Exhibit 5.3

December26, 2007

Hawker Beechcraft Acquisition Company, LLC

Hawker Beechcraft Notes Company

10511 East Central

Wichita, Kansas 67206

Ladies and Gentlemen:

We have acted as special counsel in the State of Arkansas (the “State”) to Arkansas Aerospace, Inc., an Arkansas corporation (herein the “Subsidiary Guarantor”) in connection with the consummation of the transactions described in a Registration Statement on Form S-1 dated December26, 2007 (the “Registration Statement”) filed with the U.S. Securities and Exchange Commission by Hawker Beechcraft Acquisition Company, LLC, a Delaware limited liability company, and Hawker Beechcraft Notes Company, a Delaware corporation, (collectively the “Issuers”), relating to certain notes of the Issuers (the “Notes”) and certain guarantees executed by the Subsidiary Guarantor, (the “Note Guarantees”) issued pursuant to the indenture dated March 26, 2007, relating to the 8.5% Senior Fixed Rate Notes due April 1, 2015, and the 8.875%/9.625% Senior PIK-Election Notes due April 1, 2015 and the indenture dated March 26, 2007 related to the 9.75% Senior Subordinated Notes due April 1, 2017, each by and among the Issuers, the Subsidiary Guarantor (in addition to other guarantors) and Wells Fargo Bank, N.A., as Trustee (in such capacity, the “Trustee”) (together the “Indentures”). Capitalized terms used but not defined herein shall have the meanings assigned to such terms in the Indentures.

December26, 2007

Page 2

In connection with this opinion, we have examined originals or copies, certified or otherwise identified to our satisfaction, of the following documents:

| | (a) | the Registration Statement; |

| | (c) | the form of Note Guarantees; |

| | (d) | the Certificate of Good Standing for the Subsidiary Guarantor issued by the Arkansas Secretary of State as of December26, 2007 (the “Certificate of Good Standing”); |

| | (e) | the Articles of Incorporation of the Subsidiary Guarantor and all amendments certified by the Arkansas Secretary of State as of December26, 2007 (the “Articles”); |

| | (f) | the Amended and Restated By-Laws of the Subsidiary Guarantor as provided by the Guarantor (the “By-Laws”); |

| | (g) | a certified copy of the Resolution approved by the Subsidiary Guarantor as of March 26, 2007 (the “Resolution”); and |

| | (h) | the Certificate of Incumbency of the Subsidiary Guarantor certified as of November 17, 2007 (the “Certificate of Incumbency”). |

Items (a) through (c) above are referred to hereinafter as the “Transactional Documents”; items (d) through (h) are referred to as the “Organizational Documents”; and together the Transactional Documents and the Organizational Documents are referred to as the “Documents.”

In addition, we have examined originals or copies, certified or otherwise identified to our satisfaction, of such public records, instruments and other documents and applicable statutes, regulations and court decisions of the State. We have made no independent investigation as to the accuracy or completeness of any representations, warranties, data or other information, written or oral, made or furnished by the Subsidiary Guarantor or by any of its agents, except as expressly set forth in this opinion. We have not made any investigation relating to the title to, or liens of any kind against, any real or personal property.

December26, 2007

Page 3

In rendering the opinions set forth in this letter, we have assumed with your consent and without independent investigation, the following:

| | A. | The genuineness of all signatures and the authenticity of all items submitted to us as originals and the conformity with originals of all items submitted to us as copies, and that all public records are accurate and complete; |

| | B. | The due authorization, execution and delivery of each of the Transactional Documents and all documentation in connection therewith by each of the parties thereto other than the Subsidiary Guarantor; |

| | C. | That each of the parties to the Transactional Documents (other than the Subsidiary Guarantor) is duly organized, validly existing and in good standing under the laws of the jurisdiction under which it is organized and has full power, authority, and legal right under the laws of such jurisdiction and under its organizational documents to execute and deliver and to observe and perform its obligations under the Transactional Documents to which it is a party; |

| | D. | That the Transactional Documents accurately reflect the complete understanding of the parties with respect to the transactions contemplated thereby, and the rights and obligations of the parties thereunder, and that the terms and conditions of the transaction as reflected in the Transactional Documents have not been amended, modified or supplemented by any other agreement or understanding of the parties or waiver of any of the material provisions of the Transactional Documents; |

| | E. | That each natural person executing any of the Transactional Documents is legally competent to do so. |

Subject to the foregoing assumptions, we are of the opinion that:

1. Based solely in reliance upon the Certificate of Good Standing, the Subsidiary Guarantor is validly existing as a corporation in good standing under the laws of the State, and, solely in reliance upon the Organizational Documents, with corporate power and authority to own its properties and conduct its business in the State.

2. The Note Guarantees have been duly authorized by the Subsidiary Guarantor and, constitute the valid and binding obligations of the Subsidiary Guarantor.

We are admitted and licensed to practice law only in the State. We do not hold ourselves out to be experts on the laws of any state other than the State and we express no opinion as to matters under or involving the laws of any jurisdiction other than laws of the State and its political subdivisions.

December26, 2007

Page 4

In addition to the assumptions set forth above, the opinions expressed herein are subject to the following qualifications and limitations:

| | (i) | In the event of conflicts among the Transactional Documents, we express no opinion as to which provision shall prevail. |

| | (ii) | Except as expressly set forth herein, we express no opinion as to any matters relating to the business affairs or condition (financial or otherwise) of the Issuers, or the Subsidiary Guarantor and no inference should be drawn that we have expressed any opinion on matters relating to the ability of the Issuers or the Subsidiary Guarantor to perform their respective obligations under the transactions described herein. |

| | (iii) | Except as expressly set forth herein, we have not undertaken any independent investigation of the facts and circumstances of the Issuers’ or the Subsidiary Guarantor’s business, business affairs or other matters pertaining to Issuers’ or Subsidiary Guarantor’s activities within the State. |

| | (iv) | This opinion does not consider or extend to any documents, agreements, representations or any other material of any kind concerning or referenced in the Transactional Documents not specifically mentioned above, and this opinion should in no way be considered as inclusive of any matters not set out herein. |

| | (v) | We have not reviewed and do not express any opinion with respect to the accuracy, truth or completeness of any oral or written representations concerning information about the transactions, the Issuers, the Subsidiary Guarantor or any matter related hereto which are made by any entity and provided to investors or anyone in connection with any sale of the obligations evidenced and secured by the Transactional Documents. |

| | (vi) | With your permission, we are not rendering, and we specifically disclaim, any opinion concerning the usury law of the State and its applicability, if any, to the Transactional Documents. |

The opinions set forth herein are expressed as of the date hereof, and rely upon the current status of law, and in all respects are subject to and will be limited by future legislation, as well as case law. We assume no obligations to update or supplement these opinions to reflect any facts that may hereafter come to our attention or any changes in law that may hereafter occur. We undertake no obligation to advise you of any changes in, or new developments that might affect, any matters or opinions set forth herein.

December26, 2007

Page 5

We hereby consent to the filing of this opinion as an exhibit to the Registration Statement and to the reference to us under the caption “Legal Matters” in the prospectus that is included in the Registration Statement. In giving this consent, we do not hereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act. Furthermore, Fried, Frank, Harris, Shriver & Jacobson LLP may rely on this opinion, as if it were addressed to them, in rendering their opinion that is being filed as Exhibit 5.1 to the Registration Statement. Except as set forth in the immediately preceding sentences, this opinion is rendered only to the addressees hereof and their respective successors and assigns and is solely for their benefit in connection with the above transactions.

Very truly yours,

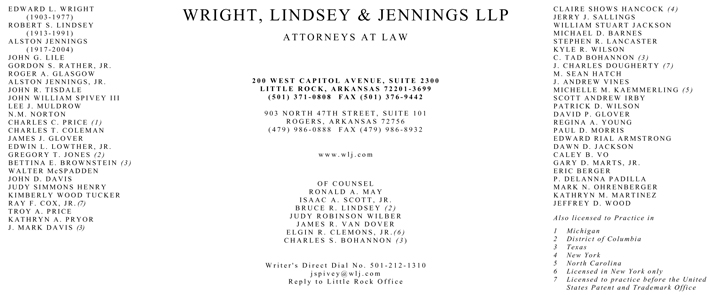

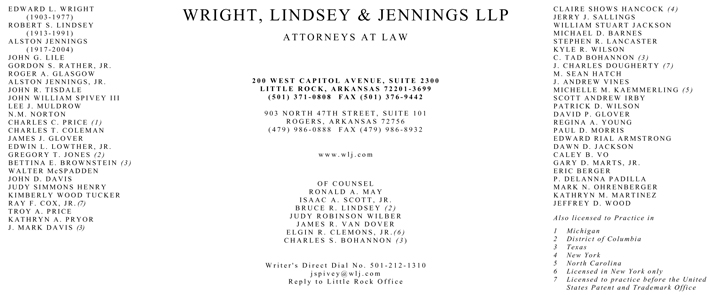

/s/ WRIGHT, LINDSEY & JENNINGS LLP

JRT/ndf