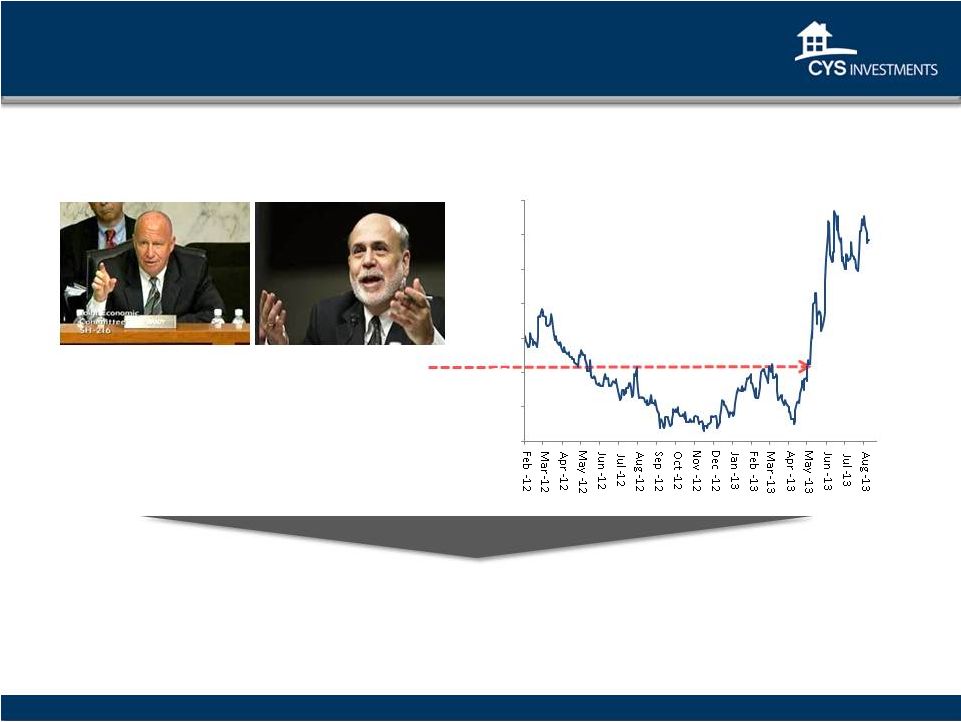

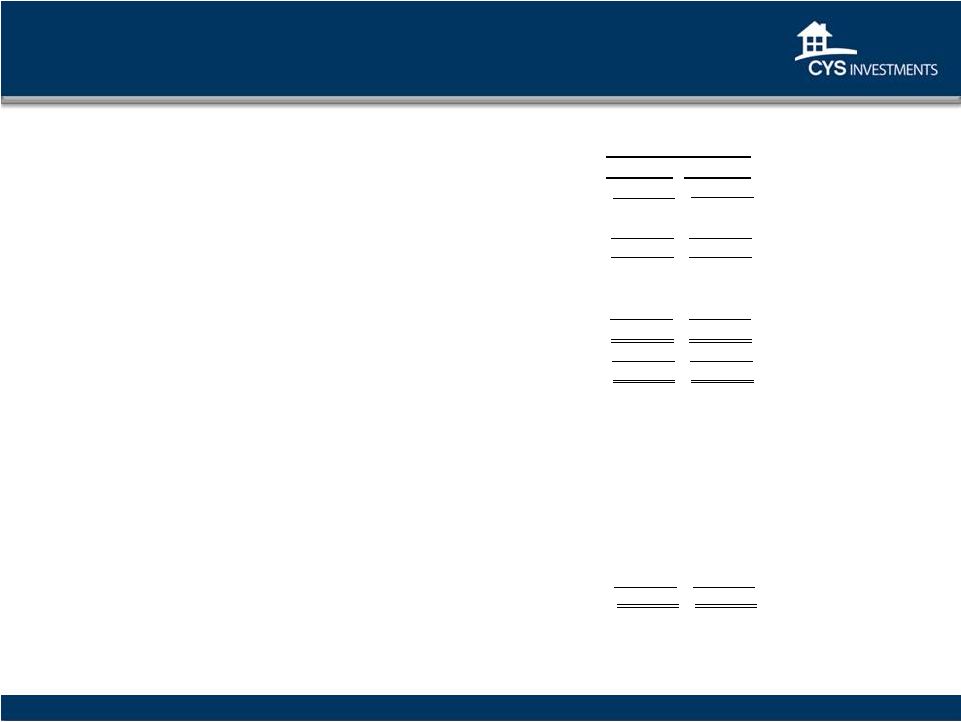

12 Yellen (Age 66) Summers (Age 59) Quantitative Easing Believes QE is effective, indeed powerful. Source: Macroeconomic Advisers, Barclays Balance Sheet Expansion Policies Must be considered in a cost-benefit framework. Focused on financial stability risks, has concerns regarding costs of further expanding the Fed’s balance sheet. Must be considered in a cost-benefit framework. Favors more aggressive asset purchase programs than Bernanke - and than the FOMC - undertook. Forward Guidance Links financial stability risks to rates being very low for too long - i.e.any policy that keeps rates lower for longer. Less inclined to move to more-aggressive forward rate guidance. Prefers more aggressive forward rate guidance than the FOMC. Labor Force Participation Concerned about hysteresis, but believes that there is not much evidence of an increase in structural unemployment. Yellen likely more inclined to delay. Concerned about hysteresis, but inclined to believe that cyclical unemployment may have already become structural unemployment. If Summers believes that there could be less slack in the economy (than Yellen), he may be more likely to raise rates when the unemployment rate reaches 6½%. Thesis Developing on a Larry Summers Fed: Significant Questions about FOMC Approach in 2014 - 2018 (- 2022?) In the short term, Yellen and Summers are more alike than different, and both are constrained by current FOMC and Chairman guidance - monetary policy will remain broadly the same. Policy differences will arise only if the economy evolves differently from FOMC expectations. Skeptical, and more concerned about financial stability risks of a very long period of low rates. More cautious about increasing the pace of asset purchases, should the economy weaken. |