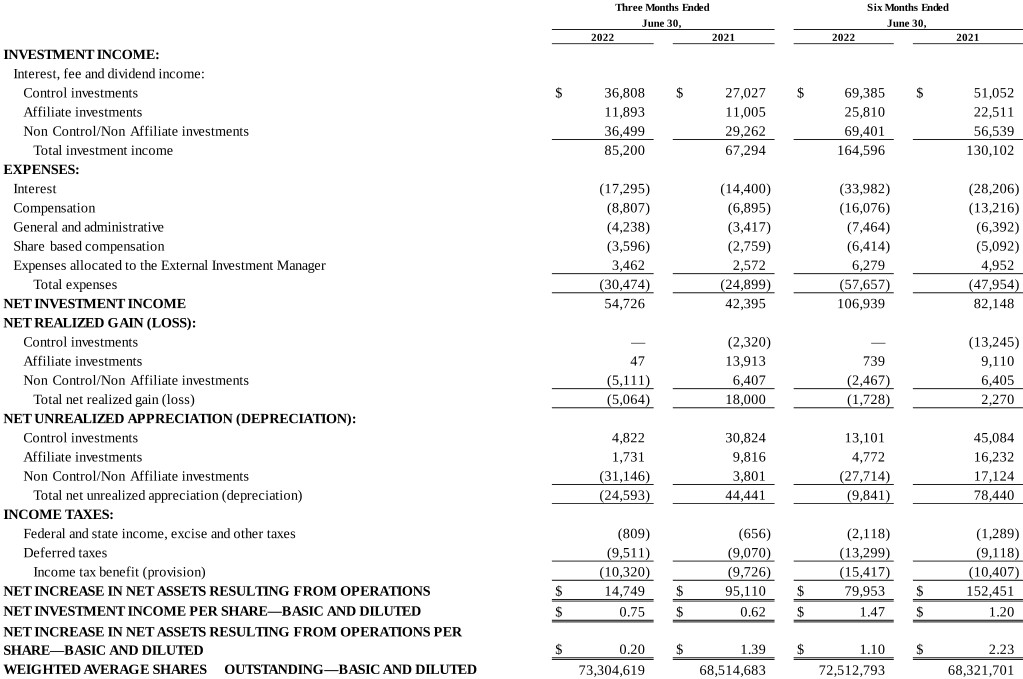

and expenses allocated were primarily related to an increase in assets under management. The combination of the dividend income we earned from the External Investment Manager and expenses we allocated to it resulted in a total contribution to our net investment income of $5.2 million, representing an increase of $1.3 million from the second quarter of 2021. The External Investment Manager ended the second quarter of 2022 with total assets under management of approximately $1.4 billion.

Second Quarter 2022 Financial Results Conference Call / Webcast

Main Street has scheduled a conference call for Friday, August 5, 2022 at 10:00 a.m. Eastern Time to discuss the second quarter 2022 financial results.

You may access the conference call by dialing 412-902-0030 at least 10 minutes prior to the start time. The conference call can also be accessed via a simultaneous webcast by logging into the investor relations section of the Main Street web site at http://www.mainstcapital.com.

A telephonic replay of the conference call will be available through Friday, August 12, 2022 and may be accessed by dialing 201-612-7415 and using the passcode 13731056#. An audio archive of the conference call will also be available on the investor relations section of the company’s website at http://www.mainstcapital.com shortly after the call and will be accessible for approximately 90 days.

For a more detailed discussion of the financial and other information included in this press release, please refer to the Main Street Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2022 to be filed with the Securities and Exchange Commission (www.sec.gov) and Main Street’s Second Quarter 2022 Investor Presentation to be posted on the investor relations section of the Main Street website at http://www.mainstcapital.com.

ABOUT MAIN STREET CAPITAL CORPORATION

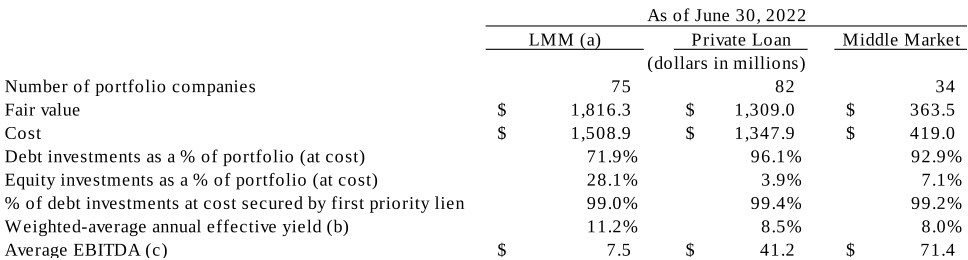

Main Street (www.mainstcapital.com) is a principal investment firm that primarily provides long-term debt and equity capital to lower middle market companies and debt capital to middle market companies. Main Street’s portfolio investments are typically made to support management buyouts, recapitalizations, growth financings, refinancings and acquisitions of companies that operate in diverse industry sectors. Main Street seeks to partner with entrepreneurs, business owners and management teams and generally provides “one stop” financing alternatives within its lower middle market investment strategy. Main Street’s lower middle market companies generally have annual revenues between $10 million and $150 million. Main Street’s private loan and middle market debt investments are made in businesses that are generally larger in size than its lower middle market portfolio companies.

Main Street, through its wholly owned portfolio company MSC Adviser I, LLC (“MSC Adviser”), also maintains an asset management business through which it manages investments for external parties. MSC Adviser is registered as an investment adviser under the Investment Advisers Act of 1940.

FORWARD-LOOKING STATEMENTS

Main Street cautions that statements in this press release which are forward-looking and provide other than historical information, including but not limited to our ability to successfully source and execute on new portfolio investments and delivery of future financial performance and results, are based on current conditions and information available to Main Street as of the date hereof and include statements regarding Main Street’s goals, beliefs, strategies and future operating results and cash flows. Although its management believes that the expectations reflected in those forward-looking statements are reasonable, Main Street can give no assurance that those expectations will prove to be correct. Those forward-looking statements are made based on various underlying assumptions and are subject to numerous uncertainties and risks, including, without limitation: Main Street’s continued effectiveness in raising, investing and managing capital; adverse changes in the economy generally or in the industries in which Main Street’s portfolio companies operate; the impacts of macroeconomic factors on Main Street and its portfolio companies’