptions available to foreign private issuers listed on the New York Stock Exchange or NASDAQ; and

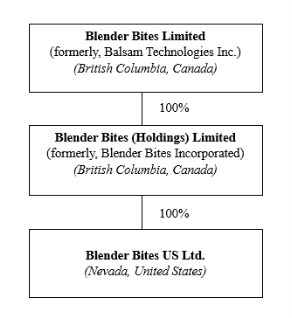

• all issuances of securities must be treated as an issuance by a U.S. domestic issuer which means (i) all privately placed securities will require a U.S. restrictive legend regardless of the jurisdiction of the purchaser, and (ii) any public offering of securities made by prospectus must first be reviewed and cleared with the SEC which would complicate the timing for, and likely make impractical, Canadian bought deal offerings.