QuickLinks -- Click here to rapidly navigate through this documentFiled Pursuant to Rule 424b(3)

Registration No. 333-142287

PROSPECTUS

NXP B.V.

NXP FUNDING LLC

Offers to Exchange

€1,000,000,000 principal amount Floating Rate Senior Secured Notes due 2013, $1,535,000,000 principal amount Floating Rate Senior Secured Notes due 2013, $1,026,000,000 principal amount 77/8% Senior Secured Notes due 2014, €525,000,000 principal amount 85/8% Senior Notes due 2015 and $1,250,000,000 principal amount 91/2% Senior Notes due 2015, all of which have been registered under the Securities Act of 1933, for any and all outstanding unregistered euro-denominated Floating Rate Senior Secured Notes due 2013, dollar-denominated Floating Rate Senior Secured Notes due 2013, 77/8% Senior Secured Notes due 2014, euro-denominated 85/8% Senior Notes due 2015 and dollar-denominated 91/2% Senior Notes due 2015.

We are conducting the exchange offers in order to provide you with an opportunity to exchange your unregistered notes for freely tradable notes that have been registered under the Securities Act.

The Exchange Offers

- •

- We will exchange all outstanding notes that are validly tendered and not validly withdrawn for an equal principal amount of exchange notes that are freely tradable.

- •

- You may withdraw tenders of outstanding notes at any time prior to the expiration date of the exchange offers.

- •

- The exchange offers for dollar-denominated outstanding notes expire at 5:00 p.m., New York City time, on May 30, 2007, unless extended.

- •

- The exchange offers for euro-denominated outstanding notes expire at 5:00 p.m., London time, on May 30, 2007, unless extended.

- •

- The terms of the exchange notes to be issued in the exchange offers are substantially identical to the outstanding notes, except that the exchange notes will be freely tradable. The exchange notes will have the same financial terms and covenants as the old notes, and are subject to the same business and financial risks.

All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the outstanding notes and in the applicable indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offers, we do not currently anticipate that we will register the outstanding notes under the Securities Act.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offers must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. By so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for the outstanding notes where such outstanding notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, starting on the latest expiration date of the exchange offers and ending on the close of business 180 days after such expiration date, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See "Plan of Distribution."

For a more detailed description of the exchange notes, see "Description of the Exchange Notes" beginning on page 149.

Application has been made to list the exchange notes on the Alternative Securities Market of the Irish Stock Exchange.

See "Risk Factors" beginning on page 24 for a discussion of certain risks you should consider before participating in the exchange offers.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the exchange notes to be issued in the exchange offers or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

April 26, 2007

TABLE OF CONTENTS

| | Page

|

|---|

| Enforcement of Civil Liabilities | | ii |

| Presentation of Financial and Other Information and Use of Non-GAAP Financial Information | | ii |

| Market and Industry Data | | iii |

| Exchange Rate Information | | iii |

| Forward-Looking Statements | | vi |

| Summary | | 1 |

| Summary Historical Combined and Consolidated Financial Data | | 19 |

| Summary Unaudited Pro Forma Condensed Financial Data | | 23 |

| Risk Factors | | 24 |

| Recent Significant Transactions | | 48 |

| Use of Proceeds | | 50 |

| Capitalization | | 51 |

| Selected Historical Combined and Consolidated Financial Data | | 52 |

| Unaudited Pro Forma Condensed Financial Data | | 56 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | | 62 |

| Business | | 97 |

| Management | | 118 |

| Principal Shareholders | | 125 |

| Certain Relationships and Related Party Transactions | | 126 |

| Description of Other Indebtedness | | 131 |

| The Exchange Offers | | 136 |

| Description of the Exchange Notes | | 149 |

| Summary of Material Dutch Tax Considerations Relating to the Exchange Notes | | 235 |

| Summary of Material U.S. Federal Tax Considerations | | 239 |

| Limitations on Validity and Enforceability of Guarantees and Security | | 240 |

| Plan of Distribution | | 254 |

| Legal Matters | | 256 |

| Experts | | 256 |

| Index to Combined and Consolidated Financial Statements | | F-1 |

i

ENFORCEMENT OF CIVIL LIABILITIES

NXP B.V. is a private company with limited liability (besloten vennootschap) incorporated under the laws of The Netherlands, and certain of its directors and executive officers are residents of The Netherlands. In addition, a substantial portion of the assets owned by us and the aforesaid individuals are located outside the United States. Similarly, most of the guarantors of the notes are organized under the laws of various jurisdictions outside of the United States. As a result, it may be difficult or impossible for you to effect service of process upon us or any of the aforesaid persons within the United States with respect to matters arising under the U.S. federal securities laws or to enforce against us or any of such persons judgments of U.S. courts predicated upon the civil liability provisions of the U.S. federal securities laws. Service of process in U.S. proceedings on persons in The Netherlands, however, is regulated by a multilateral treaty guaranteeing service of writs and other legal documents in civil cases if the current address of the defendant is known. The competent Dutch court will apply Dutch private international law to determine which laws will be applicable to any private law claim brought before it and apply that law to such claim. It is uncertain whether a Dutch court would apply or enforce the civil liability provisions of U.S. Federal securities laws.

Also, a judgment rendered by U.S. courts predicated upon the federal securities laws of the United States, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any State or territory within the United States, will not be recognized by a Dutch court and cannot be directly enforced in The Netherlands. However, if a person has obtained a final and conclusive judgment rendered by a U.S. court which is enforceable in the United States and files a claim with the competent Dutch court, the Dutch court will generally give binding effect to the foreign judgment, provided that it has been rendered on grounds which are internationally acceptable and that proper legal procedures have been observed, unless such foreign judgment contravenes Dutch public policy. Enforcement and recognition of judgments of U.S. courts in The Netherlands are solely governed by the provisions of the Dutch Civil Procedure Code.

PRESENTATION OF FINANCIAL AND OTHER INFORMATION AND

USE OF NON-GAAP FINANCIAL INFORMATION

Our combined financial statements for the years ended December 31, 2004 and 2005 and for the period January 1, 2006 through September 28, 2006 (predecessor periods) and our consolidated financial statements for the period September 29, 2006 through December 31, 2006 (successor period) are presented in accordance with accounting principles generally accepted in the United States (U.S. GAAP). In addition, we have included certain non-GAAP financial measures in this prospectus, including EBITDA. We believe that the presentation of EBITDA enhances an investor's understanding of our financial performance. Our management uses EBITDA to assess our Company's operating performance and to make decisions about allocating resources among our various segments. In addition, we believe EBITDA is a measure commonly used by investors. EBITDA is not a presentation made in accordance with U.S. GAAP and our use of the term EBITDA varies from others in our industry. EBITDA should not be considered as alternatives to net income (loss), operating income or any other performance measures derived in accordance with U.S. GAAP as measures of operating performance or operating cash flows as measures of liquidity. EBITDA has important limitations as analytical tools and you should not consider it in isolation or as substitutes for analysis of our results as reported under U.S. GAAP. For example, EBITDA:

- •

- excludes certain tax payments that may represent a reduction in cash available to us;

- •

- does not reflect any cash capital expenditure requirements for the assets being depreciated and amortized that may have to be replaced in the future;

- •

- does not reflect changes in, or cash requirements for, our working capital needs; and

ii

- •

- does not reflect the significant financial expense, or the cash requirements necessary to service interest payments, on our debts.

MARKET AND INDUSTRY DATA

Market data and certain industry data and forecasts used throughout this prospectus were obtained from internal company surveys, market research, publicly available information and industry publications and surveys. Industry surveys, publications and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. While we are not aware of any misstatements regarding the industry data and forecasts presented herein, we have not independently verified any of the data from third party sources nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, we have not independently verified internal studies, which we believe to be reliable based upon our management's knowledge of the industry.

EXCHANGE RATE INFORMATION

We publish our consolidated financial statements in euro. As used in this prospectus, "euro", "EUR" or "€" means the single unified currency of the European Monetary Union. "U.S. dollar", "USD", "U.S.$" or "$" means the lawful currency of the United States of America. As used in this prospectus, the term "noon buying rate" refers to the exchange rate for euro, expressed in U.S. dollars per euro, as announced by the Federal Reserve Bank of New York for customs purposes as the rate in the city of New York for cable transfers in foreign currencies. We currently intend to change our reporting currency to U.S. dollars effective January 1, 2008.

To enable you to ascertain how the trends in our financial results would have appeared had they been expressed in U.S. dollars, the table below shows the average noon buying rates for U.S. dollars per euro for the five years ended December 31, 2006 and the high, low, and period end rates for each of those periods. The averages set forth in the table below have been computed using the noon buying rate on the last business day of each month during the periods indicated.

Year ended December 31,

| | Average

|

|---|

| | ($ per €)

|

|---|

| 2002 | | 0.9454 |

| 2003 | | 1.1321 |

| 2004 | | 1.2438 |

| 2005 | | 1.2449 |

| 2006 | | 1.2563 |

The following table shows the high and low noon buying rates for U.S. dollars per euro for each of the six months ended March 31, 2007 and for the period from April 1, 2007 through April 26, 2007:

Month

| | High

| | Low

|

|---|

| | ($ per €)

|

|---|

| October 2006 | | 1.2773 | | 1.2502 |

| November 2006 | | 1.3261 | | 1.2705 |

| December 2006 | | 1.3327 | | 1.3073 |

| January 2007 | | 1.3280 | | 1.2909 |

| February 2007 | | 1.3246 | | 1.2933 |

| March 2007 | | 1.3374 | | 1.3094 |

| April 2007 (through April 26, 2007) | | 1.3647 | | 1.3363 |

On April 26, 2007, the noon buying rate was $1.3590 per €1.00.

iii

A substantial portion of our assets, liabilities, revenues and expenses are denominated in currencies other than the euro. Accordingly, fluctuations in the value of the euro relative to other currencies have had a significant effect on the translation into euro of our non-euro assets, liabilities, revenues and expenses, and may continue to do so in the future. For further information on the impact of fluctuations in exchange rates on our operations, see "Risk Factors—Risks Related to Our Business—Fluctuations in foreign exchange rates may have an adverse effect on our financial results."

NOTICE TO NEW HAMPSHIRE RESIDENTS

NEITHER THE FACT THAT A REGISTRATION STATEMENT OR AN APPLICATION FOR A LICENSE HAS BEEN FILED UNDER CHAPTER 421 B OF THE NEW HAMPSHIRE REVISED STATUTES WITH THE STATE OF NEW HAMPSHIRE NOR THE FACT THAT A SECURITY IS EFFECTIVELY REGISTERED OR A PERSON IS LICENSED IN THE STATE OF NEW HAMPSHIRE CONSTITUTES A FINDING BY THE SECRETARY OF STATE THAT ANY DOCUMENT FILED UNDER RSA 421 B IS TRUE, COMPLETE AND NOT MISLEADING. NEITHER ANY SUCH FACT NOR THE FACT THAT AN EXEMPTION OR EXCEPTION IS AVAILABLE FOR A SECURITY OR A TRANSACTION MEANS THAT THE SECRETARY OF STATE HAS PASSED IN ANY WAY UPON THE MERITS OR QUALIFICATIONS OF, OR RECOMMENDED OR GIVEN APPROVAL TO, ANY PERSON, SECURITY OR TRANSACTION. IT IS UNLAWFUL TO MAKE OR CAUSE TO BE MADE, TO ANY PROSPECTIVE PURCHASER, CUSTOMER OR CLIENT, ANY REPRESENTATION INCONSISTENT WITH THE PROVISIONS OF THIS PARAGRAPH.

NOTICES TO CERTAIN NON-U.S. RESIDENTS

This prospectus has been prepared on the basis that any offer of notes in any Member State of the European Economic Area which has implemented the Prospectus Directive (2003/71/EC), each, a "Relevant Member State," will be made pursuant to an exemption under the Prospectus Directive, as implemented in the Relevant Member State, from the requirement to publish a prospectus for offers of notes. Accordingly any person making or intending to make an offer in that Relevant Member State of notes which are the subject of the offering contemplated in this prospectus may only do so in circumstances in which no obligation arises for NXP B.V. to publish a prospectus pursuant to Article 3 of the Prospectus Directive or supplement a prospectus pursuant to Article 16 of the Prospectus Directive, in each case, in relation to such offer. NXP B.V. has not authorized, nor does it authorize, the making of any offer of exchange notes in circumstances in which an obligation arises for NXP B.V. to publish or supplement a prospectus for such offer.

European Economic Area

In relation to each Relevant Member State no offer of exchange notes to the public under the exchange offers described in this prospectus may be made to the public in the Relevant Member State prior to the publication of a prospectus in relation to the exchange notes which has been approved by the competent authority in the Relevant Member State or, where appropriate, approved in another Relevant Member State and notified to the competent authority in that Relevant Member State, all in accordance with the Prospectus Directive, except that, with effect from and including the Relevant Implementation Date, such exchange offers may be made:

- (a)

- to legal entities which are authorized or regulated to operate in the financial markets or, if not so authorized or regulated, whose corporate purpose is solely to invest in securities;

- (b)

- to any legal entity which has two or more of (1) an average of at least 250 employees during the last financial year; (2) a total balance sheet of more than €43,000,000 and (3) an annual net turnover of more than €50,000,000, as shown in its last annual or consolidated accounts;

iv

- (c)

- to fewer than 100 natural or legal persons (other than qualified investors as defined in the Prospectus Directive); or

- (d)

- in any other circumstances falling within Article 3(2) of the Prospectus Directive.

For the purpose of this provision, the expression an "offer of notes to the public" in relation to any of the exchange notes in any Relevant Member State means the communication in any form and by any means of sufficient information on the terms of the offer and the exchange notes to be offered so as to enable an investor to decide to exchange its existing notes for exchange notes, as the same may be varied in that Member State by any measure implementing the Prospectus Directive in that Member State, and the expression "Prospectus Directive" means Directive 2003/71/EC and includes any relevant implementing measure in each Relevant Member State.

Italy

The exchange offers described in this prospectus are not being made in the Republic of Italy. The exchange offers and this prospectus have not been submitted to the clearance procedure of theCommissione Nazionale per le Società e la Borsa (CONSOB) or the Bank of Italy pursuant to Italian laws and regulations. Holders of outstanding notes (as defined in this prospectus) are hereby notified that, to the extent such holders are Italian residents and/or persons located in the Republic of Italy, the exchange offers described in this prospectus are not available to them and they may not submit for exchange any outstanding notes in the exchange offers. Any acceptance received from such persons shall be ineffective and void, and neither the exchange offers made by this prospectus nor any other offering material relating to the exchange offers or the notes may be distributed or made available in the Republic of Italy. In order to ascertain whether a person is resident or located in the Republic of Italy, the applicable laws and regulations governing tender offers in the Republic of Italy shall apply.

United Kingdom

This prospectus has been issued by and is the sole responsibility of the Company and is only for circulation to holders of the outstanding notes described in this prospectus and other persons to whom it may lawfully be issued in accordance with the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, any person satisfying this criteria being referred to as a "relevant person." This communication may not be acted upon by anyone who is not a relevant person.

Any person who receives the exchange notes confirms that he has complied and will comply with all applicable sections of the Financial Services and Markets Act 2000.

France

The exchange offers described in this prospectus have not been submitted to the clearance procedures of the FrenchAutorité des marchés financiers and may not be used in connection with any offer or invitation to the public to exchange outstanding notes for the exchange notes offered hereby in France. The exchange offers are not being made, directly or indirectly, to the public in France and only persons licensed to provide the service of portfolio management for the account of third parties or qualified investors (investisseurs qualifiés) acting for their own account as defined in Articles L.411-2 and D.411-1 to D.411-2 of the FrenchCode monétaire et financier are eligible to accept the exchange offers in France.

Belgium

In Belgium, the exchange offers described in this prospectus will not, directly or indirectly, be made to, or for the account of, any person other than to professional or institutional investors referred to in article 3,2° of the Belgian Royal Decree of 7 July 1999 on the public character of financial

v

operations, each acting on their own account. This prospectus has not been and will not be submitted to nor approved by the Belgian Banking, Finance and Insurance Commission (Commission Bancaire, Financière et des Assurances/Commissie voor het Bank-, Financie- en Assurantiewezen) and accordingly may not be used in connection with any exchange offers in Belgium except as may otherwise be permitted by law.

Ireland

In Ireland, the exchange offers will not constitute investment advice or investment business services for purposes of the Irish Investment Intermediaries Act, 1995.

Germany

This prospectus does not constitute a Prospectus Directive compliant prospectus in accordance with the German Securities Prospectus Act (Wertpapierprospektgesetz) as of 22 June 2005 implementing Directive 2003/71/EC of the European Parliament and of the Counsel of 4 November 2003. Accordingly, the exchange notes (as defined in this prospectus) may only be offered in Germany under an exemption from the requirement to file or notify, as the case may be, a prospectus pursuant to the German Securities Prospectus Act (Wertpapierprospektgesetz) and any other applicable laws in the Federal Republic of Germany governing the issue, sale and offering of securities, or otherwise in compliance therewith.

Spain

The offering of the exchange notes (as defined in this prospectus) has not been registered with theComisión Nacional del Mercado de Valores. Accordingly, the exchange notes may be offered in Spain to qualified investors pursuant to and in compliance with Law 24/1988, as amended, and any regulation issued thereunder.

FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking statements. When used in this document, the words "anticipate," "believe," "estimate," "forecast," "expect," "intend," "plan" and "project," and similar expressions, as they relate to us, our management or third parties, identify forward-looking statements. Forward-looking statements include statements regarding our business strategy, financial condition, results of operations, and market data, as well as any other statements which are not historical facts. These statements reflect beliefs of our management as well as assumptions made by our management and information currently available to us. Although we believe that these beliefs and assumptions are reasonable, the statements are subject to numerous factors, risks and uncertainties that could cause actual outcomes and results to be materially different from those projected. These factors, risks and uncertainties expressly qualify all subsequent oral and written forward-looking statements attributable to us or persons acting on our behalf and include, in addition to those listed under "Risk Factors" and elsewhere in this prospectus, the following:

- •

- market demand and semiconductor industry conditions;

- •

- our ability to successfully introduce new technologies and products;

- •

- the demand for the goods into which our products are incorporated;

- •

- our ability to generate sufficient cash or raise sufficient capital to meet both our debt service and research and development and capital investment requirements;

- •

- our ability to accurately estimate demand and match our production capacity accordingly or obtain supplies from third party producers;

vi

- •

- our access to production from third party outsourcing partners, and any events that might affect their business or our relationship with them;

- •

- our ability to secure adequate and timely supply of equipment and materials from suppliers;

- •

- our ability to avoid operational problems and product defects and, if such issues were to arise, to rectify them quickly;

- •

- our ability to form strategic partnerships and joint ventures and successfully cooperate with our alliance partners;

- •

- our ability to win competitive bid selection processes to develop products for use in our customers' equipment and products;

- •

- our ability to successfully establish a brand identity;

- •

- our ability to successfully hire and retain key management and senior product architects; and

- •

- our ability to maintain good relationships with our suppliers.

Except for any ongoing obligation to disclose material information as required by the United States federal securities laws, we do not have any intention or obligation to update forward-looking statements after we distribute this prospectus.

In addition, this prospectus contains information concerning the semiconductor industry, our market segments and business units generally, which is forward-looking in nature and is based on a variety of assumptions regarding the ways in which the semiconductor industry, our market segments and product areas will develop. We have based these assumptions on information currently available to us, including through the market research and industry reports referred to in this prospectus. Although we believe that this information is reliable, we have not independently verified and cannot guarantee its accuracy or completeness. If any one or more of these assumptions turn out to be incorrect, actual market results may differ from those predicted. While we do not know what impact any such differences may have on our business, if there are such differences, our future results of operations and financial condition, and the market price of the notes, could be materially adversely affected.

vii

SUMMARY

This summary highlights information contained elsewhere in this prospectus. The information set forth below does not contain all the information you should consider before making any investment decision. We urge you to read the entire prospectus carefully, including the section "Risk Factors" and our combined and consolidated financial statements, including the notes thereto. References in this prospectus to "we", "our", "us", "NXP" and "the company" are to NXP B.V. and its consolidated subsidiaries or to NXP B.V. and NXP Funding LLC, the co-issuer, taken together, as the context requires. Please refer to "Recent Significant Transactions" below for more information.

NXP B.V.

Background

On September 29, 2006, Koninklijke Philips Electronics N.V. ("Philips") sold 80.1% of its semiconductors businesses to a consortium of private equity investors in a multi-step transaction. As part of this transaction, Philips transferred these businesses to us on September 28, 2006. All of our issued and outstanding shares were then acquired by KASLION Acquisition B.V. ("KASLION"), our parent company, which was formed as an acquisition vehicle by the private equity consortium and Philips.

At the time of our acquisition by KASLION, the private equity consortium was comprised of investment funds associated with or advised by each of Kohlberg Kravis Roberts & Co. L.P. ("KKR"), Bain Capital LLC ("Bain"), Silver Lake Management Company L.L.C. ("Silver Lake"), Apax Partners Europe Managers Ltd. ("Apax") and AlpInvest Partners N.V. ("AlpInvest", and together with KKR, Bain, Silver Lake and Apax, the "Sponsors") as well as other investors designated by the Sponsors (collectively, the "Consortium").

Our Company

We are one of the world's largest semiconductor companies. With total sales of €5.0 billion in the calendar year ended December 31, 2006, we rank among the world's top ten semiconductor providers and among the top three suppliers of application-specific semiconductors in terms of total sales. With over 50 years of operating history, we are also one of the longest-established companies in our industry. Our business targets the home electronics, mobile communications, personal entertainment, automotive and identification application markets. Within these markets, we provide a diversified range of application-specific semiconductors, including system solutions (which are customized products packaging one or more semiconductor components together with software) and semiconductor components. We also have a strong multimarket products business, which provides our customers with general purpose semiconductor components, including transistors and diodes, general purpose logic and power discretes as well as an array of application specific standard products. In our targeted application markets, we emphasize market leadership, and we seek to gain and maintain leading shares in the markets we address.

Our strategy centers on what we call the "connected consumer", by which we mean the modern electronics consumer who accesses a range of information and multimedia content on a wide variety of electronic devices. To meet the demands of the connected consumer, we focus on developing system solutions containing technologies that can be applied across a broad spectrum of consumer markets. We also aim to develop products that facilitate innovation and allow our customers to bring their end-products to market more quickly. We do this by combining our deep knowledge of the consumer electronics market, developed through our long experience with Original Equipment Manufacturer (OEM) customers, with our particular expertise in audio, video, radio frequency communications, power management and security technologies. Our Nexperia product line embodies this integrated approach. Nexperia enables our customers to develop connected multimedia devices that incorporate

1

one or more semiconductor components and associated software into a highly flexible, upgradable architecture. In addition, through innovative platform solutions such as Nexperia, we aim to apply advances in design and process technology across all of our business units.

We are organized into four business units: Mobile & Personal, Home, Automotive & Identification and Multimarket Semiconductors. Our Mobile & Personal, Home and Automotive & Identification business units primarily offer application-specific semiconductors with a focus on system solutions. Our Multimarket Semiconductors business unit offers standard products for use in multiple application markets, as well as application-specific standard products. The following chart lists these business units and our other reporting segments, and a selection of the key applications markets they operate in and the products they provide. For information on the total sales and financial performance of our business segments, see note 4 to our combined and consolidated financial statements included elsewhere in this prospectus.

| | Business Units

| | Other Reporting Segments

|

|---|

| | | Mobile & Personal | | Home | | Automotive & Identification | | Multimarket Semiconductors | | Integrated Circuit Manufacturing Operations (IMO) | | Corporate and Other, including software |

Key applications

and products/

business

function | | Cellular systems, connectivity, personal entertainment solutions, semiconductors for cordless and VoIP phones, sound solutions | | Digital television, analog television, set-top boxes, PC-television, tuners, radio frequency solutions | | In-car entertainment, in-vehicle networking, car access and immobilizer systems, tire pressure monitoring, radio frequency ID, eGovernment, smart cards, near-field communications | | Transistors, diodes, integrated discretes, microcontrollers, logic chips, power solutions, tuning discretes, CATV modules, power discretes, data converters, interface products, sensors, dedicated multimarket manufacturing operations | | Digital, analog and mixed-signal integrated circuit fabrication, test and packaging, outsourcing strategy | | Semiconductor software development, technology licensing, emerging businesses |

Semiconductors sold by each of our four business units are produced by our centralized integrated circuit manufacturing operations (IMO) division, which is responsible for integrated circuit fabrication, test and packaging. In addition, our Multimarket Semiconductors unit, which relies on IMO for most of the integrated circuits it sells, operates its own dedicated wafer fabrication and test and packaging facilities, primarily for discrete semiconductors. We pursue an asset-light manufacturing strategy in order to increase return on invested capital, reduce capital expenditures and lower our fixed cost base. We rely on a combination of wholly owned manufacturing facilities, manufacturing facilities operated jointly with other semiconductor companies, third-party foundries and assembly and test subcontractors. IMO operates 12 wholly owned integrated circuit manufacturing sites and coordinates our participation in our Systems on Silicon Manufacturing Company Pte. (SSMC) joint venture, which is a global leader in semiconductor fabrication, as well as our Crolles2 research and manufacturing alliance ("Crolles"). In January 2007, we announced that we would discontinue our participation in Crolles, effective December 31, 2007. Multimarket Semiconductors operates an additional seven wholly owned discrete semiconductor manufacturing facilities and one wholly owned integrated circuit wafer fabrication facility. Multimarket Semiconductors also coordinates our participation in our Jilin NXP Semiconductors Limited (JNS) joint venture, a manufacturer of discrete semiconductors for power management applications.

We also have additional business operations that report outside of our four business units and IMO, such as marketing and selling software as a separate product offering, licensing our intellectual property and investing in emerging semiconductor technologies. The segment under which these

2

activities are reported, Corporate and Other, also reflects research expenses not related to any specific business unit, corporate restructuring charges, and other extraordinary expenses.

Our customers include most of the world's leading consumer electronics and automotive suppliers, as well as a number of other technology providers, electronics distributors and governments. Within this diversified base, we have a core group of blue-chip customers on which we focus our sales efforts. In the calendar year ended December 31, 2006, we derived over 70% of our total sales from our top 50 customers, although no single customer accounted for more than 8% of our total sales. Based on total sales, for 2006, our top five customers are Nokia, Samsung, Philips, Ericsson and Arrow. Philips accounted for 6% of our total sales during this period.

Company and Co-Issuer Information

We were incorporated in The Netherlands as a Dutch private company with limited liability (besloten vennootschap) on December 21, 1990 as a wholly owned subsidiary of Philips. On September 29, 2006 we changed our name from Philips Semiconductors International B.V. to NXP B.V. Our corporate seat is in Eindhoven, The Netherlands. Our registered office is at High Tech Campus 60, 5656 AG, Eindhoven, The Netherlands, and our telephone number is +31 40 2745678. Our website is at http://www.nxp.com. The information and other content on our website are not part of this prospectus.

NXP Funding LLC, the co-issuer of the exchange notes, was formed in Delaware as a limited liability company on September 11, 2006 as a wholly owned subsidiary of the Company. The address of its registered office in Delaware is 2711 Centerville Road, Suite 400, Wilmington, DE 19808 and the telephone number is +1 212 536 0620.

3

RECENT SIGNIFICANT TRANSACTIONS

We refer to the transactions by which we acquired Philips' semiconductors businesses and Philips sold an 80.1% interest in these businesses to the Consortium as the "Transactions". The Transactions included the following steps:

- •

- Our separation from Philips. On September 28, 2006, we acquired substantially all of the semiconductors businesses of Philips. We refer to this transaction as the "Separation". As contemplated by the Separation arrangements, Philips' interest in ASMC (a joint venture in which Philips holds a 27% interest) has not yet been transferred to us. We expect that this interest will remain with Philips for a limited period of time and be transferred to us on or before June 30, 2007. In addition, not all contracts related to our business to which Philips was a party have been transferred to us. In connection with the Separation, we have entered into various agreements with Philips that relate to our ongoing affairs, including in the areas of intellectual property and research and development.

- •

- Acquisition of our company by an investment vehicle. On September 28, 2006, KASLION entered into a Stock Purchase Agreement (the "Purchase Agreement") with Philips. Pursuant to the Purchase Agreement, KASLION acquired 100% of our issued and outstanding shares from Philips on September 29, 2006 for an aggregate purchase price of €8,208 million. We refer to our acquisition by KASLION as the "Acquisition". The transfer of Philips' interest in ASMC to us referred to above is subject to a deferred closing mechanism under the Purchase Agreement, pursuant to which Philips is required to deliver these interests to us on or before June 30, 2007 or else to compensate KASLION for the value of these interests based on an agreed-upon valuation mechanism.

Separately, KASLION Holding B.V. ("Consortium Holding"), the investment vehicle of the Consortium, paid approximately €3,451 million, and Philips paid approximately €854 million, in exchange for, respectively, 80.1% and 19.9% of the total equity of KASLION (prior to dilution from our management equity program). KASLION used these funds to purchase 100% of our shares from Philips.

On September 29, 2006, Philips, Consortium Holding, KASLION, Stichting Management Co-Investment NXP (a foundation that holds equity in KASLION as part of our management equity program) and we entered into a shareholders agreement, which we refer to as the "Shareholders Agreement". For so long as Philips holds more than 10% of KASLION's equity, the Shareholders Agreement will include, among other things, limitations on our indebtedness and our ability to pay dividends or make other distributions, provisions regarding the composition of our supervisory board and provisions that subject certain of our activities to the approval of either a supervisory board member designated by Philips or the chairman of our supervisory board. The Shareholders Agreement provides that the chairman must be a person not affiliated with Philips or Consortium Holding.

- •

- Financing Transactions. On September 29, 2006, we entered into a €500 million euro-equivalent senior secured revolving credit facility. On October 12, 2006, we issued approximately €4,529 million euro-equivalent secured and senior notes in an underwritten offering. We used the proceeds from the offering to repay bridge financing facilities we had entered into in connection with the Acquisition. We are offering to exchange those notes for exchange notes in this exchange offer.

Our Relationship with Philips

We have sought to minimize the number of areas in which we rely on Philips for administrative and operational support following the Separation. However, in areas where we believe it is economical

4

to do so, we have contracted with Philips to receive such support for a transitional period. In the area of research and development, we continue to collaborate with Philips. In addition, we have entered into certain license, supply and purchase agreements with Philips. See "Certain Relationships and Related Party Transactions" for more information on these arrangements. Philips owns 19.9% of the total equity of KASLION, prior to dilution from our management equity program. Philips is also our customer, accounting for approximately 6% of our total sales for the calendar year ended December 31, 2006.

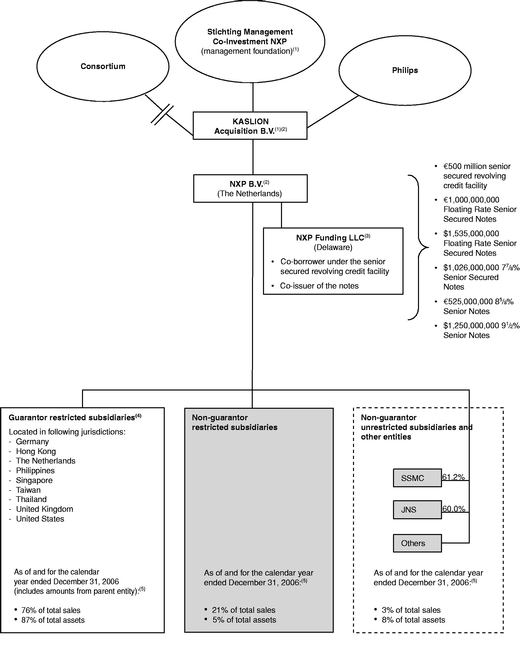

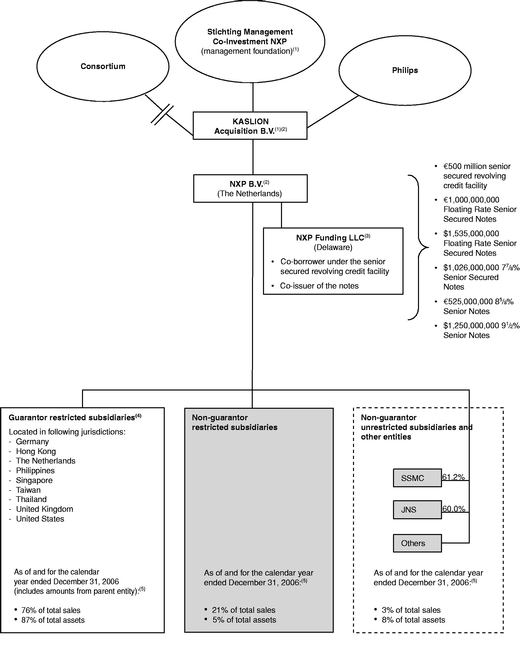

Corporate Structure

The following chart reflects our corporate structure and our principal indebtedness as of December 31, 2006.

- (1)

- Stichting Management Co-Investment NXP, a foundation established to hold shares of KASLION for the benefit of our management, holds an investment in KASLION's equity that will provide management with the possibility of sharing significantly in the success of our business.

5

- (2)

- Subject to agreed principles regarding the granting of security interests, which we refer to as "agreed security principles", we have pledged the shares of our direct subsidiaries as collateral for the secured notes. In the case of the shares of the subsidiary guarantor organized in The Philippines, a conditional assignment has been taken instead. Our senior secured revolving credit facility also benefits from a pledge of substantially all the assets of KASLION.

- (3)

- NXP Funding LLC is a co-borrower of the senior secured revolving credit facility and co-issuer of the notes. NXP Funding LLC was formed specifically for this purpose and has no assets, no revenues and no operations.

- (4)

- Each of the subsidiary guarantors has, subject to agreed security principles, pledged substantially all of its assets other than cash and bank accounts as collateral for the senior secured revolving credit facility and the secured notes. Our subsidiary organized in The Philippines has instead provided a conditional assignment of its assets.

- (5)

- Total sales represent the combined total sales for our predecessor and successor periods in 2006.

6

THE EXCHANGE OFFERS

General |

|

On October 12, 2006, NXP B.V. and NXP Funding LLC issued €1,000,000,000 aggregate principal amount of floating rate senior secured notes due 2013, $1,535,000,000 aggregate principal amount of floating rate senior secured notes due 2013, $1,026,000,000 aggregate principal amount of 77/8% senior secured notes due 2014, €525,000,000 aggregate principal amount of 85/8% senior notes due 2015 and $1,250,000,000 aggregate principal amount of 91/2% senior notes due 2015 in a private offering (the "outstanding notes"). NXP B.V. and NXP Funding LLC and the guarantors of the private offering entered into a registration rights agreement (the "Registration Rights Agreement") with the initial purchasers of the outstanding notes, for the benefit of the note holders, under which we are required to use commercially reasonable efforts to complete an offer to exchange the notes for new issues of substantially identical series of notes registered under the Securities Act of 1933 (the "exchange notes"), or have one or more shelf registration statements declared effective, prior to January 5, 2008. We are making the exchange offers to satisfy our obligations under the Registration Rights Agreement. |

The Exchange Offers |

|

We are offering €1,000,000,000 aggregate principal amount of floating rate senior secured notes due 2013 registered under the Securities Act of 1933 ("Securities Act") for any and all €1,000,000,000 aggregate principal amount of euro-denominated floating rate senior secured notes due 2013 issued on October 12, 2006 in a private offering. |

|

|

We are offering $1,535,000,000 aggregate principal amount of floating rate senior secured notes due 2013 registered under the Securities Act for any and all $1,535,000,000 aggregate principal amount of dollar-denominated floating rate senior secured notes due 2013 issued on October 12, 2006 in a private offering. |

|

|

We are offering $1,026,000,000 aggregate principal amount of 77/8% senior secured notes due 2014 registered under the Securities Act for any and all $1,026,000,000 aggregate principal amount of 77/8% senior secured notes due 2014 issued on October 12, 2006 in a private offering. |

|

|

We are offering €525,000,000 aggregate principal amount of 85/8% senior notes due 2015 registered under the Securities Act for any and all €525,000,000 aggregate principal amount of 85/8% senior notes due 2015 issued on October 12, 2006 in a private offering. |

|

|

We are offering $1,250,000,000 aggregate principal amount of 91/2% senior notes due 2015 registered under the Securities Act for any and all $1,250,000,000 aggregate principal amount of 91/2% senior notes due 2015 issued on October 12, 2006 in a private offering. |

| | | | |

7

Expiration and Exchange Dates |

|

Our offers expire (i) with respect to dollar-denominated notes, at 5:00 p.m., New York City time, on May 30, 2007, and (ii) with respect to euro-denominated notes, at 5:00 p.m., London time, on May 30, 2007, unless, in each case, we extend the deadline. We will complete the exchange and issue the exchange notes in the exchange for the outstanding notes, or the outstanding notes will be returned promptly upon expiration or termination of the exchange offers, as applicable. |

Accrued Interest on the Exchange Notes and the Notes |

|

The exchange notes will bear interest from the last maturity date of any interest installment on which interest was paid on the outstanding notes (or the issue date of the outstanding notes if no interest has been paid). If you hold outstanding notes and they are accepted for exchange: |

|

|

• |

you will waive your right to receive any interest on your outstanding notes accrued from the last maturity date of any interest installment on which interest was paid on the date the exchange notes are issued. |

|

|

• |

You will receive the same interest payment on July 15, 2007 (for floating rate senior secured exchange notes) or October 15, 2007 (for senior secured exchange notes and senior exchange notes), which is the next interest payment date with respect to the outstanding notes and the first interest payment date with respect to the exchange notes, that you would have received had you not accepted the exchange offer. |

Registration Rights |

|

Pursuant to the Registration Rights Agreement, you have the right to exchange outstanding notes that you now hold for exchange notes. We intend to satisfy this right by these exchange offers. The exchange notes will have substantially identical terms to the outstanding notes, except the exchange notes will be registered under the Securities Act and will not have registration rights. After the exchange offers are complete, you will no longer be entitled to any exchange or registration rights with respect to your outstanding notes. |

Conditions |

|

The exchange offers are subject to customary conditions, which include, among other things, the absence of any law or rule which would impair our ability to proceed. The offers apply to any and all outstanding notes validly tendered by the deadline. We will not, however, be required to accept for exchange, or exchange notes for, any outstanding notes and we may terminate the exchange offers as provided in this document if, in our judgment, any of the conditions listed in this prospectus under "The Exchange Offers—Conditions" has occurred or exists and has not been satisfied or waived prior to the expiration of the exchange offers. |

| | | | |

8

Resale Without Further

Registration |

|

We believe that you may offer for resale, resell and otherwise transfer the exchange notes without complying with the registration and prospectus delivery provisions of the Securities Act if the following is true: |

|

|

• |

you acquire the exchange notes issued in any of the exchange offers in the ordinary course of your business, |

|

|

• |

you are not an "affiliate", as defined under Rule 405 of the Securities Act, of NXP B.V., NXP Funding LLC or any guarantor and |

|

|

• |

you are not participating, and do not intend to participate, and have no arrangement or understanding with any person to participate, in a distribution of the exchange notes issued to you in the exchange offers. |

|

|

By exchanging your outstanding notes as described below, you will be making representations to this effect. |

|

|

If you are a broker-dealer that acquired outstanding notes as a result of market-making or other trading activities, you must deliver a prospectus in connection with any resale of the exchange notes as described in this summary under "Restriction on Sale by Broker-Dealers" below. |

|

|

We base our belief on interpretations by the SEC staff in no-action letters issued to other issuers in exchange offers like ours. We cannot guarantee that the SEC would make a similar decision about our exchange offers. If our belief is wrong, you could incur liability under the Securities Act. We will not protect you against any loss incurred as a result of this liability under the Securities Act. |

Liability Under the Securities Act |

|

You also may incur liability under the Securities Act if: |

|

|

(1) |

any of the representations listed above are not true, and |

|

|

(2) |

you transfer any exchange note issued to you in the exchange offers without: |

|

|

• |

delivering a prospectus meeting the requirements of the Securities Act, or |

|

|

• |

an exemption from the requirements of the Securities Act to register your exchange notes. |

|

|

We will not protect you against any loss incurred as a result of this liability under the Securities Act. |

Restriction on Sale by

Broker-Dealers |

|

If you are a broker-dealer that has received exchange notes for your own account in exchange for outstanding notes that were acquired as a result of market-making or other trading activities, you must acknowledge that you will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of the exchange notes. A broker-dealer may use this prospectus for 180 days after the last exchange date for an offer to resell, a resale or other retransfer of the exchange notes issued to it in the exchange offers. |

| | | | |

9

Procedures For Tendering Dollar-Denominated Notes |

|

If you hold dollar-denominated outstanding notes and want to accept an exchange offer, you must either: |

|

|

• |

if you hold dollar-denominated outstanding notes through The Depository Trust Company ("DTC"), you must comply with the Automated Tender Offer Program procedures of DTC, and the dollar exchange agent (as defined below) must receive a timely confirmation of a book-entry transfer of the dollar-denominated outstanding notes into its account at DTC pursuant to the procedures for book-entry transfer described herein, along with a properly transmitted agent's message, before the expiration date as described in this prospectus under "The Exchange Offers—Procedures for Tendering Dollar-Denominated Outstanding Notes". |

|

|

• |

if you hold outstanding notes registered in the name of a broker-dealer, arrange for DTC to give the dollar exchange agent the required information for a book-entry transfer. |

Procedures for Tendering Euro-Denominated Notes |

|

If you hold euro-denominated outstanding notes and want to accept an exchange offer, you must submit an electronic acceptance instruction through Euroclear or Clearstream, as described in this prospectus under "The Exchange Offers—Procedures for Tendering Euro-Denominated Outstanding Notes". |

Special Procedures for Beneficial Owners |

|

If you hold outstanding notes registered in the name of a broker-dealer, commercial bank, trust company or other nominee and you wish to exchange your outstanding notes in an exchange offer, you should promptly contact the registered holder of the outstanding notes and instruct it to tender on your behalf. |

Failure to Exchange Will Affect You Adversely |

|

If you are eligible to participate in an exchange offer and you do not tender your outstanding notes, you will not have any further registration or exchange rights and your outstanding notes will continue to be subject to transfer restrictions. These transfer restrictions and the availability of exchange notes could adversely affect the trading market for your outstanding notes. |

Withdrawal |

|

You may withdraw your tender (i) of dollar-denominated outstanding notes, at any time before 5:00 p.m., New York City time, on May 30, 2007 and (ii) of euro-denominated outstanding notes, at any time before 5:00 p.m., London time, on May 30, 2007, unless, in each case, we have already accepted your offer to exchange your outstanding notes. |

| | | | |

10

Accounting Treatment |

|

We will not recognize a gain or loss for accounting purposes as a result of the exchange. |

Tax Consequences |

|

The exchange will not be a taxable event for U.S. federal income tax purposes. This means you will not recognize any taxable gain or loss or any interest income as a result of the exchange. See "Summary of Material U.S. Federal Tax Considerations" and "Summary of Material Dutch Tax Considerations Relating to the Exchange Notes" for more information. |

Use of Proceeds |

|

We will not receive any cash proceeds from the issuance of the exchange notes. See "Use of Proceeds". |

Exchange Agent |

|

Deutsche Bank Trust Company Americas, the trustee, registrar, paying agent and transfer agent under the indentures governing the notes, is serving as the exchange agent for the dollar-denominated notes (the "dollar exchange agent") and Deutsche Bank AG, the euro paying agent and calculation agent under the indentures governing the notes, is serving as the exchange agent for the euro-denominated notes (the "euro exchange agent" and, together with the dollar exchange agent, the "exchange agent"). |

11

THE EXCHANGE NOTES

The exchange notes have the same financial terms and covenants as the outstanding notes. In this document we sometimes refer to the outstanding notes and the exchange notes as the "notes". The terms of the exchange notes are as follows.

Issuers |

|

NXP B.V. and NXP Funding LLC. The issuers will be jointly and severally liable for all obligations under the exchange notes. |

|

|

NXP Funding LLC is a wholly-owned subsidiary of NXP B.V. that has been organized as a limited liability company in Delaware as a special purpose finance subsidiary to facilitate the offering of the notes. We believe that some investors may be restricted in their ability to acquire debt securities of non-U.S. entities such as NXP B.V. unless the securities are jointly issued by an entity organized in the United States such as NXP Funding LLC. NXP Funding LLC does not have any operations or assets and does not have any revenues. Accordingly, you should not expect NXP Funding LLC to participate in servicing the principal and interest obligations on the exchange notes. |

Exchange Notes Offered |

|

€1,000,000,000 aggregate principal amount of floating rate senior secured notes due 2013 registered under the Securities Act. |

|

|

$1,535,000,000 aggregate principal amount of floating rate senior secured notes due 2013 registered under the Securities Act. |

|

|

We use the term "floating rate senior secured exchange notes" to refer to the euro- and dollar-denominated floating rate senior secured notes offered in these exchange offers. |

|

|

$1,026,000,000 aggregate principal amount of 77/8% senior secured notes due 2014 registered under the Securities Act. |

|

|

We use the term "senior secured exchange notes" to refer to the 77/8% senior secured notes (and not the floating rate senior secured exchange notes); we use the term "secured exchange notes" to refer to the senior secured exchange notes and the floating rate senior secured exchange notes, collectively. |

|

|

€525,000,000 aggregate principal amount of 85/8% senior notes due 2015 registered under the Securities Act. |

|

|

$1,250,000,000 aggregate principal amount of 91/2% senior notes due 2015 registered under the Securities Act. |

|

|

We use the term "senior exchange notes" to refer to the 85/8% senior notes due 2015 and the 91/2% senior notes due 2015 offered in these exchange offers. |

| | | | |

12

Maturity |

|

October 15, 2013 for the floating rate senior secured exchange notes, October 15, 2014 for the senior secured exchange notes and October 15, 2015 for the senior exchange notes. |

Interest on the Floating Rate Senior Secured Exchange Notes |

|

The interest rate of the dollar floating rate senior secured exchange notes will be three-month LIBOR plus 2.75%, except that the interest rate for the period beginning on the date of the issue and ending July 14, 2007 will be 8.10567%, as described in "Description of the Exchange Notes—Principal, Maturity and Interest." The interest rate on the euro floating rate senior secured exchange notes will be the three-month EURIBOR plus 2.75%, except that the interest rate for the period beginning on the date of the issue and ending July 14, 2007 will be 6.7180%, as described in "Description of the Exchange Notes—Principal, Maturity and Interest." |

Interest Payment Dates |

|

Quarterly on January 15, April 15, July 15 and October 15 of each year, commencing July 15, 2007, on the floating rate senior secured exchange notes. Semi-annually on April 15 and October 15 of each year, commencing October 15, 2007, on the senior secured exchange notes and the senior exchange notes. Interest will accrue from the issue date of the exchange notes. |

Denominations |

|

The exchange notes denominated in euros will have a minimum denomination of €50,000 and any integral multiple of €1,000 in excess thereof. The exchange notes denominated in dollars will have a minimum denomination of $75,000 and any integral multiple of $1,000 in excess thereof. |

Guarantees |

|

The exchange notes will be fully and unconditionally guaranteed, jointly and severally, on a senior basis by certain of our current and future material wholly-owned subsidiaries. If we cannot make payments on the exchange notes when they are due, the guarantors must make them instead. The laws of certain jurisdictions may limit the enforceability of certain guarantees and of the rights to the collateral supporting the guarantees of the secured exchange notes. |

Ranking of the Secured Exchange Notes and Secured Guarantees |

|

The secured exchange notes and the secured guarantees will rank: |

|

|

• |

equal in right of payment with all of our and the guarantors' existing and future senior indebtedness but, together with indebtedness under our senior secured revolving credit facility and any other first lien credit facilities and secured obligations, effectively senior in right of payment to our existing and future unsecured obligations, including the senior outstanding notes and the senior exchange notes, to the extent of the value of the collateral; |

| | | | |

13

|

|

• |

senior in right of payment to our and the guarantors' existing and future subordinated indebtedness; and |

|

|

• |

effectively junior in right of payment to all of the liabilities, including trade payables, of our subsidiaries that have not guaranteed the exchange notes. |

|

|

With respect to the collateral, the indebtedness and obligations under the secured exchange notes, our senior secured revolving credit facility and certain other existing and future indebtedness and obligations permitted under the indenture governing the secured exchange notes will have first-priority liens. Under the terms of the collateral agency agreement, however, in the event of a foreclosure on the collateral or insolvency proceedings, the holders of the secured exchange notes will receive proceeds from the collateral only after the lenders under the senior secured revolving credit facility have been repaid. |

|

|

As of December 31, 2006, we had, in addition to the secured notes: |

|

|

• |

€2 million outstanding under our senior secured revolving credit facility, with €498 million in revolving credit availability; |

|

|

• |

€1,510 million of our senior notes; and |

|

|

• |

€20 million of secured third party indebtedness at our subsidiaries. |

|

|

In addition, our non-guarantor subsidiaries had as of such date approximately €337 million of liabilities, including trade payables but excluding intercompany obligations. |

Ranking of the Senior Exchange Notes and Unsecured Guarantees |

|

The senior exchange notes and the unsecured guarantees will rank: |

|

|

• |

equal in right of payment with all of our and the guarantors' existing and future senior indebtedness but effectively junior in right of payment to all our secured debt, including the senior secured revolving credit facility, the secured outstanding notes and the secured exchange notes, to the extent of the value of the collateral; |

|

|

• |

senior in right of payment to our and the guarantors' existing and future senior subordinated and subordinated indebtedness; and |

|

|

• |

effectively junior in right of payment to all of the liabilities of our subsidiaries that have not guaranteed the senior exchange notes. |

|

|

As of December 31, 2006, we had, in addition to the unsecured notes: |

| | | | |

14

|

|

• |

€2 million outstanding under our senior secured revolving credit facility, with €498 million in revolving credit availability; and |

|

|

• |

€2,959 million of secured indebtedness. |

|

|

In addition, our non-guarantor subsidiaries had as of such date approximately €337 million of liabilities, including trade payables but excluding intercompany obligations. |

Collateral |

|

Subject to the terms of the security documents, the secured exchange notes and the secured guarantees will (except in the case of the secured guarantee given by the subsidiary guarantor organized in The Philippines) be secured by a lien ranking equally with all secured debt outstanding under our senior secured revolving credit facility and the secured outstanding notes. The liens will constitute first- priority liens on (i) the capital stock or other equity interests of the guarantors, certain of our direct wholly-owned subsidiaries and certain of our material joint ventures, (ii) substantially all other assets that are held by us or any of the guarantors, other than cash and bank accounts, (iii) intercompany loans made by us and the guarantors and (iv) proceeds from the foregoing. The shares and assets of The Philippines subsidiary will instead be subject to a conditional assignment. The lenders under our senior secured revolving credit facility and certain other indebtedness will also benefit from first-priority liens on the collateral. See "Description of the Exchange Notes—Security." |

Collateral Agency Agreement |

|

Pursuant to a collateral agency agreement, the liens securing the secured exchange notes will be first priority liens that are equal with the liens that secure (1) obligations under our senior secured revolving credit facility, (2) certain other future indebtedness permitted to be incurred under the indentures governing the secured notes, (3) certain obligations under our hedging and foreign exchange arrangements, and (4) the secured outstanding notes. Such liens will be evidenced by security documents for the benefit of the holders of the secured exchange notes, secured outstanding notes, the lenders and letter of credit issuers under the senior secured revolving credit facility and the holders of certain other future indebtedness and obligations. Under the terms of the collateral agency agreement, however, in the event of a foreclosure on the collateral or insolvency, holders of the secured exchange notes will receive proceeds from the collateral only after the lenders under the senior secured revolving credit facility have been repaid. |

Sharing of First-Priority Lien |

|

In certain circumstances, we may secure specified indebtedness permitted to be incurred by the covenant described in "Description of the Exchange Notes—Certain Covenants—Limitation on Indebtedness" by granting liens upon any or all of the collateral securing the secured exchange notes, on an equal basis with the first-priority liens securing the senior secured revolving credit facility, the secured exchange notes and the secured outstanding notes. Certain of such indebtedness may, to the extent permitted by the indentures, have priority upon the event of a foreclosure or in insolvency proceedings. |

| | | | |

15

Optional Redemption |

|

Floating rate notes. We may redeem all or part of the euro-denominated floating rate senior secured exchange notes at any time on or after October 15, 2007 and all or part of the U.S. dollar-denominated floating rate senior secured exchange notes at any time on or after October 15, 2008, at the redemption prices listed in "Description of the Exchange Notes—Optional Redemption." |

|

|

We may redeem all or part of each series of the floating rate senior secured exchange notes prior to October 15, 2007, in the case of the euro-denominated floating rate senior secured exchange notes, or October 15, 2008 in the case of the dollar-denominated floating rate senior secured exchange notes by paying a "make-whole" premium as described in "Description of the Exchange Notes—Optional Redemption." |

|

|

Senior secured exchange notes. We may redeem all or part of the senior secured exchange notes on or after October 15, 2010 at the redemption prices listed in "Description of the Exchange Notes—Optional Redemption." |

|

|

We may redeem all or part of each series of the senior secured exchange notes prior to October 15, 2010 by paying a "make-whole" premium as described in "Description of the Exchange Notes—Optional Redemption." |

|

|

On or before October 15, 2009 we may use the proceeds of specified equity offerings to redeem up to 40% of the senior secured exchange notes, at a redemption price equal to 107.875% of the aggregate principal amount of the senior secured exchange notes, plus accrued and unpaid interest, if any, to the redemption date; provided that at least 60% of the original aggregate principal amount of the notes remain outstanding after the redemption. See "Description of the Exchange Notes—Optional Redemption." |

|

|

Senior exchange notes. We may redeem all or part of the senior exchange notes on or after October 15, 2011 at the redemption prices listed in "Description of the Exchange Notes—Optional Redemption." |

|

|

We may redeem all or part of the senior exchange notes prior to October 15, 2011 by paying a "make-whole" premium as described in "Description of the Exchange Notes—Optional Redemption." |

| | | | |

16

|

|

On or before October 15, 2009 we may use the proceeds of specified equity offerings to redeem up to 40% of each series of the senior exchange notes at a redemption price equal to 108.625% of the aggregate principal amount of the euro senior exchange notes, plus accrued and unpaid interest, if any, to the redemption date, and 109.5% of the aggregate principal amount of the dollar senior exchange notes, plus accrued and unpaid interest, if any, to the redemption date, provided that at least 60% of the original aggregate principal amount of the applicable series of the senior notes remains outstanding after the redemption. See "Description of the Exchange Notes—Optional Redemption." |

|

|

Tax Redemption. We may also redeem each series of exchange notes in whole, but not in part, at any time, upon giving proper notice, if changes in tax laws impose certain withholding taxes on amounts payable on that series of the exchange notes. If we decide to do this, we must pay you a price equal to the principal amount of the notes plus interest and certain other amounts. See "Description of the Exchange Notes—Redemption for Taxation Reasons." |

Change of Control |

|

If we experience a change of control, we will be required to offer to repurchase the exchange notes at 101% of their principal amount plus accrued and unpaid interest. See "Description of the Exchange Notes—Change of Control." |

Certain Covenants |

|

The indentures governing the exchange notes contain covenants that will, among other things, limit our ability and the ability of our restricted subsidiaries to: |

|

|

• |

incur additional indebtedness; |

|

|

• |

create liens; |

|

|

• |

pay dividends, redeem capital stock or make certain other restricted payments or investments; |

|

|

• |

enter into agreements that restrict dividends from restricted subsidiaries; |

|

|

• |

sell assets, including capital stock of restricted subsidiaries; |

|

|

• |

engage in transactions with affiliates; and |

|

|

• |

effect a consolidation or merger. |

|

|

These covenants are subject to a number of important qualifications and exceptions and will be suspended with respect to any series of exchange notes if and when, and for so long as, such series is rated investment grade. For more details see "Description of the Exchange Notes—Certain Covenants." |

No Prior Listing |

|

The exchange notes will be new securities for which there is currently no market. Although the initial purchasers in the private offering of the outstanding notes have informed us that they intend to make a market in the exchange notes, they are not obligated to do so and they may discontinue market-making at any time without notice. Accordingly, we cannot assure you that a market for the exchange notes will develop or be maintained or as to the liquidity of any market. |

| | | | |

17

Trading and Listing |

|

Application has been made to list the exchange notes on the Alternative Securities Market of the Irish Stock Exchange. |

Governing Law for the Exchange Notes and the Guarantees |

|

The indentures and the guarantees are governed by the laws of the State of New York. |

Governing Law for the Collateral Agency Agreement |

|

The Collateral Agency Agreement is governed by the laws of the State of New York. |

Trustee, Registrar, Calculation Agent and Transfer Agent |

|

Deutsche Bank Trust Company Americas. |

Collateral Agent |

|

Morgan Stanley Senior Funding, Inc. will act as collateral agent for the secured exchange notes. |

Risk Factors |

|

You should carefully consider the information set forth under "Risk Factors" beginning on page 24 and all of the information in this prospectus before making any investment decision. |

18

SUMMARY HISTORICAL COMBINED AND CONSOLIDATED FINANCIAL DATA

The following table summarizes our historical combined and consolidated financial data. We prepare our financial statements in accordance with U.S. GAAP. Because our accounting basis changed in connection with the Acquisition on September 29, 2006, we present our financial statements on a predecessor and successor basis. For periods ended on or before September 28, 2006, our summary historical combined financial data principally reflects the historical financial position, results of operations and cash flows of the semiconductors businesses that were previously included as a segment of Philips. The historical combined statements of operations data for the predecessor periods set forth below do not reflect significant changes that have occurred or will occur in the operations and funding of our company as a result of the Transactions. See "Risk Factors—Risks Related to Our Separation from Philips" for a further explanation of some of these changes. For periods ended after September 28, 2006, our summary historical consolidated financial data reflects the financial position, results of operations and cash flows of our Company (including our consolidated subsidiaries) on a stand-alone basis.

The summary historical combined financial data as of December 31, 2005, and for the years ended December 31, 2005 and 2004 and for the period January 1, 2006 through September 28, 2006 (predecessor periods) have been derived from our combined financial statements included elsewhere in this prospectus. The summary historical consolidated financial data as of December 31, 2006 and for the period September 29, 2006 through December 31, 2006 (successor period) have been derived from our consolidated financial statements included elsewhere in this prospectus.

The financial information presented below may not be indicative of our future performance and, for the predecessor periods, does not necessarily reflect what our financial position and results of operations would have been had we operated as a separate, stand-alone entity during those periods.

The summary historical combined and consolidated financial data should be read in conjunction with "Selected Historical Combined and Consolidated Financial Data," "Unaudited Pro Forma Condensed Financial Data," "Management's Discussion and Analysis of Financial Condition and

19

Results of Operations" and the combined and consolidated financial statements and the accompanying notes included elsewhere in this prospectus.

| | Predecessor

| | Successor

| |

|---|

| | For the year ended

December 31,

| |

| |

For the period

September 29

through

December 31, 2006

| |

|---|

| | For the period

January 1 through

September 28, 2006

| |

|---|

| | 2004

| | 2005

| |

|---|

| |

| |

| | (€ in millions)

| |

| |

|---|

| Combined and Consolidated Statements of Operations Data: | | | | | | | | | | | | | |

| Total sales | | € | 4,823 | | € | 4,766 | | € | 3,770 | | € | 1,190 | |

| Cost of sales | | | (2,955 | ) | | (2,933 | ) | | (2,331 | ) | | (917 | ) |

| | |

| |

| |

| |

| |

| Gross margin | | | 1,868 | | | 1,833 | | | 1,439 | | | 273 | |

| Selling expenses | | | (297 | ) | | (304 | ) | | (275 | ) | | (88 | ) |

| General and administrative expenses | | | (437 | ) | | (435 | ) | | (306 | ) | | (194 | ) |

| Research and development expenses | | | (979 | ) | | (1,028 | ) | | (737 | ) | | (258 | ) |

| Write-off of acquired in-process research and development | | | — | | | — | | | — | | | (515 | ) |

| Other income | | | 79 | | | 36 | | | 18 | | | 3 | |

| | |

| |

| |

| |

| |

| Income (loss) from operations | | | 234 | | | 102 | | | 139 | | | (779 | ) |

| Financial income (expense) | | | (93 | ) | | (63 | ) | | (22 | ) | | (73 | ) |

| | |

| |

| |

| |

| |

| Income (loss) before taxes | | | 141 | | | 39 | | | 117 | | | (852 | ) |

| Income tax benefit (expense)(1) | | | (113 | ) | | (101 | ) | | (65 | ) | | 242 | |

| | |

| |

| |

| |

| |

| Income (loss) after taxes | | | 28 | | | (62 | ) | | 52 | | | (610 | ) |

| Results relating to unconsolidated companies | | | 12 | | | (5 | ) | | 3 | | | (2 | ) |

| Minority interests | | | (26 | ) | | (34 | ) | | (50 | ) | | (4 | ) |

| | |

| |

| |

| |

| |

| Net income (loss) | | € | 14 | | € | (101 | ) | € | 5 | | € | (616 | ) |

| | |

| |

| |

| |

| |

| Other Financial Data: | | | | | | | | | | | | | |

| EBITDA(2) | | € | 1,069 | | € | 881 | | € | 563 | | € | 26 | |

| Capital expenditures | | | (641 | ) | | (370 | ) | | (465 | ) | | (111 | ) |

| Depreciation and amortization | | | (849 | ) | | (818 | ) | | (471 | ) | | (811 | ) |

| Ratio of earnings to fixed charges(3) | | | 2.3x | | | 1.5x | | | 4.3x | | | — | |

| Combined Statements of Cash Flows Data: | | | | | | | | | | | | | |

| Net cash provided by (used in): | | | | | | | | | | | | | |

| Operating activities | | € | 978 | | € | 792 | | € | 468 | | € | 292 | |

| Investing activities | | | (590 | ) | | (358 | ) | | (457 | ) | | (184 | ) |

| Financing activities | | | (448 | ) | | (408 | ) | | 48 | | | 702 | |

20

| | Predecessor

| | Successor

|

|---|

| | As of

December 31, 2005

| | As of

December 31, 2006

|

|---|

| | (€ in millions)

|

|---|

| Combined Balance Sheet Data: | | | | | | |

| Cash and cash equivalents | | € | 110 | | € | 939 |

| Total assets | | | 4,005 | | | 9,867 |

| Working capital (deficit)(4) | | | (382 | ) | | 1,177 |

| Total debt(5) | | | 1,483 | | | 4,449 |

| Total business'/shareholder's equity | | | 1,126 | | | 3,685 |

- (1)

- Our taxes for predecessor periods are calculated as if we filed separate tax returns although we were historically included in the tax returns of Philips and its subsidiaries. Philips manages its tax position for the benefit of its entire portfolio of businesses, and its tax strategies are not necessarily reflective of the strategies that we would have followed or will follow in the future as a standalone company.

- (2)