UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2008. |

or

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to . |

Commission file number: 001-33975

United States Gasoline Fund, LP

(Exact name of registrant as specified in its charter)

| Delaware | | 20-8837263 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

1320 Harbor Bay Parkway, Suite 145

Alameda, California 94502

(Address of principal executive offices) (Zip code)

(510) 522-3336

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Units | | NYSE Arca, Inc. |

| (Title of each class) | | (Name of exchange on which registered) |

| | | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨

Non-accelerated filer x Smaller reporting company ¨

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

The aggregate market value of the registrant’s units held by non-affiliates of the registrant as of June 30, 2008 was: $32,830,000

The registrant had 2,700,000 outstanding units as of March 30, 2009.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

UNITED STATES GASOLINE FUND, LP

Table of Contents

| Part I. | Page |

| 1 |

| | |

| 41 |

| | |

| 58 |

| | |

| 58 |

| | |

| 58 |

| | |

| 58 |

| | |

| Part II. | |

| 59 |

| | |

| 59 |

| | |

| 59 |

| | |

| 75 |

| | |

| 77 |

| | |

| 92 |

| | |

| 92 |

| | |

| 92 |

| | |

| Part III. | |

| 92 |

| | |

| 96 |

| | |

| 97 |

| | |

| 97 |

| | |

| 97 |

| | |

| Part IV. | |

| 98 |

| | |

| 98 |

| | |

| 100 |

What is UGA?

The United States Gasoline Fund, LP (“UGA”) is a Delaware limited partnership organized on April 12, 2007. UGA maintains its main business office at 1320 Harbor Bay Parkway, Suite 145, Alameda, California 94502. UGA is a commodity pool that issues limited partnership interests (“units”) traded on the NYSE Arca, Inc. (the “NYSE Arca”). It operates pursuant to the terms of the Amended and Restated Agreement of Limited Partnership dated as of February 11, 2008 (the “LP Agreement”), which grants full management control to United States Commodity Funds LLC (the “General Partner”).

The investment objective of UGA is for the changes in percentage terms of its units’ net asset value (“NAV”) to reflect the changes in percentage terms of the spot price of gasoline (also known as reformulated gasoline blendstock for oxygen blending, or “RBOB”) for delivery to the New York harbor, as measured by the changes in the price of the futures contract for gasoline traded on the New York Mercantile Exchange (the “NYMEX”) that is the near month contract to expire, except when the near month contract is within two weeks of expiration, in which case the futures contract will be the next month contract to expire, less UGA’s expenses. UGA began trading on February 26, 2008. The General Partner is the general partner of UGA and is responsible for the management of UGA.

Who is the General Partner?

The General Partner is a single member limited liability company that was formed in the state of Delaware on May 10, 2005. Prior to June 13, 2008, the General Partner was known as Victoria Bay Asset Management, LLC. It maintains its main business office at 1320 Harbor Bay Parkway, Suite 145, Alameda, California 94502. The General Partner is a wholly-owned subsidiary of Wainwright Holdings, Inc., a Delaware corporation (“Wainwright”). Mr. Nicholas Gerber (discussed below) controls Wainwright by virtue of his ownership of Wainwright’s shares. Wainwright is a holding company that also owns an insurance company organized under Bermuda law (currently being liquidated) and a registered investment adviser firm named Ameristock Corporation. The General Partner is a member of the National Futures Association (the “NFA”) and registered with the Commodity Futures Trading Commission (the “CFTC”) on December 1, 2005. The General Partner’s registration as a Commodity Pool Operator (“CPO”) was approved on December 1, 2005.

On May 12, 2005, the General Partner formed the United States Oil Fund, LP (“USOF”), another limited partnership that is a commodity pool and issues units traded on the NYSE Arca. The investment objective of USOF is for the changes in percentage terms of its units’ NAV to reflect the changes in percentage terms of the price of light, sweet crude oil delivered to Cushing, Oklahoma, as measured by the changes in the price of the futures contract for light, sweet crude oil traded on the NYMEX, less USOF’s expenses. USOF began trading on April 10, 2006. The General Partner is the general partner of USOF and is responsible for the management of USOF.

On September 11, 2006, the General Partner formed the United States Natural Gas Fund, LP (“USNG”), another limited partnership that is a commodity pool and issues units traded on the NYSE Arca. The investment objective of USNG is for the changes in percentage terms of its units’ NAV to reflect the changes in percentage terms of the price of natural gas delivered at the Henry Hub, Louisiana, as measured by the changes in the price of the futures contract for natural gas traded on the NYMEX, less USNG’s expenses. USNG began trading on April 18, 2007. The General Partner is the general partner of USNG and is responsible for the management of USNG.

On June 27, 2007, the General Partner formed the United States 12 Month Oil Fund, LP (“US12OF”), also a limited partnership that is a commodity pool and issues units traded on the NYSE Arca. The investment objective of US12OF is for the changes in percentage terms of its units’ NAV to reflect the changes in percentage terms of the price of light, sweet crude oil delivered to Cushing, Oklahoma, as measured by the changes in the average of the prices of 12 futures contracts for light, sweet crude oil traded on the NYMEX, consisting of the near month contract to expire and the contracts for the following 11 months, for a total of 12 consecutive months’ contracts, less US12OF’s expenses. US12OF began trading on December 6, 2007. The General Partner is the general partner of US12OF and is responsible for the management of US12OF.

On April 13, 2007, the General Partner formed the United States Heating Oil Fund, LP (“USHO”), also a limited partnership that is a commodity pool and issues units traded on the NYSE Arca. The investment objective of USHO is for the changes in percentage terms of its units’ NAV to reflect the changes in percentage terms of the price of heating oil (also known as No. 2 fuel oil) for delivery to the New York harbor, as measured by the changes in the price of the futures contract for heating oil as traded on the NYMEX, less USHO’s expenses. USHO began trading on April 9, 2008. The General Partner is the general partner of USHO and is responsible for the management of USHO.

USOF, USNG, US12OF and USHO are collectively referred to herein as the “Related Public Funds.” For more information about each of the Related Public Funds, investors in UGA may call 1-800-920-0259 or go online to www.unitedstatescommodityfunds.com.

The General Partner has filed a registration statement for two other exchange traded security funds, the United States Short Oil Fund, LP (“USSO”) and the United States 12 Month Natural Gas Fund, LP (“US12NG”). The investment objective of USSO would be to have the changes in percentage terms of its units’ NAV to inversely reflect the changes in percentage terms in the spot price of light, sweet crude oil delivered to Cushing, Oklahoma, as measured by the changes in price of the futures contract on light, sweet crude oil as traded on the NYMEX, less USSO’s expenses. The investment objective of US12NG would be to have the changes in percentage terms of its units’ NAV reflect the changes in percentage terms of the price of natural gas delivered at the Henry Hub, Louisiana, as measured by the changes in the average of the prices of 12 futures contracts on natural gas traded on the NYMEX, consisting of the near month contract to expire and the contracts for the following 11 months, for a total of 12 consecutive months’ contracts, less US12NG’s expenses.

The General Partner is required to evaluate the credit risk of UGA to the futures commission merchant, oversee the purchase and sale of UGA’s units by certain authorized purchasers (“Authorized Purchasers”), review daily positions and margin requirements of UGA and manage UGA’s investments. The General Partner also pays the fees of ALPS Distributors, Inc. (the “Marketing Agent”) and Brown Brothers Harriman & Co. (“BBH&Co.”), which acts as the administrator (the “Administrator”) and the custodian (the “Custodian”) for UGA.

Limited partners have no right to elect the General Partner on an annual or any other continuing basis. If the General Partner voluntarily withdraws, however, the holders of a majority of UGA’s outstanding units (excluding for purposes of such determination units owned, if any, by the withdrawing General Partner and its affiliates) may elect its successor. The General Partner may not be removed as general partner except upon approval by the affirmative vote of the holders of at least 66 and 2/3 percent of UGA’s outstanding units (excluding units owned, if any, by the General Partner and its affiliates), subject to the satisfaction of certain conditions set forth in the LP Agreement.

The business and affairs of the General Partner are managed by a board of directors (the “Board”), which is comprised of four management directors, some of whom are also its executive officers (the “Management Directors”), and three independent directors who meet the independent director requirements established by the NYSE Arca and the Sarbanes-Oxley Act of 2002. Notwithstanding the foregoing, the Management Directors have the authority to manage the General Partner pursuant to its limited liability company agreement. Through its Management Directors, the General Partner manages the day-to-day operations of UGA. The Board has an audit committee which is made up of the three independent directors (Peter M. Robinson, Gordon L. Ellis and Malcolm R. Fobes III). For additional information relating to the audit committee, please see “Item 10. Directors, Executive Officers and Corporate Governance – Audit Committee” in this annual report on Form 10-K.

How Does UGA Operate?

The net assets of UGA consist primarily of investments in futures contracts for gasoline, but may also consist of crude oil, natural gas and other petroleum-based fuels that are traded on the NYMEX, ICE Futures (formerly, the International Petroleum Exchange) or other U.S. and foreign exchanges (collectively, “Futures Contracts”). UGA may also invest in other gasoline-related investments such as cash-settled options on Futures Contracts, forward contracts for gasoline, and over-the-counter transactions that are based on the price of gasoline and other petroleum-based fuels, Futures Contracts and indices based on the foregoing (collectively, “Other Gasoline-Related Investments”). For convenience and unless otherwise specified, Futures Contracts and Other Gasoline-Related Investments collectively are referred to as “Gasoline Interests” in this annual report on Form 10-K.

UGA invests in Gasoline Interests to the fullest extent possible without being leveraged or unable to satisfy its current or potential margin or collateral obligations with respect to its investments in Futures Contracts and Other Gasoline-Related Investments. In pursuing this objective, the primary focus of the General Partner is the investment in Futures Contracts and the management of UGA’s investments in short-term obligations of the United States of two years or less (“Treasuries”), cash and/or cash equivalents for margining purposes and as collateral.

The investment objective of UGA is to have the changes in percentage terms of its units’ NAV reflect the changes in percentage terms of the spot price of gasoline, as measured by the changes in the price of the Futures Contract on unleaded gasoline (also known as RBOB) for delivery to New York harbor, as traded on the NYMEX that is the near month contract to expire, except when the near month contract is within two weeks of expiration, in which case it will be measured by the futures contract that is the next month contract to expire, less UGA’s expenses. It is not the intent of UGA to be operated in a fashion such that its NAV will equal, in dollar terms, the spot price of gasoline or any particular futures contract based on gasoline.

UGA seeks to achieve its investment objective by investing in a mix of Futures Contracts and Other Gasoline-Related Investments such that the changes in its NAV will closely track the changes in the price of the NYMEX futures contract for gasoline delivered to the New York harbor (the “Benchmark Futures Contract”). The General Partner believes changes in the price of the Benchmark Futures Contract have historically exhibited a close correlation with the changes in the spot price of gasoline. On any valuation day (a valuation day is any trading day as of which UGA calculates its NAV as described herein), the Benchmark Futures Contract is the near month contract for gasoline traded on the NYMEX unless the near month contract will expire within two weeks of the valuation day, in which case the Benchmark Futures Contract is the next month contract for gasoline traded on the NYMEX.

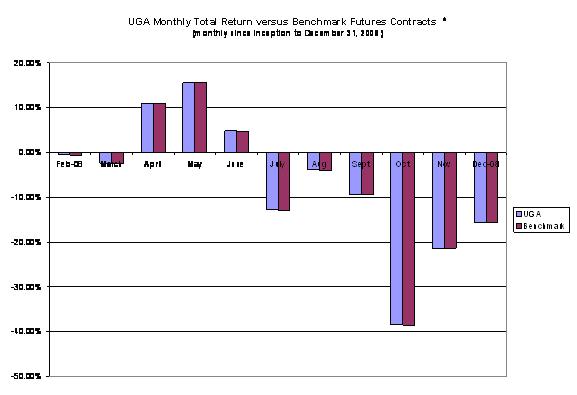

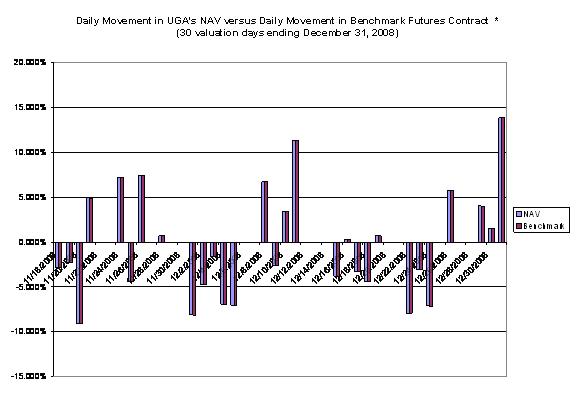

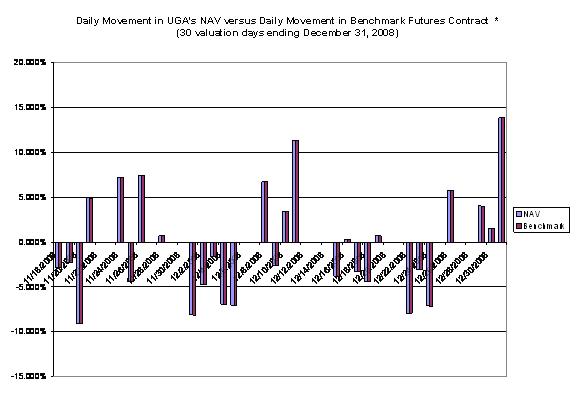

As a specific benchmark, the General Partner endeavors to place UGA’s trades in Futures Contracts and Other Gasoline-Related Investments and otherwise manage UGA’s investments so that A will be within plus/minus 10 percent of B, where:

| | · | A is the average daily change in UGA’s NAV for any period of 30 successive valuation days; i.e., any trading day as of which UGA calculates its NAV, and |

| | · | B is the average daily change in the price of the Benchmark Futures Contract over the same period. |

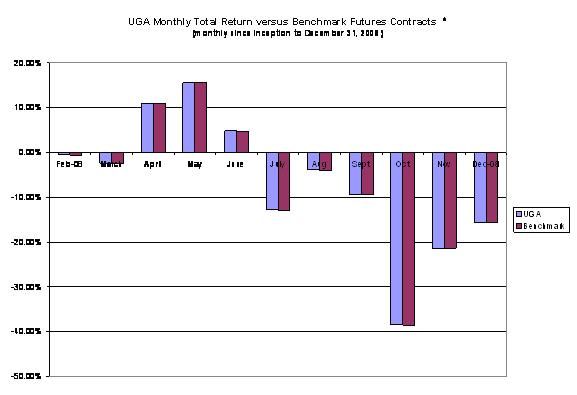

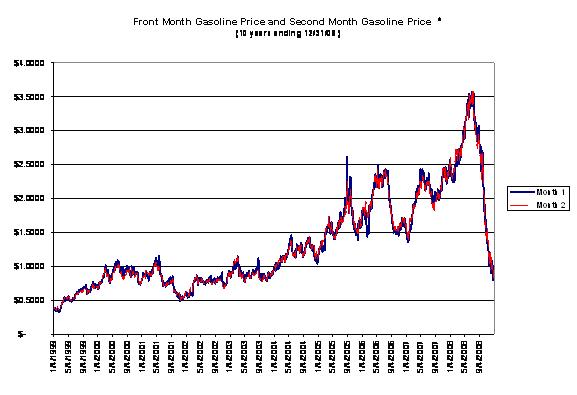

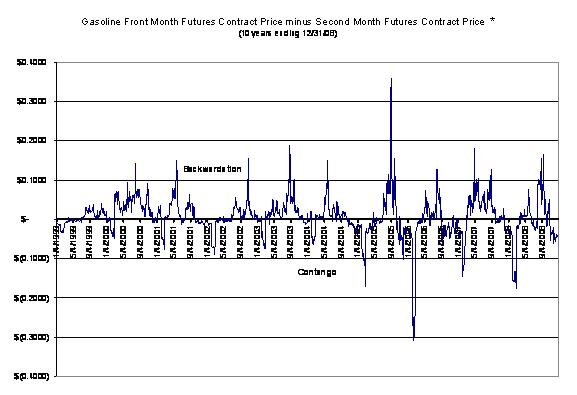

*PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

*PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

An investment in the units provides a means for diversifying an investor’s portfolio or hedging exposure to changes in gasoline prices. An investment in the units allows both retail and institutional investors to easily gain this exposure to the gasoline market in a transparent, cost-effective manner.

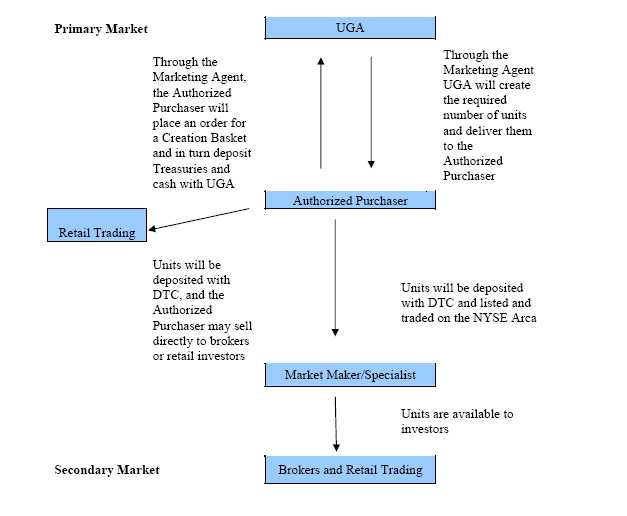

The expected correlation of the price of UGA’s units, UGA’s NAV and the price of the Benchmark Futures Contract is illustrated in the following diagram:

The Price of UGA’s Units is Expected to Correlate Closely With UGA’s NAV

|

Changes in UGA’s NAV are Expected to Correlate Closely With Changes in the Price of the Benchmark Futures Contract

The General Partner endeavors to invest UGA’s assets as fully as possible in Gasoline Futures Contracts and Other Gasoline-Related Investments so that the changes in the NAV will closely correlate with the changes in the price of the Benchmark Futures Contract. |

The General Partner employs a “neutral” investment strategy in order to track changes in the price of the Benchmark Futures Contract regardless of whether the price goes up or goes down. UGA’s “neutral” investment strategy is designed to permit investors generally to purchase and sell UGA’s units for the purpose of investing indirectly in gasoline in a cost-effective manner, and/or to permit participants in the gasoline or other industries to hedge the risk of losses in their gasoline-related transactions. Accordingly, depending on the investment objective of an individual investor, the risks generally associated with investing in gasoline and/or the risks involved in hedging may exist. In addition, an investment in UGA involves the risk that the changes in the price of UGA’s units will not accurately track the changes in the Benchmark Futures Contract.

The Benchmark Futures Contract changes from the near month contract to expire to the next month contract to expire during one day each month. On that day, UGA will “roll” its position by closing, or selling, its Gasoline Interests and reinvesting the proceeds from closing those positions in new Gasoline Interests. The anticipated monthly dates on which the Benchmark Futures Contracts will be changed and UGA’s Gasoline Interests will be “rolled” in 2009 are posted on UGA’s website at www.unitedstatesgasolinefund.com, and are subject to change without notice.

UGA’s total portfolio composition is disclosed on its website each business day that the NYSE Arca is open for trading. The website disclosure of portfolio holdings is made daily and includes, as applicable, the name and value of each Gasoline Interest, the specific types of Other Gasoline-Related Investments and characteristics of such Other Gasoline-Related Investments, Treasuries, and amount of the cash and/or cash equivalents held in UGA’s portfolio. UGA’s website is publicly accessible at no charge. UGA’s assets are held in segregated accounts pursuant to the Commodity Exchange Act (the “CEA”) and CFTC regulations.

The units issued by UGA may only be purchased by Authorized Purchasers and only in blocks of 100,000 units called Creation Baskets. The amount of the purchase payment for a Creation Basket is equal to the aggregate NAV of units in the Creation Basket. Similarly, only Authorized Purchasers may redeem units and only in blocks of 100,000 units called Redemption Baskets. The amount of the redemption proceeds for a Redemption Basket is equal to the aggregate NAV of units in the Redemption Basket. The purchase price for Creation Baskets and the redemption price for Redemption Baskets are the actual NAV calculated at the end of the business day when notice for a purchase or redemption is received by UGA. The NYSE Arca publishes an approximate intra-day NAV based on the prior day’s NAV and the current price of the Benchmark Futures Contract, but the basket price is determined based on the actual NAV at the end of the day.

While UGA issues units only in Creation Baskets, units may also be purchased and sold in much smaller increments on the NYSE Arca. These transactions, however, are effected at the bid and ask prices established by specialist firm(s). Like any listed security, units can be purchased and sold at any time a secondary market is open.

What is UGA’s Investment Strategy?

In managing UGA’s assets, the General Partner does not use a technical trading system that issues buy and sell orders. The General Partner instead employs a quantitative methodology whereby each time a Creation Basket is sold, the General Partner purchases Gasoline Interests, such as the Benchmark Futures Contract, that have an aggregate market value that approximates the amount of Treasuries and/or cash received upon the issuance of the Creation Basket.

As an example, assume that a Creation Basket is sold by UGA, and that UGA’s closing NAV per unit is $50.00. In that case, UGA would receive $5,000,000 in proceeds from the sale of the Creation Basket ($50 NAV per unit multiplied by 100,000 units, and excluding the Creation Basket fee of $1,000). If one were to assume further that the General Partner wants to invest the entire proceeds from the Creation Basket in the Benchmark Futures Contracts and that the market value of the Benchmark Futures Contract is $59,950, UGA would be unable to buy the exact number of Benchmark Futures Contract with an aggregate market value equal to $5,000,000. Instead, UGA would be able to purchase 83 Benchmark Futures Contracts with an aggregate market value of $4,975,850. Assuming a margin requirement equal to 10% of the value of the Benchmark Futures Contract, UGA would be required to deposit $497,585 in Treasuries and cash with the futures commission merchant through which the Benchmark Futures Contracts were purchased. The remainder of the proceeds from the sale of the Creation Basket, $4,502,415, would remain invested in cash, cash equivalents and Treasuries as determined by the General Partner from time to time based on factors such as potential calls for margin or anticipated redemptions.

The specific Futures Contracts purchased depend on various factors, including a judgment by the General Partner as to the appropriate diversification of UGA’s investments in futures contracts with respect to the month of expiration, and the prevailing price volatility of particular contracts. While the General Partner has made significant investments in NYMEX Futures Contracts, as UGA reaches certain accountability levels or position limits on the NYMEX, or for other reasons, it has also and may continue to invest in Futures Contracts traded on other exchanges or invest in Other Gasoline-Related Investments such as contracts in the “over-the-counter” market.

The General Partner does not anticipate letting its Futures Contracts expire and taking delivery of the underlying commodity. Instead, the General Partner will close existing positions, e.g., when it changes the Benchmark Futures Contract or it otherwise determines it would be appropriate to do so and reinvest the proceeds in new Futures Contracts. Positions may also be closed out to meet orders for Redemption Baskets and in such case proceeds for such baskets will not be reinvested.

By remaining invested as fully as possible in Futures Contracts or Other Gasoline-Related Investments, the General Partner believes that the changes in percentage terms in UGA’s NAV will continue to closely track the changes in percentage terms in the prices of the Futures Contracts in which UGA invests. The General Partner believes that certain arbitrage opportunities result in the price of the units traded on the NYSE Arca closely tracking the NAV of UGA. For performance data relating to UGA’s ability to track its benchmark, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Tracking UGA’s Benchmark”.

What are Futures Contracts?

Futures Contracts are agreements between two parties. One party agrees to buy gasoline from the other party at a later date at a price and quantity agreed upon when the contract is made. Futures Contracts are traded on futures exchanges, including the NYMEX. For example, the Benchmark Futures Contract is traded on the NYMEX in units of 42,000 gallons (1,000 barrels). Gasoline Futures Contracts traded on the NYMEX are priced by floor brokers and other exchange members both through an “open outcry” of offers to purchase or sell the contracts and through an electronic, screen-based system that determines the price by matching electronically offers to purchase and sell.

Certain typical and significant characteristics of Futures Contracts are discussed below. Additional risks of investing in Futures Contracts are included in “What are the Risk Factors Involved with an Investment in UGA?”

Impact of Accountability Levels, Position Limits and Price Fluctuation Limits. Futures Contracts include typical and significant characteristics. Most significantly, the CFTC and U.S. designated contract markets such as the NYMEX have established accountability levels and position limits on the maximum net long or net short futures contracts in commodity interests that any person or group of persons under common trading control (other than as a hedge, which an investment by UGA is not) may hold, own or control. The net position is the difference between an individual or firm’s open long contracts and open short contracts in any one commodity. In addition, most U.S. futures exchanges, such as the NYMEX, limit the daily price fluctuation for Futures Contracts. Currently, the ICE Futures imposes position and accountability limits that are similar to those imposed by NYMEX but does not limit the maximum daily price fluctuation.

The accountability levels for the Benchmark Futures Contract and other Futures Contracts traded on the NYMEX are not a fixed ceiling, but rather a threshold above which the NYMEX may exercise greater scrutiny and control over an investor’s positions. The current accountability level for investments for any one month in the Benchmark Futures Contract is 5,000 contracts. In addition, the NYMEX imposes an accountability level for all months of 7,000 net futures contracts in gasoline. If UGA and the Related Public Funds exceed these accountability levels for investments in futures contracts for gasoline, the NYMEX will monitor UGA’s and the Related Public Funds’ exposure and ask for further information on their activities, including the total size of all positions, investment and trading strategy, and the extent of liquidity resources of UGA and the Related Public Funds. If deemed necessary by the NYMEX, it could also order UGA to reduce its position back to the accountability level. In addition, the ICE Futures maintains accountability levels, position limits and monitoring authority for its gasoline contract. As of December 31, 2008, UGA and the Related Public Funds held 453 Benchmark Futures Contracts. As of December 31, 2008, UGA had no Futures Contracts traded on the ICE Futures.

If the NYMEX or ICE Futures orders UGA to reduce its position back to the accountability level, or to an accountability level that the NYMEX deems appropriate for UGA, such an accountability level may impact the mix of investments in Gasoline Interests made by UGA. To illustrate, assume that the price of the Benchmark Futures Contract and the unit price of UGA are each $10, and that the NYMEX has determined that UGA may not own more than 10,000 Benchmark Futures Contracts. In such case, UGA could invest up to $1 billion of its daily net assets in the Benchmark Futures Contract (i.e., $10 per contract multiplied by 1,000 (a Benchmark Futures Contract is a contract for 42,000 gallons (1,000 barrels) of gasoline multiplied by 10,000 contracts)) before reaching the accountability level imposed by the NYMEX. Once the daily net assets of the portfolio exceed $1 billion in Benchmark Futures Contracts, the portfolio may not be able to make any further investments in Benchmark Futures Contracts, depending on whether the NYMEX imposes limits. If the NYMEX does impose limits at the $1 billion level (or another level), UGA anticipates that it will invest the majority of its assets above that level in a mix of other Futures Contracts or Other Gasoline-Related Investments.

In addition to accountability levels, the NYMEX and the ICE Futures impose position limits on contracts held in the last few days of trading in the near month contract to expire. It is unlikely that UGA will run up against such position limits because UGA’s investment strategy is to close out its positions and “roll” from the near month contract to expire to the next month contract during one day beginning two weeks from expiration of the contract.

U.S. futures exchanges, including the NYMEX, also limit the amount of price fluctuation for Futures Contracts. For example, the NYMEX imposes a $0.25 per gallon ($10,500 per contract) price fluctuation limit for the Benchmark Futures Contract. This limit is initially based off the previous trading day’s settlement price. If any Benchmark Futures Contract is traded, bid, or offered at the limit for five minutes, trading is halted for five minutes. When trading resumes, it begins at the point where the limit was imposed and the limit is reset to be $0.25 per gallon in either direction of that point. If another halt were triggered, the market would continue to be expanded by $0.25 per gallon in either direction after each successive five-minute trading halt. There is no maximum price fluctuation limit during any one trading session.

UGA anticipates that to the extent it invests in Futures Contracts other than gasoline contracts (such as futures contracts for crude oil, natural gas, and other petroleum-based fuels) and Other Gasoline-Related Investments, it will enter into various non-exchange-traded derivative contracts to hedge the short-term price movements of such Futures Contracts and Other Gasoline-Related Investments against the current Benchmark Futures Contract.

Examples of the position and price limits imposed are as follows:

| Futures Contract | | Position Accountability Levels and Limits | | Maximum Daily Price Fluctuation |

NYMEX Gasoline (physically settled) | | Any one month: 5,000 net futures / all months: 7,000 net futures, but not to exceed 1,000 contracts in the last three days of trading in the spot month. | | $0.25 per gallon ($10,500 per contract) for all months. If any contract is traded, bid, or offered at the limit for five minutes, trading is halted for five minutes. When trading resumes, the limit is expanded by $0.25 per gallon in either direction. If another halt were triggered, the market would continue to be expanded by $0.25 per gallon in either direction after each successive five-minute trading halt. There will be no maximum price fluctuation limits during any one trading session. |

ICE NYH (RBOB) Gasoline (financially settled) | | Any one month: 7,000 net futures / all months: 7,000 net futures, but not to exceed 1,000 contracts in the last three days of trading in the spot month. | | There is no maximum daily price fluctuation limit. |

NYMEX Light, Sweet Crude Oil (physically settled) | | Any one month: 10,000 net futures / all months: 20,000 net futures, but not to exceed 3,000 contracts in the last three days of trading in the spot month. | | $10.00 per barrel ($10,000 per contract) for all months. If any contract is traded, bid, or offered at the limit for five minutes, trading is halted for five minutes. When trading resumes, the limit is expanded by $10.00 per barrel in either direction. If another halt were triggered, the market would continue to be expanded by $10.00 per barrel in either direction after each successive five-minute trading halt. There will be no maximum price fluctuation limits during any one trading session. |

NYMEX Light, Sweet Crude Oil (financially settled) | | Any one month: 20,000 net futures / all months: 20,000 net futures, but not to exceed 2,000 contracts in the last three days of trading in the spot month. | | There is no maximum daily price fluctuation limit. |

NYMEX Heating Oil (physically settled) | | Any one month: 5,000 net futures / all months: 7,000 net futures, but not to exceed 1,000 contracts in the last three days of trading in the spot month. | | $0.25 per gallon ($10,500 per contract) for all months. If any contract is traded, bid, or offered at the limit for five minutes, trading is halted for five minutes. When trading resumes, the limit is expanded by $0.25 per gallon in either direction. If another halt were triggered, the market would continue to be expanded by $0.25 per gallon in either direction after each successive five-minute trading halt. There will be no maximum price fluctuation limits during any one trading session. |

NYMEX Natural Gas (physically settled) | | Any one month: 6,000 net futures / all months: 12,000 net futures, but not to exceed 1,000 contracts in the last three days of trading in the spot month. | | $3.00 per million British thermal units (“mmBtu”) ($30,000 per contract) for all months. If any contract is traded, bid, or offered at the limit for five minutes, trading is halted for five minutes. When trading resumes, the limit is expanded by $3.00 per mmBtu in either direction. If another halt were triggered, the market would continue to be expanded by $3.00 per mmBtu in either direction after each successive five-minute trading halt. There will be no maximum price fluctuation limits during any one trading session. |

ICE Brent Crude (physically settled) | | There are no position limits. | | There is no maximum daily price fluctuation limit. |

ICE West Texas Intermediate (“WTI”) (financially settled) | | Any one month: 10,000 net futures / all months: 20,000 net futures, but not to exceed 3,000 contracts in the last three days of trading in the spot month. | | There is no maximum daily price fluctuation limit. |

Price Volatility. Despite daily price limits, the price volatility of Futures Contracts generally has been historically greater than that for traditional securities such as stocks and bonds. Price volatility often is greater day-to-day as opposed to intra-day. Futures Contracts tend to be more volatile than stocks and bonds because price movements for gasoline are more currently and directly influenced by economic factors for which current data is available and are traded by gasoline futures traders throughout the day. These economic factors include changes in interest rates; actions by oil producing countries, such as the Organization of Petroleum Exporting Countries ("OPEC") countries; governmental, agricultural, trade, fiscal, monetary and exchange control programs and policies; weather and climate conditions; changing supply and demand relationships; changes in balances of payments and trade; U.S. and international rates of inflation; currency devaluations and revaluations; U.S. and international political and economic events; and changes in philosophies and emotions of market participants. Because UGA invests a significant portion of its assets in Futures Contracts, the assets of UGA, and therefore the prices of UGA units, may be subject to greater volatility than traditional securities.

Marking-to-Market Futures Positions. Futures Contracts are marked to market at the end of each trading day and the margin required with respect to such contracts is adjusted accordingly. This process of marking-to-market is designed to prevent losses from accumulating in any futures account. Therefore, if UGA’s futures positions have declined in value, UGA may be required to post variation margin to cover this decline. Alternatively, if UGA futures positions have increased in value, this increase will be credited to UGA’s account.

What is the Gasoline Market and the Petroleum-Based Fuel Market?

UGA may purchase Futures Contracts traded on the NYMEX that are based on gasoline. The ICE Futures also offers an RBOB Gasoline Futures Contract which trades in units of 42,000 U.S. gallons (1,000 barrels). The RBOB Gasoline Futures Contract is cash settled against the prevailing market price for RBOB gasoline in the New York harbor. It may also purchase contracts on other exchanges, including the ICE Futures, the Singapore Exchange and the Dubai Mercantile Exchange.

Gasoline. Gasoline is the largest single volume refined product sold in the U.S. and accounts for almost half of national oil consumption. The gasoline Futures Contract listed and traded on the NYMEX trades in units of 42,000 gallons (1,000 barrels) and is based on delivery at petroleum products terminals in the New York harbor, the major East Coast trading center for imports and domestic shipments from refineries in the New York harbor area or from the Gulf Coast refining centers. The price of gasoline has historically been volatile.

Light, Sweet Crude Oil. Crude oil is the world’s most actively traded commodity. The Futures Contracts for light, sweet crude oil that are traded on the NYMEX are the world’s most liquid forum for crude oil trading, as well as the world’s largest volume futures contract trading on a physical commodity. Due to the liquidity and price transparency of oil Futures Contracts, they are used as a principal international pricing benchmark. The Futures Contracts for light, sweet crude oil trade on the NYMEX in units of 1,000 U.S. barrels (42,000 gallons) and, if not closed out before maturity, will result in delivery of oil to Cushing, Oklahoma, which is also accessible to the international spot markets by two major interstate petroleum pipeline systems. In Europe, Brent crude oil is the standard for futures contracts and is primarily traded on the ICE Futures, an electronic marketplace for energy trading and price discovery. Brent crude oil is the price reference for two-thirds of the world’s traded oil. The ICE Brent Futures is a deliverable contract with an option to cash settle which trades in units of 1,000 barrels (42,000 U.S. gallons). The ICE Futures also offers a WTI Futures Contract which trades in units of 1,000 barrels. The WTI Futures Contract is cash settled against the prevailing market price for U.S. light sweet crude oil.

Demand for petroleum products by consumers, as well as agricultural, manufacturing and transportation industries, determines demand for crude oil by refiners. Since the precursors of product demand are linked to economic activity, crude oil demand will tend to reflect economic conditions. However, other factors such as weather also influence product and crude oil demand.

Crude oil supply is determined by both economic and political factors. Oil prices (along with drilling costs, availability of attractive prospects for drilling, taxes and technology, among other factors) determine exploration and development spending, which influence output capacity with a lag. In the short run, production decisions by OPEC also affect supply and prices. Oil export embargoes and the current conflict in Iraq represent other routes through which political developments move the market. It is not possible to predict the aggregate effect of all or any combination of these factors.

Heating Oil. Heating oil, also known as No. 2 fuel oil, accounts for 25% of the yield of a barrel of crude oil, the second largest “cut” from oil after gasoline. The heating oil Futures Contract listed and traded on the NYMEX trades in units of 42,000 gallons (1,000 barrels) and is based on delivery in the New York harbor, the principal cash market center. The price of heating oil has historically been volatile.

Natural Gas. Natural gas accounts for almost a quarter of U.S. energy consumption. The natural gas Futures Contract listed and traded on the NYMEX trades in units of 10,000 mmBtu and is based on delivery at the Henry Hub in Louisiana, the nexus of 16 intra- and interstate natural gas pipeline systems that draw supplies from the region’s prolific gas deposits. The pipelines serve markets throughout the U.S. East Coast, the Gulf Coast, the Midwest, and up to the Canadian border. The price of natural gas has historically been volatile.

Why Does UGA Purchase and Sell Futures Contracts?

UGA’s investment objective is to have the changes in percentage terms of the units’ NAV reflect the changes in percentage terms of the Benchmark Futures Contract, less UGA’s expenses. UGA invests primarily in Futures Contracts. UGA seeks to have its aggregate NAV approximate at all times the aggregate market value of the Futures Contracts (or Other Gasoline-Related Investments) UGA holds.

Other than investing in Futures Contracts and Other Gasoline-Related Investments, UGA only invests in assets to support these investments in Gasoline Interests. At any given time, most of UGA’s investments are in Treasuries, cash and/or cash equivalents that serve as segregated assets supporting UGA’s positions in Futures Contracts and Other Gasoline-Related Investments. For example, the purchase of a Futures Contract with a stated value of $10 million would not require UGA to pay $10 million upon entering into the contract; rather, only a margin deposit, generally of 5% to 10% of the stated value of the Futures Contract, would be required. To secure its Futures Contract obligations, UGA would deposit the required margin with the futures commission merchant and hold, through its Custodian, Treasuries, cash and/or cash equivalents in an amount equal to the balance of the current market value of the contract, which at the contract’s inception would be $10 million minus the amount of the margin deposit, or $9.5 million (assuming a 5% margin).

What is the Flow of Units?

What are the Trading Policies of UGA?

Liquidity

UGA invests only in Futures Contracts and Other Gasoline-Related Investments that are traded in sufficient volume to permit, in the opinion of the General Partner, ease of taking and liquidating positions in these financial interests.

Spot Commodities

While the gasoline Futures Contracts traded on the NYMEX can be physically settled, UGA does not intend to take or make physical delivery. UGA may from time to time trade in Other Gasoline-Related Investments, including contracts based on the spot price of gasoline.

The General Partner endeavors to have the value of UGA’s Treasuries, cash and/or cash equivalents, whether held by UGA or posted as margin or collateral, to at all times approximate the aggregate market value of UGA’s obligations under its Futures Contracts and Other Gasoline-Related Investments.

Borrowings

Borrowings are not used by UGA, unless UGA is required to borrow money in the event of physical delivery, if UGA trades in cash commodities, or for short-term needs created by unexpected redemptions. UGA expects to have the value of its Treasuries, cash and/or cash equivalents whether held by UGA or posted as margin or collateral, at all times approximate the aggregate market value of its obligations under its Futures Contracts and Other Gasoline-Related Investments. UGA has not established and does not plan to establish credit lines.

UGA has not and will not employ the technique, commonly known as pyramiding, in which the speculator uses unrealized profits on existing positions as variation margin for the purchase or sale of additional positions in the same or another commodity interest.

Who are the Service Providers?

BBH&Co. is the registrar and transfer agent for the units. BBH&Co. is also the Custodian for UGA. In this capacity, BBH&Co. holds UGA’s Treasuries, cash and/or cash equivalents pursuant to a custodial agreement. In addition, in its capacity as Administrator for UGA, BBH&Co. performs certain administrative and accounting services for UGA and prepares certain U.S. Securities and Exchange Commission (the “SEC”) and CFTC reports on behalf of UGA. The General Partner pays BBH&Co. a fee for these services.

BBH&Co.’s principal business address is 50 Milk Street, Boston, MA 02109-3661. BBH&Co., a private bank founded in 1818, is not a publicly held company nor is it insured by the Federal Deposit Insurance Corporation. BBH&Co. is authorized to conduct a commercial banking business in accordance with the provisions of Article IV of the New York State Banking Law, New York Banking Law §§160–181, and is subject to regulation, supervision, and examination by the New York State Banking Department. BBH&Co. is also licensed to conduct a commercial banking business by the Commonwealths of Massachusetts and Pennsylvania and is subject to supervision and examination by the banking supervisors of those states.

UGA also employs ALPS Distributors, Inc. as a Marketing Agent. The General Partner pays the Marketing Agent an annual fee. In no event may the aggregate compensation paid to the Marketing Agent and any affiliate of the General Partner for distribution-related services in connection with the offering of units exceed ten percent (10%) of the gross proceeds of the offering. ALPS’s principal business address is 1290 Broadway, Suite 1100, Denver, CO 80203. ALPS is the marketing agent for UGA. ALPS is a broker-dealer registered with the Financial Industry Regulatory Authority (“FINRA”) and a member of the Securities Investor Protection Corporation.

UGA and the futures commission merchant, UBS Securities LLC (“UBS Securities”) have entered into an Institutional Futures Client Account Agreement. This Agreement requires UBS Securities to provide services to UGA in connection with the purchase and sale of gasoline interests that may be purchased or sold by or through UBS Securities for UGA’s account. UGA pays UBS Securities commissions for executing and clearing trades on behalf of UGA.

UBS Securities is not affiliated with UGA or the General Partner. Therefore, UGA does not believe that UGA has any conflicts of interest with UBS Securities or their trading principals arising from their acting as UGA’s futures commission merchant.

UBS Securities’s principal business address is 677 Washington Blvd, Stamford, CT 06901. UBS Securities is a futures clearing broker for UGA. UBS Securities is registered in the U.S. with FINRA as a broker-dealer and with the CFTC as a futures commission merchant. UBS Securities is a member of the NFA and various U.S. futures and securities exchanges.

UBS Securities will act only as clearing broker for UGA and as such will be paid commissions for executing and clearing trades on behalf of UGA. UBS Securities has not passed upon the adequacy or accuracy of this annual report on Form 10-K. UBS Securities neither will act in any supervisory capacity with respect to the General Partner nor participate in the management of UGA.

Currently, the General Partner does not employ commodity trading advisors. If, in the future, the General Partner does employ commodity trading advisors, it will choose each advisor based on arm’s-length negotiations and will consider the advisor’s experience, fees and reputation.

Fees of UGA

Fees and Compensation Arrangements with the General Partner and Non-Affiliated Service Providers*

| Service Provider | Compensation Paid by the General Partner |

Brown Brothers Harriman & Co., Custodian and Administrator | Minimum amount of $75,000 annually* for its custody, fund accounting and fund administration services rendered to all funds, as well as a $20,000 annual fee for its transfer agency services. In addition, an asset-based charge of (a) 0.06% for the first $500 million of UGA’s and the Related Public Funds’ combined net assets, (b) 0.0465% for UGA’s and the Related Public Funds’ combined net assets greater than $500 million but less than $1 billion, and (c) 0.035% once UGA’s and the Related Public Funds’ combined net assets exceed $1 billion.** |

| ALPS Distributors, Inc., Marketing Agent | 0.06% on UGA’s assets up to $3 billion; 0.04% on UGA’s assets in excess of $3 billion. |

| * | The General Partner pays this compensation. |

| ** | The annual minimum amount will not apply if the asset-based charge for all accounts in the aggregate exceeds $75,000. The General Partner also will pay transaction charge fees to BBH&Co., ranging from $7.00 to $15.00 per transaction for the funds. |

Compensation to the General Partner

UGA is contractually obligated to pay the General Partner a management fee based on 0.60% per annum on its average net assets. Fees are calculated on a daily basis (accrued at 1/365 of the applicable percentage of NAV on that day) and paid on a monthly basis. NAV is calculated by taking the current market value of UGA’s total assets and subtracting any liabilities.

Fees and Compensation Arrangements between UGA and Non-Affiliated Service Providers*

| Service Provider | Compensation Paid by UGA |

| UBS Securities LLC, Futures Commission Merchant | Approximately $3.50 per buy or sell; charges may vary |

| Non-Affiliated Brokers | Approximately 0.10% of assets |

| * | UGA pays this compensation. |

New York Mercantile Exchange Licensing Fee*

| Assets | Licensing Fee |

| First $1,000,000,000 | 0.04% of NAV |

| After the first $1,000,000,000 | 0.02% of NAV |

| * | Fees are calculated on a daily basis (accrued at 1/365 of the applicable percentage of NAV on that day) and paid on a monthly basis. UGA is responsible for its pro rata share of the assets held by UGA and the Related Public Funds as well as other funds managed by the General Partner, including USSO and US12NG, when and if such funds commence operations. |

Expenses paid by UGA through December 31, 2008 in dollar terms:

| Expenses: | | Amount in Dollar Terms | |

| Amount Paid to General Partner: | | $ | 97,932 | |

| Amount Paid in Portfolio Brokerage Commissions: | | $ | 16,173 | |

| Other Amounts Paid or Accrued: | | $ | 158,773 | |

| Total Expenses Paid or Accrued: | | $ | 272,878 | |

| Expenses Waived*: | | $ | (126,348 | ) |

| Net Expenses Paid or Accrued*: | | $ | 146,530 | |

| * | The General Partner, though under no obligation to do so, agreed to pay certain expenses, to the extent that such expenses exceeded 0.15% (15 basis points) of UGA’s NAV, on an annualized basis, through December 31, 2008. The General Partner has no obligation to continue such payment into subsequent years. |

Expenses paid by UGA through December 31, 2008 as a Percentage of Average Daily Net Assets:

| Expenses: | Amount as a Percentage of Average Daily Net Assets |

| General Partner | 0.60% annualized |

| Portfolio Brokerage Commissions | 0.10% annualized |

| Other Amounts Paid or Accrued | 0.97% annualized |

| Total Expense Ratio | 1.67% annualized |

| Expenses Waived | (0.77)% annualized |

| Net Expense Ratio | 0.90% annualized |

Form of Units

Registered Form. Units are issued in registered form in accordance with the LP Agreement. The Administrator has been appointed registrar and transfer agent for the purpose of transferring units in certificated form. The Administrator keeps a record of all limited partners and holders of the units in certificated form in the registry (the “Register”). The General Partner recognizes transfers of units in certificated form only if done in accordance with the LP Agreement. The beneficial interests in such units are held in book-entry form through participants and/or accountholders in the Depository Trust Company (“DTC”).

Book Entry. Individual certificates are not issued for the units. Instead, units are represented by one or more global certificates, which are deposited by the Administrator with DTC and registered in the name of Cede & Co., as nominee for DTC. The global certificates evidence all of the units outstanding at any time. Unitholders are limited to (1) participants in DTC such as banks, brokers, dealers and trust companies (“DTC Participants”), (2) those who maintain, either directly or indirectly, a custodial relationship with a DTC Participant (“Indirect Participants”), and (3) those banks, brokers, dealers, trust companies and others who hold interests in the units through DTC Participants or Indirect Participants, in each case who satisfy the requirements for transfers of units. DTC Participants acting on behalf of investors holding units through such participants’ accounts in DTC will follow the delivery practice applicable to securities eligible for DTC’s Same-Day Funds Settlement System. Units are credited to DTC Participants’ securities accounts following confirmation of receipt of payment.

DTC. DTC is a limited purpose trust company organized under the laws of the State of New York and is a member of the Federal Reserve System, a “clearing corporation” within the meaning of the New York Uniform Commercial Code and a “clearing agency” registered pursuant to the provisions of Section 17A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). DTC holds securities for DTC Participants and facilitates the clearance and settlement of transactions between DTC Participants through electronic book-entry changes in accounts of DTC Participants.

Transfer of Units

Transfers of Units Only Through DTC. The units are only transferable through the book-entry system of DTC. Limited partners who are not DTC Participants may transfer their units through DTC by instructing the DTC Participant holding their units (or by instructing the Indirect Participant or other entity through which their units are held) to transfer the units. Transfers are made in accordance with standard securities industry practice.

Transfers of interests in units with DTC are made in accordance with the usual rules and operating procedures of DTC and the nature of the transfer. DTC has established procedures to facilitate transfers among the participants and/or accountholders of DTC. Because DTC can only act on behalf of DTC Participants, who in turn act on behalf of Indirect Participants, the ability of a person or entity having an interest in a global certificate to pledge such interest to persons or entities that do not participate in DTC, or otherwise take actions in respect of such interest, may be affected by the lack of a definitive security in respect of such interest.

DTC has advised UGA that it takes any action permitted to be taken by a unitholder (including, without limitation, the presentation of a global certificate for exchange) only at the direction of one or more DTC Participants in whose account with DTC interests in global certificates are credited and only in respect of such portion of the aggregate principal amount of the global certificate as to which such DTC Participant or Participants has or have given such direction.

Transfer/Application Requirements. All purchasers of UGA’s units, and potentially any purchasers of units in the future, who wish to become limited partners or other record holders and receive cash distributions, if any, or have certain other rights, must deliver an executed transfer application in which the purchaser or transferee must certify that, among other things, he, she or it agrees to be bound by UGA’s LP Agreement and is eligible to purchase UGA’s securities. Each purchaser of units must execute a transfer application and certification. The obligation to provide the form of transfer application is imposed on the seller of units or, if a purchase of units is made through an exchange, the form may be obtained directly through UGA. Further, the General Partner may request each record holder to furnish certain information, including that record holder’s nationality, citizenship or other related status. A record holder is a unitholder that is, or has applied to be, a limited partner. An investor who is not a U.S. resident may not be eligible to become a record holder or one of UGA’s limited partners if that investor’s ownership would subject UGA to the risk of cancellation or forfeiture of any of UGA’s assets under any federal, state or local law or regulation. If the record holder fails to furnish the information or if the General Partner determines, on the basis of the information furnished by the holder in response to the request, that such holder is not qualified to become one of UGA’s limited partners, the General Partner may be substituted as a holder for the record holder, who will then be treated as a non-citizen assignee, and UGA will have the right to redeem those securities held by the record holder.

A transferee’s broker, agent or nominee may complete, execute and deliver a transfer application and certification. UGA may, at its discretion, treat the nominee holder of a unit as the absolute owner. In that case, the beneficial holder’s rights are limited solely to those that it has against the nominee holder as a result of any agreement between the beneficial owner and the nominee holder.

A person purchasing UGA’s existing units, who does not execute a transfer application and certify that the purchaser is eligible to purchase those securities acquires no rights in those securities other than the right to resell those securities. Whether or not a transfer application is received or the consent of the General Partner obtained, UGA’s units are securities and are transferable according to the laws governing transfers of securities.

Any transfer of units will not be recorded by the transfer agent or recognized by the General Partner unless a completed transfer application is delivered to the General Partner or the Administrator. When acquiring units, the transferee of such units that completes a transfer application will:

| | · | be an assignee until admitted as a substituted limited partner upon the consent and sole discretion of the General Partner and the recording of the assignment on the books and records of the partnership; |

| | · | automatically request admission as a substituted limited partner; |

· agree to be bound by the terms and conditions of, and execute, UGA’s LP Agreement;

· represent that such transferee has the capacity and authority to enter into UGA’s LP Agreement;

· grant powers of attorney to UGA’s General Partner and any liquidator of us; and

· make the consents and waivers contained in UGA’s LP Agreement.

An assignee will become a limited partner in respect of the transferred units upon the consent of UGA’s General Partner and the recordation of the name of the assignee on UGA’s books and records. Such consent may be withheld in the sole discretion of UGA’s General Partner.

If consent of the General Partner is withheld, such transferee shall be an assignee. An assignee shall have an interest in the partnership equivalent to that of a limited partner with respect to allocations and distributions, including, without limitation, liquidating distributions, of the partnership. With respect to voting rights attributable to units that are held by assignees, the General Partner shall be deemed to be the limited partner with respect thereto and shall, in exercising the voting rights in respect of such units on any matter, vote such units at the written direction of the assignee who is the record holder of such units. If no such written direction is received, such units will not be voted. An assignee shall have no other rights of a limited partner.

Until a unit has been transferred on UGA’s books, UGA and the transfer agent may treat the record holder of the unit as the absolute owner for all purposes, except as otherwise required by law or stock exchange regulations.

Withdrawal of Limited Partners

As discussed in the LP Agreement, if the General Partner gives at least fifteen (15) days’ written notice to a limited partner, then the General Partner may for any reason, in its sole discretion, require any such limited partner to withdraw entirely from the partnership or to withdraw a portion of its partner capital account. If the General Partner does not give at least fifteen (15) days’ written notice to a limited partner, then it may only require withdrawal of all or any portion of the capital account of any limited partner in the following circumstances: (i) the unitholder made a misrepresentation to the General Partner in connection with its purchase of units; or (ii) the limited partner’s ownership of units would result in the violation of any law or regulations applicable to the partnership or a partner. In these circumstances, the General Partner without notice may require the withdrawal at any time, or retroactively. The limited partner thus designated shall withdraw from the partnership or withdraw that portion of its partner capital account specified, as the case may be, as of the close of business on such date as determined by the General Partner. The limited partner thus designated shall be deemed to have withdrawn from the partnership or to have made a partial withdrawal from its partner capital account, as the case may be, without further action on the part of the limited partner and the provisions of the LP Agreement shall apply.

Calculating NAV

UGA’s NAV is calculated by:

· Taking the current market value of its total assets; and

· Subtracting any liabilities

BBH&Co., the Administrator, calculates the NAV of UGA once each trading day. The NAV for a particular trading day is released after 4:15 p.m. New York time. It calculates the NAV as of the earlier of the close of the NYSE or 4:00 p.m. New York time. Trading on the NYSE Arca typically closes at 4:15 p.m. New York time. The Administrator uses the NYMEX closing price (determined at the earlier of the close of the NYMEX or 2:30 p.m. New York time) for the contracts traded on the NYMEX, but determines the value of all other USOF investments as of the earlier of the close of the NYSE or 4:00 p.m. New York time in accordance with the current Administrative Agency Agreement among BBH&Co., UGA and the General Partner which is incorporated by reference into this annual report on Form 10-K.

In addition, in order to provide updated information relating to UGA for use by investors and market professionals, the NYSE Arca calculates and disseminates throughout the trading day an updated indicative fund value. The indicative fund value is calculated by using the prior day’s closing NAV per unit of UGA as a base and updating that value throughout the trading day to reflect changes in the most recently reported trade price for the Benchmark Futures Contract on the NYMEX. The prices reported for the active Benchmark Futures Contract month are adjusted based on the prior day’s spread differential between settlement values for that contract and the spot month contract. In the event that the spot month contract is also the active contract, the last sale price for the active contract is not adjusted. The indicative fund value unit basis disseminated during NYSE Arca trading hours should not be viewed as an actual real time update of the NAV, because the NAV is calculated only once at the end of each trading day.

The indicative fund value is disseminated on a per unit basis every 15 seconds during regular NYSE Arca trading hours of 9:30 a.m. New York time to 4:15 p.m. New York time. The normal trading hours of the NYMEX are 10:00 a.m. New York time to 2:30 p.m. New York time. This means that there is a gap in time at the beginning and the end of each day during which UGA’s units are traded on the NYSE Arca, but real-time NYMEX trading prices for gasoline Futures Contracts traded on the NYMEX are not available. As a result, during those gaps there will be no update to the indicative fund value.

The NYSE Arca disseminates the indicative fund value through the facilities of CTA/CQ High Speed Lines. In addition, the indicative fund value is published on the NYSE Arca’s website and is available through on-line information services such as Bloomberg and Reuters.

Dissemination of the indicative fund value provides additional information that is not otherwise available to the public and is useful to investors and market professionals in connection with the trading of UGA units on the NYSE Arca. Investors and market professionals are able throughout the trading day to compare the market price of UGA and the indicative fund value. If the market price of UGA units diverges significantly from the indicative fund value, market professionals will have an incentive to execute arbitrage trades. For example, if UGA appears to be trading at a discount compared to the indicative fund value, a market professional could buy UGA units on the NYSE Arca and sell short gasoline Futures Contracts. Such arbitrage trades can tighten the tracking between the market price of UGA and the indicative fund value and thus can be beneficial to all market participants.

In addition, other Futures Contracts, Other Gasoline-Related Investments and Treasuries held by UGA are valued by the Administrator, using rates and points received from client approved third party vendors (such as Reuters and WM Company) and advisor quotes. These investments are not included in the indicative value. The indicative fund value is based on the prior day’s NAV and moves up and down according solely to changes in the price of the Benchmark Futures Contract.

Creation and Redemption of Units

UGA creates and redeems units from time to time, but only in one or more Creation Baskets or Redemption Baskets. The creation and redemption of baskets are only made in exchange for delivery to UGA or the distribution by UGA of the amount of Treasuries and any cash represented by the baskets being created or redeemed, the amount of which is based on the combined NAV of the number of units included in the baskets being created or redeemed determined as of 4:00 p.m. New York time on the day the order to create or redeem baskets is properly received.

Authorized Purchasers are the only persons that may place orders to create and redeem baskets. Authorized Purchasers must be (1) registered broker-dealers or other securities market participants, such as banks and other financial institutions, that are not required to register as broker-dealers to engage in securities transactions as described below, and (2) DTC Participants. To become an Authorized Purchaser, a person must enter into an Authorized Purchaser Agreement with the General Partner. The Authorized Purchaser Agreement provides the procedures for the creation and redemption of baskets and for the delivery of the Treasuries and any cash required for such creations and redemptions. The Authorized Purchaser Agreement and the related procedures attached thereto may be amended by UGA, without the consent of any limited partner or unitholder or Authorized Purchaser. Authorized Purchasers pay a transaction fee of $1,000 to UGA for each order they place to create or redeem one or more baskets. Authorized Purchasers who make deposits with UGA in exchange for baskets receive no fees, commissions or other form of compensation or inducement of any kind from either UGA or the General Partner, and no such person will have any obligation or responsibility to the General Partner or UGA to effect any sale or resale of units. As of December 31, 2008, 4 Authorized Purchasers had entered into agreements with UGA to purchase Creation Baskets.

Certain Authorized Purchasers are expected to have the facility to participate directly in the physical gasoline market and the gasoline futures market. In some cases, an Authorized Purchaser or its affiliates may from time to time acquire gasoline or sell gasoline and may profit in these instances. The General Partner believes that the size and operation of the gasoline market make it unlikely that an Authorized Purchaser’s direct activities in the gasoline or securities markets will impact the price of gasoline, Futures Contracts, or the price of the units.

Each Authorized Purchaser is required to be registered as a broker-dealer under the Exchange Act and is a member in good standing with FINRA, or exempt from being or otherwise not required to be licensed as a broker-dealer or a member of FINRA, and qualified to act as a broker or dealer in the states or other jurisdictions where the nature of its business so requires. Certain Authorized Purchasers may also be regulated under federal and state banking laws and regulations. Each Authorized Purchaser has its own set of rules and procedures, internal controls and information barriers as it determines is appropriate in light of its own regulatory regime.

Under the Authorized Purchaser Agreement, the General Partner has agreed to indemnify the Authorized Purchasers against certain liabilities, including liabilities under the Securities Act of 1933, as amended, and to contribute to the payments the Authorized Purchasers may be required to make in respect of those liabilities.

The following description of the procedures for the creation and redemption of baskets is only a summary and an investor should refer to the relevant provisions of the LP Agreement and the form of Authorized Purchaser Agreement for more detail, each of which is incorporated by reference into this annual report on Form 10-K.

Creation Procedures

On any business day, an Authorized Purchaser may place an order with the Marketing Agent to create one or more baskets. For purposes of processing purchase and redemption orders, a “business day” means any day other than a day when any of the NYSE Arca, the NYMEX or the NYSE is closed for regular trading. Purchase orders must be placed by 12:00 p.m. New York time, or the close of regular trading on the NYSE Arca, whichever is earlier. The day on which the Marketing Agent receives a valid purchase order is the purchase order date.

By placing a purchase order, an Authorized Purchaser agrees to deposit Treasuries, cash or a combination of Treasuries and cash with UGA, as described below. Prior to the delivery of baskets for a purchase order, the Authorized Purchaser must also have wired to the Custodian the non-refundable transaction fee due for the purchase order. Authorized Purchasers may not withdraw a creation request.

Determination of Required Deposits

The total deposit required to create each basket (“Creation Basket Deposit”) is the amount of Treasuries and/or cash that is in the same proportion to the total assets of UGA (net of estimated accrued but unpaid fees, expenses and other liabilities) on the date the order to purchase is accepted as the number of units to be created under the purchase order is in proportion to the total number of units outstanding on the date the order is received. The General Partner determines, directly in its sole discretion or in consultation with the Administrator, the requirements for Treasuries and the amount of cash, including the maximum permitted remaining maturity of a Treasury and proportions of Treasury and cash that may be included in deposits to create baskets. The amount of cash deposit required is the difference between the aggregate market value of the Treasuries required to be included in a Creation Basket Deposit as of 4:00 p.m. New York time on the date the order to purchase is properly received and the total required deposit.

Delivery of Required Deposits

An Authorized Purchaser who places a purchase order is responsible for transferring to UGA’s account with the Custodian the required amount of Treasuries and cash by the end of the third business day following the purchase order date. Upon receipt of the deposit amount, the Administrator directs DTC to credit the number of baskets ordered to the Authorized Purchaser’s DTC account on the third business day following the purchase order date. The expense and risk of delivery and ownership of Treasuries until such Treasuries have been received by the Custodian on behalf of UGA shall be borne solely by the Authorized Purchaser.

Because orders to purchase baskets must be placed by 12:00 p.m., New York time, but the total payment required to create a basket during the continuous offering period will not be determined until 4:00 p.m., New York time, on the date the purchase order is received, Authorized Purchasers will not know the total amount of the payment required to create a basket at the time they submit an irrevocable purchase order for the basket. UGA’s NAV and the total amount of the payment required to create a basket could rise or fall substantially between the time an irrevocable purchase order is submitted and the time the amount of the purchase price in respect thereof is determined.

Rejection of Purchase Orders

The General Partner acting by itself or through the Marketing Agent may reject a purchase order or a Creation Basket Deposit if:

| | · | it determines that the investment alternative available to UGA at that time will not enable it to meet its investment objective; |

· it determines that the purchase order or the Creation Basket Deposit is not in proper form;

| | · | it believes that the purchase order or the Creation Basket Deposit would have adverse tax consequences to UGA or its unitholders; |

| | · | the acceptance or receipt of the Creation Basket Deposit would, in the opinion of counsel to the General Partner, be unlawful; or |

| | · | circumstances outside the control of the General Partner, Marketing Agent or Custodian make it, for all practical purposes, not feasible to process creations of baskets. |

None of the General Partner, Marketing Agent or Custodian will be liable for the rejection of any purchase order or Creation Basket Deposit.

Redemption Procedures

The procedures by which an Authorized Purchaser can redeem one or more baskets mirror the procedures for the creation of baskets. On any business day, an Authorized Purchaser may place an order with the Marketing Agent to redeem one or more baskets. Redemption orders must be placed by 12:00 p.m. New York time or the close of regular trading on the NYSE, whichever is earlier. A redemption order so received will be effective on the date it is received in satisfactory form by the Marketing Agent. The redemption procedures allow Authorized Purchasers to redeem baskets and do not entitle an individual unitholder to redeem any units in an amount less than a Redemption Basket, or to redeem baskets other than through an Authorized Purchaser. By placing a redemption order, an Authorized Purchaser agrees to deliver the baskets to be redeemed through DTC’s book-entry system to UGA not later than 3:00 p.m. New York time on the third business day following the effective date of the redemption order. Prior to the delivery of the redemption distribution for a redemption order, the Authorized Purchaser must also have wired to UGA’s account at the Custodian the non-refundable transaction fee due for the redemption order. Authorized Purchasers may not withdraw a redemption request.

Determination of Redemption Distribution

The redemption distribution from UGA consists of a transfer to the redeeming Authorized Purchaser of an amount of Treasuries and/or cash that is in the same proportion to the total assets of UGA (net of estimated accrued but unpaid fees, expenses and other liabilities) on the date the order to redeem is properly received as the number of units to be redeemed under the redemption order is in proportion to the total number of units outstanding on the date the order is received. The General Partner, directly or in consultation with the Administrator, determines the requirements for Treasuries and the amounts of cash, including the maximum permitted remaining maturity of a Treasury, and the proportions of Treasuries and cash that may be included in distributions to redeem baskets.

Delivery of Redemption Distribution

The redemption distribution due from UGA will be delivered to the Authorized Purchaser by 3:00 p.m. New York time on the third business day following the redemption order date if, by 3:00 p.m. New York time on such third business day, UGA’s DTC account has been credited with the baskets to be redeemed. If UGA’s DTC account has not been credited with all of the baskets to be redeemed by such time, the redemption distribution will be delivered to the extent of whole baskets received. Any remainder of the redemption distribution will be delivered on the next business day to the extent of remaining whole baskets received if UGA receives the fee applicable to the extension of the redemption distribution date which the General Partner may, from time to time, determine and the remaining baskets to be redeemed are credited to UGA’s DTC account by 3:00 p.m. New York time on such next business day. Any further outstanding amount of the redemption order shall be cancelled. Pursuant to information from the General Partner, the Custodian will also be authorized to deliver the redemption distribution notwithstanding that the baskets to be redeemed are not credited to UGA’s DTC account by 3:00 p.m. New York time on the third business day following the redemption order date if the Authorized Purchaser has collateralized its obligation to deliver the baskets through DTC’s book entry-system on such terms as the General Partner may from time to time determine.

Suspension or Rejection of Redemption Orders

The General Partner may, in its discretion, suspend the right of redemption, or postpone the redemption settlement date, (1) for any period during which the NYSE Arca or the NYMEX is closed other than customary weekend or holiday closings, or trading on the NYSE Arca or the NYMEX is suspended or restricted, (2) for any period during which an emergency exists as a result of which delivery, disposal or evaluation of Treasuries is not reasonably practicable, or (3) for such other period as the General Partner determines to be necessary for the protection of the limited partners. For example, the General Partner may determine that it is necessary to suspend redemptions to allow for the orderly liquidation of UGA’s assets at an appropriate value to fund a redemption. If the General Partner has difficulty liquidating its positions, e.g., because of a market disruption event in the futures markets, a suspension of trading by the exchange where the futures contracts are listed or an unanticipated delay in the liquidation of a position in an over the counter contract, it may be appropriate to suspend redemptions until such time as such circumstances are rectified. None of the General Partner, the Marketing Agent, the Administrator, or the Custodian will be liable to any person or in any way for any loss or damages that may result from any such suspension or postponement.