UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number 001-33740

Cypress Sharpridge Investments, Inc.

(Exact name of registrant as specified in its charter)

| | |

| Maryland | | 20-4072657 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

| |

65 East 55th Street New York, New York | | 10022 |

| (Address of principal executive offices) | | (Zip Code) |

(212) 612-3210

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. Check one:

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | x (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| | |

Class | | Outstanding at April 23, 2010 |

| Common Stock ($0.01 par value) | | 18,767,654 |

TABLE OF CONTENTS

PART I Financial Information

| Item 1. | Financial Statements |

CYPRESS SHARPRIDGE INVESTMENTS, INC.

STATEMENTS OF ASSETS AND LIABILITIES

| | | | | | | | |

| | | March 31, 2010 | | | December 31, | |

| | | (Unaudited) | | | 2009* | |

ASSETS: | | | | | | | | |

Investments in securities, at fair value (cost, $1,788,097,306 and $1,846,995,280, respectively) | | $ | 1,808,070,824 | | | $ | 1,853,251,613 | |

Interest rate swap contracts, at fair value | | | — | | | | 1,131,487 | |

Cash and cash equivalents | | | 775,729 | | | | 1,889,667 | |

Receivable for securities sold | | | 24,827,457 | | | | 2,724,805 | |

Interest receivable | | | 6,807,387 | | | | 6,886,816 | |

Prepaid insurance | | | 174,239 | | | | 89,642 | |

Prepaid and deferred offering costs | | | 222,266 | | | | 222,266 | |

| | | | | | | | |

Total assets | | | 1,840,877,902 | | | | 1,866,196,296 | |

| | | | | | | | |

| | |

LIABILITIES: | | | | | | | | |

Repurchase agreements | | | 1,487,589,168 | | | | 1,372,707,572 | |

Interest rate swap contracts, at fair value | | | 10,539,628 | | | | 4,925,333 | |

Payable for securities purchased | | | 82,390,486 | | | | 229,838,772 | |

Distribution payable | | | 10,318,464 | | | | 10,316,082 | |

Accrued interest payable (including accrued interest on repurchase agreements of $230,248 and $353,856, respectively) | | | 4,922,748 | | | | 3,387,431 | |

Related party management fee payable | | | 353,408 | | | | 356,873 | |

Accrued expenses and other liabilities | | | 317,790 | | | | 373,251 | |

| | | | | | | | |

Total liabilities | | | 1,596,431,692 | | | | 1,621,905,314 | |

| | | | | | | | |

Contingencies (note 10) | | | | | | | | |

NET ASSETS | | $ | 244,446,210 | | | $ | 244,290,982 | |

| | | | | | | | |

| | |

Net Assets consist of: | | | | | | | | |

Common Stock, $0.01 par value, 500,000,000 shares authorized (18,760,844 and 18,756,512 shares issued and outstanding, respectively) | | $ | 187,608 | | | $ | 187,565 | |

Additional paid in capital | | | 309,698,999 | | | | 309,368,569 | |

Accumulated net realized gain (loss) on investments | | | (97,911,278 | ) | | | (87,363,976 | ) |

Net unrealized appreciation (depreciation) on investments | | | 9,433,890 | | | | 2,462,487 | |

Undistributed net investment income | | | 23,036,991 | | | | 19,636,337 | |

| | | | | | | | |

NET ASSETS | | $ | 244,446,210 | | | $ | 244,290,982 | |

| | | | | | | | |

NET ASSET VALUE PER SHARE | | $ | 13.03 | | | $ | 13.02 | |

| | | | | | | | |

| * | Derived from audited financial statements. |

See notes to financial statements.

1

CYPRESS SHARPRIDGE INVESTMENTS, INC.

SCHEDULES OF INVESTMENTS

MARCH 31, 2010 (UNAUDITED)

INVESTMENTS IN SECURITIES—UNITED STATES OF AMERICA

| | | | | | |

| | | Face Amount | | Fair Value |

Fixed Income Securities - 739.7%(d) | | | | | | |

Mortgage Pass-Through Agency RMBS - 733.9%(d) | | | | | | |

Fannie Mae Pools - 593.2%(d) | | | | | | |

2.835%, due 3/1/2034(a)(b) | | $ | 36,464,115 | | $ | 37,774,634 |

2.853%, due 1/1/2035(a)(b) | | | 28,276,520 | | | 29,301,544 |

3.2%, due 5/1/2034(b) | | | 7,456,363 | | | 7,745,297 |

3.272%, due 9/1/2034(a)(b) | | | 26,169,837 | | | 27,118,493 |

3.334%, due 8/1/2037(a)(b) | | | 22,731,123 | | | 23,583,540 |

3.693%, due 7/1/2039(a)(b) | | | 9,021,585 | | | 9,322,906 |

3.721%, due 9/1/2039(a)(b) | | | 34,430,844 | | | 35,642,809 |

3.77%, due 4/1/2035(a)(b) | | | 9,422,333 | | | 9,787,448 |

3.811%, due 9/1/2039(a)(b) | | | 34,409,034 | | | 35,716,577 |

3.891%, due 7/1/2039(a)(b) | | | 24,233,022 | | | 24,834,001 |

3.99%, due 10/1/2039(a)(b) | | | 49,565,544 | | | 51,766,255 |

3.997%, due 9/1/2039(a)(b) | | | 23,602,576 | | | 24,652,891 |

4%, due 1/1/2025(a) | | | 48,749,911 | | | 49,473,360 |

4%, due 1/1/2025(a) | | | 76,081,662 | | | 77,210,714 |

4%, due 12/1/2024(a) | | | 24,844,059 | | | 25,212,745 |

4%, due 2/1/2025(a) | | | 49,430,683 | | | 50,164,234 |

4%, due 3/1/2025(a) | | | 50,345,601 | | | 51,092,730 |

4.006%, due 9/1/2039(a)(b) | | | 45,214,366 | | | 46,920,304 |

4.016%, due 7/1/2039(a)(b) | | | 26,115,359 | | | 26,846,589 |

4.072%, due 6/1/2039(a)(b) | | | 23,795,121 | | | 24,758,823 |

4.096%, due 9/1/2039(a)(b) | | | 37,273,190 | | | 38,717,526 |

4.118%, due 8/1/2033(a)(b) | | | 5,216,549 | | | 5,425,211 |

4.5%, due 10/1/2024(a) | | | 47,333,248 | | | 49,079,844 |

4.5%, due 10/1/2024(a) | | | 45,571,294 | | | 47,252,875 |

4.5%, due 10/1/2024(a) | | | 14,012,167 | | | 14,529,216 |

4.5%, due 10/1/2024(a) | | | 34,110,214 | | | 35,368,881 |

4.5%, due 11/1/2024(a) | | | 59,204,130 | | | 61,388,763 |

4.5%, due 11/1/2024(a) | | | 13,859,034 | | | 14,370,432 |

4.5%, due 2/1/2025(a) | | | 73,850,790 | | | 76,575,884 |

4.5%, due 4/1/2030(a) | | | 30,500,151 | | | 31,043,359 |

4.5%, due 5/1/2024(a) | | | 15,122,609 | | | 15,680,633 |

4.5%, due 5/1/2024(a) | | | 16,501,304 | | | 17,110,203 |

4.5%, due 5/1/2030(a) | | | 50,000,000 | | | 50,719,000 |

4.5%, due 6/1/2024(a) | | | 30,381,446 | | | 31,502,522 |

4.5%, due 6/1/2024(a) | | | 20,782,437 | | | 21,549,309 |

4.5%, due 6/1/2024(a) | | | 25,339,142 | | | 26,274,157 |

4.5%, due 9/1/2024(a) | | | 2,890,910 | | | 2,997,585 |

4.5%, due 9/1/2024(a) | | | 25,908,632 | | | 26,864,661 |

4.5%, due 9/1/2024(a) | | | 27,627,150 | | | 28,646,592 |

5.285%, due 3/1/2038(a)(b) | | | 21,757,129 | | | 23,008,164 |

5.495%, due 11/1/2037(a)(b) | | | 6,500,355 | | | 6,874,125 |

5.5%, due 9/1/2023(a) | | | 43,816,683 | | | 46,849,674 |

5.861%, due 8/1/2037(a)(b) | | | 38,861,810 | | | 40,742,722 |

5.945%, due 11/1/2036(a)(b) | | | 29,630,243 | | | 31,111,755 |

6%, due 4/1/2038(a) | | | 22,336,877 | | | 23,729,357 |

6%, due 5/1/2037(a) | | | 13,142,202 | | | 13,730,973 |

| | | | | | |

Total Fannie Mae Pools | | | 1,401,889,354 | | | 1,450,069,317 |

| | | | | | |

2

CYPRESS SHARPRIDGE INVESTMENTS, INC.

SCHEDULES OF INVESTMENTS���(Continued)

MARCH 31, 2010 (UNAUDITED)

| | | | | | |

| | | Face Amount | | Fair Value |

Freddie Mac Pools - 130.2%(d) | | | | | | |

3.421%, due 4/1/2035(b) | | | 10,541,231 | | | 10,936,527 |

4.5%, due 1/1/2025(a) | | | 38,957,089 | | | 40,394,605 |

4.5%, due 12/1/2024(a) | | | 18,331,074 | | | 19,007,490 |

4.5%, due 12/1/2024(a) | | | 17,281,408 | | | 17,919,092 |

4.5%, due 2/1/2025(a) | | | 50,116,907 | | | 51,966,221 |

4.5%, due 7/1/2024(a) | | | 62,857,542 | | | 65,176,985 |

4.748%, due 12/1/2038(a)(b) | | | 9,947,291 | | | 10,496,382 |

4.972%, due 5/1/2038(a)(b) | | | 40,734,238 | | | 43,170,146 |

5.5%, due 9/1/2023 | | | 6,389,195 | | | 6,836,438 |

5.761%, due 11/1/2036(a)(b) | | | 23,922,827 | | | 25,231,405 |

5.826%, due 1/1/2036(b) | | | 3,420,589 | | | 3,570,239 |

5.971%, due 10/1/2037(a)(b) | | | 22,033,569 | | | 23,575,919 |

| | | | | | |

Total Freddie Mac Pools | | | 304,532,960 | | | 318,281,449 |

| | | | | | |

Ginnie Mae Pools - 10.5%(d) | | | | | | |

4.0%, due 1/1/2040(a)(b) | | | 24,931,870 | | | 25,749,885 |

| | | | | | |

Total Ginnie Mae Pools | | | 24,931,870 | | | 25,749,885 |

| | | | | | |

Total Mortgage Pass-Through Agency RMBS (cost - $1,755,626,698) | | | 1,731,354,184 | | | 1,794,100,651 |

| | | | | | |

Collateralized Loan Obligation Securities - 5.7%(d) | | | | | | |

AMMC CLO V, LTD(c) | | | 2,249,000 | | | 624,098 |

AMMC CLO VII, LTD(c)(e) | | | 3,900,000 | | | 1,248,000 |

ARES VIR CLO, LTD(c)(e) | | | 3,775,000 | | | 1,283,500 |

AVENUE CLO V, LTD(c)(e) | | | 2,000,000 | | | 160,000 |

BALLYROCK CLO 2006-2, LTD(c) | | | 4,270,000 | | | 2,647,400 |

CARLYLE HIGH YIELD PARTNERS VIII, LTD(c) | | | 3,000,000 | | | 900,000 |

EATON VANCE CDO IX, LTD(c)(e) | | | 2,500,000 | | | 743,750 |

FLAGSHIP CLO V, LTD(c) | | | 3,750,000 | | | 1,500,000 |

PRIMUS CLO I, LTD(c)(e) | | | 2,500,000 | | | 643,750 |

START III CLO, LTD(c) | | | 3,000,000 | | | 2,983,500 |

TRIMARAN CLO VII, LTD(c) | | | 2,000,000 | | | 1,100,000 |

| | | | | | |

Total Collateralized Loan Obligation Securities (cost - $26,582,177) | | | 32,944,000 | | | 13,833,998 |

| | | | | | |

Structured Notes - 0.1%(d) | | | | | | |

RESIX 2006-B B9, 6.23%, due 7/15/2038(b)(c) | | | 1,847,507 | | | 55,425 |

RESIX 2006-B B10, 7.73%, due 7/15/2038(b)(c) | | | 539,792 | | | 10,796 |

RESIX 2007-B B11, 8.73%, due 4/15/2039(b)(c) | | | 3,497,675 | | | 69,954 |

| | | | | | |

Total Structured Notes (cost - $5,888,431) | | | 5,884,974 | | | 136,175 |

| | | | | | |

Total Investments in Securities (cost - $1,788,097,306) | | $ | 1,770,183,158 | | $ | 1,808,070,824 |

| | | | | | |

3

CYPRESS SHARPRIDGE INVESTMENTS, INC.

SCHEDULES OF INVESTMENTS—(Continued)

MARCH 31, 2010 (UNAUDITED)

| | | | | | | |

| | | Notional Amount | | Fair Value | |

Unrealized Appreciation (Depreciation) on Interest Rate Swap Contracts - (4.3%)(d) | | | | | | | |

April 2012 Expiration, Pay Rate 1.691%, Receive Rate 3-Month LIBOR | | $ | 240,000,000 | | $ | (2,470,311 | ) |

June 2012 Expiration, Pay Rate 2.266%, Receive Rate 3-Month LIBOR | | | 200,000,000 | | | (4,178,718 | ) |

July 2012 Expiration, Pay Rate 2.125%, Receive Rate 3-Month LIBOR | | | 200,000,000 | | | (3,549,348 | ) |

November 2013 Expiration, Pay Rate 2.213%, Receive Rate 3-Month LIBOR | | | 100,000,000 | | | (341,251 | ) |

| | | | | | | |

Total Unrealized Appreciation (Depreciation) on Interest Rate Swap Contracts (Cost, $0) | | $ | 740,000,000 | | $ | (10,539,628 | ) |

| | | | | | | |

LEGEND

| (a) | Securities or a portion of the securities are pledged as collateral for repurchase agreements or interest rate swap contracts. |

| (b) | The coupon rate shown on floating or adjustable rate securities represents the rate at March 31, 2010. |

| (c) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may only be resold in transactions exempt from registration, normally to qualified institutional buyers. At March 31, 2010. the fair value of these securities amounted to $13,970,173 or 5.8% of net assets. |

| (d) | Percentage of net assets. |

| (e) | Non-income producing security. |

4

CYPRESS SHARPRIDGE INVESTMENTS, INC.

SCHEDULES OF INVESTMENTS—(Continued)

DECEMBER 31, 2009*

INVESTMENTS IN SECURITIES—UNITED STATES OF AMERICA

| | | | | | |

| | | Face Amount | | Fair Value |

Fixed Income Securities—758.6%(d) | | | | | | |

Mortgage Pass-Through Agency RMBS—754.7%(d) | | | | | | |

Fannie Mae Pools—652.2%(d) | | | | | | |

2.907%, due 1/1/2035(a)(b) | | $ | 29,968,527 | | $ | 31,010,529 |

2.993%, due 4/1/2036(a)(b) | | | 39,693,779 | | | 41,083,061 |

3.004%, due 7/1/2036(a)(b) | | | 34,473,372 | | | 35,679,941 |

3.007%, due 10/1/2036(a)(b) | | | 33,776,514 | | | 34,958,692 |

3.024%, due 6/1/2036(a)(b) | | | 32,282,832 | | | 33,412,732 |

3.281%, due 9/1/2034(a)(b) | | | 28,217,356 | | | 29,147,118 |

3.533%, due 8/1/2037(a)(b) | | | 24,301,362 | | | 25,125,421 |

3.71%, due 7/1/2039(b) | | | 9,464,706 | | | 9,674,350 |

3.726%, due 3/1/2034(a)(b) | | | 38,348,806 | | | 39,680,660 |

3.736%, due 5/1/2034(a)(b) | | | 7,506,917 | | | 7,763,278 |

3.744%, due 9/1/2039(a)(b) | | | 35,213,718 | | | 35,962,010 |

3.815%, due 9/1/2039(a)(b) | | | 34,774,099 | | | 35,599,984 |

3.99%, due 10/1/2039(a)(b) | | | 52,564,978 | | | 54,059,795 |

3.997%, due 9/1/2039(a)(b) | | | 24,760,921 | | | 25,472,797 |

4%, due 12/1/2024(a) | | | 25,206,097 | | | 25,367,574 |

4%, due 1/1/2025(a) | | | 49,442,119 | | | 49,758,858 |

4%, due 2/1/2025 | | | 75,000,000 | | | 75,480,469 |

4%, due 3/1/2025 | | | 50,000,000 | | | 49,984,375 |

4.028%, due 9/1/2039(a)(b) | | | 48,482,758 | | | 49,914,454 |

4.053%, due 7/1/2039(b) | | | 41,086,634 | | | 42,324,164 |

4.071%, due 6/1/2039(a)(b) | | | 23,842,099 | | | 24,599,324 |

4.089%, due 7/1/2039(a)(b) | | | 39,480,789 | | | 40,711,405 |

4.1%, due 9/1/2039(a)(b) | | | 47,540,515 | | | 48,996,443 |

4.11%, due 8/1/2033(a)(b) | | | 6,230,747 | | | 6,470,257 |

4.5%, due 1/1/2025 | | | 75,000,000 | | | 76,945,313 |

4.5%, due 10/1/2024(a) | | | 14,215,383 | | | 14,624,075 |

4.5%, due 10/1/2024(a) | | | 35,133,397 | | | 36,143,482 |

4.5%, due 10/1/2024(a) | | | 49,070,971 | | | 50,481,761 |

4.5%, due 10/1/2024(a) | | | 48,847,852 | | | 50,252,228 |

4.5%, due 11/1/2024(a) | | | 61,023,597 | | | 62,778,025 |

4.5%, due 11/1/2024(a) | | | 14,050,143 | | | 14,454,084 |

4.5%, due 5/1/2024(a) | | | 17,126,118 | | | 17,618,494 |

4.5%, due 6/1/2024(a) | | | 32,265,407 | | | 33,193,038 |

4.5%, due 6/1/2024(a) | | | 21,583,471 | | | 22,203,996 |

4.5%, due 6/1/2024(a) | | | 27,170,767 | | | 27,951,927 |

4.5%, due 9/1/2024(a) | | | 27,005,239 | | | 27,781,640 |

4.5%, due 9/1/2024(a) | | | 28,600,339 | | | 29,422,599 |

4.5%, due 9/1/2024(a) | | | 2,928,860 | | | 3,013,065 |

4.562%, due 4/1/2035(a)(b) | | | 9,767,018 | | | 10,141,290 |

5.29%, due 3/1/2038(a)(b) | | | 23,875,089 | | | 25,188,219 |

5.5%, due 9/1/2023(a) | | | 47,390,027 | | | 50,204,995 |

5.564%, due 11/1/2037(a)(b) | | | 7,238,022 | | | 7,681,351 |

5

CYPRESS SHARPRIDGE INVESTMENTS, INC.

SCHEDULES OF INVESTMENTS—(Continued)

DECEMBER 31, 2009*

| | | | | | |

| | | Face Amount | | Fair Value |

5.859%, due 8/1/2037(a)(b) | | $ | 43,151,052 | | $ | 45,822,102 |

5.937%, due 11/1/2036(a)(b) | | | 32,327,827 | | | 34,369,653 |

5.983%, due 12/1/2036(a)(b) | | | 31,889,626 | | | 33,890,062 |

6%, due 4/1/2038(a) | | | 25,259,295 | | | 26,873,364 |

6%, due 5/1/2037(a) | | | 15,167,653 | | | 16,088,329 |

6.113%, due 5/1/2037(a)(b) | | | 22,463,223 | | | 23,923,332 |

| | | | | | |

Total Fannie Mae Pools | | | 1,544,210,021 | | | 1,593,284,115 |

| | | | | | |

| | |

Freddie Mac Pools—92.1%(d) | | | | | | |

4.145%, due 4/1/2035(a)(b) | | | 11,093,925 | | | 11,503,069 |

4.5%, due 7/1/2024 | | | 66,102,683 | | | 67,961,821 |

4.788%, due 12/1/2038(a)(b) | | | 11,411,495 | | | 11,960,387 |

4.978%, due 5/1/2038(a)(b) | | | 42,663,027 | | | 44,975,363 |

5.5%, due 9/1/2023(a) | | | 7,126,262 | | | 7,542,435 |

5.79%, due 11/1/2036(a)(b) | | | 39,662,375 | | | 41,981,830 |

5.956%, due 1/1/2036(a)(b) | | | 4,413,530 | | | 4,633,676 |

5.996%, due 10/1/2037(a)(b) | | | 32,382,377 | | | 34,406,275 |

| | | | | | |

Total Freddie Mac Pools | | | 214,855,674 | | | 224,964,856 |

| | | | | | |

| | |

Ginnie Mae Pools—10.4%(d) | | | | | | |

4.0%, due 1/1/2040(b) | | | 25,000,000 | | | 25,562,500 |

| | | | | | |

Total Ginnie Mae Pools | | | 25,000,000 | | | 25,562,500 |

| | | | | | |

Total Mortgage Pass-Through Agency RMBS (cost—$1,808,695,017) | | | 1,784,065,695 | | | 1,843,811,471 |

| | | | | | |

| | |

Collateralized Loan Obligation Securities—3.8%(d) | | | | | | |

AMMC CLO V, LTD(c)(e) | | | 2,249,000 | | | 494,780 |

AMMC CLO VII, LTD(c)(e) | | | 3,900,000 | | | 585,000 |

ARES VIR CLO, LTD(c)(e) | | | 3,775,000 | | | 792,750 |

AVENUE CLO V, LTD(c) | | | 2,000,000 | | | 80,000 |

BALLYROCK CLO 2006-2, LTD(c) | | | 4,270,000 | | | 1,750,700 |

CARLYLE HIGH YIELD PARTNERS VIII, LTD(c) | | | 3,000,000 | | | 210,000 |

EATON VANCE CDO IX, LTD(c) | | | 2,500,000 | | | 600,000 |

FLAGSHIP CLO V, LTD(c) | | | 3,750,000 | | | 825,000 |

PRIMUS CLO I, LTD(c)(e) | | | 2,500,000 | | | 500,000 |

START III CLO, LTD(c) | | | 3,000,000 | | | 2,660,400 |

TRIMARAN CLO VII, LTD(c) | | | 2,000,000 | | | 700,000 |

| | | | | | |

Total Collateralized Loan Obligation Securities (cost—$27,145,692) | | | 32,944,000 | | | 9,198,630 |

| | | | | | |

| | |

Structured Notes—0.1%(d) | | | | | | |

RESIX 2006-B B9, 6.233%, due 7/15/2038(b)(c) | | | 1,849,306 | | | 55,479 |

RESIX 2006-B B10, 7.733%, due 7/15/2038(b)(c) | | | 1,849,306 | | | 36,986 |

RESIX 2006-C B11, 7.483%, due 7/15/2038(b)(c) | | | 708,387 | | | 14,168 |

RESIX 2007-A B11, 6.733%, due 2/15/2039(b)(c) | | | 3,246,274 | | | 64,925 |

RESIX 2007-B B11, 8.733%, due 4/15/2039(b)(c) | | | 3,497,675 | | | 69,954 |

| | | | | | |

Total Structured Notes (cost—$11,154,571) | | | 11,150,948 | | | 241,512 |

| | | | | | |

Total Investments in Securities (cost—$1,846,995,280) | | $ | 1,828,160,643 | | $ | 1,853,251,613 |

| | | | | | |

6

CYPRESS SHARPRIDGE INVESTMENTS, INC.

SCHEDULES OF INVESTMENTS—(Continued)

DECEMBER 31, 2009*

| | | | | | | |

| | | Notional Amount | | Fair Value | |

Unrealized Appreciation (Depreciation) on Interest Rate Swap Contracts—(1.6%)(d) | | | | | | | |

April 2012 Expiration, Pay Rate 1.691%, Receive Rate 3-Month LIBOR | | $ | 240,000,000 | | $ | (543,716 | ) |

June 2012 Expiration, Pay Rate 2.266%, Receive Rate 3-Month LIBOR | | | 200,000,000 | | | (2,558,748 | ) |

July 2012 Expiration, Pay Rate 2.125%, Receive Rate 3-Month LIBOR | | | 200,000,000 | | | (1,822,869 | ) |

November 2013 Expiration, Pay Rate 2.213%, Receive Rate 3-Month LIBOR | | | 100,000,000 | | | 1,131,487 | |

| | | | | | | |

Total Unrealized Appreciation (Depreciation) on Interest Rate Swap Contracts (Cost, $0) | | $ | 740,000,000 | | $ | (3,793,846 | ) |

| | | | | | | |

LEGEND

| * | Derived from audited financial statements. |

| (a) | Securities or a portion of the securities are pledged as collateral for repurchase agreements or interest rate swap contracts. |

| (b) | The coupon rate shown on floating or adjustable rate securities represents the rate at December 31, 2009. |

| (c) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may only be resold in transactions exempt from registration, normally to qualified institutional buyers. At December 31, 2009, the fair value of these securities amounted to $9,440,142 or 3.9% of net assets. |

| (d) | Percentage of net assets. |

| (e) | Non-income producing security. |

7

CYPRESS SHARPRIDGE INVESTMENTS, INC.

STATEMENTS OF OPERATIONS (UNAUDITED)

| | | | | | | | |

| | | Three Months Ended March 31, | |

| | | 2010 | | | 2009 | |

INVESTMENT INCOME - Interest income | | $ | 16,936,967 | | | $ | 9,321,345 | |

| | | | | | | | |

EXPENSES: | | | | | | | | |

Interest | | | 986,412 | | | | 1,389,508 | |

Management fees | | | 1,075,550 | | | | 711,769 | |

Related party management compensation | | | 330,473 | | | | 430,295 | |

General, administrative and other | | | 825,414 | | | | 420,174 | |

| | | | | | | | |

Total expenses | | | 3,217,849 | | | | 2,951,746 | |

| | | | | | | | |

Net investment income | | | 13,719,118 | | | | 6,369,599 | |

| | | | | | | | |

GAINS AND (LOSSES) FROM INVESTMENTS: | | | | | | | | |

Net realized gain (loss) on investments | | | (7,252,882 | ) | | | 1,441,876 | |

Net unrealized appreciation (depreciation) on investments | | | 13,717,185 | | | | 5,537,245 | |

| | | | | | | | |

Net gain (loss) from investments | | | 6,464,303 | | | | 6,979,121 | |

| | | | | | | | |

GAINS AND (LOSSES) FROM SWAP CONTRACTS: | | | | | | | | |

Net swap interest income (expense) | | | (3,294,420 | ) | | | (2,029,146 | ) |

Net unrealized appreciation (depreciation) on swap contracts | | | (6,745,782 | ) | | | 1,694,602 | |

| | | | | | | | |

Net gain (loss) from swap contracts | | | (10,040,202 | ) | | | (334,544 | ) |

| | | | | | | | |

NET INCOME | | $ | 10,143,219 | | | $ | 13,014,176 | |

| | | | | | | | |

NET INCOME PER COMMON SHARE: | | | | | | | | |

Basic | | $ | 0.54 | | | $ | 1.70 | |

| | | | | | | | |

Diluted | | $ | 0.54 | | | $ | 1.70 | |

| | | | | | | | |

See notes to financial statements.

8

CYPRESS SHARPRIDGE INVESTMENTS, INC.

STATEMENT OF CHANGES IN NET ASSETS (UNAUDITED)

| | | | |

| | | Three Months Ended

March 31, 2010 | |

Net income: | | | | |

Net investment income | | $ | 13,719,118 | |

Net realized gain (loss) on investment securities | | | (7,252,882 | ) |

Net unrealized appreciation (depreciation) on investments | | | 13,717,185 | |

Net gain (loss) on swap contracts | | | (10,040,202 | ) |

| | | | |

Net income | | | 10,143,219 | |

| | | | |

| |

Capital transactions: | | | | |

Distributions to shareholders | | | (10,318,464 | ) |

Amorization of related party compensation | | | 330,473 | |

| | | | |

Increase (Decrease) in net assets from capital transactions | | | (9,987,991 | ) |

| | | | |

Total increase in net assets | | | 155,228 | |

| |

Net assets: | | | | |

Beginning of period | | | 244,290,982 | |

| | | | |

End of period | | $ | 244,446,210 | |

| | | | |

See notes to financial statements.

9

CYPRESS SHARPRIDGE INVESTMENTS, INC.

STATEMENTS OF CASH FLOWS (UNAUDITED)

| | | | | | | | |

| | | Three Months Ended March 31, | |

| | | 2010 | | | 2009 | |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | |

Net income | | $ | 10,143,219 | | | $ | 13,014,176 | |

Adjustments to reconcile net income to net cash used in operating activities: | | | | | | | | |

Purchase of investment securities | | | (281,251,252 | ) | | | (217,927,409 | ) |

Proceeds from disposition of investment securities | | | 186,004,089 | | | | 51,341,204 | |

Proceeds from paydowns of investment securities | | | 144,651,088 | | | | 25,617,016 | |

Amortization of related party compensation | | | 330,473 | | | | 430,295 | |

Amortization of premiums on investment securities | | | 477,535 | | | | 133,339 | |

Net realized (gain) loss on investments | | | 7,252,882 | | | | (1,441,876 | ) |

Net realized (gain) loss on paydowns | | | 1,763,632 | | | | 222,738 | |

Net unrealized (appreciation) depreciation on swap contracts | | | 6,745,782 | | | | (1,694,602 | ) |

Net unrealized (appreciation) depreciation on investments | | | (13,717,185 | ) | | | (5,537,245 | ) |

Change in assets and liabilities: | | | | | | | | |

Receivable for securities sold | | | (22,102,652 | ) | | | (54,072,570 | ) |

Interest receivable | | | 79,429 | | | | (320,324 | ) |

Prepaid insurance | | | (84,597 | ) | | | (830,733 | ) |

Payable for securities purchased | | | (147,448,286 | ) | | | 130,257,137 | |

Related party management fee payable | | | (3,465 | ) | | | 20,216 | |

Accrued interest payable | | | 1,535,317 | | | | 2,203,863 | |

Accrued expenses and other liabilities | | | (55,461 | ) | | | (404,780 | ) |

| | | | | | | | |

Net cash used in operating activities | | | (105,679,452 | ) | | | (58,989,555 | ) |

| | | | | | | | |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | |

Proceeds from repurchase agreements | | | 4,110,677,556 | | | | 2,194,541,402 | |

Repayments of repurchase agreements | | | (3,995,795,960 | ) | | | (2,139,161,492 | ) |

Offering costs paid | | | — | | | | (469,944 | ) |

Distributions paid | | | (10,316,082 | ) | | | — | |

| | | | | | | | |

Net cash provided by financing activities | | | 104,565,514 | | | | 54,909,966 | |

| | | | | | | | |

Net decrease in cash and cash equivalents | | | (1,113,938 | ) | | | (4,079,589 | ) |

CASH AND CASH EQUIVALENTS - Beginning of period | | | 1,889,667 | | | | 7,156,140 | |

| | | | | | | | |

CASH AND CASH EQUIVALENTS - End of period | | $ | 775,729 | | | $ | 3,076,551 | |

| | | | | | | | |

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION | | | | | | | | |

Interest paid | | $ | 3,108,816 | | | $ | 2,521,023 | |

| | | | | | | | |

SUPPLEMENTAL DISCLOSURES OF NONCASH INFORMATION | | | | | | | | |

Distributions declared, not yet paid | | $ | 10,318,464 | | | $ | — | |

| | | | | | | | |

Change in accrued offering costs | | $ | — | | | $ | (405,132 | ) |

| | | | | | | | |

See notes to financial statements.

10

CYPRESS SHARPRIDGE INVESTMENTS, INC.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

1. ORGANIZATION

Cypress Sharpridge Investments, Inc. (the “Company”) was formed as a Maryland corporation on January 3, 2006, and commenced operations on February 10, 2006. The Company is externally managed and advised by Cypress Sharpridge Advisors LLC (the “Manager”), a Delaware limited liability company, pursuant to a management agreement (the “Management Agreement”). The Manager is a joint venture between Cypress CSI Advisors LLC, a sponsor of private equity funds and leveraged buyouts of U.S. companies in the industrial, consumer, media and financial sectors, and Sharpridge Capital Management, L.P., a fixed income asset management company. Certain individuals associated with Cypress CSI Advisors LLC and Sharpridge Capital Management, L.P. serve on the Company’s board of directors and the Manager’s investment committee.

The Company has elected to be taxed and intends to continue to qualify as a real estate investment trust (“REIT”) and is required to comply with the provisions of the Internal Revenue Code of 1986, as amended (the “Code”), with respect thereto. The Company’s strategy had been to invest a majority of its capital in residential mortgage-backed securities (“RMBS”) that are issued and guaranteed by a federally chartered corporation, such as the Federal National Mortgage Association (“Fannie Mae”) or the Federal Home Loan Mortgage Corporation (“Freddie Mac”), or an agency of the U.S. government such as the Government National Mortgage Association (“Ginnie Mae”) (“Agency RMBS”), and subordinated tranches of asset-backed securities, including collateralized debt or loan obligations (“CLOs”). In March 2008, the board of directors amended the investment guidelines, pursuant to which the Company will invest exclusively in Agency RMBS. In March 2010, the board of directors further amended the investment guidelines so that the Company may also invest in collateralized mortgage obligations issued by Fannie Mae, Freddie Mac or Ginnie Mae. The Company’s common stock trades on the New York Stock Exchange under the symbol “CYS”.

2. SIGNIFICANT ACCOUNTING POLICIES

Consolidation and Basis of Presentation

The accompanying interim unaudited financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America for investment companies (“GAAP”) and the instructions to Form 10-Q and Article 10, Rule 10-01 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. The interim unaudited financial statements should be read in conjunction with the Company’s audited financial statements as of and for the year ended December 31, 2009, included in the annual report on Form 10-K. The results for interim periods are not necessarily indicative of the results to be expected for the fiscal year.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those management estimates.

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand, cash held in banks and highly liquid investments with original maturities of three months or less. Interest income earned on cash and cash equivalents is recorded in interest income.

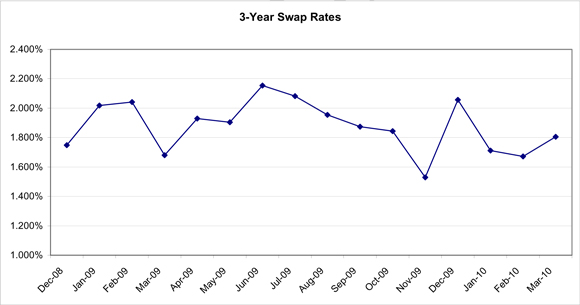

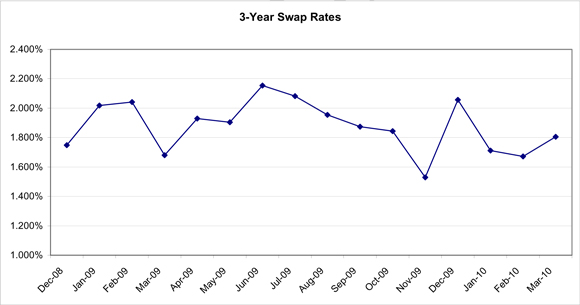

Interest Rate Swap Contracts

The Company utilizes interest rate swaps to hedge the interest rate risk associated with the financing of its portfolio. Specifically, the Company seeks to hedge the exposure to potential interest rate mismatches between the interest earned on investments and the borrowing costs caused by fluctuations in short term interest rates. In a simple interest rate swap, one investor pays a floating rate of interest on a notional principal amount and receives a fixed rate of interest on the same notional principal amount for a specified period of time. Alternatively, an investor may pay a fixed rate and receive a floating rate. Interest rate swaps are asset/liability management tools.

During the term of the interest rate swap, the Company makes or receives periodic payments and unrealized gains or losses are recorded as a result of marking the swap to its fair value. When the swap is terminated, the Company will record a realized gain or loss equal to the difference between the proceeds from (or cost of) the closing transaction and the Company’s basis in the contract, if any. The periodic payments and any realized or unrealized gains or losses are reported under gains and losses from swap contracts in the statement of operations. Swaps involve a risk that interest rates will move contrary to the Company’s expectations, thereby increasing its payment obligation.

11

CYPRESS SHARPRIDGE INVESTMENTS, INC.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)—(Continued)

The Company adopted Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 946,Clarification of the Scope of Audit and Accounting Guide Investment Companies(“ASC 946”), prior to its deferral in February 2008. Under ASC 946, the Company uses financial reporting for investment companies, and accordingly, its investments and interest rate swap contracts are carried at fair value with changes in fair value included in earnings. Consequently, there is no impact to designating interest rate swaps as cash flow or fair value hedges under the provisions of ASC 815,Accounting for Derivative Instruments and Hedging Activities.

The Company is exposed to credit loss in the event of nonperformance by the counterparty to the swap, limited to any gains recognized. However, the Company does not anticipate nonperformance by any counterparty. Should interest rates move unexpectedly, the Company may not achieve the anticipated benefits of the interest rate swap and may realize a loss.

Investment Valuation

Valuation of the Company’s investments is determined by the Manager. Investments are valued at their fair value based on quotations from brokers and dealers. The Manager normally seeks prices from at least three such brokers or dealers, although the Manager may rely on price quotes from fewer than three brokers or dealers in certain circumstances. The Manager reviews all prices used to ensure that current market conditions are represented. This review includes comparisons of similar market transactions or comparisons to a pricing model. The resulting unrealized gains and losses are reflected in the statement of operations.

Investment Transactions and Income

The Company records its transactions in securities on a trade date basis. Realized gains and losses on securities transactions are recorded on an identified cost basis. Interest income and expense are recorded on the accrual basis.Interest income on Agency RMBS and structured notes is accrued based on outstanding principal amount of the securities and their contractual terms. Interest on CLOs is accrued at a rate determined based on estimated future cash flows and adjusted prospectively as future cash flow amounts are recast. For CLO securities placed on nonaccrual status or when the Company cannot reliably estimate cash flows, the cost recovery method is used. Amortization of premium and accretion of discount are recorded using the yield to maturity method, and are included in interest income in the statement of operations.

Share-Based Compensation

The Company accounts for share-based compensation issued to its non-management directors and executive officers and certain officers and employees of its Manager and its sub-advisors and other individuals who provide services to the Company, as designated by its Manager (“Manager Designees”), using the fair value based methodology prescribed by ASC 718,Share-Based Payment (“ASC 718”). Compensation cost related to restricted common stock and common stock options issued to the Manager Designees is initially measured at estimated fair value at the grant date, and is remeasured on subsequent dates to the extent the awards are unvested. Compensation cost related to non-management directors is measured at its estimated fair value at the grant date and amortized and expensed over the vesting period. The Company has elected to use the straight line method pursuant to ASC 718 to amortize compensation expense for the restricted common stock and common stock options granted to the Manager Designees.

Income Taxes

The Company has elected to be taxed as a REIT and intends to continue to comply with provisions of the Code with respect thereto. As a REIT, the Company generally will not be subject to federal or state income tax. To maintain its qualification as a REIT, the Company must distribute at least 90% of its REIT taxable income to its stockholders and meet certain other tests relating to assets and income.

Earnings Per Share (“EPS”)

Basic EPS is computed using the two class method in accordance with ASC 260,Determining Whether Instruments Granted in Share-Based Payment Transactions Are Participating Securities(“ASC 260”), by dividing net income (loss) after adjusting for the impact of nonvested stock awards deemed to be participating securities, by the weighted average number of common shares outstanding calculated excluding nonvested stock awards. The impact of nonvested stock awards that are deemed participating securities and other dilutive instruments is included in the calculation of diluted EPS. Diluted EPS also reflects the potential additional dilution of common stock options and warrants, if they are not anti-dilutive. See note 3 for EPS computations.

Recent Accounting Pronouncements

In January 2010, the FASB provided additional disclosure requirements for fair value measurements under ASC 820, Fair Value Measurements and Disclosures. The new pronouncement requires a reporting entity to disclose the amounts of significant transfers in and out of Level 1 and Level 2 fair value measurements and describe the reasons for the transfers. In addition, the reconciliation for fair value measurements using significant unobservable inputs (Level 3) should present separately information about purchases, sales, issuances and settlements (that is, on a gross basis rather than as one net number). The Company adopted the pronouncement in January 2010, and it did not have a material effect on the Company’s financial statements.

12

CYPRESS SHARPRIDGE INVESTMENTS, INC.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)—(Continued)

3. EARNINGS PER SHARE

Components of the computation of basic and diluted EPS were as follows:

| | | | | | | |

| | | Three Months Ended March 31, |

| | | 2010 | | | 2009 |

Net income | | $ | 10,143,219 | | | $ | 13,014,176 |

Less dividends paid: | | | | | | | |

Common shares | | | (10,013,643 | ) | | | — |

Unvested shares | | | (304,821 | ) | | | — |

| | | | | | | |

Undistributed (overdistributed) earnings | | | (175,245 | ) | | | 13,014,176 |

| | | | | | | |

| | |

Basic weighted-average shares outstanding: | | | | | | | |

Common shares | | | 18,206,590 | | | | 7,596,256 |

| | | | | | | |

| | |

Basic earnings per common share: | | | | | | | |

Distributed earnings | | $ | 0.55 | | | $ | — |

Undistributed earnings | | | (0.01 | ) | | | 1.70 |

| | | | | | | |

Basic earnings per common share | | $ | 0.54 | | | $ | 1.70 |

| | | | | | | |

| | |

Diluted weighted-average shares outstanding: | | | | | | | |

Common shares | | | 18,206,590 | | | | 7,596,256 |

Net effect of dilutive warrants | | | 13,229 | | | | — |

| | | | | | | |

| | | 18,219,819 | | | | 7,596,256 |

| | | | | | | |

| | |

Diluted earnings per common share: | | | | | | | |

Distributed earnings | | $ | 0.55 | | | $ | — |

Undistributed earnings | | | (0.01 | ) | | | 1.70 |

| | | | | | | |

Diluted earnings per common share | | $ | 0.54 | | | $ | 1.70 |

| | | | | | | |

4. INVESTMENTS IN SECURITIES AND INTEREST RATE SWAP CONTRACTS

The Company’s valuation techniques are based on observable inputs. Observable inputs reflect readily obtainable data from independent sources, while unobservable inputs would reflect the Company’s market assumptions. ASC 820 classifies these inputs into the following hierarchy:

Level 1 Inputs—Quoted prices for identical instruments in active markets.

Level 2 Inputs—Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable.

Level 3 Inputs—Instruments with primarily unobservable value drivers.

Disclosures about the fair value of securities and derivatives, based on the level of inputs is summarized below:

March 31, 2010

| | | | | | | | | | | | |

| | | Fair Value Measurements Using |

| | Level 1 | | Level 2 | | Level 3 | | Total |

| | | (in thousands) |

Assets | | | | | | | | | | | | |

Agency RMBS | | $ | — | | $ | 1,794,101 | | $ | — | | $ | 1,794,101 |

CLOs and Structured Notes | | | — | | | 13,970 | | | — | | | 13,970 |

13

CYPRESS SHARPRIDGE INVESTMENTS, INC.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)—(Continued)

| | | | | | | | | | | | |

| | | Fair Value Measurements Using |

| | Level 1 | | Level 2 | | Level 3 | | Total |

| | | (in thousands) |

Total | | $ | — | | $ | 1,808,071 | | $ | — | | $ | 1,808,071 |

| | | | | | | | | | | | |

Liabilities | | | | | | | | | | | | |

Interest rate swap contracts | | $ | — | | $ | 10,540 | | $ | — | | $ | 10,540 |

| | | | | | | | | | | | |

Total | | $ | — | | $ | 10,540 | | $ | — | | $ | 10,540 |

| | | | | | | | | | | | |

December 31, 2009

| | | | | | | | | | | | |

| | | Fair Value Measurements Using |

| | Level 1 | | Level 2 | | Level 3 | | Total |

| | | (in thousands) |

Assets | | | | | | | | | | | | |

Agency RMBS | | $ | — | | $ | 1,843,811 | | $ | — | | $ | 1,843,811 |

CLOs and Structured Notes | | | — | | | 9,440 | | | — | | | 9,440 |

Interest rate swap contracts | | | — | | | 1,132 | | | — | | | 1,132 |

| | | | | | | | | | | | |

Total | | $ | — | | $ | 1,854,383 | | $ | — | | $ | 1,854,383 |

| | | | | | | | | | | | |

Liabilities | | | | | | | | | | | | |

Interest rate swap contracts | | $ | — | | $ | 4,925 | | $ | — | | $ | 4,925 |

| | | | | | | | | | | | |

Total | | $ | — | | $ | 4,925 | | $ | — | | $ | 4,925 |

| | | | | | | | | | | | |

The Agency RMBS portfolio consisted of Agency RMBS as follows:

March 31, 2010

| | | | | | | | | | | | | | |

| | | Par Amount | | Fair Value | | Weighted Average | |

Security Description | | | | Coupon | | | Months to

Reset(1) | | Constant

Prepayment

Rate(2) | |

| | | (in thousands) | | | | | | | | |

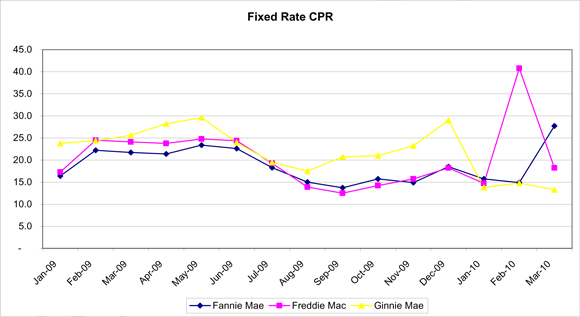

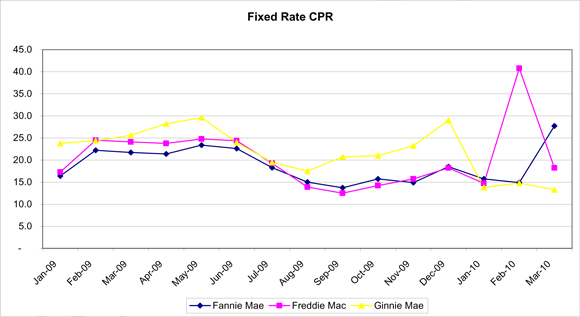

Agency RMBS collateralized by hybrid ARMs | | $ | 472,427 | | $ | 492,796 | | 4.4 | % | | 47.6 | | 32.8 | % |

Agency RMBS collateralized by short-reset hybrid ARMs(3) | | | 203,252 | | | 211,586 | | 3.9 | | | 10.0 | | 29.6 | |

Agency RMBS collateralized by fixed rate mortgages | | | 1,055,675 | | | 1,089,719 | | 4.5 | | | N/A | | 12.3 | |

| | | | | | | | | | | | | | |

Total Agency RMBS | | $ | 1,731,354 | | $ | 1,794,101 | | | | | | | | |

| | | | | | | | | | | | | | |

December 31, 2009

| | | | | | | | | | | | | | |

| | | Par Amount | | Fair Value | | Weighted Average | |

Security Description | | | | Coupon | | | Months to

Reset(1) | | Constant

Prepayment

Rate(2) | |

| | | (in thousands) | | | | | | | | |

Agency RMBS collateralized by hybrid ARMs | | $ | 565,396 | | $ | 586,834 | | 4.5 | % | | 46.8 | | 23.4 | % |

Agency RMBS collateralized by short-reset hybrid ARMs(3) | | | 263,728 | | | 275,717 | | 4.5 | | | 13.3 | | 19.0 | |

Agency RMBS collateralized by monthly reset ARMs | | | 140,226 | | | 145,134 | | 3.0 | | | 1 | | 11.2 | |

Agency RMBS collateralized by fixed rate mortgages | | | 814,716 | | | 836,126 | | 4.5 | | | N/A | | 9.0 | |

| | | | | | | | | | | | | | |

Total Agency RMBS | | $ | 1,784,066 | | $ | 1,843,811 | | | | | | | | |

| | | | | | | | | | | | | | |

| (1) | “Months to Reset” is the number of months remaining before the fixed rate on a hybrid ARM becomes a variable rate. At the end of the fixed period, the variable rate will be determined by the margin and the pre-specified caps of the ARM. |

| (2) | “Constant Prepayment Rate” is a method of expressing the prepayment rate for a mortgage pool that assumes that a constant fraction of the remaining principal is prepaid each month or year. Specifically, the constant prepayment rate is an annualized version of the prior three month prepayment rate. Securities with no prepayment history are excluded from this calculation. |

| (3) | “Short-reset” is defined as 24 months or less to reset. |

In early March 2010, both Freddie Mac and Fannie Mae announced they would purchase from the pools of mortgage loans underlying their mortgage pass-through certificates all mortgage loans that are more than 120 days delinquent. Freddie Mac implemented its purchase program in February 2010 with actual purchases beginning in March 2010. Fannie Mae began their process

14

CYPRESS SHARPRIDGE INVESTMENTS, INC.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)—(Continued)

in March 2010 and announced it would implement the initial purchases over a period of three months, beginning in April 2010. The impact of these programs thus far is reflected in the CPR of the Company’s portfolio. Further, both agencies announced that on an ongoing basis they would purchase loans from the pools of mortgage loans underlying their mortgage pass-through certificates that became 120 days delinquent.

As of March 31, 2010 and December 31, 2009, the Company’s Agency RMBS were purchased at a net premium to their par value, with a weighted-average amortized cost of $101.4 at each such date, due to the average interest rates on these investments being higher than prevailing market rates. As of March 31, 2010 and December 31, 2009, approximately $24.6 million and $25.0 million, respectively, of unamortized premium was included in the cost basis of the securities.

Actual maturities of Agency RMBS are generally shorter than stated contractual maturities (which range up to 30 years), as they are affected by the contractual lives of the underlying mortgages, periodic payments and prepayments of principal. As of March 31, 2010 and December 31, 2009, the average final contractual maturity of the Company’s Agency RMBS portfolio is in year 2030 and 2031, respectively. Based on current estimates, the Agency RMBS will have an average expected life of less than five years. Interest income on Agency RMBS for the three months ended March 31, 2010 and 2009 was $16.4 million and $9.0 million, respectively.

In order to mitigate its interest rate exposure, the Company enters into interest rate swap contracts. The Company did not enter into or terminate any interest rate swap contracts during the three months ended March 31, 2010 and 2009. As of March 31, 2010 and December 31, 2009, the Company had pledged Agency RMBS with a fair value of $24.3 and $19.5 million, respectively, as collateral on interest rate swap contracts. Below is a summary of our interest rate swap contracts:

| | | | | | | | | | | | | | | |

Derivatives not designated as hedging instruments under ASC 815(a) |

As of March 31, 2010 Expiration Date | | Pay Rate | | | Receive

Rate | | | Notional

Amount(c) | | Fair Value | | | Statement of Assets and Liabilities Location |

April 2012 | | 1.6910 | % | | 3-Month

LIBOR |

(b) | | $ | 240,000,000 | | $ | (2,470,311 | ) | | Interest rate swap contracts, at fair value |

June 2012 | | 2.2660 | % | | 3-Month

LIBOR |

(b) | | | 200,000,000 | | | (4,178,718 | ) | | Interest rate swap contracts, at fair value |

July 2012 | | 2.1250 | % | | 3-Month

LIBOR |

(b) | | | 200,000,000 | | | (3,549,348 | ) | | Interest rate swap contracts, at fair value |

November 2013 | | 2.2125 | % | | 3-Month

LIBOR |

(b) | | | 100,000,000 | | | (341,251 | ) | | Interest rate swap contracts, at fair value |

|

Derivatives not designated as hedging instruments under ASC 815(a) |

As of December 31, 2009 Expiration Date | | Pay Rate | | | Receive

Rate | | | Notional

Amount(c) | | Fair Value | | | Statement of Assets and Liabilities Location |

April 2012 | | 1.6910 | % | | 3-Month

LIBOR |

(b) | | $ | 240,000,000 | | $ | (543,716 | ) | | Interest rate swap contracts, at fair value |

June 2012 | | 2.2660 | % | | 3-Month

LIBOR |

(b) | | | 200,000,000 | | | (2,558,748 | ) | | Interest rate swap contracts, at fair value |

July 2012 | | 2.1250 | % | | 3-Month

LIBOR |

(b) | | | 200,000,000 | | | (1,822,869 | ) | | Interest rate swap contracts, at fair value |

November 2013 | | 2.2125 | % | | 3-Month

LIBOR |

(b) | | | 100,000,000 | | | 1,131,487 | | | Interest rate swap contracts, at fair value |

| | | | | | | | | | |

| | | | | Amount of Gain or (Loss)

Recognized in Income on Derivative | |

Derivatives not designated as hedging Instruments under ASC 815(a) | | Location of Gain or (Loss) Recognized in Income on Derivative | | Three Months Ended | |

| | | March 31, 2010 | | | March 31, 2009 | |

Interest rate swap contracts | | Net gain (loss) from swap contracts | | $ | (10,040,202 | ) | | $ | (334,544 | ) |

| (a) | See note 2 for additional information on the Company’s purpose for entering into interest rate swaps and the decision not to designate them as hedging instruments. |

| (b) | London InterBank Offered Rate (“LIBOR”). |

15

CYPRESS SHARPRIDGE INVESTMENTS, INC.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)—(Continued)

Credit Risk

As of March 31, 2010 and December 31, 2009, the Company has reduced its exposure to credit losses on its mortgage assets by purchasing Agency RMBS. The payment of principal and interest on the Agency RMBS are guaranteed by Freddie Mac, Fannie Mae and Ginnie Mae. In September 2008, both Freddie Mac and Fannie Mae were placed in the conservatorship of the United States government. While it is hoped that the conservatorship will help stabilize Freddie Mac’s and Fannie Mae’s losses and overall financial position, there can be no assurance that it will succeed or that, if necessary, Freddie Mac or Fannie Mae will be able to satisfy their guarantees of Agency RMBS.

The Company’s CLOs and structured notes do not have the backing of Fannie Mae, Freddie Mac or Ginnie Mae. Payment of principal and interest is dependent on the performance of the underlying loans, which are subject to borrower default and possible losses.

5. BORROWINGS

The Company leverages its Agency RMBS portfolio through the use of repurchase agreements. Each of the borrowing vehicles used by the Company bears interest at floating rates based on a spread above or below the LIBOR. The fair value of borrowings under repurchase agreements approximates their carrying amount due to the short-term nature of these financial instruments.

Certain information with respect to the Company’s borrowings is summarized in the following tables. Each of the borrowings listed is contractually due in one year or less (dollars in thousands).

| | | | |

March 31, 2010 | | | |

Outstanding borrowings | | $ | 1,487,589 | |

Interest accrued thereon | | $ | 230 | |

Weighted average borrowing rate | | | 0.26 | % |

Weighted average remaining maturity (in days) | | | 35.83 | |

Fair value of the collateral(1) | | $ | 1,567,098 | |

| |

December 31, 2009 | | | |

Outstanding borrowings | | $ | 1,372,708 | |

Interest accrued thereon | | $ | 354 | |

Weighted average borrowing rate | | | 0.28 | % |

Weighted average remaining maturity (in days) | | | 27.6 | |

Fair value of the collateral(1) | | $ | 1,445,191 | |

| (1) | Collateral for borrowings consists of Agency RMBS. |

At March 31, 2010 and December 31, 2009, the Company did not have any securities sold under agreement to repurchase where the amount at risk exceeded 10% of the Company’s net assets.

Market Risk

The current situation in the mortgage sector and the current weakness in the broader mortgage market could adversely affect one or more of the Company’s lenders and could cause one or more of the Company’s lenders to be unwilling or unable to provide additional financing. This could potentially increase the Company’s financing costs and reduce liquidity. If one or more major market participants fail, it could negatively impact the marketability of all fixed income securities, including Agency RMBS. This could negatively impact the value of the securities in the Company’s portfolio, thus reducing its net asset value. Furthermore, if the Company’s lenders are unwilling or unable to provide additional financing, the Company could be forced to sell its Agency RMBS at an inopportune time when prices are depressed. Even with the current situation in the mortgage sector, the Company does not anticipate having difficulty converting its assets to cash or extending financing terms due to the fact the principal and interest payments on the Company’s Agency RMBS are guaranteed by Freddie Mac, Fannie Mae or Ginnie Mae. In addition, the Company continues to diversify its borrowing arrangements among a number of counterparties to reduce its exposure to any one lender.

6. SHARE CAPITAL

The Company authorized 500,000,000 shares of common stock having par value of $0.01 per share. As of March 31, 2010 and December 31, 2009, the Company had issued and outstanding 18,760,844 and 18,756,512 shares of common stock, respectively, and warrants to purchase an additional 78,190 shares of common stock.

Below is a description of the warrants outstanding at March 31, 2010 and December 31, 2009:

March 31, 2010

| | | | | | |

Expiration | | Additional shares

of common stock | | Exercise Price | |

April 30, 2011 | | 78,190 | | $ | 11.00 | |

16

CYPRESS SHARPRIDGE INVESTMENTS, INC.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)—(Continued)

December 31, 2009

| | | | | | |

Expiration | | Additional shares

of common stock | | Exercise Price | |

April 30, 2011 | | 78,190 | | $ | 11.00 | |

The Company is also authorized to issue shares of preferred stock. As of March 31, 2010 and December 31, 2009, no such shares were issued or outstanding.

7. STOCK OPTIONS AND RESTRICTED STOCK

The Company has adopted a stock incentive plan (the “2006 Stock Incentive Plan”) that provides for the grant of non-qualified common stock options, stock appreciation rights, restricted common stock and other share-based awards. The compensation committee of the Company’s board of directors (the “Committee”) administers the plan. Awards under the 2006 Stock Incentive Plan may be granted to the Company’s directors and executive officers and Manager Designees.

The exercise price for any stock option granted under the 2006 Stock Incentive Plan may not be less than 100% of the fair value of the shares of common stock at the time the common stock option is granted. Each common stock option must terminate no later than ten years from the date it is granted. The 2006 Stock Incentive Plan authorizes a total of 3,333,333 shares that may be used to satisfy awards under the plan. New shares will be issued on the exercise of any option. As of March 31, 2010 and December 31, 2009, the remaining shares that have been authorized but not yet issued under the 2006 Stock Incentive Plan were 2,382,516 and 2,386,848, respectively. The following table summarizes restricted common stock transactions for the three months ended March 31, 2010 and 2009:

| | | | | | | | | |

Three months ended March 31, 2010 | | Officers and

Employees(1) | | | Directors | | | Total | |

Unvested Shares as of December 31, 2009 | | 538,000 | | | 14,988 | | | 552,988 | |

Issued | | — | | | 4,332 | | | 4,332 | |

Vested | | — | | | (3,100 | ) | | (3,100 | ) |

| | | | | | | | | |

Unvested Shares as of March 31, 2010 | | 538,000 | | | 16,220 | | | 554,220 | |

| | | | | | | | | |

| | | |

Three months ended March 31, 2009 | | Officers and

Employees(1) | | | Directors | | | Total | |

Unvested Shares as of December 31, 2008 | | 81,307 | | | 11,155 | | | 92,462 | |

Issued | | — | | | 3,100 | | | 3,100 | |

Vested | | (43,140 | ) | | (2,581 | ) | | (45,721 | ) |

| | | | | | | | | |

Unvested Shares as of March 31, 2009 | | 38,167 | | | 11,674 | | | 49,841 | |

| | | | | | | | | |

| (1) | Includes grants to the Company’s executive officers and Manager Designees. |

The shares of restricted common stock granted to the Company’s executive officers, Manager Designees and directors were valued using the fair value at the time of grant, which was $13.51 and $12.89 for shares granted on January 1, 2010 and 2009, respectively. Pursuant to ASC 718 the Company is required to value any unvested shares of restricted common stock granted to the Company’s executive officers and Manager Designees at the fair value at each reporting period. The Company valued the unvested restricted common stock at $13.38 and $13.51 per share at March 31, 2010 and December 31, 2009, respectively. Unrecognized compensation cost related to unvested restricted common stock granted as of March 31, 2010 and December 31, 2009 was $6,972,514 and $7,314,402, respectively.

There were no common stock option transactions for the three months ended March 31, 2010 and 2009. As of March 31, 2010 and December 31, 2009, there were 131,088 options outstanding and exercisable, with a weighted average exercise price of $30.00. The common stock options are valued using the Black-Scholes model using the following assumptions:

| | | |

| | | Three Months Ended

March 31, 2009 | |

Expected life | | 7.0 years | |

Discount rate | | 2.832 | % |

Volatility | | 86.78 | % |

Dividend yield | | 15.69 | % |

17

CYPRESS SHARPRIDGE INVESTMENTS, INC.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)—(Continued)

The estimated fair value of the common stock options was $3.31 per share for the three months ended March 31, 2009. The components of share based compensation expense for the three months ended March 31, 2010 and 2009 were as follows:

| | | | | | |

| | | Three Months Ended March 31, |

| | | 2010 | | 2009 |

Options granted to CEO | | $ | — | | $ | 57,278 |

Restricted shares granted to officers and employees(1) | | | 276,661 | | | 328,483 |

Restricted shares granted to certain directors | | | 53,812 | | | 44,534 |

| | | | | | |

Total shared based compensation expense | | $ | 330,473 | | $ | 430,295 |

| | | | | | |

| (1) | Includes grants to the Company’s executive officers and Manager Designees. |

8. MANAGEMENT AGREEMENT AND RELATED PARTY TRANSACTIONS

The Manager manages the Company’s day-to-day operations, subject to the direction and oversight of the Company’s board of directors. The Management Agreement was executed on February 10, 2006. The initial term of the Management Agreement expired on December 31, 2008, and it was automatically renewed for a one-year term and will continue to be automatically renewed for one-year terms on each anniversary date thereafter. The Management Agreement may be terminated upon the affirmative vote of at least two-thirds of the Company’s independent directors, or by a vote of the holders of a majority of the outstanding shares of the Company’s common stock. In the event the Management Agreement is terminated as described above, the Company shall pay to the Manager a termination fee in accordance with the provisions of the Management Agreement.

The Management Agreement provides, among other things, that the Company pays to the Manager, in exchange for managing the day-to-day operations of the Company, certain fees and reimbursements, consisting of a base management fee and reimbursement for out-of-pocket and certain other costs incurred by the Manager and on behalf of the Company. The base management fee, which is paid monthly, is equal to 1/12 of (A) 1.50% of the first $250,000,000 of Net Assets (as defined in the Management Agreement), (B) 1.25% of such Net Assets that are greater than $250,000,000 and less than or equal to $500,000,000, and (C) 1.00% of such Net Assets that are greater than $500,000,000.

For the three months ended March 31, 2010 and 2009, the Company incurred $937,197 and $409,780 in base management fees, respectively. The Company is required to reimburse the Manager for its pro-rata portion of rent, utilities, legal and investment services, market information systems and research publications and materials which amounted to $138,353 and $301,989 for the three months ended March 31, 2010 and 2009, respectively. In addition, the Company recognized share-based compensation expense related to common stock options and restricted common stock granted to the Company’s executive officers and Manager Designees which is included in related party management compensation on the statement of operations and described in note 7.

9. INCOME TAXES

The Company has elected to be taxed as a REIT under Section 856 of the Code and intends to continue to comply with the provisions of the Code. As a REIT, the Company generally is not subject to federal or state income tax. To maintain its qualification as a REIT, the Company must distribute at least 90% of its REIT taxable income to its stockholders each year and meet certain other tests relating to assets and income. If the Company fails to qualify as a REIT in any taxable year, the Company will be subject to federal income tax on its taxable income at regular corporate rates. The Company may also be subject to certain state and local taxes. Under certain circumstances, even though the Company qualifies as a REIT, federal income and excise taxes may be due on its undistributed taxable income. No provision for income taxes has been provided in the accompanying financial statements related to the REIT, because the Company has paid or will pay dividends in amounts approximating its taxable income.

Book/tax differences primarily relate to amortization of realized losses on swaps, offering costs, related party management compensation expense and income on CLOs.

The tax character of the $2.10 of distributions declared to shareholders during 2009 was determined to be $0.48 as ordinary income and $1.62 as return of capital.

10. CONTINGENCIES

The Company enters into certain contracts that contain a variety of indemnifications, principally with the Manager and brokers. The maximum potential amount of future payment the Company could be required to make under these indemnification provisions is unlimited. The Company has not incurred any costs to defend lawsuits or settle claims related to these indemnification agreements. As a result, the estimated fair value of these agreements is minimal. Accordingly, the Company has no liabilities recorded for these agreements as of March 31, 2010 and December 31, 2009.

18

CYPRESS SHARPRIDGE INVESTMENTS, INC.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)—(Continued)

11. FINANCIAL INSTRUMENTS WITH OFF-BALANCE SHEET RISK OR CONCENTRATIONS OF CREDIT RISK

In the normal course of its business, the Company trades various financial instruments and enters into various investment activities with off-balance sheet risk, including interest rate swap contracts. These financial instruments contain varying degrees of off-balance sheet risk whereby losses resulting from changes in the fair values of the securities underlying the financial instruments or the Company’s obligations thereunder may ultimately exceed the amount recognized in the statement of assets and liabilities.

The contract amounts of the swap contracts do not represent the Company’s risk of loss due to counterparty nonperformance. The Company’s exposure to credit risk associated with counterparty nonperformance on swap contracts is limited to the unrealized gains, if any, inherent in such contracts which are recognized in the statement of assets and liabilities. Any counterparty nonperformance of these transactions is not expected to have a material effect on the Company’s financial condition.

The Company’s investments are primarily concentrated in securities that pass through collections of principal and interest from underlying mortgages, and there is a risk that some borrowers on the underlying mortgages will default. Therefore, mortgage-backed securities may bear some exposure to credit losses. However, the Company mitigates credit risk by primarily holding securities that are either guaranteed by government (or government-sponsored) agencies.

The Company bears certain other risks typical in investing in a portfolio of mortgage-backed securities. The principal risks potentially affecting the Company’s financial position, results of operations and cash flows include the risks that: (a) interest rate changes can negatively affect the fair value of the Company’s mortgage-backed securities, (b) interest rate changes can influence borrowers’ decisions to prepay the mortgages underlying the securities, which can negatively affect both cash flows from, and the fair value of, the securities, and (c) adverse changes in the fair value of the Company’s mortgage-backed securities and/or the inability of the Company to renew short term borrowings under repurchase agreements can result in the need to sell securities at inopportune times and incur realized losses.

The Company enters into derivative transactions with counterparties as hedges of interest rate exposure and in the course of investing. In the event of nonperformance by a counterparty, the Company is potentially exposed to losses, although the counterparties to these agreements are primarily major financial institutions with investment grade ratings.

The Company is subject to interest rate risk. Generally, the value of fixed income securities will change inversely with changes in interest rates. As interest rates rise, the market value of fixed income securities tends to decrease. Conversely, as interest rates fall, the market value of fixed income securities tends to increase.

The Company’s principal trading activities are primarily with brokers and other financial institutions located in North America. All securities transactions of the Company are cleared by multiple major securities firms pursuant to customer agreements. At March 31, 2010 and December 31, 2009, substantially all the investments in securities and receivable for securities sold are positions with and amounts due from these brokers. The Company had substantially all of its individual counterparty concentrations with these brokers and their affiliates.

12. FINANCIAL HIGHLIGHTS

In accordance with financial reporting requirements applicable to investment companies, the Company has included below certain financial highlight information for the three months ended March 31, 2010 and 2009.

19

CYPRESS SHARPRIDGE INVESTMENTS, INC.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)—(Continued)

| | | | | | | | | | | | |

| | | Per Share |

| | | Three Months Ended March 31, |

| | | 2010 | | 2009 |

Net asset value, beginning of period | | $ | 13.02 | | | | | $ | 12.89 | | | |

Net income: | | | | | | | | | | | | |

Net investment income | | | 0.73 | | | (a) | | | 0.83 | | | (a) |

Net gain (loss) from investments and swap contracts | | | (0.19 | ) | | (a) | | | 0.87 | | | (a) |

| | | | | | | | | | | | |

Net income | | | 0.54 | | | | | | 1.70 | | | |

Capital transactions: | | | | | | | | | | | | |

Distributions to shareholders | | | (0.55 | ) | | (a) | | | — | | | |

Issuance of common shares and amortization of restricted shares | | | 0.02 | | | (a) | | | 0.05 | | | (a) |

| | | | | | | | | | | | |

Net decrease in net asset value from capital transactions | | | (0.53 | ) | | | | | 0.05 | | | |

| | | | | | | | | | | | |

Net asset value, end of period | | $ | 13.03 | | | | | $ | 14.64 | | | |

| | | | | | | | | | | | |

Total return (%) | | | 4.30 | % | | (b) | | | 13.58 | % | | (b) |

| | | | |

Ratios to Average Net Assets | | | | | | | | | | | | |

Expenses before interest expense | | | 3.63 | % | | (c) | | | 5.97 | % | | (c) |

Expenses | | | 5.23 | % | | (c) | | | 11.27 | % | | (c) |

Net investment income | | | 22.31 | % | | (c) | | | 24.32 | % | | (c) |

| (a) | Calculated based on average shares outstanding during the period. Average shares outstanding include vested and unvested restricted shares and differs from weighted average shares outstanding used in calculating EPS (see note 3). |

| (b) | Calculated based on net asset value per share. Not computed on an annualized basis. |

| (c) | Computed on an annualized basis. |

13. SUBSEQUENT EVENTS

On April 1, 2010, an aggregate of 6,810 shares of restricted common stock were granted to certain directors as a portion of their compensation for serving on the Company’s board of directors.

20

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

In this quarterly report on Form 10-Q, we refer to Cypress Sharpridge Investments, Inc. as “we,” “us,” “our company,” or “our,” unless we specifically state otherwise or the context indicates otherwise. The following defines certain of the commonly used terms in this quarterly report on Form 10-Q: RMBS refers to residential mortgage-backed securities; agency securities or Agency RMBS refers to our RMBS that are issued or guaranteed by a federally chartered corporation, such as the Federal National Mortgage Association (“Fannie Mae”) or the Federal Home Loan Mortgage Corporation (“Freddie Mac”), or an agency of the U.S. government, such as the Government National Mortgage Association (“Ginnie Mae”); hybrids refers to hybrid adjustable-rate mortgage loans that have interest rates that are fixed for a specified period of time and, thereafter, generally adjust annually to an increment over a specified interest rate index; and ARMs refers to hybrids and adjustable-rate mortgage loans which typically have interest rates that adjust annually to an increment over a specified interest rate index.

The following discussion should be read in conjunction with our financial statements and accompanying notes included in Item 1 of this quarterly report on Form 10-Q as well as our Annual Report on Form 10-K for the fiscal year ended December 31, 2009 filed on February 10, 2010.

Forward Looking Statements

When used in this quarterly report on Form 10-Q, in future filings with the Securities and Exchange Commission (“SEC”) or in press releases or other written or oral communications, statements which are not historical in nature, including those containing words such as “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may” or similar expressions, are intended to identify “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and, as such, may involve known and unknown risks, uncertainties and assumptions. The forward-looking statements we make in this quarterly report on Form 10-Q include, but are not limited to, statements about the following:

| | • | | our investment, financing and hedging strategy and the success of these strategies; |

| | • | | the effect of increased prepayment rates on our portfolio; |

| | • | | our ability to convert our assets into cash or extend the financing terms related to our assets; |

| | • | | our ability to quantify risks based on historical experience; |

| | • | | our ability to be taxed as a real estate investment trust (“REIT”) and to maintain an exemption from registration under the Investment Company Act of 1940, as amended (the “Investment Company Act”); |

| | • | | our assessment of counterparty risk; |

| | • | | our asset valuation policies; |

| | • | | our distribution policy; and |

| | • | | the effect of recent U.S. Government actions on the housing and credit markets. |

Forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. These beliefs, assumptions and expectations are subject to risks and uncertainties and can change as a result of many possible events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. The following factors could cause actual results to vary from our forward-looking statements:

| | • | | the factors referenced in this quarterly report on Form 10-Q and our annual report on Form 10-K for the fiscal year ended December 31, 2009, including those set forth under the section captioned “Risk Factors;” |

| | • | | changes in our investment, financing and hedging strategy; |

| | • | | the adequacy of our cash flow from operations and borrowings to meet our short term liquidity requirements; |

| | • | | the liquidity of our portfolio; |

| | • | | unanticipated changes in our industry, interest rates, the credit markets, the general economy or the real estate market; |

| | • | | changes in interest rates and the market value of our Agency RMBS; |

| | • | | changes in the prepayment rates on the mortgage loans underlying our Agency RMBS; |

| | • | | our ability to borrow to finance our assets; |

| | • | | changes in government regulations affecting our business; |

| | • | | our ability to maintain our qualification as a REIT for federal income tax purposes; |

| | • | �� | our ability to maintain our exemption from registration under the Investment Company Act; and |

| | • | | risks associated with investing in real estate assets, including changes in business conditions and the general economy. |

21

These and other risks, uncertainties and factors, including those described elsewhere in this report, could cause our actual results to differ materially from those projected in any forward-looking statements we make. All forward-looking statements speak only as of the date on which they are made. New risks and uncertainties arise over time and it is not possible to predict those events or how they may affect us. Except as required by law, we are not obligated to, and do not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Overview

We are a specialty finance company created with the objective of achieving consistent risk-adjusted investment income. We seek to achieve this objective by investing, on a leveraged basis, in Agency RMBS. We are currently managed by Cypress Sharpridge Advisors LLC, a joint venture between affiliates of The Cypress Group and Sharpridge Capital Management, L.P.

We earn investment income from our investment portfolio, and we use leverage to seek to enhance our returns. Our net investment income is generated primarily from the difference, or net spread, between the interest income we earn on our investment portfolio and the cost of our borrowings and hedging activities. The amount of net investment income we earn on our investments depends in part on our ability to control our financing costs, which comprise a significant portion of our operating expenses. Although we leverage our portfolio investments in Agency RMBS to seek to enhance our potential returns, leverage also may exacerbate losses.

While we use hedging to mitigate some of our interest rate risk, we do not hedge all of our exposure to changes in interest rates. This is because there are practical limitations on our ability to insulate our portfolio from all potential negative consequences associated with changes in short term interest rates in a manner that will allow us to seek attractive spreads on our portfolio.

In addition to investing in issued pools of Agency RMBS, we occasionally utilize forward-settling purchases of Agency RMBS where the pool is “to-be-announced”, or TBAs. Pursuant to these TBA transactions, we agree to purchase, for future delivery, Agency RMBS with certain principal and interest terms and certain types of underlying collateral, but the particular Agency RMBS to be delivered is not identified until shortly before the TBA settlement date.

In March 2010, the board of directors amended our investment guidelines to permit investments in collateralized mortgage obligations issued by a government agency or a government sponsored entity that are collateralized by Agency RMBS (“CMOs”). As of March 31, 2010, we had not invested in any CMOs.

In February 2006, we completed our initial capitalization pursuant to which we raised net proceeds of $78.0 million. In December 2006, we completed an additional private offering in which we raised $105.8 million in net proceeds. In May 2008, we completed an additional private offering in which we raised $14.0 million in net proceeds. In June 2009, we successfully completed an initial public offering of 10.5 million shares of common stock, raising $105.8 million in net proceeds after offering expenses and the underwriters’ exercise of their over-allotment option.

We have elected to be taxed as a REIT and have complied, and intend to continue to comply, with the provisions of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”) with respect thereto. Accordingly, we do not expect to be subject to federal income tax on our REIT taxable income that we currently distribute to our stockholders if certain asset, income and ownership tests and recordkeeping requirements are fulfilled. Even if we maintain our qualification as a REIT, we may be subject to some federal, state and local taxes on our income.

Factors that Affect our Results of Operations and Financial Condition