ABOUT THIS PROSPECTUS

This prospectus is part of an “automatic shelf” registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or SEC, using a shelf registration process as a “well-known seasoned issuer,” as defined under the Securities Act of 1933, as amended, or the Securities Act. Under the shelf registration process, we may, from time to time, offer and sell in one or more offerings, in any combination, a number and amount of common units of DCP Midstream, LP, preferred units of DCP Midstream, LP or debt securities of DCP Midstream Operating, LP and related guarantees by DCP Midstream, LP. This prospectus generally describes us, common units of DCP Midstream, LP, preferred units of DCP Midstream, LP, debt securities of DCP Midstream Operating, LP and related guarantees of the debt securities of DCP Midstream, LP.

Each time we offer to sell securities pursuant to this prospectus, we will provide a prospectus supplement that contains specific information about the offering and the specific terms of the securities offered and also may add, update or change information contained in this prospectus. If there is any inconsistency between the information contained or incorporated by reference in this prospectus, on the one hand, and the information contained or incorporated by reference in any applicable prospectus supplement, on the other hand, you should rely on the information contained or incorporated by reference in the applicable prospectus supplement.

Wherever references are made in this prospectus to information that will be included in a prospectus supplement, to the extent permitted by applicable law, rules, or regulations, we may instead include such information or add, update, or change the information contained in this prospectus by means of a post-effective amendment to the registration statement, of which this prospectus is a part, through filings we make with the SEC that are incorporated by reference into this prospectus or by any other method as may then be permitted under applicable law, rules, or regulations.

Statements made in this prospectus, in any prospectus supplement or in any document incorporated by reference in this prospectus or any prospectus supplement as to the contents of any contract or other document are not necessarily complete. In each instance we refer you to the copy of the contract or other document filed as an exhibit to the registration statement of which this prospectus is a part, or as an exhibit to the documents incorporated by reference. You may obtain copies of those documents as described in this prospectus under “Where You Can Find More Information”.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus or any accompanying prospectus supplement were made solely for the benefit of the parties to such agreement and for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

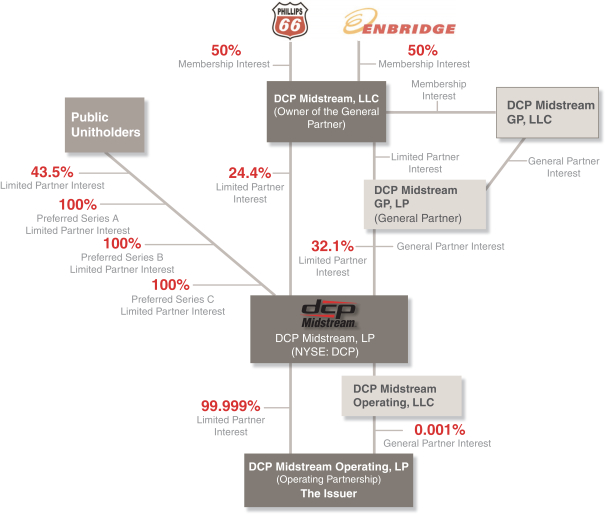

Throughout this prospectus, when we use the terms “we,” “us,” “our” or “DCP,” we are referring either to DCP Midstream, LP itself or to DCP Midstream, LP and its operating subsidiaries collectively, as the context requires. References to DCP Operating refer to DCP Midstream Operating, LP, a 100% owned subsidiary of DCP, which may be the issuer of debt securities hereunder. References in this prospectus to our “general partner” refer to DCP Midstream GP, LP and/or DCP Midstream GP, LLC, the general partner of DCP Midstream GP, LP, as the context requires.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the disclosure requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and file Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other information with the SEC. The public may read and copy these reports or other information

ii