UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Virginia Savings Bancorp, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which the transaction applies: |

| | (2) | Aggregate number of securities to which the transaction applies: |

| | (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of the transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| x | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

$30.27

| | (2) | Form, Schedule or Registration Statement No.: |

Schedule 13E-3

Virginia Savings Bancorp, Inc.

September 29, 2009

Preliminary Proxy Statement, Subject to Completion, Dated September 29, 2009

VIRGINIA SAVINGS BANCORP, INC.

Dear Fellow Shareholders:

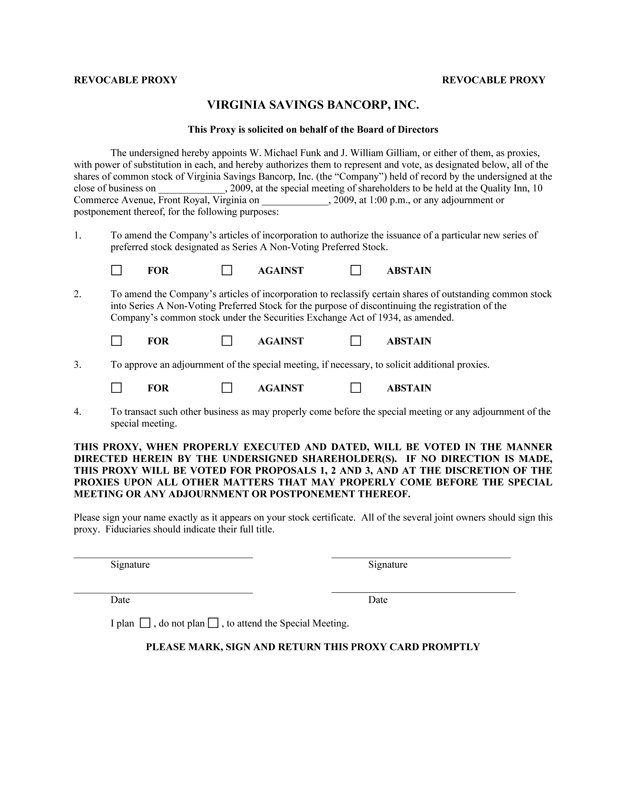

You are cordially invited to attend a special meeting of shareholders of Virginia Savings Bancorp, Inc. to be held at 1:00 p.m. on , 2009 at the Quality Inn, 10 Commerce Avenue, Front Royal, Virginia. At this important meeting, you will be asked to consider the following matters:

1. To amend our articles of incorporation to authorize the issuance of a particular new series of preferred stock designated as Series A Non-Voting Preferred Stock.

2. To amend our articles of incorporation to reclassify certain of our shares of outstanding common stock into Series A Non-Voting Preferred Stock for the purpose of discontinuing the registration of our common stock under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

3. To approve an adjournment of the special meeting, if necessary, to solicit additional proxies.

4. To transact such other business as may properly come before the special meeting or any adjournment of the special meeting.

If the proposals (i) to amend our articles of incorporation to create a new series of preferred stock, designated as Series A Non-Voting Preferred Stock, and (ii) to reclassify our common stock are approved, shares of our outstanding common stock held by record shareholders who own fewer than 1,000 shares will be reclassified into shares of Series A Non-Voting Preferred Stock (these two proposals are collectively referred to as the “Amendments”). For these shareholders, the reclassification will be made on the basis of one share of Series A Non-Voting Preferred Stock for each share of common stock held. The purpose of the Amendments is to discontinue the registration of our common stock under the Exchange Act and to no longer be a “public” company.

If approved at the special meeting, the Amendments will affect you as follows:

| | |

If, prior to the Reclassification,

you are a shareholder with | | Effect |

| 1,000 or more shares of common stock | | You will continue to hold the same number of shares of common stock. |

| |

| Fewer than 1,000 shares of common stock | | You will no longer hold shares of common stock. Instead, you will hold a number of shares of Series A Non-Voting Preferred Stock equal to the same number of shares of common stock that you held immediately before the reclassification. |

The primary effect of the Amendments will be to reduce our total number of record holders of common stock to below 300. As a result, we will terminate the registration of our common stock under the Exchange Act, suspend our public reporting obligations under the Exchange Act, and will no longer be considered a “public” company. This transaction is known as a Rule 13e-3 going private transaction under the Exchange Act.

i

We are proposing the Amendments because our board of directors and our executive officers have concluded, after careful consideration, that the direct and indirect costs associated with being a reporting company with the Securities and Exchange Commission outweigh the advantages.Our board unanimously recommends that you vote “for” both of the Amendments. Neither of the proposed Amendments will be adopted unless both Amendments are approved. We encourage you to read carefully the proxy statement and attached appendices.

We hope you can join us for the special meeting. Whether or not you plan to attend, please complete, sign and date the enclosed proxy card and return it promptly in the enclosed postage-paid envelope. Your vote is important, regardless of the number of shares you own.

We appreciate your continuing loyalty and support.

|

| Sincerely, |

|

| |

| W. Michael Funk |

| President and Chief Executive Officer |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved the Amendments to our articles of incorporation, passed upon the merits or fairness of the Amendments to our articles of incorporation, or passed upon the adequacy or accuracy of the disclosure in this document. Any representation to the contrary is a criminal offense.

This proxy statement is being mailed to shareholders on or about , 2009. The date of this proxy statement is , 2009.

ii

VIRGINIA SAVINGS BANCORP, INC.

PROXY STATEMENT

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON , 2009

Notice is hereby given that a special meeting of shareholders of Virginia Savings Bancorp, Inc. will be held at 1:00 p.m. on , 2009 at the Quality Inn, 10 Commerce Avenue, Front Royal, Virginia, for the following purposes:

| | 1. | To amend our articles of incorporation to authorize the issuance of a particular new series of preferred stock, designated as Series A Non-Voting Preferred Stock. |

| | 2. | To amend our articles of incorporation to reclassify certain of our shares of outstanding common stock into Series A Non-Voting Preferred Stock for the purpose of discontinuing the registration of our common stock under the Securities Exchange Act of 1934, as amended. |

| | 3. | To approve an adjournment of the special meeting, if necessary, to solicit additional proxies. |

| | 4. | To transact such other business as may properly come before the special meeting or any adjournment of the special meeting. |

Shareholders of record at the close of business on , 2009 are entitled to notice of and to vote at the special meeting of shareholders and any adjournment or postponement of the meeting.

Please mark, sign, date and return your proxy card promptly, whether or not you plan to attend the special meeting. If you attend the special meeting, you may vote in person even if you have already sent in your proxy card.

|

| By Order of the Board of Directors, |

|

| |

| Noel F. Pilon |

| Corporate Secretary |

Front Royal, Virginia

, 2009

THE BOARD OF DIRECTORS OF THE COMPANY UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE (1) TO AUTHORIZE THE ISSUANCE OF THE SERIES A NON-VOTING PREFERRED STOCK, AND (2) TO APPROVE THE RECLASSIFICATION OF CERTAIN OF OUR SHARES OF COMMON STOCK INTO SERIES A NON-VOTING PREFERRED STOCK

iii

TABLE OF CONTENTS

iv

VIRGINIA SAVINGS BANCORP, INC.

600 Commerce Avenue

Front Royal, Virginia 22630

PROXY STATEMENT

For the Special Meeting of Shareholders

To Be Held on , 2009

The board of directors of Virginia Savings Bancorp, Inc. (the “Company”) is furnishing this proxy statement in connection with its solicitation of proxies for use at a special meeting of shareholders. At the meeting, shareholders will be asked to vote on the following two proposed amendments to our articles of incorporation:

| | • | | an amendment to create a new series of preferred stock, designated Series A Non-Voting Preferred Stock, and |

| | • | | an amendment to reclassify certain shares of our common stock into Series A Non-Voting Preferred Stock. |

The two proposed amendments to our articles of incorporation are collectively referred to herein as the “Amendments.” We are referring to the transaction that will be effected by the implementation of the Amendments as the “Reclassification.” Unless both Amendments are approved by our shareholders, neither of the Amendments will be effected.

The Reclassification is designed to reduce the number of our common shareholders of record to below 300, which will allow us to terminate the registration of our common stock under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and suspend our public reporting obligations under the Exchange Act. The board has unanimously determined that it is in the best interests of the Company and our shareholders to effect the Reclassification because we will realize significant cost savings as a result of the suspension of our reporting obligations under the Exchange Act. The board believes these cost savings and the other benefits of deregistration described in this proxy statement outweigh the loss of the benefits of registration to our shareholders, such as a reduction in publicly available information about the Company and the elimination of certain corporate safeguards resulting from the Sarbanes-Oxley Act of 2002.

No cash will be paid to shareholders as consideration for their shares of common stock, only shares of Series A Non-Voting Preferred Stock will be issued. All other shares of our common stock will remain outstanding.

This proxy statement provides you with detailed information about the proposed Amendments. We encourage you to read this entire document carefully.

Each member of our board of directors and each of our executive officers has determined that the Reclassification is fair to our shareholders, including our unaffiliated shareholders who will retain common shares and our unaffiliated shareholders who will receive Series A Non-Voting Preferred Stock. Our board has unanimously approved the articles of amendment which include the proposed Amendments. The Reclassification cannot be completed, however, unless both of the proposed Amendments are approved by the holders of a majority of the votes entitled to be cast on the proposed Amendments. Our current directors and executive officers own approximately 37.4% of our outstanding shares of common stock. Our directors and executive officers have indicated that they intend to vote their shares in favor of the proposed Amendments.

1

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved the Amendments to our articles of incorporation, passed upon the merits or fairness of the Amendments to our articles of incorporation, or passed upon the adequacy or accuracy of the disclosure in this document. Any representation to the contrary is a criminal offense.

This proxy statement is being mailed to shareholders on or about , 2009. The date of this proxy statement is , 2009.

IMPORTANT NOTICES

Our common stock and our preferred stock, including the preferred stock to be designated as Series A Non-Voting Preferred Stock, are not deposits or bank accounts and are not insured by the Federal Deposit Insurance Corporation (“FDIC”) or any other governmental agency.

We have not authorized any person to give any information or to make any representations other than the information and statements included in this proxy statement. You should not rely on any other information. The information contained in this proxy statement is correct only as of the date of this proxy statement, regardless of the date it is delivered or when the Reclassification is effected.

We will update this proxy statement to reflect any factors or events arising after its date that individually or together represent a material change in the information included in this document.

We make forward-looking statements in this proxy statement that are subject to risks and uncertainties. Forward-looking statements include information about possible or assumed future results of our operations or performance after the Reclassification is accomplished. When we use words such as “believes,” “anticipates,” “expects,” “intends,” “targeted” and similar expressions, we are making forward-looking statements that are subject to risks and uncertainties. Various future events or factors may cause our results of operations or performance to differ materially from those expressed in our forward-looking statements. These factors include:

| | • | | changes in economic conditions, both nationally and in our primary market area; |

| | • | | changes in governmental monetary and fiscal policies, as well as legislative and regulatory changes; |

| | • | | the effect of changes in interest rates on the level and composition of deposits, loan demand, and the values of loan collateral, securities and interest rate protection agreements; |

| | • | | the effects of competition from other financial service providers operating in our primary market area and elsewhere; and |

| | • | | the failure of assumptions underlying the establishment of allowances for loan losses and estimations of values of collateral and various financial assets and liabilities. |

The words “we,” “our,” and “us,” as used in this proxy statement, refer to the Company and its wholly-owned subsidiary, Virginia Savings Bank, F.S.B. (the “Bank”), collectively, unless the context indicates otherwise.

2

QUESTIONS AND ANSWERS ABOUT AND SUMMARY TERMS OF

THE RECLASSIFICATION AND THE SPECIAL MEETING

| Q: | Why did you send me this proxy statement? |

| A: | We sent you this proxy statement and the enclosed proxy card because our board of directors is soliciting your vote for use at our special meeting of shareholders. |

This proxy statement includes all of the information that is required and necessary in order for you to cast an informed vote at the meeting. You do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card.

We first sent this proxy statement, notice of the special meeting and the enclosed proxy card on or about , 2009 to all shareholders entitled to vote. The record date for those entitled to vote is , 2009. On that date, there were shares of our common stock outstanding. Shareholders are entitled to one vote for each share of common stock held as of the record date.

| Q: | What is the time and place of the special meeting? |

| A: | The special meeting will be held at 1:00 p.m. on , 2009 at the Quality Inn, 10 Commerce Avenue, Front Royal, Virginia. |

| Q: | Who may be present at the special meeting and who may vote? |

| A: | All holders of our common stock may attend the special meeting in person. However, only holders of our common stock of record as of September 18, 2009 may cast their votes in person or by proxy at the special meeting. |

| Q: | What items will be voted upon at the special meeting? |

| A: | Our shareholders will be voting upon the following matters: |

| | 1. | To amend our articles of incorporation to authorize the issuance of a particular new class of preferred stock, designated as Series A Non-Voting Preferred Stock. |

| | 2. | To amend our articles of incorporation to reclassify certain of our shares of outstanding common stock into Series A Non-Voting Preferred Stock for the purpose of discontinuing the registration of our common stock under the Exchange Act. |

| | 3. | To approve an adjournment of the special meeting, if necessary, to solicit additional proxies. |

| | 4. | To transact such other business as may properly come before the special meeting or any adjournment of the special meeting. |

| Q: | Will I have appraisal or dissenters’ rights in connection with the Reclassification? |

| A: | No. Shareholders will have no appraisal or dissenters’ rights in connection with the Reclassification. |

3

| Q: | How do I vote by proxy? |

| A: | If you sign, date and return your proxy card before the special meeting, we will vote your shares as you direct. For the Amendments to our articles of incorporation to effect the Reclassification, you may vote “for,” “against” or you may “abstain” from voting. |

If you return your signed proxy card but do not specify how you want to vote your shares, we will vote them “for” the Amendments to our articles of incorporation.

The board of directors knows of no other business to be presented at the special meeting. If any matters other than those set forth above are properly brought before the special meeting, the individuals named in your proxy card may vote your shares in accordance with their best judgment.

| Q: | How do I change or revoke my proxy? |

| A: | You can change or revoke your proxy at any time before it is voted at the special meeting by: |

| | • | | submitting another proxy with a more recent date than that of the proxy first given; |

| | • | | attending the special meeting and voting in person, although attendance by itself will not revoke a previously granted proxy; or |

| | • | | sending written notice of revocation to our Corporate Secretary, Noel F. Pilon, at Virginia Savings Bancorp, Inc., 600 Commerce Avenue, Front Royal, Virginia 22630. |

| Q: | If I return my proxy, can I still attend the special meeting? |

| A: | You are encouraged to mark, sign and date the enclosed form of proxy and return it promptly in the enclosed postage-paid envelope, so that your shares will be represented at the special meeting. However, returning a proxy does not affect your right to attend the special meeting and vote your shares in person. |

| Q: | How many votes are required? |

| A: | Approval of each of the Amendments to our articles of incorporation will require the affirmative vote of a majority of our outstanding common stock, or at least 949,993 shares. Because approval of each of the Amendments require a majority of shares of outstanding common stock, abstentions will have the same effect as a “NO” vote. If a broker indicates that it does not have discretionary authority as to certain shares to vote on a particular matter, such shares will not be considered as present and entitled to vote with respect to such matter. Broker-non votes will also have the same effect as a “NO” vote for each of the Amendments. |

| Q: | What constitutes a “quorum” for the meeting? |

| A: | A majority of the outstanding shares of our common stock, present or represented by proxy, constitutes a quorum. Therefore, we need 949,993 shares of our common stock, present or represented by proxy, to have a quorum. A quorum is necessary to conduct business at the special meeting. You are part of the quorum if you have voted by proxy. Abstentions will be treated as present for purposes of determining a quorum, but as unvoted shares for purposes of determining the approval of any matter submitted to the shareholders for a vote. |

4

| Q: | What is the proposed Reclassification? |

| A: | We are proposing two amendments to our articles of incorporation, which, if approved and adopted, will constitute the Reclassification. First, we are proposing that our shareholders approve an amendment to our articles of incorporation to create a new class of preferred stock which will be designated as Series A Non-Voting Preferred Stock. Second, we are proposing an amendment to reclassify shares of common stock held by holders of record of fewer than 1,000 shares of common stock into shares of Series A Non-Voting Preferred Stock on the basis of one share of Series A Non-Voting Preferred Stock for each share of common stock held by such shareholders. |

Neither of the Amendments to our articles of incorporation will be implemented unless both of the Amendments are approved. Thus, for purposes of this proxy statement, when we refer to the term “Reclassification,” we are referring to both (i) the creation of the new class of preferred stock and (ii) the reclassification of certain shares of our common stock.

| Q: | What is the purpose of the proposed Reclassification? |

| A: | The purpose of the Reclassification is to allow us to suspend our Securities and Exchange Commission (“SEC”) reporting obligations (referred to as “going private”) by reducing the number of our record shareholders of common stock to fewer than 300 and by having under 500 record shareholders of our Series A Non-Voting Preferred Stock. This will allow us to terminate our registration under the Exchange Act, suspend our reporting obligations under the Exchange Act, and relieve us of the costs typically associated with the preparation and filing of public reports and other documents with the SEC. |

| Q: | What will be the effects of the Reclassification? |

| A: | The Reclassification is a “going private transaction”, meaning it will allow us to deregister with the SEC and to suspend our reporting obligations under federal securities laws. As a result of the Reclassification, among other things: |

| | • | | the number of our record shareholders holding shares of common stock will be reduced from approximately 556 to approximately 234; |

| | • | | the number of outstanding shares of our common stock will decrease by approximately 4.9%, from 1,899,984 shares to approximately 1,806,634 shares; |

| | • | | the number of authorized shares of Series A Non-Voting Preferred Stock will increase from zero shares to 150,000 shares, of which approximately 93,350 shares will be outstanding and held by approximately 322 shareholders; |

| | • | | because of the reduction of our total number of record shareholders of common stock to fewer than 300 and because the total number of record shareholders of the Series A Non-Voting Preferred Stock will be fewer than 500, we will be allowed to suspend our reporting obligations with the SEC; |

| | • | | all of our shareholders, including those shareholders receiving shares of Series A Non-Voting Preferred Stock, will continue to have an equity interest in the Company and therefore will still be entitled to participate in any future value received as a result of a sale of the Company, if any; |

5

| | • | | all of our shareholders, both affiliated and unaffiliated, who continue to own common stock will continue to exercise the sole voting control over the Company and because the number of outstanding shares of common stock will be reduced, will have a relative increase in voting power; and |

| | • | | all of our shareholders who receive Series A Non-Voting Preferred Stock will lose their voting rights (except as required by law) but will be entitled to continue to receive dividends equal to any dividends paid on the common stock. |

For a further description of how the Reclassification will affect you, please see “Special Factors — Effects of the Reclassification on Shareholders of Virginia Savings Bancorp, Inc.” beginning on page .

| Q: | What does it mean for the Company and our shareholders that the Company will no longer be a public company and subject to federal securities laws reporting obligations? |

| A: | We will no longer be required to file reports with the SEC, including annual, quarterly and periodic reports. This will reduce the amount of information that is publicly available about the Company and will eliminate certain corporate governance requirements resulting from the Sarbanes-Oxley Act, such as the requirements for an audited report on our internal controls and for our Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”) to certify as to the accuracy of our disclosures, as well as disclosure requirements relating to our audit committee composition, code of ethics and director nomination process. We do, however, intend to send shareholders annual reports and periodic information about the Company. Financial information about us will also be available on our quarterly thrift financial reports, which are filed with the Office of Thrift Supervision (“OTS”) and published on its website. Additionally, beginning 90 days after the effective date of the Reclassification, our executive officers, directors and other affiliates will no longer be subject to many of the reporting requirements and restrictions of the Exchange Act, including the reporting and short-swing profit provisions of Section 16, and information about their compensation and stock ownership will not be publicly available. Because our common stock historically has not been publicly traded on an exchange, we believe that the liquidity of the common stock and Series A Non-Voting Preferred Stock will be similar after the Reclassification. All of our stock may continue to be traded in privately negotiated transactions. |

| Q: | Will the Company be subject to regulatory controls if it is no longer subject to SEC reporting obligations? |

| A: | Although our obligations to report under the federal securities laws will be suspended, we will nevertheless remain subject to a variety of internal and external controls. In addition to our on-going internal audit controls and procedures, we will continue to be subject to examination and to regulatory control by the OTS and the FDIC. |

| Q: | Why are you proposing the Reclassification? |

| A: | Our reasons for the Reclassification are based on: |

| | • | | the administrative burden and cash expense of making periodic filings with the SEC; |

6

| | • | | increasing costs of compliance with the SEC reporting obligations as a result of the Sarbanes-Oxley Act; |

| | • | | the low trading volume of our common stock and the resulting lack of an active market for our shareholders; |

| | • | | the fact that a going-private transaction could be structured in a manner that all shareholders would still retain an equity interest in the Company, and would not be forced out by means of a cash reverse stock split or similar transaction; and |

| | • | | the estimated expense of a going private transaction relative to the anticipated cost savings from the Reclassification. |

We considered that some of our shareholders may prefer that we continue as an SEC reporting company, which is a factor weighing against the Reclassification. However, we believe that the disadvantages and costs of continuing our reporting obligations with the SEC outweigh any advantages associated with doing so. See “Special Factors — Reasons for the Reclassification; Fairness of the Reclassification; Board Recommendation” beginning on page .

Based on a careful review of the facts and circumstances relating to the Reclassification, each member of our board of directors and each of our executive officers believes that the terms and provisions of the Reclassification are substantively and procedurally fair to our shareholders as a whole, as well as each group of our unaffiliated shareholders, which includes our unaffiliated shareholders who will retain their shares of common stock, as well as our unaffiliated shareholders who will receive shares of our Series A Non-Voting Preferred Stock. Our board of directors unanimously approved the Reclassification.

In the course of determining that the Reclassification is fair to, and is in the best interests of, our shareholders, including both shareholders who will continue to hold shares of common stock as well as those shareholders whose shares of common stock will be reclassified into shares of Series A Non-Voting Preferred Stock, our board of directors considered a number of positive and negative factors affecting these groups of shareholders. To review the reasons for the Reclassification in greater detail, please see “Special Factors — Reasons for the Reclassification; Fairness of the Reclassification; Board Recommendation” beginning on page .

| Q: | What is the recommendation of our board of directors regarding the proposal? |

| A: | Our board of directors has determined that the Reclassification is in the best interests of our shareholders. Our board of directors has unanimously approved the Reclassification and recommends that you vote “FOR” approval of both Amendments at the special meeting. All of the members of our board of directors intend to vote in favor of both Amendments. |

Each member of our board of directors is an affiliate of the Company and are collectively deemed to be “filing persons” for purposes of this proxy statement. Each filing person believes that the Reclassification is substantively fair and procedurally fair, and therefore, in the best interest of our unaffiliated shareholders.

7

| Q: | Do the directors and officers have different interests in the Reclassification? |

| A: | You should be aware that our directors and executive officers have interests in the Reclassification that may present actual or potential, or the appearance of actual or potential, conflicts of interest. We expect that most of our directors and executive officers will own 1,000 or more shares of common stock at the effective time of the Reclassification, and will therefore continue as holders of common stock if the Reclassification is approved. In addition, because there will be fewer outstanding shares of common stock, these directors and executive officers will own a slightly larger relative percentage of the common stock on a post-transaction basis. As of the record date, our directors and executive officers collectively beneficially held 710,452 shares or 37.4% of our outstanding common stock. Based upon our estimates, taking into account the effect of the Reclassification on our outstanding shares of common stock as described above, the directors and executive officers will beneficially hold approximately 39.3% of our common stock. This may represent a potential conflict of interest because our directors approved the Reclassification and are recommending that you approve it. Despite this, each member of our board of directors and each of our executive officers believes the proposed Reclassification is fair to all shareholders, including our unaffiliated shareholders who will retain common stock and our unaffiliated shareholders who will receive Series A Non-Voting Preferred Stock, for the reasons discussed in this proxy statement. |

| Q: | Has the Company obtained any reports, opinions or appraisals from an outside party relating to the fairness of the consideration being offered to the shareholders in connection with the Reclassification? |

| A: | Neither the board of directors nor the officers of the Company have received or solicited any reports, opinions or appraisals from any outside party relating to the fairness of the consideration being received by our shareholders. We did not consider the liquidation value of our assets, the current or historical market price of our shares, our net book value or going concern value to be material since our shareholders are not being “cashed out” in connection with the Reclassification. In addition, the shares of the Series A Non-Voting Preferred Stock allow the holders of those shares to participate equally with the holders of the common stock in any subsequent sale of the Company. |

| Q: | What will I receive in the Reclassification? |

| A: | If approved at the special meeting, the transaction will affect you as follows: |

| | |

If, prior to the Reclassification,

you are a shareholder with | | Effect |

| |

| 1,000 or more shares of common stock | | You will continue to hold the same number of shares of common stock. |

| |

| Fewer than 1,000 shares of common stock | | You will no longer hold shares of common stock. Instead, you will hold a number of shares of Series A Non-Voting Preferred Stock equal to the same number of shares of common stock that you held immediately before the Reclassification. |

8

| Q: | What are the terms of the Series A Non-Voting Preferred Stock? |

| A: | The following table sets forth the principal differences between our common stock before and after the Reclassification and the Series A Non-Voting Preferred Stock: |

| | | | | | |

| | | Common Stock (Prior to Reclassification) | | Common Stock (After Reclassification) | | Series A Non-Voting Preferred Stock |

| | | |

| Voting Rights | | Entitled to vote on all matters submitted to a vote at any meeting of shareholders | | Entitled to vote on all matters submitted to a vote at any meeting of shareholders | | Entitled to vote only as required by law |

| | | |

| Dividends | | If and when declared by our board of directors, subject to our bank subsidiary’s ability to pay a dividend, which is subject to regulatory and statutory limitations | | If and when declared by our board of directors, subject to our bank subsidiary’s ability to pay a dividend, which is subject to regulatory and statutory limitations | | If and when declared by our board of directors, equal to the dividends declared on the common stock, and such dividends shall be paid prior to, or simultaneously with, the payment of any dividends to the holders of the common stock |

| | | |

| Liquidation Rights | | As the only class outstanding, entitled to distribution of all assets distributed to equity holders | | Entitled to distribution of assets on a pro rata basis after distribution is made to holders of Series A Non-Voting Preferred Stock | | Entitled to be paid in full (on a per share basis) the net book value of the shares of Series A Non-Voting Preferred Stock, before any distribution or payment shall be made to the holders of common stock |

| | | |

| Conversion Rights | | Not applicable | | Not applicable | | None, but holders of Series A Non-Voting Preferred Stock shall have the right to receive the same consideration to be received by each holder of common stock in the event of a Change of Control (as defined below), calculated as if the holder had converted such shares into an equal number of shares of common stock immediately before the transaction |

9

| | | | | | |

| | | |

| Preemptive Rights | | None | | None | | None |

| | | |

| Anti-Dilution Rights | | Not applicable | | Not applicable | | Appropriate adjustments will be made if the outstanding shares of common stock are increased or decreased following a reclassification, stock split or similar transaction |

As defined in the Amendments and used in this proxy statement, the term “Change of Control” means the consummation of (i) a merger, share exchange, consolidation or other business combination of the Company with any other business entity, other than a merger, share exchange, consolidation or business combination that would result in the outstanding common stock of the Company immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into common stock of the surviving entity or parent or affiliate thereof) more than fifty percent (50%) of the outstanding common stock of the Company or such surviving entity or parent or affiliate thereof outstanding immediately after such merger, share exchange, consolidation or business combination; or (ii) an agreement for the sale or disposition by the Company of all or substantially all of the Company’s assets.

For a complete description of the terms of the common stock and the Series A Non-Voting Preferred Stock, please refer to “Description of Capital Stock” beginning on page . Our ability to pay dividends is dependent upon our cash-on-hand and cash dividends that we receive from the Bank. A dividend payment by the Bank to the Company, as well as by the Company to its shareholders, is subject to the discretion of the board of directors of each entity. Under OTS capital distribution regulations, dividend payments are subject to an annual limitation equal to the Bank’s net income for the current year plus retained net income, net of dividend payments, for the two preceding years. In addition to the foregoing limitations, the Bank must file a notice of its intent to make a capital distribution to the Company which is subject to OTS approval.

| Q: | Why was 1,000 shares selected as the “cutoff” for determining which shareholders will receive Series A Non-Voting Preferred Stock and which shareholders will remain as common stock shareholders? |

| A: | The purpose of the Reclassification is to reduce the number of our record shareholders of our common stock to fewer than 300 and to have under 500 record shareholders of our Series A Non-Voting Preferred Stock, which will allow us to deregister as an SEC reporting company. Our board selected 1,000 shares as the “cutoff’ number in order to enhance the probability that after the Reclassification, if approved, we will have fewer than 300 record shareholders of our common stock and fewer than 500 record shareholders of our Series A Non-Voting Preferred Stock. |

| Q: | May I acquire additional shares in order to remain a holder of common stock? |

| A: | Yes. The key date for acquiring additional shares is the date of our special meeting. So long as you are able to acquire a sufficient number of shares so that you are the record owner of 1,000 or more shares by that date, you will retain your shares of common stock after the Reclassification. Due to the limited market for our common stock, however, it may be difficult for you to acquire the requisite number of shares of our common stock to avoid reclassification of your shares. |

10

| Q: | Who is a “holder” of stock for purposes of determining how I may be affected by the Reclassification? |

| A: | Because SEC rules require that we count “record holders” for purposes of determining our reporting obligations, the Reclassification is based on shares held of record without regard to the ultimate control of the shares. A shareholder “of record” is the shareholder whose name is listed on the front of the stock certificate, regardless of who ultimately has the power to vote or sell the shares. For example, if a shareholder holds separate certificates (i) individually, (ii) as a joint tenant with someone else, (iii) as trustee or custodian, and (iv) in an Individual Retirement Account, those four certificates represent shares held by four different record holders, even if a single shareholder controls the voting or disposition of those shares. |

As a result, a single shareholder with 1,000 or more shares held in various accounts could receive Series A Non-Voting Preferred Stock in the Reclassification for all of his or her shares depending on the number of shares held in each of those accounts. To avoid this, the shareholder may either consolidate his or her ownership into a single form of ownership, or acquire additional shares prior to the effective date of the Reclassification. Additionally, a shareholder who holds fewer than 1,000 shares of common stock in street name may be unaffected by the Reclassification if the broker holds an aggregate of 1,000 or more shares.

| Q: | What does it mean if my shares are held in “street name”? |

| A: | If you have transferred your shares of common stock into a brokerage or custodial account, you are no longer shown on our shareholder list as a record holder of these shares. Instead, the brokerage firms or custodians typically hold all shares of our common stock that its clients have deposited with it through a single nominee. This method of ownership of stock is commonly referred to as being held in “street name.” |

| Q: | What if I hold my shares in “street name”? |

| A: | The Reclassification is being effected at the record shareholder level. This means that we will look at the number of shares registered in the name of a single holder to determine if that holder will be receiving shares of Series A Non-Voting Preferred Stock. It is important that you understand how shares that are held by you in “street name” will be treated for purposes of the Reclassification described in this proxy statement. If that single nominee is the record shareholder for 1,000 or more shares, then the stock registered in that nominee’s name will be completely unaffected by the Reclassification. Because the Reclassification only affects record shareholders, it does not matter whether any of the underlying beneficial owners for whom that nominee acts owns fewer than 1,000 shares. At the end of this transaction, these beneficial owners will continue to beneficially own the same number of shares of our common stock as they did at the start of this transaction, even if the number of shares they beneficially own is fewer than 1,000. |

If you hold your shares in “street name,” you should talk to your broker, nominee or agent to determine how they expect the Reclassification to affect you. Because other “street name” holders who hold through your broker, agent or nominee may adjust their holdings prior to the Reclassification, you may have no way of knowing whether you will be receiving shares of Series A Non-Voting Preferred Stock in the Reclassification until it is completed.

11

| Q: | When is the Reclassification expected to be completed? |

| A: | If the proposed Reclassification is approved at the special meeting, we expect to complete such Reclassification as soon as practicable following the special meeting. |

| Q: | What if the proposed Reclassification is not completed? |

| A: | If the Reclassification is not completed, whether due to a failure to be approved by our shareholders or a decision by our board of directors to abandon, we will continue our current operations, and we will continue to be subject to the reporting requirements of the SEC. |

| Q: | What will happen if, through negotiated trades, the Company gains additional security holders requiring SEC registration? |

| A: | We are currently subject to the reporting obligations under Sections 13(a) and 14 of the Exchange Act, which requires us to file proxy statements and periodic reports with the SEC, because our common stock is registered under Section 12 of the Exchange Act. We registered our common stock with the SEC as part of our reorganization into a thrift holding company in 2007. Prior to that, the Bank filed proxy statements and periodic reports with the OTS, which has delegated SEC authority. Because we filed a registration statement under the Securities Act of 1933 when we reorganized into a holding company structure, we are subject to reporting obligations under Section 15(d) of the Exchange Act. If the shareholders approve the proposals to amend our articles of incorporation and to reclassify our common stock, our common stock will be held by fewer than 300 shareholders of record, which will permit us to suspend our reporting obligations. |

If the Reclassification is approved, we intend to file a Form 15 and terminate the registration of our common stock and the obligation to file under Sections 13(a) and 14 periodic reports arising under Section 12(g) of the Exchange Act. However, our periodic reporting obligations arising under Section 15(d) of the Exchange Act cannot be terminated, but can only be suspended. Therefore, if our shareholders of record for the common stock ever rise above 300 as of the last day of any fiscal year, then we will again be responsible for making filings in compliance with Section 15(d). This would require us to file periodic reports going forward and an annual report for the preceding fiscal year. If the holders of record for any class of our other equity securities, such as the Series A Non-Voting Preferred Stock, ever exceeds 500, then we will again become fully regulated under additional disclosure provisions of the Exchange Act.

| Q: | If the Reclassification is approved, will shareholders continue to receive information about the Company? |

| A: | Yes. Even if we terminate our registration with the SEC, we will continue to send out periodic information about the Company to our shareholders. Periodic information would include shareholder letters, which letters would include information updating our financial performance and any other news affecting the Company, such as new offices, acquisitions, economic updates or new product offerings. We also intend to continue to prepare and distribute annual reports to our shareholders. In addition, certain financial information about us will be available on our quarterly thrift financial reports which are filed with the OTS and published on its website. If we terminate our registration, however, we will no longer be required to file reports with the SEC, including annual, quarterly and periodic reports. This will reduce the amount of information that is publicly available about the Company and will eliminate certain corporate governance requirements resulting from the Sarbanes-Oxley Act. |

12

| Q: | What are the tax consequences of the Reclassification? |

| A: | We believe that the Reclassification, if effected, will have the following federal income tax consequences: |

| | • | | the Reclassification would be treated as a tax-free recapitalization for federal income tax purposes and should result in no material federal income tax consequences to the Company; |

| | • | | those shareholders continuing to hold common stock will not recognize any gain or loss in the Reclassification; |

| | • | | those shareholders receiving Series A Non-Voting Preferred Stock for their shares of common stock should not recognize any gain or loss in the Reclassification, their basis in the Series A Non-Voting Preferred Stock will equal the basis in their shares of common stock, and their holding period for shares of Series A Non-Voting Preferred Stock will include the holding period during which their shares of common stock were held; and |

| | • | | we expect that the proceeds from a subsequent sale of the Series A Non-Voting Preferred Stock will be treated as capital gain or loss to most shareholders. However, the Series A Non-Voting Preferred Stock could be considered Section 306 stock as defined under the Internal Revenue Code, and in that case the proceeds from a subsequent sale of Series A Non-Voting Preferred Stock (i) will be treated as ordinary income (dividend income) to the extent that the fair market value of the stock sold, on the date distributed to the shareholder, would have been a dividend to such shareholder had the Company distributed cash in lieu of stock; (ii) any excess of the amount received over the amount treated as ordinary income plus the cost basis of the stock will be treated as a capital gain; and (iii) no loss, if any, will be recognized. Under current tax law, if proceeds are treated as dividend income, such proceeds will be taxed at the same rates that apply to net capital gains (i.e., currently 5% and 15%). The current tax law provision in which dividends are taxed at net capital gain rates will not apply for tax years beginning after December 31, 2010. Unless any intervening tax legislation is enacted, ordinary income tax rates will be applicable for dividend income beginning January 1, 2011. |

Because determining the tax consequences of the Reclassification can be complicated and depends on your particular tax circumstances, you should consult your own tax advisor to understand fully how the Reclassification will affect you.

| Q: | Should I send in my stock certificates now? |

| A: | No. If you own in record name fewer than 1,000 shares of common stock of record after the Reclassification is completed, we will send you written instructions for exchanging your stock certificates for shares of Series A Non-Voting Preferred Stock. If you own in record name 1,000 or more shares of our common stock, you will continue to hold the same number and class of shares after the Reclassification as you did before the Reclassification. |

| Q: | How are you financing the Reclassification? |

| A: | We estimate that the total fees and expenses relating to the Reclassification will be approximately $80,000. We believe that we have sufficient cash available to pay these costs. In structuring the |

13

| | terms of the transaction in a manner that shares of common stock are not “cashed out” in the transaction but, rather, are converted into shares of Series A Non-Voting Preferred Stock, our board believes that it has attempted to balance the interests of reducing our expenses in transitioning to a non-SEC reporting company while at the same time affording all shareholders the opportunity to retain an equity ownership interest in the Company. |

| Q: | Who pays for the solicitation of proxies? |

| A: | This proxy statement is being furnished in connection with the solicitation of proxies by our board of directors. We will pay the cost of preparing, printing and mailing material in connection with this solicitation of proxies. In addition to being solicited through the mail, proxies may be solicited personally or by telephone, facsimile or electronic mail by our officers, directors and employees who will receive no additional compensation for such activities. Arrangements will also be made with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of shares held of record by such persons. Such brokerage houses and other custodians, nominees and fiduciaries will be reimbursed for their reasonable expenses incurred in such solicitation. We have not retained any outside party to assist in the solicitation of proxies. |

| Q: | Where can I find more information about Virginia Savings Bancorp, Inc.? |

| A: | We currently file periodic reports and other information with the SEC. You may read and copy this information at the SEC’s public reference facilities. Please call the SEC at 1-800-SEC-0330 for information about these facilities. This information is also available at the Internet site maintained by the SEC at http://www.sec.gov. For a more detailed description of the information available, please see “Other Matters — Where You Can Find More Information” on page . |

| Q: | Who can help answer my questions? |

| A: | If you have questions about the Amendments or any other matter to be voted upon at the special meeting after reading this proxy statement, or need assistance in voting your shares, you should contact our Corporate Secretary, Noel F. Pilon, at (540) 635-4137. |

SPECIAL FACTORS

Overview of the Reclassification

This proxy statement is being furnished in connection with the solicitation of proxies by our board of directors at a special meeting at which our shareholders will be asked to consider and vote on two proposed Amendments to our articles of incorporation. The proposed Amendments would collectively provide for the authorization of a specific new class of stock, entitled Series A Non-Voting Preferred Stock, and the reclassification of shares of our common stock held by shareholders who own fewer than 1,000 shares into shares of Series A Non-Voting Preferred Stock. We are referring to the transaction that will be effected by the implementation of the proposed Amendments as the “Reclassification.”

Record shareholders holding 1,000 or more shares of common stock before the Reclassification will hold the same number of shares of common stock following the Reclassification. Record holders of fewer than 1,000 shares of common stock will no longer hold common stock in the Company. We intend, immediately following the Reclassification, to terminate the registration of our shares of common stock and suspend our reporting obligations under the Exchange Act.

14

If approved by our shareholders at the special meeting and implemented by our board of directors, the Reclassification will generally affect our shareholders as follows:

| | |

If, prior to the

Reclassification, you are a

shareholder with | | Effect |

| 1,000 or more shares of common stock | | You will continue to hold the same number of shares of common stock, but your shares will no longer be eligible for public trading. Our shares historically have not been listed on an exchange and we do not believe an active trading market for our shares would have developed in the future. Sales may continue to be made in privately negotiated transactions. |

| |

| Fewer than 1,000 shares of common stock | | You will no longer hold shares of common stock. Instead, you will hold a number of shares of Series A Non-Voting Preferred Stock equal to the same number of shares of common stock that you held immediately before the Reclassification. It is not anticipated that an active trading market for these shares will develop. Sales may be made in privately negotiated transactions. |

| |

| Common stock held in “street name” through a nominee (such as a bank or broker) | | The Reclassification will be effected at the record shareholder level. Therefore, regardless of the number of beneficial holders or the number of shares held by each beneficial holder, shares held in “street name” will be treated based on the aggregate number of shares held in the name of the broker. Consequently, even if you beneficially own fewer than 1,000 shares of common stock but they are held in street name by a broker which is the holder of 1,000 or more shares of common stock prior to the Reclassification, you will continue to beneficially own the same number of shares of common stock after the Reclassification. You should check with your broker to determine the number of shares that the broker holds of record. |

The effects of the Reclassification on each group of shareholders are described more fully below under “—Effects of the Reclassification on Shareholders of Virginia Savings Bancorp, Inc.” beginning on page and the effects on the Company are described more fully below under “—Effects of the Reclassification on Virginia Savings Bancorp, Inc.” beginning on page .

Background of the Reclassification

As an SEC reporting company, we are required to prepare and file with the SEC, among other items, the following:

| | • | | Annual Reports on Form 10-K; |

| | • | | Quarterly Reports on Form 10-Q; |

| | • | | Proxy Statements and related materials as required by Regulation 14A under the Exchange Act; |

15

| | • | | Current Reports on Form 8-K; and |

| | • | | On-going reports regarding stock transfers by affiliates and insiders. |

In addition to the administrative burden on management required to prepare these reports, the costs associated with these reports and other filing obligations comprise a significant and increasing corporate overhead expense. These costs include securities counsel fees, independent auditor fees, costs of printing and mailing shareholder documents and other miscellaneous costs associated with filing periodic reports with the SEC. Administrative burdens include the time spent preparing the periodic reports and monitoring compliance with Section 16 of the Exchange Act, including preparing forms relating to such compliance. These registration and reporting related costs have been increasing over the years. We believe they will continue to increase, particularly as a result of the additional reporting and disclosure obligations imposed on SEC reporting companies by Section 404 of the Sarbanes-Oxley Act of 2002, which generally requires public companies to include an assessment of their internal control over financial reporting as well as an auditor’s attestation.

Prior to its holding company reorganization in 2007 (and since its formation in 1980), the Bank had filed reports under the Exchange Act initially with the Federal Home Loan Bank, and later, with the OTS. These reports include annual, quarterly and current reports presenting and analyzing the Bank’s financial condition and results of operations; reports regarding insiders’ stock transactions; and proxy statements disclosing information about our directors and executive officers, their compensation and our corporate governance processes. With the passage of the Sarbanes-Oxley Act in 2002, we became subject to additional compliance and documentation requirements, including disclosure and internal controls, internal and external audit relationships, and the duties and qualifications of our board committees. As a result of these new requirements, the direct cost of compliance has increased significantly, and our staff has been burdened with the task of documenting, testing and validating a significantly expanded internal control system. The direct costs incurred by us in complying with the provisions of the Sarbanes-Oxley Act requirements include increased internal and external auditor fees, increased attorney fees, and increased costs of printing and mailing expanded shareholder reports and proxy statements.

Until the Bank reorganized to a holding company structure late in 2007, management and the board of directors from time to time discussed the benefits of deregistering the Bank’s common stock by reducing the number of shareholders to less than 300. We were, however, constrained from taking action to deregister the Bank’s common stock because the primary method available to us to accomplish this goal was a re-purchase of a portion of the outstanding common stock of the Bank. OTS regulations prohibited such action by thrift institutions.

Throughout fiscal year 2008, deteriorating national and local economic conditions and the resulting collapse of the real estate market caused management and the board of directors to focus their time and efforts on problem asset management, a compressed net income margin, declining profitability and the reduction of non-interest expenses. One expense area on which we focused was the professional fees and other costs associated with SEC reporting and compliance. In addition to the current costs in this area, we face additional costs beginning in fiscal year 2009 because of a new requirement that a corporation’s external auditors attest to management’s report on internal controls.

Early in 2009, our chairman of the board, J. William Gilliam, our chairman of the audit committee, Samuel J. Baggarly, and CEO W. Michael Funk, re-examined the possibility of deregistering the Company’s common stock. While our holding company structure provided us greater flexibility to manage our capital than we had as a standalone OTS regulated savings bank, other barriers arose in connection with this effort because the Company lacked the cash resources to reduce the number of common shareholders below 300 through a stock re-purchase program. Because of the economic

16

downturn and a lack of earnings, the Bank has been unable to pay cash dividends to the Company in 2009. Furthermore, the Company’s primary asset was its investment in the Bank, and it did not have suitable collateral to support borrowings from a non-affiliated source. The opportunity to achieve deregistration from the SEC without a cash outlay did, however, come about with the passage of legislation at the state level that became effective July 1, 2009. This legislation permitted Virginia banking institutions organized as Virginia corporations to reclassify common stock to preferred stock.

On August 6, 2009, Messrs. Gilliam, Baggarly and Funk, with the assistance of our securities counsel, presented a written report to the board of directors which outlined:

| | • | | the benefits of going private through deregistration; |

| | • | | alternative methods of going private; |

| | • | | the positives and negatives of the various alternatives; |

| | • | | an explanation of a reclassification transaction; |

| | • | | the factors that might affect all shareholders after deregistration; and |

| | • | | a cost-benefit analysis. |

Discussion of each of the foregoing considerations affecting the board of directors and management’s analysis and conclusions are presented in detail in this proxy statement.

After a lengthy discussion of the foregoing report, draft resolutions and Articles of Amendment to the Company’s articles of incorporation were presented to the board of directors for their review and consideration for adoption at a future meeting. At a meeting of the board of directors held on August 13, 2009, the resolution and Articles of Amendment were approved by the unanimous vote of the directors.

Reasons for the Reclassification; Fairness of the Reclassification; Board Recommendation

Reasons for the Reclassification

As a locally owned community bank holding company whose shares are not listed on any exchange or traded on any quotation system, we have questioned the costs associated with being a public company. In addition, in 2003, the SEC adopted rules to implement Section 404 of the Sarbanes-Oxley Act of 2002, a further cost. Early in 2009, our board and management, along with their accounting and legal advisors, began to discuss alternatives to reduce costs associated with SEC compliance. Specifically, they began to review proxy statements of other community bank holding companies using reclassification as a means to deregister their securities, not only to reduce the burdens of Section 404, but also the other costs and time expended in complying with the registered securities rules. The Company and each member of our board and each executive officer supports the Reclassification at this time, which will suspend our SEC reporting obligations and save the Company and our shareholders the substantial costs associated with being a reporting company. These costs are expected to increase over time. The Company and each member of our board and each executive officer decided to undertake the Reclassification at this time, as compared to another time in the operating history of the Company, because of the increased costs associated with complying with Section 404 of the Sarbanes-Oxley Act as it relates to an auditor’s attestation with our assessment of the Company’s internal control over financial reporting, a relatively new requirement for financial institutions of comparable size as the Company.

17

We estimate that the reduction in the number of common shareholders and the suspension of our reporting requirements under the Exchange Act will result in net savings of approximately $212,000 per year. This estimate includes anticipated costs related to compliance with Section 404 of the Sarbanes-Oxley Act.

We estimate that we incur the following fees and expenses related to the preparation, review and filing of periodic reports on Form 10-K and Form 10-Q and annual proxy statements:

| | | |

Direct Costs: | | | |

Legal Fees | | $ | 5,000 |

Independent Auditor Fees | | | 87,000 |

Edgar Conversion Costs | | | 5,000 |

Proxy Solicitation, Printing and Mailing Costs | | | 5,000 |

Auditors Attestation of Adequacy of Internal Controls | | | 55,000 |

Audit Committee Meeting Fees | | | 5,000 |

| | | |

Total Direct Costs | | | 162,000 |

Indirect Costs: | | | |

Management, Accounting and Staff Time | | | 80,000 |

| | | |

Total Current Reporting Costs | | $ | 242,000 |

| | | |

After the Reclassification, we will continue to provide our shareholders with annual reports and certain periodic information about the Company including any required financial statements. We expect, however, to incur lower costs due to simplified disclosure requirements and the elimination of the preparation, auditor review and filing of our quarterly and annual reports to the SEC and other of our current reporting costs. Subsequent to the Reclassification, we expect to incur the following fees and expenses related to the preparation and review of such reports:

| | | |

Direct Costs: | | | |

Independent Auditor Fees | | $ | 59,000 |

Proxy Solicitation, Printing and Mailing Costs | | | 3,000 |

Audit Committee Meeting Fees | | | 3,000 |

| | | |

Total Direct Costs | | | 65,000 |

| Indirect Costs: | | | |

Management, Accounting and Staff Time | | | 25,000 |

| | | |

Total Anticipated Reporting Costs | | $ | 90,000 |

| | | |

As a result of these lower costs, we anticipate a net savings of approximately $152,000 related to the preparation of an annual report for our shareholders in lieu of compliance with the periodic reporting requirements under the Exchange Act. In addition, we will not be required to expend at least an additional $33,000 each year in fees and expenses related to compliance with Section 404 of the Sarbanes-Oxley Act.

18

Based on these estimates, we expect that continued compliance with SEC reporting obligations, including compliance with Section 404 of the Sarbanes-Oxley Act, would cost approximately $275,000 on an ongoing annual basis.

As noted above, we incur substantial indirect costs in management time spent on securities compliance activities. Although it is difficult to quantify these costs specifically, we estimate that our management and staff currently spend an average of approximately 11% of their time (equating to approximately 340 days per year, in the aggregate) on activities directly related to compliance with federal securities laws, such as preparing and reviewing SEC compliant financial statements and periodic reports, maintaining and overseeing disclosure and internal controls, monitoring and reporting transactions and other data relating to insiders’ stock ownership, and consulting with external auditors and counsel on compliance issues. If the Reclassification is approved by shareholders, we estimate that our management and staff will be able to reduce their time spent on annual and periodic report preparation to approximately 2% of their time (equating to approximately 60 days per year, in the aggregate).

We expect to continue to provide our shareholders with financial information included in our annual reports, but, as noted above, the costs associated with these reports will be substantially less than those we incur currently. In our board of directors’ judgment, little or no justification exists for the continuing direct and indirect costs of registration with the SEC, given the low trading volume in our common stock. If it becomes necessary to raise additional capital, we believe that there are adequate sources of additional capital available, whether through borrowing at the holding company level or through private or institutional sales of equity or debt securities, although we recognize that there can be no assurance that we will be able to raise additional capital when required, or that the cost of additional capital will be attractive.

We considered that some shareholders may prefer that we continue as an SEC reporting company, which is a factor weighing against the Reclassification. However, we believe that the disadvantages of remaining a public company subject to the registration and reporting requirements of the SEC outweigh any advantages. Historically, our shares of common stock have not been listed on an exchange and only traded in privately negotiated transactions. Also, we have no present intention to raise capital through sales of securities in a public offering in the future or to acquire other business entities using stock as the consideration for such acquisition. Accordingly, we are not likely to make use of any advantage that our status as an SEC reporting company may offer.

The Reclassification proposal allows those shareholders receiving shares of Series A Non-Voting Preferred Stock to still retain an equity interest in the Company and therefore participate at the same value per share as holders of common stock in the event of any sale of the Company, although none is contemplated at this time.

In view of the wide variety of factors considered in connection with its evaluation of the Reclassification, our board of directors did not find it practicable to, and did not, quantify or otherwise attempt to assign relative weights to the specific factors it considered in reaching its determinations.

The Reclassification, if completed, will have different effects on the holders of common stock and those receiving shares of Series A Non-Voting Preferred Stock. You should read “—Our Position as to the Fairness of the Reclassification” beginning on page and “—Effects of the Reclassification on Shareholders of Virginia Savings Bancorp, Inc.” beginning on page for more information regarding the effects of the Reclassification.

19

We considered various alternative transactions to accomplish the proposed transaction, including a tender offer and a reverse stock split whereby shareholders owning fewer than a certain number of shares would be “cashed out.” Ultimately, however, the board elected to proceed with the Reclassification because the alternatives would be more costly, might not have reduced the number of shareholders below 300 and would not allow all shareholders to retain an equity interest in the Company. Our board believes that by implementing a deregistration transaction, our management will be better positioned to focus its attention on our customers and the communities in which we operate. See “—Purpose and Structure of the Reclassification” on page for further information as to why this Reclassification structure was chosen.

In making our decision to proceed with the Reclassification, we considered other alternatives. We rejected these alternatives because we concluded that the Reclassification would be the simplest and most cost-effective manner in which to achieve the purposes described above. The alternatives we considered included:

Reverse Stock Split. The board considered declaring a reverse stock split, with cash payments to shareholders who would hold less than one whole share on a post-split basis. This alternative would have the effect of reducing the number of shareholders, but would require us to account for outstanding fractional shares after the transaction by either engaging in a forward stock split at the reverse split ratio or paying cash to shareholders holding fractional shares. While shareholders could consolidate their accounts or acquire sufficient shares in order to retain an equity interest in the Company and avoid being cashed-out, the board preferred to structure a transaction that would allow shareholders to retain an equity interest without being required to pay for additional shares or consolidate their holdings in a way that might not otherwise be advantageous for them. Additionally, the receipt of cash in exchange for shares of common stock would generally result in a negative tax consequence for those shareholders receiving cash. Assuming that all of the approximately 93,350 shares held of record by shareholders owning fewer than 1,000 shares were exchanged for $11.50 in cash (the highest known share purchase price in 2009), the capital cost of the transaction would be approximately $1,073,525. In light of the significant anticipated capital cost and the elimination of the opportunity for all shareholders to retain an equity interest, the board rejected this alternative.

Issuer Tender Offer. We also considered an issuer tender offer to repurchase shares of our outstanding common stock. The results of an issuer tender offer would be unpredictable, however, due to its voluntary nature. We were uncertain as to whether this alternative would result in shares being tendered by a sufficient number of shareholders so as to result in our common stock being held by fewer than 300 shareholders of record. As a result, we also rejected this alternative.

Expense Reductions in Other Areas. While we might be able to offset the expenses relating to SEC registration by reducing expenses in other areas, we have not pursued such an alternative because there are no areas in which we could achieve comparable savings without adversely affecting a vital part of our business or impeding our opportunity to grow. We believe the expense savings a reclassification would enable us to accomplish will not adversely affect our ability to execute our business plan, but will instead position us to execute it more efficiently. For these reasons, we did not analyze cost reductions in other areas as an alternative to the Reclassification.

Business Combination. The purpose of the proposed transaction is to discontinue our SEC reporting obligations and thereby save significant amounts of staff time and related costs. The board believes that by implementing a deregistration transaction, expenses will be reduced and our management will be better positioned to focus its attention on our customers and the communities in which we operate. The board did not consider seeking any proposals from third parties relating to any business combination transactions such as a merger, consolidation, or sale of all or substantially all of our assets for the purpose of discontinuing our SEC reporting obligations because the board believes that these types of reorganization transactions are generally inconsistent with the narrower purpose of the proposed

20

deregistration transaction. The board noted that the Reclassification as structured will not adversely affect our ability to seek or consider business combination transactions in the future. The board weighed this factor heavily in approving the proposed Reclassification because as part of its ongoing strategic planning process, the board periodically analyzes the possibility of merging with larger or similarly situated financial institutions. From time to time, representatives of the Company have had informal exploratory discussions with potential acquirers on the possibility of separate business combinations. However, there are presently no plans, proposals or negotiations relating to a business combination which the Company believes are appropriate to disclose at this time. The board believes that discussions concerning potential business combinations are normal for a financial institution of the Company’s size and the board anticipates that such discussions will occur in the future. Given that the Reclassification is being undertaken for strategic purposes that are entirely separate and unrelated to the purposes that would be served by any potential business combination, and that the Reclassification would have no meaningful affect on our ability to conduct a business combination in the future, any continuing or future discussions that the Company may have concerning a proposed business combination will be unrelated to the proposed Reclassification.

Maintaining the Status Quo. The board considered maintaining the status quo. In that case, we would continue to incur the significant expenses, as outlined in “—Reasons for the Reclassification; Fairness of the Reclassification; Board Recommendation” beginning on page , of being an SEC reporting company without the expected commensurate benefits. Thus, the board concluded that maintaining the status quo would not be in the best interests of the Company or its unaffiliated shareholders.

Our Position as to the Fairness of the Reclassification

Based on a careful review of the facts and circumstances relating to the Reclassification, each member of our board of directors and each of our executive officers believes that the “going private” transaction, including all the terms and provisions of the Reclassification, are substantively and procedurally fair to all unaffiliated shareholders as a whole, including unaffiliated shareholders who will retain their shares of common stock and unaffiliated shareholders who will receive shares of our Series A Non-Voting Preferred Stock. Our board of directors unanimously approved the Reclassification and has recommended that our shareholders vote “For” the Amendments.

Substantive Fairness

In concluding that the terms and conditions of the Amendments to our articles of incorporation and the Reclassification are substantively fair to unaffiliated shareholders, each member of our board of directors and each of our executive officers considered a number of factors. In its consideration of both the procedural and substantive fairness of the transaction, each member of our board and each of our executive officers considered the potential effect of the transaction as it relates to all shareholders, both affiliated and unaffiliated, including unaffiliated shareholders receiving Series A Non-Voting Preferred Stock and to shareholders, both affiliated and unaffiliated, continuing to own shares of common stock. See “—Effects of the Reclassification on Shareholders of Virginia Savings Bancorp, Inc.” beginning on page .

The factors that our board of directors considered positive for all shareholders, including both those that will continue to hold common stock as well as those that will have their shares converted into Series A Non-Voting Preferred Stock, included the following:

| | • | | our common stock trades infrequently, with only four trades known to management occurring within the 12 month period ended June 30, 2009, involving only 3,244 shares or 0.02% of our outstanding common stock, a volume that our board believes does not provide our shareholders with sufficient opportunity to easily obtain cash for their shares; |

21

| | • | | our smaller shareholders who prefer to remain as holders of common stock may elect to do so by acquiring sufficient shares so that they hold at least 1,000 shares of common stock in their own names immediately prior to the Reclassification, or may seek to transfer their shares into “street name” with a broker that would own at least 1,000 shares of common stock; provided, however, that due to the limited market for our common stock as it currently exists, shareholders may find it difficult to locate shareholders willing to sell any shares of common stock that will permit them to acquire additional shares; |