Filed Pursuant to Rule 424(B)(3)

File Number 333-144884

PROSPECTUS

ARAMARK Corporation

$250,000,000 5.00% Senior Notes due 2012

$1,280,000,000 8.50% Senior Notes due 2015

$500,000,000 Senior Floating Rate Notes due 2015

The 5.00% Senior Notes due 2012 (the “senior notes due 2012”) bear interest at a rate of 5% per annum and will mature on June 1, 2012. The 8.50% Senior Notes due 2015 (the “senior fixed rate notes”) bear interest at a rate of 8.50% per annum and will mature on February 1, 2015. The Senior Floating Rate Notes due 2015 (the “senior floating rate notes”) accrue interest at a rate per annum, reset quarterly, equal to three-month LIBOR (as defined) plus 3.50%. The senior notes due 2012, the senior fixed rate notes and the senior floating rate notes are collectively referred to herein as the “notes,” unless the context otherwise requires.

We may redeem some or all of the senior fixed rate notes at any time or after February 1, 2011 and some or all of the senior floating rate notes at any time on or after February 1, 2009, and all or any portion of the senior notes due 2012 at our option at any time. We may redeem some or all of the senior fixed rate notes prior to February 1, 2011 and some or all of the senior floating rate notes prior to February 1, 2009, in each case at a price equal to 100% of the principal amount of the notes redeemed plus the applicable “make-whole” premium as described in this prospectus. We may also redeem up to 35% of the senior fixed rate notes at any time before 2010 and up to 35% of the senior floating rate notes at any time before February 1, 2009, in each case, at the redemption prices set forth in this prospectus using the proceeds of certain equity offerings.

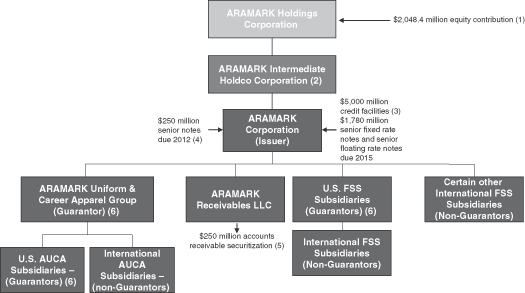

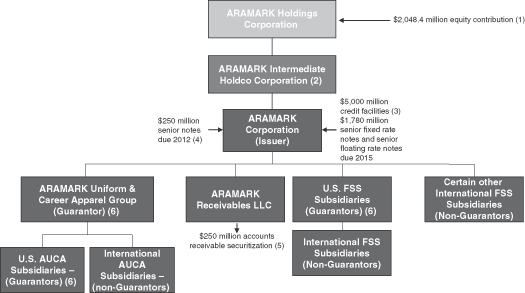

The notes are senior unsecured obligations of ARAMARK Corporation and rank senior in right of payment to our future debt and other obligations that are, by their terms, expressly subordinated in right of payment to the notes. The notes rank equal in right of payment to all of our existing and future senior debt and other obligations that are not, by their terms, expressly subordinated in right of payment to the notes. The notes are effectively subordinated to all of our existing and future secured debt, including obligations under our senior secured credit facilities, to the extent of the value of the assets securing such debt, and structurally subordinated to all obligations of each of our subsidiaries that is not a guarantor of the specific series of notes.

The senior notes due 2012 are not guaranteed by any of our subsidiaries. The senior fixed rate notes and the senior floating rate notes are both guaranteed on an unsecured basis by each of our wholly-owned domestic subsidiaries that guarantee our senior secured credit facilities. Each of the senior fixed rate note and senior floating rate note guarantees are senior unsecured obligations of the guarantors and will rank senior in right of payment to all of the applicable guarantor’s existing and future debt and other obligations that are, by their terms, expressly subordinated in right of payment to the guarantees. The guarantees rank equal in right of payment to all of the applicable guarantor’s existing and future senior debt and other obligations that are not, by their terms, expressly subordinated in right of payment to the guarantees. The guarantees are effectively subordinated to all of the guarantor’s applicable existing and future secured debt, including such guarantor’s guarantee under our senior secured credit facilities, to the extent of the value of the assets securing such debt, and are structurally subordinated to all obligations of any subsidiary of a guarantor if that subsidiary is not also a guarantor of the specific series of notes.

See “Risk Factors” beginning on page 16 for a discussion of certain risks that you should consider before investing in the notes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the notes or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

This prospectus has been prepared for and may be used by Goldman, Sachs & Co. and other affiliates of Goldman, Sachs & Co. and J.P. Morgan Securities Inc. and other affiliates of J.P. Morgan Securities Inc. in connection with offers and sales of the notes related to market-making transactions in the notes effected from time to time. Such affiliates of Goldman, Sachs & Co. or J.P. Morgan Securities Inc. may act as principal or agent in such transactions, including as agent for the counterparty when acting as principal or as agent for both counterparties, and may receive compensation in the form of discounts and commissions, including from both counterparties, when it acts as agents for both. Such sales will be made at prevailing market prices at the time of sale, at prices related thereto or at negotiated prices. We will not receive any proceeds from such sales.

The date of this prospectus is August 7, 2007.

Table of Contents

We have not authorized any dealer, salesperson or other person to give any information or represent anything to you other than the information contained in this prospectus. You must not rely on unauthorized information or representations.

This prospectus does not offer to sell nor ask for offers to buy any of the securities in any jurisdiction where it is unlawful, where the person making the offer is not qualified to do so, or to any person who cannot legally be offered the securities. The information in this prospectus is current only as of the date on its cover, and may change after that date.

i

Industry and market data

The data included in this prospectus regarding markets and ranking, including the size of certain markets and our position and the position of our competitors within these markets, are based on our management’s knowledge and experience in the markets in which we operate. These estimates have also been based on information obtained from our trade and business organizations and other contacts in the markets in which we operate. While we believe these sources are reliable, we have not verified the research by any independent source.

ii

Summary

This summary highlights information appearing elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before making your investment decision. You should carefully read this summary together with the entire prospectus, including the information presented under the section entitled “Risk factors.”

Unless otherwise indicated or the context otherwise requires, references in this prospectus to “ARAMARK,” “we,” “our,” “us” and “the Company” and similar terms refer to ARAMARK Corporation and its subsidiaries on a consolidated basis, which were acquired pursuant to the Transactions (as described below), and references to the “Issuer” refer to ARAMARK Corporation, the issuer of the notes. Financial information identified in this prospectus as “pro forma” gives effect to the closing of the Transactions. Our fiscal year ends on the Friday nearest September 30 in each year. In this prospectus, when we refer to our fiscal years, we say “fiscal” and the year number, as in “fiscal 2006,” which refers to our fiscal year ended September 29, 2006. In addition, “client” refers to those businesses and other organizations which engage us to provide services. “Customers” refers to those consumers of our services, such as employees, students and patrons, to whom our clients provide us access.

Our company

We are a leader in professional services, providing award-winning food services, facilities management, and uniform and career apparel to clients such as universities and school districts, healthcare institutions, stadiums and arenas, businesses, and government departments and agencies around the world. We operate in two businesses: Food and Support Services (“FSS”) and Uniform and Career Apparel (“AUCA”). The FSS business provides food, hospitality and facility services. The AUCA business includes the rental, sale, cleaning and delivery of personalized uniform and career apparel. Through our expansive service offerings and geographic presence, our approximately 240,000 employees as of September 29, 2006 (including seasonal employees) currently serve thousands of clients and millions of customers in 18 countries around the world, providing services that are critical to the operations of our clients. Since fiscal 1995, we have grown sales from continuing operations at a compound annual growth rate of 8.8% while maintaining generally consistent operating margins. For fiscal 2006, we generated sales and operating income of $11.6 billion and $530.5 million, respectively.

Our broad range of services, diversified client base and high client retention rates have made us the largest FSS provider in North America and among the top three providers in most other countries where we operate, as well as the second largest uniform and career apparel provider in the United States. Our sales are highly diversified by client. Other than, collectively, a number of U.S. government agencies, no single client accounted for more than 2% of consolidated sales during any of the last five fiscal years. We have had an overall annual client retention rate of approximately 94% (measured by comparing management’s projected annual sales for each period with actual sales for such period) over the previous five fiscal years, which we believe reflects strong client satisfaction and leads to a stable and predictable sales base.

1

The following chart provides a brief overview of our business:

| | | | | | | | |

| | | Food and Support Services | | Uniform and Career Apparel |

| | | United States | | International | | Rental | | Direct Marketing |

Sales (Fiscal 2006) | | $7,454 million | | $2,547 million | | $1,202 million | | $418 million |

| | | | |

Operating Income (Fiscal 2006)(1) | | $398 million | | $109 million | | $134 million | | $(44) million(2) |

| | | | |

Services | | Food, hospitality

and facilities | | Food, hospitality and

facilities | | Rental, sale, cleaning,

maintenance and

delivery of

personalized uniform

and career apparel

and other items | | Direct marketing of

personalized uniforms,

career apparel and

public safety equipment |

| | | | |

Sectors | | Education,

healthcare, business

and sports and

entertainment | | Principally business;

operations are

conducted in 17

countries, including

the United Kingdom,

Canada, Germany,

Chile, Ireland,

Spain, South Korea,

Belgium, Mexico

and China | | Business,

manufacturing,

transportation and

service industries | | Business, public

institutions and

individuals |

| (1) | Excludes unallocated corporate expenses of $66.5 million. |

| (2) | Includes a charge of $46.3 million for goodwill impairment and adjustments to asset and liability carrying values in our AUCA—Direct Marketing segment related to our decision to exit the healthcare uniform sector. |

Food and Support Services (“FSS”)

Our FSS business provides food, hospitality and facility services for colleges and universities, school districts, healthcare facilities, businesses, correctional institutions, sports, entertainment and recreational venues, conference and convention centers and national and state parks. At most of the locations where we operate, we are the exclusive provider of these services and are responsible for hiring, training and supervising substantially all of our personnel in addition to ordering, receiving, preparing and serving food and beverage items sold at those locations. Our facilities services capabilities are broad, and include plant operations and maintenance, custodial/housekeeping, energy management, clinical equipment maintenance, groundskeeping, capital project management and building commissioning. For fiscal 2006, our FSS business accounted for 86% of our consolidated sales.

We generally use two types of contracts in our FSS business: profit and loss (“P&L”) contracts and client interest contracts. These contracts differ in the amount of financial risk that we bear and, accordingly, the potential compensation, profits or fees we may receive. Under P&L contracts, we receive all of the sales from, and bear all of the expenses of, the provision of our services at a client location. Client interest contracts include management fee contracts, under which our clients reimburse our operating costs and pay us a management fee, which may be calculated as a fixed dollar amount or a percentage of sales or operating costs. For our client interest contracts, both our upside potential and downside risk are reduced compared to our P&L contracts. For fiscal 2006, approximately 74% of our FSS sales were derived from P&L contracts with the remaining 26% derived from client interest contracts. Generally, we prefer P&L contracts as these arrangements allow us more management flexibility and provide us with greater potential to grow our operating profits.

2

Our FSS business is divided into two segments—United States and International. FSS U.S. operations serve various sectors (education, healthcare, business, and sports and entertainment), while our FSS international operations predominantly service the business sector. The following table outlines our FSS sales by U.S. sector and the International segment for fiscal 2006:

| | | |

| | | 2006 | |

United States | | | |

Education | | 23.2 | % |

Healthcare | | 13.3 | % |

Business (including Corrections) | | 22.3 | % |

Sports and Entertainment | | 15.7 | % |

International | | 25.5 | % |

| | | |

Total | | 100 | % |

| | | |

FSS—U.S. segment. Our FSS U.S. segment is characterized by sector and client diversity and types of services offered. No individual client, other than, collectively, a number of U.S. government agencies, represented more than 2% of our consolidated sales during any of the last five fiscal years. Our FSS U.S. operations focus on serving clients in four principal sectors:

Education. We provide a wide range of food and facility support services at more than 1,000 colleges, universities, school systems and districts and private schools. We offer our education clients a single source provider for managed service solutions, including dining, catering, food service management, convenience-oriented retail operations, facilities maintenance, custodial, grounds, energy, construction management, capital project management and building commissioning.

Healthcare. We provide a wide range of non-clinical support services to approximately 1,000 healthcare and senior living facilities in North America. We offer healthcare organizations a single source provider for managed service solutions, including non-clinical patient food and nutrition services, retail food services, plant operations, environmental services, energy management, laundry and linen distribution, clinical equipment maintenance, strategic/technical services, supply chain management and central transportation.

Business. We specialize in offering a variety of dining services to businesses, particularly on-site restaurants, catering, vending and office coffee, convenience stores and executive dining rooms. We also provide facility management services to business and industry clients, which include the management of housekeeping, plant operations and maintenance, groundskeeping and other services. Our business clients include over 350 members of the S&P 500 and 45 members of the Fortune 50.

We provide correctional food services and operate commissaries, laundry facilities and property rooms and provide facilities management services for more than 500 state, county and municipal clients and in 2006, we served over 350 million meals at those client locations.

Sports and Entertainment. We provide concessions, suite catering, retail services, recreational and lodging services and facility management services at sports and entertainment facilities. We serve facilities that host 78 professional and college sports teams, including 45 teams in Major League Baseball, the National Basketball Association, the National Football League and the National Hockey League. Our sports and entertainment clients also include 39 convention and civic centers and 15 national and state parks. We also own 50% of SMG, a leader in providing outsourced management of public assembly facilities including arenas, stadiums and theaters, as well as convention centers. On May 11, 2007, we entered into an agreement to sell our interest in SMG. We completed this sale on June 14, 2007.

3

FSS—International segment. Our FSS International segment provides services that are similar to those provided to FSS clients in the United States. However, in this segment, our mix of clientele is weighted more towards business clients than the FSS U.S. segment. Our international services are currently provided in 17 countries outside the United States. Our largest international operations are in the United Kingdom, Canada, Germany, Chile, Ireland, Spain and Belgium, and in each of these countries we are one of the leading food service providers. We also have operations in Argentina, Mexico, South Korea, China and the Czech Republic.

We have provided food, hospitality and facility services at a number of international sporting events, including thirteen Olympic games since our first summer Olympics in Mexico City in 1968 and the FIFA World Cup, including the 2002 and 2006 World Cups. We have historically expanded our international operations to new countries through the acquisition of leading independent food service providers, with existing management maintaining an ownership interest in the operations for some post-acquisition period. Our most recent expansions were in Chile, China and Ireland. We also own 49.85% of AIM Services Co., Ltd., a leader in providing outsourced food services in Japan with revenues for its fiscal year ended March 31, 2006 of $1.0 billion.

Uniform and Career Apparel (“AUCA”)

Our AUCA business provides uniforms, career and image apparel, equipment, work clothes and accessories to meet the needs of clients in a wide range of industries in the United States, including manufacturing, transportation, construction, restaurants and hotels, public safety, healthcare and pharmaceutical and many others. We supply garments, other textile and paper products, public safety equipment and other accessories through rental and direct purchase programs to businesses, government agencies and individuals. For fiscal 2006, our AUCA business accounted for 14% of our consolidated sales. AUCA is organized into two segments: rental and direct marketing.

AUCA—Rental segment. AUCA’s Rental segment provides a full service employee uniform solution, including design, sourcing and manufacturing, delivery, cleaning and maintenance. We rent or lease uniforms, career and image apparel, work clothing, outerwear and other textile and related products to businesses in numerous industries throughout the United States. We also offer nongarment items and related services, as well as paper products and safety products. Our uniform rental business is the second largest in the United States. We provide these services through a national network of more than 2,800 pick-up and delivery routes from over 200 company facilities and cover over 180 of the top 200 metropolitan statistical areas in the United States. We manufacture a significant portion of our uniform inventory at our cutting and sewing plants in Mexico with the balance, along with other textile and related items, purchased from vendors around the world.

AUCA—Direct Marketing segment. Our Direct Marketing segment designs, sells and distributes personalized uniforms, rugged work clothing, outerwear, business casual apparel and footwear, public safety equipment and accessories through mail order catalogs, the Internet, telemarketing and field sales representatives. Our Direct Marketing segment serves to complement our higher margin Rental segment by enabling us to offer a full range of product offerings to our clients.

Industry overview

We operate in two principal businesses, both of which are highly fragmented and characterized by attractive industry conditions.

Food and Support Services

We believe based on management estimates that the total global addressable FSS business opportunity is $600.0 billion, split approximately evenly between food services and facility support. Of this, we believe only approximately 25% is currently outsourced, resulting in approximately $450.0 billion of additional opportunity for industry growth. The FSS business is highly fragmented, with the top five largest competitors capturing approximately $50.0 billion of the addressable business.

4

We expect that the demand for outsourced food and facility support services will continue to increase, driven by client preferences including: the desire to focus on their core businesses, the need to deliver a high level of customer satisfaction, the desire to reduce costs in comparison with self-administered programs, and the ability to obtain food and facility support services from a single provider.

Uniform and Career Apparel

Although we estimate the aggregate sales for the U.S. uniform and career apparel industry to be approximately $16.0 billion, we estimate the total U.S. business opportunity at $36.0 billion based on a potential addressable population of workers who could purchase or rent uniforms for work each day. This industry is both under-penetrated and highly fragmented with over 400 competitors and the two largest providers, including ARAMARK, representing only 26% of existing industry sales. Although the business is tied to the size of the U.S. labor force, demand continues to increase, driven by a number of factors including: a growing preference by employers to create corporate identity and brand awareness, an increased importance of employee identification for security reasons, employers requiring workers to wear specific uniforms for their safety and uniforms helping to enhance worker morale and promote teamwork.

Strengths

Consistent growth in sales and operating cash flows. Since fiscal 1995, we have grown sales from continuing operations at a compound annual growth rate of 8.8% while maintaining generally consistent operating margins. Our performance has been driven by high client retention rates, a strong focus on new client wins and the fact that approximately 52% of our sales come from non-cyclical sectors (education, healthcare, stadiums and arenas and correctional facilities). In addition, our company generates strong operating cash flow as a result of relatively low capital expenditures, net of asset disposals, representing approximately 2.3% of sales for fiscal 2006 and modest working capital requirements.

High client retention rates. We are focused on providing world-class experiences, environments and outcomes for our clients and customers by developing relationships based on service excellence, partnership and mutual understanding. As a result, we have had an overall annual client retention rate of approximately 94% over the previous five years for the FSS and AUCA—Rental businesses combined, and of our top twenty clients in each of FSS and AUCA in 2006, all except one have been clients since 2001.

Client and geographic diversity. We have a diverse geographic presence, serving thousands of clients and millions of customers in 18 countries around the world in our two FSS segments. We serve, among others, the facilities that host 78 professional and college sports teams, more than 1,000 colleges, universities, school systems and districts and private schools across the United States, approximately 1,000 healthcare and senior living facilities in North America, more than 500 correctional facilities, as well as over 350 members of the S&P 500 and 45 members of the Fortune 50.

In addition to the United States, we provide FSS services in 17 other countries, with our larger international operations including those in the United Kingdom, Canada, Germany, Chile, Ireland, Spain, South Korea, Belgium, Mexico and China. For fiscal 2006, international FSS sales were $2.5 billion representing 22% of overall sales, up over $1.5 billion since fiscal 2000, or an approximately 17% compound annual growth rate, and up $1.7 billion since fiscal 1995, or an approximately 11% compound annual growth rate. We continue to diversify our international operations, including through acquisitions, with 36% of fiscal 2006 international sales coming from outside the United Kingdom, Canada and Germany compared to 14% in fiscal 1995.

Our AUCA business serves a variety of businesses of different sizes and across several different industries. With clients in 45 states and one Canadian province, and over 200 service and distribution centers across the United States and two service centers in Ontario, Canada, the Rental segment has a broad, diverse client base with no client representing more than 2% of our AUCA sales during any of the last five fiscal years.

5

Leading position. We are the largest FSS provider in North America and among the top three providers in most of the countries where we operate, as well as the second largest uniform and career apparel provider in the United States.

Experienced management team with a track recordof success. Our experienced management team has a track record of operational excellence. Our Chief Executive Officer, Joseph Neubauer, has been with us for 27 years, and our executive management team has an average of 12 years with ARAMARK and 14 years in the industry. Importantly, our management is experienced operating in a levered capital structure after our management-led leveraged buyout in 1984, ultimately achieving an investment grade rating from Moody’s Investors Service, Standard and Poor’s and Fitch Ratings.

Strong equity sponsorship. Our equity sponsors, GS Capital Partners, CCMP Capital Advisors, J.P. Morgan Partners, Thomas H. Lee Partners and Warburg Pincus have over $70.0 billion in assets under management and are private equity investors with a strong track record of successful investments in the service industry.

Strategy

Maintain commitment to understanding customer preferences. Understanding the detailed food and beverage preferences of our customers is critical to our success. Through research and operational experience, we are able to tailor our service offerings to maintain and increase customer satisfaction, as we offer broad, retail-oriented food services.

Expand FSS presence in under-penetratedareas. In the FSS industry, we believe there is up to a $600.0 billion business opportunity and only approximately 25% of such opportunity is currently outsourced leaving ample room for future growth. Moreover, certain client sectors, such as healthcare, education and corrections, are particularly under-penetrated, with many large educational institutions and school districts, large healthcare facilities and correctional institutions still self-operating their internal food and facilities support services. With the growing client preference to focus on their core business, these three client sectors in particular represent attractive expansion opportunities for us.

Achieve greater participation with existing clients. We are committed to growing organically by achieving higher customer participation and spending levels within our existing FSS client base. Through our knowledge

and understanding of our customers’ particular preferences, we plan to constantly improve and tailor our service offerings to attract more customers from the on-site population and increase per customer spending levels and frequency within our existing client accounts.

Improve our cross-selling capabilities. In our FSS segment, we currently provide food, facilities and clinical technology services at only 5% of the more than 1,000 healthcare facilities in which we operate, which represents a significant cross-selling opportunity. In our AUCA segment, there is a significant opportunity to increase our provision of ancillary services, such as sanitation tools and linens, to our existing uniform clients. In addition, we intend to increase our cross-selling efforts to provide uniform services to our FSS clients and vice versa.

Further expand internationally in FSS business. We currently operate FSS operations in 17 countries outside the United States and the countries in which we operate represent nearly 70% of the world’s GDP. By focusing on organic growth and end-customer preferences, making selective acquisitions, and taking advantage of under-penetrated opportunities in certain sectors in Europe, we believe that over time we have an opportunity to be one of the top three providers in a group of countries that together represent approximately 80% of the world’s GDP.

Penetrate “non-user” population in AUCA business. It is estimated that approximately 26 million workers in the United States are currently employed in job categories that have a high propensity to be in a uniform program, but are not participating. We believe that we can convert a portion of this opportunity over time to support our organic growth.

6

Company Information

We were incorporated in Delaware on February 17, 1959. We were formerly known as ARAMARK Services, Inc. and on March 30, 2007, we completed a merger with our direct parent, ARAMARK Corporation, and the combined entity assumed the name ARAMARK Corporation. Our principal executive offices are located at ARAMARK Tower, 1101 Market Street, Philadelphia, PA 19107, and our telephone number at that address is (215) 238-3000.

7

The Sponsors

GS Capital Partners

Since 1986, Goldman Sachs has raised thirteen private equity and mezzanine investment funds aggregating $56 billion of capital commitments. GS Capital Partners is the private equity vehicle through which The Goldman Sachs Group, Inc. conducts its privately negotiated corporate equity investment activities. GS Capital Partners is currently investing its GS Capital Partners VI fund. GS Capital Partners is a global private equity group with a focus on large, sophisticated business opportunities in which value can be created through leveraging the resources of Goldman Sachs.

CCMP Capital Advisors

A premier private equity firm, CCMP Capital Advisors, LLC and its predecessors have invested over $10 billion in over 375 buyout and growth equity transactions since 1984. The foundation of CCMP Capital’s investment approach is to leverage the combined strengths of its deep industry expertise and proprietary global network of relationships by focusing on five targeted industries (Consumer, Retail and Services; Energy; Healthcare Infrastructure; Industrials; and Media and Telecom). Through active management and its powerful value creation model, CCMP Capital’s team has established a reputation as a world-class investment partner.

Prior to forming CCMP Capital, the firm’s principals led the buyout and growth equity investment business of J.P. Morgan Partners, LLC, a private equity division of JPMorgan Chase & Co. CCMP Capital follows the successful investment strategy its principals developed and implemented as members of JPMorgan Partners.

CCMP Capital is a registered investment adviser with the Commission.

J.P. Morgan Partners

J.P. Morgan Partners, LLC (“JPMP”) is a private equity division of JPMorgan Chase & Co., one of the largest financial institutions in the United States. JPMP has invested over $15 billion worldwide in consumer, media, energy, industrial, financial services, healthcare and technology companies since its inception in 1984.

As of August 1, 2006, the investment professionals of JPMP formed entities independent of JPMorgan Chase. The buyout and growth equity professionals formed CCMP Capital Advisors, LLC, which focuses exclusively on buyout and growth equity investments primarily in five targeted industry sectors in the U.S. and Europe. The venture team formed Panorama Capital, LLC, and continues to focus on technology and life sciences investments. CCMP Capital and Panorama continue to manage the JPMP investments pursuant to a management agreement with JPMorgan Chase & Co.

JPMP is a registered investment adviser with the Commission.

Thomas H. Lee Partners

Thomas H. Lee Partners, L.P. (“THL Partners”) is one of the oldest and most successful private equity investment firms in the United States. Since its founding in 1974, THL Partners has invested approximately $12 billion of equity capital in more than 100 businesses with an aggregate purchase price of more than $90 billion, completed over 200 add-on acquisitions for portfolio companies, and generated superior returns for its investors and partners. THL Partners identifies and acquires substantial ownership positions in large growth-oriented

8

companies through acquisitions, recapitalizations and direct investments. The firm currently manages approximately $20 billion of committed capital. Notable transactions sponsored by the firm include Dunkin Brands, Michael Foods, Warner Music Group, General Nutrition Companies, Houghton Mifflin Company, Fisher Scientific International, Experian Information Solutions, TransWestern Holdings, Cott Corporation and Snapple Beverage.

Warburg Pincus

Warburg Pincus LLC (“Warburg Pincus”) has been a leading private equity investor since 1971. The firm currently has approximately $20 billion of assets under management and invests in a range of industries including consumer and retail, industrial, business services, healthcare, financial services, energy, real estate, technology, media and telecommunications. Warburg Pincus is an experienced partner to management teams seeking to build durable companies with sustainable value. The firm has an active portfolio of more than 100 companies. Significant current and past investments include: Neiman Marcus, Knoll (NYSE: KNL), TransDigm (NYSE: TDG), Mattel (NYSE: MAT), Mellon Financial (NYSE: MEL), Neustar (NYSE: NSR), BEA Systems (NASDAQ: BEAS) and Coventry Health Care (NYSE: CVH). Since inception, Warburg Pincus has raised 12 private equity funds which have invested more than $26 billion in 570 companies in 30 countries.

9

Summary of the Terms of the Notes

The summary below describes the principal terms of the notes but it is not intended to be a complete description of the terms of the notes. For a more detailed description of the notes, see “Description of senior fixed rate notes and senior floating rate notes due 2015” and “Description of senior notes due 2012.”

Senior fixed rate notes and senior floating rate notes due 2015

Issuer | ARAMARK Corporation. |

Securities | $1,280,000,000 in principal amount of 8.50% senior fixed rate notes due 2015. |

| | $500,000,000 in principal amount of senior floating rate notes due 2015. |

Maturity date | The senior fixed rate notes and the senior floating rate notes each will mature on February 1, 2015. |

Interest payment dates | Interest on the senior fixed rate notes is payable on February 1 and August 1 of each year, beginning on August 1, 2007. |

| | Interest on the senior floating rate notes is payable on February 1, May 1, August 1 and November 1 of each year, beginning on May 1, 2007. |

Interest rate and form of payment | The senior fixed rate notes bear interest at a rate of 8.50% per annum. |

| | Interest on the senior floating rate notes accrues at a rate per annum, reset quarterly, equal to three-month LIBOR (as defined) plus 3.50%. |

| | Interest on the senior fixed rate notes and senior floating rate notes accrued from January 26, 2007. |

Guarantees | The senior fixed rate notes and senior floating rate notes are guaranteed on an unsecured senior basis by each of our wholly-owned domestic subsidiaries that guarantees our senior secured credit facilities. All of our domestic subsidiaries, other than our receivables finance subsidiary and certain immaterial subsidiaries, are guarantors of the senior fixed rate notes and senior floating rate notes. |

Ranking | The senior fixed rate notes and senior floating rate notes are senior unsecured obligations of the Issuer and: |

| | • | | rank senior in right of payment to our future debt and other obligations that are, by their terms, expressly subordinated in right of payment to the senior fixed rate notes and senior floating rate notes; |

| | • | | rank equal in right of payment to all of our existing and future senior debt and other obligations that are not, by their terms, expressly subordinated in right of payment to the senior fixed rate notes and senior floating rate notes, including our existing senior notes due 2012; and |

10

| | • | | be effectively subordinated to all of our existing and future secured debt (including obligations under our senior secured credit facilities), to the extent of the value of the assets securing such debt, and be structurally subordinated to all obligations of each of our subsidiaries that is not a guarantor of the senior fixed rate notes and senior floating rate notes. |

Similarly, the senior fixed rate notes and senior floating rate note guarantees will be senior unsecured obligations of the guarantors and will:

| | • | | rank senior in right of payment to all of the applicable guarantor’s existing and future debt and other obligations that are, by their terms, expressly subordinated in right of payment to the senior fixed rate notes and senior floating rate notes; |

| | • | | rank equal in right of payment to all of the applicable guarantor’s existing and future senior debt and other obligations that are not, by their terms, expressly subordinated in right of payment to the senior fixed rate notes and senior floating rate notes; and |

| | • | | be effectively subordinated to all of the applicable guarantor’s existing and future secured debt (including such guarantor’s guarantee under our senior secured credit facilities), to the extent of the value of the assets securing such debt, and be structurally subordinated to all obligations of any subsidiary of a guarantor if that subsidiary is not also a guarantor of the senior fixed rate notes and senior floating rate notes. |

| | As of March 30, 2007, (1) the senior fixed rate notes and senior floating rate notes and related guarantees ranked effectively junior to approximately $4,188.7 million of senior secured indebtedness (including $54.7 million of payment obligations relating to capital lease obligations), (2) we had an additional $563.0 million of unutilized capacity under our revolving credit facility, and (3) the senior fixed rate notes and senior floating rate notes ranked equal in right of payment to our existing senior notes due 2012. In addition, $238.0 million of funding was outstanding under our $250.0 million receivables facility as of March 30, 2007.

|

Optional redemption | We may redeem some or all of the senior fixed rate notes at any time on or after February 1, 2011 and some or all of the senior floating rate notes at any time on or after February 1, 2009, in each case at the redemption prices set forth in this prospectus. |

| | We may redeem some or all of the senior fixed rate notes prior to February 1, 2011 and some or all of the senior floating rate notes prior to February 1, 2009, in each case at a price equal to 100% of the principal amount of the notes redeemed plus the applicable “make-whole” premium as described in this prospectus. |

| | We may also redeem up to 35% of the senior fixed rate notes at any time before February 1, 2010 and up to 35% of the senior floating rate notes at any time before February 1, 2009, in each case, at the redemption prices set forth in this prospectus using the proceeds of certain equity offerings. |

11

Change of control and asset sales | If we experience specific kinds of changes of control, we will be required to make an offer to purchase the senior fixed rate notes and senior floating rate notes at a purchase price of 101% of the principal amount thereof, plus accrued and unpaid interest to the purchase date. If we sell assets under certain circumstances, we will be required to make an offer to purchase the senior fixed rate notes and senior floating rate notes at a purchase price of 100% of the principal amount thereof, plus accrued and unpaid interest to the purchase date. See “Description of senior fixed rate notes and senior floating rate notes due 2015—Repurchase at the option of Holders.” |

Certain covenants | The indenture governing the senior fixed rate notes and senior floating rate notes restricts our ability and the ability of our restricted subsidiaries to, among other things: |

| | • | | incur additional indebtedness or issue certain preferred shares; |

| | • | | pay dividends and make certain distributions, investments and other restricted payments; |

| | • | | enter into transactions with affiliates; |

| | • | | limit the ability of restricted subsidiaries to make payments to us; |

| | • | | enter into sale and leaseback transactions; |

| | • | | merge, consolidate, sell or otherwise dispose of all or substantially all of our assets; and |

| | • | | designate our subsidiaries as unrestricted subsidiaries. |

| | These covenants are subject to important exceptions and qualifications described under the heading “Description of senior fixed rate notes and senior floating rate notes due 2015.” |

| | The senior fixed rate notes and senior floating rate notes generally will be freely transferable but will also be new securities for which there will not initially be a market. |

Use of proceeds | We will not receive any cash proceeds from the issuance of the senior fixed rate notes and senior floating rate notes in the offer. See “Use of proceeds.” |

Senior notes due 2012

Issuer | ARAMARK Corporation. |

Securities | $250,000,000 principal amount of 5.00% senior notes due 2012. |

Maturity date | The senior notes due 2012 will mature on June 1, 2012. |

Interest payment dates | Interest on the senior notes due 2012 is payable each June 1 and December 1, commencing December 1, 2005. |

Interest rate and form of payment | The senior notes due 2012 bear interest at a rate of 5.00% per annum. |

12

Ranking | The senior notes due 2012 are senior unsecured obligations of the Issuer and: |

| | • | | rank senior in right of payment to our future debt and other obligations that are, by their terms, expressly subordinated in right of payment to the senior notes. |

| | • | | rank equal in right of payment to all of our existing and future senior debt and other obligations that are not, by their terms, expressly subordinated in right of payment to the senior notes. |

Optional redemption | We may redeem all or any portion of the senior notes due 2012 at our option at any time at the redemption price described in “Description of Senior Notes due 2012-Optional Redemption.” We are not required to establish a sinking fund to retire the notes prior to maturity. |

Certain covenants | The indenture governing the senior notes due 2012 contains certain covenants that, among other things, limit our ability to merge or consolidate with or into any person, enter into liens on principal property, enter into sale and lease back transactions, or to sell, lease or convey all or substantially all of our assets. |

Risk factors

See “Risk factors” for a discussion of certain factors that you should carefully consider before deciding to invest in the notes.

13

Summary historical and pro forma consolidated financial data

Set forth below is summary historical consolidated financial data and summary pro forma consolidated financial data of ARAMARK at the dates and for the periods indicated. The historical data for the fiscal years 2004, 2005 and 2006 have been derived from ARAMARK’s historical consolidated financial statements included elsewhere in this prospectus, which have been audited by KPMG LLP. We derived the historical data for the six months ended March 31, 2006 and the periods ended January 26, 2007 and March 30, 2007 and the balance sheet data presented below at March 31, 2006 and March 30, 2007 from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. These unaudited condensed consolidated financial statements include, in our opinion, all adjustments consisting of normal recurring adjustments necessary for a fair presentation of the results for the periods covered. The results of operations for the interim periods are not necessarily indicative of the results to be expected for the full year or any future period.

The summary unaudited pro forma consolidated financial data for the year ended September 29, 2006 and six months ended March 30, 2007 have been prepared to give effect to the Transactions in the manner described in the section of this prospectus captioned “Unaudited pro forma condensed consolidated financial information” as if they had occurred on October 1, 2005 and September 30, 2006, respectively, in the case of the summary unaudited pro forma consolidated statement of income data. The pro forma adjustments are based upon available information and certain assumptions that we believe are reasonable. The summary unaudited pro forma consolidated financial data are for informational purposes only and do not purport to represent what our results of operations actually would have been if the Transactions had occurred at any date, and such data do not purport to project the results of operations for any future period.

The summary historical and pro forma consolidated financial data should be read in conjunction with the sections captioned “The Transactions,” “Unaudited pro forma condensed consolidated financial information,” “Selected historical consolidated financial data,” “Management’s discussion and analysis of results of operations and financial condition” and our consolidated financial statements and related notes appearing elsewhere in this prospectus.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Historical | | Pro Forma | |

| | | Predecessor | | Successor | | Fiscal

Year(1) 2006 | | | Six Months

Ended March 30,

2007 | |

| | | Fiscal Year(1) | | | Six Months

Ended March 31,

2006 | | September 30,

2006 through

January 26,

2007 | | January 27,

2007

through

March 30,

2007 | | |

(in millions) | | 2004 | | 2005 | | 2006 | | | | | | |

| | | | | | | | | | (unaudited) | | (unaudited) | | (unaudited) | | (unaudited) | | | (unaudited) | |

Statement of income data: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Sales | | $ | 10,192.2 | | $ | 10,963.4 | | $ | 11,621.2 | | | $ | 5,755.4 | | $ | 3,945.9 | | $ | 2,145.6 | | $ | 11,621.2 | | | $ | 6,091.5 | |

| | | | | | | | |

Costs and expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cost of services provided(2) | | | 9,222.3 | | | 9,921.8 | | | 10,537.5 | | | | 5,222.0 | | | 3,587.0 | | | 1,932.5 | | | 10,538.8 | | | | 5,519.9 | |

Depreciation and amortization | | | 298.0 | | | 320.1 | | | 339.3 | | | | 165.5 | | | 116.4 | | | 79.2 | | | 453.8 | | | | 231.5 | |

Selling and general corporate expense(3) | | | 134.4 | | | 141.3 | | | 178.9 | | | | 85.7 | | | 173.9 | | | 25.2 | | | 172.5 | | | | 85.3 | |

Goodwill impairment(2) | | | — | | | — | | | 35.0 | | | | — | | | — | | | — | | | 35.0 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income | | | 537.6 | | | 580.2 | | | 530.5 | | | | 282.2 | | | 68.6 | | | 108.7 | | | 421.1 | | | | 254.8 | |

Interest and other financing costs, net(3) | | | 122.4 | | | 127.0 | | | 139.9 | | | | 69.2 | | | 48.7 | | | 104.0 | | | 537.6 | | | | 272.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income/(loss) from continuing operations before income taxes and cumulative effect of change in accounting principle | | | 415.2 | | | 453.2 | | | 390.6 | | | | 213.0 | | | 19.9 | | | 4.7 | | | (116.5 | ) | | | (17.4 | ) |

Provision/(benefit) for income taxes(4) | | | 152.1 | | | 164.7 | | | 129.2 | | | | 61.3 | | | 5.1 | | | 0.2 | | | (66.5 | ) | | | (10.9 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income/(loss) from continuing operations before cumulative effect of change in accounting principle | | | 263.1 | | | 288.5 | | | 261.4 | | | | 151.7 | | | 14.8 | | | 4.5 | | $ | (50.0 | ) | | $ | (6.5 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income from discontinued operations, net(5) | | | — | | | — | | | 3.1 | | | | — | | | — | | | — | | | | | | | | |

Cumulative effect of change in accounting principle, net(6) | | | — | | | — | | | (3.4 | ) | | | — | | | — | | | — | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income/(loss) | | $ | 263.1 | | $ | 288.5 | | $ | 261.1 | | | $ | 151.7 | | $ | 14.8 | | $ | 4.5 | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

14

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Historical | |

| | | Predecessor | | | Successor | |

| | | Fiscal Year(1) | | | Six Months

Ended March 31,

2006 | | | September 30,

2006 through

January 26,

2007 | | | January 27,

2007

through

March 30,

2007 | |

(in millions) | | 2004 | | | 2005 | | | 2006 | | | | |

| | | | | | | | | | | | (unaudited) | | | (unaudited) | | | (unaudited) | |

Statement of cash flows data: | | | | | | | | | | | | | | | | | | | | | | | | |

Net cash provided by/(used in): | | | | | | | | | | | | | | | | | | | | | | | | |

Operating activities from continuing operations | | $ | 517.6 | | | $ | 611.8 | | | $ | 585.8 | | | $ | 183.7 | | | $ | (76.1 | ) | | $ | 212.5 | |

Investing activities from continuing operations | | | (439.4 | ) | | | (365.9 | ) | | | (396.5 | ) | | | (136.3 | ) | | | (139.9 | ) | | | (6,144.1 | ) |

Financing activities from continuing operations | | | (77.3 | ) | | | (235.1 | ) | | | (197.7 | ) | | | (47.5 | ) | | | 305.0 | | | | 5,865.8 | |

| | | | | | |

Other financial data: | | | | | | | | | | | | | | | | | | | | | | | | |

Capital expenditures, net of disposals(7) | | | 288.3 | | | | 294.0 | | | | 270.7 | | | | 102.8 | | | | 61.5 | | | | 48.3 | |

| | | | | | |

Balance sheet data (at period end): | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 45.3 | | | $ | 56.1 | | | $ | 47.7 | | | $ | 56.0 | | | | | | | $ | 70.8 | |

Working capital(8) | | | (134.7 | ) | | | (85.2 | ) | | | (67.3 | ) | | | 41.4 | | | | | | | | 71.5 | |

Total assets | | | 4,821.6 | | | | 5,157.1 | | | | 5,263.3 | | | | 5,173.2 | | | | | | | | 10,316.5 | |

Total debt (including current portion of long term debt) | | | 1,868.7 | | | | 1,840.9 | | | | 1,803.3 | | | | 1,903.1 | | | | | | | | 6,226.0 | |

Total shareholders’ equity | | | 1,149.7 | | | | 1,325.5 | | | | 1,521.6 | | | | 1,413.8 | | | | | | | | 1,426.0 | |

| (1) | Fiscal years 2004, 2005 and 2006 refer to the fiscal years ended October 1, 2004, September 30, 2005, and September 29, 2006, respectively. All periods presented are 52-week years. |

| (2) | During fiscal 2006, we recorded a charge of approximately $35.0 million to reflect goodwill impairment and additional charges of $11.3 million in cost of services provided to reflect inventory write-downs and severance accruals in the Uniform and Career Apparel—Direct Marketing segment. In addition, we adopted SFAS No. 123R, “Share-Based Payment,” during the first quarter of fiscal 2006 and recorded a charge of $16.0 million in cost of services provided related to the expensing of stock options for fiscal 2006. During the second quarter of fiscal 2005, we recorded a gain of $9.7 million from the sale of real estate by an equity affiliate, as well as charges of $7.4 million for exiting our West Africa business and severance. During fiscal 2004, we incurred a $10.0 million charge related to a management change. |

| (3) | During the Predecessor period from September 30, 2006 through January 26, 2007, the Company recorded costs of $112.1 million related to the Transaction. These costs, which are included in “Selling and general corporate expenses,” consist of $11.2 million of accounting, investment banking, legal and other costs associated with the Transaction, a compensation charge of approximately $77.1 million related to the accelerated vesting and buyout of employee stock options and restricted stock units, and a charge of approximately $23.8 million related to change in control payments to certain executives. During the Successor period from January 27, 2007 through March 30, 2007, the Company recorded a charge of $12.8 million for the cost of obtaining a bridge financing facility, which is included in “Interest and Other Financing Costs, net.” |

| (4) | During fiscal 2006, we recorded a $14.9 million favorable income tax adjustment based on the settlement of certain open tax years. |

| (5) | In the third quarter of fiscal 2003, we completed the sale of ARAMARK Educational Resources (AER) to Knowledge Learning Corporation for approximately $250 million in cash. AER has been accounted for as a discontinued operation in accordance with Statement of Financial Accounting Standards (“SFAS”) No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets.” AER’s results of operations have been removed from the Company’s results of continuing operations for all periods presented. At the time of sale, certain accruals were established for liabilities expected pursuant to the indemnification provisions of the sale agreement. In the fourth quarter of fiscal 2006, the remaining accrual balances were adjusted to reflect current expectations, resulting in additional income from discontinued operations of $3.1 million, net of tax. |

| (6) | During fiscal 2006, we adopted the provisions of FASB Interpretation No. 47, “Accounting for Conditional Asset Retirement Obligations,” and recognized an after-tax charge of $3.4 million for the cumulative effect of the change in accounting principle. See note 7 to the audited consolidated financial statements of the Predecessor included elsewhere in this prospectus. |

| (7) | Capital expenditures, net of disposals represents purchases of property and equipment and client contract investments less disposals of property and equipment. For the fiscal years ended 2004, 2005 and 2006, the amount of disposals of property and equipment was $20.5 million, $21.6 million and $49.1 million, respectively; and for the periods ended March 31, 2006, January 26, 2007 and March 30, 2007 were $39.7 million, $20.1 million and $1.5 million, respectively. |

| (8) | Working capital represents accounts receivable, net, plus inventories, plus prepayments and other current assets, minus accounts payable, accrued payroll and related expenses, and other accrued expenses and current liabilities. |

15

Risk factors

You should carefully consider the risk factors set forth below as well as the other information contained in this prospectus before deciding whether to invest in the notes. The risks described below are not the only risks facing us. Additional risks and uncertainties not currently known to us or those we currently view to be immaterial may also materially and adversely affect our business, financial condition or results of operations. Any of the following risks could materially and adversely affect our business, financial condition or results of operations. In such a case, you may lose all or part of your original investment.

Risks related to our indebtedness

Our substantial leverage could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry, expose us to interest rate risk to the extent of our variable rate debt and prevent us from meeting our obligations under the notes.

We are highly leveraged. As of March 30, 2007, our indebtedness was $6,226.0 million, including the notes. We also had an additional $563.0 million available for borrowing under our revolving credit facility at that date. In addition, approximately $238.0 million of funding was outstanding under our receivables facility as of March 30, 2007. The following table shows our level of indebtedness and certain other information:

| | | |

| | | As of

March 30,

2007 |

| | | (in millions) |

Senior secured revolving credit facility(1) | | $ | 20.6 |

Senior secured term loan facility(2) | | | 4,104.9 |

Senior notes | | | 1,780.0 |

Senior notes due 2012(3) | | | 224.5 |

Other existing debt(4) | | | 96.0 |

| | | |

Total balance sheet debt | | $ | 6,226.0 |

| | | |

| (1) | Upon the closing of the Transactions, we entered into a $600.0 million revolving credit facility with a six-year maturity. |

| (2) | Upon the closing of the Transactions, we entered into a new $4,150.0 million term loan facility with a seven-year maturity, the full amount of which was borrowed on the closing date. In March 2007, we paid down $50.4 million of outstanding term loan principal. We also entered into a $250.0 million synthetic letter of credit facility. As of March 30, 2007, we had issued approximately $157.1 million in letters of credit under this facility. |

| (3) | Consists of $250.0 million aggregate principal amount of senior notes due 2012 recorded at $224.5 million on our balance sheet as of March 30, 2007 as a result of fair value adjustments related to purchase accounting. The discount of $25.5 million is being accreted as interest expense over the remaining period to maturity. |

| (4) | Consists of $54.7 million of capital lease obligations and $41.3 million of other indebtedness, consisting primarily of borrowings by our foreign subsidiaries. |

Our high degree of leverage could have important consequences for you, including:

| | • | | making it more difficult for us to make payments on the notes; |

| | • | | increasing our vulnerability to general economic and industry conditions; |

| | • | | requiring a substantial portion of cash flow from operations to be dedicated to the payment of principal and interest on our indebtedness, therefore reducing our ability to use our cash flow to fund our operations, capital expenditures and future business opportunities; |

| | • | | exposing us to the risk of increased interest rates as certain of our borrowings, including borrowings under our senior secured credit facilities and our receivables facility will be at variable rates of interest; |

| | • | | restricting us from making strategic acquisitions or causing us to make non-strategic divestitures; |

16

| | • | | limiting our ability to obtain additional financing for working capital, capital expenditures, debt service requirements, acquisitions and general corporate or other purposes; and |

| | • | | limiting our ability to adjust to changing market conditions and placing us at a competitive disadvantage compared to our competitors who are less highly leveraged. |

We and our subsidiaries may be able to incur substantial additional indebtedness in the future, subject to the restrictions contained in our senior secured credit facilities and the indenture governing the notes. If new indebtedness is added to our current debt levels, the related risks that we now face could intensify. Our pro forma interest expense for the twelve months ended September 29, 2006 would have been $537.6 million. At March 30, 2007, we had $4,125.5 million of funded debt under our senior secured credit agreement (the interest rate on $2,680.0 million and £50.0 million of which has been fixed pursuant to interest rate swap agreements) in addition to $500.0 million of senior floating rate notes and $238.0 million outstanding under our receivables facility, which are based on a floating rate index. A 0.125% increase in these floating rates would increase annual interest expense by approximately $2.4 million.

Our debt agreements contain restrictions that limit our flexibility in operating our business.

Our senior secured credit agreement and the indenture governing the senior fixed note and senior floating rate notes contain various covenants that limit our ability to engage in specified types of transactions. These covenants limit our and our restricted subsidiaries’ ability to, among other things:

| | • | | incur additional indebtedness or issue certain preferred shares; |

| | • | | pay dividends on, repurchase or make distributions in respect of our capital stock, make unscheduled payments on the notes, repurchase or redeem the notes or make other restricted payments; |

| | • | | make certain investments; |

| | • | | consolidate, merge, sell or otherwise dispose of all or substantially all of our assets; and |

| | • | | enter into certain transactions with our affiliates. |

The senior notes due 2012 contain covenants that, among other things, limit our ability to merge or consolidate with or into any person, enter into liens on principal property, enter into sale and lease back transactions, or to sell, lease or convey all or substantially all of our assets.

In addition, the senior secured revolving credit facility requires us to satisfy and maintain specified financial ratios and other financial condition tests. Our ability to meet those financial ratios and tests can be affected by events beyond our control, and we cannot assure you that we will meet those ratios and tests. A breach of any of these covenants could result in a default under the senior secured credit agreement. Upon our failure to maintain compliance with these covenants that is not waived by the lenders under the revolving credit facility, the lenders under the senior secured credit facilities could elect to declare all amounts outstanding under the senior secured credit facilities to be immediately due and payable and terminate all commitments to extend further credit under such facilities. If we were unable to repay those amounts, the lenders under the senior secured credit facilities could proceed against the collateral granted to them to secure that indebtedness. We have pledged a significant portion of our assets as collateral under the senior secured credit agreement. If the lenders under the senior secured credit facilities accelerate the repayment of borrowings, we cannot assure you that we will have sufficient assets to repay those borrowings, as well as our unsecured indebtedness, including the notes.

17

Risks related to our business

General

Unfavorable economic conditions and increased operating costs adversely affect our results of operations and financial condition.

Each of our business segments has been adversely affected by weaker economic conditions in the United States during the past several years, including with respect to manufacturing, technology and service industry clients. Layoffs and business downturns among our business clients have negatively affected our sales and operating results. A national or international economic downturn reduces demand for our services in each of our operating segments, which has resulted, and may in the future result, in the loss of business or increased pressure to contract for business on less favorable terms than our generally preferred terms. In addition, insolvency experienced by clients, especially larger clients, particularly in the non-profit healthcare and airline industries, could make it difficult for us to collect amounts we are owed and could result in the voiding of existing contracts. Similarly, financial distress or insolvency, if experienced by our key vendors and service providers such as insurance carriers, could significantly increase our costs. Any future terrorist attacks, and the national and global military, diplomatic and financial response to such attacks or other threats also may adversely affect our sales and operating results. Natural disasters also may affect our sales and operating results. For example, Hurricanes Katrina and Rita, which badly damaged the Gulf Coast of the United States in August and September of 2005, impacted many of ARAMARK’s food service, facilities and uniform clients in Louisiana, Mississippi, Alabama and Texas. ARAMARK experienced lost and closed client locations, business disruptions and delays, the loss of inventory and other assets, and the effect of the temporary conversion of a number of ARAMARK client locations to provide food and shelter to those left homeless by the storms.

Our profitability can be adversely affected to the extent we are faced with cost increases for food, wages, other labor related expenses (including workers’ compensation, state unemployment insurance and healthcare costs), insurance, fuel, utilities, piece goods, clothing and equipment, especially to the extent we were unable to recover such increased costs through increases in the prices for our products and services, due to general economic conditions, competitive conditions, or both. For example, oil and natural gas prices have fluctuated significantly in the last several years. Substantial increases in the cost of fuel and utilities have historically resulted in substantial cost increases in our uniform services business, and to a lesser extent in our food and support services segment. We also have experienced recent increases in our food costs. While we believe a portion of these increases is attributable to rising fuel prices, we believe the increases also result from rising global food demand and the increased production of biofuels such as ethanol. In addition, food prices can fluctuate as a result of temporary changes in supply, including as a result of incidences of severe weather such as droughts, heavy rains and late freezes. Approximately 74% of our food and support services sales are from profit and loss contracts under which we have limited ability to pass on cost increases to our clients.

Our business may suffer if we are unable to hire and retain sufficient qualified personnel or if labor costs increase.

In the past, the United States has periodically experienced reduced levels of unemployment, which has created a shortage of qualified workers at all levels. Given that our workforce requires large numbers of entry level and skilled workers and managers, low levels of unemployment can compromise our ability in certain of our businesses to continue to provide quality service or compete for new business. From time to time, we have had difficulty in hiring and maintaining qualified management personnel, particularly at the entry management level. We will continue to have significant requirements to hire such personnel. Our success also depends to a substantial extent on the ability, experience and performance of our management, particularly our Chairman and Chief Executive Officer, Joseph Neubauer. We also regularly hire a large number of part-time workers, particularly in our food and support services segments. Any difficulty we may encounter in hiring such workers could result in significant increases in labor costs which could have a material adverse effect on our business, financial condition and results of operations. Competition for labor has resulted in wage increases in the past and future competition could substantially increase our labor costs. Due to the labor intensive nature of our

18

businesses and the fact that 74% of our Food and Support Services segment’s sales are from profit and loss contracts under which we have limited ability to pass along cost increases, a shortage of labor or increases in wage levels in excess of normal levels could have a material adverse effect on our results of operations.

Our expansion strategy involves risks.

We may seek to acquire companies or interests in companies or enter into joint ventures that complement our business, and our inability to complete acquisitions, integrate acquired companies successfully or enter into joint ventures may render us less competitive. We may be evaluating acquisitions or engaging in acquisition negotiations at any given time. We cannot be sure that we will be able to continue to identify acquisition candidates or joint venture partners on commercially reasonable terms or at all. If we make additional acquisitions, we also cannot be sure that any benefits anticipated from the acquisitions will actually be realized. Likewise, we cannot be sure that we will be able to obtain necessary financing for acquisitions. Such financing could be restricted by the terms of our debt agreements or it could be more expensive than our current debt. The amount of such debt financing for acquisitions could be significant and the terms of such debt instruments could be more restrictive than our current covenants. In addition, our ability to control the planning and operations of our joint ventures and other less than majority owned affiliates may be subject to numerous restrictions imposed by the joint venture agreements and majority shareholders. Our joint venture partners may also have interests which differ from ours.

The process of integrating acquired operations into our existing operations may result in operating, contract and supply chain difficulties, such as the failure to retain clients or management personnel and problems coordinating technology and supply chain arrangements. Also, in connection with any acquisition, we could fail to discover liabilities of the acquired company for which we may be responsible as a successor owner or operator in spite of any investigation we make prior to the acquisition. In addition, labor laws in certain countries may require us to retain more employees than would otherwise be optimal from entities we acquire. Such difficulties may divert significant financial, operational and managerial resources from our existing operations, and make it more difficult to achieve our operating and strategic objectives. The diversion of management attention, particularly in a difficult operating environment, may affect our sales. Similarly, our business depends on effective information technology systems and implementation delays or poor execution of the integration of different information technology systems could disrupt our operations and increase costs. Possible future acquisitions could result in the incurrence of additional debt and related interest expense or contingent liabilities and amortization expenses related to intangible assets, which could have a material adverse effect on our financial condition, operating results and/or cash flow. In addition, goodwill resulting from business combinations represents a significant portion of our assets. If the goodwill were deemed to be impaired, we would need to take a charge to earnings to write down the goodwill to its fair value.

If we fail to comply with requirements imposed by applicable law or other governmental regulations, we could become subject to lawsuits and other liabilities and restrictions on our operations that could significantly and adversely affect our business.

We are subject to governmental regulation at the federal, state, national, provincial and local levels in many areas of our business, such as food safety and sanitation, the sale of alcoholic beverages, minimum wage, overtime, wage payment, wage and hour and employment discrimination, human health and safety, federal motor carrier safety, environmental protection, the import and export of goods and customs regulations and the services we provide in connection with governmentally funded entitlement programs.

From time to time, both federal and state governmental agencies have conducted audits of our billing practices as part of investigations of providers of services under governmental contracts, or otherwise. We also receive requests for information from governmental agencies in connection with these audits. While we attempt to comply with all applicable laws and regulations, we cannot assure you that we are in full compliance with all applicable laws and regulations or interpretations of these laws and regulations at all times or that we will be able to comply with any future laws, regulations or interpretations of these laws and regulations.

19

In July 2004, the Company learned that it was under investigation by the United States Department of Commerce, among others, relating to Galls, a division of the Company, in connection with record keeping and documentation of certain export sales. The Government obtained and received numerous records from the Company which is cooperating in the investigation.

If we fail to comply with applicable laws and regulations, including with respect to the export matters related to the Galls division described above, we may be subject to criminal sanctions or civil remedies, including fines, injunctions, prohibitions on exporting, seizures or debarments from government contracts. The cost of compliance or the consequences of non-compliance, including debarments, could have a material adverse effect on our business and results of operations. In addition, governmental units may make changes in the regulatory frameworks within which we operate that may require either the corporation as a whole or individual businesses to incur substantial increases in costs in order to comply with such laws and regulations.

Changes in or new interpretations of the governmental regulatory framework may affect our contract terms and may reduce our sales or profits.

A portion of our sales, estimated to be approximately 15% in fiscal 2006, is derived from business with U.S. federal, state and local governments and agencies. Changes or new interpretations in, or changes in the enforcement of, the statutory or regulatory framework applicable to services provided under governmental contracts or bidding procedures, particularly by our food and support services businesses, could result in fewer new contracts or contract renewals, modifications to the methods we apply to price government contracts, or in contract terms of shorter duration than we have historically experienced, any of which could result in lower sales or profits than we have historically achieved, which could have an adverse effect on our results of operations.

Our failure to retain our current clients and renew our existing client contracts could adversely affect our business.

Our success depends on our ability to retain our current clients and renew our existing client contracts. Our ability to do so generally depends on a variety of factors, including the quality, price and responsiveness of our services, as well as our ability to market these services effectively and differentiate ourselves from our competitors. We cannot assure you that we will be able to renew existing client contracts at the same or higher rates or that our current clients will not turn to competitors, cease operations, elect to self-operate or terminate contracts with us. The failure to renew a significant number of our existing contracts would have a material adverse effect on our business and results of operations.

We may be adversely affected if customers reduce their outsourcing or use of preferred vendors.

Our business and growth strategies depend in large part on the continuation of a current trend toward outsourcing services. Customers will outsource if they perceive that outsourcing may provide higher quality services at a lower overall cost and permit them to focus on their core business activities. We cannot be certain that this trend will continue or not be reversed or that customers that have outsourced functions will not decide to perform these functions themselves. In addition, labor unions representing employees of some of our current and prospective customers have occasionally opposed the outsourcing trend to the extent that they believed that current union jobs for their memberships might be lost. In these cases, unions typically seek to ensure that jobs that are outsourced continue to be unionized and thus, the unions seek to direct to union employees the performance of the types of services we offer. We have also identified a trend among some of our customers toward the retention of a limited number of preferred vendors to provide all or a large part of their required services. We cannot be certain that this trend will continue or not be reversed or, if it does continue, that we will be selected and retained as a preferred vendor to provide these services. Unfavorable developments with respect to either of these trends could have a material adverse effect on our business and results of operations.

20

Our international business results are influenced by currency fluctuations and other risks that could have an effect on our results of operations and financial condition.