Analyst Day will start shortly Analyst Day 2019

Analyst Day 2019

Howard Tubin Vice President of Investor Relations Analyst Day 2019

Forward-Looking Statements: This presentation includes estimates, projections, statements relating to our business plans, objectives, and expected operating results that are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. In many cases, you can identify forward-looking statements by terms such as "may," "will," "should," "expects," "plans," "anticipates," "outlook," "believes," "intends," "estimates," "predicts," "potential" or the negative of these terms or other comparable terminology. These forward-looking statements also include our guidance and outlook statements. These statements are based on management's current expectations but they involve a number of risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in the forward-looking statements as a result of risks and uncertainties, which include, without limitation: our ability to maintain the value and reputation of our brand; the acceptability of our products to our guests; our highly competitive market and increasing competition; our reliance on and limited control over third- party suppliers to provide fabrics for and to produce our products; an economic downturn or economic uncertainty in our key markets; increasing product costs and decreasing selling prices; our ability to anticipate consumer preferences and successfully develop and introduce new, innovative and updated products; our ability to accurately forecast guest demand for our products; our ability to safeguard against security breaches with respect to our information technology systems; any material disruption of our information systems; our ability to have technology-based systems function effectively and grow our e-commerce business globally; changes in consumer shopping preferences and shifts in distribution channels; the fluctuating costs of raw materials; our ability to expand internationally in light of our limited operating experience and limited brand recognition in new international markets; our ability to deliver our products to the market and to meet guest expectations if we have problems with our distribution system; imitation by our competitors; our ability to protect our intellectual property rights; changes in tax laws or unanticipated tax liabilities; our ability to source our merchandise profitably or at all if new trade restrictions are imposed or existing trade restrictions become more burdensome; our ability to manage our growth and the increased complexity of our business effectively; our ability to cancel store leases if an existing or new store is not profitable; increasing labor costs and other factors associated with the production of our products in South and South East Asia; the operations of many of our suppliers are subject to international and other risks; our ability to successfully open new store locations in a timely manner; our ability to comply with trade and other regulations; the service of our senior management; seasonality; fluctuations in foreign currency exchange rates; conflicting trademarks and the prevention of sale of certain products; our exposure to various types of litigation; actions of activist stockholders; anti-takeover provisions in our certificate of incorporation and bylaws; and other risks and uncertainties set out in filings made from time to time with the United States Securities and Exchange Commission and available at www.sec.gov, including, without limitation, our most recent reports on Form 10-K and Form 10-Q. You are urged to consider these factors carefully in evaluating the forward- looking statements contained herein and are cautioned not to place undue reliance on such forward-looking statements, which are qualified in their entirety by these cautionary statements. The forward-looking statements made herein speak only as of the date of this press release and we undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances, except as may be required by law. Analyst Day 2019

Welcome Analyst Day 2019

9:35 am 10:30 am 11:00 am 11:30 am Calvin McDonald Sun Choe Celeste Burgoyne Stuart Haselden Our Five-year Plan Product Vision Omni Guest Experiences International Growth 12:00 pm LUNCH 1:30 pm 1:50 pm 2:20 pm PJ Guido Senior Leadership Team Calvin McDonald Financial Overview Q&A Closing Remarks Analyst Day 2019

video Sizzle reel of 2018 financial results Analyst Day 2019

Calvin McDonald Chief Executive Officer Analyst Day 2019

Immersing myself in lululemon Analyst Day 2019

Product innovation Guest relationship Brand loyalty Channel agility People and culture Analyst Day 2019

Product innovation Market trend LeverageScience ofpants Feel Consumers choose Flow and breadth versatile products that enable them to live the life they want CompleteFabric assortmentinnovation Analyst Day 2019

Guest relationship Market trend +Expand7M Guestsshare of in Maximize Consumers want wallet2018 our to participate in influencers communities with 92% people who share highGlobal value their passions communityguest retention Analyst Day 2019

Brand loyalty 83 Market trend BrandNet Consumers respond awarenesspromoter Coveted score events to experiences that foster and enable human connections Experiential4k loyaltyevents Analyst Day 2019

Channel agility Market trend 46% Right size Consumers expect growth China convenient digital solutions that % create personalized Digital26 digital ecosystem experiences penetration Analyst Day 2019

People and culture Market trend Development- Dofocused more Consumers engage culture with authentic, 94% of purpose-driven employeesDrive brands with wouldour recommend impact lululemonagenda as strong values a great place to work Analyst Day 2019

Product innovation Guest relationship Brand loyalty Channel agility People and culture Analyst Day 2019

Product innovation Guest relationship Brand loyalty Channel agility People and culture Versatility Community Experiences Digital solutions Purpose-driven brand Analyst Day 2019

Ecomm comp Revenue GAAP 45% EPS growth $3.3B 90%* Total Adjusted EPS growth revenue growth 48%* 24% Our amazing 2018 * Please see page 121 for a reconciliation of non-GAAP financial metrics. Analyst Day 2019

Delivering on our 2020 plan early, looking boldly into our future

We are in the early innings of our full potential

Our Vision Be the experiential brand that ignites a community of people living the sweatlife through sweat, grow and connect

Sweat The physical challenge that pushes us past our boundaries

Grow The practice of personal development and becoming our best selves

GrowSweatConnect TheCreating practicephysical bonds of personalchallengewith others that to developmentpushesbuild something us past thatourbigger boundaries accelerates than we selfcan- aloneleadership

#thesweatlife

#thesweatlife This is lululemon

video Our Vision Analyst Day 2019

Our Vision Be the experiential brand that ignites a community of people living the sweatlife through sweat, grow and connect Analyst Day 2019

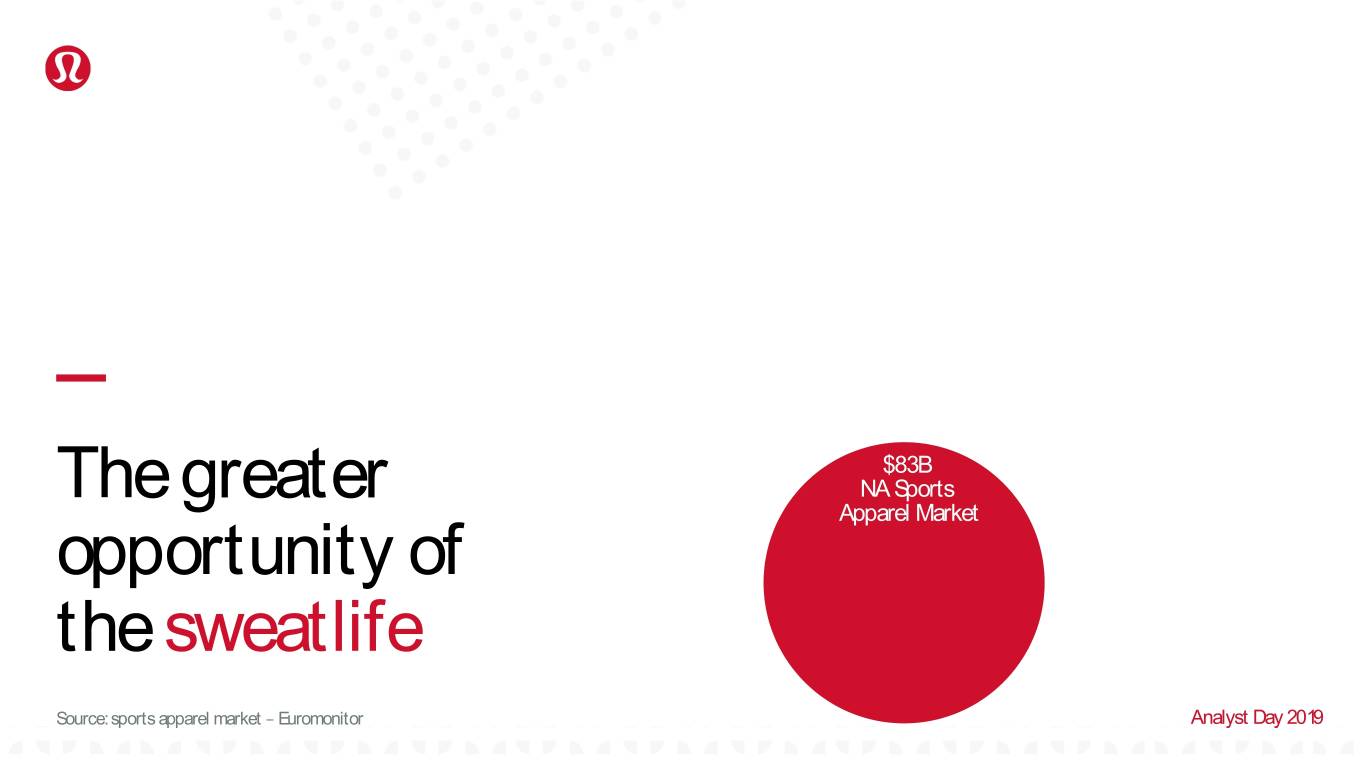

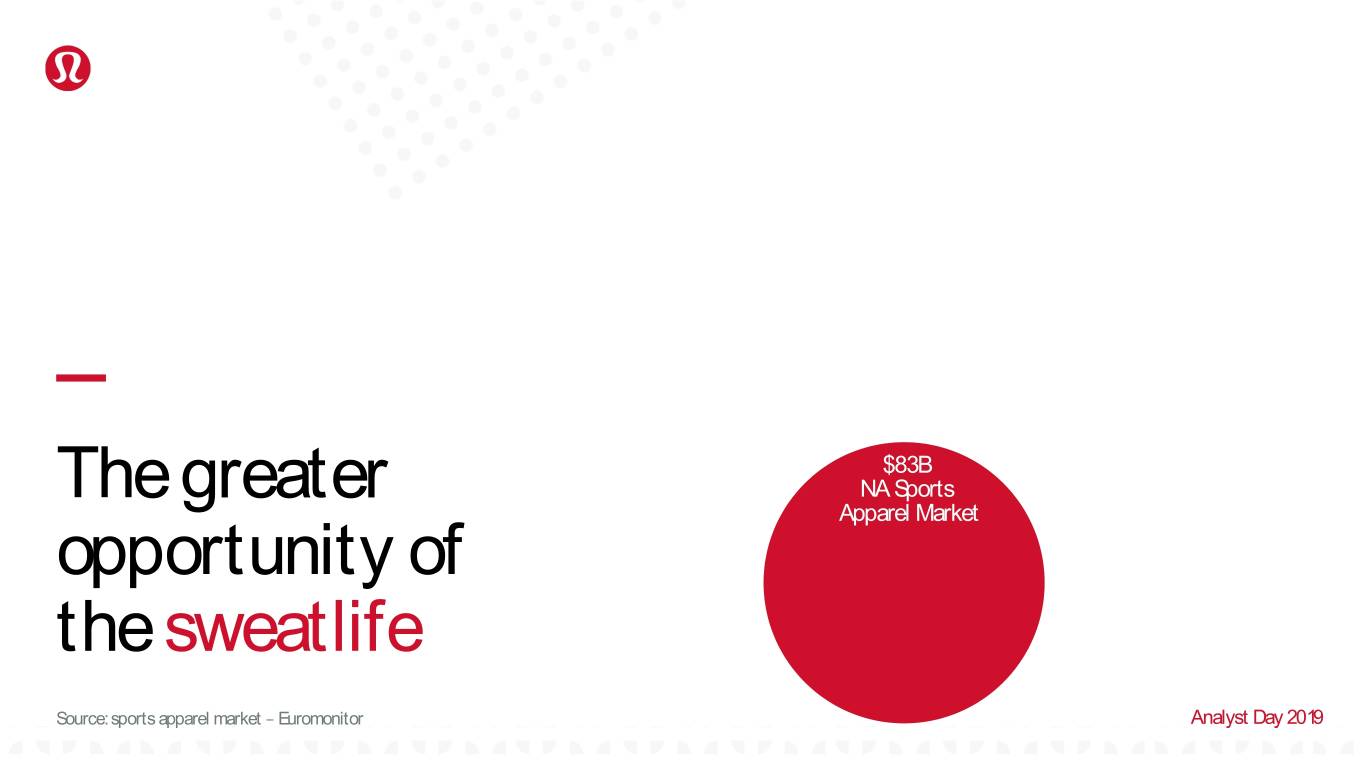

The greater opportunity of the sweatlife Analyst Day 2019

$83B NA Sports The greater Apparel Market $115B Global Sports opportunity of Apparel Market the sweatlife Source: sports apparel market Euromonitor Analyst Day 2019

$115B Global Sports Apparel Market $83B NA$630B Sports The greater Global Adjacent ApparelProduct Categories Market opportunity of the sweatlife Source: sports apparel market Euromonitor Analyst Day 2019

$630B Global Adjacent Product Categories $115B Global Sports Apparel Market $83B NA Sports The greater Apparel Market $3T opportunity of Global Wellness Market the sweatlife Source: personal care + beauty market AND sports footwear combined; personal care + beauty market global alone is $500B Euromonitor Analyst Day 2019

$3T Global Wellness Market $630B Global Adjacent Product Categories $115B Global Sports Apparel Market $83B NA Sports The greater Apparel Market opportunity of the sweatlife Source: global wellness institute Analyst Day 2019

Our five-year growth plan Analyst Day 2019

Financial summary Next five years 2018 - 2023 Revenue Gross margin SG&A EPS growth expansion leverage growth (CAGR) (Annual) (Annual) Modest Modest > Revenue Low teens expansion leverage growth Analyst Day 2019

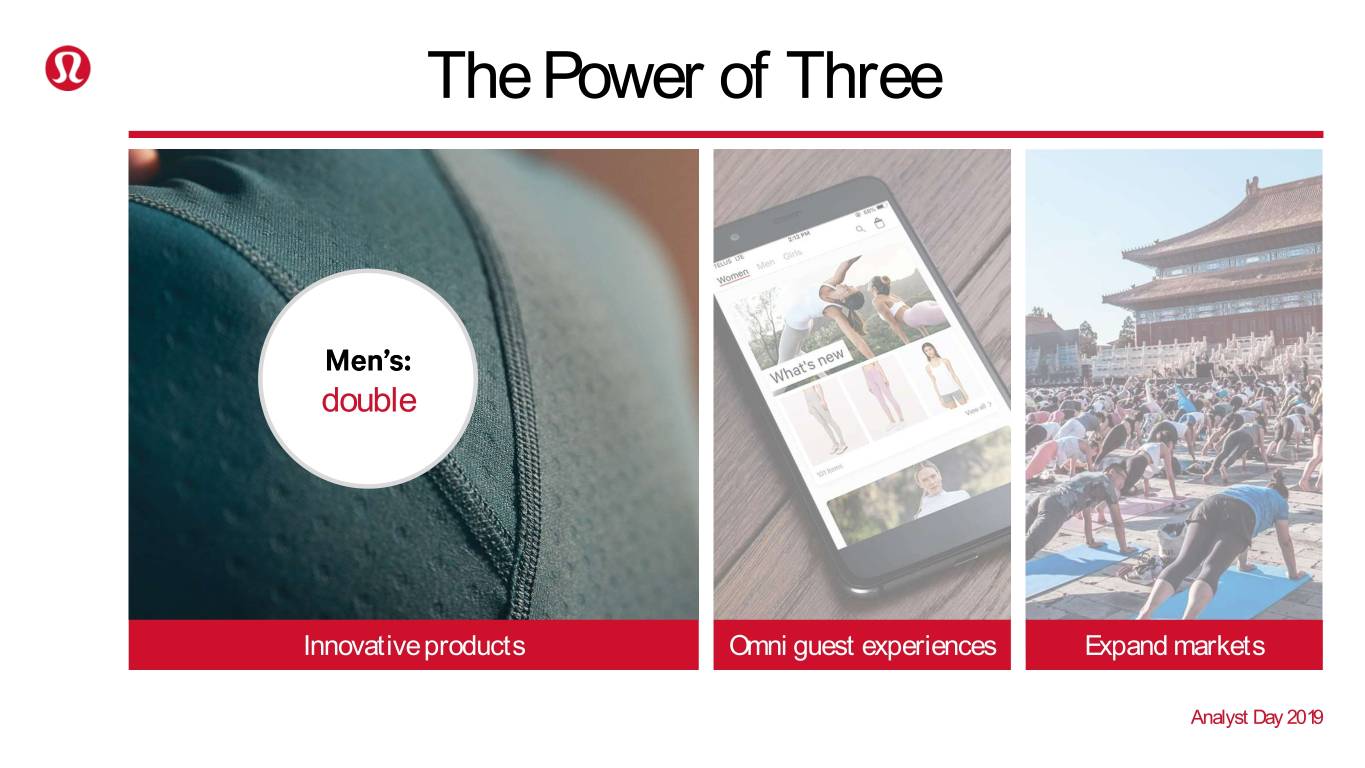

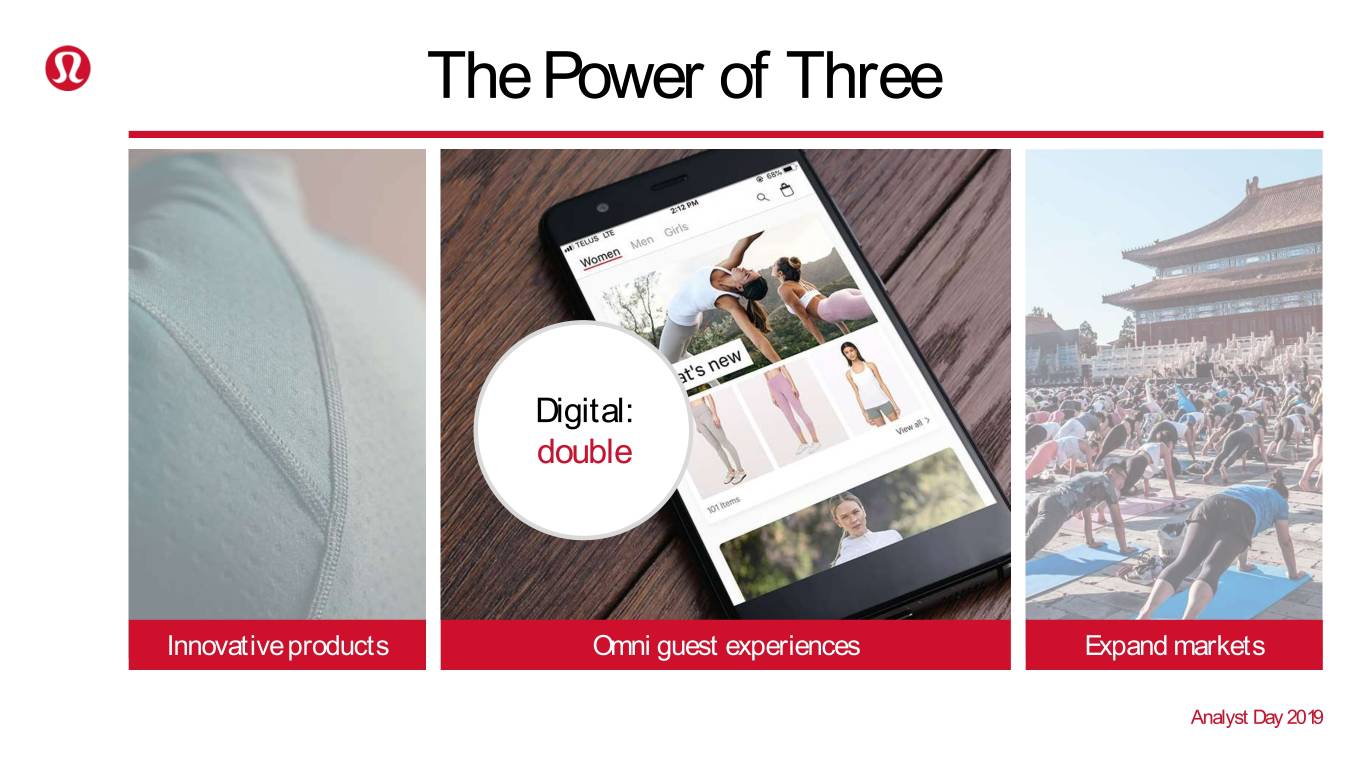

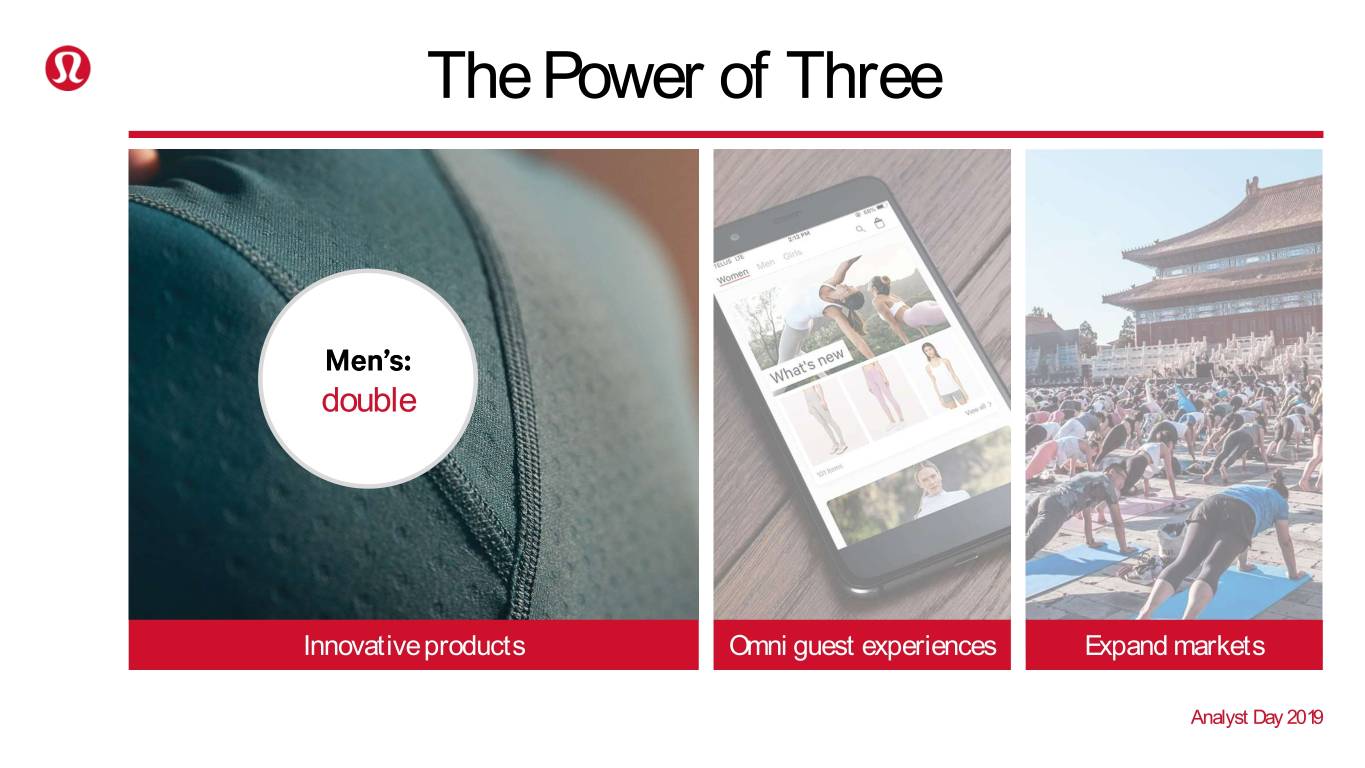

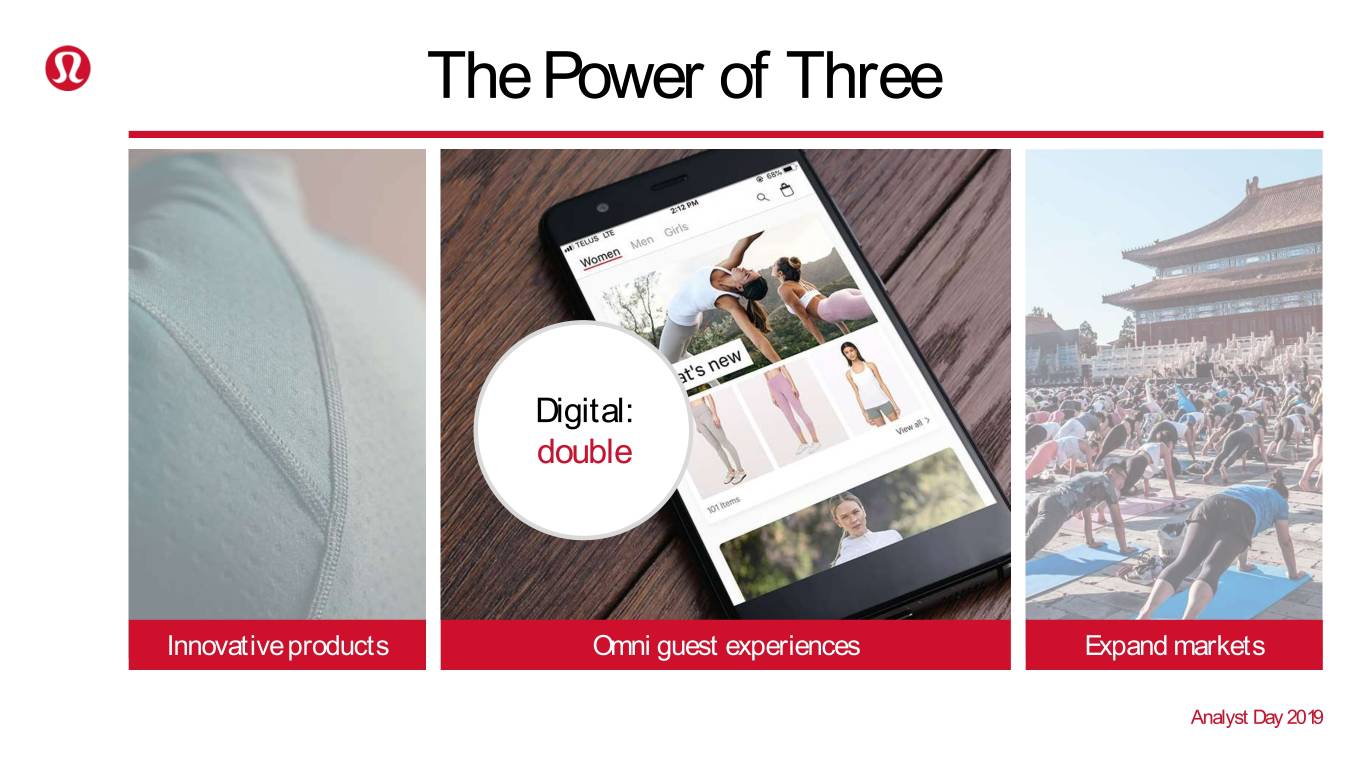

The Power of Three

The Power of Three Innovative products Omni guest experiences Expand markets Analyst Day 2019

The Power of Three double Innovative products Omni guest experiences Expand markets Analyst Day 2019

The Power of Three Digital: double Innovative products Omni guest experiences Expand markets Analyst Day 2019

The Power of Three International: quadruple Innovative products Omni guest experiences Expand markets Analyst Day 2019

The Power of Three Digital: International: double double quadruple Innovative products Omni guest experiences Expand markets Analyst Day 2019

The Power of Three Digital: International: double double quadruple Revenue Gross margin SG&A EPS growth expansion leverage growth (CAGR) (Annual) (Annual) Modest Modest > Revenue Low teens expansion leverage growth Analyst Day 2019

Powerful Whitespace Great Winning momentum innovations storytellers on talent Analyst Day 2019

The full potential of lululemon Analyst Day 2019

Leadership team Analyst Day 2019

Celeste Burgoyne Sun Choe EVP, Americas & Stuart Haselden PJ Guido Chief Product Officer Global Guest Innovation COO & EVP, International Chief Financial Officer Analyst Day 2019

Q & A Analyst Day 2019

video Science of Feel Analyst Day 2019

Sun Choe Chief Product Officer Analyst Day 2019

Innovating through Science of Feel Delivering new sensory experiences for our guests Analyst Day 2019

Infusing Science of Feel to serve guests living the sweatlife Expand beyond yoga Analyst Day 2019

Grow share of wallet by solving unmet needs for our guests Analyst Day 2019

Analyst Day 2019

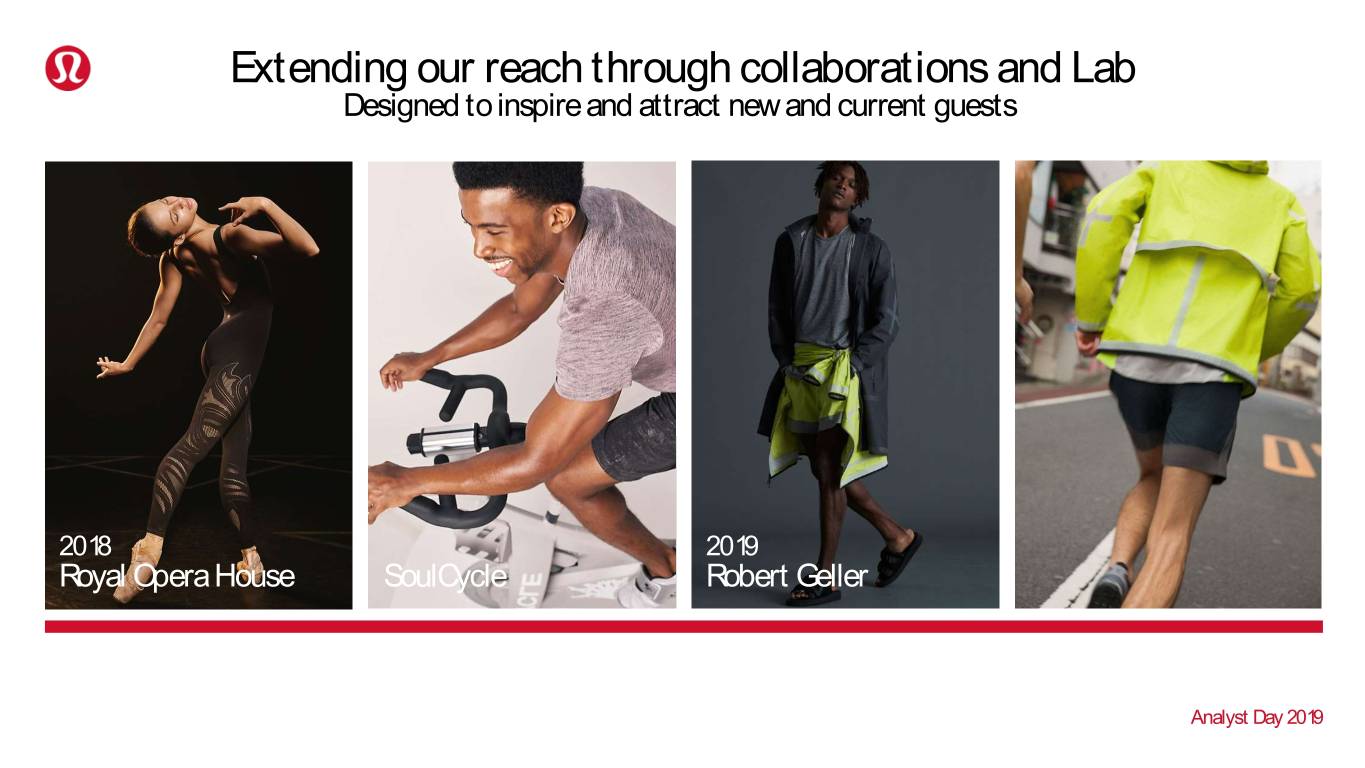

Extending our reach through collaborations and Lab Designed to inspire and attract new and current guests 2018 2019 Royal Opera House SoulCycle Robert Geller Analyst Day 2019

Continuing to build upon success in accessories Demonstrating the elasticity of our brand Analyst Day 2019

New category growth opportunities Creating functional solves for the sweatlife Analyst Day 2019

Analyst Day 2019

Celeste Burgoyne EVP, Americas & Global Guest Innovation Analyst Day 2019

Growth runway remains strong in North America 349 $2.9B Stores* $1.9B 321 Stores* 2015 2018 *company-operatedAnalyst lululemon Day stores 2019

Physical Digital Community Omni guest experience Seasonal Local

Our physical growth is fueled by our agile retail concepts Seasonal Local Mainline Co-located Analyst Day 2019

Our physical growth is fueled by our agile retail concepts Seasonal Co-located Analyst Day 2019 Core e-commerce experience

Doubling our digital growth Core e-commerce experience Growing the assortment Transactional omni Analyst Day 2019 Global Yoga Ambassador

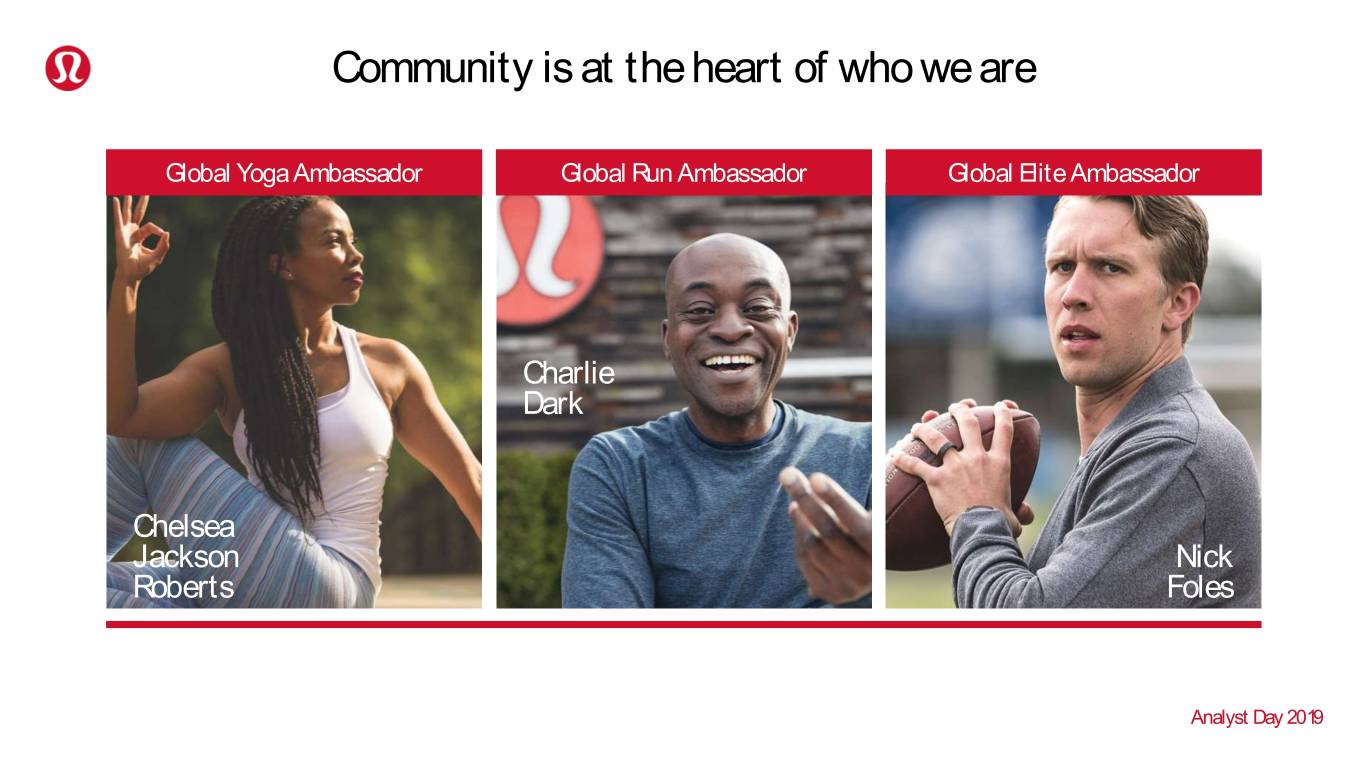

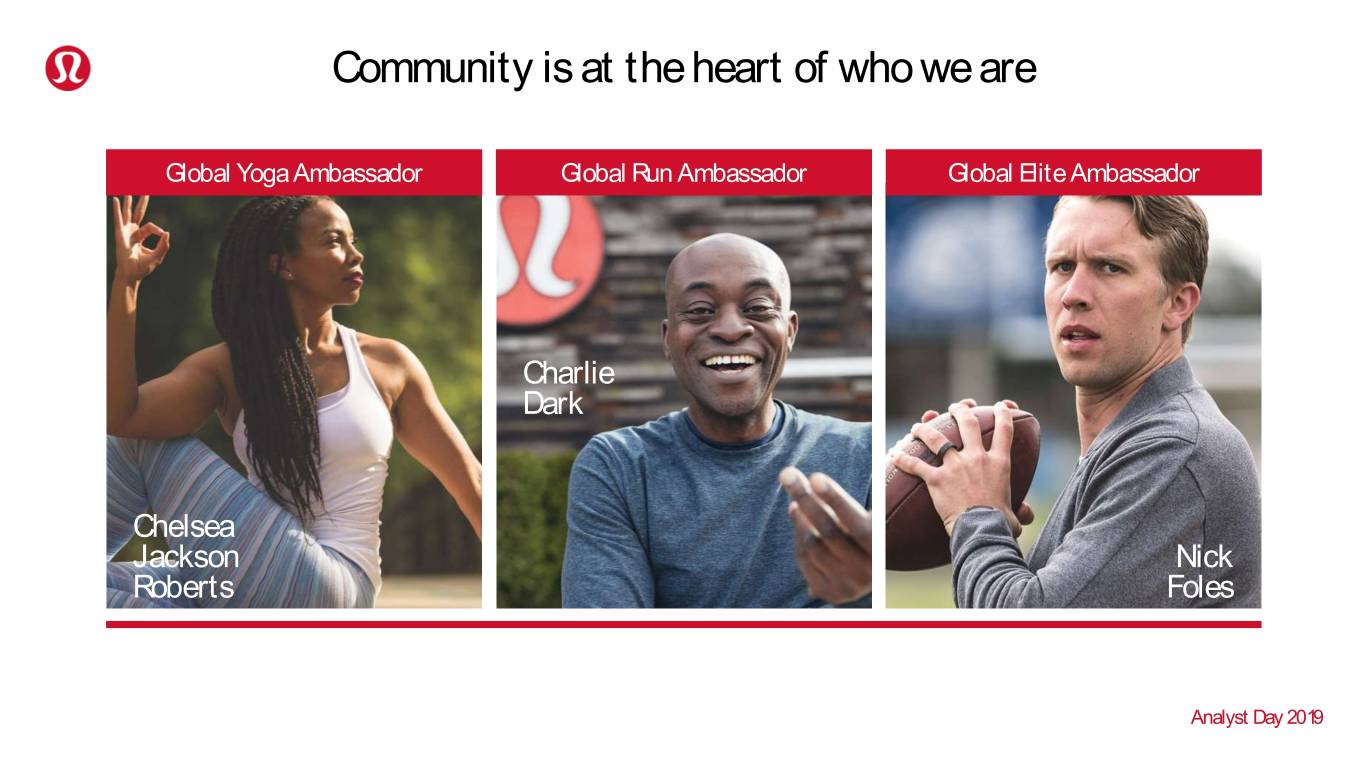

Community is at the heart of who we are Global Yoga Ambassador Global Run Ambassador Global Elite Ambassador Charlie Dark Chelsea Jackson Nick Roberts Foles Analyst Day 2019

Deepening our guest experience across channels Analyst Day 2019

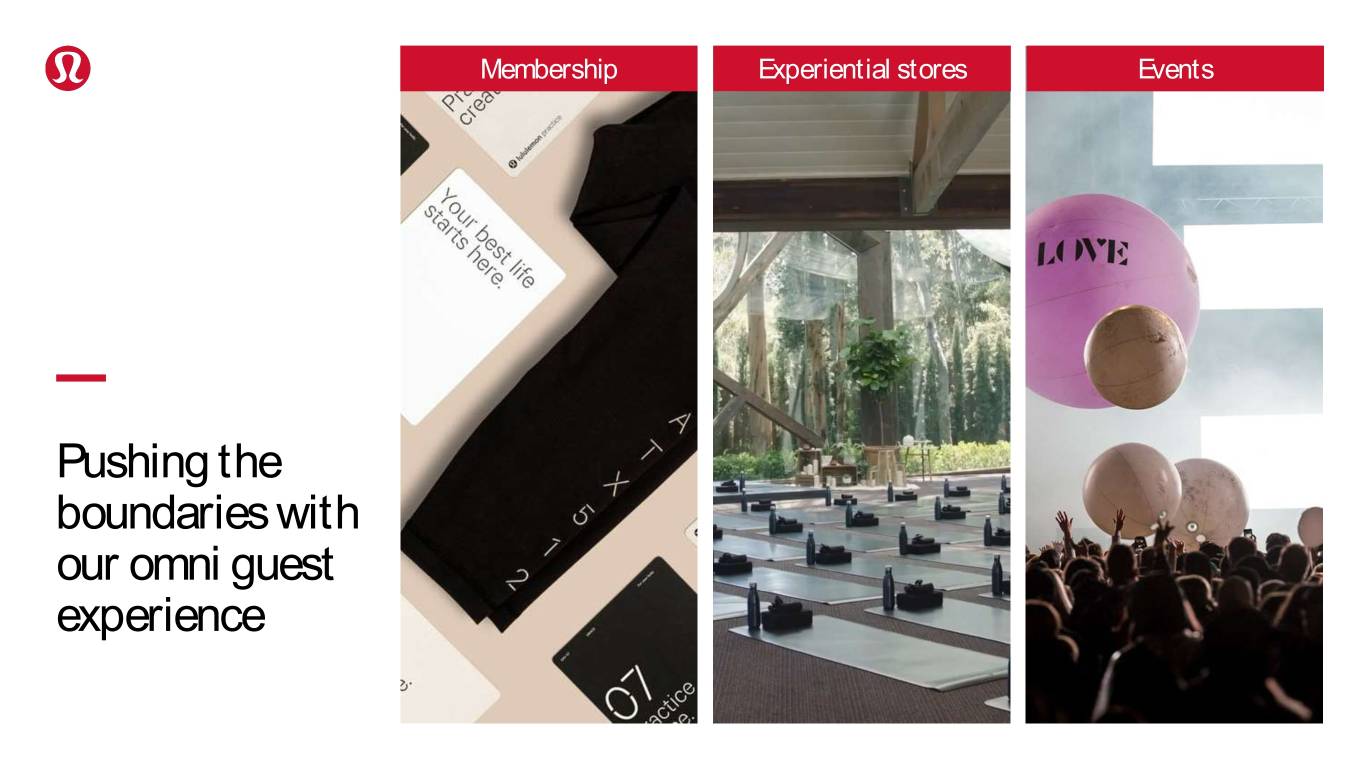

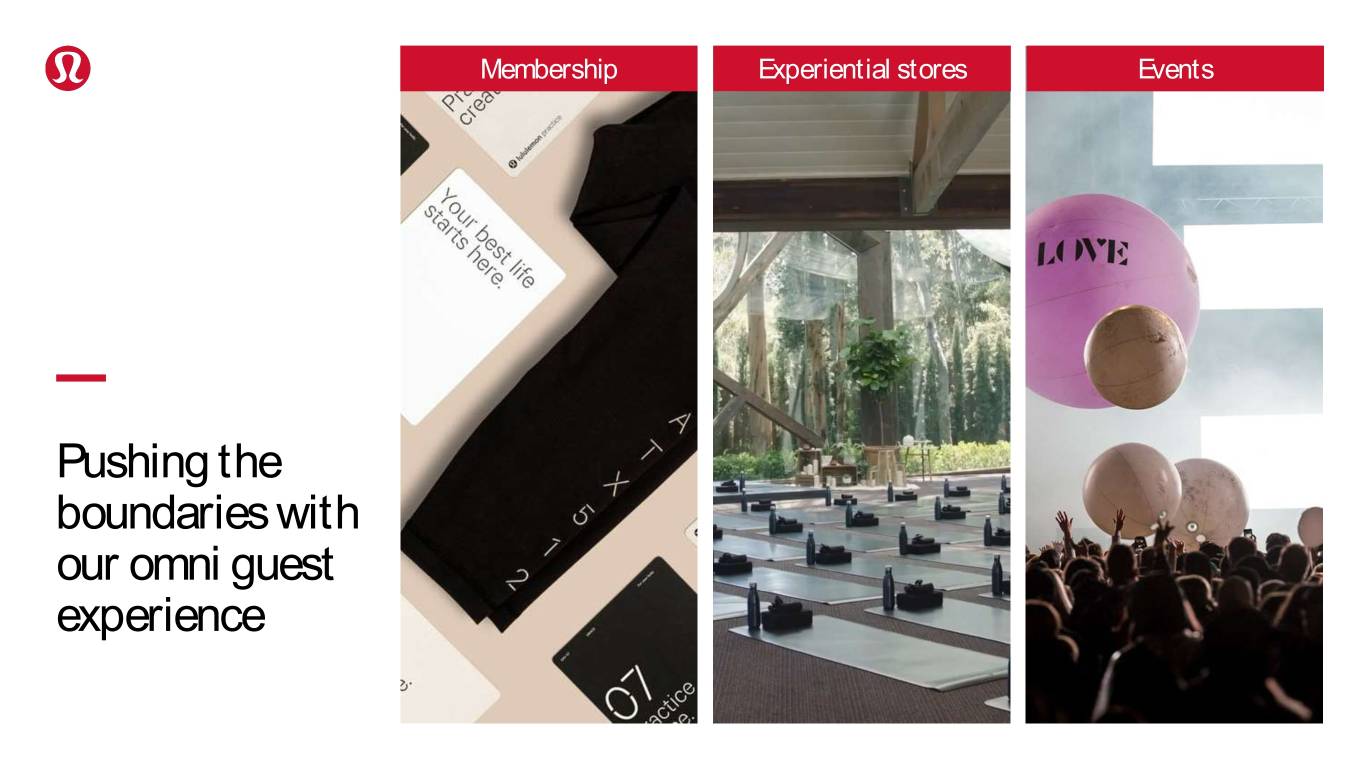

Membership Experiential stores Events Pushing the boundaries with our omni guest experience

An experiential guest membership program Analyst Day 2019

A truly unique experiential store environment Analyst Day 2019

Creating experiential events across our communities Analyst Day 2019

Our Vision Be the experiential brand that ignites a community of people living the sweatlife through sweat, grow and connect Analyst Day 2019

Stuart Haselden COO & EVP, International Analyst Day 2019

video China Community Analyst Day 2019

International Global Balanced Emerging Acceleration: Growth: Global Brand: Reaching Region & Growing Inflection Channel Awareness

Accelerating track record +40% CAGR $360M ASIA 434 EMEA Stores 721 Stores $135M ANZ 3136 Stores 2015 2018 Analyst Day 2019

International market Focus 2023 goal Our ambitions $115B* Sports • Key Geographies >30% CAGR apparel market • Omni-Channel Expansion • Product Innovation • Brand & Community *Source: Euromonitor Investments

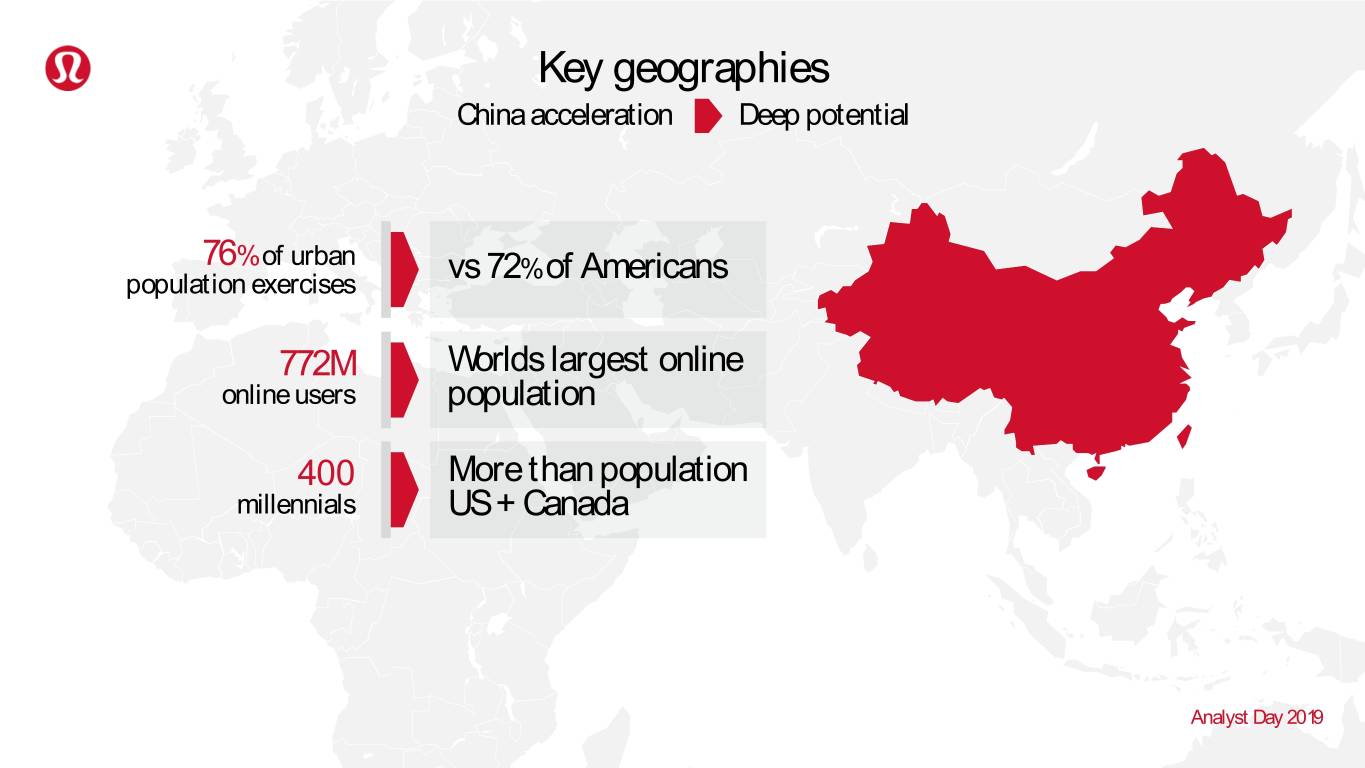

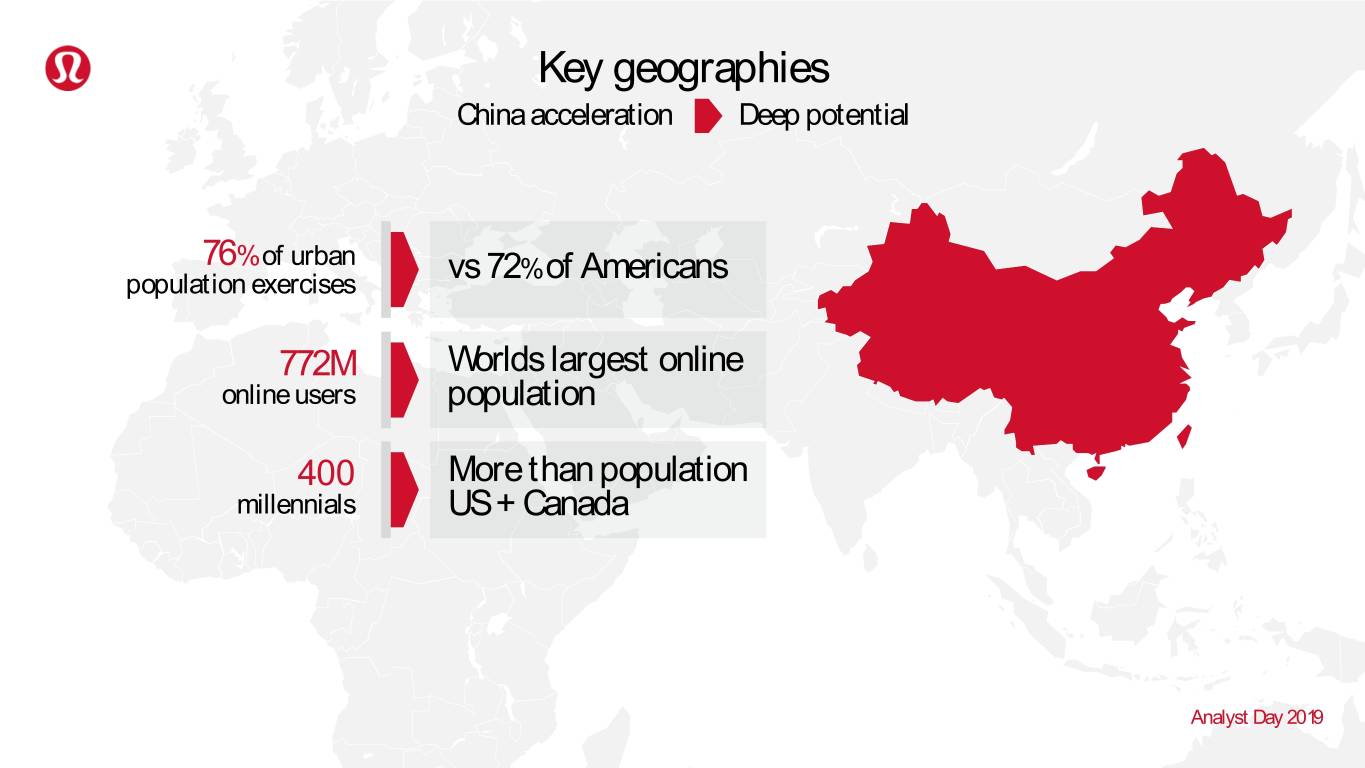

Key geographies China acceleration Deep potential 76% of urban vs % of Americans population exercises 72 772M Worlds largest online online users population 400 More than population millennials US + Canada Analyst Day 2019

Omni guest innovation Physical Accelerating unit growth Regionally tailored formats Digital Key investments Regional digital marketing Omni guest innovation Technology investments Cross-channel guest engagement Analyst Day 2019

Product innovation Asia fit Better meeting guests needs Unlocking regional demand Regional exclusives Leveraging local talent New creative capabilities Analyst Day 2019

Omni guest experiences Build community Local community Events Ambassadors & Influencers Amplify digitally Social Media Owned content & platforms Digital investments Enhanced engagement CRM investments Personalization Acquisition & retention programs Analyst Day 2019

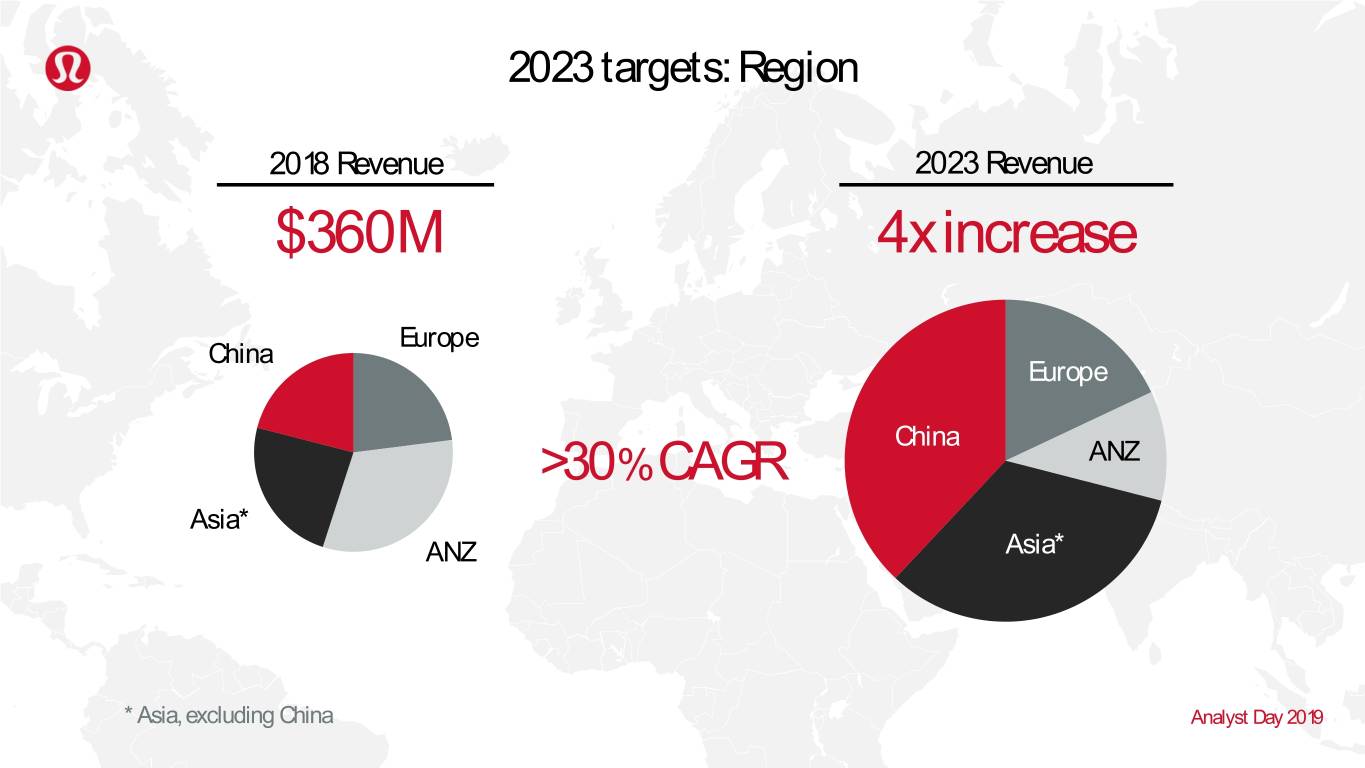

2023 International >30% CAGR

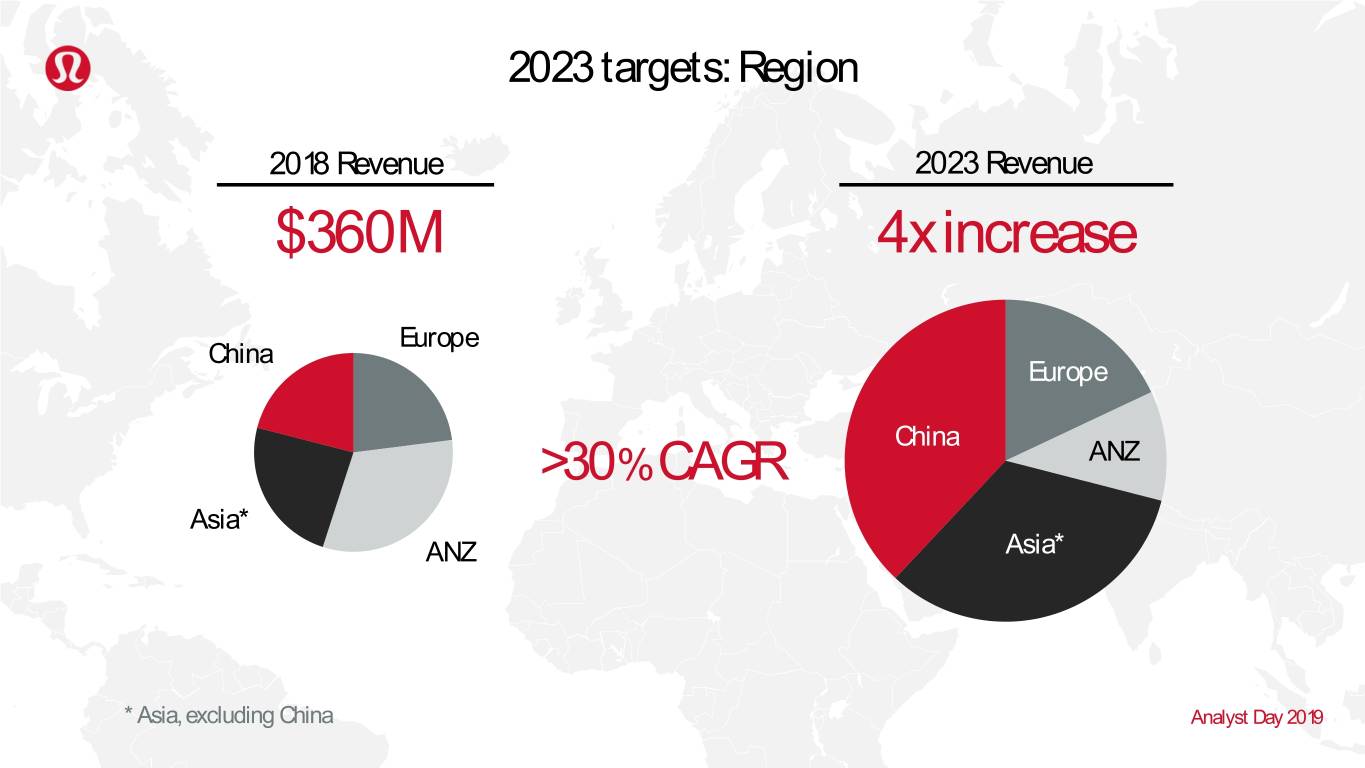

2023 targets: Region 2018 Revenue 2023 Revenue $360M 4xincrease Europe China Europe China >30% CAGR ANZ Asia* ANZ Asia* * Asia, excluding China Analyst Day 2019

2023 targets: Channel 2018 Revenue 2023 Revenue $360M 4xincrease Other Other Ecomm > % CAGR Stores Ecomm Stores 30 Analyst Day 2019

Profitability 2018 2023 China + + Asia (Excluding China) + + ANZ + + Europe ‒ + 10% - 15% Total company earnings Analyst Day 2019

We are on a lunch break and will be back at 1:15ET Analyst Day 2019

Enterprise fitness Supply chain Technology People processes Cost structure Ability to scale globally Analyst Day 2019

Enterprise fitness: Supply chain Cost Speed Flexibility Analyst Day 2019

Enterprise fitness: Supply chain 2023 Gross margin potential Modest improvement 2018 annually Gross margin 55.2% Segmentation Volume 680 bps DC network efficiencies 2015 improvement Gross margin 48.4% Sourcing efficiencies Segmentation Volume Analyst Day 2019

Enterprise fitness: Technology Channel Product Guest Infrastructure Analyst Day 2019

Enterprise fitness: People processes Organization structure planning Talent management Key people processes Analyst Day 2019

Enterprise fitness Modest SGA Leverage Analyst Day 2019

PJ Guido Financial Overview Analyst Day 2019

Financial summary Next five years 2018 - 2023 Revenue Gross margin SG&A Operating growth expansion leverage income (CAGR) (Annual) (Annual) improvement Low teens Modest Modest > Revenue expansion leverage growth Analyst Day 2019

Financial summary Next five years 2018 - 2023 EPS Square growth Capex footage growth as % of sales (Annual) income 6-8% Low Double growth Digit Analyst Day 2019

Powerful business model Continuous innovation Strong guest connection Multiple expansion opportunities Financial flexibility Analyst Day 2019

Digital International Key growth drivers

Revenue growth by product Untapped growth with continued strength in core New categories New categories Accessories Accessories Other 9% (core) (core) 70% 20% CAGR Low double digit CAGR 2018 2023 Note: New categories includes selfcare, footwear, membership, all other Analyst Day 2019

Revenue growth by region Brand resonating across the globe EMEA North America APAC EMEA APAC EMEA 2% APAC 9% North America North America 89% 30%+ CAGR LDD CAGR 2018 2023 Note: APAC includes Australia and New Zealand Analyst Day 2019

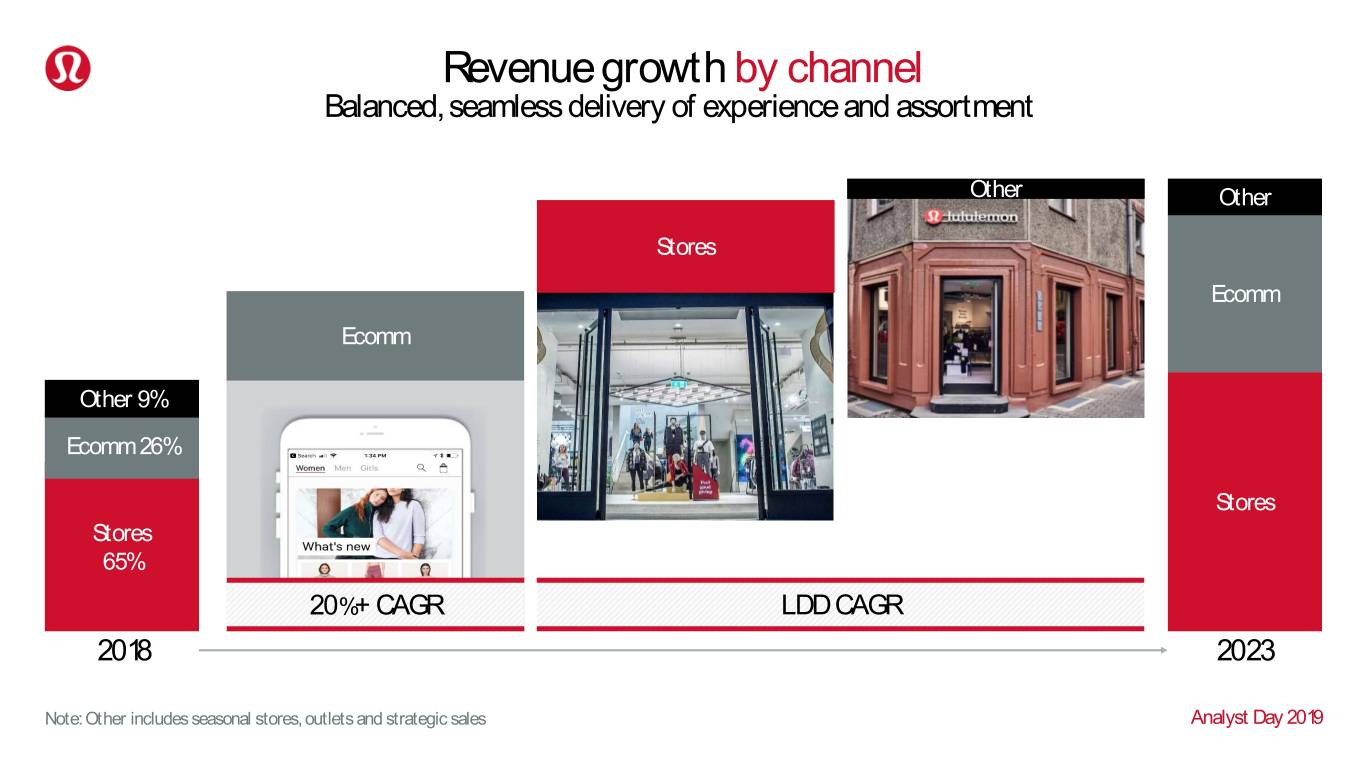

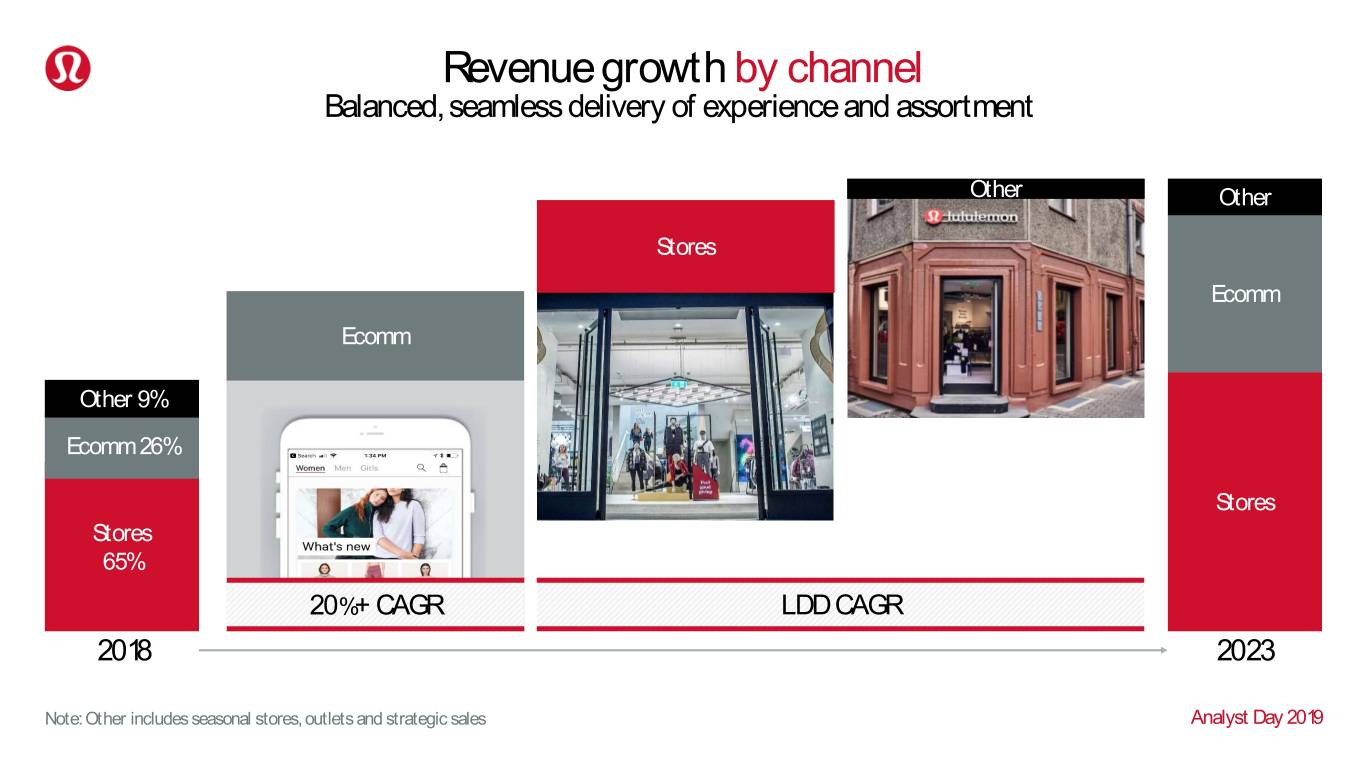

Revenue growth by channel Balanced, seamless delivery of experience and assortment Other Other Stores Ecomm Ecomm Other 9% Ecomm 26% Stores Stores 65% 20%+ CAGR LDD CAGR 2018 2023 Note: Other includes seasonal stores, outlets and strategic sales Analyst Day 2019

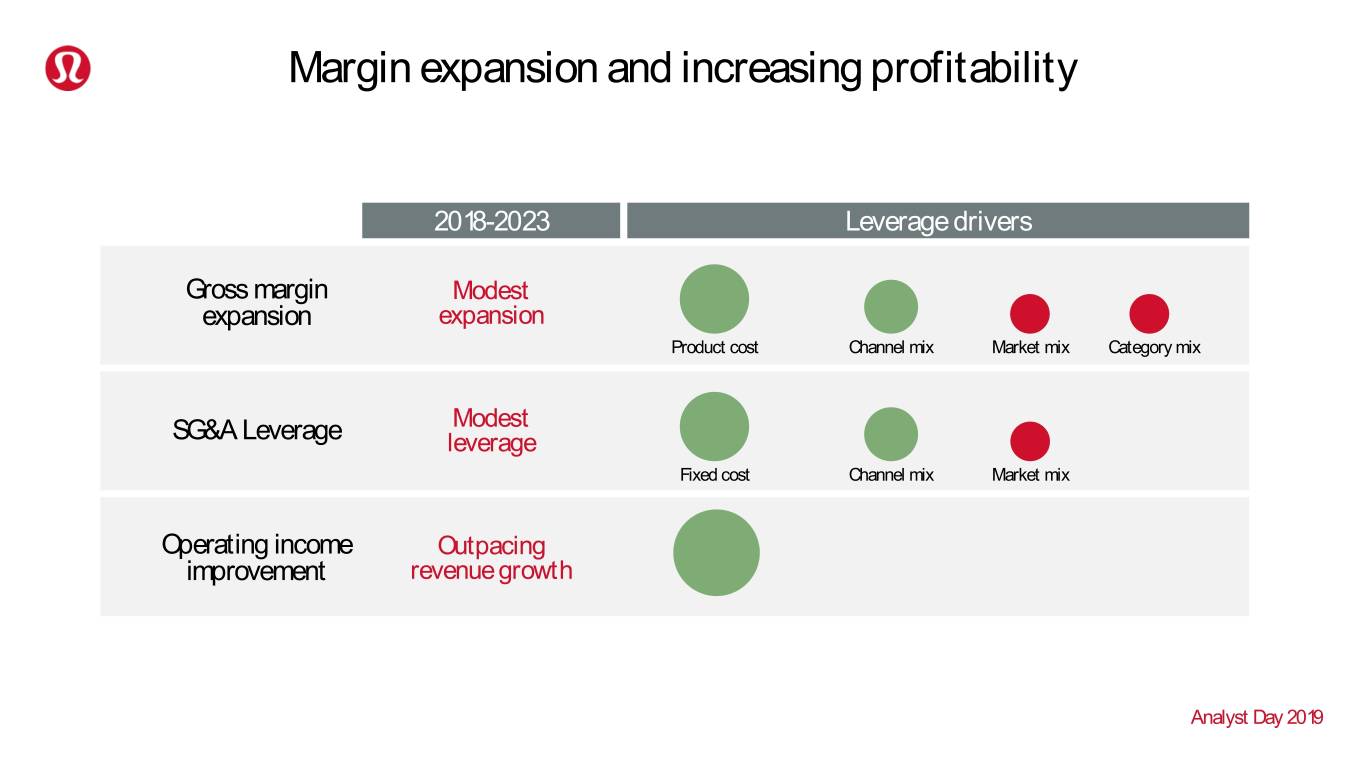

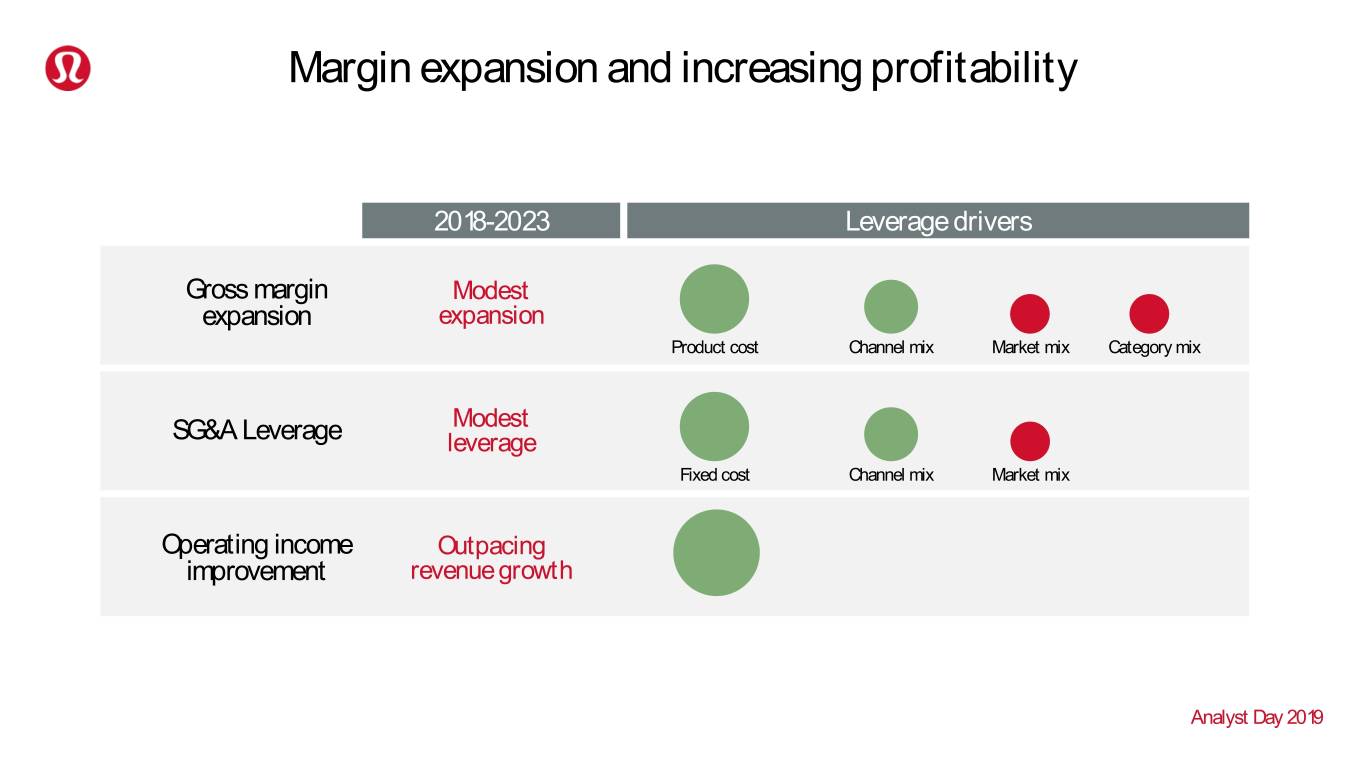

Margin expansion and increasing profitability 2018-2023 Leverage drivers Gross margin Modest expansion expansion Product cost Channel mix Market mix Category mix SG&A Leverage Modest leverage Fixed cost Channel mix Market mix Operating income Outpacing improvement revenue growth Analyst Day 2019

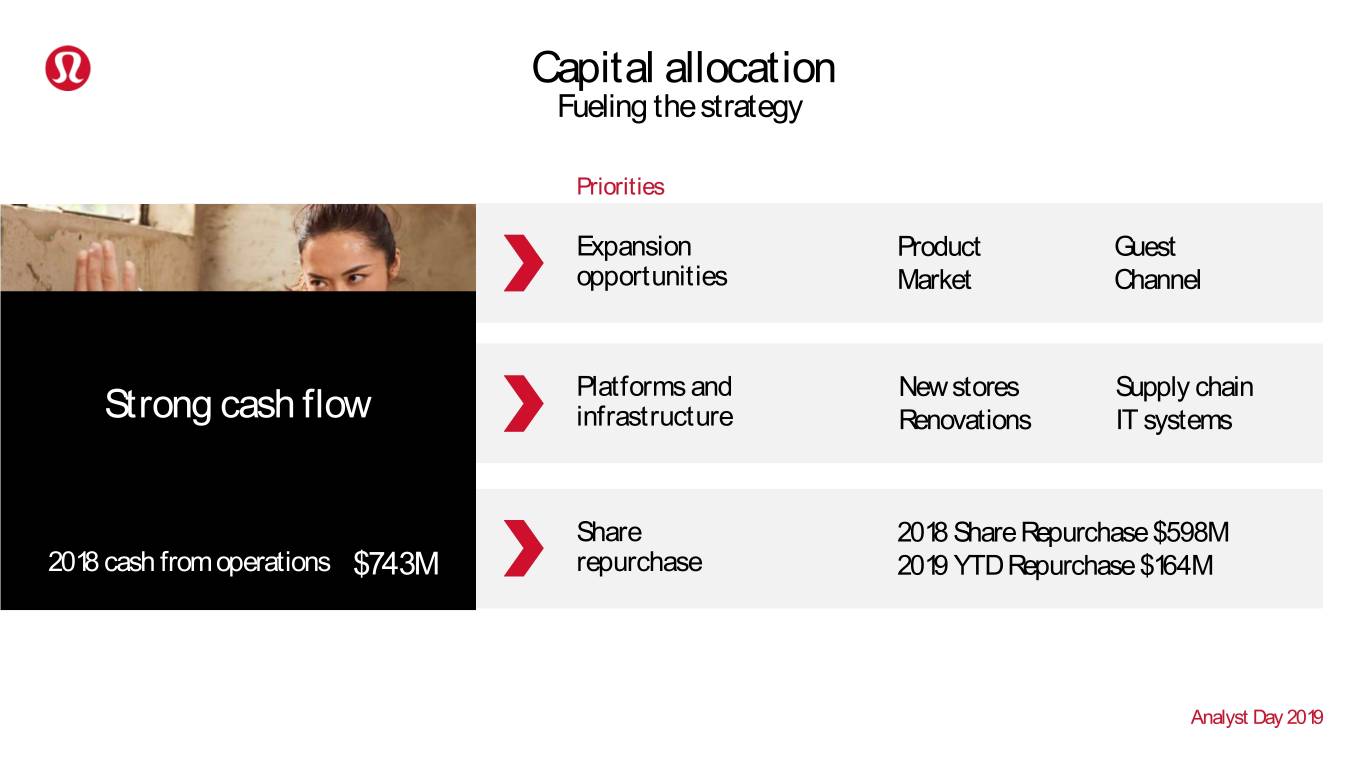

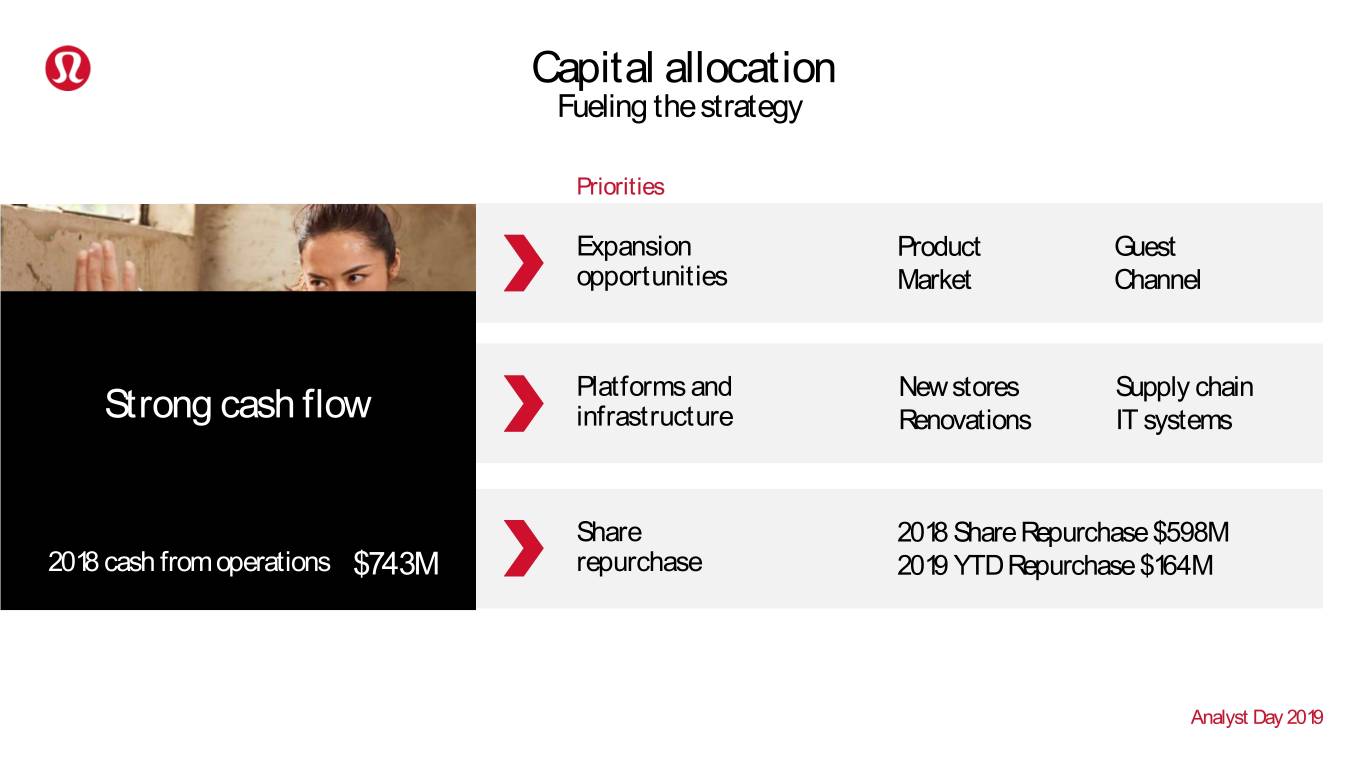

Capital allocation Fueling the strategy Priorities Expansion Product Guest opportunities Market Channel Platforms and New stores Supply chain Strong cash flow infrastructure Renovations IT systems Share 2018 Share Repurchase $598M 2018 cash from operations $743M repurchase 2019 YTD Repurchase $164M Analyst Day 2019

Global store footprint Low double digit square footage growth EMEA China North America 2023 Mid-teens 2023 APAC annual square 40%+ annual 2023 2018 (ex. China) 2018 footage21 square15 footage HSD annual growthStores growthStores square2018 footage 2023 growth349 Stores 35%+2018 annual square55 footage growthStores Analyst Day 2019

Compelling investment thesis Powerful business model Increasing profitability Multiple growth drivers Financial flexibilityAnalyst Day 2019

Q & A Analyst Day 2019

Calvin McDonald Chief Executive Officer Analyst Day 2019

The full potential of lululemon Analyst Day 2019

Our Vision Be the experiential brand that ignites a community of people living the sweatlife through sweat, grow and connect Analyst Day 2019

Thank you Analyst Day 2019

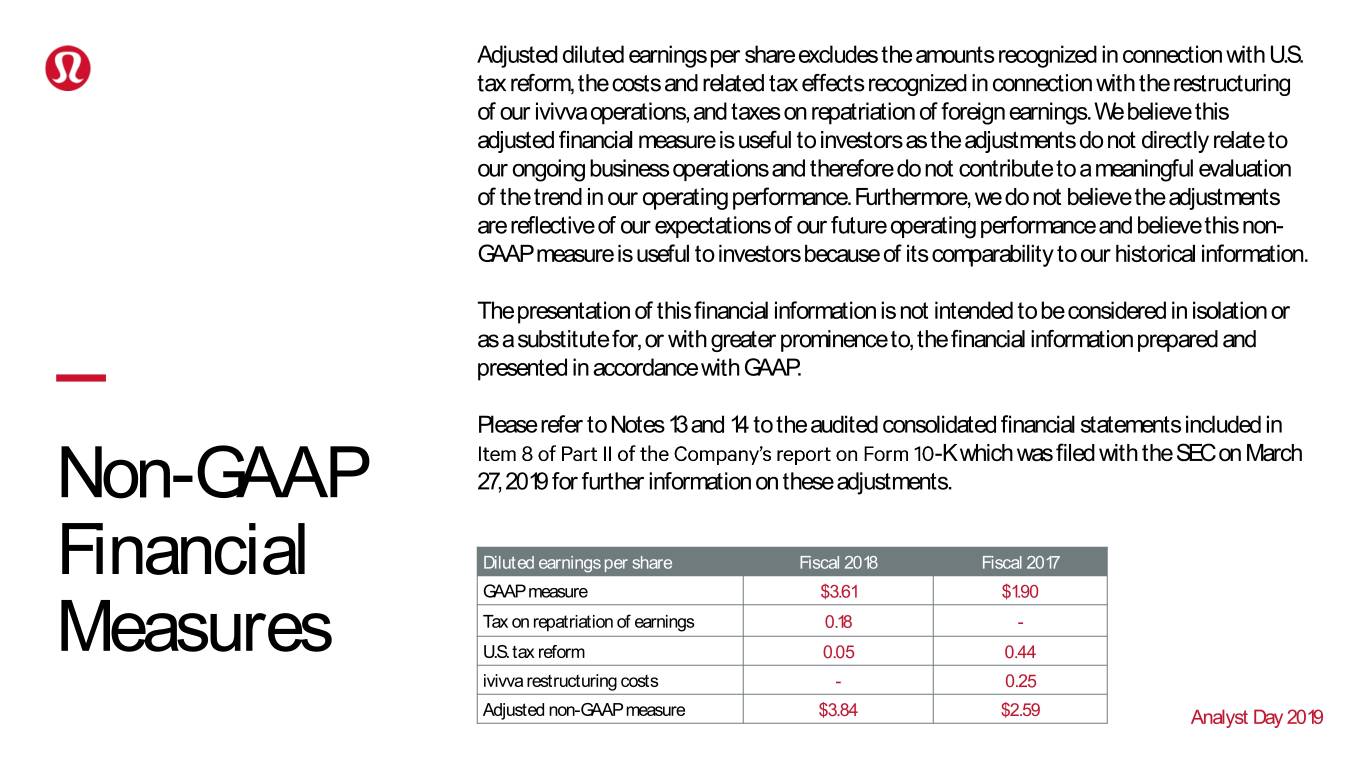

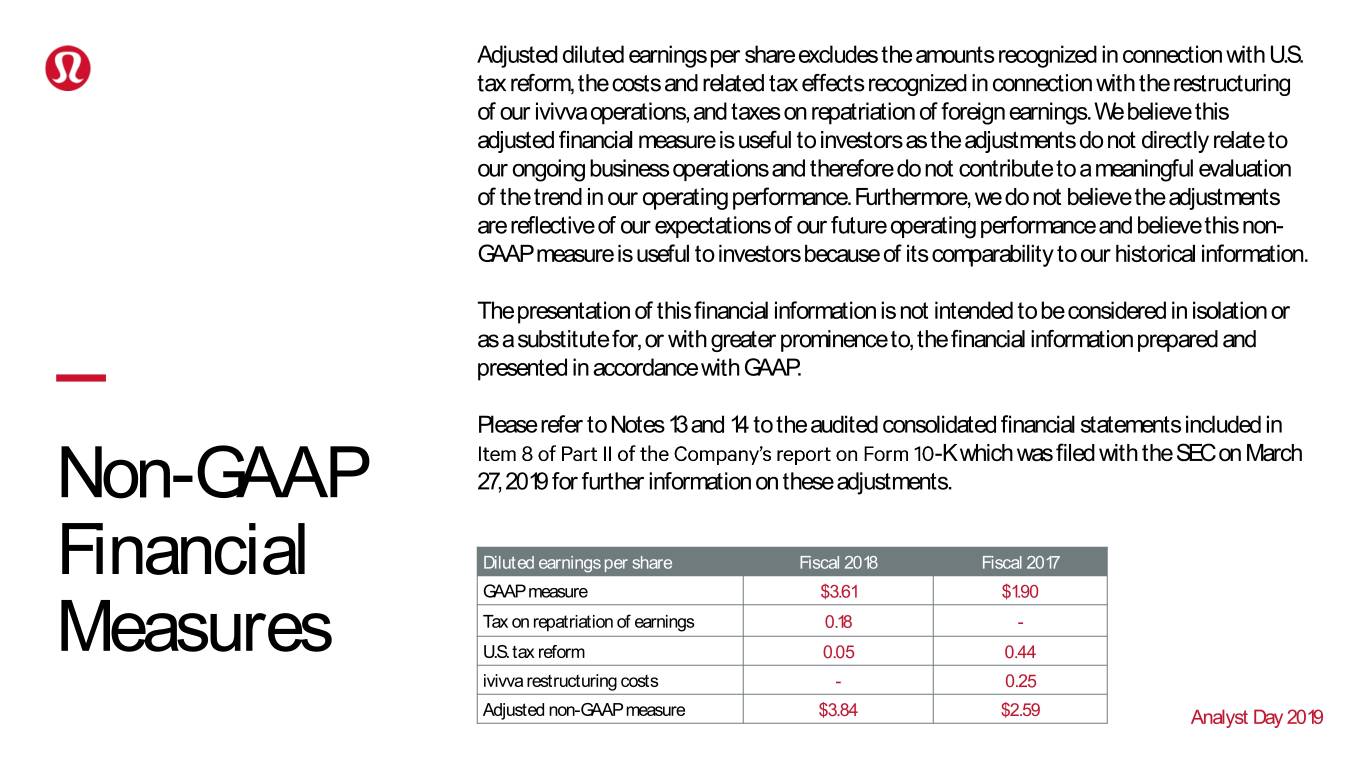

Adjusted diluted earnings per share excludes the amounts recognized in connection with U.S. tax reform, the costs and related tax effects recognized in connection with the restructuring of our ivivva operations, and taxes on repatriation of foreign earnings. We believe this adjusted financial measure is useful to investors as the adjustments do not directly relate to our ongoing business operations and therefore do not contribute to a meaningful evaluation of the trend in our operating performance. Furthermore, we do not believe the adjustments are reflective of our expectations of our future operating performance and believe this non- GAAP measure is useful to investors because of its comparability to our historical information. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or with greater prominence to, the financial information prepared and presented in accordance with GAAP. Please refer to Notes 13 and 14 to the audited consolidated financial statements included in -K which was filed with the SEC on March Non-GAAP 27, 2019 for further information on these adjustments. Financial Diluted earnings per share Fiscal 2018 Fiscal 2017 GAAP measure $3.61 $1.90 Tax on repatriation of earnings 0.18 - Measures U.S. tax reform 0.05 0.44 ivivva restructuring costs - 0.25 Adjusted non-GAAP measure $3.84 $2.59 Analyst Day 2019