- IVDA Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Iveda Solutions (IVDA) PRE 14APreliminary proxy

Filed: 8 Dec 21, 5:02pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

IVEDA SOLUTIONS, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: | |

| 2) | Aggregate number of securities to which transaction applies: | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4) | Proposed maximum aggregate value of transaction: | |

| 5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials: |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: |

Copies to:

Peter Campitiello, Esq.

McCarter & English, LLP

Two Tower Center Boulevard

East Brunswick, NJ 08816

Tel: 723-867-9741

Fax: 732.393.1901

IVEDA SOLUTIONS, INC.

8670 W. Cheyenne Avenue

Las Vegas, NV 89129

December __, 2021

To Our Stockholders:

On behalf of the Board of Directors of Iveda Solutions, Inc., I cordially invite you to attend a Special Meeting of Stockholders to be held on January __, at __ a.m., Pacific Time, at the offices of the Company at 460 S. Greenfield Road, Suite 5, Mesa AZ 85206.

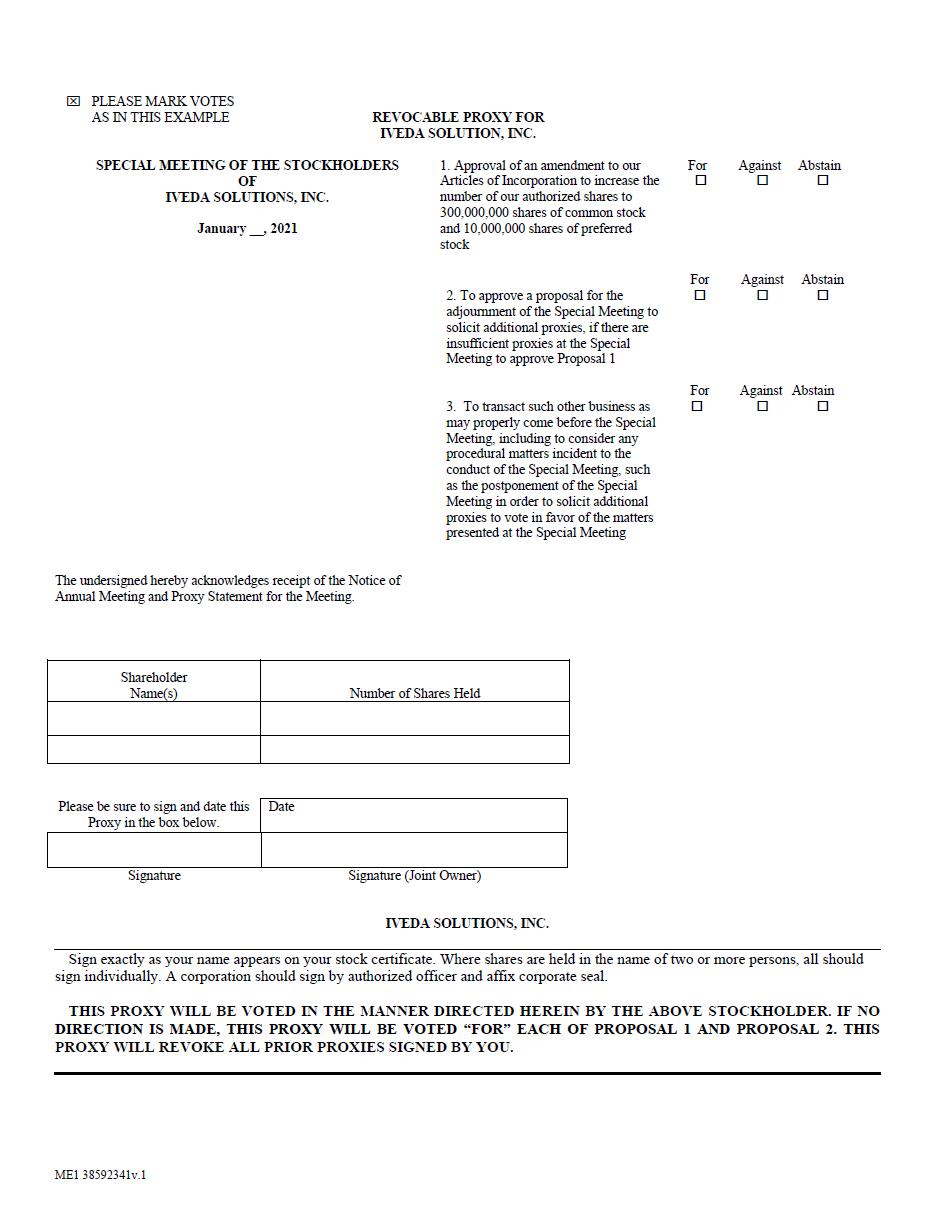

At this special meeting you will be asked to: (i) approve a proposal to amend our Articles of Incorporation to: increase the number of our authorized shares common stock, par value $0.00001 per share (the “Common Stock”) from 100,000,000 shares to 300,000,000 shares (““Proposal 1”); (ii) approve a proposal for the adjournment of the Special Meeting to solicit additional proxies, if there are insufficient proxies at the Special Meeting to approve Proposal 1 (“Proposal 2:); and (iii) transact such other business as may properly come before the Special Meeting, including to consider any procedural matters incident to the conduct of the Special Meeting, such as the postponement of the Special Meeting in order to solicit additional proxies to vote in favor of the matters presented at the Special Meeting. The accompanying Notice of Meeting and Proxy Statement describe these matters. We urge you to read this information carefully.

Our Board of Directors unanimously recommends that you vote “FOR” Proposal 1.

REGARDLESS OF WHETHER YOU PLAN TO ATTEND THE SPECIAL MEETING, I URGE YOU TO VOTE BY COMPLETING AND RETURNING YOUR PROXY CARD AS SOON AS POSSIBLE. YOUR VOTE IS IMPORTANT AND WILL BE GREATLY APPRECIATED. RETURNING YOUR PROXY CARD WILL ENSURE THAT YOUR VOTE IS COUNTED IF YOU LATER DECIDE NOT TO ATTEND THE SPECIAL MEETING.

| Cordially, | |

| IVEDA SOLUTIONS, INC. | |

| David H. Ly, | |

| Chief Executive Officer |

IVEDA SOLUTIONS, INC.

Notice of Special Meeting of Stockholders

To Be Held on January __, 2022

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the Special Meeting of Stockholders (the “Special Meeting”), of Iveda Solutions, Inc. (the “Company” or “Iveda Solutions”) will be held on January __, at __ a.m., Pacific Time, at the offices of the Company at 460 S. Greenfield Road, Suite 5, Mesa AZ 85206.

1. To approve a proposal to amend our Articles of Incorporation to increase the number of our authorized shares of common stock, par value $0.00001 per share (the “Common Stock”) from 100,000,000 shares to 300,000,000 shares (Proposal 1);

2. To approve a proposal for the adjournment of the Special Meeting to solicit additional proxies, if there are insufficient proxies at the Special Meeting to approve Proposal 1 (Proposal 2); and

3. To transact such other business as may properly come before the Special Meeting, including to consider any procedural matters incident to the conduct of the Special Meeting, such as the postponement of the Special Meeting in order to solicit additional proxies to vote in favor of the matters presented at the Special Meeting.

All shareholders are cordially invited to attend the Special Meeting. Please note that you will be asked to present the admission ticket attached to the accompanying proxy card, plus proof that you are a shareholder of the Company, as well as valid picture identification, such as a driver’s license or passport, in order to attend the Special Meeting. The use of cameras, recording devices and other electronic devices will be prohibited at the Special Meeting.

You are requested to sign, date and return the enclosed proxy card promptly, whether or not you plan to attend the Special Meeting, and regardless of the number of shares of Common Stock you own.. Any shareholder of record who submits a proxy card retains the right to revoke such proxy card by: (i) submitting a written notice of such revocation to the President of the Company so that it is received no later than 5:00 p.m. (New York City time) on _______ __, 2022; (ii) submitting a duly signed proxy card bearing a later date than the previously signed and dated proxy card to the President of the Company so that it is received no later than 5:00 p.m. (New York City time) on _______ __, 2022; or (iii) attending the Special Meeting and voting in person thereat the shares represented by such proxy card. Attendance at the Special Meeting will not, in and of itself, constitute revocation of a completed, signed and dated proxy card previously returned. All such later-dated proxy cards or written notices revoking a proxy card should be sent to Iveda Solutions, Inc., 460 S. Greenfield Road, Suite 5, Mesa AZ 85206. If you hold shares in street name, you must contact the firm that holds your shares to change or revoke any prior voting instructions.

Please carefully read the enclosed Proxy Statement, which explains the proposals to be considered by you and acted upon at the Special Meeting.

The Company’s Board of Directors (the “Board of Directors”) has fixed the close of business on December 6, 2021, as the record date for the determination of holders of record of the Company’s common stock entitled to notice of, and to vote at, the Special Meeting. A list of shareholders of record of the Company as of the record date will remain open for inspection during the Special Meeting until the closing of the polls thereat.

Whether or not you plan to attend the Special Meeting, we hope you will vote as soon as possible. You may vote over the Internet, as well as by telephone or, if you requested to receive printed proxy materials, by mailing a proxy or voting instruction card. Please review the instructions on each of your voting options described in this proxy statement as well as in the Notice you received in the mail.

| By Order of the Board of Directors | ||

| /s/ David H. Ly | ||

| Name: | David H. Ly | |

| Title: | Chief Executive Officer | |

December __, 2021

IVEDA SOLUTIONS, INC.

460 S. Greenfield Road, Suite 5

Mesa AZ, 85206

PROXY STATEMENT

SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON January __, 2022

Proxy Solicitation and General Information

This Proxy Statement and the enclosed form of proxy card (the “Proxy Card”) are being furnished to the holders of common stock, par value $0.00001 per share, of Iveda Solutions, Inc., a Nevada corporation (which is sometimes referred to in this Proxy Statement as “Iveda Solutions, Inc.,” “Iveda Solutions,” the “Company,” “we,” “us” or “our”), in connection with the solicitation of proxies by our Board of Directors for use at the Special Meeting of Stockholders to be held on January __, 2022, at 460 S. Greenfield Road, Suite 5, Mesa AZ 85206, and at any adjournments or postponements thereof (the “Special Meeting”). This Proxy Statement and the accompanying Notice of Special Meeting of Shareholders and proxy will be first sent or given on or about _____ __, 2021.

At the Special Meeting, stockholders will be asked:

1. To approve a proposal to amend our Articles of Incorporation to increase the number of our authorized shares of common stock, par value $0.00001 per share (the “Common Stock”) from 100,000,000 shares to 300,000,000 shares (Proposal 1);

2. To approve a proposal for the adjournment of the Special Meeting to solicit additional proxies, if there are insufficient proxies at the Special Meeting to approve Proposal 1 (Proposal 2); and

3. To transact such other business as may properly come before the Special Meeting, including to consider any procedural matters incident to the conduct of the Special Meeting, such as the postponement of the Special Meeting in order to solicit additional proxies to vote in favor of the matters presented at the Special Meeting.

The Board of Directors has fixed the close of business on December 6, 2021 as the record date for the determination of stockholders entitled to notice of and to vote at the Special Meeting. Each such stockholder will be entitled to one vote for each share of common stock held on all matters to come before the Special Meeting and may vote in person or by proxy authorized in writing.

Proxies and Voting

Stockholders are requested to complete, sign, date and promptly return the enclosed Proxy Card in the enclosed envelope. Proxy Cards which are not revoked will be voted at the Special Meeting in accordance with instructions contained therein. The amendment to the Company’s Articles of Incorporation to increase the Company’s authorized shares of Common Stock (Proposal 1) requires the affirmative vote of a majority of the Company’s outstanding shares of voting stock. Broker non-votes and abstentions will not count as affirmative votes. If a Proxy Card is signed and returned without instruction, the Shares will be voted against Proposal 1 and Proposal 2.

Voting

Most beneficial owners whose stock is held in street name do not receive the Proxy Card. Instead, they receive voting instruction forms or proxy ballots from their bank, broker or other agent. Beneficial owners should follow the instructions on the voter instruction form or proxy ballot they receive from their bank, broker or other agent.

| 1 |

Our Board of Directors has selected David Ly and Luz Berg and each of them, to serve as “Proxyholders” for the Special Meeting. Proxy Cards which are not revoked will be voted at the Special Meeting in accordance with instructions contained therein.

Revocation of Proxy

A stockholder who so desires may revoke its previously submitted Proxy Card at any time before it is voted at the Meeting by: (i) delivering written notice to us at Iveda Solutions, Inc., 460 S. Greenfield Road, Suite 5, Mesa AZ, 85206, c/o Secretary; (ii) duly executing and delivering a Proxy Card bearing a later date; or (iii) casting a ballot at the Special Meeting. Attendance at the Special Meeting will not in and of itself constitute a revocation of a proxy.

Voting on Other Matters

The Board of Directors knows of no other matters that are to be brought before the Special Meeting other than as set forth in the Notice of Meeting. If any other matters properly come before the Special Meeting, the persons named in the enclosed Proxy Card or their substitutes will vote in accordance with their best judgment on such matters.

Record Date; Shares Outstanding and Entitled to Vote

Only stockholders as of the close of business on December 6, 2021 (the “Record Date”) are entitled to notice of and to vote at the Special Meeting. As of December 6, 2021, there were 76,292,100 shares of our Common Stock outstanding and each entitled to one vote, per each share entitled to vote, and there were no shares of our preferred stock, par value $0.00001 per share (the “Preferred Stock”) outstanding and entitled to vote. See “Beneficial Ownership of Company Common Stock By Directors, Officers and Principal Stockholders” for information regarding the beneficial ownership of our common stock by our directors, executive officers and stockholders known to us to beneficially own 5% or more of our common stock.

Quorum; Required Votes

The presence at the Special Meeting, in person or by duly authorized proxy, of the holders of a majority of the outstanding votes entitled to vote constitutes a quorum for this Meeting.

Abstentions and “broker non-votes” are counted as present for purposes of determining whether a quorum exists. A “broker non-vote” occurs when a nominee such as a bank, broker or other agent holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received voting instructions from the beneficial owner.

Nominees may have such discretion to vote absent instructions with respect to certain “routine” matters, but not with respect to matters that are considered “non-routine,” such as the amendment of a charter to increase the number of authorized shares or a proposal considered to be related to a non-routine matter. Accordingly, without voting instructions from you, your broker will not be able to vote your shares on Proposals 1 or 2.

Each share of Common Stock entitles the holder to one vote on each matter presented for stockholder action. The affirmative vote of a majority of the Company’s outstanding voting capital stock is necessary for the amendment to the Company’s Articles of Incorporation to increase the Company’s authorized Capital Stock (Proposal 1). The affirmative vote of a majority vote of the shares cast affirmatively or negatively for this proposal is required to approve the adjournment of the Special Meeting, if necessary, to solicit additional proxies in favor of Proposal 1 (Proposal 2).

An abstention will be counted towards establishing quorum, but will not be voted on with respect to Proposal 1. Therefore, if a quorum is present, abstentions will have the same effect as a vote “AGAINST” Proposal 1. An abstention will have no effect on Proposal 2.

| 2 |

A broker non-vote will have the same effect as a vote against Proposal 1 and will have no effect on Proposal 2.

An inspector of elections appointed by Iveda Solutions will tabulate votes at the Special Meeting.

Proxy Solicitation; Expenses

Iveda Solutions will bear the costs of the solicitation of proxies for the Special Meeting. In addition to the mailing of these proxy materials, we have retained Alliance Advisors, a proxy solicitation firm, to solicit proxies in connection with the Special Meeting at a cost of approximately $15,000, plus out-of-pocket expenses.] Our directors, officers and employees may solicit proxies from stockholders by mail, telephone, telegram, e-mail, personal interview or otherwise. Such directors, officers and employees will not receive additional compensation but may be reimbursed for out-of-pocket expenses in connection with such solicitation. Brokers, nominees, fiduciaries and other custodians have been requested to forward soliciting material to the beneficial owners of our common stock held of record by them and such parties will be reimbursed for their reasonable expenses.

Voting Confidentiality

Proxy Cards, ballots and voting tabulations are handled on a confidential basis to protect your voting privacy. This information will not be disclosed to unrelated third parties except as required by law.

Appraisal Rights

Stockholders will have no rights of appraisal under the Nevada Revised Statutes in connection with the proposals to be considered at the Special Meeting.

IT IS DESIRABLE THAT AS LARGE A PROPORTION AS POSSIBLE OF THE STOCKHOLDERS’ INTERESTS BE REPRESENTED AT THE MEETING. THEREFORE, EVEN IF YOU INTEND TO BE PRESENT AT THE SPECIAL MEETING, PLEASE SIGN AND RETURN THE ENCLOSED PROXY CARD TO ENSURE THAT YOUR STOCK WILL BE REPRESENTED. IF YOU ARE PRESENT AT THE MEETING AND DESIRE TO DO SO, YOU MAY WITHDRAW YOUR PROXY CARD AND VOTE IN PERSON BY GIVING WRITTEN NOTICE TO THE SECRETARY OF THE COMPANY. YOUR PRESENCE AT THE SPECIAL MEETING WILL NOT AUTOMATICALLY REVOKE YOUR PROXY CARD. PLEASE RETURN YOUR EXECUTED PROXY CARD PROMPTLY.

| 3 |

PROPOSAL 1

APPROVE AN AMENDMENT TO OUR ARTICLES OF INCORPORATION TO INCREASE NUMBER OF AUTHORIZED SHARES OF CAPITAL STOCK

At the Special Meeting, we will ask our stockholders to approve a proposal to amend our Articles of Incorporation to increase the number of authorized shares of Common Stock (the “Amendment” or the “Share Increase”) in the form attached hereto as Annex “A”. On or about December 3, 2021, the Board of Directors approved a proposal to amend the Company’s Articles of Incorporation to increase the number of authorized shares of our Capital Stock from 100,000,000 shares of Common Stock and 10,000,000 shares of Preferred Stock to 310,000,000 shares comprised of 300,000,000 shares of Common Stock and 10,000,000 shares of preferred stock, par value $0.00001 per share (the “Preferred Stock”). On December 6, 2021, there were approximately 76,292,100 shares of our Common Stock issued and outstanding. Accordingly, approximately 23,707,900 shares of the total number of common stock currently authorized remain available for issuance or may be reserved for issuance prior to any amendment to increase the authorized shares of capital stock.

Background and Reasons for the Share Increase

Our Articles of Incorporation currently authorize the issuance of up to 100,000,000 shares of Common Stock. As of the close of business on December 6, 2021, there were approximately 76,292,100 shares of Common Stock issued and outstanding, leaving a balance of approximately 23,707,900 shares of Common Stock available for issuance. In addition, no shares of Preferred Stock are issued and outstanding leaving a balance of 10,000,000 shares that are authorized but unissued. There are currently no shares of Preferred Stock reserved for issuance.

If the Share Increase is approved by shareholders, upon its effectiveness we will have a total of 300,000,000 authorized shares of Common Stock, with approximately 76,292,100 shares of Common Stock issued and outstanding as of the date of the Proxy Statement, and approximately no shares reserved for issuance, leaving a balance of approximately 23,707,900 shares of Common Stock authorized and any specific purpose. We will have no shares of Preferred Stock issued and outstanding as of the Record Date, leaving a balance of 10,000,000 shares of Preferred Stock authorized and unissued and not reserved for any specific purpose. The Board of Directors recommends that shareholders approve the Share Increase. Adoption of the amendment requires that a majority of the Company’s outstanding shares vote in favor of the amendment at the Special Meeting.

Purpose of the Amendment

The Board of Directors believes it is in the best interest of the Company to increase the number of authorized shares of our capital stock in order to give the Company greater flexibility in considering and planning for future general corporate needs, including, but not limited to, stock dividends, grants under equity compensation plans, stock splits, financings, potential strategic transactions, as well as other general corporate transactions. The Board of Directors believes that additional authorized shares of capital stock will enable the Company to take timely advantage of market conditions and favorable financing and acquisition opportunities that become available to the Company.

The Company has engaged an investment banker to prepare for an offering and simultaneous uplist to a national stock exchange. However, the Company has no specific, current commitment, arrangement, understanding or agreement regarding the issuance of additional shares of capital stock from the additional shares to be authorized herein. The authorized but unissued shares will only be issued at the direction of the Board of Directors, and upon separate shareholder approval if and as required by applicable law or trading exchange, if applicable.

Rights of Additional Authorized Shares

Any newly authorized shares of common stock will be identical to the shares of common stock now authorized and outstanding. The amendment will not affect the rights of current holders of common stock, none of whom have preemptive or similar rights to acquire the newly authorized shares. In accordance with our Articles of Incorporation and the Nevada Revised Statutes, any of our unissued shares of Preferred Stock are “blank check” Preferred Stock which shall have such voting rights, dividend rights, liquidation preferences, conversion rights and perceptive rights as may be determined by the Company’s Board of Directors.

| 4 |

Potential Adverse Effects of the Amendment

Adoption of the amendment will have no immediate dilutive effect on the proportionate voting power or other rights of the Company’s existing stockholders. The Board of Directors has no current plan to issue shares from the additional authorized shares provided by the amendment. However, any future issuance of additional authorized shares of our Common Stock or Preferred Stock, at the future direction of the Board of Directors and upon the approval of shareholders, if and as required by applicable law and any stock exchange regulation, if applicable, may, among other things, dilute the earnings per share of common stock and the equity and voting rights of those holding common stock at the time the additional shares are issued.

In addition to the general corporate purposes mentioned above, an increase in the number of authorized shares of Common Stock or Preferred Stock may make it more difficult to, or discourage an attempt to, obtain control of the Company by means of a takeover bid that the Board of Directors determines is not in the best interest of the Company and its stockholders. However, the Board of Directors does not intend or view the proposed increase in the number of authorized shares of common stock as an anti-takeover measure and is not aware of any attempt or plan to obtain control of the Company.

Potential Anti-Takeover Effects

The Share Increase could adversely affect the ability of third parties to take us over or change our control by, for example, permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the composition of our Board of Directors or contemplating a tender offer or other transaction for the combination of us with another company that the Board determines is not in our best interests or in the best interests of our shareholders. The ability of our Board of Directors to cause us to issue substantial amounts of Common Stock or Preferred Stock without the need for shareholder approval, except as may be required by law or regulation, upon such terms and conditions as our Board of Directors may determine from time to time in the exercise of its business judgment may, among other things, be used to create voting impediments with respect to changes in our control or to dilute the stock ownership of holders of common stock seeking to obtain control of us. The issuance of Common Stock or Preferred Stock, while providing desirable flexibility in connection with potential financings and other corporate transactions, may have the effect of discouraging, delaying or preventing a change in our control. Our Board of Directors, however, does not intend or view the Share Increase Amendment as an anti-takeover measure, nor does it contemplate its use in this manner at any time in the foreseeable future.

Appraisal Rights

Pursuant to the Nevada Revised Statutes, shareholders are not entitled to appraisal rights with respect to the Share Increase.

Effectiveness of Amendment

If the amendment is adopted, it will become effective upon the filing of a certificate of amendment to our Articles of Incorporation with the Secretary of State of the State of Nevada.

THE BOARD OF DIRECTORS RECOMMENDS YOU VOTE “FOR” THE AMENDMENT TO OUR ARTICLES OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF CAPITAL STOCK.

| 5 |

OTHER MATTERS

As of the date of this Proxy Statement, the Board of Directors does not intend to present any other matter for action at the Special Meeting other than as set forth in the Notice of Special Meeting and this Proxy Statement. If any other matters properly come before the Special Meeting, it is intended that the shares represented by the proxies will be voted, in the absence of contrary instructions, in the discretion of the persons named in the Proxy Card.

BENEFICIAL OWNERSHIP OF COMPANY COMMON STOCK BY

DIRECTORS, OFFICERS AND PRINCIPAL STOCKHOLDERS

The following table lists, as of December 6, 2021, the number of shares of common stock beneficially owned by (i) each person, entity or group (as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934) known to the Company to be the beneficial owner of more than 5% of the outstanding common stock; (ii) each of our directors (iii) each of our Named Executive Officers and (iv) all executive officers and directors as a group. Information relating to beneficial ownership of common stock by our principal stockholders and management is based upon information furnished by each person using “beneficial ownership” concepts under the rules of the SEC. Under these rules, a person is deemed to be a beneficial owner of a security if that person directly or indirectly has or shares voting power, which includes the power to vote or direct the voting of the security, or investment power, which includes the power to dispose or direct the disposition of the security. The person is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership within 60 days. Under the SEC rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary interest. Except as noted below, each person has sole voting and investment power with respect to the shares beneficially owned and each stockholder’s address is c/o Iveda Solutions, Inc., 460 S. Greenfield Road, Suite 5, Mesa, AZ 85206.

| Name of Beneficial Owner | Common Shares | % of Common Shares | ||||||

| Directors and Officers | ||||||||

| David Ly (1) | 5,055,181 | 6.5 | % | |||||

| Sid Sung (2) | 400,000 | 0.5 | % | |||||

| Robert J. Brilon (3) | 1,843,988 | 2.4 | % | |||||

| Luz A. Berg (4) | 2,042,183 | 2.6 | % | |||||

| Gregory Omi (5) | 1,313,859 | 1.7 | % | |||||

| Joseph Farnsworth (6) | 1,655,538 | 2.1 | % | |||||

| Alejandro Franco (7) | 750,000 | 1.0 | % | |||||

| Robert D. Gillen (8) | 1,932,049 | 2.5 | % | |||||

| All Directors and Officers | 14,992,798 | 19.7 | % | |||||

| 5% Stockholders | ||||||||

| John Lambert (9) | 6,033,482 | 7.7 | % | |||||

| Benjamin Tran | 5,000,000 | 6.6 | % | |||||

| Philip & Wendy Wyatt (10) | 5,787,477 | 7.5 | % | |||||

| All 5% Stockholders | 16,800,959 | 21.2 | % | |||||

| 6 |

| (1) | Includes options to purchase 1,150,000 shares of common stock, which are exercisable within 60 days of December 3, 2021. |

| (2) | Consists of (a) options to purchase 250,000 shares of common stock, which are exercisable within 60 days of December 3, 2021, (b) warrants to purchase 150,000 shares of common stock, which are exercisable within 60 days of December 3, 2021, Stock. |

| (3) | Includes options to purchase 1,050,000 shares of common stock, which are exercisable within 60 days of December 3, 2021. |

| (4) | Includes options to purchase 800,000 shares of common stock, which are exercisable within 60 days of December 3, 2021. |

| (5) | Includes options to purchase 410,000 shares of common stock, which are exercisable within 60 days of December 3, 2021. |

| (6) | Consists of (a) options to purchase 800,000 shares of common stock, which are exercisable within 60 days of December 3, 2021, and b) 159,396 shares of common stock held by Farnsworth Realty, an entity owned by Mr. Farnsworth. |

| (7) | Consists of (a) options to purchase 500,000 shares of common stock, which are exercisable within 60 days of December 3, 2021, and (b) 250,000 shares of common stock held by Amextel S.A. De C.V. an entity owned by Mr. Franco. |

| (8) | Consists (a) options to purchase 540,000 shares of common stock, which are exercisable within 60 days of December 3, 2021, and (b)1,301,140 shares of common stock and c) 90,909 common stock upon conversion of debenture, held by Squirrel Away, an entity owned by Mr. Gillen. |

| (9) | Includes warrants to purchase 2,100,000 shares of common stock, which are exercisable within 60 days of December 3, 2021. |

| (10) | Includes warrants to purchase 1,010,571 shares of common stock, which are exercisable within 60 days of December 3, 2021. |

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

The Company requires that any situation, transaction or relationship that gives rise to an actual or potential conflict of interest for our executive officers must be disclosed to the Board in writing. The Company may permit the conflicted transaction only if full disclosure is made and the Company’s interests are fully protected. The Company considers conflicted transactions to consist of any transaction in which the executive (1) causes the Company to engage in business transactions with relatives or friends or companies controlled or owned by our executives; (2) uses nonpublic Company or other information for personal gain by the executive, his relatives or his friends (including securities transactions based on such information); (3) has more than a nominal financial interest in any entity with which the Company does business or competes; (4) receives a loan, or guarantee of obligations, from the Company or a third party as a result of his position at the Company; (5) competes, or prepares to compete, with the Company while still employed by the Company; or (6) has a financial interest or potential for gain in any transaction with the Company (other than Company approved compensation arrangements).

VOTING PROCEDURES

As described above, voting at the Special Meeting will consist of the following:

| ● | The Authorized Increase will be approved if holders of Common Stock representing a majority of the outstanding shares of our Common Stock vote in favor of the proposal; and | |

| ● | All other matters properly brought before the Special Meeting will be approved if the holders of a majority of shares of Common Stock voted at the Special Meeting vote in favor of the proposal, unless otherwise required by law. |

Shares represented by limited proxies will be treated as represented at the meeting only as to such matter or matters for which authority is granted in the limited proxy. Shares represented by proxies returned by brokers where the brokers’ discretionary authority is limited by stock exchange rules will be treated as represented at the Special Meeting only as to such matter or matters voted by the proxies.

As to any other business that may properly come before the Special Meeting, shares represented by proxies will be voted, to the extent permitted by law, in accordance with the recommendations of the Board, although the Company does not presently know of any such other business.

| 7 |

WHERE YOU CAN FIND MORE INFORMATION

The SEC maintains a website that contains reports, proxies and information statements and other information regarding the Company and other issuers that file electronically with the SEC at www.sec.gov. The Company’s proxy statements, annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, as well as any amendments to those reports, are available free of charge through the SEC’s website. Stockholders may also read and copy materials that the Company files with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Stockholders may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

| FOR THE BOARD OF DIRECTORS | |

| Chairman of the Board of Directors, | |

| Chief Executive Officer |

| 8 |

APPENDIX A

ARTICLES OF AMENDMENT

OF

IVEDA SOLUTIONS, INC.

Pursuant to NRS 78.390, Iveda Solutions, Inc. (the “Corporation”) hereby adopts the following Articles of Amendment to its Articles of Incorporation:

1. The name of the Corporation is Iveda Solutions, Inc.

2. Section 1 “Capital Stock” of the Articles of Incorporation is hereby amended by striking out Section 1 in its entirety and by substituting in lieu of said Section 1 the following new Section 1:

1. Capital Stock.

(a) Authorized Capital Stock. The total number of shares of stock that the Corporation shall have authority to issue is 310,000,000, consisting of (i) 300,000,000 shares of Common Stock, par value $0.00001 per share (the “Common Stock”) and (ii) 10,000,000 shares of Preferred Stock, par value $0.00001 per share (the “Preferred Stock”).

| 9 |