Issuer Free Writing Prospectus

Relating to S-3 Registration Statement

Filed Pursuant to Rule 433

Registration Nos. 333- 141357 and 333-141357-01

May 7, 2007

FPL Recovery Funding LLC Senior Secured Bonds, Series A | Preliminary Term Sheet | May 7, 2007 |

$652,000,000

FPL Recovery Funding LLC

Issuing Entity

Florida Power & Light Company

Depositor, Servicer and Sponsor

Senior Secured Bonds, Series A

Transaction Summary

We, FPL Recovery Funding LLC, are issuing $652,000,000 aggregate principal amount of Senior Secured Bonds, Series A in four tranches (the “bonds”). The bonds are our senior secured obligations secured by storm-recovery property (“storm-recovery property”), which includes the right to impose, collect and receive an irrevocable non-bypassable charge (“storm-recovery charge”) from all customers (individuals, corporations, other businesses, and federal, state and local governmental entities) receiving electric transmission or distribution service from Florida Power & Light Company (“FPL”) or its successors or assignees under rate schedules approved by the Florida Public Service Commission (the “FPSC”) or under special contracts, as discussed below (“customers”). It also includes the right to implement a true-up mechanism in respect of the charges, the right to receive all revenues and collections resulting from the storm-recovery charges, and other rights and interests that arise under the financing order issued by FPSC and described below. Storm-recovery charges are payable by customers, even if the customers elect to purchase electricity from an alternative electricity supplier following a fundamental change in regulation of public utilities in Florida.

Storm-recovery charges will be reviewed and adjusted at least semiannually to ensure that charges are sufficient to provide for the payments of scheduled principal and interest on the bonds, and other costs, including fees and expenses, in connection with the bonds on a timely basis, as discussed below. Through this storm-recovery charge adjustment mechanism, all customers cross-share in the liabilities of all other customers for the payment of storm-recovery charges.

A special statute, the Storm-Recovery Financing Act, enacted in 2005, (the “Financing Act”) authorizes the FPSC to issue irrevocable financing orders supporting the issuance of storm-recovery bonds. One purpose of the Financing Act is to lower the cost to customers associated with the long-term financing by FPL of costs incurred in connection with the restoration of service associated with electric power outages as a result of named tropical storms or hurricanes that occurred during calendar year 2004 or thereafter, as well as the funding or replenishment of storm-recovery reserves. The FPSC issued an irrevocable financing order to FPL on May 30, 2006, clarified by the FPSC’s order issued on July 21, 2006 (together, the “financing order”). Pursuant to the financing order, FPL established us as a bankruptcy remote, special purpose subsidiary company to issue the bonds. In the financing order, the FPSC authorized the imposition and collection of storm-recovery charges on all customers. FPL, as initial servicer, will collect storm-recovery charges on our behalf and will remit storm-recovery charges daily to the indenture trustee.

The FPSC guarantees pursuant to the irrevocable financing order, as expressly required by the Financing Act, that it will act to ensure that storm-recovery charges are sufficient to pay principal and interest on the bonds and other costs, including fees and expenses, in connection with the bonds on a timely basis. The financing order further provides that the FPSC’s obligations pursuant to its financing order, including the specific actions the FPSC guarantees to take, are direct, explicit, irrevocable and unconditional upon issuance of the bonds, and are legally enforceable against the FPSC, which is a United States public sector entity.

The bonds are not a liability of FPL or any of its affiliates (other than us). The bonds are not a debt or general obligation of the FPSC, the State of Florida or any of its political subdivisions, agencies or instrumentalities. However, the State of Florida and other governmental entities, as customers, will be obligated to pay storm-recovery charges securing the bonds.

All matters relating to the structuring, marketing and pricing of the bonds have been considered jointly by FPL and the designated personnel of the FPSC and their designated representative or financial advisor.

This Preliminary Term Sheet has been prepared solely for informational purposes and is not an offer to buy or sell or a solicitation of an offer to buy or sell any bonds in any jurisdiction where such offer or sale is prohibited. Please read the important information and qualifications on page 11 of this Preliminary Term Sheet.

FPL Recovery Funding LLC Senior Secured Bonds, Series A | Preliminary Term Sheet | May 7, 2007 |

$652,000,000

FPL Recovery Funding LLC

Issuing Entity

Florida Power & Light Company

Depositor, Servicer and Sponsor

Senior Secured Bonds, Series A

Summary of Terms

Anticipated Tranche Structure

Tranche1 | Expected Average Life (Years)2 | Principal Amount ($MM) | Scheduled Final Payment Date3 | Scheduled Sinking Fund Payments Begin | No. of Scheduled Semiannual Sinking Fund Payments | Interest Rate |

| A-1 | 2.02 | $124,000,000 | February 1, 2011 | February 1, 2008 | 7 | [___] |

| A-2 | 5.04 | $140,000,000 | August 1, 2013 | February 1, 2011 | 6 | [___] |

| A-3 | 7.36 | $100,000,000 | August 1, 2015 | August 1, 2013 | 5 | [___] |

| A-4 | 10.44 | $288,000,000 | August 1, 2019 | August 1, 2015 | 9 | [___] |

Issuer and Capital Structure

FPL Recovery Funding LLC. We are a special purpose bankruptcy-remote limited liability company wholly-owned by FPL. We have no commercial operations. We were formed solely to purchase and own storm-recovery property (defined in “Credit/Security”), to issue storm-recovery bonds (including the bonds), and to perform activities incidental thereto. These are the first storm-recovery bonds which we have issued. We may not issue storm-recovery bonds except as authorized under the financing order. The financing order limits the aggregate principal amount of the bonds to $708 million; however, we only intend to issue bonds in an aggregate principal amount equal to $652,000,000. We are responsible to the FPSC on an ongoing basis to the extent provided in our organizational documents, the transaction documents and the financing order.

In addition to the storm-recovery property, we will be capitalized with an upfront deposit of 0.5% of the bonds’ initial principal amount (the capital subaccount). We will also create an excess funds subaccount to retain until the next payment date amounts collected that, as of a payment date, are not needed to pay debt service on the bonds (in accordance with the expected sinking fund schedule) and related expenses and to replenish the capital subaccount.

Securities Offered

Senior secured bonds, as listed above scheduled to pay principal semiannually and sequentially in accordance with the expected sinking fund schedule described on page 10.

Required Ratings of the Bonds

Aaa/AAA/AAA by Moody’s, S&P and Fitch, respectively.

__________________

1 Each tranche pays principal sequentially and semiannually. See “Principal Payments” in the “Glossary” on page 13.

2 Based upon an assumed Closing Date of May 1, 2007. Projected Closing Date is on or about May 22, 2007.

3 The final maturity (i.e., the date by which the principal must be repaid to prevent a default) of each tranche of the bonds is two years after the scheduled final payment date for such tranche.

FPL Recovery Funding LLC Senior Secured Bonds, Series A | Preliminary Term Sheet | May 7 2007 |

Payment Dates and Interest Accrual

Interest payable semiannually, February 1 and August 1. Interest will be calculated on a 30/360 basis. The first scheduled interest and principal payment date is February 1, 2008.

Interest is due on each payment date and principal is due upon the final maturity date for each tranche.

Average Life

Stable. Prepayment is not permitted. There is no prepayment risk. Extension risk is statistically insignificant.

Optional Redemption

None. Non-callable for the life of the bonds.

Credit/Security

The bonds are secured by storm recovery property which includes the irrevocable right to impose, collect and receive a non-bypassable electricity consumption-based storm-recovery charge from all customers of FPL (during 2006 approximately 4.4 million customer accounts), including the State of Florida and other governmental entities in their capacity as customers. The Financing Act and the irrevocable financing order together require that storm-recovery charges will be imposed on all customers, and will be reviewed and adjusted at least semiannually to ensure that storm-recovery charges are sufficient to pay scheduled principal and interest on the bonds, and other costs, including fees and expenses, in connection with the bonds on a timely basis. Funds on deposit in the collection account and related subaccounts and our rights under various transaction documents are also pledged to secure the bonds. See also “Issuer and Capital Structure” and “FPSC Guaranteed True-Up Mechanism for Payment of Scheduled Principal and Interest.”

Non-bypassable Storm-Recovery Charges

Under the Financing Act, the storm-recovery charges may not be avoided and are collectible from all existing and future customers receiving transmission or distribution service from FPL or its successors or assignees under FPSC-approved rates or special contracts, even if the customer elects to purchase electricity from an alternative electric provider following a fundamental change in the regulation of public utilities in Florida. Self-generators that receive no transmission or distribution service from FPL are not liable for the storm-recovery charge. Any successor to FPL, whether pursuant to any insolvency proceeding, any merger or other business combination or transfer by operation of law, will be required to collect and remit to us the storm-recovery charges.

Storm-Recovery Property/Cross Sharing of Liabilities

The storm-recovery property securing the bonds is not a pool of receivables and the principal credit supporting the bonds is not a pool of receivables. The storm-recovery property includes the irrevocable right to impose, collect and receive non-bypassable storm-recovery charges, the right to implement the true-up mechanism described below and other rights and interests that arise under the financing order. The storm-recovery property is a present property right created by the Financing Act and the financing order and protected by the state pledge described below. Through the true-up mechanism, all customers cross-share in the liabilities of all other customers for the payment of storm-recovery charges.

FPSC Guaranteed True-Up Mechanism for Payment of Scheduled Principal and Interest

The Financing Act and the irrevocable financing order together require that storm-recovery charges on all customers will be adjusted at least semiannually to ensure that storm-recovery charges are sufficient to provide for paying scheduled principal and interest on the bonds and other costs, including fees and expenses, in connection with the bonds on a timely basis. The FPSC has guaranteed that, pursuant to the irrevocable financing order, as expressly authorized by the Financing Act, it will act to ensure that the storm-recovery charges are sufficient to pay principal and interest on the bonds and other costs, including fees and expenses, in connection with the bonds on a timely basis.

FPL Recovery Funding LLC Senior Secured Bonds, Series A | Preliminary Term Sheet | May 7, 2007 |

There is no cap on the level of storm-recovery charges that may be imposed on customers (or on the time during which the storm-recovery charges may be imposed, billed or collected), including the State of Florida and other governmental entities in their capacity as customers, as a result of the true-up mechanism.

Obligations of the FPSC

The financing order provides that the true-up mechanism and all other obligations of the FPSC pursuant to the financing order are direct, explicit, irrevocable and unconditional upon issuance of the bonds and are legally enforceable against the FPSC, a United States public sector entity. Apart from the financing order, the FPSC retains the power to adopt, revise or rescind rules or regulations affecting FPL or a successor utility. The FPSC also retains the power to interpret and implement the financing order.

Initial Storm-Recovery Charge as a Percent of Residential Customer’s Total Electricity Bill

Approximately 1% of a typical residential 1,000 kWh bill.

State Pledge

The State of Florida has pledged in the Financing Act to bondholders that it will not take or permit any action that would impair the value of the storm-recovery property or reduce, alter or impair the storm-recovery charges until the bonds are fully repaid or discharged, other than specified true-up adjustments to correct any overcollections or undercollections. This state pledge does not preclude any limitation or alteration of the Financing Act or a financing order if full compensation is made by law for the full protection of the storm-recovery charges collected pursuant to a financing order and of the holders of the storm-recovery bonds or any financing party entering into a contract with the electric utility. There is no judicial or statutory authority in Florida for a voter initiative or referendum to amend or repeal the Financing Act, although the voters retain the right to amend the Florida Constitution through the initiative process (subject to the U.S. and Florida Constitutional provisions on impairment of contracts and unlawful takings).

Effect on Credit Risk

The FPSC determined, in the financing order, that the FPSC guaranteed true-up mechanism, together with the broad-based nature of the state pledge, constitute a guarantee of regulatory action for the benefit of investors in the bonds. The FPSC further determined that it expected stress case analyses to show that these features will serve to effectively eliminate for all practical purposes and circumstances any credit risk associated with the bonds (i.e., that sufficient funds will be available and paid to discharge all principal and interest obligations when due). The FPSC directed in the financing order that this transaction be structured consistent with this expectation. With respect to the foregoing, interest is due on each payment date and principal is due upon the final maturity date for each tranche. See the Financing Order, Finding of Fact No. 81. As demonstrated in the results of the stress tests shown in “Stable Average Life” in this preliminary term sheet and in the prospectus supplement under “The Series A Bonds—Sensitivity to Credit Risk” and “—Weighted Average Life Sensitivity Table,” the FPSC’s directive to structure the transaction to effectively eliminate credit risk for all practical purposes and circumstances has been met. See also “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” in the prospectus for further information.

Tax Treatment

Bonds will be treated as debt for U.S. federal income tax purposes.

Type of Offering

SEC registered.

ERISA Eligible

Yes, as described in the prospectus.

FPL Recovery Funding LLC Senior Secured Bonds, Series A | Preliminary Term Sheet | May 7, 2007 |

20% International Risk Weighting

If held by financial institutions subject to regulation in countries (other than the United States) that have adopted the 1988 International Convergence of Capital Measurement and Capital Standards of the Basel Committee on Banking Supervision (as amended, the “1988 Basel Accord”), the bonds may attract the same risk weighting as “claims on” or “claims guaranteed by” non-central government bodies within the United States, which are accorded a 20% risk weighting.

We have been informed that the United Kingdom’s Financial Services Authority has issued individual guidance in respect of the 1988 Basel Accord to one or more investors in transactions not involving us or our affiliates that an investment in bonds issued under a Texas securitization statute similar to the Financing Act can be accorded a 20% risk weighting, which is similar to the risk weighting assigned to U. S. Agency corporate securities (FNMA, FHLMC, etc.).

In addition, under the new framework established by “International Convergence of Capital Management and Capital Standards: A Revised Framework” (as amended, “Basel II”), the bonds may also attract a risk weighting of 20% on the basis that the bonds are expected to be rated in the highest rating category by a major credit rating agency.

However, we cannot assure you that the bonds will attract a 20% risk weighting treatment under any national law, regulation or policy implementing the 1988 Basel Accord, Basel II or any transitional regime. Investors should consult their regulators before making any investment.

OTHER CONSIDERATIONS

Post-Issuance Internet-Based Information

The indenture under which the bonds will be issued requires all of the periodic reports that we file with the SEC, the principal transaction documents and other information concerning the storm-recovery charges and security relating to the bonds to be posted on the website associated with our parent company, currently located at www.fpl.com.

Parent/Servicer/Sponsor/

Depositor

Florida Power & Light Company, a Florida corporation, is a rate-regulated utility engaged primarily in the generation, transmission, distribution and sale of electric energy service throughout most of the east and lower west coasts of Florida. During 2006, FPL provided service to a population of more than 8.5 million and served approximately 4.4 million customer accounts. FPL is an operating subsidiary of FPL Group, Inc., a Florida corporation based in Juno Beach, Florida. The bonds do not constitute a debt, liability or other legal obligation of FPL or FPL Group, Inc.

SETTLEMENT

Indenture Trustee

The Bank of New York

Expected Settlement

___________ __, 2007, settling flat. DTC, Clearstream and Euroclear.

Use of Proceeds

Proceeds, net of selling commissions, will be used by us to acquire the storm-recovery property from FPL. We understand that FPL will use the net proceeds from the sale of the storm-recovery property to pay or reimburse itself for storm-recovery costs, to fund a reserve for payment of such costs, and to pay authorized financing costs.

More Information

For a complete discussion of the proposed transaction, please read the prospectus.

FPL Recovery Funding LLC Senior Secured Bonds, Series A | Preliminary Term Sheet | May 7, 2007 |

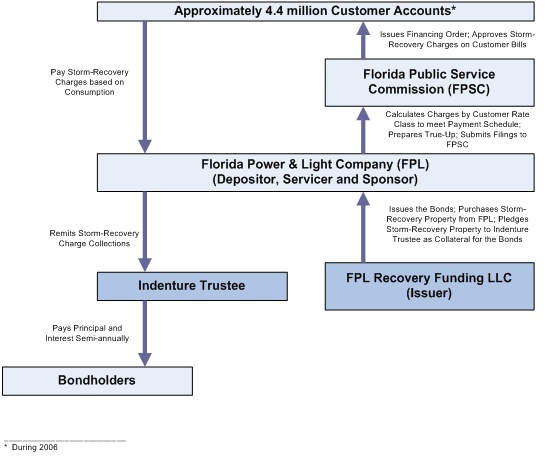

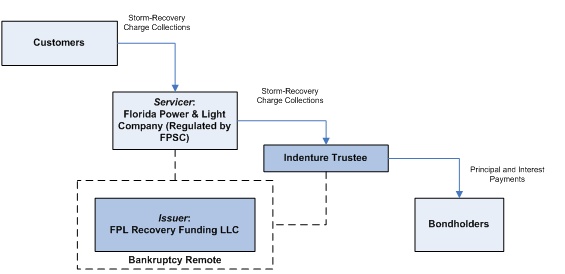

Parties to Transaction and Responsibilities

Flow of Funds to Bondholders

____________________

| * | During 2006, Florida Power & Light’s total retail billed electric consumption was approximately 52.6% residential, 42.9% commercial and 3.9% industrial, with other entities comprising approximately 0.5%. |

FPL Recovery Funding LLC Senior Secured Bonds, Series A | Preliminary Term Sheet | May 7, 2007 |

Key Questions and Answers on FPSC Guaranteed True-Up Mechanism

Q1: Could the financing order be rescinded or altered?

A: No. The Financing Act and the financing order provide that the financing order is irrevocable upon issuance of the bonds.

Q2: Could the Financing Act be repealed or altered in a manner that will impair the value of the security or prevent timely repayment of the bonds?

A: No. Any such action by the State of Florida that impairs the value of the security or the timely repayment of the bonds would violate the State’s pledge in the Financing Act not to take such action.

Q3: Are the FPSC’s obligations under the financing order, including its obligations to implement the true-up mechanism, enforceable by bondholders?

A: The financing order provides that the true-up mechanism and all other obligations of the FPSC set forth in the financing order are direct, explicit, irrevocable and unconditional upon issuance of the bonds, and are legally enforceable against the FPSC. The enforcement of any rights against the State or the FPSC may be subject to the exercise of judicial discretion and to limitations on legal remedies against State and local governmental entities in the State, as described in the Prospectus.

Q4: Are there any reasonably foreseeable circumstances in which the true-up mechanism would not be required to be applied to customer bills, e.g., economic

recession, temporary power shortages, blackouts, or bankruptcy of the parent company?

A: No. Once the bonds are issued, the provisions of the irrevocable financing order that relate to the bonds (including the true-up mechanism) are unconditional. If collections differ or are projected to differ from forecasted revenues, regardless of the reason, FPL is required semiannually, and more often following the latest final scheduled payment date, to submit to the FPSC an adjustment to the storm-recovery charges as necessary to ensure the imposition of charges sufficient to provide payment of principal and interest on the bonds and other costs, including fees and expenses, in connection with the bonds on a timely basis. Under the financing order, the FPSC must implement the adjustment within 60 days, subject only to the correction of any mathematical error in calculation. If the FPSC takes no action within 60 days of filing, the adjustment is deemed correct. The FPSC has guaranteed that, pursuant to the irrevocable financing order, as expressly authorized by the Financing Act, it will act to ensure that the storm-recovery charges are sufficient to pay principal and interest on the bonds and other costs, including fees and expenses, in connection with the bonds on a timely basis.

Q5: Can customers avoid paying storm-recovery charges if, in the future, they are permitted to switch electricity providers?

A: No. The Financing Act provides that the storm-recovery charges are non-bypassable and, through the true-up mechanism, all customers cross share in the liabilities of all other customers for the payment of storm-recovery charges. Non-bypassable means that these charges are collected from all persons who receive electric transmission or distribution service from FPL or its successor or assignee under rate schedules approved by the FPSC or under special contracts.

Q6: Is there any cap or limit on the amount of the storm-recovery charge for any customer?

A: No.

Q7: What happens if, for any reason, electricity usage and, as a result, related storm-recovery charges, as less than projected at any time over the life of the bonds?

A: The storm-recovery charges paid by all customers will be increased to assure payment of the bonds pursuant to the true-up mechanism.

FPL Recovery Funding LLC Senior Secured Bonds, Series A | Preliminary Term Sheet | May 7, 2007 |

Q8: How are customers responsible for paying storm-recovery charges on a joint and several basis?

A: In the event that some customers leave FPL’s service territory or for whatever reason fail to pay the storm-recovery charges, the customers that continue to consume electricity within FPL’s service territory using FPL’s distribution or transmission services, pursuant to the true-up mechanism, would be responsible for paying storm-recovery charges that were allocable to the defaulting customers, in amounts sufficient to service the bonds on a timely basis.

FPL Recovery Funding LLC Senior Secured Bonds, Series A | Preliminary Term Sheet | May 7, 2007 |

Expected Amortization Schedule

| Payment Date | | Tranche A-1 Balance | | | Tranche A-2 Balance | | | Tranche A-3 Balance | | | Tranche A-4 Balance | |

| Tranche Size | | | | | | | | | | | | |

May 1, 2007* | | $ | 124,000,000.00 | | | $ | 140,000,000.00 | | | $ | 100,000,000.00 | | | $ | 288,000,000.00 | |

| 2/1/2008 | | | 99,784,541.00 | | | | 140,000,000.00 | | | | 100,000,000.00 | | | | 288,000,000.00 | |

| 8/1/2008 | | | 83,218,201.00 | | | | 140,000,000.00 | | | | 100,000,000.00 | | | | 288,000,000.00 | |

| 2/1/2009 | | | 62,786,016.00 | | | | 140,000,000.00 | | | | 100,000,000.00 | | | | 288,000,000.00 | |

| 8/1/2009 | | | 44,742,612.00 | | | | 140,000,000.00 | | | | 100,000,000.00 | | | | 288,000,000.00 | |

| 2/1/2010 | | | 22,611,047.00 | | | | 140,000,000.00 | | | | 100,000,000.00 | | | | 288,000,000.00 | |

| 8/1/2010 | | | 2,958,313.00 | | | | 140,000,000.00 | | | | 100,000,000.00 | | | | 288,000,000.00 | |

| 2/1/2011 | | | – | | | | 119,215,680.00 | | | | 100,000,000.00 | | | | 288,000,000.00 | |

| 8/1/2011 | | | – | | | | 97,959,122.00 | | | | 100,000,000.00 | | | | 288,000,000.00 | |

| 2/1/2012 | | | – | | | | 72,503,506.00 | | | | 100,000,000.00 | | | | 288,000,000.00 | |

| 8/1/2012 | | | – | | | | 49,541,455.00 | | | | 100,000,000.00 | | | | 288,000,000.00 | |

| 2/1/2013 | | | – | | | | 22,401,525.00 | | | | 100,000,000.00 | | | | 288,000,000.00 | |

| 8/1/2013 | | | – | | | | – | | | | 98,011,670.00 | | | | 288,000,000.00 | |

| 2/1/2014 | | | – | | | | – | | | | 69,191,758.00 | | | | 288,000,000.00 | |

| 8/1/2014 | | | – | | | | – | | | | 43,132,977.00 | | | | 288,000,000.00 | |

| 2/1/2015 | | | – | | | | – | | | | 12,493,764.00 | | | | 288,000,000.00 | |

| 8/1/2015 | | | – | | | | – | | | | – | | | | 272,672,561.00 | |

| 2/1/2016 | | | – | | | | – | | | | – | | | | 240,117,082.00 | |

| 8/1/2016 | | | – | | | | – | | | | – | | | | 210,294,416.00 | |

| 2/1/2017 | | | – | | | | – | | | | – | | | | 175,783,895.00 | |

| 8/1/2017 | | | – | | | | – | | | | – | | | | 144,230,553.00 | |

| 2/1/2018 | | | – | | | | – | | | | – | | | | 107,698,753.00 | |

| 8/1/2018 | | | – | | | | – | | | | – | | | | 74,178,014.00 | |

| 2/1/2019 | | | – | | | | – | | | | – | | | | 35,554,081.00 | |

| | | | | | | | | | | | | | | | | |

____________________

* Assumed Closing Date. Projected Closing Date is on or about May 27, 2007.

FPL Recovery Funding LLC Senior Secured Bonds, Series A | Preliminary Term Sheet | May 7, 2007 |

Expected Sinking Fund Schedule

| | | | | | | | | | | | |

| Initial Tranche Principal Balance | | $ | 124,000,000 | | | $ | 140,000,000 | | | $ | 100,000,000 | | | $ | 288,000,000 | |

| 2/1/2008 | | | 24,215,459 | | | | – | | | | – | | | | – | |

| 8/1/2008 | | | 16,566,340 | | | | – | | | | – | | | | – | |

| 2/1/2009 | | | 20,432,185 | | | | – | | | | – | | | | – | |

| 8/1/2009 | | | 18,043,404 | | | | – | | | | – | | | | – | |

| 2/1/2010 | | | 22,131,565 | | | | – | | | | – | | | | – | |

| 8/1/2010 | | | 19,652,734 | | | | – | | | | – | | | | – | |

| 2/1/2011 | | | 2,958,313 | | | | 20,784,320 | | | | – | | | | – | |

| 8/1/2011 | | | – | | | | 21,256,558 | | | | – | | | | – | |

| 2/1/2012 | | | – | | | | 25,455,616 | | | | – | | | | – | |

| 8/1/2012 | | | – | | | | 22,962,051 | | | | – | | | | – | |

| 2/1/2013 | | | – | | | | 27,139,930 | | | | – | | | | – | |

| 8/1/2013 | | | – | | | | 22,401,525 | | | | 1,988,330 | | | | – | |

| 2/1/2014 | | | – | | | | – | | | | 28,819,912 | | | | – | |

| 8/1/2014 | | | – | | | | – | | | | 26,058,781 | | | | – | |

| 2/1/2015 | | | – | | | | – | | | | 30,639,213 | | | | – | |

| 8/1/2015 | | | – | | | | – | | | | 12,493,764 | | | | 15,327,439 | |

| 2/1/2016 | | | – | | | | – | | | | – | | | | 32,555,479 | |

| 8/1/2016 | | | – | | | | – | | | | – | | | | 29,822,666 | |

| 2/1/2017 | | | – | | | | – | | | | – | | | | 34,510,521 | |

| 8/1/2017 | | | – | | | | – | | | | – | | | | 31,553,342 | |

| 2/1/2018 | | | – | | | | – | | | | – | | | | 36,531,800 | |

| 8/1/2018 | | | – | | | | – | | | | – | | | | 33,520,739 | |

| 2/1/2019 | | | – | | | | – | | | | – | | | | 38,623,933 | |

| 8/1/2019 | | | – | | | | – | | | | – | | | | 35,554,081 | |

FPL Recovery Funding LLC Senior Secured Bonds, Series A | Preliminary Term Sheet | May 7, 2007 |

FPSC Guaranteed True-Up Mechanism for Payment of Scheduled Principal and Interest

The Financing Act and the irrevocable financing order require that storm-recovery charges be reviewed and adjusted at least semiannually to ensure that charges are sufficient to provide all scheduled payments of principal and interest and other required amounts and charges in connection with the bonds in a timely manner. Storm-recovery property is not a pool of receivables and all customers cross-share in the liabilities of all other customers for the payment of storm-recovery charges.

The following describes the mechanics for implementing the true-up mechanism with respect to all customers based on their consumption of electricity. (See also “Key Questions and Answers on FPSC Guaranteed True-Up Mechanism” on page 7.)

MANDATORY SEMIANNUAL TRUE-UPS FOR PAYMENT OF SCHEDULED PRINCIPAL AND INTEREST

| STEP 1: | Every six months, beginning in October 2007, FPL computes the total dollar requirement for the bonds for the upcoming semiannual period, which includes scheduled principal and interest payments and all other permitted costs of the transaction, adjusted to correct any prior undercollection or overcollection. |

| STEP 2: | FPL forecasts consumption by each customer class. |

| STEP 3: | FPL calculates the projected storm-recovery charge collections for the upcoming semiannual period at current rates. |

| STEP 4: | FPL ratably increases or decreases the storm-recovery charge rate by rate class unit until projected storm-recovery charge collections equal the dollar requirement for the bonds for the upcoming period. |

| STEP 5: | FPL must make a true-up filing with the FPSC, specifying such adjustments to the storm-recovery charges as may be necessary, regardless of the reason for the difference between forecasted and required collections. Under the financing order, the FPSC must implement the adjustment within 60 days, subject only to the correction of any mathematical error in calculation. If the FPSC takes no action within 60 days of filing, the adjustment is deemed correct. |

MANDATORY INTERIM TRUE-UPS FOLLOWING SCHEDULED FINAL MATURITY DATE

FPL must seek a true-up once every quarter in the year following the latest scheduled final payment date for the bonds, and once monthly if bonds are outstanding after the date that is one year before the final legal maturity date of the bonds.

STABLE AVERAGE LIFE

Changes in the expected weighted average lives of the tranches of the bonds in relation to variances in actual energy consumption levels (retail electric sales) from forecast levels are shown below. Severe stress cases on electricity consumption as shown below result in insignificant changes, if any, in the weighted average lives of each tranche.

Weighted Average Life Sensitivity

| Expected

Weighted Avg. Life (“WAL”) (yrs)* | |

-5% (2.92 Standard Deviations from Mean) | -15% (8.33 Standard Deviations from Mean) |

| | | |

| A-1 | 2.02 | 2.02 | 0 | 2.03 | 0 |

| A-2 | 5.04 | 5.04 | 0 | 5.04 | 0 |

| A-3 | 7.36 | 7.36 | 0 | 7.37 | 1 |

| A-4 | 10.44 | 10.44 | 0 | 10.44 | 1 |

* | Based upon an assumed Closing Date of May 1, 2007. Projected Closing Date is on or about May 22, 2007. |

** | Numbers rounded to whole days. |

FPL Recovery Funding LLC Senior Secured Bonds, Series A | Preliminary Term Sheet | May 7, 2007 |

For the purposes of preparing the above table, we have assumed, among other things, that:

| · | the forecast error stays constant over the life of the bonds; |

| · | the servicer makes timely and accurate filings to true-up the storm-recovery charges semiannually; |

| · | no other routine true-up adjustments are made; and |

| · | no non-routine true-up adjustments are made. |

There can be no assurance that the weighted average lives of the various tranches of the bonds will be as shown in the above table.

FPL Recovery Funding LLC Senior Secured Bonds, Series A | Preliminary Term Sheet | May 7, 2007 |

Glossary

“Storm-Recovery Charges”

Storm-recovery charges are statutorily-created, non-bypassable, consumption-based per kilowatt hour charges payable by all customers of FPL receiving transmission or distribution service from FPL or its successors or assignees under FPSC-approved rate schedules or under special contracts, even if the customer elects to purchase electricity from an alternative electricity supplier following a fundamental change in the regulation of public utilities in Florida. There is no cap on the level of storm-recovery charges that may be imposed on customers as a result of the true-up mechanism, nor on the time during which the storm-recovery charges may be imposed, billed or collected.

“Security”

All assets held by the indenture trustee for the benefit of the holders of the bonds. The principal asset securing the bonds is the storm-recovery property sold to us on the date of issuance. The storm-recovery property is not a receivable, and the principal credit supporting the bonds is not a pool of receivables. It includes the irrevocable right to impose, collect and receive non-bypassable storm-recovery charges and is a present property right created by the Financing Act and the financing order and expressly protected by the state’s pledge not to take or permit any action that would impair its value.

“Principal Payments”

Principal will be paid sequentially, i.e., no tranche will receive principal payments until all tranches of a higher numerical designation have been paid in full unless there is an acceleration of the maturity of the bonds following an event of default in which case principal will be paid to all tranches on a pro-rata basis.

“Sinking Fund”

The amortization method providing for sequential payments of scheduled principal of each tranche.

“Issuer Responsible to the FPSC”

We, the issuer, are responsible to the FPSC as follows: (i) our organizational documents and the transaction documents for the bonds prohibit us from engaging in any activities other than acquiring storm-recovery property, issuing storm-recovery bonds, and performing other activities relating thereto or otherwise authorized by the financing order, (ii) we must respond to representatives of the FPSC throughout the process of offering the bonds, and (iii) the servicer will file all required true-up adjustments on our behalf. In addition, the servicing agreement and indenture require certain reports to be submitted to the FPSC by us or on our behalf.

“Legal Structure”

The Financing Act provides, among other things, that the storm-recovery property is a present property right created pursuant to such Act and the financing order. The financing order is final and not subject to FPSC rehearing. Pursuant to the Financing Act, our right to collect storm-recovery charges is a property right against which we will have a perfected lien upon execution and delivery of the sale agreement and filing of notice with the Florida Secured Transaction Registry. We will grant our perfected security interest in the storm-recovery property to the indenture trustee under the indenture. The State of Florida has pledged not to take or permit any action that would impair the value of the storm-recovery property, or, reduce, alter or impair the storm-recovery charges to be imposed, collected and remitted to bondholders, except for the periodic true-up, until the bonds have been paid in full.

“Ratings”

A security rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time by the assigning rating agency. No person is obligated to maintain the rating on any note, and, accordingly, there can be no assurance that the ratings assigned to any tranche of the bonds upon initial issuance will not be revised or withdrawn by a rating agency at any time thereafter.

We and FPL have filed a registration statement (including a prospectus and prospectus supplement) (Registration Nos. 333-141357 and 333-141357-01), as amended, with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus and prospectus supplement in that registration statement and other documents we have filed with the SEC for more complete information about us and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. You can also obtain copies of the registration statement from the SEC upon payment of prescribed charges, or you can examine the registration statement free of charge at the SEC’s offices at 100 F Street, N.E., Washington, D.C. 20549. Alternatively, we will arrange to send you the prospectus and prospectus supplement if you request it by calling toll free at 1-800-222-4511, or 1-561-691-7796.

FPL Recovery Funding LLC Senior Secured Bonds, Series A | Preliminary Term Sheet | May 7, 2007 |

This Preliminary Term Sheet is not required to contain all information that is required to be included in the prospectus and prospectus supplement that has been prepared and provided to you for the securities offering to which this Preliminary Term Sheet relates. The prospectus and prospectus supplement contain material information not contained herein, and the prospective purchasers are referred to the prospectus and prospectus supplement, including the final prospectus and prospectus supplement. The prospectus and prospectus supplement contain all material information in respect to the bonds. This Preliminary Term Sheet is not an offer to sell or a solicitation of an offer to buy these securities in any state where such offer, solicitation or sale is not permitted.

The information in this Preliminary Term Sheet is preliminary, and may be superseded by an additional term sheet provided to you prior to the time you enter into a contract of sale. This Preliminary Term Sheet is being delivered to you solely to provide you with information about the offering of the securities referred to herein. The securities are being offered when, as and if issued. In particular, you are advised that these securities are subject to modification or revision (including, among other things, the possibility that one or more tranches of securities may be split, combined or eliminated), at any time prior to the availability of a final prospectus.

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this Preliminary Term Sheet is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential are not applicable to these materials and should be disregarded to the extent inconsistent with any legends or other information contain herein. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

Neither the SEC nor any state securities commission has approved or disapproved of the bonds or determined if this Preliminary Term Sheet is truthful or complete. Any representation to the contrary is a criminal offense.

Price and availability of the bonds are subject to change without notice.

FPL Recovery Funding LLC Senior Secured Bonds, Series A | Preliminary Term Sheet | May 7, 2007 |

OFFERING RESTRICTIONS IN CERTAIN JURISDICTIONS

NOTICE TO RESIDENTS OF SINGAPORE

Each Underwriter acknowledges that this Preliminary Term Sheet has not been registered as a Prospectus with the Monetary Authority of Singapore. Accordingly, each Underwriter represents, warrants and agrees that it has not offered or sold any bonds or caused the bonds to be made the subject of an invitation for subscription or purchase, and will not offer or sell any bonds or cause the bonds to be made the subject of an invitation for subscription or purchase, and has not circulated or distributed, nor will it circulate or distribute this Preliminary Term Sheet or any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of bonds, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor under Section 274 of the Securities and Futures Act, Chapter 289 of Singapore (the “SFA”), or any person pursuant to Section 275(1A), and in accordance with the conditions specified in Section 275 of the SFA or (ii) to a relevant person pursuant to Section 275(1) or any person pursuant to Section 275(1a) of the SFA, and in accordance with the conditions specified in Section 275 of the SFA or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the bonds are subscribed or purchased under Section 275 by a relevant person which is:

(a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

(b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor,

Shares, debentures and units of shares and debentures of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within 6 months after that corporation or that trust has acquired the bonds pursuant to an offer made under Section 275 except:

(1) to an institutional investor (for corporations, under Section 274 of the SFA) or to a relevant person defined in Section 275(2) of the SFA, or to any person pursuant to an offer that is made on terms that such rights or interest are acquired at a consideration of not less than s$200,000 (or its equivalent in a foreign currency) for each transaction, whether such amount is to be paid for in cash or by exchange of securities or other assets, and further for corporations, in accordance with the conditions specified in Section 275 of the SFA;

(2) where no consideration is or will be given for the transfer; or

(3) where the transfer is by operation of law the Prospectus relating to the bonds (“Prospectus”) will, prior to any sale of securities pursuant to the provisions of Section 106D of the Companies Act (Cap. 50), be lodged, pursuant to said Section 106D, with the Registrar of Companies in Singapore, which will take no responsibility for its contents. However, neither this Preliminary Term Sheet nor the Prospectus has been and nor will they be registered as a Prospectus with the Registrar of Companies in Singapore. Accordingly, the bonds may not be offered, and neither this Preliminary Term Sheet nor any other offering document or material relating to the bonds may be circulated or distributed, directly or indirectly, to the public or any member of the public in Singapore other than to institutional investors or other persons of the kind specified in Section 106C and Section 106D of the Companies Act or any other applicable exemption invoked under Division 5A of Part IV of the Companies Act. The first sale of securities acquired under a Section 106C or Section 106D exemption is subject to the provisions of Section 106E of the Companies Act.

NOTICE TO RESIDENTS OF THE PEOPLE’S REPUBLIC OF CHINA

The bonds have not been and will not be registered under the Securities Law of the People’s Republic of China (as the same may be amended from time to time) and are not to be offered or sold to persons within the People’s Republic of China (excluding the Hong Kong and Macau Special Administrative Regions) unless permitted by the laws of the People’s Republic of China.

FPL Recovery Funding LLC Senior Secured Bonds, Series A | Preliminary Term Sheet | May 7, 2007 |

NOTICE TO RESIDENTS OF JAPAN

The bonds have not been and will not be registered under the Securities and Exchange Law of Japan (the “SEL”), and may not be offered or sold in Japan or to, or for the account or benefit of, any resident of Japan or to, or for the account or benefit of, others for re-offering or resale, directly or indirectly, in Japan or to, or for the account or benefit of, any resident of Japan, except pursuant to an exemption from the registration requirements of, and otherwise in compliance with, the SEL, and in compliance with the other relevant laws and regulations of Japan.

NOTICE TO RESIDENTS OF HONG KONG

Each Underwriter has represented and agreed that:

It has not offered or sold and will not offer or sell in Hong Kong, by means of any document, any bonds other than (a) to professional investors within the meaning of the Securities and Futures Ordinance (Cap. 571) of the laws of Hong Kong and any rules made thereunder; or (b) in circumstances that do not result in the document being a “Prospectus” as defined in the Companies Ordinance (Cap. 32) of the laws of Hong Kong or that do not constitute an offer to the public within the meaning of that Ordinance;

No invitation, advertisement, invitation or document relating to the bonds may be issued, whether in Hong Kong or elsewhere, that is directed at, or the contents of which are likely to be accessed or read by, the public of Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to bonds that are intended to be disposed of only to persons outside Hong Kong or only to “professional investors” as defined under the Securities and Futures Ordinance (Cap. 571) of the laws of Hong Kong and any rules made thereunder that Ordinance.

NOTICE TO RESIDENTS OF THE EUROPEAN ECONOMIC AREA

In relation to each Member State of the European Economic Area which has implemented the Prospectus Directive (each, a “Relevant Member State”), the Underwriter has represented and agreed that with effect from and including the date on which the Prospectus Directive is implemented in that Relevant Member State (the “Relevant Implementation Date”) it has not made and will not make an offer of bonds to the public in that Relevant Member State prior to the publication of a Prospectus in relation to the bonds which has been approved by the competent authority in that Relevant Member State or, where appropriate, approved in another Relevant Member State and notified to the competent authority in that Relevant Member State, all in accordance with the Prospectus Directive, except that it may, with effect from and including the Relevant Implementation Date, make an offer of bonds to the public in that Relevant Member State at any time:

(a) to legal entities which are authorized or regulated to operate in the financial markets or, if not so authorized or regulated, whose corporate purpose is solely to invest in securities;

(b) to any legal entity which has two or more of (i) an average of at least 250 employees during the last financial year; (ii) a total balance sheet of more than €43,000,000 and (iii) an annual net turnover of more than €50,000,000, as shown in its last annual or consolidated accounts; or

(c) in any other circumstances which do not require the publication by the issuing entity of a Prospectus pursuant to Article 3 of the Prospectus Directive.

For the purposes of this provision, the expression an “offer of certificates to the public” in relation to any bonds in any Relevant Member State means the communication in any form and by any means of sufficient information on the terms of the offer and the bonds to be offered so as to enable an investor to decide to purchase or subscribe the bonds, as the same may be varied in that Member State by any measure implementing the Prospectus Directive in that Member State and the expression “Prospectus Directive” means Directive 2003/71/EC and includes any relevant implementing measure in each Relevant Member State.

FPL Recovery Funding LLC Senior Secured Bonds, Series A | Preliminary Term Sheet | May 7, 2007 |

NOTICE TO RESIDENTS OF THE UNITED KINGDOM

Each Underwriter has represented and agreed that:

(a) it has only communicated or caused to be communicated and will only communicate or cause to be communicated an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the Financial Services and Markets Act (the “FSMA”)) received by it in connection with the issue or sale of the bonds in circumstances in which Section 21(1) of the FSMA does not apply to the issuing entity; and

(b) it has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to the bonds in, from or otherwise involving the United Kingdom.