UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☑ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | | | | | | | | | | |

| ☐ | | Preliminary Proxy Statement |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | | Definitive Proxy Statement |

| ☐ | | Definitive Additional Materials |

| ☐ | | Soliciting Material Pursuant to §240.14a-12 |

lululemon athletica inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | | | | | | | | | | |

| Payment of Filing Fee (Check all boxes that apply): |

| ☑ | | No fee required |

| ☐ | | Fee paid previously with preliminary materials |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

TO OUR SHAREHOLDERS:

We are pleased to invite you to attend the annual meeting of shareholders of lululemon athletica inc. on Wednesday, June 8, 2022, beginning at 8:00 a.m., Pacific Time. The annual meeting will be a virtual meeting of shareholders, which will be conducted via live webcast. You will be able to attend the annual meeting of shareholders online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/lulu2022. You also will be able to vote your shares electronically at the annual meeting.

We are excited to continue to embrace the latest technology to provide expanded access, improved communication, and cost savings for our shareholders and the company. We believe hosting a virtual meeting helps enable greater shareholder attendance at the annual meeting by allowing shareholders that might not otherwise be able to travel to a physical meeting to attend online and participate from any location around the world.

Details regarding how to attend the meeting online and the business to be conducted at the annual meeting are more fully described in the accompanying notice and proxy statement.

This year we are again providing access to our proxy materials over the Internet under the U.S. Securities and Exchange Commission's "notice and access" rules. As a result, we are sending to many of our shareholders a notice instead of a paper copy of this proxy statement and our 2021 annual report. The notice contains instructions on how to access those documents over the Internet. The notice also contains instructions on how each of those shareholders can receive a paper copy of our proxy materials, including this proxy statement, our 2021 annual report, and a form of proxy card or voting instruction card. All shareholders who do not receive a notice, including shareholders who have previously requested to receive paper copies of proxy materials, will receive a paper copy of the proxy materials by mail unless they have previously requested delivery of proxy materials electronically. Continuing to employ this distribution process will conserve natural resources and reduce the costs of printing and distributing our proxy materials.

Your vote is important. Regardless of whether you plan to participate in the annual meeting online, we hope you will vote as soon as possible. You may vote by proxy over the Internet, telephone or, if you received paper copies of the proxy materials by mail, you may also vote by mail by following the instructions on the proxy card or voting instruction card. Voting over the Internet, telephone, or by paper proxy, or voting instruction card will ensure your representation at the annual meeting regardless of whether you attend the virtual meeting.

Thank you for your ongoing support of, and continued interest in, lululemon.

Sincerely,

| | |

| /s/ Calvin McDonald |

| Calvin McDonald |

| Chief Executive Officer |

TABLE OF CONTENTS

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| | | | | | | | |

| Date | | Virtual Meeting |

June 8, 2022 at 8:00 a.m., Pacific Time (Online check-in will begin at 7:30 a.m., Pacific Time) | | Virtual Live webcast at www.virtualshareholdermeeting.com/lulu2022. |

| | | | | | | | | | | | | | |

| Proposal | Board recommends you vote: |

| MANAGEMENT PROPOSALS |

| Proposal No. 1 | Election of three Class III directors to a three-year term | For ü |

| Proposal No. 2 | Ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for Fiscal 2022 | For ü |

| Proposal No. 3 | Advisory vote to approve the compensation of our named executive officers | For ü |

| SHAREHOLDER PROPOSAL |

| Proposal No. 4 | Shareholder proposal regarding a report on the slaughter methods used to procure down (if properly presented at the meeting) | Against û |

Shareholder vote

Shareholders of record at the close of business on April 12, 2022, are entitled to notice of and to vote at the annual meeting and any adjournment or postponement thereof. A list of those shareholders entitled to vote at the annual meeting will be available for examination by any shareholder for any purpose germane to the meeting for a period of ten days prior to the meeting at our principal offices. If you would like to schedule an appointment to examine the shareholder list during this period, please email our company secretary at investors@lululemon.com. The shareholder list will also be available to shareholders of record during the annual meeting on the virtual meeting website.

Online Access to Proxy

We are pleased to continue using the U.S. Securities and Exchange Commission's "notice and access" delivery model allowing companies to furnish proxy materials to their shareholders over the Internet. We believe that this delivery process will expedite shareholders' receipt of proxy materials and lower the costs and reduce the environmental impact of the annual meeting. On or about April 27, 2022, we intend to send to our shareholders a Notice of Internet Availability of Proxy Materials, containing instructions on how to access our proxy statement and 2021 annual report, on how to vote online, and on how to access the virtual annual meeting and the shareholder list. This notice also provides instructions on how to receive a paper copy of the proxy materials by mail.

Technical Help

If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Shareholder Meeting login page.

Whether or not you plan to attend the annual meeting, please vote your shares via the Internet or telephone, as described in the accompanying materials, as soon as possible to ensure that your shares are represented at the meeting, or, if you elect to receive a paper copy of the proxy card by mail, you may mark, sign and date the proxy card and return it in the enclosed postage-paid envelope. If you attend the virtual meeting you will, of course, have the right to revoke the proxy and vote your shares electronically at the meeting.

| | | | | |

| |

| By order of the board of directors, | |

| |

| /s/ Calvin McDonald | |

| Calvin McDonald | |

| Chief Executive Officer | |

Vancouver, British Columbia

April 27, 2022

LULULEMON ATHLETICA INC.

PROXY STATEMENT

2022 ANNUAL MEETING OF SHAREHOLDERS

Wednesday, June 8, 2022

GENERAL INFORMATION

This proxy statement is being provided to solicit proxies on behalf of the board of directors of lululemon athletica inc. for use at the annual meeting of shareholders to be held on Wednesday, June 8, 2022 at 8:00 a.m., Pacific Time. Our principal offices are located at 1818 Cornwall Avenue, Vancouver, British Columbia V6J 1C7.

Virtual Annual Meeting

We are pleased to inform you that this year's meeting will again be a virtual meeting, which will be conducted via live webcast. You will be able to attend the annual meeting online, vote your shares electronically, and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/lulu2022. We expect to first make this proxy statement available, together with our 2021 annual report, to shareholders on or about April 27, 2022.

Our board of directors considers the appropriate format for our annual meeting of shareholders on an annual basis. We are pleased to continue to embrace the latest technology to provide expanded access, improved communication, and cost savings for our shareholders and lululemon. Our virtual format allows shareholders to submit questions and comments and to vote during the meeting. We believe the virtual meeting format allows our shareholders to engage with us no matter where they live in the world, and is accessible and available on any internet-connected device, be it a phone, a tablet, or a computer. We believe the benefits of a virtual meeting allow our shareholders to have robust engagement with lululemon, and is in the best interests of our shareholders at this time.

Who May Vote

Only persons who are holders of record of our common stock or our special voting stock at the close of business on April 12, 2022, which is the record date, will be entitled to notice of and to vote at the annual meeting. On the record date, 122,816,107 shares of common stock and 5,203,012 shares of special voting stock were issued and outstanding. Each share of common stock and special voting stock is entitled to one vote at the annual meeting. Holders of common stock and special voting stock will vote together as a single class on all matters that come before the annual meeting. Accordingly, throughout this proxy statement we refer generally to our outstanding common stock and special voting stock together as our "common stock."

What Constitutes a Quorum

Shareholders may not take action at the annual meeting unless there is a quorum present at the meeting. Shareholders participating in the virtual meeting are considered to be attending the meeting "in person." The presence, in person or by proxy, of a majority of the outstanding shares of common stock entitled to vote as of the close of business on the record date constitutes a quorum. Abstentions and broker non-votes will each be counted as present for the purposes of determining the presence of a quorum. Broker non-votes occur when brokers holding shares in street name for beneficial owners do not receive instructions from the beneficial owners about how to vote the shares. An abstention occurs when a shareholder withholds such shareholder's vote by checking the "abstain" box on the proxy card, or similarly elects to abstain via the Internet or telephone voting. Under the rules that govern brokers who are voting with respect to shares held in street name, brokers have the discretion to vote such shares on routine matters, including the ratification of the appointment of an independent registered accounting firm.

Vote Required

MANAGEMENT PROPOSALS

Proposal No. 1: A nominee for director will be elected to the board if the votes cast for the nominee's election exceed the votes cast against that nominee's election at the meeting. Abstentions and broker non-votes will have no effect on the outcome of the election and we do not have cumulative voting in the election of directors.

Proposal No. 2: The selection of our independent registered public accounting firm will be ratified if the votes cast for this proposal exceed the votes cast against this proposal at the meeting. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

Proposal No. 3: The compensation of our named executive officers will be approved, on an advisory basis, if the votes cast for this proposal exceed the votes cast against this proposal at the meeting. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

SHAREHOLDER PROPOSALS

Proposal No. 4: Under our current bylaws, approval of the shareholder proposal requires the affirmative vote of a majority of the votes cast at the meeting. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

Voting Process

Shares that are properly voted or for which proxy cards are properly executed and returned will be voted at the annual meeting in accordance with the directions given. In the absence of directions, these shares will be voted "FOR" the election of the director nominees named in this proxy statement, "FOR" Proposals No. 2 and No. 3, and “AGAINST” Proposal No. 4 – Shareholder Proposal.

We do not expect any other matters to be brought before the annual meeting. If, however, other matters are properly presented, the persons named as proxies will vote in accordance with their discretion with respect to those matters.

The manner in which your shares may be voted depends on how your shares are held. If you are the record holder of your shares, meaning you appear as the holder of your shares on the records of our stock transfer agent, you may vote those shares via the Internet or telephone, or, if you request a printed copy of the proxy materials, via a proxy card for voting those shares included with the printed proxy materials. If you own shares in street name, meaning you are a beneficial owner with your shares held through a bank or brokerage firm, you may instead receive a notice with instructions on how to access proxy materials as well as how you may instruct your bank or brokerage firm how to vote your shares.

| | | | | |

| Voting on the Internet | You can vote your shares via the Internet by following the instructions in the notice. The Internet voting procedures are designed to authenticate your identity and to allow you to vote your shares and confirm your voting instructions have been properly recorded. If you vote via the Internet, you do not need to complete and mail a proxy card. We encourage you to vote your shares via the Internet in advance of the annual meeting even if you plan to attend the annual meeting. |

| Voting by Mail | You can vote your shares by mail by requesting a printed copy of the proxy materials sent to your address. When you receive the proxy materials, you may fill out the proxy card enclosed therein and return it per the instructions on the card. By signing and returning the proxy card according to the instructions provided, you are enabling the individuals named on the proxy card, known as "proxies," to vote your shares at the annual meeting in the manner you indicate. If you request a printed copy of the proxy materials, we encourage you to sign and return the proxy card even if you plan to attend the annual meeting. |

| Voting by Telephone | You can vote your shares by telephone. Instructions are included with your notice. If you vote by telephone, you do not need to complete and mail your proxy card. |

Attendance and Voting at the Annual Meeting

Most of our shareholders hold their shares through a broker, trustee or other nominee rather than directly in their own name. There are some distinctions between shares held of record and those owned beneficially. If your shares are registered directly in your name with our transfer agent, you are considered, with respect to those shares, the "shareholder of record." As the shareholder of record, you have the right to attend the meeting, grant your voting proxy directly to lululemon or to a third party, or to vote your shares during the meeting. If your shares are held in a brokerage account, by a trustee or by another nominee (that is, in "street name"), you are considered the "beneficial owner" of those shares. As the beneficial owner of those shares, you have the right to direct your broker, trustee or nominee how to vote, or to vote your shares during the annual meeting.

Revocation

If you are the record holder of your shares, you may revoke a previously granted proxy at any time before the annual meeting by delivering to the company secretary of lululemon a written notice of revocation or a duly executed proxy bearing a later date or by voting your shares electronically at the annual meeting. Any shareholder owning shares in street name may change or revoke previously given voting instructions by contacting the bank or brokerage firm holding the shares. Simply attending the annual meeting does not revoke your proxy. Your last vote, prior to or at the annual meeting, is the vote that will be counted.

Householding

The SEC permits companies to send a single notice, and for those shareholders that elect to receive a paper copy of proxy materials in the mail, one copy of this proxy statement, together with our 2021 annual report, to any household at which two or more shareholders reside, unless contrary instructions have been received, but only if we provide advance notice and follow certain procedures. In such cases, each shareholder continues to receive a separate notice, and for those shareholders that elect to receive a paper copy of proxy materials in the mail, one copy of our 2021 annual report and this proxy statement. This householding process reduces the volume of duplicate information and reduces printing and mailing expenses. We have not instituted householding for shareholders of record; however, certain brokerage firms may have instituted householding for beneficial owners of our common stock held through brokerage firms. If your family has multiple accounts holding our common stock, you may have already received a householding notification from your broker. Please contact your broker directly if you have any questions or require additional copies of the notice, our 2021 annual report and this proxy statement. The broker will arrange for delivery of a separate copy of the notice, and, if so requested, a separate copy of these proxy materials promptly upon your written or oral request. You may decide at any time to revoke your decision to household, and thereby receive multiple copies.

Solicitation of Proxies

We pay the cost of soliciting proxies for the annual meeting. We solicit by mail, telephone, personal contact and electronic means and arrangements are made with brokerage houses and other custodians, nominees and fiduciaries to send notices, and if requested, other proxy materials, to beneficial owners. Upon request, we will reimburse them for their reasonable expenses. In addition, our directors, officers and employees may solicit proxies, either personally or by telephone, facsimile, mail, email or other methods of electronic communication. We have also retained Alliance Advisors, LLC, a proxy solicitation firm, to assist in the solicitation of proxies for a fee of $10,000 plus reasonable out-of-pocket expenses. Shareholders are requested to return their proxies without delay.

Note Regarding Forward-Looking Statements

This proxy statement includes estimates, projections, statements relating to our business plans, objectives, and expected operating results that are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. We use words such as "anticipates," "believes," "estimates," "may," "intends," "expects," and similar expressions to identify forward-looking statements. All forward-looking statements are inherently uncertain as they are based on our current expectations and assumptions concerning future events and may be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including the risks, uncertainties and assumptions described in the "Risk Factors," “Quantitative and Qualitative Disclosures About Market Risk,” and “Management’s Discussion and Analysis” sections of our periodic reports on Form 10-K and Form 10-Q. Any or all of our forward-looking statements in this report may turn out to be inaccurate. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this report may not occur as contemplated, and our actual results could differ materially from those anticipated or implied by the forward-looking statements. All forward-looking statements in this proxy statement are made as of the date hereof, based on information available to us as of the date hereof, and we assume no obligation to update any forward-looking statement.

This proxy statement includes several website addresses and references to additional materials found on those websites. These websites and materials are not incorporated by reference herein.

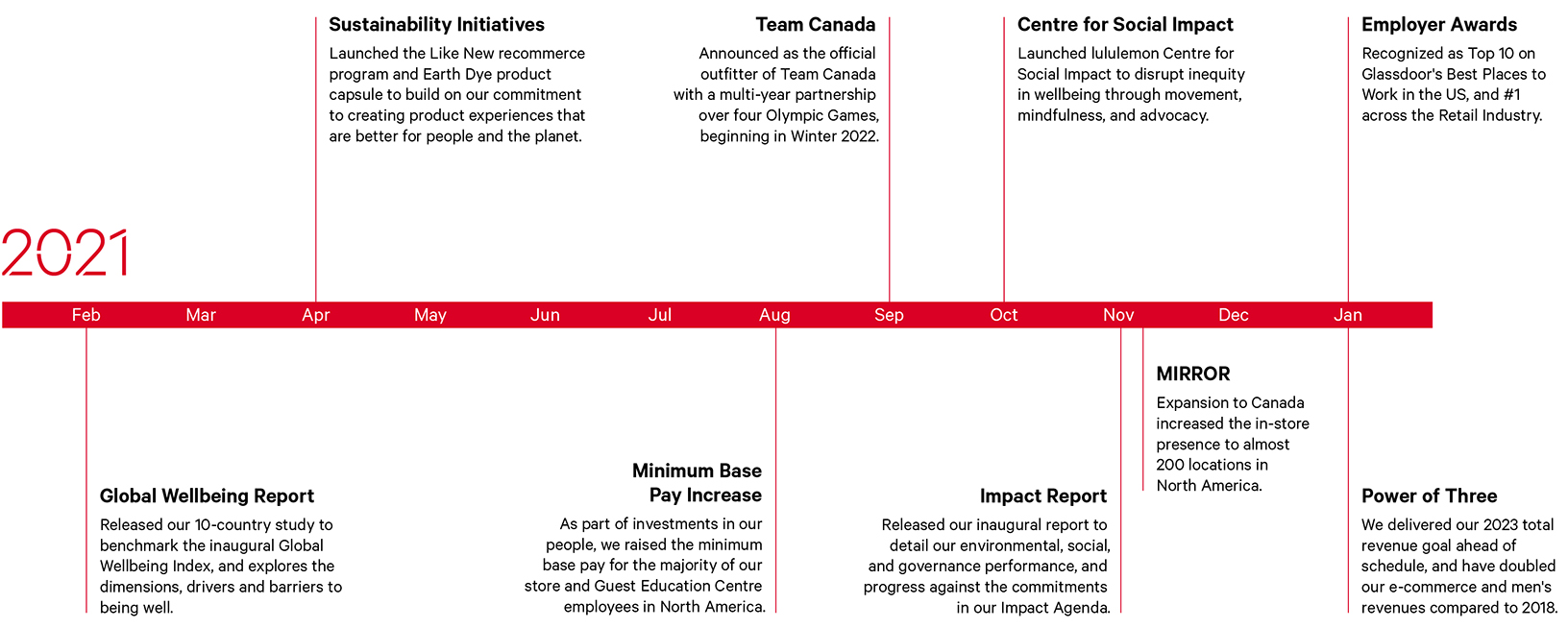

YEAR IN REVIEW

In this proxy statement, we refer to the fiscal year ended January 30, 2022 as "2021" and the fiscal year ended January 31, 2021 as "2020."

Our COVID-19 Response

We closely monitor the changing landscape of COVID-19 so that we can make appropriate decisions to support and keep our people safe. Over the last two years, we have responded to the pandemic with a variety of measures from temporarily closing our stores to committing to pay protection for employees during the COVID-19 related closures. During 2020 we launched a hardship fund for employees, the We Stand Together Fund, and launched an Ambassador Relief Fund, and these continued in 2021.

We created a wide range of resiliency and connection sessions and tools to support our people during the pandemic and we made these resources available to our guests and the broader community.

As we continue to navigate the COVID-19 pandemic, we continue to prioritize the safety of our people and our guests. We are closely monitoring the situation in the markets and communities that we serve. We will temporarily close stores and restrict operations as necessary, based upon information from government and health officials.

Global Wellbeing Report

We released our first-ever Global Wellbeing Report, advancing our commitment to advocate for holistic wellbeing through movement, mindfulness, and connection. The report reveals an urgency to improve across physical, mental, and social dimensions - punctuating the impact of the pandemic and social, political, and environmental issues. We expect this report to accelerate our efforts to support the wellbeing of our guests, employees and the communities we serve.

lululemon Studio

Building on the learnings from our lululemon pilot membership program, as well our vision to create a new path for connected fitness, we plan to launch a new two-tiered membership program in 2022. The intent of the program is to build stronger guest engagement, loyalty and community and to create a versatile and more immersive fitness offering.

lululemon studio will represent our highest level of membership. In addition to being able to access in-home fitness classes through the MIRROR, our interactive workout platform, we plan to provide members with access to exclusive digital content from new studio partners, discounts to in-person classes at partner studios, and other benefits across the lululemon eco-system.

In 2021 we set up MIRROR shop-in-shops in approximately 200 stores in North America, including launching in Canada, and we continued to enhance the offering with new content, digital enhancements and connected accessories.

Impact Report

We launched our inaugural Impact Report to share our performance and progress towards the environmental and social commitments in our Impact Agenda, released a year ago. The Impact Agenda is our broad vision and strategy to help transform our industry and create a healthier world. The annual Impact Report serves as a platform to share our evolved vision, strategies, and progress against publicly stated goals, and disclosures for key environmental, social, and governance (“ESG”) topics.

Team Canada Outfitter

The Canadian Olympic Committee (COC) and Canadian Paralympic Committee (CPC) announced lululemon as the new official clothing outfitter of Team Canada beginning with the Olympic and Paralympic Winter Games in 2022 and extending through the Los Angeles 2028 Summer Games. lululemon will design Team Canada’s apparel and accessories for the Olympic Games and provide athletes, coaches, and mission team members with clothing for the opening ceremony, podium (medal ceremony), closing ceremony, media opportunities, and athletes’ village wear. We also plan to develop experiences to help athletes maximize their potential both on and off the field of play.

Ambassadors

Our ambassadors are athletes and community members who create unique offerings for our guests, including classes and inspirational campaigns. In 2021, we welcomed new ambassadors into the lululemon family in tennis, basketball, dance, and more sweaty activities. Our relationships with our ambassadors strengthen our connection to our communities and provide instrumental feedback to inform future designs and development of our products.

Our People

Our goal is to be the number one place where people come to grow and develop as inclusive leaders and lead in supporting all to be well. Some of the wide-ranging holistic benefits we offered to our employees include:

•Raised Minimum Base Pay: We have raised the minimum base pay for the majority of our North American stores and Guest Education (GEC) employees to $15 or $17 per hour depending on role and market. In addition, employees continue to be eligible for lululemon’s team-based bonus program, with the ability to earn up to an additional $3 per hour on average, and up to $6 per hour, for store-based goals and results achieved.

•Pay Equity: We maintain 100% gender pay equity within our entire global employee population, meaning equal pay for equal work across genders. We have achieved pay equity across all areas of diversity in the United States and are seeking, to the extent permitted under local law and regulation, to collect the data necessary to confirm complete pay equity globally.

•Mental Health and Health Benefits: Our comprehensive health benefits program for eligible employees and dependents, include mental health offerings and support such as mental health first aid training, psychology benefits, an employee assistance program, and paid time off to promote wellbeing.

•Parenthood Program and Support Groups: Our global gender-neutral parenthood program offers paid leave of up to six months for employees at all levels based on tenure for maternity, paternity, and adoption leaves.

•Professional Coaching: One-on-one coaching for employees to engage in a conscious and creative process that supports living into their personal and professional potential. In 2021, a total of 5,500 coaching sessions were completed, with more than 200 professionally trained internal coaches available globally. We offer coaching to all levels of employees through a variety of offerings, such as:

◦1:1 Leadership Coaching: A nine-month experience for people leaders.

◦Parenthood Group Coaching: A group setting where parents can meet with one another and a coach to talk through challenges specifically related to being a working parent.

◦On-Demand Coaching: Coaching sessions available to anyone in the organization.

◦Career Coaching: A six-week experience for those who want to focus on clarifying their career goals and/or increase satisfaction in their current role – available to all who meet baseline eligibility.

•IDEA (Inclusion, Diversity, Equity, and Action): Our IDEA mission is to expand being well to encompass a culture of inclusion where diversity is celebrated, equity is the norm, and action is the commitment. In 2021, lululemon made strides in our IDEA journey, building what we believe is an ecosystem of inclusion that resulted in increased representation, a healthier culture, application of inclusive design principles, and the implementation of IDEA in everything we do.

◦Global IDEA Internship Program: Launched in August 2021 across North America and Australia, the 12-week full-time, paid IDEA Global Internship Program provides practical work experience and professional development for eligible employees and external interns interested in enhancing their knowledge and skills in select Store Support Centre (SSC) functions.

◦People Networks: Employee-led groups create spaces, avenues, and support for traditionally and historically underrepresented employees to connect, restore, and develop individually and as a community.

◦Hiring Transformation 2.0: Launched a standardized interview process in retail, a hiring playbook for SSC, diverse slates for all open positions, and a diverse sourcing process designed to increase representation.

◦Inclusive Design Certification: Conducted an Inclusive Design Pilot Program in close partnership with the Inclusive Design Research Center (IDRC). This 12-week pilot program skilled up cross-functional participants on active application of inclusive design principles to their role-based work at lululemon using a blend of facilitated lectures, co-design sessions, and reflective exercises.

◦IDEA Toolkits: The IDEA Toolkits were created to serve as a form of performance support for all employees to align with IDEA's priorities and operationalize the core value of inclusion. In 2021, there were four toolkits: Personal Responsibility, Honesty & Connection, Entrepreneurship & Courage, and Fun. The toolkits were translated into 11 languages.

Stores

We continued to expand our presence both in North America and in our international markets. During 2021, we opened 53 net new company-operated stores, including 31 stores in the People's Republic of China ("PRC"), seven stores in the rest of Asia Pacific, ten stores in North America, and five stores in Europe.

Financial Highlights

COVID-19 continues to impact the global economy and cause disruption and volatility. While most of our retail locations were open throughout 2021, certain locations were temporarily closed based on government and health authority guidance. We believe we will continue to experience differing levels of disruption and volatility, market by market. The summary below compares 2021 to 2020:

•Net revenue increased 42% to $6.3 billion.

•Company-operated stores net revenue increased 70% to $2.8 billion.

•Direct to consumer net revenue increased 22% to $2.8 billion.

•Gross profit increased 46% to $3.6 billion.

•Gross margin increased 170 basis points to 57.7%.

•Income from operations increased 63% to $1.3 billion.

In 2021, we continued to execute against our Power of Three growth plan. We have achieved some of our key growth goals under this plan two years ahead of schedule. These include generating $6 billion in net revenue, doubling our men's net revenue relative to fiscal 2018, and doubling our e-commerce net revenue relative to fiscal 2018 (which we achieved in 2020). We have seen the trends that we believe have fueled our business over the last few years continue. These include the desire to live an active and healthy lifestyle, the desire to be part of a diverse and inclusive community, and the desire to achieve wellness, both physically and mentally.

We achieved these goals while strategically managing a number of challenges related to the COVID-19 environment, including store closures, capacity constraints, and challenges across our supply chain including certain supplier factory closures, port slowdowns, and reduced air freight capacity.

Our three strategic pillars of the plan are:

•Product Innovation: Our lens for product development and innovation continues to be what we refer to as the Science of Feel. We are also particularly proud of our multi-year collaboration with the Canadian Olympic Committee and Paralympic

Committee. This collaboration allows us to showcase the lululemon brand and our technical expertise within apparel on the world stage; and we believe it is a compelling platform that we can leverage to continue to grow our brand presence both inside and outside of Canada.

•Omni Guest Experience: We continue to see benefits from our omni business model and in 2021, net revenue in our company-operated store channel increased 70% and our e-commerce business increased 22%. We engaged with our guests both in real life (where and when it was safe to do so) and virtually. In our digital business, we continued to see the benefits of the investments we have made over the last several years, while we continue to invest in our websites and mobile apps as we work to elevate the guest experience. In 2021, we continued to make foundational investments which included expanding our accepted payment methods, improving our storytelling, making search more predictive, and making the checkout process more seamless.

•Market Expansion: We continued to expand our presence both in North America and in our international markets. In 2021, our net revenue in North America increased 40%. In our international markets, we saw revenue growth of 53%, which keeps us on track with our goal to quadruple the business from 2018 levels by 2023.

OUR IMPACT

Our stake in the ground toward an equitable, sustainable future.

We have a unique opportunity and platform from which to inspire change. Our Impact Agenda outlines our social and environmental commitments and multi-year strategies to contribute to a healthier world. Established in 2020 to guide our efforts internally and address the increasing need for systemic change in our industry and around the world, our Impact Agenda is informed by issues that matter most for our society, industry, brand and people, as well as our values, progress, and learnings.

We take a holistic approach to driving positive impact, and draw inspiration from the interconnectedness of our people, product, planet, and the communities we serve – with an understanding that when we focus on one, we also impact another. Three pillars address priority social and environmental issues, each with a vision for success, goals, and commitments, and opportunities that support the future of our business and commitment to be a responsible industry leader.

| | | | | | | | | | | | | | |

| | | | |

| Be Human | | Be Well | | Be Planet |

Our vision for creating environments that are equitable, inclusive, and foster growth for our employees, ambassadors, and the people who make our products (makers).

We are taking thoughtful and intentional steps toward a more equitable world, by creating an inclusive work environment that reflects the global communities we serve and supporting the safety and wellbeing of people who make our products. | | Our vision for advancing equity in wellbeing and contributing to conditions that enable the communities we serve to thrive.

We believe everyone has the right to be well, and that the path to wellbeing is possible when tools, support and resources are available to all. We are setting out to break the barriers that prevent access to wellbeing for those most impacted by systemic inequities across the globe. | | Our vision for minimizing environmental harm and contribute restoring to a healthy planet.

We innovate more sustainable materials to support long-lasting products, while reducing environmental impacts. This focus is woven into all aspects of our design and manufacturing processes. We use science-based context to inform our goals and targets. |

2020 Impact Report

In October 2021, we released our Impact Report demonstrating progress against our commitments to accelerate lasting, positive environmental and social change. Details of our Impact Agenda and corresponding Impact Report can be found on our website (https://corporate.lululemon.com/our-impact).

EXECUTIVE OFFICERS & DIRECTORS

EXECUTIVE OFFICERS

| | | | | | | | | | | | | | | | | |

| Calvin McDonald, Chief Executive Officer |

| Age: 50 | Officer since: 2018 | |

Calvin McDonald was appointed chief executive officer of lululemon and a member of our board of directors in August 2018. Prior to joining lululemon, Mr. McDonald served for five years as president and chief executive officer of Sephora Americas, a division of the LVMH group of luxury brands. Prior to joining Sephora in 2013, Mr. McDonald spent two years as president and chief executive officer of Sears Canada. Prior to his tenure at Sears Canada, Mr. McDonald spent 17 years at Loblaw Companies Limited, a grocery and pharmacy leader in Canada. Mr. McDonald is on the board of directors of The Walt Disney Company. Mr. McDonald received an MBA from the University of Toronto, and a Bachelor of Science degree from the University of Western Ontario. |

|

|

| | | | | | | | | | | | | | | | | |

| Meghan Frank, Chief Financial Officer |

| Age: 45 | Officer since: 2020 | |

Meghan Frank has served as our chief financial officer since November 2020. She joined lululemon in 2016 as the senior vice president, financial planning and analysis, and is now responsible for leading finance, tax, treasury, investor relations, asset protection, facilities, operations excellence, and strategy functions. Ms. Frank has over 20 years of experience within the retail industry, previously holding senior positions at Ross Stores and J. Crew. She is a member of the board of directors of KKR Acquisition Holdings I, a blank cheque company targeting the consumer sector. She earned her Bachelor of Arts degree from Colgate University. |

|

|

| | | | | | | | | | | | | | | | | |

| Celeste Burgoyne, President, Americas & Global Guest Innovation |

| Age: 48 | Officer since: 2016 | |

Celeste Burgoyne was appointed as our president, Americas and global guest innovation in October 2020. Since joining lululemon in 2006, her role has expanded to oversee all channel and customer-facing aspects of the North American business, including stores and e-commerce. She is also responsible for leading and incubating guest innovations for lululemon globally. Prior to joining lululemon, Ms. Burgoyne held various leadership positions during her ten years at Abercrombie & Fitch. Ms. Burgoyne holds a B.A. from the University of San Diego. |

|

|

| | | | | | | | | | | | | | | | | |

| Michelle (Sun) Choe, Chief Product Officer |

| Age: 53 | Officer since: 2018 | |

Michelle (Sun) Choe has served as our chief product officer since September 2018, leading the merchandising and design teams for the company. She joined lululemon in 2016 as senior vice president, global merchandising and has been instrumental in elevating merchandising capabilities, partnering with design leadership and innovation to deliver the lululemon vision to guests through best-in-class product assortments. Prior to joining lululemon, Ms. Choe served as chief global product merchant at Marc Jacobs and worked in multi-channel merchandising at brands including West Elm, Madewell, Urban Outfitters, Levi's and The Gap. Ms. Choe received her B.A. from the University of Maryland College Park. |

|

|

| | | | | | | | | | | | | | | | | |

| Nicole (Nikki) Neuburger, Chief Brand Officer |

| Age: 41 | Officer since: 2020 | |

Nicole (Nikki) Neuburger has served as our chief brand officer since January 2020 with the responsibility to lead our marketing, sustainable business and social impact teams - including communications, brand management, creative, events, retail marketing, sports marketing and partnerships - globally. Between 2018 and 2020, Ms. Neuburger was the global head of marketing at Uber Eats where she led the introduction and expansion of the brand around the world. Prior to that, Ms. Neuburger built a 14-year career at Nike where she most recently served as the vice president of Nike Running. Ms. Neuburger received her Bachelor of Science in Business Administration from Oregon State University. |

|

|

| | | | | | | | | | | | | | | | | |

| André Maestrini, Executive Vice President, International |

| Age: 58 | Officer since: 2021 | | |

André Maestrini has served as our executive vice president, international since January 2021, leading our international expansion in the People’s Republic of China, the rest of Asia Pacific, and Europe. Prior to joining lululemon, Mr. Maestrini spent 14 years at adidas in various senior roles and across several of the company’s global offices, most recently as the global general manager of sport business units and managing director of Latin America. Prior to adidas, Mr. Maestrini held marketing roles at The Coca-Cola Company, Danone, and Kraft Jacobs Suchard. He received a master’s degree in Marketing from ESSEC Business School in Paris, France. |

DIRECTORS

| | | | | | | | | | | | | | |

| Martha Morfitt, Chair of the Board |

Age: 64 | Independent: Yes | Occupation: Principal of River Rock Partners Inc. |

Director since: 2008 | Tenure: 14 years | Committees: Audit (chair) & People, culture and compensation |

Martha (Marti) Morfitt has been a member of our board of directors since December 2008, and has been the chair of the board since March 2022. She has served as a principal of River Rock Partners, Inc., a business and cultural transformation consulting firm, since 2008. Ms. Morfitt served as the chief executive officer of Airborne, Inc. from October 2009 to March 2012. She served as the president and chief executive officer of CNS, Inc., a manufacturer and marketer of consumer healthcare products, from 2001 through March 2007. From 1998 to 2001, she was chief operating officer of CNS, Inc. Prior to joining CNS, Ms. Morfitt spent 16 years at the Pillsbury Company in a variety of marketing and senior management roles. Ms. Morfitt currently serves on the board of directors of Graco, Inc. and Olaplex Holdings, Inc. She served on the board of directors of Mercer International Inc. from 2017 to 2020, and Life Time Fitness, Inc. from 2008 to 2015. She received her HBA from the Richard Ivey School of Business at the University of Western Ontario, and an MBA from the Schulich School of Business at York University. |

Skills & Experience •Our board of directors selected Ms. Morfitt to serve as director because she has extensive public board experience and years of leading and managing branded consumer businesses and their operations and strategic planning. |

| | | | | | | | | | | | | | |

| Michael Casey |

Age: 76 | Independent: Yes | Occupation: Retired Executive Vice President, Chief Financial Officer and Chief Administrative Officer of Starbucks Corporation |

Director since: 2007 | Tenure: 15 years | Committees: Audit & People, culture and compensation |

Michael Casey has been a member of our board of directors since October 2007 and served as co-chair of the board of directors from September 2014 to April 2017 and as chair of the board of directors from May 2014 to September 2014. He retired from Starbucks Corporation in October 2007, where he had served as senior vice president and chief financial officer from August 1995 to September 1997, and executive vice president, chief financial officer and chief administrative officer from September 1997 to October 2007. Subsequent to retirement he served as a senior advisor to Starbucks Corporation from October 2007 to May 2008 and from November 2008 to January 2015. Prior to joining Starbucks, Mr. Casey was executive vice president and chief financial officer for Family Restaurants, Inc. and president and chief executive officer of El Torito Restaurants, Inc. He was also a member of the board of directors of The Nasdaq OMX Group, Inc. from January 2001 to May 2012. Mr. Casey graduated from Harvard College with a B.A. degree in Economics, cum laude, and Harvard Business School with an MBA degree. |

Skills & Experience •Our board of directors selected Mr. Casey to serve as director because he has extensive experience in corporate finance and accounting, managing retail-focused industry operations, strategic planning, and public company corporate governance. |

| | | | | | | | | | | | | | |

| Stephanie Ferris |

Age: 48 | Independent: Yes | Occupation: President of Fidelity National Information Services, Inc. (FIS) |

Director since: 2019 | Tenure: 4 years | Committees: Audit |

Stephanie Ferris has been a member of our board of directors since July 2019. Since February of 2022, Ms. Ferris has served as president of Fidelity National Information Services, Inc. Prior to her current role she was the chief administrative officer since September 2021, and the chief operating officer from 2019 to 2020. From 2018 to 2019, she was the chief financial officer of Worldpay, Inc., a payments technology company. Prior to becoming CFO of Worldpay, Ms. Ferris was the chief financial officer of Vantiv, Inc., a predecessor to Worldpay, from 2016 to 2018, and its deputy chief financial officer from 2015 to 2016. Ms. Ferris served in several capacities at Vantiv from 2010 to 2015. Earlier in her career, Ms. Ferris was employed in various positions of increasing responsibility of Fifth Third Bancorp and began her career in public accounting at PricewaterhouseCoopers. Ms. Ferris is a Certified Public Accountant and a graduate of Miami University in Oxford, Ohio. |

Skills & Experience •Our board of directors selected Ms. Ferris to serve as a director given her broad experience and background in technology and finance.

|

| | | | | | | | | | | | | | |

| Kourtney Gibson |

Age: 40 | Independent: Yes | Occupation: Executive Vice Chairman of Loop Capital Markets |

Director since: 2020 | Tenure: 2 years | Committees: Audit & People, culture and compensation |

Kourtney Gibson has been a member of our board of directors since November 2020. Ms. Gibson is executive vice chairman of Loop Capital Markets, an investment banking and brokerage firm, where she started as an intern over 20 years ago and served as President from 2016 to March 2022. She is on the board of MarketAxess Holdings Inc. She also sits on the board of trustees at the University of Miami and Viterbo University as well on the boards of the Dibia Dream Foundation and Chicago Scholars Foundation. Ms. Gibson is a member of the Economic Club of Chicago and the Treasury Market Practices Group sponsored by the Federal Reserve Bank of New York. Ms. Gibson received an MBA from the Kellogg School of Management at Northwestern University. |

Skills & Experience •Our board of directors selected Ms. Gibson to serve as a director because it believes her accomplishments as a business and finance leader provides experience in identifying opportunities for growing global consumer brands. |

| | | | | | | | | | | | | | |

| Kathryn Henry |

Age: 56 | Independent: Yes | Occupation: Co-Founder and Chief Executive Officer of LightBrite |

Director since: 2016 | Tenure: 8 years | Committees: Audit & People, culture and compensation |

Kathryn Henry has been a member of our board of directors since January 2016. Since January 2022, Ms. Henry has served as chief executive officer of LightBrite, where she is also co-founder. From 2015 through 2021, Ms. Henry served as a strategic advisor, mentor and consultant in retail and technology sectors. Ms. Henry previously served as chief information officer, logistics & distribution at lululemon from 2010 to 2014 where she oversaw all global information and technology operations for the company. Prior to joining lululemon in 2010, Ms. Henry worked at Gap, Inc., where she served as vice president and chief information officer of international IT and Gap North America and was responsible for the systems support of key international growth initiatives. Previously, she was vice president of Dockers Business Divestiture and vice president of global IT strategy & development at Levi Strauss & Co. Ms. Henry was selected as a Global CIO Top 25 Breakaway Leader in 2013, and was a member of the National Retail Federation CIO council during her tenure with lululemon. |

Skills & Experience •Our board of directors believes Ms. Henry's strategic IT and retail experience as well as her experience with lululemon provides valuable insight to our board of directors. |

| | | | | | | | | | | | | | |

| Alison Loehnis |

Age: 51 | Independent: Yes | Occupation: President of Luxury and Fashion of Yoox Net-a-Porter |

Director since: 2022 | Tenure: 4 months | Committees: N/A |

Alison Loehnis has been a member of our board of directors since January 2022. Since June of 2021, Ms. Loehnis has been president of Luxury and Fashion at Yoox Net-a-Porter where she is responsible for Net-a-Porter, Mr. Porter and the Outnet businesses, and where she was president of the luxury division from 2015 until 2021. She has held several leadership roles with expanding responsibility since she joined the company in 2007 and has been instrumental in the conception and launch of major initiatives including TheOutnet.com and MrPorter.com. Previously, Ms. Loehnis held positions with LVMH, Hachette Filipacchi and The Walt Disney Company, after starting her career with Saatchi & Saatchi. Ms. Loehnis received a degree in Art History from Brown University. |

Skills & Experience •Our board of directors selected Ms. Loehnis to serve as a director because it believes her experience as a leader in the retail industry, and international markets will provide valuable insight to the company. |

| | | | | | | | | | | | | | |

| Jon McNeill |

Age: 54 | Independent: Yes | Occupation: Chief Executive Officer of DVx Ventures |

Director since: 2016 | Tenure: 6 years | Committees: Corporate responsibility, sustainability and governance |

Jon McNeill has been a member of our board of directors since April 2016. Since January 2020, Mr. McNeill has served as chief executive officer of DVx Ventures. He served as chief operating officer of Lyft, Inc. from March 2018 to July 2019. From September 2015 to February 2018, he served as president, global sales, delivery and service of Tesla Inc., overseeing customer-facing operations. Prior to joining Tesla, Inc., he was the chief executive officer of Enservio, Inc., a software company, from 2006 until 2015, and founder of multiple technology and retail companies. He serves on the board of directors of Asurion, CrossFit, LLC, Tekion Corp, Stash Financial, Inc. and Tier Mobility. Mr. McNeill began his career at Bain & Company. He is a graduate of Northwestern University. |

Skills & Experience •Our board of directors selected Mr. McNeill because it believes his executive experience and innovative and entrepreneurial attributes provide valuable insight and are aligned with our unique culture. |

| | | | | | | | | | | | | | |

| Glenn Murphy |

Age: 60 | Independent: Yes | Occupation: Founder and Chief Executive Officer of FIS Holdings |

Director since: 2017 | Tenure: 5 years | Committees: N/A |

Glenn Murphy has been a member of our board of directors since April 2017 and served as non-executive chair of the board of directors from August 2018 to March 2022. He served as executive chair of the board of directors from February to August of 2018. He served as co-chair of the board of directors from April 2017 to November 2017 and as non-executive chair of the board of directors from November 2017 to February 2018. Mr. Murphy is an industry executive with more than 25 years of retail experience. He has led diverse retail businesses and brands in the areas of food, health & beauty, apparel and books. He is the founder and CEO of FIS Holdings, a high-impact consumer-focused investment firm deploying a combination of operating guidance and capital flexibility. He is also CEO and chairman of KKR Acquisition Holdings I, a blank cheque company targeting the consumer sector. Prior to FIS Holdings, Mr. Murphy served as chairman and chief executive officer at The Gap, Inc. from 2007 until 2014. Prior to that, Mr. Murphy served as the chairman and chief executive officer of Shoppers Drug Mart Corporation from 2001 to 2007. Prior to leading Shoppers Drug Mart, he served as the chief executive officer and president for the Retail Division of Chapters Inc. Mr. Murphy started his career at Loblaws where he spent 14 years. He holds a BA Degree from the University of Western Ontario. |

Skills & Experience •Our board of directors selected Mr. Murphy to serve as a director because it believes his extensive retail experience as a leading strategic operator will provide valuable insight to our board of directors. |

| | | | | | | | | | | | | | |

| David Mussafer, Lead Director |

Age: 58 | Independent: Yes | Occupation: Chairman and Managing Partner of Advent International Corporation |

Director since: 2014 | Tenure: 8 years | Committees: Corporate responsibility, sustainability and governance (chair) |

David Mussafer is lead director and has been a member of our board of directors since September 2014. Mr. Mussafer also served as a director of lululemon from 2005 until 2010. Mr. Mussafer is chairman and managing partner of Advent International Corporation which he joined in 1990. Prior to Advent, Mr. Mussafer worked at Chemical Bank and Adler & Shaykin in New York. Mr. Mussafer has led or co-led more than 30 buyout investments at Advent across a range of industries. Mr. Mussafer’s current directorships also include Olaplex Holdings Inc. and Thrasio. Mr. Mussafer holds a BSM, cum laude, from Tulane University and an MBA from the Wharton School of the University of Pennsylvania. |

Skills & Experience •Our board of directors believes Mr. Mussafer's extensive experience enables him to provide valuable insights to the board of directors regarding board processes and operations as well as the relationship between the board of directors and shareholders. |

| | | | | | | | | | | | | | |

| Emily White |

Age: 43 | Independent: Yes | Occupation: President of Anthos Capital |

Director since: 2011 | Tenure: 11 years | Committees: People, culture and compensation (chair) |

Emily White has been a member of our board of directors since November 2011. She has served as President of Anthos Capital, a Los Angeles-based investment firm since 2018. Prior to Anthos, Ms. White was chief operating officer at Snap, Inc. from January 2014 to March of 2015. Prior to joining Snap, Ms. White held several leadership roles at Facebook Inc. from 2010 to 2013 including as Director of Local Business Operations, Director of Mobile Business Operations and Head of Business Operations at Instagram. From 2001 to 2010, Ms. White worked at Google where she ran North American Online Sales and Operations, Asia Pacific & Latin America business and the Emerging Business channel. Ms. White is also a board member to Graco, Inc. and is on the boards of directors for Northern Start Investment Corp IV, a special purpose acquisition company, Olaplex Holdings Inc., Railsbank, and Guayaki. She has also served on the boards of the National Center for Women in I.T., a non-profit coalition working to increase the participation of girls and women in computing and technology, and X-Prize, a non-profit focused on creating breakthroughs that pull the future forward. She received a BA in Art History from Vanderbilt University. |

Skills & Experience •Our board of directors selected Ms. White to serve as a director because of her extensive experience with social networking and technology companies. |

PROPOSAL NO. 1

ELECTION OF DIRECTORS

We have a classified board of directors with a total of eleven directors, including four Class I directors, three Class II directors, and four Class III directors who will serve until the annual meetings of shareholders to be held in 2023, 2024 and 2022, respectively. One of our current Class III directors, Stephanie Ferris, will not stand for re-election at the annual meeting.

Accordingly, effective as of the 2022 annual meeting, our board of directors will consist of ten directors, including four Class I directors, three Class II directors, and three Class III directors.

Director Nominees for Election at the 2022 Annual Meeting of Shareholders

New and re-nominated directors are evaluated by the corporate responsibility, sustainability and governance committee of our board of directors using information available about the candidate, criteria and procedures included in our "guidelines for evaluating director candidates."

As the term for our Class III directors is expiring at the 2022 annual meeting, the committee has nominated the individuals noted below for re-election. If elected, the directors will serve for a three-year term until our 2025 annual meeting, and until their successors are duly elected and qualified, or until their earlier resignation or removal.

| | | | | | | | | | | | | | |

| Name | | Age(1) | | Director Since |

| Class III directors (whose terms would expire at the 2025 annual meeting) | | |

| Kathryn Henry | | 56 | | 2016 |

| Jon McNeill | | 54 | | 2016 |

| Alison Loehnis | | 51 | | 2022 |

(1) Age as of April 1, 2022.

Our board of directors has no reason to believe that any of the nominees listed above will be unable to serve as a director. If, however, any nominee becomes unavailable, the proxies will have discretionary authority to vote for a substitute nominee. There are no family relationships among any of the directors or executive officers.

Vote Required and Board Recommendation

If a quorum is present, a nominee for director will be elected to the board of directors if the votes cast for the nominee's election exceed the votes cast against that nominee's election. If an incumbent director fails to receive the required vote for re-election, then, within 90 days following certification of the shareholder vote by the inspector of elections, the board of directors will determine whether to accept the director's resignation. Abstentions and broker non-votes will have no effect on the outcome of the election.

Our board of directors unanimously recommends a vote "FOR" the election of the three Class III nominees named above.

CORPORATE GOVERNANCE

Our Board of Directors

The following table states the name, age, and principal occupation of each of our current directors (including the nominees to be elected at this meeting), and the period during which each has served as a director of lululemon.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Occupation | | Director Since |

| Class I directors (whose terms expire at the 2023 annual meeting) | | |

| David Mussafer | | 58 | | Chairman and Managing Partner of Advent International Corporation | | 2014 |

| Glenn Murphy | | 60 | | Founder and Chief Executive Officer of FIS Holdings | | 2017 |

| Kourtney Gibson | | 40 | | Executive Vice Chairman of Loop Capital Markets | | 2020 |

| Michael Casey | | 76 | | Retired Executive Vice President, Chief Financial Officer and Chief Administrative Officer of Starbucks Corporation | | 2007 |

| Class II directors (whose terms expire at the 2024 annual meeting) | | |

| Calvin McDonald | | 50 | | Chief Executive Officer of lululemon athletica inc. | | 2018 |

| Emily White | | 43 | | President of Anthos Capital | | 2011 |

| Martha Morfitt | | 64 | | Principal of River Rock Partners Inc. | | 2008 |

| Class III directors (whose terms expire and are nominees for re-election at the 2022 annual meeting) | | |

| Alison Loehnis | | 51 | | President of Luxury and Fashion of Yoox Net-a-Porter | | 2022 |

| Jon McNeill | | 54 | | Chief Executive Officer of DVx Ventures | | 2016 |

| Kathryn Henry | | 56 | | Co-Founder and Chief Executive Officer of LightBrite | | 2016 |

| Class III director (whose term expires at the 2022 annual meeting) |

| Stephanie Ferris | | 48 | | President of Fidelity National Information Services, Inc. (FIS) | | 2019 |

| | | | | | |

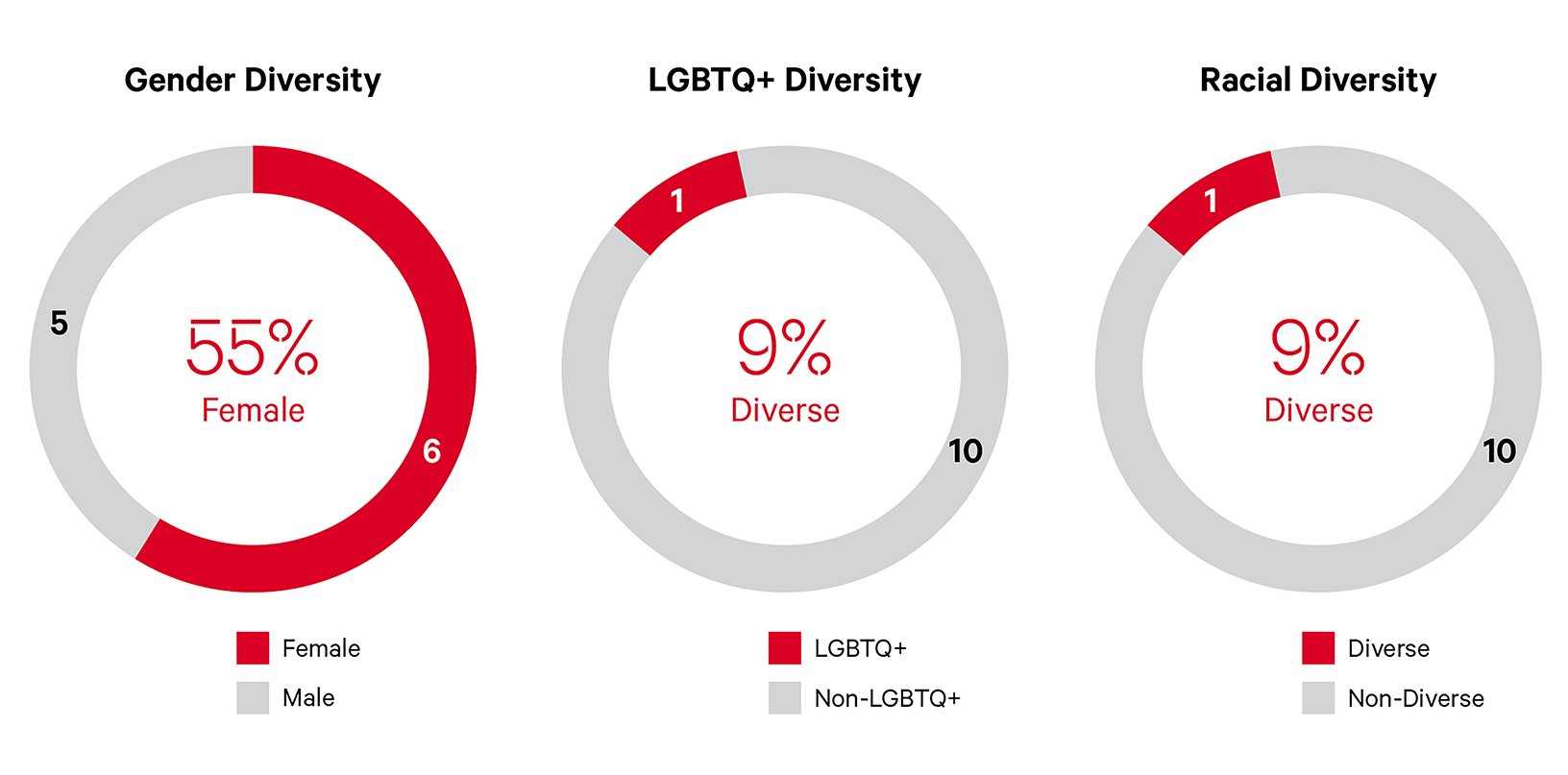

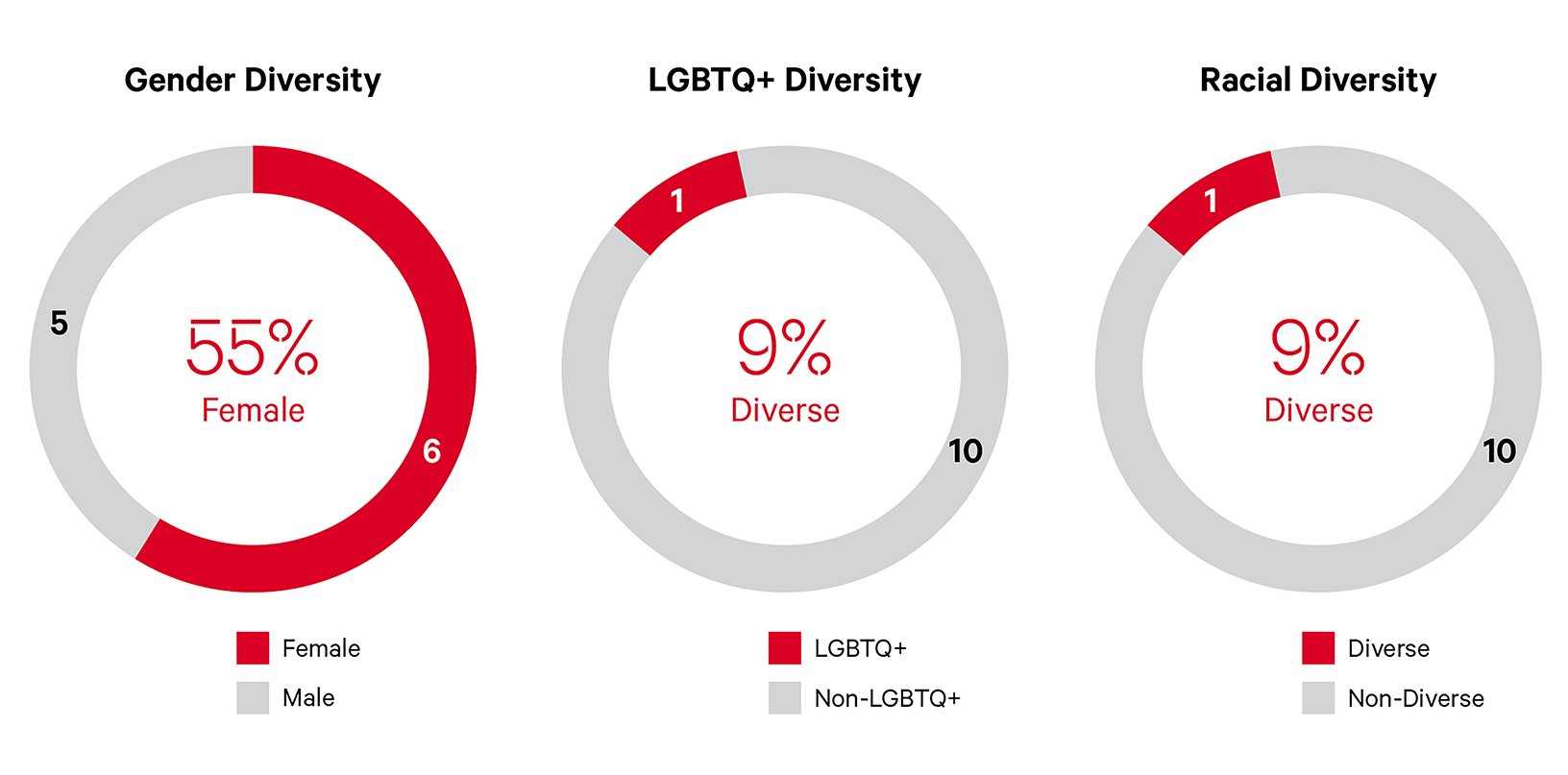

Our Board Diversity

The following are information based on voluntary, self-identified characteristics of gender, racial, and LGBTQ+ status of the company's board.

| | | | | | | | |

Board Diversity Matrix(1) |

| Board Size: |

| Total Number of Directors | 11 |

| Female | Male |

| Gender: |

| Directors | 6 | 5 |

| Number of Directors who self-identify as one of the below: |

| African American or Black | 1 | 0 |

| White | 5 | 5 |

| LGBTQ+ | 1 |

(1) as at April 1, 2022

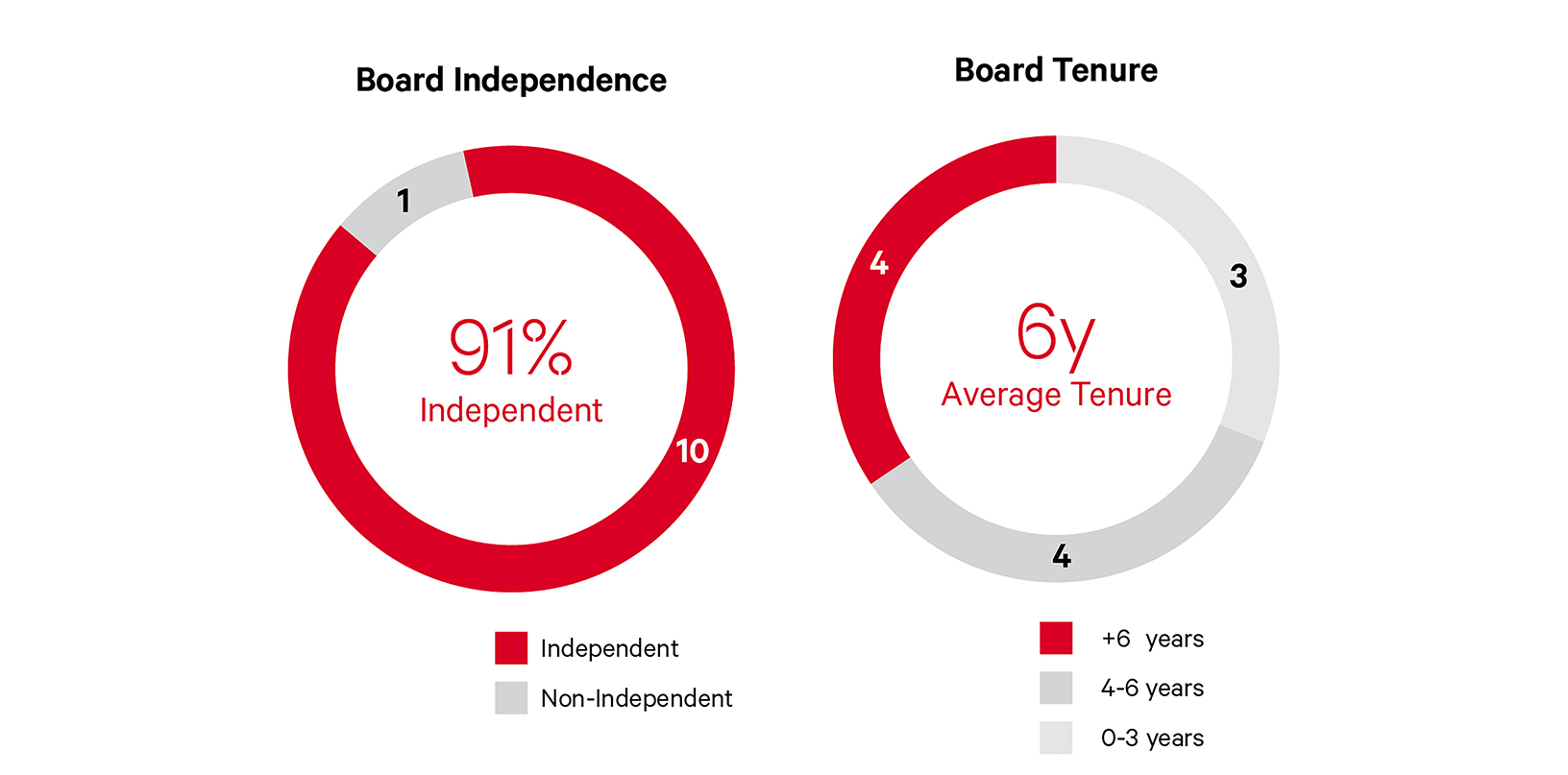

Our Board Composition

The following are information about our board's composition to our approach to independence and refreshment.

Skills Matrix

Our directors have a diverse set of skills we believe are necessary to create an effective board. Listed below are qualifications and experiences we consider important to oversee the management of our business. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director Qualifications & Experience |

Casey |

Ferris |

Gibson |

Henry |

Loehnis |

McNeill |

Morfitt |

Murphy |

Mussafer |

White |

| Senior Leadership | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü |

| International Markets | ü | ü | | | ü | ü | ü | ü | ü | |

| Finance/Accounting | ü | ü | ü | | | ü | ü | ü | ü | ü |

| Public Company Board Service | ü | ü | ü | ü | | ü | ü | ü | ü | ü |

| Retail Industry | ü | | ü | ü | ü | ü | ü | ü | ü | |

| Digital/Technology | | ü | | ü | ü | ü | | | | ü |

| Strategy | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü |

| HR & Talent | ü | | | ü | | | ü | ü | ü | ü |

Environmental, Social & Governance (ESG) | ü | | | ü | | ü | ü | ü | ü | |

Independence of the Board

The U.S. federal securities laws pertaining to corporate governance of publicly-traded companies and the Nasdaq listing standards require the board of directors to make an evaluation and determination as to the independence of members of the board of directors in accordance with the standards provided in U.S. federal law and the Nasdaq listing standards. The board of directors has reviewed the general definitions and criteria for determining the independence of directors, information provided by each director, other relevant facts and circumstances bearing on each director's ability to exercise independent judgment in carrying out the responsibilities of a director, any arrangements or understandings between any director and another person under which that director was selected as a director, and the recommendations of the corporate responsibility, sustainability and governance committee regarding the independence of our current directors. Based on this review, our board of directors has determined that the following current members of our board of directors are "independent" for the purposes of the Nasdaq listing standards as they relate to directors:

| | | | | | | | | | | |

| Michael Casey | Kathryn Henry | Martha Morfitt | Emily White |

| Stephanie Ferris | Alison Loehnis | Glenn Murphy | |

| Kourtney Gibson | Jon McNeill | David Mussafer | |

| | | |

Our board of directors has determined that Calvin McDonald, our chief executive officer, is not an independent director by virtue of his current employment with lululemon.

Executive Sessions

Non-management directors generally meet in an executive session without management present each time our board of directors holds its regularly scheduled meetings.

Committees and Meeting Attendance

Our board of directors has three standing committees, including audit; people, culture and compensation; and corporate responsibility, sustainability and governance committees. Each of these committees operates under a written charter adopted by our board of directors. Copies of these charters are available on our website at www.lululemon.com.

Our board of directors held eleven meetings of the full board of directors during 2021. Each of the standing committees held the number of meetings indicated in the table below. During 2021, each of our directors attended at least 75% of the total number of meetings of our board of directors and the committees of our board of directors on which such director served during that period.

Directors are encouraged to attend our annual meetings of shareholders. All of our directors attended the 2021 annual meeting of shareholders.

The following table shows the three standing committees of our board of directors, the members of each committee during 2021 and the number of meetings held by each committee:

| | | | | | | | | | | | | | | | | | | | |

Name of Director(1) | | Audit | | People, culture and compensation | | Corporate responsibility, sustainability and governance |

| Michael Casey | | Member | | Member | | |

| Stephanie Ferris | | Member | | | | |

| Kourtney Gibson | | Member | | | | Member |

| Kathryn Henry | | Member | | Member | | |

| Jon McNeill | | | | | | Member |

| Martha Morfitt | | Chair | | Member | | |

| David Mussafer | | | | | | Chair |

| Emily White | | | | Chair | | |

| Number of meetings in fiscal 2021 | | 8 | | 7 | | 4 |

(1) Alison Loehnis joined the board of directors effective January 25, 2022.

Audit Committee

The audit committee is appointed by our board of directors to assist it in fulfilling its oversight responsibilities by overseeing the accounting and financial reporting processes of lululemon and the audits of our financial statements as well as overseeing our risk assessment and risk management policies, procedures and practices. The audit committee's primary duties and responsibilities include:

•Appointing and retaining our independent registered public accounting firm, approving all audit, review, and other services to be provided by our independent registered public accounting firm and determining the compensation to be paid for those services;

•Overseeing the integrity of our financial reporting process and systems of internal controls regarding accounting and finance;

•Overseeing the qualifications, independence, and performance of our independent registered public accounting firm;

•Overseeing our financial risk assessment and risk management policies, procedures, and practices;

•Overseeing our enterprise risk assessment and management policies, procedures and practices (including regarding those risks related to information security, cyber security, and data protection);

•Reviewing and, if appropriate, approving any related party transactions;

•Reviewing our code of business conduct and ethics applicable to all directors, officers, and employees, and monitoring and approving any modifications or waivers of the code;

•Providing a means for processing complaints and anonymous submissions by employees of concerns regarding accounting or auditing matters; and

•Monitoring compliance with legal and regulatory requirements.

The current members of the audit committee are Martha Morfitt (chair), Michael Casey, Stephanie Ferris, Kourtney Gibson and Kathryn Henry. Our board of directors has determined that each of the members of the audit committee is "independent" for purposes of the Nasdaq listing requirements as they apply to audit committee members and that Ms. Morfitt, Mr. Casey, Ms. Ferris and Ms. Gibson qualify as "audit committee financial experts" under the rules of the SEC as they apply to audit committee members.

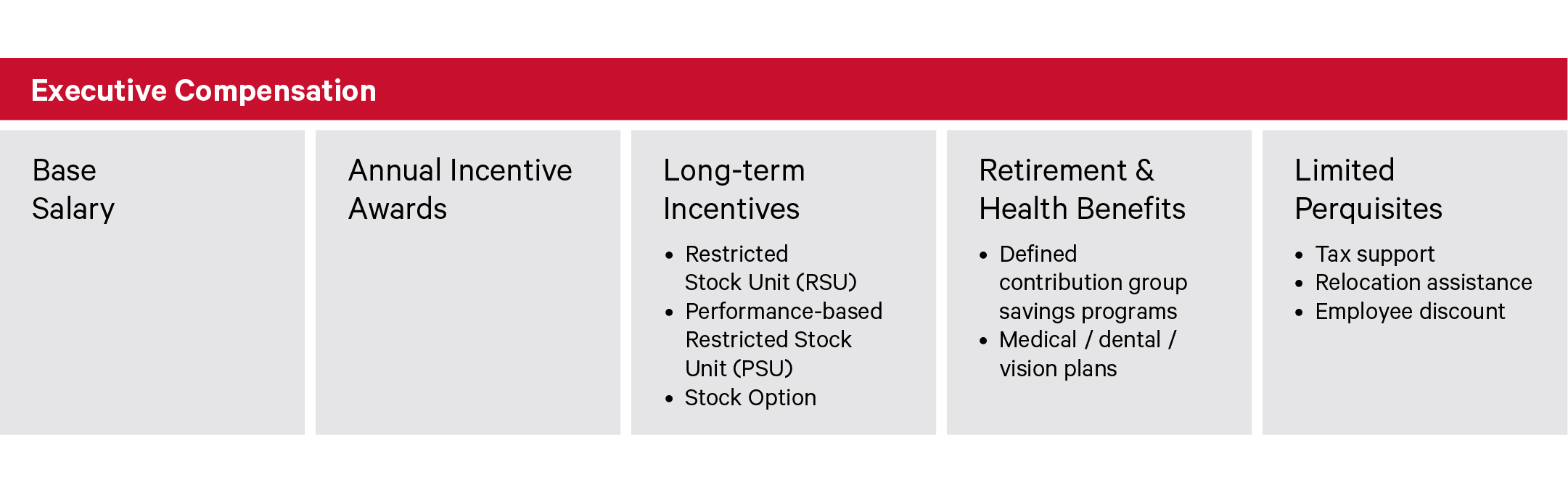

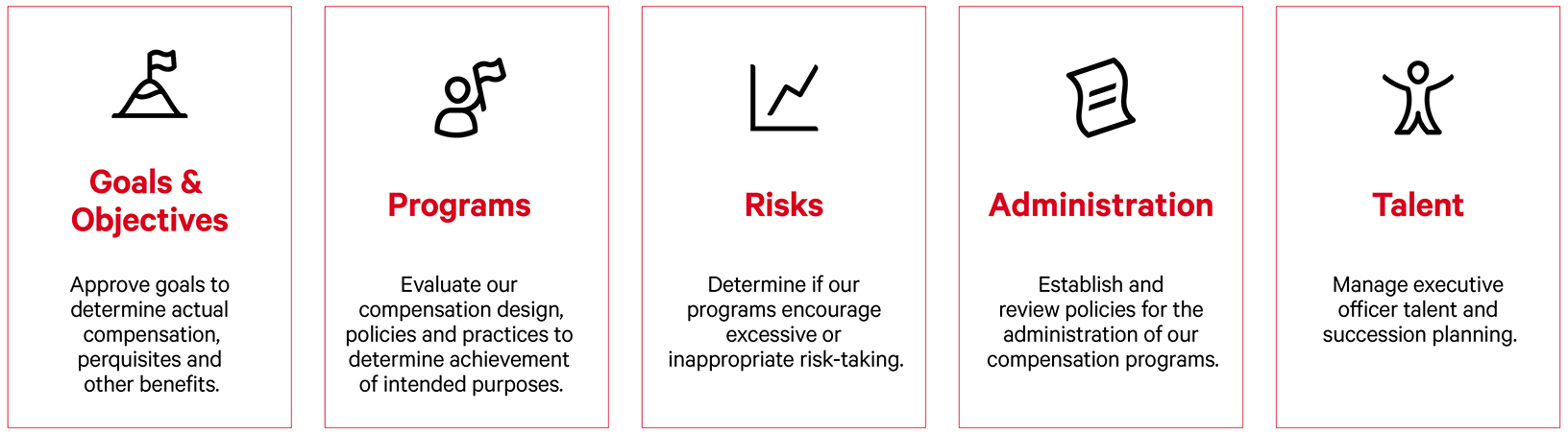

People, Culture and Compensation Committee

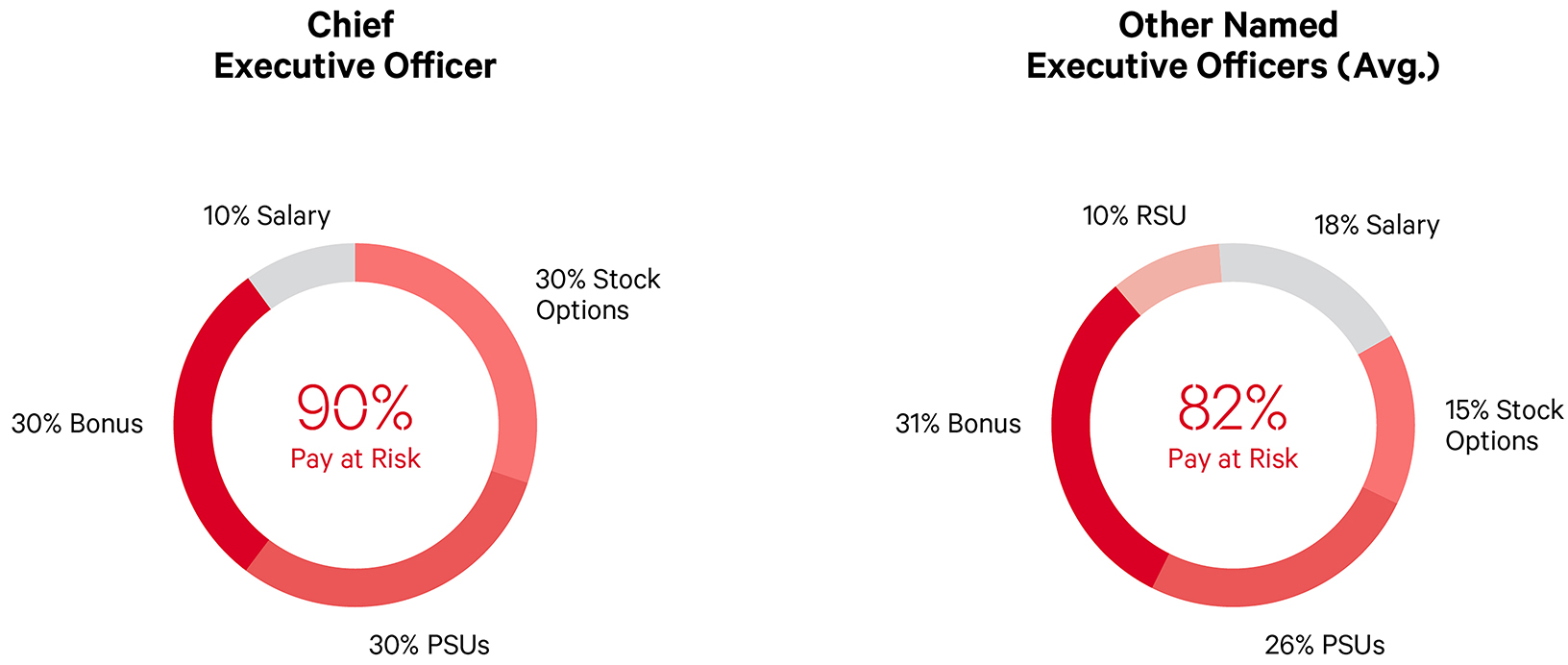

The people, culture and compensation committee is appointed by our board of directors to assist it in fulfilling its oversight responsibility by overseeing all significant aspects of our compensation policies and programs, including:

•Reviewing and recommending to our board of directors the compensation and annual performance objectives and goals of our chief executive officer;

•Reviewing and approving the compensation of our executive officers (other than the chief executive officer) and getting overall insight into each named executive officer's performance;

•Reviewing, approving, and administering incentive-based and equity-based compensation plans in which our executive officers participate;

•Evaluating risks created by our compensation policies and practices and considering any reasonably likely effect of such risks;

•Reviewing reporting on succession planning, talent management, and policies and practices with respect to diversity and inclusion;

•Reviewing and recommending to our board of directors new executive compensation programs; and

•Reviewing and recommending to our board of directors proposed changes in director compensation.

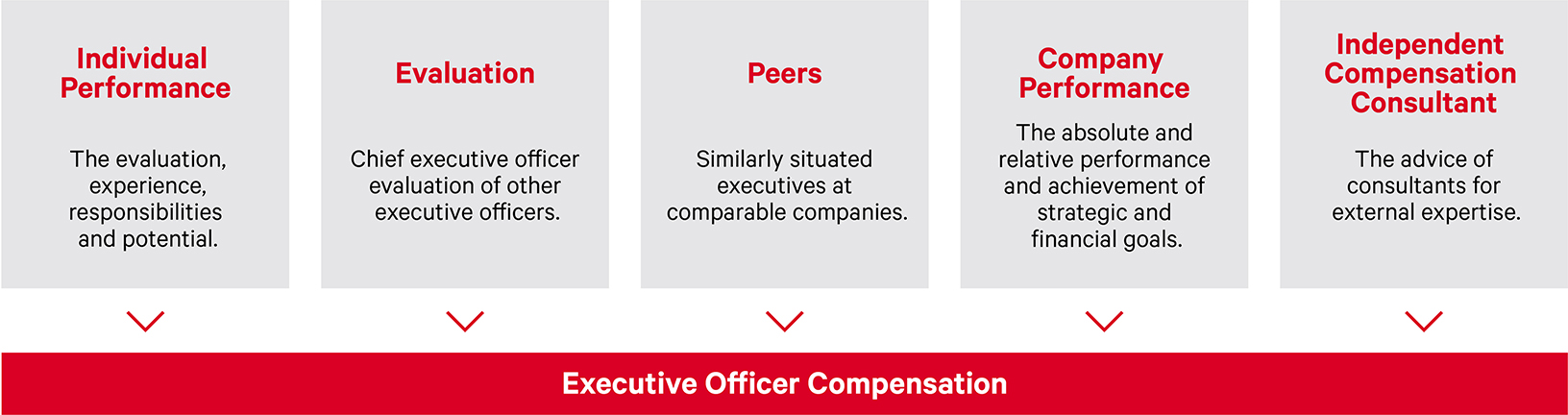

Additional information concerning the people, culture and compensation committee's processes and procedures for the consideration and determination of executive and director compensation (including the role of its independent compensation consultant, Willis Towers Watson) can be found in the Compensation Discussion and Analysis section of this proxy statement under the captions "People, Culture and Compensation Committee Duties and Responsibilities," "Role of the Independent Compensation Consultant," and "Role of People, Culture and Compensation Committee and Chief Executive Officer in Executive Compensation."

The current members of this committee are Emily White (chair), Kathryn Henry, Martha Morfitt, and Michael Casey. Our board of directors has determined that each of the members of this committee is "independent" for purposes of the Nasdaq listing standards as they apply to board committees performing the compensation function.

Corporate Responsibility, Sustainability and Governance Committee

The corporate responsibility, sustainability and governance committee is appointed by our board of directors and is responsible for matters relating to:

•The corporate governance of our company;

•Identifying individuals qualified to become members of our board of directors or any of its committees;

•Recommending nominees for election as directors at each shareholder meeting at which directors are to be elected;

•Recommending candidates to fill any vacancies on our board of directors or any of its committees; and

•Reviewing and evaluating the company's programs, policies, practices and reporting relating to corporate responsibility and sustainability, including social and environmental issues and impacts to support the sustainable growth of the company's businesses.

The current members of this committee are David Mussafer (chair), Kourtney Gibson, and Jon McNeill. Our board of directors has determined that each of the members of this committee is "independent" for purposes of the Nasdaq listing standards as they apply to board committees performing the nominating function.

Director Nominations

The corporate responsibility, sustainability and governance committee considers recommendations for nominees from directors, officers, employees, shareholders, and others based upon each candidate's qualifications, including whether a candidate possesses the specific qualities and skills desirable in members of our board of directors. Nominees for our board of directors are expected to:

•Be committed to enhancing long-term shareholder value;

•Possess a high level of personal and professional ethics, sound business judgment, appropriate experience and achievements, personal character, and integrity;

•Understand our business and the industry in which we operate;

•Regularly attend meetings of our board of directors and committee meetings;

•Participate in meetings and decision-making processes in an objective and constructive manner; and

•Be available to advise our officers and management.

Evaluations of candidates generally involve a review of background materials, internal discussions, and interviews with selected candidates, as appropriate. Upon selection of a qualified candidate, the corporate responsibility, sustainability and governance committee recommends the candidate to our board of directors. The committee may engage consultants or third-party search firms to assist in identifying and evaluating potential nominees.

We are committed to a merit-based system for composition of our board of directors, which includes multiple perspectives and views. The corporate responsibility, sustainability and governance committee considers individuals on the basis of their integrity, experience, achievements, judgment, personal character, and capacity to make independent analytical inquiries, ability and willingness to devote adequate time to director duties, and likelihood that they will be able to serve as a director for a sustained period. While we do not have a formal policy regarding the consideration of diversity in identifying nominees for directors, we value the benefits that a diversity of business experience, geography, age, gender identity, race and ethnicity can bring to our board of directors. We believe diversity on the board of directors promotes the inclusion of different perspectives and ideas and ensures that we have the opportunity to leverage all available talent and makes prudent business sense. Our board of directors believes fostering a diverse board of directors also makes for better corporate governance and will seek to maintain a board of directors comprised of talented and dedicated directors with a diverse mix of expertise, experience, skills and backgrounds that reflect the diverse nature of the business environment.

The corporate responsibility, sustainability and governance committee will consider director candidates recommended by shareholders. The committee will evaluate director candidates in light of several factors, including the general criteria outlined above. Shareholders who wish to recommend individuals for consideration by the committee to become nominees for election to our board of directors at an annual meeting of shareholders must do so in accordance with the process outlined in "Shareholder Proposals to be Presented at the 2023 Annual Meeting of Shareholders" section of this proxy statement and in compliance with our bylaws. Each submission must include: the name and address of the shareholder on whose behalf the submission is made; the number of our shares that are owned beneficially by that shareholder as of the date of the submission and the time period for which those shares have been held; the derivative securities interests owned beneficially by that shareholder as of the date of the submission; a statement from the record holder of the shares and derivative securities interests verifying the holdings; the full name of the proposed candidate; a description of the proposed candidate's business experience for at least the previous five years; complete biographical information for the proposed candidate; a description of the proposed candidate's qualifications as a director; and any other information described in our bylaws and in our "Guidelines for Evaluating Director Candidates," which is available on our website at www.lululemon.com.

Board Structure

We have a classified board structure where board members are elected to three-year terms, such that generally every year only one-third of the directors are considered for election or re-election. We have had this board structure continuously since lululemon became a publicly traded company in 2007. Our board of directors believes the classified board structure has served lululemon and our shareholders well and continues to benefit our shareholders. We believe continuity in membership of our board of directors has assisted in consistent application of our practice of combining performance and leadership to achieve our goals.

Our board of directors also believes a classified board structure provides valuable stability and continuity of leadership for lululemon which is important to long-term shareholder value. With three-year terms, directors develop a deeper understanding of our business, values, competitive environment, and strategic goals. Experienced directors are better positioned to provide effective oversight and advice consistent with the long-term best interest of shareholders. It also enhances the board's ability to make fundamental decisions that are best for lululemon and its shareholders, such as decisions on strategic transactions, significant capital commitments, and careful deployment of financial and other resources. Electing directors to three-year terms also enhances the independence of non-employee directors. It permits them to act independently and on behalf of all shareholders without worrying whether they will be re-nominated by the other members of the board each year. The longer term reduces the influence of special interest groups or significant shareholders who may have agendas contrary to the majority of shareholders and lululemon's own

long-term goals. The board of directors believes the freedom to focus on the long-term interests of lululemon, instead of short-term results and the re-nomination process, leads to greater independence and better governance.

In addition, our board of directors believes the classified board structure can be a safeguard against a purchaser gaining control of lululemon without paying fair value. Because only approximately one-third of the directors are elected at any annual meeting, a majority of the board of directors cannot be replaced at a single annual meeting. A classified board does not preclude a change in control of lululemon. It can, however, provide the board of directors more time and flexibility to evaluate the adequacy and fairness of proposed offers, to implement the optimal method of enhancing shareholder value, to protect shareholders against abusive tactics during a takeover process, and to negotiate the best terms for all shareholders, without the threat of imminent removal of a majority of board members. Our board of directors believes that without a classified board structure, its ability to deal with proposals it believes are unfair to lululemon's shareholders or inadequate would be significantly reduced.