UNITED STATES SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE TO |

Tender Offer Statement under Section 14(d)(1) or 13(e)(1) of the Securities Exchange Act of 1934 |

| |

| |

| |

MEDIMMUNE, INC. |

| (Name of Subject Company) |

| |

ASTRAZENECA BIOPHARMACEUTICALS INC. ASTRAZENECA PLC |

| (Names of Filing Persons – Offeror) |

| |

Common Stock, Par Value $0.01 Per Share |

| (Title of Class of Securities) |

|

584699102 |

| (Cusip Number of Class of Securities) |

| |

Graeme Musker AstraZeneca PLC 15 Stanhope Gate London, England, W1K 1LN Telephone: +44 20 7304 5000 |

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons) |

| |

Copies to: |

Paul R. Kingsley Davis Polk & Wardwell 450 Lexington Avenue New York, New York 10017 Telephone: (212) 450-4000 |

[NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART, IN, INTO OR FROM AUSTRALIA, CANADA OR JAPAN OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION]

AstraZeneca to acquire MedImmune for $58 per share in a fully recommended, all-cash transaction with a total enterprise value of $15.2 billion

Acquisition delivers AstraZeneca biologics ambition faster

Creates a leading, fully-integrated biotechnology business within AstraZeneca with critical mass in research, development, regulatory and manufacturing with global sales reach

Significantly expands product pipeline by adding 45 projects including 2 late-stage products and a blockbuster marketed monoclonal antibody, Synagis

Summary

AstraZeneca PLC (“AstraZeneca”) today announced that it has entered into a definitive agreement to acquire MedImmune, Inc. (“MedImmune”), in an all-cash transaction. Under the terms of the agreement, which has unanimous MedImmune Board support, AstraZeneca will acquire all of the fully diluted shares of MedImmune common stock at a price of $58 per share, for a total consideration of approximately $15.6 billion (including approximately $340m net cash).

The acquisition of MedImmune significantly accelerates AstraZeneca’s biologics strategy. The combination of MedImmune with AstraZeneca’s wholly-owned subsidiary Cambridge Antibody Technology (“CAT”) will create a world-class, fully integrated biologics and vaccines business within the AstraZeneca Group with critical mass in research, development, regulatory, manufacturing and global sales and marketing reach.

MedImmune is a world-leading, profitable, biotechnology company with a record of proven success with revenue in 2006 of $1.3bn, profit before tax of $75m and gross assets of $3.0bn.

The acquisition extends AstraZeneca’s R&D science base to allow it to address novel drug targets through 3 key technological approaches: small molecules, biologics and, for the first time, vaccines.

Overall, the combination of MedImmune with AstraZeneca’s existing capabilities will be capable of delivering a greater number of new biologic products to bring benefit to patients in AstraZeneca’s prioritised disease areas.

The deal is expected to close in June 2007.

Highlights and acquisition benefits

R&D capability

| · | Expands and diversifies AstraZeneca’s science base by establishing an international platform capable of delivering a greater flow of new medicines in AstraZeneca’s prioritised disease areas, embracing small molecules, monoclonal antibodies, next generation biologics and vaccines |

| · | Natural fit between CAT and MedImmune |

| · | Complementary with existing AstraZeneca therapeutic area strengths in Oncology, Infection and Respiratory & Inflammation |

| · | Provides entry into vaccines; through proprietary live attenuated vaccines capability |

| · | Brings significant regulatory experience in making Biologics License Applications |

| · | Enhanced biologics capability positions AstraZeneca as a more compelling licensing partner, improving AstraZeneca’s externalisation position |

Manufacturing

| · | MedImmune is a leader in protein engineering and biologics manufacturing, with a production capacity of over 30,000L planned by 2010 and world leading cell line productivity levels. Through further modest investment, capacity could be increased to over 60,000L. This would secure production requirements for the long-term and avoid the need for major near-term ‘green-field’ manufacturing investment by AstraZeneca to support its biologics strategy |

Pipeline

| · | Adds 2 late-stage assets: the next generation follow-on to ‘Synagis’, ‘Numax’ and refrigerated formulation ‘FluMist’ with an anticipated US launch for 2007-2008 influenza season |

| · | Increases the proportion of biologics in AstraZeneca’s pipeline from 7 percent to 27 percent and enlarges the total pipeline by 45 projects to 163 projects |

| · | Diversifies and expands R&D capability to deliver a greater flow of new biologic products |

Financial benefits

| · | Synergies from the acquisition of MedImmune and from related AstraZeneca activities are expected to be towards $500m per annum by 2009 |

| · | The acquisition is expected to be cash earnings enhancing in 2009 |

| · | The acquisition will be fully funded in cash, bringing improved financial efficiency through balance sheet leverage. Previously announced $4bn share buyback programme for 2007 unchanged |

| · | Addition of attractive marketed products including ‘Synagis’ and ‘FluMist’ to AstraZeneca’s portfolio adds $1.2bn in sales. Consensus sales growth for this portfolio is forecast at 12% CAGR to 2010 |

| · | Provides AstraZeneca with several other substantial assets, including a royalty stream on the sales of the HPV vaccines with estimated consensus peak sales of $5.5bn, potential milestones and royalties on MedImmune’s other licensed products and $1.5bn cash, including $89.4m relating to MedImmune Ventures investments at book value |

People

| · | Strong desire to retain employees and maintain culture, with emphasis on retaining key talent and critical skills |

| · | One-time retention grant for employees |

| · | David M. Mott, the Chief Executive Officer and President of MedImmune, and James F. Young, Ph.D., the President, Research and Development of MedImmune, have committed to remain with MedImmune and it is expected that other members of MedImmune’s senior management will stay with the company following the closing |

| · | David M. Mott will take a leadership role within AstraZeneca |

Commenting on the Offer, David Brennan, Chief Executive Officer of AstraZeneca, said:

“This acquisition represents a transformational step to deliver our biologics strategy sooner than anticipated. It creates a leading fully integrated biologics and vaccines business with critical mass and enhances AstraZeneca’s R&D science base through which we will deliver a stronger product pipeline.

MedImmune adds an exciting existing pipeline, including 2 late-stage products, great expertise in biologic drug development and state of the art manufacturing facilities.

We look forward to welcoming MedImmune’s employees into AstraZeneca and are excited by the potential to create significant value for all our shareholders, employees and patients that this acquisition brings.”

David M. Mott, CEO and President of MedImmune, said:

"After conducting a full and open process, whereby we evaluated potential interest in the value we have built over our 19 year history, we are very pleased to become a part of AstraZeneca. We believe that this transaction is in the best interest of all parties, including shareholders, employees and ultimately patients. The potential to harness the combined skills and capabilities of MedImmune, AstraZeneca and CAT and take our combined world class biologics capabilities to the next level, is very exciting and a challenge to which I am personally committed."

The Transaction

The acquisition is structured as an all cash tender offer for all outstanding shares of MedImmune common stock followed by a merger in which each remaining untendered share of MedImmune would be converted into the same $58 cash per share price paid in the tender offer. The acquisition is subject to the satisfaction of customary conditions, including the tender of a majority of the outstanding MedImmune shares on a fully-diluted basis and the expiration or earlier termination of the Hart-Scott-Rodino waiting period and other regulatory approvals. The tender offer will be commenced within 10 working days and is expected to close in June 2007, unless extended. The tender offer is not subject to a financing contingency.

The acquisition price represents a premium of approximately 53.3% to MedImmune’s closing share price of $37.84 on 11th April, 2007, this being the last business day prior to MedImmune’s announcement to explore strategic alternatives.

The transaction has been unanimously recommended by the Board of Directors of MedImmune.

The acquisition will be effected pursuant to a merger agreement. The merger agreement contains certain termination rights for each of AstraZeneca and MedImmune and further provides that, upon termination of the merger agreement under specified circumstances, MedImmune may be required to pay AstraZeneca a termination fee of $450 million.

Financing

The total consideration for the acquisition of MedImmune amounts to approximately $15 billion in cash. AstraZeneca will draw from a committed banking facility in the amount of $15 billion to provide the initial financing for the acquisition.

Additional Information

The tender offer described in this press release has not yet commenced, and this press release is neither an offer to purchase nor a solicitation of an offer to sell MedImmune common stock. Investors and security holders are urged to read both the tender offer statement and the solicitation/recommendation statement regarding the tender offer described in this press release when they become available because they will contain important information. The tender offer statement will be filed by AstraZeneca and a subsidiary of AstraZeneca with the Securities and Exchange Commission (“SEC”), and the solicitation/recommendation statement will be filed by MedImmune with the SEC. Investors and security holders may obtain a free copy of these statements (when available) and other documents filed by AstraZeneca or MedImmune with the SEC at the website maintained by the SEC at www.sec.gov. The tender offer statement and related materials may be obtained for free by directing such requests to AstraZeneca (Investor Relations) at +44 (0) 207 304 5000. The solicitation/recommendation statement and such other documents may be obtained by directing such requests to MedImmune (Investor Relations) at 301-398-4358.

Enquiries:

AstraZeneca | |

Media Enquiries: | |

| Steve Brown / Edel McCaffrey (London) | (020) 7304 5033/5034 |

| Staffan Ternby (Sweden) | (8) 553 26107 |

| Emily Denney (Wilmington) | (302) 885 3451 |

Analyst/Investor Enquiries: | |

| Jonathan Hunt / Mina Blair / Karl Hård (London) | (020) 7304 5087/5084/5322 |

| Staffan Ternby (Sweden) | (8) 553 26107 |

| Ed Seage / Jorgen Winroth (US) | (302) 886 4065/(212) 579 0506 |

Merrill Lynch (Financial Adviser to AstraZeneca) | +44 (0) 20 7628 1000 |

| Richard Girling | |

Deutsche Bank (Joint Corporate Broker to AstraZeneca) | +44 (0) 20 7545 8000 |

| Charlie Foreman | |

Goldman Sachs (Joint Corporate Broker to AstraZeneca) | +44 (0) 20 7774 1000 |

| Phil Raper | |

| | |

MedImmune | |

Media Enquiries: | |

| Lori Weiman | 240-372-4829 |

| Jamie Lacey | 301-398-4035 |

Analyst/Investor Enquiries: | |

| Pete Vozzo | 301-398-4358 |

AstraZeneca will be holding an analyst presentation by webcast and teleconference as follows:

Presentation

The presentation will be available 15 minutes prior to the start of the analysts’ teleconference/webcast.

Audio webcast

The webcast will start at 11:30 BST.

Teleconference details

11:30 BST, 12:30 CEST, 06:30 EDT

There will be an interactive Q&A session

UK freephone | 0800 559 3272 |

US freephone | +1 886 239 0753 |

Sweden freephone | 0200 887 737 |

International | +44 (0)207 138 0815 |

Journalists are invited to listen only on | +44 (0)207 138 0810 |

A replay facility will be available from 15.30 BST on 23rd April 2007

UK freephone | 0800 559 3271 |

US freephone | +1 866 239 0765 |

Sweden freephone | 0200 887 740 |

International | +44 (0)207 806 1970 |

Replay passcode | 1880494# |

Not for release, publication or distribution, in whole or in part, in, into or from Australia, Canada or Japan

AstraZeneca acquisition of

MedImmune and 1Q results

Analyst call

| | |

Delivers biologics ambition faster

o Creates leading, fully-integrated biologics & vaccines business

o Critical mass in discovery, development, regulatory, manufacturing

and sales

o Natural fit with CAT

o Significantly expands pipeline

o Improves long term product flow

o Diversifies and expands R&D (small molecules, biologics,

vaccines)

o Enhances future growth prospects

o Profitable, high quality business entering growth phase

o Cash earnings enhancement in 2009

Accelerates delivery of AZ biologics strategy at lower execution risk

Transforms science base

2

| | |

The Deal

o Fully recommended all cash offer of $58 per share;

total enterprise value of $15.2bn

o Transaction has been unanimously recommended by the

boards of both companies.

o Expected to close in June 2007

3

| | |

MedImmune

o One of the World's Leading Biologics Players

o Top 10 biopharmaceutical company by equity value

o A leader in protein engineering, biologics development &

manufacturing

o 2006 revenues of $1.3bn

o 3 marketed products, including 'blockbuster'; Synagis

o Development pipeline adds 45 projects

MedImmune is a scarce asset - fully integrated biologics capability,

with world-class development and manufacturing,

profitable and entering growth phase

4

| | |

Key strengths

o Discovery 'Search'

o Target identification and access

o Highly externally focused

o Well 'networked' internal venture fund (MedImmune Ventures)

o Extensive and effective partnering machine

o Development

o Antibody generation - "create, engineer, refine"

o Vaccines - proprietary live attenuated vaccine platform

o Clinical - innovative, paediatrics

o Regulatory - significant FDA experience (Biologic License

Application)

5

| | |

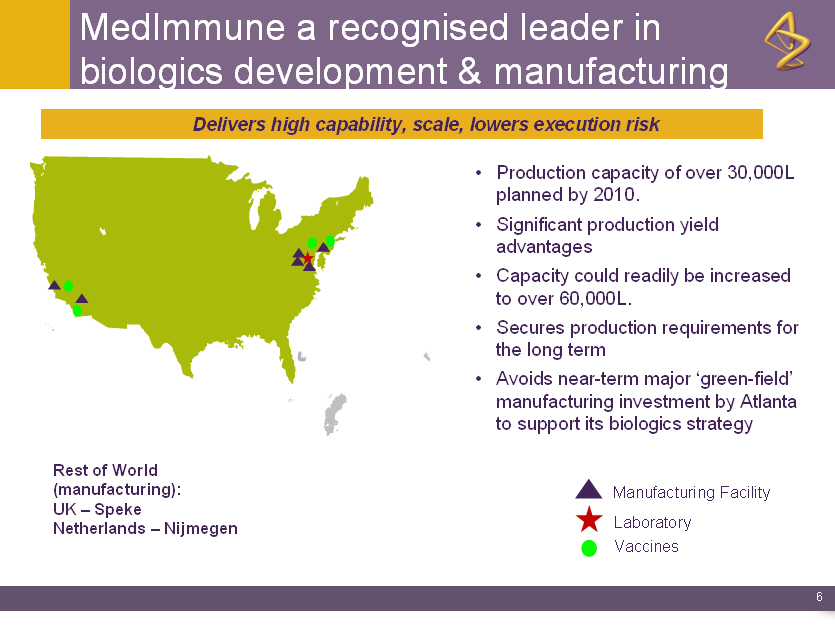

MedImmune a recognised leader in

biologics development & manufacturing

Delivers high capability, scale, lowers execution risk

o Production capacity of over 30,000L

planned by 2010.

o Significant production yield

advantages

o Capacity could readily be increased

to over 60,000L.

o Secures production requirements for

the long term

o Avoids near-term major `green-field'

manufacturing investment by Atlanta

to support its biologics strategy

Rest of World Manufacturing Facility

(manufacturing): Laboratory

UK - Speke Vaccines

Netherlands - Nijmegen

6

| | |

R&D capability

o Expands and diversifies AstraZeneca/CAT technology base

o small molecules,

o monoclonal antibodies & next generation biologics

o provides entry into vaccines

o Externalisation/ partnering

o Strengthened product pipeline

o particularly in AstraZeneca's core areas of Oncology, Infection

and Respiratory & Inflammation

7

| | |

MedImmune brings a significant pipeline

o 45 projects in R&D

o 7 antibody and 5 vaccine projects in clinical development

o RSV next generation follow-on, Numax (2H 07 filing)

o Superior potency giving possible wider utility and refreshed

patent estate

o Refrigerated FluMist (CAIV-T) with anticipated US launch for 2007-

2008 influenza season

o Extended paediatric label under review

Significant boost to the AstraZeneca pipeline, with vaccines, oncology and

inflammation-targeting biologics

8

| | |

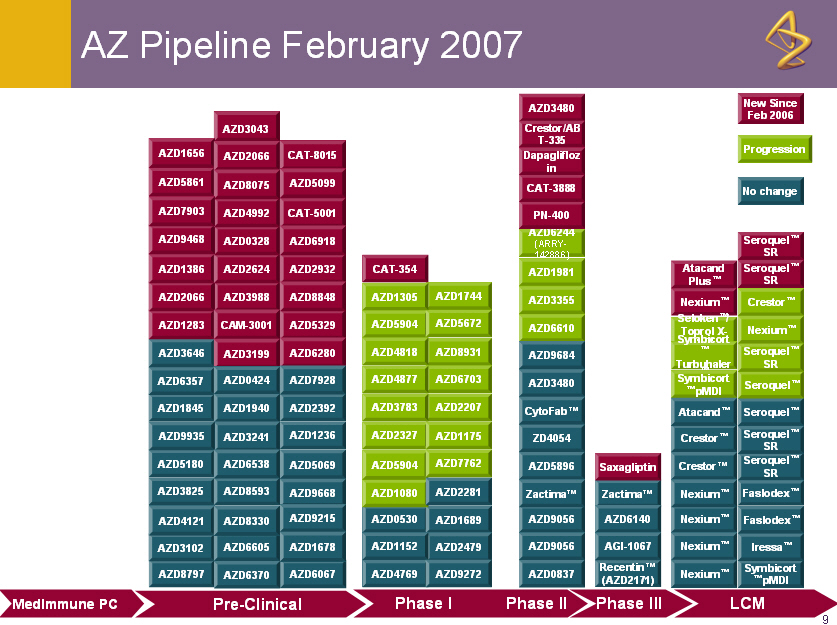

AZ Pipeline February 2007

AZD0530

AZD1845

AZD2327

AZD1689

AZD1080

AZD5896

AZD5904

AZD4769

AZD9056

Zactima(TM)

AZD6140

Recentin(TM)

(AZD2171)

AZD5672

AZD1981

AZD3355

AZD2479

AZD6610

AZD6244

(ARRY-

142886)

AZD1152

AZD5904

AZD0837

AZD3480

ZD4054

AZD9056

Zactima(TM)

Nexium(TM)

AZD2281

AZD3480

CytoFab(TM)

AGI-1067

Atacand

Plus(TM)

AZD8797 AZD6067 AZD6370

AZD3102

AZD6357

AZD2392

AZD1744

AZD3825

AZD8931

AZD6703

AZD4121

AZD1175

AZD2207

AZD1305

AZD3783 AZD1940

AZD1236

AZD4818

AZD5069

AZD9668

AZD9215

AZD1678 AZD6605

AZD5180

AZD8330

AZD3241

AZD4877

AZD7762

AZD3646

AZD9935

AZD1283

AZD3043

AZD5861

AZD5329

Crestor/AB

T-335

AZD1656

AZD3988

AZD2066

AZD2066

AZD6280

PN-400

Seroquel(TM)

SR

AZD1386 AZD2624

AZD0328 AZD9468

AZD2932

AZD4992

CAT-3888

CAT-8015

CAT-5001

AZD5099

AZD6918

AZD8848

AZD8075

CAT-354

CAM-3001

Seroquel(TM)

SR

AZD8593

Saxagliptin

Dapaglifloz

in

AZD9272

New Since

Feb 2006

No change

AZD3199

AZD7903

Progression

AZD0424

AZD9684

AZD6538

AZD7928

Nexium(TM)

Seloken(TM)/

Toprol XL

(TM)

Crestor(TM)

Crestor(TM)

Crestor(TM)

Nexium(TM)

Nexium(TM)

Seroquel(TM)

Symbicort

(TM) pMDI

Symbicort

(TM)

Turbuhaler (TM)

Symbicort

(TM) pMDI

Iressa(TM)

Seroquel(TM)

Seroquel(TM)

SR

Atacand(TM)

Nexium(TM)

Seroquel(TM)

SR

Seroquel(TM)

SR

Nexium(TM)

Faslodex(TM)

Faslodex(TM)

Pre-Clinical Phase I Phase II LCM Phase III MedImmune PC

9

| | |

AZD0530

AZD1845

AZD2327

AZD1080

AZD5896

AZD5904

AZD4769

AZD9056 Zactima(TM)

Recentin(TM)

(AZD2171)

AZD5672

AZD1981

AZD3355

AZD6610

AZD6244

(ARRY-

142886)

AZD1152

AZD5904

AZD0837

AZD3480

ZD4054

AZD9056

Zactima(TM)

Nexium(TM)

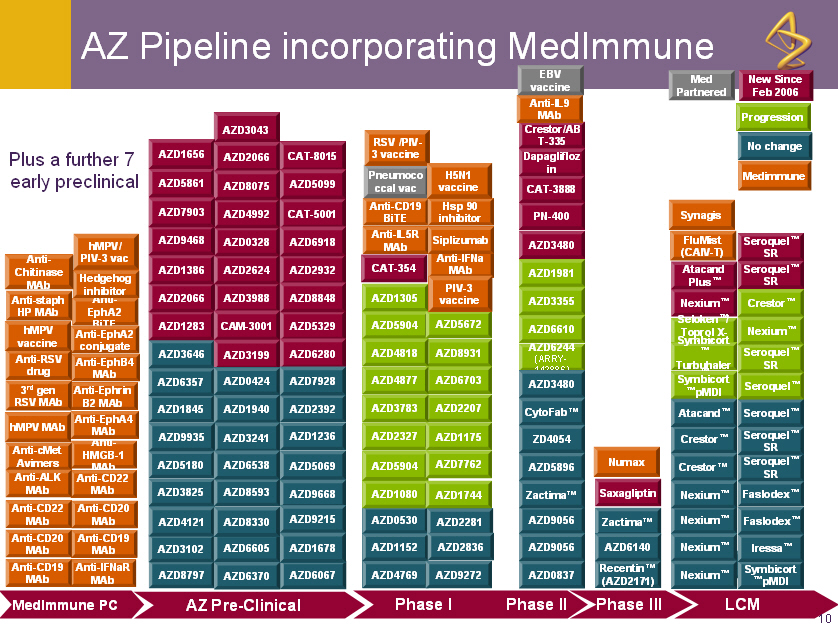

AZ Pipeline incorporating MedImmune

AZD2281

AZD3480

CytoFab(TM)

AZD6140

Atacand

Plus(TM)

AZD8797 AZD6067 AZD6370

AZD3102

AZD6357

AZD2392

AZD1744 AZD3825

AZD8931

AZD6703

AZD4121

AZD1175

AZD2207

AZD1305

AZD3783 AZD1940

AZD1236

AZD4818

AZD5069

AZD9668

AZD9215

AZD1678 AZD6605

AZD5180

AZD8330

AZD3241

AZD4877

AZD7762

AZD3646

AZD9935

AZD1283

AZD3043

AZD5861

AZD5329

Crestor/AB

T-335

AZD1656

AZD3988

AZD2066

AZD2066

AZD6280

PN-400

Seroquel(TM)

SR

AZD1386 AZD2624

AZD0328 AZD9468

AZD2932

AZD4992

CAT-3888

CAT-8015

CAT-5001

AZD5099

AZD6918

AZD8848

AZD8075

CAT-354

CAM-3001

Seroquel(TM)

SR

AZD8593 Saxagliptin

Dapaglifloz

in

AZD9272

New Since

Feb 2006

No change

AZD3199

AZD7903

Progression

AZD0424

AZD6538

AZD7928

Nexium(TM)

Seloken(TM)/

Toprol XL

(TM)

Crestor(TM)

Crestor(TM)

Crestor(TM)

Nexium(TM)

Nexium(TM)

Seroquel(TM)

Symbicort

(TM) pMDI

Symbicort

(TM)

Turbuhaler (TM)

Symbicort

(TM) pMDI

Iressa(TM)

Seroquel(TM)

Seroquel(TM)

SR

Atacand(TM)

Nexium(TM)

Seroquel(TM)

SR

Seroquel(TM)

SR

Nexium(TM)

Faslodex(TM)

Faslodex(TM)

AZ Pre-Clinical Phase I Phase II LCM Phase III MedImmune PC

Numax

Anti-IL9

MAb

Anti-IFNa

MAb

Anti-IL5R

MAb

Anti-

HMGB-1

MAb

Anti-CD22

MAb

Anti-CD20

MAb

Anti-CD19

MAb

Anti-IFNaR

MAb

Siplizumab

Anti-CD19

BiTE

Hsp 90

inhibitor

Anti-cMet

Avimers

Anti-ALK

MAb

Anti-CD22

MAb

Anti-CD20

MAb

Anti-CD19

MAb

Anti-EphA4

MAb

Anti-Ephrin

B2 MAb

Anti-EphB4

MAb

Anti-

EphA2

BiTE

Hedgehog

inhibitor

Anti-EphA2

conjugate

ZD4054

EBV

vaccine

Pneumoco

ccal vac

PIV-3

vaccine

RSV /PIV-

3 vaccine

hMPV/

PIV-3 vac

H5N1

vaccine

3rd gen

RSV MAb

Anti-RSV

drug

hMPV

vaccine

Anti-staph

HP MAb

FluMist

(CAIV-T)

Medimmune

Med

Partnered

Synagis

Anti-

Chitinase

MAb

AZD2836

hMPV MAb

Plus a further 7

early preclinical

10

| | |

AZD0530

AZD1845

AZD2327

AZD2836

AZD1080

AZD5896

AZD5904

AZD4769

AZD9056 Zactima(TM)

AZD6140

Recentin(TM)

(AZD2171)

AZD5672

AZD1981

AZD3355

AZD6610

AZD6244

(ARRY-

142886)

AZD1152

AZD5904

AZD0837

AZD3480

ZD4054

AZD9056

Zactima(TM)

Nexium(TM)

AZ Pipeline incorporating MedImmune

AZD2281

AZD3480

CytoFab(TM)

Atacand

Plus(TM)

AZD8797 AZD6067 AZD6370

AZD3102

AZD6357

AZD2392

AZD1744

AZD3825

AZD8931

AZD6703

AZD4121

AZD1175

AZD2207

AZD1305

AZD3783 AZD1940

AZD1236

AZD4818

AZD5069

AZD9668

AZD9215

AZD1678 AZD6605

AZD5180

AZD8330

AZD3241

AZD4877

AZD7762

AZD3646

AZD9935

AZD1283

AZD3043

AZD5861

AZD5329

Crestor/AB

T-335

AZD1656

AZD3988

AZD2066

AZD2066

AZD6280

PN-400

Seroquel(TM)

SR

AZD1386 AZD2624

AZD0328 AZD9468

AZD2932

AZD4992

CAT-3888

CAT-8015

CAT-5001

AZD5099

AZD6918

AZD8848

AZD8075

CAT-354

CAM-3001

Seroquel(TM)

SR

AZD8593 Saxagliptin

Dapaglifloz

in

AZD9272

Biologicals

AZD3199

AZD7903

Small

Molecules

AZD0424

AZD6538

AZD7928

Nexium(TM)

Seloken(TM)/

Toprol XL

(TM)

Crestor(TM)

Crestor(TM)

Crestor(TM)

Nexium(TM)

Nexium(TM)

Seroquel(TM)

Symbicort

(TM) pMDI

Symbicort

(TM)

Turbuhaler (TM)

Symbicort

(TM) pMDI

Iressa(TM)

Seroquel(TM)

Seroquel(TM)

SR

Atacand(TM)

Nexium(TM)

Seroquel(TM)

SR

Seroquel(TM)

SR

Nexium(TM)

Faslodex(TM)

Faslodex(TM)

AZ Pre-Clinical Phase I Phase II LCM Phase III MedImmune PC

Numax

Anti-IL9

MAb

Anti-IFNa

MAb

Anti-IL5R

MAb

Anti-

HMGB-1

MAb

Anti-CD22

MAb

Anti-CD20

MAb

Anti-CD19

MAb

Anti-IFNaR

MAb

Siplizumab

Anti-CD19

BiTE

Hsp 90

inhibitor

Anti-cMet

Avimers

Anti-ALK

MAb

Anti-CD22

MAb

Anti-CD20

MAb

Anti-CD19

MAb

Anti-EphA4

MAb

Anti-Ephrin

B2 MAb

Anti-EphB4

MAb

Anti-

EphA2

BiTE

Hedgehog

inhibitor

Anti-EphA2

conjugate

ZD4054

EBV

vaccine

Pneumoco

ccal vac

PIV-3

vaccine

RSV /PIV-

3 vaccine

hMPV/ PIV-

3 vac

H5N1

vaccine

3rd gen

RSV MAb

Anti-RSV

drug

hMPV MAb

hMPV

vaccine

Anti-staph

HP MAb

FluMist

(CAIV-T)

Synagis

Anti-

Chitinase

MAb

Plus a further 7

early preclinical

11

| | |

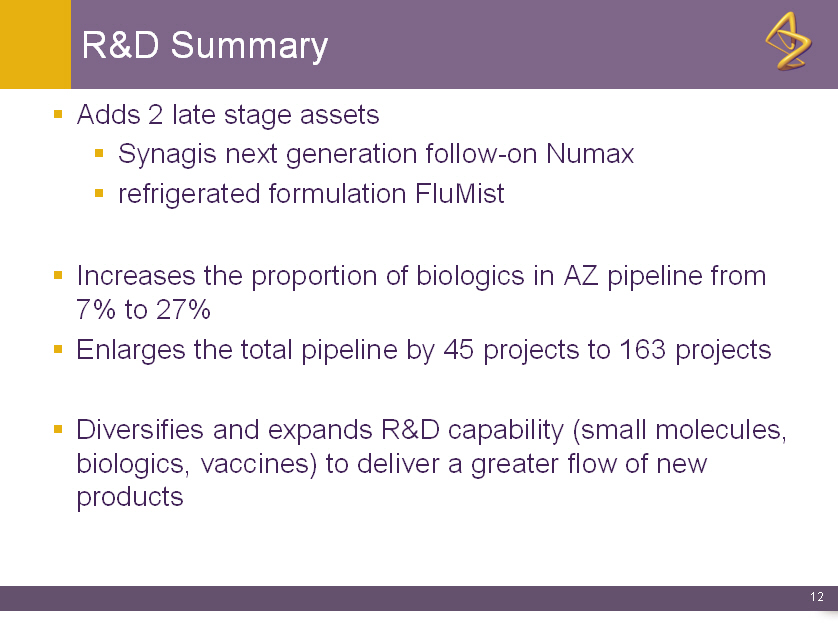

R&D Summary

o Adds 2 late stage assets

o Synagis next generation follow-on Numax

o refrigerated formulation FluMist

o Increases the proportion of biologics in AZ pipeline from

7% to 27%

o Enlarges the total pipeline by 45 projects to 163 projects

o Diversifies and expands R&D capability (small molecules,

biologics, vaccines) to deliver a greater flow of new

products

12

| | |

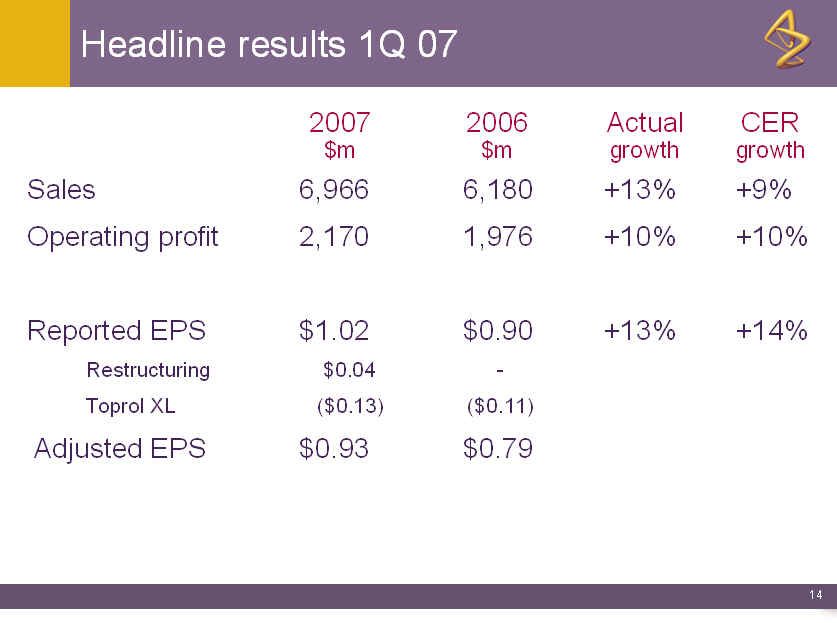

Headline results 1Q 07

2007 2006 Actual CER

$m $m growth growth

Sales 6,966 6,180 +13% +9%

Operating profit 2,170 1,976 +10% +10%

Reported EPS $1.02 $0.90 +13% +14%

Restructuring $0.04 -

Toprol XL ($0.13) ($0.11)

Adjusted EPS $0.93 $0.79

14

| | |

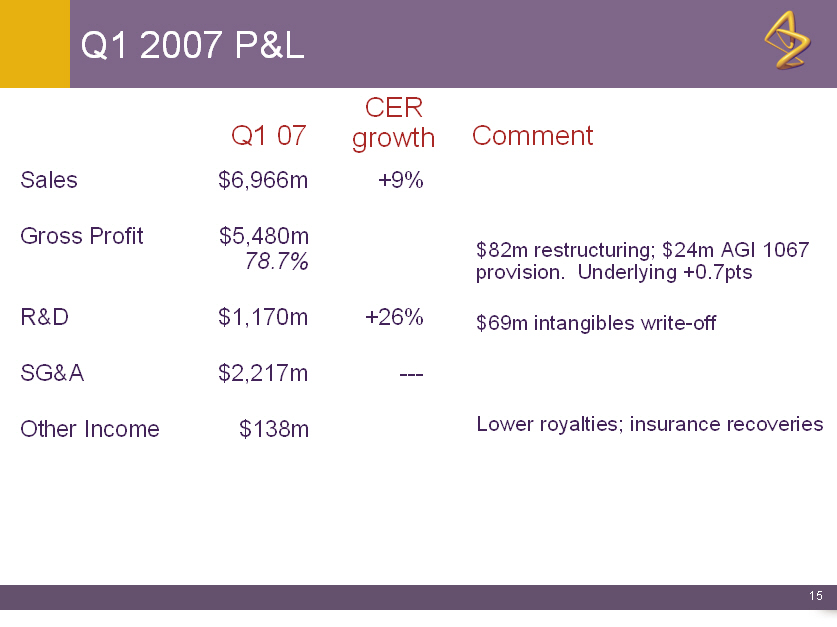

Q1 2007 P&L

CER

Q1 07 growth Comment

Sales $6,966m +9%

Gross Profit $5,480m

78.7% $82m restructuring; $24m AGI 1067

provision. Underlying +0.7pts

R&D $1,170m +26% $69m intangibles write-off

SG&A $2,217m ---

Other Income $138m Lower royalties; insurance recoveries

15

| | |

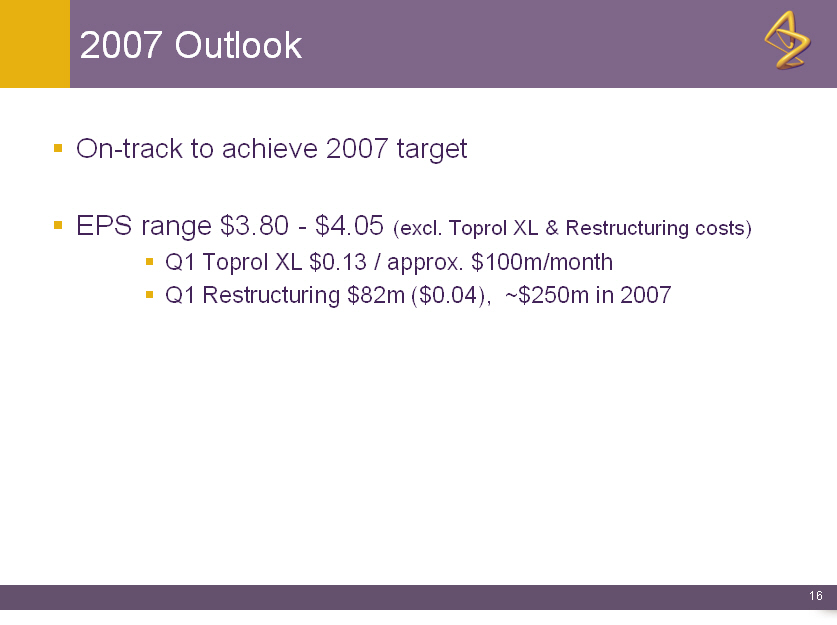

2007 Outlook

o On-track to achieve 2007 target

o EPS range $3.80 - $4.05 (excl. Toprol XL & Restructuring costs)

o Q1 Toprol XL $0.13 / approx. $100m/month

o Q1 Restructuring $82m ($0.04), ~$250m in 2007

16

| | |

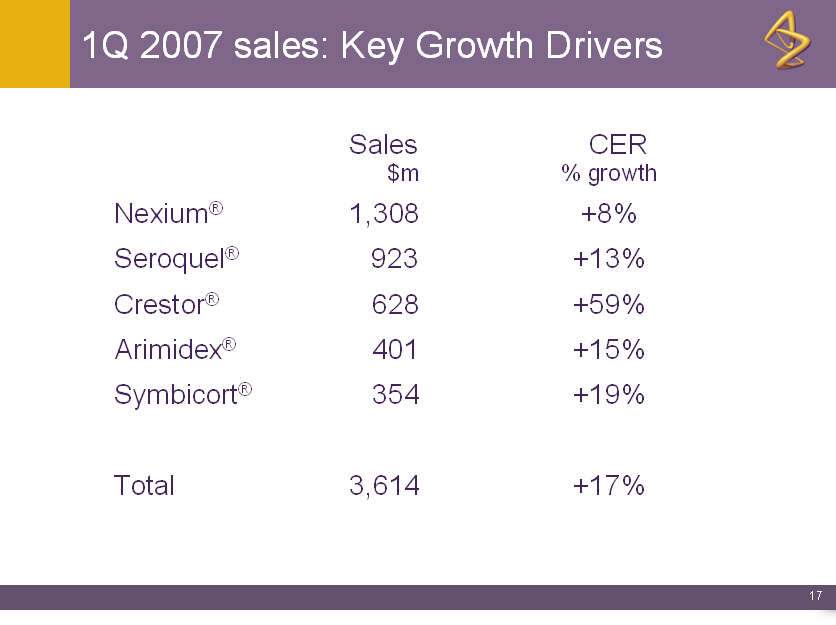

1Q 2007 sales: Key Growth Drivers

Sales CER

$m % growth

Nexium(R) 1,308 +8%

Seroquel(R) 923 +13%

Crestor(R) 628 +59%

Arimidex(R) 401 +15%

Symbicort(R) 354 +19%

Total 3,614 +17%

17

| | |

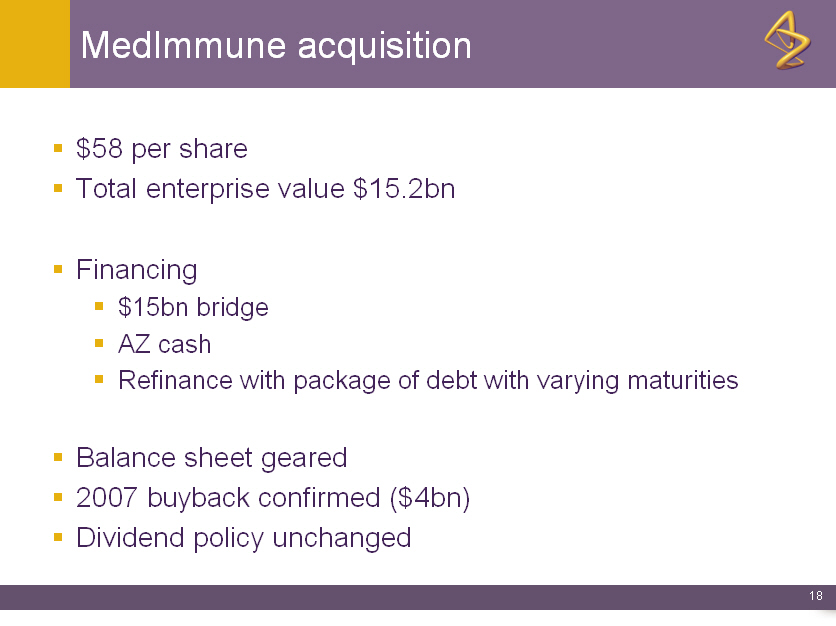

MedImmune acquisition

o $58 per share

o Total enterprise value $15.2bn

o Financing

o $15bn bridge

o AZ cash

o Refinance with package of debt with varying maturities

o Balance sheet geared

o 2007 buyback confirmed ($4bn)

o Dividend policy unchanged

18

| | |

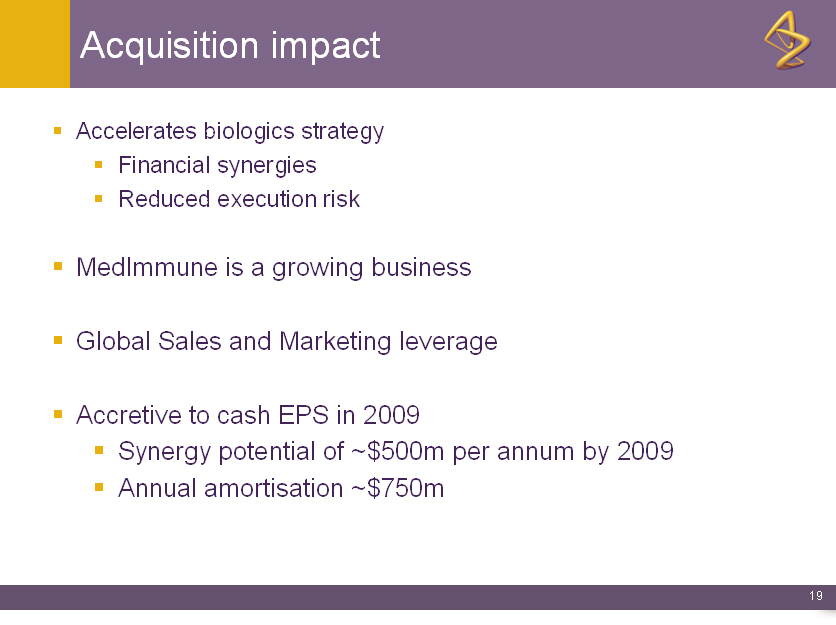

Acquisition impact

o Accelerates biologics strategy

o Financial synergies

o Reduced execution risk

o MedImmune is a growing business

o Global Sales and Marketing leverage

o Accretive to cash EPS in 2009

o Synergy potential of ~$500m per annum by 2009

o Annual amortisation ~$750m

19

| | |

People

o Strong desire to retain employees and maintain culture, with

emphasis on retaining key talent and critical skills

o One-time retention grant for employees

o Significantly increases AstraZeneca's skills and capabilities in

development and manufacture of biologics & vaccines

o Strong external collaboration/partnering skills

o David M Mott to take leadership role in AstraZeneca

o James F Young committed to remain in current role

High quality people; who combine strong science skills with

strong business skills

20

| | |

Delivers biologics ambition faster

o Creates leading, fully-integrated biologics

and vaccines business

o Significantly expands pipeline

o Enhances future growth prospects

Accelerates delivery of AZ biologics strategy at lower execution risk

Transforms science base

21

| | |

Additional Information

PRESENTATION DISCLAIMER

o The tender offer described in this presentation has not yet commenced, and

this presentation is neither an offer to purchase nor a solicitation of an

offer to sell MedImmune common stock. Investors and security holders are

urged to read both the tender offer statement and the

solicitation/recommendation statement regarding the tender offer described

in this presentation when they become available because they will contain

important information. The tender offer statement will be filed by

AstraZeneca and a subsidiary of AstraZeneca with the Securities and

Exchange Commission (SEC), and the solicitation/recommendation statement

will be filed by MedImmune with the SEC. Investors and security holders may

obtain a free copy of these statements (when available) and other documents

filed by AstraZeneca or MedImmune with the SEC at the website maintained by

the SEC at www.sec.gov. The tender offer statement and related materials

may be obtained for free by directing such requests to AstraZeneca

(Investor Relations) at +44 (0) 207 304 5000. The

solicitation/recommendation statement and such other documents may be

obtained by directing such requests to MedImmune (Investor Relations) at

301 398 4358.

o Copies of this presentation and any documentation relating to the Offer are

not being, and must not be, directly or indirectly, mailed or otherwise

forwarded, distributed or sent in or into or from Canada, Japan or

Australia or any other jurisdiction where to do so would be unlawful.

o This presentation may contain certain forward-looking statements about

AstraZeneca and MedImmune which are subject to risks and uncertainties and

may be influenced by factors that could cause actual outcomes and results

to be materially different from those predicted. We have identified the

forward-looking statements by using the words `anticipates', `believes',

`expects', `intends' and similar expressions in such statements. Important

factors that could cause actual results to differ materially from those

contained in forwardlooking statements, certain of which are beyond our

control, include, among other things: difficulties in integrating MedImmune

leading to greater costs and lower integration benefits than we anticipate;

regulatory conditions being imposed on the acquisition of MedImmune; patent

litigation and early loss or expiration of patents, marketing exclusivity

or trade marks; substantial adverse outcomes of litigation and government

litigation; exchange rate fluctuations; the risk that R&D will not yield

new products that achieve commercial success; the impact of competition,

price controls and price reductions; taxation risks; the risk of

substantial product liability claims; the impact of any failure by third

parties to supply materials or services; the risk of delay to new product

launches; the difficulties of obtaining and maintaining governmental

approvals for products; the risk of failure to observe ongoing regulatory

oversight; the risk that new products do not perform as we expect; and the

risk of environmental liabilities. For further discussion of factors that

may cause actual results to differ from expectations, you should read

AstraZeneca's most recent UK Annual Report and MedImmune's most recent

regulatory filings and submissions, including the Annual Reports on Form

20-F and Form 10-K of AstraZeneca and MedImmune, respectively. You are

cautioned not to place undue reliance on any forward-looking statements,

which speak only as of the date of this presentation. Except as required by

applicable law or regulation, AstraZeneca and MedImmune do not undertake

any obligation to publicly release any update or revisions to these

forward-looking statements.

22

| | |